Document

Exhibit 99.1

COGNIZANT REPORTS THIRD QUARTER 2022 RESULTS

•Revenue of $4.9 billion grew 2.4% year-over-year, or 5.6% in constant currency1

•Operating Margin and Adjusted Operating Margin of 16.4%, an increase of 100 and 60 basis points year-over-year, respectively

•Operating cash flow of $1,032 million and free cash flow1 of $953 million

•Over $1.5 billion deployed on share repurchases and dividends year-to-date

•Board of Directors approved an increase of $2 billion to the share repurchase authorization

•Revised full-year 2022 revenue growth guidance to 4.5%, or 7.0% in constant currency

TEANECK, N.J., November 2, 2022 - Cognizant (Nasdaq: CTSH), one of the world’s leading professional services companies, today announced its third quarter 2022 financial results.

“Revenue and bookings were below our expectations as company specific fulfillment challenges were compounded by the impact of an uncertain macroeconomic backdrop,” said Brian Humphries, Chief Executive Officer. “We are confident the steps we are taking will return the company to accelerated growth over the medium to long term.”

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q3 2022 |

|

Q3 2021 |

|

|

|

|

|

|

|

| Revenue (in billions) |

$4.9 |

|

$4.7 |

|

|

|

|

|

|

|

| Y/Y Growth |

2.4% |

|

11.8% |

|

|

|

|

|

|

|

Y/Y Growth CC1 |

5.6 |

% |

|

11.0 |

% |

|

|

|

|

|

|

| GAAP Operating Margin |

16.4 |

% |

|

15.4 |

% |

|

|

|

|

|

|

|

Adjusted Operating Margin1 |

16.4 |

% |

|

15.8 |

% |

|

|

|

|

|

|

|

| GAAP Diluted EPS |

$1.22 |

|

$1.03 |

|

|

|

|

|

|

|

Adjusted Diluted EPS1 |

$1.17 |

|

$1.06 |

|

|

|

|

|

|

Third Quarter 2022 Performance by Business Segment

Financial Services revenue declined 1.5% year-over-year, but grew 1.6% in constant currency. Growth was driven by digital services among public sector clients in the United Kingdom and insurance clients. Growth was offset by 180 basis points negative impact related to the previously disclosed sale of the Samlink subsidiary (completed February 1, 2022).

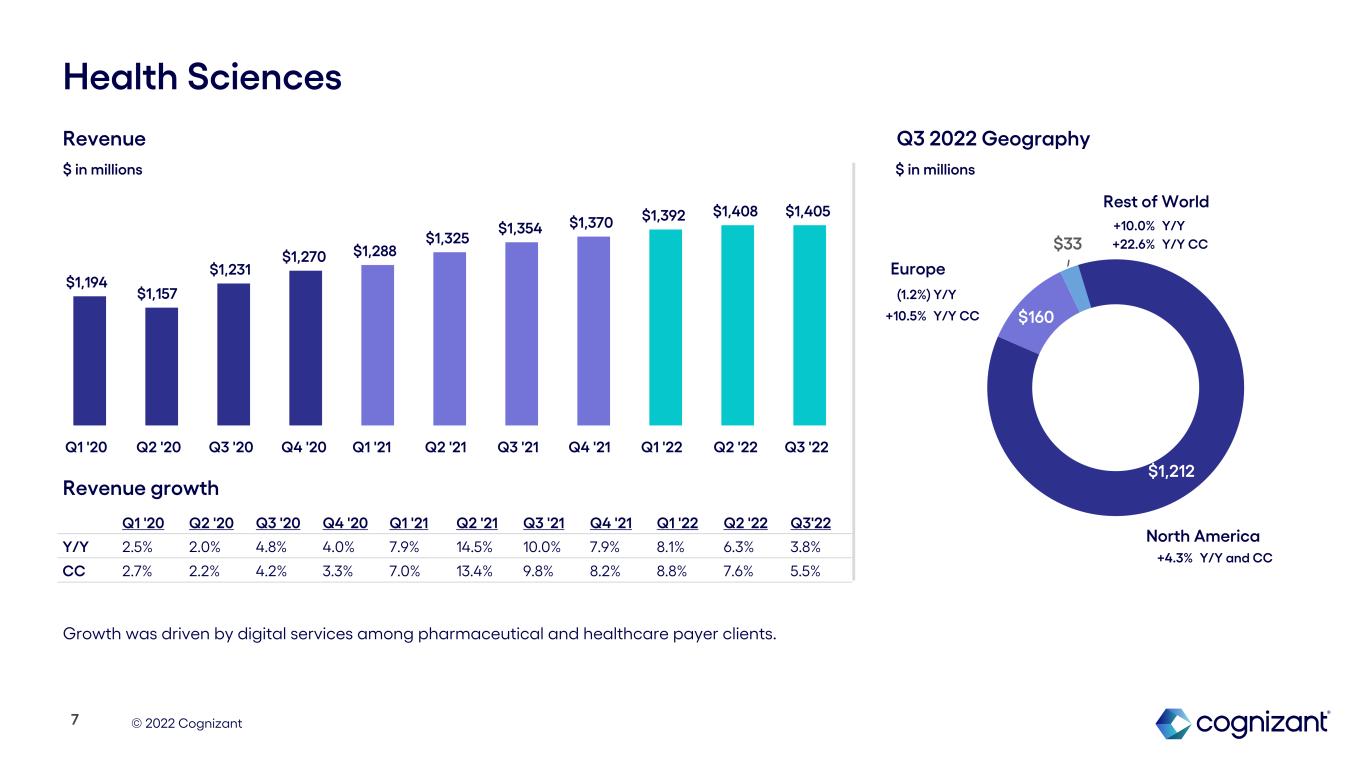

Health Sciences revenue grew 3.8% year-over-year, or 5.5% in constant currency. Growth was driven by digital services among pharmaceutical and healthcare payer clients.

Products and Resources revenue grew 3.7% year-over-year, or 8.2% in constant currency, driven by digital services among logistics, automotive, consumer goods and travel and hospitality clients.

1 Constant currency ("CC") revenue growth, Adjusted Operating Margin, Adjusted Diluted Earnings Per Share ("Adjusted Diluted EPS") and free cash flow are not measures of financial performance prepared in accordance with GAAP. See “About Non-GAAP Financial Measures and Performance Metrics” for more information and, where applicable, reconciliations to the most directly comparable GAAP financial measures.

Communications, Media and Technology revenue grew 6.0% year-over-year, or 10.4% in constant currency, driven by strength among digital native companies.

Bookings

Bookings in the quarter declined 2% year-over-year and represented an in-period book-to-bill of approximately 1.0x. This resulted in trailing 12-month bookings of $23.1 billion, which represented a book-to-bill of approximately 1.2x.

Return of Capital to Shareholders

The Company repurchased 4.6 million shares for $300 million during the third quarter and 13.9 million shares for $1.0 billion year-to-date under its share repurchase program. As of September 30, 2022, there was $1.1 billion remaining under the share repurchase authorization. On November 1, 2022, the Company increased its share repurchase authorization by $2 billion. On November 2, 2022, the Company declared a quarterly cash dividend of $0.27 per share for shareholders of record on November 18, 2022. This dividend is payable on November 29, 2022.

“Strong free cash flow conversion and a healthy balance sheet have allowed us to return $1.5 billion to shareholders year-to-date while maintaining flexibility to pursue future acquisitions. Our revised 2022 revenue guidance reflects year-to-date results, currency headwinds and an uncertain macroeconomic environment,” said Jan Siegmund, Chief Financial Officer. “We are carefully monitoring the demand picture while driving operational discipline to better position the company for revenue growth opportunities."

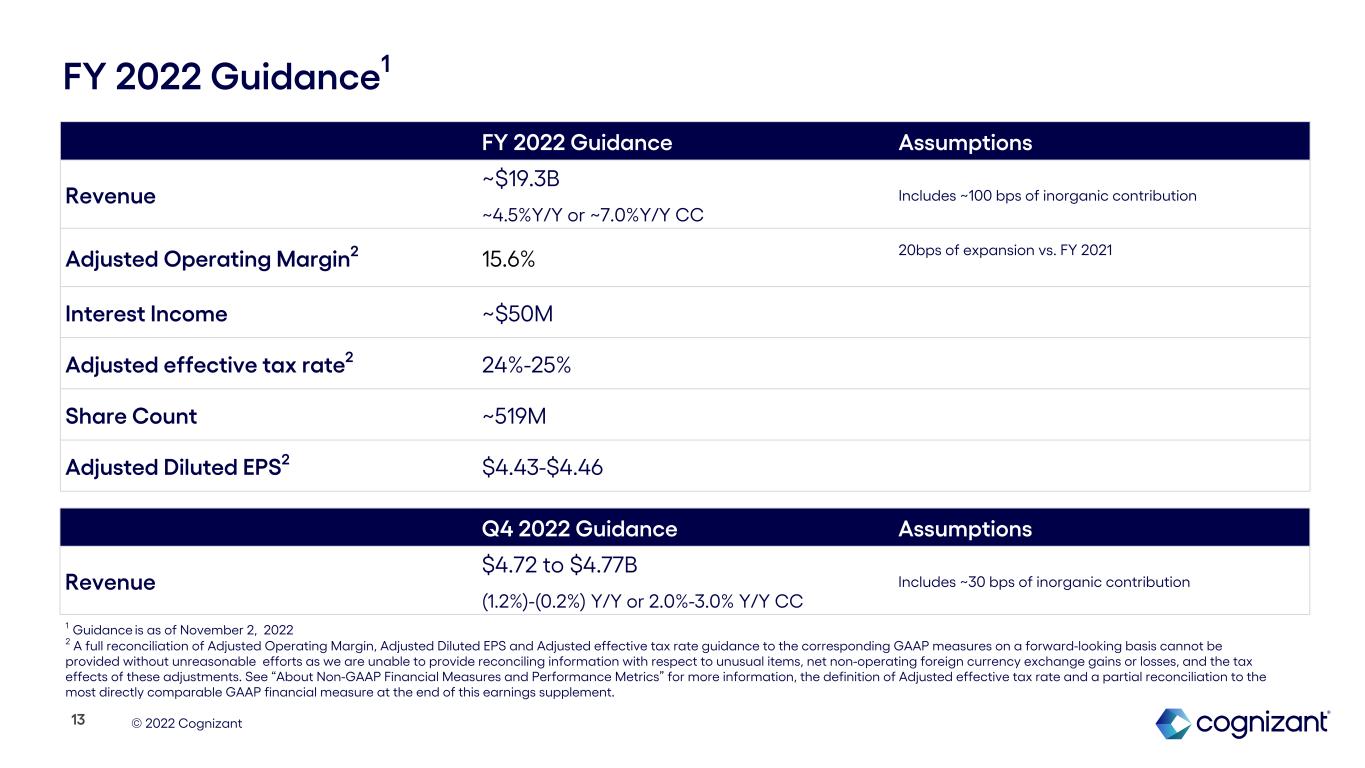

Fourth Quarter and Full Year 2022 Outlook

The Company provided the following guidance:

•Fourth quarter revenue is expected to be $4.72-$4.77 billion, or a decline of 0.2%-1.2% (growth of 2.0%-3.0% in constant currency).

•Full-year 2022 revenue is expected to be approximately $19.3 billion, or growth of 4.5% (7.0% in constant currency).

•Full-year 2022 Adjusted Operating Margin2 is expected to expand 20 basis points to 15.6%.2

•Full-year 2022 Adjusted Diluted EPS2 is expected to be in the range of $4.43-$4.46.

Conference Call

Cognizant will host a conference call on November 2, 2022, at 5:00 p.m. (Eastern) to discuss the Company’s third quarter 2022 results. To listen to the conference call, please dial (877) 810-9510 (domestic) or +1 (201) 493-6778 (international) and provide the following conference passcode: “Cognizant Call.”

The conference call will also be available live on the Investor Relations section of the Cognizant website at http://investors.cognizant.com. An earnings supplement will also be available on the Cognizant website at the time of the conference call.

2 A full reconciliation of Adjusted Operating Margin and Adjusted Diluted EPS guidance to the corresponding GAAP measure on a forward-looking basis cannot be provided without unreasonable efforts, as we are unable to provide reconciling information with respect to unusual items. See “About Non-GAAP Financial Measures and Performance Metrics” for more information and a reconciliation at the end of this release.

For those who cannot access the live broadcast, a replay will be available. To listen to the replay, please dial (877) 660-6853 (domestically) or +1 (201) 612-7415 (internationally) and enter 13732397 beginning two hours after the end of the call until 11:59 p.m. (Eastern) on Wednesday, November 16, 2022. The replay will also be available at Cognizant’s website www.cognizant.com for 60 days following the call.

About Cognizant

Cognizant (Nasdaq: CTSH) engineers modern businesses. We help our clients modernize technology, reimagine processes and transform experiences so they can stay ahead in our fast-changing world. Together, we’re improving everyday life. See how at www.cognizant.com or @cognizant.

Forward-Looking Statements

This press release includes statements that may constitute forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, the accuracy of which are necessarily subject to risks, uncertainties, and assumptions as to future events that may not prove to be accurate. These statements include, but are not limited to, express or implied forward-looking statements relating to our expectations regarding the impact of the COVID-19 pandemic on our business, our strategy, competitive position and opportunities in the marketplace, investment in and growth of our business, the effectiveness of our recruiting and talent efforts and related costs, trends in demand for digital solutions and services, labor market trends, the anticipated amount of capital to be returned to shareholders and our anticipated financial performance. These statements are neither promises nor guarantees, but are subject to a variety of risks and uncertainties, many of which are beyond our control, which could cause actual results to differ materially from those contemplated in these forward-looking statements. Existing and prospective investors are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Factors that could cause actual results to differ materially from those expressed or implied include general economic conditions, the competitive and rapidly changing nature of the markets we compete in, the competitive marketplace for talent and its impact on employee recruitment and retention, legal, reputational and financial risks resulting from cyberattacks, the impact of and effectiveness of business continuity plans during the COVID-19 pandemic, risks related to the invasion of Ukraine by Russia, changes in the regulatory environment, including with respect to immigration and taxes, and the other factors discussed in our most recent Annual Report on Form 10-K and other filings with the Securities and Exchange Commission. Cognizant undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, except as may be required under applicable securities law.

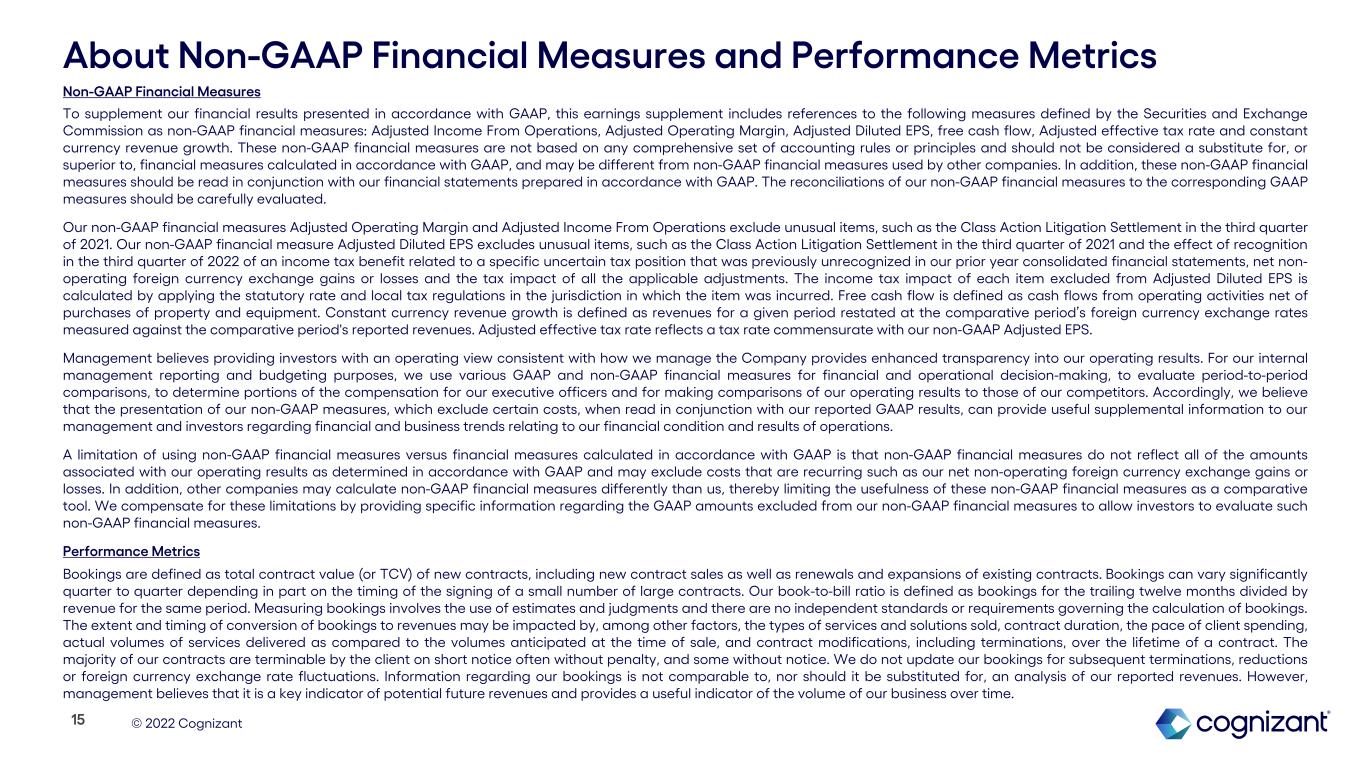

About Non-GAAP Financial Measures and Performance Metrics

Non-GAAP Financial Measures

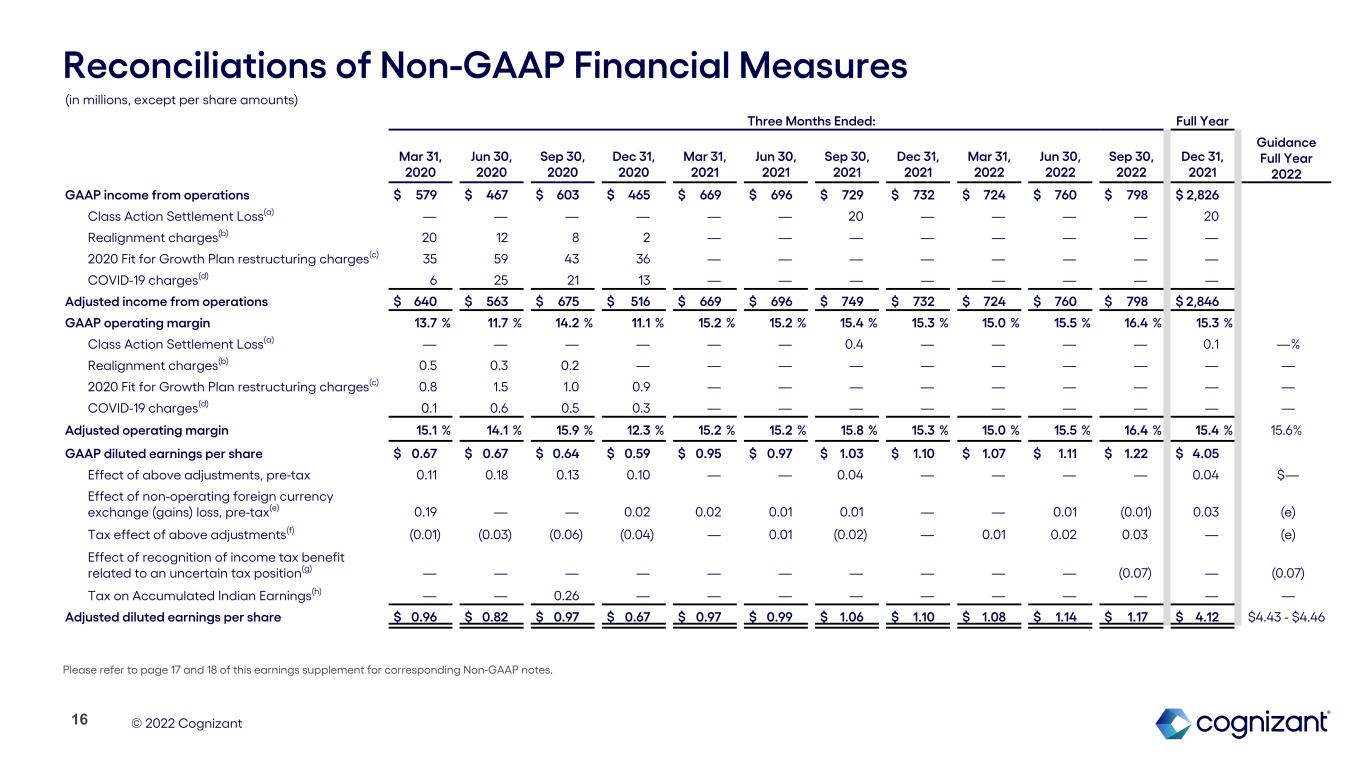

To supplement our financial results presented in accordance with GAAP, this press release includes references to the following measures defined by the Securities and Exchange Commission as non-GAAP financial measures: Adjusted Income From Operations, Adjusted Operating Margin, Adjusted Diluted EPS, free cash flow, net cash and constant currency revenue growth. These non-GAAP financial measures are not based on any comprehensive set of accounting rules or principles and should not be considered a substitute for, or superior to, financial measures calculated in accordance with GAAP, and may be different from non-GAAP financial measures used by other companies. In addition, these non-GAAP financial measures should be read in conjunction with our financial statements prepared in accordance with GAAP. The reconciliations of our non-GAAP financial measures to the corresponding GAAP measures should be carefully evaluated.

Our non-GAAP financial measures Adjusted Operating Margin and Adjusted Income From Operations exclude unusual items, such as the Class Action Litigation Settlement in the third quarter of 2021. Our non-GAAP financial measure Adjusted Diluted EPS excludes unusual items, such as the Class

Action Litigation Settlement in the third quarter of 2021 and the effect of recognition in the third quarter of 2022 of an income tax benefit related to a specific uncertain tax position that was previously unrecognized in our prior year consolidated financial statements, net non-operating foreign currency exchange gains or losses and the tax impact of all the applicable adjustments. The income tax impact of each item excluded from Adjusted Diluted EPS is calculated by applying the statutory rate and local tax regulations in the jurisdiction in which the item was incurred. Free cash flow is defined as cash flows from operating activities net of purchases of property and equipment. Net cash is defined as cash and cash equivalents and short-term investments less short-term and long-term debt. Constant currency revenue growth is defined as revenues for a given period restated at the comparative period’s foreign currency exchange rates measured against the comparative period's reported revenues.

Management believes providing investors with an operating view consistent with how we manage the Company provides enhanced transparency into our operating results. For our internal management reporting and budgeting purposes, we use various GAAP and non-GAAP financial measures for financial and operational decision-making, to evaluate period-to-period comparisons, to determine portions of the compensation for our executive officers and for making comparisons of our operating results to those of our competitors. Accordingly, we believe that the presentation of our non-GAAP measures, which exclude certain costs, when read in conjunction with our reported GAAP results, can provide useful supplemental information to our management and investors regarding financial and business trends relating to our financial condition and results of operations.

A limitation of using non-GAAP financial measures versus financial measures calculated in accordance with GAAP is that non-GAAP financial measures do not reflect all of the amounts associated with our operating results as determined in accordance with GAAP and may exclude costs that are recurring such as our net non-operating foreign currency exchange gains or losses. In addition, other companies may calculate non-GAAP financial measures differently than us, thereby limiting the usefulness of these non-GAAP financial measures as a comparative tool. We compensate for these limitations by providing specific information regarding the GAAP amounts excluded from our non-GAAP financial measures to allow investors to evaluate such non-GAAP financial measures.

Performance Metrics

Bookings are defined as total contract value (or TCV) of new contracts, including new contract sales as well as renewals and expansions of existing contracts. Bookings can vary significantly quarter to quarter depending in part on the timing of the signing of a small number of large contracts. Our book-to-bill ratio is defined as bookings for the trailing twelve months divided by revenue for the same period. Measuring bookings involves the use of estimates and judgments and there are no independent standards or requirements governing the calculation of bookings. The extent and timing of conversion of bookings to revenues may be impacted by, among other factors, the types of services and solutions sold, contract duration, the pace of client spending, actual volumes of services delivered as compared to the volumes anticipated at the time of sale, and contract modifications, including terminations, over the lifetime of a contract. The majority of our contracts are terminable by the client on short notice often without penalty, and some without notice. We do not update our bookings for subsequent terminations, reductions or foreign currency exchange rate fluctuations. Information regarding our bookings is not comparable to, nor should it be substituted for, an analysis of our reported revenues. However, management believes that it is a key indicator of potential future revenues and provides a useful indicator of the volume of our business over time.

We disclose digital revenue as management believes it provides additional insights into the Company’s business. Measuring digital revenue requires the use of estimates and judgement, there are no independent standards or requirements governing the calculation and our calculation may differ from the calculations underlying similar such metrics disclosed by other companies. In the first quarter of 2022, we

modified our definition of digital revenue to reflect our latest assessment of digital skills, growth priorities and pricing initiatives. Under the updated definition, digital revenue as a percentage of total revenue was 46%, 47%, 49% and 49% for the first, second, third and fourth quarter of 2021, respectively, and 48% for full year 2021.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Investor Relations Contact: |

|

|

|

Media Contact: |

| Tyler Scott |

|

|

|

Jeff DeMarrais |

| VP, Investor Relations |

|

|

|

VP, Corporate Communications |

| +1 551-220-8246 |

|

|

|

+1 475-223-2298 |

| Tyler.Scott@cognizant.com |

|

|

|

Jeff.DeMarrais@cognizant.com |

- tables to follow -

COGNIZANT TECHNOLOGY SOLUTIONS CORPORATION

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (in millions, except per share data) |

Three Months Ended

September 30, |

|

Nine Months Ended

September 30, |

| |

2022 |

|

2021 |

|

2022 |

|

2021 |

| Revenues |

$ |

4,857 |

|

|

$ |

4,744 |

|

|

$ |

14,589 |

|

|

$ |

13,730 |

|

| Operating expenses: |

|

|

|

|

|

|

|

| Cost of revenues (exclusive of depreciation and amortization expense shown separately below) |

3,080 |

|

|

2,947 |

|

|

9,296 |

|

|

8,574 |

|

| Selling, general and administrative expenses |

838 |

|

|

924 |

|

|

2,583 |

|

|

2,632 |

|

|

|

|

|

|

|

|

|

| Depreciation and amortization expense |

141 |

|

|

144 |

|

|

428 |

|

|

430 |

|

| Income from operations |

798 |

|

|

729 |

|

|

2,282 |

|

|

2,094 |

|

| Other income (expense), net: |

|

|

|

|

|

|

|

| Interest income |

17 |

|

|

7 |

|

|

32 |

|

|

23 |

|

| Interest expense |

(6) |

|

|

(3) |

|

|

(11) |

|

|

(7) |

|

| Foreign currency exchange gains (losses), net |

3 |

|

|

(3) |

|

|

(1) |

|

|

(19) |

|

| Other, net |

— |

|

|

1 |

|

|

— |

|

|

(1) |

|

| Total other income (expense), net |

14 |

|

|

2 |

|

|

20 |

|

|

(4) |

|

| Income before provision for income taxes |

812 |

|

|

731 |

|

|

2,302 |

|

|

2,090 |

|

| Provision for income taxes |

(183) |

|

|

(187) |

|

|

(537) |

|

|

(531) |

|

| Income (loss) from equity method investment |

— |

|

|

— |

|

|

4 |

|

|

2 |

|

| Net income |

$ |

629 |

|

|

$ |

544 |

|

|

$ |

1,769 |

|

|

$ |

1,561 |

|

| Basic earnings per share |

$ |

1.22 |

|

|

$ |

1.04 |

|

|

$ |

3.40 |

|

|

$ |

2.96 |

|

| Diluted earnings per share |

$ |

1.22 |

|

|

$ |

1.03 |

|

|

$ |

3.40 |

|

|

$ |

2.96 |

|

| Weighted average number of common shares outstanding - Basic |

516 |

|

|

525 |

|

|

520 |

|

|

527 |

|

| Dilutive effect of shares issuable under stock-based compensation plans |

1 |

|

|

1 |

|

|

1 |

|

|

1 |

|

| Weighted average number of common shares outstanding - Diluted |

517 |

|

|

526 |

|

|

521 |

|

|

528 |

|

COGNIZANT TECHNOLOGY SOLUTIONS CORPORATION

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

(in millions, except par values) |

September 30,

2022 |

|

December 31, 2021 |

| Assets |

|

|

|

| Current assets: |

|

|

|

| Cash and cash equivalents |

$ |

2,042 |

|

|

$ |

1,792 |

|

| Short-term investments |

689 |

|

|

927 |

|

| Trade accounts receivable, net |

3,686 |

|

|

3,557 |

|

| Other current assets |

900 |

|

|

1,066 |

|

| Total current assets |

7,317 |

|

|

7,342 |

|

| Property and equipment, net |

1,105 |

|

|

1,171 |

|

| Operating lease assets, net |

873 |

|

|

933 |

|

| Goodwill |

5,425 |

|

|

5,620 |

|

| Intangible assets, net |

1,038 |

|

|

1,218 |

|

| Deferred income tax assets, net |

520 |

|

|

404 |

|

| Long-term investments |

431 |

|

|

463 |

|

| Other noncurrent assets |

638 |

|

|

701 |

|

| Total assets |

$ |

17,347 |

|

|

$ |

17,852 |

|

| Liabilities and Stockholders’ Equity |

|

|

|

| Current liabilities: |

|

|

|

| Accounts payable |

$ |

367 |

|

|

$ |

361 |

|

| Deferred revenue |

345 |

|

|

403 |

|

| Short-term debt |

— |

|

|

38 |

|

| Operating lease liabilities |

173 |

|

|

195 |

|

| Accrued expenses and other current liabilities |

2,338 |

|

|

2,532 |

|

| Total current liabilities |

3,223 |

|

|

3,529 |

|

| Deferred revenue, noncurrent |

17 |

|

|

40 |

|

| Operating lease liabilities, noncurrent |

711 |

|

|

783 |

|

| Deferred income tax liabilities, net |

190 |

|

|

218 |

|

| Long-term debt |

636 |

|

|

626 |

|

| Long-term income taxes payable |

283 |

|

|

378 |

|

| Other noncurrent liabilities |

329 |

|

|

287 |

|

| Total liabilities |

5,389 |

|

|

5,861 |

|

| Stockholders’ equity: |

|

|

|

| Preferred stock, $0.10 par value, 15 shares authorized, none issued |

— |

|

|

— |

|

Class A common stock, $0.01 par value, 1,000 shares authorized, 514 and 525 shares issued and outstanding as of September 30, 2022 and December 31, 2021, respectively |

5 |

|

|

5 |

|

| Additional paid-in capital |

17 |

|

|

27 |

|

| Retained earnings |

12,447 |

|

|

11,922 |

|

| Accumulated other comprehensive income (loss) |

(511) |

|

|

37 |

|

| Total stockholders’ equity |

11,958 |

|

|

11,991 |

|

| Total liabilities and stockholders’ equity |

$ |

17,347 |

|

|

$ |

17,852 |

|

COGNIZANT TECHNOLOGY SOLUTIONS CORPORATION

Reconciliations of Non-GAAP Financial Measures

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (dollars in millions, except per share amounts) |

Three Months Ended

September 30, |

|

Nine Months Ended

September 30, |

|

|

|

Guidance |

| |

2022 |

|

2021 |

|

2022 |

|

2021 |

|

|

|

Full Year 2022 |

| GAAP income from operations |

$ |

798 |

|

|

$ |

729 |

|

|

$ |

2,282 |

|

|

$ |

2,094 |

|

|

|

|

|

Class Action Settlement Loss(a) |

— |

|

|

20 |

|

|

— |

|

|

20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted Income From Operations |

$ |

798 |

|

|

$ |

749 |

|

|

$ |

2,282 |

|

|

$ |

2,114 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP operating margin |

16.4 |

% |

|

15.4 |

% |

|

15.6 |

% |

|

15.3 |

% |

|

|

|

|

Class Action Settlement Loss(a) |

— |

|

|

0.4 |

|

|

— |

|

|

0.1 |

|

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted Operating Margin |

16.4 |

% |

|

15.8 |

% |

|

15.6 |

% |

|

15.4 |

% |

|

|

|

15.6% |

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP diluted earnings per share |

$ |

1.22 |

|

|

$ |

1.03 |

|

|

$ |

3.40 |

|

|

$ |

2.96 |

|

|

|

|

|

| Effect of above adjustments to income from operations, pre-tax |

— |

|

|

0.04 |

|

|

— |

|

|

0.04 |

|

|

|

|

— |

Non-operating foreign currency exchange (gains) losses, pre-tax(b) |

(0.01) |

|

|

0.01 |

|

|

— |

|

|

0.03 |

|

|

|

|

(b) |

Tax effect of above adjustments(c) |

0.03 |

|

|

(0.02) |

|

|

0.07 |

|

|

(0.01) |

|

|

|

|

(b) |

Effect of recognition of income tax benefit related to an uncertain tax position(d) |

(0.07) |

|

|

— |

|

|

(0.07) |

|

|

— |

|

|

|

|

(0.07) |

| Adjusted Diluted Earnings Per Share |

$ |

1.17 |

|

|

$ |

1.06 |

|

|

$ |

3.40 |

|

|

$ |

3.02 |

|

|

|

|

$4.43 - $4.46 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Notes:

(a)In the third quarter of 2021, the parties to the consolidated putative securities class action suit filed a settlement agreement that resolved the consolidated putative securities class action against us and certain of our former officers. The settlement agreement provided for a payment of $95 million to the putative class (inclusive of attorneys’ fees and litigation expenses). Adjusting for indemnification expenses, legal fees and other covered expenses incurred through September 7, 2021, the remaining available balance under the applicable directors and officers insurance policies was $75 million. As a result, we recorded a Class Action Settlement Loss of $20 million in "Selling, general and administrative expenses" in our third quarter 2021 unaudited consolidated financial statements.

(b)Non-operating foreign currency exchange gains and losses, inclusive of gains and losses on related foreign exchange forward contracts not designated as hedging instruments for accounting purposes, are reported in "Foreign currency exchange gains (losses), net" in our unaudited consolidated statements of operations. Non-operating foreign currency exchange gains and losses are subject to high variability and low visibility and therefore cannot be provided on a forward-looking basis without unreasonable efforts.

(c)Presented below are the tax impacts of each of our non-GAAP adjustments to pre-tax income for the three and nine months ended September 30:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (in millions) |

Three Months Ended

September 30, |

|

Nine Months Ended September 30, |

|

2022 |

|

2021 |

|

2022 |

|

2021 |

| Non-GAAP income tax benefit (expense) related to: |

|

|

|

|

|

|

|

| Class Action Settlement Loss |

— |

|

|

6 |

|

— |

|

|

6 |

Foreign currency exchange gains and losses |

(15) |

|

|

3 |

|

|

(35) |

|

|

(3) |

|

The effective tax rate related to non-operating foreign currency exchange gains and losses varies depending on the jurisdictions in which such income and expenses are generated and the statutory rates applicable in those jurisdictions. As such, the income tax effect of non-operating foreign currency exchange gains and losses shown in the above table may not appear proportionate to the net pre-tax foreign currency exchange gains and losses reported in our unaudited consolidated statements of operations.

(d)During the three months ended September 30, 2022, we recognized an income tax benefit of $36 million related to a specific uncertain tax position that was previously unrecognized in our prior year consolidated financial statements. The recognition of the benefit in the third quarter of 2022 was based on management’s reassessment regarding whether this unrecognized tax benefit met the more-likely-than-not threshold in light of the lapse in the statute of limitations as to a portion of such benefit.

Reconciliations of net cash

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in millions) |

|

September 30, 2022 |

|

December 31, 2021 |

| Cash and cash equivalents |

|

$ |

2,042 |

|

|

$ |

1,792 |

|

| Short-term investments |

|

689 |

|

|

927 |

|

| Less: |

|

|

|

|

| Short-term debt |

|

— |

|

|

38 |

|

| Long-term debt |

|

636 |

|

|

626 |

|

| Net cash |

|

$ |

2,095 |

|

|

$ |

2,055 |

|

The above tables serve to reconcile the Non-GAAP financial measures to the most directly comparable GAAP measures. Refer to the “About Non-GAAP Financial Measures and Performance Metrics” section of our press release for further information on the use of these Non-GAAP measures.

COGNIZANT TECHNOLOGY SOLUTIONS CORPORATION

Revenue by Business Segment and Geography

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (dollars in millions) |

Three Months Ended September 30, 2022 |

|

|

|

|

|

Year over Year |

| |

$ |

|

% of total |

|

% Change |

|

Constant Currency % Change (a) |

| Revenues by Segment: |

|

|

|

|

|

|

|

Financial Services (b) |

$ |

1,521 |

|

|

31.3 |

% |

|

(1.5) |

% |

|

1.6 |

% |

| Health Sciences |

1,405 |

|

|

28.9 |

% |

|

3.8 |

% |

|

5.5 |

% |

| Products and Resources |

1,148 |

|

|

23.7 |

% |

|

3.7 |

% |

|

8.2 |

% |

| Communications, Media and Technology |

783 |

|

|

16.1 |

% |

|

6.0 |

% |

|

10.4 |

% |

| Total Revenues |

$ |

4,857 |

|

|

|

|

2.4 |

% |

|

5.6 |

% |

| Revenues by Geography: |

|

|

|

|

|

|

|

| North America |

$ |

3,621 |

|

|

74.6 |

% |

|

3.9 |

% |

|

4.0 |

% |

| United Kingdom |

446 |

|

|

9.2 |

% |

|

3.7 |

% |

|

18.7 |

% |

Continental Europe (b) |

438 |

|

|

9.0 |

% |

|

(9.5) |

% |

|

2.9 |

% |

Europe - Total (b) |

884 |

|

|

18.2 |

% |

|

(3.3) |

% |

|

10.3 |

% |

| Rest of World |

352 |

|

|

7.2 |

% |

|

2.3 |

% |

|

9.3 |

% |

| Total Revenues |

$ |

4,857 |

|

|

|

|

2.4 |

% |

|

5.6 |

% |

|

|

|

|

|

|

|

|

| |

Nine Months Ended September 30, 2022 |

|

|

|

|

|

Year over Year |

| |

$ |

|

% of total |

|

% Change |

|

Constant Currency % Change (a) |

| Revenues by Segment: |

|

|

|

|

|

|

|

Financial Services (b) |

$ |

4,591 |

|

|

31.5 |

% |

|

1.9 |

% |

|

4.2 |

% |

| Health Sciences |

4,205 |

|

|

28.8 |

% |

|

6.0 |

% |

|

7.3 |

% |

| Products and Resources |

3,418 |

|

|

23.4 |

% |

|

8.2 |

% |

|

11.4 |

% |

| Communications, Media and Technology |

2,375 |

|

|

16.3 |

% |

|

13.1 |

% |

|

16.4 |

% |

| Total Revenues |

$ |

14,589 |

|

|

|

|

6.3 |

% |

|

8.6 |

% |

| Revenues by Geography: |

|

|

|

|

|

|

|

| North America |

$ |

10,846 |

|

|

74.3 |

% |

|

7.0 |

% |

|

7.1 |

% |

| United Kingdom |

1,357 |

|

|

9.3 |

% |

|

12.8 |

% |

|

23.1 |

% |

Continental Europe (b) |

1,342 |

|

|

9.2 |

% |

|

(5.6) |

% |

|

4.0 |

% |

Europe - Total (b) |

2,699 |

|

|

18.5 |

% |

|

2.8 |

% |

|

12.7 |

% |

| Rest of World |

1,044 |

|

|

7.2 |

% |

|

8.3 |

% |

|

13.8 |

% |

| Total Revenues |

$ |

14,589 |

|

|

|

|

6.3 |

% |

|

8.6 |

% |

Notes:

(a)Constant currency revenue growth is not a measure of financial performance prepared in accordance with GAAP. See “About Non-GAAP Financial Measures and Performance Metrics” section of our press release for further information.

(b)The sale of the Samlink subsidiary, which was completed on February 1, 2022, negatively impacted revenue growth for the three months ended September 30, 2022 in Financial Services, Continental Europe and Europe-Total by 180 basis points, 580 basis points and 310 basis points, respectively. For the nine months ended September 30, 2022, revenue growth was negatively impacted in Financial Services, Continental Europe and Europe-Total by 170 basis points, 530 basis points and 290 basis points, respectively.

COGNIZANT TECHNOLOGY SOLUTIONS CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in millions) |

Three Months Ended

September 30, |

|

Nine Months Ended

September 30, |

|

2022 |

|

2021 |

|

2022 |

|

2021 |

| Cash flows from operating activities: |

|

|

|

|

|

|

|

| Net income |

$ |

629 |

|

|

$ |

544 |

|

|

$ |

1,769 |

|

|

$ |

1,561 |

|

| Adjustments for non-cash income and expenses |

175 |

|

|

237 |

|

|

584 |

|

|

769 |

|

| Changes in assets and liabilities |

228 |

|

|

167 |

|

|

(487) |

|

|

(660) |

|

| Net cash provided by operating activities |

1,032 |

|

|

948 |

|

|

1,866 |

|

|

1,670 |

|

| Cash flows from investing activities: |

|

|

|

|

|

|

|

| Purchases of property and equipment |

(79) |

|

|

(51) |

|

|

(242) |

|

|

(214) |

|

| Net (purchases) maturities of investments |

(187) |

|

|

(299) |

|

|

186 |

|

|

(737) |

|

| Proceeds from sales of businesses |

9 |

|

|

— |

|

|

28 |

|

|

— |

|

| Payments for business combinations, net of cash acquired |

— |

|

|

(57) |

|

|

— |

|

|

(715) |

|

| Net cash (used in) investing activities |

(257) |

|

|

(407) |

|

|

(28) |

|

|

(1,666) |

|

| Cash flows from financing activities: |

|

|

|

|

|

|

|

| Repurchases of common stock |

(315) |

|

|

(129) |

|

|

(1,107) |

|

|

(689) |

|

| Repayment of term loan borrowings and finance lease and earnout obligations |

(21) |

|

|

(12) |

|

|

(47) |

|

|

(40) |

|

|

|

|

|

|

|

|

|

| Dividends paid |

(141) |

|

|

(127) |

|

|

(425) |

|

|

(382) |

|

| Issuance of common stock under stock-based compensation plans |

19 |

|

|

29 |

|

|

71 |

|

|

104 |

|

| Net cash (used in) financing activities |

(458) |

|

|

(239) |

|

|

(1,508) |

|

|

(1,007) |

|

| Effect of exchange rate changes on cash and cash equivalents |

(43) |

|

|

(6) |

|

|

(80) |

|

|

(13) |

|

| Increase (decrease) in cash and cash equivalents |

274 |

|

|

296 |

|

|

250 |

|

|

(1,016) |

|

| Cash and cash equivalents, beginning of period |

1,768 |

|

|

1,368 |

|

|

1,792 |

|

|

2,680 |

|

| Cash and cash equivalents, end of period |

$ |

2,042 |

|

|

$ |

1,664 |

|

|

$ |

2,042 |

|

|

$ |

1,664 |

|

SUPPLEMENTAL CASH FLOW INFORMATION

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (in millions) |

|

Three Months Ended |

| Stock Repurchases under Board of Directors' authorized stock repurchase program: |

|

September 30, 2022 |

|

September 30, 2021 |

| Number of shares repurchased |

|

4.6 |

|

|

1.3 |

|

|

|

|

|

|

Remaining authorized balance as of September 30, 2022 |

|

$ |

1,075 |

|

|

|

Reconciliation of Free Cash Flow Non-GAAP Financial Measure

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in millions) |

Three Months Ended

September 30, |

|

Nine Months Ended

September 30, |

|

2022 |

|

2021 |

|

2022 |

|

2021 |

| Net cash provided by operating activities |

$ |

1,032 |

|

|

$ |

948 |

|

|

$ |

1,866 |

|

|

$ |

1,670 |

|

Purchases of property and equipment |

(79) |

|

|

(51) |

|

|

(242) |

|

|

(214) |

|

| Free cash flow |

$ |

953 |

|

|

$ |

897 |

|

|

$ |

1,624 |

|

|

$ |

1,456 |

|