Document

Exhibit 99.1

COGNIZANT REPORTS FOURTH QUARTER AND FULL-YEAR 2023 RESULTS

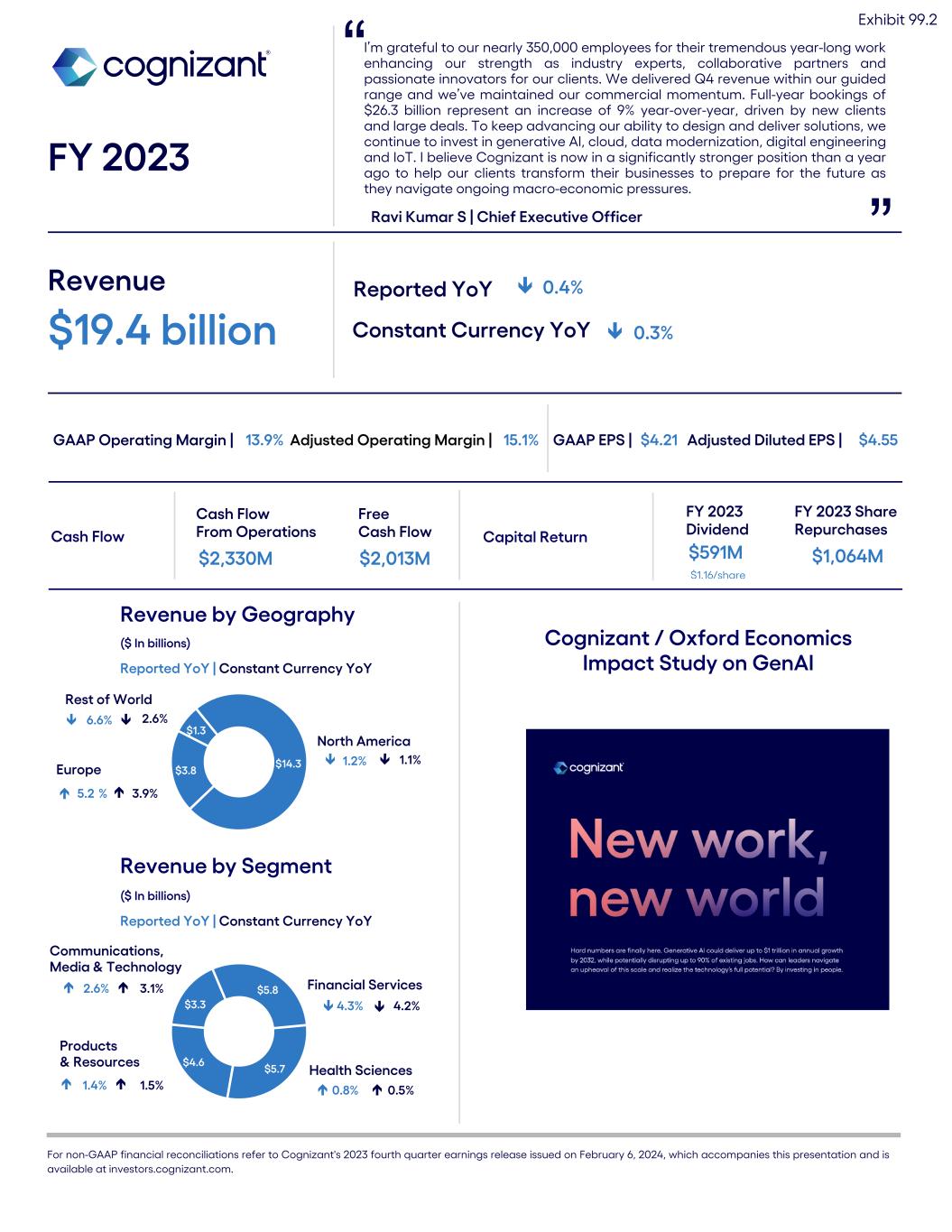

•Full-year revenue of $19.4 billion declined 0.4% year-over-year, or declined 0.3% in constant currency1, which was within our guidance range

•Full-year operating margin of 13.9% and Adjusted Operating Margin1 of 15.1%, which was 40 basis points above our guidance

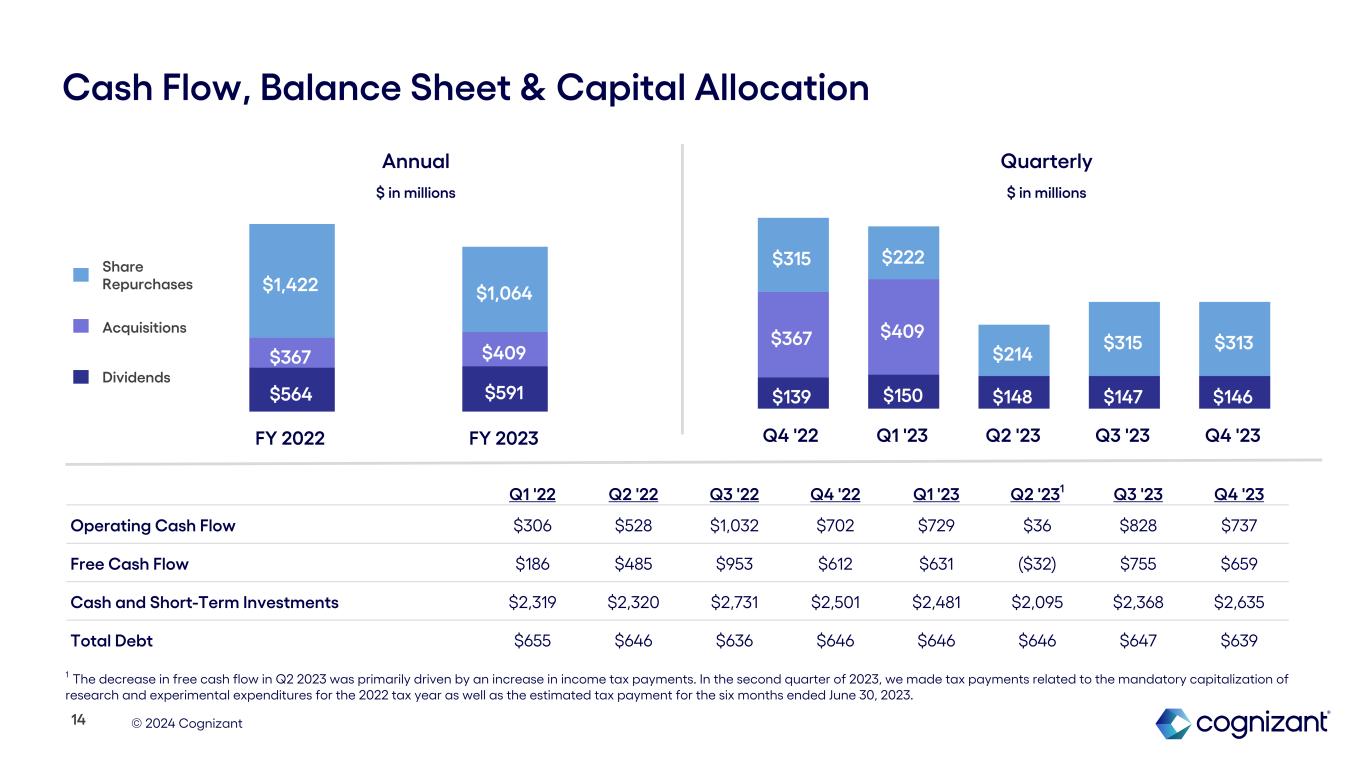

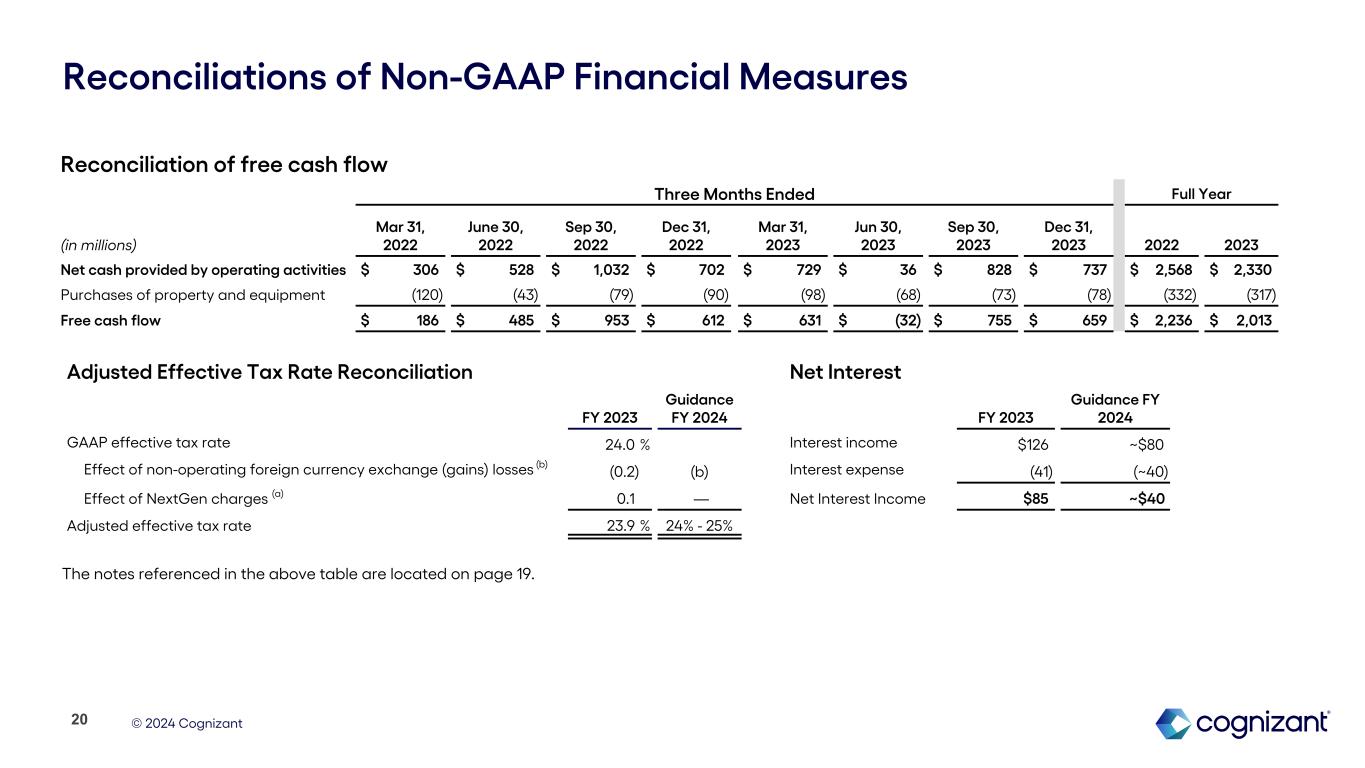

•Full-year operating cash flow of $2.3 billion; free cash flow1 of $2.0 billion was 95% of net income

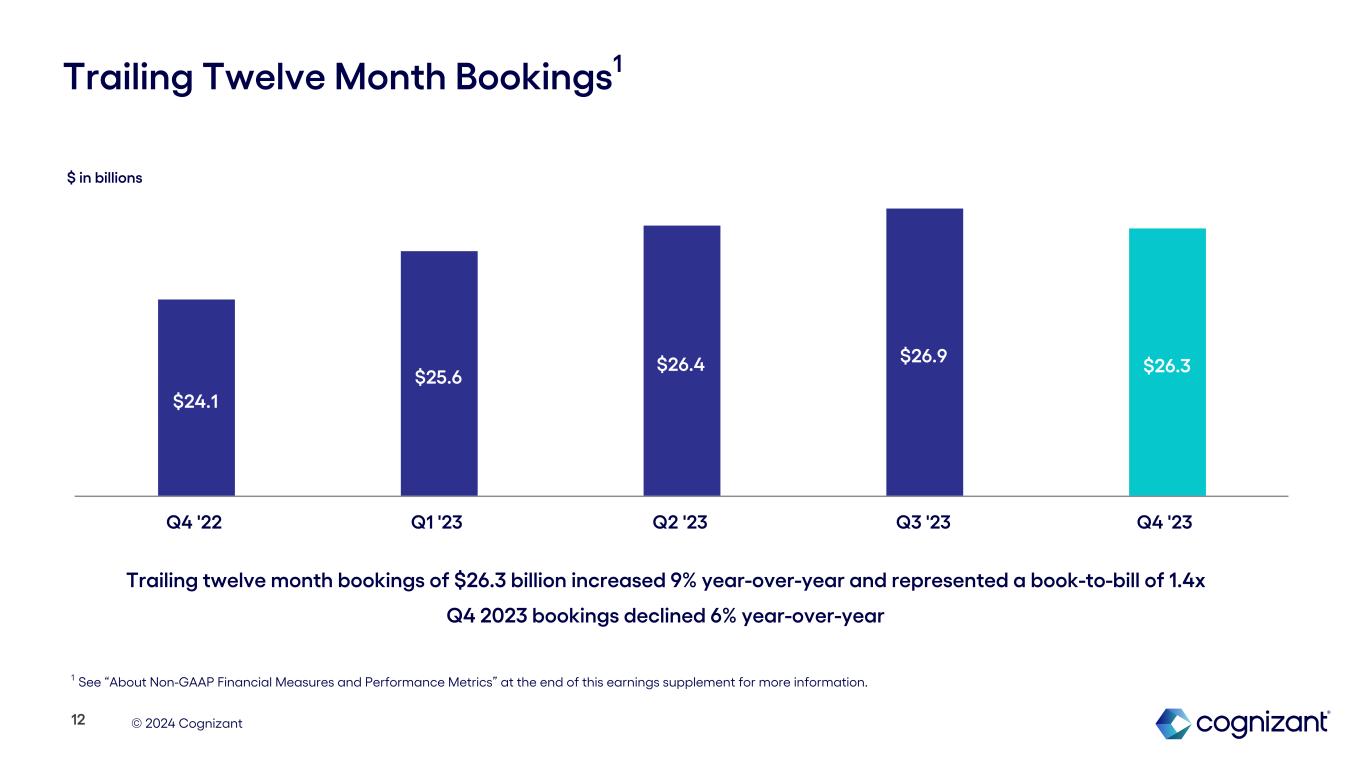

•Trailing 12-month bookings of $26.3 billion, up 9% year-over-year

•$1.7 billion returned to shareholders through share repurchases and dividends in 2023

•Cash dividend increased 3% to $0.30 per share for Q1 2024

•2024 revenue growth guidance of (2%) to 2% in constant currency

•2024 Adjusted Operating Margin guidance 15.3-15.5%, an expansion of 20 to 40 basis points

TEANECK, N.J., February 6, 2024 - Cognizant (Nasdaq: CTSH), one of the world’s leading professional services companies, today announced its fourth quarter and full-year 2023 financial results.

“I’m grateful to our nearly 350,000 employees for their tremendous year-long work enhancing our strength as industry experts, collaborative partners and passionate innovators for our clients,” said Ravi Kumar S, Chief Executive Officer. “We delivered Q4 revenue within our guided range and we’ve maintained our commercial momentum. Full-year bookings of $26.3 billion represent an increase of 9% year-over-year, driven by new clients and large deals. To keep advancing our ability to design and deliver solutions, we continue to invest in generative AI, cloud, data modernization, digital engineering and IoT. I believe Cognizant is now in a significantly stronger position than a year ago to help our clients transform their businesses to prepare for the future as they navigate ongoing macro-economic pressures."

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ in millions, except per share data |

Q4 2023 |

|

Q4 2022 |

|

|

FY 2023 |

|

FY 2022 |

|

|

Revenue |

$4,758 |

|

|

$4,839 |

|

|

|

$19,353 |

|

|

$19,428 |

|

|

|

| Y/Y Change |

(1.7 |

%) |

|

1.3% |

|

|

(0.4 |

%) |

|

5.0% |

|

|

Y/Y Change CC1 |

(2.4 |

%) |

|

4.1 |

% |

|

|

(0.3 |

%) |

|

7.5 |

% |

|

| GAAP Operating Margin |

15.2 |

% |

|

14.2 |

% |

|

|

13.9 |

% |

|

15.3 |

% |

|

|

Adjusted Operating Margin1 |

16.1 |

% |

|

14.2 |

% |

|

|

15.1 |

% |

|

15.3 |

% |

|

|

| GAAP Diluted EPS |

$1.11 |

|

$1.02 |

|

|

$4.21 |

|

$4.41 |

|

|

Adjusted Diluted EPS1 |

$1.18 |

|

$1.01 |

|

|

$4.55 |

|

$4.40 |

|

|

|

|

|

|

|

|

|

|

|

|

Operating cash flow |

$737 |

|

|

$702 |

|

|

|

$2,330 |

|

|

$2,568 |

|

|

|

Free cash flow1 |

$659 |

|

|

$612 |

|

|

|

$2,013 |

|

|

$2,236 |

|

|

|

1 Constant currency ("CC") revenue growth, Adjusted Operating Margin, Adjusted Diluted Earnings Per Share ("Adjusted Diluted EPS") and free cash flow are not measures of financial performance prepared in accordance with GAAP. A full reconciliation of Adjusted Operating Margin guidance to the corresponding GAAP measure on a forward-looking basis cannot be provided without unreasonable efforts. See “About Non-GAAP Financial Measures and Performance Metrics” for more information and, as applicable, reconciliations to the most directly comparable GAAP financial measures.

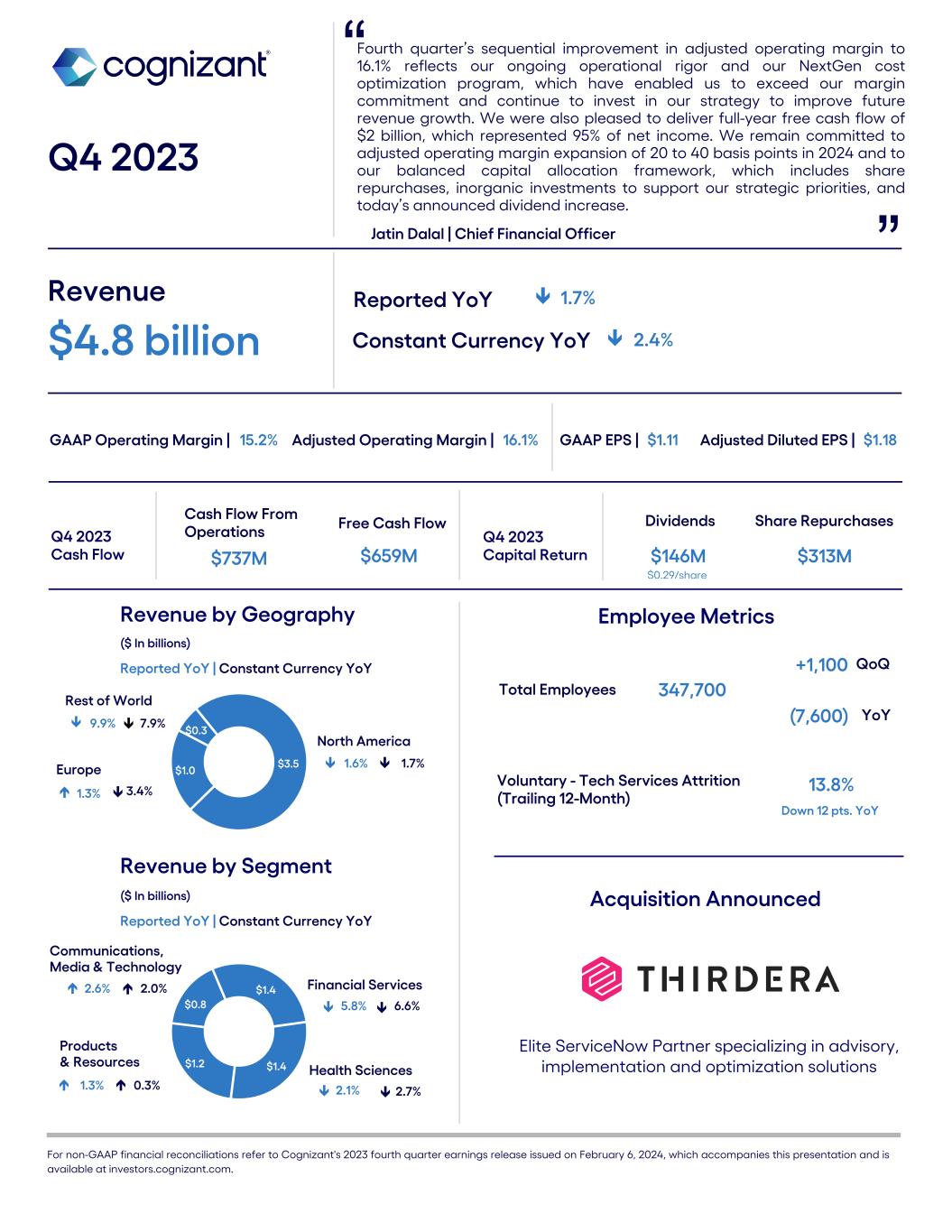

“Fourth quarter’s sequential improvement in adjusted operating margin to 16.1% reflects our ongoing operational rigor and our NextGen cost optimization program, which have enabled us to exceed our margin commitment and continue to invest in our strategy to improve future revenue growth. We were also pleased to deliver full-year free cash flow of $2 billion, which represented 95% of net income,” said Jatin Dalal, Chief Financial Officer. “We remain committed to adjusted operating margin expansion of 20 to 40 basis points in 2024 and to our balanced capital allocation framework, which includes share repurchases, inorganic investments to support our strategic priorities, and today’s announced dividend increase.”

Bookings

Bookings in the fourth quarter declined 6% year-over-year. For the full year, bookings grew 9% year-over-year to $26.3 billion, which represented a book-to-bill of approximately 1.4x.

Employee Metrics

Total headcount at the end of the fourth quarter was 347,700, an increase of 1,100 from Q3 2023 and a decrease of 7,600 from Q4 2022. Voluntary attrition - Tech Services for the year ended December 31, 2023 was 13.8% as compared to 25.6% for the year ended December 31, 2022.

Return of Capital to Shareholders

The Company repurchased 4.2 million shares for $298 million during the fourth quarter under its share repurchase program. As of December 31, 2023, there was $1.8 billion remaining under the share repurchase authorization. In February 2024, the Company declared a quarterly cash dividend of $0.30 per share, a 3% increase year-over-year, for shareholders of record on February 20, 2024 This dividend will be payable on February 28, 2024.

First Quarter and Full-Year 2024 Guidance

(all growth rates year-over-year)

•First quarter revenue is expected to be $4.68 - $4.76 billion, a decline of 2.7% to 1.2%, or a decline of 3.0% to 1.5% in constant currency.

•Full-year 2024 revenue is expected to be $19.0 - $19.8 billion, a decline of 1.8% to growth of 2.2% as reported, or a decline of 2.0% to growth of 2.0% in constant currency.

•Full-year 2024 Adjusted Operating Margin2 is expected to be in the range of 15.3% to 15.5%, or 20 to 40 basis points of expansion.

•Full-year 2024 Adjusted EPS2 is expected to be in the range of $4.50 to $4.68.

2 A full reconciliation of Adjusted Operating Margin and Adjusted Diluted EPS guidance to the corresponding GAAP measures on a forward-looking basis cannot be provided without unreasonable efforts. See “About Non-GAAP Financial Measures and Performance Metrics” for more information and a partial reconciliation at the end of this release.

Select Client and Partnership Announcements

•Announced an expanded agreement with Takeda, a global biopharmaceutical company, to support the company's digital transformation strategy. Cognizant will support Takeda in transforming its modern infrastructure and application management approaches, as well as identifying and hiring key talent to support the company's data, digital and technology ambitions.

•Announced a collaboration with ServiceNow to enhance the Cognizant WorkNEXT™ modern workplace services solution with generative AI capabilities. With the enhanced offering, clients can benefit from significantly reduced lead time for deploying and training AI systems.

•In collaboration with Microsoft, unveiled Innovation Assistant, a generative AI-powered tool built on Microsoft Azure OpenAI Service. Cognizant's Innovation Assistant is designed to enable greater creativity and innovation among Cognizant employees and will augment Cognizant's internal innovation program, Bluebolt.

•Announced that Fortrea, a leading global provider of clinical development and patient access solutions to the life sciences industry, selected Cognizant as its strategic technology transformation provider. In June 2023, Fortrea successfully completed its spin-off from its former parent company, and Cognizant will play a fundamental role in facilitating Fortrea's transition to newly established global infrastructure while providing application management and end-user services.

•Partnered with Oxford Economics to quantify generative AI's impact on productivity and the future of work. According to our research, generative AI could inject the US GDP with up to $1 trillion in additional annual value by 2032; as many as 13% of companies could be leveraging the technology in three to four years; and most jobs (90%) will be disrupted in some way by generative AI in the next 10 years. The results of our research and a description of its methodology are available on our website.

•Signed a multi-year contract with Cambridge University Press & Assessment (Cambridge), a leader in assessment, education, research and academic publishing. The renewed five-year relationship will see Cognizant and Cambridge drive digital transformation and leverage AI technology with the goal of improving operational effectiveness, maintaining exam results integrity and staying competitive in the evolving education sector.

•Selected by Alm. Brand Group (Alm), a leading insurance company in Denmark, to provide a range of business processes previously outsourced by Alm to other vendors. Cognizant expects to automate a range of processes including insurance policies and administrative tasks, which are traditionally manual and repetitive actions, and to also help identify further automation opportunities alongside Alm's own automation specialists.

•Selected to implement Amazon's Just Walk Out Technology for Canberra Institute of Technology Student Association (CITSA) to enable nearly 24/7 access for students at its Student Association store. Just Walk Out technology is designed to transform the retail experience by leveraging advanced technologies such as artificial intelligence like computer vision and deep learning, including generative AI, to create a frictionless shopping experience.

•Announced that Cognizant was selected by The University of Melbourne to help implement the Tealium Customer Data Platform (CDP) to support the creation of data-led and personalized experiences for students, staff and alumni as it looks to enhance meaningful constituent engagement.

•Appointed by Riyadh Airports Company (RAC) to enhance the capabilities of RAC's Enterprise Resource Planning (ERP) and business processes automation capabilities in the domains of finance, human resources, procurement, and planning, ultimately enhancing the traveler experience. In the initial phase, Cognizant will leverage the SAP Appian framework to establish a robust process automation for airport operations.

Select Analyst Ratings, Company Recognition and Announcements

•Acquired Thirdera, an Elite ServiceNow Partner, to enhance cross-industry digital transformation with ServiceNow and create one of the world's largest, most credentialed ServiceNow partners. This announcement builds on Cognizant and ServiceNow’s previously announced strategic partnership in AI-driven automation across industries.

•Announced Cognizant FlowsourceTM, a generative AI-enabled platform that aims to fuel the next generation of software engineering for enterprises. The platform integrates all stages of the software delivery lifecycle to help cross-functional engineering teams deliver high quality code faster, and with increased control and transparency.

•Unveiled Shakti, a unified framework of women-centric programs and policies to accelerate careers and boost women leadership in technology. Additionally, Cognizant has partnered with NASSCOM (National Association of Software and Service Companies) to establish and prioritize best practices with a shared goal of making diversity and inclusion a key differentiator of India's tech sector.

•Earned a top score in Human Rights Campaign Foundation’s 2023-2024 Corporate Equality Index, the leading US benchmarking survey and report measuring corporate policies and practices related to LGBTQ+ workplace equality.

•Recognized as a "Gold" employer, the highest rating awarded, by the India Workplace Equality Index (IWEI) 2023 for ensuring an inclusive culture and workplace for lesbian, gay, bisexual, transgender, queer, non-binary and intersex (LGBTQ+) employees and demonstrating long-term and in-depth commitment towards the LGBTQ+ community.

•Recognized as a Leader by Everest Group® in:

•Digital Workplace Services North America PEAK Matrix® Assessment, 2023

•Data and Analytics Services PEAK Matrix® Assessment, 2023

•Cloud Services In Insurance PEAK Matrix® Assessment, 2023

•Next Gen Quality Engineering Services PEAK Matrix® Assessment, 2023

•Revenue Cycle Management (RCM) Platforms PEAK Matrix® Assessment, 2023

•MedTech Operations PEAK Matrix® Assessment, 2023

•Healthcare Payer Digital Services PEAK Matrix® Assessment, 2023

•Lending IT Services PEAK Matrix® Assessment, 2023

•Artificial Intelligence (AI) Services PEAK Matrix® Assessment, 2023

•Leadership in IDC MarketScapes:

•Worldwide Life Science R&D Strategic Consulting Services Vendor Assessment, 2023 - 2024

•Worldwide Hospitality, Dining & Travel Omnichannel Guest Experience Services Providers, 2023

•Worldwide Experience Build Services Vendor Assessment, 2023–2024

•Market Leader in HFS Horizon 3:

•Life Sciences Service Providers, 2023

•Retail and CPG Service Providers, 2023

•Leadership in ISG Provider Lens™:

•Oracle Cloud & Technology Ecosystem, 2023

•Oil and Gas Industry - Services and Solutions, 2023

•Insurance Services, 2023

•Manufacturing Industry Services, 2023

•Analytics Services, 2023

•Telecom, Media & Entertainment, 2023

•Next-Gen ADM Services, 2023

•Leadership in Avasant RadarView™:

•Claims Processing Business Process Transformation, 2023

•Tech Enabled Sustainability Services, 2023–2024

•Workday HCM Services, 2023–2024

•Data Center Managed Services, 2023–2024

•Intelligent IT Ops Services, 2023–2024

•UK Digital Services, 2023–2024

•Data Management and Advanced Analytics Services, 2023

•Recognized as a Global Leader in Constellation’s 2023 ShortList Reports:

•Public Cloud Transformation Services

•AI Services

•Experience (CX) Operations Services

•Digital Transformation Services (DTX)

Conference Call

Cognizant will host a conference call on February 6, 2024, at 5:00 p.m. (Eastern) to discuss the Company’s fourth quarter 2023 results. To listen to the conference call, please dial (877) 810-9510 (domestic) or +1 (201) 493-6778 (international) and provide the following conference passcode: “Cognizant Call.”

The conference call will also be available live on the Investor Relations section of the Cognizant website at http://investors.cognizant.com. An earnings supplement will also be available on the Cognizant website at the time of the conference call.

For those who cannot access the live broadcast, a replay will be available. To listen to the replay, please dial (877) 660-6853 (domestically) or +1 (201) 612-7415 (internationally) and enter 13743343 beginning two hours after the end of the call until 11:59 p.m. (Eastern) on Tuesday, February 20, 2024. The replay will also be available at Cognizant’s website www.cognizant.com for 60 days following the call.

About Cognizant

Cognizant (Nasdaq: CTSH) engineers modern businesses. We help our clients modernize technology, reimagine processes and transform experiences so they can stay ahead in our fast-changing world. Together, we’re improving everyday life. See how at www.cognizant.com or @cognizant.

Forward-Looking Statements

This press release includes statements that may constitute forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, the accuracy of which are necessarily subject to risks, uncertainties and assumptions as to future events that may not prove to be accurate. These statements include, but are not limited to, express or implied forward-looking statements relating to our strategy, strategic partnerships and collaborations, competitive position and opportunities in the marketplace, investment in and growth of our business, the pace and magnitude of change and client needs related to generative AI, the effectiveness of our recruiting and talent efforts and related costs, labor market trends, the anticipated amount of capital to be returned to shareholders and our anticipated financial performance. These statements are neither promises nor guarantees, but are subject to a variety of risks and uncertainties, many of which are beyond our control, which could cause actual results to differ materially from those contemplated in these forward-looking statements. Existing and prospective investors are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Factors that could cause actual results to differ materially from those expressed or implied include general economic conditions, the competitive and rapidly changing nature of the markets we compete in, the competitive marketplace for talent and its impact on employee recruitment and retention, our ability to successfully implement our NextGen program and the amount of costs, timing of incurring costs and ultimate benefits of such plans, our ability to successfully use AI-based technologies, legal, reputational and financial risks resulting from cyberattacks, changes in the regulatory environment, including with respect to immigration and taxes, and the other factors discussed in our most recent Annual Report on Form 10-K and other filings with the Securities and Exchange Commission. Cognizant undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, except as may be required under applicable securities law.

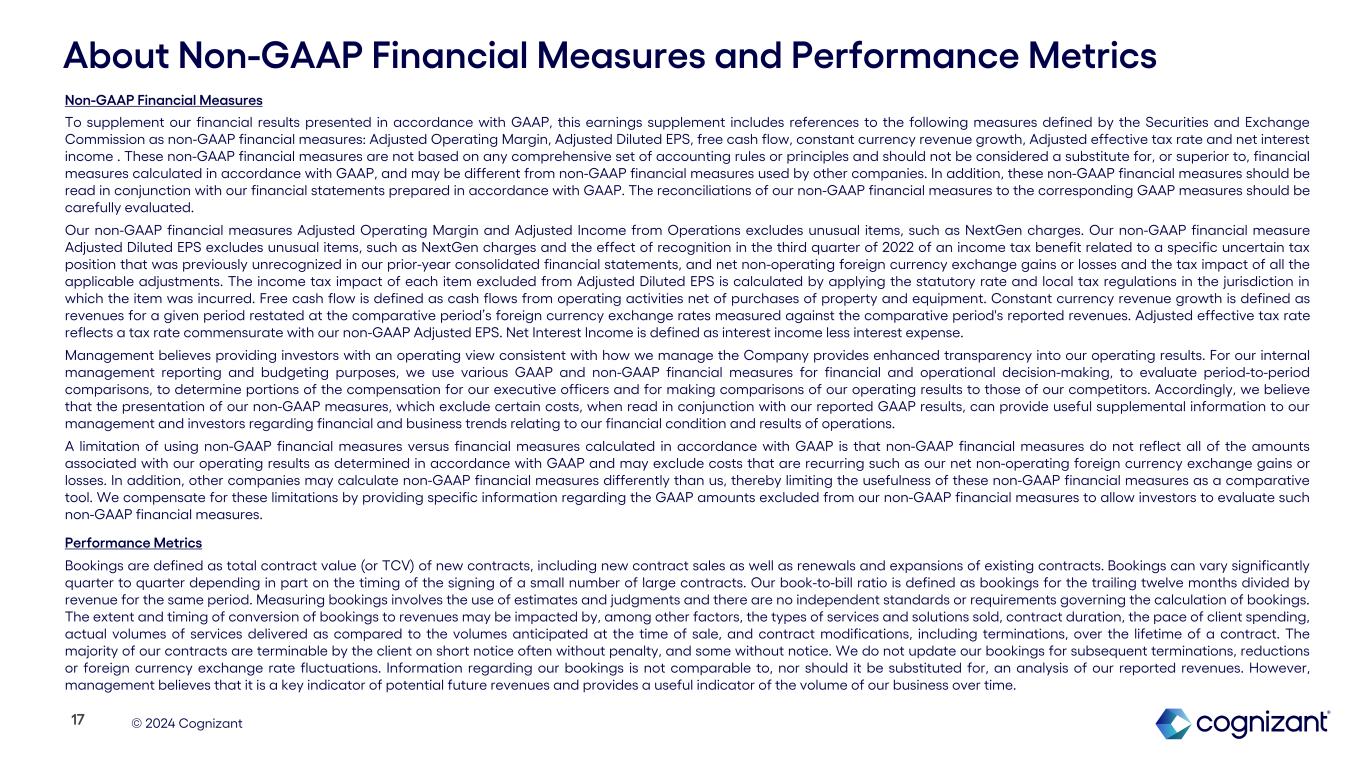

About Non-GAAP Financial Measures and Performance Metrics

Non-GAAP Financial Measures

To supplement our financial results presented in accordance with GAAP, this press release includes references to the following measures defined by the Securities and Exchange Commission as non-GAAP financial measures: Adjusted Operating Margin, Adjusted Diluted EPS, free cash flow, net cash and constant currency revenue growth. These non-GAAP financial measures are not based on any comprehensive set of accounting rules or principles and should not be considered a substitute for, or superior to, financial measures calculated in accordance with GAAP, and may be different from non-GAAP financial measures used by other companies. In addition, these non-GAAP financial measures should be read in conjunction with our financial statements prepared in accordance with GAAP. The reconciliations of our non-GAAP financial measures to the corresponding GAAP measures should be carefully evaluated.

Our non-GAAP financial measures Adjusted Operating Margin and Adjusted Income from Operations excludes unusual items, such as NextGen charges. Our non-GAAP financial measure Adjusted Diluted EPS excludes unusual items, such as Nextgen charges and the effect of recognition in the third quarter of 2022 of an income tax benefit related to a specific uncertain tax position that was previously unrecognized in our prior-year consolidated financial statements, and net non-operating foreign currency exchange gains or losses and the tax impact of all the applicable adjustments. The income tax impact of each item excluded from Adjusted Diluted EPS is calculated by applying the statutory rate and local tax regulations in the jurisdiction in which the item was incurred. Free cash flow is defined as cash flows from operating activities net of purchases of property and equipment. Net cash is defined as cash and cash equivalents and short-term investments less short-term and long-term debt. Constant currency revenue growth is defined as revenues for a given period restated at the comparative period’s foreign currency exchange rates measured against the comparative period's reported revenues.

Management believes providing investors with an operating view consistent with how we manage the Company provides enhanced transparency into our operating results. For our internal management reporting and budgeting purposes, we use various GAAP and non-GAAP financial measures for financial and operational decision-making, to evaluate period-to-period comparisons, to determine portions of the compensation for our executive officers and for making comparisons of our operating results to those of our competitors. Accordingly, we believe that the presentation of our non-GAAP measures, which exclude certain costs, when read in conjunction with our reported GAAP results, can provide useful supplemental information to our management and investors regarding financial and business trends relating to our financial condition and results of operations.

A limitation of using non-GAAP financial measures versus financial measures calculated in accordance with GAAP is that non-GAAP financial measures do not reflect all of the amounts associated with our operating results as determined in accordance with GAAP and may exclude costs that are recurring such as our net non-operating foreign currency exchange gains or losses. In addition, other companies may calculate non-GAAP financial measures differently than us, thereby limiting the usefulness of these non-GAAP financial measures as a comparative tool. We compensate for these limitations by providing specific information regarding the GAAP amounts excluded from our non-GAAP financial measures to allow investors to evaluate such non-GAAP financial measures.

Performance Metrics

Bookings are defined as total contract value (or TCV) of new contracts, including new contract sales as well as renewals and expansions of existing contracts. Bookings can vary significantly quarter to quarter depending in part on the timing of the signing of a small number of large contracts. Our book-to-bill ratio is defined as bookings for the trailing twelve months divided by revenue for the same period. Measuring bookings involves the use of estimates and judgments and there are no independent standards or requirements governing the calculation of bookings. The extent and timing of conversion of bookings to revenues may be impacted by, among other factors, the types of services and solutions sold, contract duration, the pace of client spending, actual volumes of services delivered as compared to the volumes anticipated at the time of sale, and contract modifications, including terminations, over the lifetime of a contract. The majority of our contracts are terminable by the client on short notice often without penalty, and some without notice. We do not update our bookings for subsequent terminations, reductions or foreign currency exchange rate fluctuations. Information regarding our bookings is not comparable to, nor should it be substituted for, an analysis of our reported revenues. However, management believes that it is a key indicator of potential future revenues and provides a useful indicator of the volume of our business over time.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Investor Relations Contact: |

|

|

|

Media Contact: |

| Tyler Scott |

|

|

|

Jeff DeMarrais |

| VP, Investor Relations |

|

|

|

VP, Corporate Communications |

| +1 551-220-8246 |

|

|

|

+1 475-223-2298 |

| Tyler.Scott@cognizant.com |

|

|

|

Jeff.DeMarrais@cognizant.com |

- tables to follow -

COGNIZANT TECHNOLOGY SOLUTIONS CORPORATION

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (in millions, except per share data) |

Three Months Ended

December 31, |

|

Twelve Months Ended

December 31, |

| |

2023 |

|

2022 |

|

2023 |

|

2022 |

| Revenues |

$ |

4,758 |

|

|

$ |

4,839 |

|

|

$ |

19,353 |

|

|

$ |

19,428 |

|

| Operating expenses: |

|

|

|

|

|

|

|

| Cost of revenues (exclusive of depreciation and amortization expense shown separately below) |

3,081 |

|

|

3,152 |

|

|

12,664 |

|

|

12,448 |

|

| Selling, general and administrative expenses |

786 |

|

|

860 |

|

|

3,252 |

|

|

3,443 |

|

| Restructuring charges |

40 |

|

|

— |

|

|

229 |

|

|

— |

|

| Depreciation and amortization expense |

127 |

|

|

141 |

|

|

519 |

|

|

569 |

|

| Income from operations |

724 |

|

|

686 |

|

|

2,689 |

|

|

2,968 |

|

| Other income (expense), net: |

|

|

|

|

|

|

|

| Interest income |

34 |

|

|

27 |

|

|

126 |

|

|

59 |

|

| Interest expense |

(11) |

|

|

(8) |

|

|

(41) |

|

|

(19) |

|

| Foreign currency exchange gains (losses), net |

(1) |

|

|

8 |

|

|

2 |

|

|

7 |

|

| Other, net |

3 |

|

|

1 |

|

|

11 |

|

|

1 |

|

| Total other income (expense), net |

25 |

|

|

28 |

|

|

98 |

|

|

48 |

|

| Income before provision for income taxes |

749 |

|

|

714 |

|

|

2,787 |

|

|

3,016 |

|

| Provision for income taxes |

(195) |

|

|

(193) |

|

|

(668) |

|

|

(730) |

|

| Income (loss) from equity method investment |

4 |

|

|

— |

|

|

7 |

|

|

4 |

|

| Net income |

$ |

558 |

|

|

$ |

521 |

|

|

$ |

2,126 |

|

|

$ |

2,290 |

|

| Basic earnings per share |

$ |

1.12 |

|

|

$ |

1.02 |

|

|

$ |

4.21 |

|

|

$ |

4.42 |

|

| Diluted earnings per share |

$ |

1.11 |

|

|

$ |

1.02 |

|

|

$ |

4.21 |

|

|

$ |

4.41 |

|

| Weighted average number of common shares outstanding - Basic |

500 |

|

|

512 |

|

|

505 |

|

|

518 |

|

| Dilutive effect of shares issuable under stock-based compensation plans |

1 |

|

|

1 |

|

|

— |

|

|

1 |

|

| Weighted average number of common shares outstanding - Diluted |

501 |

|

|

513 |

|

|

505 |

|

|

519 |

|

COGNIZANT TECHNOLOGY SOLUTIONS CORPORATION

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

(in millions, except par values) |

December 31,

2023 |

|

December 31, 2022 |

| Assets |

|

|

|

| Current assets: |

|

|

|

| Cash and cash equivalents |

$ |

2,621 |

|

|

$ |

2,191 |

|

| Short-term investments |

14 |

|

|

310 |

|

| Trade accounts receivable, net |

3,849 |

|

|

3,796 |

|

| Other current assets |

1,022 |

|

|

969 |

|

| Total current assets |

7,506 |

|

|

7,266 |

|

| Property and equipment, net |

1,048 |

|

|

1,101 |

|

| Operating lease assets, net |

611 |

|

|

876 |

|

| Goodwill |

6,085 |

|

|

5,710 |

|

| Intangible assets, net |

1,149 |

|

|

1,168 |

|

| Deferred income tax assets, net |

993 |

|

|

642 |

|

| Long-term investments |

435 |

|

|

427 |

|

| Other noncurrent assets |

656 |

|

|

662 |

|

| Total assets |

$ |

18,483 |

|

|

$ |

17,852 |

|

| Liabilities and Stockholders’ Equity |

|

|

|

| Current liabilities: |

|

|

|

| Accounts payable |

$ |

337 |

|

|

$ |

360 |

|

| Deferred revenue |

385 |

|

|

398 |

|

| Short-term debt |

33 |

|

|

8 |

|

| Operating lease liabilities |

153 |

|

|

174 |

|

| Accrued expenses and other current liabilities |

2,425 |

|

|

2,407 |

|

| Total current liabilities |

3,333 |

|

|

3,347 |

|

| Deferred revenue, noncurrent |

42 |

|

|

19 |

|

| Operating lease liabilities, noncurrent |

523 |

|

|

714 |

|

| Deferred income tax liabilities, net |

226 |

|

|

180 |

|

| Long-term debt |

606 |

|

|

638 |

|

| Long-term income taxes payable |

157 |

|

|

283 |

|

| Other noncurrent liabilities |

369 |

|

|

362 |

|

| Total liabilities |

5,256 |

|

|

5,543 |

|

| Stockholders’ equity: |

|

|

|

| Preferred stock, $0.10 par value, 15 shares authorized, none issued |

— |

|

|

— |

|

Class A common stock, $0.01 par value, 1,000 shares authorized, 498 and 509 shares issued and outstanding as of December 31, 2023 and 2022, respectively |

5 |

|

|

5 |

|

| Additional paid-in capital |

15 |

|

|

15 |

|

| Retained earnings |

13,301 |

|

|

12,588 |

|

| Accumulated other comprehensive income (loss) |

(94) |

|

|

(299) |

|

| Total stockholders’ equity |

13,227 |

|

|

12,309 |

|

| Total liabilities and stockholders’ equity |

$ |

18,483 |

|

|

$ |

17,852 |

|

COGNIZANT TECHNOLOGY SOLUTIONS CORPORATION

Reconciliations of Non-GAAP Financial Measures

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (dollars in millions, except per share amounts) |

Three Months Ended

December 31, |

|

Twelve Months Ended

December 31, |

|

|

|

Guidance |

| |

2023 |

|

2022 |

|

2023 |

|

2022 |

|

|

|

Full Year 2024 (1) |

| GAAP income from operations |

$ |

724 |

|

|

$ |

686 |

|

|

$ |

2,689 |

|

|

$ |

2,968 |

|

|

|

|

|

NextGen charges(a) |

40 |

|

|

— |

|

|

229 |

|

|

— |

|

|

|

|

|

| Adjusted Income From Operations |

$ |

764 |

|

|

$ |

686 |

|

|

$ |

2,918 |

|

|

$ |

2,968 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP operating margin |

15.2 |

% |

|

14.2 |

% |

|

13.9 |

% |

|

15.3 |

% |

|

|

|

|

| NextGen charges |

0.9 |

|

|

— |

|

|

1.2 |

|

|

— |

|

|

|

|

0.3% - 0.4% |

Adjusted Operating Margin |

16.1 |

% |

|

14.2 |

% |

|

15.1 |

% |

|

15.3 |

% |

|

|

|

15.3% - 15.5% |

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP diluted earnings per share |

$ |

1.11 |

|

|

$ |

1.02 |

|

|

$ |

4.21 |

|

|

$ |

4.41 |

|

|

|

|

|

| Effect of NextGen charges, pre-tax |

0.08 |

|

|

— |

|

|

0.45 |

|

|

— |

|

|

|

|

0.14 |

Non-operating foreign currency exchange (gains) losses, pre-tax(b) |

— |

|

|

(0.02) |

|

|

— |

|

|

(0.01) |

|

|

|

|

(b) |

Tax effect of above adjustments(c) |

(0.01) |

|

|

0.01 |

|

|

(0.11) |

|

|

0.07 |

|

|

|

|

(a) (b) |

Effect of recognition of income tax benefit related to an uncertain tax position(d) |

— |

|

|

— |

|

|

— |

|

|

(0.07) |

|

|

|

|

— |

| Adjusted Diluted Earnings Per Share |

$ |

1.18 |

|

|

$ |

1.01 |

|

|

$ |

4.55 |

|

|

$ |

4.40 |

|

|

|

|

$4.50 - $4.68 |

(1) A full reconciliation of Adjusted Operating Margin and Adjusted Diluted Earnings Per Share guidance to the corresponding GAAP measures on a forward-looking basis cannot be provided without unreasonable efforts, as we are unable to provide reconciling information with respect to unusual items, net non-operating foreign currency exchange gains or losses and the tax effects of these adjustments, and such adjustments may be significant.

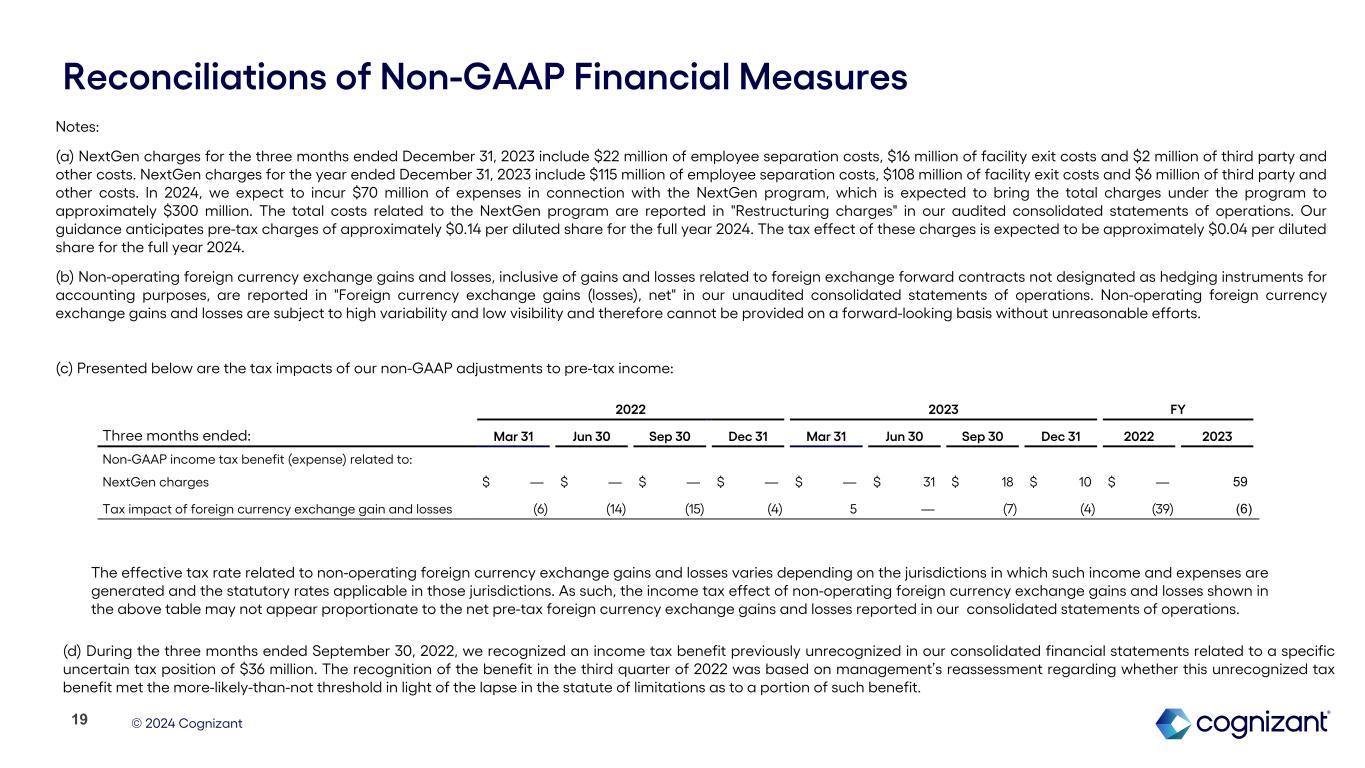

Notes:

(a)NextGen charges for the three months ended December 31, 2023 include $22 million of employee separation costs, $16 million of facility exit costs and $2 million of third party and other costs. NextGen charges for the year ended December 31, 2023 include $115 million of employee separation costs, $108 million of facility exit costs and $6 million of third party and other costs. In 2024, we expect to incur $70 million of expenses in connection with the NextGen program, which is expected to bring the total charges under the program to approximately $300 million. The total costs related to the NextGen program are reported in "Restructuring charges" in our unaudited consolidated statements of operations. Our guidance anticipates pre-tax charges of approximately $0.14 per diluted share for the full year 2024. The tax effect of these charges is expected to be approximately $0.04 per diluted share for the full year 2024.

(b)Non-operating foreign currency exchange gains and losses, inclusive of gains and losses on related foreign exchange forward contracts not designated as hedging instruments for accounting purposes, are reported in "Foreign currency exchange gains (losses), net" in our unaudited consolidated statements of operations. Non-operating foreign currency exchange gains and losses are subject to high variability and low visibility and therefore cannot be provided on a forward-looking basis without unreasonable efforts.

(c)Presented below are the tax impacts of our non-GAAP adjustment to pre-tax income for the:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (in millions) |

Three Months Ended

December 31, |

|

Twelve Months Ended December 31, |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

| Non-GAAP income tax benefit (expense) related to: |

|

|

|

|

|

|

|

| NextGen charges |

$ |

10 |

|

|

$ |

— |

|

|

$ |

59 |

|

|

$ |

— |

|

Foreign currency exchange gains and losses |

(4) |

|

|

(4) |

|

|

(6) |

|

|

(39) |

|

The effective tax rate related to non-operating foreign currency exchange gains and losses varies depending on the jurisdictions in which such income and expenses are generated and the statutory rates applicable in those jurisdictions. As such, the income tax effect of non-operating foreign currency exchange gains and losses shown in the above table may not appear proportionate to the net pre-tax foreign currency exchange gains and losses reported in our unaudited consolidated statements of operations.

(d)As previously reported in our Annual Report on Form 10-K, during the three months ended September 30, 2022, we recognized an income tax benefit of $36 million related to a specific uncertain tax position that was previously

unrecognized in our prior-year consolidated financial statements. The recognition of the benefit in the third quarter of 2022 was based on management’s reassessment regarding whether this unrecognized tax benefit met the more-likely-than-not threshold in light of the lapse in the statute of limitations as to a portion of such benefit.

Reconciliations of Net Cash

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in millions) |

|

December 31, 2023 |

|

December 31, 2022 |

Cash and unrestricted cash equivalents |

|

$ |

2,621 |

|

|

$ |

2,191 |

|

| Short-term investments |

|

14 |

|

|

310 |

|

| Less: |

|

|

|

|

| Short-term debt |

|

33 |

|

|

8 |

|

| Long-term debt |

|

606 |

|

|

638 |

|

| Net cash |

|

$ |

1,996 |

|

|

$ |

1,855 |

|

The above tables serve to reconcile the Non-GAAP financial measures to the most directly comparable GAAP measures. Refer to the “About Non-GAAP Financial Measures and Performance Metrics” section of our press release for further information on the use of these Non-GAAP measures.

COGNIZANT TECHNOLOGY SOLUTIONS CORPORATION

Revenue by Business Segment and Geography

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (dollars in millions) |

Three Months Ended December 31, 2023 |

|

|

|

|

|

Year over Year |

| |

$ |

|

% of total |

|

% Change |

|

Constant Currency % Change (a) |

| Revenues by Segment: |

|

|

|

|

|

|

|

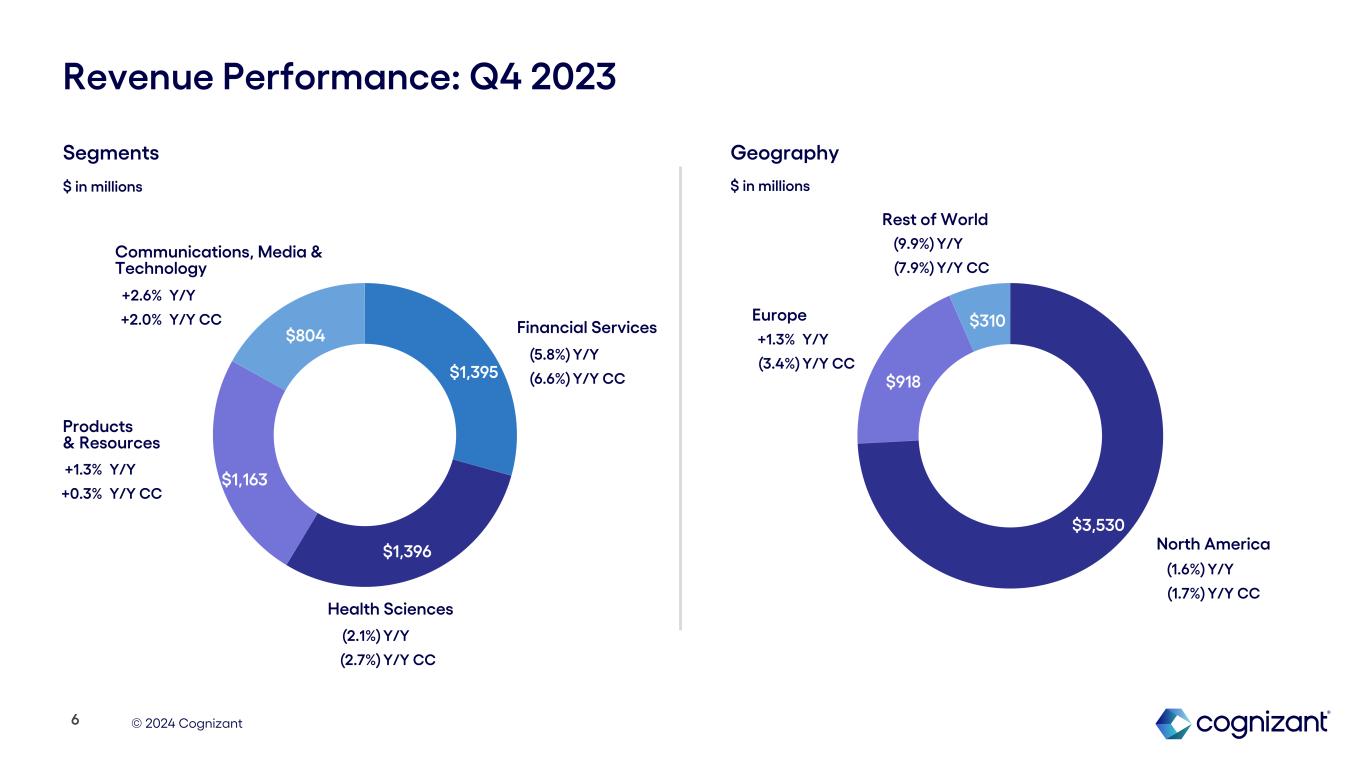

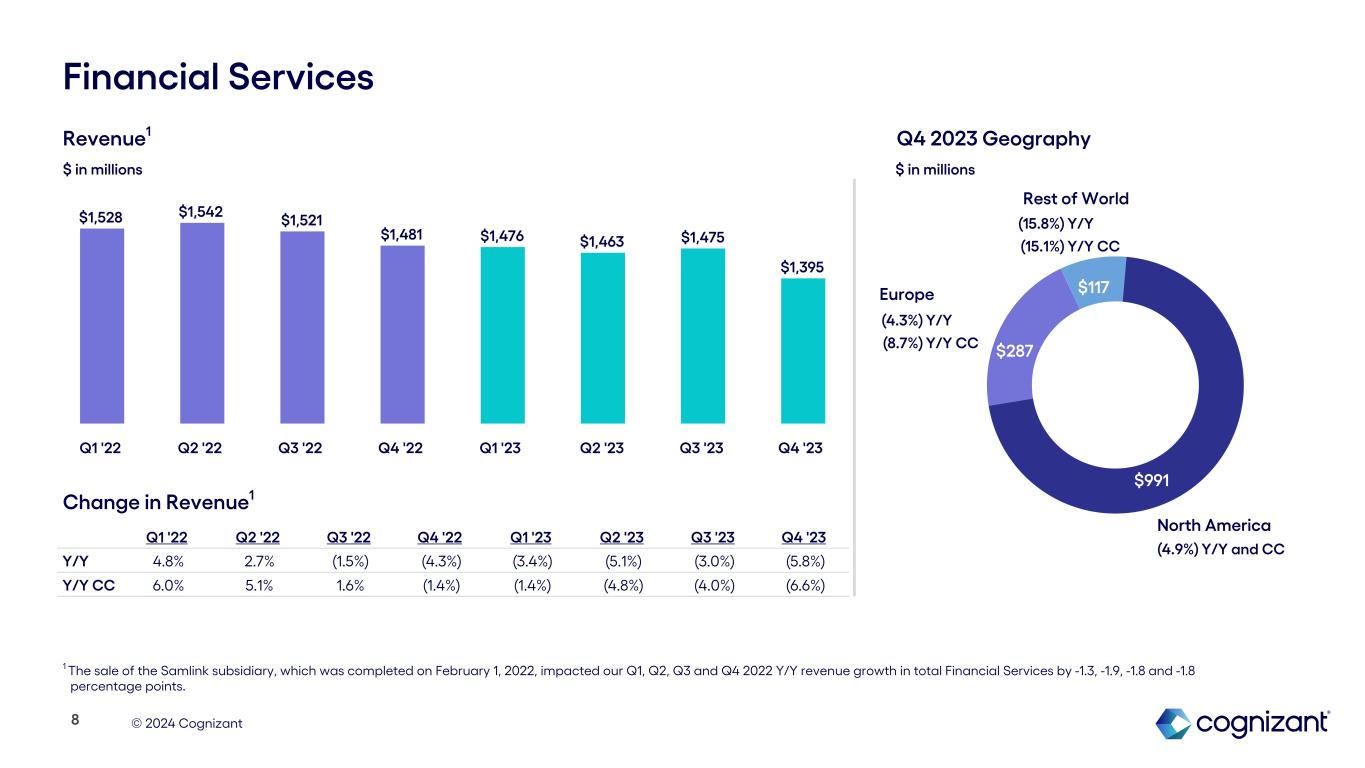

| Financial Services |

$ |

1,395 |

|

|

29.3 |

% |

|

(5.8) |

% |

|

(6.6) |

% |

| Health Sciences |

1,396 |

|

|

29.3 |

% |

|

(2.1) |

% |

|

(2.7) |

% |

| Products and Resources |

1,163 |

|

|

24.5 |

% |

|

1.3 |

% |

|

0.3 |

% |

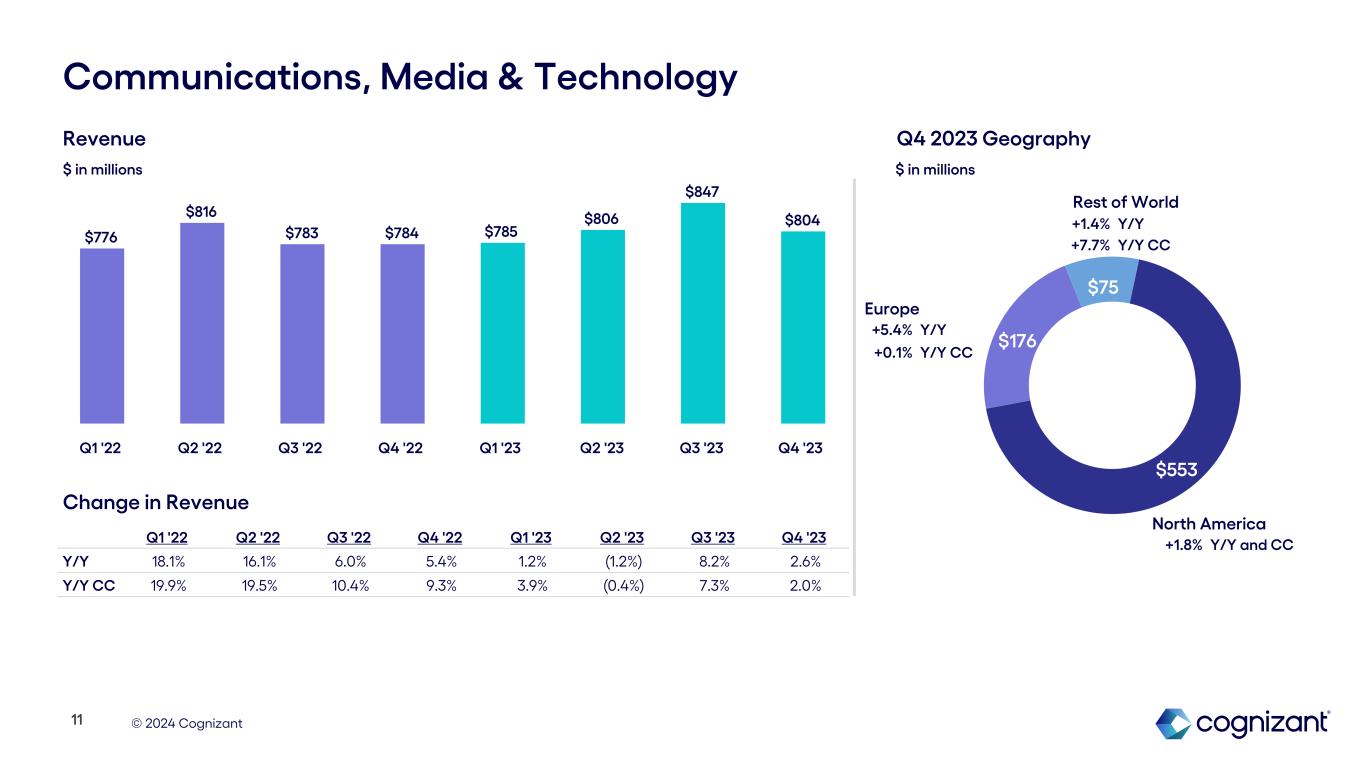

| Communications, Media and Technology |

804 |

|

|

16.9 |

% |

|

2.6 |

% |

|

2.0 |

% |

| Total Revenues |

$ |

4,758 |

|

|

|

|

(1.7) |

% |

|

(2.4) |

% |

| Revenues by Geography: |

|

|

|

|

|

|

|

| North America |

$ |

3,530 |

|

|

74.2 |

% |

|

(1.6) |

% |

|

(1.7) |

% |

| United Kingdom |

448 |

|

|

9.4 |

% |

|

(1.1) |

% |

|

(5.8) |

% |

| Continental Europe |

470 |

|

|

9.9 |

% |

|

3.8 |

% |

|

(1.0) |

% |

Europe - Total |

918 |

|

|

19.3 |

% |

|

1.3 |

% |

|

(3.4) |

% |

| Rest of World |

310 |

|

|

6.5 |

% |

|

(9.9) |

% |

|

(7.9) |

% |

| Total Revenues |

$ |

4,758 |

|

|

|

|

(1.7) |

% |

|

(2.4) |

% |

|

|

|

|

|

|

|

|

| |

Twelve Months Ended December 31, 2023 |

|

|

|

|

|

Year over Year |

| |

$ |

|

% of total |

|

% Change |

|

Constant Currency % Change (a) |

| Revenues by Segment: |

|

|

|

|

|

|

|

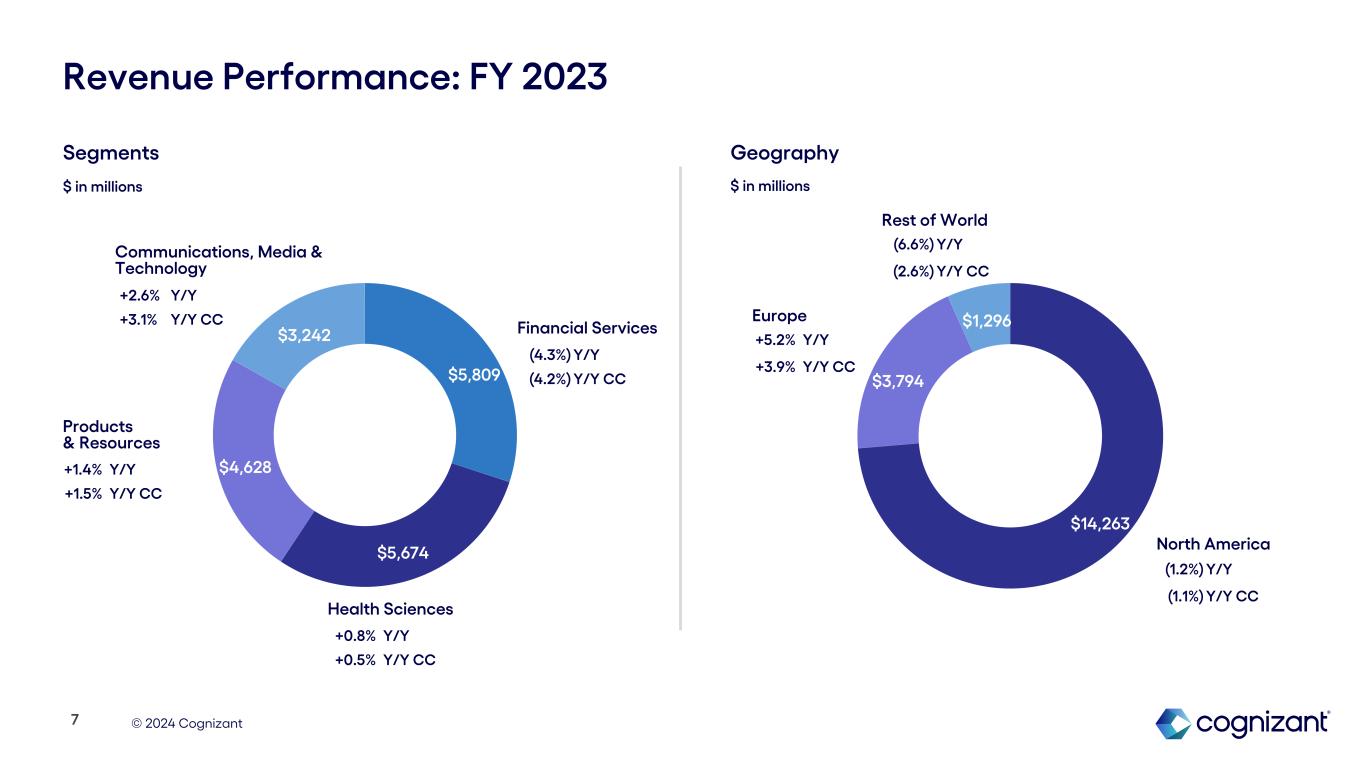

| Financial Services |

$ |

5,809 |

|

|

30.0 |

% |

|

(4.3) |

% |

|

(4.2) |

% |

| Health Sciences |

5,674 |

|

|

29.3 |

% |

|

0.8 |

% |

|

0.5 |

% |

| Products and Resources |

4,628 |

|

|

23.9 |

% |

|

1.4 |

% |

|

1.5 |

% |

| Communications, Media and Technology |

3,242 |

|

|

16.8 |

% |

|

2.6 |

% |

|

3.1 |

% |

| Total Revenues |

$ |

19,353 |

|

|

|

|

(0.4) |

% |

|

(0.3) |

% |

| Revenues by Geography: |

|

|

|

|

|

|

|

| North America |

$ |

14,263 |

|

|

73.7 |

% |

|

(1.2) |

% |

|

(1.1) |

% |

| United Kingdom |

1,885 |

|

|

9.7 |

% |

|

4.1 |

% |

|

3.5 |

% |

| Continental Europe |

1,909 |

|

|

9.9 |

% |

|

6.4 |

% |

|

4.3 |

% |

| Europe - Total |

3,794 |

|

|

19.6 |

% |

|

5.2 |

% |

|

3.9 |

% |

| Rest of World |

1,296 |

|

|

6.7 |

% |

|

(6.6) |

% |

|

(2.6) |

% |

| Total Revenues |

$ |

19,353 |

|

|

|

|

(0.4) |

% |

|

(0.3) |

% |

Notes:

(a)Constant currency revenue growth is not a measure of financial performance prepared in accordance with GAAP. See “About Non-GAAP Financial Measures and Performance Metrics” section of our press release for further information.

COGNIZANT TECHNOLOGY SOLUTIONS CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in millions) |

Three Months Ended

December 31, |

|

Twelve Months Ended

December 31, |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

| Cash flows from operating activities: |

|

|

|

|

|

|

|

| Net income |

$ |

558 |

|

|

$ |

521 |

|

|

$ |

2,126 |

|

|

$ |

2,290 |

|

| Adjustments for non-cash income and expenses |

71 |

|

|

18 |

|

|

393 |

|

|

602 |

|

| Changes in assets and liabilities |

108 |

|

|

163 |

|

|

(189) |

|

|

(324) |

|

| Net cash provided by operating activities |

737 |

|

|

702 |

|

|

2,330 |

|

|

2,568 |

|

| Cash flows from investing activities: |

|

|

|

|

|

|

|

| Purchases of property and equipment |

(78) |

|

|

(90) |

|

|

(317) |

|

|

(332) |

|

Net maturities of investments |

246 |

|

|

379 |

|

|

395 |

|

|

565 |

|

| Proceeds from sales of businesses |

— |

|

|

— |

|

|

— |

|

|

28 |

|

| Payments for business combinations, net of cash acquired |

— |

|

|

(367) |

|

|

(409) |

|

|

(367) |

|

Net cash provided by (used in) investing activities |

168 |

|

|

(78) |

|

|

(331) |

|

|

(106) |

|

| Cash flows from financing activities: |

|

|

|

|

|

|

|

| Repurchases of common stock |

(313) |

|

|

(315) |

|

|

(1,064) |

|

|

(1,422) |

|

Net change in term loan borrowings and finance lease and earnout obligations |

(10) |

|

|

8 |

|

|

(25) |

|

|

(39) |

|

|

|

|

|

|

|

|

|

| Dividends paid |

(146) |

|

|

(139) |

|

|

(591) |

|

|

(564) |

|

| Issuance of common stock under stock-based compensation plans |

14 |

|

|

15 |

|

|

71 |

|

|

86 |

|

| Net cash (used in) financing activities |

(455) |

|

|

(431) |

|

|

(1,609) |

|

|

(1,939) |

|

Effect of exchange rate changes on cash, cash equivalents and restricted cash and cash equivalents |

63 |

|

|

59 |

|

|

33 |

|

|

(21) |

|

Increase in cash, cash equivalents and restricted cash and cash equivalents |

513 |

|

|

252 |

|

|

423 |

|

|

502 |

|

| Cash, cash equivalents and restricted cash, beginning of period |

2,204 |

|

|

2,042 |

|

|

2,294 |

|

|

1,792 |

|

Cash, cash equivalents and restricted cash and cash equivalents, end of period |

$ |

2,717 |

|

|

$ |

2,294 |

|

|

$ |

2,717 |

|

|

$ |

2,294 |

|

SUPPLEMENTAL CASH FLOW INFORMATION

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (in millions) |

|

Three Months Ended

December 31,

|

| Stock Repurchases under Board of Directors' authorized stock repurchase program: |

|

2023 |

|

2022 |

| Number of shares repurchased |

|

4.2 |

|

|

5.2 |

|

|

|

|

|

|

Remaining authorized balance as of December 31, 2023 |

|

$ |

1,777 |

|

|

|

Reconciliation of Free Cash Flow Non-GAAP Financial Measure

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in millions) |

Three Months Ended

December 31, |

|

Twelve Months Ended

December 31, |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

| Net cash provided by operating activities |

$ |

737 |

|

|

$ |

702 |

|

|

$ |

2,330 |

|

|

$ |

2,568 |

|

Purchases of property and equipment |

(78) |

|

|

(90) |

|

|

(317) |

|

|

(332) |

|

| Free cash flow |

$ |

659 |

|

|

$ |

612 |

|

|

$ |

2,013 |

|

|

$ |

2,236 |

|