UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of August, 2023.

Commission File Number: 001-41566

KWESST Micro Systems Inc.

(Exact Name of Registrant as Specified in Charter)

155 Terence Matthews Crescent, Unit #1, Ottawa, Ontario, K2M 2A8

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ⊠ Form 40-F □ Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

SIGNATURE

| KWESST MICRO SYSTEMS INC. | ||

| (Registrant) | ||

| Date: August 15, 2023 | By: | /s/ Sean Homuth |

| Name: | Sean Homuth | |

| Title: | Chief Financial Officer | |

EXHIBIT INDEX

Condensed Consolidated Interim Financial Statements of

KWESST MICRO SYSTEMS INC.

Three and nine months ended June 30, 2023, and 2022

(Unaudited - Expressed in Canadian dollars)

KWESST MICRO SYSTEMS INC.

Table of contents for the three and nine months ended June 30, 2023, and 2022

| KWESST MICRO SYSTEMS INC. Condensed Consolidated Interim Statements of Financial Position At June 30, 2023 and September 30, 2022 (Unaudited) |

| In Canadian dollars | Notes | June 30, 2023 |

September 30, 2022 |

||||||

| ASSETS | |||||||||

| Cash and cash equivalents | $ | 1,759,688 | $ | 170,545 | |||||

| Restricted short-term investment | 30,000 | 30,000 | |||||||

| Trade and other receivables | 5 | 298,058 | 171,882 | ||||||

| Inventories | 6 | 1,590,987 | 393,538 | ||||||

| Prepaid expenses and other | 1,251,143 | 122,166 | |||||||

| Deferred share offering costs | 36,733 | 628,262 | |||||||

| Current assets | 4,966,609 | 1,516,393 | |||||||

| Property and equipment | 769,604 | 832,481 | |||||||

| Right-of-use assets | 251,885 | 208,131 | |||||||

| Deposit | 25,434 | 23,604 | |||||||

| Intangible assets | 7 | 4,986,583 | 4,742,854 | ||||||

| Non-current assets | 6,033,506 | 5,807,070 | |||||||

| Total Assets | $ | 11,000,115 | $ | 7,323,463 | |||||

| LIABILITIES AND SHAREHOLDERS' EQUITY | |||||||||

| Liabilities | |||||||||

| Accounts payable and accrued liabilities | 8 and 9 | $ | 2,460,099 | $ | 4,459,481 | ||||

| Accrued royalties liability | 150,000 | 150,000 | |||||||

| Lease obligations | 95,419 | 69,150 | |||||||

| Borrowings | 10 | - | 2,199,978 | ||||||

| Contract liabilities | 11 | 328,678 | 47,271 | ||||||

| Warrant liabilities | 12 and 13(b) | 3,027,148 | - | ||||||

| Current liabilities | 6,061,344 | 6,925,880 | |||||||

| Accrued royalties liability | 1,094,206 | 1,115,207 | |||||||

| Lease obligations | 216,069 | 206,471 | |||||||

| Borrowings | 10 | - | 78,796 | ||||||

| Non-current liabilities | 1,310,275 | 1,400,474 | |||||||

| Total Liabilities | 7,371,619 | 8,326,354 | |||||||

| Shareholders' Equity (Deficit) | |||||||||

| Share capital | 13(a) | 30,950,307 | 19,496,640 | ||||||

| Warrants | 13(b) | 2,089,388 | 1,959,796 | ||||||

| Contributed surplus | 13(c) | 3,460,772 | 3,551,330 | ||||||

| Accumulated other comprehensive loss | (75,281 | ) | (101,418 | ) | |||||

| Accumulated deficit | (32,796,690 | ) | (25,909,239 | ) | |||||

| Total Shareholders' Equity (Deficit) | 3,628,496 | (1,002,891 | ) | ||||||

| Total Liabilities and Shareholders' Equity (Deficit) | $ | 11,000,115 | $ | 7,323,463 |

See Note 2(a) Going concern and Note 19 Commitments and contingencies.

See accompanying notes to the unaudited condensed consolidated interim financial statements.

On behalf of the Board of Directors:

| (signed) John McCoach, Director | (signed) David Luxton, Director |

| KWESST MICRO SYSTEMS INC. Condensed Consolidated Interim Statements of Net Loss and Comprehensive Loss Three and nine months ended June 30, 2023 and 2022 (Unaudited) |

| In Canadian dollars | Notes | Three Months Ended June 30, 2023 |

Three Months Ended June 30, 2022 |

Nine Months Ended June 30, 2023 |

Nine Months Ended June 30, 2022 |

||||||||||

| Revenue | 15 | $ | 150,269 | $ | 282,432 | $ | 629,005 | $ | 466,148 | ||||||

| Cost of sales | (113,471 | ) | (238,350 | ) | (381,689 | ) | (405,841 | ) | |||||||

| Gross profit | 36,798 | 44,082 | 247,316 | 60,307 | |||||||||||

| Operating expenses | |||||||||||||||

| General and administrative | 1,802,054 | 1,322,730 | 4,446,512 | 3,410,887 | |||||||||||

| Selling and marketing | 731,543 | 851,705 | 2,338,646 | 2,931,460 | |||||||||||

| Research and development, net | 457,028 | 350,689 | 1,026,537 | 1,610,445 | |||||||||||

| Total operating expenses | 2,990,625 | 2,525,124 | 7,811,695 | 7,952,792 | |||||||||||

| Operating loss | (2,953,827 | ) | (2,481,042 | ) | (7,564,379 | ) | (7,892,485 | ) | |||||||

| Other income (expenses) | |||||||||||||||

| Share issuance costs | - | - | (1,309,545 | ) | - | ||||||||||

| Net finance costs | 16 | (40,826 | ) | (184,177 | ) | (595,510 | ) | (304,298 | ) | ||||||

| Foreign exchange gain (loss) | 24,332 | 22,901 | (125,708 | ) | 22,602 | ||||||||||

| Change in fair value of warrant liabilities | 12 | (481,704 | ) | - | 2,707,691 | - | |||||||||

| Loss on disposals | - | - | - | (1,165 | ) | ||||||||||

| Gain on acquisition | - | 41,869 | - | 41,869 | |||||||||||

| Total other income (expenses), net | (498,198 | ) | (119,407 | ) | 676,928 | (240,992 | ) | ||||||||

| Net loss | $ | (3,452,025 | ) | $ | (2,600,449 | ) | $ | (6,887,451 | ) | $ | (8,133,477 | ) | |||

| Other comprehensive income: | |||||||||||||||

| Items that are or may be reclassified subsequently to profit or loss: | |||||||||||||||

| Foreign currency translation differences | 4,713 | (34,171 | ) | 26,137 | (19,132 | ) | |||||||||

| Total comprehensive loss | $ | (3,447,312 | ) | $ | (2,634,620 | ) | $ | (6,861,314 | ) | $ | (8,152,609 | ) | |||

| Net loss per share | |||||||||||||||

| Basic and diluted | $ | (0.81 | ) | $ | (3.50 | ) | $ | (2.04 | ) | $ | (11.32 | ) | |||

| Weighted average number of shares outstanding | |||||||||||||||

| Basic and diluted | 14 | 4,272,663 | 742,697 | 3,374,705 | 718,400 |

| KWESST MICRO SYSTEMS INC. Condensed Consolidated Interim Statements of Changes in Shareholders' Equity (Deficit) Nine months ended June 30, 2023, and 2022 (Unaudited) |

| In Canadian dollars | ||||||||||||||||||||||||

| Notes | Share capital | Contingent shares |

Warrants | Contributed surplus |

Translation reserve |

Deficit | Total Shareholders' Equity (Deficit) |

|||||||||||||||||

| Balance, September 30, 2021 | $ | 17,215,068 | $ | - | $ | 1,848,389 | $ | 2,458,211 | $ | (8,991 | ) | $ | (15,388,949 | ) | $ | 6,123,728 | ||||||||

| Shares issued to settle debt | 19,000 | - | - | - | - | - | 19,000 | |||||||||||||||||

| Shares and warrants issued on acquisition | 4 | 377,503 | 83,319 | 132,000 | - | - | - | 592,822 | ||||||||||||||||

| Contingent shares converted to common shares | 4 | 83,319 | - 83,319 | - | - | - | - | - | ||||||||||||||||

| Warrants exercised | 277,098 | - | (61,173 | ) | - | - | - | 215,925 | ||||||||||||||||

| Warrants expired | - | - | (17,161 | ) | 17,161 | - | - | - | ||||||||||||||||

| Share-based compensation | 13(c) | - | - | - | 1,875,392 | - | - | 1,875,392 | ||||||||||||||||

| Shares for vested RSUs and PSUs | 854,181 | - | - | (854,181 | ) | - | - | - | ||||||||||||||||

| Vested RSUs and PSUs repurchased for withholding taxes |

- | - | - | (22,815 | ) | - | - | (22,815 | ) | |||||||||||||||

| Shares issued for unsecured loans | 365,888 | - | - | - | - | - | 365,888 | |||||||||||||||||

| Share offering costs | (26,323 | ) | - | - | - | - | - | (26,323 | ) | |||||||||||||||

| Other comprehensive income | - | - | - | - | (19,132 | ) | - | (19,132 | ) | |||||||||||||||

| Net loss | - | - | - | - | - | (8,133,477 | ) | (8,133,477 | ) | |||||||||||||||

| Balance, June 30, 2022 | $ | 19,165,734 | $ | - | $ | 1,902,055 | $ | 3,473,768 | $ | (28,123 | ) | $ | (23,522,426 | ) | $ | 991,008 | ||||||||

| Balance, September 30, 2022 | $ | 19,496,640 | $ | - | $ | 1,959,796 | $ | 3,551,330 | $ | (101,418 | ) | $ | (25,909,239 | ) | $ | (1,002,891 | ) | |||||||

| Shares issued for public offering | 13(a) | 13,675,120 | - | - | - | - | - | 13,675,120 | ||||||||||||||||

| Share offering costs | 13(a) | (3,050,278 | ) | - | 189,592 | 125,086 | - | - | (2,735,600 | ) | ||||||||||||||

| Shares issued for debt | 13(a) | 233,485 | - | - | - | - | - | 233,485 | ||||||||||||||||

| Options exercised | 13(c) | 5,836 | - | - | (1,789 | ) | - | - | 4,047 | |||||||||||||||

| Warrants exercised | 13(b) and 18 | 60,000 | - | (60,000 | ) | - | - | - | - | |||||||||||||||

| Share-based compensation | 13(c) | - | - | - | 316,261 | - | - | 316,261 | ||||||||||||||||

| Shares for vested RSUs and PSUs | 18 | 529,504 | - | - | (529,504 | ) | - | - | - | |||||||||||||||

| Vested RSUs and PSUs repurchased for withholding taxes |

- | - | - | (612 | ) | - | - | (612 | ) | |||||||||||||||

| Other comprehensive income | - | - | - | - | 26,137 | - | 26,137 | |||||||||||||||||

| Net loss | - | - | - | - | - | (6,887,451 | ) | (6,887,451 | ) | |||||||||||||||

| Balance, June 30, 2023 | $ | 30,950,307 | $ | - | $ | 2,089,388 | $ | 3,460,772 | $ | (75,281 | ) | $ | (32,796,690 | ) | $ | 3,628,496 |

See accompanying notes to the unaudited condensed consolidated interim financial statements.

| KWESST MICRO SYSTEMS INC. Condensed Consolidated Interim Statements of Cash Flows Nine months ended June 30, 2023, and 2022 (Unaudited) |

| In Canadian dollars | Notes | Nine months ended June 30, 2023 |

Nine months ended June 30, 2022 |

||||||

| OPERATING ACTIVITIES | |||||||||

| Net loss | $ | (6,887,451 | ) | $ | (8,133,477 | ) | |||

| Items not affecting cash: | |||||||||

| Depreciation and amortization | 609,634 | 225,308 | |||||||

| Share-based compensation | 13(c) | 316,261 | 1,875,392 | ||||||

| Change in fair value of warrant liabilities (including related foreign exchange gain) | 12 | (2,788,423 | ) | - | |||||

| Net finance costs | 16 | 621,022 | 304,298 | ||||||

| Loss on disposals | - | 1,165 | |||||||

| Gain on acquisition | 4 | - | (41,869 | ) | |||||

| Changes in non-cash working capital items | 18 | (3,091,998 | ) | 1,886,747 | |||||

| Interest paid | (125,364 | ) | (65,316 | ) | |||||

| Cash used in operating activities | (11,346,319 | ) | (3,947,752 | ) | |||||

| INVESTING ACTIVITIES | |||||||||

| Additions of property and equipment | (243,528 | ) | (172,158 | ) | |||||

| Investments in intangible assets | 7 | (598,525 | ) | (764,067 | ) | ||||

| Deposit for advanced royalties | (148,410 | ) | - | ||||||

| Recognition of open orders from acquisition | 7 | - | 159,650 | ||||||

| Cash acquired on acquisition | 4 | - | 162,547 | ||||||

| Cash flows used in investing activities | (990,463 | ) | (614,028 | ) | |||||

| FINANCING ACTIVITIES | |||||||||

| Proceeds from U.S. IPO and Canadian Offering, net | 13(a) | 16,346,768 | - | ||||||

| Payments of share offering costs | 13(a) and 18 | (125,397 | ) | (26,323 | ) | ||||

| Proceeds from borrowings | 10 | - | 2,000,000 | ||||||

| Payments of deferred financing fees | - | (74,055 | ) | ||||||

| Repayment of borrowings | (2,333,315 | ) | - | ||||||

| Repayments of lease obligations | 34,430 | (29,470 | ) | ||||||

| Proceeds from exercise of warrants | - | 215,925 | |||||||

| Proceeds from exercise of stock options | 4,052 | - | |||||||

| Repurchase of vested RSUs and PSUs for withholding taxes | (612 | ) | (22,815 | ) | |||||

| Cash flows provided by financing activities | 13,925,926 | 2,063,262 | |||||||

| Net change in cash during the period | 1,589,143 | (2,498,518 | ) | ||||||

| Cash, beginning of period | 170,545 | 2,688,105 | |||||||

| Cash, end of period | $ | 1,759,688 | $ | 189,587 | |||||

| Cash and cash equivalents consist of the following: | |||||||||

| Cash held in banks | (1,270,262 | ) | 189,587 | ||||||

| Short-term guaranteed investment certificates | 3,029,950 | - | |||||||

| Cash and cash equivalents | 1,759,688 | 189,587 |

See Note 18 Supplemental cash flow information.

See accompanying notes to the unaudited condensed consolidated interim financial statements.

| KWESST MICRO SYSTEMS INC. Notes to Condensed Consolidated Interim Financial Statements Three and nine months ended June 30, 2023, and 2022 (Expressed in Canadian dollars, except share amounts) |

1. Corporate information

a) Corporate information

KWESST Micro Systems Inc. (the "Company", "KWESST", "we", "our", and "us") was incorporated on November 28, 2017, under the laws of the Province of British Columbia. Our registered office is located at 550 Burrard Street, Suite 2900, Vancouver, British Columbia, Canada and our corporate office is located at Unit 1, 155 Terrence Matthews Crescent, Ottawa, Ontario, Canada. We have representative offices in the following foreign locations: Washington DC (United States), London (United Kingdom), and Abu Dhabi (United Arab Emirates).

We develop and commercialize next-generation technology solutions that deliver a tactical advantage for military, public safety agencies and personal defense markets. Our core mission is to protect and save lives.

KWESST's common stock is listed on the TSX-Venture Exchange ("TSX-V'') under the stock symbol of KWE, on the Nasdaq Capital Market ("Nasdaq") under the stock symbol of KWE and on the Frankfurt Stock Exchange under the stock symbol of 62U. Additionally, warrants issued in the United States are also listed on the Nasdaq under the stock symbol of KWESW. Effective May 1, 2023, the warrants issued in Canada are listed on the TSX-V under the stock symbol of KWE.WT.U.

b) Reverse Stock Split

In August 2022, we submitted a Form F-1 Registration Statement to the U.S. Securities and Exchange Commission and applied to have its common shares listed on Nasdaq. In connection with KWESST's listing application on Nasdaq, we effected a one for seventy (1-for-70) reverse stock split of its common stock on October 28, 2022 (the "Reverse Split"). Accordingly, all shareholders of record at the opening of business on October 28, 2022, received one issued and outstanding common share of KWESST in exchange for seventy outstanding common shares of KWESST. No fractional shares were issued in connection with the Reverse Split. All fractional shares created by the Reverse Split were rounded to the nearest whole number of common shares, with any fractional interest representing 0.5 or more common shares entitling holders thereof to receive one whole common share.

Effective on the date of the Reverse Split, the exercise price and number of common shares issuable upon the exercise of outstanding stock options were proportionately adjusted to reflect the Reverse Split. The restricted share units ("RSUs") and performance stock units ("PSUs") have also been adjusted for the Reverse Split. While the number of warrants has not changed as a result of the Reverse Split; the conversion rate for each warrant was adjusted from one common share to 0.01428571 common share. All information respecting outstanding common shares and other securities of KWESST, including net loss per share, in the current and comparative periods presented herein give effect to the Reverse Split.

2. Basis of preparation

(a) Going concern

These unaudited condensed consolidated interim financial statements have been prepared assuming we will continue as a going concern.

As an early-stage company, we have not yet reached commercial production for most of our products and have incurred significant losses and negative operating cash flows from inception that have primarily been funded from financing activities. We have incurred a $6.9 million net loss and negative operating cash flows of $11.3 million for the nine months ended June 30, 2023 (2022 - $8.1 million net loss and negative operating cash flows of $3.9 million). At June 30, 2023, we had negative $1.1 million in working capital (September 30, 2022 - negative $5.4 million).

| KWESST MICRO SYSTEMS INC. Notes to Condensed Consolidated Interim Financial Statements Three and nine months ended June 30, 2023, and 2022 (Expressed in Canadian dollars, except share amounts) |

Our ability to continue as a going concern and realize our assets and discharge our liabilities in the normal course of business is dependent upon closing timely additional sales orders, timely commercial launch of new products, and the ability to raise additional debt or equity financing, when required. There are various risks and uncertainties affecting our future financial position and our performance including, but not limited to:

Our strategy to mitigate these material risks and uncertainties is to execute timely a business plan aimed at continued focus on revenue growth, product development and innovation, improving overall gross profit, managing operating expenses and working capital requirements, and securing additional capital, as needed.

Failure to implement our business plan could have a material adverse effect on our financial condition and/or financial performance. There is no assurance that we will be able to raise additional capital as they are required in the future. Accordingly, there are material risks and uncertainties that may cast significant doubt about our ability to continue as a going concern.

These condensed consolidated interim financial statements do not include any adjustments to the carrying amounts and classification of assets, liabilities and reported expenses that may otherwise be required if the going concern basis was not appropriate.

(b) Statement of compliance

These unaudited condensed consolidated interim financial statements have been prepared in accordance with IAS 34, Interim Financial Reporting, ("IAS 34") as issued by the International Accounting Standards Board ("IASB"). They do not include all the information required for a complete set of financial statements prepared in accordance with International Financial Reporting Standards ("IFRS") and should be read in conjunction with our annual consolidated financial statements for the year ended September 30, 2022. However, selected explanatory notes are included to explain events and transactions that are significant to an understanding of the changes in our financial position and performance since the last annual consolidated financial statements as at and for the year ended September 30, 2022.

These unaudited condensed consolidated interim financial statements were authorized for issue by the Board of Directors on August 14, 2023.

(c) Basis of consolidation

These unaudited condensed consolidated interim financial statements incorporate the financial statements of KWESST and the entities it controls.

Control is achieved where we have the power to govern the financial and operating policies of an entity so as to obtain benefits from its activities, are exposed to, or have rights to, variable returns from our involvement with the entity and have the ability to affect those returns through its power over the entity. Subsidiaries are fully consolidated from the date on which control is transferred to us until the date on which control ceases. Profit or loss of subsidiaries acquired during the year are recognized from the date of acquisition or effective date of disposal as applicable. All intercompany transactions and balances have been eliminated.

| KWESST MICRO SYSTEMS INC. Notes to Condensed Consolidated Interim Financial Statements Three and nine months ended June 30, 2023, and 2022 (Expressed in Canadian dollars, except share amounts) |

At June 30, 2023, we have the following wholly owned subsidiaries:

| Location | Equity % | |

| KWESST Inc. | Ottawa, Canada | 100% |

| 2720178 Ontario Inc. | Bowmanville, Canada | 100% |

| Police Ordnance Company Inc. | Bowmanville, Canada | 100% |

| KWESST U.S. Holdings Inc. | Delaware, Canada | 100% |

| KWESST Defense Systems U.S. Inc. | Virginia, United States | 100% |

| KWESST Public Safety Systems U.S. Inc. | Virginia, United States | 100% |

| KWESST Public Safety Systems Canada Inc. | Ottawa, Canada | 100% |

(d) Functional and presentation currency

These financial statements are presented in Canadian dollars ("CAD"), our functional currency and presentation currency.

(e) Basis of measurement

The consolidated financial statements have been prepared on the historical cost basis except for certain financial instruments measured at fair value. Historical cost is generally based on the fair value of the consideration given in exchange for assets.

(f) Use of estimates and judgments

The preparation of the unaudited condensed consolidated interim financial statements in accordance with IFRS requires management to make judgments, estimates, and assumptions that affect the application of accounting policies and the reported amounts of assets and liabilities, income, expenses, and disclosure of contingent liabilities. Actual results may differ from these estimates.

Estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to estimates are recognized prospectively.

Judgments

Information about judgments made in applying accounting policies that have the most significant effects on the amounts recognized in these consolidated financial statements are the same as disclosed in Note 2(f) of the consolidated financial statements for the year ended September 30, 2022, except for the following new item:

Estimates

Information about assumptions and estimation uncertainties at June 30, 2023, that have a significant risk of resulting in a material adjustment to the carrying amounts of assets and liabilities in the next financial year are the same as disclosed in Note 2(f) of the audited consolidated financial statements for the year ended September 30, 2022.

| KWESST MICRO SYSTEMS INC. Notes to Condensed Consolidated Interim Financial Statements Three and nine months ended June 30, 2023, and 2022 (Expressed in Canadian dollars, except share amounts) |

COVID-19 Uncertainties

There is no change to our COVID-19 assessment from the disclosure provided in Note 2(f) of the audited consolidated financial statements for the year ended September 30, 2022.

3. Significant accounting policies

During the nine months ended June 30, 2023, the accounting policies in these condensed consolidated interim financial statements are the same as those applied in KWESST's consolidated financial statements as at and for the year ended September 30, 2022.

4. Acquisition

On December 15, 2021, we acquired 2720178 Ontario Inc., an Ontario (Canada) corporation, which owns all of the issued and outstanding shares of Police Ordnance Company Inc., an Ontario (Canada) corporation (together, "Police Ordnance"), herein referred as the "Police Ordnance Acquisition". Located in Bowmanville, Ontario, with ancillary operations in Florida, Police Ordnance owns all intellectual properties to the ARWENTM product line of launchers, and a proprietary line of 37 mm cartridges designed for riot control and tactical teams. Police Ordnance has law enforcement customers across Canada, the United States, and abroad. The Police Ordnance Acquisition provides us with a strategic opportunity to leverage its law enforcement customer base to accelerate growth within its specialty ordnance business.

We accounted for the acquisition of Police Ordinance pursuant to IFRS 3, Business Combinations.

Consideration Transferred:

The purchase consideration comprised of the following:

| Number | Fair Value | |||||

| Common shares | 3,965 | $ | 377,503 | |||

| Warrants | 200,000 | $ | 132,000 | |||

| Contingent shares | 875 | $ | 83,319 | |||

| Total fair value purchase consideration | $ | 592,822 |

The warrants are exercisable at $1.72 each and will expire on December 15, 2024. As a result of the Reverse Split (see Note 1(b)), each warrant converts into 0.01428571 common share or 70 warrants to receive one common share of KWESST.

We issued the 875 contingent common shares to the sellers in April 2022 following the fulfillment of the financial milestone as defined in the share purchase agreement.

We have estimated the fair value as follows:

| KWESST MICRO SYSTEMS INC. Notes to Condensed Consolidated Interim Financial Statements Three and nine months ended June 30, 2023, and 2022 (Expressed in Canadian dollars, except share amounts) |

The net cash inflow as at the closing of the acquisition was as follows:

| Cash assumed on acquisition | $ | 162,547 | |

| less: consideration paid in cash | - | ||

| Net cash inflow on acquisition | $ | 162,547 |

Net Assets Acquired:

The purchase consideration was allocated to Police Ordnance's net assets as follows:

| Total purchase consideration at fair value | $ | 592,822 | |

| Police Ordnance's net assets: | |||

| Cash | 162,547 | ||

| Trade and other receivables | 104,432 | ||

| Inventories | 352,685 | ||

| Intangible assets: | |||

| Purchase orders | 100,000 | ||

| Customer relationships | 50,000 | ||

| ARWENTM tradename | 44,000 | ||

| Accounts payable and accrued liabilities | 82,963 | ||

| Corporate tax liability | 32,338 | ||

| Contract liabilities | 29,861 | ||

| Borrowings | 26,238 | ||

| Deferred tax liabilities | 49,442 | ||

| Net assets at fair value | $ | 592,822 |

As a result of the above purchase price allocation, we have recorded no goodwill for the Police Ordnance Acquisition.

Impact on KWESST's Results of Operations:

The results of operations of Police Ordnance are included in these unaudited condensed consolidated interim statements of net loss and comprehensive loss from December 16, 2021. If the acquisition had occurred on October 1, 2021, management estimates that Police Ordnance would have contributed approximately $341,500 and $623,800 of revenue and approximately $51,600 and $2,500 of net profit to KWESST's operating results for the three and nine months ended June 30, 2022, respectively. In determining these amounts, management has assumed that the fair value adjustments that arose on the date of the acquisition would have been the same if the acquisition had occurred on October 1, 2021.

We incurred immaterial acquisition-related costs.

| KWESST MICRO SYSTEMS INC. Notes to Condensed Consolidated Interim Financial Statements Three and nine months ended June 30, 2023, and 2022 (Expressed in Canadian dollars, except share amounts) |

5. Trade and other receivables

The following table presents trade and other receivables for KWESST:

| June 30, 2023 |

September 30, 2022 |

|||||

| Trade receivables | $ | 109,965 | $ | 114,877 | ||

| Unbilled revenue | 5,211 | 8,881 | ||||

| Sales tax recoverable | 182,882 | 48,124 | ||||

| Other receivable | - | - | ||||

| Total | $ | 298,058 | $ | 171,882 |

There was no impairment of trade and other receivables during the six months ended June 30, 2023 (2022 - $nil).

The following table presents changes in unbilled receivables:

| June 30, 2023 |

September 30, 2022 |

|||||

| Balance, beginning of period | $ | 8,881 | $ | 308,728 | ||

| Revenue billed during the period | (3,670 | ) | (308,728 | ) | ||

| Revenue in excess of billings, net of amounts transferred to trade receivables | - | 8,881 | ||||

| Balance, end of period | $ | 5,211 | $ | 8,881 | ||

| Current | $ | 5,211 | $ | 8,881 | ||

| Non-current | $ | - | $ | - |

6. Inventories

The following table presents a breakdown of inventories:

| June 30, 2023 |

September 30, 2022 |

|||||

| Finished goods | $ | 53,732 | $ | 49,643 | ||

| Work-in-progress | 922,324 | 21,350 | ||||

| Raw materials | 614,931 | 322,545 | ||||

| Total | $ | 1,590,987 | $ | 393,538 |

There was no impairment of inventories during the nine months ended June 30, 2023 (2022 - $nil).

| KWESST MICRO SYSTEMS INC. Notes to Condensed Consolidated Interim Financial Statements Three and nine months ended June 30, 2023, and 2022 (Expressed in Canadian dollars, except share amounts) |

7. Intangible assets

The following table shows the movement in intangible assets since September 30, 2022:

| Cost | PhantomTM System |

PARA OPSTM System |

PARA OPSTM Patent |

ARWENTM Tradename |

Customer Relationships |

Purchase Orders |

Total | ||||||||||||||

| Balance at September 30, 2022 | $ | 1,149,585 | $ | 3,469,215 | $ | 28,783 | $ | 37,032 | $ | 46,041 | $ | 12,198 | $ | 4,742,854 | |||||||

| Additions | 19,855 | 570,414 | 8,256 | - | - | - | 598,525 | ||||||||||||||

| Amortization | - | (336,635 | ) | - | (6,600 | ) | (3,750 | ) | - | (346,985 | ) | ||||||||||

| Recognition of open orders | - | - | - | - | - | (7,811 | ) | (7,811 | ) | ||||||||||||

| Balance at June 30, 2023 | $ | 1,169,440 | $ | 3,702,994 | $ | 37,039 | $ | 30,432 | $ | 42,291 | $ | 4,387 | $ | 4,986,583 |

At June 30, 2023, management concluded there was no impairment on the intangible assets (2022 - $nil). The development of PARA OPSTM was substantially completed during the six months ended March 31, 2023, and amortization of $336,635 was recognized in General and administrative expenses. Management determined the estimated useful life to be five years.

8. Accounts payable and accrued liabilities

The following table presents a breakdown of our accounts payable and accrued liabilities:

| June 30, 2023 |

September 30, 2022 |

|||||

| Trade payable | $ | 1,034,913 | $ | 2,292,954 | ||

| Accrued liabilities | 1,157,241 | 1,045,409 | ||||

| Salary and vacation payable | 267,945 | 1,121,118 | ||||

| Total | $ | 2,460,099 | $ | 4,459,481 |

9. Related party transactions

At June 30, 2023, there was $264,959 (September 30, 2022 - $672,531) outstanding in accounts payable and accrued liabilities due to our officers and directors for unpaid wages, director fees, and expense reimbursements.

10. Borrowings

The following is a reconciliation of borrowings since September 30, 2022:

| CEBA Term Loans |

March 2022 Loans |

August 2022 Loans |

Total Borrowings |

|||||||||

| Balance, September 30, 2022 | $ | 78,796 | $ | 1,764,630 | $ | 435,348 | $ | 2,278,774 | ||||

| Accrued interest and accretion expense | 11,204 | 274,887 | 179,096 | 465,187 | ||||||||

| Interest paid | - | (39,517 | ) | (63,661 | ) | (103,178 | ) | |||||

| Repayment of principal | (70,000 | ) | (1,988,000 | ) | (275,315 | ) | (2,333,315 | ) | ||||

| Settled in equity (Notes 12 and 18) | - | (12,000 | ) | (275,468 | ) | (287,468 | ) | |||||

| Forgivable amount | (20,000 | ) | - | - | (20,000 | ) | ||||||

| Balance, June 30, 2023 | $ | - | $ | - | $ | - | $ | - |

There were no changes to KWESST's RBC Credit Facility since September 30, 2022.

| KWESST MICRO SYSTEMS INC. Notes to Condensed Consolidated Interim Financial Statements Three and nine months ended June 30, 2023, and 2022 (Expressed in Canadian dollars, except share amounts) |

11. Contract liabilities

The following is a reconciliation of contract liabilities since September 30, 2022:

| June 30, | |||

| 2023 | |||

| Balance, beginning of period | $ | 47,271 | |

| Amounts invoiced and revenue deferred | 328,678 | ||

| Recognition of deferred revenue included in the | |||

| balance at the beginning of period | (47,271 | ) | |

| Balance, end of period | $ | 328,678 |

12. Warrant liabilities

The following is a reconciliation of warrant liabilities since September 30, 2022:

| U.S. IPO and Canadian Offering | Debt Settlement | ||||||||||||||

| Over-allotment | |||||||||||||||

| 2022 | Pre-Funded | Over-allotment | |||||||||||||

| Warrants | Warrants | Warrants | Warrants | Total | |||||||||||

| Balance, beginning of period | $ | - | $ | - | $ | - | $ | - | $ | - | |||||

| Initial recognition | 4,617,451 | 832,698 | 536,681 | 80,617 | 6,067,447 | ||||||||||

| (Gain) Loss on revaluation of financial instruments | (2,641,798 | ) | 34,659 | (305,270 | ) | (47,158 | ) | (2,959,567 | ) | ||||||

| Exchange gain on revaluation | (52,788 | ) | (20,026 | ) | (7,918 | ) | - | (80,732 | ) | ||||||

| Balance, end of period | $ | 1,922,865 | $ | 847,331 | $ | 223,493 | $ | 33,459 | $ | 3,027,148 | |||||

| Number of outsanding securities as at June 30, 2023 | 3,226,392 | 199,000 | 375,000 | 56,141 | 3,856,533 | ||||||||||

U.S. IPO and Canadian Offering

On December 9, 2022, we closed an underwritten U.S. public offering (the "U.S. IPO") and an underwritten Canadian offering (the "Canadian Offering") for aggregate gross proceeds of CAD$19.4 million (US$14.1 million) (see Note 13(a)). As part of the U.S. IPO and Canadian Offering, we have issued 3,226,392 warrants (the "2022 Warrants") with an exercise price of US$5.00 per share. Additionally, the U.S. underwriter exercised its over-allotment option to purchase:

• 199,000 Pre-Funded Warrants with an exercise price of US$0.01 per share for $3.81024 per pre-funded warrant (net of underwriter discount);

• 375,000 warrants with exercise price of US$5.00 per share for $0.0001 per warrant;

Refer to Note 13(a) for further information on the U.S. IPO and Canadian Offering.

Under IFRS, the above securities are classified as financial liabilities (referred herein as "warrant liabilities") because the exercise price is denominated in U.S. dollars, which is different to our functional currency (Canadian dollars). Accordingly, the ultimate proceeds in Canadian dollars from the potential exercise of the above securities are not known at inception. These financial liabilities are classified and measured at FVTPL (see Note 3(c) of the audited consolidated financial statements for the year ended September 30, 2022). Gains on revaluation of the warrant liabilities are presented in Other income (expenses) on the unaudited condensed consolidated interim statements of net loss and comprehensive loss.

Warrant liabilities

While the warrants issued in the U.S. IPO were listed on Nasdaq and closed at US$0.90 per warrant on December 9, 2022, management concluded that this closing price was not reflective of an active market due to short trading window and therefore not representative of fair value. Accordingly, at inception, the 2022 Warrants were measured at fair value using the Black Scholes option pricing model (Level 2). We used the following assumptions:

| KWESST MICRO SYSTEMS INC. Notes to Condensed Consolidated Interim Financial Statements Three and nine months ended June 30, 2023, and 2022 (Expressed in Canadian dollars, except share amounts) |

| Over-allotment | |||||||||

| 2022 | Pre-Funded | Over-allotment | |||||||

| Warrants | Warrants (1) | Warrants (2) | |||||||

| Number of dilutive securities | 3,282,533 | 199,000 | 375,000 | ||||||

| Exercise price (in USD) | $ | 5.00 | $ | 0.01 | |||||

| Share price (in USD) | $ | 4.13 | $ | 3.08 | |||||

| Expected life | 2.50 | ||||||||

| Dividend | $ | - | |||||||

| Volatility | 75% | ||||||||

| Risk free rate | 4.20% | ||||||||

| Exchange rate (USD/CAD) | $ | 1.363 | |||||||

| Fair value per warrant (CAD) | $ | 1.43 | $ | 4.18 | 1.43 | ||||

(1) Fair value is measured at the underlying common share closing price on Nasdaq on December 9, 2022, less US$0.01 exercise price.

(2) Same fair value as calculated for Warrants.

The share price (in USD) for the over-allotment pre-funded warrants was based on the estimated fair value of the common shares issued on December 9, 2022, by deducting the fair value of the warrants of US$1.05 from the US$4.13 Unit price and the exercise price of US$0.01 (see Note 13(a)).

Based on the above fair value, the issuance of the over-allotment pre-funded warrants and warrants to the underwriter resulted in a non-cash charge of $251,877, which is included in the change in fair value of warrant liabilities in the condensed consolidated interim statements of net loss and comprehensive loss.

At June 30, 2023, we remeasured the fair value of these warrants using the following assumptions:

| Over-allotment | |||||||||

| 2022 | Pre-Funded | Over-allotment | |||||||

| Warrants (1) | Warrants (2) | Warrants (1) | |||||||

| Number of securities | 3,282,533 | 199,000 | 375,000 | ||||||

| Nasdaq closing price (in USD) | $ | 0.45 | $ | 3.23 | $ | 0.45 | |||

| Exchange rate (USD/CAD) | $ | 1.324 | $ | 1.324 | $ | 1.324 | |||

| Fair value per warrant (CAD) | $ | 0.60 | $ | 4.26 | $ | 0.60 | |||

(1) Fair value is based on the Nasdaq closing pricing on June 30, 2023, for the warrants.

(2) Fair value is measured at the Nasdaq closing price on June 30, 2023, for the underlying common stock less US$0.01 exercise price.

Including the non-cash charge for the issuance of the over-allotment pre-funded warrants and warrants to the underwriter, we recognized $481,704 as a gain in fair value and $2,707,691 as a loss in fair value of warrant liabilities during the three and nine months ended June 30, 2023, respectively, which was reported in the condensed consolidated net loss and comprehensive loss.

December 2022 Debt Settlement

On December 13, 2022, we have entered into share for debt arrangements with existing lenders (see Note 13(a)), which resulted in issuing 56,141 Units, same terms as the Units as issued in the Canadian Offering except that the underlying securities are subject to a four-month hold period. Accordingly, this resulted in issuing 56,141 common shares and 56,141 warrant liabilities with an exercise price of US$5.00 per share and maturing on December 13, 2027. We initially recorded the fair value of the warrant liabilities using the Black Scholes option pricing model with an underlying stock price equivalent to the unit price of US$4.13.

| KWESST MICRO SYSTEMS INC. Notes to Condensed Consolidated Interim Financial Statements Three and nine months ended June 30, 2023, and 2022 (Expressed in Canadian dollars, except share amounts) |

At June 30, 2023, we remeasured the fair value of these warrant liabilities using the Nasdaq closing price on June 30, 2023, of US$0.45. The remeasurement resulted in a change in fair value of warrant liabilities of $4,726 and $47,158 for the three and nine months ended June 30, 2023, respectively, which was reported in the condensed consolidated net loss and comprehensive loss.

13. Share capital and Contributed Surplus

a) Share capital

Authorized

KWESST is authorized to issue an unlimited number of common shares.

Issued Common Shares

The following is a summary of changes in outstanding common shares since September 30, 2022:

| Number | Amount | |||||

| Balance at September 30, 2022 | 773,225 | $ | 19,496,640 | |||

| Issued for U.S. IPO and Canadian Offering | 3,226,392 | $ | 13,675,120 | |||

| Issued for debt settlements | 56,134 | $ | 233,485 | |||

| Issued for conversion of stock units | 14,141 | $ | 529,504 | |||

| Issued for option exercise | 1,125 | $ | 5,836 | |||

| Issued for warrant exercise | 3,571 | $ | 60,000 | |||

| Less: share offering costs for the period | $ | (3,050,278 | ) | |||

| Balance at June 30, 2023 | 4,074,588 | $ | 30,950,307 |

U.S. IPO and Canadian Offering

On December 9, 2022, we closed the U.S. IPO and the Canadian Offering. In the U.S. IPO, we sold 2.5 million units at a public offering price of USD $4.13 per unit (the "Unit"), consisting of one share of common stock and one warrant to purchase one share of common stock ("Warrant"). The Warrants have a per share exercise price of USD $5.00 and can be exercised immediately. In connection with the closing of the U.S. IPO, the underwriter partially exercised its over-allotment option to purchase an additional 199,000 pre-funded common share purchase warrants ("Pre-Funded Warrants") at US$4.12 (before underwriter discount) and 375,000 option warrants to purchase common shares at US$0.0001 each. A Pre-Funded Warrant is a financial instrument that requires the holder to pay little consideration (exercise price of US$0.01) to receive the common share upon exercise of the Pre-Funded Warrant (see Note 14). The holder of Pre-Funded Warrants has no voting rights. All of these warrants expire on December 9, 2027.

In the Canadian Offering, we sold 726,392 units, each consisting of one common share and one warrant to purchase one common share, at a price to the public of USD $4.13 per unit. The warrants will have a per common share exercise price of USD $5.00, are exercisable immediately and expire in five years on December 9, 2027. Effective May 1, 2023, the warrants are listed on the TSX-V under the stock symbol of KWE.WT.U.

The closing of the U.S. IPO and Canadian Offering resulted in aggregate gross proceeds of CAD$19.4 million (USD $14.1 million), before deducting underwriting discounts and offering expenses.

| KWESST MICRO SYSTEMS INC. Notes to Condensed Consolidated Interim Financial Statements Three and nine months ended June 30, 2023, and 2022 (Expressed in Canadian dollars, except share amounts) |

The common shares of KWESST and the Warrants sold in the U.S. IPO began trading on the Nasdaq Capital Market under the symbols "KWE" and "KWESW", respectively, on December 7, 2022.

ThinkEquity acted as sole book-running manager for the U.S. IPO and PI Financial acted as sole book-running manager for the Canadian Offering.

Accounting Treatment

Refer to Note 12 for the accounting of the warrants issued in the U.S. IPO and Canadian Offering.

Brokers' Compensation and Share Offering Costs

As consideration for the services provided in connection with the U.S. IPO, ThinkEquity received: (a) a broker- dealer cash commission of US$835,000 (or CAD$1,138,105) equal to 7.5% of the gross offering proceeds of the U.S. Offering and (b) underwriter warrants (the "U.S. Underwriter Warrants") to purchase up to 134,950 common shares equal to 5% of the common shares and pre-funded common share purchase warrants issued under the U.S. Offering. Each U.S. Underwriter Warrant is exercisable to acquire one common share at a price of US$5.1625, exercisable as of June 4, 2023, and expiring on December 9, 2027.

As consideration for the services provided in connection with the Canadian Offering, PI Financial received: (a) a cash commission of approximately US$210,000 (or CAD$286,230); and (b) 50,848 compensation options (the "Canadian Compensation Options"). Each Canadian Compensation Option is exercisable to acquire one Canadian Unit at a price of US$4.13 and expiring on December 9, 2024.

In addition to the above brokers' compensation, we also incurred US$2.1 million share offering costs (or CAD$2.8 million) for the U.S. IPO and Canadian Offering, of which CAD$628,262 was incurred and deferred at September 30, 2022.

The total brokers compensation (including fair value of U.S. Underwriter Warrants and Canadian Compensation Options) and share offering costs was US$3.2 million (or CAD$4.4 million). This total was allocated proportionately to the fair value of common shares and warrant liabilities. Accordingly, CAD$1.3 million allocated to warrant liabilities were expensed during the nine months ended June 30, 2023.

Shares for Debt Settlement

We have entered into share for debt arrangements with existing lenders, which closed on December 13, 2022, following TSXV's conditional approval. This resulted in issuing 56,141 Units to settle $12,000 of the March 2022 Loans and USD$223,321 (or CAD$302,197) of the August 2022 Loans, including unpaid accrued interest and 10% premium at maturity (the "Debt Settlements") - see Note 10. The terms of the Units are the same as the Units issued in the Canadian Offering.

| KWESST MICRO SYSTEMS INC. Notes to Condensed Consolidated Interim Financial Statements Three and nine months ended June 30, 2023, and 2022 (Expressed in Canadian dollars, except share amounts) |

b) Warrants

The following is a summary of changes in outstanding warrants since September 30, 2022:

| Weighted | |||||||

| Number of | average | ||||||

| warrants | exercise price | ||||||

| Outstanding at September 30, 2022 | 13,417,156 | $ | 0.78 | ||||

| Issued (Note 13(a)) | 3,991,483 | $ | 6.44 | ||||

| Exercised | (250,000 | ) | $ | 0.50 | |||

| Outstanding at June 30, 2023 | 17,158,639 | $ | 2.10 | ||||

| Exercisable at June 30, 2023 | 16,648,689 | $ | 2.09 |

The table that follows outlines the ratio upon which the above warrants are converted into common shares.

U.S. Underwriter Warrants

In the U.S. IPO, we issued 134,950 warrants ("U.S. Underwriter Warrants"). Each U.S. Underwriter Warrant is exercisable to acquire one common share at US$5.1625 for a period of 5 years (expiring on December 9, 2027). Management estimated the fair value of these warrants using the Black Scholes option model with the following inputs:

| Number of dilutive securities | 134,950 | ||

| Exercise price (in USD) | $ | 5.16 | |

| Share price (in USD) | $ | 3.08 | |

| Expected life | 2.50 | ||

| Dividend | $ | - | |

| Volatility | 75% | ||

| Risk free rate | 4.20% | ||

| Exchange rate (USD/CAD) | $ | 1.363 | |

| Fair value per warrant (CAD) | $ | 1.40 | |

We have recorded $189,592 as the fair value for the U.S. Underwriter Warrants, with an equal offset to share offering costs (a non-cash transaction).

| KWESST MICRO SYSTEMS INC. Notes to Condensed Consolidated Interim Financial Statements Three and nine months ended June 30, 2023, and 2022 (Expressed in Canadian dollars, except share amounts) |

The following table provides additional information on the total outstanding warrants at June 30, 2023, see note 1(b):

| Number | Conversion ratio to | |||||||||||

| outstanding | Common Shares | Book value | Expiry Date | |||||||||

| Classified as Equity | ||||||||||||

| Founders' warrants: | ||||||||||||

| Exercise price of $0.20 | 5,520,000 | 70 for 1 | $ | 1,013 | January 1, 2024 | |||||||

| Exercise price of $0.20 | 1,900,000 | 70 for 1 | $ | 18,865 | June 14, 2024 | |||||||

| April 2021 equity financing: | ||||||||||||

| Exercise price of $1.75 | 3,274,657 | 70 for 1 | $ | 785,918 | April 29, 2023 | |||||||

| Exercise price of $1.75 | 40,000 | 70 for 1 | $ | 9,600 | August 25, 2023 | |||||||

| LEC's warrants: | ||||||||||||

| Exercise price of $0.70 | 500,000 | 70 for 1 | $ | 425,000 | April 29, 2026 | |||||||

| September 2021 equity financing: | ||||||||||||

| Exercise price of $2.35 | 750,000 | 70 for 1 | $ | 390,000 | September 16, 2023 | |||||||

| Broker warrants: | ||||||||||||

| Exercise price of $1.75 | 137,499 | 70 for 1 | $ | 33,000 | April 29, 2023 | |||||||

| Exercise price of $2.00 | 45,000 | 70 for 1 | $ | 32,400 | September 16, 2023 | |||||||

| Acquisition of Police Ordnance (Note 4): | ||||||||||||

| Exercise price of $1.72 | 200,000 | 70 for 1 | $ | 132,000 | December 15, 2024 | |||||||

| July 2022 equity financing: | ||||||||||||

| Exercise price of $0.285 | 800,000 | 70 for 1 | $ | 72,000 | July 14, 2024 | |||||||

| December 2022 U.S. Underwriter Warrants | ||||||||||||

| Exercise price of US$5.1625 | 134,950 | 1 for 1 | $ | 189,592 | December 6, 2024 | |||||||

| 13,302,106 | $ | 2,089,388 | ||||||||||

| Classified as liability | ||||||||||||

| December 2022 public offerings: | ||||||||||||

| Exercise price of US$5.00 | 3,226,392 | 1 for 1 | $ | 1,922,865 | December 9, 2027 | |||||||

| December 2022 Pre-Funded Warrants | ||||||||||||

| Exercise price of US$0.01 | 199,000 | 1 for 1 | $ | 847,331 | No expiry | |||||||

| December 2022 Option Warrants | ||||||||||||

| Exercise price of US$5.1625 | 375,000 | 1 for 1 | $ | 223,493 | December 9, 2024 | |||||||

| December 2022 debt settlement | ||||||||||||

| Exercise price of US$5.00 | 56,141 | 1 for 1 | $ | 33,459 | December 9, 2027 | |||||||

| 3,856,533 | 3,027,148 | |||||||||||

| Total outstanding warrants | 17,158,639 | $ | 5,116,536 |

c) Contributed Surplus

Broker Compensation Options

In the Canadian Offering, we issued 50,848 Canadian Compensation Options. Each Canadian Compensation Option is exercisable to acquire one Unit, as defined in Note 13(a), at a price equal to US$4.13 for a period of two years (expiring on December 9, 2024). Based on the structure of the Compensation Option, management estimated its fair value using the Monte Carlo method (Level 2). We used the following key inputs in the Monte Carlo model (100,000 simulations):

| KWESST MICRO SYSTEMS INC. Notes to Condensed Consolidated Interim Financial Statements Three and nine months ended June 30, 2023, and 2022 (Expressed in Canadian dollars, except share amounts) |

| Initial | |||

| Recognition | |||

| Number of securities | 50,848 | ||

| Exercise price - compensation option (in USD) | $ | 4.13 | |

| 1-Year CAD/USD Forward Exchange Rate | $ | 1.3560 | |

| Exercise price - compensation warrant (in USD) | $ | 5.00 | |

| 2-Year CAD/USD Forward Exchange Rate | $ | 1.3483 | |

| Share price (in CAD) | $ | 4.20 | |

| Expected life - compensation option | 1.00 | ||

| Expected life - compensation warrant | 2.50 | ||

| Dividend | $ | - | |

| Volatility - compensation option | 90% | ||

| Volatility - compensation warrant | 75% | ||

| Risk free rate - compensation option | 4.38% | ||

| Risk free rate - compensation warrant | 3.15% | ||

| Fair value per compensation option (CAD) | $ | 2.46 | |

We have recorded $125,086 of Canadian Compensation Options in contributed surplus, with an equal offset to share offering costs (a non-cash transaction).

Share-based compensation

On March 31, 2023, KWESST shareholders approved the renewal of the Long-Term Incentive Plan (the "LTIP"). Additionally, the disinterested shareholders of KWESST approved an amendment to the LTIP to increase the number of RSUs, PSUs, DSUs, and SARs (collectively "Share Units") authorized for issuance pursuant to the LTIP from 60,682 to 407,274 Share Units. Accordingly, we have 338,681 Share Units available for future grants.

Further, the disinterested shareholders of KWESST approved to revise the exercise price of 50,981 stock options to $3.60, the closing price of KWESST common shares on the TSX-V on March 31, 2023. In accordance with IFRS 2, this resulted in an immediate fair value increase of $77,001 included in share-based compensation, with an offset to contributed surplus for the three and six months ended March 31, 2023.

During the three and nine months ended June 30, 2023, we granted 10,000 stock options and did not grant any RSUs, PSUs, and SARs, pursuant to our LTIP during the nine months ended June 30, 2023. Accordingly, we had 59,907 outstanding stock options at June 30, 2023. The remaining available stock option pool for future grants was 347,551 at June 30, 2023.

For the three and nine months ended June 30, 2023, we recorded share-based compensation of $39,214 and $316,261, respectively (2022 - $524,931 and $1,875,392).

14. Earnings (loss) per share

The following table summarizes the calculation of the weighted average basic number of basic and diluted common shares to calculate the earnings (loss) per share as reported in the unaudited condensed consolidated interim statements of net loss and comprehensive loss:

| KWESST MICRO SYSTEMS INC. Notes to Condensed Consolidated Interim Financial Statements Three and nine months ended June 30, 2023, and 2022 (Expressed in Canadian dollars, except share amounts) |

| Three months ended June 30, 2023 |

Three months ended June 30, 2022 |

Nine months ended June 30, 2023 |

Nine months ended June 30, 2022 |

|||||||||

| Issued common shares, beginning of period | 4,272,113 | 735,491 | 773,225 | 699,509 | ||||||||

| Effect of shares issued from: | ||||||||||||

| December 2022 U.S. IPO and Canadian Offering (Note 13) | - | - | 2,399,112 | - | ||||||||

| Over-allotment Pre-Funded Warrants (Note 12) | - | - | 147,974 | - | ||||||||

| Debt settlements (Note 13) | - | - | 40,923 | 130 | ||||||||

| Conversion of stock units | 337 | 4,249 | 11,033 | 2,246 | ||||||||

| Exercise of options | 213 | - | 70 | - | ||||||||

| Exercise of warrants | - | 2,286 | 2,368 | 7,761 | ||||||||

| Acquisition of Police Ordnance (Note 4) | - | - | - | 2,861 | ||||||||

| Conversion of contingent shares (Note 4) | - | 671 | - | 221 | ||||||||

| Issuance of bonus shares (Note 10) | - | - | - | 5,672 | ||||||||

| Weighted average number of basic common shares | 4,272,663 | 742,697 | 3,374,705 | 718,400 | ||||||||

| Dilutive securities: | - | - | - | - | ||||||||

| Weighted average number of dilutive common shares | 4,272,663 | 742,697 | 3,374,705 | 718,400 |

At June 30, 2023 and 2022, all dilutive securities were anti-dilutive because we incurred a net loss for the above periods.

As the $0.01 exercise price per Pre-Funded Warrant is non-substantive, the 199,000 Pre-Funded Warrants issued in the U.S. IPO are included in the basic net loss per share calculation.

15. Revenue

The following table, revenue from contracts with customers is disaggregated by primary geographical market, major products and service lines, and timing of revenue recognition.

| Three months | Three months | Nine months | Nine months | |||||||||

| ended June | ended | ended | ended | |||||||||

| 30, 2023 | June 30, 2022 | June 30, 2023 | June 30, 2022 | |||||||||

| Major products / service lines | ||||||||||||

| Digitization | $ | 61,823 | $ | 157,900 | $ | 325,827 | $ | 314,515 | ||||

| Non-lethal | 87,706 | 100,684 | 301,198 | 111,176 | ||||||||

| Training and services | $ | 23,495 | - | 39,169 | ||||||||

| Other | 740 | 353 | 1,980 | 1,288 | ||||||||

| $ | 150,269 | $ | 282,432 | $ | 629,005 | $ | 466,148 | |||||

| Primary geographical markets | ||||||||||||

| United States | $ | 2,364 | $ | 27,607 | $ | 29,683 | $ | 48,658 | ||||

| Canada | 147,905 | 254,825 | 599,322 | 417,490 | ||||||||

| $ | 150,269 | $ | 282,432 | $ | 629,005 | $ | 466,148 | |||||

| Timing of revenue recognition | ||||||||||||

| Products and services transferred over time | $ | 61,823 | $ | 181,395 | $ | 325,827 | $ | 353,684 | ||||

| Products transferred at a point in time | 88,446 | 101,037 | 303,178 | 112,464 | ||||||||

| $ | 150,269 | $ | 282,432 | $ | 629,005 | $ | 466,148 | |||||

| KWESST MICRO SYSTEMS INC. Notes to Condensed Consolidated Interim Financial Statements Three and nine months ended June 30, 2023, and 2022 (Expressed in Canadian dollars, except share amounts) |

At June 30, 2023, KWESST's contracted not yet recognized revenue was $1,013,841 (2022 - $nil), of which 78.57% of this amount is expected to be recognized over the next 12 months with the remaining 21.43% expected to be recognized in 2 to 3 years.

For the three months ended June 30, 2023, three customers accounted for 48.67%, 31.47% and 9.68% (2022 - one customer accounted for 55.91%) of revenue. For the nine months ended June 30, 2023, four customers accounted for 35.84%, 14.11%, 11.63% and 8.03% (2022 - one customer accounted for 63.90%) of total revenue.

16. Net finance costs

The following table presents a breakdown of net finance costs for the following periods:

| Three months ended June 30, |

Three months ended June 30, |

Nine months ended June 30, |

Nine months ended June 30, |

||||||||||

| 2023 | 2022 | 2023 | 2022 | ||||||||||

| Finance costs from: | |||||||||||||

| Unsecured loans | - | $ | 134,563 | $ | 453,983 | $ | 162,652 | ||||||

| Accretion cost - accrued royalties liability | 41,093 | 40,393 | 127,408 | 113,899 | |||||||||

| Lease obligations | 7,810 | 7,562 | 20,895 | 23,590 | |||||||||

| Other | - | 2,709 | 63,204 | 7,668 | |||||||||

| Total financing costs | 48,903 | 185,227 | 665,490 | 307,809 | |||||||||

| Interest income | (8,077 | ) | (1,050 | ) | (59,550 | ) | (3,511 | ) | |||||

| Gain on debt settlement (Note 10) | - | - | (430 | ) | - | ||||||||

| Gain on government grant (Note 10) | - | - | (10,000 | ) | - | ||||||||

| Net finance costs | $ | 40,826 | $ | 184,177 | $ | 595,510 | $ | 304,298 | |||||

17. Financial instruments

For the three and nine months ended June 30, 2023, there were no material changes to our financial risks as disclosed in Note 22 of the audited consolidated financial statements for the year ended September 30, 2022, except for the following:

Foreign currency risk

For the three and nine months ended June 30, 2023, certain of our revenues were denominated in U.S. dollar and we also procure certain raw materials denominated in U.S. dollar for product development. Further, we raised gross proceeds of US$14.1 million in the U.S. IPO and Canadian Offering (see Note 13), including the issuance of warrants with exercise price denominated in U.S. dollar (see Note 12). Accordingly, we are exposed to the U.S. dollar currency. Where a natural hedge cannot be achieved, a significant change in the U.S. dollar currency could have a significant effect on our financial performance, financial position and cash flows. Currently, we do not use derivative instruments to hedge its U.S. dollar exposure.

At June 30, 2023, we had the following net U.S. dollar exposure:

| Total USD | |||

| Net liabilities in U.S. subsidiary | $ | (7,906 | ) |

| US denominated from other: | |||

| Assets | $ | 518,330 | |

| Liabilities | (1,555,898 | ) | |

| (1,037,568 | ) | ||

| Total net US dollar exposure | $ | (1,045,474 | ) |

| Impact to profit or loss if 5% movement in the US dollar | $ | (52,274 | ) |

| KWESST MICRO SYSTEMS INC. Notes to Condensed Consolidated Interim Financial Statements Three and nine months ended June 30, 2023, and 2022 (Expressed in Canadian dollars, except share amounts) |

During the three and nine months ended June 30, 2023, we recorded a foreign exchange gain of $19,684 and a loss of $126,872, respectively (2022 - gain of $22,901 and $22,602).

Liquidity risk

At June 30, 2023, our contractual obligations were as follows:

| 5 years and | |||||||||||||||

| Payment due: | Total | Within 1 Year | 1 to 3 years | 3 to 5 years | beyond | ||||||||||

| Minimum royalty commitments | $ | 1,050,000 | $ | 150,000 | $ | 400,000 | $ | 500,000 | $ | 1,300,000 | |||||

| Accounts payable and accrued liabilities | 2,460,099 | 2,460,099 | - | - | - | ||||||||||

| Lease obligations | 562,088 | 167,236 | 371,019 | 23,833 | - | ||||||||||

| Short-term rental obligations | 35,158 | 35,158 | - | - | - | ||||||||||

| Total contractual obligations | $ | 4,107,345 | $ | 2,812,493 | $ | 771,019 | $ | 523,833 | $ | 1,300,000 | |||||

At June 30, 2023, we had $1.8 million in cash and negative $1.1 million in working capital (see Note 2(a)).

18. Supplemental cash flow information

The following table presents changes in non-cash working capital:

| Nine months | Nine months | |||||

| ended | ended | |||||

| June 30, 2023 | June 30, 2022 | |||||

| Trade and other receivables | $ | (126,176 | ) | $ | 609,202 | |

| Inventories | (1,197,449 | ) | (11,046 | ) | ||

| Prepaid expenses | (1,128,977 | ) | 386,904 | |||

| Intangible assets | 7,811 | - | ||||

| Accounts payable and accrued liabilities | (928,614 | ) | 934,025 | |||

| Contract liabilities | 281,407 | - | ||||

| Corporate taxes payable | - | (32,338 | ) | |||

| $ | (3,091,998 | ) | $ | 1,886,747 |

In addition to the non-cash items noted in Note 13, we also had the following non-cash items that were excluded from the Statements of Cash Flows for the nine months ended June 30, 2023:

• $2,924,880 non-cash share offering costs and $453,102 accounts payables as part of the net proceeds settlement at the closing of the U.S. IPO and Canadian Offering;

• 250,000 warrants exercised in connection with the GhostStepTM acquisition in June 2020; and

• $529,504 of shares issued for vested RSUs and PSUs.

The following is a summary of non-cash items that were excluded from the Statements of Cash Flows for the nine months ended June 30, 2022:

• $19,000 debt settlement via common shares;

• $83,319 fair value of 61,264 contingent shares settled via common shares;

• $61,136 fair value of warrants exercised and transferred to share capital from warrants; and

• $125,000 for 250,000 warrants exercised in connection with the GhostStepTM acquisition in June 2020.

| KWESST MICRO SYSTEMS INC. Notes to Condensed Consolidated Interim Financial Statements Three and nine months ended June 30, 2023, and 2022 (Expressed in Canadian dollars, except share amounts) |

19. Commitments and contingencies

Except as noted below, there was no material change to the commitments and contingencies as disclosed in Note 26 of the audited consolidated financial statements for the year ended September 30, 2022.

In March 2023, we committed to signing a three-year lease agreement in Guelph, Canada for our non-lethal operations. The Company has yet to finalize the lease agreement. Terms of the accepted offer to lease included commencement on August 1, 2023, and expiring on June 30, 2026, for a total commitment of $208,285. The Company has not yet commenced occupation of the space, however, expects to in Q4.

20. Segmented information

Our Executive Chairman has been identified as the chief operating decision maker. Our Executive Chairman evaluates the performance of KWESST and allocates resources based on the information provided by our internal management system at a consolidated level. We have determined that we have only one operating segment.

At June 30, 2023, the majority of our property and equipment are located in Canada, including the right-of-use assets.

21. Subsequent Event

On July 21, 2023, the Company announced the closing of a US$5.688 million private placement in the United States. As part of the offering the Company issued 1,542,194 common shares at a price of US$2.26 (CAD$2.98) per common share and 930,548 pre-funded warrants at a price of us$2.26 (CAD$2.98) per pre-funded warrant, with each common share and pre-funded warrant being bundled with one common share purchase warrant of the Company. Each pre-funded warrant entitles the holder to acquire one common share at an exercise price of US$0.01 per common share, and each common warrant is immediately exercisable and entitles the holder to acquire one common share at an exercise price of US$2.66 (CAD$3.50) per common share for a period of 60 months following the closing of the offering.

ThinkEquity acted as sole placement agent for the Offering. As compensation for services rendered, the Company paid to ThinkEquity a cash fee of US$475,013.14 representing 8.5% of the aggregate gross proceeds of the Offering and issued 123,637 warrants to purchase a number of Common Shares (the "Placement Agent Warrants", representing 5% of the Common Shares and Pre-Funded Warrants sold in the Offering. The Placement Agent Warrants, will be exercisable, in whole or in part, immediately upon issuance and will expire 60 months after the closing date of the Offering at an initial exercise price of US$2.66 (CAD$3.50) per Common Share.

During the period ending June 30, 2023, and subsequent to period end, the Company reached settlements in two separate litigation cases involving a former employee and former consultant. The Company accrued approximately $267,000 related to these settlements at June 30. The Company expects to finalize all payments related to the settlements in Q4.

KWESST MICRO SYSTEMS INC.

MANAGEMENT'S DISCUSSION AND ANALYSIS

Three and nine months ended June 30, 2023

(Expressed in Canadian Dollars)

|

KWESST MICRO SYSTEMS INC. MANAGEMENT'S DISCUSSION AND ANALYSIS THREE AND NINE MONTHS ENDED JUNE 30, 2023 |

All references in this management's discussion and analysis (the "MD&A") to "KWESST", "we", "us", "our", and the "Company" refer to KWESST Micro Systems Inc. and its subsidiaries as at June 30, 2023. This MD&A has been prepared with an effective date of August 14, 2023.

This MD&A should be read in conjunction with our unaudited condensed consolidated interim financial statements for the three and nine months ended June 30, 2023 ("Q3 Fiscal 2023 FS") and the annual audited consolidated financial statements and related notes for the year ended September 30, 2022 ("Fiscal 2022 FS"). The financial information presented in this MD&A is derived from these unaudited condensed consolidated interim financial statements prepared in accordance with International Financial Reporting Standards ("IFRS") as issued by the International Accounting Standards Board ("IASB"). This MD&A contains forward-looking statements involves risk, uncertainties and assumptions, including statements regarding anticipated developments in future financial periods and our future plans and objectives. There can be no assurance that such information will prove to be accurate, and readers are cautioned not to place undue reliance on such forward-looking statements. See "Forward-Looking Statements".

All references to $ or dollar amounts in this MD&A are to Canadian currency unless otherwise indicated.

Additional information, including press releases, relating to KWESST is available for view on SEDAR at www.sedar.com.

| NON-IFRS MEASURES |

In this MD&A, we have presented earnings before interest, taxes, depreciation and amortization ("EBITDA") and EBITDA that has been adjusted for the removal of share-based compensation, foreign exchange loss (gain), change in fair value of derivative liabilities, and any one-time, irregular and nonrecurring items ("Adjusted EBITDA") to provide readers with a supplemental measure of our operating performance and thus highlight trends in our core business that may not otherwise be apparent when relying solely on IFRS financial measures. Management also uses non-IFRS measures, in addition to IFRS financial measures, to understand and compare operating results across accounting periods, for financial and operational decision making, for planning and forecasting purposes, and to evaluate our financial performance. We believe that these non-IFRS financial measures enable us to identify underlying trends in our business that could otherwise be hidden by the effect of certain expenses that we exclude in the calculations of the non-IFRS financial measures.

Accordingly, we believe that these non-IFRS financial measures reflect our ongoing business in a manner that allows for meaningful comparisons and analysis in the business and provides useful information to investors and securities analysts, and other interested parties in understanding and evaluating our operating results, enhancing their overall understanding of our past performance and future prospects.

We caution readers that these non-IFRS financial measures do not replace the presentation of our IFRS financial results and should only be used as a supplement to, not as a substitute for, our financial results presented in accordance with IFRS. There are limitations in the use of non-IFRS measures because they do not include all the expenses that must be included under IFRS as well as they involve the exercise of judgment concerning exclusions of items from the comparable non-IFRS financial measure. Furthermore, other peers may use other non-IFRS measures to evaluate their performance, or may calculate non- IFRS measures differently, all of which could reduce the usefulness of our non-IFRS financial measures as tools for comparison.

| GOING CONCERN |

As an early-stage company, we have not yet reached commercial production for most of our products and have incurred significant losses and negative operating cash flows from inception that have primarily been funded from financing activities. KWESST's Q3 Fiscal 2023 FS have been prepared on the "going concern" basis which presumes that KWESST will be able to realize its assets and discharge its liabilities in the normal course of business for the foreseeable future. Refer to Note 2(a) of the Q3 Fiscal 2023 FS.

|

KWESST MICRO SYSTEMS INC. MANAGEMENT'S DISCUSSION AND ANALYSIS THREE AND NINE MONTHS ENDED JUNE 30, 2023 |

| Trademarks |

We own or have rights to various trademarks, service marks and trade names that we use in connection with the operation of our business. This MD&A also contains additional trademarks, trade names and service marks belonging to other companies. Solely for convenience, trademarks, trade names and service marks referred to in this MD&A may appear without the ®, ™ or SM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks, trade names and service marks. We do not intend our use or display of other parties' trademarks, trade names or service marks to imply, and such use or display should not be construed to imply a relationship with, or endorsement or sponsorship of us by, these other parties.

| FORWARD-LOOKING STATEMENTS |

Certain statements in this document constitute "forward-looking statements" and "forward-looking information" within the meaning of applicable Canadian and United States securities laws (together, "forward-looking statements"). Such forward- looking statements include, but are not limited to, information with respect to our objectives and our strategies to achieve these objectives, as well as statements with respect to our beliefs, plans, expectations, anticipations, estimates and intentions. These forward-looking statements may be identified by the use of terms and phrases such as "may", "would", "should", "could", "expect", "intend", "estimate", "anticipate", "plan", "foresee", "believe", or "continue", the negative of these terms and similar terminology, including references to assumptions, although not all forward-looking statements contain these terms and phrases. Forward-looking statements are provided for the purposes of assisting the reader in understanding us, our business, operations, prospects and risks at a point in time in the context of historical and possible future developments and therefore the reader is cautioned that such information may not be appropriate for other purposes.

Forward-looking statements relating to us include, among other things, statements relating to:

• our expectations regarding our business, financial condition and results of operations;

• the future state of the legislative and regulatory regimes, both domestic and foreign, in which we conduct business and may conduct business in the future;

• our expansion into domestic and international markets;

• our ability to attract customers and clients;

• our marketing and business plans and short-term objectives;

• our ability to obtain and retain the licenses and personnel we require to undertake our business;

• our ability to deliver under contracts with customers;

• anticipated revenue from professional service contracts with customers;

• our strategic relationships with third parties;

• our anticipated trends and challenges in the markets in which we operate;

• governance of us as a public company; and

• expectations regarding future developments of products and our ability to bring these products to market.

Forward-looking statements are based upon a number of assumptions and are subject to a number of risks and uncertainties, many of which are beyond our control, which could cause actual results to differ materially from those that are disclosed in or implied by such forward-looking statements. These risks and uncertainties include, but are not limited to, the following risk factors, some of which are discussed in greater detail under the section "Risk Factors" in our Annual Report on Form 20-F dated January 27, 2023:

• limited operating history;

• failure to realize growth strategy;

• failure to complete transactions or realize anticipated benefits;

• reliance on key personnel;

• regulatory compliance;

• competition;

|

KWESST MICRO SYSTEMS INC. MANAGEMENT'S DISCUSSION AND ANALYSIS THREE AND NINE MONTHS ENDED JUNE 30, 2023 |

• changes in laws, regulations and guidelines;

• demand for our products;

• fluctuating prices of raw materials;

• pricing for products;

• ability to supply sufficient product;

• expansion to other jurisdictions;

• damage to our reputation;

• operating risk and insurance coverage;

• negative operating cash flow;

• management of growth;

• product liability;

• product recalls;

• environmental regulations and risks;

• ownership and protection of intellectual property;

• constraints on marketing products;

• reliance on management;

• fraudulent or illegal activity by our employees, contractors and consultants;

• breaches of security at our facilities or in respect of electronic documents and data storage and risks related to breaches of applicable privacy laws;

• government regulations with regards to COVID-19, employee health and safety regulations;

• the duration and impact of COVID-19, and including variants of COVID-19, on our operations;

• regulatory or agency proceedings, investigations and audits;

• additional capital requirements to support our operations and growth plans, leading to further dilution to shareholders;

• conflicts of interest;

• litigation;

• risks related to United States' and other international activities;

• risks related to security clearances;

• risks relating to the ownership of our securities, such as potential extreme volatility in the price of our securities;

• risks related to our foreign private issuer status; and

• risks related to our failure to meet the continued listing requirements of the Nasdaq Capital Market ("Nasdaq").

Although the forward-looking statements contained herein are based upon what we believe are reasonable assumptions, investors are cautioned against placing undue reliance on this information since actual results may vary from the forward - looking statements. Certain assumptions were made in preparing the forward-looking statements concerning availability of capital resources, business performance, market conditions and customer demand.

Consequently, all of the forward-looking statements contained herein are qualified by the foregoing cautionary statements, and there can be no guarantee that the results or developments that we anticipate will be realized or, even if substantially realized, that they will have the expected consequences or effects on our business, financial condition or results of operation. Unless otherwise noted or the context otherwise indicates, the forward-looking statements contained herein are provided as of the date hereof, and we do not undertake to update or amend such forward-looking statements whether as a result of new information, future events or otherwise, except as may be required by applicable law.

|

KWESST MICRO SYSTEMS INC. MANAGEMENT'S DISCUSSION AND ANALYSIS THREE AND NINE MONTHS ENDED JUNE 30, 2023 |

| BUSINESS OVERVIEW |

Corporate Information

We are a Canadian corporation incorporated on November 28, 2017, under the laws of the Province of British Columbia. Our registered office is located at 550 Burrard Street, Suite 2900, Vancouver, British Columbia, Canada and our corporate office is located at Unit 1, 155 Terrence Matthews Crescent, Ottawa, Ontario, Canada. We have representative offices in the following foreign locations: Washington DC (United States), London (United Kingdom), and Abu Dhabi (United Arab Emirates).

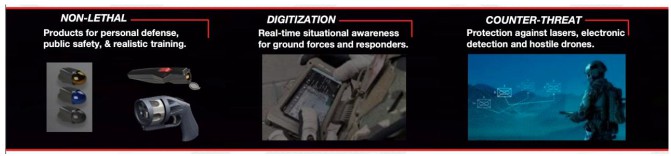

As an early commercial-stage technology company, we develop and commercialize next-generation technology solutions that deliver a tactical advantage for military, public safety agencies and personal defense markets. We focus on three niche market segments as follows:

Our core mission is to protect and save lives.

Major Highlights - Quarter ended June 30, 2023 ("Q3 Fiscal 2023")

The following is a summary of the major highlights that occurred during the quarter ended Q2 Fiscal 2023:

• From April 19 to 20, 2023, at the MDEX tradeshow held in Detroit, U.S., we showcased our BLDS vehicle applications to United States Army PEO Ground Combat Systems program managers, and related OEMs and suppliers.

• On May 1, 2023, the common share purchase warrants issued in connection with the Canadian Offering dated December 6, 2022 (see U.S. IPO and Canadian Offering below) commenced trading on the TSXV under the symbol "KWE.WT.U".