| Delaware | 001-16441 | 76-0470458 | |||||||||||||||||||||

| (State or other jurisdiction of incorporation) |

(Commission File Number) | (IRS Employer Identification No.) | |||||||||||||||||||||

| (Former name or former address, if changed since last report.) | ||

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | |||||||

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | |||||||

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | |||||||

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | |||||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

| Common Stock, $0.01 par value | CCI | New York Stock Exchange | ||||||

| Exhibit No. | Description | |||||||

| 99.1 | ||||||||

| 99.2 | ||||||||

| 104 | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document | |||||||

| CROWN CASTLE INC. | ||||||||||||||

| By: | /s/ Edward B. Adams, Jr. | |||||||||||||

| Name: | Edward B. Adams, Jr. | |||||||||||||

| Title: | Executive Vice President and General Counsel | |||||||||||||

|

NEWS RELEASE April 19, 2023 |

|||||||

| Contacts: Dan Schlanger, CFO | |||||

| Ben Lowe, SVP & Treasurer | |||||

| FOR IMMEDIATE RELEASE | Crown Castle Inc. | ||||

713-570-3050 |

|||||

| (dollars in millions, except per share amounts) | Current Full Year 2023 Outlook(a) |

Full Year 2022 Actual | Change | % Change | ||||||||||

| Site rental revenues | $6,511 | $6,289 | $222 | 4% | ||||||||||

| Net income (loss) | $1,636 | $1,675 | $(39) | (2)% | ||||||||||

| Net income (loss) per share—diluted | $3.76 | $3.86 | $(0.10) | (3)% | ||||||||||

Adjusted EBITDA(b) |

$4,472 | $4,340 | $132 | 3% | ||||||||||

AFFO(b) |

$3,319 | $3,200 | $119 | 4% | ||||||||||

AFFO per share(b) |

$7.63 | $7.38 | $0.25 | 3% | ||||||||||

| News Release continued: | Page 2 |

|||||||

| (dollars in millions, except per share amounts) | Q1 2023 | Q1 2022 | Change | % Change | ||||||||||

| Site rental revenues | $1,624 | $1,576 | $48 | 3% | ||||||||||

| Net income (loss) | $418 | $421 | $(3) | (1)% | ||||||||||

| Net income (loss) per share—diluted | $0.97 | $0.97 | $— | —% | ||||||||||

Adjusted EBITDA(a) |

$1,104 | $1,095 | $9 | 1% | ||||||||||

AFFO(a) |

$828 | $812 | $16 | 2% | ||||||||||

AFFO per share(a) |

$1.91 | $1.87 | $0.04 | 2% | ||||||||||

| News Release continued: | Page 3 |

|||||||

| (in millions, except per share amounts) | Full Year 2023(a) |

||||||||||

Site rental billings(b) |

$5,631 | to | $5,671 | ||||||||

| Amortization of prepaid rent | $570 | to | $580 | ||||||||

| Straight-lined revenues | $264 | to | $284 | ||||||||

| Site rental revenues | $6,488 | to | $6,533 | ||||||||

Site rental costs of operations(c) |

$1,643 | to | $1,688 | ||||||||

| Services and other gross margin | $210 | to | $240 | ||||||||

| Net income (loss) | $1,596 | to | $1,676 | ||||||||

| Net income (loss) per share—diluted | $3.67 | to | $3.85 | ||||||||

Adjusted EBITDA(d) |

$4,449 | to | $4,494 | ||||||||

| Depreciation, amortization and accretion | $1,712 | to | $1,807 | ||||||||

Interest expense and amortization of deferred financing costs, net(e) |

$814 | to | $859 | ||||||||

FFO(d) |

$3,350 | to | $3,395 | ||||||||

AFFO(d) |

$3,296 | to | $3,341 | ||||||||

AFFO per share(d) |

$7.58 | to | $7.68 | ||||||||

| News Release continued: | Page 4 |

|||||||

| News Release continued: | Page 5 |

|||||||

| News Release continued: | Page 6 |

|||||||

| News Release continued: | Page 7 |

|||||||

| News Release continued: | Page 8 |

|||||||

| News Release continued: | Page 9 |

|||||||

For the Three Months Ended |

For the Twelve Months Ended | ||||||||||||||||

| (in millions) | March 31, 2023 | March 31, 2022 | December 31, 2022 | ||||||||||||||

| Net income (loss) | $ | 418 | $ | 421 | $ | 1,675 | |||||||||||

| Adjustments to increase (decrease) net income (loss): | |||||||||||||||||

| Asset write-down charges | — | 14 | 34 | ||||||||||||||

| Acquisition and integration costs | — | — | 2 | ||||||||||||||

| Depreciation, amortization and accretion | 431 | 420 | 1,707 | ||||||||||||||

| Amortization of prepaid lease purchase price adjustments | 4 | 4 | 16 | ||||||||||||||

Interest expense and amortization of deferred financing costs, net(a) |

202 | 164 | 699 | ||||||||||||||

| (Gains) losses on retirement of long-term obligations | — | 26 | 28 | ||||||||||||||

| Interest income | (2) | — | (3) | ||||||||||||||

| Other (income) expense | 3 | 1 | 10 | ||||||||||||||

| (Benefit) provision for income taxes | 7 | 6 | 16 | ||||||||||||||

| Stock-based compensation expense, net | 41 | 39 | 156 | ||||||||||||||

Adjusted EBITDA(b)(c) |

$ | 1,104 | $ | 1,095 | $ | 4,340 | |||||||||||

| Full Year 2023 | |||||||||||

| (in millions) | Outlook(e) |

||||||||||

| Net income (loss) | $1,596 | to | $1,676 | ||||||||

| Adjustments to increase (decrease) net income (loss): | |||||||||||

| Asset write-down charges | $26 | to | $36 | ||||||||

| Acquisition and integration costs | $0 | to | $8 | ||||||||

| Depreciation, amortization and accretion | $1,712 | to | $1,807 | ||||||||

| Amortization of prepaid lease purchase price adjustments | $15 | to | $17 | ||||||||

Interest expense and amortization of deferred financing costs, net(d) |

$814 | to | $859 | ||||||||

| (Gains) losses on retirement of long-term obligations | $0 | to | $0 | ||||||||

| Interest income | $(4) | to | $(3) | ||||||||

| Other (income) expense | $2 | to | $7 | ||||||||

| (Benefit) provision for income taxes | $16 | to | $24 | ||||||||

| Stock-based compensation expense, net | $165 | to | $169 | ||||||||

Adjusted EBITDA(b)(c) |

$4,449 | to | $4,494 | ||||||||

| News Release continued: | Page 10 |

|||||||

For the Three Months Ended |

For the Twelve Months Ended | ||||||||||||||||

| (in millions, except per share amounts) | March 31, 2023 | March 31, 2022 | December 31, 2022 | ||||||||||||||

| Net income (loss) | $ | 418 | $ | 421 | $ | 1,675 | |||||||||||

| Real estate related depreciation, amortization and accretion | 417 | 408 | 1,653 | ||||||||||||||

| Asset write-down charges | — | 14 | 34 | ||||||||||||||

FFO(a)(b) |

$ | 835 | $ | 843 | $ | 3,362 | |||||||||||

| Weighted-average common shares outstanding—diluted | 434 | 434 | 434 | ||||||||||||||

FFO per share(a)(b) |

$ | 1.92 | $ | 1.94 | $ | 7.75 | |||||||||||

| FFO (from above) | $ | 835 | $ | 843 | $ | 3,362 | |||||||||||

| Adjustments to increase (decrease) FFO: | |||||||||||||||||

| Straight-lined revenues | (83) | (116) | (410) | ||||||||||||||

| Straight-lined expenses | 20 | 19 | 73 | ||||||||||||||

| Stock-based compensation expense, net | 41 | 39 | 156 | ||||||||||||||

| Non-cash portion of tax provision | 9 | 5 | 6 | ||||||||||||||

| Non-real estate related depreciation, amortization and accretion | 14 | 12 | 54 | ||||||||||||||

| Amortization of non-cash interest expense | 4 | 4 | 14 | ||||||||||||||

| Other (income) expense | 3 | 1 | 10 | ||||||||||||||

| (Gains) losses on retirement of long-term obligations | — | 26 | 28 | ||||||||||||||

| Acquisition and integration costs | — | — | 2 | ||||||||||||||

| Sustaining capital expenditures | (15) | (21) | (95) | ||||||||||||||

AFFO(a)(b) |

$ | 828 | $ | 812 | $ | 3,200 | |||||||||||

| Weighted-average common shares outstanding—diluted | 434 | 434 | 434 | ||||||||||||||

AFFO per share(a)(b) |

$ | 1.91 | $ | 1.87 | $ | 7.38 | |||||||||||

| News Release continued: | Page 11 |

|||||||

| Full Year 2023 | ||||||||||||||

| (in millions, except per share amounts) | Outlook(a) |

|||||||||||||

| Net income (loss) | $1,596 | to | $1,676 | |||||||||||

| Real estate related depreciation, amortization and accretion | $1,666 | to | $1,746 | |||||||||||

| Asset write-down charges | $26 | to | $36 | |||||||||||

FFO(b)(c) |

$3,350 | to | $3,395 | |||||||||||

| Weighted-average common shares outstanding—diluted | 435 | |||||||||||||

FFO per share(b)(c) |

$7.70 | to | $7.80 | |||||||||||

| FFO (from above) | $3,350 | to | $3,395 | |||||||||||

| Adjustments to increase (decrease) FFO: | ||||||||||||||

| Straight-lined revenues | $(284) | to | $(264) | |||||||||||

| Straight-lined expenses | $61 | to | $81 | |||||||||||

| Stock-based compensation expense, net | $165 | to | $169 | |||||||||||

| Non-cash portion of tax provision | $0 | to | $8 | |||||||||||

| Non-real estate related depreciation, amortization and accretion | $47 | to | $62 | |||||||||||

| Amortization of non-cash interest expense | $7 | to | $17 | |||||||||||

| Other (income) expense | $2 | to | $7 | |||||||||||

| (Gains) losses on retirement of long-term obligations | $0 | to | $0 | |||||||||||

| Acquisition and integration costs | $0 | to | $8 | |||||||||||

| Sustaining capital expenditures | $(103) | to | $(83) | |||||||||||

AFFO(b)(c) |

$3,296 | to | $3,341 | |||||||||||

| Weighted-average common shares outstanding—diluted | 435 | |||||||||||||

AFFO per share(b)(c) |

$7.58 | to | $7.68 | |||||||||||

| News Release continued: | Page 12 |

|||||||

| Three Months Ended March 31, | |||||||||||

| (dollars in millions) | 2023 | 2022 | |||||||||

| Components of changes in site rental revenues: | |||||||||||

Prior year site rental billings(a) |

$ | 1,318 | $ | 1,243 | |||||||

Core leasing activity(a) |

57 | 92 | |||||||||

| Escalators | 24 | 25 | |||||||||

Non-renewals(a) |

(42) | (42) | |||||||||

Organic Contribution to Site Rental Billings Adjusted for Impact of Sprint Cancellations(a) |

39 | 75 | |||||||||

Payments for Sprint Cancellations(b) |

48 | — | |||||||||

Non-renewals associated with Sprint Cancellations(b) |

(2) | — | |||||||||

Organic Contribution to Site Rental Billings(a) |

85 | 75 | |||||||||

| Straight-lined revenues | 83 | 116 | |||||||||

| Amortization of prepaid rent | 137 | 141 | |||||||||

Acquisitions(c) |

1 | 1 | |||||||||

| Other | — | — | |||||||||

| Total site rental revenues | $ | 1,624 | $ | 1,576 | |||||||

| Year-over-year changes in revenues: | |||||||||||

| Site rental revenues | 3.0 | % | 15.1 | % | |||||||

| Changes in revenues as a percentage of prior year site rental billings: | |||||||||||

Organic Contribution to Site Rental Billings Adjusted for Impact of Sprint Cancellations(a) |

2.9 | % | 6.0 | % | |||||||

Organic Contribution to Site Rental Billings(a) |

6.4 | % | 6.0 | % | |||||||

| News Release continued: | Page 13 |

|||||||

| (dollars in millions) | Current Full Year 2023 Outlook(a) |

||||||||||

| Components of changes in site rental revenues: | |||||||||||

Prior year site rental billings(b) |

$5,310 | ||||||||||

Core leasing activity(b) |

$285 | to | $315 | ||||||||

| Escalators | $90 | to | $100 | ||||||||

Non-renewals(b) |

$(180) | to | $(160) | ||||||||

Organic Contribution to Site Rental Billings Adjusted for Impact of Sprint Cancellations(b)(c) |

$210 | to | $240 | ||||||||

Payments for Sprint Cancellations(c) |

$160 | to | $170 | ||||||||

Non-renewals associated with Sprint Cancellations(c) |

$(30) | to | $(30) | ||||||||

Organic Contribution to Site Rental Billings(b) |

$340 | to | $380 | ||||||||

| Straight-lined revenues | $264 | to | $284 | ||||||||

| Amortization of prepaid rent | $570 | to | $580 | ||||||||

Acquisitions(d) |

— | ||||||||||

| Other | — | ||||||||||

| Total site rental revenues | $6,488 | to | $6,533 | ||||||||

Year-over-year changes in revenues:(e) |

|||||||||||

| Site rental revenues | 3.5% | ||||||||||

| Changes in revenues as a percentage of prior year site rental billings: | |||||||||||

Organic Contribution to Site Rental Billings Adjusted for Impact of Sprint Cancellations(b) |

4.2% | ||||||||||

Organic Contribution to Site Rental Billings(b) |

6.8% | ||||||||||

| News Release continued: | Page 14 |

|||||||

For the Three Months Ended |

|||||||||||||||||||||||||||||

| March 31, 2023 | March 31, 2022 | ||||||||||||||||||||||||||||

| (in millions) | Towers | Fiber | Other | Total | Towers | Fiber | Other | Total | |||||||||||||||||||||

| Discretionary capital expenditures: | |||||||||||||||||||||||||||||

| Communications infrastructure improvements and other capital projects | $ | 33 | $ | 272 | $ | 6 | $ | 311 | $ | 35 | $ | 209 | $ | 6 | $ | 250 | |||||||||||||

| Purchases of land interests | 15 | — | — | 15 | 10 | — | — | 10 | |||||||||||||||||||||

| Sustaining capital expenditures | 2 | 7 | 6 | 15 | 2 | 13 | 6 | 21 | |||||||||||||||||||||

| Total capital expenditures | $ | 50 | $ | 279 | $ | 12 | $ | 341 | $ | 47 | $ | 222 | $ | 12 | $ | 281 | |||||||||||||

For the Three Months Ended |

|||||||||||

| (in millions) | March 31, 2023 | March 31, 2022 | |||||||||

| Interest expense on debt obligations | $ | 198 | $ | 160 | |||||||

| Amortization of deferred financing costs and adjustments on long-term debt | 7 | 7 | |||||||||

| Capitalized interest | (3) | (3) | |||||||||

| Interest expense and amortization of deferred financing costs, net | $ | 202 | $ | 164 | |||||||

| (in millions) | Full Year 2023 Outlook(b) |

||||||||||

| Interest expense on debt obligations | $804 | to | $844 | ||||||||

| Amortization of deferred financing costs and adjustments on long-term debt | $20 | to | $30 | ||||||||

| Capitalized interest | $(18) | to | $(8) | ||||||||

| Interest expense and amortization of deferred financing costs, net | $814 | to | $859 | ||||||||

| News Release continued: | Page 15 |

|||||||

| (in millions) | Face Value(a) |

Final Maturity | |||||||||

| Cash, cash equivalents and restricted cash | $ | 388 | |||||||||

Senior Secured Notes, Series 2009-1, Class A-2(b) |

45 | Aug. 2029 | |||||||||

Senior Secured Tower Revenue Notes, Series 2015-2(c) |

700 | May 2045 | |||||||||

Senior Secured Tower Revenue Notes, Series 2018-2(c) |

750 | July 2048 | |||||||||

Finance leases and other obligations |

257 | Various | |||||||||

| Total secured debt | $ | 1,752 | |||||||||

2016 Revolver(d) |

1,434 | July 2027 | |||||||||

| 2016 Term Loan A | 1,185 | July 2027 | |||||||||

Commercial Paper Notes(e) |

717 | Various | |||||||||

3.150% Senior Notes |

750 | July 2023 | |||||||||

3.200% Senior Notes |

750 | Sept. 2024 | |||||||||

1.350% Senior Notes |

500 | July 2025 | |||||||||

4.450% Senior Notes |

900 | Feb. 2026 | |||||||||

3.700% Senior Notes |

750 | June 2026 | |||||||||

| 1.050% Senior Notes | 1,000 | July 2026 | |||||||||

| 2.900% Senior Notes | 750 | Mar. 2027 | |||||||||

4.000% Senior Notes |

500 | Mar. 2027 | |||||||||

3.650% Senior Notes |

1,000 | Sept. 2027 | |||||||||

| 5.000% Senior Notes | 1,000 | Jan. 2028 | |||||||||

3.800% Senior Notes |

1,000 | Feb. 2028 | |||||||||

4.300% Senior Notes |

600 | Feb. 2029 | |||||||||

| 3.100% Senior Notes | 550 | Nov. 2029 | |||||||||

3.300% Senior Notes |

750 | July 2030 | |||||||||

2.250% Senior Notes |

1,100 | Jan. 2031 | |||||||||

| 2.100% Senior Notes | 1,000 | Apr. 2031 | |||||||||

| 2.500% Senior Notes | 750 | July 2031 | |||||||||

| 2.900% Senior Notes | 1,250 | Apr. 2041 | |||||||||

4.750% Senior Notes |

350 | May 2047 | |||||||||

5.200% Senior Notes |

400 | Feb. 2049 | |||||||||

| 4.000% Senior Notes | 350 | Nov. 2049 | |||||||||

| 4.150% Senior Notes | 500 | July 2050 | |||||||||

| 3.250% Senior Notes | 900 | Jan. 2051 | |||||||||

| Total unsecured debt | $ | 20,736 | |||||||||

Net Debt(f) |

$ | 22,100 | |||||||||

| News Release continued: | Page 16 |

|||||||

| News Release continued: | Page 17 |

|||||||

| News Release continued: | Page 18 |

|||||||

|

CROWN CASTLE INC.

CONDENSED CONSOLIDATED BALANCE SHEET (UNAUDITED)

(Amounts in millions, except par values)

|

||||

| March 31, 2023 |

December 31, 2022 | ||||||||||

| ASSETS | |||||||||||

| Current assets: | |||||||||||

| Cash and cash equivalents | $ | 187 | $ | 156 | |||||||

| Restricted cash | 196 | 166 | |||||||||

| Receivables, net | 565 | 593 | |||||||||

| Prepaid expenses | 159 | 102 | |||||||||

| Deferred site rental receivables | 125 | 127 | |||||||||

| Other current assets | 93 | 73 | |||||||||

| Total current assets | 1,325 | 1,217 | |||||||||

| Deferred site rental receivables | 2,040 | 1,954 | |||||||||

| Property and equipment, net | 15,492 | 15,407 | |||||||||

| Operating lease right-of-use assets | 6,482 | 6,526 | |||||||||

| Goodwill | 10,085 | 10,085 | |||||||||

| Site rental contracts and tenant relationships | 3,436 | 3,535 | |||||||||

| Other intangible assets, net | 60 | 61 | |||||||||

| Other assets, net | 134 | 136 | |||||||||

| Total assets | $ | 39,054 | $ | 38,921 | |||||||

| LIABILITIES AND EQUITY | |||||||||||

| Current liabilities: | |||||||||||

| Accounts payable | $ | 233 | $ | 236 | |||||||

| Accrued interest | 132 | 183 | |||||||||

| Deferred revenues | 721 | 736 | |||||||||

| Other accrued liabilities | 300 | 407 | |||||||||

| Current maturities of debt and other obligations | 819 | 819 | |||||||||

| Current portion of operating lease liabilities | 330 | 350 | |||||||||

| Total current liabilities | 2,535 | 2,731 | |||||||||

| Debt and other long-term obligations | 21,513 | 20,910 | |||||||||

| Operating lease liabilities | 5,856 | 5,881 | |||||||||

| Other long-term liabilities | 1,927 | 1,950 | |||||||||

| Total liabilities | 31,831 | 31,472 | |||||||||

| Commitments and contingencies | |||||||||||

| Stockholders' equity: | |||||||||||

Common stock, 0.01 par value; 1,200 shares authorized; shares issued and outstanding: March 31, 2023—434 and December 31, 2022—433 |

4 | 4 | |||||||||

| Additional paid-in capital | 18,154 | 18,116 | |||||||||

| Accumulated other comprehensive income (loss) | (6) | (5) | |||||||||

| Dividends/distributions in excess of earnings | (10,929) | (10,666) | |||||||||

| Total equity | 7,223 | 7,449 | |||||||||

| Total liabilities and equity | $ | 39,054 | $ | 38,921 | |||||||

| News Release continued: | Page 19 |

|||||||

|

CROWN CASTLE INC.

CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS (UNAUDITED)

(Amounts in millions, except per share amounts)

|

||||

| Three Months Ended March 31, | |||||||||||

| 2023 | 2022 | ||||||||||

| Net revenues: | |||||||||||

| Site rental | $ | 1,624 | $ | 1,576 | |||||||

| Services and other | 149 | 166 | |||||||||

| Net revenues | 1,773 | 1,742 | |||||||||

| Operating expenses: | |||||||||||

Costs of operations:(a) |

|||||||||||

| Site rental | 415 | 396 | |||||||||

| Services and other | 104 | 113 | |||||||||

| Selling, general and administrative | 195 | 181 | |||||||||

| Asset write-down charges | — | 14 | |||||||||

| Acquisition and integration costs | — | — | |||||||||

| Depreciation, amortization and accretion | 431 | 420 | |||||||||

| Total operating expenses | 1,145 | 1,124 | |||||||||

| Operating income (loss) | 628 | 618 | |||||||||

| Interest expense and amortization of deferred financing costs, net | (202) | (164) | |||||||||

| Gains (losses) on retirement of long-term obligations | — | (26) | |||||||||

| Interest income | 2 | — | |||||||||

| Other income (expense) | (3) | (1) | |||||||||

| Income (loss) before income taxes | 425 | 427 | |||||||||

| Benefit (provision) for income taxes | (7) | (6) | |||||||||

| Net income (loss) | $ | 418 | $ | 421 | |||||||

| Net income (loss), per common share: | |||||||||||

| Basic | $ | 0.97 | $ | 0.97 | |||||||

| Diluted | $ | 0.97 | $ | 0.97 | |||||||

| Weighted-average common shares outstanding: | |||||||||||

| Basic | 433 | 433 | |||||||||

| Diluted | 434 | 434 | |||||||||

| News Release continued: | Page 20 |

|||||||

|

CROWN CASTLE INC.

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS (UNAUDITED)

(In millions of dollars)

|

||||

| Three Months Ended March 31, | |||||||||||

| 2023 | 2022 | ||||||||||

| Cash flows from operating activities: | |||||||||||

| Net income (loss) | $ | 418 | $ | 421 | |||||||

| Adjustments to reconcile net income (loss) to net cash provided by (used for) operating activities: | |||||||||||

| Depreciation, amortization and accretion | 431 | 420 | |||||||||

| (Gains) losses on retirement of long-term obligations | — | 26 | |||||||||

| Amortization of deferred financing costs and other non-cash interest | 7 | 4 | |||||||||

| Stock-based compensation expense, net | 41 | 38 | |||||||||

| Asset write-down charges | — | 14 | |||||||||

| Deferred income tax (benefit) provision | 1 | 1 | |||||||||

| Other non-cash adjustments, net | 2 | 1 | |||||||||

| Changes in assets and liabilities, excluding the effects of acquisitions: | |||||||||||

| Increase (decrease) in liabilities | (183) | (274) | |||||||||

| Decrease (increase) in assets | (111) | (93) | |||||||||

| Net cash provided by (used for) operating activities | 606 | 558 | |||||||||

| Cash flows from investing activities: | |||||||||||

| Capital expenditures | (341) | (281) | |||||||||

| Payments for acquisitions, net of cash acquired | (67) | (3) | |||||||||

| Other investing activities, net | 1 | (5) | |||||||||

| Net cash provided by (used for) investing activities | (407) | (289) | |||||||||

| Cash flows from financing activities: | |||||||||||

| Proceeds from issuance of long-term debt | 999 | 748 | |||||||||

| Principal payments on debt and other long-term obligations | (19) | (18) | |||||||||

| Purchases and redemptions of long-term debt | — | (1,274) | |||||||||

| Borrowings under revolving credit facility | 1,434 | 900 | |||||||||

| Payments under revolving credit facility | (1,305) | (665) | |||||||||

| Net borrowings (repayments) under commercial paper program | (524) | 777 | |||||||||

| Payments for financing costs | (10) | (8) | |||||||||

| Purchases of common stock | (28) | (63) | |||||||||

| Dividends/distributions paid on common stock | (686) | (650) | |||||||||

| Net cash provided by (used for) financing activities | (139) | (253) | |||||||||

| Net increase (decrease) in cash, cash equivalents and restricted cash | 60 | 16 | |||||||||

| Effect of exchange rate changes on cash | 1 | — | |||||||||

| Cash, cash equivalents and restricted cash at beginning of period | 327 | 466 | |||||||||

| Cash, cash equivalents and restricted cash at end of period | $ | 388 | $ | 482 | |||||||

| Supplemental disclosure of cash flow information: | |||||||||||

| Interest paid | 249 | 225 | |||||||||

| Income taxes paid (refunded) | (2) | — | |||||||||

| News Release continued: | Page 21 |

|||||||

|

CROWN CASTLE INC.

SEGMENT OPERATING RESULTS (UNAUDITED)

(In millions of dollars)

|

||||

| SEGMENT OPERATING RESULTS | |||||||||||||||||||||||||||||||||||||||||||||||

Three Months Ended March 31, 2023 |

Three Months Ended March 31, 2022 |

||||||||||||||||||||||||||||||||||||||||||||||

| Towers | Fiber | Other | Consolidated Total | Towers | Fiber | Other | Consolidated Total | ||||||||||||||||||||||||||||||||||||||||

| Segment site rental revenues | $ | 1,081 | $ | 543 | $ | 1,624 | $ | 1,075 | $ | 501 | $ | 1,576 | |||||||||||||||||||||||||||||||||||

| Segment services and other revenues | 146 | 3 | 149 | 163 | 3 | 166 | |||||||||||||||||||||||||||||||||||||||||

| Segment revenues | 1,227 | 546 | 1,773 | 1,238 | 504 | 1,742 | |||||||||||||||||||||||||||||||||||||||||

| Segment site rental costs of operations | 234 | 172 | 406 | 225 | 162 | 387 | |||||||||||||||||||||||||||||||||||||||||

| Segment services and other costs of operations | 99 | 2 | 101 | 109 | 2 | 111 | |||||||||||||||||||||||||||||||||||||||||

Segment costs of operations(a)(b) |

333 | 174 | 507 | 334 | 164 | 498 | |||||||||||||||||||||||||||||||||||||||||

Segment site rental gross margin(c) |

847 | 371 | 1,218 | 850 | 339 | 1,189 | |||||||||||||||||||||||||||||||||||||||||

Segment services and other gross margin(c) |

47 | 1 | 48 | 54 | 1 | 55 | |||||||||||||||||||||||||||||||||||||||||

Segment selling, general and administrative expenses(b) |

31 | 49 | 80 | 28 | 47 | 75 | |||||||||||||||||||||||||||||||||||||||||

Segment operating profit(c) |

863 | 323 | 1,186 | 876 | 293 | 1,169 | |||||||||||||||||||||||||||||||||||||||||

Other selling, general and administrative expenses(b) |

$ | 82 | 82 | $ | 74 | 74 | |||||||||||||||||||||||||||||||||||||||||

| Stock-based compensation expense, net | 41 | 41 | 39 | 39 | |||||||||||||||||||||||||||||||||||||||||||

Depreciation, amortization and accretion |

431 | 431 | 420 | 420 | |||||||||||||||||||||||||||||||||||||||||||

| Interest expense and amortization of deferred financing costs, net | 202 | 202 | 164 | 164 | |||||||||||||||||||||||||||||||||||||||||||

Other (income) expenses to reconcile to income (loss) before income taxes(d) |

5 | 5 | 45 | 45 | |||||||||||||||||||||||||||||||||||||||||||

Income (loss) before income taxes |

$ | 425 | $ | 427 | |||||||||||||||||||||||||||||||||||||||||||

| TABLE OF CONTENTS | |||||

| Page | |||||

| Company Overview | |||||

| Company Profile | |||||

| Strategy | |||||

| General Company Information | |||||

| Asset Portfolio Footprint | |||||

| Historical Common Stock Data | |||||

| Annualized Fourth Quarter Dividends Per Share | |||||

| Executive Management Team | |||||

| Board of Directors | |||||

| Research Coverage | |||||

| Outlook | |||||

| Outlook | |||||

| Outlook for Components of Changes in Site Rental Revenues | |||||

| Outlook for Components of Changes in Site Rental Revenues by Line of Business | |||||

| Outlook for Capital Expenditures | |||||

| Outlook for Components of Interest Expense | |||||

| Consolidated Financials | |||||

| Consolidated Summary Financial Highlights | |||||

| Consolidated Components of Changes in Site Rental Revenues | |||||

| Consolidated Summary of Capital Expenditures | |||||

| Consolidated Return on Invested Capital | |||||

| Consolidated Tenant Overview | |||||

| Consolidated Annualized Rental Cash Payments at Time of Renewal | |||||

| Consolidated Projected Revenues from Tenant Contracts | |||||

| Consolidated Projected Expenses from Existing Ground Leases and Fiber Access Agreements | |||||

| Capitalization Overview | |||||

| Capitalization Overview | |||||

| Debt Maturity Overview | |||||

| Liquidity Overview | |||||

| Summary of Maintenance and Financial Covenants | |||||

| Interest Rate Exposure | |||||

| Components of Interest Expense | |||||

| Towers Segment | |||||

| Towers Segment Summary Financial Highlights | |||||

| Towers Segment Components of Changes in Site Rental Revenues | |||||

| Towers Segment Summary of Capital Expenditures | |||||

| Tower Portfolio Highlights | |||||

| Towers Segment Cash Yield on Invested Capital | |||||

| Summary of Tower Portfolio by Vintage | |||||

| Ground Interest Overview | |||||

| Fiber Segment | |||||

| Fiber Segment Summary Financial Highlights | |||||

| Fiber Segment Components of Changes in Site Rental Revenues | |||||

| Fiber Segment Summary of Capital Expenditures | |||||

| Fiber Segment Revenue Detail by Line of Business | |||||

| Fiber Segment Portfolio Highlights | |||||

| Fiber Segment Cash Yield on Invested Capital | |||||

| Fiber Solutions Revenue Mix | |||||

| Appendix of Condensed Consolidated Financial Statements and Non-GAAP Reconciliations | |||||

| COMPANY OVERVIEW |

OUTLOOK | CONSOLIDATED FINANCIALS | CAPITALIZATION OVERVIEW | TOWERS SEGMENT | FIBER SEGMENT | APPENDIX | ||||||||||||||

COMPANY PROFILE | ||||||||||||||

STRATEGY | ||||||||||||||

| COMPANY OVERVIEW |

OUTLOOK | CONSOLIDATED FINANCIALS | CAPITALIZATION OVERVIEW | TOWERS SEGMENT | FIBER SEGMENT | APPENDIX | ||||||||||||||

| GENERAL COMPANY INFORMATION | |||||

| Principal executive offices | 8020 Katy Freeway, Houston, TX 77024 | ||||

| Common shares trading symbol | CCI | ||||

| Stock exchange listing | New York Stock Exchange | ||||

| Fiscal year ending date | December 31 | ||||

| Fitch - Long-term Issuer Default Rating | BBB+ | ||||

| Moody’s - Long-term Corporate Family Rating | Baa3 | ||||

| Standard & Poor’s - Long-term Local Issuer Credit Rating | BBB | ||||

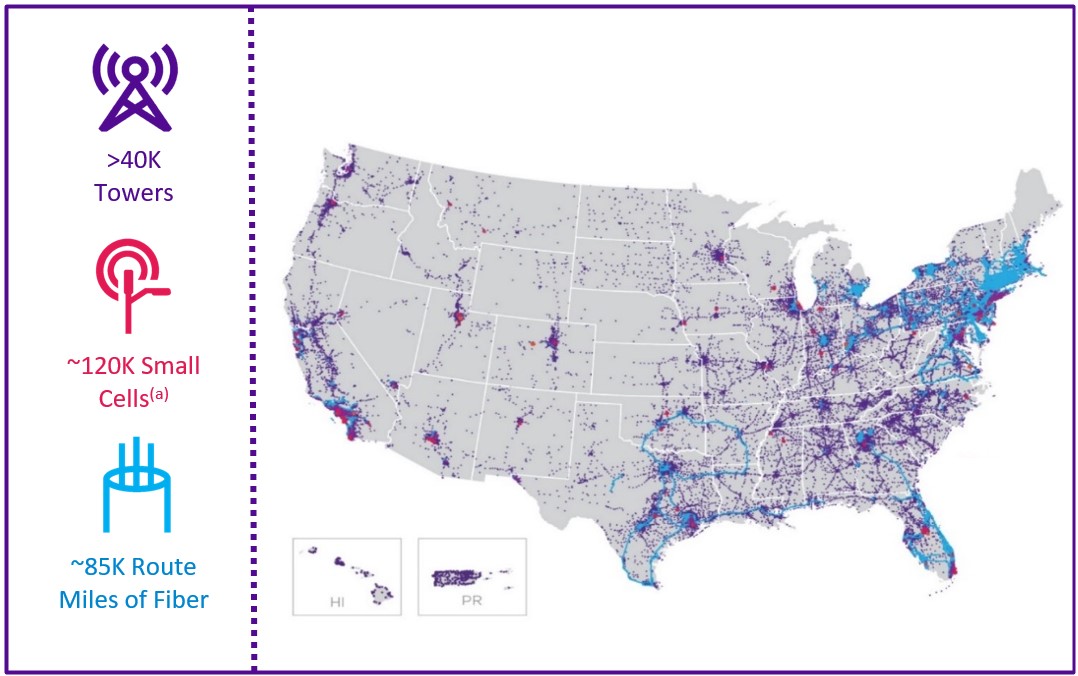

| ASSET PORTFOLIO FOOTPRINT | ||

| ||

| HISTORICAL COMMON STOCK DATA | |||||||||||||||||

| Three Months Ended | |||||||||||||||||

| (in millions, except per share amounts) | 3/31/22 | 6/30/22 | 9/30/22 | 12/31/22 | 3/31/23 | ||||||||||||

High price(b) |

$ | 199.06 | $ | 192.17 | $ | 179.18 | $ | 149.29 | $ | 152.15 | |||||||

Low price(b) |

$ | 149.26 | $ | 148.87 | $ | 139.91 | $ | 118.94 | $ | 122.75 | |||||||

Period end closing price(c) |

$ | 177.27 | $ | 163.14 | $ | 141.28 | $ | 134.01 | $ | 133.84 | |||||||

| Dividends paid per common share | $ | 1.470 | $ | 1.470 | $ | 1.470 | $ | 1.565 | $ | 1.565 | |||||||

Volume weighted average price for the period(b) |

$ | 169.03 | $ | 173.36 | $ | 164.41 | $ | 131.58 | $ | 136.69 | |||||||

| Common shares outstanding, at period end | 433 | 433 | 433 | 433 | 434 | ||||||||||||

Market value of outstanding common shares, at period end(d) |

$ | 76,762 | $ | 70,644 | $ | 61,179 | $ | 58,036 | $ | 58,042 | |||||||

| COMPANY OVERVIEW |

OUTLOOK | CONSOLIDATED FINANCIALS | CAPITALIZATION OVERVIEW | TOWERS SEGMENT | FIBER SEGMENT | APPENDIX | ||||||||||||||

ANNUALIZED FOURTH QUARTER DIVIDENDS PER SHARE(a) | ||

| EXECUTIVE MANAGEMENT TEAM | |||||||||||

| Age | Years with Company | Position | |||||||||

| Jay A. Brown | 50 | 23 | President and Chief Executive Officer | ||||||||

| Daniel K. Schlanger | 49 | 7 | Executive Vice President and Chief Financial Officer | ||||||||

| Catherine Piche | 52 | 12 | Executive Vice President and Chief Operating Officer - Towers | ||||||||

| Christopher D. Levendos | 55 | 4 | Executive Vice President and Chief Operating Officer - Fiber | ||||||||

| Michael J. Kavanagh | 54 | 12 | Executive Vice President and Chief Commercial Officer | ||||||||

| Philip M. Kelley | 50 | 25 | Executive Vice President - Corporate Development and Strategy | ||||||||

| Edward B. Adams, Jr. | 54 | 6 | Executive Vice President and General Counsel | ||||||||

| Laura B. Nichol | 62 | 8 | Executive Vice President - Business Support | ||||||||

| BOARD OF DIRECTORS | ||||||||||||||

| Name | Position | Committees | Age | Years as Director | ||||||||||

| P. Robert Bartolo | Chair | Audit, Compensation, Strategy | 51 | 9 | ||||||||||

| Cindy Christy | Director | Compensation, NESG(b), Strategy |

57 | 15 | ||||||||||

| Ari Q. Fitzgerald | Director | Compensation, NESG(b), Strategy |

60 | 20 | ||||||||||

| Anthony J. Melone | Director | Audit, NESG(b), Strategy |

62 | 7 | ||||||||||

| Jay A. Brown | Director | 50 | 6 | |||||||||||

| Andrea J. Goldsmith | Director | NESG(b), Strategy |

58 | 5 | ||||||||||

| Tammy K. Jones | Director | Audit, NESG(b), Strategy |

57 | 2 | ||||||||||

| W. Benjamin Moreland | Director | Strategy | 59 | 16 | ||||||||||

| Kevin A. Stephens | Director | Audit, Compensation, Strategy | 61 | 2 | ||||||||||

| Matthew Thornton III | Director | Compensation, Strategy | 64 | 2 | ||||||||||

| COMPANY OVERVIEW |

OUTLOOK | CONSOLIDATED FINANCIALS | CAPITALIZATION OVERVIEW | TOWERS SEGMENT | FIBER SEGMENT | APPENDIX | ||||||||||||||

| RESEARCH COVERAGE | ||||||||

| Equity Research | ||||||||

| Bank of America David Barden (646) 855-1320 |

Barclays Brendan Lynch (212) 526-9428 |

Citigroup Michael Rollins (212) 816-1116 |

||||||

| Credit Suisse Douglas Mitchelson (212) 325-7542 |

Deutsche Bank Matthew Niknam (212) 250-4711 |

Goldman Sachs Brett Feldman (212) 902-8156 |

||||||

| Green Street David Guarino (949) 640-8780 |

Jefferies Jonathan Petersen (212) 284-1705 |

JPMorgan Philip Cusick (212) 622-1444 |

||||||

| KeyBanc Brandon Nispel (503) 821-3871 |

LightShed Partners Walter Piecyk (646) 450-9258 |

MoffettNathanson Nick Del Deo (212) 519-0025 |

||||||

| Morgan Stanley Simon Flannery (212) 761-6432 |

New Street Research Jonathan Chaplin (212) 921-9876 |

Raymond James Ric Prentiss (727) 567-2567 |

||||||

| RBC Capital Markets Jonathan Atkin (415) 633-8589 |

TD Cowen Gregory Williams (646) 562-1367 |

UBS Batya Levi (212) 713-8824 |

||||||

| Wells Fargo Securities, LLC Eric Luebchow (312) 630-2386 |

Wolfe Research Andrew Rosivach (646) 582-9350 |

|||||||

| Rating Agencies | ||||||||

| Fitch John Culver (312) 368-3216 |

Moody’s Lori Marks (212) 553-1098 |

Standard & Poor’s Ryan Gilmore (212) 438-0602 |

||||||

| COMPANY OVERVIEW |

OUTLOOK | CONSOLIDATED FINANCIALS | CAPITALIZATION OVERVIEW | TOWERS SEGMENT | FIBER SEGMENT | APPENDIX | ||||||||||||||

| OUTLOOK | |||||||||||

| (in millions, except per share amounts) | Full Year 2023 Outlook(a) |

||||||||||

Site rental billings(b) |

$5,631 | to | $5,671 | ||||||||

| Amortization of prepaid rent | $570 | to | $580 | ||||||||

| Straight-lined revenues | $264 | to | $284 | ||||||||

| Site rental revenues | $6,488 | to | $6,533 | ||||||||

Site rental costs of operations(c) |

$1,643 | to | $1,688 | ||||||||

| Services and other gross margin | $210 | to | $240 | ||||||||

| Net income (loss) | $1,596 | to | $1,676 | ||||||||

| Net income (loss) per share—diluted | $3.67 | to | $3.85 | ||||||||

Adjusted EBITDA(d) |

$4,449 | to | $4,494 | ||||||||

| Depreciation, amortization and accretion | $1,712 | to | $1,807 | ||||||||

Interest expense and amortization of deferred financing costs, net(e) |

$814 | to | $859 | ||||||||

FFO(d) |

$3,350 | to | $3,395 | ||||||||

AFFO(d) |

$3,296 | to | $3,341 | ||||||||

AFFO per share(d) |

$7.58 | to | $7.68 | ||||||||

| OUTLOOK FOR COMPONENTS OF CHANGES IN SITE RENTAL REVENUES | |||||||||||

| (dollars in millions) | Full Year 2023 Outlook(a) |

||||||||||

| Components of changes in site rental revenues: | |||||||||||

Prior year site rental billings(b) |

$5,310 | ||||||||||

Core leasing activity(b) |

$285 | to | $315 | ||||||||

| Escalators | $90 | to | $100 | ||||||||

Non-renewals(b) |

$(180) | to | $(160) | ||||||||

Organic Contribution to Site Rental Billings Adjusted for Impact of Sprint Cancellations(b) |

$210 | to | $240 | ||||||||

Payments for Sprint Cancellations(f) |

$160 | to | $170 | ||||||||

Non-renewals associated with Sprint Cancellations(f) |

$(30) | to | $(30) | ||||||||

Organic Contribution to Site Rental Billings(b) |

$340 | to | $380 | ||||||||

| Straight-lined revenues | $264 | to | $284 | ||||||||

| Amortization of prepaid rent | $570 | to | $580 | ||||||||

Acquisitions(g) |

— | ||||||||||

| Other | — | ||||||||||

| Total site rental revenues | $6,488 | to | $6,533 | ||||||||

Year-over-year changes in revenues:(h) |

|||||||||||

| Site rental revenues | 3.5% | ||||||||||

| Changes in revenues as a percentage of prior year site rental billings: | |||||||||||

Organic Contribution to Site Rental Billings Adjusted for Impact of Sprint Cancellations(b) |

4.2% | ||||||||||

Organic Contribution to Site Rental Billings(b) |

6.8% | ||||||||||

| COMPANY OVERVIEW |

OUTLOOK | CONSOLIDATED FINANCIALS | CAPITALIZATION OVERVIEW | TOWERS SEGMENT | FIBER SEGMENT | APPENDIX | ||||||||||||||

| OUTLOOK FOR COMPONENTS OF CHANGES IN SITE RENTAL REVENUES BY LINE OF BUSINESS | |||||||||||||||||||||||||||||||||||

Full Year 2023 Outlook(a) |

|||||||||||||||||||||||||||||||||||

| Towers Segment | Fiber Segment | ||||||||||||||||||||||||||||||||||

| (dollars in millions) | Small Cells | Fiber Solutions | |||||||||||||||||||||||||||||||||

Core leasing activity(b) |

$135 | to | $145 | $30 | to | $40 | $120 | to | $130 | ||||||||||||||||||||||||||

Organic Contribution to Site Rental Billings Adjusted for Impact of Sprint Cancellations(b)(c) |

5% | 8% | —% | ||||||||||||||||||||||||||||||||

Organic Contribution to Site Rental Billings(b) |

5% | 25% | 5% | ||||||||||||||||||||||||||||||||

| OUTLOOK FOR CAPITAL EXPENDITURES | |||||||||||||||||||||||||||||||||||

Full Year 2023 Outlook(a) |

|||||||||||||||||||||||||||||||||||

| (in millions) | Towers Segment | Fiber Segment | Total | ||||||||||||||||||||||||||||||||

| Capital expenditures | ~$300 | $1,100 | to | $1,200 | $1,400 | to | $1,500 | ||||||||||||||||||||||||||||

Less: Prepaid rent additions(d) |

~$150 | ~$300 | ~$450 | ||||||||||||||||||||||||||||||||

| Capital expenditures less prepaid rent additions | ~$150 | $800 | to | $900 | $950 | to | $1,050 | ||||||||||||||||||||||||||||

| OUTLOOK FOR COMPONENTS OF INTEREST EXPENSE | |||||||||||

| (in millions) | Full Year 2023 Outlook(a) |

||||||||||

| Interest expense on debt obligations | $804 | to | $844 | ||||||||

| Amortization of deferred financing costs and adjustments on long-term debt | $20 | to | $30 | ||||||||

| Capitalized interest | $(18) | to | $(8) | ||||||||

| Interest expense and amortization of deferred financing costs, net | $814 | to | $859 | ||||||||

| COMPANY OVERVIEW |

OUTLOOK | CONSOLIDATED FINANCIALS | CAPITALIZATION OVERVIEW | TOWERS SEGMENT | FIBER SEGMENT | APPENDIX | ||||||||||||||

| CONSOLIDATED SUMMARY FINANCIAL HIGHLIGHTS | |||||||||||||||||||||||||||||

| 2022 | 2023 | ||||||||||||||||||||||||||||

| (in millions, except per share amounts) | Q1 | Q2 | Q3 | Q4 | Q1 | ||||||||||||||||||||||||

| Net revenues: | |||||||||||||||||||||||||||||

| Site rental | |||||||||||||||||||||||||||||

Site rental billings(a) |

$ | 1,319 | $ | 1,304 | $ | 1,338 | $ | 1,348 | $ | 1,404 | |||||||||||||||||||

| Amortization of prepaid rent | 141 | 143 | 140 | 145 | 137 | ||||||||||||||||||||||||

| Straight-lined revenues | 116 | 120 | 90 | 85 | 83 | ||||||||||||||||||||||||

| Total site rental | 1,576 | 1,567 | 1,568 | 1,578 | 1,624 | ||||||||||||||||||||||||

| Services and other | 166 | 167 | 178 | 186 | 149 | ||||||||||||||||||||||||

| Net revenues | $ | 1,742 | $ | 1,734 | $ | 1,746 | $ | 1,764 | $ | 1,773 | |||||||||||||||||||

| Select operating expenses: | |||||||||||||||||||||||||||||

Costs of operations(b) |

|||||||||||||||||||||||||||||

| Site rental exclusive of straight-lined expenses | $ | 377 | $ | 383 | $ | 387 | $ | 382 | $ | 398 | |||||||||||||||||||

| Straight-lined expenses | 19 | 19 | 18 | 18 | 17 | ||||||||||||||||||||||||

| Total site rental | 396 | 402 | 405 | 400 | 415 | ||||||||||||||||||||||||

| Services and other | 113 | 112 | 119 | 122 | 104 | ||||||||||||||||||||||||

| Total costs of operations | 509 | 514 | 524 | 522 | 519 | ||||||||||||||||||||||||

| Selling, general and administrative | $ | 181 | $ | 190 | $ | 187 | $ | 192 | $ | 195 | |||||||||||||||||||

| Net income (loss) | $ | 421 | $ | 421 | $ | 419 | $ | 413 | $ | 418 | |||||||||||||||||||

Adjusted EBITDA(c) |

1,095 | 1,078 | 1,077 | 1,090 | 1,104 | ||||||||||||||||||||||||

| Depreciation, amortization and accretion | 420 | 427 | 430 | 431 | 431 | ||||||||||||||||||||||||

| Interest expense and amortization of deferred financing costs, net | 164 | 165 | 177 | 192 | 202 | ||||||||||||||||||||||||

FFO(c) |

843 | 842 | 838 | 838 | 835 | ||||||||||||||||||||||||

AFFO(c) |

$ | 812 | $ | 783 | $ | 804 | $ | 802 | $ | 828 | |||||||||||||||||||

| Weighted-average common shares outstanding—diluted | 434 | 434 | 434 | 434 | 434 | ||||||||||||||||||||||||

| Net income (loss) per share—diluted | $ | 0.97 | $ | 0.97 | $ | 0.97 | $ | 0.95 | $ | 0.97 | |||||||||||||||||||

AFFO per share(c) |

$ | 1.87 | $ | 1.80 | $ | 1.85 | $ | 1.85 | $ | 1.91 | |||||||||||||||||||

| COMPANY OVERVIEW |

OUTLOOK | CONSOLIDATED FINANCIALS | CAPITALIZATION OVERVIEW | TOWERS SEGMENT | FIBER SEGMENT | APPENDIX | ||||||||||||||

| CONSOLIDATED COMPONENTS OF CHANGES IN SITE RENTAL REVENUES | |||||||||||||||||||||||||||||

| 2022 | 2023 | ||||||||||||||||||||||||||||

| (dollars in millions) | Q1 | Q2 | Q3 | Q4 | Q1 | ||||||||||||||||||||||||

| Components of changes in site rental revenues: | |||||||||||||||||||||||||||||

Prior year site rental billings(a) |

$ | 1,243 | $ | 1,245 | $ | 1,270 | $ | 1,290 | $ | 1,318 | |||||||||||||||||||

Core leasing activity(a) |

92 | 75 | 79 | 73 | 57 | ||||||||||||||||||||||||

| Escalators | 25 | 22 | 30 | 27 | 24 | ||||||||||||||||||||||||

Non-renewals(a) |

(42) | (39) | (42) | (43) | (42) | ||||||||||||||||||||||||

Organic Contribution to Site Rental Billings Adjusted for Impact of Sprint Cancellations(a) |

75 | 58 | 67 | 57 | 39 | ||||||||||||||||||||||||

Payments for Sprint Cancellations(b) |

— | — | — | — | 48 | ||||||||||||||||||||||||

Non-renewals associated with Sprint Cancellations(b) |

— | — | — | — | (2) | ||||||||||||||||||||||||

Organic Contribution to Site Rental Billings(a) |

75 | 58 | 67 | 57 | 85 | ||||||||||||||||||||||||

| Straight-lined revenues | 116 | 120 | 90 | 85 | 83 | ||||||||||||||||||||||||

| Amortization of prepaid rent | 141 | 143 | 140 | 145 | 137 | ||||||||||||||||||||||||

Acquisitions(c) |

1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||

| Other | — | — | — | — | — | ||||||||||||||||||||||||

| Total site rental revenues | $ | 1,576 | $ | 1,567 | $ | 1,568 | $ | 1,578 | $ | 1,624 | |||||||||||||||||||

| Year-over-year changes in revenues: | |||||||||||||||||||||||||||||

| Site rental revenues | 15.1 | % | 10.0 | % | 8.1 | % | 7.1 | % | 3.0 | % | |||||||||||||||||||

| Changes in revenues as a percentage of prior year site rental billings: | |||||||||||||||||||||||||||||

Organic Contribution to Site Rental Billings Adjusted for Impact of Sprint Cancellations(a) |

6.1 | % | 4.7 | % | 5.3 | % | 4.3 | % | 2.9 | % | |||||||||||||||||||

Organic Contribution to Site Rental Billings(a) |

6.1 | % | 4.7 | % | 5.3 | % | 4.3 | % | 6.4 | % | |||||||||||||||||||

CONSOLIDATED SUMMARY OF CAPITAL EXPENDITURES(a) | |||||||||||||||||||||||||||||

| 2022 | 2023 | ||||||||||||||||||||||||||||

| (in millions) | Q1 | Q2 | Q3 | Q4 | Q1 | ||||||||||||||||||||||||

| Discretionary capital expenditures: | |||||||||||||||||||||||||||||

| Communications infrastructure improvements and other capital projects | $ | 250 | $ | 267 | $ | 302 | $ | 343 | $ | 311 | |||||||||||||||||||

| Purchases of land interests | 10 | 15 | 12 | 16 | 15 | ||||||||||||||||||||||||

| Total discretionary capital expenditures | 260 | 282 | 314 | 359 | 326 | ||||||||||||||||||||||||

| Sustaining capital expenditures | 21 | 21 | 23 | 30 | 15 | ||||||||||||||||||||||||

| Total capital expenditures | 281 | 303 | 337 | 389 | 341 | ||||||||||||||||||||||||

Less: Prepaid rent additions(d) |

72 | 62 | 63 | 99 | 81 | ||||||||||||||||||||||||

| Capital expenditures less prepaid rent additions | $ | 209 | $ | 241 | $ | 274 | $ | 290 | $ | 260 | |||||||||||||||||||

| COMPANY OVERVIEW |

OUTLOOK | CONSOLIDATED FINANCIALS | CAPITALIZATION OVERVIEW | TOWERS SEGMENT | FIBER SEGMENT | APPENDIX | ||||||||||||||

CONSOLIDATED RETURN ON INVESTED CAPITAL(a) | ||||||||

(as of March 31, 2023; dollars in millions) |

Q1 2023 LQA |

Q1 2022 LQA | ||||||

Adjusted EBITDA(b) |

$ | 4,416 | $ | 4,380 | ||||

| Cash taxes (paid) refunded | 8 | (1) | ||||||

Adjusted EBITDA less cash taxes paid |

$ | 4,424 | $ | 4,379 | ||||

Historical gross investment in property and equipment(c) |

$ | 27,911 | $ | 26,504 | ||||

| Historical gross investment in site rental contracts and tenant relationships | 7,862 | 7,855 | ||||||

| Historical gross investment in goodwill | 10,085 | 10,078 | ||||||

Consolidated Invested Capital(a) |

$ | 45,858 | $ | 44,437 | ||||

Consolidated Return on Invested Capital(a) |

9.6 | % | 9.9 | % | ||||

| CONSOLIDATED TENANT OVERVIEW | |||||||||||

(as of March 31, 2023) |

Percentage of Q1 2023 LQA Site Rental Revenues |

Weighted Average Current Term Remaining(d) |

Long-Term Credit Rating (S&P / Moody’s) |

||||||||

| T-Mobile | 38% | 8 | BBB- / Baa3 | ||||||||

| AT&T | 18% | 4 | BBB / Baa2 | ||||||||

| Verizon | 19% | 8 | BBB+ / Baa1 | ||||||||

| All Others Combined | 25% | 3 | N/A | ||||||||

| Total / Weighted Average | 100% | 6 | |||||||||

CONSOLIDATED ANNUALIZED RENTAL CASH PAYMENTS AT TIME OF RENEWAL(e) | ||||||||||||||||||||

Remaining Nine Months |

Years Ending December 31, | |||||||||||||||||||

(as of March 31, 2023; in millions) |

2023 |

2024 |

2025 |

2026 |

2027 |

|||||||||||||||

| T-Mobile | $ | 13 | $ | 35 | $ | 240 | $ | 51 | $ | 55 | ||||||||||

| AT&T | 323 | 17 | 19 | 29 | 29 | |||||||||||||||

| Verizon | 12 | 21 | 32 | 35 | 30 | |||||||||||||||

| All Others Combined | 151 | 192 | 183 | 120 | 88 | |||||||||||||||

| Total | $ | 499 | $ | 265 | $ | 474 | $ | 235 | $ | 202 | ||||||||||

| COMPANY OVERVIEW |

OUTLOOK | CONSOLIDATED FINANCIALS | CAPITALIZATION OVERVIEW | TOWERS SEGMENT | FIBER SEGMENT | APPENDIX | ||||||||||||||

CONSOLIDATED PROJECTED REVENUES FROM TENANT CONTRACTS(a) | ||||||||||||||||||||

Remaining Nine Months |

Years Ending December 31, | |||||||||||||||||||

(as of March 31, 2023; in millions) |

2023 |

2024 |

2025 |

2026 |

2027 |

|||||||||||||||

| Components of site rental revenues: | ||||||||||||||||||||

Site rental billings(b) |

$ | 4,123 | $ | 5,647 | $ | 5,594 | $ | 5,705 | $ | 5,821 | ||||||||||

| Amortization of prepaid rent | 370 | 359 | 275 | 233 | 194 | |||||||||||||||

| Straight-lined revenues | 187 | 165 | 42 | (60) | (171) | |||||||||||||||

| Site rental revenues | $ | 4,680 | $ | 6,171 | $ | 5,911 | $ | 5,878 | $ | 5,844 | ||||||||||

CONSOLIDATED PROJECTED EXPENSES FROM EXISTING GROUND LEASES AND FIBER ACCESS AGREEMENTS(c) | ||||||||||||||||||||

Remaining Nine Months |

Years Ending December 31, | |||||||||||||||||||

(as of March 31, 2023; in millions) |

2023 |

2024 |

2025 |

2026 |

2027 |

|||||||||||||||

| Components of ground lease and fiber access agreement expenses: | ||||||||||||||||||||

| Ground lease and fiber access agreement expenses exclusive of straight-lined expenses | $ | 747 | $ | 1,013 | $ | 1,033 | $ | 1,054 | $ | 1,076 | ||||||||||

| Straight-lined expenses | 47 | 52 | 40 | 27 | 16 | |||||||||||||||

| Ground lease and fiber access agreement expenses | $ | 794 | $ | 1,065 | $ | 1,073 | $ | 1,081 | $ | 1,092 | ||||||||||

| COMPANY OVERVIEW |

OUTLOOK | CONSOLIDATED FINANCIALS | CAPITALIZATION OVERVIEW | TOWERS SEGMENT | FIBER SEGMENT | APPENDIX | ||||||||||||||

CAPITALIZATION OVERVIEW | |||||||||||||||||

(as of March 31, 2023; dollars in millions) |

Face Value(a) |

Fixed vs. Variable | Interest Rate(b) |

Debt to LQA Adjusted EBITDA(c) |

Maturity | ||||||||||||

| Cash, cash equivalents and restricted cash | $ | 388 | |||||||||||||||

Senior Secured Notes, Series 2009-1, Class A-2(d) |

45 | Fixed | 9.0% | 2029 | |||||||||||||

Senior Secured Tower Revenue Notes, Series 2015-2(e) |

700 | Fixed | 3.7% | 2045 |

|||||||||||||

Senior Secured Tower Revenue Notes, Series 2018-2(e) |

750 | Fixed | 4.2% | 2048 |

|||||||||||||

| Finance leases and other obligations | 257 | Fixed | Various | Various |

|||||||||||||

| Total secured debt | $ | 1,752 | 4.1% | 0.4x | |||||||||||||

2016 Revolver(f) |

1,434 | Variable | 5.9% | 2027 | |||||||||||||

2016 Term Loan A(g) |

1,185 | Variable | 6.0% | 2027 | |||||||||||||

Commercial Paper Notes(h) |

717 | Variable | 5.6% | 2023 | |||||||||||||

| 3.150% Senior Notes | 750 | Fixed | 3.2% | 2023 | |||||||||||||

| 3.200% Senior Notes | 750 | Fixed | 3.2% | 2024 | |||||||||||||

| 1.350% Senior Notes | 500 | Fixed | 1.4% | 2025 | |||||||||||||

| 4.450% Senior Notes | 900 | Fixed | 4.5% | 2026 | |||||||||||||

| 3.700% Senior Notes | 750 | Fixed | 3.7% | 2026 | |||||||||||||

| 1.050% Senior Notes | 1,000 | Fixed | 1.1% | 2026 | |||||||||||||

| 2.900% Senior Notes | 750 | Fixed | 2.9% | 2027 | |||||||||||||

| 4.000% Senior Notes | 500 | Fixed | 4.0% | 2027 | |||||||||||||

| 3.650% Senior Notes | 1,000 | Fixed | 3.7% | 2027 | |||||||||||||

| 5.000% Senior Notes | 1,000 | Fixed | 5.0% | 2028 | |||||||||||||

| 3.800% Senior Notes | 1,000 | Fixed | 3.8% | 2028 | |||||||||||||

| 4.300% Senior Notes | 600 | Fixed | 4.3% | 2029 | |||||||||||||

| 3.100% Senior Notes | 550 | Fixed | 3.1% | 2029 | |||||||||||||

| 3.300% Senior Notes | 750 | Fixed | 3.3% | 2030 | |||||||||||||

| 2.250% Senior Notes | 1,100 | Fixed | 2.3% | 2031 | |||||||||||||

| 2.100% Senior Notes | 1,000 | Fixed | 2.1% | 2031 | |||||||||||||

| 2.500% Senior Notes | 750 | Fixed | 2.5% | 2031 | |||||||||||||

| 2.900% Senior Notes | 1,250 | Fixed | 2.9% | 2041 | |||||||||||||

| 4.750% Senior Notes | 350 | Fixed | 4.8% | 2047 | |||||||||||||

| 5.200% Senior Notes | 400 | Fixed | 5.2% | 2049 | |||||||||||||

| 4.000% Senior Notes | 350 | Fixed | 4.0% | 2049 | |||||||||||||

| 4.150% Senior Notes | 500 | Fixed | 4.2% | 2050 | |||||||||||||

| 3.250% Senior Notes | 900 | Fixed | 3.3% | 2051 | |||||||||||||

| Total unsecured debt | $ | 20,736 | 3.7% | 4.7x | |||||||||||||

Net Debt(i) |

$ | 22,100 | 3.7% | 5.0x | |||||||||||||

Market Capitalization(j) |

58,042 | ||||||||||||||||

Firm Value(k) |

$ | 80,142 | |||||||||||||||

| COMPANY OVERVIEW |

OUTLOOK | CONSOLIDATED FINANCIALS | CAPITALIZATION OVERVIEW | TOWERS SEGMENT | FIBER SEGMENT | APPENDIX | ||||||||||||||

DEBT MATURITY OVERVIEW(a)(b) | ||

| COMPANY OVERVIEW |

OUTLOOK | CONSOLIDATED FINANCIALS | CAPITALIZATION OVERVIEW | TOWERS SEGMENT | FIBER SEGMENT | APPENDIX | ||||||||||||||

LIQUIDITY OVERVIEW(a) | |||||

| (in millions) | March 31, 2023 |

||||

Cash, cash equivalents, and restricted cash(b) |

$ | 388 | |||

Undrawn 2016 Revolver availability(c) |

5,528 | ||||

Total debt and other obligations (current and non-current)(d) |

22,332 | ||||

| Total equity | 7,223 | ||||

| SUMMARY OF MAINTENANCE AND FINANCIAL COVENANTS | |||||||||||||||||

| Debt | Borrower / Issuer | Covenant(e) |

Covenant Level Requirement | As of March 31, 2023 |

|||||||||||||

Maintenance Financial Covenants(f) | |||||||||||||||||

| 2016 Credit Facility | CCI | Total Net Leverage Ratio | ≤ 6.50x | 5.0x | |||||||||||||

| 2016 Credit Facility | CCI | Total Senior Secured Leverage Ratio | ≤ 3.50x | 0.3x | |||||||||||||

| 2016 Credit Facility | CCI | Consolidated Interest Coverage Ratio(g) |

N/A | N/A | |||||||||||||

| Financial covenants requiring excess cash flows to be deposited in a cash trap reserve account and not released | |||||||||||||||||

| 2015 Tower Revenue Notes | Crown Castle Towers LLC and its Subsidiaries | Debt Service Coverage Ratio | > 1.75x | (h) |

18.3x | ||||||||||||

| 2018 Tower Revenue Notes | Crown Castle Towers LLC and its Subsidiaries | Debt Service Coverage Ratio | > 1.75x | (h) |

18.3x | ||||||||||||

| 2009 Securitized Notes | Pinnacle Towers Acquisition Holdings LLC and its Subsidiaries | Debt Service Coverage Ratio | > 1.30x | (h) |

22.5x | ||||||||||||

| Financial covenants restricting ability of relevant issuer to issue additional notes under the applicable indenture | |||||||||||||||||

| 2015 Tower Revenue Notes | Crown Castle Towers LLC and its Subsidiaries | Debt Service Coverage Ratio | ≥ 2.00x | (i) |

18.3x | ||||||||||||

| 2018 Tower Revenue Notes | Crown Castle Towers LLC and its Subsidiaries | Debt Service Coverage Ratio | ≥ 2.00x | (i) |

18.3x | ||||||||||||

| 2009 Securitized Notes | Pinnacle Towers Acquisition Holdings LLC and its Subsidiaries | Debt Service Coverage Ratio | ≥ 2.34x | (i) |

22.5x | ||||||||||||

| COMPANY OVERVIEW |

OUTLOOK | CONSOLIDATED FINANCIALS | CAPITALIZATION OVERVIEW | TOWERS SEGMENT | FIBER SEGMENT | APPENDIX | ||||||||||||||

(as of March 31, 2023; dollars in millions) INTEREST RATE EXPOSURE(a) | |||||||||||||||||

| Fixed Rate Debt | Floating Rate Debt | ||||||||||||||||

Face value of principal outstanding(b) |

$18,895 | Face value of principal outstanding(b) |

$3,336 | ||||||||||||||

| % of total debt | 85% | % of total debt | 15% | ||||||||||||||

| Weighted average interest rate | 3.3% | Weighted average interest rate(e) |

5.9% | ||||||||||||||

| Upcoming maturities: | 2023(d) |

2024 | Interest rate sensitivity of 25 bps increase in interest rates: | ||||||||||||||

Face value of principal outstanding(b)(c) |

$750 | $750 | Full year effect(f) |

$8.3 | |||||||||||||

| Weighted average interest rate | 3.2% | 3.2% | |||||||||||||||

| COMPONENTS OF INTEREST EXPENSE | |||||||||||||||||||||||||||||

| 2022 | 2023 | ||||||||||||||||||||||||||||

| (in millions) | Q1 | Q2 | Q3 | Q4 | Q1 | ||||||||||||||||||||||||

| Interest expense on debt obligations | $ | 160 | $ | 161 | $ | 174 | $ | 189 | $ | 198 | |||||||||||||||||||

| Amortization of deferred financing costs and adjustments on long-term debt | 7 | 7 | 6 | 6 | 7 | ||||||||||||||||||||||||

| Capitalized interest | (3) | (3) | (3) | (3) | (3) | ||||||||||||||||||||||||

| Interest expense and amortization of deferred financing costs, net | $ | 164 | $ | 165 | $ | 177 | $ | 192 | $ | 202 | |||||||||||||||||||

| COMPANY OVERVIEW |

OUTLOOK | CONSOLIDATED FINANCIALS | CAPITALIZATION OVERVIEW | TOWERS SEGMENT | FIBER SEGMENT | APPENDIX | ||||||||||||||

| TOWERS SEGMENT SUMMARY FINANCIAL HIGHLIGHTS | |||||||||||||||||||||||||||||

| 2022 | 2023 | ||||||||||||||||||||||||||||

| (in millions) | Q1 | Q2 | Q3 | Q4 | Q1 | ||||||||||||||||||||||||

| Segment net revenues: | |||||||||||||||||||||||||||||

| Site rental | |||||||||||||||||||||||||||||

Site rental billings(a) |

$ | 880 | $ | 878 | $ | 915 | $ | 922 | $ | 926 | |||||||||||||||||||

| Amortization of prepaid rent | 79 | 80 | 80 | 80 | 72 | ||||||||||||||||||||||||

| Straight-lined revenues | 116 | 120 | 89 | 84 | 83 | ||||||||||||||||||||||||

| Total site rental | 1,075 | 1,078 | 1,084 | 1,086 | 1,081 | ||||||||||||||||||||||||

| Services and other | 163 | 164 | 175 | 183 | 146 | ||||||||||||||||||||||||

| Net revenues | 1,238 | 1,242 | 1,259 | 1,269 | 1,227 | ||||||||||||||||||||||||

| Segment operating expenses: | |||||||||||||||||||||||||||||

Costs of operations(b) |

|||||||||||||||||||||||||||||

| Site rental exclusive of straight-lined expenses | 206 | 213 | 212 | 213 | 217 | ||||||||||||||||||||||||

| Straight-lined expenses | 19 | 19 | 18 | 17 | 17 | ||||||||||||||||||||||||

| Total site rental | 225 | 232 | 230 | 230 | 234 | ||||||||||||||||||||||||

| Services and other | 109 | 107 | 114 | 117 | 99 | ||||||||||||||||||||||||

| Total costs of operations | 334 | 339 | 344 | 347 | 333 | ||||||||||||||||||||||||

Selling, general and administrative(c) |

28 | 28 | 28 | 30 | 31 | ||||||||||||||||||||||||

Segment operating profit(d) |

$ | 876 | $ | 875 | $ | 887 | $ | 892 | $ | 863 | |||||||||||||||||||

| COMPANY OVERVIEW |

OUTLOOK | CONSOLIDATED FINANCIALS | CAPITALIZATION OVERVIEW | TOWERS SEGMENT | FIBER SEGMENT | APPENDIX | ||||||||||||||

| TOWERS SEGMENT COMPONENTS OF CHANGES IN SITE RENTAL REVENUES | |||||||||||||||||||||||||||||

| 2022 | 2023 | ||||||||||||||||||||||||||||

| (dollars in millions) | Q1 | Q2 | Q3 | Q4 | Q1 | ||||||||||||||||||||||||

| Components of changes in site rental revenues: | |||||||||||||||||||||||||||||

Prior year site rental billings(a) |

$ | 827 | $ | 830 | $ | 853 | $ | 866 | $ | 879 | |||||||||||||||||||

Core leasing activity(a) |

41 | 37 | 42 | 40 | 32 | ||||||||||||||||||||||||

| Escalators | 23 | 20 | 28 | 25 | 22 | ||||||||||||||||||||||||

Non-renewals(a) |

(12) | (10) | (9) | (10) | (8) | ||||||||||||||||||||||||

Organic Contribution to Site Rental Billings(a) |

52 | 47 | 61 | 55 | 46 | ||||||||||||||||||||||||

| Straight-lined revenues | 116 | 120 | 89 | 84 | 83 | ||||||||||||||||||||||||

| Amortization of prepaid rent | 79 | 80 | 80 | 80 | 72 | ||||||||||||||||||||||||

Acquisitions(b) |

1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||

| Other | — | — | — | — | — | ||||||||||||||||||||||||

| Total site rental revenues | $ | 1,075 | $ | 1,078 | $ | 1,084 | $ | 1,086 | $ | 1,081 | |||||||||||||||||||

| Year-over-year changes in revenues: | |||||||||||||||||||||||||||||

| Site rental revenues | 20.0 | % | 13.2 | % | 11.5 | % | 10.3 | % | 0.6 | % | |||||||||||||||||||

| Changes in revenues as a percentage of prior year site rental billings: | |||||||||||||||||||||||||||||

Organic Contribution to Site Rental Billings(a) |

6.4 | % | 5.7 | % | 7.2 | % | 6.2 | % | 5.2 | % | |||||||||||||||||||

TOWERS SEGMENT SUMMARY OF CAPITAL EXPENDITURES(a) | |||||||||||||||||||||||||||||

| 2022 | 2023 | ||||||||||||||||||||||||||||

| (in millions) | Q1 | Q2 | Q3 | Q4 | Q1 | ||||||||||||||||||||||||

| Discretionary capital expenditures: | |||||||||||||||||||||||||||||

| Communications infrastructure improvements and other capital projects | $ | 35 | $ | 27 | $ | 30 | $ | 29 | $ | 33 | |||||||||||||||||||

| Purchases of land interests | 10 | 15 | 12 | 16 | 15 | ||||||||||||||||||||||||

| Total discretionary capital expenditures | 45 | 42 | 42 | 45 | 48 | ||||||||||||||||||||||||

| Sustaining capital expenditures | 2 | 3 | 3 | 3 | 2 | ||||||||||||||||||||||||

| Total capital expenditures | 47 | 45 | 45 | 48 | 50 | ||||||||||||||||||||||||

Less: Prepaid rent additions(c) |

22 | 23 | 20 | 23 | 22 | ||||||||||||||||||||||||

| Capital expenditures less prepaid rent additions | $ | 25 | $ | 22 | $ | 25 | $ | 25 | $ | 28 | |||||||||||||||||||

| COMPANY OVERVIEW |

OUTLOOK | CONSOLIDATED FINANCIALS | CAPITALIZATION OVERVIEW | TOWERS SEGMENT | FIBER SEGMENT | APPENDIX | ||||||||||||||

| TOWER PORTFOLIO HIGHLIGHTS | |||||

(as of March 31, 2023) |

|||||

Number of towers (in thousands)(a) |

40 | ||||

| Average number of tenants per tower | 2.4 | ||||

Remaining contracted tenant receivables (in billions)(b) |

$ | 34 | |||

Weighted average remaining tenant contract term (years)(b)(c) |

6 | ||||

| Percent of towers in the Top 50 / 100 Basic Trading Areas | 56% / 71% | ||||

Percent of ground leased / owned(d) |

59% / 41% | ||||

Weighted average maturity of ground leases (years)(d)(e) |

36 | ||||

TOWERS SEGMENT CASH YIELD ON INVESTED CAPITAL(f) | |||||||||||

(as of March 31, 2023; dollars in millions) |

Q1 2023 LQA |

Q1 2022 LQA | |||||||||

Segment site rental gross margin(g) |

$ | 3,388 | $ | 3,400 | |||||||

| Less: Amortization of prepaid rent | (288) | (316) | |||||||||

| Less: Straight-lined revenues | (332) | (464) | |||||||||

| Add: Straight-lined expenses | 68 | 76 | |||||||||

| Numerator | $ | 2,836 | $ | 2,696 | |||||||

Segment net investment in property and equipment(h) |

$ | 13,352 | $ | 13,142 | |||||||

| Segment investment in site rental contracts and tenant relationships | 4,572 | 4,568 | |||||||||

Segment investment in goodwill(i) |

5,351 | 5,351 | |||||||||

Segment Net Invested Capital(f) |

$ | 23,275 | $ | 23,061 | |||||||

Segment Cash Yield on Invested Capital(f) |

12.2 | % | 11.7 | % | |||||||

SUMMARY OF TOWER PORTFOLIO BY VINTAGE(j) | ||||||||||||||

(as of March 31, 2023; dollars in thousands) |

Acquired and Built 2006 and Prior | Acquired and Built 2007 to Present | ||||||||||||

Cash yield(k) |

20 | % | 9 | % | ||||||||||

| Number of tenants per tower | 3.0 | 2.2 | ||||||||||||

Last quarter annualized average cash site rental revenue per tower(l) |

$ | 132 | $ | 77 | ||||||||||

Last quarter annualized average site rental gross cash margin per tower(m) |

$ | 113 | $ | 54 | ||||||||||

Net invested capital per tower(n) |

$ | 553 | $ | 579 | ||||||||||

| Number of towers | 11,210 | 28,895 | ||||||||||||

| COMPANY OVERVIEW |

OUTLOOK | CONSOLIDATED FINANCIALS | CAPITALIZATION OVERVIEW | TOWERS SEGMENT | FIBER SEGMENT | APPENDIX | ||||||||||||||

| GROUND INTEREST OVERVIEW | |||||||||||||||||||||||

(as of March 31, 2023; dollars in millions) |

LQA Cash Site Rental Revenues(a) |

Percentage of LQA Cash Site Rental Revenues(a) |

LQA Towers Segment Site Rental Gross Cash Margin(b) |

Percentage of LQA Towers Segment Site Rental Gross Cash Margin(b) |

Number of Towers(c) |

Percentage of Towers | Weighted Average Term Remaining (by years)(d) |

||||||||||||||||

| Less than 10 years | $ | 403 | 11 | % | $ | 212 | 8 | % | 5,476 | 14 | % | ||||||||||||

| 10 to 20 years | 514 | 14 | % | 318 | 11 | % | 5,972 | 15 | % | ||||||||||||||

| Greater than 20 years | 1,546 | 42 | % | 1,122 | 40 | % | 17,227 | 43 | % | ||||||||||||||

| Total leased | $ | 2,463 | 67 | % | $ | 1,652 | 59 | % | 28,675 | 72 | 36 | ||||||||||||

| Owned | $ | 1,240 | 33 | % | $ | 1,162 | 41 | % | 11,430 | 28 | % | ||||||||||||

| Total / Average | $ | 3,703 | 100 | % | $ | 2,814 | 100 | % | 40,105 | 100 | % | ||||||||||||

| COMPANY OVERVIEW |

OUTLOOK | CONSOLIDATED FINANCIALS | CAPITALIZATION OVERVIEW | TOWERS SEGMENT | FIBER SEGMENT | APPENDIX | ||||||||||||||

| FIBER SEGMENT SUMMARY FINANCIAL HIGHLIGHTS | |||||||||||||||||||||||||||||

| 2022 | 2023 | ||||||||||||||||||||||||||||

| (in millions) | Q1 | Q2 | Q3 | Q4 | Q1 | ||||||||||||||||||||||||

| Segment net revenues: | |||||||||||||||||||||||||||||

| Site rental | |||||||||||||||||||||||||||||

Site rental billings(a) |

$ | 439 | $ | 426 | $ | 423 | $ | 426 | $ | 478 | |||||||||||||||||||

| Amortization of prepaid rent | 62 | 63 | 60 | 65 | 65 | ||||||||||||||||||||||||

| Straight-lined revenues | — | — | 1 | 1 | — | ||||||||||||||||||||||||

| Total site rental | 501 | 489 | 484 | 492 | 543 | ||||||||||||||||||||||||

| Services and other | 3 | 3 | 3 | 3 | 3 | ||||||||||||||||||||||||

| Net revenues | 504 | 492 | 487 | 495 | 546 | ||||||||||||||||||||||||

| Segment operating expenses | |||||||||||||||||||||||||||||

Costs of operations(b) |

|||||||||||||||||||||||||||||

| Site rental exclusive of straight-lined expenses | 162 | 162 | 166 | 161 | 172 | ||||||||||||||||||||||||

| Straight-lined expenses | — | — | — | — | — | ||||||||||||||||||||||||

| Total site rental | 162 | 162 | 166 | 161 | 172 | ||||||||||||||||||||||||

| Services and other | 2 | 2 | 3 | 2 | 2 | ||||||||||||||||||||||||

| Total costs of operations | 164 | 164 | 169 | 163 | 174 | ||||||||||||||||||||||||

Selling, general and administrative(c) |

47 | 46 | 47 | 50 | 49 | ||||||||||||||||||||||||

Segment operating profit(d) |

$ | 293 | $ | 282 | $ | 271 | $ | 282 | $ | 323 | |||||||||||||||||||

| COMPANY OVERVIEW |

OUTLOOK | CONSOLIDATED FINANCIALS | CAPITALIZATION OVERVIEW | TOWERS SEGMENT | FIBER SEGMENT | APPENDIX | ||||||||||||||

| FIBER SEGMENT COMPONENTS OF CHANGES IN SITE RENTAL REVENUES | |||||||||||||||||||||||||||||

| 2022 | 2023 | ||||||||||||||||||||||||||||

| (dollars in millions) | Q1 | Q2 | Q3 | Q4 | Q1 | ||||||||||||||||||||||||

| Components of changes in site rental revenues: | |||||||||||||||||||||||||||||

Prior year site rental billings(a) |

$ | 416 | $ | 415 | $ | 417 | $ | 424 | $ | 439 | |||||||||||||||||||

Core leasing activity(a) |

51 | 38 | 37 | 33 | 25 | ||||||||||||||||||||||||

| Escalators | 2 | 2 | 2 | 2 | 2 | ||||||||||||||||||||||||

Non-renewals(a) |

(30) | (29) | (33) | (33) | (34) | ||||||||||||||||||||||||

Organic Contribution to Site Rental Billings Adjusted for Impact of Sprint Cancellations(a) |

23 | 11 | 6 | 2 | (7) | ||||||||||||||||||||||||

Payments for Sprint Cancellations(b) |

— | — | — | — | 48 | ||||||||||||||||||||||||

Non-renewals associated with Sprint Cancellations(b) |

— | — | — | — | (2) | ||||||||||||||||||||||||

Organic Contribution to Site Rental Billings(a) |

23 | 11 | 6 | 2 | 39 | ||||||||||||||||||||||||

| Straight-lined revenues | — | — | 1 | 1 | — | ||||||||||||||||||||||||

| Amortization of prepaid rent | 62 | 63 | 60 | 65 | 65 | ||||||||||||||||||||||||

Acquisitions(c) |

— | — | — | — | — | ||||||||||||||||||||||||

| Other | — | — | — | — | — | ||||||||||||||||||||||||

| Total site rental revenues | $ | 501 | $ | 489 | $ | 484 | $ | 492 | $ | 543 | |||||||||||||||||||

| Year-over-year changes in revenues: | |||||||||||||||||||||||||||||

| Site rental revenues | 5.7 | % | 3.4 | % | 1.0 | % | 0.6 | % | 8.4 | % | |||||||||||||||||||

| Changes in revenues as a percentage of prior year site rental billings: | |||||||||||||||||||||||||||||

Organic Contribution to Site Rental Billings Adjusted for Impact of Sprint Cancellations(a) |

5.5 | % | 2.9 | % | 1.5 | % | 0.5 | % | (1.6) | % | |||||||||||||||||||

Organic Contribution to Site Rental Billings(a) |

5.5 | % | 2.9 | % | 1.5 | % | 0.5 | % | 8.8 | % | |||||||||||||||||||

FIBER SEGMENT SUMMARY OF CAPITAL EXPENDITURES(a) | |||||||||||||||||||||||||||||

| 2022 | 2023 | ||||||||||||||||||||||||||||

| (in millions) | Q1 | Q2 | Q3 | Q4 | Q1 | ||||||||||||||||||||||||

| Discretionary capital expenditures: | |||||||||||||||||||||||||||||

| Communications infrastructure improvements and other capital projects | $ | 209 | $ | 235 | $ | 267 | $ | 307 | $ | 272 | |||||||||||||||||||

| Purchases of land interests | — | — | — | — | — | ||||||||||||||||||||||||

| Total discretionary capital expenditures | 209 | 235 | 267 | 307 | 272 | ||||||||||||||||||||||||

| Sustaining capital expenditures | 13 | 12 | 10 | 6 | 7 | ||||||||||||||||||||||||

| Total capital expenditures | 222 | 247 | 277 | 313 | 279 | ||||||||||||||||||||||||

Less: Prepaid rent additions(d) |

50 | 39 | 43 | 76 | 59 | ||||||||||||||||||||||||

| Capital expenditures less prepaid rent additions | $ | 172 | $ | 208 | $ | 234 | $ | 237 | $ | 220 | |||||||||||||||||||

| COMPANY OVERVIEW |

OUTLOOK | CONSOLIDATED FINANCIALS | CAPITALIZATION OVERVIEW | TOWERS SEGMENT | FIBER SEGMENT | APPENDIX | ||||||||||||||

| FIBER SEGMENT REVENUE DETAIL BY LINE OF BUSINESS | |||||||||||||||||||||||||||||

| 2022 | 2023 | ||||||||||||||||||||||||||||

| (dollars in millions) | Q1 | Q2 | Q3 | Q4 | Q1 | ||||||||||||||||||||||||

| Small Cells | |||||||||||||||||||||||||||||

| Site rental revenues: | |||||||||||||||||||||||||||||

Site rental billings(a) |

$ | 108 | $ | 108 | $ | 109 | $ | 111 | $ | 113 | |||||||||||||||||||

| Amortization of prepaid rent | 47 | 48 | 45 | 50 | 48 | ||||||||||||||||||||||||

| Straight-lined revenues | — | — | — | — | (1) | ||||||||||||||||||||||||

| Total site rental revenues | 155 | 156 | 154 | 161 | 160 | ||||||||||||||||||||||||

| Services and other revenues | 3 | 2 | 2 | 3 | 3 | ||||||||||||||||||||||||

| Net revenues | $ | 158 | $ | 158 | $ | 156 | $ | 164 | $ | 163 | |||||||||||||||||||

| Components of changes in site rental revenues: | |||||||||||||||||||||||||||||

Prior year site rental billings(a) |

$ | 100 | $ | 100 | $ | 104 | $ | 109 | $ | 108 | |||||||||||||||||||

Core leasing activity(a) |

7 | 8 | 5 | 3 | 6 | ||||||||||||||||||||||||

| Escalators | 2 | 2 | 2 | 2 | 2 | ||||||||||||||||||||||||

Non-renewals(a) |

(1) | (2) | (2) | (3) | (3) | ||||||||||||||||||||||||

Organic Contribution to Site Rental Billings(a) |

8 | 8 | 5 | 2 | 5 | ||||||||||||||||||||||||

| Straight-lined revenues | — | — | — | — | (1) | ||||||||||||||||||||||||

| Amortization of prepaid rent | 47 | 48 | 45 | 50 | 48 | ||||||||||||||||||||||||

Acquisitions(b) |

— | — | — | — | — | ||||||||||||||||||||||||

| Other | — | — | — | — | — | ||||||||||||||||||||||||

| Total site rental revenues | $ | 155 | $ | 156 | $ | 154 | $ | 161 | $ | 160 | |||||||||||||||||||

| Year-over-year changes in revenues: | |||||||||||||||||||||||||||||

| Site rental revenues | 8.4 | % | 8.3 | % | 1.3 | % | 1.9 | % | 3.2 | % | |||||||||||||||||||

| Changes in revenues as a percentage of prior year site rental billings: | |||||||||||||||||||||||||||||

Organic Contribution to Site Rental Billings(a) |

7.3 | % | 8.2 | % | 4.1 | % | 2.2 | % | 4.5 | % | |||||||||||||||||||

| COMPANY OVERVIEW |

OUTLOOK | CONSOLIDATED FINANCIALS | CAPITALIZATION OVERVIEW | TOWERS SEGMENT | FIBER SEGMENT | APPENDIX | ||||||||||||||

| FIBER SEGMENT REVENUE DETAIL BY LINE OF BUSINESS CONTINUED | |||||||||||||||||||||||||||||

| 2022 | 2023 | ||||||||||||||||||||||||||||

| (dollars in millions) | Q1 | Q2 | Q3 | Q4 | Q1 | ||||||||||||||||||||||||

| Fiber Solutions | |||||||||||||||||||||||||||||

| Site rental revenues: | |||||||||||||||||||||||||||||

Site rental billings(a) |

$ | 331 | $ | 318 | $ | 314 | $ | 315 | $ | 365 | |||||||||||||||||||

| Amortization of prepaid rent | 15 | 15 | 15 | 15 | 17 | ||||||||||||||||||||||||

| Straight-lined revenues | — | — | 1 | 1 | 1 | ||||||||||||||||||||||||

| Total site rental revenues | 346 | 333 | 330 | 331 | 383 | ||||||||||||||||||||||||

| Services and other revenues | — | 1 | 1 | — | — | ||||||||||||||||||||||||

| Net revenues | $ | 346 | $ | 334 | $ | 331 | $ | 331 | $ | 383 | |||||||||||||||||||

| Components of changes in site rental revenues: | |||||||||||||||||||||||||||||

Prior year site rental billings(a) |

$ | 315 | $ | 314 | $ | 312 | $ | 315 | $ | 331 | |||||||||||||||||||

Core leasing activity(a) |

45 | 31 | 33 | 30 | 19 | ||||||||||||||||||||||||

| Escalators | — | — | — | — | — | ||||||||||||||||||||||||

Non-renewals(a) |

(29) | (27) | (31) | (30) | (31) | ||||||||||||||||||||||||

Organic Contribution to Site Rental Billings Adjusted for Impact of Sprint Cancellations(a) |

16 | 4 | 2 | — | (12) | ||||||||||||||||||||||||

Payments for Sprint Cancellations(b) |

— | — | — | — | 48 | ||||||||||||||||||||||||

Non-renewals associated with Sprint Cancellations(b) |

— | — | — | — | (2) | ||||||||||||||||||||||||

Organic Contribution to Site Rental Billings(a) |

16 | 4 | 2 | — | 34 | ||||||||||||||||||||||||

| Straight-lined revenues | — | — | 1 | 1 | 1 | ||||||||||||||||||||||||

| Amortization of prepaid rent | 15 | 15 | 15 | 15 | 17 | ||||||||||||||||||||||||

Acquisitions(c) |

— | — | — | — | — | ||||||||||||||||||||||||

| Other | — | — | — | — | — | ||||||||||||||||||||||||

| Total site rental revenues | $ | 346 | $ | 333 | $ | 330 | $ | 331 | $ | 383 | |||||||||||||||||||

| Year-over-year changes in revenues: | |||||||||||||||||||||||||||||

| Site rental revenues | 4.5 | % | 1.2 | % | 0.9 | % | — | % | 10.7 | % | |||||||||||||||||||

| Changes in revenues as a percentage of prior year site rental billings: | |||||||||||||||||||||||||||||

Organic Contribution to Site Rental Billings Adjusted for Impact of Sprint Cancellations(a) |

4.9 | % | 1.2 | % | 0.7 | % | — | % | (3.6) | % | |||||||||||||||||||

Organic Contribution to Site Rental Billings(a) |

4.9 | % | 1.2 | % | 0.7 | % | — | % | 10.2 | % | |||||||||||||||||||

| COMPANY OVERVIEW |

OUTLOOK | CONSOLIDATED FINANCIALS | CAPITALIZATION OVERVIEW | TOWERS SEGMENT | FIBER SEGMENT | APPENDIX | ||||||||||||||

| FIBER SEGMENT PORTFOLIO HIGHLIGHTS | |||||

(as of March 31, 2023) |

|||||

| Number of route miles of fiber (in thousands) | 85 | ||||

| Number of small cells on air or under contract (in thousands) | 120 | ||||

Remaining contracted tenant receivables (in billions)(a) |

$ | 5 | |||

Weighted average remaining tenant contract term (years)(a)(b) |

3 | ||||

FIBER SEGMENT CASH YIELD ON INVESTED CAPITAL(c) | |||||||||||

(as of March 31, 2023; dollars in millions) |

Q1 2023 LQA |

Q1 2022 LQA | |||||||||

Segment site rental gross margin(d) |

$ | 1,484 | $ | 1,356 | |||||||

| Less: Amortization of prepaid rent | (260) | (248) | |||||||||

| Less: Straight-lined revenues | — | — | |||||||||

| Add: Straight-lined expenses | — | — | |||||||||

Add: Indirect labor costs(e) |

100 | 100 | |||||||||

| Numerator | $ | 1,324 | $ | 1,208 | |||||||

Segment net investment in property and equipment(f) |

$ | 8,896 | $ | 8,163 | |||||||

| Segment investment in site rental contracts and tenant relationships | 3,290 | 3,287 | |||||||||

Segment investment in goodwill(g) |

4,080 | 4,073 | |||||||||

Segment Net Invested Capital(c) |

$ | 16,266 | $ | 15,523 | |||||||

Segment Cash Yield on Invested Capital(c) |

8.1 | % | 7.8 | % | |||||||

| FIBER SOLUTIONS REVENUE MIX | |||||

(as of March 31, 2023) |

Percentage of Q1 2023 LQA Site Rental Revenues |

||||

Carrier(h) |

39% | ||||

| Education | 13% | ||||

| Healthcare | 10% | ||||

| Financial Services | 7% | ||||

| Other | 31% | ||||

| Total | 100% | ||||

| COMPANY OVERVIEW |

OUTLOOK | CONSOLIDATED FINANCIALS | CAPITALIZATION OVERVIEW | TOWERS SEGMENT | FIBER SEGMENT | APPENDIX | ||||||||||||||

| CONDENSED CONSOLIDATED BALANCE SHEET (Unaudited) | |||||||||||

| (in millions, except par values) | March 31, 2023 | December 31, 2022 | |||||||||

| ASSETS | |||||||||||

| Current assets: | |||||||||||

| Cash and cash equivalents | $ | 187 | $ | 156 | |||||||

| Restricted cash | 196 | 166 | |||||||||

| Receivables, net | 565 | 593 | |||||||||

| Prepaid expenses | 159 | 102 | |||||||||

| Deferred site rental receivables | 125 | 127 | |||||||||

| Other current assets | 93 | 73 | |||||||||

| Total current assets | 1,325 | 1,217 | |||||||||

| Deferred site rental receivables | 2,040 | 1,954 | |||||||||

| Property and equipment, net | 15,492 | 15,407 | |||||||||

| Operating lease right-of-use assets | 6,482 | 6,526 | |||||||||

| Goodwill | 10,085 | 10,085 | |||||||||

| Site rental contracts and tenant relationships | 3,436 | 3,535 | |||||||||