Document

Video script

At Grupo Bancolombia, we are proud of our history. It has been decades filled with transformations, innovation, and growth, which have led us to become one of the most important financial groups in Latin America.

Over the years, trust has remained our foundation to support the dreams of millions of people, driven by a business strategy that seeks to grow responsibly while generating value.

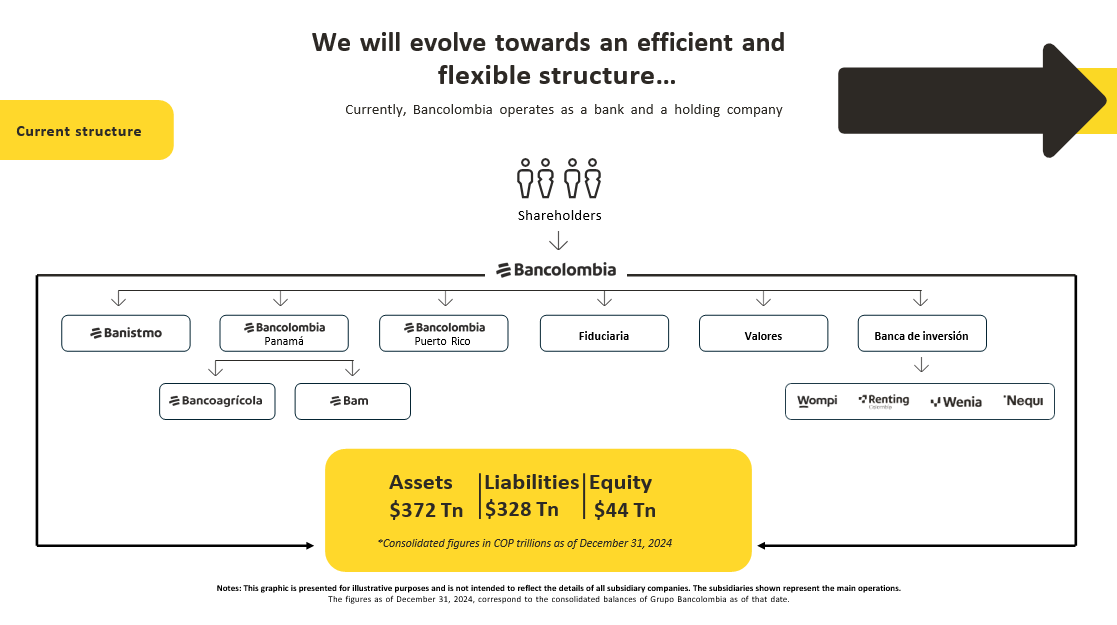

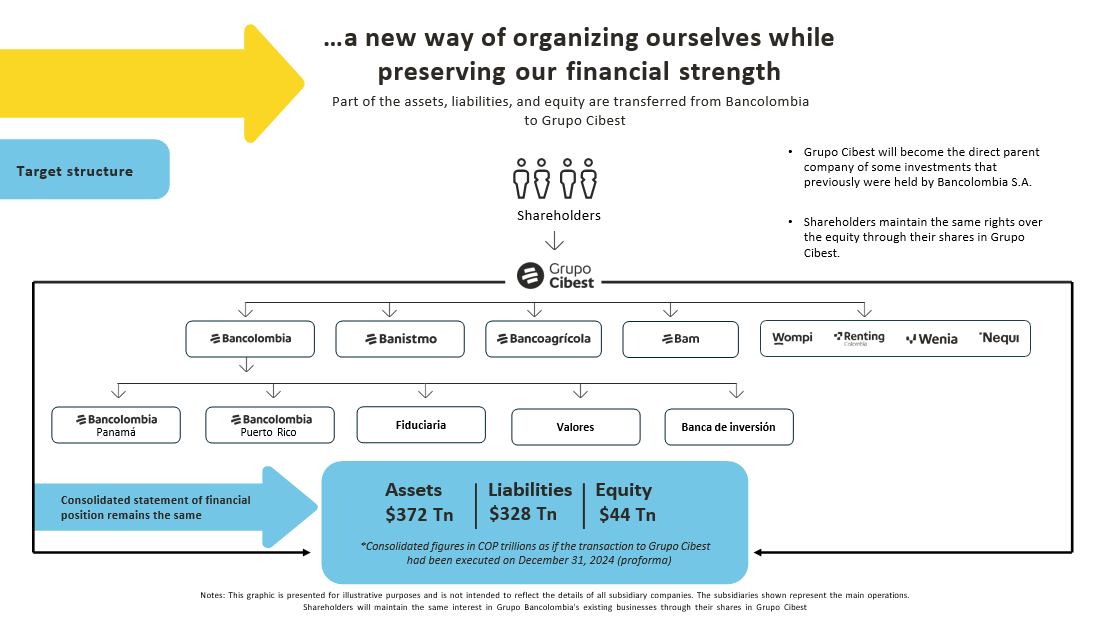

In 2024, we begun a new phase of the organization by announcing the creation of Grupo Cibest, a holding or parent company that will become the owner of all financial and non-financial businesses currently known as Grupo Bancolombia, including Bancolombia S.A.

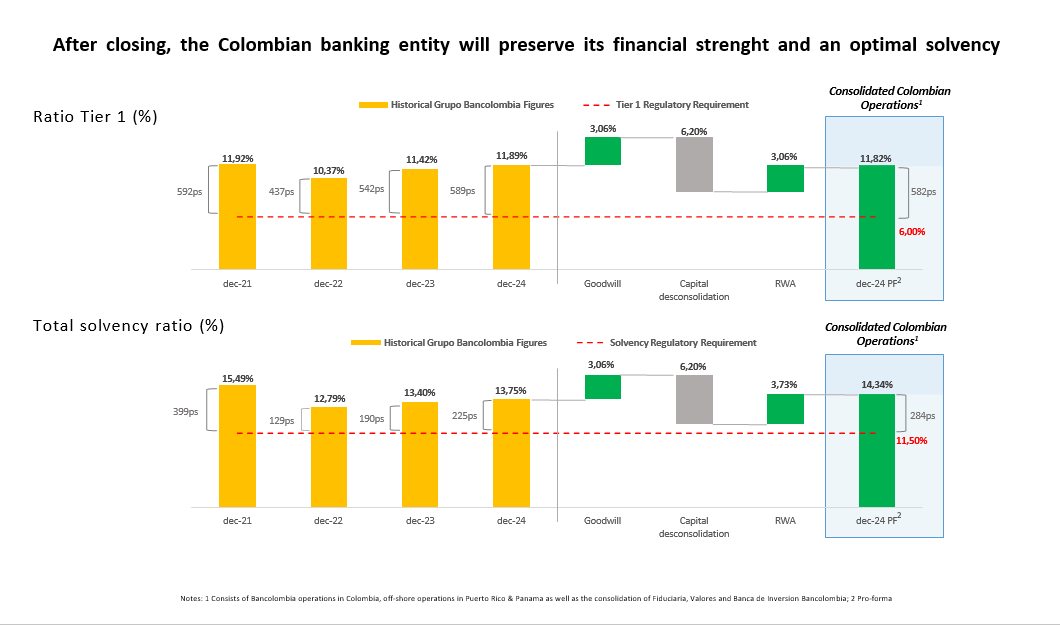

This change in the corporate structure will mean a new way of organizing ourselves based on the same equity that our shareholders hold of Bancolombia, today; thus, preserving the financial strength that has allowed us to strive towards our purpose of promoting sustainable development to achieve the well-being of all.

With Grupo Cibest, we will be able to:

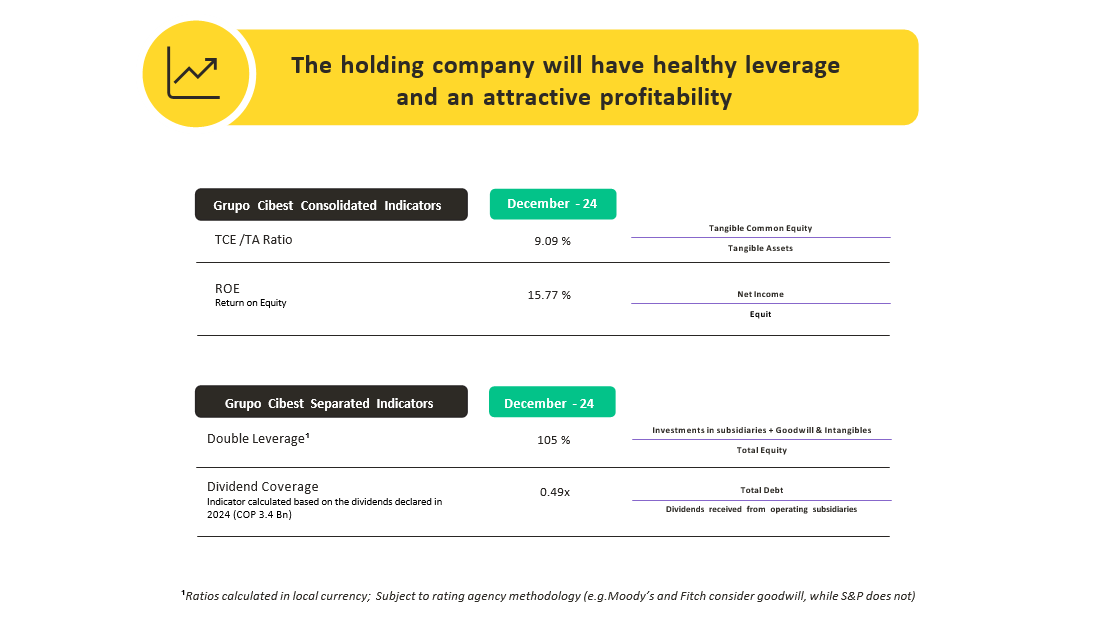

•Be more efficient in the use of capital and therefore, achieve a greater capacity to generate value for our shareholders.

•Achieve greater flexibility in the allocation of capital to different businesses, based on their growth potential and profitability.

•Conduct occasional share buybacks (with shareholder approval).

•Produce value for our stakeholders.

All of this while preserving our financial strength and the ability to meet all our obligations.

Now, let's look in detail at what the evolution of our structure towards Grupo Cibest means, through the story of Carlos and María, two of Bancolombia's 45,000 shareholders.

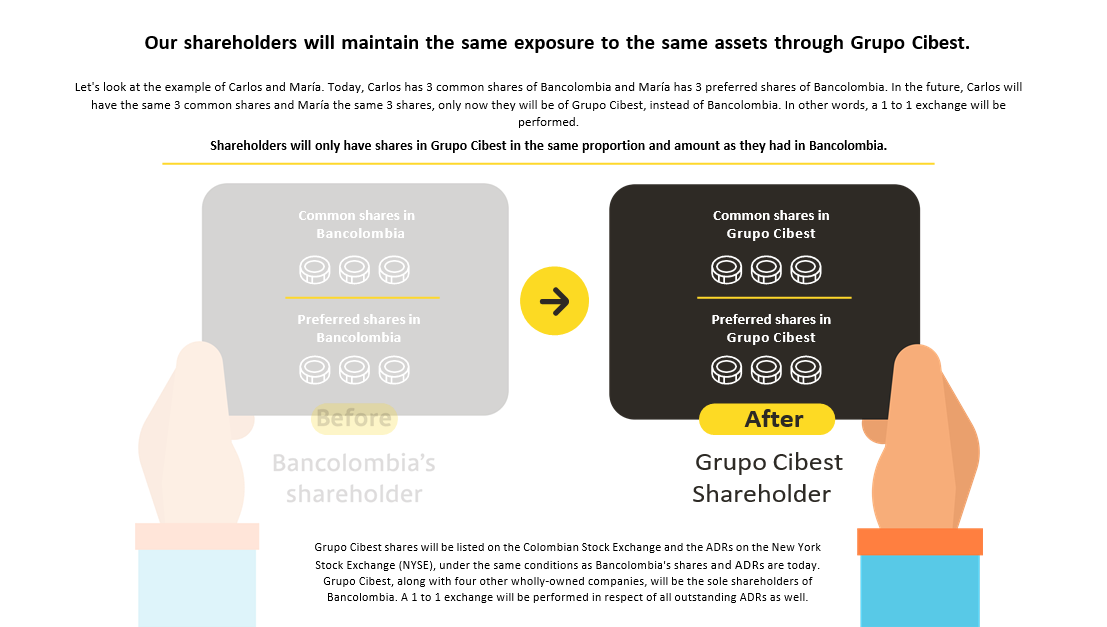

Today, Carlos owns 20 common shares and María owns 15 preferred shares, both of Bancolombia S.A., the financial institution we all know and which, until now, has served as a parent or holding company, grouping financial and non-financial assets in Colombia and the other countries where we operate.

In the future, Carlos will hold the same 20 common shares and María the same 15 preferred shares, only now they will be of Grupo Cibest, instead of Bancolombia. Simply put, both will continue to be owners of the same assets (or companies), including Bancolombia, and retain the same rights, but now through their shares in Grupo Cibest. Likewise, ADR holders will hold the same number of ADRs in Grupo Cibest as they do today in Bancolombia.

It is a different way of organizing ourselves that will offer us new and greater possibilities for growth, impact, and profitability so that Carlos, María, and thousands of shareholders and other stakeholders can continue to receive the generation of value and place their trust in us.

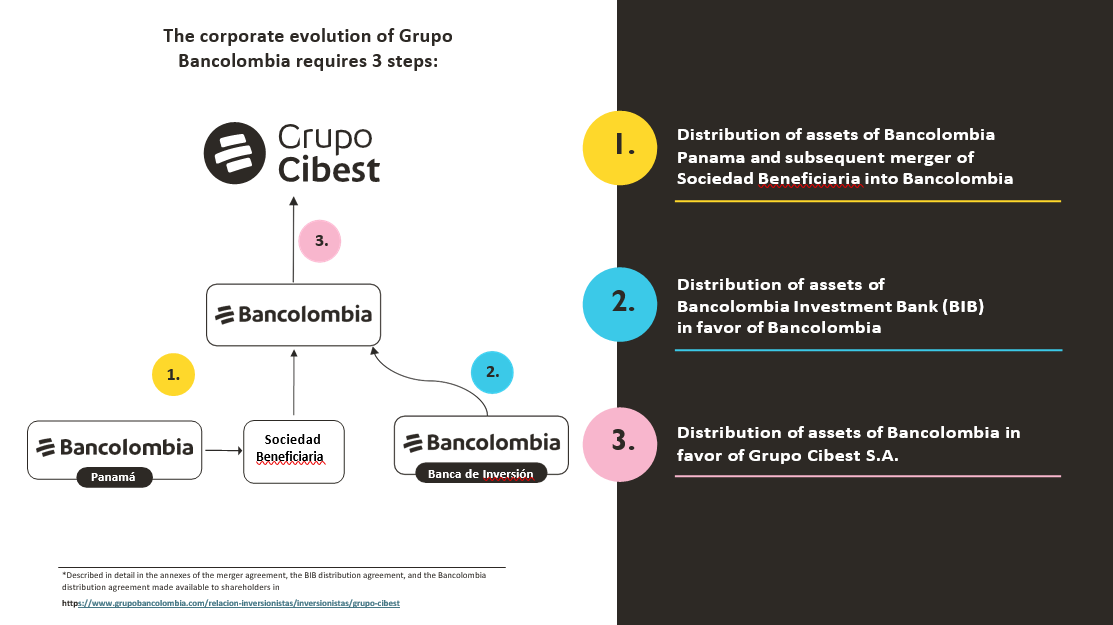

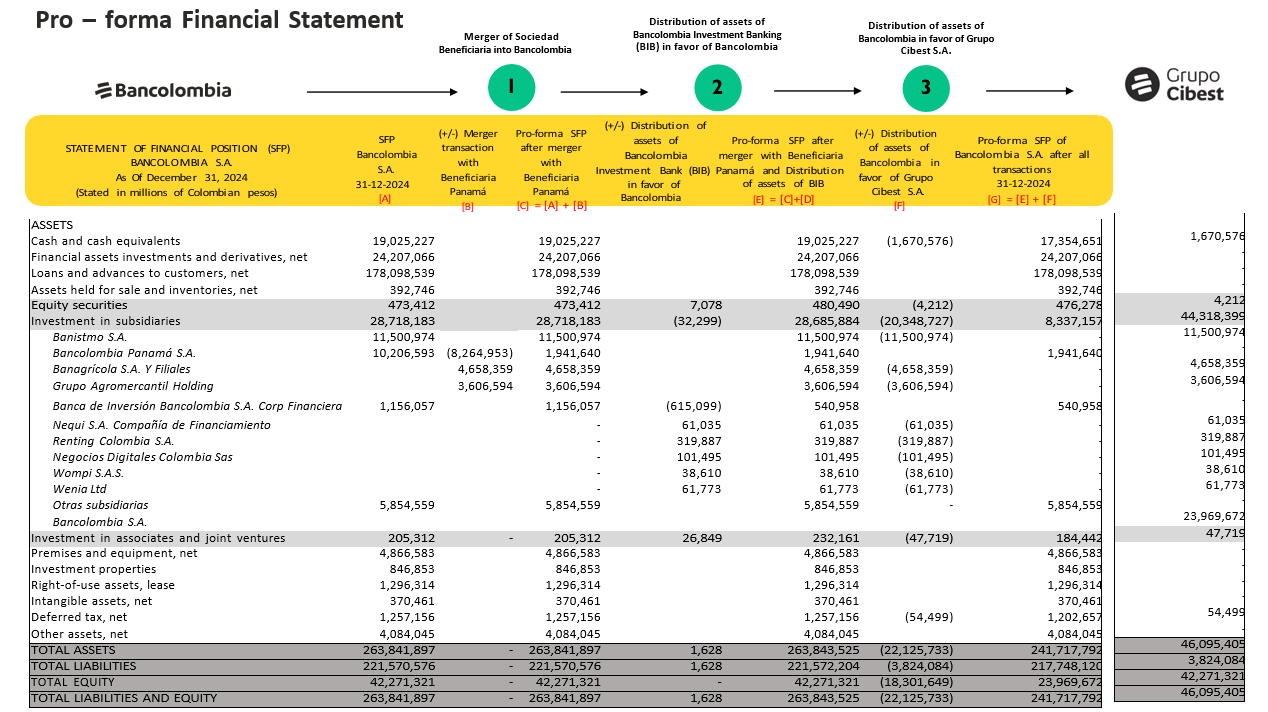

To make this a reality, a series of operations or transactions will be required, in which those companies that are not currently under Bancolombia will come directly under it, so that, subsequently, Bancolombia can transfer them to Grupo Cibest.

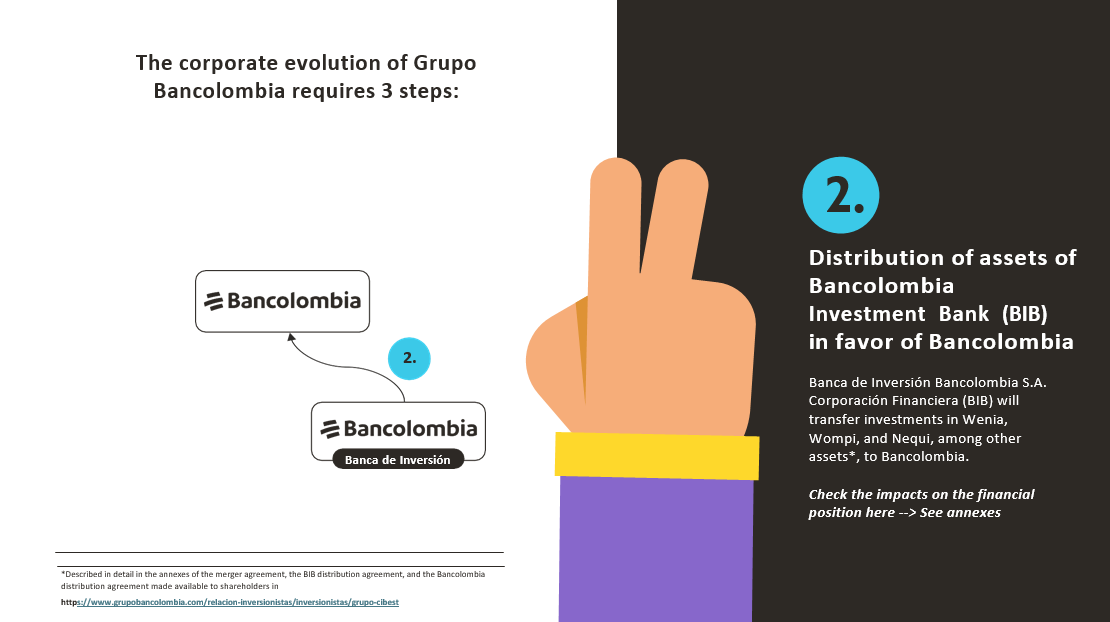

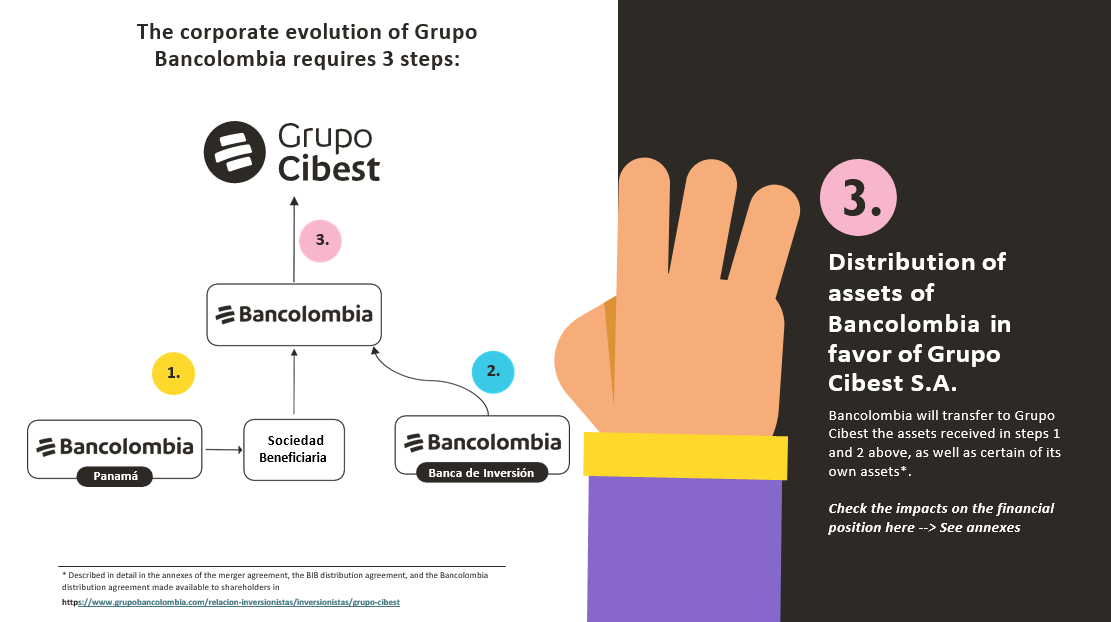

Let's look at this in detail:

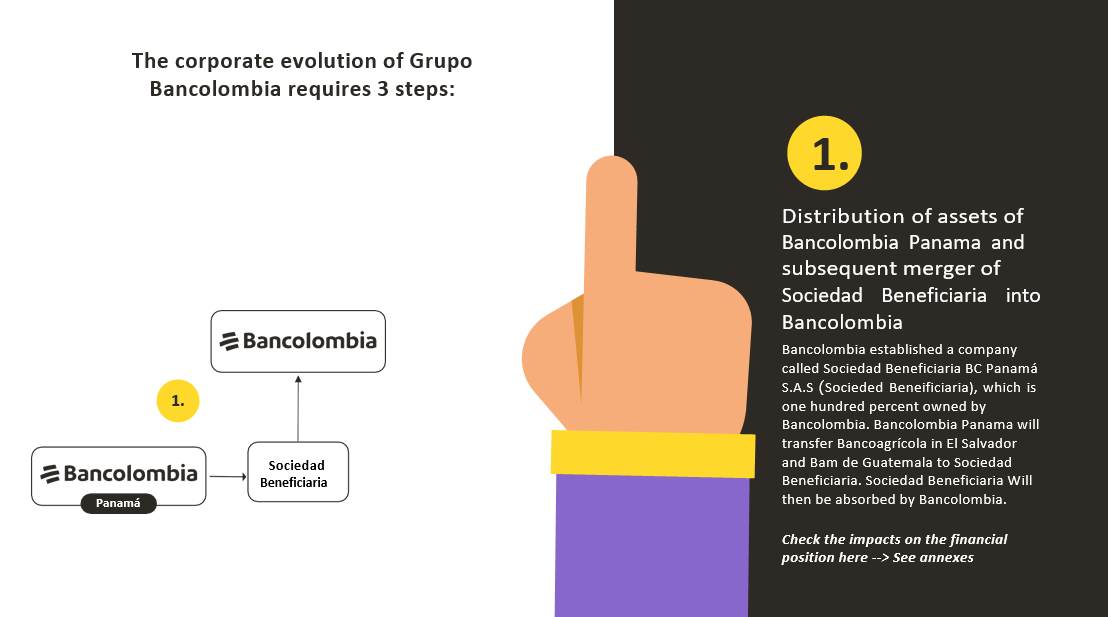

First, Bancolombia Panama will transfer the financial groups Bancoagrícola, from El Salvador, and Bam, from Guatemala, to Sociedad Beneficiaria BC Panama, and then, Sociedad Beneficiaria BC will merge into Bancolombia.

Technically, this involves a distribution of assets and a merger.

Next, in the second step, Banca de Inversión Bancolombia will distribute other assets to Bancolombia. In this case, companies such as Wompi, Renting, Wenia, Nequi, and others, will move to Bancolombia S.A.

Finally, Bancolombia will distribute all the assets received from the previous two movements, as well as some of its own assets, such as Banistmo, to Grupo Cibest S.A., finalizing the formation of our new holding company structure.

It is very important to highlight that neither Carlos nor María have to perform any task for the exchange of shares nor will they be affected by these operations, which will be carried out simultaneously: One day they will go to bed as owners of Bancolombia shares and the next day they will wake up as owners of Grupo Cibest shares, which will remain listed under the same conditions on the Colombian Stock Exchange and on the New York Stock Exchange in the case of ADRs, and will maintain the capacity and resources to meet all obligations in a timely manner.

These operations will have no impact on deposit customers, bondholders, suppliers, or any of Bancolombia's creditors, as the bank will continue to have the ability to meet all obligations with all stakeholders.

We are confident that this new stage will further boost our commitment to continue growing with a focus on value generation and comprehensive solutions for more than 30 million customers in Colombia, Panama, El Salvador, and Guatemala, as well as in other geographies where we reach with our products and services.

Together we will continue to build a story in which each of our actions translates into well-being for everyone.

This video is made for illustrative and educational purposes. For details of the operations and technical matters, you can consult [link: Grupo Cibest, an ecosystem of brands, financial and non-financial products and services].

Important information:

The information included in this communication represents only a summary of the transaction proposed by Bancolombia S.A. to its shareholders and does not constitute all the information on which they should base their decision.

This communication does not replace the information contained in the notices to shareholders, nor the other information that has been made available to shareholders by right of inspection or on the Grupo Bancolombia website, so all respective material published on the Bancolombia investor page at www.grupobancolombia.com/investor-relations/investors/grupocibest must be consulted and is

considered essential before making any decision. The figures as of December 31, 2024, included in this communication are shown for illustrative purposes. Corporate transactions must be approved based on the special purpose financial statements as of Jun2024.

The content of this communication or message does not constitute a professional recommendation to make investments within the terms of article 2.40.1.1.2 of Decree 2555 of 2010 or the regulations that amend, replace, or supplement it.

This communication does not constitute a public offer, or a solicitation of an offer, to buy or sell any security. Any information contained herein may be corrected or supplemented by Bancolombia S.A. This communication also does not constitute a recommendation for the sale of securities, in any jurisdiction where such offer, solicitation, or sale would be illegal prior to registration or qualification under the securities laws of such jurisdiction.

Bancolombia has filed a registration statement on Form F-4 (the “Form F-4”) with the U.S. Securities and Exchange Commission (the “SEC”) to register the common and preferred shares (including the preferred shares to be issued in respect of American depositary shares) to be issued by Grupo Cibest in connection with the Corporate Structure Changes of Bancolombia and its subsidiaries under the U.S. Securities Act. The Form F-4 includes a preliminary prospectus. The Form F-4 was declared effective by the SEC on March 21, 2025. The final prospectus, which was filed with the SEC on March 21, 2025, will be sent to holders of Bancolombia’s common shares, preferred shares and American depositary shares residing in the United States. Shareholders are encouraged to read the Form F-4, including any amendments thereto, and the other documents Bancolombia files with the SEC in connection with the Corporate Structure Changes of Bancolombia and its subsidiaries because they contain important information about the Corporate Structure Changes of Bancolombia and its subsidiaries.

This communication contains statements that may constitute "forward-looking statements." These forward-looking statements are not based on historical facts but rather represent our beliefs regarding future events, many of which, by their nature, are inherently uncertain and beyond our control. Words such as "anticipate," "believe," "estimate," "approximate," "expect," "may," "intend," "plan," "predict," "target," "forecast," "guideline," "should," "project," and similar words and expressions are intended to identify forward-looking statements. Actual results may differ, possibly materially, from the anticipated results indicated in these forward-looking statements. Forward-looking statements speak only as of the date they are made, and no obligation is assumed to publicly update or revise any forward-looking statement after the date it is made in light of new information, future events, and other factors.