UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 40-F

(Check One)

[ ] Registration statement pursuant to Section 12 of the Securities Exchange Act of 1934

or

[X] Annual report pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934

For the fiscal year ended December 31, 2023

Commission file number 1-35075

WESTERN COPPER AND GOLD CORPORATION

(Exact name of registrant as specified in its charter)

| British Columbia, Canada (Province or other jurisdiction of incorporation or organization) |

1000 (Primary Standard Industrial Classification Code Number (if applicable)) |

98-0496216 |

1200 - 1166 Alberni Street,

Vancouver, British Columbia V6E 3Z3

Canada

(604) 684-9497

(Address and Telephone Number of Registrant's Principal Executive Offices)

DL Services Inc.

701 Fifth Avenue, Suite 6100

Seattle, Washington 98104

(206) 903-5448

(Name, Address (Including Zip Code) and Telephone Number

(Including Area Code) of Agent For Service in the United States)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

|

Title of each class |

Trading Symbol |

Name of each exchange on which registered |

Securities registered or to be registered pursuant to Section 12(g) of the Act. None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act. None

For annual reports, indicate by check mark the information filed with this Form:

| [X] Annual Information Form | [X] Audited Annual Financial Statements |

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report: 166,091,245

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days.

Yes X No___

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files).

Yes X No___

1

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 12b-2 of the Exchange Act.

Emerging growth company X

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. __

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Yes No X

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ____

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to §240.10D-1(b). __ The following documents, filed as Exhibits 99.1 through 99.3 hereto, are hereby incorporated by reference into this Annual Report on Form 40-F of Western Copper and Gold Corporation (the "Company" or the "Registrant"):

2

FORM 40-F

PRINCIPAL DOCUMENTS

(a) Annual Information Form for the fiscal year ended December 31, 2023;

(b) Management's Discussion and Analysis of Financial Condition and Results of Operations for the fiscal year ended December 31, 2023; and

(c) Audited Annual Consolidated Financial Statements for the years ended December 31, 2023 and 2022 and notes thereto, together with the Report of Independent Registered Public Accounting Firm thereon.

Our independent auditor is PricewaterhouseCoopers LLP, Vancouver, British Columbia, Canada (PCAOB Firm ID 271).

The Company's Audited Consolidated Financial Statements included in this Annual Report on Form 40-F have been prepared in accordance with International Financial Reporting Standards, as issued by the International Accounting Standards Board. Therefore, they are not comparable in all respects to financial statements of United States companies that are prepared in accordance with United States generally accepted accounting principles.

3

ADDITIONAL DISCLOSURE

Resource and Reserve Estimates

The Company's Annual Information Form for the fiscal year ended December 31, 2023, which is attached hereto as Exhibit 99.1, has been prepared in accordance with the requirements of the securities laws in effect in Canada as of December 31, 2023, which differ in certain material respects from the disclosure requirements of United States securities laws. The terms "mineral reserve", "proven mineral reserve" and "probable mineral reserve" are Canadian mining terms as defined in accordance with Canadian National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101") and the Canadian Institute of Mining, Metallurgy and Petroleum (the "CIM") - CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended. NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. The definitions of these terms differ from the definitions of such terms for purposes of the disclosure requirements of the Securities and Exchange Commission (the "Commission").

Accordingly, information contained and incorporated by reference into this Annual Report on Form 40-F that describes the Company's mineral deposits may not be comparable to similar information made public by issuers subject to the Commission's reporting and disclosure requirements applicable to domestic United States issuers.

Certifications and Disclosure Regarding Controls and Procedures.

(a) Certifications. See Exhibits 99.4, 99.5, 99.6 and 99.7 to this Annual Report on Form 40-F.

(b) Disclosure Controls and Procedures. As of the end of the Company's fiscal year ended December 31, 2023, an evaluation of the effectiveness of the Company's "disclosure controls and procedures" was carried out by the Company's management with the participation of the Chief Executive Officer and Chief Financial Officer, who are the principal executive officer and principal financial officer of the Company, respectively. Based upon that evaluation, the Company's Chief Executive Officer and Chief Financial Officer have concluded that as of the end of that fiscal year, as a result of the material weakness identified during the Company's assessment of its internal control over financial reporting, the Company's disclosure controls and procedures are not effective to ensure that information required to be disclosed by the Company in reports that it files or submits under the Exchange Act is (i) recorded, processed, summarized and reported within the time periods specified in Commission rules and forms and (ii) accumulated and communicated to the Company's management, including the Chief Executive Officer and Chief Financial Officer, to allow timely decisions regarding required disclosure.

4

(c) Management's Annual Report on Internal Control Over Financial Reporting.

The required disclosure is included in "Management's Report on Internal Control Over Financial Reporting" that accompanies the Company's Consolidated Financial Statements for the fiscal year ended December 31, 2023, filed as Exhibit 99.3 to this Annual Report on Form 40-F.

(d) Attestation Report of the Registered Public Accounting Firm.

This Annual Report on Form 40-F does not include an attestation report of the Company's registered public accounting firm because the Company qualified as an Emerging Growth Company pursuant to Section 2(a)(19) of the Securities Act of 1933 during the year covered by this Annual Report on Form 40-F, and this Annual Report is therefore not required to include such an attestation report.

(e) Changes in Internal Control Over Financial Reporting.

The required disclosure is included in the "Management's Report on Internal Control Over Financial Reporting" that accompanies the Company's Consolidated Financial Statements for the fiscal year ended December 31, 2023, filed as Exhibit 99.3 to this Annual Report on Form 40-F.

Notices Pursuant to Regulation BTR.

None.

Identification of the Audit Committee.

The Company's board of directors has a separately-designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Exchange Act. The members of the audit committee are Michael Vitton, Tara Christie and Klaus Zeitler. The board of directors has determined that each member of the audit committee is "independent" within the meaning of Section 803(A) of the NYSE American Company Guide and "financially sophisticated" within the meaning of Section 803(B) of the NYSE American Company Guide.

Audit Committee Financial Expert.

The Company's board of directors has determined that Michael Vitton, a member of its audit committee, qualifies as an "audit committee financial expert" (as such term is defined in Form 40-F).

Code of Ethics.

The Company has adopted a code of business conduct (the "Code") that meets the requirements for a "code of ethics" within the meaning of Form 40-F and that applies to all of the Company's officers, directors and employees, including, without limitation, its principal executive officer, principal financial officer, principal accounting officer or controller, and persons performing similar functions. The Code is available for viewing on the Company's website, which may be accessed at www.westerncopperandgold.com.

5

During the fiscal year ended December 31, 2023, there was no amendment to the Code or waiver, including an implicit waiver, from any provision of the Code.

If any amendment to the Code is made, or if any waiver from the provisions thereof is granted, the Company may elect to disclose the information about such amendment or waiver required by Form 40-F to be disclosed, by posting such disclosure on the Company's website, which may be accessed at www.westerncopperandgold.com.

Principal Accountant Fees and Services.

The required disclosure is included under the heading "Additional Information-Audit Committee Information-External auditor service fees (by category)" in the Company's Annual Information Form for the fiscal year ended December 31, 2023, filed as Exhibit 99.1 to this Annual Report on Form 40-F.

Pre-Approval Policies and Procedures.

(a) All audit, audit related, tax and non-audit services to be performed by PricewaterhouseCoopers LLP, the Company's independent registered public accountant, are pre-approved by the audit committee of the Company's board of directors. Before approval is given, the audit committee examines the independence of the external auditor in relation to the services to be provided and assesses the reasonableness of the fees to be charged for such services.

(b) Of the fees reported under the heading "Additional Information-Audit Committee Information-External auditor service fees (by category)" in the Company's Annual Information Form for the fiscal year ended December 31, 2023, filed as Exhibit 99.1 to this Annual Report on Form 40-F, none of the fees billed by PricewaterhouseCoopers LLP were approved by the audit committee of the Company's board of directors pursuant to the de minimis exception provided by Section (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

Off-Balance Sheet Arrangements.

The Company does not have any off-balance sheet arrangements.

Cash Requirements

The required disclosure is contained under the heading(s) LIQUIDITY AND CAPITAL RESOURCES and CONTRACTUAL OBLIGATIONS in the Management's Discussion and Analysis included as Exhibit 99.2 to this Annual Report on Form 40-F.

6

Mine Safety Disclosure.

Not applicable.

Disclosure Regarding Foreign Jurisdictions That Prevent Inspections.

Not applicable.

Recovery of Erroneously Awarded Compensation

Not applicable.

NYSE American Statement of Governance Differences.

As a Canadian corporation listed on the NYSE American, the Company is not required to comply with most of the NYSE American corporate governance standards, so long as the Company complies with Canadian corporate governance practices. In order to claim such an exemption, however, Section 110 of the NYSE American Company Guide requires that the Company provide to NYSE American written certification from independent Canadian counsel that the non-complying practice is not prohibited by Canadian law. In addition, the Company must disclose the significant differences between its corporate governance practices and those required to be followed by U.S. domestic issuers under the NYSE American's corporate governance standards.

The Company has included a description of such significant differences in corporate governance practices on its website: www.westerncopperandgold.com. In addition, the Company has included a description of such significant differences below:

Shareholder Meeting Quorum Requirement: The NYSE American minimum quorum requirement for a shareholder meeting is one-third of the outstanding common shares. In addition, a company listed on NYSE American is required to state its quorum requirement in its bylaws. The Company's quorum requirement is set forth in its Articles and bylaws. A quorum for a meeting of shareholders of the Company is one person of the outstanding common shares present or represented by proxy.

7

Shareholder Approval Requirement: The Company will follow Toronto Stock Exchange rules for shareholder approval of new issuances of its common shares. Following Toronto Stock Exchange rules, shareholder approval is required for certain issuances of shares that: (i) materially affect control of the Company; or (ii) provide consideration to insiders in aggregate of 10% or greater of the market capitalization of the listed issuer and have not been negotiated at arm's length. Shareholder approval is also required, pursuant to Toronto Stock Exchange rules, in the case of private placements: (i) for an aggregate number of listed securities issuable greater than 25% of the number of securities of the listed issuer which are outstanding, on a non-diluted basis, prior to the date of closing of the transaction if the price per security is less than the market price; or (ii) that during any six month period are to insiders for listed securities or options, rights or other entitlements to listed securities greater than 10% of the number of securities of the listed issuer which are outstanding, on a non-diluted basis, prior to the date of the closing of the first private placement to an insider during the six month period.

Equity Compensation Plan Approval Requirements: Section 711 of the NYSE American's Listed Company Guide requires shareholder approval of all equity compensation plans and material revisions to such plans. The definition of "equity compensation plans" covers plans that provide for the delivery of both newly issued and treasury securities, as well as plans that rely on securities re-acquired in the open market by the issuing company for the purpose of redistribution to employees and directors. The Toronto Stock Exchange rules provide that only the creation of or certain material amendments to equity compensation plans that provide for new issuances of securities are subject to shareholder approval. The Company will follow the Toronto Stock Exchange rules with respect to the requirements for shareholder approval of equity compensation plans and material revisions to such plans.

8

UNDERTAKING AND CONSENT TO SERVICE OF PROCESS

A. Undertaking.

The Company undertakes to make available, in person or by telephone, representatives to respond to inquiries made by the Commission staff, and to furnish promptly, when requested to do so by the Commission staff, information relating to: the securities registered pursuant to Form 40-F; the securities in relation to which the obligation to file an annual report on Form 40-F arises; or transactions in said securities.

B. Consent to Service of Process.

The Company has previously filed a Form F-X in connection with the class of securities in relation to which the obligation to file this report arises.

Any change to the name or address of the agent for service of process of the Company shall be communicated promptly to the Commission by an amendment to the Form F-X referencing the file number of the relevant registration statement.

SIGNATURES

Pursuant to the requirements of the Exchange Act, the registrant certifies that it meets all of the requirements for filing on Form 40-F and has duly caused this annual report to be signed on its behalf by the undersigned, thereunto duly authorized, on March 28, 2024.

Western Copper and Gold Corporation

By: /s/ Varun Prasad

Name: Varun Prasad

Title: Chief Financial Officer

9

EXHIBIT INDEX

10

| 101.INS | Inline XBRL Instance Document–the instance document does not appear in the Interactive Data File as its XBRL tags are embedded within the Inline XBRL document |

| 101.SCH | |

| 101.CAL |

Inline XBRL Taxonomy Extension Calculation Linkbase Document |

| 101.DEF | |

| 101.LAB | |

| 101.PRE |

Inline XBRL Taxonomy Extension Presentation Linkbase Document |

| 104 | Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101) |

11

| Exhibit 97.1 |

INCENTIVE COMPENSATION RECOVERY POLICY

1. Introduction.

The Board of Directors of Western Copper and Gold Corporation (the "Company") believes that it is in the best interests of the Company and its shareholders to create and maintain a culture that emphasizes integrity and accountability and that reinforces the Company's compensation philosophy. The Board has therefore adopted this policy, which provides for the recovery of erroneously awarded incentive compensation in the event that the Company is required to prepare an accounting restatement due to material noncompliance of the Company with any financial reporting requirements under the federal securities laws (the "Policy"). This Policy is designed to comply with Section 10D of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), related rules and the listing standards of the NYSE American or any other securities exchange on which the Company's shares are listed in the future.

2. Administration.

This Policy shall be administered by the Board or, if so designated by the Board, the Compensation Committee of the Board (the "Committee"), in which case, all references herein to the Board shall be deemed references to the Committee. Any determinations made by the Board shall be final and binding on all affected individuals.

3. Covered Executives.

Unless and until the Board determines otherwise, for purposes of this Policy, the term "Covered Executive" means a current or former employee who is or was identified by the Company as the Company's president, principal financial officer, principal accounting officer (or if there is no such accounting officer, the controller), any vice-president of the Company in charge of a principal business unit, division, or function (such as sales, administration, or finance), any other officer who performs a policy-making function, or any other person (including any executive officer of the Company's subsidiaries or affiliates) who performs similar policy-making functions for the Company. "Policy-making function" excludes policy-making functions that are not significant. For the avoidance of doubt, "Covered Executives" will include at least the following Company officers: Chief Executive Officer, President, Chief Financial Officer and Vice President, Environmental and Community Affairs.

This Policy covers Incentive Compensation received by a person after beginning service as a Covered Executive and who served as a Covered Executive at any time during the performance period for that Incentive Compensation.

| Exhibit 97.1 |

4. Recovery: Accounting Restatement.

In the event of an "Accounting Restatement," the Company will recover reasonably promptly any excess Incentive Compensation received by any Covered Executive during the three completed fiscal years immediately preceding the date on which the Company is required to prepare an Accounting Restatement, including transition periods resulting from a change in the Company's fiscal year as provided in Rule 10D-1 of the Exchange Act. Incentive Compensation is deemed "received" in the Company's fiscal period during which the Financial Reporting Measure specified in the Incentive Compensation award is attained, even if the payment or grant of the Incentive Compensation occurs after the end of that period.

(a) Definition of Accounting Restatement.

For the purposes of this Policy, an "Accounting Restatement" means the Company is required to prepare an accounting restatement of its financial statements filed with the Securities and Exchange Commission (the "SEC") due to the Company's material noncompliance with any financial reporting requirements under the federal securities laws (including any required accounting restatement to correct an error in previously issued financial statements that is material to the previously issued financial statements, or that would result in a material misstatement if the error were corrected in the current period or left uncorrected in the current period).

The determination of the time when the Company is "required" to prepare an Accounting Restatement shall be made in accordance with applicable SEC and national securities exchange rules and regulations.

An Accounting Restatement does not include situations in which financial statement changes did not result from material non-compliance with financial reporting requirements, such as, but not limited to retrospective: (i) application of a change in accounting principles; (ii) revision to reportable segment information due to a change in the structure of the Company's internal organization; (iii) reclassification due to a discontinued operation; (iv) application of a change in reporting entity, such as from a reorganization of entities under common control; (v) adjustment to provision amounts in connection with a prior business combination; and (vi) revision for stock splits, stock dividends, reverse stock splits or other changes in capital structure.

(b) Definition of Incentive Compensation.

For purposes of this Policy, "Incentive Compensation" means any compensation that is granted, earned, or vested based wholly or in part upon the attainment of a Financial Reporting Measure, including, for example, bonuses or awards under the Company's short and long-term incentive plans, grants and awards under the Company's equity incentive plans, and contributions of such bonuses or awards to the Company's deferred compensation plans or other employee benefit plans. Incentive Compensation does not include awards which are granted, earned and vested without regard to attainment of Financial Reporting Measures, such as time-vesting awards, discretionary awards and awards based wholly on subjective standards, strategic measures or operational measures.

| Exhibit 97.1 |

(c) Financial Reporting Measures.

"Financial Reporting Measures" are those that are determined and presented in accordance with the accounting principles used in preparing the Company's financial statements (including non-GAAP financial measures) and any measures derived wholly or in part from such financial measures. For the avoidance of doubt, Financial Reporting Measures include stock price and total shareholder return. A measure need not be presented within the financial statements or included in a filing with the SEC to constitute a Financial Reporting Measure for purposes of this Policy.

(d) Excess Incentive Compensation: Amount Subject to Recovery.

The amount(s) to be recovered from the Covered Executive will be the amount(s) by which the Covered Executive's Incentive Compensation for the relevant period(s) exceeded the amount(s) that the Covered Executive otherwise would have received had such Incentive Compensation been determined based on the restated amounts contained in the Accounting Restatement. All amounts shall be computed without regard to taxes paid.

For Incentive Compensation based on Financial Reporting Measures such as stock price or total shareholder return, where the amount of excess compensation is not subject to mathematical recalculation directly from the information in an Accounting Restatement, the Board will calculate the amount to be reimbursed based on a reasonable estimate of the effect of the Accounting Restatement on such Financial Reporting Measure upon which the Incentive Compensation was received. The Company will maintain documentation of that reasonable estimate and will provide such documentation to the applicable national securities exchange.

(e) Method of Recovery.

The Board will determine, in its sole discretion, the method(s) for recovering reasonably promptly excess Incentive Compensation hereunder. Such methods may include, without limitation:

(i) requiring reimbursement of compensation previously paid;

(ii) forfeiting any compensation contribution made under the Company's deferred compensation plans, as well as any matching amounts and earnings thereon;

(iii) offsetting the recovered amount from any compensation that the Covered Executive may earn or be awarded in the future (including, for the avoidance of doubt, recovering amounts earned or awarded in the future to such individual equal to compensation paid or deferred into tax-qualified plans or plans subject to the Employee Retirement Income Security Act of 1974 (collectively, "Exempt Plans"); provided that, no such recovery will be made from amounts held in any Exempt Plan of the Company); (iv) taking any other remedial and recovery action permitted by law, as determined by the Board; or

| Exhibit 97.1 |

(v) some combination of the foregoing.

5. No Indemnification or Advance.

Subject to applicable law, the Company shall not indemnify, including by paying or reimbursing for premiums for any insurance policy covering any potential losses, any Covered Executives against the loss of any erroneously awarded Incentive Compensation, nor shall the Company advance any costs or expenses to any Covered Executives in connection with any action to recover excess Incentive Compensation.

6. Interpretation.

The Board is authorized to interpret and construe this Policy and to make all determinations necessary, appropriate or advisable for the administration of this Policy. It is intended that this Policy be interpreted in a manner that is consistent with the requirements of Section 10D of the Exchange Act and any applicable rules or standards adopted by the SEC or any national securities exchange on which the Company's securities are listed.

7. Effective Date.

The effective date of this Policy is October 2, 2023 (the "Effective Date"). This Policy applies to Incentive Compensation received by Covered Executives on or after the Effective Date that results from attainment of a Financial Reporting Measure based on or derived from financial information for any fiscal period ending on or after the Effective Date. In addition, this Policy is intended to be and will be incorporated as an essential term and condition of any Incentive Compensation agreement, plan or program that the Company establishes or maintains on or after the Effective Date.

8. Amendment and Termination.

The Board may amend this Policy from time to time in its discretion, and shall amend this Policy as it deems necessary to reflect changes in regulations adopted by the SEC under Section 10D of the Exchange Act and to comply with any rules or standards adopted by the NYSE American or any other securities exchange on which the Company's shares are listed in the future.

9. Other Recovery Rights.

The Board intends that this Policy will be applied to the fullest extent of the law. Upon receipt of this Policy, each Covered Executive is required to complete the Receipt and Acknowledgement attached as Schedule A to this Policy. The Board may require that any employment agreement or similar agreement relating to Incentive Compensation received on or after the Effective Date shall, as a condition to the grant of any benefit thereunder, require a Covered Executive to agree to abide by the terms of this Policy. Any right of recovery under this Policy is in addition to, and not in lieu of, any (i) other remedies or rights of compensation recovery that may be available to the Company pursuant to the terms of any similar policy in any employment agreement, or similar agreement relating to Incentive Compensation, unless any such agreement expressly prohibits such right of recovery, and (ii) any other legal remedies available to the Company. The provisions of this Policy are in addition to (and not in lieu of) any rights to repayment the Company may have under Section 304 of the Sarbanes-Oxley Act of 2002 and other applicable laws.

| Exhibit 97.1 |

10. Impracticability.

The Company shall recover any excess Incentive Compensation in accordance with this Policy, except to the extent that certain conditions are met and the Board has determined that such recovery would be impracticable, all in accordance with Rule 10D-1 of the Exchange Act and the rules and listing standards of the NYSE American or any other securities exchange on which the Company's shares are listed in the future.

11. Successors.

This Policy shall be binding upon and enforceable against all Covered Executives and their beneficiaries, heirs, executors, administrators or other legal representatives.

| Exhibit 97.1 |

Schedule A

INCENTIVE-BASED COMPENSATION CLAWBACK POLICY

RECEIPT AND ACKNOWLEDGEMENT

I, __________________________________________, hereby acknowledge that I have received and read a copy of the Incentive Compensation Recovery Policy. As a condition of my receipt of any Incentive Compensation as defined in the Policy, I hereby agree to the terms of the Policy. I further agree that if recovery of excess Incentive Compensation is required pursuant to the Policy, the Company shall, to the fullest extent permitted by governing laws, require such recovery from me up to the amount by which the Incentive Compensation received by me, and amounts paid or payable pursuant or with respect thereto, constituted excess Incentive Compensation. If any such reimbursement, reduction, cancelation, forfeiture, repurchase, recoupment, offset against future grants or awards and/or other method of recovery does not fully satisfy the amount due, I agree to immediately pay the remaining unpaid balance to the Company.

|

|

|

|

|

Signature |

|

Date |

ANNUAL INFORMATION FORM

For the year ended December 31, 2023

Suite 1200 - 1166 Alberni Street This document is the annual information form (the "AIF") of Western Copper and Gold Corporation for the year ended December 31, 2023.

Vancouver, British Columbia

V6E 3Z3

Dated: March 28, 2024

TABLE OF CONTENTS

PRELIMINARY NOTES

Unless the context indicates otherwise, references in this AIF to "Western", the "Company", "we" or "our" include Western Copper and Gold Corporation and its subsidiary, Casino Mining Corp. References in this AIF to "Common Shares" are to common shares in the capital of the Company. All information contained herein is as at December 31, 2023 unless otherwise stated.

Financial Statements

The Company's financial statements are prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board.

This AIF should be read in conjunction with the Company's audited annual consolidated financial statements and notes thereto, as well as with the management's discussion and analysis for the year ended December 31, 2023.

Currency

All sums of money which are referred to in this AIF are expressed in lawful money of Canada, unless otherwise specified.

Disclosure of Mineral Resources and Mineral Reserves

Disclosure about our exploration properties in this AIF uses the terms "mineral resources", "measured mineral resources", "indicated mineral resources" and "inferred mineral resources", "mineral reserves", "proven mineral reserves" and "probable mineral reserves", which are Canadian geological and mining terms as defined in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") of the Canadian Securities Administrators, set out in the Canadian Institute of Mining, Metallurgy and Petroleum (the "CIM") - CIM Definition Standards for Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended.

Cautionary Note to U.S. Investors

This AIF has been prepared in accordance with the requirements of the securities laws in effect in Canada as of the date of this AIF, which differ in certain material respects from the disclosure requirements of United States securities laws. The terms "mineral reserve", "proven mineral reserve" and "probable mineral reserve" are Canadian mining terms as defined in accordance with NI 43-101and the CIM Definition Standards for Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended. NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. The definitions of these terms and other mining terms, such as "inferred mineral resource", differ from the definitions of such terms, if any, for purposes of the disclosure requirements of the United States Securities and Exchange Commission (the "SEC"). Accordingly, information contained and incorporated by reference into this AIF that describes the Company's mineral deposits may not be comparable to similar information made public by issuers subject to the SEC's reporting and disclosure requirements applicable to domestic United States issuers.

Non-GAAP Measures and Other Financial Measures

Alternative performance measures in this AIF, such as "cash cost" and "free cash flow", are used to provide additional information. These non-generally accepted accounting principles performance measures are included in this AIF because these statistics are used as key performance measures that management uses to monitor and assess performance of the Company's property and to plan and assess the overall effectiveness and efficiency of mining operations. These performance measures do not have a standard meaning within international financial reporting standards ("IFRS accounting standards") and, therefore, amounts presented may not be comparable to similar data presented by other mining companies. These performance measures should not be considered in isolation as a substitute for measures of performance in accordance with IFRS accounting standards.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Statements contained in this AIF and the documents incorporated by reference herein that are not historical facts are forward-looking statements that involve risks and uncertainties. Forward-looking statements include, but are not limited to, statements with respect to the future price of metals; the estimation of mineral reserves and mineral resources, the realization of mineral reserve estimates; the timing and amount of any estimated future production, costs of production, and capital expenditures; project schedules; the Company's proposed plan for its properties; recommended work programs; costs and timing of the development of new deposits; success of exploration and permitting activities; permitting timelines; currency fluctuations; requirements for additional capital; government regulation of mineral exploration or mining operations; environmental risks; unanticipated reclamation expenses; title disputes or claims; limitations on insurance coverage; the timing and possible outcome of potential litigation; and the impact of global pandemics on the Company's business and operations. In certain cases, forward-looking statements can be identified by the use of words such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions, events or results "may" or "may not", "could", "would" or "would not", "might" or "will be", "occur" or "be achieved". Such statements are included, among other places, in this AIF under the headings "General Development of the Business", "Description of the Business", "Risk Factors" and "Mineral Properties" and in the documents incorporated by reference herein and may include, but are not limited to, statements regarding perceived merit of properties; mineral reserve and mineral resource estimates; capital expenditures; feasibility study results (including projected economic returns, operating costs and capital costs in connection with the Casino Project (as defined herein)); exploration results at the Company's properties; budgets; work programs; permitting or other timelines; strategic plans; market price of precious and base metals; or other statements that are not statements of historical fact.

Forward-looking statements involve known and unknown risks, uncertainties and other factors, which may cause the actual results, performance or achievements of Western to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such risks and other factors include, among others, history of losses; risks inherit to mineral exploration and development activities; uncertainties relating to interpretation of drill results and the geology, continuity and grade of mineral deposits; risks related to the potential loss of the Company's properties; uncertainty as to timely availability of permits and licenses and other governmental approvals; risks related to the Company's dependence on a single project; title risks; price fluctuations of the Common Shares; risks surrounding statutory and regulatory compliance; risks surrounding environmental laws and regulations; risks surrounding land reclamation costs; operational risks surrounding the location of assets; risks surrounding the Company's ability to maintain its infrastructure; risks involved in fluctuations in gold, copper and other commodity prices; uncertainty of estimates of capital and operating costs, recovery rates, production estimates, and estimated economic return; changes in project parameters as plans continue to be refined; risks related to the cooperation of government agencies and Indigenous Peoples in the exploration and development of the Company's property; volatility in the price of metals; climate change risks; risks related to fluctuations in currency exchange rates; risks surrounding dilution of the Common Shares; dependence on members of management and key personnel; competition risks; inflation risks; risks related to macro-economic factors including global financial volatility; potential natural disasters, terrorist acts, health crises and future pandemics; risks related to the need to obtain additional financing to develop the Company's property and uncertainty as to the availability and terms of future financing; litigation risks; the possibility of delay in exploration or development programs or in construction projects and uncertainty of meeting anticipated program milestones; risks related to the integration of acquisitions; risks related to operations; risks related to the feasibility study and the possibility that future exploration and development will not be consistent with the Company's expectations; risks related to joint venture operations; conclusions of economic evaluations; possible variations in mineral reserves, grade or recovery rates; insurance risk; reclamation costs; risks related to conflicts of interest; risks related to internal controls; tax risks, specifically related to the Company's classification as a PFIC (as defined herein); failure of plant, equipment or processes to operate as anticipated; accidents, labour disputes and other risks of the mining industry; risks related to information technology and cybersecurity; risks related to regulatory compliance; the Company's history of not paying dividends; and risks related to shareholder activism as well as those factors discussed in the section entitled "Risk Factors" in this AIF.

Although Western has attempted to identify important factors that could affect it and may cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Forward-looking statements may prove to be inaccurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. Western does not undertake any obligation to release publicly any revisions to these forward-looking statements to reflect events or circumstances after the date hereof to reflect the occurrence of unanticipated events unless required by applicable securities law.

The material factors or assumptions used to develop forward-looking statements include prevailing and projected market prices and foreign exchange rates; exploitation and exploration estimates and results will not change in a materially adverse manner; continued availability of capital and financing on acceptable terms; proposed developments of mineral projects will be viable operationally and economically as planned; availability of equipment and personnel for required operations, permitting and construction on a continual basis; the Company not experiencing unforeseen delays, unexpected geological or other effects, equipment failures, permitting delays, and general economic, market or business conditions will not change in a materially adverse manner; the Company successfully withstanding the economic impact of the COVID-19 and any future pandemics; and as more specifically disclosed throughout this AIF. Assumptions relating to the mineral resource and mineral reserve estimates, development, and future economic benefit reported in respect of the Casino Project are discussed in the Feasibility Study (as defined herein). Forward-looking statements and other information contained herein concerning mineral exploration and our general expectations concerning mineral exploration are based on estimates prepared by us using data from publicly available industry sources as well as from market research and industry analysis and on assumptions based on data and knowledge of this industry which we believe to be reasonable.

CORPORATE STRUCTURE

Name, Address and Incorporation

The Company was incorporated under the Business Corporations Act (British Columbia) on March 17, 2006 under the name "Western Copper Corporation". It changed its name to Western Copper and Gold Corporation on October 17, 2011.

The Company's head office is located at Suite 1200 - 1166 Alberni Street, Vancouver, British Columbia, V6E 3Z3. Its registered office address is located at Suite 2200 - 885 West Georgia Street, Vancouver, British Columbia, V6C 3E8.

Intercorporate Relationships

The Company has one material wholly-owned subsidiary, Casino Mining Corp. ("CMC"), incorporated under the Business Corporations Act (British Columbia) and which holds the Casino mineral property ("Casino" or the "Casino Project") located in the Yukon, Canada.

GENERAL DEVELOPMENT OF THE BUSINESS

Three Year History

Subsequent to the Year Ended December 31, 2023

Changes to Directors and Officers

On February 22, 2024, Kenneth Williamson retired from the board of directors of the Company (the "Board") and his position of Interim Chairman. Bill Williams, a director of the Company, assumed the role of Interim Chairman.

Also on February 22, 2024, Sandeep Singh was appointed as Chief Executive Officer of the Company, taking over this position from Paul West-Sells, who remains President of the Company.

Financing

On March 1, 2024, the Company completed a private placement of Common Shares with Sandeep Singh, issuing 2,222,222 Common Shares at a price of $1.35 per share for proceeds of approximately $3 million.

During the Year Ended December 31, 2023

Changes to Directors and Officers

On July 1, 2023, Cameron Brown stepped down from his position as Vice President Engineering, but remained employed by the Company as a Special Technical Advisor. In January 2024, Mr. Brown retired from the Company but continues to consult on the Casino Project.

On October 19, 2023, Kenneth Engquist ceased to be the Chief Operating Officer of the Company.

Further Investment by Rio Tinto

On December 12, 2023, the Company completed a private placement representing a further $6 million investment by Rio Tinto Canada Inc. ("Rio Tinto") to continue to advance the Casino Project in the Yukon.

Rio Tinto acquired 3,468,208 Common Shares at a price of $1.73 per share for aggregate gross proceeds of approximately $6 million, resulting in Rio Tinto's ownership increasing to approximately 9.7% of the Company's outstanding Common Shares.

In connection with this further investment by Rio Tinto, the Company and Rio Tinto entered into an amended and restated investor rights agreement dated December 12, 2023 (the "Amended and Restated Rio Tinto Investor Rights Agreement"), whereby, subject to certain conditions, including ownership thresholds, Rio Tinto has certain rights for a period of 18 months from closing of the investment, including the right to appoint:

• one member to the Casino Project Technical and Sustainability Committee;

• one non-voting observer to attend all meetings of the Board;

• one director of the Company, if Rio Tinto's ownership increases to at least 12.5%; and

• up to three secondees to the Casino Project.

In addition, Rio Tinto has a right to participate in future equity issuances to maintain its ownership in the Company and a one-time "demand registration right" and "piggy-back registration rights."

Under the Amended and Restated Rio Tinto Investor Rights Agreement, for a period of 18 months, Rio Tinto has also agreed:

• to vote any shares in favor of each director nominated by the Board for election by shareholders;

• not to acquire any securities of the Company, subject to certain exceptions; and

• not to sell, transfer, offer or otherwise dispose of any shares, subject to certain exceptions.

Update on the Port of Skagway

On December 5, 2023, the Company announced that during the 2023 Fall Sitting of the Yukon Legislative Assembly, the Yukon Government approved $21.4 million for investment in the Municipality of Skagway's (or "Skagway") redevelopment of their dock infrastructure to include a Marine Services Platform ("MSP") to continue to support ore export for the Yukon mining industry.

The MSP at Skagway is located in South-east Alaska and is 560 km from, and is the closest tidewater port to, the Casino Project. The Port of Skagway has historically been the preferred port to ship concentrates from the Yukon, and most recently was used to ship copper concentrates from the Minto Mine.

Submission of Environmental and Socio-Economic Effects Statement and Infrastructure Update

On November 10, 2023, the Company, through CMC, its wholly-owned subsidiary, has submitted to the Yukon Environmental and Socio-Economic Assessment Board ("YESAB") Executive Committee a schedule for submission of the Environmental and Socio-economic Effects Statement ("ESE Statement") for the Casino Project, as prescribed by the Revised Environmental and Socio-economic Effects Statement Guidelines (the "Guidelines") received from YESAB on September 13, 2023.

In the schedule, the Company indicated that it plans to submit the ESE Statement in the second half of 2024. The ESE Statement forms the basis for the Company's assessment application for the Panel Review and includes all the material outlined in the Guidelines. In addition, the Company has been engaging and consulting with First Nations that may be impacted by the project.

The Company is committed to ensuring that review of the Casino Project occurs in a robust manner using the most up to date methodologies in environmental assessment and providing benefits to Yukon communities and First Nations for generations to come.

Infrastructure Update

On November 10, 2023, the Company announced that the Carmacks Bypass Project (the "Bypass"), the first section of the Casino Project access road and a $29.6 million investment by the Yukon and Federal Governments has been completed ahead of schedule. The Bypass will allow industrial vehicles to bypass the Village of Carmacks, reducing heavy traffic, improving community safety, and improving access to mineral exploration and development activities in the area.

Updates on Casino Drilling Program and Government Infrastructure Development

On August 23, 2023, the Company announced its 2023 drilling program (the "Program") at the Casino Project.

The Program was developed by the Company's Technical and Sustainability Committee, which is comprised of members from the Company, Rio Tinto and Mitsubishi Materials Corporation ("Mitsubishi Materials") as outlined in the respective investor rights agreement entered by the Company as part of the respective investments by Rio Tinto and Mitsubishi Materials (see "Further Investment by Rio Tinto" above and "Strategic Investment by Mitsubishi Materials" below)

Exercise of Subscription Rights by Rio Tinto

On May 1, 2023, the Company completed a $2.3 million subscription by Rio Tinto, whereby Rio Tinto exercised its pre-existing right to participate on a pro rata basis in equity financings by the Company to maintain its then current ownership interest.

Driven by a strategic equity investment by Mitsubishi Materials, as detailed below, Rio Tinto acquired 878,809 Common Shares at a price of $2.63 per share for proceeds of approximately $2.3 million, allowing Rio Tinto to maintain its interest of approximately 7.84%.

Strategic Investment by Mitsubishi Materials

On April 14, 2023, the Company completed a $21.3 million strategic investment by Mitsubishi Materials to further advance the Casino Project.

Mitsubishi Materials acquired 8,091,390 Common Shares at a price of $2.63 per share for proceeds of approximately $21.3 million, resulting in Mitsubishi Materials owning approximately 5.0% of the outstanding Common Shares, on an undiluted basis, following completion of the Rio Tinto subscription.

In connection with the strategic investment by Mitsubishi Materials, the Company and Mitsubishi Materials entered into an investor rights agreement dated April 14, 2023 (the "Mitsubishi Materials Investor Rights Agreement") whereby, subject to certain conditions, Mitsubishi Materials has certain rights until the earlier of (a) its ownership falling below 3.0%, and (b) the date that is 24 months following completion of the investment, including:

• to appoint one member to the Casino Project Technical and Sustainability Committee;

• to appoint the greater of one director of the Company or 17% of the number of directors (rounding to the nearest whole number), if Mitsubishi Materials' ownership increases to at least 12.5%;

• to participate in future equity issuances to maintain its ownership in the Company and, in the event its ownership increases to 8.0%, a one-time "demand registration right" and "piggy-back registration rights"; and

the right of first negotiation to offtake at least its proportionate share of minerals produced from the Casino Project.

Under the Mitsubishi Materials Investor Rights Agreement, for a period of 24 months, Mitsubishi Materials has agreed:

• not to sell, transfer, offer or otherwise dispose of any Common Shares without first notifying the Company;

• to abstain from voting or vote any shares in favor of each director nominated by the board of directors of the Company for election by shareholders; and

• not to acquire any securities of the Company, subject to certain exceptions.

The Company and Mitsubishi Materials have agreed to negotiate in good faith new rights and restrictions attaching to its share ownership on the earlier of (a) 18 months following completion of the investment, and (b) Mitsubishi Materials' ownership reaching 12.5% or greater.

Updated Study on Casino Project to Have Significant Impact on Yukon Economy

On February 2, 2023, the Company announced the results of an updated study on the potential economic impact of the development of the Casino Project on the Yukon and Canada completed by MNP LLP (the "Report").

The Report incorporates the results from the Feasibility Study.

The Report highlights the impressive cumulative economic effect that developing Casino will have on the Yukon and Canada during the project's construction, operation, closure, and reclamation. The Casino Project is estimated to contribute $44.3 billion to Canada's Gross Domestic Product ("GDP"), create 132,280 full-time equivalent positions ("FTE"), and generate $12.8 billion in wages and salaries over the entire life of the Project. Note that the use of FTEs is a method to account for partial employment or employment for different durations and 1.0 FTE is equivalent to a full-time job for one year of employment.

The Report estimates the GDP generated in Yukon by the construction of Casino at $1.7 billion. The construction phase is estimated to contribute $3.6 billion to Canada's economy while generating 25,580 FTEs resulting in $2.1 billion in wages and salaries across Canada.

During each of its 27 years of operation, the Casino Project is expected to contribute $1.3 billion to Yukon's economy. Operation of the mine is estimated to contribute $1.5 billion to Canada's GDP annually while creating 3,880 FTEs and generating $391 million in wages and salaries across Canada.

The Casino Project is also expected to generate $11.2 billion in taxes and royalties to various governments during the life of mine.

During the Year Ended December 31, 2022

Changes to Directors and Officers

On January 15, 2022, Kenneth Engquist was appointed as the Chief Operating Officer of the Company.

Extension of Rio Tinto's Rights

On November 23, 2022, Rio Tinto exercised its right to extend certain rights under the Initial Rio Tinto Investor Rights Agreement (as defined below) as the parties continued to work to assess the Casino Project. Such rights were superseded by those contained in the Amended and Restated Rio Tinto Investor Rights Agreement. For a summary of these rights, see "General Development of the Business - Three Year History - During the Year Ended December 31, 2023 - Further Investment by Rio Tinto".

Positive Feasibility Study on Casino Project

On August 9, 2022, the Company filed the technical report titled "Casino Project, Form NI 43-101F1 Technical Report Feasibility, Yukon, Canada" with an effective date of June 13, 2022 and issued on August 8, 2022 (the "Feasibility Study") which summarizes the results of a feasibility study on the Casino Project, which results were first reported by the Company on June 28, 2022.

The executive summary of the Feasibility Study has been included verbatim as Schedule "A" of this AIF.

The results from the Feasibility Study confirm the project's robustness and ability to withstand inflationary pressures. The Feasibility Study reaffirms Casino as one of the very few long-life copper-gold projects with robust economics in a top mining district, the Yukon.

Infrastructure

The Yukon Government commenced construction of the Bypass, later completed in November 2023.

During the Year Ended December 31, 2021

Changes to Directors and Officers

On June 30, 2021, Dale Corman, Founder of Western and Executive Chairman of the Board, retired. The Board appointed Kenneth Williamson as Interim Chairman, later retiring from the Board in February 2024.

On October 1, 2021, Shena Shaw was appointed as the Vice President, Environmental and Community Affairs of the Company.

Financing

On July 29, 2021, the Company completed a brokered private placement of Common Shares that qualify as "flow-through shares" within the meaning of subsection 66(15) of the Income Tax Act (Canada) ("Flow-Through Shares"). The Company issued an aggregate of 2,670,000 Flow-Through Shares at a price of $3.00 per share for gross proceeds of $8,010,000.

Strategic Investment by Rio Tinto

On May 31, 2021, the Company completed a $25.6 million strategic investment by Rio Tinto to advance the Casino Project. Rio Tinto acquired 11,808,490 Common Shares at a price of $2.17 per share for gross proceeds of approximately $25.6 million, resulting in Rio Tinto owning approximately 8.0% of Western's Common Shares.

In connection with the strategic investment by Rio Tinto, the Company and Rio Tinto entered into an investor rights agreement (the "Initial Rio Tinto Investor Rights Agreement"). For a summary of these rights, as amended, see "General Development of the Business - Three Year History - During the Year Ended December 31, 2023 - Further Investment by Rio Tinto.

Infrastructure

On November 9, 2021, the Company announced that the Yukon Government had awarded Yukon-based company Pelly Construction the contract for the Bypass, the first section of the Casino Project access road, since competed ahead of schedule. See "General Development of the Business - Three Year History - During the Year Ended December 31, 2023 - Infrastructure".

Positive PEA on Casino Project

On June 22, 2021, the Company announced the results of its preliminary economic assessment (the "PEA") on the Casino Project. The PEA has subsequently been superseded by the Feasibility Study.

DESCRIPTION OF THE BUSINESS

General

The Company is focused on advancing the Casino Project towards production. The Casino Project hosts one of the largest undeveloped copper-gold deposits in Canada. The Casino Project consists of a total of 1,136 full and partial quartz claims (the "Casino Quartz Claims") and 55 placer claims (the "Casino Placer Claims") acquired in accordance with the Yukon Quartz Mining Act. The 825 quartz claims, of a total of 1,136, comprise the initial Casino property (the "Casino Property") and 311 claims comprise the Canadian Creek property (the "Canadian Creek Property").

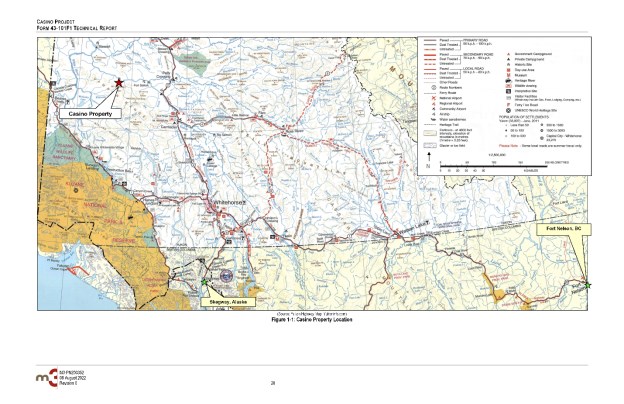

Western acquired the historical Casino claims in 2006 as part of an arrangement with prior owners and significantly expanded the area of its mineral property by staking and acquiring mineral claims currently known as the Casino Project. The Casino Project is primarily a copper and gold project located in the Whitehorse Mining District in west central Yukon, in the northwest trending Dawson Range mountains, 300 kilometres northwest of the territorial capital of Whitehorse. The Casino Project is located on Crown land administered by the Yukon government and within the Selkirk First Nation traditional territory. The total area covered by the Casino Quartz Claims is 21,288 hectares and the total area covered by the Casino Placer Claims is 490.34 hectares.

The Company does not have any producing properties and consequently has no current operating income or cash flow. Western is an exploration stage company and has not generated any revenues to date. Commercially viable mineral deposits may not exist on any of the Company's properties.

Employees

On December 31, 2023, the Company had 13 employees. The Company also uses consultants with specific skills to assist with various tasks.

Specialized Skills and Knowledge

The Company's business requires people with specialized skills and knowledge in the areas of geology, drilling, logistical planning, geophysics, metallurgy and mineral processing, implementation of exploration programs, mining, engineering, accounting, environmental, social management and governance, among others, in the jurisdictions that the Company operates. To date, the Company has been able to locate and retain such professionals, employees and consultants and management believes it will continue to be able to do so.

Competitive Conditions

The mineral acquisition, exploration and development business is a competitive business. The Company competes with numerous other companies and individuals who may have greater financial resources in the search for and acquisition of personnel and funding, and the search for and acquisition, exploration and development of attractive mineral properties. As a result of this competition, the Company may be unable to obtain additional capital or other types of financing on acceptable terms or at all, acquire, explore and develop properties of interest or retain qualified personnel. See "Risk Factors".

Changes to Contracts

It is not expected that the Company's business will be affected in the current financial year by the renegotiation or termination of contracts or sub-contracts.

Environmental Protection

The Company is subject to the laws and regulations relating to environmental matters in all jurisdictions in which it operates, including provisions relating to property reclamation, discharge of hazardous materials and other matters.

The Company has a reclamation bond of approximately $798,000 which is currently financed by a third-party. In the event that the amount of the reclamation bond increases significantly, and the Company is unable to obtain financing for this increase, it could have a material adverse effect on the Company's operations. See "Risk Factors".

MINERAL PROPERTY

Casino Project (Yukon, Canada)

The Company's only material mineral property for the purposes of NI 43-101 is the Casino Project. More details regarding the Casino Project are detailed in the Feasibility Study, prepared by: Daniel Roth, PE, P.Eng., Mike Hester, F Aus IMM, John M. Marek, P.E., Laurie M. Tahija, MMSA-QP, Carl Schulze, P.Geo., Daniel Friedman, P.Eng., and Scott Weston, P.Geo.; each of whom is a qualified person pursuant to NI 43-101.

The Feasibility Study is incorporated by reference in this AIF. The complete Feasibility Study may be viewed under the Company's profile at www.sedarplus.ca or on its website at www.westerncopperandgold.com. The executive summary of the Feasibility Study has been included verbatim as Schedule "A" of this AIF.

RISK FACTORS

The operations of the Company are speculative due to the high-risk nature of its business and the present stage of its development. The risks described herein are not the only risks facing the Company. These risk factors could materially affect the Company's future operating results and could cause actual events to differ materially from those described in forward-looking statements relating to the Company. Additional risks and uncertainties not currently known to the Company, or that the Company currently deems immaterial, may also materially and adversely affect its business. If any of the Company's properties move to a development stage, the Company would be subject to additional risks respecting any development and production activities.

History of Net Losses; Uncertainty of Additional Financing; Negative Operating Cash Flow

The Company has received no revenue to date from the exploration activities on its properties and has negative cash flow from operating activities. The Company incurred the following losses: (i) $3,338,299 for the year ended December 31, 2023, and (ii) $4,994,178 for the year ended December 31, 2022. As of December 31, 2023, the Company had an accumulated deficit of $114,929,737. In the event the Company undertakes development activity on any of its properties, there is no certainty that the Company will produce revenue, operate profitably or provide a return on investment in the future.

The business of mining and exploration involves a high degree of risk and there can be no assurance that current exploration and development programs will result in profitable mining operations. The Company has no source of revenue and has significant cash requirements to meet its exploration and development commitments and to fund administrative overhead and to maintain its mineral interests. The Company will need to raise sufficient funds to meet these obligations as well as fund ongoing exploration, advance detailed engineering, and provide for capital costs of building its mining facilities.

Mineral Exploration and Development Activities are Inherently Risky

The business of exploration for minerals and mining involves a high degree of risk. Few properties that are explored are ultimately developed into mineral deposits with significant value. Unusual or unexpected ground conditions, geological formation pressures, fires, power outages, labour disruptions, flooding, earthquakes, explorations, cave-ins, landslides and the inability to obtain suitable machinery, equipment or labour are other risks involved in the operation of mines and the conduct of exploration programs. Substantial expenditures are required to establish mineral reserves through drilling, to develop metallurgical processes to extract the metal from the ore and, in the case of new properties, to develop the mining and processing facilities and infrastructure at any site chosen for mining. No assurance can be given that minerals will be discovered in sufficient quantities to justify commercial operations or that funds required for development can be obtained on a timely basis. The economics of developing copper, gold and other mineral properties is affected by many factors including the cost of operations, variations in the grade of ore mined, fluctuations in metal markets, costs of processing equipment and government regulations, including regulations relating to royalties, allowable production, importing and exporting of minerals and environmental protection. The remoteness and restrictions on access of certain of the properties in which the Company has an interest could have an adverse effect on profitability in that infrastructure costs would be higher.

In addition, previous mining operations may have caused environmental damage at certain of the Company's properties. It may be difficult or impossible to assess the extent to which such damage was caused by the Company or by the activities of previous operators, in which case, any indemnities and exemptions from liability may be ineffective.

Uncertainty of Mineral Resources and Mineral Reserves

The figures for mineral resources and mineral reserves with respect to the Casino Project disclosed in this AIF are estimates and no assurance can be given that the anticipated tonnages and grades will be achieved or that the indicated level of recovery will be realized. Market fluctuations and the prices of metals may render mineral resources and mineral reserves uneconomic. Moreover, short-term operating factors relating to the mineral deposits, such as the need for orderly development of the deposits or the processing of new or different grades of ore, may cause any mining operation to be unprofitable in any particular accounting period. Additionally, estimates may change over time as new information becomes available. If the Company encounters mineralization or geological formations different from those predicted by past drilling, sampling and interpretations, any estimates may need to be altered in a way that could adversely affect the Company's operations or proposed operations.

Possible Loss of Interests in Exploration Properties

The regulations pursuant to which the Company holds its interests in certain of its properties provide that the Company must make a series of payments over certain time periods or expend certain minimum amounts on the exploration of the properties. If the Company fails to make such payments or expenditures in a timely fashion, the Company may lose its interest in those properties. This loss of interest could have an adverse effect on the Company's operations and the value of the Common Shares.

Possible Failure to Obtain Applicable Licenses and Permits

The Company's activities are and will be subject to obtaining and maintaining licenses, permits and approvals to conduct mining operations on the properties. The Company's continued exploration activities are dependent on maintaining, complying with and renewing required permits and licenses in addition to obtaining additional permits and licenses required for future activities.

The Company may be unable to obtain, on a timely basis, or maintain in the future, all necessary permits or licenses required to maintain its activities on its projects, including the Casino Project. Delays may occur in connection with obtaining necessary renewals of its existing permits or licenses or additional permits or licenses for future operations or activities. It is possible that previously issued permits or licenses may be suspended, revoked or lapse for a variety of reasons, including through government or court action. If the Company is unable to maintain or renew its current permits or licenses or obtain additional permits or licenses required for future operations, this may have an adverse effect on the Company's operations and the value of the Common Shares.

Dependence on Single Project

The Casino Project is currently the Company's sole project and therefore, any adverse development with respect to the Casino Project will have a material adverse effect on the Company.

Title Risks

Although title to its mineral properties and surface rights has been reviewed by or on behalf of the Company, no assurances can be given that there are no title defects affecting such properties. Title insurance generally is not available for mining claims in Canada, and the Company's ability to ensure that it has obtained secure claim to individual mineral properties may be severely constrained. The Company has not conducted surveys of all of the claims in which it holds direct or indirect interests; therefore, the precise area and location of such properties may be in doubt. Accordingly, the properties may be subject to prior unregistered liens, agreements, transfers or claims, and title may be affected by, among other things, undetected defects. In addition, the Company may be unable to conduct work on the properties as permitted or to enforce its rights with respect to its properties.

Price Fluctuations: Share Price Volatility

In recent years, the securities markets in the United States and Canada have experienced a high level of price and volume volatility, and the market price of securities of many companies, particularly those considered exploration stage companies, including the Company, have experienced wide fluctuations which have not necessarily been related to the operating performance, underlying asset values or prospects of such companies. From January 1, 2023, to December 31, 2023, the price of the Common Shares has ranged from $1.63 to $2.66 on the Toronto Stock Exchange (the "TSX"). There can be no assurance that continual and significant fluctuations in the price of the Common Shares will not occur.

Changes in the Market Price of the Common Shares

The Common Shares are listed on the TSX and the NYSE American. The price of the Common Shares is likely to be significantly affected by short-term changes in copper and gold prices or in its financial condition or results of operations. Other factors unrelated to the Company's performance that may have an effect on the price of the Common Shares include the following: a reduction in analytical coverage by investment banks with research capabilities; a drop in trading volume and general market interest in the Company's securities may adversely affect an investors' ability to liquidate an investment and consequently an investor's interest in acquiring a significant stake in the Company; a failure to meet the reporting and other obligations under relevant securities laws or imposed by applicable stock exchanges could result in a delisting of the Common Shares and a substantial decline in the price of the Common Shares that persists for a significant period of time.

As a result of any of these factors, the market price of the Common Shares at any given point in time may not accurately reflect their long-term value. Securities class action litigation often has been brought against companies following periods of volatility in the market price of their securities. The Company may in the future be the target of similar litigation. Securities litigation could result in substantial costs and damages and divert management's attention and resources.

Risks Relating to Statutory and Regulatory Compliance

The current and future operations of the Company, from exploration through development activities and commercial production, if any, are and will be governed by applicable laws and regulations governing mineral claims acquisition, prospecting, development, mining, production, exports, taxes, labour standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety and other matters. Companies engaged in exploration activities and in the development and operation of mines and related facilities, generally experience increased costs and delays in production and other schedules as a result of the need to comply with applicable laws, regulations and permits. The Company has received all necessary permits for the exploration work it is presently conducting; however, there can be no assurance that all permits which the Company may require for future exploration, construction of mining facilities and conduct of mining operations, if any, will be obtainable on reasonable terms or on a timely basis, or that such laws and regulations would not have an adverse effect on any project which the Company may undertake.

Failure to comply with applicable laws, regulations and permits may result in enforcement actions thereunder, including the forfeiture of claims, orders issued by regulatory or judicial authorities requiring operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment or costly remedial actions. The Company may be required to compensate those suffering loss or damage by reason of its mineral exploration activities and may have civil or criminal fines or penalties imposed for violations of such laws, regulations and permits. The Company is not currently covered by any form of environmental liability insurance. See "Insurance Risk", below.

Existing and possible future laws, regulations and permits governing operations and activities of exploration companies, or more stringent implementation thereof, could have a material adverse impact on the Company and cause increases in capital expenditures or require abandonment or delays in exploration.

Environmental Laws and Regulations That May Increase Costs and Restrict Operations

All of the Company's exploration and potential development and production activities are subject to regulation by Canadian governmental agencies under various environmental laws. To the extent that the Company conducts exploration activities or new mining activities in other countries, it will also be subject to the laws and regulations of those jurisdictions, including environmental laws and regulations.

Environmental laws generally provides for restrictions and prohibitions on spills, releases or emissions of various substances produced in association with certain mining industry operations, such as seepage from tailings disposal areas, which would result in environmental pollution. A breach of such legislation may result in imposition of fines and penalties. In addition, certain types of operations require the submission and approval of environmental impact assessments. Environmental legislation is evolving to stricter standards, and enforcement, fines and penalties for noncompliance are more stringent. Environmental assessments of proposed projects carry a heightened degree of responsibility for companies and directors, officers, and employees. The cost of compliance with changes in governmental regulations has a potential to reduce the profitability of operations. Environmental hazards may exist on the properties in which the Company holds its interests or on properties that will be acquired which are unknown to the Company at present and which have been caused by previous or existing owners or operators of those properties.