UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of March 2025

Commission File Number: 001-41085

SNOW LAKE RESOURCES LTD.

(Translation of registrant's name into English)

360 Main St 30th Floor

Winnipeg, Manitoba R3C 4G1 Canada

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

☒ Form 20-F ☐ Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| SNOW LAKE RESOURCES LTD. | ||

| (Registrant) | ||

| Date: March 12, 2025 | By | /s/ Kyle Nazareth |

| Kyle Nazareth | ||

| Chief Financial Officer | ||

EXHIBIT INDEX

| Exhibit | Description of Exhibit | |

| 99.1 |

Transformational U.S. Uranium Transaction

Snow Lake Energy Acquires the

Advanced Pine Ridge Uranium Project in Wyoming Through a Strategic Partnership with

Global Uranium and Enrichment Limited

Winnipeg, Manitoba, Canada, March 12, 2025 - Snow Lake Resources Ltd., d/b/a Snow Lake Energy (Nasdaq: LITM) ("Snow Lake"), a uranium exploration and development company, is pleased to announce that it has entered into a 50/50 joint venture (the "Joint Venture") with Global Uranium and Enrichment Limited ("GUE") (ASX:GUE), to acquire 100% of the Pine Ridge Uranium Project ("Pine Ridge") in the Powder River Basin in Wyoming, United States. In addition, Snow Lake will become a cornerstone investor in GUE though the acquisition of a 19.99% interest in GUE by participating in GUE's proposed AUD$9 million capital raise.

This acquisition and investment positions Snow Lake at the forefront of the uranium supply chain, securing exposure to significant and large uranium JORC 20121 resources in the United States, while also gaining access to next-generation uranium enrichment technology. For more information on GUE, their uranium asset portfolio, and the scope of their JORC 2012 mineral resource base, please refer to their website.2

Following its recent capital raisings totaling ~USD$37 million, Snow Lake is fully funded to make its contributions to the Joint Venture, and to make its strategic investment in GUE.

Investment and Acquisition Highlights

1 The Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves ("the JORC Code") 2012 edition.

2 https://globaluranium.com.au

CEO Remarks

"We are thrilled to make the acquisition of the Pine Ridge Uranium Project together with Global Uranium and Enrichment Limited, and to make the investment in GUE to become their cornerstone investor" said Frank Wheatley, CEO of Snow Lake.

"The Powder River Basin in Wyoming is one of the preeminent uranium producing regions in the United States and this acquisition provides Snow Lake with a robust and strategic foothold in the United States. With global focus turning to nuclear energy to address energy security concerns, coupled with the United States administration's policies favoring domestic energy security and advanced nuclear technology, we see this acquisition and investment as a transformative opportunity to expand our uranium footprint and create value for our shareholders.

We are especially pleased with the exploration and development team GUE has assembled, with extensive background in both uranium exploration and operating in Wyoming, and we look forward to working closely with GUE and their team to rapidly advance the Pine Ridge Project, which we believe holds the potential to create substantial value for Snow Lake shareholders."

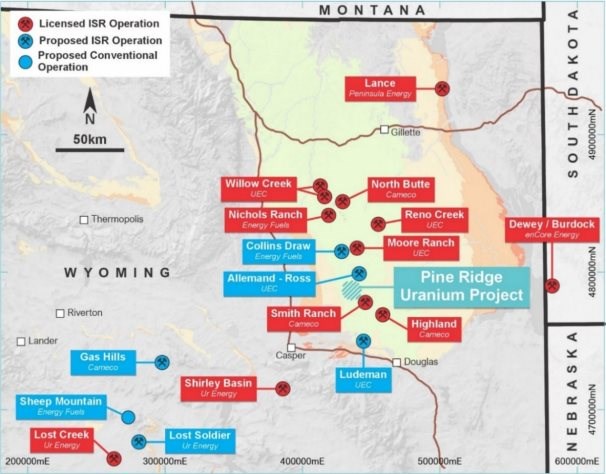

Figure 1: Location of Pine Ridge Uranium Project in Wyoming, U.S.

About Global Uranium and Enrichment Limited

Global Uranium and Enrichment Limited (GUE) is an Australian public listed company providing unique exposure to not only uranium exploration and development, but to the uranium enrichment space. Amid a nuclear energy renaissance, GUE is developing a portfolio of advanced, high grade uranium assets in prolific uranium districts in the United States and Canada, and has established a cornerstone position in Ubaryon Pty Ltd, an Australian uranium enrichment technology company.

For more information on GUE, please refer to their website5.

5 https://globaluranium.com.au

GUE Uranium Asset Portfolio:

GUE Management

GUE's Operational Staff includes Andrew Ferrier, Tim Brown, and Jim Viellenave. These three individuals have more than 80 years of exploration, development, and operating experience in mining and mineral processing, much of which is in uranium. Among the major projects worked on was the development, resource expansion, and full permitting for construction and operation of the Reno Creek ISR uranium project in Wyoming. Reno Creek is a very similar project to Pine Ridge and is located approximately 30 miles away.

Snow Lake Resources Ltd.

Snow Lake Resources Ltd., d/b/a Snow Lake Energy, is a Canadian mineral exploration company listed on Nasdaq:LITM, with a global portfolio of clean energy mineral projects comprised of three uranium projects and two hard rock lithium projects. The Engo Valley Uranium Project is an exploration stage project located in the Skeleton Coast of Namibia, the Black Lake Uranium Project is an exploration stage project located in the Athabasca Basin, Saskatchewan, and the Buffalo Uranium Project is an exploration stage project in Wyoming, United States. The Shatford Lake Project is an exploration stage project located adjacent to the Tanco lithium, cesium and tantalum mine in Southern Manitoba, and the Snow Lake Lithium™ Project is an exploration stage project located in the Snow Lake region of Northern Manitoba. Learn more at www.snowlakeenergy.com.

6 Refer to GUE's ASX announcement dated 9 November 2021 for the JORC details of the Athabasca Projects and other historical information. GUE confirms that it is not aware of any new information or data that materially affects the information included in the original market announcement of 9 November 2021.

Forward-Looking Statements: This press release contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934 and the "safe harbor" provisions under the Private Securities Litigation Reform Act of 1995 that are subject to substantial risks and uncertainties. All statements, other than statements of historical fact, contained in this press release are forward-looking statements, including without limitation statements with regard to Snow Lake Resources Ltd. We base these forward-looking statements on our expectations and projections about future events, which we derive from the information currently available to us. Forward-looking statements contained in this press release may be identified by the use of words such as "anticipate," "believe," "contemplate," "could," "estimate," "expect," "intend," "seek," "may," "might," "plan," "potential," "predict," "project," "target," "aim," "should," "will," "would," or the negative of these words or other similar expressions, although not all forward-looking statements contain these words. Forward-looking statements are based on Snow Lake Resources Ltd.'s current expectations and are subject to inherent uncertainties, risks and assumptions that are difficult to predict. Further, certain forward-looking statements are based on assumptions as to future events that may not prove to be accurate. Some of these risks and uncertainties are described more fully in the section titled "Risk Factors" in our registration statements and annual reports filed with the Securities and Exchange Commission. Forward-looking statements contained in this announcement are made as of this date, and Snow Lake Resources Ltd. undertakes no duty to update such information except as required under applicable law.

| Contact and Information Frank Wheatley, CEO |

Investor Relations Investors: ir@snowlakelithium.com Website: www.snowlakeenergy.com |

Follow us on Social Media Twitter: www.twitter.com/SnowLakeEnergy LinkedIn: www.linkedin.com/company/snow-lake-energy |

Schedule A

Key Terms of Material Agreements

1. Purchase and Sale Agreement - Pine Ridge Uranium Project

|

PARTIES |

Stakeholder Energy, LLC (Seller), Powder River Basin LLC (Buyer) The Buyer is owned 50% by Usuran Resources Inc, a wholly owned subsidiary of Global Uranium and Enrichment Limited (GUE), and 50% by Snow Lake Exploration (US) Ltd., a wholly owned subsidiary of Snow Lake Resources Ltd. |

|

ACQUISITION |

The Seller agrees to sell, and the Buyer agrees to purchase, the Pine Ridge Uranium Project held by the Seller (Acquisition). The Pine Ridge Uranium Project will be transferred to the Buyer upon payment of the Third Instalment. |

|

CONSIDERATION |

In consideration for Acquisition, the Buyer is to: (a) pay the Seller a total of US$22,500,000 cash, to be paid in three equal installments of US$7,500,000, payable as follows: (i) US$7,500,000 to be paid at closing (Closing) of the Acquisition contemplated by the Purchase and Sale Agreement (Acquisition Agreement) (First Instalment); (ii) US$7,500,000 to be paid on or before one-year from the date of Closing (Second Instalment); and (iii) US$7,500,000 to be paid on or before two years from the date of Closing (Third Instalment) Unless the Parties otherwise agree, the Closing shall occur on or before April 22, 2025. |

|

ROYALTY |

The Buyer shall pay the Seller a production royalty based on an applicable royalty percentage (which will be calculated by a Net Smelter Returns variable between 3.5% and 6%, dependent on U3O8 Realized Price) from uranium, vanadium and related minerals produced and sold or deemed sold by Buyer from any additional property or property interests acquired by the Buyer, or its affiliates or permitted assigns, within twenty (20) years after the effective date of March 11, 2025. |

|

PRE-CLOSING CONDITIONS |

Closing of the Acquisition will be subject to standard closing conditions, including the Buyer and GUE obtaining all necessary shareholder, third-party, and regulatory approvals necessary to complete the transaction contemplated by the Acquisition Agreement (together, the Conditions). |

|

EXPENDITURE REQUIREMENT |

The Buyer shall expend a minimum of US$10,000,000 in exploration and development costs by the three-year anniversary of the Closing. |

|

RIGHTS DURING TERM |

The Seller grants to the Buyer the sole and exclusive right to enter upon and use the Mining Claims and the properties covered by the Underlying Agreements, and to grant such rights to its affiliates and permitted assigns, for the purpose and with the sole and exclusive right and privilege of prospecting, exploring for and developing uranium, vanadium and related minerals. |

|

DEFAULT AND TERMINATION |

(a) Default: the Buyer's failure to abide by the terms of the Acquisition Agreement, including its obligation to make full payment when due and without demand, constitutes a default. Upon the Buyer's default, the Seller may give the Buyer notice requiring the Buyer to satisfy the obligations within a period of twenty (20) business days from the date of the notice. (b) Termination: the Acquisition Agreement may be terminated as follows: (i) at the Buyer's sole discretion at any time prior to the payment of the Third Instalment and delivery of the transaction documents to the Buyer by the escrow agent; (ii) upon notice by the Seller to the Buyer if the Conditions have not been satisfied and have not been waived by the Seller by May 15, 2025; (iv) upon notice by the Buyer to the Seller if the Conditions have not been satisfied and have not been waived by Seller by May 15, 2025; (v) at the Seller's sole discretion, upon the Buyer's default; or (vi) at the Buyer's sole direction, upon the Seller's default. (c) Effect of Termination: if such termination occurs prior to the Closing as a result of a default by the Buyer, the Buyer shall be obligated to pay to the Seller, as liquidated damages and not a penalty, a single break fee in the amount of US$500,000. |

|

GOVERNING LAW |

The Acquisition Agreement is to be governed by, and construed in accordance with, the laws of the State of Wyoming, other than its rules as to conflicts of laws which would result in the imposition of the laws of some other jurisdiction. |

|

OTHER TERMS |

The Acquisition Agreement otherwise contains provisions considered standard for an agreement of its nature (including exclusivity, representations and warranties and confidentiality provisions). |

Joint Venture Agreement

| PARTIES |

Usuran Resources, Inc (a wholly owned subsidiary of Global Uranium and Enrichment Limited) (Usuran) Snow Lake Exploration (US) Ltd (a wholly owned subsidiary of Snow Lake Resources Ltd (Snow Lake) |

| JOINT VENTURE |

The parties will have an initial interest in Powder River Basin LLC (JVCo) as follows: In connection with the JVCo's payment and performance obligations under the Acquisition Agreement, each of the parties acknowledges its obligation to contribute the following to the JVCo: (i) cash in the amount of US$5,250,000 prior to the first anniversary of the Closing under the Acquisition Agreement (of which US$750,000 shall be contributed at least 3 business days before the closing date of the Acquisition Agreement), (ii) cash in the amount of US$5,250,000 prior to the second anniversary of the Closing under the Acquisition Agreement, and (iii) cash in the amount of $2,000,000 prior to the third anniversary of the Closing under the Acquisition Agreement. |

| MANAGEMENT COMMITTEE AND MANAGER |

The parties will establish a committee (Management Committee) consisting of four representatives, of which two representatives shall be appointed by Usuran and two representatives shall be appointed by Snow Lake. The JVCo will be managed by one Manager. The initial manager shall be Usuran. |

| DILUTION |

Dilution due to Default If the Non-Defaulting Member elects to proceed as follows, the payment by the Non-Defaulting Member of the Default Amount shall be treated as a capital contribution by the Non-Defaulting Member to the JVCo on behalf of the Delinquent Member. In such case, the Interest of the Delinquent Member shall be reduced by an amount (expressed as a percentage) equal to: (i) the Default Dilution Multiple; multiplied by the Default Amount; divided by (ii) the aggregate Contributed Capital of all parties (determined after taking into account the contribution of the Default Amount). The Interest of the Non-Defaulting Member shall be increased by the reduction in the Interest of the Delinquent Member. The foregoing adjustments shall be effective as of the date of the default. Default Dilution Multiple means: (a) during the period prior to an affirmative vote of the Management Committee to undertake mining on any portion of the JVCo's properties (Affirmative Mining Decision), 1.5, and (b) during the period from and after an Affirmative Mining Decision, 2.0. (i) the contributed capital of the party as of the beginning of the period covered by the Program and Budget; plus (ii) the amount, if any, that the party has agreed to contribute to the Program and Budget; plus (iii) if the party is the member which has or is deemed to have elected to contribute its proportionate amount to the Program and Budget in accordance with its Interest (Contributing Member), the amount of the Excess Contribution (being all or any portion of the underfunded amount by the Non-Contributing Member), if any, that the Contributing Member has agreed to contribute to the Program and Budget with respect to the Underfunded Amount, multiplied by the Non-Contribution Dilution Multiple; and (b) the denominator of which equals the sum of the amounts calculated under item (i) above for all parties. Non-Contribution Dilution Multiple means (a) during the period prior to an Affirmative Mining Decision, 1.0, and (b) during the period from and after an Affirmative Mining Decision, 1.5. |

| NON-COMPETE COVENANT | If a party voluntarily resigns or relinquishes its interest, the party and its affiliates may not directly or indirectly acquire any interest in property within the Area of Interest (as that term is defined in JVA) for a period 24 months from the date of the resignation of relinquishment. |

| TERMINATION | The JVCo will be terminated upon: (a) the unanimous agreement of the parties to dissolve the JVCo; or (a) upon completion of the distribution of the assets of the JVCo. |

| TRANSFER ON INSOLVENCY | In a party becomes the subject of an insolvency event (Insolvent Party), the Insolvent Party must notify the other party of its insolvency and transfer its entire interest in the JVCo, free of any encumbrances, to the other party as soon as reasonably practicable in exchange for payment of an amount equal to the fair market value of the transferred interest minus any fees and expenses incurred in the appraisal of the fair market value. |

| GOVERNING LAW | The JVA is to be governed by, and interpreted in accordance with, the laws of the State of Delaware, except for its rules as to conflicts of laws that would apply the laws of another state. |

| OTHER TERMS | The JVA otherwise contains provisions considered standard for an agreement of its nature (including programs and budgets, distributions and confidentiality provisions). |