Document

Exhibit 99.1

October 17, 2024

Fellow shareholders,

•In Q3, revenue grew 15% year over year and operating margin was 30% vs. 22% last year. For 2024, we expect revenue growth of 15% (the high end of our 14% to 15% range), and operating margin of 27% (vs 26% previously).

•We’ve delivered a string of hits this quarter, including new series like The Perfect Couple, Nobody Wants This and Tokyo Swindlers, returning favorites like Emily in Paris and Cobra Kai and big films like Beverly Hills Cop: Axel F, Rebel Ridge and Officer Black Belt.

•Engagement, our best proxy for member happiness, remains healthy. Through the first three quarters of 2024, view hours per member amongst owner households (the clearest view of engagement trends post the introduction of paid sharing) increased year over year.

•We continue to build our advertising business and improve our offering for advertisers. Ads membership was up 35% quarter on quarter, and our ad tech platform is on track to launch in Canada in Q4 and more broadly in 2025.

•We’ve delivered on our plan to reaccelerate our business, and we’re excited to finish the year strong with a great Q4 slate, including Squid Game S2, the Jake Paul/Mike Tyson fight and two NFL games on Christmas Day. As we look ahead to 2025, we’re focused on improving every aspect of our service and continuing to deliver healthy revenue and profit growth.

Our summary results, and forecast for Q4, are below.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (in millions except per share data) |

Q3'23 |

Q4'23 |

Q1'24 |

Q2'24 |

Q3'24 |

Q4'24 Forecast |

| Revenue |

$ |

8,542 |

|

$ |

8,833 |

|

$ |

9,370 |

|

$ |

9,559 |

|

$ |

9,825 |

|

$ |

10,128 |

|

| Y/Y % Growth |

7.8 |

% |

12.5 |

% |

14.8 |

% |

16.8 |

% |

15.0 |

% |

14.7 |

% |

| Operating Income |

$ |

1,916 |

|

$ |

1,496 |

|

$ |

2,633 |

|

$ |

2,603 |

|

$ |

2,909 |

|

$ |

2,190 |

|

| Operating Margin |

22.4 |

% |

16.9 |

% |

28.1 |

% |

27.2 |

% |

29.6 |

% |

21.6 |

% |

| Net Income |

$ |

1,677 |

|

$ |

938 |

|

$ |

2,332 |

|

$ |

2,147 |

|

$ |

2,364 |

|

$ |

1,847 |

|

| Diluted EPS |

$ |

3.73 |

|

$ |

2.11 |

|

$ |

5.28 |

|

$ |

4.88 |

|

$ |

5.40 |

|

$ |

4.23 |

|

|

|

|

|

|

|

|

| Global Streaming Paid Memberships |

247.15 |

|

260.28 |

|

269.60 |

|

277.65 |

|

282.72 |

|

|

| Y/Y % Growth |

10.8 |

% |

12.8 |

% |

16.0 |

% |

16.5 |

% |

14.4 |

% |

|

| Global Streaming Paid Net Additions |

8.76 |

|

13.12 |

|

9.33 |

|

8.05 |

|

5.07 |

|

|

|

|

|

|

|

|

|

| Net cash provided by operating activities |

$ |

1,992 |

|

$ |

1,663 |

|

$ |

2,213 |

|

$ |

1,291 |

|

$ |

2,321 |

|

|

| Free Cash Flow |

$ |

1,888 |

|

$ |

1,581 |

|

$ |

2,137 |

|

$ |

1,213 |

|

$ |

2,194 |

|

|

| Shares (FD) |

450.0 |

|

444.3 |

|

441.7 |

|

439.7 |

|

437.9 |

|

|

|

|

|

|

|

|

|

|

Q3 Results

Revenue in Q3 grew 15% (21% on a foreign exchange (F/X) neutral basis1), 1% higher than our beginning of quarter forecast. Average paid memberships increased 15% year over year as paid net additions in Q3 were 5.1M vs. 8.8M in Q3’23. ARM2 was flat year over year and up 5% on a F/X neutral basis3. Regional highlights include:

•UCAN, our most mature market, saw a 16% year over year increase in revenue, driven by 10% and 5% growth in average paid memberships and ARM, respectively.

•Revenue in EMEA grew 16% year over year, consistent with the increase in average paid memberships.

•We’re improving our product/market fit in APAC and had a strong local content slate in Japan, Korea, Thailand and India in Q3. As a result, our revenue growth rate in APAC (+19% year over year) led all regions.

•LATAM revenue rose 9% year over year. Paid net adds of -0.1M was due to recent price changes and a softer content slate. However, membership growth has rebounded nicely early in Q4’24.

Q3’24 operating income increased 52% year over year to $2.9B, while operating margin of 30% improved seven percentage points vs. the year ago quarter. This was above our guidance forecast due to slightly higher revenue and the timing of spending.

EPS amounted to $5.40 vs. $3.73 (+45% year over year) and included a $91M loss from F/X , predominantly related to our Euro denominated debt remeasurement (net of hedging impacts), which is recognized below operating income in “interest and other income”.

Forecast

As a reminder, the quarterly guidance we provide is our actual internal forecast at the time we report and we strive for accuracy, not conservatism. Our primary financial metrics are revenue for growth and operating margin for profitability. Our goals are to sustain healthy revenue growth, expand our operating margin and grow free cash flow.

For Q4’24, we forecast 15% revenue growth, or 17% on a F/X neutral basis. We expect paid net additions to be higher in Q4 than in Q3’24 due to normal seasonality and a strong content slate. We project Q4 operating margin of 22%, a five percentage point year-over-year improvement.

Our fourth quarter guidance implies that revenue will grow 15% year over year for the full year 2024, at the high end of our prior 14%-15% revenue growth expectation. Given the slightly higher revenue forecast, we’re now forecasting 2024 operating margin of 27% based on F/X rates as of 1/1/24 and on a reported basis, up from 26% previously. This would represent a six percentage point increase compared with the full year 2023.

We’re pleased that we’ve reaccelerated our growth and, as we head into 2025, we expect to deliver solid revenue and profit growth by both improving our core series and film offering while investing in new growth initiatives like ads and gaming. For 2025, based on F/X rates as of 9/30/24, we forecast

__________________________________

1 Excluding the year over year effect of foreign exchange rate movements and the impact of hedging gains/losses realized as revenues. Assumes foreign exchange rates remained constant with foreign exchange rates from each of the corresponding months of the prior-year period.

2 ARM (Average Revenue per Membership) is defined as streaming revenue divided by the average number of streaming paid memberships divided by the number of months in the period. These figures do not include sales taxes or VAT.

3 Similar to recent quarters, the primary difference between F/X neutral and reported growth for both revenue and ARM was large peso price increases in Argentina due to local inflation and the devaluation of the Argentine peso relative to the US dollar.

revenue of $43B-$44B, which would represent growth of 11%-13% off of our 2024 revenue guidance of $38.9B. We expect revenue growth to be driven by a healthy increase in paid memberships and ARM. We’re targeting a 2025 operating margin of 28% (also based on F/X rates as of 9/30) vs. our forecast for 27% in 2024; after delivering outsized margin improvement in 2024, we want to balance near term margin growth with investing appropriately in our business. We still see plenty of room to increase our margins over the long term.

Engagement & Content

Our members rely on Netflix to entertain them, and we want to be the first place they go for that entertainment. With an audience of 600M+ and growing, we’re programming for more tastes, cultures and languages than any company has ever done before. It’s why we invest in a wide variety of TV shows and films, and work so hard to make them great. Because when people love something, they’ll keep coming back (increased retention), talk more about Netflix (increased acquisition) and place a higher value on our service.

A strong measure of whether members loved a title is watch time. How many people liked a movie or TV show enough to press play and stay? It’s why we share Weekly Top 10 lists4 and twice a year engagement reports5, both of which are based on views (i.e. the total hours watched divided by the run time) and demonstrate that success on Netflix comes in all shapes and sizes. We have mega hits with enormous audiences, and hugely successful shows or movies with smaller ones. Critical acclaim is another measure of success that’s especially important for our creators. At this year’s Primetime Emmys, our talent received 107 nominations and 24 wins6 across multiple genres — from Ripley and The Crown to Beckham, Blue Eye Samurai and Love on the Spectrum. Baby Reindeer took home six awards, including Outstanding Limited Series, best actor and writing for creator Richard Gadd and best supporting actress for Jessica Gunning. All in, Netflix nominated titles generated more Nielsen Top 10 view hours, and appeared on these lists more frequently, than all other streamers combined.

Engagement on Netflix is healthy: around two hours a day per paid membership on average, despite the impact of paid sharing. As we’ve discussed before, paid sharing led to lower viewing on accounts that were shared as fewer people were watching on them. In addition, when sharers bought their own subscriptions, much of that viewing was already reflected in hours viewed (impacting the trend in view hours per membership). When you isolate owner households (which excludes the impact of paid sharing), view hours for those owner households rose year over year in the first three quarters of 2024.

Programming for such a large, engaged audience, with so much variety and great quality, is hard. It’s why streaming services which lack our breadth of content are increasingly looking to bundle their offerings (selling and discounting their services together, channel offerings, etc.). Netflix is already an extraordinary package of series and films (licensed and original), and increasingly games and live events — all in one place and for one price, easy to use and great value for money. At just under 10% of TV time today in our biggest countries, we believe there’s a huge opportunity to grow that share by investing even more in our slate and continuing to improve the variety and quality of our offering. Part of that improvement is ensuring we have a steady drumbeat of great, new TV shows, movies and games throughout the year to satisfy our members.

Our 2024 programming has been patchier than normal due to last year’s strikes. But our volume has picked up again and we’re excited for what’s ahead. We’ve seen break-out hit shows with The Perfect

___________________________________

4 https://www.netflix.com/tudum/top10/

5 https://about.netflix.com/en/news/what-we-watched-the-first-half-of-2024

6 https://about.netflix.com/en/news/netflix-awards-database-complete-list-of-academy-award-r-emmy-r-and-bafta

Couple*, starring Nicole Kidman and Liev Schreiber (65.2M views7), Monsters: The Lyle and Erik Menendez Story* by Ryan Murphy (54.6M views) — coupled with The Menendez Brothers* documentary in October (24.2M views) — Nobody Wants This* with Kristen Bell and Adam Brody (37.0M views), Simone Biles: Rising* (19.0M views), The Accident* from Mexico (37.2M views), Desperate Lies from Brazil (19.5M views), Breathless* from Spain (17.3M views), Tokyo Swindlers* from Japan (10.5M views) and Culinary Class Wars9* from Korea (11.0M views).

We had beloved returning seasons too: Emily in Paris season 4* (51.0M views), Selling Sunset season 8* (10.9M views), Too Hot to Handle season 6* (10.2M views) and Cobra Kai season 6* (36.5M views). And as fan favorites like Umbrella Academy* (25.5M views for its final fourth season; 326M across all seasons10) and Elite* (12.2M views for its final eighth season; 494M across all seasons) come to an end, we’re excited by the promise of our newer titles — with subsequent seasons recently announced for Nobody Wants This, The Diplomat, The Night Agent, Supacell, The Gentlemen, Culinary Class Wars and Desperate Lies.

On the film side, we’re generating very large audiences — making our movies some of the most watched of any studio in the world. These include The Union* (111.9M views), Rebel Ridge* (104.7M views), Beverly Hills Cop: Axel F (87.5M views), Vanished into the Night (Italy, 39.2M views), Officer Black Belt* (South Korea, 32.8M views), Maharaja (India, 22.6M views) and Blame the Game (Germany, 22.4M views).

In Q4, members will be able to choose from hit returning series Squid Game S211, Outer Banks S4, and Love is Blind S7 as well as new dramas like Black Doves from the UK (starring Keira Knightley) and comedies like No Good Deed (starring Lisa Kudrow and Ray Romano) and Man on The Inside with Ted Danson. In Latin America, we have two of the biggest, most ambitious shows ever made in the region premiering this winter: 100 Years of Solitude12 based on the iconic novel by Gabriel García Márquez from Colombia; and Senna13, a biopic about one of the greatest Formula 1 drivers of all time from Brazil. Our unscripted offerings include Aaron Rodgers: Enigma, which chronicles the life and career of the NFL legend, and the second season of our music competition series Rhythm + Flow. Our film slate includes Carry-On, an action thriller starring Taron Egerton and Jason Bateman, The Six Triple Eight, a Tyler Perry-directed war drama starring Kerry Washington, and Spellbound produced by John Lasseter.

We’ve also expanded our offering to include big live events, including the Mike Tyson and Jake Paul boxing match on November 1514 — and two Christmas Day NFL games, with the Kansas City Chiefs facing the Pittsburgh Steelers, and the Baltimore Ravens facing the Houston Texans.

Monetization

As we seek to grow engagement and deliver more value to our members, we’re also working to improve our monetization by refining our plans and pricing. Key is ensuring that we have a range of prices and plans to meet a variety of needs. Earlier this month, we increased prices in a few countries in EMEA plus Japan and starting tomorrow we'll increase prices in Spain and Italy. We phased out the Basic plan in the US and France this past quarter and we’ll do the same in Brazil later in Q4.

___________________________________

7 A view is defined as hours viewed divided by runtime for each title. Views for a title are based on the first 91 days since the release of each episode (less than 91 days denoted with an asterisk and data is from launch date through October 14, 2024). We publish our top titles based on views each week at Netflix Top 10.8

8 https://www.netflix.com/tudum/top10/

9 https://www.bloomberg.com/news/articles/2024-10-08/winner-of-netflix-hit-korean-cooking-show-culinary-class-wars-napoli-mafia

10 Views across all seasons are calculated based on launch date for each season through October 14, 2024.

11 https://www.youtube.com/watch?v=1GqzyjUbT4c

12 https://www.youtube.com/watch?v=vG45GfgD2JU

13 https://www.youtube.com/watch?v=LT7h6sUeUhU

14 https://www.netflix.com/tudum/articles/jake-paul-vs-mike-tyson-live-release-date-news

We’re now approaching the second anniversary of the launch of our advertising business and we’re making good progress. Our ads plan allows us to offer a lower price point for consumers, which is proving to be popular: in Q3, it accounted for over 50% of sign-ups in our ads countries and membership on our ads plan grew 35% quarter over quarter. We’re on track to reach what we believe to be critical ad subscriber scale for advertisers in all of our ads countries in 2025, creating a strong base from which we can further increase our ad membership in 2026 and beyond. We’re also pleased with the engagement on our ads plan with view hours per membership similar to engagement on our standard plan in our 12 ads countries.

However, we have much more work to do improving our offering for advertisers, which will be a priority over the next few years. Our in-house first party ad tech platform is on track to roll out in Canada next month, with a broader launch to all ads countries in 2025. We’ve also expanded our programmatic capabilities with The Trade Desk and Google DV 360, which is going well.

It’s still very early for our advertising initiative. As we said last quarter, it takes time to build a new revenue stream and we don’t expect ads to be a primary driver of our revenue growth in 2025. The near term challenge (and medium term opportunity) is that we’re scaling faster than our ability to monetize our growing ad inventory. While this creates a short term drag on ARM, we are balancing building ads scale (for more meaningful ads revenue and ARM contribution over time) while still delivering healthy overall revenue growth in the near term (as noted, we expect our total company revenue to grow 15% year over year in 2024). And we’re making progress with ads monetization, as we saw in this year’s US Upfront - closing deals with all major holding companies as well as independent agencies, with a 150% plus increase in upfront ad sales commitments over 2023, in-line with our expectations.

Cash Flow and Capital Structure

Net cash generated by operating activities in Q3 was $2.3B vs. $2.0B in the prior year period. Free cash flow (FCF)15 totaled $2.2B compared with $1.9B in last year’s Q3. For the full year, we now expect 2024 FCF of $6.0B-$6.5B (assuming no material swings in F/X rates), up from approximately $6B due to our higher operating income forecast. During Q3, we repurchased 2.6M shares for $1.7B, and we have $3.1B remaining under our existing authorization. We also raised $1.8B in our first investment grade bond deal during Q3. As a result, our total debt increased to $16B from $14B in Q2, but net debt16 decreased from $7.4B in Q2 to $6.8B at the end of Q3. Proceeds from our bond offering will be used to pay down $1.8B in bonds that mature over the next 12 months.

Reference

For quick reference, our past investor letters can be found here17.

___________________________________

15 Defined as cash provided by (used in) operating activities less purchases of property and equipment and change in other assets.

16 Defined as total debt less cash and cash equivalents and short-term investments. Total debt consists of short-term and long-term debt, plus debt issuance costs and original issuance discount.

17 https://ir.netflix.net/financials/quarterly-earnings/default.aspx

Regional Breakdown

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (in millions) |

Q3'23 |

Q4'23 |

Q1'24 |

Q2'24 |

Q3'24 |

| UCAN Streaming: |

|

|

|

|

|

| Revenue |

$ |

3,735 |

|

$ |

3,931 |

|

$ |

4,224 |

|

$ |

4,296 |

|

$ |

4,322 |

|

| Paid Memberships |

77.32 |

|

80.13 |

|

82.66 |

|

84.11 |

|

84.80 |

|

| Paid Net Additions |

1.75 |

|

2.81 |

|

2.53 |

|

1.45 |

|

0.69 |

|

| Average Revenue per Membership |

$ |

16.29 |

|

$ |

16.64 |

|

$ |

17.30 |

|

$ |

17.17 |

|

$ |

17.06 |

|

| Y/Y % Growth |

— |

% |

3 |

% |

7 |

% |

7 |

% |

5 |

% |

| F/X Neutral Y/Y % Growth |

— |

% |

3 |

% |

7 |

% |

7 |

% |

5 |

% |

|

|

|

|

|

|

| EMEA: |

|

|

|

|

|

| Revenue |

$ |

2,693 |

|

$ |

2,784 |

|

$ |

2,958 |

|

$ |

3,008 |

|

$ |

3,133 |

|

| Paid Memberships |

83.76 |

|

88.81 |

|

91.73 |

|

93.96 |

|

96.13 |

|

| Paid Net Additions |

3.95 |

|

5.05 |

|

2.92 |

|

2.24 |

|

2.17 |

|

Average Revenue per Membership |

$ |

10.98 |

|

$ |

10.75 |

|

$ |

10.92 |

|

$ |

10.80 |

|

$ |

10.99 |

|

| Y/Y % Growth |

2 |

% |

3 |

% |

— |

% |

(1) |

% |

— |

% |

| F/X Neutral Y/Y % Growth |

(2) |

% |

(1) |

% |

— |

% |

1 |

% |

1 |

% |

|

|

|

|

|

|

| LATAM: |

|

|

|

|

|

| Revenue |

$ |

1,143 |

|

$ |

1,156 |

|

$ |

1,165 |

|

$ |

1,204 |

|

$ |

1,241 |

|

| Paid Memberships |

43.65 |

|

46.00 |

|

47.72 |

|

49.25 |

|

49.18 |

|

| Paid Net Additions |

1.18 |

|

2.35 |

|

1.72 |

|

1.53 |

|

(0.07) |

|

Average Revenue per Membership |

$ |

8.85 |

|

$ |

8.60 |

|

$ |

8.29 |

|

$ |

8.28 |

|

$ |

8.40 |

|

| Y/Y % Growth |

3 |

% |

4 |

% |

(4) |

% |

(3) |

% |

(5) |

% |

| F/X Neutral Y/Y % Growth |

8 |

% |

16 |

% |

16 |

% |

24 |

% |

27 |

% |

|

|

|

|

|

|

| APAC: |

|

|

|

|

|

| Revenue |

$ |

948 |

|

$ |

963 |

|

$ |

1,023 |

|

$ |

1,052 |

|

$ |

1,128 |

|

| Paid Memberships |

42.43 |

|

45.34 |

|

47.50 |

|

50.32 |

|

52.60 |

|

| Paid Net Additions |

1.88 |

|

2.91 |

|

2.16 |

|

2.83 |

|

2.28 |

|

Average Revenue per Membership |

$ |

7.62 |

|

$ |

7.31 |

|

$ |

7.35 |

|

$ |

7.17 |

|

$ |

7.31 |

|

| Y/Y % Growth |

(9) |

% |

(5) |

% |

(8) |

% |

(6) |

% |

(4) |

% |

| F/X Neutral Y/Y % Growth |

(6) |

% |

(4) |

% |

(4) |

% |

(3) |

% |

(2) |

% |

F/X Neutral ARM growth excludes the year over year effect of foreign exchange rate movements and the impact of hedging gains/losses realized as revenues. Assumes foreign exchange rates remained constant with foreign exchange rates from each of the corresponding months of the prior-year period.

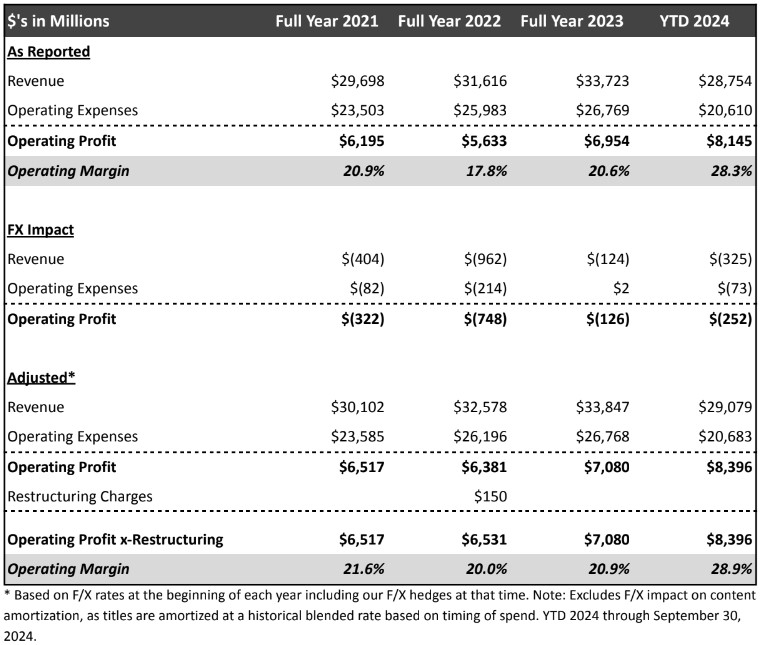

F/X Neutral Operating Margin Disclosure

To provide additional transparency around our operating margin, we disclose each quarter our year-to-date (YTD) operating margin based on F/X rates at the beginning of each year. This will allow investors to see how our operating margin is tracking against our target (which was set in January of 2024 based on F/X rates at that time), absent intra-year fluctuations in F/X.

October 17, 2024 Earnings Interview, 1:45pm PT

Our live video interview will be on youtube/netflixir18 at 1:45pm PT today. Co-CEOs Greg Peters and Ted Sarandos, CFO Spence Neumann and VP of Finance/IR/Corporate Development Spencer Wang, will all be on the video to answer questions submitted by sellside analysts.

|

|

|

|

|

|

IR Contact: |

PR Contact: |

| Lowell Singer |

Emily Feingold |

| VP, Investor Relations |

VP, Corporate Communications |

| 818 434-2141 |

323 287-0756 |

__________________________________

18 https://www.youtube.com/netflixir

Use of Non-GAAP Measures

This shareholder letter and its attachments include reference to the non-GAAP financial measures of F/X neutral revenue and adjusted operating profit and margin, free cash flow and net debt. Management believes that free cash flow is an important liquidity metric because it measures, during a given period, the amount of cash generated that is available to repay debt obligations, make strategic acquisitions and investments and for certain other activities like stock repurchases. Management believes that F/X neutral revenue and adjusted operating profit and margin allow investors to compare our projected results to our actual results absent year-over-year and intra-year currency fluctuations, respectively, and the impact of restructuring costs. Management believes net debt is a useful measure of the company's liquidity, capital structure, and leverage. However, these non-GAAP financial measures should be considered in addition to, not as a substitute for or superior to, net income, operating income (profit), operating margin, diluted earnings per share and net cash provided by (used in) operating activities, or other financial measures prepared in accordance with GAAP. Reconciliation to the GAAP equivalent of these non-GAAP measures are contained in tabular form on the attached unaudited financial statements and in the F/X neutral operating margin disclosure above. We are not able to reconcile forward-looking non-GAAP financial measures because we are unable to predict without unreasonable effort the exact amount or timing of the reconciling items, including property and equipment and change in other assets, and the impact of changes in currency exchange rates. The variability of these items could have a significant impact on our future GAAP financial results.

Forward-Looking Statements

This shareholder letter contains certain forward-looking statements within the meaning of the federal securities laws, including statements regarding our expected results for the fiscal quarter and fiscal year ending December 31, 2024; adoption and growth of streaming entertainment; growth strategy and outlook; market opportunity; competitive landscape and position; entertainment offerings, including TV shows, movies, games, and live programming; engagement; slate strength; pricing and plans strategy; ad-supported tier and its prospects; advertising business, including the launch of our ad-tech platform; product strategy; partnerships; impact of foreign exchange rates; foreign currency exchange hedging program; stock repurchases; debt refinancings and expected use of proceeds; paid net additions; revenue and revenue growth; ARM, operating income, operating margin, net income, earnings per share, and free cash flow. The forward-looking statements in this letter are subject to risks and uncertainties that could cause actual results and events to differ, including, without limitation: our ability to attract new members and engage and retain existing members; our ability to compete effectively, including for consumer engagement with different modes of entertainment; failing to improve the variety and quality of entertainment offerings; adoption of the ads plan and paid sharing; maintenance and expansion of device platforms for streaming; fluctuations in consumer usage of our service; service disruptions; production risks; macroeconomic conditions; content slate and timing of content releases. A detailed discussion of these and other risks and uncertainties that could cause actual results and events to differ materially from such forward-looking statements is included in our filings with the Securities and Exchange Commission, including our Annual Report on Form 10-K, filed with the Securities and Exchange Commission (“SEC”) on January 26, 2024. The Company provides internal forecast numbers. Investors should anticipate that actual performance will vary from these forecast numbers based on risks and uncertainties discussed above and in our Annual Report on Form 10-K. We undertake no obligation to update forward-looking statements to reflect events or circumstances occurring after the date of this shareholder letter.

Netflix, Inc.

Consolidated Statements of Operations

(unaudited)

(in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

September 30,

2024 |

|

June 30,

2024 |

|

September 30,

2023 |

|

September 30,

2024 |

|

September 30,

2023 |

| Revenues |

$ |

9,824,703 |

|

|

$ |

9,559,310 |

|

|

$ |

8,541,668 |

|

|

$ |

28,754,453 |

|

|

$ |

24,890,472 |

|

Cost of revenues |

5,119,884 |

|

|

5,174,143 |

|

|

4,930,788 |

|

|

15,271,100 |

|

|

14,407,883 |

|

Marketing |

642,926 |

|

|

644,084 |

|

|

558,736 |

|

|

1,941,350 |

|

|

1,741,266 |

|

Technology and development |

735,063 |

|

|

711,254 |

|

|

657,159 |

|

|

2,148,790 |

|

|

2,002,417 |

|

General and administrative |

417,353 |

|

|

426,992 |

|

|

478,591 |

|

|

1,248,365 |

|

|

1,281,012 |

|

| Operating income |

2,909,477 |

|

|

2,602,837 |

|

|

1,916,394 |

|

|

8,144,848 |

|

|

5,457,894 |

|

| Other income (expense): |

|

|

|

|

|

|

|

|

|

| Interest expense |

(184,830) |

|

|

(167,986) |

|

|

(175,563) |

|

|

(526,130) |

|

|

(524,614) |

|

| Interest and other income (expense) |

(21,693) |

|

|

79,005 |

|

|

168,218 |

|

|

212,671 |

|

|

123,975 |

|

| Income before income taxes |

2,702,954 |

|

|

2,513,856 |

|

|

1,909,049 |

|

|

7,831,389 |

|

|

5,057,255 |

|

| Provision for income taxes |

(339,445) |

|

|

(366,550) |

|

|

(231,627) |

|

|

(988,365) |

|

|

(587,103) |

|

| Net income |

$ |

2,363,509 |

|

|

$ |

2,147,306 |

|

|

$ |

1,677,422 |

|

|

$ |

6,843,024 |

|

|

$ |

4,470,152 |

|

| Earnings per share: |

|

|

|

|

|

|

|

|

|

| Basic |

$ |

5.52 |

|

|

$ |

4.99 |

|

|

$ |

3.80 |

|

|

$ |

15.91 |

|

|

$ |

10.08 |

|

| Diluted |

$ |

5.40 |

|

|

$ |

4.88 |

|

|

$ |

3.73 |

|

|

$ |

15.56 |

|

|

$ |

9.90 |

|

| Weighted-average shares of common stock outstanding: |

|

|

|

|

|

|

|

|

|

| Basic |

428,239 |

|

|

430,065 |

|

|

441,537 |

|

|

430,125 |

|

|

443,540 |

|

| Diluted |

437,898 |

|

|

439,739 |

|

|

450,011 |

|

|

439,757 |

|

|

451,319 |

|

Netflix, Inc.

Consolidated Balance Sheets

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of |

|

|

September 30,

2024 |

|

December 31,

2023 |

|

|

(unaudited) |

|

|

| Assets |

|

|

|

|

| Current assets: |

|

|

|

|

| Cash and cash equivalents |

|

$ |

7,457,025 |

|

|

$ |

7,116,913 |

|

| Short-term investments |

|

1,766,902 |

|

|

20,973 |

|

| Other current assets |

|

2,905,172 |

|

|

2,780,247 |

|

| Total current assets |

|

12,129,099 |

|

|

9,918,133 |

|

| Content assets, net |

|

32,175,382 |

|

|

31,658,056 |

|

| Property and equipment, net |

|

1,568,212 |

|

|

1,491,444 |

|

| Other non-current assets |

|

6,409,151 |

|

|

5,664,359 |

|

| Total assets |

|

$ |

52,281,844 |

|

|

$ |

48,731,992 |

|

| Liabilities and Stockholders' Equity |

|

|

|

|

| Current liabilities: |

|

|

|

|

| Current content liabilities |

|

$ |

4,489,971 |

|

|

$ |

4,466,470 |

|

| Accounts payable |

|

641,953 |

|

|

747,412 |

|

| Accrued expenses and other liabilities |

|

2,241,758 |

|

|

1,803,960 |

|

| Deferred revenue |

|

1,513,048 |

|

|

1,442,969 |

|

| Short-term debt |

|

1,820,396 |

|

|

399,844 |

|

| Total current liabilities |

|

10,707,126 |

|

|

8,860,655 |

|

| Non-current content liabilities |

|

1,918,089 |

|

|

2,578,173 |

|

| Long-term debt |

|

14,160,932 |

|

|

14,143,417 |

|

| Other non-current liabilities |

|

2,774,961 |

|

|

2,561,434 |

|

| Total liabilities |

|

29,561,108 |

|

|

28,143,679 |

|

| Stockholders' equity: |

|

|

|

|

| Common stock |

|

5,887,903 |

|

|

5,145,172 |

|

| Treasury stock at cost |

|

(12,254,855) |

|

|

(6,922,200) |

|

| Accumulated other comprehensive loss |

|

(344,622) |

|

|

(223,945) |

|

| Retained earnings |

|

29,432,310 |

|

|

22,589,286 |

|

| Total stockholders' equity |

|

22,720,736 |

|

|

20,588,313 |

|

| Total liabilities and stockholders' equity |

|

$ |

52,281,844 |

|

|

$ |

48,731,992 |

|

|

|

|

|

|

| Supplemental Information |

|

|

|

|

| Total streaming content obligations* |

|

$ |

22,698,295 |

|

|

$ |

21,713,349 |

|

* Total streaming content obligations are comprised of content liabilities included in "Current content liabilities" and "Non-current content liabilities" on the Consolidated Balance Sheets and obligations that are not reflected on the Consolidated Balance Sheets as they did not yet meet the criteria for recognition.

Netflix, Inc.

Consolidated Statements of Cash Flows

(unaudited)

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

September 30,

2024 |

|

June 30,

2024 |

|

September 30,

2023 |

|

September 30,

2024 |

|

September 30,

2023 |

| Cash flows from operating activities: |

|

|

|

|

|

|

|

|

|

| Net income |

$ |

2,363,509 |

|

|

$ |

2,147,306 |

|

|

$ |

1,677,422 |

|

|

$ |

6,843,024 |

|

|

$ |

4,470,152 |

|

| Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

|

| Additions to content assets |

(4,016,396) |

|

|

(4,048,852) |

|

|

(2,883,839) |

|

|

(11,794,215) |

|

|

(9,025,512) |

|

| Change in content liabilities |

(83,585) |

|

|

(366,572) |

|

|

(325,989) |

|

|

(639,598) |

|

|

(634,661) |

|

| Amortization of content assets |

3,699,521 |

|

|

3,769,690 |

|

|

3,573,353 |

|

|

11,140,016 |

|

|

10,443,358 |

|

| Depreciation and amortization of property, equipment and intangibles |

80,914 |

|

|

81,227 |

|

|

90,660 |

|

|

249,375 |

|

|

270,380 |

|

| Stock-based compensation expense |

65,650 |

|

|

68,766 |

|

|

79,720 |

|

|

210,761 |

|

|

256,849 |

|

| Foreign currency remeasurement loss (gain) on debt |

104,809 |

|

|

(42,692) |

|

|

(172,678) |

|

|

(68,684) |

|

|

(63,075) |

|

| Other non-cash items |

128,082 |

|

|

138,588 |

|

|

115,688 |

|

|

363,851 |

|

|

357,179 |

|

| Deferred income taxes |

(200,982) |

|

|

(209,387) |

|

|

(86,277) |

|

|

(517,446) |

|

|

(288,231) |

|

| Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

| Other current assets |

54,956 |

|

|

(28,959) |

|

|

103,766 |

|

|

64,046 |

|

|

(167,805) |

|

| Accounts payable |

30,597 |

|

|

(19,358) |

|

|

(68,390) |

|

|

(134,026) |

|

|

(119,726) |

|

| Accrued expenses and other liabilities |

179,011 |

|

|

(114,303) |

|

|

(65,029) |

|

|

316,490 |

|

|

298,101 |

|

| Deferred revenue |

39,328 |

|

|

4,236 |

|

|

(5,733) |

|

|

70,079 |

|

|

41,524 |

|

| Other non-current assets and liabilities |

(124,313) |

|

|

(88,843) |

|

|

(40,359) |

|

|

(279,203) |

|

|

(227,246) |

|

| Net cash provided by operating activities |

2,321,101 |

|

|

1,290,847 |

|

|

1,992,315 |

|

|

5,824,470 |

|

|

5,611,287 |

|

| Cash flows from investing activities: |

|

|

|

|

|

|

|

|

|

| Purchases of property and equipment |

(126,863) |

|

|

(78,287) |

|

|

(103,929) |

|

|

(280,864) |

|

|

(266,920) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Purchases of investments |

(1,742,246) |

|

|

— |

|

|

— |

|

|

(1,742,246) |

|

|

(504,862) |

|

| Proceeds from maturities of investments |

— |

|

|

— |

|

|

400,000 |

|

|

— |

|

|

901,937 |

|

| Net cash provided by (used in) investing activities |

(1,869,109) |

|

|

(78,287) |

|

|

296,071 |

|

|

(2,023,110) |

|

|

130,155 |

|

| Cash flows from financing activities: |

|

|

|

|

|

|

|

|

|

| Proceeds from issuance of debt |

1,794,460 |

|

|

— |

|

|

— |

|

|

1,794,460 |

|

|

— |

|

| Repayments of debt |

— |

|

|

— |

|

|

— |

|

|

(400,000) |

|

|

— |

|

| Proceeds from issuance of common stock |

143,244 |

|

|

118,750 |

|

|

57,818 |

|

|

530,875 |

|

|

118,563 |

|

| Repurchases of common stock |

(1,700,000) |

|

|

(1,599,998) |

|

|

(2,500,100) |

|

|

(5,299,998) |

|

|

(3,545,347) |

|

| Taxes paid related to net share settlement of equity awards |

(2,024) |

|

|

(1,883) |

|

|

— |

|

|

(5,732) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

| Other financing activities |

(9,084) |

|

|

(6,250) |

|

|

(32,826) |

|

|

(15,334) |

|

|

(71,746) |

|

| Net cash provided by (used in) financing activities |

226,596 |

|

|

(1,489,381) |

|

|

(2,475,108) |

|

|

(3,395,729) |

|

|

(3,498,530) |

|

| Effect of exchange rate changes on cash, cash equivalents, and restricted cash |

153,452 |

|

|

(122,723) |

|

|

(122,707) |

|

|

(65,061) |

|

|

(56,658) |

|

| Net increase (decrease) in cash, cash equivalents, and restricted cash |

832,040 |

|

|

(399,544) |

|

|

(309,429) |

|

|

340,570 |

|

|

2,186,254 |

|

| Cash, cash equivalents and restricted cash at beginning of period |

6,627,045 |

|

|

7,026,589 |

|

|

7,666,265 |

|

|

7,118,515 |

|

|

5,170,582 |

|

| Cash, cash equivalents and restricted cash at end of period |

$ |

7,459,085 |

|

|

$ |

6,627,045 |

|

|

$ |

7,356,836 |

|

|

$ |

7,459,085 |

|

|

$ |

7,356,836 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

September 30,

2024 |

|

June 30,

2024 |

|

September 30,

2023 |

|

September 30,

2024 |

|

September 30,

2023 |

| Non-GAAP free cash flow reconciliation: |

|

|

|

|

|

|

|

|

|

| Net cash provided by operating activities |

$ |

2,321,101 |

|

|

$ |

1,290,847 |

|

|

$ |

1,992,315 |

|

|

$ |

5,824,470 |

|

|

$ |

5,611,287 |

|

| Purchases of property and equipment |

(126,863) |

|

|

(78,287) |

|

|

(103,929) |

|

|

(280,864) |

|

|

(266,920) |

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP free cash flow |

$ |

2,194,238 |

|

|

$ |

1,212,560 |

|

|

$ |

1,888,386 |

|

|

$ |

5,543,606 |

|

|

$ |

5,344,367 |

|

Netflix, Inc.

Non-GAAP Information

(unaudited)

(in thousands, except percentages)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As Reported |

|

Constant Currency Adjustment |

|

Hedging Gain Included in Revenue |

|

Constant Currency Revenue |

|

Reported Change |

|

Constant Currency Change |

| Non-GAAP reconciliation of reported and constant currency revenue growth for the quarter ended September 30, 2024: |

| Total revenues |

$ |

9,824,703 |

|

|

$ |

524,153 |

|

|

$ |

(48,184) |

|

|

$ |

10,300,672 |

|

|

15 |

% |

|

21 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of |

|

|

September 30,

2024 |

|

June 30,

2024 |

| Non-GAAP Net Debt reconciliation: |

|

|

|

|

| Total debt |

|

$ |

15,981,328 |

|

|

$ |

13,980,065 |

|

| Add: Debt issuance costs and original issue discount |

|

73,969 |

|

|

58,039 |

|

| Less: Cash and cash equivalents |

|

(7,457,025) |

|

|

(6,624,939) |

|

| Less: Short-term investments |

|

(1,766,902) |

|

|

(30,973) |

|

| Net debt |

|

$ |

6,831,370 |

|

|

$ |

7,382,192 |

|