Document

TSMC Reports Fourth Quarter EPS of NT$14.45

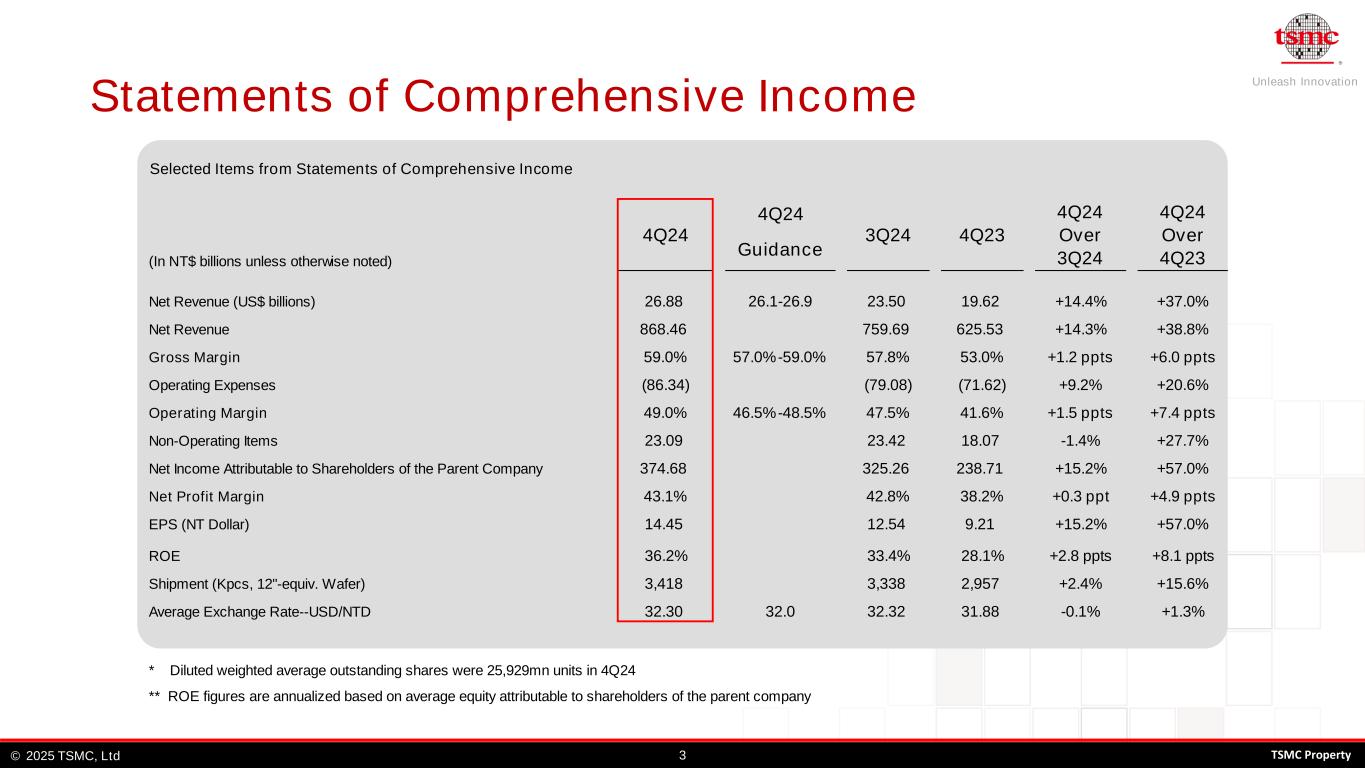

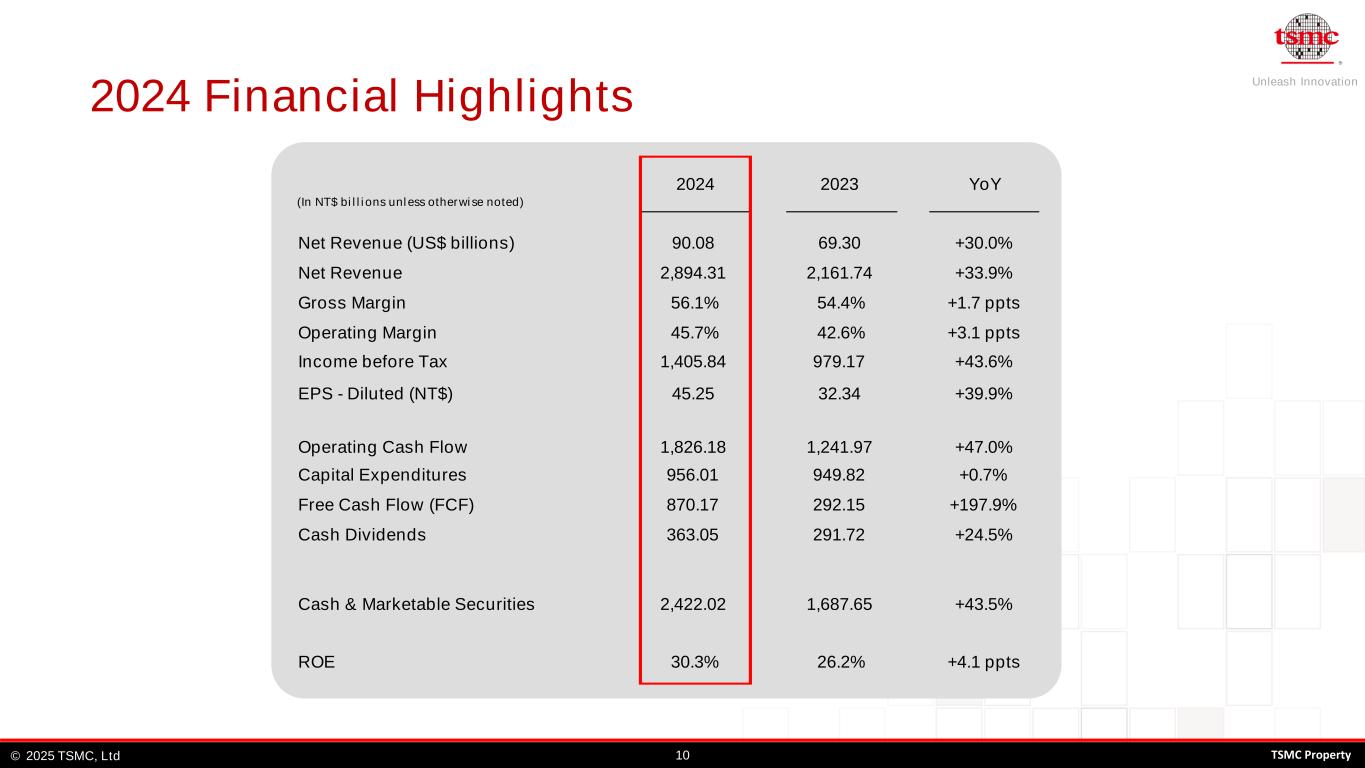

HSINCHU, Taiwan, R.O.C., Jan. 16, 2025 -- TSMC (TWSE: 2330, NYSE: TSM) today announced consolidated revenue of NT$868.46 billion, net income of NT$374.68 billion, and diluted earnings per share of NT$14.45 (US$2.24 per ADR unit) for the fourth quarter ended December 31, 2024.

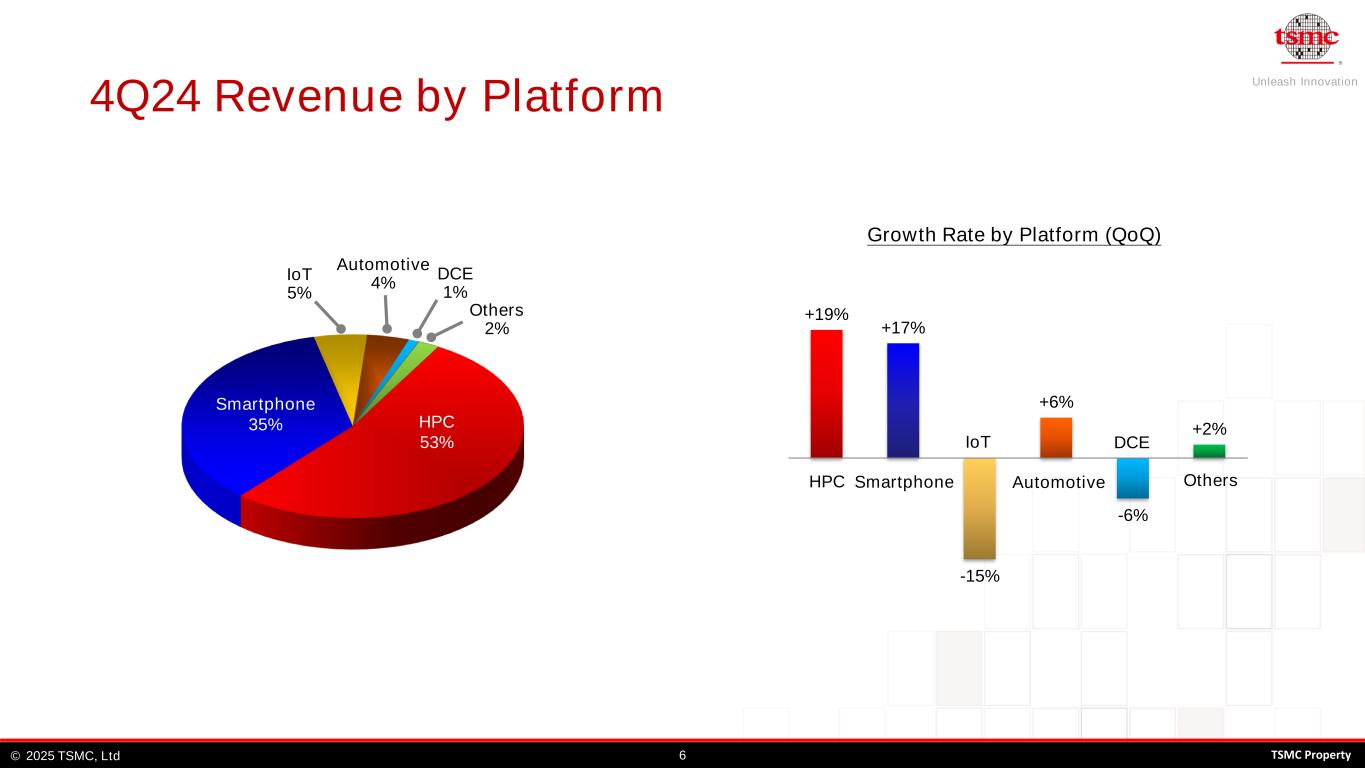

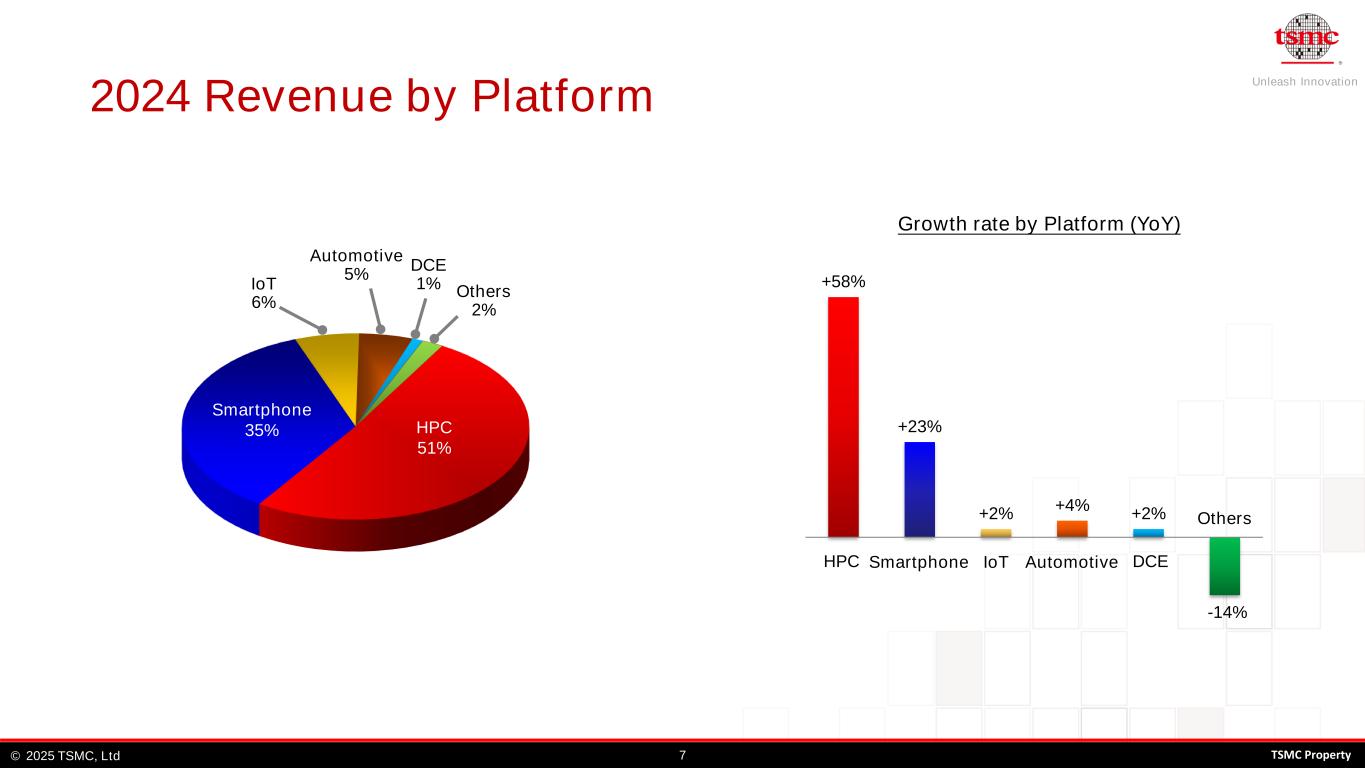

Year-over-year, fourth quarter revenue increased 38.8% while net income and diluted EPS both increased 57.0%. Compared to third quarter 2024, fourth quarter results represented a 14.3% increase in revenue and a 15.2% increase in net income. All figures were prepared in accordance with TIFRS on a consolidated basis.

In US dollars, fourth quarter revenue was $26.88 billion, which increased 37.0% year-over-year and increased 14.4% from the previous quarter.

Gross margin for the quarter was 59.0%, operating margin was 49.0%, and net profit margin was 43.1%.

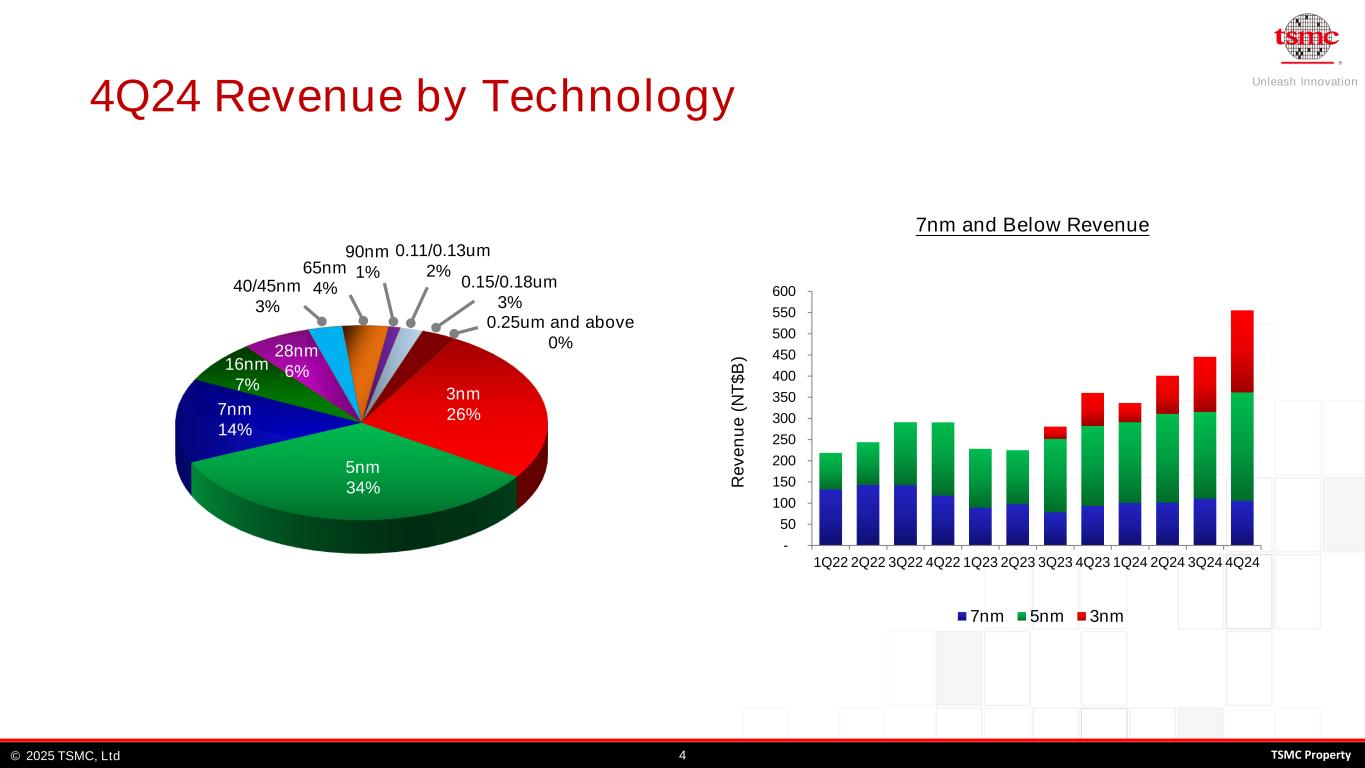

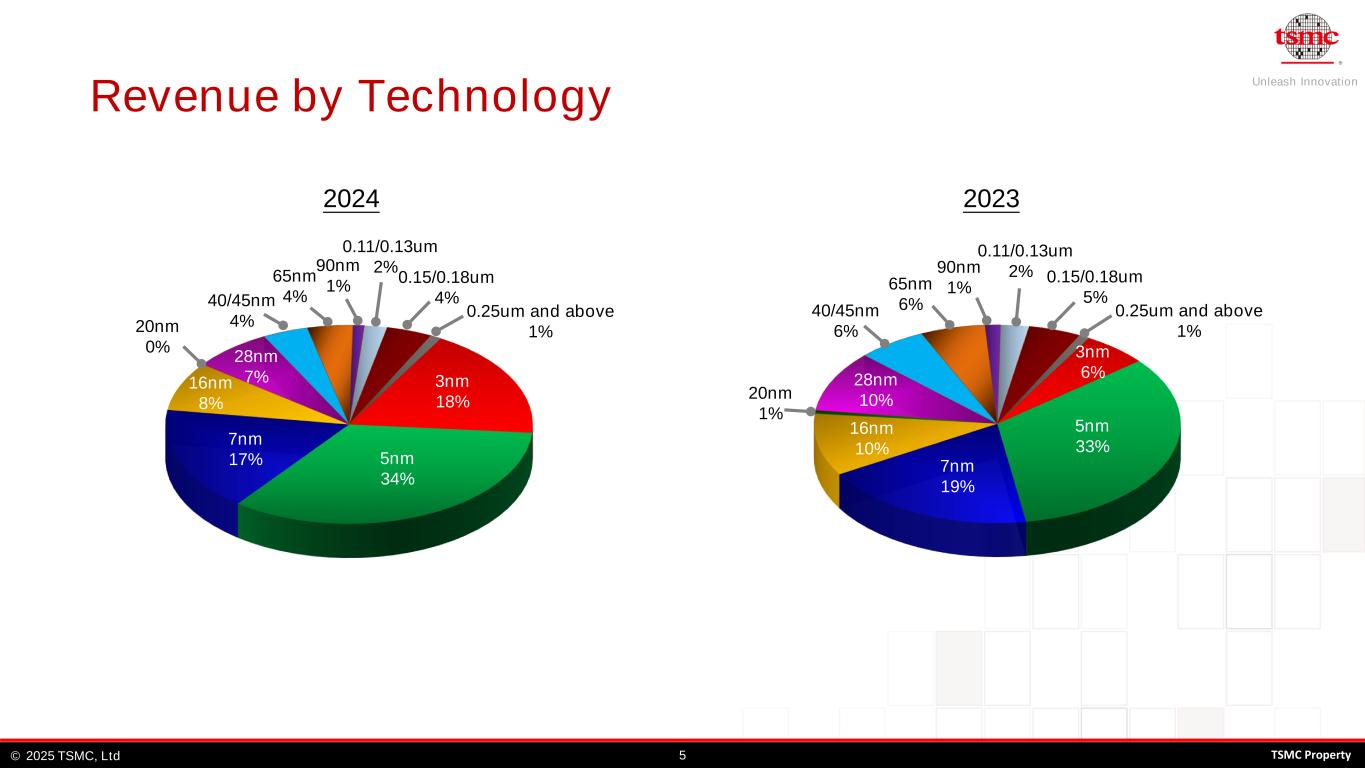

In the fourth quarter, shipments of 3-nanometer accounted for 26% of total wafer revenue; 5-nanometer accounted for 34%; 7-nanometer accounted for 14%. Advanced technologies, defined as 7-nanometer and more advanced technologies, accounted for 74% of total wafer revenue.

“Our business in the fourth quarter was supported by strong demand for our industry-leading 3nm and 5nm technologies,” said Wendell Huang, Senior VP and Chief Financial Officer of TSMC. “Moving into first quarter 2025, we expect our business to be impacted by smartphone seasonality, partially offset by continued growth in AI-related demand.”

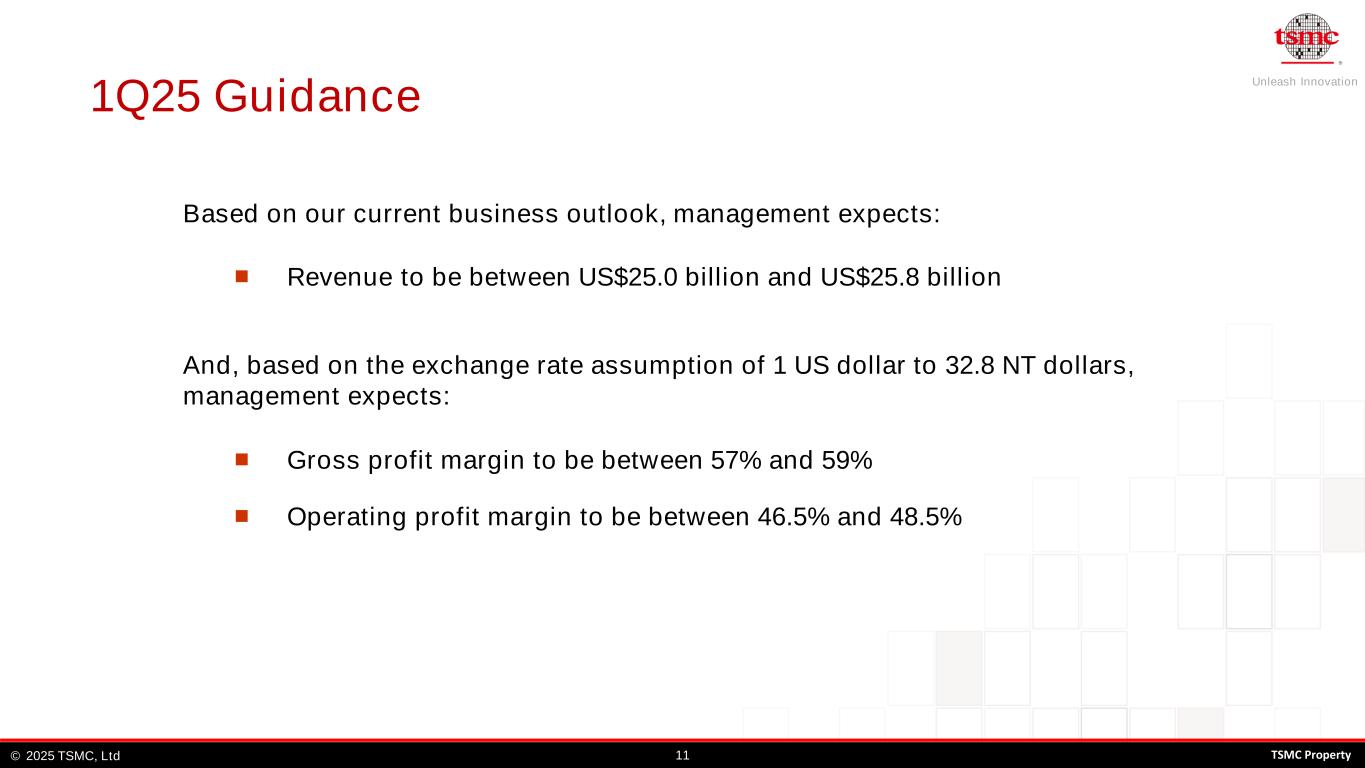

Based on the Company’s current business outlook, management expects the overall performance for first quarter 2025 to be as follows:

•Revenue is expected to be between US$25.0 billion and US$25.8 billion;

And, based on the exchange rate assumption of 1 US dollar to 32.8 NT dollars,

•Gross profit margin is expected to be between 57% and 59%;

•Operating profit margin is expected to be between 46.5% and 48.5%.

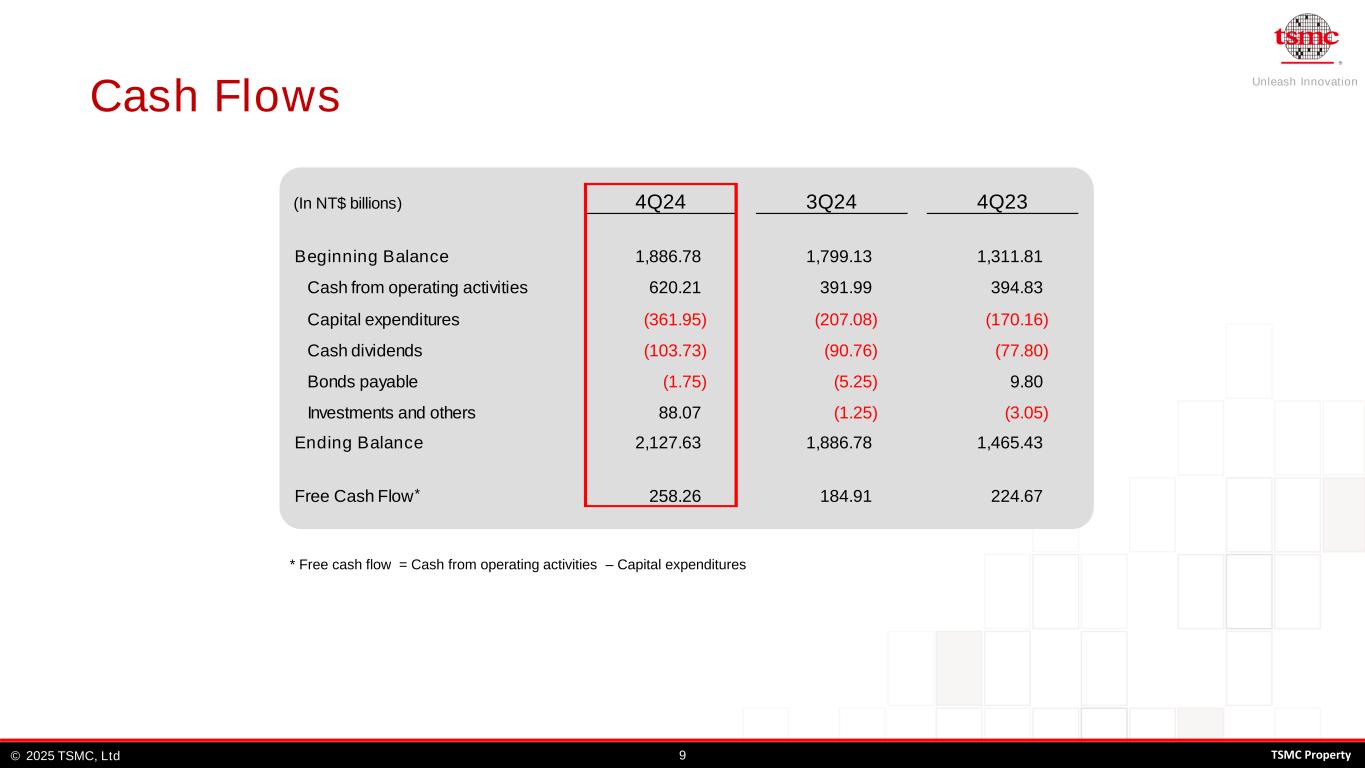

The management further expects the 2025 capital budget to be between US$38 billion and US$42 billion.

TSMC’s 2024 fourth quarter consolidated results:

(Unit: NT$ million, except for EPS)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4Q24

Amounta

|

4Q23

Amount

|

YoY

Inc. (Dec.) %

|

3Q24

Amount

|

QoQ

Inc. (Dec.) %

|

Net sales |

868,461 |

625,529 |

38.8 |

759,692 |

14.3 |

Gross profit |

512,379 |

331,768 |

54.4 |

439,345 |

16.6 |

Income from operations |

425,713 |

260,205 |

63.6 |

360,766 |

18.0 |

Income before tax |

448,798 |

278,281 |

61.3 |

384,187 |

16.8 |

Net income |

374,680 |

238,712 |

57.0 |

325,258 |

15.2 |

EPS (NT$) |

14.45b |

9.21b |

57.0 |

12.54c |

15.2 |

a: 4Q2024 figures have not been approved by Board of Directors

b: Based on 25,929 million weighted average outstanding shares

c: Based on 25,928 million weighted average outstanding shares

About TSMC

TSMC pioneered the pure-play foundry business model when it was founded in 1987, and has been the world’s leading dedicated semiconductor foundry ever since. The Company supports a thriving ecosystem of global customers and partners with the industry’s leading process technologies and portfolio of design enablement solutions to unleash innovation for the global semiconductor industry. With global operations spanning Asia, Europe, and North America, TSMC serves as a committed corporate citizen around the world.

TSMC deployed 288 distinct process technologies, and manufactured 11,878 products for 522 customers in 2024 by providing the broadest range of advanced, specialty and advanced packaging technology services. The Company is headquartered in Hsinchu, Taiwan. For more information please visit https://www.tsmc.com.

# # #

|

|

|

|

|

|

|

|

|

|

|

|

|

TSMC Spokesperson:

Wendell Huang

Senior Vice President and CFO

Tel: 886-3-505-5901

|

Media Contacts:

Nina Kao

Head of Public Relations

Tel: 886-3-563-6688 ext.7125036

Mobile: 886-988-239-163

E-Mail:nina_kao@tsmc.com

|

|

Ulric Kelly

Public Relations

Tel: 886-3-563-6688 ext. 7126541

Mobile: 886-978-111-503

E-Mail:ukelly@tsmc.com

|