UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of April 2024

Commission File Number 001-32535

Bancolombia S.A.

(Translation of registrant’s name into English)

Cra. 48 # 26-85

Medellín, Colombia

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F þ Form 40-F ◻

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):___

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(2):___

Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ◻ No þ

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- .

EXHIBIT INDEX

|

Exhibit Number |

|

Description |

1

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

BANCOLOMBIA S.A. |

|

Date April 9, 2024 |

By: |

/s/ JOSE HUMBERTO ACOSTA MARTIN. |

|

Name: |

Jose Humberto Acosta Martin. |

|

Title: |

Vice President of Finance |

April 9, 2024

Medellín

Contacts |

|

|

|

Julian Mora Gomez |

Jose Humberto Acosta |

Catalina Tobon Rivera |

|

Corporate VP |

Financial VP |

IR Director |

|

Tel.: (57 601) 4042436 |

Tel.: (57 601) 4885934 |

Tel: (57 601) 4485950 |

|

2

2023 REGULAR FISCAL YEAR-END REPORT

BANCOLOMBIA S.A.

CARRERA 48 # 26-85, MEDELLÍN, COLOMBIA

*The issuer's outstanding securities can be found in the Our Shareholders section.

The issuer's legal representative certifies that the provided information covers all material aspects of the company.

1

Contents

2

3

4

In this report, we cover the key topics of our management in 2023. We report on the main achievements aligned with the strategy and the goals to be met.

In the final segment, we present the Global Reporting Initiative (GRI) content index, the economic, environmental, and social indicators that contribute to the compilation of a sustainability report. We also present the Sustainability Accounting Standards Board (SASB) indicator index to estimate structured reporting of these indicators in this first year.

This document has been prepared per the Core option of the GRI Standards. We will continue to use this methodology to deliver a management report increasingly tailored to different stakeholders and to continue learning in the process. This report was verified by a third party who reviewed its content adaptation to the Global Reporting Initiative's Sustainability Reporting Standard (GRI Standard).

Likewise, we demonstrate our commitment to sustainability by showcasing our efforts in voluntarily managing the 10 Global Compact Principles, our contribution to the fulfillment of the Sustainable Development Goals (SDGs), the commitments of the Paris Agreement, and participation in frameworks such as the Dow Jones Sustainability Index (DJSI), Equator Principles, United Nations Environmental Program - Financial Initiative (UNEP FI), Carbon Disclosure Project (CDP), Principles for Responsible Investment (PRI), Principles for Responsible Banking, Partnership for Carbon Accounting Financials (PCAF), Net Zero Banking Alliance (NZBA), Task Force on Climate-Related Financial Disclosure (TCFD), the Global Investors for Sustainable Development (GISD) Alliance, and the Glasgow Financial Alliance for NetZero (GFANZ), among others.

We promote sustainable development to achieve the well-being of ALL.

We have selected three strategic approaches that align with the United Nations SDGs. We believe they will help us achieve our purpose and measure our outcomes.

5

We enhance the competitiveness of the production network

Quality education

Gender equality

Sustainable cities and communities

Climate action

Industry, innovation, and infrastructure

SDGs

Decent work and economic growth

No poverty

We develop sustainable cities and communities

We promote financial inclusion

| I. | ABOUT GRUPO BANCOLOMBIA |

Grupo Bancolombia aims to promote sustainable development for the well-being of all.

This technology roadmap serves as a guide for over 30,000 employees within our organization. Our purpose is to positively influence the economy, society, and environment in all our endeavors. We uphold a culture of ethics and integrity to achieve this goal.

For nearly 150 years, we have evolved and grown continuously. This has led us to become what we are today: a group present in Colombia, Panama, Guatemala, and El Salvador. In these countries, we work daily to strengthen the productive network, develop sustainable cities and communities, and promote financial inclusion.

This is made possible thanks to a broad range of financial and non-financial solutions and the largest physical and digital network that provides services to over 30 million individuals and companies. They rely on us in an easy, timely, reliable, and close way, and we always strive to ensure financial well-being.

With our banking activity (accounts, deposits, transactional services, consumer, commercial, and housing credits, microcredits, and our A la Mano and Nequi platforms), leasing, renting, stock brokerage, trust, investment banking, and capital market solutions, we meet the needs of households and businesses. We also promote initiatives that foster growth, competitiveness, and quality of life in the countries where we operate.

6

In Colombia, we serve individuals and companies with our solutions through brands like Bancolombia, Plink, Wompi, Nequi, Sufi, and Renting. We also operate in Panama as Banistmo, Guatemala as BAM, and El Salvador as Banco Agrícola.

We understand that financial services are just one aspect of people's and businesses' needs. That is why we are expanding our capabilities in collaboration with other players to become a platform that provides comprehensive solutions and ensure that our products and services are integrated into third-party platforms.

Our shares have been listed on the Colombian capital market since 1981 and on the New York Stock Exchange (NYSE) since 1995. This ensures continuous access to both local and international capital markets, as well as ongoing enhancement of our corporate governance practices.

According to the Company Monitor on Corporate Reputation (MERCO), our company has been acknowledged as having the best reputation, corporate governance, and ability to attract and retain talent in the country for several years.

Our commitment extends beyond our borders. We are aligned with the United Nations Sustainable Development Goals and collaborate with global stakeholders to find solutions to the environmental and social challenges facing the world.

In short, this is the path we have chosen to grow beyond profitability. We aim for our impact on the economy to result in a better quality of life in our societies. Similarly, our long-term vision is to build a future of well-being for ALL.

At Grupo Bancolombia, we promote sustainable development to achieve the well-being of ALL. Every day, we evolve to address the economic, environmental, and social challenges we face by aligning ourselves with a global agenda framed by the 17 Sustainable Development Goals of the UN.

Our 149 years of solidity and experience enable us to be the financial ally of over 30 million customers, including individuals, independent workers, small and medium-sized enterprises (SMEs), companies, and corporations. We offer them a wide range of products and services through which we materialize our purpose of creating well-being. Beyond financial alternatives, we proactively provide comprehensive solutions to our customers' everyday needs.

This evolution is part of our action plan to address the challenges of an ever-changing environment. Our purpose guides our strategic priorities. This vision of success seeks to ensure our sustainability as an organization while positively impacting the well-being of society.

Our strategic objectives stem from the premises that we develop below:

Achieving the Well-Being of All

We provide services that generate well-being and development in the communities where we operate. We want to be the ally that enables them to seize opportunities and better manage their resources in their day-to-day lives. To achieve this, we strengthen the competitiveness of companies (the country's productive network). We promote financial inclusion so that more individuals and companies can integrate and contribute to economic development. Additionally, we offer solutions that contribute to the construction of more sustainable cities and communities.

7

In this way, we contribute to making the planet increasingly cleaner.

Achieving Customer Loyalty and Preference

We are a customer-focused organization. We stand out by providing reliable, approachable, timely, and user-friendly experiences for our customers. We want to earn their loyalty by being their top choice for recommendation ahead of other competitors. To achieve this, we prioritize enhancing service delivery by increasing speed and minimizing obstacles. We also advocate for adopting digital solutions to streamline their processes and enhance efficiency. We endeavor to offer a range of improved options for managing their finances, providing solutions that meet their everyday needs.

Maintaining Financial Stability through Responsible Growth

We manage risk prudently by ensuring stability (credit risk + liquidity), anticipating moderate economic growth, and maintaining good performance in our portfolio deterioration. We leverage our growth by enabling pre-approvals, instant responses, and personalized offers from our financial and non-financial portfolio tailored to our customers' needs. We prioritize our efficiency by proactively managing the organization's expenses and focusing on becoming increasingly productive.

Building Culture and Talent to Foster Competitiveness

We have a team of over 34,000 employees across the four countries. Every day, they rise to work within a strong culture driven by dynamism, ethics, and integrity. Our employees focus on customers and sustainable growth. They always strive to achieve extraordinary performance. Our talent is one of our core assets. Accordingly, we ensure their well-being and professional development. We aim to recruit and retain top talent in the market. We instill the principles that define our distinctive culture within our staff. Furthermore, we continuously enhance inclusivity, equity, simply, approachability, and empathy toward our customers' diverse realities and expectations.

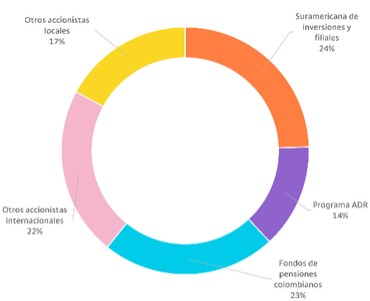

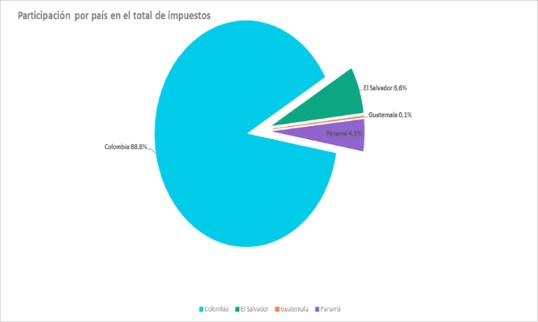

Suramericana de Inversiones and Subsidiaries 24%

Other local shareholders 17%

|

Common |

Preferred |

Total |

Suramericana de Inversiones and Subsidiaries |

46.2% |

0.0% |

24.5% |

ADR program |

0.0% |

28.9% |

13.6% |

Colombian Pension Funds* |

20.5% |

25.2% |

22.7% |

Other International Shareholders |

21.4% |

23.0% |

22.1% |

Other Local Shareholders |

11.9% |

23.0% |

17.1% |

ADR Program 14%

Colombian Pension Funds 23%

Other international shareholders 22%

*Private Funding

8

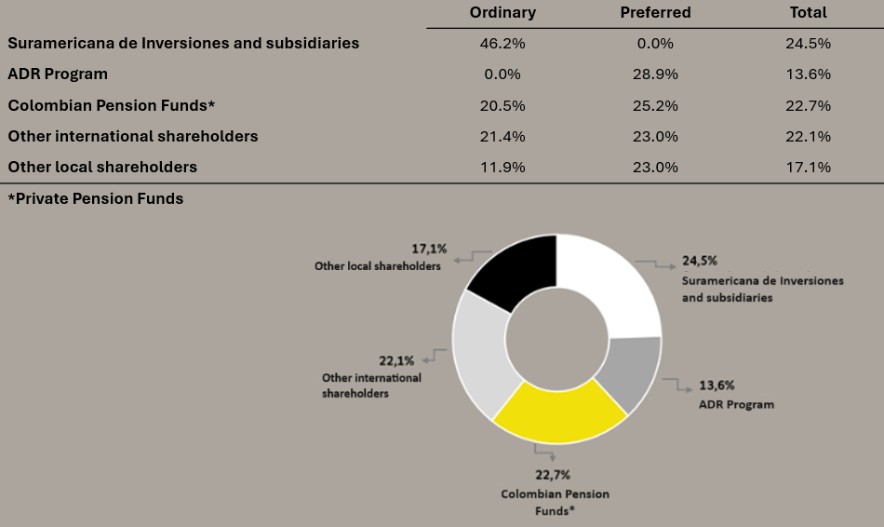

Asset Type |

Common Shares |

Preferred Shares |

Trading System |

Stock Exchange |

Stock Exchange |

Stock Exchange |

Colombian Stock Exchange (BVC) |

Colombian Stock Exchange (BVC) |

Outstanding Shares (12/31/2023) |

509,704,584 |

452,122,416 |

Number of Shareholders |

16,640 |

25,552 |

Amount Issued |

509,704,584 |

452,122,416 |

Amount Placed |

509,704,584 |

452,122,416 |

Bancolombia has a Level III ADR listed on the New York Stock Exchange. Each ADR is equivalent to four preferred shares.

Type of Shares |

Number of Outstanding Shares |

Number of Shareholders Owning a Type of Shares |

Percentage of Participation in Share Capital for Each Type of Share |

Common |

509,704,584 |

13,988 |

52.99% |

Preferred |

452,122,416 |

22,900 |

47.01% |

Total |

961,827,000 |

39,540* |

100% |

*2,652 shareholders have common and preferred shares.

Board of Directors

9

Vice President of Legal Affairs and Secretary General

Vice President of Risk Management

Vice President of Products

Vice President of Business

Vice President of Finance

Corporate Vice President

Vice President of Corporate Services

Vice President of Internal Audit

Vice President of Innovation and Sustainability

Bam President

Bancoagrícola President

Banistmo President

Grupo Bancolombia President

| ● | According to the MERCO, Bancolombia remains the financial institution with the best capacity to attract, develop, and retain talent in the country. This recognition demonstrates its effort to promote quality of life and well-being among its more than 23,000 employees. |

| ● | Bancolombia is the only Colombian financial institution that ranked in the top 5% of the best banks in the S&P Sustainability Yearbook. This ranking distinguishes companies in each sector with the greatest strengths in this area. |

| ● | According to the MERCO, Bancolombia has been recognized as the company with the best reputation in the country for the ninth time for its performance beyond financial metrics and drive towards sustainable development for the well-being of all. |

| ● | Juan Carlos Mora and Cristina Arrastía were listed in Bloomberg's ranking of the 500 most influential people in Latin America and the Caribbean for 2023. |

| ● | The Economic, Sectorial, and Market Research team consolidated its leadership by receiving eight awards in 11 categories at the AIE awards from the Colombian Stock Exchange. |

10

| ● | The Board of Directors of Bancolombia is among the best in the country according to KPMG’s Board Leadership Center. |

| ● | Bancolombia has solidified its position as the most sustainable bank in Colombia according to the Dow Jones Sustainability Index (DJSI). This index measures the performance of leading companies worldwide in environmental, social, and corporate governance (ESG) issues. |

| ● | According to the MERCO, Bancolombia is the Colombian company with the highest environmental, social, and corporate governance responsibility. |

| ● | Global Finance recognized Grupo Bancolombia Capital as the Best Investment Banking in Colombia and El Salvador. It also highlighted it as one of the most innovative organizations in designing financial solutions with ESG criteria. |

| ● | Best bank for small and medium-sized enterprises in Colombia, according to the Euromoney Awards for Excellence 2023. |

| ● | BAM was recognized as Guatemala's top bank in the 2023 Summa Magazine ranking of diverse, equitable, and inclusive companies in Central America and the Dominican Republic. |

| ● | The QR Code received the Platinum Award in Colombia in the Financial Inclusion Category at Fintech Americas 2023. |

| ● | Bancolombia was named Bank of the Year 2023, according to Latin Finance. |

| ● | With Bancolombia a La Mano and Crédito a La Mano, Bancolombia won in the 'Digital Transformation' category at the Acercando La Banca a Los Colombianos awards presented by Asobancaria. |

Communication with our Stakeholders

We implement communication and engagement strategies with our different stakeholders to identify how we are generating shared value through the most relevant economic, social, and environmental actions. To learn more, click here and go to the Communication with our Stakeholders section.

| II. | MAINTAINING FINANCIAL STABILITY THROUGH RESPONSIBLE GROWTH |

Main Trends in the Region (LAC)

In 2023, Latin America's major economies faced a combination of challenges and opportunities that shaped their performance. Economic uncertainty, political changes, and external factors influenced the region's growth, estimated at 2.3% (compared to 4.1% in 2022) according to the International Monetary Fund (IMF). It occurred amidst a widespread backdrop of slowdown, persistent inflation, and restrictive financial conditions.

The global economic landscape was a key factor. The region relies heavily on international trade. Fluctuations in global demand and commodity prices hit export-driven economies.

11

While some countries benefited from increased demand for commodities, others faced challenges due to market volatility.

Trade agreements also played a key role. The region engaged in negotiations to strengthen existing trade partnerships and explore new opportunities. This action was aimed at improving market access, reducing trade barriers, and fostering economic cooperation. In this regard, it is worth highlighting the favorable performance of economies such as Brazil (estimated GDP growth of 3.1% for 2023), Mexico (3.2%), and Panama (4%). These economies have capitalized on opportunities (near-shoring, friend-shoring) amidst global fragmentation to attract investment and energize various productive sectors.

Inflation captured the world's attention. Some countries experienced persistent inflationary pressures driven by high commodity prices and wages. This affected consumers' purchasing power and weakened demand. While in certain nations the deflationary process accelerated during the second half of 2023, even allowing their central banks to start cutting interest rates (Brazil, Chile, Peru, and Colombia towards the end of the year), the inflationary challenge is still ahead. Likewise, its drag has impacted growth.

Finally, political dynamics played a crucial role in shaping economic policies. Several countries in the region experienced elections or political transitions in 2023. These led to adjustments in economic strategies. The level of political stability influenced investor trust, the ability to implement revitalization policies, and consequently, economic growth. This trend is observable in countries such as Argentina (-2.5% expected contraction in 2023), Chile (-0.5%), Peru (1.1%), and Ecuador (1.4%).

While some countries grappled with uncertainties, others demonstrated resilience and adaptability. This was achieved by leveraging innovation and sustainable practices to attain positive economic outcomes. The region's performance underscored the importance of comprehensive policies addressing various economic, social, and environmental aspects to foster long-term growth and stability.

Colombia

A look at recent economic history reflects the progress made in the normalization of growth in the post-pandemic era. This is accompanied by a persistent behavior of inflation. Indeed, the Colombian economy contracted as a result of the pandemic in 2020 (-7.3%). It then rebounded in 2021 with a historic expansion (11%). The slowdown in 2023 leaves the economy with low growth (0.6%). However, it is still amidst high inflation (9.6%) and high interest rates.

Given the restrictive financial conditions, it was expected that 2023 would be a year of slowdown and normalization for the Colombian economy. Even so, the slow decline in inflation, driven by high prices of regulated goods, will entail a cautious monetary policy stance amid the downturn in the economic cycle. Returning to inflation levels within the tolerance range of the Bank of the Republic (2%-4%) and the targeted potential growth (3%-3.5%) will take more time and prudence. Nevertheless, the economy is heading in that direction.

12

As a result, the most affected sectors were those most sensitive to the challenging combination of high prices and rates, such as construction (-6%), manufacturing (-3.7%), and commerce (-2.1%), in real terms. Construction activity represents the backbone of investment in the country. However, this sector faces a landscape where major national infrastructure projects are not on the horizon, given the short-term focus of public spending on social programs. Similarly, the sharp decline in home sales would continue to exert downward pressure on the sector's activity.

The lingering effects of the economic slowdown and persistent inflation have also begun to exert pressure on the labor market. National unemployment increased to 9.9% in October and could return to double digits in the coming months. This is despite the public sector's push, which has been instrumental in increasing the number of employed individuals in 2023.

Finally, the economic slowdown will also put pressure on public finances, especially given the government's stance on increasing expenditure. This will mainly be directed towards strengthening social policies, particularly cash transfer programs and subsidies.

El Salvador

In the first half of 2023, El Salvador’s economy was driven by public consumption, public and private investment, and the dynamism of the public administration and construction sectors. According to the Central Reserve Bank of El Salvador, increased security in the country has benefited tourism and investment decisions. This has also driven tourism and commerce construction alongside public projects in road infrastructure, sports venues, and private investments in residential sectors. In this scenario, El Salvador's GDP recorded a solid progress in the second quarter of the year (3%). This came after the modest figure of 0.8% in the first quarter of 2023.

Regarding prices, El Salvador reached its inflation peak in June 2022 with a record of 7.8% annually. Since then, it has decelerated to close 2023 at an annual rate of 1.2%. This result is attributed to the reduced dynamics of food prices but faces upward risks in the coming months due to the intensity of the El Niño phenomenon and rising fuel prices. We anticipate that El Salvador's inflation will reach 1.9% by the end of 2024.

A significant driver of the economy, particularly household consumption, is remittances. They account for about 24% of GDP, making El Salvador the third most dependent country in Latin America on them. They even contribute more income than exports. In 2023, the total remittances received exceeded USD 8,181 million (+4.6% annually).

Guatemala

During the first two quarters of 2023, the GDP expanded by 3.7% and 3.8%, respectively. Similar to El Salvador, the resilience of the labor market in the U.S. has allowed Guatemala to benefit from the strength in remittance inflows as they represent around 16% of GDP and drive household spending. In the latter half of the year, activity was impacted by political uncertainty and recent social unrest. As a result, it grew by 3.5% in the full year of 2023.

13

In February, inflation peaked at 9.9% annually. Since reaching that peak, it has rapidly declined. By June, it returned to the target range (3%-5%). However, upward pressure from fuel prices and protests resulting from social unrest were evident during September and October. Consequently, the Bank of Guatemala has taken actions, resulting in nine increases that brought the interest rate to 5%. This level has remained stable since April 2023.

Panama

Panama's economic activity expanded by 9.3% in the first quarter of the year and 8.2% in the second. These results highlight the strength of production driven by the good performance of commerce and construction. We expect growth to be around 6.9% in 2023 and to decelerate to levels close to its potential in 2024 (around 4%). The construction sector will be the driving force due to public works projects such as the Panama City Metro, a bridge over the Panama Canal, and the construction of a gas power plant. However, the impact of the El Niño phenomenon is one of the main risks to the activity as it could restrict Canal operations.

At the same time, Panama's inflation situation has been somewhat less challenging as it peaked in June 2023 at a rate of 5.2% annually. Nevertheless, it underwent a rapid process of disinflation as a result of the government's freezing of fuel and food prices.

At the same time, various spending pressures and low tax collection would hinder the consolidation of public finances. Under this context, different rating agencies have recently downgraded the country's sovereign rating and the outlook has been revised due to weak tax collection, high dependence on Canal revenues, increased public spending, and the then likely cessation of mine operations.

2024 Economic Outlook

The outlook for 2024 is framed amidst anticipated risks, albeit with lagged effects, and a backdrop of high uncertainty. The global economy is expected to enter a soft landing phase in which inflation decreases without implying a significant slowdown in the economy. Indeed, in its latest edition of the World Economic Outlook (WEO), the IMF forecasts that Latin America will grow by 2.3% in 2024. This reflects its stagnation compared to the previous year.

In 2024, the spotlight will be on the shift in the monetary policy stance of developed economies. This process will unfold cautiously due to the resilience of economic activity and the labor market. Uncertainty about the effects of "higher rates for longer" is also expected to persist.

Furthermore, the gradual process of disinflation would persist, leading to gradual cuts in the policy rate. However, managing the risks of upward price pressures will remain crucial. The prolonged conflicts (Ukraine-Russia, Israel-Hamas) could intermittently drive up international oil prices. Meanwhile, the effects of the El Niño phenomenon will be felt in international trade, agricultural production, and the rise in food and energy prices.

14

Colombia

There are good reasons to believe that the economy may be nearing the end of the most challenging part of the cycle. It's also plausible to anticipate that in 2024, a slow recovery process may begin as inflation subsides and rate cuts persist. However, underlying factors such as investment lag and credit contraction suggest that there will be limitations to returning to potential economic growth levels in the medium term. Consequently, our GDP growth estimate for 2024 is 0.9%.

We anticipate that the most significant macro environments will continue to set the tone. Secondary activities (manufacturing and construction) and trade would continue to deteriorate due to lower private consumption and weak economic growth. Likewise, the primary sector (agriculture and mining) would face challenges from El Niño and regulatory uncertainty (such as in the mining, health, and public services sectors). Meanwhile, service-related activities and those tied to public spending would remain dynamic.

At the same time, the process of moderation in prices will continue. We anticipate that inflation would close around 5.9% by the end of 2024. In the medium term, we believe it will reach the upper limit of the issuer's tolerance range (2%-4%) by mid-2026. This means that the path for the Colombian economy to reach the 3% inflation target will be challenging and prolonged.

Given this context, we expect the rate-cut cycle that commenced in December 2023 with an initial 25 basis points reduction to potentially pick up pace throughout 2024, as inflation continues its path towards the target. Having this in mind, we anticipate that 2024 could end with a monetary policy rate close to 9%.

El Salvador

It is expected that in the coming months, a period of slowdown will begin as the construction boom moderates, household consumption weakens due to tight global financial conditions, persistent high inflation, declining remittance inflows, slower growth among trading partners, and the increasing impact of the El Niño phenomenon. Given this backdrop, we anticipate that the economy will experience moderate growth in 2024 (1.9%) as the delayed effects of the strong monetary tightening cycle become evident and the US economy slows down. Going forward, the economy would recover and grow in the medium term around potential (2.2%).

Guatemala

Regarding Guatemala, we anticipate a slight slowdown in GDP growth in 2024 due to weakening private consumption. This slowdown is because remittances, mostly from the U.S., would decrease as a result of tightening labor market conditions in that country. Therefore, Guatemala's economic growth is projected to be 3.3% in 2024, also supported by stability in the price trend (inflation expected within the range set by the Bank of Guatemala of 3-5%). The primary evident risk is political instability and governance due to the current political and social situation. Now, we expect the elected government to implement measures to increase tax revenues and combat corruption.

15

Panama

Panama's growth outlook remains positive for 2024. It will be bolstered by economic diversification and increased public investment related to the implementation of different public infrastructure projects. While Panama's economy could be significantly impacted by a strong El Niño phenomenon and its implications, particularly on the operation of the Panama Canal, it is estimated to grow by 4% in 2024.

The economy faces a significant downside risk due to the suspension of operations at the Cobre Panama mine. Coupled with the deterioration of the fiscal deficit and debt, it would hinder the country's fiscal consolidation. This could jeopardize its investment grade status and further complicate the management of external and fiscal deficits. Specifically, the fiscal deficit, economic slowdown, and electoral spending pressures would prevent the government from achieving the balance goal for the next year. Furthermore, low tax collection would also be a short-term challenge and another hurdle against achieving the fiscal target.

GDP Growth in Latin America (Annual Variation %) | ||||

Country |

2021 |

2022 |

2023 |

2024 |

Latin America* |

7.2% |

3.8% |

2.1% |

1.6% |

Peru* |

13.4% |

2.7% |

0.3% |

2.3% |

Mexico* |

5.7% |

3.9% |

3.2% |

2.1% |

Chile* |

11.7% |

2.4% |

-0.2% |

1.8% |

Brazil* |

5.0% |

2.9% |

2.9% |

1.5% |

Colombia |

11.0% |

7.3% |

1.2% |

0.9% |

Panama |

15.8% |

10.8% |

5.4% |

4.3% |

Costa Rica* |

7.9% |

4.6% |

4.3% |

3.4% |

Guatemala |

8.0% |

4.1% |

3.1% |

3.3% |

Honduras* |

12.5% |

4.0% |

3.0% |

3.0% |

Nicaragua* |

10.3% |

3.8% |

3.3% |

2.8% |

El Salvador |

11.2% |

2.6% |

2.3% |

1.9% |

Source: Grupo Bancolombia, FocusEconomics. *Focus Economics Forecasts.

Impact of Economic and Monetary Policies on Bancolombia's Results

Bancolombia's operational results are affected by macroeconomic factors, primarily in Colombia but also in the other countries where the Group operates. The key variables include GDP growth, interest rates, inflation, and exchange rates, mainly the USD to COP exchange rate. The trends of these variables for Colombia in 2023 are summarized below.

Economic Activity

Colombia's real GDP growth in 2023 was 0.6% annually. Thus, 2023 was a period of marked weakening of Colombia's economic dynamics, following a period of high GDP growth in 2022 (of 7.3% per annum).

16

This sharp drop in GDP growth has been part of a cycle in which Banco de la República significantly increased the policy interest rate to address inflationary pressures. Consequently, high-interest rates began to strain household and corporate budgets. It led to a decrease in both consumption and investment capacity. Similarly, public investment budget execution was also low.

The growth of the key components of GDP in 2023, at constant prices, was as follows: fixed investment decreased 8.9%, total consumption grew 1.1%, imports decreased 14.7%, and exports increased 3.1%.

The sectors that experienced the most dynamic growth in the first three quarters of 2023 (compared to the same period in 7.9) were arts, entertainment, and recreational activities along with other service-related activities (demonstrated an annual growth of 7.0%), financial and insurance activities (3.9%), and the macro environment encompassing public administration, defense, health, and education (4.0%).

Monetary Policy Interest Rate

As of December 31, 2023, the reference interest rate set by the Bank of the Republic stood at 13.00%. This followed a 125 basis points increase during the first half of the year and a 25 basis points reduction in December. Thus, the year concluded with a signal indicating the beginning of the phase of interest rate cuts in monetary policy.

Despite the initial rate cut, the stance of monetary policy remains highly contractionary. The Central Bank has considerable leeway to continue with the interest rate-cutting process while maintaining the contractionary stance of the policy. This will allow inflation to continue approaching its target throughout 2024.

Inflation

The annual consumer inflation (measured by CPI) stood at 9.28% at the end of 2023. It is significantly lower than the 13.12% recorded in 2022. In 2023, inflation was driven up by transportation (with a 15.42% annual increase), restaurant and hotel services (a 13.22% increase), and alcoholic beverages and tobacco (an 11.95% increase). Conversely, prices for information and communication services (with an annual increase of 0.12%), food and non-alcoholic beverages (a 5.00% increase), and clothing and footwear (a 5.23% increase) experienced the least growth.

In the latter part of 2023, annual inflation consistently exhibited a slow downward trend. This pattern is anticipated to persist throughout 2024 and underscores the likelihood of the policy interest rate continuing to decrease, albeit at an equally slow pace.

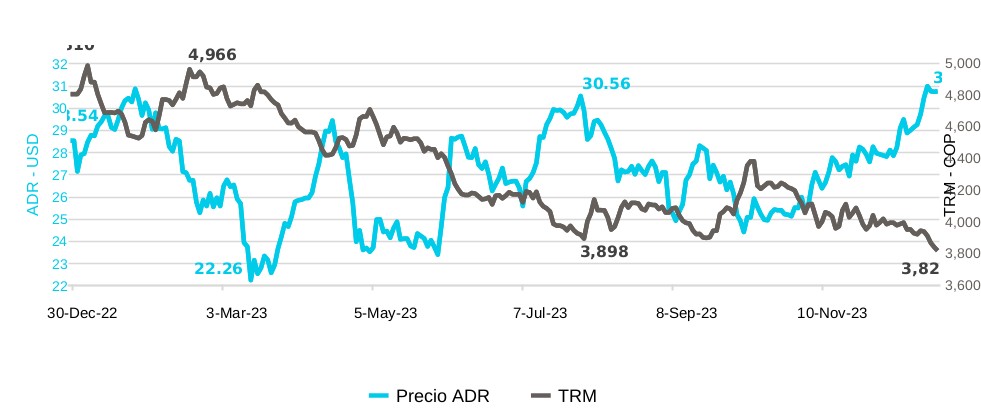

Exchange Type

The Colombian peso appreciated by 20.54% against the US dollar during 2023. The USD to COP exchange rate closed the year at COP 3,822.05. This contrasts with the 20.82% depreciation experienced by the pair in 2022, which resulted in a year-end closing of COP 4,810.20. Therefore, 2023 marked a year of recovery for the Colombian peso following the setbacks experienced in 2022. Several indicators of institutional strength, along with positive economic outcomes such as a reduction in the checking account deficit and the beginning of the inflation normalization process, would be the primary factors driving the currency's strengthening.

17

Outlooks

The future dynamics of the Colombian economy, the financial sector at large, and Bancolombia in particular are expected to be influenced by the following factors:

Positive Factors for the Colombian Economy in the Medium Term |

Challenges for the Colombian Economy in the Medium Term |

|---|---|

|

Rapid economic recovery from the recession caused by the pandemic. The country is expected to maintain responsible fiscal and monetary policies amidst a stable political environment. Colombia's stable democracy, division of power, and checks and balances underpin the predictability of policy measures and economic pragmatism. A significant decrease in the checking account deficit to 3%-4% of GDP in 2023 from 6.3% in 2022 will help mitigate short-term external vulnerabilities. The Bank of the Republic continues to adhere to its institutional tradition of targeting inflation and allowing the currency to float freely. The country’s ample international reserves help mitigate external vulnerabilities arising from the checking account deficit. Despite a decrease, this deficit remains relatively high compared to peer countries. |

Private investment remains low, which will limit medium-term economic growth. The potentially persistent low investor trust could impact private investment and pose risks to the expectation that GDP growth will return to its potential level, which is slightly above 3% in the coming years. A low medium-term potential growth could lead to challenges for public finances or increased external vulnerabilities. Colombia is exposed to the adverse effects of climate change, especially flooding. With over 80% of its population and economic activity concentrated in roughly 20% of its territory, the country is vulnerable to natural disasters. In terms of revenue, public finances could be affected if commodity prices decline in international markets. The country is exposed to significant volatility in terms of international trade due to its dependence on hydrocarbons. A low level of trade openness and a commodity-dependent export base implies high vulnerability to price shocks. Increased social spending will widen the fiscal deficit in 2024. The risk of civil unrest will remain high throughout the forecast period of 2024-2028. It reflects deep divisions within Colombian society. Likewise, the fragmentation in Congress will hinder rapid progress in addressing issues such as poverty and low-quality education. |

18

Trends, Events, or Uncertainties that Could Materially Impact the Issuer's Operations, Financial Position, or Changes to its Financial Situation

2023 faced a macroeconomic environment marked by rising interest rates and increasing inflation. Despite these challenges, Grupo Bancolombia maintained its margin due to its portfolio composition and the prudent management of funding resources, focusing on market liquidity.

During the same period, high inflation affected the cost of credit by hampering Colombians' ability to meet their financial obligations. This situation led to an increase in provisioning expenses, ultimately impacting the Group's profitability. Similarly, high levels of inflation also impacted operating expenses and put downward pressure on profits.

In 2024, we expect a more restrictive monetary policy as long as inflation keeps decreasing. This might prompt higher lending across various channels, contingent upon a risk appetite that depends on people's borrowing capacity in a year where unemployment rates could face pressure.

The interest rate cuts are expected to lead to a decrease in the net interest margin. Combined with operating expenses largely influenced by inflation, which is still expected to remain outside the target range set by the Bank of the Republic, this could create additional pressure on the financial results.

Grupo Bancolombia Consolidated Results

GRUPO BANCOLOMBIA |

|

|

|

|

|

CONSOLIDATED FINANCIAL STATEMENTS |

|

|

|

|

|

|

|

|

|

|

|

RESULTS AND BALANCE |

|

|

|

|

|

(Closing figures in millions of COP) |

December |

2023 vs. 2022 |

|||

2023 |

2022 |

2021 |

Var $ |

Var % |

|

Operating Income |

48,316,872 |

35,456,762 |

23,780,034 |

12,860,110 |

36.27% |

Net Operating Result |

8,147,526 |

9,744,786 |

5,984,012 |

-1,597,260 |

-16.39% |

Net Profit (Attributable to Shareholders) |

6,116,936 |

6,783,490 |

4,086,795 |

-666,554 |

-9.83% |

Total Assets |

342,928,809 |

352,814,733 |

289,855,048 |

-9,885,924 |

-2.80% |

Net Loan Portfolio and Financial Leasing |

237,728,544 |

254,444,099 |

204,459,001 |

-16,715,555 |

-6.57% |

Net Investments |

28,671,798 |

30,855,773 |

32,009,860 |

-2,183,975 |

-7.08% |

Total Liabilities |

303,879,080 |

312,817,182 |

255,929,590 |

-8,938,102 |

-2.86% |

19

Deposits |

247,941,180 |

250,992,323 |

210,390,848 |

-3,051,143 |

-1.22% |

Equity |

39,049,729 |

39,997,551 |

33,925,458 |

-947,822 |

-2.37% |

20

|

|

|

|

|||

PERFORMANCE AND PROFITABILITY |

|

|

|

|

|

|

|

|

|

|

|

|

2023 |

2022 |

2021 |

|

|

Net Interest Margin |

6.99% |

6.80% |

5.09% |

||

Financial Efficiency |

45.33% |

44.58% |

52.16% |

||

Operational Efficiency |

3.77% |

3.45% |

3.43% |

||

Return on Average Assets |

1.78% |

2.15% |

1.53% |

||

Return On Average Equity |

16.14% |

19.80% |

14.03% |

||

Portfolio Quality |

5.01%* |

3.24% |

4.05% |

||

Total Coverage Overdue Portfolio |

120.04%* |

168.73% |

166.29% |

|

|

Basic Solvency Ratio |

11.42% |

10.37% |

11.92% |

||

Total Solvency Ratio |

13.40% |

12.79% |

15.49% |

||

|

|

|

|

|

|

Accounting accounts parameterization per the Board of Directors report and press release. |

|||||

* This indicator is calculated using the equity balance of the portfolio.

At Grupo Bancolombia, we firmly believe that sustainable success stems from responsible, committed management focused on the well-being of all.

Our total assets closed at COP 342,928,809 million at the end of 2023, marking a decrease of COP 9,885,924 million (-2.8%) compared to the previous year. This decline was mainly attributable to the total net portfolio, which decreased by COP 16,715,555 million, partially offset by an increase of COP 6,829,631 million in other assets.

Considering that the exchange rate shifted from COP 4,810 at the end of 2022 to COP 3,822 at the end of 2023, the foreign currency balances on the Financial Position Statement were affected by a 20.5% appreciation of the peso against the dollar. This appreciation resulted in a decrease of COP 20,050,974 million in the gross loan portfolio, affecting the commercial portfolio by COP 11,950,164 million, the consumer portfolio by COP 4,174,125 million, and the housing segment by COP 3,774,178 million.

21

Deposits also decreased by COP 20,874,006 million. Specifically, time deposits fell by COP 10,222,525 million, while savings and checking accounts decreased by COP 6,700,798 million and COP 3,950,683 million, respectively. Other sources of financing were also reduced by this effect, such as bonds by COP 2,731,686 million and financial obligations by COP 2,368,378 million.

Without the peso appreciation, the gross portfolio grew by COP 4,078,882 million (1.5%). The commercial portfolio increased by COP 2,281,521 million (1.3%), primarily driven by the corporate segment. Likewise, the housing portfolio had an increase of COP 2,653,214 million (7.1%). This was the modality with the most dynamic growth. Also, the consumption pattern decreased by COP 825,005 million (1.4%).

Provisions for portfolio balance and financial leasing increased by COP 743,463 million and closed the year at COP 16,223,103 million. This increase was due to the deterioration of customers in the individual portfolio who were over 90 days in arrears and significant defaults from customers in the construction sector. Meanwhile, the portfolio’s capital coverage over 90 days closed at 183.5%. This underscores the strength we have in dealing with potential future deteriorations.

Throughout the year, other assets experienced an increase of COP 6,829,631 million (6.9%). This growth was primarily driven by increases in cash and cash equivalents by COP 8,154,318 million, trading derivatives by COP 1,291,033 million, and net investment properties by COP 715,853 million. All of this is offset by decreases in commercial credit by COP 1,949,495 and in net investments by COP 2,183,975 million (8.1%), primarily affected by exchange rate variations.

2023 ended with total liabilities for Grupo Bancolombia of COP 303,879,080 million. It represents an annual decrease of COP 8,938,102 million (2.9%).

Excluding the impact of exchange rate fluctuations, customer deposits increased by COP 16,692,013 million (6.8%) to reach a year-end total of COP 247,941,180 million. This result reflects the confidence of our customers in our organization's management of resources. Those with the greatest variation were time deposits, which increased by COP 21,770,974 million (25%). They accounted for 41% of total deposits, offset by a decrease in savings and checking accounts, by COP 3,163,254 million (2.7%) and COP 1,915,706 million (4.7%), respectively.

Bonds ended 2023 with a balance of COP 14,663,576 million, showing a decrease unaffected by the depreciation of the dollar against the peso by COP 2,180,726 million (11.1%). This aligns with the maturities occurring during the year, which were covered with internal resources. This reflects an appropriate management of the organization's liquidity. Furthermore, loans with institutions without this exchange rate effect had maturities that left a decrease of COP 1,675,875 million (8.5%).

Despite generating profits during 2023, the equity attributable to shareholders decreased by COP 999,391 million (2.6%). It ended the year at COP 38,089,512 million due to the restatement of the financial statements of foreign subsidiaries in our consolidated financial statements by COP 3,787,835 million and dividends declared in March 2023 amounting to COP 3,401,020 million. The equity's share of the balance sheet structure ended 2023 with a participation of 11.11% compared to 11.08% in 2022, allowing for a marginal reduction in asset leverage.

22

Solvency levels remained above the regulatory requirements, ending with a basic solvency ratio of 11.42%. This figure increased by 105 bps compared to the 10.37% reported in 2022. The increase is mainly attributed to the impact of Risk-Weighted Assets (RWA), earnings for the fiscal year, and the appreciation of the peso against the dollar.

We closed 2023 with a net profit attributable to shareholders of COP 6,116,936 million. This figure recorded an annual decrease of COP 666,554 million (9.8%). It can be explained as follows.

The net interest income grew by COP 2,023,387 million (11.0%). This is mainly attributed to the portfolio income, which increased by COP 10,457,294 million. It is a result of the increase in the monetary policy rate of the Bank of the Republic of Colombia and the Banking Benchmark (IBR). The financial expense increased by COP 8,225,825 million (97.4%). This rise aligns with the execution of the asset and liability management strategy. We observed an increase in the cost of funds associated with high deposit rates, product of the economic cycle. Net commissions grew by COP 203,238 million (5.4%), primarily driven by the net revenues generated from the customers' transactions when using our payment methods.

The portfolio provision and net leasing expense increased by COP 3,740,126 million (96.8%). This increase is attributed to higher allocations for impairment in the portfolio of natural persons. The situation mainly arose in BAM and Bancolombia’s unsecured consumer products, housing at Banistmo, and the portfolio of SMEs and Independent Businesses at Bancolombia.

Operating expenses increased by COP 2,054,542 million (18.9%). Within these, labor costs rose by COP 932,578 million primarily due to salary increases and actuarial calculations, which were significantly impacted by the behavior of TES discount rates. General expenses increased by COP 1,121,964 million. The most notable factors were local tax expenses (due to changes brought about by the tax reform in the industry and commerce tax), expenses associated with asset impairment, maintenance and repairs related to the Renting business, and fees for projects aimed at business evolution and transformation. In addition to a 16.9% increase in operating income before provisions, the above led to a deterioration in financial efficiency of 75 basis points, closing at 45.33%.

The income tax provision closed the year at COP 1,932,555 million. This represented a contribution to the national revenue for the country's development.

Consequently, we achieved a return on assets indicator of 1.78% and a return on equity attributable to shareholders of 16.14%. There was a deterioration compared to the figures recorded at the end of 2022 by 37 bps and 366 bps, respectively.

Bancolombia, a Commercial Bank

BANCOLOMBIA |

|

|

|

|

|

Commercial Bank |

|

|

|

|

|

UNCONSOLIDATED SUBSIDIARIES FINANCIAL RESULTS |

|

|

|

|

|

23

|

|

|

|

|

|

RESULTS AND BALANCE |

|

|

|

|

|

(Closing figures in millions of COP) |

|

|

|

2023 vs. 2022 |

|

2023 |

2022 |

2021 |

Var $ |

Var % |

|

Operating Income |

39,713,228 |

28,162,548 |

18,334,487 |

11,550,680 |

41.01% |

Net Operating Income (Operating Profit) |

7,662,543 |

9,090,560 |

5,243,413 |

-1,428,017 |

-15.71% |

Net Profit |

5,979,730 |

6,932,965 |

4,149,704 |

-953,235 |

-13.75% |

Total Assets |

251,590,338 |

243,175,544 |

206,914,719 |

8,414,794 |

3.46% |

Net Loan Portfolio |

170,029,117 |

168,203,995 |

139,105,688 |

1,825,122 |

1.09% |

Net Investments |

38,808,445 |

43,150,832 |

41,719,426 |

-4,342,387 |

-10.06% |

Total Liabilities |

214,508,670 |

204,433,764 |

175,147,270 |

10,074,906 |

4.93% |

Deposits |

170,231,400 |

156,480,283 |

138,702,086 |

13,751,117 |

8.79% |

Equity |

37,081,668 |

38,741,780 |

31,767,449 |

-1,660,112 |

-4.29% |

|

|

|

|

|

|

PERFORMANCE AND PROFITABILITY |

|

|

|

|

|

|

|

|

|

|

|

|

2023 |

2022 |

2021 |

|

|

Net Interest Margin |

7.93% |

7.94% |

5.55% |

||

Financial Efficiency |

37.90% |

37.85% |

45.67% |

||

Operational Efficiency |

3.55% |

3.26% |

3.26% |

||

Return on Average Assets |

2.42% |

3.08% |

2.12% |

||

Return on Average Equity |

15.77% |

19.67% |

14.42% |

||

Portfolio Quality |

4.95% |

3.35% |

4.19% |

||

Total Coverage Overdue Portfolio |

146.77% |

187.57% |

186.72% |

||

Basic Solvency Ratio |

15.30% |

14.70% |

16.18% |

||

Total Solvency Ratio |

18.08% |

18.29% |

21.01% |

||

|

|

|

|

|

|

MARKET |

|

|

|

|

|

(Figures as of December 31) |

|

|

|

2023 vs. 2022 |

|

2023 |

2022 |

2021 |

Var $ |

Var % |

|

24

Weighted Average Share Price |

38,293 |

33,431 |

-38,293 |

-100.00% |

|

Market Capitalization (in millions) |

36,831,152 |

32,154,666 |

-36,831,152 |

-100.00% |

|

Number of Outstanding Shares |

961,827,000 |

961,827,000 |

961,827,000 |

- |

0.00% |

Intrinsic Value |

38,553 |

40,279 |

33,028 |

-1,726 |

-4.29% |

Earnings Per Share-Unit |

6,217 |

7,208 |

4,314 |

-991 |

-13.75% |

|

|||||

Accounting accounts parameterization per the Board of Directors report and press release. |

|||||

Amidst 2023, marked by high inflation in the Colombian economy and a contractionary monetary policy rate, Bancolombia experienced a 3.46% growth in assets. This represents COP 8,414,794 million more compared to the end of 2022.

This variation was mainly leveraged by the gross portfolio, which grew by 1.92% during the year (COP 3,448,890 million). Additionally, the balance of cash and cash equivalents stood at COP 24,348,860 million at year-end, given the Bank's liquidity conditions.

The performance of portfolio balances was largely represented by the commercial segment, which grew by 4.01% (COP 3,685,879 million). Consumer loans decreased 4.94% (COP 2,021,414 million), due to a lower demand for credit. The housing portfolio grew 10.86% (COP 2,139,181 million). The financial services and natural resources sectors were the main drivers of this growth, especially in the commercial mode.

Investments in subsidiaries, associates, and joint ventures decreased by 16.56%, equivalent to COP 4,970,915 million. This outcome is attributed to investments in foreign subsidiaries and the currency revaluation effect caused by the exchange rate fluctuation, which shifted from COP 4,810 at the end of 2022 to COP 3,822 at the end of 2023.

The growth of COP 1,623,768 million in the portfolio provision balance indicates increased credit risk. This reflects a deterioration in portfolio quality with an increase in the non-performing loan ratio, which reached 4.95%.

The company ended the year 2023 with a total liability balance of COP 214,508,670 million, which is COP 10,074,906 million higher than the 2022 year-end figure. This behavior was primarily driven by time deposits, which grew by COP 16,599,660 million, reflecting higher profitability rates. The performance of virtual investment was notable, closing at COP 10,100,000 million in 2023. This represented an increase of COP 9,700,000 million compared to the previous year.

On the contrary, demand accounts experienced a downward trend: savings accounts decreased by COP -1,939,013 million and checking accounts by COP -2,132,066 million. This indicates a shift in funding structure. CDs gained 745 basis points of total deposit share, while savings and checking accounts lost share. This implies an increase in the cost of liabilities. The decrease in bonds is due to a restatement effect, along with bond maturities in pesos totaling around COP 612,522 million and a bond buyback operation of senior bonds maturing in 2025 for approximately USD 468 million conducted in August 2023.

25

In equity, Bancolombia decreased COP 1,660,112 million. This is primarily due to the exchange rate difference from investments in affiliates and subsidiaries due to the decrease in the Representative Market Exchange Rate (TRM) and lower net profit in the period.

In line with the increasing trend of the gross portfolio, the net interest income grew by 8.97%, equivalent to COP 1,273,799 million. This increase was primarily due to the revenue generation from the commercial portfolio. This favorable trend was offset by the deterioration of the portfolio. It led to an increase in provisions expense of COP 3,759,401 million. Consequently, interest income and valuation of financial instruments after provisions showed an annual decrease of COP 2,485,602 million.

Income from equity method amounted to COP 2,040,133 million. It represented an increase of COP 73,335 million compared to the balance in 2022. This was due to higher profits from subsidiary investments.

Net income before provisions grew by 19.44% compared to a 19.64% increase in operational expenses. This represents a 6 basis points deterioration in the efficiency indicator, which stood at 37.91%. Thus, pre-tax profit amounted to COP 7,662,543 million. It reflects a decrease of COP -1,428,017 million compared to the previous year.

As a result, Bancolombia ultimately closed 2023 with a net profit of COP 5,979,730 million. This amount represents an annual decrease of 13.75%, equivalent to COP 953,235 million. This leads to a decrease in the profitability of equity, which decreased by -389 basis points, standing at 15.77%.

Material Changes related to the Issuer's Liquidity and Solvency Position

Liquid Assets

One of the Bank’s main guidelines is to maintain a strong liquidity position. Therefore, the Asset and Liability Management (ALM) Committee has established a minimum level of liquid assets based on the financing needs of the parent company and each subsidiary. The objective is to ensure, as far as possible, that there will always be sufficient liquidity to meet its liabilities as they mature. This is both in normal conditions and stress scenarios without incurring significant losses or risking damage to the Bank's reputation.

As mentioned earlier, the Bank aims to maintain the optimal level of liquid assets to ensure not only smooth operation under normal conditions but also to operate under stress scenarios in the markets. In 2023, the Bank maintained a solid liquidity position with high levels of liquidity during the second half of the year.

The following table shows the distribution of liquid assets in the last two years:

Liquid assets (1) |

|

December 31, 2023 |

|

December 31, 2022 |

High-quality liquid assets* |

|

|

|

|

26

Cash |

|

25,273,317 |

|

26,299,990 |

High-quality liquid marketable securities |

|

19,951,771 |

|

17,739,501 |

Other liquid assets |

|

|

|

|

Other marketable securities** |

|

5,455,735 |

|

4,019,688 |

Total liquid assets |

|

50,680,823 |

|

48,059,179 |

27

Cash and liquid assets are those assets readily accepted as collateral by central banks in Colombia and other jurisdictions for monetary expansion or contraction operations. Liquid assets are adjusted by a reduction. They include cash, repos held for trading, and investments held for trading in stocks listed on the Colombian Stock Exchange, units of investment funds, or other debt trading instruments.

*High-quality liquid assets: Cash and shares that are eligible for reportable or repo operations, in addition to those liquid assets that the Central Bank receives for its monetary expansion and contraction operations described in Paragraph 3.1.1 of the Foreign Regulatory Circular DODM-142 of Bank of the Republic.

**Other marketable securities: Securities issued by financial and corporate entities.

As of December 31, 2023, liquid assets grew by COP 2,621,000 million primarily due to the increase in high-quality liquid securities. This change stems from increased deposits and excess liquidity managed through the treasury portfolio with purchases of liquid securities.

The Bank measures liquid assets on a daily basis and compares the result with a target set by the Risk Committee. Under this rule, daily liquid assets must be equal to or greater than the target. In case the limit is not reached, there is a period of five days to increase liquidity levels.

Cash is important to ensure branch and ATM operations. The Bank's expansion throughout Colombia requires significant levels of cash, and cash levels are monitored on a daily basis to minimize opportunity costs. In addition, cash is considered in the mandatory bank reserve established by the Central Bank.

Marketable securities comprising liquid assets are reviewed by the ALM Committee considering the Bank's liquidity objective. Although available-for-sale and held-to-maturity debt securities cannot be sold, they can be pledged as collateral in repurchase agreements. Some of them are mandatory investments that can be sent to the Central Bank as collateral.

The Financial Superintendence of Colombia (SFC) requires financial institutions to have liquid assets greater than the contractual one-month accumulated liquidity gap. This contractual gap reflects the maturity of current asset and liability positions and does not reflect projections of future operations. The maturity of the loan portfolio for this purpose is affected by the historical default indicator and the maturity of deposits is modeled in accordance with regulation.

The Bank's management believes that the current level of liquidity is adequate and seeks to maintain its strong deposit base and access to alternative sources of funding, such as loans from domestic and international development and commercial banks, repurchase agreements, bond issuances, overnight funds, and Central Bank funds, considering market conditions, interest rates and the desired maturity profile of liabilities.

Financing Structure

As of December 31, 2023, the Bank's liabilities reached COP 303,879,000 million, a 2.86% decrease compared to December 31, 2022. Liabilities in COP increased by 10.46%, while liabilities in USD decreased by 20.64%. This change is mainly due to the increase in time deposits in COP, offset by a decrease in savings and checking accounts in COP, financial obligations, and debt securities in USD. However, while USD liabilities decreased by 20.64%, this reduction was affected by the appreciation of the USD to COP exchange rate (20.54% in 2023).

28

|

As of December 31 |

|

|

2023 |

2022 |

|

In millions of COP |

|

Total financing |

|

|

In COP |

197,575,174 |

178,861,272 |

In USD |

106,303,906 |

133,955,910 |

Total liabilities |

303,879,080 |

312,817,182 |

In 2023, the Bank's deposits amounted to COP 247,941,000 million at the year-end, a decrease of COP 3,051,000 million, or 1.22%, compared to 2022. Deposits in COP increased by 9.18%, primarily due to the rise in time deposits. In contrast, deposits in USD decreased by 17.25% due to the reduction in savings accounts and the effect of exchange rate fluctuations. The ratio between deposits and total assets was 72.3%. This represented an increase of 116 basis points compared to 2022.

|

|

As of December 31 |

||

|

|

2023 |

|

2022 |

|

|

In millions of COP |

||

Total deposits |

|

247,941,180 |

|

250,992,323 |

The following table shows checking accounts, savings accounts, and time deposits as a percentage of the Bank's total liabilities for 2023 and 2022:

|

2023 |

|

2022 |

|

Check deposits |

11.6 |

% |

12.9 |

% |

Fixed-term deposits |

32.5 |

% |

27.9 |

% |

Savings deposits |

35.8 |

% |

37.8 |

% |

Other deposits |

1.7 |

% |

1.5 |

% |

Percentage of total liabilities |

81.6 |

% |

80.1 |

% |

29

The Bank's main sources of funding are deposits. They are mainly composed of checking accounts, time deposits, and savings accounts. During 2023, term deposits played a key role in the balance sheet financial structure. High inflation led the Bank of the Republic to maintain a contractionary monetary policy. Consequently, there was lower demand for liquidity and credit, prompting investors to rebalance their portfolios towards higher-yield investments. As a result, the cost of funds was negatively affected due to high interest rates. Additionally, the increase in time deposits was offset by the reduction in demand deposits.

Deposits as a percentage of the Bank's total liabilities in 2023 were 81.6%. This percentage increased compared to the 80.1% of total liabilities at the end of the 2022 fiscal year.

The ratio between net portfolio and deposits (including loans from other institutions) was 90.19% at the end of 2023. This figure decreased from 94.00% compared to 2022. This change is mainly explained by the decrease in net loans and advances to customers. These decreased from COP 254,444,000 million in 2022 to COP 237,728,000 in 2023. The reduction was less compared to the variation in deposits (the reduction was COP 7,095,000 million, reaching a total of COP 263,589,000 million in 2023).

|

|

As of December 31 |

|

||

|

|

2023 |

|

2022 |

|

Net Portfolio / Deposits |

|

90.19 |

% |

94.00 |

% |

The Bank also finances its operations with loans from financial institutions. However, the primary source of funding during 2023 was time deposits as interest rates remained high and liquidity demand was lower. Moreover, time deposits and loans with financial institutions are indexed to different market rates and indices such as the IBR (an overnight reference interest rate of the Colombian money market liquidity reflecting the price at which banks are willing to lend or borrow funds in the financial market), DTF, IPC1, LIBOR, and SOFR.

Furthermore, compliance with the CFEN in 2023, increased inflation, high-interest rates, and local and international political uncertainty generated additional pressures on the cost of short and long-term financing operations.

Outstanding Debt Instruments

In 2023, Bancolombia issued USD 50.5 million in bonds, while Bancolombia Panamá, Bancolombia Puerto Rico, and Banistmo issued bonds amounting to USD 41.9 million, USD 69.6 million, and USD 122.2 million, respectively. However, a prepayment of USD 468 million in senior bonds was executed during 2023. Consequently, the carrying amount of the issued obligations decreased by COP 4,912,000 million.

As of December 31, 2023, the total aggregate principal amount outstanding of bonds issued by the Bank was COP 14,663 million.

The following table shows the maturity profile of the Bank's debt securities in issue:

2024 |

2025 |

2026 |

2027 |

2028 |

2029 and beyond |

Total |

30

In millions of COP | |||||||

Bonds issued |

3,368,076 |

2,424,364 |

675,502 |

5,019,584 |

0 |

3,176,050 |

14,663,576 |

The following table outlines the components of the Bank's liabilities for fiscal years 2023 and 2022:

|

|

As of December |

|||

|

2023 |

% of total financing |

2022 |

% of total financing |

|

|

In millions of COP, except percentages |

||||

Checking accounts |

|

||||

In COP |

19,712,279 |

6.50% |

21,583,536 |

6.90% |

|

In USD |

15,280,787 |

5.10% |

19,225,320 |

6.00% |

|

Total |

34,993,066 |

11.60% |

40,808,856 |

12.90% |

|

Fixed-term deposits |

|||||

In COP |

59,146,972 |

19.50% |

42,493,753 |

13.60% |

|

In USD |

39,539,544 |

13.00% |

44,644,314 |

14.30% |

|

Total |

98,686,516 |

32.50% |

87,138,067 |

27.90% |

|

Savings accounts |

|||||

In COP |

83,053,422 |

27.30% |

84,542,389 |

27.00% |

|

In USD |

25,917,912 |

8.50% |

33,901,211 |

10.80% |

|

Total |

108,971,334 |

35.80% |

118,443,600 |

37.80% |

|

Other deposits |

|||||

In COP |

4,336,318 |

1.40% |

3,645,007 |

1.20% |

|

In USD |

953,946 |

0.30% |

956,793 |

0.30% |

|

Total |

5,290,264 |

1.70% |

4,601,800 |

1.50% |

|

Interbank deposits |

|||||

In COP |

0 |

0.00% |

0 |

0.00% |

|

In USD |

606,141 |

0.20% |

902,132 |

0.30% |

|

Total |

606,141 |

0.20% |

902,132 |

0.30% |

|

Derivative financial instrument-Liabilities |

|||||

In COP |

6,635,034 |

2.20% |

4,696,545 |

1.50% |

|

In USD |

75,330 |

0.00% |

40,909 |

0.00% |

|

31

Total |

6,710,364 |

2.20% |

4,737,454 |

1.50% |

|

Borrowings from other financial institutions (1) |

|||||

In COP |

6,488,331 |

2.10% |

4,877,928 |

1.60% |

|

In USD |

9,160,275 |

3.00% |

14,814,710 |

4.70% |

|

Total |

15,648,606 |

5.10% |

19,692,638 |

6.30% |

|

Bonds issued |

|||||

In COP |

4,097,729 |

1.30% |

4,708,588 |

1.50% |

|

In USD |

10,565,847 |

3.50% |

14,867,400 |

4.80% |

|

Total |

14,663,576 |

4.80% |

19,575,988 |

6.30% |

|

Repurchase agreements and other similar secured borrowings |

|||||

In COP |

308,711 |

0.10% |

167,774 |

0.10% |

|

In USD |

161,584 |

0.10% |

21,278 |

0.00% |

|

Total |

470,295 |

0.20% |

189,052 |

0.10% |

|

Leases |

|||||

In COP |

1,107,405 |

0.40% |

967,902 |

0.30% |

|

In USD |

666,205 |

0.20% |

932,366 |

0.30% |

|

Total |

1,773,610 |

0.60% |

1,900,268 |

0.60% |

|

Other liabilities |

|||||

In COP |

12,688,973 |

4.20% |

11,177,850 |

3.60% |

|

In USD |

3,376,335 |

1.10% |

3,649,477 |

1.20% |

|

Total |

16,065,308 |

5.30% |

14,827,327 |

4.80% |

|

Total financing |

|||||

In COP |

197,575,174 |

65.00% |

178,861,272 |

57.30% |

|

In USD |

106,303,906 |

35.00% |

133,955,910 |

42.70% |

|

Total liabilities |

303,879,080 |

100% |

312,817,182 |

100% |

|

(1) Includes borrowings from commercial banks and other non-financial entities.

32

Consolidated Cash Flow Statement

The following table displays the net cash provided by operating activities, net cash used in investing activities, and net cash used in financing activities for the years ended December 31, 2023, 2022, and 2021:

|

2023 |

2022 |

2021 |

In millions of COP |

|||

Operational activities |

19,153,084 |

6,339,438 |

6,095,305 |

Investment activities |

(159,689) |

(4,654,502) |

(650,486) |

Financing activities |

(5,430,672) |

853,436 |

(6,809,972) |

Increase (decrease) in cash and cash equivalents |

13,562,723 |

2,538,372 |

(1,365,153) |

Operational Activities

In 2023, operating activities generated a positive net cash flow due to the increase of COP 17,025,000 million in customer deposits, compared to an increase of COP 23,214,000 million in 2022, and COP 34,702,000 million in interest received, compared to COP 23,603,000 million in 2022.

The increase in loans and advances to customers and financial institutions was COP 10,554,000 million, compared to COP 37,593,000 million and COP 24,057,000 million in 2022 and 2021, respectively. Interest payments resulted in a cash outflow of COP 15,978,000 million in 2023, COP 7,508,000 million in 2022, and COP 4,410,000 million in 2021. The net change in the value of investment securities recognized at fair value through profit or loss was negative at COP 1,988,000 million in 2023. This compares to 2022 when the net change was COP 6,321,000 million.

Investment Activities

In 2023, the Bank purchased debt securities at amortized cost for COP 3,629,000 million, COP 4,915,000 million in 2022, and COP 3,722,000 million in 2021. The maturity of debt securities at amortized cost contributed COP 4,738,000 million in 2023, COP 4,260,000 million in 2022, and COP 2,984,000 million in 2021.

Investment activities related to debt instruments at fair value through OCI provided net cash of COP 1,415,000 million during 2023 and COP 235,000 million during 2022. Investment activities associated with equity securities and interests in associates utilized net cash of COP 106,000 million during 2023, whereas in 2022 it used COP 56,000 million. Investment activities related to purchases and sales of property, equipment, and investment properties utilized net cash of COP 2,226,000 million, compared to COP 3,117,000 million used during 2022 and COP 1,632,000 million in 2021.

33

Financing Activities

The proceeds from loans to other financial institutions contributed COP 9,855,000 million in 2023, COP 14,374,000 million in 2022, and COP 4,182,000 million in 2021. The issuance of outstanding debt securities provided COP 1,781,000 million in 2023, COP 2,138 million in 2022, and COP 1,387,000 million in 2021.

The repayment of loans used COP 9,921,000 million in 2023, compared to COP 5,874,000 million used in 2022 and COP 8,447,000 million used in 2021. Similarly, debt securities payments in issuance utilized COP 3,928,000 million during 2023, COP 6,699,000 million during 2022, and COP 1,871,000 million during 2021.

Cash was also used to pay dividends of COP 3,298,000 million to shareholders. In 2022 and 2021, this amount was COP 2,310,000 million and COP 467,000 million, respectively.

The decrease in repurchase agreements and other similar secured loans provided cash of COP 304,000 million, compared to the COP 579,000 million used in 2022 and COP 1,457,000 million in 2021.

Capital Solvency

The Bank and its subsidiaries comply with the capital solvency requirements in their respective operating countries.

The equity attributable to Bancolombia's owners amounted to COP 38,090,000 million as of December 31, 2023, which is 2.56% lower than the COP 39,089,000 million recorded as of December 31, 2022. This decrease is mainly explained by the appreciation of the Colombian peso against the US dollar and the lower net income generated during the period.

The Bank’s consolidated capital solvency ratio was 13.40% as of December 31, 2023, higher than the 12.79% in 2022.

The Bank's capital solvency ratio exceeded the requirements of the Colombian government and the Superintendence of Finance by 440 basis points above the minimum 9% required by the Colombian regulator. The core capital ratio (Tier 1) was 11.42 % and the tangible capital ratio, which is equal to the ratio of the difference between net equity and goodwill and intangible assets over tangible assets, was 8.66 % at the end of 2023. For a complete description of the Bank's capital adequacy requirements, see Item 4. "Information about the Company - B. Business Overview - B.8 - Supervision and Regulation".

The following table provides information on the Bank's consolidated capital solvency as of December 31, 2023, and 2022:

|

GRUPO BANCOLOMBIA |

|

|

December 31, 2023 |

December 31, 2022 |

Ordinary Basic Equity |

39,704,541 |

40,652,350 |

Share |

480,914 |

480,914 |

Premium in the Issue of Shares |

5,441,658 |

5,441,658 |

34

Translation Adjustment in Financial Statements |

|

|

Legal Reserve |

14,541,561 |

14,534,766 |

Voluntary Reserves |

7,250,712 |

3,162,401 |

Minority Interest |

960,217 |

908,648 |

ORI Profit/Loss |

4,065,182 |

7,749,234 |

Profit for the Fiscal Year |

6,116,936 |

6,783,490 |

Profit from Previous Fiscal Years |

847,362 |

1,591,239 |

PBO Deductions |

-8,919,345 |

-11,001,874 |

Capital Investments |

|

|

Losses from Previous Fiscal Years |

-79,587 |

-79,577 |

Goodwill |

-7,818,125 |

-9,836,661 |

PPE Revaluation |

-350,061 |

-351,871 |

Intangible |

-671,572 |

-602,531 |

Net Deferred Income Tax |

0 |

-131,233 |

Net PBO |

30,785,197 |

29,650,476 |

Minority Interest |

- |

- |

Hybrid Bonds |

4,283,448 |

6,109,531 |

Old Style Bonds |

678,797 |

794,881 |

Other PA Accounts |

0 |

0 |

General Provisions |

375,902 |

12,759 |

Additional Equity |

5,338,147 |

6,917,171 |

Deductions of Technical Equity |

-10,687 |

-16,136 |

|

36,112,657 |

36,551,511 |

Capital Ratios |

|

|

Tier I |

11.42% |

10.37% |

Tier II |

1.98% |

2.41% |

Assets weighted by level of credit risk including market risk and operational risk |

269,591,211 |

285,878,639 |

Total Solvency Ratio |

13.40% |

12.79% |

35

(1)Technical capital is the sum of core and additional capital.

(2)Capital solvency is calculated by dividing technical capital by risk-weighted assets.

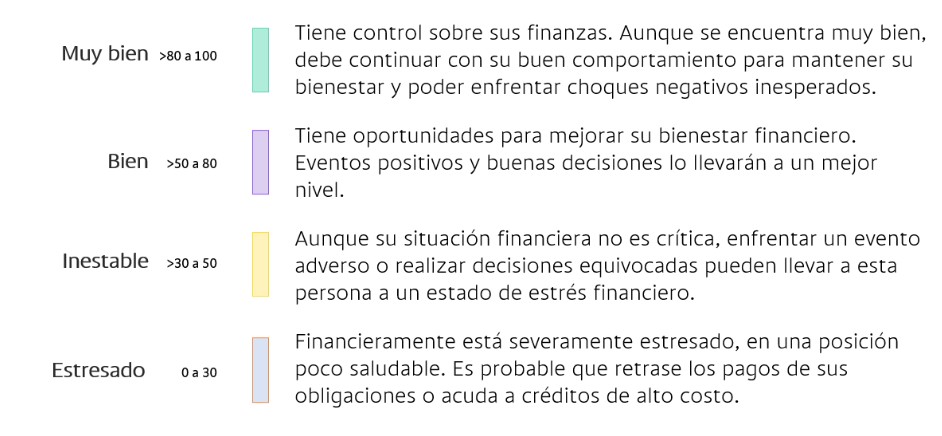

Seasonality in Deposits