| Maryland | 0-25923 | 52-2061461 | ||||||

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) | ||||||

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

| Common Stock, $0.01 par value | EGBN | The Nasdaq Stock Market LLC |

||||||

| Exhibit Number | Description | |||||||

| Press Release dated April 24, 2024 | ||||||||

Earnings Presentation |

||||||||

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | |||||||

| EAGLE BANCORP, INC. | ||||||||

| Date: April 24, 2024 | By: | /s/ Eric R. Newell | ||||||

| Eric R. Newell | ||||||||

| Executive Vice President, Chief Financial Officer | ||||||||

PRESS RELEASE FOR |

EAGLE BANCORP, INC. |

|||||||

| IMMEDIATE RELEASE | CONTACT: | |||||||

Eric R. Newell |

||||||||

April 24, 2024 |

240.497.1796 |

|||||||

Eagle Bancorp, Inc. | |||||||||||||||||

Consolidated Statements of Operations (Unaudited) | |||||||||||||||||

| (Dollars in thousands, except per share data) | |||||||||||||||||

| Three Months Ended | |||||||||||||||||

| March 31, | December 31, | March 31, | |||||||||||||||

| 2024 | 2023 | 2023 | |||||||||||||||

| Interest Income | |||||||||||||||||

| Interest and fees on loans | $ | 137,994 | $ | 135,964 | $ | 120,850 | |||||||||||

| Interest and dividends on investment securities | 12,680 | 13,142 | 13,545 | ||||||||||||||

| Interest on balances with other banks and short-term investments | 24,862 | 18,230 | 5,774 | ||||||||||||||

| Interest on federal funds sold | 66 | 85 | 78 | ||||||||||||||

| Total interest income | 175,602 | 167,421 | 140,247 | ||||||||||||||

| Interest Expense | |||||||||||||||||

| Interest on deposits | 79,383 | 78,239 | 48,954 | ||||||||||||||

| Interest on customer repurchase agreements | 315 | 272 | 302 | ||||||||||||||

| Interest on borrowings | 21,206 | 15,918 | 15,967 | ||||||||||||||

| Total interest expense | 100,904 | 94,429 | 65,223 | ||||||||||||||

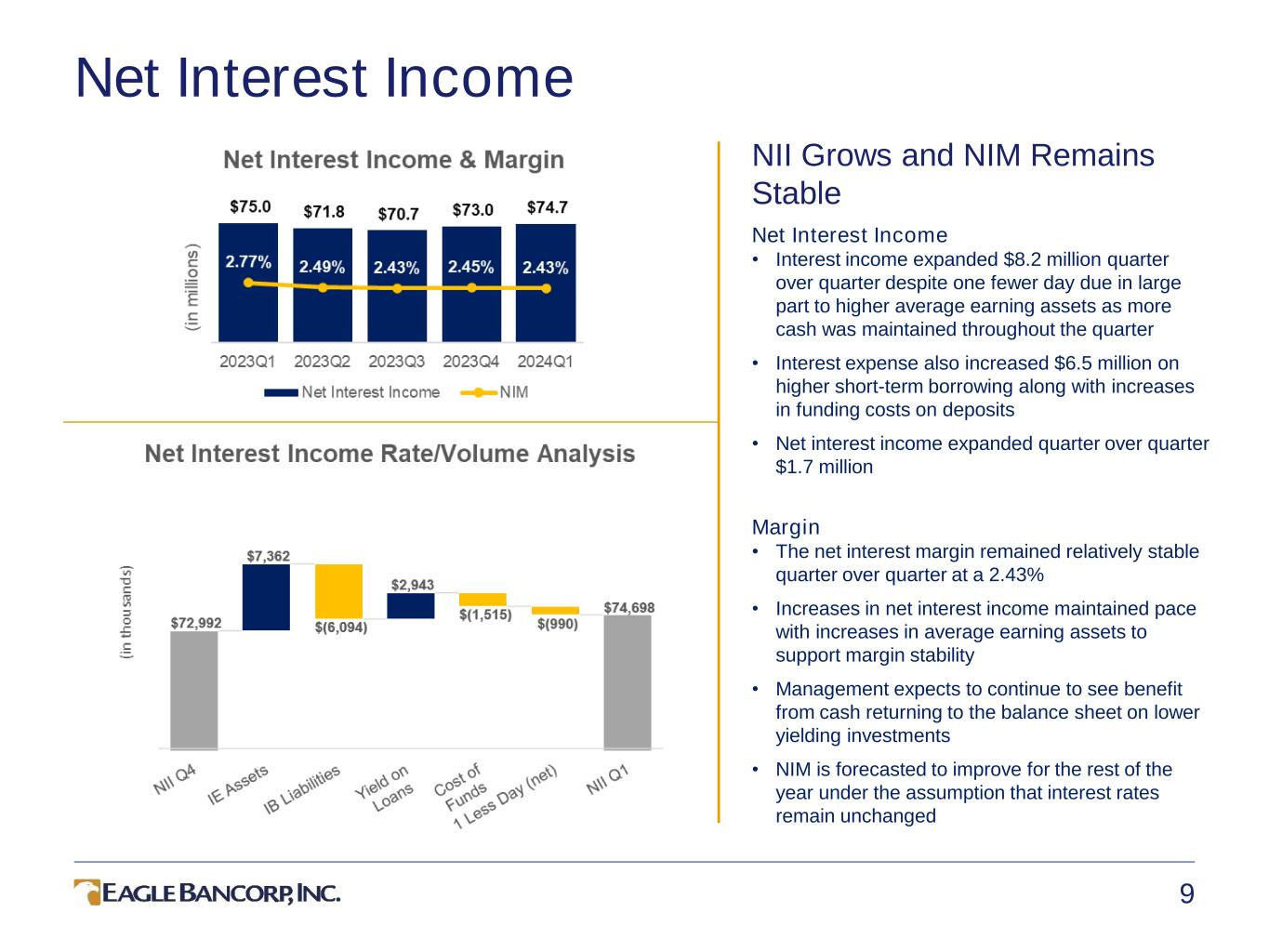

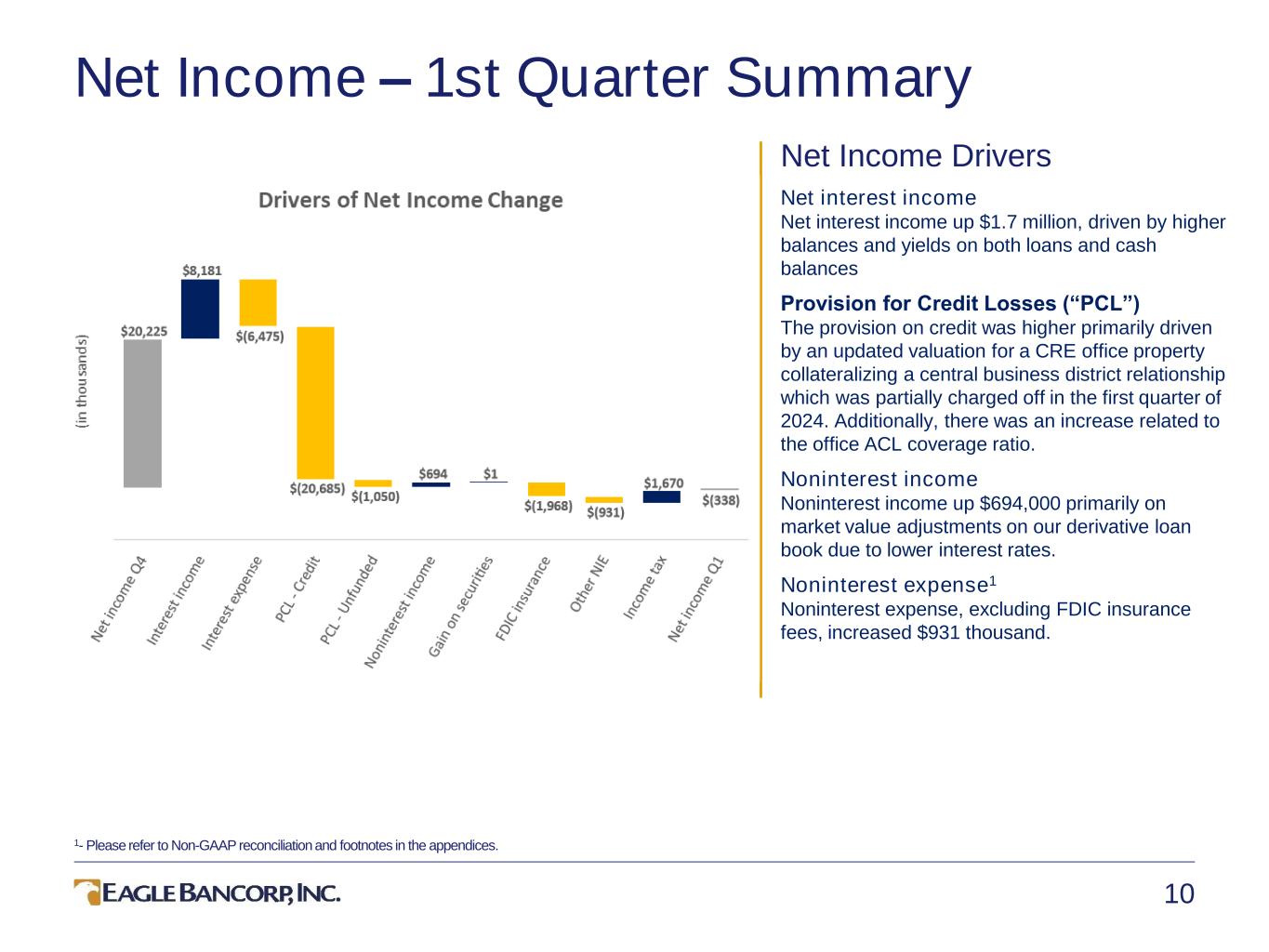

| Net Interest Income | 74,698 | 72,992 | 75,024 | ||||||||||||||

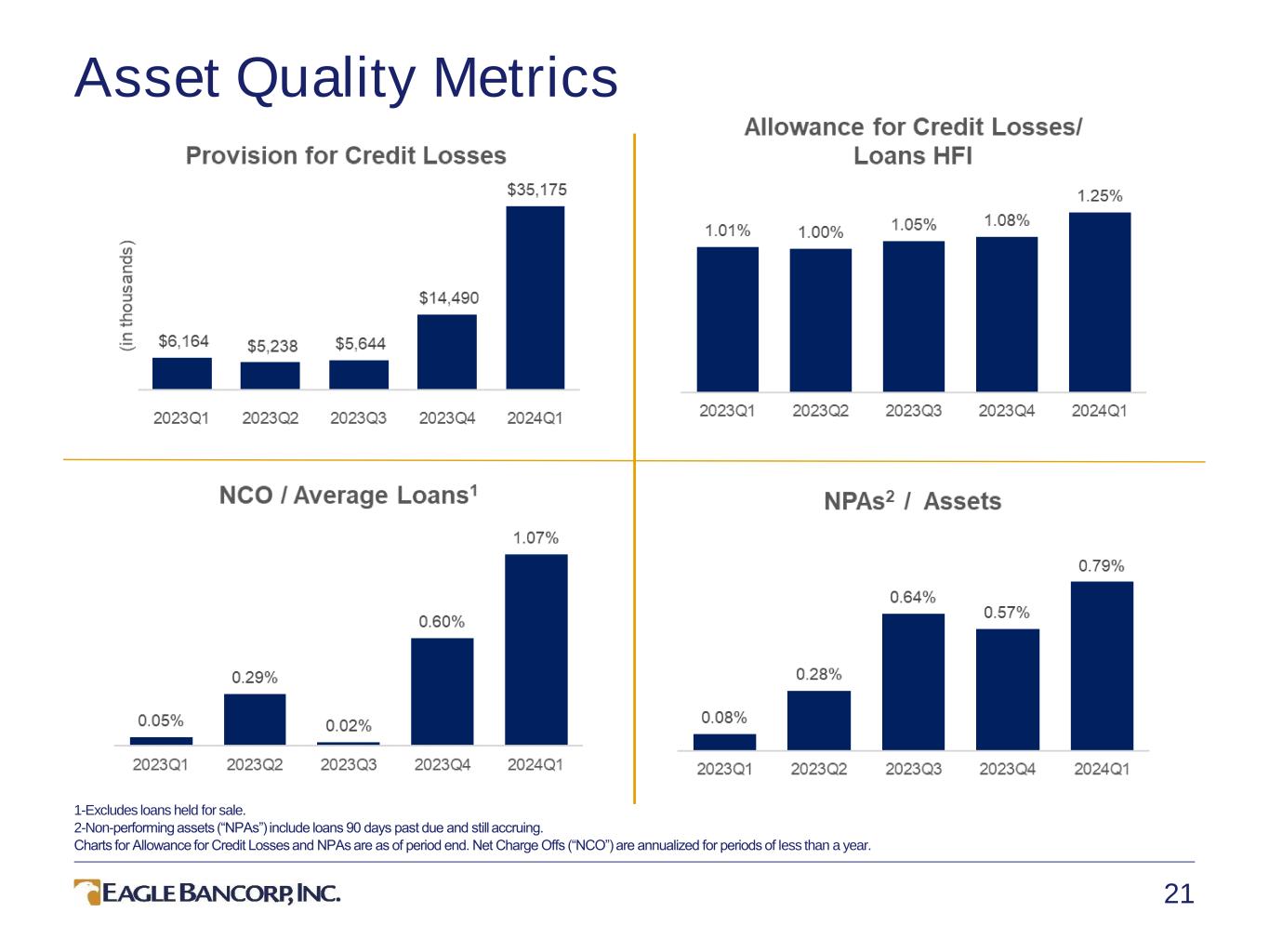

| Provision for Credit Losses | 35,175 | 14,490 | 6,164 | ||||||||||||||

Provision for (Reversal of) Credit Losses for Unfunded Commitments |

456 | (594) | 848 | ||||||||||||||

Net Interest Income After Provision For (Reversal of) Credit Losses |

39,067 | 59,096 | 68,012 | ||||||||||||||

| Noninterest Income | |||||||||||||||||

| Service charges on deposits | 1,699 | 1,688 | 1,510 | ||||||||||||||

Gain on sale of loans |

— | 23 | 305 | ||||||||||||||

Net gain (loss) on sale of investment securities |

4 | 3 | (21) | ||||||||||||||

| Increase in cash surrender value of bank-owned life insurance | 703 | 687 | 655 | ||||||||||||||

| Other income | 1,183 | 493 | 1,251 | ||||||||||||||

| Total noninterest income | 3,589 | 2,894 | 3,700 | ||||||||||||||

| Noninterest Expense | |||||||||||||||||

| Salaries and employee benefits | 21,726 | 18,416 | 24,174 | ||||||||||||||

| Premises and equipment expenses | 3,059 | 2,967 | 3,317 | ||||||||||||||

| Marketing and advertising | 859 | 1,071 | 636 | ||||||||||||||

| Data processing | 3,293 | 3,436 | 3,099 | ||||||||||||||

| Legal, accounting and professional fees | 2,507 | 2,722 | 3,254 | ||||||||||||||

| FDIC insurance | 6,412 | 4,444 | 1,486 | ||||||||||||||

| Other expenses | 2,141 | 4,042 | 4,618 | ||||||||||||||

| Total noninterest expense | 39,997 | 37,098 | 40,584 | ||||||||||||||

| Income Before Income Tax Expense | 2,659 | 24,892 | 31,128 | ||||||||||||||

| Income Tax Expense | 2,997 | 4,667 | 6,894 | ||||||||||||||

Net (Loss) Income |

$ | (338) | $ | 20,225 | $ | 24,234 | |||||||||||

(Loss) Earnings Per Common Share |

|||||||||||||||||

| Basic | $ | (0.01) | $ | 0.68 | $ | 0.78 | |||||||||||

| Diluted | $ | (0.01) | $ | 0.67 | $ | 0.78 | |||||||||||

| Eagle Bancorp, Inc. | |||||||||||||||||

| Consolidated Balance Sheets (Unaudited) | |||||||||||||||||

| (Dollars in thousands, except per share data) | |||||||||||||||||

| March 31, | December 31, | March 31, | |||||||||||||||

| 2024 | 2023 | 2023 | |||||||||||||||

Assets |

|||||||||||||||||

| Cash and due from banks | $ | 10,076 | $ | 9,047 | $ | 9,940 | |||||||||||

| Federal funds sold | 11,343 | 3,740 | 3,746 | ||||||||||||||

| Interest-bearing deposits with banks and other short-term investments | 696,453 | 709,897 | 159,078 | ||||||||||||||

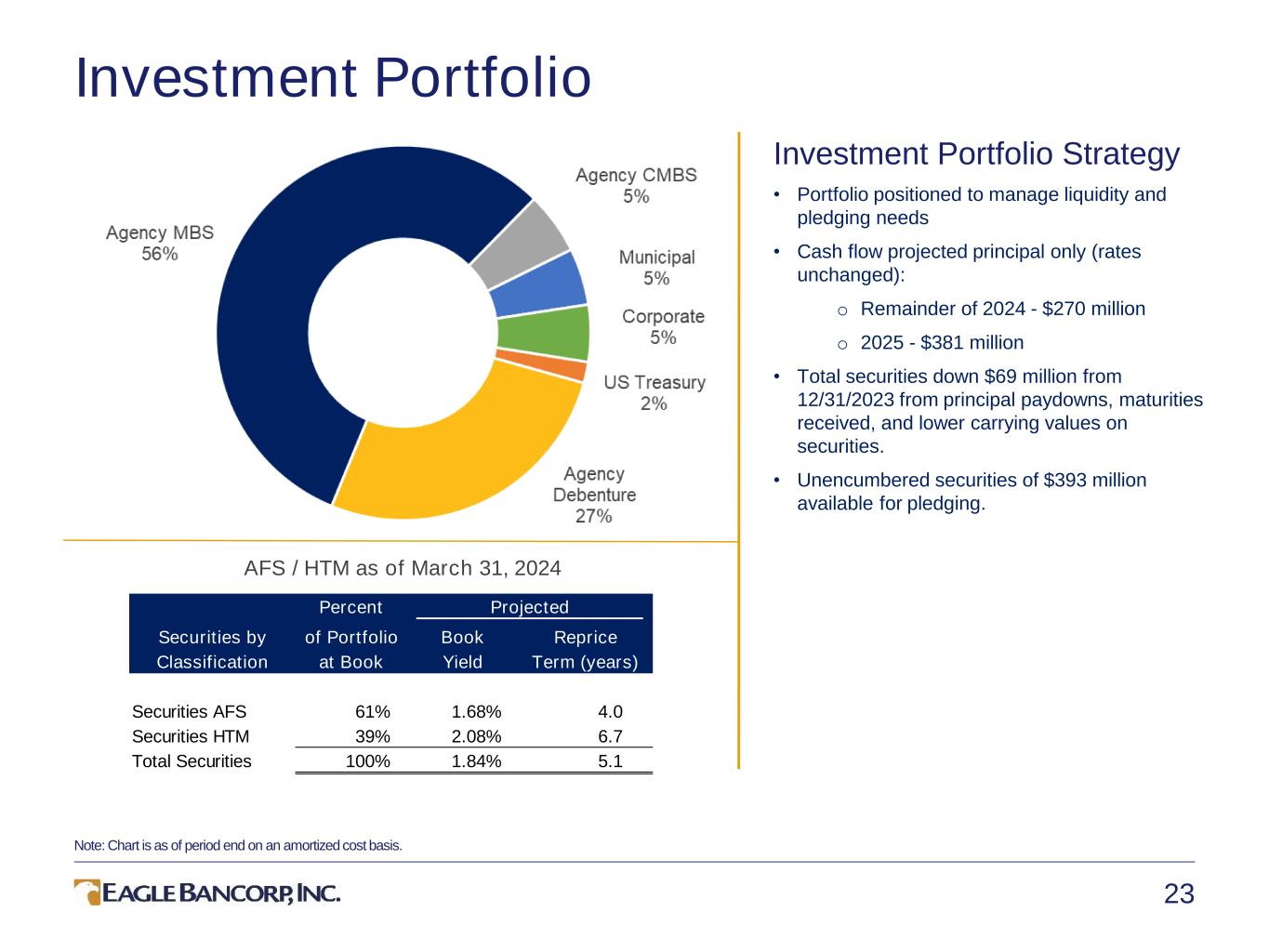

Investment securities available-for-sale at fair value (amortized cost of $1,613,659, $1,668,316, and $1,763,371, respectively, and allowance for credit losses of $17, $17 and $31, respectively) |

1,445,034 | 1,506,388 | 1,582,185 | ||||||||||||||

Investment securities held-to-maturity at amortized cost, net of allowance for credit losses of $1,957, $1,956 and $2,008, respectively (fair value of $878,159, $901,582 and $965,786, respectively) |

1,000,732 | 1,015,737 | 1,075,303 | ||||||||||||||

| Federal Reserve and Federal Home Loan Bank stock | 54,678 | 25,748 | 79,134 | ||||||||||||||

| Loans held for sale | — | — | 6,488 | ||||||||||||||

| Loans | 7,982,702 | 7,968,695 | 7,737,676 | ||||||||||||||

Less: allowance for credit losses |

(99,684) | (85,940) | (78,377) | ||||||||||||||

| Loans, net | 7,883,018 | 7,882,755 | 7,659,299 | ||||||||||||||

| Premises and equipment, net | 9,504 | 10,189 | 12,929 | ||||||||||||||

| Operating lease right-of-use assets | 17,679 | 19,129 | 23,060 | ||||||||||||||

| Deferred income taxes | 87,813 | 86,620 | 89,117 | ||||||||||||||

| Bank-owned life insurance | 113,624 | 112,921 | 111,217 | ||||||||||||||

| Goodwill and intangible assets, net | 104,611 | 104,925 | 104,226 | ||||||||||||||

| Other real estate owned | 773 | 1,108 | 1,962 | ||||||||||||||

| Other assets | 177,310 | 176,334 | 171,183 | ||||||||||||||

Total Assets |

$ | 11,612,648 | $ | 11,664,538 | $ | 11,088,867 | |||||||||||

| Liabilities and Shareholders' Equity | |||||||||||||||||

Liabilities |

|||||||||||||||||

| Deposits: | |||||||||||||||||

Noninterest-bearing demand |

$ | 1,835,524 | $ | 2,279,081 | $ | 2,247,706 | |||||||||||

Interest-bearing transaction |

1,207,566 | 997,448 | 907,637 | ||||||||||||||

| Savings and money market | 3,235,391 | 3,314,043 | 2,970,093 | ||||||||||||||

| Time deposits | 2,222,958 | 2,217,467 | 1,337,805 | ||||||||||||||

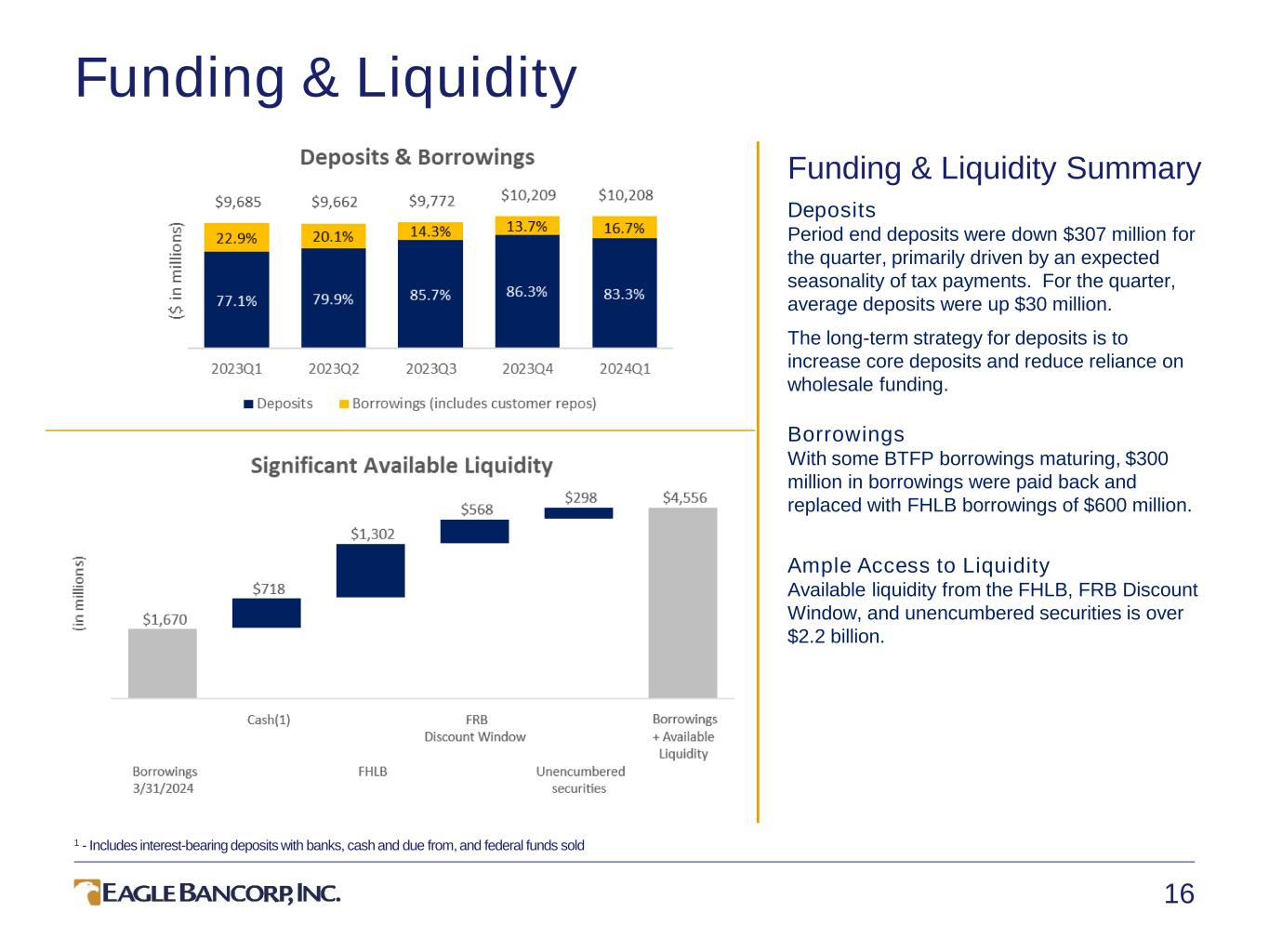

| Total deposits | 8,501,439 | 8,808,039 | 7,463,241 | ||||||||||||||

| Customer repurchase agreements | 37,059 | 30,587 | 37,854 | ||||||||||||||

Borrowings |

1,669,948 | 1,369,918 | 2,183,626 | ||||||||||||||

| Operating lease liabilities | 21,611 | 23,238 | 27,634 | ||||||||||||||

| Reserve for unfunded commitments | 6,045 | 5,590 | 6,704 | ||||||||||||||

| Other liabilities | 117,133 | 152,883 | 127,850 | ||||||||||||||

Total Liabilities |

10,353,235 | 10,390,255 | 9,846,909 | ||||||||||||||

| Shareholders' Equity | |||||||||||||||||

Common stock, par value $0.01 per share; shares authorized 100,000,000, shares issued and outstanding 30,185,732, 29,925,612, and 31,111,647, respectively |

297 | 296 | 308 | ||||||||||||||

Additional paid-in capital |

377,334 | 374,888 | 397,012 | ||||||||||||||

| Retained earnings | 1,047,550 | 1,061,456 | 1,025,552 | ||||||||||||||

| Accumulated other comprehensive loss | (165,768) | (162,357) | (180,914) | ||||||||||||||

| Total Shareholders' Equity | 1,259,413 | 1,274,283 | 1,241,958 | ||||||||||||||

| Total Liabilities and Shareholders' Equity | $ | 11,612,648 | $ | 11,664,538 | $ | 11,088,867 | |||||||||||

| March 31, | December 31, | March 31, | ||||||||||||||||||||||||

| 2024 | 2023 | 2023 | ||||||||||||||||||||||||

| Amount | % | Amount | % | Amount | % | |||||||||||||||||||||

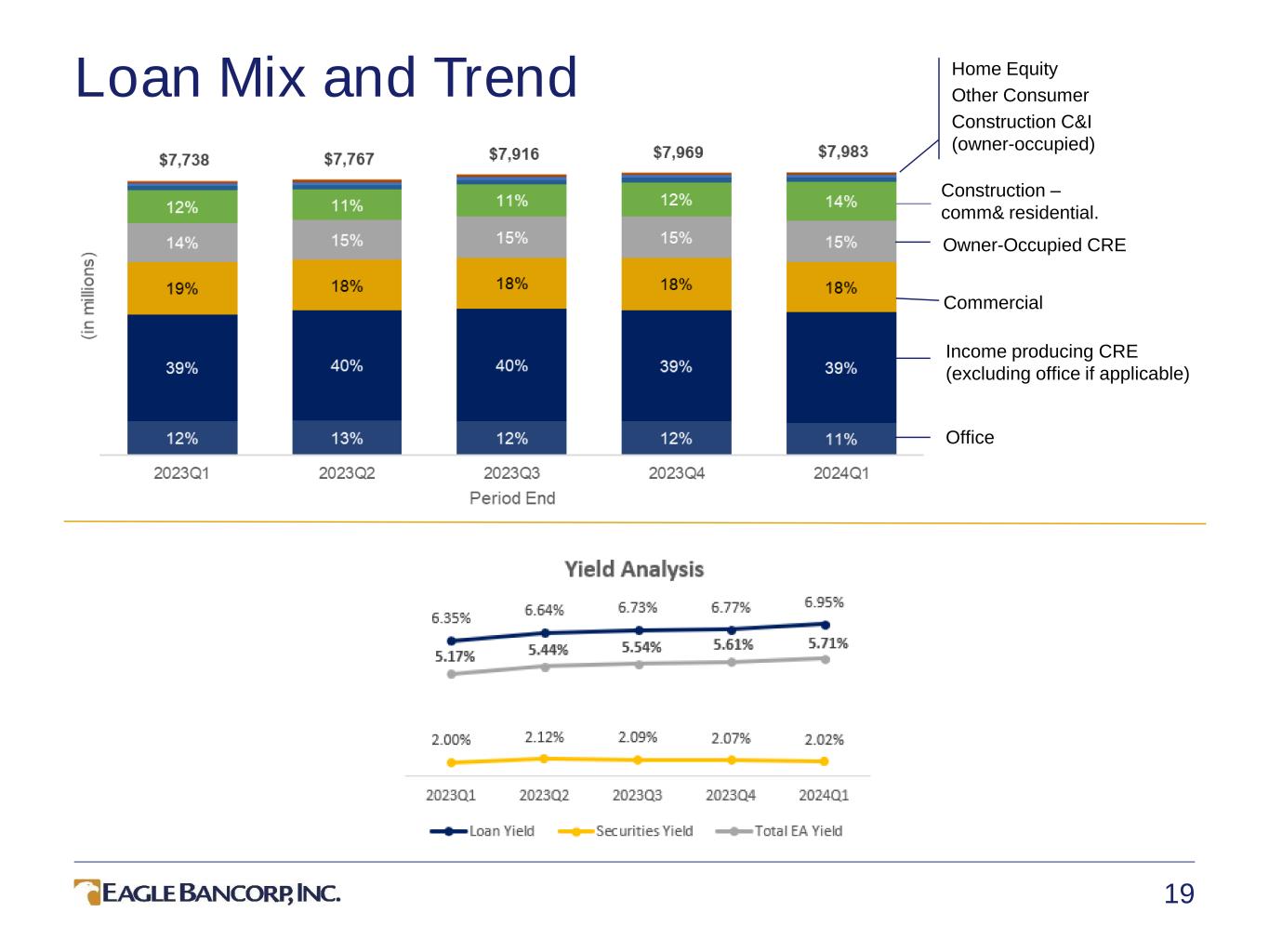

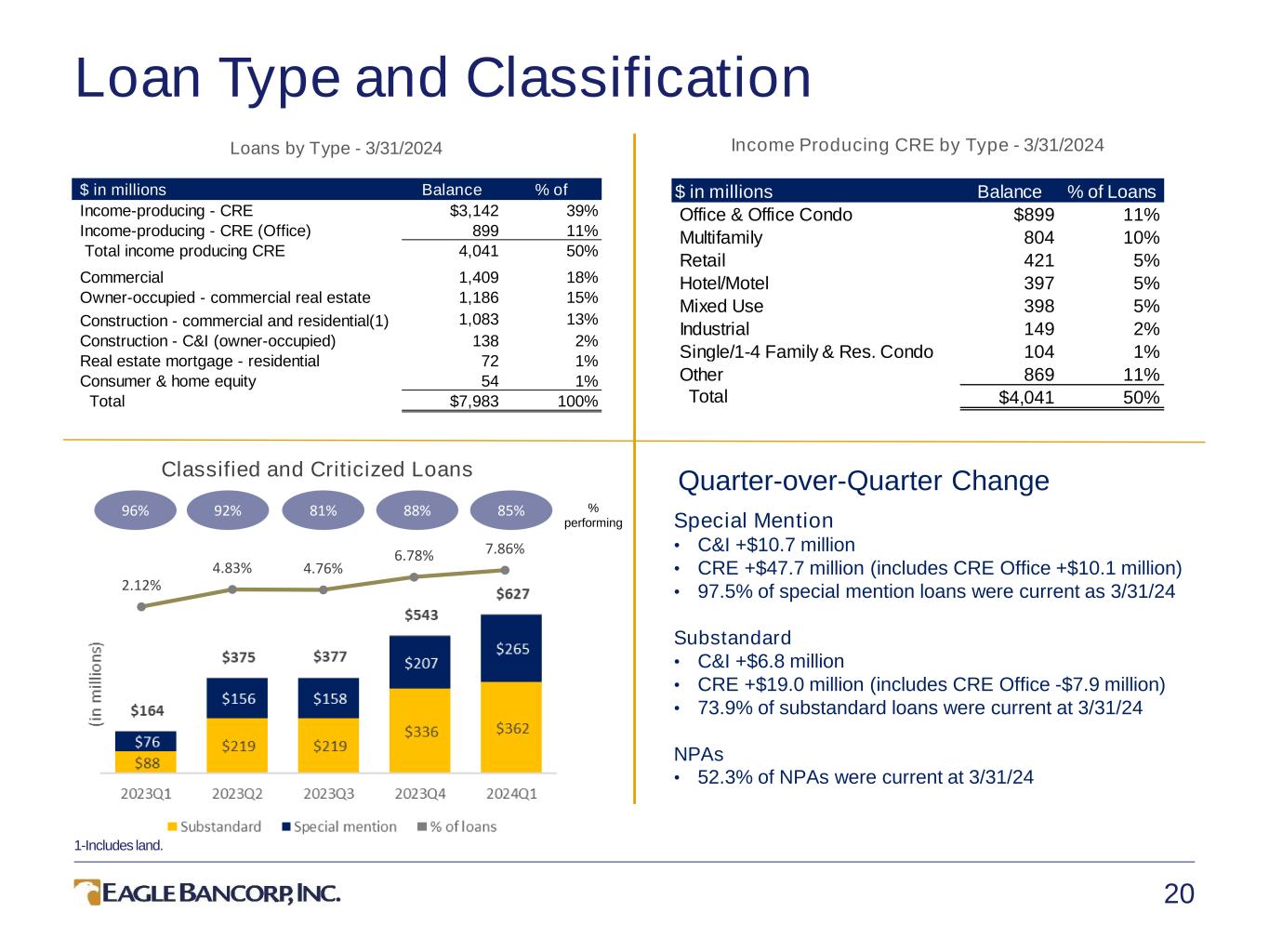

| Loan Balances - Period End: | ||||||||||||||||||||||||||

Commercial |

$ | 1,408,767 | 18 | % | $ | 1,473,766 | 18 | % | $ | 1,482,983 | 19 | % | ||||||||||||||

| PPP loans | 467 | — | % | 528 | — | % | 709 | — | % | |||||||||||||||||

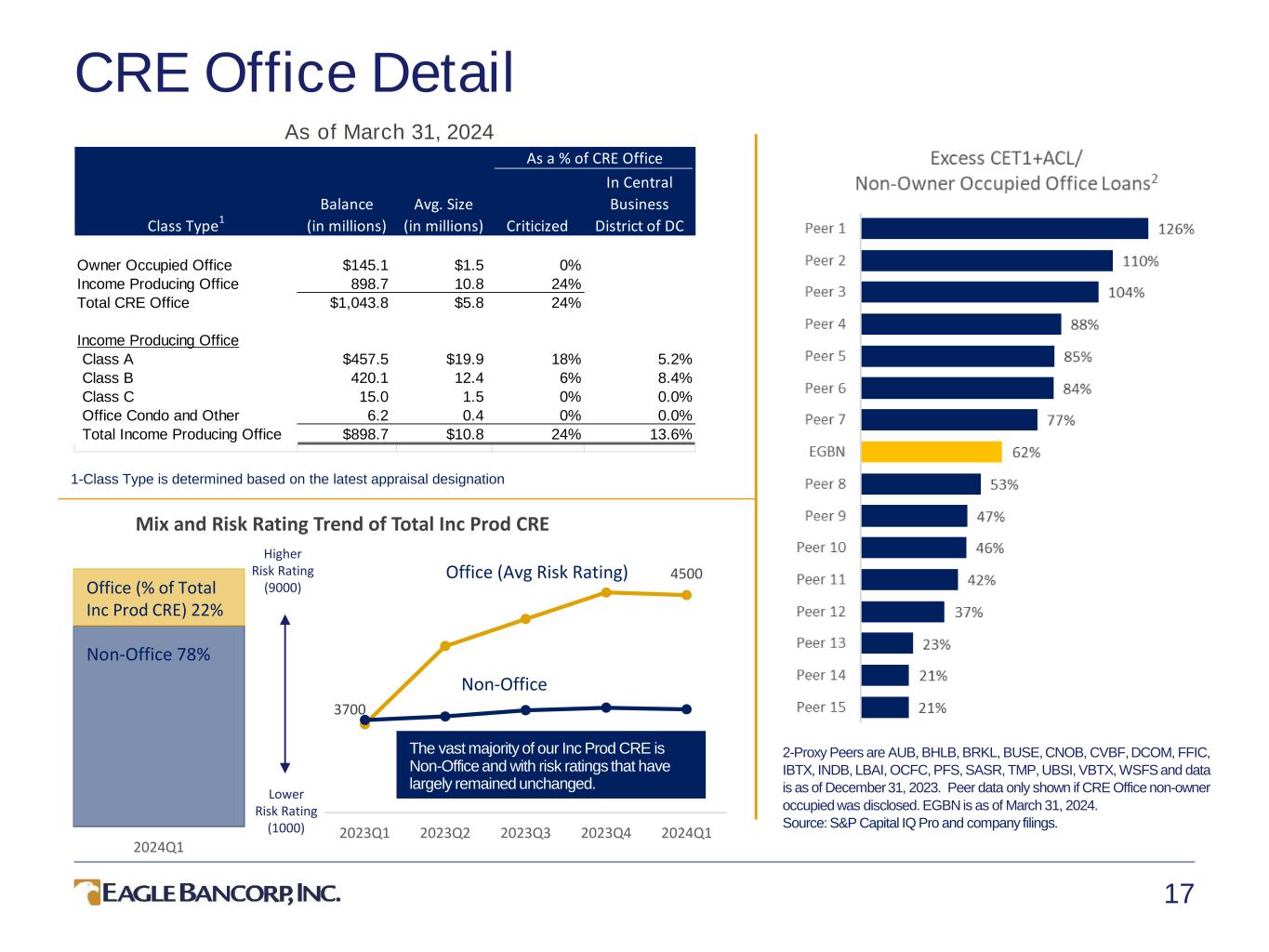

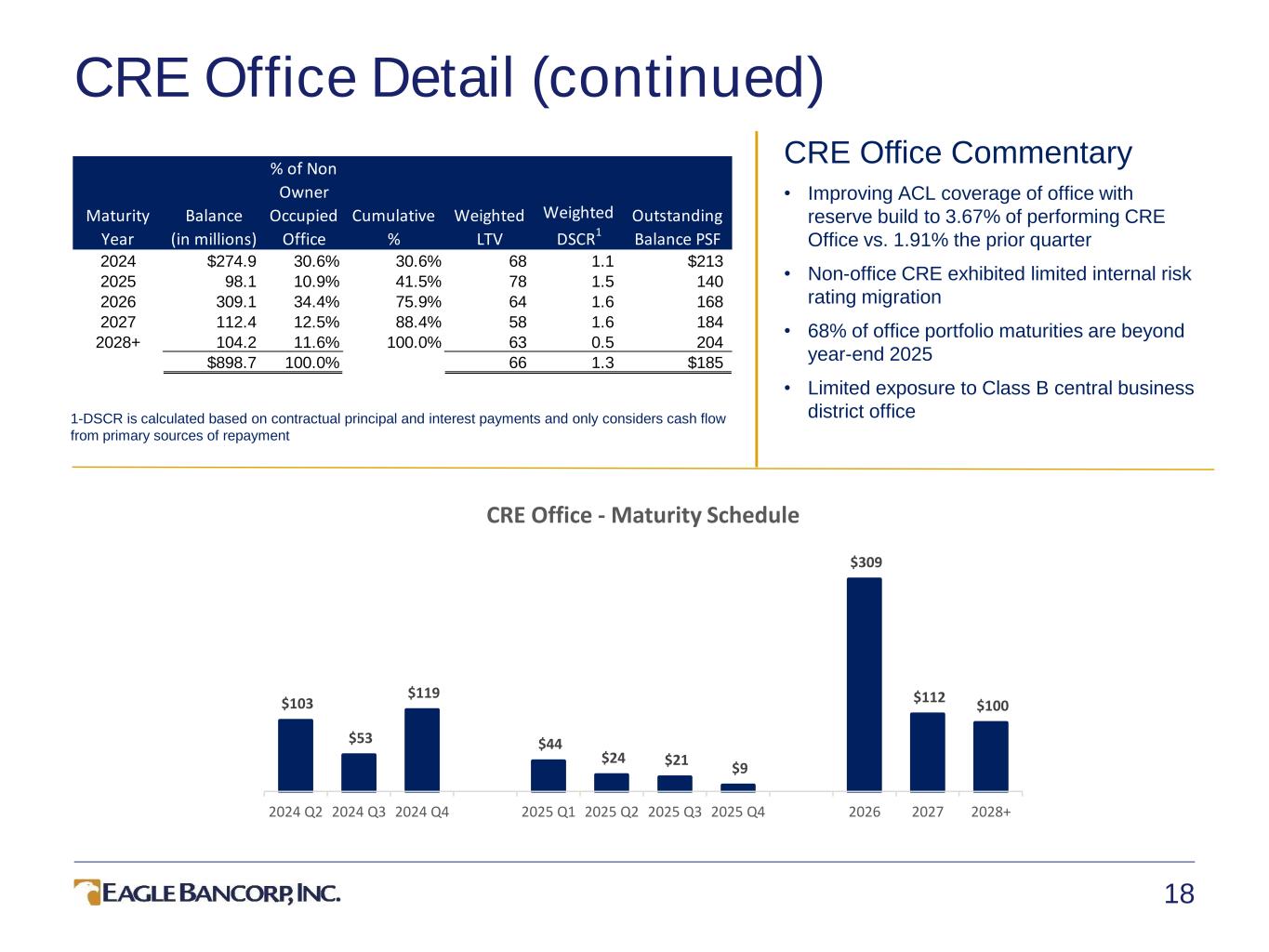

Income producing - commercial real estate |

4,040,655 | 50 | % | 4,094,614 | 51 | % | 3,970,903 | 51 | % | |||||||||||||||||

Owner occupied - commercial real estate |

1,185,582 | 15 | % | 1,172,239 | 15 | % | 1,095,699 | 14 | % | |||||||||||||||||

Real estate mortgage - residential |

72,087 | 1 | % | 73,396 | 1 | % | 73,677 | 1 | % | |||||||||||||||||

| Construction - commercial and residential | 1,082,556 | 13 | % | 969,766 | 12 | % | 948,877 | 13 | % | |||||||||||||||||

| Construction - C&I (owner occupied) | 138,379 | 2 | % | 132,021 | 2 | % | 109,013 | 1 | % | |||||||||||||||||

| Home equity | 53,251 | 1 | % | 51,964 | 1 | % | 53,829 | 1 | % | |||||||||||||||||

| Other consumer | 958 | — | % | 401 | — | % | 1,986 | — | % | |||||||||||||||||

| Total loans | $ | 7,982,702 | 100 | % | $ | 7,968,695 | 100 | % | $ | 7,737,676 | 100 | % | ||||||||||||||

| Three Months Ended or As Of | |||||||||||||||||

| March 31, | December 31, | March 31, | |||||||||||||||

| 2024 | 2023 | 2023 | |||||||||||||||

| Asset Quality: | |||||||||||||||||

Net charge-offs |

$ | 21,430 | $ | 11,936 | $ | 975 | |||||||||||

| Nonperforming loans | $ | 91,491 | $ | 65,524 | $ | 6,757 | |||||||||||

| Other real estate owned | $ | 773 | $ | 1,108 | $ | 1,962 | |||||||||||

| Nonperforming assets | $ | 92,264 | $ | 66,632 | $ | 8,719 | |||||||||||

| Special mention | $ | 265,348 | $ | 207,059 | $ | 76,032 | |||||||||||

| Substandard | $ | 361,776 | $ | 335,815 | $ | 87,950 | |||||||||||

| Eagle Bancorp, Inc. | |||||||||||||||||||||||||||||||||||

| Consolidated Average Balances, Interest Yields And Rates vs. Prior Quarter (Unaudited) | |||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||||||||

| March 31, 2024 | December 31, 2023 | ||||||||||||||||||||||||||||||||||

| Average Balance | Interest | Average Yield/Rate |

Average Balance | Interest | Average Yield/Rate |

||||||||||||||||||||||||||||||

| ASSETS | |||||||||||||||||||||||||||||||||||

| Interest earning assets: | |||||||||||||||||||||||||||||||||||

Interest-bearing deposits with other banks and other short-term investments |

$ | 1,841,771 | $ | 24,862 | 5.43 | % | $ | 1,340,972 | $ | 18,230 | 5.39 | % | |||||||||||||||||||||||

Loans (1) (2) |

7,988,941 | 137,994 | 6.95 | % | 7,963,074 | 135,964 | 6.77 | % | |||||||||||||||||||||||||||

Investment securities available-for-sale (2) |

1,516,503 | 7,247 | 1.92 | % | 1,498,132 | 7,611 | 2.02 | % | |||||||||||||||||||||||||||

Investment securities held-to-maturity (2) |

1,011,231 | 5,433 | 2.16 | % | 1,027,230 | 5,531 | 2.14 | % | |||||||||||||||||||||||||||

| Federal funds sold | 7,051 | 66 | 3.76 | % | 8,314 | 85 | 4.06 | % | |||||||||||||||||||||||||||

| Total interest earning assets | 12,365,497 | $ | 175,602 | 5.71 | % | 11,837,722 | $ | 167,421 | 5.61 | % | |||||||||||||||||||||||||

| Total noninterest earning assets | 508,987 | 530,364 | |||||||||||||||||||||||||||||||||

| Less: allowance for credit losses | (90,014) | (84,783) | |||||||||||||||||||||||||||||||||

| Total noninterest earning assets | 418,973 | 445,581 | |||||||||||||||||||||||||||||||||

| TOTAL ASSETS | $ | 12,784,470 | $ | 12,283,303 | |||||||||||||||||||||||||||||||

| LIABILITIES AND SHAREHOLDERS' EQUITY | |||||||||||||||||||||||||||||||||||

| Interest bearing liabilities: | |||||||||||||||||||||||||||||||||||

Interest-bearing transaction |

$ | 1,833,493 | $ | 16,830 | 3.69 | % | $ | 1,843,617 | $ | 16,607 | 3.57 | % | |||||||||||||||||||||||

| Savings and money market | 3,423,388 | 35,930 | 4.22 | % | 3,297,581 | 35,384 | 4.26 | % | |||||||||||||||||||||||||||

| Time deposits | 2,187,320 | 26,623 | 4.90 | % | 2,164,038 | 26,248 | 4.81 | % | |||||||||||||||||||||||||||

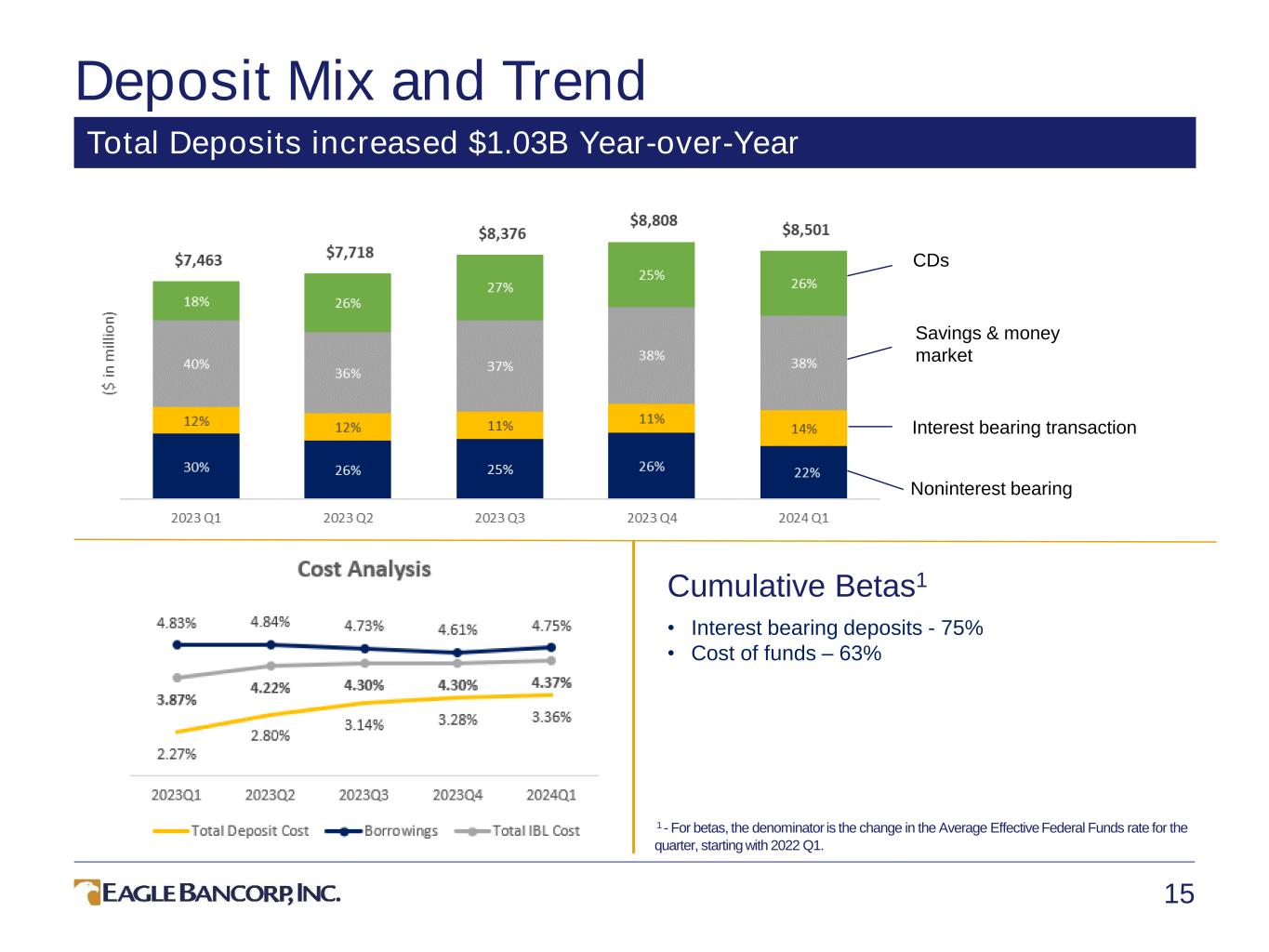

| Total interest bearing deposits | 7,444,201 | 79,383 | 4.29 | % | 7,305,236 | 78,239 | 4.25 | % | |||||||||||||||||||||||||||

| Customer repurchase agreements | 36,084 | 315 | 3.51 | % | 31,290 | 272 | 3.45 | % | |||||||||||||||||||||||||||

Borrowings |

1,796,863 | 21,206 | 4.75 | % | 1,370,627 | 15,918 | 4.61 | % | |||||||||||||||||||||||||||

| Total interest bearing liabilities | 9,277,148 | $ | 100,904 | 4.37 | % | 8,707,153 | $ | 94,429 | 4.30 | % | |||||||||||||||||||||||||

| Noninterest bearing liabilities: | |||||||||||||||||||||||||||||||||||

| Noninterest bearing demand | 2,057,460 | 2,166,133 | |||||||||||||||||||||||||||||||||

| Other liabilities | 160,206 | 171,254 | |||||||||||||||||||||||||||||||||

| Total noninterest bearing liabilities | 2,217,666 | 2,337,387 | |||||||||||||||||||||||||||||||||

Shareholders' equity |

1,289,656 | 1,238,763 | |||||||||||||||||||||||||||||||||

| TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY | $ | 12,784,470 | $ | 12,283,303 | |||||||||||||||||||||||||||||||

| Net interest income | $ | 74,698 | $ | 72,992 | |||||||||||||||||||||||||||||||

| Net interest spread | 1.34 | % | 1.31 | % | |||||||||||||||||||||||||||||||

| Net interest margin | 2.43 | % | 2.45 | % | |||||||||||||||||||||||||||||||

Cost of funds |

3.58 | % | 3.45 | % | |||||||||||||||||||||||||||||||

| Eagle Bancorp, Inc. | |||||||||||||||||||||||||||||||||||

| Consolidated Average Balances, Interest Yields And Rates vs. Year Ago Quarter (Unaudited) | |||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||||||||

| Three Months Ended March 31, | |||||||||||||||||||||||||||||||||||

| 2024 | 2023 | ||||||||||||||||||||||||||||||||||

| Average Balance | Interest | Average Yield/Rate |

Average Balance | Interest | Average Yield/Rate |

||||||||||||||||||||||||||||||

| ASSETS | |||||||||||||||||||||||||||||||||||

| Interest earning assets: | |||||||||||||||||||||||||||||||||||

| Interest bearing deposits with other banks and other short-term investments | $ | 1,841,771 | $ | 24,862 | 5.43 | % | $ | 526,506 | $ | 5,774 | 4.45 | % | |||||||||||||||||||||||

Loans held for sale (1) |

— | — | — | % | 4,093 | 60 | 5.95 | % | |||||||||||||||||||||||||||

Loans (1) (2) |

7,988,941 | 137,994 | 6.95 | % | 7,712,023 | 120,790 | 6.35 | % | |||||||||||||||||||||||||||

Investment securities available-for-sale (2) |

1,516,503 | 7,247 | 1.92 | % | 1,660,258 | 7,811 | 1.91 | % | |||||||||||||||||||||||||||

Investment securities held-to-maturity (2) |

1,011,231 | 5,433 | 2.16 | % | 1,087,047 | 5,734 | 2.14 | % | |||||||||||||||||||||||||||

| Federal funds sold | 7,051 | 66 | 3.76 | % | 14,890 | 78 | 2.12 | % | |||||||||||||||||||||||||||

| Total interest earning assets | 12,365,497 | $ | 175,602 | 5.71 | % | 11,004,817 | $ | 140,247 | 5.17 | % | |||||||||||||||||||||||||

| Total noninterest earning assets | 508,987 | 495,889 | |||||||||||||||||||||||||||||||||

| Less: allowance for credit losses | (90,014) | (74,650) | |||||||||||||||||||||||||||||||||

| Total noninterest earning assets | 418,973 | 421,239 | |||||||||||||||||||||||||||||||||

| TOTAL ASSETS | $ | 12,784,470 | $ | 11,426,056 | |||||||||||||||||||||||||||||||

| LIABILITIES AND SHAREHOLDERS' EQUITY | |||||||||||||||||||||||||||||||||||

| Interest bearing liabilities: | |||||||||||||||||||||||||||||||||||

| Interest bearing transaction | $ | 1,833,493 | $ | 16,830 | 3.69 | % | $ | 1,065,421 | $ | 6,107 | 2.32 | % | |||||||||||||||||||||||

| Savings and money market | 3,423,388 | 35,930 | 4.22 | % | 3,326,807 | 33,274 | 4.06 | % | |||||||||||||||||||||||||||

| Time deposits | 2,187,320 | 26,623 | 4.90 | % | 1,078,227 | 9,573 | 3.60 | % | |||||||||||||||||||||||||||

| Total interest bearing deposits | 7,444,201 | 79,383 | 4.29 | % | 5,470,455 | 48,954 | 3.63 | % | |||||||||||||||||||||||||||

| Customer repurchase agreements | 36,084 | 315 | 3.51 | % | 38,257 | 302 | 3.20 | % | |||||||||||||||||||||||||||

Borrowings |

1,796,863 | 21,206 | 4.75 | % | 1,321,206 | 15,967 | 4.90 | % | |||||||||||||||||||||||||||

| Total interest bearing liabilities | 9,277,148 | $ | 100,904 | 4.37 | % | 6,829,918 | $ | 65,223 | 3.87 | % | |||||||||||||||||||||||||

| Noninterest bearing liabilities: | |||||||||||||||||||||||||||||||||||

| Noninterest bearing demand | 2,057,460 | 3,263,670 | |||||||||||||||||||||||||||||||||

| Other liabilities | 160,206 | 91,490 | |||||||||||||||||||||||||||||||||

| Total noninterest bearing liabilities | 2,217,666 | 3,355,160 | |||||||||||||||||||||||||||||||||

Shareholders' equity |

1,289,656 | 1,240,978 | |||||||||||||||||||||||||||||||||

| TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY | $ | 12,784,470 | $ | 11,426,056 | |||||||||||||||||||||||||||||||

| Net interest income | $ | 74,698 | $ | 75,024 | |||||||||||||||||||||||||||||||

| Net interest spread | 1.34 | % | 1.30 | % | |||||||||||||||||||||||||||||||

| Net interest margin | 2.43 | % | 2.77 | % | |||||||||||||||||||||||||||||||

Cost of funds(3) |

3.58 | % | 2.62 | % | |||||||||||||||||||||||||||||||

| Eagle Bancorp, Inc. | |||||||||||||||||||||||||||||||||||||||||||||||

Statements of Operations and Highlights Quarterly Trends (Unaudited) | |||||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in thousands, except per share data) | |||||||||||||||||||||||||||||||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||||||||||||||||||||

| March 31, | December 31, | September 30, | June 30, | March 31, | December 31, | September 30, | June 30, | ||||||||||||||||||||||||||||||||||||||||

| Income Statements: | 2024 | 2023 | 2023 | 2023 | 2023 | 2022 | 2022 | 2022 | |||||||||||||||||||||||||||||||||||||||

| Total interest income | $ | 175,602 | $ | 167,421 | $ | 161,149 | $ | 156,510 | $ | 140,247 | $ | 129,130 | $ | 111,527 | $ | 95,635 | |||||||||||||||||||||||||||||||

| Total interest expense | 100,904 | 94,429 | 90,430 | 84,699 | 65,223 | 43,530 | 27,630 | 12,717 | |||||||||||||||||||||||||||||||||||||||

| Net interest income | 74,698 | 72,992 | 70,719 | 71,811 | 75,024 | 85,600 | 83,897 | 82,918 | |||||||||||||||||||||||||||||||||||||||

| Provision for (reversal of) credit losses | 35,175 | 14,490 | 5,644 | 5,238 | 6,164 | (464) | 3,022 | 495 | |||||||||||||||||||||||||||||||||||||||

Provision for (reversal of) credit losses for unfunded commitments |

456 | (594) | (839) | 318 | 848 | 161 | 774 | 553 | |||||||||||||||||||||||||||||||||||||||

Net interest income after provision for (reversal of) credit losses |

39,067 | 59,096 | 65,914 | 66,255 | 68,012 | 85,903 | 80,101 | 81,870 | |||||||||||||||||||||||||||||||||||||||

| Noninterest income before investment gain (loss) | 3,585 | 2,891 | 6,342 | 8,593 | 3,721 | 5,326 | 5,304 | 5,715 | |||||||||||||||||||||||||||||||||||||||

| Net gain (loss) on sale of investment securities | 4 | 3 | 5 | 2 | (21) | 3 | 4 | (151) | |||||||||||||||||||||||||||||||||||||||

| Total noninterest income | 3,589 | 2,894 | 6,347 | 8,595 | 3,700 | 5,329 | 5,308 | 5,564 | |||||||||||||||||||||||||||||||||||||||

| Salaries and employee benefits | 21,726 | 18,416 | 21,549 | 21,957 | 24,174 | 23,691 | 21,538 | 21,805 | |||||||||||||||||||||||||||||||||||||||

Premises and equipment expenses |

3,059 | 2,967 | 3,095 | 3,227 | 3,317 | 3,292 | 3,275 | 3,523 | |||||||||||||||||||||||||||||||||||||||

| Marketing and advertising | 859 | 1,071 | 768 | 884 | 636 | 1,290 | 1,181 | 1,186 | |||||||||||||||||||||||||||||||||||||||

| Other expenses | 14,353 | 14,644 | 12,221 | 11,910 | 12,457 | 10,645 | 10,212 | 32,448 | |||||||||||||||||||||||||||||||||||||||

| Total noninterest expense | 39,997 | 37,098 | 37,633 | 37,978 | 40,584 | 38,918 | 36,206 | 58,962 | |||||||||||||||||||||||||||||||||||||||

| Income before income tax expense | 2,659 | 24,892 | 34,628 | 36,872 | 31,128 | 52,314 | 49,203 | 28,472 | |||||||||||||||||||||||||||||||||||||||

| Income tax expense | 2,997 | 4,667 | 7,245 | 8,180 | 6,894 | 10,121 | 11,906 | 12,776 | |||||||||||||||||||||||||||||||||||||||

Net (loss) income |

$ | (338) | $ | 20,225 | $ | 27,383 | $ | 28,692 | $ | 24,234 | $ | 42,193 | $ | 37,297 | $ | 15,696 | |||||||||||||||||||||||||||||||

| Per Share Data: | |||||||||||||||||||||||||||||||||||||||||||||||

(Loss) earnings per weighted average common share, basic |

$ | (0.01) | $ | 0.68 | $ | 0.91 | $ | 0.94 | $ | 0.78 | $ | 1.32 | $ | 1.16 | $ | 0.49 | |||||||||||||||||||||||||||||||

(Loss) earnings per weighted average common share, diluted |

$ | (0.01) | $ | 0.67 | $ | 0.91 | $ | 0.94 | $ | 0.78 | $ | 1.32 | $ | 1.16 | $ | 0.49 | |||||||||||||||||||||||||||||||

| Weighted average common shares outstanding, basic | 30,068,173 | 29,925,557 | 29,910,218 | 30,454,766 | 31,109,267 | 31,819,631 | 32,084,464 | 32,080,657 | |||||||||||||||||||||||||||||||||||||||

| Weighted average common shares outstanding, diluted | 30,068,173 | 29,966,962 | 29,944,692 | 30,505,468 | 31,180,346 | 31,898,619 | 32,155,678 | 32,142,427 | |||||||||||||||||||||||||||||||||||||||

| Actual shares outstanding at period end | 30,185,732 | 29,925,612 | 29,917,982 | 29,912,082 | 31,111,647 | 31,346,903 | 32,082,321 | 32,081,241 | |||||||||||||||||||||||||||||||||||||||

| Book value per common share at period end | $ | 41.72 | $ | 42.58 | $ | 40.64 | $ | 40.78 | $ | 39.92 | $ | 39.18 | $ | 38.02 | $ | 39.05 | |||||||||||||||||||||||||||||||

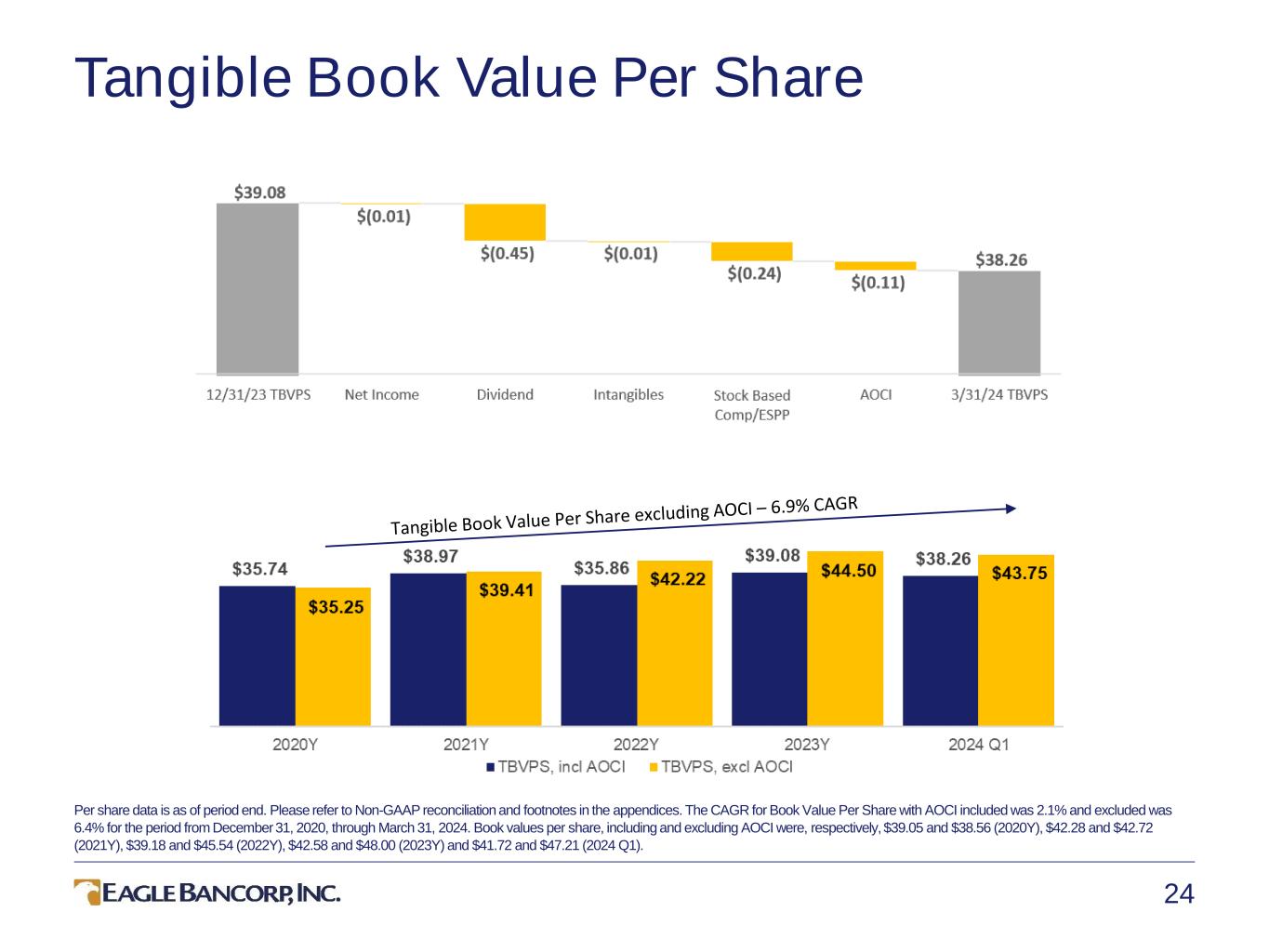

Tangible book value per common share at period end (1) |

$ | 38.26 | $ | 39.08 | $ | 37.12 | $ | 37.29 | $ | 36.57 | $ | 35.86 | $ | 34.77 | $ | 35.80 | |||||||||||||||||||||||||||||||

| Dividend per common share | $ | 0.45 | $ | 0.45 | $ | 0.45 | $ | 0.45 | $ | 0.45 | $ | 0.45 | $ | 0.45 | $ | 0.45 | |||||||||||||||||||||||||||||||

| Performance Ratios (annualized): | |||||||||||||||||||||||||||||||||||||||||||||||

| Return on average assets | (0.01) | % | 0.65 | % | 0.91 | % | 0.96 | % | 0.86 | % | 1.49 | % | 1.29 | % | 0.54 | % | |||||||||||||||||||||||||||||||

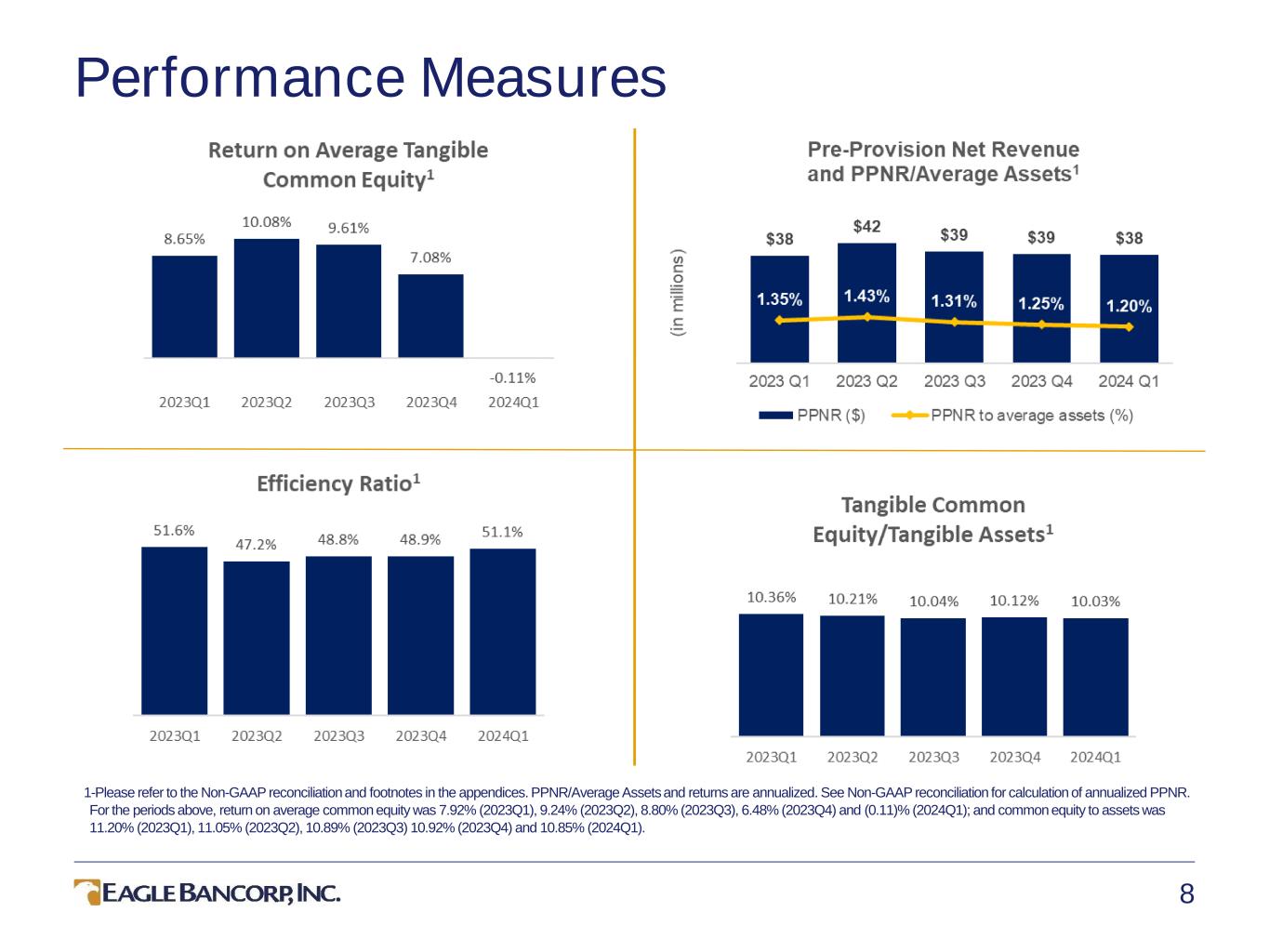

| Return on average common equity | (0.11) | % | 6.48 | % | 8.80 | % | 9.24 | % | 7.92 | % | 13.57 | % | 11.64 | % | 4.91 | % | |||||||||||||||||||||||||||||||

Return on average tangible common equity (1) |

(0.11) | % | 7.08 | % | 9.61 | % | 10.08 | % | 8.65 | % | 14.82 | % | 12.67 | % | 5.35 | % | |||||||||||||||||||||||||||||||

| Net interest margin | 2.43 | % | 2.45 | % | 2.43 | % | 2.49 | % | 2.77 | % | 3.14 | % | 3.02 | % | 2.94 | % | |||||||||||||||||||||||||||||||

Efficiency ratio (2) |

51.1 | % | 48.9 | % | 48.8 | % | 47.2 | % | 51.6 | % | 42.8 | % | 40.6 | % | 66.6 | % | |||||||||||||||||||||||||||||||

| Other Ratios: | |||||||||||||||||||||||||||||||||||||||||||||||

Allowance for credit losses to total loans (3) |

1.25 | % | 1.08 | % | 1.05 | % | 1.00 | % | 1.01 | % | 0.97 | % | 1.04 | % | 1.02 | % | |||||||||||||||||||||||||||||||

| Allowance for credit losses to total nonperforming loans | 109 | % | 131 | % | 119 | % | 268 | % | 1,160 | % | 1,151 | % | 997 | % | 386 | % | |||||||||||||||||||||||||||||||

Nonperforming assets to total assets |

0.79 | % | 0.57 | % | 0.64 | % | 0.28 | % | 0.08 | % | 0.08 | % | 0.09 | % | 0.19 | % | |||||||||||||||||||||||||||||||

Net charge-offs (recoveries) (annualized) to average total loans (3) |

1.07 | % | 0.60 | % | 0.02 | % | 0.29 | % | 0.05 | % | 0.05 | % | — | % | (0.04) | % | |||||||||||||||||||||||||||||||

| Tier 1 capital (to average assets) | 10.26 | % | 10.73 | % | 10.96 | % | 10.84 | % | 11.42 | % | 11.63 | % | 11.55 | % | 10.68 | % | |||||||||||||||||||||||||||||||

| Total capital (to risk weighted assets) | 14.87 | % | 14.79 | % | 14.54 | % | 14.51 | % | 14.74 | % | 14.94 | % | 15.60 | % | 15.14 | % | |||||||||||||||||||||||||||||||

| Common equity tier 1 capital (to risk weighted assets) | 13.80 | % | 13.90 | % | 13.68 | % | 13.55 | % | 13.75 | % | 14.03 | % | 14.64 | % | 14.06 | % | |||||||||||||||||||||||||||||||

Tangible common equity ratio (1) |

10.03 | % | 10.12 | % | 10.04 | % | 10.21 | % | 10.36 | % | 10.18 | % | 10.52 | % | 10.60 | % | |||||||||||||||||||||||||||||||

| Average Balances (in thousands): | |||||||||||||||||||||||||||||||||||||||||||||||

| Total assets | $ | 12,784,470 | $ | 12,283,303 | $ | 11,942,905 | $ | 11,960,111 | $ | 11,426,056 | $ | 11,255,956 | $ | 11,431,110 | $ | 11,701,679 | |||||||||||||||||||||||||||||||

| Total earning assets | $ | 12,365,497 | $ | 11,837,722 | $ | 11,532,186 | $ | 11,546,050 | $ | 11,004,817 | $ | 10,829,703 | $ | 11,030,670 | $ | 11,300,267 | |||||||||||||||||||||||||||||||

Total loans (3) |

$ | 7,988,941 | $ | 7,963,074 | $ | 7,795,144 | $ | 7,790,555 | $ | 7,712,023 | $ | 7,379,198 | $ | 7,282,589 | $ | 7,104,727 | |||||||||||||||||||||||||||||||

| Total deposits | $ | 9,501,661 | $ | 9,471,369 | $ | 8,946,641 | $ | 8,514,938 | $ | 8,734,125 | $ | 9,524,139 | $ | 9,907,497 | $ | 10,184,886 | |||||||||||||||||||||||||||||||

| Total borrowings | $ | 1,832,947 | $ | 1,401,917 | $ | 1,646,179 | $ | 2,102,507 | $ | 1,359,463 | $ | 411,060 | $ | 158,001 | $ | 152,583 | |||||||||||||||||||||||||||||||

Total shareholders' equity |

$ | 1,289,656 | $ | 1,238,763 | $ | 1,235,162 | $ | 1,245,647 | $ | 1,240,978 | $ | 1,233,705 | $ | 1,271,753 | $ | 1,281,742 | |||||||||||||||||||||||||||||||

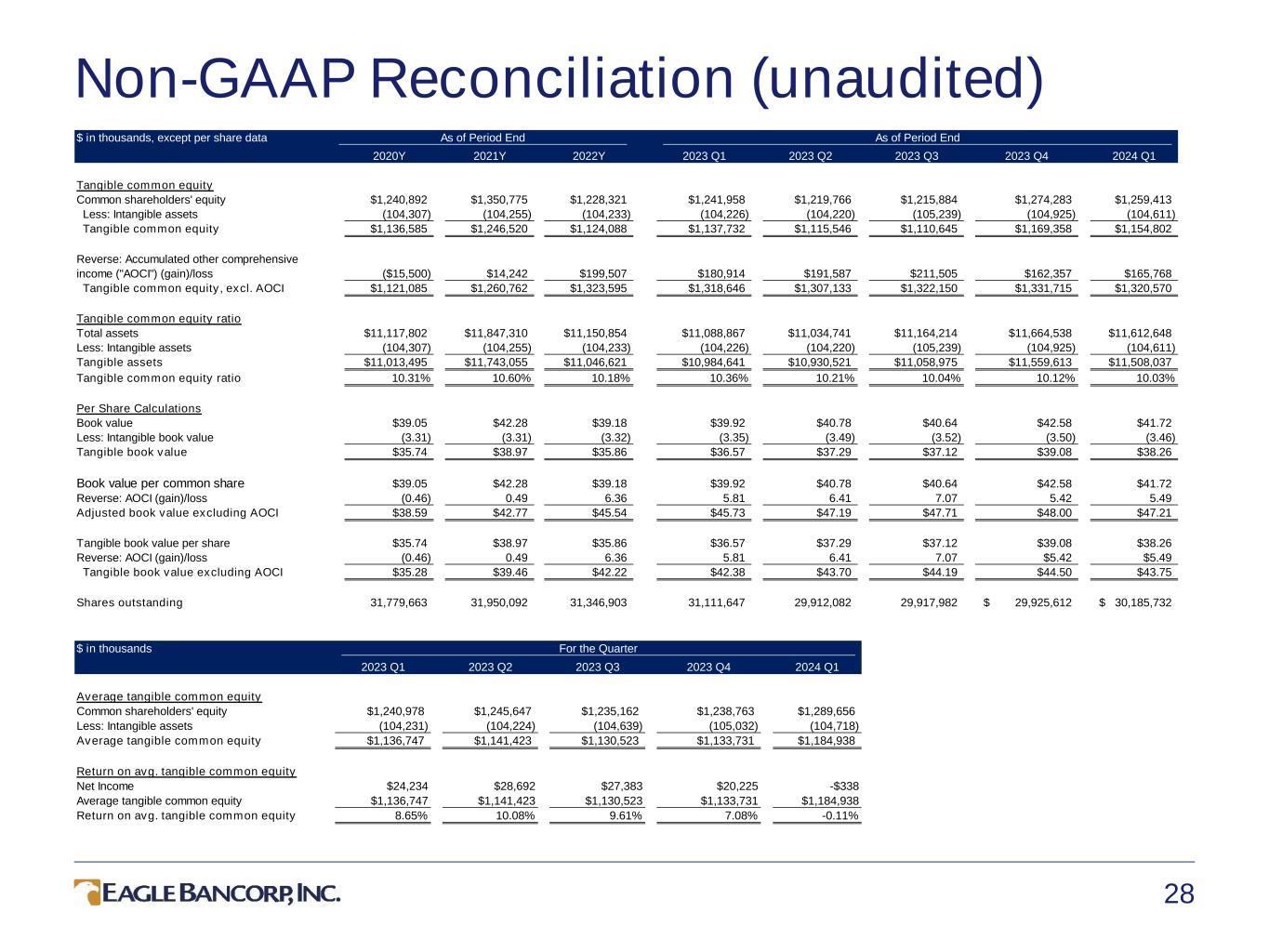

GAAP Reconciliation to Non-GAAP Financial Measures (unaudited) | |||||||||||||||||

| (dollars in thousands, except per share data) | |||||||||||||||||

| March 31, | December 31, | March 31, | |||||||||||||||

| 2024 | 2023 | 2023 | |||||||||||||||

| Tangible common equity | |||||||||||||||||

Common shareholders' equity |

$ | 1,259,413 | $ | 1,274,283 | $ | 1,241,958 | |||||||||||

Less: Intangible assets |

(104,611) | (104,925) | (104,226) | ||||||||||||||

Tangible common equity |

$ | 1,154,802 | $ | 1,169,358 | $ | 1,137,732 | |||||||||||

| Tangible common equity ratio | |||||||||||||||||

Total assets |

$ | 11,612,648 | $ | 11,664,538 | $ | 11,088,867 | |||||||||||

Less: Intangible assets |

(104,611) | (104,925) | (104,226) | ||||||||||||||

Tangible assets |

$ | 11,508,037 | $ | 11,559,613 | $ | 10,984,641 | |||||||||||

Tangible common equity ratio |

10.03 | % | 10.12 | % | 10.36 | % | |||||||||||

| Per share calculations | |||||||||||||||||

Book value per common share |

$ | 41.72 | $ | 42.58 | $ | 39.92 | |||||||||||

Less: Intangible book value per common share |

(3.46) | (3.50) | (3.35) | ||||||||||||||

Tangible book value per common share |

$ | 38.26 | $ | 39.08 | $ | 36.57 | |||||||||||

Shares outstanding at period end |

30,185,732 | 29,925,612 | 31,111,647 | ||||||||||||||

| Three Months Ended | |||||||||||||||||

| March 31, | December 31, | March 31, | |||||||||||||||

| 2024 | 2023 | 2023 | |||||||||||||||

| Average tangible common equity | |||||||||||||||||

Average common shareholders' equity |

$ | 1,289,656 | $ | 1,238,763 | $ | 1,240,978 | |||||||||||

Less: Average intangible assets |

(104,718) | (105,032) | (104,231) | ||||||||||||||

Average tangible common equity |

$ | 1,184,938 | $ | 1,133,731 | $ | 1,136,747 | |||||||||||

Return on average tangible common equity |

|||||||||||||||||

Net (loss) income |

$ | (338) | $ | 20,225 | $ | 24,234 | |||||||||||

Return on average tangible common equity |

(0.11) | % | 7.08 | % | 8.65 | % | |||||||||||

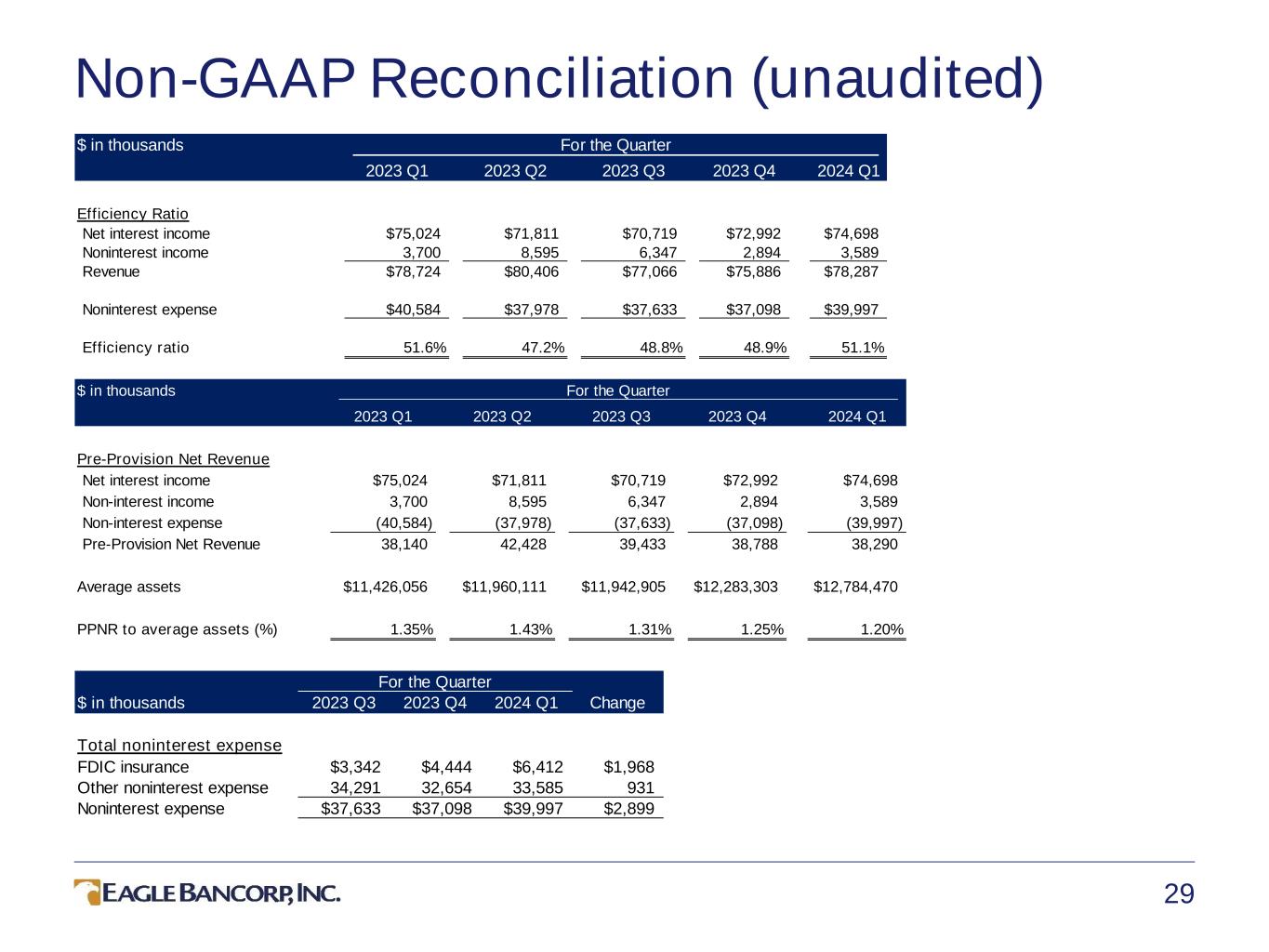

Efficiency ratio |

|||||||||||||||||

Net interest income |

$ | 74,698 | $ | 72,992 | $ | 75,024 | |||||||||||

Noninterest income |

3,589 | 2,894 | 3,700 | ||||||||||||||

Operating revenue |

$ | 78,287 | $ | 75,886 | $ | 78,724 | |||||||||||

Noninterest expense |

$ | 39,997 | $ | 37,098 | $ | 40,584 | |||||||||||

Efficiency ratio |

51.09 | % | 48.89 | % | 51.55 | % | |||||||||||

Pre-provision net revenue |

|||||||||||||||||

Net interest income |

$ | 74,698 | $ | 72,992 | $ | 75,024 | |||||||||||

Noninterest income |

3,589 | 2,894 | 3,700 | ||||||||||||||

Less: Noninterest expense |

(39,997) | (37,098) | (40,584) | ||||||||||||||

Pre-provision net revenue |

$ | 38,290 | $ | 38,788 | $ | 38,140 | |||||||||||