UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of June 2023

Commission File Number: 001-33153

ENDEAVOUR SILVER CORP.

(Translation of registrant's name into English)

#1130-609 Granville Street

Vancouver, British Columbia, Canada V7Y 1G5

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

[ ] Form 20-F [ x ] Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): [ ]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): [ ]

SUBMITTED HEREWITH

Exhibits

| Exhibit | Description | |

| 99.1 | Material Change Report dated June 6, 2023 | |

| 99.2 | Summary of the Amended Terronera Report |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Endeavour Silver Corp. | ||

| (Registrant) | ||

| Date: June 6, 2023 | By: | /s/ Daniel Dickson |

| Daniel Dickson | ||

| Title: | CEO | |

Form 51-102F3

Material Change Report

Item 1. Name and Address of Company

Endeavour Silver Corp. (the "Company")

1130 - 609 Granville Street

Vancouver, British Columbia

Canada V7Y 1G5

Item 2. Date of Material Change

May 31, 2023

Item 3. News Release

News Release dated May 31, 2023 was disseminated through GlobeNewswire.

Item 4. Summary of Material Change

On May 31, 2023, the Company filed an amended technical report titled "NI 43-101 Technical Report on the Feasibility Study of the Terronera Project, Jalisco State, Mexico - Amended" dated May 15, 2023, with an effective date of September 9, 2021 in respect of the Company's Terronera project (the "Amended Terronera Report").

Item 5.1 Full Description of Material Change

On May 31, 2023, the Company filed the Amended Terronera Report. The Amended Terronera Report addresses comments raised by the British Columbia Securities Commission (the "BCSC") in the course of a pre-filing review conducted by the BCSC at the Company's request.

The Amended Terronera Report amends the technical report titled "NI 43-101 Technical Report on the Feasibility Study of the Terronera Project, Jalisco State, Mexico" dated October 21, 2021 and effective September 9, 2021 (the "Original Terronera Report") and contains no material differences to the Original Terronera Report filed on October 25, 2021. A summary of the scientific and technical information contained in the Original Terronera Report can be found in the Company's news release dated September 9, 2021. Two of the eight qualified persons who had prepared the Original Terronera Report were replaced by two new qualified persons.

Attached to this Material Change Report is the summary of the Amended Terronera Report which is a direct extract and reproduction of the complete summary contained in the Amended Terronera Report, without material modification or revision.

The detailed disclosure in the Amended Terronera Report is incorporated by reference into this Material Change Report. The Amended Terronera Report is not contained within, nor attached to, this report, but may be accessed under the Company's profile at www.sedar.com (posted on May 31, 2023 under Document Type, "Amended & restated technical report (NI 43-101)-English"), or on the Company's website at www.edrsilver.com.

Item 5.2 Disclosure for Restructuring Transactions

Not applicable.

Item 6. Reliance on subsection 7.1(2) of National Instrument 51-102

Not applicable.

Item 7. Omitted Information

Not applicable.

Item 8. Executive Officer

Daniel Dickson, Chief Executive Officer

Telephone: (604) 685-9775

Item 9. Date of Report

June 6, 2023

Schedule A

1.0 SUMMARY

1.1 Introduction

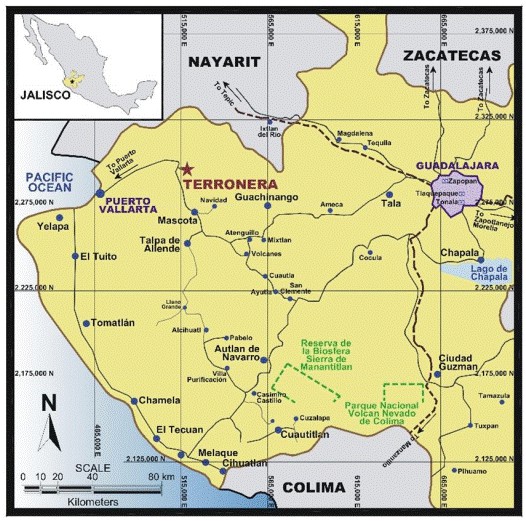

Qualified persons from Wood Canada Ltd. (Wood), WSP Group, Inc., KH Mining LLC, together with a qualified person from Endeavour Silver Corp. (Endeavour Silver), prepared the Technical Report (Report) summarizing the results of a feasibility study (FS) on the Terronera Silver-Gold Project (Terronera Project). The Company requested the British Columbia Securities Commission ("BCSC") to conduct a pre-filing review of the 2021 Terronera Technical Report, among others. As a result of comments received from the BCSC, the Company anticipates filing an amended technical report. The comments include questions as to the qualifications of one of seven qualified persons who prepared the 2021 Terronera Technical Report, and certain minor matters. None of the comments concern the actual mineral resource or mineral reserve estimates on the Terronera Project. The Terronera Project is located 50 km northeast of Puerto Vallarta in Jalisco State, Mexico.

1.2 Terms of Reference

Mineral Resource and Mineral Reserve estimates were prepared in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines (November 29, 2019) and followed the definitions in CIM Definition Standards for Mineral Resources and Mineral Reserves (May 10, 2014).

Measurement units used in this Report are metric unless otherwise noted. Currency is expressed in US dollars or unless specified as Mexican pesos (MXN).

1.3 Property Description and Location

The Terronera Project is located in the mountainous region of San Sebastián, a historical mining district in Mexico. The site can be accessed via Federal Highway No. 70 from Guadalajara, approximately 160 km southeast, and from Puerto Vallarta approximately 50 km southwest (Figure 1-1).

Endeavour Silver holds the Terronera Project through its 100% owned Mexican subsidiary, Endeavour Gold Corporation S.A. de C.V. (Endeavour Gold). Endeavour Gold holds the Terronera Project through its 100% owned subsidiaries Terronera Precious Metals S.A. de C.V. (TPM) and Minera Plata Adelante S.A. de C.V. (MPA).

The Terronera Project consists of 24 mineral concessions, totalling 17,369 ha all of which are valid and in good standing. Surface rights and access rights have been negotiated with various private ranch owners and three local three local Ejidos in support of exploration activities. Mexican Mining law provides the right to use water from the mine for exploration, exploitation, processing, and project personnel.

The Terronera Project is subject to three royalties. The Mexican government retains 0.5% royalty on any precious metals produced. Industrias Minera México S.A. de C.V. (IMMSA) and Compañia Plata San Sebastian S.A. de C.V. (AGREMIN) retains 2% net smelter return (NSR) royalty on mineral production from the concessions each individually conveyed or optioned to Endeavour Silver (10 concessions totaling 3,388 ha from IMMSA; and 4 concessions totaling 9,752 ha from AGREMIN).

Figure 1-1: Terronera Project Location Map (Burga et al., 2020)

1.4 History

The Terronera Project is situated near the town of Sebastián del Oeste founded in 1605 during the Spanish colonial period. By 1785 the Sebastián del Oeste mining district consisted of more than 25 mines and a number of smelters and was considered one of the principal sources of gold, silver, and copper for New Spain. The main mines in the district included Real de Oxtotipan, Los Reyes, Santa Gertrudis, Terronera, and La Quiteria.

In 1979 Consejo de Recursos Minerales conducted regional and local semi-detailed mapping and exploration followed by prospecting activities in 1985 by Compañía Minera Bolaños, S.A. In the late 1980s IMMSA began exploring the historical mining district and continued with geological mapping and sampling of outcropping structures of a number of veins to the mid- 1990s. Over the years, IMMSA drilled several holes intersecting widespread silver-gold mineralization, mainly at the Terronera Vein; however, a Mineral Resource estimate was not undertaken.

In 2010, Endeavour Silver acquired the option to purchase the San Sebastián properties from IMMSA and have conducted several exploration, and drilling campaigns that have resulted in Mineral Resource estimates, a preliminary economic assessment in 2015, a pre-feasibility study in 2017, and an updated pre-feasibility study in 2020.

There has reportedly been significant historical production from the San Sebastian del Oeste region spanning from 1566 through to the early 20th century; however, the amount of silver production is unknown.

1.5 Geology and Mineralization

The San Sebastián del Oeste mining district is situated at the southern end of the Sierra Madre Occidental metallogenic province, a north-northwesterly trending volcanic belt of mainly Tertiary age. This volcanic belt is more than 1,200 km long and 200 to 300 km wide and hosts most of Mexico's gold and silver deposits. The volcanic belt is one of the world's largest epithermal precious metal systems.

The San Sebastián del Oeste silver-gold district hosts high-grade silver-gold, epithermal vein deposits characterized by low-sulphidation mineralization and adularia-sericite alteration. The veins are typical of epithermal silver-gold vein deposits in Mexico in that they are primarily hosted in volcanic flows, pyroclastic, and epiclastic rocks, or sedimentary sequences of shale and its metamorphic counterparts.

The Terronera Project lies within the structurally and tectonically complex Jalisco Block at the western end of the younger (early Miocene to late Pliocene) Trans-Mexican Volcanic Belt. The more important mineralized veins in the San Sebastián del Oeste district are controlled by west- northwest to northwest striking structures related to a transcurrent fault system.

The Terronera Project is underlain by a volcano-sedimentary sequence which consists of shale, sandstone, and narrow calcareous-clayey interbeds overlain by tuffs, volcanic breccias, and lava flows of mainly andesitic composition. The volcano-sedimentary units crop out in the north- central part of the district. Further to the north, granitic to granodioritic intrusive rocks are present.

The principal Terronera Vein has been traced by drilling for 1.5 km on strike and from surface to the maximum depth of drilling at 546 m identifying its average true width to be 3.9 m. In addition to the main Terronera Vein, there are additional hanging wall and footwall veins. The veins are primarily hosted in volcanic flows, pyroclastic and epiclastic rocks, associated shales, and metamorphic counterparts.

1.6 Exploration

Endeavour Silver has conducted several exploration programs since 2010. Exploration activities include geological mapping, data compilation, rock chip sampling, trenching, soil geochemistry surveys, and topographical and geographical mapping using satellite photogrammetry.

Areas explored include: Real Alto, located in the southern part of the Terronera Project (including the Real, Tajo, Las Animas, Los Negros, La Escurana, Los Lodos, La Mora, Peña Gorda, El Maguey, Monte Obscuro and several other structures located in the area); Central part of the project (which includes the Terronera, La Luz and Quiteria West veins, in addition, several other structures in the area, highlighting El Padre, Los Espinos, Democrata, El Fraile, La Escondida, Vista Hermosa, La Atrevida, La Loma, Los Pajaros, Valentina, Jabalí, Lindero, San Simón, El Fresno, Zavala and Pendencia); North part of the project, around the Santiago de los Pinos town, including Los Reyes, La Ermita, Las Coloradas, La Plomosa and Los Encinos veins; La Unica area (La Unica vein and Julio-Camichina system); and more recently Los Cuates area (La Sanguijuela and San Sebastian 11 claims).

1.7 Drilling and Sampling

Drilling was initiated by IMMSA between 1995 and 2010, completing 17 diamond drill holes. Since 2011 Endeavour Silver completed 194 diamond drill holes and 40 channels totaling 66,076.6 m on the Terronera Vein and 41 diamond drill holes totaling 9,795.65 m on the La Luz Vein. Only holes drilled by Endeavour Silver were used to construct the Mineral Resource estimates.

Core logging recorded mineralization types, structure, density, recovery, rock quality designation (RQD), alteration, and geology. Core recovery is within acceptable levels with an average of 90% in the Terronera Vein, 100% in the La Luz Vein, and 100% in the host rock surrounding both.

Collar surveys are carried out with total station and a dual-band global positioning system (GPS), while surface holes are surveyed using a Reflex multi-shot down-hole survey instrument at 30 m intervals from the bottom of the hole and back up the collar.

Sampling is conducted in the Endeavour Silver core storage facilities, where it is geologically and geotechnically logged (RQD). Sampling is done in the mineralized structure with intervals between 20 and 100 cm and within the surrounding host rock with intervals between 20 and 150 cm. Photographs and density measurements are taken.

The whole core is cut in half with a diamond rotary saw, and broken core pieces are split with a pneumatic core splitter for sampling and are bagged and tagged. Samples are prepared at the ALS Chemex facility Guadalajara (ALS Guadalajara) which is independent of Endeavour Silver and holds an ISO/IEC 17025 accreditation. Independent laboratory ALS laboratory in Vancouver, Canada (ALS Canada) with ISO/IEC 17025 accreditation carried out the analytical process between 2012 and 2018. Samples from the 2020 campaign were sent to the SGS Durango-Mexico laboratory (SGS Durango) which is also independent of Endeavour Silver and accredited under ISO/IEC 17025. SGS Durango were also used as the secondary laboratory for the 2019 drilling campaign. Inspectorate laboratory in Hermosillo has been used as a secondary laboratory since 2012. They are independent of Endeavour Silver and hold global quality certifications under ISO9001:2008, Environmental Management under ISO14001, and Safety Management under OH SAS 18001 and AS4801.

Silver grades were determined by ALS Canada using inductively couple plasma atomic emission spectroscopy (ICP-AES) following aqua regia digestion. Gold was assayed by fire assay (FA) followed by atomic absorption (AA) analysis of the FA bead on a 30 g pulp sample. Assays reporting over the gold and silver limit is FA followed by gravimetric analysis on a 30 g pulp sample. Detection limits for high-grade gold assays are 0.5 to 1,000 ppm and 5 to 10,000 ppm for silver assays.

SGS Durango uses aqua regia digestion followed by ICP optical emission spectroscopy (OES) for silver and FA for gold. Overlimit silver and gold assays are by FA with a gravimetric finish.

Endeavour Silver employed a quality assurance quality control (QA/QC) program, including certified reference materials (CRMs), blanks, and duplicates inserted in the sample stream at a rate of approximately one control for every 20 samples. Check assaying was also conducted with a frequency of approximately 5%. A review of the QC data from drilling used for Mineral Resource estimation found potential low-level carry-through contamination in ALS Canada results that have been deemed minor and not material to the Mineral Resource estimate. The Qualified Person (QP) concludes that the sample preparation, security, and analytical procedures are adequate for use in Mineral Resource estimation.

1.8 Data Verification

The drill hole database was inspected and validated by the Wood QP. Assay data was verified against the original laboratory certificates. Minor errors were found, addressed and discussed with Terronera's team.

The Endeavour Silver QP performed verification and validation of drill hole collars, downhole surveys, geological logging, sampling, sample preparation, and assaying procedures during their site visit. Drilling practices were reviewed by visiting a rig, drilling an exploration drill hole, and checking downhole survey measurements. Core logging of drill holes from the Terronera and La Luz veins were reviewed. Sampling practices were reviewed together with the Terronera Project geologists. Witness samples were selected from the Terronera and La Luz veins, sent to ALS Canada, and a blank and standard for each vein. Results confirm the data to be reliable and suitable for use in updating the Mineral Resource.

The mining QP verified the resource model was suitable for mine planning and design purposes. The mining costs were verified to the source documents and are considered adequate for use in mine planning and meet feasibility level study.

The mineral process QP reviewed the composite samples that were selected for metallurgical testing and the metallurgical test results and considers them suitable to support feasibility level of study and the process design in this Report.

1.9 Mineral Processing and Metallurgical Testing

Hazen Research completed initial comminution testing in 2016 and 2019. Samples were subjected to semi-autogenous grind mill comminution (SMC), Bond rod mill and ball mill work indexes (BWi and RWi, respectively), Bond abrasion index (Ai), and Bond impact work index (CWi) with results showing material classified as hard and highly abrasive. Additional comminution testing performed in 2021 supported these initial results with ore classified as very hard and highly abrasive.

ALS Metallurgy performed metallurgical test work in Kamloops, B.C., Canada. Testing before 2019 focused on evaluating flotation parameters from composite samples representative of materials with various precious metal grades and reviewing the potential for deleterious elements.

The 2019/2020 metallurgical program included grind versus recovery, flash flotation, rougher and cleaner circuit confirmation testing with the aim to refine the process design parameters and flowsheet. Recovery models were generated from composites from current and previous testwork campaigns.

The 2021 testwork focused on assessing the metallurgical performance of both the Terronera and La Luz veins. Testwork completed includes Ai, BWi, flash flotation, rougher and batch cleaner flotation, and locked cycle tests. Additional comminution tests determined the hardness of the Terronera ore be 19.1 kWh/t and an Ai of 0.47. Results showed a two-stage flotation cleaning circuit is recommended to achieve a marketable concentrate grade. Additionally, recycling the cleaner scavenger tails should be implemented and maintained as an option in the current circuit. The final concentrate quality used in the lock cycle tests was analyzed for minor and deleterious elements and was deemed not to affect the extraction of gold and silver significantly.

Based on the projected LOM plan, overall recoveries of silver and gold are 87.7% and 76.3%, respectively.

1.10 Mineral Resource Estimate

Mineral Resources estimates were prepared for the Terronera and La Luz veins using drill holes completed by Endeavour Silver between 2010 and 2020. Estimation domains were constructed to include the mineralization portions of the veins and wall rock along the structural corridors responsible for vein emplacement and silver and gold deposition using a nominal 150 g/t silver equivalent (AgEq) cut-off grade.

Following the identification of a high-grade silver sample population, continuity of high-grade samples at the scale of the drill hole spacing and sampling interval was found. Based on these findings, a high-yield restriction was used to model the high-grade mineralization and prevent the over-projection of extreme silver grades.

An in-situ bulk density model used core recovery data to adjust the modeled density to reflect voids and open spaces and expected reduction in metal contained in the rock mass.

Estimation for both veins was performed in three passes using anisotropic search ellipsoids and inverse distance weighting to the third power. The models were validated by means of visual inspection and checked for global bias and local bias using swath plots. No areas of significant bias were noted.

Blocks in the Terronera Mineral Resource model have been assigned a resource confidence category based on drill hole spacing criteria selected that considers a visual assessment of the continuity of the mineralized zones width along strike and down dip, and a geostatistical drill hole spacing study. For the Terronera Zone, a 50 m drill spacing was used to define Indicated Mineral Resources with all remaining blocks inside the mineralized domain classified Inferred Mineral Resources. For the La Luz Zone, blocks estimated with composites from at least two drill holes with a nominal drill hole spacing of 30 m are classified as Indicated Mineral Resources. Holes spaced wider than the nominal 30 m spacing are classified as Inferred Mineral Resources.

A cut-off grade of 150 g/t silver equivalent (AgEq) is applied to identify blocks that will have reasonable prospects of eventual economic extraction.

The silver equivalent calculation and cut-off grades used for the 2021 Mineral Resource estimate are consistent with values used from the preliminary economic assessment and pre- feasibility studies. AgEq for the Terronera Project is Ag + 75 x Au. The AgEq value takes into account silver grade plus gold grade factored by the differential of gold and silver metal prices and metallurgical recoveries. The 150 g/t AgEq cut-off grade generates sufficient revenue assuming metallurgical recovery and long-range silver price to cover operating costs, including mining, processing, general and administrative (G&A), treatment, refining, and royalties.

The Mineral Resource estimates for the Terronera, and La Luz deposits are summarized in Table 1-1 and Table 1-2, respectively and are reported according to the 2014 CIM Definition Standards.

The majority of the Terronera Mineral Resources have been classified as Indicated, and it is possible that infill and grade control drilling and production sampling may result in local changes to the thickness and grade of the blocks currently drilled at nominally 50 m spacing. Additional drilling and production sampling are recommended to produce accurate forecasts for annual and short-range plans. Other factors that could affect the Mineral Resource estimate include changes to metal prices, mine, and process operating cost, variability in metallurgical performance, mine design, and mining method selection due to geotechnical stability.

Table 1-1: Terronera Deposit Mineral Resource Estimate with Effective Date March 5, 2021

| Classification | Tonnes (000s) |

Ag (g/t) |

Contained Ag (000s oz) |

Au (g/t) |

Contained Au (000s oz) |

AgEq (g/t) |

Contained AgEq (000s oz) |

| Indicated | 5,181 | 256 | 42,707 | 2.49 | 415 | 443 | 73,755 |

| Inferred | 997 | 216 | 6,919 | 1.96 | 63 | 363 | 11,624 |

Notes:

1. Mineral Resources have an effective date of March 5, 2021. The Qualified Person responsible for the Mineral Resource estimate is Henry Kim, P. Geo, an employee of Wood Canada Ltd.

2. Mineral Resources are reported inclusive of Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

3. AgEq is calculated as the sum of silver plus gold grades factored by the differential in gold and silver metal prices and metallurgical recoveries

4. Mineral Resources are constrained within a wireframe constructed at a nominal 150 g/t AuEq cut-off grade

5. A 150 g/t AgEq cut-off grade considers Wood's guidance on industry consensus for long-term silver and gold prices for Mineral Resource estimation, metallurgical performance including metallurgical recoveries (assuming the mean silver recovery of 87% and the mean gold recovery of 76%), mining, processing, and site G&A operating costs, treatment and refining charges, and royalties

6. The cut-off grade assumed a long-term silver price of $23.00/oz and gold price of $1,810/oz.

7. Mineral Resources are stated as in-situ with no consideration for planned or unplanned external mining dilution.

8. The silver and gold ounces presented in the Mineral Resource estimate table are contained metal, not the recoverable metal .

9. Numbers have been rounded as required by reporting guidelines and may result in apparent summation differences.

Table 1-2: La Luz Deposit Mineral Resource Estimate with Effective Date March 5, 2021

| Classification | Tonnes (000s) |

Ag (g/t) |

Contained Ag (000s oz) |

Au (g/t) |

Contained Au (000s oz) |

AgEq (g/t) |

Contained AgEq (000s oz) |

| Indicated | 122 | 182 | 745 | 13.11 | 54 | 1,165 | 4,774 |

| Inferred | 61 | 150 | 295 | 11.35 | 22 | 1,001 | 1,977 |

Notes:

1. Mineral Resources have an effective date of March 5, 2021. The Qualified Person responsible for the Mineral Resource estimate is Henry Kim, P. Geo, an employee of Wood Canada Ltd.

2. Mineral Resources are reported inclusive of Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

3. AgEq is calculated as the sum of silver plus gold grades factored by the differential in gold and silver metal prices and metallurgical recoveries

4. Mineral Resources are constrained within a wireframe constructed at a nominal 150 g/t AuEq cut-off grade

5. A 150 g/t AgEq cut-off grade considers Wood's guidance on industry consensus for long-term silver and gold prices for Mineral Resource estimation, metallurgical performance including metallurgical recoveries (assuming the mean silver recovery of 87% and the mean gold recovery of 76%), mining, processing, and site G&A operating costs, treatment and refining charges, and royalties

6. The cut-off grade assumed a long-term silver price of $23.00/oz and gold price of $1,810/oz

7. Mineral Resources are stated as in-situ with no consideration for planned or unplanned external mining dilution.

8. The silver and gold ounces presented in the Mineral Resource estimate table are contained metal, not the recoverable metal.

9. Numbers have been rounded as required by reporting guidelines and may result in apparent summation differences.

1.11 Mineral Reserve Estimate

Mineral Reserves were classified in accordance with the 2014 CIM Definition Standards. All Mineral Reserves were converted from Indicated Mineral Resources and are classified as Probable.

The Probable Mineral Reserve estimates for the Terronera and La Luz deposits are provided in Table 1-3. There is no Proven Mineral Reserve for either zone.

Factors that could affect the Mineral Reserve estimate include but are not limited to dilution, recovery, metal prices, underground and site operating costs, and management of the operation and environmental or social impacts. Factors with the largest impacts to the Mineral Reserve estimates are the gold price for the La Luz Zone, silver prices for the Terronera Zone, and the ground conditions in the Terronera Zone during mining.

Table 1-3: Terronera and La Luz Probable Mineral Reserve

| Zone | Tonnes (000s) |

Ag (g/t) |

Au (g/t) |

AgEq (g/t) |

Ag (000s oz) |

Au (000s oz) |

AgEq (000s oz) |

| Terronera | 7,227 | 197 | 1.97 | 353 | 45,856 | 459 | 82,055 |

| La Luz | 153 | 173 | 15.00 | 1,378 | 851 | 75 | 6,780 |

| Total | 7,380 | 197 | 2.25 | 374 | 46,707 | 534 | 88,834 |

Note:

1. The Mineral Reserve estimate was prepared in accordance with the 2014 CIM Definition Standards by William Bagnell, P.Eng., an employee of Wood.

2. The Mineral Reserves have an effective date of June 30, 2021.

3. Mineral reserves are reported using a silver equivalency cut-off formula

AgEq (g/t) = Ag (g/t) + (Au (g/t) x 78.9474). Cut-off grade varies between 156 g/t to 200 g/t AgEq depending on mining method. Metal prices used were $1,500/oz Au and $19.00/oz Ag. Metallurgical recovery of 84.9% for silver and 79.8% for gold, transport, treatment and refining charges of $0.75/oz Ag, and NSR royalties of 2.5%.

4. Mineral Reserves are reported based on mining costs of $30.00/t for sub-level open stoping, $49.18/t for cut and fill, and $48.00/t for shrinkage mining, and $28.46/t for process costs, and $8.49/t for G&A costs.

5. Figures in the table may not sum due to rounding.

1.12 Mining Methods

A geomechanical underground mine design study was performed on available core and review of previous studies. The study was used to determine location within the orebodies of the mining method, stability of openings, and requirements for ground support and dilution estimates.

Three declines from the surface will achieve underground access to Terronera and La Luz. The declines collar at the process plant pad, the mine dry, and the upper zone of the deposit. The La Luz access decline extends from the process plant decline to the La luz deposit.

Shrinkage mining methods will extract mineral Reserves at La Luz. Shrinkage is an amenable method given the narrow thickness and the vertical nature of the deposit. Broken ore will be extracted with scooptrams and hauled to remucks or direct loaded to 30-tonne haul trucks. The trucks will then haul the material to the process plant stockpile.

The Terronera deposit will be extracted by a combination of sub-level stoping (SLS) methods and cut and fill (CAF) mining. SLS accounts for approximately 59% of the extraction at Terronera. CAF mining accounts for approximately 23% of the extraction, and the remaining 11% is extracted as development ore. Primary transverse sub-level stopes and longitudinal sub-level stopes will be backfilled with cemented rockfill with an average of 5% binder content. Secondary transverse stopes will be backfilled with uncemented mine development rock.

Development of the declines will start in January 2022, and development ore extracted during this time will be stockpiled for later processing. The process plant is commissioned at the end of the third quarter of 2023. Between October and December 2023, the process plant will ramp up to 1,700 tpd sustained production rate on stockpiled material and development ore. Stoping commences in January 2024 from La Luz and Terronera. Mining is completed in La Luz in late 2025, and Terronera mining is complete at the end of the first half of 2035.

1.13 Recovery Methods

The process design was developed from the comminution and flotation testwork completed between 2017 and 2021. The process plant will operate continuously 365 days per annum with an assumed availability of 92% producing a high-grade concentrate.

Run-of-mine (ROM) material is transported to stockpiles, where a three-stage then processes it, closed crushing circuit with a designed capacity of 1,700 dry tpd in 16 hours of operation. Finely crushed product with a P80 of 6.7 mm will be conveyed to a fine ore bin and then to a primary grinding circuit to produce a product that is 80% minus 70 μm. Ground ores will be treated by flash flotation and conventional flotation with two stages of cleaning. Based on testwork results, overall recoveries of 87.7% for silver and 76.3% for gold are assumed for the LOM. Flotation tailings will be filtered and stored on the surface in a dry tailings storage facility (TSF).

Reagents used in the flotation of sulphide mineralization will be handled and stored on site. Freshwater will be provided by the Terronera and La Luz underground mining operations and used as make-up/firewater and process water. Annual power consumption required by the process is 43.3 GWh and will be supplied to the various process plant areas by the onsite power plant via overhead powerlines.

1.14 Project Infrastructure

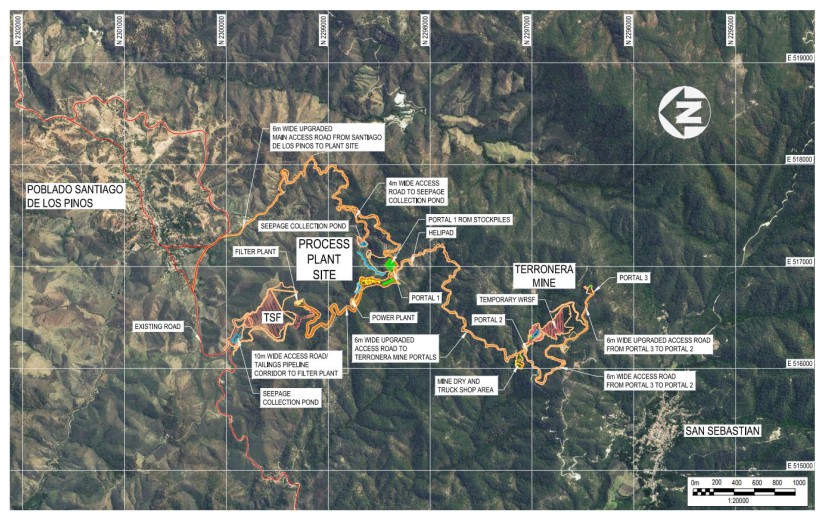

Onsite infrastructure and services required for the Terronera Project include road and air (helipad) access, a process plant, process, and mine ancillary buildings, mine portals and associated mine facilities, waste and tailings storage facilities, onsite power generation and distribution, sewage and potable water treatment facilities (Figure 1-2).

The site can be accessed by unpaved public roads that will require upgrading to a single-lane road of crushed gravel material. A helipad will provide additional access with its primary purpose for emergency use.

The majority of the process facilities will be open structures that are typically structural steel stick built. Ancillary buildings located in and around the process plant site and Portal 1 will include the gatehouse, mine emergency services, dining room, mine portal tag in/out building, truck shop and wash bay and a maintenance workshop and warehouse. Additional ancillary buildings around Portal 2/3 include a truck shop and mine portal tag in/out buildings and mine dry and administration buildings.

Tailings will be piped from the process plant to a filter plant, where a dry tailings material will be produced and trucked to the TSF located northwest of the process plant. The current footprint of the TSF occupies an area of approximately 89,760 m2 and will accommodate approximately 3.2 million m3 (5.3 million tonnes) of compacted filtered tailings over a 12-year mine life based on a process rate of 1,700 tpd.

A temporary waste rock storage facility (WRSF) will be constructed southeast and uphill from Portal 2 and will vary in size throughout the life-of-mine (LOM), reaching a maximum capacity of approximately 1.2 million tonnes.

Power will be provided by an onsite natural gas generator and will supply the 14.6 MW of connected load power required at the site. Power will be distributed by 13.8 kV overhead power lines from the primary power switchgear line up with two breakers. One breaker will supply for the process plant and ancillary buildings, while the second breaker will supply the surface ancillary loads at Portal 1, Portal 2, Portal 3, and the mine water management system. Electrical houses will be modular units and installed close to the main load points.

Freshwater will be piped from Portal 1 and Portal 2 to tanks located close by. Potable water will be distributed by a high-density polyethylene pipe (HDPE) pipeline to facilities around the process plant site and those around Portal 2.

An offsite construction camp facility adjacent to Santiago de Los Pinos will be converted to a permanent camp to provide personnel accommodation, meals, and ancillary services.

|

Endeavour Silver Corp. |

| Terronera Project | |

| NI 43-101 Technical Report on the Feasibility Study of the Terronera Project |

Figure 1-2: Terronera Site Layout (prepared by Wood QP, dated 2021)

|

Endeavour Silver Corp. |

| Terronera Project | |

| NI 43-101 Technical Report on the Feasibility Study of the Terronera Project |

1.15 Market Studies and Contracts

The long-term silver price is assumed at $20.00/oz, and the long term gold price is assumed at $1,575/oz based on Wood's third-quarter 2021 guidelines derived from a survey of industry- consensus of forecast prices.

Endeavour Silver has not conducted any market studies, as gold and silver are commodities widely traded in world markets. Due to the size of the bullion market and the above-ground inventory of bullion, Endeavour Silver's activities will not influence gold or silver prices. Endeavour Silver produces a silver concentrate from its other current operating mines, which is then shipped to third parties for further refining before being sold. To a large extent, silver concentrate is sold at the spot price.

In its current operations, Endeavour Silver has no current contracts or agreements for mining, concentrating, smelting, refining, transportation, handling, or sales that are outside normal or generally accepted practices within the mining industry. No contracts or agreements are in place for the Terronera Project. Endeavour Silver's current hedge policy is to not enter into long-term hedge contracts or forward sales.

1.16 Environmental Studies, Permitting, and Social or Community Impact

Environmental baseline studies relating to meteorology and air quality, climatology, soil erosion and contamination, surface and subsurface hydrology, flora and fauna, and cultural, historical, and archaeological resources have been performed in support of the Manifest of Environmental Impact (MIA) initially submitted to SEMARNAT (Secretaria de Medio Ambiente y Recursos Naturales) in December 2013 for a 500 tpd operation. A modified MIA application was submitted to SEMARNAT in February 2017 with a proposed process rate of up to 1,500 tpd and a TSF developed as a filtered tailings storage facility. A further update to the MIA will be required to address the current production rate of 1,700 tpd. The QP does not consider this to be an issue.

A conceptual closure plan has been developed to ensure the post-mining landscape is safe and physically, geochemically, and ecologically stable. The plan ensures that the quality of water resources (possible effluents) in the area is protected and that communities and regulators welcome the restitution plan.

|

Endeavour Silver Corp. |

| Terronera Project | |

| NI 43-101 Technical Report on the Feasibility Study of the Terronera Project |

1.17 Capital and Operating Costs

1.17.1 Capital Cost

Terronera Project's initial capital cost (Table 1-4) is $175 M expressed in the second quarter of 2021 US dollars. This estimate falls under the AACE International Recommended Practice No. 47R-11 Class 3 Classification Guideline, with an expected accuracy to be within +15%/-10% of the Terronera Project's final cost, including contingency.

Sustaining capital is estimated to be $108.5 M and considers underground mining activities, mine surface facilities, tailings management, and filter plant standby requirements.

Table 1-4: Summary of Capital Costs

| Area | Initial Capital ($M) |

Sustaining Capital ($M) |

Total Cost ($M) |

| Mining | 54.2 | 105.4 | 159.6 |

| Tailings management facility | 2.6 | 1.1 | 3.7 |

| Ore crushing and handling | 6.6 | - | 6.6 |

| Mineral processing | 28.6 | 2.0 | 30.6 |

| Onsite infrastructure | 22.2 | - | 22.2 |

| Offsite infrastructure | 2.3 | - | 2.3 |

| Project indirects and Owner costs | 43.8 | - | 43.8 |

| Contingency | 14.6 | - | 14.6 |

| Total | 175.0 | 108.5 | 283.5 |

Note: Figures may not sum due to rounding.

1.17.2 Operating Cost

Total operating costs over the LOM is estimated at $494.1 M. Average operating costs are estimated at $66.96/t of processed ore and summarized in Table 1-5.

Mine operating costs account for all mining operations, excluding capital development and delineation drilling. Cost models are based on site-specific inputs provided from Endeavour Silver.

Process operating costs include labour, energy consumption, supplies (operating and maintenance), mobile equipment, laboratory, and TSF and were estimated using first principles, budget quotations for reagents, and experience with similar projects.

|

Endeavour Silver Corp. |

| Terronera Project | |

| NI 43-101 Technical Report on the Feasibility Study of the Terronera Project |

G&A operating costs average approximately $6.8 M/yr or $ 10.90/t of processed ore.

Table 1-5: Operating Cost Summary

| Cost Area | Total ($M) | $/t | % of Total |

| Mining | 225.7 | 30.58 | 46 |

| Process | 188.0 | 25.47 | 38 |

| G&A | 80.5 | 10.90 | 16 |

| Total | 494.1 | 66.96 | 100 |

Note: Figures may not sum due to rounding.

1.18 Economic Analysis

Certain information and statements contained in this section are forward-looking in nature and are subject to known and unknown risks, uncertainties, and other factors, many of which cannot be controlled or predicted and may cause actual results to differ materially from those presented here. Forward-looking statements include, but are not limited to, statements with respect to the economic and study parameters of the Terronera Project; mineral reserves; the cost and timing of any development of the Terronera Project; the proposed mine plan and mining strategy; dilution and extraction recoveries; processing method and rates and production rates; projected metallurgical recovery rates; infrastructure requirements; capital, operating and sustaining cost estimates; concentrate marketability and commercial terms; the projected LOM and other expected attributes of the project; the net present value (NPV), internal rate of return (IRR) and payback period of capital; future metal prices and currency exchange rates; government regulations and permitting timelines; estimates of reclamation obligations; requirements for additional capital; environmental risks; and general business and economic conditions.

The financial analysis was carried out using a discounted cash flow (DCF) methodology. Net annual cash flows were estimated to project yearly cash inflows (or revenues) and subtract projected cash outflows (such as capital and operating costs, royalties, and taxes). These annual cash flows were assumed to occur at year-end and were discounted back to the beginning of 2022 (Year -2), the start year of capital expenditure, and totalled to determine the NPV of the Terronera Project at a selected discount rate.

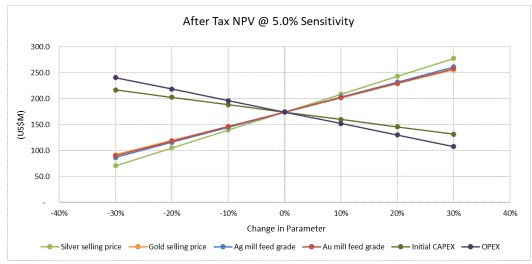

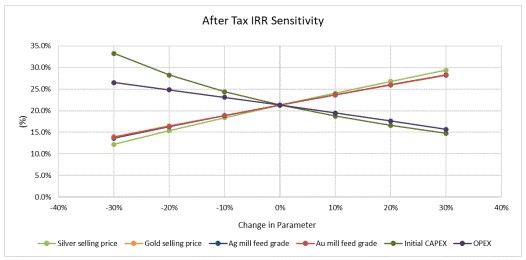

The financial evaluation of the Terronera Project generates positive before and after-tax results. The results show an after-tax NPV of $174.1 M at a 5% discount rate, an IRR of 21.3%, and a payback period of 3.6 years. A summary of the financial analysis results is presented in Table 1-6.

|

Endeavour Silver Corp. |

| Terronera Project | |

| NI 43-101 Technical Report on the Feasibility Study of the Terronera Project |

The Terronera Project is most sensitive to fluctuations in the silver price, then to silver feed grades, gold price, and gold feed grades. It is less sensitive to changes in operating costs. It is least sensitive to changes in initial capital cost. Spider graphs showing the Terronera Project's sensitivity to capital costs, operating costs, grade, and metal price are shown in Figure 1-3 and Figure 1-4.

Table 1-6: Summary of Economic Results

| Description | Units | Value |

| Ag payable | 000 oz | 39,341 |

| Au payable | 000 oz | 393 |

| Ag payable equivalent | 000 oz | 70,310 |

| After-Tax Valuation Indicators | ||

| Undiscounted cash flow | $M | 311.4 |

| NPV @ 5% | $M | 174.1 |

| Payback period (from start of operations) | years | 3.6 |

| IRR | % | 21.3% |

| Project capital (initial) | $M | 175.0 |

| Sustaining capital | $M | 108.5 |

| Closure cost | $M | 7.1 |

| Mining operating cost | $M | 225.7 |

| Processing operating cost | $M | 188.0 |

| G&A | $M | 80.5 |

|

Endeavour Silver Corp. |

| Terronera Project | |

| NI 43-101 Technical Report on the Feasibility Study of the Terronera Project |

Figure 1-3: Sensitivity of After-Tax NPV Discounted at 5% (prepared by Kirk Hanson, dated 2021)

Figure 1-4: Sensitivity of After-Tax IRR Discounted at 5% (prepared by Kirk Hanson, dated 2021)

1.19 Interpretation and Conclusions

Under the assumptions discussed in this Report, the Terronera Project is technically feasible and returns a positive economic outcome.

|

Endeavour Silver Corp. |

| Terronera Project | |

| NI 43-101 Technical Report on the Feasibility Study of the Terronera Project |

1.20 Opportunities and Risk

The following opportunities for the Terronera Project have been identified:

• A better understanding of the distribution of oxide, transition, and sulphide could improve the production and metallurgical performance forecast.

• Use mineralogical analysis to improve the understanding of the losses of gold and silver to tailings, which could identify how to reduce these losses.

• Rock mechanics conditions underground are better than currently modeled and actual conditions may allow more extensive use of SLS as the primary production method and a reduction in external dilution.

• Groundwater flows are lower than estimated, and the dewatering system requirements are less than currently designed

• If surface rights outside the property boundary can be negotiated, the filter plant could be relocated north (downhill) from its current location. This would result in cost savings of up to $1.5 M associated with access road infrastructure and filtered tailings transport.

The following risks have been identified for the Terronera Project:

• The presence of clays has potential of a negative impact on plant performance.

• Underground development, production costs and dilution may increase due to actual ground conditions being different from what was captured in the rock mechanics analysis.

• Operating costs estimates may increase as Endeavour Silver G&A costs are typically higher than those of similar-sized Mexican operations.

• The current mine plan does not optimize production from oxide, transition and sulphide ore zones. Ore blending may be required for optimal process plant performance, and this may impact mine production rate and operating costs.

• The drainage water quality at Terronera assumed to be similar to other Endeavour Silver mine sites of similar geological conditions. However, mine water quality is also influenced by site-specific factors, which could result in Terronera mine drainage requiring treatment.

• The current filtered TSF does not have an out-of-specification area for temporary filtered tailings disposal. This could result in the need for redundant filtering systems at the filter plant or an additional temporary tailings disposal site.

|

Endeavour Silver Corp. |

| Terronera Project | |

| NI 43-101 Technical Report on the Feasibility Study of the Terronera Project |

1.21 Recommendations

Recommended work programs provide opportunities for improvements to mitigate risks and have higher confidence in how the mine will behave in the first few years of mining. The program is estimated at $6.05 M and includes recommendations relating to rock mechanics, hydrogeological testing and modeling, testwork to support refinements to the processing plant, activities to support the TSF, investigations to support the design of site infrastructure, and water management.