0001069157false00010691572023-12-122023-12-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

December 12, 2023

EAST WEST BANCORP, INC.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation)

000-24939

(Commission File Number)

95-4703316

(IRS Employer Identification No.)

135 N Los Robles Ave., 7th Floor, Pasadena, California 91101

(Address of principal executive offices) (Zip code)

(626) 768-6000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

|

Common Stock, par value $0.001 per share |

|

EWBC |

|

The Nasdaq Global Select Market |

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure

East West Bancorp, Inc. (the “Company”) is furnishing herewith its Fourth Quarter Investor Update presentation, attached as Exhibit 99.1 to this Current Report on Form 8-K. The Company intends to use the presentation in one or more meetings with its shareholders and other constituents.

The information furnished pursuant to this Item 7.01, including Exhibit 99.1 hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities under that Section and shall not be deemed to be incorporated by reference into any filing by the Company under the Securities Act of 1933 or the Exchange Act.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

|

|

|

|

|

|

|

Presentation Materials, dated December 12, 2023. |

| 104 |

Cover Page Interactive Data (formatted in Inline XBRL). |

|

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

| Date: December 12, 2023 |

|

|

|

|

EAST WEST BANCORP, INC. |

|

|

|

By: |

/s/ Christopher J. Del Moral-Niles |

|

|

|

Christopher J. Del Moral-Niles |

|

|

Executive Vice President and Chief Financial Officer |

EX-99.1

2

ewbc4q23midquarterupdate.htm

EX-99.1

ewbc4q23midquarterupdate

East West Bancorp, Inc. Fourth Quarter Investor Update December 12, 2023

Forward-Looking Statements 2 Forward-Looking Statements This presentation contains forward-looking statements that are intended to be covered by the safe harbor for such statements provided by the Private Securities Litigation Reform Act of 1995. These statements are based on the current beliefs and expectations of the management of East West Bancorp, Inc. (the “Company”) and are subject to significant risks and uncertainties. You should not place undue reliance on these statements. There are various important factors that could cause the Company’s future results to differ materially from historical performance and any forward-looking statements, including the factors described in the Company’s third-quarter 2023 earnings release, as well as those factors contained in the Company’s filings with the Securities and Exchange Commission, including the “Risk Factors” section of the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 and in its subsequent Quarterly Reports on Form 10-Q. When considering these forward-looking statements, you should keep in mind these risks and uncertainties, as well as any cautionary statements the Company may make. These statements speak only as of the date they are made and are based only on information then actually known to the Company. The Company does not undertake to update any forward-looking statements except as required by law. Non-GAAP Financial Measures Certain financial information in this presentation has not been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”) and is presented on a non-GAAP basis. Investors should refer to the reconciliations included in this presentation and should consider the Company’s non-GAAP measures in addition to, not as a substitute for or superior to, measures prepared in accordance with GAAP. These measures may not be comparable to similarly titled measures used by other companies.

15.2% 18.7% Return on Average Tangible Common Equity(1) - 3Q23 1.06% 1.66% Return on Average Assets - 3Q23 East West at a Glance 3 Highlights A Diversified Model (1) See reconciliation of GAAP to non-GAAP financial measures in the appendix and in the Company’s Earnings Press Releases (2) EWBC peers include BKU, BOKF, BPOP, CFR, CMA, COLB, FCNC.A, FHN, HBAN, KEY, NTRS, PNFP, RF, SNV, VLY, WAL, WTFC, and ZION. Source: S&P Capital IQ Peer Median(2) EWBC 12.07.23 09.30.23 09.30.23 09.30.23 Top Quartile Returns $15.9bn 31% $20.4bn 40% $14.6bn 29% C&I Resi. Mortgage & Other Consumer CRE $50.9bn Total Loans, 09.30.23 $16.2bn 29% $12.6bn 23% $9.6bn 18% $16.7bn 30% Time Demand Deposit Money Market IB Checking, Savings $55.1bn Total Deposits, 09.30.23 $9.5B Market Cap $68.3B Assets $55.1B Deposits 104 Branches

Private Equity 15% Other 15% Media & Entertainment 11% Structured Finance 11% Real Estate Inv., Mgmt, & Services 9% Manufacturing & Wholesale 6% Infrastructure & Clean Energy 6% Healthcare, Pharma, & Life Sciences 4% Tech & Telecom 4% Food Production & Distribution 4% Hospitality & Leisure 4% Oil & Gas 4% Equipment Finance 3% Art Finance 2% Consumer Nondurable Goods 2% Multifamily 24% Retail 21% Industrial 19% Hotel 11% Office 11% Healthcare, 4% All other CRE, 6% Const. & Land, 4% 4 Commercial Loan Portfolio ▪ 50% in SoCal, 19% in NorCal, remainder predominantly in-footprint: primarily Texas, New York, Washington ▪ Portfolio has been below FFIEC concentration guidelines since 2009 Over 70% of EWBC’s loans support commercial customers and are well-diversified C&I Loans by Industry (as % of Total C&I Loans, 09.30.23) $15.9bn Loans Outstanding (as % of Total CRE, 09.30.23) $20.4 billion Loans Outstanding CRE Loans by Type ▪ 65.3% utilization as of 09.30.23 ▪ ~$2bn outstanding of Greater China loans, nearly all of which is C&I and well-diversified by industry

Residential Mortgage Portfolio 5 51% Average LTV1 Well-diversified by geography, with low LTVs and average loan size Resi. Mortgage Distribution by Geography3 (as of 09.30.23) Resi. Mortgage Distribution by LTV1 (as of 09.30.23) $436,000 Average loan size2 (1) Combined LTV for 1st and 2nd liens; based on commitment (2) Avg. size based on loan outstanding for single-family residential and commitment for HELOC (3) Geographic distribution based on commitment size of residential mortgage Portfolio Highlights as of 09.30.23 Outstandings ▪ $14.6bn loans outstanding ▪ +3% Q-o-Q and +12% Y-o-Y Originations ▪ $0.9bn in 3Q23 ▪ -1% Q-o-Q and -38% Y-o-Y ▪ Primarily originated through East West Bank branches Single-family Residential ▪ $12.8bn loans outstanding ▪ +4% Q-o-Q and +18% Y-o-Y HELOC ▪ $1.8bn loans outstanding ▪ $3.5bn in undisbursed commitments ▪ 33% utilization, vs. 35% as of 06.30.23 ▪ 81% of commitments in first lien position <=50% 44% >50% to 55% 12% >55% to 60% 33% >60% 11% SoCal 40% NorCal 16% NY 27% WA 7% TX 2% Other 8%

$50.0bn Customer Deposits1 Total Deposit Portfolio 6 (1) Total deposits excluding wholesale deposits Granular and diversified by segment, customer type ▪ Grew customer deposits by $1bn Q-o-Q − Commercial up $600mm − Consumer up $400mm ▪ Reduced wholesale deposits by $1.6bn Q-o-Q ▪ Portfolio Detail (as of 09.30.23) − Over 580,000 accounts − Average commercial deposit account size: ~$332,000 − Average consumer deposit account size: ~$39,000 HighlightsDeposits by Segment as % of Total Deposits (as of 09.30.23, $ in billions) Total Deposits by Account Type $55.1 billion Total Deposits $52.1bn1 $53.1bn1 (as of 09.30.23, $ in billions) $26.3 $26.7 $27.3 $16.7 $18.0 $18.4 $4.0 $4.5 $4.4 $3.0 $2.9 $3.0 $3.9 $3.6 $2.0 $53.9 $55.7 $55.1 09.30.22 06.30.23 09.30.23 Wholesale Greater China State & Public Agency Consumer Commercial $16.2 29% $12.6 23% $9.6 18% $16.7 30% Demand Deposit Accounts (DDA) Money Market (MMDA) Int. Bearing Checking & Savings Time

Net Interest Income & Net Interest Margin 7 $ i n m ill io n s +0.01% +0.14% 3.55% Higher loan yields, balances 3.48% Higher other AEA yields -0.04% Higher cost of IB deposits, balances -0.22% Favorable earning asset mix shift +0.04% Deposit mix shift Record third quarter NII, growth Q-o-Q ▪ 3Q23 NII up 1% Q-o-Q ▪ 3Q23 NIM down 7bp Q-o-Q ▪ NIM Drivers − Higher cost of interest-bearing deposits and deposit mix shift − Higher loan balances and interest-earning asset yields provided a partial offset − Changes in yields and rates reflected an increase in benchmark interest rates in the quarter amid customer preferences for deposit products with higher yields HighlightsNet Interest Income (NII) & Net Interest Margin (NIM) Impact to NIM from Q-o-Q Change in Yields, Rates & Mix 2Q23 3Q23 $552 $606 $600 $567 $571 3.68% 3.98% 3.96% 3.55% 3.48% 2.35% 3.82% 4.68% 5.16% 5.43% 3Q22 4Q22 1Q23 2Q23 3Q23 NII NIM Avg. Fed Funds Rate

Notable Updates 8 Share Repurchases ▪ 1.5 million shares repurchased as of December 7th Trust Preferred Securities ▪ Redeeming ~$117 million Noninterest Expense ▪ Accruing ~$70 million (pre-tax) for FDIC special assessment in 4Q 4Q23 Activity FY 2023 Expectations 1Q24 Expectation

-12.5% 14.9% 17.2% 5.6% 54.8% 58.0% 1-Year 3-Year 5-Year Peer Median EWBC High Performance for Clients and Shareholders 9 ✓ Largest Minority Depository Institution in the U.S. by Assets(2) ✓ #1 Performing Bank, $50 Billion and Above Bank Director ✓ #1 U.S. Public Bank by Financial Performance S&P Global Market Intelligence ✓ #3 Best Reputation Among Noncustomers RepTrak ✓ Top 5 Art World Banks ArtNews Total Shareholder Return(1) Designations and Awards (1) Market data as of 12.07.2023. EWBC peers include BKU, BOKF, BPOP, CFR, CMA, COLB, FCNC.A, FHN, HBAN, KEY, NTRS, PNFP, RF, SNV, VLY, WAL, WTFC, and ZION. Source: S&P Capital IQ (2) Source: Federal Deposit Insurance Corporation (FDIC) Minority Depository Institutions List, Third Quarter 2023

APPENDIX

24 22 23 20 21 20 10 13 12 9 7 6 4 6 6 $67 $69 $67 3Q22 2Q23 3Q23 IRC Revenue Wealth Mgmt. Fees FX Income Lending Fees Deposit Acct. Fees Noninterest Income 11 Interest Rate Contracts (IRC) and Other Derivative Income Detail ($mm) 3Q22 2Q23 3Q23 Revenue $ 4.0 $ 6.0 $ 5.9 MTM 4.8 1.4 5.3 Total $ 8.8 $ 7.4 $ 11.2 Consistent relationship-based fee base ▪ Total noninterest income − $77mm in 3Q23, down $2mm, or 2% from $79mm in 2Q23 − Other investment income of $2mm down from $4mm Q-o- Q, reflecting higher equity recognition of Community Reinvestment Act investments during 2Q23 ▪ Interest rate contracts & other − Up $4mm Q-o-Q, driven primarily by a favorable mark-to-market adjustment HighlightsFee Income1 (1) Fee income excludes MTM adjustments related to IRC and other derivatives; net gains on sales of loans; net gains on sales of securities; other investment income and other income $ i n m ill io n s

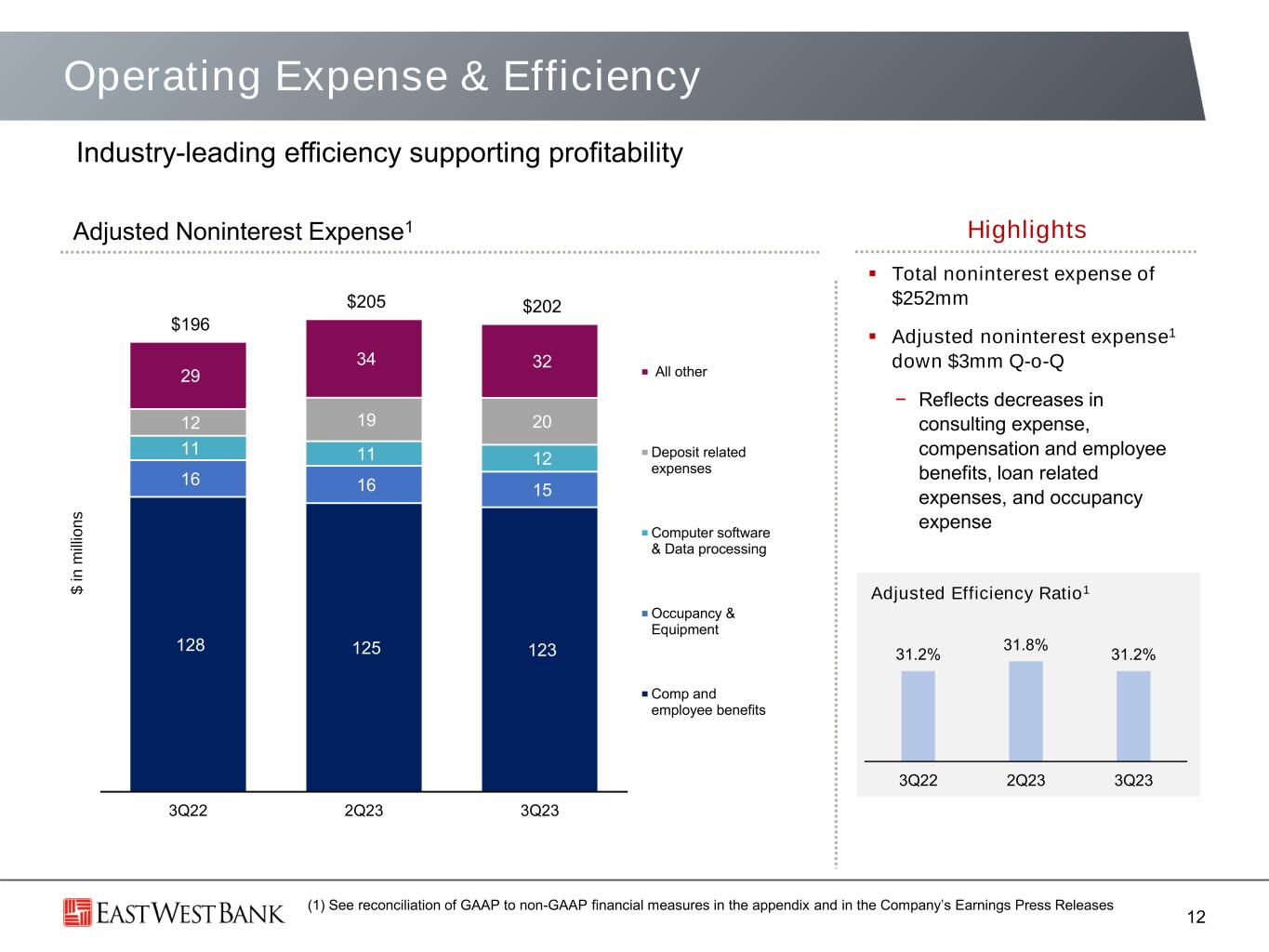

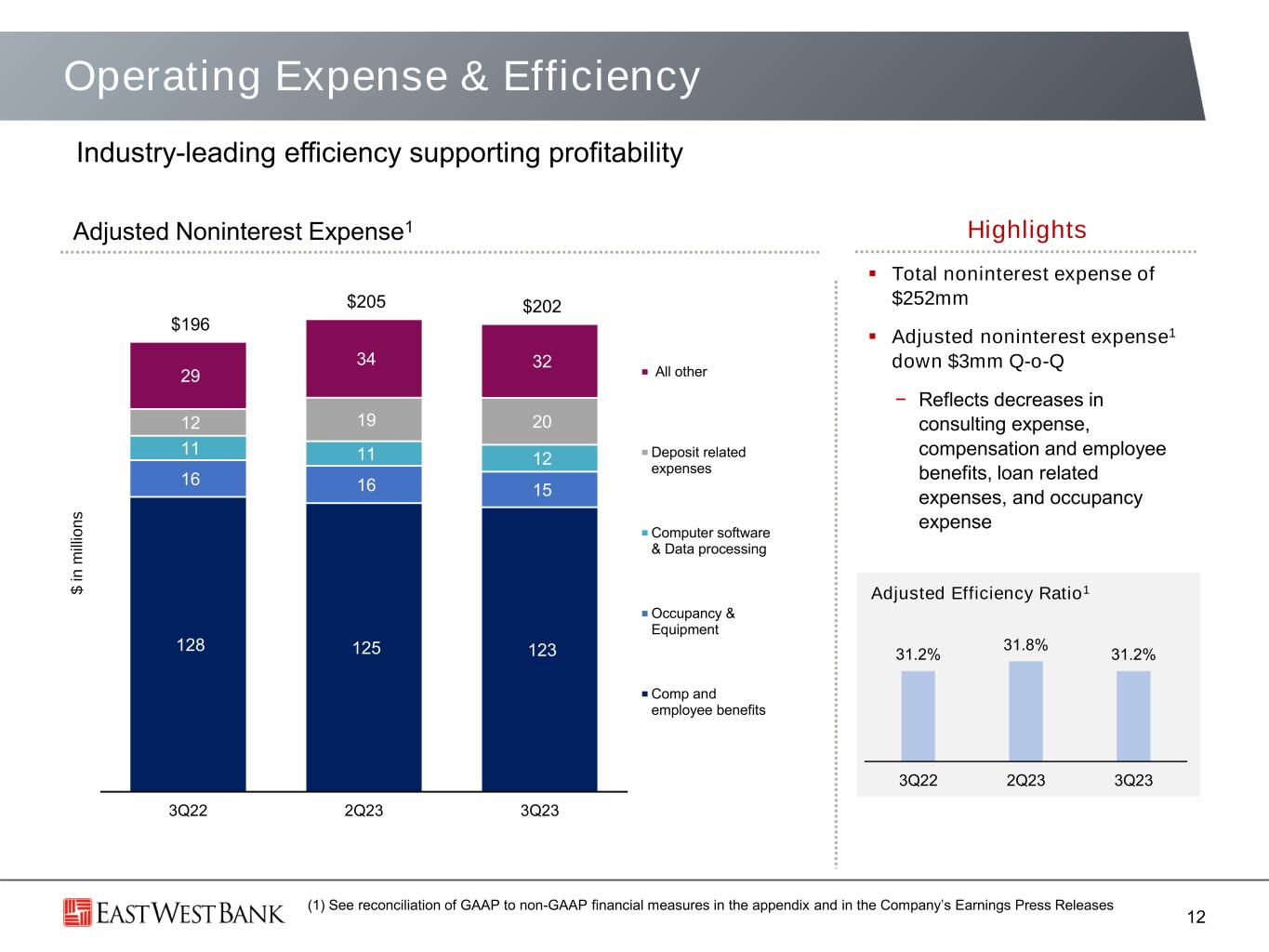

128 125 123 16 16 15 11 11 12 12 19 20 29 34 32 $196 $205 $202 3Q22 2Q23 3Q23 All other Deposit related expenses Computer software & Data processing Occupancy & Equipment Comp and employee benefits Operating Expense & Efficiency 12 $ i n m ill io n s Industry-leading efficiency supporting profitability ▪ Total noninterest expense of $252mm ▪ Adjusted noninterest expense1 down $3mm Q-o-Q − Reflects decreases in consulting expense, compensation and employee benefits, loan related expenses, and occupancy expense HighlightsAdjusted Noninterest Expense1 (1) See reconciliation of GAAP to non-GAAP financial measures in the appendix and in the Company’s Earnings Press Releases Adjusted Efficiency Ratio1 31.2% 31.8% 31.2% 3Q22 2Q23 3Q23

Commercial Real Estate Portfolio Detail 13 (1) Weighted average LTV is based on most recent LTV, using most recent available appraisal and current loan commitment (2) Construction & Land average size based on total commitment 51% Average LTV1 Low LTVs and granular, many loans have full recourse and personal guarantees Distribution by LTV1 Size and LTV by Property Type (as of 09/30.23) (as of 09.30.23) ▪ Fewer than 25% of CRE loans have an LTV over 60% Total Portfolio Size ($bn) Weighted Avg. LTV1 (%) Average Loan Size ($mm) Multifamily $4.9 52% $2 Retail 4.3 48 2 Industrial 3.9 47 3 Hotel 2.3 53 9 Office 2.3 52 4 Healthcare 0.8 56 4 Other 1.1 49 3 Construction & Land2 0.8 54 14 Total CRE $20.4 51% $3 <=50% 44% >50% to 55% 16% >55% to 60% 16% >60% to 65% 15% >65% to 70% 6% >70% 3%

$7 $10 $1 $8 $18 3Q22 4Q22 1Q23 2Q23 3Q23 Solid & Stable Asset Quality Metrics 14 Nonaccrual loans OREO & other NPAs NPAs / Total Assets Criticized Loans / Loans HFI Classified loans HFI Special Mention loans HFI HFI represents Held-for-Investment Classified loans HFI Special Mention loans HFI Criticized Ratio by Loans HFI Portfolio (as of 09.30.23) ▪ Net charge-offs of $18mm, or annualized 0.14% of avg. loans, vs. 0.06% in 2Q23 ▪ Provision for credit losses: $42mm for 3Q23 compared with $26mm for 2Q23 ▪ ALLL coverage of loans: 1.29% as of 09.30.23, vs. 1.28% as of 06.30.23 ▪ Nonperforming assets: decreased to $104mm (0.15% of assets) as of 09.30.23, compared with $116mm (0.17% of assets) as of 06.30.23 ▪ Criticized loans: $1.0bn (2.01% of loans HFI) as of 09.30.23, up from $812mm (1.63% of loans HFI) as of 06.30.23 Net Charge-offs Net charge-offsNCO ratio (ann.) Allowance for Loan Losses Coverage Ratio C&I Total CRE Resi. mort. & consumer ALLL/Loans HFI $ i n m ill io n s $ i n m ill io n s 0.06% 0.08% 0.01% 0.06% 0.14% 372 372 376 375 384 178 182 189 203 211 33 42 55 57 61$583 $596 $620 $635 $656 1.23% 1.24% 1.27% 1.28% 1.29% 09.30.22 12.31.22 03.31.23 06.30.23 09.30.23 0.16% 0.16% 0.14% 0.17% 0.15% 09.30.22 12.31.22 03.31.23 06.30.23 09.30.23 0.92% 0.89% 0.93% 0.97% 1.06% 0.99% 0.97% 0.94% 0.66% 0.95% 1.91% 1.86% 1.87% 1.63% 2.01% 09.30.22 12.31.22 03.31.23 06.30.23 09.30.23 3.40% 2.08% 0.40% C&I CRE Resi. mortgage & consumer

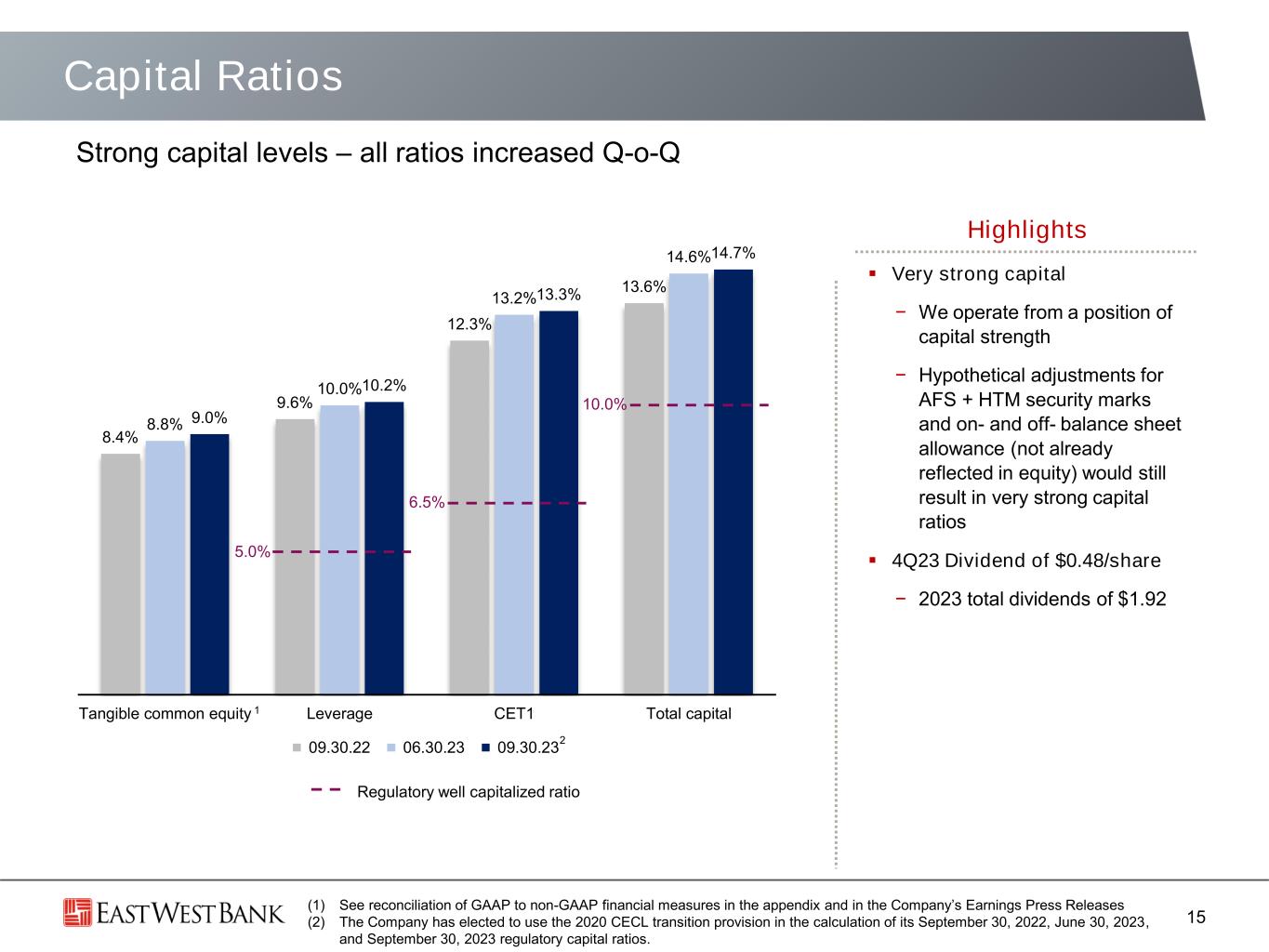

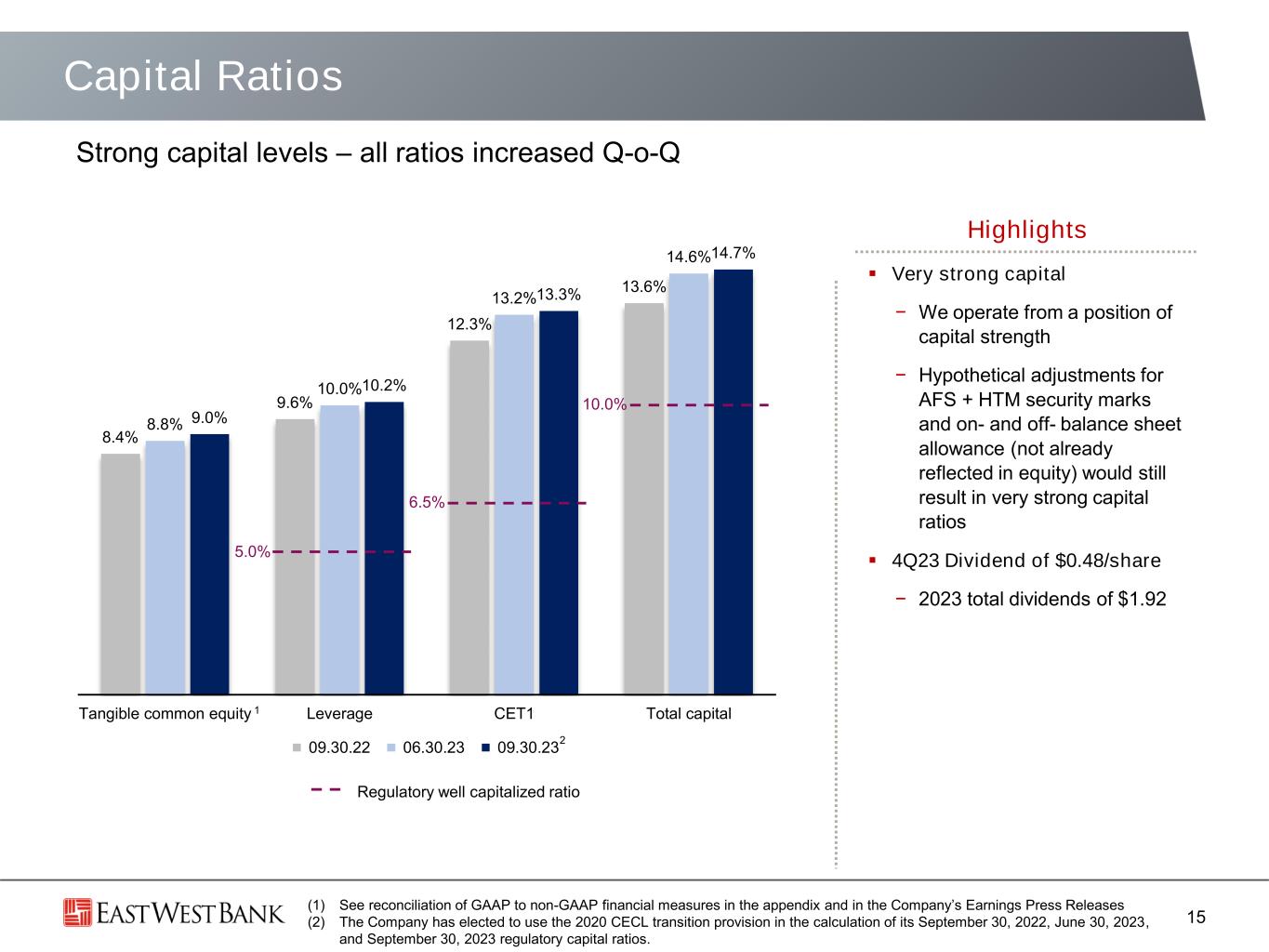

8.4% 9.6% 12.3% 13.6% 8.8% 10.0% 13.2% 14.6% 9.0% 10.2% 13.3% 14.7% Tangible common equity Leverage CET1 Total capital 09.30.22 06.30.23 09.30.23 ▪ Very strong capital − We operate from a position of capital strength − Hypothetical adjustments for AFS + HTM security marks and on- and off- balance sheet allowance (not already reflected in equity) would still result in very strong capital ratios ▪ 4Q23 Dividend of $0.48/share − 2023 total dividends of $1.92 Capital Ratios 15 Highlights Strong capital levels – all ratios increased Q-o-Q 2 (1) See reconciliation of GAAP to non-GAAP financial measures in the appendix and in the Company’s Earnings Press Releases (2) The Company has elected to use the 2020 CECL transition provision in the calculation of its September 30, 2022, June 30, 2023, and September 30, 2023 regulatory capital ratios. Regulatory well capitalized ratio 6.5% 10.0% 5.0% 1

Appendix: GAAP to Non-GAAP Reconciliation 16 (1) Annualized EAST WEST BANCORP, INC. AND SUBSIDIARIES GAAP TO NON-GAAP RECONCILIATION ($ in thousands) (unaudited) The Company uses certain non-GAAP financial measures to provide supplemental information regarding the Company’s performance. Adjusted efficiency ratio represents adjusted noninterest expense divided by adjusted revenue. Adjusted revenue excludes the write-off of an AFS debt security (where applicable). Adjusted noninterest expense excludes the amortization of tax credit and other investments, the amortization of core deposit intangibles and the repurchase agreements’ extinguishment cost (where applicable). Management believes that the measures and ratios presented below provide clarity to financial statement users regarding the ongoing performance of the Company and allow comparability to prior periods.

Appendix: GAAP to Non-GAAP Reconciliation 17 EAST WEST BANCORP, INC. AND SUBSIDIARIES GAAP TO NON-GAAP RECONCILIATION ($ in thousands) (unaudited) The Company uses certain non-GAAP financial measures to provide supplemental information regarding the Company’s performance. Tangible book value, tangible book value per share and TCE ratio are non-GAAP financial measures. Tangible book value and tangible assets represent stockholders’ equity and total assets, respectively, which have been reduced by goodwill and other intangible assets. Given that the use of such measures and ratios is more prevalent in the banking industry, and such measures and ratios are used by banking regulators and analysts, the Company has included them below for discussion. (1) Includes core deposit intangibles and mortgage servicing assets.

Appendix: GAAP to Non-GAAP Reconciliation 18 (1) Includes core deposit intangibles and mortgage servicing assets. (2) Applied statutory tax rate of 29.29% for the three and nine months ended September 30, 2023, and the three months ended June 30, 2023. Applied statutory tax rate of 28.77% for the three and nine months ended September 30, 2022. (3) Annualized. EAST WEST BANCORP, INC. AND SUBSIDIARIES GAAP TO NON-GAAP RECONCILIATION ($ in thousands) (unaudited) Return on average TCE represents tangible net income divided by average tangible book value. Adjusted return on average TCE represents adjusted tangible net income divided by average tangible book value. Tangible net income excludes the after-tax impacts of the amortization of core deposit intangibles and mortgage servicing assets. Adjusted tangible net income excludes the after-tax impacts of the tangible net income adjustments and the write-off of an AFS debt security. Given that the use of such measures and ratios is more prevalent in the banking industry, and such measures and ratios are used by banking regulators and analysts, the Company has included them below for discussion.