UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 40-F

☐ Registration statement pursuant to Section 12 of the Securities Exchange Act of 1934

or

☒ Annual report pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934

| For the fiscal year ended: December 31, 2023 | Commission File Number: 001-39166 |

Metalla Royalty & Streaming Ltd.

(Exact name of registrant as specified in its charter)

|

British Columbia |

1040 |

Not Applicable |

543 Granville Street

Suite 501

Vancouver BC

Canada V6C 1X8

(604) 696-0741

(Address and telephone number of registrant's principal executive offices)

|

DL Services Inc. Columbia Center 701 Fifth Avenue, Suite 6100 Seattle, WA 98104-7043 (206) 903-8800 (Name, address (including zip code) and telephone number (including area code) of agent for service in the United States) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class: | Trading Symbol(s) | Name of Each Exchange On Which Registered: |

| Common shares, no par value | MTA | NYSE American LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

For annual reports, indicate by check mark the information filed with this form:

| ☒ Annual Information Form | ☒ Audited Annual Financial Statements |

Indicate the number of outstanding shares of each of the registrant's classes of capital or common stock as of the close of the period covered by the annual report:

As of December 31, 2023, there were 90,877,231 common shares outstanding.

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files).

☒ Yes ☐ No

Indicate by check mark whether the Registrant is an emerging growth company as defined in Rule 12b-2 of the Exchange Act.

☒ Emerging growth company

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

EXPLANATORY NOTE

Metalla Royalty & Streaming Ltd. ("we", "us", "our", "Metalla" or the "Company") is a Canadian corporation that is permitted, under a multijurisdictional disclosure system adopted by the United States, to prepare this Annual Report on Form 40-F ("Annual Report") pursuant to Section 13 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), in accordance with disclosure requirements in effect in Canada, which are different from those of the United States.

FORWARD LOOKING STATEMENTS

This Annual Report, including the Exhibits incorporated by reference into this Annual Report, contains "forward-looking information" and "forward-looking statements" (collectively, "forward-looking statements") within the meaning of applicable securities legislation. The forward-looking statements are provided as of the date of this Annual Report and the Company does not intend to and does not assume any obligation to update forward-looking information, except as required by applicable law. For this reason and the reasons set forth below, investors should not place undue reliance on forward-looking statements.

All statements included herein that address events or developments that we expect to occur in the future are forward-looking statements. Generally, forward-looking statements can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or statements that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved".

The forward-looking statements are based on reasonable assumptions that have been made by Metalla as at the date hereof and are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Metalla to be materially different from those expressed or implied by such forward-looking statements, including but not limited to:

risks related to commodity price fluctuations;

the absence of control over mining operations from which Metalla will purchase precious metals pursuant to gold streams, silver streams and other agreements (collectively, "Streams" and each individually a "Stream") or from which it will receive royalty payments pursuant to net smelter returns ("NSR Royalties"), gross overriding royalties ("GOR Royalties"), gross value royalties ("GVR Royalties") and other royalty agreements or interests (collectively, "Royalties" and each individually a "Royalty") and risks related to those mining operations, including risks related to international operations, government and environmental regulation, delays in mine construction and operations, actual results of mining and current exploration activities, conclusions of economic evaluations and changes in project parameters as plans are refined;

risks related to exchange rate fluctuations;

that payments in respect of Streams and Royalties may be delayed or may never be made;

risks related to Metalla's reliance on public disclosure and other information regarding the mines or projects underlying its Streams and Royalties;

that some Royalties or Streams may be subject to confidentiality arrangements that limit or prohibit disclosure regarding those Royalties and Streams;

business opportunities that become available to, or are pursued by, Metalla;

that Metalla's cash flow is dependent on the activities of others;

that Metalla has had negative cash flow from operating activities in the past;

that some Royalty and Stream interests are subject to rights of other interest-holders;

that Metalla's Royalties and Streams may have unknown defects;

risks related to Metalla’s two material assets, the Côté and Gosselin gold property (the “Côté Property”) and the Taca Taca copper-gold-molybdenum project (the “Taca Taca Property”);

risks related to general business and economic conditions;

risks related to global financial conditions;

geopolitical events and other uncertainties;

risks related to epidemics, pandemics or other public health crises, including the COVID-19 global health pandemic, and the spread of other viruses or pathogens, and the potential impact thereof on Metalla's business, operations and financial condition;

that Metalla is dependent on its key personnel;

risks related to Metalla's financial controls;

dividend policy and future payment of dividends;

competition;

that project operators may not respect contractual obligations;

that Metalla's Royalties and Streams may be unenforceable;

risks related to conflicts of interest of Metalla's directors and officers;

that Metalla may not be able to obtain adequate financing in the future;

risks related to Metalla's current credit facility and financing agreements;

litigation;

title, permit or license disputes related to interests on any of the properties in which Metalla holds, or may acquire, a royalty, stream or other interest;

interpretation by government entities of tax laws or the implementation of new tax laws;

changes in tax laws impacting Metalla;

risks related to anti-bribery and anti-corruption laws;

credit and liquidity risk;

risks related to Metalla's information systems and cyber security;

risks posed by activist shareholders;

that Metalla may suffer reputational damage in the ordinary course of business;

risks related to acquiring, investing in or developing resource projects;

risks applicable to owners and operators of properties in which Metalla holds an interest;

exploration, development and operating risks;

risks related to climate change;

environmental risks;

that the exploration and development activities related to mine operations are subject to extensive laws and regulations;

that the operation of a mine or project is subject to the receipt and maintenance of permits from governmental authorities;

risks associated with the acquisition and maintenance of mining infrastructure;

that Metalla's success is dependent on the efforts of operators' employees;

risks related to mineral resource and mineral reserve estimates;

that mining depletion may not be replaced by the discovery of new mineral reserves;

that operators' mining operations are subject to risks that may not be able to be insured against;

risks related to land title;

risks related to international operations;

risks related to operating in countries with developing economies;

risks related to the construction, development and expansion of mines or projects;

risks associated with operating in areas that are presently, or were formerly, inhabited or used by indigenous peoples;

that Metalla is required, in certain jurisdictions, to allow individuals from that jurisdiction to hold nominal interests in Metalla's subsidiaries in that jurisdiction;

the volatility of the stock market;

that existing securityholders may be diluted;

risks related to Metalla's public disclosure obligations;

risks associated with future sales or issuances of debt or equity securities;

risks associated with the convertible loan facility with Beedie Investments Ltd.;

that there can be no assurance that an active trading market for Metalla's securities will be sustained;

risks related to the enforcement of civil judgments against Metalla; and

risks relating to Metalla potentially being a passive foreign investment company within the meaning of U.S. federal tax laws, as well as those factors discussed under the heading "Risk Factors" in the AIF (as defined below).

Forward-looking statements included in the AIF include statements regarding:

the completion of future transactions;

our plans and objectives;

our future financial and operational performance;

expectations regarding the Streams of Metalla;

royalty payments to be paid to Metalla by property owners or operators of mining projects pursuant to each Royalty;

the future outlook of Metalla and the mineral reserves and resource estimates for the Côté Property, the Taca Taca Property, and other properties with respect to which the Company has or proposes to acquire an interest;

the expected output, costs, and date of commercial production for the Côté Property, the Taca Taca Property, and other properties with respect to which the Company has or proposes to acquire an interest;

future gold and silver prices;

other potential developments relating to, or achievements by, the counterparties for our Stream and Royalty agreements, and with respect to the mines and other properties in which we have, or may acquire, a Stream or Royalty interest;

estimates of future production, costs and other financial or economic measures;

prospective transactions, growth and achievements;

financing and adequacy of capital;

future payment of dividends;

future sales of common shares under the new at-the-market offering program; and

the future achievement of any milestones in respect of the payment or satisfaction of contingent consideration by Metalla, including with respect to the CentroGold property in accordance with the purchase and sale agreement, pursuant to which Metalla purchased its NSR Royalty on the CentroGold property.

Estimates of mineral resources and mineral reserves are also forward-looking statements because they involve estimates of mineralization that will be encountered in the future, and projections regarding other matters that are uncertain, such as future costs and commodity prices.

Forward-looking statements are based on a number of material assumptions, which management of Metalla believe to be reasonable, including, but not limited to, the continuation of mining operations from which Metalla will purchase precious or other metals or in respect of which Metalla will receive Royalty payments, that commodity prices will not experience a material decline, mining operations that underlie Streams or Royalties will operate in accordance with disclosed parameters and achieve their stated production outcomes and such other assumptions as may be set out herein.

Although Metalla has attempted to identify important factors that could cause actual actions, events or results to differ materially from those contained in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such forward-looking statements. Accordingly, readers should not place undue reliance on forward-looking statements. Investors and readers of this Annual Report should also carefully review the risk factors set out in the AIF under the heading "Risk Factors".

RESOURCE AND RESERVE ESTIMATES

Unless otherwise indicated, all scientific and technical information, including mineral resource and mineral reserve estimates, included in the documents incorporated by reference into this Annual Report have been prepared in accordance with Canadian National Instrument 43-101 ("NI 43-101") and the Canadian Institute of Mining and Metallurgy Classification System. NI 43-101 is a rule developed by the Canadian securities administrators, which establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Canadian standards, including NI 43-101, differ from the requirements of the United States Securities and Exchange Commission (the "SEC"), and scientific and technical information, including mineral resource and mineral reserve estimates, contained in the documents incorporated by reference into this Annual Report may not be comparable to similar information disclosed by U.S. companies subject to technical disclosure requirements of the SEC.

DIFFERENCES IN UNITED STATES AND CANADIAN REPORTING PRACTICES

We prepare our financial statements, which are filed with this report on Form 40-F, in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board. Accordingly, our financial statements may not be comparable to financial statements of the United States companies.

DOCUMENTS INCORPORATED BY REFERENCE

The following documents, or the portions thereof indicated below, that are filed as exhibits to this Annual Report, are incorporated herein by reference.

• Annual Information Form of the Company for the financial year ended December 31, 2023 (the "AIF");

• Audited Annual Consolidated Financial Statements for the year ended December 31, 2023 and notes thereto, together with the report of auditors thereon (the "2023 Financial Statements"); and

• Management's Discussion and Analysis of the Company for the year ended December 31, 2023.

CONTROLS AND PROCEDURES

Information regarding our disclosure controls and procedures, internal control over financial reporting and changes in internal control over financial reporting is included in the Management Discussion and Analysis incorporated herein by reference to Exhibit 99.3, under the heading "Disclosure Controls and Internal Control Over Financial Reporting."

Attestation Report of the Registered Public Accounting Firm

This Annual Report does not include an attestation report of the Company's registered public accounting firm because emerging growth companies are exempt from this requirement for so long as they remain emerging growth companies.

NOTICES PURSUANT TO REGULATION BTR

There were no notices required by Rule 104 of Regulation BTR that the Company sent during the financial year ended December 31, 2023 concerning any equity security subject to a blackout period under Rule 101 of Regulation BTR.

AUDIT COMMITTEE AND AUDITOR INFORMATION

We have a separately-designated standing audit committee established in accordance with section 3(a)(58)(A) of the Exchange Act. The following information is included in the "Audit Committee" section of our AIF, which are incorporated herein by reference to Exhibit 99.1:

• Information regarding our Audit Committee composition, independence, audit committee financial expert and pre-approval policies and procedures; and

• Information regarding fees billed by our principal accountants, KPMG LLP (Vancouver, Canada; PCAOB ID Number 85), for each of the last two fiscal years.

CODE OF ETHICS

We have adopted a code of business conduct and ethics that applies to all of our directors, officers and employees. A copy of the code of business conduct and ethics is posted on our website at https://metallaroyalty.com/corporate-responsibility/governance/. The code was most recently amended on September 24, 2019, in connection with the listing of our common shares on the NYSE American. The Company did not grant any waiver from a provision of the code to any of its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, during the fiscal period ended December 31, 2023.

OFF-BALANCE SHEET ARRANGEMENTS

The Company has no off-balance sheet arrangements.

MATERIAL CASH REQUIREMENTS FROM KNOWN CONTRACTUAL AND OTHER OBLIGATIONS

Information regarding our material cash requirements from known contractual and other obligations is included in the Management Discussion and Analysis incorporated herein by reference to Exhibit 99.3.

MINE SAFETY DISCLOSURE

We do not operate any mine in the United States and have no mine safety incidents to report for the financial year ended December 31, 2023.

DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS

Not applicable.

RECOVERY OF ERRONEOUSLY AWARDED COMPENSATION

Since the beginning of the last fiscal year, we have not been required to prepare an accounting restatement that required recovery of erroneously awarded compensation pursuant to our Clawback Policy, nor was there an outstanding balance as of the end of the last completed fiscal year of erroneously awarded compensation to be recovered from the application of the Clawback Policy to a prior restatement.

UNDERTAKINGS

We undertake to make available, in person or by telephone, representatives to respond to inquiries made by the SEC staff, and to furnish promptly, when requested to do so by the SEC staff, information relating to the securities registered pursuant to Form 40-F; the securities in relation to which the obligation to file an annual report on Form 40-F arises; or transactions in said securities.

CONSENT TO SERVICE OF PROCESS

We have previously filed with the SEC a written consent to service of process and power of attorney on Form F-X. Any change to the name or address of our agent for service shall be communicated promptly to the SEC by amendment to the Form F-X referencing our file number.

EXHIBIT INDEX

The following documents are being filed with the SEC as exhibits to this Annual Report on Form 40-F.

SIGNATURES

Pursuant to the requirements of the Exchange Act, the Company certifies that it meets all of the requirements for filing on Form 40-F and has duly caused this Annual Report to be signed on its behalf by the undersigned, thereunto duly authorized.

| METALLA ROYALTY & STREAMING LTD. | |

| /s/ Brett Heath | |

| Name: Brett Heath | |

| Title: President and Chief Executive Officer | |

| Date: March 28, 2024 | |

CLAWBACK POLICY

This policy will apply if there is a material adverse restatement of the financial results of Metalla Royalty & Streaming Ltd. (the "Company"), other than due to a change in applicable accounting methods, rules, or interpretations (a "Financial Restatement"), and the result of such restatement is that any performance-based compensation issued, paid, granted, or awarded to any executive officer of the Company would have been lower had it been calculated based on such restated results. If a Financial Restatement occurs, the Board of Directors of the Company (the "Board") or such other persons as may be designated by the Board (the Board or such other persons being referred to in this policy as the "Administrators") shall make the determinations and take the steps contemplated in accordance with this policy. Interested executive officers of the Company will not be entitled to participate as Administrators.

If a Financial Restatement occurs, and if the Administrators determine (i) that the amount of any performance-based compensation actually issued, paid, granted, or awarded to any executive officer of the Company (the "Awarded Compensation") would have been a lower amount had it been calculated based on such restated financial results (the "Actual Compensation"), and (ii) that such executive officer engaged in fraud or intentional illegal conduct (whether or not such conduct has been determined by court judgement) which materially contributed to the need for such Financial Restatement, then the Administrators shall, except as provided below, cancel, rescind, or otherwise seek to recover from such executive officer for the benefit of the Company, and such executive officer will be required to forfeit or repay to the Company, the after-tax portion of the difference between the Awarded Compensation and the Actual Compensation (the "Excess Compensation"). In determining the after-tax portion of the Excess Compensation, the Administrators may take into account their good faith estimate of the tax paid or payable by such executive officer in respect of the Awarded Compensation, their good faith estimate of the value of any tax deduction or other tax relief available to such executive officer in respect of any cancelation, rescission, forfeiture, or repayment on account of the Excess Compensation, and such other factors as they consider reasonable in the circumstances.

The Administrators shall not seek such cancelation, rescission, forfeiture, or recovery from an executive officer to the extent the Administrators determine in their discretion (i) that to do so would be unreasonable, or (ii) that it would be in the best interests of the Company not to do so. In making such determination, the Administrators shall take into account such considerations as the Administrators deem appropriate, including without limitation (A) the likelihood of success of such a claim under governing law versus the cost and effort involved, (B) whether the expense of such a claim is likely to exceed the amount sought and whether it is likely to be recovered; (C) whether the assertion of a claim may prejudice the interests of the Company, including in any related proceeding or investigation, (D) the passage of time since the occurrence of the act in respect of the applicable fraud or intentional illegal conduct, and (E) any threatened or pending legal proceeding relating to the applicable fraud or intentional illegal conduct.

Before the Administrators determine to seek cancelation, rescission, forfeiture, or recovery pursuant to this policy, the Administrators may, in their discretion provide to the applicable executive officer written notice and the opportunity to be heard at a meeting of the Administrators (which may be in-person or telephonic, as determined by the Administrators) held after a reasonable period of time.

If the Administrators determine to seek cancelation, rescission, forfeiture, or recovery pursuant to this policy, the Administrators shall make a written demand for repayment from the applicable executive officer and, if such executive officer does not, within a reasonable period, forfeit or tender repayment in response to such demand, as may be required, and the Administrators determine that such executive officer is unlikely to do so, the Administrators may seek a court order against such executive officer for any such cancelation, rescission, forfeiture, or repayment.

This policy is in addition to (and not in lieu of) any right of repayment, forfeiture or right of offset against any executive officer that is required pursuant to any statutory repayment requirement (regardless of whether implemented at any time prior to or following the adoption of this policy). In addition to and notwithstanding the foregoing, the Administrators may also seek cancellation, rescission, forfeiture or repayment of any awards or amounts as required by any applicable law or stock exchange rule.

For the purposes of this policy, (i) the term "executive officer" shall refer to any current or former "senior officer" of the Company or any subsidiary for purposes of the Business Corporations Act (British Columbia), and (ii) the term "performance-based compensation" means all equity compensation which may be issued, paid, granted, or awarded to an executive officer of the Company pursuant to the share compensation plan of the Company having an effective date of November 6, 2019, as such share compensation plan may be amended, replaced, or restated from time to time.

Any determination, modification, interpretation, or other action by the Administrators pursuant to this policy shall be made and taken by a vote of a majority of its members. The Administrators have the sole authority to construe, interpret, and implement this policy, make any determination necessary or advisable in administering this policy, and modify, supplement, rescind, or replace all or any portion of this policy.

ANNUAL INFORMATION FORM

FOR THE FINANCIAL YEAR ENDED DECEMBER 31, 2023

MARCH 28, 2024

SUITE 501, 543 GRANVILLE STREET

VANCOUVER, B.C. V6C 1X8

METALLA ROYALTY & STREAMING LTD.

ANNUAL INFORMATION FORM

FOR THE FINANCIAL YEAR ENDED December 31, 2023

Table of Contents

- i -

INTRODUCTORY NOTES

Cautionary Note Regarding Forward-Looking Statements

This annual information form ("AIF") contains "forward-looking information" or "forward-looking statements" (collectively, "forward-looking statements") within the meaning of applicable securities legislation. The forward-looking statements are provided as of the date of this AIF and Metalla Royalty & Streaming Ltd. ("Metalla" or the "Company") does not intend to and does not assume any obligation to update forward-looking statements, except as required by applicable law. For this reason and the reasons set forth below, investors should not place undue reliance on forward-looking statements.

All statements included herein that address events or developments that we expect to occur in the future are forward-looking statements. Generally, forward-looking statements can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or statements that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved".

The forward-looking statements are based on reasonable assumptions that have been made by Metalla as at the date hereof and are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Metalla to be materially different from those expressed or implied by such forward-looking statements, including but not limited to:

- 2 -

as well as those factors discussed under the heading "Risk Factors" in this AIF.

Forward-looking statements included in this AIF include statements regarding:

- 3 -

Estimates of mineral resources and mineral reserves are also forward-looking statements because they involve estimates of mineralization that will be encountered in the future, and projections regarding other matters that are uncertain, such as future costs and commodity prices.

Forward-looking statements are based on a number of material assumptions, which management of Metalla believe to be reasonable, including, but not limited to, the continuation of mining operations from which Metalla will purchase precious or other metals or in respect of which Metalla will receive Royalty payments, that commodity prices will not experience a material decline, mining operations that underlie Streams or Royalties will operate in accordance with disclosed parameters and achieve their stated production outcomes and such other assumptions as may be set out herein.

Although Metalla has attempted to identify important factors that could cause actual actions, events or results to differ materially from those contained in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such forward-looking statements. Accordingly, readers should not place undue reliance on forward-looking statements. Investors and readers of this AIF should also carefully review the risk factors set out in this AIF under the heading "Risk Factors".

Technical and Third-Party Information and Cautionary Note for United States Readers

Except where otherwise stated, the disclosure in this AIF relating to properties and operations in which Metalla holds Royalty, Stream or other interests, including the disclosure in this AIF under the heading "Material Assets" is based on information publicly disclosed by the owners or operators of these properties and information/data available in the public domain as at the date hereof, and none of this information has been independently verified by Metalla. Specifically, as a Royalty or Stream holder, Metalla has limited, if any, access to properties on which it holds Royalties, Streams, or other interests in its asset portfolio. The Company may from time to time receive operating information from the owners and operators of the mining properties, which it is not permitted to disclose to the public. Metalla is dependent on, (i) the operators of the mining properties and their qualified persons to provide information to Metalla, or (ii) on publicly available information to prepare disclosure pertaining to properties and operations on the properties on which the Company holds Royalty, Stream or other interests, and may have limited or no ability to independently verify such information. Although the Company does not have any knowledge that such information may not be accurate, there can be no assurance that such third-party information is complete or accurate. Some reported public information in respect of a mining property may relate to a larger property area than the area covered by Metalla's Royalty, Stream or other interest. Metalla's Royalty, Stream or other interests may cover less than 100% of a specific mining property and may only apply to a portion of the publicly reported mineral reserves, mineral resources and or production from a mining property.

- 4 -

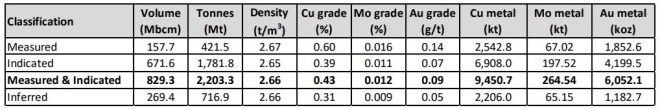

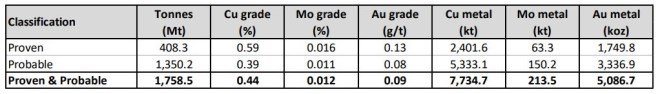

As at the date of this AIF the Company considers its Royalty and Stream interests in a portion of the Côté deposit and all of the Gosselin deposit which form the Côté gold project (collectively, the "Côté Property") and in the Taca Taca copper-gold-molybdenum project in Salta Province, Argentina ("Taca Taca Property" or "Taca Taca Project") to be its only material mineral properties for the purposes of National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101"). Information included in this AIF with respect to the Côté Property and with respect to the Taca Taca Property has been prepared in accordance with the exemption set forth in section 9.2 of NI 43-101.

Unless otherwise noted, the disclosure contained in this AIF of a scientific or technical nature for the Côté Property is based on the technical report entitled "Technical Report on the Côté Gold Project, Ontario, Canada - Report for NI 43-101" having an effective date of June 30, 2022 which technical report was prepared for IAMGOLD Corporation ("IAMGOLD"), and filed under IAMGOLD's SEDAR+ profile on www.sedarplus.ca, and information that has been provided by IAMGOLD and/or has been sourced from their news releases with respect to the Côté Property.

Unless otherwise noted, the disclosure contained in this AIF of a scientific or technical nature for the Taca Taca Property is based on the amended and restated technical report entitled "Taca Taca Project - Salta Province, Argentina - Amended and Restated NI 43-101 Technical Report" having an effective date of October 30, 2020, which technical report was prepared for First Quantum Minerals Ltd. ("First Quantum") and filed under First Quantum's SEDAR+ profile on www.sedarplus.ca, and information that has been provided by First Quantum and/or has been sourced from their news releases with respect to the Taca Taca Property.

Unless otherwise indicated, all of the mineral reserves and mineral resources disclosed in this AIF have been prepared in accordance with NI 43-101. Canadian standards for public disclosure of scientific and technical information concerning mineral projects differ significantly from the requirements adopted by the United States Securities and Exchange Commission (the "SEC").

Accordingly, the scientific and technical information contained in this AIF, including estimates of mineral reserves and mineral resources, may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements of the SEC.

Charles Beaudry, M.Sc., P.Geo. and géo. for Metalla and a "Qualified Person" under NI 43-101 has reviewed and approved the written scientific and technical disclosure contained in this AIF.

Currency Presentation

All dollar amounts referenced as "C$", "CAD" or "CAD$" are references to Canadian dollars, all references to "$", "US$", "USD" or "USD$" are references to United States dollars.

CORPORATE STRUCTURE

Metalla was incorporated on May 11, 1983 pursuant to the Company Act (British Columbia) under the name Cactus West Explorations Ltd. The Company's name was changed to Cimarron Minerals Ltd. and its share capital was consolidated on a five (old) for one (new) basis, on April 29, 1996. On May 1, 2000, the Company's name was changed to DiscFactories Corporation, and its share capital was consolidated on a two (old) for one (new) basis and the Company was continued into the federal jurisdiction under the Canada Business Corporations Act. On February 20, 2007, the Company completed a change of business transaction pursuant to which it changed its name from DiscFactories Corporation to Excalibur Resources Ltd. On January 11, 2010, its share capital was consolidated on an eight (old) for one (new) basis. On December 1, 2016 it changed its name from Excalibur Resources Ltd. to Metalla, and completed a share consolidation on a three (old) for one (new) basis. On November 16, 2017, Metalla continued under the Business Corporations Act (British Columbia) ("BCBCA").

- 5 -

On December 17, 2019 (the "Effective Date"), Metalla completed a share consolidation (the "Share Consolidation") on a one common share of the Company ("Common Share") (new) to four Common Shares (old) basis. Unless otherwise indicated in this AIF, all references to Common Shares, Common Share purchase warrants, stock options or RSUs issued prior to the Effective Date (collectively, the "Consolidated Securities"), including the exercise price and/or conversion prices in respect to any of the Consolidated Securities, have been adjusted to reflect this Share Consolidation.

On December 1, 2023, Metalla acquired all of the issued and outstanding common shares (the "Nova Shares") in the capital of Nova Royalty Corp. ("Nova"), by way of a court-approved plan of arrangement. In consideration for the Nova Shares, Metalla issued Common Shares to the former Nova shareholders. See "General Development of the Business - Current Business of Metalla - 3 Year History - Arrangement with Nova Royalty Corp." for additional information.

The Company's head office is located at 501-543 Granville Street, Vancouver, British Columbia, V6C 1X8, Canada. The Company's registered and records office is located at Suite 2800, 666 Burrard Street, Vancouver, British Columbia, V6C 2Z7, Canada.

The Company is a reporting issuer in British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, Quebec, New Brunswick, Nova Scotia, Prince Edward Island and Newfoundland. As at the date of this AIF, the Common Shares are listed on the TSX Venture Exchange (the "TSXV") under the symbol "MTA", on the Frankfurt Exchange under the Symbol "X9C", and on the NYSE American stock exchange ("NYSE") under the symbol "MTA".

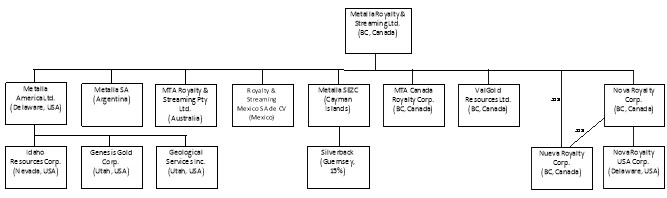

The Company has thirteen (13) material subsidiaries: (i) MTA Canada Royalty Corp. which was incorporated under the laws of British Columbia; (ii) ValGold Resources Ltd. which was incorporated under the laws of British Columbia; (iii) MTA Royalty & Streaming Pty Ltd. which was incorporated under the laws of Australia; (iv) Metalla S.A. which was incorporated under the laws of Argentina; (v) Royalty & Streaming Mexico, S.A. de C.V. which was incorporated under the laws of Mexico; (vi) Metalla SEZC which was incorporated under the laws of Cayman Islands; (vii) Metalla America Ltd. (“MTA America”) which was incorporated under the laws of the State of Delaware; (viii) Nueva Royalty Ltd. which was incorporated under the laws of British Columbia; and (ix) Nova Royalty Corp. which was incorporated under the laws of British Columbia. MTA America has three wholly-owned subsidiaries, (i) Idaho Resources Corporation, which was incorporated under the laws of Nevada, (ii) Genesis Gold Corporation (“Genesis”), which was incorporated under the laws of Utah, and (iii) Geological Services Inc. (“GSI”), which was incorporated under the laws of Utah. Metalla SEZC has a 15% interest in Silverback Limited, a private Guernsey based company, which solely owns 100% of the silver Stream in the New Luika Gold Mine. Nova has one wholly owned subsidiary, Nova Royalty USA Corp., which was incorporated under the laws of the State of Delaware.

Inter-Corporate Relationships

The chart below illustrates the Company's material inter-corporate relationships as at the date hereof:

- 6 -

GENERAL DEVELOPMENT OF THE BUSINESS

Current Business of Metalla - 3 Year History

Acquisitions

Metalla acquires AK and North AK Royalty, Kirkland Lake, Ontario

On February 15, 2021, Metalla acquired an aggregate 0.45% NSR Royalty on the AK and North AK Claims in Kirkland Lake, Ontario from two private vendors for a total consideration of C$681,820 in cash. The AK and North AK Claims are owned and operated by Agnico Eagle.

Metalla acquires Tocantinzinho Royalty

On March 17, 2021, Metalla acquired a 0.75% GVR Royalty on the mining claims, tenements and licenses comprising the Tocantinzinho Project located in Para State Brazil from Sailfish Royalty Corp. ("Sailfish") for a total consideration of $9.0 million in cash, of which $6.0 million was paid upon closing and the remaining $3.0 million was paid 60 days after closing. The Tocantinzinho Project is owned and operated by G Mining Ventures Corp. ("G Mining") (TSXV: GMIN; OTCQX: GMINF).

In 2022, G Mining announced it has completed a comprehensive financing package totaling $481 million for the development and construction of the Tocantinzinho Project, which remains on track and on budget to achieve commercial production in the second half of 2024.

Metalla acquires CentroGold Royalty

On March 24, 2021, Metalla acquired an NSR Royalty on the CentroGold Project ("CentroGold") located in Maranhão State and Para State, Brazil from Jaguar Mining Inc. ("Jaguar") and Mineração Serras Do Oeste Ltda., a wholly owned subsidiary of Jaguar ("MSOL") pursuant to a purchase and sale agreement (the "Jaguar Sale Agreement") with Jaguar and MSOL. CentroGold is owned and operated by MCT Mineração Ltda., a wholly owned subsidiary of BHP.

The Royalty is comprised of a 1.0% NSR Royalty on the first 500Koz ounces of gold production on CentroGold, a 2.0% NSR Royalty on the next 1Moz of gold production on CentroGold, and reverts to a 1.0% NSR Royalty on gold production thereafter in perpetuity.

- 7 -

Metalla paid Jaguar $7.0 million in cash at closing of the transaction and agreed to pay Jaguar up to $11.0 million in contingent post-closing payments, consisting of Common Shares and cash, upon the achievement of certain milestones relating to CentroGold.

The first milestone will be triggered upon (a) the grant of all applicable project licenses and, if required, the completion of any necessary community relocations allowing for full access to the CentroGold property, and (b) the litigation relating to the CentroGold project, including the injunction imposed thereon, being lifted or extinguished with no pending or expected appeal. The first milestone payment will be satisfied by Metalla issuing Common Shares with a value of $7.0 million based on the fifteen (15) trading day volume-weighted average price on the NYSE on a date that is 120 days following completion of the trigger. Metalla's obligation to make the first milestone payment will expire after ten years if the foregoing conditions have not been completed.

The second milestone will be triggered upon the CentroGold project achieving commercial production and will be satisfied by Metalla through a $4.0 million payment in cash. Metalla's obligation to make the second milestone payment will expire after fifteen years if the foregoing condition has not been completed.

Metalla acquires Del Carmen Royalty

On March 24, 2021, Metalla acquired a 0.5% NSR Royalty on the Del Carmen Project in San Juan, Argentina from COIN Hodl Inc. (formerly Malbex Resources Ltd.) for a total consideration of C$1.6 million in cash. The Del Carmen Project is operated by Minera Del Carmen S.A., an entity which is controlled by Barrick Gold Corporation ("Barrick Gold"). On July 19, 2023, Metalla was notified that the agreement for Barrick Gold to explore and exploit the Del Carmen Project has been terminated and, as a result, the NSR royalty held by Metalla has also been terminated.

Metalla acquires additional La Fortuna Royalty

On April 30, 2021, the Company completed an acquisition from Argonaut Gold Inc., through its wholly-owned subsidiary, Minera Real Del Oro, S.A. de C.V., of a 2.5% NSR Royalty on the mineral concessions known as the La Fortuna property in the State of Durango, Mexico, pursuant to a royalty purchase and sale agreement, for a total consideration of $2.25 million in cash.

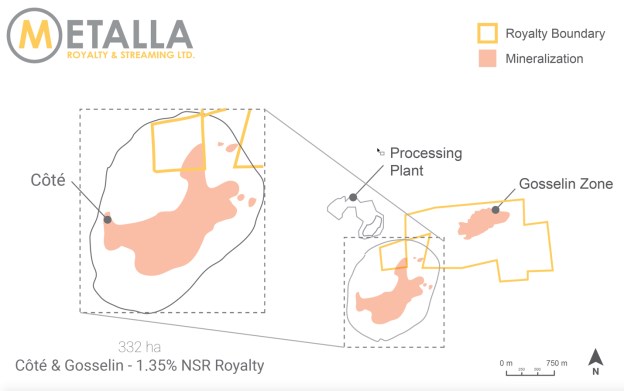

Metalla acquires Côté Royalty

On June 17, 2021, the Company completed an acquisition of an existing 1.35% NSR Royalty on the Côté Property operated by IAMGOLD, for a total consideration of C$7.5 million in cash from arm's length sellers. The Company was granted a right of first refusal on the sale of the remaining 0.15% NSR Royalty held by one of the sellers.

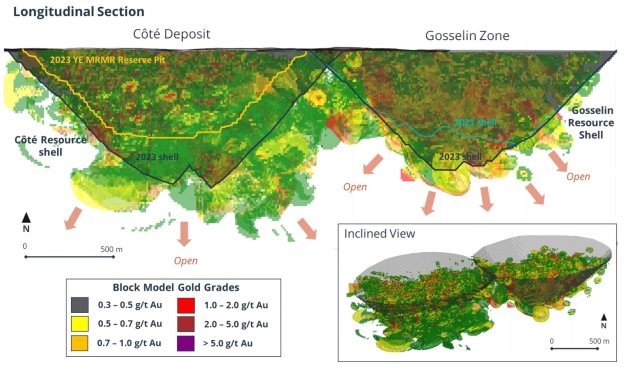

The Côté Property is poised to become one of Canada's largest gold mines with an expected annual output of 495Koz in the first six years of operation with life-of-mine ("LOM") average cash costs of $693/oz. Construction of the mine commenced in the fall of 2020 and is expected to ramp up to commercial production in the first half of 2024. The Côté Property currently boasts a 7.6Moz proven and probable reserve, a measured and indicated resource of 16.5Moz and an inferred resource of 4.2Moz making it one of the largest gold resources in Canada. See "Material Assets - Côté Property" below for more information.

Metalla acquires Castle Mountain Royalty

On October 1, 2021, Metalla acquired an existing 5% NSR Royalty from an arm's length seller on the South Domes portion of the Castle Mountain gold mine ("Castle Mountain") owned by Equinox Gold Corp. ("Equinox Gold") for a total consideration of $15.0 million in cash. On closing, the Company paid $10.0 million in cash to the arm's length seller with the remaining $5.0 million of the purchase price to be paid within twenty months from the closing date bearing interest at a rate of 4% per annum from the closing date.

- 8 -

Equinox Gold's Feasibility Study, dated March 17, 2021 (with an effective date of February 26, 2021), outlines Castle Mountain to have an expected annual production output of 218Koz gold and total all-in sustaining cost of $858/oz over the 14-year Phase 2 mine plan.

First Amendment to Alamos Royalty Agreement

On February 8, 2022, the Company and Monarch Mining Corporation ("Monarch") entered into an agreement entitled "Agreement and First Amendment to Royalty Agreement", pursuant to which the Company paid $1.0 million to Monarch to remove the royalty exemption in respect of the Beaufor mine and make certain consequential amendments to the Alamos Royalty Agreement.

Metalla acquires Lac Pelletier Royalty

On October 4, 2022, Metalla acquired a 1.0% NSR royalty on the Lac Pelletier Project, located in Rouyn-Noranda, Quebec, owned by Maritime Resources Corp. ("Maritime") from an arm's length seller for total consideration of C$0.3 million in cash.

Metalla acquires Portfolio of Royalties from First Majestic

On December 21, 2022, the Company completed an acquisition of eight royalties on exploration, development and mining properties in Mexico from First Majestic Silver Corp. ("First Majestic") (NYSE: AG; TSX: FR), for a total consideration of $20 million in Common Shares based on the 25-day volume-weighted average price of shares traded on the NYSE prior to the date of the announcement at a price of US$4.7984 per share (representing an aggregate of 4,168,056 Common Shares).

The portfolio comprises of a total of eight royalties, including one producing gold royalty, two development silver royalties, four advanced exploration silver royalties, and one exploration silver royalty. The royalties cover 100% of all the concessions on the eight properties, all of which are located in Mexico:

La Encantada: 100% GVR Royalty on gold production from the producing La Encantada mine located in Coahuila, Mexico operated by First Majestic, limited to 1,000 ounces annually;

Del Toro: 2.0% NSR Royalty on the Del Toro mine, placed on care and maintenance, located in Zacatecas, Mexico owned by First Majestic;

La Guitarra: 2.0% NSR Royalty on the La Guitarra mine, placed on care and maintenance, located in Temascaltepec, Mexico owned by Sierra Madre Gold and Silver Ltd. ("Sierra Madre") (TSXV: SM);

Plomosas: 2.0% NSR Royalty on the Plomosas project located in Sinaloa, Mexico owned by GR Silver Mining Ltd. ("GR Silver") (TSXV: GRSL);

San Martin: 2.0% NSR Royalty on San Martin mine, placed on care and maintenance, located in Jalisco, Mexico owned by First Majestic;

La Parrilla: 2.0% NSR Royalty on the Parrilla mine, placed on care and maintenance, located in Durango, Mexico. Silver Storm Mining Ltd. ("Silver Storm") (TSXV: SVR) has acquired a 100% interest in the property from First Majestic;

La Joya: 2.0% NSR Royalty on the La Joya project located in Durango, Mexico owned by Silver Dollar Resources Inc. ("Silver Dollar") (CSE: SLV); and

- 9 -

The Company and First Majestic also entered into a securityholder rights and obligations agreement which, subject to certain conditions and phase outs over time, restricts transfers of the shares issued to First Majestic, and obligates First Majestic to vote the shares in favor of the Board's proposals for certain matters including the election of directors and approval of equity compensation plans, and to refrain from certain types of shareholder activism.

Metalla acquires Portfolio of Royalties from Alamos Gold

On February 23, 2023, the Company acquired one silver stream and three royalties from Alamos Gold Inc. for 939,355 Common Shares at a price of US$5.3228 per share (representing the 20-day volume-weighted average price on the NYSE American at signing).

Esperanza: 20% silver Stream over the Esperanza project owned by Zacatecas Corp. ("Zacatecas") (TSXV: ZAC) located in Mexico;

Fenn Gibb South: 1.4% NSR Royalty on the Fenn Gibb South project owned by Mayfair Gold Corp. ("Mayfair") (TSX: MFG) located in Ontario, Canada;

Ronda: 2.0% NSR Royalty on the Ronda project owned by PTX Metals Inc. ("PTX") (CSE: PTX) located in Ontario, Canada; and

Northshore West: 2.0% NSR Royalty on the Northshore West property owned by Newpath Resources Inc. ("Newpath") (CSE: RDY) located in Ontario, Canada.

Metalla acquires Lama Royalties

On March 9, 2023, Metalla completed the acquisition of one half of an existing 5% to 7.5% step scale gross gold proceeds royalty (constituting a 2.5% to 3.75% step scale gross gold proceeds royalty payable to Metalla) that is payable on gold bullion and unrefined gold, and one half of an existing 0.5% to 6% sliding scale NSR royalty (constituting a 0.25% to 3.0% sliding scale NSR royalty payable to Metalla) on copper and all other minerals (other than silver and gold), extracted from the Lama project owned and operated by a wholly-owned subsidiary of Barrick Gold, from an arm's length third party for $2.5 million in cash and 466,827 Common Shares at a price of $5.3553 per share (representing $2.5 million priced on the 15-day volume-weighted average price on the NYSE at signing). An additional $2.5 million in cash or Common Shares is to be paid to the third party within 90 days upon the earlier of (i) a 2 Moz gold proven & probable mineral reserve estimate on the royalty area, or (ii) 36 months after the closing for a total purchase price of $7.5 million in cash and Common Shares.

Amendment to Castle Mountain Royalty

On March 30, 2023, the Company signed an amendment with the arm's length seller of the Castle Mountain royalty to extend the maturity date of the $5.0 million Castle Mountain loan from June 1, 2023, to April 1, 2024. As part of the amendment, on March 31, 2023, the Company will pay any accrued interest on the loan, effective April 1, 2023, the interest rate will increase to 12.0% per annum, and the principal and accrued interest will be repaid no later than April 1, 2024.

Sale of Cortez Mineral Claims

On June 30, 2023, the Company sold the JR mineral claims that make up the Pine Valley property ("Pine Valley Property") which is part of the Cortez complex in Eureka County, Nevada, to Nevada Gold Mines, LLC, an entity formed by Barrick Gold and Newmont Corporation ("Newmont") (NYSE: NEM), for $5.0 million in cash. Metalla has retained a 3.0% NSR Royalty on the Pine Valley Property.

- 10 -

Acquisition of Nova Royalty Corp.

On September 7, 2023, Metalla and Nova entered into an arrangement agreement (the "Arrangement Agreement"), pursuant to which Metalla agreed to acquire all of the issued and outstanding Nova Shares by way of a court-approved plan of arrangement under the Business Corporations Act (British Columbia) (the "Arrangement").

Nova completed an auction process with the assistance of its financial advisor, PI Financial Corp. ("PI Financial"), and Metalla was the successful bidder.

The Arrangement was approved at a special meeting of Nova shareholders, by at least 66 2/3% of the votes cast by Nova shareholders, as well as by a simple majority of the votes cast by the Nova shareholders, excluding the votes cast by certain persons as required by Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions.

On December 1, 2023, the Arrangement was completed and Nova became a wholly-owned subsidiary of Metalla. Under the terms of the Arrangement, (i) each former Nova shareholder received 0.36 (the "Exchange Ratio") of a Common Share per each Nova Share held immediately prior to the completion of the Arrangement; (ii) Nova options became immediately vested, and such Nova options were exchanged for replacement options (the "Replacement Options") exercisable for Common Shares at the Exchange Ratio; and (iii) each restricted share unit of Nova that was outstanding immediately prior to completion of the Arrangement was deemed to be fully vested and settled in Nova Shares, which Nova Shares participated in the Arrangement.

The Nova Shares were de-listed from the TSXV on close of business of December 5, 2023, and Nova was granted an order that it ceased to be a reporting issued in each of the provinces of Canada on December 28, 2023.

Financings

Amendment, Conversion and Drawdown of Beedie Loan Facility

On July 29, 2020, Metalla announced that it had reached an agreement with Beedie Capital ("Beedie") to amend and restate (the "First Amended and Restated Beedie Loan") its existing convertible loan facility (the "Original Beedie Loan", collectively with the First Amended and Restated Beedie Loan, and as further amended from time to time, the "Beedie Loan Facility") pursuant to which (i) Beedie converted C$6.0 million of the outstanding C$7.0 million principal amount drawn under the Original Beedie Loan (the "Initial Advance") at a conversion price of C$5.56 per Common Share for a total of 1,079,136 Common Shares; (ii) the conversion price of the previously undrawn C$5.0 million tranche of the Original Beedie Loan was increased from C$5.56 to C$9.90 per Common Share; and (iii) the aggregate amount available under the Beedie Loan Facility was increased by an additional C$20 million. The second drawdown of C$5.0 million (the "Second Advance") pursuant to the Amended and Restated Beedie Loan occurred on August 6, 2020 at a conversion price of C$9.90 per Common Share.

The remaining C$1.0 million outstanding under the Initial Advance was converted by Beedie on October 30, 2020 at a conversion price of C$5.56 per Common Share, representing a 25% premium to the 30-day volume-weighted-average price ("VWAP") per Common Share as of March 15, 2019, for a total of 179,856 Common Shares.

On March 17, 2021, Metalla completed a drawdown of C$5.0 million the Beedie Loan Facility (the "Third Advance") and the Second Advance was converted by Beedie at a conversion price of C$9.90, representing a 27% premium to the 30-day VWAP per Common Share as of July 28, 2020, for a total of 505,050 Common Shares. The Third Advance may be converted by Beedie at a price of C$14.30 per Common Share, representing a 20% premium to the 30-day VWAP of the Common Shares on the TSXV calculated as of March 16, 2021, in accordance with the terms of the Beedie Loan Facility.

- 11 -

On October 1, 2021, Metalla completed a fourth drawdown of an additional C$3.0 million (the "Fourth Advance") under the Beedie Loan Facility. The Fourth Advance may be converted by Beedie at a price of C$11.16 per Common Share, representing a 20% premium to the 30-day VWAP of the Common Shares on the TSXV calculated as of September 30, 2021, in accordance with the terms of the Beedie Loan Facility.

On August 9, 2022, the Company and Beedie entered into an agreement (the "First Supplemental Loan Agreement") to extend the maturity date of the Beedie Loan Facility from April 21, 2023, to January 22, 2024 (the "Loan Extension"). In consideration for the Loan Extension the Company incurred a fee of 2.0% of the drawn amount at that time, which was C$8.0 million. The C$160,000 fee will be convertible into Common Shares at a conversion price of C$7.34 per Common Share, calculated based on a 20% premium to the 30-day VWAP of the Common Shares on the trading day immediately prior to the effective date of the Loan Extension.

Effective March 31, 2023, the Company and Beedie entered into a supplemental agreement (the "Second Supplemental Loan Agreement") to amend the Beedie Loan Facility by:

The Beedie Loan Facility is secured by certain assets of Metalla and can be repaid with no penalty at any time after the 12-month anniversary of each advance.

On October 19, 2023, Metalla and Beedie entered into an amended and restated convertible loan facility agreement (the "Second Amended and Restated Convertible Loan Agreement"), which became effective as at the closing of the Arrangement. Pursuant to the Second Amended and Restated Convertible Loan Agreement, the parties agreed:

to increase the Beedie Loan Facility from C$25.0 million to C$50.0 million;

to drawdown C$16.4 million (convertible at a conversion price of C$6.00 per Common Share), to refinance the C$4.2 million principal outstanding under the Beedie Loan Facility as at the time of the closing of the Arrangement, and the C$12.2 million principal outstanding under Nova's convertible loan facility with Beedie Capital (the "Nova Convertible Loan"), plus C$2.7 million, being the aggregate accrued and unpaid interest and fees outstanding under the Nova Convertible Loan and the Beedie Loan Facility as at the time of the closing of the Arrangement, with the interest convertible at a conversion price as of the date of conversion and unpaid fees shall not be convertible, plus an amendment fee of approximately C$0.1 million payable to Beedie, plus certain expenses of Beedie (collectively, the "Initial Drawdown");

that the interest on the principal will accrue at a rate of 10.0% per annum;

- 12 -

for an eighteen-month period from the close of the Arrangement, accrued interest will be capitalized and added to the principal amount, and thereafter, at Metalla's election, 2.0% per annum of the interest accruing on the principal will be capitalized and added to the principal amount;

that the standby fee (1.5% per annum), the commitment fee (1.0% on any subsequent advance (not payable on the Initial Drawdown)), the make whole fee (entitling Beedie to earn a minimum of 12 months of interest on each advance made) and the default interest rate (14.0% per annum) remain the same; and

to update existing security arrangements to reflect security provided by Nova and its subsidiary for the Beedie Loan Facility, along with updated security arrangements at Metalla to reflect developments in our business.

Concurrent with closing of the Arrangement, Metalla drew down on the Beedie Loan Facility and paid out and discharged all obligations under the Nova Convertible Loan, and the Nova Convertible Loan has been terminated.

Any future advances from the remaining C$30.9 million made available by Beedie under the Beedie Loan Facility will require a minimum drawdown of C$2.5 million by Metalla with a conversion price based on a 20% premium to the 30-day VWAP of the Common Shares on the date of such advance.

At-The-Market Equity Program

On September 4, 2020, Metalla entered into a distribution agreement with a syndicate of agents including BMO Nesbitt Burns Inc., Cormark Securities Inc. and Eight Capital, as the Canadian agents, and BMO Capital Markets Corp. and Cormark Securities (USA) Limited, as the United States agents, to establish an at-the-market equity program (the "First ATM Program"). From inception to May 14, 2021, when the First ATM Program was terminated, Metalla sold a total of 1,809,300 common shares under the First ATM Program at an average price of $9.63 per share for gross proceeds of $17.4 million, with aggregate commissions paid or payable to the agents for the First ATM Program and other share issue costs of $0.9 million, resulting in aggregate net proceeds of $16.5 million.

Prospectus Supplement and Second ATM Program

On May 14, 2021, Metalla filed a prospectus supplement to the Company's short form base shelf prospectus dated May 1, 2020 and U.S. registration statement on Form F-10 filed on May 1, 2020, qualifying the distribution of Common Shares having an aggregate sale price of up to $35,000,000 to be sold from time to time by a syndicate of agents including BMO Nesbitt Burns Inc., PI Financial Corp, and Scotia Capital Inc. (the "Canadian Agents") and BMO Capital Markets Corp. and Scotia Capital (USA) Inc. (the "United States Agents" and, together with the Canadian Agents, the "Agents"), for a new at-the-market equity program (the "Second ATM Program" and, together with the First ATM Program, the "ATM Program") in accordance with the terms and conditions of an equity distribution agreement dated May 14, 2021 by and among Metalla and the Agents (the "Distribution Agreement").

From the effective date of the Second ATM Program until its termination on May 12, 2022, Metalla sold 1,990,778 Common Shares under the Second ATM Program at an average price of $8.18 per share for gross proceeds of $16.3 million, with aggregate commissions paid or payable to the agents under the Distribution Agreement and other share issue costs of $1.0 million, resulting in aggregate net proceeds of $15.3 million.

Filing of Base Shelf Prospectus

On May 12, 2022, Metalla filed a new short form base shelf prospectus (the "Shelf Prospectus") with the securities regulatory authorities in each of the provinces of Canada and a corresponding registration statement on Form F-10 (the "Registration Statement") with the SEC under the Multijurisdictional Disclosure System established between Canada and the United States.

- 13 -

The Shelf Prospectus and the Registration Statement will enable the Company to make offerings of up to C$300 million of Common Shares, warrants, subscription receipts, units and share purchase contracts or a combination thereof of the Company from time to time, separately or together, in amounts, at prices and on terms to be determined based on market conditions at the time of the offering and as set out in an accompanying prospectus supplement, during the 25-month period that the Shelf Prospectus and Registration Statement remains effective.

New Prospectus Supplement and Third ATM Program

On May 27, 2022, Metalla filed a prospectus supplement qualifying the distribution of Common Shares having an aggregate sale price of up to $50 million to be sold from time to time by the Agents, for a new at-the-market equity program (the "Third ATM Program") in accordance with the terms and conditions of a new equity distribution agreement dated May 27, 2022 by and among Metalla and the Agents (the "New Distribution Agreement").

From the effective date of the Third ATM Program until its termination on December 28, 2023, Metalla sold 1,328,079 Common Shares under the Third ATM Program at an average price of $5.01 per Common Share for gross proceeds of $6.6 million, with aggregate commissions paid or payable to the agents under the New Distribution Agreement and other share issue costs of $0.6 million, resulting in aggregate net proceeds of $6.0 million.

Amendment to Beedie Loan Facility

On October 19, 2023, Metalla and Beedie entered into the Second Amended and Restated Convertible Loan Agreement to amend the Beedie Loan Facility. See "Amendment, Conversion and Drawdown of Beedie Loan Facility" above for details.

Subscription Receipt Financing

On October 23, 2023, Metalla completed a private placement, pursuant to which Beedie subscribed for 2,835,539 subscription receipts (the "Subscription Receipts") of Metalla at a price of C$5.29 per Subscription Receipt for aggregate gross proceeds of C$15.0 million (the "Financing"). As per the terms of the Financing, in connection with the completion of the Arrangement, on December 1, 2023, each Subscription Receipt converted into one Common Share without payment of additional consideration or further action on the part of Beedie, for an aggregate total of 2,835,539 Common Shares. The proceeds of the Financing will be used for the acquisition of royalties and streams, transaction expenses, and general and administrative expenses of the combined company following completion of the Arrangement.

Corporate Developments

Appointment of Douglas Silver as Director

On April 28, 2021, the Company appointed Douglas Silver to the board of directors of the Company as an independent director.

Establishment of Environmental, Social and Governance Committee

On February 11, 2022, the board of directors of the Company established a new committee, the environmental, social and governance committee (the "ESG Committee"), to oversee the Company's environmental, social and governance ("ESG") practices.

The ESG Committee formalizes the Company's ongoing commitment to ESG principles in the evaluation and monitoring of the Company's Royalty and Stream interests and related corporate practices. The scope of the ESG Committee's mandate is to implement the Company's ESG policy and to evaluate and monitor the ESG performance of the companies which operate the properties in which the Company has a Royalty or Stream interest or is considering acquiring such an interest.

- 14 -

Appointment of Amanda Johnston as Director

On August 16, 2022, the Company appointed Amanda Johnston to the board of directors of the Company as an independent director.

Change in the Board of Directors

On May 16, 2023, Douglas Silver stepped down from the board of directors of the Company as an independent director.

Payment of Special Dividend

On July 10, 2023, the board of directors of the Company approved and declared a special dividend (the "Special Dividend") payment on the Common Shares, in the amount of C$0.03 per Common Share in cash (subject to any applicable tax withholding obligations). The Special Dividend was paid on September 15, 2023.

Director Retirement

On December 5, 2023, E.B. Tucker retired from the board of directors of the Company.

Subsequent Events to December 31, 2023

Conversion under Beedie Loan Agreement

On March 19, 2024, Beedie converted C$1,500,002 of the accrued and unpaid interest under the Beedie Loan Facility into 429,800 Common Shares, at a price of C$3.49 per Common Share, being the closing price of the Common Shares on the TSXV on February 20, 2024, the date that Beedie provided notice of their intention to convert.

Departure of Vice President

Drew Clark, Vice President Corporate Development, will be leaving the Company to pursue other opportunities, effective as of March 29, 2024.

DESCRIPTION OF THE BUSINESS

Metalla is a publicly traded precious metals royalty and streaming company listed on the TSXV, NYSE and Frankfurt Exchange. Metalla's business model is focused on managing and growing its portfolio of Royalties and Streams. Metalla's long-term goal is to provide its shareholders with a model which provides:

exposure to gold, silver, and copper price optionality;

a perpetual discovery option over large areas of geologically prospective lands which it acquires at no additional cost other than the initial investment;

limited exposure to many of the risks associated with operating companies;

free cash-flow and limited cash calls;

high margins that can generate cash through the entire commodity cycle;

- 15 -

diversity that is scalable, in which a large number of assets can be managed with a small stable overhead; and

management focus on forward-looking growth opportunities rather than operational or development issues.

A Royalty is a non-dilutive asset level perpetual interest in an underlying mineral project that, when in production, provides topline cash relative to the percentage of the royalty. Depending on the nature of a royalty interest, the laws applicable to it and the specific project, the royalty holder is generally not responsible for, and has no obligation to contribute to operating or capital costs or environmental liabilities. An NSR Royalty is generally based on the value of production or net proceeds received by an operator from a smelter or refinery for the minerals sold. These proceeds are usually subject to deductions or charges for transportation, insurance, smelting and refining costs as set out in the agreement governing the terms of the royalty.

A Stream provides the purchaser the right to acquire all or a portion of the future metal production from a mining project at the lesser of a defined price and the market price.

Principal Product

Since inception, Metalla has deployed over $300 million, comprised of cash consideration, Common Shares and other equity related structures, issued to sellers, across 33 transactions amassing a portfolio of over 102 Royalties and Streams. Metalla's portfolio provides exposure to established counterparties, including Agnico Eagle, Pan American, Polymetals Resources Ltd. ("Polymetals"), SSR Mining Inc. ("SSR Mining"), St. Barbara Limited, Newmont, Teck, Barrick Gold, BHP, Eldorado Gold, IAMGOLD, First Majestic, First Quantum, Aura Minerals, Los Andes Copper, Anglo American, Hudbay, Transition Metals, Pacific Empire, Lundin Mining, and many more.

The principal products of Metalla are: (i) precious metals that it has agreed to purchase pursuant to Stream agreements that it has entered into with mining companies; and (ii) Royalty payments pursuant to Royalty agreements acquired by Metalla or entered into with mining companies. Metalla is focused on precious metal streams and royalties for gold, silver and copper.

The Company's sole material assets are its Royalty interests in the Côté Property and in the Taca Taca Property. See "Material Assets" below.

Project Statuses

For this AIF, Metalla introduced a new classification scheme for each royalty asset. The four stages are described below. Readers should note that this classification scheme is used by Metalla for purposes of categorizing its own portfolio of assets; however, such classification scheme and categorization may not necessarily be the same as, or consistent with, the classification scheme used in our financial statements and management’s discussion & analysis, which is governed by the applicable financial reporting standards, or any particular owner’s classification of its property:

Production: A project is considered to be in "Production" when the underlying property, or part of it, is subject to active mining to produce a payable product and the Company's Royalty is cash flowing based on this production. "Production" includes properties that are in the later stages of their lives, such as residual leaching and stockpile processing.

Development: A project is considered to be in "Development" when the project has sufficiently initiated or completed economic studies (e.g., Preliminary Economic Assessment, Pre-Feasibility Study or Feasibility Study) or where the operator has otherwise disclosed an active plan or decision to construct mine workings including a reasonable estimate with projected costs and timeline to commence development which will lead to eventual production. In most cases, the project will have a Mineral Resource estimate and in some cases, there may also be a Mineral Reserve estimate. Generally, projects in the "Development" status will be in active construction or development towards production, while others are sufficiently advanced and will be based upon sufficient confidence of the operator that construction and development towards production will occur. Developing projects also include assets which previously had cash-flow and have been placed on Care and Maintenance or assets that are currently producing but the Company's royalty does not cover the producing part of the mine.

- 16 -

Advanced Exploration: A project is considered to be in "Advanced Exploration" when exploration work has advanced sufficiently to prepare a Mineral Resource estimate or material exploration activities are occurring or are planned to occur that are designed to support a Mineral Resource estimate on the property. Projects with historical non-compliant technical studies may be included in this category. Exploration work may include enhancing geological studies, drilling programs, technical studies, and any other work including permitting activities that would de-risk the project. Advanced Exploration projects may have had study work initiated or completed to better understand economic potential on the property, but which has generally not resulted in work being approved, initiated or advanced that would substantially progress the project towards development and eventual production.

Exploration: A project is considered to be "Exploration" when there has been primarily early-stage exploration activities (such as exploration drilling, geophysics, geochemical sampling, lithological / structural mapping, etc.) or insufficient exploration work to prepare a Mineral Resource estimate. In some cases, the project may have a historical Mineral Resource estimate or an Inferred Mineral Resource estimate, but without current material exploration work being performed or proposed to further advance the project.

The following table summarizes the Royalty and Stream interests that are owned by Metalla or are under contract to be acquired as of the date of filing this AIF:

| Property | Operator | Location | Stage | Metal(1) | Terms | |

| 1. | Wharf | Coeur Mining | South Dakota, U.S.A. | Production | Au | 1.0% GVR Royalty |

| 2. | New Luika | Shanta Gold | Lupa Goldfields, Tanzania | Production | Au, Ag | Stream on 15% of Ag |

| 3. | El Realito | Agnico Eagle | Sonora, Mexico | Production | Au, Ag | 2.0 % NSR Royalty (subject to 1.0% buy back) |

| 4. | La Encantada | First Majestic | Mexico | Production | Au | 100.0% Gold GVR Royalty (limited to 1,000 ounces annually) |

| 5. | Aranzazu | Aura Minerals Inc. | Mexico | Production | Cu-Au-Ag | 1.0% NSR Royalty |

| 6. | Côté and Gosselin | IAMGOLD | Gogama, Canada | Development | Au | 1.35% NSR Royalty |

| 7. | Santa Gertrudis | Agnico Eagle | Sonora, Mexico | Development | Au | 2.0% NSR Royalty (subject to a 1.0% buy back for $7.5M) |

| 8. | Cap-Oeste Sur East Mine | Pan American | Santa Cruz, Argentina | Development | Au, Ag | 1.5% NSR Royalty |

- 17 -

| Property | Operator | Location | Stage | Metal(1) | Terms | |

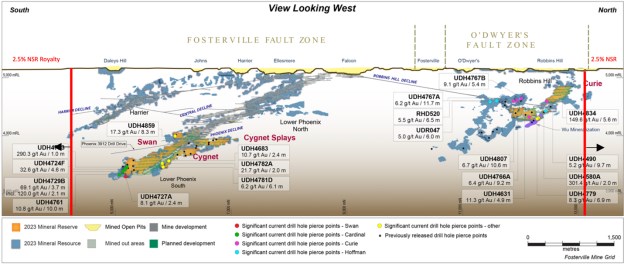

| 9. | Fosterville | Agnico Eagle | Victoria, Australia | Development | Au | 2.5% GVR Royalty |

| 10. | Castle Mountain | Equinox Gold | California | Development | Au | 5% NSR Royalty |

| 11. | Fifteen Mile Stream (Hudson, Egerton-Maclean, 149 East Zone, Plenty deposit) |

St Barbara | Nova Scotia, Canada | Development | Au | 1.0% NSR Royalty |

| 12. | Fifteen Mile Stream (Plenty deposit and Seloam Brook prospect) |

St Barbara | Nova Scotia, Canada | Development | Au | 3.0% NSR Royalty (subject to Royalty payor's buy back right to purchase two-thirds of the 3.0% NSR Royalty for a period five years) |

| 13. | NuevaUnion | Newmont and Teck Resources Limited | Chile | Development | Au, Cu | 2.0% NSR Royalty(3) |

| 14. | Garrison Mine | Moneta Gold | Kirkland Lake, Canada | Development | Au | 2.0% NSR Royalty |

| 15. | Hoyle Pond Extension | Newmont | Timmins, Canada | Development | Au | 2.0% NSR, subject to 500Koz exemption |

| 16. | West Timmins Extension | Pan American | Timmins, Canada | Development | Au | 1.5% NSR Royalty (subject to a 0.75% buy back) |

| 17. | Akasaba West | Agnico Eagle | Val d'Or, Canada | Development | Au, Cu | 2.0% NSR Royalty, payable after 210Koz Au (subject to a 1.0% buy back for C$7.0 million) |

| 18. | La Fortuna | Minera Alamos | Durango, Mexico | Development | Au, Ag, Cu | 3.5 % NSR Royalty (2.5% of the 3.5% NSR Royalty subject to cap at $4.5M) |

- 18 -

| Property | Operator | Location | Stage | Metal(1) | Terms | |

| 19. | Wasamac | Agnico Eagle | Rouyn-Noranda, Canada | Development | Au | 1.5% NSR Royalty (subject to 0.5% buy back) (9) |

| 20. | Tocantinzinho | G Mining | Brazil | Development | Au | 0.75% GVR Royalty |

| 21. | CentroGold | Oz Minerals | Brazil | Development | Au | 1.0% - 2.0% NSR Royalty(6) |

| 22. | Amalgamated Kirkland | Agnico Eagle | Kirkland Lake, Canada | Development | Au | 0.45% NSR Royalty |

| 23. | North Amalgamated Kirkland | Agnico Eagle | Kirkland Lake, Canada | Development | Au | 0.45% NSR Royalty |

| 24. | Lama | Barrick Gold | Argentina | Development |

Au | 2.5% GVR Royalty (subject to escalation up to 3.75%) |

| 25. | Lama | Barrick Gold | Argentina | Development | Cu | 0.25% NSR Royalty (subject to escalation up to 3.0%) |

| 26. | Esperanza | Zacatecas | Mexico | Development | Ag | 20% Ag Stream |

| 27. | Taca Taca | First Quantum Minerals Ltd. | Argentina | Development | Cu-Au-Mo | 0.42% NSR Royalty (subject to a buyback based on amount of proven reserves in a feasibility study multiplied by the prevailing market prices of all applicable commodities) |