UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of April, 2024.

Commission File Number: 001-39038

EQUINOX GOLD CORP.

(Translation of registrant's name into English)

700 West Pender Street, Suite 1501, Vancouver, British Columbia, V6C 1G8

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☐ Form 40-F ☒

INCORPORATION BY REFERENCE

Exhibit 99.1 of this Form 6-K is incorporated by reference as an additional exhibit to the registrant's Registration Statement on Form F-10 (File No. 333-268499).

EXHIBIT INDEX

|

Exhibit Number |

Description |

| 99.1 | Management Information Circular and Notice of Meeting |

| 99.2 | Notice and Access Notification |

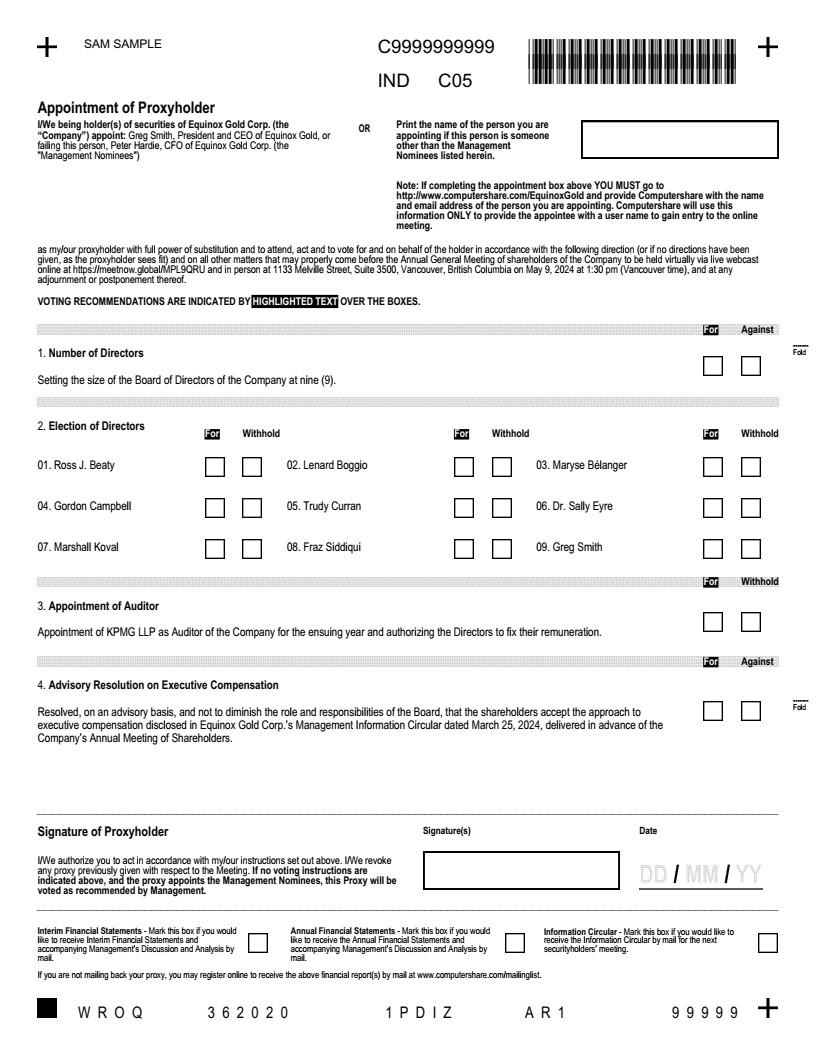

| 99.3 | Form of Proxy |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

EQUINOX GOLD CORP.

(Registrant)

|

Date: April 1, 2024 |

By: |

/s/ Susan Toews |

|

|

|

Name: Susan Toews |

|

|

|

Title: General Counsel |

| 2024 Annual Meeting of Shareholders |

TABLE OF CONTENTS

i

| 2024 Annual Meeting of Shareholders |

ii

| 2024 Annual Meeting of Shareholders |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

|

MEETING INFORMATION |

|

|

When Thursday, May 9, 2024 1:30 p.m. (Vancouver time) |

Where 1133 Melville Street, Suite 3500 Vancouver, British Columbia and online at: https://meetnow.global/MPL9QRU |

You are invited to attend the annual meeting of shareholders (the Meeting) of Equinox Gold Corp. (Equinox Gold or the Company) at which you will be asked to vote on:

Setting the size of the Company's Board of Directors

Electing nine director nominees

Appointing KPMG as the Company's auditor for 2024

Approving a non-binding advisory resolution on executive compensation

Equinox Gold's Board of Directors has approved the contents of this notice and management information circular (Circular), and the sending of this notice and Circular to the Company's shareholders, each of its directors and its auditor. Equinox Gold is using the notice and access method for delivering this notice and meeting materials to shareholders. This notice, the Circular and other meeting materials are available for review and download on Equinox Gold's website at https://www.equinoxgold.com/shareholder-events/ and under Equinox Gold's profile on SEDAR+ at www.sedarplus.ca and EDGAR at www.sec.gov/edgar.

Equinox Gold shareholders can attend the Meeting in person or online and can vote in person, by proxy or online at the Meeting. Shareholders will have an equal opportunity to participate in the Meeting, regardless of whether they are attending in person or online. See "Attending the Meeting and Voting Procedures" beginning on page 7 of the Circular for detailed information on how to attend, participate in and vote at the Meeting. Shareholders are invited to submit any questions about Equinox Gold, the Meeting materials or the voting process in advance via our website at https://www.equinoxgold.com/investors/agm-contact/.

The Circular contains important information about what the Meeting will cover, who can vote and how to vote. Please read the Circular carefully. You are eligible to vote your Equinox Gold shares if you were a shareholder of record at the close of business on March 21, 2024. Exercising your right to vote gives you a voice in how Equinox Gold shapes its governance practices and strategy. We encourage you to vote and provide feedback.

By order of the Board of Directors

"Susan Toews"

Susan Toews

General Counsel and Corporate Secretary

March 25, 2024

iii

| 2024 Annual Meeting of Shareholders |

Letter from the Chair

|

Dear Fellow Shareholders, My 2023 report card for Equinox Gold concludes: "It was a pretty good year." Our seven mines generally operated well, we met our production guidance, and we had no operating disruptions of any consequence. Our $1.2 billion Greenstone development project continued its construction progress on time and on budget and was effectively complete at year-end. Exploration programs successfully replaced mined gold reserves. Our finance team raised $513 million in new capital to fund Greenstone construction and our other corporate objectives. All these successes were made possible by our outstanding management teams in Vancouver and at our operations, and to each of them I extend my profound appreciation. |

I was, however, disappointed with our share price performance in 2023. While our share price increased nearly 50% during the year, outperforming most other gold companies and other investment classes, our share price still lags comparable companies and does not reflect our extraordinary growth prospects. But I expect achieving production at Greenstone will be a tremendous catalyst, and I'm optimistic that better share prices are in store for 2024!

What was very pleasing to me in 2023 was the gold price! It began the year at $1,817 per ounce and ended at $2,078 per ounce - a record high year-end close. And it did this despite much negative commentary from pundits who anticipated a gold price decline from a strong US dollar, high interest rates, high inflation, and a weakening global economy. What the pundits forgot is gold's role as a store of value - it behaved in 2023 as it has done for 5,000 years! To partly diversify their reserves away from the US dollar, several central banks collectively purchased 1,037 tonnes (33 million ounces) of gold, following similar amounts purchased by central banks in 2022.

Gold is an asset class by itself and has kept its purchasing power for millennia, particularly when measured against fiat currencies. As global monetary reserves grow and geopolitical tensions continue, I'm confident gold's monetary demand will grow in tandem, providing ongoing support for rising gold prices. If the dollar weakens, inflation declines and interest rates decline, which are all likely in 2024, I expect further strength in gold. Indeed, as I write this letter gold has achieved new all-time highs, reaching $2,222 on March 20th. Equinox Gold was created to provide shareholders with tremendous leverage to higher gold prices through our growing gold production and large gold reserves and resources, and the rising gold price should translate to higher valuations for our company in 2024.

What lies ahead in 2024 from Equinox Gold? The most important milestone this year will be the start of gold production at Greenstone. When operating at capacity Greenstone will be the largest, lowest cost, longest life and most profitable mine in our portfolio, contributing profoundly to our goal of producing more than a million ounces a year and, in the process, lowering our average cost of gold production and improving our operating cashflow. A second important goal will be to resolve several community issues at our Los Filos mine that have impaired its operation since we acquired the mine in 2020. Los Filos has a world-class gold resource, but we need significant changes to the operating agreements with our local communities to support investments that will decrease Los Filos costs and increase its production for the long term. Our Brazil operations should continue their good performance, and in California we will advance Castle Mountain Phase 2 permitting and engineering to enable a large expansion that will take gold production from today's 20,000 ounces per year to more than 200,000 ounces per year.

Equinox Gold now has more than 8,000 employees and contractors working at our operations, supporting their families, and strengthening their communities and countries. Our $1.1 billion in gross gold revenues in 2023 fund tax payments to the municipalities, regions, and countries where we operate, enable a myriad of small businesses to operate, and support many community education, social, sport and health facilities. We strive to maintain high standards of environmental care and good governance everywhere we operate. I extend my thanks to our strong Board of Directors for their attention to these critical areas.

I fully expect my report card for 2024 to say "Outstanding!" and look forward to 2024 with great enthusiasm as Equinox Gold further executes its mission of becoming a senior gold producer on the global stage. I thank all shareholders who are sharing this journey with me and our entire management and operations teams.

Ross Beaty, C.M.

March 25, 2024

iv

| 2024 Annual Meeting of Shareholders |

Letter from the Chief Executive Officer

|

Dear Fellow Shareholders, After a challenging year in 2022, 2023 brought more stability to our industry with inflation and supply chain issues easing, interest rates steadying and, helpfully, the gold price hitting record highs. Against this backdrop we focused on three core areas during the year: delivering on our production and cost targets, advancing our world-class Greenstone project toward commercial production in 2024, and ensuring we maintained a strong financial position to deliver on these goals and our long-term vision to build a premier Americas-focused gold producer of scale. |

Initiatives to improve productivity and efficiencies at our mine sites began to pay off in 2023. Our seven gold mines collectively produced 564,458 ounces of gold at cash costs of $1,350 per ounce and all-in sustaining costs of $1,612 per ounce. Both production and all-in sustaining costs were within our guided expectations for 2023 with cash costs beating our expectations, reflecting a strong focus on cost management during the year. While these results show good progress, we will continue to do better. We have expanded our asset optimization scope to include all areas of the Company, relentlessly looking for opportunities to reduce our cost of doing business while improving productivity and enhancing our ESG performance.

Advancing Greenstone toward production was a major focus for both Equinox Gold and our joint venture partner, Orion Mine Finance, during 2023. After 2.5 years of construction, the project remains on track to pour gold in the first half of 2024, which is an incredible accomplishment for the team. Achieving production this year will be transformative for Equinox Gold. Greenstone is a world-class deposit and will be one of the largest gold mines in Canada, significantly increasing our production while meaningfully reducing our consolidated costs per ounce. As I write this letter, Greenstone is rapidly progressing through commissioning and first gold production is in sight.

Construction at Greenstone has continued safely with more than 5.9 million hours worked project-to-date with one lost-time incident. This an excellent safety achievement and I commend the Greenstone team. Our 2023 total recordable injury frequency rate of 1.47 per million hours worked across all our operations was a 31% improvement compared to 2022, and four of our sites had no lost-time incidents during the year. Unfortunately, after more than five years with no fatalities we experienced a fatality at our Santa Luz mine in 2023. The well-being of our workforce is a top priority for Equinox Gold and we continue to focus on ensuring the safety of our personnel.

To maintain a strong financial position through Greenstone construction we raised funds during the year through gold pre-pay transactions, investment sales and our at-the-market equity facility. We also issued a $172.5 million convertible note and used the proceeds to partially pay down our revolving credit facility, reducing our interest costs and ensuring we have adequate liquidity to pay notes maturing in 2024. As Greenstone enters commercial operations during 2024, we expect to start generating excess cash flow that we intend to use to further reduce leverage and strengthen our balance sheet.

With my first full year as CEO of Equinox Gold now complete, I appreciate the continued support of our shareholders, lending syndicate and community partners. We are persistent in our pursuit to deliver the long-term growth and value our stakeholders expect and deserve, and I'd like to thank the entire Equinox Gold team for their continued efforts.

Greg Smith

March 25, 2024

v

| 2024 Annual Meeting of Shareholders |

ABOUT THIS INFORMATION CIRCULAR

You have received this management information circular (the Circular) for the 2024 annual meeting of shareholders of Equinox Gold to be held at 1:30 p.m. (Vancouver time) on Thursday, May 9, 2024 (the Meeting), because our records indicate that you owned Equinox Gold shares at the close of business on March 21, 2024 (the Record Date). You have the right to attend the Meeting and vote on the various items of business to be addressed at the Meeting personally or by proxy. You retain these rights if the Meeting is adjourned or postponed.

Your vote is important. The Board of Directors (Board) and management (Management) of Equinox Gold encourage you to voice your opinion on Equinox Gold's governance practices and strategy by voting your shares.

This Circular describes what the Meeting will cover and how to vote. Please read it carefully and vote, either by completing the form included with this package or by attending the Meeting in person or by webcast. If you have any questions about the procedures to follow to qualify your vote at the Meeting, or about obtaining and depositing the required proxy form, you should contact Equinox Gold's transfer agent, Computershare Investor Services Inc. (Computershare) by phone at 1-800-564-6253 (North American toll free) or 1-514-982-7555 (International).

Defined Terms

In this Circular, we, us, our, Equinox Gold and the Company mean Equinox Gold Corp. You, your and shareholder mean holders of Equinox Gold shares as of the Record Date. All other terms used are defined within the Circular.

Proxy Solicitation

Management may solicit your vote for this Meeting, and at any meeting that is reconvened if the Meeting is postponed or adjourned. Management's solicitation of proxies will be conducted without special compensation by mail, email, telephone or other personal contact by our directors, officers, and employees or by Computershare. The Company will bear the cost of soliciting proxies.

The Company is not aware of any items of business to be considered at the Meeting other than as set out in the Notice of Meeting. If any other matter properly comes before the Meeting, it is the intention of the persons named in the enclosed proxy form to vote the shares represented thereby in accordance with their best judgment on such matter.

Quorum and Approval

A quorum of shareholders is required to transact business at the Meeting. According to the Company's articles, a quorum for the transaction of business at any meeting of shareholders is at least two shareholders present, or represented by proxy, holding 33% or more of the shares entitled to vote at the meeting of shareholders.

Annual and Interim Reports

As a shareholder, you can decide if you want to receive paper copies of our interim and annual consolidated financial statements and management's discussion and analysis (MD&A). To receive paper copies of these materials, please complete the request contained on the proxy form provided in connection with the Meeting or register online at www.computershare.com/mailinglist.

You can find financial information relating to Equinox Gold in our audited consolidated financial statements and MD&A for our most recently completed financial year. These documents are available on our website at www.equinoxgold.com, on SEDAR+ (www.sedarplus.ca) and on EDGAR (www.sec.gov/edgar).

| 2024 Annual Meeting of Shareholders |

Notice and Access

Equinox Gold is using the notice and access process (Notice and Access) provided under National Instrument 54-101 - Communication with Beneficial Owners of Securities of a Reporting Issuer, for delivery of the Notice of Meeting and Circular for the year ended December 31, 2023 (collectively, the Meeting Materials) to registered and beneficial shareholders. Equinox Gold has adopted the Notice and Access delivery process to further its commitment to environmental stewardship and to reduce its printing and mailing costs.

Under Notice and Access, instead of receiving printed copies of the Meeting Materials, shareholders receive a notice containing details of the Meeting date, location, and purpose, as well as information on how to access the Meeting Materials electronically. Only shareholders with existing instructions on their account to receive printed materials will receive a printed copy of the Meeting Materials.

The Company is not using a procedure known as "stratification" in relation to its use of Notice and Access. Stratification occurs when a reporting issuer provides a paper copy of the Circular to select shareholders along with the Notice and Access notification. In relation to the Meeting, all shareholders will receive the required documentation under Notice and Access and shareholders will not receive a paper copy of the Circular unless requested.

Shareholders without pre-existing instructions to receive printed materials may request that paper copies of the Meeting Materials be sent to them by postal delivery at no cost to the shareholder for up to one year from the date this Circular is filed on SEDAR+ and EDGAR. To request a paper copy of the Meeting Materials, please contact Equinox Gold by phone at 1-833-EQX-GOLD (1-833-379-4653) (North America toll free) or 1-604-558-0560 (International) or by email at info@equinoxgold.com. To receive the Meeting Materials in advance of 1:30 p.m. (Vancouver time) on Tuesday, May 7, 2024 (the Proxy Deadline) and in advance of the Meeting date, Equinox Gold must receive requests for printed copies of the Meeting Materials at least five business days in advance of the Proxy Deadline.

Non-IFRS and Other Financial Measures

This Circular includes certain non-International Financial Reporting Standards (IFRS) measures, namely: cash costs; cash costs per ounce (oz) sold; all-in sustaining costs (AISC); AISC per oz sold; and sustaining capital expenditures. Such measures are "non-GAAP financial measures", "non-GAAP ratios", "supplementary financial measures" or "capital management measures" (as such terms are defined in National Instrument 52-112 - Non-GAAP and Other Financial Measures Disclosure).

Equinox Gold believes these measures, while not a substitute for measures of performance prepared in accordance with IFRS, provide investors with an improved ability to evaluate the underlying performance of the Company. These measures do not have any standardized meaning prescribed under IFRS, and therefore may not be comparable to the information provided by other issuers.

Please see the information under the heading Non-IFRS Measures in Equinox Gold's MD&A for the year ended December 31, 2023, which section is incorporated by reference in this Circular, for a description of the non-IFRS financial measures noted above. The MD&A can be found on our website at www.equinoxgold.com, on SEDAR+ and on EDGAR.

General Information

Unless otherwise stated, information in this Circular is accurate as of the Record Date.

| 2024 Annual Meeting of Shareholders |

This Circular contains references to lawful currency of the United States (US$ or US dollars) and of Canada (C$ or Canadian dollars). All dollar amounts referenced in this Circular, unless otherwise indicated, are expressed in US dollars. Unless otherwise stated, any US dollar amounts that have been converted from Canadian dollars have been converted at the following daily exchange rates, as quoted by S&P Global Market Intelligence:

| 2024 Annual Meeting of Shareholders |

BUSINESS OF THE MEETING

Receive our Financial Statements and the Auditor's Report

Our audited consolidated financial statements for the year ended December 31, 2023, and related auditor's report, will be presented at the Meeting. The audited consolidated financial statements are available on our website, on SEDAR+ and on EDGAR. Printed copies will be mailed to shareholders who requested a copy.

Board Size

The Company's articles require that the Board of Equinox Gold consist of the greater of three directors or the number set by ordinary resolution. At the meeting the nine director nominees listed in the section "Directors" beginning on page 30 of this Circular will be proposed for election as directors of the Company. Equinox Gold is asking shareholders to set, by ordinary resolution, the number of directors of the Company at nine.

|

|

The Board recommends you vote FOR setting the Board size at nine persons. |

Unless otherwise instructed, Management Proxyholders (defined below) will vote FOR the resolution setting the Board size at nine persons.

Elect Directors

At the Meeting, shareholders of the Company will be asked to elect a board of directors to hold office until the close of our next annual meeting of shareholders or until their successor is elected or appointed, unless their office is earlier vacated in accordance with our articles or with the provisions of the Business Corporations Act (British Columbia). Information on the director nominees begins on page 30 of this Circular.

|

|

The Board recommends you vote FOR all of the director nominees. |

Unless otherwise instructed, the Management Proxyholders appointed pursuant to the accompanying proxy form will vote FOR the election of the nominated directors. If a proposed nominee is unable to serve as a director or withdraws their name, the Management Proxyholders reserve the right to nominate and vote for another individual at their discretion.

Appointment of Independent Auditor

The Board, on the recommendation of the Audit Committee, recommends that KPMG LLP be reappointed as the Company's independent external auditor to serve for the ensuing year, and that the Board be authorized to set the auditor's remuneration.

KPMG LLP has been Equinox Gold's auditor since January 5, 2017. The auditor conducts the annual audit of our financial statements, provides audit-related, tax and other services, and reports to the Audit Committee of the Board. At the Company's 2023 annual meeting of shareholders, 99.67% of the votes cast were in favour of appointing KPMG LLP as the Company's auditor, with 0.33% of votes cast withheld.

| 2024 Annual Meeting of Shareholders |

The fees paid or payable to the Company's auditor, KPMG LLP, in each of the last two fiscal years are as follows:

|

|

20231 |

20221 |

|

Audit Fees |

|

|

|

Services provided by the independent auditor for the audit of the financial statements and internal controls over financial reporting. |

$2,605,977 |

$2,459,059 |

|

Audit Related Services |

|

|

|

In 2023, special attest services as required by regulatory and statutory requirements in Mexico. |

$66,250 |

Nil |

|

All Other Fees |

|

|

|

No other fees in 2023 or 2022. |

Nil |

Nil |

|

Tax Compliance Fees |

|

|

|

For the preparation and review of tax returns, claims for refund and tax payment planning services. |

$292,653 |

$275,544 |

|

Tax Fees |

|

|

|

No other tax fees in 2023 or 2022. |

Nil |

Nil |

|

Total |

$2,964,790 |

$2,734,602 |

Notes:

1. The fees were converted from Canadian dollars into US dollars at the average exchange rate for 2023 of C$1 = US$0.741 (US$1=C$1.3497) and for 2022 of C$1 = US$0.7978 (US$1=C$1.2534).

|

|

The Board recommends you vote FOR the appointment of KPMG LLP as Equinox Gold's auditor and authorize the Board to fix the auditor's pay. |

Unless otherwise instructed, Management Proxyholders will vote FOR the resolution appointing KPMG LLP as our auditor to hold office until our 2025 annual meeting of shareholders and authorizing the Board to fix the auditor's remuneration.

Advisory Resolution on Executive Compensation

The Board has adopted a non-binding "Say on Pay" advisory vote to solicit feedback on our approach to executive compensation. Say on Pay is intended to enhance accountability for the Board's compensation decisions by giving shareholders a formal opportunity to provide their views on the Board's approach to executive compensation through an annual non-binding advisory vote.

The 2023 Say on Pay advisory vote received 98.10% approval from shareholders who voted. The results of this year's vote will be reported following the Meeting. As this is an advisory vote, the results are not binding, and the Board will remain fully responsible for its compensation decisions and will not be relieved of these responsibilities by the advisory vote. However, the Board will take the voting results into account when considering future compensation policies, procedures and decisions and in determining if there is a need to modify any aspect of the Board's engagement with shareholders.

Shareholders are encouraged to review and consider the information regarding Equinox Gold's approach to compensation under the heading "Executive Compensation Discussion and Analysis" beginning on page 45. Shareholders who vote against the Say on Pay resolution are encouraged to contact the Board using the contact information provided on the last page of this Circular to discuss their concerns about Equinox Gold's approach to executive compensation.

| 2024 Annual Meeting of Shareholders |

At the Meeting, shareholders of the Company will be asked to consider, and if thought fit, pass the following resolution regarding executive compensation:

"Resolved that, on an advisory basis, and not to diminish the role and responsibilities of the Board, that the shareholders accept the approach to executive compensation disclosed in the Company's Management Information Circular dated March 25, 2024, delivered in advance of its Annual Meeting of Shareholders."

|

|

The Board recommends you vote FOR the advisory resolution on executive compensation. |

Unless otherwise instructed, Management Proxyholders will vote FOR the advisory resolution on Executive Compensation.

If the advisory resolution is not approved by a majority of the votes cast at the Meeting, the Board will consult with shareholders (particularly those who are known to have voted against the resolution) to understand their concerns and will review Equinox Gold's approach to compensation in the context of those concerns. Results from the Board's review will be discussed in Equinox Gold's management information circular for the following year.

Other Business

If any other items of business are properly brought before the Meeting, you (or your proxyholder, if you are voting by proxy) can vote as you see fit. As of the date of this Circular, we are not aware of any other items of business to be considered at the Meeting.

Corporate Update

Following the formal business of the Meeting, the Company's Chair, Mr. Ross Beaty, will present an overview of the Company's business strategy, objectives, and activities underway, starting at 1:45 p.m. (Vancouver time).

You can join the corporate update webcast here: https://www.equinoxgold.com/shareholder-events/.

Individuals will have an opportunity to ask questions of Mr. Beaty and Management throughout the Meeting and during the corporate update.

| 2024 Annual Meeting of Shareholders |

ATTENDING THE MEETING AND VOTING PROCEDURES

Who Can Vote

You are entitled to vote at the Meeting if you held Equinox Gold shares as of the close of business on March 21, 2024, the Record Date for the Meeting. Each share you owned on the Record Date entitles you to one vote on each item of business to be considered at the Meeting.

How to Vote

How you can vote depends on if you are a registered shareholder or a non-registered (beneficial) shareholder. The different voting options are summarised below, and more detail is provided in the following section.

Please follow the appropriate voting option based on whether you are a registered or non-registered shareholder.

If you are unsure whether you are a registered or non-registered shareholder, please contact Computershare by phone at 1-800-564-6253 (North American toll free) or 1-514-982-7555 (International) or by email at service@computershare.com.

If you have any questions before the Meeting about Equinox Gold, the Meeting Materials, or the voting process, please contact us through our dedicated Meeting site: https://www.equinoxgold.com/investors/agm-contact/.

Voting Process: Registered Shareholders

As described below, registered shareholders have three options for voting: by proxy, in person or online.

|

Registered Shareholders Option 1 - Voting by Proxy |

Voting by proxy is the easiest way to vote. By completing and returning your proxy form, you are authorizing your proxyholder to vote your shares at the Meeting, or to withhold your vote, according to your instructions. Greg Smith, President and CEO of Equinox Gold, and Peter Hardie, CFO of Equinox Gold, have agreed to act as the Equinox Gold management proxyholders for the Meeting (Management Proxyholders). If you appoint the Management Proxyholders but do not tell them how to vote, your shares will be voted FOR each of the items of business currently proposed for the Meeting.

Unless otherwise noted, the following instructions assume that you are appointing the Management Proxyholders as your proxy.

If there are other items of business that properly come before the Meeting, or amendments or variations to the items of business, your proxyholder has the discretion to vote your shares as they see fit. It is important that you provide voting instructions with your proxy.

A proxy will not be valid unless it is dated and signed by you, as the registered shareholder, or by your attorney with proof that they are authorized to sign, and completed according to the instructions set out in the proxy form. If you represent a registered shareholder who is a company or an association, your proxy should have the seal of the company or association, if applicable, and must be executed by a duly authorized officer or an attorney.

| 2024 Annual Meeting of Shareholders |

If a proxy is executed by an attorney for a registered shareholder who is an individual, or by an officer or attorney of a registered shareholder who is a company or association, the relevant attorney or officer must include the original authorization, or a notarized copy of the written authorization for the officer or attorney, with the proxy form.

Your completed proxy must be deposited with Computershare by 1:30 p.m. (Vancouver time) on Tuesday, May 7, 2024, or at least 48 hours (excluding Saturdays, Sundays, and statutory holidays in the province of British Columbia) before the time set for any adjournment or postponement of the Meeting (Proxy Deadline).

If you are appointing someone other than the Management Proxyholders as your proxy, you must register them with Computershare before the Proxy Deadline. If you do not register your proxyholder before the Proxy Deadline, they will not receive an invitation code to participate in the Meeting. Instructions on how to register your proxyholder are provided below. Computershare will email proxyholders their invitation code after the Proxy Deadline has passed. Management Proxyholders do not need to be registered.

|

|

Internet Go to www.investorvote.com and follow the instructions on screen. If you vote using the internet, you will need your 15-digit control number, which appears in the bottom left corner of the first page of your proxy form. If you are using a smartphone, you can scan the QR code on your proxy form. |

|

|

Telephone Call 1-866-732-8683 (in North America) or 1-312-588-4290 (outside North America) from a touch-tone telephone and follow the instructions. You will need your 15-digit control number, which appears in the bottom left corner of the first page of your proxy form. If you vote by telephone, you cannot appoint anyone other than the Management Proxyholders as your proxyholder. |

|

|

Mail or courier Complete your proxy form, sign, and date it, and send it to Computershare in the envelope provided. If you did not receive a return envelope, please send the completed form to: Computershare Investor Services Inc. Attention: Proxy Department 100 University Avenue, 8th Floor Toronto, Ontario Canada M5J 2Y1 |

|

|

Appointing another person to attend the Meeting, either in person or online, and vote your shares on your behalf You can appoint a person other than the Management Proxyholders to attend the Meeting, either in person or online, and vote on your behalf. If you want to appoint someone else as your proxyholder, strike out the names of the Management Proxyholders in your proxy form and print the name of the person that you want to appoint as your proxyholder in the space provided. This person does not need to be an Equinox Gold shareholder. Complete your voting instructions, sign, and date the proxy form, and return your proxy form to Computershare using one of the methods noted above. To participate in the Meeting, your appointed proxyholder must be registered to attend. If you do not register your proxyholder, your proxyholder will not receive an invitation code to participate in the Meeting. To register your proxyholder, please visit http://www.computershare.com/EquinoxGold before 1:30 p.m. (Vancouver time) on Tuesday, May 7, 2024 and provide Computershare with your proxyholder's contact information, including email so that Computershare can provide your proxyholder with an invitation code. |

| 2024 Annual Meeting of Shareholders |

|

Registered Shareholders Option 2 - Voting at the Meeting in Person |

|

|

|

Registered shareholders and duly appointed proxyholders can vote at the Meeting. If you are a registered shareholder and want to vote in person at the Meeting, you do not need to complete or return your proxy form as you will cast your vote at the Meeting. However, even if you are planning to attend the Meeting in person, we still recommend that you vote in advance by proxy so that your vote will be counted if you are subsequently unable to attend the Meeting. You can change your original vote by voting again at the Meeting, if you so desire. |

|

Registered Shareholders Option 3 - Voting at the Meeting Online |

|

|

|

Registered shareholders and duly appointed proxyholders can vote at the Meeting online. To participate online, registered shareholders must have a valid 15-digit control number and appointed proxyholders must be registered with and have received an invitation code for the Meeting from Computershare. Registered shareholders and duly appointed proxyholders can participate in the Meeting online as follows:

- Registered shareholders: the 15-digit control number is in the bottom left corner on the front of your proxy form. - Duly appointed Proxyholders: the invitation code will be emailed to you by Computershare after the Proxy Deadline has passed.

It is important that you or your proxyholder are always connected to the internet during the Meeting to ensure your shares can be voted when balloting commences. It is your responsibility to ensure connectivity for the duration of the Meeting. See the "Virtual AGM User Guide" enclosed with the Notice of Meeting for information on how to join the Meeting online, ask questions and vote. If you are a registered shareholder and use the 15-digit control number on your proxy form to login to the Meeting, you will be able to vote by ballot on the matters put forth at the Meeting. If you DO NOT wish to revoke previously submitted proxies, do not vote again during the Meeting. Guests are not eligible to vote. |

| 2024 Annual Meeting of Shareholders |

Voting Process: Non-Registered Shareholders

As described below, non-registered shareholders have three options for voting: by proxy or voting instruction form, in person, or online. In accordance with applicable securities law requirements, Equinox Gold has distributed copies of the Notice and Access notification, the Meeting Materials and the form of proxy and voting information form to the Intermediaries and clearing agencies and will pay for the Intermediaries and clearing agencies to distribute that material to non-registered shareholders. The Company intends to pay for Intermediaries to forward the Meeting Materials and Form 54-101F7 - Request for Voting Instructions Made by Intermediary to OBOs under NI 54-101.

|

Non-Registered Shareholders Option 1 - Voting by Proxy or Voting Instruction Form |

|

|

|

You should receive from your Intermediary either a voting instruction form that is not signed by the Intermediary, or a pre-authorized form of proxy that has already been signed by the Intermediary, indicating the number of Equinox Gold shares to be voted. Your Intermediary must ask for your voting instructions before the Meeting. Please contact your Intermediary if you did not receive either a voting instruction form or a pre-authorized form of proxy. Voting by proxy or using the voting instruction form is the easiest way to vote. By completing and returning the voting instruction form or form of proxy, you are providing instructions to your Intermediary for how you would like your shares to be voted at the Meeting. Your Intermediary will have its own procedures that you should carefully follow to ensure your shares are voted on your behalf by your Intermediary at the Meeting. Please be aware that the deadline for submitting your voting instruction form or form of proxy to your Intermediary may be earlier than the deadlines for registered shareholders set out above. Your voting instructions must be received in sufficient time to allow your instructions to be forwarded by your Intermediary to Computershare for receipt before 1:30 p.m. (Vancouver time) on Tuesday, May 7, 2024. |

|

Non-Registered Shareholders Option 2 - Voting at the Meeting in Person |

|

|

|

Only registered shareholders and duly appointed Proxyholders can vote at the Meeting. If you are a non-registered shareholder and you wish to vote your shares in person at the Meeting, you should strike out the names of the persons listed in the form of proxy and insert your name in the space provided or, in the case of a voting instruction form, follow the directions indicated on the form. In either case, you should carefully follow the instructions of your Intermediary, including those regarding when and where the proxy or voting instruction form is to be delivered. To participate in the Meeting, Proxyholders must be registered to attend. To register a Proxyholder, please visit http://www.computershare.com/EquinoxGold before 1:30 p.m. (Vancouver time) on Tuesday, May 7, 2024 and provide Computershare with your Proxyholder's contact information, including email, so that Computershare can provide your Proxyholder with an invitation code. |

| Non-Registered Shareholders Option 3 - Voting at the Meeting Online | |

|

|

If you are a non-registered shareholder and you wish to vote your shares online at the Meeting, you should strike out the names of the persons listed in the form of proxy and insert your name in the space provided or, in the case of a voting instruction form, follow the directions indicated on the form. In either case, you should carefully follow the instructions of your Intermediary, including those regarding when and where the proxy or voting instruction form is to be delivered. If you are appointing yourself as proxyholder, you must also register with Computershare to obtain an invitation code that will allow you to login to the Meeting and vote your shares. To register, please visit http://www.computershare.com/EquinoxGold by 1:30 p.m. (Vancouver time) on Tuesday, May 7, 2024 and provide Computershare with your contact information, including email. If you do not register with Computershare, you will not receive an invitation code and will not be able to participate in the Meeting online to vote your shares. You can also appoint a person other than the Management Proxyholders to attend the Meeting and vote on your behalf. You may appoint someone else as the Proxyholder to vote your Equinox Gold shares by printing their name in the space provided on your voting instruction form or form of proxy, and submitting it as directed on the form. If your Proxyholder intends to participate in the Meeting, they must also be registered with Computershare as described above. Once registered, you or your Proxyholder can participate in the Meeting using the following process:

It is important that you or your Proxyholder are always connected to the internet during the Meeting to ensure your shares can be voted when balloting commences. It is your responsibility to ensure connectivity for the duration of the Meeting. See the "Virtual AGM User Guide" enclosed with the Notice of Meeting for information on how to login, ask questions and vote at the Meeting. |

| 2024 Annual Meeting of Shareholders |

Processing the Votes

Our transfer agent, Computershare, or its authorized agents, will count and tabulate the votes on our behalf. We will announce the voting results of the Meeting by press release after the Meeting and file them on SEDAR+ and EDGAR.

Changing Your Vote

Registered Shareholders

If you are a registered shareholder, you can revoke a vote you made by proxy as follows:

Voting again on the internet or by telephone before 1:30 pm (Vancouver time) on Tuesday, May 7, 2024, following the procedures described above;

Voting during the Meeting by logging into the Meeting and following the procedures described above. Voting at the Meeting will revoke previously submitted proxies;

Submitting a new completed proxy form that is dated later than your original proxy and is received by Computershare before 1:30 p.m. (Vancouver time) on Tuesday, May 7, 2024;

Submitting a written notice of revocation signed by you or your duly authorized attorney (Revocation Notice) as described below; or

Any other manner permitted by law.

If you represent a registered shareholder who is a company or association, your Revocation Notice must have the seal of the company or association, if applicable, and must be executed by an officer of the company or an attorney who has written authorization. The written authorization must accompany the Revocation Notice.

We must receive the Revocation Notice any time up to and including the last business day before the day of the Meeting, or the day the Meeting is reconvened if it was postponed or adjourned. Send the signed Revocation Notice to:

| 2024 Annual Meeting of Shareholders |

Equinox Gold Corp.

Suite 1501, 700 West Pender Street

Vancouver, BC Canada V6C 1G8

Attention: Corporate Secretary

Non-Registered Shareholders

Please follow the instructions provided by your Intermediary.

Participating in the Meeting

All shareholders have an equal opportunity to participate in the Meeting regardless of their geographic location. You can participate in person at:

1133 Melville Street, Suite 3500

Vancouver, British Columbia

You can participate online using your smartphone, tablet or computer. Once logged in, you will be able to listen to a live webcast of the Meeting, ask questions online and submit your votes in real time.

The following processes will apply during the Meeting:

Questions about a motion can be submitted by any registered shareholder or duly appointed Proxyholder using the instant messaging service of the virtual interface. Unless questions are procedural or directly related to motions before the Meeting, they will be addressed during the Company's corporate update after the Meeting. Refer to "Corporate Update" on page 6 for details of how to access the corporate update webcast.

Voting on all matters during the Meeting will be conducted by electronic ballot. If you have already voted by proxy, it is important that you do NOT vote again during the Meeting, unless you intend to change your initial vote.

All questions received in advance of the meeting through our dedicated Meeting site (https://www.equinoxgold.com/investors/agm-contact/) that are procedural or directly related to motions before the Meeting will be addressed at the Meeting. All other questions received through the site will be answered during the Company's corporate update after the Meeting. Refer to "Corporate Update" on page 6 for details of how to access the corporate update webcast.

See the "Virtual AGM User Guide" enclosed with the Notice of Meeting for additional information on how to login to the Meeting online, ask questions and vote.

Attending the Meeting as a Guest

Only registered shareholders and duly appointed Proxyholders may vote at the Meeting. Other persons who wish to listen to the business of the Meeting can do so by either attending the Meeting in person as a guest or logging into the Meeting online as a guest. If you are a registered shareholder and have voted by proxy in advance of the Meeting and want to listen to the Meeting but not change your voting instructions, you may login to the online Meeting as a guest.

Questions

If you have any questions before the Meeting about Equinox Gold, the Meeting Materials or the voting process, please contact us through our dedicated Meeting site at https://www.equinoxgold.com/investors/agm-contact/.

| 2024 Annual Meeting of Shareholders |

OPERATIONAL HIGHLIGHTS

About the Company

Equinox Gold is a growth-focused mining company delivering on its strategy of creating the premier Americas gold producer. In our first six years we have grown from a single-asset developer to a multi-asset gold producer with seven operating gold mines in the Americas, an eighth mine expected to commence operations in 2024, a multi-million-ounce gold reserve base and a strong growth profile from a pipeline of expansion projects.

Our leadership team is aligned on the Company's vision to build a diversified, Americas-focused gold company that will responsibly and safely produce more than one million ounces of gold annually, bring long-term social and economic benefits to its host communities, create a safe and rewarding workplace for its employees and contractors, and provide above average investment returns to its shareholders.

Since starting the Company, we have constructed and achieved production at three mines, spun-out non-core assets into two new companies, and sold two mines. During 2023 the Company advanced construction of the Greenstone project, which is on track to pour gold in the first half of 2024. For continued growth, the Company intends to expand and extend production from its current asset base through exploration and development and will look for opportunities to acquire other companies, producing mines and/or development projects that fit the Company's portfolio and strategy.

Creating the Premier Americas Gold Producer

1. Mid-point of Equinox Gold's 2024 production guidance. The Company may revise guidance during the year to reflect changes to expected results.

2. Greenstone is expected to pour first gold in H1 2024.

At the date of this Circular, we have seven operating gold mines: the Mesquite and Castle Mountain mines in the United States, the Los Filos mine in Mexico and the Aurizona, Fazenda, Santa Luz and RDM mines in Brazil. We also have a 60% interest in the Greenstone project in Canada, with production on track for the first half of 2024, and are advancing expansion projects at Aurizona, Castle Mountain and Los Filos.

With an experienced Management and Board, a strong treasury, cash flow from our producing mines, access to a corporate revolving credit facility, an at-the-market equity offering program, and a portfolio of marketable investments, we are well positioned to execute on our growth objectives.

| 2024 Annual Meeting of Shareholders |

Equinox Gold's Asset Portfolio

2023 Results

Equinox Gold produced 564,458 ounces of gold in 2023 at total cash costs of $1,350 per ounce and AISC of $1,612 per ounce.0F1 Our full year production was within the range of 2023 Guidance of 555,000 to 625,000 ounces of gold. Cash costs were below 2023 Guidance at $1,350 per ounce compared to guidance of $1,355 to $1,460 per ounce and ASIC was within the lower range of 2023 Guidance at $1,612 per ounce compared to guidance of $1,575 to $1,695 per ounce.

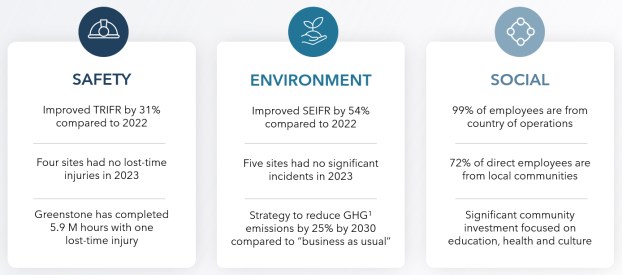

During 2023, we completed 20.3 million work hours with seven lost-time incidents across our sites resulting in a lost time injury frequency rate (LTIFR) of 0.34 per million hours worked compared to the target of 0.63 for 2023. Four of our sites had no lost-time incidents during 2023. Our total recordable injury frequency rate (TRIFR), which is a measure of all injuries that require the attention of medically trained personnel, was 1.47 per million hours worked compared to the target of 3.25 for 2023, a 31% improvement over our TRIFR of 2.12 for 2022.

After more than five years with no fatalities, we had a fatality during 2023 at our Santa Luz mine; no other personnel were injured. A site-wide safety stop took place and Santa Luz held three full days of safety refresher training for its workforce before restarting operations. An investigation to determine the cause of the incident was undertaken and the learnings were shared across the organization.

Environmental stewardship is fundamental to Equinox Gold's operations. We aim to minimize or mitigate the potential effects of our operations on regional flora, fauna, water quality and air quality. Understanding the components of the ecosystem and the potential impacts of mining activities allows us to plan appropriately and adopt mitigation strategies to eliminate or reduce the impact of our operations. During 2023, we achieved a significant environmental incident frequency rate (SEIFR) of 0.29 per million hours worked, using our internal environmental reporting standards, compared to the target of 1.4 for 2023, which was a 54% improvement over our SEIFR of 0.63 for 2022.

____________________________________________

1 Cash costs per ounce and AISC per ounce are non-IFRS measures. See "Non-IFRS Measures".

| 2024 Annual Meeting of Shareholders |

2024 Outlook

During 2024 we expect to produce between 660,000 to 750,000 ounces of gold at cash costs of $1,340 to $1,445 per ounce and AISC of $1,630 to $1,740 per ounce.1 Guidance is intended to provide baseline estimates from which investors can assess Management's expectations for our production and operating costs for the year. We may revise our guidance during the year to reflect changes to expected results.

Cash costs reflect the life cycle stages of the assets in our portfolio and that, while consumables inflation has abated, labour and equipment costs are expected to face continued upward pressure throughout 2024. In addition, compared to many other countries' currencies, the Brazilian Réal and Mexican Peso were top performers against the US dollar in 2022 and 2023 and we expect relative stability in these currencies compared to the US dollar throughout 2024.

Production and cash flow are expected to grow each quarter through 2024 due to normal seasonality and Greenstone ramping up throughout the year.

Sustaining expenditures in 2024 are forecast at $212 million and include capitalized stripping programs to access ore bodies, equipment maintenance and tailings storage facility lifts and maintenance. Sustaining expenditures also include exploration with a focus on reserve replacement across the portfolio. Non-sustaining expenditures for 2024 are forecast at $213 million. Our primary development focus for 2024 continues to be advancing Greenstone to commercial production, with our 60% share of capital in 2024 forecast to be $95 million. In addition, we are advancing engineering and permitting for the Castle Mountain Phase 2 expansion, expect to start underground portal development for the Aurizona underground expansion in the second half of the year and are advancing dialogue with local communities at Los Filos to agree on a long-term development plan for the mine.

| 2024 Annual Meeting of Shareholders |

COMMITMENT TO RESPONSIBLE MINING

Equinox Gold's success in both the public markets and the communities in which we operate is based on sound management of the Company. Responsible mining is our core focus, and sustainable environmental, social and governance (ESG) practices are integral to the success of our business strategy. The following are examples of how we upheld our commitment to responsible mining in 2023.

1. GHG - greenhouse gas emissions.

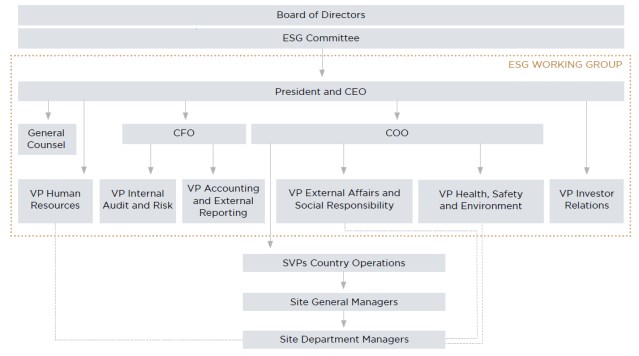

Leadership

Equinox Gold's commitment to responsible mining comes from the very top, with a clearly stated vision from our Board to be a leader in responsible mining, and a commitment from every member of our team to demonstrate excellence at each stage of development. Our ESG governance structure demonstrates the importance we place on embedding ESG priorities throughout the organization. Strong governance of ESG issues flows from the highest level of the organization, creating clear accountabilities across multiple reporting lines.

Equinox Gold's Board provides strategic oversight regarding the Company's ESG strategy. The Board oversees the Company's performance and management of ESG risks and opportunities with the intention that our ESG strategy enhances shareholder value. Two Board-level committees are directly involved in oversight of Equinox Gold's ESG and risk management strategies:

The Environment, Social and Governance Committee oversees ESG matters, including target setting and management of ESG-related initiatives

The Audit Committee oversees the Company's enterprise risk management process, including ESG-related risks and opportunities

Both the ESG and Audit committees meet at least quarterly with Management to review progress on the Company's ESG and risk-management initiatives, and report at least quarterly to the Board.

The multi-disciplinary ESG Working Group, composed of the Chief Executive Officer, Chief Operating Officer, Chief Financial Officer, General Counsel and the Vice Presidents of relevant departments, has a mandate to oversee our policies, standards, accountabilities and programs for ESG-related matters to ensure we are applying best practices and meeting our objectives and obligations.

| 2024 Annual Meeting of Shareholders |

At the management level, our executive team and country managers participate in developing and recommending ESG initiatives for approval by the Board, approve our ESG-related strategies and targets, manage and evaluate the Company's ESG performance, and ensure we are meeting our commitments and adequately managing ESG-related risks and opportunities.

The departments and teams across Equinox Gold are responsible for incorporating ESG programs and practices into their daily activities, and the responsibility for achieving our ESG targets is primarily led by our mine sites. The site-based teams are responsible for adopting and applying initiatives to help the Company achieve its objectives. Mine site management communicate the Company's ESG strategy and initiatives to the workforce and ensure their teams have the necessary skills and training to achieve our objectives. Mine site management report to the respective Country Operations senior vice presidents, who in turn report to Equinox Gold's Chief Operating Officer who is a member of the ESG Working Group.

ESG Strategy

Equinox Gold's commitment to responsible mining guides our ESG strategy. Protecting the health and safety of our workforce and our host communities is our greatest responsibility. We respect the rights of our workforce, Indigenous peoples and host communities and seek to bring long-term social and economic benefits to the regions in which we work. The primary elements of our ESG strategy are outlined below.

Governance

Corporate policies: Ensuring that our policies are reviewed regularly, are appropriate for the size and stage of our business, reflect the key elements of effective corporate compliance and provide an effective framework to guide the conduct and behaviour of our workforce.

Ethics: Ensuring that the actions of Equinox Gold's directors, officers, workforce, and suppliers reflect the Company's values, uphold the Company's codes and policies, and are in accordance with laws and regulations.

Risk management: Ensuring the processes are in place to monitor and mitigate potential risks to our business.

| 2024 Annual Meeting of Shareholders |

Social

Health and safety: Achieving zero harm by ensuring our workforce has the knowledge, skills, and resources they need to operate safely.

Human rights: Upholding our responsibility to respect the rights of workers and communities across our business activities and to ensure we do not cause and are not complicit in human rights abuses.

Employment practices: Ensuring unbiased hiring practices and fair remuneration and benefits across all site locations, reflecting a reasonable living wage.

Inclusion and diversity: Creating workplaces that are respectful and inclusive and reflect the gender and racial diversity of the communities in which we work.

Community engagement: Communicating regularly and transparently with local communities and Indigenous peoples, soliciting feedback, and finding collaborative solutions to issues and concerns.

Community development: Hiring and procuring locally, contributing to both social and economic development to bring tangible, long-term benefits that endure beyond the life of a mine.

Environment

Energy and greenhouse gas emissions: Contributing positively to the global fight against climate change by developing a long-term plan to prioritize green power sources and reduce our emissions.

Water management: Protecting the quality of local water resources and minimizing the amount of water used to maintain operations.

Mine waste and tailings facility management: Ensuring mine waste and tailings are safely managed, monitoring systems are in place, and all facilities are routinely monitored, inspected, and audited.

Biodiversity: Promoting the protection and conservation of local biodiversity by preventing or mitigating the impact of mining activities on habitat and species loss.

Reclamation and closure: Undertaking progressive site remediation and planning for responsible reclamation and closure when mining is complete.

Governance Policies and Practices

Equinox Gold is a member of the World Gold Council and the Mining Association of Canada and a signatory to the United Nations Global Compact. Our policies and practices are guided by the standards and principles of these organizations. The Company has developed robust policies intended to provide a common framework to guide conduct across our operations and is implementing leading industry standards at our mine sites, including the Mining Association of Canada's Towards Sustaining Mining Protocols and the World Gold Council's Responsible Gold Mining Principles. Our policies are carefully designed, recognizing their central role in managing Equinox Gold's business activities and ensuring the Company's long-term success. We review our governance policies at least annually to ensure they appropriately reflect any changes to our business and applicable regulations. Policies integral to executing the Company's ESG strategy include:

Code of Conduct and Business Ethics

Anti-Bribery and Anti-Corruption Policy

Health and Safety Policy

Environment and Climate Change Policy

Social Responsibility and Human Rights Policy

Supplier Code of Conduct

Diversity Policy

Board Mandate and Committee Charters

Equinox Gold's policies and governance frameworks are available in English, Spanish and Portuguese for review on our website at www.equinoxgold.com/corporate-governance/.

| 2024 Annual Meeting of Shareholders |

ESG Transparency and Reporting

Our ESG strategy is supported by a commitment to honest and transparent communication with all stakeholders and includes using standard reporting frameworks such as the Global Reporting Initiative (GRI), the Sustainability Accounting Standards Board (SASB) and the Task Force on Climate-related Financial Disclosures (TCFD). We also report our greenhouse gas (GHG) emissions and energy data to the CDP (formerly the Carbon Disclosure Project) annually and regularly update our tailings management reporting.

Key 2023 ESG reporting highlights are summarized below. All the reports are available for review and download on our website at https://www.equinoxgold.com/responsible-mining/.

Published our inaugural Climate Action Report aligned with the TCFD framework, as described below.

Published our ESG Report and data tables in line with the reporting frameworks of GRI and SASB. This report is available in English, Spanish and Portuguese.

Published our inaugural Water Stewardship Report, which is aligned with the International Council on Mining and Metals Water Stewardship framework.

Submitted our second year of GHG emissions and energy data to the CDP.

In December 2023, we received our S&P Global Corporate Sustainability Assessment score, achieving a score of 46 out of 100, which was a 28% improvement compared to the 2022 score and was in the top quartile of the metals and mining industry.

Climate Action

On February 7, 2023, the Company published its inaugural Climate Action Report aligned with the TCFD framework. The report summarizes the Company's strategy to reduce GHG emissions and mitigate potential negative impacts of climate change on our operations. As detailed in the report, we have committed to a target of reducing the Company's scope 1 and scope 2 GHG emissions by 25% by 2030, compared to "business-as-usual" forecast GHG emissions in 2030 if no intervention measures were taken.

We are implementing initiatives at our producing mines that will reduce GHG emissions and operating costs while also considering GHG emissions mitigation opportunities at our development projects so we can achieve both production growth and our climate-related objectives. Based on an assessment of existing operations and planned expansions, we determined that diesel combustion in mobile equipment and electricity generation for fixed equipment account for nearly all our GHG emissions. As such, we have identified GHG emissions reduction initiatives focused on improving the efficiency of our haul trucks, reducing our electricity consumption and, where possible, sourcing electricity from green power sources.

The Climate Action Report provides detailed information regarding the governance framework and standards, methodology and metrics and targets applicable to the Company's GHG emissions reduction strategy. The report is available for review and download on our website at https://www.equinoxgold.com/responsible-mining/.

Diversity and Inclusion

Equinox Gold believes having a workforce with diverse backgrounds and experiences promotes innovation, improved performance and more effective decision making. We strive to have a highly talented workforce with ethnic and gender diversity that reflects the regions and communities in which we operate, and to create a welcoming and inclusive culture. Refer to the Equity, Diversity and Inclusion section of our ESG report for more information on our commitment to diversity and inclusion.

| 2024 Annual Meeting of Shareholders |

CORPORATE GOVERNANCE OVERVIEW

Equinox Gold's success as a company, in both the public markets and the communities in which we operate, is based on our reputation for sound corporate governance and ethical business practices. We believe that good corporate governance is essential to effectively manage our Company and operations, to achieve our long-term business strategy and to maximize shareholder value.

Guidelines for effective corporate governance of listed companies are established by several sources, including National Instrument 58-101 - Disclosure of Corporate Governance Practices and National Policy 58-201 - Corporate Governance Guidelines (together, the Corporate Governance Disclosure Rules). The Company has reviewed its own corporate governance practices considering the Corporate Governance Disclosure Rules and has complied with the applicable rules.

Ethical Business Conduct

The Board considers good corporate governance to be integral to the success of the Company and a requirement to meet its responsibilities to the Company's shareholders.

The Board, through its observations of the Company when visiting the operations and through meetings and other informal discussions with Management, believes the Company's Management team promotes a culture of ethical business conduct. Management is expected to monitor the activities of the Company's employees, consultants and agents in that regard.

The Board has adopted a Code of Conduct and Business Ethics (Code) and an Anti-Bribery and Anti-Corruption Policy ABAC Policy) to which all employees, consultants, contractors, officers and directors are expected to adhere. In addition, the Company has adopted a Supplier Code of Conduct (Supplier Code), which all suppliers are expected to adhere. A copy of the Code, the ABAC Policy and the Supplier Code are available on the Company's website and the Code has been posted on SEDAR+ and EDGAR.

Training on the Code, the ABAC Policy and other key corporate governance matters was delivered through online and in-classroom training to all employees, consultants, officers and directors in 2023. The training reviews applicable obligations and requires all participants to acknowledge their responsibility to conduct themselves in compliance with the Code and its requirements. The Board reviews compliance with the Code on an annual basis and is responsible for granting any waivers from the Code. The Company will disclose waivers (if any) from the requirements of the Code granted to directors or executive officers in the next quarterly report following the waiver. There were no waivers of the Code during 2023.

It is a requirement of applicable corporate law that directors and officers who have an interest in a transaction or agreement with the Company promptly disclose that interest at any meeting of the Board at which the transaction or agreement will be discussed and, in the case of directors, abstain from discussions and voting in respect to same if the interest is material. These requirements are also contained in the Company's Articles, which are available for review on our website.

| 2024 Annual Meeting of Shareholders |

ABOUT THE BOARD

Subject to the constating documents of the Company and applicable law, the Board has a responsibility for stewardship of the Company, including the responsibility to supervise management of and oversee conduct of the business of the Company, provide leadership and direction to Management and consider Management's performance in conjunction with the Company's compensation plans, set policies appropriate for the business of the Company, and approve corporate strategies and goals.

The Board relies on Management to ensure the Company is conducting its everyday business to the appropriate standards and to provide regular, forthright reports to the Board. The Board works with Management to develop the Company's strategic direction, including matters relating to the Company's long-term strategic plan, budgets, financial plans and strategies, and corporate opportunities, as well as identifying strategic risks. The Board and Management discuss strategic issues at quarterly Board meetings and as needed throughout the year.

The Board has developed and adopted a mandate that sets out in writing the Board's authority, responsibility and function, a copy of which is available on our website.

Independence

Independence is in part a legal and regulatory construct. It is formally assessed annually and considered continually throughout the year to ensure the directors can act objectively and in an unfettered manner, independent of Management and free from any interest and any business or other relationship that could, or could reasonably be perceived to, materially interfere with their ability to act in the Company's best interests. The following table shows a three year look back of the Board's independence, committee independence and Board gender diversity, together with the anticipated composition of the Board for 2024.

|

Board |

Target Standard |

20244 |

2023 |

2022 |

2021 |

|

Independent Chair |

Yes1 |

Yes |

Yes |

Yes |

Yes |

|

Lead Director |

Yes1 |

Yes |

Yes |

Yes |

Yes |

|

Board Independence |

50%1 |

78% |

75% |

78% |

78% |

|

Gender Diversity |

30%2 |

33% |

25% |

22% |

22% |

|

Committees |

|

|

|

|

|

|

Audit Committee Independence |

100%3 |

100% |

100% |

100% |

100% |

|

CN Committee Independence |

100%1 |

100% |

100% |

100% |

100% |

|

ESG Committee Independence |

N/A |

66% |

66% |

75% |

75% |

Notes:

1. Recommended under Corporate Governance Disclosure Rules.

2. Target set by the Company's Diversity Policy.

3. National Instrument 52-110 - Audit Committees.

4. Based on anticipated composition of the Equinox Gold Board if all the proposed director Nominees are elected at the Meeting.

Six of the current directors and seven of the nine director nominees qualify as independent directors under the Corporate Governance Disclosure Rules. Fraz Siddiqui is "not independent" because he is the Board appointee of Mubadala Investment Company (Mubadala), an insider of Equinox Gold. See page 69 for information about Mubadala's Board nomination. Greg Smith is "not independent" because he is President and CEO of Equinox Gold.

The Company has both an independent chair and a lead director. The Board considers it good governance practice to appoint an independent lead director to help oversee the Company's corporate governance structure and act as another point of contact for the shareholder community since Ross Beaty, the Board Chair, is a founder of the Company and remains a significant shareholder.

| 2024 Annual Meeting of Shareholders |

In-camera Meetings

The independent directors meet with the non-independent directors and Management at regularly scheduled Board meetings. They can also choose to meet in-camera (privately) at any Board meeting or can hold a separate meeting of only independent directors. In addition, the Audit Committee holds in-camera sessions with our auditor or amongst themselves at each Board meeting, and other Board committees hold in-camera sessions as required.

Position Descriptions

The Board has developed and approved written position descriptions for the chair of the Board, the chairs of the Board's committees, the Lead Director and the Company's CEO. Each position description describes the responsibilities of the relevant role; copies are available on our website.

Nomination of Directors

The CN Committee annually reviews the skills, expertise and other qualities the Board should collectively possess, and the skills, expertise and other qualities possessed by each director, to identify any gaps. This review was most recently completed in January 2024.

The CN Committee is responsible for recommending to the Board appropriate criteria for the selection of new directors and, in consultation with the Board, establishing a process for the selection of new directors. While the CN Committee has the primary responsibility for identifying prospective directors, all qualified candidates proposed are considered.

During 2023, the CN Committee conducted a process to identify a new director nominee. From a list of over 20 potential candidates, the CN Committee identified a shortlist of 10 candidates based on their skills and experience, including financial expertise. In addition, gender and ethnic diversity were considered. The CN Committee Chair and the Board Chair spoke with each of the shortlisted candidates and ultimately four finalists were interviewed by the CN Committee Chair, CN Committee members and the Board Chair. The Board approved the final two individuals as nominees for election to the Board at the Meeting, and Trudy Curran accepted the offer.

Director Term Limits and Retirement

The current average tenure of the Board is four years. Equinox Gold does not believe that directors should be forced to leave the Board simply due to the length of their tenure or their age. Numerous factors are considered by the CN Committee when recommending a director for nomination. Term limit restrictions and mandatory retirement age policies do not consider the value that a knowledgeable and experienced director can provide to the Company. Instead, the CN Committee annually reviews and considers the performance of each director, amongst other factors, when determining if a director should be nominated for election. We believe this approach provides more value to the Company than if we adopted term limit restrictions or a mandatory retirement age.

Board Composition and Experience

The following table sets out the skills and areas of expertise possessed by each of the director nominees, together with key demographic information about the nominees and their existing committee memberships.

Effective October 31, 2023, Francois Bellemare resigned from the Company's Board of Directors. Mr. Bellemare was the director nominee of Mubadala under its investor rights and governance agreement with the Company. Mubadala nominated Fraz Siddiqui as its nominee and Mr. Siddiqui was appointed as a non-independent director of the Company effective October 31, 2023, to fill the vacancy created by the resignation of Mr. Bellemare. In addition, the Board has nominated Ms. Curran as a new director nominee for 2024, following an extensive recruitment and nomination process. Additional information about each director nominee is contained in their relevant profile, starting on page 30.

| 2024 Annual Meeting of Shareholders |

|

|

Beaty (Chair) |

Boggio (Lead) |

Bélanger |

Campbell |

Curran |

Eyre |

Koval |

Siddiqui |

Smith |

Total |

||

|

Experience and Expertise |

Accounting and tax |

|

|

|

|

|

|

|

|

|

5 |

|

|

Capital markets and finance |

|

|

|

|

|

|

|

|

|

9 |

||

|

Corporate governance |

|

|

|

|

|

|

|

|

|

9 |

||

|

Executive management / senior officer experience |

|

|

|

|

|

|

|

|

|

9 |

||

|

Human resources and compensation |

|

|

|

|

|

|

|

|

|

8 |

||

|

International business |

|

|

|

|

|

|

|

|

|

8 |

||

|

Mining operations |

|

|

|

|

|

|

|

|

|

7 |

||

|

Corporate social responsibility |

|

|

|

|

|

|

|

|

|

8 |

||

|

ESG and/or HSE expertise |

|

|

|

|

|

|

|

|

|

8 |

||

|

Government relations / regulatory |

|

|

|

|

|

|

|

|

|

9 |

||

|

Strategic planning and M&A |

|

|

|

|

|

|

|

|

|

9 |

||

|

Risk Management |

|

|

|

|

|

|

|

|

|

9 |

||

|

South American mining industry |

|

|

|

|

|

|

|

|

|

7 |

||

|

North American mining industry |

|

|

|

|

|

|

|

|

|

6 |

||

|

Climate change governance |

|

|

|

|

|

|

|

|

|

6 |

||

|

Cybersecurity |

|

|

|

|

|

|

|

|

|

1 |

||

|

Board leadership |

|

|

|

|

|

|

|

|

|

8 |

||

|

Board Composition |

Age |

72 |

69 |

62 |

76 |

61 |

52 |

66 |

48 |

48 |

Avg. 62 yrs. |

|

|

Gender |

Male |

|

|

|

|

|

|

|

|

|

6 (66%) |

|

|

|

Female |

|

|

|

|

|

|

|

|

|

3 (33%) |

|

|

Indigenous person, member of a visible minority, or person with a disability |

|

|

|

|

|

|

|

|

|

1 (11%) |

||

|

Independent |

|

|

|

|

|

|

|

|

|

6 (75%) |

||

|

Committees |

Audit Committee |