|

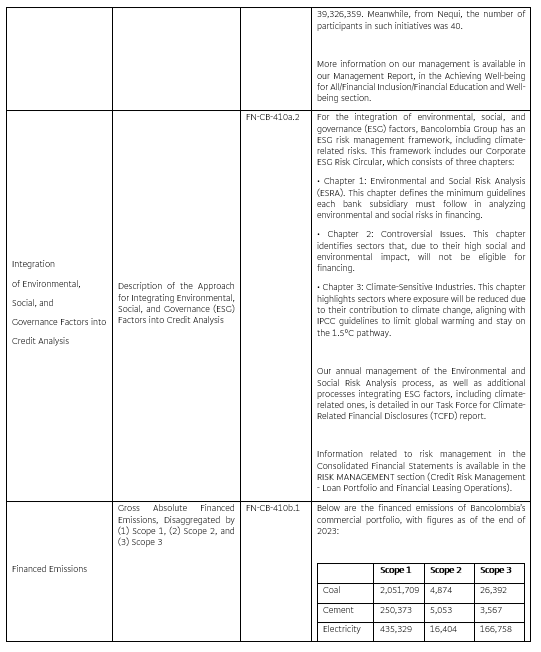

|

||||

Form 20-F þ |

Form 40-F o |

|||||||

Yes o |

No þ |

|||||||

| Exhibit Number | Description | ||||

1 | ||

|

|

||||

|

BANCOLOMBIA S.A.

(Registrant)

|

||||||||

| Date April 4, 2025 | By: | /s/ MAURICIO BOTERO WOLFF. | ||||||

| Name: | Mauricio Botero Wolff | |||||||

| Title: | Vice President of Strategy and Finance | |||||||

| Mauricio Botero Wolff | Catalina Tobón Rivera | |||||||

| Strategy and Financial VP | IR Director | |||||||

| Tel.: (57 604) 4040858 | Tel.: (57 601) 4885950 | |||||||

2 | ||

BANCOLOMBIA S.A.

BANCOLOMBIA S.A.

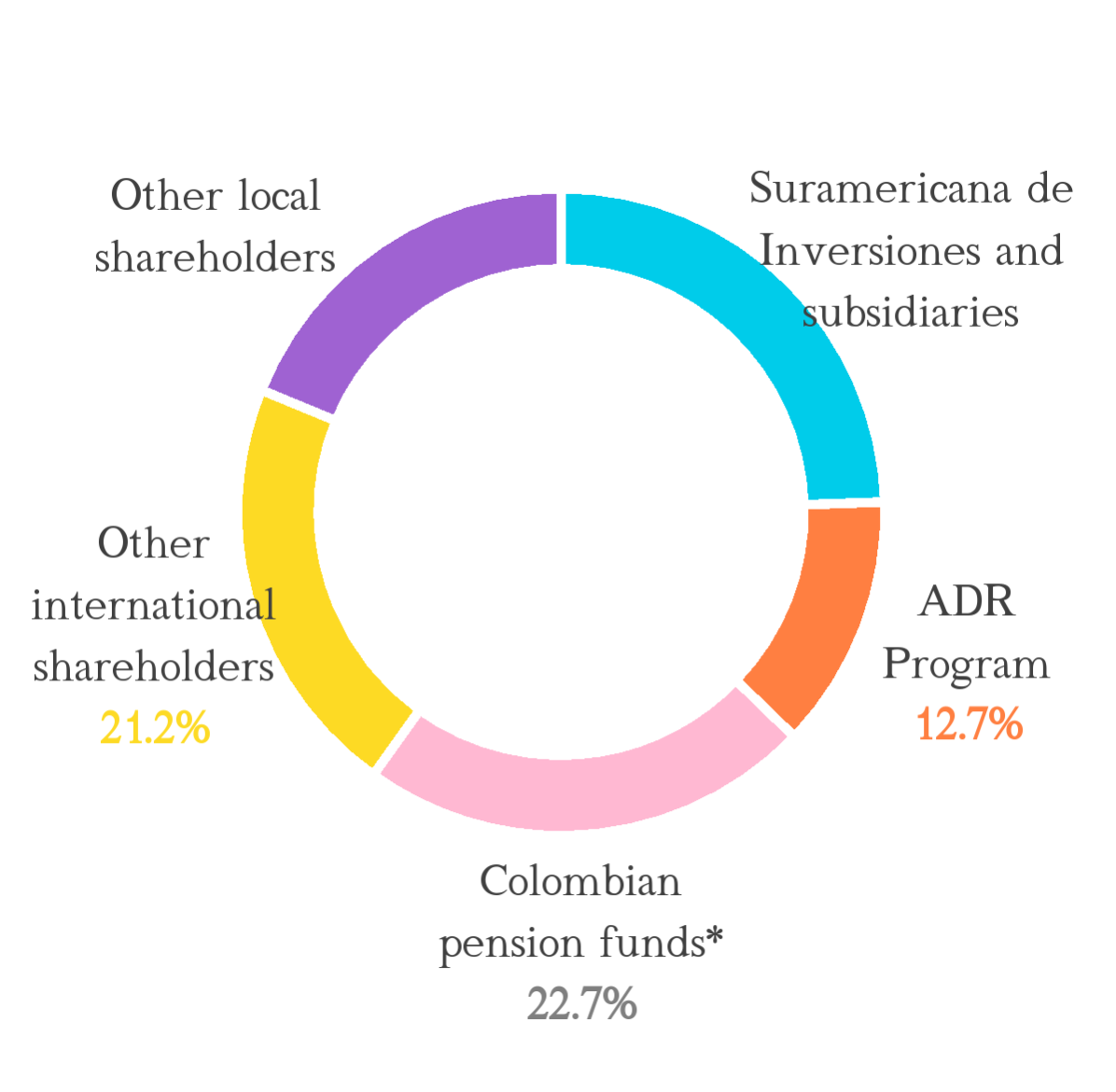

| Common | Preferred | Total | |||||||||

| Suramericana de Inversiones and Subsidiaries | 46.2% | 0.0% | 24.5% | ||||||||

| ADR program | 0.0% | 27.0% | 12.7% | ||||||||

| Colombian Pension Funds* | 22.0% | 23.4% | 22.7% | ||||||||

| Other International Shareholders | 17.9% | 25.0% | 21.2% | ||||||||

| Other Local Shareholders | 13.9% | 24.6% | 18.9% | ||||||||

| Asset Type | Common Shares | Preferred Shares | ||||||

| Trading System | Stock Exchange | Stock Exchange | ||||||

| Stock Exchange | Colombian Stock Exchange (BVC) | Colombian Stock Exchange (BVC) | ||||||

| Outstanding Shares (12/31/2024) | 509,704,584 | 452,122,416 | ||||||

| Number of Shareholders | 17,822 | 28,888 | ||||||

| Amount Issued | 509,704,584 | 452,122,416 | ||||||

| Amount Placed | 509,704,584 | 452,122,416 | ||||||

| Type of Shares | Number of Outstanding Shares | Number of Shareholders owning the Exclusive Types of Shares | Percentage of Participation in Share Capital for Each Type of Share | ||||||||

| Common | 509,704,584 | 14,634 | 52.99% | ||||||||

| Preferred | 452,122,416 | 25,700 | 47.01% | ||||||||

| Total | 961,827,000 | 43,522* | 100% | ||||||||

| GDP Growth in Latin America (Annual Variation %) | ||||||||||||||

| Country | 2022 | 2023 | 2024 | 2025 | ||||||||||

| Latin America* | 3.9% | 2.2% | 1.8% | 2.2% | ||||||||||

| Peru* | 2.8% | -0.4% | 2.9% | 2.8% | ||||||||||

| Mexico* | 3.7% | 3.3% | 1.5% | 1.3% | ||||||||||

| Chile* | 2.1% | 0.2% | 2.3% | 2.2% | ||||||||||

| Brazil* | 3.0% | 2.9% | 3.0% | 2.0% | ||||||||||

| Colombia | 7.3% | 0.6% | 1.8% | 2.6% | ||||||||||

| Panama | 10.8% | 7.4% | 2.5% | 3.5% | ||||||||||

| Costa Rica* | 4.6% | 5.1% | 3.9% | 3.5% | ||||||||||

| Guatemala | 4.2% | 3.5% | 3.5% | 3.5% | ||||||||||

| Honduras* | 4.1% | 3.6% | 3.4% | 3.2% | ||||||||||

| Nicaragua* | 3.8% | 4.6% | 3.5% | 3.0% | ||||||||||

| El Salvador | 2.8% | 3.5% | 2.6% | 2.4% | ||||||||||

| BANCOLOMBIA GROUP | |||||||||||||||||

| CONSOLIDATED FINANCIAL RESULTS | |||||||||||||||||

| RESULTS AND BALANCE | |||||||||||||||||

| (Amounts in millions of Colombian pesos, as of year-end) | December | 2023 vs 2022 | |||||||||||||||

| 2024 | 2023 | 2022 | Var $ | Var % | |||||||||||||

| Operational Income | 46,379,617 | 48,316,872 | 35,456,762 | -1,937,255 | -4.01% | ||||||||||||

| Net Operational Result | 8,757,917 | 8,147,526 | 9,744,786 | 610,391 | 7.49% | ||||||||||||

| Net Profit (Attributable to Shareholders) | 6,267,744 |

6,116,936 | 6,783,490 | 150,808 | 2.47% | ||||||||||||

| Total Assets | 372,215,382 | 342,928,809 | 352,814,733 | 29,286,573 | 8.54% | ||||||||||||

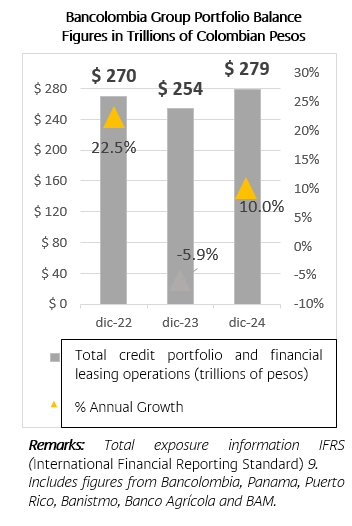

| Credit Portfolio and Financial Leasing, Net | 263,274,170 |

237,728,544 | 254,444,099 | 25,545,626 | 10.75% | ||||||||||||

| Investments, Net | 40,499,254 | 28,671,798 | 30,855,773 | 11,827,456 | 41.25% | ||||||||||||

| Total Liabilities | 327,631,107 | 303,879,080 | 312,817,182 | 23,752,027 | 7.82% | ||||||||||||

|

Deposits

(Current Accounts, Savings Accounts, and Term Deposits)

|

279,059,401 |

247,941,180 | 250,992,323 | 31,118,221 | 12.55% | ||||||||||||

| Equity | 44,584,275 | 39,049,729 | 39,997,551 | 5,534,546 | 14.17% | ||||||||||||

| EFFICIENCY AND PROFITABILITY | |||||||||||

| December | |||||||||||

| 2024 | 2023 | 2022 | |||||||||

| Net interest margin | 6.85% | 6.99% | 6.80% | ||||||||

| Financial efficiency | 48.96% | 45.33% | 44.58% | ||||||||

| Operational efficiency | 3.90% | 3.77% | 3.45% | ||||||||

| Average return on total assets | 1.79% | 1.78% | 2.15% | ||||||||

| Average return on equity | 15.77% | 16.14% | 19.80% | ||||||||

|

Portfolio quality

(Past-due portfolio / Gross portfolio)

|

4.78% | 5.01% | 3.24% | ||||||||

|

Total past due portfolio coverage

(Provisions / Past-due portfolio)

|

112.39% | 120.04% | 168.73% | ||||||||

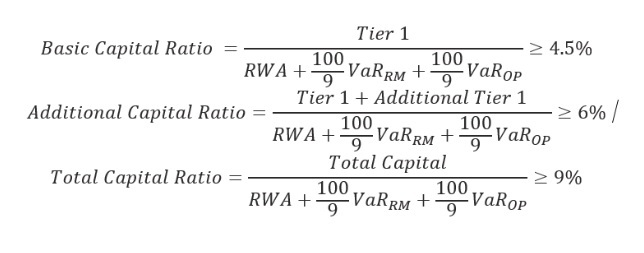

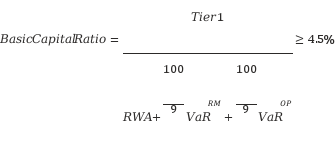

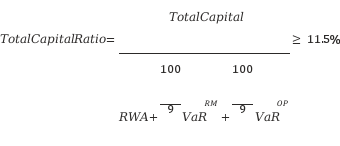

| Basic solvency | 11.89% | 11.42% | 10.37% | ||||||||

| Total solvency | 13.75% | 13.40% | 12.79% | ||||||||

| Framework of accounting accounts according to the board of directors’ report and press release. | |||||||||||

Liquid assets (1) |

December 31, 2024 | December 31, 2023 | ||||||||||||

| High-quality liquid assets* | ||||||||||||||

| Cash | 27,931,834 | 25,273,317 | ||||||||||||

| High-quality liquid marketable securities | 24,862,860 | 19,951,771 | ||||||||||||

| Other liquid assets | ||||||||||||||

| Other marketable securities** | 6,823,145 | 5,455,735 | ||||||||||||

| Total liquid assets | 59,617,839 | 50,680,823 | ||||||||||||

| As of December 31, | ||||||||

| 2024 | 2023 | |||||||

| In millions of COP | ||||||||

| Total financing | ||||||||

| In COP | 204,977,765 | 197,575,174 | ||||||

| In USD | 122,653,342 | 106,303,906 | ||||||

| Total liabilities | 327,631,107 | 303,879,080 | ||||||

| As of December 31, | ||||||||||||||

| 2024 | 2023 | |||||||||||||

| In millions of COP | ||||||||||||||

| Total deposits | 279,059,401 | 247,941,180 | ||||||||||||

| 2024 | 2023 | ||||||||||||||||

| Savings deposits | 38.1 | % | 35.8 | % | |||||||||||||

| Fixed-term deposits | 33.5 | % | 32.5 | % | |||||||||||||

| Check deposits | 11.6 | % | 11.6 | % | |||||||||||||

| Other deposits | 2.0 | % | 1.7 | % | |||||||||||||

| Percentage of total liabilities | 85.2 | % | 81.6 | % | |||||||||||||

| As of December 31, | |||||||||||||||||

| 2024 | 2023 | ||||||||||||||||

| Net Portfolio / Deposits | 89.32 | % | 90.19 | % | |||||||||||||

| 2025 | 2026 | 2027 | 2028 | 2029 | 2030 and later | Total | |||||||||||||||||

| In millions of COP | |||||||||||||||||||||||

| Bonds issued | 1,297,811 | 1,052,776 | 4,461,862 | - | 360,713 | 4,102,054 | 11,275,216 | ||||||||||||||||

| At the end of December | ||||||||||||||

| 2024 | % of total financing | 2023 | % of total financing | |||||||||||

| (In millions of COP, except percentages) | ||||||||||||||

| Savings accounts | ||||||||||||||

| In COP | 93,938,152 | 28.7% | 83,053,422 | 27.3% | ||||||||||

| In USD | 30,698,842 | 9.4% | 25,917,912 | 8.5% | ||||||||||

| Total | 124,636,994 | 38.1% | 108,971,334 | 35.8% | ||||||||||

| Fixed-term deposits | ||||||||||||||

| In COP | 60,608,350 | 18.5% | 59,146,972 | 19.5% | ||||||||||

| In USD | 49,152,372 | 15.0% | 39,539,544 | 13.0% | ||||||||||

| Total | 109,760,722 | 33.5% | 98,686,516 | 32.5% | ||||||||||

| Checking accounts | ||||||||||||||

| In COP | 20,567,300 | 6.3% | 19,712,279 | 6.5% | ||||||||||

| In USD | 17,466,396 | 5.3% | 15,280,787 | 5.1% | ||||||||||

| Total | 38,033,696 | 11.6% | 34,993,066 | 11.6% | ||||||||||

| Other deposits | ||||||||||||||

| In COP | 5,863,094 | 1.8% | 4,336,318 | 1.4% | ||||||||||

| In USD | 764,895 | 0.2% | 953,946 | 0.3% | ||||||||||

| Total | 6,627,989 | 2.0% | 5,290,264 | 1.7% | ||||||||||

| Interbank deposits | ||||||||||||||

| In COP | 0 | 0.0% | 0 | 0.0% | ||||||||||

| In USD | 716,493 | 0.2% | 606,141 | 0.2% | ||||||||||

| Total | 716,493 | 0.2% | 606,141 | 0.2% | ||||||||||

| Derivative financial instrument-Liabilities | ||||||||||||||

| In COP | 2,642,149 | 0.8% | 6,635,034 | 2.2% | ||||||||||

| In USD | 37,494 | 0.0% | 75,330 | 0.0% | ||||||||||

| Total | 2,679,643 | 0.8% | 6,710,364 | 2.2% | ||||||||||

| Borrowings from other financial institutions (1) | ||||||||||||||

| In COP | 5,055,039 | 1.5% | 6,488,331 | 2.1% | ||||||||||

| In USD | 10,634,493 | 3.3% | 9,160,275 | 3.0% | ||||||||||

| Total | 15,689,532 | 4.8% | 15,648,606 | 5.1% | ||||||||||

| Bonds issued | ||||||||||||||

| In COP | 2,241,026 | 0.7% | 4,097,729 | 1.3% | ||||||||||

| In USD | 9,034,190 | 2.8% | 10,565,847 | 3.5% | ||||||||||

| Total | 11,275,216 | 3.5% | 14,663,576 | 4.8% | ||||||||||

| Repurchase agreements and other similar secured borrowings | ||||||||||||||

| In COP | 679,878 | 0.2% | 308,711 | 0.1% | ||||||||||

| In USD | 380,594 | 0.1% | 161,584 | 0.1% | ||||||||||

| Total | 1,060,472 | 0.3% | 470,295 | 0.2% | ||||||||||

| Leases | ||||||||||||||

| In COP | 1,141,239 | 0.4% | 1,107,405 | 0.4% | ||||||||||

| In USD | 748,125 | 0.2% | 666,205 | 0.2% | ||||||||||

| Total | 1,889,364 | 0.6% | 1,773,610 | 0.6% | ||||||||||

| Other liabilities | ||||||||||||||

| In COP | 12,241,538 | 3.7% | 12,688,973 | 4.2% | ||||||||||

| In USD | 3,019,448 | 0.9% | 3,376,335 | 1.1% | ||||||||||

| Total | 15,260,986 | 4.6% | 16,065,308 | 5.3% | ||||||||||

| Total financing | ||||||||||||||

| In COP | 204,977,765 | 62.6% | 197,575,174 | 65.0% | ||||||||||

| In USD | 122,653,342 | 37.4% | 106,303,906 | 35.0% | ||||||||||

| Total liabilities | 327,631,107 | 100% | 303,879,080 | 100% | ||||||||||

| 2024 | 2023 | 2022 | |||||||||

| In millions of COP | |||||||||||

| Operational activities | 435,895 | 19,153,084 | 6,339,438 | ||||||||

| Investment activities | (559,196) | (159,689) | (4,654,502) | ||||||||

| Financing activities | (9,244,376) | (5,430,672) | 853436 | ||||||||

| Increase (decrease) in cash and cash equivalents | (9,367,677) | 13,562,723 | 2,538,372 | ||||||||

| December 31, 2024 | |||||||||||||||||

| Denominated in |

Uninsured

Denominated in

|

Total | |||||||||||||||

| Pesos | Foreign Currency | ||||||||||||||||

| In millions of Colombian pesos | |||||||||||||||||

| Less than 3 months | 17,810,529 | 10,773,646 | 28,584,175 | ||||||||||||||

| Between 3 and 6 months | 7,967,231 | 6,678,490 | 14,645,721 | ||||||||||||||

| Between 6 and 12 months | 5,179,422 | 8,418,227 | 13,597,649 | ||||||||||||||

| More than 12 months | 15,895,727 | 1,545,271 | 17,440,998 | ||||||||||||||

| Total Term Deposits | 46,852,909 | 27,415,634 | 74,268,543 | ||||||||||||||

| December 31, 2023 | |||||||||||||||||

| Denominated in |

Uninsured

Denominated in

|

Total | |||||||||||||||

| Pesos | Foreign Currency | ||||||||||||||||

| In millions of Colombian pesos | |||||||||||||||||

| Less than 3 months | 14,028,847 | 5,592,275 | 19,621,122 | ||||||||||||||

| Between 3 and 6 months | 5,856,589 | 4,632,261 | 10,488,850 | ||||||||||||||

| Between 6 and 12 months | 7,986,745 | 8,756,038 | 16,742,783 | ||||||||||||||

| More than 12 months | 18,798,384 | 3,279,197 | 22,077,581 | ||||||||||||||

| Total Term Deposits | 46,670,565 | 22,259,771 | 68,930,336 | ||||||||||||||

| Positive factors for the Colombian economy in the medium term | Challenges for the Colombian economy in the medium term | ||||

|

Rapid economic recovery after the sustained increase in local and global interest rates.

The country is expected to continue to pursue responsible monetary policies.

Institutional strength will continue to be a guarantee of a stable political environment.

Colombia's democracy, the division of power and checks and balances underpin the predictability of policy measures and economic pragmatism.

A sharp drop in the current account deficit in 2024 to levels between 1% and 2% of GDP from 6.1% in 2022 means lower external vulnerabilities in the short term.

Colombian Central Bank continues to adhere to its institutional tradition of targeting inflation and allowing the currency to float freely.

The country’s ample international reserves help mitigate external vulnerabilities arising from the checking account deficit. Despite a decrease, this deficit remains relatively high compared to peer countries.

|

Private investment remains low, which will limit medium-term economic growth.

Persistently low investor confidence could affect private investment and translate into risks to the expectation that GDP growth will return to its potential level, slightly above 3%, in the coming years.

A low medium-term potential growth could lead to challenges for public finances or increased external vulnerabilities.

Colombia is exposed to the adverse effects of climate change, especially flooding. With over 80% of its population and economic activity concentrated in roughly 20% of its territory, the country is vulnerable to natural disasters.

In terms of revenue, public finances could be affected if commodity prices decline in international markets.

The country is exposed to significant volatility in terms of international trade due to its dependence on hydrocarbons.

A low level of trade openness and an commodity-dependent export base imply high vulnerability to price shocks.

High spending expectations for 2025, relative to revenues, represent risks to compliance with the Fiscal Rule.

The risk of civil unrest will remain high throughout the forecast period of 2024-2028, reflecting deep divisions within Colombian society. Likewise, the fragmentation in Congress will hinder rapid progress in addressing issues such as poverty and low-quality education.

|

||||

| Date |

ADR

(USD)

|

Common

(COP)

|

Preferred (COP) | TRM (COP) |

COLCAP

(points)

|

||||||||||||

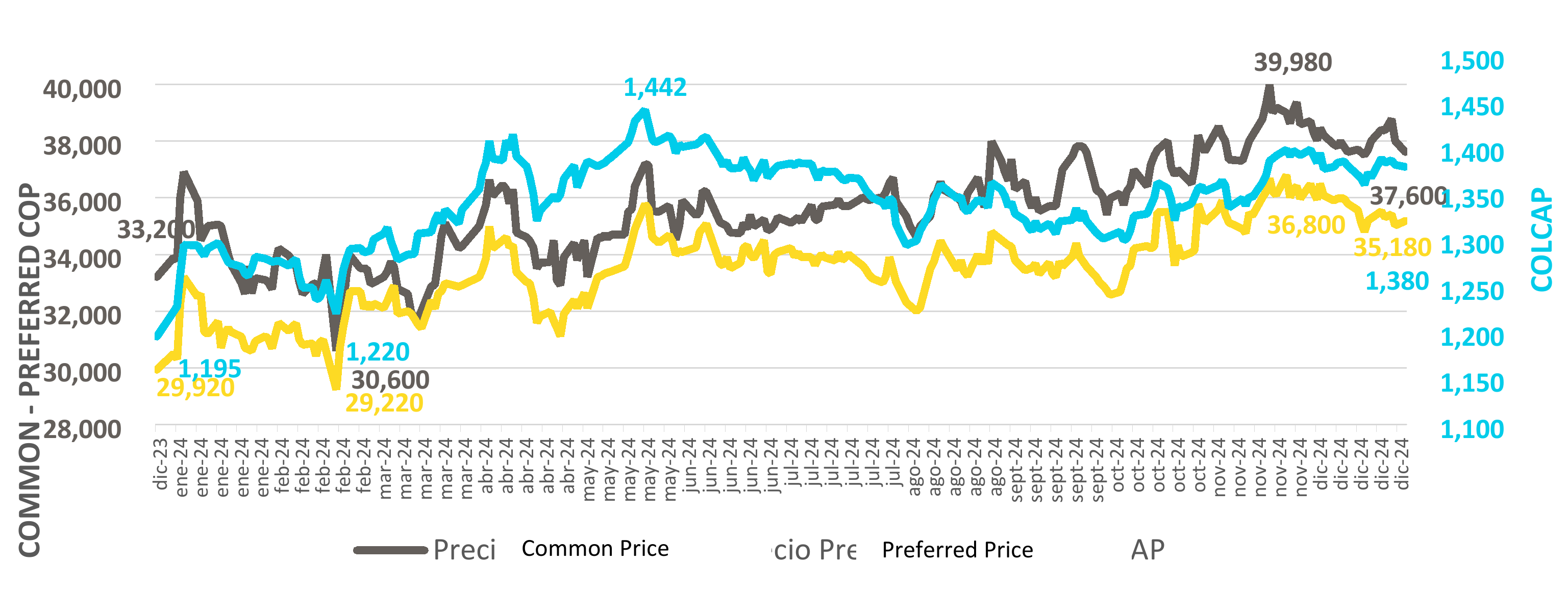

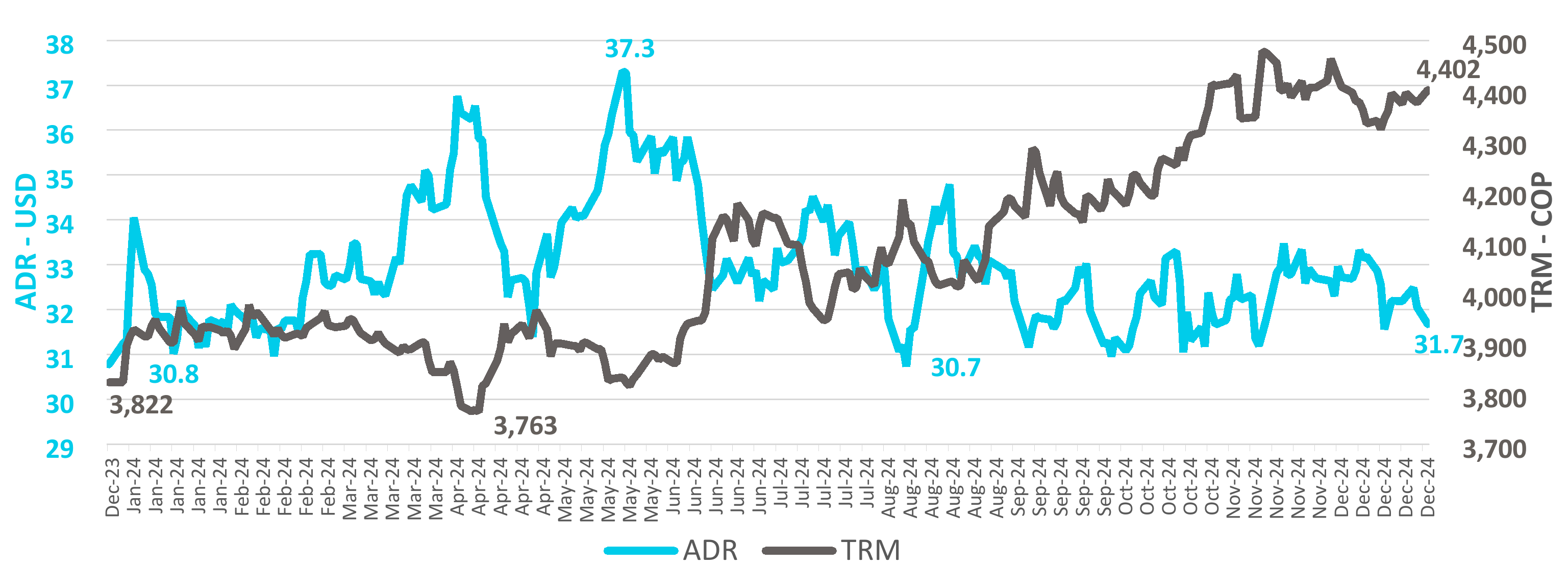

| Dec 28, 2023 | 30.77 | 33,200 | 29,920 | 3,822 | 1,195 | ||||||||||||

| Dec 30, 2024 | 31.67 | 37,600 | 35,180 | 4,402 | 1,380 | ||||||||||||

| Var % | 3% | 13% | 18% | 15% | 15% | ||||||||||||

| Type | Nemo | Registration Date | Outstanding Shares |

Market Capitalization*

(COP million)

|

||||||||||

| Common | BCOLOMBIA | 07-01-1945 | 509,704,584 | 19,164,892.36 | ||||||||||

| Preferred | PFBCOLOM | 07-26-1995 | 452,122,416 | 15,905,666.59 | ||||||||||

| Nemo | Average Daily Price | Maximum Price (COP) | Maximum Price Date | Minimum Price (COP) | Minimum Price Date | ||||||||||||

| BCOLOMBIA | 35,612 | 39,980 | 11/20/2024 | 30,600 | 02/19/2024 | ||||||||||||

| PFBCOLOM | 33,517 | 36,800 | 11/25/2024 | 29,220 | 02/19/2024 | ||||||||||||

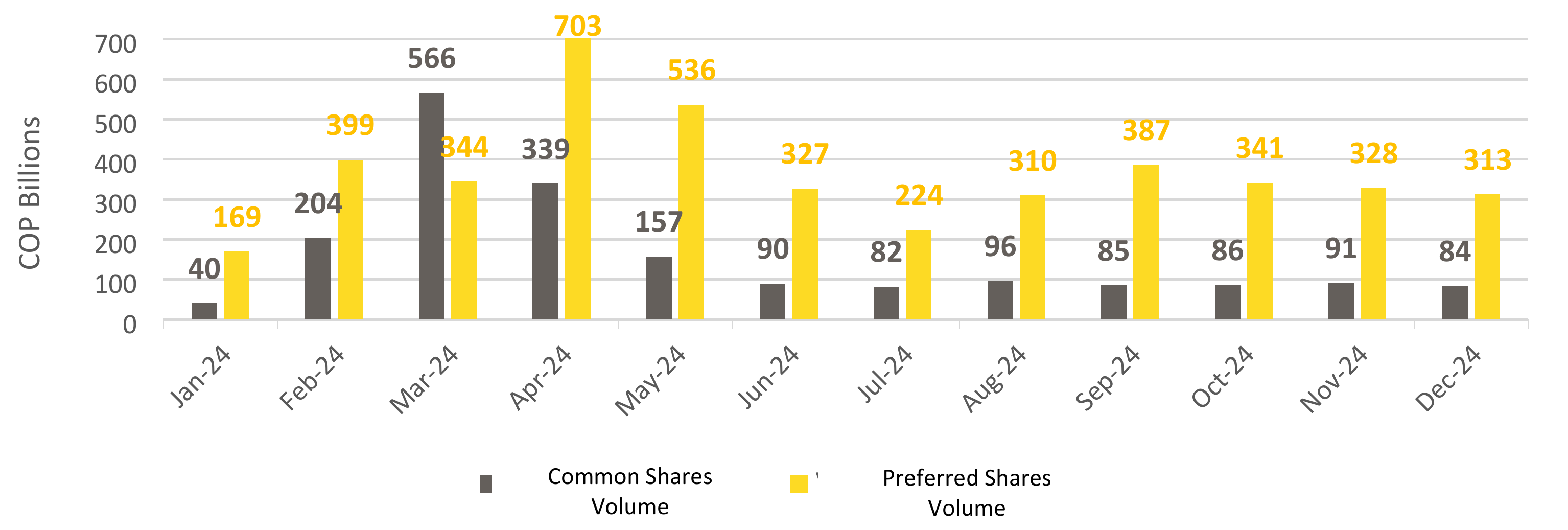

| Nemo | Operations | Amount | ||||||

| BCOLOMBIA | Operation number | 52,799 | ||||||

| Average daily operations | 232 | |||||||

| PFBCOLOM | Operation number | 135,336 | ||||||

| Average daily operations | 576 | |||||||

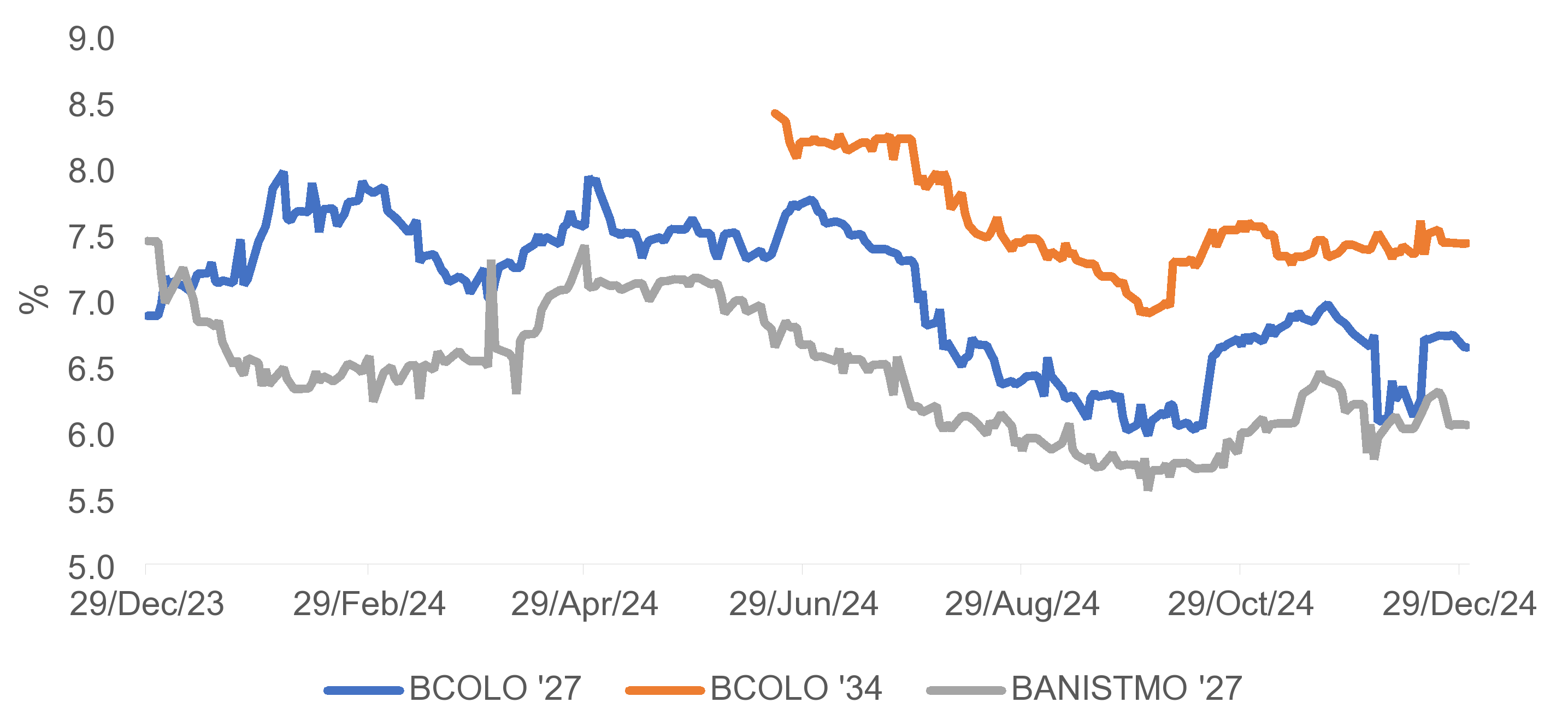

| Bond | Amount | Yield | Price L | G-Spread | ||||||||||

| Subordinates | ||||||||||||||

| BCOLO SUB 27 | USD 462 million | 6.159% | 101.887 | 189 | ||||||||||

| BCOLO SUB 34 | USD 800 million | 7.951% | 104.784 | 297 | ||||||||||

| Regular | ||||||||||||||

| BANISTMSR 27 | USD 400 million | 6.098% | 95.648 | 184 | ||||||||||

| Primary Nemo | Secondary Nemo | Date of Issue | Expiration Date | Term (Years) | Bond Type | Reference Rate | Issue Date | Currency | Amount Issued (COP Millions) | ||||||||||||||||||||

| BBCB209D15 | 7/27/11 | 7/27/26 | 15 | ORDINARY BONDS | CPI | 4.6 | COP | 248,030 | |||||||||||||||||||||

| BBCB319D15 | 11/2/11 | 11/2/26 | 15.01 | ORDINARY BONDS | CPI | 4.62 | COP | 224,050 | |||||||||||||||||||||

| BBCB149D15 | 9/24/14 | 9/24/29 | 15 | SUBORDINATED BONDS | CPI | 4.65 | COP | 360,000 | |||||||||||||||||||||

| BBCB149D20 | 9/24/14 | 9/24/34 | 20 | SUBORDINATED BONDS | CPI | 4.79 | COP | 254,500 | |||||||||||||||||||||

| BLGC659C10 | 3/18/15 | 3/18/25 | 10 | ORDINARY BONDS | CPI | 4 | COP | 91,884 | |||||||||||||||||||||

| BSBCB219C5 | BSBCB2219C05 | 9/16/21 | 9/16/26 | 5 | ORDINARY BONDS | CPI | 2.47 | COP | 183,797 | ||||||||||||||||||||

| BSBCB219C1 | BSBCB2219C12 | 9/16/21 | 9/16/33 | 12.01 | ORDINARY BONDS | CPI | 3.69 | COP | 251,500 | ||||||||||||||||||||

| Gross profit 2024 | 7,103,221,483,848.23 | |||||||

| Allocations for income tax and deferred tax | (1,525,001,351,375.72) | |||||||

| Liquid profit for the period 2024 | 5,578,220,132,472.51 | |||||||

| Plus retained earnings recognized in opening balance and effectively realized during 2024 | 9,448,864,614.99 | |||||||

| Plus release of provisioned resources for payment of preferred shares dividends | 57,701,443,512.77 | |||||||

| Total Distributable | 5,645,370,440,600.27 | |||||||

| Reserve for equity strengthening and future growth | 1,860,245,140,600.27 | |||||||

| To pay a dividend corresponding to 509,704,584 common shares and 452,122,416 preferred dividend shares without voting rights, subscribed and paid as of December 31, 2024, at a rate of COP 3,900 per share, payable as follows: COP 3,900 per share in a single payment on April 01, 2025 | 3,751,125,300,000.00 | |||||||

| Occasional reserve at the Board's disposal for donations to social benefit projects | 34,000,000,000.00 | |||||||

| EQUAL TOTALS | 5,645,370,440,600.27 | 5,645,370,440,600.27 | ||||||

| Disbursements (Colombia) | 2023 | 2024 | Annual Variation | ||||||||

| Corporate | 55,737,618 | 74,589,733 | 33.82% | ||||||||

| Individuals | 16,376,287 | 20,472,709 | 25.01% | ||||||||

| SMEs | 17,055,984 | 18,789,471 | 10.2% | ||||||||

| Independents | 2,144,241 | 2,038,767 | -4.92 | ||||||||

| Business | 17,866,711 | 20,998,523 | 17.5 | ||||||||

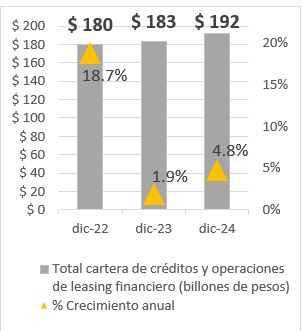

| Modality | 2023 | 2024 | Var % | ||||||||

| Commercial | 95,614,822 | 102,823,571 | 7.5% | ||||||||

| Consumption | 38,862,513 | 37,130,451 | -4.5% | ||||||||

| Leasing | 26,056,199 | 26,154,135 | 0.4% | ||||||||

| Housing | 21,840,258 | 25,163,198 | 15.2% | ||||||||

| Microcredit | 547,677 | 656,350 | 19.8% | ||||||||

| Total | 182,921,469 | 191,927,705 | 4.9% | ||||||||

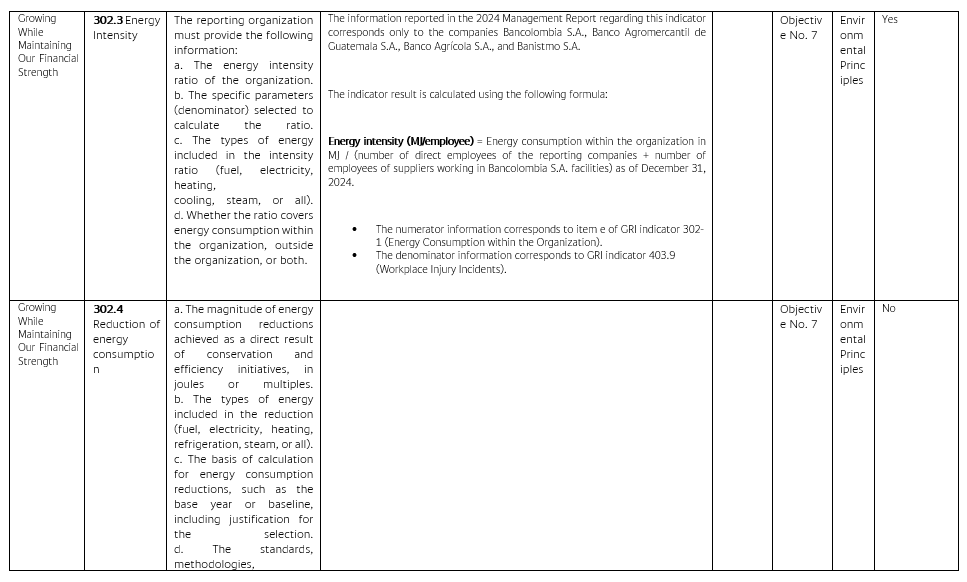

| Year | Self-generated renewable energy (MJ) | Purchased renewable energy (MJ) | Renewable electric energy (MJ) | TOTAL RENEWABLE ENERGY (MJ) | ||||||||||

| 2024 | 4,362,841.5 | 257,903,992.6 | 35,829,031.3 | 298,095,865.4 | ||||||||||

| Year | DIESEL or ACPM (diesel oil) (MJ) | B8 (MJ) | B2 (MJ) | B10 (MJ) | Gasoline E10 (MJ) | Non-renewable electric energy (MJ) | TOTAL NON-RENEWABLE ENERGY (MJ) | ||||||||||||||||

| 2024 | 3,026,985.8 | 53,744,987 | 1,201,302.2 | 5,031,842.8 | 181,394.8 | 25,283,501.81 | 34,778,772.49 | ||||||||||||||||

| ENERGY MATRIX | ||||||||

| GUATEMALA | EL SALVADOR | |||||||

| Renewable | 62.2% | 56.95% | ||||||

| Non-renewable | 37.8% | 43.05% | ||||||

| YEAR | TOTAL ENERGY CONSUMPTION (MJ) | YEAR-TO-YEAR VARIATION (MJ) | YEAR-TO-YEAR VARIATION (%) | ENERGY/EMPLOYEE (MJ/employee) | YEAR-TO-YEAR VARIATION (%) | ||||||||||||

| 2019 | 398,555,002.8 | -4.0% | 7,477.6 | -8.5% | |||||||||||||

| 2020 | 336,718,154.2 | -61,836,848.6 | -15.5% | 6,079.5 | -19% | ||||||||||||

| 2021 | 321,108,100.5 | -15,610,053.7 | -4.6% | 5,388.8 | -11% | ||||||||||||

| 2022 | 328,967,626.3 | 7,859,525.8 | 2.4% | 5,400.1 | 0.2% | ||||||||||||

| 2023 | 328,756,823 | -210,803 | -0.1% | 5,595 | 4% | ||||||||||||

| 2024 | 332,874,637.9 | 4,117,814.9 | 1.3% | 6,459.7 | 15% | ||||||||||||

| YEAR | TOTAL ENERGY CONSUMPTION (MJ) | 2024 target compared to 2019 | Achievement of 2024 target compared to 2019 | ||||||||

| 2024 | 332,874,637.9 | -10% | -16% | ||||||||

| YEAR | TOTAL ELECTRICITY CONSUMPTION (MJ) | ||||

| 2024 | 323,379,367,2 | ||||

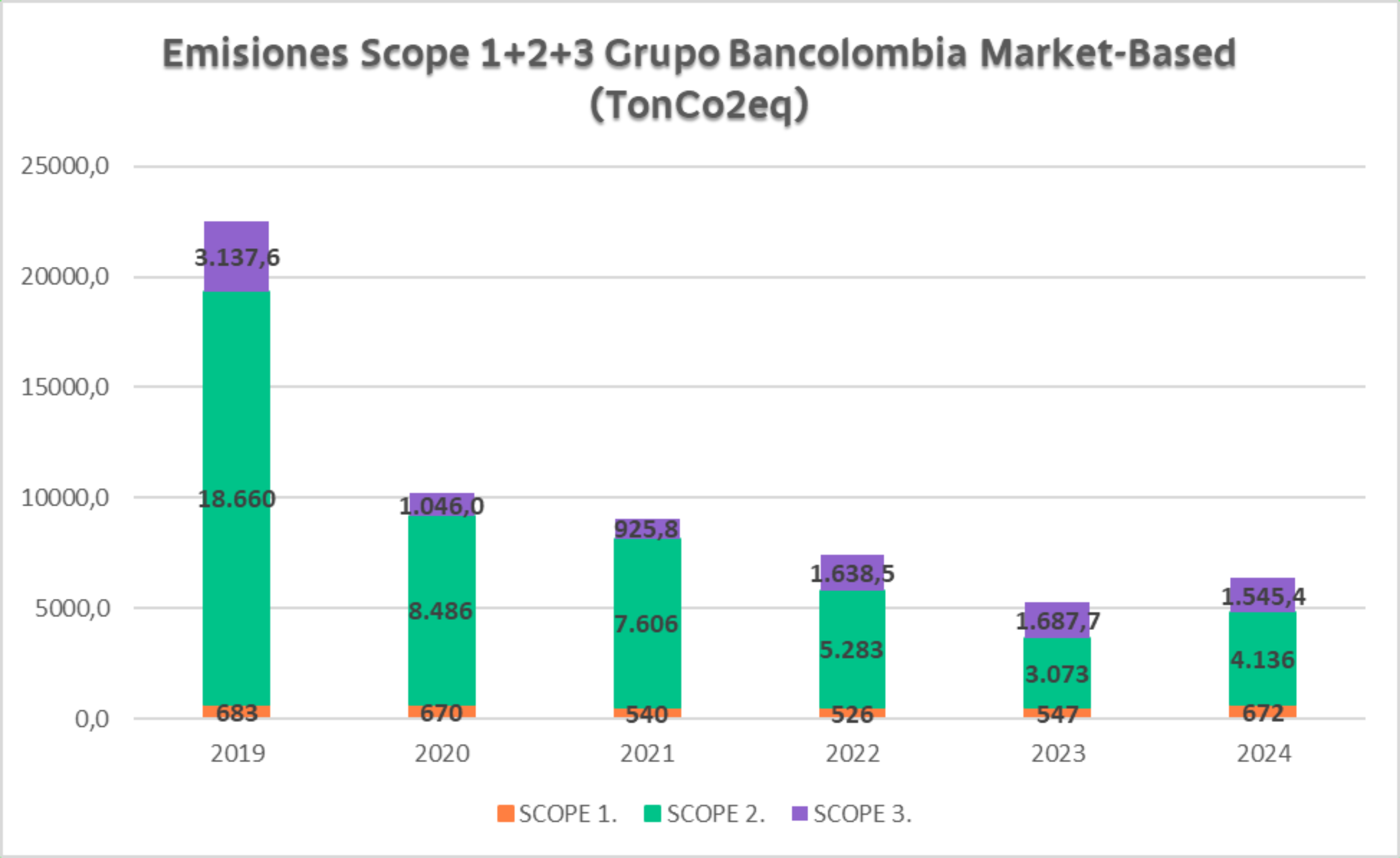

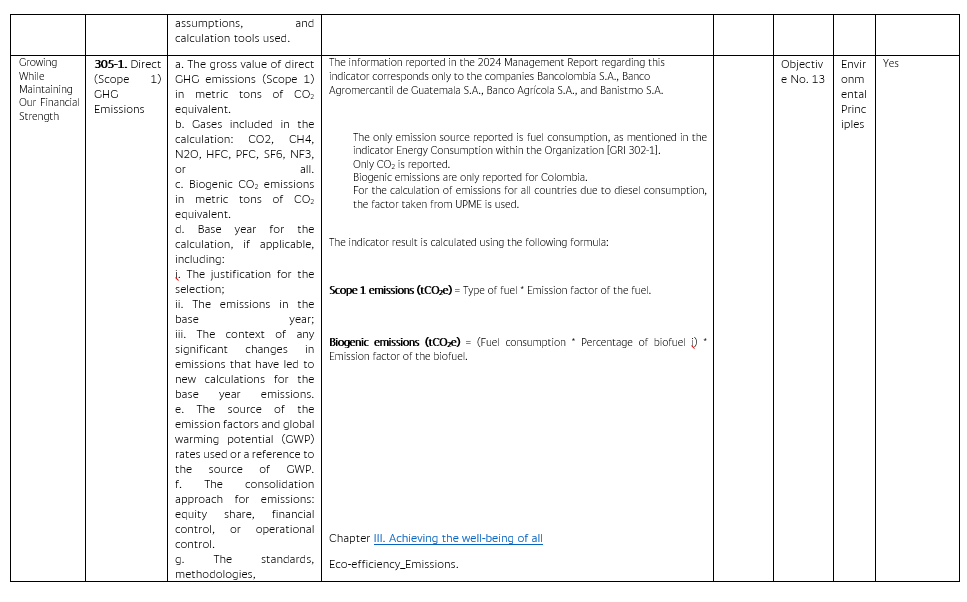

| YEAR | SCOPE 1 (TonCO2e) |

SCOPE 2 (TonCO2e) |

SCOPE 1+2 (TonCO2e) |

2024 target compared to 2019 | Achievement of 2024 target compared to 2019 | ||||||||||||||||||

| Location Based | Market Based | Location Based | Market Based | ||||||||||||||||||||

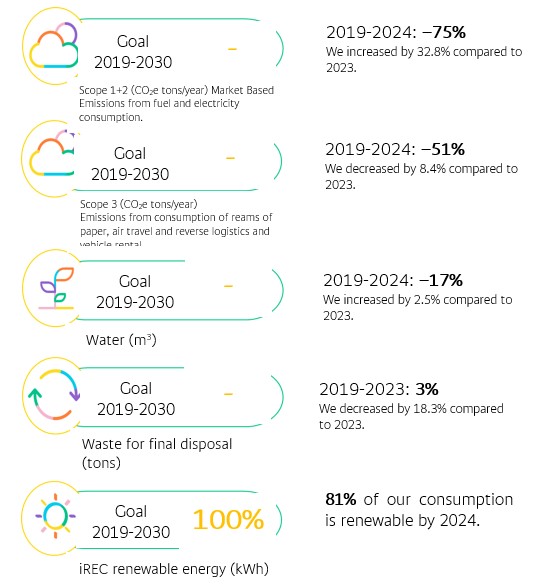

| 2024 | 671.50 | 13,200.82 | 4,135.66 | 13,872.33 | 4,807.16 | -47.5% | -75% | ||||||||||||||||

| YEAR | Biogenic emissions (Tons of CO2e) |

||||

| 2024 | 26.66 | ||||

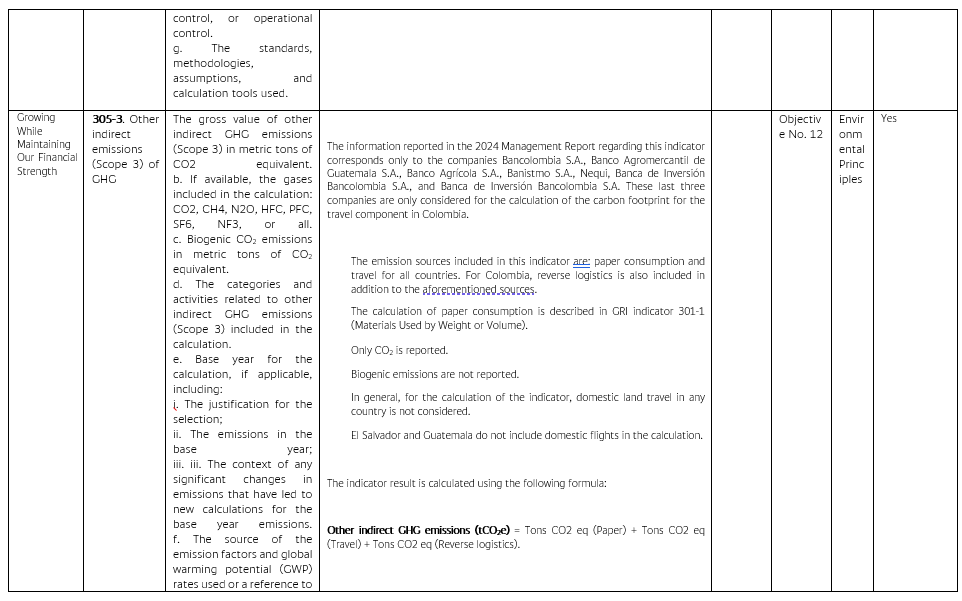

| YEAR | SCOPE 3 (Tons of CO2e) |

2024 target compared to 2019 | Achievement of 2024 target compared to 2019 | ||||||||

| 2024 | 1,545.37 | -25% | -51% | ||||||||

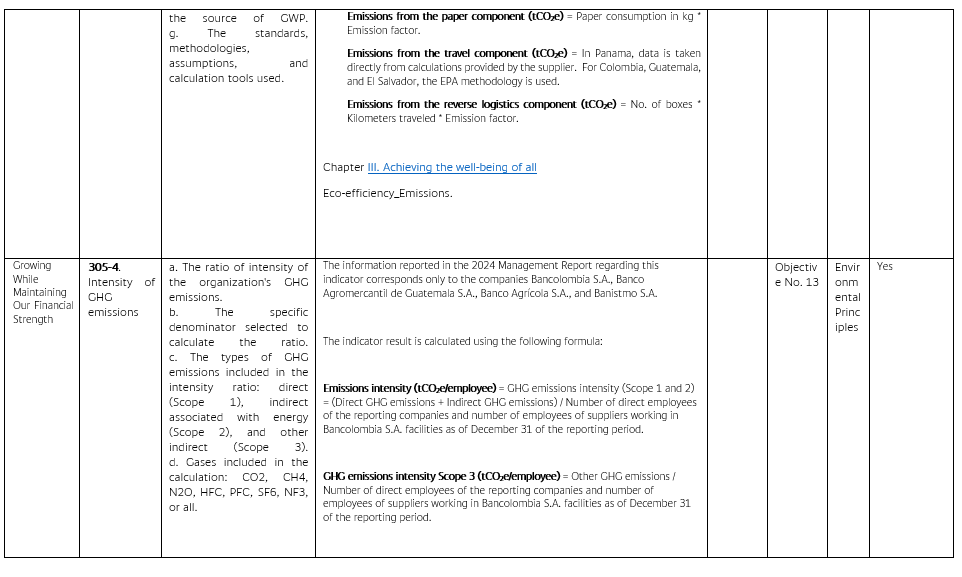

| YEAR | SCOPE 1 | SCOPE 2 | SCOPE 2 | SCOPE 1+2 | SCOPE 1+2 | SCOPE 3 | TOTAL | TOTAL | VARIATION | VARIATION | TOTAL/EMPLOYEE | TOTAL/EMPLOYEE | VARIATION (Total/Employee) | VARIATION (Total/Employee) | ||||||||||||||||||||||||||||||

| Location Based | Market Based | Location Based | Market Based | Location Based | Market Based | Total Location Based | Total Market Based | Location Based | Market Based | Location Based | Market Based | |||||||||||||||||||||||||||||||||

| 2019 | 682.64 | 22,717.14 | 18,660.33 | 23,399.78 | 19,342.97 | 3,137.63 | 26,537.41 | 22,480.60 | -9% | -23% | 0.50 | 0.42 | -13% | -26% | ||||||||||||||||||||||||||||||

| 2020 | 670.28 | 19,127.70 | 8,486.25 | 19,797.97 | 9,156.53 | 1,046.00 | 20,843.98 | 10,202.53 | -21% | -55% | 0.38 | 0.18 | -24% | -56% | ||||||||||||||||||||||||||||||

| 2021 | 540.26 | 19,997.80 | 7,605.60 | 20,538.06 | 8,145.86 | 925.82 | 21,463.87 | 9,071.68 | 3% | -11% | 0.36 | 0.15 | -4% | -17% | ||||||||||||||||||||||||||||||

| 2022 | 526.10 | 20,847.68 | 5,283.00 | 21,373.78 | 5,809.10 | 1,638.55 | 23,012.33 | 7,447.65 | 7% | -18% | 0.38 | 0.12 | 5% |

-20% | ||||||||||||||||||||||||||||||

| 2023 | 546.74 | 14,720.66 | 3,072.74 | 15,267.39 | 3,619.48 | 1,687.71 | 16,955.10 | 5,307.19 | -26% | -29% | 0.29 | 0.09 | -24% | -26% | ||||||||||||||||||||||||||||||

| 2024 | 671.50 | 13,200.82 | 4,135.66 | 13,872.33 | 4,807.16 | 1,545.37 | 15,417.70 | 6,352.54 | -9% | 20% | 0.30 | 0.12 | 4% | 36% | ||||||||||||||||||||||||||||||

| Year | Scope 1+2 (Tons of CO2e) |

Total/Employee Scope 1+2 (TonCO2e/employee) |

Scope 3 (Tons of CO2e) |

Total/Employee Scope 3 (TonCO2e/employee) |

||||||||||||||||

| Location Based | Market Based | Location Based | Market Based | |||||||||||||||||

| 2019 | 23,400 | 19,343 | 0.44 | 0.36 | 3,138 | 0.06 | ||||||||||||||

| 2020 | 19,798 | 9,157 | 0.36 | 0.17 | 1,046 | 0.02 | ||||||||||||||

| 2021 | 20,538 | 8,146 | 0.34 | 0.14 | 926 | 0.02 | ||||||||||||||

| 2022 | 21,374 | 5,809 | 0.35 | 0.10 | 1,638 | 0.03 | ||||||||||||||

| 2023 | 15,267 | 3,619 | 0.26 | 0.06 | 1,688 | 0.03 | ||||||||||||||

| 2024 | 13,872 | 4,807 | 0.27 | 0.09 | 1,545 | 0.03 | ||||||||||||||

| EMISSION REDUCTIONS | ||||||||||||||

| IREC | SELF-GENERATED ENERGY | |||||||||||||

| COUNTRY | CONSUMPTION | TONS OF CO2 AVOIDED |

CONSUMPTION | TONS OF CO2 AVOIDED |

||||||||||

| El Salvador | 462,010.85 | 107.16 | ||||||||||||

| Panama | 9,171,614.67 | 1,807.73 | ||||||||||||

| Guatemala | 1,665,489.80 | 447.52 | ||||||||||||

| Colombia | 60,802,893.46 | 6,809.92 | ||||||||||||

| TOTAL | 71,639,997.93 | 9,065.17 | 107.16 | |||||||||||

| WASTE NOT INTENDED FOR OFF-SITE DISPOSAL (TONS) | ||||||||||||||||||||

| HAZARDOUS WASTE | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | ||||||||||||||

| Reuse/recycling | 0 | 0 | 4.45 | 0 | 3.09 | 219.84 | ||||||||||||||

| Other types of classification | 0 | 0 | 0 | 0 | 0 | 0 | ||||||||||||||

| TOTAL | 0 | 0 | 4.45 | 0 | 3.09 | 219.84 | ||||||||||||||

| NON-HAZARDOUS WASTE | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | ||||||||||||||

| Reuse/recycling | 1,184.33 | 2,428.08 | 883.68 | 887.94 | 1,138 | 308.90 | ||||||||||||||

| Other types of classification | 0 | 0 | 0 | 0 | 0 | 0 | ||||||||||||||

| TOTAL | 1,184.33 | 2,428.08 | 883.68 | 887.94 | 1,138 | 308.90 | ||||||||||||||

| WASTE DESTINED FOR OFF-SITE DISPOSAL | ||||||||||||||||||||

| HAZARDOUS WASTE | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | ||||||||||||||

| Waste incinerated with energy recovery | 12.45 | 6.96 | 0.11 | 0.7 | 0.11 | 0.08 | ||||||||||||||

| Waste incinerated without energy recovery | 0.12 | 0.07 | 3.14 | 5.2 | 1.90 | 3.32 | ||||||||||||||

| Landfill waste | 0 | 0 | 0 | 0 | 0 | 0.00 | ||||||||||||||

| Waste disposed of in other ways (cells) | 0 | 0 | 1.07 | 1.93 | 1.10 | 0.50 | ||||||||||||||

| TOTAL | 12.56 | 7.03 | 4.32 | 7.82 | 3.11 | 3.90 | ||||||||||||||

| NON-HAZARDOUS WASTE | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | ||||||||||||||

| Waste incinerated with energy recovery | 0 | 0 | 0 | 0 | 0 | 0.00 | ||||||||||||||

| Waste incinerated without energy recovery | 0 | 0 | 0 | 0 | 0 | 0.00 | ||||||||||||||

| Landfill waste | 1,090.31 | 581.49 | 682.74 | 681 | 1,387 | 1132.08 | ||||||||||||||

| Waste disposed of in other ways (cells) | 0 | 0 | 0 | 0 | 0 | 0.00 | ||||||||||||||

| TOTAL | 1,090.31 | 581.49 | 682.74 | 681.00 | 1,387 | 1,132.08 | ||||||||||||||

| TOTAL WASTE | 2,287 | 3,017 | 1,575 | 1,577 | 2,532 | 1,665 | ||||||||||||||

| Recycling % | 52% | 80% | 56% | 56% | 45% | 19% | ||||||||||||||

| YEAR | Waste not intended for off-site disposal (Ton) | Waste intended for off-site disposal (Ton) | ||||||

| 2024 | 528,74 | 1,135.98 | ||||||

| YEAR | Waste for final disposal (Tons) | 2024 target compared to 2019 | Achievement of 2024 target compared to 2019 | ||||||||

| 2024 | 1,136 | -15% | 3.0% | ||||||||

| Environmental Investments | Costs (COP) | ||||

| Investments in energy and water management systems, replacement of equipment, and facilities’ adaptations | 25,481,126,190.83 | ||||

| Waste management | 6,360,994 | ||||

| Emissions | 125,254,325 | ||||

| Other | 15,700,000,000 | ||||

| TOTAL | 41,312,741,509 | ||||

| Type of Shares | Number of Outstanding Shares | Number of Shareholders Owning a Type of Shares | Percentage of Participation in Share Capital for Each Type of Share | ||||||||

| Common | 509,704,584 | 14,634 | 52.99% | ||||||||

| Preferred | 452,122,416 | 28,888 | 47.01% | ||||||||

| Total | 961,827,000 | 43,522 | 100% | ||||||||

| Name | Common % | Preferred % | Total % | ||||||||

| Grupo de Inversiones Suramericana S.A. | 46.11% | 0.00% | 24.43% | ||||||||

| Fondo Bancolombia ADR Program | 0.0% | 27.02% | 12.70% | ||||||||

| Fondo de Pensiones Obligatorias Porvenir Moderado | 8.19% | 1.97% | 5.27% | ||||||||

| Fondo de Pensiones Obligatorias Protección Moderado | 5.65% | 3.58% | 4.68% | ||||||||

| Fondo Bursátil Ishares MSIC COLCAP | 3.63% | 7.26% | 5.34% | ||||||||

| Shareholder Name | Total Shares | % Interest | ||||||

| Juan David Escobar Franco | 88 | 0.00% | ||||||

| Stages | Identification | Measurement | Control | Monitoring | ||||||||||

| Tools | Risk assessments | Impact measurement | Controls policy | Risk indicators | ||||||||||

| Risk certification | Frequency measurement | Control certification | Operations monitoring | |||||||||||

| Accounting cycle paths | Accounting and financial materiality analysis | Access certification | Transactional monitoring | |||||||||||

| Segregation analysis | Risk maps | Action plans management | Behavioral monitoring | |||||||||||

| Event report | Business Impact Analysis (BIA) | Control effectiveness measurement | Risks tracking | |||||||||||

| Among others | ||||||||||||||

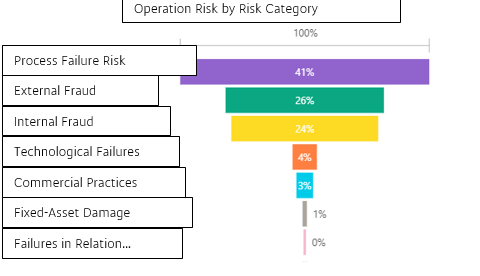

| Risks | Operational Risks / Financial Reporting Risks / Fraud Risks / Compliance Risks (AML/ATF, Corruption, Regulatory Compliance). | |||||||||||||

| Taxes registered by region | ||||||||

| Region |

Registered Taxes

(COP million)

|

Share in total | ||||||

| Colombia | 3,547,724 | 92.8% | ||||||

| El Salvador | 185,059 | 4.8% | ||||||

| Guatemala | 36,025 | 0.9% | ||||||

| Panama | 54,311 | 1.5% | ||||||

| TOTAL | 3,823,119 | 100% | ||||||

| December 2024 | ||||||||||||||||||||||||||

| In Millions of Colombian Pesos | ||||||||||||||||||||||||||

| Factor | End of the Year | Average | Maximum | Minimum | ||||||||||||||||||||||

| Interest Rate | 540,397 | 507,425 | 586,194 | 433,465 | ||||||||||||||||||||||

| Exchange Rate | 764,920 | 554,900 | 764,920 | 364,421 | ||||||||||||||||||||||

| Share Price | 360,287 | 351,134 | 360,287 | 340,363 | ||||||||||||||||||||||

| Collective Portfolios | 31,962 | 25,653 | 31,962 | 18,005 | ||||||||||||||||||||||

| Total VaR | 1,697,566 | 1,439,112 | ||||||||||||||||||||||||

| December 2023 | ||||||||||||||||||||||||||

| In Millions of Colombian Pesos | ||||||||||||||||||||||||||

| Factor | End of the Year | Average | Maximum | Minimum | ||||||||||||||||||||||

| Interest Rate | 405,467 | 418,472 | 542,464 | 383,914 | ||||||||||||||||||||||

| Exchange Rate | 332,662 | 185,624 | 374,407 | 51,410 | ||||||||||||||||||||||

| Share Price | 342,024 | 332,443 | 347,539 | 312,136 | ||||||||||||||||||||||

| Collective Portfolios | 15,847 | 23,292 | 27,923 | 15,847 | ||||||||||||||||||||||

| Total VaR | 1,096,000 | 959,832 | ||||||||||||||||||||||||

| Legal Currency | December 31, 2024 | December 31, 2023 | ||||||

| In Millions of Colombian Pesos | ||||||||

| Asset sensitivity to 100 bps | 1,262,776 | 1,152,782 | ||||||

| Liability sensitivity at 100 bps | 915,528 | 595,749 | ||||||

| Sensitivity of Net Interest Margin to 100 bps | 347,248 | 557,033 | ||||||

| Foreign Currency | December 31, 2024 | December 31, 2023 | ||||||

| In Thousands of USD | ||||||||

| Asset sensitivity to 100 bps | 76,219 | 75,052 | ||||||

| Liability sensitivity at 100 bps | 83,051 | 74,800 | ||||||

| Sensitivity of Net Interest Margin to 100 bps | -6,832 | 252 | ||||||

| December 31, 2024 | December 31, 2023 | |||||||

| Amount | 36,226 | 41,096 | ||||||

| Delta | 14.70% | 14.70% | ||||||

| Sensitivity | 5,325 | 6,041 | ||||||

| Assets | 0-30 days | 31 Days – 1 Year |

1–3 Years | 3–5 Years | More Than 5 Years | ||||||||||||

| December 31, 2024 | In Millions of Colombian Pesos | ||||||||||||||||

| Available in | 13,292,127 | - | - | - | - | ||||||||||||

| Asset liquidity transactions | 5,697,440 | - | - | - | - | ||||||||||||

| Investments | 995,155 | 7,699,148 | 8,727,586 | 2,430,000 | 5,325,958 | ||||||||||||

| Loan portfolio | 8,128,320 | 65,765,834 | 78,036,549 | 46,330,763 | 78,012,086 | ||||||||||||

| Derivative financial assets | 8,676,006 | 4,685,855 | 1,694,141 | 743,790 | 836,395 | ||||||||||||

| Total Assets | 36,789,048 | 78,150,837 | 88,458,276 | 49,504,553 | 84,174,439 | ||||||||||||

| Liabilities | 0-30 days | 31 days–1 year | 1–3 Years | 3–5 Years | More Than 5 Years | ||||||||||||

| December 31, 2024 | In Millions of Colombian Pesos | ||||||||||||||||

| Deposit accounts | 115,768,639 | - | - | - | - | ||||||||||||

| Term deposits | 11,309,077 | 35,826,396 | 8,349,029 | 3,583,268 | 15,246,849 | ||||||||||||

| Liability liquidity transactions | 646,806 | - | - | - | - | ||||||||||||

| Bank loans | 148,800 | 4,123,676 | 4,830,763 | 865,447 | 1,205,849 | ||||||||||||

| Outstanding investment securities | 40,491 | 759,393 | 4,581,252 | 1,131,868 | 5,761,272 | ||||||||||||

| Preferred shares | - | 57,701 | 115,403 | 115,403 | 295,697 | ||||||||||||

| Derivative financial liabilities | 8,444,434 | 4,517,066 | 1,559,856 | 763,789 | 754,418 | ||||||||||||

| Total Liabilities | 136,358,247 | 45,284,232 | 19,436,303 | 6,459,775 | 23,264,085 | ||||||||||||

| December 31, 2024 | December 31, 2023 | ||||||||||||||||||||||

| Book value | Fair Value | Book Value | Fair Value | ||||||||||||||||||||

| In Millions of Colombian Pesos | |||||||||||||||||||||||

| Assets | |||||||||||||||||||||||

Debt securities, marketable investments and pledged financial assets (1) |

13,866,824 | 13,866,824 | 6,942,468 | 6,942,468 | |||||||||||||||||||

Debt securities, available-for-sale investments (1) |

3,326,813 | 3,326,813 | 3,211,425 | 3,211,425 | |||||||||||||||||||

Debt securities, held-to-maturity investments, net (1) |

4,117,051 | 4,095,270 | 3,423,265 | 3,410,468 | |||||||||||||||||||

Equity instruments (1) |

445,356 | 454,423 | 180,744 | 188,124 | |||||||||||||||||||

Hedging instruments (1) |

2,924,434 | 2,924,434 | 6,215,942 | 6,215,942 | |||||||||||||||||||

Loan portfolio and financial leasing operations (2) (3) |

178,098,539 | 185,267,812 | 170,029,117 | 171,005,705 | |||||||||||||||||||

Investment properties (4) |

846,853 | 846,853 | 574,550 | 574,550 | |||||||||||||||||||

| Total Assets | 203,625,870 | 210,782,429 | 190,577,511 | 191,548,682 | |||||||||||||||||||

| Liabilities | |||||||||||||||||||||||

Customer deposits (5) |

185,801,073 | 186,106,658 | 170,231,400 | 171,398,021 | |||||||||||||||||||

Repos (6) |

628,483 | 628,483 | 263,751 | 263,751 | |||||||||||||||||||

Hedging instruments (1) |

2,667,439 | 2,667,439 | 6,699,521 | 6,699,521 | |||||||||||||||||||

Financial obligations (7) |

10,557,864 | 10,557,864 | 12,000,269 | 12,000,269 | |||||||||||||||||||

Debt securities issued (8) |

7,801,008 | 8,006,510 | 10,958,823 | 10,919,613 | |||||||||||||||||||

Preferred shares (9) |

584,204 | 407,174 | 584,204 | 394,550 | |||||||||||||||||||

| Total liabilities | 208,040,071 | 208,374,128 | 200,737,968 | 201,675,725 | |||||||||||||||||||

| December 2024 | ||||||||||||||||||||||||||

| In Millions of Colombian Pesos | ||||||||||||||||||||||||||

| Factor | End of the Year | Average | Maximum | Minimum | ||||||||||||||||||||||

| Interest Rate | 413,000 | 405,330 | 452,682 | 351,696 | ||||||||||||||||||||||

| Exchange Rate | 615,479 | 404,782 | 615,479 | 234,652 | ||||||||||||||||||||||

| Share Price | 14,996 | 15,638 | 26,578 | 11,674 | ||||||||||||||||||||||

| Collective Portfolios | 439,564 | 417,525 | 439,564 | 401,821 | ||||||||||||||||||||||

| Total VaR | 1,483,039 | 1,243,275 | ||||||||||||||||||||||||

| December 2023 | ||||||||||||||||||||||||||

| In Millions of Colombian Pesos | ||||||||||||||||||||||||||

| Factor | End of the Year | Average | Maximum | Minimum | ||||||||||||||||||||||

| Interest Rate | 334,375 | 352,633 | 484,964 | 308,204 | ||||||||||||||||||||||

| Exchange Rate | 203,244 | 128,096 | 239,366 | 42,283 | ||||||||||||||||||||||

| Share Price | 25,951 | 20,880 | 25,951 | 17,313 | ||||||||||||||||||||||

| Collective Portfolios | 402,159 | 396,851 | 412,474 | 370,716 | ||||||||||||||||||||||

| Total VaR | 965,729 | 898,460 | ||||||||||||||||||||||||

| Currency (c) | Parallel (+/-) | ||||

| COP | 400 | ||||

| RVU | 200 | ||||

| USD | 200 | ||||

|

Positions

|

December 31, 2024 | ||||

| (In Millions of COP) | |||||

| Asset sensitivity | 5,047,412 | ||||

| Liability sensitivity | 3,989,352 | ||||

| NIM Sensitivity (Delta NIM) | 1,058,060 | ||||

| Currency (c) | Parallel | Short-Term | Long-Term | ||||||||

| COP | 400 | 500 | 300 | ||||||||

| RVU | 200 | 300 | 100 | ||||||||

| USD | 200 | 300 | 150 | ||||||||

| Positions | December 31, 2024 | ||||

| In Millions of COP | |||||

| Asset sensitivity | 6,848,837 | ||||

| Liability sensitivity | 4,985,977 | ||||

| EVE Sensitivity (Delta EVE) | 1,862,860 | ||||

| Liquidity Coverage Ratio | December 31, 2024 | December 31, 2023 | ||||||

| In Millions of Colombian Pesos | ||||||||

| 30-day Liquidity Requirement | 23,887,074 | 13,752,496 | ||||||

| Liquid Assets | 59,617,840 | 50,680,823 | ||||||

| Liquidity Ratio* | 249.58% | 368.52% | ||||||

| Liquidity Coverage Ratio | December 31, 2024 | December 31, 2023 | ||||||

| In Millions of Colombian Pesos | ||||||||

| 30-day liquidity requirement | 18,811,459 | 10,179,043 | ||||||

| Liquid assets | 35,329,433 | 28,612,973 | ||||||

| Liquidity Ratio | 187.80% | 281.10% | ||||||

Liquid Assets (1) |

December 31, 2024 | December 31, 2023 | ||||||

| In Millions of Colombian Pesos | ||||||||

| Highly Liquid Assets | ||||||||

| Available in | 12,463,277 | 12,314,552 | ||||||

| High-quality securities | 20,622,441 | 14,197,252 | ||||||

| Other Liquid Assets | ||||||||

| Other securities | 2,243,715 | 2,101,169 | ||||||

| Total Liquid Assets | 35,329,433 | 28,612,973 | ||||||

| Net Stable Funding Ratio | ||||||||

| In Millions of Colombian Pesos | ||||||||

| CATEGORY | December 31, 2024 | December 31, 2023 | ||||||

| Available Stable Funding (ASF) | 205,786.90 | 192,571.29 | ||||||

| Required Stable Funding (RSF) | 168,405.51 | 158,734.45 | ||||||

| NSFR | 122.20% | 121.32% | ||||||

| Bancolombia Group | Amount (USD) | Number of Clients | ||||||||||||

| Bancolombia | 4,576,938,127 | 127 | ||||||||||||

| Banco Agromercantil de Guatemala (BAM) | 1,255,836,277 | 49 | ||||||||||||

| Banco Agrícola | 648,752,187 | 25 | ||||||||||||

| Banistmo | 117,730,352 | 15 | ||||||||||||

| Total | 2024 | 6,599,256,943 |   216 216 |

|||||||||||

| 2023 | 3,218,454,620 | 130 clients | ||||||||||||

| Bancolombia Group | Favorable | Favorable with Conditions | Not Favorable | ||||||||

| Banco Agromercantil de Guatemala (BAM) | 71.43% | 24.49% | 4.08% | ||||||||

| Banco Agrícola | 88.00% | 12.00% | 0.00% | ||||||||

| Bancolombia | 66.14% | 29.92% | 3.94% | ||||||||

| Banistmo | 33.33% | 66.67% | 0.00% | ||||||||

| Total | 68% | 29% | 3% | ||||||||

| Sector / Risk Level |

High Risk (A)

(COP)

|

Medium Risk (B)

(COP)

|

Total

(COP)

|

||||||||

| Infrastructure | 694,569,654 | 694,569,654 | |||||||||

| Agribusiness | 40,501,056 | 17,357,595 | 57,858,651 | ||||||||

| Energy | 90,720,434 | 243,587,028 | 334,307,462 | ||||||||

| Sector | 6,970,330 | 6,970,330 | |||||||||

| Other sectors | 5,000,000 | 5,000,000 | |||||||||

| Total | 825,791,144 | 272,914,953 | 1,098,706,097 | ||||||||

| Promoting financial inclusion | |||||

| Through our financial inclusion initiatives, we bring banking services to underserved sectors, aiming to enhance financial well-being and improve their quality of life. | |||||

|

We generate knowledge and support strategies for our clients, employees and the community in general to make better financial decisions.

We provide educational loans so that more people can access quality education.

From our Fundación (Foundation) we provide higher education scholarships to rural youth from vulnerable populations so that they can fulfill their dream of studying and becoming professionals who will transform their territories.

|

|||||

|

We continue with our Diversity, Equity and Inclusion strategy, in which we work for gender equity covering female employees, suppliers, investors, customers and the community in general.

We have made progress in the formalization and structure of this strategy, integrating the Bancolombia Diversa project (gender identity and sexual orientation) under the same focus, and updating the governance model.

|

|||||

| Strengthening the production network | |||||

|

We finance SMEs and entrepreneurs and accompany them in their growth so that their productivity and employment generation increase and have a positive impact on the economy.

We prioritize agriculture and rural development with a value proposition designed to spur growth in this key economic sector.

We generate quality employment directly and indirectly through our value chain.

|

|||||

|

We contribute to the technological reconversion of our industries, helping them to become more productive and efficient.

We promote sustainable industrialization through our sustainable credit line that supports companies seeking to increase their positive impact on the environment and society.

We support major infrastructure works to build a better country.

|

|||||

| Building sustainable cities and communities | |||||

| Since 2023, we have incorporated water conservation into our purpose, from inland regions to coastal areas. We do this by supporting client investments in infrastructure that enhances water efficiency in production processes, sanitation and water supply infrastructure, sustainable coastal tourism, and circular economy models that reduce water pollution, among others. | |||||

|

We support access to housing through innovative solutions that go beyond financing.

We promote sustainable mobility from financial and non-financial solutions aligned with market trends.

|

|||||

| Climate change is at the core of our strategy, therefore we have a zero net emissions strategy and support our clients in reducing their impact through a comprehensive financial and non-financial product offer. | |||||

| SUSTAINABLE FINANCING IMPACTS 2024 | VALUES | EQUIVALENTS | BASELINE | |||||||||||

| WATER SAVED (m³/year) | 39,151,099 | 15,660 | Filling 15,660 Olympic-sized swimming pools | (assuming each pool holds 2,500 m³ of water) | ||||||||||

| WASTE UTILIZED (tons/year) | 20,988,090 | 1.7 | Preventing waste generated by Bogotá for one year and seven months (Bogotá generates 12 million tons per year, according to the Bogotá Planning Office 2023) | |||||||||||

|

WASTE AVOIDED

(tons/year)

|

68,282 | 2,968,792 | Equivalent to the waste generation of 2,968,792 people in Colombia per month | (average Colombian generates about 0.75 kg of waste per day, totaling 23 kg per month). In 11.6 weeks, a person could generate an average of their body weight in waste. Only 12.9% of the waste generated in the country is recycled repositorio.cepal.org/repositorio.cepal.org/sever/api/core/blitstreams/bf1b769d-2ea1-434d-b2c3-0d1/content |

||||||||||

| RECIRCULATED WATER (m³/year) | 13,332 | 5 | Filling 5 Olympic-sized swimming pools | (assuming each pool holds 2,500 m³ of water) | ||||||||||

|

ENERGY GENERATED

(MWh/year)

|

1,017,141 | 470,899 | Supplying the energy demand of 470,899 households in Colombia for one year. | Colombia’s energy demand is 255.39 GWh/day, according to UPME data |

||||||||||

|

EMISSIONS AVOIDED

(tons CO2e/year)

|

1,142,931 | 799,253 | Equivalent to removing 799,253 combustion vehicles from the market. According to the European Agency, a vehicle traveling 10,000 km per year emits 1.43 tons of CO2 annually. | According to data from the European Environment Agency, a medium-sized gasoline car emits an average of about 143 grams of CO2 per kilometer. |

||||||||||

|

ENERGY SAVED

(MWh/year)

|

2,572,617 | 1,191,026 | Supplying the energy demand of 1,191,026 households in Colombia for one year. | Colombia’s energy demand is 255.39 GWh/day, according to UPME data |

||||||||||

| 2023 (COP) | 2024 (COP) | ||||||||||

| Own Resources | Sustainable Housing Line | 0.186 trillion | 0.431 trillion | ||||||||

| Leasing, Rent, and Use | 0.697 trillion | 1.3 trillion | |||||||||

| Sufi Third-Party Channels (Electric Mobility) | 0.35 trillion | 0.57 trillion | |||||||||

| Local Development Banks | Rediscount (Bancóldex, Findeter, Finagro) Bank and Leasing | 0.66 trillion |

2.27 trillion | ||||||||

|

Purpose-Driven Business: Climate Commitment

Goals and Compliance

| ||||||||||||||

| Year | Goal (COP millions) | Disbursements (COP millions) | Compliance | |||||||||||

| 2024 | 3,086,000 | 5,410,000 | 140% | |||||||||||

| Dec-24 | Dec-23 | Variation | |||||||||

| Number of Bancolombia A La Mano clients |

6,372,171 | 6,364,050 | 0.1% | ||||||||

| Total Balance in Bancolombia A la Mano (COP millions) | 1,148,021 | 970,584 | 18.3% | ||||||||

| Number of Loans Granted | 155,268 | 164,314 | -5.5% | ||||||||

| Loan Amount Granted (COP millions) | 199,338 | 190,592 | 4.6% | ||||||||

| Loan Portfolio Balance (COP millions) | 121,710 | 103,583 | 17.5% | ||||||||

| 2023 | 2024 | |||||||

| Total users (#) | 18,598,442 | 21,320,389 | ||||||

| Active users per month (#) | 13,399,397 | 16,499,498 | ||||||

| Deposit balance (COP millions) | 2,924,906 | 4,449,420 | ||||||

| Loan portfolio balance (COP millions) | 157,705 | 603,482 | ||||||

| Loans disbursed (COP millions) | 140,302 | 502,901 | ||||||

| Emergency loans disbursed (#) | 68,440 | 189,037 | ||||||

| Propulsor loans disbursed (#) | 71,862 | 313,864 | ||||||

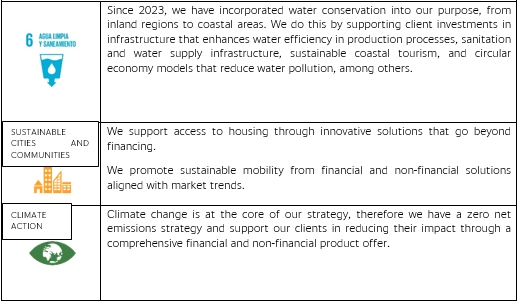

| # | TIN | Product Name | Subcategory | Level | Certification Year | ||||||||||||

| 1 | Bancolombia | Elévate – Financial Education Program | Education Program | One | 2022 | ||||||||||||

| 2 | Fundación Bancolombia (Bancolombia Foundation) | Cuentas sin Cuento – Libertat | Education Program | One | 2022 | ||||||||||||

| 3 | Bancolombia | Financial Well-being Platform – Day to Day | Education Program | One | 2023 | ||||||||||||

| 4 | Bancolombia | Financiera-Mente | Education Program | One | 2023 | ||||||||||||

| 5 | Bancolombia | Elévate – Financial Education Program | Education Program | Two | 2023 | ||||||||||||

| 6 | Nequi | Financial Education – Nequi | Education Program | One | 2023 | ||||||||||||

| 7 | Fundación Bancolombia (Bancolombia Foundation) | Cuentas sin Cuento – Libertat | Education Program | Two | 2023 | ||||||||||||

| 8 | Bancolombia | Bus Escuela – Bancolombia | Education Program | Unique | 2023 | ||||||||||||

| 9 | Bancolombia | A la Mano Te Enseña | Campaign | One | 2023 | ||||||||||||

| 10 | Fiduciaria (Fiduciary) | Invernews | Education Program | One | 2023 | ||||||||||||

| 11 | Values | Telegram | Education Program | One | 2023 | ||||||||||||

| 12 | Bancolombia | Sueños a la Mano | Education Program | One | 2024 | ||||||||||||

| 13 | Fundación Bancolombia (Bancolombia Foundation) | Cuentas sin Cuento – Libertat | Education Program | Three | 2024 | ||||||||||||

| 14 | Bancolombia | A la Mano Te Enseña | Campaign | Two | 2024 | ||||||||||||

| 15 | Bancolombia | Financial Well-Being Indicator | Education Program | One | 2024 | ||||||||||||

| 16 | Values | Mercado en Movimiento | Education Program | One | 2024 | ||||||||||||

| 17 | Bancolombia | Emprender Mujer | Education Program | One | 2024 | ||||||||||||

| 18 | Fundación Bancolombia (Bancolombia Foundation) | Cuentas sin Cuento – DID | Education Program | One | 2024 | ||||||||||||

| # of Initiatives | # of Participants/Scope | Budget (COP) | ||||||||||||||||||||||||

| TIN | Semester 1 | Semester 2 | Semester 1 | Semester 2 | Semester 1 | Semester 2 | ||||||||||||||||||||

|

# People/

Companies

|

#Views/Likes/ Replays |

# People/

Companies

|

#Views/Likes/ Replays |

|||||||||||||||||||||||

| Bancolombia | 42 | 27 | 52,724,452 | 32,385,151 | 69,083,737 | 184,878 | 4,519,614,327 | 3,646,059,958 | ||||||||||||||||||

| Values | 6 | 9 | 1,266 | 0 | 2,752 | 0 | 0 | 762,895 | ||||||||||||||||||

| Fiduciaria (Fiduciary) | 7 | 4 | 1,450 | 199 | 1,631 | 561 | 0 | 0 | ||||||||||||||||||

| Banca de Inversión (Investment Banking) | 1 | 2 | 21 | 0 | 130 | 0 | 0 | 0 | ||||||||||||||||||

| Sufi | 2 | 3 | 231,739 | 0 | 545,100 | 0 | 0 | 0 | ||||||||||||||||||

| Nequi | 7 | 8 | 981,622 | 2,670,546 | 40 | 76,794,526 | 73,021,446 | 119,150,633 | ||||||||||||||||||

| Fundación Bancolombia (Bancolombia Foundation) | 3 | 5 | 4,373 | 0 | 23,206 | 0 | 1,067,791,897 | 2,279,953,493 | ||||||||||||||||||

| Cross-cutting Actions (affecting multiple TINs) | 9 | 8 | 28,295 | 1,300 | 7,150 | 347 | 154,636,746 | 65,000,000 | ||||||||||||||||||

| Total per Semester | 77 | 66 | 53,973,218 | 35,057,196 | 69,663,746 | 76,980,312 | 5,815,064,416 | 6,110,926,979 | ||||||||||||||||||

| Total Annual | 143 | 235,674,472 | 11,925,991,395 | |||||||||||||||||||||||

| Line | Program | Beneficiaries | Total Investment (USD) | ||||||||

| Quality of Life | FESA “Lindo del Fútbol” 2024 | 7,127 | 310,297 | ||||||||

| Financial Education | 2,776,440 reach on Radio and TV; average social media reach 4,507,589 | 150,335 | |||||||||

| Banco de la TELETÓN support for the Asociación Teletón Pro- Rehabilitación – FUNTER 2023 | 8,000 therapies | 80,000 | |||||||||

| La Cuenta del Mar (Sea Account) |

113 blue jobs,

direct beneficiaries involved in mangrove rehabilitation actions

|

399,109 | |||||||||

| TOTAL | 4 programs | 939,741 | |||||||||

| LINE | PROGRAM | BENEFICIARIES | TOTAL INVESTMENT (USD) | |||||||||||||||||

| Education | Nacer Aprendiendo – United Way (Early Childhood) | 1,900 | 15,000 | |||||||||||||||||

| Financial Education for the Youth – Asociación Bancaria de Panamá | 65 | 5,000 | ||||||||||||||||||

| Financial Education and Entrepreneurship for Children, Youth, and Women – Junior Achievement Panama | 2,710 | 47,250 | ||||||||||||||||||

| Women and Girls in STEAM | 58 | 30,500 | ||||||||||||||||||

| Impulsa: Mentoring Program for Women Entrepreneurs – Glasswing Foundation | 78 | 80,000 | ||||||||||||||||||

| Environment | Environmental Conservation and Community Support in the Panama Canal Watershed – Fundación Natura | 2,410 | 71,250 | |||||||||||||||||

| CONSOLIDATED TOTAL | 6 programs | 7,721 | 249,000 | |||||||||||||||||

| LINE | PROGRAM | BENEFICIARIES | TOTAL INVESTMENT (USD) | |||||||||||||||||

| Support to Communities | Fighting Chronic Malnutrition – Partnership with United Way | 150 families - 5 communities | 25,000 | |||||||||||||||||

| Emprender Mujer | 24 women-led SMEs, 22 mentors | 15,466 | ||||||||||||||||||

| Strengthening the education of Guatemalan children and youth – Partnership with Funsepa | 5,695 children and teenagers, 253 teachers | 125,000 | ||||||||||||||||||

| Financial Education | Annual campaign | 11,646,958 people* | 29,386 | |||||||||||||||||

| La Casa de la Plata | 8,581,000 people* | 30,685 | ||||||||||||||||||

| Environmental Care | La Cuenta del Mar – Marine Conservation Center |

15,516 turtles, 11 beaches, 6 communities

1,500 people trained

2,000 mangroves planted

|

38,000 | |||||||||||||||||

| CONSOLIDATED TOTAL | 6 programs | 263,537 | ||||||||||||||||||

| Sustainability Index | 2023 | 2024 | ||||||

| Dow Jones Sustainability Index |

78 points out of 100

Included in the Global index

|

85 points out of 100, included in the Global Index, ranked 1st in Emerging Markets and MILA | ||||||

| CDP | B | B | ||||||

| MSCI ESG Research | YY | YY | ||||||

| Moody’s formerly Vigeo | 57 “Robust” | 57 “Robust” | ||||||

| PRI (Investments) |

Policy Governance and Strategy: 74

Direct - Listed equity - Active fundamental: 42

Direct - Fixed income - SSA: 42

Direct - Fixed income - Corporate: 42

Confidence building measures: 40

|

Policy Governance and Strategy: 64

Direct - Listed equity - Active fundamental: 42

Direct - Fixed income - SSA: 52

Direct - Fixed income - Corporate: 52

Confidence building measures: 60

|

||||||

| Sustainalytics (ESG Risk Rating) | 17.8, positioning us positively in a “Low Risk” category | 16.3, positioning us positively in a “Low Risk” category | ||||||

| IR Recognition | 98.3% | 98.4% | ||||||

| Engagement Strategy | No. of Engagements | ||||

| ESG Assessment Issuers | 6 issuers | ||||

| Sustainability as a Service* | 264 clients | ||||

| Climate change | 45 clients | ||||

| Company* | Branches 2024 | Branches 2023 | Branches 2022 | ||||||||

| Bancolombia S.A. (Colombia) | 575 | 578 | 583 | ||||||||

| BAM (Guatemala) | 151 | 155 | 157 | ||||||||

| Renting Colombia** | 37 | 63 | 65 | ||||||||

| Banco Agrícola | 91 | 91 | 90 | ||||||||

| Banistmo | 37 | 39 | 39 | ||||||||

| Valores Bancolombia | 17 | 19 | 19 | ||||||||

| Fiduciaria Bancolombia | 8 | 8 | 7 | ||||||||

| Financomer | 1 | 3 | 4 | ||||||||

| SUFI | 2 | 2 | 2 | ||||||||

| Inversiones CFNS S.A.S. | 2 | 2 | 2 | ||||||||

| Banca de Inversión (Investment Banking) | 2 | 2 | 2 | ||||||||

| Bancolombia Panamá | 1 | 1 | 1 | ||||||||

| Bancolombia S.A. Panamá Branch | 1 | 1 | 1 | ||||||||

| Valores Banistmo | 1 | 1 | 1 | ||||||||

| Bancolombia Puerto Rico International Inc. | 1 | 1 | 1 | ||||||||

| Arrendadora Financiera S.A. | 1 | 1 | 1 | ||||||||

| Valores Banagrícola, S.A. de C.V. | 1 | 1 | 1 | ||||||||

| Bancolombia Capital Holding LLC (Miami) | 1 | 1 | 1 | ||||||||

| Transportempo S.A.S. | 0 | 0 | 1 | ||||||||

| Total | 930 | 969 | 978 | ||||||||

| Bancolombia, Domestic Subsidiaries and Foreign Subsidiaries | |||||||||||

| Country | No. Employees | ||||||||||

| Bancolombia (Colombia) | 23,113 | ||||||||||

| Banco Agrícola (El Salvador) | 3,079 | ||||||||||

| Banistmo (Panama) | 2,326 | ||||||||||

| OffShore | 181 | ||||||||||

| BAM (Guatemala) | 3,691 | ||||||||||

| Other Bancolombia Group Companies | |||||||||||

|

Other Bancolombia Group Companies:

*Number of employees: Renting, Nequi, Wenia, Wompi, Valores Simesa, among others.

|

1724 | ||||||||||

| Other Types of Non-Direct Contracts | |||||||||||

| External - Service Contract | 27,572 | ||||||||||

| Interns/trainees | 578 | ||||||||||

| Subtotal Employees | 32,390 | ||||||||||

| Other companies | 1724 | ||||||||||

| Total Employees | 34,114 | ||||||||||

| Index | 2023 | 2024 | Variation (%) | Numerical Variation | ||||||||||

| Number | Number | |||||||||||||

| Number of employees | 32,945 | 32,390 | -1.71% | -555 | ||||||||||

| Index | 2023 | 2024 | |||||||||||||||

| Number | % | Number | % | ||||||||||||||

| Gender | Women | 19,700 | 60% | 19,264 | 59% | ||||||||||||

| Men | 13,245 | 40% | 13,126 | 41% | |||||||||||||

| Age | Employees under 30 years old | 9,743 | 30% | 8,927 | 28% | ||||||||||||

| Employees aged 30 - 50 years old | 20,669 | 63% | 20,787 | 64% | |||||||||||||

| Employees over 50 years old | 2,533 | 8% | 2,676 | 8% | |||||||||||||

| Seniority | Employees with less than 3 years of service | 10,271 | 31% | 9,468 | 29% | ||||||||||||

| Employees with 3-10 years of service | 9,508 | 29% | 9,568 | 30% | |||||||||||||

| Employees with more than 10 years of service | 13,166 | 40% | 13,354 | 41% | |||||||||||||

| Diversity | Number and % of women in leadership roles | 1,955 | 52% | 2012 | 50% | ||||||||||||

| Number of women in junior roles | 1,763 | 53% | 1,796 | 52% | |||||||||||||

| Number and % of women in senior management | 192 | 40% | 216 | 40% | |||||||||||||

| Number and % of women in commercial roles | 1,165 | 58% | 951 | 58% | |||||||||||||

| Number and % of women in STEM (Science, Technology, Engineering, and Mathematics) roles | 3,542 | 40% | 3,937 | 39% | |||||||||||||

| Number of minority employees (people with disabilities, ethnic minorities, Afro-descendants, etc.) | 248 | 0.8% | 256 | 0.8% | |||||||||||||

| Women in Leadership Positions (Colombia): | ||||||||||||||

| CLASSIFICATION | 2023 | 2024 | ||||||||||||

| Number of Employees | Participation | Number of Employees | Participation | |||||||||||

| Female | 145 | 40.2% | 151 | 40.3% | ||||||||||

| Male | 216 | 59.8% | 224 | 59.7% | ||||||||||

| Grand Total | 361 | 100.0% | 375 | 100.0% | ||||||||||

| Index | 2023 | 2024 | ||||||||||||

| Cases | % / rate | Cases | % / rate | |||||||||||

| Total Revenues | 4,686 | 14% | 2,985 | 9% | ||||||||||

| Female Hires | 2,571 | 55% | 1,633 | 55% | ||||||||||

| Male Hires | 2,115 | 45% | 1,352 | 45% | ||||||||||

| Employee Hires under 30 years old | 3,143 | 67% | 2,132 | 71% | ||||||||||

| Employee Hires aged 30 - 50 years old | 1,517 | 32% | 831 | 28% | ||||||||||

| Employee Hires over 50 years old | 26 | 1% | 22 | 1% | ||||||||||

| Hires at Bancolombia | 2,731 | 12% | 1,064 | 5% | ||||||||||

| Hires at Banistmo | 446 | 18% | 383 | 16% | ||||||||||

| Hires OffShore | 22 | 13.66% | 40 | 22% | ||||||||||

| Hires at Banco Agrícola | 517 | 18% | 602 | 20% | ||||||||||

| Hires at BAM | 970 | 26% | 896 | 24% | ||||||||||

Index |

2023 | 2024 | ||||||||||||

| Cases | % Turnover | Cases | % Turnover | |||||||||||

| Total resignations | 2,910 | 8.83% | 3,512 | 10.84% | ||||||||||

| Female Departures | 1,678 | 58% | 2,041 | 58% | ||||||||||

| Male Departures | 1,232 | 42% | 1,471 | 42% | ||||||||||

| Employee Departures under 30 years old | 1,168 | 40% | 1,392 | 40% | ||||||||||

| Employee Departures aged 30 - 50 years old | 1,430 | 49% | 1,695 | 48% | ||||||||||

| Employee Departures over 50 years old | 312 | 11% | 425 | 12% | ||||||||||

| Voluntary Departures | 1,452 | 50% | 1,333 | 38% | ||||||||||

| Departures without just cause (dismissals) | 257 | 9% | 449 | 13% | ||||||||||

| Departures by mutual agreement | 626 | 22% | 897 | 26% | ||||||||||

| Departures with just cause | 122 | 4% | 165 | 5% | ||||||||||

| Departures due to retirement/pension | 55 | 2% | 89 | 3% | ||||||||||

| Departures during probation period | 44 | 2% | 34 | 1% | ||||||||||

| Departures due to death | 15 | 1% | 23 | 1% | ||||||||||

| Departures due to contract termination | 331 | 11% | 512 | 15% | ||||||||||

| Departures - pension due to disability | 0 | 0% | 0 | 0% | ||||||||||

| Departures due to other reasons | 8 | 0% | 10 | 0% | ||||||||||

| Representative Turnover Indicator | 2023 | 2024 | ||||||||||||

| Cases | % Turnover | Cases | % Turnover | |||||||||||

| Rotation of Bancolombia Withdrawals | 1,370 | 5.8% | 1,649 | 7.1% | ||||||||||

| Turnover Banistmo Departures | 306 | 12.6% | 469 | 20.2% | ||||||||||

| Turnover OffShore Departures | 13 | 8.1% | 20 | 11.0% | ||||||||||

| Turnover Banco Agrícola Departures | 463 | 15.7% | 463 | 15.0% | ||||||||||

| Turnover BAM Departures | 758 | 20.5% | 911 | 24.7% | ||||||||||

Index |

2023 | 2024 | ||||||||||||

| Cases | % Turnover | Cases | % Turnover | |||||||||||

| Voluntary Departures | 1,452 | 4.41% | 1,333 | 4.12% | ||||||||||

| Departures without just cause (dismissals) | 257 | 0.78% | 449 | 1.39% | ||||||||||

| Departures by mutual agreement | 626 | 1.90% | 897 | 2.77% | ||||||||||

| Departures with just cause | 122 | 0.37% | 165 | 0.51% | ||||||||||

| Departures due to retirement/pension | 55 | 0.17% | 89 | 0.27% | ||||||||||

| Departures during probation period | 44 | 0.13% | 34 | 0.10% | ||||||||||

| Departures due to death | 15 | 0.05% | 23 | 0.07% | ||||||||||

| Departures due to contract termination | 331 | 1.00% | 512 | 1.58% | ||||||||||

| Departures - pension due to disability | 0 | 0.00% | 0 | 0.00% | ||||||||||

| Departures due to other reasons | 8 | 0.02% | 10 | 0.03% | ||||||||||

Index |

2023 | 2024 | ||||||||||||

| Cases | Promotions rate | Cases | Promotion Rate | |||||||||||

| Total Promotions | 4,093 | 12% | 3,930 | 12% | ||||||||||

| Female Promotions | 2300 | 56% | 2,025 | 52% | ||||||||||

| Male Promotions | 1,793 | 44% | 1,905 | 48% | ||||||||||

| Bancolombia – Colombia 2024 | |||||||||||||||||||||||

| Hierarchical Level | Gender | 2023 | 2024 | ||||||||||||||||||||

| Population Percentage | Average Monthly Salary (COP) | % Below Men | Population Percentage | Average Monthly Salary (COP) | % Below Men | ||||||||||||||||||

| Senior Management | Female | 40% | 19,187,110 | 2.18% | 40% | 21,195,674 | 2.38% | ||||||||||||||||

| Male | 60% | 20,820,116 | 60% | 23,552,368 | |||||||||||||||||||

| Mid-Level Strategic | Female | 55% | 9,116,748 | 3.99% | 53% | 9,815,593 | 3.57% | ||||||||||||||||

| Male | 45% | 9,583,151 | 47% | 10,118,809 | |||||||||||||||||||

| Professional | Female | 54% | 5,011,414 | 0.29% | 53% | 5,511,662 | 0.49% | ||||||||||||||||

| Male | 46% | 5,140,476 | 47% | 5,695,473 | |||||||||||||||||||

| Operational | Female | 69% | 3,457,890 | 0.98% | 69% | 3,952,365 | 0.49% | ||||||||||||||||

| Male | 31% | 3,529,151 | 31% | 3,995,963 | |||||||||||||||||||

| Banistmo 2024 | |||||||||||||||||||||||

| Hierarchical Level | Gender | 2023 | 2024 | ||||||||||||||||||||

| Population Percentage | Average Monthly Salary (USD) | % Below Men | Population Percentage | Average Monthly Salary (USD) | % Below Men | ||||||||||||||||||

| Senior Management | Female | 50% | 9,875 | 4.34% | 45% | 10,471 | 3.40% | ||||||||||||||||

| Male | 50% | 10,455 | 55% | 10,450 | |||||||||||||||||||

| Mid-Level Strategic | Female | 62% | 4,138 | 5.77% | 58% | 4,259 | 3.30% | ||||||||||||||||

| Male | 38% | 4,452 | 42% | 4,437 | |||||||||||||||||||

| Professional | Female | 57% | 1,870 | 9.07% | 57% | 1,896 | 8.14% | ||||||||||||||||

| Male | 43% | 2,101 | 43% | 2,162 | |||||||||||||||||||

| Operational | Female | 77% | 937 | 1.14% | 77% | 954 | 1.56% | ||||||||||||||||

| Male | 23% | 968 | 23% | 991 | |||||||||||||||||||

| Offshore 2024 | |||||||||||||||||||||||

| Hierarchical Level | Gender | 2023 | 2024 | ||||||||||||||||||||

| Population Percentage | Average Monthly Salary (USD) | % Below Men | Population Percentage | Average Monthly Salary (USD) | % Below Men | ||||||||||||||||||

| Senior Management | Female | 50% | 12,544 | -9.32% | 20% | 14,386 | -3.36%* | ||||||||||||||||

| Male | 50% | 12,339 | 80% | 13,918 | |||||||||||||||||||

| Mid-Level Strategic | Female | 59% | 4,374 | -3.70% | 69% | 4,835 | -5.03% | ||||||||||||||||

| Male | 41% | 3,617 | 31% | 4,658 | |||||||||||||||||||

| Professional | Female | 68% | 2,146 | 2.36% | 66% | 2,209 | 0.82% | ||||||||||||||||

| Male | 32% | 2,174 | 34% | 2,304 | |||||||||||||||||||

| Operational | Female | 70% | 1,015 | 10.44% | 67% | 1,051 | 5.38% | ||||||||||||||||

| Male | 30% | 1,163 | 33% | 1,112 | |||||||||||||||||||

| Banco Agrícola 2024 | |||||||||||||||||||||||

| Hierarchical Level | Gender | 2023 | 2024 | ||||||||||||||||||||

| Population Percentage | Average Monthly Salary (COP) | % Below Men | Population Percentage | Average Monthly Salary (COP) | % Below Men | ||||||||||||||||||

| Senior Management | Female | 39% | 6,563 | 7.73% | 43% | 6,862 | 3.03% | ||||||||||||||||

| Male | 61% | 7,583 | 57% | 7,984 | |||||||||||||||||||

| Mid-Level Strategic | Female | 51% | 2,680 | 3.03% | 51% | 2,752 | 1.85% | ||||||||||||||||

| Male | 49% | 2,909 | 49% | 2,934 | |||||||||||||||||||

| Professional | Female | 50% | 1,278 | 1.62% | 50% | 1,307 | 0.86% | ||||||||||||||||

| Male | 50% | 1,341 | 50% | 1,363 | |||||||||||||||||||

| Operational | Female | 59% | 580 | 0.29% | 59% | 594 | 0.40% | ||||||||||||||||

| Male | 41% | 578 | 41% | 595 | |||||||||||||||||||

| BAM 2024 | |||||||||||||||||||||||

| Hierarchical Level | Gender | 2023 | 2024 | ||||||||||||||||||||

| Population Percentage | Average monthly salary | % Below Men | Population Percentage | Average monthly salary | % Below Men | ||||||||||||||||||

| Senior Management | Female | 27% | 11,695 | -10.58% | 30% | 11,345 | -6.85% | ||||||||||||||||

| Male | 73% | 10,032 | 70% | 10,509 | |||||||||||||||||||

| Mid-Level Strategic | Female | 34% | 3,974 | 0.68% | 36% | 4,020 | 0.85% | ||||||||||||||||

| Male | 66% | 3,444 | 64% | 3,597 | |||||||||||||||||||

| Professional | Female | 46% | 1,323 | 3.69% | 46% | 1,386 | 4.20% | ||||||||||||||||

| Male | 54% | 1,412 | 54% | 1,527 | |||||||||||||||||||

| Operational | Female | 58% | 519 | -0.38% | 60% | 550 | -1.13% | ||||||||||||||||

| Male | 42% | 523 | 40% | 564 | |||||||||||||||||||

| Index | 2024 | |||||||

| Leaders trained in the Instituto de Liderazgo (Leadership Institute) program* | 5,696 managers, 98% of the total managers. |

|||||||

| New trained managers* | 689 managers, 88% of new managers. |

|||||||

| Total training hours | 1,192,519 | |||||||

| Average training hours per employee | 36 hours/employee |

|||||||

| Average virtual training hours per employee | ||||||||

28 hours/employee |

||||||||

| Average face-to-face training hours per employee | ||||||||

8 hours/employee |

||||||||

| Average hours of training per male employee | ||||||||

37 hours/employee |

||||||||

| Average hours of training per female employee | 36 hours/employee |

|||||||

| Index | 2024 | ||||

| Average hours of training per employee managers | 59 | ||||

| Average hours of training per non-managers employee | 33 | ||||

| Average investment in training per person* | USD 206 | ||||

| In-person and virtual trainees | 70 employees | ||||

| Compliance with Anti-Corruption and Anti-Fraud Training 2024 | ||||||||||||||

| Employees | Approved | In progress | Grand Total | Compliance % | ||||||||||

| Bancolombia Panamá | 128 | 0 | 128 | 100.00% | ||||||||||

| Banistmo | 1,761 | 1 | 1,762 | 99.94% | ||||||||||

| BAM | 2,864 | 7 | 2,871 | 99.76% | ||||||||||

| Banco Agrícola | 2,501 | 0 | 2,501 | 100.00% | ||||||||||

| Bancolombia | 19,106 | 64 | 19,170 | 99.67% | ||||||||||

| Puerto Rico | 5 | 0 | 5 | 100.00% | ||||||||||

| Grand Total | 26,365 | 72 | 26,437 | 99.73% | ||||||||||

| Managers | Approved | In progress | Grand Total | Compliance % | ||||||||||

| Bancolombia Panamá | 28 | 0 | 28 | 100.00% | ||||||||||

| Banistmo | 389 | 0 | 389 | 100.00% | ||||||||||

| BAM | 628 | 1 | 629 | 99.84% | ||||||||||

| Banco Agrícola | 446 | 1 | 447 | 99.78% | ||||||||||

| Bancolombia | 2,651 | 5 | 2,656 | 99.81% | ||||||||||

| Puerto Rico | 1 | 0 | 1 | 100.00% | ||||||||||

| Grand Total | 4,143 | 7 | 4,150 | 99.83% | ||||||||||

| Compliance with Free Competition Training 2024 | ||||||||||||||

| Employees | Approved | In progress | Grand Total | Compliance % | ||||||||||

| Bancolombia | 19,128 | 42 | 19,170 | 99.78% | ||||||||||

| Grand Total | 19,128 | 42 | 19,170 | 99.78% | ||||||||||

| Managers | Approved | In progress | Grand Total | Compliance % | ||||||||||

| Bancolombia | 2653 | 3 | 2,656 | 99.89% | ||||||||||

| Grand Total | 2653 | 3 | 2,656 | 99.89% | ||||||||||

| Compliance with Cybersecurity Training 2024 | ||||||||||||||

| Employees | Approved | In progress | Grand Total | Compliance % | ||||||||||

| Bancolombia Panamá | 128 | 0 | 128 | 100.00% | ||||||||||

| Banistmo | 1,761 | 1 | 1,762 | 99.94% | ||||||||||

| Banco Agromercantil de Guatemala (BAM) | 2,864 | 7 | 2,871 | 99.76% | ||||||||||

| Banco Agrícola | 2,501 | 0 | 2,501 | 100.00% | ||||||||||

| Bancolombia | 19,122 | 48 | 19,170 | 99.75% | ||||||||||

| Puerto Rico | 5 | 0 | 5 | 100.00% | ||||||||||

| Grand Total | 26,381 | 56 | 26,437 | 99.79% | ||||||||||

| Managers | Approved | In progress | Grand Total | Compliance % | ||||||||||

| Bancolombia Panamá | 28 | 0 | 28 | 100.00% | ||||||||||

| Banistmo | 389 | 0 | 389 | 100.00% | ||||||||||

| Banco Agromercantil de Guatemala (BAM) | 628 | 1 | 629 | 99.84% | ||||||||||

| Banco Agrícola | 446 | 1 | 447 | 99.78% | ||||||||||

| Bancolombia | 2653 | 3 | 2,656 | 99.89% | ||||||||||

| Puerto Rico | 1 | 0 | 1 | 100.00% | ||||||||||

| Grand Total | 4,145 | 5 | 4,150 | 99.88% | ||||||||||

| Compliance with Ethics Code Training 2024 | ||||||||||||||

| Employees | Approved | In Progress | Grand Total | Compliance % | ||||||||||

| Bancolombia Panamá | 128 | 0 | 128 | 100.00% | ||||||||||

| Banistmo | 1,762 | 0 | 1,762 | 100.00% | ||||||||||

| Banco Agromercantil de Guatemala (BAM) | 2,867 | 4 | 2,871 | 99.86% | ||||||||||

| Banco Agrícola | 2,501 | 0 | 2,501 | 100.00% | ||||||||||

| Bancolombia | 19,141 | 29 | 19,170 | 99.85% | ||||||||||

| Puerto Rico | 5 | 0 | 5 | 100.00% | ||||||||||

| Grand Total | 26,404 | 33 | 26,437 | 99.88% | ||||||||||

| Managers | Approved | In Progress | Grand Total | Compliance % | ||||||||||

| Bancolombia Panamá | 28 | 0 | 28 | 100.00% | ||||||||||

| Banistmo | 389 | 0 | 389 | 100.00% | ||||||||||

| Banco Agromercantil de Guatemala (BAM) | 628 | 1 | 629 | 99.84% | ||||||||||

| Banco Agrícola | 447 | 0 | 447 | 100.00% | ||||||||||

| Bancolombia | 2653 | 3 | 2,656 | 99.89% | ||||||||||

| Puerto Rico | 1 | 0 | 1 | 100.00% | ||||||||||

| Grand Total | 4,146 | 4 | 4,150 | 99.90% | ||||||||||

| Compliance with Diversity, Equity, and Inclusion Training 2024 | ||||||||||||||

| Employees | Approved | In progress | Grand Total | Compliance % | ||||||||||

| Bancolombia Panamá | 128 | 0 | 128 | 100.00% | ||||||||||

| Banistmo | 1,761 | 1 | 1,762 | 99.94% | ||||||||||

| Banco Agromercantil de Guatemala (BAM) | 2,862 | 9 | 2,871 | 99.69% | ||||||||||

| Banco Agrícola | 2,499 | 2 | 2,501 | 99.92% | ||||||||||

| Bancolombia | 19,096 | 74 | 19,170 | 99.61% | ||||||||||

| Puerto Rico | 5 | 0 | 5 | 100.00% | ||||||||||

| Grand Total | 26,351 | 86 | 26,437 | 99.67% | ||||||||||

| Managers | Approved | In progress | Grand Total | Compliance % | ||||||||||

| Bancolombia Panamá | 28 | 0 | 28 | 100.00% | ||||||||||

| Banistmo | 389 | 0 | 389 | 100.00% | ||||||||||

| Banco Agromercantil de Guatemala (BAM) | 628 | 1 | 629 | 99.84% | ||||||||||

| Banco Agrícola | 447 | 1 | 448 | 99.78% | ||||||||||

| Bancolombia | 2652 | 4 | 2,656 | 99.85% | ||||||||||

| Puerto Rico | 1 | 0 | 1 | 100.00% | ||||||||||

| Grand Total | 4,145 | 6 | 4,151 | 99.86% | ||||||||||

| Compliance with Occupational Health and Safety Risk Management Training 2024 | ||||||||||||||

| Employees | Approved | In Progress | Grand Total | Compliance % | ||||||||||

| Banco Agromercantil de Guatemala (BAM) | 2,864 | 7 | 2,871 | 99.76% | ||||||||||

| Bancolombia | 19,085 | 85 | 19,170 | 99.56% | ||||||||||

| Grand Total | 21,949 | 0 | 22,041 | 99.58% | ||||||||||

| Managers | Approved | In Progress | Grand Total | Compliance % | ||||||||||

| Banco Agromercantil de Guatemala (BAM) | 628 | 1 | 629 | 99.84% | ||||||||||

| Bancolombia | 2,650 | 6 | 2,656 | 99.77% | ||||||||||

| Grand Total | 3,278 | 7 | 3,285 | 99.79% | ||||||||||

| Compliance with Personal Data Protection Training 2024 | ||||||||||||||

| Employees | Approved | In Progress | Grand Total | Compliance % | ||||||||||

| Bancolombia Panamá | 128 | 0 | 128 | 100.00% | ||||||||||

| Banistmo | 1,761 | 1 | 1,762 | 99.94% | ||||||||||

| Banco Agrícola | 2,501 | 0 | 2,501 | 100.00% | ||||||||||

| Bancolombia | 19,106 | 64 | 19,170 | 99.67% | ||||||||||

| Grand Total | 23,496 | 65 | 23,561 | 99.72% | ||||||||||

| Managers | Approved | In Progress | Grand Total | Compliance % | ||||||||||

| Bancolombia Panamá | 28 | 0 | 28 | 100.00% | ||||||||||

| Banistmo | 389 | 0 | 389 | 100.00% | ||||||||||

| Banco Agrícola | 446 | 1 | 447 | 99.78% | ||||||||||

| Bancolombia | 2,651 | 5 | 2,656 | 99.81% | ||||||||||

| Grand Total | 3,514 | 6 | 3,520 | 99.83% | ||||||||||

| Compliance with SAC and Conduct Risk Training 2024 | ||||||||||||||

| Employees | Approved | In Progress | Grand Total | Compliance % | ||||||||||

| Bancolombia | 19,088 | 82 | 19,170 | 99.57% | ||||||||||

| Grand Total | 19,088 | 82 | 19,170 | 99.57% | ||||||||||

| Managers | Approved | In Progress | Grand Total | Compliance % | ||||||||||

| Bancolombia | 2,649 | 7 | 2,656 | 99.74% | ||||||||||

| Grand Total | 2,649 | 7 | 2,656 | 99.74% | ||||||||||

| Compliance with SARLAFT Training 2024 | ||||||||||||||

| Employees | Approved | In Progress | Grand Total | Compliance % | ||||||||||

| Bancolombia Panamá | 128 | 0 | 128 | 100.00% | ||||||||||

| Banistmo | 1,761 | 1 | 1,762 | 99.94% | ||||||||||

| Banco Agromercantil de Guatemala (BAM) | 2,864 | 7 | 2,871 | 99.76% | ||||||||||

| Banco Agrícola | 2,499 | 2 | 2,501 | 99.92% | ||||||||||

| Bancolombia | 19,093 | 77 | 19,170 | 99.60% | ||||||||||

| Puerto Rico | 5 | 0 | 5 | 100.00% | ||||||||||

| Grand Total | 26,350 | 87 | 26,437 | 99.67% | ||||||||||

| Managers | Approved | In Progress | Grand Total | Compliance % | ||||||||||

| Bancolombia Panamá | 28 | 0 | 28 | 100.00% | ||||||||||

| Banistmo | 389 | 0 | 389 | 100.00% | ||||||||||

| Banco Agromercantil de Guatemala (BAM) | 628 | 1 | 629 | 99.84% | ||||||||||

| Banco Agrícola | 446 | 1 | 447 | 99.78% | ||||||||||

| Bancolombia | 2,650 | 6 | 2,656 | 99.77% | ||||||||||

| Puerto Rico | 1 | 0 | 1 | 100.00% | ||||||||||

| Grand Total | 4,142 | 8 | 4,150 | 99.81% | ||||||||||

| Compliance with SARO Training 2024 | ||||||||||||||

| Employees | Approved | In Progress | Grand Total | Compliance % | ||||||||||

| Bancolombia Panamá | 128 | 0 | 128 | 100.00% | ||||||||||

| Banistmo | 1,761 | 1 | 1,762 | 99.94% | ||||||||||

| Banco Agromercantil de Guatemala (BAM) | 2,864 | 7 | 2,871 | 99.76% | ||||||||||

| Banco Agrícola | 2,499 | 2 | 2,501 | 99.92% | ||||||||||

| Bancolombia | 19,092 | 78 | 19,170 | 99.59% | ||||||||||

| Puerto Rico | 5 | 0 | 5 | 100.00% | ||||||||||

| Grand Total | 26,349 | 88 | 26,437 | 99.67% | ||||||||||

| Managers | Approved | In Progress | Grand Total | Compliance % | ||||||||||

| Bancolombia Panamá | 28 | 0 | 28 | 100.00% | ||||||||||

| Banistmo | 389 | 0 | 389 | 100.00% | ||||||||||

| Banco Agromercantil de Guatemala (BAM) | 628 | 1 | 629 | 99.84% | ||||||||||

| Banco Agrícola | 446 | 1 | 447 | 99.78% | ||||||||||

| Bancolombia | 2,650 | 6 | 2,656 | 99.77% | ||||||||||

| Puerto Rico | 1 | 0 | 1 | 100.00% | ||||||||||

| Grand Total | 4,142 | 8 | 4,150 | 99.81% | ||||||||||

| Compliance with Information Security Training 2024 | ||||||||||||||

| Employees | Approved | In Progress | Grand Total | Compliance % | ||||||||||

| Bancolombia Panamá | 128 | 0 | 128 | 100.00% | ||||||||||

| Banistmo | 1,761 | 1 | 1,762 | 99.94% | ||||||||||

| Banco Agromercantil de Guatemala (BAM) | 2,864 | 7 | 2,871 | 99.76% | ||||||||||

| Banco Agrícola | 2,501 | 0 | 2,501 | 100.00% | ||||||||||

| Bancolombia | 19,114 | 56 | 19,170 | 99.71% | ||||||||||

| Puerto Rico | 5 | 0 | 5 | 100.00% | ||||||||||

| Grand Total | 26,373 | 64 | 26,437 | 99.76% | ||||||||||

| Managers | Approved | In Progress | Grand Total | Compliance % | ||||||||||

| Bancolombia Panamá | 28 | 0 | 28 | 100.00% | ||||||||||

| Banistmo | 389 | 0 | 389 | 100.00% | ||||||||||

| Banco Agromercantil de Guatemala (BAM) | 628 | 1 | 629 | 99.84% | ||||||||||

| Banco Agrícola | 446 | 1 | 447 | 99.78% | ||||||||||

| Bancolombia | 2652 | 4 | 2,656 | 99.85% | ||||||||||

| Puerto Rico | 1 | 0 | 1 | 100.00% | ||||||||||

| Grand Total | 4,144 | 6 | 4,150 | 99.86% | ||||||||||

| Compliance with Sustainability Training 2024 | ||||||||||||||

| Employees | Approved | In Progress | Grand Total | Compliance % | ||||||||||

| Bancolombia Panamá | 128 | 0 | 128 | 100.00% | ||||||||||

| Banistmo | 1,757 | 5 | 1,762 | 99.72% | ||||||||||

| Banco Agromercantil de Guatemala (BAM) | 2,866 | 5 | 2,871 | 99.83% | ||||||||||

| Banco Agrícola | 2,501 | 0 | 2,501 | 100.00% | ||||||||||

| Bancolombia | 19,136 | 34 | 19,170 | 99.82% | ||||||||||

| Puerto Rico | 5 | 0 | 5 | 100.00% | ||||||||||

| Grand Total | 26,393 | 44 | 26,437 | 99.83% | ||||||||||

| Managers | Approved | In Progress | Grand Total | Compliance % | ||||||||||

| Bancolombia Panamá | 28 | 0 | 28 | 100.00% | ||||||||||

| Banistmo | 389 | 0 | 389 | 100.00% | ||||||||||

| Banco Agromercantil de Guatemala (BAM) | 628 | 1 | 629 | 99.84% | ||||||||||

| Banco Agrícola | 447 | 0 | 447 | 100.00% | ||||||||||

| Bancolombia | 2653 | 3 | 2,656 | 99.89% | ||||||||||

| Puerto Rico | 1 | 0 | 1 | 100.00% | ||||||||||

| Grand Total | 4,146 | 4 | 4,150 | 99.90% | ||||||||||

| Compliance with SOX Training 2024 | ||||||||||||||

| Employees | Approved | In Progress | Grand Total | Compliance % | ||||||||||

| Bancolombia Panamá | 126 | 0 | 126 | 100.00% | ||||||||||

| Banistmo | 1,761 | 1 | 1,762 | 99.94% | ||||||||||

| Banco Agromercantil de Guatemala (BAM) | 2,864 | 7 | 2,871 | 99.76% | ||||||||||

| Banco Agrícola | 2,500 | 1 | 2,501 | 99.96% | ||||||||||

| Bancolombia | 19,099 | 71 | 19,170 | 99.63% | ||||||||||

| Puerto Rico | 5 | 0 | 5 | 100.00% | ||||||||||

| Grand Total | 26,355 | 80 | 26,435 | 99.70% | ||||||||||

| Managers | Approved | In Progress | Grand Total | Compliance % | ||||||||||

| Bancolombia Panamá | 28 | 0 | 28 | 100.00% | ||||||||||

| Banistmo | 389 | 0 | 389 | 100.00% | ||||||||||