| Delaware | 001-16441 | 76-0470458 | |||||||||||||||||||||

| (State or other jurisdiction of incorporation) |

(Commission File Number) | (IRS Employer Identification No.) | |||||||||||||||||||||

| (Former name or former address, if changed since last report.) | ||

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | |||||||

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | |||||||

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | |||||||

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | |||||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

| Common Stock, $0.01 par value | CCI | New York Stock Exchange | ||||||

| Exhibit No. | Description | |||||||

| 99.1 | ||||||||

| 99.2 | ||||||||

| 104 | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document | |||||||

| CROWN CASTLE INC. | ||||||||||||||

| By: | /s/ Edward B. Adams, Jr. | |||||||||||||

| Name: | Edward B. Adams, Jr. | |||||||||||||

| Title: | Executive Vice President and General Counsel |

|||||||||||||

|

NEWS RELEASE October 22, 2025 |

|||||||

Contacts: Sunit Patel, CFO |

|||||

| Kris Hinson, VP Corp Finance & Treasurer | |||||

FOR IMMEDIATE RELEASE |

Crown Castle Inc. | ||||

713-570-3050 |

|||||

| (dollars in millions, except per share amounts) | Current Full Year 2025 Outlook Midpoint(a) |

Full Year 2024 Actual | % Change |

Previous Full Year 2025 Outlook(b) |

Current Compared to Previous Outlook | ||||||||||||

Site rental revenues(c) |

$4,030 | $4,268 | (6)% | $4,020 | $10 | ||||||||||||

| Net income (loss) | $285 | $(3,903) | N/A | $240 | $45 | ||||||||||||

| Net income (loss) per share—diluted | $0.65 | $(8.98) | N/A | $0.55 | $0.10 | ||||||||||||

Adjusted EBITDA(c)(d) |

$2,835 | $3,035 | (7)% | $2,805 | $30 | ||||||||||||

AFFO(c)(d) |

$1,870 | $1,980 | (6)% | $1,830 | $40 | ||||||||||||

AFFO per share(c)(d) |

$4.29 | $4.55 | (6)% | $4.20 | $0.09 | ||||||||||||

| News Release continued: | Page 2 |

|||||||

| (dollars in millions, except per share amounts) | Q3 2025 | Q3 2024 | Change | % Change | |||||||||||||

Site rental revenues(a) |

$1,012 | $1,066 | $(54) | (5)% | |||||||||||||

| Net income (loss) | $323 | $303 | $20 | 7% | |||||||||||||

| Net income (loss) per share—diluted | $0.74 | $0.70 | $0.04 | 6% | |||||||||||||

Adjusted EBITDA(a)(b) |

$718 | $777 | $(59) | (8)% | |||||||||||||

AFFO(a)(b) |

$490 | $525 | $(35) | (7)% | |||||||||||||

AFFO per share(a)(b) |

$1.12 | $1.20 | $(0.08) | (7)% | |||||||||||||

($ in millions; totals may not sum due to rounding) |

Current Full Year 2025 Outlook Midpoint(a) |

Q3 2025 | Q3 2024 | ||||||||||||||||||||||||||

Core leasing activity(b) |

$115 | 2.9% | $33 | 3.3% | $27 | 2.9% | |||||||||||||||||||||||

Escalators |

$95 |

2.4% | $24 | 2.5% | $23 | 2.5% | |||||||||||||||||||||||

Non-renewals(b) |

($30) |

(0.8)% | $(7) | (0.7)% | $(8) | (0.8)% | |||||||||||||||||||||||

Change in other billings(b) |

$5 | 0.1% | $2 | 0.2% | $— | —% | |||||||||||||||||||||||

Organic Contribution to Site Rental Billings as Adjusted for Impact of Sprint Cancellations(b) |

$185 | 4.7% | $52 | 5.2% | $43 | 4.5% | |||||||||||||||||||||||

| News Release continued: | Page 3 |

|||||||

| News Release continued: | Page 4 |

|||||||

| (in millions, except per share amounts) | Full Year 2025(a) |

Changes to Midpoint from Previous Outlook(b) |

||||||||||||||||||

Site rental billings(c) |

$3,895 | to | $3,925 | $— | ||||||||||||||||

| Amortization of prepaid rent | $80 | to | $110 | $— | ||||||||||||||||

| Straight-lined revenues | ($5) | to | $25 | $10 | ||||||||||||||||

Other revenues |

$15 | to | $15 | $— | ||||||||||||||||

| Site rental revenues | $4,007 | to | $4,052 | $10 | ||||||||||||||||

Site rental costs of operations(d) |

$967 | to | $1,012 | ($5) | ||||||||||||||||

| Services and other gross margin | $80 | to | $110 | $5 | ||||||||||||||||

Net income (loss)(e) |

$145 | to | $425 | $45 | ||||||||||||||||

Net income (loss) per share—diluted(e) |

$0.33 | to | $0.97 | $0.10 | ||||||||||||||||

Adjusted EBITDA(c) |

$2,810 | to | $2,860 | $30 | ||||||||||||||||

| Depreciation, amortization and accretion | $678 | to | $773 | $— | ||||||||||||||||

Interest expense and amortization of deferred financing costs, net(f) |

$957 | to | $1,002 | ($15) | ||||||||||||||||

Income (loss) from discontinued operations, net of tax(g) |

($830) | to | ($590) | $— | ||||||||||||||||

FFO(c) |

$1,690 | to | $1,720 | $45 | ||||||||||||||||

AFFO(c) |

$1,845 | to | $1,895 | $40 | ||||||||||||||||

AFFO per share(c) |

$4.23 | to | $4.35 | $0.09 | ||||||||||||||||

Discretionary capital expenditures(c) |

$155 | to | $155 | ($30) | ||||||||||||||||

Discretionary capital expenditures from discontinued operations(c)(h) |

$920 | to | $1,020 | $— | ||||||||||||||||

| News Release continued: | Page 5 |

|||||||

| News Release continued: | Page 6 |

|||||||

| News Release continued: | Page 7 |

|||||||

| News Release continued: | Page 8 |

|||||||

| News Release continued: | Page 9 |

|||||||

For the Three Months Ended |

For the Nine Months Ended |

For the Twelve Months Ended |

|||||||||||||||||||||||||||

(in millions; totals may not sum due to rounding) |

September 30, 2025 | September 30, 2024 | September 30, 2025 | September 30, 2024 | December 31, 2024 | ||||||||||||||||||||||||

Net income (loss)(a) |

$ | 323 | $ | 303 | $ | 150 | $ | 865 | $ | (3,903) | |||||||||||||||||||

| Adjustments to increase (decrease) net income (loss): | |||||||||||||||||||||||||||||

| Asset write-down charges | 3 | 2 | 7 | 10 | 11 | ||||||||||||||||||||||||

| Depreciation, amortization and accretion | 167 | 181 | 520 | 552 | 736 | ||||||||||||||||||||||||

Restructuring charges(b) |

— | 38 | — | 67 | 70 | ||||||||||||||||||||||||

| Amortization of prepaid lease purchase price adjustments | 4 | 4 | 11 | 12 | 16 | ||||||||||||||||||||||||

Interest expense and amortization of deferred financing costs, net(c) |

247 | 236 | 726 | 692 | 932 | ||||||||||||||||||||||||

| Interest income | (3) | (6) | (10) | (14) | (20) | ||||||||||||||||||||||||

| Other (income) expense | — | 5 | (3) | 3 | 26 | ||||||||||||||||||||||||

| (Benefit) provision for income taxes | 4 | 3 | 13 | 14 | 18 | ||||||||||||||||||||||||

| Stock-based compensation expense, net | 19 | 19 | 55 | 69 | 84 | ||||||||||||||||||||||||

(Income) loss from discontinued operations, net of tax(d) |

(46) | (9) | 676 | (12) | 5,065 | ||||||||||||||||||||||||

Adjusted EBITDA(e)(f) |

$ | 718 | $ | 777 | $ | 2,145 | $ | 2,258 | $ | 3,035 | |||||||||||||||||||

| Full Year 2025 | |||||||||||

(in millions; totals may not sum due to rounding) |

Outlook(g) |

||||||||||

Net income (loss)(a) |

$145 | to | $425 | ||||||||

| Adjustments to increase (decrease) net income (loss): | |||||||||||

Asset write-down charges |

5 | to | 15 | ||||||||

| Acquisition and integration costs | — | to | 6 | ||||||||

| Depreciation, amortization and accretion | 678 | to | 773 | ||||||||

| Amortization of prepaid lease purchase price adjustments | 14 | to | 16 | ||||||||

Interest expense and amortization of deferred financing costs, net(h) |

957 | to | 1,002 | ||||||||

| (Gains) losses on retirement of long-term obligations | — | to | — | ||||||||

| Interest income | (15) | to | (15) | ||||||||

| Other (income) expense | 6 | to | 15 | ||||||||

| (Benefit) provision for income taxes | 11 | to | 19 | ||||||||

| Stock-based compensation expense, net | 78 | to | 82 | ||||||||

(Income) loss from discontinued operations, net of tax(i) |

590 | to |

830 | ||||||||

Adjusted EBITDA(e)(f) |

$2,810 | to | $2,860 | ||||||||

| News Release continued: | Page 10 |

|||||||

For the Three Months Ended |

For the Nine Months Ended |

For the Twelve Months Ended | |||||||||||||||||||||||||||

(in millions; totals may not sum due to rounding) |

September 30, 2025 | September 30, 2024 | September 30, 2025 | September 30, 2024 | December 31, 2024 | ||||||||||||||||||||||||

Net income (loss)(a) |

$ | 323 | $ | 303 | $ | 150 | $ | 865 | $ | (3,903) | |||||||||||||||||||

| Real estate related depreciation, amortization and accretion | 163 | 170 | 489 | 517 | 690 | ||||||||||||||||||||||||

| Asset write-down charges | 3 | 2 | 7 | 10 | 11 | ||||||||||||||||||||||||

(Income) loss from discontinued operations, net of tax(b) |

(46) | (9) | 676 | (12) | 5,065 | ||||||||||||||||||||||||

FFO(c)(d) |

$ | 443 | $ | 466 | $ | 1,322 | $ | 1,380 | $ | 1,863 | |||||||||||||||||||

| Weighted-average common shares outstanding—diluted | 437 | 436 | 436 | 435 | 434 | ||||||||||||||||||||||||

| FFO (from above) | $ | 443 | $ | 466 | $ | 1,322 | $ | 1,380 | $ | 1,863 | |||||||||||||||||||

| Adjustments to increase (decrease) FFO: | |||||||||||||||||||||||||||||

| Straight-lined revenues | 11 | (28) | (27) | (140) | (160) | ||||||||||||||||||||||||

| Straight-lined expenses | 15 | 16 | 44 | 49 | 65 | ||||||||||||||||||||||||

| Stock-based compensation expense, net | 19 | 19 | 55 | 69 | 84 | ||||||||||||||||||||||||

| Non-cash portion of tax provision | 2 | — | 2 | 6 | 8 | ||||||||||||||||||||||||

| Non-real estate related depreciation, amortization and accretion | 4 | 11 | 31 | 35 | 46 | ||||||||||||||||||||||||

| Amortization of non-cash interest expense | 3 | 2 | 11 | 8 | 12 | ||||||||||||||||||||||||

| Other (income) expense | — | 5 | (3) | 3 | 26 | ||||||||||||||||||||||||

Restructuring charges(e) |

— | 38 | — | 67 | 70 | ||||||||||||||||||||||||

| Sustaining capital expenditures | (6) | (6) | (19) | (22) | (34) | ||||||||||||||||||||||||

AFFO(c)(d) |

$ | 490 | $ | 525 | $ | 1,414 | $ | 1,457 | $ | 1,980 | |||||||||||||||||||

| Weighted-average common shares outstanding—diluted | 437 | 436 | 436 | 435 | 434 | ||||||||||||||||||||||||

| News Release continued: | Page 11 |

|||||||

For the Three Months Ended |

For the Nine Months Ended |

For the Twelve Months Ended | |||||||||||||||||||||||||||

(in millions, except per share amounts; totals may not sum due to rounding) |

September 30, 2025 | September 30, 2024 | September 30, 2025 | September 30, 2024 | December 31, 2024 | ||||||||||||||||||||||||

Net income (loss)(a) |

$ | 0.74 | $ | 0.70 | $ | 0.34 | $ | 1.99 | $ | (8.98) | |||||||||||||||||||

| Real estate related depreciation, amortization and accretion | 0.37 | 0.39 | 1.12 | 1.19 | 1.59 | ||||||||||||||||||||||||

| Asset write-down charges | 0.01 | — | 0.02 | 0.02 | 0.03 | ||||||||||||||||||||||||

(Income) loss from discontinued operations, net of tax(b) |

(0.11) | (0.02) | 1.55 | (0.03) | 11.64 | ||||||||||||||||||||||||

FFO(c)(d) |

$ | 1.01 | $ | 1.07 | $ | 3.03 | $ | 3.17 | $ | 4.28 | |||||||||||||||||||

| Weighted-average common shares outstanding—diluted | 437 | 436 | 436 | 435 | 434 | ||||||||||||||||||||||||

| FFO (from above) | $ | 1.01 | $ | 1.07 | $ | 3.03 | $ | 3.17 | $ | 4.28 | |||||||||||||||||||

| Adjustments to increase (decrease) FFO: | |||||||||||||||||||||||||||||

| Straight-lined revenues | 0.03 | (0.06) | (0.06) | (0.32) | (0.37) | ||||||||||||||||||||||||

| Straight-lined expenses | 0.03 | 0.04 | 0.10 | 0.11 | 0.15 | ||||||||||||||||||||||||

| Stock-based compensation expense, net | 0.04 | 0.04 | 0.13 | 0.16 | 0.20 | ||||||||||||||||||||||||

| Non-cash portion of tax provision | — | — | — | 0.01 | 0.02 | ||||||||||||||||||||||||

| Non-real estate related depreciation, amortization and accretion | 0.01 | 0.03 | 0.07 | 0.08 | 0.11 | ||||||||||||||||||||||||

| Amortization of non-cash interest expense | 0.01 | — | 0.02 | 0.02 | 0.03 | ||||||||||||||||||||||||

| Other (income) expense | — | 0.01 | (0.01) | 0.01 | 0.06 | ||||||||||||||||||||||||

Restructuring charges(e) |

— | 0.09 | — | 0.16 | 0.16 | ||||||||||||||||||||||||

| Sustaining capital expenditures | (0.01) | (0.01) | (0.04) | (0.05) | (0.08) | ||||||||||||||||||||||||

AFFO(c)(d) |

$ | 1.12 | $ | 1.20 | $ | 3.24 | $ | 3.35 | $ | 4.55 | |||||||||||||||||||

| Weighted-average common shares outstanding—diluted | 437 | 436 | 436 | 435 | 434 | ||||||||||||||||||||||||

| News Release continued: | Page 12 |

|||||||

| Full Year 2025 | Full Year 2025 | ||||||||||||||||||||||

(in millions, except per share amounts; totals may not sum due to rounding) |

Outlook(a) |

Outlook per Share(a) |

|||||||||||||||||||||

Net income (loss)(b) |

$145 | to | $425 | $0.33 | to | $0.97 | |||||||||||||||||

| Real estate related depreciation, amortization and accretion | 660 | to | 740 | 1.51 | to | 1.70 | |||||||||||||||||

Asset write-down charges |

5 | to | 15 | 0.01 | to | 0.03 | |||||||||||||||||

(Income) loss from discontinued operations, net of tax(c) |

590 | to |

830 | 1.35 | to |

1.90 | |||||||||||||||||

FFO(d)(e) |

$1,690 | to | $1,720 | $3.88 | to | $3.94 | |||||||||||||||||

| Weighted-average common shares outstanding—diluted | 436 | 436 | |||||||||||||||||||||

| FFO (from above) | $1,690 | to | $1,720 | $3.88 | to | $3.94 | |||||||||||||||||

| Adjustments to increase (decrease) FFO: | |||||||||||||||||||||||

| Straight-lined revenues | (25) | to | 5 | (0.06) | to | 0.01 | |||||||||||||||||

| Straight-lined expenses | 55 | to | 75 | 0.13 | to | 0.17 | |||||||||||||||||

| Stock-based compensation expense, net | 78 | to | 82 | 0.18 | to | 0.19 | |||||||||||||||||

| Non-cash portion of tax provision | (8) | to | 8 | (0.02) | to | 0.02 | |||||||||||||||||

| Non-real estate related depreciation, amortization and accretion | 20 | to | 35 | 0.04 | to | 0.08 | |||||||||||||||||

| Amortization of non-cash interest expense | 7 | to | 17 | 0.02 | to | 0.04 | |||||||||||||||||

| Other (income) expense | 6 | to | 15 | 0.01 | to | 0.03 | |||||||||||||||||

| (Gains) losses on retirement of long-term obligations | — | to | — | — | to | — | |||||||||||||||||

| Acquisition and integration costs | — | to | 6 | — | to | 0.01 | |||||||||||||||||

| Sustaining capital expenditures | (50) | to | (30) | (0.11) | to | (0.07) | |||||||||||||||||

AFFO(d)(e) |

$1,845 | to | $1,895 | $4.23 | to | $4.35 | |||||||||||||||||

| Weighted-average common shares outstanding—diluted | 436 | 436 | |||||||||||||||||||||

| News Release continued: | Page 13 |

|||||||

| Previously Issued | |||||||||||

(in millions; totals may not sum due to rounding) |

Full Year 2025 Outlook(a) |

||||||||||

Net income (loss)(b) |

$100 | to | $380 | ||||||||

Adjustments to increase (decrease) net income (loss): |

|||||||||||

| Asset write-down charges | 5 | to | 15 | ||||||||

| Acquisition and integration costs | — | to | 6 | ||||||||

| Depreciation, amortization and accretion | 678 | to | 773 | ||||||||

| Amortization of prepaid lease purchase price adjustments | 14 | to | 16 | ||||||||

Interest expense and amortization of deferred financing costs, net(c) |

972 | to | 1,017 | ||||||||

| (Gains) losses on retirement of long-term obligations | — | to | — | ||||||||

| Interest income | (15) | to | (15) | ||||||||

| Other (income) expense | 6 | to | 15 | ||||||||

| (Benefit) provision for income taxes | 11 | to | 19 | ||||||||

| Stock-based compensation expense, net | 78 | to | 82 | ||||||||

(Income) loss from discontinued operations, net of tax(d) |

590 | to | 830 | ||||||||

Adjusted EBITDA(e)(f) |

$2,780 | to | $2,830 | ||||||||

| Previously Issued | Previously Issued | ||||||||||||||||||||||

(in millions, except per share amounts; totals may not sum due to rounding) |

Full Year 2025

Outlook(a)

|

Full Year 2025 Outlook

per share(a)

|

|||||||||||||||||||||

Net income (loss)(b) |

$100 | to | $380 | $0.23 | to | $0.87 | |||||||||||||||||

| Real estate related depreciation, amortization and accretion | 660 | to | 740 | 1.51 | to | 1.70 | |||||||||||||||||

| Asset write-down charges | 5 | to | 15 | 0.01 | to | 0.03 | |||||||||||||||||

(Income) loss from discontinued operations, net of tax(d) |

590 | to | 830 | 1.35 | to | 1.90 | |||||||||||||||||

FFO(e)(f) |

$1,645 | to | $1,675 | $3.77 | to | $3.84 | |||||||||||||||||

| Weighted-average common shares outstanding—diluted | 436 | 436 | |||||||||||||||||||||

| FFO (from above) | $1,645 | to | $1,675 | $3.77 | to | $3.84 | |||||||||||||||||

| Adjustments to increase (decrease) FFO: | |||||||||||||||||||||||

| Straight-lined revenues | (15) | to | 15 | (0.03) | to | 0.03 | |||||||||||||||||

| Straight-lined expenses | 55 | to | 75 | 0.13 | to | 0.17 | |||||||||||||||||

| Stock-based compensation expense, net | 78 | to | 82 | 0.18 | to | 0.19 | |||||||||||||||||

| Non-cash portion of tax provision | (8) | to | 8 | (0.02) | to | 0.02 | |||||||||||||||||

| Non-real estate related depreciation, amortization and accretion | 20 | to | 35 | 0.04 | to | 0.08 | |||||||||||||||||

| Amortization of non-cash interest expense | 7 | to | 17 | 0.02 | to | 0.04 | |||||||||||||||||

| Other (income) expense | 6 | to | 15 | 0.01 | to | 0.03 | |||||||||||||||||

| (Gains) losses on retirement of long-term obligations | — | to | — | — | to | — | |||||||||||||||||

| Acquisition and integration costs | — | to | 6 | — | to | 0.01 | |||||||||||||||||

| Sustaining capital expenditures | (55) | to | (35) | (0.13) | to | (0.08) | |||||||||||||||||

AFFO(e)(f) |

$1,805 | to | $1,855 | $4.14 | to | $4.25 | |||||||||||||||||

| Weighted-average common shares outstanding—diluted | 436 | 436 | |||||||||||||||||||||

| News Release continued: | Page 14 |

|||||||

| Three Months Ended September 30, | |||||||||||

(dollars in millions; totals may not sum due to rounding) |

2025 | 2024 | |||||||||

| Components of changes in site rental revenues: | |||||||||||

Prior year site rental billings(b) |

$ | 995 | $ | 952 | |||||||

Core leasing activity(b) |

33 | 27 | |||||||||

| Escalators | 24 | 23 | |||||||||

Non-renewals(b) |

(7) | (8) | |||||||||

Other billings(b) |

2 | — | |||||||||

Organic Contribution to Site Rental Billings as Adjusted for Impact of Sprint Cancellations(b) |

52 | 43 | |||||||||

Non-renewals associated with Sprint Cancellations(b) |

(51) | — | |||||||||

Organic Contribution to Site Rental Billings(b) |

1 | 43 | |||||||||

| Straight-lined revenues | (11) | 28 | |||||||||

| Amortization of prepaid rent | 23 | 39 | |||||||||

Other revenues |

4 | 4 | |||||||||

| Total site rental revenues | $ | 1,012 | $ | 1,066 | |||||||

| Year-over-year changes in revenues: | |||||||||||

| Site rental revenues as a percentage of prior year site rental revenues | (5.1) | % | (0.8) | % | |||||||

Organic Contribution to Site Rental Billings as Adjusted for Impact of Sprint Cancellations as a percentage of prior year site rental billings(b) |

5.2 | % | 4.5 | % | |||||||

Organic Contribution to Site Rental Billings as a percentage of prior year site rental billings(b) |

0.1 | % | 4.5 | % | |||||||

| News Release continued: | Page 15 |

|||||||

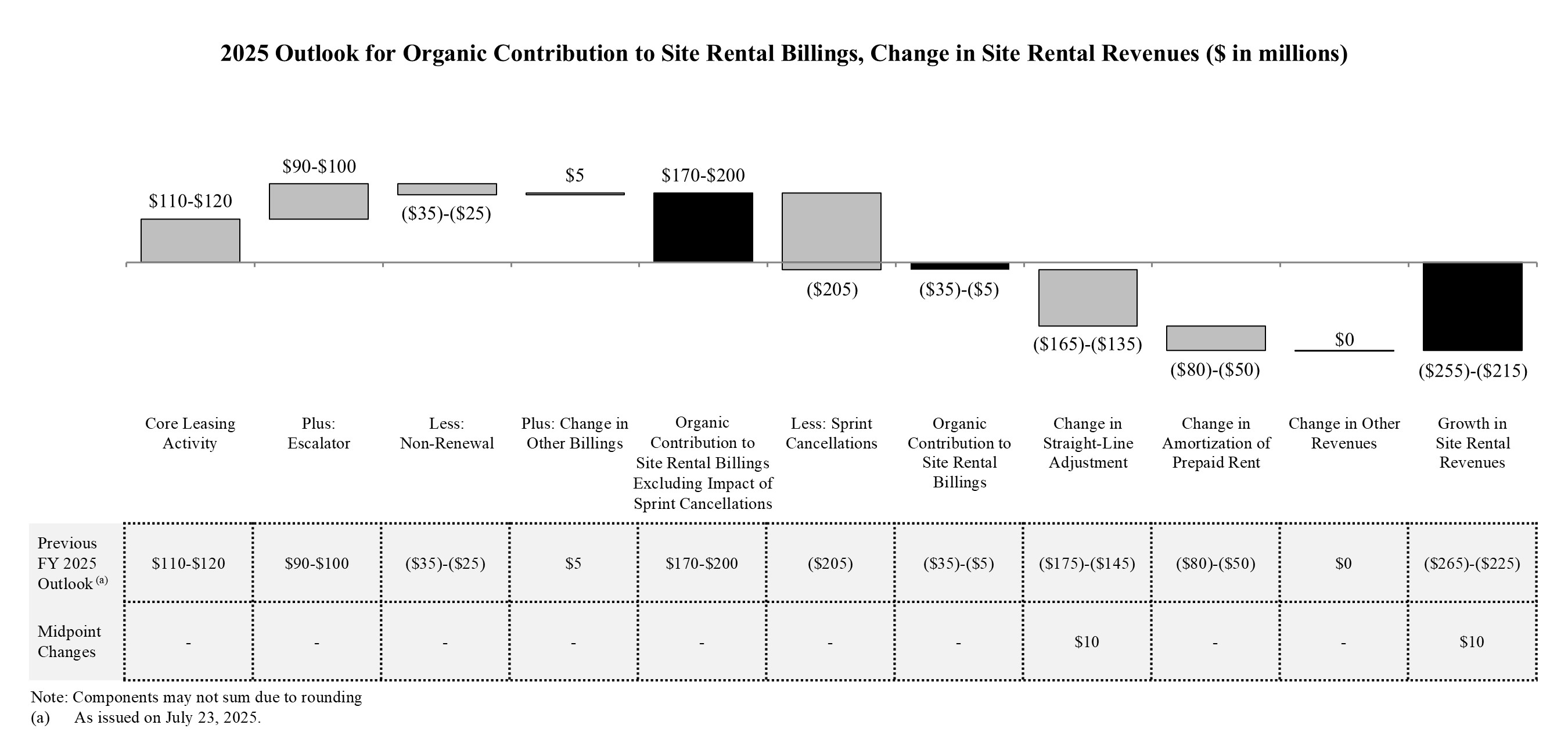

(dollars in millions; totals may not sum due to rounding) |

Full Year 2025 Outlook(a)(c) |

Previously Issued Full Year 2025 Outlook(b)(c) |

|||||||||||||||||||||

| Components of changes in site rental revenues: | |||||||||||||||||||||||

Prior year site rental billings(d)(e) |

$3,931 | $3,931 | |||||||||||||||||||||

Core leasing activity(e) |

110 | to | 120 | 110 | to | 120 | |||||||||||||||||

| Escalators | 90 | to | 100 | 90 | to | 100 | |||||||||||||||||

Non-renewals(e) |

(35) | to | (25) | (35) | to | (25) | |||||||||||||||||

Other billings(e) |

5 | to | 5 | 5 | to | 5 | |||||||||||||||||

Organic Contribution to Site Rental Billings as Adjusted for Impact of Sprint Cancellations(e) |

170 | to | 200 | 170 | to | 200 | |||||||||||||||||

Non-renewals associated with Sprint Cancellations(e) |

(205) | to | (205) | (205) | to | (205) | |||||||||||||||||

Organic Contribution to Site Rental Billings(e) |

(35) | to | (5) | (35) | to | (5) | |||||||||||||||||

| Straight-lined revenues | (5) | to | 25 | (15) | to | 15 | |||||||||||||||||

| Amortization of prepaid rent | 80 | to | 110 | 80 | to | 110 | |||||||||||||||||

Other revenues |

15 | to | 15 | 15 | to | 15 | |||||||||||||||||

Acquisitions(f) |

— | — | |||||||||||||||||||||

| Total site rental revenues | $4,007 | to | $4,052 | $3,997 | to | $4,042 | |||||||||||||||||

Year-over-year changes in revenues:(g) |

|||||||||||||||||||||||

Site rental revenues as a percentage of prior year site rental revenues |

(5.6)% | (5.8)% | |||||||||||||||||||||

Organic Contribution to Site Rental Billings as Adjusted for Impact of Sprint Cancellations as a percentage of prior year site rental billings(e) |

4.7% | 4.7% | |||||||||||||||||||||

Organic Contribution to Site Rental Billings as a percentage of prior year site rental billings(e) |

(0.5)% | (0.5)% | |||||||||||||||||||||

| News Release continued: | Page 16 |

|||||||

For the Three Months Ended |

For the Nine Months Ended |

||||||||||||||||||||||

| (in millions) | September 30, 2025 | September 30, 2024 | September 30, 2025 | September 30, 2024 | |||||||||||||||||||

| Discretionary capital expenditures: | |||||||||||||||||||||||

Tower improvements and other capital projects |

$ | 20 | $ | 21 | $ | 54 | $ | 64 | |||||||||||||||

| Purchases of land interests | 16 | 14 | 50 | 38 | |||||||||||||||||||

| Sustaining capital expenditures | 6 | 6 | 19 | 22 | |||||||||||||||||||

| Total capital expenditures | $ | 42 | $ | 41 | $ | 123 | $ | 124 | |||||||||||||||

| (in millions) | Full Year 2025 Outlook(d) |

Previously Issued Full Year 2025 Outlook(f) |

|||||||||||||||||||||

Discretionary capital expenditures |

$155 | to | $155 | $185 | to | $185 | |||||||||||||||||

Less: Prepaid rent additions(e) |

~40 | ~40 | |||||||||||||||||||||

Discretionary capital expenditures less prepaid rent additions |

$115 | to | $115 | $145 | to | $145 | |||||||||||||||||

For the Three Months Ended |

|||||||||||

| (in millions) | September 30, 2025 | September 30, 2024 | |||||||||

| Interest expense on debt obligations | $ | 244 | $ | 234 | |||||||

| Amortization of deferred financing costs and adjustments on long-term debt | 8 | 8 | |||||||||

| Capitalized interest | (5) | (6) | |||||||||

| Interest expense and amortization of deferred financing costs, net | $ | 247 | $ | 236 | |||||||

| (in millions) | Full Year 2025 Outlook(d) |

Previously Issued Full Year 2025 Outlook(f) |

|||||||||||||||||||||

| Interest expense on debt obligations | $945 | to | $985 | $960 | to | $1,000 | |||||||||||||||||

| Amortization of deferred financing costs and adjustments on long-term debt | 20 | to | 30 | 20 | to | 30 | |||||||||||||||||

| Capitalized interest | (15) | to | (5) | (15) | to | (5) | |||||||||||||||||

| Interest expense and amortization of deferred financing costs, net | $957 | to | $1,002 | $972 | to | $1,017 | |||||||||||||||||

| News Release continued: | Page 17 |

|||||||

| (in millions) | Face Value(a) |

Maturity |

|||||||||

Cash and cash equivalents and restricted cash and cash equivalents(b) |

$ | 238 | |||||||||

Senior Secured Notes, Series 2009-1, Class A-2(c) |

27 | Aug. 2029 | |||||||||

Senior Secured Tower Revenue Notes, Series 2018-2(d) |

750 | July 2048 | |||||||||

Installment purchase liabilities and finance leases(e) |

260 | Various | |||||||||

| Total secured debt | $ | 1,037 | |||||||||

2016 Revolver(f) |

900 | July 2027 | |||||||||

2016 Term Loan A(g) |

1,072 | July 2027 | |||||||||

Commercial Paper Notes(h) |

1,946 | Various |

|||||||||

4.450% Senior Notes |

900 | Feb. 2026 | |||||||||

3.700% Senior Notes |

750 | June 2026 | |||||||||

| 1.050% Senior Notes | 1,000 | July 2026 | |||||||||

| 2.900% Senior Notes | 750 | Mar. 2027 | |||||||||

4.000% Senior Notes |

500 | Mar. 2027 | |||||||||

3.650% Senior Notes |

1,000 | Sept. 2027 | |||||||||

| 5.000% Senior Notes | 1,000 | Jan. 2028 | |||||||||

3.800% Senior Notes |

1,000 | Feb. 2028 | |||||||||

| 4.800% Senior Notes | 600 | Sept. 2028 | |||||||||

4.300% Senior Notes |

600 | Feb. 2029 | |||||||||

5.600% Senior Notes |

750 | June 2029 | |||||||||

4.900% Senior Notes |

550 | Sept. 2029 | |||||||||

| 3.100% Senior Notes | 550 | Nov. 2029 | |||||||||

3.300% Senior Notes |

750 | July 2030 | |||||||||

2.250% Senior Notes |

1,100 | Jan. 2031 | |||||||||

| 2.100% Senior Notes | 1,000 | Apr. 2031 | |||||||||

| 2.500% Senior Notes | 750 | July 2031 | |||||||||

| 5.100% Senior Notes | 750 | May 2033 | |||||||||

5.800% Senior Notes |

750 | Mar. 2034 | |||||||||

5.200% Senior Notes |

700 | Sept. 2034 | |||||||||

| 2.900% Senior Notes | 1,250 | Apr. 2041 | |||||||||

4.750% Senior Notes |

350 | May 2047 | |||||||||

5.200% Senior Notes |

400 | Feb. 2049 | |||||||||

| 4.000% Senior Notes | 350 | Nov. 2049 | |||||||||

| 4.150% Senior Notes | 500 | July 2050 | |||||||||

| 3.250% Senior Notes | 900 | Jan. 2051 | |||||||||

| Total unsecured debt | $ | 23,418 | |||||||||

Net Debt(i) |

$ | 24,217 | |||||||||

| News Release continued: | Page 18 |

|||||||

| News Release continued: | Page 19 |

|||||||

| News Release continued: | Page 20 |

|||||||

|

CROWN CASTLE INC.

CONDENSED CONSOLIDATED BALANCE SHEET (UNAUDITED)

(Amounts in millions, except par values)

|

||||

| September 30, 2025 | December 31, 2024 | ||||||||||

| ASSETS | |||||||||||

| Current assets: | |||||||||||

| Cash and cash equivalents | $ | 57 | $ | 100 | |||||||

Restricted cash and cash equivalents |

176 | 170 | |||||||||

| Receivables, net | 125 | 129 | |||||||||

| Prepaid expenses | 89 | 74 | |||||||||

| Deferred site rental receivables | 226 | 164 | |||||||||

| Other current assets | 22 | 24 | |||||||||

Current assets of discontinued operations |

419 | 429 | |||||||||

| Total current assets | 1,114 | 1,090 | |||||||||

| Deferred site rental receivables | 2,244 | 2,279 | |||||||||

| Property and equipment, net | 6,330 | 6,577 | |||||||||

| Operating lease right-of-use assets | 5,513 | 5,600 | |||||||||

| Goodwill | 5,127 | 5,127 | |||||||||

| Other intangible assets, net | 905 | 1,037 | |||||||||

| Other assets, net | 63 | 58 | |||||||||

Non-current assets of discontinued operations |

10,205 | 10,968 | |||||||||

| Total assets | $ | 31,501 | $ | 32,736 | |||||||

LIABILITIES AND EQUITY (DEFICIT) |

|||||||||||

| Current liabilities: | |||||||||||

| Accounts payable | $ | 65 | $ | 48 | |||||||

| Accrued interest | 160 | 244 | |||||||||

| Deferred revenues | 147 | 141 | |||||||||

| Other accrued liabilities | 156 | 167 | |||||||||

| Current maturities of debt and other obligations | 2,769 | 603 | |||||||||

| Current portion of operating lease liabilities | 268 | 264 | |||||||||

| Current liabilities of discontinued operations | 732 | 710 | |||||||||

| Total current liabilities | 4,297 | 2,177 | |||||||||

| Debt and other long-term obligations | 21,550 | 23,451 | |||||||||

| Operating lease liabilities | 4,988 | 5,062 | |||||||||

| Other long-term liabilities | 623 | 645 | |||||||||

Non-current liabilities of discontinued operations |

1,536 | 1,534 | |||||||||

| Total liabilities | 32,994 | 32,869 | |||||||||

| Commitments and contingencies | |||||||||||

Stockholders' equity (deficit): |

|||||||||||

Common stock, 0.01 par value; 1,200 shares authorized; shares issued and outstanding: September 30, 2025—435 and December 31, 2024—435 |

4 | 4 | |||||||||

| Additional paid-in capital | 18,497 | 18,393 | |||||||||

| Accumulated other comprehensive income (loss) | (4) | (5) | |||||||||

| Dividends/distributions in excess of earnings | (19,990) | (18,525) | |||||||||

Total equity (deficit) |

(1,493) | (133) | |||||||||

Total liabilities and equity (deficit) |

$ | 31,501 | $ | 32,736 | |||||||

| News Release continued: | Page 21 |

|||||||

|

CROWN CASTLE INC.

CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS (UNAUDITED)

(Amounts in millions, except per share amounts)

|

||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||

| 2025 | 2024 | 2025 | 2024 | ||||||||||||||||||||

| Net revenues: | |||||||||||||||||||||||

| Site rental | $ | 1,012 | $ | 1,066 | $ | 3,031 | $ | 3,198 | |||||||||||||||

| Services and other | 60 | 54 | 162 | 143 | |||||||||||||||||||

| Net revenues | 1,072 | 1,120 | 3,193 | 3,341 | |||||||||||||||||||

| Operating expenses: | |||||||||||||||||||||||

Costs of operations:(a) |

|||||||||||||||||||||||

| Site rental | 250 | 247 | 741 | 740 | |||||||||||||||||||

| Services and other | 30 | 27 | 84 | 81 | |||||||||||||||||||

| Selling, general and administrative | 97 | 93 | 289 | 343 | |||||||||||||||||||

| Asset write-down charges | 3 | 2 | 7 | 10 | |||||||||||||||||||

| Depreciation, amortization and accretion | 167 | 181 | 520 | 552 | |||||||||||||||||||

Restructuring charges |

— | 38 | — | 67 | |||||||||||||||||||

| Total operating expenses | 547 | 588 | 1,641 | 1,793 | |||||||||||||||||||

| Operating income (loss) | 525 | 532 | 1,552 | 1,548 | |||||||||||||||||||

| Interest expense and amortization of deferred financing costs, net | (247) | (236) | (726) | (692) | |||||||||||||||||||

| Interest income | 3 | 6 | 10 | 14 | |||||||||||||||||||

| Other income (expense) | — | (5) | 3 | (3) | |||||||||||||||||||

Income (loss) from continuing operations before income taxes |

281 | 297 | 839 | 867 | |||||||||||||||||||

| Benefit (provision) for income taxes | (4) | (3) | (13) | (14) | |||||||||||||||||||

Income (loss) from continuing operations |

$ | 277 | $ | 294 | $ | 826 | $ | 853 | |||||||||||||||

Discontinued Operations |

|||||||||||||||||||||||

| Income (loss) from discontinued operations before gain (loss) from disposal, net of tax | 277 | 9 | 637 | 12 | |||||||||||||||||||

Gain (loss) from disposal of discontinued operations |

(231) | — | (1,313) | — | |||||||||||||||||||

Income (loss) from discontinued operations, net of tax |

46 | 9 | (676) | 12 | |||||||||||||||||||

Net income (loss) |

$ | 323 | $ | 303 | $ | 150 | $ | 865 | |||||||||||||||

| Net income (loss), per common share: | |||||||||||||||||||||||

Income (loss) from continuing operations, basic |

$ | 0.64 | $ | 0.68 | $ | 1.89 | $ | 1.96 | |||||||||||||||

Income (loss) from discontinued operations, basic |

0.10 | 0.02 | (1.55) | 0.03 | |||||||||||||||||||

| Net income (loss)—basic | $ | 0.74 | $ | 0.70 | $ | 0.34 | $ | 1.99 | |||||||||||||||

Income (loss) from continuing operations, diluted |

$ | 0.64 | $ | 0.68 | $ | 1.89 | $ | 1.96 | |||||||||||||||

Income (loss) from discontinued operations, diluted |

0.10 | 0.02 | (1.55) | 0.03 | |||||||||||||||||||

| Net income (loss)—diluted | $ | 0.74 | $ | 0.70 | $ | 0.34 | $ | 1.99 | |||||||||||||||

| Weighted-average common shares outstanding: | |||||||||||||||||||||||

| Basic | 435 | 435 | 435 | 434 | |||||||||||||||||||

| Diluted | 437 | 436 | 436 | 435 | |||||||||||||||||||

| News Release continued: | Page 22 |

|||||||

|

CROWN CASTLE INC.

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS (UNAUDITED)

(In millions of dollars)

|

||||

| Nine Months Ended September 30, | |||||||||||

| 2025 | 2024 | ||||||||||

| Cash flows from operating activities: | |||||||||||

| Net income (loss) | $ | 150 | $ | 865 | |||||||

(Income) loss from discontinued operations before (gain) loss from disposal, net of tax |

(637) | (12) | |||||||||

(Gain) loss from disposal of discontinued operations |

1,313 | — | |||||||||

Income (loss) from continuing operations |

826 | 853 | |||||||||

Adjustments to reconcile income (loss) from continuing operations to net cash provided by (used for) operating activities: |

|||||||||||

| Depreciation, amortization and accretion | 520 | 552 | |||||||||

| Amortization of deferred financing costs and other non-cash interest | 24 | 24 | |||||||||

| Stock-based compensation expense, net | 55 | 69 | |||||||||

| Asset write-down charges | 7 | 10 | |||||||||

| Deferred income tax (benefit) provision | 1 | 5 | |||||||||

| Other non-cash adjustments, net | (4) | 12 | |||||||||

Net cash provided by (used for) operating activities from discontinued operations |

897 | 830 | |||||||||

| Changes in assets and liabilities, excluding the effects of acquisitions: | |||||||||||

| Increase (decrease) in liabilities | (111) | (208) | |||||||||

| Decrease (increase) in assets | (28) | (81) | |||||||||

| Net cash provided by (used for) operating activities | 2,187 | 2,066 | |||||||||

| Cash flows from investing activities: | |||||||||||

| Capital expenditures | (123) | (124) | |||||||||

| Payments for acquisitions, net of cash acquired | — | (8) | |||||||||

| Other investing activities, net | 5 | 5 | |||||||||

| Net cash provided by (used for) investing activities from discontinued operations | (687) | (820) | |||||||||

| Net cash provided by (used for) investing activities | (805) | (947) | |||||||||

| Cash flows from financing activities: | |||||||||||

| Proceeds from issuance of long-term debt | — | 1,244 | |||||||||

| Principal payments on debt and other long-term obligations | (89) | (71) | |||||||||

| Purchases and redemptions of long-term debt | (1,200) | (750) | |||||||||

| Borrowings under revolving credit facility | 900 | — | |||||||||

| Payments under revolving credit facility | — | (670) | |||||||||

Net issuances (repayments) under commercial paper program |

605 | 1,312 | |||||||||

| Payments for financing costs | — | (12) | |||||||||

| Purchases of common stock | (23) | (32) | |||||||||

| Dividends/distributions paid on common stock | (1,615) | (2,049) | |||||||||

| Net cash provided by (used for) financing activities | (1,422) | (1,028) | |||||||||

Net increase (decrease) in cash and cash equivalents and restricted cash and cash equivalents |

(40) | 91 | |||||||||

| Effect of exchange rate changes on cash | — | (1) | |||||||||

Cash and cash equivalents and restricted cash and cash equivalents at beginning of period(a) |

295 | 281 | |||||||||

Cash and cash equivalents and restricted cash and cash equivalents at end of period(a) |

$ | 255 | $ | 371 | |||||||

| Supplemental disclosure of cash flow information: | |||||||||||

| Interest paid | $ | 799 | $ | 739 | |||||||

| Income taxes paid (refunded) | $ | 12 | $ | 8 | |||||||

| TABLE OF CONTENTS | |||||

| Page | |||||

| Company Overview | |||||

| Company Profile | |||||

| Strategy | |||||

| General Company Information | |||||

Tower Asset Portfolio Footprint |

|||||

| Historical Common Stock Data | |||||

| Executive Management Team | |||||

| Board of Directors | |||||

| Research Coverage | |||||

| Outlook | |||||

| Outlook | |||||

| Outlook for Components of Changes in Site Rental Revenues | |||||

| Outlook for Components of Interest Expense | |||||

Financial Highlights |

|||||

Summary Financial Highlights |

|||||

Components of Changes in Site Rental Revenues |

|||||

Summary of Capital Expenditures |

|||||

Portfolio Highlights |

|||||

Consolidated Return on Invested Capital |

|||||

Cash Yield on Invested Capital |

11 |

||||

Tenant Overview |

|||||

Annualized Rental Cash Payments at Time of Renewal |

|||||

Projected Revenues from Tenant Contracts Associated with Active Licenses |

|||||

Projected Expenses from Existing Ground Leases |

|||||

| Summary of Tower Portfolio by Vintage | |||||

| Ground Interest Overview | |||||

| Capitalization Overview | |||||

| Capitalization Overview | |||||

| Debt Maturity Overview | |||||

| Liquidity Overview | |||||

| Summary of Maintenance and Financial Covenants | |||||

| Interest Rate Exposure | |||||

| Components of Interest Expense | |||||

| Appendix of Condensed Consolidated Financial Statements and Non-GAAP Reconciliations | |||||

| COMPANY OVERVIEW |

OUTLOOK |

FINANCIAL

HIGHLIGHTS

|

CAPITALIZATION OVERVIEW | APPENDIX | ||||||||||

COMPANY PROFILE | ||||||||||||||

STRATEGY | ||||||||||||||

| COMPANY OVERVIEW |

OUTLOOK |

FINANCIAL

HIGHLIGHTS

|

CAPITALIZATION OVERVIEW | APPENDIX | ||||||||||

| GENERAL COMPANY INFORMATION | |||||

| Principal executive offices | 8020 Katy Freeway, Houston, TX 77024 | ||||

| Common shares trading symbol | CCI | ||||

| Stock exchange listing | New York Stock Exchange | ||||

| Fiscal year ending date | December 31 | ||||

| Fitch - Long-term Issuer Default Rating | BBB+ | ||||

| Moody’s - Long-term Corporate Family Rating | Baa3 | ||||

| Standard & Poor’s - Long-term Local Issuer Credit Rating | BBB | ||||

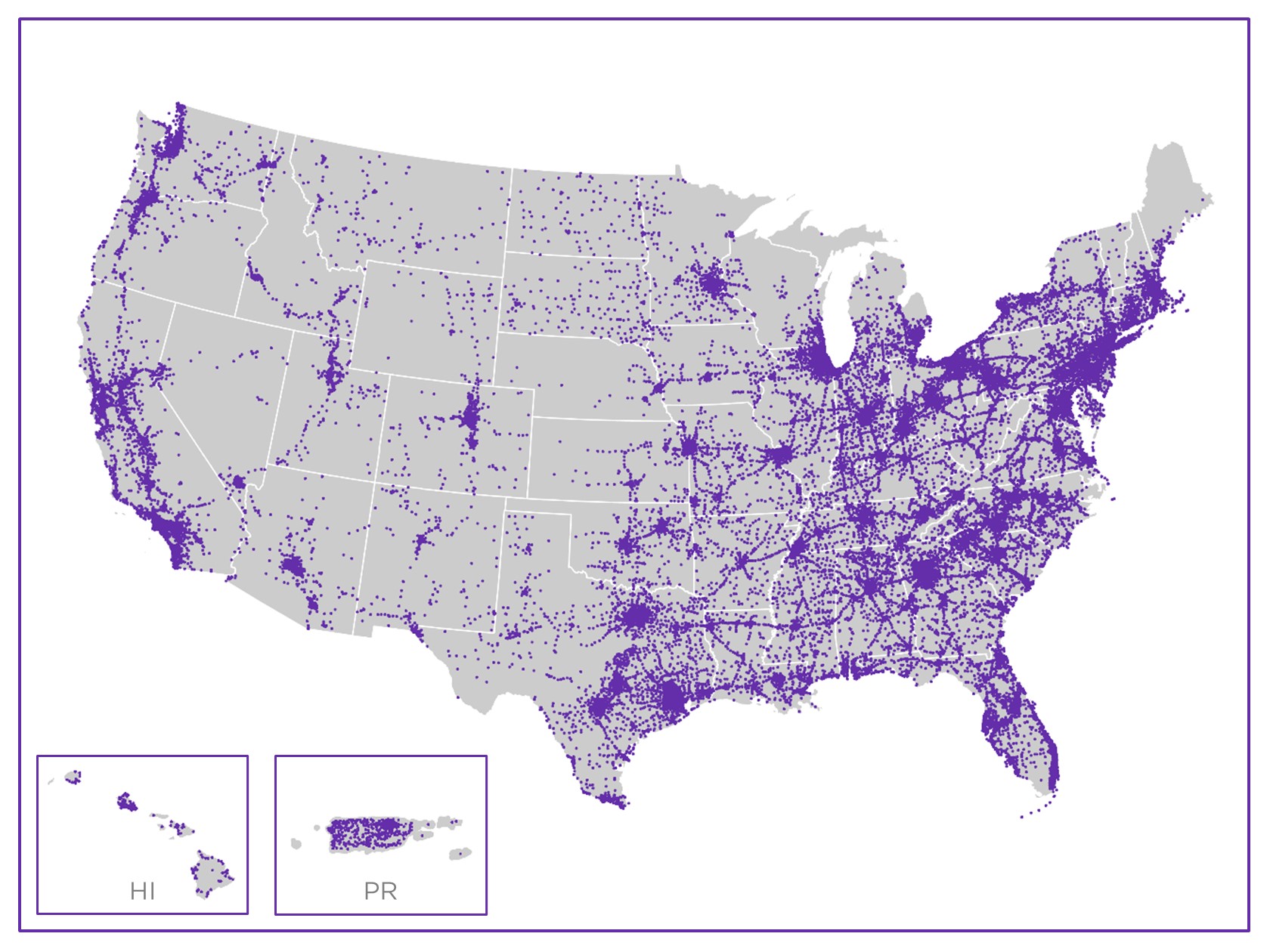

TOWER ASSET PORTFOLIO FOOTPRINT | ||

| ||

| HISTORICAL COMMON STOCK DATA | ||||||||||||||||||||||||||||||||

| Three Months Ended | ||||||||||||||||||||||||||||||||

| (in millions, except per share amounts) | 9/30/24 | 12/31/24 | 3/31/25 | 6/30/25 | 9/30/25 | |||||||||||||||||||||||||||

High price(a) |

$ | 114.55 | $ | 113.42 | $ | 105.07 | $ | 106.81 | $ | 114.49 | ||||||||||||||||||||||

Low price(a) |

$ | 88.78 | $ | 85.53 | $ | 81.01 | $ | 89.11 | $ | 90.25 | ||||||||||||||||||||||

Period end closing price(b) |

$ | 112.34 | $ | 87.33 | $ | 101.97 | $ | 101.59 | $ | 96.49 | ||||||||||||||||||||||

| Dividends paid per common share | $ | 1.57 | $ | 1.57 | $ | 1.57 | $ | 1.06 | $ | 1.06 | ||||||||||||||||||||||

Volume weighted average price for the period(a) |

$ | 103.48 | $ | 97.83 | $ | 91.66 | $ | 99.06 | $ | 99.98 | ||||||||||||||||||||||

| Common shares outstanding, at period end | 435 | 435 | 435 | 435 | 435 | |||||||||||||||||||||||||||

Market value of outstanding common shares, at period end(c) |

$ | 48,824 | $ | 37,957 | $ | 44,403 | $ | 44,237 | $ | 42,019 | ||||||||||||||||||||||

| COMPANY OVERVIEW |

OUTLOOK |

FINANCIAL

HIGHLIGHTS

|

CAPITALIZATION OVERVIEW | APPENDIX | ||||||||||

| EXECUTIVE MANAGEMENT TEAM | ||||||||||||||||||||

Name |

Position | Age | Years with Company | |||||||||||||||||

Christian H. Hillabrant |

President and Chief Executive Officer |

60 | <1 |

|||||||||||||||||

Sunit Patel |

Executive Vice President and Chief Financial Officer |

63 | <1 |

|||||||||||||||||

Catherine Piche |

Executive Vice President and Chief Operating Officer - Towers |

54 | 13(a) |

|||||||||||||||||

| Christopher D. Levendos | Executive Vice President and Chief Operating Officer - Fiber |

58 | 7 | |||||||||||||||||

| Edward B. Adams, Jr. | Executive Vice President and General Counsel | 56 | 9 | |||||||||||||||||

| Daniel K. Schlanger | Executive Vice President and Chief Transformation Officer |

51 | 9 | |||||||||||||||||

| BOARD OF DIRECTORS | ||||||||||||||||||||||||||

| Name | Position | Committees | Age | Years as Director | ||||||||||||||||||||||

| P. Robert Bartolo | Chair | Nominating and Governance, Finance, Fiber Review |

53 | 11 | ||||||||||||||||||||||

| Jason Genrich | Director | Finance, Fiber Review |

38 | 1 | ||||||||||||||||||||||

| Andrea J. Goldsmith | Director | Compensation and Human Capital |

61 | 7 | ||||||||||||||||||||||

Christian H. Hillabrant |

Director |

60 | <1 |

|||||||||||||||||||||||

| Tammy K. Jones | Director | Audit, Nominating and Governance, Finance |

60 | 4 | ||||||||||||||||||||||

| Kevin T. Kabat | Director | Compensation and Human Capital, Nominating and Governance |

68 | 2 | ||||||||||||||||||||||

| Anthony J. Melone | Director | Audit, Nominating and Governance, Fiber Review |

65 | 10 | ||||||||||||||||||||||

Katherine Motlagh |

Director |

Audit, Compensation and Human Capital, Finance |

51 | <1 |

||||||||||||||||||||||

| Kevin A. Stephens | Director |

Audit, Compensation and Human Capital, Fiber Review |

64 | 4 | ||||||||||||||||||||||

| Matthew Thornton III | Director |

Audit, Compensation and Human Capital, Nominating and Governance |

67 | 4 | ||||||||||||||||||||||

| RESEARCH COVERAGE | ||||||||

| Equity Research | ||||||||

|

Bank of America

Michael Funk

(646) 855-5664

|

Barclays Brendan Lynch (212) 526-9428 |

BMO Capital Markets Ari Klein (212) 885-4103 |

||||||

| Citigroup Michael Rollins (212) 816-1116 |

Goldman Sachs

Jim Schneider

(212) 357-2929

|

Green Street David Guarino (949) 640-8780 |

||||||

|

HSBC

Luigi Minerva

(207) 991-6928

|

Jefferies Jonathan Petersen (212) 284-1705 |

JMP Securities

Greg Miller

(212) 699-2917

|

||||||

|

JPMorgan

Richard Choe

(212) 622-6708

|

KeyBanc Brandon Nispel (503) 821-3871 |

MoffettNathanson Nick Del Deo (212) 519-0025 |

||||||

|

Morgan Stanley

Benjamin Swinburne

(212) 761-7527

|

New Street Research Jonathan Chaplin (212) 921-9876 |

Raymond James Ric Prentiss (727) 567-2567 |

||||||

| RBC Capital Markets Jonathan Atkin (415) 633-8589 |

Scotiabank

Maher Yaghi

(437) 995-5548

|

TD Cowen

Michael Elias

(646) 562-1358

|

||||||

| UBS Batya Levi (212) 713-8824 |

Wells Fargo Eric Luebchow (312) 630-2386 |

Wolfe Research Andrew Rosivach (646) 582-9350 |

||||||

| Rating Agencies | ||||||||

|

Fitch

Jeff Danforth

(312) 368-5447

|

Moody’s

Ranjini Venkatesan

(212) 553-3828

|

Standard & Poor’s

Allyn Arden

(212) 438-7832

|

||||||

| COMPANY OVERVIEW |

OUTLOOK |

FINANCIAL

HIGHLIGHTS

|

CAPITALIZATION OVERVIEW | APPENDIX | ||||||||||

| OUTLOOK | ||||||||||||||

| (in millions, except per share amounts) | Full Year 2025 Outlook(a) |

|||||||||||||

Site rental billings(b) |

$3,895 | to | $3,925 | |||||||||||

| Amortization of prepaid rent | 80 | to | 110 | |||||||||||

| Straight-lined revenues | (5) | to | 25 | |||||||||||

Other revenues |

15 | to | 15 | |||||||||||

| Site rental revenues | 4,007 | to | 4,052 | |||||||||||

Site rental costs of operations(c) |

967 | to | 1,012 | |||||||||||

| Services and other gross margin | 80 | to | 110 | |||||||||||

Net income (loss)(d) |

145 | to | 425 | |||||||||||

Net income (loss) per share—diluted(d) |

0.33 | to | 0.97 | |||||||||||

Adjusted EBITDA(b) |

2,810 | to | 2,860 | |||||||||||

| Depreciation, amortization and accretion | 678 | to | 773 | |||||||||||

Interest expense and amortization of deferred financing costs, net(e) |

957 | to | 1,002 | |||||||||||

Income (loss) from discontinued operations, net of tax(f) |

(830) | to | (590) | |||||||||||

FFO(b) |

1,690 | to | 1,720 | |||||||||||

AFFO(b) |

1,845 | to | 1,895 | |||||||||||

AFFO per share(b) |

$4.23 | to | $4.35 | |||||||||||

| COMPANY OVERVIEW |

OUTLOOK |

FINANCIAL

HIGHLIGHTS

|

CAPITALIZATION OVERVIEW | APPENDIX | ||||||||||

| OUTLOOK FOR COMPONENTS OF CHANGES IN SITE RENTAL REVENUES | ||||||||||||||

(dollars in millions; totals may not sum due to rounding) |

Full Year 2025 Outlook(a) |

|||||||||||||

| Components of changes in site rental revenues: | ||||||||||||||

Prior year site rental billings(b)(c) |

$3,931 | |||||||||||||

Core leasing activity(b) |

110 | to | 120 | |||||||||||

| Escalators | 90 | to | 100 | |||||||||||

Non-renewals(b) |

(35) | to | (25) | |||||||||||

Other billings(b) |

5 | to | 5 | |||||||||||

Organic Contribution to Site Rental Billings as Adjusted for Impact of Sprint Cancellations(b) |

170 | to | 200 | |||||||||||

Non-renewals associated with Sprint Cancellations(b) |

(205) | to | (205) | |||||||||||

Organic Contribution to Site Rental Billings(b) |

(35) | to | (5) | |||||||||||

| Straight-lined revenues | (5) | to | 25 | |||||||||||

| Amortization of prepaid rent | 80 | to | 110 | |||||||||||

Other revenues |

15 | to | 15 | |||||||||||

Acquisitions(d) |

— | to | — | |||||||||||

| Total site rental revenues | $4,007 | to | $4,052 | |||||||||||

Year-over-year changes in revenues:(e) |

||||||||||||||

Site rental revenues as a percentage of prior year site rental revenues |

(5.6)% | |||||||||||||

Organic Contribution to Site Rental Billings as Adjusted for Impact of Sprint Cancellations as a percentage of prior year site rental billings(b) |

4.7% | |||||||||||||

Organic Contribution to Site Rental Billings as a percentage of prior year site rental billings(b) |

(0.5)% | |||||||||||||

| OUTLOOK FOR COMPONENTS OF INTEREST EXPENSE | ||||||||||||||

| (in millions) | Full Year 2025 Outlook(a) |

|||||||||||||

| Interest expense on debt obligations | $945 | to | $985 | |||||||||||

| Amortization of deferred financing costs and adjustments on long-term debt | 20 | to | 30 | |||||||||||

| Capitalized interest | (15) | to | (5) | |||||||||||

| Interest expense and amortization of deferred financing costs, net | $957 | to | $1,002 | |||||||||||

| COMPANY OVERVIEW |

OUTLOOK |

FINANCIAL

HIGHLIGHTS

|

CAPITALIZATION OVERVIEW | APPENDIX | ||||||||||

SUMMARY FINANCIAL HIGHLIGHTS(a) | ||||||||||||||||||||||||||||||||||||||||||||

| 2024 | 2025 | |||||||||||||||||||||||||||||||||||||||||||

(in millions, except per share amounts; totals may not sum due to rounding) |

Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | Q3 | |||||||||||||||||||||||||||||||||||||

| Net revenues: | ||||||||||||||||||||||||||||||||||||||||||||

| Site rental | ||||||||||||||||||||||||||||||||||||||||||||

Site rental billings(b) |

$ | 966 | $ | 967 | $ | 995 | $ | 1,006 | $ | 964 | $ | 961 | $ | 996 | ||||||||||||||||||||||||||||||

| Amortization of prepaid rent | 41 | 39 | 39 | 40 | 25 | 23 | 23 | |||||||||||||||||||||||||||||||||||||

| Straight-lined revenues | 57 | 54 | 28 | 20 | 19 | 20 | (11) | |||||||||||||||||||||||||||||||||||||

Other revenues |

4 | 4 | 4 | 4 | 4 | 4 | 4 | |||||||||||||||||||||||||||||||||||||

| Total site rental | 1,068 | 1,064 | 1,066 | 1,070 | 1,011 | 1,008 | 1,012 | |||||||||||||||||||||||||||||||||||||

| Services and other | 46 | 43 | 54 | 49 | 50 | 52 | 60 | |||||||||||||||||||||||||||||||||||||

| Net revenues | $ | 1,114 | $ | 1,107 | $ | 1,120 | (c) |

$ | 1,119 | $ | 1,061 | $ | 1,060 | $ | 1,072 | |||||||||||||||||||||||||||||

| Select operating expenses: | ||||||||||||||||||||||||||||||||||||||||||||

Costs of operations(d) |

||||||||||||||||||||||||||||||||||||||||||||

| Site rental exclusive of straight-lined expenses | $ | 227 | $ | 233 | $ | 232 | (c) |

$ | 227 | $ | 225 | $ | 236 | $ | 235 | |||||||||||||||||||||||||||||

| Straight-lined expenses | 16 | 16 | 15 | 15 | 15 | 15 | 15 | |||||||||||||||||||||||||||||||||||||

| Total site rental | 243 | 249 | 247 | (c) |

242 | 240 | 251 | 250 | ||||||||||||||||||||||||||||||||||||

| Services and other | 29 | 25 | 27 | 26 | 28 | 27 | 30 | |||||||||||||||||||||||||||||||||||||

| Total costs of operations | 272 | 274 | 274 | (c) |

268 | 268 | 278 | 280 | ||||||||||||||||||||||||||||||||||||

| Selling, general and administrative | $ | 114 | $ | 136 | $ | 93 | $ | 92 | $ | 93 | $ | 99 | $ | 97 | ||||||||||||||||||||||||||||||

Net income (loss) |

$ | 311 | $ | 251 | $ | 303 | $ | (4,768) | $ | (464) | $ | 291 | $ | 323 | ||||||||||||||||||||||||||||||

Adjusted EBITDA(e) |

754 | 727 | 777 | 777 | 722 | 705 | 718 | |||||||||||||||||||||||||||||||||||||

| Depreciation, amortization and accretion | 191 | 180 | 181 | 183 | 177 | 175 | 167 | |||||||||||||||||||||||||||||||||||||

| Interest expense and amortization of deferred financing costs, net | 226 | 230 | 236 | 240 | 236 | 243 | 247 | |||||||||||||||||||||||||||||||||||||

FFO(e) |

478 | 436 | 466 | 483 | 451 | 429 | 443 | |||||||||||||||||||||||||||||||||||||

AFFO(e) |

$ | 484 | $ | 449 | $ | 525 | $ | 523 | $ | 479 | $ | 444 | $ | 490 | ||||||||||||||||||||||||||||||

Weighted-average common shares outstanding— diluted |

435 | 435 | 436 | 435 | 436 | 437 | 437 | |||||||||||||||||||||||||||||||||||||

Net income (loss) per share—diluted |

$ | 0.71 | $ | 0.58 | $ | 0.70 | $ | (10.97) | $ | (1.07) | $ | 0.67 | $ | 0.74 | ||||||||||||||||||||||||||||||

AFFO per share(e) |

$ | 1.11 | $ | 1.03 | $ | 1.20 | $ | 1.20 | $ | 1.10 | $ | 1.02 | $ | 1.12 | ||||||||||||||||||||||||||||||

| COMPANY OVERVIEW |

OUTLOOK |

FINANCIAL

HIGHLIGHTS

|

CAPITALIZATION OVERVIEW | APPENDIX | ||||||||||

COMPONENTS OF CHANGES IN SITE RENTAL REVENUES(a) | ||||||||||||||||||||||||||||||||||||||||||||

| 2024 | 2025 | |||||||||||||||||||||||||||||||||||||||||||

(dollars in millions; totals may not sum due to rounding) |

Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | Q3 | |||||||||||||||||||||||||||||||||||||

| Components of changes in site rental revenues: | ||||||||||||||||||||||||||||||||||||||||||||

Prior year site rental billings(b) |

$ | 923 | $ | 922 | $ | 952 | $ | 966 | $ | 966 | $ | 966 | $ | 995 | ||||||||||||||||||||||||||||||

Core leasing activity(b) |

28 | 28 | 27 | 28 | 28 | 28 | 33 | |||||||||||||||||||||||||||||||||||||

| Escalators | 23 | 23 | 23 | 24 | 24 | 24 | 24 | |||||||||||||||||||||||||||||||||||||

Non-renewals(b) |

(8) | (7) | (8) | (8) | (7) | (7) | (7) | |||||||||||||||||||||||||||||||||||||

Other billings(b) |

— | 2 | — | (4) | 3 | — | 2 | |||||||||||||||||||||||||||||||||||||

Organic Contribution to Site Rental Billings as Adjusted for Impact of Sprint Cancellations(b) |

43 | 45 | 43 | 40 | 49 | 45 | 52 | |||||||||||||||||||||||||||||||||||||

Non-renewals associated with Sprint Cancellations(b) |

— | — | — | — | (51) | (51) | (51) | |||||||||||||||||||||||||||||||||||||

Organic Contribution to Site Rental Billings(b) |

43 | 45 | 43 | 40 | (2) | (6) | 1 | |||||||||||||||||||||||||||||||||||||

| Straight-lined revenues | 57 | 54 | 28 | 20 | 19 | 20 | (11) | |||||||||||||||||||||||||||||||||||||

| Amortization of prepaid rent | 41 | 39 | 39 | 40 | 25 | 23 | 23 | |||||||||||||||||||||||||||||||||||||

Other revenues |

4 | 4 | 4 | 4 | 4 | 4 | 4 | |||||||||||||||||||||||||||||||||||||

| Total site rental revenues | $ | 1,068 | $ | 1,064 | $ | 1,066 | $ | 1,070 | $ | 1,011 | $ | 1,008 | $ | 1,012 | ||||||||||||||||||||||||||||||

| Year-over-year changes in revenues: | ||||||||||||||||||||||||||||||||||||||||||||

Site rental revenues as a percentage of prior year site rental revenues |

(1.2) | % | (1.5) | % | (0.8) | % | (0.8) | % | (5.3) | % | (5.3) | % | (5.1) | % | ||||||||||||||||||||||||||||||

Organic Contribution to Site Rental Billings as Adjusted for Impact of Sprint Cancellations as a percentage of prior year site rental billings(b) |

4.6 | % | 4.8 | % | 4.5 | % | 4.1 | % | 5.1 | % | 4.7 | % | 5.2 | % | ||||||||||||||||||||||||||||||

Organic Contribution to Site Rental Billings as a percentage of prior year site rental billings(b) |

4.6 | % | 4.8 | % | 4.5 | % | 4.1 | % | (0.2) | % | (0.6) | % | 0.1 | % | ||||||||||||||||||||||||||||||

| COMPANY OVERVIEW |

OUTLOOK |

FINANCIAL

HIGHLIGHTS

|

CAPITALIZATION OVERVIEW | APPENDIX | ||||||||||

SUMMARY OF CAPITAL EXPENDITURES(a) | ||||||||||||||||||||||||||||||||||||||||||||

| 2024 | 2025 | |||||||||||||||||||||||||||||||||||||||||||

(dollars in millions; totals may not sum due to rounding) |

Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | Q3 | |||||||||||||||||||||||||||||||||||||

| Discretionary capital expenditures: | ||||||||||||||||||||||||||||||||||||||||||||

Tower improvements and other capital projects |

$ | 26 | $ | 20 | $ | 21 | $ | 18 | $ | 15 | $ | 17 | $ | 20 | ||||||||||||||||||||||||||||||

| Purchases of land interests | 13 | 11 | 14 | 20 | 18 | 16 | 16 | |||||||||||||||||||||||||||||||||||||

| Total discretionary capital expenditures | 39 | 31 | 35 | 38 | 33 | 33 | 36 | |||||||||||||||||||||||||||||||||||||

| Sustaining capital expenditures | 8 | 9 | 6 | 12 | 7 | 7 | 6 | |||||||||||||||||||||||||||||||||||||

| Total capital expenditures | 47 | 40 | 41 | 50 | 40 | 40 | 42 | |||||||||||||||||||||||||||||||||||||

Less: Prepaid rent additions(b) |

12 | 8 | 13 | 12 | 10 | 11 | 11 | |||||||||||||||||||||||||||||||||||||

| Capital expenditures less prepaid rent additions | $ | 35 | $ | 32 | $ | 28 | $ | 38 | $ | 30 | $ | 29 | $ | 31 | ||||||||||||||||||||||||||||||

PORTFOLIO HIGHLIGHTS | |||||

(as of September 30, 2025) |

|||||

Number of towers (in thousands)(c) |

40 | ||||

| Average number of tenants per tower | 2.4 | ||||

Remaining contracted tenant receivables (in billions)(d) |

$ | 28 | |||

Weighted average remaining tenant contract term (years)(d)(e) |

6 | ||||

| Percent of towers in the Top 50 / 100 Basic Trading Areas | 56% / 71% | ||||

Percent of ground leased / owned(f) |

57% / 43% |

||||

Weighted average maturity of ground leases (years)(f)(g) |

35 | ||||

| COMPANY OVERVIEW |

OUTLOOK |

FINANCIAL

HIGHLIGHTS

|

CAPITALIZATION OVERVIEW | APPENDIX | ||||||||||

CONSOLIDATED RETURN ON INVESTED CAPITAL(a)(b) | ||||||||||||||

(as of September 30, 2025; dollars in millions) |

Q3 2025 LQA |

Q3 2024 LQA | ||||||||||||

Adjusted EBITDA(c) |

$ | 2,872 | $ | 3,108 | ||||||||||

| Cash taxes (paid) refunded | (10) | (11) | ||||||||||||

Adjusted EBITDA less cash taxes paid |

$ | 2,862 | $ | 3,097 | ||||||||||

Historical gross investment in property and equipment(d) |

$ | 16,927 | $ | 16,895 | ||||||||||

| Historical gross investment in site rental contracts and tenant relationships | 4,589 | 4,590 | ||||||||||||

Historical gross investment in goodwill |

5,127 | 5,127 | ||||||||||||

Consolidated Invested Capital(a) |

$ | 26,643 | $ | 26,612 | ||||||||||

Consolidated Return on Invested Capital(a) |

10.7 | % | 11.6 | % | ||||||||||

CASH YIELD ON INVESTED CAPITAL(a)(b)(e) | ||||||||||||||

(as of September 30, 2025; dollars in millions) |

Q3 2025 LQA |

Q3 2024 LQA | ||||||||||||

Adjusted Site Rental Gross Margin(c) |

$ | 3,068 | $ | 3,292 | ||||||||||

| Less: Amortization of prepaid rent | (92) | (156) | ||||||||||||

Add (less): Straight-lined revenues |

45 | (112) | ||||||||||||

Add: Straight-lined expenses |

44 | 48 | ||||||||||||

Numerator |

$ | 3,065 | $ | 3,072 | ||||||||||

Net investment in property and equipment(f) |

$ | 13,611 | $ | 13,526 | ||||||||||

Investment in site rental contracts and tenant relationships |

4,589 | 4,590 | ||||||||||||

Investment in goodwill(g) |

5,351 | 5,351 | ||||||||||||

Net Invested Capital(a) |

$ | 23,551 | $ | 23,467 | ||||||||||

Cash Yield on Invested Capital(a) |

13.0 | % | 13.1 | % | ||||||||||

| COMPANY OVERVIEW |

OUTLOOK |

FINANCIAL

HIGHLIGHTS

|

CAPITALIZATION OVERVIEW | APPENDIX | ||||||||||

TENANT OVERVIEW(a) | ||||||||||||||

(as of September 30, 2025) |

Percentage of Q3 2025 LQA Site Rental Revenues |

Weighted Average Current Term Remaining(b) |

||||||||||||

| T-Mobile | 40% | 7 | ||||||||||||

| AT&T | 27% | 4 | ||||||||||||

| Verizon | 22% | 6 | ||||||||||||

| All Others Combined | 11% | 7 | ||||||||||||

| Total / Weighted Average | 100% | 6 | ||||||||||||

ANNUALIZED RENTAL CASH PAYMENTS AT TIME OF RENEWAL(a)(c) | ||||||||||||||||||||||||||||||||

Remaining Three Months |

Years Ending December 31, | |||||||||||||||||||||||||||||||

(as of September 30, 2025; in millions) |

2025 |

2026 |

2027 |

2028 |

2029 |

|||||||||||||||||||||||||||

| T-Mobile | $ | 1 | $ | 27 | $ | 32 | $ | 26 | $ | 24 | ||||||||||||||||||||||

| AT&T | 3 | 23 | 13 | 774 | 238 | |||||||||||||||||||||||||||

| Verizon | 1 | 6 | 7 | 31 | 48 | |||||||||||||||||||||||||||

| All Others Combined | 8 | 50 | 37 | 29 | 44 | |||||||||||||||||||||||||||

| Total | $ | 13 | $ | 106 | $ | 89 | $ | 860 | $ | 354 | ||||||||||||||||||||||

PROJECTED REVENUES FROM TENANT CONTRACTS ASSOCIATED WITH ACTIVE LICENSES(a)(d) | ||||||||||||||||||||||||||||||||

Remaining Three Months |

Years Ending December 31, | |||||||||||||||||||||||||||||||

(as of September 30, 2025; in millions) |

2025 |

2026 |

2027 |

2028 |

2029 |

|||||||||||||||||||||||||||

| Components of site rental revenues: | ||||||||||||||||||||||||||||||||

Site rental billings(e) |

$ | 991 | $ | 4,008 | $ | 4,117 | $ | 4,236 | $ | 4,361 | ||||||||||||||||||||||

| Amortization of prepaid rent | 22 | 79 | 66 | 45 | 29 | |||||||||||||||||||||||||||

| Straight-lined revenues | (1) | (57) | (170) | (234) | (206) | |||||||||||||||||||||||||||

| Site rental revenues | $ | 1,012 | $ | 4,030 | $ | 4,013 | $ | 4,047 | $ | 4,184 | ||||||||||||||||||||||

| COMPANY OVERVIEW |

OUTLOOK |

FINANCIAL

HIGHLIGHTS

|

CAPITALIZATION OVERVIEW | APPENDIX | ||||||||||

PROJECTED EXPENSES FROM EXISTING GROUND LEASES(a)(b) | ||||||||||||||||||||||||||||||||

Remaining Three Months |

Years Ending December 31, | |||||||||||||||||||||||||||||||

(as of September 30, 2025; in millions) |

2025 |

2026 |

2027 |

2028 |

2029 |

|||||||||||||||||||||||||||

Components of ground lease expenses: |

||||||||||||||||||||||||||||||||

Ground lease expenses exclusive of straight-lined expenses |

$ | 172 | $ | 701 | $ | 722 | $ | 741 | $ | 762 | ||||||||||||||||||||||

| Straight-lined expenses | 13 | 45 | 32 | 22 | 11 | |||||||||||||||||||||||||||

Ground lease expenses |

$ | 185 | $ | 746 | $ | 754 | $ | 763 | $ | 773 | ||||||||||||||||||||||

SUMMARY OF TOWER PORTFOLIO BY VINTAGE(c) | ||||||||||||||||||||

(as of September 30, 2025; dollars in thousands) |

Acquired and Built 2006 and Prior | Acquired and Built 2007 to Present | ||||||||||||||||||

Cash yield(d) |

21 | % | 10 | % | ||||||||||||||||

| Number of tenants per tower | 2.9 | 2.2 | ||||||||||||||||||

Last quarter annualized average cash site rental revenue per tower(e) |

$ | 137 | $ | 83 | ||||||||||||||||

Last quarter annualized average site rental gross cash margin per tower(f) |

$ | 118 | $ | 58 | ||||||||||||||||

Net invested capital per tower(g) |

$ | 567 | $ | 593 | ||||||||||||||||

| Number of towers | 11,165 | 28,693 | ||||||||||||||||||

| GROUND INTEREST OVERVIEW | ||||||||||||||||||||||||||||||||||||||||||||

(as of September 30, 2025; dollars in millions) |

LQA Cash Site Rental Revenues(e) |

Percentage of LQA Cash Site Rental Revenues(e) |

LQA Site Rental Gross Cash Margin(f) |

Percentage of LQA Site Rental Gross Cash Margin(f) |

Number of Towers(h) |

Percentage of Towers | Weighted Average Term Remaining (by years)(i) |

|||||||||||||||||||||||||||||||||||||

| Less than 10 years | $ | 432 | 11 | % | $ | 235 | 8 | % | 5,364 | 14 | % | |||||||||||||||||||||||||||||||||

| 10 to 20 years | $ | 566 | 14 | % | $ | 355 | 12 | % | 6,011 | 15 | % | |||||||||||||||||||||||||||||||||

| Greater than 20 years | $ | 1,556 | 40 | % | $ | 1,119 | 37 | % | 16,456 | 41 | % | |||||||||||||||||||||||||||||||||

| Total leased | $ | 2,554 | 65 | % | $ | 1,709 | 57 | % | 27,831 | 70 | % | 35 | ||||||||||||||||||||||||||||||||

| Owned | $ | 1,358 | 35 | % | $ | 1,271 | 43 | % | 12,027 | 30 | % | |||||||||||||||||||||||||||||||||

| Total / Average | $ | 3,912 | 100 | % | $ | 2,980 | 100 | % | 39,858 | 100 | % | |||||||||||||||||||||||||||||||||

| COMPANY OVERVIEW |

OUTLOOK |

FINANCIAL

HIGHLIGHTS

|

CAPITALIZATION OVERVIEW | APPENDIX | ||||||||||

CAPITALIZATION OVERVIEW | ||||||||||||||||||||||||||

(as of September 30, 2025; dollars in millions) |

Face Value(a) |

Fixed vs. Variable | Interest Rate(b) |

Maturity | ||||||||||||||||||||||

Cash and cash equivalents and restricted cash and cash equivalents(c) |

$ | 238 | ||||||||||||||||||||||||

Senior Secured Notes, Series 2009-1, Class A-2(d) |

27 | Fixed | 9.0% | Aug. 2029 | ||||||||||||||||||||||

Senior Secured Tower Revenue Notes, Series 2018-2(e) |

750 | Fixed | 4.2% | July 2048 | ||||||||||||||||||||||

Installment purchase liabilities and finance leases(f) |

260 | Fixed | Various | Various |

||||||||||||||||||||||

| Total secured debt | $ | 1,037 | 4.4% | |||||||||||||||||||||||

2016 Revolver(g) |

900 | Variable | 5.5% | July 2027 | ||||||||||||||||||||||

2016 Term Loan A(h) |

1,072 | Variable | 5.2% | July 2027 | ||||||||||||||||||||||

Commercial Paper Notes(i) |

1,946 | Variable | 4.8% | Various | ||||||||||||||||||||||

| 4.450% Senior Notes | 900 | Fixed | 4.5% | Feb. 2026 | ||||||||||||||||||||||

| 3.700% Senior Notes | 750 | Fixed | 3.7% | June 2026 | ||||||||||||||||||||||

| 1.050% Senior Notes | 1,000 | Fixed | 1.1% | July 2026 | ||||||||||||||||||||||

| 2.900% Senior Notes | 750 | Fixed | 2.9% | Mar. 2027 | ||||||||||||||||||||||

| 4.000% Senior Notes | 500 | Fixed | 4.0% | Mar. 2027 | ||||||||||||||||||||||

| 3.650% Senior Notes | 1,000 | Fixed | 3.7% | Sept. 2027 | ||||||||||||||||||||||

| 5.000% Senior Notes | 1,000 | Fixed | 5.0% | Jan. 2028 | ||||||||||||||||||||||

| 3.800% Senior Notes | 1,000 | Fixed | 3.8% | Feb. 2028 | ||||||||||||||||||||||

| 4.800% Senior Notes | 600 | Fixed | 4.8% | Sept. 2028 | ||||||||||||||||||||||

| 4.300% Senior Notes | 600 | Fixed | 4.3% | Feb. 2029 | ||||||||||||||||||||||

| 5.600% Senior Notes | 750 | Fixed | 5.6% | June 2029 | ||||||||||||||||||||||

| 4.900% Senior Notes | 550 | Fixed | 4.9% | Sept. 2029 | ||||||||||||||||||||||

| 3.100% Senior Notes | 550 | Fixed | 3.1% | Nov. 2029 | ||||||||||||||||||||||

| 3.300% Senior Notes | 750 | Fixed | 3.3% | July 2030 | ||||||||||||||||||||||

| 2.250% Senior Notes | 1,100 | Fixed | 2.3% | Jan. 2031 | ||||||||||||||||||||||

| 2.100% Senior Notes | 1,000 | Fixed | 2.1% | Apr. 2031 | ||||||||||||||||||||||

| 2.500% Senior Notes | 750 | Fixed | 2.5% | July 2031 | ||||||||||||||||||||||

| 5.100% Senior Notes | 750 | Fixed | 5.1% | May 2033 | ||||||||||||||||||||||

| 5.800% Senior Notes | 750 | Fixed | 5.8% | Mar. 2034 | ||||||||||||||||||||||

| 5.200% Senior Notes | 700 | Fixed | 5.2% | Sept. 2034 | ||||||||||||||||||||||

| 2.900% Senior Notes | 1,250 | Fixed | 2.9% | Apr. 2041 | ||||||||||||||||||||||

| 4.750% Senior Notes | 350 | Fixed | 4.8% | May 2047 | ||||||||||||||||||||||

| 5.200% Senior Notes | 400 | Fixed | 5.2% | Feb. 2049 | ||||||||||||||||||||||

| 4.000% Senior Notes | 350 | Fixed | 4.0% | Nov. 2049 | ||||||||||||||||||||||

| 4.150% Senior Notes | 500 | Fixed | 4.2% | July 2050 | ||||||||||||||||||||||

| 3.250% Senior Notes | 900 | Fixed | 3.3% | Jan. 2051 | ||||||||||||||||||||||

| Total unsecured debt | $ | 23,418 | 4.0% | |||||||||||||||||||||||

Net Debt(j) |

$ | 24,217 | 4.0% | |||||||||||||||||||||||

Market Capitalization(k) |

42,019 | |||||||||||||||||||||||||

Firm Value(l) |

$ | 66,236 | ||||||||||||||||||||||||

| COMPANY OVERVIEW |

OUTLOOK | FINANCIAL HIGHLIGHTS |

CAPITALIZATION OVERVIEW | APPENDIX | ||||||||||

DEBT MATURITY OVERVIEW(a)(b) | ||

| COMPANY OVERVIEW |

OUTLOOK |

FINANCIAL

HIGHLIGHTS

|

CAPITALIZATION OVERVIEW | APPENDIX | ||||||||||

LIQUIDITY OVERVIEW(a) | ||||||||

| (in millions) | September 30, 2025 |

|||||||

Cash and cash equivalents, and restricted cash and cash equivalents(b)(c) |

$ | 238 | ||||||

Undrawn 2016 Revolver availability(d) |

6,061 | |||||||

Total debt and other obligations (current and non-current)(c)(e) |

24,319 | |||||||

Total equity (deficit) |

(1,493) | |||||||

| SUMMARY OF MAINTENANCE AND FINANCIAL COVENANTS | ||||||||||||||||||||||||||

| Debt | Borrower / Issuer | Covenant(f) |

Covenant Level Requirement | As of September 30, 2025 |

||||||||||||||||||||||

Maintenance Financial Covenants(g) | ||||||||||||||||||||||||||

| 2016 Credit Facility | CCI | Total Net Leverage Ratio | ≤ 6.50x | 5.9x | ||||||||||||||||||||||

| 2016 Credit Facility | CCI | Total Senior Secured Leverage Ratio | ≤ 3.50x | 0.2x | ||||||||||||||||||||||

| 2016 Credit Facility | CCI | Consolidated Interest Coverage Ratio(h) |

N/A | N/A | ||||||||||||||||||||||

| Financial covenants requiring excess cash flows to be deposited in a cash trap reserve account and not released | ||||||||||||||||||||||||||

Tower Revenue Notes, Series 2018-2 |

Crown Castle Towers LLC and its Subsidiaries | Debt Service Coverage Ratio | > 1.75x | (i) |

30.5x | |||||||||||||||||||||

| 2009 Securitized Notes | Pinnacle Towers Acquisition Holdings LLC and its Subsidiaries | Debt Service Coverage Ratio | > 1.30x | (i) |

39.9x | |||||||||||||||||||||

| Financial covenants restricting ability of relevant issuer to issue additional notes under the applicable indenture | ||||||||||||||||||||||||||

Tower Revenue Notes, Series 2018-2 |

Crown Castle Towers LLC and its Subsidiaries | Debt Service Coverage Ratio | ≥ 2.00x | (j) |

30.5x | |||||||||||||||||||||

| 2009 Securitized Notes | Pinnacle Towers Acquisition Holdings LLC and its Subsidiaries | Debt Service Coverage Ratio | ≥ 2.34x | (j) |

39.9x | |||||||||||||||||||||

| COMPANY OVERVIEW |

OUTLOOK |

FINANCIAL

HIGHLIGHTS

|

CAPITALIZATION OVERVIEW | APPENDIX | ||||||||||

INTEREST RATE EXPOSURE(a) | ||||||||||||||||||||||||||

(as of September 30, 2025; dollars in millions) | ||||||||||||||||||||||||||

| Fixed Rate Debt | Floating Rate Debt | |||||||||||||||||||||||||

Face value of principal outstanding(b) |

$20,277 | Face value of principal outstanding(b) |

$3,918 | |||||||||||||||||||||||

| % of total debt | 84% | % of total debt | 16% | |||||||||||||||||||||||

| Weighted average interest rate | 3.8% | Weighted average interest rate(c) |

5.1% | |||||||||||||||||||||||

| Upcoming maturities: | 2025 | 2026 | Interest rate sensitivity of 25 bps increase in interest rates: | |||||||||||||||||||||||

Face value of principal outstanding(b) |

$— | $2,650 | Full year effect(d) |

$9.8 | ||||||||||||||||||||||

| Weighted average interest rate | —% | 3.0% | ||||||||||||||||||||||||

| COMPONENTS OF INTEREST EXPENSE | ||||||||||||||||||||||||||||||||||||||||||||

| 2024 | 2025 | |||||||||||||||||||||||||||||||||||||||||||

| (in millions) | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | Q3 | |||||||||||||||||||||||||||||||||||||

| Interest expense on debt obligations | $ | 223 | $ | 227 | $ | 234 | $ | 236 | $ | 233 | $ | 239 | $ | 244 | ||||||||||||||||||||||||||||||

| Amortization of deferred financing costs and adjustments on long-term debt | 8 | 8 | 8 | 8 | 8 | 8 | 8 | |||||||||||||||||||||||||||||||||||||

| Capitalized interest | (5) | (5) | (6) | (4) | (5) | (4) | (5) | |||||||||||||||||||||||||||||||||||||

| Interest expense and amortization of deferred financing costs, net | $ | 226 | $ | 230 | $ | 236 | $ | 240 | $ | 236 | $ | 243 | $ | 247 | ||||||||||||||||||||||||||||||

| COMPANY OVERVIEW |

OUTLOOK |

FINANCIAL

HIGHLIGHTS

|

CAPITALIZATION OVERVIEW | APPENDIX | ||||||||||

| CONDENSED CONSOLIDATED BALANCE SHEET (Unaudited) | ||||||||||||||

| (in millions, except par values) | September 30, 2025 | December 31, 2024 | ||||||||||||

| ASSETS | ||||||||||||||

| Current assets: | ||||||||||||||

| Cash and cash equivalents | $ | 57 | $ | 100 | ||||||||||

Restricted cash and cash equivalents |

176 | 170 | ||||||||||||

| Receivables, net | 125 | 129 | ||||||||||||

| Prepaid expenses | 89 | 74 | ||||||||||||

Deferred site rental receivables |

226 | 164 | ||||||||||||

| Other current assets | 22 | 24 | ||||||||||||

Current assets of discontinued operations |

419 | 429 | ||||||||||||

| Total current assets | 1,114 | 1,090 | ||||||||||||

| Deferred site rental receivables | 2,244 | 2,279 | ||||||||||||

| Property and equipment, net | 6,330 | 6,577 | ||||||||||||

| Operating lease right-of-use assets | 5,513 | 5,600 | ||||||||||||

| Goodwill | 5,127 | 5,127 | ||||||||||||

| Other intangible assets, net | 905 | 1,037 | ||||||||||||

| Other assets, net | 63 | 58 | ||||||||||||

Non-current assets of discontinued operations |

10,205 | 10,968 | ||||||||||||

| Total assets | $ | 31,501 | $ | 32,736 | ||||||||||

LIABILITIES AND EQUITY (DEFICIT) | ||||||||||||||

| Current liabilities: | ||||||||||||||

| Accounts payable | $ | 65 | $ | 48 | ||||||||||

| Accrued interest | 160 | 244 | ||||||||||||

| Deferred revenues | 147 | 141 | ||||||||||||

| Other accrued liabilities | 156 | 167 | ||||||||||||

| Current maturities of debt and other obligations | 2,769 | 603 | ||||||||||||

| Current portion of operating lease liabilities | 268 | 264 | ||||||||||||

Current liabilities of discontinued operations |

732 | 710 | ||||||||||||

| Total current liabilities | 4,297 | 2,177 | ||||||||||||

| Debt and other long-term obligations | 21,550 | 23,451 | ||||||||||||

| Operating lease liabilities | 4,988 | 5,062 | ||||||||||||

| Other long-term liabilities | 623 | 645 | ||||||||||||

Non-current liabilities of discontinued operations |

1,536 | 1,534 | ||||||||||||

| Total liabilities | 32,994 | 32,869 | ||||||||||||

| Commitments and contingencies | ||||||||||||||

Stockholders' equity (deficit): |

||||||||||||||

Common stock, 0.01 par value; 1,200 shares authorized; shares issued and outstanding: September 30, 2025—435 and December 31, 2024—435 |

4 | 4 | ||||||||||||

| Additional paid-in capital | 18,497 | 18,393 | ||||||||||||

| Accumulated other comprehensive income (loss) | (4) | (5) | ||||||||||||

| Dividends/distributions in excess of earnings | (19,990) | (18,525) | ||||||||||||

Total equity (deficit) |

(1,493) | (133) | ||||||||||||

Total liabilities and equity (deficit) |

$ | 31,501 | $ | 32,736 | ||||||||||

| COMPANY OVERVIEW |

OUTLOOK |

FINANCIAL

HIGHLIGHTS

|

CAPITALIZATION OVERVIEW | APPENDIX | ||||||||||

| CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS (Unaudited) | ||||||||||||||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||||||||||||

| (in millions, except per share amounts) | 2025 | 2024 | 2025 | 2024 | ||||||||||||||||||||||

| Net revenues: | ||||||||||||||||||||||||||

| Site rental | $ | 1,012 | $ | 1,066 | $ | 3,031 | $ | 3,198 | ||||||||||||||||||

| Services and other | 60 | 54 | 162 | 143 | ||||||||||||||||||||||

| Net revenues | 1,072 | 1,120 | 3,193 | 3,341 | ||||||||||||||||||||||

| Operating expenses: | ||||||||||||||||||||||||||

Costs of operations:(a) |

||||||||||||||||||||||||||

| Site rental | 250 | 247 | 741 | 740 | ||||||||||||||||||||||

| Services and other | 30 | 27 | 84 | 81 | ||||||||||||||||||||||

| Selling, general and administrative | 97 | 93 | 289 | 343 | ||||||||||||||||||||||

| Asset write-down charges | 3 | 2 | 7 | 10 | ||||||||||||||||||||||

| Depreciation, amortization and accretion | 167 | 181 | 520 | 552 | ||||||||||||||||||||||

| Restructuring charges | — | 38 | — | 67 | ||||||||||||||||||||||

| Total operating expenses | 547 | 588 | 1,641 | 1,793 | ||||||||||||||||||||||

| Operating income (loss) | 525 | 532 | 1,552 | 1,548 | ||||||||||||||||||||||

| Interest expense and amortization of deferred financing costs, net | (247) | (236) | (726) | (692) | ||||||||||||||||||||||

| Interest income | 3 | 6 | 10 | 14 | ||||||||||||||||||||||

| Other income (expense) | — | (5) | 3 | (3) | ||||||||||||||||||||||

Income (loss) from continuing operations before income taxes |

281 | 297 | 839 | 867 | ||||||||||||||||||||||

| Benefit (provision) for income taxes | (4) | (3) | (13) | (14) | ||||||||||||||||||||||

Income (loss) from continuing operations |

$ | 277 | $ | 294 | $ | 826 | $ | 853 | ||||||||||||||||||

| Discontinued operations: | ||||||||||||||||||||||||||

Income (loss) from discontinued operations before gain (loss) from disposal, net of tax |

277 | 9 | 637 | 12 | ||||||||||||||||||||||

Gain (loss) from disposal of discontinued operations |

(231) | — | (1,313) | — | ||||||||||||||||||||||

Income (loss) from discontinued operations, net of tax |

46 | 9 | (676) | 12 | ||||||||||||||||||||||

| Net income (loss) | $ | 323 | $ | 303 | $ | 150 | $ | 865 | ||||||||||||||||||

| Net income (loss), per common share: | ||||||||||||||||||||||||||

| Income (loss) from continuing operations, basic | $ | 0.64 | $ | 0.68 | $ | 1.89 | $ | 1.96 | ||||||||||||||||||

| Income (loss) from discontinued operations, basic | $ | 0.10 | $ | 0.02 | $ | (1.55) | $ | 0.03 | ||||||||||||||||||

| Net income (loss)—basic | $ | 0.74 | $ | 0.70 | $ | 0.34 | $ | 1.99 | ||||||||||||||||||

Income (loss) from continuing operations, diluted |

$ | 0.64 | $ | 0.68 | $ | 1.89 | $ | 1.96 | ||||||||||||||||||

Income (loss) from discontinued operations, diluted |

$ | 0.10 | $ | 0.02 | $ | (1.55) | $ | 0.03 | ||||||||||||||||||

Net income (loss)—diluted |

$ | 0.74 | $ | 0.70 | $ | 0.34 | $ | 1.99 | ||||||||||||||||||

| Weighted-average common shares outstanding: | ||||||||||||||||||||||||||

| Basic | 435 | 435 | 435 | 434 | ||||||||||||||||||||||

| Diluted | 437 | 436 | 436 | 435 | ||||||||||||||||||||||

| COMPANY OVERVIEW |

OUTLOOK |

FINANCIAL

HIGHLIGHTS

|