| 1-13395 | 56-2010790 | |||||||

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

|||||||

4401 Colwick Road |

||||||||||||||||||||

| Charlotte, | North Carolina | 28211 | ||||||||||||||||||

| (Address of principal executive offices) | (Zip Code) | |||||||||||||||||||

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||||

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

| Class A Common Stock, par value $0.01 per share | SAH | New York Stock Exchange | ||||||

|

Exhibit

No.

|

Description |

|||||||

| 99.1 | ||||||||

| 99.2 | ||||||||

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). | |||||||

| SONIC AUTOMOTIVE, INC. | ||||||||

| April 25, 2024 | By: | /s/ STEPHEN K. COSS | ||||||

| Stephen K. Coss | ||||||||

| Senior Vice President and General Counsel | ||||||||

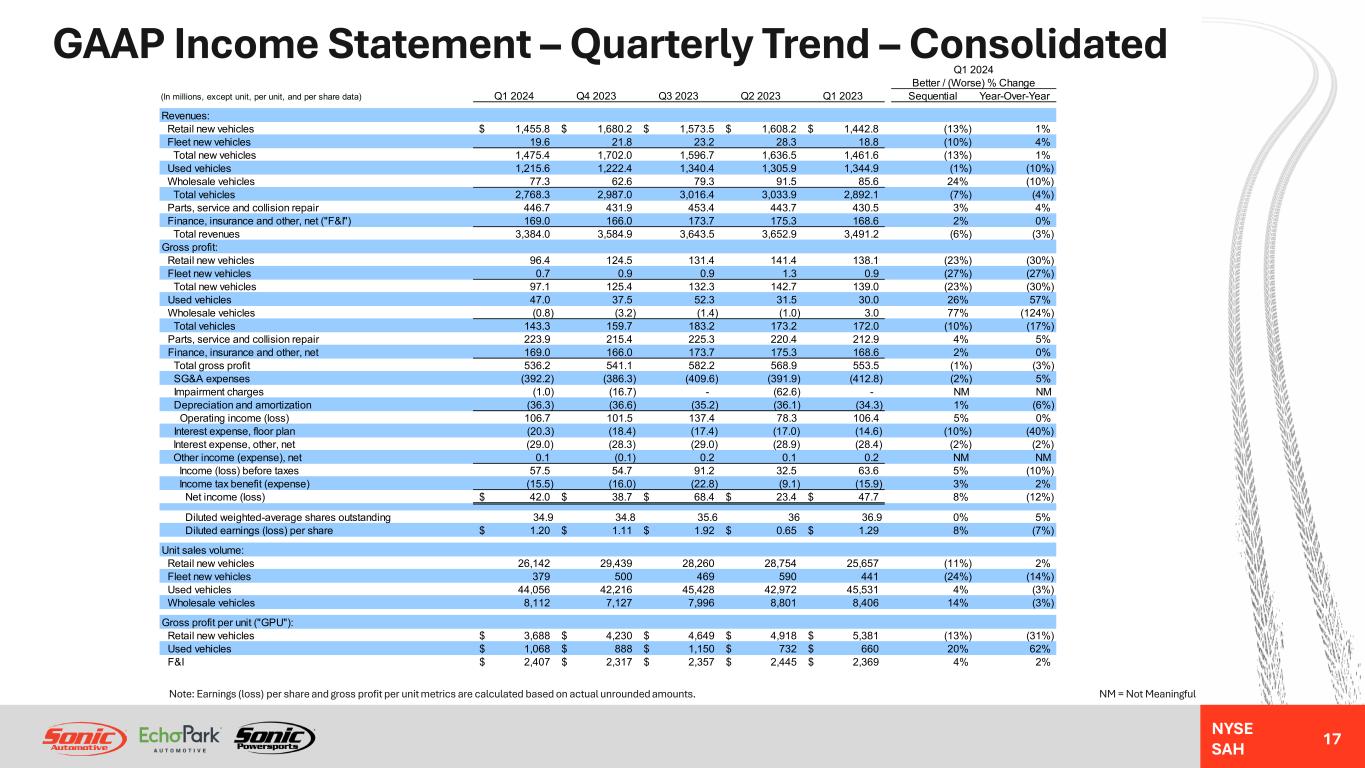

| Three Months Ended March 31, | Better / (Worse) | ||||||||||||||||

| 2024 | 2023 | % Change | |||||||||||||||

| (In millions, except per share amounts) | |||||||||||||||||

| Revenues: | |||||||||||||||||

| Retail new vehicles | $ | 1,455.8 | $ | 1,442.8 | 1 | % | |||||||||||

| Fleet new vehicles | 19.6 | 18.8 | 4 | % | |||||||||||||

| Total new vehicles | 1,475.4 | 1,461.6 | 1 | % | |||||||||||||

| Used vehicles | 1,215.6 | 1,344.9 | (10) | % | |||||||||||||

| Wholesale vehicles | 77.3 | 85.6 | (10) | % | |||||||||||||

| Total vehicles | 2,768.3 | 2,892.1 | (4) | % | |||||||||||||

| Parts, service and collision repair | 446.7 | 430.5 | 4 | % | |||||||||||||

| Finance, insurance and other, net | 169.0 | 168.6 | — | % | |||||||||||||

| Total revenues | 3,384.0 | 3,491.2 | (3) | % | |||||||||||||

| Cost of sales: | |||||||||||||||||

| Retail new vehicles | (1,359.4) | (1,304.7) | (4) | % | |||||||||||||

| Fleet new vehicles | (18.9) | (17.9) | (6) | % | |||||||||||||

| Total new vehicles | (1,378.3) | (1,322.6) | (4) | % | |||||||||||||

| Used vehicles | (1,168.6) | (1,314.9) | 11 | % | |||||||||||||

| Wholesale vehicles | (78.1) | (82.6) | 5 | % | |||||||||||||

| Total vehicles | (2,625.0) | (2,720.1) | 3 | % | |||||||||||||

| Parts, service and collision repair | (222.8) | (217.6) | (2) | % | |||||||||||||

| Total cost of sales | (2,847.8) | (2,937.7) | 3 | % | |||||||||||||

| Gross profit | 536.2 | 553.5 | (3) | % | |||||||||||||

| Selling, general and administrative expenses | (392.2) | (412.8) | 5 | % | |||||||||||||

| Impairment charges | (1.0) | — | (100) | % | |||||||||||||

| Depreciation and amortization | (36.3) | (34.3) | (6) | % | |||||||||||||

| Operating income (loss) | 106.7 | 106.4 | — | % | |||||||||||||

| Other income (expense): | |||||||||||||||||

| Interest expense, floor plan | (20.3) | (14.6) | (39) | % | |||||||||||||

| Interest expense, other, net | (29.0) | (28.4) | (2) | % | |||||||||||||

| Other income (expense), net | 0.1 | 0.2 | (50) | % | |||||||||||||

| Total other income (expense) | (49.2) | (42.8) | (15) | % | |||||||||||||

| Income (loss) before taxes | 57.5 | 63.6 | (10) | % | |||||||||||||

| Provision for income taxes - benefit (expense) | (15.5) | (15.9) | 3 | % | |||||||||||||

| Net income (loss) | $ | 42.0 | $ | 47.7 | (12) | % | |||||||||||

| Basic earnings (loss) per common share | $ | 1.24 | $ | 1.33 | (7) | % | |||||||||||

| Basic weighted-average common shares outstanding | 34.0 | 35.9 | 5 | % | |||||||||||||

| Diluted earnings (loss) per common share | $ | 1.20 | $ | 1.29 | (7) | % | |||||||||||

| Diluted weighted-average common shares outstanding | 34.9 | 36.9 | 5 | % | |||||||||||||

| Dividends declared per common share | $ | 0.30 | $ | 0.28 | 7 | % | |||||||||||

| Three Months Ended March 31, | Better / (Worse) | ||||||||||||||||

| 2024 | 2023 | % Change | |||||||||||||||

| (In millions, except unit and per unit data) | |||||||||||||||||

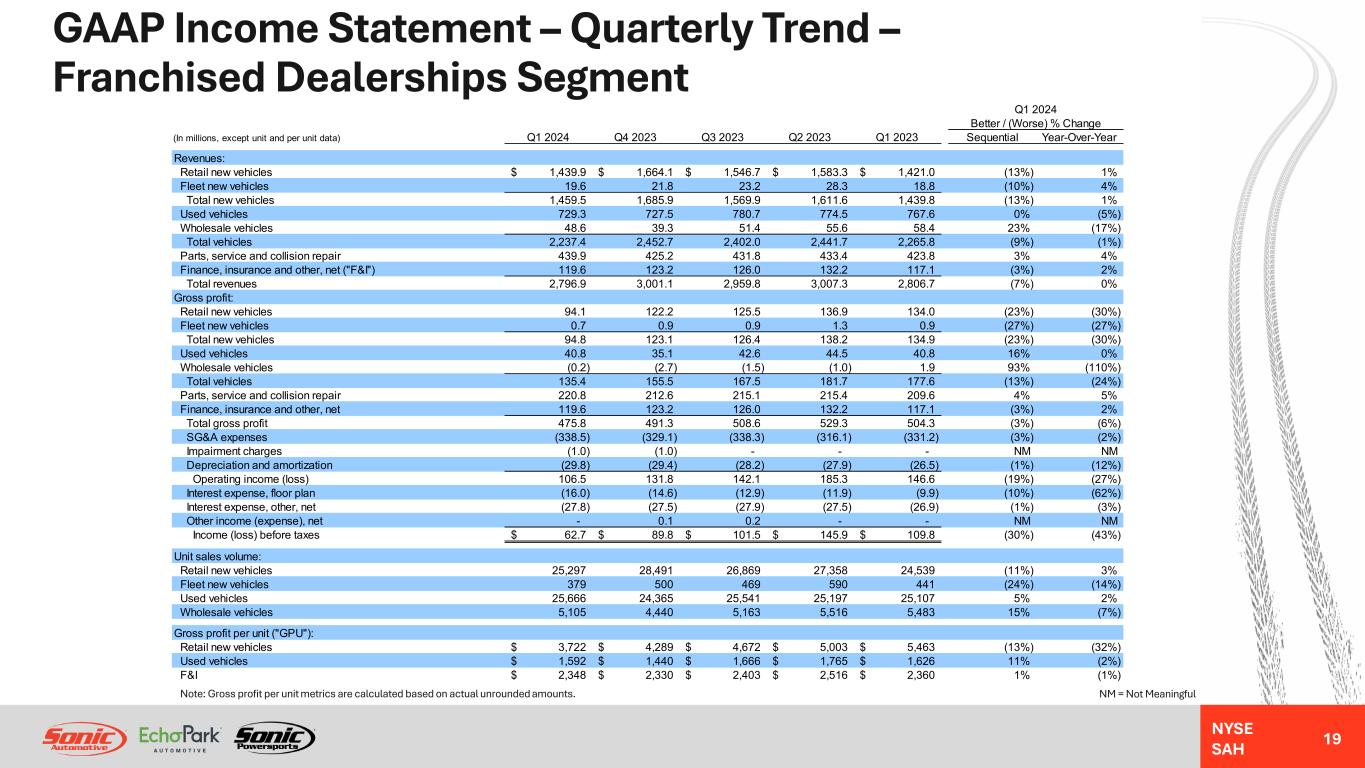

| Revenues: | |||||||||||||||||

| Retail new vehicles | $ | 1,439.9 | $ | 1,421.0 | 1 | % | |||||||||||

| Fleet new vehicles | 19.6 | 18.8 | 4 | % | |||||||||||||

| Total new vehicles | 1,459.5 | 1,439.8 | 1 | % | |||||||||||||

| Used vehicles | 729.3 | 767.6 | (5) | % | |||||||||||||

| Wholesale vehicles | 48.6 | 58.4 | (17) | % | |||||||||||||

| Total vehicles | 2,237.4 | 2,265.8 | (1) | % | |||||||||||||

| Parts, service and collision repair | 439.9 | 423.8 | 4 | % | |||||||||||||

| Finance, insurance and other, net | 119.6 | 117.1 | 2 | % | |||||||||||||

| Total revenues | 2,796.9 | 2,806.7 | — | % | |||||||||||||

| Gross Profit: | |||||||||||||||||

| Retail new vehicles | 94.1 | 134.0 | (30) | % | |||||||||||||

| Fleet new vehicles | 0.7 | 0.9 | (22) | % | |||||||||||||

| Total new vehicles | 94.8 | 134.9 | (30) | % | |||||||||||||

| Used vehicles | 40.8 | 40.8 | — | % | |||||||||||||

| Wholesale vehicles | (0.2) | 1.9 | (111) | % | |||||||||||||

| Total vehicles | 135.4 | 177.6 | (24) | % | |||||||||||||

| Parts, service and collision repair | 220.8 | 209.6 | 5 | % | |||||||||||||

| Finance, insurance and other, net | 119.6 | 117.1 | 2 | % | |||||||||||||

| Total gross profit | 475.8 | 504.3 | (6) | % | |||||||||||||

| Selling, general and administrative expenses | (338.5) | (331.2) | (2) | % | |||||||||||||

| Impairment charges | (1.0) | — | (100) | % | |||||||||||||

| Depreciation and amortization | (29.8) | (26.5) | (12) | % | |||||||||||||

| Operating income (loss) | 106.5 | 146.6 | (27) | % | |||||||||||||

| Other income (expense): | |||||||||||||||||

| Interest expense, floor plan | (16.0) | (9.9) | (62) | % | |||||||||||||

| Interest expense, other, net | (27.8) | (26.9) | (3) | % | |||||||||||||

| Other income (expense), net | — | — | — | % | |||||||||||||

| Total other income (expense) | (43.8) | (36.8) | (19) | % | |||||||||||||

| Income (loss) before taxes | 62.7 | 109.8 | (43) | % | |||||||||||||

| Add: Impairment charges | 1.0 | — | 100 | % | |||||||||||||

| Segment income (loss) | $ | 63.7 | $ | 109.8 | (42) | % | |||||||||||

| Unit Sales Volume: | |||||||||||||||||

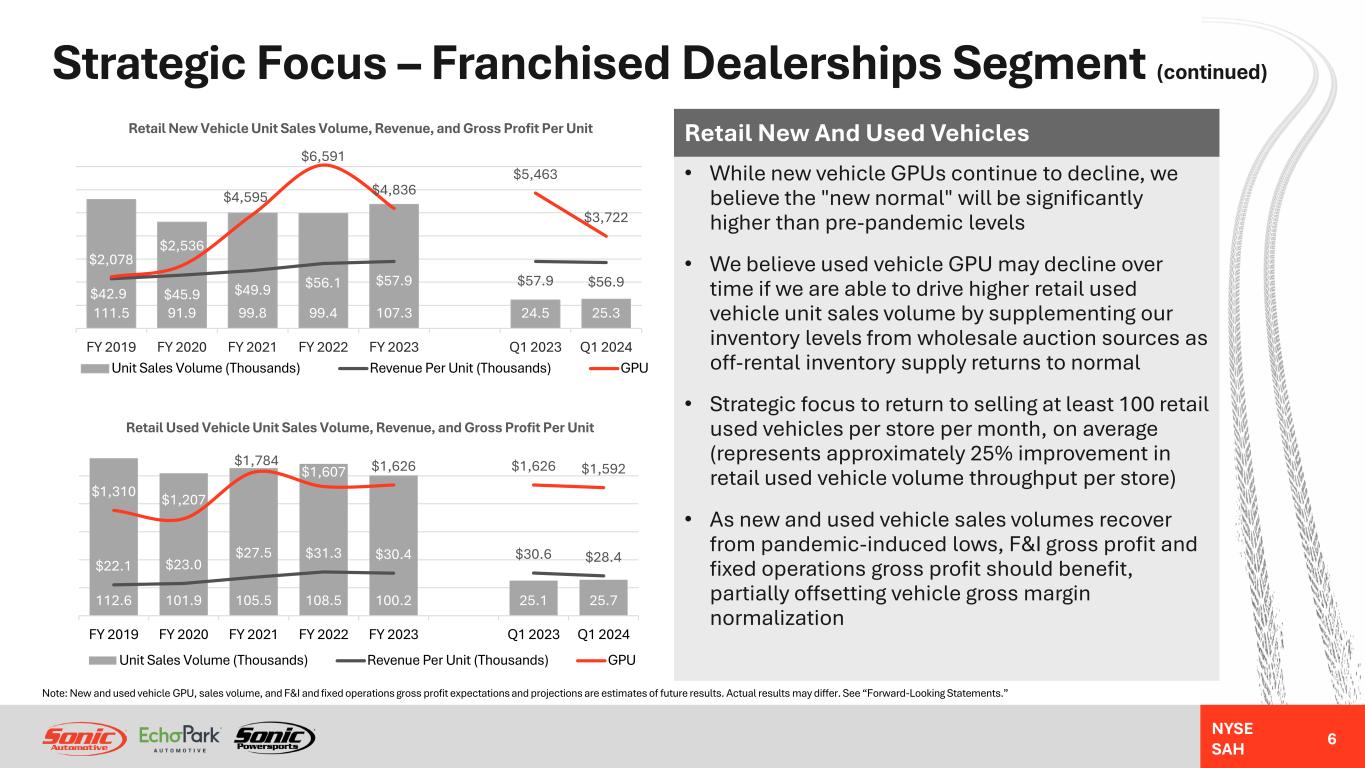

| Retail new vehicles | 25,297 | 24,539 | 3 | % | |||||||||||||

| Fleet new vehicles | 379 | 441 | (14) | % | |||||||||||||

| Total new vehicles | 25,676 | 24,980 | 3 | % | |||||||||||||

| Used vehicles | 25,666 | 25,107 | 2 | % | |||||||||||||

| Wholesale vehicles | 5,105 | 5,483 | (7) | % | |||||||||||||

| Retail new & used vehicles | 50,963 | 49,646 | 3 | % | |||||||||||||

| Used-to-New Ratio | 1.01 | 1.02 | (1) | % | |||||||||||||

| Gross Profit Per Unit: | |||||||||||||||||

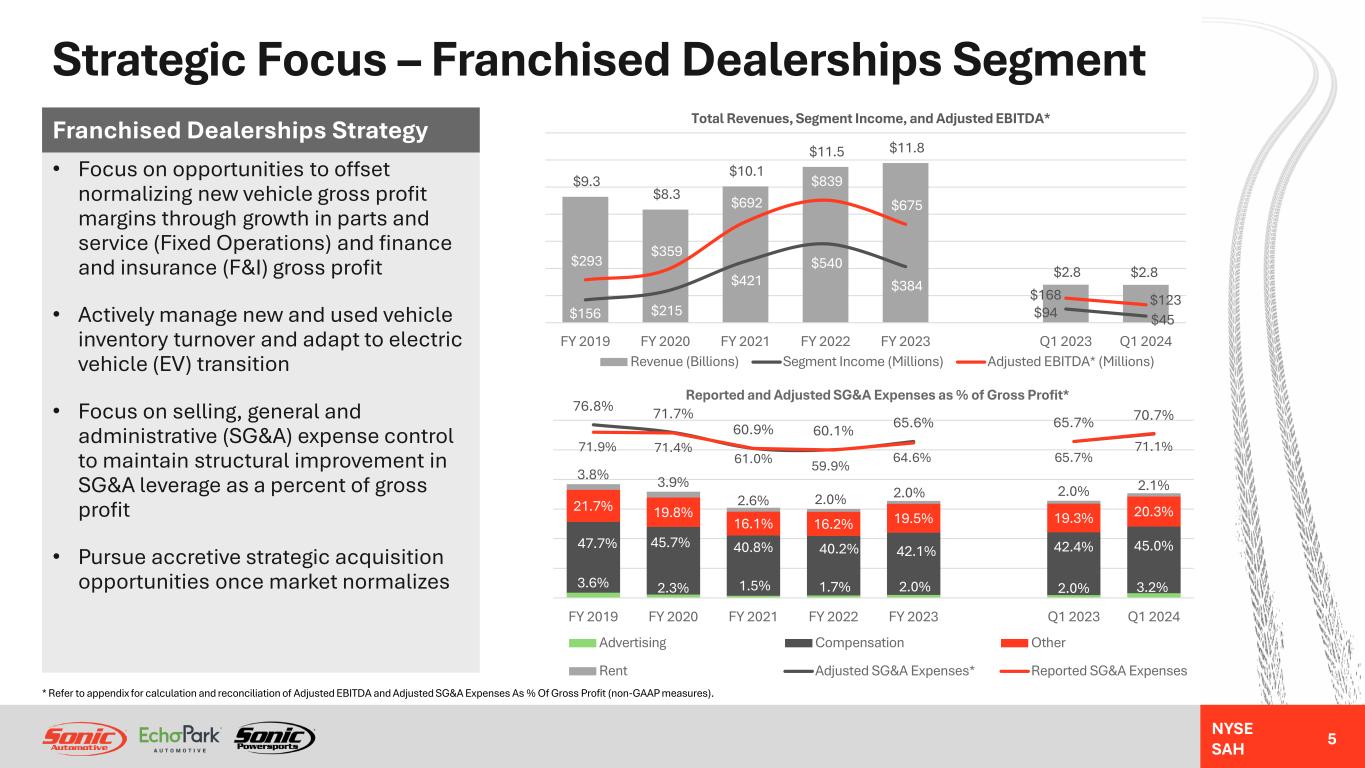

| Retail new vehicles | $ | 3,722 | $ | 5,463 | (32) | % | |||||||||||

| Fleet new vehicles | $ | 1,706 | $ | 2,020 | (16) | % | |||||||||||

| New vehicles | $ | 3,692 | $ | 5,402 | (32) | % | |||||||||||

| Used vehicles | $ | 1,592 | $ | 1,626 | (2) | % | |||||||||||

| Finance, insurance and other, net | $ | 2,348 | $ | 2,360 | (1) | % | |||||||||||

| Three Months Ended March 31, | Better / (Worse) | ||||||||||||||||

| 2024 | 2023 | % Change | |||||||||||||||

| (In millions, except unit and per unit data) | |||||||||||||||||

| Revenues: | |||||||||||||||||

| Retail new vehicles | $ | 1,435.5 | $ | 1,398.8 | 3 | % | |||||||||||

| Fleet new vehicles | 19.6 | 18.9 | 4 | % | |||||||||||||

| Total new vehicles | 1,455.1 | 1,417.7 | 3 | % | |||||||||||||

| Used vehicles | 726.0 | 753.9 | (4) | % | |||||||||||||

| Wholesale vehicles | 48.4 | 57.6 | (16) | % | |||||||||||||

| Total vehicles | 2,229.5 | 2,229.2 | — | % | |||||||||||||

| Parts, service and collision repair | 438.6 | 417.8 | 5 | % | |||||||||||||

| Finance, insurance and other, net | 119.3 | 115.3 | 3 | % | |||||||||||||

| Total revenues | 2,787.4 | 2,762.3 | 1 | % | |||||||||||||

| Gross Profit: | |||||||||||||||||

| Retail new vehicles | 93.7 | 132.3 | (29) | % | |||||||||||||

| Fleet new vehicles | 0.7 | 0.9 | (22) | % | |||||||||||||

| Total new vehicles | 94.4 | 133.2 | (29) | % | |||||||||||||

| Used vehicles | 40.5 | 40.1 | 1 | % | |||||||||||||

| Wholesale vehicles | (0.2) | 1.8 | (111) | % | |||||||||||||

| Total vehicles | 134.7 | 175.1 | (23) | % | |||||||||||||

| Parts, service and collision repair | 219.6 | 206.3 | 6 | % | |||||||||||||

| Finance, insurance and other, net | 119.3 | 115.3 | 3 | % | |||||||||||||

| Total gross profit | $ | 473.6 | $ | 496.7 | (5) | % | |||||||||||

| Unit Sales Volume: | |||||||||||||||||

| Retail new vehicles | 25,225 | 24,053 | 5 | % | |||||||||||||

| Fleet new vehicles | 379 | 441 | (14) | % | |||||||||||||

| Total new vehicles | 25,604 | 24,494 | 5 | % | |||||||||||||

| Used vehicles | 25,552 | 24,601 | 4 | % | |||||||||||||

| Wholesale vehicles | 5,094 | 5,389 | (5) | % | |||||||||||||

| Retail new & used vehicles | 50,777 | 48,654 | 4 | % | |||||||||||||

| Used-to-New Ratio | 1.01 | 1.02 | (1) | % | |||||||||||||

| Gross Profit Per Unit: | |||||||||||||||||

| Retail new vehicles | $ | 3,716 | $ | 5,499 | (32) | % | |||||||||||

| Fleet new vehicles | $ | 1,706 | $ | 2,020 | (16) | % | |||||||||||

| New vehicles | $ | 3,686 | $ | 5,437 | (32) | % | |||||||||||

| Used vehicles | $ | 1,585 | $ | 1,631 | (3) | % | |||||||||||

| Finance, insurance and other, net | $ | 2,350 | $ | 2,370 | (1) | % | |||||||||||

| Three Months Ended March 31, | Better / (Worse) | ||||||||||||||||

| 2024 | 2023 | % Change | |||||||||||||||

| (In millions, except unit and per unit data) | |||||||||||||||||

| Revenues: | |||||||||||||||||

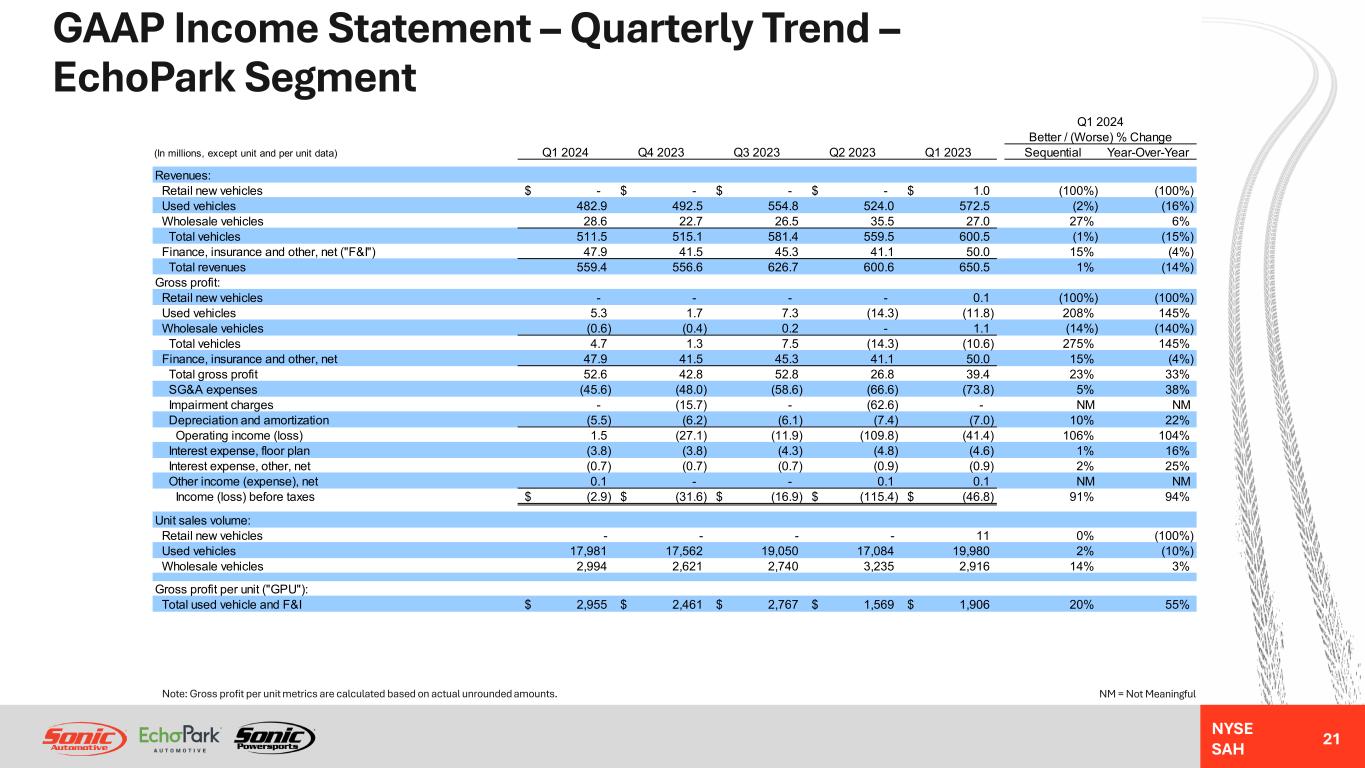

| Retail new vehicles | $ | — | $ | 1.0 | (100) | % | |||||||||||

| Used vehicles | 482.9 | 572.5 | (16) | % | |||||||||||||

| Wholesale vehicles | 28.6 | 27.0 | 6 | % | |||||||||||||

| Total vehicles | 511.5 | 600.5 | (15) | % | |||||||||||||

| Finance, insurance and other, net | 47.9 | 50.0 | (4) | % | |||||||||||||

| Total revenues | 559.4 | 650.5 | (14) | % | |||||||||||||

| Gross Profit: | |||||||||||||||||

| Retail new vehicles | — | 0.1 | (100) | % | |||||||||||||

| Used vehicles | 5.3 | (11.8) | 145 | % | |||||||||||||

| Wholesale vehicles | (0.6) | 1.1 | (155) | % | |||||||||||||

| Total vehicles | 4.7 | (10.6) | 144 | % | |||||||||||||

| Finance, insurance and other, net | 47.9 | 50.0 | (4) | % | |||||||||||||

| Total gross profit | 52.6 | 39.4 | 34 | % | |||||||||||||

| Selling, general and administrative expenses | (45.6) | (73.8) | 38 | % | |||||||||||||

| Impairment charges | — | — | — | % | |||||||||||||

| Depreciation and amortization | (5.5) | (7.0) | 21 | % | |||||||||||||

| Operating income (loss) | 1.5 | (41.4) | 104 | % | |||||||||||||

| Other income (expense): | |||||||||||||||||

| Interest expense, floor plan | (3.8) | (4.6) | 17 | % | |||||||||||||

| Interest expense, other, net | (0.7) | (0.9) | 22 | % | |||||||||||||

| Other income (expense), net | 0.1 | 0.1 | — | % | |||||||||||||

| Total other income (expense) | (4.4) | (5.4) | 19 | % | |||||||||||||

| Income (loss) before taxes | (2.9) | (46.8) | 94 | % | |||||||||||||

| Add: Impairment charges | — | — | — | % | |||||||||||||

| Segment income (loss) | $ | (2.9) | $ | (46.8) | 94 | % | |||||||||||

| Unit Sales Volume: | |||||||||||||||||

| Retail new vehicles | — | 11 | (100) | % | |||||||||||||

| Used vehicles | 17,981 | 19,980 | (10) | % | |||||||||||||

| Wholesale vehicles | 2,994 | 2,916 | 3 | % | |||||||||||||

| Gross Profit Per Unit: | |||||||||||||||||

| Total used vehicle and F&I | $ | 2,955 | $ | 1,906 | 55 | % | |||||||||||

| Three Months Ended March 31, | Better / (Worse) | ||||||||||||||||

| 2024 | 2023 | % Change | |||||||||||||||

| (In millions, except unit and per unit data) | |||||||||||||||||

| Revenues: | |||||||||||||||||

| Used vehicles | $ | 473.2 | $ | 433.7 | 9 | % | |||||||||||

| Wholesale vehicles | 25.5 | 17.9 | 42 | % | |||||||||||||

| Total vehicles | 498.7 | 451.6 | 10 | % | |||||||||||||

| Finance, insurance and other, net | 47.5 | 38.3 | 24 | % | |||||||||||||

| Total revenues | 546.2 | 489.9 | 11 | % | |||||||||||||

| Gross Profit: | |||||||||||||||||

| Used vehicles | 5.6 | (9.8) | 157 | % | |||||||||||||

| Wholesale vehicles | 0.1 | 1.2 | (92) | % | |||||||||||||

| Total vehicles | 5.7 | (8.6) | 166 | % | |||||||||||||

| Finance, insurance and other, net | 47.5 | 38.3 | 24 | % | |||||||||||||

| Total gross profit | $ | 53.2 | $ | 29.7 | 79 | % | |||||||||||

| Unit Sales Volume: | |||||||||||||||||

| Used vehicles | 17,618 | 15,551 | 13 | % | |||||||||||||

| Wholesale vehicles | 2,785 | 2,119 | 31 | % | |||||||||||||

| Gross Profit Per Unit: | |||||||||||||||||

| Total used vehicle and F&I | $ | 3,018 | $ | 1,833 | 65 | % | |||||||||||

| Three Months Ended March 31, | Better / (Worse) | ||||||||||||||||

| 2024 | 2023 | % Change | |||||||||||||||

| (In millions, except unit and per unit data) | |||||||||||||||||

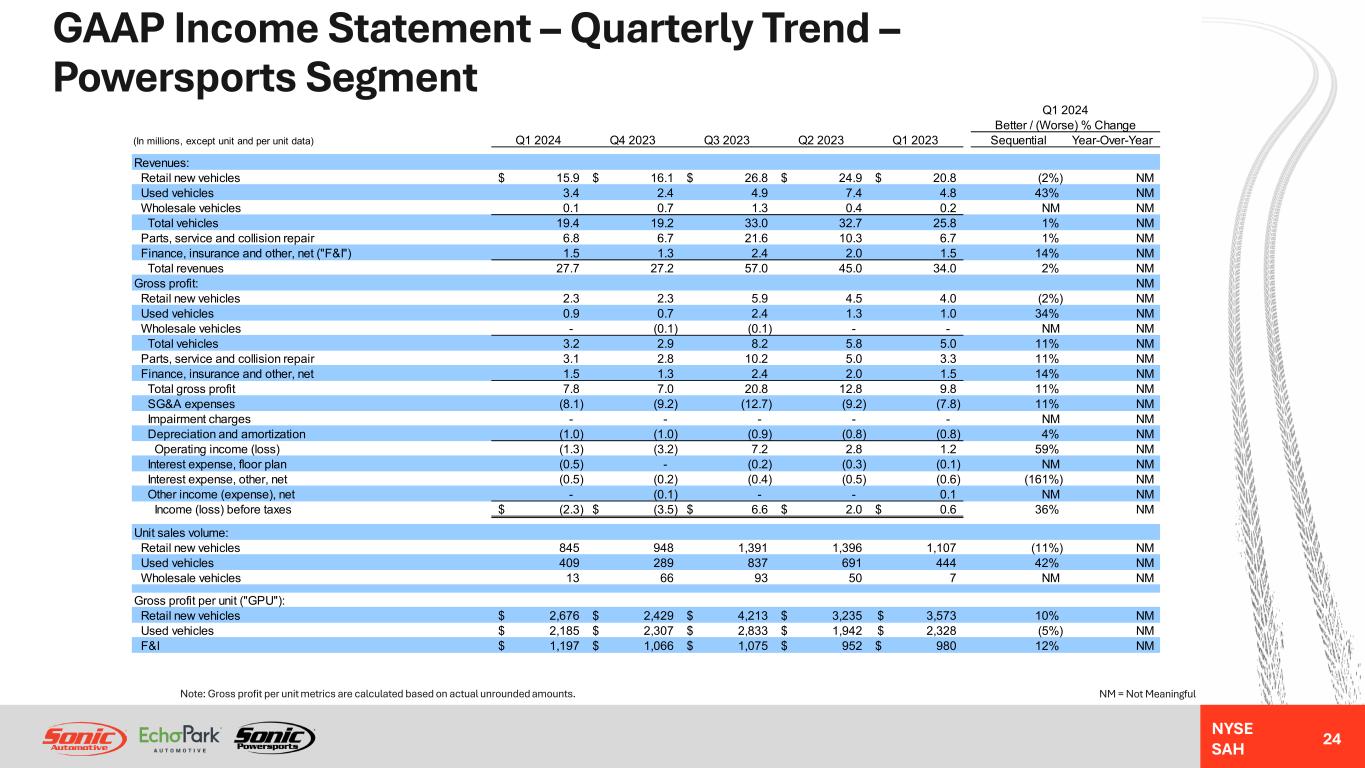

| Revenues: | |||||||||||||||||

| Retail new vehicles | $ | 15.9 | $ | 20.8 | (24) | % | |||||||||||

| Used vehicles | 3.4 | 4.8 | (29) | % | |||||||||||||

| Wholesale vehicles | 0.1 | 0.2 | (50) | % | |||||||||||||

| Total vehicles | 19.4 | 25.8 | (25) | % | |||||||||||||

| Parts, service and collision repair | 6.8 | 6.7 | 1 | % | |||||||||||||

| Finance, insurance and other, net | 1.5 | 1.5 | — | % | |||||||||||||

| Total revenues | 27.7 | 34.0 | (19) | % | |||||||||||||

| Gross Profit: | |||||||||||||||||

| Retail new vehicles | 2.3 | 4.0 | (43) | % | |||||||||||||

| Used vehicles | 0.9 | 1.0 | (10) | % | |||||||||||||

| Wholesale vehicles | — | — | — | % | |||||||||||||

| Total vehicles | 3.2 | 5.0 | (36) | % | |||||||||||||

| Parts, service and collision repair | 3.1 | 3.3 | (6) | % | |||||||||||||

| Finance, insurance and other, net | 1.5 | 1.5 | — | % | |||||||||||||

| Total gross profit | 7.8 | 9.8 | (20) | % | |||||||||||||

| Selling, general and administrative expenses | (8.1) | (7.8) | (4) | % | |||||||||||||

| Depreciation and amortization | (1.0) | (0.8) | (25) | % | |||||||||||||

| Operating income (loss) | (1.3) | 1.2 | (208) | % | |||||||||||||

| Other income (expense): | |||||||||||||||||

| Interest expense, floor plan | (0.5) | (0.1) | (400) | % | |||||||||||||

| Interest expense, other, net | (0.5) | (0.6) | 17 | % | |||||||||||||

| Other income (expense), net | — | 0.1 | (100) | % | |||||||||||||

| Total other income (expense) | (1.0) | (0.6) | (67) | % | |||||||||||||

| Income (loss) before taxes | (2.3) | 0.6 | (483) | % | |||||||||||||

| Add: Impairment charges | — | — | — | % | |||||||||||||

| Segment income (loss) | $ | (2.3) | $ | 0.6 | (483) | % | |||||||||||

| Unit Sales Volume: | |||||||||||||||||

| Retail new vehicles | 845 | 1,107 | (24) | % | |||||||||||||

| Used vehicles | 409 | 444 | (8) | % | |||||||||||||

| Wholesale vehicles | 13 | 7 | 86 | % | |||||||||||||

| Gross Profit Per Unit: | |||||||||||||||||

| Retail new vehicles | $ | 2,676 | $ | 3,573 | (25) | % | |||||||||||

| Used vehicles | $ | 2,185 | $ | 2,328 | (6) | % | |||||||||||

| Finance, insurance and other, net | $ | 1,197 | $ | 980 | 22 | % | |||||||||||

| Three Months Ended March 31, | Better / (Worse) | ||||||||||||||||

| 2024 | 2023 | % Change | |||||||||||||||

| (In millions, except unit and per unit data) | |||||||||||||||||

| Revenues: | |||||||||||||||||

| Retail new vehicles | $ | 15.3 | $ | 20.6 | (26) | % | |||||||||||

| Used vehicles | 2.7 | 4.3 | (37) | % | |||||||||||||

| Wholesale vehicles | 0.3 | 0.1 | 200 | % | |||||||||||||

| Total vehicles | 18.3 | 25.0 | (27) | % | |||||||||||||

| Parts, service and collision repair | 6.1 | 6.4 | (5) | % | |||||||||||||

| Finance, insurance and other, net | 1.4 | 1.5 | (7) | % | |||||||||||||

| Total revenues | 25.8 | 32.9 | (22) | % | |||||||||||||

| Gross Profit: | |||||||||||||||||

| Retail new vehicles | 2.1 | 3.9 | (46) | % | |||||||||||||

| Used vehicles | 0.7 | 0.9 | (22) | % | |||||||||||||

| Wholesale vehicles | 0.1 | (0.1) | 200 | % | |||||||||||||

| Total vehicles | 2.9 | 4.7 | (38) | % | |||||||||||||

| Parts, service and collision repair | 2.8 | 3.2 | (13) | % | |||||||||||||

| Finance, insurance and other, net | 1.4 | 1.5 | (7) | % | |||||||||||||

| Total gross profit | $ | 7.1 | $ | 9.4 | (24) | % | |||||||||||

| Unit Sales Volume: | |||||||||||||||||

| Retail new vehicles | 828 | 1,100 | (25) | % | |||||||||||||

| Used vehicles | 336 | 401 | (16) | % | |||||||||||||

| Wholesale vehicles | 10 | 6 | 67 | % | |||||||||||||

| Retail new & used vehicles | 1,164 | 1,501 | (22) | % | |||||||||||||

| Used-to-New Ratio | 0.41 | 0.36 | 14 | % | |||||||||||||

| Gross Profit Per Unit: | |||||||||||||||||

| Retail new vehicles | $ | 2,553 | $ | 3,549 | (28) | % | |||||||||||

| Used vehicles | $ | 2,202 | $ | 2,274 | (3) | % | |||||||||||

| Finance, insurance and other, net | $ | 1,225 | $ | 981 | 25 | % | |||||||||||

| Three Months Ended March 31, | Better / (Worse) | ||||||||||||||||||||||

| 2024 | 2023 | Change | % Change | ||||||||||||||||||||

| (In millions) | |||||||||||||||||||||||

| Reported: | |||||||||||||||||||||||

| Compensation | $ | 247.3 | $ | 258.8 | $ | 11.5 | 4 | % | |||||||||||||||

| Advertising | 22.3 | 26.1 | 3.8 | 15 | % | ||||||||||||||||||

| Rent | 9.3 | 11.3 | 2.0 | 18 | % | ||||||||||||||||||

| Other | 113.3 | 116.6 | 3.3 | 3 | % | ||||||||||||||||||

| Total SG&A expenses | $ | 392.2 | $ | 412.8 | $ | 20.6 | 5 | % | |||||||||||||||

| Adjustments: | |||||||||||||||||||||||

| Closed store accrued expenses | $ | (2.1) | $ | — | |||||||||||||||||||

| Severance and long-term compensation charges | (4.3) | (2.0) | |||||||||||||||||||||

| Total SG&A adjustments | $ | (6.4) | $ | (2.0) | |||||||||||||||||||

| Adjusted: | |||||||||||||||||||||||

| Total adjusted SG&A expenses | $ | 385.8 | $ | 410.8 | $ | 25.0 | 6 | % | |||||||||||||||

| Reported: | |||||||||||||||||||||||

| SG&A expenses as a % of gross profit: | |||||||||||||||||||||||

| Compensation | 46.1 | % | 46.7 | % | 60 | bps | |||||||||||||||||

| Advertising | 4.2 | % | 4.7 | % | 50 | bps | |||||||||||||||||

| Rent | 1.7 | % | 2.0 | % | 30 | bps | |||||||||||||||||

| Other | 21.1 | % | 21.2 | % | 10 | bps | |||||||||||||||||

| Total SG&A expenses as a % of gross profit | 73.1 | % | 74.6 | % | 150 | bps | |||||||||||||||||

| Adjustments: | |||||||||||||||||||||||

| Closed store accrued expenses | (0.4) | % | — | % | |||||||||||||||||||

| Severance and long-term compensation charges | (0.7) | % | (0.4) | % | |||||||||||||||||||

| Total effect of adjustments | (1.1) | % | (0.4) | % | |||||||||||||||||||

| Adjusted: | |||||||||||||||||||||||

| Total adjusted SG&A expenses as a % of gross profit | 72.0 | % | 74.2 | % | 220 | bps | |||||||||||||||||

| Three Months Ended March 31, | Better / (Worse) | ||||||||||||||||||||||

| 2024 | 2023 | Change | % Change | ||||||||||||||||||||

| (In millions) | |||||||||||||||||||||||

| Reported: | |||||||||||||||||||||||

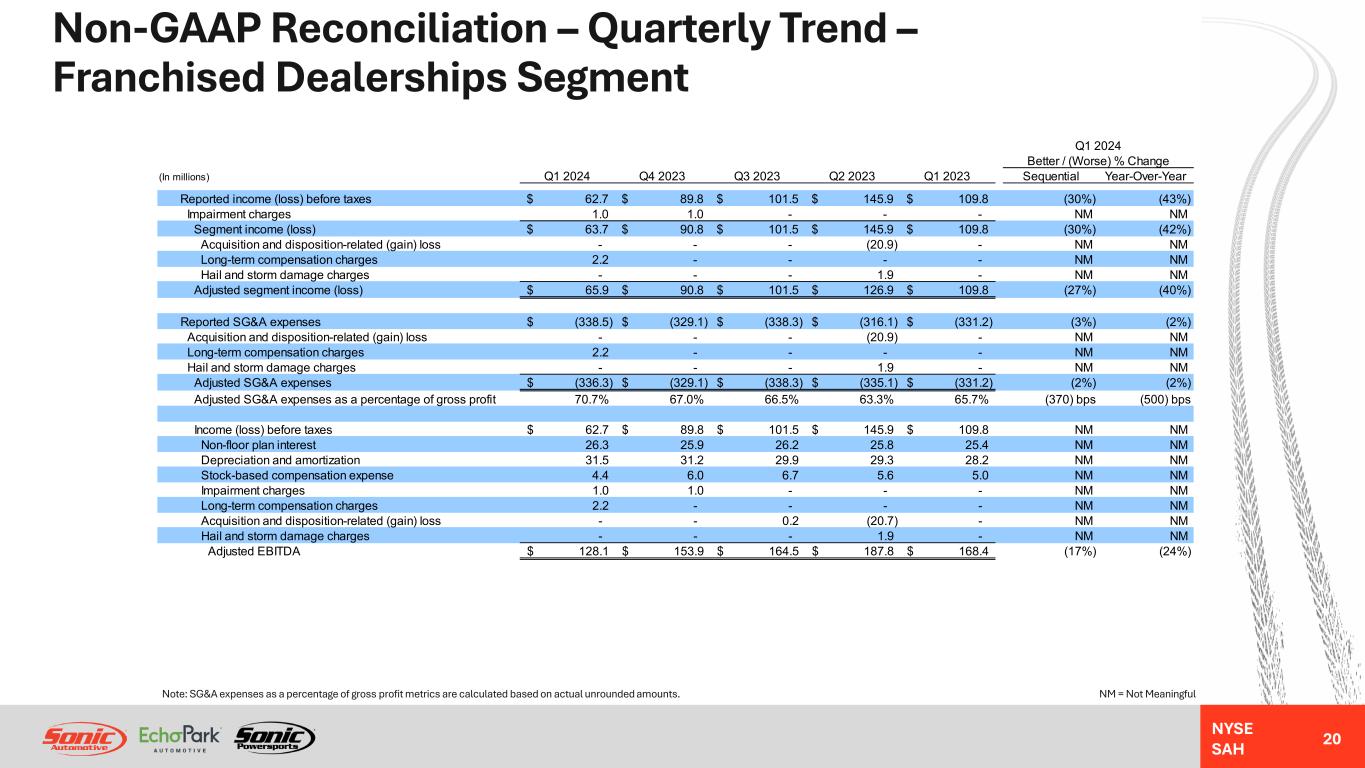

| Compensation | $ | 216.5 | $ | 213.8 | $ | (2.7) | (1) | % | |||||||||||||||

| Advertising | 15.3 | 9.9 | (5.4) | (55) | % | ||||||||||||||||||

| Rent | 10.1 | 10.2 | 0.1 | 1 | % | ||||||||||||||||||

| Other | 96.6 | 97.3 | 0.7 | 1 | % | ||||||||||||||||||

| Total SG&A expenses | $ | 338.5 | $ | 331.2 | $ | (7.3) | (2) | % | |||||||||||||||

| Adjustments: | |||||||||||||||||||||||

| Long-term compensation charges | $ | (2.2) | $ | — | |||||||||||||||||||

| Total SG&A adjustments | $ | (2.2) | $ | — | |||||||||||||||||||

| Adjusted: | |||||||||||||||||||||||

| Total adjusted SG&A expenses | $ | 336.3 | $ | 331.2 | $ | (5.1) | (2) | % | |||||||||||||||

| Reported: | |||||||||||||||||||||||

| SG&A expenses as a % of gross profit: | |||||||||||||||||||||||

| Compensation | 45.5 | % | 42.4 | % | (310) | bps | |||||||||||||||||

| Advertising | 3.2 | % | 2.0 | % | (120) | bps | |||||||||||||||||

| Rent | 2.1 | % | 2.0 | % | (10) | bps | |||||||||||||||||

| Other | 20.3 | % | 19.3 | % | (100) | bps | |||||||||||||||||

| Total SG&A expenses as a % of gross profit | 71.1 | % | 65.7 | % | (540) | bps | |||||||||||||||||

| Adjustments: | |||||||||||||||||||||||

| Long-term compensation charges | (0.4) | % | — | % | |||||||||||||||||||

| Total effect of adjustments | (0.4) | % | — | % | |||||||||||||||||||

| Adjusted: | |||||||||||||||||||||||

| Total adjusted SG&A expenses as a % of gross profit | 70.7 | % | 65.7 | % | (500) | bps | |||||||||||||||||

| Three Months Ended March 31, | Better / (Worse) | ||||||||||||||||||||||

| 2024 | 2023 | Change | % Change | ||||||||||||||||||||

| (In millions) | |||||||||||||||||||||||

| Reported: | |||||||||||||||||||||||

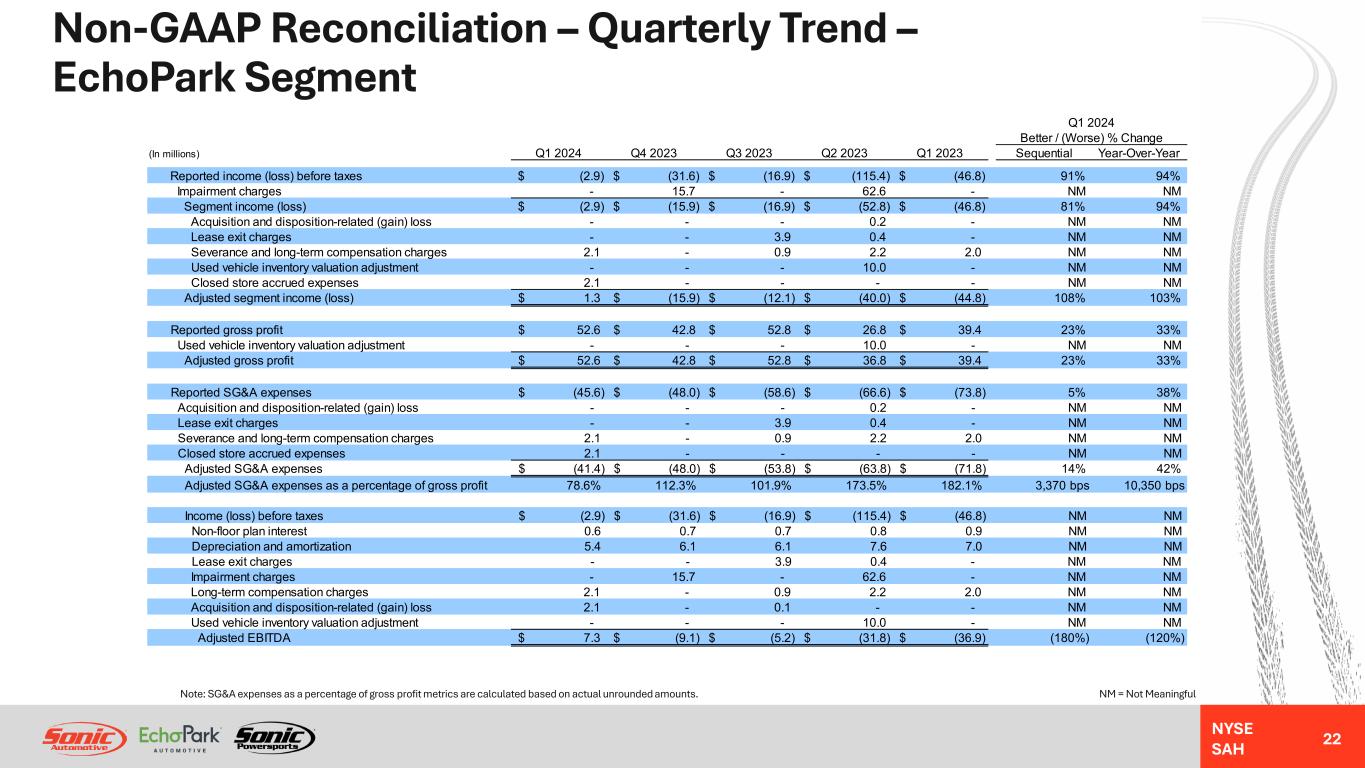

| Compensation | $ | 25.2 | $ | 39.7 | $ | 14.5 | 37 | % | |||||||||||||||

| Advertising | 6.6 | 15.8 | 9.2 | 58 | % | ||||||||||||||||||

| Rent | (0.8) | 1.1 | 1.9 | 173 | % | ||||||||||||||||||

| Other | 14.6 | 17.2 | 2.6 | 15 | % | ||||||||||||||||||

| Total SG&A expenses | $ | 45.6 | $ | 73.8 | $ | 28.2 | 38 | % | |||||||||||||||

| Adjustments: | |||||||||||||||||||||||

| Closed store accrued expenses | $ | (2.1) | $ | — | |||||||||||||||||||

| Severance and long-term compensation charges | (2.1) | (2.0) | |||||||||||||||||||||

| Total SG&A adjustments | $ | (4.2) | $ | (2.0) | |||||||||||||||||||

| Adjusted: | |||||||||||||||||||||||

| Total adjusted SG&A expenses | $ | 41.4 | $ | 71.8 | $ | 30.4 | 42 | % | |||||||||||||||

| Reported: | |||||||||||||||||||||||

| SG&A expenses as a % of gross profit: | |||||||||||||||||||||||

| Compensation | 47.8 | % | 100.6 | % | 5,280 | bps | |||||||||||||||||

| Advertising | 12.6 | % | 40.0 | % | 2,740 | bps | |||||||||||||||||

| Rent | (1.4) | % | 2.7 | % | 410 | bps | |||||||||||||||||

| Other | 27.6 | % | 43.9 | % | 1,630 | bps | |||||||||||||||||

| Total SG&A expenses as a % of gross profit | 86.6 | % | 187.2 | % | 10,060 | bps | |||||||||||||||||

| Adjustments: | |||||||||||||||||||||||

| Closed store accrued expenses | (4.0) | % | — | % | |||||||||||||||||||

| Severance and long-term compensation charges | (4.0) | % | (5.1) | % | |||||||||||||||||||

| Total effect of adjustments | (8.0) | % | (5.1) | % | |||||||||||||||||||

| Adjusted: | |||||||||||||||||||||||

| Total adjusted SG&A expenses as a % of gross profit | 78.6 | % | 182.1 | % | 10,350 | bps | |||||||||||||||||

| Three Months Ended March 31, | Better / (Worse) | ||||||||||||||||||||||

| 2024 | 2023 | Change | % Change | ||||||||||||||||||||

| (In millions) | |||||||||||||||||||||||

| Reported: | |||||||||||||||||||||||

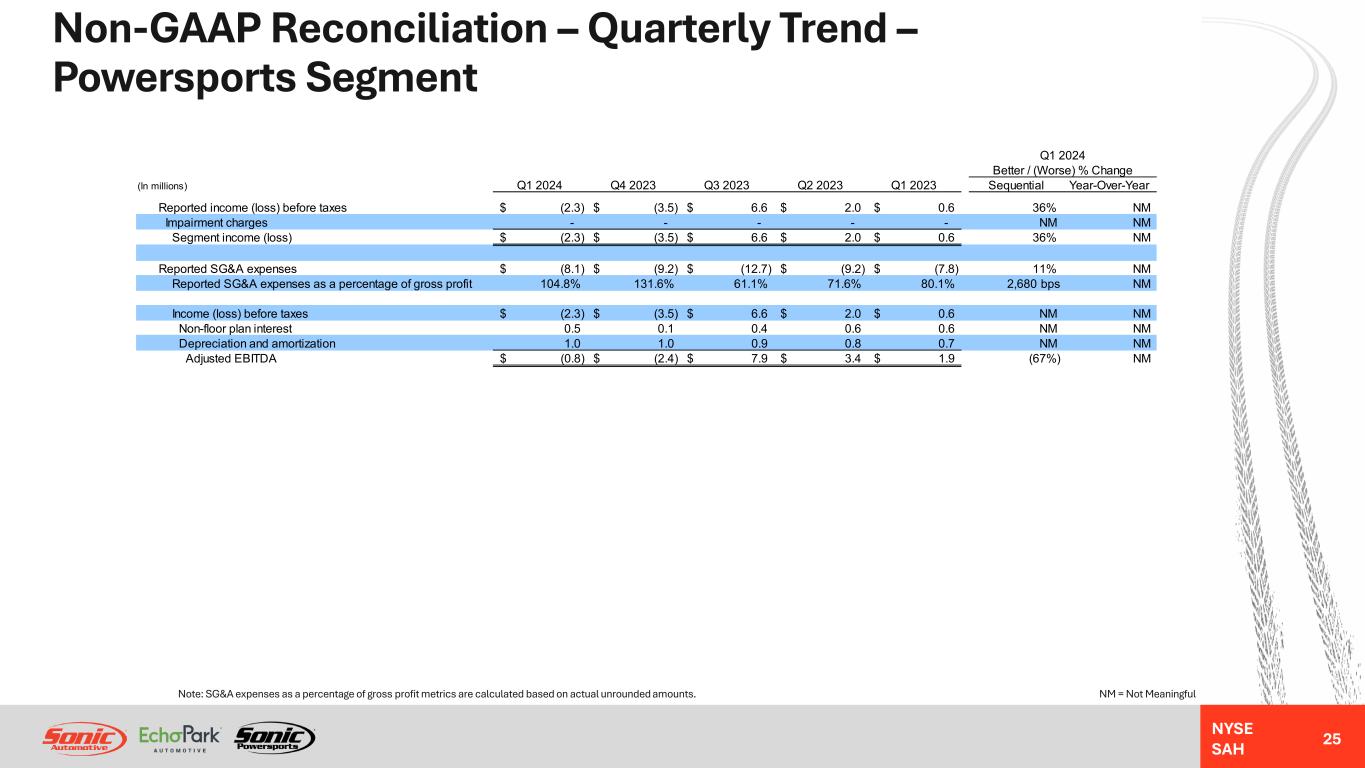

| Compensation | $ | 5.6 | $ | 5.3 | $ | (0.3) | (6) | % | |||||||||||||||

| Advertising | 0.4 | 0.4 | — | — | % | ||||||||||||||||||

| Rent | — | — | — | — | % | ||||||||||||||||||

| Other | 2.1 | 2.1 | — | — | % | ||||||||||||||||||

| Total SG&A expenses | $ | 8.1 | $ | 7.8 | $ | (0.3) | (4) | % | |||||||||||||||

| Reported: | |||||||||||||||||||||||

| SG&A expenses as a % of gross profit: | |||||||||||||||||||||||

| Compensation | 72.7 | % | 53.9 | % | (1,880) | bps | |||||||||||||||||

| Advertising | 5.1 | % | 4.2 | % | (90) | bps | |||||||||||||||||

| Rent | 0.4 | % | 0.4 | % | — | bps | |||||||||||||||||

| Other | 26.6 | % | 21.6 | % | (500) | bps | |||||||||||||||||

| Total SG&A expenses as a % of gross profit | 104.8 | % | 80.1 | % | (2,470) | bps | |||||||||||||||||

| Three Months Ended March 31, | |||||||||||||||||

| 2024 | 2023 | % Change | |||||||||||||||

| (In millions) | |||||||||||||||||

| Reported: | |||||||||||||||||

| Income (loss) before taxes | $ | 62.7 | $ | 109.8 | (43) | % | |||||||||||

| Add: Impairment charges | 1.0 | — | |||||||||||||||

| Segment income (loss) | $ | 63.7 | $ | 109.8 | (42) | % | |||||||||||

| Adjustments: | |||||||||||||||||

| Long-term compensation charges | $ | 2.2 | $ | — | |||||||||||||

| Total pre-tax adjustments | $ | 2.2 | $ | — | |||||||||||||

| Adjusted: | |||||||||||||||||

| Segment income (loss) | $ | 65.9 | $ | 109.8 | (40) | % | |||||||||||

| Three Months Ended March 31, | |||||||||||||||||

| 2024 | 2023 | % Change | |||||||||||||||

| (In millions) | |||||||||||||||||

| Reported: | |||||||||||||||||

| Income (loss) before taxes | $ | (2.9) | $ | (46.8) | 94 | % | |||||||||||

| Add: Impairment charges | — | — | |||||||||||||||

| Segment income (loss) | $ | (2.9) | $ | (46.8) | 94 | % | |||||||||||

| Adjustments: | |||||||||||||||||

| Closed store accrued expenses | $ | 2.1 | $ | — | |||||||||||||

| Severance and long-term compensation charges | 2.1 | 2.0 | |||||||||||||||

| Total pre-tax adjustments | $ | 4.2 | $ | 2.0 | |||||||||||||

| Adjusted: | |||||||||||||||||

| Segment income (loss) | $ | 1.3 | $ | (44.8) | 103 | % | |||||||||||

| Three Months Ended March 31, | |||||||||||||||||

| 2024 | 2023 | % Change | |||||||||||||||

| (In millions) | |||||||||||||||||

| Reported: | |||||||||||||||||

| Income (loss) before taxes | $ | (2.3) | $ | 0.6 | (483) | % | |||||||||||

| Add: Impairment charges | — | — | |||||||||||||||

| Segment income (loss) | $ | (2.3) | $ | 0.6 | (483) | % | |||||||||||

| Three Months Ended March 31, 2024 | Three Months Ended March 31, 2023 | ||||||||||||||||||||||||||||||||||

| Weighted- Average Shares |

Net Income (Loss) | Per Share Amount |

Weighted- Average Shares |

Net Income (Loss) | Per Share Amount |

||||||||||||||||||||||||||||||

| (In millions, except per share amounts) | |||||||||||||||||||||||||||||||||||

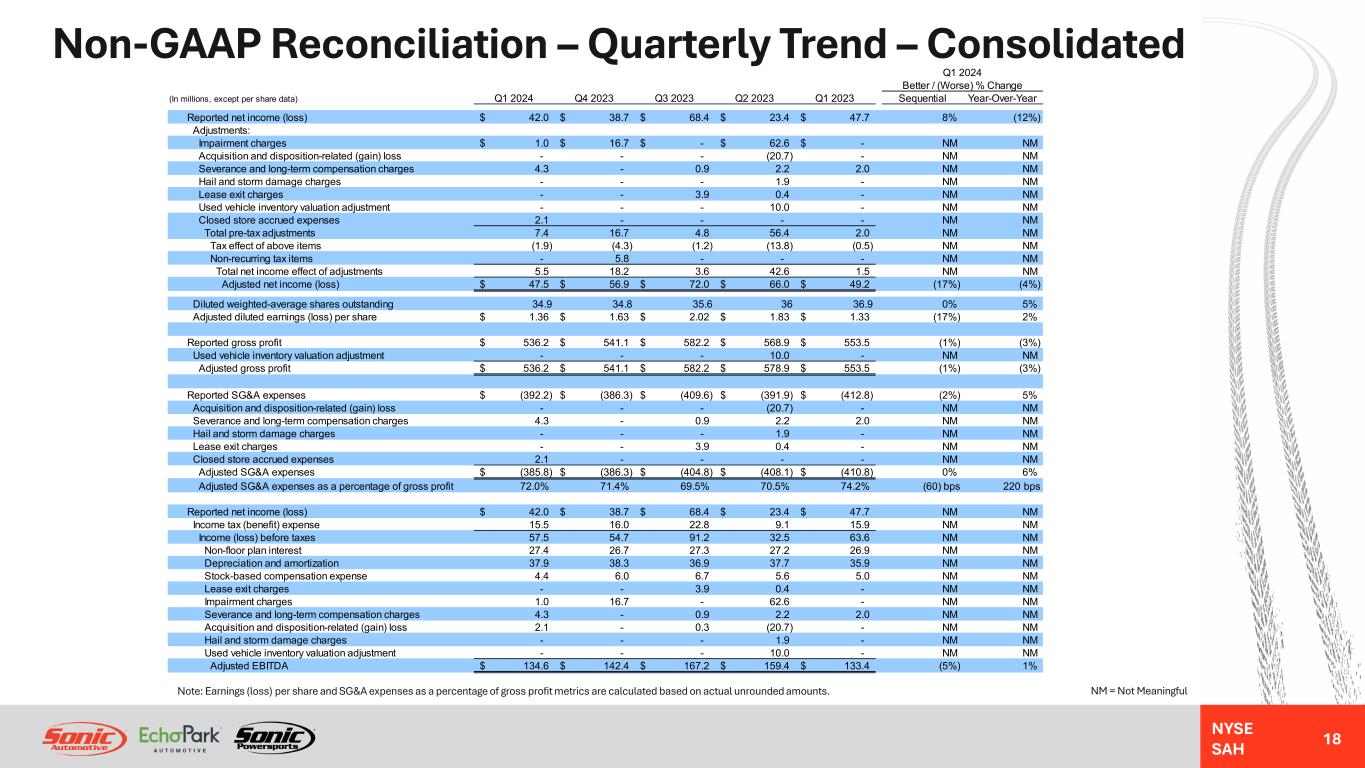

| Reported net income (loss), diluted shares, and diluted earnings (loss) per share | 34.9 | $ | 42.0 | $ | 1.20 | 36.9 | $ | 47.7 | $ | 1.29 | |||||||||||||||||||||||||

| Adjustments: | |||||||||||||||||||||||||||||||||||

| Closed store accrued expenses | $ | 2.1 | $ | — | |||||||||||||||||||||||||||||||

| Impairment charges | 1.0 | — | |||||||||||||||||||||||||||||||||

| Severance and long-term compensation charges | 4.3 | 2.0 | |||||||||||||||||||||||||||||||||

| Total pre-tax items of interest | $ | 7.4 | $ | 2.0 | |||||||||||||||||||||||||||||||

| Tax effect of above items | (1.9) | (0.5) | |||||||||||||||||||||||||||||||||

| Adjusted net income (loss), diluted shares, and diluted earnings (loss) per share | 34.9 | $ | 47.5 | $ | 1.36 | 36.9 | $ | 49.2 | $ | 1.33 | |||||||||||||||||||||||||

| Three Months Ended March 31, 2024 | Three Months Ended March 31, 2023 | ||||||||||||||||||||||||||||||||||||||||||||||

| Franchised Dealerships Segment | EchoPark Segment | Powersports Segment | Total | Franchised Dealerships Segment | EchoPark Segment | Powersports Segment | Total | ||||||||||||||||||||||||||||||||||||||||

| (In millions) | |||||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) | $ | 42.0 | $ | 47.7 | |||||||||||||||||||||||||||||||||||||||||||

| Provision for income taxes | 15.5 | 15.9 | |||||||||||||||||||||||||||||||||||||||||||||

| Income (loss) before taxes | $ | 62.7 | $ | (2.9) | $ | (2.3) | $ | 57.5 | $ | 109.8 | $ | (46.8) | $ | 0.6 | $ | 63.6 | |||||||||||||||||||||||||||||||

| Non-floor plan interest (1) | 26.3 | 0.6 | 0.5 | 27.4 | 25.4 | 0.9 | 0.6 | 26.9 | |||||||||||||||||||||||||||||||||||||||

| Depreciation and amortization (2) | 31.5 | 5.4 | 1.0 | 37.9 | 28.2 | 7.0 | 0.7 | 35.9 | |||||||||||||||||||||||||||||||||||||||

| Stock-based compensation expense | 4.4 | — | — | 4.4 | 5.0 | — | — | 5.0 | |||||||||||||||||||||||||||||||||||||||

| Impairment charges | 1.0 | — | — | 1.0 | — | — | — | — | |||||||||||||||||||||||||||||||||||||||

| Severance and long-term compensation charges | 2.2 | 2.1 | — | 4.3 | — | 2.0 | — | 2.0 | |||||||||||||||||||||||||||||||||||||||

| Closed store accrued expenses | $ | — | $ | 2.1 | $ | — | $ | 2.1 | $ | — | $ | — | $ | — | $ | — | |||||||||||||||||||||||||||||||

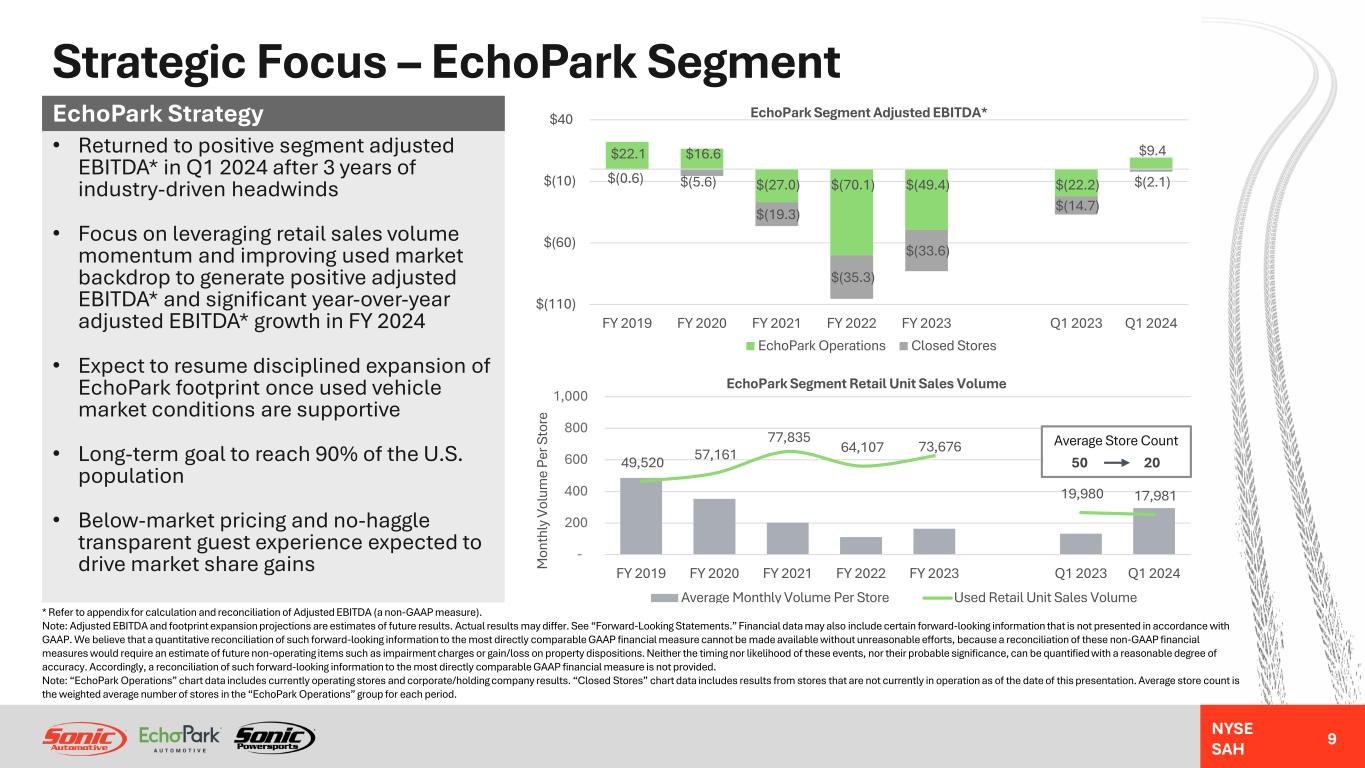

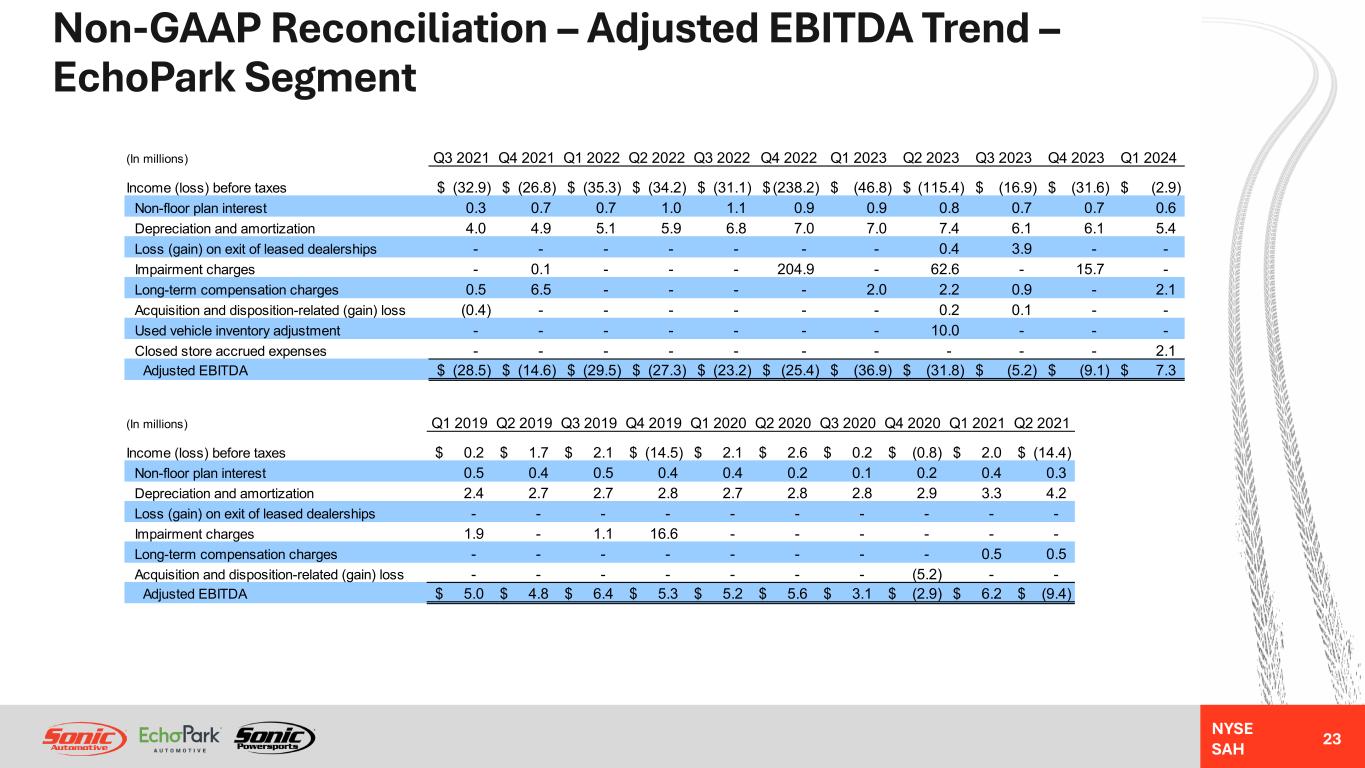

| Adjusted EBITDA | $ | 128.1 | $ | 7.3 | $ | (0.8) | $ | 134.6 | $ | 168.4 | $ | (36.9) | $ | 1.9 | $ | 133.4 | |||||||||||||||||||||||||||||||

| Three Months Ended March 31, 2024 | Three Months Ended March 31, 2023 | Better / (Worse) % Change | |||||||||||||||||||||||||||||||||||||||||||||||||||

| EchoPark Operations |

Closed Stores |

Total EchoPark Segment |

EchoPark Operations |

Closed Stores |

Total EchoPark Segment |

EchoPark Operations |

Closed Stores |

Total EchoPark Segment |

|||||||||||||||||||||||||||||||||||||||||||||

| (In millions, except unit and per unit data) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total revenues | $ | 546.2 | $ | 13.2 | $ | 559.4 | $ | 489.9 | $ | 160.6 | $ | 650.5 | 11 | % | (92) | % | (14) | % | |||||||||||||||||||||||||||||||||||

| Total gross profit | $ | 53.2 | $ | (0.6) | $ | 52.6 | $ | 29.7 | $ | 9.7 | $ | 39.4 | 79 | % | (106) | % | 34 | % | |||||||||||||||||||||||||||||||||||

| Income (loss) before taxes | $ | 2.9 | $ | (5.8) | $ | (2.9) | $ | (28.0) | $ | (18.8) | $ | (46.8) | 110 | % | 69 | % | 94 | % | |||||||||||||||||||||||||||||||||||

| Non-floor plan interest (1) | 0.6 | — | 0.6 | 0.5 | 0.4 | 0.9 | NM | NM | NM | ||||||||||||||||||||||||||||||||||||||||||||

| Depreciation and amortization (2) | 5.4 | — | 5.4 | 5.3 | 1.7 | 7.0 | NM | NM | NM | ||||||||||||||||||||||||||||||||||||||||||||

| Severance and long-term compensation charges | 0.5 | 1.6 | 2.1 | — | 2.0 | 2.0 | NM | NM | NM | ||||||||||||||||||||||||||||||||||||||||||||

| Closed store accrued expenses | — | 2.1 | 2.1 | — | — | — | NM | NM | NM | ||||||||||||||||||||||||||||||||||||||||||||

| Adjusted EBITDA | $ | 9.4 | $ | (2.1) | $ | 7.3 | $ | (22.2) | $ | (14.7) | $ | (36.9) | 142 | % | 86 | % | 120 | % | |||||||||||||||||||||||||||||||||||

| Used vehicle unit sales volume | 17,618 | 363 | 17,981 | 15,551 | 4,429 | 19,980 | 13 | % | (92) | % | (10) | % | |||||||||||||||||||||||||||||||||||||||||

| Total used vehicle and F&I gross profit per unit | $ | 3,018 | $ | 314 | $ | 2,955 | $ | 1,833 | $ | 2,290 | $ | 1,906 | 65 | % | (86) | % | 55 | % | |||||||||||||||||||||||||||||||||||