UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May, 2025

Commission File Number: 001-38072

NexGen Energy Ltd.

(Translation of registrant's name into English)

3150 - 1021 West Hastings Street, Vancouver, BC, V6E 0C3

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

[ ] Form 20-F [ x ] Form 40-F Exhibit 99.1 to this Report on Form 6-K is hereby incorporated by reference as Exhibits to the Registration Statement on Form F-10 of NexGen Energy Ltd. (File No. 333.266575)

INCORPORATION BY REFERENCE

SUBMITTED HEREWITH

Exhibits

| 99.1 | Management Information Circular | |

| 99.2 | Notice and Access Notification to Shareholders | |

| 99.3 | Form of Proxy | |

| 99.4 | Notice of Meeting | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| NexGen Energy Ltd. | ||

| (Registrant) | ||

| Date: May 9, 2025 | By: | /s/ Benjamin Salter |

|

|

||

| Benjamin Salter | ||

| Title: | Chief Financial Officer | |

Management Information Circular Summary

This summary highlights important information about NexGen Energy Ltd. ("NexGen" or the "Company"), as well as other matters discussed elsewhere in this Circular Statement. You should carefully review this entire Circular. We encourage you to vote as promptly as possible to ensure that your views are reflected, even if you plan to attend NexGen's 2025 Annual Shareholder's Meeting.

| About NexGen Building on NexGen's strong multi-year performance, the Company's culture is a commitment to continuous improvement and maximizing long-term value. NexGen is steadfast in advancing the Rook I Project (the "Project") toward production with optimized development plans, enhancing sustainability initiatives through responsible environmental stewardship and Indigenous partnerships, and diligently deploying capital for the development of the Project and long-term financial sustainability. Additionally, the Company is expanding exploration and resource development to unlock future growth opportunities while leveraging technological innovations to drive operational efficiencies. This strategic positioning is designed to deliver sustained, long- term value for NexGen's investors, stakeholders, and the global clean energy transition. |

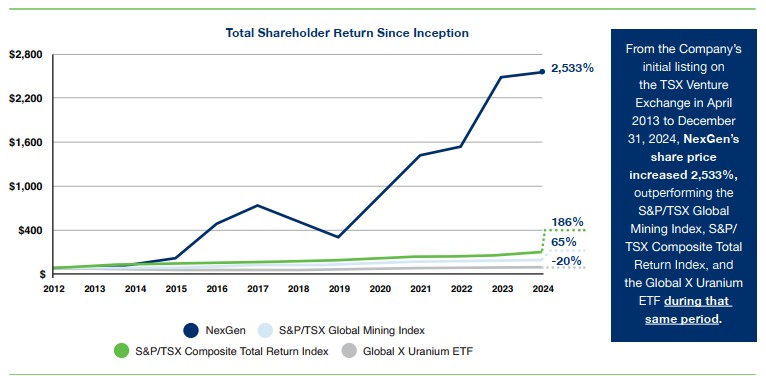

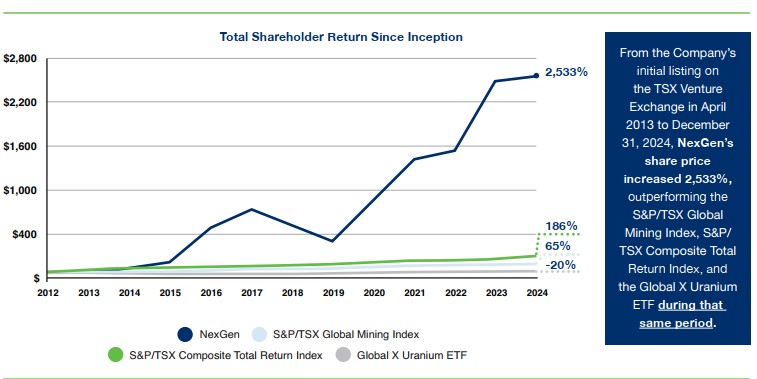

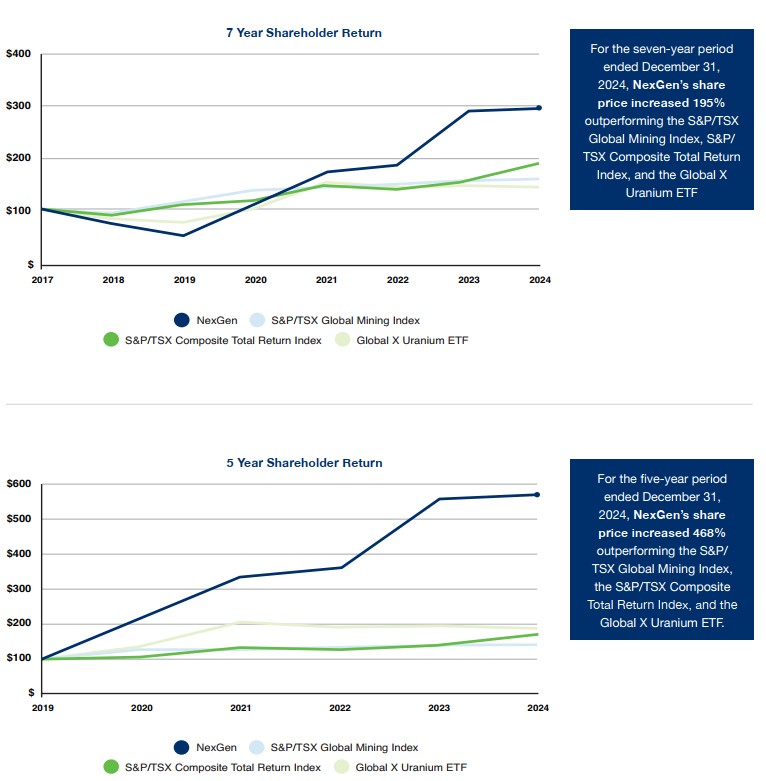

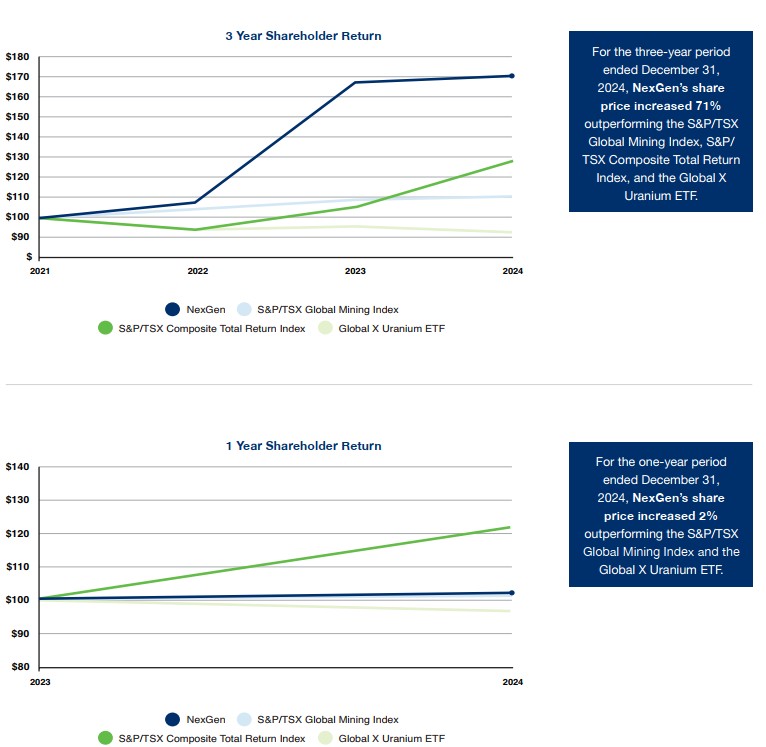

+2,533% Share price appreciation since listing From the Company’s initial listing on the TSX Venture Exchange in April 2013 to December 31, 2024, NexGen’s share price has increased 2,533% outperforming the S&P/TSX Global Mining Index, S&P/TSX Composite Total Return Index, and the Global X Uranium ETF. |

|

| Company Values At NexGen, the commitment to responsible resource development is driven by four core values that shape the Company's culture, approach and decision-making. These values were defined embracing our stakeholders, Indigenous partners, and local communities, reflecting what makes NexGen a leader in sustainable uranium development. NexGen's people set the Company apart, bringing these values to life every day as we work to deliver clean energy fuel for the future. The philosophy of delivering genuine, sustainable outcomes and setting new industry standards is embedded in the Company's approach-guiding not only how the operations are conducted but also how contributions are made to the well-being of the communities and environments in which NexGen operates. |

Honesty |

Respect |

Resilience |

Accountability |

|

Agenda

|

Climate Commitment NexGen recognizes the urgency of climate action and vital role of nuclear power in achieving carbon-free emissions. NexGen is dedicated to minimizing its environmental footprint by integrating best-in-class sustainability practices, |

|||

|

NexGen is committed to delivering the next generation of clean energy fuel through responsible uranium development. As a future leader in the nuclear fuel supply chain, NexGen will play a critical role in enabling a low-carbon future while setting new industry standards for environmental stewardship, community engagement, and corporate governance. NexGen’s approach prioritizes innovation, sustainability, and long-term value creation for all stakeholders. |

|

||

|

Purpose: To responsibly develop and supply the uranium needed to power a cleaner world while driving sustainable growth for stakeholders, communities, and the global energy transition. | ||

|

Vision: To be the global leader in delivering uranium for the world’s current and future clean energy needs - recognized for industry-leading sustainability practices, operational excellence, and unwavering commitment to continuous improvement in setting new industry standards in everything we do. |

||

|

Impact: Through the Rook I Project, NexGen is shaping the future of energy security by supplying ethically sourced uranium from a secure jurisdiction, essential for global decarbonization. NexGen is deeply engaged with Indigenous and local communities, ensuring shared economic benefits, responsible land stewardship, and a legacy of positive impact for generations to come. | ||

Message from the Chair of the Board

Dear Valued Shareholders,

You are invited to attend the Annual General and Special Meeting of Shareholders (the "Meeting") of NexGen Energy Ltd. ("NexGen" or the "Company"), which will be held on June 17, 2025 at 2:00 p.m. (Pacific Time) at the offices of NexGen located at 1021 West Hastings Street, Suite 3150, Vancouver, British Columbia.

I am pleased to report that 2024 was a year of significant progress and achievement for NexGen as we advanced our disciplined long-term strategy for the development of the Company's 100%-owned Rook I Project. We are firmly on track to establish Rook I as the leading global supplier of clean energy fuel, capable of meeting the demands of current and future generations.

The year was further strengthened by favourable market conditions and the growing global momentum behind nuclear energy production. Combined with our robust financial position, these tailwinds provide a strong foundation for sustained growth into future periods.

The Board of Directors and Executive Team are pleased with the progress achieved over the past year. We remain committed to setting new global benchmarks in genuine sustainability and community engagement, ensuring NexGen is recognized not only as a leader in resource development but also as a steward of responsible and clean energy production.

Key milestones and achievements during 2024 include:

On March 17, NexGen was added to the S&P/ASX 300 Index, reflecting increased recognition and positioning the Company for broader investor exposure within the Australian market.

On April 30, NexGen announced a C$180 million CHESS Depository Interest ("CDIs") offering in Australia, which was subsequently significantly upsized to C$224 million following substantial interest from Australian investors. The successful capital raise closed on May 14, highlighting the Australian market's confidence in NexGen's Rook I Project and long-term strategy.

On May 28, NexGen completed a strategic purchase of 2.7 million pounds of uranium, financed through the issuance of a USD$250 million convertible debenture. The purchase was strategically designed to secure essential resources ahead of contracting and financing negotiations, which preceded to December 4, when NexGen announced it was awarded the first uranium sales with multiple leading US nuclear utility companies. These awards, representing five million pounds of uranium delivered over five (5) years, mark the initial step in NexGen's long stated focus on maximizing leverage to future uranium prices and the Company's positioning as a new reliable Western World source of nuclear fuel.

On November 19, NexGen reached a major permitting milestone, with the Canadian Nuclear Safety Commission ("CNSC") completing its technical review of the Rook I Project. This achievement represents significant progress in the Federal Environmental Assessment process, positioning NexGen to commence major site works promptly following final approval.

In line with NexGen's commitment to support and advance local Indigenous communities, 96% of the procurement for the Rook I site was made through our Nation partners during 2024. We continue to deliver quality training initiatives for Local Priority Area Community members, so they are skilled and prepared to take the opportunities associated with the progression of the Rook I Project.

To date, expressions of interest totaling over USD$1.6 billion have been received from prospective financial institutions, including commercial lenders and export credit agencies, for the project financing of Rook I. This progress highlights the exceptional quality of Rook I as a low-cost operation in the tier- one jurisdiction of Saskatchewan, renowned for its elite technical, environmental, and social standards, with strong support from local communities.

As both Chair of NexGen and a fellow Shareholder, I am proud of the strides we made in 2024. These accomplishments reflect the unwavering dedication of our team and our collective focus on delivering on our mission to become a global leader in the production of clean, secure, and sustainable uranium.

I would like to express my gratitude to our people for their hard work and commitment to NexGen's strategic objectives. I also extend my sincere thanks to you, our Shareholders, for your continued trust and support as we build a Company poised to make a lasting positive impact on the global energy landscape.

NexGen appreciates your continued support and participation in the Meeting.

|

|

||

Chris McFadden Chair of the Board of Directors |

Message from the Founder and Chief Executive Officer

Dear Fellow Shareholders,

As global demand for safe, secure, and clean energy accelerates, NexGen's Rook I Project stands as the cornerstone of this transformative era in energy production. Governments and industries worldwide continue to prioritize nuclear energy as a key pillar for achieving emission free energy targets, with ambitious milestones set for 2030 and beyond lining up well with the sequencing of our production.

2024 marked a pivotal year that further underscored uranium's critical role in the global energy transition, and highlighted the current fragility of supply. Significant geopolitical and macroeconomic developments have shaped the uranium market, including legislative actions and sanctions on Russian uranium, highlighting the importance of long-term supply security for Western nations to develop stable, sustainable uranium mines. With 70% of global supply originating from politically unstable regions, a deficit nearing 60 million pounds annually, and the global drive to triple nuclear capacity by 2050, the outlook for uranium demand is more robust than ever. In Canada, site preparation has started for the construction of the country's first Small Modular Reactor, signaling a commitment to advanced nuclear technology.

Globally, countries like France, Poland, Japan, South Korea, UAE and India are ramping up their nuclear programs, while others, such as Turkey, Saudi Arabia, and the Philippines, are exploring large potential new projects. Collectively, these actions reflect a clear and growing recognition of nuclear energy as an indispensable component of a clean and secure energy future.

Notably, at September's World Nuclear Symposium, utilities emphasized the urgency to diversify uranium supply chains away from geopolitical and technical risks, highlighting the increasing demand for secure, Western-based uranium sources.

Amidst this evolving environment, NexGen's transformative Rook I Project will play a primary role in the delivery of uranium fuel for the world's growing clean energy needs. In 2024, the Company made significant advancements in bringing Arrow - the world's largest single-source uranium deposit - into production this decade.

As announced late last year, the permitting process for the Rook I Project is in its final stages as we prepare for the Canadian Nuclear Commission hearing set for November 2025 and February 2026 for the final approval decision to commence construction for this generational project. The team is ready, the engineering, procurement, and vendors are in place, and we look forward to completing the final stage of approvals and moving into full-scale construction.

Rook I is not just a critical growth project for NexGen and its Indigenous community partners, but it is also foundational to Canada's energy commitments.

In anticipation of final approvals during the Commission Hearing, NexGen has made remarkable progress in preparing for construction. Procurement of critical path items is well advanced, including shaft sinking equipment, which are now complete and ready for shipment to the site. Critical path detailed engineering and vendor engagement is well advanced as are community partnerships in place and ready to maximize positive impacts to the region. These developments place NexGen in a strong position to mobilize immediately following a final Federal approval decision.

The Project's economics are truly remarkable, and underscore the strength of Rook I as a world-class asset capable of delivering exceptional value to all stakeholders. The rigor and honest approach taken since the beginning towards the safe development of the Rook I Project is clearly evident and something that speaks to the commitment by the team over many years.

In addition to advancing Rook I, NexGen has continued to expand its exploration activities. The new discovery at Patterson Corridor East ("PCE"), located 3.5 km east of the Arrow deposit, represents an exciting development. The fact we have made the grassroots discovery at Arrow in 2014 and now another one at PCE in 2024 which looks incredibly promising speaks to the disciplined and systematic approach NexGen takes in all aspects of our business. These early stage results highlight the strength of NexGen's long-term growth beyond Arrow.

NexGen has long been committed to excellence in sustainability. With sustainability embedded in all of the Company's business and operational decisions and practices in a truly genuine and organic manner. NexGen continues to maximize benefits to all communities, local businesses and all of our stakeholders to create lasting positive impacts. This year, the Company is releasing its fifth annual Sustainability Report, which details robust sustainability initiatives and achievements across all facets of the organization. In the past two (2) years over 500 Indigenous students and community members participated in NexGen initiated and funded education programs. NexGen also supported local communities by providing employment and procurement opportunities, with 82% of site employees coming from local communities, and 96% of site procurement conducted through Nation partners. These achievements reflect the Company's focus on fostering local economic growth and creating sustainable career opportunities.

Furthermore, NexGen was honoured with the 2024 ABEX Community Involvement Award, recognizing the Company's contributions and positive impact to Saskatchewan, our Indigenous Nation partners in the local priority area, and the broader community. NexGen's approach to Indigenous partnership in the resources sector is unparalleled and it's been based on our core values including respect and transparency over the long-term. We are proud to be working closely with our Indigenous and community partners and stakeholders to build prosperous communities that will contribute to a thriving Provincial economy.

NexGen's financial position remains strong, with approximately C$475 million in cash and C$340 million in uranium inventory as of the end of 2024. This solid foundation provides the flexibility to advance Rook I while maintaining focus on disciplined capital allocation.

The Company's uranium marketing efforts have also gained traction throughout the period, with utilities actively seeking contracts for uranium supply as early as 2025 and 2026. The scarcity of new technically sound uranium from Canada in the market has bolstered NexGen's contracting approach, which prioritizes volume-based, spot-exposed term agreements.

NexGen's strategy is simple, which is to maximize the value of each pound produced and leverage the unique production flexibility the Project has. Additional binding contracts are expected to be finalized by the end of this calendar year, further strengthening NexGen's position as a key diversifying supplier to utilities around the globe seeking secure, affordable clean energy fuel from a secure jurisdiction.

As we look to the future, NexGen is poised to make history with the Rook I Project. This is something all of us at NexGen have been meticulously planning since we made the discovery in 2014.

The convergence of strong market fundamentals, geopolitical realignments, and global commitments to significant investment in energy production and from cleaner sources presents an unparalleled opportunity for NexGen. With the final Commission Hearing date where an approval decision will be rendered scheduled for early 2026, pre-construction readiness is at an advanced stage which means we will begin full scale construction immediately following approvals. Further, the material exploration results at PCE demonstrate mineralization analogous to the mighty Arrow Deposit, positioning NexGen as the leader guiding the industry into a new era of sustainable uranium production, one that will be diversified and based on optimizing the value of each pound produced.

I want to extend my sincere thank you to our dedicated team, our Indigenous partners, and all our stakeholders for their unwavering long-term support. Taking something from discovery through to production rarely happens, yet the team alongside our stakeholders have had their eye on the enormous prize NexGen represents over a long period of time. The prize is massive for the communities in Northern Saskatchewan, for the Province, where it will be a significant economic contributor and for Canada as it seeks to boost its economy as an energy superpower.

We are well positioned as a leader in the clean energy transition and our team's expertise and readiness has placed NexGen on a clear path to bringing this generational asset into production with the best interests of all stakeholders in mind.

|

|

||

Leigh Curyer President & Chief Executive Officer |

|

Notice of Annual General and Special Meeting of Shareholders The purposes of the meeting are to: 01 Elect the directors of the Company for the ensuing year; 02 Re-appoint KPMG LLP as independent auditor of the Company for the 2025 financial year and authorize the directors to fix their remunerations; 03 Approve the continuation of the Company's Stock Option Plan, reducing the rolling maximum from 20% to 10% of outstanding common shares; 04 Set the number of directors of the Company at ten; 05 Receive the audited consolidated financial statements of the Company for the financial year ended December 31, 2024, together with the report of the independent auditor thereon; and 06 Transact such other business as may properly come before the Meeting or any adjournment or postponement thereof. Your vote is important: Your vote is important regardless of the number of NexGen shares you own. Registered NexGen Shareholders who are unable to attend the Meeting or any postponement or adjournment thereof in person are requested to complete, date, sign and return the enclosed form of proxy or, alternatively, to vote by telephone, or over the internet, in each case in accordance with the enclosed instructions. To be used at the Meeting, the completed proxy form must be deposited at the office of Computershare Investor Services Inc., no later than 2:00 p.m. (Pacific Time) on June 13, 2025 or, if the Meeting is adjourned or postponed, not later than 48 hours (excluding Saturdays, Sundays and statutory holidays in the Province of British Columbia) prior to the time set for the adjourned or postponed Meeting. Non-registered NexGen Shareholders who receive these materials through their broker or other intermediary should complete and send the form of proxy or voting instruction form in accordance with the instructions provided by their broker or intermediary. By order of the Board of Directors of NexGen Energy Ltd.

Leigh Curyer President & Chief Executive Officer DATED at Vancouver, British Columbia, this 1st day of May 2025. |

Meeting Details | |

|

When: Tuesday, June 17, 2025 2:00 p.m. (Pacific Time) |

|

|

Where: NexGen Energy Ltd. Suite 3150 - 1021 West Hastings St Vancouver, BC, V6E 0C3 |

|

|

Shareholders will also be able to access but not participate in the formal aspect of the Meeting by webcast or teleconference using the details below: WEBCAST URL: https://app.webinar.net/GZY52aQ2oyj CONFERENCE DIAL-IN: To instantly join the conference call by phone, please use the following URL to easily register yourself and be connected into the conference call automatically or dial direct. URL: https://emportal.ink/44603lB Conference ID: 04817 Toronto: 1-416-945-7677 Vancouver: 1-604-259-0841 Australia: 61-280-171-385 Hong Kong: 852-5808-0636 North American Toll Free:1-888-699-1199 |

||

| Please plan to vote in advance of the meeting. Your vote is important, and the Company encourages you to vote promptly. The deadline to submit your vote is 2:00 p.m. Pacific Time on June 13, 2025. | ||

| Key 2024 Achievements |

|

|||

| Testimonials on NexGen |

2024 marked a year of significant growth for NexGen, underscoring the Company’s track record of progress driven by a clear strategy, bold approach, and determined team. From awarding uranium sales at market-influenced prices to navigating permitting at a pace once deemed impossible—and continuing to earn unprecedented Indigenous support— NexGen has once again set new standards for responsible resource development, while maintaining a strong balance sheet and implementing innovative marketing strategies that leverage the scalability of the Rook I Project. In addition, the Company embarked on the largest exploration program in the Athabasca Basin, discovering new mineralization and expanding the overall value proposition. As a founder-led organization, supported by the Company’s largest active Shareholders, including a representative of a top-five Shareholder on the Board, NexGen remains guided by doing what is right rather than what is merely expected or prescribed. Over the past decade, the Company has built strong and collaborative relationships with Indigenous communities local to the Project, working together to create social, educational, and economic programs and initiatives including skills training programs. Since 2023 more than 500 community members have participated in these trades and certification opportunities for long-term careers. With the world’s most valuable uranium assets under development, NexGen is positioned to be the global leader in supplying uranium for clean energy needs. With a strategy endorsed by the Board and Shareholders, the Company is well-equipped to execute on this significant opportunity. |

|||

| “No other Project has had this level of support from the Indigenous communities, as no other project |

||||

| has had such a positive impact like the Rook I Project will with our community.” |

||||

|

- Chief Teddy Clark, |

||||

|

“The Rook I Project is bringing |

||||

| and change to our Citizens in Métis Nation–Saskatchewan Northern Region II. NexGen has shown leadership in the industry, by working with us, and recognizing our voice and our people... We applaud NexGen for its leadership and its respectful and collaborative approach, and we look forward to the development of the Rook I Project.” |

||||

| - Leonard Montgrand, Regional Director, MN - S for NRII |

||||

| Company Achievements: | ||||

| • • • | Announced a major milestone on November 19, 2024 with the successful completion of the final Federal technical review by the CNSC for its Rook I Project, confirming all environmental, safety, health, community and security requirements, and positioning Rook I for final regulatory approval and eventual construction. | |||

| • • • | Continued to maintain a low General & Administrative ("G&A") spend relative to market capitalization at 0.87% vs peers at 1.57%, ensuring more capital is directed toward advancing Rook I. | |||

| • • • | Secured its first awards for uranium sales for 5 million pounds with major U.S. utilities, marking a significant milestone in its commercialization strategy. These awards, featuring market-related pricing at delivery, position NexGen to maximize value amid a strengthening uranium market while reinforcing its role as a premier, reliable Western supplier of nuclear fuel. | |||

| • • • | Safely executed the largest exploration program in the Athabasca Basin, discovering mineralization a mere 3.5 km from the Arrow deposit. This underscores the commitment to unlocking additional deposits across the extensive land package, enhancing Shareholder value through exploration success and supporting a rapidly expanding nuclear industry. | |||

| • • • | Advanced engineering activities significantly on critical path items, including procurement of long-lead equipment and award of critical path contracts. | |||

| • • • | Implemented and advanced industry-leading engagement programs throughout the Local Priority Area ("LPA"), Regional Priority Area and Saskatchewan, such as 'Pathways to Your Future' which trains students on careers in mining and the nuclear industry. This earned recognition from regulatory agencies, peers, and community groups. | |||

| • • • | Expanded training initiatives from Carpentry and Safety Ticket Training to include Electrical and Radiation Environmental Monitoring emphasizing Nation-specific training in LPA communities, resulting in more than 500 community members having participated since 2023. | |||

| • • • |

Expanded mentorship initiatives such as the Saskatchewan Rush Northern Prospects and Canucks Youth Mentorship Programs, to include additional off-ice career learning opportunities, and a regional visit from Canadian hockey legends involving more than 600 community members. |

|||

|

||||

|

2025 and Beyond: NexGen achieved remarkable progress in 2024, driven by disciplined planning, strategic execution, and adherence to its core values of Honesty, Respect, Resilience, and Accountability. With a clear vision and unwavering commitment to continuous improvement, NexGen is set to achieve more significant milestones including the final step in the regulatory approval process – the Commission Hearing. The Company’s dedication to people, processes, and planning continues to foster a culture of pride and ownership, attracting top-tier talent and further strengthening the organization during this exciting stage of high growth. The team is unwavering in its determination to bring Arrow into production in the most environmentally and socially responsible way, supported by unrelenting community, shareholder, and Board alignment, for this strategic vision. |

||||

2024 Year in Review Detail

In 2024, uranium solidified its position as a critical component of the global clean energy transition. Recognized for its ability to provide reliable, high-density energy essential to achieving decarbonization goals, while supporting the advancement of societies, this pivotal resource has the potential to:

The uranium market experienced a year of volatility and growth, driven by rising demand, supply chain constraints, and heightened geopolitical uncertainties. Utility procurement accelerated as concerns over supply disruptions prompted European and global buyers to prioritize long-term contracts with Western suppliers, reducing reliance on politically unstable regions.

Countries worldwide advanced pro-nuclear policies, reinforcing uranium's role in achieving net-zero goals. Notably, Japan revitalized its nuclear fleet, South Korea re-embraced nuclear expansion, and India and China pursued aggressive development of new reactors. These actions have cemented the long-term demand outlook for uranium, with significant growth projected in the coming decade.

NexGen's Rook I Project stands at the forefront of this clean energy transition. Situated in one of the world's premier mining regions, the Project is poised to deliver large-scale, long-life, low-cost, and highly cash-generative operations. Against a backdrop of a widening supply deficit and tightening markets, NexGen remains committed to ensuring a stable, safe, and secure supply of uranium for nuclear power generation worldwide.

| SIGNIFICANT PROGRESS |

|

|

| Permitting | ||

|

- On November 19, 2024, NexGen Energy announced the successful completion of the final Federal technical review by the CNSC for its Rook I Project. On January 29, 2025, the CNSC confirmed the completion of its review of NexGen's final Environmental Impact Statement ("EIS") submission for the Rook I Project and deemed the submission complete and accepted. The CNSC informed NexGen that the Commission Hearing process would be completed by February 13, 2026 setting NexGen up immediately following the approval decision to commence the construction execution phase.

- Taking a project from discovery through to final permitting approval is a rare and significant milestone in the mining industry. Statistically, only 1 in 1,000 mineral exploration projects ever becomes a producing mine.(1) Furthermore, in Canada, this process typically takes an average of 17.9 years.(2) By overcoming these challenges, NexGen is near being in an elite group of projects on the cusp of construction and production, positioning the Company for significant value creation and de-risked development. |

||

Notes:

1. Minerals Council of Australia

2. S&P Global

Project Advancement

- Front-End Engineering Design ("FEED") was largely completed, and engineering activities advanced significantly on critical path items, including procurement of long-lead equipment, detailed engineering and award of critical path contracts.

- Key on-site achievements during the year included activities such as road works, bridge installation, construction and commissioning of a new hard-walled camp at the existing exploration site, and design confirmation drilling of the No. 1 and No. 2 shafts to finalize the temporary freeze design as well as completing the construction of the freeze plant which is being held at a warehouse in Saskatchewan.

- Major purchases were executed for the production and service hoists, and the shaft sinking contractor was selected and awarded with a Limited Notice to Proceed for critical path activities.

- In addition to a substantial aggregate crushing program - executed with a Clearwater River Dene Nation ("CRDN") partnered business - other infrastructure enhancements were completed on and around the site, in preparation for full construction to commence upon final Federal approval. These accomplishments have further advanced the team's readiness, while optimizing for the construction ramp-up phase, which are all foundational ahead of advancement of future underground infrastructure work.

- The updated economics were completed and subsequently announced August 2024, with the Company providing an update to the initial capital, sustaining, and operating cost estimates for the Project. The estimated pre-production capital costs were updated to C$2.2 billion / USD$1.58 billion, with an average cash operating cost over the life of mine ("LOM") estimated at an industry- leading C$13.86/lb (USD$9.98/lb) U3O8. Further, the annual cash flow generation of the Project takes NexGen into the top 10 of all global mining companies once in production.(1)

Exploration

- NexGen safely completed the largest-ever drilling program at PCE, totaling 34,210 meters across 47 drill holes, marking the most extensive drill initiative in the Athabasca Basin for the year which targeted high-priority areas on its 100%-owned properties in the southwest Athabasca Basin. In February 2024, these exploration efforts led to a significant uranium discovery at PCE, located 3.5 km east of the Arrow deposit. Drilling expanded the mineralized zone to a 600-meter strike length and 600-meter vertical extent, with 32 of 47 holes intersecting mineralization, including 11 holes with intervals exceeding 10,000 counts per second ("cps").

- Notably, drill hole RK-24-222 returned a 17.0-meter-wide vein with multiple high-intensity (>61,000 cps) occurrences.

- In 2025, the Company commenced a 43,000 meter drill program focused on unlocking the potential at PCE. Early in this program, the best discovery-phase hole, including Arrow, was discovered with RK-25-232, which recorded 3.9 meters of exceptionally high radioactivity (>61,000 cps) within a 13.8-meter mineralized interval. Additionally, the high-grade subdomain has expanded, now covering a 210-meter strike length and a vertical extent of 335 meters.

Commercial

- Expressions of interest for over USD$1.6 billion from leading commercial banks and export credit agencies to finance the Rook I Project have been received. Further, other strategic financing options advanced over 2024 and into 2025 with potential to bring forward the value recognition of NexGen.

- The Company executed approximately C$695 million in primary transactions and C$139 million in secondary, demonstrating strong market confidence and strategic financial management. These transactions attracted a diverse range of investors, including global value funds, long-only institutional investors and mission-driven funds focused on sustainable energy solutions. The transactions included:

- ATM Raise (C$135 million): Successfully executed with enthusiastic participation from existing and new institutional investors, ensuring efficient access to capital while maintaining financial flexibility.

- ASX Raise (C$225 million): Completed at near all-time highs, highlighting significant interest from both new and existing long-only institutional investors.

- Convertible Debenture (C$335 million): Issued near all-time highs, reinforcing the Company's capacity to attract substantial investment.

- Li Ka-shing Secondary (15.1 million block trade): Li Ka-shing's sale of his entire ~70 million share position was replaced with new long-term Shareholders at a higher valuation. During this period, the Company's share price outperformed its peers, underscoring continued investor confidence in the Company's growth trajectory.

Note:

1. Excluding precious metal and steel companies.

Benefit Agreements and Community Support

- Implemented and advanced industry-leading engagement programs throughout the LPA, Regional Priority Area and Saskatchewan, earning recognition from regulatory agencies, industry peers, and community groups. These efforts led to unsolicited support from LPA communities, including letters of support for the Project and a prioritization of the Federal Environmental Assessment ("EA") approvals, as well as collaborative meetings with regulatory leaders.

- Delivered impactful community programs and introduced a transparent procurement process. These initiatives exceeded targets and were recognized as a model for success in Saskatchewan and Canada. The initiatives included:

- Expanded training initiatives to include over 500 participants since 2023, emphasizing Nation-specific training in LPA communities.

- The launch of a proprietary program, Pathways to Your Future - A Career in Uranium Mining, on October 8, 2024, further enhancing career development opportunities.

- Expanded educational training and programming from safety ticket training and carpentry, to include electrical and environmental training.

- Expanded mentorship initiatives such as the Canucks Youth Mentorship Program, to include additional off-ice learning opportunities and a community visit involving over 600 members. New initiatives, such as the Northern Prospects Mentorship Initiative with the Saskatchewan Rush and Saskatoon Blades were introduced, and NexGen secured naming rights at Cairns Field to support the inaugural Saskatoon Berries baseball season.

- In 2024, there were over 150 training opportunities through 14 separate programs including an investment of over $1 million.

- The total spend at the Rook I site was $60.3 million, with $56.6 million awarded to community (local priority area businesses or partnered business), accounting for ~94% of the total spend. A total of 47 local businesses actively participated in the Project.

- Earned the 2024 ABEX Community Involvement Award from the Saskatchewan Chamber of Commerce, reflecting the Company's ability to make an impact in areas that extend beyond its core business functions, and dedication to delivering lasting social and economic benefits to its stakeholders.

Sustainability Performance

- In 2024, NexGen made significant strides in advancing sustainability-related goals through enhanced climate-related disclosure, progressing energy efficiency initiatives at the Rook I site, improving S&P Global CSA ratings, and continuing to evolve an unprecedented level of community involvement.

- NexGen's 5th annual Sustainability Report highlights the Company's elite sustainability profile, while advancing alignment with the recommendations of Task Force on Climate-related Financial Disclosures ("TCFD"), and reporting in accordance with the Global Reporting Initiatives ("GRI") Standards.

Enhanced Climate-Related Disclosure:

- Increased alignment with the TCFD through completing a climate related risk and opportunity assessment and integrating findings into the Company's broader risk management framework. This strengthened transparency ensures a more structured approach to assessing climate-related risks and opportunities, and supports informed decision-making.

Energy Efficiency Initiatives:

- Advanced emissions reduction efforts through energy efficiency projects at the Rook I site, including the implementation of a centralized power generation system and a pilot solar power project. These initiatives reflect NexGen's proactive approach to mitigating environmental impacts while improving operational efficiency.

2025 and Beyond

NexGen achieved remarkable progress in 2024, driven by disciplined planning, strategic execution, and adherence to its core values of Honesty, Respect, Resilience, and Accountability. This momentum positions the Company for an extraordinary 2025 as it advances towards full-scale production and solidifies its reputation as a global leader in mining and sustainability.

With a clear vision and unwavering commitment to excellence and continuous improvement, NexGen is set to achieve another year of significant milestones. As the Company prepares for critical next steps, including the Commission Hearing and the commencement of construction, its mission to deliver unparalleled value and positive impacts to all stakeholders remains steadfast.

| Key Milestones Ahead | ||

|

Looking ahead, NexGen will leverage increasing global interest in nuclear energy and the critical need for a sustainable and reliable uranium supply. By maintaining its focus on shareholder value, sustainable development, and community engagement, the Company is well-equipped to thrive in the evolving energy landscape. As NexGen enters this transformative phase, the team recognizes the immense opportunity and responsibility at hand. With the right people, processes, and systems in place, NexGen is prepared to commence construction of the Rook I Project immediately following final Federal approvals, while exploring new opportunities to enhance its value proposition on a provincial, national, and global scale. |

CNSC Commission Hearings for the Federal EA and Licence, followed by a licensing decision, mark pivotal steps in advancing the Rook I Project. |

|

| Major construction activities to begin, marking a new phase in the journey from discovery to production. |

||

| Execution of an expanded and significant 2025 drill program to further define mineralization at PCE. |

||

| Finalization and announcement of a comprehensive financing plan and the awarding of key engineering and procurement packages to mitigate project risks. |

||

| Continuation of rigorous hiring and onboarding processes to attract and integrate top talent aligned with NexGen’s values. |

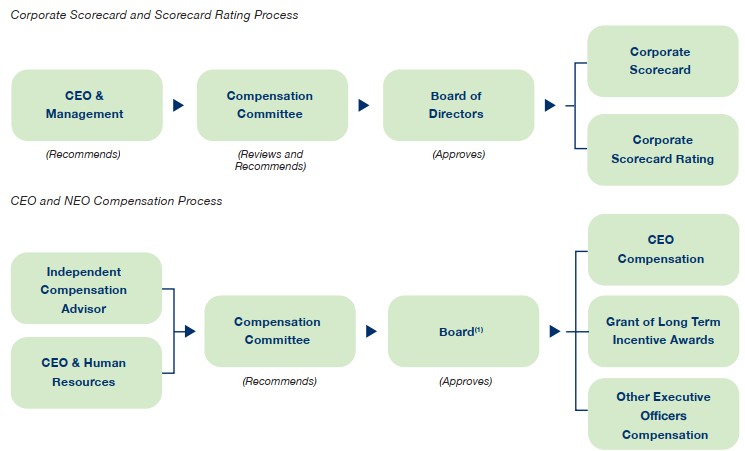

Compensation Highlights

Following extensive consultation with an independent advisor Laulima Consulting Ltd ("Laulima"), NexGen is seeking Shareholder approval for a three (3) year compensation plan that includes reducing the share reserve relating to options from 20% to 10% of outstanding shares. The Stock Option Plan does not require use of the Company's cash reserves to award performance, reflecting the Company's phase of development. This is entirely appropriate and reflects total Shareholder alignment during this phase of development prior to operations. This strategic plan is essential for retaining and attracting the specialized talent required to advance Rook I through construction. The timing is crucial - without the approved equity compensation framework, the Company would need to rely solely on cash compensation, resulting in a sub-optimal workforce that does not value ownership and high accountability in line with Shareholder expectations. The Compensation Committee recognizes the evolving needs of the business and, working with Laulima, has designed this plan to bridge NexGen's transition while actively developing future compensation structures aligned with the Company's progression toward production. Shareholder support of this plan is a key component in maintaining the momentum of Rook I's development and ensuring NexGen retains its industry-leading talent at a time where NexGen's destiny is firmly in the hands of its team.

Pay for High-Performance Compensation Philosophy

Building on this foundation, NexGen is committed to offering a competitive and performance-driven compensation program that aligns to the Company's strategic vision and long-term value creation. The compensation practices follow a pay-for-high-performance philosophy, evaluating performance based on the Company's financial and operational results, along with individual contributions. The Company believes that compensation should reflect the value employees bring to the organization while fostering a culture of ownership, entrepreneurship, accountability, honesty and operational excellence.

| Competitive Pay |

- Maintain fairness and competitiveness by setting compensation at reasonable levels, with consideration of local market conditions and comparable industry roles. - Attract, retain, and inspire top talent whose expertise, skills, and performance are essential to NexGen’s success. - Align employee interests with NexGen’s strategic vision and business objectives to drive sustainable growth. - Encourage a focus on key business drivers that impact long-term shareholder value. - Ensure compensation aligns with NexGen’s corporate strategy, financial goals, and the long-term interests of shareholders. |

|||

| Strategic Alignment to Vision |

||||

| Long-term Value Creation |

||||

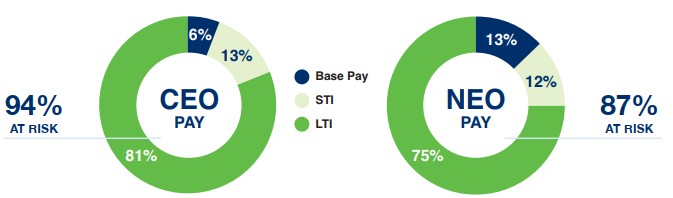

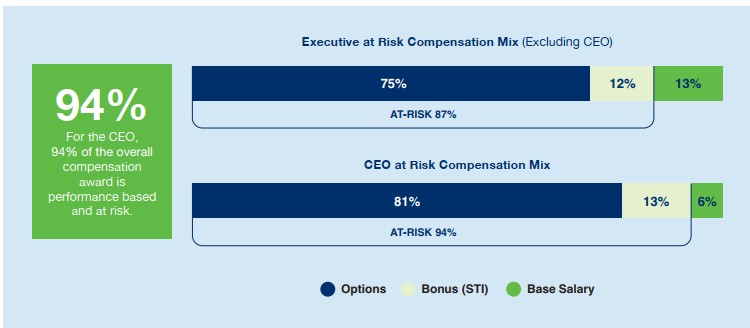

Executive compensation consists of both annual and long-term incentive awards, with an emphasis on aligning with long term objectives and stakeholder value creation.

Salary, Short Term Incentive ("STI") and Long Term Incentive ("LTI")

The majority of total compensation is directly tied to performance. This is for both the CEO pay as well as Named Executive Officers ("NEO"). This approach incentivizes employees and executives to drive long-term success by linking rewards to the achievement of strategic, financial, and operational objectives. By emphasizing variable compensation elements, the program ensures disciplined decision making, accountability, and aligns employee interests with sustainable value creation for Shareholders.

Total Shareholder Return

The Board and Compensation Committee believe the Company's long-term success has been significantly influenced by its historical practice of granting employee stock options as the primary long-term equity incentive. The use of stock options has allowed NexGen to successfully secure top-tier industry talent who live the Company's core values, support its strategic objectives, preserve cash reserves and has ensured the optimal continuation of the path towards production in line with Shareholder expectations.

Following shareholder engagement by management and the Board, and based on the recommendation of the Compensation Committee, the Board adopted the Stock Option Plan (the "Stock Option Plan").

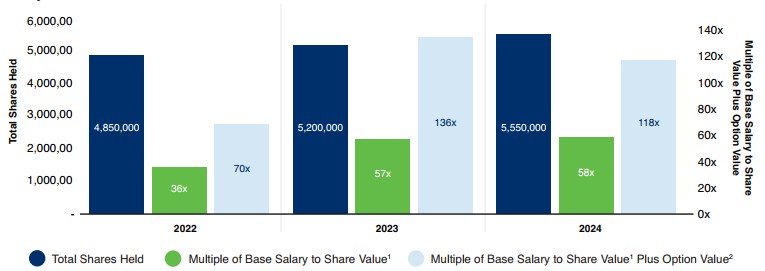

|

Full details of NexGen's compensation programs are contained in the section entitled Compensation Discussion and Analysis starting on page 53. Since becoming a publicly traded company, NexGen's stock price performance, Total Shareholder Return ("TSR") and Compound Annual Growth Rate ("CAGR") demonstrates that the shareholder value creation strategy and compensation plan is working.(1)

1. TSR From April 24 (indexed to $100) to December 2024. |

|

|

Stock option values can look high on paper due to the Black- Scholes valuation, which estimates potential future value based on a number of assumptions. However, the intrinsic value-the actual worth based on the current stock price-is significantly lower. For options issued in 2024: |

|

|

|

Black-Scholes Valuation for CEO (2024): Intrinsic Value for CEO (December 31, 2024): Required Share Price Growth to Match Black-Scholes |

||

|

The disclosed value reflects potential future gains, not immediate earnings. Stock options only hold value if NexGen's share price increases, aligning executive compensation with long-term shareholder returns. Further, the Company's Board and Executives typically only exercise stock options when in the money and at their 5-year expiry. At that time, the team has created shareholder value over 5-years and they are exercised, or they haven't and the value is zero. The Company has consistently demonstrated sector-leading capital efficiency. Among its uranium peers, NexGen maintains the highest ratio of Exploration and Development expenditure to General and Administrative expenditure, while also having the lowest General and Administrative expenditure relative to market cap. Notes: 1. Exploration and Development spend includes costs related to exploration, drilling, environmental and permitting, engineering and design, direct labour and associated costs. Source: Publicly filed Annual Financial Statements and Management Information Circular of the management selected "Uranium Peers" for 2024, or projected if not available at the time of publishing this report, being Cameco Corp, Denison Mines Corp, Energy Fuels Inc, Fission Uranium Corp and Uranium Energy Corp. Fission's Exploration and Development spend is prorated based on the cumulative spend up to and include 3Q24 as 4Q24 results were not released due to the acquisition by Paladin. 2. General and Administrative spend includes General or Administrative expenses as defined in each peer's financial statements, or projected if not available at the time of publishing this report. Source: Publicly filed Annual Financial Statements and Management Information Circular of the management selected "Uranium Peers", being Cameco Corp, Denison Mines Corp, Energy Fuels Inc, Fission Uranium Corp and Uranium Energy Corp. 3. Market Capitalization sourced from S&P Capital IQ. Fission's Market capitalization is as of December 24th 2024, the last day it traded on TSX prior to being de-listed at market close |

||

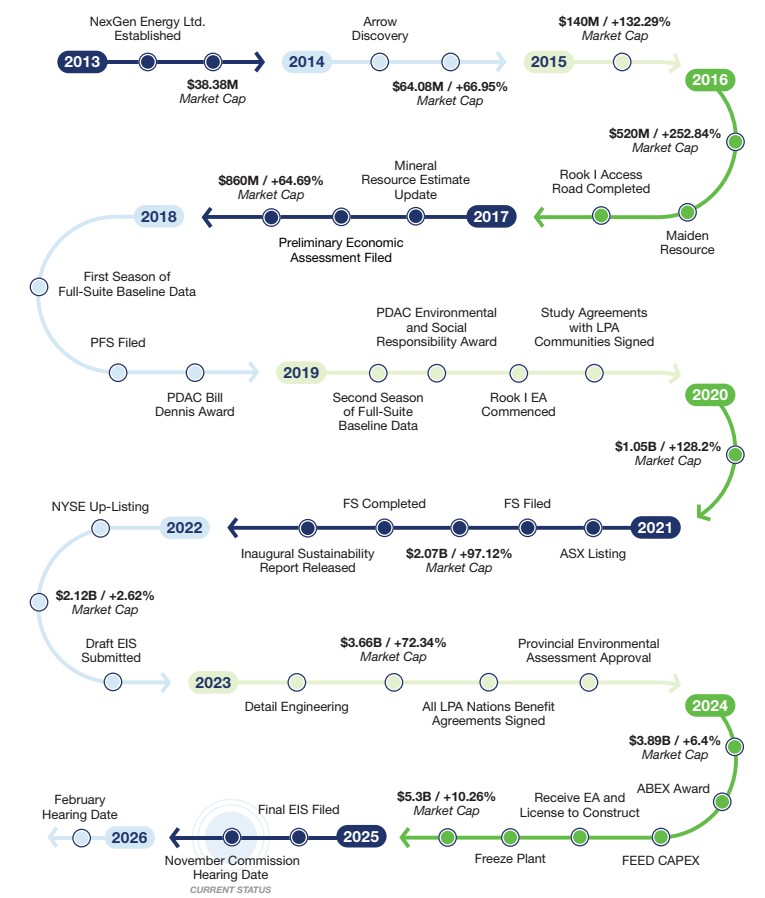

Historical Timeline

Corporate Governance Highlights

NexGen's unique business and strategic vision require a tailored approach to corporate governance-one that prioritizes long-term value creation for Shareholders and all stakeholders. The Board of Directors and management remain committed to governance structures and practices that support NexGen's mission to responsibly advance the development of the Arrow Deposit and deliver significant, sustainable benefits to all stakeholders.

The Board firmly believes that a strong corporate governance regime attuned to the nature of a company and aligned with the interests of its Shareholders is essential to the successful creation of shareholder value. NexGen's governance practices are outlined in detail in the "Corporate Governance" section, starting on page 86.

Board independence is a fundamental pillar of effective corporate governance, ensuring that a company's leadership remains accountable, transparent, and aligned with shareholder interests. Independent directors play a critical role in maintaining oversight, reducing conflicts of interest, and enhancing decision-making processes. NexGen always maintains a highly qualified and skilled Board that aligns with the Company's current stage of development. Through its long-standing approach to Board oversight, the Company ensures directors possess the necessary expertise, experience, and competencies to guide strategic growth. NexGen actively engages in Board refreshment, including annual director evaluations, to sustain an optimal mix of skills and qualifications.

By maintaining a strong, independent Board, we foster a governance environment that drives value creation, protects shareholder interests, and upholds the highest standards of accountability and transparency.

| Best Practice Highlights |

| ✓ All directors are elected annually |

| ✓ Independent Chair |

| ✓ 100% independent Audit, Compensation and Nomination and Governance Committees |

| ✓ No loans to any officers or directors |

| ✓ Prohibit directors from engaging in hedging or derivative trading in NexGen securities |

| ✓ Board Approved Code of Ethics and annual sign off |

| ✓ Board oversight of the corporate strategy and annual operating plan |

| ✓ Board oversight of Enterprise Risk Management including cyber security and global insurance program |

| ✓ Board oversight of Sustainability matters |

| ✓ Annual evaluation of Board members, Board operations and Board Committees |

| ✓ Recently updated charters for all Board committees |

| ✓ In camera sessions held at the end of each Board meeting |

| ✓ Director stock ownership guidelines at 3x retainer |

| ✓ Succession planning |

| ✓ All Director nominees except the CEO and Brad Wall are independent |

| ✓ Majority voting policy |

|

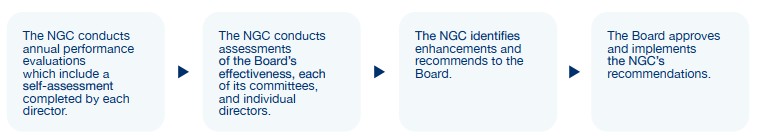

Board Composition, Refreshment & Organizational Commitments The Board conducts a robust annual evaluation process to assess the performance of individual Board members, its committees, and the Board as a whole. This comprehensive review considers a range of factors, including individual contributions, relevant experience, diversity of perspectives (including gender), and critical skill sets essential to the Company's evolving development needs. The Company remains focused on maintaining a balance of expertise and experience, incorporating new skills as required to support its strategic goals. Additionally, the Board considers diversity, including gender diversity, as a key aspect of its composition strategy. As part of its ongoing review process, the Board assesses opportunities to add new or complementary skill sets while also fostering greater diversity to enhance governance effectiveness. As part of the 2024 review process, the Board welcomed Susannah Pierce as a new director. Ms. Pierce brings over 20 years of experience in successfully aligning business, government, communities, Indigenous groups, and other stakeholders to facilitate major capital project development and maximize investment returns. |

Note: 1. Upon successful nomination of Sharon Birkett to the Board |

Mr. Trevor Thiele, a director of the Company since 2013, has chosen not to stand for re-election to the Board and as a result the Board has nominated Sharon Birkett for election as a director at the Meeting. See "Election of Directors" in this Circular. In the event of the successful election of Ms. Birkett as a director of the Company, the number of women on the Board would increase to 4, and represent 40% of the members of the Board.

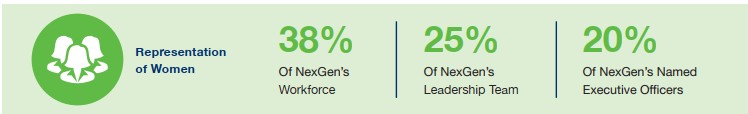

NexGen integrates this approach across the organization and is committed to providing equal opportunities based strictly on merit. In 2024, the Company's gender composition was 62% male and 38% female, compared to the Canadian mining industry average of 16% female.

Over the past two (2) years, NexGen has exceeded its aspirational target that is set for 75% of the Project's workforce to be composed of residents from LPA communities in Northern Saskatchewan - having achieved 80% in 2023 and 82% in 2024. In 2024, 82% of the Rook I site employees were from the LPA in Northern Saskatchewan. Additionally, 94% of total Rook I site expenditures, including construction, service, and supply contracts, were awarded to LPA-partnered or member-owned businesses, significantly surpassing the Company's 30% aspirational procurement target.

Overview of Board

| Standard Committee | ||||||||

| Membership | ||||||||

| Director | Board Tenure | Primary Occupation | Independent | SC | AC | NGC | CC | Other Company Boards |

| Leigh Curyer | 12 Years | Founder & CEO of NexGen Energy |

⬤ | Iso Energy | ||||

| Christopher McFadden | 12 Years | Director & Chairman of NexGen Energy |

⬤ | Iso Energy, Engenco Ltd. | ||||

| Richard Patricio | 12 Years | President & CEO of Mega Uranium |

⬤ | ⬤ | ⬤ | ⬤ | Iso Energy, Toro Energy, Borealis Mining |

|

| Warren Gilman | 8 Years | Chairman & CEO of Queen's Road Capital |

⬤ | ⬤ | Gold Royalty Corp, Queen's Road Capital |

|||

| Sybil Veenman | 7 Years | Corporate Director | ⬤ | ⬤ | ⬤ | Major Drilling Group, Royal Gold |

||

| Karri Howlett | 7 Years | Founder Karri Howlett Consulting |

⬤ | ⬤ | ⬤ | Gold Royalty Corp | ||

| Brad Wall | 6 Years | President, Flying W Consulting Inc, Former Premier of Saskatchewan |

⬤ | Maxim Power, Whitecap Resources, Helium Evolution |

||||

| Ivan Mullany | 2 Years | Director of NexGen Energy | ⬤ | ⬤ | ⬤ | |||

| Susannah Pierce | 1 Year | Former President & Country Chair, Shell Canada |

⬤ | |||||

| Sharon Birkett | - | Former Vice President & Chief Financial Officer, Multi-Color Corp. |

⬤ | |||||

*IsoEnergy is ~32% owned by NexGen, the company was spun out of NexGen in 2016.

*Mega Uranium is strictly a holding company with no operations. Mega owns ~19M shares of NexGen.

*Queen's Road Capital (QRC) is strictly a holding company with no operations.

| Shareholder Engagement | Areas of focus for year-round engagement: |

|

|

- Company values and culture- Business strategy - Short term & long term initiatives - Sustainability & Community initiatives and reporting - Talent acquisition, scaling, and management - Workplace health & safety - Management, director and executive compensation - Board governance and composition |

Over the past year, NexGen has actively engaged with Shareholders representing a large majority of the outstanding common shares. Through nearly 700 direct interactions-including one-on-one investor meetings, group discussions, conference calls, sales desk briefings, and site visits-the Company has ensured that Shareholders are well-informed and actively involved in not only the key milestones but also in the Company's philosophy and approach to executing its strategy. NexGen also hosted five site visits and participated in 25 global conferences, reinforcing its commitment to proactive investor outreach.

In addition to these engagements, NexGen actively discusses input on key governance matters, including voting items ahead of the Annual Meeting. Shareholder feedback is formally reported to the Nomination & Governance Committee for review and action, ensuring alignment with best practices and long-term strategy.

|

To uphold governance excellence, NexGen continuously reviews corporate governance trends, regulatory developments, and best practices, assessing opportunities to refine policies and governance frameworks. This comprehensive engagement process ensures that Shareholder perspectives directly inform corporate strategy-supporting the advancement of Arrow into production to meet the growing global demand for uranium fuel. As a result of NexGen's ongoing and proactive shareholder engagement, the Board and management continue to receive valuable input on key governance and strategic matters. This feedback has directly influenced several important enhancements, including: Board Composition & Governance Enhancements: - Appointed Susannah Pierce in 2024, bringing extensive leadership experience and a proven ability to strengthen relationships with stakeholders, Indigenous communities, and corporate partners, while further enhancing Board diversity. - Appointed Ivan Mullany in 2023, leveraging his mine development expertise to support NexGen's transition to construction. - Reduced the number of directorships held by Board members. - Enhanced compensation transparency, detailing performance metrics and weighting disclosures. - Increased alignment with the TCFD which has increased transparency and governance on climate related risks and opportunities. |

NexGen is covered by 20 analysts worldwide, all of whom have issued a Buy / Outperform rating reflecting broad confidence globally in NexGen. George Ross, Argonaut Securities - BUY Regan Burrows, Bell Potter Securities - BUY Alexander Pearce, BMO Capital - OUTPERFORM Katie Lachapelle, Canaccord Genuity - BUY Nicolas Dion, Cormark Securities - BUY Ralph Profiti, Stifel Canada - BUY Steven Clark, Euroz Hartleys - BUY Marcus Giannini, Haywood - BUY Mohamed Sidibé, National Bank of Canada - OUTPERFORM Colin McLelland, Petra Capital - BUY Brian MacArthur, Raymond James - OUTPERFORM Andrew Wong, RBC Dominion Securities - OUTPERFORM David Talbot, Red Cloud Securities - BUY Orest Wowkodaw, Scotiabank - OUTPERFORM Andrew Hines, Shaw and Partners - BUY Justin Chan, Sprott Capital Partners - BUY Josh Baker, Taylor Collison - OUTPERFORM Craig Hutchinson, TD Securities Inc - BUY Ventum Capital - BUY |

Equity Incentive Plan Optimization:

- Proposed a 10% rolling Stock Option Plan, which continues to reflect a balanced approach to shareholder alignment and incentive structure.

- Maintained an Stock Option Plan that does not require use of Company treasury unlike other Performance Share Units ("PSUs") and Restricted Share Units ("RSUs") plans adopted by peers. The Stock Option Plan ensures the right entrepreneurial, highly accountable culture and preserve the treasury for project development, ensuring strong alignment with long-term value creation-a strategy that has earned recognition for NexGen's disciplined stewardship of its industry-leading asset.

The insights gained from these discussions, along with input from proxy and investor advisory firms, are regularly reviewed by the Nomination & Governance and Compensation Committees and the Board to refine governance and compensation practices and strategic priorities. By maintaining this continuous cycle of engagement, feedback, and action, NexGen fosters maximum positive value creation, ensuring strong governance, operational excellence, and long-term shareholder value.

Management Information Circular

Information Regarding Organization and Conduct of Meeting

This Management Information Circular (the "Circular") is furnished in connection with the solicitation of proxies by the management of NexGen Energy Ltd. (the "Company" or "NexGen") for use at the annual general and special meeting (the "Meeting") of its Shareholders to be held on Tuesday, June 17, 2025 at the time and place and for the purposes set forth in the accompanying notice of annual general and special meeting of Shareholders (the "Notice of Meeting"). Unless otherwise stated, this Circular contains information as at May 1, 2025. References in this Circular to the Meeting include any adjournment or postponement thereof and, unless otherwise indicated, in this Circular all references to "$" are to Canadian dollars.

Solicitation of Proxies

It is expected that proxies will be solicited primarily by mail, but proxies may also be solicited personally, by telephone, email or by other means of electronic communication, by directors, officers or employees of the Company, to whom no additional compensation will be paid. All costs of solicitation will be borne by NexGen. In addition, the Company shall, upon request, reimburse brokerage firms and other custodians for their reasonable expenses in forwarding proxies and related material to beneficial owners of common shares of the Company.

| NexGen has engaged TMX Investor Solutions Inc. ("TMX") to assist with communicating with Shareholders in connection with these services, TMX is to receive a fee of approximately $45,000, plus out-of-pocket expenses. The Company will bear all costs of this solicitation. | If you have any questions or require assistance with voting, please contact TMX, by telephone or email at: 1-800-706-3274 toll-free in North America or 1-437-561-5062 (outside of North America) or info_tmxis@tmx.com. |

Notice-and-Access

The Company has elected to use the notice and access mechanism (the "Notice-and-Access Provisions") under National Instrument 54-101 - Communication with Beneficial Owners of Securities of a Reporting Issuer ("NI 54-101") for the delivery of this Circular to Shareholders for the Meeting.

Under the Notice-and-Access Provisions, instead of receiving printed copies of this Circular, Shareholders will receive a notice ("Notice") with information on the Meeting as well as information on how they may access this Circular electronically and how they may vote.

The Company will not use the procedures known as "stratification" in relation to the use of Notice-and-Access Provisions meaning that all Shareholders will receive a Notice in accordance with the Notice-and-Access Provisions.

Shareholders can request that printed copies of this Circular be sent to them by postal delivery, at no cost to them, up to one (1) year after the date this Circular was filed on SEDAR+ by calling toll-free (in Canada and the United States) 1- 800-841-5821 or by emailing ddang@nxe-energy.ca. See under the heading "How to Obtain Paper Copies of the Circular" in the accompanying Notice and Access Notification to Shareholders.

Appointment of Proxyholders

The persons named in the enclosed form of proxy or voting instruction form are Executive Officers of the Company. You have the right to appoint someone other than the persons designated in the enclosed form of proxy, who need not be a Shareholder, to attend and act on your behalf at the Meeting by printing the name of the person you want in the blank space provided or by completing and delivering another suitable form of proxy.

Voting by Proxyholder

On any ballot, the nominees named in the accompanying proxy form will vote, withhold from voting or vote against (as applicable), your common shares in accordance with your instructions. In respect of any matter for which a choice is not specified, the persons named in the accompanying proxy form will vote at their own discretion, except where management recommends that Shareholders vote in favour of a matter, in which case the nominees will vote FOR the approval of such matter.

The form of proxy confers discretionary authority upon the nominees named therein with respect to amendments or variations to matters identified in the Notice of Meeting and with respect to other matters which may properly come before the Meeting.

As of the date of this Circular, Management of NexGen knows of no such amendment, variation or other matter that may come before the Meeting. However, if any amendment, variation or other matter should properly come before the Meeting, each nominee named in the accompanying proxy form intends to vote thereon in accordance with the nominee's best judgment or as stated above.

Registered Shareholders

A "Registered Shareholder" is a person whose common shares are registered in the Shareholder's own name. Registered Shareholders who are unable to attend the Meeting or any postponement or adjournment thereof in person are requested to complete, date, sign and return the enclosed form of proxy or, alternatively, to vote by telephone, or over the Internet, in each case in accordance with the enclosed instructions.

| To vote by telephone, Registered Shareholders should call Computershare Investor Services Inc. at 1-866-732- VOTE (8683). Registered Shareholders will need to enter the 15-digit control number provided on the form of proxy to identify themselves as Shareholders on the telephone voting system. | To vote over the Internet, Registered Shareholders should go to www. investorvote.com. NexGen Shareholders will need to enter the 15-digit control number provided on the form of proxy to identify themselves as Shareholders on the voting website. | To vote by mail, Registered Shareholders should complete, date and sign the form of proxy and mail in the enclosed return envelope to the office of Computershare Investor Services Inc. | ||

Voting instructions must be received no later than 2:00 p.m. (Pacific Time) on June 13, 2025, or, if the Meeting is adjourned or postponed, not later than 48 hours (excluding Saturdays, Sundays and statutory holidays in either the Province of Ontario or the Province of British Columbia) prior to the time set for the adjourned or postponed meeting. Late proxies may be accepted or rejected by the Chair of the Meeting in his or her discretion.

Non-Registered Shareholders

Most Shareholders of the Company are "Non-Registered Shareholders" because the common shares they own are not registered in their name but are registered in the name of an intermediary such as a bank, trust company, securities dealer or broker, trustee or administrator, of a self-administered RRSP, RRIF, or RESP or a clearing agency (such as CDS Clearing and Depositary Services Inc.) of which the intermediary is a participant.

Applicable regulatory policy requires intermediaries/brokers to whom meeting materials have been sent to seek voting instructions from Non-Registered Shareholders in advance of Shareholders' meetings. Every intermediary has its own mailing procedures and provides its own return instructions, which should be carefully followed to ensure that the Non-Registered Shareholder's common shares are voted at the Meeting.

Many brokers now delegate responsibility for obtaining instructions from Non-Registered Shareholders to Broadridge Financial Solutions, Inc. ("Broadridge"). Broadridge typically mails a scannable voting instruction form ("VIF"), instead of the form of proxy. Non- Registered Shareholders are requested to complete and return the VIF to Broadridge. Alternatively, Non-Registered Shareholders can call a toll-free telephone number or access Broadridge's dedicated voting website www.proxyvote.com.

The VIF must be returned as directed by Broadridge well in advance of the Meeting in order to have the common shares voted. Non- Registered Shareholders who receive forms of proxies or voting materials from organizations other than Broadridge should complete and return such forms of proxies or voting materials in accordance with the instructions on such materials in order to properly vote their common shares at the Meeting.

NexGen may utilize the Broadridge QuickVoteTM service to assist Non-Registered Shareholders vote their shares. Those Shareholders who have not objected to NexGen knowing who they are (non-objecting beneficial owners) may be contacted by TMX Group to conveniently obtain a vote directly over the phone.

| Non-Registered Shareholders are not entitled, as such, to vote at the Meeting in person or to deliver a form of proxy. If you are a Non-Registered Shareholder and wish to appoint yourself as proxyholder to vote in person at the Meeting or appoint someone else to attend the Meeting and vote on your behalf, please see the voting instructions you received or contact your intermediary/broker well in advance of the Meeting to determine how you can do so. | If you have any questions or require assistance with voting, please contact TMX, the Company’s proxy solicitation agent, by telephone at 1-800-706-3274 (toll-free in North America) or 1-437-561-5062 (outside of North America) |

Non-Registered Shareholders should carefully follow the voting instructions they receive, including those on how and when voting instructions are to be provided, in order to have their common shares voted at the Meeting.

Revocation of Proxies

Only a Registered Shareholder who has submitted a proxy may revoke it at any time prior to the exercise thereof. In addition to revocation in any other manner permitted by law, a proxy may be revoked by instrument in writing executed by the Registered Shareholder or such Shareholder's legal representative, or if the Registered Shareholder is a corporation, by its duly authorized legal representative, and deposited at the Company's registered office: Suite 2500, 700 West Georgia Street, Vancouver, BC V7Y 1B3 at any time up to and including the last business day preceding the day of the Meeting at which the proxy is to be used, or with the Chair of the Meeting on the day of the Meeting prior to voting and, upon either of such deposits, the proxy is revoked.

Non-Registered Shareholders who wish to change their vote must, in sufficient time in advance of the Meeting, arrange for their respective intermediaries to change their vote and if necessary, revoke the proxy on their behalf.

CDI Holders

Each person who is recorded as the holder of CDIs on May 1, 2025 in the register of holders of CDIs kept by or on behalf of NexGen (each such person being a "Relevant CDI Holder") is entitled to instruct CHESS Depository Nominees Pty Limited ("CDN"), a wholly owned subsidiary company of ASX Limited that was created to fulfill the functions of a depositary nominee, or its custodian which holds the NexGen common shares underlying their CDIs how to vote those shares on the resolutions to be considered at the Meeting. If you are a Relevant CDI Holder and wish to give such voting instructions, you must complete and submit the CDI voting instruction form accompanying this Notice of Meeting or lodge your vote online at www.investorvote.com.au using your secure access information contained in the CDI voting instruction form. Relevant CDI Holders can expect to receive a CDI voting instruction form, together with the Meeting materials from Computershare, the CDI registry in Australia.

For your CDI voting instruction form to be valid, it must be received by Computershare Investor Services Pty Limited ("Computershare") no later than 9:00am on June 12, 2025 (Australian Western Standard Time) in order to allow CDN or its custodian which holds the underlying common shares sufficient time to provide voting instructions in respect of the relevant common shares to NexGen by the proxy submission deadline of 2:00pm on June 13, 2025 (Pacific time) or, if the Meeting is adjourned or postponed, not later than 48 hours (excluding Saturdays, Sundays and statutory holidays in either the Province of Ontario or the Province of British Columbia) prior to the time set for the adjourned or postponed meeting, and in addition you must be a Relevant CDI Holder.

Please note that holders of CDIs are not Registered Holders of the common shares to which those CDIs relate, and therefore are not entitled to vote in person at a Meeting in their capacity as a holder of CDIs.

Advance Notice Provisions

On May 21, 2015, Shareholders approved an amendment to the Company's articles to implement advance notice provisions for the nomination of directors (the "Advance Notice Provisions"). Under the Advance Notice Provisions, a director nomination must be made, in the case of an annual meeting of Shareholders, at least 30 days and no more than 65 days before the date of the meeting, and in the case of a special meeting of Shareholders (which is not also an annual meeting of Shareholders) called for the purpose of electing directors (whether or not called for other purposes), not later than the close of business on the fifteenth (15th) day following the day on which the first public announcement of the date of the special meeting of Shareholders was made. The Advance Notice Provisions also set forth the information that a Shareholder must include in the notice to the Company. See the Company's amended articles which are available under the Company's profile on SEDAR+ at www.sedarplus.ca for full details (filed on May 26, 2015). No director nominations have been made by Shareholders in connection with the Meeting under the terms of the Advance Notice Provisions, and as such the only nominations for directors at the Meeting are the nominees set forth below under "Business to be Transacted at the Meeting - Election of Directors".

Voting Shares and Principal Shareholders

Record Date

The Board of Directors of NexGen (the "Board") has fixed May 1, 2025, as the record date, being the date for the determination of the holders of the Company's common shares entitled to notice of, and to vote at, the Meeting and any adjournment or postponement thereof.

Shares Outstanding and Principal Holders

As of May 1, 2025, there were a total of 569,668,514 NexGen common shares issued and outstanding. The holders of the common shares are entitled to receive notice of, and to attend, all meetings of NexGen Shareholders and to have one vote for each common share held.

To the knowledge of the directors and Executive Officers of the Company, as of the date of this Circular, no person or company beneficially owns, or controls or directs, directly or indirectly, voting securities carrying 10% or more of the voting rights attached to any class of voting securities of NexGen.

Interest of Certain Persons in Matters to be Acted Upon

The Company is unaware of any material interest, direct or indirect, by way of beneficial ownership of securities or otherwise, of any person who has been a director or Executive Officer of the Company at any time since the beginning of the Company's last financial year, or is a proposed nominee for election as a director (or an associate or affiliate of such director, Executive Officer or director nominee) in any matter to be acted upon at the Meeting, other than the election of directors and the resolution regarding the approval of the Stock Option Plan as such persons are eligible to participate in such plan.

Interest of Informed Persons in Material Transactions

The Company is unaware of any material interest, direct or indirect, of any informed person or any proposed nominee for election as a director of the Company (or an associate or affiliate of such informed person or director nominee) in any transaction since the beginning of the Company's last financial year or any proposed transaction, which has materially affected or would materially affect the Company or any of its subsidiaries.

Financial Statements

The audited consolidated financial statements of the Company for the financial year ended December 31, 2024, and the report of the independent auditors thereon will be presented at the Meeting. These consolidated financial statements and the related management's discussion and analysis were sent to all Shareholders who have requested a copy. The Company's consolidated financial statements and related management's discussion and analysis for the financial year ended December 31, 2024, are also available under the Company's profile on SEDAR+ (www.sedarplus.ca) and on the Company's website (www.nexgenenergy.ca).

Business of the Meeting

| PROPOSAL 1 Election of Directors The directors of the Company are elected annually and hold office until the next annual general meeting of the Shareholders or until their successors are elected or appointed. The Board unanimously recommends the re-election of the nine Director nominees and the new election of Sharon Birkett listed on the right, each to serve a one (1) year term beginning at the 2025 Annual Shareholders' Meeting and continuing until the 2026 Annual Shareholders' Meeting, or until their successors are elected or appointed. Unless otherwise indicated, the persons designated as proxyholders in the accompanying form of proxy will vote the common shares represented by such form of proxy FOR setting the number of directors at ten and the election of the ten director nominees listed in this Circular. Management does not contemplate that any of the nominees will be unable to serve as a director. |

|

|

Board unanimously recommends that you vote FOR each of its Director nominees. |

Director Qualifications

The Board consists of a diverse and highly committed group of individuals who play a vital role in advising and overseeing the Company as it progresses through this pivotal development phase. Collectively, the directors bring a wealth of experience, skills, and qualifications that support the effective oversight of operations and the achievement of the Company's long-term strategic goals, including the advancement of the Rook I Project towards production.

Each nominee for the Board has extensive leadership experience, having held senior executive roles such as CEOs, executive level leaders, and a former Premier of Saskatchewan. The majority of nominees have direct experience in resource development and major project execution, which is highly valuable to the Company's current stage of growth.