UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13A-16 OR 15D-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2025

Commission File Number: 001-34244

HUDBAY MINERALS INC.

(Translation of registrant’s name into English)

25 York Street, Suite 800

Toronto, Ontario

M5J 2V5, Canada

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F [ ] Form 40-F [X]

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes [ ] No [X]

EXPLANATORY NOTE

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- _____________________________ On November 12, 2025, Hudbay Minerals Inc. (“Hudbay”) filed on the Canadian Securities Administrators’ System for Electronic Document Analysis and Retrieval (SEDAR) website at www.sedarplus.ca the following documents: (1) Management's Discussion and Analysis for the period ended September 30, 2025, (2) Unaudited Condensed Consolidated Interim Financial Statements for the period ended September 30, 2025, (3) News Release dated November 12, 2025, (4) Form 52-109F2 Certification of Interim Filings Full Certificate - CEO, (5) Form 52-109F2 Certification of Interim Filings Full Certificate - CFO.

Copies of the filings are attached to this Form 6-K and incorporated herein by reference, as follows:

Exhibit 99.1 — Management's Discussion and Analysis for the period ended September 30, 2025

Exhibit 99.2 — Unaudited Condensed Consolidated Interim Financial Statements for the period ended September 30, 2025

Exhibit 99.3 — News Release dated November 12, 2025

Exhibit 99.4 — Form 52-109F2 Certification of Interim Filings Full Certificate - CEO

Exhibit 99.5 — Form 52-109F2 Certification of Interim Filings Full Certificate - CFO Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

2

SIGNATURE

| HUDBAY MINERALS INC. | ||

| (registrant) | ||

| By: | /s/ Eugene Lei | |

| Name: | Eugene Lei | |

| Title: | Chief Financial Officer | |

Date: November 13, 2025

3

EXHIBIT INDEX

The following exhibits are furnished as part of this Form 6-K:

4

Management's Discussion and Analysis of

Results of Operations and Financial Condition

For the three and nine months ended

September 30, 2025

November 11, 2025

INTRODUCTION

This Management's Discussion and Analysis ("MD&A") dated November 11, 2025 is intended to supplement Hudbay Minerals Inc.'s unaudited condensed consolidated interim financial statements and related notes for the three and nine months ended September 30, 2025 and 2024 (the "consolidated interim financial statements"). The consolidated interim financial statements have been prepared in accordance with IFRS® Accounting Standards ("IFRS" or "GAAP") as issued by the International Accounting Standards Board ("IASB").

References to "Hudbay" or the "Company" refer to Hudbay Minerals Inc. and its direct and indirect subsidiaries as at September 30, 2025.

Readers should be aware that:

- This MD&A contains certain "forward-looking statements" and "forward-looking information" (collectively, "forward-looking information") that are subject to risk factors set out in a cautionary note contained in Hudbay's MD&A.

- This MD&A has been prepared in accordance with the requirements of the securities laws in effect in Canada, which may differ materially from the requirements of United States securities laws applicable to US issuers.

- Hudbay uses a number of non-GAAP financial performance measures in Hudbay's MD&A, which do not have standardized meaning under IFRS. For further information and detailed reconciliations of such measures, please see the discussion under the "Non-GAAP Financial Performance Measures" section herein.

- The technical and scientific information in this MD&A has been approved by qualified persons based on a variety of assumptions and estimates. Please see the discussion under the "Qualified Persons and NI 43-101" section herein.

Readers are also urged to review the "Notes to Reader" section beginning on page 69 of this MD&A.

Additional information regarding Hudbay, including the risks related to its business and those that are reasonably likely to affect its consolidated interim financial statements in the future, is contained in Hudbay's continuous disclosure materials, including its most recent Annual Information Form, consolidated interim financial statements and Management Information Circular available on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov.

All amounts are in US dollars unless otherwise noted.

HUDBAY'S BUSINESS

Hudbay is a copper-focused critical minerals company with three long-life operations and a world-class pipeline of copper growth projects in tier-one mining jurisdictions of Canada, Peru and the United States. Hudbay's operating portfolio includes the Constancia mine in Cusco (Peru), the Snow Lake operations in Manitoba (Canada) and the Copper Mountain mine in British Columbia (Canada). Copper is the primary metal produced by the company, which is complemented by meaningful gold production and by-product zinc, silver and molybdenum. The Company's growth pipeline includes the Copper World project in Arizona (United States), the Mason project in Nevada (United States), the Llaguen project in La Libertad (Peru) and several expansion and exploration opportunities near its existing operations. Hudbay is governed by the Canada Business Corporations Act and its shares are listed under the symbol "HBM" on the Toronto Stock Exchange, New York Stock Exchange and Bolsa de Valores de Lima.

HUDBAY'S PURPOSE

The value Hudbay creates and the impact it has is embodied in its purpose statement: "We care about our people, our communities and our planet. Hudbay provides the metals the world needs. We work sustainably, transform lives and create better futures for communities."

Hudbay transforms lives: Hudbay invests in its employees, their families and local communities through long-term employment, local procurement and economic development to improve their quality of life and ensure the communities benefit from the Company's presence.

Hudbay operates responsibly: From exploration to closure, Hudbay operates safely and responsibly, welcomes innovation and strives to minimize its environmental footprint while following leading operating practices in all facets of mining.

Hudbay provides critical metals: Hudbay produces copper and other metals needed for everyday products and essential for applications to support the energy transition toward a more sustainable future.

SUMMARY

Demonstrated Operating Resilience in the Third Quarter

• Achieved revenue of $346.8 million and adjusted EBITDA1 of $142.6 million in the third quarter of 2025.

• Achieved consolidated copper production of 24,205 tonnes and consolidated gold production of 53,581 ounces in the third quarter, demonstrating strong operational resilience with Manitoba operations suspended for the majority of the quarter due to the wildfire evacuations and temporary operational interruptions in Peru.

• Strong cost performance continued in the third quarter with consolidated cash cost1 and sustaining cash cost1 per pound of copper produced, net of by-product credits, of $0.42 and $2.09, respectively.

• Reaffirmed full year 2025 consolidated production guidance for copper and gold, despite the temporary operational interruptions and production deferrals. Full-year consolidated copper and gold production is now expected to be near the low end of the guidance ranges.

• Further improved full year 2025 consolidated cash cost1 guidance range to $0.15 to $0.35 per pound, an additional improvement from the previously updated guidance range of $0.65 to $0.85 per pound, as year-to-date results are trending well below the low end of the cost ranges. Also improved full year 2025 consolidated sustaining cash cost guidance range to $1.85 to $2.25 per pound copper from the original guidance range of $2.25 to $2.65 per pound as a result of increased exposure to gold by-product credits and continued strong operating cost control.

• Peru operations produced 18,114 tonnes of copper and 26,380 ounces of gold in the third quarter, with copper being slightly lower than quarterly cadence expectations and gold far exceeding quarterly cadence expectations while navigating intermittent interruptions and a temporary mill suspension during the quarter. Peru cash cost1 per pound of copper produced, net of by-product credits, was $1.30 in the third quarter, outperforming the low-end of the cost guidance range. Full year copper production in Peru is expected to be in line with 2025 annual guidance and full year gold production is expected to exceed the top end of the guidance range.

• Manitoba operations produced 22,441 ounces of gold in the third quarter, lower than quarterly cadence expectations as a result of temporary production interruptions from mandatory wildfire evacuations that shut down operations for the majority of the third quarter and deferred gold production. A business interruption insurance claim has been submitted to compensate for a portion of the wildfire-related downtime. Manitoba cash cost1 per ounce of gold produced, net of by-product credits, was $379 in the third quarter. Subsequent to the quarter, due to additional unplanned down time in October as a result of winter storm power outages, some gold production has been further deferred and full year gold production in Manitoba is now expected to be slightly below the low end of the 2025 annual guidance range.

• British Columbia operations produced 5,249 tonnes of copper in the third quarter at a cash cost1 per pound of copper produced, net of by-product credits, of $3.21. While the initial phase of the conversion of the third ball mill to a second semi-autogenous grinding ("SAG") mill was completed successfully in the third quarter, there was required maintenance at the primary SAG mill at the end of September and into early October, which is expected to result in reduced mill throughput levels for the balance of 2025 and full year copper production in British Columbia is now expected to be below the low end of the 2025 annual guidance range.

• Third quarter net earnings attributable to owners and earnings per share attributable to owners were $222.4 million and $0.56, respectively, reflecting a pre-tax full impairment reversal of $322.3 million on Hudbay's carrying value of the Copper World project as a result of the announcement of a $600 million strategic partnership with Mitsubishi Corporation ("Mitsubishi") for a 30% minority interest in Copper World, which is expected to close in late 2025 or early 2026. After adjusting for this transaction and various other non-cash items, third quarter adjusted earnings1 per share attributable to owners was $0.03.

• Financial results in the third quarter were impacted by the deferral of a 20,000 dry metric tonne copper concentrate shipment in Peru, valued at approximately $60 million (high gold content), from the end of September into early October due to ocean swells at the port.

• Cash and cash equivalents decreased by $14.4 million to $611.1 million during the third quarter and total liquidity2 was $1,036.3 million as at September 30, 2025, reflecting $13.2 million of additional senior unsecured note repurchases during the third quarter.

Further Debt Reduction and Balance Sheet Strength

• Hudbay's unique copper and gold diversification across its operations provides exposure to higher copper and gold prices, which together with a focus on cost control across the business, continues to expand margins and generate attractive operating cash flow.

• While the majority of revenues continue to be derived from copper production, revenue from gold production represented more than 38% of total revenues in the third quarter of 2025.

• Generated positive free cash flow1 in Peru and Manitoba in the third quarter of 2025 despite operational interruptions, offset by negative free cash flow1 in British Columbia with planned stripping activities. Consolidated free cash flow1 would have been positive if the excess copper concentrate inventory in Peru was sold at the end of September.

• Achieved adjusted EBITDA1 of $142.6 million in the third quarter of 2025, resulting in annual trailing twelve-month adjusted EBITDA1 of $932.3 million.

• Repurchased and retired an additional $13.2 million of senior unsecured notes through open market purchases at a discount to par during the third quarter reducing total principal debt to $1.05 billion as of September 30, 2025. Subsequent to the quarter end, deleveraging efforts continued with an additional $20.0 million of open market purchases of the senior unsecured notes, at a discount to par.

• As of November 11, 2025, approximately $328.1 million in total principal debt and gold prepayment liability reductions have been achieved since the beginning of 2024.

• Net debt1 reduced to $435.9 million as at September 30, 2025 compared to $525.7 million at December 31, 2024, a decrease of $89.8 million year-to-date.

• Net debt to adjusted EBITDA ratio1 was 0.5x at the end of the third quarter of 2025, a further improvement from 0.6x at the end of fourth quarter of 2024.

Prudently Advancing Copper World Towards a Sanction Decision in 2026

• In August 2025, announced accretive $600 million Copper World joint venture transaction with Mitsubishi for a 30% minority interest ("JV Transaction").

◦ Secures a premier long-term strategic partner in Mitsubishi, one of the largest Japanese trading houses with a global mining presence and a significant U.S. based business.

◦ Implies a significant premium to consensus net asset value for Copper World3.

◦ Increases levered project IRR to Hudbay to approximately 90% based on pre-feasibility study ("PFS") estimates4.

• In August 2025, agreed on terms with Wheaton Precious Metals Corp. ("Wheaton") to amend the existing precious metals streaming agreement.

◦ In addition to the initial $230 million stream deposit, provides an additional contingent payment of up to $70 million on a future mill expansion recognizing the long-term potential at Copper World.

◦ Ongoing payments for gold and silver amended from fixed pricing to 15% of spot prices to provide upside exposure to higher precious metals prices.

• Successful completion of the final key elements of Hudbay's prudent financial strategy as part of the three prerequisites ("3-P") plan for Copper World.

◦ Hudbay's estimated share of the remaining equity capital contributions has been reduced to approximately $200 million based on PFS estimates and Hudbay's first capital contribution has been deferred to 2028 at the earliest.

• Feasibility study activities for Copper World are underway with expected completion of a definitive feasibility study ("DFS") in mid-2026.

◦ Hudbay is accelerating detailed engineering, certain long lead items and other de-risking activities in 2025 and, as announced in August 2025, has advanced $20 million in growth capital expenditures to 2025 from future years.

Reinvesting in Several Additional High-return Growth Initiatives

• Optimization efforts at Copper Mountain have continued and are focused on executing the planned accelerated stripping program and mill throughput improvement projects. A key component, the conversion of the third ball mill to a second SAG mill ("SAG2"), remains on schedule. Completion of the initial phase on July 10, 2025 enabled the mill to achieve several days of 50,000 tonnes per day in September, the highest level achieved since Hudbay acquired the operations. Construction of the final phase of the SAG2 project is expected to conclude in December 2025.

• Large exploration program in Snow Lake continues to execute the threefold strategy focused on near-mine exploration to increase near-term production and mineral reserves, testing regional satellite deposits for additional ore feed to utilize available capacity at the Stall mill, and exploring the large land package for a new anchor deposit to meaningfully extend mine life.

• Following the completion of the initial 1901 exploration drift some additional development ore was delivered for processing at Stall. The focus now turns to advancing exploration platforms in both base metal and gold mineralization and developing the haulage drift to confirm mining methods, establish critical infrastructure and de-risk the path towards full production in late 2027.

• Drilling commenced at the Talbot copper-zinc-gold deposit near Snow Lake in July with a focus on expanding the known mineralization and testing geophysical targets. Full assay results expected later this year.

• Continuing to advance Flin Flon tailings reprocessing opportunities through metallurgical test work and economic evaluations to assess the possibility of producing critical minerals and precious metals in an environmentally friendly manner.

• Continuing to enhance stakeholder engagement and advance additional metallurgical studies at the Mason copper project in Nevada.

Summary of Third Quarter Results

Hudbay's diversified asset portfolio delivered consolidated copper production of 24,205 tonnes and consolidated gold production of 53,581 ounces in the third quarter of 2025, despite temporary operational interruptions and production deferrals. Consolidated copper and gold production was lower than the second quarter of 2025 primarily due to the impact of the mandatory wildfire evacuations that persisted in northern Manitoba for a majority of the third quarter, a temporary production interruption in Peru for nine days during the third quarter due to social unrest and unplanned mill downtime and processing of low-grade stockpiles at Copper Mountain during the third quarter. Consolidated silver production of 730,394 ounces and zinc production of 548 tonnes in the third quarter of 2025 were also lower than the second quarter of 2025 for the aforementioned reasons.

Cash generated from operating activities of $113.5 million decreased compared to the same period in 2024 and compared to the second quarter of 2025 as a result of the temporary operational interruptions during the third quarter, as mentioned above, and lower sales volumes as a result of a delayed 20,000 dry metric tonne copper concentrate shipment in Peru with high grade gold content, valued at approximately $60 million, from the end of September into early October due to ocean swells at the port. This was partially offset by higher realized metal prices.

Adjusted EBITDA1 was $142.6 million in the third quarter of 2025, a decrease compared to $245.2 million in the second quarter of 2025 primarily due to the temporary operational interruptions and the lower sales volumes as a result of the delayed copper concentrate shipment in Peru, as noted above.

Net earnings attributable to owners was $222.4 million, or $0.56 per share, in the third quarter of 2025 compared to $117.7 million, or $0.30 per share, in the second quarter of 2025 and $49.7 million, or $0.13 per share, in the third quarter of 2024. The increase in earnings compared to the second quarter of 2025 and third quarter 2024, is the result of a non-cash after-tax gain of $242.7 million from a full impairment reversal relating to Hudbay's Copper World project and the receipt of $14.9 million in contingent consideration in respect of Copper Mountain's previous sale of a non-core project. These gains were partially offset by temporary operational interruptions in Manitoba and Peru which resulted in lower production and delayed sales volumes impacting overall gross margins and operating cash flow during the quarter.

Adjusted net earnings attributable to owners1 and adjusted net earnings per share attributable to owners1 in the third quarter of 2025 were $10.1 million and $0.03 per share, respectively, after adjusting for various non-cash items on a pre-tax basis including a $322.3 million full impairment reversal related to Hudbay's Copper World project following the announcement of the JV Transaction, $14.9 million of contingent consideration received from the previous sale of a non-core project, an $8.7 million mark-to-market revaluation loss on various instruments such as investments and share-based compensation, and a non-cash $8.8 million foreign exchange loss, among other items. This compares to adjusted net earnings attributable to owners1 and net earnings per share attributable to owners1 of $50.2 million and $0.13 per share in the third quarter of 2024 and $75.5 million and $0.19 per share in the second quarter of 2025. The decrease in adjusted net earnings attributable to owners1 and adjusted net earnings per share attributable to owners1 compared to the second quarter of 2025 and third quarter of 2024 is for the same reasons discussed above for net earnings.

In the third quarter of 2025, consolidated cash cost per pound of copper produced, net of by-product credits1, was $0.42, compared to $(0.02) in the second quarter of 2025 and $0.18 in the third quarter of 2024, as Hudbay continued to demonstrate industry-leading cost performance. The increase in cash cost, net of by-product credits, from the comparative periods was a result of lower by-product credits due to lower production in Manitoba from the impact of the wildfires during the third quarter, partially offset by strong gold production in Peru despite the nine-day operational interruption during the third quarter of 2025.

Consolidated sustaining cash cost per pound of copper produced, net of by-product credits1, was $2.09 in the third quarter of 2025, compared to $1.65 in the second quarter of 2025 and $1.71 in the third quarter of 2024. The increase was primarily due to the same factors impacting consolidated cash cost noted above.

Consolidated all-in sustaining cash cost per pound of copper produced, net of by-product credits1, was $2.78 in the third quarter of 2025, higher than the second quarter of 2025 and the third quarter of 2024 mainly due to the same reasons outlined above as well as higher corporate G&A from the revaluation of Hudbay's stock-based compensation due to relative higher share prices.

As at September 30, 2025, total liquidity was $1,036.3 million, including $611.1 million in cash and cash equivalents, and undrawn availability of $425.2 million under Hudbay's revolving credit facilities. The Company's liquidity is expected to be further enhanced upon the closing of the JV Transaction, which is expected to occur in late 2025 or early 2026. Net debt1 at the end of the third quarter was $435.9 million, marking an $89.8 million improvement from fourth quarter of 2024 as a result of deleveraging activities which included the repurchase and retirement of senior unsecured notes. Hudbay expects that the current liquidity, together with cash flows from operations, will be sufficient to meet the Company's liquidity needs for the year.

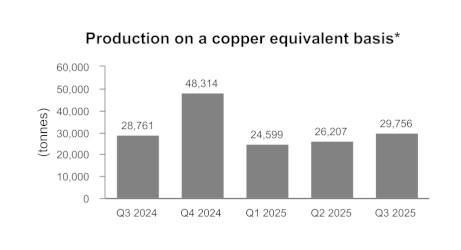

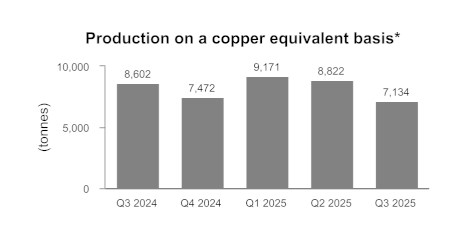

*Copper equivalent production is calculated using the quarter average LME prices for each metal.

1 Adjusted net earnings - attributable to owners and adjusted net earnings per share - attributable to owners, adjusted EBITDA, cash cost, sustaining cash cost, all-in sustaining cash cost per pound of copper produced, net of by-product credits, cash cost, sustaining cash cost per ounce of gold produced, net of by-product credits, combined unit cost, net debt, net debt to adjusted EBITDA ratio and free cash flow are non-GAAP financial performance measures with no standardized definition under IFRS. For further information and a detailed reconciliation, please see the discussion under the "Non-GAAP Financial Performance Measures" section of this MD&A.

2 Liquidity includes $611.1 million in cash and cash equivalents as well as undrawn total availability of $425.2 million under Hudbay's revolving credit facilities.

3 Average analyst consensus net asset value estimate for 100% of Copper World is approximately $1.16 billion as of August 12, 2025.

4 Based on the initial capital investment and the $3.75 per pound copper price used in the PFS published on September 8, 2023 with assumptions of approximately $145 million for pre-sanctioning costs, $230 million from the precious metals stream, $350 million from project-level financing and approximately $700 million from the joint venture partner earn-in, matching contribution and capital contribution.

KEY FINANCIAL RESULTS

| Financial Condition | ||||||

| (in $ millions, except net debt to adjusted EBITDA ratio) | Sep. 30, 2025 | Dec. 31, 2024 | ||||

| Cash and cash equivalents and short-term investments | $ | 611.1 | $ | 581.8 | ||

| Total long-term debt | 1,047.0 | 1,107.5 | ||||

| Net debt1 | 435.9 | 525.7 | ||||

| Working capital2 | (34.7 | ) | 511.3 | |||

| Total assets | 5,916.8 | 5,487.6 | ||||

| Equity attributable to owners of the Company | 3,080.5 | 2,553.2 | ||||

| Net debt to adjusted EBITDA 1 | 0.5 | 0.6 | ||||

| 1 Net debt and net debt to adjusted EBITDA are non-GAAP financial performance measures with no standardized definition under IFRS. For further information and a detailed reconciliation, please see discussion under the "Non-GAAP Financial Performance Measures" section of this MD&A. | ||||||

| 2 Working capital is determined as total current assets less total current liabilities as defined under IFRS and disclosed on the consolidated interim financial statements. Working capital as of September 30, 2025 was impacted by an increase in the current portion of long-term debt of $511.0 million as the 2026 Notes are now maturing within one year. | ||||||

| Financial Performance | Three months ended | Nine months ended | |||||||||||||

| (in $ millions, except per share amounts or as noted below) | Sep. 30, 2025 |

Jun. 30, 2025 |

Sep. 30, 2024 |

Sep. 30, 2025 |

Sep. 30, 2024 |

||||||||||

| Revenue | $ | 346.8 | $ | 536.4 | $ | 485.8 | $ | 1,478.1 | $ | 1,436.3 | |||||

| Cost of sales | 281.5 | 359.9 | 346.0 | 1,005.0 | 1,066.9 | ||||||||||

| Earnings before tax | 330.5 | 153.1 | 79.7 | 654.9 | 147.9 | ||||||||||

| Net earnings | 222.4 | 114.7 | 50.3 | 436.3 | 48.5 | ||||||||||

| Net earnings attributable to owners | 222.4 | 117.7 | 49.7 | 440.5 | 55.5 | ||||||||||

| Basic and diluted earnings per share - attributable | 0.56 | 0.30 | 0.13 | 1.11 | 0.15 | ||||||||||

| Adjusted earnings per share - attributable1 | 0.03 | 0.19 | 0.13 | 0.45 | 0.30 | ||||||||||

| Operating cash flow before change in non-cash working capital | 70.3 | 193.9 | 188.3 | 427.4 | 459.5 | ||||||||||

| Adjusted EBITDA1 | 142.6 | 245.2 | 206.0 | 675.0 | 566.0 | ||||||||||

| Free cash flow1 | (15.2 | ) | 87.8 | 88.4 | 159.7 | 208.0 | |||||||||

| 1 Adjusted earnings per share - attributable to owners, adjusted EBITDA and free cash flow are non-GAAP financial performance measures with no standardized definition under IFRS. For further information and a detailed reconciliation, please see discussion under the "Non-GAAP Financial Performance Measures" section of this MD&A. | |||||||||||||||

KEY PRODUCTION RESULTS

| Three months ended | Nine months ended | Guidance | |||||||||||||||||

| Sep. 30, 2025 |

Jun. 30, 2025 |

Sep. 30, 2024 |

Sep. 30, 2025 |

Sep. 30, 2024 |

Annual 2025 | ||||||||||||||

| Contained metal in concentrate and doré produced1 | |||||||||||||||||||

| Copper | tonnes | 24,205 | 29,956 | 31,354 | 85,119 | 94,681 | 117,000 - 149,000 | ||||||||||||

| Gold | oz | 53,581 | 56,271 | 89,073 | 183,636 | 238,079 | 247,500 - 308,000 | ||||||||||||

| Silver | oz | 730,394 | 814,989 | 985,569 | 2,465,158 | 2,672,193 | 3,520,000 - 4,390,000 | ||||||||||||

| Zinc | tonnes | 548 | 5,130 | 8,069 | 11,943 | 24,954 | 21,000 - 27,000 | ||||||||||||

| Molybdenum | tonnes | 185 | 375 | 362 | 957 | 1,128 | 1,300 - 1,500 | ||||||||||||

| Payable metal sold | |||||||||||||||||||

| Copper | tonnes | 18,280 | 30,354 | 27,760 | 80,402 | 87,167 | |||||||||||||

| Gold2 | oz | 38,279 | 62,466 | 73,232 | 175,837 | 242,608 | |||||||||||||

| Silver2 | oz | 418,418 | 894,160 | 663,413 | 2,319,546 | 2,399,297 | |||||||||||||

| Zinc | tonnes | 3,452 | 2,871 | 8,607 | 11,180 | 19,859 | |||||||||||||

| Molybdenum | tonnes | 269 | 427 | 343 | 1,144 | 1,105 | |||||||||||||

| 1 Metal reported in concentrate is prior to deductions associated with smelter contract terms and includes other secondary products. | |||||||||||||||||||

| 2 Includes total payable gold and silver in concentrate and in doré sold. | |||||||||||||||||||

KEY COST RESULTS

| Three months ended | Nine months ended | Guidance | |||||||||||||||||

| Sep. 30, 2025 |

Jun. 30, 2025 |

Sep. 30, 2024 |

Sep. 30, 2025 |

Sep. 30, 2024 |

Annual 20252 |

||||||||||||||

| Peru cash cost per pound of copper produced | |||||||||||||||||||

| Cash cost1 | $/lb | 1.30 | 1.45 | 1.80 | 1.29 | 1.28 | 1.35 - 1.65 | ||||||||||||

| Sustaining cash cost1 | $/lb | 2.11 | 2.63 | 2.78 | 2.23 | 2.07 | |||||||||||||

| Manitoba cash cost per ounce of gold produced | |||||||||||||||||||

| Cash cost1 | $/oz | 379 | 710 | 372 | 491 | 606 | 650 - 850 | ||||||||||||

| Sustaining cash cost1 | $/oz | 762 | 1,025 | 553 | 787 | 855 | |||||||||||||

| British Columbia cash cost per pound of copper produced | |||||||||||||||||||

| Cash cost1 | $/lb | 3.21 | 2.39 | 1.81 | 2.63 | 2.67 | 2.45 - 3.45 | ||||||||||||

| Sustaining cash cost1 | $/lb | 7.43 | 5.18 | 5.06 | 5.44 | 5.15 | |||||||||||||

| Consolidated cash cost per pound of copper produced | |||||||||||||||||||

| Cash cost1 | $/lb | 0.42 | (0.02 | ) | 0.18 | (0.06 | ) | 0.46 | 0.15 - 0.35 | ||||||||||

| Sustaining cash cost1 | $/lb | 2.09 | 1.65 | 1.71 | 1.44 | 1.73 | 1.85 - 2.25 | ||||||||||||

| All-in sustaining cash cost1 | $/lb | 2.78 | 2.03 | 1.95 | 1.86 | 2.04 | |||||||||||||

| 1 Cash cost, sustaining cash cost, all-in sustaining cash cost per pound of copper produced, net of by-product credits, gold cash cost, sustaining cash cost per ounce of gold produced, and net of by-product credits are non-GAAP financial performance measures with no standardized definition under IFRS. For further information and a detailed reconciliation, please see the discussion under the "Non-GAAP Financial Performance Measures" section of this MD&A. | |||||||||||||||||||

| 2 Further improved full year 2025 consolidated copper cash cost guidance range to $0.15 to $0.35 per pound from prior guidance of $0.65 to $0.85 per pound and the original guidance range of $0.80 to $1.00 per pound. Improved full year 2025 consolidated sustaining copper cash cost guidance range to $1.85 to $2.25 per pound from the original guidance range of $2.25 to $2.65 per pound. | |||||||||||||||||||

RECENT DEVELOPMENTS

2025 Consolidated Production and Cost Guidance

Hudbay reaffirms its full year 2025 consolidated production guidance for copper and gold as the Company demonstrates resilience after overcoming recent temporary operational interruptions. While the Company expects the fourth quarter to be a strong copper and gold production quarter, full year consolidated copper and gold production is expected to be near the low end of the guidance ranges.

In Peru, the fourth quarter is expected to be the strongest copper and gold production quarter this year with steady operations achieved since early October after the resolution of social protests. Peru production in the month of October totaled approximately 9,200 tonnes of copper and 16,600 ounces of gold, reflecting optimal mill ore feed with strong ore contribution from Pampacancha and lower stockpiled ore being processed. Peru full year copper production is expected to be within the guidance ranges while gold production is expected to be above the top end of the guidance range in 2025.

In Manitoba, subsequent to the quarter, Hudbay experienced power outages in October due to severe winter storms and operations were shut down for approximately one week. While the Company was previously tracking within the 2025 guidance ranges despite the significant impacts from the wildfire evacuations, it now expects to be slightly below the low end of gold production guidance range as a result of the further deferral of gold production due to these power outages and the associated ramp-up after power was restored. Given the strong cash cost performance to-date in Manitoba, Hudbay will prioritize primary gold production over by-product zinc production in 2025 and full year zinc production is now expected to be below the low end of the guidance range.

In British Columbia, fourth quarter production is expected to be impacted by lower mill throughput due to reduced throughput at SAG1, which together with a higher portion of ore milled from low-grade stockpiles year-to-date, has resulted in full year copper production expectations to be below the low end of the guidance range.

Hudbay is again improving its full-year 2025 consolidated cash cost guidance range to $0.15 to $0.35 per pound copper from the previously announced range of $0.65 to $0.85 per pound and the original guidance range of $0.80 to $1.00 per pound. The Company is also improving its 2025 annual consolidated sustaining cash cost guidance range to $1.85 to $2.25 per pound copper from the original guidance range of $2.25 to $2.65 per pound. This is a result of increased exposure to gold by-product credits and continued strong cost control at all operations, despite the temporary production interruptions in Manitoba and Peru.

Hudbay expects total capital expenditures to be $35 million lower than 2025 guidance levels, primarily due to the deferral of certain expenditures to 2026. This includes $15 million lower sustaining capital expenditures primarily due to temporary operational interruptions in Manitoba and Peru. Growth capital expenditures are expected to be $20 million lower primarily due to spending deferrals into 2026.

Resilient Operating Base Enables Continued Debt Reduction and Balance Sheet Strength

Hudbay continued its prudent balance sheet management and reduced overall debt levels even with the temporary interruptions to its operations during the third quarter of 2025. During the third quarter of 2025, the Company was able to repurchase and retire an additional $13.2 million of senior unsecured notes at a discount to par, and an additional $20.0 million was repurchased subsequent to the quarter. This has contributed to approximately $328.1 million in total debt repayments and gold prepayment liability reductions since the beginning of 2024:

• Repurchased and retired a total of $165.8 million of senior unsecured notes in 2024 and year-to-date as of November 11, 2025.

• Repaid $100 million of prior drawdowns under the revolving credit facilities in 2024.

• Fully repaid the gold prepay facility with $62.3 million in gold deliveries in 2024 and the final payment completed in August 2024.

These deleveraging achievements have reduced total principal debt to $1.05 billion as of September 30, 2025, which together with Hudbay's strengthened cash balance, has substantially reduced net debti to $435.9 million, compared to $625.6 million as of September 30, 2024. Hudbay's net debt to adjusted EBITDA ratioi is 0.5x as of September 30, 2025.

Prudently Advancing Copper World Towards a Sanction Decision in 2026

During the third quarter, significant strides were made to advance the Copper World project. On August 13, 2025, Hudbay announced the JV Transaction with Mitsubishi, securing a premier, long-term strategic partner for the development of Copper World, and agreed on terms with Wheaton to amend the precious metals streaming agreement at Copper World. The Company continues to de-risk Copper World with detailed engineering underway.

• Accretive JV Transaction and Secured the Premier Joint Venture Partner - Highly accretive $600 million transaction with Mitsubishi for a 30% minority joint venture interest, creating a long-term partnership with a premier strategic partner that has a global mining presence and an established U.S. based metals trading business. The $600 million proceeds from Mitsubishi will consist of $420 million at closing and $180 million within 18 months of closing and will be used to fund the remaining definitive feasibility study ("DFS") costs and pre-sanction costs in addition to project development costs for Copper World. Mitsubishi will also fund its pro-rata 30% share of future equity capital contributions. The JV Transaction is expected to close in late 2025 or early 2026 and is conditional upon receipt of certain regulatory approvals and the satisfaction of other customary closing conditions.

• Enhanced Wheaton Precious Metals Stream - Agreed on terms with Wheaton in August 2025 to amend the existing precious metals streaming agreement that aligns with the current development plan for Copper World. In addition to the initial $230 million stream deposit, Wheaton will provide an additional contingent payment of up to $70 million on a future mill expansion recognizing the long-term potential at Copper World. Ongoing payments for gold and silver were amended from fixed pricing to 15% of spot prices to provide Hudbay with upside exposure to higher precious metals prices.

• Achieved Key Elements of Hudbay's Three Prerequisites (3-P) Plan - Hudbay has achieved the final key elements of its prudent 3-P financial strategy with the announcements of the JV Transaction and the enhanced Wheaton stream, together with the achievement of stated balance sheet targets. Before accounting for proceeds from the JV Transaction, Hudbay has already achieved more than $600 million of cash and cash equivalents and a 0.5x net debt to adjusted EBITDA ratio1 as of September 30, 2025, far exceeding the stated balance sheet targets. Hudbay's estimated share of the remaining capital contributions has been reduced to approximately $200 million2 based on PFS estimates and Hudbay's first capital contribution has been deferred to 2028 at the earliest.

• Feasibility Study and Detailed Engineering Underway - Feasibility activities for Copper World are underway with expected completion of a DFS in mid-2026. Hudbay is accelerating detailed engineering, certain long lead items and other de-risking activities in 2025 and, as announced in August 2025, has advanced $20 million in growth capital expenditures to 2025 from future years. The Company expects to make a Copper World sanction decision in 2026.

Exploration Update

Large Snow Lake Exploration Program Continues to Execute Threefold Strategy

Hudbay continues to execute the largest exploration program in Snow Lake in the Company's history through extensive geophysical surveying and multi-phased drilling campaigns as part of Hudbay's threefold exploration strategy:

• Near-mine Exploration at Lalor and 1901 to Further Increase Near-term Production and Extend Mine Life - Hudbay completed the development of the initial exploration drift at the 1901 deposit earlier this year and the development of the haulage drift is underway. Positive initial step-out drilling from the exploration drift was achieved earlier this year, and during the third quarter, some additional zinc development ore was delivered for processing at Stall. Activities at 1901 over the next two years will focus on exploration, definition drilling, orebody access, and establishing critical infrastructure for full production in late 2027. Exploration activities at 1901 will target additional step-out drilling to potentially extend the orebody and infill drilling to convert inferred mineral resources in the gold lenses to mineral reserves. Following the improved wildfire situation, underground exploration drilling at Lalor has resumed.

• Testing Regional Satellite Deposits to Utilize Available Processing Capacity and Increase Production - Hudbay increased its regional land package by more than 250% in 2023 through the acquisition of Rockcliff Metals Corp. ("Rockcliff"), which included the addition of several known deposits located within trucking distance of the Snow Lake processing infrastructure. The deposits acquired as part of the Rockcliff acquisition, together with several deposits already owned by Hudbay in Snow Lake, have created an attractive portfolio of regional deposits in Snow Lake, including the Talbot, Rail, Pen II, Watts, 3 Zone and WIM deposits. The continued strong performance from the New Britannia mill has freed up processing capacity at the Stall mill, where there is approximately 1,500 tonnes per day of available capacity which could be utilized by the regional satellite deposits to increase production and extend the life of the Snow Lake operations beyond 2037. Hudbay commenced an extensive summer drill program at the Talbot copper-zinc-gold deposit in July focused on expanding the known mineralization and testing geophysical targets. Core logging from the first three holes confirm the continuity of the Talbot copper-gold mineralization at depth, with full assay results expected later in the year.

• Exploring Large Land Package for New Anchor Deposit to Significantly Extend Mine Life - A majority of the land claims acquired as part of the Rockcliff acquisition have been untested by modern deep geophysics, which was the discovery method for the Lalor deposit. A large geophysics program is currently underway consisting of surface electromagnetic surveys using cutting edge techniques that enable the team to detect targets at depths of almost 1,000 metres below surface. The planned geophysics program in 2025 is the largest geophysics program in Hudbay's history and includes 800 kilometres of ground electromagnetic surveys and an extensive airborne geophysics survey. The Company resumed the Snow Lake regional geophysics program following the improved wildfire situation.

Maria Reyna and Caballito Drill Permits Update

Hudbay controls a large, contiguous block of mineral rights with the potential to host satellite mineral deposits in close proximity to the Constancia processing facility, including the past producing Caballito property and the highly prospective Maria Reyna property. The Company commenced the drill permitting process at Maria Reyna and Caballito after completing a surface rights exploration agreement with the community of Uchucarcco in August 2022. As part of the drill permitting process, environmental impact assessment (EIA) applications were approved by the government in June 2024 for Maria Reyna and September 2024 for Caballito. The remaining steps in the drill permitting process include the completion by the government of the Consulta Previa consultation process with the local community.

Board & Executive Management Appointments

In September 2025, Hudbay appointed Laura Tyler to its Board of Directors (the "Board"). Ms. Tyler has over 30 years of extensive experience with world-class global mining companies, including a 20-year career at BHP in progressively more senior leadership roles and ultimately serving as Chief Technical Officer where she oversaw the integration of the technology function with exploration, innovation, value engineering and BHP's Centres of Excellence. Ms. Tyler's extensive experience in the mining industry, deep technical knowledge and operational leadership experience make her an excellent addition to the Board.

In addition, the Company has promoted Candace Brûlé to Senior Vice President, Capital Markets and Corporate Affairs, and Mark Gupta to Senior Vice President, Corporate Development and Strategy.

In this broader role, Ms. Brûlé will retain responsibility for Investor Relations, Financial Planning & Analysis (FP&A), External Communications and Sustainability Reporting, while leading Hudbay's Canadian government engagement efforts. Ms. Brûlé has over 18 years of experience in investor relations, corporate development and financial communications in the mining sector.

Mr. Gupta will continue to be responsible for optimizing Hudbay's portfolio of assets through acquisitions, divestitures, investments and partnerships, as well as leading the Company's corporate strategy function. Mr. Gupta has over 15 years of experience in the mining industry across investment banking, corporate development, capital planning and operations strategy.

1 Adjusted EBITDA, net debt, net debt to adjusted EBITDA ratio and free cash flow are non-GAAP financial performance measures with no standardized definition under IFRS. For further information and a detailed reconciliation, please see the discussion under the "Non-GAAP Financial Performance Measures" section of this MD&A.

2 Based on the initial capital investment and the $3.75 per pound copper price used in the PFS published on September 8, 2023 with assumptions of approximately $145 million for pre-sanctioning costs, $230 million from the precious metals stream, $350 million from project-level financing and approximately $700 million from the joint venture partner earn-in, matching contribution and capital contribution.

PERU OPERATIONS REVIEW

| Three months ended | Nine months ended | |||||||||||||||

| Sep. 30, 2025 | Jun. 30, 2025 | Sep. 30, 2024 | Sep. 30, 2025 | Sep. 30, 2024 | ||||||||||||

| Constancia ore mined1 | tonnes | 564,579 | 6,735,316 | 3,022,931 | 15,928,174 | 10,860,132 | ||||||||||

| Copper | % | 0.25 | 0.34 | 0.36 | 0.31 | 0.31 | ||||||||||

| Gold | g/tonne | 0.02 | 0.03 | 0.04 | 0.03 | 0.03 | ||||||||||

| Silver | g/tonne | 1.92 | 3.26 | 3.20 | 3.15 | 2.76 | ||||||||||

| Molybdenum | % | 0.01 | 0.02 | 0.02 | 0.02 | 0.01 | ||||||||||

| Pampacancha ore mined1 | tonnes | 4,260,081 | 762,172 | 1,777,092 | 5,411,442 | 5,280,235 | ||||||||||

| Copper | % | 0.38 | 0.26 | 0.48 | 0.37 | 0.50 | ||||||||||

| Gold | g/tonne | 0.31 | 0.24 | 0.27 | 0.30 | 0.28 | ||||||||||

| Silver | g/tonne | 4.87 | 4.59 | 6.23 | 4.74 | 4.98 | ||||||||||

| Molybdenum | % | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | ||||||||||

| Total ore mined | tonnes | 4,824,660 | 7,497,488 | 4,800,023 | 21,339,616 | 16,140,367 | ||||||||||

| Strip ratio2 | 1.38 | 1.47 | 2.62 | 1.26 | 2.07 | |||||||||||

| Ore milled | tonnes | 6,991,744 | 7,559,047 | 8,137,248 | 22,664,815 | 23,934,171 | ||||||||||

| Copper | % | 0.31 | 0.34 | 0.32 | 0.32 | 0.32 | ||||||||||

| Gold | g/tonne | 0.16 | 0.05 | 0.11 | 0.09 | 0.11 | ||||||||||

| Silver | g/tonne | 3.94 | 3.58 | 3.70 | 3.56 | 3.35 | ||||||||||

| Molybdenum | % | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | ||||||||||

| Copper concentrate | tonnes | 82,796 | 94,813 | 100,462 | 269,780 | 304,190 | ||||||||||

| Concentrate grade | % Cu | 21.88 | 22.90 | 21.12 | 22.28 | 21.37 | ||||||||||

| Copper recovery | % | 83.2 | 84.5 | 82.6 | 84.2 | 83.6 | ||||||||||

| Gold recovery | % | 72.1 | 56.0 | 68.1 | 65.4 | 69.2 | ||||||||||

| Silver recovery | % | 65.2 | 63.5 | 67.0 | 64.9 | 67.4 | ||||||||||

| Molybdenum recovery | % | 33.9 | 38.7 | 39.0 | 36.2 | 42.7 | ||||||||||

| Combined unit operating costs3,4,5 | $/tonne | 13.03 | 13.59 | 12.78 | 12.52 | 12.12 | ||||||||||

| 1 Reported tonnes and grade for ore mined are estimates based on mine plan assumptions and may not reconcile fully to ore milled. | ||||||||||||||||

| 2 Strip ratio is calculated as waste mined divided by ore mined. | ||||||||||||||||

| 3 Reflects combined mine, mill and general and administrative ("G&A") costs per tonne of ore milled. Reflects the deduction of expected capitalized stripping costs. | ||||||||||||||||

| 4 Combined unit costs is a non-GAAP financial performance measure with no standardized definition under IFRS. For further information and a detailed reconciliation, please see the discussion under the "Non-GAAP Financial Performance Measures" section of this MD&A. | ||||||||||||||||

| 5 Excludes approximately $7.3 million or $1.04 per tonne of overhead costs incurred during temporary suspension during the three months ended September 30, 2025 and $7.3 million or $0.32 per tonne during the nine months ended September 30, 2025. | ||||||||||||||||

| Three months ended | Nine months ended | |||||||||||||||

| Sep. 30, 2025 | Jun. 30, 2025 | Sep. 30, 2024 | Sep. 30, 2025 | Sep. 30, 2024 | ||||||||||||

| Contained metal in concentrate produced | ||||||||||||||||

| Copper | tonnes | 18,114 | 21,710 | 21,220 | 60,117 | 65,013 | ||||||||||

| Gold | oz | 26,380 | 7,366 | 20,331 | 41,615 | 60,147 | ||||||||||

| Silver | oz | 577,446 | 551,979 | 648,209 | 1,684,117 | 1,738,760 | ||||||||||

| Molybdenum | tonnes | 185 | 375 | 362 | 957 | 1,128 | ||||||||||

| Payable metal sold | ||||||||||||||||

| Copper | tonnes | 11,769 | 21,418 | 18,803 | 56,077 | 59,363 | ||||||||||

| Gold | oz | 9,798 | 9,721 | 9,795 | 33,881 | 65,905 | ||||||||||

| Silver | oz | 258,215 | 616,578 | 365,198 | 1,589,448 | 1,519,207 | ||||||||||

| Molybdenum | tonnes | 269 | 427 | 343 | 1,144 | 1,105 | ||||||||||

| Cost per pound of copper produced | ||||||||||||||||

| Cash cost1,2 | $/lb | 1.30 | 1.45 | 1.80 | 1.29 | 1.28 | ||||||||||

| Sustaining cash cost1 | $/lb | 2.11 | 2.63 | 2.78 | 2.23 | 2.07 | ||||||||||

| 1 Cash cost and sustaining cash costs per pound of copper produced, net of by-product credits, are not recognized under IFRS. For more detail on these non-GAAP financial performance measures, please see the discussion under the "Non-GAAP Financial Performance Measures" section of this MD&A. | ||||||||||||||||

| 2 Excludes $7.3 million or $0.19 per pound of overhead costs incurred during temporary suspension during the three months ended September 30, 2025 and $7.3 million or $0.06 per pound during the nine months ended September 30, 2025. | ||||||||||||||||

Overview

The Peru operations continued to demonstrate steady operating performance despite facing temporary interruptions as a result of social unrest in the third quarter.

Country wide protests that began early in the third quarter temporarily impacted the transportation routes leading to limitations of supplies and concentrate transportation. To manage through these limitations, Hudbay adjusted mine sequencing to prioritize Pampacancha mining activities and blend low-grade stockpile ore in the mill feed. The road blockades along the transportation route reopened midway through the third quarter, allowing Hudbay to reduce site concentrate inventory levels and replenish supplies.

In late September, the social unrest escalated across Peru. Along with other mines in the southern mining corridor, Hudbay's Constancia mine was impacted by local protests and illegal blockades. The safety of all personnel is the Company's top priority, and Hudbay suspended Constancia operations on September 22nd as a precaution to ensure the safety of personnel and allow time for Hudbay and the authorities to address the illegal protests. During the temporary downtime, Hudbay's team at Constancia performed preventative maintenance at the mill and on certain mining equipment. Since the restart of mining activities on October 3rd and milling activities on October 5th, the Constancia operations have normalized. Post-quarter end, production in the month of October totaled approximately 9,200 tonnes of copper and 16,600 ounces of gold, reflecting optimal mill ore feed with strong ore contribution from Pampacancha and lower stockpiled ore being processed. Despite short-term interruptions, the Company remains on track to achieve its 2025 production guidance for all metals in Peru and expects to exceed the top end of the gold production guidance range in 2025.

With the regional social unrest impacting transportation routes during the quarter and ocean swells impacting port shipments in late September, a 20,000 dry metric tonne copper concentrate shipment, valued at approximately $60 million as a result of the high gold content, was deferred from late September to early October, thereby reducing sales volumes in the third quarter of 2025. This shipment was subsequently sold in October and total concentrate inventory levels have since normalized.

Social protests and unplanned changes in government happen from time to time in Peru, and since the start of operations at Constancia in 2014, Hudbay has been focused on working with local stakeholders and governmental authorities to ensure successful and sustainable long-term operations. Hudbay actively maintains strong relationships with the communities near Constancia and ensures continuous constructive dialogue. The Company is committed to being a safe and responsible operator and a significant long-term contributor to the prosperity of the local and regional communities.

Mining Activities

Total ore mined in Peru in the third quarter of 2025 was relatively unchanged from the same period in 2024, despite the impacts from social unrest in the third quarter of 2025 because ore mined in the same period in 2024 was lower than typical levels due to a stripping campaign. Total ore mined was lower than the second quarter of 2025 as a result of the temporary operational shutdown described above. However, Pampacancha ore mined significantly increased in the third quarter compared to the second quarter, reflecting the completion of a major stripping program in the second quarter.

Year-to-date ore mined in Peru was 32% higher than the same period in 2024 primarily due to the waste stripping campaign in 2024, partially offset by the impacts of the temporary interruption of certain mining activities in the current quarter.

Milling Activities

Mill throughput levels averaged approximately 76,000 tonnes per day in the third quarter of 2025, lower than the second quarter of 2025 due to the lower amount of ore mined and the temporary operational shutdown. Milled copper grades decreased by 9% compared to the second quarter 2025, primarily due to lower grades from ore feed from stockpiles, partially offset by higher grades from Pampacancha. Milled gold grades significantly increased in the third quarter of 2025 compared to the comparative periods due to a higher portion of ore feed from Pampacancha where the gold grades are meaningfully higher than in the other ore sources. The mill achieved higher copper recoveries of 83% in the third quarter of 2025 compared to the same period in 2024, but lower copper recoveries compared to the second quarter of 2025 due to the nature of the feed from the stockpile. Recoveries of gold and silver during the third quarter of 2025 were in line with Hudbay's metallurgical models for the ore that was being processed.

Year-to-date ore milled was 5% lower compared to the same period in 2024 mainly due to social issues in the third quarter of 2025. Year-to-date milled copper grades were consistent with the same period in 2024, while milled gold grades decreased by 18% due to lower grade of ore mined and lower grade from ore feed from stockpiles. Recoveries of copper during the nine months ended September 30, 2025 were 84%, representing an increase of 1%, compared with the 2024 period, despite being impacted by ore feed from stockpiles. Gold and silver recoveries during the nine months ended September 30, 2025 were 65% and 65%, respectively, representing a decrease of 5% and 4%, respectively, due to ore feed from stockpiles.

Production and Sales Performance

The Peru operations produced 18,114 tonnes of copper, 26,380 ounces of gold, 577,446 ounces of silver and 185 tonnes of molybdenum during the third quarter of 2025. Production of copper was lower than the comparative periods primarily due to lower ore milled as a result of the temporary operational shutdown. Production of gold was higher than the second quarter of 2025 and the same period in 2024 due to higher head grades from a larger portion of the Pampacancha ore feed. Production of silver was lower than the same period in 2024 but higher than the second quarter of 2025 as a result of commensurate movements in the respective periods' silver grades and throughput levels. Production of molybdenum was lower than the second quarter of 2025 and the same period in 2024 due to lower ore milled and lower recoveries.

Year-to-date production of copper, gold, silver and molybdenum in 2025 was 60,117 tonnes, 41,615 ounces, 1,684,117 ounces, and 957 tonnes, respectively, representing a decrease of 8%, 31%, 3% and 15%, respectively, from the comparative 2024 period primarily due to lower ore milled in the current period due to the temporary operational shutdown and a lower gold grade in the current year-to-date period as a result of comparably less Pampacancha ore being mined.

Quantities of gold sold during the nine months ended 2025 were lower than the same period in 2024 as a result of the

regional social unrest impacting transportation routes during the quarter and ocean swells negatively affecting port shipments in late September which specifically impacted a higher gold content shipment, as mentioned above.

*Copper equivalent production is calculated using the quarter average LME prices for each metal excluding molybdenum.

Cost Performance

Combined mine, mill and G&A unit operating cost in the third quarter of 2025 was $13.03 per tonne, 2% higher than the same period in 2024 primarily from lower deferred stripping due to mining restrictions and lower mill throughput, which was partially offset by lower labour costs due to the payment of the union agreement in July 2024 and certain fixed costs being excluded from this metric during the temporary operational shutdown. Combined mine, mill and G&A unit operating cost was 4% lower than the second quarter of 2025 as lower milling and G&A costs more than offset the impacts of higher mining costs and lower mill throughput associated with the temporary shutdown.

Combined mine, mill and G&A unit operating costs for the nine months ended September 30, 2025 was $12.52 per tonne, a 3% increase compared to the same period in 2024 for the same reasons as the quarter.

Cash cost per pound of copper produced, net of by-product credits, in the third quarter of 2025 was $1.30, a 28% decrease compared to the same period in 2024 as a result of higher gold by-product credits and lower treatment and refining costs. These favourable impacts were partially offset by lower copper produced. Cash cost per pound of copper produced, net of by-product credits, decreased by 10% compared to the second quarter of 2025 due to higher gold by-product credits and lower plant maintenance cost as planned maintenance was completed in the second quarter of 2025.

Year-to-date 2025 cash cost per pound of copper produced, net of by-product credits2 was $1.29, an increase from $1.28 in the same period of 2024 due to lower gold by-product credits partially offset by lower treatment and refining charges.

Sustaining cash cost per pound of copper produced, net of by-product credits2, was $2.11 in the third quarter of 2025, a decrease of 24% compared to the same period in 2024 due to the same impacts as cash cost above. Sustaining cash cost per pound of copper produced, net of by-product credits, decreased by 20% compared to the second quarter of 2025 for the same reasons that impacted cash costs as well as from lower tailings management facility capital expenditures, timing on plant projects, and lower cash payments pertaining to community agreements.

On a year-to-date basis, sustaining cash cost per pound of copper produced, net of by-products credits2, was $2.23, higher than the $2.07 for the comparable period in 2024 due to the cash cost factors mentioned above along with higher lease payments and higher plant projects.

Peru Guidance Outlook

| Three months ended | Nine months ended | Guidance | ||||||||||||||

| Sep. 30, 2025 | Sep. 30, 2024 | Sep. 30, 2025 |

Sep. 30, 2024 |

Annual 2025 | ||||||||||||

| Contained metal in concentrate produced | ||||||||||||||||

| Copper | tonnes | 18,114 | 21,220 | 60,117 | 65,013 | 80,000 - 97,000 | ||||||||||

| Gold | oz | 26,380 | 20,331 | 41,615 | 60,147 | 49,000 - 60,000 | ||||||||||

| Silver | oz | 577,446 | 648,209 | 1,684,117 | 1,738,760 | 2,475,000 - 3,025,000 | ||||||||||

| Molybdenum | tonnes | 185 | 362 | 957 | 1,128 | 1,300 - 1,500 | ||||||||||

| Cost per pound of copper produced | ||||||||||||||||

| Cash cost1 | $/lb | 1.30 | 1.80 | 1.29 | 1.28 | 1.35 - 1.65 | ||||||||||

| 1 Cash cost per pound of copper produced, net of by-product credits, are not recognized under IFRS. For more detail on these non-GAAP financial performance measures, please see the discussion under the "Non-GAAP Financial Performance Measures" section of this MD&A. | ||||||||||||||||

Despite the impact from the temporary operational shutdown due to social unrest, Hudbay is on track to achieve its 2025 production guidance for all metals in Peru with gold production expected to exceed the top end of the 2025 guidance range. On a related note, with cash costs continuing to outperform the low end of the cash cost guidance range, Hudbay is reaffirming its full year 2025 cash cost guidance range in Peru.

MANITOBA OPERATIONS REVIEW

| Three months ended | Nine months ended | |||||||||||||||

| Sep. 30, 2025 | Jun. 30, 2025 | Sep. 30, 2024 | Sep. 30, 2025 | Sep. 30, 2024 | ||||||||||||

| Lalor ore mined | tonnes | 139,006 | 303,062 | 411,295 | 826,302 | 1,204,481 | ||||||||||

| Gold | g/tonne | 5.42 | 4.97 | 5.45 | 5.28 | 4.70 | ||||||||||

| Copper | % | 0.67 | 0.61 | 0.91 | 0.78 | 0.82 | ||||||||||

| Zinc | % | 1.93 | 2.46 | 2.73 | 2.35 | 2.80 | ||||||||||

| Silver | g/tonne | 31.57 | 29.94 | 30.45 | 30.82 | 25.46 | ||||||||||

| New Britannia ore milled | tonnes | 92,765 | 162,934 | 191,298 | 444,823 | 529,606 | ||||||||||

| Gold | g/tonne | 6.88 | 6.48 | 6.77 | 6.94 | 6.39 | ||||||||||

| Copper | % | 0.76 | 0.65 | 0.93 | 0.90 | 1.00 | ||||||||||

| Zinc | % | 1.00 | 1.01 | 1.12 | 1.00 | 0.96 | ||||||||||

| Silver | g/tonne | 32.18 | 30.29 | 30.24 | 31.99 | 25.62 | ||||||||||

| Copper concentrate | tonnes | 4,410 | 6,278 | 10,856 | 25,084 | 31,853 | ||||||||||

| Concentrate grade | % Cu | 14.46 | 14.73 | 15.18 | 14.28 | 15.70 | ||||||||||

| Gold recovery1 | % | 91.8 | 89.4 | 90.0 | 90.3 | 89.5 | ||||||||||

| Copper recovery | % | 90.0 | 87.4 | 92.8 | 89.5 | 94.5 | ||||||||||

| Silver recovery1 | % | 78.5 | 78.0 | 79.9 | 79.7 | 81.4 | ||||||||||

| Contained metal in concentrate produced | ||||||||||||||||

| Gold | oz | 12,330 | 17,801 | 24,355 | 56,617 | 68,000 | ||||||||||

| Copper | tonnes | 637 | 926 | 1,648 | 3,582 | 5,001 | ||||||||||

| Silver | oz | 55,012 | 80,516 | 114,157 | 255,765 | 277,132 | ||||||||||

| Metal in doré produced2 | ||||||||||||||||

| Gold | oz | 6,933 | 15,379 | 16,768 | 37,423 | 44,106 | ||||||||||

| Silver | oz | 25,058 | 46,311 | 42,244 | 116,681 | 118,977 | ||||||||||

| Stall ore milled | tonnes | 43,940 | 144,204 | 222,621 | 403,430 | 671,506 | ||||||||||

| Gold | g/tonne | 3.10 | 3.19 | 4.23 | 3.54 | 3.44 | ||||||||||

| Copper | % | 0.56 | 0.56 | 0.89 | 0.67 | 0.71 | ||||||||||

| Zinc | % | 3.61 | 4.20 | 4.12 | 3.73 | 4.23 | ||||||||||

| Silver | g/tonne | 31.04 | 29.55 | 30.20 | 29.71 | 25.43 | ||||||||||

| Copper concentrate | tonnes | 1,293 | 3,854 | 8,438 | 11,855 | 21,807 | ||||||||||

| Concentrate grade | % Cu | 15.80 | 17.79 | 20.74 | 19.74 | 19.20 | ||||||||||

| Zinc concentrate | tonnes | 1,053 | 9,739 | 15,338 | 23,376 | 48,456 | ||||||||||

| Concentrate grade | % Zn | 52.06 | 52.68 | 52.61 | 51.09 | 51.50 | ||||||||||

| Gold recovery | % | 72.6 | 67.9 | 70.5 | 69.7 | 68.3 | ||||||||||

| Copper recovery | % | 83.4 | 84.7 | 88.3 | 86.7 | 88.5 | ||||||||||

| Zinc recovery | % | 34.6 | 84.8 | 88.1 | 79.4 | 87.9 | ||||||||||

| Silver recovery | % | 50.3 | 51.9 | 57.8 | 55.4 | 57.4 | ||||||||||

| Contained metal in concentrate produced | ||||||||||||||||

| Gold | oz | 3,178 | 10,055 | 21,345 | 31,990 | 50,681 | ||||||||||

| Copper | tonnes | 205 | 686 | 1,750 | 2,341 | 4,188 | ||||||||||

| Zinc | tonnes | 548 | 5,130 | 8,069 | 11,943 | 24,954 | ||||||||||

| Silver | oz | 22,062 | 71,143 | 124,996 | 213,259 | 315,758 | ||||||||||

| 1 Gold and silver recovery includes total recovery from concentrate and doré. | ||||||||||||||||

| 2 Doré includes sludge, slag and carbon fines. | ||||||||||||||||

| Three months ended | Nine months ended | |||||||||||||||

| Sep. 30, 2025 | Jun. 30, 2025 | Sep. 30, 2024 | Sep. 30, 2025 | Sep. 30, 2024 | ||||||||||||

| Total contained metal in concentrate and doré produced1 | ||||||||||||||||

| Gold | oz | 22,441 | 43,235 | 62,468 | 126,030 | 162,787 | ||||||||||

| Copper | tonnes | 842 | 1,612 | 3,398 | 5,923 | 9,189 | ||||||||||

| Zinc | tonnes | 548 | 5,130 | 8,069 | 11,943 | 24,954 | ||||||||||

| Silver | oz | 102,132 | 197,970 | 281,397 | 585,705 | 711,867 | ||||||||||

| Payable metal sold in concentrate and doré | ||||||||||||||||

| Gold | oz | 23,118 | 46,932 | 57,238 | 125,815 | 162,004 | ||||||||||

| Copper | tonnes | 769 | 2,133 | 2,931 | 5,627 | 8,281 | ||||||||||

| Zinc | tonnes | 3,452 | 2,871 | 8,607 | 11,180 | 19,859 | ||||||||||

| Silver | oz | 112,142 | 209,594 | 244,974 | 553,990 | 674,301 | ||||||||||

| Unit Operating Costs2 | ||||||||||||||||

| Lalor | C$/tonne | 157.38 | 153.08 | 132.97 | 149.20 | 143.10 | ||||||||||

| New Britannia | C$/tonne | 61.54 | 67.98 | 66.14 | 66.70 | 71.66 | ||||||||||

| Stall | C$/tonne | 57.90 | 51.53 | 46.72 | 43.92 | 41.92 | ||||||||||

| Combined unit operating costs3,4,5 | C$/tonne | 258 | 241 | 211 | 231 | 224 | ||||||||||

| Cost per ounce of gold produced | ||||||||||||||||

| Cash cost5,6 | $/oz | 379 | 710 | 372 | 491 | 606 | ||||||||||

| Sustaining cash cost5 | $/oz | 762 | 1,025 | 553 | 787 | 855 | ||||||||||

1 Metal reported in concentrate is prior to deductions associated with smelter terms and includes other secondary products.

2 Reflects costs per tonne of ore mined/milled.

3 Reflects combined mine, mill and G&A costs per tonne of milled ore.

4 Excludes overhead costs of $16.0 million or C$163 per tonne of ore milled incurred during temporary suspension during the three months ended September 30, 2025, $3.2 million or C$14 per tonne of ore milled during the three months ended June 30, 2025 and $19.2 million or C$32 per tonne of ore milled during the nine months ended September 30, 2025.

5 Combined unit costs, cash cost and sustaining cash cost per ounce of gold produced, net of by-product credits, are non-GAAP financial performance measures with no standardized definition under IFRS. For further information and a detailed reconciliation, please see the discussion under the "Non-GAAP Financial Performance Measures" section of this MD&A.

6 Excludes overhead costs of $16.0 million or $713 per ounce of gold produced incurred during temporary suspension during the three months ended September 30, 2025, $3.2 million or $74 per ounce of gold produced during the three months ended June 30, 2025 and $19.2 million or $152 per ounce of gold produced during the nine months ended September 30, 2025.

Overview

Wildfire disruptions persisted in northern Manitoba for the majority of the third quarter, leading to evacuations in the Snow Lake region throughout July and August, with a full seven-week operational shutdown and several weeks of subsequent ramp-up significantly impacting Hudbay's operations. Despite these challenges, Hudbay's Manitoba business unit demonstrated continued resilience with a comprehensive restart plan that was implemented to focus on the safety of the Company's employees and the integrity of Hudbay's assets. There was no structural damage to Hudbay's onsite surface infrastructure and facilities in Snow Lake. Following the lifting of mandatory evacuations, milling activities at the New Britannia mill resumed on August 26, 2025 and milling activities at Stall restarted on September 9, 2025. At Lalor, the full mining workforce returned as of August 27, 2025 and mining operations ramped up to reach normal operating capacity in the second half of September 2025. The Company submitted a business interruption insurance claim relating to the wildfires and expects the claim to be resolved in 2026 and compensate for a portion of the wildfire downtime.

Achievements in the third quarter of 2025 included successful safeguarding of the Company's assets and people, the orderly resumption of operations, including the exploration programs in Flin Flon and Snow Lake and achieving an average throughput of almost 2,300 tonnes per operating day at the New Britannia mill, all of which was a result of the tremendous effort and unwavering commitment demonstrated by the on-site team.

Subsequent to quarter-end, Hudbay experienced power outages due to severe winter storms, and the Snow Lake operations were shut down for approximately one week in October. While the Company was previously tracking within the 2025 guidance ranges despite the significant wildfire impacts, it now expects to be slightly below the low end of the gold production guidance range as a result of the power outage in October and the associated ramp-up after power was restored.

Mining Activities

Total ore mined in Manitoba in the third quarter of 2025 was lower than the comparable periods, reflecting the impacts from the wildfires. In the third quarter of 2025, gold grades decreased by 1% compared to the same period in 2024 but increased by 9% compared to the second quarter of 2025. Copper, zinc and silver grades were in line with mine plan expectations.

Total ore mined at Hudbay's Manitoba operations during the nine months ended September 30, 2025 was 31% lower than the same period in 2024, as a result of the impact of the multiple wildfires in 2025. Year-to-date gold and silver grades mined at Lalor were 12% and 21% higher, respectively, compared with the same period in 2024 due to mining sequence and prioritizing mining gold zones in efforts to keep New Britannia full during the unprecedented wildfire season. Year-to-date copper and zinc grades mined were 5% and 16% lower than the same period in 2024.

There was limited access to the 1901 deposit in the third quarter due to the wildfires, resulting in reduced advance rates at the exploration and haulage drifts, but some additional development zinc ore was extracted during the third quarter of 2025. Notwithstanding the reduced advancement rate in the quarter, the 1901 project is on track for full production by the end of 2027 and activities over the next two years will focus on exploration, definition drilling, orebody access, and establishing critical infrastructure.

Milling Activities

Consistent with Hudbay's strategy of allocating more Lalor ore feed to New Britannia to maximize gold recoveries, adjusting for days interrupted by wildfire evacuations, the New Britannia mill operated for 40.5 days during the quarter at an average throughput of approximately 2,290 tonnes per operating day. Total ore milled at New Britannia was significantly lower in the quarter due to the wildfire evacuation shutdown. Gold recovery in the third quarter of 2025 was a record 92% reflecting an increase compared to the same period in 2024 and the second quarter of 2025 which is mostly the result of the higher gold grades.

The Stall mill experienced a greater throughput impact from the wildfire evacuation shutdown during the current quarter as the Lalor mine prioritized mining from gold zones over base metal zones to ensure a consistent feed to the New Britannia mill. Despite these challenges, the team at Stall focused on process optimization and enhanced gold recovery initiatives. The Stall mill achieved record gold recoveries of 73% in the third quarter of 2025, reflecting benefits from recent recovery improvement programs.

Production and Sales Performance

Production during the third quarter of 2025 included 22,441 ounces of gold, 842 tonnes of copper, 548 tonnes of zinc and 102,132 ounces of silver. Production of gold, copper, silver, and zinc decreased by 64%, 75%, 64% and 93%, respectively, compared to the third quarter of 2024, due to the wildfire evacuation shutdown in July and August. Production of all metals in the third quarter was also lower then the second quarter of 2025, but to a lesser extent as a result of a more prolonged wildfire evacuation impacting the third quarter of 2025 compared to a shorter wildfire evacuation period in the preceding quarter.

Year-to-date production of all metals was lower than the comparative 2024 period as a result of the same factors explained above.

Cost Performance

Combined mine, mill and G&A unit operating costs in the third quarter were C$258 per tonne, higher than the comparative periods primarily due to lower total throughput partially offset by lower variable costs.

Cash cost per ounce of gold produced, net of by-product credits, in the third quarter of 2025 was $379, relatively unchanged compared to the same period in 2024 primarily as a result of lower treatment and refining costs partially offsetting lower gold production in the quarter. Compared to the second quarter of 2025, cash costs decreased primarily due to higher by-product credits and the recovery of secondary gold products as a result of mill tank clean-outs.

Sustaining cash cost per ounce of gold produced, net of by-product credits, in the third quarter of 2025 was $762, a 38% increase compared to the same period in 2024 primarily the result of lower gold production in the quarter and a 26% decrease compared to the second quarter of 2025, primarily due to the same factors affecting cash costs.

Cash cost per ounce of gold produced, net of by-product credits, during the nine months ended September 30, 2025 was $491, a 19% decrease compared to the same period in 2024 primarily due to lower treatment and refining costs, the previously mentioned impact of the mill tank clean-outs, partially offset by lower gold production. Sustaining cash cost per ounce of gold produced, net of by-product credits, for the nine months ended September 30, 2025 was $787 per ounce, a decrease of 8% from the same period in 2024 primarily due to the same factors affecting cash cost noted above.

Manitoba Guidance Outlook

| Three months ended | Nine months ended | Guidance | ||||||||||||||

| Sep. 30, 2025 |

Sep. 30, 2024 |

Sep. 30, 2025 |

Sep. 30, 2024 |

Annual 2025 | ||||||||||||

| Total contained metal in concentrate and doré produced1 | ||||||||||||||||

| Gold2 | oz | 22,441 | 62,468 | 126,030 | 162,787 | 180,000 - 220,000 | ||||||||||

| Copper | tonnes | 842 | 3,398 | 5,923 | 9,189 | 9,000 - 11,000 | ||||||||||

| Zinc | tonnes | 548 | 8,069 | 11,943 | 24,954 | 21,000 - 27,000 | ||||||||||

| Silver3 | oz | 102,132 | 281,397 | 585,705 | 711,867 | 800,000 - 1,000,000 | ||||||||||

| Cost per ounce of gold produced | ||||||||||||||||

| Cash cost4,5 | $/oz | 379 | 372 | 491 | 606 | 650 - 850 | ||||||||||

1 Metal reported in concentrate is prior to deductions associated with smelter terms.

2 Gold production guidance includes gold contained in concentrate produced and gold in doré.

3 Silver production guidance includes silver contained in concentrate produced and silver in doré.

4 Combined unit costs, cash cost per ounce of gold produced, net of by-product credits, are non-GAAP financial performance measures with no standardized definition under IFRS. For further information and a detailed reconciliation, please see the discussion under the "Non-GAAP Financial Performance Measures" section of this MD&A.

5 Excludes $16 million or $713 per ounce of overhead costs incurred during temporary suspension during the three months ended September 30, 2025 and $19.2 million or $152 per ounce during the nine months ended September 30, 2025.

While Hudbay was previously tracking within the 2025 guidance ranges despite the wildfire impacts, the Company now expects to be slightly below the low end of gold production guidance range as a result of the power outage in October and the associated ramp-up after power was restored. With cash costs during 2025 continuing to outperform the low end of the cash cost guidance range, Hudbay is reaffirming its full year 2025 cash cost guidance range in Manitoba. Given the strong cash cost performance to-date in Manitoba, Hudbay will continue to prioritize primary gold production over by-product zinc production in 2025 and full year zinc production is now expected to be below the low end of the guidance range.

BRITISH COLUMBIA OPERATIONS REVIEW

| Three months ended5 | Nine months ended5 | |||||||||||||||

| Sep. 30, 2025 | Jun. 30, 2025 | Sep. 30, 2024 | Sep. 30, 2025 | Sep. 30, 2024 | ||||||||||||

| Ore mined1 | tonnes | 1,815,689 | 2,509,969 | 3,098,863 | 6,973,752 | 8,986,081 | ||||||||||

| Strip ratio2 | 8.84 | 7.50 | 6.05 | 7.56 | 5.62 | |||||||||||

| Ore milled | tonnes | 3,087,443 | 2,900,008 | 3,363,176 | 8,748,437 | 9,775,752 | ||||||||||

| Copper | % | 0.22 | 0.28 | 0.24 | 0.28 | 0.25 | ||||||||||

| Gold | g/tonne | 0.08 | 0.09 | 0.09 | 0.09 | 0.08 | ||||||||||

| Silver | g/tonne | 0.78 | 0.97 | 0.73 | 1.00 | 0.97 | ||||||||||

| Copper concentrate | tonnes | 21,560 | 28,198 | 28,049 | 80,992 | 87,974 | ||||||||||

| Concentrate grade | % Cu | 24.4 | 23.5 | 24.0 | 23.6 | 23.3 | ||||||||||

| Copper recovery | % | 76.6 | 81.0 | 84.1 | 78.7 | 83.2 | ||||||||||

| Gold recovery | % | 59.2 | 68.2 | 67.3 | 63.6 | 62.2 | ||||||||||

| Silver recovery | % | 65.5 | 71.8 | 71.2 | 69.3 | 72.6 | ||||||||||