UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13A-16 OR 15D-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of April 2024

Commission File Number: 001-34244

HUDBAY MINERALS INC.

(Translation of registrant’s name into English)

25 York Street, Suite 800

Toronto, Ontario

M5J 2V5, Canada

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F [ ] Form 40-F [X]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): [ ]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): [ ]

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes [ ] No [X]

EXPLANATORY NOTE

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- _____________________________ On March 28, 2024, Hudbay Minerals Inc. (“Hudbay”) filed on the Canadian Securities Administrators’ System for Electronic Document Analysis and Retrieval (SEDAR) website at www.sedarplus.ca the following documents: (1) News Release dated March 28, 2024, (2) Form 52-109F1 Certification of Annual Filings Full Certificate - CEO, (3) Form 52-109F1 Certification of Annual Filings Full Certificate - CFO, (4) Amendment No. 3 to Canadian Credit Agreement and (5) Amendment No. 3 to Peru Credit Agreement

Copies of the filings are attached to this Form 6-K and incorporated herein by reference, as follows:

Exhibit 99.1 — News Release dated March 28, 2024

Exhibit 99.2 — Form 52-109F1 Certification of Annual Filings Full Certificate - CEO

Exhibit 99.3 — Form 52-109F1 Certification of Annual Filings Full Certificate - CFO

Exhibit 99.4 — Amendment No. 3 to Canadian Credit Agreement

Exhibit 99.5 — Amendment No. 3 to Peru Credit Agreement Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

2

SIGNATURE

| HUDBAY MINERALS INC. | ||

| (registrant) | ||

| By: | /s/ Patrick Donnelly | |

| Name: | Patrick Donnelly | |

| Title: | Senior Vice President, Legal and Organizational Effectiveness | |

Date: April 1, 2024

3

EXHIBIT INDEX

The following exhibits are furnished as part of this Form 6-K:

4

|

TSX, NYSE - HBM 2024 No. 4 |

|

| 25 York Street, Suite 800 Toronto, Ontario Canada, M5J 2V5 tel: 416 362-8181 fax: 416 362-7844 hudbay.com |

|

| News Release | |

Hudbay Provides Annual Reserve and Resource Update and Production Outlook

Toronto, Ontario, March 28, 2024 - Hudbay Minerals Inc. ("Hudbay" or the "company") (TSX, NYSE: HBM) today released its annual mineral reserve and resource update and issued new three-year production guidance. All amounts are in U.S. dollars, unless otherwise noted.

"Our updated mineral reserve estimates and three-year production outlook demonstrate Hudbay's high-quality operating platform with annual production of more than 150,000 tonnes of copper and 270,000 ounces of gold from three long-life mines located in tier-one mining friendly jurisdictions in the Americas," said Peter Kukielski, Hudbay's President and Chief Executive Officer. "We saw strong reserve conversion in Peru after successful geotechnical work confirmed the addition of another mining phase at Constancia, extending the mine life to 2041, and we continued to progress drill permitting activities for the high-potential exploration satellites in Peru. Manitoba exploration efforts are focused on advancing the largest geophysical and drilling program in our history in Snow Lake to test the newly acquired land claims for another anchor deposit and extend the mine life well beyond 2038. Our Copper Mountain mine has a robust copper production profile over its 21-year mine life as reflected in the recent technical report. We already have a resilient operating platform delivering stable copper production and complementary gold production, and we expect to continue to add to our robust production outlook by leveraging our proven track record of delivering value through exploration and development as we advance our quality pipeline of growth assets." Constancia is Hudbay's 100% owned copper operation located in the province of Chumbivilcas in southern Peru and consists of the Constancia and Pampacancha deposits.

|

TSX, NYSE - HBM 2024 No. 4 |

|

Constancia Operations

Current mineral reserve estimates total 548 million tonnes at 0.27% copper containing approximately 1.5 million tonnes of copper. Constancia's expected mine life has been extended by three years to 2041 as a result of the successful conversion of mineral resources to mineral reserves with the addition of a further mining phase at the Constancia pit following positive geotechnical drilling and studies in 2023. There remains potential for future mine life extensions based on the mineral resources that have not yet been converted to mineral reserves.

Hudbay continues to mine the high-grade Pampacancha satellite deposit located approximately six kilometres from the Constancia processing plant. Mining at the Pampacancha pit commenced in 2021 and is expected to extend until the third quarter of 2025, resulting in continued higher copper and gold production over this period. Annual production at the Constancia operations is expected to average approximately 101,000i tonnes of copper and 62,000i ounces of gold over the next three years.

Current mineral reserves and resources (exclusive of reserves) for Constancia and Pampacancha as of January 1, 2024 are summarized below.

|

TSX, NYSE - HBM 2024 No. 4 |

|

|

Constancia Operations |

Tonnes |

Cu Grade |

Mo Grade |

Au Grade |

Ag Grade |

|

Constancia Reserves |

|

||||

|

Proven |

465,600,000 |

0.260 |

78 |

0.038 |

2.63 |

|

Probable |

61,600,000 |

0.212 |

64 |

0.034 |

2.24 |

|

Total Proven and Probable - Constancia |

527,200,000 |

0.254 |

76 |

0.037 |

2.59 |

|

Pampacancha Reserves |

|

||||

|

Proven |

20,000,000 |

0.542 |

128 |

0.330 |

5.44 |

|

Probable |

500,000 |

0.157 |

295 |

0.111 |

1.98 |

|

Total Proven and Probable - Pampacancha |

20,500,000 |

0.533 |

132 |

0.324 |

5.36 |

|

Total Proven and Probable |

547,700,000 |

0.265 |

78 |

0.048 |

2.69 |

|

Constancia Resources |

|

||||

|

Measured |

78,400,000 |

0.213 |

74 |

0.039 |

2.20 |

|

Indicated |

93,100,000 |

0.224 |

90 |

0.040 |

1.98 |

|

Inferred - Open Pit |

29,700,000 |

0.233 |

68 |

0.056 |

2.58 |

|

Inferred - Underground |

6,500,000 |

1.200 |

69 |

0.140 |

8.62 |

|

Pampacancha Resources |

|

||||

|

Inferred |

700,000 |

0.149 |

65 |

0.098 |

2.71 |

|

Total Measured and Indicated |

171,500,000 |

0.219 |

83 |

0.039 |

2.08 |

|

Total Inferred |

36,900,000 |

0.402 |

68 |

0.072 |

3.65 |

Note: totals may not add up correctly due to rounding.

1 Mineral resources are exclusive of mineral reserves and do not have demonstrated economic viability.

2 Mineral resource estimates are based on resource pit design and do not include factors for mining recovery or dilution.

3 The open pit mineral resources are estimated using a minimum NSR cut-off of $6.40 per tonne and assuming metallurgical recoveries (applied by ore type) of 86% for copper on average for the life of mine, while the underground inferred resources at Constancia Norte are based on a 0.65% copper cut-off grade.

4 Mineral reserves are estimated using a minimum NSR cut-off of $6.40 per tonne at Pampacancha, $7.30 per tonne at Constancia and assuming metallurgical recoveries (applied by ore type) of 86% for copper on average for the life of mine.

5 Long-term metal prices of $4.00 per pound copper, $12.00 per pound molybdenum, $1,700 per ounce gold and $23.00 per ounce silver were used to confirm the economic viability of the mineral reserve estimates and to estimate mineral resources.

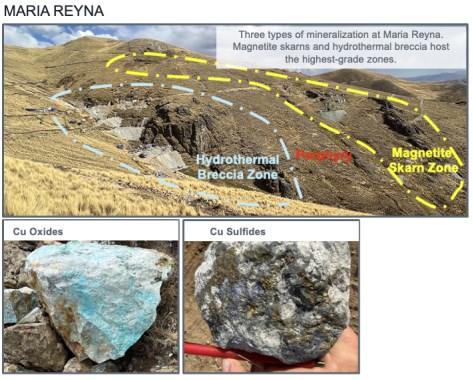

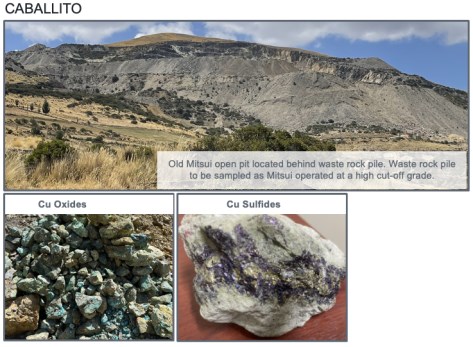

Maria Reyna and Caballito Exploration

Hudbay controls a large, contiguous block of mineral rights with the potential to host satellite mineral deposits in close proximity to the Constancia processing facility, including the past producing Caballito property and the highly prospective Maria Reyna property. The company commenced early exploration activities at Maria Reyna and Caballito after completing a surface rights exploration agreement with the community of Uchucarcco in August 2022. A drill permit application was submitted for the Maria Reyna property in November 2023, and a similar application for the Caballito property is planned for the first half of 2024. In parallel, Hudbay continues to advance community engagement activities. Surface mapping and geochemical sampling confirm that both Caballito and Maria Reyna host sulfide and oxide rich copper mineralization in skarns, hydrothermal breccias and large porphyry intrusive bodies, as shown in Figure 1.

|

TSX, NYSE - HBM 2024 No. 4 |

|

Snow Lake Operations

Hudbay's 100% owned Snow Lake operations in Manitoba include the Lalor gold, copper and zinc mine, the New Britannia gold mill, the Stall base metals concentrator and several satellite deposits. Current mineral reserve estimates in Snow Lake total 17 million tonnes with approximately 2 million ounces in contained gold, and the expected mine life of the Snow Lake operations continues to extend until 2038. The Snow Lake operations continue to achieve higher gold production levels due to the New Britannia mill operating at 10% above design capacity in 2023, the recent completion of the Stall mill recovery improvement project and the implementation of several optimization initiatives at the Lalor mine to improve the quality of ore production and minimize waste dilution. The company also increased its land package in Snow Lake by 250% in 2023, as shown in Figure 2, and has since launched the largest Snow Lake exploration program in the company's history to explore the highly prospective land package for new discoveries to maximize and extend the life of the Snow Lake operations beyond 2038.

Infill drilling at Lalor in 2023 resulted in the successful conversion of high value gold material from inferred resources to mineral reserves. There remains another 1.4 million ounces of gold contained in inferred resources in Snow Lake that have the potential to maintain strong annual gold production levels beyond 2030 and further extend the mine life in Snow Lake. The company is advancing an access drift at the nearby 1901 deposit to enable infill drilling aimed at converting the inferred mineral resources in the gold lenses to mineral reserves.

The Snow Lake mineral reserve and mineral resource estimates include the copper-gold WIM deposit, the gold-rich 3 Zone and the zinc-rich Watts, Pen II and Talbot deposits, which have the potential to provide feed for the Stall and New Britannia processing facilities and further extend the life of the Snow Lake operations. Hudbay is also conducting geophysical and drilling programs on the newly acquired land in Snow Lake, including the Cook Lake claims and the former Rockcliff claims, as discussed further below.

Hudbay has been executing a multi-phased gold strategy in Snow Lake since 2019, which has resulted in increased annual gold production from optimization initiatives, including higher processing capacity and gold recoveries since the start-up of the New Britannia mill in late 2021. As a result, annual gold production from Snow Lake increased from 69,657 ounces in 2020 to 146,233 ounces in 2022, New Britannia's first full year of production. The New Britannia mill achieved record throughput levels averaging 1,650 tonnes per day in 2023, exceeding its design capacity of 1,500 tonnes per day, which contributed to record annual gold production of 187,363 ounces in 2023. Annual gold production from Snow Lake is expected to average 185,000i ounces over the next three years, in line with 2023 levels.

Current mineral reserves and resources (exclusive of reserves) for Lalor, 1901 and other Snow Lake satellite deposits as of January 1, 2024 are summarized below.

|

TSX, NYSE - HBM 2024 No. 4 |

|

|

Lalor Mine and 1901 Deposit |

Tonnes |

Au Grade |

Zn Grade |

Cu Grade |

Ag Grade |

|

Gold Zone Reserves |

|

||||

|

Proven - Lalor |

3,263,000 |

5.5 |

0.73 |

0.59 |

29.6 |

|

Proven - 1901 |

102,000 |

2.8 |

1.33 |

1.00 |

19.2 |

|

Probable - Lalor |

3,678,000 |

4.5 |

0.37 |

1.22 |

22.1 |

|

Probable - 1901 |

52,000 |

1.7 |

0.44 |

1.88 |

5.4 |

|

Total Proven and Probable - Gold |

7,096,000 |

4.9 |

0.55 |

0.93 |

25.3 |

|

Base Metal Zone Reserves |

|

||||

|

Proven - Lalor |

4,406,000 |

2.8 |

5.17 |

0.41 |

30.2 |

|

Proven - 1901 |

1,154,000 |

2.3 |

8.31 |

0.31 |

25.4 |

|

Probable - Lalor |

649,000 |

1.9 |

4.63 |

0.35 |

35.1 |

|

Probable - 1901 |

264,000 |

0.8 |

11.45 |

0.31 |

28.1 |

|

Total Proven and Probable - Base Metal |

6,474,000 |

2.5 |

5.93 |

0.38 |

29.8 |

|

Total Gold and Base Metal Zone Reserves |

|

||||

|

Proven and Probable - Lalor |

11,997,000 |

4.0 |

2.46 |

0.70 |

27.8 |

|

Proven and Probable - 1901 |

1,573,000 |

2.1 |

8.12 |

0.40 |

24.8 |

|

Total Proven and Probable (Gold and Base Metal) |

13,570,000 |

3.8 |

3.12 |

0.67 |

27.4 |

|

Gold Zone Resources |

|

||||

|

Inferred - Lalor |

2,979,000 |

4.3 |

0.24 |

1.68 |

25.7 |

|

Inferred - 1901 |

1,605,000 |

5.4 |

0.30 |

0.84 |

16.5 |

|

Total Inferred - Gold |

4,584,000 |

4.7 |

0.26 |

1.39 |

22.5 |

|

Base Metal Zone Resources |

|

||||

|

Inferred - Lalor |

710,000 |

1.7 |

5.34 |

0.38 |

31.6 |

|

Inferred - 1901 |

334,000 |

1.6 |

5.58 |

0.22 |

30.9 |

|

Total Inferred - Base Metal |

1,044,000 |

1.7 |

5.42 |

0.33 |

31.4 |

|

Total Gold and Base Metal Zone Resources |

|

||||

|

Inferred - Lalor |

3,689,000 |

3.6 |

6.28 |

1.69 |

21.8 |

|

Inferred - 1901 |

1,939,000 |

4.8 |

1.21 |

0.74 |

19.0 |

|

Total Inferred (Gold and Base Metal) |

5,628,000 |

4.0 |

4.53 |

1.36 |

20.8 |

Note: totals may not add up correctly due to rounding.

1 Mineral resources are exclusive of mineral reserves and do not have demonstrated economic viability.

2 Mineral resources do not include factors for mining recovery or dilution.

3 Base metal mineral resources are estimated based on the assumption that they would be processed at the Stall concentrator while gold mineral resources are estimated based on the assumption that they would be processed at the New Britannia concentrator.

4 Long-term metal prices of $1,700 per ounce gold, $1.25 per pound zinc, $4.00 per pound copper and $23.00 per ounce silver with an exchange rate of 1.33 C$/US$ were used to confirm the economic viability of the mineral reserve estimates.

5 Long-term metal prices of $1,900 per ounce gold, $1.25 per pound zinc, $4.00 per pound copper and $23.00 per ounce silver with an exchange rate of 1.33 C$/US$ were used to estimate mineral resources.

6 Lalor mineral reserves and resources are estimated using NSR cut-off ranging from C$146 to C$173 per tonne assuming a long hole mining method and depending on the mill destination.

7 Individual stope gold grades at Lalor were capped at 10 grams per tonne. This capping method resulted in an approximate 3% reduction in the overall gold reserve grade at Lalor.

8 1901 mineral reserves and resources are estimated using a minimum NSR cut-off of C$166 per tonne.

|

TSX, NYSE - HBM 2024 No. 4 |

|

|

Snow Lake Regional Deposits - Gold |

Tonnes |

Au Grade |

Zn Grade |

Cu Grade |

Ag Grade |

|

Probable Reserves |

|

||||

|

WIM |

2,450,000 |

1.6 |

0.25 |

1.63 |

6.3 |

|

3 Zone |

660,000 |

4.2 |

- |

- |

- |

|

Total Probable (Gold) |

3,110,000 |

2.2 |

0.20 |

1.28 |

5.0 |

|

Inferred Resources |

|

||||

|

New Britannia |

2,750,000 |

4.5 |

- |

- |

- |

|

Birch |

570,000 |

4.4 |

- |

- |

- |

|

Total Inferred (Gold) |

3,320,000 |

4.5 |

- |

- |

- |

Note: totals may not add up correctly due to rounding.

1 Mineral resources are exclusive of mineral reserves and do not have demonstrated economic viability.

2 Mineral resources do not include factors for mining recovery or dilution.

3 Gold mineral resources are estimated based on the assumption that they would be processed at the New Britannia concentrator.

4 Long-term metal prices of $1,700 per ounce gold, $1.25 per pound zinc, $4.00 per pound copper and $23.00 per ounce silver with an exchange rate of 1.33 C$/US$ were used to confirm the economic viability of the mineral reserve estimates.

5 WIM mineral reserves assume processing recoveries of 98% for copper, 88% for gold, and 70% for silver based on processing through New Britannia's flotation and tails leach circuits.

6 3 Zone mineral reserves assume processing recoveries of 85% for gold based on processing through New Britannia's leach circuit.

7 New Britannia mineral resource estimates have been reported at a minimum true width of 1.5 metres and with a cut-off grade varying from 2 grams per tonne (at the lower part of New Britannia) to 3.5 grams per tonne (at the upper part of New Britannia).

|

Snow Lake Regional Deposits - Base Metal |

Tonnes |

Au Grade |

Zn Grade |

Cu Grade |

Ag Grade |

|

Indicated Resources |

|

||||

|

Pen II |

470,000 |

0.3 |

8.89 |

0.49 |

6.8 |

|

Talbot |

2,190,000 |

2.1 |

1.79 |

2.33 |

36.0 |

|

Total Indicated (Base Metals) |

2,660,000 |

1.8 |

3.04 |

2.01 |

30.9 |

|

Inferred Resources |

|

||||

|

Watts |

3,150,000 |

1.0 |

2.58 |

2.34 |

31.0 |

|

Pen II |

130,000 |

0.3 |

9.81 |

0.37 |

6.8 |

|

Talbot |

2,450,000 |

1.9 |

1.74 |

1.13 |

25.8 |

|

Total Inferred (Base Metals) |

5,730,000 |

1.3 |

2.39 |

1.78 |

28.3 |

Note: totals may not add up correctly due to rounding.

1 Mineral resources are exclusive of mineral reserves and do not have demonstrated economic viability.

2 Mineral resources do not include factors for mining recovery or dilution.

3 Base metal mineral resources are estimated based on the assumption that they would be processed at the Stall concentrator.

4 Watts and Pen II mineral resources were initially estimated using metal price assumptions that vary marginally over the assumptions used to estimate mineral resources at Lalor. In the Qualified Person's opinion, the combined impact of these small variations does not have any impact on the mineral resource estimates.

5 Watts mineral resources are estimated using a minimum NSR cut-off of C$150 per tonne, assuming processing recoveries of 90% for copper, 80% for zinc, 70% for gold and 70% for silver.

6 Pen II mineral resources are estimated using a minimum NSR cut-off of C$75 per tonne.

7 The above resource estimates table includes 100% of the Talbot mineral resources reported by Rockcliff Metals Corp. in its 2020 NI 43-101 technical report published on SEDAR+.

|

TSX, NYSE - HBM 2024 No. 4 |

|

2024 Snow Lake Exploration Program

The planned 2024 exploration program is Hudbay's largest Snow Lake program in the company's history and consists of modern geophysical programs and multi-phased drilling campaigns:

The goal of the 2024 exploration program is to test mineralized extensions of the Lalor deposit and to find a new anchor deposit within trucking distance of the Snow Lake processing infrastructure, which has the potential to extend the life of the Snow Lake operations beyond 2038.

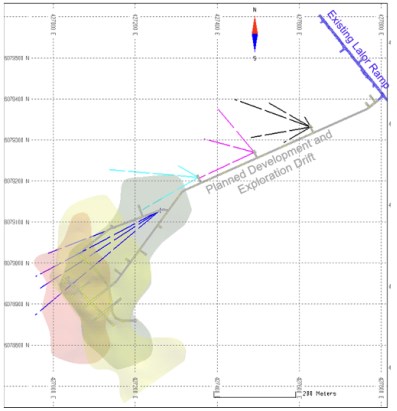

Advancing Access to the 1901 Deposit

The 1901 deposit was discovered by Hudbay in 2019 and is located within 1,000 metres of the existing underground haulage ramp to Lalor. The deposit consists of a series of zinc and gold-rich lenses that were defined by surface drilling and pre-feasibility studies conducted between 2019 and 2021. In early 2024, the company commenced the development of an access drift from the existing Lalor ramp, which is expected to enable underground drill platforms for diamond drilling to further confirm the optimal mining method to extract the base metal and gold lenses and to convert the inferred mineral resources in the gold lenses to mineral reserves. The 1901 development and exploration drift program is expected to take place over 2024 and 2025. For further information, please see Figure 4.

Copper Mountain Mine

Current mineral reserve estimates at the Copper Mountain mine total 367 million tonnes at 0.25% copper and 0.12 grams per tonne gold with approximately 900 thousand tonnes of contained copper and 1.4 million ounces of contained gold. Hudbay acquired Copper Mountain as part of its acquisition of Copper Mountain Mining Corporation in June 2023 and holds a 75% interest in the mine with Mitsubishi Materials Corp. holding the remaining 25% interest. The current mineral reserve estimates support a 21-year mine life, as previously disclosed on December 5, 2023 in the company's first NI 43-101 technical report in respect of the Copper Mountain mine.

As detailed in the technical report, the mine plan contemplates average annual copper production of 46,500 tonnes in the first five years, 45,000 tonnes in the first ten years and 37,000 tonnes over the 21-year mine life. The updated mine plan represents an approximate 90% increase in average annual copper production and an approximate 50% decrease in cash costs over the first 10 years compared to 2022 levels.

Hudbay's mine plan for Copper Mountain is based on a revised resource model that was constructed using the same methods applied at the Constancia, Copper World and Mason deposits. There exists significant upside potential for reserve conversion and extending mine life beyond 21 years through an additional 140 million tonnes of measured and indicated resources at 0.21% copper and 0.10 grams per tonne gold and 370 million tonnes of inferred resources at 0.25% copper and 0.13 grams per tonne gold, in each case, exclusive of mineral reserves.

Since completing the acquisition of Copper Mountain in June 2023, Hudbay has been focused on advancing its plans to stabilize the Copper Mountain mine over the next few years to improve reliability and drive sustainable long-term value. This includes increasing mining activities by remobilizing the idle mining fleet from 14 trucks to 28 trucks, accelerating stripping to access higher grades, and improving mill throughput and recoveries with a more consistent ore feed grade and several planned mill enhancement projects. The new technical report filed in December 2023 reflects Hudbay's base case stabilization plan.

|

TSX, NYSE - HBM 2024 No. 4 |

|

Current mineral reserves and resources (exclusive of reserves) for Copper Mountain as of January 1, 2024 are summarized below.

|

Copper Mountain Mine |

Tonnes |

Cu Grade |

Au Grade |

Ag Grade |

|

Reserves |

|

|||

|

Proven |

195,000,000 |

0.27 |

0.12 |

0.8 |

|

Probable |

172,000,000 |

0.22 |

0.11 |

0.6 |

|

Total proven and probable |

367,000,000 |

0.25 |

0.12 |

0.7 |

|

Resources |

|

|||

|

Measured |

41,000,000 |

0.21 |

0.09 |

0.7 |

|

Indicated |

97,000,000 |

0.21 |

0.11 |

0.7 |

|

Total measured and indicated |

138,000,000 |

0.21 |

0.10 |

0.7 |

|

Inferred |

371,000,000 |

0.25 |

0.13 |

0.6 |

Note: totals may not add up correctly due to rounding.

1 Mineral resource estimates are exclusive of mineral reserves. Mineral resources are not mineral reserves as they do not have demonstrated economic viability.

2 Mineral reserves are reported using an NSR cut-off value of $5.67 per tonne that meets a minimum 0.10% copper grade.

3 Long term metal prices of $4.00 per pound copper, $1,700 per ounce gold and $23.00 per ounce silver were used to confirm the economic viability of the mineral reserve estimates.

4. Long term metal prices of $4.00 per pound copper, $1,650 per ounce gold and $22.00 per ounce silver were used to estimate mineral resources.

5 Mineral resource estimate tonnes and grades constrained to a Lerch Grossman revenue factor 1 pit shell.

6 Mineral reserve and resource estimates presented on a 100% basis. Hudbay holds a 75% interest in the Copper Mountain mine.

3-Year Production Outlook

The consolidated copper and gold production guidance demonstrates the continued strong growth from the successful completion of brownfield investments in Peru and Manitoba and the enhanced operating platform with the acquisition of Copper Mountain. Consolidated copper production over the next three years is expected to average 153,000i tonnes, representing an increase of 16% from 2023 levels. Consolidated gold production over the next three years is expected to average 272,500i ounces, reflecting continued high annual gold production levels in Manitoba and a smoothing of Pampacancha high grade gold zones in Peru over the 2023 to 2025 period, as further described below.

Peru's three-year production guidance reflects continued higher copper and gold grades from Pampacancha into the third quarter of 2025. Mill ore feed throughout 2024 and 2025 is expected to revert to the typical one-third from Pampacancha and two-thirds from Constancia until the depletion of Pampacancha, unlike 2023 when a majority of the ore feed was from Pampacancha in the second half of the year. Gold production reflects a smoothing of Pampacancha high grade gold zones over the 2023 to 2025 period as additional high grade areas were mined in 2023 ahead of schedule, resulting in gold production exceeding 2023 guidance levels, and other high grade areas being deferred to 2025. Total expected gold production in Peru over the 2023 to 2025 period is higher than previous expectations with 2025 gold production now expected to total 80,000i, compared to 58,500i ounces in the company's previous guidance.

|

TSX, NYSE - HBM 2024 No. 4 |

|

Manitoba's three-year production guidance reflects continued strong gold production levels averaging 185,000i ounces per year as the Snow Lake operations have achieved steady levels after the successful refurbishment and optimization of the New Britannia mill, the completion of the Stall mill recovery improvement program and the improvement in the quality of ore production and operating efficiencies at the Lalor mine. The production guidance anticipates Lalor operating at 4,500 tonnes per day and an increase in New Britannia mill throughput to 1,800 tonnes per day starting in 2024 given the mill has been consistently operating above its 1,500 tonnes per day nameplate capacity. Zinc production is expected to decline over the next three years as the Lalor mine continues to prioritize higher grade gold and copper zones.

British Columbia's three-year production guidance reflects sequentially higher annual copper production as a result of the implementation of several improvement initiatives as part of the company's stabilization plan. The Copper Mountain production guidance ranges in 2024 and 2025 are wider than typical ranges and coincide with the operation ramp up activities over the stabilization period. Copper production at the Copper Mountain mine is expected to increase by 32%i in 2026 compared to 2024, reflecting operational improvements consistent with the NI 43-101 technical report for Copper Mountain issued in December 2023.

|

3-Year Production Outlook Contained Metal in Concentrate and Doré1 |

2024 Guidance |

2025 Guidance |

2026 Guidance |

|

|

Peru |

|

|

|

|

|

Copper |

tonnes |

98,000 - 120,000 |

94,000 - 115,000 |

80,000 - 100,000 |

|

Gold |

ounces |

76,000 - 93,000 |

70,000 - 90,000 |

15,000 - 25,000 |

|

Silver |

ounces |

2,500,000 - 3,000,000 |

2,700,000 - 3,300,000 |

1,500,000 - 1,900,000 |

|

Molybdenum |

tonnes |

1,250 - 1,500 |

1,200 - 1,600 |

1,500 - 1,900 |

|

|

|

|

|

|

|

Manitoba |

|

|

|

|

|

Gold |

ounces |

170,000 - 200,000 |

170,000 - 200,000 |

170,000 - 200,000 |

|

Zinc |

tonnes |

27,000 - 35,000 |

25,000 - 33,000 |

18,000 - 24,000 |

|

Copper |

tonnes |

9,000 - 12,000 |

8,000 - 12,000 |

10,000 - 14,000 |

|

Silver |

ounces |

750,000 - 1,000,000 |

800,000 - 1,100,000 |

800,000 - 1,100,000 |

|

|

|

|

|

|

|

British Columbia2 |

|

|

|

|

|

Copper |

tonnes |

30,000 - 44,000 |

30,000 - 45,000 |

44,000 - 54,000 |

|

Gold |

ounces |

17,000 - 26,000 |

24,000 - 36,000 |

24,000 - 29,000 |

|

Silver |

ounces |

300,000 - 455,000 |

290,000 - 400,000 |

450,000 - 550,000 |

|

|

|

|

|

|

|

Total |

|

|

|

|

|

Copper |

tonnes |

137,000 - 176,000 |

132,000 - 172,000 |

134,000 - 168,000 |

|

Gold |

ounces |

263,000 - 319,000 |

264,000 - 326,000 |

209,000 - 254,000 |

|

Zinc |

tonnes |

27,000 - 35,000 |

25,000 - 33,000 |

18,000 - 24,000 |

|

Silver |

ounces |

3,550,000 - 4,455,000 |

3,790,000 - 4,800,000 |

2,750,000 - 3,550,000 |

|

Molybdenum |

tonnes |

1,250 - 1,500 |

1,200 - 1,600 |

1,500 - 1,900 |

|

1 Metal reported in concentrate and doré is prior to smelting and refining losses or deductions associated with smelter terms. 2 Represents 100% of the production from the Copper Mountain mine. Hudbay holds a 75% interest in the Copper Mountain mine. |

||||

|

TSX, NYSE - HBM 2024 No. 4 |

|

Copper World Project

The 100% owned Copper World project is located in Pima County, Arizona, approximately 50 kilometres southeast of Tucson. The Copper World project includes seven deposits discovered in 2021, together with the East deposit (formerly known as the Rosemont deposit). The new deposits were defined after the completion of an expanded drill program following a successful initial drill program in 2020. A new resource model was completed for the preliminary economic assessment ("PEA") of Copper World in 2022, which contemplated a two-phased mine plan with Phase I as a standalone operation requiring state and local permits only and Phase II expanding onto federal lands requiring federal permits.

In September 2023, Hudbay released its enhanced pre-feasibility study ("PFS") for Copper World reflecting the results of further technical work on Phase I of the project. Phase I has a mine life of 20 years, which is four years longer than the Phase I mine life that was presented in the PEA, largely due to an increase in the capacity for tailings and waste deposition as a result of optimizing the site layout. Phase II is expected to involve an expansion on to federal lands with a significantly longer mine life and enhanced project economics. Phase II would be subject to the federal permitting process and was not included in the PFS results.

The first key state permit required for Copper World, the Mined Land Reclamation Plan, was initially approved by the Arizona State Mine Inspector in October 2021 and was subsequently amended to reflect a larger private land project footprint. This approval was challenged in state court, but the challenge was dismissed in May 2023. In late 2022, Hudbay submitted the applications for an Aquifer Protection Permit and an Air Quality Permit to the Arizona Department of Environmental Quality. Hudbay expects to receive these two outstanding state permits in 2024.

Based on the PFS, Phase I contemplates average annual copper production of 85,000 tonnes over a 20-year mine life, at average cash costs and sustaining cash costs of $1.47 and $1.81 per pound of copperiii, respectively. A variable cut-off grade strategy allows for higher mill head grades in the first ten years, which increases annual production to approximately 92,000 tonnes of copper at average cash costs and sustaining cash costs of $1.53 and $1.95 per pound of copperiii, respectively.

At a copper price of $3.75 per pound, the after-tax net present value ("NPV") of Phase I using an 8% discount rate is $1.1 billion and the internal rate of return ("IRR") is 19%. The valuation metrics are leveraged to higher copper prices and at a price of $4.25 per pound, the after-tax NPV (8%) of Phase I increases to $1.7 billion, and the IRR increases to 25.5%.

Copper World is one of the highest-grade open pit copper projects in the Americasiv with proven and probable mineral reserves of 385 million tonnes at 0.54% copper. There remains approximately 60% of the total copper contained in measured and indicated mineral resources (exclusive of mineral reserves), providing significant potential for Phase II expansion and mine life extension. In addition, the inferred mineral resource estimates are at a comparable copper grade and also provide significant upside potential.

|

TSX, NYSE - HBM 2024 No. 4 |

|

Current mineral reserves and resources (exclusive of reserves) for the Copper World project as of January 1, 2024 are summarized below.

|

Copper World Project |

Tonnes |

Cu Grade |

Soluble Cu |

Mo Grade |

Au Grade |

Ag Grade |

|

Reserves |

|

|||||

|

Proven |

319,400,000 |

0.54 |

0.11 |

110 |

0.03 |

5.7 |

|

Probable |

65,700,000 |

0.52 |

0.14 |

96 |

0.02 |

4.3 |

|

Total Proven and Probable Reserves |

385,100,000 |

0.54 |

0.12 |

108 |

0.02 |

5.4 |

|

Resources - Flotation |

|

|||||

|

Measured |

424,000,000 |

0.39 |

0.04 |

150 |

0.02 |

4.1 |

|

Indicated |

191,000,000 |

0.36 |

0.06 |

125 |

0.02 |

3.5 |

|

Total Measured and Indicated (Flotation) |

615,000,000 |

0.38 |

0.05 |

142 |

0.02 |

3.9 |

|

Inferred |

192,000,000 |

0.35 |

0.07 |

117 |

0.01 |

3.1 |

|

Resources - Leach |

|

|||||

|

Measured |

159,000,000 |

0.28 |

0.20 |

- |

- |

- |

|

Indicated |

70,000,000 |

0.26 |

0.20 |

- |

- |

- |

|

Total Measured and Indicated (Leach) |

229,000,000 |

0.27 |

0.20 |

- |

- |

- |

|

Inferred |

83,000,000 |

0.26 |

0.19 |

- |

- |

- |

|

Total Measured and Indicated |

844,000,000 |

0.35 |

0.09 |

104 |

0.01 |

2.9 |

|

Total Inferred |

275,000,000 |

0.32 |

0.11 |

82 |

0.01 |

2.2 |

Note: totals may not add up correctly due to rounding.

1 Mineral resource estimates are exclusive of mineral reserves. CIM definitions were followed for the estimation of mineral resources. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

2 Long term metal prices of $4.00 per pound copper, $12.00 per pound molybdenum, $1,700 per ounce gold and $23.00 per ounce silver were used to confirm the economic viability of the mineral reserve estimates.

3 Mineral reserve estimates are limited to the portion of the measured and indicated resource estimates scheduled for milling and included in the financial model of the Copper World PFS.

3 Mineral resources are constrained within a computer-generated pit using the Lerchs-Grossman algorithm.

4 Mineral resource estimates were reported using a 0.1% copper cut-off grade and an oxidation ratio lower than 50% for flotation material and a 0.1% soluble copper cut-off grade and an oxidation ratio higher than 50% for leach material.

5 Long-term metals prices of $3.75 per pound copper, $12.00 per pound molybdenum, $1,650 per ounce gold and $22.00 per ounce silver were used to estimate mineral resources.

6 Estimate of the mineral reserve does not account for marginal amounts of historical small-scale operations in the area that occurred between 1870 and 1970 and is estimated to have extracted approximately 200,000 tonnes, which is within rounding approximations of the current reserve estimates.

Mason Project

The Mason project is a 100% owned greenfield copper deposit located in the historic Yerington District of Nevada and is one of the largest undeveloped copper porphyry deposits in North America. The Mason project's measured and indicated mineral resources are comparable in size to Constancia. Hudbay views the Mason project as a long-term future development asset as part of the company's pipeline of high-quality copper growth opportunities. Since acquiring Mason, Hudbay has consolidated a prospective package of patented and unpatented mining claims contiguous to the Mason project and has advanced a number of technical studies, including a revised resource model and the completion of a PEA on Mason.

|

TSX, NYSE - HBM 2024 No. 4 |

|

The Mason PEA was completed in April 2021 and contemplates a 27-year mine life with average annual copper production of approximately 140,000 tonnes over the first ten years of full production. At a copper price of $3.50 per pound, the after-tax net present value using a 10% discount rate is $1,191 million and the internal rate of return is 18%. For information regarding the limitations of a PEA, please refer to the Qualified Person and NI 43-101 statement at the end of this news release.

Since 2021, the company completed a geophysical program and additional drilling at Mason, while continuing to focus on local stakeholder engagement. For the first time since Hudbay acquired the Mason project, Hudbay initiated a drill program in September 2023 to test satellite deposits which confirmed the occurrence of high-grade skarn mineralization near the historical mines potentially amenable to open pit mining but of limited spatial extent. Hudbay is currently compiling and analyzing the results from the 2023 drilling. Additional metallurgical studies are underway with the objective of further enhancing the project economics.

Current mineral resource estimates for Mason as of January 1, 2024 are summarized below.

|

Mason Project |

Tonnes |

Cu Grade |

Mo Grade |

Au Grade |

Ag Grade |

|

Measured |

1,417,000,000 |

0.29 |

59 |

0.031 |

0.66 |

|

Indicated |

801,000,000 |

0.30 |

80 |

0.025 |

0.57 |

|

Total Measured and Indicated |

2,219,000,000 |

0.29 |

67 |

0.029 |

0.63 |

|

Inferred |

237,000,000 |

0.24 |

78 |

0.033 |

0.73 |

Note: totals may not add up correctly due to rounding.

1 Mineral resource estimates that are not mineral reserves do not have demonstrated economic viability.

2 Mineral resource estimates do not include factors for mining recovery or dilution.

3 Metal prices of $3.10 per pound copper, $11.00 per pound molybdenum, $1,500 per ounce gold, and $18.00 per ounce silver were used to estimate mineral resources.

4 Mineral resources are estimated using a minimum NSR cut-off of $6.25 per tonne.

5 Mineral resources are based on resource pit designs containing measured, indicated, and inferred mineral resources.

Llaguen Project

The Llaguen project is a 100% owned copper-molybdenum porphyry deposit located near the city of Trujillo, the third largest city in Peru. Llaguen is at moderate altitude and in close proximity to existing infrastructure, water and power supply, including the port of Salaverry located 62 kilometres away and the Trujillo Nueva electric power substation located 40 kilometres away. Hudbay completed a 28-hole confirmatory drill program in 2021 and 2022 which confirmed and extended the footprint of the known mineralization and highlighted the existence of a high-grade zone in the center of the deposit.

After completing an initial mineral resource estimate in November 2022, Hudbay initiated preliminary technical studies, including metallurgical test work as well as geotechnical and hydrogeological studies, which are expected to be incorporated into a preliminary economic assessment for the Llaguen project. Additional exploration drilling is warranted on the Llaguen property to test the areas of the deposit that remain open and the several untested geophysical targets in the area to fully define the regional extent of the mineralization. The current mineral resource is also surrounded by a large halo of low grade hypogene copper mineralization, not currently included in the mineral resource estimate, but for which metallurgical test work could assess the potential for economic sulfide heap leaching via commercially available technologies.

Current mineral resource estimates for Llaguen as of January 1, 2024 are summarized below.

|

TSX, NYSE - HBM 2024 No. 4 |

|

|

Llaguen |

Metric Tonnes |

Cu (%) |

Mo (g/t) |

Au (g/t) |

Ag (g/t) |

CuEq |

|

Indicated Global |

271,000,000 |

0.33 |

218 |

0.033 |

2.04 |

0.42 |

|

Including Indicated High-grade |

113,000,000 |

0.49 |

261 |

0.046 |

2.73 |

0.60 |

|

Inferred Global |

83,000,000 |

0.24 |

127 |

0.024 |

1.47 |

0.30 |

|

Including Inferred High-grade |

16,000,000 |

0.45 |

141 |

0.038 |

2.60 |

0.52 |

Note: totals may not add up correctly due to rounding.

1 CIM definitions were followed for the estimation of mineral resources. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

2 Mineral resources are reported within an economic envelope defined by a pit shell optimization algorithm. This pit shell is defined by a revenue factor of 0.33 assuming operating costs adjusted from Hudbay's Constancia open pit operation.

3 Long-term metal prices of $3.60 per pound copper, $11.00 per pound molybdenum, $1,650 per ounce gold and $22.00 per ounce silver were used for the estimation of mineral resources.

4 Metal recovery estimates assume that this mineralization would be processed at a combination of facilities, including copper and molybdenum flotation.

5 Copper-equivalent ("CuEq") grade is calculated assuming 85% copper recovery, 80% molybdenum recovery, 60% gold recovery and 60% silver recovery.

6 Specific gravity measurements were estimated by industry standard laboratory measurements.

Flin Flon Opportunities

Unlocking Value Through Tailings Reprocessing

Hudbay is advancing studies to evaluate the opportunity to reprocess Flin Flon tailings where more than 100 million tonnes of tailings have been deposited for over 90 years from the mill and the zinc plant. Please refer to Figure 5 for an aerial view of the tailings facility. The studies are evaluating the potential to use the existing Flin Flon concentrator, which is currently on care and maintenance after the closure of the 777 mine in 2022, with flow sheet modifications to reprocess tailings to recover critical minerals and precious metals while creating environmental and social benefits for the region. The company is completing metallurgical test work and an early economic study to evaluate the tailings reprocessing opportunity.

|

TSX, NYSE - HBM 2024 No. 4 |

|

Marubeni Flin Flon Exploration Partnership

In March 2024, Hudbay entered into an option agreement (the "Marubeni Option Agreement") with Marubeni Corporation ("Marubeni"), pursuant to which Hudbay has granted Marubeni's wholly-owned Canadian subsidiary an option to acquire a 20% interest in three projects located within trucking distance of Hudbay's processing facilities in the Flin Flon area. Pursuant to the Marubeni Option Agreement, Marubeni must fund a minimum of C$12 million in exploration expenditures over a period of approximately five years in order to exercise its option. All three properties hold past producing mines that generated meaningful production with attractive grades of both base metals and precious metals. The properties remain highly prospective with potential for further discovery based on the attractive geological setting, limited historical deep drilling and promising geochemical and geophysical targets.

Upon successful completion of Marubeni's earn-in obligations and the exercise of the option, a joint venture will be formed to hold the selected projects with Hudbay, acting as operator, holding an 80% interest and Marubeni indirectly holding the remaining 20% interest.

Qualified Person and NI 43-101

The technical and scientific information in this news release related to the company's material mineral projects has been approved by Olivier Tavchandjian, P. Geo, Senior Vice President, Exploration and Technical Services. Mr. Tavchandjian is a qualified person pursuant to NI 43-101 (as defined below). Additional details on the company's material mineral projects, including a year-over-year reconciliation of reserves and resources for all of our material projects except for Copper Mountain, is included in Hudbay's Annual Information Form for the year ended December 31, 2023 (the "AIF"), which is available on SEDAR+ at www.sedarplus.ca.

The Mason PEA is preliminary in nature, includes inferred resources that are considered too speculative to have the economic considerations applied to them that would enable them to be categorized as mineral reserves and there is no certainty the preliminary economic assessments will be realized.

Note to United States Investors

This news release has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of United States securities laws. Canadian reporting requirements for disclosure of mineral properties are governed by the Canadian Securities Administrators' National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101").

For this reason, information contained in this news release containing descriptions of the company's mineral deposits may not be comparable to similar information made public by United States companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder. For further information on the differences between the disclosure requirements for mineral properties under the United States federal securities laws and NI 43-101, please refer to the company's AIF, a copy of which has been filed under Hudbay's profile on SEDAR+ at www.sedarplus.ca and the company's Form 40-F, a copy of which will be filed under Hudbay's profile on EDGAR at www.edgar.com.

Forward-Looking Information

This news release contains forward-looking information within the meaning of applicable Canadian and United States securities legislation. All information contained in this news release, other than statements of current and historical fact, is forward-looking information. Often, but not always, forward-looking information can be identified by the use of words such as "plans", "expects", "budget", "guidance", "scheduled", "estimates", "forecasts", "strategy", "target", "intends", "objective", "goal", "understands", "anticipates" and "believes" (and variations of these or similar words) and statements that certain actions, events or results "may", "could", "would", "should", "might" "occur" or "be achieved" or "will be taken" (and variations of these or similar expressions). All of the forward-looking information in this news release is qualified by this cautionary note.

|

TSX, NYSE - HBM 2024 No. 4 |

|

Forward-looking information includes, but is not limited to, statements with respect to the company's production, cost and capital and exploration expenditure guidance, expectations regarding reductions in discretionary spending and capital expenditures, the ability of the company to stabilize and optimize the Copper Mountain mine operation and achieve operating synergies, the fleet production ramp up plan and the accelerated stripping strategies at the Copper Mountain site, the ability of the company to complete business integration activities at the Copper Mountain mine, the estimated timelines and pre-requisites for sanctioning the Copper World project and the pursuit of a potential minority joint venture partner, expectations regarding the permitting requirements for the Copper World project (including expected timing for receipt of such applicable permits), the expected benefits of Manitoba growth initiatives, including the advancement of the development and exploration drift at the 1901 deposit; the anticipated use of proceeds from the flow-through financing completed during the fourth quarter of 2023, the company's future deleveraging strategies and the company's ability to deleverage and repay debt as needed, expectations regarding the company's cash balance and liquidity, the company's ability to increase the mining rate at Lalor, the anticipated benefits from completing the Stall recovery improvement program, expectations regarding the ability to conduct exploration work and execute on exploration programs on its properties and to advance related drill plans, including the advancement of the exploration program at Maria Reyna and Caballito, the ability to continue mining higher-grade ore in the Pampacancha pit and the company's expectations resulting therefrom, expectations regarding the ability for the company to further reduce greenhouse gas emissions, the company's evaluation and assessment of opportunities to reprocess tailings using various metallurgical technologies, expectations regarding the prospective nature of the Maria Reyna and Caballito properties, the anticipated impact of brownfield and greenfield growth projects on the company's performance, anticipated expansion opportunities and extension of mine life in Snow Lake and the ability for Hudbay to find a new anchor deposit near the company's Snow Lake operations, anticipated future drill programs and exploration activities and any results expected therefrom, anticipated mine plans, anticipated metals prices and the anticipated sensitivity of the company's financial performance to metals prices, events that may affect its operations and development projects, anticipated cash flows from operations and related liquidity requirements, the anticipated effect of external factors on revenue, such as commodity prices, estimation of mineral reserves and resources, mine life projections, reclamation costs, economic outlook, government regulation of mining operations, and business and acquisition strategies. Forward-looking information is not, and cannot be, a guarantee of future results or events. Forward-looking information is based on, among other things, opinions, assumptions, estimates and analyses that, while considered reasonable by the company at the date the forward-looking information is provided, inherently are subject to significant risks, uncertainties, contingencies and other factors that may cause actual results and events to be materially different from those expressed or implied by the forward-looking information.

The material factors or assumptions that Hudbay has identified and were applied in drawing conclusions or making forecasts or projections set out in the forward-looking information include, but are not limited to:

|

TSX, NYSE - HBM 2024 No. 4 |

|

The risks, uncertainties, contingencies and other factors that may cause actual results to differ materially from those expressed or implied by the forward-looking information may include, but are not limited to, risks related to the ongoing business integration of Copper Mountain and the process for designing, implementing and maintaining effective internal controls for Copper Mountain, the failure to effectively complete the integration and optimization of the Copper Mountain operations or to achieve anticipated operating synergies, political and social risks in the regions Hudbay operates, including the navigation of the complex political and social environment in Peru, risks generally associated with the mining industry and the current geopolitical environment, including future commodity prices, currency and interest rate fluctuations, energy and consumable prices, supply chain constraints and general cost escalation in the current inflationary environment, risks related to the renegotiation of collective bargaining agreements with the labour unions representing certain of the company's employees in Manitoba and Peru, uncertainties related to the development and operation of the company's projects, the risk of an indicator of impairment or impairment reversal relating to a material mineral property, risks related to the Copper World project, including in relation to permitting, project delivery and financing risks, risks related to the Lalor mine plan, including the ability to convert inferred mineral resource estimates to higher confidence categories, dependence on key personnel and employee and union relations, risks related to political or social instability, unrest or change, risks in respect of Indigenous and community relations, rights and title claims, operational risks and hazards, including the cost of maintaining and upgrading the company's tailings management facilities and any unanticipated environmental, industrial and geological events and developments and the inability to insure against all risks, failure of plant, equipment, processes, transportation and other infrastructure to operate as anticipated, compliance with government and environmental regulations, including permitting requirements and anti-bribery legislation, depletion of the company's reserves, volatile financial markets and interest rates that may affect the company's ability to obtain additional financing on acceptable terms, the failure to obtain required approvals or clearances from government authorities on a timely basis, uncertainties related to the geology, continuity, grade and estimates of mineral reserves and resources, and the potential for variations in grade and recovery rates, uncertain costs of reclamation activities, the company's ability to comply with its pension and other post-retirement obligations, the company's ability to abide by the covenants in its debt instruments and other material contracts, tax refunds, hedging transactions, as well as the risks discussed under the heading "Risk Factors" in the company's most recent Annual Information Form and under the heading "Financial Risk Management" in the company's management's discussion and analysis for the year ended December 31, 2023.

|

TSX, NYSE - HBM 2024 No. 4 |

|

Should one or more risk, uncertainty, contingency or other factor materialize or should any factor or assumption prove incorrect, actual results could vary materially from those expressed or implied in the forward-looking information. Accordingly, you should not place undue reliance on forward-looking information. Hudbay does not assume any obligation to update or revise any forward-looking information after the date of this news release or to explain any material difference between subsequent actual events and any forward-looking information, except as required by applicable law.

About Hudbay

Hudbay (TSX, NYSE: HBM) is a copper-focused mining company with three long-life operations and a world-class pipeline of copper growth projects in tier-one mining-friendly jurisdictions of Canada, Peru and the United States.

Hudbay's operating portfolio includes the Constancia mine in Cusco (Peru), the Snow Lake operations in Manitoba (Canada) and the Copper Mountain mine in British Columbia (Canada). Copper is the primary metal produced by the company, which is complemented by meaningful gold production. Hudbay's growth pipeline includes the Copper World project in Arizona (United States), the Mason project in Nevada (United States), the Llaguen project in La Libertad (Peru) and several expansion and exploration opportunities near its existing operations.

The value Hudbay creates and the impact it has is embodied in its purpose statement: "We care about our people, our communities and our planet. Hudbay provides the metals the world needs. We work sustainably, transform lives and create better futures for communities." Hudbay's mission is to create sustainable value and strong returns by leveraging its core strengths in community relations, focused exploration, mine development and efficient operations.

For further information, please contact:

Candace Brûlé

Vice President, Investor Relations

(416) 814-4387

investor.relations@hudbay.com

|

TSX, NYSE - HBM 2024 No. 4 |

|

Figure 1: Hudbay's Satellite Properties Near Constancia in Peru

The highly prospective Maria Reyna property and the past producing Caballito property are located within trucking distance of the Constancia processing infrastructure and have the potential to host satellite mineral deposits. Surface mapping and geochemical sampling confirm that both Caballito and Maria Reyna host sulfide and oxide rich copper mineralization in skarns, hydrothermal breccias and large porphyry intrusive bodies.

|

TSX, NYSE - HBM 2024 No. 4 |

|

Figure 2: Hudbay Expanded Land Package in Snow Lake

Hudbay increased its land package in Snow Lake by 250% in 2023 and has since launched the largest geophysics and drilling exploration program in the company's history in Snow Lake. The 2024 program includes surface electromagnetic surveys using modern technology to target depths up to 1,000 metres. A majority of the newly acquired claims have been untested by modern deep geophysics, which was the discovery method for the Lalor deposit.

Figure 3: Lalor 2024 Winter Drill Program

A winter 2024 surface drill program is currently underway at Lalor focused on completing follow-up drilling from the first step-out drill program in 2023. The drill rigs continue to test the down-plunge extensions of Lalor and the Lalor Northwest target.

|

TSX, NYSE - HBM 2024 No. 4 |

|

Figure 4: 1901 Development and Exploration Drift

The 1901 deposit is located within 1,000 metres of the existing underground ramp at the Lalor mine in Snow Lake. The deposit consists of a series of zinc and gold-rich lenses that were defined by drilling and pre-feasibility studies conducted over the 2019 to 2021 period. In early 2024, Hudbay commenced the development of an underground drift to access to the 1901 deposit for exploration and future mine development.

|

TSX, NYSE - HBM 2024 No. 4 |

|

Figure 5: Aerial View of Flin Flon Tailings Facility

Hudbay advancing early economic studies on the potential for tailings reprocessing in Flin Flon where more than 100 million tonnes of material were deposited over 90 years until completion of mining activities in 2022.

________________________

i Calculated using the mid-point of the guidance range. All production estimates reflect the Copper Mountain mine on a 100% basis, with Hudbay owning a 75% interest in the mine.

ii Sourced from Wood Mackenzie, Global Copper Investment Horizon Outlook report, 2023 actual production for Canadian based mining companies.

iii Cash costs and sustaining cash costs are non-IFRS financial performance measures with no standardized definition under IFRS. For further details on why Hudbay believes cash costs are a useful performance indicator, please refer to the company's most recent management's discussion and analysis for the period ended December 31, 2023.

iv Sourced from S&P Global, August 2023 and based on greenfield, open pit porphyry projects with reserves located in the Americas with average life-of-mine annual copper production of more than 65,000 tonnes.

FORM 52-109F1

CERTIFICATION OF ANNUAL FILINGS

FULL CERTIFICATE

I, Peter Kukielski, President and Chief Executive Officer of Hudbay Minerals Inc., certify the following:

1. Review: I have reviewed the AIF, if any, annual financial statements and annual MD&A, including, for greater certainty, all documents and information that are incorporated by reference in the AIF (together, the "annual filings") of Hudbay Minerals Inc. (the "issuer") for the financial year ended December 31, 2023.

2. No misrepresentations: Based on my knowledge, having exercised reasonable diligence, the annual filings do not contain any untrue statement of a material fact or omit to state a material fact required to be stated or that is necessary to make a statement not misleading in light of the circumstances under which it was made, for the period covered by the annual filings.

3. Fair presentation: Based on my knowledge, having exercised reasonable diligence, the annual financial statements together with the other financial information included in the annual filings fairly present in all material respects the financial condition, financial performance and cash flows of the issuer, as of the date of and for the periods presented in the annual filings.

4. Responsibility: The issuer's other certifying officer(s) and I are responsible for establishing and maintaining disclosure controls and procedures (DC&P) and internal control over financial reporting (ICFR), as those terms are defined in National Instrument 52-109 Certification of Disclosure in Issuers' Annual and Interim Filings, for the issuer.

5. Design: Subject to the limitations, if any, described in paragraphs 5.2 and 5.3, the issuer's other certifying officer(s) and I have, as at the financial year end

(a) designed DC&P, or caused it to be designed under our supervision, to provide reasonable assurance that:

(i) material information relating to the issuer is made known to us by others, particularly during the period in which the annual filings are being prepared; and

(ii) information required to be disclosed by the issuer in its annual filings, interim filings or other reports filed or submitted by it under securities legislation is recorded, processed, summarized and reported within the time periods specified in securities legislation; and

(b) designed ICFR, or caused it to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with the issuer's GAAP.

5.1 Control framework: The control framework the issuer's other certifying officer(s) and I used to design the issuer's ICFR is the Internal Control - Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO).

5.2 N/A

5.3 Limitation on scope of design: The issuer has disclosed in its annual MD&A (a) the fact that the issuer's other certifying officer and I have limited the scope of our design of DC&P and ICFR to exclude controls, policies and procedures of a business that the issuer acquired not more than 365 days before the issuer's financial year end and (b) summary financial information about the business that the issuer acquired that has been consolidated in the issuer's financial statements.

6. Evaluation: The issuer's other certifying officer(s) and I have

(a) evaluated, or caused to be evaluated under our supervision, the effectiveness of the issuer's DC&P at the financial year end and the issuer has disclosed in its annual MD&A our conclusions about the effectiveness of DC&P at the financial year end based on that evaluation; and

(b) evaluated, or caused to be evaluated under our supervision, the effectiveness of the issuer's ICFR at the financial year end and the issuer has disclosed in its annual MD&A

(i) our conclusions about the effectiveness of ICFR at the financial year end based on that evaluation; and

(ii) N/A

7. Reporting changes in ICFR: The issuer has disclosed in its annual MD&A any change in the issuer's ICFR that occurred during the period beginning on October 1, 2023 and ended on December 31, 2023 that has materially affected, or is reasonably likely to materially affect, the issuer's ICFR.

8. Reporting to the issuer's auditors and board of directors or audit committee: The issuer's other certifying officer(s) and I have disclosed, based on our most recent evaluation of ICFR, to the issuer's auditors, and the board of directors or the audit committee of the board of directors any fraud that involves management or other employees who have a significant role in the issuer's ICFR.

Date: March 27, 2024

| (signed) "Peter Kukielski" | ||

|

Peter Kukielski President and Chief Executive Officer |

FORM 52-109F1

CERTIFICATION OF ANNUAL FILINGS

FULL CERTIFICATE

I, Eugene Lei, Chief Financial Officer of Hudbay Minerals Inc., certify the following:

1. Review: I have reviewed the AIF, if any, annual financial statements and annual MD&A, including, for greater certainty, all documents and information that are incorporated by reference in the AIF (together, the "annual filings") of Hudbay Minerals Inc. (the "issuer") for the financial year ended December 31, 2023.

2. No misrepresentations: Based on my knowledge, having exercised reasonable diligence, the annual filings do not contain any untrue statement of a material fact or omit to state a material fact required to be stated or that is necessary to make a statement not misleading in light of the circumstances under which it was made, for the period covered by the annual filings.

3. Fair presentation: Based on my knowledge, having exercised reasonable diligence, the annual financial statements together with the other financial information included in the annual filings fairly present in all material respects the financial condition, financial performance and cash flows of the issuer, as of the date of and for the periods presented in the annual filings.

4. Responsibility: The issuer's other certifying officer(s) and I are responsible for establishing and maintaining disclosure controls and procedures (DC&P) and internal control over financial reporting (ICFR), as those terms are defined in National Instrument 52-109 Certification of Disclosure in Issuers' Annual and Interim Filings, for the issuer.

5. Design: Subject to the limitations, if any, described in paragraphs 5.2 and 5.3, the issuer's other certifying officer(s) and I have, as at the financial year end

(a) designed DC&P, or caused it to be designed under our supervision, to provide reasonable assurance that:

(i) material information relating to the issuer is made known to us by others, particularly during the period in which the annual filings are being prepared; and

(ii) information required to be disclosed by the issuer in its annual filings, interim filings or other reports filed or submitted by it under securities legislation is recorded, processed, summarized and reported within the time periods specified in securities legislation; and

(b) designed ICFR, or caused it to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with the issuer's GAAP.

5.1 Control framework: The control framework the issuer's other certifying officer(s) and I used to design the issuer's ICFR is the Internal Control - Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO).

5.2 N/A

5.3 Limitation on scope of design: The issuer has disclosed in its annual MD&A (a) the fact that the issuer's other certifying officer and I have limited the scope of our design of DC&P and ICFR to exclude controls, policies and procedures of a business that the issuer acquired not more than 365 days before the issuer's financial year end and (b) summary financial information about the business that the issuer acquired that has been consolidated in the issuer's financial statements.

6. Evaluation: The issuer's other certifying officer(s) and I have

(a) evaluated, or caused to be evaluated under our supervision, the effectiveness of the issuer's DC&P at the financial year end and the issuer has disclosed in its annual MD&A our conclusions about the effectiveness of DC&P at the financial year end based on that evaluation; and

(b) evaluated, or caused to be evaluated under our supervision, the effectiveness of the issuer's ICFR at the financial year end and the issuer has disclosed in its annual MD&A

(i) our conclusions about the effectiveness of ICFR at the financial year end based on that evaluation; and

(ii) N/A

7. Reporting changes in ICFR: The issuer has disclosed in its annual MD&A any change in the issuer's ICFR that occurred during the period beginning on October 1, 2023 and ended on December 31, 2023 that has materially affected, or is reasonably likely to materially affect, the issuer's ICFR.

8. Reporting to the issuer's auditors and board of directors or audit committee: The issuer's other certifying officer(s) and I have disclosed, based on our most recent evaluation of ICFR, to the issuer's auditors, and the board of directors or the audit committee of the board of directors any fraud that involves management or other employees who have a significant role in the issuer's ICFR.

Date: March 27, 2024

| (signed) "Eugene Lei" | ||

|

Eugene Lei Chief Financial Officer |

REDACTED - Execution Version

AMENDING AGREEMENT NO. 3

MEMORANDUM OF AGREEMENT made as of June 16, 2023.

AMONG:

HUDBAY MINERALS INC.,

as Borrower,

- and -

CERTAIN OF ITS SUBSIDIARIES,

as Guarantors, Material Subsidiaries, Restricted Subsidiaries and/or Obligors,

- and -

CANADIAN IMPERIAL BANK OF COMMERCE,

as Administrative Agent,

- and -

THE LENDERS FROM TIME TO TIME PARTY TO THE CREDIT AGREEMENT.

WHEREAS the Borrower, certain of its Subsidiaries, the Agent and certain financial institutions as lenders entered into a fifth amended and restated credit agreement dated as of October 26, 2021, as amended by an amending agreement no.1 dated as of April 13, 2022 and amending agreement no. 2 dated as of September 29, 2022 (as further amended, modified, supplemented or replaced to the date hereof, the "Credit Agreement");

AND WHEREAS the parties hereto wish to further amend the Credit Agreement;

NOW THEREFORE THIS AGREEMENT WITNESSES that, in consideration of the premises, the covenants herein contained and for other valuable consideration (the receipt and sufficiency of which are hereby acknowledged by each of the parties), the parties hereto agree as follows:

1. Interpretation

(a) All words and expressions defined in the Credit Agreement and not otherwise defined in this Agreement have the meaning specified in the Credit Agreement, as amended by this Agreement (notwithstanding the application of Section 2).

(b) Sections 1.2, 1.3, 1.4 and 13.2 of the Credit Agreement are incorporated herein by reference.

(c) Unless expressly stated otherwise, all references herein to sections of an agreement other than this Agreement shall be to sections of the Credit Agreement.

(d) Section headings are for convenience only.

- 2 -

(e) For purposes of this Agreement:

(i) "Part A Amendments" means the amendments to the following sections of the Credit Agreement as set forth in the pages attached hereto as Exhibit A: (i) the definitions of "Adjusted Term SOFR", "AML Legislation", "Arizona Group", "Arizona Streaming Agreement", "Available Tenor", "Banking Day", "Base Rate", "Benchmark", "Benchmark Replacement", "Benchmark Replacement Adjustment", "Benchmark Replacement Date", "Benchmark Transition Event", "Benchmark Unavailability Period", "Breakage Costs", "Conforming Changes", "Copper World Project Property", "Daily Simple SOFR", "Interest Payment Date", "Interest Period", "LIBO Rate", "LIBOR Advance", "LIBOR Period", "Material Adverse Effect", clause (k) of the definition of "Material Subsidiary", paragraph (n) of the definition of "Permitted Debt", paragraphs (c), (aa) and (bb) of the definition of "Permitted Liens", "Rosemont Property", "Sanctions", "SOFR", "SOFR Advance", "SOFR Margin", "Term SOFR", "Term SOFR Administrator", "Term SOFR Reference Rate", "Unadjusted Benchmark Replacement", "Unrestricted Subsidiary", "U.S. Government Securities Banking Day" and "US Welfare Plan" in Section 1.1 of the Credit Agreement, Sections 2.1, 2.6, 2.8, 2.9, 2.11, 2.13, 4.1(c), 4.2(a)(v), 4.4(a), 6.3, 6.4, 6.5, 6.6, 6.7, 6.8, 6.9, 7.1(o)(iii), 7.1(v), 7.1(x), 7.1(aa), 8.2(e), 9.1(b), 9.9 and 13.13(a) of the Credit Agreement and Schedules 7.1(t)(iii), 7.1(t)(v) and 7.1(t)(vi) of the Credit Agreement; (ii) the definitions of "CDOR", "CDOR Scheduled Unavailability Date" and "CDOR Successor Rate" in Section 1.1 of the Credit Agreement and Section 2.12 of the Credit Agreement; (iii) Section 8.1(c) of the Credit Agreement; and (iv) Sections 4.1(c) and 4.2(a)(v) of the Credit Agreement;

(ii) "Part B Amendments" means all amendments to the Credit Agreement as set forth in the pages attached hereto as Exhibit A which are not Part A Amendments;

(iii) "Deed of Confirmation" means the deed of confirmation dated as of the date hereof between HudBay Peru SAC, as chargor, and the Peruvian Collateral Agent, as collateral agent; and

(iv) "Existing Credit Agreement" means the Credit Agreement as it exists on the date hereof without giving effect to the amendments contemplated by this Agreement.

2. Effective Date

The Part A Amendments shall be effective on and as of the date the conditions set forth in Section 6 have been satisfied. The Part B Amendments shall be effective on and as of the date the conditions set forth in Section 7 have been satisfied.

3. Amendments to the Credit Agreement

The Credit Agreement is hereby amended to delete the stricken text (indicated textually in the same manner as the following example: ) and to add the bold, double-underlined text (indicated textually in the same manner as the following example: double-underlined text) as set forth in the pages of the Credit Agreement attached hereto as Exhibit A.

- 3 -

4. Existing LIBOR Loans