UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2025

Commission File Number: 001-37814

OR ROYALTIES INC.

(Translation of registrant's name into English)

1100 Avenue des Canadiens-de-Montréal, Suite 300, Montréal, Qc H3B 2S2

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

[ ] Form 20-F [X] Form 40-F

SUBMITTED HEREWITH

Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| OR ROYALTIES INC. | |

| (Registrant) |

| Date: November 5, 2025 | By: | /s/ André Le Bel |

| André Le Bel | ||

| Title: | Vice President, Legal Affairs and Corporate Secretary |

Unaudited Condensed Interim

Consolidated Financial Statements

For the three and nine months

ended

September 30, 2025

| OR Royalties Inc. Consolidated Balance Sheets (Unaudited) |

| (tabular amounts expressed in thousands of U.S. dollars) |

| September 30, | December 31, | ||||||

| 2025 | 2024 | ||||||

| Notes | $ | $ | |||||

| Assets | |||||||

| Current assets | |||||||

| Cash | 3 | 57,042 | 59,096 | ||||

| Amounts receivable | 3,448 | 3,106 | |||||

| Other assets | 723 | 1,612 | |||||

| Investment held for sale | 5 | 48,840 | - | ||||

| 110,053 | 63,814 | ||||||

| Non-current assets | |||||||

| Investments in associates | 4 | - | 43,262 | ||||

| Other investments | 5 | 178,559 | 74,043 | ||||

| Royalty, stream and other interests | 6 | 1,140,218 | 1,113,855 | ||||

| Goodwill | 79,878 | 77,284 | |||||

| Other assets | 8,045 | 5,376 | |||||

| 1,516,753 | 1,377,634 | ||||||

| Liabilities | |||||||

| Current liabilities | |||||||

| Accounts payable and accrued liabilities | 5,451 | 5,331 | |||||

| Dividends payable | 10,349 | 8,433 | |||||

| Income tax liabilities | 10 | 8,120 | - | ||||

| Lease liabilities | 1,249 | 852 | |||||

| 25,169 | 14,616 | ||||||

| Non-current liabilities | |||||||

| Lease liabilities | 4,027 | 3,931 | |||||

| Long-term debt | 7 | - | 93,900 | ||||

| Deferred income taxes | 91,368 | 76,234 | |||||

| 120,564 | 188,681 | ||||||

| Equity | |||||||

| Share capital | 8 | 1,696,038 | 1,675,940 | ||||

| Contributed surplus | 64,327 | 63,567 | |||||

| Accumulated other comprehensive loss | (57,328 | ) | (141,841 | ) | |||

| Deficit | (306,848 | ) | (408,713 | ) | |||

| 1,396,189 | 1,188,953 | ||||||

| 1,516,753 | 1,377,634 |

| OR Royalties Inc. Consolidated Statements of Income For the three and nine months ended September 30, 2025 and 2024 |

| (tabular amounts expressed in thousands of U.S. dollars, except per share amounts) |

| Three months ended September 30, |

Nine months ended September 30, |

||||||||||||

| 2025 | 2024 | 2025 | 2024 | ||||||||||

| Notes | $ | $ | $ | $ | |||||||||

| Restated (Note 2) | Restated (Note 2) | ||||||||||||

| Revenues | 10 | 71,625 | 41,977 | 186,905 | 134,415 | ||||||||

| Cost of sales | 10 | (2,367 | ) | (1,570 | ) | (6,546 | ) | (4,557 | ) | ||||

| Depletion | 10 | (10,159 | ) | (6,977 | ) | (25,516 | ) | (23,132 | ) | ||||

| Gross profit | 59,099 | 33,430 | 154,843 | 106,726 | |||||||||

| Other operating expenses | |||||||||||||

| General and administrative | (4,902 | ) | (4,896 | ) | (15,799 | ) | (14,089 | ) | |||||

| Business development | (2,015 | ) | (1,106 | ) | (6,920 | ) | (3,645 | ) | |||||

| Impairment of royalty, stream and other interests | 6 | (5,495 | ) | - | (5,495 | ) | (49,558 | ) | |||||

| Operating income | 46,687 | 27,428 | 126,629 | 39,434 | |||||||||

| Interest income | 1,062 | 1,166 | 2,278 | 3,009 | |||||||||

| Finance costs | (886 | ) | (1,658 | ) | (3,740 | ) | (6,500 | ) | |||||

| Foreign exchange gain (loss) | 300 | 540 | 1,125 | (2,653 | ) | ||||||||

| Share of loss of associates | (8,313 | ) | (8,203 | ) | (14,178 | ) | (20,534 | ) | |||||

| Other gains (losses), net | 10 | 53,236 | (76 | ) | 52,926 | 1,402 | |||||||

| Earnings before income taxes | 92,086 | 19,197 | 165,040 | 14,158 | |||||||||

| Income tax expense | 10 | (9,241 | ) | (5,788 | ) | (24,197 | ) | (4,996 | ) | ||||

| Net earnings | 82,845 | 13,409 | 140,843 | 9,162 | |||||||||

| Net earnings per share | 11 | ||||||||||||

| Basic | 0.44 | 0.07 | 0.75 | 0.05 | |||||||||

| Diluted | 0.44 | 0.07 | 0.74 | 0.05 | |||||||||

| OR Royalties Inc. Consolidated Statements of Comprehensive Income (Loss) For the three and nine months ended September 30, 2025 and 2024 |

| (tabular amounts expressed in thousands of U.S. dollars) |

| Three months ended September 30, |

Nine months ended September 30, |

|||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||

| $ | $ | $ | $ | |||||||||

| Restated (Note 2) | Restated (Note 2) | |||||||||||

| Net earnings | 82,845 | 13,409 | 140,843 | 9,162 | ||||||||

| Other comprehensive income (loss) | ||||||||||||

| Items that will not be reclassified to the consolidated statements of income | ||||||||||||

| Changes in fair value of financial assets at fair value through comprehensive income | 42,221 | (1,231 | ) | 57,636 | 6,183 | |||||||

| Income tax effect | (379 | ) | 55 | (2,061 | ) | (739 | ) | |||||

| Share of other comprehensive loss of an associate | (847 | ) | (1,048 | ) | (964 | ) | (1,994 | ) | ||||

| Items that may be reclassified to the consolidated statements of income | ||||||||||||

| Cumulative translation adjustments | (14,424 | ) | 9,023 | 22,241 | (13,897 | ) | ||||||

| Share of other comprehensive (loss) income of an associate | (41 | ) | 2,576 | 363 | 386 | |||||||

| Deemed disposal of an investment in associate | ||||||||||||

| Reclassification to the statement of income of other comprehensive loss | 1,147 | - | 1,147 | - | ||||||||

| Other comprehensive income (loss) | 27,677 | 9,375 | 78,362 | (10,061 | ) | |||||||

| Comprehensive income (loss) | 110,522 | 22,784 | 219,205 | (899 | ) | |||||||

| OR Royalties Inc. Consolidated Statements of Cash Flows For the three and nine months ended September 30, 2025 and 2024 |

| (tabular amounts expressed in thousands of U.S. dollars) |

| Three months ended September 30, |

Nine months ended September 30, |

||||||||||||

| Notes | 2025 | 2024 | 2025 | 2024 | |||||||||

| $ | $ | $ | $ | ||||||||||

| Restated (Note 2) | Restated (Note 2) | ||||||||||||

| Operating activities | |||||||||||||

| Net earnings | 82,845 | 13,409 | 140,843 | 9,162 | |||||||||

| Adjustments for: | |||||||||||||

| Share-based compensation | 2,056 | 1,582 | 6,316 | 4,800 | |||||||||

| Depletion and amortization | 10,493 | 7,219 | 26,434 | 23,859 | |||||||||

| Impairment of royalty, stream and other interests | 5,495 | - | 5,495 | 49,558 | |||||||||

| Changes in expected credit losses of other investments | - | - | - | (1,399 | ) | ||||||||

| Share of loss of associates | 8,313 | 8,203 | 14,178 | 20,534 | |||||||||

| Change in fair value of financial assets at fair value through profit and loss | 56 | 76 | 366 | (3 | ) | ||||||||

| Gain on deemed disposal of an associate | 4 | (54,439 | ) | - | (54,439 | ) | - | ||||||

| Reclassification to the statement of income of other comprehensive loss on the deemed disposal of an investment in associate | 10 | 1,147 | - | 1,147 | - | ||||||||

| Foreign exchange (gain) loss | (291 | ) | (555 | ) | (1,170 | ) | 2,652 | ||||||

| Deferred income tax expense | 5,598 | 5,150 | 13,905 | 3,646 | |||||||||

| Other | (74 | ) | 111 | 196 | 338 | ||||||||

| Net cash flows provided by operating activities before changes in non-cash working capital items |

61,199 | 35,195 | 153,271 | 113,147 | |||||||||

| Changes in non-cash working capital items | 12 | 3,405 | (631 | ) | 8,787 | (2,987 | ) | ||||||

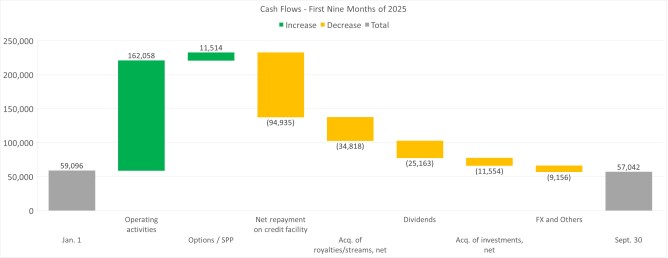

| Net cash flows provided by operating activities | 64,604 | 34,564 | 162,058 | 110,160 | |||||||||

| Investing activities | |||||||||||||

| Acquisitions of short-term investments | - | (963 | ) | - | (5,333 | ) | |||||||

| Acquisitions of investments | - | - | (12,359 | ) | - | ||||||||

| Proceeds on disposal of investments | 805 | - | 805 | 3,847 | |||||||||

| Acquisitions of royalty, stream and other interests | (13,655 | ) | (10,522 | ) | (36,869 | ) | (10,522 | ) | |||||

| Proceeds on the exercise of a buy-down right | 2,051 | - | 2,051 | - | |||||||||

| Other | (371 | ) | (26 | ) | (844 | ) | (31 | ) | |||||

| Net cash flows used in investing activities | (11,170 | ) | (11,511 | ) | (47,216 | ) | (12,039 | ) | |||||

| Financing activities | |||||||||||||

| Increase in long-term debt | - | - | 10,437 | - | |||||||||

| Repayment of long-term debt | (35,372 | ) | (20,000 | ) | (105,372 | ) | (84,721 | ) | |||||

| Exercise of share options and shares issued under the share purchase plan | 38 | 614 | 11,514 | 6,223 | |||||||||

| Normal course issuer bid purchase of common shares | - | (428 | ) | - | (428 | ) | |||||||

| Dividends paid | (9,700 | ) | (7,880 | ) | (25,163 | ) | (22,963 | ) | |||||

| Withholding taxes on settlement of restricted and deferred share units | - | (238 | ) | (6,464 | ) | (2,442 | ) | ||||||

| Other | (361 | ) | 24 | (1,836 | ) | (978 | ) | ||||||

| Net cash flows used in financing activities | (45,395 | ) | (27,908 | ) | (116,884 | ) | (105,309 | ) | |||||

| Increase (decrease) in cash before effects of exchange rate changes on cash | 8,039 | (4,855 | ) | (2,042 | ) | (7,188 | ) | ||||||

| Effects of exchange rate changes on cash | (623 | ) | 203 | (12 | ) | (650 | ) | ||||||

| Net increase (decrease) in cash | 7,416 | (4,652 | ) | (2,054 | ) | (7,838 | ) | ||||||

| Cash - beginning of period | 49,626 | 48,018 | 59,096 | 51,204 | |||||||||

| Cash - end of period | 3 | 57,042 | 43,366 | 57,042 | 43,366 | ||||||||

Additional information on the consolidated statements of cash flows is presented in Note 12.

| OR Royalties Inc. Consolidated Statement of Changes in Equity For the nine months ended September 30, 2025 |

| (tabular amounts expressed in thousands of U.S. dollars) |

| Number of | Accumulated | |||||||||||||||||

| common | Contributed surplus |

other | ||||||||||||||||

| shares | Share | comprehensive | ||||||||||||||||

| outstanding | capital | loss (i) | Deficit | Total | ||||||||||||||

| $ | $ | $ | $ | $ | ||||||||||||||

| Balance - January 1, 2025 | 186,679,202 | 1,675,940 | 63,567 | (141,841 | ) | (408,713 | ) | 1,188,953 | ||||||||||

| Net earnings | - | - | - | - | 140,843 | 140,843 | ||||||||||||

| Other comprehensive income | - | - | - | 78,362 | - | 78,362 | ||||||||||||

| Comprehensive income | - | - | - | 78,362 | 140,843 | 219,205 | ||||||||||||

| Dividends declared | - | - | - | - | (29,168 | ) | (29,168 | ) | ||||||||||

| Shares issued - Dividends reinvestment plan | 113,082 | 2,362 | - | - | - | 2,362 | ||||||||||||

| Shares issued - Employee share purchase plan | 8,967 | 190 | - | - | - | 190 | ||||||||||||

| Share options - Share-based compensation | - | - | 566 | - | - | 566 | ||||||||||||

| Share options exercised | 1,105,109 | 14,658 | (3,264 | ) | - | - | 11,394 | |||||||||||

| Restricted share units to be settled in common shares: | ||||||||||||||||||

| Share-based compensation | - | - | 5,095 | - | - | 5,095 | ||||||||||||

| Settlements | 204,887 | 2,244 | (4,218 | ) | - | (2,628 | ) | (4,602 | ) | |||||||||

| Income tax impact | - | - | 1,897 | - | - | 1,897 | ||||||||||||

| Deferred share units to be settled in common shares: | ||||||||||||||||||

| Share-based compensation | - | - | 655 | - | - | 655 | ||||||||||||

| Settlements | 65,400 | 644 | (1,397 | ) | - | (1,031 | ) | (1,784 | ) | |||||||||

| Income tax impact | - | - | 1,426 | - | - | 1,426 | ||||||||||||

| Transfer of realized loss on financial assets at fair value through other comprehensive income, net of income taxes | - | - | - | 6,151 | (6,151 | ) | - | |||||||||||

| Balance - September 30, 2025 | 188,176,647 | 1,696,038 | 64,327 | (57,328 | ) | (306,848 | ) | 1,396,189 |

(i) As at September 30, 2025, accumulated other comprehensive loss comprises items that will not be recycled to the consolidated statements of income amounting to $49.3 million and items that may be recycled to the consolidated statements of income amounting to ($106.6) million.

| OR Royalties Inc. Consolidated Statement of Changes in Equity For the nine months ended September 30, 2024 |

| (tabular amounts expressed in thousands of U.S. dollars) |

| Number of | Accumulated | |||||||||||||||||

| common | Contributed surplus |

other | ||||||||||||||||

| shares | Share | comprehensive | ||||||||||||||||

| outstanding | capital | loss (i) | Deficit | Total | ||||||||||||||

| $ | $ | $ | $ | $ | ||||||||||||||

| Balance - January 1, 2024 (restated - Note 2) | 185,346,524 | 1,658,908 | 62,331 | (84,816 | ) | (388,492 | ) | 1,247,931 | ||||||||||

| Net earnings | - | - | - | - | 9,162 | 9,162 | ||||||||||||

| Other comprehensive loss | - | - | - | (10,061 | ) | - | (10,061 | ) | ||||||||||

| Comprehensive (loss) income | - | - | - | (10,061 | ) | 9,162 | (899 | ) | ||||||||||

| Dividends declared | - | - | - | - | (25,991 | ) | (25,991 | ) | ||||||||||

| Shares issued - Dividends reinvestment plan | 151,789 | 2,307 | - | - | - | 2,307 | ||||||||||||

| Shares issued - Employee share purchase plan | 12,687 | 194 | - | - | - | 194 | ||||||||||||

| Share options - Share-based compensation | - | - | 1,238 | - | - | 1,238 | ||||||||||||

| Share options exercised | 605,892 | 7,720 | (1,615 | ) | - | - | 6,105 | |||||||||||

| Restricted share units to be settled in common shares: | ||||||||||||||||||

| Share-based compensation | - | - | 2,791 | - | - | 2,791 | ||||||||||||

| Settlement | 160,331 | 1,586 | (2,978 | ) | - | (722 | ) | (2,114 | ) | |||||||||

| Income tax impact | - | - | 249 | - | - | 249 | ||||||||||||

| Deferred share units to be settled in common shares: | ||||||||||||||||||

| Share-based compensation | - | - | 771 | - | - | 771 | ||||||||||||

| Settlement | 19,351 | 201 | (437 | ) | - | (92 | ) | (328 | ) | |||||||||

| Income tax impact | - | - | 420 | - | - | 420 | ||||||||||||

| Normal course issuer bid purchase of common shares | (26,000 | ) | (216 | ) | - | - | (212 | ) | (428 | ) | ||||||||

| Transfer of realized loss on financial assets at fair value through other comprehensive income, net of income taxes | - | - | - | 36 | (36 | ) | - | |||||||||||

| Balance - September 30, 2024 | 186,270,574 | 1,670,700 | 62,770 | (94,841 | ) | (406,383 | ) | 1,232,246 |

(i) As at September 30, 2024, accumulated other comprehensive loss comprises items that will not be recycled to the consolidated statement of income amounting to ($90.5) million and items that may be recycled to the consolidated statements of income amounting to ($4.3) million.

| OR Royalties Inc. Notes to the Interim Consolidated Financial Statements For the three and nine months ended September 30, 2025 and 2024 |

| (tabular amounts expressed in thousands of U.S. dollars, except per share amounts) |

1. Nature of activities

OR Royalties Inc. (formerly Osisko Gold Royalties Ltd.) and its subsidiaries (together, "OR Royalties" or the "Company") are engaged in the business of acquiring and managing royalties, streams and similar interests on precious metals and other commodities that fit the Company's risk/reward objectives. OR Royalties is a public company domiciled in the Province of Québec, Canada, whose shares trade on the Toronto Stock Exchange and the New York Stock Exchange and is constituted under the Business Corporations Act (Québec). The address of its registered office is 1100, avenue des Canadiens-de-Montréal, Suite 300, Montréal, Québec. The Company owns a portfolio of royalties, streams, options on royalty/stream financings and exclusive rights to participate in future royalty/stream financings on various projects. The Company's cornerstone asset is a 3-5% net smelter return ("NSR") royalty on the Canadian Malartic Complex, located in Québec, Canada.

2. Material accounting policy information

Basis of presentation

These unaudited condensed interim consolidated financial statements have been prepared in accordance with IFRS Accounting Standards as issued by the International Accounting Standards Board ("IASB") applicable to the preparation of interim financial statements under IAS 34, Interim Financial Reporting. The condensed interim consolidated financial statements should be read in conjunction with the Company's annual consolidated financial statements for the years ended December 31, 2024 and 2023, which have been prepared in accordance with IFRS Accounting Standards as issued by the IASB. The accounting policies, methods of computation and presentation applied in these unaudited condensed interim consolidated financial statements are consistent with those of the previous financial year. The Board of Directors approved these condensed interim consolidated financial statements for issue on November 5, 2025.

The condensed interim consolidated financial statements included herein reflect all adjustments, consisting only of normal recurring adjustments which, in the opinion of management, are necessary for a fair presentation of the results for the interim periods presented. The results of operations for the three and nine months ended September 30, 2025 are not necessarily indicative of the results to be expected for the full year. Income taxes in the respective interim periods have been accrued using the tax rates that would be applicable to expected total annual income.

Change in presentation currency

During the year ended December 31, 2024, the Company elected to change its presentation currency from Canadian dollars ("C$") to U.S. dollars. The change in presentation currency is to improve investors and other stakeholders' ability to compare the Company's financial results with other precious metals royalty and streaming companies, who mostly report their results in U.S. dollars.

In accordance with IAS 8, Accounting Policies, Changes in Accounting Estimates and Errors, this change in presentation currency was applied retrospectively as if the new presentation currency had always been the Company's presentation currency and, accordingly, the comparative figures for 2024 have been restated (including in the notes to the condensed interim consolidated financial statements).

| OR Royalties Inc. Notes to the Interim Consolidated Financial Statements For the three and nine months ended September 30, 2025 and 2024 |

| (tabular amounts expressed in thousands of U.S. dollars, except per share amounts) |

2. Material accounting policy information (continued)

Accounting standards issued but not yet effective

The Company has not yet adopted certain standards, interpretations to existing standards and amendments which have been issued but have an effective date of later than December 31, 2025. These standards, interpretations to existing standards and amendments, other than IFRS 18 Presentation and Disclosure in Financial Statements and the amendments to IFRS 9 Financial Instruments and IFRS 7 Financial Instruments: Disclosures, which are presented below, are not expected to have any significant impact on the Company or are not considered material and are therefore not discussed herein.

IFRS 18 Presentation and Disclosure in Financial Statements

In April 2024, the IASB issued IFRS 18, the new standard on presentation and disclosure in financial statements, with a focus on updates to the statement of profit or loss. IFRS 18 was issued in response to investors' concerns about the comparability and transparency of entities' performance reporting. The new requirements introduced in IFRS 18 will help to achieve comparability of the financial performance of similar entities, especially related to how 'operating profit or loss' is defined. The new disclosures required for some management-defined performance measures will also enhance transparency. The key new concepts introduced in IFRS 18 relate to:

IFRS 18 will replace IAS 1; many of the other existing principles in IAS 1 are retained, with limited changes. IFRS 18 will not impact the recognition or measurement of items in the financial statements, but it might change what an entity reports as its 'operating profit or loss'.

IFRS 18 will apply for reporting periods beginning on or after January 1, 2027 and also applies to comparative information. Management is currently assessing the impact of the new standard on its consolidated financial statements.

Amendments - IFRS 9 Financial Instruments and IFRS 7 Financial Instruments: Disclosures

On May 30, 2024, the IASB issued targeted amendments to IFRS 9 and IFRS 7, which respond to recent questions arising in practice. The amendments were issued to:

The new requirements will apply from January 1, 2026, with early application permitted. Management is currently assessing the impact of the amendments on its consolidated financial statements.

Critical accounting estimates and significant judgements

The preparation of consolidated financial statements in conformity with IFRS Accounting Standards requires the Company to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. The Company also makes estimates and assumptions concerning the future. The areas of judgement and estimation are consistent with those reported in the annual consolidated financial statements for the years ended December 31, 2024 and 2023.

| OR Royalties Inc. Notes to the Interim Consolidated Financial Statements For the three and nine months ended September 30, 2025 and 2024 |

| (tabular amounts expressed in thousands of U.S. dollars, except per share amounts) |

3. Cash

As at September 30, 2025 and December 31, 2024, the consolidated cash position was as follows:

| September 30, | December 31, | |||||

| 2025 | 2024 | |||||

| $ | $ | |||||

| Cash held in U.S. dollars | 43,264 | 48,223 | ||||

| Cash held in Canadian dollars (i) | 13,778 | 10,873 | ||||

| Total cash | 57,042 | 59,096 |

(i) Cash held in Canadian dollars amounted to C$19.2 million as at September 30, 2025 (C$15.6 million as at December 31, 2024).

4. Investments in associates

| Nine months ended | Year ended | ||||||

| September 30, 2025 |

December 31, 2024 |

||||||

| $ | $ | ||||||

| Balance - Beginning of period | 43,262 | 87,444 | |||||

| Share of loss, net (i) | (14,178 | ) | (30,025 | ) | |||

| Share of other comprehensive (loss) income, net (i) | (601 | ) | 463 | ||||

| Net loss on ownership dilution (ii) | - | (9,300 | ) | ||||

| Gain on deemed disposal (iii) | 54,439 | - | |||||

| Transfer to other investments (iii) (Note 5) | (84,502 | ) | - | ||||

| Foreign exchange revaluation impact | 1,580 | (5,320 | ) | ||||

| Balance - End of period | - | 43,262 | |||||

(i) The net shares of income (or loss) and comprehensive income (or loss) are adjusted to the extent that management is aware of material events that affect the associates' net income (or loss) and comprehensive income (or loss) during the period where earnings in equity accounted for investments are recorded on up-to a 3-month lag basis, which is the case for the investment in Osisko Development Corp. ("Osisko Development").

(ii) In October and November 2024, Osisko Development completed private placements, which reduced the ownership percentage from 39.01% to 24.41% and resulted in a loss on dilution of $9.3 million.

(iii) In August 2025, Osisko Development completed a private placement, which reduced the Company's ownership percentage from 24.15% to 13.97%, and based on the investment agreement also impacted the nomination rights to the board of directors of Osisko Development. As a result of these changes, among other considerations, the Company has concluded that it has lost its significant influence over the investee. In August 2025, the carrying amount of the equity accounted investment was derecognised and the retained interest in Osisko Development was revalued at its fair value (i.e. quoted market price), which generated a gain on deemed disposal of an associate of $54.4 million, and accumulated other comprehensive loss of $1.1 million was reclassified to the statement of income. The retained interest in Osisko Development has been designated as an equity investment at fair value through other comprehensive income or loss on initial recognition without subsequent reclassification to net income or loss.

| OR Royalties Inc. Notes to the Interim Consolidated Financial Statements For the three and nine months ended September 30, 2025 and 2024 |

| (tabular amounts expressed in thousands of U.S. dollars, except per share amounts) |

5. Other investments

| Nine months ended | Year ended | |||||

| September 30, 2025 |

December 31, 2024 |

|||||

| $ | $ | |||||

| Fair value through profit or loss (warrants and convertible instruments) | ||||||

| Balance - Beginning of period | 6,548 | 6,766 | ||||

| Change in fair value | (366 | ) | 343 | |||

| Foreign exchange revaluation impact | 211 | (561 | ) | |||

| Balance - End of period | 6,393 | 6,548 | ||||

| Fair value through other comprehensive loss (common shares) | ||||||

| Balance - Beginning of period | 55,313 | 63,569 | ||||

| Acquisitions | 10,764 | - | ||||

| Change in fair value | 57,636 | (4,778 | ) | |||

| Disposals | (805 | ) | (2,448 | ) | ||

| Transfer from associates (Note 4) | 84,502 | - | ||||

| Foreign exchange revaluation impact | (371 | ) | (1,030 | ) | ||

| Balance - End of period | 207,039 | 55,313 | ||||

| Amortized cost (notes) | ||||||

| Balance - Beginning of period | 12,182 | - | ||||

| Additions | 1,595 | - | ||||

| Effective interests | 190 | - | ||||

| Repayments | - | (1,399 | ) | |||

| Change in allowance for expected credit loss and write-offs | - | 1,399 | ||||

| Reclassification from short-term investments (i) | - | 12,182 | ||||

| Balance - End of period | 13,967 | 12,182 | ||||

| Total | 227,399 | 74,043 | ||||

| Investment held for sale (ii) | 48,840 | - | ||||

| Other investments | 178,559 | 74,043 | ||||

| Total | 227,399 | 74,043 |

(i) During the year 2024, the Company advanced funds to an associate, which holds a mining project in development on which the Company owns a stream interest. Following signature of a term sheet with the associate in 2024, the carrying value of the loan ($12.2 million) was reclassified to other investments as the repayment terms were not expected to be within the next 12 months.

During the six months ended June 30, 2025, the Company advanced additional funds of $1.6 million to the associate. In June 2025, the Company sold its interest to a third party for a nominal amount. The stream interest held on the project as well as the note receivable were amended at the time of the transaction and will continue to be assumed by the new operator. As of September 30, 2025, the net book value of the amended note receivable amounted to $14.0 million. The note bears an interest rate of 8% and is secured by the assets of the mining project. Repayment of the note will commence after production starts and the full repayment by the operator of a $150 million bank credit facility.

(ii) On May 27, 2025, MAC Copper Limited ("MAC Copper") announced that it had entered into a binding scheme implementation deed (the "Transaction") with Harmony Gold Mining Company Limited ("Harmony") and Harmony Gold (Australia) Pty Ltd ("Harmony Australia"), a wholly-owned subsidiary of Harmony, under which it was proposed that Harmony Australia would acquire 100% of the issued share capital in MAC Copper in exchange for $12.25 cash per MAC Copper share. The Transaction closed in October 2025 and OR Royalties International Ltd. (formerly Osisko Bermuda Limited), a fully-owned subsidiary of OR Royalties, received proceeds of $49.0 million in exchange for its 4.0 million shares of MAC Copper. Consequently, the investment in MAC Copper is presented under investment held for sale on the consolidated balance sheet as at September 30, 2025.

Other investments comprise common shares, warrants and convertible instruments, mostly from companies publicly traded in Canada and in the United States of America, as well as loans receivable (notes).

| OR Royalties Inc. Notes to the Interim Consolidated Financial Statements For the three and nine months ended September 30, 2025 and 2024 |

| (tabular amounts expressed in thousands of U.S. dollars, except per share amounts) |

6. Royalty, stream and other interests

| Nine months ended September 30, 2025 |

||||||||||||||

| Royalty interests |

Stream interests |

Offtake interests |

Total | |||||||||||

| $ | $ | $ | $ | |||||||||||

| Balance - January 1 | 637,413 | 465,671 | 10,771 | 1,113,855 | ||||||||||

| Additions | 13,829 | 23,040 | - | 36,869 | ||||||||||

| Exercise of a buy-down right | (2,051 | ) | - | - | (2,051 | ) | ||||||||

| Depletion | (8,815 | ) | (16,701 | ) | - | (25,516 | ) | |||||||

| Impairment | (5,495 | ) | - | - | (5,495 | ) | ||||||||

| Foreign exchange revaluation impact | 20,086 | 2,470 | - | 22,556 | ||||||||||

| Balance - September 30 | 654,967 | 474,480 | 10,771 | 1,140,218 | ||||||||||

| Producing | ||||||||||||||

| Cost | 444,801 | 567,766 | - | 1,012,567 | ||||||||||

| Accumulated depletion and impairment | (324,666 | ) | (244,306 | ) | - | (568,972 | ) | |||||||

| Net book value - September 30 | 120,135 | 323,460 | - | 443,595 | ||||||||||

| Development | ||||||||||||||

| Cost | 327,109 | 173,876 | - | 500,985 | ||||||||||

| Accumulated depletion and impairment | (71,142 | ) | (58,601 | ) | - | (129,743 | ) | |||||||

| Net book value - September 30 | 255,967 | 115,275 | - | 371,242 | ||||||||||

| Exploration and evaluation | ||||||||||||||

| Cost | 284,593 | 36,268 | 10,771 | 331,632 | ||||||||||

| Accumulated depletion and impairment | (5,728 | ) | (523 | ) | - | (6,251 | ) | |||||||

| Net book value - September 30 | 278,865 | 35,745 | 10,771 | 325,381 | ||||||||||

| Total net book value - September 30 | 654,967 | 474,480 | 10,771 | 1,140,218 | ||||||||||

Main additions - 2025

Silver stream - South Railroad project

In May 2025, OR Royalties International Ltd. ("OR Royalties International") acquired a silver stream on Orla Mining Ltd.'s South Railroad project in Nevada, United States, from a third party for $13.0 million. OR Royalties International will be entitled to receive 100% of the silver production from the Dark Star, Pinion and Jasperoid Wash deposits for the life of mine, in exchange for ongoing cash payments for refined silver equal to 15% of the silver spot price at the time of delivery.

Gold stream - Cascabel project

In July 2025, OR Royalties International made the second deposit of US$10.0 million on its gold stream on SolGold plc's Cascabel project.

Impairments - 2025

During the nine months ended September 30, 2025, the Company recorded impairment charges totaling $5.5 million on certain royalty interests. These impairment charges resulted from the revision of certain operating parameters and the loss of royalty rights following the abandonment of properties by the respective operators.

| OR Royalties Inc. Notes to the Interim Consolidated Financial Statements For the three and nine months ended September 30, 2025 and 2024 |

| (tabular amounts expressed in thousands of U.S. dollars, except per share amounts) |

6. Royalty, stream and other interests (continued)

| Year ended December 31, 2024 |

|||||||||||||

| Royalty interests |

Stream interests |

Offtake interests |

Total | ||||||||||

| $ | $ | $ | $ | ||||||||||

| Balance - January 1 | 695,356 | 468,171 | 10,771 | 1,174,298 | |||||||||

| Additions | 50,121 | 23,328 | - | 73,449 | |||||||||

| Depletion | (12,208 | ) | (20,399 | ) | - | (32,607 | ) | ||||||

| Impairment | (49,558 | ) | - | - | (49,558 | ) | |||||||

| Foreign exchange revaluation impact | (46,298 | ) | (5,429 | ) | - | (51,727 | ) | ||||||

| Balance - December 31 | 637,413 | 465,671 | 10,771 | 1,113,855 | |||||||||

| Producing | |||||||||||||

| Cost | 390,283 | 561,690 | - | 951,973 | |||||||||

| Accumulated depletion and impairment | (303,757 | ) | (223,253 | ) | - | (527,010 | ) | ||||||

| Net book value - December 31 | 86,526 | 338,437 | - | 424,963 | |||||||||

| Development | |||||||||||||

| Cost | 352,216 | 160,017 | 20,842 | 533,075 | |||||||||

| Accumulated depletion and impairment | (68,832 | ) | (58,531 | ) | (20,842 | ) | (148,205 | ) | |||||

| Net book value - December 31 | 283,384 | 101,486 | - | 384,870 | |||||||||

| Exploration and evaluation | |||||||||||||

| Cost | 274,874 | 26,271 | 10,771 | 311,916 | |||||||||

| Accumulated depletion and impairment | (7,371 | ) | (523 | ) | - | (7,894 | ) | ||||||

| Net book value - December 31 | 267,503 | 25,748 | 10,771 | 304,022 | |||||||||

| Total net book value - December 31 | 637,413 | 465,671 | 10,771 | 1,113,855 | |||||||||

| OR Royalties Inc. Notes to the Interim Consolidated Financial Statements For the three and nine months ended September 30, 2025 and 2024 |

| (tabular amounts expressed in thousands of U.S. dollars, except per share amounts) |

7. Long-term debt

| September 30, | December 31, | |||||

| 2025 | 2024 | |||||

| $ | $ | |||||

| Balance - Beginning of period | 93,900 | 145,080 | ||||

| Increase in revolving credit facility | 10,437 | 35,000 | ||||

| Repayment of revolving credit facility | (105,372 | ) | (84,721 | ) | ||

| Foreign exchange revaluation impact | 1,035 | (1,459 | ) | |||

| Balance - End of period | - | 93,900 | ||||

| Current portion | - | - | ||||

| Non-current portion | - | 93,900 | ||||

| - | 93,900 |

Revolving credit facility

In May 2025, the Company amended its existing revolving credit facility (the "Credit Facility"), including the conversion from a Canadian dollar denominated facility to a United States dollar denominated facility, as well as an increase in the overall size of the Credit Facility. Under the amended agreement, the Company has now access to a Credit Facility of $650.0 million with an additional uncommitted accordion of up to $200.0 million (subject to acceptance by the lenders). The previous credit facility agreement had a maximum amount of C$550.0 million with an uncommitted accordion of up to C$200.0 million.

The maturity date of the Facility was extended from April 30, 2028 to May 30, 2029. The Facility is to be used for general corporate purposes and investments in the mineral industry, including the acquisition of royalties, streams and other interests, and is secured by the Company's assets.

The Facility is subject to standby fees. Funds drawn bear interest based on the base rate, prime rate, Canadian Overnight Repo Rate Average ("CORRA") or Secured Overnight Financing Rate ("SOFR"), plus an applicable margin depending on the Company's leverage ratio.

The Facility includes quarterly covenants that require the Company to maintain certain financial ratios, including leverage ratios, and to meet certain non-financial requirements. As at September 30, 2025, all such ratios and requirements were met.

8. Share capital

Shares

Authorized

Unlimited number of common shares, without par value

Unlimited number of preferred shares, issuable in series

Issued and fully paid

188,176,647 common shares

Normal Course Issuer Bid

In December 2024, OR Royalties renewed its normal course issuer bid ("NCIB") program. Under the terms of the NCIB program, OR Royalties may acquire up to 9,331,275 of its common shares from time to time in accordance with the normal course issuer bid procedures of the TSX. Repurchases under the 2024 NCIB program are authorized from December 12, 2024 until December 11, 2025. Daily purchases are limited to 73,283 common shares, other than block purchase exemptions. During the nine months ended September 30, 2025, the Company did not purchase any common shares under the NCIB program.

| OR Royalties Inc. Notes to the Interim Consolidated Financial Statements For the three and nine months ended September 30, 2025 and 2024 |

| (tabular amounts expressed in thousands of U.S. dollars, except per share amounts) |

8. Share capital (continued)

Dividends

The following table provides details on the dividends declared for the nine months ended September 30, 2025:

| Declaration date |

Dividend per share |

Record date |

Payment date |

Dividend declared |

||||

| $ | $ | |||||||

| February 19, 2025 (i) | 0.046 | March 31, 2025 | April 15, 2025 | 8,475,000 | ||||

| May 7, 2025 | 0.055 | June 30, 2025 | July 15, 2025 | 10,201,000 | ||||

| August 5, 2025 | 0.055 | September 30, 2025 | October 15, 2025 | 10,492,000 | ||||

| 0.156 | 29,168,000 |

(i) Prior to May 2025, the dividends were declared in Canadian dollars. From May 2025, the quarterly dividend is declared in United States dollars. On February 19, 2025, the Board of Directors declared a quarterly dividend of C$0.065 to shareholders of record as of the close of business on March 31, 2025. Based on the foreign currency rate (C$/US$) on the declaration date, the corresponding dividend per share in U.S. dollars was $0.046.

As at September 30, 2025, the holders of 10.8 million common shares had elected to participate in the Dividend Reinvestment Plan, representing dividends payable of $0.6 million. Therefore, 15,602 common shares were issued on October 15, 2025 at a discount rate of 3%.

9. Share-based compensation

Share options

The following table summarizes information about the movement of the share options outstanding:

| Nine months ended September 30, 2025 |

Year ended December 31, 2024 |

||||||||||||

| Weighted | Weighted | ||||||||||||

| Number of | average | Number of | average | ||||||||||

| options | exercise price | options | exercise price | ||||||||||

| C$ | C$ | ||||||||||||

| Balance - Beginning of period | 2,452,542 | 15.41 | 3,122,006 | 14.50 | |||||||||

| Granted (i) | - | - | 287,300 | 18.72 | |||||||||

| Exercised | (1,105,109 | ) | 14.39 | (956,758 | ) | 13.44 | |||||||

| Forfeited / Cancelled | (6,666 | ) | 18.61 | - | - | ||||||||

| Expired | - | - | (6 | ) | 13.93 | ||||||||

| Balance - End of period | 1,340,767 | 16.23 | 2,452,542 | 15.41 | |||||||||

| Options exercisable - End of period | 1,006,466 | 15.51 | 1,703,943 | 14.51 | |||||||||

(i) The Company ceased granting options in 2025.

The weighted average share price when share options were exercised during the nine months ended September 30, 2025 was C$32.19 (C$23.59 for the year ended December 31, 2024).

| OR Royalties Inc. Notes to the Interim Consolidated Financial Statements For the three and nine months ended September 30, 2025 and 2024 |

| (tabular amounts expressed in thousands of U.S. dollars, except per share amounts) |

9. Share-based compensation (continued)

Share options (continued)

The following table summarizes the share options outstanding as at September 30, 2025:

| Options outstanding | Options exercisable | |||||||||||||||

| Weighted | ||||||||||||||||

| average | ||||||||||||||||

| Weighted | remaining | Weighted | ||||||||||||||

| Exercise | average | contractual | average | |||||||||||||

| price range | Number | exercise price | life (years) | Number | exercise price | |||||||||||

| C$ | C$ | C$ | ||||||||||||||

| 12.70 - 14.50 | 593,501 | 13.55 | 1.1 | 593,501 | 13.55 | |||||||||||

| 15.97 - 22.20 | 747,266 | 18.36 | 3.2 | 412,965 | 18.31 | |||||||||||

| 1,340,767 | 16.23 | 2.3 | 1,006,466 | 15.51 | ||||||||||||

The fair value of the share options is recognized as compensation expense over the vesting period. During the three and nine months ended September 30, 2025, the total share-based compensation related to share options amounted to $0.1 million and $0.6 million, respectively ($0.4 million and $1.2 million during the three and nine months ended September 30, 2024, respectively).

Deferred and restricted share units

The Company offers a deferred share unit ("DSU") plan and a restricted share unit ("RSU") plan, which allow DSUs and RSUs to be granted, respectively, to non-executive directors, officers and/or employees as part of their director's fees or long-term compensation package, as applicable.

The following table summarizes information about the DSUs and RSUs movements:

| Nine months ended September 30, 2025 |

Year ended December 31, 2024 |

||||||||||||

| DSUs (i) | RSUs (ii) | DSUs (i) | RSUs (ii) | ||||||||||

| Balance - Beginning of period | 435,505 | 742,202 | 414,278 | 717,105 | |||||||||

| Granted | 35,310 | 342,340 | 70,440 | 308,000 | |||||||||

| Reinvested dividends | 2,583 | 5,484 | 4,578 | 8,247 | |||||||||

| Settled | (141,570 | ) | (298,156 | ) | (42,095 | ) | (272,160 | ) | |||||

| Forfeited | - | - | (11,696 | ) | (18,990 | ) | |||||||

| Balance - End of period | 331,828 | 791,870 | 435,505 | 742,202 | |||||||||

| Balance - Vested | 296,449 | 2,995 | 381,246 | - | |||||||||

(i) Unless otherwise decided by the Board of Directors of the Company, the DSUs vest the day prior to the next annual general meeting and are payable in common shares, cash or a combination of common shares and cash, at the sole discretion of the Company, to each non-executive director when he or she leaves the board or is not re-elected. The accounting value of the payout is determined by multiplying the number of DSUs expected to vest at the settlement date by the closing price of the Company's shares on the day prior to the grant date, and is recognized over the vesting period. When payment is settled by issuing common shares, one common share will be issued for each DSU, after deducting any income taxes payable on the benefit earned by the director that must be remitted by the Company to the tax authorities. The DSUs granted in the first nine months of 2025 have a weighted average value of C$34.01 per DSU (the DSUs granted during the first nine months of 2024 had a weighted average value of C$21.84 per DSU).

| OR Royalties Inc. Notes to the Interim Consolidated Financial Statements For the three and nine months ended September 30, 2025 and 2024 |

| (tabular amounts expressed in thousands of U.S. dollars, except per share amounts) |

9. Share-based compensation (continued)

Deferred and restricted share units (continued)

(ii) One half of the RSUs is time-based (the "time-based RSUs") and the other half is time-based and depends on the achievement of certain performance measures (the "performance-based RSUs"). The time-based RSUs granted prior to 2024 vest and are payable three years after the grant date. The time-based RSUs granted in 2024 and 2025 vest and are payable in three equal tranches at each anniversary of the grant date. The performance-based RSUs vest and are payable three years after the grant date. The RSUs are payable in common shares, cash or a combination of common shares and cash, at the sole discretion of the Company. The accounting value of the payout is determined by multiplying the number of RSUs expected to vest at the settlement date by the closing price of the Company's shares on the day prior to the grant date, and is recognized over the vesting period and adjusted for the performance-based components, when applicable. When payment is settled by issuing common shares, one common share is issued for each vested RSU, after deducting any income taxes payable on the benefit earned by the employee that must be remitted by the Company to the tax authorities. The RSUs granted in the first nine months of 2025 have a weighted average value of C$26.68 per RSU (the RSUs granted during the first nine months of 2024 had a weighted average value of C$18.79 per RSU).

The total share-based compensation expense related to the DSU and RSU plans for the three and nine months ended September 30, 2025 amounted to $1.9 million and $5.8 million, respectively ($1.2 million and $3.6 million for the three and nine months ended September 30, 2024, respectively).

Based on the closing price of the common shares at September 30, 2025 ($40.08 or C$55.78), and considering a marginal income tax rate of 53.3%, the estimated amount that the Company is expected to transfer to the tax authorities to settle the employees' tax obligations related to the vested DSUs and RSUs to be settled in equity amounts to $6.4 million ($3.7 million as at December 31, 2024) and to $24.0 million based on all DSUs and RSUs outstanding ($11.4 million as at December 31, 2024).

10. Additional information on the consolidated statements of income

| Three months ended September 30, |

Nine months ended September 30, |

|||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||

| $ | $ | $ | $ | |||||||||

| Revenues | ||||||||||||

| Royalty interests | 42,734 | 28,207 | 121,709 | 95,026 | ||||||||

| Stream interests | 28,891 | 13,770 | 65,196 | 39,389 | ||||||||

| 71,625 | 41,977 | 186,905 | 134,415 | |||||||||

| Cost of sales | ||||||||||||

| Royalty interests | 251 | 49 | 567 | 233 | ||||||||

| Stream interests | 2,116 | 1,521 | 5,979 | 4,324 | ||||||||

| 2,367 | 1,570 | 6,546 | 4,557 | |||||||||

| Depletion | ||||||||||||

| Royalty interests | 2,697 | 2,026 | 8,815 | 10,048 | ||||||||

| Stream interests | 7,462 | 4,951 | 16,701 | 13,084 | ||||||||

| 10,159 | 6,977 | 25,516 | 23,132 | |||||||||

| OR Royalties Inc. Notes to the Interim Consolidated Financial Statements For the three and nine months ended September 30, 2025 and 2024 |

| (tabular amounts expressed in thousands of U.S. dollars, except per share amounts) |

10. Additional information on the consolidated statements of income (continued)

| Three months ended September 30, |

Nine months ended September 30, |

|||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||

| $ | $ | $ | $ | |||||||||

| Other gains (losses), net | ||||||||||||

| Change in fair value of financial assets at fair value through profit and loss | (56 | ) | (76 | ) | (366 | ) | 3 | |||||

| Change in allowance for expected credit loss of other investments | - | - | - | 1,399 | ||||||||

| Gain on deemed disposal of an associate (Note 4) | 54,439 | - | 54,439 | - | ||||||||

| Reclassification of other comprehensive loss on the deemed disposal of an associate (Note 4) | (1,147 | ) | - | (1,147 | ) | - | ||||||

| 53,236 | (76 | ) | 52,926 | 1,402 | ||||||||

| Income tax expense | ||||||||||||

| Current income taxes | (3,643 | ) | (638 | ) | (10,292 | ) | (1,350 | ) | ||||

| Deferred income taxes | (5,598 | ) | (5,150 | ) | (13,905 | ) | (3,646 | ) | ||||

| (9,241 | ) | (5,788 | ) | (24,197 | ) | (4,996 | ) | |||||

The Company recognized income tax liabilities of $8.1 million as of September 30, 2025 related to Canadian and provincial income taxes. As of September 30, 2025, the Company had limited remaining non-capital losses and other tax attributes available to fully offset profits earned in Canada.

11. Net earnings per share

| Three months ended September 30, |

Nine months ended September 30, |

||||||||||||

| 2025 | 2024 | 2025 | 2024 | ||||||||||

| $ | $ | $ | $ | ||||||||||

| Net earnings | 82,845 | 13,409 | 140,843 | 9,162 | |||||||||

| Basic weighted average number of common shares outstanding (in thousands) | 188,312 | 186,408 | 187,685 | 186,145 | |||||||||

| Dilutive effect of share options | 822 | 941 | 967 | 849 | |||||||||

| Dilutive effect of RSUs and DSUs | 385 | 383 | 411 | 368 | |||||||||

| Diluted weighted average number of common shares (in thousands) |

189,519 | 187,732 | 189,063 | 187,362 | |||||||||

| Net earnings per share | |||||||||||||

| Basic | 0.44 | 0.07 | 0.75 | 0.05 | |||||||||

| Diluted | 0.44 | 0.07 | 0.74 | 0.05 | |||||||||

For the three and nine months ended September 30, 2024, 53,200 and 327,300 share options, respectively, were excluded from the computation of diluted earnings per share as their effect was anti-dilutive.

| OR Royalties Inc. Notes to the Interim Consolidated Financial Statements For the three and nine months ended September 30, 2025 and 2024 |

| (tabular amounts expressed in thousands of U.S. dollars, except per share amounts) |

12. Additional information on the consolidated statements of cash flows

| Three months ended September 30, |

Nine months ended September 30, |

|||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||

| $ | $ | $ | $ | |||||||||||

| Interest received | 1,078 | 1,178 | 2,301 | 3,294 | ||||||||||

| Interest paid on long-term debt | 678 | 1,503 | 3,409 | 6,085 | ||||||||||

| Income taxes paid | 864 | 638 | 2,108 | 1,350 | ||||||||||

| Changes in non-cash working capital items | ||||||||||||||

| Increase in amounts receivable | (436 | ) | (1,733 | ) | (342 | ) | (1,700 | ) | ||||||

| Decrease in other current assets | 257 | 191 | 889 | 542 | ||||||||||

| Increase (decrease) in accounts payable and accrued liabilities |

946 | 911 | 120 | (1,829 | ) | |||||||||

| Increase in income tax liabilities | 2,638 | - | 8,120 | - | ||||||||||

| 3,405 | (631 | ) | 8,787 | (2,987 | ) | |||||||||

13. Fair value of financial instruments

The following table provides information about financial assets and liabilities measured at fair value in the consolidated balance sheets and categorized by level according to the significance of the inputs used in making the measurements.

Level 1- Unadjusted quoted prices in active markets for identical assets or liabilities;

Level 2- Inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly (that is, as prices) or indirectly (that is, derived from prices); and

Level 3- Inputs for the asset or liability that are not based on observable market data (that is, unobservable inputs).

| September 30, 2025 | |||||||||||||

| Level 1 | Level 2 | Level 3 | Total | ||||||||||

| $ | $ | $ | $ | ||||||||||

| Recurring measurements | |||||||||||||

| Financial assets at fair value through profit or loss (i) | |||||||||||||

| Warrants on equity securities and convertible notes | |||||||||||||

| Publicly traded mining companies | |||||||||||||

| Precious metals | - | - | 6,393 | 6,393 | |||||||||

| Financial assets at fair value through other comprehensive income (i) | |||||||||||||

| Equity securities | |||||||||||||

| Publicly traded mining companies | |||||||||||||

| Precious metals | 142,650 | - | 340 | 142,990 | |||||||||

| Other minerals (ii) | 64,049 | - | - | 64,049 | |||||||||

| 206,699 | - | 6,733 | 213,432 | ||||||||||

| OR Royalties Inc. Notes to the Interim Consolidated Financial Statements For the three and nine months ended September 30, 2025 and 2024 |

| (tabular amounts expressed in thousands of U.S. dollars, except per share amounts) |

13. Fair value of financial instruments (continued)

| December 31, 2024 | |||||||||||||

| Level 1 | Level 2 | Level 3 | Total | ||||||||||

| $ | $ | $ | $ | ||||||||||

| Recurring measurements | |||||||||||||

| Financial assets at fair value through profit or loss (i) | |||||||||||||

| Warrants on equity securities and convertible debentures and notes | |||||||||||||

| Publicly traded mining companies | |||||||||||||

| Precious metals | - | - | 6,534 | 6,534 | |||||||||

| Other minerals | 11 | - | 3 | 14 | |||||||||

| Financial assets at fair value through other comprehensive (loss) income (i) |

|||||||||||||

| Equity securities | |||||||||||||

| Publicly traded mining companies | |||||||||||||

| Precious metals | 1,822 | - | 138 | 1,960 | |||||||||

| Other minerals (ii) | 53,353 | - | - | 53,353 | |||||||||

| 55,186 | - | 6,675 | 61,861 | ||||||||||

(i) On the basis of its analysis of the nature, characteristics and risks of equity securities, the Company has determined that presenting them by industry and type of investment is appropriate.

(ii) Equity securities classified under other minerals are mostly related to copper.

During the nine months ended September 30, 2025 and 2024, there were no transfers among Level 1, Level 2 and Level 3.

The following table presents the changes in the Level 3 investments (comprised of warrants and convertible instruments) for the nine months ended September 30, 2025 and 2024:

| 2025 | 2024 | ||||||

| $ | $ | ||||||

| Balance - January 1 | 6,675 | 6,883 | |||||

| Acquisitions | 200 | - | |||||

| Change in fair value - investments held at the end of the period (i) | (366 | ) | 19 | ||||

| Foreign exchange revaluation impact | 224 | (139 | ) | ||||

| Balance - September 30 | 6,733 | 6,763 | |||||

(i) Recognized in the consolidated statements of income under other gains (losses), net.

The fair value of the financial instruments classified as Level 3 depends on the nature of the financial instruments.

The fair value of the warrants on equity securities and the convertible instruments of publicly traded mining exploration and development companies, classified as Level 3, is determined using directly or indirectly the Black-Scholes option pricing model. The main non-observable input used in the model is the expected volatility (warrants) or the discount rate (convertible instruments). An increase/decrease in the expected volatility used in the models of 10% or in the discount rate of 5% would have resulted in an insignificant variation of the fair value of the warrants and convertible instruments as at September 30, 2025 and December 31, 2024.

| OR Royalties Inc. Notes to the Interim Consolidated Financial Statements For the three and nine months ended September 30, 2025 and 2024 |

| (tabular amounts expressed in thousands of U.S. dollars, except per share amounts) |

13. Fair value of financial instruments (continued)

Financial instruments not measured at fair value on the consolidated balance sheets

Financial instruments that are not measured at fair value on the consolidated balance sheets are represented by cash, revenues receivable from royalty, stream and other interests, other receivables, notes receivable, accounts payable and accrued liabilities, and long-term debt. The fair values of cash, revenues receivable from royalty, stream and other interests, other receivables and accounts payable and accrued liabilities approximate their carrying values due to their short-term nature. The carrying value of the liability under the revolving credit facility approximates its fair value given that the credit spread is similar to the credit spread the Company would obtain under similar conditions at the reporting date. The fair value of the notes receivable approximates their carrying value as there were no significant negative changes in economic and risk parameters or assumptions related directly to the instruments since the issuance, acquisition, renewal or revaluation of those financial instruments.

14. Segment disclosure

The President and Chief Executive Officer (chief operating decision-maker) organizes and manages the business under a single operating segment, consisting of acquiring and managing precious metals and other royalties, streams and other interests. All of the Company's assets, liabilities, revenues, expenses and cash flows are attributable to this single operating segment. The following tables present segmented information for this single segment.

Geographic revenues

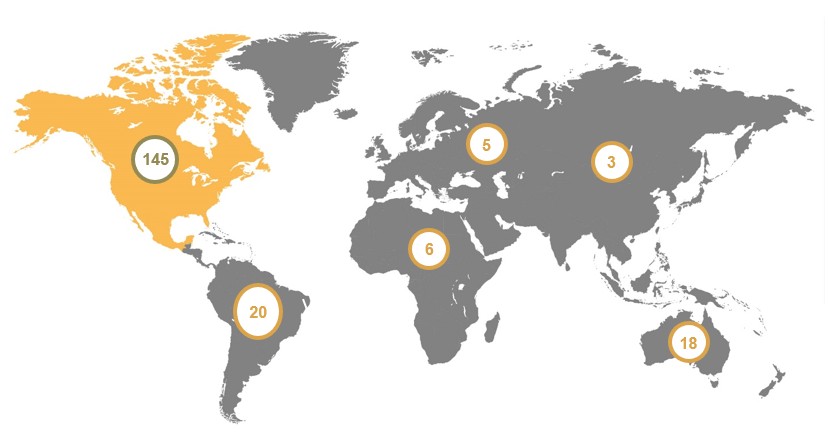

Geographic revenues from the sale of precious metals and other commodities received or acquired from in-kind royalties, streams and other interests are determined by the location of the mining operations giving rise to the royalty, stream or other interest. For the nine months ended September 30, 2025 and 2024, royalty, stream and other interest revenues were earned from the following jurisdictions:

| North America (i) | South America | Australia | Africa | Europe | Total | |||||||||||||

| $ | $ | $ | $ | $ | $ | |||||||||||||

| 2025 | ||||||||||||||||||

| Royalties | 115,039 | 3,760 | 314 | 2,596 | - | 121,709 | ||||||||||||

| Streams | 8,012 | 26,599 | 19,870 | - | 10,715 | 65,196 | ||||||||||||

| 123,051 | 30,359 | 20,184 | 2,596 | 10,715 | 186,905 | |||||||||||||

| 2024 | ||||||||||||||||||

| Royalties | 94,183 | 715 | 128 | - | - | 95,026 | ||||||||||||

| Streams | 5,832 | 16,048 | 9,922 | - | 7,587 | 39,389 | ||||||||||||

| 100,015 | 16,763 | 10,050 | - | 7,587 | 134,415 |

(i) During the nine months ended September 30, 2025, revenues generated from Canada amounted to $111.5 million ($90.6 million during the nine months ended September 30, 2024).

For the nine months ended September 30, 2025, two royalty and stream interests generated revenues of $100.7 million ($72.9 million for the nine months ended September 30, 2024), which represented 54% of revenues (54% of revenues for the nine months ended September 30, 2024), including one royalty interest that generated revenues of $74.1 million ($56.8 million for the nine months ended September 30, 2024).

For the nine months ended September 30, 2025, revenues generated from precious metals represented 94% of total revenues (98% for the nine months ended September 30, 2024).

| OR Royalties Inc. Notes to the Interim Consolidated Financial Statements For the three and nine months ended September 30, 2025 and 2024 |

| (tabular amounts expressed in thousands of U.S. dollars, except per share amounts) |

14. Segment disclosure (continued)

Geographic net assets

The following table summarizes the royalty, stream and other interests by jurisdiction, as at September 30, 2025 and December 31, 2024, which is based on the location of the properties related to the royalty, stream or other interests:

| North America (i) |

South America | Australia |

Africa |

Asia |

Europe |

Total |

|||||||||||||||

| $ | $ | $ | $ | $ | $ | $ | |||||||||||||||

| September 30, 2025 | |||||||||||||||||||||

| Royalties | 402,696 | 130,353 | 57,239 | 48,834 | 5,166 | 10,679 | 654,967 | ||||||||||||||

| Streams | 160,587 | 131,838 | 129,034 | - | 22,300 | 30,721 | 474,480 | ||||||||||||||

| Offtakes | - | - | 7,067 | - | 3,704 | - | 10,771 | ||||||||||||||

| 563,283 | 262,191 | 193,340 | 48,834 | 31,170 | 41,400 | 1,140,218 | |||||||||||||||

| December 31, 2024 | |||||||||||||||||||||

| Royalties | 392,520 | 127,008 | 57,646 | 49,906 | - | 10,333 | 637,413 | ||||||||||||||

| Streams | 146,408 | 127,974 | 136,386 | - | 22,300 | 32,603 | 465,671 | ||||||||||||||

| Offtakes | - | - | 7,067 | - | 3,704 | - | 10,771 | ||||||||||||||

| 538,928 | 254,982 | 201,099 | 49,906 | 26,004 | 42,936 | 1,113,855 | |||||||||||||||

(i) As at September 30, 2025, the carrying value of the net interests located in Canada amounted to $352.0 million ($338.5 million as at December 31, 2024).

15. Subsequent events

MAC Copper Limited Shares

On November 4, 2025, OR Royalties International received proceeds of $49.0 million from Harmony upon closing of Harmony's transaction to acquire MAC Copper Ltd. (4,000,000 shares at $12.25 per share).

Dividend

On November 5, 2025, the Board of Directors declared a quarterly dividend of $0.055 per common share payable on January 15, 2026 to shareholders of record as of the close of business on December 31, 2025.

Management's

Discussions and Analysis

For the three and nine months

ended

September 30, 2025

| OR Royalties Inc. | Management's Discussion and Analysis |

| 2025 - Third Quarter Report |

The following management discussion and analysis ("MD&A") of the consolidated operations and financial position of OR Royalties Inc. (formerly Osisko Gold Royalties Ltd.) and its subsidiaries (together, "OR Royalties" or the "Company") for the three and nine months ended September 30, 2025 should be read in conjunction with the Company's unaudited condensed interim consolidated financial statements and related notes for the three and nine months ended September 30, 2025. The unaudited condensed interim consolidated financial statements have been prepared in accordance with IFRS Accounting Standards as issued by the International Accounting Standards Board ("IASB") applicable to the preparation of interim financial statements. Management is responsible for the preparation of the unaudited condensed interim consolidated financial statements and other financial information relating to the Company included in this report. The Board of Directors is responsible for ensuring that management fulfills its responsibilities for financial reporting. In furtherance of the foregoing, the Board of Directors has appointed an Audit and Risk Committee composed of independent directors. The Audit Committee meets with management and the auditors in order to discuss results of operations and the financial condition of the Company prior to making recommendations and submitting the unaudited condensed interim consolidated financial statements to the Board of Directors for its consideration and approval for issuance to shareholders. The information included in this MD&A is as of November 5, 2025, the date when the Board of Directors has approved the Company's unaudited condensed interim consolidated financial statements for the three and nine months ended September 30, 2025, following the recommendation of the Audit and Risk Committee. All monetary amounts included in this report are expressed in U.S. dollars, the Company's reporting currency, unless otherwise noted. During the three months ended December 31, 2024, the Company elected to change its presentation currency from Canadian dollars ("C$") to U.S. dollars. In accordance with IAS 8, Accounting Policies, Changes in Accounting Estimates and Errors, this change in presentation currency was applied retrospectively as if the new presentation currency had always been the Company's presentation currency and, accordingly, the historical figures have been restated. This MD&A contains forward-looking statements and should be read in conjunction with the risk factors described in the "Forward-Looking Statements" section.

| OR Royalties Inc. | Management's Discussion and Analysis |

| 2025 - Third Quarter Report |

Description of the Business

At the annual and special meeting of shareholders held on May 8, 2025, the shareholders of the Company approved the resolution to amend the articles of the Company to change its name from "Osisko Gold Royalties Ltd." to "OR Royalties Inc.". The name change became effective on that date.

OR Royalties is engaged in the business of acquiring and managing royalties, streams and similar interests on precious metals and other commodities that fit the Company's risk/reward objectives. The Company owns a portfolio of royalties, streams, options on royalty/stream financings and exclusive rights to participate in future royalty/stream financings on various projects. The Company's cornerstone asset is a 3-5% net smelter return ("NSR") royalty on the Canadian Malartic Complex, located in Québec, Canada.

OR Royalties is a public company domiciled in the Province of Québec, Canada, whose shares trade on the Toronto Stock Exchange ("TSX") and the New York Stock Exchange ("NYSE") and is constituted under the Business Corporations Act (Québec). The address of its registered office is 1100, avenue des Canadiens-de-Montréal, Suite 300, Montréal, Québec.

Business Model and Strategy

OR Royalties is focused on acquiring high-quality, long-life precious metals royalties and streams on assets located in favourable jurisdictions that are operated by established mining companies. The Company deploys capital through the acquisition of royalty and stream investments on metal mining projects at various stages of operation and development. OR Royalties endeavours to provide investors with lower-risk precious metals exposure via a geographically and operationally diversified asset base. OR Royalties' objective is to deploy capital into new and accretive investment opportunities to further enhance its growth profile.

Highlights

Third Quarter of 2025

Subsequent to September 30, 2025

1 GEOs are calculated on a quarterly basis and include royalties and streams. Silver ounces and copper tonnes earned from royalty and stream agreements are converted to gold equivalent ounces by multiplying the silver ounces or copper tonnes earned by the average silver price per ounce or copper price per tonne for the period and dividing by the average gold price per ounce for the period. Cash royalties, other metals and commodities are converted into gold equivalent ounces by dividing the associated revenue by the average gold price per ounce for the period. For average metal prices used, refer to the Portfolio of Royalty, Stream and Other Interests section of this MD&A.

2 Three months ended September 30, 2024 ("Q3 2024").

3 "Adjusted earnings" and "Adjusted earnings per basic share" are non-IFRS financial performance measures which have no standard definition under IFRS Accounting Standards and might not be comparable to similar financial measures disclosed by other issuers. Refer to the non-IFRS measures provided under the Non-IFRS Financial Performance Measures section of this MD&A for further information and for a quantitative reconciliation of each non-IFRS financial measure to the most directly comparable IFRS financial measure.

| OR Royalties Inc. | Management's Discussion and Analysis |

| 2025 - Third Quarter Report |

Guidance for 2025 and 5-Year Outlook

2025 Guidance

OR Royalties expects GEOs earned to range between 80,000 to 88,000 in 2025 at an average cash margin4 of approximately 97%. For the 2025 guidance, deliveries of silver, copper, and cash royalties were converted to GEOs using commodity prices based on February 2025 consensus commodity prices and a gold/silver price ratio of 83:1. The 2025 guidance assumed Capstone Copper Corp.'s Mantos Blancos mine would continue to operate at its Phase I nameplate throughput capacity of 20,000 tonnes per day ("tpd"), as well as a ramp-up in payments associated with GEOs earned from Cardinal Namdini Mining Ltd.'s Namdini mine in the second half of 2025. In addition, the guidance assumed a full year of GEOs earned from the copper stream from Harmony's CSA mine and the NSR royalty on G Mining Ventures Corp.'s Tocantinzinho mine.

OR Royalties' 2025 guidance on royalty and stream interests is largely based on publicly available forecasts from its operating partners. When publicly available forecasts on properties are not available, OR Royalties obtains internal forecasts from the producers or uses management's best estimate.

5-Year Outlook

OR Royalties expects its portfolio to generate between 110,000 and 125,000 GEOs in 2029. The outlook assumes the commencement of production at Gold Fields Limited's Windfall project and South32 Limited's Hermosa/Taylor project, amongst others. It also assumes increased production from certain other operators that are advancing expansions, including Alamos Gold Inc.'s Island Gold Phase 3+ Expansion. The 5-year outlook assumes there will be no GEO contribution from the Eagle Gold mine, which is currently in receivership.

Beyond this growth profile, OR Royalties owns several other growth assets, which have not been factored into the 5-year outlook, as their respective development timelines are either longer, or difficult to reasonably forecast at this time. As these operators provide additional clarity on these respective assets, OR Royalties will seek to include them in future long-term outlooks.

The 5-year outlook is based on internal judgements of publicly available forecasts and other disclosure by the third-party owners and operators of the Company's assets and could differ materially from actual results. When publicly available forecasts on properties are not available, OR Royalties obtains internal forecasts from the operators or uses management's best estimate. The commodity price assumptions that were used in the 5-year outlook are based on current long-term consensus and a gold/silver price ratio of 80:1.

The 5-year outlook, originally published on February 19, 2025, replaces the 5-year outlook previously released in February 2024, the latter of which should be considered as withdrawn. Investors should not use the current 5-year outlook to extrapolate forecast results to any year within the 5-year period (2025-2029).

4 Cash margin is a non-IFRS financial performance measure which has no standard definition under IFRS Accounting Standards and might not be comparable to similar financial measures disclosed by other issuers. It is calculated by deducting the cost of sales (excluding depletion) from the revenues. Please refer to the Non-IFRS Financial Performance Measures section of this MD&A for further information and for a quantitative reconciliation of each non-IFRS financial measure to the most directly comparable IFRS financial measure.

| OR Royalties Inc. | Management's Discussion and Analysis |

| 2025 - Third Quarter Report |

Portfolio of Royalty, Stream and Other Interests

The following table details the GEOs earned by the Company's producing royalty, stream and other interests:

| Three months ended September 30, |

Nine months ended September 30, |

|||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||

| Gold | ||||||||||||

| Canadian Malartic Complex royalty | 8,069 | 7,598 | 24,084 | 25,128 | ||||||||

| Éléonore royalty | 1,103 | 1,311 | 3,912 | 3,915 | ||||||||

| Island Gold royalty | 895 | 872 | 2,451 | 2,246 | ||||||||

| Seabee royalty | 254 | 534 | 1,874 | 2,158 | ||||||||

| Ermitaño royalty | 500 | 620 | 1,490 | 1,767 | ||||||||

| Lamaque royalty | 461 | 421 | 1,404 | 1,328 | ||||||||

| Pan royalty | 313 | 362 | 922 | 996 | ||||||||

| Tocantinzinho royalty (i) | 292 | - | 797 | - | ||||||||

| Namdini royalty (ii) | 628 | - | 758 | - | ||||||||

| Bald Mountain royalty | 63 | 21 | 468 | 869 | ||||||||

| Fruta del Norte royalty | 129 | 122 | 347 | 301 | ||||||||

| Eagle Gold royalty (iii) | - | - | - | 2,857 | ||||||||

| Others | 284 | 123 | 828 | 529 | ||||||||

| 12,991 | 11,984 | 39,335 | 42,094 | |||||||||

| Silver | ||||||||||||

| Mantos Blancos stream | 3,344 | 1,905 | 8,147 | 7,045 | ||||||||

| Sasa stream | 1,075 | 1,149 | 3,276 | 3,192 | ||||||||

| CSA stream | 1,279 | 1,307 | 3,299 | 3,862 | ||||||||

| Gibraltar stream | 518 | 390 | 1,470 | 1,660 | ||||||||

| Canadian Malartic Complex royalty | 46 | 42 | 130 | 129 | ||||||||

| Others | 53 | 34 | 156 | 117 | ||||||||

| 6,315 | 4,827 | 16,478 | 16,005 | |||||||||

| Copper and others | ||||||||||||

| CSA copper stream (iv) | 1,015 | 1,329 | 2,522 | 1,329 | ||||||||

| Renard diamond stream (v) | - | 259 | 646 | 1,244 | ||||||||

| Others | 5 | 9 | 59 | 63 | ||||||||

| 1,020 | 1,597 | 3,227 | 2,636 | |||||||||

| Total GEOs | 20,326 | 18,408 | 59,040 | 60,735 | ||||||||

(i) G Mining Ventures Corp. announced its first gold production on July 9, 2024. Commercial production was declared on September 3, 2024, and the first royalty payment was received in the fourth quarter of 2024.

(ii) The Company received its first payment during the second quarter of 2025. The Namdini mine is currently ramping up production.

(iii) On June 24, 2024, Victoria Gold Corp. ("Victoria") announced a slope failure of its heap leach facility at the Eagle Gold mine and operations have since been suspended. Please refer to the Portfolio of Royalty, Stream and Other Interests section of this MD&A for more details.

(iv) The CSA copper stream was acquired on June 15, 2023, with an effective date of June 15, 2024. The first delivery of copper was received and sold by OR Royalties International (formerly Osisko Bermuda Limited), a subsidiary of the Company, during the third quarter of 2024. Copper is delivered on the last day of each quarter, and may, in certain situations, be sold in the subsequent quarter.

(v) On October 27, 2023, Stornoway Diamonds (Canada) Inc. ("Stornoway"), the operator of the Renard diamond mine, announced it was suspending operations and placing itself under the protection of the Companies' Creditors Arrangement Act ("CCAA"). In 2024 and 2025, the Renard mine processed and sold a small number of diamonds as part of the care and maintenance plan.

| OR Royalties Inc. | Management's Discussion and Analysis |

| 2025 - Third Quarter Report |

GEOs by Product

| Q3 2025 | Q3 2024 | YTD 2025 | YTD 2024 |

|

|

|

|

|

Average Metal Prices and Exchange Rate

| Three months ended September 30, | Nine months ended Septmber 30, | |||||||||||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||||||||||

| Realized | Average | Realized | Average | Realized | Average | Realized | Average | |||||||||||||||||

| Gold (i) | $3,434 | $3,457 | $2,467 | $2,474 | $3,188 | $3,201 | $2,275 | $2,296 | ||||||||||||||||

| Silver (ii) | $40.22 | $39.40 | $30.61 | $29.43 | $35.95 | $35.05 | $27.45 | $27.22 | ||||||||||||||||

| Copper (iii) | $9,897 | $9,797 | $9,283 | $9,210 | $9,867 | $9,556 | $9,283 | $9,131 | ||||||||||||||||

| Exchange rate (C$/US$) (iv) | n/a | 0.7261 | n/a | 0.7332 | n/a | 0.7152 | n/a | 0.7351 | ||||||||||||||||

(i) The average price represents the London Bullion Market Association's PM price in U.S. dollars per ounce.

(ii) The average price represents the London Bullion Market Association's price in U.S. dollars per ounce.

(iii) The average price represents the London Metal Exchange's price in U.S. dollars per tonne.

(iv) Bank of Canada daily rate.

| OR Royalties Inc. | Management's Discussion and Analysis |

| 2025 - Third Quarter Report |

Royalty, Stream and Other Interests Portfolio Overview

As at November 5, 2025, OR Royalties owned a portfolio of 179 royalties, 15 streams and 3 offtakes, as well as 7 royalty options. Currently, the Company has 22 producing assets.

Portfolio by asset stage

| Asset stage | Royalties | Streams | Offtakes | Total number of assets |

||||||||

| Producing | 17 | 5 | - | 22 | ||||||||

| Development | 15 | 9 | 1 | 25 | ||||||||

| Exploration and evaluation | 147 | 1 | 2 | 150 | ||||||||

| 179 | 15 | 3 | 197 |

Producing assets (i)

| Asset | Operator | Interest (ii) | Commodity | Jurisdiction |

| North America | ||||

| Akasaba West (iii) | Agnico Eagle Mines Limited | 2.5% NSR royalty | Au, Cu | Canada |

| Bald Mtn. Alligator Ridge / Duke & Trapper | Kinross Gold Corporation | 1% / 4% GSR (iv) royalty | Au | USA |

| Bralorne (v) | Talisker Resources Ltd. | 1.7% NSR royalty | Au | Canada |

| Canadian Malartic Complex | Agnico Eagle Mines Limited | 3 - 5% NSR royalty | Au, Ag | Canada |

| Éléonore | Dhilmar Ltd. | 1.8 - 3.5% NSR royalty | Au | Canada |

| Ermitaño | First Majestic Silver Corp. | 2% NSR royalty | Au, Ag | Mexico |

| Gibraltar | Taseko Mines Limited | 100% stream | Ag | Canada |

| Island Gold District | Alamos Gold Inc. | 1.38 - 3% NSR royalty | Au | Canada |

| Lamaque Complex | Eldorado Gold Corporation | 1% NSR royalty | Au | Canada |

| Macassa TH | Agnico Eagle Mines Limited | 1% NSR royalty | Au | Canada |

| Pan | Minera Alamos Inc. | 4% NSR royalty | Au | USA |

| Parral | GoGold Resources Inc. | 2.4% stream | Au, Ag | Mexico |

| Santana | Minera Alamos Inc. | 3% NSR royalty | Au | Mexico |

| Seabee | SSR Mining Inc. | 3% NSR royalty | Au | Canada |

| Outside of North America | ||||

| Brauna | Lipari Mineração Ltda | 1% GRR (vi) | Diamonds | Brazil |

| CSA | Harmony Gold Mining Company Limited | 100% stream 3.0 - 4.875% stream |

Ag Cu |

Australia |

| Dolphin Tungsten | Group 6 Metals Limited | 1.5% GRR | Tungsten (W) | Australia |

| Fruta del Norte | Lundin Gold Inc. | 0.1% NSR royalty | Au | Ecuador |

| Mantos Blancos | Capstone Copper Corp. | 100% stream | Ag | Chile |

| Namdini (vii) | Cardinal Namdini Mining Ltd. | 1% NSR royalty | Au | Ghana |

| Sasa | Central Asia Metals plc | 100% stream | Ag | North Macedonia |