UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): April 18, 2024

ASCENT SOLAR TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 001-32919 | 20-3672603 | ||

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| 12300 Grant Street | ||

| Thornton, CO 80241 | ||

| (Address of principal executive offices) |

| (720) 872-5000 | ||

| (Registrant’s telephone number, including area code) |

Not Applicable

(Former name, former address, and former fiscal year, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common | ASTI | Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry Into a Material Definitive Agreement.

Public Offering Closings

On April 18, 2024, Ascent Solar Technologies, Inc. (“Ascent” or the “Company”), completed additional closings under its previously announced “best efforts” public offering of common stock and/or Pre-Funded Warrants, at a per share offering price of $0.14. The Pre-Funded Warrants are immediately exercisable at a price of $0.0001 per share of common stock and only expire when such Pre-Funded warrants are fully exercised.

Aggregate gross proceeds from all closings under the offering total $5.09 million before deducting offering expenses. In the completed closings, the Company has issued an aggregate of (i) 15,179,460 common shares and (ii) 21,162,277 Pre-Funded Warrants.

The net proceeds from the closings of the offering were utilized to pay $3.6 million to repurchase and cancel a total of 5,596,232 outstanding common warrants with an exercise price of $1.76 per share that were issued with our secured notes issued in December 2022. The repurchase of these warrants eliminated a substantial potential future issuance of common stock at a substantially reduced price. These warrants would have been adjusted in accordance with their terms to provide for the purchase of 70,554,495 shares of the Company’s common stock at an exercise price of $0.14 if they had not been repurchased by the Company.

The remaining proceeds of the offering will be used for general and administration expenses and other general corporate purposes.

Placement Agent Agreement

On April 9, 2024, the Company entered into a placement agency agreement (the “Placement Agent Agreement”) with Dawson James Securities Inc. (“Dawson James” or the “Placement Agent”) pursuant to which the Company engaged the Dawson James as the placement agent in connection with the offering. The Placement Agent agreed to use its reasonable best efforts to arrange for the sale of the shares of common stock. The Company agreed to pay the Placement Agent a placement agent fee in cash equal to 8.00% of the gross proceeds from the sale of the shares of common stock; provided, however, that the placement agent fee shall equal 4% for investors that the Company directs to the offering. The Company also agreed to reimburse the Placement Agent for all reasonable travel and other out-of-pocket expenses, including the reasonable fees of legal counsel, not to exceed $155,000. The Placement Agent Agreement also contains representations, warranties, indemnification and other provisions customary for transactions of this nature.

Placement Agent’s Warrant

In connection with the offering, pursuant to the Placement Agent Agreement, the Company issued a warrant (the “Placement Agent’s Warrant”) which enables the Placement Agent to purchase up to an aggregate of 1,090,252 of shares of common stock, at an exercise price equal to $0.175 per share. The Placement Agent’s Warrant may be exercised beginning in October 2024 until April 2029.

Pre-Funded Warrant Agency Agreement

On April 12, 2024, the Company also entered into a Pre-Funded Warrant Agency Agreement (the “Pre-Funded Warrant Agency Agreement”) with Computershare Investor Services, pursuant to which Computershare agreed to act as transfer agent with respect to the Pre-Funded warrants.

*******

The foregoing summaries of the Pre-Funded Warrants, the Placement Agent Agreement, the Placement Agent’s Warrant, and the Pre-Funded Warrant Agency Agreement do not purport to be complete and are subject to, and qualified in their entirety by, such documents attached as exhibits to this Current Report on Form 8-K, which are incorporated herein by reference.

This Current Report on Form 8-K does not constitute an offer to sell any securities or a solicitation of an offer to buy any securities, nor shall there be any sale of any securities in any state or jurisdiction in which such an offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

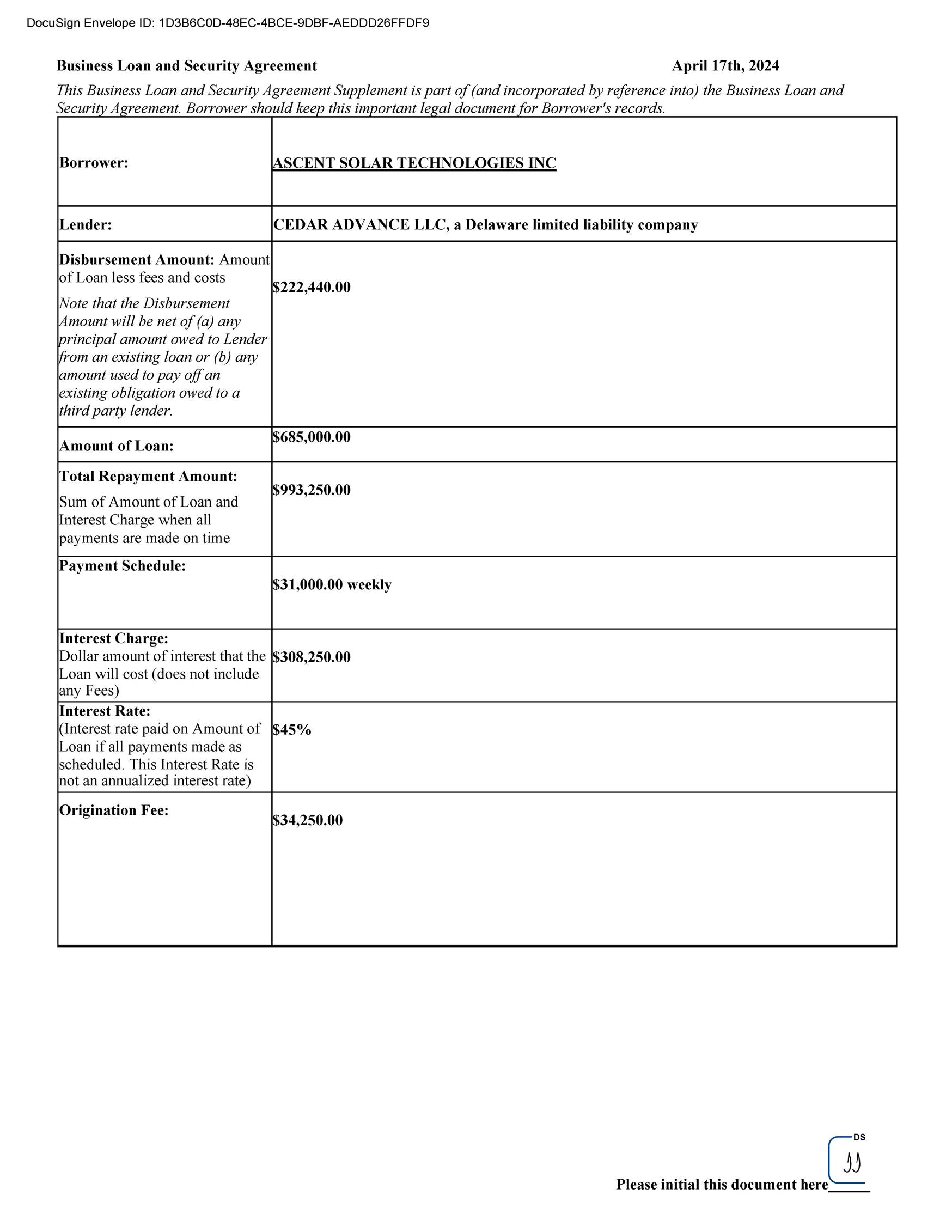

Cedar Loan Agreement

On April 17, 2024, the Company entered into a loan agreement with Cedar Advance LLC. (“Cedar”), for a principal amount of $685,000. Total interest on this loan is $308,250. The Company will repay the loan in 32 weekly payments of $31,000. The loan is not convertible into equity shares of the Company and are secured by a second lien on the Company’s assets.

The foregoing summary of the Cedar loan agreement does not purport to be complete and is subject to, and qualified in its entirety by, such document attached as an exhibit to this Current Report on Form 8-K, which is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| ASCENT SOLAR TECHNOLOGIES, INC. | ||||||||

| April 18, 2024 | By: | /s/ Jin Jo | ||||||

| Name: Jin Jo | ||||||||

| Title: Chief Financial Officer | ||||||||

Exhibit 10.1