UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of October 2025

Commission File No. 001-31965

TASEKO MINES LIMITED

(Translation of registrant's name into English)

12th Floor - 1040 West Georgia Street

Vancouver, British Columbia, V6E 4H1, Canada

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F

Form 20-F [ ] Form 40-F [X]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1) [ ]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7) [ ]

SUBMITTED HEREWITH

| Exhibits | |

| 99.1 | Technical Report Update on the Yellowhead Copper Project, British Columbia Canada dated June 15, 2025 with an effective date of July 10, 2025 |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

TASEKO MINES LIMITED

Date: October 15, 2025

/s/ Bryce Hamming

________________________________

Bryce Hamming

Chief Financial Officer

TECHNICAL REPORT UPDATE

ON THE YELLOWHEAD COPPER PROJECT

BRITISH COLUMBIA, CANADA

QUALIFIED PERSONS:

Richard Weymark, P.Eng., MBA

Jeremy Guichon, P.Eng.

Adil Cheema, P.Eng.

Effective date: June 15th, 2025

date: July 10th, 2025

TABLE OF CONTENTS

| Section | |

| Summary | 1 |

| Introduction | 2 |

| Reliance on Other Experts | 3 |

| Property Description and Location | 4 |

| Accessibility, Climate, Local Resources, Infrastructure and Physiography | 5 |

| History | 6 |

| Geological Setting and Mineralization | 7 |

| Deposit Type | 8 |

| Exploration | 9 |

| Drilling | 10 |

| Sample Preparation, Analysis and Security | 11 |

| Data Verification | 12 |

| Mineral Processing and Metallurgical Testing | 13 |

| Mineral Resource Estimate | 14 |

| Mineral Reserve Estimate | 15 |

| Mining Method | 16 |

| Recovery Method | 17 |

| Project Infrastructure | 18 |

| Market Studies and Contracts | 19 |

| Environmental Studies, Permitting and Social or Community Impact | 20 |

| Capital and Operating Costs | 21 |

| Economic Analysis | 22 |

| Adjacent Properties | 23 |

TABLE OF CONTENTS - Cont'd

| Section | |

| Other Relevant Data and Information | 24 |

| Interpretation and Conclusions | 25 |

| Recommendations | 26 |

| References | 27 |

SECTION 1

SUMMARY

SECTION 1: SUMMARY

Table of Contents

| Page | ||

| 1.1 | Introduction | 1 |

| 1.2 | Property Description and Location | 1 |

| 1.3 | Accessibility and Infrastructure | 2 |

| 1.4 | History | 3 |

| 1.5 | Geology and Deposit | 4 |

| 1.6 | Mineral Processing and Metallurgical Testing | 5 |

| 1.7 | Mineral Resource and Reserve Estimate | 6 |

| 1.8 | Mining Method | 9 |

| 1.9 | Recovery Method | 10 |

| 1.10 | Project Infrastructure | 11 |

| 1.11 | Market Studies & Contracts | 12 |

| 1.12 | Environmental, Permitting, Social and Community Impact | 12 |

| 1.13 | Capital and Operating Costs | 13 |

| 1.14 | Economic Analysis | 15 |

| 1.15 | Interpretation and Conclusions | 16 |

| 1.16 | Recommendations | 16 |

| List of Tables | ||

| Table 1-1: Yellowhead Mineral Resource Estimate | 7 | |

| Table 1-2: Yellowhead Mineral Reserve Estimate | 8 | |

| Table 1-3: Mine Production Schedule | 9 | |

| Table 1-4: Initial Capital Costs | 13 | |

| Table 1-5: Sustaining Capital Costs | 14 |

| Table 1-6: Operating Costs Summary | 14 |

| Table 1-7: Onsite Operating Costs Summary | 14 |

| Table 1-8: Long-Term Street Consensus Metal Pricing and Foreign Exchange Rate | 15 |

| Table 1-9: Before-Tax Economic Valuation | 15 |

| Table 1-10: Before-Tax Yellowhead Project Cashflow Summary | 15 |

| Table 1-11: After-Tax Economic Valuation | 16 |

| Section 1 | Summary | Page 1 |

1.1 Introduction

The purpose of this report is to summarize the prefeasibility level engineering and cost estimate that support the updated Yellowhead Copper Project (the "Yellowhead Project" or the "Project") economics which incorporate updated metal prices, foreign exchange rates, capital and operating costs, gold recovery projections and a new transmission line design. The mineral reserve estimate, production schedule and project design remain consistent with the 2020 Technical Report. This report also describes the geotechnical site investigation, metallurgical testing, environmental baseline, permitting and First Nations engagement work completed since then.

The Qualified Persons (QPs) responsible for the content of this report are Richard Weymark, P.Eng., MBA, Jeremy Guichon, P.Eng. and Adil Cheema, P.Eng. Mr. Weymark is employed by the company as Vice President, Engineering, Mr. Guichon as Director, Mine Engineering and Mr. Cheema as Director, Process Engineering.

All measurement units used in this report are metric, and currency is expressed in Canadian dollars unless otherwise stated.

1.2 Property Description and Location

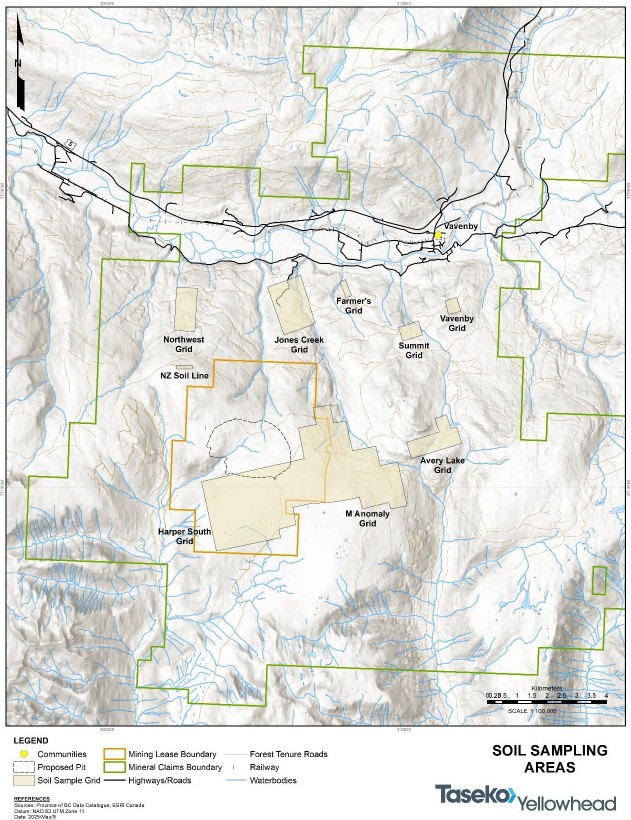

The Yellowhead property is located in the Thompson-Nicola area of BC, approximately 150 km northeast of Kamloops and are centered at latitude 51°30' north and longitude 119°48' west (Figure 4-1) in the Kamloops Mining Division.

The property consists of 1 mining lease and 94 mineral claims covering approximately 42,358 hectares. Taseko, through its wholly owned subsidiary Yellowhead Mining Inc. (YMI) (FMC 285998), is the 100% owner of these mineral tenures which are all in good standing. There are three parcels of fee simple land located 2.5 km west of Vavenby where the rail load-out facility will be located.

Six mineral claims, five of which have been incorporated into the mining lease are subject to a 2.5% NSR royalty to XStrata. Additionally, 31 claims, 27 of which have been incorporated into the mining lease, are subject to a 3% NSR royalty to US Steel Corp., capped at $3.9 million, subject to inflation. The mining lease encompasses the deposit area and plant site footprint.

| Section 1 | Summary | Page 2 |

1.3 Accessibility and Infrastructure

The Yellowhead Project is accessed via the Yellowhead Highway (Highway #5), 150 km by road north of Kamloops, which is serviced with daily flights from Vancouver and Calgary.

The primary access to site from Highway #5 is via the Vavenby Bridge Road through Vavenby and across the North Thompson River to the Birch Island Lost Creek Road (BILCR). From there, access is about 20 km along a network of existing Forest Service Roads (FSRs) that climb up to the Project site.

The Yellowhead Highway, the CN Rail transcontinental main line, and the 138 kV BC Hydro North Thompson transmission line all pass approximately 8 km north of the Project area.

YMI owns a property with an existing rail siding 2.5 km west of Vavenby and approximately 25 km by road from the Project site. This property will be used for the rail load-out facility and central parking and bus staging for transporting site personnel during construction and operations.

| Section 1 | Summary | Page 3 |

1.4 History

Copper mineralization was discovered in the immediate vicinity of the deposit in the mid- 1960s. The initial discovery was followed up by extensive prospecting, line cutting, road building, surface geochemical sampling, geological mapping, geophysics, trenching and diamond drilling programs.

Noranda Exploration Company (Noranda) and Québec Cartier Mining Company (QCM), a 100% wholly owned subsidiary of US Steel, staked claims in the deposit area in 1965 and 1966 respectively. This resulted in the area west of the Harper Creek tributary belonging to Noranda and east of it to QCM. The two companies worked independently on their properties from 1966 until 1970. In late 1970, the companies formed a joint venture, which explored their contiguous properties until 1974.

Further work in the deposit area occurred in 1986 and 1996. This included sampling historical trenches, core resampling and additional drilling.

Historical core drilling took place on the property in 11 different years totalling 30,800 m from 191 holes. Of these holes, 165 are located within what is now known as the Yellowhead Copper Deposit, for a total of 28,200 m or 92% of the overall drilling. No further drilling took place on the deposit area until 2006.

Yellowhead Mining Inc. (YMI) formed as a private British Columbia company in 2005 and obtained control of the Project through staking, purchase and option agreements. Exploration completed between 2005 and 2013 included diamond drilling, historical core relogging, airborne and ground geophysics, soil and rock sampling, geological mapping and other exploration activities.

By the end of 2013 YMI had completed 65,000 m of additional drilling on the property from 217 drillholes. A Feasibility Study was published on July 31, 2014 which proposed an open pit mine with a production capacity of 70,000 tpd and a 28-year operating life.

In 2015, an Environmental Assessment (EA) Application was accepted for review by the BC Environmental Assessment Office (BC EAO) and Canadian Environmental Assessment Agency (CEAA). In mid-2015, the application review was suspended at YMI's request and after an initial three-year extension, the provincial EA process was terminated in July 2018 by the BC EAO due to inactivity on the file.

In February 2019, Taseko acquired a 100% interest in YMI thus acquiring a 100% interest in the Project and withdrew from the federal EA process in May 2019. In 2020, Taseko published a technical report which summarized an updated development plan for the Project based on a mill throughput of 90,000 tonnes per day and a 25-year operating life.

| Section 1 | Summary | Page 4 |

1.5 Geology and Deposit

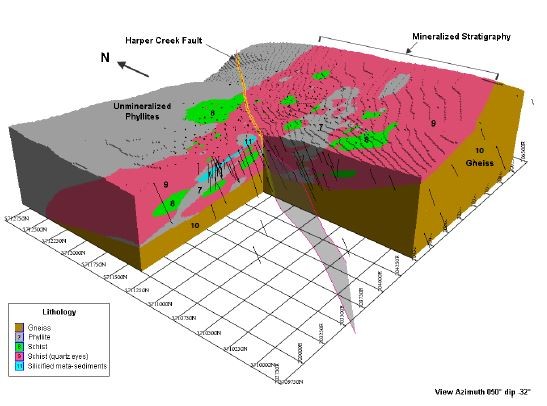

The Project is located within structurally complex, low-grade metamorphic rocks of the Eagle Bay Assemblage, part of the Kootenay Terrane on the western margin of the Omineca Belt in south-central BC.

The Eagle Bay Assemblage incorporates Lower Cambrian to Mississippian sedimentary and volcanic rocks subject to deformation and metamorphism. The Eagle Bay Assemblage divides into four northeast-dipping thrust sheets that collectively contain a succession of Lower Cambrian rocks overlain by a succession of Devonian-Mississippian rocks. The Lower Cambrian rocks include quartzites, grits and quartz mica schists (units EBH and EBQ), mafic metavolcanic rocks and limestone (unit EBG), and overlying schistose sandstones and grits (unit EBS) with minor calcareous and mafic volcanic units. These older units are overlain by Devonian-Mississippian succession of mafic to intermediate metavolcanic rocks (units EBA and EBF) intercalated with and overlain by dark grey phyllite, sandstone and grit (unit EBP).

Unit EBA of the Devonian-Mississippian succession hosts the deposit.

The deposit type is interpreted as a remobilized polymetallic volcanogenic massive sulphide deposit, comprising lenses of disseminated, fracture-filling and banded iron and copper sulphides with accessory magnetite. Mineralization is generally conformable with the host-rock stratigraphy as is consistent with the volcanogenic model. Observed sulphide lenses measure many tens of metres in thickness with km-scale strike and dip extents.

The northeast trending Harper Creek Fault separates the deposit into a west domain and east domain. In the west domain, chalcopyrite mineralization is primarily in three copper bearing horizons. The upper horizon ranges from 60 m to 170 m in width and is continuous along an east-west strike for some 1,300 m, dipping approximately 30º north. The middle horizon is not as well developed and is often fragmented. It ranges from 30 m to 40 m in width at the western extent, increasing up to 90 m locally eastward, gradually appearing to blend into the upper horizon. The lowest or third horizon has less definition mainly due to a lack of drill intersections. It can range from 30 m to 90 m in width although typical intersections are in the 30 m range. These horizons generally contain foliation-parallel wisps and bands as the dominant style of sulphide mineralization.

In the east domain, mineralization characterized by high angle, discontinuous, tension fractures of pyrrhotite, chalcopyrite ± bornite. Mineralization is not selective to individual units and frequently transgresses lithological contacts throughout the area. At the near surface areas in the south and down-dip to the north, widths of mineralization typically range from 120 m to 160 m. In the central area of the east domain where thrust/reverse fault stacking has been interpreted, mineralization thicknesses typically range from 220 m to 260 m with local intersections of up to 290 m.

| Section 1 | Summary | Page 5 |

1.6 Mineral Processing and Metallurgical Testing

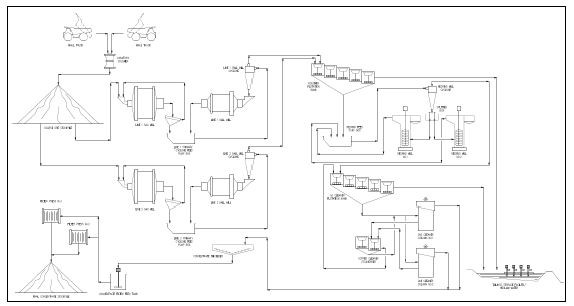

The Yellowhead Project's process flowsheet consists of a conventional SAG and ball milling circuit, followed by rougher flotation, regrinding of rougher concentrate, and a three-stage cleaner flotation circuit. Metallurgical testing from both the historical G&T program and more recent SGS program confirms the suitability of this design for the ore.

Comminution testing demonstrated that the ore is soft to moderately soft, with low abrasivity and no requirement for pebble crushing. Mineralogical characterization confirmed chalcopyrite is the dominant copper bearing mineral across the deposit, comprising more than 98% of the copper species in the majority of the deposit.

Lock cycle tests from both programs consistently produced final copper concentrates grading between approximately 25.5% to 26%, with copper recoveries near 90%. Final concentrates were clean with minor deleterious elements below typical smelter penalty thresholds, and also contained payable gold and silver credits.

The copper and silver recovery models remain consistent with historical models used for the Project and are well supported by the more recent test work completed at SGS. The gold recovery model was refined based on SGS test results and a re-evaluation of historical test data. Together, the validated historical copper and silver models and refined gold model form the basis for the Project's updated metallurgical recovery projections.

Future metallurgical test programs undertaken for the Project should consider evaluating opportunities to improve gold recovery and additional variability testing using the updated flowsheet and reagent scheme.

| Section 1 | Summary | Page 6 |

1.7 Mineral Resource and Reserve Estimate

(a) Resource Estimate

The most recent update to the resource block model was completed in 2014 as documented in the technical report titled "Technical Report & Feasibility Study of the Harper Creek Copper Project", dated July 31, 2014 which has an effective date of July 31, 2014. There have been no additional relevant exploration results within the resource area nor changes to the resource block model since that time.

The sample database for the Project contains results from 353 core holes (90,779 m) drilled between 1967 and the end of 2013.

The mineralized stratigraphy comprises a sequence of phyllites and schists overlying un- mineralized gneiss. Weakly mineralized to barren phyllites overlie the main mineralized horizons. The Harper Creek Fault bisects the deposit in a southwest-northeast direction and dips steeply to the southeast. The three main lithologic domains (gneiss, mineralized meta- sediments and overlying phyllites) were modeled as 3D wireframes. The Harper Creek Fault was modeled as a surface and acts as a hard boundary for both the lithologic and grade models. In order to further constrain the block model grade estimation, gradeshells based on a 700ppm copper cut-off were generated by modeling log transformed data. Separate zones were modeled on either side of the Harper Creek Fault.

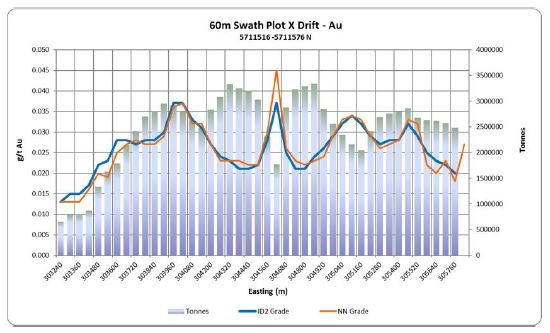

Block dimension are 12 m x 12 m x 12 m. Block volumes in in-situ rock domains use a density factor ranging from 2.71 to 2.85 dependant on lithology while density of overburden was assigned a factor of 2.2.

Copper, gold and silver grades within the northwest and southeast zone domains were estimated in three passes using the inverse distance squared weighting method (ID2). The second pass used an octant search in order to differentiate interpolated from extrapolated block grade estimates for classification.

Resource classifications used conform to CIM Definition Standards for Mineral Resources and Mineral Reserves (2014). Blocks were initially classified as measured if they were estimated in the first pass with a minimum of 4 composites from at least 2 drillholes within 82.5 m of the block centroid corresponding to one third of the maximum variogram range. The blocks meeting these criteria were then examined visually and some blocks were downgraded to indicated if they were in areas missing precious metal assays or in isolated clusters.

| Section 1 | Summary | Page 7 |

1.7 Mineral Resource and Reserve Estimate - Cont'd

(a) Resource Estimate - Cont'd

Remaining unclassified blocks were flagged as indicated if they were estimate in the 2nd pass which used an octant search to limit extrapolation. Some extrapolated estimates from the third pass were also classified as indicated if the closest composite was within 125 m of a block centroid corresponding to half the maximum variogram range. A series of blocks estimated in the third pass that were adjacent to the Harper Creek Fault and not estimated in the octant search due to the imposed hard boundary were also classified as indicated.

All other estimated blocks were classified as inferred.

A Lerchs-Grossman pit optimization was generated to constrain the resource within the block model. Metal prices used were US$4.25/lb for copper, US$2,400/oz for gold and US$28.00/oz for silver at a foreign exchange rate of C$1.30 : US$1.00. Average metal recoveries are 89% for copper, 35% for gold and 59% for silver at a 0.15% copper cut-off grade. Combined processing and G&A costs were set at C$7.40/t milled. Pit-rim mining cost for ore and waste were C$2.31/t mined with a bench increment of C$0.035/t mined and pit slopes were set based on wall azimuth.

The mineral resource estimate for the Project is shown in Table 1-1.

Table 1-1: Yellowhead Mineral Resource Estimate

| Yellowhead Project Mineral Resources Effective June 1, 2025 At 0.15% Copper Cut-off |

||||

| Classification | Tonnes (millions) |

Copper Grade (%) |

Gold Grade (gpt) |

Silver Grade (gpt) |

| Measured | 561 | 0.27 | 0.029 | 1.2 |

| Indicated | 735 | 0.24 | 0.027 | 1.2 |

| Measured and Indicated | 1,296 | 0.25 | 0.028 | 1.2 |

| Inferred | 111 | 0.24 | 0.026 | 1.2 |

Notes:

1. Mineral Resources follow CIM Definition Standards for Mineral Resources and Mineral Reserves (2014).

2. Mineral Resources are reported inclusive of Mineral Reserves.

3. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

4. The Mineral Resource has been confined by a Lerchs-Grossman pit optimization to meet "reasonable prospects of eventual economic extraction" using the following assumptions: Metal prices of US$4.25/lb Cu, US$2,400/oz Au and US$28.00/oz Ag; a foreign exchange rate of C$1.30 : US$1.00; average metal recoveries of 89% for copper, 35% for gold and 59% for silver; combined processing and G&A costs of C$7.40/t milled; and pit-rim mining cost of C$2.31/t mined with a bench increment of C$0.035/t mined.

5. Bulk density is estimated by lithology and ranges between 2.71 t/m3 and 2.85 t/m3 in rock and 2.2 t/m3 in overburden.

6. Numbers may not add due to rounding.

| Section 1 | Summary | Page 8 |

1.7 Mineral Resource and Reserve Estimate - Cont'd

(b) Reserve Estimate

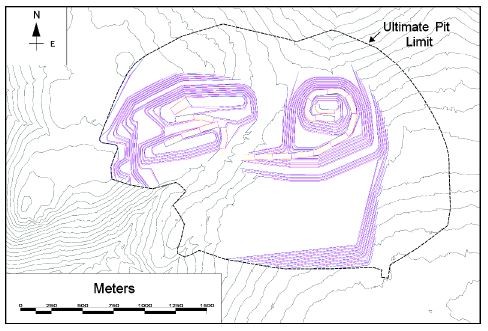

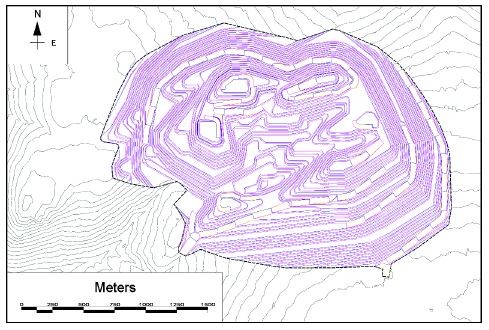

The extent of the reserve pit was determined by applying the Lerchs-Grossman pit optimization algorithm to the measured and indicated resources. The resultant reserve basis pit shell was used as a guide to develop the detailed reserve pit design.

The input parameters used to derive the reserve basis pit shell include conservative commodity prices, appropriate metal recoveries and unit costs for mining, processing, water treatment, general and administration (G&A), a sustaining capital allowance, and consultant recommended pit wall slopes.

Reserves are stated at a copper cut-off grade of 0.17% based an evaluation documented in the 2020 Technical Report. A break-even cut-off grade analysis was performed and demonstrated that the copper cut-off grade of 0.17% is conservative.

Proven and probable reserves are derived from measured and indicated resources respectively, that are contained within the reserve pit design and are above the stated copper cut-off grade. Table 1-2 summarizes the proven and probable mineral reserves as of June 1, 2025.

Table 1-2: Yellowhead Mineral Reserve Estimate

| Yellowhead Project Mineral Reserves Effective June 1, 2025 At 0.17% Copper Cut-off |

|||||

| Category | Tonnes (millions) |

Cu (%) |

Au (gpt) | Ag (gpt) | Cu Eq. * (%) |

| Proven | 458 | 0.29 | 0.031 | 1.3 | 0.30 |

| Probable | 359 | 0.26 | 0.028 | 1.2 | 0.28 |

| Total | 817 | 0.28 | 0.030 | 1.3 | 0.29 |

Notes:

1. Mineral Reserves follow CIM Definition Standards for Mineral Resources and Mineral Reserves (2014).

2. Mineral Reserves are contained within Mineral Resources.

3. Mineral Reserves are assumed to be extracted using open pit mining methods and are based on the following assumption: Metal prices of US$2.85/lb Cu, US$1,610/oz Au and US$18.75/oz Ag; a foreign exchange rate of C$1.30 : US$1.00; average metal recoveries of 90% for copper, 36% for gold and 59% for silver; combined processing, G&A and water treatment costs of C$7.40/t milled; pit-rim mining costs of C$2.33/t of overburden, C$2.28/t of non-PAG waste, C$2.79/t of PAG waste and C$2.07/t of ore with a bench increment of C$0.035/t mined per bench and sustaining capital allowance of C$0.20/t mined; average offsite costs of C$0.48/lb of copper; payable metal terms of 96.1% for copper, 90% for gold and 90% for silver; and overall pit slopes of 30 to 40 degrees.

4. Bulk density is estimated by lithology and ranges between 2.71 and 2.85 in rock and 2.2 in overburden.

5. Copper equivalency is based on US$4.25/lb price and 90% metallurgical recovery for copper, US$2,400/oz and 36% metallurgical recovery for gold, and US$28.00/oz and 59% metallurgical recovery for silver. CuEq can be calculated using the formula CuEq% = Cu% + Au(gpt) × 0.3351 + Ag(gpt) × 0.006331.

6. Numbers may not add due to rounding.

| Section 1 | Summary | Page 9 |

1.8 Mining Method

The Yellowhead Project envisions an open pit mine utilizing conventional truck and shovel mining techniques. The equipment utilized will be typical of that found in other modern, large-scale, open pit mines. Open pit operations are planned to supply the concentrator with 90,000 tpd of ore at a cut-off grade of 0.17% copper. Ore will be delivered to a primary crusher located at the southwestern rim of the ultimate pit. An ore stockpile will be built during the first five years of operation to maximize ore grade delivered to the concentrator during that period and mitigate operational disruptions.

Overburden of sufficient quality for use in reclamation will be segregated from non-acid generating (NAG) waste rock and stockpiled in several locations surrounding the pit. Surplus NAG waste rock not designated for TSF embankment construction will be stored in four locations located to the south and southwest of the open pit. Potentially acid generating (PAG) waste rock will be co-disposed within the TSF.

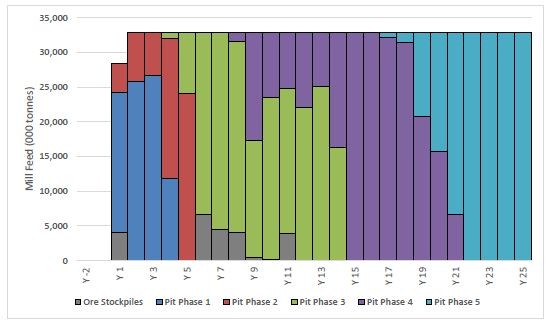

A summary of the production schedule is shown in Table 1-3.

Table 1-3: Mine Production Schedule

| Project Period | Pre- Production Total |

Years 1-5 Total |

Years 6-10 Total |

Years 11- 15 Total |

Years 16- 20 Total |

Years 21- 25 Total |

Grand Total |

|

| Tonnes Mined | (Mt) | 45 | 378 | 425 | 435 | 395 | 246 | 1,923 |

| Mill Feed | (Mt) | -- | 160 | 164 | 164 | 164 | 164 | 817 |

| Copper in Mill Feed | (%) | -- | 0.32 | 0.24 | 0.26 | 0.26 | 0.30 | 0.28 |

| Gold in Mill Feed | (gpt) | -- | 0.039 | 0.025 | 0.028 | 0.027 | 0.029 | 0.030 |

| Silver in Mill Feed | (gpt) | -- | 1.3 | 1.2 | 1.2 | 1.4 | 1.2 | 1.3 |

| Section 1 | Summary | Page 10 |

1.9 Recovery Method

The sulphide concentrator for the Project will include three stages of comminution, followed by three stages of flotation and a final concentrate dewatering stage. Process design and equipment sizing for the concentrator were informed by results from the G&T FS program completed in 2011 to 2012 and the SGS metallurgical test program completed in 2020 to 2021.

The concentrator is designed to process a nominal 90,000 tpd of ore and produce a marketable copper concentrate containing payable amounts of gold and silver. The concentrator will consist of a primary gyratory crusher fed run-of-mine (ROM) ore from the pit transported via haul trucks. The product from the crusher will be transported via overland conveyors to a coarse ore stockpile. Ore from the stockpile will then be reclaimed and fed to two parallel SAG-ball mill circuits which produce feed for a single rougher flotation bank. The rougher flotation concentrate will be reground with two parallel vertical stirred mills prior to being upgraded in a two-stage cleaner flotation circuit which includes both tank and column flotation cells. Flotation reagents added will include dual collectors with mercaptan and thionocarbamate based chemistry, a frother with an alcohol and glycol- ether based chemistry, and lime as pH regulator.

The final concentrate will be dewatered by thickening followed by filtration prior to being conveyed to the final concentrate stockpile. The final concentrate will be trucked off site to a nearby rail load-out facility for subsequent transport to the Port of Vancouver or direct rail to other North American markets.

Both rougher and first cleaner flotation tailings will be transported separately to the tailings storage facility (TSF). Process water from the TSF will be reclaimed and recycled back to the concentrator for reuse.

| Section 1 | Summary | Page 11 |

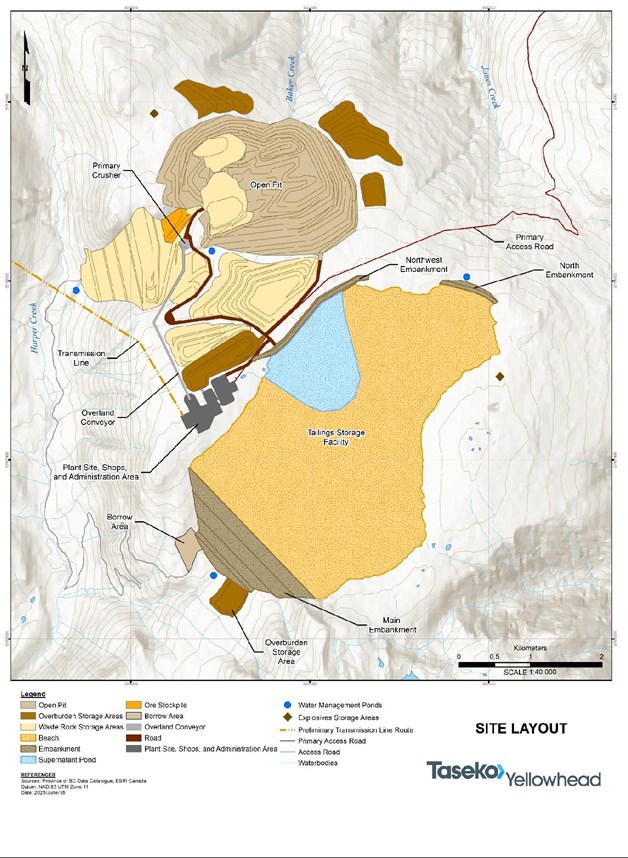

1.10 Project Infrastructure

During construction, a full-service, self-contained temporary construction camp will be installed on site to accommodate the construction workforce.

During operations, mine support facilities will include a mobile equipment maintenance shop, a welding tent, a bulk explosives facility and storage magazines, fuel stations for mining and ancillary equipment, and designated storage areas for overburden, waste rock and ore.

The concentrator and supporting facilities will include a primary crusher, overland conveyor system, a coarse ore stockpile, and the concentrator buildings housing the grinding, flotation, dewatering, and reagent storage and distribution equipment. Additional support facilities near the concentrator will include a process water pond, assay laboratory, separate concentrator office building, a fixed plant maintenance shop, and a covered concentrate storage and truck loading area.

Tailings and water management infrastructure will include a TSF designed to store tailings from the concentrator and PAG waste rock from the mine, with cyclone sand from NAG tailings used to construct the TSF main embankment. Process water will be reclaimed from a floating barge in the TSF to the process water pond and recirculated to the concentrator for reuse. A water treatment plant will treat excess contact water, and site water management systems will handle pit dewatering and surface runoff.

Additional onsite ancillary infrastructure will include a gatehouse and emergency response building, mine dry, warehouse with additional cold storage area, potable water and sewage treatment systems, and fire protection infrastructure.

Offsite infrastructure will include a new 230 kV transmission line from 100 Mile House which will tie into a new substation located at the plant site and a rail load-out facility located near Vavenby.

| Section 1 | Summary | Page 12 |

1.11 Market Studies & Contracts

The Project's copper concentrate is estimated to have a 25.5% copper grade with payable amounts of gold and silver and no element approaching typical smelter penalty levels. A concentrate marketing study completed in 2025 confirmed the marketability of the anticipated final concentrate quality.

While there are currently no contracts in place for the sale of concentrate, it is expected that the clean nature of the concentrate will make it attractive to a large array of smelters globally. The offsite costs associated with concentrate transport, port storage, stevedoring, shipping, treatment and refining have been incorporated into the Project's economic analysis based on inputs developed from the concentrate marketing study and Taseko's current experience at it's Gibraltar Mine.

For evaluating the Project, Taseko has relied on long-term street consensus metal pricing as of May 2025. Standard procurement contracts will be required for construction, materials delivery and some site services.

1.12 Environmental, Permitting, Social and Community Impact

Environmental baseline studies were performed between 2007 and 2014 with additional studies conducted by Taseko from 2019 to present.

Taseko has engaged with both the BC Environmental Assessment Office (EAO) and the Impact Assessment Agency of Canada (IAAC) regarding submission of an Initial Project Description (IPD) and Engagement Plan (EP) to start the Early Engagement and Planning phases of the provincial and federal assessment processes, respectively.

A comprehensive permitting process will be undertaken following the assessment process for the Project to enable construction, operation, and eventual closure of the Project.

The Project is situated primarily within the territory of the Simpcw First Nation

̓

(Simpcwúlecw). Taseko is focused on working collaboratively with the Simpcw and has agreed to participate in the Simpcw Process, an Indigenous-led assessment process.

In British Columbia, mining companies are required to reclaim mine disturbance when mining is complete in accordance with the Code. Further discussion of post-closure requirements will occur during the Environmental Assessment (EA) and subsequent permitting processes. This period will continue until all conditions of the Code and permits have been fulfilled and Taseko has been released from all regulatory obligations.

Before any work on a site is conducted, the province requires companies to provide security in accordance with the Code. The reclamation security amount will be developed as part of the permitting phase.

| Section 1 | Summary | Page 13 |

1.13 Capital and Operating Costs

Capital costs are based on budgetary quotes for equipment and current pricing for materials, labour and services in the Province of British Columbia. Operating costs are based on a combination of vendor supplied quotes and Taseko's experience operating the Gibraltar Mine.

All costs shown are current as of Q2, 2025 and are stated in Canadian dollars unless otherwise stated.

A summary of the initial capital costs estimated for the Project is provided in Table 1-4.

Table 1-4: Initial Capital Costs

| Area | Total Capital ($ millions) |

| Mine and Support Infrastructure | 295 |

| Concentrator and Support Infrastructure | 623 |

| Tailings and Water Management | |

| Infrastructure | 213 |

| Onsite Ancillary Infrastructure | 143 |

| Offsite Infrastructure | 153 |

| Subtotal Direct Costs | 1,427 |

| Indirect Costs | 207 |

| Owner's Costs | 52 |

| Contingency | 299 |

| Subtotal Indirect Costs | 558 |

| Total Initial Capital | 1,985 |

Note: totals may not add due to rounding

The sustaining capital cost estimate includes a water treatment plant (WTP), staged TSF embankment construction, additional water collection systems, additional mining equipment, primary mining equipment fleet lease payments, and general sustaining capital through the life of the mine. Sustaining capital costs are shown in Table 1-5.

| Section 1 | Summary | Page 14 | ||||

1.13 Capital and Operating Costs - Cont'd

Table 1-5: Sustaining Capital Costs

| Area | Total Capital ($ millions) |

| Water Treatment, TSF Construction & Water Management | 182 |

| Mine Incremental Capital and Equipment Leases | 458 |

| General Sustaining Capital | 323 |

| Total Sustaining Capital | 963 |

Note: totals may not add due to rounding

Operating costs for the Project are summarized in Table 1-6.

Table 1-6: Operating Costs Summary

| Area | Unit Cost (US$/lb) |

| Onsite Costs | 1.76 |

| Offsite Costs | 0.39 |

| Byproduct Credits | (0.25) |

| Total Operating Cost* | 1.90 |

Note: totals may not add due to rounding

* Net of byproduct credits

Onsite operating costs include mining, processing and general and administration costs as summarized in Table 1-7. Offsite costs include copper concentrate transportation costs, smelter fees and deductions, and royalty payments. Byproduct credits are calculated using the metal prices and production rates described in Section 1.14.

Table 1-7: Onsite Operating Costs Summary

| Area | Cost per Tonne Milled ($/t) |

| Mining | 6.06 |

| Processing | 5.75 |

| G&A | 1.07 |

| Total Onsite Cost | 12.89 |

Note: totals may not add due to rounding

| Section 1 | Summary | Page 15 |

1.14 Economic Analysis

Metal prices are based on long-term street consensus metal pricing as of Q2 2025 and long- term foreign exchange rates based on Taseko's expectations informed by historical exchange rates and are shown in Table 1-8. A discounted cashflow model using a discount rate of 8% is used for the valuation basis with an effective date of June 15, 2025. Results of the valuation are presented on a 100% basis and assume no debt financing costs except for mining equipment leases. All values are in Canadian dollars unless otherwise stated.

Table 1-8: Long-Term Street Consensus Metal Pricing and Foreign Exchange Rate

| Long-Term Forecasts | Metal Price |

| Copper Price | US$4.25/lb |

| Gold Price | US$2400/oz |

| Silver Price | US$28.00/oz |

| Foreign Exchange | US$1.00 : C$1.35 |

Before-tax economic indicators for the Project are presented in Table 1-9.

Table 1-9: Before-Tax Economic Valuation

| Economic Indicator | Value |

| Average Annual Before-Tax Cash Flow | $480 million |

| Before-Tax NPV at 8% | $2.8 billion |

| Before-Tax Internal Rate of Return | 22% |

| Before-Tax Payback Period | 3.7 years |

A summary of the before-tax cashflow for the Project is presented in Table 1-10.

Table 1-10: Before-Tax Yellowhead Project Cashflow Summary

| Project Period | Pre- Production Total |

Years 1-5 Total |

Years 6-10 Total |

Years 11-15 Total |

Years 16-20 Total |

Years 21- 25 Total |

Grand Total |

|

| Copper Production | (M lbs) | -- | 1,028 | 760 | 837 | 852 | 965 | 4,441 |

| Gold Production | (000 oz) | -- | 82 | 43 | 52 | 49 | 56 | 282 |

| Silver Production | (000 oz) | -- | 3,762 | 3,547 | 3,846 | 4,605 | 3,642 | 19,402 |

| Operating Profit | (C$ M) | -- | 3,415 | 1,865 | 2,226 | 2,291 | 3,276 | 13,073 |

| Capital Costs | (C$ M) | 1,985 | 576 | 108 | 168 | 93 | 18 | 2,948 |

| Net Cash Flow | (C$ M) | -1,985 | 2,839 | 1,758 | 2,058 | 2,198 | 3,258 | 10,125 |

Note: totals may not add due to rounding

| Section 1 | Summary | Page 16 |

1.14 Economic Analysis - Cont'd

After-tax economic indicators for the Project are presented in Table 1-11. This assessment assumes current federal and provincial tax laws remain in force and that the Project is eligible for the Clean Technology Manufacturing Investment Tax Credit that would result in a tax refund of approximately $540 million in the year following completion of construction.

Table 1-11: After-Tax Economic Valuation

| Economic Indicator | Value |

| After-Tax NPV at 8% | $2.0 billion |

| After-Tax Internal Rate of Return | 21% |

| After-Tax Payback Period | 3.3 years |

1.15 Interpretation and Conclusions

The Yellowhead property contains adequate mineral reserves to develop an open pit mine and supply a process plant with 90,000 tpd of ore for a period of at least 25 years.

The design is to a sufficient level of study to support a mineral reserve statement and there are no known conditions that would preclude the establishment of the infrastructure as designed.

Environmental baseline studies have been advanced by a number of consultant groups to a level commensurate with initiating an environmental assessment.

The estimation of capital and operating costs is based on a sufficient level of study to support a mineral reserve statement and are current as of Q2 2025.

The economics of mining and processing the stated mineral reserves of this project are appropriate and demonstrate that, as of the effective date of this report, extraction can reasonably be justified.

1.16 Recommendations

Additional environmental baseline studies, geotechnical site investigation, modelling and effects assessment work are recommended as inputs to support an environmental assessment.

It is recommended that additional bench-scale metallurgical test work be undertaken consisting of gold recovery testing, additional variability testing and settling and filtration testing.

SECTION 2

INTRODUCTION

SECTION 2: INTRODUCTION

Table of Contents

| Page | ||

| 2.1 | Introduction | 1 |

| Section 2 | Introduction | Page 1 |

2.1 Introduction

This technical report has been prepared by Taseko Mines Limited (Taseko) a company existing under the British Columbia Business Corporations Act and having its head office at 1040 West Georgia Street, Vancouver, British Columbia, Canada.

The purpose of this report is to summarize the prefeasibility level engineering and cost estimate that support the updated Yellowhead Copper Project (the "Yellowhead Project" or the "Project") economics which incorporate updated metal prices, foreign exchange rates, capital and operating costs, gold recovery projections and a new transmission line design. The mineral reserve estimate, production schedule and project design remain consistent with the 2020 Technical Report. This report also describes the geotechnical site investigation, metallurgical testing, environmental baseline, permitting and First Nations engagement work completed since then.

The information, conclusions, opinions, and estimates contained herein are based on:

• Information available to Taseko at the time of preparation of this report;

• Assumptions, conditions and qualifications as set forth in this report;

• Data, reports and opinions supplied by Taseko and other third party sources listed as references.

The Qualified Persons (QPs) responsible for the content of this report are Richard Weymark, P.Eng., MBA, Jeremy Guichon, P.Eng. and Adil Cheema, P.Eng.

Mr. Weymark supervised preparation of Sections 1 through 5, 19, 20 and 23 through 27 and has reviewed the mineral tenure, environmental baseline studies, permitting requirements and long-term commodity price assumptions. Mr. Weymark's current position is Vice President, Engineering and he has been employed by Taseko since July 2018. His most recent personal inspection of the property occurred on October 4th and 5th, 2024.

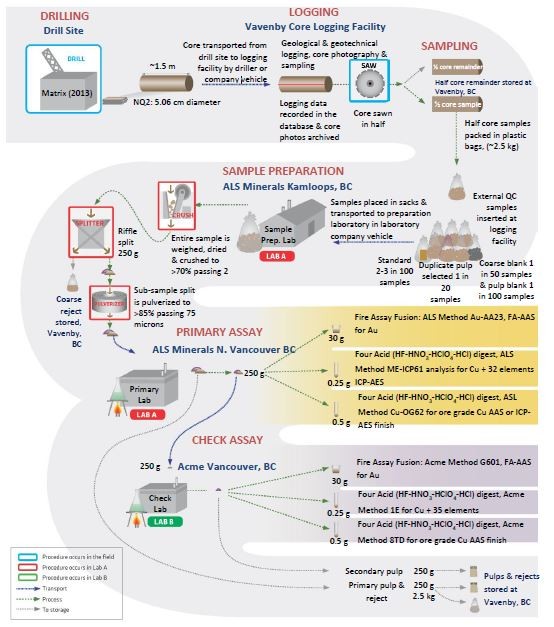

Mr. Guichon supervised the preparation of Sections 6 through 11, 14 through 16, 21 and 22 of this report and has reviewed the methods used to produce the grade and tonnage estimates in the geological model, the mineral resource estimate, the pit design, the long range mine plan, the capital and operating cost estimates and the economic analysis. In addition, he reviewed the drilling, sampling, QA/QC, sample preparation and analytical methodologies used. Mr. Guichon's current position is Director, Mine Engineering and he has been employed by Taseko since June 2012. His most recent personal inspection of the property occurred on October 3rd to 5th, 2024.

| Section 2 | Introduction | Page 2 |

2.1 Introduction - Cont'd

Mr. Cheema supervised the preparation of Sections 12, 13, 17 and 18 of this report and has reviewed the data verification activities, laboratory analytical methods as well as the test work methodology used to determine the metallurgical recovery projections used in the economic analysis accompanying this report. Mr. Cheema's current position is Director, Process Engineering and he has been employed by Taseko since March of 2019. His most recent personal inspection of the property occurred on October 3rd to 5th, 2024.

All measurement units used in this report are metric, and currency is expressed in Canadian dollars unless otherwise stated.

SECTION 3

RELIANCE ON OTHER EXPERTS

SECTION 3: RELIANCE ON OTHER EXPERTS

Table of Contents

| Page | ||

| 3.1 | Reliance on Other Experts | 1 |

| Section 3 | Reliance on Other Experts | Page 1 |

3.1 Reliance on Other Experts

Standard professional procedures have been followed in the preparation of this technical report. Data used in this report has been verified where possible and the authors have no reason to believe that data was not collected in a professional manner and no information has been withheld that will affect the conclusions of this report.

The information, conclusions, opinions, and estimates contained herein are based on:

• Information available to Taseko as of the effective date of this report; and,

• Assumptions, conditions, and qualifications as stated in this report.

For the purposes of this report, the QPs have relied on title and property ownership obtained from the Mineral Titles Online (MTO) system as of June 15, 2025 to confirm Taseko's internal tenure tracking system. MTO is an internet-based mineral title administration system maintained by the Mineral Titles Branch of the B.C Ministry of Mining and Critical Minerals. This tenure information applies to Section 4.2 of this report.

Standard tax calculations for BC based mining projects were reviewed internally in June 2025 by Taseko's CFO Bryce Hamming CFA, CPA, CA, an accountant with knowledge in Canadian mining taxation, and were incorporated into the cashflow model and tax related information referenced in Section 22.

Except for the purposes legislated under provincial securities laws, any use of this report by any third party is at that party's sole risk.

SECTION 4

PROPERTY DESCRIPTION AND LOCATION

SECTION 4: PROPERTY DESCRIPTION AND LOCATION

| Table of Contents | ||

| Page | ||

| 4.1 | Property Description and Location | 1 |

| 4.2 | Land Tenure | 3 |

| 4.3 | Environmental Liabilities | 8 |

| 4.4 | Permits Obtained and To Be Acquired | 8 |

| List of Tables | ||

| Table 4-1: Mineral Tenures | 3 | |

| Table 4-2: Yellowhead Mineral Tenures | 5 | |

| List of Figures | ||

| Figure 4-1: Project Location | 2 | |

| Figure 4-2: Mineral Tenures | 4 | |

| Section 4 | Property Description and Location | Page 1 |

4.1 Property Description and Location

The Yellowhead property is located in the Thompson-Nicola area of BC, approximately 150 km northeast of Kamloops and is centered at latitude 51°30' north and longitude 119°48' west (Figure 4-1) in the Kamloops Mining Division. Clearwater, the largest community in the project area is 124 km north of Kamloops, along the Yellowhead Highway route (Highway #5). Vavenby, the closest community to the project area, is 27 km east of Clearwater along Highway #5.

| Section 4 | Property Description and Location | Page 2 |

4.1 Property Description and Location - Cont'd

Figure 4-1: Project Location

| Section 4 | Property Description and Location | Page 3 |

4.2 Land Tenure

The property consists of 1 mining lease, which is valid until at least June 2050, and 94 mineral claims. Taseko, through its wholly owned subsidiary Yellowhead Mining Inc. (FMC 285998), is the 100% owner of these mineral tenures which cover a total combined area of approximately 42,358 hectares as summarized in Table 4-1 and shown in Figure 4- 2.

Table 4-1: Mineral Tenures

| Tenure Type | Number | Area (ha) |

| Claims | 94 | 39,552 |

| Leases | 1 | 2,805 |

| Total | 95 | 42,358 |

All mineral tenures are in good standing and details of each are provided in Table 4-2.

There are three parcels of fee simple land located 2.5 km west of Vavenby where the rail load-out facility will be located.

Six mineral claims, five of which have been incorporated into the mining lease are subject to a 2.5% NSR royalty to XStrata. Additionally, 31 claims, 27 of which have been incorporated into the mining lease, are subject to a 3% NSR royalty to US Steel Corp., capped at $3.9 million, subject to inflation. The mining lease encompasses the deposit area and plant site footprint.

| Section 4 | Property Description and Location | Page 4 |

4.2 Land Tenure - Cont'd

Figure 4-2: Mineral Tenures

| Section 4 | Property Description and Location | Page 5 |

4.2 Land Tenure - Cont'd

Table 4-2: Yellowhead Mineral Tenures

| Title Number |

Claim Name | Title Sub Type |

Issue Date | Good To Date |

Area (ha) |

| 1076941 | Lease | 2020/JUN/25 | 2026/JUN/25 | 2805 | |

| 572097 | SANDRA4 | Claim | 2007/DEC/18 | 2026/AUG/01 | 503.4 |

| 572098 | CHELSEA | Claim | 2007/DEC/18 | 2026/AUG/01 | 382.6 |

| 572099 | STEPHANIE | Claim | 2007/DEC/18 | 2026/AUG/01 | 382.6 |

| 572100 | ISABEL | Claim | 2007/DEC/18 | 2026/AUG/01 | 463.2 |

| 582783 | Claim | 2008/APR/25 | 2026/AUG/01 | 201.3 | |

| 592574 | Claim | 2008/OCT/05 | 2026/AUG/01 | 503.1 | |

| 592579 | Claim | 2008/OCT/05 | 2026/AUG/01 | 502.9 | |

| 592580 | Claim | 2008/OCT/05 | 2026/AUG/01 | 462.5 | |

| 592581 | Claim | 2008/OCT/05 | 2026/AUG/01 | 442.7 | |

| 606977 | DUNN | Claim | 2009/JUL/03 | 2026/AUG/01 | 415.4 |

| 627844 | HARP | Claim | 2009/SEP/03 | 2026/AUG/01 | 301.7 |

| 663643 | Claim | 2009/NOV/02 | 2026/AUG/01 | 502.4 | |

| 663658 | Claim | 2009/NOV/02 | 2026/AUG/01 | 402.0 | |

| 1096428 | Claim | 2022/JUN/29 | 2026/AUG/01 | 281.1 | |

| 1096429 | Claim | 2022/JUN/29 | 2026/AUG/01 | 40.2 | |

| 1098385 | Claim | 2022/OCT/20 | 2026/AUG/01 | 120.5 | |

| 220797 | HAIL 102 | Claim | 1966/JUL/22 | 2026/AUG/02 | 25.0 |

| 220798 | HAIL 104 | Claim | 1966/JUL/22 | 2026/AUG/02 | 25.0 |

| 220799 | HAIL 106 | Claim | 1966/JUL/22 | 2026/AUG/02 | 25.0 |

| 220800 | HAIL 108 | Claim | 1966/JUL/22 | 2026/AUG/02 | 25.0 |

| 501608 | HARPER 2 | Claim | 2005/JAN/12 | 2026/AUG/02 | 221.3 |

| 502603 | Claim | 2005/JAN/12 | 2026/AUG/02 | 603.4 | |

| 502606 | Claim | 2005/JAN/12 | 2026/AUG/02 | 502.9 | |

| 506422 | Claim | 2005/FEB/09 | 2026/AUG/02 | 563.0 | |

| 509217 | Claim | 2005/MAR/18 | 2026/AUG/02 | 422.2 | |

| 513235 | Claim | 2005/MAY/24 | 2026/AUG/02 | 321.7 | |

| 519327 | TOM1 | Claim | 2005/AUG/25 | 2026/AUG/02 | 502.4 |

| 519329 | TOM2 | Claim | 2005/AUG/25 | 2026/AUG/02 | 502.4 |

| 519330 | TOM3 | Claim | 2005/AUG/25 | 2026/AUG/02 | 502.4 |

| Section 4 | Property Description and Location | Page 6 |

4.2 Land Tenure - Cont'd

Table 4-2: Yellowhead Mineral Tenures - Cont'd

| Title Number |

Claim Name | Title Sub Type |

Issue Date | Good To Date |

Area (ha) |

| 519331 | TOM4 | Claim | 2005/AUG/25 | 2026/AUG/02 | 502.4 |

| 519332 | TOM5 | Claim | 2005/AUG/25 | 2026/AUG/02 | 502.5 |

| 519333 | TOM6 | Claim | 2005/AUG/25 | 2026/AUG/02 | 502.3 |

| 519334 | TOM7 | Claim | 2005/AUG/25 | 2026/AUG/02 | 462.1 |

| 530337 | SUN 1 | Claim | 2006/MAR/20 | 2026/AUG/02 | 502.3 |

| 530338 | SUN 2 | Claim | 2006/MAR/20 | 2026/AUG/02 | 502.7 |

| 532057 | HAR2 | Claim | 2006/APR/13 | 2026/AUG/02 | 241.5 |

| 538962 | Claim | 2006/AUG/09 | 2026/AUG/02 | 501.8 | |

| 538963 | Claim | 2006/AUG/09 | 2026/AUG/02 | 501.6 | |

| 538966 | Claim | 2006/AUG/09 | 2026/AUG/02 | 501.8 | |

| 538968 | Claim | 2006/AUG/09 | 2026/AUG/02 | 501.9 | |

| 538970 | Claim | 2006/AUG/09 | 2026/AUG/02 | 501.6 | |

| 538971 | Claim | 2006/AUG/09 | 2026/AUG/02 | 421.5 | |

| 538972 | Claim | 2006/AUG/09 | 2026/AUG/02 | 501.6 | |

| 538973 | Claim | 2006/AUG/09 | 2026/AUG/02 | 501.6 | |

| 538974 | Claim | 2006/AUG/09 | 2026/AUG/02 | 200.6 | |

| 538996 | Claim | 2006/AUG/09 | 2026/AUG/02 | 502.0 | |

| 538997 | Claim | 2006/AUG/09 | 2026/AUG/02 | 502.1 | |

| 538999 | Claim | 2006/AUG/09 | 2026/AUG/02 | 421.8 | |

| 539000 | Claim | 2006/AUG/09 | 2026/AUG/02 | 502.1 | |

| 539001 | Claim | 2006/AUG/09 | 2026/AUG/02 | 421.7 | |

| 539002 | Claim | 2006/AUG/09 | 2026/AUG/02 | 421.7 | |

| 539004 | Claim | 2006/AUG/09 | 2026/AUG/02 | 281.1 | |

| 539770 | Claim | 2006/AUG/22 | 2026/AUG/02 | 442.8 | |

| 539771 | Claim | 2006/AUG/22 | 2026/AUG/02 | 322.0 | |

| 564330 | GRAF1 | Claim | 2007/AUG/09 | 2026/AUG/02 | 503.0 |

| 564331 | GRAF2 | Claim | 2007/AUG/09 | 2026/AUG/02 | 503.0 |

| 564333 | DUNN1 | Claim | 2007/AUG/09 | 2026/AUG/02 | 503.2 |

| 564334 | DUNN2 | Claim | 2007/AUG/09 | 2026/AUG/02 | 503.3 |

| 564335 | DUNN3 | Claim | 2007/AUG/09 | 2026/AUG/02 | 463.2 |

| 564337 | DUNN4 | Claim | 2007/AUG/09 | 2026/AUG/02 | 362.6 |

| Section 4 | Property Description and Location | Page 7 |

4.2 Land Tenure - Cont'd

Table 4-2: Yellowhead Mineral Tenures - Cont'd

| Title Number |

Claim Name | Title Sub Type |

Issue Date | Good To Date |

Area (ha) |

| 564338 | GRAF3 | Claim | 2007/AUG/09 | 2026/AUG/02 | 502.8 |

| 564339 | GRAF4 | Claim | 2007/AUG/09 | 2026/AUG/02 | 502.8 |

| 564340 | GRAF5 | Claim | 2007/AUG/09 | 2026/AUG/02 | 503.0 |

| 564341 | GRAF6 | Claim | 2007/AUG/09 | 2026/AUG/02 | 442.8 |

| 564342 | GRAF7 | Claim | 2007/AUG/09 | 2026/AUG/02 | 503.0 |

| 564343 | GRAF8 | Claim | 2007/AUG/09 | 2026/AUG/02 | 502.8 |

| 564344 | GRAF9 | Claim | 2007/AUG/09 | 2026/AUG/02 | 503.1 |

| 564346 | GRAF10 | Claim | 2007/AUG/09 | 2026/AUG/02 | 442.5 |

| 564347 | GRAF11 | Claim | 2007/AUG/09 | 2026/AUG/02 | 462.5 |

| 564348 | GRAF12 | Claim | 2007/AUG/09 | 2026/AUG/02 | 402.0 |

| 564349 | GRAF13 | Claim | 2007/AUG/09 | 2026/AUG/02 | 502.3 |

| 564350 | GRAF14 | Claim | 2007/AUG/09 | 2026/AUG/02 | 502.3 |

| 564351 | GRAF15 | Claim | 2007/AUG/09 | 2026/AUG/02 | 461.9 |

| 564352 | GRAF16 | Claim | 2007/AUG/09 | 2026/AUG/02 | 502.1 |

| 564353 | GRAF17 | Claim | 2007/AUG/09 | 2026/AUG/02 | 401.5 |

| 564354 | GRAF18 | Claim | 2007/AUG/09 | 2026/AUG/02 | 501.7 |

| 564355 | GRAF19 | Claim | 2007/AUG/09 | 2026/AUG/02 | 501.7 |

| 564356 | GRAF20 | Claim | 2007/AUG/09 | 2026/AUG/02 | 461.6 |

| 564357 | DUNN5 | Claim | 2007/AUG/09 | 2026/AUG/02 | 120.7 |

| 564358 | GRAF21 | Claim | 2007/AUG/09 | 2026/AUG/02 | 401.2 |

| 564360 | GRAF22 | Claim | 2007/AUG/09 | 2026/AUG/02 | 200.6 |

| 564361 | GRAF23 | Claim | 2007/AUG/09 | 2026/AUG/02 | 501.6 |

| 564362 | GRAF24 | Claim | 2007/AUG/09 | 2026/AUG/02 | 501.8 |

| 564363 | GRAF25 | Claim | 2007/AUG/09 | 2026/AUG/02 | 502.1 |

| 564364 | GRAF26 | Claim | 2007/AUG/09 | 2026/AUG/02 | 502.3 |

| 564365 | GRAF27 | Claim | 2007/AUG/09 | 2026/AUG/02 | 502.5 |

| 564366 | GRAF28 | Claim | 2007/AUG/09 | 2026/AUG/02 | 502.7 |

| 564367 | GRAF29 | Claim | 2007/AUG/09 | 2026/AUG/02 | 503.0 |

| 564368 | GRAF30 | Claim | 2007/AUG/09 | 2026/AUG/02 | 503.2 |

| 564370 | GRAF31 | Claim | 2007/AUG/09 | 2026/AUG/02 | 322.1 |

| 569337 | Claim | 2007/NOV/04 | 2026/AUG/02 | 261.6 |

| Section 4 | Property Description and Location | Page 8 |

4.2 Land Tenure - Cont'd

Table 4-2: Yellowhead Mineral Tenures - Cont'd

| Title Number |

Claim Name | Title Sub Type |

Issue Date | Good To Date |

Area (ha) |

| 572094 | SANDRA1 | Claim | 2007/DEC/18 | 2026/AUG/02 | 503.4 |

| 572095 | SANDRA2 | Claim | 2007/DEC/18 | 2026/AUG/02 | 483.1 |

| 572096 | SANDRA3 | Claim | 2007/DEC/18 | 2026/AUG/02 | 483.1 |

4.3 Environmental Liabilities

The Yellowhead property is subject to environmental liabilities related to the reclamation of surface disturbance associated with permits received for previous exploration and site investigation programs. Funds to cover the expense of these reclamation activities are held in trust and are fully recoverable once the site has been rehabilitated to the satisfaction of the Inspector of Mines. There are no other environmental liabilities to which the property is subject.

4.4 Permits Obtained and To Be Acquired

Section 20 provides the list of major permits, licenses, approvals, consents and material authorizations required to occupy, use, construct and operate the project.

SECTION 5

ACCESSIBILITY, CLIMATE, LOCAL RESOURCES,

INFRASTRUCTURE AND PHYSIOGRAPHY

SECTION 5: ACCESSIBILITY, CLIMATE, LOCAL RESOURCES,

INFRASTRUCTURE AND PHYSIOGRAPHY

Table of Contents

| Page | ||

| 5.1 | Accessibility | 1 |

| 5.2 | Climate | 3 |

| 5.3 | Physiography | 3 |

| 5.4 | Local Resources | 4 |

| 5.5 | Infrastructure | 4 |

| Table of Figures | ||

| Figure 5-1: Site Access | 2 | |

| Section 5 Accessibility, Climate, Local Resources, Infrastructure and Physiography | Page 1 |

5.1 Accessibility

The Yellowhead Project is accessed via the Yellowhead Highway (Highway #5), 150 km by road north of Kamloops, which is serviced with daily flights from Vancouver and Calgary.

As shown in Figure 5-1, the primary access to site from Highway #5 is via the Vavenby Bridge Road through Vavenby and across the North Thompson River to the Birch Island Lost Creek Road (BILCR). From there, access is about 20 km along a network of existing Forest Service Roads (FSRs) that climb up to the project site. The FSRs will be upgraded where required including a 2.5 km road extension to the project site.

The primary access route will be in frequent use during the operations phase for the transport of concentrate from the mine site to the rail load out facility and transportation of personnel, goods and services.

Oversized and heavy loads will use a secondary access route across the North Thompson River. This route crosses the North Thompson River at the BILCR bridge then follows the previously described access. The secondary route will be in use primarily during construction and as required during operations.

| Section 5 Accessibility, Climate, Local Resources, Infrastructure and Physiography | Page 2 |

5.1 Accessibility - Cont'd

Figure 5-1: Site Access

| Section 5 Accessibility, Climate, Local Resources, Infrastructure and Physiography | Page 3 |

5.2 Climate

The climate is typical of the central interior of BC, with short warm summers and comparatively mild Canadian winters. The winter season runs from late October to late March. There is significant relief on the project site, and site climatic conditions are dependent on location and elevation.

Temperatures on site range from highs of +26°C to lows of -35°C. The mean annual precipitation is 1,259 mm at an elevation of 1,837 masl, with about 40% falling as rain and 60% falling as snow. At the higher site elevations, precipitation falls almost exclusively as snow from November through March, and as rain from June through August. The mean annual wind speed is approximately 1.6 m/s, with the wind predominantly blowing from the east-southeast year-round, although east-northeast winds are common during the summer. The mean annual relative humidity is approximately 75%.

5.3 Physiography

The project area is hosted within the Shuswap Highlands characterized by gently sloping upland ridges and flanked by steepened valley slopes. These valleys include the Harper Creek Valley to the west and the Barrière River to the East, with the moderately sloped Thompson River Valley to the north. The elevations of the area range from approximately 1,100 masl at the floor of the Harper Creek Valley to 1,900 masl at the ridges surrounding the TSF area.

The average elevation of the open pit area and plant site is approximately 1,800 masl. The area has been glaciated and mountain tops are typically rounded. The project site is covered in coniferous forest and has undergone extensive logging.

| Section 5 Accessibility, Climate, Local Resources, Infrastructure and Physiography | Page 4 |

5.4 Local Resources

In 2021, the population of the Thompson-Nicola Regional District numbered 144,000 residents. Kamloops is the largest centre in the area and has a population of 98,000. With several operating mines in the area, Kamloops is a regional mining hub home to many suppliers, consultants, and contractors that service the mining industry.

Accommodation for mine employees is available in the nearby towns of Clearwater, Vavenby, Barrière, and surrounding district which have a combined population of approximately 6,000. With the recent decline in the forestry sector and the closure of several mills in the North Thompson Valley, including the permanent closure of the last operating sawmill in Vavenby in 2019, there is a local workforce with industrial experience in need of economic development.

The Project will give employment preference to people from the North Thompson Valley. Vavenby has served as the local base for the Project's exploration activities but provides limited facilities or services at this time. Industrial activities within the regional area include forestry, CN Rail and Trans Mountain pipeline operations, all of which run through the North Thompson Valley, including Vavenby.

5.5 Infrastructure

The Yellowhead Highway, the CN Rail transcontinental main line, and the 138 kV BC Hydro North Thompson transmission line all pass approximately 8 km north of the project area.

Other than the existing network of FSRs, there are no services or utilities currently routed to the immediate project site.

The area's established infrastructure reduces the extent of offsite infrastructure required for the Project, aside from upgrading and extending the site access road and constructing a new overhead transmission line. Power for the Project will be supplied by a new 230 kV transmission line extending approximately 110 km from the existing BC Hydro substation at 100 Mile House to a new substation at the project site. Routing for the transmission line has been identified and may be refined through the Environmental Assessment process.

YMI holds sufficient mineral tenures to accommodate mining operations, tailings storage areas, waste disposal areas, processing facilities and site infrastructure.

YMI owns a property with an existing rail siding 2.5 km west of Vavenby and approximately 25 km by road from the project site. This property will be used for the rail load-out facility and central parking and bus staging for transporting site personnel during construction and operations.

SECTION 6

HISTORY

SECTION 6: HISTORY

Table of Contents

| Page | ||

| 6.1 | Historical Operators | 1 |

| 6.2 | Yellowhead Mining Inc. | 2 |

| 6.3 | Production from the Project | 2 |

| Section 6 | History | Page 1 |

6.1 Historical Operators

Prospecting and geochemical reconnaissance led to the discovery of copper mineralization in the immediate vicinity of the deposit in 1966. In 1967, the initial discovery was followed up by extensive prospecting, line cutting, road building, surface geochemical sampling, geological mapping, geophysics, trenching and diamond drilling programs.

Noranda Exploration Company (Noranda) and Québec Cartier Mining Company (QCM), a 100% wholly owned subsidiary of US Steel, staked claims in the deposit area in 1965 and 1966 respectively. This resulted in the area west of the Harper Creek tributary belonging to Noranda (Harper Creek claims) and east of it to QCM (Hail claims). The two companies worked independently on their properties from 1966 until 1970. In late 1970, the companies formed a joint venture, which explored their contiguous copper deposits.

Work on the property continued for nine consecutive years and included extensive drilling on the deposit, a number of expanded geophysical and geochemical surveys and some drilling of other targets on the property. By the end of 1974, work was curtailed on the original showing. Sporadic prospecting, geochemical, geophysical and geological work by a number of operators continued in other outlying areas of the current property.

In April 1986, Aurun Mines Ltd. (Aurun) signed an option agreement with QCM to investigate the potential of both small higher-grade and large lower-grade copper deposits and to test for the presence of precious metals in the massive sulphide layers on the QCM claims. Assessments also considered the significance of titanium-bearing minerals and the possibility of leaching low-grade copper mineralization. Work proceeded through sampling of historical trenches and selected historical drill core. Results of gold and silver analysis showed the potential for modest credits to be attributable to these metals.

Aurun also commissioned a pre-feasibility study by Phillips Barratt Kaiser Engineering Ltd. in April 1986 that considered both the eastern QCM and western Noranda deposits. In July, 1991 QCM officially terminated the option agreement with Aurun (insolvent and in receivership as of 2014).

American Comstock Exploration Ltd (American Comstock) purchased the Noranda claims and acquired an option on the QCM claims in 1996 and completed an 8-hole drilling program of that year. Eventually American Comstock dropped the option but maintained ownership of the Noranda group of claims.

| Section 6 | History | Page 2 |

6.1 Historical Operators - Cont'd

Outside of the deposit area, Esso Resources Canada Limited drilled one hole on a geochemical and geological target 3 km northeast of the deposit on the historical Len claims which yielded no results of interest. Then from 1985 to 1987, Nu-Crown Resources Inc (Nu-Crown) conducted drilling on geophysical targets 4 km north of the deposit on the historical Tia claims. This drilling intersected anomalous to low-grade lead, zinc and barium mineralization.

Between 1967 and 1996, drilling took place on the property in 11 different years totalling 30,800 m from 191 holes. Of these holes, 165 are located within what is now known as the Yellowhead Copper Deposit, for a total of 28,200 m or 92% of the overall drilling. No further drilling took place on the deposit area until 2006.

6.2 Yellowhead Mining Inc.

Yellowhead Mining Inc. (YMI) formed as a private British Columbia company in 2005 and obtained control of the Project through staking, purchase and option agreements. Exploration completed between 2005 and 2013 included diamond drilling, historical core relogging, airborne and ground geophysics, soil and rock sampling, geological mapping and other exploration activities.

By the end of 2013 YMI had completed 65,000 m of additional drilling on the property from 217 drillholes. A Feasibility Study was published on July 31, 2014 which proposed an open pit mine with a production capacity of 70,000 tpd and a 28-year operating life.

In 2015, an Environmental Assessment (EA) Application was accepted for review by the BC Environmental Assessment Office (BC EAO) and Canadian Environmental Assessment Agency (CEAA). In mid-2015, the application review was suspended at YMI's request and after an initial three-year extension, the provincial EA process was terminated in July 2018 by the BC EAO due to inactivity on the file.

In February 2019, Taseko acquired a 100% interest in YMI thus acquiring a 100% interest in the Project and withdrew from the federal EA process in May 2019. In 2020, Taseko published a technical report (2020 Technical Report) which summarized an updated development plan for the Project based on a mill throughput of 90,000 tonnes per day and a 25-year operating life.

6.3 Production from the Project

There has been no production from the Project to date.

SECTION 7

GEOLOGICAL SETTING AND MINERALIZATION

SECTION 7: GEOLOGICAL SETTING AND MINERALIZATION

Table of Contents

| Page | ||

| 7.1 | Regional Geology and Mineralization | 1 |

| 7.2 | Property Geology and Mineralization | 5 |

| 7.3 | Deposit Geology and Mineralization | 8 |

| List of Tables | ||

| Table 7-1: Geological Rock Type Code List and Descriptions | 9 | |

| Table 7-2: Geological Package Code List and Descriptions | 10 | |

| Table 7-3: Deposit Sequence of Formation | 25 | |

| List of Figures | ||

| Figure 7-1: Regional Geology and Economic Setting | 3 | |

| Figure 7-2: Geology Map, Yellowhead Copper Property | 6 | |

| Figure 7-3: Geology & Drilling Plan | 11 | |

| Figure 7-4: Geological Cross Section 304060E (West Domain) | 12 | |

| Figure 7-5: Geological Cross Section 305420E (East Domain) | 13 | |

| Section 7 | Geological Setting and Mineralization | Page 1 |

7.1 Regional Geology and Mineralization

(a) Regional Geology

The project is located within structurally complex, low-grade metamorphic rocks of the Eagle Bay Assemblage, part of the Kootenay Terrane on the western margin of the Omineca Belt in south-central BC (Figure 7-1). Flanking these rocks are high-grade Kootenay Terrane metamorphic rocks of the Shuswap Complex immediately to the east and rocks of the Fennell Assemblage immediately to the west. The project lies within the Cretaceous Bayonne plutonic belt represented by two large batholiths, Baldy to the south and Raft to the north.

Regional unit names (typically prefixed EB) and many of the descriptions used in Sections 7.1 through 7.3 are after Schiarizza and Preto (1987) and Naas (2012a, 2012b, 2012c, 2013), except as noted.

Lower Cambrian to Mississippian Eagle Bay Assemblage

The Eagle Bay Assemblage incorporates Lower Cambrian to Mississippian sedimentary and volcanic rocks subject to deformation and metamorphism during a Jurassic-Cretaceous orogeny. The Eagle Bay Assemblage divides into four northeast-dipping thrust sheets that collectively contain a succession of Lower Cambrian rocks overlain by a succession of Devonian-Mississippian rocks. The Lower Cambrian (and possibly Late Proterozoic) rocks include quartzites, grits and quartz mica schists (units EBH and EBQ), mafic metavolcanic rocks and limestone (unit EBG), and overlying schistose sandstones and grits (unit EBS) with minor calcareous and mafic volcanic units. These older units are overlain by Devonian-Mississippian succession of mafic to intermediate metavolcanic rocks (units EBA and EBF) intercalated with and overlain by dark grey phyllite, sandstone and grit (unit EBP).

Unit EBA of the Devonian-Mississippian succession hosts the deposit. To the south, unit EBA is over-thrusted by the Lower Cambrian greenstones, chloritic phyllites, quartzitic units and orthogneiss of unit EBG and to the north by dominantly metasedimentary rocks of unit EBP.

According to Bailey et al (2001), the Devonian volcanic rocks of the Eagle Bay Assemblage (EBA and EBF) belong to bimodal basalt-rhyolite association of alkalic affinity corresponding to a rifted continental marginal setting.

| Section 7 | Geological Setting and Mineralization | Page 2 |

7.1 Regional Geology and Mineralization - Cont'd

(a) Regional Geology - Cont'd

Devonian to Permian Fennell Formation

The Fennell Formation is located northeast of the project and is comprised of Devonian to Permian oceanic rocks of the Slide Mountain Terrane. Tectonic emplacement of these units over the Mississippian rocks of the Eagle Bay Assemblage occurred in the early Mesozoic. The Fennell Formation comprises two major divisions. The lower structural division is a heterogeneous assemblage of bedded chert, gabbro, diabase, pillowed basalt, sandstone, quartz-feldspar-porphyry rhyolite and intraformational conglomerate. The upper division consists almost entirely of pillowed and massive basalt, with minor bedded cherts and gabbros. The Fennell Formation appears to be the deep oceanic basin distal equivalent to the Eagle Bay Assemblage. There are striking similarities found in both formations and a hypothesis is that the sandstone of the Fennell Formation derived from the sandstones of the Eagle Bay Assemblage.

Mid-Cretaceous Bayonne Plutonic Belt

The north-south belt of mid-Cretaceous Bayonne Plutonic rocks consists of mostly peraluminous, subalkalic hornblende-biotite granodiorite and highly fractionated two-mica granites, aplites and pegmatites (Logan, 2002). The Baldy batholith to the south and the Raft batholith to the north are representative of this plutonic suite in the project area.

The west-trending multiphase Baldy batholith pluton covers approximately 650 square kilometres. It intrudes Proterozoic to middle Paleozoic Kootenay Terrane metasedimentary and metavolcanic rocks and postdates most of the penetrative deformation in the area. The pluton incorporates potassium-feldspar megacrystic hornblende-biotite quartz monzonite, biotite monzogranite to granite and biotite-muscovite granite.

The Raft batholith is an elongate granitic pluton that extends for about 70 kilometres in a west-northwest direction, and cuts across the boundaries between the Kootenay, Slide Mountain and Quesnel Terranes (Schiarizza et al, 2002). It is composed mostly of hornblende-biotite granodiorite to monzogranite intruded by dykes of pegmatite, aplite and quartz-feldspar porphyry. The southern Raft batholith margin dips southward in exposures of deeper structural levels (Okulitch, 1979).

| Section 7 | Geological Setting and Mineralization | Page 3 |

7.1 Regional Geology and Mineralization - Cont'd

(a) Regional Geology - Cont'd

Figure 7-1: Regional Geology and Economic Setting

| Section 7 | Geological Setting and Mineralization | Page 4 |

7.1 Regional Geology and Mineralization - Cont'd

(b) Regional Mineralization

The Eagle Bay Assemblage hosts numerous polymetallic massive sulphide deposits, found mainly within Devonian felsic volcanic rocks (Figure 7-1). These deposits formed in a volcanic arc environment in response to eastward subduction of a paleo-Pacific ocean (Höy and Goutier, 1986; Höy, 1999; Bailey et al, 2000). The general characteristics of these massive sulphide deposits allow the more important ones to be grouped into several types, such as silver-lead-zinc stratabound massive sulphides within metasedimentary rocks (units EBG and EBQ), copper-zinc-cobalt volcanogenic massive sulphides (Fennell Formation) and gold-silver-zinc-lead-copper-barite volcanogenic massive sulphides (units EBA and EBF).

The Baldy batholith hosts a variety of mineral occurrences. According to Logan (2000, 2001), copper, copper-molybdenum porphyry and base metal polymetallic vein showings are associated with the hornblende-biotite granite phase of the pluton. Muscovite-biotite granite is associated with pegmatites, aplites and porphyry molybdenum mineralization. Areas encompassing the known intrusive-related deposits extend from the mainly steep- dipping contacts of the Baldy batholith for at least 7.5 km (Logan, 2001).

| Section 7 | Geological Setting and Mineralization | Page 5 |

7.2 Property Geology and Mineralization

(a) Property Geology

Rocks that underlie the property are primarily of the Eagle Bay Assemblage with a lithological succession interpreted as the Dgn, EBQ, EBA, EBF and EBG units of this group. This succession consists of a series of orthogneisses, metasediments, metavolcanics and metavolcanic clastics respectively, structurally overlain by the Tshinakin limestone unit belonging to unit EBG. Regional structure encompasses a complicated sequence of polyphase deformation consisting of sequences of thrust faulting, intrusion‐related folding and faulting, strike‐slip and normal faulting all of which imposed a complex alteration and metamorphic fabric on the rocks.

The mid-Cretaceous Baldy batholith cuts this succession at the southern end of the property and a late epidote alteration event relates to this intrusion. (Armstrong and Hawkins, 2009). Figure 7‐2 is a simplified property-scale geology map modified from Paradis et al (2006).

| Section 7 | Geological Setting and Mineralization | Page 6 |

7.2 Property Geology and Mineralization - Cont'd

(a) Property Geology - Cont'd

Figure 7-2: Geology Map, Yellowhead Copper Property

| Section 7 | Geological Setting and Mineralization | Page 7 |

7.2 Property Geology and Mineralization - Cont'd

(b) Property Mineralization

The principal area of mineralization on the property is the Yellowhead Copper Deposit (the Deposit). The northeast trending Harper Creek Fault separates the deposit into a west domain and an east domain (Figure 7-3). In the west domain, chalcopyrite mineralization is primarily in three copper bearing horizons. The upper horizon ranges from 60 m to 170 m in width and is continuous along an east-west strike for some 1,300 m, dipping approximately 30º north. Mineralization within this horizon occurs within felsic and mafic volcanics and volcaniclastic rock units. The middle horizon is not as well developed and is often fragmented. It primarily exists within a graphitic and variably silicified package of rocks that range from 30 m to 40 m in width at the western extent, increasing up to 90 m locally eastward, gradually appearing to blend into the upper horizon. Of the three horizons, this contains strong to intense silicification and localized tension fractures filled with mineralization. The lowest or third horizon has less definition mainly due to a lack of drill intersections. Commonly hosted within mafic to intermediate volcaniclastics and fragmental rocks, it can range from 30 m to 90 m in width although typical intersections are in the 30 m range. These horizons host within felsic and mafic metavolcanics and metavolcaniclastics and generally contain foliation-parallel wisps and bands as the dominant style of sulphide mineralization.

In the east domain, mineralization characterized by high angle, discontinuous, tension fractures of pyrrhotite, chalcopyrite ± bornite is frequently associated with quartz carbonate gangue. This style is common within, but not limited to, the metasedimentary rocks and areas of increased pervasive silicification. Mineralization is not selective to individual units and frequently transgresses lithological contacts throughout the area. Locating mineralized horizons in this area has proven difficult due to multiple east-west trending and northward dipping interpreted thrust faults (or possible reverse faults). At the near surface areas in the south and down-dip to the north, widths of mineralization typically range from 120 m to 160 m. In the central area of the east domain where thrust/reverse fault stacking has been interpreted, mineralization thicknesses typically range from 220 m to 260 m with local intersections of up to 290 m. Mafic metavolcanics and coarse-grained quartz-rich metasedimentary rocks generally contain higher grade copper mineralization.

The primary focus of exploration by YMI on the property has been on the main deposit area and mineralization outside of there is not well known.

| Section 7 | Geological Setting and Mineralization | Page 8 |

7.3 Deposit Geology and Mineralization

(a) Geological Lithologies

Metamorphic rocks of the Eagle Bay Assemblage host the deposit. Pervasive alteration and structural deformation of these host rocks has made confident identification of their protolith difficult. Four metamorphic rock types: quartz-bearing schists, non-quartz- bearing schists, phyllite, orthogneiss, comprise about 90% of lithologies drilled in the deposit and the quartz/quartz-eye schist unit comprises almost half of them. The four dominant lithologic units are coded in drill core as 7, 8, 9 and 10. Phyllites and schists are subdivided further based on their mineral or textural characteristics. Table 7-1 summarizes the geological rock type groups, subgroups, code lists and descriptions used on the project.

Phyllites of unit 7 have been subdivided into graphite (unit 7a), sericite-chlorite (7b), calcareous chlorite-sericite (unit 7c) and sericite-chlorite-quartz (unit 7d) with unit 7d being the most common phyllite subunit identified through drilling.

Schists of unit 8 have been subdivided into sericite-chlorite (unit 8a), sericite-chlorite- fuchsite (unit 8b) and chlorite sericite fragmental (unit 8c). Of these, unit 8a is the most common subunit encountered in drilling.

Schists of unit 9 have been subdivided into sericite hornblende-quartz-feldspar (unit 9a), sericite-chlorite-quartz (unit 9b), sericite-chlorite-quartz-feldspar (unit 9c), sericite-augen quartz (unit 9d) and siliceous chlorite-sericite quartz (unit 9e). Within unit 9, the sericite- chlorite-quartz schists represent the most significant component, followed by sericite- chlorite-quartz-feldspar type.