UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 40-F

| ☐ | REGISTRATION STATEMENT PURSUANT TO SECTION 12 OF THE SECURITIES EXCHANGE ACT OF 1934 |

| OR | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13(a) OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2023

| Commission file number: 001-33153 |

ENDEAVOUR SILVER CORP.

(Exact Name of Registrant as Specified in its Charter)

| British Columbia | 1040 | N/A | ||

| (Province or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code) | (I.R.S. Employer Identification No.) |

#1130-609 Granville Street

Vancouver, British Columbia, Canada V7Y 1G5

(604) 685-9775

(Address and Telephone Number of Registrant's Principal Executive Offices)

| DL Services Inc. Columbia Center, 701 Fifth Avenue, Suite 6100 Seattle, Washington 98104 (206) 903-8800 |

Copies to: Jason K. Brenkert Dorsey & Whitney LLP 1400 Wewatta Street, Suite 400 Denver, Colorado 80202-5549 (303) 629-3400 |

| (Name, address (including zip code) and telephone number (including area code) of agent for service in the United States) |

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of Each Class: | Trading Symbol(s) | Name of Each Exchange On Which Registered: |

| Common Shares, no par value | EXK | New York Stock Exchange |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

For annual reports, indicate by check mark the information filed with this form:

☒ Annual Information Form ☒ Audited Annual Financial Statements

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report: As at December 31, 2023, 216,891,784 common shares of the Registrant were issued and outstanding.

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 12b-2 of the Exchange Act. ☐ Emerging growth company.

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards † provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term "new or revised financial accounting standard" refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report: ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to § 240.10D-1(b).☐

EXPLANATORY NOTE

Endeavour Silver Corp. (the "Company" or the "Registrant") is a Canadian issuer eligible to file its annual report pursuant to Section 13 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), on Form 40-F pursuant to the multi-jurisdictional disclosure system of the Exchange Act (the "MJDS"). The Company is a "foreign private issuer" as defined in Rule 3b-4 under the Exchange Act. Equity securities of the Company are accordingly exempt from Sections 14(a), 14(b), 14(c), 14(f) and 16 of the Exchange Act pursuant to Rule 3a12-3 thereunder.

FORWARD-LOOKING STATEMENTS

This annual report on Form 40-F and the exhibits attached hereto contain "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as "expects" or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "estimates" or "intends", or stating that certain actions, events or results "may", "could", "would", "might" or "will" (or the negative and grammatical variations of any of these terms and similar expressions) be taken, occur or be achieved,) are not statements of historical fact and may be forward-looking statements. Such forward-looking statements concern the Company's anticipated results and developments in the Company's operations in future periods, planned exploration and development of its properties, plans related to its business and other matters that may occur in the future.

Forward looking statements are made based upon certain assumptions and other important factors that, while considered reasonable by the Company, are inherently subject to significant business economic, competitive, political and social uncertainties and contingencies. The Company has made assumptions based on many of these factors which include, without limitation, present and future business strategies, the environment in which the Company will operate in the future, including the price of silver and gold, anticipated cost and the ability to achieve goals.

Statements concerning reserves and mineral resource estimates may also be deemed to constitute forward-looking statements to the extent that they involve estimates of the mineralization that will be encountered if the Company's property is developed, and in the case of mineral reserves, such statements reflect the conclusion based on certain assumptions that a mineral deposit can be economically exploited. Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors which could cause actual events or results to differ from those expressed or implied by the forward-looking statements, including, without limitation:

risks related to precious and base metal price fluctuations;

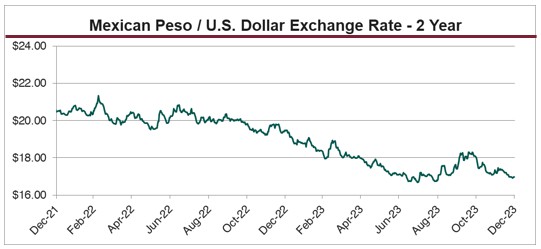

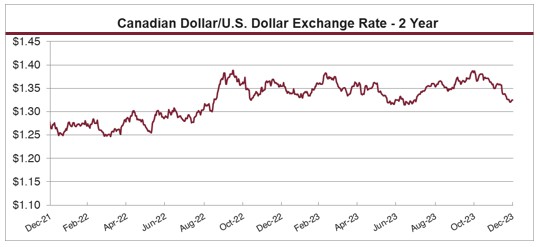

risks related to fluctuations in the currency markets (particularly the Mexican peso, Canadian dollar and United States dollar);

risks related to the impact of COVID-19 or future pandemics on our operations;

risks related to the Ukraine-Russian and Israel-Palestine conflicts;

risks related to increased interest rates;

risks related to precious and base metal price fluctuations;

risks related to the fluctuations in the price of consumed commodities;

risks related to the inherently dangerous activity of mining, including conditions or events beyond our control, and operating or technical difficulties in mineral exploration, development and mining activities;

uncertainty in our ability to obtain adequate financing for planned mine development and further exploration programs;

uncertainty in the Company's ability to fund the development of its mineral properties or the completion of further exploration programs;

2

uncertainty as to actual capital costs, operating costs, production and economic returns, and uncertainty that our development activities will result in profitable mining operations;

risks related to the adequacy or availability of infrastructure to support current or future mining developments

risks related to our reserves and mineral resource figures being estimates based on interpretations and assumptions which may result in less mineral production under actual conditions than is currently estimated and to diminishing quantities or grades of mineral reserves as properties are mined;

uncertainty as to the market price of silver or gold;

risks related to volatility of global financial markets and the Company's share price;

risks related to the Company's ability to acquire new projects and to successfully integrate the acquisitions;

risks related to changes in governmental regulations, tax and labour laws and obtaining necessary licenses and permits;

risks related to mine closure and reclamation;

risks related to climate change;

risks related to our mineral properties being subject to prior unregistered agreements, transfers, or claims and other defects in title;

risks related to recruiting and retaining qualified personnel;

risks relating to inadequate insurance or inability to obtain insurance;

the Company operating in foreign jurisdictions, including political, economic, and regulatory instability;

risks related to our officers and directors becoming associated with other natural resource companies which may give rise to conflicts of interests

risks relating to financial instruments; and

risks relating to our securities

This list is not exhaustive of the factors that may affect our forward-looking statements. Some of the important risks and uncertainties that could affect forward-looking statements are described further in the exhibits attached to this annual report on Form 40-F, including in the Annual Information Form ("AIF") of the Company filed as Exhibit 99.1 to this annual report on Form 40-F and are incorporated by reference herein. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in the forward-looking statements. The Company's forward-looking statements and information are based on beliefs, expectations and opinions of management on the date the statements are made and the Company does not assume any obligation to update forward-looking statements if circumstances or management's beliefs, expectations or opinions change, except as required by law. For the reasons set forth above, investors should not place undue reliance on forward-looking statements.

NOTE TO UNITED STATES READERS-

DIFFERENCES IN UNITED STATES AND CANADIAN REPORTING PRACTICES

The Company is permitted, under the multi-jurisdictional disclosure system adopted by the United States Securities and Exchange Commission (the "SEC"), to prepare this annual report on Form 40-F in accordance with Canadian disclosure requirements, which differ from those of the United States. The Company has prepared its consolidated financial statements, which are filed as Exhibit 99.2 to this annual report on Form 40-F, in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board ("IFRS") and they are not comparable to financial statements of United States companies.

3

MINERAL RESOURCE AND RESERVE ESTIMATES

The Company's AIF filed as Exhibit 99.1 to this annual report on Form 40-F and management's discussion and analysis for the fiscal year ended December 31,2023 filed as Exhibit 99.3 have been prepared in accordance with the requirements of Canadian provincial securities laws, which differ from the requirements of United States securities laws.

As a result, the Company reports the mineral reserves and resources of the projects it has an interest in according to Canadian standards. Canadian reporting requirements for disclosure of mineral properties are governed by National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101"). NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. These standards differ from the requirements of the SEC that are applicable to domestic United States reporting companies under subpart 1300 of Regulation S-K ("S-K 1300") under the Exchange Act. As an issuer that prepares and files its reports with the SEC pursuant to the MJDS, the Company is not subject to the requirements of S-K 1300. Any mineral reserves and mineral resources reported by the Company in accordance with NI 43-101 may not qualify as such under or differ from those prepared in accordance with S-K 1300. Accordingly, information included or incorporated by reference in the Company's AIF filed as Exhibit 99.1 to this annual report on Form 40-F and management's discussion and analysis for the fiscal year ended December 31, 2023 filed as Exhibit 99.3 concerning descriptions of mineralization and estimates of mineral reserves and resources under Canadian standards may not be comparable to similar information made public by United States companies subject to the reporting and disclosure requirements of S-K 1300.

CURRENCY

Unless otherwise indicated, all dollar amounts in this annual report on Form 40-F are in United States dollars. The exchange rate of Canadian dollars into United States dollars, on December 29, 2023, based upon the closing exchange rate as quoted by the Bank of Canada, was Cdn.$1.00 = US.$0.7561.

ANNUAL INFORMATION FORM

The Company's AIF for the fiscal year ended December 31, 2023 is filed as Exhibit 99.1 to this annual report on Form 40-F and is incorporated by reference herein.

AUDITED ANNUAL FINANCIAL STATEMENTS

The audited consolidated financial statements of the Company for the years ended December 31, 2023 and 2022, including the report of the independent auditor with respect thereto, are filed as Exhibit 99.2 to this annual report on Form 40-F and are incorporated by reference herein.

MANAGEMENT'S DISCUSSION AND ANALYSIS

The Company's management's discussion and analysis for the fiscal year ended December 31, 2023 ("MD&A") is filed as Exhibit 99.3 to this annual report on Form 40-F and is incorporated by reference herein.

TAX MATTERS

Purchasing, holding, or disposing of the Company's securities may have tax consequences under the laws of the United States and Canada that are not described in this annual report on Form 40-F or the documents incorporated by reference herein.

4

CONTROLS AND PROCEDURES

Disclosure Controls and Procedures

At the end of the period covered by this annual report on Form 40-F for the fiscal year ended December 31, 2023, an evaluation was carried out under the supervision of, and with the participation of, the Company's management, including its Chief Executive Officer (CEO) and Chief Financial Officer (CFO), of the effectiveness of the design and operation of the Company's disclosure controls and procedures (as defined in Rule 13a-15(e) of the Exchange Act). Based upon that evaluation, the Company's CEO and CFO have concluded that the Company's disclosure controls and procedures were effective to give reasonable assurance that the information required to be disclosed by the Company in reports that it files or submits under the Exchange Act is (i) recorded, processed, summarized and reported, within the time periods specified in the SEC's rules and forms, and (ii) accumulated and communicated to management, including its principal executive and principal financial officers, or persons performing similar functions, as appropriate to allow timely decisions regarding required disclosure.

Management's Report on Internal Control over Financial Reporting

Management is responsible for establishing and maintaining adequate internal control over financial reporting, as defined in Rules 13a-15(f) of the Exchange Act. A company's internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles.

A company's internal control over financial reporting includes those policies and procedures that (i) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (ii) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and (iii) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company's assets that could have a material effect on the financial statements. It should be noted that a control system, no matter how well conceived or operated, can only provide reasonable assurance, not absolute assurance, that the objectives of the control system are met.

Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with policies and procedures may deteriorate.

Management, including the CEO and CFO, assessed the effectiveness of the Company's internal control over financial reporting as of December 31, 2023. In making this assessment, management used the criteria set forth in the Internal Control Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO). Based on its assessment, management has concluded that, as of December 31, 2023, the Company's internal control over financial reporting was effective and no material weaknesses in the Company's internal control over financial reporting were discovered.

The Company is required to provide an auditor's attestation report on its internal control over financial reporting for the fiscal year ended December 31, 2023. In this annual report on Form 40-F, the Company's independent registered public accounting firm, KPMG LLP ("KPMG"), has provided its opinion as to the effectiveness of the Company's internal control over financial reporting as of December 31, 2023. KPMG has also audited the Company's financial statements included in this annual report on Form 40-F and issued a report thereon.

Auditor's Attestation Report

KPMG's attestation report on the Company's internal control over financial reporting is included in the Audited Consolidated Financial Statements filed in Exhibit 99.2 of this annual report on Form 40-F and is incorporated by reference herein.

5

Changes in Internal Control over Financial Reporting

There have been no changes in internal control over financial reporting that occurred during the fiscal year ended December 31, 2023 that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

CORPORATE GOVERNANCE

The Company's Board of Directors (the "Board of Directors") is responsible for the Company's Corporate Governance policies and has separately designated standing Compensation, Corporate Governance and Nominating, and Audit Committees. The Board of Directors has determined that all the members of the Compensation, Corporate Governance and Nominating, and Audit Committees are independent, based on the criteria for independence prescribed by section 303A.02 of the NYSE Listed Company Manual.

Compensation Committee

Compensation of the Company's CEO and all other officers is recommended by management to the Compensation Committee, established in accordance with section 303A.05 of the NYSE Listed Company Manual, for evaluation and recommendation to the Board of Directors.

The Compensation Committee develops, reviews and monitors director and executive compensation and policies. The Compensation Committee is also responsible for annually reviewing the adequacy of compensation for directors and others and the composition of compensation packages. The Company's CEO cannot be present during the Committee's deliberations or vote. The Compensation Committee is composed of three independent directors (as determined under section 303A.02 and section 303A.05 of the NYSE Listed Company Manual): Ricardo Campoy (Chair), Ken Pickering and Mario Szotlender. The Company's Compensation Committee Charter is available on the Company's website at www.edrsilver.com.

Corporate Governance and Nominating Committee

The Company's Corporate Governance and Nominating Committee, established in accordance with section 303A.04 of the NYSE Listed Company Manual, is tasked with (a) developing and recommending to the Board of Directors corporate governance principles applicable to the Company; (b) identifying and recommending qualified individuals for nomination to the Board of Directors; and (c) providing such assistance as the Chair of the Board of Directors, if independent, or alternatively the lead director of the Board of Directors, may require. The Corporate Governance and Nominating Committee is composed of three independent directors (as determined under Section 303A.02 of the NYSE Listed Company Manual): Rex McLennan (Chair), Mario Szotlender and Margaret Beck. The Corporate Governance and Nominating Committee Charter is available on the Company's website at www.edrsilver.com.

The principal corporate governance responsibilities of the Corporate Governance and Nominating Committee include the following:

a) reviewing and reassessing at least annually the adequacy of the Company's corporate governance procedures and recommending any proposed changes to the Board of Directors for approval;

b) reviewing and recommending changes to the Board of Directors of the Company's Code of Conduct and considering any requests for waivers from the Company's Code of Conduct;

c) receiving comments from all directors and reporting annually to the Board of Directors with an assessment of the Board of Director's performance to be discussed with the full Board of Directors following the end of each fiscal year.

6

The principal responsibilities of the Corporate Governance and Nominating Committee for selection and nomination of director nominees include the following:

a) in making recommendations to the Board of Directors regarding director nominees, the Corporate Governance and Nominating Committee shall consider the appropriate size of the Board of Directors; the competencies and skills that the Board of Directors considers to be necessary for the Board of Directors, as a whole, to possess; the competencies and skills that the Board of Directors considers each existing director to possess; the competencies and skills each new nominee will bring to the Board of Directors; and whether or not each new nominee can devote sufficient time and resources to the nominee's duties as a director of the Company;

b) developing qualification criteria for directors for recommendation to the Board of Directors and, in conjunction with the Chair of the Board of Directors (or, if the Chair is not an independent director, any lead director of the Board of Directors), the Corporate Governance and Nominating Committee shall appoint directors to the various committees of the Board of Directors;

c) having the sole authority to retain and terminate any search firm to be used to identify director candidates or any other outside advisors considered necessary to carry out its duties and to determine the terms of such retainer;

d) in conjunction with the Chair of the Board of Directors (or, if the Chair of the Board of Directors is not an independent director, any lead director of the Board of Directors), overseeing the evaluation of the Board of Directors and of the Company and making recommendations to the Board of Directors as appropriate.

AUDIT COMMITTEE

The Company's Board of Directors has a separately designated standing Audit Committee established in accordance with section 3(a)(58)(A) of the Exchange Act and section 303A.06 and 303A.07 of the NYSE Listed Company Manual. The Company's Audit Committee is comprised of:

In the opinion of the Company's Board of Directors, all members of the Audit Committee are independent (as determined under Rule 10A-3 of the Exchange Act and section 303A.02 of the NYSE Listed Company Manual) and are financially literate. The members of the Audit Committee do not have fixed terms and are appointed and replaced from time to time by resolution of the Board of Directors.

The Audit Committee meets with the Company's President, the CEO, the CFO and the Company's independent auditors to review and inquire into matters affecting financial reporting, the system of internal accounting and financial controls, as well as audit procedures and audit plans. The Audit Committee also recommends to the Board of Directors which independent registered public auditing firm should be appointed by the Company. In addition, the Audit Committee reviews and recommends to the Board of Directors for approval the annual financial statements, the MD&A, and undertakes other activities required by exchanges on which the Company's securities are listed and by regulatory authorities to which the Company is held responsible. The Company's Audit Committee Charter is available on the Company's website at www.edrsilver.com.

7

Audit Committee Financial Expert

The Company's Board of Directors has determined that Margaret Beck and Rex McLennan qualify as financial experts (as defined in Item 407 (d)(5)(ii) of Regulation S-K under the Exchange Act), has financial management expertise (pursuant to section 303A.07 of the NYSE Listed Company Manual) and is independent (as determined under Exchange Act Rule 10A-3 and section 303A.02 of the NYSE Listed Company Manual).

PRINCIPAL ACCOUNTING FEES AND SERVICES - INDEPENDENT AUDITORS

The following table shows the aggregate fees billed to the Company by KPMG LLP, Chartered Professional Accountants, the Company's independent registered public auditing firm, and its affiliates in each of the last two years.

| 2023 | 2022 | |

| Audit Fees (1) |

$1,069,845 |

$914,934 |

| Tax Fees (2) | $0 | $0 |

| All other fees (3) | $0 | $0 |

| Total* |

$1,069,845 |

$914,934 |

* All amounts are expressed in Canadian dollars

(1) The aggregate fees billed in each of the last two fiscal years for audit services by the Company's external auditor that are reasonably related to the performance of the audit or review of the Company's financial statements.

(2) The aggregate fees billed in each of the last two fiscal years for professional services rendered by the company's external auditor for tax compliance and tax advice.

(3) The aggregate fees billed in each of the last two fiscal years for products and services provided by the Company's external auditor, other than the services reported under clauses 1 and 2 above.

PRE-APPROVAL OF AUDIT AND NON-AUDIT SERVICES PROVIDED BY

INDEPENDENT AUDITORS

The Audit Committee pre-approves all audit services to be provided to the Company by its independent auditors. Non-audit services that are prohibited to be provided to the Company by its independent auditors may not be pre-approved. In addition, prior to the granting of any pre-approval, the Audit Committee must be satisfied that the performance of the services in question will not compromise the independence of the independent auditors. All non-audit services performed by the Company's auditor for the fiscal year ended December 31, 2023 were pre-approved by the Audit Committee of the Company. No non-audit services were approved pursuant to the de minimis exemption to the pre-approval requirement.

OFF-BALANCE SHEET TRANSACTIONS

The Company does not have any off-balance sheet financing arrangements or relationships with unconsolidated special purpose entities.

CODE OF ETHICS

The Company has adopted a Code of Business Conduct and Ethics (the "Code") that applies to all the Company's directors, executive officers and employees, which is available on the Company's website at www.edrsilver.com and in print to any shareholder who requests it. The Code meets the requirements for a "code of ethics" within the meaning of that term in General Instruction 9(b) of Form 40-F.

All amendments to the Code, and all waivers of the Code with respect to any of the officers covered by it, will be posted on the Company's website, www.edrsilver.com within five business days of the amendment or waiver and will remain available for a twelve-month period and provided in print to any shareholder who requests them. During the fiscal year ended December 31, 2023, the Company did not substantively amend, waive or implicitly waive any provision of the Code with respect to any of the directors, executive officers or employees subject to it.

8

CASH REQUIREMENTS

The Company's material cash requirements are discussed in management's discussion and analysis for the fiscal year ended December 31, 2023 filed as Exhibit 99.3 under the headings "Capital Requirements" and "Contractual Obligations".

NOTICES PURSUANT TO REGULATION BTR

There were no notices required by Rule 104 of Regulation BTR that the Registrant sent during the year ended December 31, 2023 concerning any equity security subject to a blackout period under Rule 101 of Regulation BTR.

NYSE CORPORATE GOVERNANCE

The Company's common shares are listed on the NYSE. Sections 103.00 and 303A.11 of the NYSE Listed Company Manual permit foreign private issuers to follow home country practices in lieu of certain provisions of the NYSE Listed Company Manual. A foreign private issuer that follows home country practices in lieu of certain provision of the NYSE Listed Company Manual must disclose any significant ways in which its corporate governance practices differ from those followed by domestic companies either on its website or in the annual report that it distributes to shareholders in the United States. A description of the significant ways in which the Company's governance practices differ from those followed by domestic companies pursuant to NYSE standards is as follows:

Shareholder Meeting Quorum Requirement: The NYSE is of the opinion that the quorum required for any meeting of shareholders should be sufficiently high to insure a representative vote. The Company's quorum requirement is set forth in its Memorandum and Articles. A quorum for a meeting of members of the Company is two persons who are, or who represent by proxy, shareholders who, in the aggregate, hold at least 5% of the shares entitled to be voted at the meeting.

Proxy Delivery Requirement: The NYSE requires the solicitation of proxies and delivery of proxy statements for all shareholder meetings, and requires that these proxies shall be solicited pursuant to a proxy statement that conforms to SEC proxy rules. The Company is a "foreign private issuer" as defined in Rule 3b-4 under the Exchange Act, and the equity securities of the Company are accordingly exempt from the proxy rules set forth in Sections 14(a), 14(b), 14(c) and 14(f) of the Exchange Act. The Company solicits proxies in accordance with applicable rules and regulations in Canada.

Shareholder Approval Requirement: The Company will follow Toronto Stock Exchange rules for shareholder approval of new issuances of its common shares and for the approval of equity plans. Following Toronto Stock Exchange rules, shareholder approval is required for certain issuances of shares that: (i) materially affect control of the Company; or (ii) provide consideration to insiders in aggregate of 10% or greater of the market capitalization of the listed issuer and have not been negotiated at arm's length. Shareholder approval is also required, pursuant to Toronto Stock Exchange rules, in the case of private placements: (x) for an aggregate number of listed securities issuable greater than 25% of the number of securities of the listed issuer which are outstanding, on a non-diluted basis, prior to the date of closing of the transaction if the price per security is less than the market price; or (y) that during any six month period are to insiders for listed securities or options, rights or other entitlements to listed securities greater than 10% of the number of securities of the listed issuer which are outstanding, on a non-diluted basis, prior to the date of the closing of the first private placement to an insider during the six month period. The Company will also follow Toronto Stock Exchange rules for shareholder approval of the Company's equity compensation plans rather than NYSE requirements. Under NYSE rules, shareholder approval is required for all equity compensation plans and any material revisions thereto. For "Rolling" or "evergreen" equity plans, like the Company's, which reserve a set percentage of the Company's issued and outstanding shares under the plan, each increase pursuant to such formula is subject to shareholder approval unless the plan has a term of not more than ten years. TSX rules provide that all security based compensation arrangements must be approved by a listed issuer's security holders at a meeting. This applies not only to plans, but also to individual stock options and entitlements not granted pursuant to an arrangement. Security holder approval is also required for any amendment to an arrangement or entitlement (e.g. an individual option or award), unless the plan permits such amendment without security holder approval. For evergreen plans, the TSX requires shareholder approval within three years after institution and within every three years thereafter.

9

The foregoing are consistent with the laws, customs and practices in Canada.

In addition, the Company may from time-to-time seek relief from the NYSE corporate governance requirements on specific transactions under the NYSE Listed Company Guide, in which case, the Company shall make the disclosure of such transactions available on the Company's website at www.edrsilver.com. Information contained on the Company's website is not part of this annual report on Form 40-F.

MINE SAFETY DISCLOSURE

Pursuant to Section 1503(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 ("Dodd-Frank Act"), issuers that are operators, or that have a subsidiary that is an operator, of a coal or other mine in the United States are required to disclose in their periodic reports filed with the SEC information regarding specified health and safety violations, orders and citations, related assessments and legal actions, and mining-related fatalities under the regulation of the Federal Mine Safety and Health Administration ("MSHA") under the Federal Mine Safety and Health Act of 1977 (the "Mine Act"). During the fiscal year ended December 31, 2023, the Company had no mines in the United States subject to regulation by MSHA under the Mine Act.

RECOVERY OF ERRONEOUSLY AWARDED COMPENSATION

The Company has adopted a compensation recovery policy effective October 2, 2023 (referred to as the "Incentive Compensation Clawback Policy") as required by NYSE listing standards and pursuant to Rule 10D-1 of the Exchange Act. The Incentive Compensation Clawback Policy is filed as Exhibit 97 to this Form 40-F. At no time during or after the fiscal year ended December 31, 2023 (as of the date of this Annual Report), was the Company required to prepare an accounting restatement that required recovery of erroneously awarded compensation pursuant to the Incentive Compensation Clawback Policy and, as of December 31, 2023, there was no outstanding balance of erroneously awarded compensation to be recovered from the application of the Incentive Compensation Clawback Policy to a prior restatement.

DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS.

Not applicable.

UNDERTAKING

The Company undertakes to make available, in person or by telephone, representatives to respond to inquiries made by the Commission staff, and to furnish promptly, when requested to do so by the Commission staff, information relating to: the securities registered pursuant to Form 40-F; the securities in relation to which the obligation to file an annual report on Form 40-F arises; or transactions in said securities.

CONSENT TO SERVICE OF PROCESS

The Company filed an Appointment of Agent for Service of Process and Undertaking on Form F-X/A with the SEC on February 25, 2021, with respect to the class of securities in relation to which the obligation to file this annual report on Form 40-F arises. Any change to the name or address of the agent for service of process will be communicated promptly to the SEC by amendment to Form F-X/A referencing the Company's file number.

10

EXHIBIT INDEX

The following exhibits have been filed as part of this annual report on Form 40-F:

11

12

SIGNATURES

Pursuant to the requirements of the Exchange Act, the Registrant certifies that it meets all of the requirements for filing on Form 40-F and has duly caused this annual report to be signed on its behalf by the undersigned, thereto duly authorized.

| ENDEAVOUR SILVER CORP. | ||

| By: | /s/ Daniel Dickson | |

| Name: | Daniel Dickson | |

| Title: | Chief Executive Officer | |

Date: March 11, 2024

13

Executive Compensation Clawback Policy

1. Introduction

The Board of Directors (the "Board") of Endeavour Silver Corp. (the "Company") believes that it is in the best interests of the Company and its shareholders to create and maintain a culture that emphasizes integrity and accountability and that reinforces the Company's compensation philosophy. The Board has therefore adopted this policy, which provides for the recovery of erroneously awarded incentive compensation in the event that the Company is required to prepare an accounting restatement due to material noncompliance of the Company with any financial reporting requirements under the federal securities laws (the "Policy"). This Policy is designed to comply with Section 10D of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), related rules and the listing standards of the New York Stock Exchange (the "NYSE"), including but not limited to Section 811 of the NYSE American Company Guide, or any other securities exchange on which the Company's shares are listed in the future.

2. Administration

This Policy shall be administered by the Board or, if so designated by the Board, the Compensation Committee of the Board (the "Committee"), in which case, all references herein to the Board shall be deemed references to the Committee. Any determinations made by the Board shall be final and binding on all affected individuals.

3. Covered Executives

Unless and until the Board determines otherwise, for purposes of this Policy, the term "Covered Executive" means a current or former employee who is or was identified by the Company as the Company's president, principal financial officer, principal accounting officer (or if there is no such accounting officer, the controller), any vice-president of the Company in charge of a principal business unit, division, or function (such as sales, administration, or finance), any other officer who performs a policy-making function, or any other person (including any executive officer of the Company's subsidiaries or affiliates) who performs similar policy-making functions for the Company. "Policy-making function" excludes policy-making functions that are not significant. "Covered Executives" will include, at minimum, the executive officers identified by the Company in its disclose prepared in response to either (i) Item 6.B of Form 20-F if the Company files its annual report with the United States Securities and Exchange Commission (the "SEC") on Form 20-F, or (ii) Item B.19 of Form 40-F if the Company files its annual report with the SEC on Form 40-F. For the avoidance of doubt, "Covered Executives" will include at least the following Company officers: Chief Executive Officer, Chief Financial Officer, Chief Operating Officer, Vice President of Operations and Vice President of Exploration.

This Policy covers Incentive Compensation received by a person after beginning service as a Covered Executive and who served as a Covered Executive at any time during the performance period for that Incentive Compensation.

4. Recovery: Accounting Restatement

In the event of an "Accounting Restatement," the Company will recover reasonably promptly any excess Incentive Compensation received by any Covered Executive during the three completed fiscal years immediately preceding the date on which the Company is required to prepare an Accounting Restatement, including transition periods resulting from a change in the Company's fiscal year as provided in Rule 10D-1 of the Exchange Act. Incentive Compensation is deemed "received" in the Company's fiscal period during which the Financial Reporting Measure specified in the Incentive Compensation award is attained, even if the payment or grant of the Incentive Compensation occurs after the end of that period. Directors are strongly encouraged to attend director education programs that they deem appropriate based on their individual backgrounds. These programs should help them to stay abreast of developments in corporate governance and best practices relevant to their roles.

(a) Definition of Accounting Restatement

For the purposes of this Policy, an "Accounting Restatement" means the Company is required to prepare an accounting restatement of its financial statements filed with the Securities and Exchange Commission (the "SEC") due to the Company's material noncompliance with any financial reporting requirements under the federal securities laws (including any required accounting restatement to correct an error in previously issued financial statements that is material to the previously issued financial statements, or that would result in a material misstatement if the error were corrected in the current period or left uncorrected in the current period).

The determination of the time when the Company is "required" to prepare an Accounting Restatement shall be made in accordance with applicable SEC and national securities exchange rules and regulations.

An Accounting Restatement does not include situations in which financial statement changes did not result from material non-compliance with financial reporting requirements, such as, but not limited to retrospective: (i) application of a change in accounting principles; (ii) revision to reportable segment information due to a change in the structure of the Company's internal organization; (iii) reclassification due to a discontinued operation; (iv) application of a change in reporting entity, such as from a reorganization of entities under common control; (v) adjustment to provision amounts in connection with a prior business combination; and (vi) revision for stock splits, stock dividends, reverse stock splits or other changes in capital structure.

(b) Definition of Incentive Compensation

For purposes of this Policy, "Incentive Compensation" means any compensation that is granted, earned, or vested based wholly or in part upon the attainment of a Financial Reporting Measure, including, for example, bonuses or awards under the Company's short and long-term incentive plans, grants and awards under the Company's equity incentive plans, and contributions of such bonuses or awards to the Company's deferred compensation plans or other employee benefit plans that are not tax-qualified plans. For avoidance of doubt, Incentive Compensation that is deferred (either mandatorily or voluntarily) under the Company's non-qualified deferred compensation plans, as well as any matching amounts and earnings thereon, are subject to this Policy. Incentive Compensation does not include awards which are granted, earned and vested without regard to attainment of Financial Reporting Measures, such as time-vesting awards, discretionary awards and awards based wholly on subjective standards, strategic measures or operational measures.

(c) Financial Reporting Measures

"Financial Reporting Measures" are those that are determined and presented in accordance with the accounting principles used in preparing the Company's financial statements (including non-GAAP financial measures) and any measures derived wholly or in part from such financial measures. For the avoidance of doubt, Financial Reporting Measures include stock price and total shareholder return. A measure need not be presented within the financial statements or included in a filing with the SEC to constitute a Financial Reporting Measure for purposes of this Policy.

(d) Excess Incentive Compensation: Amount Subject to Recovery

The amount(s) to be recovered from the Covered Executive will be the amount(s) by which the Covered Executive's Incentive Compensation for the relevant period(s) exceeded the amount(s) that the Covered Executive otherwise would have received had such Incentive Compensation been determined based on the restated amounts contained in the Accounting Restatement. All amounts shall be computed without regard to taxes paid.

For Incentive Compensation based on Financial Reporting Measures such as stock price or total shareholder return, where the amount of excess compensation is not subject to mathematical recalculation directly from the information in an Accounting Restatement, the Board will calculate the amount to be reimbursed based on a reasonable estimate of the effect of the Accounting Restatement on such Financial Reporting Measure upon which the Incentive Compensation was received. The Company will maintain documentation of that reasonable estimate and will provide such documentation to the applicable national securities exchange.

(e) Method of Recovery

The Board will determine, in its sole discretion, the method(s) for recovering reasonably promptly excess Incentive Compensation hereunder. Such methods may include, without limitation:

(i) requiring reimbursement of Incentive Compensation previously paid;

(ii) forfeiting any Incentive Compensation contribution made under the Company's deferred compensation plans;

(iii) offsetting the recovered amount from any compensation or Incentive Compensation that the Covered Executive may earn or be awarded in the future;

(iv) taking any other remedial and recovery action permitted by law, as determined by the Board; or

(v) some combination of the foregoing.

5. No Indemnification or Advance

Subject to applicable law, the Company shall not indemnify, including by paying or reimbursing for premiums for any insurance policy covering any potential losses, any Covered Executives against the loss of any erroneously awarded Incentive Compensation, nor shall the Company advance any costs or expenses to any Covered Executives in connection with any action to recover excess Incentive Compensation.

6. Interpretation

The Board is authorized to interpret and construe this Policy and to make all determinations necessary, appropriate or advisable for the administration of this Policy. It is intended that this Policy be interpreted in a manner that is consistent with the requirements of Section 10D of the Exchange Act and any applicable rules or standards adopted by the SEC or any national securities exchange on which the Company's securities are listed.

7. Effective Date

The effective date of this Policy is November 3, 2023 (the "Effective Date"). This Policy applies to Incentive Compensation received by Covered Executives on or after the Effective Date that results from attainment of a Financial Reporting Measure based on or derived from financial information for any fiscal period ending on or after the Effective Date. Without limiting the scope or effectiveness of this Policy, Incentive Compensation granted or received by Covered Executives prior to the Effective Date remains subject to the Company's prior Executive Compensation Clawback Policy dated March 9, 2016). In addition, this Policy is intended to be and will be incorporated as an essential term and condition of any Incentive Compensation agreement, plan or program that the Company establishes or maintains on or after the Effective Date.

8. Amendment and Termination

The Board may amend this Policy from time to time in its discretion and shall amend this Policy as it deems necessary to reflect changes in regulations adopted by the SEC under Section 10D of the Exchange Act and to comply with any rules or standards adopted by the NYSE or any other securities exchange on which the Company's shares are listed in the future.

9. Other Recovery Rights

The Board intends that this Policy will be applied to the fullest extent of the law. Upon receipt of this Policy, each Covered Executive is required to complete the Receipt and Acknowledgement attached as Schedule A to this Policy. The Board may require that any employment agreement or similar agreement relating to Incentive Compensation received on or after the Effective Date shall, as a condition to the grant of any benefit thereunder, require a Covered Executive to agree to abide by the terms of this Policy. Any right of recovery under this Policy is in addition to, and not in lieu of, any (i) other remedies or rights of compensation recovery that may be available to the Company pursuant to the terms of any similar policy in any employment agreement, or similar agreement relating to Incentive Compensation, unless any such agreement expressly prohibits such right of recovery, and (ii) any other legal remedies available to the Company. The provisions of this Policy are in addition to (and not in lieu of) any rights to repayment the Company may have under Section 304 of the Sarbanes-Oxley Act of 2002 and other applicable laws.

10. Impracticability

The Company shall recover any excess Incentive Compensation in accordance with this Policy, except to the extent that certain conditions are met, and the Board has determined that such recovery would be impracticable, all in accordance with Rule 10D 1 of the Exchange Act and Section 303A.14 of the NYSE Listed Company Manual or any other securities exchange on which the Company's shares are listed in the future.

11. Successors

This Policy shall be binding upon and enforceable against all Covered Executives and their beneficiaries, heirs, executors, administrators or other legal representatives.

12. Revisions

Approved by the Board on November 3, 2023.

Schedule A

EXECUTIVE COMPENSATION CLAWBACK POLICY

RECEIPT AND ACKNOWLEDGEMENT

I, __________________________________________, hereby acknowledge that I have received and read a copy of the Executive Compensation Clawback Policy. As a condition of my receipt of any Incentive Compensation as defined in the Policy, I hereby agree to the terms of the Policy. I further agree that if recovery of excess Incentive Compensation is required pursuant to the Policy, the Company shall, to the fullest extent permitted by governing laws, require such recovery from me up to the amount by which the Incentive Compensation received by me, and amounts paid or payable pursuant or with respect thereto, constituted excess Incentive Compensation. If any such reimbursement, reduction, cancelation, forfeiture, repurchase, recoupment, offset against future grants or awards and/or other method of recovery does not fully satisfy the amount due, I agree to immediately pay the remaining unpaid balance to the Company.

|

|

|

|

|

Signature |

|

Date |

ANNUAL INFORMATION FORM

of

ENDEAVOUR SILVER CORP.

(the "Company" or "Endeavour")

Suite 1130 - 609 Granville Street

Vancouver, British Columbia

Canada, V7Y 1G5

Phone: (604) 685-9775

Dated as of March 8, 2024

TABLE OF CONTENTS

ITEM 1: PRELIMINARY NOTES

1.1 Incorporation of Documents by Reference

Except as otherwise disclosed herein, all financial information in this Annual Information Form ("AIF") has been prepared in accordance with International Financial Reporting Standards ("IFRS") as prescribed by the International Accounting Standards Board.

The information provided in the AIF is supplemented by disclosure contained in the technical reports listed below. The detailed disclosure in each of the technical reports below is incorporated by reference into this AIF. The technical reports listed below are not contained within, nor attached to, this document but may be accessed at www.sedarplus.ca or on the Company's website at www.edrsilver.com.

|

Type of Document |

Report Date / |

Date Filed / |

Document name which may be |

|

NI 43-101 Technical Report: Updated Mineral Resource and Reserve Estimates for the Guanaceví Project, Durango State, Mexico |

December 14, 2022 (Effective date: November 5, 2022) |

January 26, 2023 |

Technical Report (NI 43-101) - English Qualification Certificate(s) and Consent(s) |

|

NI 43-101 Technical Report: Updated Mineral Resource and Reserve Estimates for the Bolañitos Project, Guanajuato State, Mexico |

December 14, 2022 (Effective date: November 9, 2022) |

January 26, 2023 |

Technical Report (NI 43-101) - English Qualification Certificate(s) and Consent(s) |

|

NI 43-101 Technical Report on the Feasibility Study of the Terronera Project, Jalisco State, Mexico - Amended |

Dated May 15, 2023 (Effective date: September 9, 2021) |

May 31, 2023 |

Technical Report (NI 43-101) - English Qualification Certificate(s) and Consent(s) |

|

Mineral Resource Estimate for the Pitarrilla Ag-Pb-Zn Project, Durango State, Mexico (Amended) |

Report Date: March 15, 2023 (Effective Date: October 6, 2022) |

March 29, 2023 |

Technical Report (NI 43-101) - English Qualification Certificate(s) and Consent(s) |

References to "the Company" or "Endeavour" are to Endeavour Silver Corp. and, where applicable and as the context requires, include its subsidiaries.

1.2 Date of Information

All information in this AIF is as of December 31, 2023 unless otherwise indicated.

1.3 Forward-Looking Statements

This AIF contains "forward-looking statements" within the meaning of the U.S. Securities Litigation Reform Act of 1995, as amended and "forward-looking information" within the meaning of applicable Canadian securities legislation. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, forecasts, objectives, assumptions or future events or performance are not statements of historical fact and may be forward-looking statements. Such forward-looking statements concern the Company's anticipated results and developments in the Company's operations in future periods, planned exploration and development of its properties, plans related to its business and other matters that may occur in the future. These statements relate to analyses and other information that are based on expectations of future performance, including silver and gold production and planned work programs.

Statements concerning reserves and mineral resource estimates may also be deemed to constitute forward-looking statements to the extent that they involve estimates of the mineralization that will be encountered if the property is developed and, in the case of mineral reserves, such statements reflect the conclusion based on certain assumptions that the mineral deposit can be economically exploited.

Forward-looking statements are made based upon certain assumptions and other important factors that, while considered reasonable by the Company, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. The Company has made assumptions based on many of these factors which include, without limitation, present and future business strategies, the environment in which the Company will operate in the future, including the price of silver and gold, anticipated cost and the ability to achieve goals.

Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors which could cause actual events or results to differ from those expressed or implied by the forward-looking statements, including, without limitation, the following and those disclosed in this AIF under "Description of the Business - Risk Factors":

This list is not exhaustive of the factors that may affect the Company's forward-looking statements. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in the forward-looking statements. The Company's forward-looking statements and information are based on the assumptions, beliefs, expectations and opinions of management as of the date of this AIF. The Company will update forward-looking statements and information if and when, and to the extent, required by applicable securities laws. Readers should not place undue reliance on forward-looking statements. The forward-looking statements and information contained herein are expressly qualified by this cautionary statement.

1.4 Conversion Table

All data and information are presented in metric units. In this AIF, the following conversion factors were used:

|

2.47 acres |

= |

1 hectare |

1% |

= |

10,000 ppm |

|

3.28 feet |

= |

1 metre |

0.4047 hectares |

= |

1 acre |

|

0.62 miles |

= |

1 kilometre |

0.3048 metres |

= |

1 foot |

|

0.032 ounces (troy) |

= |

1 gram |

1.609 kilometres |

= |

1 mile |

|

1.102 tons (short) |

= |

1 tonne |

31.103 grams |

= |

1 ounce (troy) |

|

0.029 ounces/ton |

= |

1 gram/tonne |

0.907 tonnes |

= |

1 ton |

|

1 ppm |

= |

1 gram/tonne |

34.286 grams/tonne |

= |

1 ounce/ton |

|

1 ounce/ton |

= |

34.286 ppm |

|

|

|

1.5 Technical Abbreviations

|

Ag |

silver |

|

m |

metres |

|

Ag Eq. |

silver equivalent |

|

NI 43-101 |

National Instrument 43-101 Standards of Disclosure for Mineral Projects |

|

Au |

gold |

|

NSR |

net smelter returns |

|

Au Eq. |

gold equivalent |

|

opt |

ounces per ton |

|

aver. |

average |

|

oz |

ounce(s) |

|

cm |

centimetres |

|

Pb |

lead |

|

g |

grams |

|

RC |

reverse circulation |

|

gpt or g/t |

grams per tonne |

|

t |

tonne |

|

ha |

hectares |

|

tpd |

tonnes per day |

|

km |

kilometres |

|

tr |

trench |

|

lb |

pound |

|

Zn |

zinc |

1.6 Currency and Exchange Rates

All dollar amounts in this AIF are expressed in U.S. dollars ("$") unless otherwise indicated. References to "Cdn.$" are to Canadian dollars.

The high, low, average and closing rates for the United States dollar in terms of Canadian dollars for each of the financial periods of the Company ended December 31, 2023, December 31, 2022, and December 31, 2021, as quoted by the Bank of Canada, were as follows:

|

|

Year ended |

Year ended |

Year ended |

|||

|

|

|

|

|

|||

|

High |

1.3875 |

1.3856 |

1.2942 |

|||

|

Low |

1.3128 |

1.2451 |

1.2040 |

|||

|

Average |

1.3497 |

1.3011 |

1.2535 |

|||

|

Closing |

1.3226 |

1.3544 |

1.2678 |

On December 29, 2023, the closing exchange rate for the United States dollar in terms of Canadian dollars, as quoted by the Bank of Canada, was U.S.$1.00 = Cdn.$1.3226 (Cdn.$1.00 = U.S.$0.7561). On March 8, 2024, the daily average exchange rate for the United States dollar in terms of Canadian dollars, as quoted by the Bank of Canada, was U.S.$1.00 = Cdn.$1.3471(Cdn.$1.00 = U.S.$0.7423).

1.7 Classification of Mineral Reserves and Resources

In this AIF, the definitions of proven and probable mineral reserves, and measured, indicated and inferred mineral resources are those used by the Canadian provincial securities regulatory authorities and conform to the definitions utilized by the Canadian Institute of Mining, Metallurgy and Petroleum, as the CIM Definition Standards on Mineral Resources and Mineral Reserves adopted by the CIM Council, as amended.

1.8 Cautionary Note to U.S. Investors concerning Estimates of Mineral Reserves and Measured, Indicated and Inferred Mineral Resources

This AIF has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of United States securities laws. As a result, the Company reports the mineral reserves and resources of the projects it has an interest in according to Canadian standards. Canadian reporting requirements for disclosure of mineral properties are governed by National Instrument 43-101 - Standards of Disclosure for Mineral Projects (“NI 43-101”). NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. These standards differ from the requirements of the United States Securities and Exchange Commission (“SEC”) that are applicable to domestic United States reporting companies under subpart 1300 of Regulation S-K (“S K 1300”) under the Exchange Act. As an issuer that prepares and files its reports with the SEC pursuant to the MJDS, the Company is not subject to the requirements of S K 1300. Any mineral reserves and mineral resources reported by the Company in accordance with NI 43-101 may not qualify as such under or differ from those prepared in accordance with S K 1300. Accordingly, information included or incorporated by reference in this AIF concerning descriptions of mineralization and estimates of mineral reserves and resources under Canadian standards may not be comparable to similar information made public by United States companies subject to the reporting and disclosure requirements of S K 1300.

ITEM 2: CORPORATE STRUCTURE

2.1 Name, Address and Incorporation

The Company was incorporated under the laws of the Province of British Columbia on March 11, 1981, under the name, "Levelland Energy & Resources Ltd". Effective August 27, 2002, the Company changed its name to "Endeavour Gold Corp.", consolidated its share capital on the basis of four old common shares for one new common share and increased its share capital to 100,000,000 common shares without par value. On September 13, 2004, the Company changed its name to "Endeavour Silver Corp.", transitioned from the Company Act (British Columbia) to the Business Corporations Act (British Columbia) and increased its authorized share capital to unlimited common shares without par value.

The Company's principal business office is located at:

Suite 1130 - 609 Granville Street

Vancouver, British Columbia

Canada, V7Y 1G5

and its registered and records office is located at:

19th Floor, 885 West Georgia Street

Vancouver, British Columbia

Canada, V6C 3H4

2.2 Subsidiaries

The Company conducts its business primarily in Mexico through subsidiary companies. The following table lists the Company's material direct and indirect subsidiaries, their jurisdiction of incorporation, and percentage owned by the Company directly, indirectly or beneficially.

|

Name of Company |

Incorporated |

Percentage |

||

|

|

|

|

||

|

Endeavour Gold Corporation S.A. de C.V. |

Mexico |

100% |

||

|

EDR Silver de Mexico S.A. de C.V. SOFOM |

Mexico |

100% |

||

|

Minera Plata Adelante, S.A. de C.V. |

Mexico |

100% |

||

| Minera Santa Cruz y Garibaldi S.A. de C.V. | Mexico | 100% | ||

|

Refinadora Plata Guanaceví, S.A. de C.V. |

Mexico |

100% |

||

|

Mina Bolañitos S.A de C.V. |

Mexico |

100% |

||

|

Minas Lupycal S.A. de C.V. |

Mexico |

100% |

||

|

Terronera Precious Metals S.A. de C.V. |

Mexico |

100% |

||

|

Minera Pitarrilla S.A. de C.V. |

Mexico |

100% |

||

|

Minera Plata Carina S.P.A. |

Chile |

100% |

||

|

Endeavour USA Holdings |

USA |

100% |

||

|

Endeavour USA Corp. |

USA |

100% |

||

|

Oro Silver Resources Ltd. |

British Columbia, Canada |

100% |

||

|

MXRT Holdings Ltd. |

British Columbia, Canada |

100% |

||

| Endeavour Management Corp. | British Columbia, Canada | 100% |

ITEM 3: GENERAL DEVELOPMENT OF THE BUSINESS

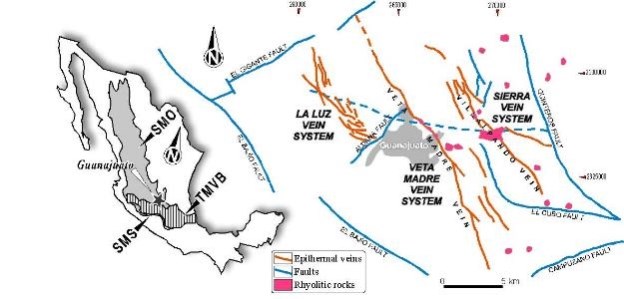

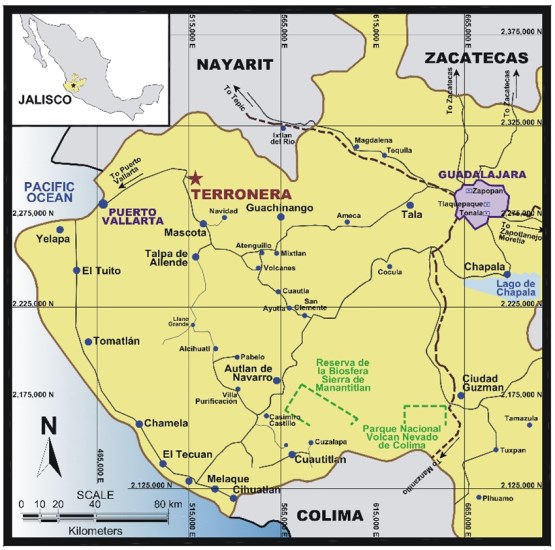

The Company is a Canadian mineral company engaged in the evaluation, acquisition, exploration, development and exploitation of precious metal properties in Mexico, Chile and the USA. The Company has two producing silver‑gold mines in Mexico: the Guanaceví Mine in Durango acquired in 2004 and the Bolañitos Mine in Guanajuato acquired in 2007. In addition to operating these two mines, the Company is advancing one development and two exploration projects in Mexico: the Terronera property in Jalisco state acquired in 2010 that is now in the development stage, the prospective Pitarrilla property in Durango State acquired in 2022 and the Parral properties in Chihuahua acquired in 2016.

The Company has several early stage exploration projects in Chile that have accumulated since 2012.

In 2021, the Company acquired the Bruner Property, located in Nye County, Nevada, USA which is an exploration project that includes mineral claims, mining rights, property assets, water rights, and government authorizations and permits.

3.1 Three Year History

Financial Year ended December 31, 2023

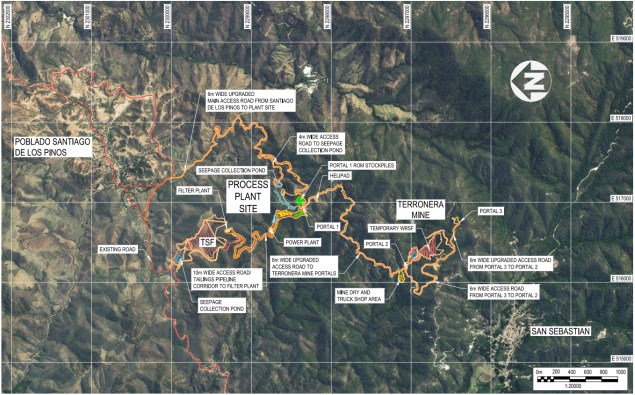

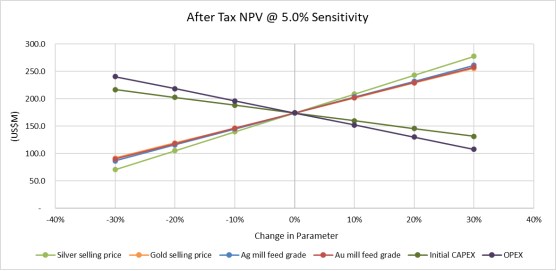

In April 2023, the Company made a formal decision to proceed with the construction of an underground mine and mill at the Terronera Project. The Board approved the construction based on an operating scenario, consisting of a process plant with 2,000 tonne per day capacity and an initial capital expenditure cost of $230 million. A comprehensive review of the remaining cost-to-complete has since been completed in January 2024 with forecasted initial capital costs now estimated to be $271 million. (See “Mineral Projects – Recent Developments – Terronera Project, Jalisco State, Mexico” for further details.)

On June 16, 2023, the Company filed a short form base shelf prospectus (the “Base Shelf”) to qualify the distribution of various securities, including common shares. The distribution of such securities of the Company may be effected from time to time in one or more transactions at a fixed price or prices, which may vary with market prices prevailing at the time of sale, or at prices related to such prevailing market prices to be negotiated with purchasers and as set forth in an accompanying prospectus supplement, including transactions that are deemed to be at-the-market (“ATM”) distributions.

On June 27, 2023, the Company entered into an ATM equity facility (the “June 2023 ATM Facility”) with BMO Capital Markets Corp. (the lead agent), CIBC World Markets Inc., TD Securities (USA) LLC, H.C. Wainwright & Co., LLC, B. Riley Securities, Inc., Raymond James (USA) Ltd. and National Bank of Canada Financial, Inc. Under the terms of the June 2023 ATM Facility, the Company could, from time to time, sell common stock having an aggregate offering value of up to $60 million on the New York Stock Exchange. The Company determined, at its sole discretion, the timing and number of shares to be sold under the June 2023 ATM Facility.

From June 27, 2023 to November 30, 2023, the Company issued 23,428,572 common shares under the June 2023 ATM Facility at an average price of $2.47 per share for gross proceeds of $57.9 million, less commission of $1.1 million and recognized $0.2 million of other transaction costs. The June 2023 ATM Facility was completed in November 2023.

On August 30, 2023, the Company through its wholly owned subsidiary, Minera Plata Adelante, S.A. de C.V., completed the sale of its interest in the 1% Cozamin royalty (the “Cozamin Royalty”) to Gold Royalty Corp. for total consideration of $7.5 million in cash. The Cozamin Royalty applies to two concessions (Calicanto and Vicochea) on Capstone Copper’s Cozamin copper-silver mine. The Company obtained the Cozamin Royalty through a concession division agreement signed in 2017 on seven wholly-owned concessions which were acquired for $0.5 million. The sale agreement includes an option granted to Gold Royalty Corp. to purchase any additional royalties which may be granted on the five remaining concessions under the 2017 concession division agreement.

On October 6, 2023, the Company, through its wholly-owned subsidiary Terronera Precious Metals, S.A. de C.V., entered into a credit agreement with Société Generale and ING Capital LLC (together with ING Bank N.V.) for a senior secured debt facility for up to $120 million (the “Debt Facility”). Proceeds from the Debt Facility will be used towards construction of the underground mine and mill at the Company’s Terronera Project in Jalisco state, Mexico. A summary of the key terms of the Debt Facility are as follows:

As at December 31, 2023, the Company had not drawn on the Debt Facility.

On December 18, 2023, the Company entered into an ATM equity facility (the "December 2023 ATM Facility") with BMO Capital Markets Corp. (the lead agent), TD Securities (USA) LLC, CIBC World Markets Inc., Raymond James (USA) Inc., B. Riley Securities Inc., H.C. Wainwright & Co. LLC, A.G.P./Alliance Global Partners and Stifel Nicolaus Canada Inc. (together, the "Agents"). Under the terms of the December 2023 ATM Facility, the Company can, from time to time, sell common stock having an aggregate offering value of up to $60 million on the New York Stock Exchange. The Company determines, at its sole discretion, the timing and number of shares to be sold under the December 2023 ATM Facility.

From December 18, 2023 to December 31, 2023, the Company has issued 2,311,621 common shares under the December 2023 ATM Facility at an average price of $2.05 per share for gross proceeds of $4.8 million, less commission of $1.1 million and recognized $0.2 million of other transaction costs.

Subsequent to December 31, 2023, the Company issued an additional 15,861,552 common shares under the December 2023 ATM Facility at an average price of $1.51 per share for gross proceeds of $23,906,420, less commission of $478,128.

Financial Year ended December 31, 2022

On January 12, 2022, the Company entered into a definitive agreement to purchase the Pitarrilla project in Durango State, Mexico from SSR Mining Inc. ("SSR") for total consideration of $70 million, consisting of $35 million in common shares and a further $35 million in cash or in common shares at the election of SSR and agreed to by the Company, and a grant of a 1.25% net smelter returns ("NSR") royalty.

Pitarrilla is a large undeveloped silver, lead, and zinc project located 160 kilometres north of Durango City, in northern Mexico. The Pitarrilla property consists of 4,950 hectares across five concessions and has significant infrastructure in place with direct access to utilities.

The acquisition was completed on July 6, 2022. Total consideration included 8,577,380 shares of the Company issued on July 6, 2022 based on a deemed price of $4.07 per share and a $35.1 million cash payment. Fair value of the 8,577,380 common shares issued on July 6, 2022 was $25.6 million at Cdn$3.89 per share.

On March 22, 2022, the Company completed a prospectus equity financing with the offering co-led by BMO Capital Markets and PI Financial Corp., together with a syndicate of underwriters consisting of CIBC World Markets Inc., B. Riley Securities Inc., and H.C. Wainwright & Co., LLC. The Company issued a total of 9,293,150 common shares at a price of $4.95 per share for aggregate proceeds of $46 million, less commission of $2.5 million and $0.3 million in transaction related costs.

On September 9, 2022, the Company entered into an agreement to sell a 100% interest in Minera Oro Silver de Mexico, S.A. de C.V. ("MOS"), a wholly-owned subsidiary of Endeavour to Grupo ROSGO, S.A. de C.V., ("Grupo ROSGO"). MOS held the El Compas property and the lease on the La Plata processing plant in Zacatecas, Mexico.

Pursuant to the agreement, Grupo ROSGO will pay Endeavour $5 million cash over five years with an initial payment of $250,000 on signing of the definitive agreement. Instalment payments of $500,000 will be made every six months other than the third payment, which will be $750,000. The payments are secured by a pledge of the shares of MOS.

During 2022, the Company continued progress on development activities at the Terronera Project including onsite delivery of mobile mining equipment, procurement of major equipment, and assembly of initial project infrastructure such as the temporary mine maintenance shop and a permanent camp facility. Earthworks included site clearing, road upgrades and underground mine access development. The Company intends to make a formal construction decision subject to completion of a financing package and receipt of additional amended permits in 2023.

Financial Year ended December 31, 2021

On March 17, 2021, the Company signed a definitive agreement to sell the El Cubo Mine in Guanajuato, Mexico to Guanajuato Silver Company Ltd. (formerly VanGold Mining Corp.) ("GSilver") for $15 million in cash and share payments plus up to $3 million in future contingent payments (the "El Cubo Transaction"). On April 9, 2021, the purchase was completed for the following gross consideration:

GSilver has also agreed to pay the Company up to an additional $3 million in contingent payments based on the following:

In mid-August 2021, the Company suspended mining and milling operations at El Compas. Mining assets and key talent were transferred within the Company to Bolañitos and Terronera.

On August 31, 2021, the Company acquired the Bruner Property, located in Nye County, Nevada, from Canamex Gold Corp. ("Canamex"). The Company paid $10 million in cash for 100% of the Bruner Gold Project which includes mineral claims, mining rights, property assets, water rights, and government authorizations and permits.

The Bruner Gold Project is an exploration and development stage project located approximately 180 km southeast of Reno, Nevada. Gold was originally discovered in the district in 1906 and saw intermittent historic mining between 1906 and 1998. Recent exploration activities by previous operators included mapping, drilling, geophysical surveys and sampling culminating in a mineral resource estimate in 2015 and a preliminary economic assessment in 2017 outlining a low capital cost, open pit, heap leach operation.

A historic resource estimate of 342,000 oz of gold contained in 17.5 million tonnes grading 0.61 gpt Au in three zones, Paymaster, HRA and Penelas, was prepared for Canamex in a technical report dated January 22, 2018 titled "NI 43-101 Technical Report on the Bruner Gold Project, Updated Preliminary Economic Assessment, Nye County, Nevada, USA" by Welsh Hagen Associates. A "qualified person" (as defined in NI 43-101) has not done sufficient work for the Company to classify the historical estimate as a current mineral resource or mineral reserve. The Company is not treating the historical estimate as a current mineral resource or mineral reserve, has not verified the historical resource estimate and is not relying on it.

On September 9, 2021, the Company announced positive results from a feasibility study (the "2021 Feasibility Study") on its 100% owned Terronera Project in Jalisco state, Mexico. Details of the 2021 Feasibility Study, including updated mineral resource and mineral reserve estimates, are provided in the technical report titled "NI 43-101 Technical Report on the Feasibility Study of the Terronera Project, Jalisco State, Mexico" dated October 21, 2021 with an effective date of September 9, 2021 (the "2021 Terronera Technical Report"). The 2021 Terronera Technical Report was prepared by Wood Canada Limited together with the Company.

The 2021 Feasibility Study supports a high grade, silver-gold underground mining operation at Terronera producing an average of 3.3 million payable oz Ag and 32.8 thousand payable oz Au per year over a 12-year mine life. The Company commenced initial earthworks with the intention of making a formal construction decision, subject to completion of a financing package and receipt of additional amended permits.

3.2 Significant Acquisitions

No significant acquisitions for which disclosure is required under Part 8 of National Instrument 51-102 were completed by the Company during its most recently completed financial year.

ITEM 4: DESCRIPTION OF THE BUSINESS

4.1 General Description

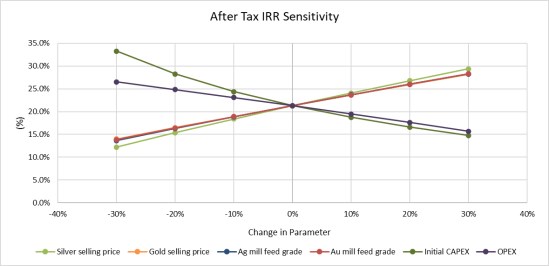

Business of the Company