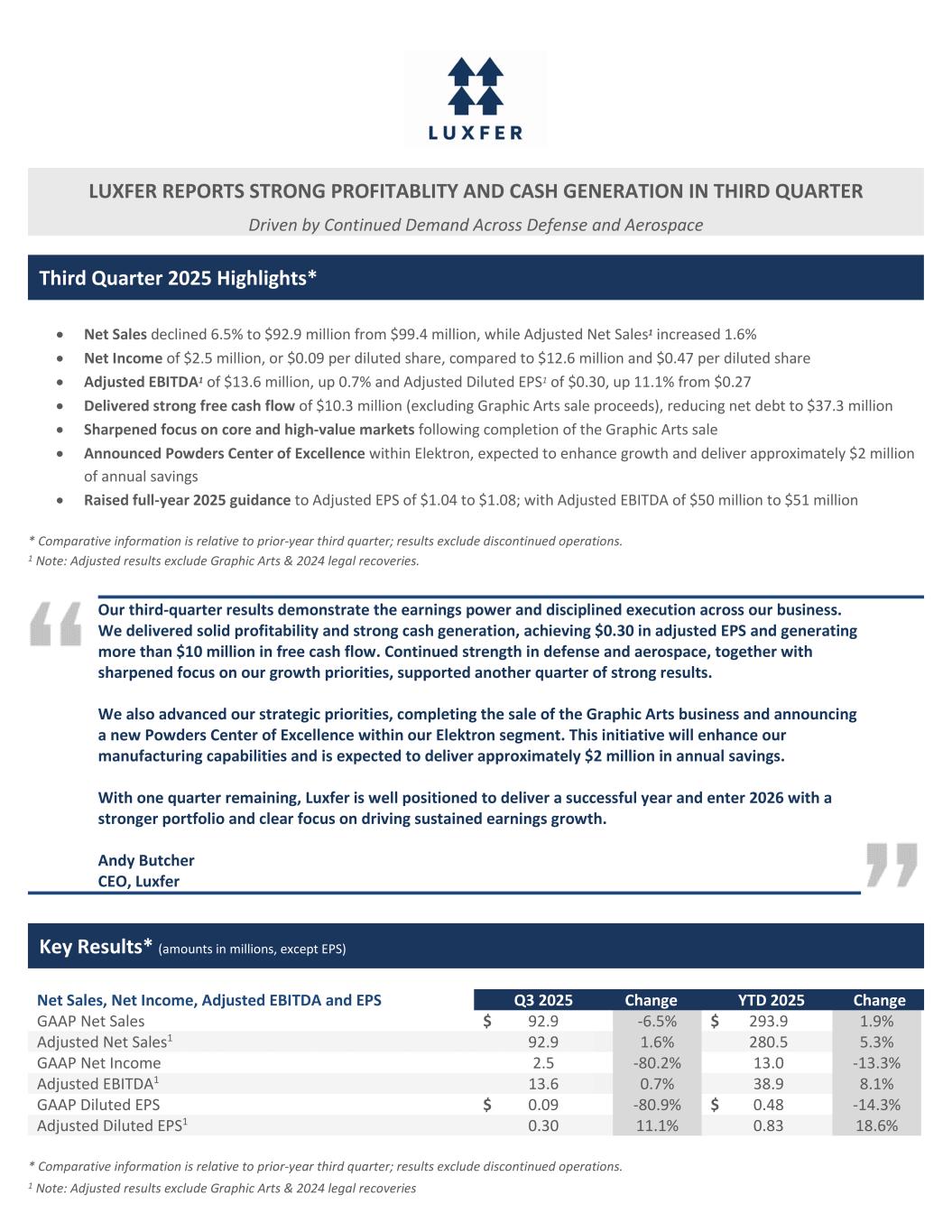

LUXFER REPORTS STRONG PROFITABLITY AND CASH GENERATION IN THIRD QUARTER Driven by Continued Demand Across Defense and Aerospace Third Quarter 2025 Highlights* • Net Sales declined 6.5% to $92.9 million from $99.4 million, while Adjusted Net Sales1 increased 1.6% • Net Income of $2.5 million, or $0.09 per diluted share, compared to $12.6 million and $0.47 per diluted share • Adjusted EBITDA1 of $13.6 million, up 0.7% and Adjusted Diluted EPS1 of $0.30, up 11.1% from $0.27 • Delivered strong free cash flow of $10.3 million (excluding Graphic Arts sale proceeds), reducing net debt to $37.3 million • Sharpened focus on core and high-value markets following completion of the Graphic Arts sale • Announced Powders Center of Excellence within Elektron, expected to enhance growth and deliver approximately $2 million of annual savings • Raised full-year 2025 guidance to Adjusted EPS of $1.04 to $1.08; with Adjusted EBITDA of $50 million to $51 million * Comparative information is relative to prior-year third quarter; results exclude discontinued operations. 1 Note: Adjusted results exclude Graphic Arts & 2024 legal recoveries. Our third-quarter results demonstrate the earnings power and disciplined execution across our business. We delivered solid profitability and strong cash generation, achieving $0.30 in adjusted EPS and generating more than $10 million in free cash flow. Continued strength in defense and aerospace, together with sharpened focus on our growth priorities, supported another quarter of strong results. We also advanced our strategic priorities, completing the sale of the Graphic Arts business and announcing a new Powders Center of Excellence within our Elektron segment. This initiative will enhance our manufacturing capabilities and is expected to deliver approximately $2 million in annual savings. With one quarter remaining, Luxfer is well positioned to deliver a successful year and enter 2026 with a stronger portfolio and clear focus on driving sustained earnings growth. Andy Butcher CEO, Luxfer Key Results* (amounts in millions, except EPS) Net Sales, Net Income, Adjusted EBITDA and EPS Q3 2025 Change YTD 2025 Change GAAP Net Sales $ 92.9 -6.5% $ 293.9 1.9% Adjusted Net Sales1 92.9 1.6% 280.5 5.3% GAAP Net Income 2.5 -80.2% 13.0 -13.3% Adjusted EBITDA1 13.6 0.7% 38.9 8.1% GAAP Diluted EPS $ 0.09 -80.9% $ 0.48 -14.3% Adjusted Diluted EPS1 0.30 11.1% 0.83 18.6% * Comparative information is relative to prior-year third quarter; results exclude discontinued operations. 1 Note: Adjusted results exclude Graphic Arts & 2024 legal recoveries

Third Quarter Financial Summary GAAP net sales of $92.9 million compared to $99.4 million in the prior-year period, reflecting the absence of sales from the Graphic Arts business, which was divested in early July 2025. Excluding Graphic Arts, adjusted net sales increased 1.6% from the prior year, supported by continued strength in Defense and First Response end markets. The Elektron segment delivered strong results, supported by strong demand in Defense and Aerospace, with elevated magnesium-related sales including UGR-Es, MRE flameless ration heaters and magnesium alloys. Gas Cylinders’ performance tracked with expectations, reflecting typical demand patterns across core SCBA and Specialty Industrial markets, and with continued activity in Space exploration programs. GAAP net income for the third quarter of 2025 was $2.5 million, or $0.09 per diluted share, compared to $12.6 million, or $0.47 per diluted share, in the prior-year period. Adjusted net income, excluding Graphic Arts and 2024 legal recoveries, was $8.1 million, or $0.30 per diluted share, up from $7.1 million, or $0.27 per diluted share, in the third quarter of 2024. Adjusted EBITDA was $13.6 million, compared to $13.5 million in the prior year. Adjusted sales were marginally up and improved mix within Elektron and operational execution supported stable margins and strong earnings. Sequentially, profitability improved despite lower revenue, driven by favorable mix and performance. Segment Results* (amounts in millions) Elektron Q3 2025 Change YTD 2025 Change Net Sales $ 50.0 2.5% $ 149.5 16.3% Gross Profit 14.8 6.5% 44.6 20.9% Gross Margin 29.6% 110bps 29.8% 110bps Adjusted EBITDA1 $ 9.9 11.2% $ 27.7 23.7% Adjusted EBITDA Margin1 19.8% 160bps 18.5% 110bps Gas Cylinders Q3 2025 Change YTD 2025 Change Net Sales $ 42.9 0.7% $ 131.0 -4.9% Gross Profit 6.9 1.5% 20.6 -9.6% Gross Margin 16.1% 10bps 15.7% -80bps Adjusted EBITDA $ 3.7 -19.6% $ 11.2 -17.6% Adjusted EBITDA Margin 8.6% -220bps 8.5% -140bps * Comparative information is relative to prior-year third quarter; results exclude discontinued operations 1 Note: Adjusted Results exclude 2024 legal recoveries

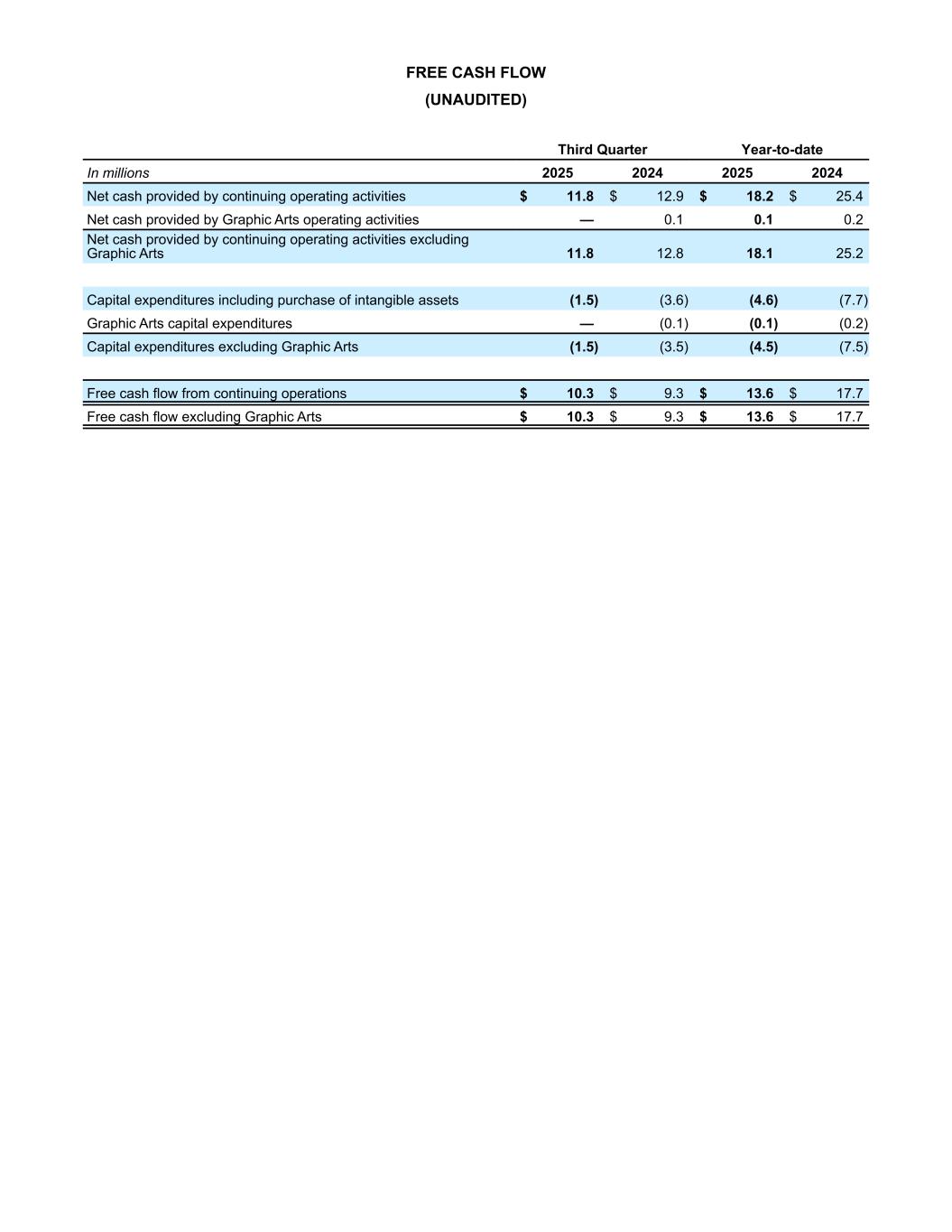

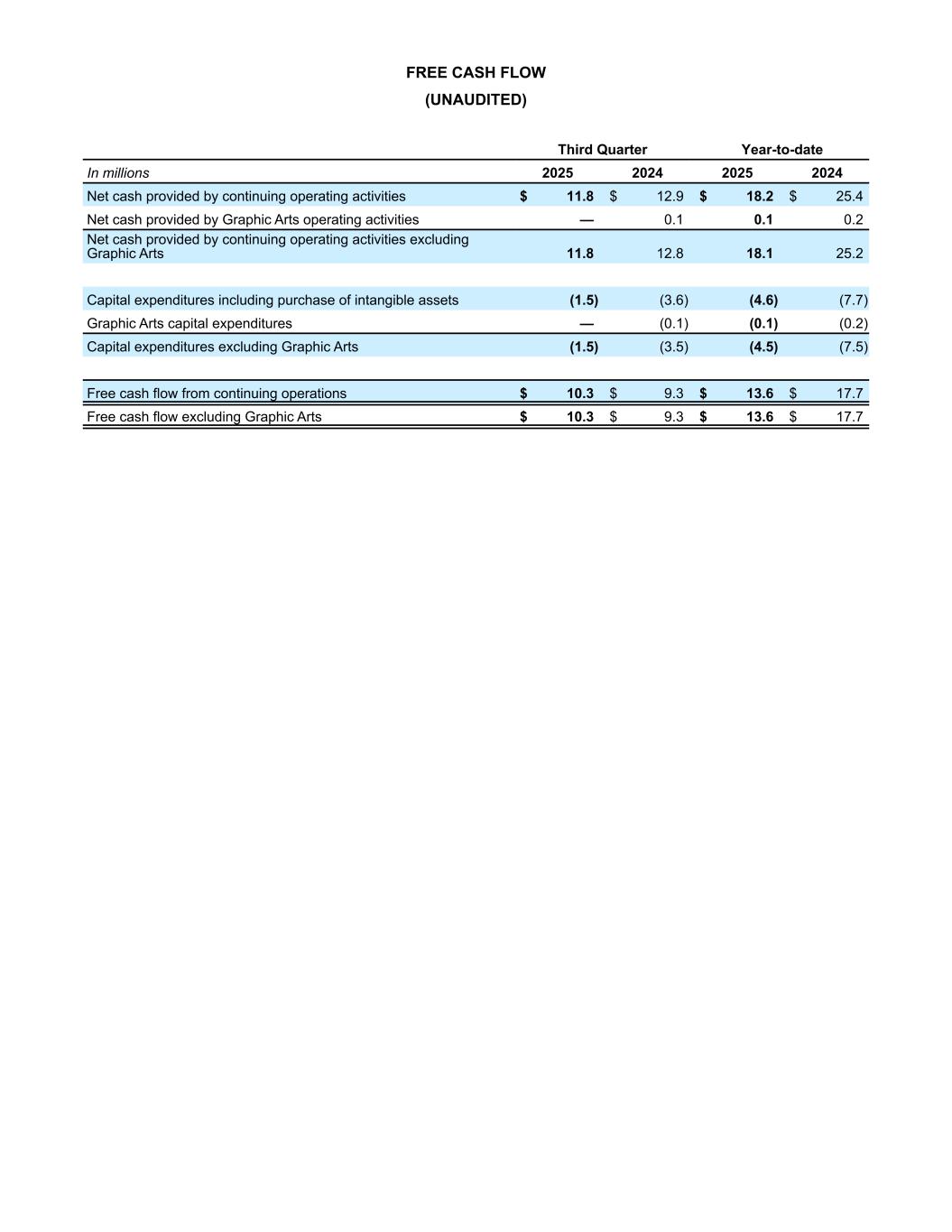

Capital Resources and Liquidity Net cash provided by continuing operations for the third quarter of 2025 was $11.8 million, compared to $12.9 million in the prior year period. Free cash flow from continuing operations totaled $10.3 million, excluding proceeds from the sale of Graphic Arts, compared to $9.3 million in the prior year. Net debt was reduced to $37.3 million at the end of the quarter, resulting in a net debt-to-adjusted EBITDA ratio of approximately 0.7x, compared to 1.3x in the prior year. During the third quarter of 2025, approximately $0.8 million of common stock, equating to 65,000 shares, was repurchased. Year-to-date, a total of approximately $1.9 million in common stock, or 155,000 shares, has been repurchased. Additionally, $3.5 million was returned to shareholders through dividends during the quarter, bringing the year-to-date total to $10.5 million. 2025 Guidance Raised Reflecting strong performance from the first three quarters of the year, strength in Defense and Aerospace, combined with operational improvements, is expected to offset softness in certain transportation markets. Third Quarter 2025 Earnings Conference Call Information Luxfer will conduct an investor teleconference at 8:30 a.m. ET on Wednesday October 29, 2025. Investors can access this conference via any of the following: • Webcast: Accessible by clicking on this link Q3 2025 Earnings Call • Live Telephone: Call 800-343-4849 within the U.S. or +1 203-518-9848 outside the U.S. Please join the call at least 15 minutes before the start time (Conference ID:LXFRQ325). • Webcast Replay: Available on Luxfer’s website beginning at approximately 4:30 p.m. Eastern Time on October 29, 2025. • Telephone Replay: Call 800-934-8436 within the U.S. or +1 402-220-6996 outside the U.S. • Presentation Material: Earnings presentation material and podcasts can be accessed through the Investors portion of the Company’s website at luxfer.com under Quarterly Reports and Presentations. About Luxfer Luxfer is a global industrial company innovating niche applications in materials engineering. Using its broad array of proprietary technologies, Luxfer focuses on value creation, customer satisfaction, and demanding applications where technical know-how and manufacturing expertise combine to deliver a superior product. Luxfer’s high-performance materials, components, and high-pressure gas containment devices are used in defense and emergency response, clean energy, healthcare, transportation, and specialty industrial applications. For more information, please visit www.luxfer.com. Luxfer is listed on the New York Stock Exchange and its ordinary shares trade under the symbol LXFR. Full Year Guidance Prior Updated Sales Revenue LSD LSD Adjusted Diluted EPS $0.97 - $1.05 $1.04 - $1.08 Adjusted EBITDA $49M - $52M $50M - $51M Free Cash Flow $20M - $25M $20M - $25M

Non-GAAP Financial Measures Luxfer Holdings PLC prepares its financial statements using U.S. Generally Accepted Accounting Principles (GAAP). When a company discloses material information containing non-GAAP financial measures, SEC regulations require that the disclosure include a presentation of the most directly comparable GAAP measure and a reconciliation of the GAAP and non-GAAP financial measures. Management’s inclusion of non-GAAP financial measures in this release is intended to supplement, not replace, the presentation of the Company’s financial results in accordance with GAAP. Luxfer management believes that these non-GAAP financial measures, when considered together with the GAAP financial measures, provide information that is useful to investors in understanding period-over-period operating results separate and apart from items that may, or could, have a disproportionately positive or negative impact on results in any period. Management also believes that these non-GAAP financial measures enhance the ability of investors to analyze the Company’s business trends and understand the Company’s performance. In addition, management may utilize non-GAAP financial measures as a guide in the Company’s forecasting, budgeting, and long-term planning process. Non-GAAP financial measures should be considered in addition to, and not as a substitute for, or superior to, financial measures presented in accordance with GAAP. With respect to the Company’s 2025 adjusted earnings per share guidance, the Company is not able to provide a reconciliation of the non-GAAP financial measure to GAAP because it does not provide specific guidance for the various extraordinary, nonrecurring, or unusual charges and other certain items. These items have not yet occurred, are out of the Company’s control, and/or cannot be reasonably predicted. As a result, reconciliation of the non-GAAP guidance measure to GAAP is not available without unreasonable effort, and the Company is unable to address the probable significance of the unavailable information. Forward-Looking Statements This release contains certain forward-looking statements that involve risks and uncertainties that could cause actual results to differ materially from those projected in the forward-looking statements. Examples of such forward-looking statements include but are not limited to: (i) statements regarding the Company’s results of operations and financial condition; (ii) statements of plans, objectives or goals of the Company or its management, including those related to financing, products, or services; (iii) statements of future economic performance; and (iv) statements of assumptions underlying such statements. Words such as “believes,” “anticipates,” “expects,” “intends,” “forecasts,” and “plans,” and similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. By their very nature, forward- looking statements involve inherent risks and uncertainties, both general and specific, and risks exist that the predictions, forecasts, projections, and other forward-looking statements will not be achieved. The Company cautions that several important factors could cause actual results to differ materially from the plans, objectives, expectations, estimates, and intentions expressed in such forward-looking statements. These factors include but are not limited to: (i) lower than expected future sales; (ii) increasing competitive industry pressures; (iii) general economic conditions or conditions affecting demand for the products and services it offers, both domestically and internationally; (iv) worldwide economic and business conditions and conditions in the industries in which the Company operates; (v) geopolitical issues / tariffs (vi) fluctuations in the cost or availability of raw materials , utilities, and other inputs; (vii) currency fluctuations and hedging risks; (viii) the Company’s ability to protect its intellectual property; and (ix) the significant amount of indebtedness the Company has incurred and may incur and the obligations to service such of indebtedness the Company has incurred and may incur and the obligations to service such indebtedness and to comply with the covenants contained therein. The Company cautions that the foregoing list of important factors are not exhaustive. These factors are more fully discussed in the sections entitled “Forward-Looking Statements” and “Risk Factors” in its Annual Report on Form 10-K for the year ended December 31, 2024, which was filed with the U.S. Securities and Exchange Commission on February 25, 2025. When relying on forward-looking statements to make decisions with respect to the Company, investors and others should carefully consider the foregoing factors and other uncertainties and events. Forward- looking statements speak only as of the date on which they are made, and the Company does not undertake any obligation to update or revise any such statement, whether because of new information, future events, or otherwise. Contact Info: Kevin Cornelius Grant Vice President of Investor Relations and Business Development Kevin.Grant@Luxfer.com

LUXFER HOLDINGS PLC CONDENSED CONSOLIDATED STATEMENTS OF INCOME (UNAUDITED) Third Quarter Year-to-date In millions, except share and per-share data 2025 2024 2025 2024 Net sales $ 92.9 $ 99.4 $ 293.9 $ 288.5 Cost of goods sold (71.2) (77.0) (226.8) (225.7) Gross profit 21.7 22.4 67.1 62.8 Selling, general and administrative expenses (10.8) (11.4) (36.5) (34.9) Research and development (0.9) (1.0) (3.1) (3.3) Restructuring charges (3.5) (0.5) (5.6) (2.3) Disposal related costs (1.1) (0.1) (1.2) (9.5) Gain on disposal of assets held-for-sale — 6.1 — 6.1 Other income — 1.9 — 7.2 Operating income 5.4 17.4 20.7 26.1 Net interest expense (0.7) (1.4) (2.4) (4.1) Defined benefit pension credit 0.6 0.3 1.8 0.8 Income before income taxes 5.3 16.3 20.1 22.8 Provision for income taxes (2.8) (3.7) (7.1) (7.8) Net income from continuing operations 2.5 12.6 13.0 15.0 Net income / (loss) from discontinued operations 0.2 0.1 (2.2) (0.1) Net income $ 2.7 $ 12.7 $ 10.8 $ 14.9 Earnings / (loss) per share1 Basic from continuing operations $ 0.09 $ 0.47 $ 0.49 $ 0.56 Basic from discontinued operations $ 0.01 $ — $ (0.08) $ — Basic $ 0.10 $ 0.47 $ 0.41 $ 0.56 Diluted from continuing operations $ 0.09 $ 0.47 $ 0.48 $ 0.56 Diluted from discontinued operations2 $ 0.01 $ — $ (0.08) $ — Diluted $ 0.10 $ 0.47 $ 0.40 $ 0.55 Weighted average ordinary shares outstanding Basic 26,746,390 26,831,372 26,743,059 26,820,280 Diluted 27,159,024 26,932,291 27,189,456 26,961,125 1 The calculation of earnings per share is performed separately for continuing and discontinued operations. As a result, the sum of the two in any particular period may not equal the earnings-per-share amount in total. 2 The loss per share for discontinued operations has not been diluted, since the incremental shares included in the weighted-average number of shares outstanding would have been anti-dilutive.

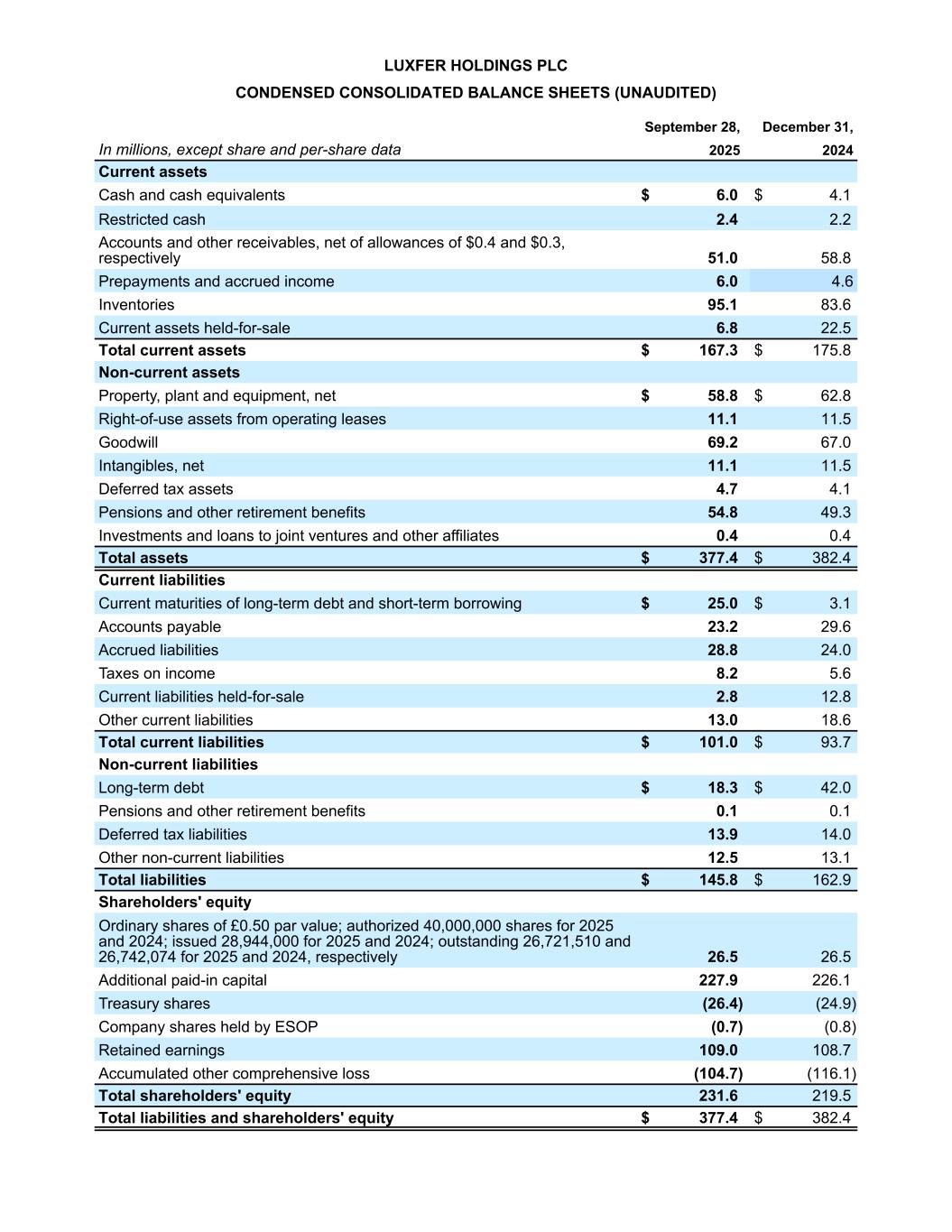

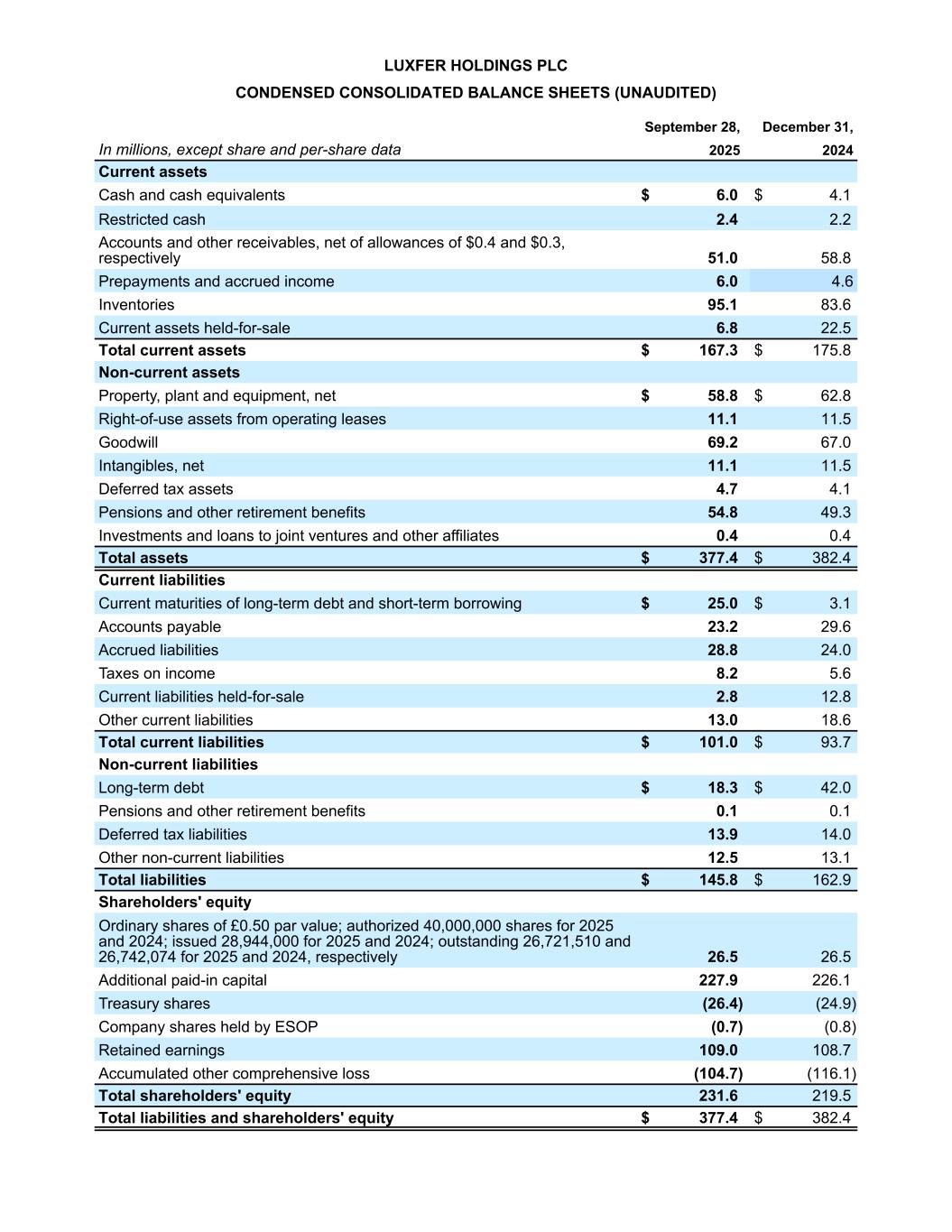

LUXFER HOLDINGS PLC CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED) September 28, December 31, In millions, except share and per-share data 2025 2024 Current assets Cash and cash equivalents $ 6.0 $ 4.1 Restricted cash 2.4 2.2 Accounts and other receivables, net of allowances of $0.4 and $0.3, respectively 51.0 58.8 Prepayments and accrued income 6.0 4.6 Inventories 95.1 83.6 Current assets held-for-sale 6.8 22.5 Total current assets $ 167.3 $ 175.8 Non-current assets Property, plant and equipment, net $ 58.8 $ 62.8 Right-of-use assets from operating leases 11.1 11.5 Goodwill 69.2 67.0 Intangibles, net 11.1 11.5 Deferred tax assets 4.7 4.1 Pensions and other retirement benefits 54.8 49.3 Investments and loans to joint ventures and other affiliates 0.4 0.4 Total assets $ 377.4 $ 382.4 Current liabilities Current maturities of long-term debt and short-term borrowing $ 25.0 $ 3.1 Accounts payable 23.2 29.6 Accrued liabilities 28.8 24.0 Taxes on income 8.2 5.6 Current liabilities held-for-sale 2.8 12.8 Other current liabilities 13.0 18.6 Total current liabilities $ 101.0 $ 93.7 Non-current liabilities Long-term debt $ 18.3 $ 42.0 Pensions and other retirement benefits 0.1 0.1 Deferred tax liabilities 13.9 14.0 Other non-current liabilities 12.5 13.1 Total liabilities $ 145.8 $ 162.9 Shareholders' equity Ordinary shares of £0.50 par value; authorized 40,000,000 shares for 2025 and 2024; issued 28,944,000 for 2025 and 2024; outstanding 26,721,510 and 26,742,074 for 2025 and 2024, respectively 26.5 26.5 Additional paid-in capital 227.9 226.1 Treasury shares (26.4) (24.9) Company shares held by ESOP (0.7) (0.8) Retained earnings 109.0 108.7 Accumulated other comprehensive loss (104.7) (116.1) Total shareholders' equity 231.6 219.5 Total liabilities and shareholders' equity $ 377.4 $ 382.4

LUXFER HOLDINGS PLC CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED) Year-to-date In millions 2025 2024 Operating activities Net income $ 10.8 $ 14.9 Net loss from discontinued operations 2.2 0.1 Net income from continuing operations 13.0 15.0 Adjustments to reconcile net income to net cash provided / (used) by operating activities Depreciation 6.9 6.9 Depreciation of right of use assets 2.3 — Amortization of purchased intangible assets 0.6 0.6 Amortization of debt issuance costs 0.2 0.2 Share-based compensation charges 2.8 2.1 Deferred income taxes (1.1) 0.5 Loss on disposal of property, plant and equipment — 0.1 Non-cash restructuring charges 4.0 — Loss / (gain) on disposal of held for sale assets — (6.1) Loss on held for sale asset group 1.1 7.5 Defined benefit pension credit (1.8) (0.8) Changes in assets and liabilities Accounts and other receivables 2.5 (5.5) Inventories (9.3) (10.3) Current assets held-for-sale (1.6) (2.2) Prepayments and accrued income (1.4) — Accounts payable (7.3) (4.4) Accrued liabilities 4.1 12.9 Current liabilities held-for-sale (0.1) 0.1 Other current liabilities 5.5 8.9 Other non-current assets and liabilities (2.2) (0.1) Net cash provided by operating activities - continuing 18.2 25.4 Net cash provided by operating activities - discontinued 0.2 0.2 Net cash provided by operating activities 18.4 25.6 Investing activities Capital expenditures (4.6) (7.3) Net proceeds from sale of businesses 4.3 — Purchase of intangible assets — (0.4) Net cash used by investing activities - continuing (0.3) (7.7) Net cash used by investing activities - discontinued (0.2) (0.2) Net cash used by investing activities (0.5) (7.9) Financing activities Net repayment of bank overdraft (3.1) (0.9) Net drawdown / (repayment) of long-term borrowings 0.9 (2.9) Debt issuance costs (0.9) — Repurchase of own shares (1.9) (1.6) Share-based compensation cash paid (0.7) (0.4) Dividends paid (10.5) (10.5) Net cash used by financing activities (16.2) (16.3) Effect of exchange rate changes on cash and cash equivalents 0.4 0.1 Net increase $ 2.1 $ 1.5 Cash, cash equivalents and restricted cash; beginning of year 6.3 2.6 Cash, cash equivalents and restricted cash; end of the third quarter 8.4 4.1 Supplemental cash flow information: Interest payments $ 2.7 $ 4.4 Income tax payments, net 6.6 0.5

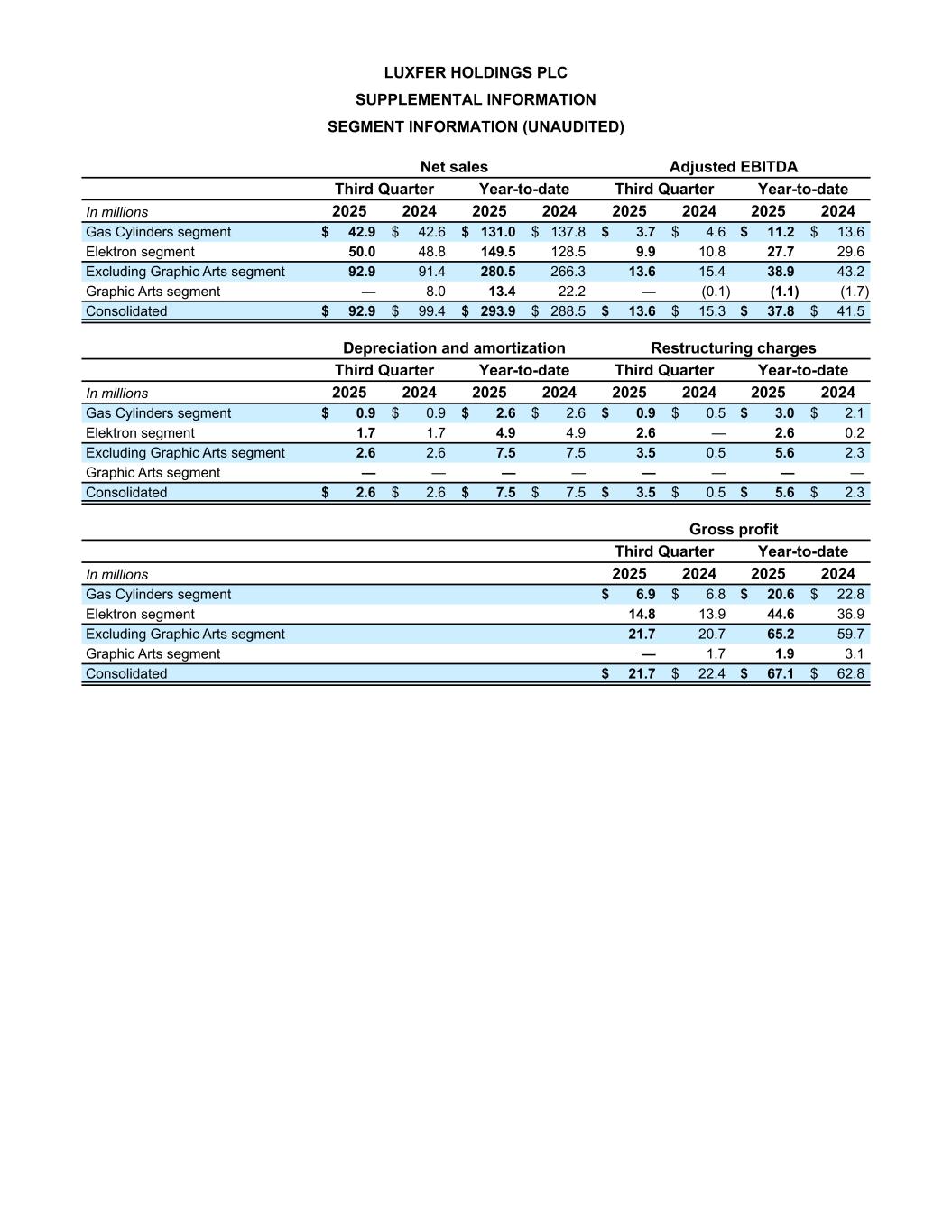

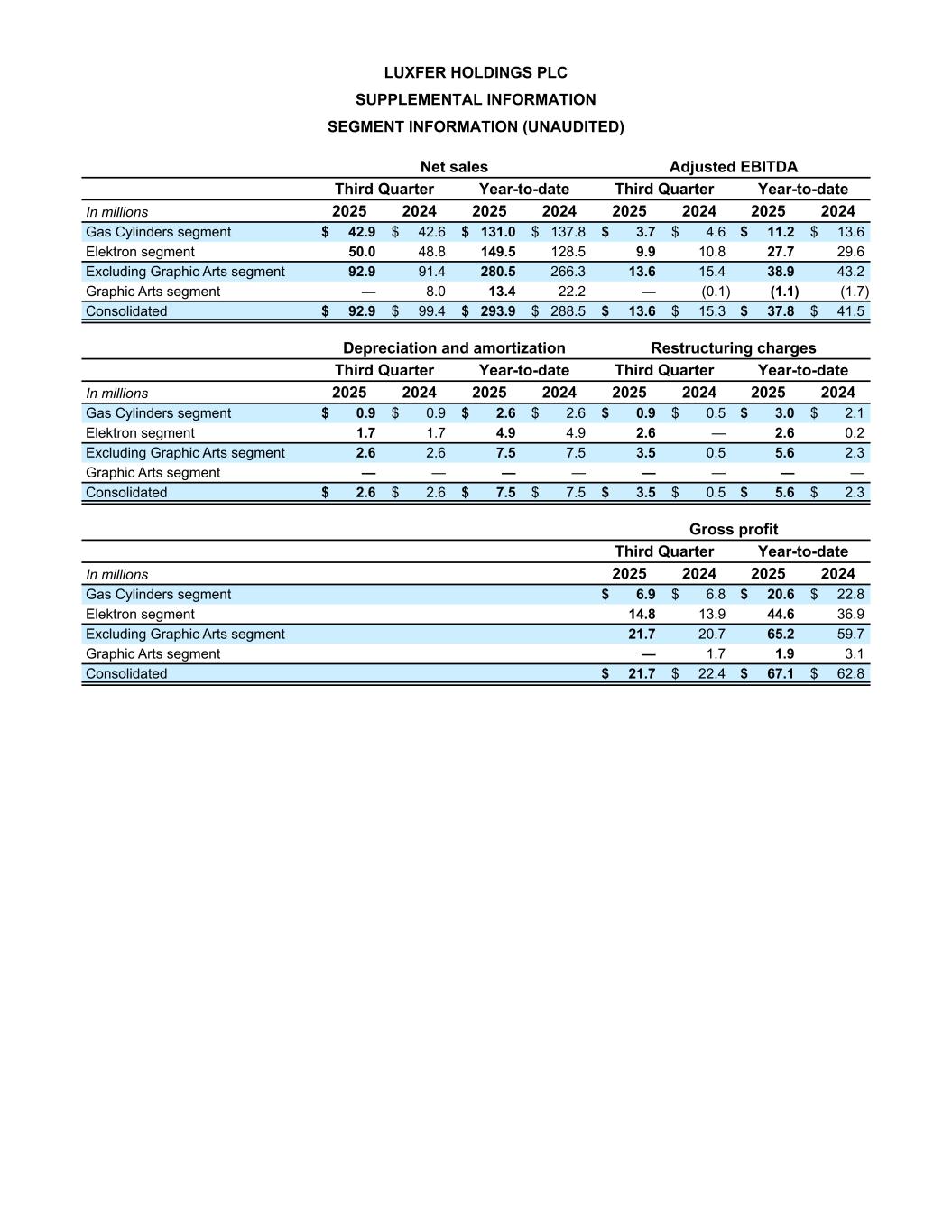

LUXFER HOLDINGS PLC SUPPLEMENTAL INFORMATION SEGMENT INFORMATION (UNAUDITED) Net sales Adjusted EBITDA Third Quarter Year-to-date Third Quarter Year-to-date In millions 2025 2024 2025 2024 2025 2024 2025 2024 Gas Cylinders segment $ 42.9 $ 42.6 $ 131.0 $ 137.8 $ 3.7 $ 4.6 $ 11.2 $ 13.6 Elektron segment 50.0 48.8 149.5 128.5 9.9 10.8 27.7 29.6 Excluding Graphic Arts segment 92.9 91.4 280.5 266.3 13.6 15.4 38.9 43.2 Graphic Arts segment — 8.0 13.4 22.2 — (0.1) (1.1) (1.7) Consolidated $ 92.9 $ 99.4 $ 293.9 $ 288.5 $ 13.6 $ 15.3 $ 37.8 $ 41.5 Depreciation and amortization Restructuring charges Third Quarter Year-to-date Third Quarter Year-to-date In millions 2025 2024 2025 2024 2025 2024 2025 2024 Gas Cylinders segment $ 0.9 $ 0.9 $ 2.6 $ 2.6 $ 0.9 $ 0.5 $ 3.0 $ 2.1 Elektron segment 1.7 1.7 4.9 4.9 2.6 — 2.6 0.2 Excluding Graphic Arts segment 2.6 2.6 7.5 7.5 3.5 0.5 5.6 2.3 Graphic Arts segment — — — — — — — — Consolidated $ 2.6 $ 2.6 $ 7.5 $ 7.5 $ 3.5 $ 0.5 $ 5.6 $ 2.3 Gross profit Third Quarter Year-to-date In millions 2025 2024 2025 2024 Gas Cylinders segment $ 6.9 $ 6.8 $ 20.6 $ 22.8 Elektron segment 14.8 13.9 44.6 36.9 Excluding Graphic Arts segment 21.7 20.7 65.2 59.7 Graphic Arts segment — 1.7 1.9 3.1 Consolidated $ 21.7 $ 22.4 $ 67.1 $ 62.8

ADJUSTED NET INCOME AND ADJUSTED EARNINGS PER SHARE (UNAUDITED) Third Quarter In millions except per share data 2025 2024 Continuing operations Graphic Arts Adjusted Total Continuing operations Graphic Arts Adjusted Total Net income / (loss) $ 2.5 $ (1.1) $ 3.6 $ 12.6 — $ 12.6 Accounting charges relating to acquisitions and disposals of businesses: Amortization on acquired intangibles 0.2 — 0.2 0.2 — 0.2 Disposal related charge 1.1 1.1 — 0.1 0.1 — Defined benefit pension credit (0.6) — (0.6) (0.3) — (0.3) Restructuring charge 3.5 — 3.5 0.5 — 0.5 Gain on disposal of assets held-for-sale — — — (6.1) — (6.1) Share-based compensation charge 1.0 — 1.0 0.7 0.1 0.6 Income tax on adjusted items 0.4 — 0.4 1.1 — 1.1 Adjusted net income 8.1 — 8.1 8.8 0.2 8.6 Less: Legal cost recovery — — — (1.9) — (1.9) Tax on legal cost recovery — — — 0.4 — 0.4 Adjusted net income excluding Legal cost recovery $ 8.1 $ — $ 8.1 $ 7.3 $ 0.2 $ 7.1 Adjusted earnings per ordinary share (1) Diluted earnings / (loss) per ordinary share $ 0.09 $ (0.04) $ 0.13 $ 0.47 $ — $ 0.47 Impact of adjusted items 0.21 0.04 0.17 (0.14) 0.01 (0.15) Adjusted diluted earnings / (loss) per ordinary share 0.30 — 0.30 0.33 0.01 0.32 Impact of legal cost recovery — — — (0.05) — (0.05) Adjusted diluted earnings / (loss) per ordinary share excluding Legal cost recovery $ 0.30 $ — $ 0.30 $ 0.28 $ 0.01 $ 0.27 Year-to-date In millions except per share data 2025 2024 Continuing operations Graphic Arts Adjusted Total Continuing operations Graphic Arts Adjusted Total Net income / (loss) $ 13.0 $ (2.0) $ 15.0 $ 15.0 (10.6) $ 25.6 Accounting charges relating to acquisitions and disposals of businesses: Amortization on acquired intangibles 0.6 — 0.6 0.6 — 0.6 Disposal related charge 1.2 1.1 0.1 9.5 9.4 0.1 Defined benefit pension credit (1.8) — (1.8) (0.8) — (0.8) Restructuring charge 5.6 — 5.6 2.3 — 2.3 Gain on disposal of assets held-for-sale — — — (6.1) — (6.1) Share-based compensation charge 2.8 0.2 2.6 2.1 0.3 1.8 Income tax on adjusted items 0.4 — 0.4 0.7 (0.1) 0.8 Adjusted net income / (loss) $ 21.8 $ (0.7) $ 22.5 $ 23.3 $ (1.0) $ 24.3 Less: Legal cost recovery — — — (7.2) — (7.2) Tax on legal cost recovery — — — 1.7 — 1.7 Adjusted net income / (loss) excluding Legal cost recovery $ 21.8 $ (0.7) $ 22.5 $ 17.8 $ (1.0) $ 18.8 Adjusted earnings per ordinary share (1) Diluted earnings / (loss) per ordinary share $ 0.49 $ (0.07) $ 0.56 $ 0.56 $ (0.39) $ 0.95 Impact of adjusted items 0.32 0.04 0.28 0.30 0.36 (0.05) Adjusted diluted earnings / (loss) per ordinary share 0.80 (0.03) 0.83 0.86 (0.04) 0.90 Impact of legal cost recovery — — — (0.20) — (0.20) Adjusted diluted earnings / (loss) per ordinary share excluding Legal cost recovery $ 0.80 $ (0.03) $ 0.83 $ 0.66 $ (0.04) $ 0.70 (1) For the purpose of calculating diluted earnings per share, the weighted average number of ordinary shares outstanding during the financial year has been adjusted for the dilutive effects of all potential ordinary shares and share options granted to employees, except where there is a loss in the period, then no adjustment is made.

ADJUSTED EBITDA (UNAUDITED) Third Quarter In millions except per share data 2025 2024 Continuing operations Graphic Arts Adjusted Total Continuing operations Graphic Arts Adjusted Total Adjusted net income from continuing operations $ 8.1 $ — $ 8.1 $ 8.8 $ 0.2 $ 8.6 Add back: Income tax on adjusted items (0.4) — (0.4) (1.1) — (1.1) Provision for income taxes 2.8 — 2.8 3.7 — 3.7 Net finance costs 0.7 — 0.7 1.4 (0.3) 1.7 Adjusted EBITA 11.2 — 11.2 12.8 (0.1) 12.9 Loss on disposal of property, plant and equipment — — — 0.1 — 0.1 Depreciation 2.4 — 2.4 2.4 — 2.4 Adjusted EBITDA 13.6 — 13.6 15.3 (0.1) 15.4 Less: Legal cost recovery — — — (1.9) — (1.9) Adjusted EBITDA excluding legal cost recovery $ 13.6 $ — $ 13.6 $ 13.4 $ (0.1) $ 13.5 Year-to-date In millions except per share data 2025 2024 Continuing operations Graphic Arts Adjusted Total Continuing operations Graphic Arts Adjusted Total Adjusted net income from continuing operations $ 21.8 $ (0.7) $ 22.5 $ 23.3 $ (1.0) $ 24.3 Add back: Income tax on adjusted items (0.4) — (0.4) (0.7) 0.1 (0.8) Provision for income taxes 7.1 (0.2) 7.3 7.8 (0.5) 8.3 Net finance costs 2.4 (0.2) 2.6 4.1 (0.3) 4.4 Adjusted EBITA 30.9 (1.1) 32.0 34.5 (1.7) 36.2 Loss on disposal of property, plant and equipment — — — 0.1 — 0.1 Depreciation 6.9 — 6.9 6.9 — 6.9 Adjusted EBITDA 37.8 (1.1) 38.9 41.5 (1.7) 43.2 Less: Legal cost recovery — — — (7.2) — (7.2) Adjusted EBITDA excluding legal cost recovery $ 37.8 $ (1.1) $ 38.9 $ 34.3 $ (1.7) $ 36.0

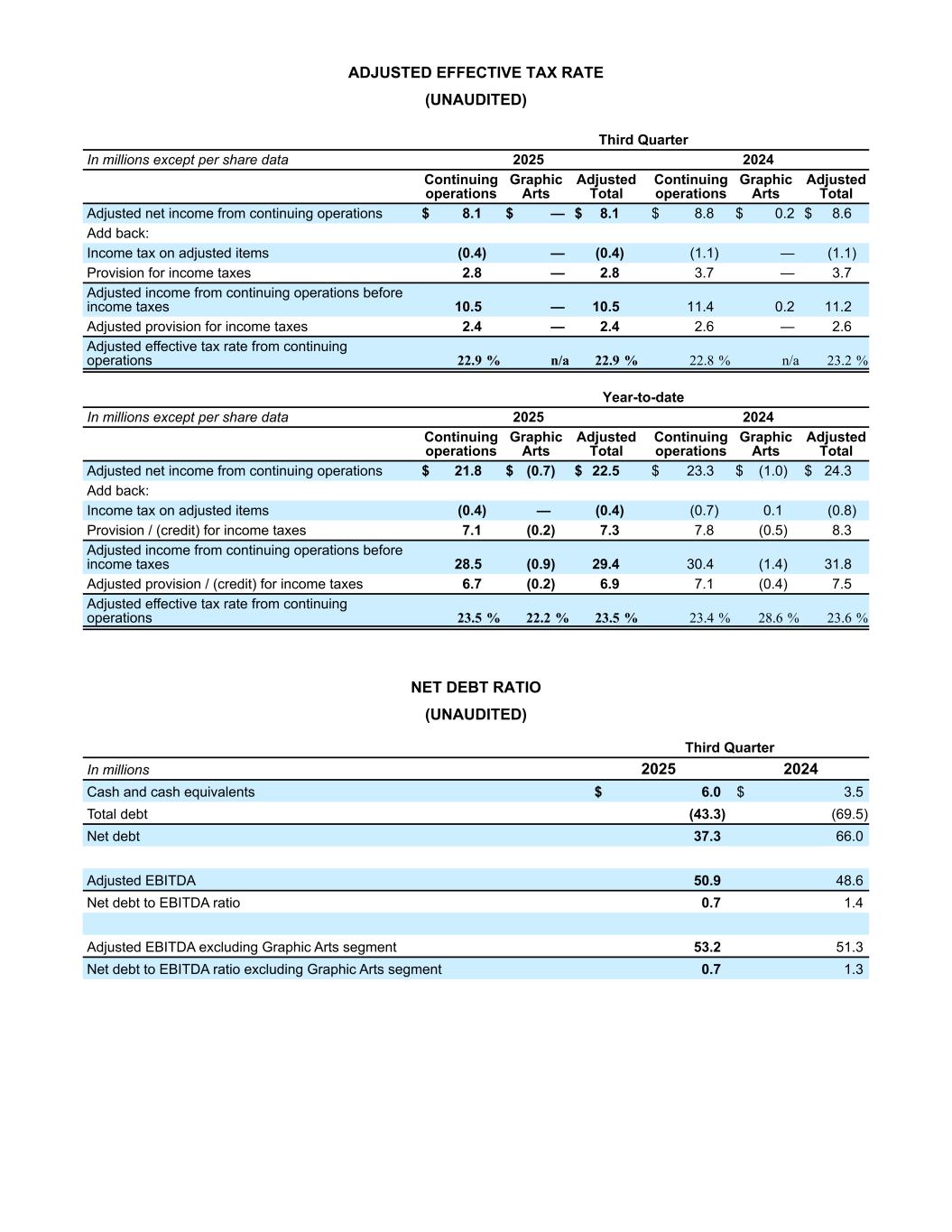

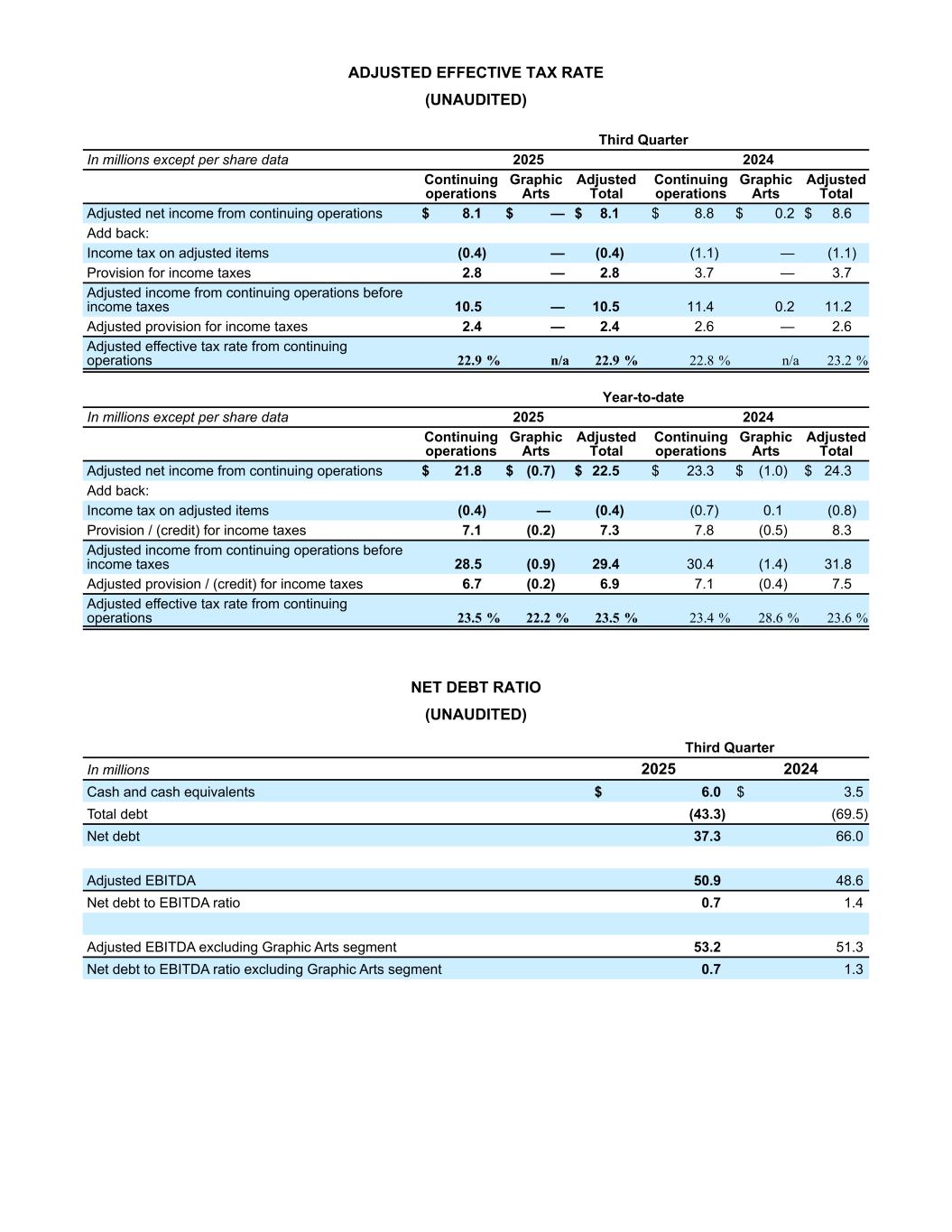

ADJUSTED EFFECTIVE TAX RATE (UNAUDITED) Third Quarter In millions except per share data 2025 2024 Continuing operations Graphic Arts Adjusted Total Continuing operations Graphic Arts Adjusted Total Adjusted net income from continuing operations $ 8.1 $ — $ 8.1 $ 8.8 $ 0.2 $ 8.6 Add back: Income tax on adjusted items (0.4) — (0.4) (1.1) — (1.1) Provision for income taxes 2.8 — 2.8 3.7 — 3.7 Adjusted income from continuing operations before income taxes 10.5 — 10.5 11.4 0.2 11.2 Adjusted provision for income taxes 2.4 — 2.4 2.6 — 2.6 Adjusted effective tax rate from continuing operations 22.9 % n/a 22.9 % 22.8 % n/a 23.2 % Year-to-date In millions except per share data 2025 2024 Continuing operations Graphic Arts Adjusted Total Continuing operations Graphic Arts Adjusted Total Adjusted net income from continuing operations $ 21.8 $ (0.7) $ 22.5 $ 23.3 $ (1.0) $ 24.3 Add back: Income tax on adjusted items (0.4) — (0.4) (0.7) 0.1 (0.8) Provision / (credit) for income taxes 7.1 (0.2) 7.3 7.8 (0.5) 8.3 Adjusted income from continuing operations before income taxes 28.5 (0.9) 29.4 30.4 (1.4) 31.8 Adjusted provision / (credit) for income taxes 6.7 (0.2) 6.9 7.1 (0.4) 7.5 Adjusted effective tax rate from continuing operations 23.5 % 22.2 % 23.5 % 23.4 % 28.6 % 23.6 % NET DEBT RATIO (UNAUDITED) Third Quarter In millions 2025 2024 Cash and cash equivalents $ 6.0 $ 3.5 Total debt (43.3) (69.5) Net debt 37.3 66.0 Adjusted EBITDA 50.9 48.6 Net debt to EBITDA ratio 0.7 1.4 Adjusted EBITDA excluding Graphic Arts segment 53.2 51.3 Net debt to EBITDA ratio excluding Graphic Arts segment 0.7 1.3

FREE CASH FLOW (UNAUDITED) Third Quarter Year-to-date In millions 2025 2024 2025 2024 Net cash provided by continuing operating activities $ 11.8 $ 12.9 $ 18.2 $ 25.4 Net cash provided by Graphic Arts operating activities — 0.1 0.1 0.2 Net cash provided by continuing operating activities excluding Graphic Arts 11.8 12.8 18.1 25.2 Capital expenditures including purchase of intangible assets (1.5) (3.6) (4.6) (7.7) Graphic Arts capital expenditures — (0.1) (0.1) (0.2) Capital expenditures excluding Graphic Arts (1.5) (3.5) (4.5) (7.5) Free cash flow from continuing operations $ 10.3 $ 9.3 $ 13.6 $ 17.7 Free cash flow excluding Graphic Arts $ 10.3 $ 9.3 $ 13.6 $ 17.7