UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2023

Commission File Number: 001-33153

ENDEAVOUR SILVER CORP.

(Translation of registrant's name into English)

#1130-609 Granville Street

Vancouver, British Columbia, Canada V7Y 1G5

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

[ ] Form 20-F [ x ] Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): [ ]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): [ ]

SUBMITTED HEREWITH

Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Endeavour Silver Corp. | ||

| (Registrant) | ||

| Date: May 31, 2023 | By: | /s/ Daniel Dickson |

| Daniel Dickson | ||

| Title: | CEO | |

|

CERTIFICATE OF QUALIFIED PERSON

William Bagnell, P.Eng.

Wood Canada Limited

111 Dunsmuir St, Suite 400

Vancouver, British Columbia, Canada V6B 5W3

I, William Bagnell, P.Eng., am employed as a Manager, Consulting and Technical Director of Underground Mining with Wood Canada Limited.

This certificate applies to the technical report entitled "NI 43-101 Technical Report on the Feasibility Study of the Terronera Project, Jalisco State, Mexico - Amended" with an effective date of September 9, 2021 (the "Technical Report").

I am a Professional Licensee Engineering with Association of Professional Engineers and Geoscientists Saskatchewan. I graduated from the Technical University of Nova Scotia with a bachelor's degree in engineering (Mining) in 1996.

I have practiced my profession for 26 years. I have been directly involved in Underground mining operations, Mining design, construction and commissioning of underground mines for base and precious metals.

As a result of my experience and qualifications, I am a Qualified Person as defined in National Instrument 43-101 Standards of Disclosure for Mineral Projects (NI 43-101) for those sections of the Technical Report that I am responsible for preparing.

I have not conducted a personal inspection of the Terronera property.

I am responsible for Sections 1.1, 1.2, 1.8, 1.11, 1.12, 1.17.1, 1.17.2, 1.18, 1.19, 1.20, 1.21; Section 2; Section 3; Section 15; Section 16.1, 16.5,16.6,16.7,16.8,16.9,16.9.1,16.9.2; Section 12.1; Sections 21.1, 21.2.1-21.2.4, 21.2.10, 21.2.11, 21.2.12, 21.3, 21.4.1, 21.4.2, 21.4.4; Sections 25.5, 25.6; Sections 26.3, 26.4; and Section 27 of the Technical Report.

I am independent of Endeavour Silver Corp. as independence is described by Section 1.5 of NI 43-101.

I have had no previous involvement with the Terronera property.

I have read NI 43-101 and the sections of the Technical Report that I am responsible for preparing have been prepared in compliance with that Instrument.

As of the effective date of the Technical Report, to the best of my knowledge, information and belief, the sections of the Technical Report that I am responsible for preparing contain all scientific and technical information that is required to be disclosed to make the Technical Report not misleading.

"signed and stamped"

____________________________

William Bagnell, P.Eng.

Dated: 15 May 2023

|

CERTIFICATE OF QUALIFIED PERSON

Alan Drake, P.L.Eng.

Wood Canada Limited

111 Dunsmuir St, Suite 400

Vancouver, British Columbia, Canada V6B 5W3

I, Alan Drake, P.L.Eng., am employed as a Manager, Process Engineering with Wood Canada Limited.

This certificate applies to the technical report entitled "NI 43-101 Technical Report on the Feasibility Study of the Terronera Project, Jalisco State, Mexico - Amended" with an effective date of September 9, 2021 (the "Technical Report").

I am a Professional Licensee Engineering with Engineers and Geoscientists British Columbia. I graduated from the Technicon Witwatersrand with a National Higher Diploma in Extraction Metallurgy in 1993.

I have practiced my profession for 29 years. I have been directly involved in metallurgical plant operations, process design, construction and commissioning of minerals processing and hydrometallurgical facilities for base and precious metals.

As a result of my experience and qualifications, I am a Qualified Person as defined in National Instrument 43-101 Standards of Disclosure for Mineral Projects (NI 43-101).

I am responsible for Sections 1.1, 1.8, 1.9, 1.13, 1.17.1, 1.17.2, 1.19, 1.20, 1.21; Section 2; Section 12.1.1, 12.2; Section 13; Section 17; Sections 21.1, 21.2.1-21.2.3, 21.2.6, 21.2.7, 21.2.10, 21.2.11, 21.2.12, 21.4.1, 21.4.3, 21.4.4; Sections 25.7, 25.11, 25.13, 25.14; Sections 26.1, 26.5 and Section 27 of the Technical Report.

I am independent of Endeavour Silver Corp. as independence is described by Section 1.5 of NI 43-101.

I have had no previous involvement with the Terronera property.

I have read NI 43-101 and this report has been prepared in compliance with that Instrument.

At the effective date of the Technical Report, to the best of my knowledge, information and belief, the Technical Report contains all scientific and technical information that is required to be disclosed to make the Technical Report not misleading.

"signed and stamped"

_____________________________

Alan Drake, P.L.Eng.

Dated: 15 May 2023

|

CERTIFICATE OF QUALIFIED PERSON

Henry H. Kim, P.Geo.

Wood Canada Limited

111 Dunsmuir St, Suite 400

Vancouver, British Columbia, Canada V6B 5W3

I, Henry H. Kim, P.Geo., am employed as a Principal Resource Geologist with Wood Canada Limited.

This certificate applies to the technical report entitled "NI 43-101 Technical Report on the Feasibility Study of the Terronera Project, Jalisco State, Mexico - Amended" with an effective date of September 9, 2021 (the "Technical Report").

I am a member of Engineers and Geoscientist of British Columbia (Reg. No. 42519). I graduated with a B.Sc. degree in geology from University of British Columbia in 2008. I completed the Applied Geostatistics Citation Program, with the University of Alberta in 2014, and the Specialized Training Cycle in Geostatistics (CFSG) from Mines ParisTech at Fontainebleau and Geovariances in 2022.

I have practiced mineral exploration and resource estimation for 15 years. I have been involved in exploration drilling programs involving core logging, sampling, QAQC, and database validation. I conducted onsite grade control and management of mine operation crews for an open pit mine in eastern Canada. I have conducted audits and due diligence exercises on geological models, including epithermal systems, sampling databases, drill hole spacing studies, preparation of resource models, validation of mineral resource estimates, and mineral resource estimates on advanced mining studies and active mine operations including narrow vein and structurally controlled precious metal deposits in British Columbia and Ontario, Canada, and Idaho and Nevada, USA.

As a result of my experience and qualifications, I am a Qualified Person as defined in National Instrument 43-101 Standards of Disclosure for Mineral Projects (NI 43-101) for those sections of the Technical Report that I take responsibility.

I am responsible for Sections 1.1, 1.2, 1.7, 1.8, 1.10, 1.21; Section 2; Section 3.0, 3.1, 3.3; Section 11; Section 12.1, 12.2; Section 14; Section 25.3, 25.4; Sections 26.1, 26.2, 26.4 and Section 27 of the Technical Report.

I am independent of Endeavour Silver Corp. as independence is described by Section 1.5 of NI 43-101.

I have had no previous involvement with the Terronera property.

I have read NI 43-101 and this report has been prepared in compliance with that Instrument.

As of the effective date of the Technical Report, to the best of my knowledge, information and belief, the Technical Report contains all scientific and technical information that is required to be disclosed to make the Technical Report not misleading.

"signed and stamped"

___________________________

Henry H. Kim, P.Geo.

Principal Resource Geologist

Dated: 15 May 2023

CERTIFICATE OF QUALIFIED PERSON Humberto F. Preciado, P.E.

I, Humberto F. Preciado, P.E., state that:

(a) I am a Principal Geotechnical Engineer at:

WSP USA Environment & Infrastructure Inc.

2000 South Colorado Blvd., Suite 2-1000

Denver, CO 80222

(b) This certificate applies to the technical report titled "NI 43-101 Technical Report on the Feasibility Study of the Terronera Project, Jalisco State, Mexico - Amended" with an effective date of: September 9, 2021 (the "Technical Report").

(c) I am a "qualified person" for the purposes of National Instrument 43-101 ("NI 43-101"). My qualifications as a qualified person are as follows. I am a graduate of Universidad Autonoma de Guadalajara in 1992 with a Bachelor of Science in Civil Engineering and from The University of British Columbia in 2005 with a PhD in Civil Engineering. I am a Registered Professional Engineer in AZ (46625), CO (0052648) and NV (019528). My relevant experience after graduation and over 31 years for the purpose of the Technical Report includes design of Tailings Storage Facilities, Heap Leach Pads, Mine Waste Dumps, Mining Closure, and Geo-environmental Site Investigations. I have coordinated and conducted geotechnical studies for mine waste facilities at the scoping, prefeasibility, feasibility, and detailed engineering level, and have performed reviews for internal and external audits for existing operations in North and South America.

(d) My most recent personal inspection of each property described in the Technical Report occurred on December 11, 2015, and was for a duration of four days.

(e) I am responsible for Item(s) Sections 1.1, 1.2, 1.14, 1.16, 1.17.1, 1.19-1.21; Section 2; Sec on 3; Section 18; Sec on 20; Sections 21.1, 21.2.1-21.2.3, 21.2.5, 21.2.8-21.2.12, 21.3; Sections 25.8, 25.9, 25.13, 25.14; Sections 26.1, 26.6-26.9; and Section 27 of the Technical Report.

(f) I am independent of the issuer as described in sec on 1.5 of NI 43-101.

(g) My prior involvement with the property that is the subject of the Technical Report is as follows. I have been involved with the Terronera property since 2015 participating in the geotechnical investigation and the Pre-Feasibility design of the tailings and waste rock storage facilities.

(h) I have read NI 43-101 and the part of the Technical Report for which I am responsible has been prepared in compliance with NI 43-101; and

(i) At the effective date of the Technical Report, to the best of my knowledge, information, and belief, the parts of the Technical Report for which I am responsible, contain(s) all scientific and technical information that is required to be disclosed to make the Technical Report not misleading.

Dated at Denver, CO this 15 of May, 2023.

"Signed and stamped"

Humberto F. Preciado, P.E.

CERTIFICATE OF QUALIFIED PERSON Paul G. Ivancie, P.G.

I, Paul Gill Ivancie, P.G., state that:

(a) I am an Associate Hydrogeologist at:

WSP USA Environment and Infrastructure Inc.

920 E. Sheridan St, Ste. A

Laramie Wyoming 82070

(b) This certificate applies to the technical report titled "NI 43-101 Technical Report on the Feasibility Study of the Terronera Project, Jalisco State, Mexico - Amended" with an effective date of: September 9, 2021 (the "Technical Report").

(c) I am a "qualified person" for the purposes of National Instrument 43-101 ("NI 43-101"). My qualifications as a qualified person are as follows. I am a graduate of University of Colorado with a B.A. Degree in Geology in 1982. I am a member of American Institute of Professional Geologists (Certified Professional Geologist, #8507), and a registered professional geologist in the following States: Wyoming, PG -171, Texas, 5235 and Nebraska, G-0479. My relevant experience after graduation and the past 13 years for the purpose of the Technical Report includes all aspects of surface water and groundwater characterization, dewatering well design, and conceptual site model development. I have been working with and supporting Mining in scoping, pre-feasibility, and feasibility studies.

(d) My most recent personal inspection of each property described in the Technical Report occurred on January 11-14, 2021, and was for a dura on of 4 days.

(e) I am responsible for Item(s) Sections 1.1, 1.2, 1.19, 1,21: Section 2, Section 3, Section 16.4: Sections 25.13, 25.14: Sections 26.1, 26.7, 26.9: and Section 27 of the Technical Report.

(f) I am independent of the issuer as described in sec on 1.5 of NI 43-101.

(g) My prior involvement with the property that is the subject of the Technical Report is as follows. I have been involved with the Terronera property since 2020 participating in hydrogeologic site characterization, dewatering well system design and conceptual site model development.

(h) I have read NI 43-101 and the part of the Technical Report for which I am responsible has been prepared in compliance with NI 43-101; and

(i) At the effective date of the Technical Report, to the best of my knowledge, information, and belief, the parts of the Technical Report for which I am responsible, contain(s) all scientific and technical information that is required to be disclosed to make the Technical Report not misleading.

Dated at Denver, Colorado this 15 of May, 2023.

"Signed and stamped"

Paul Gill Ivancie, P.G.

CERTIFICATE OF QUALIFIED PERSON James D. Tod, P.Eng.

I, James D. Tod, P.Eng., state that:

(a) I am a Senior Associate Rock Mechanics Engineer at:

WSP E&I Canada Limited.

2020 Winston Park Drive, Suite 600

Oakville, ON, L6H 6X7

(b) This certificate applies to the technical report titled "NI 43-101 Technical Report on the Feasibility Study of the Terronera Project, Jalisco State, Mexico - Amended" with an effective date of: September 9, 2021 (the "Technical Report").

(c) I am a "qualified person" for the purposes of National Instrument 43-101 ("NI 43-101"). My qualifications as a qualified person are as follows. I am a graduate of The University of British Columbia with a B.A.Sc in Geological Engineering (1988) and Queen's University with a M.Sc.(Eng). in Mining Engineering (1996). I am a registered Professional Engineer in Ontario (90518275), British Columbia (18148), and Alberta (276339). My relevant experience after graduation and over 34 years for the purpose of the Technical Report includes involvement in multiple geomechanics projects for both open pit and underground mining. I have coordinated and conducted rock mechanics studies at the scoping, pre-feasibility and feasibility level, and have performed reviews for internal and external studies, and audits for existing operations in Canada, the United States, Mexico, Chile, Turkey, Australia, Russia, Finland, and Indonesia.

(d) I am responsible for Item(s) 16.2 and 16.3 of the Technical Report.

(e) I am independent of the issuer as described in section 1.5 of NI 43-101.

(f) I have not had prior involvement with the property that is the subject of the Technical Report.

(g) I have read NI 43-101 and the part of the Technical Report for which I am responsible has been prepared in compliance with NI 43-101; and

(h) At the effective date of the Technical Report, to the best of my knowledge, information, and belief, the parts of the Technical Report for which I am responsible, contain(s) all scientific and technical information that is required to be disclosed to make the Technical Report not misleading.

Dated at Gananoque/ON this 15 of May, 2023.

"Signed and stamped"

James D. Tod, P,Eng. 90518275 (ON)

CERTIFICATE OF QUALIFIED PERSON

Dale Mah, P.Geo.

Endeavour Silver Corp.

609 Granville St, Suite1130

Vancouver, British Columbia, Canada, V7Y 1G5

Tel: (604) 685-9775

I, Dale Mah, P,Geo., am currently employed as Vice President, Corporate Development with Endeavour Silver Corp. ("Endeavour Silver").

This certificate applies to the technical report entitled "NI 43-101 Technical Report on the Feasibility Study of the Terronera Project, Jalisco State, Mexico - Amended" with an effective date of September 9, 2021 (the "Technical Report").

I am a member of the Engineers & Geoscientists, British Columbia (#52136). I graduated from the University of Alberta with a Bachelor of Science (Specialization) degree in Geology in 1996.

I have practiced my profession for over 25 years. In this time I have been directly involved in generating and managing exploration activities, and in the collection, supervision and review of geological, mineralization, exploration and drilling data; geological models; sampling, sample preparation, assaying and other resource-estimation related analyses; assessment of quality assurance-quality control data and databases; supervision of Mineral Resource estimates; project valuation and cash flow modeling.

As a result of my experience and qualifications, I am a Qualified Person as defined in National Instrument 43-101 Standards of Disclosure for Mineral Projects (NI 43-101).

I visited the Terronera Property between November 9-10, 2016, October 15-16, 2021 and most recently between March 27-28, 2023, with the most recent visit having a duration of 2 days

I am responsible for Sections 1.1-1.7, 1.15, 1.19, 1.21; Sections 2-10; Section 19; Section 23; Section 24, Section 25.1-25.3, 25.10; Sections 26.1, 26.2, 26.9; and Section 27 of the Technical Report.

I am not independent of Endeavour Silver as independence is described by Section 1.5 of NI 43-101.

I have been involved with the Terronera property since my employment commenced with Endeavour Silver in June 2016.

I have read NI 43-101 and the sections of the Technical Report for which I am responsible have been prepared in compliance with that Instrument.

As of the effective date of the Technical Report, to the best of my knowledge, information and belief, the sections of the technical report for which I am responsible contain all scientific and technical information that is required to be disclosed to make the Technical Report not misleading.

"signed and stamped"

_____________________________

Dale Mah, P.Geo.

Dated: May 15, 2023

CERTIFICATE of QUALIFIED PERSON

Kirk Hanson, P.E., MBA

KH Mining LLC

2889 S Pajaro Way

Eagle, ID 83616

I, Kirk Hanson, MBA, P.E., am the sole proprietor of KH Mining LLC, a limited liability company operating in Boise, Idaho USA.

This certificate applies to the technical report entitled "NI 43-101 Technical Report on the Feasibility Study of the Terronera Project, Jalisco State, Mexico - Amended" with an effective date of September 9, 2021 (the "Technical Report").

I am registered as a Professional Engineer in the State of Idaho (#11063). I graduated with a B.Sc. degree from Montana Tech of the University of Montana, Butte, Montana in 1989 and from Boise State University, Boise, Idaho with an MBA degree in 2004.

I have practiced my profession for 32 years. I was Engineering Superintendent at Barrick's Goldstrike operation, where I was responsible for all aspects of open-pit mining, mine designs, mine expansions and strategic planning. After earning an MBA in 2004, I was assistant manager of operations and maintenance for the largest road department in Idaho. In 2007, I joined AMEC (now Wood) as a principal mining consultant. After leaving Wood in 2022, I formed KH Mining LLC of which I am the sole proprietor. Over the past 16 years, I have been the mining lead for multiple scoping, pre-feasibility, and feasibility studies. I have also done financial modelling for multiple mines as part of completing the scoping, pre-feasibility and feasibility studies.

I have read the definition of a "qualified person" as set out in National Instrument 43-101 (NI 43101) and certify that, by reason of my education, affiliation with a professional association (as defined in NI 43-101) and past relevant work experience, I am a "qualified person for the purpose of NI 43-101.

I have not visited the "Terronera Project" site.

I am responsible for Sections: 1.18, 12.1.3, 22, 25.12

I am independent of the Issuer and related companies in accordance with Section 1.5 of NI 43-101.

I have had no previous involvement with the Terronera property.

I have read NI 43-101, and the sections of the technical report for which I am responsible have been prepared in compliance with that Instrument.

As of the effective date of the Technical Report, to the best of my knowledge, information and belief, the sections of the technical report for which I am responsible contain all scientific and technical information that is required to be disclosed to make those sections of the Technical Report not misleading.

"signed and stamped"

_____________________________

Kirk Hanson, MBA, P.E., 15 May 2023

Contents

| 1.0 SUMMARY | 1-1 |

| 1.1 Introduction | 1-1 |

| 1.2 Terms of Reference | 1-1 |

| 1.3 Property Description and Location | 1-1 |

| 1.4 History | 1-3 |

| 1.5 Geology and Mineralization | 1-3 |

| 1.6 Exploration | 1-4 |

| 1.7 Drilling and Sampling | 1-4 |

| 1.8 Data Verification | 1-6 |

| 1.9 Mineral Processing and Metallurgical Testing | 1-6 |

| 1.10 Mineral Resource Estimate | 1-7 |

| 1.11 Mineral Reserve Estimate | 1-9 |

| 1.12 Mining Methods | 1-10 |

| 1.13 Recovery Methods | 1-11 |

| 1.14 Project Infrastructure | 1-11 |

| 1.15 Market Studies and Contracts | 1-14 |

| 1.16 Environmental Studies, Permitting, and Social or Community Impact | 1-14 |

| 1.17 Capital and Operating Costs | 1-15 |

| 1.17.1 Capital Cost | 1-15 |

| 1.17.2 Operating Cost | 1-15 |

| 1.18 Economic Analysis | 1-16 |

| 1.19 Interpretation and Conclusions | 1-18 |

| 1.20 Opportunities and Risk | 1-19 |

| 1.21 Recommendations | 1-20 |

| 2.0 INTRODUCTION | 2-1 |

| 2.1 Introduction | 2-1 |

| 2.2 Terms of Reference | 2-1 |

| 2.3 Qualified Persons | 2-1 |

| 2.4 Site Visits | 2-1 |

| 2.5 Effective Dates | 2-2 |

| 2.6 Previous Technical Reports | 2-2 |

| 2.7 Sources of Information | 2-3 |

| 3.0 RELIANCE ON OTHER EXPERTS | 3-1 |

| 3.1 Legal Status | 3-1 |

| 3.2 Taxation | 3-1 |

| 3.3 Baseline Studies, Environmental, and Permitting | 3-2 |

| 4.0 PROPERTY DESCRIPTION AND LOCATION | 4-1 |

| 4.1 Location | 4-1 |

| 4.2 Mexican Regulations for Mineral Concessions | 4-2 |

| 4.3 Property Description and Tenure | 4-2 |

| 4.4 Surface Rights | 4-7 |

| 4.5 Water Rights | 4-8 |

| 4.6 Royalties, Government Fees and Encumbrances | 4-8 |

| 4.7 Environmental and Permitting Considerations | 4-9 |

| 4.8 Significant Factors and Risks | 4-9 |

| 5.0 ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE, AND PHYSIOGRAPHY | 5-1 |

| 5.1 Accessibility | 5-1 |

| 5.2 Local Resources and Infrastructure | 5-1 |

| 5.3 Climate | 5-2 |

| 5.4 Physiography | 5-2 |

| 6.0 HISTORY | 6-1 |

| 6.1 San Sebastián del Oeste Mining District | 6-1 |

| 6.2 Past Production History | 6-3 |

| 7.0 GEOLOGICAL SETTING AND MINERALIZATION | 7-1 |

| 7.1 Regional Geology | 7-1 |

| 7.2 Local and Property Geology | 7-2 |

| 7.3 Structure | 7-4 |

| 7.4 Alteration | 7-4 |

| 7.5 Mineralization | 7-4 |

| 8.0 DEPOSIT TYPES | 8-1 |

| 8.1 Low-Sulphidation Epithermal Deposits | 8-1 |

| 8.1.1 Geological Setting | 8-1 |

| 8.1.2 Mineralization | 8-1 |

| 8.1.3 Alteration | 8-2 |

| 8.2 Applicability of the Low-Sulphidation Model to the Terronera Project | 8-2 |

| 9.0 EXPLORATION | 9-1 |

| 9.1 Grids and Surveys | 9-1 |

| 9.2 Sampling Method and Approach | 9-1 |

| 9.2.1 Surface Channel Samples | 9-1 |

| 9.2.2 Rock Chip Samples | 9-1 |

| 9.2.3 Soil Geochemical Samples | 9-1 |

| 9.3 2010 to 2019 Endeavour Silver Exploration Programs | 9-2 |

| 9.4 2020 Endeavour Silver Exploration Program | 9-3 |

| 9.4.1 Terronera North | 9-4 |

| 9.4.2 Terronera Central and Terronera South | 9-4 |

| 9.4.3 El Fresno-La Zavala | 9-5 |

| 9.4.4 La Sanguijuela Claim | 9-8 |

| 9.4.5 San Sabastián 11 Claim | 9-11 |

| 9.4.6 Real Alto | 9-11 |

| 9.4.7 La Unica Claim | 9-11 |

| 10.0 DRILLING | 10-1 |

| 10.1 Sampling and Logging | 10-11 |

| 10.2 Core Recovery | 10-11 |

| 10.3 Drill Hole Surveying | 10-11 |

| 10.3.1 Collar | 10-11 |

| 10.3.2 Downhole | 10-12 |

| 10.4 Geotechnical Drilling Program | 10-12 |

| 10.4.1 2016 Drilling Program | 10-12 |

| 10.4.2 2018-2019 Drilling Program | 10-12 |

| 11.0 SAMPLE PREPARATION, ANALYSES, AND SECURITY | 11-1 |

| 11.1 Introduction | 11-1 |

| 11.2 Sampling | 11-1 |

| 11.3 Sample Preparation | 11-2 |

| 11.4 Drill Core Storage | 11-3 |

| 11.5 Laboratory Certification | 11-3 |

| 11.6 Analytical Methods | 11-3 |

| 11.7 Quality Assurance/Quality Control Program | 11-4 |

| 11.7.1 Standard Samples | 11-4 |

| 11.7.2 Duplicate Samples | 11-4 |

| 11.7.3 Blanks | 11-5 |

| 11.7.4 Check Assaying | 11-5 |

| 11.8 QP Comments on Section 11 | 11-6 |

| 12.0 DATA VERIFICATION | 12-1 |

| 12.1 Database Verification | 12-1 |

| 12.1.1 Metallurgical Data | 12-2 |

| 12.1.2 Market Studies and Contracts | 12-2 |

| 12.1.3 Economic Analysis | 12-2 |

| 12.2 QP Comments on Section 12 | 12-2 |

| 13.0 MINERAL PROCESSING AND METALLURGICAL TESTING | 13-1 |

| 13.1 Summary of Historical Metallurgical Testwork | 13-1 |

| 13.1.1 Pre-2019 Testwork | 13-1 |

| 13.1.2 2020 Recovery Model | 13-5 |

| 13.2 2021 Testwork | 13-8 |

| 13.2.1 Comminution Testing | 13-12 |

| 13.2.2 Flash Flotation | 13-12 |

| 13.2.3 Flash Flotation Blend Tests | 13-13 |

| 13.2.4 Cleaner Flotation Testing | 13-14 |

| 13.2.5 Locked Cycle Tests | 13-15 |

| 13.2.6 Concentrate Quality/Deleterious Elements | 13-18 |

| 13.3 Recovery Model | 13-19 |

| 14.0 MINERAL RESOURCE ESTIMATES | 14-1 |

| 14.1 Terronera Deposit Mineral Resource Estimate | 14-1 |

| 14.1.1 Introduction | 14-1 |

| 14.1.2 Database | 14-1 |

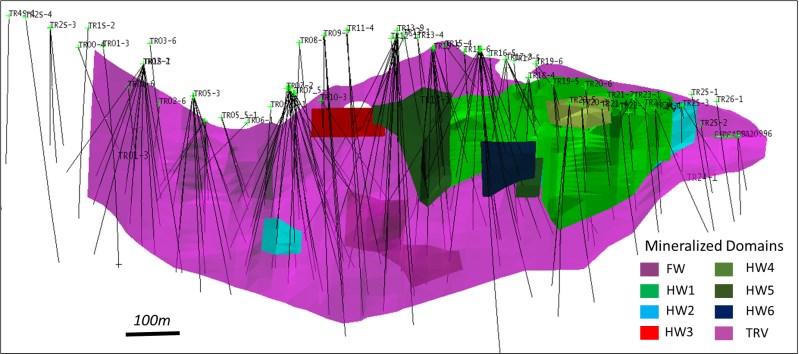

| 14.1.3 Estimation Domains | 14-2 |

| 14.1.4 Exploratory Data Analysis | 14-2 |

| 14.1.5 Management of Extreme Grades | 14-10 |

| 14.1.6 Grade Estimation | 14-13 |

| 14.1.7 Density Estimation | 14-14 |

| 14.1.8 Model Validation | 14-15 |

| 14.1.9 Mineral Resource Classification | 14-17 |

| 14.2 La Luz Deposit Mineral Resource Estimate | 14-18 |

| 14.2.1 Introduction | 14-18 |

| 14.2.2 Database | 14-18 |

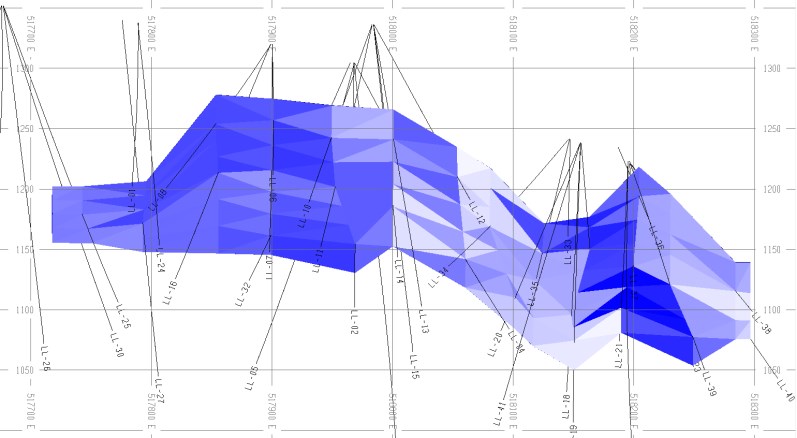

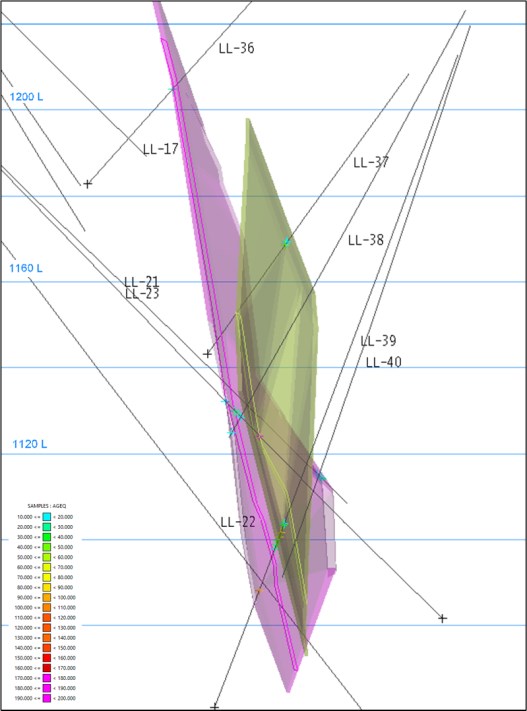

| 14.2.3 Estimation Domains | 14-20 |

| 14.2.4 Exploratory Data Analysis | 14-22 |

| 14.2.5 Management of Extreme Grades | 14-24 |

| 14.2.6 Grade Estimation | 14-24 |

| 14.2.7 Model Validation | 14-25 |

| 14.2.8 Mineral Resource Classification | 14-27 |

| 14.3 Reasonable Prospects of Eventual Economic Extraction | 14-28 |

| 14.4 Mineral Resource Estimate | 14-29 |

| 14.5 Factors that Could Affect the Mineral Resource Estimate | 14-30 |

| 15.0 MINERAL RESERVE ESTIMATES | 15-1 |

| 15.1 Introduction | 15-1 |

| 15.2 Cut-Off Grade | 15-1 |

| 15.3 Mining Dilution | 15-2 |

| 15.4 Mining Recovery | 15-3 |

| 15.5 Mineral Reserve Table | 15-4 |

| 15.6 Factors That May Affect the Mineral Reserve Estimate | 15-4 |

| 16.0 MINING METHODS | 16-1 |

| 16.1 Introduction | 16-1 |

| 16.2 Geotechnical Considerations | 16-2 |

| 16.2.1 Geotechnical Characterization | 16-2 |

| 16.2.2 Geotechnical Domains and Rock Mass Properties | 16-2 |

| 16.2.3 In-Situ Stresses and Numerical Stress Modeling | 16-6 |

| 16.2.4 Empirical Stope Design Analysis | 16-8 |

| 16.2.5 Unplanned Dilution (Equivalent Linear Overbreak or Slough) | 16-9 |

| 16.2.6 Ground Support | 16-11 |

| 16.3 Backfill Strength Requirements | 16-13 |

| 16.4 Hydrogeological Considerations | 16-14 |

| 16.5 Mine Design | 16-14 |

| 16.5.1 Mine Access | 16-14 |

| 16.5.2 Ramps | 16-15 |

| 16.5.3 Lateral Development | 16-15 |

| 16.5.4 Vertical Development | 16-16 |

| 16.5.5 Sub-level Stoping | 16-16 |

| 16.5.6 Cut and Fill Mining | 16-17 |

| 16.5.7 Shrinkage Stoping | 16-18 |

| 16.6 Material Handling | 16-18 |

| 16.6.1 Ore Handling | 16-18 |

| 16.6.2 Waste Handling | 16-19 |

| 16.6.3 Backfill Handling | 16-19 |

| 16.7 Mine Infrastructure | 16-19 |

| 16.7.1 Ventilation | 16-19 |

| 16.7.2 Electrical | 16-20 |

| 16.7.3 Dewatering | 16-20 |

| 16.7.4 Compressed Air | 16-21 |

| 16.7.5 Underground Maintenance Shops | 16-22 |

| 16.7.6 Explosives and Detonator Magazines | 16-22 |

| 16.8 Equipment | 16-23 |

| 16.9 Schedule | 16-24 |

| 16.9.1 Development | 16-24 |

| 16.9.2 Production | 16-24 |

| 17.0 RECOVERY METHODS | 17-1 |

| 17.1 Overall Process Design | 17-1 |

| 17.2 Process Design Basis and Criteria | 17-1 |

| 17.3 Process Plant Description | 17-2 |

| 17.3.1 Crushing and Stockpiling | 17-3 |

| 17.3.2 Grinding Circuit | 17-3 |

| 17.3.3 Flash Flotation | 17-5 |

| 17.3.4 Flotation and Concentrate Thickening | 17-5 |

| 17.3.5 Tailings Thickening | 17-5 |

| 17.3.6 Concentrate Storage | 17-6 |

| 17.4 Reagent Requirements | 17-6 |

| 17.5 Power Requirements | 17-6 |

| 17.6 Water Requirements | 17-7 |

| 18.0 PROJECT INFRASTRUCTURE | 18-1 |

| 18.1 Summary | 18-1 |

| 18.2 Site Access | 18-1 |

| 18.2.1 Roads | 18-1 |

| 18.2.2 Helipad | 18-3 |

| 18.3 Plant Site Roads | 18-3 |

| 18.4 Process Plant | 18-3 |

| 18.5 Filter Plant | 18-4 |

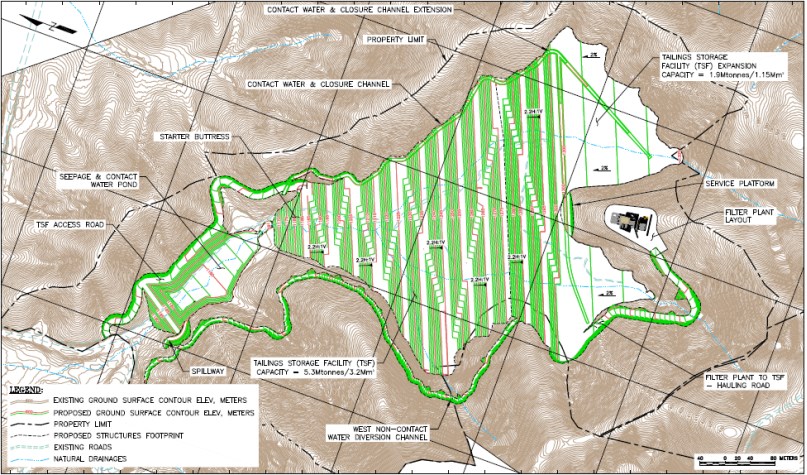

| 18.6 Tailings Storage Facility | 18-4 |

| 18.7 Temporary Waste Rock Storage Facility | 18-5 |

| 18.8 Ancillary Buildings | 18-5 |

| 18.9 Mine Power Supply and Distribution | 18-5 |

| 18.10 Surface Water Control | 18-7 |

| 18.11 Utilities | 18-7 |

| 18.11.1 Water Supply and Distribution | 18-7 |

| 18.11.2 Waste Management | 18-7 |

| 18.12 Communications | 18-7 |

| 18.13 Offsite Camp Facilities | 18-8 |

| 19.0 MARKET STUDIES AND CONTRACTS | 19-1 |

| 19.1 Market Studies | 19-1 |

| 19.2 Commodity Prices | 19-1 |

| 19.3 Contracts | 19-1 |

| 19.4 QP Comments on Section 19 | 19-4 |

| 20.0 ENVIRONMENTAL STUDIES, PERMITTING, AND SOCIAL OR COMMUNITY IMPACT | 20-1 |

| 20.1 Environmental Baseline Studies | 20-1 |

| 20.1.1 Meteorology / Air Quality | 20-1 |

| 20.1.2 Soil | 20-1 |

| 20.1.3 Surface and Subsurface Hydrology | 20-2 |

| 20.1.4 Land Use | 20-3 |

| 20.1.5 Vegetation and Ecosystems | 20-4 |

| 20.1.6 Cultural, Historical, Archaeological Resources | 20-4 |

| 20.2 Environmental Management | 20-4 |

| 20.2.1 Dry Stack Tailings Storage Facility | 20-4 |

| 20.2.2 Temporary Waste Rock Storage Facility | 20-5 |

| 20.2.3 Water Management | 20-9 |

| 20.2.4 Mine Water Discharge | 20-10 |

| 20.2.5 Groundwater Management | 20-10 |

| 20.2.6 Site Monitoring | 20-12 |

| 20.2.7 Air Quality | 20-12 |

| 20.2.8 Solid Waste Disposal | 20-12 |

| 20.3 Environmental Permitting Requirements | 20-12 |

| 20.4 Socio-Economic and Community Relations | 20-23 |

| 20.5 Reclamation and Closure Activities | 20-23 |

| 20.5.1 Mine Surface Disturbance Closure Activities | 20-24 |

| 20.5.2 Underground Mine Infrastructure Closure Activities | 20-25 |

| 20.5.3 Closure Cost Estimate | 20-25 |

| 21.0 CAPITAL AND OPERATING COSTS | 21-1 |

| 21.1 Summary | 21-1 |

| 21.2 Capital Cost Estimates | 21-2 |

| 21.2.1 Basis of Estimate | 21-2 |

| 21.2.2 Quantity Development Basis | 21-3 |

| 21.2.3 Labour Assumptions | 21-5 |

| 21.2.4 Mine Capital Costs | 21-5 |

| 21.2.5 Tailings Management Facility Capital Costs | 21-5 |

| 21.2.6 Ore Crushing and Handling Capital Costs | 21-5 |

| 21.2.7 Mineral Processing Capital Costs | 21-6 |

| 21.2.8 Onsite Infrastructure Capital Costs | 21-6 |

| 21.2.9 Offsite Infrastructure Capital Costs | 21-6 |

| 21.2.10 Indirect Costs | 21-6 |

| 21.2.11 Contingency | 21-8 |

| 21.2.12 Exclusions | 21-8 |

| 21.3 Sustaining Capital Costs | 21-9 |

| 21.4 Operating Cost Estimates | 21-11 |

| 21.4.1 Summary | 21-11 |

| 21.4.2 Mine Operating Costs | 21-11 |

| 21.4.3 Process Operating Costs | 21-12 |

| 21.4.4 General and Administrative Operating Costs | 21-14 |

| 22.0 ECONOMIC ANALYSIS | 22-1 |

| 22.1 Cautionary Statement | 22-1 |

| 22.2 Methodology Used | 22-1 |

| 22.3 Financial Model Parameters | 22-2 |

| 22.3.1 Metallurgical Recovery | 22-2 |

| 22.3.2 Metal Price | 22-2 |

| 22.3.3 Smelting and Refining Terms | 22-2 |

| 22.3.4 Capital Costs | 22-2 |

| 22.3.5 Leasing | 22-3 |

| 22.3.6 Royalty | 22-3 |

| 22.3.7 Taxes | 22-3 |

| 22.3.8 Working Capital | 22-4 |

| 22.3.9 Closure Costs | 22-4 |

| 22.3.10 Salvage Value | 22-4 |

| 22.3.11 Inflation | 22-4 |

| 22.3.12 Financing | 22-5 |

| 22.4 Economic Analysis | 22-5 |

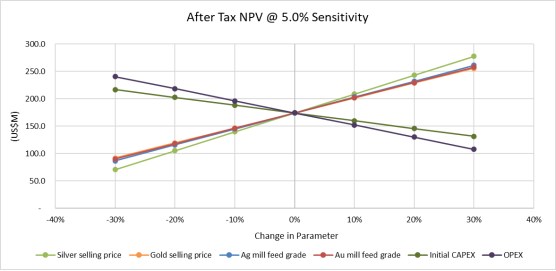

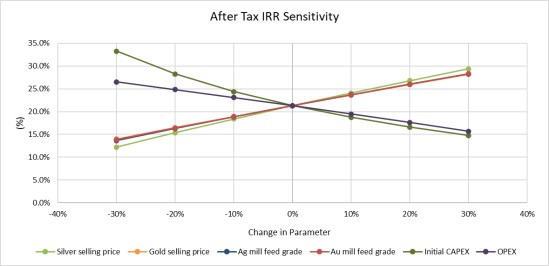

| 22.5 Sensitivity Analysis | 22-12 |

| 23.0 ADJACENT PROPERTIES | 23-1 |

| 24.0 OTHER RELEVANT DATA AND INFORMATION | 24-1 |

| 25.0 INTERPRETATION AND CONCLUSIONS | 25-1 |

| 25.1 Surface Rights, Mineral Tenure, Royalties, and Agreements | 25-1 |

| 25.2 Geology and Mineralization | 25-1 |

| 25.3 Data Collection in Support of Mineral Resource Estimation | 25-1 |

| 25.4 Mineral Resources | 25-2 |

| 25.5 Mineral Reserves | 25-2 |

| 25.6 Mine Plan | 25-2 |

| 25.7 Metallurgical Testwork and Mineral Processing | 25-3 |

| 25.8 Infrastructure | 25-3 |

| 25.9 Environmental Studies, Permitting and Social Impact | 25-3 |

| 25.10 Markets and Contracts | 25-4 |

| 25.11 Capital and Operating Costs | 25-4 |

| 25.12 Economic Analysis | 25-4 |

| 25.13 Opportunities | 25-5 |

| 25.14 Risks | 25-5 |

| 26.0 RECOMMENDATIONS | 26-1 |

| 26.1 Summary | 26-1 |

| 26.2 Exploration and Definition Drilling | 26-1 |

| 26.3 Mining | 26-2 |

| 26.4 Mineral Resources and Mineral Reserves | 26-3 |

| 26.5 Metallurgical Testwork | 26-3 |

| 26.6 Site Infrastructure | 26-3 |

| 26.7 Water Management | 26-4 |

| 26.8 Tailings Storage Facility | 26-4 |

| 26.9 Environmental, Permitting, and Community Relations | 26-4 |

| 27.0 REFERENCES | 27-1 |

Tables

| Table 1-1: Terronera Deposit Mineral Resource Estimate with Effective Date March 5, 2021 | 1-8 |

| Table 1-2: La Luz Deposit Mineral Resource Estimate with Effective Date March 5, 2021 | 1-9 |

| Table 1-3: Terronera and La Luz Probable Mineral Reserve | 1-10 |

| Table 1-4: Summary of Capital Costs | 1-15 |

| Table 1-5: Operating Cost Summary | 1-16 |

| Table 1-6: Summary of Economic Results | 1-17 |

| Table 4-1: Concessions and Fees on Each Concession | 4-3 |

| Table 4-2: Concessions for which a Request was Re-filed with the Mexican Government. | 4-7 |

| Table 4-3: Summary of Endeavour Silver's Surface Access Rights | 4-8 |

| Table 6-1: Exploration History Summary | 6-1 |

| Table 10-1: Drill Hole Summary | 10-1 |

| Table 10-2: Surface Drill Hole Assay Summary for Mineral Intercepts in the La Loma - Los Pajaros Area | 10-7 |

| Table 10-3: Surface Drill Hole Assay Summary for Mineral Intercepts in the Real Alto Area | 10-8 |

| Table 10-4: Surface Drill Hole Assay Summary for Mineral Intercepts in the San Simón - El Fresno Area | 10-9 |

| Table 10-5: Surface Drill Hole Assay Summary for Mineral Intercepts in the Los Cuates Vein Area | 10-10 |

| Table 10-6: Surface Drill-Hole Assay Summary for Mineral Intercepts in the Terronera Vein Area | 10-11 |

| Table 11-1: Number of Samples and Control Samples by Campaign | 11-2 |

| Table 13-1: Samples Characterization and Head Assay, Fire Assay, and Whole Rock Analysis (%) on Low Grade, Medium Grade, and High-Grade Composite Samples | 13-2 |

| Table 13-2: Head Analyses of the Average Grade Composite Sample | 13-3 |

| Table 13-3: Metallurgical Test Data for Second Cleaner Concentrate | 13-3 |

| Table 13-4: Metallurgical Data Developed by ALS Metallurgy | 13-3 |

| Table 13-5: Hazen Research Comminution Test Results | 13-4 |

| Table 13-6: Bond Ball Mill Work Index Test Results | 13-5 |

| Table 13-7: Test Samples Head Assays | 13-6 |

| Table 13-8: Chemical Assays - Composites | 13-8 |

| Table 13-9: 2021 Comminution Test Results | 13-12 |

| Table 13-10: 2021 Flash Flotation Blend Composites | 13-14 |

| Table 13-11: 2021 Concentrate Quality | 13-18 |

| Table 13-12: Grade and Recovery for LOM Projected Production | 13-20 |

| Table 14-1: 2021 Terronera Drill Hole Database Statistics | 14-1 |

| Table 14-2: Terronera Deposit Estimation Parameters | 14-13 |

| Table 14-3: Terronera Deposit High-Yield Restriction Parameters | 14-14 |

| Table 14-4: 2021 La Luz Drill Hole Database Statistics | 14-18 |

| Table 14-5: La Luz Deposit Estimation Parameters | 14-24 |

| Table 14-6: La Luz Deposit High-Yield Restriction Parameters | 14-25 |

| Table 14-7: Terronera Deposit Mineral Resource Estimate with Effective Date March 5, 2021 | 14-29 |

| Table 14-8: La Luz Deposit Mineral Resource Estimate with Effective Date March 5, 2021 | 14-30 |

| Table 15-1: Cut-off Grade Input Parameters | 15-2 |

| Table 15-2: Estimated Dilution at the Terronera Zone | 15-3 |

| Table 15-3: Recovery Factors based on Mining Activity | 15-3 |

| Table 15-4: Terronera and La Luz Probable Mineral Reserve | 15-4 |

| Table 16-1: Q' Statistics by Domain and Sub-domain, Terronera Deposit | 16-4 |

| Table 16-2: Rock Mass Classification Statistics for the La Luz Deposit | 16-6 |

| Table 16-3: Estimate Hanging Wall and Footwall ELOS for MZ2 and MZ4 | 16-10 |

| Table 16-4: Estimated ELOS for CAF stopes MZ1, MZ3 and MZ5 | 16-11 |

| Table 16-5: Summary of Estimated Mine Water Inflows | 16-14 |

| Table 16-6: Vertical Development Quantities Through LOM | 16-16 |

| Table 16-7: Terronera and La Luz Pump Station Details | 16-21 |

| Table 16-8: Proposed Mining Equipment over the LOM | 16-23 |

| Table 16-9: Terronera LOM Lateral and Vertical Development | 16-25 |

| Table 16-10: La Luz LOM Lateral and Vertical Development | 16-26 |

| Table 16-11: Terronera LOM Production Schedule | 16-27 |

| Table 16-12: La Luz LOM Production Schedule | 16-28 |

| Table 17-1: Key Process Design Criteria for the Mill | 17-1 |

| Table 17-2: Reagents and Dosage | 17-6 |

| Table 17-3: Power Requirements | 17-7 |

| Table 18-1: Terronera Project Electrical Load | 18-6 |

| Table 19-1: Forecast Concentrate Grades over the LOM | 19-2 |

| Table 19-2: Concentrate Treatment and Refining Charges | 19-3 |

| Table 20-1: Return Period Storm Event Precipitation | 20-2 |

| Table 20-2: Water Balance Flow List | 20-9 |

| Table 20-3: Environmental Permits Required for the Terronera Project | 20-15 |

| Table 21-1: Currency Conversion Rates | 21-1 |

| Table 21-2: Capital Cost Estimate Summary | 21-2 |

| Table 21-3: Quantity Development Method | 21-3 |

| Table 21-4: Sustaining Capital Cost | 21-10 |

| Table 21-5: Operating Cost Summary | 21-11 |

| Table 21-6: Summary of Mine Operating Costs over the LOM | 21-11 |

| Table 21-7: Summary of Process Plant Operating Costs per Year | 21-13 |

| Table 21-8: G&A Operating Costs | 21-14 |

| Table 22-1: Forecast Metallurgical Recoveries over the LOM | 22-2 |

| Table 22-2: Capital Distribution Among Depreciation Categories | 22-4 |

| Table 22-3: Summary of Economic Results | 22-5 |

| Table 22-4: Summary of LOM Cash Costs and AISC | 22-6 |

| Table 22-5: Cash flow Forecast on an Annual Basis | 22-10 |

| Table 22-6: Sensitivity of After-Tax NPV Discounted at 5% and IRR at Selected Metal Prices Based on 75:1 Silver to Gold Ratio | 22-13 |

| Table 22-7: Summary of Economic Results of Base Case and Spot Price Sensitivity | 22-14 |

| Table 22-8: After-Tax NPV at Different Discount Rates | 22-14 |

Figures

| Figure 1-1: Terronera Project Location Map (Burga et al., 2020) | 1-3 |

| Figure 1-2: Terronera Site Layout (prepared by Wood QP, dated 2021) | 1-13 |

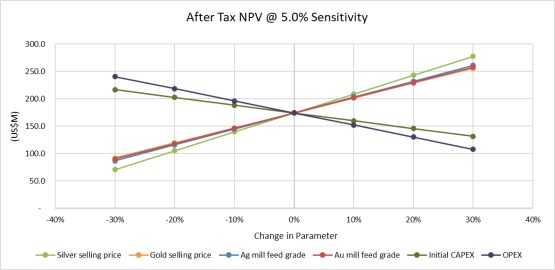

| Figure 1-3: Sensitivity of After-Tax NPV Discounted at 5% (prepared by Kirk Hanson, dated 2021) | 1-18 |

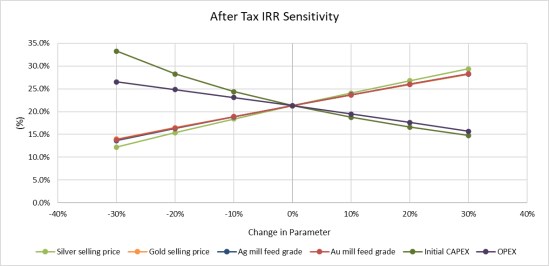

| Figure 1-4: Sensitivity of After-Tax IRR Discounted at 5% (prepared by Kirk Hanson, dated 2021) | 1-18 |

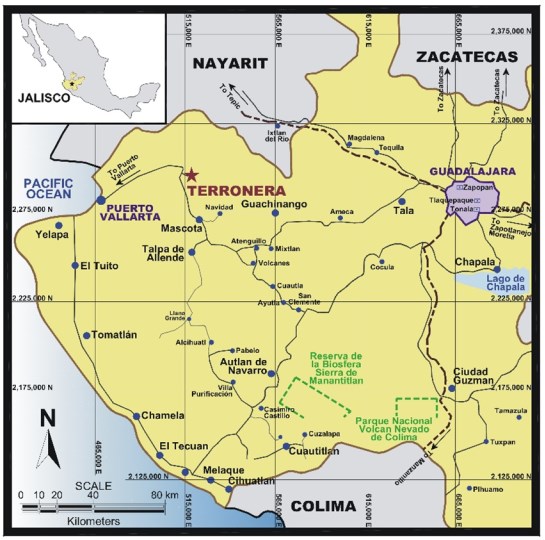

| Figure 4-1: Terronera Project Location Map (Burga et al., 2020) | 4-1 |

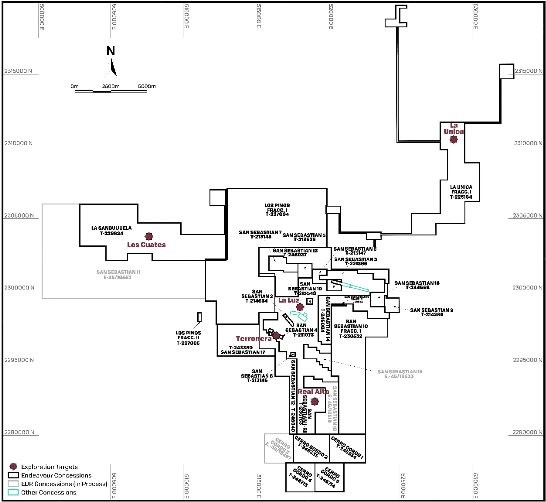

| Figure 4-2: Terronera Project Concessions Map (prepared by Endeavour Silver, dated 2021) | 4-5 |

| Figure 5-1: View of Topography Surrounding the Town of San Sebastián (provided by Endeavour Silver, dated 2020) | 5-3 |

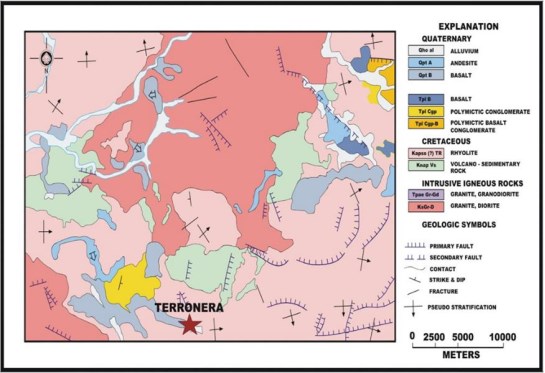

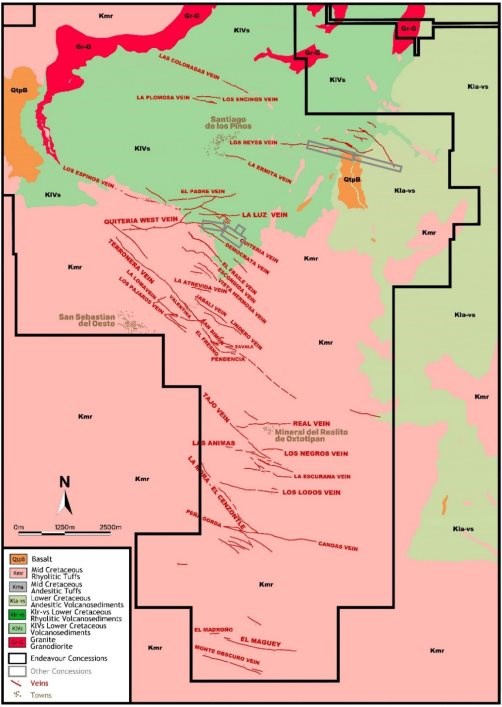

| Figure 7-1: Geology of the San Sebastián del Oeste Area (Lewis and Murahwi, 2013) | 7-2 |

| Figure 7-2: Terronera Project Geology Showing Mineralized Veins (prepared by Endeavour Silver, dated 2020) | 7-3 |

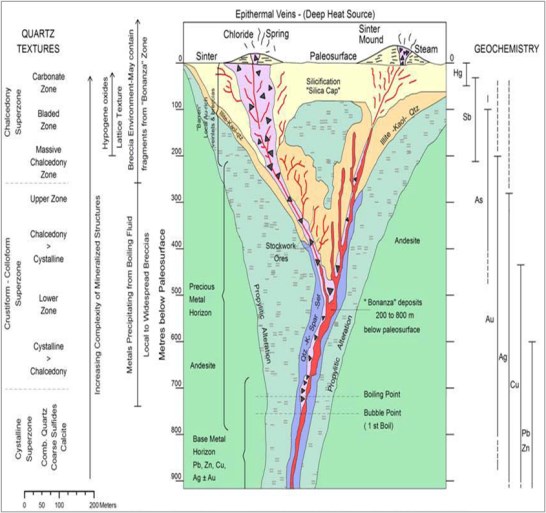

| Figure 8-1: Alteration and Mineralization Distributions within a Low-Sulphidation Epithermal Vein System (Lewis and Murahwi, 2013) | 8-3 |

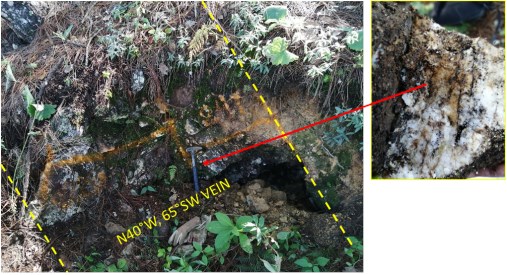

| Figure 9-1: Outcrops of the Lindero Vein (prepared by Endeavour Silver, dated 2020) | 9-5 |

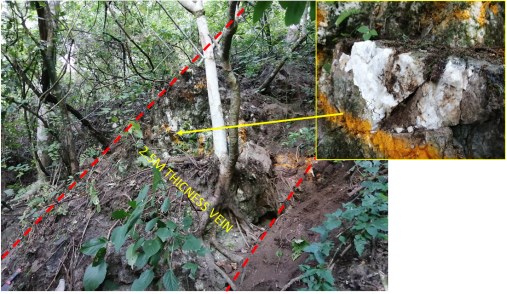

| Figure 9-2: Outcrops of the Jabalí Vein (prepared by Endeavour Silver, dated 2020) | 9-5 |

| Figure 9-3: Strong Alteration Zone (hematite-jarosite) with Fractured Quartz, Argillic Alteration Zone, with Outcrops of Massive Quartz, on the Trend of the El Fresno Structure (prepared by Endeavour Silver, dated 2020) | 9-6 |

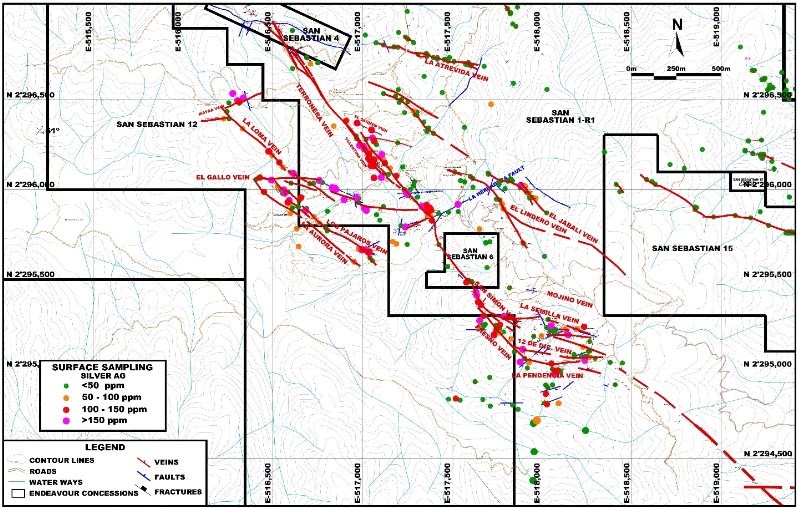

| Figure 9-4: Silver Results in the Terronera El Fresno-La Zavala Area (prepared by Endeavour Silver, dated 2020) | 9-7 |

| Figure 9-5: Adits to Los Cuates Mine (Number 4 shows the Main Adit; Numbers 1 to 3 shows the secondary adits) (prepared by Endeavour Silver, dated 2020) | 9-9 |

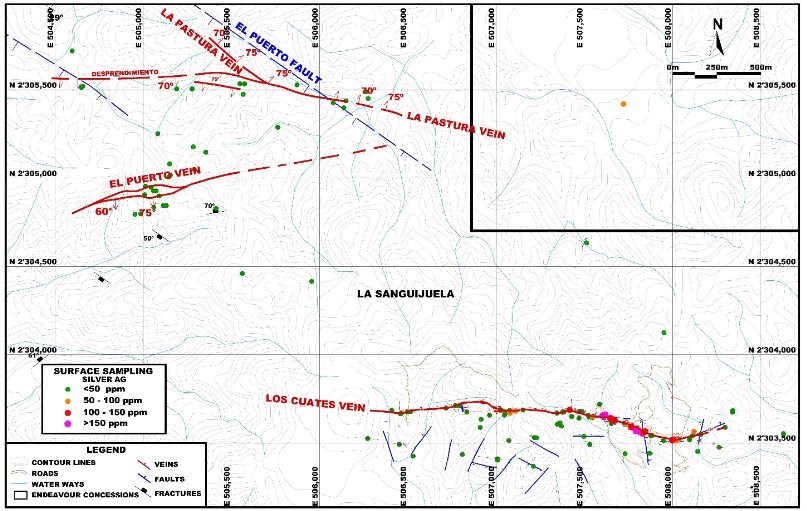

| Figure 9-6: Silver Results in the La Sanguijuela Area (prepared by Endeavour Silver, dated 2020) | 9-10 |

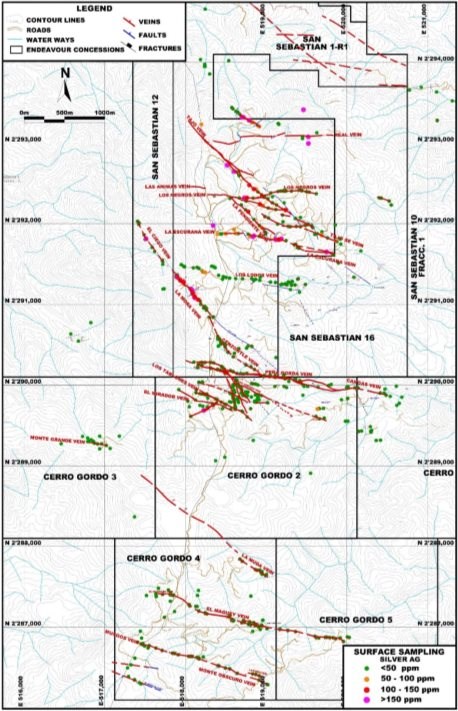

| Figure 9-7: Silver Results in the Real Alto Area (prepared by Endeavour Silver, dated 2020) | 9-12 |

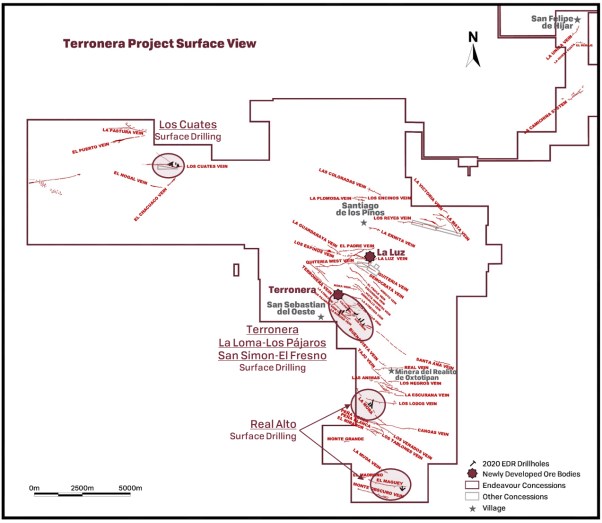

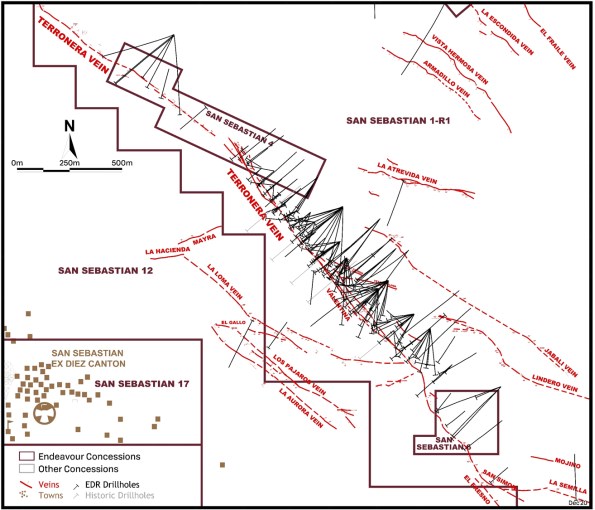

| Figure 10-1: Terronera Surface Map Showing Completed 2020 Drill Holes (prepared by Endeavour Silver, dated 2020) | 10-2 |

| Figure 10-2: Drill Collar Locations - Terronera Vein (prepared by Endeavour Silver, dated 2020) | 10-3 |

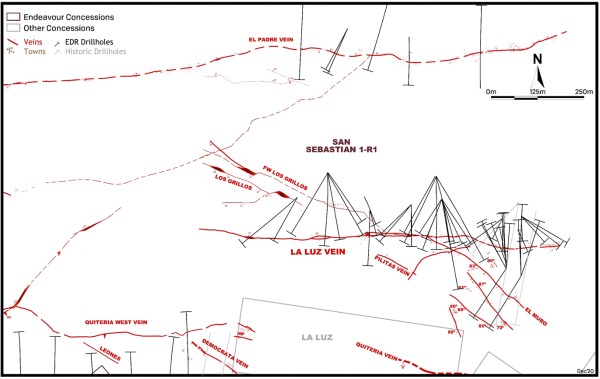

| Figure 10-3: Drill Collar Locations - La Luz Vein (prepared by Endeavour Silver, dated 2020) | 10-4 |

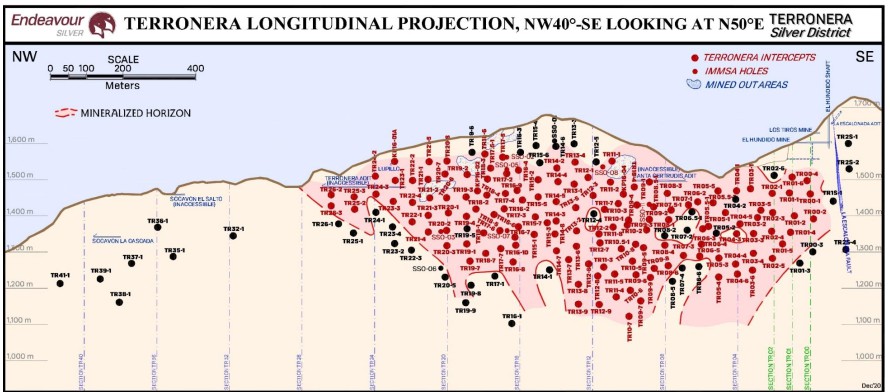

| Figure 10-4: 2020 Drill Intersections - Terronera Vein Longitudinal Projection (prepared by Endeavour Silver, dated 2020) | 10-5 |

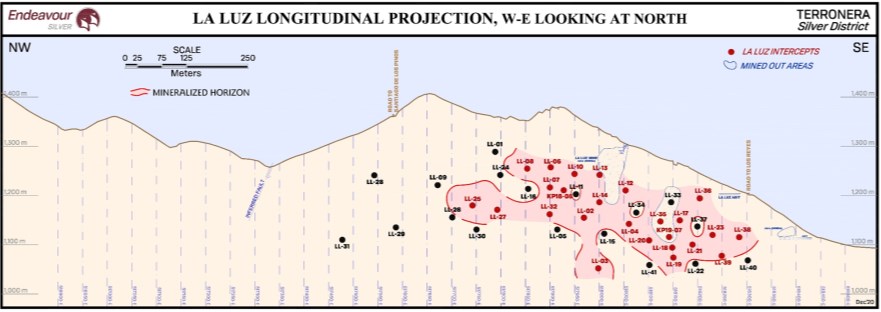

| Figure 10-5: 2020 Drill Intersections - La Luz Vein Longitudinal Projection (prepared by Endeavour Silver, dated 2020) | 10-6 |

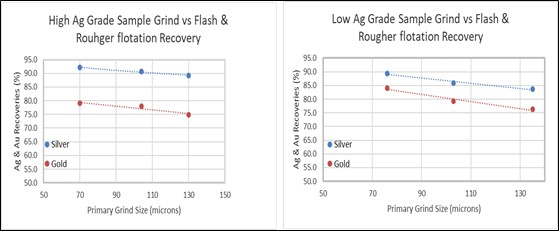

| Figure 13-1: High and Low-Grade Grind Size versus Recovery (Burga et al., 2020) | 13-6 |

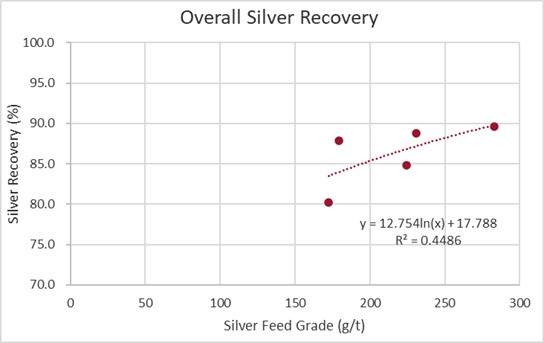

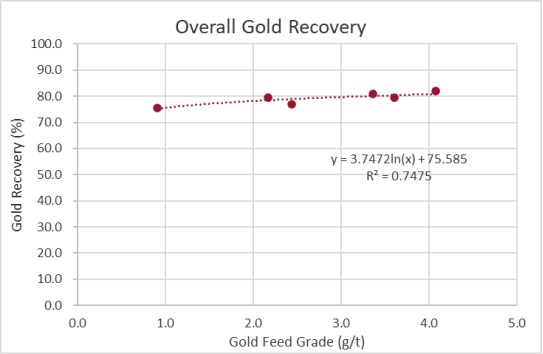

| Figure 13-2: 2020 Silver Recovery Model (Burga et al., 2020) | 13-7 |

| Figure 13-3: 2020 Gold Recovery Model (Burga et al., 2020) | 13-7 |

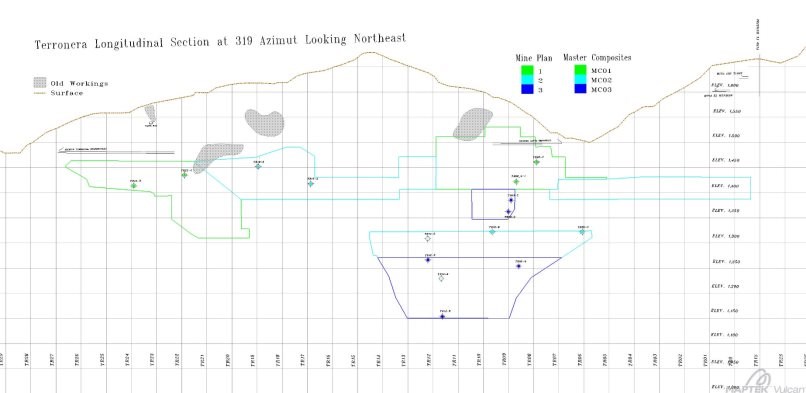

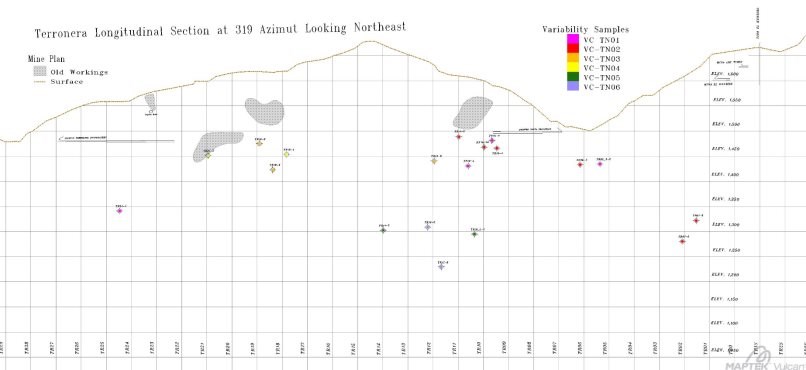

| Figure 13-4: Location of Master Composites at Terronera Vein (prepared by Endeavour Silver, dated 2020) | 13-9 |

| Figure 13-5: Location of Variability Composites at Terronera Vein (prepared by Endeavour Silver, dated 2020) | 13-10 |

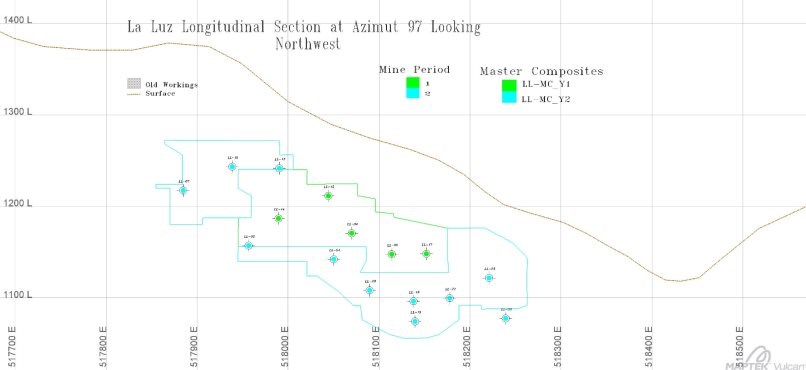

| Figure 13-6: Location of Master Composites at La Luz Vein (prepared by Endeavour Silver, dated 2020) | 13-11 |

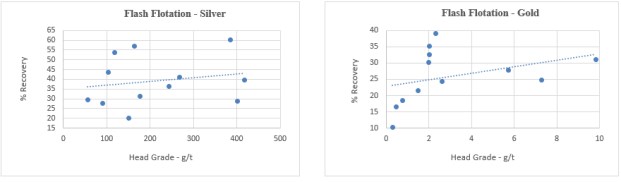

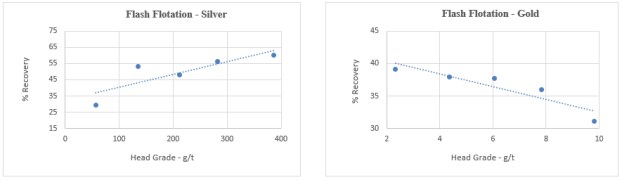

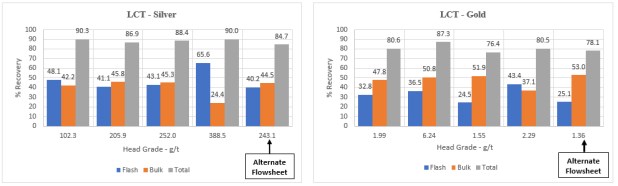

| Figure 13-7: 2021 Recovery versus Head Grade for Silver and Gold (prepared by Wood , dated 2021) | 13-13 |

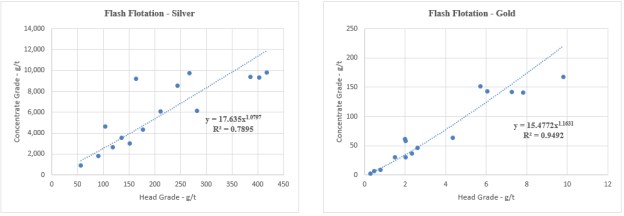

| Figure 13-8: 2021 Flash Concentrate Grade versus Head Grade for Silver and Gold (prepared by Wood, dated 2021) | 13-13 |

| Figure 13-9: 2021 Recovery versus Head Grade of Blended Material for Silver and Gold (prepared by Wood, dated 2021) | 13-14 |

| Figure 13-10: 2021 Flash Concentrate Grade vs Head Grade of Blended Material for Silver and Gold (prepared by Wood, dated 2021) | 13-14 |

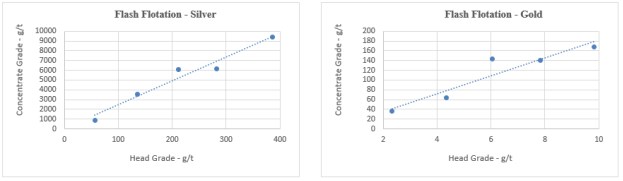

| Figure 13-11: 2021 Cleaning Performance - Silver and Gold (prepared by Wood, dated 2021) | 13-15 |

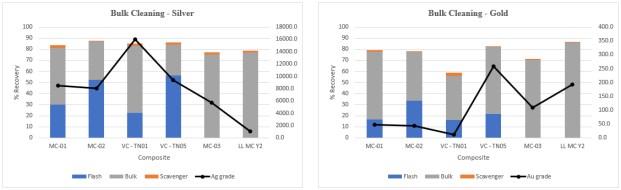

| Figure 13-12: Locked Cycle Test Flowsheet (prepared by Wood, dated 2021) | 13-16 |

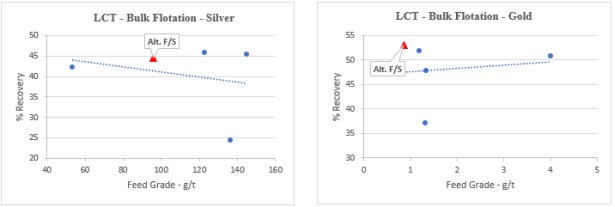

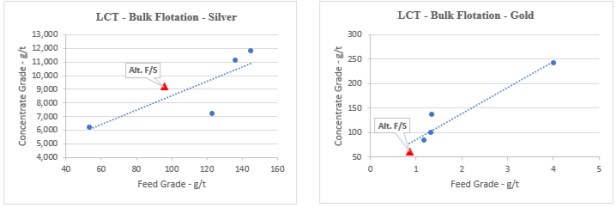

| Figure 13-13: Flash and Bulk Flotation Recovery versus Head Grade (prepared by Wood, dated 2021) | 13-16 |

| Figure 13-14: Bulk Flotation Recovery versus Feed Grade (prepared by Wood, dated 2021) | 13-17 |

| Figure 13-15: Bulk Flotation Concentrate Grade versus Feed Grade (prepared by Wood, dated 2021) | 13-17 |

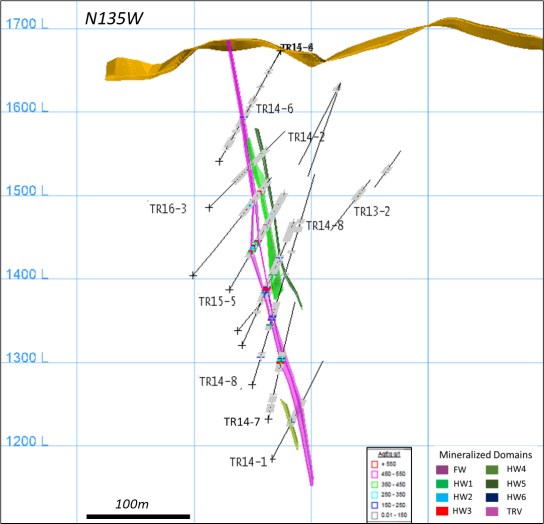

| Figure 14-1: Longitudinal View Looking North of the Terronera Deposit and Drill Hole and Channel Sample Database (prepared by Wood, dated 2021) | 14-3 |

| Figure 14-2: Cross-Section of the Terronera Deposit Estimation Domains (prepared by Wood, dated 2021) | 14-4 |

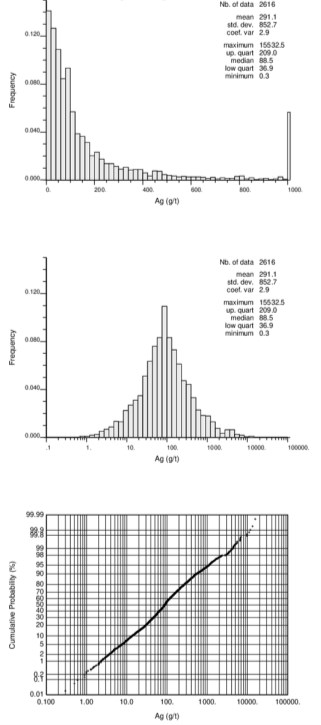

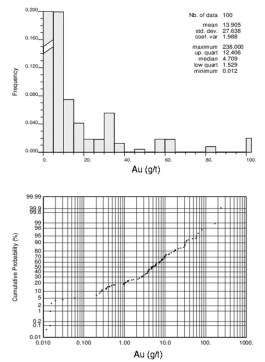

| Figure 14-3: Distribution of Silver Assays - Terronera Deposit (prepared by Wood, dated 2021) | 14-5 |

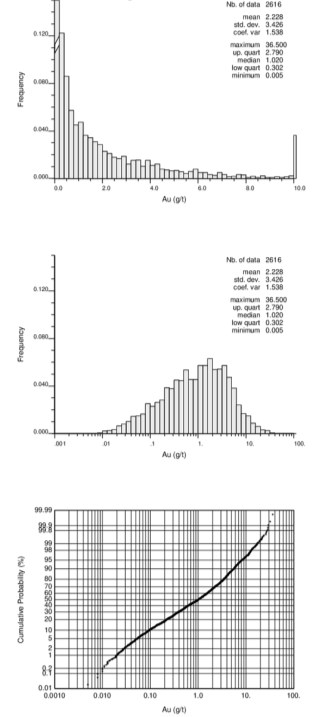

| Figure 14-4: Distribution of Gold Assays - Terronera Deposit (prepared by Wood, dated 2021) | 14-6 |

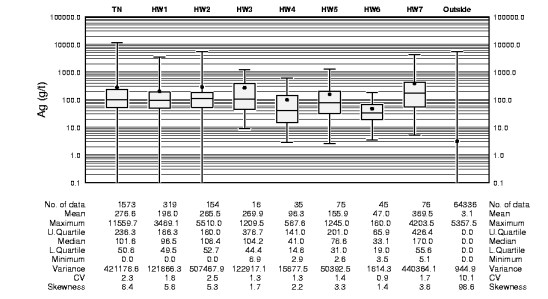

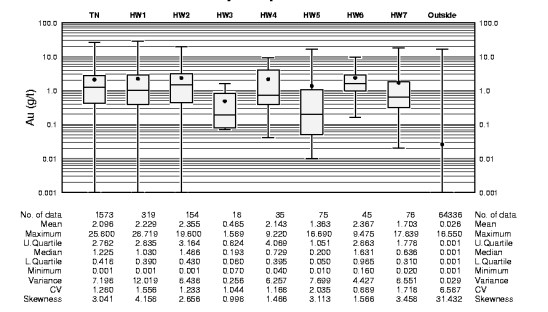

| Figure 14-5: Boxplot of Terronera Deposit Silver Composite by Zone (prepared by Wood, dated 2021) | 14-8 |

| Figure 14-6: Boxplot of Terronera Deposit Gold Composites by Zone (prepared by Wood, dated 2021) | 14-8 |

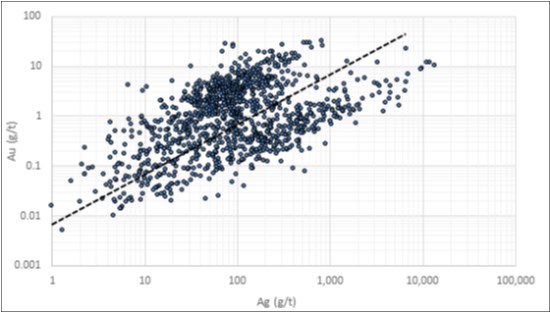

| Figure 14-7: Scatterplot Terronera Deposit Silver and Gold Grades (prepared by Wood, dated 2021) | 14-9 |

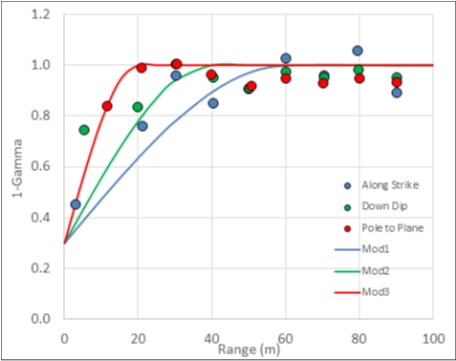

| Figure 14-8: Silver Experimental and Model Correlograms (prepared by Wood, dated 2021) | 14-9 |

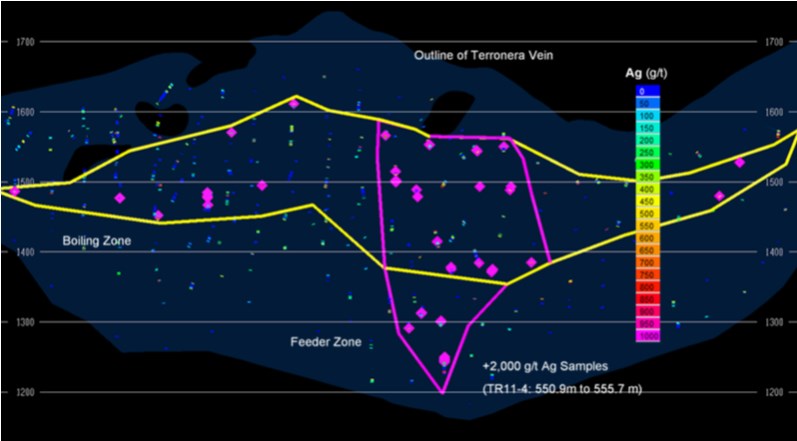

| Figure 14-9: High-Grade Silver Mineralization from TR11-4 (551.9 to 555.8 m) (prepared by Wood, dated 2021) | 14-11 |

| Figure 14-10: Longitudinal View Looking 50° Northeast of High-Grade Samples in the Feeder and Boiling Zones of the Terronera Vein (prepared by Wood, dated 2021) | 14-12 |

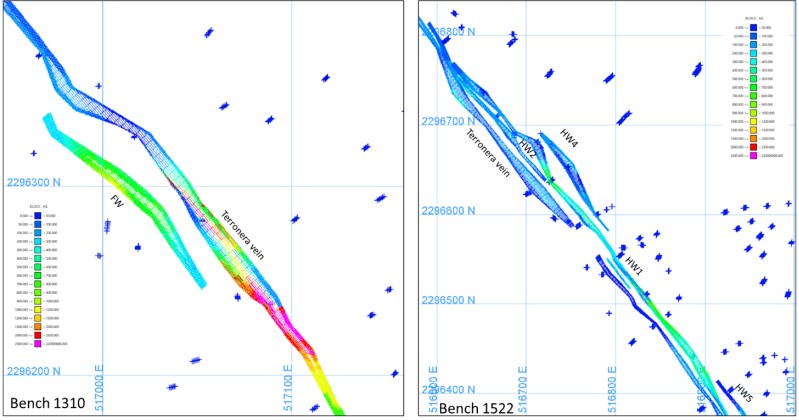

| Figure 14-11: Bench Plan Showing Block Silver Grades and Declustered Silver Composites (prepared by Wood, dated 2021) | 14-16 |

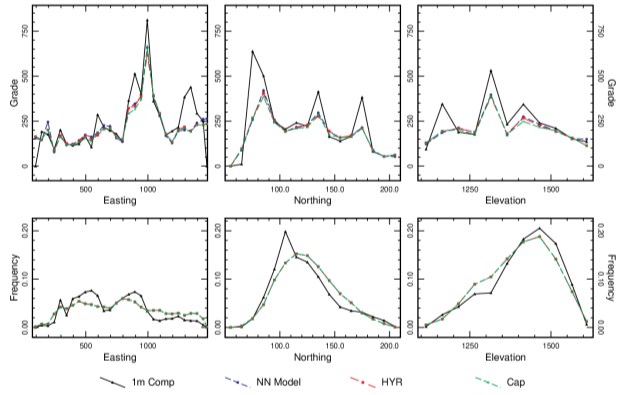

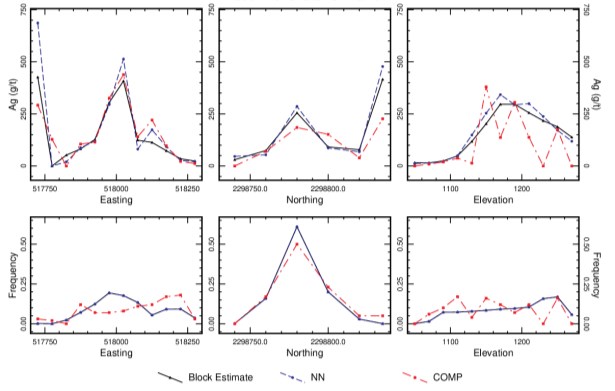

| Figure 14-12: Swath Plot of Silver Grades in the Terronera Vein (prepared by Wood, dated 2021) | 14-17 |

| Figure 14-13: Longitudinal View Looking North of the La Luz Deposit and Drill Hole Database (prepared by Wood, dated 2021) | 14-19 |

| Figure 14-14: Cross-Section of the La Luz (pink) and La Luz HW (gold) Zones Looking West (281 azimuth, 100 m width of view) (prepared by Wood, dated 2021) | 14-21 |

| Figure 14-15: Distribution of Silver (left) and Gold (right) Composites - La Luz Deposit (prepared by Wood, dated 2021) | 14-23 |

| Figure 14-16: Boxplots La Luz Deposit Silver (left) and Gold Composites by Zone (prepared by Wood, dated 2021) | 14-23 |

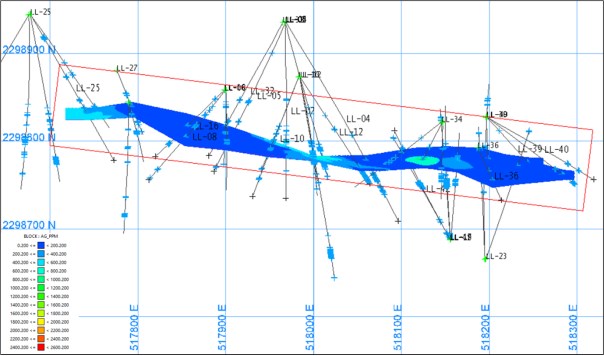

| Figure 14-17: Plan View of the Silver Block Model with the Silver Composites - La Luz Zone (prepared by Wood, dated 2021) | 14-26 |

| Figure 14-18: Swath Plot of Silver Grades in the La Luz Vein (prepared by Wood, dated 2021) | 14-27 |

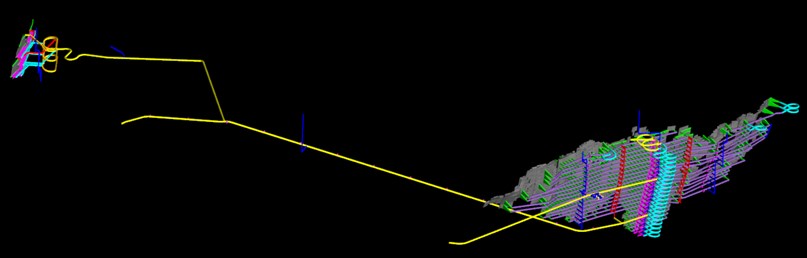

| Figure 16-1: Isometric View of the Mine Design Layout (prepared by Wood, dated 2021) | 16-3 |

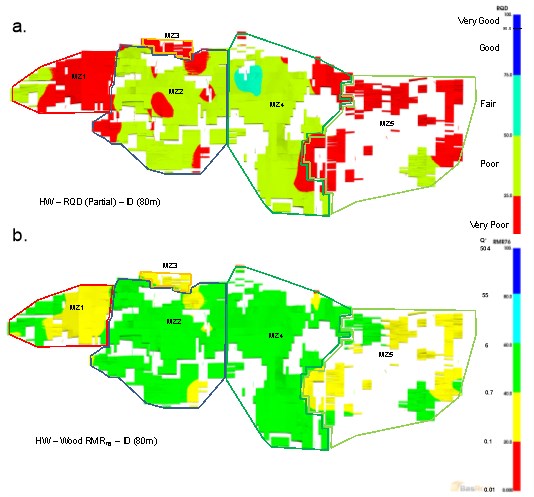

| Figure 16-2: a) Terronera Contoured Hanging wall (HW) RQD and Indicated Mining Zones, b) Terronera Contoured HW RMR'76 and equivalent Q' values HW (prepared by Wood, dated 2021) | 16-5 |

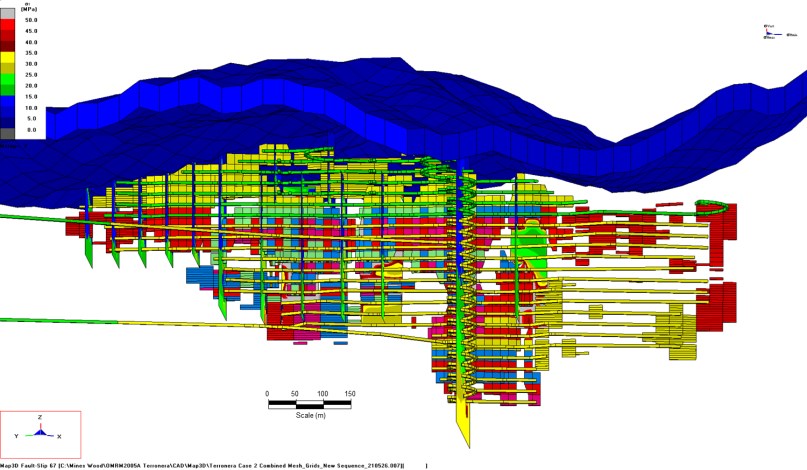

| Figure 16-3: Terronera Map3D© Model View Looking Northeast (prepared by Wood, dated 2021) | 16-7 |

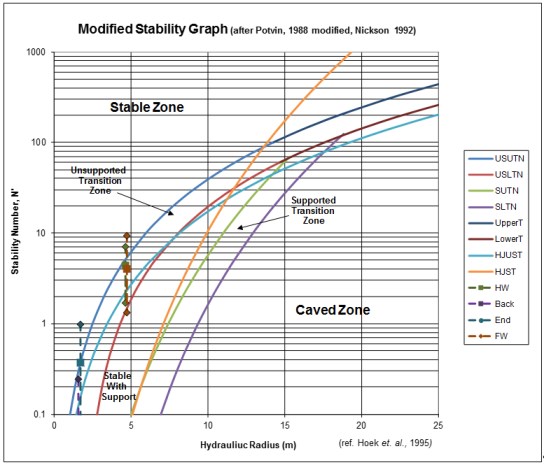

| Figure 16-4: Example MZ4 - Modified Stability Graph (modified after Potvin, 1988; Nickson, 1992) | 16-9 |

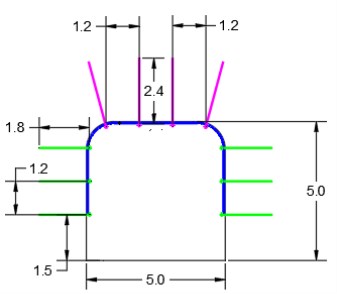

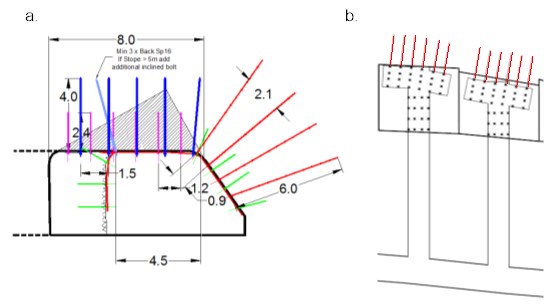

| Figure 16-5: Simplified Typical Ground Support Section (wall bolts (green), back bolts (magenta), mesh (blue)) (prepared by Wood, dated 2021) | 16-12 |

| Figure 16-6: Typical SLS Back and Hanging Wall Support a) Cross Section through Typical Stope b) Plan View of Typical Stopes (prepared by Wood, dated 2021) | 16-13 |

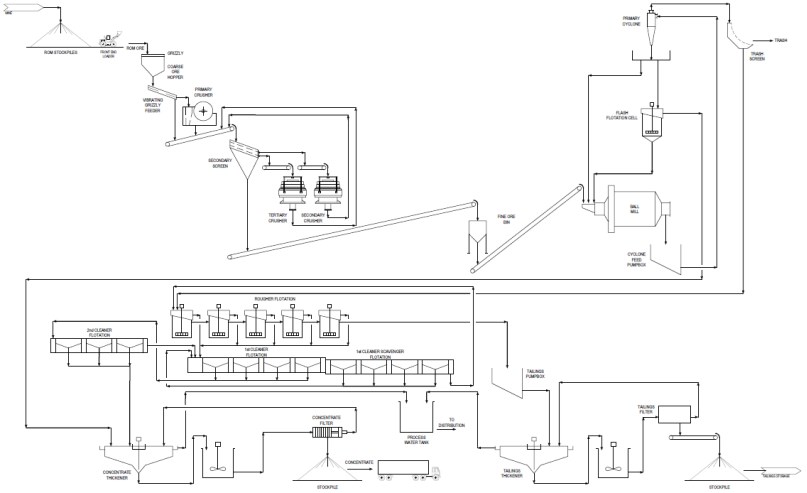

| Figure 17-1: Overall Process Flow Sheet (prepared by Wood QP, dated 2021) | 17-4 |

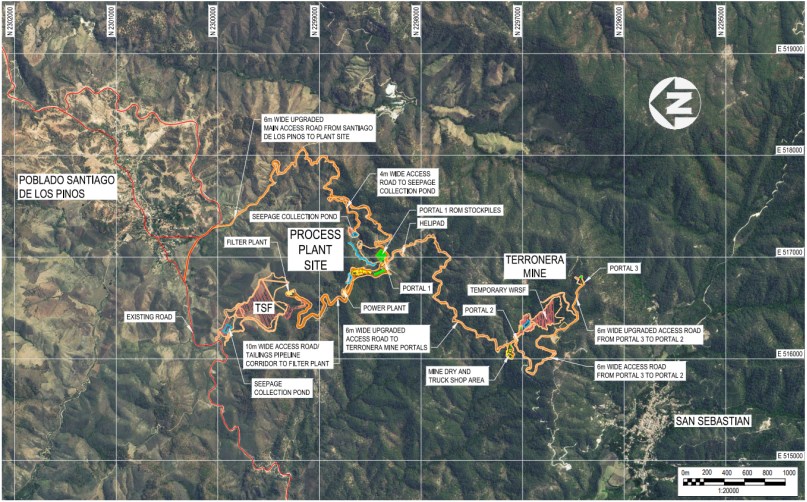

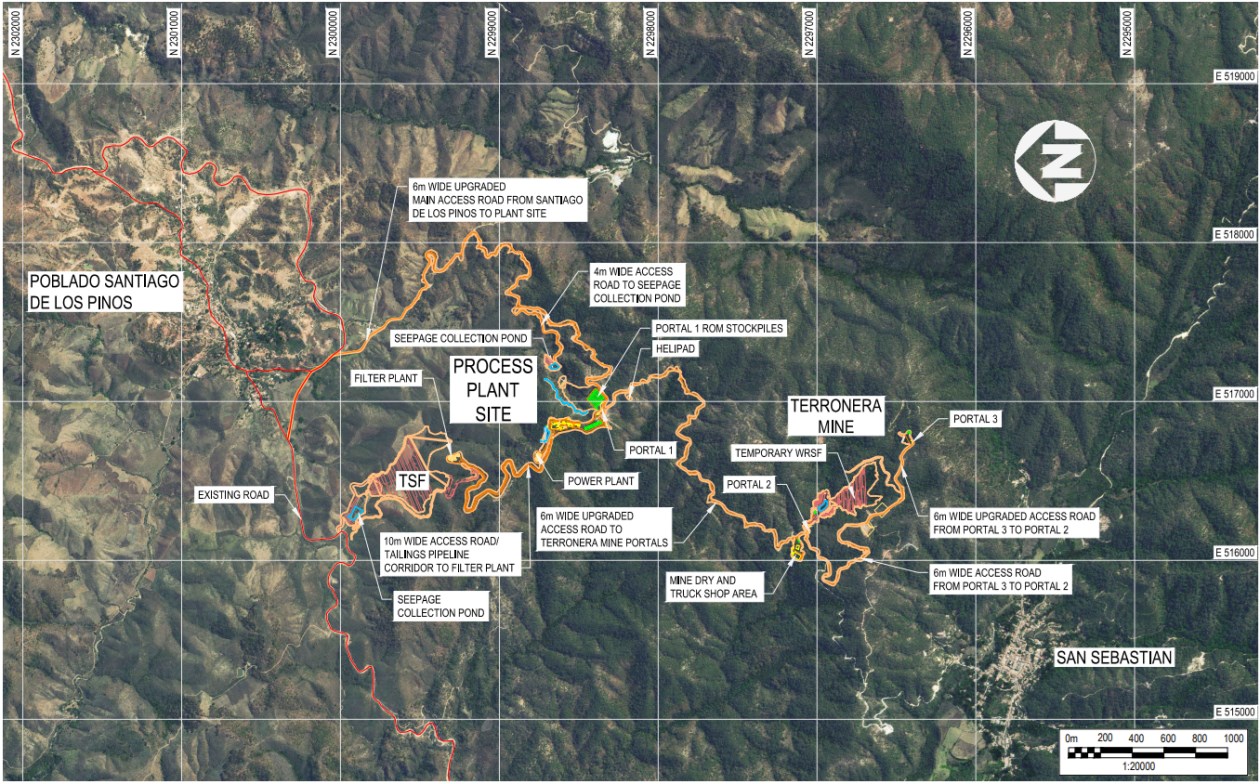

| Figure 18-1: Terronera Site Layout (prepared by Wood, dated 2021) | 18-2 |

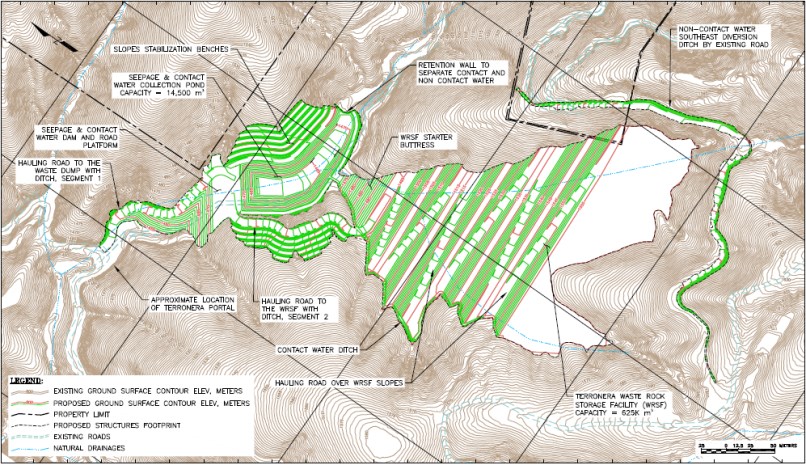

| Figure 20-1: Map of the TSF Layout (prepared by Wood, dated 2021) | 20-7 |

| Figure 20-2: Proposed Layout of the Temporary WRSF (prepared by Wood, dated 2021) | 20-8 |

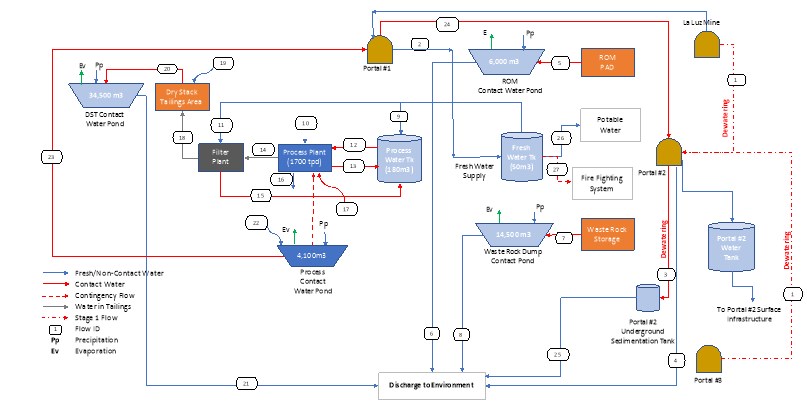

| Figure 20-3: Water Balance Flow Chart (prepared by Wood, dated 2021) | 20-11 |

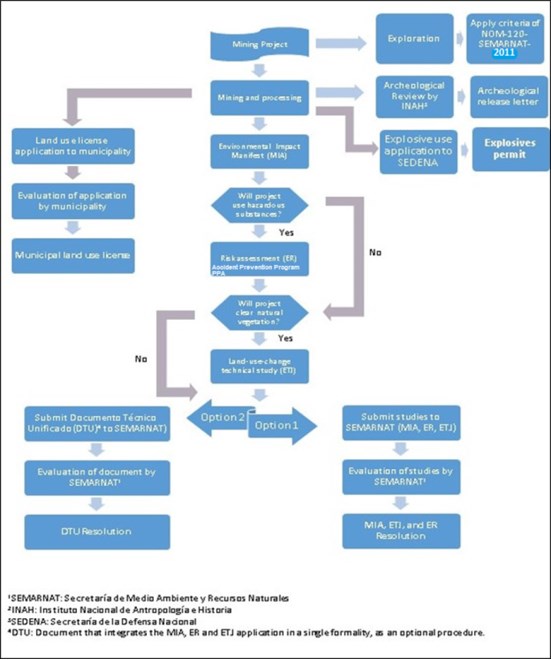

| Figure 20-4: Environmental Permitting Steps for Mining Projects in Mexico (prepared by Endeavour Silver, dated 2020) | 20-14 |

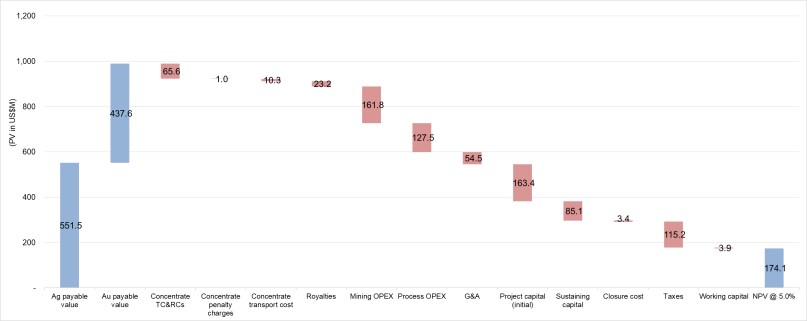

| Figure 22-1: Main Cost Value Drivers (Discounted at 5%) (prepared by Wood, dated 2021) | 22-7 |

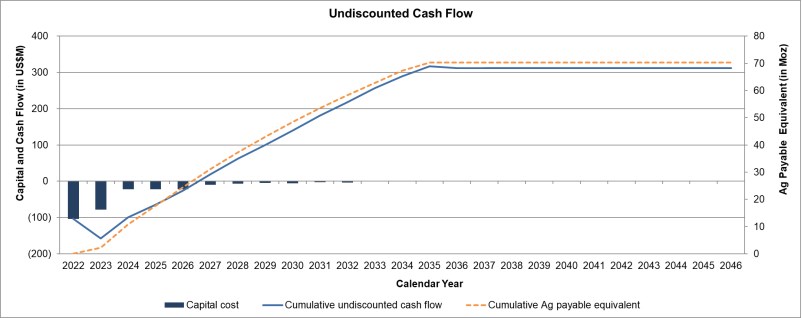

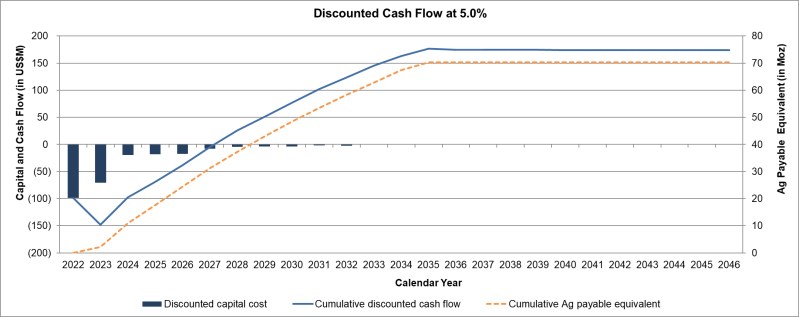

| Figure 22-2: Cumulative After-Tax Undiscounted Cash Flow (prepared by Wood, dated 2021) | 22-8 |

| Figure 22-3: Cumulative After-Tax Discounted Cash Flow (prepared by Wood, dated 2021) | 22-9 |

| Figure 22-4: Sensitivity of After-Tax NPV Discounted at 5% (prepared by Wood, dated 2021) | 22-12 |

| Figure 22-5: Sensitivity of After-Tax IRR Discounted at 5% (prepared by Wood, dated 2021) | 22-13 |

1.0 SUMMARY

1.1 Introduction

Qualified persons from Wood Canada Ltd. (Wood), WSP Group, Inc., KH Mining LLC, together with a qualified person from Endeavour Silver Corp. (Endeavour Silver), prepared the Technical Report (Report) summarizing the results of a feasibility study (FS) on the Terronera Silver-Gold Project (Terronera Project). The Company requested the British Columbia Securities Commission ("BCSC") to conduct a pre-filing review of the 2021 Terronera Technical Report, among others. As a result of comments received from the BCSC, the Company anticipates filing an amended technical report. The comments include questions as to the qualifications of one of seven qualified persons who prepared the 2021 Terronera Technical Report, and certain minor matters. None of the comments concern the actual mineral resource or mineral reserve estimates on the Terronera Project. The Terronera Project is located 50 km northeast of Puerto Vallarta in Jalisco State, Mexico.

1.2 Terms of Reference

Mineral Resource and Mineral Reserve estimates were prepared in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines (November 29, 2019) and followed the definitions in CIM Definition Standards for Mineral Resources and Mineral Reserves (May 10, 2014).

Measurement units used in this Report are metric unless otherwise noted. Currency is expressed in US dollars or unless specified as Mexican pesos (MXN).

1.3 Property Description and Location

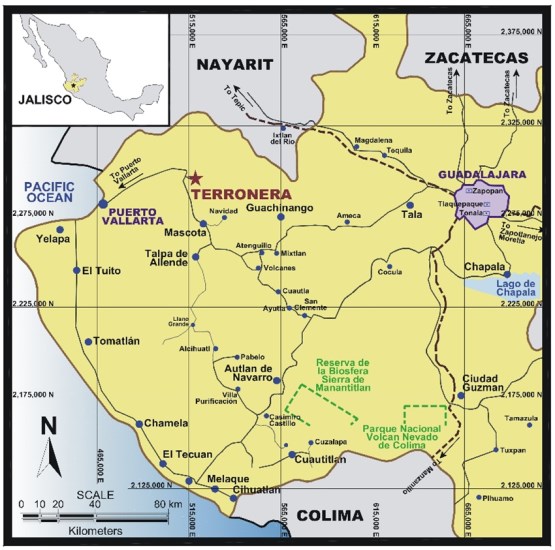

The Terronera Project is located in the mountainous region of San Sebastián, a historical mining district in Mexico. The site can be accessed via Federal Highway No. 70 from Guadalajara, approximately 160 km southeast, and from Puerto Vallarta approximately 50 km southwest (Figure 1-1).

Endeavour Silver holds the Terronera Project through its 100% owned Mexican subsidiary, Endeavour Gold Corporation S.A. de C.V. (Endeavour Gold). Endeavour Gold holds the Terronera Project through its 100% owned subsidiaries Terronera Precious Metals S.A. de C.V. (TPM) and Minera Plata Adelante S.A. de C.V. (MPA).

The Terronera Project consists of 24 mineral concessions, totalling 17,369 ha all of which are valid and in good standing. Surface rights and access rights have been negotiated with various private ranch owners and three local three local Ejidos in support of exploration activities. Mexican Mining law provides the right to use water from the mine for exploration, exploitation, processing, and project personnel.

The Terronera Project is subject to three royalties. The Mexican government retains 0.5% royalty on any precious metals produced. Industrias Minera México S.A. de C.V. (IMMSA) and Compañia Plata San Sebastian S.A. de C.V. (AGREMIN) retains 2% net smelter return (NSR) royalty on mineral production from the concessions each individually conveyed or optioned to Endeavour Silver (10 concessions totaling 3,388 ha from IMMSA; and 4 concessions totaling 9,752 ha from AGREMIN).

Figure 1-1: Terronera Project Location Map (Burga et al., 2020)

1.4 History

The Terronera Project is situated near the town of Sebastián del Oeste founded in 1605 during the Spanish colonial period. By 1785 the Sebastián del Oeste mining district consisted of more than 25 mines and a number of smelters and was considered one of the principal sources of gold, silver, and copper for New Spain. The main mines in the district included Real de Oxtotipan, Los Reyes, Santa Gertrudis, Terronera, and La Quiteria.

In 1979 Consejo de Recursos Minerales conducted regional and local semi-detailed mapping and exploration followed by prospecting activities in 1985 by Compañía Minera Bolaños, S.A. In the late 1980s IMMSA began exploring the historical mining district and continued with geological mapping and sampling of outcropping structures of a number of veins to the mid-1990s. Over the years, IMMSA drilled several holes intersecting widespread silver-gold mineralization, mainly at the Terronera Vein; however, a Mineral Resource estimate was not undertaken.

In 2010, Endeavour Silver acquired the option to purchase the San Sebastián properties from IMMSA and have conducted several exploration, and drilling campaigns that have resulted in Mineral Resource estimates, a preliminary economic assessment in 2015, a pre-feasibility study in 2017, and an updated pre-feasibility study in 2020.

There has reportedly been significant historical production from the San Sebastian del Oeste region spanning from 1566 through to the early 20th century; however, the amount of silver production is unknown.

1.5 Geology and Mineralization

The San Sebastián del Oeste mining district is situated at the southern end of the Sierra Madre Occidental metallogenic province, a north-northwesterly trending volcanic belt of mainly Tertiary age. This volcanic belt is more than 1,200 km long and 200 to 300 km wide and hosts most of Mexico's gold and silver deposits. The volcanic belt is one of the world's largest epithermal precious metal systems.

The San Sebastián del Oeste silver-gold district hosts high-grade silver-gold, epithermal vein deposits characterized by low-sulphidation mineralization and adularia-sericite alteration. The veins are typical of epithermal silver-gold vein deposits in Mexico in that they are primarily hosted in volcanic flows, pyroclastic, and epiclastic rocks, or sedimentary sequences of shale and its metamorphic counterparts.

The Terronera Project lies within the structurally and tectonically complex Jalisco Block at the western end of the younger (early Miocene to late Pliocene) Trans-Mexican Volcanic Belt. The more important mineralized veins in the San Sebastián del Oeste district are controlled by west-northwest to northwest striking structures related to a transcurrent fault system.

The Terronera Project is underlain by a volcano-sedimentary sequence which consists of shale, sandstone, and narrow calcareous-clayey interbeds overlain by tuffs, volcanic breccias, and lava flows of mainly andesitic composition. The volcano-sedimentary units crop out in the north-central part of the district. Further to the north, granitic to granodioritic intrusive rocks are present.

The principal Terronera Vein has been traced by drilling for 1.5 km on strike and from surface to the maximum depth of drilling at 546 m identifying its average true width to be 3.9 m. In addition to the main Terronera Vein, there are additional hanging wall and footwall veins. The veins are primarily hosted in volcanic flows, pyroclastic and epiclastic rocks, associated shales, and metamorphic counterparts.

1.6 Exploration

Endeavour Silver has conducted several exploration programs since 2010. Exploration activities include geological mapping, data compilation, rock chip sampling, trenching, soil geochemistry surveys, and topographical and geographical mapping using satellite photogrammetry.

Areas explored include: Real Alto, located in the southern part of the Terronera Project (including the Real, Tajo, Las Animas, Los Negros, La Escurana, Los Lodos, La Mora, Peña Gorda, El Maguey, Monte Obscuro and several other structures located in the area); Central part of the project (which includes the Terronera, La Luz and Quiteria West veins, in addition, several other structures in the area, highlighting El Padre, Los Espinos, Democrata, El Fraile, La Escondida, Vista Hermosa, La Atrevida, La Loma, Los Pajaros, Valentina, Jabalí, Lindero, San Simón, El Fresno, Zavala and Pendencia); North part of the project, around the Santiago de los Pinos town, including Los Reyes, La Ermita, Las Coloradas, La Plomosa and Los Encinos veins; La Unica area (La Unica vein and Julio-Camichina system); and more recently Los Cuates area (La Sanguijuela and San Sebastian 11 claims).

1.7 Drilling and Sampling

Drilling was initiated by IMMSA between 1995 and 2010, completing 17 diamond drill holes. Since 2011 Endeavour Silver completed 194 diamond drill holes and 40 channels totaling 66,076.6 m on the Terronera Vein and 41 diamond drill holes totaling 9,795.65 m on the La Luz Vein. Only holes drilled by Endeavour Silver were used to construct the Mineral Resource estimates.

Core logging recorded mineralization types, structure, density, recovery, rock quality designation (RQD), alteration, and geology. Core recovery is within acceptable levels with an average of 90% in the Terronera Vein, 100% in the La Luz Vein, and 100% in the host rock surrounding both.

Collar surveys are carried out with total station and a dual-band global positioning system (GPS), while surface holes are surveyed using a Reflex multi-shot down-hole survey instrument at 30 m intervals from the bottom of the hole and back up the collar.

Sampling is conducted in the Endeavour Silver core storage facilities, where it is geologically and geotechnically logged (RQD). Sampling is done in the mineralized structure with intervals between 20 and 100 cm and within the surrounding host rock with intervals between 20 and 150 cm. Photographs and density measurements are taken.

The whole core is cut in half with a diamond rotary saw, and broken core pieces are split with a pneumatic core splitter for sampling and are bagged and tagged. Samples are prepared at the ALS Chemex facility Guadalajara (ALS Guadalajara) which is independent of Endeavour Silver and holds an ISO/IEC 17025 accreditation. Independent laboratory ALS laboratory in Vancouver, Canada (ALS Canada) with ISO/IEC 17025 accreditation carried out the analytical process between 2012 and 2018. Samples from the 2020 campaign were sent to the SGS Durango-Mexico laboratory (SGS Durango) which is also independent of Endeavour Silver and accredited under ISO/IEC 17025. SGS Durango were also used as the secondary laboratory for the 2019 drilling campaign. Inspectorate laboratory in Hermosillo has been used as a secondary laboratory since 2012. They are independent of Endeavour Silver and hold global quality certifications under ISO9001:2008, Environmental Management under ISO14001, and Safety Management under OH SAS 18001 and AS4801.

Silver grades were determined by ALS Canada using inductively couple plasma atomic emission spectroscopy (ICP-AES) following aqua regia digestion. Gold was assayed by fire assay (FA) followed by atomic absorption (AA) analysis of the FA bead on a 30 g pulp sample. Assays reporting over the gold and silver limit is FA followed by gravimetric analysis on a 30 g pulp sample. Detection limits for high-grade gold assays are 0.5 to 1,000 ppm and 5 to 10,000 ppm for silver assays.

SGS Durango uses aqua regia digestion followed by ICP optical emission spectroscopy (OES) for silver and FA for gold. Overlimit silver and gold assays are by FA with a gravimetric finish.

Endeavour Silver employed a quality assurance quality control (QA/QC) program, including certified reference materials (CRMs), blanks, and duplicates inserted in the sample stream at a rate of approximately one control for every 20 samples. Check assaying was also conducted with a frequency of approximately 5%. A review of the QC data from drilling used for Mineral Resource estimation found potential low-level carry-through contamination in ALS Canada results that have been deemed minor and not material to the Mineral Resource estimate. The Qualified Person (QP) concludes that the sample preparation, security, and analytical procedures are adequate for use in Mineral Resource estimation.

1.8 Data Verification

The drill hole database was inspected and validated by the Wood QP. Assay data was verified against the original laboratory certificates. Minor errors were found, addressed and discussed with Terronera's team.

The Endeavour Silver QP performed verification and validation of drill hole collars, downhole surveys, geological logging, sampling, sample preparation, and assaying procedures during their site visit. Drilling practices were reviewed by visiting a rig, drilling an exploration drill hole, and checking downhole survey measurements. Core logging of drill holes from the Terronera and La Luz veins were reviewed. Sampling practices were reviewed together with the Terronera Project geologists. Witness samples were selected from the Terronera and La Luz veins, sent to ALS Canada, and a blank and standard for each vein. Results confirm the data to be reliable and suitable for use in updating the Mineral Resource.

The mining QP verified the resource model was suitable for mine planning and design purposes. The mining costs were verified to the source documents and are considered adequate for use in mine planning and meet feasibility level study.

The mineral process QP reviewed the composite samples that were selected for metallurgical testing and the metallurgical test results and considers them suitable to support feasibility level of study and the process design in this Report.

1.9 Mineral Processing and Metallurgical Testing

Hazen Research completed initial comminution testing in 2016 and 2019. Samples were subjected to semi-autogenous grind mill comminution (SMC), Bond rod mill and ball mill work indexes (BWi and RWi, respectively), Bond abrasion index (Ai), and Bond impact work index (CWi) with results showing material classified as hard and highly abrasive. Additional comminution testing performed in 2021 supported these initial results with ore classified as very hard and highly abrasive.

ALS Metallurgy performed metallurgical test work in Kamloops, B.C., Canada. Testing before 2019 focused on evaluating flotation parameters from composite samples representative of materials with various precious metal grades and reviewing the potential for deleterious elements.

The 2019/2020 metallurgical program included grind versus recovery, flash flotation, rougher and cleaner circuit confirmation testing with the aim to refine the process design parameters and flowsheet. Recovery models were generated from composites from current and previous testwork campaigns.

The 2021 testwork focused on assessing the metallurgical performance of both the Terronera and La Luz veins. Testwork completed includes Ai, BWi, flash flotation, rougher and batch cleaner flotation, and locked cycle tests. Additional comminution tests determined the hardness of the Terronera ore be 19.1 kWh/t and an Ai of 0.47. Results showed a two-stage flotation cleaning circuit is recommended to achieve a marketable concentrate grade. Additionally, recycling the cleaner scavenger tails should be implemented and maintained as an option in the current circuit. The final concentrate quality used in the lock cycle tests was analyzed for minor and deleterious elements and was deemed not to affect the extraction of gold and silver significantly.

Based on the projected LOM plan, overall recoveries of silver and gold are 87.7% and 76.3%, respectively.

1.10 Mineral Resource Estimate

Mineral Resources estimates were prepared for the Terronera and La Luz veins using drill holes completed by Endeavour Silver between 2010 and 2020. Estimation domains were constructed to include the mineralization portions of the veins and wall rock along the structural corridors responsible for vein emplacement and silver and gold deposition using a nominal 150 g/t silver equivalent (AgEq) cut-off grade.

Following the identification of a high-grade silver sample population, continuity of high-grade samples at the scale of the drill hole spacing and sampling interval was found. Based on these findings, a high-yield restriction was used to model the high-grade mineralization and prevent the over-projection of extreme silver grades.

An in-situ bulk density model used core recovery data to adjust the modeled density to reflect voids and open spaces and expected reduction in metal contained in the rock mass.

Estimation for both veins was performed in three passes using anisotropic search ellipsoids and inverse distance weighting to the third power. The models were validated by means of visual inspection and checked for global bias and local bias using swath plots. No areas of significant bias were noted.

Blocks in the Terronera Mineral Resource model have been assigned a resource confidence category based on drill hole spacing criteria selected that considers a visual assessment of the continuity of the mineralized zones width along strike and down dip, and a geostatistical drill hole spacing study. For the Terronera Zone, a 50 m drill spacing was used to define Indicated Mineral Resources with all remaining blocks inside the mineralized domain classified Inferred Mineral Resources. For the La Luz Zone, blocks estimated with composites from at least two drill holes with a nominal drill hole spacing of 30 m are classified as Indicated Mineral Resources. Holes spaced wider than the nominal 30 m spacing are classified as Inferred Mineral Resources.

A cut-off grade of 150 g/t silver equivalent (AgEq) is applied to identify blocks that will have reasonable prospects of eventual economic extraction.

The silver equivalent calculation and cut-off grades used for the 2021 Mineral Resource estimate are consistent with values used from the preliminary economic assessment and pre-feasibility studies. AgEq for the Terronera Project is Ag + 75 x Au. The AgEq value takes into account silver grade plus gold grade factored by the differential of gold and silver metal prices and metallurgical recoveries. The 150 g/t AgEq cut-off grade generates sufficient revenue assuming metallurgical recovery and long-range silver price to cover operating costs, including mining, processing, general and administrative (G&A), treatment, refining, and royalties.

The Mineral Resource estimates for the Terronera, and La Luz deposits are summarized in Table 1-1 and Table 1-2, respectively and are reported according to the 2014 CIM Definition Standards.

The majority of the Terronera Mineral Resources have been classified as Indicated, and it is possible that infill and grade control drilling and production sampling may result in local changes to the thickness and grade of the blocks currently drilled at nominally 50 m spacing. Additional drilling and production sampling are recommended to produce accurate forecasts for annual and short-range plans. Other factors that could affect the Mineral Resource estimate include changes to metal prices, mine, and process operating cost, variability in metallurgical performance, mine design, and mining method selection due to geotechnical stability.

Table 1-1: Terronera Deposit Mineral Resource Estimate with Effective Date March 5, 2021

| Classification | Tonnes (000s) |

Ag (g/t) |

Contained Ag (000s oz) |

Au (g/t) |

Contained Au (000s oz) |

AgEq (g/t) |

Contained AgEq (000s oz) |

|

| Indicated | 5,181 | 256 | 42,707 | 2.49 | 415 | 443 | 73,755 | |

| Inferred | 997 | 216 | 6,919 | 1.96 | 63 | 363 | 11,624 | |

Notes:

1. Mineral Resources have an effective date of March 5, 2021. The Qualified Person responsible for the Mineral Resource estimate is Henry Kim, P. Geo, an employee of Wood Canada Ltd.

2. Mineral Resources are reported inclusive of Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

3. AgEq is calculated as the sum of silver plus gold grades factored by the differential in gold and silver metal prices and metallurgical recoveries

4. Mineral Resources are constrained within a wireframe constructed at a nominal 150 g/t AuEq cut-off grade

5. A 150 g/t AgEq cut-off grade considers Wood's guidance on industry consensus for long-term silver and gold prices for Mineral Resource estimation, metallurgical performance including metallurgical recoveries (assuming the mean silver recovery of 87% and the mean gold recovery of 76%), mining, processing, and site G&A operating costs, treatment and refining charges, and royalties

6. The cut-off grade assumed a long-term silver price of $23.00/oz and gold price of $1,810/oz.

7. Mineral Resources are stated as in-situ with no consideration for planned or unplanned external mining dilution.

8. The silver and gold ounces presented in the Mineral Resource estimate table are contained metal, not the recoverable metal .

9. Numbers have been rounded as required by reporting guidelines and may result in apparent summation differences.

Table 1-2: La Luz Deposit Mineral Resource Estimate with Effective Date March 5, 2021

|

Classification |

Tonnes |

Ag |

Contained |

Au |

Contained |

AgEq |

Contained |

|

|

Indicated |

122 |

182 |

745 |

13.11 |

54 |

1,165 |

4,774 |

|

|

Inferred |

61 |

150 |

295 |

11.35 |

22 |

1,001 |

1,977 |

|

Notes:

1. Mineral Resources have an effective date of March 5, 2021. The Qualified Person responsible for the Mineral Resource estimate is Henry Kim, P. Geo, an employee of Wood Canada Ltd.

2. Mineral Resources are reported inclusive of Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

3. AgEq is calculated as the sum of silver plus gold grades factored by the differential in gold and silver metal prices and metallurgical recoveries

4. Mineral Resources are constrained within a wireframe constructed at a nominal 150 g/t AuEq cut-off grade

5. A 150 g/t AgEq cut-off grade considers Wood's guidance on industry consensus for long-term silver and gold prices for Mineral Resource estimation, metallurgical performance including metallurgical recoveries (assuming the mean silver recovery of 87% and the mean gold recovery of 76%), mining, processing, and site G&A operating costs, treatment and refining charges, and royalties

6. The cut-off grade assumed a long-term silver price of $23.00/oz and gold price of $1,810/oz

7. Mineral Resources are stated as in-situ with no consideration for planned or unplanned external mining dilution.

8. The silver and gold ounces presented in the Mineral Resource estimate table are contained metal, not the recoverable metal.

9. Numbers have been rounded as required by reporting guidelines and may result in apparent summation differences.

1.11 Mineral Reserve Estimate

Mineral Reserves were classified in accordance with the 2014 CIM Definition Standards. All Mineral Reserves were converted from Indicated Mineral Resources and are classified as Probable.

The Probable Mineral Reserve estimates for the Terronera and La Luz deposits are provided in Table 1-3. There is no Proven Mineral Reserve for either zone.

Factors that could affect the Mineral Reserve estimate include but are not limited to dilution, recovery, metal prices, underground and site operating costs, and management of the operation and environmental or social impacts. Factors with the largest impacts to the Mineral Reserve estimates are the gold price for the La Luz Zone, silver prices for the Terronera Zone, and the ground conditions in the Terronera Zone during mining.

Table 1-3: Terronera and La Luz Probable Mineral Reserve

|

Zone |

Tonnes |

Ag |

Au |

AgEq |

Ag |

Au |

AgEq |

|

Terronera |

7,227 |

197 |

1.97 |

353 |

45,856 |

459 |

82,055 |

|

La Luz |

153 |

173 |

15.00 |

1,378 |

851 |

75 |

6,780 |

|

Total |

7,380 |

197 |

2.25 |

374 |

46,707 |

534 |

88,834 |

Note:

1. The Mi.neral Reserve estimate was prepared in accordance with the 2014 CIM Definition Standards by William Bagnell, P.Eng., an employee of Wood.

2. The Mineral Reserves have an effective date of June 30, 2021.

3. Mineral reserves are reported using a silver equivalency cut-off formula AgEq (g/t) = Ag (g/t) + (Au (g/t) x 78.9474). Cut-off grade varies between 156 g/t to 200 g/t AgEq depending on mining method. Metal prices used were $1,500/oz Au and $19.00/oz Ag. Metallurgical recovery of 84.9% for silver and 79.8% for gold, transport, treatment and refining charges of $0.75/oz Ag, and NSR royalties of 2.5%.

4. Mineral Reserves are reported based on mining costs of $30.00/t for sub-level open stoping, $49.18/t for cut and fill, and $48.00/t for shrinkage mining, and $28.46/t for process costs, and $8.49/t for G&A costs.

5. Figures in the table may not sum due to rounding.

1.12 Mining Methods

A geomechanical underground mine design study was performed on available core and review of previous studies. The study was used to determine location within the orebodies of the mining method, stability of openings, and requirements for ground support and dilution estimates.

Three declines from the surface will achieve underground access to Terronera and La Luz. The declines collar at the process plant pad, the mine dry, and the upper zone of the deposit. The La Luz access decline extends from the process plant decline to the La luz deposit.

Shrinkage mining methods will extract mineral Reserves at La Luz. Shrinkage is an amenable method given the narrow thickness and the vertical nature of the deposit. Broken ore will be extracted with scooptrams and hauled to remucks or direct loaded to 30-tonne haul trucks. The trucks will then haul the material to the process plant stockpile.

The Terronera deposit will be extracted by a combination of sub-level stoping (SLS) methods and cut and fill (CAF) mining. SLS accounts for approximately 59% of the extraction at Terronera. CAF mining accounts for approximately 23% of the extraction, and the remaining 11% is extracted as development ore. Primary transverse sub-level stopes and longitudinal sub-level stopes will be backfilled with cemented rockfill with an average of 5% binder content. Secondary transverse stopes will be backfilled with uncemented mine development rock.

Development of the declines will start in January 2022, and development ore extracted during this time will be stockpiled for later processing. The process plant is commissioned at the end of the third quarter of 2023. Between October and December 2023, the process plant will ramp up to 1,700 tpd sustained production rate on stockpiled material and development ore. Stoping commences in January 2024 from La Luz and Terronera. Mining is completed in La Luz in late 2025, and Terronera mining is complete at the end of the first half of 2035.

1.13 Recovery Methods

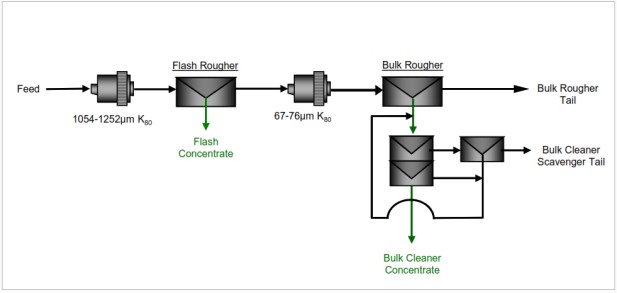

The process design was developed from the comminution and flotation testwork completed between 2017 and 2021. The process plant will operate continuously 365 days per annum with an assumed availability of 92% producing a high-grade concentrate.

Run-of-mine (ROM) material is transported to stockpiles, where a three-stage then processes it, closed crushing circuit with a designed capacity of 1,700 dry tpd in 16 hours of operation. Finely crushed product with a P80 of 6.7 mm will be conveyed to a fine ore bin and then to a primary grinding circuit to produce a product that is 80% minus 70 μm. Ground ores will be treated by flash flotation and conventional flotation with two stages of cleaning. Based on testwork results, overall recoveries of 87.7% for silver and 76.3% for gold are assumed for the LOM. Flotation tailings will be filtered and stored on the surface in a dry tailings storage facility (TSF).

Reagents used in the flotation of sulphide mineralization will be handled and stored on site. Freshwater will be provided by the Terronera and La Luz underground mining operations and used as make-up/firewater and process water. Annual power consumption required by the process is 43.3 GWh and will be supplied to the various process plant areas by the onsite power plant via overhead powerlines.

1.14 Project Infrastructure

Onsite infrastructure and services required for the Terronera Project include road and air (helipad) access, a process plant, process, and mine ancillary buildings, mine portals and associated mine facilities, waste and tailings storage facilities, onsite power generation and distribution, sewage and potable water treatment facilities (Figure 1-2).

The site can be accessed by unpaved public roads that will require upgrading to a single-lane road of crushed gravel material. A helipad will provide additional access with its primary purpose for emergency use.