UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of April 2024

Commission File Number: 001-33153

ENDEAVOUR SILVER CORP.

(Translation of registrant's name into English)

#1130-609 Granville Street

Vancouver, British Columbia, Canada V7Y 1G5

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

[ ] Form 20-F [ x ] Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): [ ]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): [ ]

SUBMITTED HEREWITH

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Endeavour Silver Corp. | ||

| (Registrant) | ||

| Date: April 17, 2024 | By: | /s/ Daniel Dickson |

| Daniel Dickson | ||

| Title: | CEO | |

Notice of Annual General Meeting

of Shareholders

To be held on May 28, 2024

MEETING INFORMATION

NOTICE IS HEREBY GIVEN that the Annual General Meeting (the "Meeting") of shareholders of Endeavour Silver Corp. ("Endeavour Silver" or the "Company") will be held at 10:00 a.m. (Vancouver time) at Suite 1130 - 609 Granville Street, Vancouver, British Columbia, V7Y 1G5 on Tuesday, May 28, 2024 for the following purposes:

1. To receive the audited consolidated financial statements of the Company for the year ended December 31, 2023 with auditor's report thereon;

2. To elect eight directors for the ensuing year;

3. To appoint the auditors for the ensuing year and authorize the directors to fix the auditors' remuneration;

4. To approve certain amendments to the Company's rolling percentage Stock Option Plan and to approve the unallocated options that may be grantable under the Stock Option Plan, as amended;

5. To approve the unallocated awards that may be grantable under the Company's rolling Equity-Based Share Unit Plan; and

6. To transact such other business as may properly come before the meeting or any adjournment thereof.

All matters set forth above for consideration at the Meeting are more particularly described in the accompanying Information Circular.

The Company is using the notice-and-access provisions ("Notice and Access") under the Canadian Securities Administrators' National Instrument 54-101 for the delivery of its Information Circular to its shareholders for the Meeting.

Under Notice and Access, instead of receiving paper copies of the Information Circular, shareholders will be receiving a Notice and Access notification with information on how they may obtain a copy of the Information Circular electronically or request a paper copy. Registered shareholders will still receive a Proxy form enabling them to vote at the Meeting. The use of the alternative Notice and Access procedures in connection with the Meeting helps reduce paper use, as well as the Company's printing and mailing costs. The Company will arrange to mail paper copies of the Information Circular to those registered shareholders who have existing instructions on their account to receive paper copies of the Company's meeting materials.

This Notice of Meeting, the Information Circular and other Meeting materials will be available on Endeavour Silver's website at https://edrsilver.com/t/investor-disclosure/ and under Endeavour Silver's profile on SEDAR+ at www.sedarplus.ca and EDGAR at www.sec.gov/edgar as of April 17, 2024 and will remain on the website for one full year thereafter. Meeting materials are also available upon request, without charge, by email at info@edrsilver.com or by calling toll free at 1-877-685-9775 (Canada and U.S.A.) or at +1-604-685-9775.

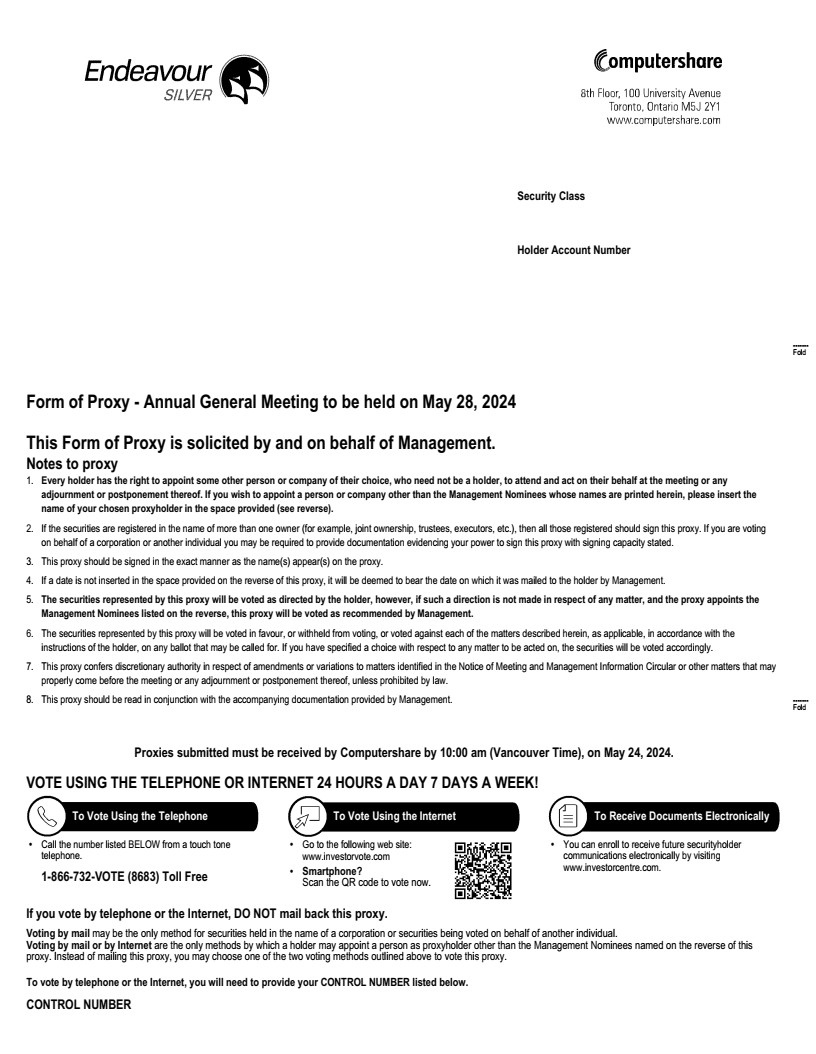

Only shareholders of record at the close of business on April 4, 2024 will be entitled to receive notice of, and to vote at, the Meeting or any adjournment thereof. Shareholders who are unable to or who do not wish to attend the Meeting in person are requested to date and sign the enclosed Proxy form promptly and return it in the self-addressed envelope enclosed for that purpose or by any of the other methods indicated in the Proxy form. To be used at the Meeting, proxies must be received by Computershare Investor Services Inc., Proxy Department, 100 University Avenue, 8th Floor, Toronto, Ontario M5J 2Y1 by 10:00 a.m. (Vancouver time) on May 24, 2024 or, if the Meeting is adjourned, by 10:00 a.m. (Vancouver time), on the second last business day prior to the date on which the Meeting is reconvened. Alternatively, registered shareholders may vote by telephone (1-866-732-8683) or online (www.investorvote.com) using the control number listed on the Proxy form. If a registered shareholder receives more than one Proxy form because such shareholder owns shares registered in different names or addresses, each Proxy form should be completed and returned.

Dated at Vancouver, British Columbia this 4th day of April 2024.

By Order of the Board of Directors

(signed)

Daniel Dickson

Director and CEO

ENDEAVOUR SILVER CORP.

NOTICE AND ACCESS NOTIFICATION TO SHAREHOLDERS

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

TO BE HELD ON TUESDAY, MAY 28, 2024

Shareholders of Endeavour Silver Corp. (the "Company") are receiving this notification as the Company is using the notice-and-access provisions ("Notice and Access") under the Canadian Securities Administrators' National Instrument 54-101 for the delivery of meeting materials to its shareholders for its annual general meeting of shareholders to be held on Tuesday, May 28, 2024 (the "Meeting").

Under Notice and Access, instead of receiving paper copies of the Company's notice of meeting and information circular ("Information Circular") for the Meeting (collectively, the "Meeting Materials"), shareholders are receiving this Notice and Access notification with information on how they may obtain a copy of the Meeting Materials electronically or request a paper copy. Registered shareholders will still receive a Proxy form enabling them to vote at the Meeting. The use of the alternative Notice and Access procedures in connection with the Meeting helps reduce paper use, as well as the Company's printing and mailing costs. The Company will arrange to mail paper copies of the Meeting Materials to those registered shareholders who have existing instructions on their account to receive paper copies of the Company's meeting materials.

This notice serves as notice of meeting under section 169 of the Business Corporations Act (British Columbia).

Meeting Date, Location and Purposes

The Meeting will be held on Tuesday, May 28, 2024 at 10:00 a.m. (Vancouver time) at Suite 1130 - 609 Granville Street, Vancouver, British Columbia, for the following purposes:

1. Receiving the Audited Consolidated Financial Statements: to receive and consider the audited consolidated financial statements of the Company for the financial year ended December 31, 2023, together with the auditor's report thereon;

2. Election of Directors: to elect eight directors of the Company for the ensuing year;

3. Appointment of Auditors: to appoint KPMG LLP as auditors of the Company for the ensuing year and authorize the directors to fix their remuneration;

4. Approval of Certain Amendments to the Stock Option Plan and Approval of the Unallocated Options under the Stock Option Plan: to approve certain amendments to the Company's rolling percentage Stock Option Plan and to approve the unallocated options that may be grantable under the Stock Option Plan, as amended;

5. Approval of the Unallocated Awards under the Equity-Based Share Unit Plan: to approve the unallocated awards that may be grantable under the Company's rolling Equity-Based Share Unit Plan; and

6. Other Business: to transact such other business as may properly come before the Meeting or any adjournment thereof.

For detailed information with respect to each of the matters in items 2 through 5 above, please refer to the section bearing the corresponding heading in the Information Circular.

1 of 2

THE COMPANY URGES SHAREHOLDERS TO REVIEW THE INFORMATION CIRCULAR BEFORE VOTING.

Accessing Meeting Materials Online

The Meeting Materials can be viewed online under the Company's profile at www.sedarplus.ca (Canada) or at www.sec.gov (United States).

The Meeting Materials for the Meeting are also available on the Company's website at https://edrsilver.com/t/investor-disclosure/ and will remain on the website for one year until April 17, 2025.

Requesting Printed Meeting Materials

Shareholders can request that printed copies of the Meeting Materials for the Meeting be sent to them by postal delivery at no cost to them for up to one year until April 17, 2025.

Shareholders may make their request without charge by email at info@edrsilver.com or by calling toll free number 1-877-685-9775 (Canada and United States) or at +1-604-685-9775.

To receive the Meeting Materials in advance of the proxy deposit date and Meeting date, shareholders must request printed copies at least five business days (i.e. by May 16, 2024) in advance of the proxy deposit date and time set out in the accompanying Proxy form. Meeting Materials will be sent to such shareholders within three business days of their request if such requests are made before the Meeting.

Voting Process

Registered Shareholders

Only shareholders of record at the close of business on April 4, 2024 will be entitled to receive notice of, and to vote at, the Meeting or any adjournment thereof. Shareholders who are unable to or who do not wish to attend the Meeting in person are requested to date and sign the enclosed Proxy form promptly and return it in the self-addressed envelope enclosed for that purpose or by any of the other methods indicated in the Proxy form. To be used at the Meeting, proxies must be received by Computershare Investor Services Inc., Proxy Department, 100 University Avenue, 8th Floor, Toronto, Ontario M5J 2Y1 by 10:00 a.m. (Vancouver time) on May 24, 2024 or, if the Meeting is adjourned, by 10:00 a.m. (Vancouver time), on the second last business day prior to the date on which the Meeting is reconvened. If a registered shareholder receives more than one Proxy form because such shareholder owns shares registered in different names or addresses, each Proxy form should be completed and returned.

Non-registered shareholders

Non-Registered Holders should carefully follow the voting instructions of their intermediaries and their service companies, including instructions regarding when and where a voting instruction form is to be delivered.

Questions

Shareholders with questions about Notice and Access and the information contained in this notification or require assistance in completing the Proxy form may contact Galina Meleger, Vice President, Investor Relations of the Company, at info@edrsilver.com or by calling toll free number 1-877-685-9775 (Canada and U.S.A.) or at +1-604-685-9775.

Dated as of the 4th day of April, 2024.

BY ORDER OF THE BOARD

"Daniel Dickson"

DANIEL DICKSON

Director and CEO

2 of 2

Table of Contents

Contents

Notice of Annual General Meeting

of Shareholders

To be held on May 28, 2024

MEETING INFORMATION

NOTICE IS HEREBY GIVEN that the Annual General Meeting (the "Meeting") of shareholders of Endeavour Silver Corp. ("Endeavour Silver" or the "Company") will be held at 10:00 a.m. (Vancouver time) at Suite 1130 - 609 Granville Street, Vancouver, British Columbia, V7Y 1G5 on Tuesday, May 28, 2024 for the following purposes:

1. To receive the audited consolidated financial statements of the Company for the year ended December 31, 2023 with auditor's report thereon;

2. To elect eight directors for the ensuing year;

3. To appoint the auditors for the ensuing year and authorize the directors to fix the auditors' remuneration;

4. To approve certain amendments to the Company's rolling percentage Stock Option Plan and to approve the unallocated options that may be grantable under the Stock Option Plan, as amended;

5. To approve the unallocated awards that may be grantable under the Company's rolling Equity-Based Share Unit Plan; and

6. To transact such other business as may properly come before the meeting or any adjournment thereof.

All matters set forth above for consideration at the Meeting are more particularly described in the accompanying Information Circular.

The Company is using the notice-and-access provisions ("Notice and Access") under the Canadian Securities Administrators' National Instrument 54-101 for the delivery of its Information Circular to its shareholders for the Meeting.

Under Notice and Access, instead of receiving paper copies of the Information Circular, shareholders will be receiving a Notice and Access notification with information on how they may obtain a copy of the Information Circular electronically or request a paper copy. Registered shareholders will still receive a Proxy form enabling them to vote at the Meeting. The use of the alternative Notice and Access procedures in connection with the Meeting helps reduce paper use, as well as the Company's printing and mailing costs. The Company will arrange to mail paper copies of the Information Circular to those registered shareholders who have existing instructions on their account to receive paper copies of the Company's meeting materials.

|

This Notice of Meeting, the Information Circular and other Meeting materials will be available on Endeavour Silver's website at https://edrsilver.com/t/investor-disclosure/ and under Endeavour Silver's profile on SEDAR+ at www.sedarplus.ca and EDGAR at www.sec.gov/edgar as of April 17, 2024 and will remain on the website for one full year thereafter. Meeting materials are also available upon request, without charge, by email at info@edrsilver.com or by calling toll free at 1-877-685-9775 (Canada and U.S.A.) or at +1-604-685-9775.

Only shareholders of record at the close of business on April 4, 2024 will be entitled to receive notice of, and to vote at, the Meeting or any adjournment thereof. Shareholders who are unable to or who do not wish to attend the Meeting in person are requested to date and sign the enclosed Proxy form promptly and return it in the self-addressed envelope enclosed for that purpose or by any of the other methods indicated in the Proxy form. To be used at the Meeting, proxies must be received by Computershare Investor Services Inc., Proxy Department, 100 University Avenue, 8th Floor, Toronto, Ontario M5J 2Y1 by 10:00 a.m. (Vancouver time) on May 24, 2024 or, if the Meeting is adjourned, by 10:00 a.m. (Vancouver time), on the second last business day prior to the date on which the Meeting is reconvened. Alternatively, registered shareholders may vote by telephone (1-866-732-8683) or online (www.investorvote.com) using the control number listed on the Proxy form. If a registered shareholder receives more than one Proxy form because such shareholder owns shares registered in different names or addresses, each Proxy form should be completed and returned.

Dated at Vancouver, British Columbia this 4th day of April 2024.

By Order of the Board of Directors (signed)

Daniel Dickson

Director and CEO

|

Message from our CEO

Dear Stakeholders,

2023 stands out as a transformative year in our history, one that I will always remember for executing on our growth plans and setting Endeavour on a path for long- term success. Amid a challenging macro environment, including volatile equity markets and persistent cost pressures, our management team displayed dedication and strategic agility in navigating the complexities across various fronts. We achieved many milestones, such as securing project loan financing from top-tier lenders in the sector and initiating full-scale construction at our flagship Terronera mine. These strides were made while maintaining a steadfast commitment to safety and sustainable development.

Business and market highlights

Throughout the year, as we faced numerous external forces, it became paramount to focus on areas where we could exert real influence. Operationally, we met the lower end of our annual production guidance, reaching 8.7 million ounces of silver equivalent metal (80:1 ratio). We encountered a production shortfall in Q3, which necessitated a swift response at Guanacevi. Our Operations team re-sequenced the mine plan to enhance ventilation and worker safety, resulting in additional sill development and reduced ore grades. Throughput was affected by an extended maintenance program in the mill. While these one-time occurrences led to escalated costs, the remediation initiatives were essential to ensure stable and consistent production moving forward.

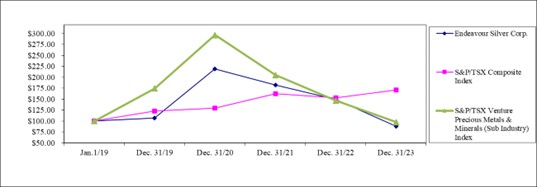

Our recovery strategy more than met expectations as silver grades, gold grades and plant-throughput exceeded our estimates in Q4.

In 2023, the broader U.S. stock market saw surprisingly strong returns, even as interest rates climbed higher. Defensive stocks declined and our stock was no different, with a trading range of USD$4.55 - $1.83. In turn, it was a breakout year for AI stocks and big tech, which lifted the entire S&P 500. Interestingly, spot gold prices continued to climb, offering investors a chance to take advantage of a rare imbalance, while the equities have not followed suit. Even as gold continues to reach new highs, near term market sentiment is closely tied to Federal Reserve actions; the investment thesis for holding precious metals continues to build. I am excited about the Company's potential to capitalize significantly once this transition occurs.

Financial and operating performance

Through the dedicated efforts of our 1,375 employees and 955 contractors, we have numerous achievements to be proud of. We attained our consolidated production guidance for the third year in a row, totalling 5.7 million ounces of silver and 38,000 ounces of gold. As a result, revenue reached $206 million, bolstered by strong realized silver and gold prices of $23.76 per oz and $1,968 per oz respectively. The strong revenue translated into cash flow with mine operating earnings of $37 million, which drove earnings of $6 million or $0.03 per share.

Due to the substantial investments made to drive development at Terronera, our cash position decreased to $35 million. To ensure that we see Terronera completed, we utilized an At-The-Market offering to support our growth trajectory and completed our first drawdown on the project loan in April.

During 2023, all miners in Mexico faced overarching challenges. Inflationary pressures impacted the entire spectrum of inputs. Both of our producing operations, Guanacevi and Bolañitos, experienced higher operating costs metrics due to increased labour, power, steel and consumables prices.

Additionally, the Mexican Peso strengthened by nearly 13% against the US dollar, which had cascading effects on our in-country purchases. Consequently, our direct operating cost per tonne (1) increased by 8% over the year to $141.72 per tonne, a trend that echoed across Mexico's mining industry during the year. The combination of unexpected expenses at Guanacevi and broader economic factors led to deviations from our initial budget projections, prompting us to retract our annual cost guidance. Although our full year 2023 all-in sustaining cost per ounce (1) exceeded our upper-end guidance by 15%, we saw significant productivity improvements in Q4, bringing all-in-sustaining costs per ounce (1) down to a 7% overage. Managing inputs and their associated costs remain a primary focus in 2024.

Sector leading growth

With formal board approval and project financing in place, we officially embarked on our journey of growth. In the silver mining industry especially, opportunities for growth are rare, and I strongly believe that exceptional silver companies are formed when new projects come to fruition, a feat that requires valour, perseverance, and discipline.

|

Specifically, I am referring to Terronera, our largest "in- house" discovery, which is now paving the way for near- term growth. Once in production, Terronera will significantly increase our consolidated production and reduce our consolidated cost metrics, with a cost profile projected to be in the lowest quartile among the primary silver producers.

During 2023, the project team made substantial construction progress, bringing the total investment so far to over $120 million. Given the cost pressures experienced at our other sites, we conducted a comprehensive risk analysis on the remaining expenditures to assess the impacts on the project. To that end, a stronger Mexican Peso, ongoing inflation and tight markets for equipment and bulk materials all contributed to an 18% increase to our initial capital estimate, at $271 million up from $230 million. Capital pressures notwithstanding, the pace of project development continues to advance on track with previous guidance, with commissioning to start in Q4 of 2024.

At year end, Terronera had over 520 employees and 230 contractors onsite, and ongoing recruitment efforts will further expand our workforce. During the year, the project team concentrated on completing key activities including the upper mill platform earthworks, equipment purchases and plant concrete advances, all of which led to significant progress in our process plant construction. As I visit the site frequently, it has been rewarding to see Terronera progress through the various stages of construction. At year end, surface construction was nearly 50% complete with concrete work well advanced to enable structural steel and mechanical installations.

As the year unfolded, our underground mine development rates also improved, meeting our target of four meters per day per critical heading in Q4. This positive momentum provided reassurance for us to meet our construction timeline.

Beyond Terronera, we have multiple opportunities for silver-focused growth in Mexico, Chile and the US. As a company that has been built through the drill bit, we believe that discovery and development are the true drivers of value. We have two promising projects proceeding in tandem - the Pitarrilla project in Durango and the Parral project in Chihuahua.

The Pitarrilla project is a source of great excitement for us. We acquired this asset for several compelling reasons, as it stands as one of the world's largest undeveloped silver projects. The comprehensive work conducted to date, coupled with the size and scale of the deposit, not only complements our regional platform but also provides versatility for various mining scenarios. In 2024, we plan to invest $5 million to extend an underground ramp for drilling to gain a better understanding of high-grade zones within the deposit as we progress towards an economic study.

Our Parral project is equally exciting. Like our other operations, it is located in a historic silver producing district with district scale exploration and development potential. Over the years, we have made significant headway in understanding the mineralization system through ongoing drilling programs and are advancing the project to support an economic study to model a production scenario.

Driving sustainable and inclusive growth

We're now more than two-thirds of the way through executing our Sustainability Strategy 2022-2024. Launched in January 2022, the three-year strategy aims to deliver positive impacts for people, the planet and our business. Over the first two years we completed many initiatives and achieved key targets we set for ourselves.

Running safe operations is always a top priority, and we aim to meet industry best practices. To that end, we continued to align Endeavour's Safety Management System with ISO 45001, the global standard for reducing occupational injuries and diseases.

We strategically invested to develop our workforce, recruit new talent and ensure our people are ready for Endeavour's growth. Among these efforts, we implemented a new onboarding program and turnover reduction strategies and enhanced several site facilities to create a more comfortable working environment. We are proud of our consistently high rates of local hiring in Mexico, facilitating the culture we strive to build.

Environmental stewardship remains an enduring focus, and our work at Terronera was especially important this past year. The project team there has worked diligently to design a sustainable project in line with equator principles and that reflects sound environmental management practices. Being a greenfield project, our goal is to minimize the site's water requirements, its waste and its overall footprint.

Our community investments more than doubled last year, reaching over $900,000 and, supporting programs to help people and communities thrive. We proudly contributed both funding and expertise to road improvement projects, the building of a new community well, the delivery of skill- training workshops for local residents and many other initiatives.

2024 outlook and beyond

2024 marks our 20th anniversary of mining operations, and with Terronera coming into commissioning later this year, it's a fitting time to begin the next chapter of Endeavour's story. We're on the doorstep of a transformation bringing us closer to becoming a premier senior silver producer.

|

Over the past few years, we have re-invested in the business for long term growth. Now, with less than a year to go before Terronera comes on stream, we expect to see the benefits of these significant investments accrue to our shareholders. We are laser focused on delivery and progression and I have strong conviction that when I write this letter next year, we will be generating significant free cash flow from Terronera.

Looking ahead, we are focused on several key objectives for 2024 to create shareholder value:

• Continue to optimize our operations, with a focus on delivering free cash flow by raising productivity, improving safety and improving costs;

• Complete construction at Terronera and commission our new flagship mine;

• Advance Pitarrilla project towards better understanding the high-grade zone and feeder structures, so that we can initiate an economic assessment for future production;

• Grow through accretive M&A opportunities to enhance our production and organic growth profile; and

• Complete implementation of our three year Sustainability Strategy and craft a new ESG road map that builds on our efforts to address critical issues like climate change, health and safety, and community development.

All of the objectives highlight Endeavour Silver's 'Transformation in Motion'.

On that note, I would like to extend my gratitude to Christine West, our former CFO, who announced her retirement after 16 years of dedicated service. Mrs. West has been an integral part of Endeavour, playing a pivotal role in our growth and success. In conjunction, I am delighted to welcome Elizabeth Senez as our new CFO. With extensive financial expertise in mining, she brings valuable insights to our team. Additionally, during 2023, we were pleased to welcome Greg Blaylock, VP Operations, to our executive leadership team. With over 35 years of experience in mining operations, planning, and project development, Greg's expertise deepens our capabilities.

I am honoured to lead a company driven by an exceptional team that rose to meet every challenge in 2023. I would like to thank everyone here at Endeavour Silver for delivering a solid year and setting us up for a truly transformative path ahead.

Thank you also to our shareholders and stakeholders for your ongoing support, trust and partnership as we strive to build long-term value and a premier silver mining company.

Sincerely, Dan Dickson,

Chief Executive Officer & Director

April 4, 2024

Notes:

(1) These are non-IFRS financial measures and ratios. Further details on these non-IFRS financial measures and ratios can be found in the section "Non-IFRS Measures" in the December 31, 2023 MD&A available on SEDAR+ at www.sedarplus.ca and on the Company's website.

|

Annual General Meeting of Shareholders Information Circular

General Information

References in this management information circular ("Information Circular") to "Endeavour Silver", the "Company", "we", "us" and "our" are references to Endeavour Silver Corp., and its subsidiaries unless otherwise specified or the context otherwise requires. "You", "your" and "shareholder" means the holders of common shares of Endeavour Silver ("Common Shares") as of the Record Date (as defined herein).

You have received this Information Circular for the 2024 annual general meeting of shareholders of Endeavour Silver to be held at 10:00 a.m. (Vancouver time) on Tuesday, May 28, 2024 (the "Meeting"), as our records indicate that you owned Common Shares as of the close of business on April 4, 2024 (the "Record Date"). You have the right to attend the Meeting and vote on the various items of business to be addressed at the Meeting personally or by proxy, including at any postponement or adjournment of the Meeting.

Your vote is important. The Board of Directors (the "Board") and management ("Management") of Endeavour Silver encourage you to vote.

This Information Circular describes what the Meeting will cover and how to vote. Please read it carefully and vote using the applicable procedures described herein. If you have any questions about the voting procedures related to voting at the Meeting or about obtaining and depositing the required Proxy form, you should contact Endeavour Silver's transfer agent, Computershare Investor Services Inc. ("Computershare") by phone at 1-800-564-6253 (North American toll free).

Unless otherwise stated, information in this Information Circular is as of April 4, 2024.

This Information Circular contains references to lawful currency of the United States (US$ or US dollars) and of Canada (C$ or Canadian dollars). All dollar amounts referenced in this Information Circular, unless otherwise indicated, are expressed in US dollars. The daily rate of exchange on April 4, 2024 as reported by the Bank of Canada, for the conversion of US$1.00 into Canadian dollars was C$1.3504 (C$1.00 equals US$0.7405).

As a shareholder, you can decide if you want to receive paper copies of the Company's interim and annual consolidated financial statements and management's discussion and analysis ("MD&A"). To receive paper copies of these materials, please complete the request contained on the proxy form provided in connection with the Meeting or register online at www.computershare.com/mailinglist.

You can find financial information relating to Endeavour Silver in the Company's audited consolidated financial statements, MD&A and annual information form ("AIF") for our most recently completed financial year. These documents are available on the Company's website at www.edrsilver.com, on the System for Electronic Document Analysis and Retrieval + (SEDAR+) and on the Electronic Data Gathering, Analysis and Retrieval (EDGAR) database.

|

Cautionary statement regarding forward-looking information

Certain statements contained in this Information Circular may constitute "forward-looking statements" or "forward-looking information" (collectively, "forward-looking statements") within the meaning of applicable securities legislation and may include future-oriented financial information. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, forecasts, objectives, assumptions or future events or performance are not statements of historical fact and may be forward-looking statements. Forward-looking statements contained in this Information Circular are based on expectations, estimates and projections as of the date of this Information Circular and include, without limitation, those statements made in the "Message From Our CEO" section of this Information Circular; statements relating to the strategic vision for the Company and expectations regarding the development and financing of the Terronera Project including: anticipated timing of the project; anticipated timing and completion of conditions precedent to drawdown under the project loan, estimated project economics, Terronera's forecasted operation, costs and expenditures, and the timing and results of various related activities, Endeavour's exploration potential; production capabilities and future financial or operational performance; the Company's ability to successfully advance its growth and development projects; planned exploration and development of the Company's mineral properties, including prospects for the Company's Pitarrilla and Parral projects; the Company's anticipated performance in 2024 and beyond, including changes in mining operations and forecasts of production levels; anticipated production costs and all-in sustaining costs; and plans related to the Company's business and other matters that may occur in the future.

Statements concerning mineral reserves and mineral resource estimates may also be deemed to constitute forward-looking statements to the extent that they involve estimates of the mineralization that will be encountered if the applicable property is developed and, in the case of mineral reserves, such statements reflect the conclusion based on certain assumptions that the mineral deposit can be economically exploited.

Forward-looking statements are made based upon certain assumptions and other important factors that, while considered reasonable by the Company, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. The Company has made assumptions based on many of these factors which include, without limitation, present and future business strategies, the environment in which the Company will operate in the future, including the price of silver and gold, anticipated costs and the ability to achieve goals.

Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors which could cause actual events or results to differ from those expressed or implied by the forward-looking statements, including, without limitation, uncertainty as to duration and impact of the following: risks related to the Company's debt facility; risks related to increased interest rates; precious and base metal price fluctuations; risks related to fluctuations in the currency markets (particularly the Mexican peso, Chilean peso, Canadian dollar and United States dollar); fluctuations in the price of consumed commodities; risks related to increased competition; risks and hazards of mineral exploration, development and mining activities; risks in obtaining necessary licenses and permits, and challenges to the Company's title to properties; uncertainty as to actual capital costs, operating costs, production and economic returns, and uncertainty that the Company's development activities will result in profitable mining operations; risks related to the adequacy or availability of infrastructure to support current or future mining developments; uncertainty in the Company's ability to fund the development of its mineral properties or the completion of further exploration programs; risks related to the Company's reserves and mineral resource figures being estimates based on interpretations and assumptions which may result in less mineral production under actual conditions than is currently estimated and to diminishing quantities or grades of mineral reserves as properties are mined; risks related to the Company operating in foreign jurisdictions, including political, economic, and regulatory instability; risks related to changes in governmental regulations, including environmental, tax and labour laws and obtaining necessary licenses and permits; and risks related to recruiting and retaining qualified personnel, as well as those other factors described in the section entitled "Risk Factors" contained in the Company's most recently filed AIF and MD&A available on the Company's website at www.edrsilver.com, on SEDAR+ and on EDGAR.

|

This list is not exhaustive of the factors that may affect the Company's forward-looking statements. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in the forward-looking statements. The Company's forward-looking statements and information are based on the assumptions, beliefs, expectations and opinions of Management as of the date of this Information Circular. The Company will update forward-looking statements and information if and when, and to the extent, required by applicable securities laws. Readers should not place undue reliance on forward-looking statements. The forward-looking statements and information contained herein are expressly qualified by this cautionary statement.

Voting Information

Solicitation of Proxies

This Information Circular is furnished in connection with the solicitation of proxies. The enclosed form of proxy (the "Proxy") is solicited by and on behalf of Management of the Company. The enclosed Proxy is for use at the Meeting for the purposes set forth in the accompanying Notice of Meeting and at any adjournment thereof. The Company may retain other persons or companies to solicit proxies on behalf of Management, in which event customary fees for such services will be paid. The cost of solicitation by Management of the Company will be borne by the Company.

Notice and Access Process

The Company has decided to use the notice-and-access delivery process ("Notice and Access") under National Instrument 54-101-Communication with Beneficial Owners of Securities of a Reporting Issuer ("NI 54-101") adopted by the Canadian Securities Administrators for the delivery of the Notice of Meeting and Information Circular (collectively, the "Meeting Materials") to its registered and beneficial shareholders for the Meeting. Endeavour Silver has adopted this process to further its commitment to environmental sustainability and to reduce its printing and mailing costs.

Under Notice and Access, instead of receiving printed copies of the Meeting Materials, shareholders receive a notice ("Notice and Access Notification") with information on the Meeting date, location and purpose, as well as information on how they may access the Meeting Materials electronically or request a paper copy. The Company will arrange to mail paper copies of the Meeting Materials to those registered and beneficial shareholders who have existing instructions on their account to receive paper copies of the Meeting Materials.

Shareholders who receive a Notice and Access Notification can request that printed copies of the Meeting Materials be sent to them by postal delivery at no cost to them up to one year from the date of the filing of this Information Circular on SEDAR+ and EDGAR. Shareholders with questions about the Notice and Access system, or who would like to request printed copies of the Meeting Materials, should contact the Company by email at info@edrsilver.com or by calling toll free at 1-877-685- 9775 (Canada and U.S.A.) or at +1-604-685-9775. A request for printed copies which are required in advance of the Meeting should be made no later than May 16, 2024 in order to allow sufficient time for mailing.

|

Voting Procedures

Who can Vote

You are entitled to vote at the Meeting if you held Endeavour Silver Common Shares as of the close of business on April 4, 2024, the Record Date for the Meeting. Each Common Share you owned on the Record Date entitles you to one vote on each item of business to be considered at the Meeting.

How to vote

How you can vote depends on if you are a registered shareholder or a non-registered holder. The different voting options are summarised below. Please follow the appropriate voting option based on whether you are a registered shareholder or non-registered holder.

If you are unsure whether you are a registered shareholder or non-registered shareholder, please contact Computershare by phone at 1-800-564-6253 (North American toll free) or 1-514-982-7555 (International) or by email at service@computershare.com.

If you have any questions before the Meeting about Endeavour Silver, the Meeting Materials, or the voting process, please contact us at info@edrsilver.com.

Voting Process

Registered Shareholders

You are a registered shareholder if your name appears on your share certificate, or your Common Shares are registered in your name with Computershare. Registered shareholders may vote by participating in the Meeting, by appointing proxyholders, by telephone or by voting online.

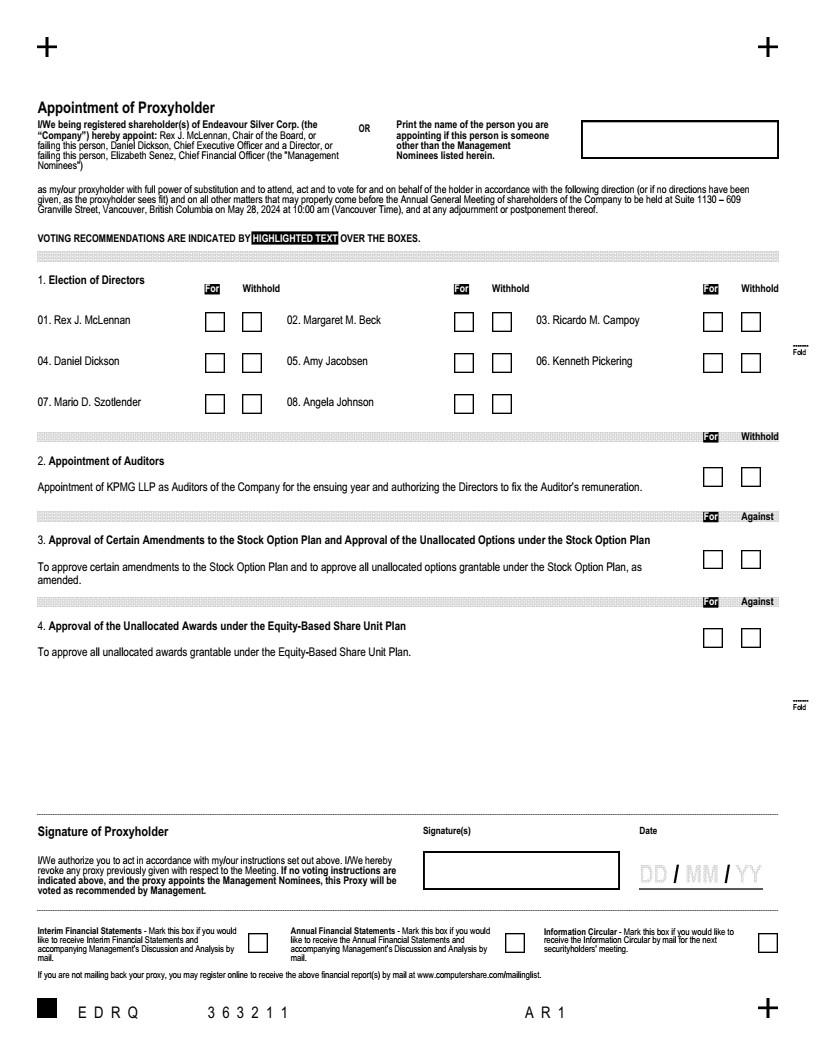

Registered shareholders that wish to participate in the Meeting do not need to complete and deposit the Proxy and should register with the scrutineer at the Meeting.

Registered shareholders that wish to appoint a proxyholder to vote at the Meeting may complete the Proxy. The Proxy names Rex J. McLennan, Chair of the Board, or failing him, Daniel Dickson, Chief Executive Officer and a Director or failing him, Elizabeth Senez, Chief Financial Officer as the Management designated proxyholders (the "Management Designated Proxyholders"). Shareholders have the right to appoint a person or company to represent the shareholder at the meeting other than the Management Designated Proxyholders. Registered shareholders that wish to appoint another person (who need not be a shareholder) to serve as proxyholder/alternate proxyholder at the Meeting may do so by striking out the names of the Management Designated Proxyholders and inserting the name(s) of the desired proxyholder/alternate proxyholder in the blank space provided in the Proxy.

Registered shareholders may direct the manner in which their Common Shares are to be voted or withheld from voting at the Meeting by marking their instructions on the Proxy. Any Common Shares represented by the Proxy will be voted or withheld from voting by the Management Designated Proxyholders/proxyholder/alternate proxyholder in accordance with the instructions of the registered shareholder contained in the Proxy. If there are no instructions, those Common Shares will be voted "FOR" each matter set out in the Notice of Meeting. The Proxy grants the proxyholder discretion to vote as such person sees fit on any amendments or variations to matters identified in the Notice of Meeting, or any other matters which may properly come before the Meeting. At the time of printing of this Information Circular, Management of the Company knows of no other matters which may come

before the Meeting other than those referred to in the Notice of Meeting. No person who is a director of the Company has informed Management that he or she intends to oppose any action to be taken by Management at the Meeting.

|

Registered shareholders may deposit their proxies with Computershare by mail or courier, or alternatively, may vote by telephone of the internet in accordance with the following instructions:

By Internet:

Go to www.investorvote.com and follow the instructions on screen. If you vote using the internet, you will need your 15-digit control number, which appears in the bottom left corner of the first page of your proxy form. If you are using a smartphone, you can scan the QR code on your proxy form.

By Telephone:

Call 1-866-732-8683 from a touch-tone telephone and follow the instructions. You will need your 15-digit control number, which appears in the bottom left corner of the first page of your proxy form. If you vote by telephone, you cannot appoint anyone other than the Management Designated Proxyholders as your proxyholder.

By Mail or Courier

Complete your proxy form, sign and date it, and send it to Computershare in the envelope provided. If you did not receive a return envelope, please send the completed form to:

Computershare Investor Services Inc.

Attention: Proxy Department

100 University Avenue, 8th Floor

Toronto, Ontario Canada M5J 2Y1

To be used at the Meeting, a completed Proxy must be deposited with, or telephonic/online votes must be received by Computershare by 10:00 a.m. (Vancouver time) on May 24, 2024 or, if the Meeting is adjourned, by 10:00 a.m. (Vancouver time), on the second last business day prior to the date on which the Meeting is reconvened.

Registered shareholders may revoke a vote made by Proxy by:

• voting again on the internet or by telephone before 10:00 am (Vancouver time) on May 24, 2024, following the procedures described above;

• submitting a new completed Proxy that is dated later than your original proxy and is received by Computershare at the registered office of the Company (19th Floor, 885 West Georgia Street, Vancouver, British Columbia V6C 3H4) at any time up to and including the last business day before the day set for the holding of the Meeting at which the Proxy is to be used;

• an instrument in writing provided to the Chair of the Meeting, at the Meeting of shareholders, before any vote in respect of which the Proxy is to be used shall have been taken; or

• any other manner permitted by law.

Non-Registered Holders

You are a non-registered holder if your Common Shares are registered in the name of an intermediary ("Intermediary") (such as a broker, bank, trust company, securities dealer, trustees or administrators of RRSPs, RRIFs, RESPs or similar plans) or clearing agency (such as CDS Clearing and Depository Services Inc. or The Depository Trust Company).

|

Non-registered holders who have not objected to their Intermediary disclosing certain ownership information about themselves to the Company are referred to as "NOBOs". Those non-registered holders who have objected to their Intermediary disclosing ownership information about themselves to the Company are referred to as "OBOs".

In accordance with the requirements of NI 54-101, the Company has distributed the Notice and Access Notification in connection with this Meeting to Intermediaries and clearing agencies for onward distribution to non-registered holders.

The Company will not be paying for Intermediaries to deliver to OBOs (who have not otherwise waived their right to receive proxy-related materials) copies of proxy related materials and related documents (including the Notice and Access Notification). Accordingly, an OBO will not receive copies of proxy-related materials and related documents unless the OBO's Intermediary assumes the costs of delivery.

Intermediaries which receive the proxy-related materials (including Notice and Access Notification) are required to forward the proxy-related materials to non-registered holders unless a non-registered holder has waived the right to receive them. Intermediaries often use service companies to forward proxy-related materials to non-registered holders. Generally, non- registered holders who have not waived the right to receive proxy-related materials (including OBOs who have made the necessary arrangements with their Intermediary for the payment of delivery and receipt of such proxy-related materials) will be sent a voting instruction form which must be completed, signed and returned by the non-registered holder in accordance with the Intermediary's directions on the voting instruction form. In some cases, such non-registered holders will instead be given a proxy which has already been signed by the Intermediary (typically by a facsimile, stamped signature) which is restricted as to the number of Common Shares beneficially owned by the non-registered holder but which is otherwise not completed. This form of proxy does not need to be signed by the non-registered holder, but to be used at the Meeting, needs to be properly completed and deposited with Computershare as described under "Voting Procedures - Voting Process - Registered Shareholders" above. Alternatively, some non-registered holders may be able to vote by telephone or online and should refer to the voting instruction form or form of proxy, as applicable, for further details and instructions. Non-registered holders should contact their Intermediaries if they did not receive either a voting instruction form or a pre- authorized form of proxy.

Your Intermediary will have its own procedures that you should carefully follow to ensure your Common Shares are voted on your behalf by your Intermediary at the Meeting. Please be aware that the deadline for submitting your voting instruction form or form of proxy to your Intermediary may be earlier than the deadlines for registered shareholders set out above. Your voting instructions must be received in sufficient time to allow your instructions to be forwarded by your Intermediary to Computershare for receipt before 10:00 a.m. (Vancouver time) on May 24, 2024.

Non-registered holders should carefully follow the instructions of their Intermediaries and their service companies, including instructions regarding when and where the voting instruction form or form of proxy is to be delivered.

The purpose of these procedures is to permit non-registered holders to direct the voting of the Common Shares that they beneficially own. Should a non-registered holder wish to attend and vote at the Meeting in person (or have another person attend and vote on behalf of the non-registered holder), the non-registered holder should insert the non-registered holder's (or such other person's) name in the blank space provided or, in the case of a voting instruction form, follow the corresponding instructions on the form.

Non-registered holders who wish to revoke a voting instruction form or a waiver of the right to receive proxy-related materials should contact their Intermediaries for instructions.

|

Processing the Votes

The Company's transfer agent, Computershare, or its authorized agents, count and tabulate the votes on our behalf. Endeavour Silver will announce the voting results of the Meeting by press release and file them on SEDAR+ and EDGAR after the Meeting.

Quorum and Approval

The Company's Articles provide that a quorum for the transaction of business at a meeting of shareholders is two persons who are, or who represent by proxy, shareholders who, in the aggregate, hold at least 5% of the issued Common Shares entitled to be voted at the Meeting. A simple majority of the votes cast at the Meeting (in person or by proxy) is required in order to pass the resolutions referred to in the accompanying Notice of Meeting.

Voting Shares and Principal Holders Thereof

The authorized share structure of the Company consists of an unlimited number of Common Shares without par value. As of the Record Date, 240,337,478 Common Shares were issued and outstanding.

Each shareholder is entitled to one vote for each Common Share held as of the Record Date. The failure of any shareholder to receive the Notice of Meeting does not deprive such shareholder of his, her, their or its entitlement to vote at the Meeting.

To the knowledge of the directors or executive officers of the Company, no person beneficially owns, directly or indirectly, or exercises control or direction over shares carrying more than 10% of the voting rights attached to the Company's issued and outstanding Common Shares as at the Record Date.

Business to be transacted at the Meeting

The Meeting will address the following matters:

1. Receiving the audited consolidated financial statements of the Company for the year ended December 31, 2023 with auditor's report thereon.

2. Electing eight directors for the ensuing year.

3. Appointing the auditors for the ensuing year and authorizing the directors to fix the auditors' remuneration.

4. To approve the unallocated options that may be grantable under the Company's rolling percentage Stock Option Plan, as amended;

5. To approve the unallocated awards that may be grantable under the Company's rolling Equity-Based Share Unit Plan ("SU Plan").

6. Transacting such other business as may properly come before the Meeting or any adjournment thereof.

Receiving the Audited Consolidated Financial Statements

Our audited consolidated financial statements for the year ended December 31, 2023, and related auditor's report, will be presented at the Meeting. The audited consolidated financial statements are available on the Company's website, on SEDAR+ and EDGAR. Printed copies will be mailed to shareholders who requested a copy.

|

Election of Directors

The term of office of each of the present directors expires at the close of the Meeting. Management proposes to nominate the persons listed below in "Nominees for Election of Directors" for election as directors at the Meeting and the Management Designated Proxyholders named in the Proxy intend to vote for the election of these nominees. In the absence of instructions to the contrary, all Proxies will be voted "For" the nominees herein listed. Each director elected at the Meeting will hold office until the Company's next annual general meeting, or until their successor is elected or appointed, unless their office is earlier vacated in accordance with the Company's Articles or with the provisions of the Business Corporations Act (British Columbia). Management does not contemplate that any of the nominees will be unable to serve as a director. In the event that prior to the Meeting, any of the listed nominees withdraws or for any other reason will not stand for election at the Meeting, it is intended that discretionary authority shall be exercised by the Management Designated Proxyholders or other proxyholder/alternate proxyholder, as the case may be, named in the Proxy as nominee to vote the Common Shares represented by the Proxy for the election of any other person or persons nominated by the Company to stand for election as directors, unless the shareholder has specified in his, her, their or its Proxy that the shareholder's Common Shares are to be withheld from voting on the election of directors.

Advance Notice Policy

Pursuant to the Advance Notice Policy of the Company adopted by the Board of Directors on April 11, 2013, as amended and which was most recently approved by the shareholders on May 23, 2023, any additional director nominations for the Meeting must be received by the Company in compliance with the Advance Notice Policy by April 28, 2024. The Company will publish details of any such additional director nominations through a public announcement in accordance with the Advance Notice Policy.

No director nominations have been received from any shareholders of the Company in connection with the Meeting under the terms of the Advance Notice Policy as at the date of this Information Circular.

Majority Voting Policy

The Board of Directors has adopted a Majority Voting Policy for the election of directors in uncontested elections. Under this policy, if a nominee does not receive the affirmative vote of at least the majority of votes cast, the director shall promptly tender a resignation for consideration by the Corporate Governance and Nominating Committee ("CG&NC") and the Board. The CG&NC shall consider the resignation and recommend to the Board the action to be taken with respect to such offered resignation, which may include: accepting the resignation, maintaining the director but addressing what the CG&NC believes to be the underlying cause of the withheld votes, resolving that the director will not be re-nominated in the future for election, or rejecting the resignation and explaining the basis for such determination. Further to Toronto Stock Exchange ("TSX") rules, the Board shall accept such director's resignation absent exceptional circumstances.

The CG&NC in making its recommendation, and the Board in making its decision, may consider any factors or other information they consider appropriate and relevant. Any director who tenders a resignation pursuant to the Majority Voting Policy may not participate in the recommendation of the CG&NC or the decision of the Board with respect to the resignation. The Board will act on the recommendation of the CG&NC within 90 days after the shareholder meeting at which the election of directors occurred. Following the Board's decision, the Company will promptly issue a press release disclosing the Board's determination (and, if applicable, the reasons for rejecting the resignation).

If the Board accepts any tendered resignation in accordance with the Majority Voting Policy, then the Board may (i) proceed to fill the vacancy through the appointment of a new director, or (ii) determine not to fill the vacancy and instead decrease the size of the Board. If a director's resignation is not accepted by the Board, such director will continue to serve until the next annual meeting and until the director's successor is duly elected, or the director's earlier resignation or removal; alternatively, the director shall otherwise serve for such shorter time and under such other conditions as determined by the Board, considering all of the relevant facts and circumstances.

|

Nominees for Election as Directors

The shareholders of the Company last fixed the number of directors of the Company at eight. The Company currently has eight directors, including Christine West who will not be seeking re-election. At the Meeting, shareholders of the Company will be asked to elect eight directors. Voting for the election of the eight nominee directors will be conducted on an individual basis. All nominees have agreed to stand for election. If, however, one or more of them should become unable to stand for election, it is likely that one or more other persons would be nominated for election at the Meeting. The Board has determined that seven of the eight nominees are independent under Canadian National Instrument 52-110 - Audit Committees ("NI 52- 110") and the New York Stock Exchange ("NYSE") requirements.

The following disclosure sets out, as at the Record Date: (a) the names of all eight nominees for election as directors and their residency; (b) all major offices and positions with the Company each nominee now holds; (c) each nominee's present principal occupation, business or employment; (d) the period of time during which each nominee has been a director of the Company, if applicable; (e) the number of Common Shares, stock options, performance-share units ("PSUs") and deferred share units ("DSUs") beneficially owned by each nominee, directly or indirectly, or over which each nominee exercised control or direction; (f) other current public company board memberships and committees, and (g) each nominee's attendance at the Company's Board and Board committee meetings in the year ended December 31 2023, if applicable.

The information as to the securities of the Company beneficially owned, directly or indirectly, or over which control or direction is exercised has been furnished to the Company by the nominees or has been extracted from insider reports filed by the respective nominees which are publicly available through the internet at the website for the Canadian System for Electronic Disclosure by Insiders (SEDI) at www.sedi.ca.

| ✓ The Board recommends you vote FOR all of the director nominees. |

UNLESS OTHERWISE INSTRUCTED, THE MANAGEMENT DESIGNATED PROXYHOLDERS APPOINTED PURSUANT TO THE ACCOMPANYING PROXY FORM WILL VOTE "FOR" THE ELECTION OF THE NOMINATED DIRECTORS.

A glance at our Nominees

|

| Rex J. McLennan | |||||

Independent Director Age: 72 Residence: British Columbia, Canada Director since: June 12, 2007 Principal Occupation: Corporate Director |

Rex J. McLennan is an experienced corporate director and former senior executive, having served on many public and private company boards over the past 15 years. His professional and executive career of over 35 years also included C-level executive positions serving as chief financial officer for Viterra, prior to its acquisition by Glencore in 2012, and Placer Dome, a global mining company acquired by Barrick Gold in 2006; with an earlier career in Imperial Oil, a major subsidiary of Exxon-Mobil. As an independent corporate director, he has chaired the audit committees of several publicly traded companies. He is also a director of the First Circle Financial Group and a past director of Pinnacle Renewable Energy Inc., Boart Longyear Ltd., and the World Gold Council, London UK. Mr. McLennan holds an MBA (Finance & Accounting) from McGill University and BSc (Mathematics & Economics) from the University of British Columbia. He is a member of the Institute of Corporate Directors (Canada) having received his ICD.D designation in June 2013. |

||||

| Voting Results of 2023 Annual General Meeting |

Board/Committee Membership | Attendance | ||

| For: | 90.00% | Board (Chair) | 7 of 7 | 100% |

| Withheld: | 10.00% | Corporate Governance and Nominating Committee (Chair) | 3 of 3 |

100% |

| Audit Committee (member) | 4 of 4 | 100% |

||

| Sustainability Committee (member) | 4 of 4 | 100% | ||

| Securities Held on Record Date | Other Public Company Directorships | Other Public Company Committee Appointments |

||

| Stock Options: DSUs: |

87,000 346,850 |

None | None | |

|

| Margaret M. Beck | |||||

Independent Director Age: 61 Residence: Arizona, U.S.A. Director since: May 7, 2019 Principal Occupation: Corporate Director |

Margaret Beck is a highly regarded Executive Committee member and Finance Senior Executive with over 30 years in the mining business. Primarily, Margaret ascended the ranks with global conglomerate BHP at different levels of the organization, including executive, regional and operational levels across four countries. Margaret started her career as a graduate at BHP in San Francisco working in the finance team and moved her way up to various VP Finance roles, leading the finance teams in Base Metals, Exploration, Iron Ore and, most recently, for the Minerals Australia Division. She held the VP roles in Chile, Singapore and Australia. During her time at BHP, she consistently delivered financial excellence influencing key decisions regarding investments for the business, including major capital project approvals, business-wide strategy and the end-to-end planning framework. She also maintained relationships with key stakeholders including financial institutions, joint venture partners and governments, and oversaw the reporting processes. Margaret led the team that won the CFO Award for Excellence in Financial Reporting in BHP Billiton in 2009 and again in 2011. She also acted as President of the global minerals exploration business for BHP Billiton in 2013. Margaret holds a Bachelor of Science in Business Administration, Accounting from the University of Arizona, Tucson and speaks intermediate Spanish. |

||||

| Voting Results of 2023 Annual General Meeting |

Board/Committee Membership | Attendance | ||

| For: | 97.21% | Board (member) | 7 of 7 | 100% |

| Withheld: | 2.79% | Audit Committee (Chair) | 4 of 4 | 100% |

| Corporate Governance and Nominating Committee (member) | 3 of 3 | 100% | ||

| Terronera Special Committee (member) (1) | 4 of 4 | 100% | ||

| Securities Held on Record Date | Other Public Company Directorships | Other Public Company Committee Appointments |

||

| Stock Options: DSUs: |

81,597 215,459 |

None | None | |

Notes:

(1) Ms. Beck joined the Terronera Special Committee on May 23, 2023.

|

| Ricardo M. Campoy | |||||

Independent Director Age: 73 Residence: New York, U.S.A Director since: July 9, 2010 Principal Occupation: Senior Advisor, Capstone Partners and Managing Director of HeadwatersMB |

Ricardo Campoy is a mining engineer with a decades-long career in mining, merchant and investment banking, and financial advisory roles for resource companies, financial institutions and investment funds. Mr. Campoy is the Managing Director of the Minerals Capital and Advisory practice for Capstone Partners, an investment bank. Previously, since mid-2006, he was in private practice as a financial advisor. From 2004 to 2006 he was Managing Director and Head of the Mining and Metals Group for WestLB in New York. Prior to 2004, Mr. Campoy held senior management positions with McFarland Dewey & Co. LLC, ING Capital, Swiss Bank, Elders Resources Finance Inc., European Banking Company and Continental Illinois Bank. Before his banking career, Mr. Campoy worked in various engineering and supervisory production positions with Inspiration Copper Inc., Dravo Corporation, BCL Bamangwato Concessions Ltd. and AMAX Inc. In addition to the Company, Mr. Campoy has served on a number of mining company boards. Mr. Campoy holds a B.Sc. in Mining Engineering from the Colorado School of Mines and a Masters of International Management (Finance) from the American Graduate School of International Management in Phoenix, Arizona. |

||||

| Voting Results of 2023 Annual General Meeting |

Board/Committee Membership | Attendance | ||

| For: | 96.46% | Board (member) | 7 of 7 | 100% |

| Withheld: | 3.54% | Compensation Committee (Chair) | 3 of 3 | 100% |

| Audit Committee (member) | 4 of 4 | 100% | ||

| Terronera Special Committee (member) (1) | 4 of 4 | 100% | ||

| Securities Held on Record Date | Other Public Company Directorships | Other Public Company Committee Appointments |

||

| Common Shares: Stock Options: DSUs: |

4,000 18,500 204,949 |

None | None | |

Notes:

(1) Mr. Campoy joined the Terronera Special Committee on May 23, 2023.

|

| Daniel Dickson | |||||

Non-Independent Director Age: 44 Residence: British Columbia, Canada Director since: May 12, 2021 Principal Occupation: Chief Executive Officer of the Company |

Dan Dickson was appointed as Chief Executive Officer in May 2021 and is responsible for the company’s strategic direction, vision, growth and performance, with a focus on creating shareholder value. In Dan’s previous role as the Chief Financial Officer of the Company, he was responsible for financial reporting, leading financing solutions, steering M&A, and overseeing the IT, legal and administration functions. He also has a solid track record in supporting and guiding the Company’s executive board. Dan has been instrumental in building the Company’s financial infrastructure as the Company grew over the past 15 years from four employees to a team of more than 2,000. Prior to joining the Company, Dan worked with KPMG LLP in the assurance group where he focused on publicly traded precious metals companies. Dan holds a Bachelor of Commerce in Accounting from the University of British Columbia and is a member of the British Columbia Institute of Chartered Accountants (CPA, CA). |

||||

| Voting Results of 2023 Annual General Meeting |

Board/Committee Membership | Attendance | ||

| For: | 98.42% | Board (member) | 7 of 7 | 100% |

| Withheld: | 1.58% | |||

| Securities Held on Record Date | Other Public Company Directorships | Other Public Company Committee Appointments |

||

| Common Shares: Stock Options: PSUs: |

271,624 970,000 339,000 |

None | None | |

|

| Amy Jacobsen | |||||

Independent Director Age: 57 Residence: South Carolina, U.S.A Director since: January 3, 2022 Principal Occupation: President of Windward Consulting LLC |

Amy Jacobsen has a diverse global experience in the minerals industry and was recognized among the 100 Global Inspirational Women in Mining 2020. Her experience includes business leadership combined with a strong knowledge of the technical aspects of mineral projects and the requirements for Mineral Resource and Ore Reserve reporting. This is the result of over 30 years of experience in the industry and in managing and conducting independent technical evaluations and valuations in support of mineral project development and financial transactions. Ms. Jacobsen started her career at Homestake and Hazen Research. Most recently, she spent 17 years in various management positions at Behre Dolbear Group, including 3 years as chair of the board of directors from 2016 to 2019. Ms. Jacobsen is currently the President of Windward Consulting as well as Adjunct Professor in the Professional Masters – Mining Industry Management degree program at the Colorado School of Mines, where she teaches Mine Project Investment Evaluations. Ms. Jacobsen graduated from the Colorado School of Mines with a B.S. in metallurgical engineering as well as a Master of Business Administration from the Executive MBA program at the University of Denver. She is a Qualified Professional, a registered Professional Engineer and an Associate Member of the International Institute of Mineral Appraisers. Ms. Jacobsen is a past president of the Mining and Metallurgical Society of America. |

||||

| Voting Results of 2023 Annual General Meeting |

Board/Committee Membership | Attendance | ||

| For: | 97.75% | Board (member) | 7 of 7 | 100% |

| Withheld: | 2.25% | Audit Committee (member) | 4 of 4 | 100% |

| Sustainability Committee (member) | 4 of 4 | 100% | ||

| Terronera Special Committee (member) (1) | 0 of 0 | N/A | ||

| Securities Held on Record Date | Other Public Company Directorships | Other Public Company Committee Appointments |

||

| Stock Options: DSUs: |

43,500 78,373 |

None | None | |

Notes:

(1) Ms. Jacobsen joined the Terronera Special Committee on December 8, 2023. No Terronera Special Committee meetings were held during the remainder of 2023.

|

| Kenneth Pickering | |||||

Independent Director Age: 76 Residence: British Columbia, Canada Director since: August 20, 2012 Principal Principal Occupation: Corporate Director |

Ken Pickering is a professional engineer and former mining executive with more than 50 years of experience working in the natural resource sector building and operating major mining operations in Canada, Chile, Australia, Peru and the US. Mr. Pickering is currently an international mining operations and project development private consultant. Mr. Pickering has held independent director positions with Teck Resources, Taseko Mines and Northern Dynasty Minerals. Mr. Pickering previously held a number of positions worldwide over a 39 year career with BHP Billiton Base Metals including President of Minera Escondida Ltda. And was intimately involved in the planning, development, initial operation and subsequent expansion phase of the Escondida copper project. He is a graduate of the University of British Columbia (BASc) and AMP Harvard Business School. |

||||

| Voting Results of 2023 Annual General Meeting |

Board/Committee Membership | Attendance | ||

| For: | 97.59% | Board (member) | 7 of 7 | 100% |

| Withheld: | 2.41% | Sustainability Committee (Chair) | 4 of 4 | 100% |

| Compensation Committee (member) | 3 of 3 | 100% | ||

| Audit Committee (member) | 4 of 4 | 100% | ||

| Terronera Special Committee (Chair) (1) | 4 of 4 | 100% | ||

| Securities Held on Record Date | Other Public Company Directorships | Other Public Company Committee Appointments |

||

| Common Shares: Stock Options: DSUs: |

27,500 58,597 414,678 |

Northern Dynasty Minerals Ltd., Director, TSX (2) |

Chair Compensation Committee | |

|

Taseko Mines Limited, TSX (2) |

Chair Environmental, Health & Safety Committee Chair Compensation Committee |

|||

Notes: (1) Mr. Pickering joined the Terronera Special Committee on May 23, 2023.

(2) "TSX" means the Toronto Stock Exchange.

(3) "NYSE" means the New York Stock Exchange.

|

| Mario D. Szotlender | |||||

Independent Director Age: 62 Residence: Caracas, Venezuela Director since: July 25, 2002 Principal Occupation: Corporate Director |

Mario Szotlender is a financier and businessman with a Bachelor’s degree in International Relations from the Universidad Central de Venezuela. He has successfully directed Latin American affairs for numerous private and public companies for over 25 years, specializing in developing new business opportunities and establishing relationships with the investment community. In addition to the Company, Mr. Szotlender is a director of Atico Mining Corporation, Fortuna Silver Mines Inc. and Radius Gold Inc. |

||||

| Voting Results of 2023 Annual General Meeting |

Board/Committee Membership | Attendance | ||

| For: | 97.19% | Board (member) | 7 of 7 | 100% |

| Withheld: | 2.81% | Corporate Governance and Nominating Committee (member) | 3 of 3 | 100% |

| Sustainability Committee (member) | 4 of 4 | 100% | ||

| Compensation Committee (member) | 3 of 3 | 100% | ||

| Securities Held on Record Date | Other Public Company Directorships | Other Public Company Committee Appointments |

||

| Common Shares: Stock Options: DSUs: |

153,600 38,097 321,831 |

Atico Mining Corporation, TSXV (2) | Compensation Committee Chair Audit Committee member |

|

|

Fortuna Silver Mines Inc., TSX(1); |

Sustainability Committee member | |||

| Radius Gold Inc., TSXV (2) | Compensation Committee member Audit Committee member |

|||

Notes: (1) "TSX" means the Toronto Stock Exchange.

(2) "TSXV" means TSX Venture Exchange.

(3) "NYSE" means the New York Stock Exchange.

|

| Angela Johnson | |||||

Independent Director Age: 40 Residence: British Columbia, Canada Director since: N/A Principal Occupation: VP, Corporate Development & Sustainability of Faraday Copper Corp. |

Angela Johnson is a professional geologist and diversified mining and exploration professional with over 13 years of experience holding numerous technical, operational, and corporate level leadership roles for junior and intermediate producers across North and South America. Ms. Johnson currently serves as the VP, Corporate Development & Sustainability at Faraday Copper, since April 2022. From December 2020 to March 2022, Ms. Johnson was the Corporate Development Manager at Silvercorp Metals, where she led the assessment and evaluation of international precious and base metal projects for potential acquisition or strategic investment. Prior to that, she held the role of Exploration Manager at Calibre Mining, from 2019 to 2020, where she led the operational exploration teams and managed near-mine drilling activities at the company’s operations in Nicaragua. Ms. Johnson also serves as an independent director for Gold Royalty Corp. |

||||

| Voting Results of 2023 Annual General Meeting |

Board/Committee Membership | Attendance | ||

| N/A | N/A | None (1) | N/A | N/A |

| Securities Held on Record Date | Other Public Company Directorships | Other Public Company Committee Appointments |

||

| Common Shares: Stock Options: DSUs: |

Nil Nil Nil |

Gold Royalty Corp. NYSE (2) | ESG Committee, Nomination & Corporate Governance Committee | |

Notes:

(1) Ms. Johnson has been nominated by the Board for election as a director at the Meeting.

(2) "NYSE" means the New York Stock Exchange.

|

Cease Trade Orders, Bankruptcies, Penalties or Sanctions

Other than as disclosed herein, none of the proposed directors is, as at the date of this Information Circular, or has been, within the 10 years preceding the date of this Information Circular, a director, chief executive officer or chief financial officer of any company (including the Company) that:

a) was subject to a cease trade or similar order or an order that denied the relevant company access to any exemption under securities legislation that was in effect for a period of more than 30 consecutive days (collectively, an "Order"), when such Order was issued while the person was acting in the capacity of a director, chief executive officer or chief financial officer of the relevant company; or

b) was subject to an Order that was issued after such person ceased to be a director, chief executive officer or chief financial officer of the relevant company, and which resulted from an event that occurred while the person was acting in the capacity of a director, chief executive officer or chief financial officer of the relevant company.

Mario D. Szotlender is a director of Fortuna Silver Mines Inc. ("Fortuna") and was a director of Fortuna when a management cease trade order was issued by the British Columbia Securities Commission ("BCSC") on April 3, 2017 against the Chief Executive Officer and Chief Financial Officer of Fortuna in connection with Fortuna's failure to timely file financial statements, related management discussion and analysis and an annual information form for its financial year ended December 31, 2016. Fortuna reported that the delay in the filing of these documents was due to pending resolution of a regulatory review of certain of the Company's filings by the United States Securities and Exchange Commission. On May 25, 2017, the BCSC revoked this management cease trade order after Fortuna filed the required records.