UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 40-F

[Check one]

| ☐ | REGISTRATION STATEMENT PURSUANT TO SECTION 12 OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13(a) OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended December 31, 2023 | Commission File Number 001-34244 |

HUDBAY MINERALS INC.

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant's name into English (if applicable))

Canada

(Province or other jurisdiction of incorporation or organization)

1000

(Primary Standard Industrial Classification Code Number (if applicable))

98-0485558

(I.R.S. Employer Identification Number (if applicable))

25 York Street

Suite 800

Toronto, Ontario

M5J 2V5, Canada

416 362-8181

(Address and telephone number of Registrant's principal executive offices)

Corporation Service Company

2711 Centerville Road, Suite 400

Wilmington, DE 19808

302 636-5401

(Name, address (including zip code) and telephone number (including area code) of agent for service in the United States)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

||

|

Common Shares, no par value |

HBM |

The New York Stock Exchange |

||

Securities registered or to be registered pursuant to Section 12(g) of the Act.

N/A

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

N/A

(Title of Class)

| For annual reports, indicate by check mark the information filed with this form: | |

| ☒ Annual Information Form | ☒ Audited Annual Financial Statements |

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: As at December 31, 2023, 350,728,536 common shares were outstanding.

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13(d) or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements in the past 90 days.

| Yes ☒ | No ☐ |

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit).

| Yes ☒ | No ☐ |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 12b-2 of the Exchange Act.

Emerging growth company ☐

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act.. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

EXPLANATORY NOTE

Hudbay Minerals Inc. (the "Registrant") is a Canadian issuer eligible to file its annual report ("Annual Report") pursuant to Section 13(a) of the Exchange Act, on Form 40-F pursuant to the multi-jurisdictional disclosure system under the Exchange Act. The Registrant is a "foreign private issuer" as defined in Rule 405 under the Securities Act of 1933, as amended (the "Securities Act"), and Rule 3b-4 under the Exchange Act. The equity securities of the Registrant are accordingly exempt from Sections 14(a), 14(b), 14(c), 14(f) and 16 of the Exchange Act pursuant to Rule 3a12-3 under the Exchange Act.

The Registrant is permitted, under the multi-jurisdictional disclosure system adopted by the United States and Canada, to prepare this Annual Report on Form 40-F in accordance with Canadian disclosure requirements, which are different from those of the United States.

This Annual Report contains references to both United States dollars and Canadian dollars. All dollar amounts referenced, unless otherwise indicated, are expressed in United States dollars, and Canadian dollars are referred to as "Canadian dollars" or "C$".

DOCUMENTS INCORPORATED BY REFERENCE

The Registrant's Annual Information Form ("AIF") for the fiscal year ended December 31, 2023 is incorporated herein by reference as Exhibit 99.1.

The audited consolidated financial statements (the "Audited Annual Financial Statements") of the Registrant for the years ended December 31, 2023 and 2022, including the reports of the Independent Registered Public Accounting Firm with respect thereto, are incorporated herein by reference as Exhibit 99.2. The Audited Annual Financial Statements have been prepared using accounting policies consistent with International Financial Reporting Standards ("IFRS") as issued by the International Accounting Standards Board.

The Registrant's Management's Discussion & Analysis for the year ended December 31, 2023 is incorporated herein by reference as Exhibit 99.3.

The Registrant's Disclosure Pursuant to Section 1503(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act is incorporated herein by reference as Exhibit 99.4.

DISCLOSURE CONTROLS AND PROCEDURES

As of the end of the period covered by this Annual Report for the Registrant's fiscal year ended December 31, 2023, an evaluation of the effectiveness of the Registrant's "disclosure controls and procedures" (as such term is defined in Rules 13a-15(e) and 15d-15(e) of the Exchange Act) was carried out by the Registrant's management with the participation and supervision of the principal executive officer and principal financial officer. Based upon that evaluation, the Registrant's principal executive officer and principal financial officer have concluded that as of December 31, 2023, the Registrant's disclosure controls and procedures are effective to ensure that information required to be disclosed by the Registrant in reports that it files or submits under the Exchange Act is (i) recorded, processed, summarized and reported within the time periods specified in Commission rules and forms and (ii) accumulated and communicated to the Registrant's management, including its principal executive officer and principal financial officer, to allow timely decisions regarding required disclosure.

INTERNAL CONTROL OVER FINANCIAL REPORTING

The disclosure provided under the heading "Disclosure Controls and Procedures and Internal Control Over Financial Reporting" on page 78 of Exhibit 99.3, Management's Discussion & Analysis for the Year Ended December 31, 2023, is incorporated by reference herein. Management has excluded from its assessment of internal controls and disclosure controls the controls, policies and procedures of Copper Mountain Mining Corp. ("Copper Mountain"), which the Registrant acquired on June 20, 2023. This scope of limitation is in accordance with section 3.3(1)(b) of National Instrument 52-109 - Certification of Disclosure in Issuers' Annual and Interim Filings, which allows for an issuer to limit the design of such controls to exclude a business that the issuer acquired not more than 365 days before the end of the financial period reported, and in accordance with similar SEC staff guidance, which allows for the exclusion of an acquired business for up to 365 days from the acquisition date. Copper Mountain's financial statements constitute 34% and 19% of net and total assets, respectively, 10% of revenues, and 19% of net income of the consolidated financial statement amounts as of and for the year ended December 31, 2023. The Registrant did not make any changes to its "internal control over financial reporting" (as such term is defined in Rules 13a-15(f) and 15d-15(f) of the Exchange Act) during the year ended December 31, 2023 that materially affected, or are reasonably likely to materially affect, its internal control over financial reporting.

Management's report dated February 22, 2024 on the Registrant's internal control over financial reporting contained in Exhibit 99.2, Audited Annual Financial Statements, is incorporated by reference herein.

The Registrant's internal control over financial reporting as of December 31, 2023 has been audited by Deloitte LLP, Independent Registered Public Accounting Firm, who also audited the Audited Annual Financial Statements. Deloitte LLP expressed an unqualified opinion on the effectiveness of the Registrant's internal control over financial reporting.

All internal control systems, no matter how well designed, have inherent limitations. As a result, even systems determined to be effective may not prevent or detect misstatements on a timely basis, as systems can provide only reasonable assurance that the objectives of the control system are met. In addition, projections of any evaluation of the effectiveness of internal control over financial reporting to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may change.

ATTESTATION REPORT OF THE REGISTERED PUBLIC ACCOUNTING FIRM

The disclosure provided in the two reports of Deloitte LLP titled "Report of Independent Registered Public Accounting Firm" contained in Exhibit 99.2, Audited Annual Financial Statements for the years ended December 31, 2023 and 2022, are incorporated herein by reference.

BLACKOUT PERIODS

There were no "blackout periods", as defined under Rule 100(b) of Regulation BTR, requiring notice pursuant to Rule 104 of Regulation BTR during the fiscal year ended December 31, 2023.

AUDIT COMMITTEE IDENTIFICATION AND FINANCIAL EXPERT

As at December 31, 2023, the Registrant's audit committee consisted of Carol T. Banducci, Daniel Muñiz Quintanilla, Paula C. Rogers and David S. Smith. The Registrant's board of directors has determined that each of Ms. Banducci, Mr. Muñiz Quintanilla, Ms. Rogers and Mr. Smith is an "audit committee financial expert" within the meaning of the Commission's rules. Each of Ms. Banducci, Mr. Muñiz Quintanilla, Ms. Rogers and Mr. Smith is also "independent" under the criteria of Rule 10A-3 of the Exchange Act as required by the New York Stock Exchange (the "NYSE"). The Commission has indicated that the designation of Ms. Banducci, Mr. Muñiz Quintanilla, Ms. Rogers and Mr. Smith as audit committee financial experts does not make any of them an "expert" for any purpose or impose any duties, obligations or liability on Ms. Banducci, Mr. Muñiz Quintanilla, Ms. Rogers and Mr. Smith that are greater than those imposed on members of the audit committee and board of directors who do not carry this designation. The audit committee's charter sets out its responsibilities and duties, qualifications for membership, procedures for committee appointment and reporting to the Registrant's board of directors. A copy of the current charter is attached to the AIF as Schedule C thereto and is available on the Registrant's website at www.hudbayminerals.com/about-us/governance/default.aspx.

CODE OF ETHICS

The Registrant has adopted a Code of Business Conduct and Ethics (the "Code of Ethics") that applies to its principal executive officer, principal financial officer, principal accounting officer or controller and persons performing similar functions. A copy of the Code of Ethics is available on the Registrant's website at www.hudbayminerals.com/about-us/governance/default.aspx. The Registrant undertakes to provide to any person, without charge, upon request, a copy of the Code of Ethics. Requests for copies of the Code of Ethics should be made by contacting the Registrant's Senior Vice President, Legal and Organizational Effectiveness at 416 362-8181. No waivers of the Registrant's Code of Ethics were granted to any principal officer of the Registrant or any person performing similar functions during the fiscal year ended December 31, 2023.

During the fiscal year ended December 31, 2023 the Registrant did not make any amendments to its Code of Ethics. All amendments to the Code of Ethics, and all waivers of the Code of Ethics with respect to any of the officers covered by it, will be posted on the Registrant's website at www.hudbayminerals.com/about-us/governance/default.aspx.

PRINCIPAL ACCOUNTANT FEES AND SERVICES

The information about aggregate fees billed to us by our principal accountant, Deloitte LLP (PCAOB ID No. 1208) provided under the heading "Audit Committee Disclosure - Remuneration of Auditor" on page 64 of the AIF is incorporated by reference herein. All audit services, audit-related services, tax services, and other services provided for the fiscal year ended December 31, 2023 were pre-approved by the audit committee in accordance with the Registrant's pre-approval policy as described under the heading "Audit Committee Disclosure - Policy Regarding Non-Audit Services Rendered by Auditors" on pages 63 and 64 of the AIF.

OFF-BALANCE SHEET ARRANGEMENTS

The Registrant has no off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on the Registrant's financial condition, changes in financial condition, revenues or expenses, results of operation, liquidity, capital expenditures or capital resources that is material to investors.

TABULAR DISCLOSURE OF CONTRACTUAL OBLIGATIONS

The disclosure provided under the heading "Contractual Obligations" on page 54 of Exhibit 99.3, Management's Discussion & Analysis for the Year Ended December 31, 2023, is incorporated by reference herein.

COMPARISON WITH NEW YORK STOCK EXCHANGE GOVERNANCE RULES

The NYSE requires that each listed company meet certain corporate governance standards. These standards supplement the corporate governance reforms adopted by the United States Securities and Exchange Commission pursuant to the Sarbanes-Oxley Act of 2002.

Under the NYSE's Listed Company Manual, a "foreign private issuer", such as the Registrant, is not required to comply with most of the NYSE corporate governance standards. However, foreign private issuers are required to disclose any significant ways in which their corporate governance practices differ from those followed by U.S. companies under the NYSE corporate governance standards.

The Registrant is subject to the listing standards of the Toronto Stock Exchange (the "TSX") and the corporate governance rules of Canadian Securities Administrators. These listing standards and corporate governance rules are substantially similar to the NYSE listing standards. The Registrant complies with these TSX listing standards and Canadian corporate governance rules.

The following are the significant ways in which the Registrant's governance practices differ from those followed by domestic companies under the NYSE corporate governance standards:

Director Independence

The Registrant determines independence of its directors under the policies of the Canadian Securities Administrators. For a director to be considered independent under the policies of the Canadian Securities Administrators, he or she must have no direct or indirect material relationship with us, being a relationship that could, in the view of the board of directors reasonably be expected to interfere with the exercise of his or her independent judgment, and must not be in any relationship deemed to be not independent pursuant to such policies. To assist in determining the independence of directors for purposes that include compliance with applicable legal and regulatory requirements and policies, the board of directors has adopted certain categorical standards, which are part of our Corporate Governance Guidelines. The Registrant's board of directors also determines whether each member of the Registrant's audit committee is independent pursuant to National Instrument 52-110 Audit Committees and Rule 10A-3 of the Exchange Act. The Registrant's board of directors has not adopted the director independence standards contained in Section 303A.02 of the NYSE's Listed Company Manual.

Approval of Equity Compensation Plans

Section 303A.08 of the NYSE's Listed Company Manual requires shareholder approval of all equity compensation plans and material revisions to such plans. The definition of "equity compensation plans" covers plans that provide for the delivery of both newly issued and treasury securities, as well as plans that rely on securities re-acquired in the open market by the issuing company for the purpose of redistribution to employers and directors. The TSX rules only require that shareholders approve the adoption of equity compensation plans that provide for new issuances of securities. Any amendments to such plans are subject to shareholder approval unless the specific equity compensation plan contains detailed provisions, approved by the shareholders, which specify those amendments requiring shareholder approval and those amendments which can be made without shareholder approval. The Registrant follows the TSX rules with respect to the requirements for shareholder approval of equity compensation plans and revisions to such plans.

Shareholder Approval Requirement

In lieu of Section 312 of the NYSE's Listed Company Manual, the Registrant will follow the TSX rules for shareholder approval of new issuances of its common shares. Following the TSX rules, shareholder approval is required for certain issuances of shares that (i) materially affect control of the Registrant or (ii) provide consideration to insiders in aggregate of 10% or greater of the market capitalization of the listed issuer and have not been negotiated at arm's length. Shareholder approval is also required, pursuant to the TSX rules, in the case of private placements (x) for an aggregate number of listed securities issuable greater than 25% of the number of securities of the listed issuer which are outstanding, on a non-diluted basis, prior to the date of closing of the transaction if the price per security is less than the market price or (y) that during any six month period are to insiders for listed securities or options, rights or other entitlements to listed securities greater than 10% of the number of securities of the listed issuer which are outstanding, on a non-diluted basis, prior to the date of the closing of the first private placement to an insider during the six month period.

INTERACTIVE DATA FILE

The required disclosure for the fiscal year ended December 31, 2023 is filed as Exhibit 101 to this Annual Report on Form 40-F.

MINE SAFETY DISCLOSURE

Pursuant to Section 1503(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act, issuers that are operators, or that have a subsidiary that is an operator, of a coal or other mine are required to disclose in their periodic reports filed with the Commission information regarding specified health and safety violations, orders and citations, related assessments and legal actions, and mining-related fatalities. For information regarding the Registrant's mine safety disclosures, see "Disclosure Pursuant to Section 1503(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act" filed as Exhibit 99.4 to this Annual Report on Form 40-F.

FORWARD-LOOKING STATEMENTS

Certain statements in this Annual Report on Form 40-F are forward-looking statements within the meaning of Section 21E of the Exchange Act and Section 27A of the Securities Act. Please see "Forward Looking Information" in the AIF for a discussion of risks, uncertainties, and assumptions that could cause actual results to vary from those forward-looking statements.

UNDERTAKING

The Registrant undertakes to make available, in person or by telephone, representatives to respond to inquiries made by the Commission staff, and to furnish promptly, when requested to do so by the Commission staff, information relating to: the securities registered pursuant to Form 40-F; the securities in relation to which the obligation to file an annual report on Form 40-F arises; or transactions in said securities.

CONSENT TO SERVICE OF PROCESS

The Registrant has previously filed with the Commission a written consent to service of process and power of attorney on Form F-X. Any change to the name or address of the Registrant's agent for service shall be communicated promptly to the Commission by amendment to the Form F-X referencing the file number of the Registrant.

* * *

SIGNATURES

Pursuant to the requirements of the Exchange Act, the Registrant certifies that it meets all of the requirements for filing on Form 40-F and has duly caused this Annual Report to be signed on its behalf by the undersigned, thereto duly authorized.

| HUDBAY MINERALS INC. | ||

| By: | /s/ Patrick Donnelly | |

| Name: | Patrick Donnelly | |

| Title: | Senior Vice President, Legal and Organizational Effectiveness |

|

| Date: | March 27, 2024 | |

EXHIBIT INDEX

Exhibit Description and Date of Document

HUDBAY MINERALS INC.

INCENTIVE-BASED COMPENSATION CLAWBACK POLICY

1. Purpose

This incentive-based compensation clawback policy (the "Policy") has been adopted by the Board of Directors (the "Board") of Hudbay Minerals Inc. (the "Company") in order to allow the Board to require, in specific situations, the reimbursement of short-term or long-term incentive compensation received by an Executive Officer (as defined below). The Board believes that it is in the best interests of the Company and its shareholders to create and maintain a culture that emphasizes integrity and accountability and that reinforces the Company's pay-for-performance compensation philosophy.

2. Definitions

For purposes of this Policy, the following terms shall have the meanings set forth below:

"Excess Incentive-Based Compensation" means (i) the amount by which any Incentive-Based Compensation that is approved, granted, awarded or paid to an Executive Officer based on erroneous or inaccurate data contained in Materially Non-Compliant Financial Statements as originally publicly filed exceeds the amount of any Incentive-Based Compensation that otherwise would have been approved, granted, awarded or paid to such Executive Officer based on the correct data contained (or to be provided in) in any subsequent restatement or other correction of such Materially Non-Compliant Financial Statements or (ii) the amount by which any Incentive-Based Compensation that is approved, granted, awarded or paid to an Executive Officer following a Wrongful Act of an Executive Officer of which the Board was not aware exceeds the amount of any Incentive-Based Compensation that otherwise would have been approved, granted, awarded or paid to such Executive Officer had the Board been aware of the Executive Officer's involvement in a Wrongful Act. The amount of Excess Incentive-Based Compensation shall be determined on a gross basis without any regard to any tax payment obligations of an Executive Officer with respect to the Incentive Compensation in question.

"Executive Officers" means Company's president, principal financial officer, principal accounting officer (or if there is no such accounting officer, the controller), any vice-president of the Company in charge of a principal business unit, division, or function (such as sales, administration, or finance), any other officer who performs a policy-making function, any other person who performs similar policy-making functions for the Company or any other officer of the Company who reports directly to the Chief Executive Officer. Executive officers of the Company's subsidiaries are deemed executive officers of the Company if they perform such policy making functions for the Company. Both current and former executive officers as defined above are included as "Executive Officers" for purposes of this Policy.

"HR Committee" means the Compensation and Human Resources Committee of the Board or such other committee as the Board may, from time to time, appoint to oversee the application of this Company's executive compensation policies.

2

"Incentive-Based Compensation" means any variable compensation (for greater certainty, not including base salary), including cash bonuses, stock options, share units and other incentive compensation (cash or equity-based, whether vested or unvested) awarded as compensation, the amount or payment of which is based in whole or in part on a measure or measures (whether quantitative or qualitative) that are intended to serve as an incentive for performance, notwithstanding whether such compensation is determined in whole or in part on an objective, subjective or discretionary basis by the person(s), Board or committee of the Board setting the amount or determining payment of such compensation, which is approved, granted, awarded or paid to an Executive Officer by the Company on or after the Effective Date.

"Lookback Period" means the three-year period preceding the date on which the Company (a)

reasonably determines (or should have determined) that it is required to prepare an accounting restatement to correct the Materially Non-Compliant Financial Statements or (b) discovers the Wrongful Act.

"Materially Non-Compliant Financial Statements" means any financial statements of the Company where (a) a restatement of the financial statements (a "Restatement") is required due to (i) material non-compliance with any financial reporting requirement under applicable securities laws, other than the retrospective application of a change or amendment in accounting principles, or (ii) any materially inaccurate misstatement of the Company's earnings, revenues, gains or other similar criteria; or (b) the Company's financial results are found to be inaccurate in a manner that materially affects the calculation of compensation for Executive Officers but does not give rise to a restatement.

"Wrongful Act" means any material breach of the Company's Code of Conduct, as amended from time to time, that results in the termination of the Executive Officer's employment.

3. Recoupment of Excess Incentive-Based Compensation

In the event of Materially Non-Compliant Financial Statements or if the Board determines in its sole discretion that the Executive Officer has been involved in any Wrongful Act on or following the Effective Date, the Board will review all Incentive-Based Compensation paid, granted or awarded to, or received or earned by, or vested in favour of, Executive Officers on the basis of having attained any financial reporting measure during the current period and the Lookback Period.

In the event that the Board determines that a Restatement is required the Board shall recoup any Excess Incentive-Based Compensation paid, granted or awarded to, or received or earned by, or vested in favour of, any current or former Executive Officer during the current period and the Lookback Period.

If (i) the Materially Non-Compliant Financial Statements do not require a Restatement or (ii) the Board determines in its sole discretion that an Executive Officer has been involved in any Wrongful Act on or following the Effective Date, the Board may determine the amount of any Excess Incentive-Based Compensation and seek to recoup such Excess Incentive-Based Compensation paid, granted or awarded to, or received or earned by, or vested in favour of, any current or former Executive Officer during the current period and the Lookback Period.

3

4. Limitation on Recoupment Period

Any recoupment under Section 3 of this Policy shall be in respect of Incentive-Based Compensation paid, granted or awarded to, or received or earned by, or vested in favour of, any current or former Executive Officer in the current period and the Lookback Period.

5. Means of Recoupment

The Board shall have the sole discretion and authority to determine the means by which any reimbursement required by this Policy shall occur. Reimbursement may, without limitation, (a) require the Executive Officer to repay all or a portion of any cash bonus (including any performance bonus) or other Incentive-Based Compensation granted, awarded or paid to the Executive Officer; (b) cancel all or a portion of any unvested or vested Incentive-Based Compensation granted, awarded or paid to the Executive Officer; (c) require the Executive Officer to repay all or a portion of any gains realized by the Executive Officer on the exercise of stock options or other equity-based compensation; (d) offset the recoupment/clawback amount against any current or future Incentive-Based Compensation; or (e) combine any of items (a) to (d) above.

If the Board cannot determine the amount of Excess Incentive-Based Compensation received by the Executive Officer directly from the information in a Restatement, then it will make its determination based on a reasonable estimate of the effect of such Restatement.

6. Effective Date

This Policy shall be effective as of March 29, 2023 (the "Effective Date") and shall apply to all individuals who are or become Executive Officers on or after the Effective Date in respect of all Incentive-Based Compensation paid, granted, awarded, received, earned or vested in respect of the financial year ending December 31, 2022 and all subsequent periods, whether before or after they became Executive Officers.

7. Board Authority

All determinations, decisions and interpretations to be made under this Policy shall be made by the Board, on the recommendation of the HR Committee. Any determination, decision or interpretation made by the Board under this Policy shall be final, binding and conclusive on all parties. This Policy may be amended or terminated at any time by the Board.

8. Administration of the Policy

Any applicable award agreement, form or other document setting forth the terms and conditions of any Incentive-Based Compensation covered by the Policy which is approved, granted, awarded or paid on or after the Effective Date shall be deemed to include the restrictions imposed herein and incorporate the Policy by reference and, in the event of any inconsistency, the terms of the Policy will govern.

Any determinations of the Board under this Policy shall be binding on the applicable Executive Officer.

4

To the extent necessary and where permitted by law, this Policy shall constitute an agreement to extend and to exclude the applicability of any statute of limitations (including, without limitation, the Limitations Act, 2002 (Ontario)) for recoupment by the Company of any Excess Incentive-Based Compensation or Incentive-Based Compensation.

Executive Officers shall not be entitled to any indemnification by or from the Company with respect to any amounts they are required to repay or forfeit pursuant to this Policy. Further, the Company shall not pay or reimburse any Executive Officers for any insurance policy entered into by an Executive Officer that provides for full or partial coverage of any recoupment obligation under this Policy.

9. No Impairment of Other Remedies

Any recoupment under this Policy is in addition to, and not in lieu of, any other remedies or rights of recoupment that may be available to the Company under applicable law, including, without limitation, (a) dismissing the Executive Officer, (b) adjusting the future compensation of the Executive Officer or (c) authorizing legal action or taking such other action to enforce the Executive Officer's obligations to the Company as it may deem appropriate in view of all of the facts and circumstances surrounding the particular case.

10. Impracticability

The Board shall recover any Excess Incentive-Based Compensation in accordance with this Policy unless such recovery would be impracticable, as determined by the Board in accordance with Rule 10D-1 of the Securities Exchange Act of 1934, as amended, and the New York Stock Exchange's listing standards or the listing standards of any other national securities exchange on which the Company's securities may be listed.

TABLE OF CONTENTS

CAUTION REGARDING FORWARD-LOOKING INFORMATION

This annual information form ("AIF") contains "forward-looking information" within the meaning of applicable Canadian securities laws and "forward looking statements" within the meaning of the "safe harbor" provisions of the U.S. Private Securities Litigation Reform Act of 1995. We refer to such forward-looking statements and forward-looking information together in this AIF as forward-looking information. All information contained in this AIF, other than statements of current and historical fact, is forward-looking information. Often, but not always, forward-looking information can be identified by the use of words such as "plans", "expects", "budget", "guidance", "scheduled", "estimates", "forecasts", "strategy", "target", "intends", "objective", "goal", "understands", "anticipates" and "believes" (and variations of these or similar words) and statements that certain actions, events or results "may", "could", "would", "should", "might" "occur" or "be achieved" or "will be taken" (and variations of these or similar expressions). All of the forward-looking information in this AIF is qualified by this cautionary note.

Forward-looking information includes, but is not limited to, statements with respect to the company's production, cost and capital and exploration expenditure guidance, expectations regarding reductions in discretionary spending and capital expenditures, the ability of the company to stabilize and optimize the Copper Mountain mine operation and achieve operating synergies, the fleet production ramp up plan and the accelerated stripping strategies at the Copper Mountain site, the ability of the company to complete business integration activities at the Copper Mountain mine, the estimated timelines and pre-requisites for sanctioning the Copper World project and the pursuit of a potential minority joint venture partner, expectations regarding the permitting requirements for the Copper World project (including expected timing for receipt of such applicable permits), the expected benefits of Manitoba growth initiatives, including the advancement of the development and exploration drift at the 1901 deposit; the anticipated use of proceeds from the flow-through financing completed during the fourth quarter of 2023, the company's future deleveraging strategies and the company's ability to deleverage and repay debt as needed, expectations regarding the company's cash balance and liquidity, the company's ability to increase the mining rate at Lalor, the anticipated benefits from completing the Stall recovery improvement program, expectations regarding the ability to conduct exploration work and execute on exploration programs on its properties and to advance related drill plans, including the advancement of the exploration program at Maria Reyna and Caballito, the ability to continue mining higher-grade ore in the Pampacancha pit and the company's expectations resulting therefrom, expectations regarding the ability for the company to further reduce greenhouse gas emissions, the company's evaluation and assessment of opportunities to reprocess tailings using various metallurgical technologies, expectations regarding the prospective nature of the Maria Reyna and Caballito properties, the anticipated impact of brownfield and greenfield growth projects on the company's performance, anticipated expansion opportunities and extension of mine life in Snow Lake and the ability for Hudbay to find a new anchor deposit near the company's Snow Lake operations, anticipated future drill programs and exploration activities and any results expected therefrom, anticipated mine plans, anticipated metals prices and the anticipated sensitivity of the company's financial performance to metals prices, events that may affect its operations and development projects, anticipated cash flows from operations and related liquidity requirements, the anticipated effect of external factors on revenue, such as commodity prices, estimation of mineral reserves and resources, mine life projections, reclamation costs, economic outlook, government regulation of mining operations, and business and acquisition strategies. Forward-looking information is not, and cannot be, a guarantee of future results or events. Forward-looking information is based on, among other things, opinions, assumptions, estimates and analyses that, while considered reasonable by us at the date the forward-looking information is provided, inherently are subject to significant risks, uncertainties, contingencies and other factors that may cause actual results and events to be materially different from those expressed or implied by the forward-looking information.

The material factors or assumptions that we identified and were applied by us in drawing conclusions or making forecasts or projections set out in the forward-looking information include, but are not limited to:

- the ability to achieve production, cost and capital guidance;

- the ability to achieve discretionary spending reductions without impacting operations;

- no significant interruptions to our operations due to social or political unrest in the regions Hudbay operates, including the navigation of the complex environment in Peru;

- no interruptions to our plans for advancing the Copper World project, including with respect to timely receipt of applicable permits and the pursuit of a potential minority joint venture partner;

- the ability for us to successfully complete the integration and optimization of the Copper Mountain operations, achieve operating synergies and develop and maintain good relations with key stakeholders;

- the ability to execute on our exploration plans, including but not limited to (a) the potential ramp up of exploration in respect of the Maria Reyna and Caballito properties and (b) our ongoing Manitoba exploration strategies with respect to extending the mine life at our Snow Lake operations and deferring reclamation activities;

- the ability to advance drill plans;

- the success of mining, processing, exploration and development activities;

- the scheduled maintenance and availability of our processing facilities;

- the accuracy of geological, mining and metallurgical estimates;

- anticipated metals prices and the costs of production;

- the supply and demand for metals we produce;

- the supply and availability of all forms of energy and fuels at reasonable prices;

- no significant unanticipated operational or technical difficulties;

- the execution of our business and growth strategies, including the success of our strategic investments and initiatives;

- the ability to achieve our objectives and targets with respect to our environmental and climate change initiatives;

- the availability of additional financing;

- the ability to deleverage and repay debt as needed;

- the ability to complete projects on time and on budget and other events that may affect our ability to develop our projects;

- the timing and receipt of various regulatory and governmental approvals;

- the availability of personnel for our exploration, development and operational projects and ongoing employee relations;

- maintaining good relations with the employees at our operations;

- maintaining good relations with the labour unions that represent certain of our employees in Manitoba and Peru;

- maintaining good relations with the communities in which we operate, including the neighbouring Indigenous communities and local governments;

- no significant unanticipated challenges with stakeholders at our various projects;

- no significant unanticipated events or changes relating to regulatory, environmental, health and safety matters;

- no contests over title to our properties, including as a result of rights or claimed rights of Indigenous peoples or challenges to the validity of our unpatented mining claims;

- the timing and possible outcome of pending litigation and no significant unanticipated litigation;

- certain tax matters, including, but not limited to current tax laws and regulations, changes in taxation policies and the refund of certain value added taxes from the Canadian and Peruvian governments; and

- no significant and continuing adverse changes in general economic conditions or conditions in the financial markets (including commodity prices and foreign exchange rates).

The risks, uncertainties, contingencies and other factors that may cause actual results to differ materially from those expressed or implied by the forward-looking information may include, but are not limited to, risks related to the ongoing business integration of Copper Mountain and the process for designing, implementing and maintaining effective internal controls for Copper Mountain, the failure to effectively complete the integration and optimization of the Copper Mountain operations or to achieve anticipated operating synergies, political and social risks in the regions Hudbay operates, including the navigation of the complex political and social environment in Peru, risks generally associated with the mining industry and the current geopolitical environment, including future commodity prices, currency and interest rate fluctuations, energy and consumable prices, supply chain constraints and general cost escalation in the current inflationary environment, risks related to the renegotiation of collective bargaining agreements with the labour unions representing certain of our employees in Manitoba and Peru, uncertainties related to the development and operation of the company's projects, the risk of an indicator of impairment or impairment reversal relating to a material mineral property, risks related to the Copper World project, including in relation to permitting, project delivery and financing risks, risks related to the Lalor mine plan, including the ability to convert inferred mineral resource estimates to higher confidence categories, dependence on key personnel and employee and union relations, risks related to political or social instability, unrest or change, risks in respect of Indigenous and community relations, rights and title claims, operational risks and hazards, including the cost of maintaining and upgrading the company's tailings management facilities and any unanticipated environmental, industrial and geological events and developments and the inability to insure against all risks, failure of plant, equipment, processes, transportation and other infrastructure to operate as anticipated, compliance with government and environmental regulations, including permitting requirements and anti-bribery legislation, depletion of the company's reserves, volatile financial markets and interest rates that may affect the company's ability to obtain additional financing on acceptable terms, the failure to obtain required approvals or clearances from government authorities on a timely basis, uncertainties related to the geology, continuity, grade and estimates of mineral reserves and resources, and the potential for variations in grade and recovery rates, uncertain costs of reclamation activities, the company's ability to comply with its pension and other post-retirement obligations, the company's ability to abide by the covenants in its debt instruments and other material contracts, tax refunds, hedging transactions, as well as the risks discussed under the heading "Risk Factors" in this AIF.

Should one or more risk, uncertainty, contingency or other factor materialize or should any factor or assumption prove incorrect, actual results could vary materially from those expressed or implied in the forward-looking information. Accordingly, you should not place undue reliance on forward-looking information. We do not assume any obligation to update or revise any forward-looking information after the date of this AIF or to explain any material difference between subsequent actual events and any forward-looking information, except as required by applicable law.

NOTE TO UNITED STATES INVESTORS

This AIF (and documents incorporated by reference herein) has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of the United States Securities and Exchange Commission (the "SEC") and reserve and resource information included herein may not be comparable to similar information disclosed by U.S. companies.

Canadian reporting requirements for disclosure of mineral properties are governed by the Canadian Securities Administrators' National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101") and the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by CIM Council on May 10, 2014, as amended (the "CIM Standards"). Further to recent amendments, mineral property disclosure requirements in the United States are governed by subpart 1300 of Regulation S-K of the Securities Act of 1933, as amended (the "U.S. Rules") which differ from the CIM Standards. The definitions used in NI 43-101 are incorporated by reference from the CIM Standards.

As a foreign private issuer that is eligible to file reports with the SEC pursuant to the multi-jurisdictional disclosure system (the "MJDS"), the Company is not required to provide disclosure on its mineral properties under the U.S. Rules and will continue to provide disclosure under NI 43-101 and the CIM Standards. If the Company ceases to be a foreign private issuer or loses its eligibility to file its annual report on Form 40-F pursuant to the MJDS, then the Company will be subject to the U.S. Rules, which differ from the requirements of NI 43-101 and the CIM Standards.

Pursuant to the U.S. Rules, the SEC recognizes estimates of "measured mineral resources", "indicated mineral resources" and "inferred mineral resources". In addition, the definitions of "proven mineral reserves" and "probable mineral reserves" under the U.S. Rules are "substantially similar" to the corresponding CIM Standards, incorporated by reference in NI 43-101.

United States investors are cautioned that while the above terms are "substantially similar" under NI 43-101 and the CIM Standards, there are differences in the definitions under the U.S. Rules and the CIM Standards. Accordingly, there is no assurance any mineral reserves or mineral resources that the Company may report as "proven mineral reserves", "probable mineral reserves", "measured mineral resources", "indicated mineral resources" and "inferred mineral resources" under NI 43-101 would be the same had the Company prepared the reserve or resource estimates under the standards adopted under the U.S. Rules.

Mineralization described using these terms has a greater amount of uncertainty as to their existence and feasibility than mineralization that has been characterized as reserves. Accordingly, investors are cautioned not to assume that any "measured mineral resources", "indicated mineral resources", or "inferred mineral resources" that the Company reports are or will be economically or legally mineable.

Further, "inferred mineral resources" have a greater amount of uncertainty as to their existence and as to whether they can be mined legally or economically. In accordance with Canadian rules, estimates of "inferred mineral resources" cannot form the basis of feasibility or other economic studies, except in limited circumstances where permitted under NI 43-101.

OTHER IMPORTANT INFORMATION

Certain scientific and technical terms and abbreviations used in this AIF are defined in the "Glossary of Mining Terms" attached as Schedule A.

Unless the context suggests otherwise, references to "we", "us", "our" and similar terms, as well as references to "Hudbay" and "Company", refer to Hudbay Minerals Inc. and its direct and indirect subsidiaries.

CURRENCY AND EXCHANGE RATES

This AIF contains references to both United States dollars and Canadian dollars. All references to "dollars" or "$", unless otherwise indicated, are expressed in United States dollars, and Canadian dollars are referred to as "Canadian dollars" or "C$". The average exchange rate for 2023 and the closing exchange rate as at December 29, 2023 (being the final trading day of 2023) as reported by the Bank of Canada, were one United States dollar per 1.3226 and 1.3497 Canadian dollars, respectively.

On March 26, 2024 (being the final trading day prior to the date of this AIF), the Bank of Canada daily exchange rate was one United States dollar per 1.3572 Canadian dollars.

NON-IFRS FINANCIAL PERFORMANCE MEASURES

Hudbay uses certain non-IFRS financial performance measures in this AIF and certain of its other public disclosure documents, including adjusted net earnings (loss), adjusted net earnings (loss) per share, adjusted EBITDA, realized prices, net debt, net debt to adjusted EBITDA, cash cost, sustaining and all-in sustaining cash cost per pound of copper produced, cash cost and sustaining cash cost per ounce of gold produced and combined unit costs. These measures do not have a meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other issuers. These measures should not be considered in isolation or as a substitute for measures prepared in accordance with IFRS and are not necessarily indicative of operating profit or cash flow from operations as determined under IFRS. Other companies may calculate these measures differently.

Management believes adjusted net earnings (loss) and adjusted net earnings (loss) per share provides an alternate measure of the Company's performance for the current period and gives insight into its expected performance in future periods. These measures are used internally by the Company to evaluate the performance of its underlying operations and to assist with its planning and forecasting of future operating results. As such, the Company believes these measures are useful to investors in assessing the Company's underlying performance. We provide adjusted EBITDA to help users analyze our results and to provide additional information about our ongoing cash generating potential in order to assess our capacity to service and repay debt, carry out investments and cover working capital needs. Net debt is shown because it is a performance measure used by the Company to assess our financial position. Net debt to adjusted EBITDA is shown because it is a performance measure used by the Company to assess our financial leverage and debt capacity. Realized price is shown to understand the average realized price of metals sold to third parties in each reporting period. Cash cost, sustaining and all-in sustaining cash cost per pound of copper produced are shown because we believe they help investors and management assess the performance of our operations, including the margin generated by the operations and the Company. Cash cost and sustaining cash cost per ounce of gold produced are shown because we believe they help investors and management assess the performance of our Manitoba operations. Combined unit cost is shown because we believe it helps investors and management assess our cost structure and margins that are not impacted by variability in by-product commodity prices.

For a description and reconciliation of each of these measures, please see the Non-IFRS Financial Performance Measures section on pages 61 through 76 of Hudbay's management's discussion and analysis for the year ended December 31, 2023, a copy of which has been filed on SEDAR+ at www.sedarplus.ca and EDGAR at www.sec.gov.

CORPORATE STRUCTURE

INCORPORATION AND REGISTERED OFFICE

We were formed by the amalgamation of Pan American Resources Inc. and Marvas Developments Ltd. on January 16, 1996, pursuant to the Business Corporations Act (Ontario) and changed our name to Pan American Resources Inc. On March 12, 2002, we acquired ONTZINC Corporation, a private Ontario corporation, through a reverse takeover and changed our name to ONTZINC Corporation. On December 21, 2004, we acquired Hudson Bay Mining and Smelting Co., Limited ("HBMS") and changed our name to HudBay Minerals Inc. In connection with the acquisition of HBMS, on December 21, 2004, we amended our articles to consolidate our common shares on a 30 to 1 basis. On October 25, 2005, we were continued under the Canada Business Corporations Act ("CBCA"). On August 15, 2011, we completed a vertical short-form amalgamation under the CBCA with our subsidiary (HMI Nickel Inc.). On January 1, 2017, we completed a vertical short-form amalgamation under the CBCA with two of our subsidiaries (HBMS and Hudson Bay Exploration and Development Company Limited) and changed our name from HudBay Minerals Inc. to Hudbay Minerals Inc. On January 1, 2024, we completed a vertical short-form amalgamation under the CBCA (the "2024 Amalgamation") with three of our subsidiaries (Copper Mountain Mining Inc., Hudbay British Columbia Inc. and Rockcliff Metals Corporation) and continued carrying on business as Hudbay Minerals Inc., as the amalgamated successor entity.

Our registered office is located at 333 Bay Street, Suite 3400, Bay Adelaide Centre, Toronto, Ontario M5H 2S7 and our principal executive office is located at 25 York Street, Suite 800, Toronto, Ontario M5J 2V5.

Our common shares are listed on the Toronto Stock Exchange ("TSX"), New York Stock Exchange ("NYSE") and Bolsa de Valores de Lima under the symbol "HBM".

INTERCORPORATE RELATIONSHIPS

The following chart shows our principal subsidiaries as at January 1, 2024 (after giving effect to the 2024 Amalgamation), their jurisdiction of incorporation and the percentage of voting securities we beneficially own or over which we have control or direction.

Notes:

1. Hudbay owns our mining operations in Manitoba, is the borrower under our Canadian Credit Facility, the issuer of our Senior Unsecured Notes and a guarantor of our Peru Facility.

2. HudBay Peru Inc. owns 99.98% of HudBay Peru S.A.C. ("Hudbay Peru"). The remaining 0.02% is owned by 6502873 Canada Inc., our wholly-owned subsidiary. HudBay Peru Inc. is a guarantor of our Credit Facilities and our Senior Unsecured Notes.

3. Hudbay Peru owns the Constancia mine and certain exploration properties in Peru, is the borrower under our Peru Facility and is a guarantor of our Canadian Credit Facility and our Senior Unsecured Notes.

4. HudBay (BVI) Inc. ("Hudbay BVI") is the party to the precious metals stream agreement in respect of the Constancia mine and its sole purpose is to fulfill its obligations thereunder.

5. Copper Mountain Mine (BC) Ltd. ("CMMBC"), the entity that holds the Copper Mountain mine in British Columbia, is 25% owned by MM Corporation, a wholly-owned subsidiary of Mitsubishi Materials Corporation.

6. Hudbay Arizona Inc., through its subsidiaries, indirectly owns 100% of Copper World, Inc. and Mason Resources (US) Inc. ("Mason US").

7. Copper World, Inc. (formerly known as Rosemont Copper Company) owns a 100% interest in the Copper World project.

8. Mason US owns a 100% interest in the Mason project in Nevada as well as certain exploration properties in the surrounding area.

9. HudBay Arizona (Barbados) SRL is the party to the precious metals stream agreement in respect of the Copper World project and its sole purpose is to fulfill its obligations thereunder.

DEVELOPMENT OF OUR BUSINESS

BUSINESS, PURPOSE & STRATEGY

Our Business

We are a diversified mining company with long-life assets in North and South America. Our Constancia operations in Cusco (Peru) produce copper with gold, silver and molybdenum by-products. Our Snow Lake operations in Manitoba (Canada) produce gold with copper, zinc and silver by-products. Our Copper Mountain operations in British Columbia (Canada) produce copper with gold and silver by-products. We have a copper development pipeline that includes the Copper World project in Arizona (United States) and the Mason project in Nevada (United States), and our growth strategy is focused on the exploration, development, operation, and optimization of properties we already control, as well as other mineral assets we may acquire that fit our strategic criteria.

Our Purpose

"We care about our people, our communities and our planet. Hudbay provides the metals the world needs.

We work sustainably, transform lives and create better futures for communities."

We transform lives: We invest in our employees, their families and local communities through long-term employment, local procurement and economic development to improve their quality of life and ensure the communities benefit from our presence.

We operate responsibly: From exploration to closure, we operate safely and responsibly, we welcome innovation and we strive to minimize our environmental footprint while following leading operating practices in all facets of mining.

We provide critical metals: We produce copper and other metals needed for everyday products and essential for applications to support the energy transition toward a more sustainable future.

Our Strategy

Our mission is to create sustainable value and strong returns by leveraging our core strengths in community relations, focused exploration, mine development and efficient operations.

We believe that copper is the commodity with the best long-term supply/demand fundamentals and offers shareholders the greatest opportunity for sustained risk-adjusted returns. Copper is essential for achieving global climate change goals - it is one of the most heavily utilized metals in renewable energy systems and is the least carbon intensive. Through the discovery and successful development of economic mineral deposits, and through highly efficient low-cost operations to extract the metals, we believe sustainable value will be created for all stakeholders.

Hudbay's successful development, ramp-up and operation of the Constancia open-pit mine in Peru, our long history of underground mining and full life-cycle experience in northern Manitoba, and our track record of reserve expansion through effective exploration, and our organic pipeline of copper development projects including Copper World, Mason and Llaguen, provide us with a competitive advantage to deliver sustainable value relative to other mining companies of similar scale.

Over the past decade, we have built a world-class asset portfolio by executing a consistent long-term growth strategy focused on copper. We continuously work to generate strong free cash flow and optimize the value of our producing assets through exploration, brownfield expansion projects and efficient and safe operations. Furthermore, we intend to sustainably grow Hudbay through the exploration and development of our robust project pipeline, as well as through the acquisition of other properties that fit our stringent strategic criteria.

To ensure that any investment in our existing assets or acquisition of other mineral assets is consistent with our purpose and mission, we have established a number of criteria for evaluating these opportunities. The criteria include the following:

- Sustainability: We are focused on jurisdictions that support responsible mining activity. Our current geographic focus is on select investment grade countries in the Americas, with strong rule of law and respect for human rights consistent with our long-standing focus on environmental, social and governance ("ESG") principles;

- Copper Focus: We believe copper is the commodity with the best long-term supply/demand fundamentals. Global copper mine supply is challenged due to declining industry grades, limited exploration success and an insufficient pipeline of development-ready projects while demand will continue to increase through global decarbonization initiatives. We believe this long-term supply/demand gap will create opportunities for increased risk-adjusted returns. While our primary focus is on copper, we recognize and value the polymetallic nature of copper deposits and, in particular, the counter-cyclical nature of gold in our portfolio;

- Quality: We are focused on investing in long-life, low-cost, expandable, high-quality assets that can capture peak pricing of multiple commodity price cycles and can generate free cash flow through the troughs of price cycles;

- Potential: We consider the full spectrum of acquisition and investment opportunities, from early-stage exploration to producing assets, that offer significant incremental potential for exploration, development, expansion and optimization beyond the stated resources and mine plan;

- Process: We develop a clear understanding of how an investment or acquisition can create value through our robust due diligence and capital allocation process that applies our technical, social, operational and project execution expertise;

- Operatorship: We believe value is created through leveraging Hudbay's competitive advantages in safe and efficient operations and effective exploration and project development and community relations. While operatorship is a key criterion, we are open to joint ventures and partnerships that de-risk our portfolio and increase risk-adjusted returns; and

- Capital Allocation: We pursue investments and acquisitions that are accretive to Hudbay on a per share basis. Given that our strategic focus includes allocating capital to assets at various stages of development, when evaluating accretion, we will consider measures such as internal rate of return ("IRR"), return on invested capital ("ROIC"), net asset value per share and the contained value of reserves and resources per share.

THREE YEAR HISTORY

Peru Operations

In early January 2021, we received the final mining permit for the development and operation of the Pampacancha satellite deposit located near the Constancia mine in Peru. Pampacancha achieved first production and commercial production in April 2021, following the approval of a surface rights agreement with the community of Chilloroya, completion of all land user agreements and consultation with key stakeholders.

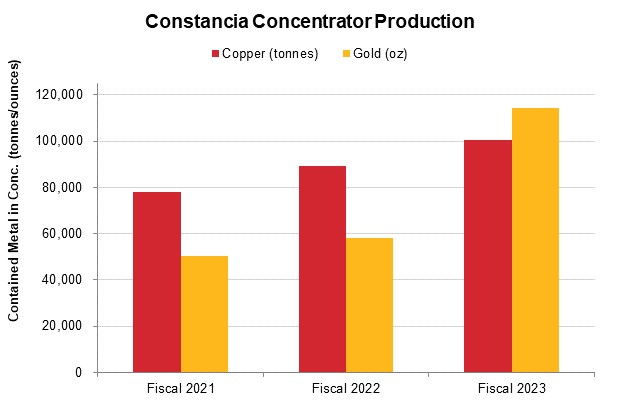

On March 29, 2021, the Company released an updated mine plan for Constancia that included an increase in copper and gold production between 2022 and 2024 due to the higher grades from the Pampacancha deposit and also included higher-grade reserves from the Constancia Norte pit extension. During 2021, Hudbay also completed an internal scoping study which indicated the potential for economic extraction of an inferred mineral resource of 6.5 million tonnes of 1.2% copper in two high grade skarn lenses located below the open pit in the Constancia Norte area.

In late 2022 and early 2023, regional road blockades limited the ability to transport fuel and concentrate, but the Constancia mill continued to operate uninterrupted as the Company implemented risk mitigation plans with strong support from the local communities. Partially as a result of processing stockpiles to lower fuel consumption in early 2023, the mine life of the Pampacancha deposit has now been extended to the third quarter of 2025.

Hudbay also controls a large, contiguous block of mineral rights with the potential to host mineral deposits within trucking distance of the Constancia processing facility, including the past producing Caballito property and the highly prospective Maria Reyna property. We commenced early exploration activities at the Maria Reyna and Caballito properties after completing a surface rights exploration agreement with the community of Uchucarcco in August 2022. A drill permit application was submitted for the Maria Reyna property in November 2023, and a similar application for the Caballito property is planned for the first half of 2024.

During the first quarter of 2023, Hudbay signed a new 10-year power purchase agreement with ENGIE Energía Perú for access to a 100% renewable energy supply to Constancia (the "Power Purchase Agreement"). The Power Purchase Agreement will come into effect in January 2026 following the conclusion of Constancia's existing power supply agreement. Total Scope 1 and Scope 2 GHG emissions company-wide at Hudbay's current operations (other than Copper Mountain) are expected to decline by 40% during the life of the contract (as compared to our 2021 baseline), furthering our climate change goals and initiatives.

In 2024, the Company increased mineral reserve estimates at Constancia to include the addition of a tenth mining phase in the Constancia pit after conducting positive geotechnical drilling and studies in 2023. This extended the expected mine life at Constancia by three years to 2041 and there is potential for future mine life extensions based on the mineral resource estimates that have not yet been converted to mineral reserve estimates.

Manitoba Operations

On March 29, 2021, we released an updated mine plan for Snow Lake that increased annual gold production to over 180,000 ounces during the first six years of New Britannia's operation at a cash cost and sustaining cash cost, net of by-product credits, of $412 and $788 per ounce of gold, respectively. This enhanced mine plan incorporated the results from several optimization initiatives, including: increasing the production rate at Lalor; increasing the throughput rate at the Stall mill; incorporating mineral reserves from the 1901 deposit into the mine plan; and implementing a recovery improvement project at the Stall mill to increase copper and precious metal recoveries. These mine plan enhancements optimize the processing capacity of the Snow Lake operations in a manner that maximizes the net present value of the operations.

Refurbishment and commissioning activities at the New Britannia mill were completed in July 2021 and the construction of the new copper flotation facility at New Britannia was completed in October 2021, ahead of the original schedule. Following a brief commissioning period, the New Britannia mill achieved commercial production on November 30, 2021.

The 777 mine was closed on schedule, in June 2022, after 18 years of steady production. The Company's hydrometallurgical zinc facility in Flin Flon was also closed after more than 25 years of successful operations. Hudbay is committed to strong and safe closure practices and has considered stringent and detailed environmental plans to manage water and the remaining infrastructure and processing plants in Flin Flon.

Following the closure of the 777 mine, the Flin Flon concentrator and tailings impoundment area were placed on care and maintenance, providing optionality should another mineral discovery lead to a new mine in the Flin Flon area. With this in mind, in March 2024, Hudbay entered into an option agreement (the "Marubeni Option Agreement") with Marubeni Corporation ("Marubeni"), pursuant to which Hudbay has granted Marubeni's wholly-owned Canadian subsidiary an option to acquire a 20% interest in three projects located within trucking distance of Hudbay's processing facilities in the Flin Flon area. Pursuant to the Marubeni Option Agreement, Marubeni must fund no less than C$12 million in exploration expenditures over a period of approximately 5 years in order to exercise its option. Upon successful completion of Marubeni's earn-in obligations and the exercise of the option, a joint venture will be formed to hold the selected projects with Hudbay, acting as operator, holding an 80% interest and Marubeni indirectly holding the remaining 20% interest.

In addition, we continue to evaluate the economic feasibility of reprocessing the tailings in the Flin Flon tailings impoundment area ("FFTIA"), which holds more than 100 million tonnes of tailings that have been deposited over approximately 90 years. Recent drill programs indicate higher zinc, copper, and silver grades than predicted by historical mill records while confirming the historical gold grade and that may also be amenable to economic modern extraction and recovery methods. Included in our evaluation of moving forward with the tailings reprocessing opportunity is the potential to more efficiently manage the environmental impacts associated with the existing tailings in the FFTIA and simplify the long-term reclamation process.

On September 14, 2023, Hudbay successfully completed its acquisition of Rockcliff Metals Corp. ("Rockcliff"), pursuant to which Hudbay acquired all of the issued and outstanding common shares of Rockcliff that it did not already own (the "Rockcliff Transaction") by way of a court-approved plan of arrangement. Rockcliff was one of the largest landholders in the Snow Lake area, with approximately 1,800 square kilometres across all its properties. Prior to the Rockcliff Transaction, Rockcliff was Hudbay's 49% joint venture partner of the Talbot deposit. The Talbot deposit and the additional Rockcliff exploration properties provide further optionality and potential future feed sources for the Stall and New Britannia mills. In 2023, Hudbay also completed the acquisition of mineral claims in the Cook Lake area, which is also located within trucking distance of the existing Snow Lake processing infrastructure and which forms part of Hudbay's 2024 exploration strategy.

British Columbia Operations

On April 13, 2023, Hudbay entered into a definitive arrangement agreement (the "CMMC Arrangement Agreement") with Copper Mountain Mining Corp. ("Copper Mountain"). On June 20, 2023, Hudbay completed the acquisition of all of the issued and outstanding common shares of CMMC (including all CMMC CHESS Depositary Interests ("CMMC CDIs")) (collectively, the "CMMC Shares") in accordance with the terms of the CMMC Arrangement Agreement and pursuant to a court-approved plan of arrangement under the Business Corporations Act (British Columbia) (collectively, the "CMMC Transaction") and, in consideration therefor, former holders of CMMC Shares ("CMMC Shareholders") received 0.381 of a Hudbay Share for each CMMC Share held immediately prior to the effective time of the CMMC Transaction.

Pursuant to the CMMC Transaction, in aggregate, Hudbay issued 84,165,617 Hudbay Shares to former CMMC Shareholders as consideration for their CMMC Shares. The CMMC Shares were de-listed from the TSX on June 21, 2023 and Copper Mountain has ceased to be a reporting issuer under Canadian securities laws. The CMMC CDIs were de-listed from the Australian Securities Exchange on June 21, 2023.

As a result of the completion of the CMMC Transaction, Copper Mountain became a wholly-owned subsidiary of Hudbay and Hudbay became the indirect owner of 75% of the Copper Mountain mine, with Mitsubishi Materials Corporation ("MMC") holding the remaining interest. After giving effect to the 2024 Amalgamation described herein, Hudbay became the direct owner of 75% of the Copper Mountain mine. In connection with the closing of the CMMC Transaction, Hudbay appointed Jeane Hull and Paula Rogers, former directors of Copper Mountain, to the board of Hudbay.

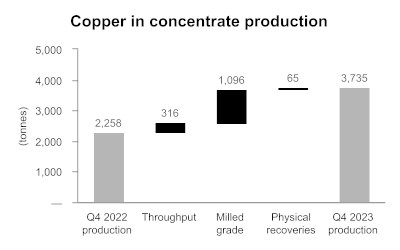

Since completing the CMMC Transaction, Hudbay has been focused on advancing integration, stabilization and optimization plans, including opening up the mine by adding additional mining faces and re-mobilizing idle haul trucks, optimizing the ore feed to the plant and implementing plant improvement initiatives.

On December 5, 2023, Hudbay released its first NI 43-101 technical report in respect of the Copper Mountain mine. As detailed in the technical report, the mine plan contemplates average annual copper production of 46,500 tonnes in the first five years, 45,000 tonnes in the first ten years and 37,000 tonnes over the 21-year mine life. The updated mine plan represents an approximate 90% increase in average annual copper production and an approximate 50% decrease in cash costs over the first 10 years compared to 2022 levels.

Arizona Development Strategy

As part of its private land development plan, Hudbay began exploring its patented mining claims in the historic Helvetia mining district in 2020. The Company initiated a drill program to confirm historical drilling in this past-producing region, and the drill program was further expanded throughout 2021 after continuing to receive encouraging results. Four deposits were discovered in early 2021 with oxide and sulfide mineralization occurring at shallow depths on Hudbay's wholly-owned patented mining claims. By September 2021, the exploration program had identified seven mineral deposits (referred to at the time as the "Copper World deposits") over a seven-kilometre strike area. An initial mineral resource estimate was declared at the Copper World deposits in December 2021, which was larger and at a higher level of geological confidence than expected.

Following our exploration success on patented mining claims and ongoing litigation uncertainty regarding the project design set forth in Hudbay's 2017 feasibility study and technical report for the Rosemont deposit, Hudbay began to evaluate alternative design options to unlock value within this prospective district. This included remodeling the 2017 mineral resources, incorporating the new mineral resources from successful exploration results and completing new metallurgical testing work, which led to a comprehensive review of the mine plan, process plant design, tailings deposition strategies and permitting requirements for the new project.

This culminated in the release of a preliminary economic assessment of our 100%-owned Copper World project in July 2022 (the "Copper World PEA"). The Copper World PEA included the recently discovered Copper World deposits along with the East deposit (which we formerly referred to as the Rosemont deposit). The Copper World PEA contemplated a two-phased mine plan with the first phase reflecting a standalone operation with processing infrastructure on Hudbay's private land and mining occurring on patented mining claims.

In September 2023, Hudbay released its de-risked and enhanced pre-feasibility study for Phase I of the Copper World project (the "Copper World PFS"). The Copper World PFS reflects the results of Hudbay's further technical work on Phase I of the Copper World project. Phase I is a standalone operation requiring state and local permits only. Phase I has a mine life of 20 years, which is four years longer than the Phase I mine life that was presented in the Copper World PEA, largely due to an increase in the capacity for tailings and waste deposition as a result of optimizing the site layout. Phase II is expected to involve an expansion onto federal lands with an extended mine life and enhanced project economics. Phase II would be subject to the federal permitting process and was not included in the PFS results. See "Material Mineral Projects - Copper World" for further information regarding the Copper World PFS findings.

The first key state permit required for Copper World, the Mined Land Reclamation Plan, was initially approved by the Arizona State Mine Inspector in October 2021 and was subsequently amended to reflect a larger private land project footprint. This approval was challenged in state court, but the challenge was dismissed in May 2023 as having no basis. In late 2022, Hudbay submitted the applications for an Aquifer Protection Permit and an Air Quality Permit to the Arizona Department of Environmental Quality. Hudbay expects to receive these two outstanding state permits in 2024.

As part of our disciplined approach to developing Copper World, in November 2022, Hudbay introduced a three prerequisites plan, including specific leverage targets that it would need to achieve prior to making an investment decision in the project:

1. Permits - receipt of all state level permits required for Phase I

2. Plan - completion of a definitive feasibility study with an internal rate of return of greater than 15%

3. Prudent Financing Strategy - multi-faceted financing strategy including

- a committed minority joint venture partner;

- a renegotiated precious metals stream agreement optimized for the current project;

- net debt to EBITDA ratio of less than 1.2 times;

- a minimum cash balance of $600 million; and,

- limited non-recourse project level debt of up to $500 million.

While Hudbay has made significant progress on all aspects of its three prerequisites plan, the opportunity to sanction Copper World is not currently expected until late 2025 based on current estimated timelines and will ultimately be evaluated against other competing investment opportunities as part of Hudbay's capital allocation process.

Financing Activities

In May 2020, we entered into a gold forward sale and prepay arrangement ("Gold Prepay") with a syndicate of our existing lenders whereby we received an upfront payment of $115 million in exchange for delivering a total of 79,954 gold ounces in future years on gold forward curve prices averaging approximately $1,682 per ounce. The Gold Prepay was executed to pre-fund substantially all of the expected capital costs to complete the New Britannia project. We repaid approximately 50% of the original Gold Prepay in 2022 and recommenced deliveries under the Gold Prepay in October 2023, further reducing the outstanding liability. Hudbay is currently scheduled to fully repay the Gold Prepay by August 2024.