1 PRESS RELEASE FOR EAGLE BANCORP, INC. IMMEDIATE RELEASE CONTACT: Eric R. Newell October 22, 2025 240.497.1796 EAGLE BANCORP, INC. ANNOUNCES THIRD QUARTER 2025 RESULTS AND CASH DIVIDEND BETHESDA, MD, Eagle Bancorp, Inc. ("Eagle" or the "Company") (NASDAQ: EGBN), the Bethesda-based holding company for EagleBank, one of the largest community banks in the Washington D.C. area, reported its unaudited results for the third quarter ended September 30, 2025. Eagle reported a net loss of $67.5 million or $2.22 per share for the third quarter 2025, compared to a net loss of $69.8 million or $2.30 per share for the second quarter. The $2.3 million improvement in the net loss from the prior quarter is primarily due to a $24.9 million decrease in provision expense, offset by a $22.5 million reduction in the tax benefit. In the quarter, net interest income increased $383 thousand, noninterest income decreased $3.9 million, and noninterest expenses decreased $1.6 million. Pre-provision net revenue ("PPNR")1 in the third quarter was $28.8 million compared to $30.7 million for the prior quarter. The decrease is primarily due to a $3.6 million loss on sale of loans in the third quarter. "We continued to execute our strategy to resolve asset quality challenges within the loan portfolio," said Susan G. Riel, Chair, President, and Chief Executive Officer of the Company. "The credit costs recognized this quarter reflect our commitment to managing credit risk with discipline and accountability. Following an independent review of our loan portfolio and expanded supplemental internal analysis, we took actions to reduce valuation risk in the office portfolio." Ms. Riel added, “The core franchise remains sound and resilient. Our capital, liquidity, and customer relationships continue to provide a strong foundation as we move through this cycle and toward a more normalized earnings environment.” 1 A reconciliation of non-GAAP financial measures and the nearest GAAP measures is provided in the GAAP Reconciliation to Non-GAAP Financial Measures tables that accompany this document.

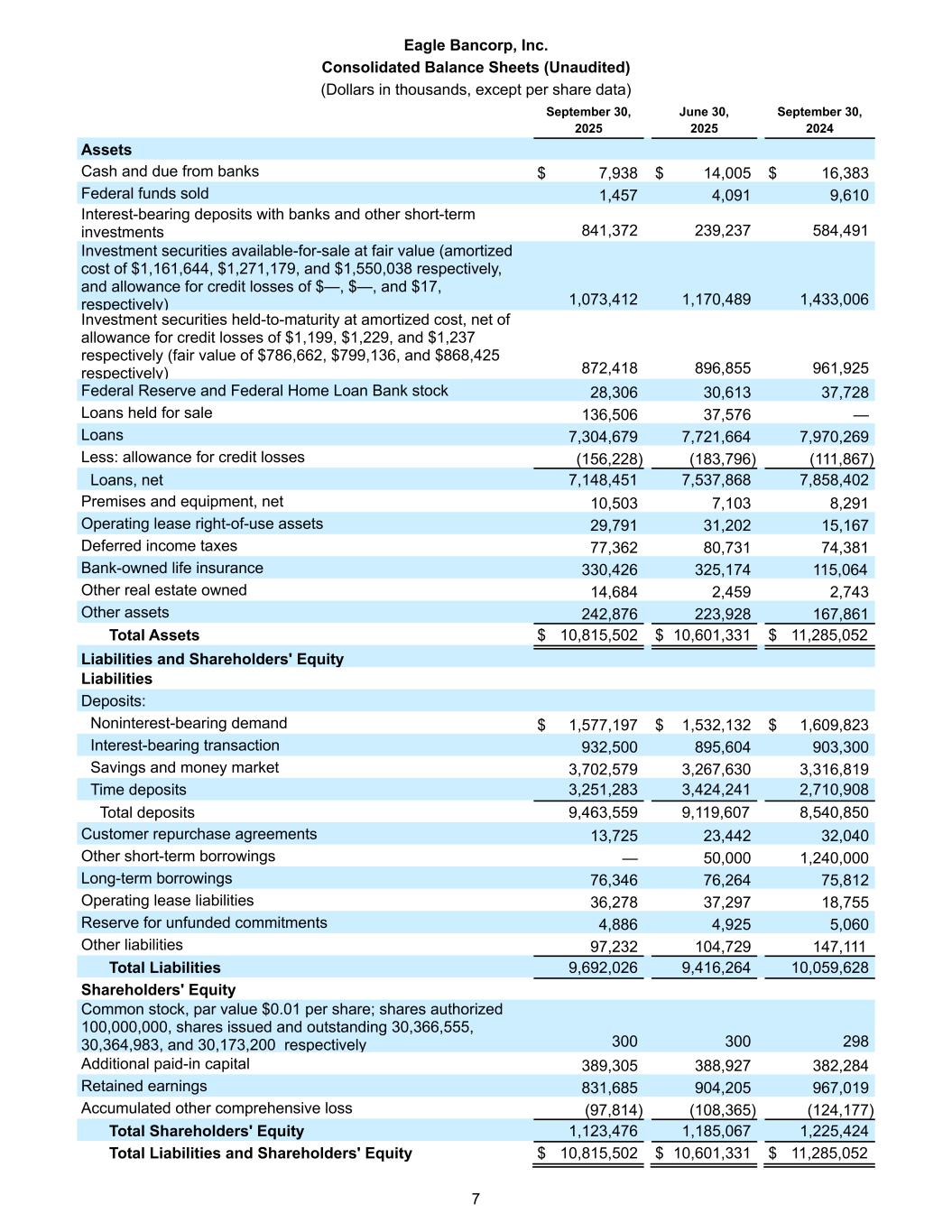

2 Additionally, the Company is announcing today a cash dividend in the amount of $0.01 per share. The cash dividend will be payable on November 14, 2025 to shareholders of record on November 3, 2025. Third Quarter of 2025 Key Elements • The Company announces today the declaration of a common stock dividend of $0.01 per share. • Total C&I loans (including owner-occupied) increased $105 million and average C&I deposits increased $134 million, or 8.6% from the previous quarter. • The ACL as a percentage of total loans was 2.14% at quarter-end; down from 2.38% at the prior quarter-end. Performing office coverage2 was 11.36% at quarter-end; as compared to 11.54% at the prior quarter-end. • Nonperforming assets decreased by $95.5 million to $133.3 million as of September 30, 2025, representing 1.23% of total assets, compared to $228.9 million, representing 2.16% of total loans as of June 30, 2025. During the quarter, nonperforming loan inflows totaled $211.8 million. Reductions of $319.6 million reflected charge-offs, loans moved to held for sale, and paydowns. • Substandard and special mention loans totaled $958.5 million at September 30, 2025, compared to $875.4 million in the prior quarter. • Annualized quarterly net charge-offs for the third quarter of 2025 were 7.36% compared to 4.22% for the second quarter of 2025. • The net interest margin ("NIM") increased to 2.43% for the third quarter of 2025, compared to 2.37% for the prior quarter, primarily driven by the reduction in interest earning assets associated with a decline in nonaccrual loan balances in the CRE loan portfolio. • At quarter-end, the common equity ratio, tangible common equity ratio1, and common equity tier 1 capital (to risk-weighted assets) ratio were 10.39%, 10.39%, and 13.58%, respectively. • Total estimated insured deposits increased at quarter-end to $7.2 billion, representing 75.6% of deposits, compared to $6.8 billion, or 75.0% in the prior quarter. • Total on-balance sheet liquidity and available capacity was $5.3 billion, compared to $2.3 billion in uninsured deposits, resulting in a coverage ratio of over 230%. 1 A reconciliation of non-GAAP financial measures and the nearest GAAP measures is provided in the GAAP Reconciliation to Non-GAAP Financial Measures tables that accompany this document.2 Calculated as the ACL attributable to loans collateralized by performing office properties as a percentage of total loans.

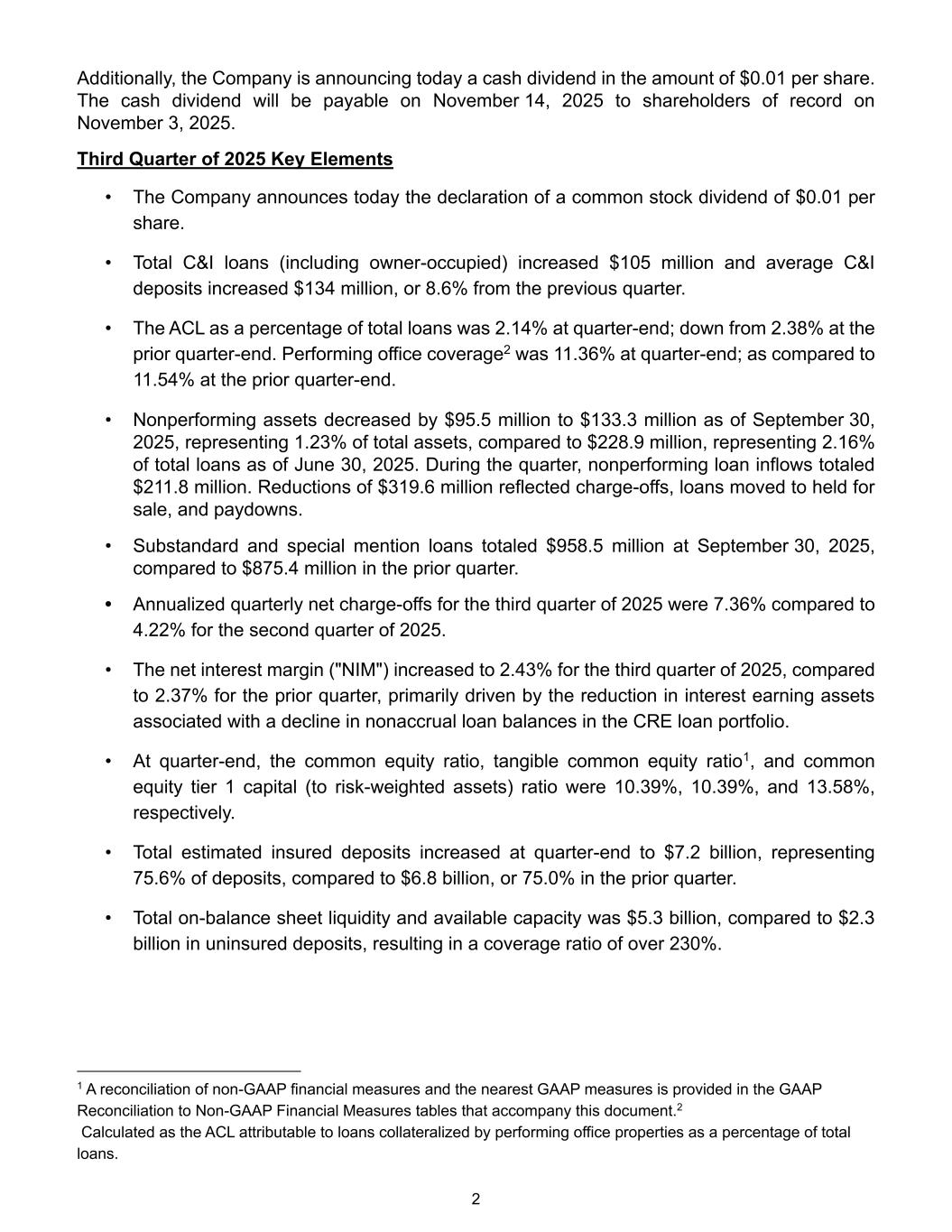

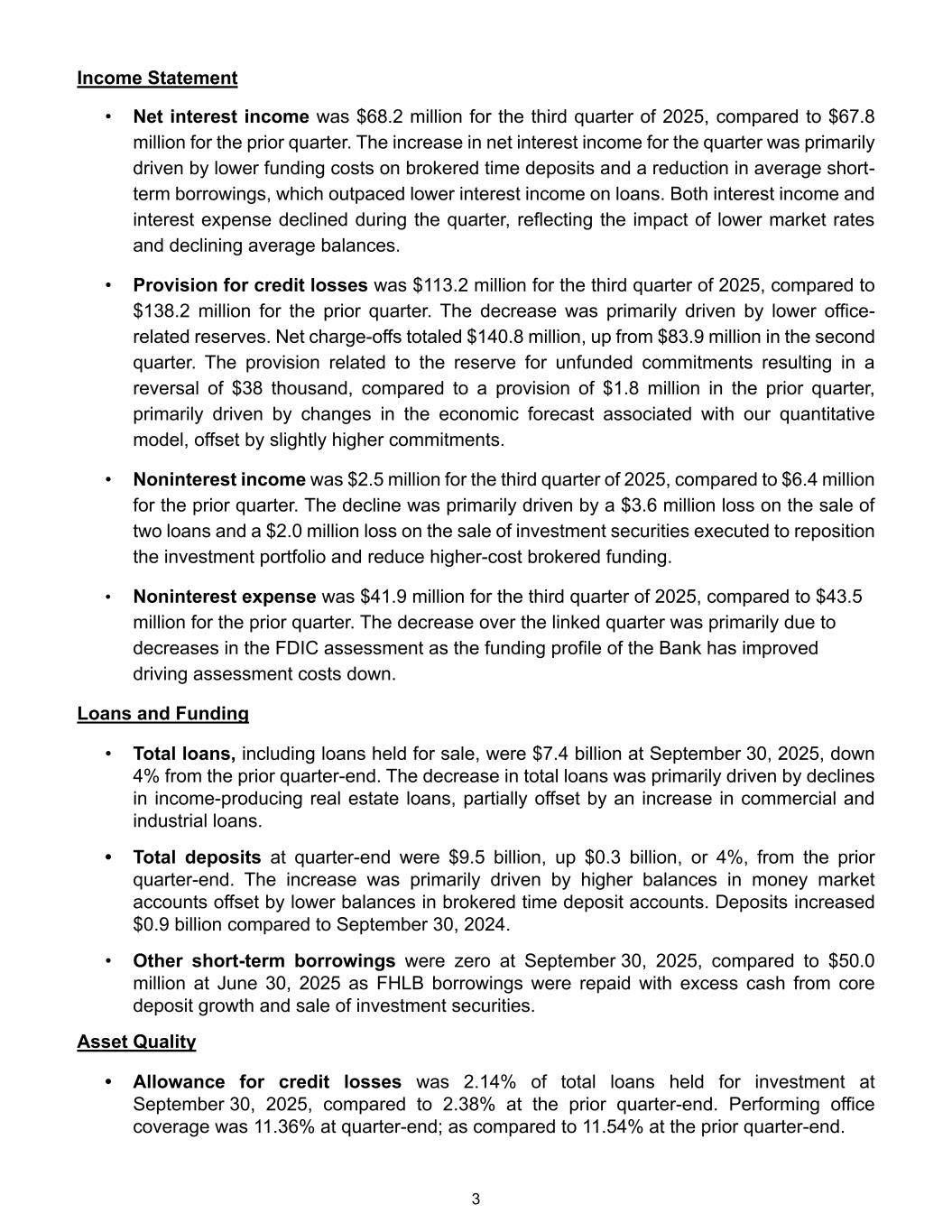

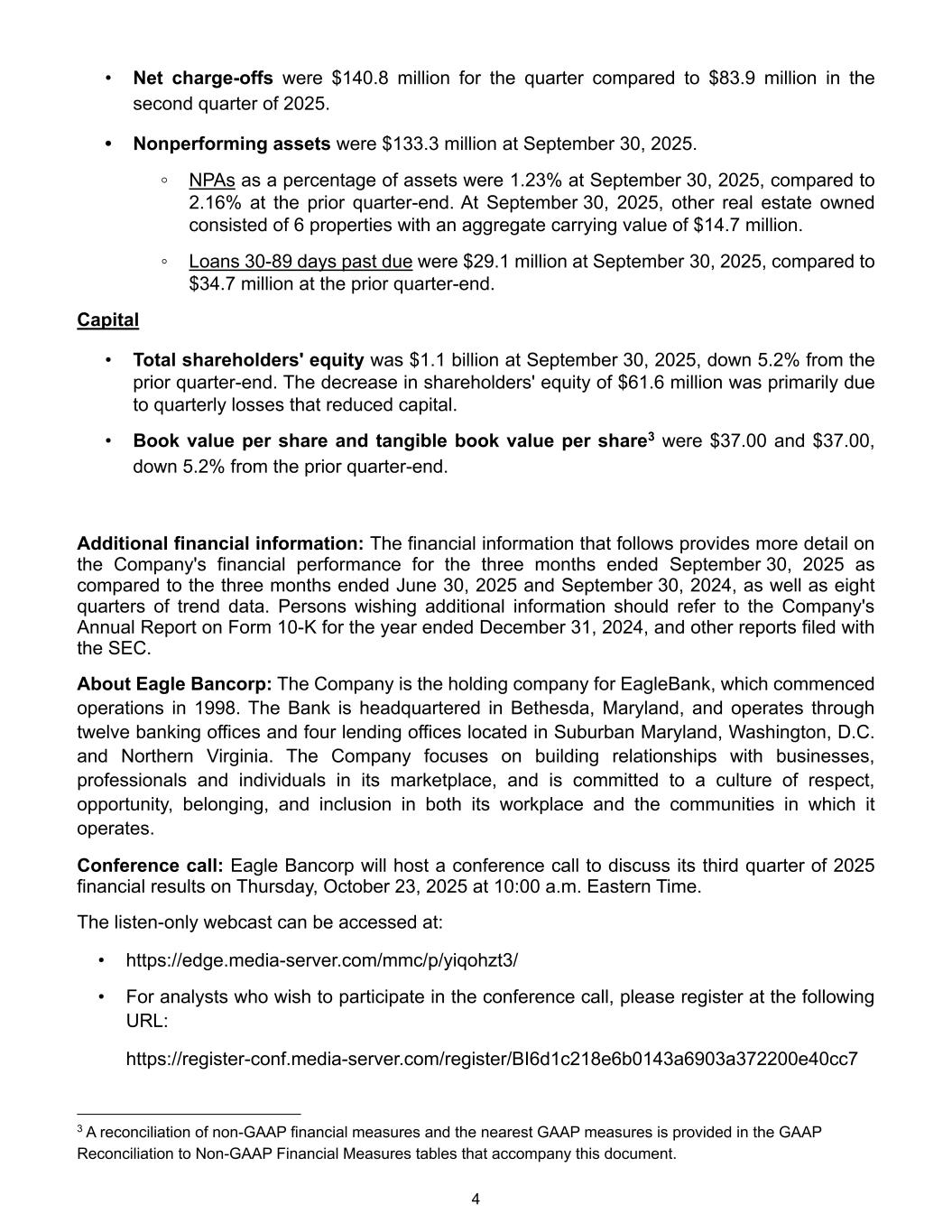

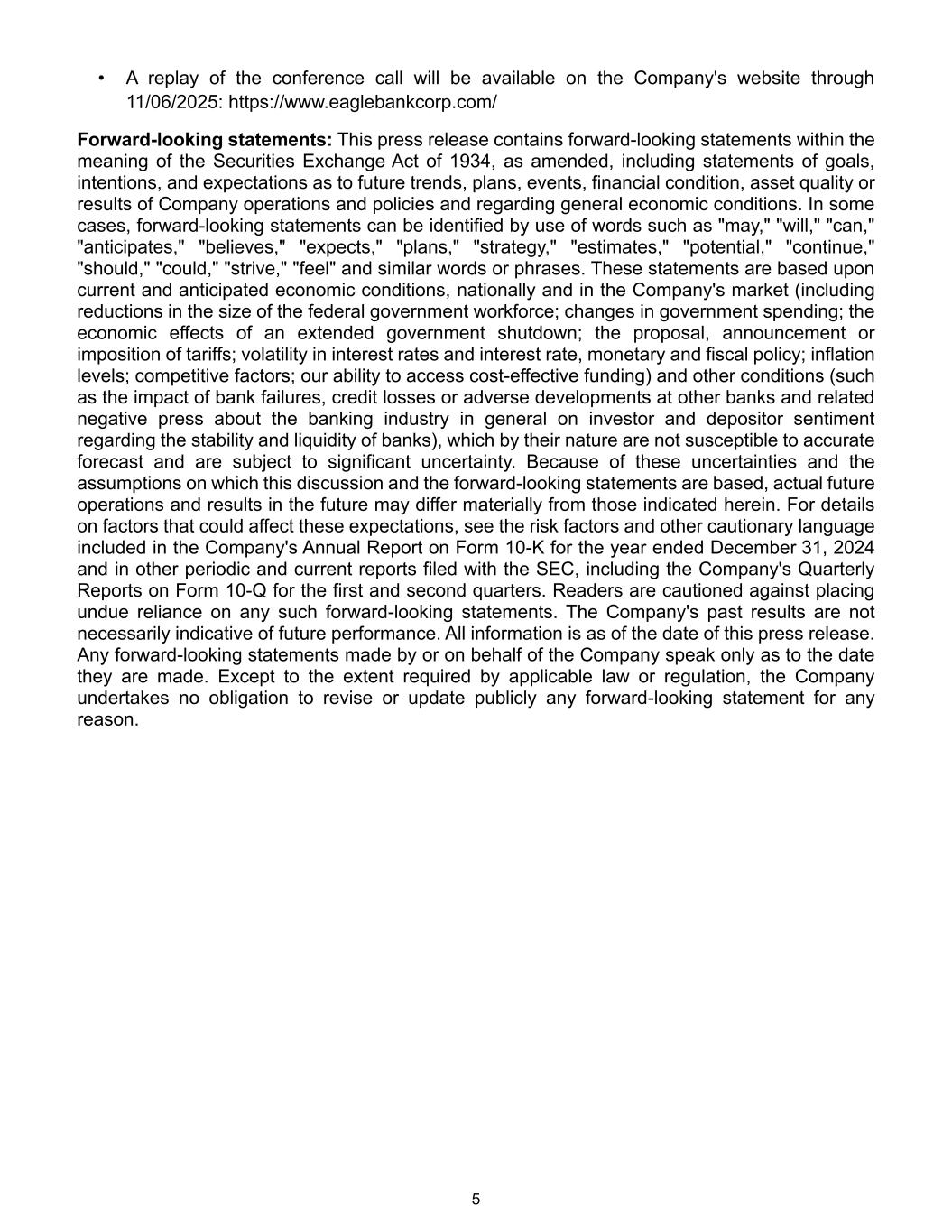

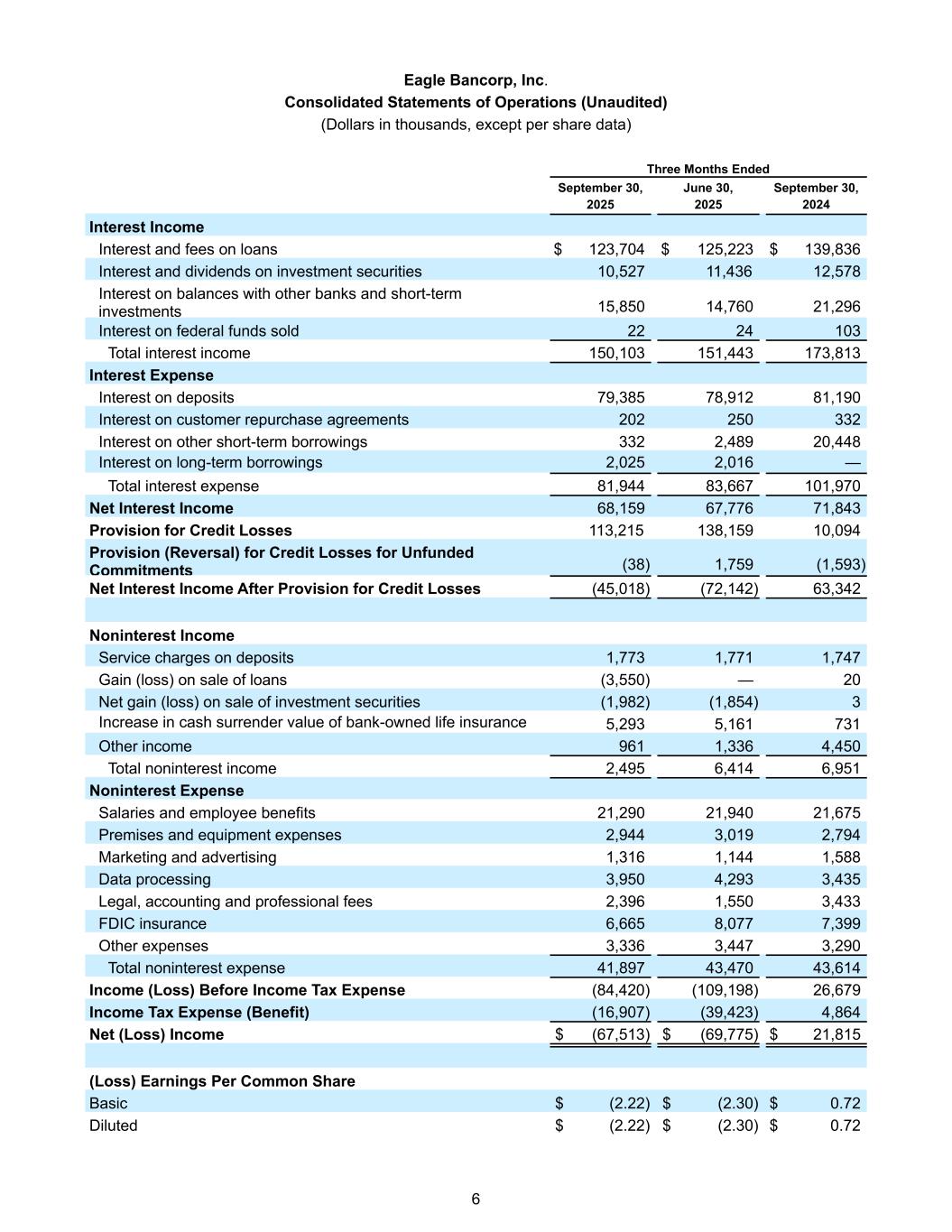

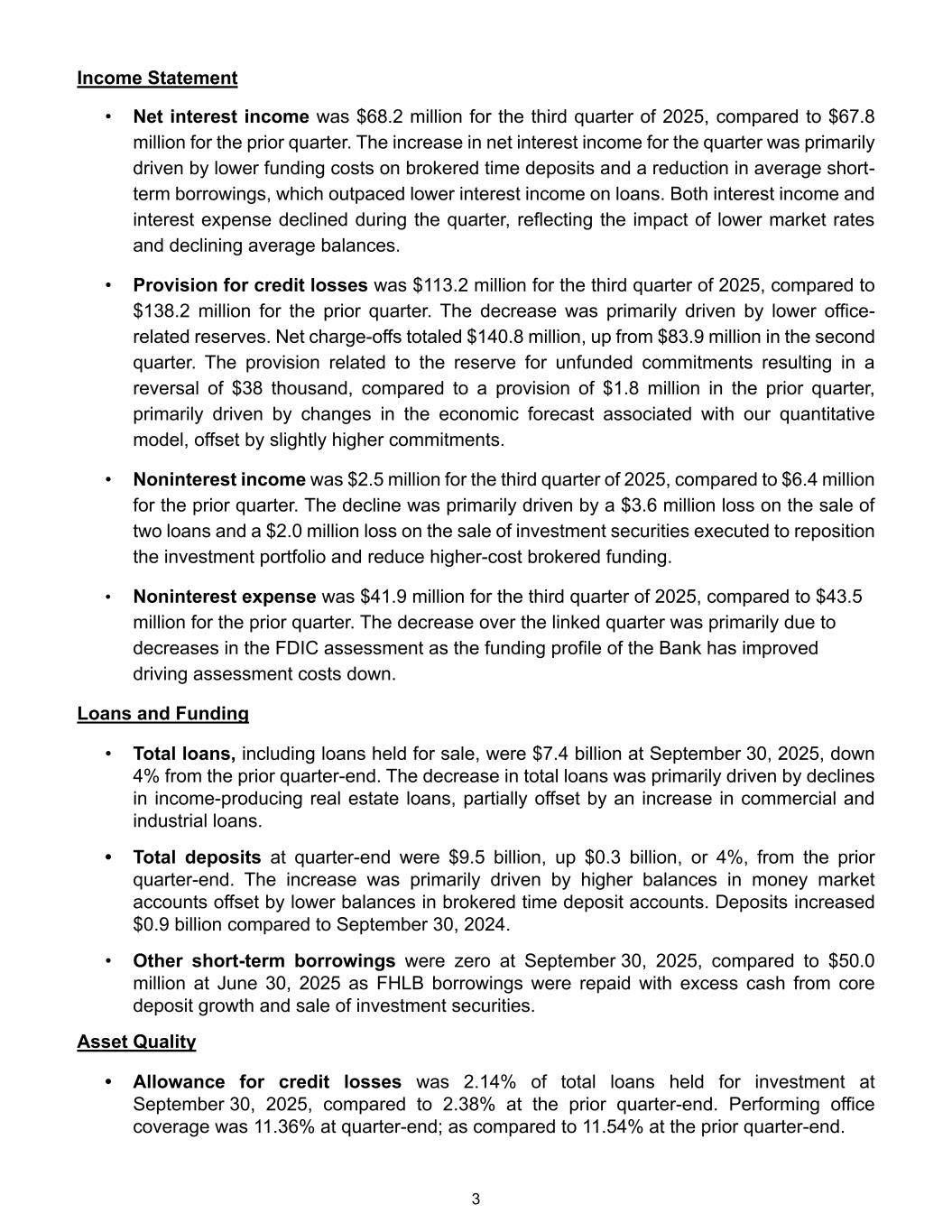

3 Income Statement • Net interest income was $68.2 million for the third quarter of 2025, compared to $67.8 million for the prior quarter. The increase in net interest income for the quarter was primarily driven by lower funding costs on brokered time deposits and a reduction in average short- term borrowings, which outpaced lower interest income on loans. Both interest income and interest expense declined during the quarter, reflecting the impact of lower market rates and declining average balances. • Provision for credit losses was $113.2 million for the third quarter of 2025, compared to $138.2 million for the prior quarter. The decrease was primarily driven by lower office- related reserves. Net charge-offs totaled $140.8 million, up from $83.9 million in the second quarter. The provision related to the reserve for unfunded commitments resulting in a reversal of $38 thousand, compared to a provision of $1.8 million in the prior quarter, primarily driven by changes in the economic forecast associated with our quantitative model, offset by slightly higher commitments. • Noninterest income was $2.5 million for the third quarter of 2025, compared to $6.4 million for the prior quarter. The decline was primarily driven by a $3.6 million loss on the sale of two loans and a $2.0 million loss on the sale of investment securities executed to reposition the investment portfolio and reduce higher-cost brokered funding. • Noninterest expense was $41.9 million for the third quarter of 2025, compared to $43.5 million for the prior quarter. The decrease over the linked quarter was primarily due to decreases in the FDIC assessment as the funding profile of the Bank has improved driving assessment costs down. Loans and Funding • Total loans, including loans held for sale, were $7.4 billion at September 30, 2025, down 4% from the prior quarter-end. The decrease in total loans was primarily driven by declines in income-producing real estate loans, partially offset by an increase in commercial and industrial loans. • Total deposits at quarter-end were $9.5 billion, up $0.3 billion, or 4%, from the prior quarter-end. The increase was primarily driven by higher balances in money market accounts offset by lower balances in brokered time deposit accounts. Deposits increased $0.9 billion compared to September 30, 2024. • Other short-term borrowings were zero at September 30, 2025, compared to $50.0 million at June 30, 2025 as FHLB borrowings were repaid with excess cash from core deposit growth and sale of investment securities. Asset Quality • Allowance for credit losses was 2.14% of total loans held for investment at September 30, 2025, compared to 2.38% at the prior quarter-end. Performing office coverage was 11.36% at quarter-end; as compared to 11.54% at the prior quarter-end.

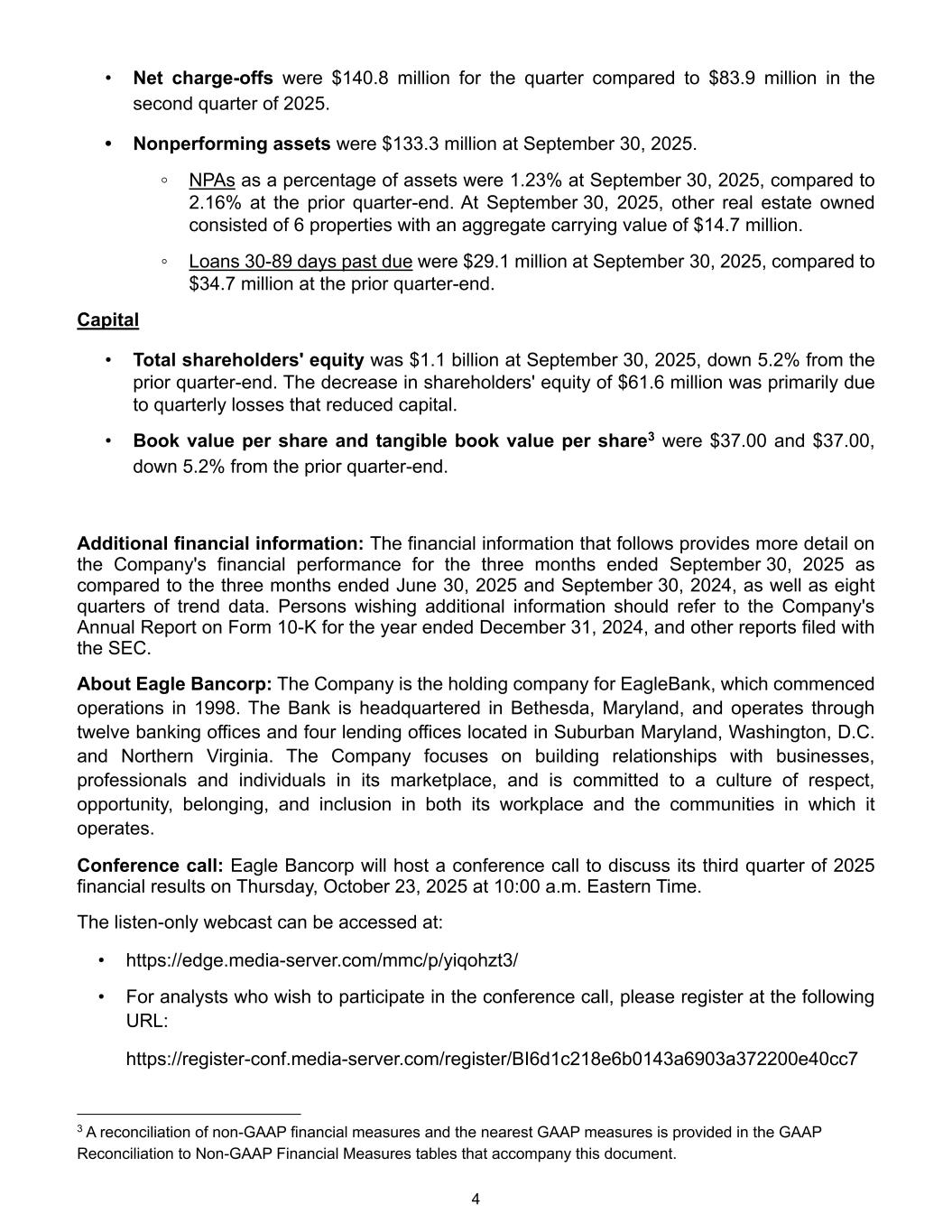

4 • Net charge-offs were $140.8 million for the quarter compared to $83.9 million in the second quarter of 2025. • Nonperforming assets were $133.3 million at September 30, 2025. ◦ NPAs as a percentage of assets were 1.23% at September 30, 2025, compared to 2.16% at the prior quarter-end. At September 30, 2025, other real estate owned consisted of 6 properties with an aggregate carrying value of $14.7 million. ◦ Loans 30-89 days past due were $29.1 million at September 30, 2025, compared to $34.7 million at the prior quarter-end. Capital • Total shareholders' equity was $1.1 billion at September 30, 2025, down 5.2% from the prior quarter-end. The decrease in shareholders' equity of $61.6 million was primarily due to quarterly losses that reduced capital. • Book value per share and tangible book value per share3 were $37.00 and $37.00, down 5.2% from the prior quarter-end. Additional financial information: The financial information that follows provides more detail on the Company's financial performance for the three months ended September 30, 2025 as compared to the three months ended June 30, 2025 and September 30, 2024, as well as eight quarters of trend data. Persons wishing additional information should refer to the Company's Annual Report on Form 10-K for the year ended December 31, 2024, and other reports filed with the SEC. About Eagle Bancorp: The Company is the holding company for EagleBank, which commenced operations in 1998. The Bank is headquartered in Bethesda, Maryland, and operates through twelve banking offices and four lending offices located in Suburban Maryland, Washington, D.C. and Northern Virginia. The Company focuses on building relationships with businesses, professionals and individuals in its marketplace, and is committed to a culture of respect, opportunity, belonging, and inclusion in both its workplace and the communities in which it operates. Conference call: Eagle Bancorp will host a conference call to discuss its third quarter of 2025 financial results on Thursday, October 23, 2025 at 10:00 a.m. Eastern Time. The listen-only webcast can be accessed at: • https://edge.media-server.com/mmc/p/yiqohzt3/ • For analysts who wish to participate in the conference call, please register at the following URL: https://register-conf.media-server.com/register/BI6d1c218e6b0143a6903a372200e40cc7 3 A reconciliation of non-GAAP financial measures and the nearest GAAP measures is provided in the GAAP Reconciliation to Non-GAAP Financial Measures tables that accompany this document.

5 • A replay of the conference call will be available on the Company's website through 11/06/2025: https://www.eaglebankcorp.com/ Forward-looking statements: This press release contains forward-looking statements within the meaning of the Securities Exchange Act of 1934, as amended, including statements of goals, intentions, and expectations as to future trends, plans, events, financial condition, asset quality or results of Company operations and policies and regarding general economic conditions. In some cases, forward-looking statements can be identified by use of words such as "may," "will," "can," "anticipates," "believes," "expects," "plans," "strategy," "estimates," "potential," "continue," "should," "could," "strive," "feel" and similar words or phrases. These statements are based upon current and anticipated economic conditions, nationally and in the Company's market (including reductions in the size of the federal government workforce; changes in government spending; the economic effects of an extended government shutdown; the proposal, announcement or imposition of tariffs; volatility in interest rates and interest rate, monetary and fiscal policy; inflation levels; competitive factors; our ability to access cost-effective funding) and other conditions (such as the impact of bank failures, credit losses or adverse developments at other banks and related negative press about the banking industry in general on investor and depositor sentiment regarding the stability and liquidity of banks), which by their nature are not susceptible to accurate forecast and are subject to significant uncertainty. Because of these uncertainties and the assumptions on which this discussion and the forward-looking statements are based, actual future operations and results in the future may differ materially from those indicated herein. For details on factors that could affect these expectations, see the risk factors and other cautionary language included in the Company's Annual Report on Form 10-K for the year ended December 31, 2024 and in other periodic and current reports filed with the SEC, including the Company's Quarterly Reports on Form 10-Q for the first and second quarters. Readers are cautioned against placing undue reliance on any such forward-looking statements. The Company's past results are not necessarily indicative of future performance. All information is as of the date of this press release. Any forward-looking statements made by or on behalf of the Company speak only as to the date they are made. Except to the extent required by applicable law or regulation, the Company undertakes no obligation to revise or update publicly any forward-looking statement for any reason.

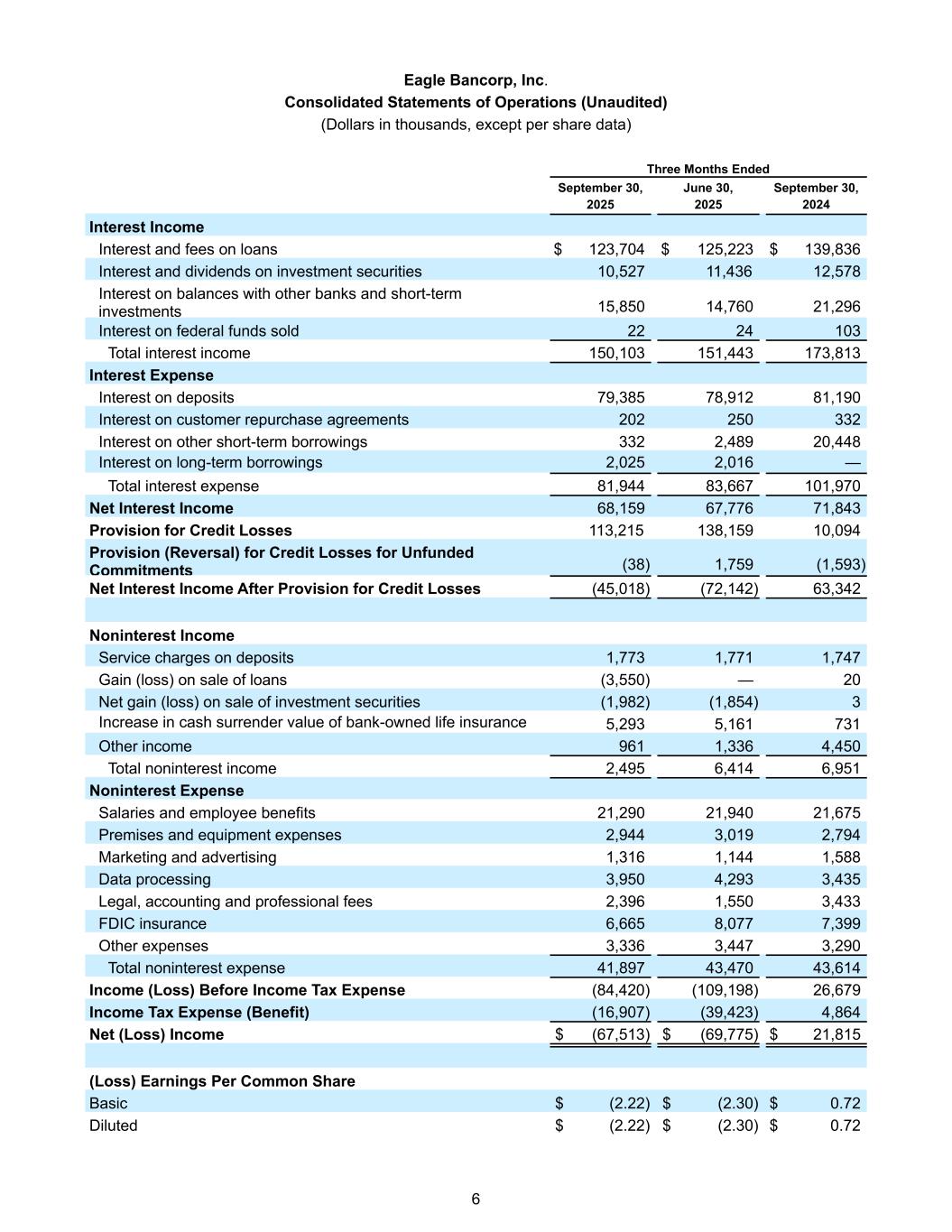

6 Eagle Bancorp, Inc. Consolidated Statements of Operations (Unaudited) (Dollars in thousands, except per share data) Three Months Ended September 30, June 30, September 30, 2025 2025 2024 Interest Income Interest and fees on loans $ 123,704 $ 125,223 $ 139,836 Interest and dividends on investment securities 10,527 11,436 12,578 Interest on balances with other banks and short-term investments 15,850 14,760 21,296 Interest on federal funds sold 22 24 103 Total interest income 150,103 151,443 173,813 Interest Expense Interest on deposits 79,385 78,912 81,190 Interest on customer repurchase agreements 202 250 332 Interest on other short-term borrowings 332 2,489 20,448 Interest on long-term borrowings 2,025 2,016 — Total interest expense 81,944 83,667 101,970 Net Interest Income 68,159 67,776 71,843 Provision for Credit Losses 113,215 138,159 10,094 Provision (Reversal) for Credit Losses for Unfunded Commitments (38) 1,759 (1,593) Net Interest Income After Provision for Credit Losses (45,018) (72,142) 63,342 Noninterest Income Service charges on deposits 1,773 1,771 1,747 Gain (loss) on sale of loans (3,550) — 20 Net gain (loss) on sale of investment securities (1,982) (1,854) 3 Increase in cash surrender value of bank-owned life insurance 5,293 5,161 731 Other income 961 1,336 4,450 Total noninterest income 2,495 6,414 6,951 Noninterest Expense Salaries and employee benefits 21,290 21,940 21,675 Premises and equipment expenses 2,944 3,019 2,794 Marketing and advertising 1,316 1,144 1,588 Data processing 3,950 4,293 3,435 Legal, accounting and professional fees 2,396 1,550 3,433 FDIC insurance 6,665 8,077 7,399 Other expenses 3,336 3,447 3,290 Total noninterest expense 41,897 43,470 43,614 Income (Loss) Before Income Tax Expense (84,420) (109,198) 26,679 Income Tax Expense (Benefit) (16,907) (39,423) 4,864 Net (Loss) Income $ (67,513) $ (69,775) $ 21,815 (Loss) Earnings Per Common Share Basic $ (2.22) $ (2.30) $ 0.72 Diluted $ (2.22) $ (2.30) $ 0.72

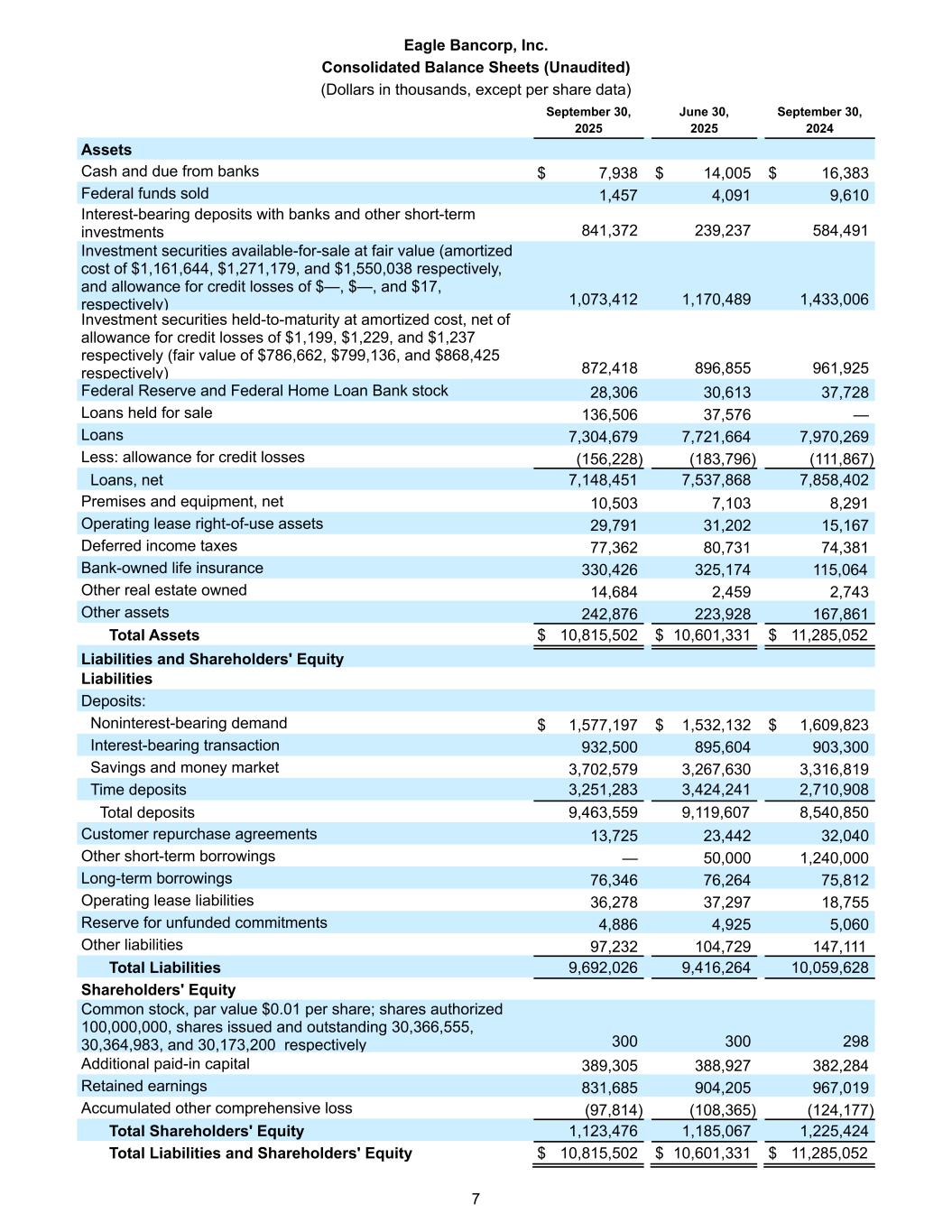

7 Eagle Bancorp, Inc. Consolidated Balance Sheets (Unaudited) (Dollars in thousands, except per share data) September 30, June 30, September 30, 2025 2025 2024 Assets Cash and due from banks $ 7,938 $ 14,005 $ 16,383 Federal funds sold 1,457 4,091 9,610 Interest-bearing deposits with banks and other short-term investments 841,372 239,237 584,491 Investment securities available-for-sale at fair value (amortized cost of $1,161,644, $1,271,179, and $1,550,038 respectively, and allowance for credit losses of $—, $—, and $17, respectively) 1,073,412 1,170,489 1,433,006 Investment securities held-to-maturity at amortized cost, net of allowance for credit losses of $1,199, $1,229, and $1,237 respectively (fair value of $786,662, $799,136, and $868,425 respectively) 872,418 896,855 961,925 Federal Reserve and Federal Home Loan Bank stock 28,306 30,613 37,728 Loans held for sale 136,506 37,576 — Loans 7,304,679 7,721,664 7,970,269 Less: allowance for credit losses (156,228) (183,796) (111,867) Loans, net 7,148,451 7,537,868 7,858,402 Premises and equipment, net 10,503 7,103 8,291 Operating lease right-of-use assets 29,791 31,202 15,167 Deferred income taxes 77,362 80,731 74,381 Bank-owned life insurance 330,426 325,174 115,064 Other real estate owned 14,684 2,459 2,743 Other assets 242,876 223,928 167,861 Total Assets $ 10,815,502 $ 10,601,331 $ 11,285,052 Liabilities and Shareholders' Equity Liabilities Deposits: Noninterest-bearing demand $ 1,577,197 $ 1,532,132 $ 1,609,823 Interest-bearing transaction 932,500 895,604 903,300 Savings and money market 3,702,579 3,267,630 3,316,819 Time deposits 3,251,283 3,424,241 2,710,908 Total deposits 9,463,559 9,119,607 8,540,850 Customer repurchase agreements 13,725 23,442 32,040 Other short-term borrowings — 50,000 1,240,000 Long-term borrowings 76,346 76,264 75,812 Operating lease liabilities 36,278 37,297 18,755 Reserve for unfunded commitments 4,886 4,925 5,060 Other liabilities 97,232 104,729 147,111 Total Liabilities 9,692,026 9,416,264 10,059,628 Shareholders' Equity Common stock, par value $0.01 per share; shares authorized 100,000,000, shares issued and outstanding 30,366,555, 30,364,983, and 30,173,200 respectively 300 300 298 Additional paid-in capital 389,305 388,927 382,284 Retained earnings 831,685 904,205 967,019 Accumulated other comprehensive loss (97,814) (108,365) (124,177) Total Shareholders' Equity 1,123,476 1,185,067 1,225,424 Total Liabilities and Shareholders' Equity $ 10,815,502 $ 10,601,331 $ 11,285,052

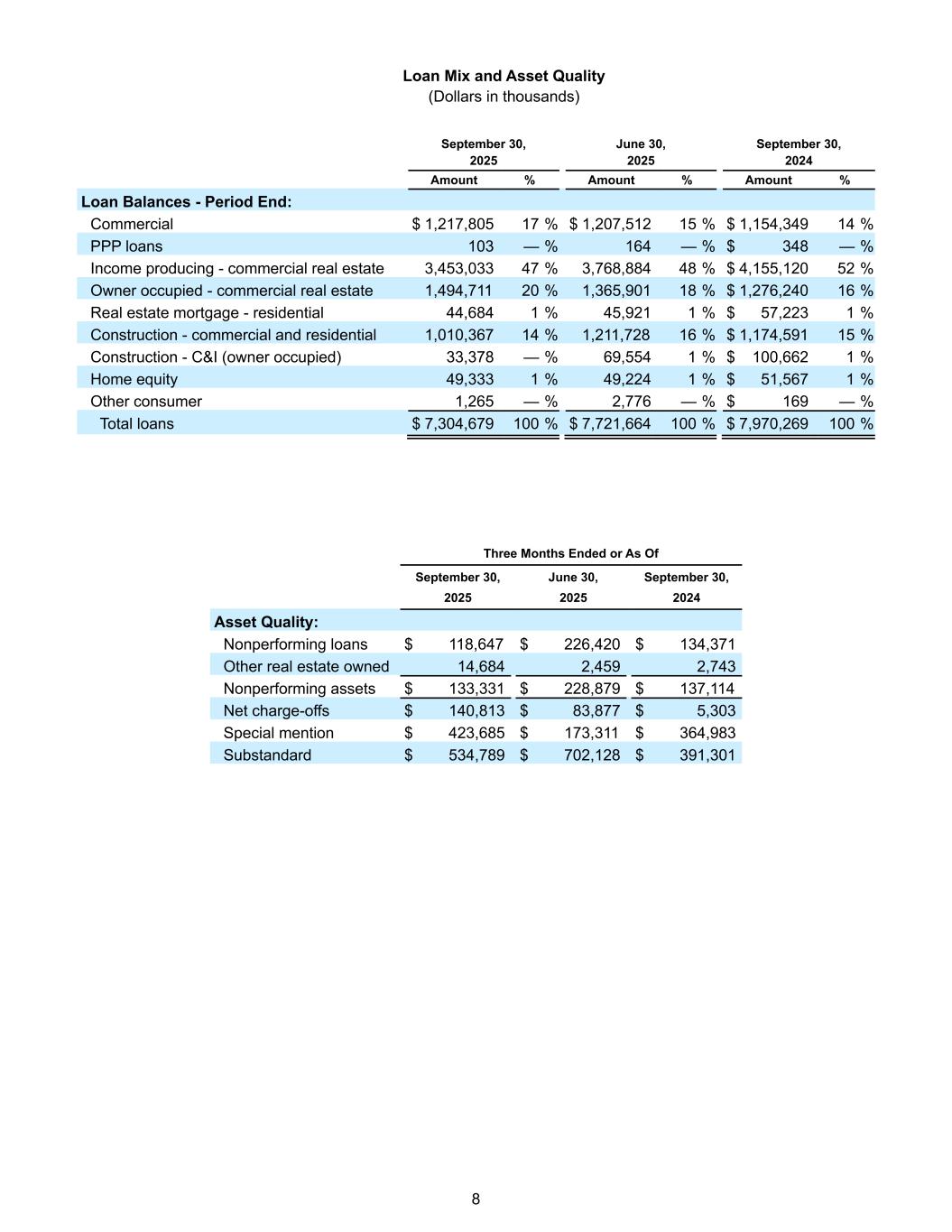

8 Loan Mix and Asset Quality (Dollars in thousands) September 30, June 30, September 30, 2025 2025 2024 Amount % Amount % Amount % Loan Balances - Period End: Commercial $ 1,217,805 17 % $ 1,207,512 15 % $ 1,154,349 14 % PPP loans 103 — % 164 — % $ 348 — % Income producing - commercial real estate 3,453,033 47 % 3,768,884 48 % $ 4,155,120 52 % Owner occupied - commercial real estate 1,494,711 20 % 1,365,901 18 % $ 1,276,240 16 % Real estate mortgage - residential 44,684 1 % 45,921 1 % $ 57,223 1 % Construction - commercial and residential 1,010,367 14 % 1,211,728 16 % $ 1,174,591 15 % Construction - C&I (owner occupied) 33,378 — % 69,554 1 % $ 100,662 1 % Home equity 49,333 1 % 49,224 1 % $ 51,567 1 % Other consumer 1,265 — % 2,776 — % $ 169 — % Total loans $ 7,304,679 100 % $ 7,721,664 100 % $ 7,970,269 100 % Three Months Ended or As Of September 30, June 30, September 30, 2025 2025 2024 Asset Quality: Nonperforming loans $ 118,647 $ 226,420 $ 134,371 Other real estate owned 14,684 2,459 2,743 Nonperforming assets $ 133,331 $ 228,879 $ 137,114 Net charge-offs $ 140,813 $ 83,877 $ 5,303 Special mention $ 423,685 $ 173,311 $ 364,983 Substandard $ 534,789 $ 702,128 $ 391,301

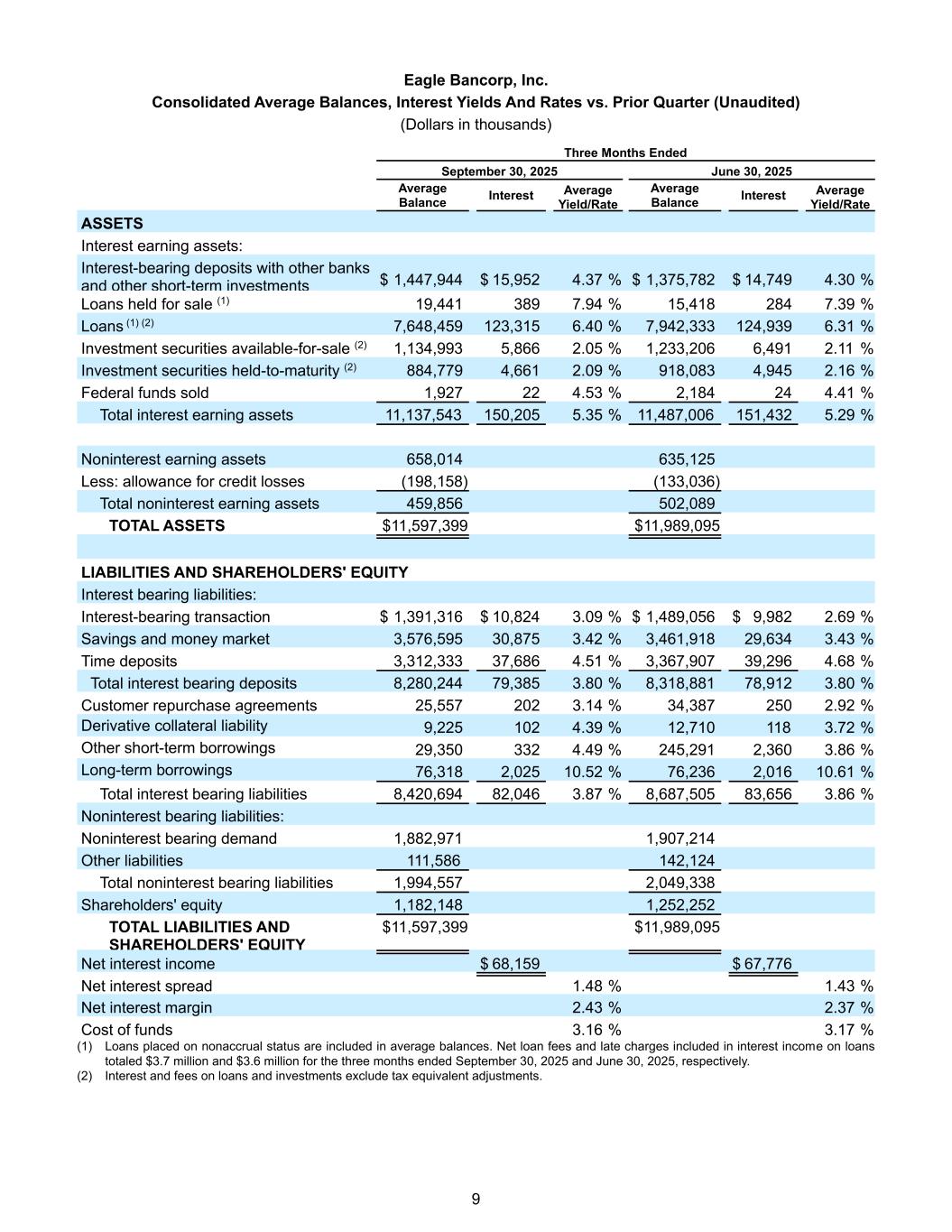

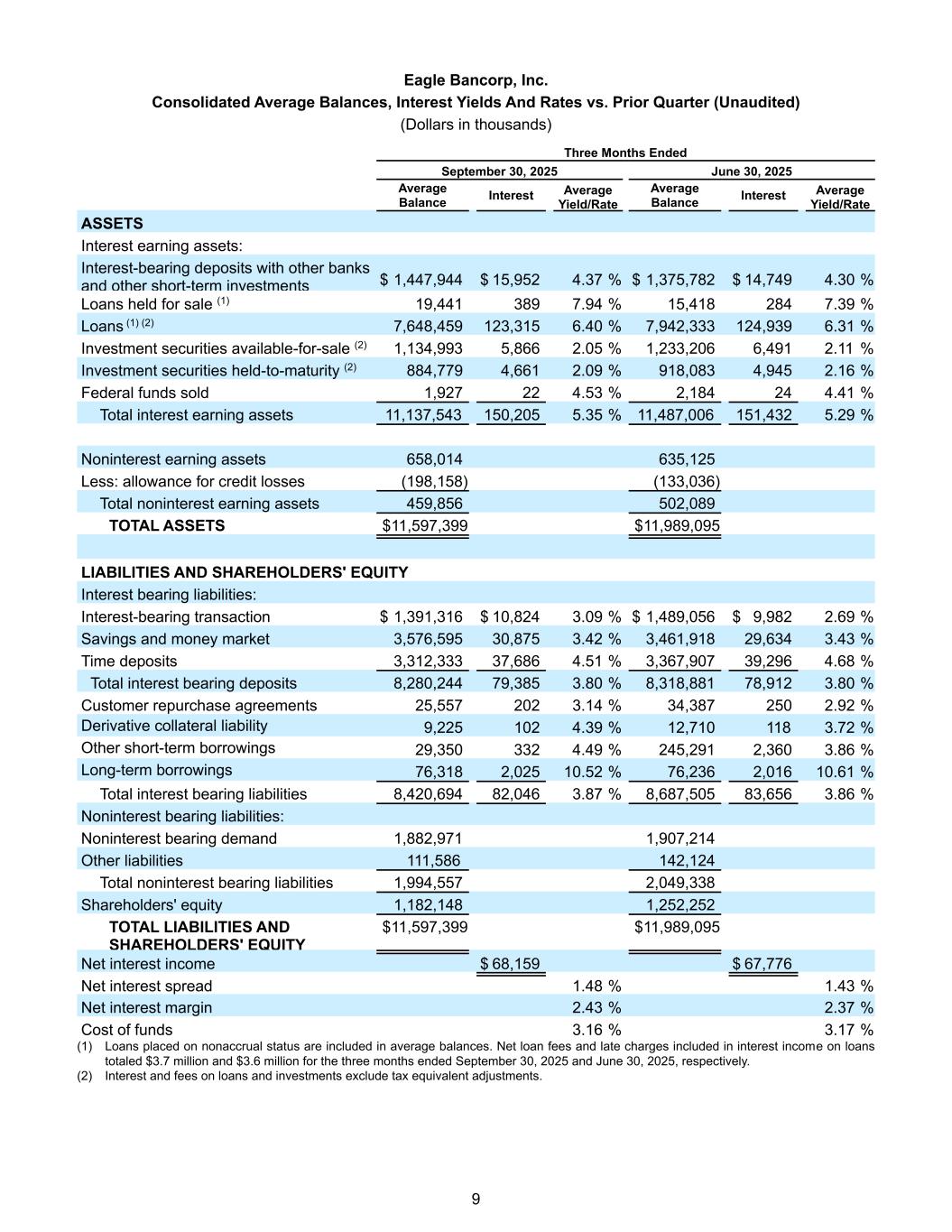

9 Eagle Bancorp, Inc. Consolidated Average Balances, Interest Yields And Rates vs. Prior Quarter (Unaudited) (Dollars in thousands) Three Months Ended September 30, 2025 June 30, 2025 Average Balance Interest Average Yield/Rate Average Balance Interest Average Yield/Rate ASSETS Interest earning assets: Interest-bearing deposits with other banks and other short-term investments $ 1,447,944 $ 15,952 4.37 % $ 1,375,782 $ 14,749 4.30 % Loans held for sale (1) 19,441 389 7.94 % 15,418 284 7.39 % Loans (1) (2) 7,648,459 123,315 6.40 % 7,942,333 124,939 6.31 % Investment securities available-for-sale (2) 1,134,993 5,866 2.05 % 1,233,206 6,491 2.11 % Investment securities held-to-maturity (2) 884,779 4,661 2.09 % 918,083 4,945 2.16 % Federal funds sold 1,927 22 4.53 % 2,184 24 4.41 % Total interest earning assets 11,137,543 150,205 5.35 % 11,487,006 151,432 5.29 % Noninterest earning assets 658,014 635,125 Less: allowance for credit losses (198,158) (133,036) Total noninterest earning assets 459,856 502,089 TOTAL ASSETS $ 11,597,399 $ 11,989,095 LIABILITIES AND SHAREHOLDERS' EQUITY Interest bearing liabilities: Interest-bearing transaction $ 1,391,316 $ 10,824 3.09 % $ 1,489,056 $ 9,982 2.69 % Savings and money market 3,576,595 30,875 3.42 % 3,461,918 29,634 3.43 % Time deposits 3,312,333 37,686 4.51 % 3,367,907 39,296 4.68 % Total interest bearing deposits 8,280,244 79,385 3.80 % 8,318,881 78,912 3.80 % Customer repurchase agreements 25,557 202 3.14 % 34,387 250 2.92 % Derivative collateral liability 9,225 102 4.39 % 12,710 118 3.72 % Other short-term borrowings 29,350 332 4.49 % 245,291 2,360 3.86 % Long-term borrowings 76,318 2,025 10.52 % 76,236 2,016 10.61 % Total interest bearing liabilities 8,420,694 82,046 3.87 % 8,687,505 83,656 3.86 % Noninterest bearing liabilities: Noninterest bearing demand 1,882,971 1,907,214 Other liabilities 111,586 142,124 Total noninterest bearing liabilities 1,994,557 2,049,338 Shareholders' equity 1,182,148 1,252,252 TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY $ 11,597,399 $ 11,989,095 Net interest income $ 68,159 $ 67,776 Net interest spread 1.48 % 1.43 % Net interest margin 2.43 % 2.37 % Cost of funds 3.16 % 3.17 % (1) Loans placed on nonaccrual status are included in average balances. Net loan fees and late charges included in interest income on loans totaled $3.7 million and $3.6 million for the three months ended September 30, 2025 and June 30, 2025, respectively. (2) Interest and fees on loans and investments exclude tax equivalent adjustments.

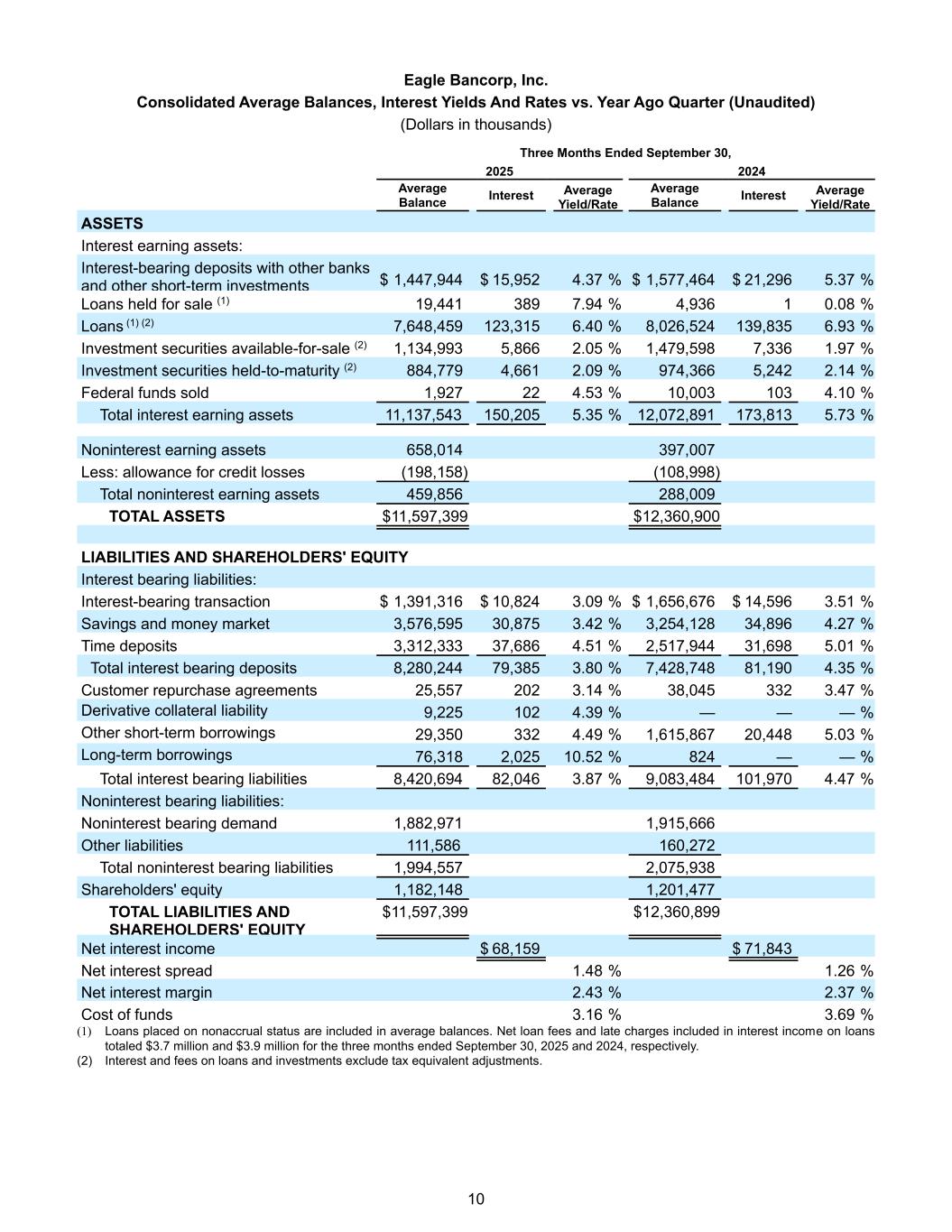

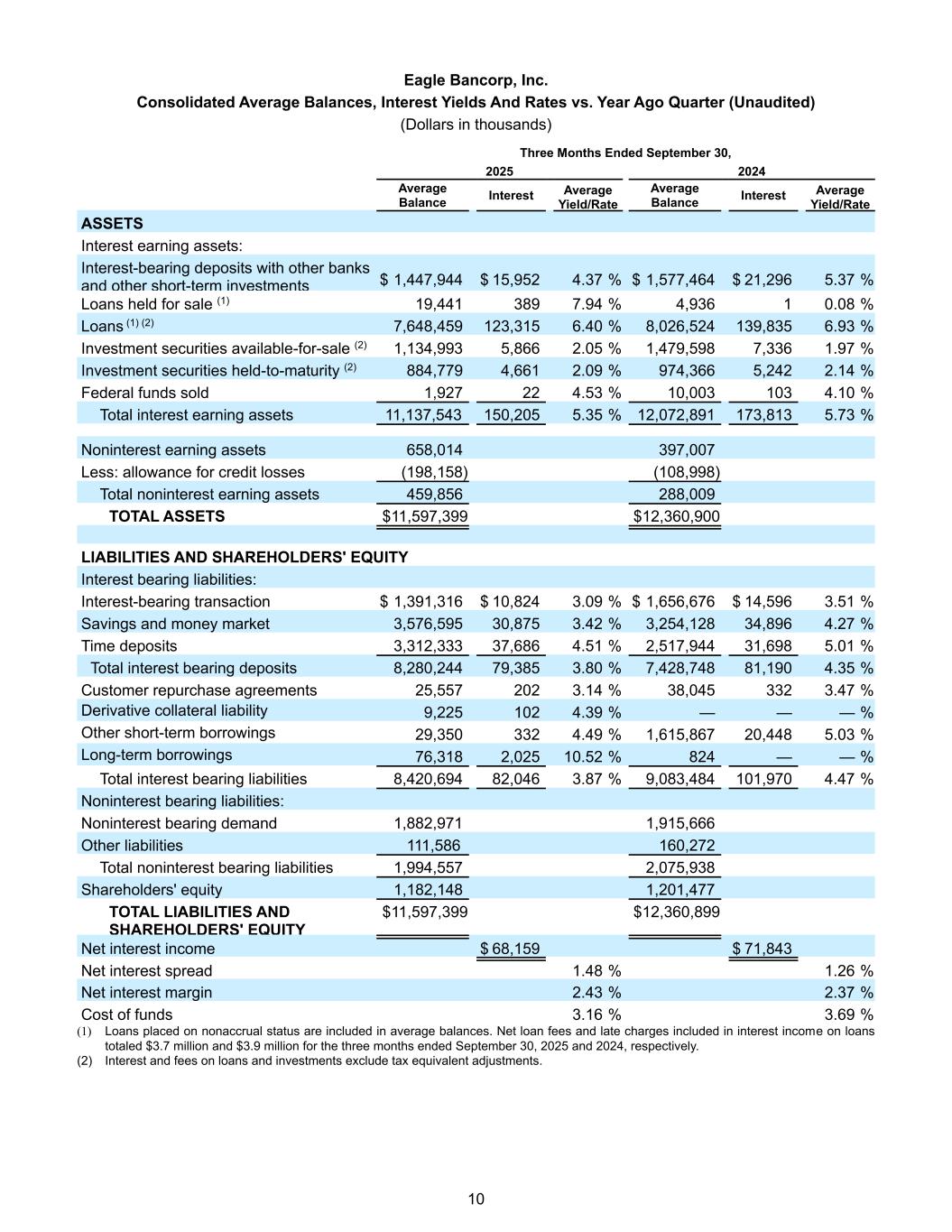

10 Eagle Bancorp, Inc. Consolidated Average Balances, Interest Yields And Rates vs. Year Ago Quarter (Unaudited) (Dollars in thousands) Three Months Ended September 30, 2025 2024 Average Balance Interest Average Yield/Rate Average Balance Interest Average Yield/Rate ASSETS Interest earning assets: Interest-bearing deposits with other banks and other short-term investments $ 1,447,944 $ 15,952 4.37 % $ 1,577,464 $ 21,296 5.37 % Loans held for sale (1) 19,441 389 7.94 % 4,936 1 0.08 % Loans (1) (2) 7,648,459 123,315 6.40 % 8,026,524 139,835 6.93 % Investment securities available-for-sale (2) 1,134,993 5,866 2.05 % 1,479,598 7,336 1.97 % Investment securities held-to-maturity (2) 884,779 4,661 2.09 % 974,366 5,242 2.14 % Federal funds sold 1,927 22 4.53 % 10,003 103 4.10 % Total interest earning assets 11,137,543 150,205 5.35 % 12,072,891 173,813 5.73 % Noninterest earning assets 658,014 397,007 Less: allowance for credit losses (198,158) (108,998) Total noninterest earning assets 459,856 288,009 TOTAL ASSETS $ 11,597,399 $ 12,360,900 LIABILITIES AND SHAREHOLDERS' EQUITY Interest bearing liabilities: Interest-bearing transaction $ 1,391,316 $ 10,824 3.09 % $ 1,656,676 $ 14,596 3.51 % Savings and money market 3,576,595 30,875 3.42 % 3,254,128 34,896 4.27 % Time deposits 3,312,333 37,686 4.51 % 2,517,944 31,698 5.01 % Total interest bearing deposits 8,280,244 79,385 3.80 % 7,428,748 81,190 4.35 % Customer repurchase agreements 25,557 202 3.14 % 38,045 332 3.47 % Derivative collateral liability 9,225 102 4.39 % — — — % Other short-term borrowings 29,350 332 4.49 % 1,615,867 20,448 5.03 % Long-term borrowings 76,318 2,025 10.52 % 824 — — % Total interest bearing liabilities 8,420,694 82,046 3.87 % 9,083,484 101,970 4.47 % Noninterest bearing liabilities: Noninterest bearing demand 1,882,971 1,915,666 Other liabilities 111,586 160,272 Total noninterest bearing liabilities 1,994,557 2,075,938 Shareholders' equity 1,182,148 1,201,477 TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY $ 11,597,399 $ 12,360,899 Net interest income $ 68,159 $ 71,843 Net interest spread 1.48 % 1.26 % Net interest margin 2.43 % 2.37 % Cost of funds 3.16 % 3.69 % (1) Loans placed on nonaccrual status are included in average balances. Net loan fees and late charges included in interest income on loans totaled $3.7 million and $3.9 million for the three months ended September 30, 2025 and 2024, respectively. (2) Interest and fees on loans and investments exclude tax equivalent adjustments.

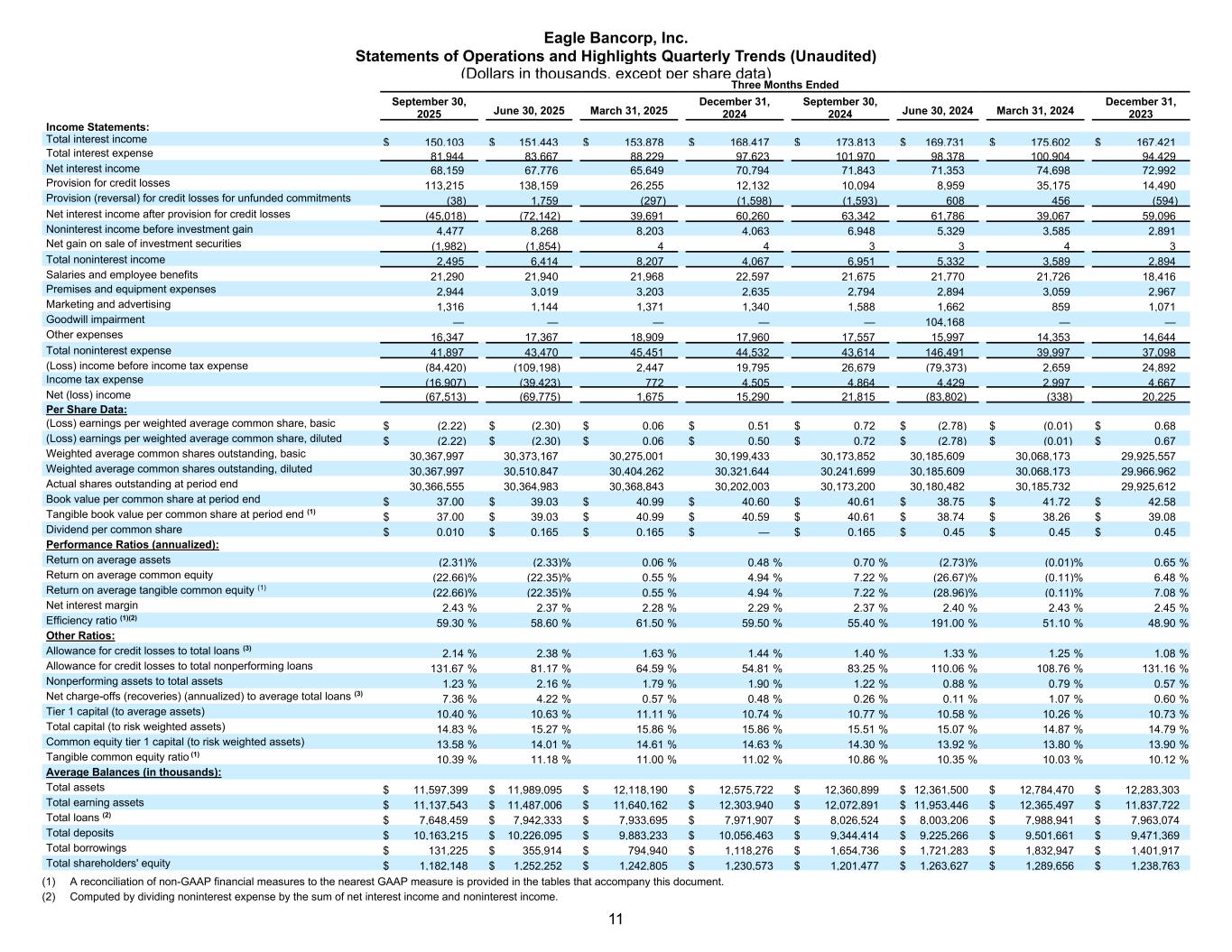

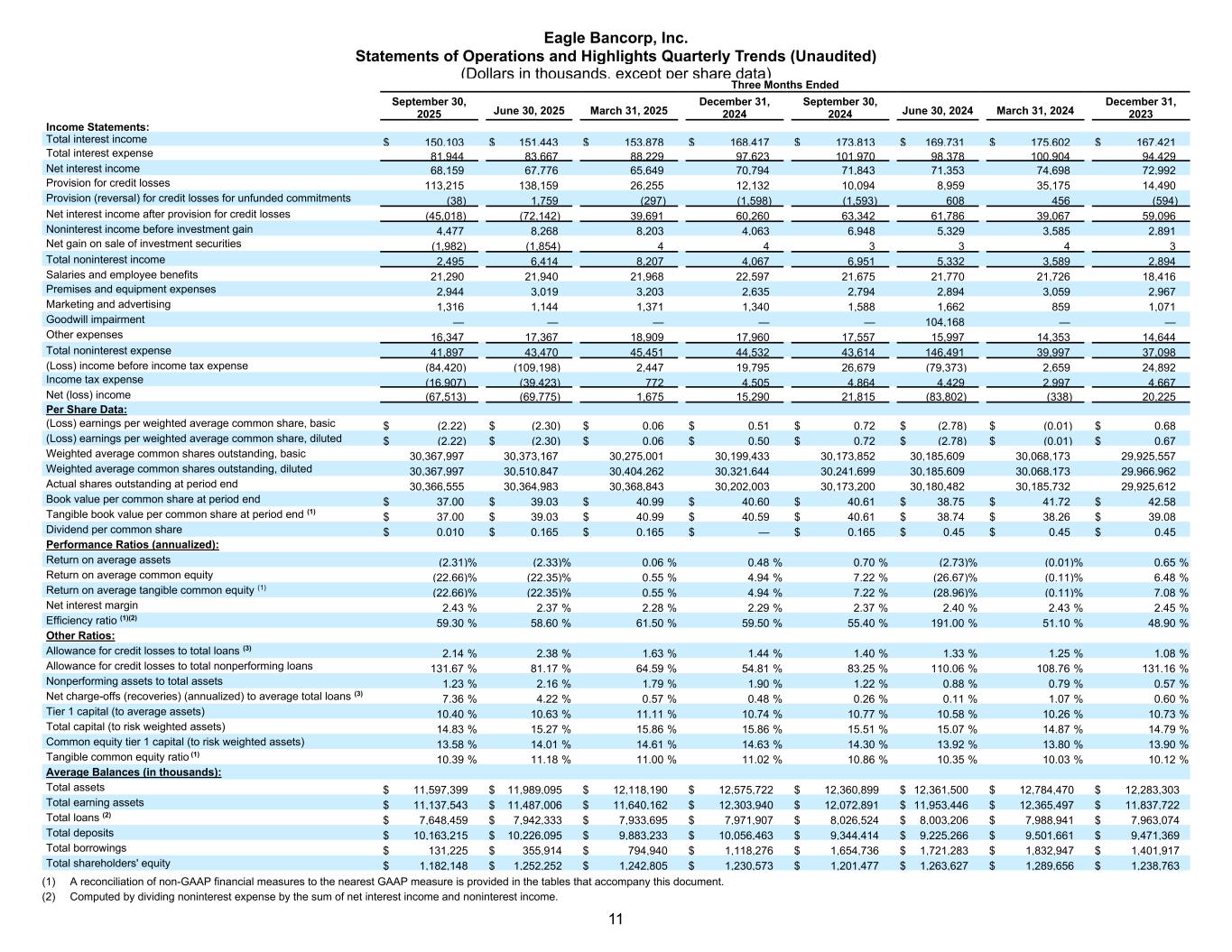

11 Eagle Bancorp, Inc. Statements of Operations and Highlights Quarterly Trends (Unaudited) (Dollars in thousands, except per share data) Three Months Ended September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 June 30, 2024 March 31, 2024 December 31, 2023 Income Statements: Total interest income $ 150,103 $ 151,443 $ 153,878 $ 168,417 $ 173,813 $ 169,731 $ 175,602 $ 167,421 Total interest expense 81,944 83,667 88,229 97,623 101,970 98,378 100,904 94,429 Net interest income 68,159 67,776 65,649 70,794 71,843 71,353 74,698 72,992 Provision for credit losses 113,215 138,159 26,255 12,132 10,094 8,959 35,175 14,490 Provision (reversal) for credit losses for unfunded commitments (38) 1,759 (297) (1,598) (1,593) 608 456 (594) Net interest income after provision for credit losses (45,018) (72,142) 39,691 60,260 63,342 61,786 39,067 59,096 Noninterest income before investment gain 4,477 8,268 8,203 4,063 6,948 5,329 3,585 2,891 Net gain on sale of investment securities (1,982) (1,854) 4 4 3 3 4 3 Total noninterest income 2,495 6,414 8,207 4,067 6,951 5,332 3,589 2,894 Salaries and employee benefits 21,290 21,940 21,968 22,597 21,675 21,770 21,726 18,416 Premises and equipment expenses 2,944 3,019 3,203 2,635 2,794 2,894 3,059 2,967 Marketing and advertising 1,316 1,144 1,371 1,340 1,588 1,662 859 1,071 Goodwill impairment — — — — — 104,168 — — Other expenses 16,347 17,367 18,909 17,960 17,557 15,997 14,353 14,644 Total noninterest expense 41,897 43,470 45,451 44,532 43,614 146,491 39,997 37,098 (Loss) income before income tax expense (84,420) (109,198) 2,447 19,795 26,679 (79,373) 2,659 24,892 Income tax expense (16,907) (39,423) 772 4,505 4,864 4,429 2,997 4,667 Net (loss) income (67,513) (69,775) 1,675 15,290 21,815 (83,802) (338) 20,225 Per Share Data: (Loss) earnings per weighted average common share, basic $ (2.22) $ (2.30) $ 0.06 $ 0.51 $ 0.72 $ (2.78) $ (0.01) $ 0.68 (Loss) earnings per weighted average common share, diluted $ (2.22) $ (2.30) $ 0.06 $ 0.50 $ 0.72 $ (2.78) $ (0.01) $ 0.67 Weighted average common shares outstanding, basic 30,367,997 30,373,167 30,275,001 30,199,433 30,173,852 30,185,609 30,068,173 29,925,557 Weighted average common shares outstanding, diluted 30,367,997 30,510,847 30,404,262 30,321,644 30,241,699 30,185,609 30,068,173 29,966,962 Actual shares outstanding at period end 30,366,555 30,364,983 30,368,843 30,202,003 30,173,200 30,180,482 30,185,732 29,925,612 Book value per common share at period end $ 37.00 $ 39.03 $ 40.99 $ 40.60 $ 40.61 $ 38.75 $ 41.72 $ 42.58 Tangible book value per common share at period end (1) $ 37.00 $ 39.03 $ 40.99 $ 40.59 $ 40.61 $ 38.74 $ 38.26 $ 39.08 Dividend per common share $ 0.010 $ 0.165 $ 0.165 $ — $ 0.165 $ 0.45 $ 0.45 $ 0.45 Performance Ratios (annualized): Return on average assets (2.31) % (2.33) % 0.06 % 0.48 % 0.70 % (2.73) % (0.01) % 0.65 % Return on average common equity (22.66) % (22.35) % 0.55 % 4.94 % 7.22 % (26.67) % (0.11) % 6.48 % Return on average tangible common equity (1) (22.66) % (22.35) % 0.55 % 4.94 % 7.22 % (28.96) % (0.11) % 7.08 % Net interest margin 2.43 % 2.37 % 2.28 % 2.29 % 2.37 % 2.40 % 2.43 % 2.45 % Efficiency ratio (1)(2) 59.30 % 58.60 % 61.50 % 59.50 % 55.40 % 191.00 % 51.10 % 48.90 % Other Ratios: Allowance for credit losses to total loans (3) 2.14 % 2.38 % 1.63 % 1.44 % 1.40 % 1.33 % 1.25 % 1.08 % Allowance for credit losses to total nonperforming loans 131.67 % 81.17 % 64.59 % 54.81 % 83.25 % 110.06 % 108.76 % 131.16 % Nonperforming assets to total assets 1.23 % 2.16 % 1.79 % 1.90 % 1.22 % 0.88 % 0.79 % 0.57 % Net charge-offs (recoveries) (annualized) to average total loans (3) 7.36 % 4.22 % 0.57 % 0.48 % 0.26 % 0.11 % 1.07 % 0.60 % Tier 1 capital (to average assets) 10.40 % 10.63 % 11.11 % 10.74 % 10.77 % 10.58 % 10.26 % 10.73 % Total capital (to risk weighted assets) 14.83 % 15.27 % 15.86 % 15.86 % 15.51 % 15.07 % 14.87 % 14.79 % Common equity tier 1 capital (to risk weighted assets) 13.58 % 14.01 % 14.61 % 14.63 % 14.30 % 13.92 % 13.80 % 13.90 % Tangible common equity ratio (1) 10.39 % 11.18 % 11.00 % 11.02 % 10.86 % 10.35 % 10.03 % 10.12 % Average Balances (in thousands): Total assets $ 11,597,399 $ 11,989,095 $ 12,118,190 $ 12,575,722 $ 12,360,899 $ 12,361,500 $ 12,784,470 $ 12,283,303 Total earning assets $ 11,137,543 $ 11,487,006 $ 11,640,162 $ 12,303,940 $ 12,072,891 $ 11,953,446 $ 12,365,497 $ 11,837,722 Total loans (2) $ 7,648,459 $ 7,942,333 $ 7,933,695 $ 7,971,907 $ 8,026,524 $ 8,003,206 $ 7,988,941 $ 7,963,074 Total deposits $ 10,163,215 $ 10,226,095 $ 9,883,233 $ 10,056,463 $ 9,344,414 $ 9,225,266 $ 9,501,661 $ 9,471,369 Total borrowings $ 131,225 $ 355,914 $ 794,940 $ 1,118,276 $ 1,654,736 $ 1,721,283 $ 1,832,947 $ 1,401,917 Total shareholders' equity $ 1,182,148 $ 1,252,252 $ 1,242,805 $ 1,230,573 $ 1,201,477 $ 1,263,627 $ 1,289,656 $ 1,238,763 (1) A reconciliation of non-GAAP financial measures to the nearest GAAP measure is provided in the tables that accompany this document. (2) Computed by dividing noninterest expense by the sum of net interest income and noninterest income.

12 (3) Excludes loans held for sale.

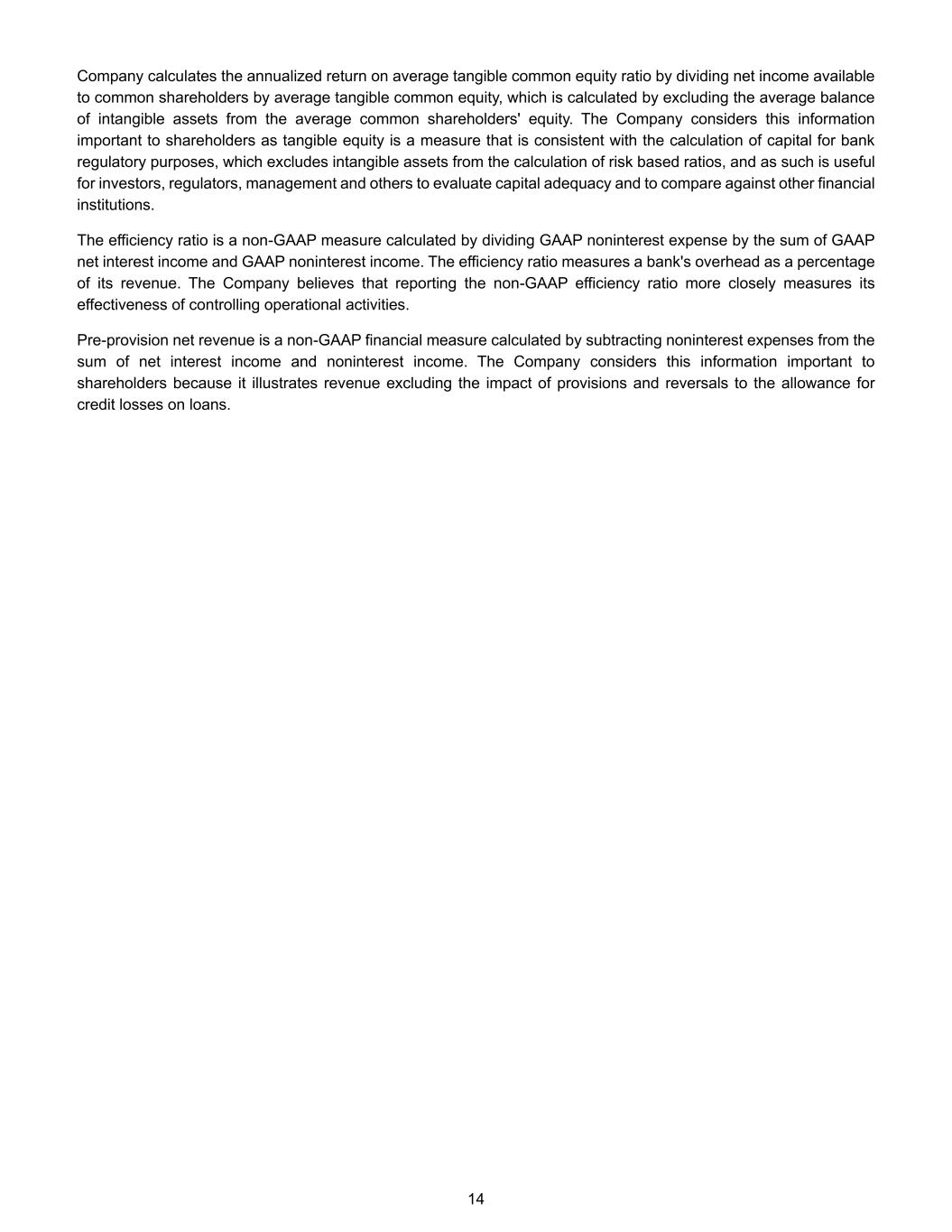

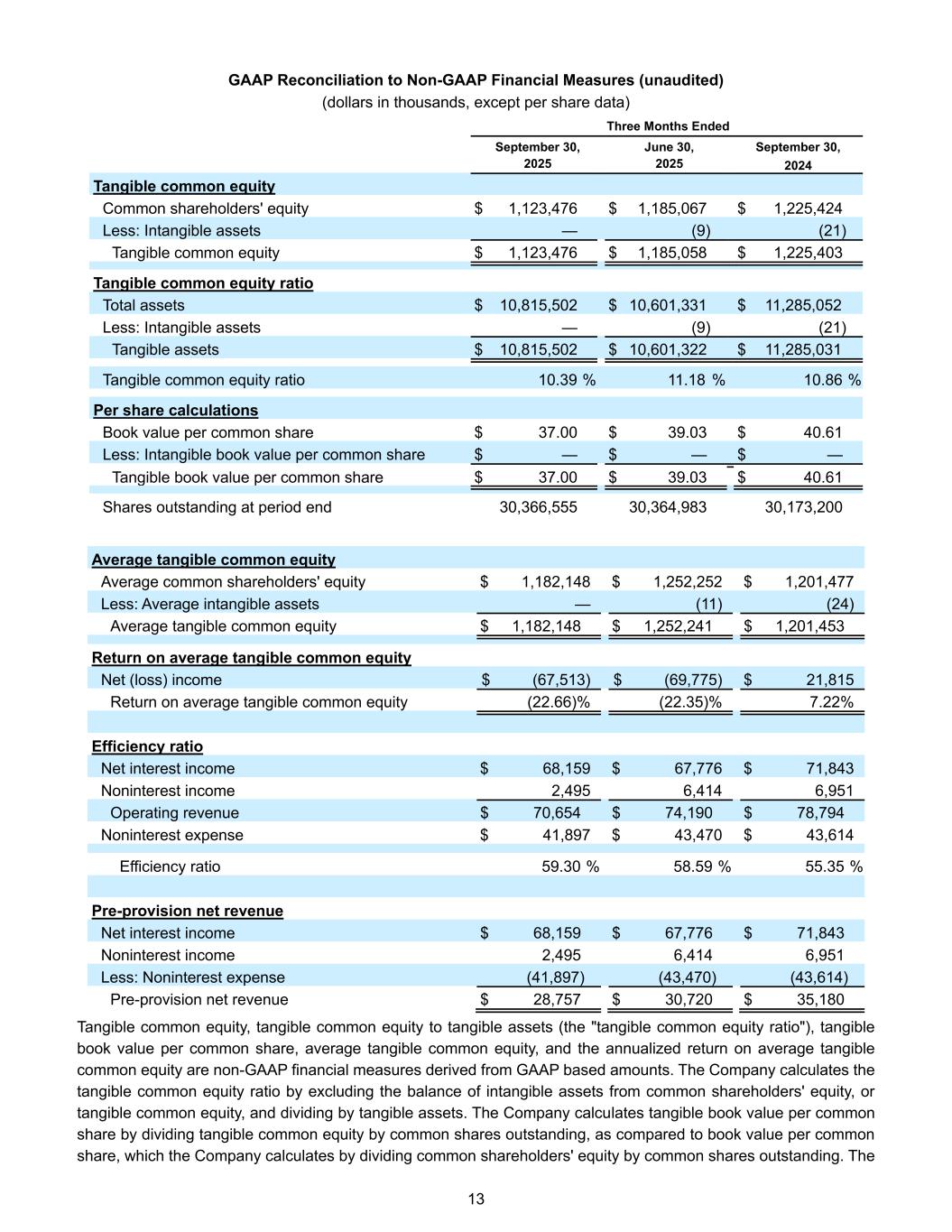

13 GAAP Reconciliation to Non-GAAP Financial Measures (unaudited) (dollars in thousands, except per share data) Three Months Ended September 30, June 30, September 30, 2025 2025 2024 Tangible common equity Common shareholders' equity $ 1,123,476 $ 1,185,067 $ 1,225,424 Less: Intangible assets — (9) (21) Tangible common equity $ 1,123,476 $ 1,185,058 $ 1,225,403 Tangible common equity ratio Total assets $ 10,815,502 $ 10,601,331 $ 11,285,052 Less: Intangible assets — (9) (21) Tangible assets $ 10,815,502 $ 10,601,322 $ 11,285,031 Tangible common equity ratio 10.39 % 11.18 % 10.86 % Per share calculations Book value per common share $ 37.00 $ 39.03 $ 40.61 Less: Intangible book value per common share $ — $ — $ — Tangible book value per common share $ 37.00 $ 39.03 $ 40.61 Shares outstanding at period end 30,366,555 30,364,983 30,173,200 Average tangible common equity Average common shareholders' equity $ 1,182,148 $ 1,252,252 $ 1,201,477 Less: Average intangible assets — (11) (24) Average tangible common equity $ 1,182,148 $ 1,252,241 $ 1,201,453 Return on average tangible common equity Net (loss) income $ (67,513) $ (69,775) $ 21,815 Return on average tangible common equity (22.66) % (22.35) % 7.22 % Efficiency ratio Net interest income $ 68,159 $ 67,776 $ 71,843 Noninterest income 2,495 6,414 6,951 Operating revenue $ 70,654 $ 74,190 $ 78,794 Noninterest expense $ 41,897 $ 43,470 $ 43,614 Efficiency ratio 59.30 % 58.59 % 55.35 % Pre-provision net revenue Net interest income $ 68,159 $ 67,776 $ 71,843 Noninterest income 2,495 6,414 6,951 Less: Noninterest expense (41,897) (43,470) (43,614) Pre-provision net revenue $ 28,757 $ 30,720 $ 35,180 Tangible common equity, tangible common equity to tangible assets (the "tangible common equity ratio"), tangible book value per common share, average tangible common equity, and the annualized return on average tangible common equity are non-GAAP financial measures derived from GAAP based amounts. The Company calculates the tangible common equity ratio by excluding the balance of intangible assets from common shareholders' equity, or tangible common equity, and dividing by tangible assets. The Company calculates tangible book value per common share by dividing tangible common equity by common shares outstanding, as compared to book value per common share, which the Company calculates by dividing common shareholders' equity by common shares outstanding. The

14 Company calculates the annualized return on average tangible common equity ratio by dividing net income available to common shareholders by average tangible common equity, which is calculated by excluding the average balance of intangible assets from the average common shareholders' equity. The Company considers this information important to shareholders as tangible equity is a measure that is consistent with the calculation of capital for bank regulatory purposes, which excludes intangible assets from the calculation of risk based ratios, and as such is useful for investors, regulators, management and others to evaluate capital adequacy and to compare against other financial institutions. The efficiency ratio is a non-GAAP measure calculated by dividing GAAP noninterest expense by the sum of GAAP net interest income and GAAP noninterest income. The efficiency ratio measures a bank's overhead as a percentage of its revenue. The Company believes that reporting the non-GAAP efficiency ratio more closely measures its effectiveness of controlling operational activities. Pre-provision net revenue is a non-GAAP financial measure calculated by subtracting noninterest expenses from the sum of net interest income and noninterest income. The Company considers this information important to shareholders because it illustrates revenue excluding the impact of provisions and reversals to the allowance for credit losses on loans.