UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 40-F

| ☐ | REGISTRATION STATEMENT PURSUANT TO SECTION 12 OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| OR | ||

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13(a) OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the fiscal year ended December 31, 2024

| Commission file number: 001-33153 |

ENDEAVOUR SILVER CORP.

(Exact Name of Registrant as Specified in its Charter)

|

British Columbia |

1040 |

N/A |

|

(Province or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code) |

(I.R.S. Employer Identification No.) |

| #1130-609 Granville Stree | ||||

| Vancouver, British Columbia, Canada V7Y 1G5 | ||||

| (604) 685-9775 | ||||

| (Address and Telephone Number of Registrant's Principal Executive Offices) |

|

DL Services Inc. Columbia Center, 701 Fifth Avenue, Suite 6100 Seattle, Washington 98104 (206) 903-8800 |

Copies to: Jason K. Brenkert Dorsey & Whitney LLP Denver, Colorado 80202-5549 (303) 629-3400 |

|

(Name, address (including zip code) and telephone number (including area code) of agent for service in the United States) |

|

|

|

|

Securities registered or to be registered pursuant to Section 12(b) of the Act:

|

Title of Each Class: |

Trading Symbol(s) |

Name of Each Exchange On Which Registered: |

|

Common Shares, no par value |

EXK |

New York Stock Exchange |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

For annual reports, indicate by check mark the information filed with this form:

☒ Annual Information Form ☒ Audited Annual Financial Statements

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report: As at December 31, 2024, 262,323,863 common shares of the Registrant were issued and outstanding.

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 12b-2 of the Exchange Act.

☐ Emerging growth company.

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards † provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term "new or revised financial accounting standard" refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report: ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to § 240.10D-1(b). ☐

EXPLANATORY NOTE

Endeavour Silver Corp. (the "Company" or the "Registrant") is a Canadian issuer eligible to file its annual report pursuant to Section 13 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), on Form 40-F pursuant to the multi-jurisdictional disclosure system of the Exchange Act (the "MJDS"). The Company is a "foreign private issuer" as defined in Rule 3b-4 under the Exchange Act. Equity securities of the Company are accordingly exempt from Sections 14(a), 14(b), 14(c), 14(f) and 16 of the Exchange Act pursuant to Rule 3a12-3 thereunder.

FORWARD-LOOKING STATEMENTS

This annual report on Form 40-F and the exhibits attached hereto contain "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as "expects" or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "estimates" or "intends", or stating that certain actions, events or results "may", "could", "would", "might" or "will" (or the negative and grammatical variations of any of these terms and similar expressions) be taken, occur or be achieved,) are not statements of historical fact and may be forward-looking statements. Such forward-looking statements concern the Company's anticipated results and developments in the Company's operations in future periods, planned exploration and development of its properties, plans related to its business and other matters that may occur in the future. Please see section 1.3 "Forward-Looking Statements" in the Annual Information Form ("AIF") of the Company filed as Exhibit 99.1 to this annual report on Form 40-F for a more detailed discussion of forward-looking statements and the risks related thereto.

NOTE TO UNITED STATES READERS-

DIFFERENCES IN UNITED STATES AND CANADIAN REPORTING PRACTICES

The Company is permitted, under the multi-jurisdictional disclosure system adopted by the United States Securities and Exchange Commission (the "SEC"), to prepare this annual report on Form 40-F in accordance with Canadian disclosure requirements, which differ from those of the United States. The Company has prepared its consolidated financial statements, which are filed as Exhibit 99.2 to this annual report on Form 40-F, in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board ("IFRS") and they are not comparable to financial statements of United States companies.

MINERAL RESOURCE AND RESERVE ESTIMATES

The Company's AIF filed as Exhibit 99.1 to this annual report on Form 40-F and management's discussion and analysis for the fiscal year ended December 31, 2024 filed as Exhibit 99.3 have been prepared in accordance with the requirements of Canadian provincial securities laws, which differ from the requirements of United States securities laws.

As a result, the Company reports the mineral reserves and resources of the projects it has an interest in according to Canadian standards. Canadian reporting requirements for disclosure of mineral properties are governed by National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101"). NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. These standards differ from the requirements of the SEC that are applicable to domestic United States reporting companies under subpart 1300 of Regulation S-K ("S-K 1300") under the Exchange Act. As an issuer that prepares and files its reports with the SEC pursuant to the MJDS, the Company is not subject to the requirements of S-K 1300. Any mineral reserves and mineral resources reported by the Company in accordance with NI 43-101 may not qualify as such under or differ from those prepared in accordance with S-K 1300. Accordingly, information included or incorporated by reference in the Company's AIF filed as Exhibit 99.1 to this annual report on Form 40-F and management's discussion and analysis for the fiscal year ended December 31, 2024 filed as Exhibit 99.3 concerning descriptions of mineralization and estimates of mineral reserves and resources under Canadian standards may not be comparable to similar information made public by United States companies subject to the reporting and disclosure requirements of S-K 1300.

2

CURRENCY

Unless otherwise indicated, all dollar amounts in this annual report on Form 40-F are in United States dollars. The exchange rate of Canadian dollars into United States dollars, on December 31, 2024, based upon the closing exchange rate as quoted by the Bank of Canada, was U.S.$1.00 = CAD$ 1.4389 (CAD$1.00 = U.S.$ 0.6950).

ANNUAL INFORMATION FORM

The Company's AIF for the fiscal year ended December 31, 2024 is filed as Exhibit 99.1 to this annual report on Form 40-F and is incorporated by reference herein.

AUDITED ANNUAL FINANCIAL STATEMENTS

The audited consolidated financial statements of the Company for the years ended December 31, 2024 and 2023, including the report of the independent auditor with respect thereto, are filed as Exhibit 99.2 to this annual report on Form 40-F and are incorporated by reference herein.

MANAGEMENT'S DISCUSSION AND ANALYSIS

The Company's management's discussion and analysis for the fiscal year ended December 31, 2024 ("MD&A") is filed as Exhibit 99.3 to this annual report on Form 40-F and is incorporated by reference herein.

TAX MATTERS

Purchasing, holding, or disposing of the Company's securities may have tax consequences under the laws of the United States and Canada that are not described in this annual report on Form 40-F or the documents incorporated by reference herein.

CONTROLS AND PROCEDURES

Disclosure Controls and Procedures

At the end of the period covered by this annual report on Form 40-F for the fiscal year ended December 31, 2024, an evaluation was carried out under the supervision of, and with the participation of, the Company's management, including its Chief Executive Officer (CEO) and Chief Financial Officer (CFO), of the effectiveness of the design and operation of the Company's disclosure controls and procedures (as defined in Rule 13a-15(e) of the Exchange Act). Based upon that evaluation, the Company's CEO and CFO have concluded that the Company's disclosure controls and procedures were effective to give reasonable assurance that the information required to be disclosed by the Company in reports that it files or submits under the Exchange Act is (i) recorded, processed, summarized and reported, within the time periods specified in the SEC's rules and forms, and (ii) accumulated and communicated to management, including its principal executive and principal financial officers, or persons performing similar functions, as appropriate to allow timely decisions regarding required disclosure.

Management's Report on Internal Control over Financial Reporting

Management is responsible for establishing and maintaining adequate internal control over financial reporting, as defined in Rules 13a-15(f) of the Exchange Act. A company's internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles.

A company's internal control over financial reporting includes those policies and procedures that (i) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (ii) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and (iii) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company's assets that could have a material effect on the financial statements. It should be noted that a control system, no matter how well conceived or operated, can only provide reasonable assurance, not absolute assurance, that the objectives of the control system are met.

3

Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with policies and procedures may deteriorate.

Management, including the CEO and CFO, assessed the effectiveness of the Company's internal control over financial reporting as of December 31, 2024. In making this assessment, management used the criteria set forth in the Internal Control Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO). Based on its assessment, management has concluded that, as of December 31, 2024, the Company's internal control over financial reporting was effective and no material weaknesses in the Company's internal control over financial reporting were discovered.

The Company is required to provide an auditor's attestation report on its internal control over financial reporting for the fiscal year ended December 31, 2024. In this annual report on Form 40-F, the Company's independent registered public accounting firm, KPMG LLP ("KPMG"), has provided its opinion as to the effectiveness of the Company's internal control over financial reporting as of December 31, 2024. KPMG has also audited the Company's financial statements included in this annual report on Form 40-F and issued a report thereon.

Auditor's Attestation Report

KPMG's attestation report on the Company's internal control over financial reporting is included in the Audited Consolidated Financial Statements filed in Exhibit 99.2 of this annual report on Form 40-F and is incorporated by reference herein.

Changes in Internal Control over Financial Reporting

There have been no changes in internal control over financial reporting that occurred during the fiscal year ended December 31, 2024 that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

CORPORATE GOVERNANCE

The Company's Board of Directors (the "Board of Directors") is responsible for the Company's Corporate Governance policies and has separately designated standing Compensation, Corporate Governance and Nominating, and Audit Committees. The Board of Directors has determined that all the members of the Compensation, Corporate Governance and Nominating, and Audit Committees are independent, based on the criteria for independence prescribed by section 303A.02 of the NYSE Listed Company Manual.

Compensation Committee

Compensation of the Company's CEO and all other officers is recommended by management to the Compensation Committee, established in accordance with section 303A.05 of the NYSE Listed Company Manual, for evaluation and recommendation to the Board of Directors.

The Compensation Committee develops, reviews and monitors director and executive compensation and policies. The Compensation Committee is also responsible for annually reviewing the adequacy of compensation for directors and others and the composition of compensation packages. The Company's CEO cannot be present during the Committee's deliberations or vote. The Compensation Committee is composed of three independent directors (as determined under section 303A.02 and section 303A.05 of the NYSE Listed Company Manual): Ricardo Campoy (Chair), Ken Pickering and Mario Szotlender. The Company's Compensation Committee Charter is available on the Company's website at www.edrsilver.com.

4

Corporate Governance and Nominating Committee

The Company's Corporate Governance and Nominating Committee, established in accordance with section 303A.04 of the NYSE Listed Company Manual, is tasked with (a) developing and recommending to the Board of Directors corporate governance principles applicable to the Company; (b) identifying and recommending qualified individuals for nomination to the Board of Directors; and (c) providing such assistance as the Chair of the Board of Directors, if independent, or alternatively the lead director of the Board of Directors, may require. The Corporate Governance and Nominating Committee is composed of three independent directors (as determined under Section 303A.02 of the NYSE Listed Company Manual): Rex McLennan (Chair), Mario Szotlender and Margaret Beck. The Corporate Governance and Nominating Committee Charter is available on the Company's website at www.edrsilver.com.

The principal corporate governance responsibilities of the Corporate Governance and Nominating Committee include the following:

a) reviewing and reassessing at least annually the adequacy of the Company's corporate governance procedures and recommending any proposed changes to the Board of Directors for approval;

b) reviewing and recommending changes to the Board of Directors of the Company's Code of Conduct and considering any requests for waivers from the Company's Code of Conduct;

c) receiving comments from all directors and reporting annually to the Board of Directors with an assessment of the Board of Director's performance to be discussed with the full Board of Directors following the end of each fiscal year.

The principal responsibilities of the Corporate Governance and Nominating Committee for selection and nomination of director nominees include the following:

a) in making recommendations to the Board of Directors regarding director nominees, the Corporate Governance and Nominating Committee shall consider the appropriate size of the Board of Directors; the competencies and skills that the Board of Directors considers to be necessary for the Board of Directors, as a whole, to possess; the competencies and skills that the Board of Directors considers each existing director to possess; the competencies and skills each new nominee will bring to the Board of Directors; and whether or not each new nominee can devote sufficient time and resources to the nominee's duties as a director of the Company;

b) developing qualification criteria for directors for recommendation to the Board of Directors and, in conjunction with the Chair of the Board of Directors (or, if the Chair is not an independent director, any lead director of the Board of Directors), the Corporate Governance and Nominating Committee shall appoint directors to the various committees of the Board of Directors;

c) having the sole authority to retain and terminate any search firm to be used to identify director candidates or any other outside advisors considered necessary to carry out its duties and to determine the terms of such retainer;

d) in conjunction with the Chair of the Board of Directors (or, if the Chair of the Board of Directors is not an independent director, any lead director of the Board of Directors), overseeing the evaluation of the Board of Directors and of the Company and making recommendations to the Board of Directors as appropriate.

Audit Committee

The Company's Board of Directors has a separately designated standing Audit Committee established in accordance with section 3(a)(58)(A) of the Exchange Act and section 303A.06 and 303A.07 of the NYSE Listed Company Manual. The Company's Audit Committee is comprised of:

5

In the opinion of the Company's Board of Directors, all members of the Audit Committee are independent (as determined under Rule 10A-3 of the Exchange Act and section 303A.02 of the NYSE Listed Company Manual) and are financially literate. The members of the Audit Committee do not have fixed terms and are appointed and replaced from time to time by resolution of the Board of Directors.

The Audit Committee meets with the Company's CEO, the CFO and the Company's independent auditors to review and inquire into matters affecting financial reporting, the system of internal accounting and financial controls, as well as audit procedures and audit plans. The Audit Committee also recommends to the Board of Directors which independent registered public auditing firm should be appointed by the Company. In addition, the Audit Committee reviews and recommends to the Board of Directors for approval the annual financial statements, the MD&A, and undertakes other activities required by exchanges on which the Company's securities are listed and by regulatory authorities to which the Company is held responsible. The Company's Audit Committee Charter is available on the Company's website at www.edrsilver.com.

Audit Committee Financial Expert

The Company's Board of Directors has determined that Margaret Beck and Rex McLennan qualify as financial experts (as defined in Item 407 (d)(5)(ii) of Regulation S-K under the Exchange Act), has financial management expertise (pursuant to section 303A.07 of the NYSE Listed Company Manual) and is independent (as determined under Exchange Act Rule 10A-3 and section 303A.02 of the NYSE Listed Company Manual).

PRINCIPAL ACCOUNTING FEES AND SERVICES - INDEPENDENT AUDITORS

The following table shows the aggregate fees billed to the Company by KPMG LLP, Chartered Professional Accountants, the Company's independent registered public auditing firm, and its affiliates in each of the last two years.

| 2024 | 2023 | |

| Audit Fees (1) | $1,159,465 | $1,069,845 |

| Tax Fees (2) | $0 | $0 |

| All other fees (3) | $0 | $0 |

| Total* | $1,159,465 | $1,069,845 |

* All amounts are expressed in Canadian dollars

(1) The aggregate fees billed in each of the last two fiscal years for audit services by the Company's external auditor that are reasonably related to the performance of the audit or review of the Company's financial statements.

(2) The aggregate fees billed in each of the last two fiscal years for professional services rendered by the company's external auditor for tax compliance and tax advice.

(3) The aggregate fees billed in each of the last two fiscal years for products and services provided by the Company's external auditor, other than the services reported under clauses 1 and 2 above.

PRE-APPROVAL OF AUDIT AND NON-AUDIT SERVICES PROVIDED BY

INDEPENDENT AUDITORS

The Audit Committee pre-approves all audit services to be provided to the Company by its independent auditors. Non-audit services that are prohibited to be provided to the Company by its independent auditors may not be pre-approved. In addition, prior to the granting of any pre-approval, the Audit Committee must be satisfied that the performance of the services in question will not compromise the independence of the independent auditors. All non-audit services performed by the Company's auditor for the fiscal year ended December 31, 2024 were pre-approved by the Audit Committee of the Company. No non-audit services were approved pursuant to the de minimis exemption to the pre-approval requirement.

6

OFF-BALANCE SHEET TRANSACTIONS

The Company does not have any off-balance sheet financing arrangements or relationships with unconsolidated special purpose entities.

CODE OF ETHICS

The Company has adopted a Code of Business Conduct and Ethics (the "Code") that applies to all the Company's directors, executive officers and employees, which is available on the Company's website at www.edrsilver.com and in print to any shareholder who requests it. The Code meets the requirements for a "code of ethics" within the meaning of that term in General Instruction 9(b) of Form 40-F.

All amendments to the Code, and all waivers of the Code with respect to any of the officers covered by it, will be posted on the Company's website, www.edrsilver.com within five business days of the amendment or waiver and will remain available for a twelve-month period and provided in print to any shareholder who requests them. During the fiscal year ended December 31, 2024, the Company did not substantively amend, waive or implicitly waive any provision of the Code with respect to any of the directors, executive officers or employees subject to it.

CASH REQUIREMENTS

The Company's material cash requirements are discussed in management's discussion and analysis for the fiscal year ended December 31, 2024 filed as Exhibit 99.3 under the headings "Capital Requirements" and "Contractual Obligations".

NOTICES PURSUANT TO REGULATION BTR

There were no notices required by Rule 104 of Regulation BTR that the Registrant sent during the year ended December 31, 2024 concerning any equity security subject to a blackout period under Rule 101 of Regulation BTR.

NYSE CORPORATE GOVERNANCE

The Company's common shares are listed on the NYSE. Sections 103.00 and 303A.11 of the NYSE Listed Company Manual permit foreign private issuers to follow home country practices in lieu of certain provisions of the NYSE Listed Company Manual. A foreign private issuer that follows home country practices in lieu of certain provision of the NYSE Listed Company Manual must disclose any significant ways in which its corporate governance practices differ from those followed by domestic companies either on its website or in the annual report that it distributes to shareholders in the United States. A description of the significant ways in which the Company's governance practices differ from those followed by domestic companies pursuant to NYSE standards is as follows:

Shareholder Meeting Quorum Requirement: The NYSE is of the opinion that the quorum required for any meeting of shareholders should be sufficiently high to insure a representative vote. The Company's quorum requirement is set forth in its Memorandum and Articles. A quorum for a meeting of members of the Company is two persons who are, or who represent by proxy, shareholders who, in the aggregate, hold at least 5% of the shares entitled to be voted at the meeting.

Proxy Delivery Requirement: The NYSE requires the solicitation of proxies and delivery of proxy statements for all shareholder meetings, and requires that these proxies shall be solicited pursuant to a proxy statement that conforms to SEC proxy rules. The Company is a "foreign private issuer" as defined in Rule 3b-4 under the Exchange Act, and the equity securities of the Company are accordingly exempt from the proxy rules set forth in Sections 14(a), 14(b), 14(c) and 14(f) of the Exchange Act. The Company solicits proxies in accordance with applicable rules and regulations in Canada.

7

Shareholder Approval Requirement: The Company will follow Toronto Stock Exchange rules for shareholder approval of new issuances of its common shares and for the approval of equity plans. Following Toronto Stock Exchange rules, shareholder approval is required for certain issuances of shares that: (i) materially affect control of the Company; or (ii) provide consideration to insiders in aggregate of 10% or greater of the market capitalization of the listed issuer and have not been negotiated at arm's length. Shareholder approval is also required, pursuant to Toronto Stock Exchange rules, in the case of private placements: (x) for an aggregate number of listed securities issuable greater than 25% of the number of securities of the listed issuer which are outstanding, on a non-diluted basis, prior to the date of closing of the transaction if the price per security is less than the market price; or (y) that during any six month period are to insiders for listed securities or options, rights or other entitlements to listed securities greater than 10% of the number of securities of the listed issuer which are outstanding, on a non-diluted basis, prior to the date of the closing of the first private placement to an insider during the six month period. The Company will also follow Toronto Stock Exchange rules for shareholder approval of the Company's equity compensation plans rather than NYSE requirements. Under NYSE rules, shareholder approval is required for all equity compensation plans and any material revisions thereto. For "Rolling" or "evergreen" equity plans, like the Company's, which reserve a set percentage of the Company's issued and outstanding shares under the plan, each increase pursuant to such formula is subject to shareholder approval unless the plan has a term of not more than ten years. TSX rules provide that all security based compensation arrangements must be approved by a listed issuer's security holders at a meeting. This applies not only to plans, but also to individual stock options and entitlements not granted pursuant to an arrangement. Security holder approval is also required for any amendment to an arrangement or entitlement (e.g. an individual option or award), unless the plan permits such amendment without security holder approval. For evergreen plans, the TSX requires shareholder approval within three years after institution and within every three years thereafter.

The foregoing are consistent with the laws, customs and practices in Canada.

In addition, the Company may from time-to-time seek relief from the NYSE corporate governance requirements on specific transactions under the NYSE Listed Company Guide, in which case, the Company shall make the disclosure of such transactions available on the Company's website at www.edrsilver.com. Information contained on the Company's website is not part of this annual report on Form 40-F.

MINE SAFETY DISCLOSURE

Pursuant to Section 1503(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 ("Dodd-Frank Act"), issuers that are operators, or that have a subsidiary that is an operator, of a coal or other mine in the United States are required to disclose in their periodic reports filed with the SEC information regarding specified health and safety violations, orders and citations, related assessments and legal actions, and mining-related fatalities under the regulation of the Federal Mine Safety and Health Administration ("MSHA") under the Federal Mine Safety and Health Act of 1977 (the "Mine Act"). During the fiscal year ended December 31, 2024, the Company had no mines in the United States subject to regulation by MSHA under the Mine Act.

RECOVERY OF ERRONEOUSLY AWARDED COMPENSATION

The Company has adopted a compensation recovery policy effective October 2, 2023 (referred to as the "Incentive Compensation Clawback Policy") as required by NYSE listing standards and pursuant to Rule 10D-1 of the Exchange Act. The Incentive Compensation Clawback Policy isincorporated by reference to Exhibit 97 to the Registrant’s Annual Report on Form 40-F for the fiscal year ended December 31, 2023. At no time during or after the fiscal year ended December 31, 2024 (as of the date of this Annual Report), was the Company required to prepare an accounting restatement that required recovery of erroneously awarded compensation pursuant to the Incentive Compensation Clawback Policy and, as of December 31, 2024, there was no outstanding balance of erroneously awarded compensation to be recovered from the application of the Incentive Compensation Clawback Policy to a prior restatement.

8

DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS.

Not applicable.

UNDERTAKING

The Company undertakes to make available, in person or by telephone, representatives to respond to inquiries made by the Commission staff, and to furnish promptly, when requested to do so by the Commission staff, information relating to: the securities registered pursuant to Form 40-F; the securities in relation to which the obligation to file an annual report on Form 40-F arises; or transactions in said securities.

CONSENT TO SERVICE OF PROCESS

The Company filed an Appointment of Agent for Service of Process and Undertaking on Form F-X/A with the SEC on February 25, 2021, with respect to the class of securities in relation to which the obligation to file this annual report on Form 40-F arises. Any change to the name or address of the agent for service of process will be communicated promptly to the SEC by amendment to Form F-X/A referencing the Company's file number.

EXHIBIT INDEX

The following exhibits have been filed as part of this annual report on Form 40-F:

9

10

| 101.CAL | XBRL Taxonomy Extension Calculation Linkbase Document |

| 101.DEF | XBRL Taxonomy Extension Definition Linkbase Document |

| 101.LAB | XBRL Taxonomy Extension Label Linkbase Document |

| 101.PRE | XBRL Taxonomy Extension Presentation Linkbase Document |

| 104 | Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101) |

11

SIGNATURES

Pursuant to the requirements of the Exchange Act, the Registrant certifies that it meets all of the requirements for filing on Form 40-F and has duly caused this annual report to be signed on its behalf by the undersigned, thereto duly authorized.

ENDEAVOUR SILVER CORP.

By: __/s/ Daniel Dickson

Name: Daniel Dickson

Title: Chief Executive Officer

Date: March 11, 2025

12

ANNUAL INFORMATION FORM

of

ENDEAVOUR SILVER CORP.

(the "Company" or "Endeavour")

Suite 1130 - 609 Granville Street

Vancouver, British Columbia

Canada, V7Y 1G5

Phone: (604) 685-9775

Dated as of March 10, 2025

TABLE OF CONTENTS

ii

ITEM 1: PRELIMINARY NOTES

1.1 Incorporation of Documents by Reference

Except as otherwise disclosed herein, all financial information in this Annual Information Form ("AIF") has been prepared in accordance with International Financial Reporting Standards ("IFRS") as prescribed by the International Accounting Standards Board.

The information provided in the AIF is supplemented by disclosure contained in the technical reports listed below. The detailed disclosure in each of the technical reports below is incorporated by reference into this AIF.

| Type of Document | Report Date / Effective Date |

Date Filed / Posted |

Document name which may be viewed at the SEDAR website at www.sedarplus.ca |

| NI 43-101 Technical Report: Updated Mineral Resource and Reserve Estimates for the Guanaceví Project, Durango State, Mexico | December 14, 2022 (Effective date: November 5, 2022) | January 26, 2023 | Technical Report (NI 43-101) - English Qualification Certificate(s) and Consent(s) |

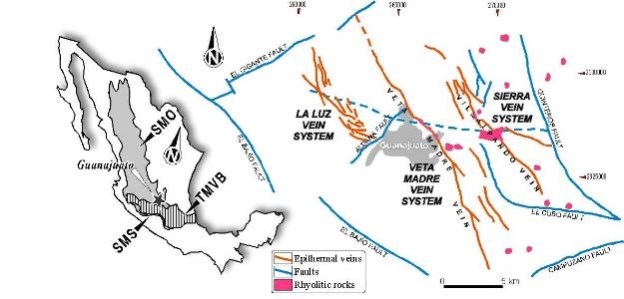

| NI 43-101 Technical Report: Updated Mineral Resource and Reserve Estimates for the Bolañitos Project, Guanajuato State, Mexico | December 14, 2022 (Effective date: November 9, 2022) | January 26, 2023 | Technical Report (NI 43-101) - English Qualification Certificate(s) and Consent(s) |

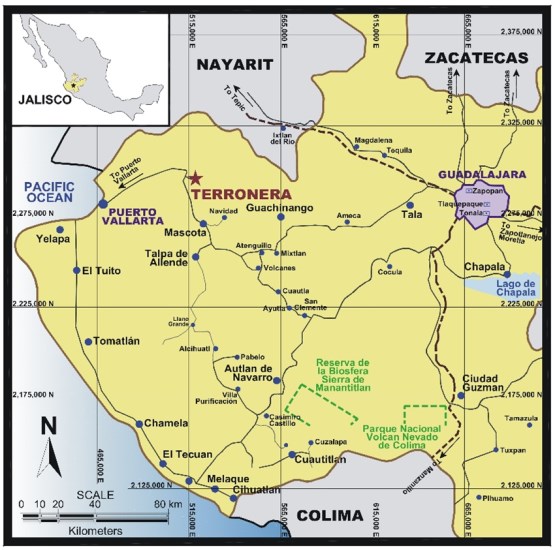

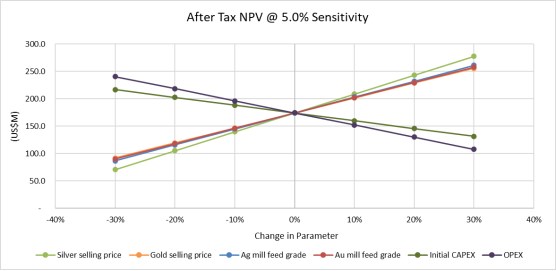

| NI 43-101 Technical Report on the Feasibility Study of the Terronera Project, Jalisco State, Mexico - Amended | Dated May 15, 2023 (Effective date: September 9, 2021) | May 31, 2023 | Technical Report (NI 43-101) - English Qualification Certificate(s) and Consent(s) |

| Mineral Resource Estimate for the Pitarrilla Ag-Pb-Zn Project, Durango State, Mexico (Amended) | Report Date: March 15, 2023 (Effective Date: October 6, 2022) |

March 29, 2023 | Technical Report (NI 43-101) - English Qualification Certificate(s) and Consent(s) |

References to "the Company" or "Endeavour" are to Endeavour Silver Corp. and, where applicable and as the context requires, include its subsidiaries.

1.2 Date of Information

All information in this AIF is as of December 31, 2024, unless otherwise indicated.

1.3 Forward-Looking Statements

This AIF contains "forward-looking statements" within the meaning of the U.S. Securities Litigation Reform Act of 1995, as amended and "forward-looking information" within the meaning of applicable Canadian securities legislation. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, forecasts, objectives, assumptions or future events or performance are not statements of historical fact and may be forward looking statements. Such forward-looking statements concern, without limitation: the Company's anticipated results and developments in the Company's operations in future periods; planned exploration and development of the Company's properties, including the timing of construction and commencement of commissioning; the timing and completion of the Company's studies; plans related to the Company's business, economic estimates, estimated future exploration and development expenditures and other expenses, and the timing and results of various related activities. These statements relate to analyses and other information that are based on expectations of future performance, including silver and gold production and planned work programs.

Statements concerning reserves and mineral resource estimates may also be deemed to constitute forward-looking statements to the extent that they involve estimates of the mineralization that will be encountered if the property is developed and, in the case of mineral reserves, such statements reflect the conclusion based on certain assumptions that the mineral deposit can be economically exploited.

Forward-looking statements are made based upon certain assumptions and other important factors that, while considered reasonable by the Company, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. The Company has made assumptions based on many of these factors which include, without limitation:

• present and future business strategies;

• the environment in which the Company will operate in the future, including the price of silver and gold;

• anticipated cost and the ability to achieve goals;

• the Company's forecasted mine economics;

• the reliability of mineral resource estimates;

• the continuation of exploration and mining operations; and

• no material adverse change in the market price of commodities.

Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors which could cause actual events or results to differ from those expressed or implied by the forward-looking statements, including, without limitation, the following and those disclosed in this AIF under "Description of the Business - Risk Factors":

This list is not exhaustive of the factors that may affect the Company's forward-looking statements. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in the forward-looking statements. The Company's forward-looking statements and information are based on the assumptions, beliefs, expectations and opinions of management as of the date of this AIF. The Company will update forward-looking statements and information if and when, and to the extent, required by applicable securities laws. Readers should not place undue reliance on forward-looking statements. The forward-looking statements and information contained herein are expressly qualified by this cautionary statement.

Certain forward-looking statements and information in this AIF may be considered "financial outlook" within the meaning of applicable Canadian securities legislation. Financial outlook is presented in this AIF for the purpose of assisting investors and others in understanding certain key elements of the Company's financial results and business plan, as well as the objectives, strategic priorities and business outlook of the Company, and in obtaining a better understanding of the Company's anticipated operating environment. Readers are cautioned that such financial outlook may not be appropriate for other purposes.

1.4 Conversion Table

All data and information are presented in metric units. In this AIF, the following conversion factors were used:

|

2.47 acres |

= |

1 hectare |

1% |

= |

10,000 ppm |

|

3.28 feet |

= |

1 metre |

0.4047 hectares |

= |

1 acre |

|

0.62 miles |

= |

1 kilometre |

0.3048 metres |

= |

1 foot |

|

0.032 ounces (troy) |

= |

1 gram |

1.609 kilometres |

= |

1 mile |

|

1.102 tons (short) |

= |

1 tonne |

31.103 grams |

= |

1 ounce (troy) |

|

0.029 ounces/ton |

= |

1 gram/tonne |

0.907 tonnes |

= |

1 ton |

|

1 ppm |

= |

1 gram/tonne |

34.286 grams/tonne |

= |

1 ounce/ton |

|

1 ounce/ton |

= |

34.286 ppm |

|

|

|

1.5 Technical Abbreviations

|

Ag |

silver |

m |

metres |

|

Ag Eq. |

silver equivalent |

NI 43-101 |

National Instrument 43-101 Standards of Disclosure for Mineral Projects |

|

Au |

Gold |

NSR |

net smelter returns |

|

Au Eq. |

gold equivalent |

opt |

ounces per ton |

|

aver. |

average |

oz |

ounce(s) |

|

cm |

centimetres |

Pb |

lead |

|

g |

grams |

RC |

reverse circulation |

|

gpt or g/t |

grams per tonne |

t |

tonne |

|

ha |

hectares |

tpd |

tonnes per day |

|

km |

kilometres |

tr |

trench |

|

lb |

pound |

Zn |

zinc |

1.6 Currency and Exchange Rates

All dollar amounts in this AIF are expressed in U.S. dollars ("$") unless otherwise indicated. References to "CAD" are to Canadian dollars.

The high, low, average and closing rates for the United States dollar in terms of Canadian dollars for each of the financial periods of the Company ended December 31, 2024, December 31, 2023, and December 31, 2022, as quoted by the Bank of Canada, were as follows:

| Year ended December 31, 2024 |

Year ended December 31, 2023 |

Year ended December 31, 2022 |

|

| High | 1.4416 | 1.3875 | 1.3856 |

| Low | 1.3316 | 1.3128 | 1.2451 |

| Average | 1.3698 | 1.3497 | 1.3011 |

| Closing | 1.4389 | 1.3226 | 1.3544 |

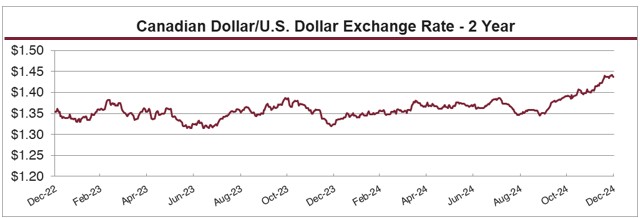

On December 31, 2024, the closing exchange rate for the United States dollar in terms of Canadian dollars, as quoted by the Bank of Canada, was U.S.$1.00 = CAD$ 1.4389 (CAD$1.00 = U.S.$ 0.6950). On March 10, 2025, the daily average exchange rate for the United States dollar in terms of Canadian dollars, as quoted by the Bank of Canada, was U.S.$1.00 = CAD$1.4431 (CAD$1.00 = U.S.$0.6930).

1.7 Classification of Mineral Reserves and Resources

In this AIF, the definitions of proven and probable mineral reserves, and measured, indicated and inferred mineral resources are those used by the Canadian provincial securities regulatory authorities and conform to the definitions utilized by the Canadian Institute of Mining, Metallurgy and Petroleum (the "CIM"), as the CIM Definition Standards on Mineral Resources and Mineral Reserves adopted by the CIM Council, as amended.

1.8 Cautionary Note to U.S. Investors concerning Estimates of Mineral Reserves and Measured, Indicated and Inferred Mineral Resources

This AIF has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of United States securities laws. As a result, the Company reports the mineral reserves and resources of the projects it has an interest in according to Canadian standards. Canadian reporting requirements for disclosure of mineral properties are governed by National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") and the Canadian Institute of Mining, Metallurgy and Petroleum - CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended. NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. These standards differ from the requirements of the United States Securities and Exchange Commission ("SEC") that are applicable to domestic United States reporting companies under subpart 1300 of Regulation S-K ("S K 1300") under the Exchange Act. As an issuer that prepares and files its reports with the SEC pursuant to the MJDS, the Company is not subject to the requirements of S K 1300. Any mineral reserves and mineral resources reported by the Company in accordance with NI 43-101 may not qualify as such under or differ from those prepared in accordance with S K 1300. Accordingly, information included or incorporated by reference in this AIF concerning descriptions of mineralization and estimates of mineral reserves and resources under Canadian standards may not be comparable to similar information made public by United States companies subject to the reporting and disclosure requirements of S K 1300.

ITEM 2: CORPORATE STRUCTURE

2.1 Name, Address and Incorporation

The Company was incorporated under the laws of the Province of British Columbia on March 11, 1981, under the name, "Levelland Energy & Resources Ltd". Effective August 27, 2002, the Company changed its name to "Endeavour Gold Corp.". On September 13, 2004, the Company changed its name to "Endeavour Silver Corp.", transitioned from the Company Act (British Columbia) to the Business Corporations Act (British Columbia) and increased its authorized share capital to unlimited common shares without par value.

The Company's principal business office is located at:

Suite 1130 - 609 Granville Street

Vancouver, British Columbia

Canada, V7Y 1G5

and its registered and records office is located at:

1133 Melville St #3500,

Vancouver, BC V6E 4E5

Canada, V6C 3H4

2.2 Subsidiaries

The Company conducts its business primarily in Mexico through subsidiary companies. The following table lists the Company's material direct and indirect subsidiaries, their jurisdiction of incorporation, and percentage owned by the Company directly, indirectly or beneficially.

| Name of Company | Incorporated | Percentage owned directly or indirectly |

| Refinadora Plata Guanaceví, S.A. de C.V. | Mexico | 100% |

| Mina Bolañitos S.A de C.V. | Mexico | 100% |

| Terronera Precious Metals S.A. de C.V. | Mexico | 100% |

| Minera Pitarrilla S.A. de C.V. | Mexico | 100% |

ITEM 3: GENERAL DEVELOPMENT OF THE BUSINESS

The Company is a Canadian mineral company engaged in the evaluation, acquisition, exploration, development and exploitation of precious metal properties in Mexico, Chile and the USA. The Company has two producing silver-gold mines in Mexico: the Guanaceví Mine in Durango acquired in 2004 (the "Guanaceví Project") and the Bolañitos Mine in Guanajuato acquired in 2007 (the "Bolañitos Project"). In addition to operating these two mines, the Company is advancing one development and two exploration projects in Mexico: the Terronera property in Jalisco state acquired in 2010 that is now in the development stage (the "Terronera Project" or "Terronera Property"), the prospective Pitarrilla property in Durango State acquired in 2022 and the Parral properties in Chihuahua acquired in 2016.

The Company has several early stage exploration projects in Chile accumulated from 2012.

In 2021, the Company acquired the Bruner property, located in Nye County, Nevada, USA which is an exploration project that includes mineral claims, mining rights, property assets, water rights, and government authorizations and permits.

3.1 Three Year History

Financial Year ended December 31, 2022

On January 12, 2022, the Company entered into a definitive agreement to purchase the Pitarrilla project in Durango State, Mexico from SSR Mining Inc. ("SSR") for total consideration of $70 million, consisting of $35 million in common shares and a further $35 million in cash or in common shares at the election of SSR and agreed to by the Company, and a grant of a 1.25% net smelter returns ("NSR") royalty.

Pitarrilla is a large undeveloped silver, lead, and zinc project located 160 kilometres north of Durango City, in northern Mexico. The Pitarrilla property consists of 4,950 hectares across five concessions and has significant infrastructure in place with direct access to utilities.

The acquisition was completed on July 6, 2022. Total consideration included 8,577,380 shares of the Company issued on July 6, 2022, based on a deemed price of $4.07 per share and a $35.1 million cash payment. Fair value of the 8,577,380 common shares issued on July 6, 2022, was $25.6 million at CAD$3.89 per share.

On March 22, 2022, the Company completed a prospectus equity financing issuing a total of 9,293,150 common shares at a price of $4.95 per share for aggregate proceeds of $46 million, less commission of $2.5 million and $0.3 million in transaction related costs.

On September 9, 2022, the Company entered into an agreement to sell a 100% interest in Minera Oro Silver de Mexico, S.A. de C.V. ("MOS"), a wholly-owned subsidiary of Endeavour to Grupo ROSGO, S.A. de C.V., ("Grupo ROSGO"). MOS held the El Compas property and the lease on the La Plata processing plant in Zacatecas, Mexico. Pursuant to the agreement, Grupo ROSGO were to pay Endeavour $5 million cash over five years with an initial payment of $250,000 on signing of the definitive agreement. Instalment payments of $500,000 will be made every six months other than the third payment, which will be $750,000. The payments are secured by a pledge of the shares of MOS. As at December 31, 2024, $2.9 million remained outstanding.

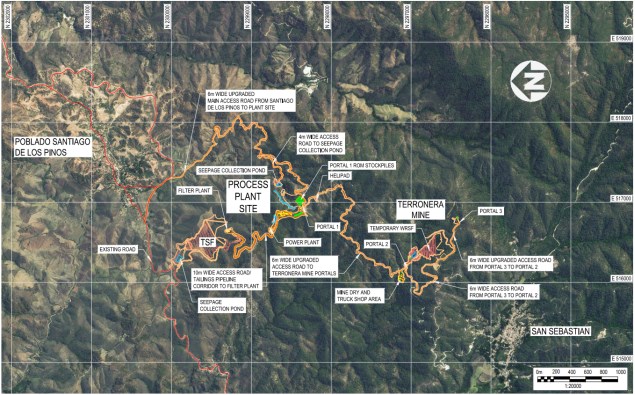

During 2022, the Company continued progress on development activities at the Terronera Project including onsite delivery of mobile mining equipment, procurement of major equipment, and assembly of initial project infrastructure such as the temporary mine maintenance shop and a permanent camp facility. Earthworks included site clearing, road upgrades and underground mine access development. The Company intends to make a formal construction decision subject to completion of a financing package and receipt of additional amended permits in 2023.

Financial Year ended December 31, 2023

In April 2023, the Company made a formal decision to proceed with the construction of an underground mine and mill at the Terronera Project. The board of directors of the Company (the "Board") approved the construction based on an operating scenario, consisting of a process plant with 2,000 tonne per day capacity and an initial capital expenditure cost of $230 million. A comprehensive review of the remaining cost-to-complete was then completed in January 2024 with forecasted initial capital costs updated to $271 million.

On June 16, 2023, the Company filed a short form base shelf prospectus (the "Base Shelf") to qualify the distribution of various securities, including common shares. The distribution of such securities of the Company may be effected from time to time in one or more transactions at a fixed price or prices, which may vary with market prices prevailing at the time of sale, or at prices related to such prevailing market prices to be negotiated with purchasers and as set forth in an accompanying prospectus supplement, including transactions that are deemed to be at-the-market ("ATM") distributions.

On June 27, 2023, the Company entered into an ATM equity facility under which were issued 23,428,572 common shares at an average price of $2.47 per share for gross proceeds of $57.9 million, less commission of $1.1 million and recognized $0.2 million of other transaction costs. The June 2023 ATM facility was completed in November 2023.

On August 30, 2023, the Company through its wholly owned subsidiary, Minera Plata Adelante, S.A. de C.V., completed the sale of its interest in the 1% Cozamin royalty (the "Cozamin Royalty") to Gold Royalty Corp. for total consideration of $7.5 million in cash. The Cozamin Royalty applies to two concessions (Calicanto and Vicochea) on Capstone Copper's Cozamin copper-silver mine. The Company obtained the Cozamin Royalty through a concession division agreement signed in 2017 on seven wholly-owned concessions which were acquired for $0.5 million. The sale agreement includes an option granted to Gold Royalty Corp. to purchase any additional royalties which may be granted on the five remaining concessions under the 2017 concession division agreement.

On October 6, 2023, the Company, through its wholly owned subsidiary Terronera Precious Metals, S.A. de C.V., executed a credit agreement with Société Générale and ING Bank N. V. with certain definitive terms agreed for a senior secured debt facility for up to $120 million (the "Debt Facility").

A summary of the key terms of the Debt Facility are as follows:

• Facility Amount: Up to $120 million principal amount on senior secured debt.

• Term: 8.5 years, including a 2-year grace period during the construction phase.

• Interest rate: US Secured Overnight Financing Rate ("SOFR") + 4.50% per annum prior to completion and SOFR + 3.75% per annum from completion of the Terronera Project until the fifth anniversary of the loan, and SOFR + 4.25% from the fifth anniversary onwards.

• Repayment and Maturity: Principal payments are payable in quarterly installments commencing in the fourth quarter of 2025. Cash sweep will be applied to 35% of excess cash flow after debt service from the fourth quarter of 2025, until $35 million of loan principal has been prepaid.

• Gold Hedge: Prior to initial drawdown, Terronera must enter into a hedging program for 68,000 ounces of gold over the initial two operating years prior to initial drawdown.

• Foreign Exchange Hedge: Prior to initial drawdown, Terronera must enter into a hedging program for managing exposure to the Mexico Peso during construction. The program requires approximately 75% of the remaining capital expenditure incurred in Mexican Pesos to be hedged. Prior to initial production, a hedging program is required for managing exposure to the Mexican Peso during operations. Under this program 50% of the projected operating costs incurred in Mexican Pesos are hedged prior to completion. Thereafter, the foreign exchange protection program for operations will rise to 70% of the projected operating costs incurred in Mexican Pesos.

• Project Cost Overrun Funding: Cost overrun funding is required in the form of cash, letter of credit issued by a Canadian financial institution or a combination of both for up to $48 million.

• Financial Covenants: The Debt Facility is subject to certain customary conditions precedent and debt servicing covenants. The Debt Facility is secured through corporate guarantees from Endeavour and certain Endeavour subsidiaries and a first ranking security interest over the Terronera Project.

The Debt Facility is secured through corporate guarantees from the Company, certain of the Company's subsidiaries and a first ranking security interest over the Terronera Project. The Debt Facility is subject to certain customary covenants including that at all times the corporate entity must maintain a cash balance in excess of $10,000 and the Reserve Tail Ratio must be in excess of 20% (subsequently amended to 30%). Then at certain measurement dates, the following must be observed: Loan Life Coverage Ratio must be in excess of 1.3; Project Life Coverage Ratio must be in excess of 1.5; Historical Debt Service Coverage Ratio must be in excess of 1.25; Gross Leverage Ratio must be less than 3.5; and Interest Service Coverage Ratio must be in excess of 2.5. The definitions of capitalized terms used for the financial covenants are in the Debt Facility agreement.

On December 18, 2023, the Company entered into an ATM equity facility ("December 2023 ATM Facility") under which were issued in 2023 and 2024 a total of 29,852,592 common shares at an average price of $2.01 per share for gross proceeds of $59.9 million, less commission of $1.2 million and recognized $0.3 million of other transaction costs.

Financial Year ended December 31, 2024

During 2024 the Company drew down on the Terronera Debt Facility for $120 million in full. Proceeds from the debt facility have been used towards construction of the underground mine and mill at the Company's Terronera Project. In connection with the Debt Facility, the Company was required to undertake certain hedging activities:

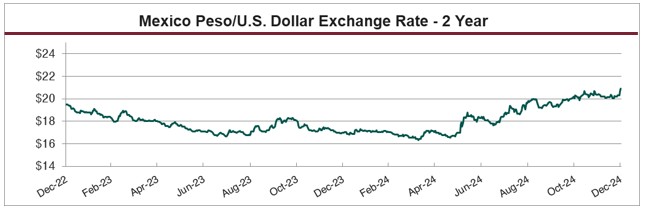

• hedge a portion of the estimated remaining capital expenditures incurred in Mexican Pesos, and hedge a portion of expected operating costs during the first two years of operations. The Company has entered into additional Mexican peso forward purchase contracts to reduce the exposure of operating mines to the currency fluctuation. During 2024, the Company entered into Mexican peso forward purchase contracts for a total of $95 million with an average price of 18.90 pesos per US dollar. At the end of 2024, $49 million of these contracts remained outstanding.

• hedge against the fluctuation in gold prices using gold forward swap contracts for 68,000 ounces of gold at forward price at settlement of $2,389. Subsequent to the 2024 year end on January 29, 2025, the Company amended the swap contracts, with updated settlements from June 2025 to October 2027 and revised forward price for those settlements of $2,329 per oz.

In August 2024, the trunnion on the primary ball mill at the Guanaceví project failed which suspended operations for more than a week. Temporary modifications were completed within the plant to re-purpose one of the regrind mills as the primary ball mill, allowing the processing of ore to continue at a reduced capacity, averaging 565 tonnes per day (tpd). After the newly fabricated trunnion was installed, production resumed to full capacity in the second half of December 2024.

On November 21, 2024, the Company filed a prospectus supplement to the Base Shelf for the distribution of 15,825,000 common shares at a price of $4.60 per share pursuant to a bought deal financing. On November 27, 2024, the Company completed this prospectus offering for gross proceeds of $72.8 million less commission of $3.9 million and recognized $0.4 of other transaction costs related to the bought deal financing as share issuance costs.

During 2024, the Company advanced the construction at Terronera Project, and as at December 31, 2024, the project was 89.4% complete, with focus remaining on the lower platform and a goal to commence full commissioning in early Q2 2025.

3.2 Significant Acquisitions

No significant acquisitions for which disclosure is required under Part 8 of National Instrument 51-102 were completed by the Company during its most recently completed financial year.

ITEM 4: DESCRIPTION OF THE BUSINESS

4.1 General Description

Business of the Company

The Company's principal business activities are the evaluation, acquisition, exploration, development and exploitation of mineral properties. The Company produces silver and gold from its underground mines at Guanaceví and Bolañitos and is advancing the development of the Terronera Project in Mexico. The Company also has interests in and is advancing certain exploration properties in Mexico, the USA and Chile.

Since 2002, the Company's business strategy has been to focus on acquiring advanced-stage silver mining properties in Mexico. Mexico, despite its long and prolific history of metal production, appears to be relatively under-explored using modern exploration techniques and offers promising geological potential for precious metals exploration and production.

The Company's Guanaceví and Bolañitos mines acquired in 2004 and 2007, respectively, demonstrate its business model of acquiring fully built and permitted silver mines that were about to close for lack of ore. By bringing the money and expertise needed to find new silver mineralized bodies, Endeavour successfully re-opened and expanded these mines to develop their full potential. The benefit of acquiring fully built and permitted mining and milling infrastructure is that, if new exploration efforts are successful, the mine development cycle from discovery to production only takes a matter of months instead of the several years normally required in the traditional mining business model.

In addition to operating the Guanaceví and Bolañitos mines, the Company is nearing completion of the Terronera development project after making a construction decision in April 2023. As of December 31, 2024, overall project progress reached 89.4% completion. As at December 31, 2024, the Company has invested more than $302 million of the total $332 million required to build Terronera. Full commissioning is anticipated in the second quarter of 2025. The Company is advancing exploration and evaluation initiatives at Pitarrilla project and exploring a number of other properties in Mexico, the USA and Chile towards achieving its goal to become a premier senior producer in the silver mining sector.

Production

The Guanaceví and Bolañitos mines produce silver and gold which are sold as bullion or in the form of metal concentrates. The Guanaceví mine produces silver doré delivered to the Penoles Torreon refinery, in Chihuahua state. After the doré is refined to bullion, the silver and gold bullion is sold by an agent through commodity exchanges. In 2024, the Guanaceví mine accounted for 90% of silver revenue (2023: 92%), 35% of gold revenue (2023: 40%) and 68% of total consolidated revenue (2023: 74%).

The Bolañitos mine produces a concentrate that contains high grade gold and silver. The concentrate is shipped to Manzanillo and sold to various metal traders for blending with other metal concentrate and shipped globally for smelting and refining. The high-grade precious metal contents of the Bolañitos concentrate are highly conducive for concentrate blending and therefore highly marketable. Annually, the mine renews sales contracts through a competitive bid process. During 2024, Bolañitos annual sales to three customers accounted for 100% of concentrate sales (2023: three customers).

In 2024, the Bolañitos mine accounted for 10% of silver revenue (2023: 8%), 65% of gold revenue (2023: 60%) and 32% of total consolidated revenue (2023: 26%).

On a consolidated basis, silver attributed 58% of total revenue (2023: 64%) and gold attributed 42% of total revenue (2023:36%).

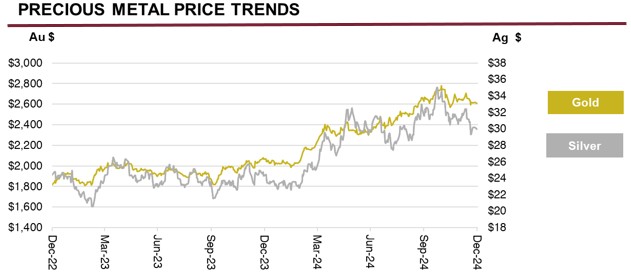

The market prices of gold and silver are key drivers of the Company's profitability. The prices of gold and silver can fluctuate widely and are affected by a number of macroeconomic factors, including global or regional consumption patterns, the supply of and demand for gold and silver, interest rates, exchange rates, inflation or deflation, global geo-political uncertainty, and the political and economic conditions of major gold and silver producing and gold and silver consuming countries throughout the world. Importantly, the price of gold and silver can be impacted by their role as safe havens during periods of market turmoil and as defense against the perceived inflationary impacts and currency depreciation caused by the responses of governments and central banking authorities to economic threats.

During the year ended December 31, 2024, the average price of silver was $28.24 per ounce, with silver trading between $22.09 and $34.51 per oz based on the London Fix silver price. This compares to an average of $23.35 per oz for the year ended December 31, 2023, with a low of $20.09 and a high of $26.03 per oz.

During the year ended December 31, 2024, the average price of gold was $2,384 per oz, with gold trading between $1,811 and $2,078 per oz based on the London Fix PM gold price. This compares to an average of $1,800 per oz for the year ended December 31, 2023, with a low of $1,629 and a high of $2,039 per oz.

Specialized Skill and Knowledge

Most aspects of the Company's business require specialized skills and knowledge. Such skills and knowledge include the areas of geology, exploration, development, technology, financing and accounting. The Company has executive officers and employees with extensive experience in geology, exploration and mine development in Mexico and other parts of North and South America. Furthermore, the Company's executive officers, directors and employees have significant experience in mining, processing technologies, international finance, mergers and acquisitions and accounting. They provide a strong foundation of advanced skills and knowledge and specialized mineral exploration experience, complemented by their demonstrated ability to succeed in the management and administration of a mining company.

Competitive Conditions

The Company competes with other mining companies and smaller natural resource companies in the acquisition, exploration, development and financing of new properties and projects in Mexico. Many of these companies are more experienced, larger and have greater financial resources for, among other things, financing and the recruitment and retention of qualified personnel. See "Risk Factors - Competitive Conditions".

Environmental Protection

The Company's environmental permits require that it reclaim certain lands it disturbs during mining operations and exploration and development activities. Significant reclamation and closure activities include land rehabilitation, decommissioning of buildings and mine facilities, ongoing care and maintenance and other costs. Although the ultimate amount of the reclamation and rehabilitation costs to be incurred cannot be predicted with certainty, the total undiscounted, uninflated amount of probability weighted estimated cash flows required to settle the Company's estimated obligations is $5.9 million for the Guanaceví mine operations, $3.4 million for the Bolañitos mine operations, $2.3 million for the Terronera Project and $0.1 million for the Pitarrilla project.

Employees

As at December 31, 2024, the Company had 19 employees based in its Vancouver corporate office and employed through its Mexican subsidiaries over 1,520 full and part-time employees. Consultants and contractors are also retained from time to time to assist with or conduct specific corporate activities, development and exploration programs.

Foreign Operations

As the Company's producing mines, development project and mineral exploration interests are principally located in Mexico, the Company's business is dependent on foreign operations. As a developing economy, operating in Mexico has certain risks. See "Risk Factors - Foreign Operations".

Intangibles, Cycles and Changes to Contracts

The Company's business is not materially affected by intangibles such as licences, patents and trademarks, nor is it significantly affected by seasonal changes. Other than as disclosed in this AIF, the Company is not aware of any aspect of its business which may be affected in the current financial year by renegotiation or termination of contracts.

Community, Environmental and Corporate Safety Policies

Endeavour is focused on the development of sustainability programs for all stakeholders and understands that such programs contribute to the long-term benefit of the Company and society at large. Sustainability programs implemented by the Company range from improving the Company's safety policies and practices; supporting health programs for the Company's employees and the local communities; enhancing environmental stewardship and reclamation; sponsoring educational scholarships and job skills training programs; sponsoring community cultural events and infrastructure improvements; and supporting charitable causes.

The Company's Sustainability Committee oversees the Company's compliance with the Sustainability Policy. The Sustainability Policy sets out the Company's sustainability strategy which centres on three pillars: people, planet and business. Under the "people" pillar, Endeavour is committed to, amongst other things, protecting the health and safety of our workforce and host communities, providing a work environment free of discrimination, promoting respect for human rights, promoting the development of communities in the jurisdictions in which the Company operates, and working to identify hazards in order to minimize or eliminate socio-environmental risks associated with work tasks. Under the "planet" pillar, Endeavour is committed to promoting efficient use of natural resources, identifying and evaluating environmental impacts produced in all stages of the Company's operations, promoting use of clean technologies, and considering environmental factors (including climate-related risks) in operational decisions and new projects. Under the "business" pillar, Endeavour is committed to conducting business in an ethical way, prioritizing local recruitment, promoting diversity based on principles of merit and qualifications and maintaining a risk management system that supports monitoring or traditional and emerging risks. The Company publishes a sustainability report annually available on the Company's website.

The Sustainability Committee also oversees the Company's compliance with its Human Rights Policy, which sets out the Company's commitment to respecting human rights related to working conditions and equal opportunity, engaging with indigenous peoples to respect cultural traditions, protecting against discrimination towards any individual based on religion, ethnicity, gender or other protected characteristics.

4.2 Risk Factors

Investment in securities of the Company should be considered a speculative investment due to the high-risk nature of the Company's business and the present stage of the Company's development. The following risk factors, as well as risks currently unknown to the Company, could materially adversely affect the future business, operations and financial condition of the Company and could cause them to differ materially from the Company's current business, property or financial results, each of which could cause investors to lose part or all of their investment in the Company's securities.

The following factors are those which are the most applicable to the Company. The discussion which follows is not inclusive of all potential risks. Risk management is an ongoing exercise upon which the Company spends a substantial amount of time. While it is not possible to eliminate all of the risks inherent to the mining business, the Company strives to manage these risks, to the greatest extent possible, to ensure that its assets are protected.

Debt Facility

The terms of the Debt Facility require the Company to satisfy various affirmative and negative covenants and financial ratios. These covenants and ratios limit, among other things, the Company's ability to incur further indebtedness, create certain liens on assets, engage in certain types of transactions, or pay dividends. The Company can provide no assurances that in the future, it will not be limited in its ability to respond to changes in its business or competitive activities or be restricted in its ability to engage in mergers, acquisitions, or dispositions or acquisitions of assets. A failure to comply with these covenants and ratios could result in an event of default under the Debt Facility agreement.

Interest Rate Risk

Increases to benchmark interest rates may have an impact on the Company's cost of borrowing under the Debt Facility and any debt financing that the Company may negotiate, resulting in reduced amounts available to fund the Company's exploration, development and production activities and could negatively impact the market price of its common shares and/or the price of gold or silver, which could have a material adverse effect on the Company's operations and financial condition.

Precious and Base Metal Price Fluctuations

The Company's revenue is primarily dependent on the sale of silver and gold and movements in the spot price of silver or gold may have a direct and immediate impact on the Company's income and the value of related financial instruments. The Company's sales are directly dependent on commodity prices. Metal prices have historically fluctuated widely and are affected by numerous factors beyond the Company's control including international economic and political trends, expectations for inflation, currency exchange rate fluctuations, interest rates, global and regional supply and demand, consumption patterns, speculative market activities, worldwide production and inventory levels, and sales programs by central banks. The exact effect of these factors on metal prices cannot be accurately predicted. Declining market prices for these metals could materially adversely affect the Company's operations and profitability and could affect the Company's ability to finance the exploration and development of any of the Company's other mineral properties.

Fluctuations in the Price of Consumed Commodities

Prices and availability of commodities consumed or used in connection with exploration, development and mining, such as natural gas, diesel, oil, electricity, cyanide and other re-agents, fluctuate and affect the Company's operations and financial condition. These fluctuations can be unpredictable, can occur over short periods of time and may have a materially adverse impact on the Company's operating costs or the timing and costs of various projects. The Company's general policy is not to hedge its exposure to changes in prices of the commodities that its uses in its operations.

Foreign Exchange Rate Fluctuations

Operations in Mexico, Chile, USA and Canada are subject to foreign currency exchange fluctuations. The Company raises its funds through equity issuances which are priced in Canadian or United States dollars, and the majority of the mining, development and exploration costs of the Company are denominated in United States dollars, Mexican pesos and Chilean pesos. The Debt Facility drawdowns are denominated in United States dollars. The Company has pro-actively executed foreign exchange hedge contracts to help mitigate the risk of changes to foreign exchange rates, however it may suffer losses due to adverse foreign currency fluctuations.

Competitive Conditions

Significant competition exists for natural resource acquisition opportunities. As a result of this competition, some of which are with large, well established mining companies with substantial capabilities and significant financial and technical resources, the Company may be unable to either compete for or acquire rights to exploit additional attractive mining properties on terms it considers acceptable. Accordingly, there can be no assurance that the Company will be able to acquire any interest in additional projects that would yield resources, reserves or results for commercial mining operations and failure to do so could have a material adverse effect on the Company's business, financial condition or results of operations.

Operating Hazards and Risks

Mining operations generally involve a high degree of risk, which even a combination of experience, knowledge and careful evaluation may not be able to overcome. These risks include, but are not limited to, the following: environmental hazards and catastrophes, industrial accidents and explosions, third party accidents, unusual or unexpected geological structures or formations, failure of engineered structures, inaccurate mineral modelling, metallurgical and other processing problems, remote locations and inadequate infrastructure, equipment failure, changes in the costs of consumables, power outages, fires, labour shortages and disruptions (including due to public health issues or strikes), floods, cave-ins, land-slides, acts of God, periodic interruptions due to inclement or hazardous weather conditions, earthquakes, war, rebellion, organized crime, revolution, delays in transportation, inaccessibility to property, restrictions of courts and/or government authorities, other restrictive matters beyond the reasonable control of the Company, and the inability to obtain suitable or adequate machinery, equipment or labour and other risks involved in the operation of mines.

Operations in which the Company has a direct or indirect interest will be subject to all the hazards and risks normally incidental to exploration, development and production of precious and base metals, any of which could result in work stoppages, delayed production and resultant losses, increased production costs, asset write downs, monetary losses, damage to or destruction of mines and other producing facilities, damage to life and property, environmental damage and possible legal liability for any or all damages. The Company may become subject to liability for pollution, cave-ins or hazards against which it cannot insure or against which it may elect not to insure. Any compensation for such liabilities may have a material, adverse effect on the Company's financial position.

The Company's property, business interruption and liability insurance may not provide sufficient coverage for losses related to these or other hazards. Insurance against certain risks, including certain liabilities for environmental pollution, may not be available to the Company or to other companies within the industry at reasonable terms or at all. In addition, the Company's insurance coverage may not continue to be available at economically feasible premiums, or at all. Any such event could have a material adverse effect on the Company's business.

Mining Operations