00010647282023FYfalsehttp://fasb.org/us-gaap/2023#AccountsPayableAndAccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#AccountsPayableAndAccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#LongTermDebtAndCapitalLeaseObligationshttp://fasb.org/us-gaap/2023#LongTermDebtAndCapitalLeaseObligations00010647282023-01-012023-12-3100010647282023-06-30iso4217:USD00010647282024-02-16xbrli:shares00010647282022-01-012022-12-3100010647282022-12-3100010647282021-12-3100010647282023-12-310001064728btu:AssetRetirementObligationsMember2023-12-310001064728btu:OtherObligationsMember2023-12-310001064728btu:AssetRetirementAndOtherObligationsMember2023-12-3100010647282023-10-012023-12-3100010647282021-01-012021-12-31iso4217:USDxbrli:shares0001064728us-gaap:PreferredStockMember2023-12-310001064728us-gaap:PreferredStockMember2022-12-310001064728btu:SeriesCommonStockMember2023-12-310001064728btu:SeriesCommonStockMember2022-12-3100010647282020-12-310001064728us-gaap:CommonStockMember2020-12-310001064728us-gaap:AdditionalPaidInCapitalMember2020-12-310001064728us-gaap:TreasuryStockCommonMember2020-12-310001064728us-gaap:RetainedEarningsMember2020-12-310001064728us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001064728us-gaap:NoncontrollingInterestMember2020-12-310001064728us-gaap:RetainedEarningsMember2021-01-012021-12-310001064728us-gaap:NoncontrollingInterestMember2021-01-012021-12-310001064728us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001064728us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001064728us-gaap:CommonStockMember2021-01-012021-12-310001064728us-gaap:CommonStockMemberus-gaap:CommonStockMember2021-01-012021-12-310001064728us-gaap:AdditionalPaidInCapitalMemberus-gaap:CommonStockMember2021-01-012021-12-310001064728us-gaap:CommonStockMember2021-01-012021-12-310001064728us-gaap:TreasuryStockCommonMember2021-01-012021-12-310001064728us-gaap:CommonStockMember2021-12-310001064728us-gaap:AdditionalPaidInCapitalMember2021-12-310001064728us-gaap:TreasuryStockCommonMember2021-12-310001064728us-gaap:RetainedEarningsMember2021-12-310001064728us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001064728us-gaap:NoncontrollingInterestMember2021-12-310001064728us-gaap:RetainedEarningsMember2022-01-012022-12-310001064728us-gaap:NoncontrollingInterestMember2022-01-012022-12-310001064728us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001064728us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001064728us-gaap:CommonStockMemberus-gaap:CommonStockMember2022-01-012022-12-310001064728us-gaap:AdditionalPaidInCapitalMemberus-gaap:CommonStockMember2022-01-012022-12-310001064728us-gaap:TreasuryStockCommonMember2022-01-012022-12-310001064728us-gaap:CommonStockMember2022-12-310001064728us-gaap:AdditionalPaidInCapitalMember2022-12-310001064728us-gaap:TreasuryStockCommonMember2022-12-310001064728us-gaap:RetainedEarningsMember2022-12-310001064728us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001064728us-gaap:NoncontrollingInterestMember2022-12-310001064728us-gaap:RetainedEarningsMember2023-01-012023-12-310001064728us-gaap:NoncontrollingInterestMember2023-01-012023-12-310001064728us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001064728us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310001064728us-gaap:TreasuryStockCommonMember2023-01-012023-12-310001064728us-gaap:CommonStockMember2023-12-310001064728us-gaap:AdditionalPaidInCapitalMember2023-12-310001064728us-gaap:TreasuryStockCommonMember2023-12-310001064728us-gaap:RetainedEarningsMember2023-12-310001064728us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001064728us-gaap:NoncontrollingInterestMember2023-12-310001064728srt:MaximumMemberus-gaap:ProductiveLandMember2023-12-310001064728us-gaap:MachineryAndEquipmentMembersrt:MinimumMemberus-gaap:BuildingAndBuildingImprovementsMember2023-12-310001064728srt:MaximumMemberus-gaap:MachineryAndEquipmentMemberus-gaap:BuildingAndBuildingImprovementsMember2023-12-31xbrli:pure0001064728btu:MiddlemountMineMember2023-12-310001064728us-gaap:DomesticDestinationMemberbtu:ThermalCoalMemberbtu:SeaborneThermalMiningMember2023-01-012023-12-310001064728us-gaap:DomesticDestinationMemberbtu:ThermalCoalMemberbtu:SeaborneMetallurgicalMiningMember2023-01-012023-12-310001064728us-gaap:DomesticDestinationMemberbtu:PowderRiverBasinMiningMemberbtu:ThermalCoalMember2023-01-012023-12-310001064728us-gaap:DomesticDestinationMemberbtu:OtherUSThermalMiningMemberbtu:ThermalCoalMember2023-01-012023-12-310001064728us-gaap:DomesticDestinationMemberus-gaap:CorporateAndOtherMemberbtu:ThermalCoalMember2023-01-012023-12-310001064728us-gaap:DomesticDestinationMemberbtu:ThermalCoalMember2023-01-012023-12-310001064728us-gaap:GeographicDistributionForeignMemberbtu:ThermalCoalMemberbtu:SeaborneThermalMiningMember2023-01-012023-12-310001064728us-gaap:GeographicDistributionForeignMemberbtu:ThermalCoalMemberbtu:SeaborneMetallurgicalMiningMember2023-01-012023-12-310001064728us-gaap:GeographicDistributionForeignMemberbtu:PowderRiverBasinMiningMemberbtu:ThermalCoalMember2023-01-012023-12-310001064728us-gaap:GeographicDistributionForeignMemberbtu:OtherUSThermalMiningMemberbtu:ThermalCoalMember2023-01-012023-12-310001064728us-gaap:GeographicDistributionForeignMemberus-gaap:CorporateAndOtherMemberbtu:ThermalCoalMember2023-01-012023-12-310001064728us-gaap:GeographicDistributionForeignMemberbtu:ThermalCoalMember2023-01-012023-12-310001064728btu:ThermalCoalMemberbtu:SeaborneThermalMiningMember2023-01-012023-12-310001064728btu:ThermalCoalMemberbtu:SeaborneMetallurgicalMiningMember2023-01-012023-12-310001064728btu:PowderRiverBasinMiningMemberbtu:ThermalCoalMember2023-01-012023-12-310001064728btu:OtherUSThermalMiningMemberbtu:ThermalCoalMember2023-01-012023-12-310001064728us-gaap:CorporateAndOtherMemberbtu:ThermalCoalMember2023-01-012023-12-310001064728btu:ThermalCoalMember2023-01-012023-12-310001064728us-gaap:GeographicDistributionForeignMemberbtu:MetallurgicalCoalMemberbtu:SeaborneThermalMiningMember2023-01-012023-12-310001064728us-gaap:GeographicDistributionForeignMemberbtu:MetallurgicalCoalMemberbtu:SeaborneMetallurgicalMiningMember2023-01-012023-12-310001064728us-gaap:GeographicDistributionForeignMemberbtu:PowderRiverBasinMiningMemberbtu:MetallurgicalCoalMember2023-01-012023-12-310001064728us-gaap:GeographicDistributionForeignMemberbtu:OtherUSThermalMiningMemberbtu:MetallurgicalCoalMember2023-01-012023-12-310001064728us-gaap:GeographicDistributionForeignMemberbtu:MetallurgicalCoalMemberus-gaap:CorporateAndOtherMember2023-01-012023-12-310001064728us-gaap:GeographicDistributionForeignMemberbtu:MetallurgicalCoalMember2023-01-012023-12-310001064728btu:MetallurgicalCoalMemberbtu:SeaborneThermalMiningMember2023-01-012023-12-310001064728btu:MetallurgicalCoalMemberbtu:SeaborneMetallurgicalMiningMember2023-01-012023-12-310001064728btu:PowderRiverBasinMiningMemberbtu:MetallurgicalCoalMember2023-01-012023-12-310001064728btu:OtherUSThermalMiningMemberbtu:MetallurgicalCoalMember2023-01-012023-12-310001064728btu:MetallurgicalCoalMemberus-gaap:CorporateAndOtherMember2023-01-012023-12-310001064728btu:MetallurgicalCoalMember2023-01-012023-12-310001064728us-gaap:ProductAndServiceOtherMemberbtu:SeaborneThermalMiningMember2023-01-012023-12-310001064728us-gaap:ProductAndServiceOtherMemberbtu:SeaborneMetallurgicalMiningMember2023-01-012023-12-310001064728btu:PowderRiverBasinMiningMemberus-gaap:ProductAndServiceOtherMember2023-01-012023-12-310001064728btu:OtherUSThermalMiningMemberus-gaap:ProductAndServiceOtherMember2023-01-012023-12-310001064728us-gaap:CorporateAndOtherMemberus-gaap:ProductAndServiceOtherMember2023-01-012023-12-310001064728us-gaap:ProductAndServiceOtherMember2023-01-012023-12-310001064728btu:SeaborneThermalMiningMember2023-01-012023-12-310001064728btu:SeaborneMetallurgicalMiningMember2023-01-012023-12-310001064728btu:PowderRiverBasinMiningMember2023-01-012023-12-310001064728btu:OtherUSThermalMiningMember2023-01-012023-12-310001064728us-gaap:CorporateAndOtherMember2023-01-012023-12-310001064728us-gaap:DomesticDestinationMemberbtu:ThermalCoalMemberbtu:SeaborneThermalMiningMember2022-01-012022-12-310001064728us-gaap:DomesticDestinationMemberbtu:ThermalCoalMemberbtu:SeaborneMetallurgicalMiningMember2022-01-012022-12-310001064728us-gaap:DomesticDestinationMemberbtu:PowderRiverBasinMiningMemberbtu:ThermalCoalMember2022-01-012022-12-310001064728us-gaap:DomesticDestinationMemberbtu:OtherUSThermalMiningMemberbtu:ThermalCoalMember2022-01-012022-12-310001064728us-gaap:DomesticDestinationMemberus-gaap:CorporateAndOtherMemberbtu:ThermalCoalMember2022-01-012022-12-310001064728us-gaap:DomesticDestinationMemberbtu:ThermalCoalMember2022-01-012022-12-310001064728us-gaap:GeographicDistributionForeignMemberbtu:ThermalCoalMemberbtu:SeaborneThermalMiningMember2022-01-012022-12-310001064728us-gaap:GeographicDistributionForeignMemberbtu:ThermalCoalMemberbtu:SeaborneMetallurgicalMiningMember2022-01-012022-12-310001064728us-gaap:GeographicDistributionForeignMemberbtu:PowderRiverBasinMiningMemberbtu:ThermalCoalMember2022-01-012022-12-310001064728us-gaap:GeographicDistributionForeignMemberbtu:OtherUSThermalMiningMemberbtu:ThermalCoalMember2022-01-012022-12-310001064728us-gaap:GeographicDistributionForeignMemberus-gaap:CorporateAndOtherMemberbtu:ThermalCoalMember2022-01-012022-12-310001064728us-gaap:GeographicDistributionForeignMemberbtu:ThermalCoalMember2022-01-012022-12-310001064728btu:ThermalCoalMemberbtu:SeaborneThermalMiningMember2022-01-012022-12-310001064728btu:ThermalCoalMemberbtu:SeaborneMetallurgicalMiningMember2022-01-012022-12-310001064728btu:PowderRiverBasinMiningMemberbtu:ThermalCoalMember2022-01-012022-12-310001064728btu:OtherUSThermalMiningMemberbtu:ThermalCoalMember2022-01-012022-12-310001064728us-gaap:CorporateAndOtherMemberbtu:ThermalCoalMember2022-01-012022-12-310001064728btu:ThermalCoalMember2022-01-012022-12-310001064728us-gaap:GeographicDistributionForeignMemberbtu:MetallurgicalCoalMemberbtu:SeaborneThermalMiningMember2022-01-012022-12-310001064728us-gaap:GeographicDistributionForeignMemberbtu:MetallurgicalCoalMemberbtu:SeaborneMetallurgicalMiningMember2022-01-012022-12-310001064728us-gaap:GeographicDistributionForeignMemberbtu:PowderRiverBasinMiningMemberbtu:MetallurgicalCoalMember2022-01-012022-12-310001064728us-gaap:GeographicDistributionForeignMemberbtu:OtherUSThermalMiningMemberbtu:MetallurgicalCoalMember2022-01-012022-12-310001064728us-gaap:GeographicDistributionForeignMemberbtu:MetallurgicalCoalMemberus-gaap:CorporateAndOtherMember2022-01-012022-12-310001064728us-gaap:GeographicDistributionForeignMemberbtu:MetallurgicalCoalMember2022-01-012022-12-310001064728btu:MetallurgicalCoalMemberbtu:SeaborneThermalMiningMember2022-01-012022-12-310001064728btu:MetallurgicalCoalMemberbtu:SeaborneMetallurgicalMiningMember2022-01-012022-12-310001064728btu:PowderRiverBasinMiningMemberbtu:MetallurgicalCoalMember2022-01-012022-12-310001064728btu:OtherUSThermalMiningMemberbtu:MetallurgicalCoalMember2022-01-012022-12-310001064728btu:MetallurgicalCoalMemberus-gaap:CorporateAndOtherMember2022-01-012022-12-310001064728btu:MetallurgicalCoalMember2022-01-012022-12-310001064728us-gaap:ProductAndServiceOtherMemberbtu:SeaborneThermalMiningMember2022-01-012022-12-310001064728us-gaap:ProductAndServiceOtherMemberbtu:SeaborneMetallurgicalMiningMember2022-01-012022-12-310001064728btu:PowderRiverBasinMiningMemberus-gaap:ProductAndServiceOtherMember2022-01-012022-12-310001064728btu:OtherUSThermalMiningMemberus-gaap:ProductAndServiceOtherMember2022-01-012022-12-310001064728us-gaap:CorporateAndOtherMemberus-gaap:ProductAndServiceOtherMember2022-01-012022-12-310001064728us-gaap:ProductAndServiceOtherMember2022-01-012022-12-310001064728btu:SeaborneThermalMiningMember2022-01-012022-12-310001064728btu:SeaborneMetallurgicalMiningMember2022-01-012022-12-310001064728btu:PowderRiverBasinMiningMember2022-01-012022-12-310001064728btu:OtherUSThermalMiningMember2022-01-012022-12-310001064728us-gaap:CorporateAndOtherMember2022-01-012022-12-310001064728us-gaap:DomesticDestinationMemberbtu:ThermalCoalMemberbtu:SeaborneThermalMiningMember2021-01-012021-12-310001064728us-gaap:DomesticDestinationMemberbtu:ThermalCoalMemberbtu:SeaborneMetallurgicalMiningMember2021-01-012021-12-310001064728us-gaap:DomesticDestinationMemberbtu:PowderRiverBasinMiningMemberbtu:ThermalCoalMember2021-01-012021-12-310001064728us-gaap:DomesticDestinationMemberbtu:OtherUSThermalMiningMemberbtu:ThermalCoalMember2021-01-012021-12-310001064728us-gaap:DomesticDestinationMemberus-gaap:CorporateAndOtherMemberbtu:ThermalCoalMember2021-01-012021-12-310001064728us-gaap:DomesticDestinationMemberbtu:ThermalCoalMember2021-01-012021-12-310001064728us-gaap:GeographicDistributionForeignMemberbtu:ThermalCoalMemberbtu:SeaborneThermalMiningMember2021-01-012021-12-310001064728us-gaap:GeographicDistributionForeignMemberbtu:ThermalCoalMemberbtu:SeaborneMetallurgicalMiningMember2021-01-012021-12-310001064728us-gaap:GeographicDistributionForeignMemberbtu:PowderRiverBasinMiningMemberbtu:ThermalCoalMember2021-01-012021-12-310001064728us-gaap:GeographicDistributionForeignMemberbtu:OtherUSThermalMiningMemberbtu:ThermalCoalMember2021-01-012021-12-310001064728us-gaap:GeographicDistributionForeignMemberus-gaap:CorporateAndOtherMemberbtu:ThermalCoalMember2021-01-012021-12-310001064728us-gaap:GeographicDistributionForeignMemberbtu:ThermalCoalMember2021-01-012021-12-310001064728btu:ThermalCoalMemberbtu:SeaborneThermalMiningMember2021-01-012021-12-310001064728btu:ThermalCoalMemberbtu:SeaborneMetallurgicalMiningMember2021-01-012021-12-310001064728btu:PowderRiverBasinMiningMemberbtu:ThermalCoalMember2021-01-012021-12-310001064728btu:OtherUSThermalMiningMemberbtu:ThermalCoalMember2021-01-012021-12-310001064728us-gaap:CorporateAndOtherMemberbtu:ThermalCoalMember2021-01-012021-12-310001064728btu:ThermalCoalMember2021-01-012021-12-310001064728us-gaap:GeographicDistributionForeignMemberbtu:MetallurgicalCoalMemberbtu:SeaborneThermalMiningMember2021-01-012021-12-310001064728us-gaap:GeographicDistributionForeignMemberbtu:MetallurgicalCoalMemberbtu:SeaborneMetallurgicalMiningMember2021-01-012021-12-310001064728us-gaap:GeographicDistributionForeignMemberbtu:PowderRiverBasinMiningMemberbtu:MetallurgicalCoalMember2021-01-012021-12-310001064728us-gaap:GeographicDistributionForeignMemberbtu:OtherUSThermalMiningMemberbtu:MetallurgicalCoalMember2021-01-012021-12-310001064728us-gaap:GeographicDistributionForeignMemberbtu:MetallurgicalCoalMemberus-gaap:CorporateAndOtherMember2021-01-012021-12-310001064728us-gaap:GeographicDistributionForeignMemberbtu:MetallurgicalCoalMember2021-01-012021-12-310001064728btu:MetallurgicalCoalMemberbtu:SeaborneThermalMiningMember2021-01-012021-12-310001064728btu:MetallurgicalCoalMemberbtu:SeaborneMetallurgicalMiningMember2021-01-012021-12-310001064728btu:PowderRiverBasinMiningMemberbtu:MetallurgicalCoalMember2021-01-012021-12-310001064728btu:OtherUSThermalMiningMemberbtu:MetallurgicalCoalMember2021-01-012021-12-310001064728btu:MetallurgicalCoalMemberus-gaap:CorporateAndOtherMember2021-01-012021-12-310001064728btu:MetallurgicalCoalMember2021-01-012021-12-310001064728us-gaap:ProductAndServiceOtherMemberbtu:SeaborneThermalMiningMember2021-01-012021-12-310001064728us-gaap:ProductAndServiceOtherMemberbtu:SeaborneMetallurgicalMiningMember2021-01-012021-12-310001064728btu:PowderRiverBasinMiningMemberus-gaap:ProductAndServiceOtherMember2021-01-012021-12-310001064728btu:OtherUSThermalMiningMemberus-gaap:ProductAndServiceOtherMember2021-01-012021-12-310001064728us-gaap:CorporateAndOtherMemberus-gaap:ProductAndServiceOtherMember2021-01-012021-12-310001064728us-gaap:ProductAndServiceOtherMember2021-01-012021-12-310001064728btu:SeaborneThermalMiningMember2021-01-012021-12-310001064728btu:SeaborneMetallurgicalMiningMember2021-01-012021-12-310001064728btu:PowderRiverBasinMiningMember2021-01-012021-12-310001064728btu:OtherUSThermalMiningMember2021-01-012021-12-310001064728us-gaap:CorporateAndOtherMember2021-01-012021-12-310001064728us-gaap:CorporateAndOtherMemberbtu:CoalContractAndPhysicalCommodityPurchaseSaleContractsMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-01-012023-12-310001064728us-gaap:CorporateAndOtherMemberbtu:CoalContractAndPhysicalCommodityPurchaseSaleContractsMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-01-012022-12-310001064728us-gaap:CorporateAndOtherMemberbtu:CoalContractAndPhysicalCommodityPurchaseSaleContractsMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-01-012021-12-310001064728us-gaap:CorporateAndOtherMemberbtu:PhysicalCommodityPurchaseSaleContractsMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-01-012023-12-310001064728us-gaap:CorporateAndOtherMemberbtu:PhysicalCommodityPurchaseSaleContractsMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-01-012022-12-310001064728us-gaap:CorporateAndOtherMemberbtu:PhysicalCommodityPurchaseSaleContractsMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-01-012021-12-310001064728us-gaap:CoalContractMemberus-gaap:CorporateAndOtherMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-01-012023-12-310001064728us-gaap:CoalContractMemberus-gaap:CorporateAndOtherMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-01-012022-12-310001064728us-gaap:CoalContractMemberus-gaap:CorporateAndOtherMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-01-012021-12-3100010647282021-01-012023-12-310001064728us-gaap:TradeAccountsReceivableMember2023-12-310001064728us-gaap:TradeAccountsReceivableMember2022-12-310001064728us-gaap:EquitySecuritiesMember2023-01-012023-12-310001064728us-gaap:LandMember2022-01-012022-12-310001064728us-gaap:EquitySecuritiesMember2022-01-012022-12-310001064728btu:MaterialAndSuppliesMember2023-12-310001064728btu:MaterialAndSuppliesMember2022-12-310001064728btu:MiddlemountMineMember2022-12-310001064728btu:MiddlemountMineMember2023-01-012023-12-310001064728btu:MiddlemountMineMember2022-01-012022-12-310001064728btu:MiddlemountMineMember2021-01-012021-12-310001064728btu:OtherEquityMethodInvestmentsMember2023-12-310001064728btu:OtherEquityMethodInvestmentsMember2022-12-310001064728btu:OtherEquityMethodInvestmentsMember2023-01-012023-12-310001064728btu:OtherEquityMethodInvestmentsMember2022-01-012022-12-310001064728btu:OtherEquityMethodInvestmentsMember2021-01-012021-12-310001064728btu:MiddlemountMineMember2023-01-012023-12-310001064728btu:MiddlemountMineMember2022-01-012022-12-310001064728btu:MiddlemountMineMember2021-01-012021-12-310001064728btu:MiddlemountMineMember2023-12-310001064728btu:MiddlemountMineMember2021-01-012021-12-310001064728btu:MiddlemountMineMember2023-01-012023-12-310001064728btu:MiddlemountMineMember2022-01-012022-12-310001064728btu:MiddlemountMineMember2021-01-012021-12-310001064728btu:MiddlemountMineMember2023-12-310001064728btu:MiddlemountMineMember2022-12-310001064728btu:R3RenewablesMember2023-12-310001064728btu:R3RenewablesMember2022-12-310001064728btu:DieselFuelHedgeContractsMember2023-12-31iso4217:AUD0001064728us-gaap:ForeignExchangeContractMember2023-12-310001064728srt:ScenarioForecastMembersrt:MinimumMemberus-gaap:ForeignExchangeContractMember2024-06-30iso4217:USDiso4217:AUD0001064728srt:ScenarioForecastMembersrt:MaximumMemberus-gaap:ForeignExchangeContractMember2024-06-300001064728us-gaap:ForeignExchangeContractMemberus-gaap:SubsequentEventMember2024-09-300001064728srt:ScenarioForecastMemberus-gaap:ForeignExchangeContractMember2024-09-300001064728btu:CoalDerivativeContractsRelatedToForecastedSalesMember2023-12-310001064728btu:PhysicalCommodityPurchaseSaleContractsMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-01-012023-12-310001064728us-gaap:ForwardContractsMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-10-012023-12-310001064728btu:PhysicalCommodityPurchaseSaleContractsMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-01-012022-12-310001064728us-gaap:GainLossOnDerivativeInstrumentsMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-10-012022-12-310001064728us-gaap:ForwardContractsMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-10-012022-12-310001064728btu:PhysicalCommodityPurchaseSaleContractsMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-01-012021-12-310001064728us-gaap:GainLossOnDerivativeInstrumentsMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-10-012021-12-310001064728us-gaap:ForwardContractsMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-01-012021-12-310001064728us-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-12-310001064728us-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-12-310001064728btu:PhysicalCommodityPurchaseSaleContractsMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-12-310001064728btu:PhysicalCommodityPurchaseSaleContractsMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-12-310001064728us-gaap:CoalContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-12-310001064728us-gaap:CoalContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-12-310001064728us-gaap:DesignatedAsHedgingInstrumentMember2023-12-310001064728us-gaap:DesignatedAsHedgingInstrumentMember2022-12-310001064728btu:NetAmountMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-12-310001064728btu:CoalTradingMember2022-12-310001064728us-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-01-012023-12-310001064728us-gaap:CoalContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-01-012023-12-310001064728us-gaap:DesignatedAsHedgingInstrumentMember2023-01-012023-12-310001064728us-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-01-012022-12-310001064728us-gaap:CoalContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-01-012022-12-310001064728us-gaap:DesignatedAsHedgingInstrumentMember2022-01-012022-12-310001064728us-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-01-012021-12-310001064728us-gaap:CoalContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-01-012021-12-310001064728us-gaap:DesignatedAsHedgingInstrumentMember2021-01-012021-12-310001064728us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForeignExchangeContractMember2023-12-310001064728us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForeignExchangeContractMember2023-12-310001064728us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForeignExchangeContractMember2023-12-310001064728us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForeignExchangeContractMember2023-12-310001064728btu:PhysicalCommodityPurchaseSaleContractsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001064728us-gaap:FairValueInputsLevel2Memberbtu:PhysicalCommodityPurchaseSaleContractsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001064728us-gaap:FairValueInputsLevel3Memberbtu:PhysicalCommodityPurchaseSaleContractsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001064728btu:PhysicalCommodityPurchaseSaleContractsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001064728us-gaap:CoalContractMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001064728us-gaap:FairValueInputsLevel2Memberus-gaap:CoalContractMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001064728us-gaap:FairValueInputsLevel3Memberus-gaap:CoalContractMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001064728us-gaap:CoalContractMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001064728us-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001064728us-gaap:FairValueInputsLevel2Memberus-gaap:EquitySecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001064728us-gaap:FairValueInputsLevel3Memberus-gaap:EquitySecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001064728us-gaap:EquitySecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001064728us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001064728us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001064728us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001064728us-gaap:FairValueMeasurementsRecurringMember2023-12-310001064728us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForeignExchangeContractMember2022-12-310001064728us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForeignExchangeContractMember2022-12-310001064728us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForeignExchangeContractMember2022-12-310001064728us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForeignExchangeContractMember2022-12-310001064728btu:PhysicalCommodityPurchaseSaleContractsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001064728us-gaap:FairValueInputsLevel2Memberbtu:PhysicalCommodityPurchaseSaleContractsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001064728us-gaap:FairValueInputsLevel3Memberbtu:PhysicalCommodityPurchaseSaleContractsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001064728btu:PhysicalCommodityPurchaseSaleContractsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001064728us-gaap:CoalContractMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001064728us-gaap:FairValueInputsLevel2Memberus-gaap:CoalContractMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001064728us-gaap:FairValueInputsLevel3Memberus-gaap:CoalContractMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001064728us-gaap:CoalContractMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001064728us-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001064728us-gaap:FairValueInputsLevel2Memberus-gaap:EquitySecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001064728us-gaap:FairValueInputsLevel3Memberus-gaap:EquitySecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001064728us-gaap:EquitySecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001064728us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001064728us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001064728us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001064728us-gaap:FairValueMeasurementsRecurringMember2022-12-310001064728us-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310001064728us-gaap:CarryingReportedAmountFairValueDisclosureMember2022-12-310001064728us-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001064728us-gaap:EstimateOfFairValueFairValueDisclosureMember2022-12-310001064728btu:CoalTradingMember2021-12-310001064728btu:CoalTradingMember2020-12-310001064728btu:CoalTradingMember2023-01-012023-12-310001064728btu:CoalTradingMember2022-01-012022-12-310001064728btu:CoalTradingMember2021-01-012021-12-310001064728btu:CoalTradingMember2023-12-310001064728us-gaap:FairValueInputsLevel12And3Member2023-12-310001064728us-gaap:ProductiveLandMember2023-12-310001064728us-gaap:ProductiveLandMember2022-12-310001064728us-gaap:BuildingAndBuildingImprovementsMember2023-12-310001064728us-gaap:BuildingAndBuildingImprovementsMember2022-12-310001064728us-gaap:MachineryAndEquipmentMember2023-12-310001064728us-gaap:MachineryAndEquipmentMember2022-12-310001064728btu:MiscellaneousReceivablesMember2023-12-310001064728btu:MiscellaneousReceivablesMember2022-12-310001064728btu:CoalReservesHeldByFeeOwnershipMember2023-12-310001064728btu:CoalReservesHeldByFeeOwnershipMember2022-12-310001064728us-gaap:DomesticCountryMember2023-12-310001064728us-gaap:ForeignCountryMember2023-12-310001064728us-gaap:DomesticCountryMember2023-01-012023-12-310001064728us-gaap:DomesticCountryMember2022-01-012022-12-310001064728us-gaap:DomesticCountryMember2021-01-012021-12-310001064728us-gaap:StateAndLocalJurisdictionMember2023-01-012023-12-310001064728us-gaap:StateAndLocalJurisdictionMember2022-01-012022-12-310001064728us-gaap:StateAndLocalJurisdictionMember2021-01-012021-12-310001064728us-gaap:ForeignCountryMember2023-01-012023-12-310001064728us-gaap:ForeignCountryMember2022-01-012022-12-310001064728us-gaap:ForeignCountryMember2021-01-012021-12-310001064728us-gaap:SeniorNotesMemberbtu:A3250ConvertibleSeniorNotesDueMarch2028Member2023-12-310001064728us-gaap:SeniorNotesMemberbtu:A3250ConvertibleSeniorNotesDueMarch2028Member2022-12-310001064728us-gaap:SeniorNotesMemberbtu:A6.000SeniorSecuredNotesDue2022Member2022-01-012022-03-310001064728us-gaap:SeniorNotesMemberbtu:A8500SeniorSecuredNotesDue2024Member2022-01-012022-12-310001064728us-gaap:SeniorNotesMemberbtu:A8500SeniorSecuredNotesDue2024Member2022-03-310001064728us-gaap:SeniorNotesMemberbtu:LCAgreementMember2022-01-012022-12-310001064728btu:LCAgreementMember2022-01-012022-12-310001064728us-gaap:SeniorNotesMemberbtu:A6.375SeniorSecuredNotesDue2025Member2022-01-012022-12-310001064728btu:A6.375SeniorSecuredNotesDue2025Member2022-01-012022-12-310001064728btu:SeniorSecuredTermLoanDue2025Memberbtu:TermLoanMember2022-01-012022-12-310001064728btu:A10000SeniorSecuredNotesDueDecember2024AndSeniorSecuredTermLoanDue2024Member2022-01-012022-12-310001064728us-gaap:SeniorNotesMemberbtu:A1000SeniorSecuredNotesDue2024Member2022-01-012022-12-310001064728btu:SeniorSecuredTermLoanDue2024Memberbtu:TermLoanMember2022-01-012022-12-310001064728btu:SeniorSecuredTermLoanDue2024Memberbtu:TermLoanMember2022-12-310001064728us-gaap:SeniorNotesMemberbtu:A1000SeniorSecuredNotesDue2024Member2022-12-310001064728us-gaap:SeniorNotesMemberbtu:A10000SeniorSecuredNotesDueDecember2024AndSeniorSecuredTermLoanDue2024Member2022-01-012022-12-310001064728btu:SeniorNotesAndTermLoansMember2022-01-012022-12-310001064728us-gaap:SeniorNotesMemberbtu:A3250ConvertibleSeniorNotesDueMarch2028Member2022-03-010001064728us-gaap:SeniorNotesMemberbtu:A8500SeniorSecuredNotesDue2024Member2022-01-012022-03-310001064728us-gaap:SeniorNotesMemberbtu:A6.375SeniorSecuredNotesDue2025Member2022-01-012022-03-310001064728us-gaap:SeniorNotesMemberbtu:A3250ConvertibleSeniorNotesDueMarch2028Member2022-03-310001064728btu:A8500SeniorSecuredNotesDueDecember2024And6375SeniorSecuredNotesDueMarch2025Domain2022-01-012022-03-310001064728btu:A3250ConvertibleSeniorNotesDueMarch2028Member2023-10-012023-12-31btu:buyer0001064728us-gaap:SeniorNotesMemberbtu:A3250ConvertibleSeniorNotesDueMarch2028Member2023-10-012023-12-310001064728us-gaap:SeniorNotesMemberbtu:A3250ConvertibleSeniorNotesDueMarch2028Memberus-gaap:SubsequentEventMember2024-02-212024-02-210001064728us-gaap:SeniorNotesMemberbtu:A3250ConvertibleSeniorNotesDueMarch2028Memberus-gaap:SubsequentEventMember2025-03-010001064728us-gaap:SeniorNotesMembersrt:MinimumMemberbtu:A3250ConvertibleSeniorNotesDueMarch2028Member2023-10-012023-12-310001064728us-gaap:SeniorNotesMemberbtu:A3250ConvertibleSeniorNotesDueMarch2028Member2023-01-012023-12-310001064728us-gaap:SeniorNotesMemberbtu:A1000RevolvingCreditFacilityMaturing2025Member2022-03-070001064728btu:AtMarketIssuanceMemberus-gaap:CommonStockMember2022-03-072022-03-070001064728btu:A1000RevolvingCreditFacilityMaturing2025Member2022-03-310001064728btu:A1000RevolvingCreditFacilityMaturing2025Member2022-01-012022-03-310001064728btu:AtMarketIssuanceMemberbtu:A1000RevolvingCreditFacilityMaturing2025Memberus-gaap:CommonStockMember2022-01-012022-03-310001064728btu:IndebtednessMember2023-01-012023-12-310001064728btu:IndebtednessMember2022-01-012022-12-310001064728btu:IndebtednessMember2021-01-012021-12-310001064728us-gaap:RevolvingCreditFacilityMemberus-gaap:SubsequentEventMember2024-01-180001064728us-gaap:RevolvingCreditFacilityMembersrt:MinimumMemberus-gaap:SubsequentEventMember2024-01-182024-12-310001064728srt:MaximumMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:SubsequentEventMember2024-01-182024-12-310001064728srt:MinimumMemberus-gaap:SubsequentEventMember2024-01-182024-12-310001064728srt:MaximumMemberus-gaap:SubsequentEventMember2024-01-182024-12-310001064728us-gaap:LongTermDebtMember2023-12-310001064728us-gaap:LongTermDebtMember2022-12-310001064728srt:MinimumMember2023-01-012023-12-310001064728srt:MaximumMember2023-01-012023-12-310001064728us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-01-012023-12-310001064728us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-01-012022-12-310001064728us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2021-01-012021-12-310001064728us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310001064728us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-12-310001064728us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2021-12-310001064728btu:RetirementPlanAmendmentTwoMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310001064728btu:RetirementPlanAmendmentTwoMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-12-310001064728btu:RetirementPlanAmendmentOneMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310001064728btu:RetirementPlanAmendmentOneMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-12-310001064728btu:RetirementPlan2018AmendmentMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310001064728btu:RetirementPlan2018AmendmentMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-12-310001064728srt:MaximumMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-01-012023-12-310001064728btu:PreMedicareMember2023-12-310001064728btu:PreMedicareMember2022-12-310001064728btu:PostMedicareMember2023-12-310001064728btu:PostMedicareMember2022-12-310001064728us-gaap:DefinedBenefitPlanEquitySecuritiesMember2023-12-310001064728us-gaap:FixedIncomeSecuritiesMember2023-12-310001064728us-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310001064728us-gaap:FairValueInputsLevel2Memberus-gaap:EquitySecuritiesMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310001064728us-gaap:FairValueInputsLevel3Memberus-gaap:EquitySecuritiesMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310001064728us-gaap:EquitySecuritiesMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310001064728btu:InternationalEquitySecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310001064728btu:InternationalEquitySecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310001064728btu:InternationalEquitySecuritiesMemberus-gaap:FairValueInputsLevel3Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310001064728btu:InternationalEquitySecuritiesMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310001064728us-gaap:FairValueInputsLevel1Memberus-gaap:CorporateDebtSecuritiesMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310001064728us-gaap:FairValueInputsLevel2Memberus-gaap:CorporateDebtSecuritiesMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310001064728us-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310001064728us-gaap:CorporateDebtSecuritiesMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310001064728us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel1Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310001064728us-gaap:FairValueInputsLevel2Memberus-gaap:USTreasuryAndGovernmentMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310001064728us-gaap:FairValueInputsLevel3Memberus-gaap:USTreasuryAndGovernmentMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310001064728us-gaap:USTreasuryAndGovernmentMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310001064728us-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310001064728us-gaap:FairValueInputsLevel2Memberus-gaap:MoneyMarketFundsMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310001064728us-gaap:FairValueInputsLevel3Memberus-gaap:MoneyMarketFundsMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310001064728us-gaap:MoneyMarketFundsMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310001064728us-gaap:FairValueInputsLevel1Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310001064728us-gaap:FairValueInputsLevel2Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310001064728us-gaap:FairValueInputsLevel3Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310001064728us-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-12-310001064728us-gaap:FairValueInputsLevel2Memberus-gaap:EquitySecuritiesMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-12-310001064728us-gaap:FairValueInputsLevel3Memberus-gaap:EquitySecuritiesMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-12-310001064728us-gaap:EquitySecuritiesMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-12-310001064728btu:InternationalEquitySecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-12-310001064728btu:InternationalEquitySecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-12-310001064728btu:InternationalEquitySecuritiesMemberus-gaap:FairValueInputsLevel3Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-12-310001064728btu:InternationalEquitySecuritiesMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-12-310001064728us-gaap:FairValueInputsLevel1Memberus-gaap:CorporateDebtSecuritiesMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-12-310001064728us-gaap:FairValueInputsLevel2Memberus-gaap:CorporateDebtSecuritiesMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-12-310001064728us-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-12-310001064728us-gaap:CorporateDebtSecuritiesMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-12-310001064728us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel1Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-12-310001064728us-gaap:FairValueInputsLevel2Memberus-gaap:USTreasuryAndGovernmentMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-12-310001064728us-gaap:FairValueInputsLevel3Memberus-gaap:USTreasuryAndGovernmentMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-12-310001064728us-gaap:USTreasuryAndGovernmentMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-12-310001064728us-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-12-310001064728us-gaap:FairValueInputsLevel2Memberus-gaap:MoneyMarketFundsMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-12-310001064728us-gaap:FairValueInputsLevel3Memberus-gaap:MoneyMarketFundsMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-12-310001064728us-gaap:MoneyMarketFundsMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-12-310001064728us-gaap:FairValueInputsLevel1Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-12-310001064728us-gaap:FairValueInputsLevel2Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-12-310001064728us-gaap:FairValueInputsLevel3Memberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-12-3100010647282022-03-310001064728us-gaap:PensionPlansDefinedBenefitMember2023-01-012023-12-310001064728us-gaap:PensionPlansDefinedBenefitMember2022-01-012022-12-310001064728us-gaap:PensionPlansDefinedBenefitMember2021-01-012021-12-310001064728us-gaap:PensionPlansDefinedBenefitMember2022-12-310001064728us-gaap:PensionPlansDefinedBenefitMember2021-12-310001064728us-gaap:PensionPlansDefinedBenefitMember2023-12-310001064728btu:WesternPlanMember2023-01-012023-12-310001064728srt:ScenarioForecastMemberbtu:WesternPlanMember2024-01-012024-12-310001064728btu:PeabodyPlanMember2023-12-310001064728btu:PeabodyPlanMember2022-12-310001064728btu:WesternPlanMember2023-12-310001064728btu:WesternPlanMember2022-12-310001064728us-gaap:FixedIncomeInvestmentsMember2022-12-310001064728us-gaap:FixedIncomeInvestmentsMember2023-12-310001064728us-gaap:RealEstateMember2022-12-310001064728us-gaap:RealEstateMember2023-12-310001064728us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Memberus-gaap:CorporateDebtSecuritiesMember2023-12-310001064728us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateDebtSecuritiesMember2023-12-310001064728us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateDebtSecuritiesMember2023-12-310001064728us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel12And3Memberus-gaap:CorporateDebtSecuritiesMember2023-12-310001064728us-gaap:USTreasuryAndGovernmentMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2023-12-310001064728us-gaap:FairValueInputsLevel2Memberus-gaap:USTreasuryAndGovernmentMemberus-gaap:PensionPlansDefinedBenefitMember2023-12-310001064728us-gaap:FairValueInputsLevel3Memberus-gaap:USTreasuryAndGovernmentMemberus-gaap:PensionPlansDefinedBenefitMember2023-12-310001064728us-gaap:USTreasuryAndGovernmentMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel12And3Member2023-12-310001064728us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2023-12-310001064728us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMember2023-12-310001064728us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMember2023-12-310001064728us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel12And3Member2023-12-310001064728us-gaap:AssetBackedSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2023-12-310001064728us-gaap:FairValueInputsLevel2Memberus-gaap:AssetBackedSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2023-12-310001064728us-gaap:FairValueInputsLevel3Memberus-gaap:AssetBackedSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2023-12-310001064728us-gaap:AssetBackedSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel12And3Member2023-12-310001064728us-gaap:ShortTermInvestmentsMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2023-12-310001064728us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMember2023-12-310001064728us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMember2023-12-310001064728us-gaap:ShortTermInvestmentsMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel12And3Member2023-12-310001064728us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2023-12-310001064728us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMember2023-12-310001064728us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMember2023-12-310001064728us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel12And3Member2023-12-310001064728us-gaap:PrivateEquityFundsMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2023-12-310001064728us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Memberus-gaap:CorporateDebtSecuritiesMember2022-12-310001064728us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateDebtSecuritiesMember2022-12-310001064728us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateDebtSecuritiesMember2022-12-310001064728us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel12And3Memberus-gaap:CorporateDebtSecuritiesMember2022-12-310001064728us-gaap:USTreasuryAndGovernmentMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2022-12-310001064728us-gaap:FairValueInputsLevel2Memberus-gaap:USTreasuryAndGovernmentMemberus-gaap:PensionPlansDefinedBenefitMember2022-12-310001064728us-gaap:FairValueInputsLevel3Memberus-gaap:USTreasuryAndGovernmentMemberus-gaap:PensionPlansDefinedBenefitMember2022-12-310001064728us-gaap:USTreasuryAndGovernmentMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel12And3Member2022-12-310001064728us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2022-12-310001064728us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMember2022-12-310001064728us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMember2022-12-310001064728us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel12And3Member2022-12-310001064728us-gaap:AssetBackedSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2022-12-310001064728us-gaap:FairValueInputsLevel2Memberus-gaap:AssetBackedSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2022-12-310001064728us-gaap:FairValueInputsLevel3Memberus-gaap:AssetBackedSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2022-12-310001064728us-gaap:AssetBackedSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel12And3Member2022-12-310001064728us-gaap:ShortTermInvestmentsMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2022-12-310001064728us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMember2022-12-310001064728us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMember2022-12-310001064728us-gaap:ShortTermInvestmentsMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel12And3Member2022-12-310001064728us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Memberbtu:GroupAnnuityContractMember2022-12-310001064728us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberbtu:GroupAnnuityContractMember2022-12-310001064728us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberbtu:GroupAnnuityContractMember2022-12-310001064728us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel12And3Memberbtu:GroupAnnuityContractMember2022-12-310001064728us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Memberus-gaap:RealEstateInvestmentMember2022-12-310001064728us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:RealEstateInvestmentMember2022-12-310001064728us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:RealEstateInvestmentMember2022-12-310001064728us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel12And3Memberus-gaap:RealEstateInvestmentMember2022-12-310001064728us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2022-12-310001064728us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMember2022-12-310001064728us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMember2022-12-310001064728us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel12And3Member2022-12-310001064728us-gaap:PrivateEquityFundsMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2022-12-310001064728us-gaap:FairValueInputsLevel3Member2022-12-310001064728us-gaap:FairValueInputsLevel3Member2021-12-310001064728us-gaap:FairValueInputsLevel3Member2020-12-310001064728us-gaap:FairValueInputsLevel3Member2023-01-012023-12-310001064728us-gaap:FairValueInputsLevel3Member2022-01-012022-12-310001064728us-gaap:FairValueInputsLevel3Member2021-01-012021-12-310001064728us-gaap:FairValueInputsLevel3Member2023-12-31btu:numberOfPlan0001064728us-gaap:ForeignPlanMember2023-01-012023-12-310001064728us-gaap:ForeignPlanMember2022-01-012022-12-310001064728us-gaap:ForeignPlanMember2021-01-012021-12-310001064728us-gaap:CommonStockMember2023-12-31btu:numberOfVote0001064728btu:DebtForEquityExchangeMember2023-12-310001064728btu:DebtForEquityExchangeMember2022-12-310001064728btu:DebtForEquityExchangeMember2021-12-310001064728btu:AtMarketIssuanceMember2023-12-310001064728btu:AtMarketIssuanceMember2022-12-310001064728btu:AtMarketIssuanceMember2021-12-3100010647282017-08-0100010647282018-10-3000010647282017-04-022020-12-3100010647282017-04-022017-12-3100010647282023-04-170001064728us-gaap:SubsequentEventMember2024-01-012024-01-030001064728us-gaap:TreasuryStockCommonMember2023-01-012023-12-310001064728us-gaap:TreasuryStockCommonMember2022-01-012022-12-310001064728us-gaap:TreasuryStockCommonMember2021-01-012021-12-310001064728btu:A2017IncentivePlanMember2020-12-310001064728btu:DeferredStockUnitsMember2023-01-012023-12-310001064728us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001064728us-gaap:RestrictedStockUnitsRSUMember2023-12-310001064728us-gaap:RestrictedStockUnitsRSUMember2022-12-310001064728us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001064728us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001064728btu:DividendEquivalentUnitsMember2023-12-310001064728btu:A2020PerformanceUnitsMember2023-01-012023-12-310001064728srt:MaximumMemberbtu:A2020PerformanceUnitsMember2023-01-012023-12-310001064728btu:A2023PerformanceUnitsMember2023-01-012023-12-310001064728srt:MaximumMemberbtu:A2023PerformanceUnitsMember2023-01-012023-12-310001064728us-gaap:PerformanceSharesMember2022-01-012022-12-310001064728us-gaap:PerformanceSharesMember2021-01-012021-12-310001064728us-gaap:PerformanceSharesMember2022-12-310001064728us-gaap:PerformanceSharesMember2023-01-012023-12-310001064728us-gaap:PerformanceSharesMember2023-12-310001064728btu:DividendEquivalentUnitsPerformanceSharesMember2023-12-310001064728btu:TransitionAgreementMember2021-01-012021-12-310001064728btu:WardsWellCoalDepositMember2023-10-252023-10-250001064728btu:NorthAntelopeRochelleMineMember2023-01-012023-12-310001064728btu:MaterialsAndSuppliesInventoriesMemberbtu:NorthAntelopeRochelleMineMember2023-01-012023-12-310001064728btu:BuildingsAndEquipmentMemberbtu:NorthAntelopeRochelleMineMember2023-01-012023-12-310001064728btu:IncrementalRepairCostsMemberbtu:NorthAntelopeRochelleMineMember2023-01-012023-12-310001064728btu:ShoalCreekMember2023-01-012023-12-310001064728btu:ShoalCreekMemberbtu:LongwallAndDevelopmentAndOtherCostsMember2023-01-012023-12-310001064728btu:ShoalCreekMemberbtu:EquipmentDeemedInoperableMember2023-01-012023-12-310001064728btu:MillenniumMineMember2023-01-012023-12-310001064728btu:WilkieCreekMineMember2023-01-012023-12-31btu:numberOfEmployeebtu:numberOfMine0001064728btu:RepresentedByOrganizedLaborUnionMemberbtu:KayentaMineMember2023-12-310001064728btu:RepresentedByOrganizedLaborUnionMemberbtu:ShoalCreekMember2023-12-310001064728btu:RepresentedByOrganizedLaborUnionMemberbtu:WilpinjongMineMember2023-12-310001064728btu:RepresentedByOrganizedLaborUnionMemberbtu:CoppabellaMineMember2023-12-310001064728btu:RepresentedByOrganizedLaborUnionMemberbtu:MoorvaleMineMember2023-12-310001064728btu:CenturionMineMemberbtu:RepresentedByOrganizedLaborUnionMember2023-12-310001064728btu:RepresentedByOrganizedLaborUnionMemberbtu:MetropolitanUndergroundMineMember2023-12-310001064728btu:RepresentedByOrganizedLaborUnionMemberbtu:MetropolitanPrepPlantMember2023-12-310001064728btu:RepresentedByOrganizedLaborUnionMemberbtu:WamboUndergroundMineMember2023-12-310001064728btu:RepresentedByOrganizedLaborUnionMemberbtu:WamboPrepPlantMember2023-12-310001064728srt:MaximumMember2023-04-140001064728us-gaap:SuretyBondMember2023-12-310001064728srt:MaximumMemberus-gaap:SuretyBondMember2023-12-310001064728us-gaap:SuretyBondMembersrt:MinimumMember2023-12-310001064728btu:SuretyTrustAccountMember2023-03-310001064728us-gaap:SuretyBondMember2023-01-012023-03-310001064728us-gaap:SuretyBondMember2023-03-3100010647282023-04-140001064728us-gaap:LetterOfCreditMember2023-02-032023-02-030001064728btu:AccountsReceivableSecuritizationProgramMember2023-02-130001064728btu:AccountsReceivableSecuritizationProgramMemberus-gaap:SecuredDebtMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2023-01-012023-12-310001064728btu:AccountsReceivableSecuritizationProgramMemberus-gaap:SecuredDebtMember2023-12-310001064728btu:AccountsReceivableSecuritizationProgramMemberus-gaap:SecuredDebtMember2023-12-310001064728btu:AccountsReceivableSecuritizationProgramMemberus-gaap:SecuredDebtMember2023-01-012023-12-310001064728btu:AccountsReceivableSecuritizationProgramMemberus-gaap:SecuredDebtMember2022-01-012022-12-310001064728btu:AccountsReceivableSecuritizationProgramMemberus-gaap:SecuredDebtMember2021-01-012021-12-310001064728us-gaap:LetterOfCreditMember2023-12-310001064728us-gaap:LetterOfCreditMembersrt:MaximumMember2023-12-310001064728btu:CollateralizedLetterOfCreditAgreementMember2023-12-310001064728btu:SuretyTrustAccountMember2023-12-310001064728btu:SuretyTrustAccountMember2022-12-310001064728btu:CollateralizedLettersOfCreditFundingMember2023-12-310001064728btu:CollateralizedLettersOfCreditFundingMember2022-12-310001064728btu:CashBackedBankGuaranteesMember2023-12-310001064728btu:CashBackedBankGuaranteesMember2022-12-310001064728btu:DepositsWithRegulatoryAuthoritiesMember2023-12-310001064728btu:DepositsWithRegulatoryAuthoritiesMember2022-12-310001064728btu:LCFacilityMember2023-12-310001064728btu:LCFacilityMember2022-12-310001064728btu:DepositsHeldOnBehalfOfSuretyMember2023-12-310001064728btu:DepositsHeldOnBehalfOfSuretyMember2022-12-310001064728btu:LCFacilityMember2022-12-310001064728btu:LCFacilityMember2023-04-140001064728us-gaap:CapitalAdditionsMember2023-12-310001064728btu:PatriotCoalCorporationMember2015-10-090001064728us-gaap:DisposalGroupDisposedOfByMeansOtherThanSaleNotDiscontinuedOperationsSpinoffMemberbtu:BlackLungOccupationalDiseaseLiabilityMemberbtu:PatriotCoalCorporationMember2007-12-310001064728btu:BlackLungOccupationalDiseaseLiabilityMemberus-gaap:DisposalGroupDisposedOfByMeansOtherThanSaleNotDiscontinuedOperationsMemberbtu:PatriotCoalCorporationMember2022-12-3100010647282023-08-080001064728btu:SeaborneMiningMember2023-12-310001064728btu:U.SThermalMiningMember2023-12-310001064728us-gaap:CorporateAndOtherMember2023-12-310001064728btu:SeaborneMiningMember2022-12-310001064728btu:U.SThermalMiningMember2022-12-310001064728us-gaap:CorporateAndOtherMember2022-12-310001064728btu:SeaborneMiningMember2021-12-310001064728btu:U.SThermalMiningMember2021-12-310001064728us-gaap:CorporateAndOtherMember2021-12-310001064728country:US2023-01-012023-12-310001064728country:US2022-01-012022-12-310001064728country:US2021-01-012021-12-310001064728country:JP2023-01-012023-12-310001064728country:JP2022-01-012022-12-310001064728country:JP2021-01-012021-12-310001064728country:CN2023-01-012023-12-310001064728country:CN2022-01-012022-12-310001064728country:CN2021-01-012021-12-310001064728country:AU2023-01-012023-12-310001064728country:AU2022-01-012022-12-310001064728country:AU2021-01-012021-12-310001064728country:TW2023-01-012023-12-310001064728country:TW2022-01-012022-12-310001064728country:TW2021-01-012021-12-310001064728country:BR2023-01-012023-12-310001064728country:BR2022-01-012022-12-310001064728country:BR2021-01-012021-12-310001064728country:VN2023-01-012023-12-310001064728country:VN2022-01-012022-12-310001064728country:VN2021-01-012021-12-310001064728country:ID2023-01-012023-12-310001064728country:ID2022-01-012022-12-310001064728country:ID2021-01-012021-12-310001064728country:FR2023-01-012023-12-310001064728country:FR2022-01-012022-12-310001064728country:FR2021-01-012021-12-310001064728country:IN2023-01-012023-12-310001064728country:IN2022-01-012022-12-310001064728country:IN2021-01-012021-12-310001064728country:DE2023-01-012023-12-310001064728country:DE2022-01-012022-12-310001064728country:DE2021-01-012021-12-310001064728country:BE2023-01-012023-12-310001064728country:BE2022-01-012022-12-310001064728country:BE2021-01-012021-12-310001064728country:KP2023-01-012023-12-310001064728country:KP2022-01-012022-12-310001064728country:KP2021-01-012021-12-310001064728country:CL2023-01-012023-12-310001064728country:CL2022-01-012022-12-310001064728country:CL2021-01-012021-12-310001064728btu:OtherRegionsMember2023-01-012023-12-310001064728btu:OtherRegionsMember2022-01-012022-12-310001064728btu:OtherRegionsMember2021-01-012021-12-310001064728btu:ReserveForMaterialsAndSuppliesMember2022-12-310001064728btu:ReserveForMaterialsAndSuppliesMember2023-01-012023-12-310001064728btu:ReserveForMaterialsAndSuppliesMember2023-12-310001064728us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2022-12-310001064728us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2023-01-012023-12-310001064728us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2023-12-310001064728btu:AdvanceRoyaltyRecoupmentReserveMember2021-12-310001064728btu:AdvanceRoyaltyRecoupmentReserveMember2022-01-012022-12-310001064728btu:AdvanceRoyaltyRecoupmentReserveMember2022-12-310001064728btu:ReserveForMaterialsAndSuppliesMember2021-12-310001064728btu:ReserveForMaterialsAndSuppliesMember2022-01-012022-12-310001064728us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2021-12-310001064728us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2022-01-012022-12-310001064728btu:AdvanceRoyaltyRecoupmentReserveMember2020-12-310001064728btu:AdvanceRoyaltyRecoupmentReserveMember2021-01-012021-12-310001064728btu:ReserveForMaterialsAndSuppliesMember2020-12-310001064728btu:ReserveForMaterialsAndSuppliesMember2021-01-012021-12-310001064728us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2020-12-310001064728us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2021-01-012021-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________________

FORM 10-K

(Mark One)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

☑ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934 |

|

|

|

|

For the Fiscal Year Ended |

December 31, 2023 |

|

|

or

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934 |

|

|

Commission File Number 1-16463

____________________________________________

PEABODY ENERGY CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

| Delaware |

|

13-4004153 |

| (State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

701 Market Street, |

St. Louis, |

Missouri |

|

|

63101-1826 |

| (Address of principal executive offices) |

|

(Zip Code) |

(314) 342-3400

(Registrant’s telephone number, including area code)

Securities Registered Pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

| Title of Each Class |

Trading Symbol(s) |

Name of Each Exchange on Which Registered |

| Common Stock, par value $0.01 per share |

BTU |

New York Stock Exchange |

Securities Registered Pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☑ Accelerated filer ☐

Non-accelerated filer ☐ Smaller reporting company ☐

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

Aggregate market value of the voting and non-voting common equity held by non-affiliates (stockholders who are not directors or executive officers) of the Registrant, calculated using the closing price on June 30, 2023: Common Stock, par value $0.01 per share, $2.5 billion.

Number of shares outstanding of each of the Registrant’s classes of Common Stock, as of February 16, 2024: Common Stock, par value $0.01 per share, 128,363,495 shares outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Company’s Proxy Statement to be filed with the Securities and Exchange Commission in connection with the Company’s 2024 Annual Meeting of Shareholders (the Company’s 2024 Proxy Statement) are incorporated by reference into Part III hereof. Other documents incorporated by reference in this report are listed in the Exhibit Index of this Form 10-K.

CAUTIONARY NOTICE REGARDING FORWARD-LOOKING STATEMENTS

This report includes statements of the Company’s expectations, intentions, plans and beliefs that constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the Securities Act), and Section 21E of the Securities Exchange Act of 1934, as amended (the Exchange Act), and are intended to come within the safe harbor protection provided by those sections. These statements relate to future events or the Company’s future financial performance. The Company uses words such as “anticipate,” “believe,” “expect,” “may,” “forecast,” “project,” “should,” “estimate,” “plan,” “outlook,” “target,” “likely,” “will,” “to be” or other similar words to identify forward-looking statements.

Without limiting the foregoing, all statements relating to the Company’s future operating results, anticipated capital expenditures, future cash flows and borrowings, and sources of funding are forward-looking statements and speak only as of the date of this report. These forward-looking statements are based on numerous assumptions that the Company believes are reasonable, but are subject to a wide range of uncertainties and business risks, and actual results may differ materially from those discussed in these statements. These factors include but are not limited to those described in Part I, Item 1A. “Risk Factors.” Such factors are difficult to accurately predict and may be beyond the Company’s control.

When considering these forward-looking statements, you should keep in mind the cautionary statements in this document and in the Company’s other Securities and Exchange Commission (SEC) filings. These forward-looking statements speak only as of the date on which such statements were made, and the Company undertakes no obligation to update these statements except as required by federal securities laws.

|

|

|

|

|

|

|

|

|

| Peabody Energy Corporation |

2023 Form 10-K |

i |

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

|

| Peabody Energy Corporation |

2023 Form 10-K |

1 |

|

|

|

|

|

|

| Note: |

The words “Peabody” or “the Company” as used in this report, refer to Peabody Energy Corporation or its applicable subsidiary or subsidiaries. Unless otherwise noted herein, disclosures in this Annual Report on Form 10-K relate only to the Company’s continuing operations. |

|

When used in this filing, the term “ton” refers to short or net tons, equal to 2,000 pounds (907.18 kilograms), while “tonne” refers to metric tons, equal to 2,204.62 pounds (1,000 kilograms). |

PART I

Item 1. Business.

Overview

Peabody is a leading producer of metallurgical and thermal coal. At December 31, 2023, the Company owned interests in 17 active coal mining operations located in the United States (U.S.) and Australia, including a 50% equity interest in Middlemount Coal Pty Ltd. (Middlemount). In addition to its mining operations, the Company markets and brokers coal from other coal producers; trades coal and freight-related contracts; and, since 2022, is partnered in a joint venture with the intent of developing various sites, including certain reclaimed mining land held by the Company in the U.S., for utility-scale photovoltaic solar generation and battery storage.

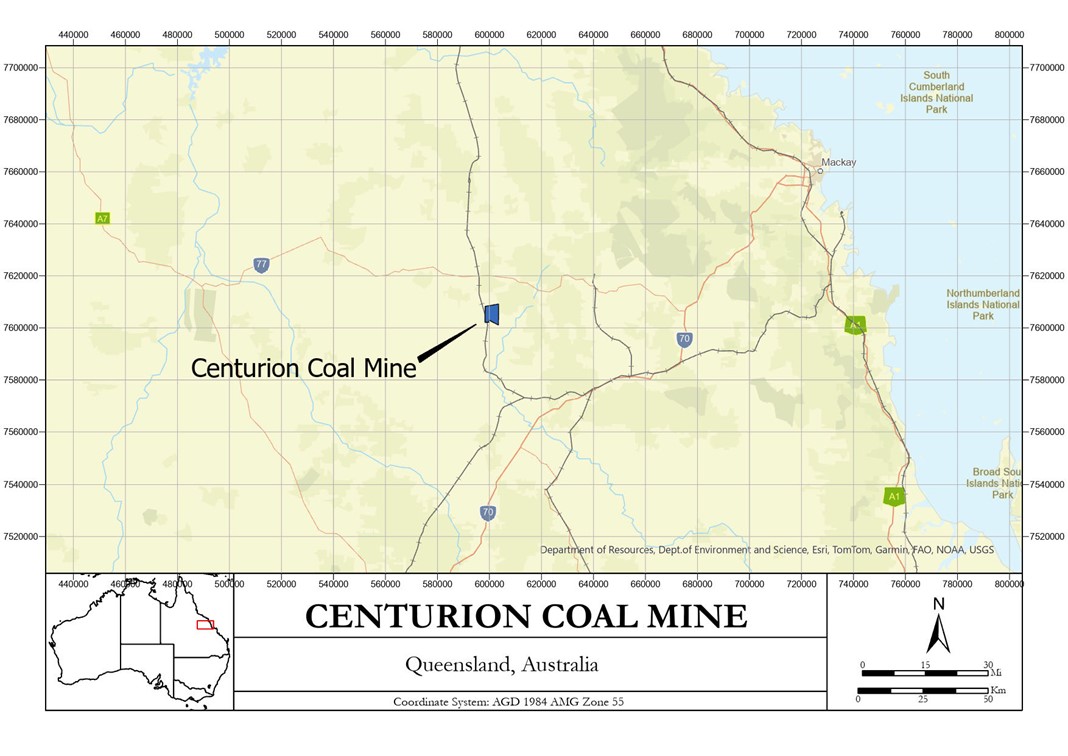

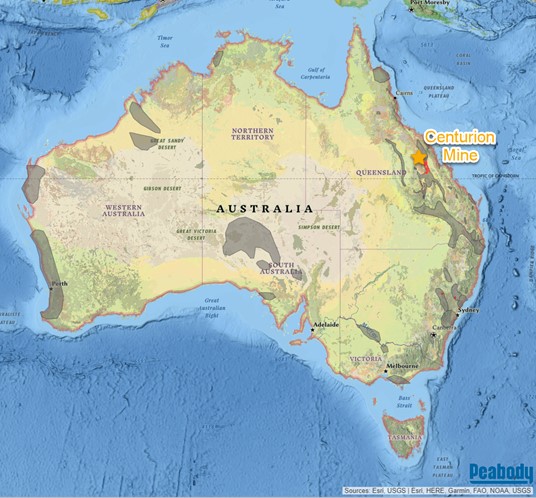

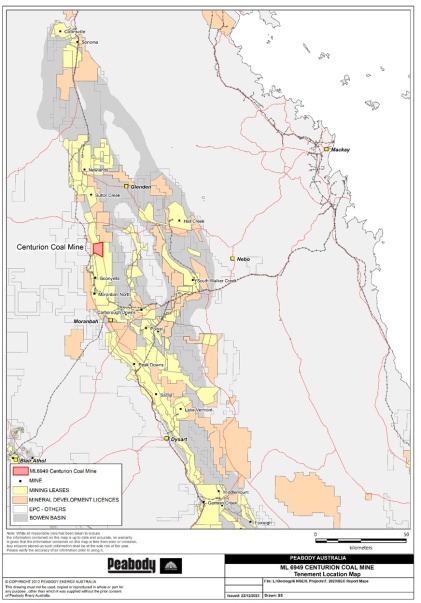

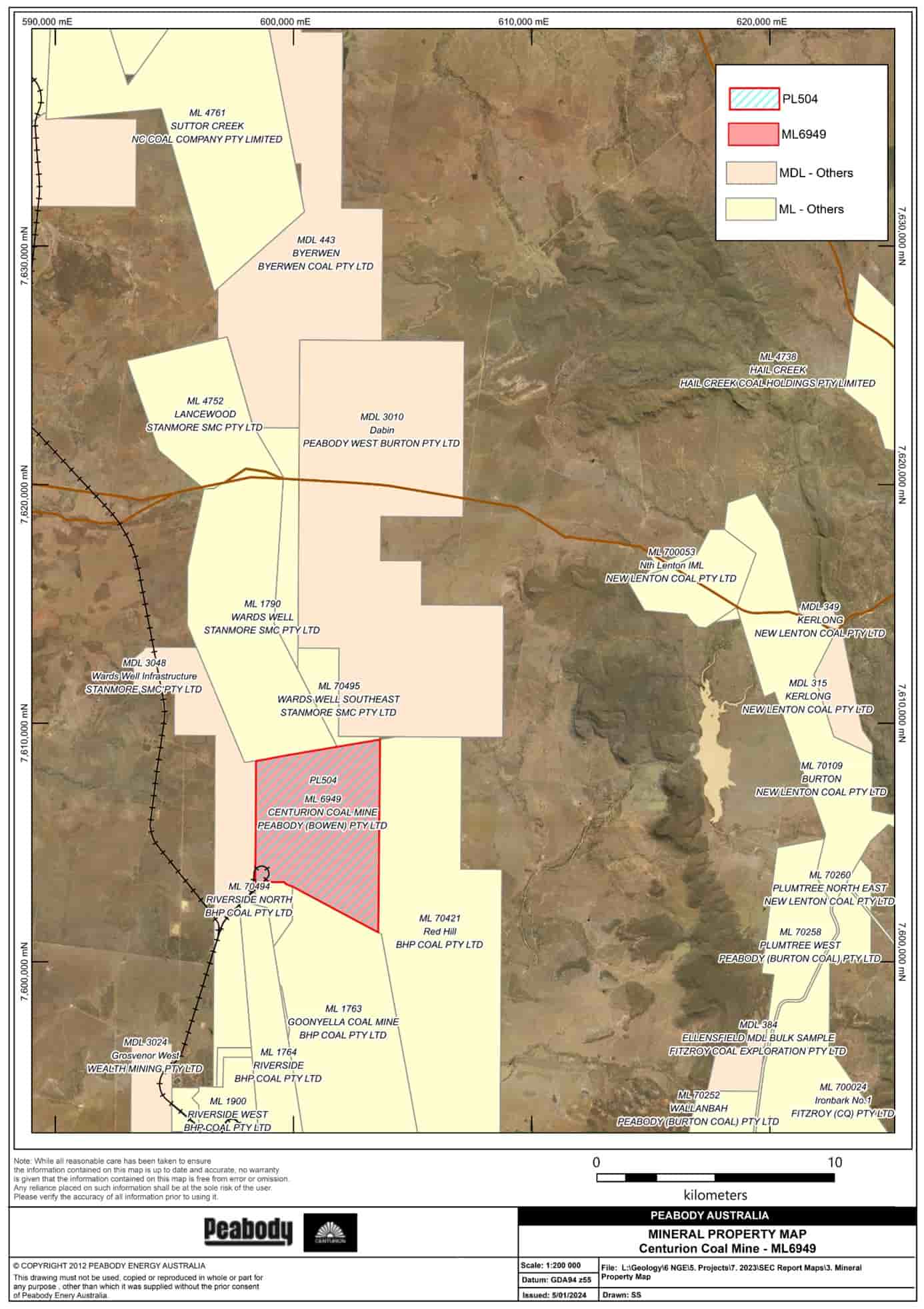

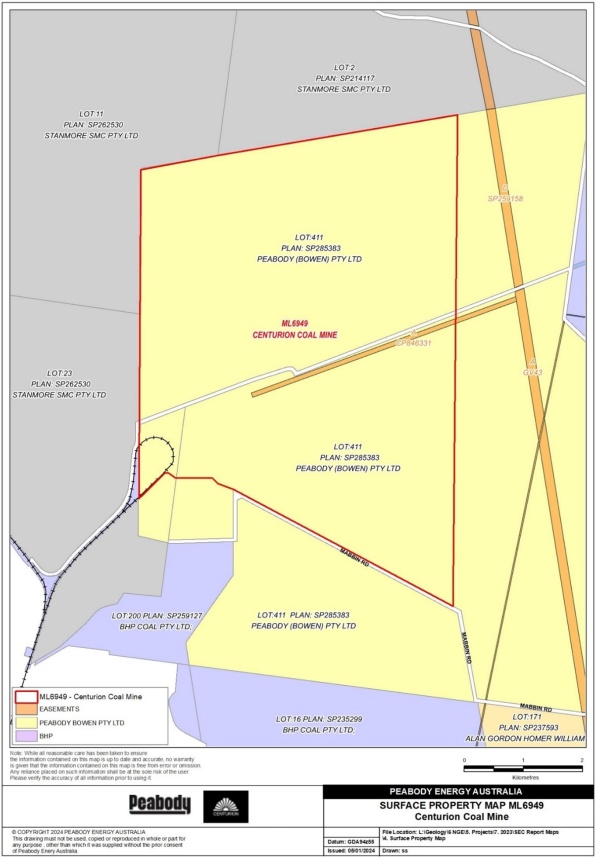

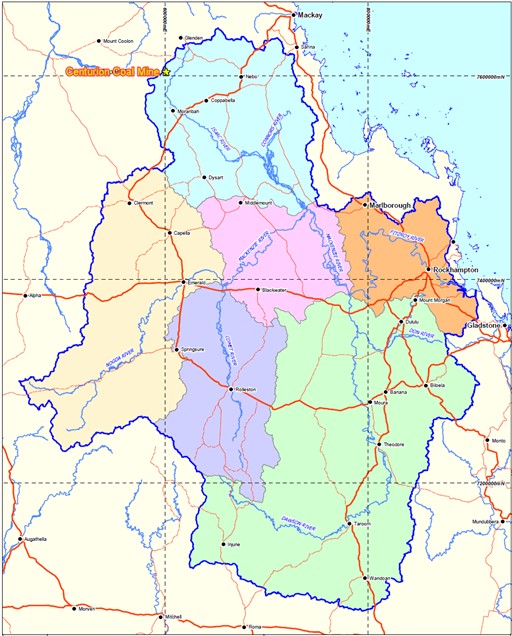

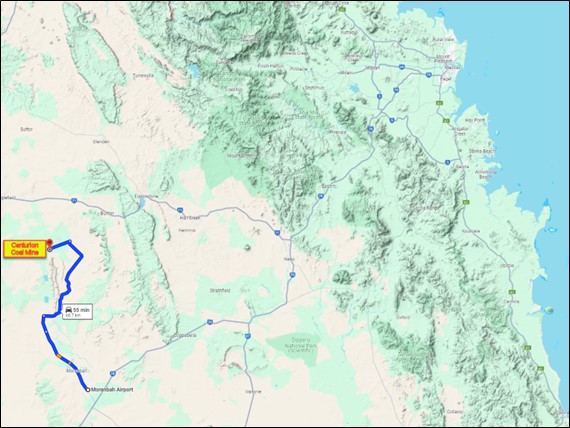

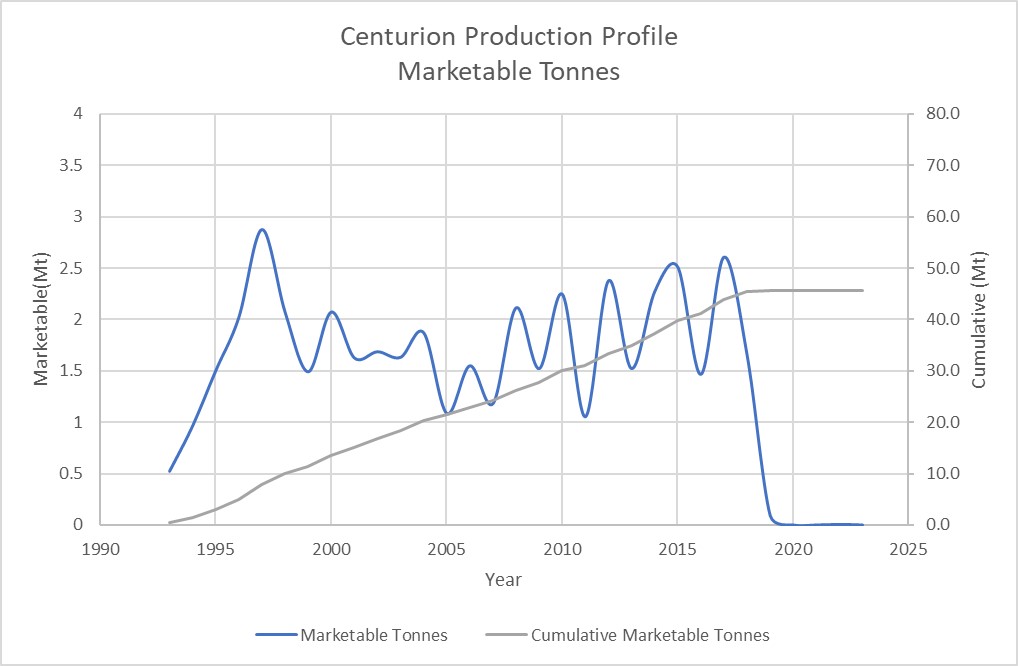

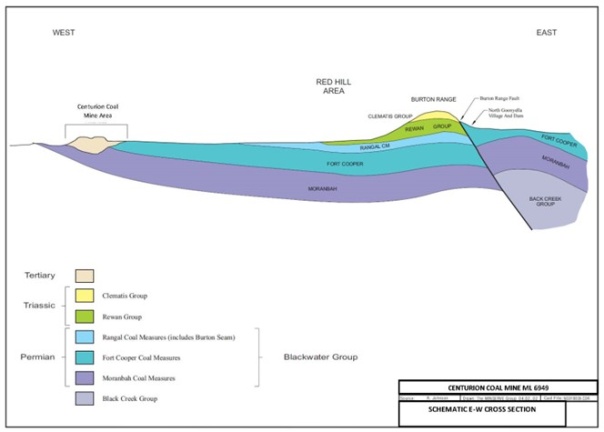

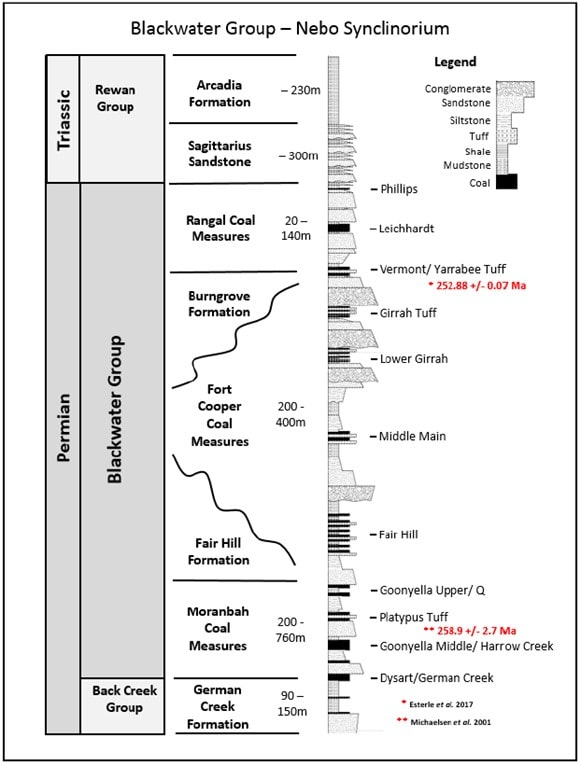

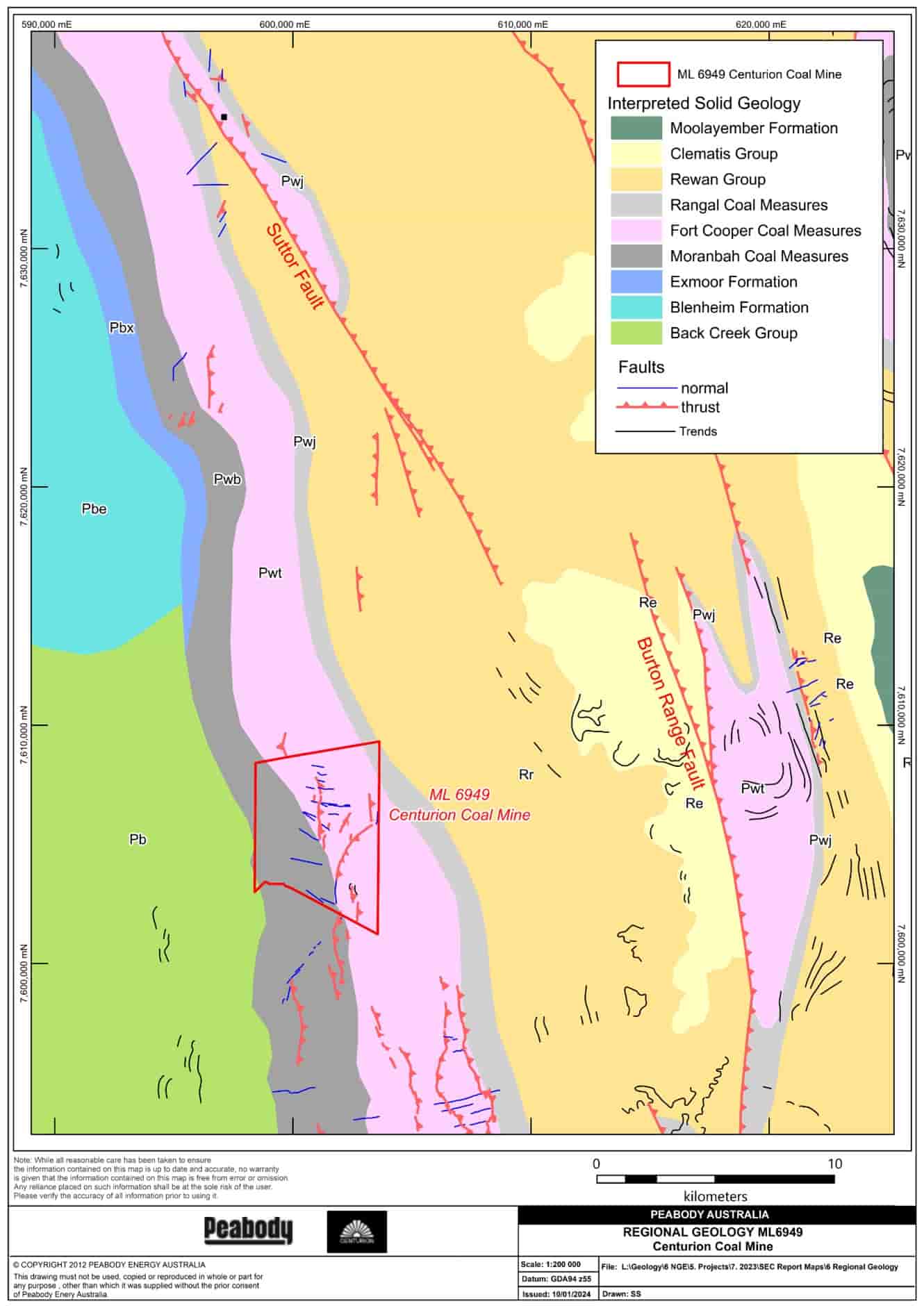

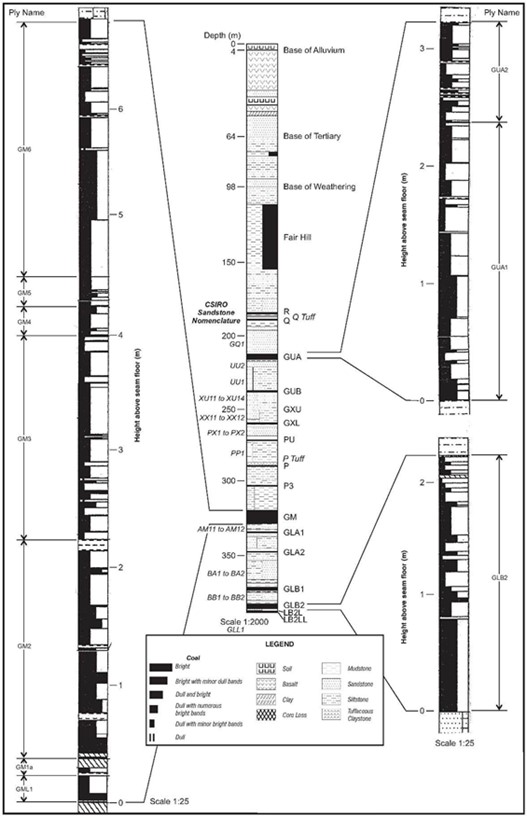

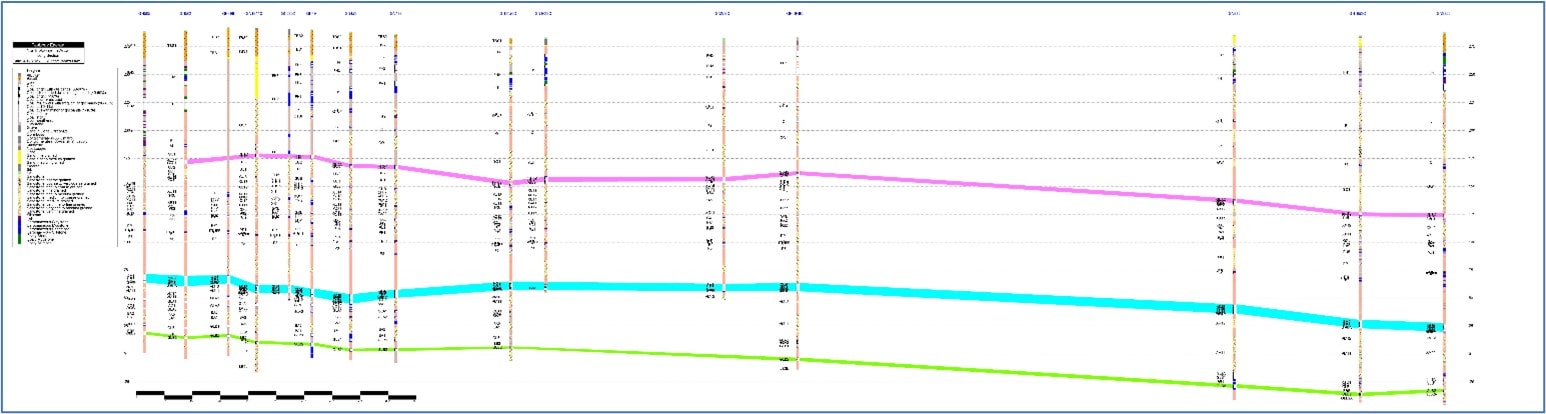

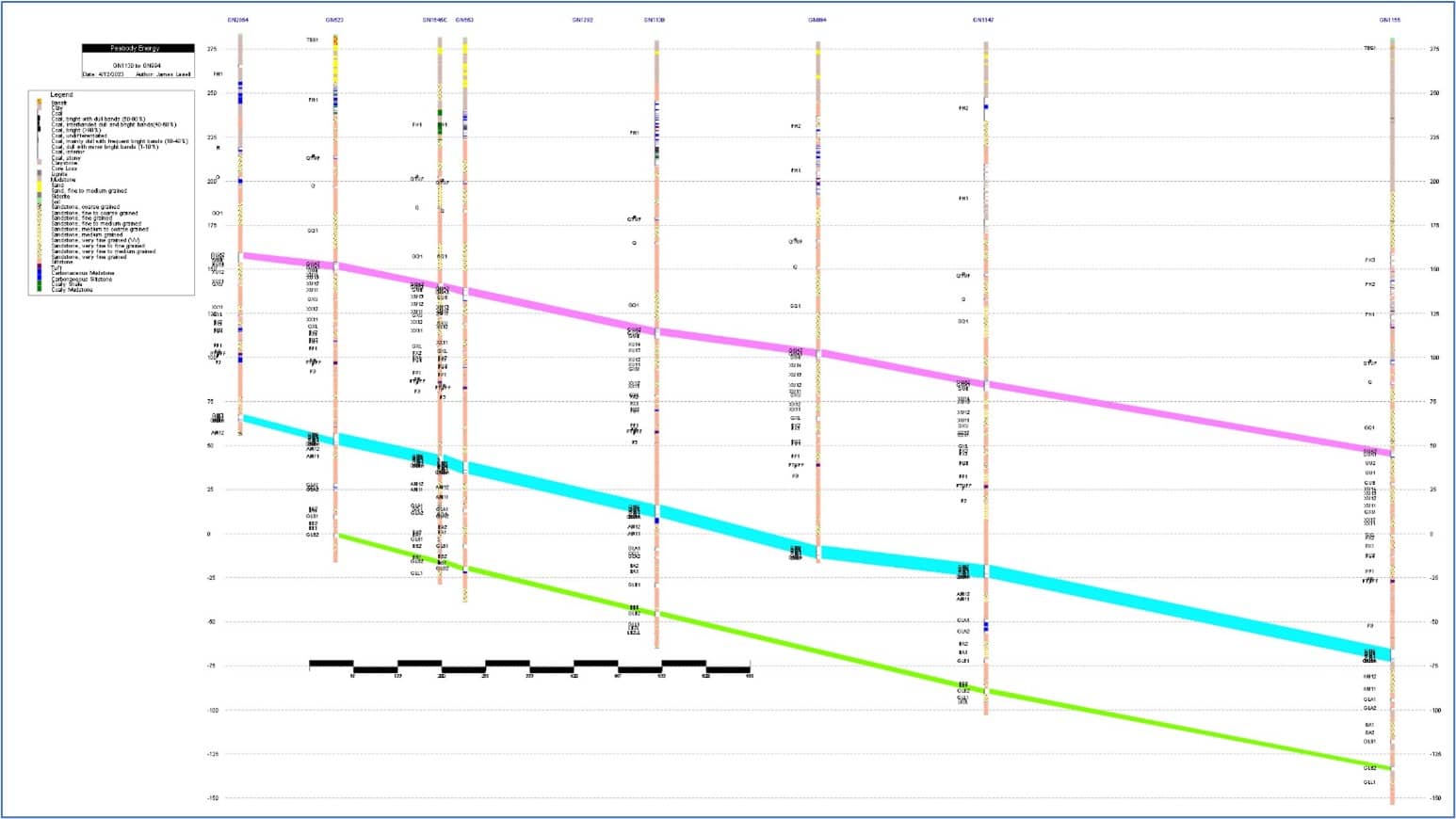

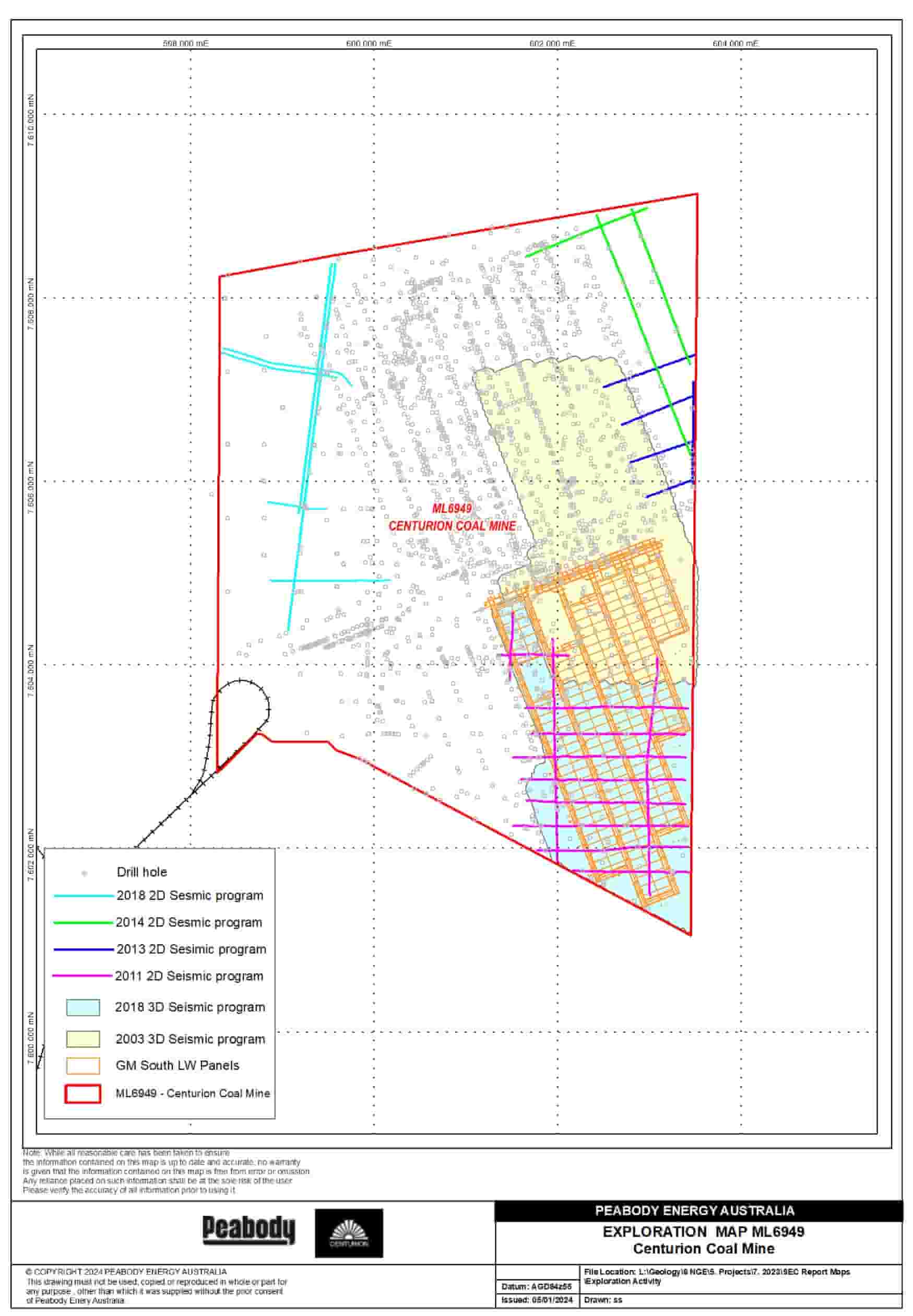

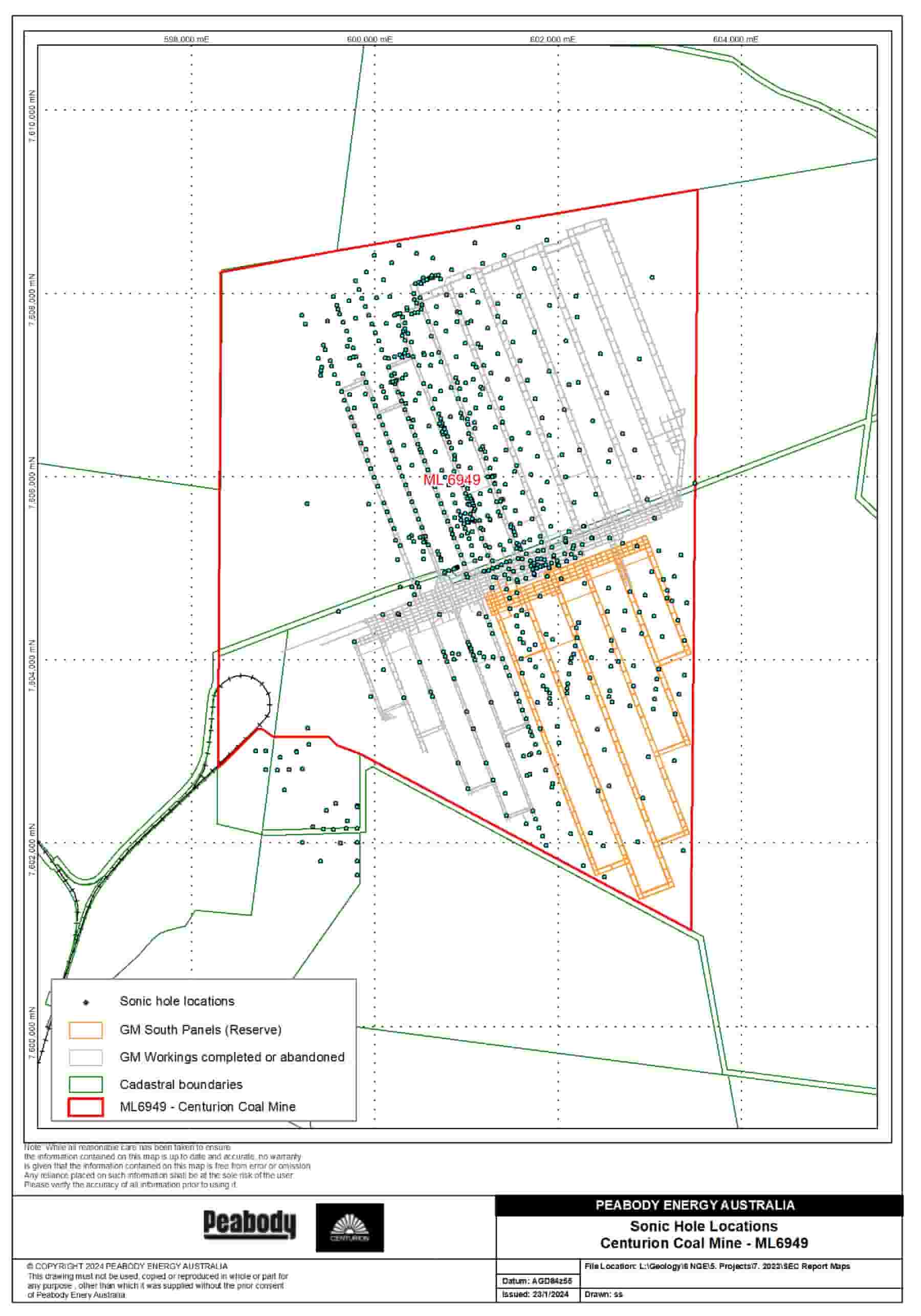

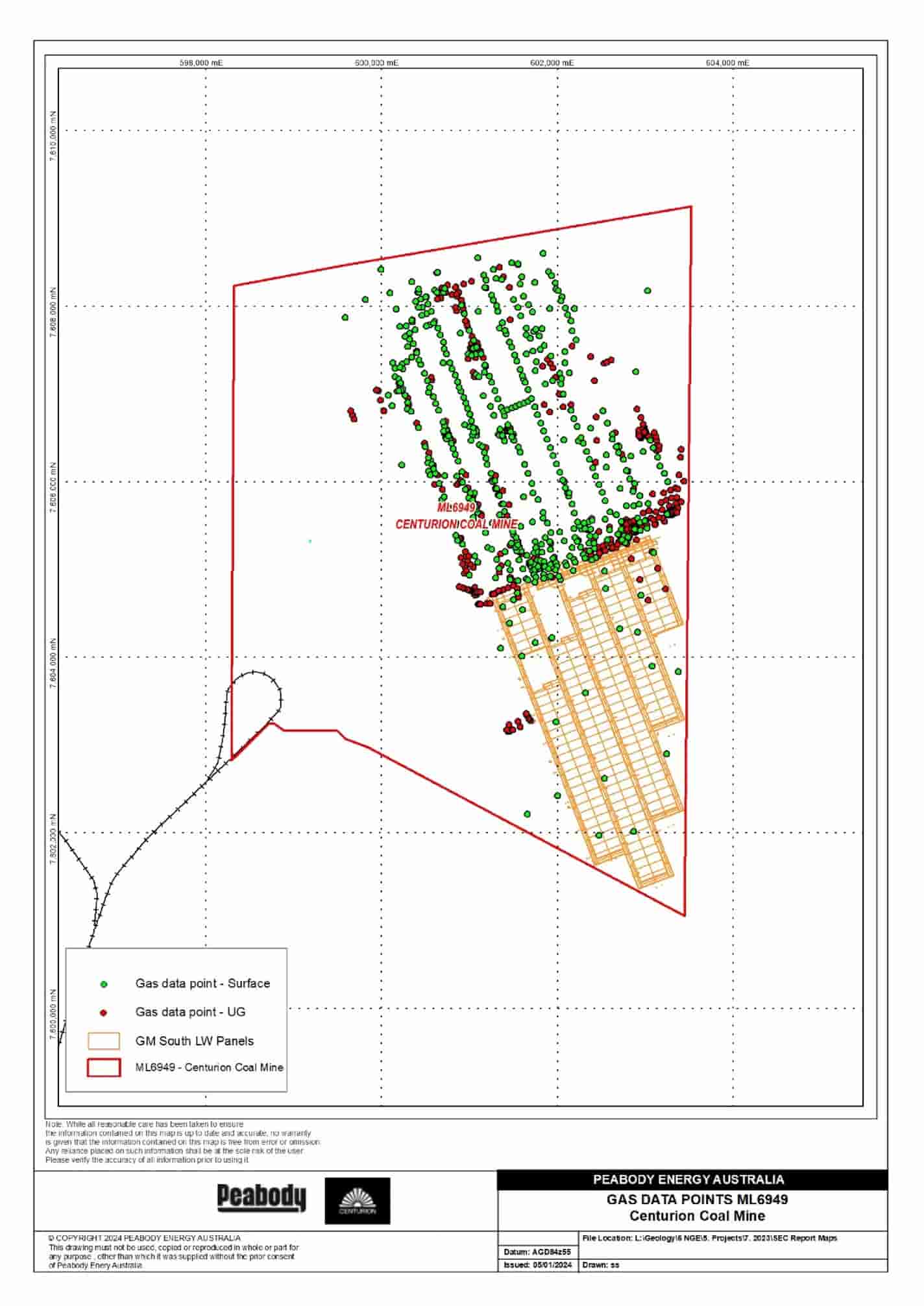

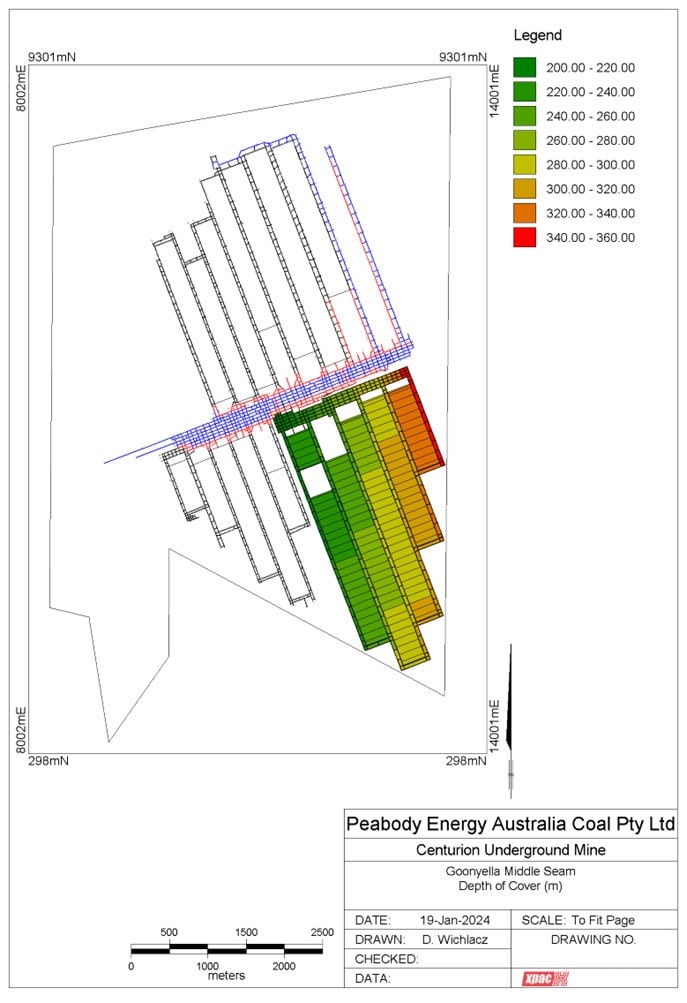

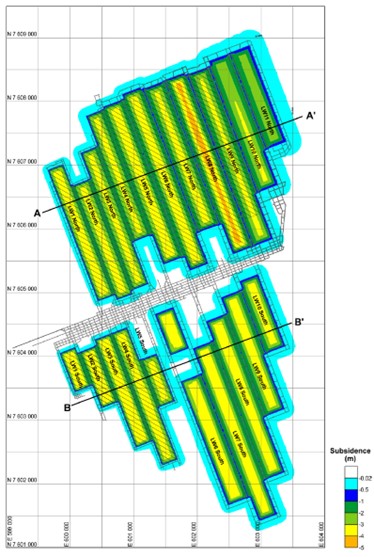

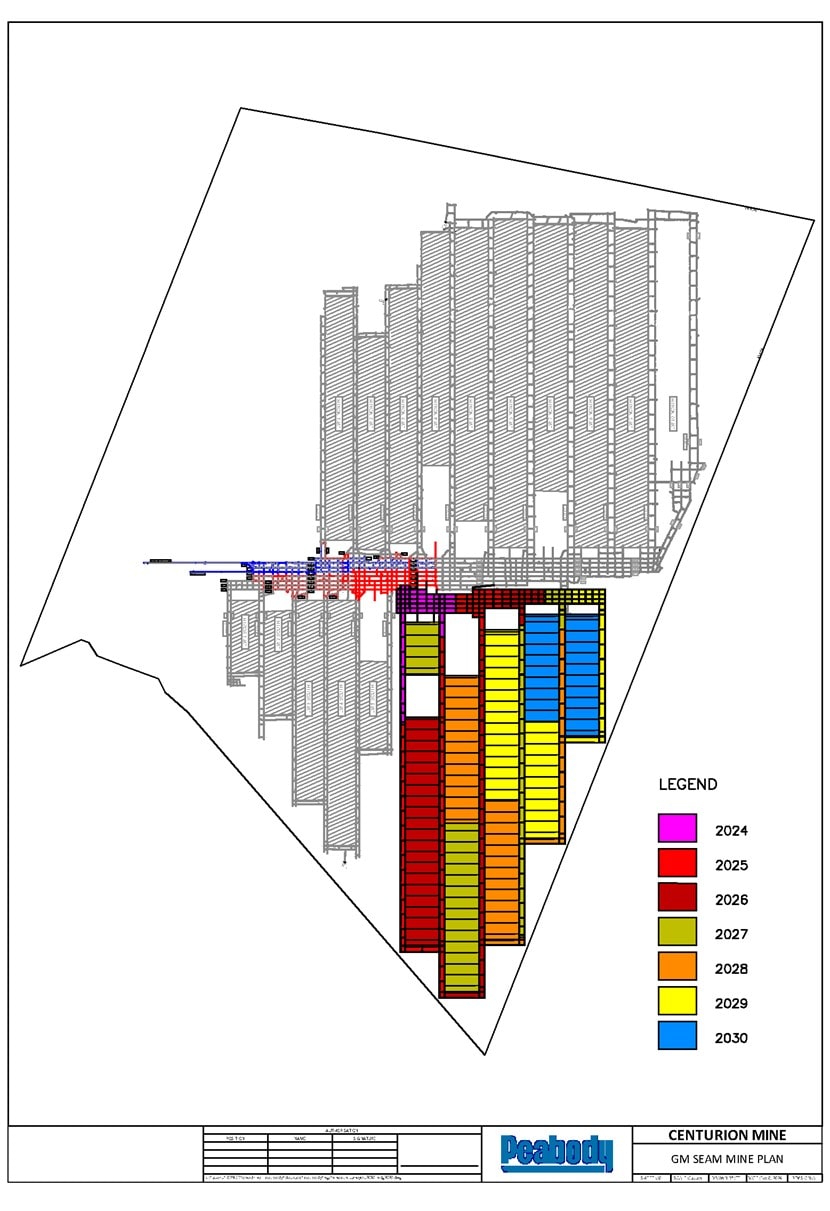

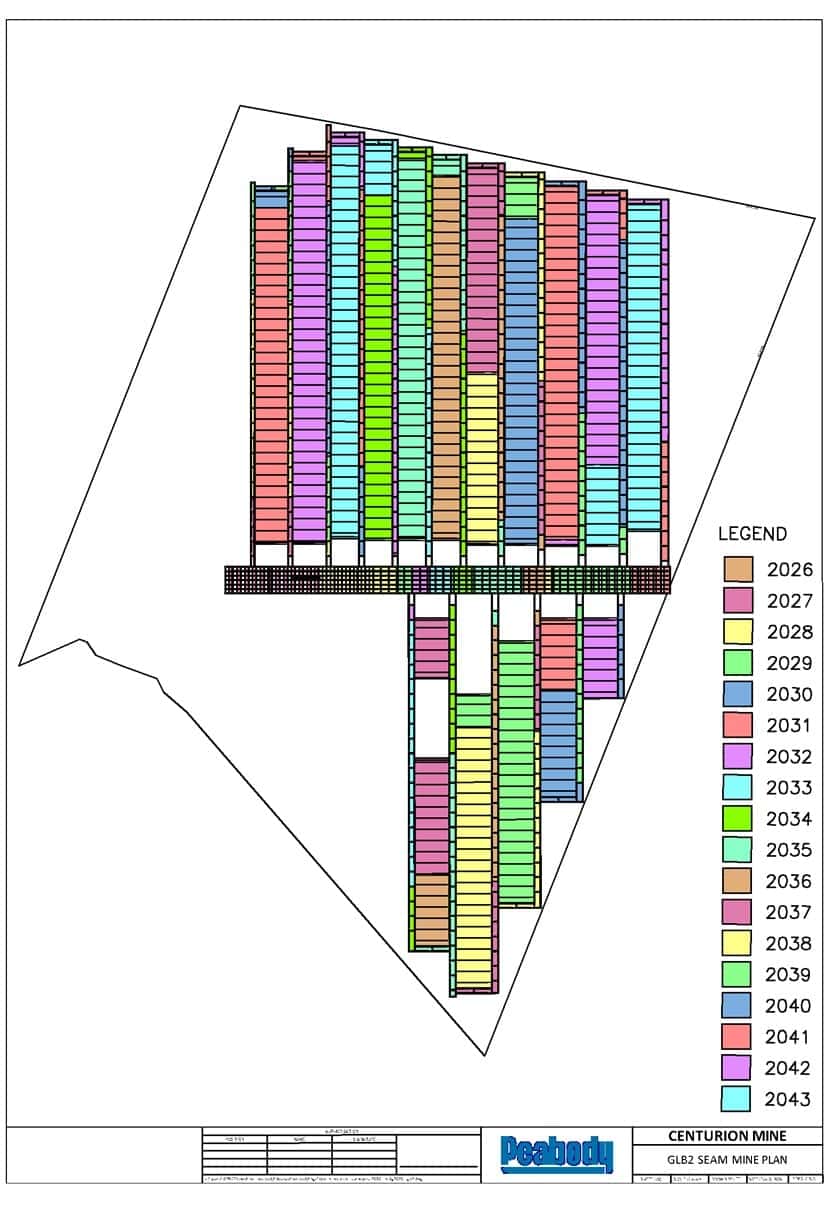

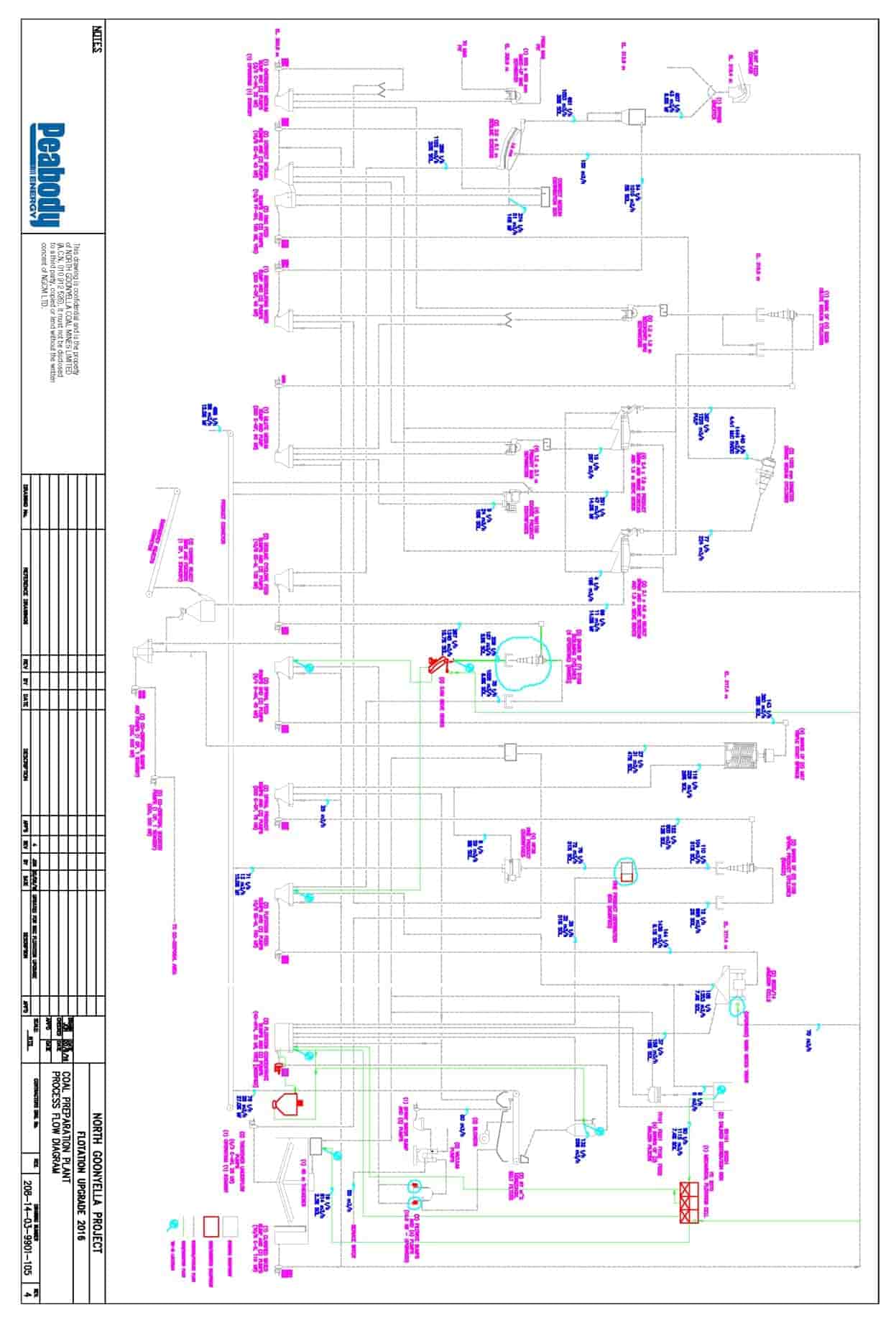

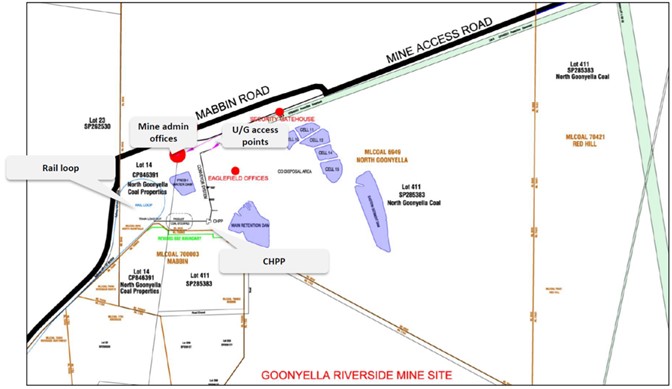

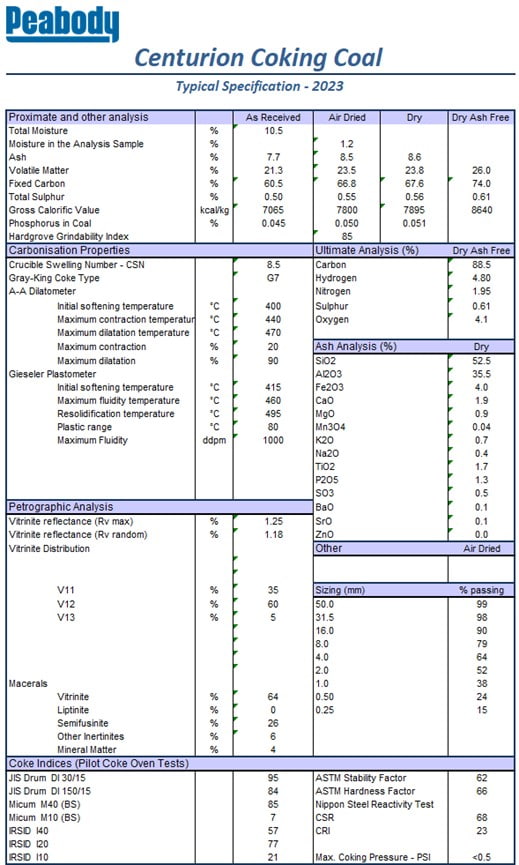

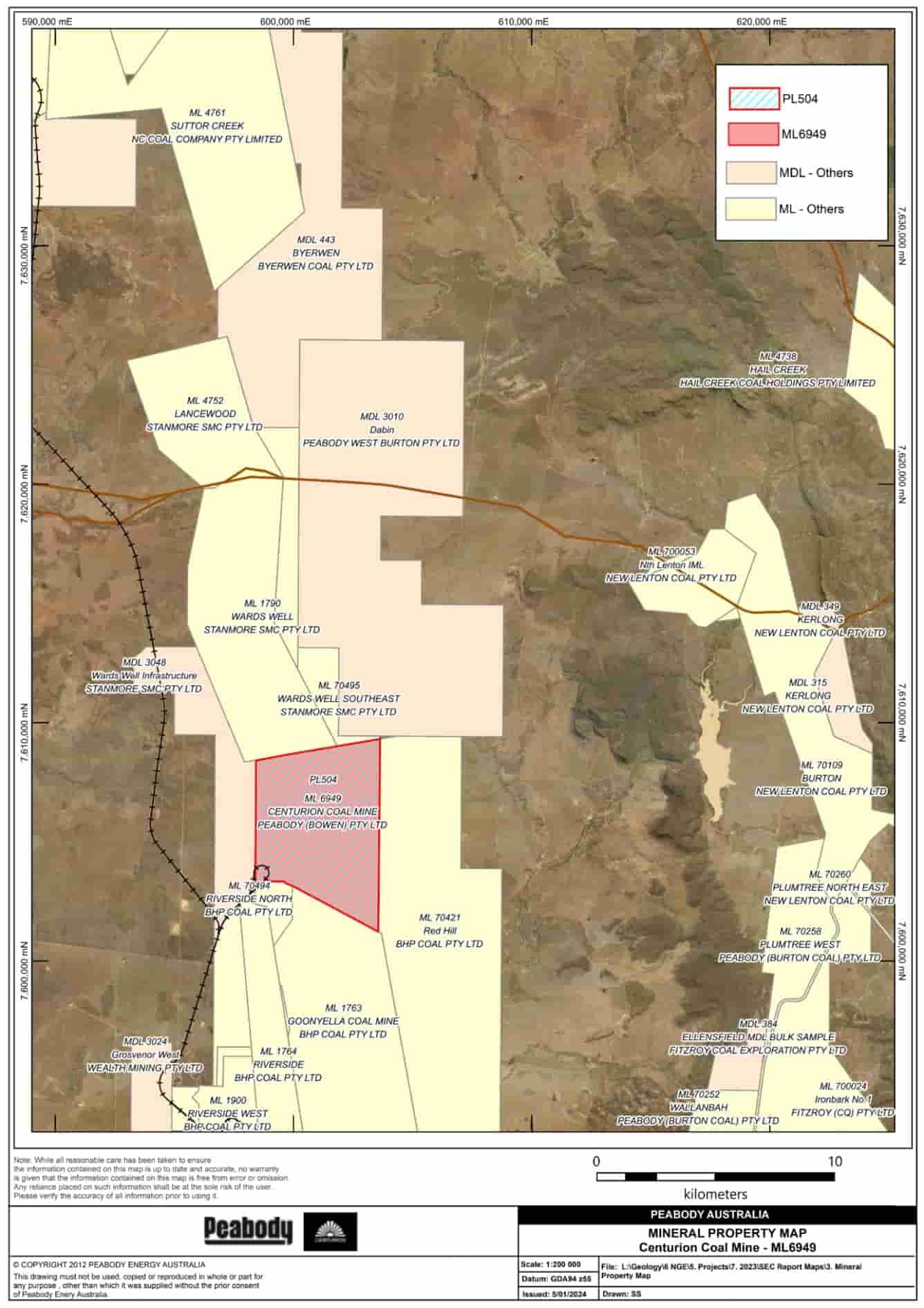

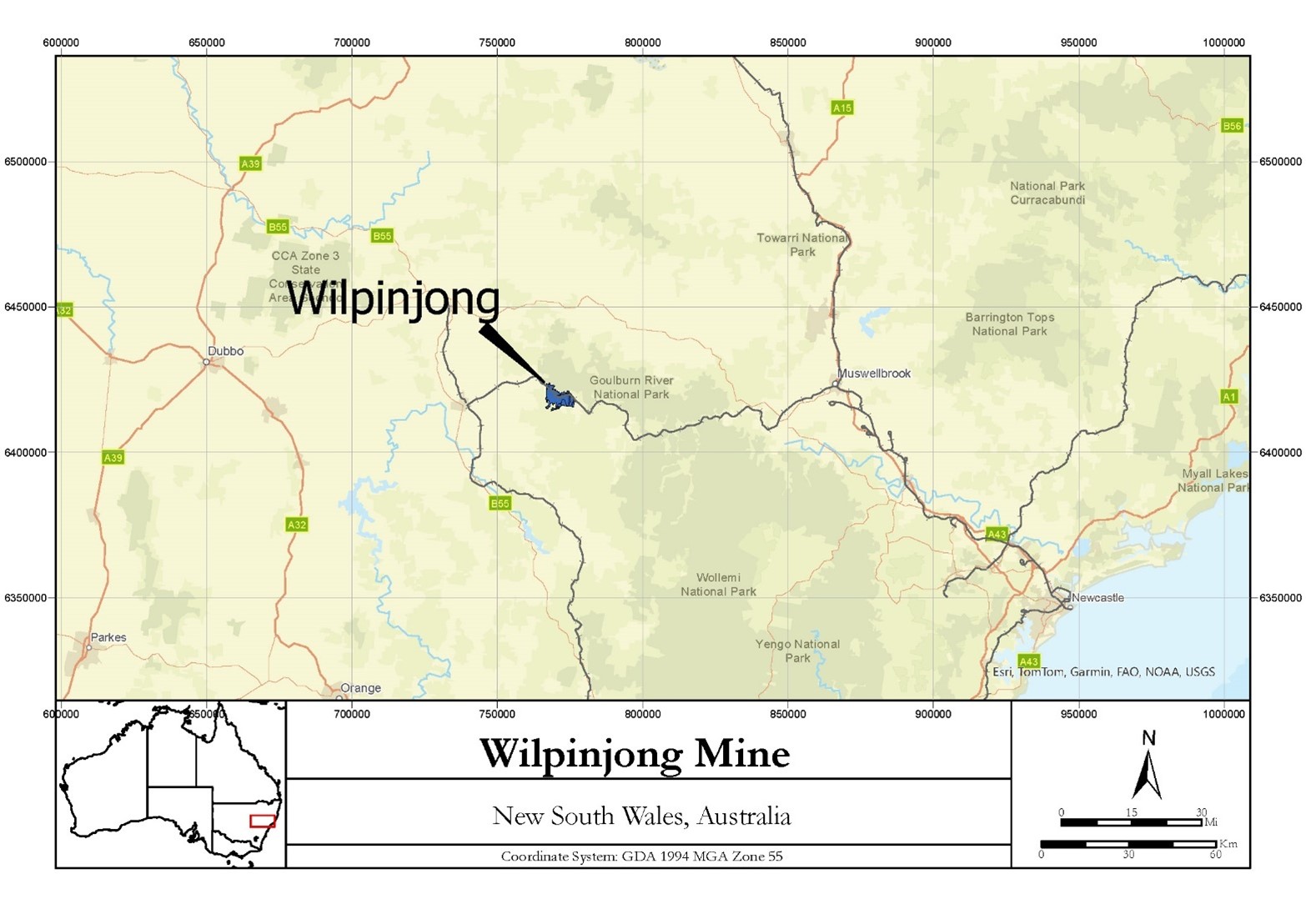

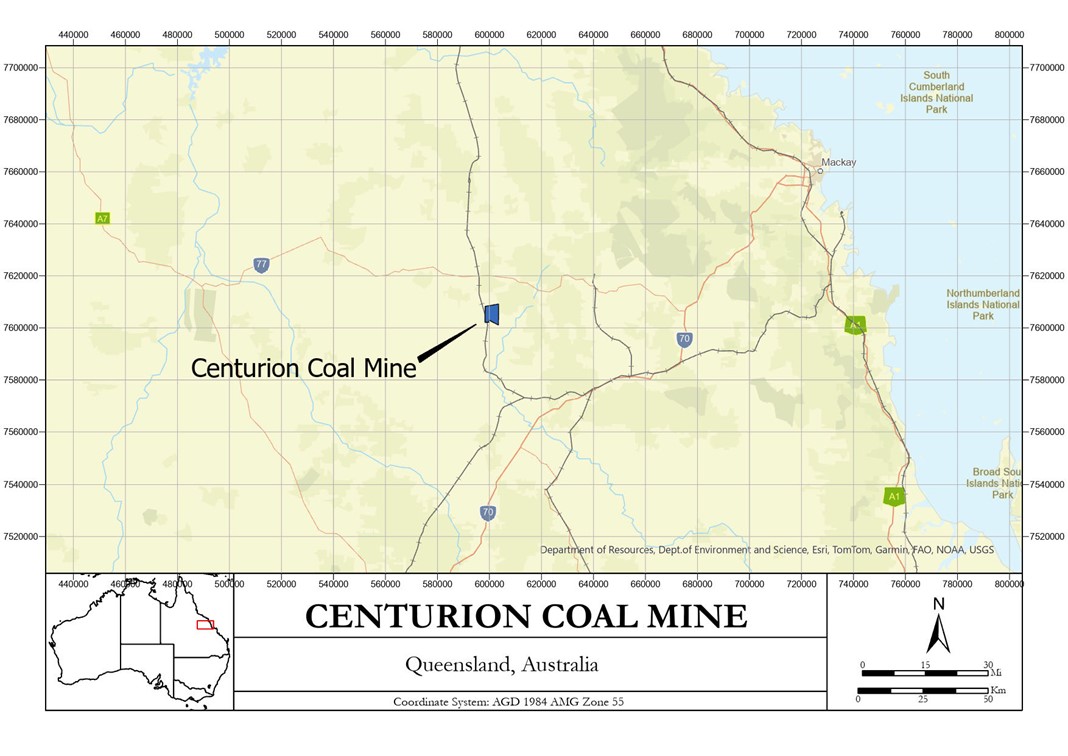

During 2023, Peabody advanced the redevelopment of its North Goonyella Mine in Australia. During the fourth quarter, the mine was renamed to Centurion Mine to reflect the next stage of redevelopment and the Company’s agreement to acquire an adjacent coal deposit. The first development coal from the Centurion Mine is anticipated in the second quarter of 2024.

Segment and Geographic Information

As of December 31, 2023, Peabody reports its results of operations primarily through the following reportable segments: Seaborne Thermal, Seaborne Metallurgical, Powder River Basin, Other U.S. Thermal and Corporate and Other. Refer to Part II, Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for additional information regarding the Company’s segments. Note 22. “Segment and Geographic Information” to the accompanying consolidated financial statements is incorporated herein by reference and also contains segment and geographic financial information.

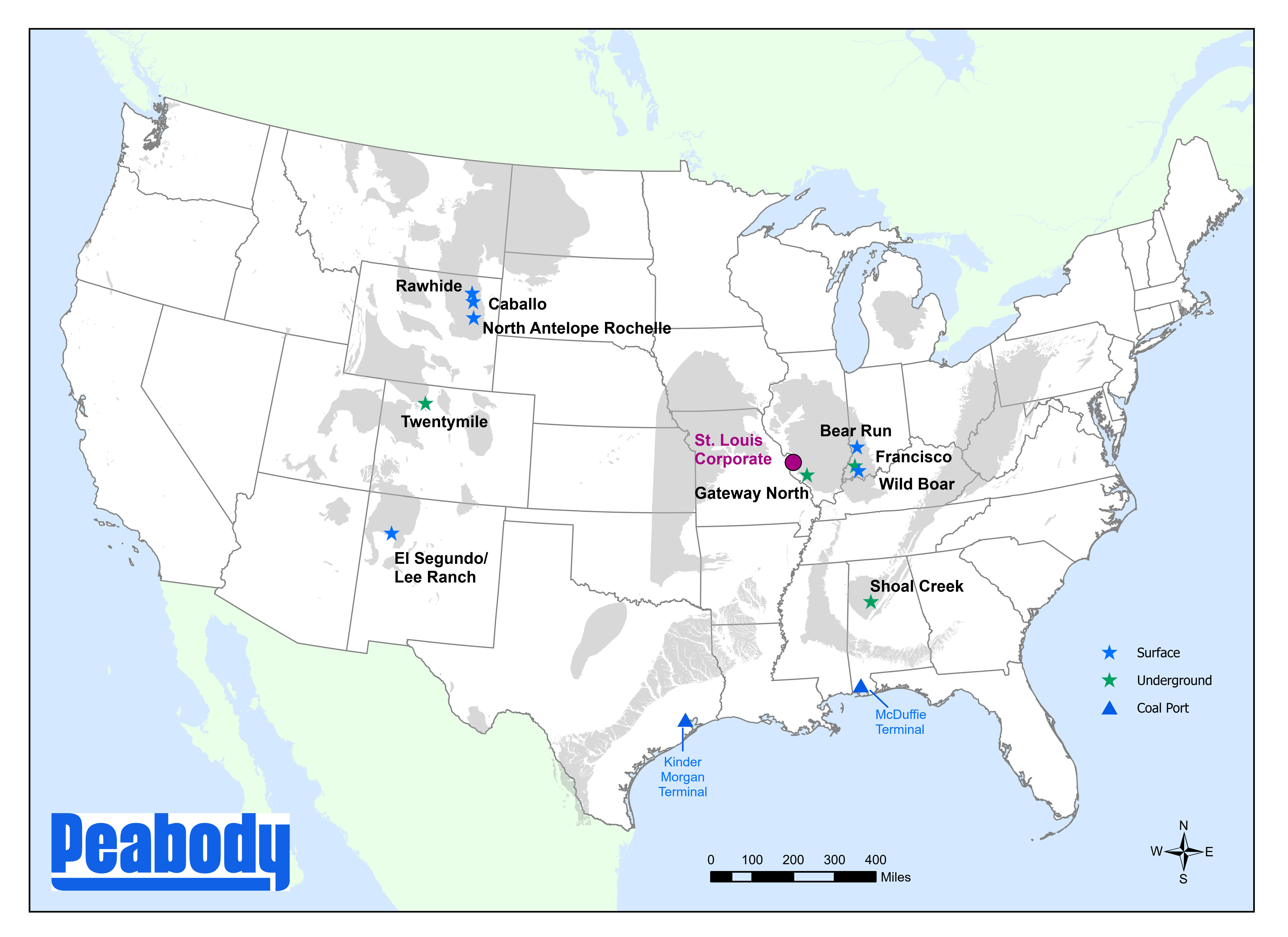

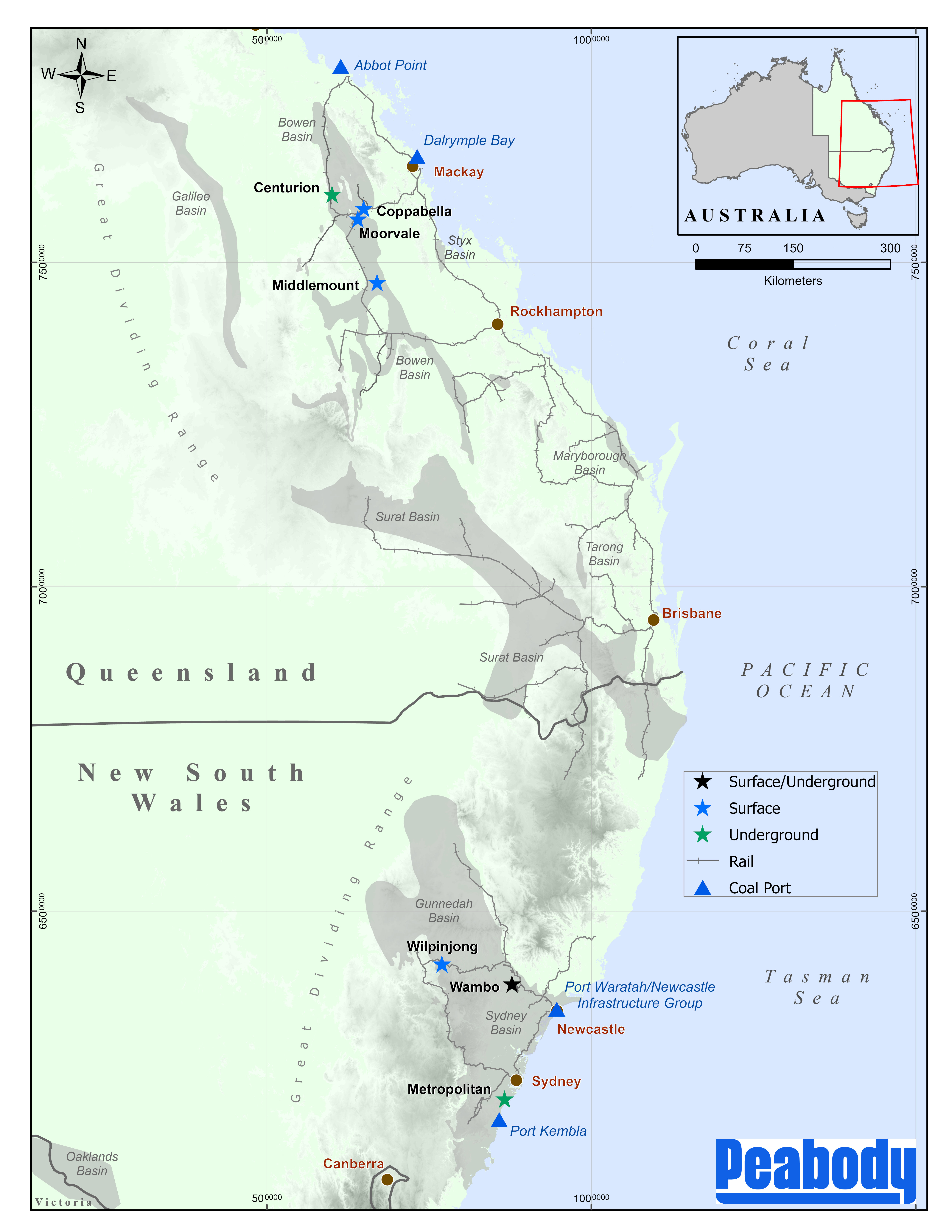

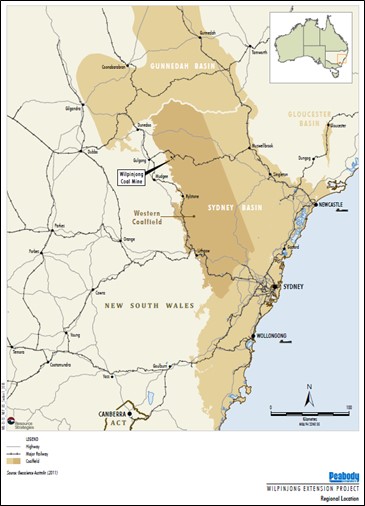

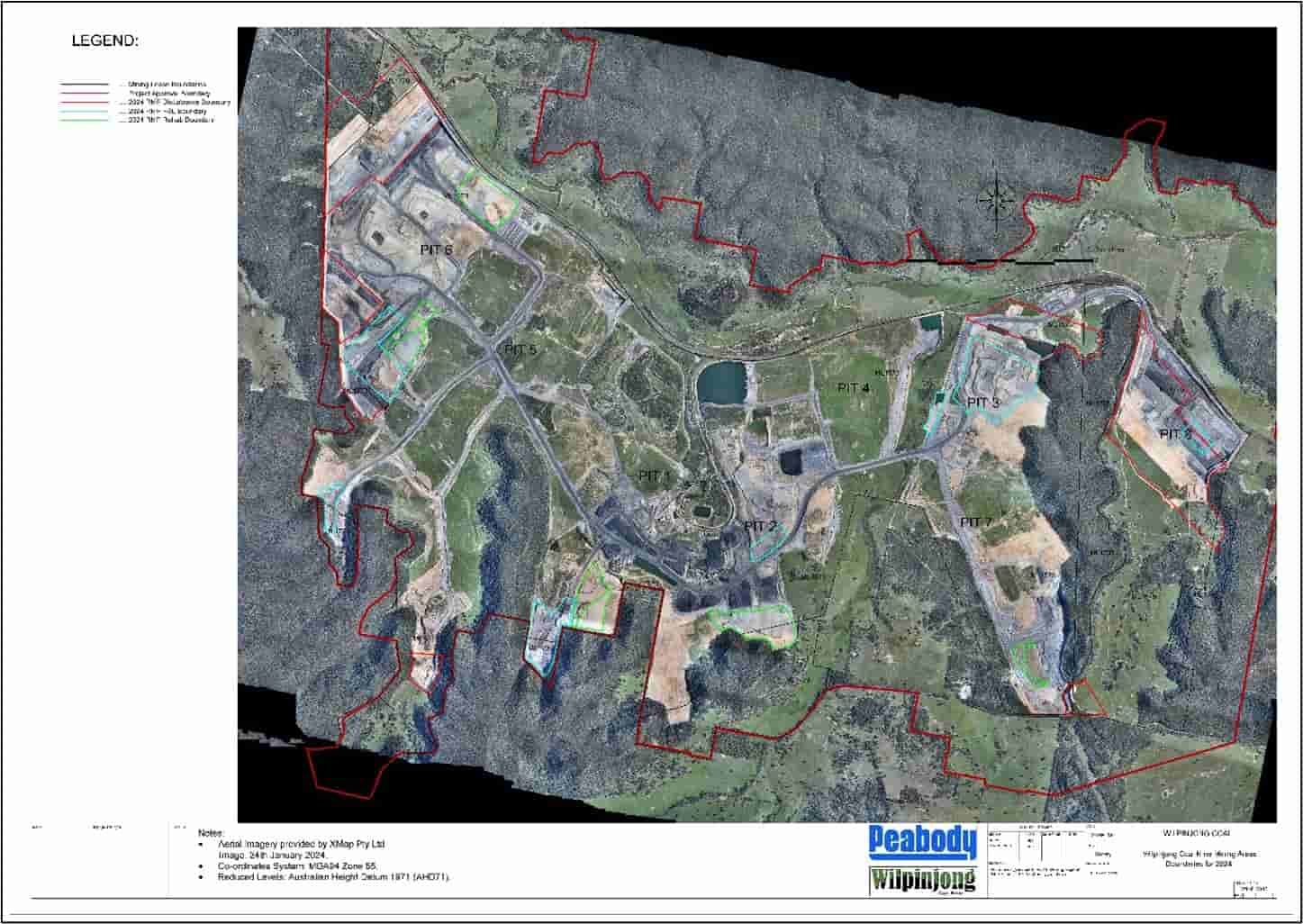

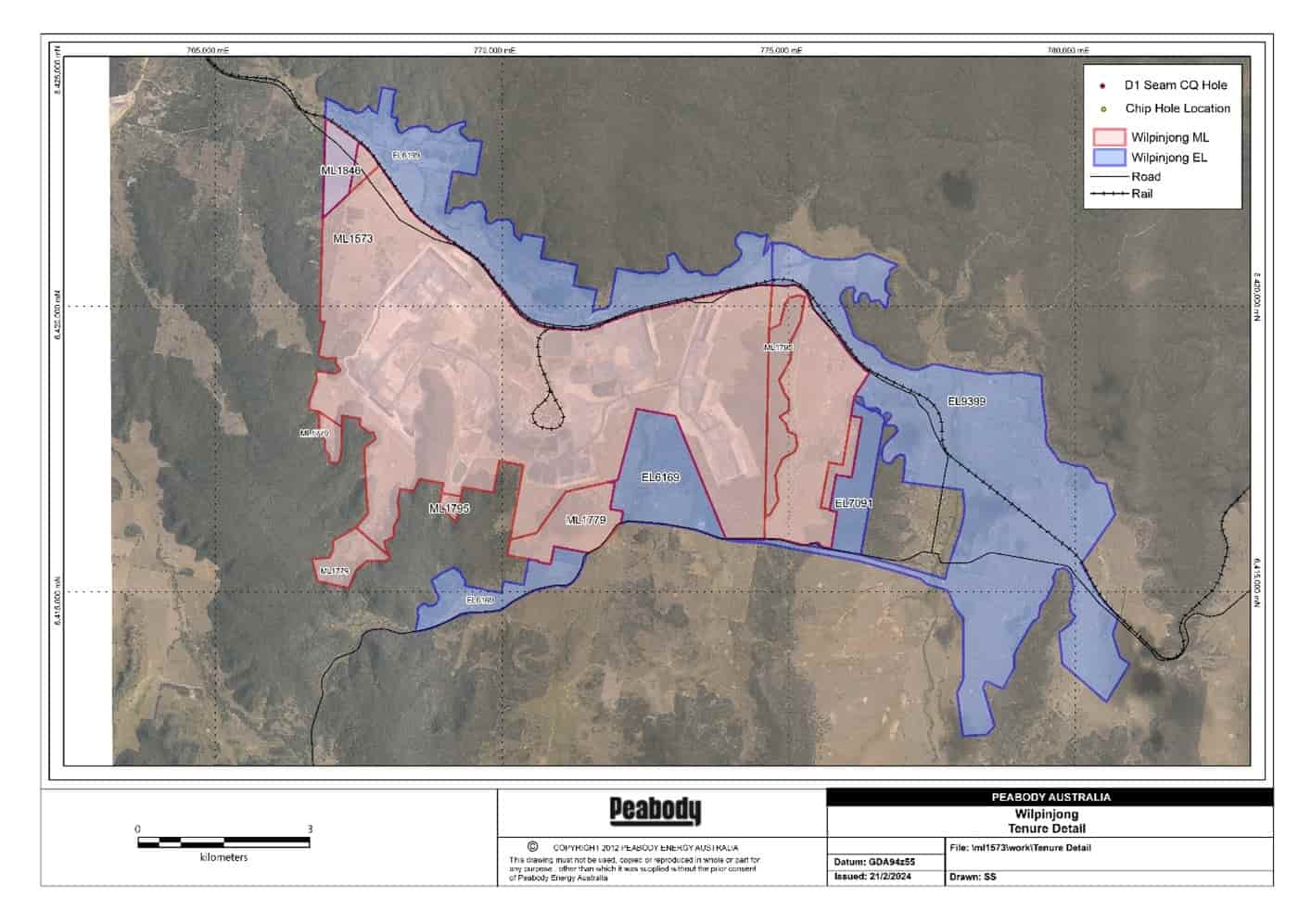

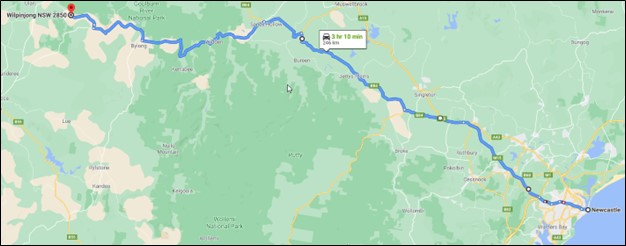

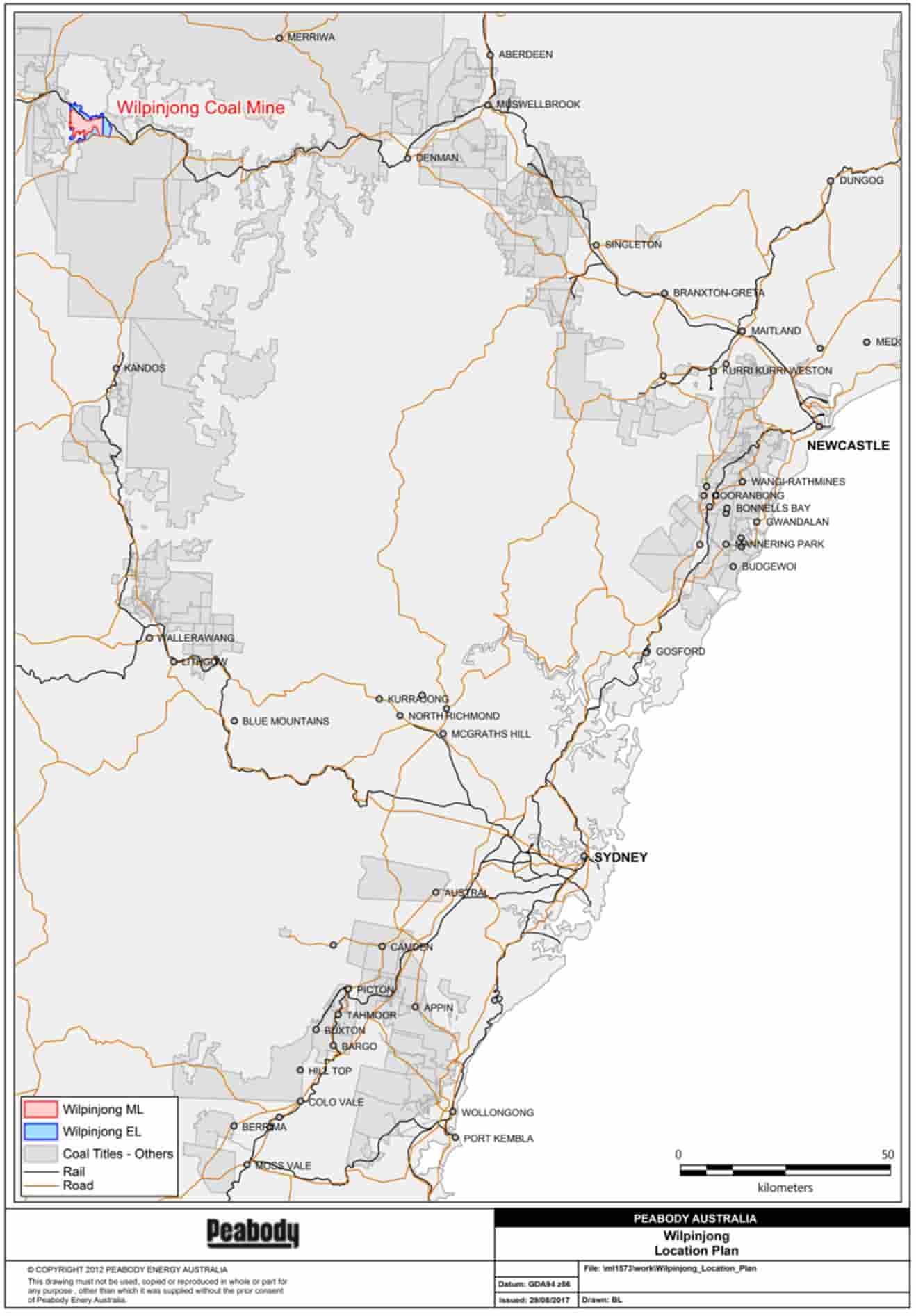

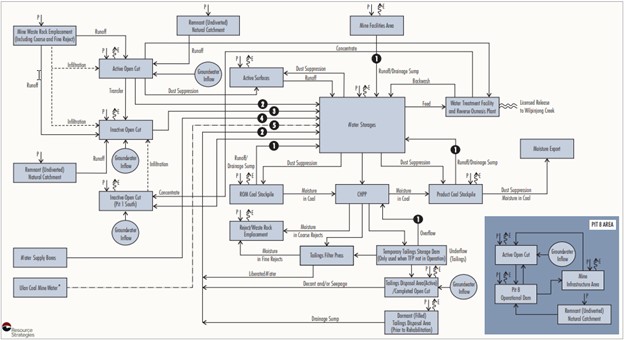

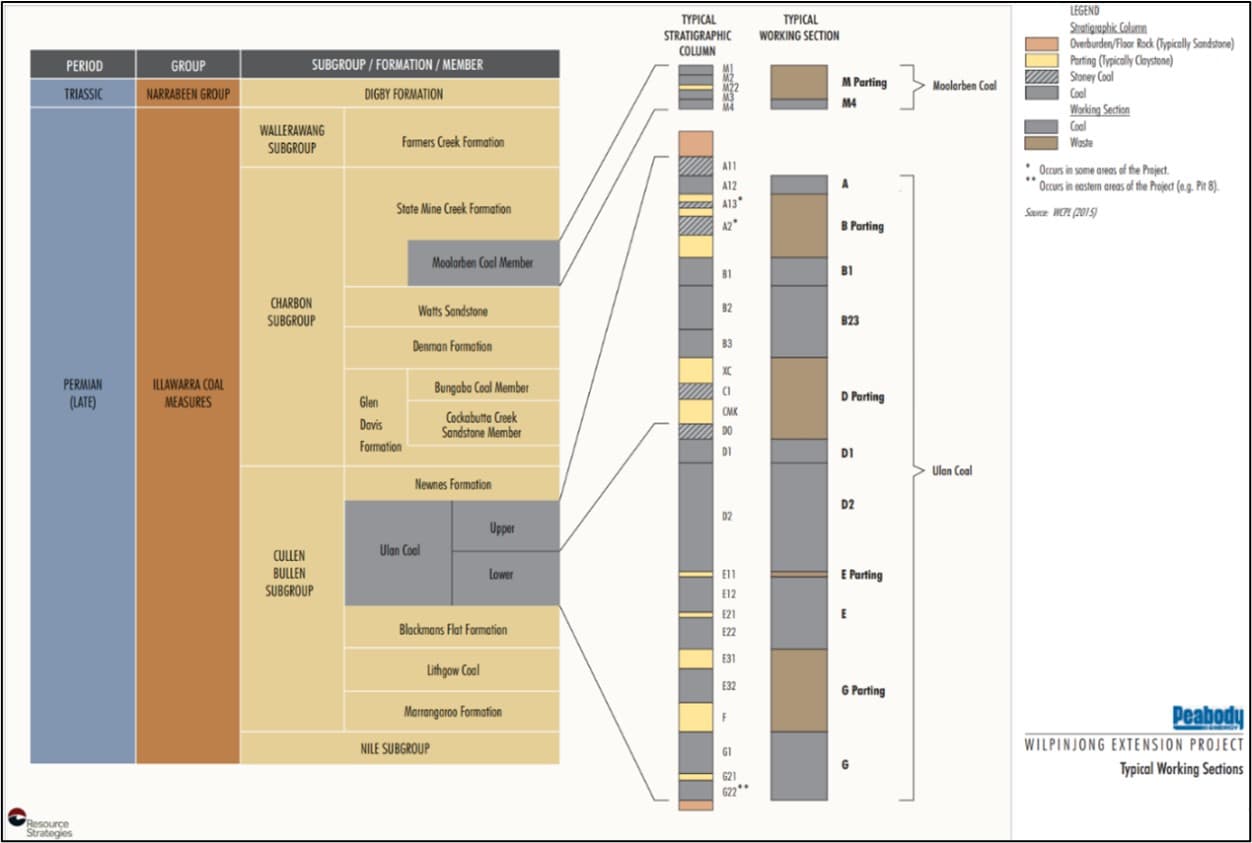

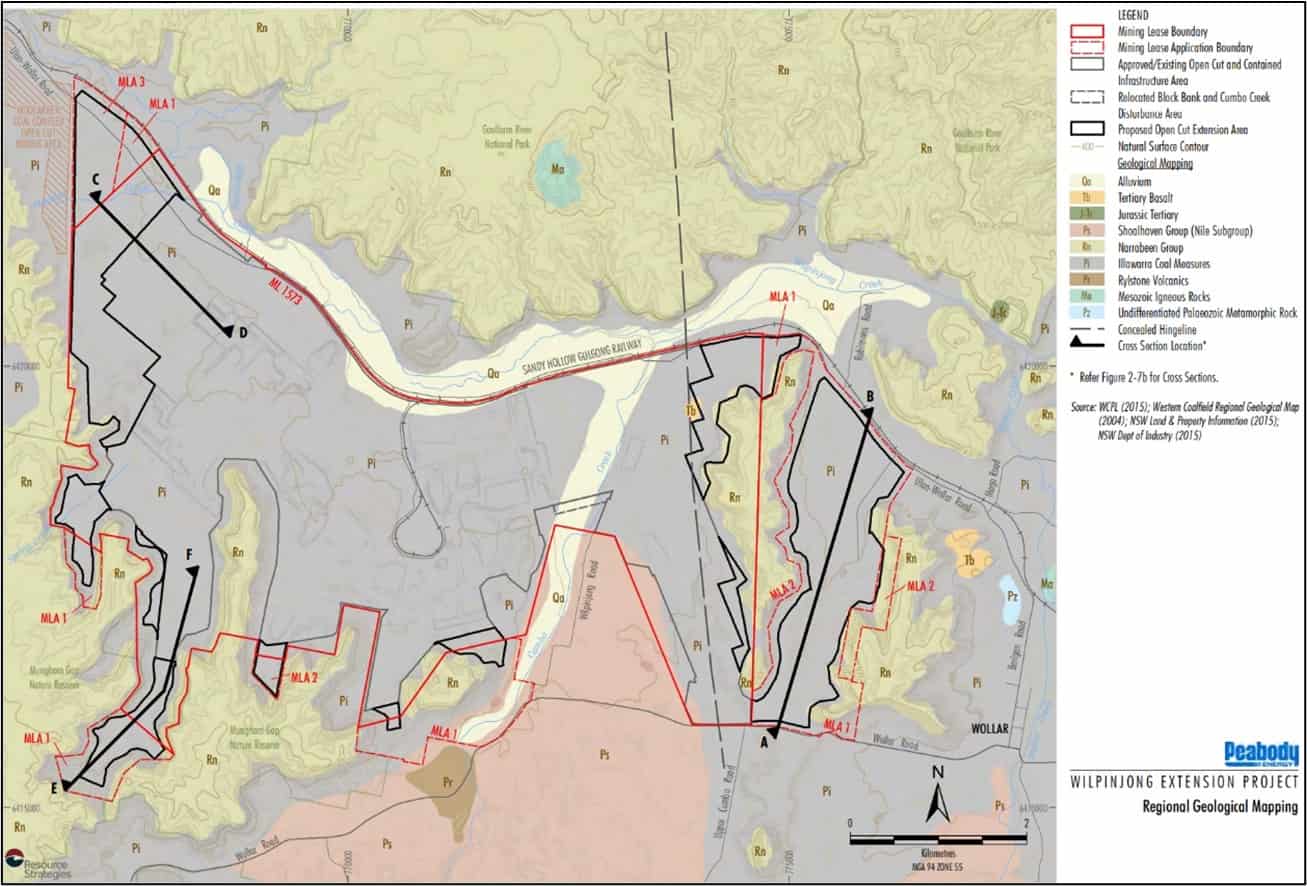

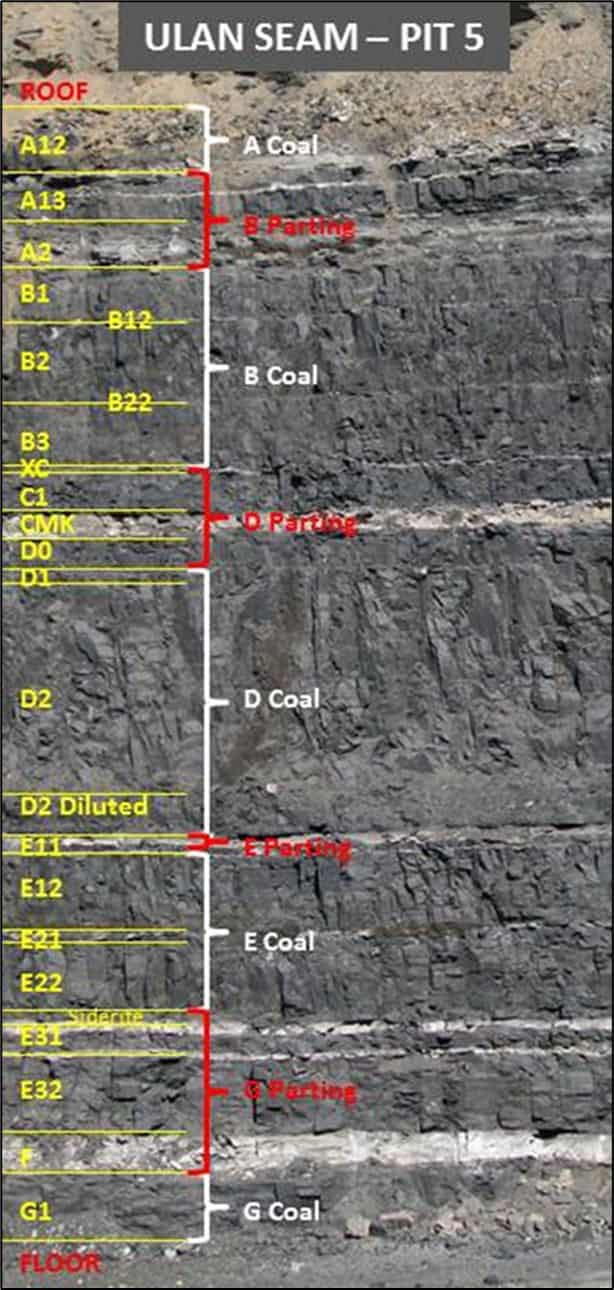

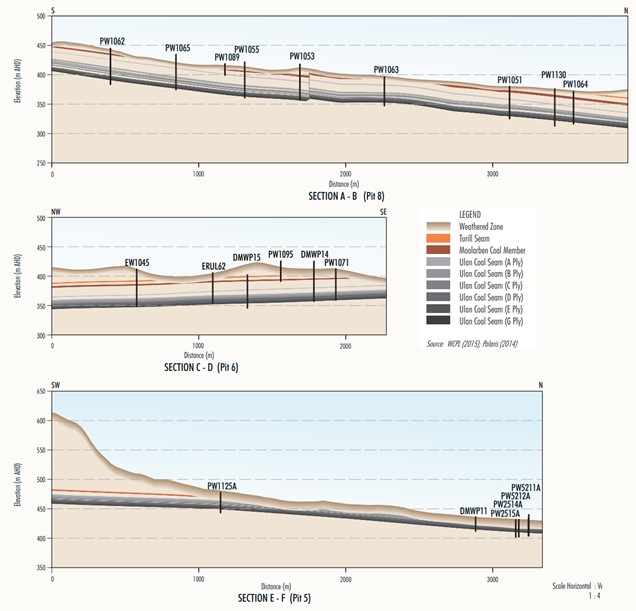

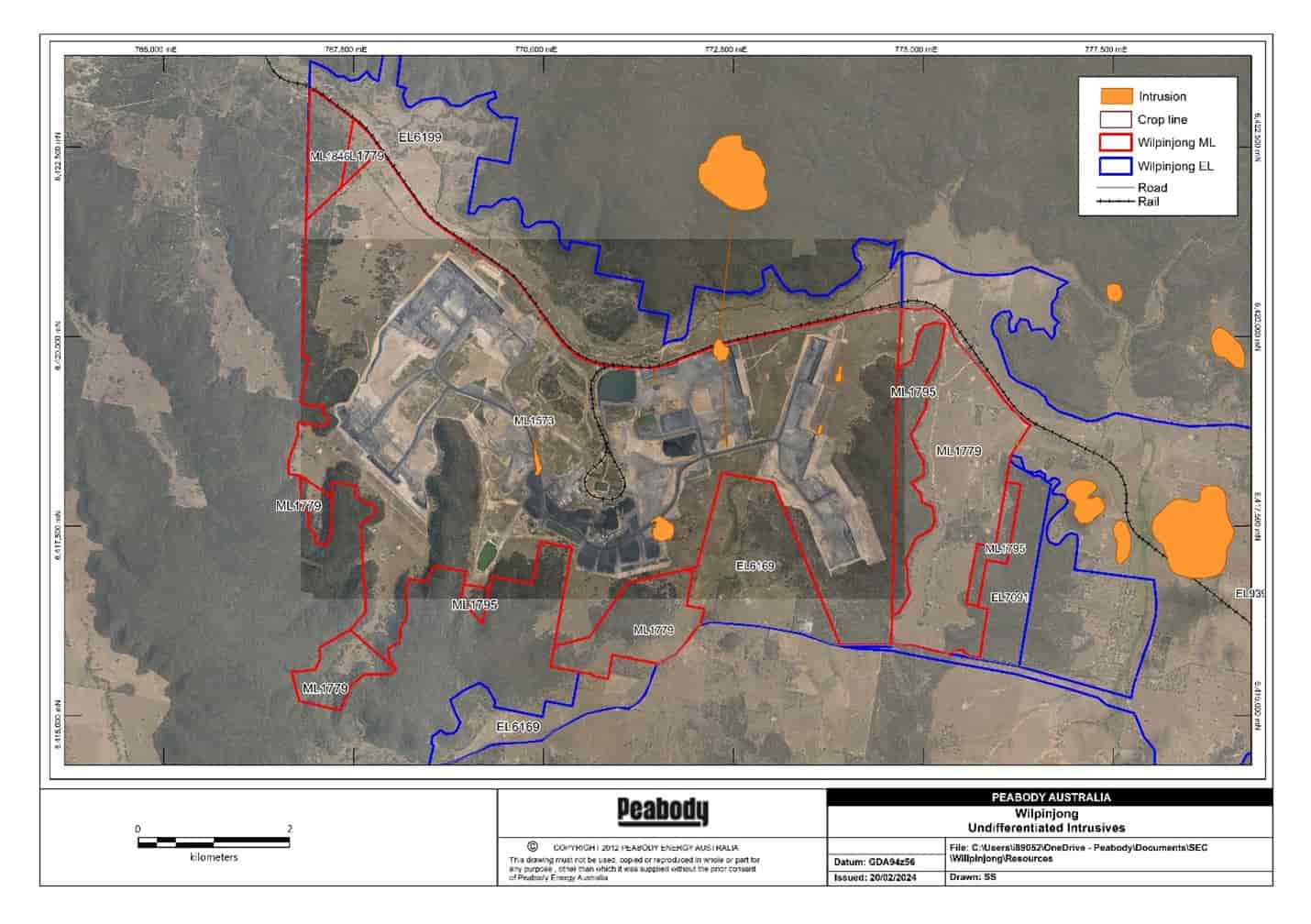

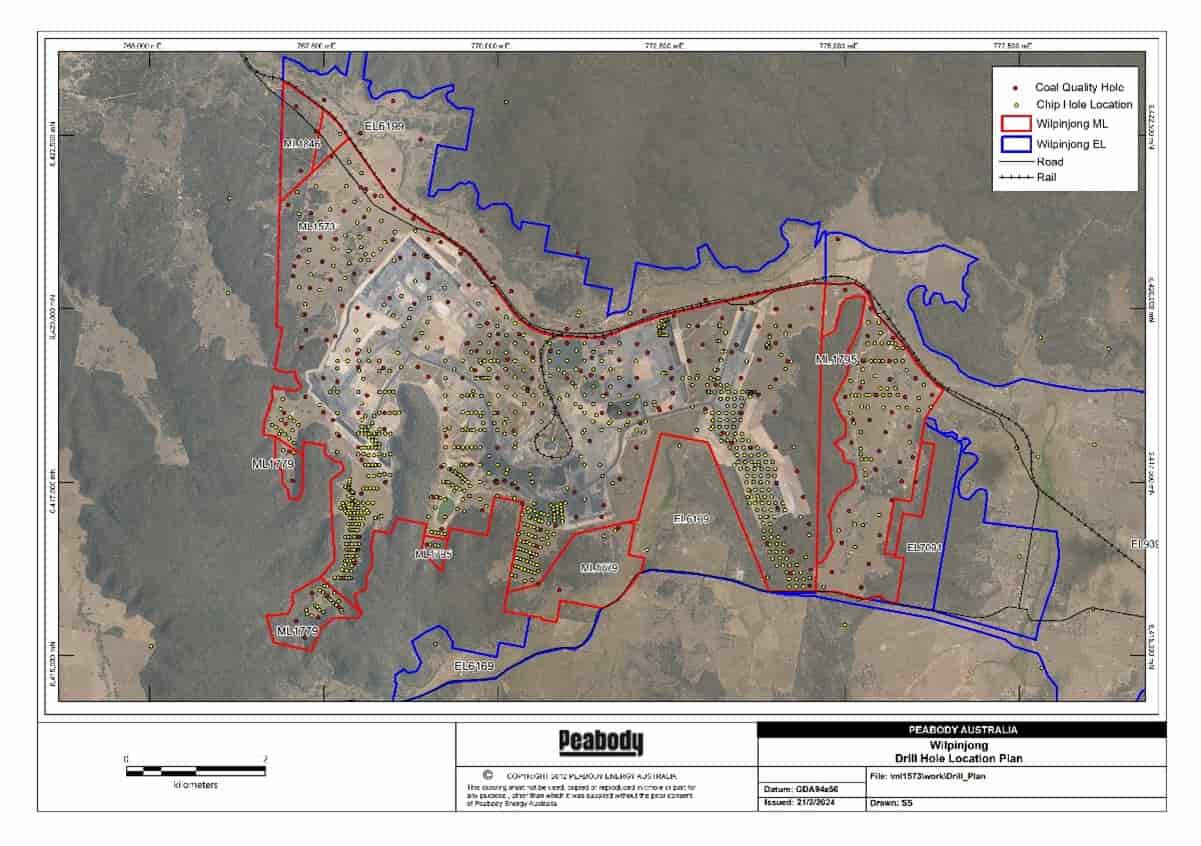

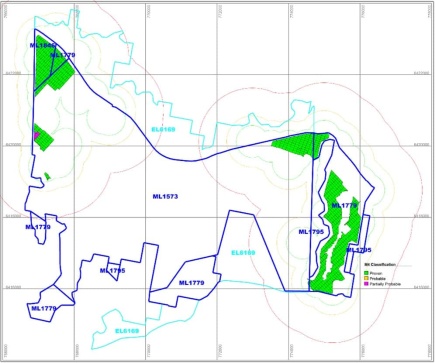

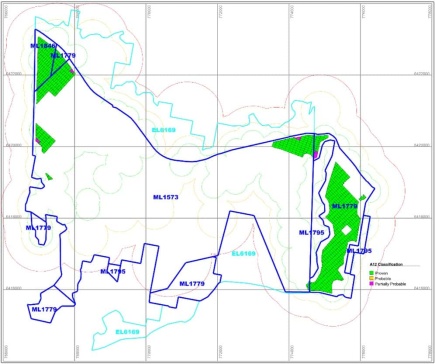

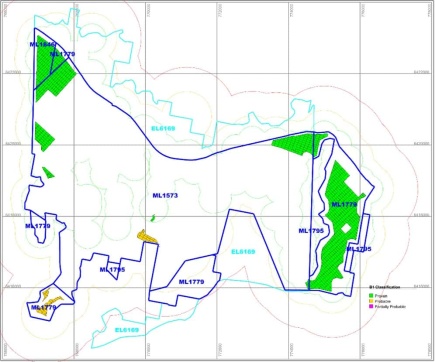

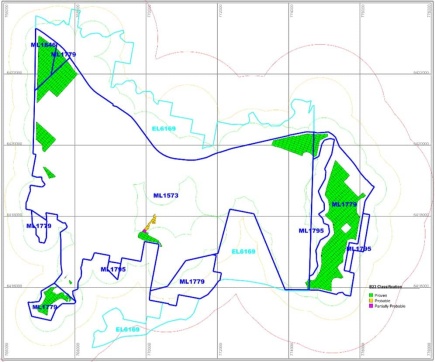

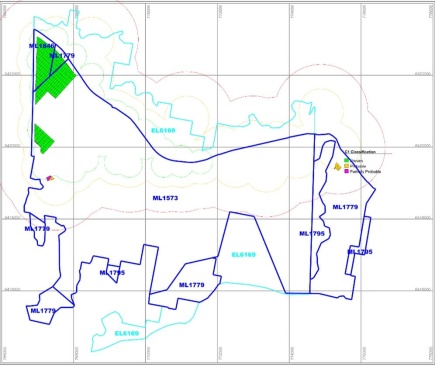

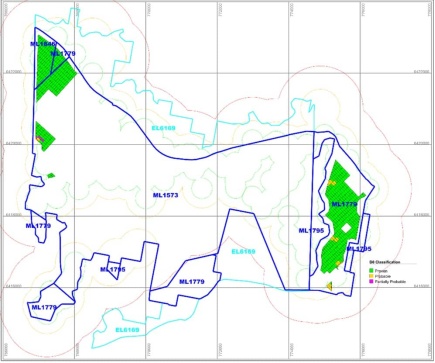

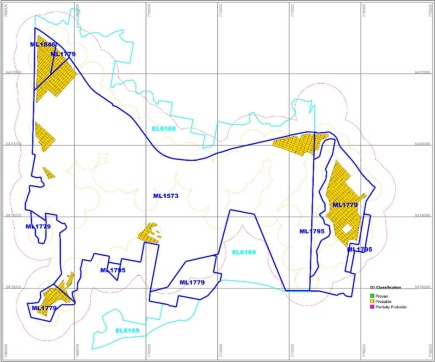

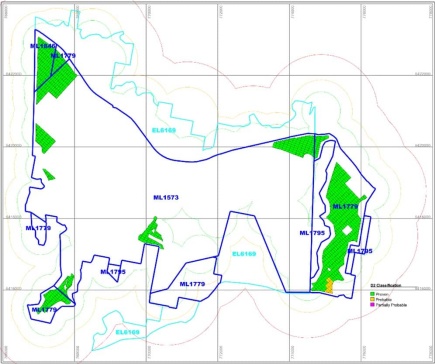

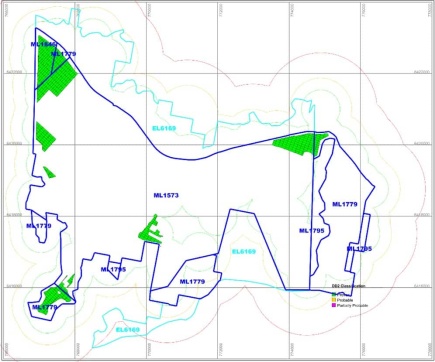

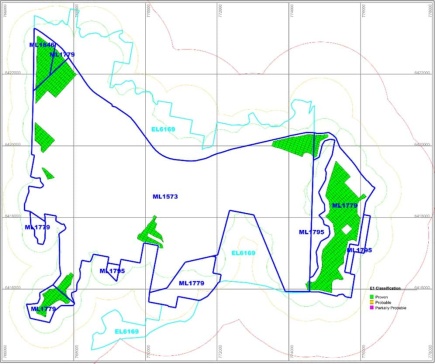

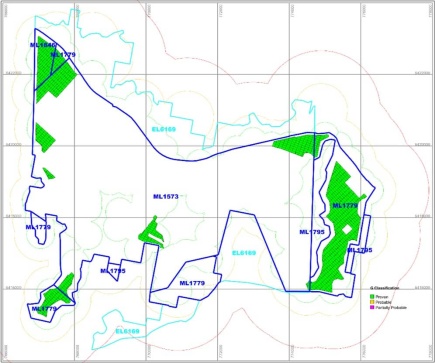

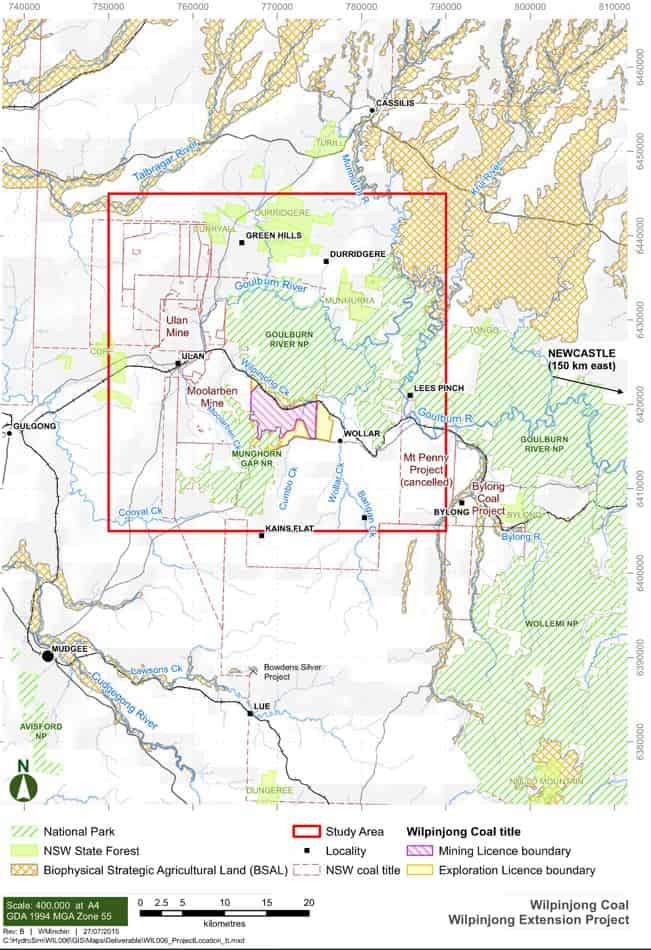

Mining Locations

The maps that follow display Peabody’s active and development mine locations as of December 31, 2023. Also shown are the primary ports that the Company uses for its coal exports and the Company’s corporate headquarters in St. Louis, Missouri.

|

|

|

|

|

|

|

|

|

| Peabody Energy Corporation |

2023 Form 10-K |

2 |

U.S. Locations

|

|

|

|

|

|

|

|

|

| Peabody Energy Corporation |

2023 Form 10-K |

3 |

Australian Locations

|

|

|

|

|

|

|

|

|

| Peabody Energy Corporation |

2023 Form 10-K |

4 |

The table below summarizes information regarding the operating characteristics of each of the Company’s mines in the U.S. and Australia. The mines are listed within their respective reporting segment in descending order, as determined by tons produced in 2023.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Production |

| Segment/Mining Complex |

|

Location |

|

Mine Type |

|

Mining Method |

|

Coal Type |

|

Primary Transport Method |

|

Processing

Plants |

|

Year Ended December 31, |

|

|

|

|

|

|

|

2023 |

|

2022 |

|

2021 |

| Seaborne Thermal |

|

|

|

|

|

|

|

|

|

|

|

(Tons in millions) |

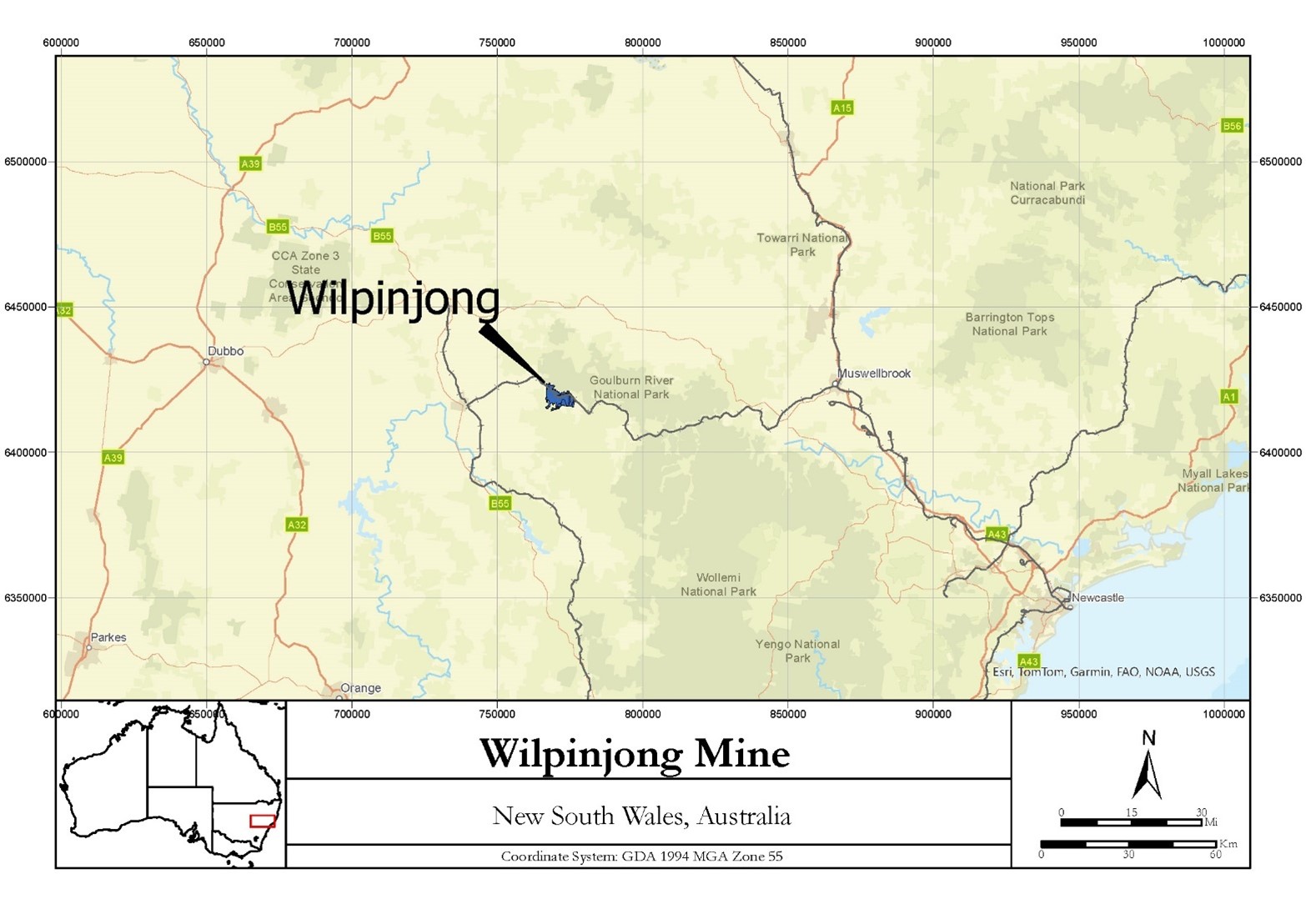

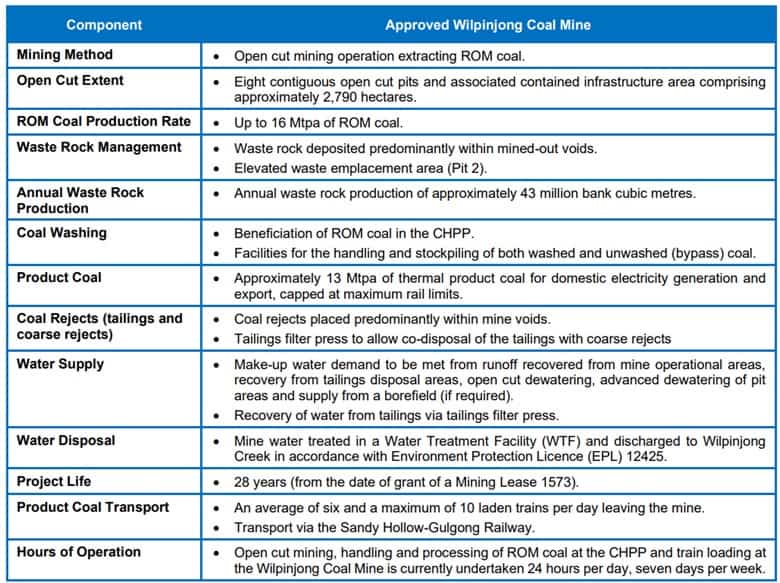

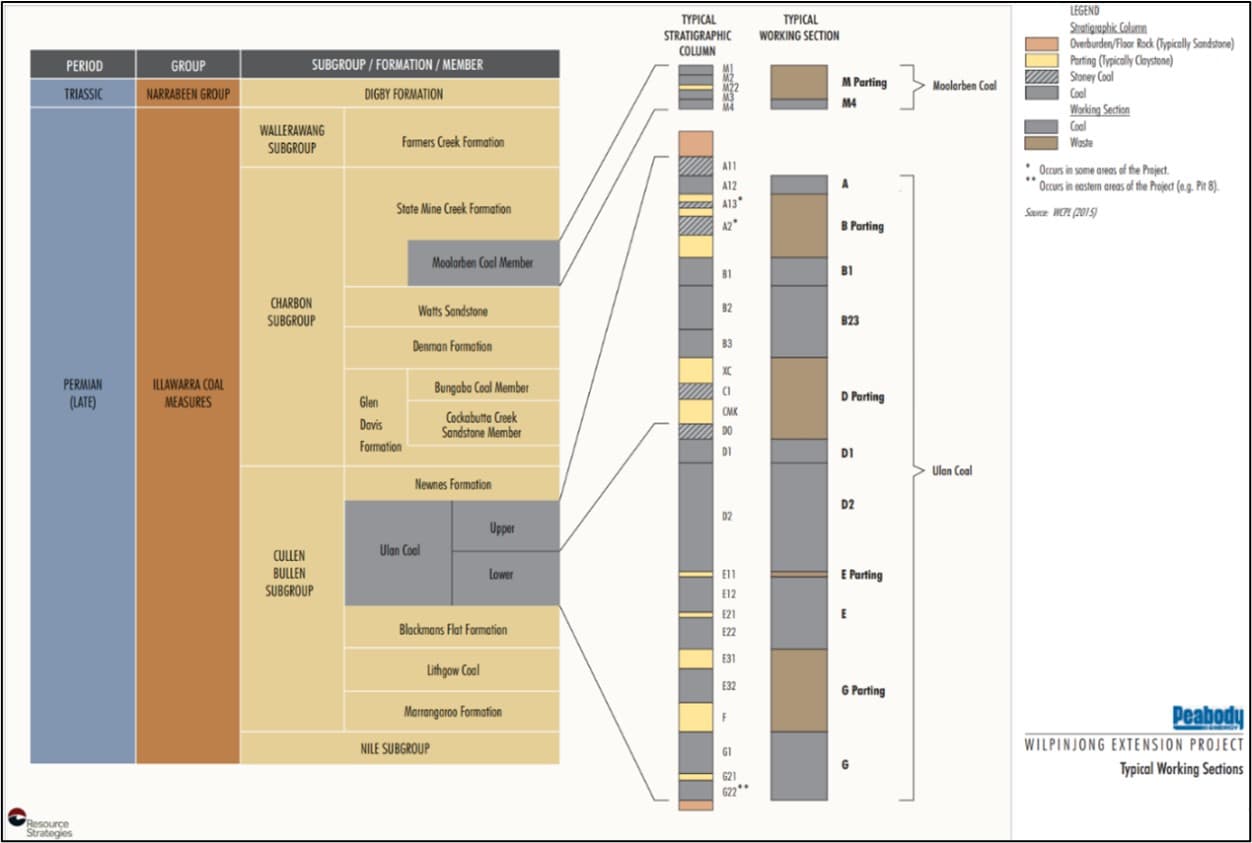

| Wilpinjong |

|

New South Wales |

|

S |

|

D, T/S |

|

T |

|

R, EV |

|

Yes |

|

12.0 |

|

|

12.1 |

|

|

13.2 |

|

Wambo Open-Cut (1) |

|

New South Wales |

|

S |

|

T/S |

|

T, C |

|

R, EV |

|

Yes |

|

2.6 |

|

|

2.0 |

|

|

2.4 |

|

Wambo Underground (2) |

|

New South Wales |

|

U |

|

LW |

|

T, C |

|

R, EV |

|

Yes |

|

1.2 |

|

|

1.1 |

|

|

1.4 |

|

| Seaborne Metallurgical |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Metropolitan (3) |

|

New South Wales |

|

U |

|

LW |

|

C, P, T |

|

R, EV |

|

Yes |

|

2.2 |

|

|

1.8 |

|

|

1.0 |

|

Coppabella (4) |

|

Queensland |

|

S |

|

DL, D, T/S |

|

P |

|

R, EV |

|

Yes |

|

2.2 |

|

|

2.4 |

|

|

2.1 |

|

Moorvale (4) |

|

Queensland |

|

S |

|

D, T/S |

|

C, P, T |

|

R, EV |

|

Yes |

|

2.2 |

|

|

1.5 |

|

|

1.3 |

|

Shoal Creek (5) |

|

Alabama |

|

U |

|

LW |

|

C |

|

B, EV |

|

Yes |

|

0.6 |

|

|

0.8 |

|

|

0.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Middlemount (6) |

|

Queensland |

|

S |

|

D, T/S |

|

C, P |

|

R, EV |

|

Yes |

|

— |

|

|

— |

|

|

— |

|

| Powder River Basin |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

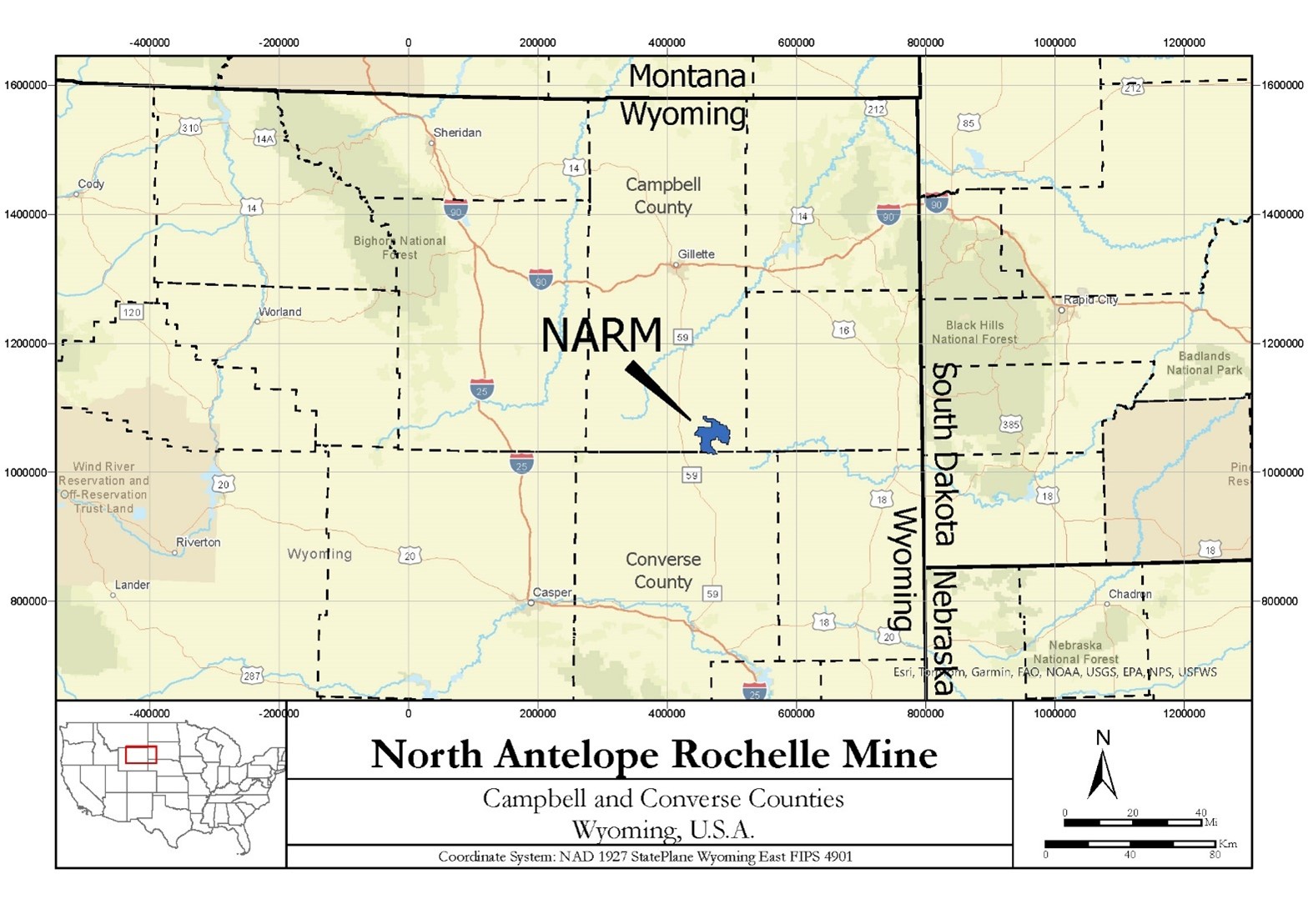

| North Antelope Rochelle |

|

Wyoming |

|

S |

|

DL, D, T/S |

|

T |

|

R |

|

No |

|

62.0 |

|

|

60.4 |

|

|

62.8 |

|

| Caballo |

|

Wyoming |

|

S |

|

D, T/S |

|

T |

|

R |

|

No |

|

15.3 |

|

|

12.1 |

|

|

13.9 |

|

| Rawhide |

|

Wyoming |

|

S |

|

D, T/S |

|

T |

|

R |

|

No |

|

9.8 |

|

|

10.3 |

|

|

11.6 |

|

| Other U.S. Thermal |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Bear Run |

|

Indiana |

|

S |

|

DL, D, T/S |

|

T |

|

Tr, R, EV |

|

Yes |

|

5.5 |

|

|

6.7 |

|

|

6.0 |

|

| El Segundo/Lee Ranch |

|

New Mexico |

|

S |

|

DL, D, T/S |

|

T |

|

R |

|

No |

|

3.4 |

|

|

3.7 |

|

|

3.7 |

|

| Gateway North |

|

Illinois |

|

U |

|

CM |

|

T |

|

Tr, R, R/B, T/B, EV |

|

Yes |

|

2.5 |

|

|

2.4 |

|

|

1.8 |

|

| Francisco Underground |

|

Indiana |

|

U |

|

CM |

|

T |

|

R |

|

Yes |

|

2.0 |

|

|

1.8 |

|

|

1.5 |

|

| Wild Boar |

|

Indiana |

|

S |

|

HW, DL, D, T/S |

|

T |

|

Tr, R, R/B, T/B |

|

Yes |

|

1.9 |

|

|

2.3 |

|

|

2.4 |

|

| Twentymile |

|

Colorado |

|

U |

|

LW |

|

T |

|

R, Tr, EV |

|

Yes |

|

1.3 |

|

|

1.5 |

|

|

1.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Legend: |

|

|

|

| S |

Surface Mine |

|

B |

Barge |

| U |

Underground Mine |

|

Tr |

Truck |

| HW |

Highwall Miner |

|

R/B |

Rail to Barge |

| DL |

Dragline |

|

T/B |

Truck to Barge |

| D |

Dozer/Casting |

|

T/R |

Truck to Rail |

| T/S |

Truck and Shovel |

|

EV |

Export Vessel |

| LW |

Longwall |

|

T |

Thermal/Steam |

| CM |

Continuous Miner |

|

C |

Coking |

| R |

Rail |

|

P |

Pulverized Coal Injection |

(1)Peabody owns a 50% undivided interest in an unincorporated joint venture that owns the Wambo Open-Cut Mine. The tons shown reflect its share. The Company’s 50% joint venture interest is subject to an outside non-controlling ownership interest.

(2)Majority-owned mine in which there is an outside non-controlling ownership interest.

(3)The mine restarted production in the second quarter of 2021 after being idled in the fourth quarter of 2020.

(4)Peabody owns a 73.3% undivided interest in an unincorporated joint venture that owns the Coppabella and Moorvale mines. The tons shown reflect its share.

(5)The mine experienced a fire in March 2023 and restarted production in June 2023. In November 2021 the mine restarted production after being idled in the fourth quarter of 2020.

(6)Peabody owns a 50% equity interest in Middlemount, which owns the Middlemount Mine. Because Middlemount is accounted for as an unconsolidated equity affiliate, the table above excludes tons produced from that mine, which totaled 1.2 million, 1.4 million and 2.0 million tons, respectively (on a 50% basis).

Refer to the Reserves and Resources tables within Item 2. “Properties,” which is incorporated by reference herein, for additional information regarding coal reserves and resources, and product characteristics associated with each mine.

|

|

|

|

|

|

|

|

|

| Peabody Energy Corporation |

2023 Form 10-K |

5 |

Coal Supply Agreements

Customers. Peabody’s coal supply agreements are primarily with electricity generators, industrial facilities and steel manufacturers. Most of the Company’s sales from its mining operations are made under long-term coal supply agreements (those with initial terms of one year or longer and which often include price reopener and/or extension provisions). A smaller portion of the Company’s sales from its mining operations are made under contracts with terms of less than one year, including sales made on a spot basis. Sales under long-term coal supply agreements comprised approximately 92%, 85% and 84% of the Company’s worldwide sales from its mining operations (by volume) for the years ended December 31, 2023, 2022 and 2021, respectively.