Document

Exhibit 99.1

January 20, 2026

Fellow shareholders,

•In 2025, we met or exceeded all of our financial objectives.

◦For the year, we delivered $45.2B of revenue (+16% year over year, or 17% on a FX-neutral basis)1 and operating margin of 29.5% (+3 points). Ad revenue rose more than 2.5x to over $1.5B.

◦In Q4, revenue increased 18% year over year, and we crossed the 325M paid memberships milestone during the quarter. Operating income rose 30% year over year.

•Engagement remains healthy. In the second half of 2025, view hours increased 2% year over year, driven by a 9% rise in viewing of branded originals.

•In 2026, we’re focused on:

◦Improving our core business with an increasing variety and quality of series and films, enhancing our product experience, and further growing our ads business.

◦Building out newer initiatives like live, with events including the World Baseball Classic in Japan, expanding into more content categories like video podcasts, and scaling our cloud-first games strategy.

◦Working to close our acquisition of Warner Bros.

◦Sustaining healthy growth – we forecast 2026 revenue of $50.7B-$51.7B (+12%-14% year over year) with ad revenue expected to roughly double, and an operating margin of 31.5%.

•The entertainment business remains vibrant and intensely competitive and we’re optimistic about our future.

Our summary results, and forecast for Q1, are below.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (in millions except per share data) |

Q4'24 |

Q1'25 |

Q2'25 |

Q3'25 |

Q4'25 |

Q1'26 Forecast |

| Revenue |

$ |

10,247 |

|

$ |

10,543 |

|

$ |

11,079 |

|

$ |

11,510 |

|

$ |

12,051 |

|

$ |

12,157 |

|

| Y/Y % Growth |

16.0 |

% |

12.5 |

% |

15.9 |

% |

17.2 |

% |

17.6 |

% |

15.3 |

% |

| Operating Income |

$ |

2,273 |

|

$ |

3,347 |

|

$ |

3,775 |

|

$ |

3,248 |

|

$ |

2,957 |

|

$ |

3,906 |

|

| Operating Margin |

22.2 |

% |

31.7 |

% |

34.1 |

% |

28.2 |

% |

24.5 |

% |

32.1 |

% |

| Net Income |

$ |

1,869 |

|

$ |

2,890 |

|

$ |

3,125 |

|

$ |

2,547 |

|

$ |

2,419 |

|

$ |

3,264 |

|

| Diluted EPS |

$ |

0.43 |

|

$ |

0.66 |

|

$ |

0.72 |

|

$ |

0.59 |

|

$ |

0.56 |

|

$ |

0.76 |

|

|

|

|

|

|

|

|

| Net cash provided by operating activities |

$ |

1,537 |

|

$ |

2,789 |

|

$ |

2,423 |

|

$ |

2,825 |

|

$ |

2,112 |

|

|

| Free Cash Flow |

$ |

1,378 |

|

$ |

2,661 |

|

$ |

2,267 |

|

$ |

2,660 |

|

$ |

1,872 |

|

|

| Shares (FD) |

4,378 |

|

4,370 |

|

4,349 |

|

4,340 |

|

4,317 |

|

|

|

|

|

|

|

|

|

|

__________________________________

1 Excluding the year over year effect of foreign exchange rate movements and the impact of hedging gains/losses realized as revenues. Assumes foreign exchange rates remained constant with foreign exchange rates from each of the corresponding months of the prior-year period.

Q4 Results and Forecast

Q4 revenue grew 18% year over year (+17% on a foreign exchange (F/X) neutral basis), driven primarily by membership growth, higher pricing, and increased ad revenue. Despite unfavorable F/X movements during the quarter, revenue was 1% above our guidance due to stronger-than-forecasted membership growth and ad sales.

Operating income in Q4 was $3.0B, up 30% year over year, and operating margin expanded two percentage points year over year to 25% - both slightly ahead of our forecast due primarily to the revenue upside. Diluted EPS amounted to $0.56 vs $0.43 in Q4’24 (+31% year over year), slightly above our forecast (adjusted for our 10-for-1 stock split). Net income included ~$60M of costs (booked in interest expense) related to our recent Warner Bros.-related bridge loan and associated bridge reduction financings (which was not included in our guidance).

With our strong Q4 results, we met or exceeded all of our full year 2025 financial objectives. We grew revenue 16% to $45B (+17% on a F/X neutral basis) and we increased our operating margin to 29.5% for the year, up from 26.7% in 2024. We also made great progress growing advertising revenue. In 2025, which was only our third year selling advertising, ad revenue grew by more than 2.5x vs. 2024 to over $1.5 billion.

As a reminder, the guidance we provide is our actual internal forecast at the time we report and we strive for accuracy. Our primary financial metrics are revenue for growth and operating margin for profitability. Our goal is to sustain healthy revenue growth, expand operating profit and margin, and deliver growing free cash flow.

For 2026, based on F/X rates as of 1/1/2026, we forecast revenue of $50.7B-$51.7B. This represents 12%-14% year over year growth (or 11%-13% F/X neutral growth), driven by increases in membership and pricing plus a projected rough doubling of ad revenue in 2026 vs. 2025.

We’re targeting a 2026 operating margin of 31.5% (based on 1/1/26 F/X rates), up from 29.5% in 2025, which includes approximately $275M of acquisition-related expenses. Our margin forecast also reflects content amortization growth of ~10% in 2026, with higher growth in the first half than the second half due to the timing of title launches. As a result, we expect higher operating income growth in the second half of 2026 than in the first half. We still see plenty of room to increase our margins and our intent is to grow our operating margin each year, although the magnitude of margin expansion will vary year-to-year as we balance reinvesting in our business with improving profitability.

Content and Engagement

With over 325M paid memberships, we’re now serving an audience approaching one billion people globally. Our aim is to delight and satisfy all of them by providing an amazing variety of series, films, and games so they stick around longer (retention), recommend Netflix to others (acquisition), and place a higher value on our service. Engagement remains one proxy to measure the health of the business. As detailed in our bi-annual Engagement Report2, in the second half of 2025, our members watched 96 billion hours on Netflix, up 2% (+1.5 billion hours) year over year vs. a 1% increase in the first half of the year. This growth was driven by viewing of our originals, which was up 9% year over year in the second half of 2025 due, in part, to our strong Q4 branded slate, including:

__________________________________

2 https://about.netflix.com/en/news/what-we-watched-the-second-half-of-2025

•Returning Series: the massive final season of Stranger Things* (120M views3), Nobody Wants This S2* (31M), Selling Sunset S9* (11M), anime series Record of Ragnarok S3* from Japan (13M), Culinary Class Wars S2* from Korea (10M), and Emily in Paris S5* (41M).

•New shows from around the world: The Beast in Me* from the US (48M), The Asset* from Denmark (24M), Rulers of Fortune* from Brazil (23M), and Last Samurai Standing* from Japan (22M).

•A strong lineup of documentaries: Being Eddie* (12M), The Perfect Neighbor (50M), Sean Combs: The Reckoning* (54M) and Babo from Germany* (7M).

•New stand-up specials: Dave Chappelle: The Unstoppable…* (17M), Kevin Hart: Acting My Age* (13M), Leanne Morgan: Unspeakable Things* (5M), Matt Rife: Unwrapped - A Christmas Crowd Work Special* (8M), Tom Segura: Teacher* (5M), and Ricky Gervais: Mortality* (7M).

•A broad slate of films: Guillermo del Toro’s Frankenstein* (102M), Wake Up Dead Man: A Knives Out Mystery* (66M), A House of Dynamite* (78M), Jay Kelly* (21M), Train Dreams* (20M), Caramelo (54M) from Brazil, Troll 2* (47M) from Norway, Champagne Problems* (52M), My Secret Santa* (51M), and A Merry Little Ex-Mas* (40M).

Our overall engagement growth in the second half of 2025, however, was partially offset by a year-over-year decline in viewing of non-branded view hours. This decrease primarily reflected a lower volume of licensed, second-run content across most regions following an elevated period of licensing during 2023-2024 as a result of the WGA strike, which temporarily shut down new production.

Our goal is to continue to grow engagement and we’ll do this first and foremost by improving our core series and film offering, including both originals and second run titles. Highlights of our broad 2026 slate5 of originals includes:

•New seasons of fan favorites including Bridgerton S4, ONE PIECE S2, The Night Agent S3, BEEF S2, One Hundred Years of Solitude S2 (Colombia), Avatar: The Last Airbender S2, series finale of Outer Banks S5, The Hunting Wives S2, Berlin S2 (Spain), The Gentlemen S2 (UK), 3 Body Problem S2, The Diplomat S4, North of North S2 (Canada), Nobody Wants This S3, Lupin Part 4 (France), Running Point S2, and Virgin River S7.

•Exciting new scripted series including Something Very Bad Is Going to Happen and The Boroughs from the Duffer brothers, Pride & Prejudice (UK), Man on Fire, Can This Love Be Translated (Korea), Little House on the Prairie, Human Vapor (Japan), East of Eden starring Florence Pugh, Operation Safed Sagar (India), Will Ferrell's untitled golf series, Detective Hole (Norway), The Altruists, a limited series about Sam Bankman-Fried, Radioactive Emergency (Brazil), and Courtney A. Kemp’s Nemesis.

•Unscripted shows America’s Sweethearts: Dallas Cowboys Cheerleaders S3, Love is Blind S10, series finale of Queer Eye, Age of Attraction, The Golden Ticket, and Let’s Marry Harry.

•An expansive lineup of films during the year including People We Meet on Vacation, The Rip starring Ben Affleck and Matt Damon, Peaky Blinders: The Immortal Man starring Cillian Murphy, Greta Gerwig’s Narnia, Apex starring Charlize Theron, animated feature Steps, The Swedish Connection (Sweden), 72 Hours with Kevin Hart, the Denzel Washington-Robert Pattinson heist caper Here Comes the Flood, rom-com Office Romance starring Jennifer Lopez and Brett Goldstein, Quasimodo (France), and Enola Holmes 3.

__________________________________

3 A view is defined as hours viewed divided by runtime for each title. Views for a title are based on the first 91 days since the release of each episode (less than 91 days denoted with an asterisk and data is from launch date through January 18, 2026). We publish our top titles based on views each week at Netflix Top 104.

4 https://www.netflix.com/tudum/top10

5 https://about.netflix.com/en/news/what-next-netflix-reveals-series-films-and-games-coming-in-2026

In 2026, we’ll also expand our offering of licensed titles. Starting this month, members will be able to enjoy new release live action films from our new US licensing partnership with Universal. This deal complements our existing licensing deal for animated films from Universal’s animation studios, Illumination and DreamWorks Animation. We’ve also licensed ~20 shows from Paramount including Matlock and King of Queens for international territories and Seal Team, Watson and Mayor of Kingstown for US and international territories. Additionally, we recently announced we expanded our pay 1 film pact with Sony Pictures Entertainment from a US to a global deal. This partnership marks the first time that a distribution service will premiere theatrical films in the pay 1 window simultaneously on a global basis, with Netflix’s footprint expanding each year as Sony’s regional deals expire, with full global availability in early 2029.

We continue to broaden our entertainment offering, finding success with fresh voices—in H2, Ms. Rachel S1 was our 9th most-watched show with 47M views globally, while Mark Rober’s CrunchLabs had 12M views. This year, we’ll work with a broader set of creators6 and introduce new programming formats, like video podcasts. We’ve already begun to launch video podcasts from our partnerships with Spotify/The Ringer, iHeartMedia and Barstool Sports, and have just announced two new original podcasts with comedian Pete Davidson7 and NFL legend Michael Irvin8.

We’re also making progress bringing more and better games to our members across all devices. This quarter we launched the next phase of our games evolution with our cloud-delivered TV-based party games9, including Boggle, Pictionary, Lego Party and Tetris, to roughly one-third of our members. Early results are encouraging and we’ll be expanding our cloud games lineup in 2026 with titles like our recently announced, newly reimagined FIFA football simulation game.

As we seek to better satisfy members and increase the value of each hour of engagement, we recognize that not all viewing is created equal. Some titles spark a level of passion and fandom that delivers outsized impact for both our members and our business, and fandom is a powerful engine for our business. When members form a deep connection with a title—whether it’s Stranger Things, KPop Demon Hunters, or Bridgerton—they don’t just watch; they engage, share, and become passionate advocates. This passion translates into greater member satisfaction, higher retention, and increased word-of-mouth and acquisition, fueling both audience growth and brand loyalty. Fandom also drives new ways for audiences to engage with the stories they love, as seen with KPop Demon Hunters—not only the success of the sing-along in theaters, but also a cultural phenomenon with hit music and fast-selling themed merchandise. Other examples of this connection are our editorial site for fans, Tudum10, which reached a record 23.4M visits in December and 232M total visits in 2025 (up 18% from the prior year) and our recently opened Netflix Houses in Dallas, TX and King of Prussia, PA11, which have been attracting fans from in and out of state. By nurturing these deep bonds between members and the stories they love, we believe we unlock greater value for both our audience and our business.

Live programming is another example of where any given hour of entertainment has the potential to deliver outsized value. While accounting for a small proportion of total view hours, big live events like Anthony Joshua’s sixth round knockout of Jake Paul (33M average minute audience (Live+1)) and NFL Christmas Day12 drive disproportionate excitement and signups. This year we’re excited to deliver our first local live event outside the US: the World Baseball Classic (WBC) in Japan. Netflix will stream all 47 games of the 2026 WBC live and on demand for viewers in Japan, where the event is hugely popular.

__________________________________

6 https://www.netflix.com/tudum/articles/alan-chikin-chow-k-pop-series

7 https://www.netflix.com/tudum/articles/pete-davidson-podcast-news-release-date

8 https://www.netflix.com/tudum/articles/white-house-with-michael-irvin-podcast

9 https://www.nytimes.com/2025/11/13/business/media/netflix-video-game-tv.html

10 https://www.netflix.com/tudum

11 https://www.netflix.com/house

12 https://about.netflix.com/en/news/nfl-christmas-gameday-on-netflix-scores-again-with-the-lions-vikings

We’re also expanding and strengthening our live slate with our new show Star Search, with live fan voting, Skyscraper Live, and three Major League Baseball events including an exclusive Opening Night game and the Home Run Derby.

Product + Innovation

In 2025, we rolled out our redesigned TV experience to provide our members with an even better discovery experience. In addition, our new TV UI capabilities allow us to more seamlessly integrate our expanding entertainment offering, supporting our launch of video podcasts, TF1 programming in France, and a growing slate of live events and games. In 2026, we’ll continue to innovate on product features including interactive experiences such as live voting and Moments13, convenient and seamless connectivity to play games on TV using your phone as your controller, real-time personalized recommendations that respond to your moods and interests in the moment, and new discovery and viewing experiences including thematic title collections (like our Holiday collection in the graphic below) and vertical video experiences on mobile.

We continue to harness AI to enhance the experience for our members, and we’re expanding these capabilities to support our creative teams and advertisers. In 2025, we began testing new AI tools to help advertisers create custom ads based on Netflix’s intellectual property, and we plan to build on this progress in 2026. We also introduced automated workflows for ad concepts and used advanced AI models to streamline campaign planning, significantly speeding up these processes. In content production and promotion, we’re using AI to improve subtitle localization, making it easier for our titles to reach more viewers around the world. Additionally, we’re implementing AI-driven tools to help with merchandising, which improves our ability to connect members with the most relevant titles for them to watch.

__________________________________

13 https://www.netflix.com/tudum/articles/netflix-moments

Competition

We have long stated that we compete against all activities people engage with during their leisure time, including, but not limited to, other streaming services, linear television, social media, open content platforms, video gaming, and concerts to name just a few. As a result, the entertainment business has always been and remains fiercely competitive with strong players like the US media conglomerates, large technology companies, and local broadcasters and media companies outside the US.

At the same time, TV consumption patterns are constantly evolving, and competitive lines are increasingly blurring. A number of services place content on both their linear channels and streaming services at the same time. For example, the Golden Globes were available simultaneously on CBS and Paramount+, while last year’s Super Bowl was simulcast on Fox and Tubi. YouTube has been leaning into TV over the last several years by adding live professional sports and, starting in 2029, will be the global home to the Oscars14. Amazon owns a vast library of series and films through its acquisition of MGM Studios and is investing more into sports with Thursday Night Football and a full slate of NBA games. And Instagram is bringing Reels to TVs with a new app15.

We relish competition and work to earn more of consumers’ attention. Despite our success over the years, our share of TV time remains below 10% in the major markets in which we operate. For example, according to Nielsen, in December, our share of US TV time reached an all-time high of 9.0% (+0.5 points year over year), yet linear TV still comprises over 40% of US TV screen time.

Cash Flow and Capital Structure

Net cash generated from operating activities in Q4 was $2.1B vs. $1.5B in the prior year period. Free cash flow (FCF)16 in Q4’25 totaled $1.9B vs. $1.4B in Q4’24. For the full year 2025, we produced $10.1B of net cash generated from operating activities and $9.5B of FCF, up from $7.4B and $6.9B, respectively in 2024. FCF was higher than our forecast of $9B (+/- a few hundred million dollars) as the timing of an expected deposit of ~$700M related to our ongoing dispute with the Brazilian tax authorities shifted from 2025 to 2026. For 2026, assuming no material swings in F/X, we expect to generate free cash flow of roughly $11B, which assumes a cash content spend to content amortization ratio of ~1.1x.

During the quarter we repurchased 18.9M shares for $2.1B, leaving $8.0B remaining under our existing share repurchase authorization. We ended the quarter with gross debt of $14.5B and cash and cash equivalents of $9.0B.

On December 4, we obtained commitments for a $59B senior unsecured bridge facility to support our pending acquisition of Warner Bros. with the intention of replacing the bridge facility commitments with a more permanent and cost effective funding structure prior to closing. On December 19, we entered a $5B senior unsecured revolving credit facility and a $20B senior unsecured delayed draw term loan facility, and reduced our outstanding bridge facility commitments by a corresponding amount to $34B. On January 19, 2026, we obtained an increase to our bridge facility commitments of $8.2B to support our change to an all-cash transaction, increasing our aggregate bridge facility commitments to $42.2B. We anticipate reductions to these bridge facility commitments between now and closing through a combination of future bond offerings and cash we expect to accumulate on our balance sheet. Our capital allocation priorities are unchanged. We first prioritize reinvestment in the business, both organically and through selective M&A, while maintaining liquidity and then returning excess cash to

__________________________________

14 https://press.oscars.org/news/academy-partners-youtube-exclusive-global-rights-oscarsr-and-other-academy-content-starting

15 https://about.instagram.com/blog/announcements/instagram-tv-app

16 Defined as cash provided by (used in) operating activities less purchases of property and equipment.

shareholders through share repurchases. Consistent with that framework, we’ll pause our share buybacks to accumulate cash to help fund the pending acquisition of Warner Bros. We remain committed to maintaining a solid investment grade rating.

Warner Bros. Acquisition

In December, we announced that we’ll acquire Warner Bros.17, including its film and television studios, HBO Max and HBO. As announced earlier today, we and WBD amended our merger agreement, which now provides for an all-cash transaction18 valued at $27.75 per WBD share, replacing the previous mix of cash and Netflix stock. The revised transaction structure expedites the timeline to a WBD shareholder vote and provides greater certainty of value that will be delivered at closing.

We believe our proposed purchase of Warner Bros. will allow us to accelerate our business strategy. Together19, we see two main areas of opportunity. First, Warner Bros.’ library, development and IP will allow us to provide an even broader and higher-quality selection of content for members; and, second, the addition of HBO Max will allow us to offer more personalized and flexible subscription options, better meeting the diverse preferences of our global audience. Netflix and Warner Bros. are highly complementary businesses and together we’ll be able to offer more opportunities to creators and strengthen the entire entertainment industry. This will allow us to offer more choice and greater value to consumers. Additionally, we’ll expand production capacity in the US20 and abroad and grow investment in original content over the long-term, which will create jobs and help sustain a healthy entertainment industry.

__________________________________

17 https://ir.netflix.net/investor-news-and-events/financial-releases/press-release-details/2025/NETFLIX-TO-ACQUIRE-WARNER-BROS--FOLLOWING-THE-SEPARATION-OF-DISCOVERY-GLOBAL-FOR-A-TOTAL-ENTERPRISE-VALUE-OF-82-7-BILLION-Equity-Value-of-72-0-Billion/default.aspx

18 https://ir.netflix.net/investor-news-and-events/financial-releases/press-release-details/2026/Netflix-and-Warner-Bros--Discovery-Amend-Agreement-to-All-Cash-Transaction/default.aspx

19 https://www.netflixwbtogether.com/

20 https://about.netflix.com/en/impact/made-in-america

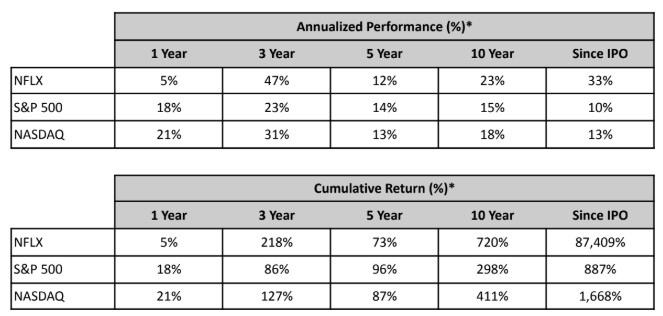

Long Term Stock Price Performance

In each January investor letter, we provide an update on our long term stock performance. We continue to manage our business for the long term and under the belief that pleasing our members will lead to strong value creation for our fellow shareholders. We thank our investors for their trust and for coming along with us on our journey to build one of the world's leading entertainment companies.

*As of 12/31/2025. Source: Bloomberg. For NFLX, based on IPO price, split adjusted. IPO was May 23, 2002. Total Shareholder Returns basis.

Reference

For quick reference, our past investor letters can be found here21.

___________________________________

21 https://ir.netflix.net/financials/quarterly-earnings/default.aspx

Regional Breakdown

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (in millions) |

Q4'24 |

Q1'25 |

Q2'25 |

Q3'25 |

Q4'25 |

| UCAN: |

|

|

|

|

|

| Revenue |

$ |

4,517 |

|

$ |

4,617 |

|

$ |

4,929 |

|

$ |

5,072 |

|

$ |

5,339 |

|

| Y/Y % Growth |

15 |

% |

9 |

% |

15 |

% |

17 |

% |

18 |

% |

| F/X Neutral Y/Y % Growth |

15 |

% |

9 |

% |

15 |

% |

17 |

% |

18 |

% |

|

|

|

|

|

|

| EMEA: |

|

|

|

|

|

| Revenue |

$ |

3,288 |

|

$ |

3,405 |

|

$ |

3,538 |

|

$ |

3,699 |

|

$ |

3,873 |

|

| Y/Y % Growth |

18 |

% |

15 |

% |

18 |

% |

18 |

% |

18 |

% |

| F/X Neutral Y/Y % Growth |

16 |

% |

16 |

% |

16 |

% |

15 |

% |

15 |

% |

|

|

|

|

|

|

| LATAM: |

|

|

|

|

|

| Revenue |

$ |

1,230 |

|

$ |

1,262 |

|

$ |

1,307 |

|

$ |

1,371 |

|

$ |

1,418 |

|

| Y/Y % Growth |

6 |

% |

8 |

% |

9 |

% |

10 |

% |

15 |

% |

| F/X Neutral Y/Y % Growth |

35 |

% |

27 |

% |

23 |

% |

20 |

% |

20 |

% |

|

|

|

|

|

|

| APAC: |

|

|

|

|

|

| Revenue |

$ |

1,212 |

|

$ |

1,259 |

|

$ |

1,305 |

|

$ |

1,369 |

|

$ |

1,421 |

|

| Y/Y % Growth |

26 |

% |

23 |

% |

24 |

% |

21 |

% |

17 |

% |

| F/X Neutral Y/Y % Growth |

24 |

% |

26 |

% |

23 |

% |

20 |

% |

19 |

% |

F/X Neutral revenue growth excludes the year over year effect of foreign exchange rate movements and the impact of hedging gains/losses realized as revenues. Assumes foreign exchange rates remained constant with foreign exchange rates from each of the corresponding months of the prior-year period.

January 20, 2026 Earnings Interview, 1:45pm PT

Our live video interview will be on youtube/netflixir22 at 1:45pm PT today. Co-CEOs Greg Peters and Ted Sarandos, CFO Spence Neumann and VP of Finance & Capital Markets Spencer Wang, will all be on the video to answer questions submitted by sellside analysts.

|

|

|

|

|

|

IR Contact: |

PR Contact: |

| Lowell Singer |

Emily Feingold |

| VP, Investor Relations |

VP, Corporate Communications |

| 818 434-2141 |

323 287-0756 |

__________________________________

22 https://www.youtube.com/netflixir

Use of Non-GAAP Measures

This shareholder letter and its attachments include reference to the non-GAAP financial measures of F/X neutral revenue and adjusted operating profit and margin, free cash flow and net debt. Management believes that free cash flow is an important liquidity metric because it measures, during a given period, the amount of cash generated that is available to repay debt obligations, make strategic acquisitions and investments and for certain other activities like stock repurchases. Management believes that F/X neutral revenue and adjusted operating profit and margin allow investors to compare our projected results to our actual results absent year-over-year and intra-year currency fluctuations, respectively. Management believes net debt is a useful measure of the company's liquidity, capital structure, and leverage. However, these non-GAAP financial measures should be considered in addition to, not as a substitute for or superior to, net income, operating income (profit), operating margin, diluted earnings per share and net cash provided by (used in) operating activities, or other financial measures prepared in accordance with GAAP. Reconciliation to the GAAP equivalent of these non-GAAP measures are contained in tabular form on the attached unaudited financial statements and in the F/X neutral operating margin disclosure above. We are not able to reconcile forward-looking non-GAAP financial measures because we are unable to predict without unreasonable effort the exact amount or timing of the reconciling items, including property and equipment and change in other assets, and the impact of changes in currency exchange rates. The variability of these items could have a significant impact on our future GAAP financial results.

Important Information and Where to Find It

In connection with the proposed transaction between Netflix and WBD, WBD filed a preliminary proxy statement on Schedule 14A (the “Proxy Statement”) with the U.S. Securities and Exchange Commission (the “SEC”) on January 20, 2026. The preliminary Proxy Statement is not final and may be amended, and the definitive Proxy Statement (if and when available) will be mailed to stockholders of WBD. WBD also intends to file a registration statement for the newly formed subsidiary of WBD (“Discovery Global”) that will be spun off from WBD prior to the closing of the proposed transaction. Each of Netflix and WBD may also file with or furnish to the SEC other relevant documents regarding the proposed transaction. This communication is not a substitute for the Proxy Statement or any other document that Netflix or WBD may file with the SEC or mail to WBD’s stockholders in connection with the proposed transaction. INVESTORS AND SECURITY HOLDERS OF NETFLIX AND WBD ARE URGED TO READ THE PROXY STATEMENT, AS WELL AS ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION OR INCORPORATED BY REFERENCE INTO THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO), BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION REGARDING NETFLIX, WBD, THE PROPOSED TRANSACTION AND RELATED MATTERS. The documents filed by Netflix with the SEC also may be obtained free of charge at Netflix’s website at https://ir.netflix.net/home/default.aspx. The documents filed by WBD with the SEC also may be obtained free of charge at WBD’s website at https://ir.wbd.com.

Participants in the Solicitation

Netflix, WBD and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of WBD in connection with the proposed transaction under the rules of the SEC. Information about the interests of the directors and executive officers of WBD and other persons who may be deemed to be participants in the solicitation of stockholders of WBD in connection with the proposed transaction and a description of their direct and indirect interests, by security holdings or otherwise, will be included in the Proxy Statement, which will be filed by WBD with the SEC. Information about WBD’s directors and executive officers is set forth in WBD’s proxy statement for its 2025 Annual Meeting of Stockholders on Schedule 14A filed with the SEC on April 23, 2025, WBD’s Annual Report on Form 10-K for the year ended December 31, 2024, and any subsequent filings with the SEC. Information about Netflix’s directors and executive officers is set forth

in Netflix’s proxy statement for its 2025 Annual Meeting of Stockholders on Schedule 14A filed with the SEC on April 17, 2025, and any subsequent filings with the SEC. Additional information regarding the direct and indirect interests of those persons and other persons who may be deemed participants in the proposed transaction may be obtained by reading the Proxy Statement regarding the proposed transaction when it becomes available. Free copies of these documents may be obtained as described above.

Cautionary Statement Regarding Forward-Looking Statements

This document contains “forward-looking statements” within the meaning of the federal securities laws, including Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are based on Netflix’s and WBD’s current expectations, estimates and projections about the expected date of closing of the proposed transaction and the potential benefits thereof, their respective businesses and industries, management’s beliefs and certain assumptions made by Netflix and WBD, all of which are subject to change. In this context, forward-looking statements often address expected future business and financial performance and financial condition, and often contain words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “could,” “seek,” “see,” “will,” “may,” “would,” “might,” “potentially,” “estimate,” “continue,” “expect,” “target,” similar expressions or the negatives of these words or other comparable terminology that convey uncertainty of future events or outcomes. Other forward-looking statements include statements regarding Netflix’s expected results for the fiscal quarter ending March 31, 2026 and fiscal year ending December 31, 2026, including for revenue, revenue growth, advertising revenue, operating income, operating margin, net income, earnings per share, expenses, free cash flow, content amortization; adoption and growth of streaming entertainment; growth strategy and outlook; expectations regarding series, films, live programming, and games and expansion into new content categories such as video podcasts; content slate; partnerships; market opportunity; engagement; advertising business; product innovation, including use of AI and enhancements to our platform; competitive landscape and positioning; subscription plan strategy; engagement and retention of members; slate strength; capital allocation, including share repurchases and reductions of the bridge facility commitments; credit rating; and the impact of foreign exchange rates and hedging activities. All forward-looking statements by their nature address matters that involve risks and uncertainties, many of which are beyond our control and are not guarantees of future results, such as statements about the consummation of the proposed transaction and the anticipated benefits thereof. These and other forward-looking statements, including the failure to consummate the proposed transaction or to make or take any filing or other action required to consummate the transaction on a timely matter or at all, are not guarantees of future results and are subject to risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed in any forward-looking statements. Accordingly, there are or will be important factors that could cause actual results to differ materially from those indicated in such statements and, therefore, you should not place undue reliance on any such statements and caution must be exercised in relying on forward-looking statements. Important risk factors that may cause such a difference include, but are not limited to: (i) the completion of the proposed transaction on anticipated terms and timing, including obtaining stockholder and regulatory approvals, completing the separation of WBD’s Discovery Global business and Warner Bros. business, anticipated tax treatment, unforeseen liabilities, future capital expenditures, revenues, expenses, earnings, synergies, economic performance, indebtedness, financial condition, losses, future prospects, business and management strategies, expansion and growth of WBD’s and Netflix’s businesses and other conditions to the completion of the proposed transaction; (ii) failure to realize the anticipated benefits of the proposed transaction, including as a result of delay in completing the transaction or integrating the businesses of Netflix and WBD; (iii) Netflix’s and WBD’s ability to implement their business strategies; (iv) consumer viewing trends; (v) potential litigation relating to the proposed transaction that could be instituted against Netflix, WBD or their respective directors; (vi) the risk that disruptions from the proposed transaction will harm Netflix’s or WBD’s business, including current plans

and operations; (vii) the ability of Netflix or WBD to retain and hire key personnel; (viii) potential adverse reactions or changes to business relationships resulting from the announcement, pendency or completion of the proposed transaction; (ix) uncertainty as to the long-term value of Netflix’s common stock; (x) legislative, regulatory and economic developments affecting Netflix’s and WBD’s businesses; (xi) general economic and market developments and conditions; (xii) the evolving legal, regulatory and tax regimes under which Netflix and WBD operate; (xiii) potential business uncertainty, including changes to existing business relationships, during the pendency of the proposed transaction that could affect Netflix’s or WBD’s financial performance; (xiv) restrictions during the pendency of the proposed transaction that may impact Netflix’s or WBD’s ability to pursue certain business opportunities or strategic transactions; and (xv) failure to receive the approval of the stockholders of WBD. Discussions of additional risks and uncertainties are contained in Netflix’s and WBD’s filings with the SEC, including their Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q, and the Proxy Statement filed by WBD in connection with the proposed transaction and the registration statement to be filed by Discovery Global in connection with the separation. While the list of factors presented here is, and the list of factors presented in the Proxy Statement and registration statement will be considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. Consequences of material differences in results as compared with those anticipated in the forward-looking statements could include, among other things, business disruption, operational problems, financial loss, legal liability to third parties and similar risks, any of which could have a material adverse effect on Netflix’s or WBD’s consolidated financial condition, results of operations or liquidity. Neither Netflix nor WBD assumes any obligation to publicly provide revisions or updates to any forward-looking statements, whether as a result of new information, future developments or otherwise, should circumstances change, except as otherwise required by securities and other applicable laws.

Netflix, Inc.

Consolidated Statements of Operations

(unaudited)

(in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Twelve Months Ended |

|

December 31,

2025 |

|

September 30,

2025 |

|

December 31,

2024 |

|

December 31,

2025 |

|

December 31,

2024 |

| Revenues |

$ |

12,050,762 |

|

|

$ |

11,510,307 |

|

|

$ |

10,246,513 |

|

|

$ |

45,183,036 |

|

|

$ |

39,000,966 |

|

Cost of revenues |

6,522,621 |

|

|

6,164,250 |

|

|

5,767,364 |

|

|

23,275,329 |

|

|

21,038,464 |

|

| Sales and marketing |

1,113,376 |

|

|

786,295 |

|

|

976,204 |

|

|

3,301,306 |

|

|

2,917,554 |

|

Technology and development |

890,300 |

|

|

853,584 |

|

|

776,505 |

|

|

3,391,390 |

|

|

2,925,295 |

|

General and administrative |

567,802 |

|

|

457,931 |

|

|

453,674 |

|

|

1,888,408 |

|

|

1,702,039 |

|

| Operating income |

2,956,663 |

|

|

3,248,247 |

|

|

2,272,766 |

|

|

13,326,603 |

|

|

10,417,614 |

|

| Other income (expense): |

|

|

|

|

|

|

|

|

|

| Interest expense |

(234,395) |

|

|

(175,294) |

|

|

(192,603) |

|

|

(776,510) |

|

|

(718,733) |

|

| Interest and other income |

45,473 |

|

|

36,457 |

|

|

54,105 |

|

|

172,459 |

|

|

266,776 |

|

| Income before income taxes |

2,767,741 |

|

|

3,109,410 |

|

|

2,134,268 |

|

|

12,722,552 |

|

|

9,965,657 |

|

| Provision for income taxes |

(349,220) |

|

|

(562,494) |

|

|

(265,661) |

|

|

(1,741,351) |

|

|

(1,254,026) |

|

| Net income |

$ |

2,418,521 |

|

|

$ |

2,546,916 |

|

|

$ |

1,868,607 |

|

|

$ |

10,981,201 |

|

|

$ |

8,711,631 |

|

| Earnings per share*: |

|

|

|

|

|

|

|

|

|

| Basic |

$ |

0.57 |

|

|

$ |

0.60 |

|

|

$ |

0.44 |

|

|

$ |

2.58 |

|

|

$ |

2.03 |

|

| Diluted |

$ |

0.56 |

|

|

$ |

0.59 |

|

|

$ |

0.43 |

|

|

$ |

2.53 |

|

|

$ |

1.98 |

|

| Weighted-average shares of common stock outstanding*: |

|

|

|

|

|

|

|

|

|

| Basic |

4,229,221 |

|

|

4,244,553 |

|

|

4,277,159 |

|

|

4,249,512 |

|

|

4,295,191 |

|

| Diluted |

4,317,144 |

|

|

4,340,392 |

|

|

4,377,861 |

|

|

4,343,863 |

|

|

4,392,608 |

|

* Share and per share amounts have been retroactively adjusted to reflect the ten-for-one forward stock split which was effected on November 14, 2025.

Netflix, Inc.

Consolidated Balance Sheets

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of |

|

|

December 31,

2025 |

|

December 31,

2024 |

|

|

(unaudited) |

|

|

| Assets |

|

|

|

|

| Current assets: |

|

|

|

|

| Cash and cash equivalents |

|

$ |

9,033,681 |

|

|

$ |

7,804,733 |

|

| Short-term investments |

|

28,678 |

|

|

1,779,006 |

|

| Other current assets |

|

3,957,832 |

|

|

3,516,640 |

|

| Total current assets |

|

13,020,191 |

|

|

13,100,379 |

|

| Content assets, net |

|

32,778,392 |

|

|

32,452,462 |

|

| Property and equipment, net |

|

2,004,350 |

|

|

1,593,756 |

|

| Other non-current assets |

|

7,794,060 |

|

|

6,483,777 |

|

| Total assets |

|

$ |

55,596,993 |

|

|

$ |

53,630,374 |

|

| Liabilities and Stockholders' Equity |

|

|

|

|

| Current liabilities: |

|

|

|

|

| Current content liabilities |

|

$ |

4,084,854 |

|

|

$ |

4,393,681 |

|

| Accounts payable |

|

900,612 |

|

|

899,909 |

|

| Accrued expenses and other liabilities |

|

3,220,869 |

|

|

2,156,544 |

|

| Deferred revenue |

|

1,775,730 |

|

|

1,520,813 |

|

| Short-term debt |

|

998,865 |

|

|

1,784,453 |

|

| Total current liabilities |

|

10,980,930 |

|

|

10,755,400 |

|

| Non-current content liabilities |

|

1,579,476 |

|

|

1,780,806 |

|

| Long-term debt |

|

13,463,971 |

|

|

13,798,351 |

|

| Other non-current liabilities |

|

2,957,128 |

|

|

2,552,250 |

|

| Total liabilities |

|

28,981,505 |

|

|

28,886,807 |

|

| Stockholders' equity: |

|

|

|

|

| Common stock |

|

7,286,410 |

|

|

6,252,126 |

|

| Treasury stock at cost |

|

(22,372,658) |

|

|

(13,171,638) |

|

| Accumulated other comprehensive income (loss) |

|

(580,382) |

|

|

362,162 |

|

| Retained earnings |

|

42,282,118 |

|

|

31,300,917 |

|

| Total stockholders' equity |

|

26,615,488 |

|

|

24,743,567 |

|

| Total liabilities and stockholders' equity |

|

$ |

55,596,993 |

|

|

$ |

53,630,374 |

|

|

|

|

|

|

| Supplemental Information |

|

|

|

|

| Total streaming content obligations* |

|

$ |

24,039,228 |

|

|

$ |

23,248,931 |

|

* Total streaming content obligations are comprised of content liabilities included in "Current content liabilities" and "Non-current content liabilities" on the Consolidated Balance Sheets and obligations that are not reflected on the Consolidated Balance Sheets as they did not yet meet the criteria for recognition.

Netflix, Inc.

Consolidated Statements of Cash Flows

(unaudited)

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Twelve Months Ended |

|

December 31,

2025 |

|

September 30,

2025 |

|

December 31,

2024 |

|

December 31,

2025 |

|

December 31,

2024 |

| Cash flows from operating activities: |

|

|

|

|

|

|

|

|

|

| Net income |

$ |

2,418,521 |

|

|

$ |

2,546,916 |

|

|

$ |

1,868,607 |

|

|

$ |

10,981,201 |

|

|

$ |

8,711,631 |

|

| Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

|

| Additions to content assets |

(5,057,212) |

|

|

(4,653,935) |

|

|

(4,429,402) |

|

|

(17,096,617) |

|

|

(16,223,617) |

|

| Change in content liabilities |

(9,795) |

|

|

24,262 |

|

|

(139,537) |

|

|

(610,838) |

|

|

(779,135) |

|

| Amortization of content assets |

4,764,236 |

|

|

4,002,744 |

|

|

4,161,501 |

|

|

16,422,166 |

|

|

15,301,517 |

|

| Depreciation and amortization of property, equipment and intangibles |

85,983 |

|

|

87,326 |

|

|

79,539 |

|

|

333,389 |

|

|

328,914 |

|

| Stock-based compensation expense |

134,624 |

|

|

80,986 |

|

|

61,827 |

|

|

368,449 |

|

|

272,588 |

|

| Foreign currency remeasurement loss (gain) on debt |

(9,730) |

|

|

(1,707) |

|

|

(52,855) |

|

|

72,348 |

|

|

(121,539) |

|

| Other non-cash items |

200,289 |

|

|

142,293 |

|

|

130,927 |

|

|

577,451 |

|

|

494,778 |

|

| Deferred income taxes |

(162,912) |

|

|

20,539 |

|

|

(73,252) |

|

|

(442,056) |

|

|

(590,698) |

|

| Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

| Other current assets |

(313,014) |

|

|

(169,597) |

|

|

(41,866) |

|

|

(790,661) |

|

|

22,180 |

|

| Accounts payable |

117,890 |

|

|

139,451 |

|

|

255,379 |

|

|

(8,039) |

|

|

121,353 |

|

| Accrued expenses and other liabilities |

134,889 |

|

|

707,151 |

|

|

(124,591) |

|

|

881,218 |

|

|

191,899 |

|

| Deferred revenue |

51,055 |

|

|

(3,686) |

|

|

7,765 |

|

|

254,917 |

|

|

77,844 |

|

| Other non-current assets and liabilities |

(243,182) |

|

|

(97,569) |

|

|

(167,148) |

|

|

(793,655) |

|

|

(446,351) |

|

| Net cash provided by operating activities |

2,111,642 |

|

|

2,825,174 |

|

|

1,536,894 |

|

|

10,149,273 |

|

|

7,361,364 |

|

| Cash flows from investing activities: |

|

|

|

|

|

|

|

|

|

| Purchases of property and equipment |

(239,335) |

|

|

(164,719) |

|

|

(158,674) |

|

|

(688,220) |

|

|

(439,538) |

|

|

|

|

|

|

|

|

|

|

|

| Acquisitions |

(17,194) |

|

|

— |

|

|

— |

|

|

(17,194) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Purchases of investments |

(8,450) |

|

|

(3,850) |

|

|

— |

|

|

(169,965) |

|

|

(1,742,246) |

|

| Proceeds from maturities and sales of investments |

8,450 |

|

|

176,250 |

|

|

— |

|

|

1,917,067 |

|

|

— |

|

| Other investing activities |

— |

|

|

36,190 |

|

|

— |

|

|

— |

|

|

— |

|

| Net cash provided by (used in) investing activities |

(256,529) |

|

|

43,871 |

|

|

(158,674) |

|

|

1,041,688 |

|

|

(2,181,784) |

|

| Cash flows from financing activities: |

|

|

|

|

|

|

|

|

|

| Proceeds from issuance of debt |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

1,794,460 |

|

| Repayments of debt |

— |

|

|

— |

|

|

— |

|

|

(1,833,450) |

|

|

(400,000) |

|

| Proceeds from issuance of common stock |

76,082 |

|

|

70,215 |

|

|

302,012 |

|

|

666,965 |

|

|

832,887 |

|

| Repurchases of common stock |

(2,079,559) |

|

|

(1,856,885) |

|

|

(963,748) |

|

|

(9,127,167) |

|

|

(6,263,746) |

|

| Taxes paid related to net share settlement of equity awards |

(5,985) |

|

|

(6,196) |

|

|

(2,553) |

|

|

(46,165) |

|

|

(8,285) |

|

|

|

|

|

|

|

|

|

|

|

| Other financing activities |

(67,948) |

|

|

55,837 |

|

|

(14,409) |

|

|

(5,806) |

|

|

(29,743) |

|

| Net cash used in financing activities |

(2,077,410) |

|

|

(1,737,029) |

|

|

(678,698) |

|

|

(10,345,623) |

|

|

(4,074,427) |

|

| Effect of exchange rate changes on cash, cash equivalents, and restricted cash |

(29,377) |

|

|

(21,721) |

|

|

(351,270) |

|

|

386,519 |

|

|

(416,331) |

|

| Net increase (decrease) in cash, cash equivalents, and restricted cash |

(251,674) |

|

|

1,110,295 |

|

|

348,252 |

|

|

1,231,857 |

|

|

688,822 |

|

| Cash, cash equivalents and restricted cash at beginning of period |

9,290,868 |

|

|

8,180,573 |

|

|

7,459,085 |

|

|

7,807,337 |

|

|

7,118,515 |

|

| Cash, cash equivalents and restricted cash at end of period |

$ |

9,039,194 |

|

|

$ |

9,290,868 |

|

|

$ |

7,807,337 |

|

|

$ |

9,039,194 |

|

|

$ |

7,807,337 |

|

|

Netflix, Inc.

Non-GAAP Information

(unaudited)

(in thousands, except percentages)

Non-GAAP Free Cash Flow

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Twelve Months Ended |

|

December 31,

2025 |

|

September 30,

2025 |

|

December 31,

2024 |

|

December 31,

2025 |

|

December 31,

2024 |

| Non-GAAP free cash flow reconciliation: |

|

|

|

|

|

|

|

|

|

| Net cash provided by operating activities |

$ |

2,111,642 |

|

|

$ |

2,825,174 |

|

|

$ |

1,536,894 |

|

|

$ |

10,149,273 |

|

|

$ |

7,361,364 |

|

| Purchases of property and equipment |

(239,335) |

|

|

(164,719) |

|

|

(158,674) |

|

|

(688,220) |

|

|

(439,538) |

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP free cash flow |

$ |

1,872,307 |

|

|

$ |

2,660,455 |

|

|

$ |

1,378,220 |

|

|

$ |

9,461,053 |

|

|

$ |

6,921,826 |

|

Non-GAAP Constant Currency Information

The tables below provide a non-GAAP reconciliation of reported and constant currency revenue growth by region for the quarters ended December 31, 2024, March 31, 2025, June 30, 2025, September 30, 2025, and December 31, 2025. The regions presented in the tables below include United States and Canada ("UCAN"), Europe, Middle East, and Africa ("EMEA"), Latin America ("LATAM"), and Asia-Pacific ("APAC").

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Three Months Ended |

|

Change |

|

|

December 31,

2024 |

|

December 31,

2023 |

|

Q4'24 vs. Q4'23 |

|

|

As Reported |

|

Constant Currency Adjustment |

|

Hedging (Gains) Losses Included in Revenues |

|

Constant Currency Revenues |

|

As Reported |

|

Hedging (Gains) Losses Included in Revenues |

|

Revenues

Less Hedging Impact |

|

Reported Change |

|

Constant Currency Change |

| UCAN |

|

$ |

4,517,018 |

|

|

$ |

3,153 |

|

|

$ |

(5,564) |

|

|

$ |

4,514,607 |

|

|

$ |

3,930,557 |

|

|

$ |

— |

|

|

$ |

3,930,557 |

|

|

15 |

% |

|

15 |

% |

| EMEA |

|

3,287,604 |

|

|

(46,338) |

|

|

(12,789) |

|

|

3,228,477 |

|

|

2,783,530 |

|

|

— |

|

|

2,783,530 |

|

|

18 |

% |

|

16 |

% |

| LATAM |

|

1,229,771 |

|

|

356,709 |

|

|

(28,307) |

|

|

1,558,173 |

|

|

1,156,023 |

|

|

— |

|

|

1,156,023 |

|

|

6 |

% |

|

35 |

% |

| APAC |

|

1,212,120 |

|

|

(12,752) |

|

|

(7,107) |

|

|

1,192,261 |

|

|

962,715 |

|

|

— |

|

|

962,715 |

|

|

26 |

% |

|

24 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Three Months Ended |

|

Change |

|

|

March 31,

2025 |

|

March 31,

2024 |

|

Q1'25 vs. Q1'24 |

|

|

As Reported |

|

Constant Currency Adjustment |

|

Hedging (Gains) Losses Included in Revenues |

|

Constant Currency Revenues |

|

As Reported |

|

Hedging (Gains) Losses Included in Revenues |

|

Revenues

Less Hedging Impact |

|

Reported Change |

|

Constant Currency Change |

| UCAN |

|

$ |

4,617,098 |

|

|

$ |

23,338 |

|

|

$ |

(14,552) |

|

|

$ |

4,625,884 |

|

|

$ |

4,224,315 |

|

|

$ |

831 |

|

|

$ |

4,225,146 |

|

|

9 |

% |

|

9 |

% |

| EMEA |

|

3,404,676 |

|

|

146,975 |

|

|

(105,225) |

|

|

3,446,426 |

|

|

2,958,193 |

|

|

4,687 |

|

|

2,962,880 |

|

|

15 |

% |

|

16 |

% |

| LATAM |

|

1,261,934 |

|

|

243,068 |

|

|

(13,936) |

|

|

1,491,066 |

|

|

1,165,008 |

|

|

6,266 |

|

|

1,171,274 |

|

|

8 |

% |

|

27 |

% |

| APAC |

|

1,259,093 |

|

|

62,243 |

|

|

(31,083) |

|

|

1,290,253 |

|

|

1,022,924 |

|

|

(543) |

|

|

1,022,381 |

|

|

23 |

% |

|

26 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Three Months Ended |

|

Change |

|

|

June 30,

2025 |

|

June 30,

2024 |

|

Q2'25 vs. Q2'24 |

|

|

As Reported |

|

Constant Currency Adjustment |

|

Hedging (Gains) Losses Included in Revenues |

|

Constant Currency Revenues |

|

As Reported |

|

Hedging (Gains) Losses Included in Revenues |

|

Revenues

Less Hedging Impact |

|

Reported Change |

|

Constant Currency Change |

| UCAN |

|

$ |

4,929,003 |

|

|

$ |

8,036 |

|

|

$ |

(6,431) |

|

|

$ |

4,930,608 |

|

|

$ |

4,295,560 |

|

|

$ |

(3,183) |

|

|

$ |

4,292,377 |

|

|

15 |

% |

|

15 |

% |

| EMEA |

|

3,538,175 |

|

|

(122,664) |

|

|

42,049 |

|

|

3,457,560 |

|

|

3,007,772 |

|

|

(15,344) |

|

|

2,992,428 |

|

|

18 |

% |

|

16 |

% |

| LATAM |

|

1,306,735 |

|

|

161,306 |

|

|

14,033 |

|

|

1,482,074 |

|

|

1,204,145 |

|

|

(1,759) |

|

|

1,202,386 |

|

|

9 |

% |

|

23 |

% |

| APAC |

|

1,305,253 |

|

|

(16,166) |

|

|

(12,266) |

|

|

1,276,821 |

|

|

1,051,833 |

|

|

(13,015) |

|

|

1,038,818 |

|

|

24 |

% |

|

23 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Three Months Ended |

|

Change |

|

|

September 30,

2025 |

|

September 30,

2024 |

|

Q3'25 vs. Q3'24 |

|

|

As Reported |

|

Constant Currency Adjustment |

|

Hedging (Gains) Losses Included in Revenues |

|

Constant Currency Revenues |

|

As Reported |

|

Hedging (Gains) Losses Included in Revenues |

|

Revenues

Less Hedging Impact |

|

Reported Change |

|

Constant Currency Change |

| UCAN |

|

$ |

5,071,781 |

|

|

$ |

1,816 |

|

|

$ |

(2,196) |

|

|

$ |

5,071,401 |

|

|

$ |

4,322,476 |

|

|

$ |

(3,265) |

|

|

$ |

4,319,211 |

|

|

17 |

% |

|

17 |

% |

| EMEA |

|

3,699,052 |

|

|

(199,597) |

|

|

113,580 |

|

|

3,613,035 |

|

|

3,133,466 |

|

|

(1,857) |

|

|

3,131,609 |

|

|

18 |

% |

|

15 |

% |

| LATAM |

|

1,370,913 |

|

|

53,678 |

|

|

26,300 |

|

|

1,450,891 |

|

|

1,240,892 |

|

|

(34,654) |

|

|

1,206,238 |

|

|

10 |

% |

|

20 |

% |

| APAC |

|

1,368,561 |

|

|

(14,750) |

|

|

(8,319) |

|

|

1,345,492 |

|

|

1,127,869 |

|

|

(8,408) |

|

|

1,119,461 |

|

|

21 |

% |

|

20 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Three Months Ended |

|

Change |

|

|

December 31,

2025 |

|

December 31,

2024 |

|

Q4'25 vs. Q4'24 |

|

|

As Reported |

|

Constant Currency Adjustment |

|

Hedging (Gains) Losses Included in Revenues |

|

Constant Currency Revenues |

|

As Reported |

|

Hedging (Gains) Losses Included in Revenues |

|

Revenues

Less Hedging Impact |

|

Reported Change |

|

Constant Currency Change |

| UCAN |

|

$ |

5,339,270 |

|

|

$ |

3,801 |

|

|

$ |

(6,612) |

|

|

$ |

5,336,459 |

|

|

$ |

4,517,018 |

|

|

$ |

(5,564) |

|

|

$ |

4,511,454 |

|

|

18 |

% |

|

18 |

% |

| EMEA |

|

3,872,743 |

|

|

(198,888) |

|

|

87,364 |

|

|

3,761,219 |

|

|

3,287,604 |

|

|

(12,789) |

|

|

3,274,815 |

|

|

18 |

% |

|

15 |

% |

| LATAM |

|

1,417,939 |

|

|

(1,052) |

|

|

27,711 |

|

|

1,444,598 |

|

|

1,229,771 |

|

|

(28,307) |

|

|

1,201,464 |

|

|

15 |

% |

|

20 |

% |

| APAC |

|

1,420,810 |

|

|

28,413 |

|

|

(19,274) |

|

|

1,429,949 |

|

|

1,212,120 |

|

|

(7,107) |

|

|

1,205,013 |

|

|

17 |

% |

|

19 |

% |

| Total Revenues |

|

$ |

12,050,762 |

|

|

$ |

(167,726) |

|

|

$ |

89,189 |

|

|

$ |

11,972,225 |

|

|

$ |

10,246,513 |

|

|

$ |

(53,767) |

|

|

$ |

10,192,746 |

|

|

18 |

% |

|

17 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP F/X Neutral Operating Margin

To provide additional transparency around our operating margin, we disclose each quarter our year-to-date (YTD) operating margin based on F/X rates at the beginning of each year. This will allow investors to see how our operating margin is tracking against our target (which was set in January of 2025 based on F/X rates at that time), absent intra-year fluctuations in F/X.

|

|

|

|

|

|

|

|

|

|

|

Full Year 2025 |

| As Reported |

|

|

| Revenue |

|

$ |

45,183,036 |

|

| Operating Expenses |

|

31,856,433 |

|

| Operating Profit |

|

$ |

13,326,603 |

|

| Operating Margin |

|

29.5 |

% |

|

|

|

| FX Impact |

|

|

| Revenue |

|

$ |

540,673 |

|

| Operating Expenses |

|

317,482 |

|

| Operating Profit |

|

$ |

223,191 |

|

|

|

|

| Adjusted* |

|

|

| Revenue |

|

$ |

44,642,363 |

|

| Operating Expenses |

|

31,538,951 |

|

| Operating Profit |

|

$ |

13,103,412 |

|

| Operating Margin |

|

29.4 |

% |

* Based on F/X rates at the beginning of each year including our F/X hedges at that time. Note: Excludes F/X impact on content amortization, as titles are amortized at a historical blended rate based on timing of spend.

Non-GAAP Net Debt

|

|

|

|

|

|

|

|

|

|

|

|

|

As of |

|

|

December 31,

2025 |

|

|

| Non-GAAP Net Debt reconciliation: |

|

|

|

|

| Total debt |

|

$ |

14,462,836 |

|

|

|

| Add: Debt issuance costs and original issue discount |

|

56,139 |

|

|

|

| Less: Cash and cash equivalents |

|

(9,033,681) |

|

|

|

| Less: Short-term investments |

|

(28,678) |

|

|

|

| Net debt |

|

$ |

5,456,616 |

|

|

|