UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of October 2023

Commission File Number: 001-41579

American Lithium Corp.

(Translation of registrant's name into English)

1030 West Georgia St., Suite 710

Vancouver, BC

Canada V6E 2Y3

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☐ Form 40-F ☒ Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

SIGNATURES

| American Lithium Corp. | |

| (Registrant) | |

| Date: October 17, 2023 | /s/ Simon Clarke Simon Clarke Chief Executive Officer & Director |

EXHIBIT INDEX

American Lithium Corp.

Condensed Interim Consolidated Financial Statements

For the three and six months ended August 31, 2023 and 2022

(Expressed in Canadian Dollars - Unaudited)

American Lithium Corp.

Table of Contents

NOTICE OF NO AUDITOR REVIEW OF

CONDENSED INTERIM FINANCIAL STATEMENTS

Under National Instrument 51-102, Part 4, subsection 4.3(3)(a), if an auditor has not performed a review of the condensed interim financial statements, they must be accompanied by a notice indicating that the financial statements have not been reviewed by an auditor.

The accompanying unaudited condensed interim financial statements have been prepared by and are the responsibility of management.

The Company's independent auditor has not performed a review of these financial statements in accordance with the standards established by the Chartered Professional Accountants of Canada for a review of condensed interim financial statements by an entity's auditor.

American Lithium Corp.

Condensed Interim Consolidated Statements of Financial Position

(Expressed in Canadian Dollars – Unaudited)

| August 31, | February 28, | ||||||||

| Notes | 2023 | 2023 | |||||||

| $ | $ | ||||||||

| Assets | |||||||||

| Current assets | |||||||||

| Cash and cash equivalents | 4 | 19,800,215 | 11,985,766 | ||||||

| Guaranteed investment certificates | 5 | 2,066,723 | 28,636,414 | ||||||

| Short-term investments | 6 | 6,298,000 | - | ||||||

| Amounts receivable | 455,751 | 400,804 | |||||||

| Prepaid expenses and deposits | 2,310,496 | 2,109,932 | |||||||

| 30,931,185 | 43,132,916 | ||||||||

| Non-current assets | |||||||||

| Deposits | 33,828 | 34,023 | |||||||

| Investment in Surge Battery Metals Inc. | 7 | 2,987,708 | - | ||||||

| Reclamation deposits | 8 | 591,305 | 594,713 | ||||||

| Property and equipment | 9 | 258,896 | 51,885 | ||||||

| Right-of-use assets | 10 | 167,285 | 208,828 | ||||||

| Exploration and evaluation assets | 11 | 150,459,421 | 150,257,776 | ||||||

| 154,498,443 | 151,147,225 | ||||||||

| Total assets | 185,429,628 | 194,280,141 | |||||||

| Liabilities | |||||||||

| Current liabilities | |||||||||

| Accounts payable and accrued liabilities | 13 | 2,424,868 | 1,663,785 | ||||||

| Deferred revenue | 7 | 180,000 | - | ||||||

| Current portion of lease liabilities | 10 | 78,670 | 74,981 | ||||||

| 2,683,538 | 1,738,766 | ||||||||

| Non-current liabilities | |||||||||

| Deferred gain on short-term investments | 7 | 2,316,286 | - | ||||||

| Lease liabilities | 10 | 111,175 | 151,308 | ||||||

| 2,427,461 | 151,308 | ||||||||

| Total liabilities | 5,110,999 | 1,890,074 | |||||||

| Equity | |||||||||

| Share capital | 12 | 263,354,092 | 261,911,478 | ||||||

| Equity reserves | 12 | 55,128,478 | 46,941,088 | ||||||

| Deficit | (138,699,550 | ) | (116,992,922 | ) | |||||

| Accumulated other comprehensive income | 535,609 | 530,423 | |||||||

| 180,318,629 | 192,390,067 | ||||||||

| Total liabilities and equity | 185,429,628 | 194,280,141 |

Nature of operations and going concern (Note 1)

Approved on behalf of the Board of Directors on October 13, 2023:

| /s/ Claudia Tornquist | /s/ G.A. (Ben) Binninger |

| Claudia Tornquist, Director | G.A. (Ben) Binninger, Director |

American Lithium Corp.

Condensed Interim Consolidated Statements of Loss and Comprehensive Loss

(Expressed in Canadian Dollars – Unaudited)

| Three months ended | Six months ended | ||||||||||||||

| Notes | August 31, 2023 | August 31, 2022 | August 31, 2023 | August 31, 2022 | |||||||||||

| $ | $ | $ | $ | ||||||||||||

| Operating Expenses | |||||||||||||||

| Conferences and tradeshows | 73,176 | 67,384 | 159,853 | 67,384 | |||||||||||

| Consulting and employment costs | 193,306 | 309,068 | 410,407 | 482,358 | |||||||||||

| Depreciation | 9,10 | 30,554 | 22,561 | 59,195 | 44,990 | ||||||||||

| Exploration and evaluation expenditures | 13 | 5,394,032 | 4,879,673 | 10,129,231 | 9,031,209 | ||||||||||

| Foreign exchange loss (gain) | 183,164 | 302,625 | 227,997 | 397,059 | |||||||||||

| General and administrative | 109,486 | 61,759 | 185,203 | 108,423 | |||||||||||

| Insurance | 377,518 | 20,545 | 772,558 | 46,832 | |||||||||||

| Interest - lease obligations | 10 | 5,986 | 37,823 | 12,591 | 75,855 | ||||||||||

| Management and directors fees | 13 | 516,750 | 440,000 | 1,033,500 | 828,954 | ||||||||||

| Marketing | 1,230,455 | 239,969 | 1,464,574 | 399,037 | |||||||||||

| Professional fees | 212,192 | 1,031,005 | 640,714 | 1,335,313 | |||||||||||

| Regulatory and transfer agent fees | 75,070 | 871,264 | 133,388 | 911,662 | |||||||||||

| Share-based compensation | 12,13 | 4,104,968 | 2,802,987 | 8,782,295 | 6,253,741 | ||||||||||

| Travel | 37,095 | 145,425 | 98,688 | 280,855 | |||||||||||

| 12,543,752 | 11,232,088 | 24,110,194 | 20,263,672 | ||||||||||||

| Other items | |||||||||||||||

| Advisory fee income | 7 | 60,000 | - | 60,000 | - | ||||||||||

| Gain on short-term investments | 6,7 | 1,684,571 | - | 1,684,571 | - | ||||||||||

| Interest and miscellaneous income | 293,325 | 188,889 | 734,144 | 296,829 | |||||||||||

| Share of loss from equity investment in Surge Battery Metals Inc. | 7 | (60,878 | ) | - | (60,878 | ) | - | ||||||||

| Dilution loss on investment in Surge Battery Metals Inc. | 7 | (14,271 | ) | - | (14,271 | ) | - | ||||||||

| Net loss for the period | (10,581,005 | ) | (11,043,199 | ) | (21,706,628 | ) | (19,966,843 | ) | |||||||

| Other comprehensive loss | |||||||||||||||

| Foreign currency translation adjustment | 1,978 | 333,235 | 5,186 | 264,099 | |||||||||||

| Comprehensive loss for the period | (10,579,027 | ) | (10,709,964 | ) | (21,701,442 | ) | (19,702,744 | ) | |||||||

| Basic and diluted loss per share | (0.05 | ) | (0.05 | ) | (0.10 | ) | (0.10 | ) | |||||||

| Weighted average number of common shares outstanding – basic and diluted | 214,650,834 | 207,266,586 | 214,490,219 | 206,005,675 | |||||||||||

American Lithium Corp.

Condensed Interim Consolidated Statements of Cash Flows

(Expressed in Canadian Dollars – Unaudited)

| Three months ended | Six months ended | ||||||||||||||

| Notes | August 31, 2023 | August 31, 2022 | August 31, 2023 | August 31, 2022 | |||||||||||

| $ | $ | $ | $ | ||||||||||||

| OPERATING ACTIVITIES | |||||||||||||||

| Net loss for the period | (10,581,005 | ) | (11,043,199 | ) | (21,706,628 | ) | (19,966,843 | ) | |||||||

| Items not affecting cash and cash equivalents: | |||||||||||||||

| Depreciation | 9,10 | 30,554 | 22,561 | 59,195 | 44,990 | ||||||||||

| Finance charge | 10 | 5,986 | 37,823 | 12,591 | 75,855 | ||||||||||

| Share-based compensation | 12,13 | 4,104,968 | 2,802,987 | 8,782,295 | 6,253,741 | ||||||||||

| Gain on short-term investments | 7 | (1,684,571 | ) | - | (1,684,571 | ) | - | ||||||||

| Share of loss from equity investment in Surge Battery Metals Inc. | 7 | 60,878 | - | 60,878 | - | ||||||||||

| Dilution loss on investment in Surge Battery Metals Inc. | 7 | 14,271 | - | 14,271 | - | ||||||||||

| Changes in non-cash working capital items: | |||||||||||||||

| Amounts receivable | (43,691 | ) | (65,997 | ) | (54,947 | ) | 33,124 | ||||||||

| Accrued interest receivable | 309,843 | (161,791 | ) | 181,690 | (305,279 | ) | |||||||||

| Prepaid expenses and deposits | 402,583 | (88,260 | ) | (200,369 | ) | 163,932 | |||||||||

| Accounts payable and accrued liabilities | 537,931 | 2,068,266 | 761,083 | 2,550,261 | |||||||||||

| Deferred revenue | 180,000 | - | 180,000 | - | |||||||||||

| Cash used in operating activities | (6,662,253 | ) | (6,427,610 | ) | (13,594,512 | ) | (11,150,219 | ) | |||||||

| INVESTING ACTIVITIES | |||||||||||||||

| Exploration and evaluation assets expenditures | 11 | (201,645 | ) | (4,600,811 | ) | (201,645 | ) | (4,600,811 | ) | ||||||

| Redemption of guaranteed investment certificates | 21,462,507 | - | 33,563,808 | - | |||||||||||

| Purchase of short-term investments | - | - | (7,257,649 | ) | - | ||||||||||

| Investment in Surge Battery Metals Inc. | (5,360,000 | ) | - | (5,360,000 | ) | - | |||||||||

| Purchase of equipment | 9 | (78,404 | ) | - | (228,617 | ) | (9,777 | ) | |||||||

| Refund of reclamation bonds | - | - | - | 64,775 | |||||||||||

| Cash provided by (used in) investing activities | 15,822,458 | (4,600,811 | ) | 20,515,897 | (4,545,813 | ) | |||||||||

| FINANCING ACTIVITIES | |||||||||||||||

| Stock options exercised | 12 | - | 287,330 | 801,908 | 2,198,615 | ||||||||||

| Warrants exercised | 12 | 29,085 | 201,158 | 45,801 | 382,805 | ||||||||||

| Repayment of long-term debt | - | (1,051,075 | ) | - | (1,051,075 | ) | |||||||||

| Repayment of lease liabilities | 10 | (20,185 | ) | (105 | ) | (44,571 | ) | (8,346 | ) | ||||||

| Cash provided by (used in) financing activities | 8,900 | (562,692 | ) | 803,138 | 1,521,999 | ||||||||||

| Effect of foreign exchange on cash and cash equivalents | 84,246 | 388,779 | 89,926 | 324,209 | |||||||||||

| Change in cash and cash equivalents during the period | 9,253,351 | (11,202,334 | ) | 7,814,449 | (13,849,824 | ) | |||||||||

| Cash and cash equivalents, beginning of period | 10,546,864 | 17,051,272 | 11,985,766 | 19,698,762 | |||||||||||

| Cash and cash equivalents, end of period | 19,800,215 | 5,848,938 | 19,800,215 | 5,848,938 | |||||||||||

Supplementary cash flow disclosures (Note 17)

American Lithium Corp.

Condensed Interim Consolidated Statements of Changes in Shareholders’ Equity

(Expressed in Canadian Dollars – Unaudited)

| Number of Shares |

Share Capital | Equity Reserves |

Deficit | Accumulated Other Comprehensive Income |

Total | ||||||||||||||||

| Notes | # | $ | $ | $ | $ | $ | |||||||||||||||

| Balance as at February 28, 2022 (1) | 204,280,109 | 230,593,327 | 41,685,611 | (81,326,380 | ) | (151,115 | ) | 190,801,443 | |||||||||||||

| Shares issued for exploration and evaluation assets | 11 | 2,250,000 | 4,635,000 | - | - | - | 4,635,000 | ||||||||||||||

| Share-based compensation | 12 | - | - | 6,253,742 | - | - | 6,253,742 | ||||||||||||||

| Stock options exercised | 12 | 1,425,967 | 3,568,276 | (1,369,661 | ) | - | - | 2,198,615 | |||||||||||||

| Warrants exercised | 12 | 205,935 | 613,587 | (230,782 | ) | - | - | 382,805 | |||||||||||||

| Loss for the period | - | - | - | (19,966,843 | ) | - | (19,966,843 | ) | |||||||||||||

| Foreign currency translation adjustment | - | - | - | - | 264,099 | 264,099 | |||||||||||||||

| Balance as at August 31, 2022 | 208,162,011 | 239,410,190 | 46,338,910 | (101,293,223 | ) | 112,984 | 184,568,861 | ||||||||||||||

| Shares issued for exploration and evaluation assets | 11 | 1,150,000 | 5,449,000 | - | - | - | 5,449,000 | ||||||||||||||

| Share-based compensation | 12 | - | - | 6,309,441 | - | - | 6,309,441 | ||||||||||||||

| Stock options exercised | 12 | 2,016,622 | 4,147,874 | (1,763,097 | ) | - | - | 2,384,777 | |||||||||||||

| Warrants exercised | 12 | 2,760,347 | 12,904,414 | (3,944,166 | ) | - | - | 8,960,248 | |||||||||||||

| Loss for the period | - | - | - | (15,699,699 | ) | - | (15,699,699 | ) | |||||||||||||

| Foreign currency translation adjustment | - | - | - | - | 417,439 | 417,439 | |||||||||||||||

| Balance as at February 28, 2023 | 214,088,980 | 261,911,478 | 46,941,088 | (116,992,922 | ) | 530,423 | 192,390,067 | ||||||||||||||

| Share-based compensation | 12 | - | - | 8,782,295 | - | - | 8,782,295 | ||||||||||||||

| Stock options exercised | 12 | 540,600 | 1,363,257 | (561,349 | ) | - | - | 801,908 | |||||||||||||

| Stock options expired | 12 | - | 79,357 | (33,556 | ) | - | - | 45,801 | |||||||||||||

| Warrants exercised | 12 | 26,234 | - | - | - | - | - | ||||||||||||||

| Loss for the period | - | - | - | (21,706,628 | ) | - | (21,706,628 | ) | |||||||||||||

| Foreign currency translation adjustment | - | - | - | - | 5,186 | 5,186 | |||||||||||||||

| Balance as at August 31, 2023 | 214,655,814 | 263,354,092 | 55,128,478 | (138,699,550 | ) | 535,609 | 180,318,629 |

(1) The opening balances of "Equity Reserves" and "Deficit" were changed to reflect the accounting policy change indicated in Note 3.

| American Lithium Corp. Notes to the Condensed Interim Consolidated Financial Statements For the three and six months ended August 31, 2023 and 2022 (Expressed in Canadian Dollars – unaudited) |

1. NATURE OF OPERATIONS AND GOING CONCERN

American Lithium Corp. (the "Company") was incorporated in the Province of British Columbia. The Company is engaged in the business of identification, acquisition, and exploration of mineral interests in the Unites States of America and Peru. The Company's head office is located at 710 - 1030 West Georgia Street, Vancouver, British Columbia, V6E 2Y3, Canada, and its registered and records office is located at Suite 2200, 885 West Georgia Street, Vancouver, BC, V6C 3E8, Canada. The Company's common shares are listed for trading on Tier 2 of the TSX Venture Exchange (the "Exchange") under the symbol "LI", the Frankfurt Stock Exchange under the symbol "5LA", and on the NASDAQ exchange under the symbol "AMLI".

The Company is in the process of exploring its principal mineral properties and has not yet determined whether the properties contain ore reserves that are economically recoverable. The recoverability of amounts shown as exploration and evaluation assets is dependent upon the discovery of economically recoverable reserves, the confirmation of the Company's interest in the underlying mineral claims, the ability of the Company to obtain necessary financing to complete the development and upon future profitable production or proceeds from the disposition thereof.

These financial statements have been prepared on the basis of accounting principles applicable to a going concern which assumes that the Company will be able to realize its assets and discharge its liabilities in the normal course of business. As at August 31, 2023, the Company had a working capital position of $28,247,647 (February 23, 2023 - $41,394,150), and for the six months ended August 31, 2023, incurred a net loss of $21,706,628 (six months ended August 31, 2022 - $19,966,843). In addition, as at August 31, 2023, the Company had an accumulated deficit of $138,699,550 (February 28, 2023 - $116,992,922), which has been funded primarily by the issuance of equity. The Company's ability to continue as a going concern and to realize assets at their carrying values is dependent upon obtaining additional financing. Though the Company has raised financing in the past, there is no guarantee that it will be able to in the future. As at August 31, 2023, management believes that the Company has sufficient working capital to meet the Company's obligations over the ensuing twelve-month period from the date of the statement of financial position.

2. BASIS OF PRESENTATION

Statement of compliance

These condensed interim consolidated financial statements, including comparatives, have been prepared in accordance with International Accounting Standards ("IAS") 34, "Interim Financial Reporting" using accounting policies consistent with International Financial Reporting Standards ("IFRS") as issued by the International Accounting Standards Board ("IASB") and Interpretations issued by the International Financial Reporting Interpretations Committee ("IFRIC").

Certain accounts have been reclassified to be consistent with the current period classification.

These condensed interim consolidated financial statements were approved and authorized for issue by the Board of Directors on October 13, 2023.

| American Lithium Corp. Notes to the Condensed Interim Consolidated Financial Statements For the three and six months ended August 31, 2023 and 2022 (Expressed in Canadian Dollars – unaudited) |

2. BASIS OF PRESENTATION (continued)

Basis of preparation

These condensed interim consolidated financial statements have been prepared on a historical cost basis except for certain financial instruments that are measured at fair value. In addition, the condensed interim consolidated financial statements have been prepared using the accrual basis of accounting except for cash flow disclosure.

The condensed interim consolidated financial statements are presented in Canadian dollars unless otherwise noted.

Principles of consolidation

The condensed interim consolidated financial statements include the accounts of the Company and the following subsidiaries:

| Name | Jurisdiction |

| American Lithium Holdings Corp. | British Columbia, Canada |

| Big Smoky Holdings, Inc. | Nevada, USA |

| Tonopah Lithium Corp. | Nevada, USA |

| Maran Ventures Ltd. ("Maran") | Nevada, USA |

| Plateau Energy Metals Inc. ("Plateau") | Ontario, Canada |

| Macusani Yellowcake S.A.C. ("Macusani Yellowcake") | Peru |

| Macusani Uranium S.A.C. ("Macusani Uranium") | Peru |

All intercompany transactions, balances, revenue and expenses are eliminated on consolidation. During the year ended February 28, 2023, the Company amalgamated 1032701 Nevada Ltd., 1065604 Nevada Ltd., 1067323 Nevada Ltd., 1134989 Nevada Ltd., 1301420 Nevada Ltd., and 4286128 Nevada Corp. as one company under Tonopah Lithium Corp. In addition, the Company amalgamated Big Smoky Holdings Corp. as one company under American Lithium Holdings Corp. On January 24, 2023, the Company acquired 100% of the outstanding shares of Maran (note 11).

Functional currency

The reporting and functional currency of the Company and its subsidiaries is the Canadian dollar, except for Macusani Yellowcake and Macusani Uranium where the functional currency is the United States ("US") dollar.

Transactions in currencies other than an entity's functional currency are recorded at the rates of exchange prevailing at the dates of the transactions. Monetary assets and liabilities denominated in foreign currencies are translated at period-end rates with the resulting gains or losses are reflected in profit or loss in the period of translation. Non-monetary assets and liabilities are translated at historical rates.

For the Company's foreign Peruvian subsidiaries, the functional currency is translated into the presentation currency using the period end rates for assets and liabilities, while the operations and cash flows are translated using average rates of exchange and the exchange differences arising on translation are recognized in other comprehensive loss. The Company treats specific intercompany balances, which are not intended to be repaid in the foreseeable future, as part of its net investment, whereby the exchange difference on translation is recorded in other comprehensive loss.

| American Lithium Corp. Notes to the Condensed Interim Consolidated Financial Statements For the three and six months ended August 31, 2023 and 2022 (Expressed in Canadian Dollars – unaudited) |

3. MATERIAL ACCOUNTING POLICIES, JUDGEMENTS AND ESTIMATES

These condensed interim consolidated financial statements do not include all the information required of the audited annual consolidated financial statements and is intended to provide users with an update in relation to events and transactions that are significant to an understanding of the changes in the financial position and performance of the Company since the end of the last annual reporting period. The accounting policies followed in these condensed consolidated interim financial statements are the same as those applied in the Company's most recent audited consolidated annual financial statements for the year ended February 28, 2023, except for the adoption of Disclosure of Accounting Policies (Amendments to IAS 1 and IFRS Practice Statement 2) and the change in accounting policy for expired share-based payment arrangements mentioned below. Therefore, it is recommended that this financial report be read in conjunction with the audited annual consolidated financial statements of the Company for the years ended February 28, 2023 and 2022.

Accounting standards adopted during the period

The Company adopted the following new IFRS standard effective January 1, 2023. The nature and impact of the standard on the Company's consolidated annual audited financial statements is indicated below.

In February 2021, the IASB issued Disclosure of Accounting Policies (amendments to IAS 1 and IFRS Practice Statement 2 Making Materiality Judgements). IAS 1 is amended to require that an entity discloses its material accounting policies, instead of its significant accounting policies. Further amendments explain how an entity can identify a material accounting policy and clarify that information may be material because of its nature, even if the related amounts are immaterial. These amendments to IAS 1 are effective for annual reporting periods beginning on or after January 1, 2023, and have not had a material impact on the Company's condensed interim consolidated financial statements nor are they expected to for the Company's annual financial statements.

Change in accounting policy for expiry of share-based payment arrangements

The Company previously had an accounting policy to reclassify to deficit any balance in reserves upon the expiry of share-based awards under a view that IFRS 2 does not preclude an entity from recognizing a transfer within equity (from one component to another) in the event of an expiration; however, IFRS 2 does not mandatorily require the Company to perform such reclassifications. The Company has determined not to reclassify reserves to deficit upon expiry for all share-based awards as management believes that the expiry of a fully vested equity instrument does not result in a gain to the entity and is more accurately reflected outside of deficit. Additionally, upon examining other accounting frameworks, specifically United States generally accepted accounting principles, a movement within equity for expired share-based awards is not permitted and further supports the Company's decision to no longer reclassify reserves to deficit.

As a result, in the current period, the Company has changed its existing policy for the expiry of share-based payments and will no longer reclassify such reserves to deficit upon expiry. The consolidated equity is not modified by this change in presentation. As per IAS 8, financial information from previous years presented for comparative purposes has been restated so that the information is comparable. Consequently, the deficit heading no longer includes the effects arising from the expiry of share-based payment awards which have been reclassified to reserves amounting to $1,157,471 on February 28, 2023 (February 28, 2022 - $44,275).

| American Lithium Corp. Notes to the Condensed Interim Consolidated Financial Statements For the three and six months ended August 31, 2023 and 2022 (Expressed in Canadian Dollars – unaudited) |

3. MATERIAL ACCOUNTING POLICIES, JUDGEMENTS AND ESTIMATES (continued)

Critical judgements and estimates

The preparation of condensed interim consolidated financial statements in conformity with IFRS requires management to make judgments, estimates and assumptions that affect the application of accounting policies and the reported amounts of assets, liabilities and contingent liabilities as at the date of the condensed interim consolidated financial statements and the reported amounts of revenue and expenses during the reporting period. Estimates and assumptions are continuously evaluated and are based on management's experience and other factors, including expectations of future events that are believed to be reasonable under the circumstances. However, actual outcomes can differ from these estimates. The results of estimates form the basis for making the judgments about carrying values of assets and liabilities that are not readily apparent from other sources.

The estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are recognized in the period in which the estimate is revised if the revision affects only that period or in the period of the revision and further periods if the review affects both current and future periods.

The critical areas of judgement and estimation impacting these condensed interim consolidated financial statements are as follows:

Carrying value of exploration and evaluation assets

Valuation of share-based compensation awards

Valuation of common shares and common share purchase warrants received from investment in Surge Battery Metals Inc. (note 7)

| American Lithium Corp. Notes to the Condensed Interim Consolidated Financial Statements For the three and six months ended August 31, 2023 and 2022 (Expressed in Canadian Dollars – unaudited) |

3. MATERIAL ACCOUNTING POLICIES, JUDGEMENTS AND ESTIMATES (continued)

Accounting pronouncements not yet adopted

The Company has performed an assessment of new standards issued by the IASB that are not yet effective and has determined that any standards that have been issued would have no or very minimal impact on the Company's condensed interim consolidated financial statements.

4. CASH AND CASH EQUIVALENTS

| August 31, 2023 | February 28, 2023 | |||||

| $ | $ | |||||

| Cash held in banks | 11,743,020 | 5,638,435 | ||||

| Redeemable guaranteed investment certificates | 8,057,195 | 4,908,429 | ||||

| Balance, August 31, 2023 | 19,800,215 | 10,546,864 |

The Company's cash and cash equivalents include an aggregate of $8,057,195 in redeemable guaranteed investment certificates ("GICs") including accumulated interest from Canadian financial institutions, which earn interest at rates ranging from 4.8% - 5.4% per annum and mature between June 27, 2024 and July 31, 2024.

The Company's GICs that are included in cash and cash equivalents are fully redeemable without a loss of accumulated interest.

5. GUARANTEED INVESTMENT CERTIFICATES

The Company has $2,066,723 in a non-redeemable GIC including accumulated interest from a Canadian financial institution, which earns interest at 5.2% per annum and matures on October 25, 2023.

6. SHORT-TERM INVESTMENTS

As part of the Company’s strategic investment in Surge Battery Metals Inc.’s (“Surge”) private placement (note 7), the Company was issued 13,400,000 common share purchase warrants (“Warrants”). The Warrants are financial assets carried at fair value through profit and loss (“FVTPL”) and will be revalued at each reporting period end.

The following table provides a reconciliation of changes in the carrying value of the Warrants.

| $ | |||

| Balance, February 28, 2023 | - | ||

| Allocated transaction price of Surge's Warrants (note 7) | 2,297,143 | ||

| Deferred gain on Warrants (note 7) | 2,526,857 | ||

| Fair value of Warrants at date of acquisition | 4,824,000 | ||

| Fair value increase at August 31, 2023 | 1,474,000 | ||

| Balance, August 31, 2023 | 6,298,000 |

| American Lithium Corp. Notes to the Condensed Interim Consolidated Financial Statements For the three and six months ended August 31, 2023 and 2022 (Expressed in Canadian Dollars – unaudited) |

6. SHORT-TERM INVESTMENTS (continued)

The fair value of Surge’s Warrants at August 31, 2023 was determined using the following inputs:

| August 31, 2023 | |||

| Expected volatility | 125% | ||

| Risk-free interest rate | 4.45% | ||

| Spot Price(1) | 0.63 | ||

| Exercise Price | 0.55 | ||

| Time to expiration | 2.78 years | ||

| Dividend yield | Nil |

(1) The spot price is based on the market price of Surge’s common shares, less a discount to reflect the 4-month hold period (note 7).

The spot price is based on the calculated value of Surge Battery Metals Inc.'s common shares, subject to a 4-month hold (note 7).

7. INVESTMENT IN SURGE BATTERY METALS INC.

On June 9, 2023, the Company completed a strategic investment in Surge, a company incorporated in Canada, whose principal business activity is the acquisition, exploration and development of mineral properties in Nevada. The Company, through a combination of its shareholding and its board representation, has significant influence over Surge, and therefore accounts for the investment using the equity method.

Surge closed the first tranche of a non-brokered private placement financing by issuing 13,400,000 units (“Units”) at a price of $0.40 per Unit to the Company for a total transaction value of $5,360,000. Each Unit consists of one common share and one Warrant exercisable at $0.55 per Warrant for a period of three years from the date of issuance, and are subject to a 4-month hold.

The allocation of the transaction value to the Surge common shares and Warrants at June 9, 2023 was determined based on the relative fair values of each asset, $3,062,857 and $2,297,143, respectively, both calculated using the Black-Scholes option pricing model and reflecting the 4-month hold period.

| American Lithium Corp. Notes to the Condensed Interim Consolidated Financial Statements For the three and six months ended August 31, 2023 and 2022 (Expressed in Canadian Dollars – unaudited) |

7. INVESTMENT IN SURGE BATTERY METALS INC. (continued)

Surge’s common shares and warrants were valued at June 9, 2023, using the following Black-Scholes assumptions:

| Common Shares 4-month hold |

Warrants | |||||

| Expected volatility | 102% | 132% | ||||

| Risk-free interest rate | 4.08% | 4.08% | ||||

| Spot Price(1) | 0.62 | 0.48 | ||||

| Exercise Price | 0.62 | 0.55 | ||||

| Time to expiration | 4 months | 3 years | ||||

| Dividend yield | Nil | Nil |

(1) The spot price for the Warrants is based on the market price of Surge's common shares, less a discount to reflect the 4-month hold period.

The Company determined that the fair value of Surge’s Warrants acquired was $4,824,000 at June 9, 2023. Since the fair value of this financial instrument exceeded the Unit offering’s allocated transaction value of $2,297,143, and the fair value is not based solely on observable inputs, $2,526,857 was recorded as a deferred gain, which will be recognized over the three-year life of the Warrants. The fair value of the Warrants will be determined at each reporting date, and gains or losses on the fair value changes will be recognized in the statements of loss and comprehensive loss each period.

For the period ended August 31, 2023 the Company recognized $210,571 (period ended August 31, 2022 – $nil) of the deferred gain. The Company determined that the fair value of the Surge Warrants at August 31, 2023 was $6,298,000 (February 28, 2023 – $nil) and therefore recognized an unrealized gain of $1,474,000 (period ended August 31, 2022 – $nil). A gain of $1,684,571 (period ended August 31, 2022 - $nil) was recorded within other items in the statements of loss and comprehensive loss.

Due to the fact that Surge’s financial statements for the period ending September 30, 2023 are not publicly available at the time the Company files its financial statements, the Company has recognized its proportionate share of Surge’s loss for the one-month ended June 30, 2023 in determining the carrying value of its investment in Surge at August 31, 2023.

| $ | |||

| Balance, February 28, 2023 | - | ||

| Allocated transaction value of Surge's common shares | 3,062,857 | ||

| Share of loss for the month ended June 30, 2023 (1) | (60,878 | ) | |

| Dilution loss on investment in Surge (2) | (14,271 | ) | |

| Balance, August 31, 2023 | 2,987,708 |

(1) Since the investment in Surge was purchased on June 9, 2023, the share of Surge's loss is only calculated from the date of acquisition to June 30, 2023.

(2) The Company's investment in Surge represented 9.73% of the outstanding share capital of Surge, decreasing to 9.27% by the end of the current period which resulted in a dilution loss of $14,271.

The trading price of Surge's common shares on August 31, 2023 was $0.72. The quoted market value of the investment in Surge was $9,648,000.

Surge’s loss and comprehensive loss for the periods is as follows:

| One month ended | One month ended | |||||

| June 30, 2023 | June 30, 2022 | |||||

| Comprehensive loss for the period (per Surge Financial Statements) |

(522,939 | ) | (91,737 | ) | ||

| Exploration & evaluation expenditures | (102,628 | ) | (61,999 | ) | ||

| Comprehensive loss for the period (in accordance with ALC's accounting policies) |

(625,567 | ) | (153,736 | ) |

| American Lithium Corp. Notes to the Condensed Interim Consolidated Financial Statements For the three and six months ended August 31, 2023 and 2022 (Expressed in Canadian Dollars – unaudited) |

7. INVESTMENT IN SURGE BATTERY METALS INC. (continued)

Select information from Surge’s statements of financial position is as follows:

| June 30, 2023 | December 31, 2022 | |||||

| Current assets | 10,133,453 | 1,149,033 | ||||

| Non-current assets (per Surge Financial Statements) | 4,400,751 | 3,478,195 | ||||

| Exploration & evaluation expenditures | (2,106,924 | ) | (1,697,883 | ) | ||

| Non-current assets (In accordance with ALC's accounting policies) | 2,293,827 | 1,780,312 | ||||

| Current liabilities | 233,889 | 199,683 |

Surge’s statements of financial position and statements of loss and comprehensive loss for the period have been adjusted to align Surge’s accounting policies with the Company’s, specifically relating to the accounting of exploration and evaluation expenditures.

The Company was appointed as an advisor by Surge to assist in the exploration and development of Surge's Nevada North Lithium project. The Company has received an upfront fee of $240,000 from Surge in relation to the advisory engagement which covers a period of 12 months starting on June 9, 2023. As at August 31, 2023, the Company recognized $60,000 of revenue related to the advisory engagement and $180,000 of deferred revenue remained on the Company's statement of financial position.

8. RECLAMATION DEPOSITS

Reclamation deposits of $591,305 (February 28, 2023 - $594,713) as at August 31, 2023, consisted of a bond recorded at cost and held as security by the State of Nevada, with regard to certain exploration properties described in note 11.

| American Lithium Corp. Notes to the Condensed Interim Consolidated Financial Statements For the three and six months ended August 31, 2023 and 2022 (Expressed in Canadian Dollars – unaudited) |

9. PROPERTY AND EQUIPMENT

| Computer | Furniture | Ranch | Leasehold | ||||||||||||

| Equipment | Equipment | Equipment | Improvement | Total | |||||||||||

| $ | $ | $ | $ | $ | |||||||||||

| Cost: | |||||||||||||||

| Balance, February 28, 2022 | 12,960 | 15,957 | - | 30,959 | 59,876 | ||||||||||

| Additions | 7,884 | 9,777 | - | - | 17,661 | ||||||||||

| Balance, February 28, 2023 | 20,844 | 25,734 | - | 30,959 | 77,537 | ||||||||||

| Additions | 2,529 | - | 226,088 | - | 228,617 | ||||||||||

| Balance, August 31, 2023 | 23,373 | 25,734 | 226,088 | 30,959 | 306,154 | ||||||||||

| Depreciation: | |||||||||||||||

| Balance, February 28, 2022 | 4,108 | 3,933 | - | 2,064 | 10,105 | ||||||||||

| Depreciation for the year | 5,973 | 3,382 | - | 6,192 | 15,547 | ||||||||||

| Balance, February 28, 2023 | 10,081 | 7,315 | - | 8,256 | 25,652 | ||||||||||

| Depreciation for the period | 3,540 | 1,842 | 13,129 | 3,096 | 21,607 | ||||||||||

| Balance, August 31, 2023 | 13,621 | 9,157 | 13,129 | 11,352 | 47,259 | ||||||||||

| Net book value: | |||||||||||||||

| As at February 28, 2023 | 10,763 | 18,419 | - | 22,703 | 51,885 | ||||||||||

| As at August 31, 2023 | 9,752 | 16,577 | 212,959 | 19,607 | 258,895 |

| American Lithium Corp. Notes to the Condensed Interim Consolidated Financial Statements For the three and six months ended August 31, 2023 and 2022 (Expressed in Canadian Dollars – unaudited) |

10. RIGHT-OF-USE ASSETS AND LEASE LIABILITIES

The Company has two leases: one for an office space in Vancouver, Canada and another for an office space in Nevada, USA.

Right-of-Use Assets

| Office Leases | |||

| $ | |||

| Cost: | |||

| Balance, February 28, 2022 | 304,438 | ||

| Foreign exchange adjustment | 8,277 | ||

| As at February 28, 2023 | 312,715 | ||

| ROU asset adjustment | (3,952 | ) | |

| As at August 31, 2023 | 308,763 | ||

| Accumulated Depreciation: | |||

| Balance, February 28, 2022 | 25,077 | ||

| Depreciation for the year | 76,519 | ||

| Foreign exchange adjustment | 2,291 | ||

| As at February 28, 2023 | 103,887 | ||

| Depreciation for the period | 37,591 | ||

| As at August 31, 2023 | 141,478 | ||

| Net book value: | |||

| As at February 28, 2023 | 208,828 | ||

| As at August 31, 2023 | 167,285 |

Depreciation of right-of-use assets is calculated using the straight-line method over the remaining lease term.

Total lease liabilities

| $ | |||

| As at February 28, 2022 | 284,859 | ||

| Lease payments | (84,318 | ) | |

| Finance charge | 28,751 | ||

| Foreign exchange adjustment | (3,003 | ) | |

| As at February 28, 2023 | 226,289 | ||

| Lease payments | (44,571 | ) | |

| Finance charge | 12,591 | ||

| Lease liability adjustment | (3,952 | ) | |

| Foreign exchange adjustment | (512 | ) | |

| 189,845 | |||

| Less: current portion of lease liability | (78,670 | ) | |

| As at August 31, 2023 | 111,175 |

| American Lithium Corp. Notes to the Condensed Interim Consolidated Financial Statements For the three and six months ended August 31, 2023 and 2022 (Expressed in Canadian Dollars – unaudited) |

10. RIGHT-OF-USE ASSETS AND LEASE LIABILITIES (continued)

The lease liabilities were discounted at a discount rate of 12%.

The remaining minimum future lease payments, excluding estimated operating costs, for the term of the lease including assumed renewal periods are as follows:

| Year | $ | ||

| Fiscal 2024 | 49,172 | ||

| Fiscal 2025 | 87,059 | ||

| Fiscal 2026 | 51,443 | ||

| Fiscal 2027 | 34,961 |

11. EXPLORATION AND EVALUATION ASSETS

| Nevada | Falchani | Macusani | |||||||||||||

| TLC Project | Option | Project | Project | Total | |||||||||||

| $ | $ | $ | $ | $ | |||||||||||

| Balance, February 28, 2022 | 25,273,612 | - | 93,737,781 | 16,534,354 | 135,545,747 | ||||||||||

| Additions: | |||||||||||||||

| Acquisition costs | 5,056,899 | - | 5,152,130 | - | 10,209,029 | ||||||||||

| Royalty Buyback | 4,503,000 | - | - | - | 4,503,000 | ||||||||||

| Balance, February 28, 2023 | 34,833,511 | - | 98,889,911 | 16,534,354 | 150,257,776 | ||||||||||

| Additions: | |||||||||||||||

| Acquisition costs | - | 201,645 | - | - | 201,645 | ||||||||||

| Balance, August 31, 2023 | 34,833,511 | 201,645 | 98,889,911 | 16,534,354 | 150,459,421 |

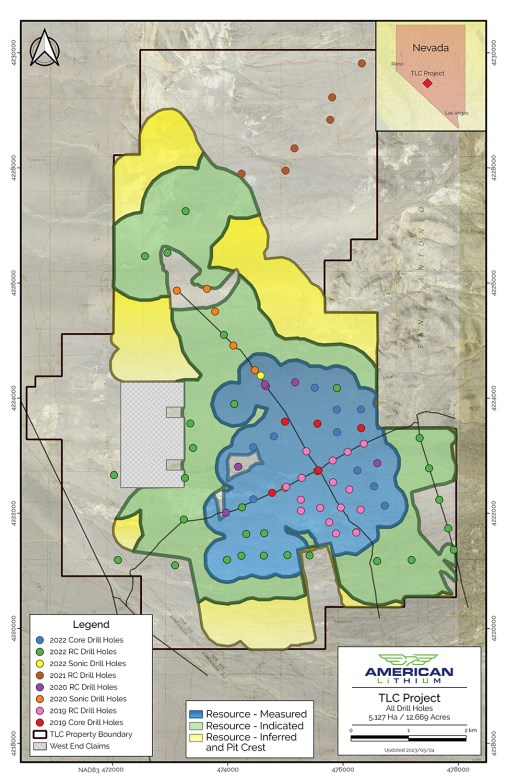

TLC Lithium Project ("TLC Project") - Nevada, USA

In August 2018, the Company purchased a series of unpatented lode mining claims located in Nye County, Nevada, USA, from Nevada Alaska Mining Co., Inc. ("TLC Royalty Holder"). The TLC Project was subject to an overriding 2.5% gross royalty, however, as at February 28, 2023, the royalty had been bought back in full.

The Company made the following payments for the TLC Project in during the year ended February 28, 2023:

| American Lithium Corp. Notes to the Condensed Interim Consolidated Financial Statements For the three and six months ended August 31, 2023 and 2022 (Expressed in Canadian Dollars – unaudited) |

11. EXPLORATION AND EVALUATION ASSETS (continued)

Option – Nevada, USA

During August 2023, the Company entered into an option and right-of-first refusal to purchase a property with certain water rights for $201,645, expiring in 3 years.

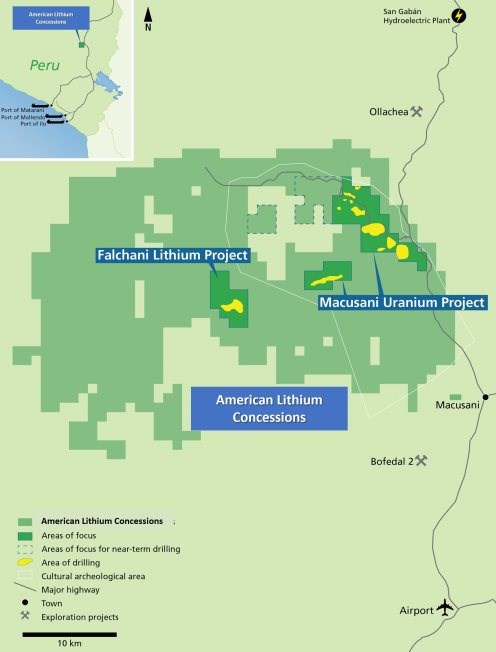

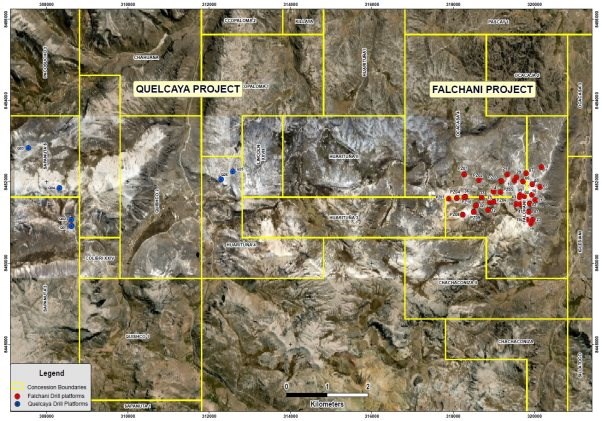

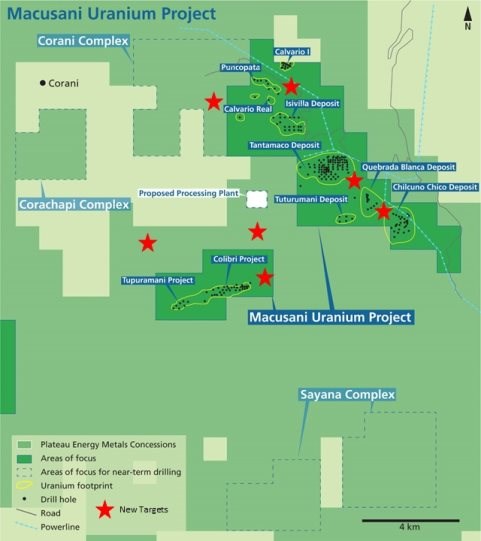

Falchani Lithium Project ("Falchani Project"), Macusani Uranium Project ("Macusani Project") - Puno, Peru

Following the acquisition in May 2021 of Plateau and its Peruvian subsidiary, Macusani SAC, the Company holds title, or has court injunctions preserving title, on mineral concessions in the Province of Carabaya, Department of Puno in southeastern Peru.

In June 2022, the Company entered into a mining rights transfer agreement to acquire additional concessions in Southern Peru, close to the Company's Falchani Project. The Company paid $517,130 and issued 2,250,000 common shares of the Company with a fair value of $4,635,000 to the vendor.

32 of the 174 Falchani Project and Macusani Project concessions held collectively by the Company's subsidiaries, Macusani Yellowcake and Macusani Uranium, are currently subject to Administrative and Judicial processes (together, the "Processes") in Peru to overturn resolutions issued by the Geological, Mining, and Metallurgical Institute of Peru ("INGEMMET") and the Mining Council of the Ministry of Energy and Mines of Peru ("MINEM") in February 2019 and July 2019, respectively, which declared Macusani Yellowcake's title to the 32 of the 174 concessions invalid due to late receipt of the annual validity payment. Macusani Yellowcake successfully applied for injunctive relief on these 32 concessions in a Court in Lima, Peru, and the grant of the Precautionary Measures (Medida Cautelar) has restored and maintained the title, rights, and validity of those 32 concessions to Macusani Yellowcake.

On November 2, 2021, the Company was made aware that the judicial ruling in relation to those 32 concessions had been issued in favour of Macusani Yellowcake. The ruling restored full title to these concessions. On November 26, 2021, the Company confirmed that appeals of the judicial ruling were lodged by INGEMMET and MINEM, and subsequently by other parties. The appeals were considered by a higher court tribunal on September 7, 2023. If the appeals are allowed, the title to the 32 concessions held by the Company's Peruvian subsidiaries could be revoked. However, the Company would have further legal options available to it at that time, including a petition to the Supreme Court of Peru.

12. SHARE CAPITAL

Authorized

Unlimited number of common shares, without par value.

Stock options

The Company has established a stock option plan for directors, employees, and consultants. Under the Company's stock option plan, the exercise price of each option is determined by the Board, subject to the Discounted Market Price policies of the TSX Venture Exchange. The aggregate number of shares issuable pursuant to options granted under the plan is limited to 10% of the Company's issued shares at the time the options are granted. The aggregate number of options granted to any one optionee in a 12-month period is limited to 10% of the issued shares of the Company.

| American Lithium Corp. Notes to the Condensed Interim Consolidated Financial Statements For the three and six months ended August 31, 2023 and 2022 (Expressed in Canadian Dollars – unaudited) |

12. SHARE CAPITAL (continued)

Stock options (continued)

A summary of changes of stock options outstanding is as follows:

| Options | Weighted average exercise price |

|||||

| $ | ||||||

| Balance, February 28, 2022 | 14,339,775 | 2.00 | ||||

| Granted | 1,800,000 | 4.10 | ||||

| Exercised | (3,442,589 | ) | 1.32 | |||

| Cancelled/Expired | (717,970 | ) | 2.67 | |||

| Balance, February 28, 2023 | 11,979,216 | 2.47 | ||||

| Granted | 75,000 | 2.73 | ||||

| Exercised | (540,600 | ) | 1.47 | |||

| Forfeited | (85,000 | ) | 4.85 | |||

| Expired | (159,850 | ) | 3.37 | |||

| Balance, August 31, 2023 | 11,268,766 | 2.49 |

As at August 31, 2023, the following options were outstanding and exercisable:

| Number of options |

Number of options | |||

| outstanding | exercisable | Exercise price | Remaining life | Expiry date |

| $ | (years) | |||

| 166,750 | 166,750 | 2.24 | 0.65 | 23-Apr-24 |

| 200,000 | 200,000 | 0.25 | 1.44 | 04-Feb-25 |

| 1,729,167 | 1,729,167 | 1.28 | 2.05 | 17-Sep-25 |

| 51,515 | 51,515 | 1.03 | 2.28 | 09-Dec-25 |

| 5,758,334 | 5,758,334 | 2.17 | 2.78 | 10-Jun-26 |

| 1,573,000 | 1,573,000 | 3.63 | 3.47 | 16-Feb-27 |

| 100,000 | 100,000 | 2.74 | 3.83 | 29-Jun-27 |

| 250,000 | 250,000 | 1.91 | 3.85 | 04-Jul-27 |

| 150,000 | 112,500 | 2.14 | 4.10 | 04-Oct-27 |

| 1,215,000 | 809,996 | 4.85 | 4.43 | 02-Feb-28 |

| 75,000 | 25,000 | 2.73 | 4.89 | 18-Jul-28 |

| 11,268,766 | 10,776,262 |

During the three and six months ended August 31, 2023, the Company recorded share-based compensation of $860,661 and $2,056,111, respectively (three and six months ended August 31, 2022 - $1,450,578 and $3,581,951, respectively) in relation to stock options.

| American Lithium Corp. Notes to the Condensed Interim Consolidated Financial Statements For the three and six months ended August 31, 2023 and 2022 (Expressed in Canadian Dollars – unaudited) |

12. SHARE CAPITAL (continued)

Stock options (continued)

The weighted average fair value of stock options granted was $2.09 per stock option during the six months ended August 31, 2023 (six months ended August 31, 2022 – $1.47). Weighted average assumptions used in the Black-Scholes option pricing model for stock options granted during the six months ended August 31, 2023 and 2022 were as follows:

| Six months ended | ||||||

| August 31, 2023 | August 31, 2022 | |||||

| Exercise price | 2.73 | 2.40 | ||||

| Expected volatility | 101.12% | 110.37% | ||||

| Risk-free interest rate | 3.76% | 3.01% | ||||

| Forfeiture rate | 2.61% | 2.61% | ||||

| Expected life | 5 years | 5 years | ||||

| Dividend yield | Nil | Nil | ||||

Restricted share units

In February 2022, the Company adopted an incentive plan for its directors, officers, and employees, under which it is authorized to grant a maximum of 5% of the Company's issued shares reserved for issuance for restricted share units ("RSUs") under the incentive plan. Upon vesting, at the Company's discretion, the holder of an RSU award can receive one common share or the equivalent cash payment based on the market price of the common share on settlement date. The aggregate number of RSUs granted to any one recipient in a 12-month period is limited to 2% of the issued shares of the Company. As of August 31, 2023, all RSUs granted are equity settled and vest over a 2-year period.

The fair value of RSUs granted during the six months ended August 31, 2023 was $2.71 per RSU (August 31, 2022 - $1.87 per RSU).

During the three and six months ended August 31, 2023, the Company recorded share-based compensation of $2,772,307 and $5,624,851, respectively (three and six months ended August 31, 2022 - $1,352,410 and $2,671,791, respectively) in relation to the RSUs.

RSU transactions are summarized as follows:

| Number of RSUs | |||

| Balance, February 28, 2022 | 2,900,000 | ||

| Granted | 2,795,000 | ||

| Balance, February 28, 2023 | 5,695,000 | ||

| Granted | 75,000 | ||

| Forfeited | (40,000 | ) | |

| Balance, August 31, 2023 | 5,730,000 |

| American Lithium Corp. Notes to the Condensed Interim Consolidated Financial Statements For the three and six months ended August 31, 2023 and 2022 (Expressed in Canadian Dollars – unaudited) |

12. SHARE CAPITAL (continued)

Restricted share units (continued)

A summary of changes of RSUs outstanding is as follows:

| Number of RSUs | Remaining life | Vesting Date | ||||

| (years) | ||||||

| 2,900,000 | 0.47 | February 16, 2024 | ||||

|

225,000 |

0.85 | July 4, 2024 | ||||

| 150,000 | 1.10 | October 4, 2024 | ||||

| 2,380,000 | 1.43 | February 2, 2025 | ||||

| 75,000 | 1.88 | July 18, 2025 | ||||

| 5,730,000 |

Performance share units

In February 2022, the Company adopted an incentive plan for its directors, officers, and employees, under which it is authorized to grant a maximum of 5% of the Company's issued shares reserved for issuance for Performance share units ("PSUs") under the incentive plan. Upon vesting, at the Company's discretion, the holder of a PSU award can receive one common share or the equivalent cash payment based on the market price of the common share on settlement date. The aggregate number of PSUs granted to any one recipient in a 12-month period is limited to 2% of the issued shares of the Company. As of August 31, 2023, all granted PSUs are equity settled.

In February 2023, the Company issued 2,000,000 PSUs to various directors, officers, employees, and consultants of the Company. These 2,000,000 PSUs will vest upon a change of control or disposition of a controlling interest in one of the Company's core assets. These PSUs were granted with a fair value of $9,440,000 which is being recorded over an estimated 5 year period.

During the three and six months ended August 31, 2023, the Company recorded share-based compensation of $472,000 and $1,101,333 (three and six months ended August 31, 2022 - $nil for both periods) in relation to the PSUs.

PSU transactions are summarized as follows:

| Number of RSUs | |||

| Balance, February 28, 2022 | - | ||

| Granted | 2,000,000 | ||

| Balance, February 28 and August 31, 2023 | 2,000,000 |

Warrants

During the six months ended August 31, 2023, the Company issued 10,150 warrants in relation to the exercise of Plateau's warrants and transferred $32,792 from Reserves to Share Capital representing the fair value of the warrants exercised.

During the year ended February 28, 2023, the Company issued 82,650 warrants in relation to the exercises of Plateau's warrants.

| American Lithium Corp. Notes to the Condensed Interim Consolidated Financial Statements For the three and six months ended August 31, 2023 and 2022 (Expressed in Canadian Dollars – unaudited) |

12. SHARE CAPITAL (continued)

Warrants (continued)

Details of common share purchase warrants outstanding as at August 31, 2023 are as follows:

| Number of warrants | Exercise price | Remaining life | Expiry date | |||||||

| $ | (years) | |||||||||

| 5,791,893 | 4.00 | 0.18 | November 3, 2023 | |||||||

| 2,956,250 | 3.00 | 0.66 | April 29, 2024 | |||||||

| 16,507,608 | 3.00 | 0.70 | May 11, 2024 | |||||||

| 378,533* | 1.379 | 0.66 | April 27, 2024 | |||||||

| 253,905* | 1.379 | 0.70 | May 12, 2024 | |||||||

| 5,023* | 1.379 | 0.70 | May 13, 2024 | |||||||

| 25,893,212 |

*Upon the exercise of each of these warrants, the holder will receive one common share and one-half share purchase warrant, each full warrant exercisable until May 11, 2024 at $3.00.

A summary of changes of warrants outstanding is as follows:

| Weighted average | ||||||

| Warrants | exercise price | |||||

| $ | ||||||

| Balance, February 28, 2022 | 28,792,928 | 3.18 | ||||

| Issued | 82,650 | 3.00 | ||||

| Exercised | (2,966,282 | ) | 3.15 | |||

| Balance, February 28, 2023 | 25,909,296 | 3.18 | ||||

| Issued | 10,150 | 3.00 | ||||

| Exercised | (26,234 | ) | 1.75 | |||

| Balance, August 31, 2023 | 25,893,212 | 3.18 |

13. RELATED PARTY TRANSACTIONS

Key management personnel include those persons having authority and responsibility for planning, directing, and controlling the activities of the Company as a whole. The Company has determined that key management personnel consist of executive and non-executive members of the Company's Board of Directors and corporate officers.

| Three months ended | Six months ended | |||||||||||

| August 31 | August 31 | |||||||||||

| 2023 | 2022 | 2023 | 2022 | |||||||||

| $ | $ | $ | $ | |||||||||

| Exploration and evaluation expenditures | - | 98,124 | - | 214,472 | ||||||||

| Management fees | 516,750 | 440,000 | 1,033,500 | 828,954 | ||||||||

| Share-based compensation | 3,371,358 | 1,477,776 | 5,923,071 | 3,104,630 | ||||||||

| 3,888,108 | 2,015,900 | 6,956,571 | 4,148,056 | |||||||||

| American Lithium Corp. Notes to the Condensed Interim Consolidated Financial Statements For the three and six months ended August 31, 2023 and 2022 (Expressed in Canadian Dollars – unaudited) |

13. RELATED PARTY TRANSACTIONS (continued)

As at August 31, 2023, the Company owed $36,453 (February 28, 2023 - $4,608) to companies controlled by officers and directors of the Company for unpaid management fees and exploration and evaluation expenses.

Transactions with Surge, which is deemed to be a related party, have been disclosed in note 7.

These transactions were in the normal course of operations.

14. CAPITAL MANAGEMENT

The Company's objectives when managing capital are to safeguard the Company's ability to continue as a going concern in order to pursue the exploration of its mineral properties and to maintain a flexible capital structure for its projects for the benefit of its stakeholders, to maintain creditworthiness and to maximize returns for shareholders over the long-term. The Company does not have any externally imposed capital requirements to which it is subject. As the Company is in the exploration stage, its principal source of funds is from the issuance of common shares. The Company includes the components of shareholders' equity in its management of capital.

The Company manages the capital structure and makes adjustments to it in light of changes in economic conditions and the risk characteristics of the underlying assets. To maintain or adjust the capital structure, the Company may attempt to issue new shares to raise cash and obtain bridging loans from related parties. The Company's investment policy is to invest its cash in low-risk investment instruments in financial institutions with terms to maturity selected with regards to the expected time of expenditures from continuing operations.

There were no changes in the Company's management of capital during the six months ended August 31, 2023.

15. FINANCIAL INSTRUMENTS AND RISK MANAGEMENT

The Company's financial instruments consist of cash and cash equivalents, GICs, short-term investments, amounts receivable, prepaid expenses and deposits, and accounts payable and accrued liabilities. As at August 31, 2023, the Company classifies its short-term investments as FVTPL and its remaining financial instruments at amortized cost. For financial instruments at amortized cost, their carrying values approximate their fair values because of their current nature.

The Company classifies financial instruments carried at fair value according to the following hierarchy based on the amount of observable inputs used to value the financial instrument:

Level 1 - Quoted prices are available in active markets for identical assets or liabilities as of the reporting date. Active markets are those in which transactions occur in sufficient frequency and volume to provide pricing information on an ongoing basis.

Level 2 - Fair value measurements are those derived from inputs other than quoted prices that are observable for the asset or liability, either directly (i.e. as prices) or indirectly (derived from prices).

Level 3 - Valuations in this level are those with inputs for the asset or liability that are not based on observable market data. The Company's Surge Warrants (short-term investments) are classified under Level 3.

| American Lithium Corp. Notes to the Condensed Interim Consolidated Financial Statements For the three and six months ended August 31, 2023 and 2022 (Expressed in Canadian Dollars – unaudited) |

15. FINANCIAL INSTRUMENTS AND RISK MANAGEMENT (continued)

The Company's financial instruments are exposed to the following risks:

Credit Risk

Credit risk is the risk of financial loss to the Company if a counterparty to a financial instrument fails to meet its contractual obligations. Financial instruments which are potentially subject to credit risk for the Company consist primarily of cash and cash equivalents and GICs. The cash and cash equivalents and GICs are held at Canadian financial institutions and the Company considers the credit risk to be minimal.

The Company's maximum exposure to credit risk is as follows:

| August 31, | February 28, | |||||

| 2023 | 2023 | |||||

| $ | $ | |||||

| Cash and cash equivalents | 19,800,215 | 11,985,766 | ||||

| Guaranteed investment certificates | 2,066,723 | 28,636,414 | ||||

| 21,866,938 | 40,622,180 |

Liquidity Risk

Liquidity risk is the risk that the Company will not be able to meet its obligations with respect to financial liabilities as they come due. The Company's financial liabilities are comprised of accounts payable and accrued liabilities. The Company manages its liquidity risk by forecasting cash flows from operations and anticipating any investing and financing activities. Liquidity risk is assessed as low.

The following table summarizes the Company's outstanding financial liabilities.

| August 31, | February 28, | |||||

| 2023 | 2023 | |||||

| $ | $ | |||||

| Accounts payable and accrued liabilities | 2,424,868 | 1,663,785 |

Foreign Exchange Risk

The Company is exposed to foreign currency risk on fluctuations related to cash and cash equivalents, reclamation deposits, and accounts payable and accrued liabilities that are denominated in a foreign currency. As at August 31, 2023, the Company had foreign currency net assets of $8,820,880. A 10% fluctuation in the foreign exchange rate of foreign currencies against the Canadian dollar would result in a foreign exchange gain/loss of approximately $882,088.

Interest Rate Risk

Interest rate risk is the risk the fair value or future cash flows of a financial instrument will fluctuate because of changes in market interest rates. The Company has cash and cash equivalents balances and term deposits with interest based on the prime rate. The Company's current policy is to invest excess cash in investment-grade short-term deposit certificates issued by its banking institution. The Company periodically monitors the investments it makes and is satisfied with the credit ratings of its banks.

| American Lithium Corp. Notes to the Condensed Interim Consolidated Financial Statements For the three and six months ended August 31, 2023 and 2022 (Expressed in Canadian Dollars – unaudited) |

15. FINANCIAL INSTRUMENTS AND RISK MANAGEMENT (continued)

Price Risk

Price risk is the risk that assets or liabilities carried at fair value or future cash flows of a financial instrument will fluctuate because of changes in market conditions.

The Company's maximum exposure to price risk on its short-term investments is as follows:

| August 31, | February 28, | |||||

| 2023 | 2023 | |||||

| $ | $ | |||||

| Level 3 | 6,298,000 | - |

During the six months ended August 31, 2023, there were no transfers between level 1, level 2 and level 3 classified assets and liabilities.

16. SEGMENTED INFORMATION

The Company has one reportable segment, being the acquisition and exploration of exploration and evaluation assets. Geographic information on the Company's non-current assets is as follows:

| August 31, 2023 | Canada | USA | Peru | Total | ||||||||

| $ | $ | $ | $ | |||||||||

| Exploration and evaluation assets | - | 35,035,156 | 115,424,265 | 150,459,421 | ||||||||

| Other non-current assets | 3,153,387 | 851,807 | 33,828 | 4,039,022 | ||||||||

| Total non-current assets | 3,153,387 | 35,886,963 | 115,458,093 | 154,498,443 | ||||||||

| February 28, 2023 | Canada | USA | Peru | Total | ||||||||

| $ | $ | $ | $ | |||||||||

| Exploration and evaluation assets | - | 34,833,511 | 115,424,265 | 150,257,776 | ||||||||

| Other assets | 785,248 | 70,178 | 34,023 | 889,449 | ||||||||

| Total non-current assets | 785,248 | 34,903,689 | 115,458,288 | 151,147,225 |

17. SUPPLEMENTAL DISCLOSURES WITH RESPECT TO CASH FLOWS

| For the three months | For the six months ended | |||||||||||

| August 31 | August 31 | |||||||||||

| 2023 | 2022 | 2023 | 2022 | |||||||||

| $ | $ | $ | $ | |||||||||

| Supplemental non-cash disclosure: | ||||||||||||

| Shares issued for exploration and evaluation assets acquisition | - | 4,635,000 | - | 4,635,000 | ||||||||

| Reclassification of stock options exercised | - | 225,332 | 561,349 | 1,369,661 | ||||||||

| Reclassification of warrants exercised | 32,793 | 230,782 | 33,556 | 230,782 | ||||||||

|

Management's Discussion and Analysis |

American Lithium Corp.

Management Discussion and Analysis

For the three and six months ended August 31, 2023

Dated: October 13, 2023

|

Management's Discussion and Analysis |

Introduction

American Lithium Corp. (the "Company" or "American Lithium") was incorporated in British Columbia under the Business Corporations Act (British Columbia) and is engaged in the acquisition, exploration, and development of resource properties. The Company's common shares are listed for trading on Tier 2 of the TSX Venture Exchange (the "Exchange") under the symbol "LI", the Frankfurt Stock Exchange under the symbol "5LA", and the NASDAQ Capital Market under the symbol "AMLI".

This management's discussion and analysis ("MD&A") reports on the operating results and financial condition of the Company for the three and six months, ended August 31, 2023, and is prepared as of October 13, 2023. The MD&A should be read in conjunction with the Company's condensed interim consolidated financial statements for the three and six months, ended August 31, 2023, and 2022, and the notes thereto which were prepared in accordance with International Financial Reporting Standards ("IFRS"); and with our IFRS financial statements for the fiscal year ended February 28, 2023.

All dollar amounts referred to in this MD&A are expressed in Canadian dollars except where indicated otherwise.

Cautionary Note Regarding Forward-Looking Information

This document may contain "forward-looking information" and "forward-looking statements" within the meaning of applicable securities legislation ("forward-looking statements"). All statements, other than statements of historical fact, are forward-looking statements. Forward-looking statements relate to future events or future performance and reflect management's expectations or beliefs regarding future events and include, but are not limited to, statements regarding the business, operations, outlook and financial performance and condition of the Company; plans, objectives and advancement of the TLC Project, the Falchani Project and the Macusani Project (each as defined below, and collectively, the "Projects"); exploration drilling plans, in-fill and expansion drilling plans and other work plans, exploration programs and development plans to be conducted; results of exploration, development and operations; expansion of resources and testing of new deposits; environmental and social community and other permitting; timing, type and amount of capital and operating and exploration expenditures, as well as future production costs; estimation of mineral resources and mineral reserves; realization of mineral reserves; preliminary economic assessments, including the assumptions and parameters upon which they are based, and the timing and amount of future estimated production; development and advancement of the Projects; success of mining operations; treatment under regulatory regimes; ability to realize value from the Company's assets; adequacy of the Company's financial resources; environmental matters, including reclamation expenses; insurance coverage; title disputes or claims, including the status of the "Precautionary Measures" filed by the Company's subsidiary Macusani Yellowcake S.A.C. ("Macusani"), the outcome of the administrative process, the judicial process, and any and all future remedies pursued by the Company and its subsidiary Macusani to resolve the title for 32 of its concessions; the anticipated New Uranium Regulations affecting Peru; and limitations on insurance coverage any other statements regarding the business plans, expectations and objectives of the Company; and any other information contained herein that is not a statement of historical fact. In certain cases, forward-looking statements can be identified by the use of words such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or statements that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved" or the negative of these terms or comparable terminology. In this document, certain forward-looking statements are identified by words including "may", "future", "expected", "intends" and "estimates".

Forward-looking statements are based on management's reasonable estimates, expectations, analyses, and opinions at the date the information is provided and is based on a number of assumptions and subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking statements. Assumptions upon which such forward-looking statements are based include, without limitation: that no significant event will occur outside the ordinary course of business of the Company; the Company's ability to achieve its stated goals and objectives, including the anticipated benefits of the acquisition of Plateau and its subsidiaries; legislative and regulatory environment; impact of increasing competition; current technological trends; price of lithium, uranium and other metals; costs of development and advancement; anticipated results of exploration and development activities; the ability to operate in a safe and effective manner; and the ability to obtain financing on reasonable terms. Readers are cautioned that the foregoing list is not exhaustive. Further, experience gained during the "COVID-19" pandemic demonstrated the impact that any potential pandemic might have on all aspects of business, and a future pandemic occurrence cannot be ruled out. Although the Company believes that the current opinions and expectations reflected in such forward-looking statements are reasonable based on information available at the time, undue reliance should not be placed on forward-looking statements since the Company can provide no assurance that such opinions and expectations will prove to be correct.

|

Management's Discussion and Analysis |

All forward-looking statements are inherently uncertain and subject to a variety of assumptions, risks and uncertainties, including risks, uncertainties and assumptions related to: the Company's ability to achieve its stated goals, including the anticipated benefits of the acquisition of Plateau and its subsidiaries, the estimated costs associated with the advancement of the Projects; legislative changes that impact operations of the Company; risks and uncertainties relating to the spread of contagious diseases on a pandemic scale, which could have a material adverse impact on many aspects of the Company's business activities including but not limited to: the ability to access mineral properties for indeterminate amounts of time, the health of the employees or consultants resulting in delays or diminished capacity; social or political instability in Peru which in turn could impact the Company's ability to maintain the continuity of its business operating requirements, may result in the reduced availability or failures of various local administration and critical infrastructure, reduced demand for the Company's potential products, availability of materials, global travel restrictions, and the availability of insurance and the associated costs; the anticipated New Uranium Regulations affecting Peru; risks related to the certainty of title to the properties of the Company, including the status of the "Precautionary Measures" filed by the Company's subsidiary Macusani, the outcome of the administrative process, the judicial process, and any and all future remedies pursued by the Company and Macusani to resolve the title for 32 of its concessions; the ongoing ability to work cooperatively with stakeholders, including, but not limited to, local communities and all levels of government; the potential for delays in exploration or development activities and other effects due to global pandemics,; the interpretation of drill results, the geology, grade and continuity of mineral deposits; variations in ore reserves, grade and recover rates; changes in project parameters as plans continue to be refined; the possibility that any future exploration, development or mining results will not be consistent with expectations; risks that permits or approvals will not be obtained as planned or delays in obtaining permits or approvals; mining and development risks, including risks related to accidents, equipment breakdowns, labour disputes (including work stoppages, strikes and loss of personnel) or other unanticipated difficulties with or interruptions in exploration and development; other risks of the mining industry; risks related to commodity price and foreign exchange rate fluctuations; risks related to foreign operations; the cyclical nature of the industry in which the Company operate; risks related to failure to obtain adequate financing on a timely basis and on acceptable terms or delays in obtaining governmental approvals; risks related to environmental regulation and liability; political and regulatory risks associated with mining and exploration; risks related to the uncertain global economic environment and the effects upon the global market generally, any of which could continue to negatively affect global financial markets, including the trading price of the Company's shares and could negatively affect the Company's ability to raise capital and may also result in additional and unknown risks or liabilities to the Company. Other risks and uncertainties related to prospects, properties and business strategy of the Company are identified in the "Risk Factors" section of this MD&A, as well as those factors detailed from time to time in the Company's condensed interim and annual consolidated financial statements and other recent securities filings available at www.sedarplus.ca.

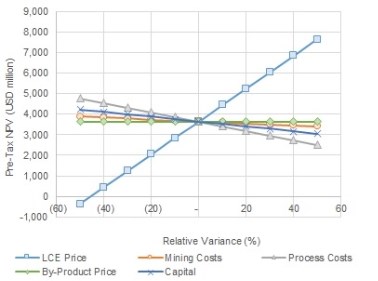

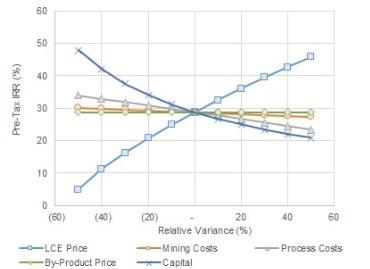

Readers are cautioned that PEA results are preliminary in nature and include inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty the results of the PEAs will be realized. Mineral resources are not mineral reserves and do not have demonstrated economic viability. Additional work is required to upgrade the mineral resources to mineral reserves. In addition, the mineral resource estimates could be materially affected by environmental, geotechnical, permitting, legal, title, taxation, socio-political, marketing, or other relevant factors.

Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated, or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company does not undertake to update any forward-looking statements that are contained herein, except in accordance with applicable securities laws.

|

Management's Discussion and Analysis |

Description of Business

American Lithium is an exploration and development stage company engaged in the acquisition, exploration, and development of resource properties in North and South America. The Company has been actively involved in lithium exploration since April 2016 when the initial focus was on lithium projects in Nevada through which process the Company explored, discovered, and is now developing the TLC Lithium Project ("TLC Project" or "TLC") in Nevada. Drilling in 2019 and 2020 lead to the publication of a maiden mineral resource in April 2020 with a subsequent resource update and publication of a maiden Preliminary Economic Assessment ("PEA") in 2023. Through the acquisition of Plateau Energy Metals Inc. ("Plateau") in May 2021, the Company added additional significant lithium properties and uranium properties in Peru.

As such, the Company is pursuing development of two lithium projects, the TLC Project and the Falchani Lithium Project in Peru ("Falchani Project" or "Falchani"), and has initiated work on Prefeasibility Studies ("PFS") on both projects. In addition, the Company has the Macusani Uranium Project ("Macusani Project" or "Macusani") in Peru and is engaged in work to update the existing PEA (which was published in February of 2016) and then move to PFS. The Company recognizes that each of these projects has the potential for continued development and future commercialization.

Cautionary Note Regarding Peru Project Concessions

32 of the 174 Falchani Project and Macusani Project concessions now held by American Lithium's subsidiary Macusani, are currently subject to Administrative and Judicial processes (together, the "Processes") in Peru to overturn resolutions issued by the Geological, Mining, and Metallurgical Institute of Peru ("INGEMMET") and the Mining Council of the Ministry of Energy and Mines of Peru ("MINEM") in February 2019 and July 2019, respectively, which declared Macusani's title to the 32 concessions invalid due to late receipt of the annual validity payment. Macusani successfully applied for injunctive relief on these 32 concessions in a Court in Lima, Peru, and the grant of the Precautionary Measures (Medida Cautelar) has restored and maintained the title, rights, and validity of those 32 concessions to Macusani. On November 2, 2021, the Company was made aware that the judicial ruling in relation to those 32 concessions had been issued in favour of the Company. The ruling restored full title to these concessions. On November 26, 2021, the Company confirmed that appeals of the judicial ruling were lodged by INGEMMET and MINEM, and subsequently by other parties. The appeals were considered by a higher court tribunal on September 7, 2023. If the appeals are allowed, Macusani's title to the 32 concessions could be revoked. However, the Company would then have further legal options available to it at that time, including a further judicial appeal.

Recent Developments

|

Management's Discussion and Analysis |

Environmental, Sustainability, Safety and Governance

The Company places a large emphasis on Environmental, Sustainability, Safety and Governance ("ESG") matters, enhancing its protocols through the engagement of Onyen Corporation to assist with implementation of ESG best practices and systems to measure and monitor performance in these areas. The Company published its maiden ESG Report for the 2022 year, which included the following highlights:

• Environmental Stewardship: Zero instances of non-compliance with environmental regulations.

• Ethics & Integrity: All Board of Directors have received anti-corruption training.

• Human Rights and Diversity Policy: Commitments reference the Universal Declaration of Human Rights, the United Nations Guiding Principles, and international humanitarian law.

• Social Risk Management: Mechanisms in place through which early alerts are launched on risks identified for the continuity of operations, and to address concerns, requests, and claims.

The full report may be accessed via the following link, or from the Company's website: http://www.americanlithiumcorp.com/esg/