0001051512false--12-312024Q20.040.1850.230.3741441482882837537575075061xbrli:sharesiso4217:USDiso4217:USDxbrli:sharesxbrli:puretds:unittds:asset_group00010515122024-01-012024-06-300001051512us-gaap:CommonClassBMember2024-01-012024-06-300001051512tds:PreferredStockMember1Member2024-01-012024-06-300001051512tds:PreferredStockMember2Member2024-01-012024-06-300001051512us-gaap:CommonClassBMember2024-06-300001051512us-gaap:CommonClassAMember2024-06-300001051512us-gaap:ServiceMember2024-04-012024-06-300001051512us-gaap:ServiceMember2023-04-012023-06-300001051512us-gaap:ServiceMember2024-01-012024-06-300001051512us-gaap:ServiceMember2023-01-012023-06-300001051512us-gaap:ProductMember2024-04-012024-06-300001051512us-gaap:ProductMember2023-04-012023-06-300001051512us-gaap:ProductMember2024-01-012024-06-300001051512us-gaap:ProductMember2023-01-012023-06-3000010515122024-04-012024-06-3000010515122023-04-012023-06-3000010515122023-01-012023-06-3000010515122023-12-3100010515122022-12-3100010515122024-06-3000010515122023-06-300001051512us-gaap:CommonClassAMember2023-12-310001051512us-gaap:CommonClassBMember2023-12-310001051512tds:PreferredStockMember1Member2023-12-310001051512tds:PreferredStockMember1Member2024-06-300001051512tds:PreferredStockMember2Member2023-12-310001051512tds:PreferredStockMember2Member2024-06-300001051512tds:AssetsHeldMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2024-06-300001051512tds:AssetsHeldMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-12-310001051512us-gaap:NonrecourseMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-12-310001051512us-gaap:NonrecourseMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2024-06-300001051512us-gaap:CommonStockMember2024-03-310001051512us-gaap:AdditionalPaidInCapitalMember2024-03-310001051512us-gaap:PreferredStockMember2024-03-310001051512us-gaap:TreasuryStockCommonMember2024-03-310001051512us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310001051512us-gaap:RetainedEarningsMember2024-03-310001051512us-gaap:ParentMember2024-03-310001051512us-gaap:NoncontrollingInterestMember2024-03-3100010515122024-03-310001051512us-gaap:RetainedEarningsMember2024-04-012024-06-300001051512us-gaap:ParentMember2024-04-012024-06-300001051512us-gaap:NoncontrollingInterestMember2024-04-012024-06-300001051512tds:PreferredStockMember1Member2024-04-012024-06-300001051512tds:PreferredStockMember2Member2024-04-012024-06-300001051512us-gaap:AdditionalPaidInCapitalMember2024-04-012024-06-300001051512us-gaap:TreasuryStockCommonMember2024-04-012024-06-300001051512us-gaap:CommonStockMember2024-06-300001051512us-gaap:AdditionalPaidInCapitalMember2024-06-300001051512us-gaap:PreferredStockMember2024-06-300001051512us-gaap:TreasuryStockCommonMember2024-06-300001051512us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-300001051512us-gaap:RetainedEarningsMember2024-06-300001051512us-gaap:ParentMember2024-06-300001051512us-gaap:NoncontrollingInterestMember2024-06-300001051512us-gaap:CommonStockMember2023-03-310001051512us-gaap:AdditionalPaidInCapitalMember2023-03-310001051512us-gaap:PreferredStockMember2023-03-310001051512us-gaap:TreasuryStockCommonMember2023-03-310001051512us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310001051512us-gaap:RetainedEarningsMember2023-03-310001051512us-gaap:ParentMember2023-03-310001051512us-gaap:NoncontrollingInterestMember2023-03-3100010515122023-03-310001051512us-gaap:RetainedEarningsMember2023-04-012023-06-300001051512us-gaap:ParentMember2023-04-012023-06-300001051512us-gaap:NoncontrollingInterestMember2023-04-012023-06-300001051512tds:PreferredStockMember1Member2023-04-012023-06-300001051512tds:PreferredStockMember2Member2023-04-012023-06-300001051512us-gaap:TreasuryStockCommonMember2023-04-012023-06-300001051512us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300001051512us-gaap:CommonStockMember2023-06-300001051512us-gaap:AdditionalPaidInCapitalMember2023-06-300001051512us-gaap:PreferredStockMember2023-06-300001051512us-gaap:TreasuryStockCommonMember2023-06-300001051512us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300001051512us-gaap:RetainedEarningsMember2023-06-300001051512us-gaap:ParentMember2023-06-300001051512us-gaap:NoncontrollingInterestMember2023-06-300001051512us-gaap:CommonStockMember2023-12-310001051512us-gaap:AdditionalPaidInCapitalMember2023-12-310001051512us-gaap:PreferredStockMember2023-12-310001051512us-gaap:TreasuryStockCommonMember2023-12-310001051512us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001051512us-gaap:RetainedEarningsMember2023-12-310001051512us-gaap:ParentMember2023-12-310001051512us-gaap:NoncontrollingInterestMember2023-12-310001051512us-gaap:RetainedEarningsMember2024-01-012024-06-300001051512us-gaap:ParentMember2024-01-012024-06-300001051512us-gaap:NoncontrollingInterestMember2024-01-012024-06-300001051512us-gaap:TreasuryStockCommonMember2024-01-012024-06-300001051512us-gaap:AdditionalPaidInCapitalMember2024-01-012024-06-300001051512us-gaap:CommonStockMember2022-12-310001051512us-gaap:AdditionalPaidInCapitalMember2022-12-310001051512us-gaap:PreferredStockMember2022-12-310001051512us-gaap:TreasuryStockCommonMember2022-12-310001051512us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001051512us-gaap:RetainedEarningsMember2022-12-310001051512us-gaap:ParentMember2022-12-310001051512us-gaap:NoncontrollingInterestMember2022-12-310001051512us-gaap:RetainedEarningsMember2023-01-012023-06-300001051512us-gaap:ParentMember2023-01-012023-06-300001051512us-gaap:NoncontrollingInterestMember2023-01-012023-06-300001051512tds:PreferredStockMember1Member2023-01-012023-06-300001051512tds:PreferredStockMember2Member2023-01-012023-06-300001051512us-gaap:TreasuryStockCommonMember2023-01-012023-06-300001051512us-gaap:AdditionalPaidInCapitalMember2023-01-012023-06-300001051512tds:UnitedStatesCellularCorporationMember2024-06-300001051512us-gaap:TransferredOverTimeMembertds:RetailServiceRevenueMembertds:USCellularSegmentMember2024-04-012024-06-300001051512tds:TDSTelecomSegmentMemberus-gaap:TransferredOverTimeMembertds:RetailServiceRevenueMember2024-04-012024-06-300001051512tds:OtherSegmentMemberus-gaap:TransferredOverTimeMembertds:RetailServiceRevenueMember2024-04-012024-06-300001051512us-gaap:TransferredOverTimeMembertds:RetailServiceRevenueMember2024-04-012024-06-300001051512tds:ResidentialRevenueMemberus-gaap:TransferredOverTimeMembertds:USCellularSegmentMember2024-04-012024-06-300001051512tds:ResidentialRevenueMembertds:TDSTelecomSegmentMemberus-gaap:TransferredOverTimeMember2024-04-012024-06-300001051512tds:ResidentialRevenueMembertds:OtherSegmentMemberus-gaap:TransferredOverTimeMember2024-04-012024-06-300001051512tds:ResidentialRevenueMemberus-gaap:TransferredOverTimeMember2024-04-012024-06-300001051512tds:CommercialRevenueMemberus-gaap:TransferredOverTimeMembertds:USCellularSegmentMember2024-04-012024-06-300001051512tds:CommercialRevenueMembertds:TDSTelecomSegmentMemberus-gaap:TransferredOverTimeMember2024-04-012024-06-300001051512tds:CommercialRevenueMembertds:OtherSegmentMemberus-gaap:TransferredOverTimeMember2024-04-012024-06-300001051512tds:CommercialRevenueMemberus-gaap:TransferredOverTimeMember2024-04-012024-06-300001051512tds:WholesaleRevenueMemberus-gaap:TransferredOverTimeMembertds:USCellularSegmentMember2024-04-012024-06-300001051512tds:WholesaleRevenueMembertds:TDSTelecomSegmentMemberus-gaap:TransferredOverTimeMember2024-04-012024-06-300001051512tds:OtherSegmentMembertds:WholesaleRevenueMemberus-gaap:TransferredOverTimeMember2024-04-012024-06-300001051512tds:WholesaleRevenueMemberus-gaap:TransferredOverTimeMember2024-04-012024-06-300001051512tds:OtherServiceRevenueMemberus-gaap:TransferredOverTimeMembertds:USCellularSegmentMember2024-04-012024-06-300001051512tds:OtherServiceRevenueMembertds:TDSTelecomSegmentMemberus-gaap:TransferredOverTimeMember2024-04-012024-06-300001051512tds:OtherServiceRevenueMembertds:OtherSegmentMemberus-gaap:TransferredOverTimeMember2024-04-012024-06-300001051512tds:OtherServiceRevenueMemberus-gaap:TransferredOverTimeMember2024-04-012024-06-300001051512us-gaap:TransferredOverTimeMembertds:USCellularSegmentMember2024-04-012024-06-300001051512tds:TDSTelecomSegmentMemberus-gaap:TransferredOverTimeMember2024-04-012024-06-300001051512tds:OtherSegmentMemberus-gaap:TransferredOverTimeMember2024-04-012024-06-300001051512us-gaap:TransferredOverTimeMember2024-04-012024-06-300001051512us-gaap:TransferredAtPointInTimeMembertds:EquipmentAndProductSalesMembertds:USCellularSegmentMember2024-04-012024-06-300001051512us-gaap:TransferredAtPointInTimeMembertds:EquipmentAndProductSalesMembertds:TDSTelecomSegmentMember2024-04-012024-06-300001051512tds:OtherSegmentMemberus-gaap:TransferredAtPointInTimeMembertds:EquipmentAndProductSalesMember2024-04-012024-06-300001051512us-gaap:TransferredAtPointInTimeMembertds:EquipmentAndProductSalesMember2024-04-012024-06-300001051512tds:USCellularSegmentMember2024-04-012024-06-300001051512tds:TDSTelecomSegmentMember2024-04-012024-06-300001051512tds:OtherSegmentMember2024-04-012024-06-300001051512us-gaap:TransferredOverTimeMembertds:RetailServiceRevenueMembertds:USCellularSegmentMember2023-04-012023-06-300001051512tds:TDSTelecomSegmentMemberus-gaap:TransferredOverTimeMembertds:RetailServiceRevenueMember2023-04-012023-06-300001051512tds:OtherSegmentMemberus-gaap:TransferredOverTimeMembertds:RetailServiceRevenueMember2023-04-012023-06-300001051512us-gaap:TransferredOverTimeMembertds:RetailServiceRevenueMember2023-04-012023-06-300001051512tds:ResidentialRevenueMemberus-gaap:TransferredOverTimeMembertds:USCellularSegmentMember2023-04-012023-06-300001051512tds:ResidentialRevenueMembertds:TDSTelecomSegmentMemberus-gaap:TransferredOverTimeMember2023-04-012023-06-300001051512tds:ResidentialRevenueMembertds:OtherSegmentMemberus-gaap:TransferredOverTimeMember2023-04-012023-06-300001051512tds:ResidentialRevenueMemberus-gaap:TransferredOverTimeMember2023-04-012023-06-300001051512tds:CommercialRevenueMemberus-gaap:TransferredOverTimeMembertds:USCellularSegmentMember2023-04-012023-06-300001051512tds:CommercialRevenueMembertds:TDSTelecomSegmentMemberus-gaap:TransferredOverTimeMember2023-04-012023-06-300001051512tds:CommercialRevenueMembertds:OtherSegmentMemberus-gaap:TransferredOverTimeMember2023-04-012023-06-300001051512tds:CommercialRevenueMemberus-gaap:TransferredOverTimeMember2023-04-012023-06-300001051512tds:WholesaleRevenueMemberus-gaap:TransferredOverTimeMembertds:USCellularSegmentMember2023-04-012023-06-300001051512tds:WholesaleRevenueMembertds:TDSTelecomSegmentMemberus-gaap:TransferredOverTimeMember2023-04-012023-06-300001051512tds:OtherSegmentMembertds:WholesaleRevenueMemberus-gaap:TransferredOverTimeMember2023-04-012023-06-300001051512tds:WholesaleRevenueMemberus-gaap:TransferredOverTimeMember2023-04-012023-06-300001051512tds:OtherServiceRevenueMemberus-gaap:TransferredOverTimeMembertds:USCellularSegmentMember2023-04-012023-06-300001051512tds:OtherServiceRevenueMembertds:TDSTelecomSegmentMemberus-gaap:TransferredOverTimeMember2023-04-012023-06-300001051512tds:OtherServiceRevenueMembertds:OtherSegmentMemberus-gaap:TransferredOverTimeMember2023-04-012023-06-300001051512tds:OtherServiceRevenueMemberus-gaap:TransferredOverTimeMember2023-04-012023-06-300001051512us-gaap:TransferredOverTimeMembertds:USCellularSegmentMember2023-04-012023-06-300001051512tds:TDSTelecomSegmentMemberus-gaap:TransferredOverTimeMember2023-04-012023-06-300001051512tds:OtherSegmentMemberus-gaap:TransferredOverTimeMember2023-04-012023-06-300001051512us-gaap:TransferredOverTimeMember2023-04-012023-06-300001051512us-gaap:TransferredAtPointInTimeMembertds:EquipmentAndProductSalesMembertds:USCellularSegmentMember2023-04-012023-06-300001051512us-gaap:TransferredAtPointInTimeMembertds:EquipmentAndProductSalesMembertds:TDSTelecomSegmentMember2023-04-012023-06-300001051512tds:OtherSegmentMemberus-gaap:TransferredAtPointInTimeMembertds:EquipmentAndProductSalesMember2023-04-012023-06-300001051512us-gaap:TransferredAtPointInTimeMembertds:EquipmentAndProductSalesMember2023-04-012023-06-300001051512tds:USCellularSegmentMember2023-04-012023-06-300001051512tds:TDSTelecomSegmentMember2023-04-012023-06-300001051512tds:OtherSegmentMember2023-04-012023-06-300001051512us-gaap:TransferredOverTimeMembertds:RetailServiceRevenueMembertds:USCellularSegmentMember2024-01-012024-06-300001051512tds:TDSTelecomSegmentMemberus-gaap:TransferredOverTimeMembertds:RetailServiceRevenueMember2024-01-012024-06-300001051512tds:OtherSegmentMemberus-gaap:TransferredOverTimeMembertds:RetailServiceRevenueMember2024-01-012024-06-300001051512us-gaap:TransferredOverTimeMembertds:RetailServiceRevenueMember2024-01-012024-06-300001051512tds:ResidentialRevenueMemberus-gaap:TransferredOverTimeMembertds:USCellularSegmentMember2024-01-012024-06-300001051512tds:ResidentialRevenueMembertds:TDSTelecomSegmentMemberus-gaap:TransferredOverTimeMember2024-01-012024-06-300001051512tds:ResidentialRevenueMembertds:OtherSegmentMemberus-gaap:TransferredOverTimeMember2024-01-012024-06-300001051512tds:ResidentialRevenueMemberus-gaap:TransferredOverTimeMember2024-01-012024-06-300001051512tds:CommercialRevenueMemberus-gaap:TransferredOverTimeMembertds:USCellularSegmentMember2024-01-012024-06-300001051512tds:CommercialRevenueMembertds:TDSTelecomSegmentMemberus-gaap:TransferredOverTimeMember2024-01-012024-06-300001051512tds:CommercialRevenueMembertds:OtherSegmentMemberus-gaap:TransferredOverTimeMember2024-01-012024-06-300001051512tds:CommercialRevenueMemberus-gaap:TransferredOverTimeMember2024-01-012024-06-300001051512tds:WholesaleRevenueMemberus-gaap:TransferredOverTimeMembertds:USCellularSegmentMember2024-01-012024-06-300001051512tds:WholesaleRevenueMembertds:TDSTelecomSegmentMemberus-gaap:TransferredOverTimeMember2024-01-012024-06-300001051512tds:OtherSegmentMembertds:WholesaleRevenueMemberus-gaap:TransferredOverTimeMember2024-01-012024-06-300001051512tds:WholesaleRevenueMemberus-gaap:TransferredOverTimeMember2024-01-012024-06-300001051512tds:OtherServiceRevenueMemberus-gaap:TransferredOverTimeMembertds:USCellularSegmentMember2024-01-012024-06-300001051512tds:OtherServiceRevenueMembertds:TDSTelecomSegmentMemberus-gaap:TransferredOverTimeMember2024-01-012024-06-300001051512tds:OtherServiceRevenueMembertds:OtherSegmentMemberus-gaap:TransferredOverTimeMember2024-01-012024-06-300001051512tds:OtherServiceRevenueMemberus-gaap:TransferredOverTimeMember2024-01-012024-06-300001051512us-gaap:TransferredOverTimeMembertds:USCellularSegmentMember2024-01-012024-06-300001051512tds:TDSTelecomSegmentMemberus-gaap:TransferredOverTimeMember2024-01-012024-06-300001051512tds:OtherSegmentMemberus-gaap:TransferredOverTimeMember2024-01-012024-06-300001051512us-gaap:TransferredOverTimeMember2024-01-012024-06-300001051512us-gaap:TransferredAtPointInTimeMembertds:EquipmentAndProductSalesMembertds:USCellularSegmentMember2024-01-012024-06-300001051512us-gaap:TransferredAtPointInTimeMembertds:EquipmentAndProductSalesMembertds:TDSTelecomSegmentMember2024-01-012024-06-300001051512tds:OtherSegmentMemberus-gaap:TransferredAtPointInTimeMembertds:EquipmentAndProductSalesMember2024-01-012024-06-300001051512us-gaap:TransferredAtPointInTimeMembertds:EquipmentAndProductSalesMember2024-01-012024-06-300001051512tds:USCellularSegmentMember2024-01-012024-06-300001051512tds:TDSTelecomSegmentMember2024-01-012024-06-300001051512tds:OtherSegmentMember2024-01-012024-06-300001051512us-gaap:TransferredOverTimeMembertds:RetailServiceRevenueMembertds:USCellularSegmentMember2023-01-012023-06-300001051512tds:TDSTelecomSegmentMemberus-gaap:TransferredOverTimeMembertds:RetailServiceRevenueMember2023-01-012023-06-300001051512tds:OtherSegmentMemberus-gaap:TransferredOverTimeMembertds:RetailServiceRevenueMember2023-01-012023-06-300001051512us-gaap:TransferredOverTimeMembertds:RetailServiceRevenueMember2023-01-012023-06-300001051512tds:ResidentialRevenueMemberus-gaap:TransferredOverTimeMembertds:USCellularSegmentMember2023-01-012023-06-300001051512tds:ResidentialRevenueMembertds:TDSTelecomSegmentMemberus-gaap:TransferredOverTimeMember2023-01-012023-06-300001051512tds:ResidentialRevenueMembertds:OtherSegmentMemberus-gaap:TransferredOverTimeMember2023-01-012023-06-300001051512tds:ResidentialRevenueMemberus-gaap:TransferredOverTimeMember2023-01-012023-06-300001051512tds:CommercialRevenueMemberus-gaap:TransferredOverTimeMembertds:USCellularSegmentMember2023-01-012023-06-300001051512tds:CommercialRevenueMembertds:TDSTelecomSegmentMemberus-gaap:TransferredOverTimeMember2023-01-012023-06-300001051512tds:CommercialRevenueMembertds:OtherSegmentMemberus-gaap:TransferredOverTimeMember2023-01-012023-06-300001051512tds:CommercialRevenueMemberus-gaap:TransferredOverTimeMember2023-01-012023-06-300001051512tds:WholesaleRevenueMemberus-gaap:TransferredOverTimeMembertds:USCellularSegmentMember2023-01-012023-06-300001051512tds:WholesaleRevenueMembertds:TDSTelecomSegmentMemberus-gaap:TransferredOverTimeMember2023-01-012023-06-300001051512tds:OtherSegmentMembertds:WholesaleRevenueMemberus-gaap:TransferredOverTimeMember2023-01-012023-06-300001051512tds:WholesaleRevenueMemberus-gaap:TransferredOverTimeMember2023-01-012023-06-300001051512tds:OtherServiceRevenueMemberus-gaap:TransferredOverTimeMembertds:USCellularSegmentMember2023-01-012023-06-300001051512tds:OtherServiceRevenueMembertds:TDSTelecomSegmentMemberus-gaap:TransferredOverTimeMember2023-01-012023-06-300001051512tds:OtherServiceRevenueMembertds:OtherSegmentMemberus-gaap:TransferredOverTimeMember2023-01-012023-06-300001051512tds:OtherServiceRevenueMemberus-gaap:TransferredOverTimeMember2023-01-012023-06-300001051512us-gaap:TransferredOverTimeMembertds:USCellularSegmentMember2023-01-012023-06-300001051512tds:TDSTelecomSegmentMemberus-gaap:TransferredOverTimeMember2023-01-012023-06-300001051512tds:OtherSegmentMemberus-gaap:TransferredOverTimeMember2023-01-012023-06-300001051512us-gaap:TransferredOverTimeMember2023-01-012023-06-300001051512us-gaap:TransferredAtPointInTimeMembertds:EquipmentAndProductSalesMembertds:USCellularSegmentMember2023-01-012023-06-300001051512us-gaap:TransferredAtPointInTimeMembertds:EquipmentAndProductSalesMembertds:TDSTelecomSegmentMember2023-01-012023-06-300001051512tds:OtherSegmentMemberus-gaap:TransferredAtPointInTimeMembertds:EquipmentAndProductSalesMember2023-01-012023-06-300001051512us-gaap:TransferredAtPointInTimeMembertds:EquipmentAndProductSalesMember2023-01-012023-06-300001051512tds:USCellularSegmentMember2023-01-012023-06-300001051512tds:TDSTelecomSegmentMember2023-01-012023-06-300001051512tds:OtherSegmentMember2023-01-012023-06-3000010515122024-07-012024-06-3000010515122025-01-012024-06-3000010515122026-01-012024-06-300001051512tds:SalesCommissionsMember2024-06-300001051512tds:SalesCommissionsMember2023-12-310001051512tds:InstallationCostsMember2024-06-300001051512tds:InstallationCostsMember2023-12-310001051512us-gaap:CarryingReportedAmountFairValueDisclosureMember2024-06-300001051512us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Member2024-06-300001051512us-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310001051512us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Member2023-12-310001051512us-gaap:AccountsReceivableMember2024-06-300001051512us-gaap:AccountsReceivableMember2023-12-310001051512us-gaap:OtherNoncurrentAssetsMember2024-06-300001051512us-gaap:OtherNoncurrentAssetsMember2023-12-310001051512tds:LowestRiskMemberus-gaap:UnbilledRevenuesMember2024-06-300001051512us-gaap:UnbilledRevenuesMemberus-gaap:PrimeMember2024-06-300001051512us-gaap:UnbilledRevenuesMembertds:SlightRiskMember2024-06-300001051512us-gaap:SubprimeMemberus-gaap:UnbilledRevenuesMember2024-06-300001051512us-gaap:UnbilledRevenuesMember2024-06-300001051512tds:LowestRiskMemberus-gaap:UnbilledRevenuesMember2023-12-310001051512us-gaap:UnbilledRevenuesMemberus-gaap:PrimeMember2023-12-310001051512us-gaap:UnbilledRevenuesMembertds:SlightRiskMember2023-12-310001051512us-gaap:SubprimeMemberus-gaap:UnbilledRevenuesMember2023-12-310001051512us-gaap:UnbilledRevenuesMember2023-12-310001051512us-gaap:BilledRevenuesMembertds:LowestRiskMemberus-gaap:FinancialAssetNotPastDueMember2024-06-300001051512us-gaap:BilledRevenuesMemberus-gaap:FinancialAssetNotPastDueMemberus-gaap:PrimeMember2024-06-300001051512us-gaap:BilledRevenuesMemberus-gaap:FinancialAssetNotPastDueMembertds:SlightRiskMember2024-06-300001051512us-gaap:BilledRevenuesMemberus-gaap:SubprimeMemberus-gaap:FinancialAssetNotPastDueMember2024-06-300001051512us-gaap:BilledRevenuesMemberus-gaap:FinancialAssetNotPastDueMember2024-06-300001051512us-gaap:BilledRevenuesMembertds:LowestRiskMemberus-gaap:FinancialAssetNotPastDueMember2023-12-310001051512us-gaap:BilledRevenuesMemberus-gaap:FinancialAssetNotPastDueMemberus-gaap:PrimeMember2023-12-310001051512us-gaap:BilledRevenuesMemberus-gaap:FinancialAssetNotPastDueMembertds:SlightRiskMember2023-12-310001051512us-gaap:BilledRevenuesMemberus-gaap:SubprimeMemberus-gaap:FinancialAssetNotPastDueMember2023-12-310001051512us-gaap:BilledRevenuesMemberus-gaap:FinancialAssetNotPastDueMember2023-12-310001051512us-gaap:BilledRevenuesMemberus-gaap:FinancialAssetPastDueMembertds:LowestRiskMember2024-06-300001051512us-gaap:BilledRevenuesMemberus-gaap:FinancialAssetPastDueMemberus-gaap:PrimeMember2024-06-300001051512us-gaap:BilledRevenuesMemberus-gaap:FinancialAssetPastDueMembertds:SlightRiskMember2024-06-300001051512us-gaap:BilledRevenuesMemberus-gaap:SubprimeMemberus-gaap:FinancialAssetPastDueMember2024-06-300001051512us-gaap:BilledRevenuesMemberus-gaap:FinancialAssetPastDueMember2024-06-300001051512us-gaap:BilledRevenuesMemberus-gaap:FinancialAssetPastDueMembertds:LowestRiskMember2023-12-310001051512us-gaap:BilledRevenuesMemberus-gaap:FinancialAssetPastDueMemberus-gaap:PrimeMember2023-12-310001051512us-gaap:BilledRevenuesMemberus-gaap:FinancialAssetPastDueMembertds:SlightRiskMember2023-12-310001051512us-gaap:BilledRevenuesMemberus-gaap:SubprimeMemberus-gaap:FinancialAssetPastDueMember2023-12-310001051512us-gaap:BilledRevenuesMemberus-gaap:FinancialAssetPastDueMember2023-12-310001051512tds:LowestRiskMember2024-06-300001051512us-gaap:PrimeMember2024-06-300001051512tds:SlightRiskMember2024-06-300001051512us-gaap:SubprimeMember2024-06-300001051512tds:LowestRiskMember2023-12-310001051512us-gaap:PrimeMember2023-12-310001051512tds:SlightRiskMember2023-12-310001051512us-gaap:SubprimeMember2023-12-310001051512tds:EquipmentInstallmentPlanReceivableMember2024-01-012024-06-300001051512tds:EquipmentInstallmentPlanReceivableMember2023-12-310001051512tds:EquipmentInstallmentPlanReceivableMember2022-12-310001051512tds:EquipmentInstallmentPlanReceivableMember2023-01-012023-06-300001051512tds:EquipmentInstallmentPlanReceivableMember2024-06-300001051512tds:EquipmentInstallmentPlanReceivableMember2023-06-300001051512us-gaap:CommonClassBMember2024-04-012024-06-300001051512us-gaap:CommonClassBMember2023-04-012023-06-300001051512us-gaap:CommonClassBMember2023-01-012023-06-300001051512us-gaap:CommonClassAMember2024-04-012024-06-300001051512us-gaap:CommonClassAMember2023-04-012023-06-300001051512us-gaap:CommonClassAMember2024-01-012024-06-300001051512us-gaap:CommonClassAMember2023-01-012023-06-300001051512tds:USCellularSegmentMember2024-06-300001051512srt:MaximumMembertds:USCellularSegmentMember2024-06-300001051512tds:PutCallOptionMembertds:USCellularSegmentMember2024-06-300001051512tds:TDSTelecomSegmentMember2024-06-300001051512tds:OtherSegmentMember2024-06-300001051512us-gaap:EquityMethodInvestmentsMember2024-04-012024-06-300001051512us-gaap:EquityMethodInvestmentsMember2023-04-012023-06-300001051512us-gaap:EquityMethodInvestmentsMember2024-01-012024-06-300001051512us-gaap:EquityMethodInvestmentsMember2023-01-012023-06-300001051512tds:UsGaap_RevolvingCreditFacilityMemberBMember2024-06-300001051512tds:UsGaap_RevolvingCreditFacilityMemberBMember2024-01-012024-06-300001051512tds:UsGaap_RevolvingCreditFacilityMemberBMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2024-01-012024-06-300001051512tds:LendersCostOfFundsMembertds:ReceivablesSecuritizationFacilityMembertds:USCellularSegmentMember2024-01-012024-06-300001051512tds:ReceivablesSecuritizationFacilityMembertds:USCellularSegmentMember2024-01-012024-06-300001051512tds:ReceivablesSecuritizationFacilityMembertds:USCellularSegmentMember2024-06-300001051512tds:ReceivablesSecuritizationFacilityMembertds:USCellularSegmentMemberus-gaap:AssetPledgedAsCollateralWithoutRightMember2024-06-300001051512tds:TDSTermLoan1Member2024-06-300001051512tds:TDSTermLoan1Member2024-01-012024-06-300001051512tds:TDSTermLoan1Memberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2024-01-012024-06-300001051512us-gaap:SubsequentEventMembertds:TDSTermLoan1Member2024-09-012024-09-0100010515122024-04-010001051512us-gaap:SubsequentEventMember2025-04-010001051512tds:TDSTermLoan1Member2024-04-010001051512us-gaap:SubsequentEventMembertds:TDSTermLoan1Member2025-04-010001051512us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2024-06-300001051512us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-12-310001051512tds:VariableInterestEntityUsccEipLlcMember2024-01-012024-06-300001051512tds:VariableInterestEntityUsccEipLlcMember2023-01-012023-06-300001051512tds:UnitedStatesCellularCorporationMemberus-gaap:OperatingSegmentsMembertds:WirelessSegmentMemberus-gaap:ServiceMember2024-04-012024-06-300001051512tds:UnitedStatesCellularCorporationMemberus-gaap:OperatingSegmentsMembertds:TowersSegmentMemberus-gaap:ServiceMember2024-04-012024-06-300001051512srt:ConsolidationEliminationsMembertds:UnitedStatesCellularCorporationMemberus-gaap:ServiceMember2024-04-012024-06-300001051512us-gaap:OperatingSegmentsMemberus-gaap:ServiceMembertds:USCellularSegmentMember2024-04-012024-06-300001051512us-gaap:OperatingSegmentsMembertds:TDSTelecomSegmentMemberus-gaap:ServiceMember2024-04-012024-06-300001051512us-gaap:CorporateNonSegmentMemberus-gaap:ServiceMember2024-04-012024-06-300001051512tds:UnitedStatesCellularCorporationMemberus-gaap:OperatingSegmentsMembertds:WirelessSegmentMemberus-gaap:ProductMember2024-04-012024-06-300001051512tds:UnitedStatesCellularCorporationMemberus-gaap:OperatingSegmentsMembertds:TowersSegmentMemberus-gaap:ProductMember2024-04-012024-06-300001051512srt:ConsolidationEliminationsMembertds:UnitedStatesCellularCorporationMemberus-gaap:ProductMember2024-04-012024-06-300001051512us-gaap:OperatingSegmentsMemberus-gaap:ProductMembertds:USCellularSegmentMember2024-04-012024-06-300001051512us-gaap:OperatingSegmentsMembertds:TDSTelecomSegmentMemberus-gaap:ProductMember2024-04-012024-06-300001051512us-gaap:CorporateNonSegmentMemberus-gaap:ProductMember2024-04-012024-06-300001051512tds:UnitedStatesCellularCorporationMemberus-gaap:OperatingSegmentsMembertds:WirelessSegmentMember2024-04-012024-06-300001051512tds:UnitedStatesCellularCorporationMemberus-gaap:OperatingSegmentsMembertds:TowersSegmentMember2024-04-012024-06-300001051512srt:ConsolidationEliminationsMembertds:UnitedStatesCellularCorporationMember2024-04-012024-06-300001051512us-gaap:OperatingSegmentsMembertds:USCellularSegmentMember2024-04-012024-06-300001051512us-gaap:OperatingSegmentsMembertds:TDSTelecomSegmentMember2024-04-012024-06-300001051512us-gaap:CorporateNonSegmentMember2024-04-012024-06-300001051512us-gaap:OperatingSegmentsMembertds:USCellularSegmentMember2024-06-300001051512us-gaap:OperatingSegmentsMembertds:TDSTelecomSegmentMember2024-06-300001051512us-gaap:CorporateNonSegmentMember2024-06-300001051512tds:UnitedStatesCellularCorporationMemberus-gaap:OperatingSegmentsMembertds:WirelessSegmentMemberus-gaap:ServiceMember2023-04-012023-06-300001051512tds:UnitedStatesCellularCorporationMemberus-gaap:OperatingSegmentsMembertds:TowersSegmentMemberus-gaap:ServiceMember2023-04-012023-06-300001051512srt:ConsolidationEliminationsMembertds:UnitedStatesCellularCorporationMemberus-gaap:ServiceMember2023-04-012023-06-300001051512us-gaap:OperatingSegmentsMemberus-gaap:ServiceMembertds:USCellularSegmentMember2023-04-012023-06-300001051512us-gaap:OperatingSegmentsMembertds:TDSTelecomSegmentMemberus-gaap:ServiceMember2023-04-012023-06-300001051512us-gaap:CorporateNonSegmentMemberus-gaap:ServiceMember2023-04-012023-06-300001051512tds:UnitedStatesCellularCorporationMemberus-gaap:OperatingSegmentsMembertds:WirelessSegmentMemberus-gaap:ProductMember2023-04-012023-06-300001051512tds:UnitedStatesCellularCorporationMemberus-gaap:OperatingSegmentsMembertds:TowersSegmentMemberus-gaap:ProductMember2023-04-012023-06-300001051512srt:ConsolidationEliminationsMembertds:UnitedStatesCellularCorporationMemberus-gaap:ProductMember2023-04-012023-06-300001051512us-gaap:OperatingSegmentsMemberus-gaap:ProductMembertds:USCellularSegmentMember2023-04-012023-06-300001051512us-gaap:OperatingSegmentsMembertds:TDSTelecomSegmentMemberus-gaap:ProductMember2023-04-012023-06-300001051512us-gaap:CorporateNonSegmentMemberus-gaap:ProductMember2023-04-012023-06-300001051512tds:UnitedStatesCellularCorporationMemberus-gaap:OperatingSegmentsMembertds:WirelessSegmentMember2023-04-012023-06-300001051512tds:UnitedStatesCellularCorporationMemberus-gaap:OperatingSegmentsMembertds:TowersSegmentMember2023-04-012023-06-300001051512srt:ConsolidationEliminationsMembertds:UnitedStatesCellularCorporationMember2023-04-012023-06-300001051512us-gaap:OperatingSegmentsMembertds:USCellularSegmentMember2023-04-012023-06-300001051512us-gaap:OperatingSegmentsMembertds:TDSTelecomSegmentMember2023-04-012023-06-300001051512us-gaap:CorporateNonSegmentMember2023-04-012023-06-300001051512us-gaap:OperatingSegmentsMembertds:USCellularSegmentMember2023-06-300001051512us-gaap:OperatingSegmentsMembertds:TDSTelecomSegmentMember2023-06-300001051512us-gaap:CorporateNonSegmentMember2023-06-300001051512tds:UnitedStatesCellularCorporationMemberus-gaap:OperatingSegmentsMembertds:WirelessSegmentMemberus-gaap:ServiceMember2024-01-012024-06-300001051512tds:UnitedStatesCellularCorporationMemberus-gaap:OperatingSegmentsMembertds:TowersSegmentMemberus-gaap:ServiceMember2024-01-012024-06-300001051512srt:ConsolidationEliminationsMembertds:UnitedStatesCellularCorporationMemberus-gaap:ServiceMember2024-01-012024-06-300001051512us-gaap:OperatingSegmentsMemberus-gaap:ServiceMembertds:USCellularSegmentMember2024-01-012024-06-300001051512us-gaap:OperatingSegmentsMembertds:TDSTelecomSegmentMemberus-gaap:ServiceMember2024-01-012024-06-300001051512us-gaap:CorporateNonSegmentMemberus-gaap:ServiceMember2024-01-012024-06-300001051512tds:UnitedStatesCellularCorporationMemberus-gaap:OperatingSegmentsMembertds:WirelessSegmentMemberus-gaap:ProductMember2024-01-012024-06-300001051512tds:UnitedStatesCellularCorporationMemberus-gaap:OperatingSegmentsMembertds:TowersSegmentMemberus-gaap:ProductMember2024-01-012024-06-300001051512srt:ConsolidationEliminationsMembertds:UnitedStatesCellularCorporationMemberus-gaap:ProductMember2024-01-012024-06-300001051512us-gaap:OperatingSegmentsMemberus-gaap:ProductMembertds:USCellularSegmentMember2024-01-012024-06-300001051512us-gaap:OperatingSegmentsMembertds:TDSTelecomSegmentMemberus-gaap:ProductMember2024-01-012024-06-300001051512us-gaap:CorporateNonSegmentMemberus-gaap:ProductMember2024-01-012024-06-300001051512tds:UnitedStatesCellularCorporationMemberus-gaap:OperatingSegmentsMembertds:WirelessSegmentMember2024-01-012024-06-300001051512tds:UnitedStatesCellularCorporationMemberus-gaap:OperatingSegmentsMembertds:TowersSegmentMember2024-01-012024-06-300001051512srt:ConsolidationEliminationsMembertds:UnitedStatesCellularCorporationMember2024-01-012024-06-300001051512us-gaap:OperatingSegmentsMembertds:USCellularSegmentMember2024-01-012024-06-300001051512us-gaap:OperatingSegmentsMembertds:TDSTelecomSegmentMember2024-01-012024-06-300001051512us-gaap:CorporateNonSegmentMember2024-01-012024-06-300001051512tds:UnitedStatesCellularCorporationMemberus-gaap:OperatingSegmentsMembertds:WirelessSegmentMemberus-gaap:ServiceMember2023-01-012023-06-300001051512tds:UnitedStatesCellularCorporationMemberus-gaap:OperatingSegmentsMembertds:TowersSegmentMemberus-gaap:ServiceMember2023-01-012023-06-300001051512srt:ConsolidationEliminationsMembertds:UnitedStatesCellularCorporationMemberus-gaap:ServiceMember2023-01-012023-06-300001051512us-gaap:OperatingSegmentsMemberus-gaap:ServiceMembertds:USCellularSegmentMember2023-01-012023-06-300001051512us-gaap:OperatingSegmentsMembertds:TDSTelecomSegmentMemberus-gaap:ServiceMember2023-01-012023-06-300001051512us-gaap:CorporateNonSegmentMemberus-gaap:ServiceMember2023-01-012023-06-300001051512tds:UnitedStatesCellularCorporationMemberus-gaap:OperatingSegmentsMembertds:WirelessSegmentMemberus-gaap:ProductMember2023-01-012023-06-300001051512tds:UnitedStatesCellularCorporationMemberus-gaap:OperatingSegmentsMembertds:TowersSegmentMemberus-gaap:ProductMember2023-01-012023-06-300001051512srt:ConsolidationEliminationsMembertds:UnitedStatesCellularCorporationMemberus-gaap:ProductMember2023-01-012023-06-300001051512us-gaap:OperatingSegmentsMemberus-gaap:ProductMembertds:USCellularSegmentMember2023-01-012023-06-300001051512us-gaap:OperatingSegmentsMembertds:TDSTelecomSegmentMemberus-gaap:ProductMember2023-01-012023-06-300001051512us-gaap:CorporateNonSegmentMemberus-gaap:ProductMember2023-01-012023-06-300001051512tds:UnitedStatesCellularCorporationMemberus-gaap:OperatingSegmentsMembertds:WirelessSegmentMember2023-01-012023-06-300001051512tds:UnitedStatesCellularCorporationMemberus-gaap:OperatingSegmentsMembertds:TowersSegmentMember2023-01-012023-06-300001051512srt:ConsolidationEliminationsMembertds:UnitedStatesCellularCorporationMember2023-01-012023-06-300001051512us-gaap:OperatingSegmentsMembertds:USCellularSegmentMember2023-01-012023-06-300001051512us-gaap:OperatingSegmentsMembertds:TDSTelecomSegmentMember2023-01-012023-06-300001051512us-gaap:CorporateNonSegmentMember2023-01-012023-06-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

|

|

|

|

|

|

|

|

|

| (Mark One) |

☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2024

OR

|

|

|

|

|

|

|

|

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-14157

|

|

|

|

|

|

|

|

|

TELEPHONE AND DATA SYSTEMS, INC. |

| (Exact name of Registrant as specified in its charter) |

Delaware |

|

36-2669023 |

| (State or other jurisdiction of incorporation or organization) |

|

(IRS Employer Identification No.) |

30 North LaSalle Street, Suite 4000, Chicago, Illinois 60602

(Address of principal executive offices) (Zip code)

Registrant's telephone number, including area code: (312) 630-1900

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class |

|

Trading Symbol |

|

Name of each exchange on which registered |

| Common Shares, $.01 par value |

|

TDS |

|

New York Stock Exchange |

| Depository Shares each representing a 1/1000th interest in a share of 6.625% Series UU Cumulative Redeemable Perpetual Preferred Stock, $.01 par value |

|

TDSPrU |

|

New York Stock Exchange |

| Depository Shares each representing a 1/1000th interest in a share of 6.000% Series VV Cumulative Redeemable Perpetual Preferred Stock, $.01 par value |

|

TDSPrV |

|

New York Stock Exchange |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. |

Yes |

☒ |

No |

☐ |

|

|

|

|

|

|

|

|

| Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). |

Yes |

☒ |

No |

☐ |

|

|

|

|

|

|

|

|

| Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. |

Large accelerated filer |

☒ |

|

Accelerated filer |

☐ |

| Non-accelerated filer |

☐ |

|

Smaller reporting company |

☐ |

|

|

|

Emerging growth company |

☐ |

|

|

|

|

|

|

|

|

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. |

☐ |

| Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). |

Yes |

☐ |

No |

☒ |

The number of shares outstanding of each of the issuer's classes of common stock, as of June 30, 2024, is 106 million Common Shares, $.01 par value, and 7 million Series A Common Shares, $.01 par value.

Telephone and Data Systems, Inc.

Quarterly Report on Form 10-Q

For the Period Ended June 30, 2024

|

|

|

|

|

|

|

Telephone and Data Systems, Inc.

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

|

Executive Overview

The following discussion and analysis compares Telephone and Data Systems, Inc.’s (TDS) financial results for the three and six months ended June 30, 2024, to the three and six months ended June 30, 2023. It should be read in conjunction with TDS’ interim consolidated financial statements and notes included herein, and with the description of TDS’ business, its audited consolidated financial statements and Management's Discussion and Analysis of Financial Condition and Results of Operations (MD&A) included in TDS’ Annual Report on Form 10-K (Form 10-K) for the year ended December 31, 2023. Certain numbers included herein are rounded to millions for ease of presentation; however, certain calculated amounts and percentages are determined using the unrounded numbers.

This report contains statements that are not based on historical facts, which may be identified by words such as “believes,” “anticipates,” “estimates,” “expects,” “plans,” “intends,” “projects,” “will” and similar expressions. These statements constitute and represent “forward looking statements” as this term is defined in the Private Securities Litigation Reform Act of 1995. Such forward looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results, events or developments to be significantly different from any future results, events or developments expressed or implied by such forward looking statements. See the disclosure under the heading Private Securities Litigation Reform Act of 1995 Safe Harbor Cautionary Statement elsewhere in this report for additional information.

The accounting policies of TDS conform to accounting principles generally accepted in the United States of America (GAAP). However, TDS uses certain “non-GAAP financial measures” in the MD&A. A discussion of the reasons TDS determines these metrics to be useful and reconciliations of these measures to their most directly comparable measures determined in accordance with GAAP are included in the disclosure under the heading Supplemental Information Relating to Non-GAAP Financial Measures within the MD&A of this report.

General

TDS is a diversified telecommunications company that provides high-quality communications services to approximately 6 million connections nationwide as of June 30, 2024. TDS provides wireless services through its 82%-owned subsidiary, United States Cellular Corporation (UScellular). TDS also provides broadband, video and voice services through its wholly-owned subsidiary, TDS Telecommunications LLC (TDS Telecom). TDS operates entirely in the United States.

During the second quarter of 2024, TDS and UScellular modified their reporting structure due to the planned disposal of the UScellular wireless operations and, as a result, disaggregated the UScellular operations into two reportable segments - Wireless and Towers. This presentation reflects how TDS' and UScellular's chief operating decision maker allocates resources and evaluates operating performance following this strategic shift. Prior periods have been updated to conform to the new reportable segments. See Note 12 — Business Segment Information in the Notes to Consolidated Financial Statements for additional information about TDS' segments.

TDS Mission and Strategy

TDS’ mission is to provide outstanding communications services to its customers and meet the needs of its shareholders, its people, and its communities. In pursuing this mission, TDS seeks to grow its businesses, create opportunities for its associates, support the communities it serves, and build value over the long term for its shareholders. Since its founding, TDS has been committed to bringing high-quality communications services to rural and underserved communities. TDS continues to make progress on developing and enhancing its Environmental, Social and Governance (ESG) program, including the publication of the most recent TDS ESG Report in July 2023, which is available on the TDS website.

TDS’ historical long-term strategy has been to re-invest the majority of its operating capital in its businesses to strengthen their competitive positions and financial performance, while also returning value to TDS shareholders primarily through the payment of a regular quarterly cash dividend. In the second quarter of 2024, TDS reset its approach to capital allocation and declared dividends at approximately 20% of the previous level for TDS Common and Series A shares. This shift in approach is expected to free up additional capital that can be used to support TDS' fiber program, among other purposes.

TDS plans to build shareholder value by continuing to execute on its strategies to build strong, competitive businesses providing high-quality, data-focused services and products. Strategic efforts include:

▪UScellular offers economical and competitively priced service plans and devices to its customers and is focused on increasing revenues from sales of related products such as device protection plans and from services such as fixed wireless home internet. In addition, UScellular is focused on increasing tower rent revenues and expanding its solutions available to business and government customers.

▪UScellular continues to enhance its network capabilities, including by deploying 5G technology. 5G technology helps address customers’ growing demand for data services and creates opportunities for new services requiring high speed and reliability as well as low latency. UScellular's initial 5G deployment in 2019-2022 predominantly used low-band spectrum to launch 5G services in portions of substantially all of its markets. During 2023, UScellular continued to invest in 5G with a focus on deployment of mid-band spectrum, which largely overlaps areas already covered with low-band 5G service. During 2024, UScellular is continuing the multi-year deployment of 5G mid-band spectrum. 5G service deployed over mid-band spectrum further enhances speed and capacity for UScellular's mobility and fixed wireless services.

▪UScellular seeks to grow revenue in its Towers segment primarily through increasing third-party colocations on existing towers through providing unique tower locations, attractive terms and streamlined implementation to third-party wireless operators.

▪TDS Telecom strives to provide high-quality broadband services in its markets with the ability to provide value-added bundling with video and voice service options. TDS Telecom focuses on driving growth by investing in fiber deployment primarily in its expansion markets and also in its incumbent and cable markets that have historically utilized copper and coaxial cable technologies.

▪TDS Telecom seeks to grow its operations by creating clusters of markets in attractive, growing locations and may seek to acquire and/or divest of assets to support its strategy.

Announced Transaction and Strategic Alternatives Review

On August 4, 2023, TDS and UScellular announced that the Boards of Directors of both companies decided to initiate a process to explore a range of strategic alternatives for UScellular. On May 28, 2024, UScellular announced that its Board of Directors unanimously approved the execution of a Securities Purchase Agreement (Securities Purchase Agreement) by and among TDS, UScellular, T-Mobile US, Inc. (T-Mobile) and USCC Wireless Holdings, LLC, pursuant to which, among other things, UScellular agreed to sell its wireless operations and select spectrum assets to T-Mobile for a purchase price, subject to adjustment as specified in the Securities Purchase Agreement, of $4,400 million, which is payable in a combination of cash and the assumption of up to approximately $2,000 million in debt. The transaction is expected to close in mid-2025, subject to the receipt of regulatory approvals and the satisfaction of customary closing conditions.

The strategic alternatives review process is ongoing as UScellular seeks to opportunistically monetize its spectrum assets that are not subject to the Securities Purchase Agreement. During the three and six months ended June 30, 2024, TDS incurred third-party expenses of $21 million and $33 million, respectively, related to the strategic alternatives review.

Terms Used by TDS

The following is a list of definitions of certain industry terms that are used throughout this document:

▪4G LTE – fourth generation Long-Term Evolution, which is a wireless technology that enables more network capacity for more data per user as well as faster access to data compared to third generation (3G) technology.

▪5G – fifth generation wireless technology that helps address customers’ growing demand for data services and creates opportunities for new services requiring high speed and reliability as well as low latency.

▪Alternative Connect America Cost Model (ACAM) – a USF support mechanism for certain carriers, which provides revenue support through 2028. This support comes with an obligation to build defined broadband speeds to a certain number of locations.

▪Account – represents an individual or business financially responsible for one or multiple associated connections. An account may include a variety of types of connections such as handsets and connected devices.

▪Broadband Connections – refers to the individual customers provided internet access through various transmission technologies, including fiber, coaxial and copper.

▪Broadband Penetration – metric which is calculated by dividing total broadband connections by total service addresses.

▪Cable Markets – markets where TDS provides service as the cable provider using coaxial cable and fiber technologies.

▪Churn Rate – represents the percentage of the connections that disconnect service each month. These rates represent the average monthly churn rate for each respective period.

▪Colocations – represents instances where a third-party wireless carrier rents or leases space on a company-owned tower.

▪Connected Devices – non-handset devices that connect directly to the UScellular network. Connected devices include products such as tablets, wearables, modems, fixed wireless, and hotspots.

▪EBITDA – refers to earnings before interest, taxes, depreciation, amortization and accretion and is used in the non-GAAP metric Adjusted EBITDA throughout this document. See Supplemental Information Relating to Non-GAAP Financial Measures within this MD&A for additional information.

▪Enhanced Alternative Connect America Cost Model (E-ACAM) – a USF support mechanism for certain carriers, which provides revenue support through 2038. This support comes with an obligation to provide 100 megabits per second (Mbps) of download speed and 20 Mbps of upload speed (100/20 Mbps) to a certain number of locations.

▪Expansion Markets – markets utilizing fiber networks in areas where TDS does not serve as the incumbent service provider.

▪Free Cash Flow – non-GAAP metric defined as Cash flows from operating activities less Cash paid for additions to property, plant and equipment and less Cash paid for software license agreements. See Supplemental Information Relating to Non-GAAP Financial Measures within this MD&A for additional information.

▪Gross Additions – represents the total number of new connections added during the period, without regard to connections that were terminated during that period.

▪Incumbent Markets – markets where TDS is positioned as the traditional local telephone company.

▪IPTV – internet protocol television.

▪Net Additions (Losses) – represents the total number of new connections added during the period, net of connections that were terminated during that period.

▪OIBDA – refers to operating income before depreciation, amortization and accretion and is used in the non-GAAP metric Adjusted OIBDA throughout this document. See Supplemental Information Relating to Non-GAAP Financial Measures within this MD&A for additional information.

▪Postpaid Average Revenue per Account (Postpaid ARPA) – metric which is calculated by dividing total postpaid service revenues by the average number of postpaid accounts and by the number of months in the period.

▪Postpaid Average Revenue per User (Postpaid ARPU) – metric which is calculated by dividing total postpaid service revenues by the average number of postpaid connections and by the number of months in the period.

▪Residential Revenue per Connection – metric which is calculated by dividing total residential revenue by the average number of residential connections and by the number of months in the period.

▪Retail Connections – individual lines of service associated with each device activated by a postpaid or prepaid customer. Connections are associated with all types of devices that connect directly to the UScellular network.

▪Service Addresses – number of single residence homes, multi-dwelling units, and business locations that are capable of being connected to the TDS network, based on best available information.

▪Tower Tenancy Rate – average number of tenants that lease space on company-owned towers, measured on a per-tower basis.

▪Universal Service Fund (USF) – a system of telecommunications collected fees and support payments managed by the Federal Communications Commission (FCC) intended to promote universal access to telecommunications services in the United States.

▪Video Connections – represents the individual customers provided video services.

▪Voice Connections – refers to the individual circuits connecting a customer to TDS' central office facilities that provide voice services or the billable number of lines into a building for voice services.

Results of Operations — TDS Consolidated

The following discussion and analysis compares financial results for the three and six months ended June 30, 2024, to the three and six months ended June 30, 2023.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

June 30, |

|

Six Months Ended

June 30, |

| |

2024 |

|

2023 |

|

2024 vs. 2023 |

|

2024 |

|

2023 |

|

2024 vs. 2023 |

| (Dollars in millions) |

|

|

|

|

|

|

|

|

|

|

|

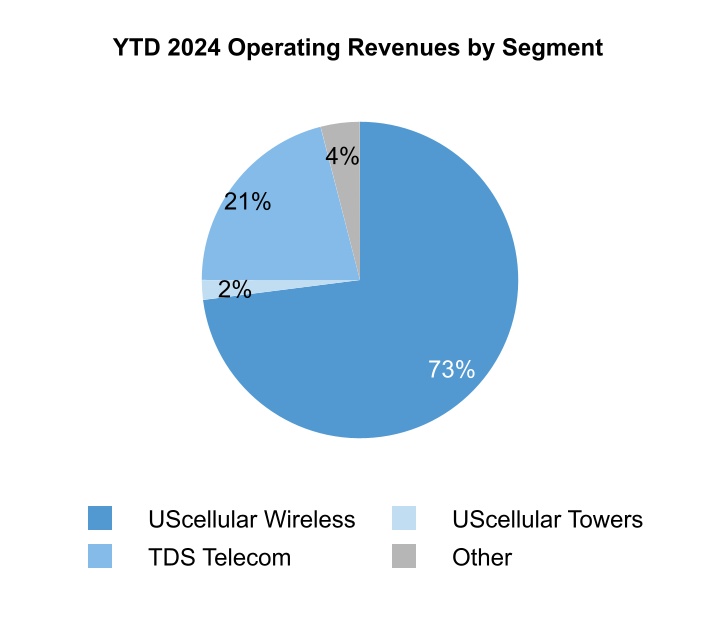

| Operating revenues |

|

|

|

|

|

|

|

|

|

|

|

| UScellular |

$ |

927 |

|

|

$ |

957 |

|

|

(3) |

% |

|

$ |

1,877 |

|

|

$ |

1,942 |

|

|

(3) |

% |

| TDS Telecom |

267 |

|

|

257 |

|

|

4 |

% |

|

534 |

|

|

510 |

|

|

5 |

% |

All other1 |

44 |

|

|

53 |

|

|

(19) |

% |

|

89 |

|

|

118 |

|

|

(24) |

% |

| Total operating revenues |

1,238 |

|

|

1,267 |

|

|

(2) |

% |

|

2,500 |

|

|

2,570 |

|

|

(3) |

% |

| Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

| UScellular |

891 |

|

|

923 |

|

|

(3) |

% |

|

1,789 |

|

|

1,881 |

|

|

(5) |

% |

| TDS Telecom |

248 |

|

|

251 |

|

|

(1) |

% |

|

488 |

|

|

496 |

|

|

(1) |

% |

All other1 |

60 |

|

|

60 |

|

|

(2) |

% |

|

117 |

|

|

131 |

|

|

(11) |

% |

| Total operating expenses |

1,199 |

|

|

1,234 |

|

|

(3) |

% |

|

2,394 |

|

|

2,508 |

|

|

(5) |

% |

| Operating income (loss) |

|

|

|

|

|

|

|

|

|

|

|

| UScellular |

36 |

|

|

34 |

|

|

6 |

% |

|

88 |

|

|

61 |

|

|

44 |

% |

| TDS Telecom |

19 |

|

|

7 |

|

|

N/M |

|

46 |

|

|

15 |

|

|

N/M |

All other1 |

(16) |

|

|

(8) |

|

|

N/M |

|

(28) |

|

|

(14) |

|

|

N/M |

| Total operating income |

39 |

|

|

33 |

|

|

17 |

% |

|

106 |

|

|

62 |

|

|

72 |

% |

| Investment and other income (expense) |

|

|

|

|

|

|

|

|

|

|

|

| Equity in earnings of unconsolidated entities |

39 |

|

|

38 |

|

|

3 |

% |

|

82 |

|

|

82 |

|

|

— |

| Interest and dividend income |

7 |

|

|

6 |

|

|

28 |

% |

|

12 |

|

|

11 |

|

|

13 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense |

(73) |

|

|

(62) |

|

|

(18) |

% |

|

(131) |

|

|

(116) |

|

|

(14) |

% |

| Other, net |

1 |

|

|

— |

|

|

N/M |

|

2 |

|

|

1 |

|

|

N/M |

| Total investment and other expense |

(26) |

|

|

(18) |

|

|

(42) |

% |

|

(35) |

|

|

(22) |

|

|

(62) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| Income before income taxes |

13 |

|

|

15 |

|

|

(13) |

% |

|

71 |

|

|

40 |

|

|

77 |

% |

| Income tax expense |

6 |

|

|

15 |

|

|

(57) |

% |

|

26 |

|

|

28 |

|

|

(8) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

7 |

|

|

— |

|

|

N/M |

|

45 |

|

|

12 |

|

|

N/M |

| Less: Net income attributable to noncontrolling interests, net of tax |

4 |

|

|

2 |

|

|

N/M |

|

13 |

|

|

6 |

|

|

N/M |

| Net income attributable to TDS shareholders |

3 |

|

|

(2) |

|

|

N/M |

|

32 |

|

|

6 |

|

|

N/M |

| TDS Preferred Share dividends |

17 |

|

|

17 |

|

|

— |

|

35 |

|

|

35 |

|

|

— |

| Net income (loss) attributable to TDS common shareholders |

$ |

(14) |

|

|

$ |

(19) |

|

|

24 |

% |

|

$ |

(3) |

|

|

$ |

(29) |

|

|

91 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted OIBDA (Non-GAAP)2 |

$ |

310 |

|

|

$ |

263 |

|

|

18 |

% |

|

$ |

629 |

|

|

$ |

534 |

|

|

18 |

% |

Adjusted EBITDA (Non-GAAP)2 |

$ |

357 |

|

|

$ |

307 |

|

|

17 |

% |

|

$ |

725 |

|

|

$ |

628 |

|

|

15 |

% |

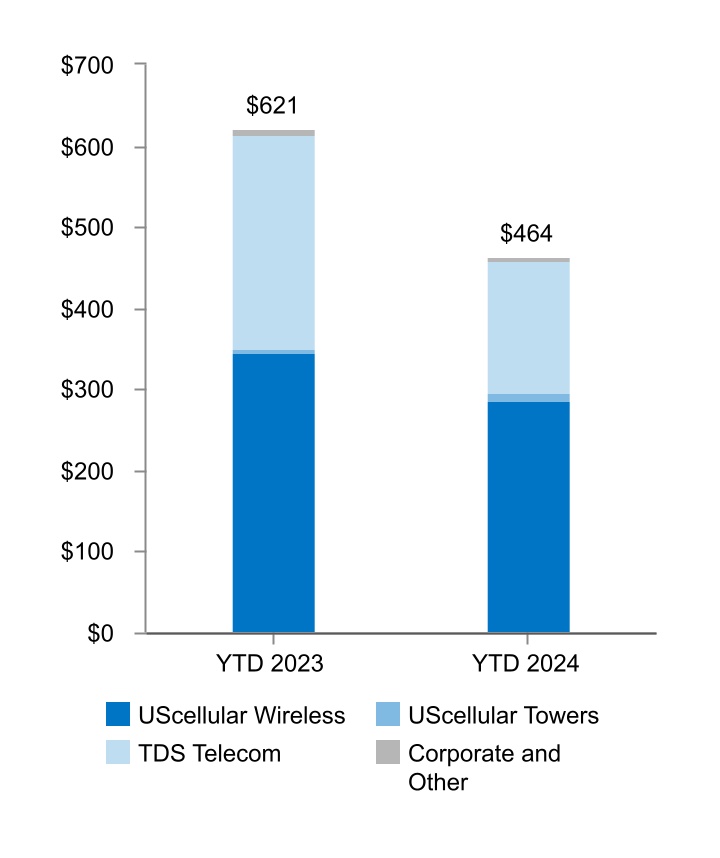

Capital expenditures3 |

$ |

244 |

|

|

$ |

278 |

|

|

(12) |

% |

|

$ |

464 |

|

|

$ |

621 |

|

|

(25) |

% |

Numbers may not foot due to rounding.

N/M - Percentage change not meaningful

1Consists of corporate and other operations and intercompany eliminations.

2Refer to Supplemental Information Relating to Non-GAAP Financial Measures within this MD&A for a reconciliation of this measure.

3Refer to Liquidity and Capital Resources within this MD&A for additional information on Capital expenditures.

Refer to individual segment discussions in this MD&A for additional details on operating revenues and expenses at the segment level.

Equity in earnings of unconsolidated entities

Equity in earnings of unconsolidated entities represents TDS’ share of net income from entities in which it has a noncontrolling interest and that are accounted for using the equity method or the net asset value practical expedient. TDS’ investment in the Los Angeles SMSA Limited Partnership (LA Partnership) contributed pre-tax income of $17 million and $18 million for the three months ended June 30, 2024 and 2023, respectively and $33 million and $38 million for the six months ended June 30, 2024 and 2023, respectively. See Note 8 — Investments in Unconsolidated Entities in the Notes to Consolidated Financial Statements for additional information.

Interest expense

Interest expense increased for the three and six months ended June 30, 2024 due primarily to an increase in borrowings under the TDS term loan agreements, partially offset by a decrease in the average principal balance outstanding on the receivables securitization agreement. See Market Risk for additional information regarding maturities of long-term debt and weighted average interest rates.

Income tax expense

Income tax expense decreased for the three months ended June 30, 2024 due primarily to state valuation allowance adjustments recorded in the second quarter of 2023 that reduced the net value of deferred tax assets.

Income tax expense decreased for the six months ended June 30, 2024 due primarily to state valuation allowance adjustments recorded in the second quarter of 2023 that reduced the net value of deferred tax assets, partially offset by an increase in Income before income taxes.

TDS calculated income taxes for the three and six months ended June 30, 2024, based on an estimated year-to-date tax rate. The effective tax rates are expected to vary in subsequent interim periods in 2024 due primarily to fluctuations in Income before income taxes, as well as tax impacts of sales of businesses expected to close later in 2024.

Net income attributable to noncontrolling interests, net of tax

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

June 30, |

|

Six Months Ended

June 30, |

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

| (Dollars in millions) |

|

|

|

|

|

|

|

| UScellular noncontrolling public shareholders’ |

$ |

3 |

|

|

$ |

1 |

|

|

$ |

6 |

|

|

$ |

3 |

|

| Noncontrolling shareholders’ or partners’ |

1 |

|

|

1 |

|

|

7 |

|

|

3 |

|

| Net income attributable to noncontrolling interests, net of tax |

$ |

4 |

|

|

$ |

2 |

|

|

$ |

13 |

|

|

$ |

6 |

|

Net income attributable to noncontrolling interests, net of tax includes the noncontrolling public shareholders’ share of UScellular’s net income, the noncontrolling shareholders’ or partners’ share of certain UScellular subsidiaries’ net income and other TDS noncontrolling interests.

Earnings

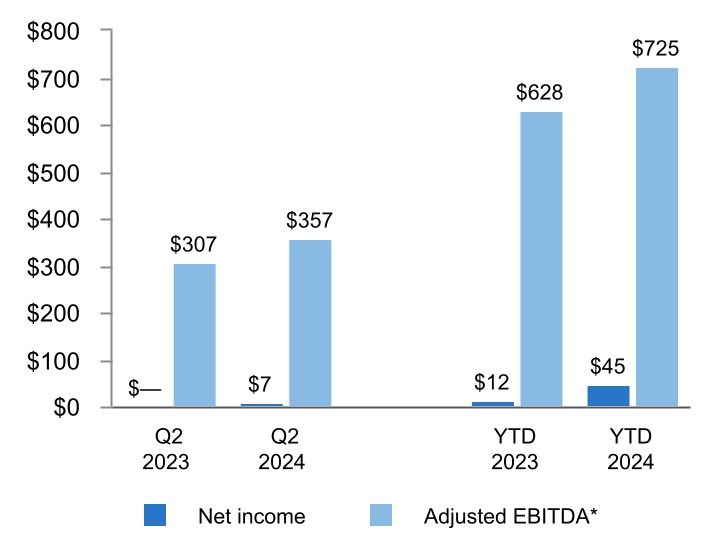

(Dollars in millions)

Three Months Ended

Net income increased due primarily to lower operating and income tax expenses, partially offset by lower operating revenues and higher interest expense. Adjusted EBITDA increased due primarily to lower operating expenses, partially offset by lower operating revenues.

Six Months Ended

Net income increased due primarily to lower operating expenses, partially offset by lower operating revenues and higher interest expense. Adjusted EBITDA increased due primarily to lower operating expenses, partially offset by lower operating revenues.

*Represents a non-GAAP financial measure. Refer to Supplemental Information Relating to Non-GAAP Financial Measures within this MD&A for a reconciliation of this measure.

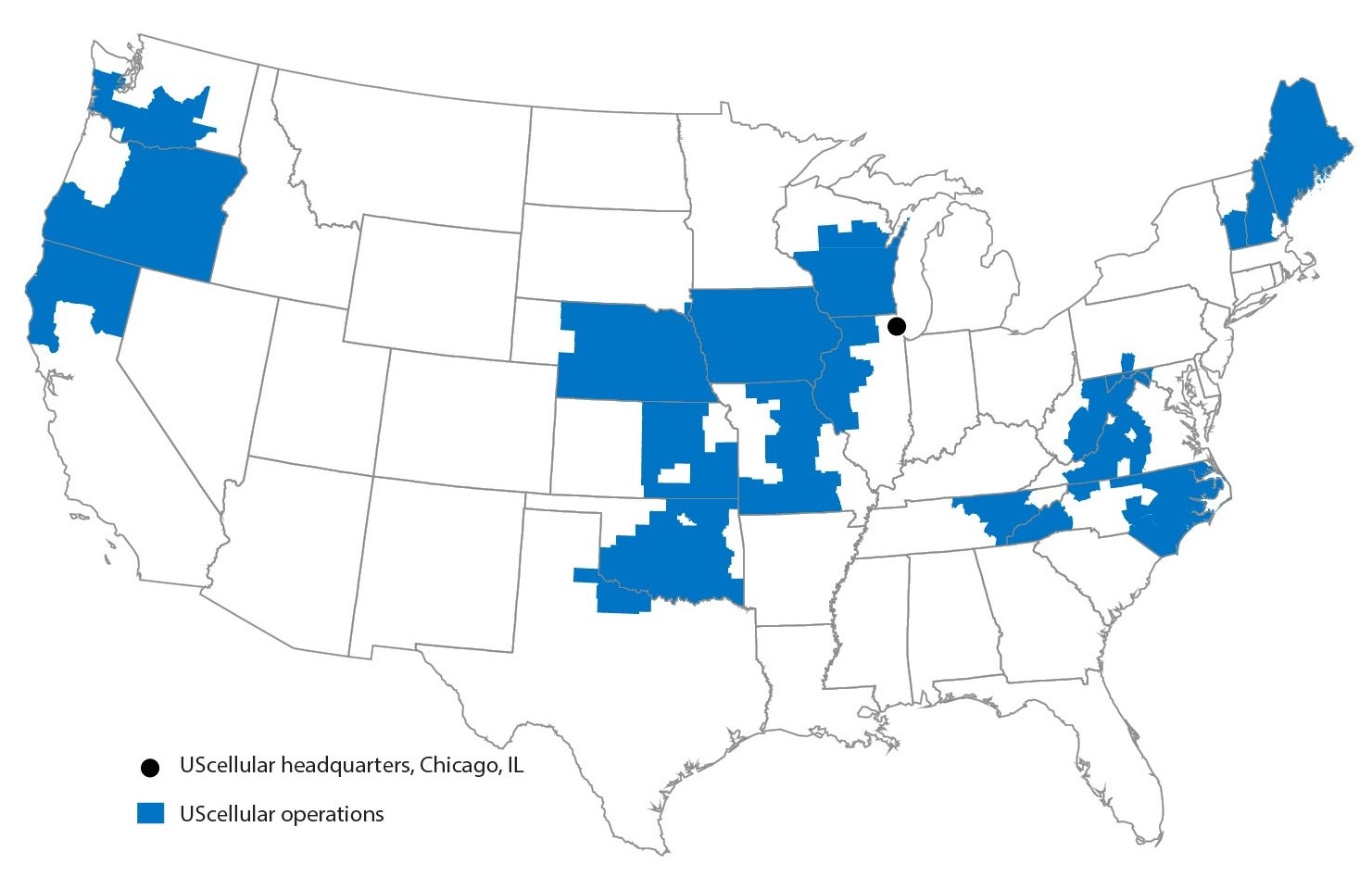

Business Overview

UScellular provides wireless service throughout its footprint, and leases tower space to third-party carriers on UScellular-owned towers. UScellular’s strategy is to attract and retain customers by providing a high-quality network, outstanding customer service, and competitive devices, plans and pricing - all provided with a community focus. UScellular is an 82%-owned subsidiary of TDS.

OPERATIONS

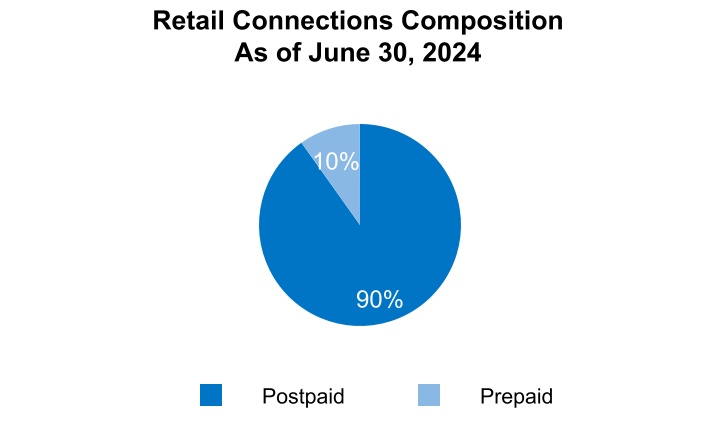

▪Serves customers with 4.5 million retail connections including approximately 4.0 million postpaid and 0.4 million prepaid connections

▪Operates in 21 states

▪Employs approximately 4,300 associates

▪Owns 4,388 towers

▪Operates 6,990 cell sites in service

Financial Overview — UScellular

The following discussion and analysis compares financial results for the three and six months ended June 30, 2024 to the three and six months ended June 30, 2023.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

June 30, |

|

Six Months Ended

June 30, |

|

2024 |

|

2023 |

|

2024 vs. 2023 |

|

2024 |

|

2023 |

|

2024 vs. 2023 |

| (Dollars in millions) |

|

|

|

|

|

|

|

|

|

|

|

| Operating Revenues |

|

|

|

|

|

|

|

|

|

|

|

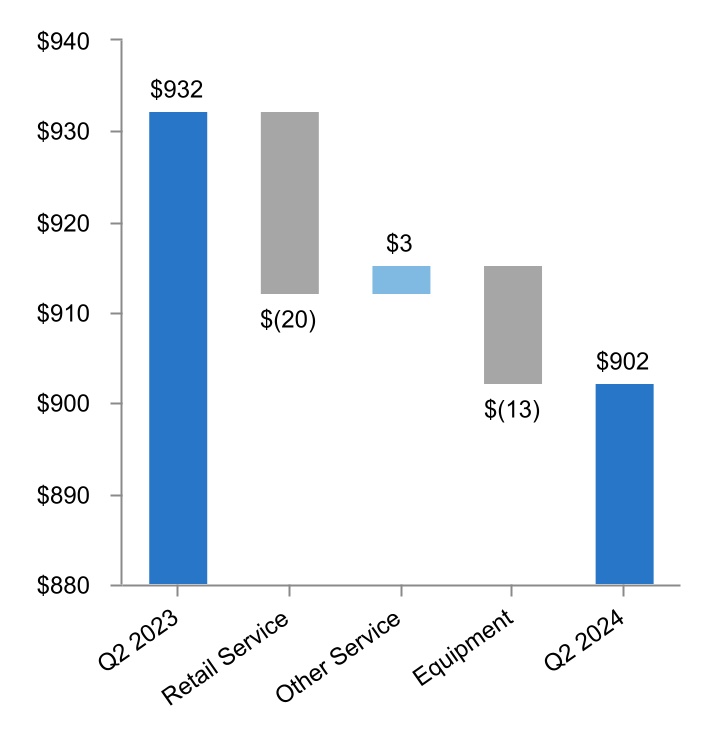

| Wireless |

$ |

902 |

|

|

$ |

932 |

|

|

(3) |

% |

|

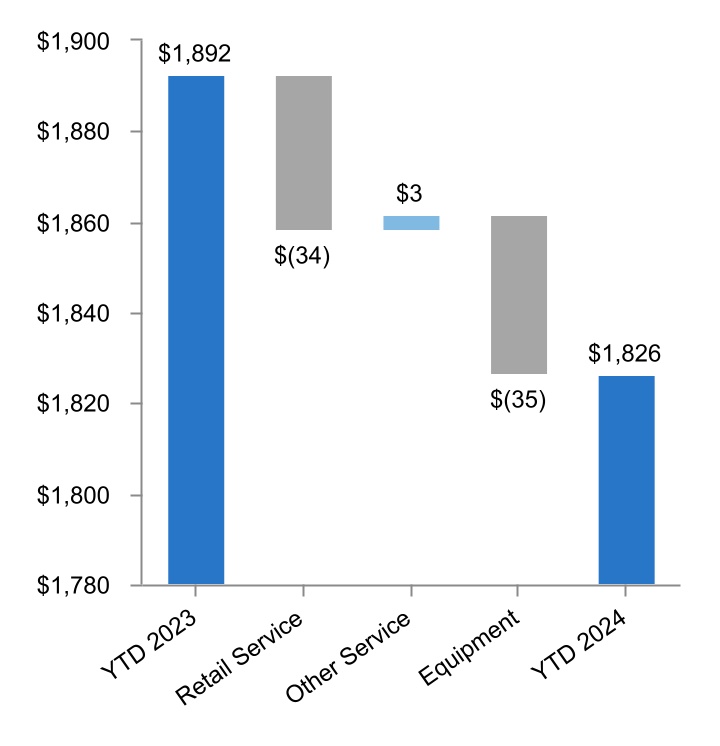

$ |

1,826 |

|

|

$ |

1,892 |

|

|

(3) |

% |

| Towers |

58 |

|

|

57 |

|

|

3 |

% |

|

116 |

|

|

113 |

|

|

3 |

% |

| Intra-company eliminations |

(33) |

|

|

(32) |

|

|

(4) |

% |

|

(65) |

|

|

(63) |

|

|

(3) |

% |

| Total operating revenues |

927 |

|

|

957 |

|

|

(3) |

% |

|

1,877 |

|

|

1,942 |

|

|

(3) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

| Wireless |

885 |

|

|

916 |

|

|

(3) |

% |

|

1,779 |

|

|

1,868 |

|

|

(5) |

% |

| Towers |

39 |

|

|

39 |

|

|

1 |

% |

|

75 |

|

|

76 |

|

|

(1) |

% |

| Intra-company eliminations |

(33) |

|

|

(32) |

|

|

(4) |

% |

|

(65) |

|

|

(63) |

|

|

(3) |

% |

| Total operating expenses |

891 |

|

|

923 |

|

|

(3) |

% |

|

1,789 |

|

|

1,881 |

|

|

(5) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income |

$ |

36 |

|

|

$ |

34 |

|

|

6 |

% |

|

$ |

88 |

|

|

$ |

61 |

|

|

44 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

$ |

18 |

|

|

$ |

5 |

|

|

N/M |

|

$ |

42 |

|

|

$ |

20 |

|

|

N/M |

Adjusted OIBDA (Non-GAAP)1 |

$ |

227 |

|

|

$ |

198 |

|

|

14 |

% |

|

$ |

456 |

|

|

$ |

404 |

|

|

13 |

% |

Adjusted EBITDA (Non-GAAP)1 |

$ |

268 |

|

|

$ |

239 |

|

|

13 |

% |

|

$ |

542 |

|

|

$ |

491 |

|

|

10 |

% |

Capital expenditures2 |

$ |

165 |

|

|

$ |

143 |

|

|

15 |

% |

|

$ |

295 |

|

|

$ |

351 |

|

|

(16) |

% |

N/M - Percentage change not meaningful

1Refer to Supplemental Information Relating to Non-GAAP Financial Measures within this MD&A for a reconciliation of this measure.

2Refer to Liquidity and Capital Resources within this MD&A for additional information on Capital expenditures.

Wireless Operations

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| As of June 30, |

|

2024 |

|

2023 |

| Retail Connections – End of Period |

|

|

|

Postpaid |

|

4,027,000 |

|

|

4,194,000 |

|

Prepaid |

|

439,000 |

|

|

462,000 |

|

Total |

|

4,466,000 |

|

|

4,656,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q2 2024 |

|

Q2 2023 |

|

Q2 2024 vs. Q2 2023 |

|

YTD 2024 |

|

YTD 2023 |

YTD 2024 vs. YTD 2023 |

| Postpaid Activity and Churn |

|

| Gross Additions |

|

|

|

|

|

|

|

|

|

|

| Handsets |

73,000 |

|

|

83,000 |

|

|

(12) |

% |

|

136,000 |

|

|

176,000 |

|

(23) |

% |

| Connected Devices |

44,000 |

|

|

42,000 |

|

|

5 |

% |

|

87,000 |

|

|

85,000 |

|

2 |

% |

| Total Gross Additions |

117,000 |

|

|

125,000 |

|

|

(6) |

% |

|

223,000 |

|

|

261,000 |

|

(15) |

% |

| Net Additions (Losses) |

|

|

|

|

|

|

|

|

|

|

| Handsets |

(29,000) |

|

|

(29,000) |

|

|

— |

|

(76,000) |

|

|

(54,000) |

|

(41) |

% |

| Connected Devices |

5,000 |

|

|

1,000 |

|

|

N/M |

|

9,000 |

|

|

1,000 |

|

N/M |

| Total Net Additions (Losses) |

(24,000) |

|

|

(28,000) |

|

|

14 |

% |

|

(67,000) |

|

|

(53,000) |

|

(26) |

% |

| Churn |

|

|

|

|

|

|

|

|

|

|

| Handsets |

0.97 |

% |

|

1.01 |

% |

|

|

|

1.00 |

% |

|

1.03 |

% |

|

| Connected Devices |

2.47 |

% |

|

2.65 |

% |

|

|

|

2.50 |

% |

|

2.72 |

% |

|

| Total Churn |

1.16 |

% |

|

1.21 |

% |

|

|

|

1.19 |

% |

|

1.24 |

% |

|

N/M - Percentage change not meaningful

Total postpaid handset net losses were flat for the three months ended June 30, 2024, when compared to the same period last year due to lower gross additions as a result of a decrease in the pool of available customers and continued aggressive industry-wide competition. This was offset by lower defections as a result of improvements in churn.

Total postpaid handset net losses increased for the six months ended June 30, 2024 when compared to the same period last year due to lower gross additions as a result of a decrease in the pool of available customers and continued aggressive industry-wide competition.

Total postpaid connected device net additions increased for the three and six months ended June 30, 2024, when compared to the same period last year due to higher demand for fixed wireless home internet as well as a decrease in tablet, hotspot and home phone defections as a result of improvements in churn.

Postpaid Revenue

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

June 30, |

|

Six Months Ended

June 30, |

|

2024 |

|

2023 |

|

2024 vs. 2023 |

|

2024 |

|

2023 |

|

2024 vs. 2023 |

Average Revenue Per User (ARPU) |

$ |

51.45 |

|

|

$ |

50.64 |

|

|

2 % |

|

$ |

51.69 |

|

|

$ |

50.64 |

|

|

2 % |

|

|

|

|

|

|

|

|

|

|

|

|

Average Revenue Per Account (ARPA) |

$ |

130.41 |

|

|

$ |

130.19 |

|

|

— |

|

$ |

131.18 |

|

|

$ |

130.49 |

|

|

1 % |

|

|

|

|

|

|

|

|

|

|

|

|

Postpaid ARPU increased for the three and six months ended June 30, 2024, when compared to the same period last year, due to favorable plan and product offering mix and an increase in cost recovery surcharges.

Postpaid ARPA increased slightly for the three and six months ended June 30, 2024, when compared to the same period last year, due to the impacts to Postpaid ARPU, partially offset by a decrease in the number of connections per account.

Financial Overview — Wireless

The following discussion and analysis compares financial results for the three and six months ended June 30, 2024 to the three and six months ended June 30, 2023.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

June 30, |

|

Six Months Ended

June 30, |

|

2024 |

|

2023 |

|

2024 vs. 2023 |

|

2024 |

|

2023 |

|

2024 vs. 2023 |

| (Dollars in millions) |

|

|

|

|

|

|

|

|

|

|

|

| Retail service |

$ |

666 |

|

|

$ |

686 |

|

|

(3) |

% |

|

$ |

1,344 |

|

|

$ |

1,378 |

|

|

(2) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| Other |

52 |

|

|

49 |

|

|

7 |

% |

|

102 |

|

|

99 |

|

|

3 |

% |

| Service revenues |

718 |

|

|

735 |

|

|

(2) |

% |

|

1,446 |

|

|

1,477 |

|

|

(2) |

% |

| Equipment sales |

184 |

|

|

197 |

|

|

(6) |

% |

|

380 |

|

|

415 |

|

|

(9) |

% |

| Total operating revenues |

902 |

|

|

932 |

|

|

(3) |

% |

|

1,826 |

|

|

1,892 |

|

|

(3) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| System operations (excluding Depreciation, amortization and accretion reported below) |

194 |

|

|

203 |

|

|

(4) |

% |

|

390 |

|

|

398 |

|

|

(2) |

% |

| Cost of equipment sold |

211 |

|

|

228 |

|

|

(7) |

% |

|

427 |

|

|

480 |

|

|

(11) |

% |

| Selling, general and administrative |

313 |

|

|

333 |

|

|

(6) |

% |

|

637 |

|

|

670 |

|

|

(5) |

% |

| Depreciation, amortization and accretion |

154 |

|

|

149 |

|

|

3 |

% |

|

308 |

|

|

307 |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Gain) loss on asset disposals, net |

5 |

|

|

3 |

|

|

40 |

% |

|

10 |

|

|

13 |

|

|

(23) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| (Gain) loss on license sales and exchanges, net |

8 |

|

|

— |

|

|

N/M |

|

7 |

|

|

— |

|

|

N/M |

| Total operating expenses |

885 |

|

|

916 |

|

|

(3) |

% |

|

1,779 |

|