| Washington | 91-1857900 | |||||||||||||

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|||||||||||||

| 201 Fifth Avenue SW, | Olympia | WA | 98501 | |||||||||||

| (Address of principal executive offices) | (Zip Code) | |||||||||||||

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||||

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||

| Title of each class | Trading symbol | Name of each exchange on which registered | ||||||

| Common stock, no par value | HFWA | NASDAQ | ||||||

| Exhibit 99.1 | ||||||||

| Exhibit 99.2 | ||||||||

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | |||||||

| HERITAGE FINANCIAL CORPORATION | ||||||||

| Date: | ||||||||

| July 21, 2022 | /S/ JEFFREY J. DEUEL | |||||||

| Jeffrey J. Deuel | ||||||||

| President and Chief Executive Officer | ||||||||

| (Duly Authorized Officer) | ||||||||

| As of or for the Quarter Ended | |||||||||||||||||

| June 30, 2022 |

March 31, 2022 |

June 30, 2021 |

|||||||||||||||

| (Dollars in thousands, except per share amounts) | |||||||||||||||||

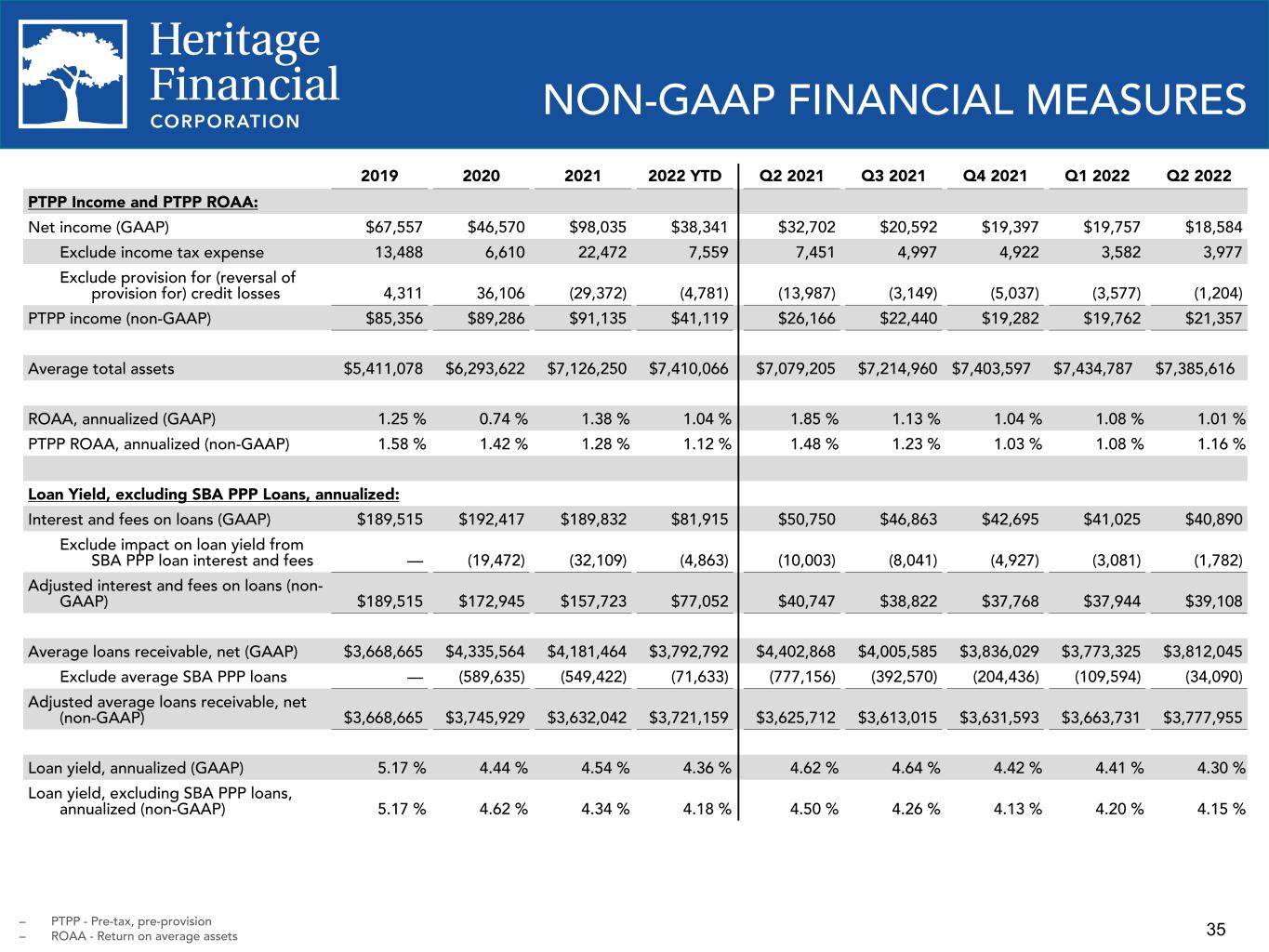

| Net income | $ | 18,584 | $ | 19,757 | $ | 32,702 | |||||||||||

Pre-tax, pre-provision income (1) |

$ | 21,357 | $ | 19,762 | $ | 26,166 | |||||||||||

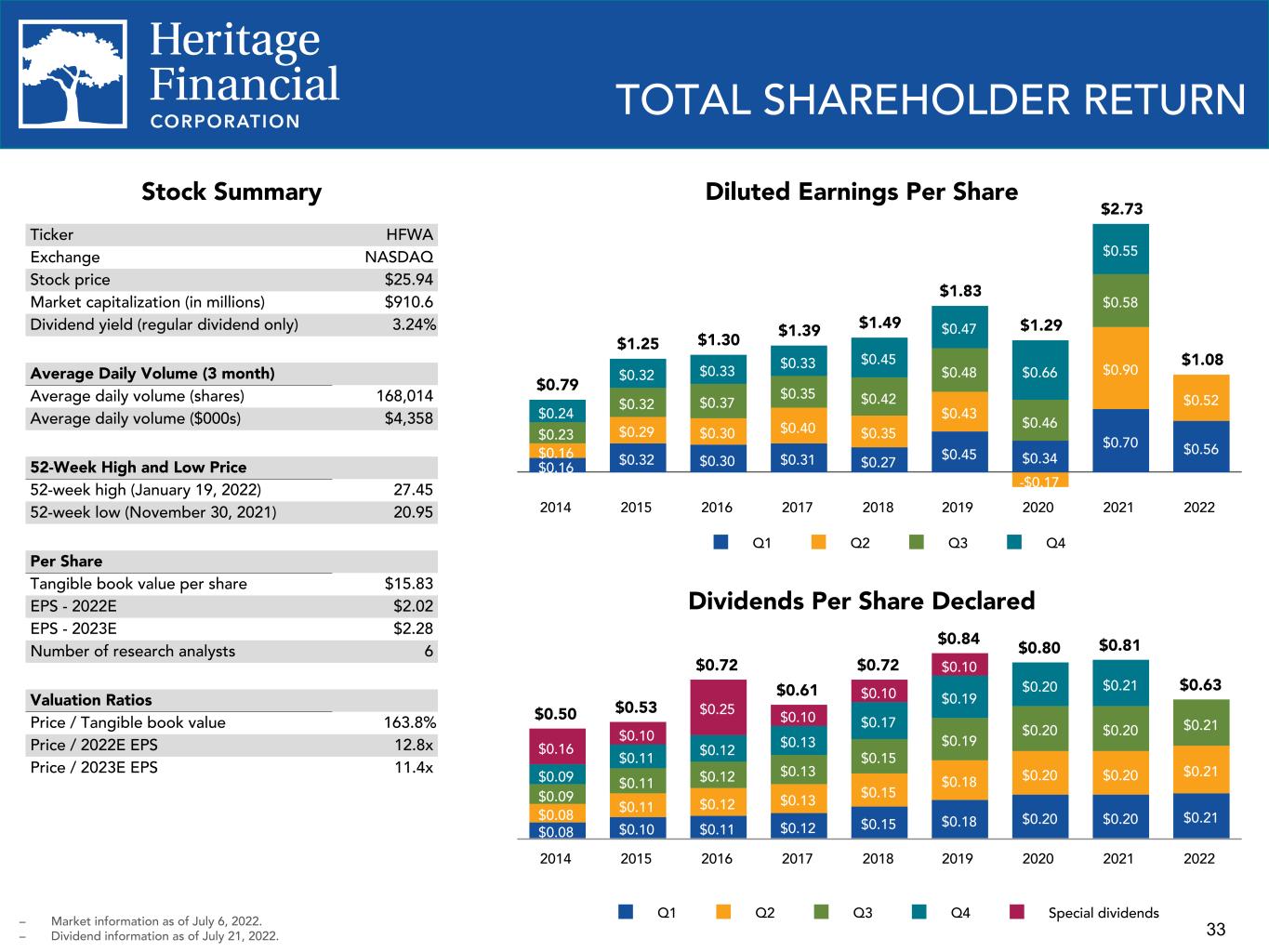

| Diluted earnings per share | $ | 0.52 | $ | 0.56 | $ | 0.90 | |||||||||||

Return on average assets (2) |

1.01 | % | 1.08 | % | 1.85 | % | |||||||||||

| As of or for the Quarter Ended | |||||||||||||||||

| June 30, 2022 |

March 31, 2022 |

June 30, 2021 |

|||||||||||||||

| (Dollars in thousands, except per share amounts) | |||||||||||||||||

Pre-tax, pre-provision return on average assets (1) (2) |

1.16 | % | 1.08 | % | 1.48 | % | |||||||||||

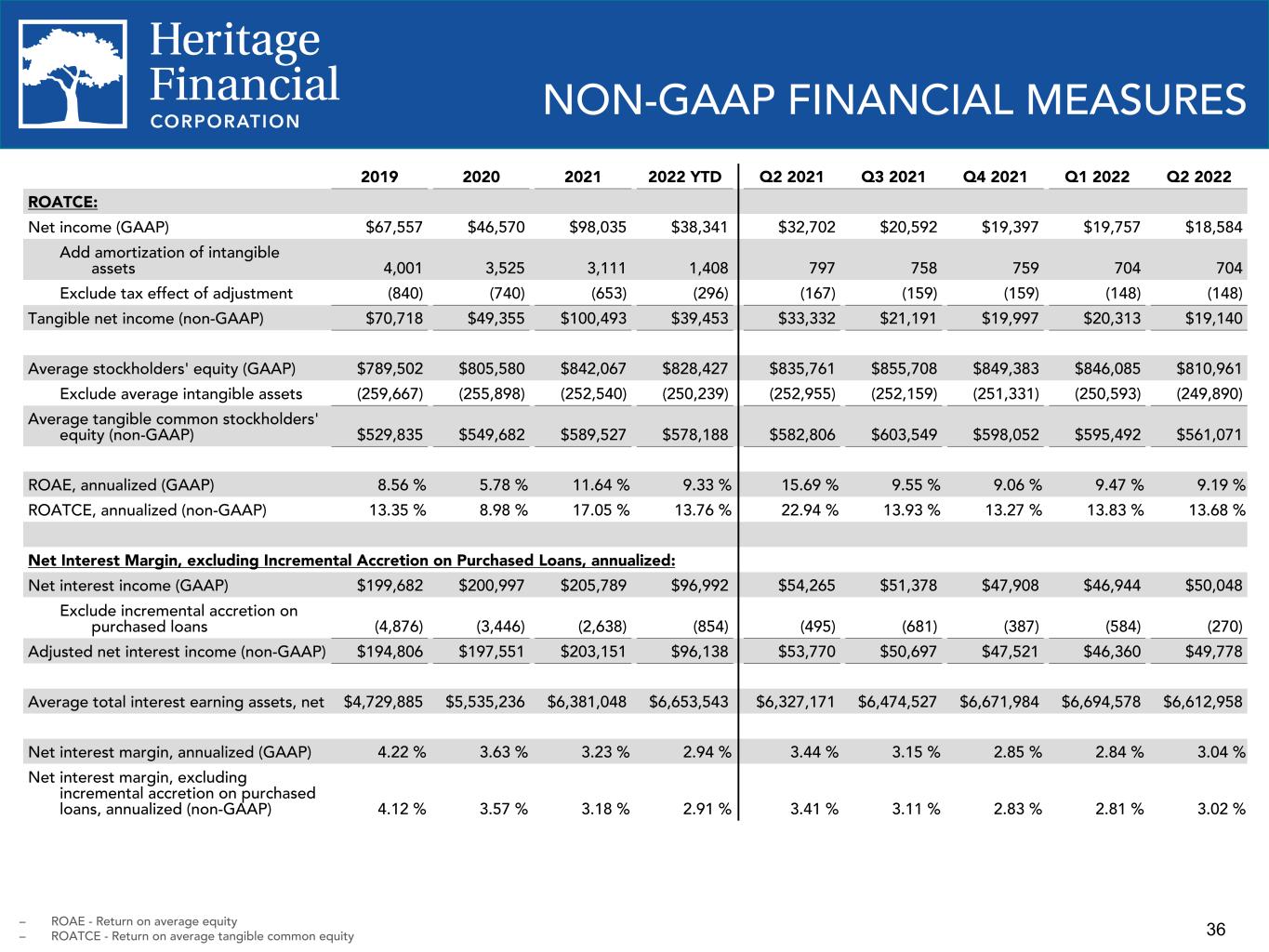

Return on average common equity (2) |

9.19 | % | 9.47 | % | 15.69 | % | |||||||||||

Return on average tangible common equity (1) (2) |

13.68 | % | 13.83 | % | 22.94 | % | |||||||||||

Net interest margin (2) |

3.04 | % | 2.84 | % | 3.44 | % | |||||||||||

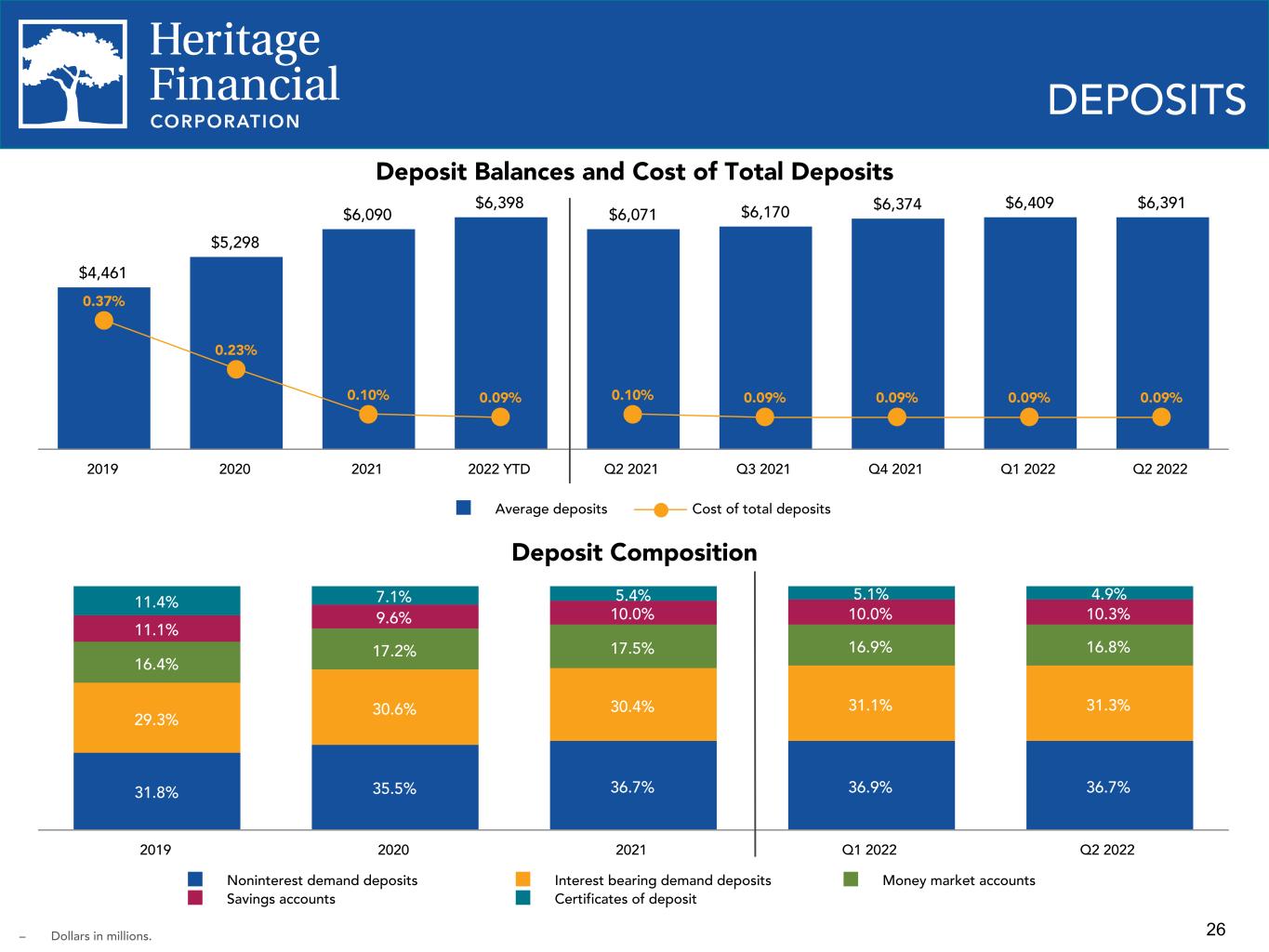

Cost of total deposits (2) |

0.09 | % | 0.09 | % | 0.10 | % | |||||||||||

| Efficiency ratio | 62.57 | % | 64.38 | % | 58.18 | % | |||||||||||

Noninterest expense to average total assets (2) |

1.94 | % | 1.95 | % | 2.06 | % | |||||||||||

| Total assets | $ | 7,316,467 | $ | 7,483,814 | $ | 7,105,672 | |||||||||||

| Loans receivable, net | $ | 3,834,368 | $ | 3,780,845 | $ | 4,155,968 | |||||||||||

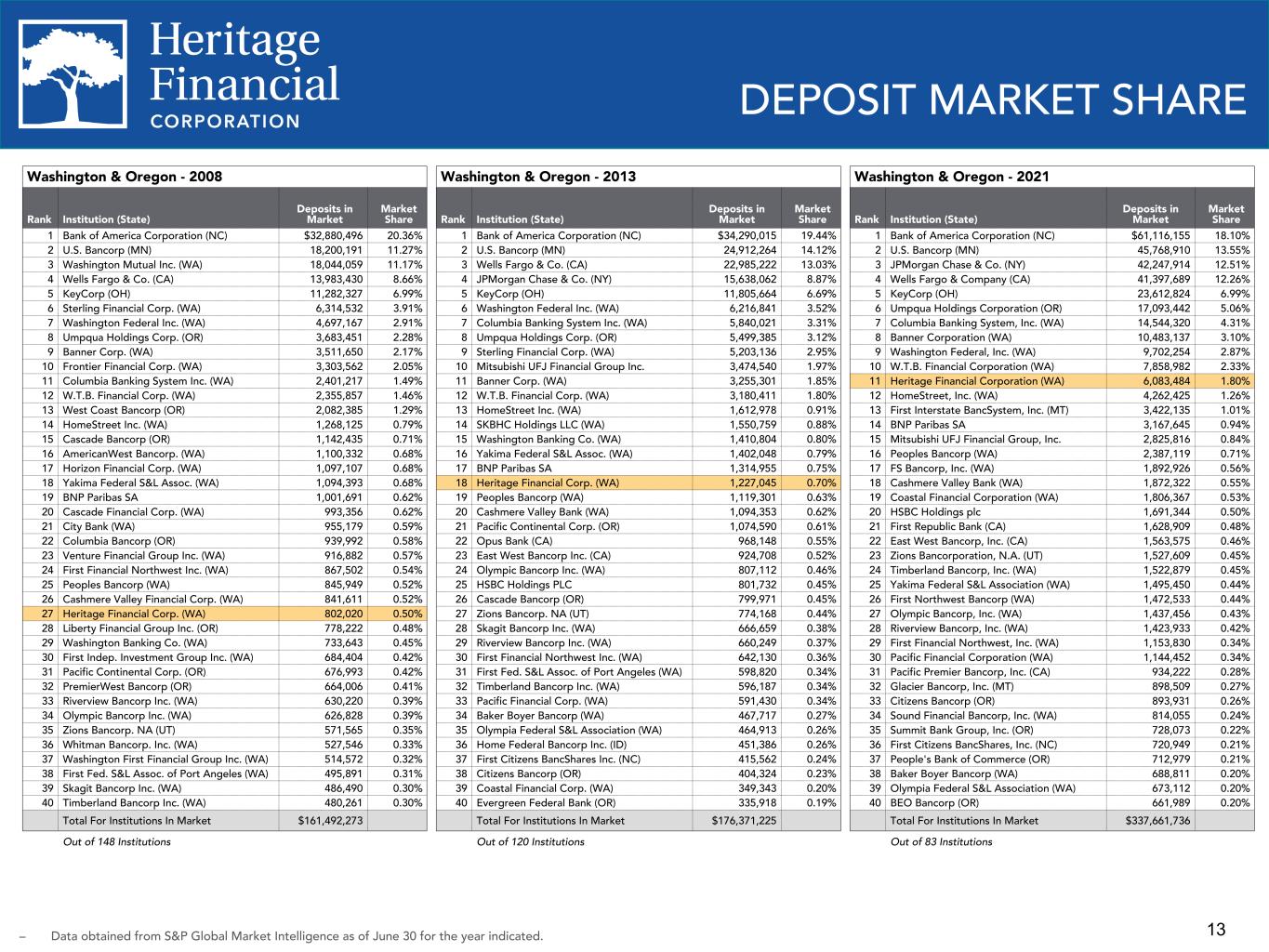

| Total deposits | $ | 6,330,190 | $ | 6,491,500 | $ | 6,074,385 | |||||||||||

Loan to deposit ratio (3) |

61.2 | % | 58.9 | % | 69.3 | % | |||||||||||

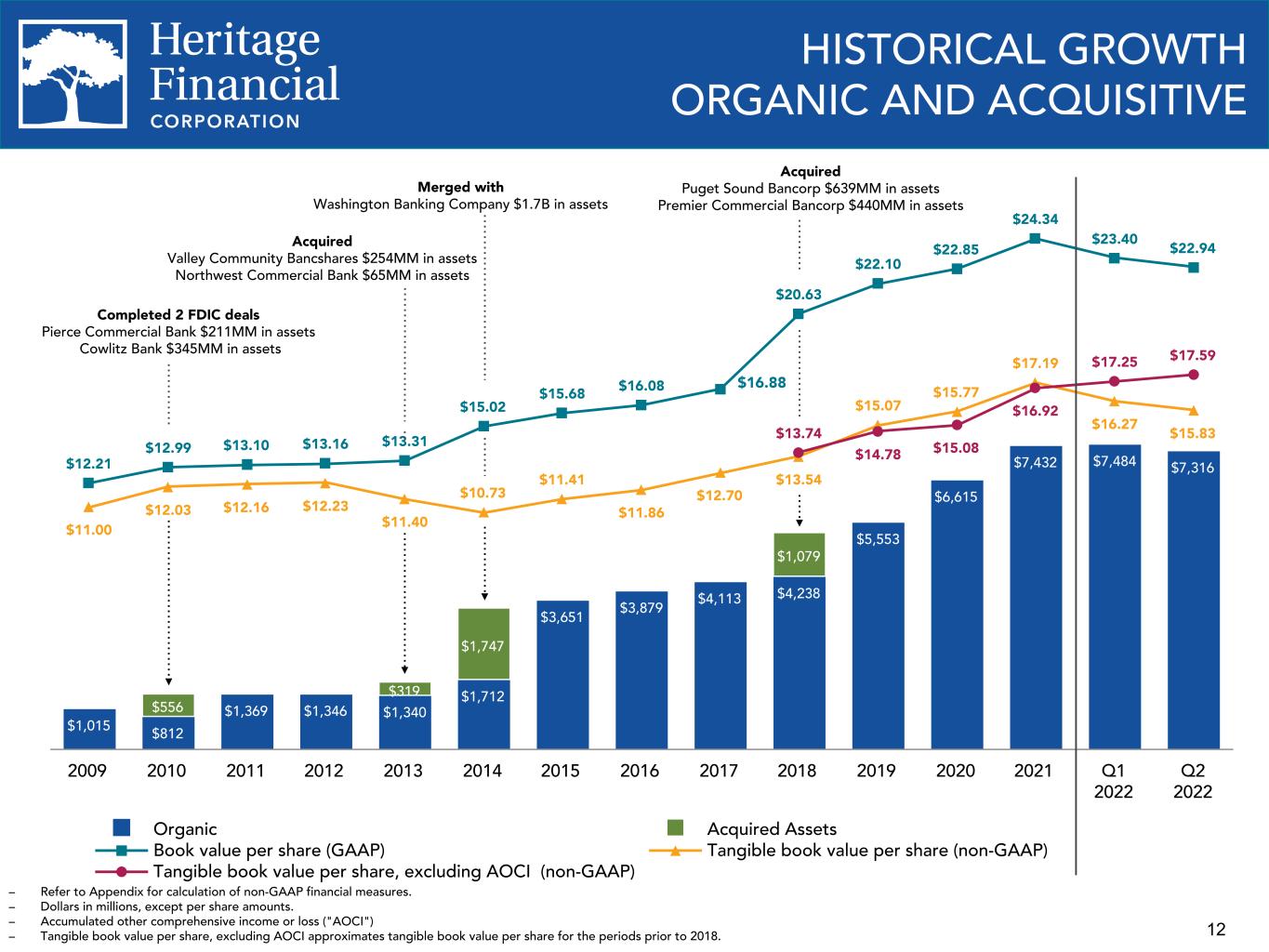

| Book value per share | $ | 22.94 | $ | 23.40 | $ | 23.77 | |||||||||||

Tangible book value per share (1) |

$ | 15.83 | $ | 16.27 | $ | 16.76 | |||||||||||

Tangible book value per share, excluding AOCI (1) (4) |

$ | 17.59 | $ | 17.25 | $ | 16.32 | |||||||||||

| June 30, 2022 | March 31, 2022 | ||||||||||||||||||||||||||||||||||

| Balance | % of Total |

Balance | % of Total |

Change | % Change | ||||||||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||||||||

| Investment securities available for sale, at fair value: | |||||||||||||||||||||||||||||||||||

| U.S. government and agency securities | $ | 65,668 | 3.6 | % | $ | 39,555 | 2.7 | % | $ | 26,113 | 66.0 | % | |||||||||||||||||||||||

| Municipal securities | 200,010 | 11.1 | 210,239 | 14.4 | (10,229) | (4.9) | |||||||||||||||||||||||||||||

| Residential CMO and MBS | 398,156 | 22.1 | 358,409 | 24.5 | 39,747 | 11.1 | |||||||||||||||||||||||||||||

| Commercial CMO and MBS | 493,620 | 27.4 | 404,505 | 27.7 | 89,115 | 22.0 | |||||||||||||||||||||||||||||

| Corporate obligations | 5,978 | 0.3 | 2,009 | 0.1 | 3,969 | 197.6 | |||||||||||||||||||||||||||||

| Other asset-backed securities | 24,156 | 1.3 | 25,207 | 1.7 | (1,051) | (4.2) | |||||||||||||||||||||||||||||

| Total | $ | 1,187,588 | 65.8 | % | $ | 1,039,924 | 71.1 | % | $ | 147,664 | 14.2 | % | |||||||||||||||||||||||

| Investment securities held to maturity, at amortized cost: | |||||||||||||||||||||||||||||||||||

| U.S. government and agency securities | $ | 150,960 | 8.4 | % | $ | 150,973 | 10.3 | % | $ | (13) | — | % | |||||||||||||||||||||||

| Residential CMO and MBS | 159,007 | 8.8 | 54,486 | 3.7 | 104,521 | 191.8 | |||||||||||||||||||||||||||||

| Commercial CMO and MBS | 305,686 | 17.0 | 216,754 | 14.9 | 88,932 | 41.0 | |||||||||||||||||||||||||||||

| Total | $ | 615,653 | 34.2 | % | $ | 422,213 | 28.9 | % | $ | 193,440 | 45.8 | % | |||||||||||||||||||||||

| Total investment securities | $ | 1,803,241 | 100.0 | % | $ | 1,462,137 | 100.0 | % | $ | 341,104 | 23.3 | % | |||||||||||||||||||||||

| June 30, 2022 | March 31, 2022 | Change | |||||||||||||||||||||||||||||||||

| Balance | % of Total | Balance | % of Total | Amount | % | ||||||||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||||||||

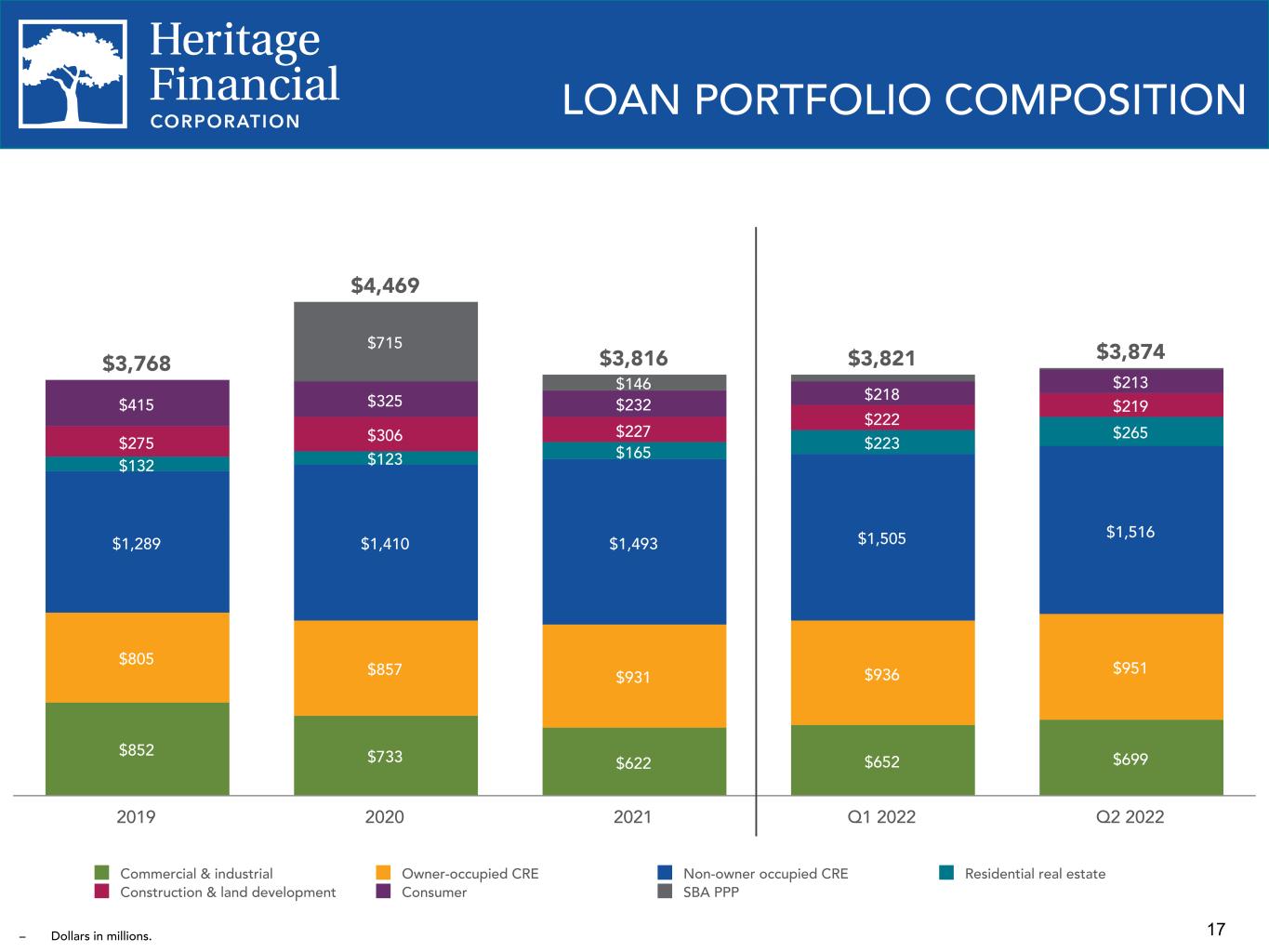

| Commercial business: | |||||||||||||||||||||||||||||||||||

| Commercial and industrial | $ | 698,828 | 18.0 | % | $ | 651,523 | 17.1 | % | $ | 47,305 | 7.3 | % | |||||||||||||||||||||||

| SBA PPP | 11,334 | 0.3 | 64,962 | 1.7 | (53,628) | (82.6) | |||||||||||||||||||||||||||||

| Owner-occupied commercial real estate ("CRE") | 950,699 | 24.6 | 935,705 | 24.5 | 14,994 | 1.6 | |||||||||||||||||||||||||||||

| Non-owner occupied CRE | 1,515,796 | 39.1 | 1,505,483 | 39.4 | 10,313 | 0.7 | |||||||||||||||||||||||||||||

| Total commercial business | 3,176,657 | 82.0 | 3,157,673 | 82.7 | 18,984 | 0.6 | |||||||||||||||||||||||||||||

Residential real estate |

265,382 | 6.9 | 223,442 | 5.8 | 41,940 | 18.8 | |||||||||||||||||||||||||||||

| Real estate construction and land development: | |||||||||||||||||||||||||||||||||||

Residential |

90,546 | 2.3 | 83,529 | 2.2 | 7,017 | 8.4 | |||||||||||||||||||||||||||||

Commercial and multifamily |

128,060 | 3.3 | 138,583 | 3.6 | (10,523) | (7.6) | |||||||||||||||||||||||||||||

| Total real estate construction and land development | 218,606 | 5.6 | 222,112 | 5.8 | (3,506) | (1.6) | |||||||||||||||||||||||||||||

| Consumer | 213,419 | 5.5 | 217,951 | 5.7 | (4,532) | (2.1) | |||||||||||||||||||||||||||||

| Loans receivable | 3,874,064 | 100.0 | % | 3,821,178 | 100.0 | % | 52,886 | 1.4 | |||||||||||||||||||||||||||

| Allowance for credit losses on loans | (39,696) | (40,333) | 637 | (1.6) | |||||||||||||||||||||||||||||||

| Loans receivable, net | $ | 3,834,368 | $ | 3,780,845 | $ | 53,523 | 1.4 | % | |||||||||||||||||||||||||||

| June 30, 2022 | March 31, 2022 | Change | |||||||||||||||||||||||||||||||||

| Balance | % of Total | Balance | % of Total | Amount | % | ||||||||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||||||||

| Noninterest demand deposits | $ | 2,325,139 | 36.7 | % | $ | 2,393,972 | 36.9 | % | $ | (68,833) | (2.9) | % | |||||||||||||||||||||||

| Interest bearing demand deposits | 1,977,527 | 31.3 | 2,018,032 | 31.1 | (40,505) | (2.0) | |||||||||||||||||||||||||||||

| Money market accounts | 1,062,178 | 16.8 | 1,099,539 | 16.9 | (37,361) | (3.4) | |||||||||||||||||||||||||||||

| Savings accounts | 654,577 | 10.3 | 651,541 | 10.0 | 3,036 | 0.5 | |||||||||||||||||||||||||||||

| Total non-maturity deposits | 6,019,421 | 95.1 | 6,163,084 | 94.9 | (143,663) | (2.3) | |||||||||||||||||||||||||||||

| Certificates of deposit | 310,769 | 4.9 | 328,416 | 5.1 | (17,647) | (5.4) | |||||||||||||||||||||||||||||

| Total deposits | $ | 6,330,190 | 100.0 | % | $ | 6,491,500 | 100.0 | % | $ | (161,310) | (2.5) | % | |||||||||||||||||||||||

| June 30, 2022 |

March 31, 2022 |

Change | |||||||||||||||

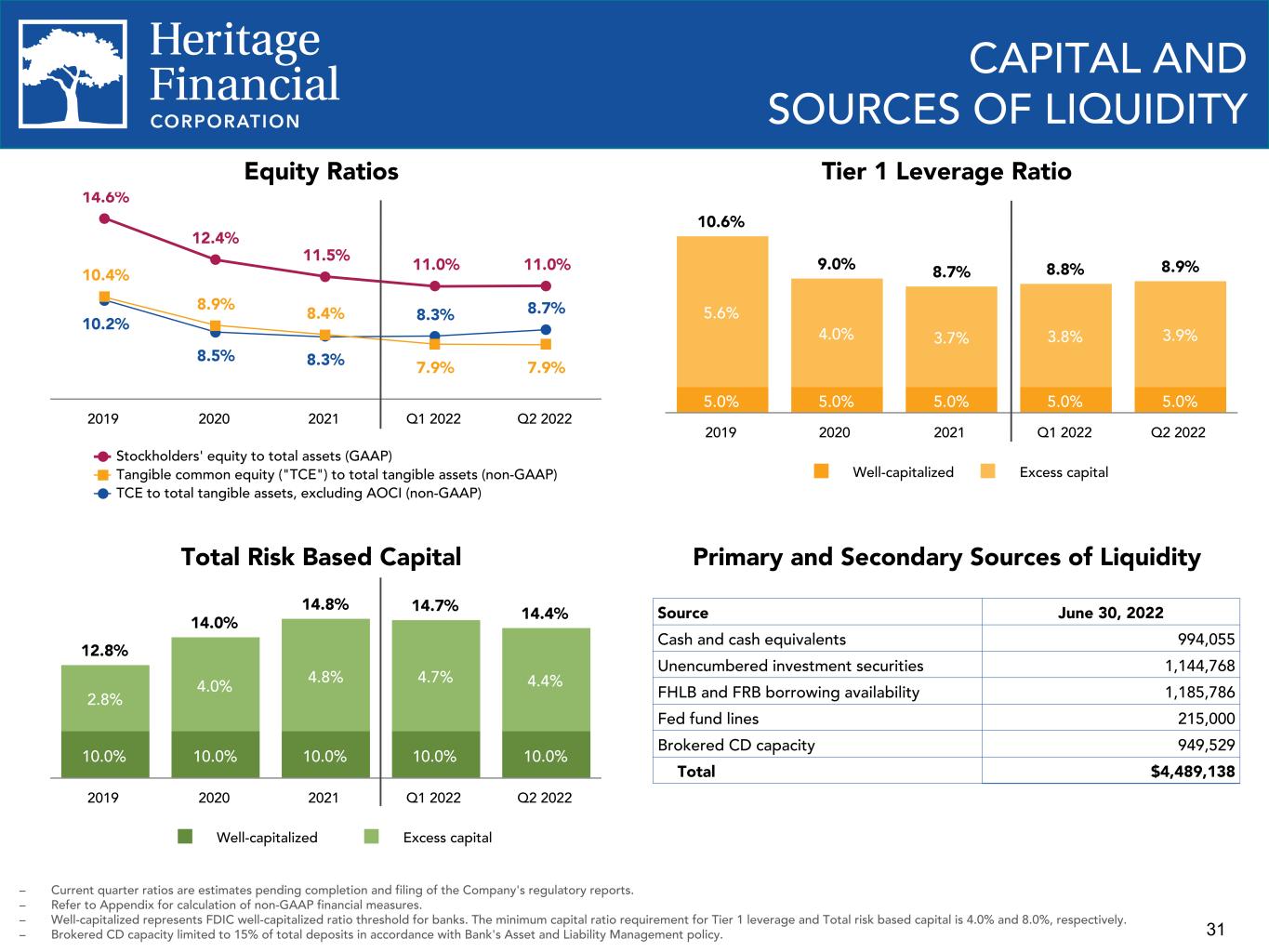

| Stockholders' equity to total assets | 11.0 | % | 11.0 | % | — | % | |||||||||||

Tangible common equity to tangible assets (1) |

7.9 | 7.9 | — | ||||||||||||||

Tangible common equity to tangible assets, excluding AOCI (1) |

8.7 | 8.3 | 0.4 | ||||||||||||||

Common equity Tier 1 capital to risk-weighted assets (2) |

13.2 | 13.4 | (0.2) | ||||||||||||||

Tier 1 leverage capital to average quarterly assets (2) |

8.9 | 8.8 | 0.1 | ||||||||||||||

Tier 1 capital to risk-weighted assets (2) |

13.6 | 13.9 | (0.3) | ||||||||||||||

Total capital to risk-weighted assets (2) |

14.4 | 14.7 | (0.3) | ||||||||||||||

| As of or for the Quarter Ended | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| June 30, 2022 | March 31, 2022 | June 30, 2021 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| ACL on Loans | ACL on Unfunded | Total | ACL on Loans | ACL on Unfunded | Total | ACL on Loans | ACL on Unfunded | Total | |||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance, beginning of period | $ | 40,333 | $ | 1,552 | $ | 41,885 | $ | 42,361 | $ | 2,607 | $ | 44,968 | $ | 64,225 | $ | 3,617 | $ | 67,842 | |||||||||||||||||||||||||||||||||||

| Reversal of provision for credit losses | (649) | (555) | (1,204) | (2,522) | (1,055) | (3,577) | (12,821) | (1,166) | (13,987) | ||||||||||||||||||||||||||||||||||||||||||||

| Net recovery | 12 | — | 12 | 494 | — | 494 | 158 | — | 158 | ||||||||||||||||||||||||||||||||||||||||||||

| Balance, end of period | $ | 39,696 | $ | 997 | $ | 40,693 | $ | 40,333 | $ | 1,552 | $ | 41,885 | $ | 51,562 | $ | 2,451 | $ | 54,013 | |||||||||||||||||||||||||||||||||||

| Quarter Ended | |||||||||||||||||

| June 30, 2022 |

March 31, 2022 |

June 30, 2021 |

|||||||||||||||

| (In thousands) | |||||||||||||||||

| Balance, beginning of period | $ | 16,527 | $ | 23,754 | $ | 52,868 | |||||||||||

| Additions | 720 | — | 401 | ||||||||||||||

| Net principal payments and transfers to accruing status | (5,964) | (3,804) | (2,093) | ||||||||||||||

| Payoffs | (691) | (3,369) | (15,835) | ||||||||||||||

| Charge-offs | (117) | (54) | — | ||||||||||||||

| Balance, end of period | $ | 10,475 | $ | 16,527 | $ | 35,341 | |||||||||||

| Quarter Ended | |||||||||||||||||

| June 30, 2022 |

March 31, 2022 |

June 30, 2021 |

|||||||||||||||

| Loan yield (GAAP) | 4.30 | % | 4.41 | % | 4.62 | % | |||||||||||

| Exclude impact from SBA PPP loans | (0.15) | (0.21) | (0.12) | ||||||||||||||

| Exclude impact from incremental accretion on purchased loans | (0.03) | (0.06) | (0.05) | ||||||||||||||

Loan yield, excluding SBA PPP loans and incremental accretion on purchased loans (non-GAAP) (1) |

4.12 | % | 4.14 | % | 4.45 | % | |||||||||||

| Quarter Ended | Quarter Over Quarter Change | Prior Year Quarter Change | |||||||||||||||||||||||||||||||||||||||

| June 30, 2022 |

March 31, 2022 |

June 30, 2021 |

Change | % Change | Change | % Change | |||||||||||||||||||||||||||||||||||

| (Dollar amounts in thousands) | |||||||||||||||||||||||||||||||||||||||||

| Service charges and other fees | $ | 2,391 | $ | 2,296 | $ | 2,067 | $ | 95 | 4.1 | % | $ | 324 | 15.7 | % | |||||||||||||||||||||||||||

| Card revenue | 2,332 | 2,441 | 2,338 | (109) | (4.5) | (6) | (0.3) | ||||||||||||||||||||||||||||||||||

| Gain on sale of loans, net | 219 | 241 | 1,003 | (22) | (9.1) | (784) | (78.2) | ||||||||||||||||||||||||||||||||||

| Interest rate swap fees | 26 | 279 | 209 | (253) | (90.7) | (183) | (87.6) | ||||||||||||||||||||||||||||||||||

| Bank owned life insurance income | 764 | 1,695 | 717 | (931) | (54.9) | 47 | 6.6 | ||||||||||||||||||||||||||||||||||

| Gain on sale of other assets, net | — | 204 | 724 | (204) | (100.0) | (724) | (100.0) | ||||||||||||||||||||||||||||||||||

| Other income | 1,284 | 1,382 | 1,239 | (98) | (7.1) | 45 | 3.6 | ||||||||||||||||||||||||||||||||||

| Total noninterest income | $ | 7,016 | $ | 8,538 | $ | 8,297 | $ | (1,522) | (17.8) | % | $ | (1,281) | (15.4) | % | |||||||||||||||||||||||||||

| Quarter Ended | Quarter Over Quarter Change | Prior Year Quarter Change | |||||||||||||||||||||||||||||||||||||||

| June 30, 2022 |

March 31, 2022 |

June 30, 2021 |

Change | % Change | Change | % Change | |||||||||||||||||||||||||||||||||||

| (Dollar amounts in thousands) | |||||||||||||||||||||||||||||||||||||||||

| Compensation and employee benefits | $ | 21,778 | $ | 21,252 | $ | 21,803 | $ | 526 | 2.5 | % | $ | (25) | (0.1) | % | |||||||||||||||||||||||||||

| Occupancy and equipment | 4,171 | 4,331 | 4,091 | (160) | (3.7) | 80 | 2.0 | ||||||||||||||||||||||||||||||||||

| Data processing | 4,185 | 4,061 | 3,998 | 124 | 3.1 | 187 | 4.7 | ||||||||||||||||||||||||||||||||||

| Marketing | 344 | 266 | 567 | 78 | 29.3 | (223) | (39.3) | ||||||||||||||||||||||||||||||||||

| Professional services | 529 | 699 | 1,037 | (170) | (24.3) | (508) | (49.0) | ||||||||||||||||||||||||||||||||||

| State/municipal business and use tax | 867 | 796 | 991 | 71 | 8.9 | (124) | (12.5) | ||||||||||||||||||||||||||||||||||

| Federal deposit insurance premium | 425 | 600 | 339 | (175) | (29.2) | 86 | 25.4 | ||||||||||||||||||||||||||||||||||

| Amortization of intangible assets | 704 | 704 | 797 | — | — | (93) | (11.7) | ||||||||||||||||||||||||||||||||||

| Other expense | 2,704 | 3,011 | 2,773 | (307) | (10.2) | (69) | (2.5) | ||||||||||||||||||||||||||||||||||

| Total noninterest expense | $ | 35,707 | $ | 35,720 | $ | 36,396 | $ | (13) | — | % | $ | (689) | (1.9) | % | |||||||||||||||||||||||||||

| Quarter Ended | Quarter Over Quarter Change | Prior Year Quarter Change | |||||||||||||||||||||||||||||||||||||||

| June 30, 2022 |

March 31, 2022 |

June 30, 2021 |

Change | % Change | Change | % Change | |||||||||||||||||||||||||||||||||||

| (Dollar amounts in thousands) | |||||||||||||||||||||||||||||||||||||||||

| Income before income taxes | $ | 22,561 | $ | 23,339 | $ | 40,153 | $ | (778) | (3.3) | % | $ | (17,592) | (43.8) | % | |||||||||||||||||||||||||||

| Income tax expense | $ | 3,977 | $ | 3,582 | $ | 7,451 | $ | 395 | 11.0 | % | $ | (3,474) | (46.6) | % | |||||||||||||||||||||||||||

| Effective income tax rate | 17.6 | % | 15.3 | % | 18.6 | % | 2.3 | % | 15.0 | % | (1.0) | % | (5.4) | % | |||||||||||||||||||||||||||

| June 30, 2022 |

March 31, 2022 |

December 31, 2021 |

|||||||||||||||

| Assets | |||||||||||||||||

| Cash on hand and in banks | $ | 93,675 | $ | 87,907 | $ | 61,377 | |||||||||||

| Interest earning deposits | 900,380 | 1,488,815 | 1,661,915 | ||||||||||||||

| Cash and cash equivalents | 994,055 | 1,576,722 | 1,723,292 | ||||||||||||||

Investment securities available for sale, at fair value (amortized cost of $1,267,715, $1,085,016 and $883,832, respectively) |

1,187,588 | 1,039,924 | 894,335 | ||||||||||||||

Investment securities held to maturity, at amortized cost (fair value of $559,312, $384,822 and $376,331, respectively) |

615,653 | 422,213 | 383,393 | ||||||||||||||

| Total investment securities | 1,803,241 | 1,462,137 | 1,277,728 | ||||||||||||||

| Loans held for sale | 1,311 | 1,142 | 1,476 | ||||||||||||||

| Loans receivable | 3,874,064 | 3,821,178 | 3,815,662 | ||||||||||||||

| Allowance for credit losses on loans | (39,696) | (40,333) | (42,361) | ||||||||||||||

| Loans receivable, net | 3,834,368 | 3,780,845 | 3,773,301 | ||||||||||||||

| Other real estate owned | — | — | — | ||||||||||||||

| Premises and equipment, net | 77,164 | 78,737 | 79,370 | ||||||||||||||

| Federal Home Loan Bank stock, at cost | 8,916 | 8,916 | 7,933 | ||||||||||||||

| Bank owned life insurance | 120,646 | 119,929 | 120,196 | ||||||||||||||

| Accrued interest receivable | 15,908 | 14,582 | 14,657 | ||||||||||||||

| Prepaid expenses and other assets | 211,350 | 190,592 | 183,543 | ||||||||||||||

| Other intangible assets, net | 8,569 | 9,273 | 9,977 | ||||||||||||||

| Goodwill | 240,939 | 240,939 | 240,939 | ||||||||||||||

| Total assets | $ | 7,316,467 | $ | 7,483,814 | $ | 7,432,412 | |||||||||||

| Liabilities and Stockholders' Equity | |||||||||||||||||

| Deposits | $ | 6,330,190 | $ | 6,491,500 | $ | 6,394,290 | |||||||||||

| Junior subordinated debentures | 21,326 | 21,253 | 21,180 | ||||||||||||||

| Securities sold under agreement to repurchase | 41,827 | 49,069 | 50,839 | ||||||||||||||

| Accrued expenses and other liabilities | 117,758 | 100,543 | 111,671 | ||||||||||||||

| Total liabilities | 6,511,101 | 6,662,365 | 6,577,980 | ||||||||||||||

| Common stock | 550,417 | 550,096 | 551,798 | ||||||||||||||

| Retained earnings | 316,732 | 305,581 | 293,238 | ||||||||||||||

| Accumulated other comprehensive (loss) income, net | (61,783) | (34,228) | 9,396 | ||||||||||||||

| Total stockholders' equity | 805,366 | 821,449 | 854,432 | ||||||||||||||

| Total liabilities and stockholders' equity | $ | 7,316,467 | $ | 7,483,814 | $ | 7,432,412 | |||||||||||

| Shares outstanding | 35,103,929 | 35,102,372 | 35,105,779 | ||||||||||||||

| Quarter Ended | Six Months Ended | ||||||||||||||||||||||||||||

| June 30, 2022 |

March 31, 2022 |

June 30, 2021 |

June 30, 2022 |

June 30, 2021 |

|||||||||||||||||||||||||

| Interest Income | |||||||||||||||||||||||||||||

| Interest and fees on loans | $ | 40,890 | $ | 41,025 | $ | 50,750 | $ | 81,915 | $ | 100,274 | |||||||||||||||||||

| Taxable interest on investment securities | 7,607 | 6,003 | 4,050 | 13,610 | 7,584 | ||||||||||||||||||||||||

| Nontaxable interest on investment securities | 893 | 860 | 947 | 1,753 | 1,905 | ||||||||||||||||||||||||

| Interest on interest earning deposits | 2,342 | 706 | 263 | 3,048 | 438 | ||||||||||||||||||||||||

| Total interest income | 51,732 | 48,594 | 56,010 | 100,326 | 110,201 | ||||||||||||||||||||||||

| Interest Expense | |||||||||||||||||||||||||||||

| Deposits | 1,413 | 1,424 | 1,524 | 2,837 | 3,252 | ||||||||||||||||||||||||

| Junior subordinated debentures | 239 | 194 | 186 | 433 | 373 | ||||||||||||||||||||||||

| Other borrowings | 32 | 32 | 35 | 64 | 73 | ||||||||||||||||||||||||

| Total interest expense | 1,684 | 1,650 | 1,745 | 3,334 | 3,698 | ||||||||||||||||||||||||

| Net interest income | 50,048 | 46,944 | 54,265 | 96,992 | 106,503 | ||||||||||||||||||||||||

| Reversal of provision for credit losses | (1,204) | (3,577) | (13,987) | (4,781) | (21,186) | ||||||||||||||||||||||||

| Net interest income after reversal of provision for credit losses | 51,252 | 50,521 | 68,252 | 101,773 | 127,689 | ||||||||||||||||||||||||

| Noninterest Income | |||||||||||||||||||||||||||||

| Service charges and other fees | 2,391 | 2,296 | 2,067 | 4,687 | 3,959 | ||||||||||||||||||||||||

| Card revenue | 2,332 | 2,441 | 2,338 | 4,773 | 4,435 | ||||||||||||||||||||||||

| Gain on sale of investment securities, net | — | — | — | — | 29 | ||||||||||||||||||||||||

| Gain on sale of loans, net | 219 | 241 | 1,003 | 460 | 2,373 | ||||||||||||||||||||||||

| Interest rate swap fees | 26 | 279 | 209 | 305 | 361 | ||||||||||||||||||||||||

| Bank owned life insurance income | 764 | 1,695 | 717 | 2,459 | 1,373 | ||||||||||||||||||||||||

| Gain on sale of other assets, net | — | 204 | 724 | 204 | 746 | ||||||||||||||||||||||||

| Other income | 1,284 | 1,382 | 1,239 | 2,666 | 3,272 | ||||||||||||||||||||||||

| Total noninterest income | 7,016 | 8,538 | 8,297 | 15,554 | 16,548 | ||||||||||||||||||||||||

| Noninterest Expense | |||||||||||||||||||||||||||||

| Compensation and employee benefits | 21,778 | 21,252 | 21,803 | 43,030 | 44,004 | ||||||||||||||||||||||||

| Occupancy and equipment | 4,171 | 4,331 | 4,091 | 8,502 | 8,545 | ||||||||||||||||||||||||

| Data processing | 4,185 | 4,061 | 3,998 | 8,246 | 7,810 | ||||||||||||||||||||||||

| Marketing | 344 | 266 | 567 | 610 | 1,080 | ||||||||||||||||||||||||

| Professional services | 529 | 699 | 1,037 | 1,228 | 2,307 | ||||||||||||||||||||||||

| State/municipal business and use taxes | 867 | 796 | 991 | 1,663 | 1,963 | ||||||||||||||||||||||||

| Federal deposit insurance premium | 425 | 600 | 339 | 1,025 | 928 | ||||||||||||||||||||||||

| Amortization of intangible assets | 704 | 704 | 797 | 1,408 | 1,594 | ||||||||||||||||||||||||

| Other expense | 2,704 | 3,011 | 2,773 | 5,715 | 5,407 | ||||||||||||||||||||||||

| Total noninterest expense | 35,707 | 35,720 | 36,396 | 71,427 | 73,638 | ||||||||||||||||||||||||

| Income before income taxes | 22,561 | 23,339 | 40,153 | 45,900 | 70,599 | ||||||||||||||||||||||||

| Income tax expense | 3,977 | 3,582 | 7,451 | 7,559 | 12,553 | ||||||||||||||||||||||||

| Net income | $ | 18,584 | $ | 19,757 | $ | 32,702 | $ | 38,341 | $ | 58,046 | |||||||||||||||||||

| Basic earnings per share | $ | 0.53 | $ | 0.56 | $ | 0.91 | $ | 1.09 | $ | 1.61 | |||||||||||||||||||

| Diluted earnings per share | $ | 0.52 | $ | 0.56 | $ | 0.90 | $ | 1.08 | $ | 1.60 | |||||||||||||||||||

| Dividends declared per share | $ | 0.21 | $ | 0.21 | $ | 0.20 | $ | 0.42 | $ | 0.40 | |||||||||||||||||||

| Average shares outstanding - basic | 35,110,334 | 35,094,725 | 35,994,740 | 35,102,572 | 35,961,032 | ||||||||||||||||||||||||

| Average shares outstanding - diluted | 35,409,524 | 35,412,098 | 36,289,464 | 35,412,722 | 36,268,861 | ||||||||||||||||||||||||

| Quarter Ended | Six Months Ended | ||||||||||||||||||||||||||||

| June 30, 2022 |

March 31, 2022 |

June 30, 2021 |

June 30, 2022 |

June 30, 2021 |

|||||||||||||||||||||||||

| Allowance for Credit Losses on Loans: | |||||||||||||||||||||||||||||

| Balance, beginning of period | $ | 40,333 | $ | 42,361 | $ | 64,225 | $ | 42,361 | $ | 70,185 | |||||||||||||||||||

| Reversal of provision for credit losses on loans | (649) | (2,522) | (12,821) | (3,171) | (18,956) | ||||||||||||||||||||||||

| Charge-offs: | |||||||||||||||||||||||||||||

| Commercial business | (117) | (199) | (13) | (316) | (14) | ||||||||||||||||||||||||

Residential real estate |

— | (30) | — | (30) | — | ||||||||||||||||||||||||

| Real estate construction and land development | — | — | — | — | (1) | ||||||||||||||||||||||||

| Consumer | (132) | (126) | (120) | (258) | (305) | ||||||||||||||||||||||||

| Total charge-offs | (249) | (355) | (133) | (604) | (320) | ||||||||||||||||||||||||

| Recoveries: | |||||||||||||||||||||||||||||

| Commercial business | 149 | 272 | 143 | 421 | 350 | ||||||||||||||||||||||||

Residential real estate |

— | 3 | — | 3 | — | ||||||||||||||||||||||||

| Real estate construction and land development | 59 | 8 | 4 | 67 | 20 | ||||||||||||||||||||||||

| Consumer | 53 | 566 | 144 | 619 | 283 | ||||||||||||||||||||||||

| Total recoveries | 261 | 849 | 291 | 1,110 | 653 | ||||||||||||||||||||||||

| Net recoveries (charge-offs) | 12 | 494 | 158 | 506 | 333 | ||||||||||||||||||||||||

| Balance, end of period | $ | 39,696 | $ | 40,333 | $ | 51,562 | $ | 39,696 | $ | 51,562 | |||||||||||||||||||

| Net (recoveries) charge-offs on loans to average loans, annualized | — | % | (0.05) | % | (0.01) | % | (0.03) | % | (0.02) | % | |||||||||||||||||||

| June 30, 2022 |

March 31, 2022 |

December 31, 2021 |

|||||||||||||||

| Nonperforming Assets: | |||||||||||||||||

| Nonaccrual loans: | |||||||||||||||||

| Commercial business | $ | 10,475 | $ | 15,956 | $ | 23,107 | |||||||||||

Residential real estate |

— | — | 47 | ||||||||||||||

| Real estate construction and land development | — | 571 | 571 | ||||||||||||||

| Consumer | — | — | 29 | ||||||||||||||

| Total nonaccrual loans | 10,475 | 16,527 | 23,754 | ||||||||||||||

| Other real estate owned | — | — | — | ||||||||||||||

| Nonperforming assets | $ | 10,475 | $ | 16,527 | $ | 23,754 | |||||||||||

| Restructured performing loans | $ | 63,694 | $ | 62,627 | $ | 59,110 | |||||||||||

| Accruing loans past due 90 days or more | 2,036 | 1,318 | 293 | ||||||||||||||

| ACL on loans to: | |||||||||||||||||

| Loans receivable | 1.02 | % | 1.06 | % | 1.11 | % | |||||||||||

Loans receivable, excluding SBA PPP loans (1) |

1.03 | % | 1.07 | % | 1.15 | % | |||||||||||

| Nonaccrual loans | 378.96 | % | 244.04 | % | 178.33 | % | |||||||||||

| Nonperforming loans to loans receivable | 0.27 | % | 0.43 | % | 0.62 | % | |||||||||||

| Nonperforming assets to total assets | 0.14 | % | 0.22 | % | 0.32 | % | |||||||||||

| Quarter Ended | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| June 30, 2022 | March 31, 2022 | June 30, 2021 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Average Balance |

Interest Earned/ Paid |

Average Yield/ Rate (1) |

Average Balance |

Interest Earned/ Paid |

Average Yield/ Rate (1) |

Average Balance |

Interest Earned/ Paid |

Average Yield/ Rate (1) |

|||||||||||||||||||||||||||||||||||||||||||||

| Interest Earning Assets: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Loans receivable, net (2)(3) |

$ | 3,812,045 | $ | 40,890 | 4.30 | % | $ | 3,773,325 | $ | 41,025 | 4.41 | % | $ | 4,402,868 | $ | 50,750 | 4.62 | % | |||||||||||||||||||||||||||||||||||

| Taxable securities | 1,450,328 | 7,607 | 2.10 | 1,271,557 | 6,003 | 1.91 | 799,023 | 4,050 | 2.03 | ||||||||||||||||||||||||||||||||||||||||||||

Nontaxable securities (3) |

137,429 | 893 | 2.61 | 146,409 | 860 | 2.38 | 160,489 | 947 | 2.37 | ||||||||||||||||||||||||||||||||||||||||||||

| Interest earning deposits | 1,213,156 | 2,342 | 0.77 | 1,503,287 | 706 | 0.19 | 964,791 | 263 | 0.11 | ||||||||||||||||||||||||||||||||||||||||||||

| Total interest earning assets | 6,612,958 | 51,732 | 3.14 | % | 6,694,578 | 48,594 | 2.94 | % | 6,327,171 | 56,010 | 3.55 | % | |||||||||||||||||||||||||||||||||||||||||

| Noninterest earning assets | 772,658 | 740,209 | 752,034 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total assets | $ | 7,385,616 | $ | 7,434,787 | 7,079,205 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Interest Bearing Liabilities: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Certificates of deposit | $ | 321,926 | $ | 324 | 0.40 | % | $ | 336,353 | $ | 338 | 0.41 | % | $ | 381,417 | $ | 481 | 0.51 | % | |||||||||||||||||||||||||||||||||||

| Savings accounts | 652,407 | 88 | 0.05 | 646,684 | 87 | 0.05 | 591,616 | 89 | 0.06 | ||||||||||||||||||||||||||||||||||||||||||||

| Interest bearing demand and money market accounts | 3,067,373 | 1,001 | 0.13 | 3,066,320 | 999 | 0.13 | 2,836,717 | 954 | 0.13 | ||||||||||||||||||||||||||||||||||||||||||||

| Total interest bearing deposits | 4,041,706 | 1,413 | 0.14 | 4,049,357 | 1,424 | 0.14 | 3,809,750 | 1,524 | 0.16 | ||||||||||||||||||||||||||||||||||||||||||||

| Junior subordinated debentures | 21,287 | 239 | 4.50 | 21,214 | 194 | 3.71 | 20,986 | 186 | 3.55 | ||||||||||||||||||||||||||||||||||||||||||||

| Securities sold under agreement to repurchase | 48,272 | 32 | 0.27 | 50,017 | 32 | 0.26 | 43,259 | 35 | 0.32 | ||||||||||||||||||||||||||||||||||||||||||||

| Total interest bearing liabilities | 4,111,265 | 1,684 | 0.16 | % | 4,120,588 | 1,650 | 0.16 | % | 3,873,995 | 1,745 | 0.18 | % | |||||||||||||||||||||||||||||||||||||||||

| Noninterest demand deposits | 2,349,746 | 2,359,451 | 2,261,373 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Other noninterest bearing liabilities | 113,644 | 108,663 | 108,076 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Stockholders’ equity | 810,961 | 846,085 | 835,761 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities and stockholders’ equity | $ | 7,385,616 | $ | 7,434,787 | $ | 7,079,205 | |||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income and spread | $ | 50,048 | 2.98 | % | $ | 46,944 | 2.78 | % | $ | 54,265 | 3.37 | % | |||||||||||||||||||||||||||||||||||||||||

| Net interest margin | 3.04 | % | 2.84 | % | 3.44 | % | |||||||||||||||||||||||||||||||||||||||||||||||

| Six Months Ended | |||||||||||||||||||||||||||||||||||

| June 30, 2022 | June 30, 2021 | ||||||||||||||||||||||||||||||||||

| Average Balance |

Interest Earned/ Paid |

Average Yield/ Rate (1) |

Average Balance |

Interest Earned/ Paid |

Average Yield/ Rate (1) |

||||||||||||||||||||||||||||||

| Interest Earning Assets: | |||||||||||||||||||||||||||||||||||

Loans receivable, net (2) (3) |

$ | 3,792,792 | $ | 81,915 | 4.36 | % | $ | 4,446,442 | $ | 100,274 | 4.55 | % | |||||||||||||||||||||||

| Taxable securities | 1,361,437 | 13,610 | 2.02 | 736,990 | 7,584 | 2.08 | |||||||||||||||||||||||||||||

Nontaxable securities (3) |

141,894 | 1,753 | 2.49 | 162,192 | 1,905 | 2.37 | |||||||||||||||||||||||||||||

| Interest earning deposits | 1,357,420 | 3,048 | 0.45 | 840,030 | 438 | 0.11 | |||||||||||||||||||||||||||||

| Total interest earning assets | 6,653,543 | 100,326 | 3.04 | % | 6,185,654 | 110,201 | 3.59 | % | |||||||||||||||||||||||||||

| Noninterest earning assets | 756,523 | 754,533 | |||||||||||||||||||||||||||||||||

| Total assets | $ | 7,410,066 | $ | 6,940,187 | |||||||||||||||||||||||||||||||

| Interest Bearing Liabilities: | |||||||||||||||||||||||||||||||||||

| Certificates of deposit | $ | 329,100 | $ | 662 | 0.41 | % | $ | 387,310 | $ | 1,040 | 0.54 | % | |||||||||||||||||||||||

| Savings accounts | 649,562 | 175 | 0.05 | 575,942 | 184 | 0.06 | |||||||||||||||||||||||||||||

| Interest bearing demand and money market accounts | 3,066,849 | 2,000 | 0.13 | 2,784,714 | 2,028 | 0.15 | |||||||||||||||||||||||||||||

| Total interest bearing deposits | 4,045,511 | 2,837 | 0.14 | 3,747,966 | 3,252 | 0.17 | |||||||||||||||||||||||||||||

| Junior subordinated debentures | 21,250 | 433 | 4.11 | 20,950 | 373 | 3.59 | |||||||||||||||||||||||||||||

| Securities sold under agreement to repurchase | 49,140 | 64 | 0.26 | 41,676 | 73 | 0.35 | |||||||||||||||||||||||||||||

| Total interest bearing liabilities | 4,115,901 | 3,334 | 0.16 | % | 3,810,592 | 3,698 | 0.20 | % | |||||||||||||||||||||||||||

| Noninterest demand deposits | 2,354,571 | 2,183,638 | |||||||||||||||||||||||||||||||||

| Other noninterest bearing liabilities | 111,167 | 114,542 | |||||||||||||||||||||||||||||||||

| Stockholders’ equity | 828,427 | 831,415 | |||||||||||||||||||||||||||||||||

| Total liabilities and stockholders’ equity | $ | 7,410,066 | $ | 6,940,187 | |||||||||||||||||||||||||||||||

| Net interest income and spread | $ | 96,992 | 2.88 | % | $ | 106,503 | 3.39 | % | |||||||||||||||||||||||||||

| Net interest margin | 2.94 | % | 3.47 | % | |||||||||||||||||||||||||||||||

| Quarter Ended | |||||||||||||||||||||||||||||

| June 30, 2022 |

March 31, 2022 |

December 31, 2021 |

September 30, 2021 |

June 30, 2021 |

|||||||||||||||||||||||||

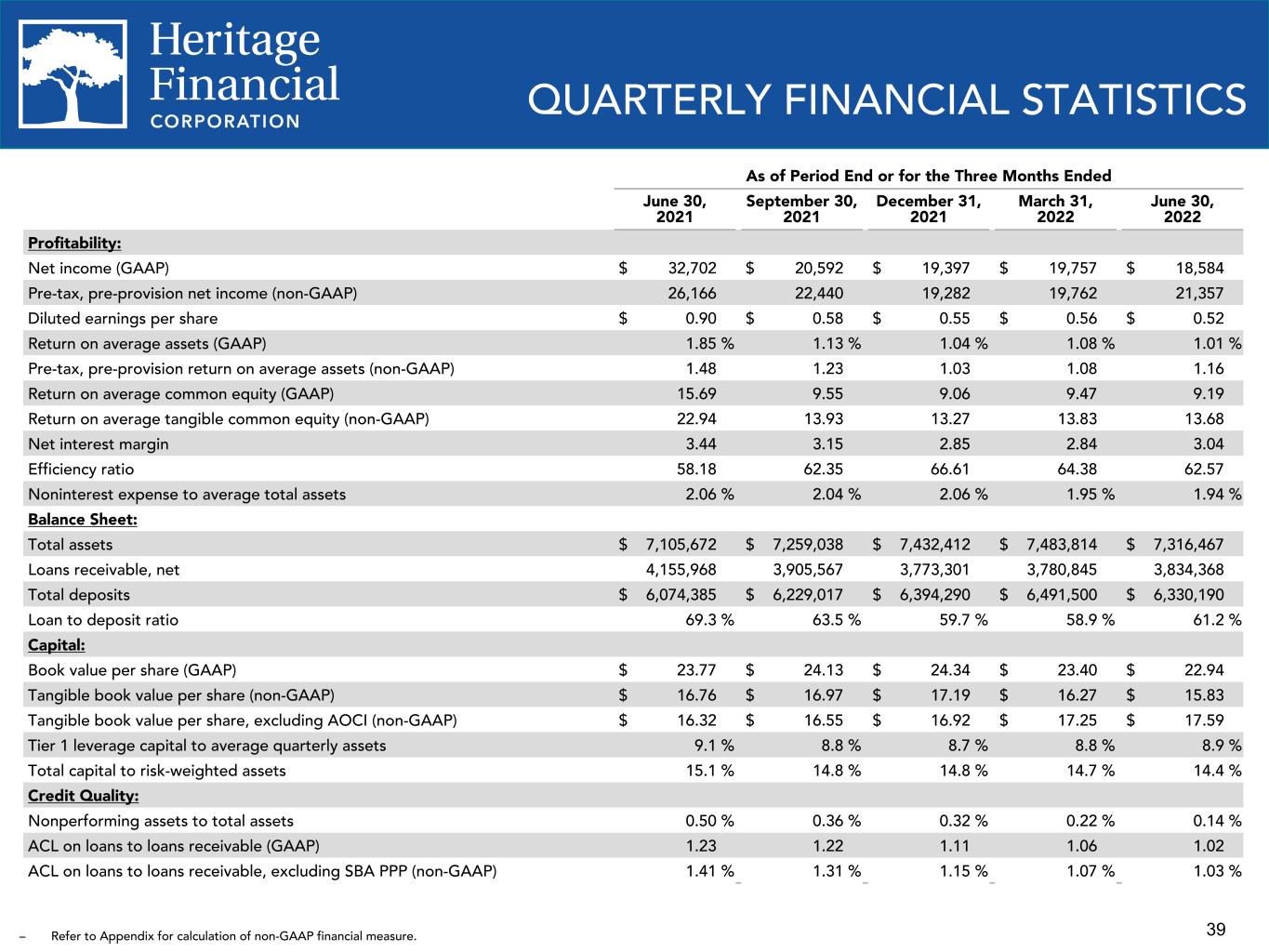

| Earnings: | |||||||||||||||||||||||||||||

| Net interest income | $ | 50,048 | $ | 46,944 | $ | 47,908 | $ | 51,378 | $ | 54,265 | |||||||||||||||||||

| Reversal of provision for credit losses | (1,204) | (3,577) | (5,037) | (3,149) | (13,987) | ||||||||||||||||||||||||

| Noninterest income | 7,016 | 8,538 | 9,839 | 8,228 | 8,297 | ||||||||||||||||||||||||

| Noninterest expense | 35,707 | 35,720 | 38,465 | 37,166 | 36,396 | ||||||||||||||||||||||||

| Net income | 18,584 | 19,757 | 19,397 | 20,592 | 32,702 | ||||||||||||||||||||||||

Pre-tax, pre-provision net income (3) |

21,357 | 19,762 | 19,282 | 22,440 | 26,166 | ||||||||||||||||||||||||

| Basic earnings per share | $ | 0.53 | $ | 0.56 | $ | 0.56 | $ | 0.58 | $ | 0.91 | |||||||||||||||||||

| Diluted earnings per share | $ | 0.52 | $ | 0.56 | $ | 0.55 | $ | 0.58 | $ | 0.90 | |||||||||||||||||||

| Average Balances: | |||||||||||||||||||||||||||||

Loans receivable, net (1) |

$ | 3,812,045 | $ | 3,773,325 | $ | 3,836,029 | $ | 4,005,585 | $ | 4,402,868 | |||||||||||||||||||

| Total investment securities | 1,587,757 | 1,417,966 | 1,170,315 | 1,051,281 | 959,512 | ||||||||||||||||||||||||

| Total interest earning assets | 6,612,958 | 6,694,578 | 6,671,984 | 6,474,527 | 6,327,171 | ||||||||||||||||||||||||

| Total assets | 7,385,616 | 7,434,787 | 7,403,597 | 7,214,960 | 7,079,205 | ||||||||||||||||||||||||

| Total interest bearing deposits | 4,041,706 | 4,049,357 | 3,977,721 | 3,856,663 | 3,809,750 | ||||||||||||||||||||||||

| Total noninterest demand deposits | 2,349,746 | 2,359,451 | 2,396,452 | 2,313,145 | 2,261,373 | ||||||||||||||||||||||||

| Stockholders' equity | 810,961 | 846,085 | 849,383 | 855,708 | 835,761 | ||||||||||||||||||||||||

| Financial Ratios: | |||||||||||||||||||||||||||||

Return on average assets (2) |

1.01 | % | 1.08 | % | 1.04 | % | 1.13 | % | 1.85 | % | |||||||||||||||||||

Pre-tax, pre-provision return on average assets (2)(3) |

1.16 | 1.08 | 1.03 | 1.23 | 1.48 | ||||||||||||||||||||||||

Return on average common equity (2) |

9.19 | 9.47 | 9.06 | 9.55 | 15.69 | ||||||||||||||||||||||||

Return on average tangible common equity (2) (3) |

13.68 | 13.83 | 13.27 | 13.93 | 22.94 | ||||||||||||||||||||||||

| Efficiency ratio | 62.57 | 64.38 | 66.61 | 62.35 | 58.18 | ||||||||||||||||||||||||

Noninterest expense to average total assets (2) |

1.94 | 1.95 | 2.06 | 2.04 | 2.06 | ||||||||||||||||||||||||

Net interest spread (2) |

2.98 | 2.78 | 2.79 | 3.08 | 3.37 | ||||||||||||||||||||||||

Net interest margin (2) |

3.04 | 2.84 | 2.85 | 3.15 | 3.44 | ||||||||||||||||||||||||

| As of or for the Quarter Ended | |||||||||||||||||||||||||||||

| June 30, 2022 |

March 31, 2022 |

December 31, 2021 |

September 30, 2021 |

June 30, 2021 |

|||||||||||||||||||||||||

| Select Balance Sheet: | |||||||||||||||||||||||||||||

| Total assets | $ | 7,316,467 | $ | 7,483,814 | $ | 7,432,412 | $ | 7,259,038 | $ | 7,105,672 | |||||||||||||||||||

| Loans receivable, net | 3,834,368 | 3,780,845 | 3,773,301 | 3,905,567 | 4,155,968 | ||||||||||||||||||||||||

| Total investment securities | 1,803,241 | 1,462,137 | 1,277,728 | 1,072,600 | 1,049,524 | ||||||||||||||||||||||||

| Deposits | 6,330,190 | 6,491,500 | 6,394,290 | 6,229,017 | 6,074,385 | ||||||||||||||||||||||||

| Noninterest demand deposits | 2,325,139 | 2,393,972 | 2,343,909 | 2,312,707 | 2,269,020 | ||||||||||||||||||||||||

| Stockholders' equity | 805,366 | 821,449 | 854,432 | 848,404 | 855,984 | ||||||||||||||||||||||||

| Financial Measures: | |||||||||||||||||||||||||||||

| Book value per share | $ | 22.94 | $ | 23.40 | $ | 24.34 | $ | 24.13 | $ | 23.77 | |||||||||||||||||||

Tangible book value per share (1) |

15.83 | 16.27 | 17.19 | 16.97 | 16.76 | ||||||||||||||||||||||||

Tangible book value per share, excluding AOCI (1) |

17.59 | 17.25 | 16.92 | 16.55 | 16.32 | ||||||||||||||||||||||||

| Stockholders' equity to total assets | 11.0 | % | 11.0 | % | 11.5 | % | 11.7 | % | 12.0 | % | |||||||||||||||||||

Tangible common equity to tangible assets (1) |

7.9 | 7.9 | 8.4 | 8.5 | 8.8 | ||||||||||||||||||||||||

Tangible common equity to tangible assets, excluding AOCI (1) |

8.7 | 8.3 | 8.3 | 8.3 | 8.6 | ||||||||||||||||||||||||

| Loans to deposits ratio | 61.2 | 58.9 | 59.7 | 63.5 | 69.3 | ||||||||||||||||||||||||

| Regulatory Capital Ratios: | |||||||||||||||||||||||||||||

Common equity Tier 1 capital to risk-weighted assets(2) |

13.2 | % | 13.4 | % | 13.5 | % | 13.3 | % | 13.6 | % | |||||||||||||||||||

Tier 1 leverage capital to average assets(2) |

8.9 | % | 8.8 | % | 8.7 | % | 8.8 | % | 9.1 | % | |||||||||||||||||||

Tier 1 capital to risk-weighted assets(2) |

13.6 | % | 13.9 | % | 13.9 | % | 13.8 | % | 14.0 | % | |||||||||||||||||||

Total capital to risk-weighted assets(2) |

14.4 | % | 14.7 | % | 14.8 | % | 14.8 | % | 15.1 | % | |||||||||||||||||||

| Credit Quality Metrics: | |||||||||||||||||||||||||||||

ACL on loans to: |

|||||||||||||||||||||||||||||

| Loans receivable | 1.02 | % | 1.06 | % | 1.11 | % | 1.22 | % | 1.23 | % | |||||||||||||||||||

Loans receivable, excluding SBA PPP loans (1) |

1.03 | 1.07 | 1.15 | 1.31 | 1.41 | ||||||||||||||||||||||||

| Nonperforming loans | 378.96 | 244.04 | 178.33 | 186.60 | 145.90 | ||||||||||||||||||||||||

| Nonperforming loans to loans receivable | 0.27 | 0.43 | 0.62 | 0.65 | 0.84 | ||||||||||||||||||||||||

| Nonperforming assets to total assets | 0.14 | 0.22 | 0.32 | 0.36 | 0.50 | ||||||||||||||||||||||||

| Net (recoveries) charge-offs on loans to average loans receivable | — | (0.05) | 0.05 | 0.04 | (0.01) | ||||||||||||||||||||||||

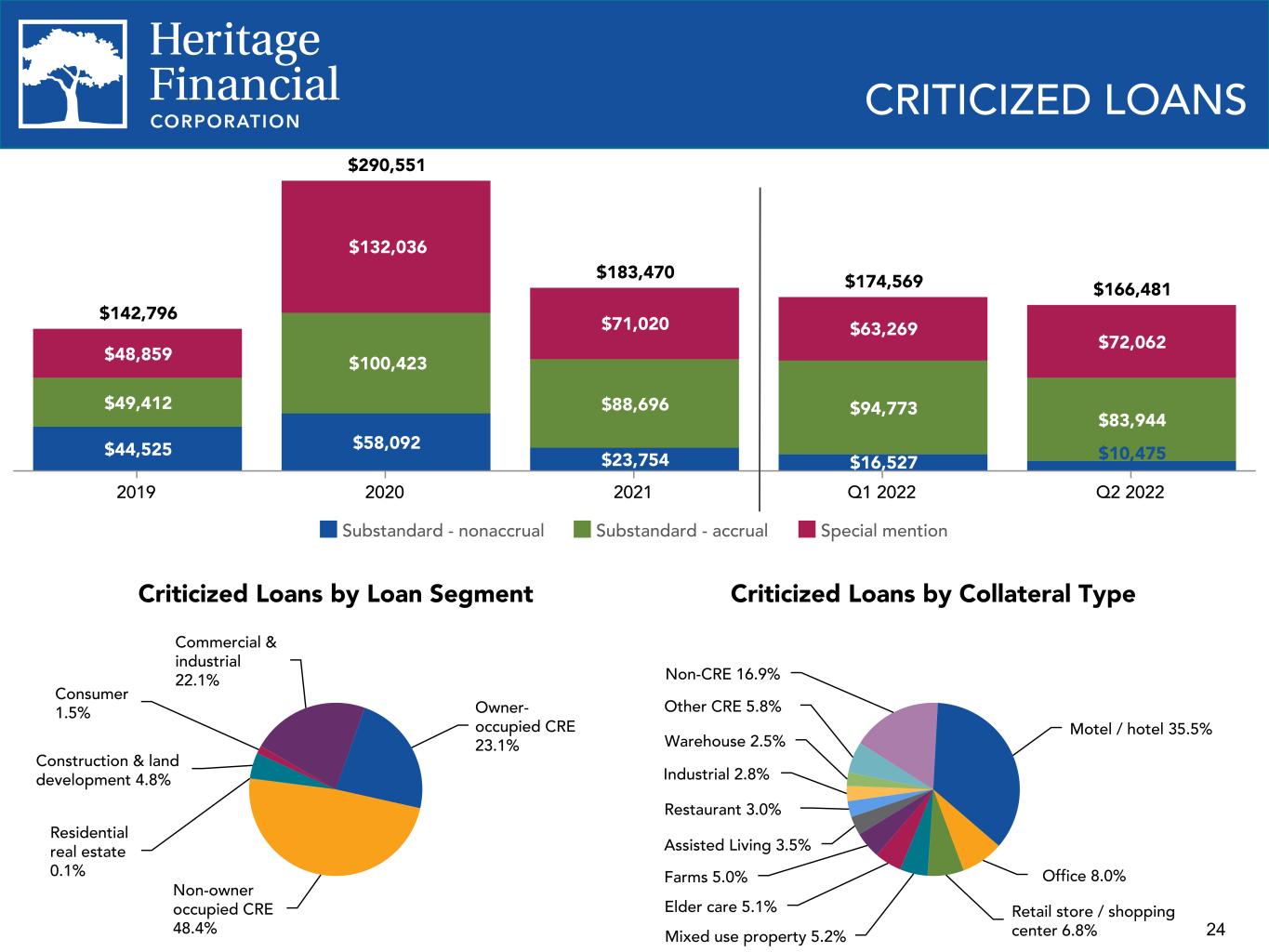

| Criticized Loans by Credit Quality Rating: | |||||||||||||||||||||||||||||

| Special mention | $ | 72,062 | $ | 63,269 | $ | 71,020 | $ | 90,554 | $ | 100,317 | |||||||||||||||||||

| Substandard | 94,419 | 111,300 | 112,450 | 126,694 | 135,374 | ||||||||||||||||||||||||

| Other Metrics: | |||||||||||||||||||||||||||||

| Number of banking offices | 49 | 49 | 49 | 53 | 53 | ||||||||||||||||||||||||

| Average number of full-time equivalent employees | 765 | 751 | 782 | 813 | 822 | ||||||||||||||||||||||||

| Deposits per branch | $ | 129,188 | $ | 132,480 | $ | 130,496 | $ | 117,529 | $ | 114,611 | |||||||||||||||||||

| Average assets per full-time equivalent employee | 9,654 | 9,900 | 9,468 | 8,874 | 8,612 | ||||||||||||||||||||||||

| June 30, 2022 |

March 31, 2022 |

December 31, 2021 |

September 30, 2021 |

June 30, 2021 |

|||||||||||||||||||||||||

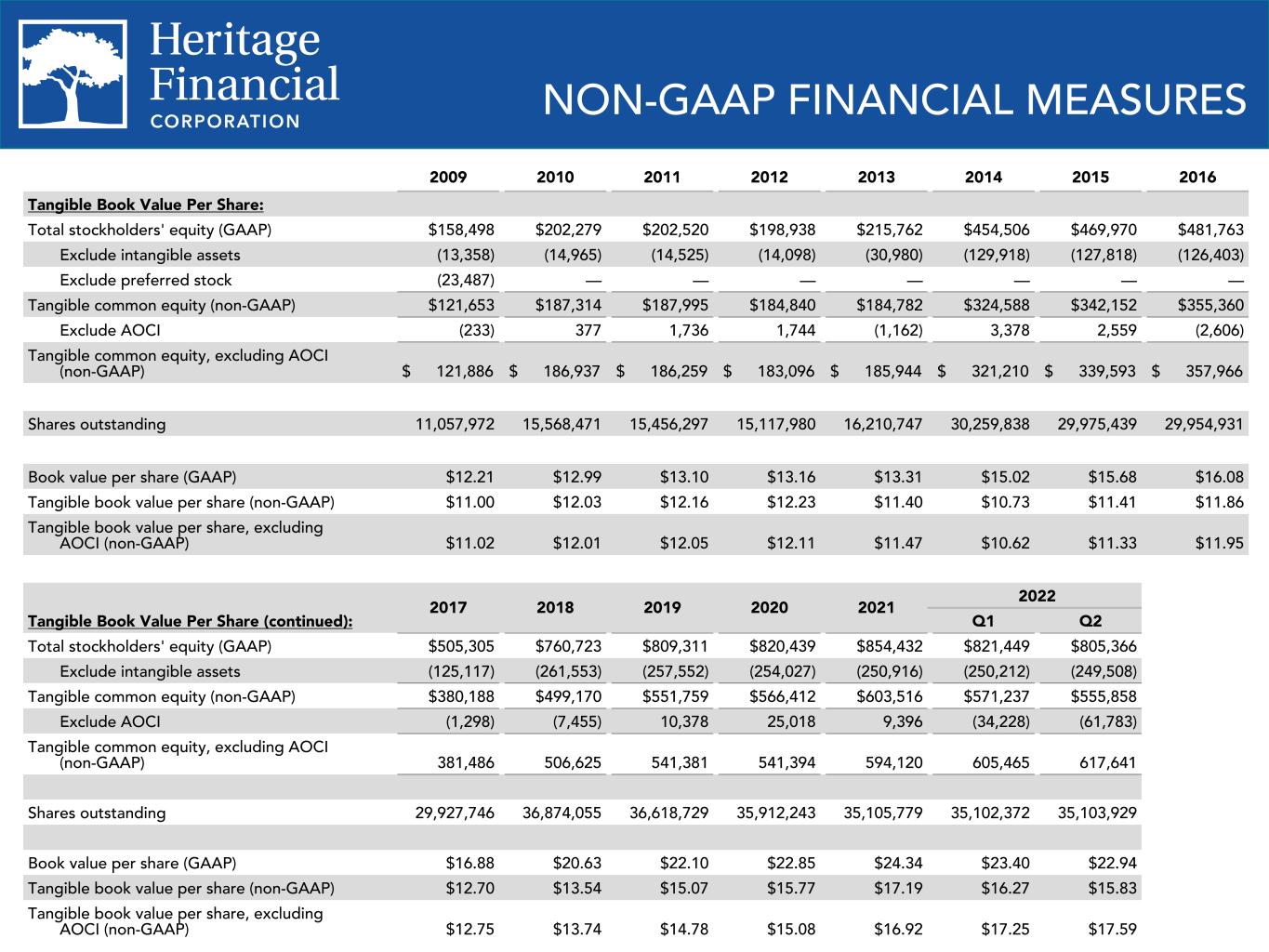

| Tangible Common Equity to Tangible Assets and Tangible Book Value Per Share: | |||||||||||||||||||||||||||||

| Total stockholders' equity (GAAP) | $ | 805,366 | $ | 821,449 | $ | 854,432 | $ | 848,404 | $ | 855,984 | |||||||||||||||||||

| Exclude intangible assets | (249,508) | (250,212) | (250,916) | (251,675) | (252,433) | ||||||||||||||||||||||||

| Tangible common equity (non-GAAP) | $ | 555,858 | $ | 571,237 | $ | 603,516 | $ | 596,729 | $ | 603,551 | |||||||||||||||||||

| Exclude AOCI | 61,783 | 34,228 | (9,396) | (14,734) | (16,061) | ||||||||||||||||||||||||

| Tangible common equity, excluding AOCI (non-GAAP) | $ | 617,641 | $ | 605,465 | $ | 594,120 | $ | 581,995 | $ | 587,490 | |||||||||||||||||||

| Total assets (GAAP) | $ | 7,316,467 | $ | 7,483,814 | $ | 7,432,412 | $ | 7,259,038 | $ | 7,105,672 | |||||||||||||||||||

| Exclude intangible assets | (249,508) | (250,212) | (250,916) | (251,675) | (252,433) | ||||||||||||||||||||||||

| Tangible assets (non-GAAP) | $ | 7,066,959 | $ | 7,233,602 | $ | 7,181,496 | $ | 7,007,363 | $ | 6,853,239 | |||||||||||||||||||

| Exclude UGL, net of tax | 61,783 | 34,228 | (9,396) | (14,734) | (16,061) | ||||||||||||||||||||||||

| Tangible assets, excluding UGL, net of tax (non-GAAP) | $ | 7,128,742 | $ | 7,267,830 | $ | 7,172,100 | $ | 6,992,629 | $ | 6,837,178 | |||||||||||||||||||

| Stockholders' equity to total assets (GAAP) | 11.0 | % | 11.0 | % | 11.5 | % | 11.7 | % | 12.0 | % | |||||||||||||||||||

| Tangible common equity to tangible assets (non-GAAP) | 7.9 | % | 7.9 | % | 8.4 | % | 8.5 | % | 8.8 | % | |||||||||||||||||||

| Tangible common equity to tangible assets, excluding AOCI (non-GAAP) | 8.7 | % | 8.3 | % | 8.3 | % | 8.3 | % | 8.6 | % | |||||||||||||||||||

| Shares outstanding | 35,103,929 | 35,102,372 | 35,105,779 | 35,166,599 | 36,006,560 | ||||||||||||||||||||||||

| Book value per share (GAAP) | $ | 22.94 | $ | 23.40 | $ | 24.34 | $ | 24.13 | $ | 23.77 | |||||||||||||||||||

| Tangible book value per share (non-GAAP) | $ | 15.83 | $ | 16.27 | $ | 17.19 | $ | 16.97 | $ | 16.76 | |||||||||||||||||||

| Tangible book value per share, excluding AOCI (non-GAAP) | $ | 17.59 | $ | 17.25 | $ | 16.92 | $ | 16.55 | $ | 16.32 | |||||||||||||||||||

| June 30, 2022 |

March 31, 2022 |

December 31, 2021 |

September 30, 2021 |

June 30, 2021 |

|||||||||||||||||||||||||

| ACL on Loans to Loans Receivable, excluding SBA PPP Loans: | |||||||||||||||||||||||||||||

| Allowance for credit losses on loans | $ | 39,696 | $ | 40,333 | $ | 42,361 | $ | 48,317 | $ | 51,562 | |||||||||||||||||||

| Loans receivable (GAAP) | $ | 3,874,064 | $ | 3,821,178 | $ | 3,815,662 | $ | 3,953,884 | $ | 4,207,530 | |||||||||||||||||||

| Exclude SBA PPP loans | (11,334) | (64,962) | (145,840) | (266,896) | (544,250) | ||||||||||||||||||||||||

| Loans receivable, excluding SBA PPP loans (non-GAAP) | $ | 3,862,730 | $ | 3,756,216 | $ | 3,669,822 | $ | 3,686,988 | $ | 3,663,280 | |||||||||||||||||||

| ACL on loans to loans receivable (GAAP) | 1.02 | % | 1.06 | % | 1.11 | % | 1.22 | % | 1.23 | % | |||||||||||||||||||

| ACL on loans to loans receivable, excluding SBA PPP loans (non-GAAP) | 1.03 | % | 1.07 | % | 1.15 | % | 1.31 | % | 1.41 | % | |||||||||||||||||||

| Quarter Ended | |||||||||||||||||||||||||||||

| June 30, 2022 |

March 31, 2022 |

December 31, 2021 |

September 30, 2021 |

June 30, 2021 |

|||||||||||||||||||||||||

| Return on Average Tangible Common Equity, annualized: | |||||||||||||||||||||||||||||

| Net income (GAAP) | $ | 18,584 | $ | 19,757 | $ | 19,397 | $ | 20,592 | $ | 32,702 | |||||||||||||||||||

| Add amortization of intangible assets | 704 | 704 | 759 | 758 | 797 | ||||||||||||||||||||||||

| Exclude tax effect of adjustment | (148) | (148) | (159) | (159) | (167) | ||||||||||||||||||||||||

| Tangible net income (non-GAAP) | $ | 19,140 | $ | 20,313 | $ | 19,997 | $ | 21,191 | $ | 33,332 | |||||||||||||||||||

| Average stockholders' equity (GAAP) | $ | 810,961 | $ | 846,085 | $ | 849,383 | $ | 855,708 | $ | 835,761 | |||||||||||||||||||

| Exclude average intangible assets | (249,890) | (250,593) | (251,331) | (252,159) | (252,955) | ||||||||||||||||||||||||

| Average tangible common stockholders' equity (non-GAAP) | $ | 561,071 | $ | 595,492 | $ | 598,052 | $ | 603,549 | $ | 582,806 | |||||||||||||||||||

| Return on average common equity, annualized (GAAP) | 9.19 | % | 9.47 | % | 9.06 | % | 9.55 | % | 15.69 | % | |||||||||||||||||||

| Return on average tangible common equity, annualized (non-GAAP) | 13.68 | % | 13.83 | % | 13.27 | % | 13.93 | % | 22.94 | % | |||||||||||||||||||

| Quarter Ended | |||||||||||||||||||||||||||||

| June 30, 2022 |

March 31, 2022 |

December 31, 2021 |

September 30, 2021 |

June 30, 2021 |

|||||||||||||||||||||||||

| Pre-tax, Pre-provision Income and Pre-tax, Pre-provision Return on Average Assets, annualized: | |||||||||||||||||||||||||||||

| Net income (GAAP) | $ | 18,584 | $ | 19,757 | $ | 19,397 | $ | 20,592 | $ | 32,702 | |||||||||||||||||||

| Add income tax expense | 3,977 | 3,582 | 4,922 | 4,997 | 7,451 | ||||||||||||||||||||||||

| Add reversal of provision for credit losses | (1,204) | (3,577) | (5,037) | (3,149) | (13,987) | ||||||||||||||||||||||||

| Pre-tax, pre-provision income (non-GAAP) | $ | 21,357 | $ | 19,762 | $ | 19,282 | $ | 22,440 | $ | 26,166 | |||||||||||||||||||

| Average total assets (GAAP) | $ | 7,385,616 | $ | 7,434,787 | $ | 7,403,597 | $ | 7,214,960 | $ | 7,079,205 | |||||||||||||||||||

| Return on average assets, annualized (GAAP) | 1.01 | % | 1.08 | % | 1.04 | % | 1.13 | % | 1.85 | % | |||||||||||||||||||

| Pre-tax, pre-provision return on average assets (non-GAAP) | 1.16 | % | 1.08 | % | 1.03 | % | 1.23 | % | 1.48 | % | |||||||||||||||||||

| Quarter Ended | |||||||||||||||||

| June 30, 2022 |

March 31, 2022 |

June 30, 2021 |

|||||||||||||||

| Loan Yield, excluding SBA PPP Loans and Incremental Accretion on Purchased Loans, annualized: | |||||||||||||||||

| Interest and fees on loans (GAAP) | $ | 40,890 | $ | 41,025 | $ | 50,750 | |||||||||||

| Exclude interest and fees on SBA PPP loans | (1,782) | (3,081) | (10,003) | ||||||||||||||

| Exclude incremental accretion on purchased loans | (270) | (584) | (495) | ||||||||||||||

| Adjusted interest and fees on loans (non-GAAP) | $ | 38,838 | $ | 37,360 | $ | 40,252 | |||||||||||

| Average loans receivable, net (GAAP) | $ | 3,812,045 | $ | 3,773,325 | $ | 4,402,868 | |||||||||||

| Exclude average SBA PPP loans | (34,090) | (109,594) | (777,156) | ||||||||||||||

| Adjusted average loans receivable, net (non-GAAP) | $ | 3,777,955 | $ | 3,663,731 | $ | 3,625,712 | |||||||||||

| Loan yield, annualized (GAAP) | 4.30 | % | 4.41 | % | 4.62 | % | |||||||||||

| Loan yield, excluding SBA PPP loans and incremental accretion on purchased loans, annualized (non-GAAP) | 4.12 | % | 4.14 | % | 4.45 | % | |||||||||||