|

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

|

|

FORM 8-K

|

|

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 7, 2023

CF BANKSHARES INC.

(Exact name of registrant as specified in its charter)

|

|

|

Delaware |

0-25045 |

34-1877137 |

(State or other jurisdiction of |

(Commission |

(IRS Employer |

incorporation) |

File Number) |

Identification Number) |

|

|

|

|

|

|

4960 E. Dublin Granville Road, Suite #400, Columbus, Ohio |

43081 |

(614) 334-7979 |

(Address of principal executive offices) |

(Zip Code) |

(Registrant’s Telephone Number) |

|

|

(former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Stock, $.01 par value |

CFBK |

The NASDAQ Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure.

CF Bankshares Inc. is providing additional information in conjunction with its Annual Meeting of Stockholders to be held at 10:00 a.m. on June 7, 2023. The slides provided in conjunction with the Annual Meeting are furnished as Exhibit 99 to this Form 8-K, and are incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits

|

|

|

|

(a) |

Not applicable |

|

(b) |

Not applicable |

|

(c) |

Not applicable |

|

(d) |

Exhibits |

|

|

|

|

|

99 Slides provided in conjunction with the Annual Meeting of Stockholders of CF Bankshares Inc. to be held on June 7, 2023 (furnished pursuant to Item 7.01 hereof). |

|

|

104Cover Page Interactive Data File (the cover page XBRL tags are embedded within the Inline XBRL document). |

|

|

|

|

|

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

CF Bankshares Inc. |

|

|

|

|

Date: June 7, 2023 |

|

By: |

/s/ Kevin J. Beerman |

|

|

|

Kevin J. Beerman |

|

|

|

Executive Vice President and Chief Financial Officer |

Exhibit 99

CF Bankshares Inc.

Forward Looking Statements Comments made in this presentation include “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and are made in good faith by us. Forward-looking statements include but are not limited to: (1) projections of revenues, income or loss, earnings or loss per common share, expense or savings, credit quality, capital structure and other financial items; (2) plans and objectives of the management or Boards of Directors of CF Bankshares Inc. (the “Holding Company”) or CFBank, National Association (“CFBank”); (3) statements regarding future events, actions or economic performance; and (4) statements of assumptions underlying such statements. Words such as "estimate," "strategy," "may," "believe," "anticipate," "expect," "predict," "will," "intend," "plan," "targeted," and the negative of these terms, or similar expressions, are intended to identify forward-looking statements, but are not the exclusive means of identifying such statements. Various risks and uncertainties may cause actual results to differ materially from those indicated by our forward-looking statements. For factors that could cause actual results to differ from our forward-looking statements, please refer to the “Risk Factors” in the Company’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other reports filed with the SEC.

Annual Stockholders Meeting Wednesday June 7, 2023 Columbus Cleveland Cincinnati Indianapolis CFBANK 1st Quarter 2023 Highlights Net income of $4.4 million and Earnings Per Share of $0.68.ROA of 0.98%; ROE of 12.55%.Book Value per common share increased to $21.88.During the quarter, Loans grew by $44 million (2.79%)Thus far in 2023, implemented efficiencies anticipated to result in future savings in excess of $2 million annualized. Efficiency Ratio goal of 50%.Consistently strong Credit quality with only 0.06% of loans being more than 30 days past due at 3/31/2023.

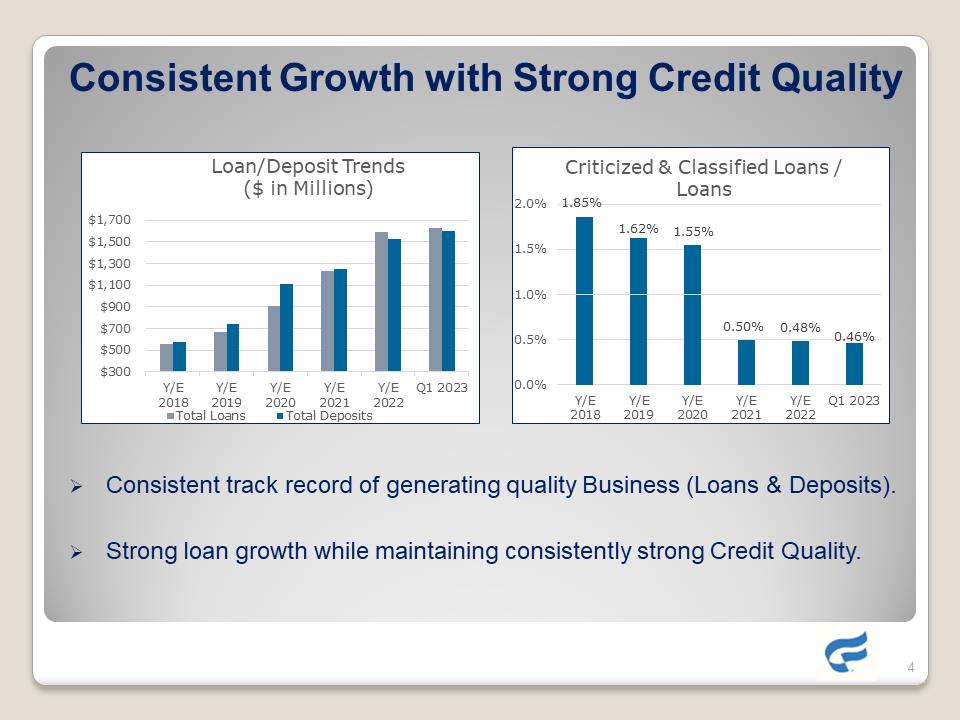

Consistent Growth with Strong Credit Quality Consistent track record of generating quality Business (Loans & Deposits).Strong loan growth while maintaining consistently strong Credit Quality. $300 $500 $700 $900 $1,100 $1,300 $1,500 $1,700 Y/E 2022 Y/E 2018 Y/E 2019 Y/E 2020 Y/E 2021 Q1 2023 * Loan/Deposit Trends Total Loans ($ in Millions) 1.85% 1.62% 1.55% 0.50% 0.48% 0.46% 0.0% 0.5% 1.0% 1.5% 2.0% Y/E 2022 Y/E 2018 Y/E 2019Y/E 2020 Y/E 2021 Q1 2023 Criticized & Classified Loans / Loans Sustainable Growth & Franchise Value Our commercial banking focused business model resonates with business owners and entrepreneurs.

Sustainable Growth: Building franchise value consistently as proven by our 5-year Tangible Book Value CAGR of 17%. Expect to top $2 Billion in assets threshold during 2023.Demonstrated operational discipline.CF is uniquely positioned in 4 solid Metro growth markets (Columbus, Cleveland, Cincinnati & Indianapolis).Expected benefit from Intel’s $20 billion business investment in Columbus metro. Our new HQ is located approximately 6 miles proximity. Expanding depth and strength by attracting top performing bankers from regional banks Demonstrated ability to attract “A” caliber talent & proven performers Our team is capable of building & managing a much larger bank.

Our flexibility & responsiveness makes us an attractive alternative to regional banks.10 Year proven track record of achieving quality growth while maintaining Strong Credit Quality Credit quality remains strong with a steady improvement in Criticized & Classified Loans as a percentage of Total Loans and no commercial loans > 30 days past due at 3/31/23 Noninterest-Bearing (NIB) Deposit CAGR of 19% since 2017. Enhanced Treasury Management capabilities through our 2022 core operating platform conversion will support driving future NIB Deposit growth and Fee Income opportunities. Looking ahead, we anticipate deposit re-pricing opportunities to accompany a return to lower interest rates.

Key Strategic & Business Focus Assets expected to top $2 Billion during 2023.Leaning into our Core Competency – Commercial Banking..Exited the national direct to consumer mortgage lending business in favor of traditional retail mortgage lending. Our traditional Regional Mortgage lending is focused on expanding saleable (fee income) loan volumes. On-interest income opportunities: T/M fees thru expanded product offerings Increasing SWAP Fees SBA – expect expanding volumes in 2023 Saleable Residential Mortgage loans gaining traction

CF BANKSHARES / CFBANK Uniquely positioned to scale and expand market share in our 4 major Metro Markets. CFBank possesses significant Upside successfully growing Market Share in Major Commercial Markets. Potential for significant market share growth in all 4 Metro Markets. Full Service National Charter Commercial Bank, with a successful track record of competing vs. Regional Banks .Expanding Core Business with recurring, predictable non-interest income. Favorable stock performance in 2022 versus Peers. CFBK stock price increased by over 3% during 2022 vs. KBW Nasdaq Bank Index, which declined in value by 24%.CONSISTENT GROWTH AND FRANCHISE EXPANSION