0001051512false--12-312023Q30.1850.180.5550.544144141,2421,2423753751,1251,1253100010515122023-01-012023-09-300001051512us-gaap:CommonClassBMember2023-01-012023-09-300001051512tds:PreferredStockMember1Member2023-01-012023-09-300001051512tds:PreferredStockMember2Member2023-01-012023-09-300001051512us-gaap:CommonClassBMember2023-09-30xbrli:shares0001051512us-gaap:CommonClassAMember2023-09-300001051512us-gaap:ServiceMember2023-07-012023-09-30iso4217:USD0001051512us-gaap:ServiceMember2022-07-012022-09-300001051512us-gaap:ServiceMember2023-01-012023-09-300001051512us-gaap:ServiceMember2022-01-012022-09-300001051512us-gaap:ProductMember2023-07-012023-09-300001051512us-gaap:ProductMember2022-07-012022-09-300001051512us-gaap:ProductMember2023-01-012023-09-300001051512us-gaap:ProductMember2022-01-012022-09-3000010515122023-07-012023-09-3000010515122022-07-012022-09-3000010515122022-01-012022-09-30iso4217:USDxbrli:shares00010515122022-12-3100010515122021-12-3100010515122023-09-3000010515122022-09-300001051512us-gaap:CommonClassAMember2022-12-310001051512us-gaap:CommonClassBMember2022-12-310001051512tds:PreferredStockMember1Member2022-12-310001051512tds:PreferredStockMember1Member2023-09-300001051512tds:PreferredStockMember2Member2022-12-310001051512tds:PreferredStockMember2Member2023-09-300001051512us-gaap:VariableInterestEntityPrimaryBeneficiaryMembertds:AssetsHeldMember2023-09-300001051512us-gaap:VariableInterestEntityPrimaryBeneficiaryMembertds:AssetsHeldMember2022-12-310001051512us-gaap:VariableInterestEntityPrimaryBeneficiaryMemberus-gaap:NonrecourseMember2023-09-300001051512us-gaap:VariableInterestEntityPrimaryBeneficiaryMemberus-gaap:NonrecourseMember2022-12-310001051512us-gaap:CommonStockMember2023-06-300001051512us-gaap:AdditionalPaidInCapitalMember2023-06-300001051512us-gaap:PreferredStockMember2023-06-300001051512us-gaap:TreasuryStockCommonMember2023-06-300001051512us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300001051512us-gaap:RetainedEarningsMember2023-06-300001051512us-gaap:ParentMember2023-06-300001051512us-gaap:NoncontrollingInterestMember2023-06-3000010515122023-06-300001051512us-gaap:ParentMember2023-07-012023-09-300001051512us-gaap:NoncontrollingInterestMember2023-07-012023-09-300001051512us-gaap:RetainedEarningsMember2023-07-012023-09-300001051512tds:PreferredStockMember1Member2023-07-012023-09-300001051512tds:PreferredStockMember2Member2023-07-012023-09-300001051512us-gaap:TreasuryStockCommonMember2023-07-012023-09-300001051512us-gaap:AdditionalPaidInCapitalMember2023-07-012023-09-300001051512us-gaap:CommonStockMember2023-09-300001051512us-gaap:AdditionalPaidInCapitalMember2023-09-300001051512us-gaap:PreferredStockMember2023-09-300001051512us-gaap:TreasuryStockCommonMember2023-09-300001051512us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-300001051512us-gaap:RetainedEarningsMember2023-09-300001051512us-gaap:ParentMember2023-09-300001051512us-gaap:NoncontrollingInterestMember2023-09-300001051512us-gaap:CommonStockMember2022-06-300001051512us-gaap:AdditionalPaidInCapitalMember2022-06-300001051512us-gaap:PreferredStockMember2022-06-300001051512us-gaap:TreasuryStockCommonMember2022-06-300001051512us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-06-300001051512us-gaap:RetainedEarningsMember2022-06-300001051512us-gaap:ParentMember2022-06-300001051512us-gaap:NoncontrollingInterestMember2022-06-3000010515122022-06-300001051512us-gaap:RetainedEarningsMember2022-07-012022-09-300001051512us-gaap:ParentMember2022-07-012022-09-300001051512us-gaap:NoncontrollingInterestMember2022-07-012022-09-300001051512us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-07-012022-09-300001051512tds:PreferredStockMember1Member2022-07-012022-09-300001051512tds:PreferredStockMember2Member2022-07-012022-09-300001051512us-gaap:TreasuryStockCommonMember2022-07-012022-09-300001051512us-gaap:AdditionalPaidInCapitalMember2022-07-012022-09-300001051512us-gaap:CommonStockMember2022-09-300001051512us-gaap:AdditionalPaidInCapitalMember2022-09-300001051512us-gaap:PreferredStockMember2022-09-300001051512us-gaap:TreasuryStockCommonMember2022-09-300001051512us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-09-300001051512us-gaap:RetainedEarningsMember2022-09-300001051512us-gaap:ParentMember2022-09-300001051512us-gaap:NoncontrollingInterestMember2022-09-300001051512us-gaap:CommonStockMember2022-12-310001051512us-gaap:AdditionalPaidInCapitalMember2022-12-310001051512us-gaap:PreferredStockMember2022-12-310001051512us-gaap:TreasuryStockCommonMember2022-12-310001051512us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001051512us-gaap:RetainedEarningsMember2022-12-310001051512us-gaap:ParentMember2022-12-310001051512us-gaap:NoncontrollingInterestMember2022-12-310001051512us-gaap:RetainedEarningsMember2023-01-012023-09-300001051512us-gaap:ParentMember2023-01-012023-09-300001051512us-gaap:NoncontrollingInterestMember2023-01-012023-09-300001051512us-gaap:TreasuryStockCommonMember2023-01-012023-09-300001051512us-gaap:AdditionalPaidInCapitalMember2023-01-012023-09-300001051512us-gaap:CommonStockMember2021-12-310001051512us-gaap:AdditionalPaidInCapitalMember2021-12-310001051512us-gaap:PreferredStockMember2021-12-310001051512us-gaap:TreasuryStockCommonMember2021-12-310001051512us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001051512us-gaap:RetainedEarningsMember2021-12-310001051512us-gaap:ParentMember2021-12-310001051512us-gaap:NoncontrollingInterestMember2021-12-310001051512us-gaap:RetainedEarningsMember2022-01-012022-09-300001051512us-gaap:ParentMember2022-01-012022-09-300001051512us-gaap:NoncontrollingInterestMember2022-01-012022-09-300001051512us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-09-300001051512tds:PreferredStockMember1Member2022-01-012022-09-300001051512tds:PreferredStockMember2Member2022-01-012022-09-300001051512us-gaap:TreasuryStockCommonMember2022-01-012022-09-300001051512us-gaap:AdditionalPaidInCapitalMember2022-01-012022-09-300001051512tds:UnitedStatesCellularCorporationMember2023-09-30xbrli:pure0001051512tds:USCellularSegmentMemberus-gaap:TransferredOverTimeMembertds:RetailServiceRevenueMember2023-07-012023-09-300001051512tds:TDSTelecomSegmentMemberus-gaap:TransferredOverTimeMembertds:RetailServiceRevenueMember2023-07-012023-09-300001051512us-gaap:TransferredOverTimeMembertds:RetailServiceRevenueMembertds:OtherSegmentMember2023-07-012023-09-300001051512us-gaap:TransferredOverTimeMembertds:RetailServiceRevenueMember2023-07-012023-09-300001051512tds:USCellularSegmentMemberus-gaap:TransferredOverTimeMembertds:InboundRoamingRevenueMember2023-07-012023-09-300001051512tds:TDSTelecomSegmentMemberus-gaap:TransferredOverTimeMembertds:InboundRoamingRevenueMember2023-07-012023-09-300001051512us-gaap:TransferredOverTimeMembertds:InboundRoamingRevenueMembertds:OtherSegmentMember2023-07-012023-09-300001051512us-gaap:TransferredOverTimeMembertds:InboundRoamingRevenueMember2023-07-012023-09-300001051512tds:USCellularSegmentMembertds:ResidentialRevenueMemberus-gaap:TransferredOverTimeMember2023-07-012023-09-300001051512tds:TDSTelecomSegmentMembertds:ResidentialRevenueMemberus-gaap:TransferredOverTimeMember2023-07-012023-09-300001051512tds:ResidentialRevenueMemberus-gaap:TransferredOverTimeMembertds:OtherSegmentMember2023-07-012023-09-300001051512us-gaap:TransferredOverTimeMembertds:ResidentialRevenueMember2023-07-012023-09-300001051512tds:USCellularSegmentMemberus-gaap:TransferredOverTimeMembertds:CommercialRevenueMember2023-07-012023-09-300001051512tds:TDSTelecomSegmentMemberus-gaap:TransferredOverTimeMembertds:CommercialRevenueMember2023-07-012023-09-300001051512us-gaap:TransferredOverTimeMembertds:CommercialRevenueMembertds:OtherSegmentMember2023-07-012023-09-300001051512us-gaap:TransferredOverTimeMembertds:CommercialRevenueMember2023-07-012023-09-300001051512tds:USCellularSegmentMemberus-gaap:TransferredOverTimeMembertds:WholesaleRevenueMember2023-07-012023-09-300001051512tds:TDSTelecomSegmentMemberus-gaap:TransferredOverTimeMembertds:WholesaleRevenueMember2023-07-012023-09-300001051512us-gaap:TransferredOverTimeMembertds:WholesaleRevenueMembertds:OtherSegmentMember2023-07-012023-09-300001051512us-gaap:TransferredOverTimeMembertds:WholesaleRevenueMember2023-07-012023-09-300001051512tds:USCellularSegmentMemberus-gaap:TransferredOverTimeMembertds:OtherServiceRevenueMember2023-07-012023-09-300001051512tds:TDSTelecomSegmentMemberus-gaap:TransferredOverTimeMembertds:OtherServiceRevenueMember2023-07-012023-09-300001051512us-gaap:TransferredOverTimeMembertds:OtherServiceRevenueMembertds:OtherSegmentMember2023-07-012023-09-300001051512us-gaap:TransferredOverTimeMembertds:OtherServiceRevenueMember2023-07-012023-09-300001051512tds:USCellularSegmentMemberus-gaap:TransferredOverTimeMember2023-07-012023-09-300001051512tds:TDSTelecomSegmentMemberus-gaap:TransferredOverTimeMember2023-07-012023-09-300001051512us-gaap:TransferredOverTimeMembertds:OtherSegmentMember2023-07-012023-09-300001051512us-gaap:TransferredOverTimeMember2023-07-012023-09-300001051512tds:USCellularSegmentMemberus-gaap:TransferredAtPointInTimeMembertds:EquipmentAndProductSalesMember2023-07-012023-09-300001051512tds:TDSTelecomSegmentMemberus-gaap:TransferredAtPointInTimeMembertds:EquipmentAndProductSalesMember2023-07-012023-09-300001051512us-gaap:TransferredAtPointInTimeMembertds:EquipmentAndProductSalesMembertds:OtherSegmentMember2023-07-012023-09-300001051512us-gaap:TransferredAtPointInTimeMembertds:EquipmentAndProductSalesMember2023-07-012023-09-300001051512tds:USCellularSegmentMember2023-07-012023-09-300001051512tds:TDSTelecomSegmentMember2023-07-012023-09-300001051512tds:OtherSegmentMember2023-07-012023-09-300001051512tds:USCellularSegmentMemberus-gaap:TransferredOverTimeMembertds:RetailServiceRevenueMember2022-07-012022-09-300001051512tds:TDSTelecomSegmentMemberus-gaap:TransferredOverTimeMembertds:RetailServiceRevenueMember2022-07-012022-09-300001051512us-gaap:TransferredOverTimeMembertds:RetailServiceRevenueMembertds:OtherSegmentMember2022-07-012022-09-300001051512us-gaap:TransferredOverTimeMembertds:RetailServiceRevenueMember2022-07-012022-09-300001051512tds:USCellularSegmentMemberus-gaap:TransferredOverTimeMembertds:InboundRoamingRevenueMember2022-07-012022-09-300001051512tds:TDSTelecomSegmentMemberus-gaap:TransferredOverTimeMembertds:InboundRoamingRevenueMember2022-07-012022-09-300001051512us-gaap:TransferredOverTimeMembertds:InboundRoamingRevenueMembertds:OtherSegmentMember2022-07-012022-09-300001051512us-gaap:TransferredOverTimeMembertds:InboundRoamingRevenueMember2022-07-012022-09-300001051512tds:USCellularSegmentMembertds:ResidentialRevenueMemberus-gaap:TransferredOverTimeMember2022-07-012022-09-300001051512tds:TDSTelecomSegmentMembertds:ResidentialRevenueMemberus-gaap:TransferredOverTimeMember2022-07-012022-09-300001051512tds:ResidentialRevenueMemberus-gaap:TransferredOverTimeMembertds:OtherSegmentMember2022-07-012022-09-300001051512us-gaap:TransferredOverTimeMembertds:ResidentialRevenueMember2022-07-012022-09-300001051512tds:USCellularSegmentMemberus-gaap:TransferredOverTimeMembertds:CommercialRevenueMember2022-07-012022-09-300001051512tds:TDSTelecomSegmentMemberus-gaap:TransferredOverTimeMembertds:CommercialRevenueMember2022-07-012022-09-300001051512us-gaap:TransferredOverTimeMembertds:CommercialRevenueMembertds:OtherSegmentMember2022-07-012022-09-300001051512us-gaap:TransferredOverTimeMembertds:CommercialRevenueMember2022-07-012022-09-300001051512tds:USCellularSegmentMemberus-gaap:TransferredOverTimeMembertds:WholesaleRevenueMember2022-07-012022-09-300001051512tds:TDSTelecomSegmentMemberus-gaap:TransferredOverTimeMembertds:WholesaleRevenueMember2022-07-012022-09-300001051512us-gaap:TransferredOverTimeMembertds:WholesaleRevenueMembertds:OtherSegmentMember2022-07-012022-09-300001051512us-gaap:TransferredOverTimeMembertds:WholesaleRevenueMember2022-07-012022-09-300001051512tds:USCellularSegmentMemberus-gaap:TransferredOverTimeMembertds:OtherServiceRevenueMember2022-07-012022-09-300001051512tds:TDSTelecomSegmentMemberus-gaap:TransferredOverTimeMembertds:OtherServiceRevenueMember2022-07-012022-09-300001051512us-gaap:TransferredOverTimeMembertds:OtherServiceRevenueMembertds:OtherSegmentMember2022-07-012022-09-300001051512us-gaap:TransferredOverTimeMembertds:OtherServiceRevenueMember2022-07-012022-09-300001051512tds:USCellularSegmentMemberus-gaap:TransferredOverTimeMember2022-07-012022-09-300001051512tds:TDSTelecomSegmentMemberus-gaap:TransferredOverTimeMember2022-07-012022-09-300001051512us-gaap:TransferredOverTimeMembertds:OtherSegmentMember2022-07-012022-09-300001051512us-gaap:TransferredOverTimeMember2022-07-012022-09-300001051512tds:USCellularSegmentMemberus-gaap:TransferredAtPointInTimeMembertds:EquipmentAndProductSalesMember2022-07-012022-09-300001051512tds:TDSTelecomSegmentMemberus-gaap:TransferredAtPointInTimeMembertds:EquipmentAndProductSalesMember2022-07-012022-09-300001051512us-gaap:TransferredAtPointInTimeMembertds:EquipmentAndProductSalesMembertds:OtherSegmentMember2022-07-012022-09-300001051512us-gaap:TransferredAtPointInTimeMembertds:EquipmentAndProductSalesMember2022-07-012022-09-300001051512tds:USCellularSegmentMember2022-07-012022-09-300001051512tds:TDSTelecomSegmentMember2022-07-012022-09-300001051512tds:OtherSegmentMember2022-07-012022-09-300001051512tds:USCellularSegmentMemberus-gaap:TransferredOverTimeMembertds:RetailServiceRevenueMember2023-01-012023-09-300001051512tds:TDSTelecomSegmentMemberus-gaap:TransferredOverTimeMembertds:RetailServiceRevenueMember2023-01-012023-09-300001051512us-gaap:TransferredOverTimeMembertds:RetailServiceRevenueMembertds:OtherSegmentMember2023-01-012023-09-300001051512us-gaap:TransferredOverTimeMembertds:RetailServiceRevenueMember2023-01-012023-09-300001051512tds:USCellularSegmentMemberus-gaap:TransferredOverTimeMembertds:InboundRoamingRevenueMember2023-01-012023-09-300001051512tds:TDSTelecomSegmentMemberus-gaap:TransferredOverTimeMembertds:InboundRoamingRevenueMember2023-01-012023-09-300001051512us-gaap:TransferredOverTimeMembertds:InboundRoamingRevenueMembertds:OtherSegmentMember2023-01-012023-09-300001051512us-gaap:TransferredOverTimeMembertds:InboundRoamingRevenueMember2023-01-012023-09-300001051512tds:USCellularSegmentMembertds:ResidentialRevenueMemberus-gaap:TransferredOverTimeMember2023-01-012023-09-300001051512tds:TDSTelecomSegmentMembertds:ResidentialRevenueMemberus-gaap:TransferredOverTimeMember2023-01-012023-09-300001051512tds:ResidentialRevenueMemberus-gaap:TransferredOverTimeMembertds:OtherSegmentMember2023-01-012023-09-300001051512us-gaap:TransferredOverTimeMembertds:ResidentialRevenueMember2023-01-012023-09-300001051512tds:USCellularSegmentMemberus-gaap:TransferredOverTimeMembertds:CommercialRevenueMember2023-01-012023-09-300001051512tds:TDSTelecomSegmentMemberus-gaap:TransferredOverTimeMembertds:CommercialRevenueMember2023-01-012023-09-300001051512us-gaap:TransferredOverTimeMembertds:CommercialRevenueMembertds:OtherSegmentMember2023-01-012023-09-300001051512us-gaap:TransferredOverTimeMembertds:CommercialRevenueMember2023-01-012023-09-300001051512tds:USCellularSegmentMemberus-gaap:TransferredOverTimeMembertds:WholesaleRevenueMember2023-01-012023-09-300001051512tds:TDSTelecomSegmentMemberus-gaap:TransferredOverTimeMembertds:WholesaleRevenueMember2023-01-012023-09-300001051512us-gaap:TransferredOverTimeMembertds:WholesaleRevenueMembertds:OtherSegmentMember2023-01-012023-09-300001051512us-gaap:TransferredOverTimeMembertds:WholesaleRevenueMember2023-01-012023-09-300001051512tds:USCellularSegmentMemberus-gaap:TransferredOverTimeMembertds:OtherServiceRevenueMember2023-01-012023-09-300001051512tds:TDSTelecomSegmentMemberus-gaap:TransferredOverTimeMembertds:OtherServiceRevenueMember2023-01-012023-09-300001051512us-gaap:TransferredOverTimeMembertds:OtherServiceRevenueMembertds:OtherSegmentMember2023-01-012023-09-300001051512us-gaap:TransferredOverTimeMembertds:OtherServiceRevenueMember2023-01-012023-09-300001051512tds:USCellularSegmentMemberus-gaap:TransferredOverTimeMember2023-01-012023-09-300001051512tds:TDSTelecomSegmentMemberus-gaap:TransferredOverTimeMember2023-01-012023-09-300001051512us-gaap:TransferredOverTimeMembertds:OtherSegmentMember2023-01-012023-09-300001051512us-gaap:TransferredOverTimeMember2023-01-012023-09-300001051512tds:USCellularSegmentMemberus-gaap:TransferredAtPointInTimeMembertds:EquipmentAndProductSalesMember2023-01-012023-09-300001051512tds:TDSTelecomSegmentMemberus-gaap:TransferredAtPointInTimeMembertds:EquipmentAndProductSalesMember2023-01-012023-09-300001051512us-gaap:TransferredAtPointInTimeMembertds:EquipmentAndProductSalesMembertds:OtherSegmentMember2023-01-012023-09-300001051512us-gaap:TransferredAtPointInTimeMembertds:EquipmentAndProductSalesMember2023-01-012023-09-300001051512tds:USCellularSegmentMember2023-01-012023-09-300001051512tds:TDSTelecomSegmentMember2023-01-012023-09-300001051512tds:OtherSegmentMember2023-01-012023-09-300001051512tds:USCellularSegmentMemberus-gaap:TransferredOverTimeMembertds:RetailServiceRevenueMember2022-01-012022-09-300001051512tds:TDSTelecomSegmentMemberus-gaap:TransferredOverTimeMembertds:RetailServiceRevenueMember2022-01-012022-09-300001051512us-gaap:TransferredOverTimeMembertds:RetailServiceRevenueMembertds:OtherSegmentMember2022-01-012022-09-300001051512us-gaap:TransferredOverTimeMembertds:RetailServiceRevenueMember2022-01-012022-09-300001051512tds:USCellularSegmentMemberus-gaap:TransferredOverTimeMembertds:InboundRoamingRevenueMember2022-01-012022-09-300001051512tds:TDSTelecomSegmentMemberus-gaap:TransferredOverTimeMembertds:InboundRoamingRevenueMember2022-01-012022-09-300001051512us-gaap:TransferredOverTimeMembertds:InboundRoamingRevenueMembertds:OtherSegmentMember2022-01-012022-09-300001051512us-gaap:TransferredOverTimeMembertds:InboundRoamingRevenueMember2022-01-012022-09-300001051512tds:USCellularSegmentMembertds:ResidentialRevenueMemberus-gaap:TransferredOverTimeMember2022-01-012022-09-300001051512tds:TDSTelecomSegmentMembertds:ResidentialRevenueMemberus-gaap:TransferredOverTimeMember2022-01-012022-09-300001051512tds:ResidentialRevenueMemberus-gaap:TransferredOverTimeMembertds:OtherSegmentMember2022-01-012022-09-300001051512us-gaap:TransferredOverTimeMembertds:ResidentialRevenueMember2022-01-012022-09-300001051512tds:USCellularSegmentMemberus-gaap:TransferredOverTimeMembertds:CommercialRevenueMember2022-01-012022-09-300001051512tds:TDSTelecomSegmentMemberus-gaap:TransferredOverTimeMembertds:CommercialRevenueMember2022-01-012022-09-300001051512us-gaap:TransferredOverTimeMembertds:CommercialRevenueMembertds:OtherSegmentMember2022-01-012022-09-300001051512us-gaap:TransferredOverTimeMembertds:CommercialRevenueMember2022-01-012022-09-300001051512tds:USCellularSegmentMemberus-gaap:TransferredOverTimeMembertds:WholesaleRevenueMember2022-01-012022-09-300001051512tds:TDSTelecomSegmentMemberus-gaap:TransferredOverTimeMembertds:WholesaleRevenueMember2022-01-012022-09-300001051512us-gaap:TransferredOverTimeMembertds:WholesaleRevenueMembertds:OtherSegmentMember2022-01-012022-09-300001051512us-gaap:TransferredOverTimeMembertds:WholesaleRevenueMember2022-01-012022-09-300001051512tds:USCellularSegmentMemberus-gaap:TransferredOverTimeMembertds:OtherServiceRevenueMember2022-01-012022-09-300001051512tds:TDSTelecomSegmentMemberus-gaap:TransferredOverTimeMembertds:OtherServiceRevenueMember2022-01-012022-09-300001051512us-gaap:TransferredOverTimeMembertds:OtherServiceRevenueMembertds:OtherSegmentMember2022-01-012022-09-300001051512us-gaap:TransferredOverTimeMembertds:OtherServiceRevenueMember2022-01-012022-09-300001051512tds:USCellularSegmentMemberus-gaap:TransferredOverTimeMember2022-01-012022-09-300001051512tds:TDSTelecomSegmentMemberus-gaap:TransferredOverTimeMember2022-01-012022-09-300001051512us-gaap:TransferredOverTimeMembertds:OtherSegmentMember2022-01-012022-09-300001051512us-gaap:TransferredOverTimeMember2022-01-012022-09-300001051512tds:USCellularSegmentMemberus-gaap:TransferredAtPointInTimeMembertds:EquipmentAndProductSalesMember2022-01-012022-09-300001051512tds:TDSTelecomSegmentMemberus-gaap:TransferredAtPointInTimeMembertds:EquipmentAndProductSalesMember2022-01-012022-09-300001051512us-gaap:TransferredAtPointInTimeMembertds:EquipmentAndProductSalesMembertds:OtherSegmentMember2022-01-012022-09-300001051512us-gaap:TransferredAtPointInTimeMembertds:EquipmentAndProductSalesMember2022-01-012022-09-300001051512tds:USCellularSegmentMember2022-01-012022-09-300001051512tds:TDSTelecomSegmentMember2022-01-012022-09-300001051512tds:OtherSegmentMember2022-01-012022-09-3000010515122023-10-012023-09-3000010515122024-01-012023-09-3000010515122025-01-012023-09-300001051512tds:SalesCommissionsMember2023-09-300001051512tds:SalesCommissionsMember2022-12-310001051512tds:InstallationCostsMember2023-09-300001051512tds:InstallationCostsMember2022-12-310001051512us-gaap:CarryingReportedAmountFairValueDisclosureMembertds:PublicDebtMember2023-09-300001051512us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Membertds:PublicDebtMember2023-09-300001051512us-gaap:CarryingReportedAmountFairValueDisclosureMembertds:PublicDebtMember2022-12-310001051512us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Membertds:PublicDebtMember2022-12-310001051512us-gaap:CarryingReportedAmountFairValueDisclosureMembertds:NonPublicDebtMember2023-09-300001051512us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Membertds:NonPublicDebtMember2023-09-300001051512us-gaap:CarryingReportedAmountFairValueDisclosureMembertds:NonPublicDebtMember2022-12-310001051512us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Membertds:NonPublicDebtMember2022-12-310001051512us-gaap:CarryingReportedAmountFairValueDisclosureMembertds:OtherDebtMember2023-09-300001051512us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Membertds:OtherDebtMember2023-09-300001051512us-gaap:CarryingReportedAmountFairValueDisclosureMembertds:OtherDebtMember2022-12-310001051512us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Membertds:OtherDebtMember2022-12-310001051512srt:SubsidiariesMembertds:SixPointSevenPercentSeniorNotesMember2023-09-300001051512srt:MinimumMembertds:InstitutionalAndOtherDebtMember2023-09-300001051512tds:InstitutionalAndOtherDebtMembersrt:MaximumMember2023-09-300001051512srt:MinimumMembertds:InstitutionalAndOtherDebtMember2022-12-310001051512tds:InstitutionalAndOtherDebtMembersrt:MaximumMember2022-12-310001051512us-gaap:AccountsReceivableMember2023-09-300001051512us-gaap:AccountsReceivableMember2022-12-310001051512us-gaap:OtherNoncurrentAssetsMember2023-09-300001051512us-gaap:OtherNoncurrentAssetsMember2022-12-310001051512us-gaap:UnbilledRevenuesMembertds:LowestRiskMember2023-09-300001051512us-gaap:UnbilledRevenuesMemberus-gaap:PrimeMember2023-09-300001051512us-gaap:UnbilledRevenuesMembertds:SlightRiskMember2023-09-300001051512us-gaap:UnbilledRevenuesMemberus-gaap:SubprimeMember2023-09-300001051512us-gaap:UnbilledRevenuesMember2023-09-300001051512us-gaap:UnbilledRevenuesMembertds:LowestRiskMember2022-12-310001051512us-gaap:UnbilledRevenuesMemberus-gaap:PrimeMember2022-12-310001051512us-gaap:UnbilledRevenuesMembertds:SlightRiskMember2022-12-310001051512us-gaap:UnbilledRevenuesMemberus-gaap:SubprimeMember2022-12-310001051512us-gaap:UnbilledRevenuesMember2022-12-310001051512tds:LowestRiskMemberus-gaap:FinancialAssetNotPastDueMemberus-gaap:BilledRevenuesMember2023-09-300001051512us-gaap:FinancialAssetNotPastDueMemberus-gaap:PrimeMemberus-gaap:BilledRevenuesMember2023-09-300001051512tds:SlightRiskMemberus-gaap:FinancialAssetNotPastDueMemberus-gaap:BilledRevenuesMember2023-09-300001051512us-gaap:FinancialAssetNotPastDueMemberus-gaap:BilledRevenuesMemberus-gaap:SubprimeMember2023-09-300001051512us-gaap:FinancialAssetNotPastDueMemberus-gaap:BilledRevenuesMember2023-09-300001051512tds:LowestRiskMemberus-gaap:FinancialAssetNotPastDueMemberus-gaap:BilledRevenuesMember2022-12-310001051512us-gaap:FinancialAssetNotPastDueMemberus-gaap:PrimeMemberus-gaap:BilledRevenuesMember2022-12-310001051512tds:SlightRiskMemberus-gaap:FinancialAssetNotPastDueMemberus-gaap:BilledRevenuesMember2022-12-310001051512us-gaap:FinancialAssetNotPastDueMemberus-gaap:BilledRevenuesMemberus-gaap:SubprimeMember2022-12-310001051512us-gaap:FinancialAssetNotPastDueMemberus-gaap:BilledRevenuesMember2022-12-310001051512us-gaap:FinancialAssetPastDueMembertds:LowestRiskMemberus-gaap:BilledRevenuesMember2023-09-300001051512us-gaap:FinancialAssetPastDueMemberus-gaap:PrimeMemberus-gaap:BilledRevenuesMember2023-09-300001051512us-gaap:FinancialAssetPastDueMembertds:SlightRiskMemberus-gaap:BilledRevenuesMember2023-09-300001051512us-gaap:FinancialAssetPastDueMemberus-gaap:BilledRevenuesMemberus-gaap:SubprimeMember2023-09-300001051512us-gaap:FinancialAssetPastDueMemberus-gaap:BilledRevenuesMember2023-09-300001051512us-gaap:FinancialAssetPastDueMembertds:LowestRiskMemberus-gaap:BilledRevenuesMember2022-12-310001051512us-gaap:FinancialAssetPastDueMemberus-gaap:PrimeMemberus-gaap:BilledRevenuesMember2022-12-310001051512us-gaap:FinancialAssetPastDueMembertds:SlightRiskMemberus-gaap:BilledRevenuesMember2022-12-310001051512us-gaap:FinancialAssetPastDueMemberus-gaap:BilledRevenuesMemberus-gaap:SubprimeMember2022-12-310001051512us-gaap:FinancialAssetPastDueMemberus-gaap:BilledRevenuesMember2022-12-310001051512tds:LowestRiskMember2023-09-300001051512us-gaap:PrimeMember2023-09-300001051512tds:SlightRiskMember2023-09-300001051512us-gaap:SubprimeMember2023-09-300001051512tds:LowestRiskMember2022-12-310001051512us-gaap:PrimeMember2022-12-310001051512tds:SlightRiskMember2022-12-310001051512us-gaap:SubprimeMember2022-12-310001051512tds:EquipmentInstallmentPlanReceivableMember2023-01-012023-09-300001051512tds:EquipmentInstallmentPlanReceivableMember2022-12-310001051512tds:EquipmentInstallmentPlanReceivableMember2021-12-310001051512tds:EquipmentInstallmentPlanReceivableMember2022-01-012022-09-300001051512tds:EquipmentInstallmentPlanReceivableMember2023-09-300001051512tds:EquipmentInstallmentPlanReceivableMember2022-09-300001051512us-gaap:CommonClassBMember2023-07-012023-09-300001051512us-gaap:CommonClassBMember2022-07-012022-09-300001051512us-gaap:CommonClassBMember2022-01-012022-09-300001051512us-gaap:CommonClassAMember2023-07-012023-09-300001051512us-gaap:CommonClassAMember2022-07-012022-09-300001051512us-gaap:CommonClassAMember2023-01-012023-09-300001051512us-gaap:CommonClassAMember2022-01-012022-09-300001051512tds:Auction107AquisitionEventMember2021-12-31tds:license0001051512tds:Auction107AquisitionEventMember2021-01-012021-12-310001051512tds:Auction107AquisitionEventMember2020-01-012020-12-310001051512us-gaap:SubsequentEventMembertds:Auction107AquisitionEventMember2021-10-012025-03-310001051512tds:Auction107AquisitionEventMember2023-01-012023-09-300001051512tds:Auction107AquisitionEventMember2022-01-012022-12-310001051512tds:USCellularSegmentMemberus-gaap:SubsequentEventMembertds:Auction107AquisitionEventMember2023-10-012023-10-010001051512tds:USCellularSegmentMemberus-gaap:AccountsPayableMembertds:Auction107AquisitionEventMember2023-09-300001051512tds:USCellularSegmentMemberus-gaap:OtherCurrentLiabilitiesMembertds:Auction107AquisitionEventMember2023-09-300001051512tds:USCellularSegmentMemberus-gaap:OtherCurrentLiabilitiesMembertds:Auction107AquisitionEventMember2022-12-310001051512tds:USCellularSegmentMemberus-gaap:OtherNoncurrentLiabilitiesMembertds:Auction107AquisitionEventMember2022-12-310001051512us-gaap:EquityMethodInvestmentsMember2023-07-012023-09-300001051512us-gaap:EquityMethodInvestmentsMember2022-07-012022-09-300001051512us-gaap:EquityMethodInvestmentsMember2023-01-012023-09-300001051512us-gaap:EquityMethodInvestmentsMember2022-01-012022-09-300001051512tds:UsGaap_RevolvingCreditFacilityMemberBMember2023-09-300001051512tds:UsGaap_RevolvingCreditFacilityMemberBMember2023-01-012023-09-300001051512us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembertds:UsGaap_RevolvingCreditFacilityMemberBMember2023-01-012023-09-300001051512tds:TDSExportCreditFinancingAgreementMember2023-09-300001051512tds:TDSExportCreditFinancingAgreementMember2023-01-012023-09-300001051512us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembertds:TDSExportCreditFinancingAgreementMember2023-01-012023-09-300001051512tds:TDSSecuredTermLoanMember2023-09-300001051512us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembertds:TDSSecuredTermLoanMember2023-01-012023-09-300001051512tds:TDSSecuredTermLoanMember2023-01-012023-09-300001051512tds:USCellularSegmentMembertds:TDSSecuredTermLoanMemberus-gaap:AssetPledgedAsCollateralWithoutRightMember2023-09-300001051512tds:USCellularSegmentMembertds:LendersCostOfFundsMembertds:ReceivablesSecuritizationFacilityMember2023-01-012023-09-300001051512tds:USCellularSegmentMembertds:ReceivablesSecuritizationFacilityMember2023-01-012023-09-300001051512tds:USCellularSegmentMembertds:ReceivablesSecuritizationFacilityMember2023-09-300001051512tds:USCellularSegmentMemberus-gaap:AssetPledgedAsCollateralWithoutRightMembertds:ReceivablesSecuritizationFacilityMember2023-09-300001051512tds:USCellularSegmentMemberus-gaap:SubsequentEventMembertds:ReceivablesSecuritizationFacilityMember2023-10-012023-10-010001051512tds:USCellularSegmentMembertds:UScellularRepurchaseAgreementMember2023-09-300001051512tds:USCellularSegmentMembertds:LendersCostOfFundsMembertds:UScellularRepurchaseAgreementMember2023-01-012023-09-300001051512tds:USCellularSegmentMembertds:UScellularRepurchaseAgreementMember2023-01-012023-09-300001051512tds:USCellularSegmentMembertds:UScellularRepurchaseAgreementMemberus-gaap:AssetPledgedAsCollateralWithoutRightMember2023-09-300001051512us-gaap:SubsequentEventMember2024-04-010001051512us-gaap:SubsequentEventMember2025-04-010001051512us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-09-300001051512us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2022-12-310001051512tds:VariableInterestEntityUsccEipLlcMember2023-01-012023-09-300001051512tds:VariableInterestEntityUsccEipLlcMember2022-01-012022-09-300001051512tds:USCellularSegmentMemberus-gaap:ServiceMember2023-07-012023-09-300001051512tds:TDSTelecomSegmentMemberus-gaap:ServiceMember2023-07-012023-09-300001051512us-gaap:ServiceMembertds:OtherSegmentMember2023-07-012023-09-300001051512tds:USCellularSegmentMemberus-gaap:ProductMember2023-07-012023-09-300001051512tds:TDSTelecomSegmentMemberus-gaap:ProductMember2023-07-012023-09-300001051512us-gaap:ProductMembertds:OtherSegmentMember2023-07-012023-09-300001051512tds:USCellularSegmentMember2023-09-300001051512tds:TDSTelecomSegmentMember2023-09-300001051512tds:OtherSegmentMember2023-09-300001051512tds:USCellularSegmentMemberus-gaap:ServiceMember2022-07-012022-09-300001051512tds:TDSTelecomSegmentMemberus-gaap:ServiceMember2022-07-012022-09-300001051512us-gaap:ServiceMembertds:OtherSegmentMember2022-07-012022-09-300001051512tds:USCellularSegmentMemberus-gaap:ProductMember2022-07-012022-09-300001051512tds:TDSTelecomSegmentMemberus-gaap:ProductMember2022-07-012022-09-300001051512us-gaap:ProductMembertds:OtherSegmentMember2022-07-012022-09-300001051512tds:USCellularSegmentMember2022-09-300001051512tds:TDSTelecomSegmentMember2022-09-300001051512tds:OtherSegmentMember2022-09-300001051512tds:USCellularSegmentMemberus-gaap:ServiceMember2023-01-012023-09-300001051512tds:TDSTelecomSegmentMemberus-gaap:ServiceMember2023-01-012023-09-300001051512us-gaap:ServiceMembertds:OtherSegmentMember2023-01-012023-09-300001051512tds:USCellularSegmentMemberus-gaap:ProductMember2023-01-012023-09-300001051512tds:TDSTelecomSegmentMemberus-gaap:ProductMember2023-01-012023-09-300001051512us-gaap:ProductMembertds:OtherSegmentMember2023-01-012023-09-300001051512tds:USCellularSegmentMemberus-gaap:ServiceMember2022-01-012022-09-300001051512tds:TDSTelecomSegmentMemberus-gaap:ServiceMember2022-01-012022-09-300001051512us-gaap:ServiceMembertds:OtherSegmentMember2022-01-012022-09-300001051512tds:USCellularSegmentMemberus-gaap:ProductMember2022-01-012022-09-300001051512tds:TDSTelecomSegmentMemberus-gaap:ProductMember2022-01-012022-09-300001051512us-gaap:ProductMembertds:OtherSegmentMember2022-01-012022-09-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

|

|

|

|

|

|

|

|

|

| (Mark One) |

☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2023

OR

|

|

|

|

|

|

|

|

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-14157

|

|

|

|

|

|

|

|

|

TELEPHONE AND DATA SYSTEMS, INC. |

| (Exact name of Registrant as specified in its charter) |

Delaware |

|

36-2669023 |

| (State or other jurisdiction of incorporation or organization) |

|

(IRS Employer Identification No.) |

30 North LaSalle Street, Suite 4000, Chicago, Illinois 60602

(Address of principal executive offices) (Zip code)

Registrant's telephone number, including area code: (312) 630-1900

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class |

|

Trading Symbol |

|

Name of each exchange on which registered |

| Common Shares, $.01 par value |

|

TDS |

|

New York Stock Exchange |

| Depository Shares each representing a 1/1000th interest in a share of 6.625% Series UU Cumulative Redeemable Perpetual Preferred Stock, $.01 par value |

|

TDSPrU |

|

New York Stock Exchange |

| Depository Shares each representing a 1/1000th interest in a share of 6.000% Series VV Cumulative Redeemable Perpetual Preferred Stock, $.01 par value |

|

TDSPrV |

|

New York Stock Exchange |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. |

Yes |

☒ |

No |

☐ |

|

|

|

|

|

|

|

|

| Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). |

Yes |

☒ |

No |

☐ |

|

|

|

|

|

|

|

|

| Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. |

Large accelerated filer |

☒ |

|

Accelerated filer |

☐ |

| Non-accelerated filer |

☐ |

|

Smaller reporting company |

☐ |

|

|

|

Emerging growth company |

☐ |

|

|

|

|

|

|

|

|

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. |

☐ |

| Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). |

Yes |

☐ |

No |

☒ |

The number of shares outstanding of each of the issuer's classes of common stock, as of September 30, 2023, is 106 million Common Shares, $.01 par value, and 7 million Series A Common Shares, $.01 par value.

Telephone and Data Systems, Inc.

Quarterly Report on Form 10-Q

For the Period Ended September 30, 2023

|

|

|

|

|

|

|

Telephone and Data Systems, Inc.

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

|

Executive Overview

The following discussion and analysis compares Telephone and Data Systems, Inc.’s (TDS) financial results for the three and nine months ended September 30, 2023, to the three and nine months ended September 30, 2022. It should be read in conjunction with TDS’ interim consolidated financial statements and notes included herein, and with the description of TDS’ business, its audited consolidated financial statements and Management's Discussion and Analysis of Financial Condition and Results of Operations (MD&A) included in TDS’ Annual Report on Form 10-K (Form 10-K) for the year ended December 31, 2022. Certain numbers included herein are rounded to millions for ease of presentation; however, certain calculated amounts and percentages are determined using the unrounded numbers.

This report contains statements that are not based on historical facts, which may be identified by words such as “believes,” “anticipates,” “estimates,” “expects,” “plans,” “intends,” “projects,” “will” and similar expressions. These statements constitute and represent “forward looking statements” as this term is defined in the Private Securities Litigation Reform Act of 1995. Such forward looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results, events or developments to be significantly different from any future results, events or developments expressed or implied by such forward looking statements. See the disclosure under the heading Private Securities Litigation Reform Act of 1995 Safe Harbor Cautionary Statement elsewhere in this report for additional information.

The accounting policies of TDS conform to accounting principles generally accepted in the United States of America (GAAP). However, TDS uses certain “non-GAAP financial measures” in the MD&A. A discussion of the reasons TDS determines these metrics to be useful and reconciliations of these measures to their most directly comparable measures determined in accordance with GAAP are included in the disclosure under the heading Supplemental Information Relating to Non-GAAP Financial Measures within the MD&A of this report.

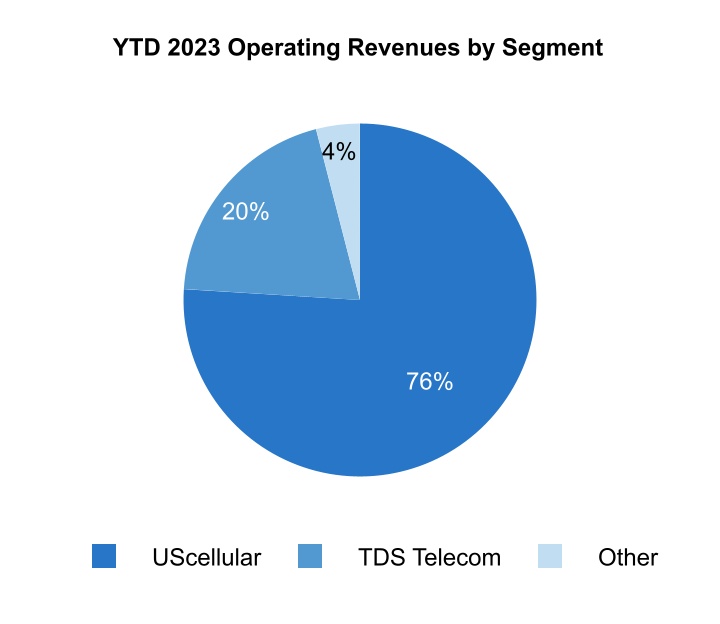

General

TDS is a diversified telecommunications company that provides high-quality communications services to approximately 6 million connections nationwide. TDS provides wireless services through its 83%-owned subsidiary, United States Cellular Corporation (UScellular). TDS also provides broadband, video and voice services through its wholly-owned subsidiary, TDS Telecommunications LLC (TDS Telecom). TDS operates entirely in the United States. UScellular and TDS Telecom are reporting segments of TDS. See Note 12 — Business Segment Information in the Notes to Consolidated Financial Statements for additional information.

TDS Mission and Strategy

TDS’ mission is to provide outstanding communications services to its customers and meet the needs of its shareholders, its people, and its communities. In pursuing this mission, TDS seeks to grow its businesses, create opportunities for its associates, support the communities it serves, and build value over the long term for its shareholders. Across all of its businesses, TDS is focused on providing exceptional customer experiences through best-in-class services and products and superior customer service. Since its founding, TDS has been committed to bringing high-quality communications services to rural and underserved communities. TDS continues to make progress on developing and enhancing its Environmental, Social and Governance (ESG) program, including the publication of the most recent TDS ESG Report in July 2023, which is available on the TDS website.

TDS’ long-term strategy has been to re-invest the majority of its operating capital in its businesses to strengthen their competitive positions and financial performance, while also returning value to TDS shareholders primarily through the payment of a regular quarterly cash dividend.

TDS plans to build shareholder value by continuing to execute on its strategies to build strong, competitive businesses providing high-quality, data-focused services and products. Strategic efforts include:

▪UScellular offers economical and competitively priced service plans and devices to its customers and is focused on increasing revenues from sales of related products such as device protection plans and from new services such as fixed wireless home internet. In addition, UScellular is focused on increasing revenues from prepaid plans, tower rent revenues and expanding its solutions available to business and government customers.

▪UScellular continues to enhance its network capabilities, including by deploying 5G technology. 5G technology helps address customers’ growing demand for data services and creates opportunities for new services requiring high speed and reliability as well as low latency. UScellular's initial 5G deployment has predominantly used low-band spectrum to launch 5G services in portions of substantially all of its markets. During 2023, UScellular is continuing to invest in 5G with a focus on deployment of mid-band spectrum, which will largely overlap portions of areas already covered with low-band 5G service. 5G service deployed over mid-band spectrum will further enhance speed and capacity for UScellular's mobility and fixed wireless services.

▪UScellular assesses its existing wireless interests on an ongoing basis with a goal of improving the competitiveness of its operations and maximizing its long-term return on capital. As part of this strategy, UScellular may seek attractive opportunities to acquire wireless spectrum, including pursuant to Federal Communications Commission (FCC) auctions.

▪TDS Telecom strives to be the preferred broadband provider in its markets with the ability to provide value-added bundling with video and voice service options. TDS Telecom focuses on driving growth by investing in fiber deployment primarily in its expansion markets and also in its incumbent markets that have historically utilized copper and coaxial cable technologies.

▪TDS Telecom seeks to grow its operations by creating clusters of markets in attractive, growing locations and may seek to acquire and/or divest of assets to support its strategy.

Recent Development

On August 4, 2023, TDS and UScellular announced that the Boards of Directors of both companies have decided to initiate a process to explore a range of strategic alternatives for UScellular. During the three and nine months ended September 30, 2023, TDS incurred third-party expenses of $4 million related to the strategic alternatives review. At this time, TDS cannot predict the ultimate outcome of such process or estimate the potential impact of such process on the financial statements.

Terms Used by TDS

The following is a list of definitions of certain industry terms that are used throughout this document:

▪5G – fifth generation wireless technology that helps address customers’ growing demand for data services and creates opportunities for new services requiring high speed and reliability as well as low latency.

▪Account – represents an individual or business financially responsible for one or multiple associated connections. An account may include a variety of types of connections such as handsets and connected devices.

▪Alternative Connect America Cost Model (ACAM) – a USF support mechanism for certain carriers, which provides revenue support through 2028. This support comes with an obligation to build defined broadband speeds to a certain number of locations.

▪Auction 107 – Auction 107 was an FCC auction of 3.7-3.98 GHz wireless spectrum licenses that started in December 2020 and concluded in February 2021.

▪Broadband Connections – refers to the individual customers provided internet access through various transmission technologies, including fiber, coaxial and copper.

▪Broadband Penetration – metric which is calculated by dividing total broadband connections by total service addresses.

▪Coronavirus Aid, Relief, and Economic Security (CARES) Act – economic relief package signed into law on March 27, 2020 to address the public health and economic impacts of COVID-19, including a variety of tax provisions.

▪Churn Rate – represents the percentage of the connections that disconnect service each month. These rates represent the average monthly churn rate for each respective period.

▪Connected Devices – non-handset devices that connect directly to the UScellular network. Connected devices include products such as tablets, wearables, modems, and hotspots.

▪EBITDA – refers to earnings before interest, taxes, depreciation, amortization and accretion and is used in the non-GAAP metric Adjusted EBITDA throughout this document. See Supplemental Information Relating to Non-GAAP Financial Measures within this MD&A for additional information.

▪Enhanced Alternative Connect America Cost Model (E-ACAM) – a USF support mechanism for certain carriers, which provides revenue support through 2038. This support comes with an obligation to provide 100/20 Mbps service to a certain number of locations.

▪Expansion Markets – markets utilizing fiber networks in areas where TDS does not serve as the incumbent service provider.

▪Free Cash Flow – non-GAAP metric defined as Cash flows from operating activities less Cash paid for additions to property, plant and equipment and less Cash paid for software license agreements. See Supplemental Information Relating to Non-GAAP Financial Measures within this MD&A for additional information.

▪Gross Additions – represents the total number of new connections added during the period, without regard to connections that were terminated during that period.

▪Incumbent Markets – markets where TDS is positioned as the traditional local telephone or cable company.

▪IPTV – internet protocol television.

▪Net Additions (Losses) – represents the total number of new connections added during the period, net of connections that were terminated during that period.

▪OIBDA – refers to operating income before depreciation, amortization and accretion and is used in the non-GAAP metric Adjusted OIBDA throughout this document. See Supplemental Information Relating to Non-GAAP Financial Measures within this MD&A for additional information.

▪Postpaid Average Revenue per Account (Postpaid ARPA) – metric which is calculated by dividing total postpaid service revenues by the average number of postpaid accounts and by the number of months in the period.

▪Postpaid Average Revenue per User (Postpaid ARPU) – metric which is calculated by dividing total postpaid service revenues by the average number of postpaid connections and by the number of months in the period.

▪Residential Revenue per Connection – metric which is calculated by dividing total residential revenue by the average number of residential connections and by the number of months in the period.

▪Retail Connections – individual lines of service associated with each device activated by a postpaid or prepaid customer. Connections are associated with all types of devices that connect directly to the UScellular network.

▪Service Addresses – number of single residence homes, multi-dwelling units, and business locations that are capable of being connected to the TDS network, based on best available information.

▪Universal Service Fund (USF) – a system of telecommunications collected fees and support payments managed by the FCC intended to promote universal access to telecommunications services in the United States.

▪Video Connections – represents the individual customers provided video services.

▪Voice Connections – refers to the individual circuits connecting a customer to TDS' central office facilities that provide voice services or the billable number of lines into a building for voice services.

Results of Operations — TDS Consolidated

The following discussion and analysis compares financial results for the three and nine months ended September 30, 2023, to the three and nine months ended September 30, 2022

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

Nine Months Ended

September 30, |

| |

2023 |

|

2022 |

|

2023 vs. 2022 |

|

2023 |

|

2022 |

|

2023 vs. 2022 |

| (Dollars in millions) |

|

|

|

|

|

|

|

|

|

|

|

| Operating revenues |

|

|

|

|

|

|

|

|

|

|

|

| UScellular |

$ |

963 |

|

|

$ |

1,083 |

|

|

(11) |

% |

|

$ |

2,906 |

|

|

$ |

3,120 |

|

|

(7) |

% |

| TDS Telecom |

256 |

|

|

256 |

|

|

— |

|

767 |

|

|

763 |

|

|

— |

All other1 |

59 |

|

|

53 |

|

|

10 |

% |

|

175 |

|

|

173 |

|

|

2 |

% |

| Total operating revenues |

1,278 |

|

|

1,392 |

|

|

(8) |

% |

|

3,848 |

|

|

4,056 |

|

|

(5) |

% |

| Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

| UScellular |

906 |

|

|

1,098 |

|

|

(17) |

% |

|

2,789 |

|

|

3,024 |

|

|

(8) |

% |

| TDS Telecom |

256 |

|

|

246 |

|

|

4 |

% |

|

752 |

|

|

702 |

|

|

7 |

% |

All other1 |

68 |

|

|

59 |

|

|

15 |

% |

|

197 |

|

|

183 |

|

|

9 |

% |

| Total operating expenses |

1,230 |

|

|

1,403 |

|

|

(12) |

% |

|

3,738 |

|

|

3,909 |

|

|

(4) |

% |

| Operating income (loss) |

|

|

|

|

|

|

|

|

|

|

|

| UScellular |

57 |

|

|

(15) |

|

|

N/M |

|

117 |

|

|

96 |

|

|

22 |

% |

| TDS Telecom |

— |

|

|

10 |

|

|

(98) |

% |

|

15 |

|

|

61 |

|

|

(76) |

% |

All other1 |

(9) |

|

|

(6) |

|

|

(52) |

% |

|

(22) |

|

|

(10) |

|

|

N/M |

| Total operating income (loss) |

48 |

|

|

(11) |

|

|

N/M |

|

110 |

|

|

147 |

|

|

(26) |

% |

| Investment and other income (expense) |

|

|

|

|

|

|

|

|

|

|

|

| Equity in earnings of unconsolidated entities |

40 |

|

|

40 |

|

|

(1) |

% |

|

122 |

|

|

123 |

|

|

(1) |

% |

| Interest and dividend income |

5 |

|

|

4 |

|

|

50 |

% |

|

16 |

|

|

10 |

|

|

57 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense |

(62) |

|

|

(46) |

|

|

(35) |

% |

|

(178) |

|

|

(118) |

|

|

(49) |

% |

| Other, net |

— |

|

|

— |

|

|

23 |

% |

|

1 |

|

|

1 |

|

|

25 |

% |

| Total investment and other income (expense) |

(17) |

|

|

(2) |

|

|

N/M |

|

(39) |

|

|

16 |

|

|

N/M |

|

|

|

|

|

|

|

|

|

|

|

|

| Income (loss) before income taxes |

31 |

|

|

(13) |

|

|

N/M |

|

71 |

|

|

163 |

|

|

(57) |

% |

| Income tax expense (benefit) |

27 |

|

|

(3) |

|

|

N/M |

|

55 |

|

|

62 |

|

|

(11) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

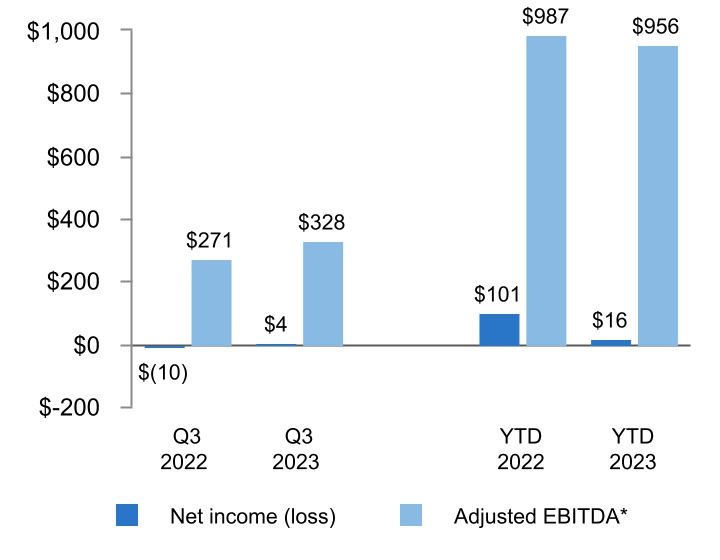

| Net income (loss) |

4 |

|

|

(10) |

|

|

N/M |

|

16 |

|

|

101 |

|

|

(84) |

% |

| Less: Net income (loss) attributable to noncontrolling interests, net of tax |

4 |

|

|

(2) |

|

|

N/M |

|

10 |

|

|

14 |

|

|

(29) |

% |

| Net income (loss) attributable to TDS shareholders |

— |

|

|

(8) |

|

|

94 |

% |

|

6 |

|

|

87 |

|

|

(93) |

% |

| TDS Preferred Share dividends |

17 |

|

|

17 |

|

|

— |

|

52 |

|

|

52 |

|

|

— |

| Net income (loss) attributable to TDS common shareholders |

$ |

(17) |

|

|

$ |

(25) |

|

|

30 |

% |

|

$ |

(46) |

|

|

$ |

35 |

|

|

N/M |

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted OIBDA (Non-GAAP)2 |

$ |

283 |

|

|

$ |

227 |

|

|

25 |

% |

|

$ |

817 |

|

|

$ |

853 |

|

|

(4) |

% |

Adjusted EBITDA (Non-GAAP)2 |

$ |

328 |

|

|

$ |

271 |

|

|

21 |

% |

|

$ |

956 |

|

|

$ |

987 |

|

|

(3) |

% |

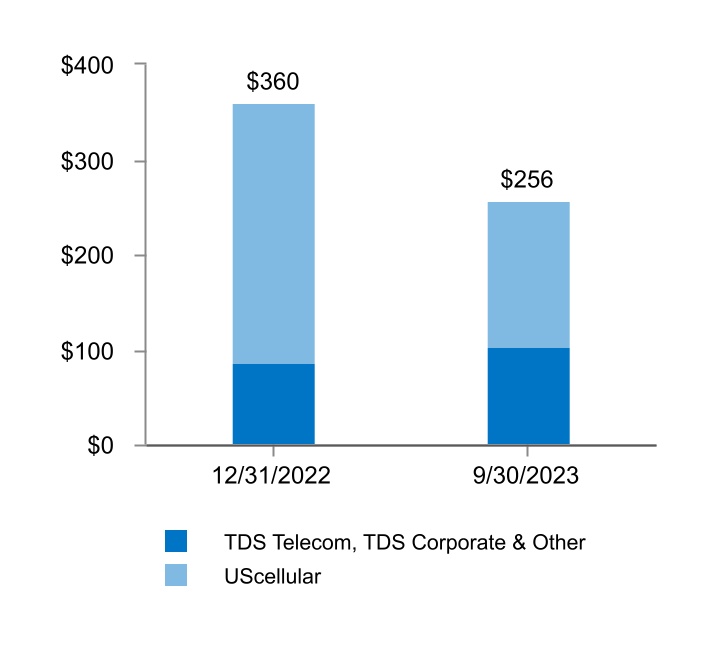

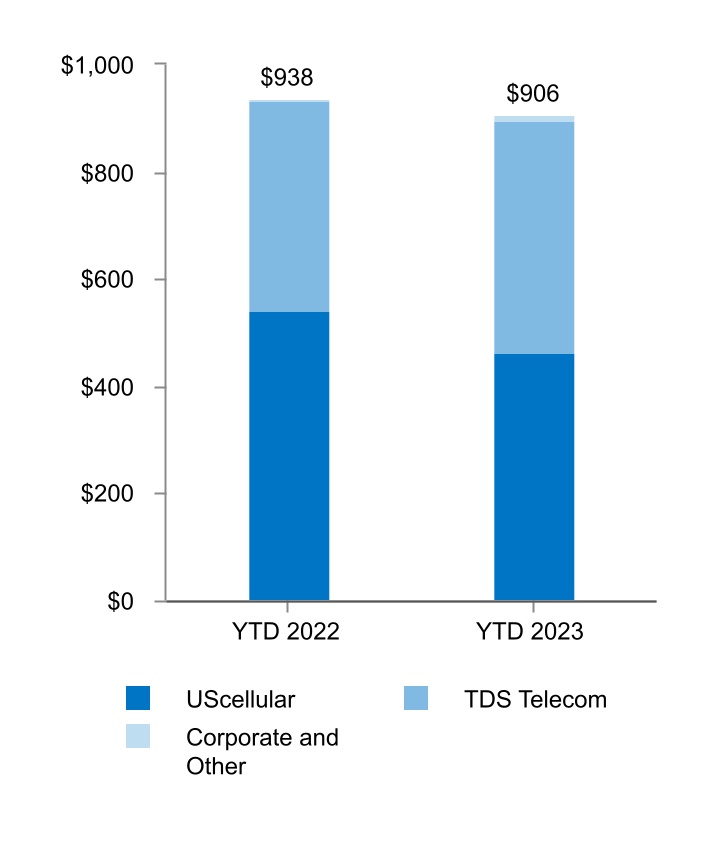

Capital expenditures3 |

$ |

285 |

|

|

$ |

305 |

|

|

(7) |

% |

|

$ |

906 |

|

|

$ |

938 |

|

|

(3) |

% |

Numbers may not foot due to rounding.

N/M - Percentage change not meaningful

1Consists of corporate and other operations and intercompany eliminations.

2Refer to Supplemental Information Relating to Non-GAAP Financial Measures within this MD&A for a reconciliation of this measure.

3Refer to Liquidity and Capital Resources within this MD&A for additional information on Capital expenditures.

Refer to individual segment discussions in this MD&A for additional details on operating revenues and expenses at the segment level.

Equity in earnings of unconsolidated entities

Equity in earnings of unconsolidated entities represents TDS’ share of net income from entities in which it has a noncontrolling interest and that are accounted for using the equity method or the net asset value practical expedient. TDS’ investment in the Los Angeles SMSA Limited Partnership (LA Partnership) contributed pre-tax income of $14 million and $18 million for the three months ended September 30, 2023 and 2022, respectively and $52 million and $52 million for the nine months ended September 30, 2023 and 2022, respectively. See Note 8 — Investments in Unconsolidated Entities in the Notes to Consolidated Financial Statements for additional information.

Interest expense

Interest expense increased for the three and nine months ended September 30, 2023 due primarily to interest rate increases on variable rate debt. See Market Risk for additional information regarding maturities of long-term debt and weighted average interest rates.

Income tax expense

Income tax expense increased for the three months ended September 30, 2023 due primarily to the increase in Income (loss) before income taxes.

Income tax expense decreased for the nine months ended September 30, 2023 due primarily to the decrease in Income (loss) before income taxes, partially offset by increases to state valuation allowances that reduce the net value of deferred tax assets.

In April 2023, TDS received a federal income tax refund of $57 million related to the 2020 net operating loss carryback enabled by the CARES Act.

Net income (loss) attributable to noncontrolling interests, net of tax

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

Nine Months Ended

September 30, |

| |

2023 |

|

2022 |

|

2023 |

|

2022 |

| (Dollars in millions) |

|

|

|

|

|

|

|

| UScellular noncontrolling public shareholders’ |

$ |

4 |

|

|

$ |

(2) |

|

|

$ |

7 |

|

|

$ |

10 |

|

| Noncontrolling shareholders’ or partners’ |

— |

|

|

— |

|

|

3 |

|

|

4 |

|

| Net income (loss) attributable to noncontrolling interests, net of tax |

$ |

4 |

|

|

$ |

(2) |

|

|

$ |

10 |

|

|

$ |

14 |

|

Net income (loss) attributable to noncontrolling interests, net of tax includes the noncontrolling public shareholders’ share of UScellular’s net income (loss), the noncontrolling shareholders’ or partners’ share of certain UScellular subsidiaries’ net income (loss) and other TDS noncontrolling interests.

Earnings

(Dollars in millions)

Three Months Ended

Net income (loss) increased due primarily to lower operating expenses, partially offset by lower operating revenues and higher interest and income tax expenses. Adjusted EBITDA increased due primarily to lower operating expenses, partially offset by lower operating revenues.

Nine Months Ended

Net income (loss) decreased due primarily to lower operating revenues and higher interest expense, partially offset by lower operating expenses. Adjusted EBITDA decreased due primarily to lower operating revenues, partially offset by lower operating expenses.

*Represents a non-GAAP financial measure. Refer to Supplemental Information Relating to Non-GAAP Financial Measures within this MD&A for a reconciliation of this measure.

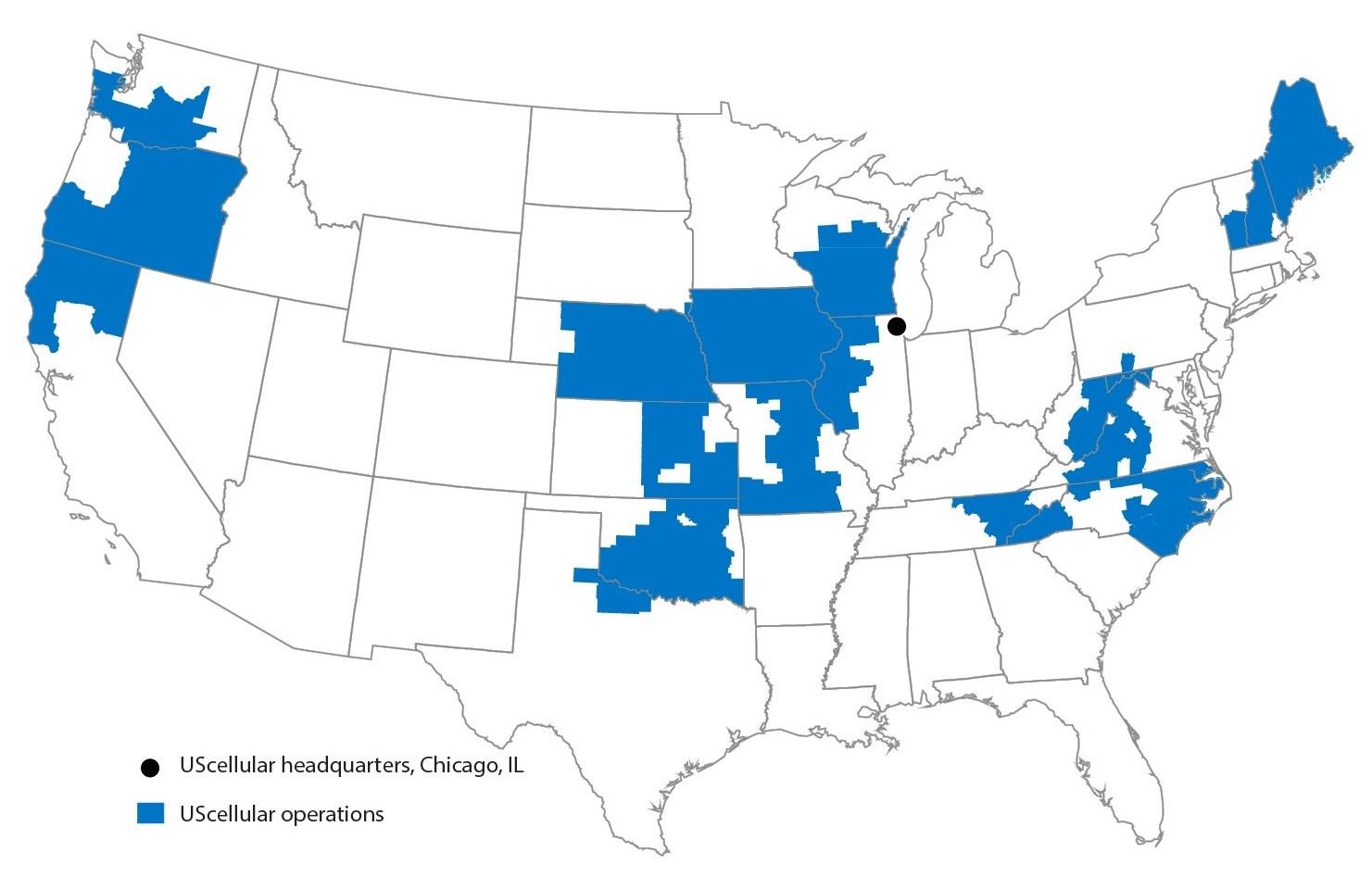

Business Overview

UScellular owns, operates, and invests in wireless markets throughout the United States. UScellular is an 83%-owned subsidiary of TDS. UScellular’s strategy is to attract and retain customers by providing a high-quality network, outstanding customer service, and competitive devices, plans and pricing - all provided with a community focus.

OPERATIONS

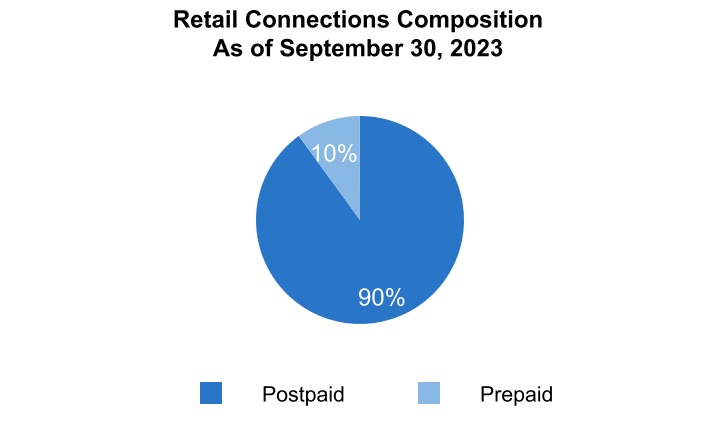

▪Serves customers with 4.6 million retail connections including approximately 4.2 million postpaid and 0.5 million prepaid connections

▪Operates in 21 states

▪Employs approximately 4,500 associates

▪Owns 4,356 towers

▪Operates 6,973 cell sites in service

Operational Overview — UScellular

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| As of September 30, |

|

2023 |

|

2022 |

| Retail Connections – End of Period |

|

|

| |

Postpaid |

|

4,159,000 |

|

|

4,264,000 |

| |

Prepaid |

|

462,000 |

|

|

493,000 |

| |

Total |

|

4,621,000 |

|

|

4,757,000 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q3 2023 |

|

Q3 2022 |

|

Q3 2023 vs. Q3 2022 |

|

YTD 2023 |

|

YTD 2022 |

YTD 2023 vs. YTD 2022 |

| Postpaid Activity and Churn |

|

| Gross Additions |

|

|

|

|

|

|

|

|

|

|

| Handsets |

84,000 |

|

|

107,000 |

|

|

(21) |

% |

|

260,000 |

|

|

292,000 |

|

(11) |

% |

| Connected Devices |

44,000 |

|

|

44,000 |

|

|

— |

|

129,000 |

|

|

113,000 |

|

14 |

% |

| Total Gross Additions |

128,000 |

|

|

151,000 |

|

|

(15) |

% |

|

389,000 |

|

|

405,000 |

|

(4) |

% |

| Net Additions (Losses) |

|

|

|

|

|

|

|

|

|

|

| Handsets |

(38,000) |

|

|

(22,000) |

|

|

(73) |

% |

|

(92,000) |

|

|

(89,000) |

|

(3) |

% |

| Connected Devices |

3,000 |

|

|

(9,000) |

|

|

N/M |

|

4,000 |

|

|

(26,000) |

|

N/M |

| Total Net Additions (Losses) |

(35,000) |

|

|

(31,000) |

|

|

(13) |

% |

|

(88,000) |

|

|

(115,000) |

|

23 |

% |

| Churn |

|

|

|

|

|

|

|

|

|

|

| Handsets |

1.11 |

% |

|

1.15 |

% |

|

|

|

1.06 |

% |

|

1.12 |

% |

|

| Connected Devices |

2.64 |

% |

|

3.40 |

% |

|

|

|

2.69 |

% |

|

2.94 |

% |

|

| Total Churn |

1.30 |

% |

|

1.42 |

% |

|

|

|

1.26 |

% |

|

1.34 |

% |

|

N/M - Percentage change not meaningful

Total postpaid handset net losses increased for the three and nine months ended September 30, 2023, when compared to the same period last year due to aggressive industry-wide competition.

Total postpaid connected device net additions increased for the three and nine months ended September 30, 2023, when compared to the same period last year due primarily to higher demand for fixed wireless home internet as well as decreases in tablet and mobile hotspot churn.

Postpaid Revenue

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

Nine Months Ended

September 30, |

|

2023 |

|

2022 |

|

2023 vs. 2022 |

|

2023 |

|

2022 |

|

2023 vs. 2022 |

| Average Revenue Per User (ARPU) |

$ |

51.11 |

|

|

$ |

50.21 |

|

|

2 |

% |

|

$ |

50.81 |

|

|

$ |

49.99 |

|

|

2 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average Revenue Per Account (ARPA) |

$ |

130.91 |

|

|

$ |

130.27 |

|

|

— |

|

$ |

130.64 |

|

|

$ |

130.20 |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

Postpaid ARPU increased for the three months ended September 30, 2023, when compared to the same period last year, due to a decrease in promotional discounts, favorable plan and product offering mix, and an increase in device protection plan revenues.

Postpaid ARPU increased for the nine months ended September 30, 2023, when compared to the same period last year, due to favorable plan and product offering mix and an increase in device protection plan revenues, partially offset by an increase in promotional discounts.

Postpaid ARPA was relatively flat for the three and nine months ended September 30, 2023, when compared to the same period last year, due to the impacts to Postpaid ARPU, offset by a decrease in the number of connections per account.

Financial Overview — UScellular

The following discussion and analysis compares financial results for the three and nine months ended September 30, 2023, to the three and nine months ended September 30, 2022.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

Nine Months Ended

September 30, |

|

2023 |

|

2022 |

|

2023 vs. 2022 |

|

2023 |

|

2022 |

|

2023 vs. 2022 |

| (Dollars in millions) |

|

|

|

|

|

|

|

|

|

|

|

| Retail service |

$ |

687 |

|

|

$ |

696 |

|

|

(1) |

% |

|

$ |

2,065 |

|

|

$ |

2,098 |

|

|

(2) |

% |

| Inbound roaming |

8 |

|

|

17 |

|

|

(53) |

% |

|

25 |

|

|

56 |

|

|

(55) |

% |

| Other |

67 |

|

|

68 |

|

|

(1) |

% |

|

199 |

|

|

197 |

|

|

1 |

% |

| Service revenues |

762 |

|

|

781 |

|

|

(2) |

% |

|

2,289 |

|

|

2,351 |

|

|

(3) |

% |

| Equipment sales |

201 |

|

|

302 |

|

|

(33) |

% |

|

617 |

|

|

769 |

|

|

(20) |

% |

| Total operating revenues |

963 |

|

|

1,083 |

|

|

(11) |

% |

|

2,906 |

|

|

3,120 |

|

|

(7) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| System operations (excluding Depreciation, amortization and accretion reported below) |

185 |

|

|

197 |

|

|

(6) |

% |

|

557 |

|

|

574 |

|

|

(3) |

% |

| Cost of equipment sold |

228 |

|

|

354 |

|

|

(36) |

% |

|

708 |

|

|

887 |

|

|

(20) |

% |

| Selling, general and administrative |

333 |

|

|

369 |

|

|

(10) |

% |

|

1,020 |

|

|

1,032 |

|

|

(1) |

% |

| Depreciation, amortization and accretion |

159 |

|

|

177 |

|

|

(10) |

% |

|

490 |

|

|

520 |

|

|

(6) |

% |

| Loss on impairment of licenses |

— |

|

|

— |

|

|

— |

|

— |

|

|

3 |

|

|

N/M |

| (Gain) loss on asset disposals, net |

1 |

|

|

1 |

|

|

(33) |

% |

|

14 |

|

|

9 |

|

|

62 |

% |

| (Gain) loss on sale of business and other exit costs, net |

— |

|

|

— |

|

|

85 |

% |

|

— |

|

|

(1) |

|

|

N/M |

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating expenses |

906 |

|

|

1,098 |

|

|

(17) |

% |

|

2,789 |

|

|

3,024 |

|

|

(8) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income (loss) |

$ |

57 |

|

|

$ |

(15) |

|

|

N/M |

|

$ |

117 |

|

|

$ |

96 |

|

|

22 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) |

$ |

23 |

|

|

$ |

(12) |

|

|

N/M |

|

$ |

43 |

|

|

$ |

62 |

|

|

(30) |

% |

Adjusted OIBDA (Non-GAAP)1 |

$ |

220 |

|

|

$ |

163 |

|

|

35 |

% |

|

$ |

624 |

|

|

$ |

627 |

|

|

(1) |

% |

Adjusted EBITDA (Non-GAAP)1 |

$ |

263 |

|

|

$ |

205 |

|

|

28 |

% |

|

$ |

753 |

|

|

$ |

754 |

|

|

— |

Capital expenditures2 |

$ |

111 |

|

|

$ |

136 |

|

|

(18) |

% |

|

$ |

462 |

|

|

$ |

541 |

|

|

(15) |

% |

N/M - Percentage change not meaningful

1Refer to Supplemental Information Relating to Non-GAAP Financial Measures within this MD&A for a reconciliation of this measure.

2Refer to Liquidity and Capital Resources within this MD&A for additional information on Capital expenditures.

Operating Revenues

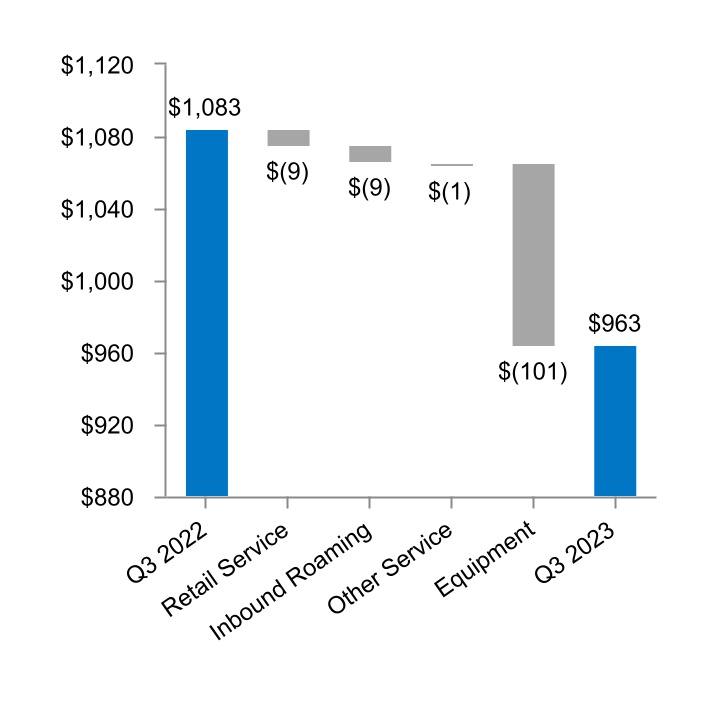

Three Months Ended September 30, 2023 and 2022

(Dollars in millions)

Operating Revenues

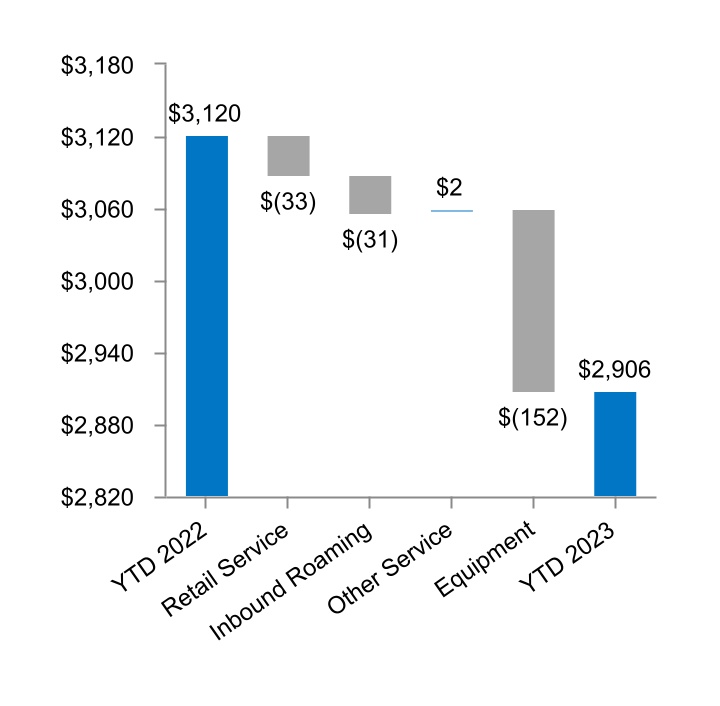

Nine Months Ended September 30, 2023 and 2022

(Dollars in millions)

Service revenues consist of:

▪Retail Service - Postpaid and prepaid charges for voice, data and value-added services and cost recovery surcharges

▪Inbound Roaming - Consideration from other wireless carriers whose customers use UScellular’s wireless systems when roaming

▪Other Service - Amounts received from the Federal USF, tower rental revenues, miscellaneous other service revenues and Internet of Things (IoT)

Equipment revenues consist of:

▪Sales of wireless devices and related accessories to new and existing customers, agents, and third-party distributors

Key components of changes in the statement of operations line items were as follows:

Total operating revenues

Retail service revenues decreased for the three and nine months ended September 30, 2023, primarily as result of a decrease in average postpaid and prepaid connections, partially offset by an increase in Postpaid ARPU as previously discussed in the Operational Overview section.

Inbound roaming revenues decreased for the three and nine months ended September 30, 2023, primarily driven by lower data revenues resulting from lower rates. UScellular expects inbound roaming revenues to continue to decline for the remainder of 2023 relative to prior year levels, due primarily to continued reductions in roaming rates.

Equipment sales revenues decreased for the three and nine months ended September 30, 2023, due primarily to a decline in smartphone upgrades and gross additions.

Wireless service providers have been aggressive promotionally and on price to attract and retain customers. This includes both traditional carriers and cable companies operating as mobile virtual network operators (MVNOs). UScellular expects promotional aggressiveness by traditional carriers and pricing pressures from cable companies to continue into the foreseeable future. Operating revenues and Operating income have been negatively impacted in current and prior periods, and may be negatively impacted in future periods, by competitive promotional offers to new and existing customers.

Total operating expenses

Total operating expenses for the nine months ended September 30, 2023 include $9 million of severance and related expenses associated with a reduction in workforce that was recorded in the first quarter of 2023. These severance expenses are included in System operations expenses and Selling, general and administrative expenses.

Systems operations expenses

System operations expenses decreased for the three and nine months ended September 30, 2023, due primarily to decreases in roaming and customer usage expenses, partially offset by an increase in maintenance, utility, and cell site expenses. UScellular expects roaming expenses to continue to decline for the remainder of 2023 relative to prior year levels, due primarily to continued reductions in roaming rates.

Cost of equipment sold

Cost of equipment sold decreased for the three and nine months ended September 30, 2023, due primarily to a decline in smartphone upgrades and gross additions.

Selling, general and administrative expenses

Selling, general and administrative expenses decreased for the three months ended September 30, 2023, due primarily to decreases in bad debts expense, employee-related expenses, commissions, and advertising expense.

Selling, general and administrative expenses decreased for the nine months ended September 30, 2023 due primarily to decreases in bad debts expense and commissions, partially offset by an increase in advertising expense.

Depreciation, amortization and accretion

Depreciation, amortization and accretion expenses decreased for the three and nine months ended September 30, 2023 due primarily to enhancements that extended the useful life of a software platform.

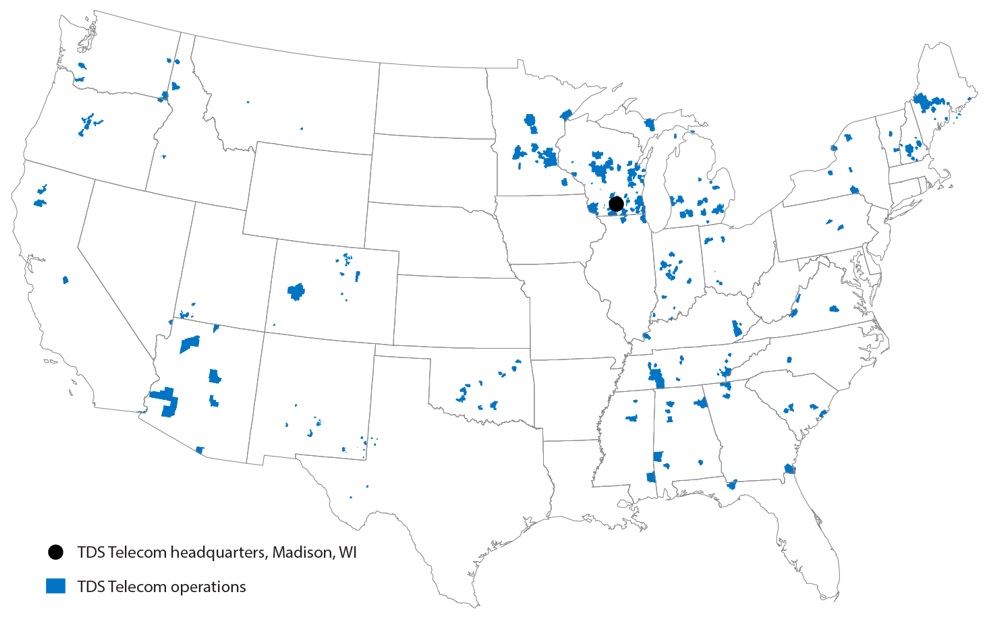

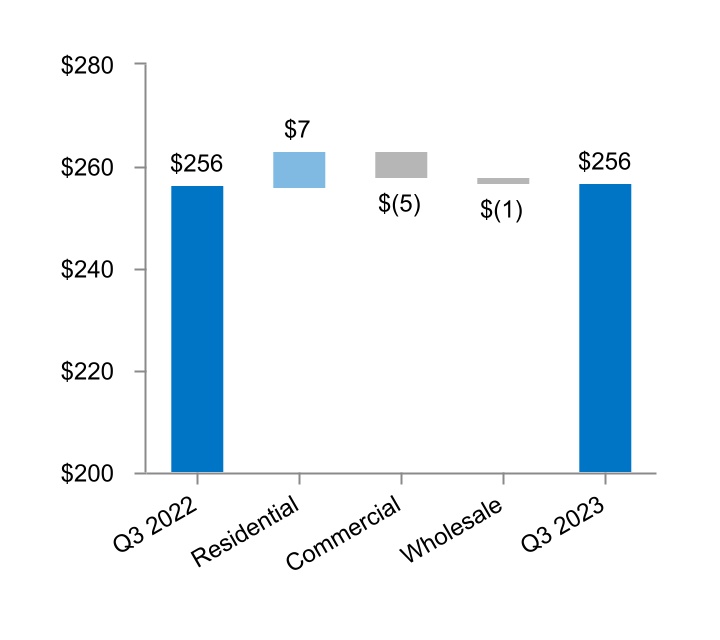

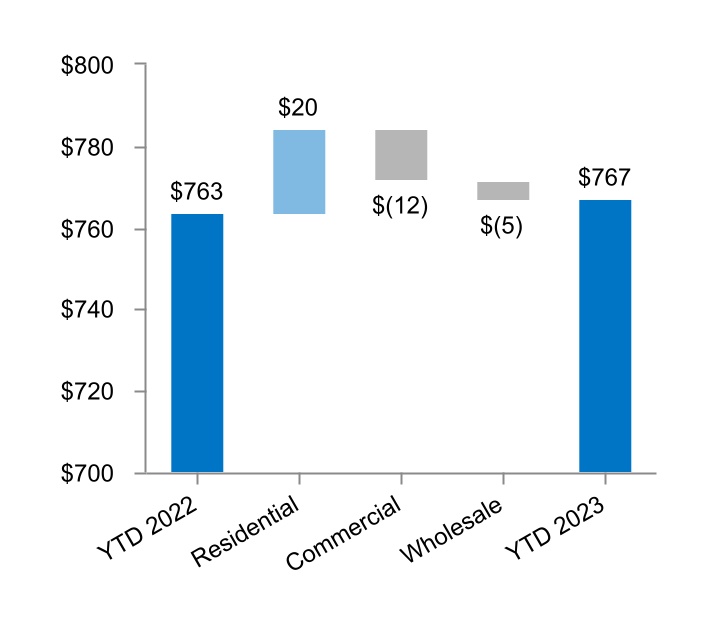

Business Overview

TDS Telecom owns, operates and invests in high-quality networks, services and products in a mix of small to mid-sized urban, suburban and rural communities throughout the United States. TDS Telecom is a wholly-owned subsidiary of TDS and provides a wide range of broadband, video and voice communications services to residential, commercial and wholesale customers, with the constant focus on delivering superior customer service.

OPERATIONS

▪Serves 1.2 million connections in 32 states TDS Telecom increased its service addresses 11% from a year ago to 1.6 million as of September 30, 2023 through network expansion.

▪Employs approximately 3,600 associates

Operational Overview — TDS Telecom

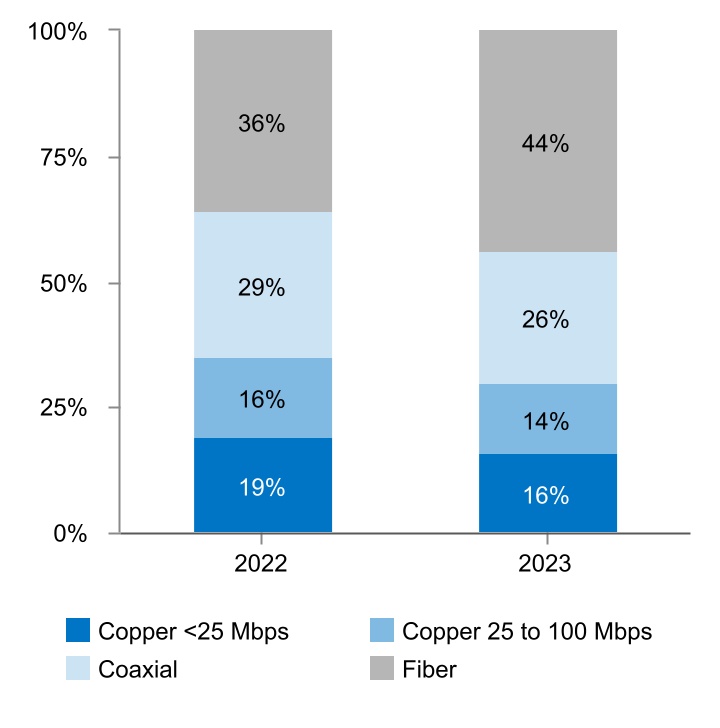

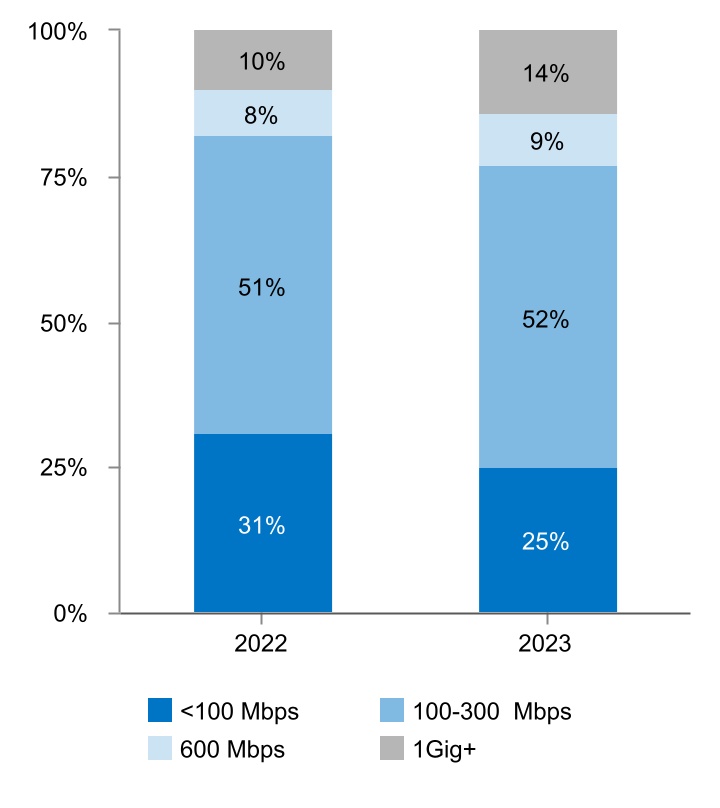

Total Service Address Mix

As of September 30,

TDS Telecom offers 1Gig+ service to 69% of its total footprint as of September 30, 2023, compared to 64% a year ago.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of September 30, |

2023 |

|

2022 |

|

2023 vs. 2022 |

| Residential connections |

|

|

|

|

|

| Broadband |

|

|

|

|

|

| Wireline, Incumbent |

248,800 |

|

|

252,600 |

|

|

(2) |

% |

| Wireline, Expansion |

79,400 |

|

|

49,400 |

|

|

61 |

% |

| Cable |

204,400 |

|

|

204,500 |

|

|

— |

| Total Broadband |

532,600 |

|

|

506,500 |

|

|

5 |

% |

| Video |

132,400 |

|

|

136,600 |

|

|

(3) |

% |

| Voice |

284,000 |

|

|

295,500 |

|

|

(4) |

% |

| Total Residential Connections |

949,000 |

|

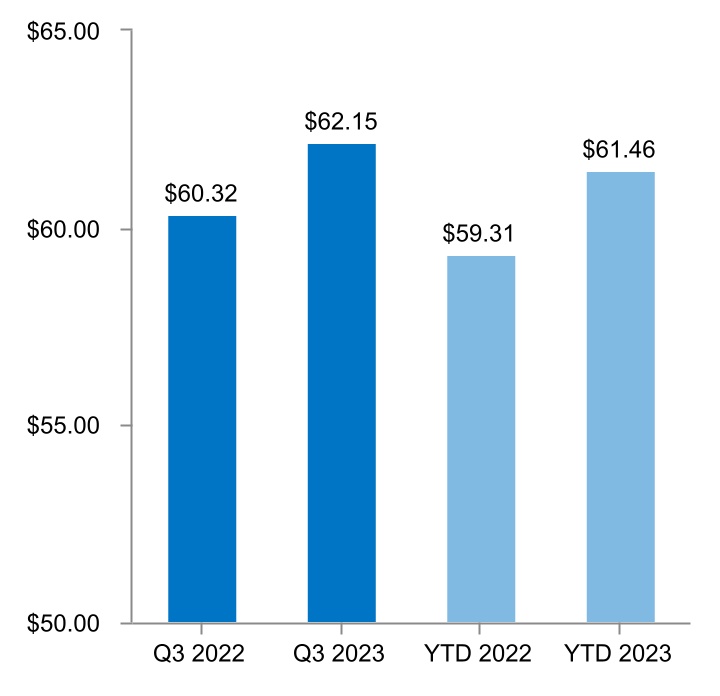

|