| 1-13395 | 56-2010790 | |||||||

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

|||||||

4401 Colwick Road |

||||||||||||||||||||

| Charlotte, | North Carolina | 28211 | ||||||||||||||||||

| (Address of principal executive offices) | (Zip Code) | |||||||||||||||||||

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||||

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

| Class A Common Stock, par value $0.01 per share | SAH | New York Stock Exchange | ||||||

|

Exhibit

No.

|

Description |

|||||||

| 99.1 | ||||||||

| 99.2 | ||||||||

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). | |||||||

| SONIC AUTOMOTIVE, INC. | ||||||||

| October 27, 2022 | By: | /s/ STEPHEN K. COSS | ||||||

| Stephen K. Coss | ||||||||

| Senior Vice President and General Counsel | ||||||||

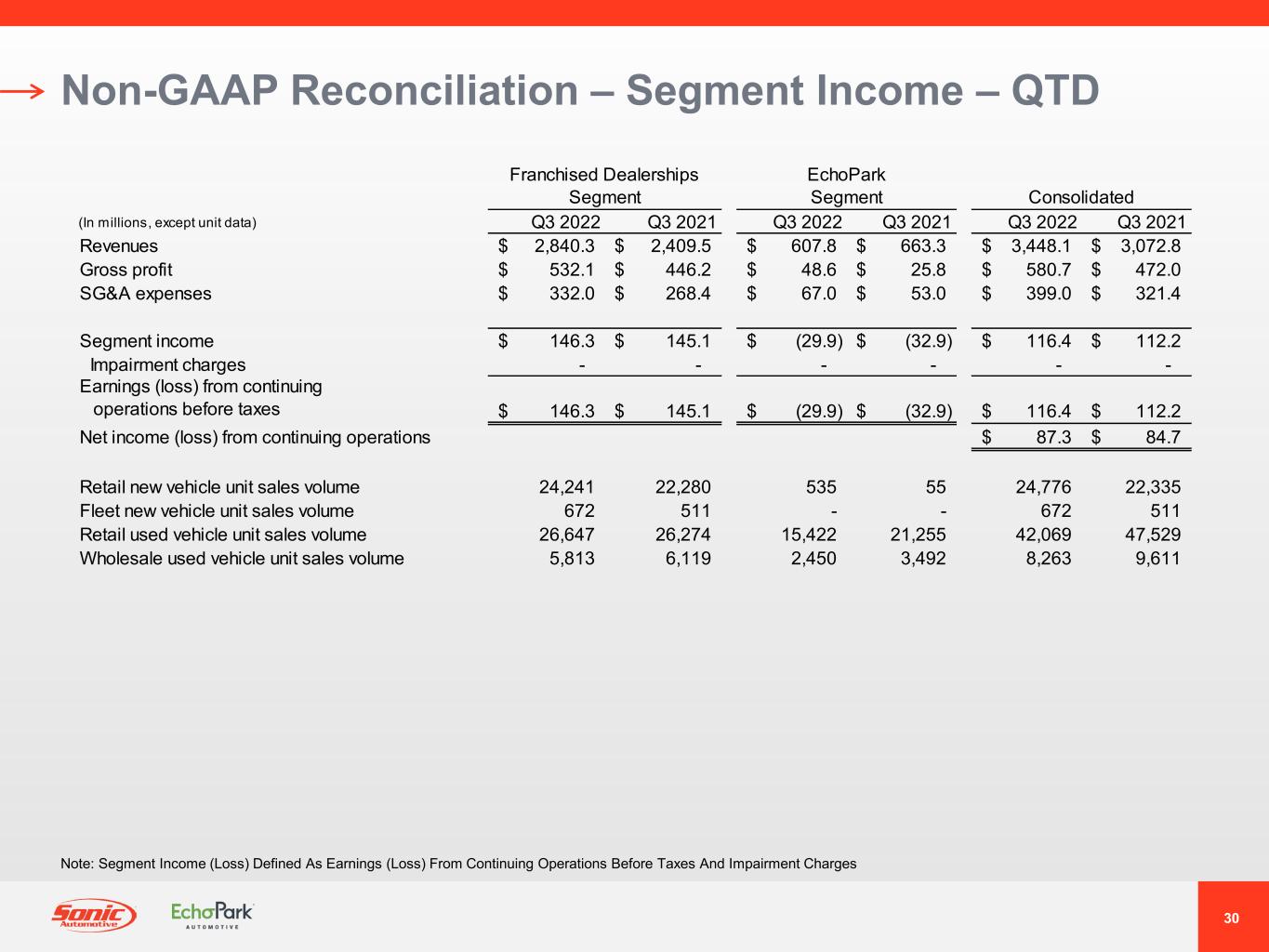

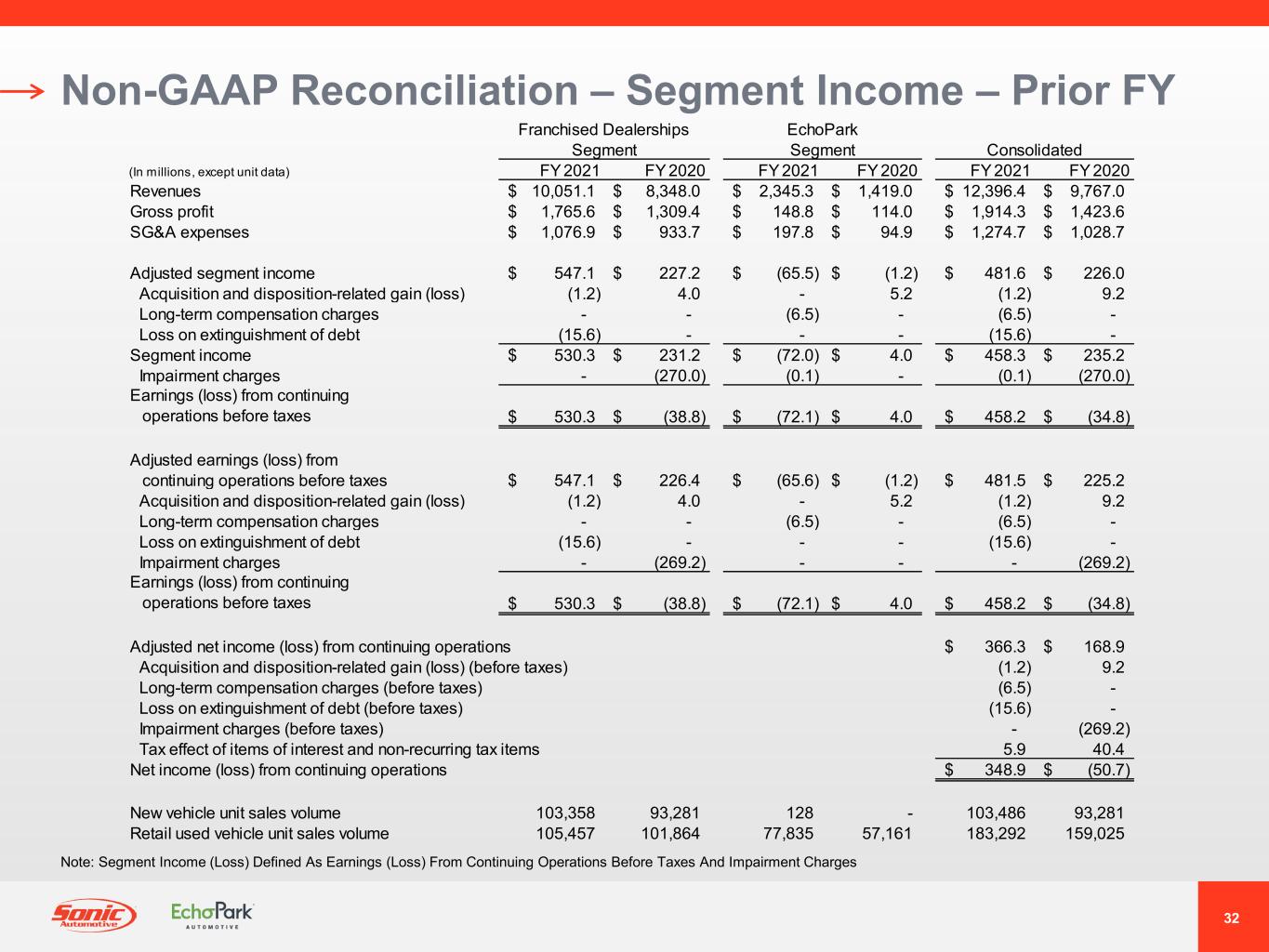

| Three Months Ended September 30, |

Better / (Worse) | Nine Months Ended September 30, |

Better / (Worse) | ||||||||||||||||||||||||||||||||

| 2022 | 2021 | % Change | 2022 | 2021 | % Change | ||||||||||||||||||||||||||||||

| (In millions, except per share amounts) | |||||||||||||||||||||||||||||||||||

| Revenues: | |||||||||||||||||||||||||||||||||||

| Retail new vehicles | $ | 1,373.1 | $ | 1,128.0 | 22 | % | $ | 4,068.7 | $ | 3,715.2 | 10 | % | |||||||||||||||||||||||

| Fleet new vehicles | 32.0 | 18.9 | 69 | % | 70.0 | 50.9 | 38 | % | |||||||||||||||||||||||||||

| Total new vehicles | 1,405.1 | 1,146.9 | 23 | % | 4,138.7 | 3,766.1 | 10 | % | |||||||||||||||||||||||||||

| Used vehicles | 1,358.0 | 1,324.8 | 3 | % | 4,178.3 | 3,708.9 | 13 | % | |||||||||||||||||||||||||||

| Wholesale vehicles | 114.7 | 97.1 | 18 | % | 404.8 | 256.7 | 58 | % | |||||||||||||||||||||||||||

| Total vehicles | 2,877.8 | 2,568.8 | 12 | % | 8,721.8 | 7,731.7 | 13 | % | |||||||||||||||||||||||||||

| Parts, service and collision repair | 404.7 | 339.9 | 19 | % | 1,183.4 | 994.1 | 19 | % | |||||||||||||||||||||||||||

| Finance, insurance and other, net | 165.6 | 164.1 | 1 | % | 505.3 | 486.1 | 4 | % | |||||||||||||||||||||||||||

| Total revenues | 3,448.1 | 3,072.8 | 12 | % | 10,410.5 | 9,211.9 | 13 | % | |||||||||||||||||||||||||||

| Cost of sales: | |||||||||||||||||||||||||||||||||||

| Retail new vehicles | (1,209.6) | (1,012.9) | (19) | % | (3,569.2) | (3,412.8) | (5) | % | |||||||||||||||||||||||||||

| Fleet new vehicles | (30.7) | (18.6) | (65) | % | (66.9) | (50.0) | (34) | % | |||||||||||||||||||||||||||

| Total new vehicles | (1,240.3) | (1,031.5) | (20) | % | (3,636.1) | (3,462.8) | (5) | % | |||||||||||||||||||||||||||

| Used vehicles | (1,306.6) | (1,304.6) | — | % | (4,031.6) | (3,623.1) | (11) | % | |||||||||||||||||||||||||||

| Wholesale vehicles | (116.8) | (95.9) | (22) | % | (404.2) | (250.1) | (62) | % | |||||||||||||||||||||||||||

| Total vehicles | (2,663.7) | (2,432.0) | (10) | % | (8,071.9) | (7,336.0) | (10) | % | |||||||||||||||||||||||||||

| Parts, service and collision repair | (203.7) | (168.8) | (21) | % | (597.7) | (492.2) | (21) | % | |||||||||||||||||||||||||||

| Total cost of sales | (2,867.4) | (2,600.8) | (10) | % | (8,669.6) | (7,828.2) | (11) | % | |||||||||||||||||||||||||||

| Gross profit | 580.7 | 472.0 | 23 | % | 1,740.9 | 1,383.7 | 26 | % | |||||||||||||||||||||||||||

| Selling, general and administrative expenses | (399.0) | (321.4) | (24) | % | (1,188.8) | (931.3) | (28) | % | |||||||||||||||||||||||||||

| Depreciation and amortization | (32.8) | (25.2) | (30) | % | (94.0) | (73.7) | (28) | % | |||||||||||||||||||||||||||

| Operating income (loss) | 148.9 | 125.4 | 19 | % | 458.1 | 378.7 | 21 | % | |||||||||||||||||||||||||||

| Other income (expense): | |||||||||||||||||||||||||||||||||||

| Interest expense, floor plan | (9.6) | (3.3) | (191) | % | (20.6) | (12.8) | (61) | % | |||||||||||||||||||||||||||

| Interest expense, other, net | (22.9) | (9.8) | (134) | % | (65.1) | (30.2) | (116) | % | |||||||||||||||||||||||||||

| Other income (expense), net | — | (0.1) | 100 | % | 0.1 | 0.1 | 64 | % | |||||||||||||||||||||||||||

| Total other income (expense) | (32.5) | (13.2) | (146) | % | (85.6) | (42.9) | (100) | % | |||||||||||||||||||||||||||

| Income (loss) from continuing operations before taxes | 116.4 | 112.2 | 4 | % | 372.5 | 335.8 | 11 | % | |||||||||||||||||||||||||||

| Provision for income taxes for continuing operations - benefit (expense) | (29.1) | (27.5) | (6) | % | (93.1) | (83.4) | (12) | % | |||||||||||||||||||||||||||

| Income (loss) from continuing operations | 87.3 | 84.7 | 3 | % | 279.4 | 252.4 | 11 | % | |||||||||||||||||||||||||||

| Discontinued operations: | |||||||||||||||||||||||||||||||||||

| Income (loss) from discontinued operations before taxes | — | (0.3) | 100 | % | — | 0.2 | (100) | % | |||||||||||||||||||||||||||

| Provision for income taxes for discontinued operations - benefit (expense) | — | 0.1 | (100) | % | — | — | — | % | |||||||||||||||||||||||||||

| Income (loss) from discontinued operations | — | (0.2) | 100 | % | — | 0.2 | (100) | % | |||||||||||||||||||||||||||

| Net income (loss) | $ | 87.3 | $ | 84.5 | 3 | % | $ | 279.4 | $ | 252.6 | 11 | % | |||||||||||||||||||||||

| Basic earnings (loss) per common share: | |||||||||||||||||||||||||||||||||||

| Earnings (loss) per share from continuing operations | $ | 2.28 | $ | 2.04 | 12 | % | $ | 7.09 | $ | 6.07 | 17 | % | |||||||||||||||||||||||

| Earnings (loss) per share from discontinued operations | — | (0.01) | 100 | % | — | 0.01 | (100) | % | |||||||||||||||||||||||||||

| Earnings (loss) per common share | $ | 2.28 | $ | 2.03 | 12 | % | $ | 7.09 | $ | 6.08 | 17 | % | |||||||||||||||||||||||

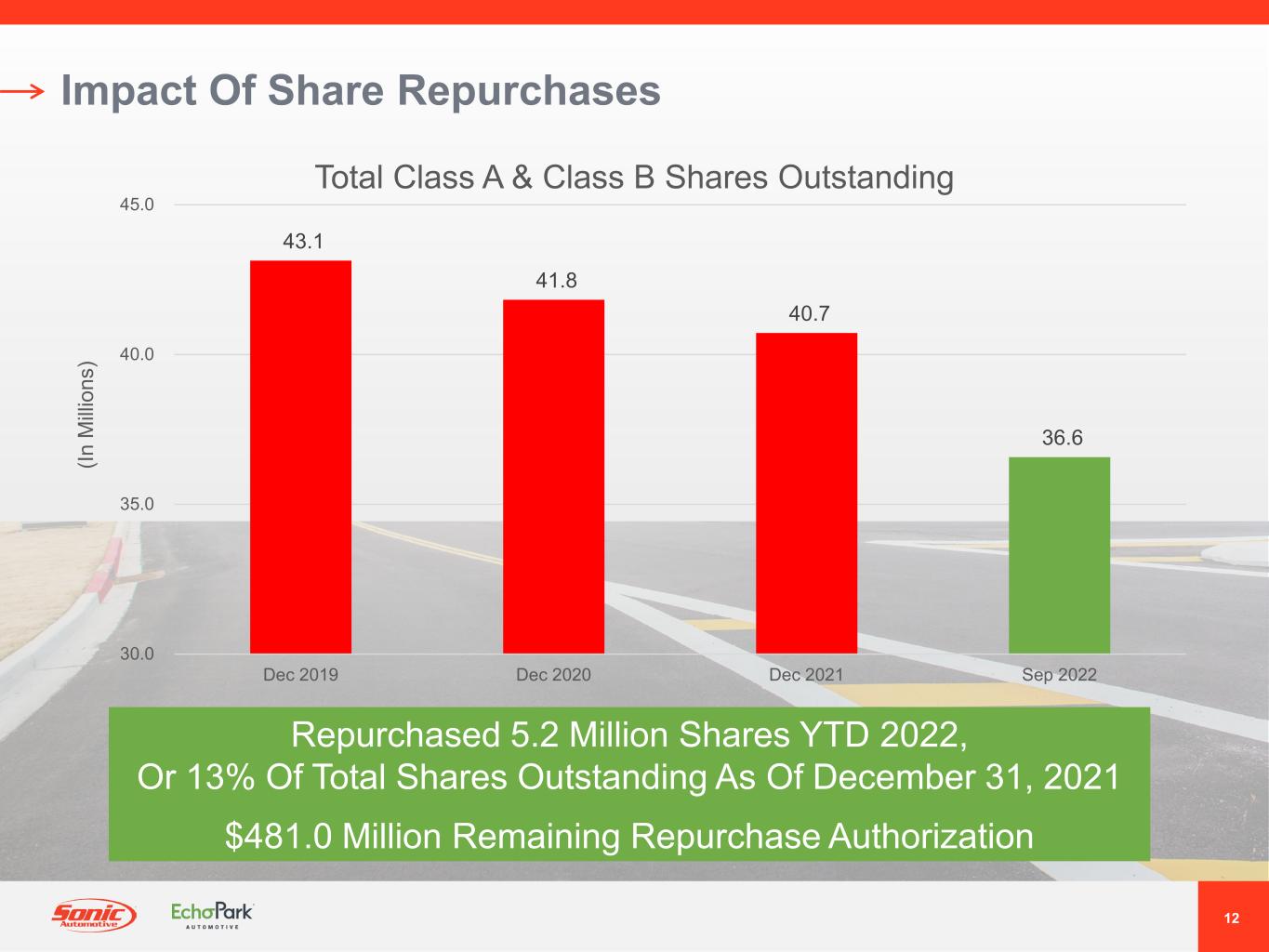

| Weighted-average common shares outstanding | 38.3 | 41.6 | 8 | % | 39.4 | 41.6 | 5 | % | |||||||||||||||||||||||||||

| Diluted earnings (loss) per common share: | |||||||||||||||||||||||||||||||||||

| Earnings (loss) per share from continuing operations | $ | 2.23 | $ | 1.96 | 14 | % | $ | 6.90 | $ | 5.81 | 19 | % | |||||||||||||||||||||||

| Earnings (loss) per share from discontinued operations | — | (0.01) | 100 | % | — | 0.01 | (100) | % | |||||||||||||||||||||||||||

| Earnings (loss) per common share | $ | 2.23 | $ | 1.95 | 14 | % | $ | 6.90 | $ | 5.82 | 19 | % | |||||||||||||||||||||||

| Weighted-average common shares outstanding | 39.2 | 43.3 | 9 | % | 40.5 | 43.4 | 7 | % | |||||||||||||||||||||||||||

| Dividends declared per common share | $ | 0.25 | $ | 0.12 | 108 | % | $ | 0.62 | $ | 0.34 | 82 | % | |||||||||||||||||||||||

| Three Months Ended September 30, |

Better / (Worse) | Nine Months Ended September 30, |

Better / (Worse) | ||||||||||||||||||||||||||||||||

| 2022 | 2021 | % Change | 2022 | 2021 | % Change | ||||||||||||||||||||||||||||||

| (In millions, except unit and per unit data) | |||||||||||||||||||||||||||||||||||

| Revenues: | |||||||||||||||||||||||||||||||||||

| Retail new vehicles | $ | 1,359.6 | $ | 1,124.5 | 21 | % | $ | 4,047.1 | $ | 3,710.8 | 9 | % | |||||||||||||||||||||||

| Fleet new vehicles | 32.0 | 18.9 | 69 | % | 70.0 | 50.9 | 38 | % | |||||||||||||||||||||||||||

| Total new vehicles | 1,391.6 | 1,143.4 | 22 | % | 4,117.1 | 3,761.7 | 9 | % | |||||||||||||||||||||||||||

| Used vehicles | 842.4 | 750.3 | 12 | % | 2,568.1 | 2,173.3 | 18 | % | |||||||||||||||||||||||||||

| Wholesale vehicles | 75.8 | 64.1 | 18 | % | 261.2 | 183.2 | 43 | % | |||||||||||||||||||||||||||

| Total vehicles | 2,309.8 | 1,957.8 | 18 | % | 6,946.4 | 6,118.2 | 14 | % | |||||||||||||||||||||||||||

| Parts, service and collision repair | 404.7 | 339.9 | 19 | % | 1,183.4 | 994.1 | 19 | % | |||||||||||||||||||||||||||

| Finance, insurance and other, net | 125.8 | 111.8 | 13 | % | 382.1 | 333.5 | 15 | % | |||||||||||||||||||||||||||

| Total revenues | 2,840.3 | 2,409.5 | 18 | % | 8,511.9 | 7,445.8 | 14 | % | |||||||||||||||||||||||||||

| Gross Profit: | |||||||||||||||||||||||||||||||||||

| Retail new vehicles | 160.7 | 114.9 | 40 | % | 494.5 | 302.1 | 64 | % | |||||||||||||||||||||||||||

| Fleet new vehicles | 1.3 | 0.3 | 333 | % | 3.1 | 0.9 | 244 | % | |||||||||||||||||||||||||||

| Total new vehicles | 162.0 | 115.2 | 41 | % | 497.6 | 303.0 | 64 | % | |||||||||||||||||||||||||||

| Used vehicles | 45.4 | 50.1 | (9) | % | 136.0 | 137.3 | (1) | % | |||||||||||||||||||||||||||

| Wholesale vehicles | (2.1) | (2.0) | (5) | % | (3.0) | 0.2 | NM | ||||||||||||||||||||||||||||

| Total vehicles | 205.3 | 163.3 | 26 | % | 630.6 | 440.4 | 43 | % | |||||||||||||||||||||||||||

| Parts, service and collision repair | 201.0 | 171.1 | 17 | % | 585.7 | 501.9 | 17 | % | |||||||||||||||||||||||||||

| Finance, insurance and other, net | 125.8 | 111.8 | 13 | % | 382.1 | 333.5 | 15 | % | |||||||||||||||||||||||||||

| Total gross profit | 532.1 | 446.2 | 19 | % | 1,598.4 | 1,275.8 | 25 | % | |||||||||||||||||||||||||||

| Selling, general and administrative expenses | (332.0) | (268.4) | (24) | % | (974.9) | (794.1) | (23) | % | |||||||||||||||||||||||||||

| Depreciation and amortization | (25.8) | (21.2) | (22) | % | (75.8) | (62.3) | (22) | % | |||||||||||||||||||||||||||

| Operating income (loss) | 174.3 | 156.6 | 11 | % | 547.7 | 419.4 | 31 | % | |||||||||||||||||||||||||||

| Other income (expense): | |||||||||||||||||||||||||||||||||||

| Interest expense, floor plan | (6.6) | (2.0) | (230) | % | (13.9) | (9.2) | (50) | % | |||||||||||||||||||||||||||

| Interest expense, other, net | (21.4) | (9.5) | (125) | % | (61.7) | (29.2) | (112) | % | |||||||||||||||||||||||||||

| Other income (expense), net | — | — | — | % | 0.1 | — | NM | ||||||||||||||||||||||||||||

| Total other income (expense) | (28.0) | (11.5) | (143) | % | (75.5) | (38.3) | (97) | % | |||||||||||||||||||||||||||

| Income (loss) before taxes | 146.3 | 145.1 | 1 | % | 472.2 | 381.1 | 24 | % | |||||||||||||||||||||||||||

| Add: impairment charges | — | — | NM | — | — | NM | |||||||||||||||||||||||||||||

| Segment income (loss) | $ | 146.3 | $ | 145.1 | 1 | % | $ | 472.2 | $ | 381.1 | 24 | % | |||||||||||||||||||||||

| Unit Sales Volume: | |||||||||||||||||||||||||||||||||||

| Retail new vehicles | 24,241 | 22,280 | 9 | % | 73,185 | 76,340 | (4) | % | |||||||||||||||||||||||||||

| Fleet new vehicles | 672 | 511 | 32 | % | 1,454 | 1,297 | 12 | % | |||||||||||||||||||||||||||

| Total new vehicles | 24,913 | 22,791 | 9 | % | 74,639 | 77,637 | (4) | % | |||||||||||||||||||||||||||

| Used vehicles | 26,647 | 26,274 | 1 | % | 81,881 | 82,060 | — | % | |||||||||||||||||||||||||||

| Wholesale vehicles | 5,813 | 6,119 | (5) | % | 18,436 | 19,704 | (6) | % | |||||||||||||||||||||||||||

| Retail new & used vehicles | 50,888 | 48,554 | 5 | % | 155,066 | 158,400 | (2) | % | |||||||||||||||||||||||||||

| Used-to-New Ratio | 1.07 | 1.15 | (7) | % | 1.10 | 1.06 | 4 | % | |||||||||||||||||||||||||||

| Gross Profit Per Unit: | |||||||||||||||||||||||||||||||||||

| Retail new vehicles | $ | 6,627 | $ | 5,153 | 29 | % | $ | 6,757 | $ | 3,956 | 71 | % | |||||||||||||||||||||||

| Fleet new vehicles | $ | 1,955 | $ | 773 | 153 | % | $ | 2,132 | $ | 745 | 186 | % | |||||||||||||||||||||||

| Total new vehicles | $ | 6,501 | $ | 5,055 | 29 | % | $ | 6,667 | $ | 3,903 | 71 | % | |||||||||||||||||||||||

| Used vehicles | $ | 1,704 | $ | 1,907 | (11) | % | $ | 1,661 | $ | 1,673 | (1) | % | |||||||||||||||||||||||

| Finance, insurance and other, net | $ | 2,473 | $ | 2,303 | 7 | % | $ | 2,464 | $ | 2,105 | 17 | % | |||||||||||||||||||||||

| Three Months Ended September 30, |

Better / (Worse) | Nine Months Ended September 30, |

Better / (Worse) | ||||||||||||||||||||||||||||||||

| 2022 | 2021 | % Change | 2022 | 2021 | % Change | ||||||||||||||||||||||||||||||

| (In millions, except unit and per unit data) | |||||||||||||||||||||||||||||||||||

| Revenues: | |||||||||||||||||||||||||||||||||||

| Retail new vehicles | $ | 1,177.4 | $ | 1,121.3 | 5 | % | $ | 3,413.5 | $ | 3,699.4 | (8) | % | |||||||||||||||||||||||

| Fleet new vehicles | 27.0 | 18.9 | 43 | % | 57.9 | 51.0 | 14 | % | |||||||||||||||||||||||||||

| Total new vehicles | 1,204.4 | 1,140.2 | 6 | % | 3,471.4 | 3,750.4 | (7) | % | |||||||||||||||||||||||||||

| Used vehicles | 736.4 | 747.4 | (1) | % | 2,210.9 | 2,165.2 | 2 | % | |||||||||||||||||||||||||||

| Wholesale vehicles | 58.8 | 63.9 | (8) | % | 196.9 | 182.7 | 8 | % | |||||||||||||||||||||||||||

| Total vehicles | 1,999.6 | 1,951.5 | 2 | % | 5,879.2 | 6,098.3 | (4) | % | |||||||||||||||||||||||||||

| Parts, service and collision repair | 373.6 | 338.7 | 10 | % | 1,080.5 | 990.5 | 9 | % | |||||||||||||||||||||||||||

| Finance, insurance and other, net | 105.6 | 111.2 | (5) | % | 314.6 | 332.2 | (5) | % | |||||||||||||||||||||||||||

| Total revenues | 2,478.8 | 2,401.4 | 3 | % | 7,274.3 | 7,421.0 | (2) | % | |||||||||||||||||||||||||||

| Gross Profit: | |||||||||||||||||||||||||||||||||||

| Retail new vehicles | 136.9 | 114.3 | 20 | % | 413.8 | 300.6 | 38 | % | |||||||||||||||||||||||||||

| Fleet new vehicles | 1.0 | 0.4 | 150 | % | 2.4 | 0.9 | 167 | % | |||||||||||||||||||||||||||

| Total new vehicles | 137.9 | 114.7 | 21 | % | 416.2 | 301.5 | 38 | % | |||||||||||||||||||||||||||

| Used vehicles | 38.5 | 48.2 | (20) | % | 115.9 | 137.2 | (16) | % | |||||||||||||||||||||||||||

| Wholesale vehicles | (1.7) | 0.8 | (313) | % | (2.3) | 5.8 | (140) | % | |||||||||||||||||||||||||||

| Total vehicles | 174.7 | 163.7 | 7 | % | 529.8 | 444.5 | 19 | % | |||||||||||||||||||||||||||

| Parts, service and collision repair | 186.5 | 170.2 | 10 | % | 537.5 | 498.8 | 8 | % | |||||||||||||||||||||||||||

| Finance, insurance and other, net | 105.6 | 111.2 | (5) | % | 314.6 | 332.2 | (5) | % | |||||||||||||||||||||||||||

| Total gross profit | $ | 466.8 | $ | 445.1 | 5 | % | $ | 1,381.9 | $ | 1,275.5 | 8 | % | |||||||||||||||||||||||

| Unit Sales Volume: | |||||||||||||||||||||||||||||||||||

| Retail new vehicles | 20,829 | 22,208 | (6) | % | 61,247 | 76,073 | (19) | % | |||||||||||||||||||||||||||

| Fleet new vehicles | 574 | 511 | 12 | % | 1,232 | 1,297 | (5) | % | |||||||||||||||||||||||||||

| Total new vehicles | 21,403 | 22,719 | (6) | % | 62,479 | 77,370 | (19) | % | |||||||||||||||||||||||||||

| Used vehicles | 23,043 | 26,164 | (12) | % | 69,315 | 81,713 | (15) | % | |||||||||||||||||||||||||||

| Wholesale vehicles | 4,583 | 6,102 | (25) | % | 14,258 | 19,634 | (27) | % | |||||||||||||||||||||||||||

| Retail new & used vehicles | 43,872 | 48,372 | (9) | % | 130,562 | 157,786 | (17) | % | |||||||||||||||||||||||||||

| Used-to-New Ratio | 1.08 | 1.15 | (7) | % | 1.11 | 1.06 | 5 | % | |||||||||||||||||||||||||||

| Gross Profit Per Unit: | |||||||||||||||||||||||||||||||||||

| Retail new vehicles | $ | 6,571 | $ | 5,147 | 28 | % | $ | 6,756 | $ | 3,951 | 71 | % | |||||||||||||||||||||||

| Fleet new vehicles | $ | 1,782 | $ | 773 | 131 | % | $ | 1,968 | $ | 745 | 164 | % | |||||||||||||||||||||||

| New vehicles | $ | 6,443 | $ | 5,049 | 28 | % | $ | 6,661 | $ | 3,897 | 71 | % | |||||||||||||||||||||||

| Used vehicles | $ | 1,669 | $ | 1,844 | (9) | % | $ | 1,672 | $ | 1,679 | — | % | |||||||||||||||||||||||

| Finance, insurance and other, net | $ | 2,406 | $ | 2,300 | 5 | % | $ | 2,410 | $ | 2,106 | 14 | % | |||||||||||||||||||||||

| Three Months Ended September 30, |

Better / (Worse) | Nine Months Ended September 30, |

Better / (Worse) | ||||||||||||||||||||||||||||||||

| 2022 | 2021 | % Change | 2022 | 2021 | % Change | ||||||||||||||||||||||||||||||

| (In millions, except unit and per unit data) | |||||||||||||||||||||||||||||||||||

| Revenues: | |||||||||||||||||||||||||||||||||||

| Retail new vehicles | $ | 13.5 | $ | 3.5 | 286 | % | $ | 21.6 | $ | 4.4 | 391 | % | |||||||||||||||||||||||

| Used vehicles | 515.6 | 574.5 | (10) | % | 1,610.2 | 1,535.6 | 5 | % | |||||||||||||||||||||||||||

| Wholesale vehicles | 38.9 | 33.0 | 18 | % | 143.6 | 73.5 | 95 | % | |||||||||||||||||||||||||||

| Total vehicles | 568.0 | 611.0 | (7) | % | 1,775.4 | 1,613.5 | 10 | % | |||||||||||||||||||||||||||

| Finance, insurance and other, net | 39.8 | 52.3 | (24) | % | 123.2 | 152.6 | (19) | % | |||||||||||||||||||||||||||

| Total revenues | 607.8 | 663.3 | (8) | % | 1,898.6 | 1,766.1 | 8 | % | |||||||||||||||||||||||||||

| Gross Profit: | |||||||||||||||||||||||||||||||||||

| Retail new vehicles | 2.8 | — | 100 | % | 5.0 | 0.3 | NM | ||||||||||||||||||||||||||||

| Used vehicles | 6.0 | (29.9) | 120 | % | 10.7 | (51.4) | 121 | % | |||||||||||||||||||||||||||

| Wholesale vehicles | — | 3.2 | (100) | % | 3.6 | 6.4 | (44) | % | |||||||||||||||||||||||||||

| Total vehicles | 8.8 | (26.7) | 133 | % | 19.3 | (44.7) | 143 | % | |||||||||||||||||||||||||||

| Finance, insurance and other, net | 39.8 | 52.3 | (24) | % | 123.2 | 152.6 | (19) | % | |||||||||||||||||||||||||||

| Total gross profit | 48.6 | 25.8 | 88 | % | 142.5 | 107.9 | 32 | % | |||||||||||||||||||||||||||

| Selling, general and administrative expenses | (67.0) | (53.0) | (26) | % | (213.9) | (137.2) | (56) | % | |||||||||||||||||||||||||||

| Depreciation and amortization | (7.0) | (4.0) | (75) | % | (18.2) | (11.4) | (60) | % | |||||||||||||||||||||||||||

| Operating income (loss) | (25.4) | (31.2) | 19 | % | (89.6) | (40.7) | (120) | % | |||||||||||||||||||||||||||

| Other income (expense): | |||||||||||||||||||||||||||||||||||

| Interest expense, floor plan | (3.0) | (1.3) | (131) | % | (6.7) | (3.5) | (89) | % | |||||||||||||||||||||||||||

| Interest expense, other, net | (1.5) | (0.3) | (400) | % | (3.4) | (1.0) | (233) | % | |||||||||||||||||||||||||||

| Total other income (expense) | (4.5) | (1.7) | (165) | % | (10.1) | (4.6) | (120) | % | |||||||||||||||||||||||||||

| Income (loss) before taxes | (29.9) | (32.9) | 9 | % | (99.7) | (45.3) | (120) | % | |||||||||||||||||||||||||||

| Add: impairment charges | — | — | NM | — | — | NM | |||||||||||||||||||||||||||||

| Segment income (loss) | $ | (29.9) | $ | (32.9) | 9 | % | $ | (99.7) | $ | (45.3) | (120) | % | |||||||||||||||||||||||

| Unit Sales Volume: | |||||||||||||||||||||||||||||||||||

| Retail new vehicles | 535 | 55 | NM | 705 | 69 | NM | |||||||||||||||||||||||||||||

| Used vehicles | 15,422 | 21,255 | (27) | % | 47,025 | 62,186 | (24) | % | |||||||||||||||||||||||||||

| Wholesale vehicles | 2,450 | 3,492 | (30) | % | 8,793 | 9,231 | (5) | % | |||||||||||||||||||||||||||

| Gross Profit Per Unit: | |||||||||||||||||||||||||||||||||||

| Total used vehicle and F&I | $ | 2,880 | $ | 1,023 | 182 | % | $ | 2,808 | $ | 1,618 | 74 | % | |||||||||||||||||||||||

| Three Months Ended September 30, |

Better / (Worse) | Nine Months Ended September 30, |

Better / (Worse) | ||||||||||||||||||||||||||||||||

| 2022 | 2021 | % Change | 2022 | 2021 | % Change | ||||||||||||||||||||||||||||||

| (In millions, except unit and per unit data) | |||||||||||||||||||||||||||||||||||

| Revenues: | |||||||||||||||||||||||||||||||||||

| Retail new vehicles | $ | 3.4 | $ | 3.5 | (3) | % | $ | 10.3 | $ | 4.4 | 134 | % | |||||||||||||||||||||||

| Used vehicles | 367.8 | 569.7 | (35) | % | 1,176.8 | 1,529.7 | (23) | % | |||||||||||||||||||||||||||

| Wholesale vehicles | 29.6 | 33.0 | (10) | % | 121.1 | 73.5 | 65 | % | |||||||||||||||||||||||||||

| Total vehicles | 400.8 | 606.2 | (34) | % | 1,308.2 | 1,607.6 | (19) | % | |||||||||||||||||||||||||||

| Finance, insurance and other, net | 27.9 | 52.0 | (46) | % | 90.2 | 152.0 | (41) | % | |||||||||||||||||||||||||||

| Total revenues | 428.7 | 658.2 | (35) | % | 1,398.4 | 1,759.6 | (21) | % | |||||||||||||||||||||||||||

| Gross Profit: | |||||||||||||||||||||||||||||||||||

| Retail new vehicles | 0.3 | 0.2 | 50 | % | 0.9 | 0.3 | 50 | % | |||||||||||||||||||||||||||

| Used vehicles | 0.1 | (29.7) | 100 | % | (11.3) | (51.2) | 78 | % | |||||||||||||||||||||||||||

| Wholesale vehicles | 0.1 | 3.3 | (97) | % | 3.6 | 6.5 | (45) | % | |||||||||||||||||||||||||||

| Total vehicles | 0.5 | (26.2) | 102 | % | (6.8) | (44.4) | 85 | % | |||||||||||||||||||||||||||

| Finance, insurance and other, net | 27.9 | 52.0 | (46) | % | 90.2 | 152.0 | (41) | % | |||||||||||||||||||||||||||

| Total gross profit | $ | 28.4 | $ | 25.8 | 10 | % | $ | 83.4 | $ | 107.6 | (22) | % | |||||||||||||||||||||||

| Unit Sales Volume: | |||||||||||||||||||||||||||||||||||

| Retail new vehicles | 45 | 55 | (18) | % | 126 | 69 | 83 | % | |||||||||||||||||||||||||||

| Used vehicles | 11,809 | 21,078 | (44) | % | 36,960 | 61,970 | (40) | % | |||||||||||||||||||||||||||

| Wholesale vehicles | 1,925 | 3,492 | (45) | % | 7,452 | 9,231 | (19) | % | |||||||||||||||||||||||||||

| Gross Profit Per Unit: | |||||||||||||||||||||||||||||||||||

| Total used vehicle and F&I | $ | 2,361 | $ | 1,028 | 130 | % | $ | 2,125 | $ | 1,615 | 32 | % | |||||||||||||||||||||||

| Three Months Ended September 30, | Better / (Worse) | ||||||||||||||||||||||

| 2022 | 2021 | Change | % Change | ||||||||||||||||||||

| (In millions) | |||||||||||||||||||||||

| Reported: | |||||||||||||||||||||||

| Compensation | $ | 255.2 | $ | 206.2 | $ | (49.0) | (24) | % | |||||||||||||||

| Advertising | 21.1 | 16.7 | (4.4) | (26) | % | ||||||||||||||||||

| Rent | 11.9 | 13.8 | 1.9 | 14 | % | ||||||||||||||||||

| Other | 110.8 | 84.7 | (26.1) | (31) | % | ||||||||||||||||||

| Total SG&A expenses | $ | 399.0 | $ | 321.4 | $ | (77.6) | (24) | % | |||||||||||||||

| Reported: | |||||||||||||||||||||||

| SG&A expenses as a % of gross profit: | |||||||||||||||||||||||

| Compensation | 43.9 | % | 43.7 | % | (20) | bps | |||||||||||||||||

| Advertising | 3.6 | % | 3.5 | % | (10) | bps | |||||||||||||||||

| Rent | 2.1 | % | 2.9 | % | 80 | bps | |||||||||||||||||

| Other | 19.1 | % | 18.0 | % | (110) | bps | |||||||||||||||||

| Total SG&A expenses as a % of gross profit | 68.7 | % | 68.1 | % | (60) | bps | |||||||||||||||||

| Nine Months Ended September 30, | Better / (Worse) | ||||||||||||||||||||||

| 2022 | 2021 | Change | % Change | ||||||||||||||||||||

| (In millions) | |||||||||||||||||||||||

| Reported: | |||||||||||||||||||||||

| Compensation | $ | 774.1 | $ | 608.5 | $ | (165.6) | (27) | % | |||||||||||||||

| Advertising | 72.8 | 44.2 | (28.6) | (65) | % | ||||||||||||||||||

| Rent | 38.3 | 41.2 | 2.9 | 7 | % | ||||||||||||||||||

| Other | 303.6 | 237.4 | (66.2) | (28) | % | ||||||||||||||||||

| Total SG&A expenses | $ | 1,188.8 | $ | 931.3 | $ | (257.5) | (28) | % | |||||||||||||||

| Items of interest: | |||||||||||||||||||||||

| Long term compensation charges | (4.4) | $ | — | ||||||||||||||||||||

| Total SG&A adjustments | $ | (4.4) | $ | — | |||||||||||||||||||

| Adjusted: | |||||||||||||||||||||||

| Total adjusted SG&A expenses | $ | 1,184.4 | $ | 931.3 | $ | (253.1) | (27) | % | |||||||||||||||

| Reported: | |||||||||||||||||||||||

| SG&A expenses as a % of gross profit: | |||||||||||||||||||||||

| Compensation | 44.5 | % | 44.0 | % | (50) | bps | |||||||||||||||||

| Advertising | 4.2 | % | 3.2 | % | (100) | bps | |||||||||||||||||

| Rent | 2.2 | % | 3.0 | % | 80 | bps | |||||||||||||||||

| Other | 17.4 | % | 17.1 | % | (30) | bps | |||||||||||||||||

| Total SG&A expenses as a % of gross profit | 68.3 | % | 67.3 | % | (100) | bps | |||||||||||||||||

| Items of interest: | |||||||||||||||||||||||

| Long term compensation charges | (0.3) | % | — | % | |||||||||||||||||||

| Total effect of adjustments | (0.3) | % | — | % | |||||||||||||||||||

| Adjusted: | |||||||||||||||||||||||

| Total adjusted SG&A expenses as a % of gross profit | 68.0 | % | 67.3 | % | (70) | bps | |||||||||||||||||

| Three Months Ended September 30, | Better / (Worse) | ||||||||||||||||||||||

| 2022 | 2021 | Change | % Change | ||||||||||||||||||||

| (In millions) | |||||||||||||||||||||||

| Reported: | |||||||||||||||||||||||

| Compensation | $ | 216.2 | $ | 176.6 | $ | (39.6) | (22) | % | |||||||||||||||

| Advertising | 10.5 | 6.4 | (4.1) | (64) | % | ||||||||||||||||||

| Rent | 10.1 | 11.9 | 1.8 | 15 | % | ||||||||||||||||||

| Other | 95.2 | 73.5 | (21.7) | (30) | % | ||||||||||||||||||

| Total SG&A expenses | $ | 332.0 | $ | 268.4 | $ | (63.6) | (24) | % | |||||||||||||||

| Reported: | |||||||||||||||||||||||

| SG&A expenses as a % of gross profit: | |||||||||||||||||||||||

| Compensation | 40.6 | % | 39.6 | % | (100) | bps | |||||||||||||||||

| Advertising | 2.0 | % | 1.4 | % | (60) | bps | |||||||||||||||||

| Rent | 1.9 | % | 2.7 | % | 80 | bps | |||||||||||||||||

| Other | 17.9 | % | 16.5 | % | (140) | bps | |||||||||||||||||

| Total SG&A expenses as a % of gross profit | 62.4 | % | 60.2 | % | (220) | bps | |||||||||||||||||

| Nine Months Ended September 30, | Better / (Worse) | ||||||||||||||||||||||

| 2022 | 2021 | Change | % Change | ||||||||||||||||||||

| (In millions) | |||||||||||||||||||||||

| Reported: | |||||||||||||||||||||||

| Compensation | $ | 657.2 | $ | 529.7 | $ | (127.5) | (24) | % | |||||||||||||||

| Advertising | 26.2 | 19.8 | (6.4) | (32) | % | ||||||||||||||||||

| Rent | 31.9 | 36.2 | 4.3 | 12 | % | ||||||||||||||||||

| Other | 259.6 | 208.4 | (51.2) | (25) | % | ||||||||||||||||||

| Total SG&A expenses | $ | 974.9 | $ | 794.1 | $ | (180.8) | (23) | % | |||||||||||||||

| Items of interest: | |||||||||||||||||||||||

| Long term compensation charges | $ | (4.4) | $ | — | |||||||||||||||||||

| Total SG&A adjustments | $ | (4.4) | $ | — | |||||||||||||||||||

| Adjusted: | |||||||||||||||||||||||

| Total adjusted SG&A expenses | $ | 970.5 | $ | 794.1 | $ | (176.4) | (22) | % | |||||||||||||||

| Reported: | |||||||||||||||||||||||

| SG&A expenses as a % of gross profit: | |||||||||||||||||||||||

| Compensation | 41.1 | % | 41.5 | % | 40 | bps | |||||||||||||||||

| Advertising | 1.6 | % | 1.6 | % | — | bps | |||||||||||||||||

| Rent | 2.0 | % | 2.8 | % | 80 | bps | |||||||||||||||||

| Other | 16.3 | % | 16.3 | % | — | bps | |||||||||||||||||

| Total SG&A expenses as a % of gross profit | 61.0 | % | 62.2 | % | 120 | bps | |||||||||||||||||

| Items of interest: | |||||||||||||||||||||||

| Long term compensation charges | (0.3) | % | — | % | |||||||||||||||||||

| Total effect of adjustments | (0.3) | % | — | % | |||||||||||||||||||

| Adjusted: | |||||||||||||||||||||||

| Total adjusted SG&A expenses as a % of gross profit | 60.7 | % | 62.2 | % | 150 | bps | |||||||||||||||||

| Three Months Ended September 30, | Better / (Worse) | ||||||||||||||||||||||

| 2022 | 2021 | Change | % Change | ||||||||||||||||||||

| (In millions) | |||||||||||||||||||||||

| Reported: | |||||||||||||||||||||||

| Compensation | $ | 39.0 | $ | 29.6 | $ | (9.4) | (32) | % | |||||||||||||||

| Advertising | 10.6 | 10.3 | (0.3) | (3) | % | ||||||||||||||||||

| Rent | 1.8 | 1.9 | 0.1 | 5 | % | ||||||||||||||||||

| Other | 15.6 | 11.2 | (4.4) | (39) | % | ||||||||||||||||||

| Total SG&A expenses | $ | 67.0 | $ | 53.0 | $ | (14.0) | (26) | % | |||||||||||||||

| Reported: | |||||||||||||||||||||||

| SG&A expenses as a % of gross profit: | |||||||||||||||||||||||

| Compensation | 80.2 | % | 114.7 | % | 3,450 | bps | |||||||||||||||||

| Advertising | 21.8 | % | 39.9 | % | 1,810 | bps | |||||||||||||||||

| Rent | 3.7 | % | 7.4 | % | 370 | bps | |||||||||||||||||

| Other | 32.2 | % | 43.4 | % | 1,120 | bps | |||||||||||||||||

| Total SG&A expenses as a % of gross profit | 137.9 | % | 205.4 | % | 6,750 | bps | |||||||||||||||||

| Nine Months Ended September 30, | Better / (Worse) | ||||||||||||||||||||||

| 2022 | 2021 | Change | % Change | ||||||||||||||||||||

| (In millions) | |||||||||||||||||||||||

| Reported: | |||||||||||||||||||||||

| Compensation | $ | 116.9 | $ | 78.8 | $ | (38.1) | (48) | % | |||||||||||||||

| Advertising | 46.6 | 24.4 | (22.2) | (91) | % | ||||||||||||||||||

| Rent | 6.4 | 5.0 | (1.4) | (28) | % | ||||||||||||||||||

| Other | 44.0 | 29.0 | (15.0) | (52) | % | ||||||||||||||||||

| Total SG&A expenses | $ | 213.9 | $ | 137.2 | $ | (76.7) | (56) | % | |||||||||||||||

| Reported: | |||||||||||||||||||||||

| SG&A expenses as a % of gross profit: | |||||||||||||||||||||||

| Compensation | 82.0 | % | 73.0 | % | (900) | bps | |||||||||||||||||

| Advertising | 32.7 | % | 22.6 | % | (1,010) | bps | |||||||||||||||||

| Rent | 4.5 | % | 4.6 | % | 10 | bps | |||||||||||||||||

| Other | 30.9 | % | 27.0 | % | (390) | bps | |||||||||||||||||

| Total SG&A expenses as a % of gross profit | 150.1 | % | 127.2 | % | (2,290) | bps | |||||||||||||||||

| Three Months Ended September 30, 2022 | Three Months Ended September 30, 2021 | ||||||||||||||||||||||||||||||||||

| Weighted- Average Shares |

Amount | Per Share Amount |

Weighted- Average Shares |

Amount | Per Share Amount |

||||||||||||||||||||||||||||||

| (In millions, except per share amounts) | |||||||||||||||||||||||||||||||||||

| Diluted earnings (loss) and shares from continuing operations | 39.2 | $ | 87.3 | $ | 2.23 | 43.3 | $ | 84.7 | $ | 1.96 | |||||||||||||||||||||||||

| Nine Months Ended September 30, 2022 | Nine Months Ended September 30, 2021 | ||||||||||||||||||||||||||||||||||

| Weighted- Average Shares |

Amount | Per Share Amount |

Weighted- Average Shares |

Amount | Per Share Amount |

||||||||||||||||||||||||||||||

| (In millions, except per share amounts) | |||||||||||||||||||||||||||||||||||

| Diluted earnings (loss) and shares from continuing operations | 40.5 | $ | 279.4 | $ | 6.90 | 43.4 | $ | 252.4 | $ | 5.82 | |||||||||||||||||||||||||

| Pre-tax items of interest: | |||||||||||||||||||||||||||||||||||

| Long term compensation charges | $ | 4.4 | $ | — | |||||||||||||||||||||||||||||||

| Total pre-tax items of interest | $ | 4.4 | $ | — | |||||||||||||||||||||||||||||||

| Adjusted diluted earnings (loss) and shares from continuing operations | 40.5 | $ | 283.8 | $ | 7.01 | 43.4 | $ | 252.4 | $ | 5.82 | |||||||||||||||||||||||||

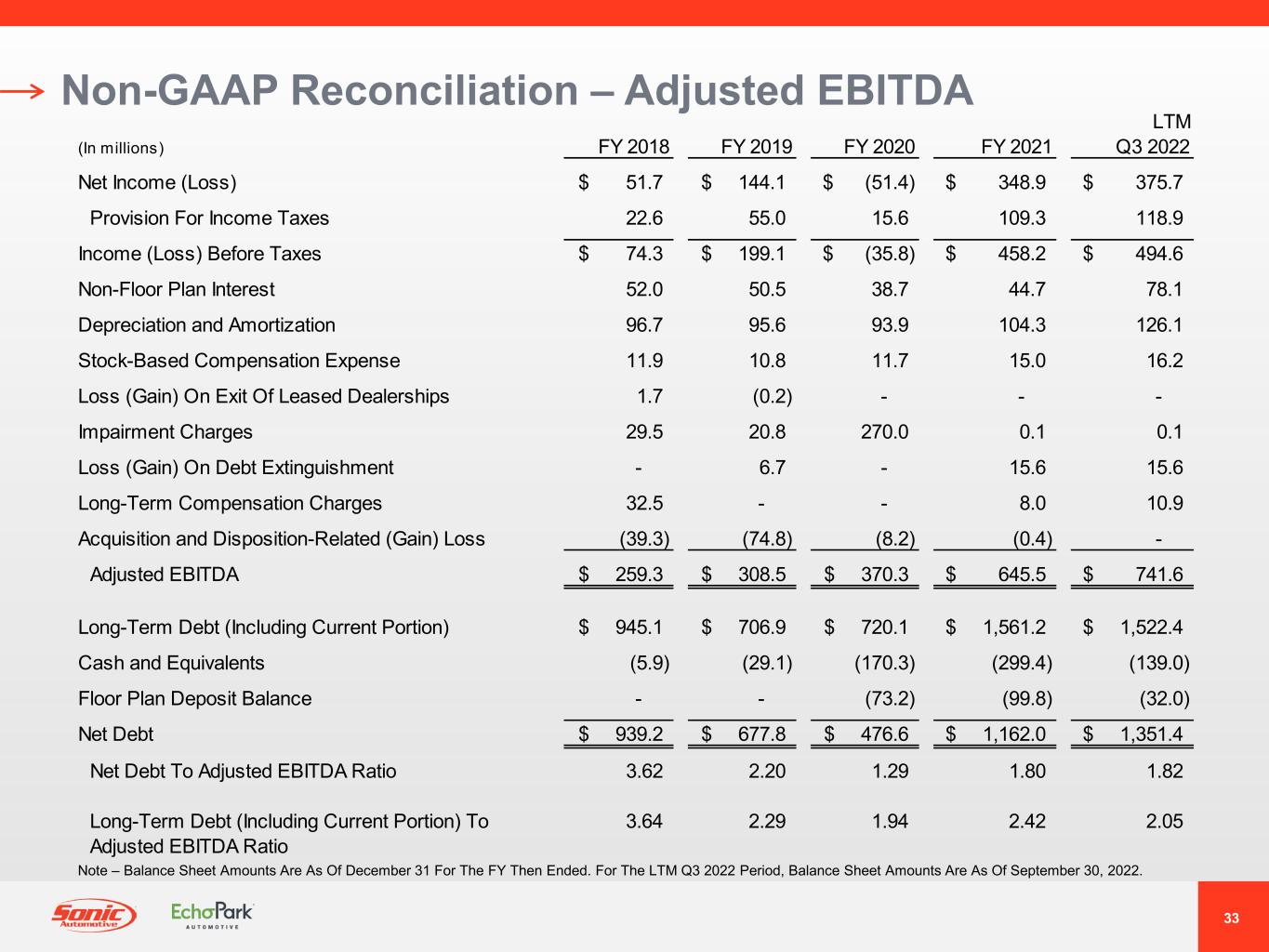

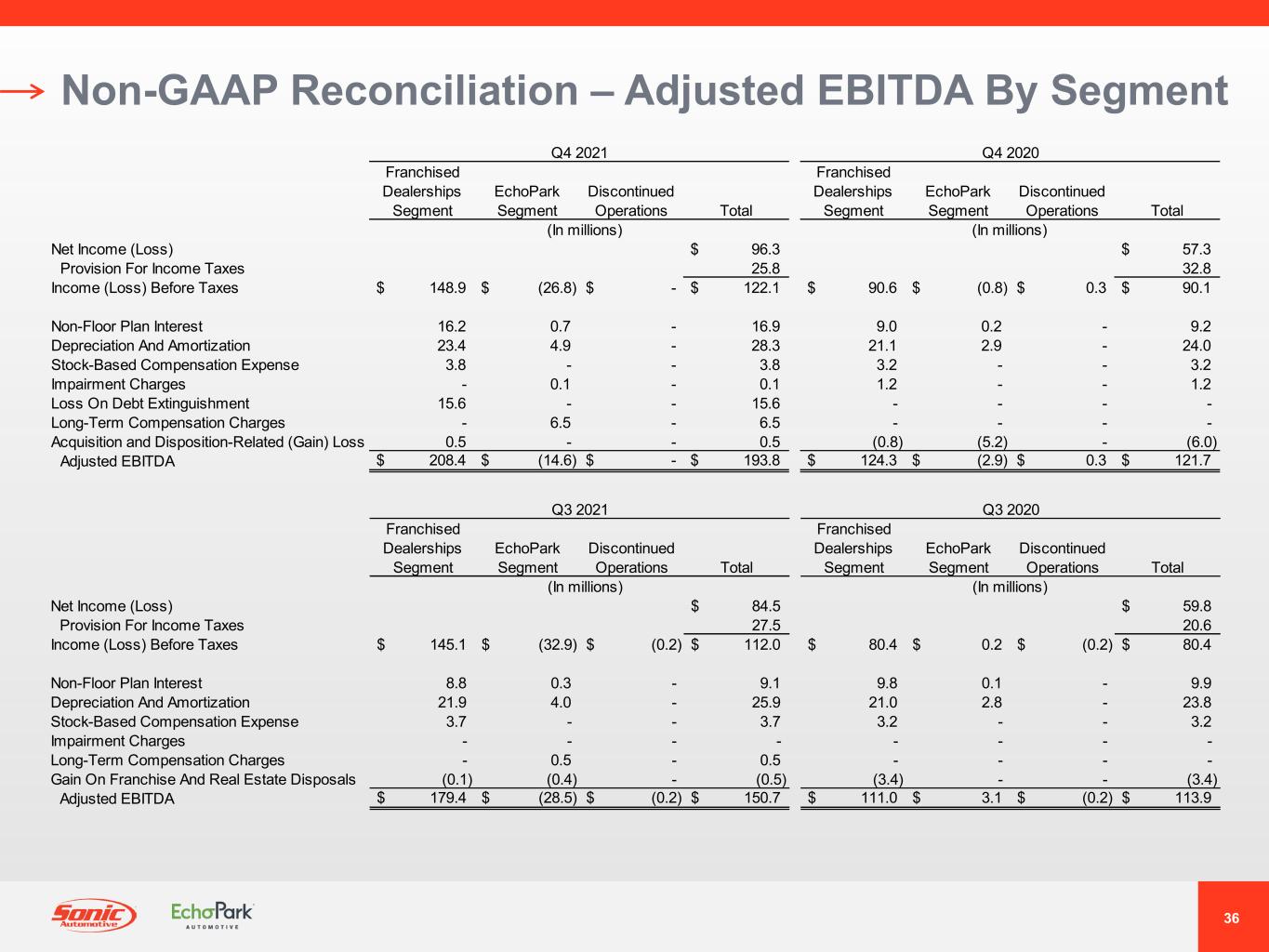

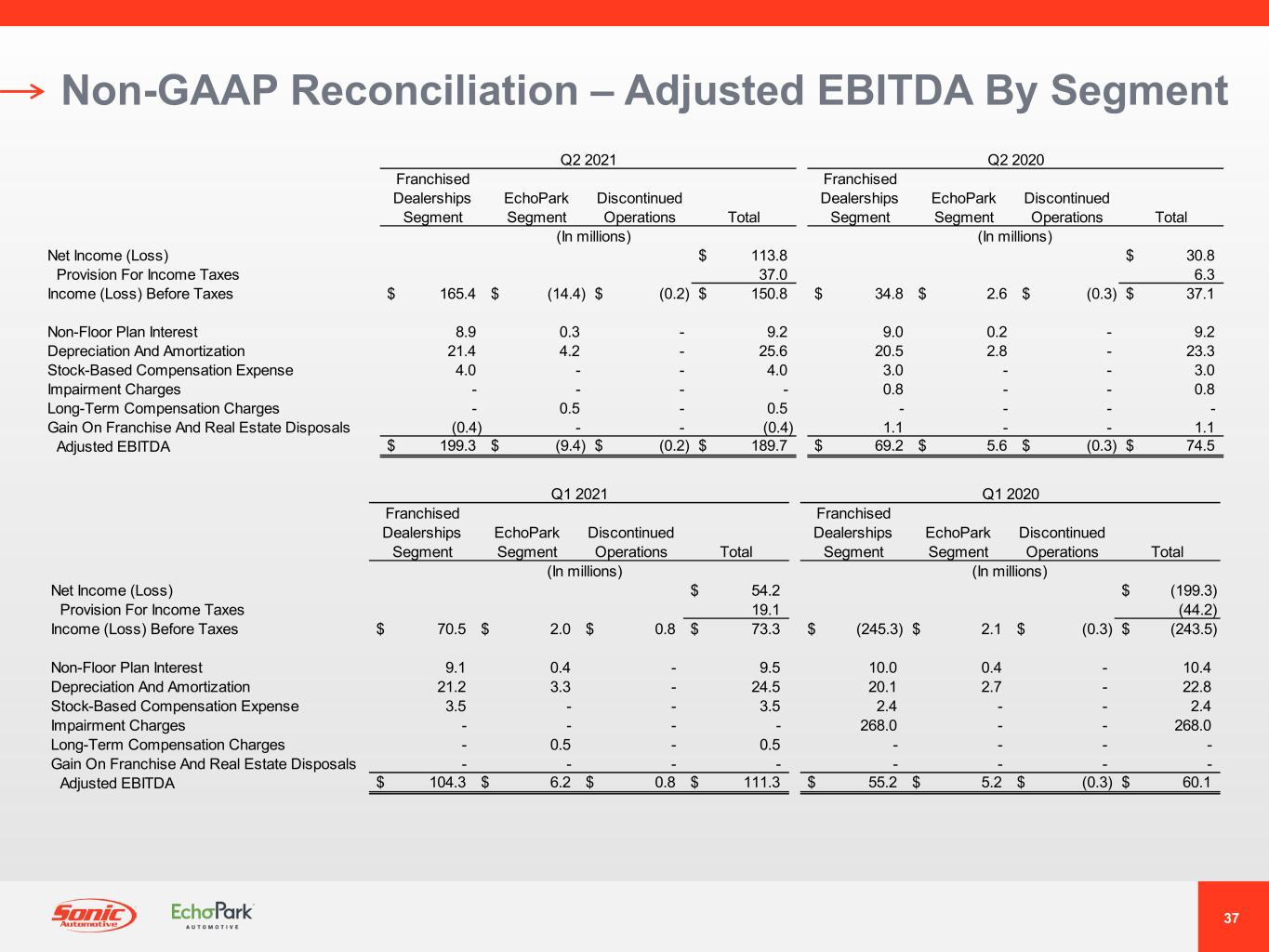

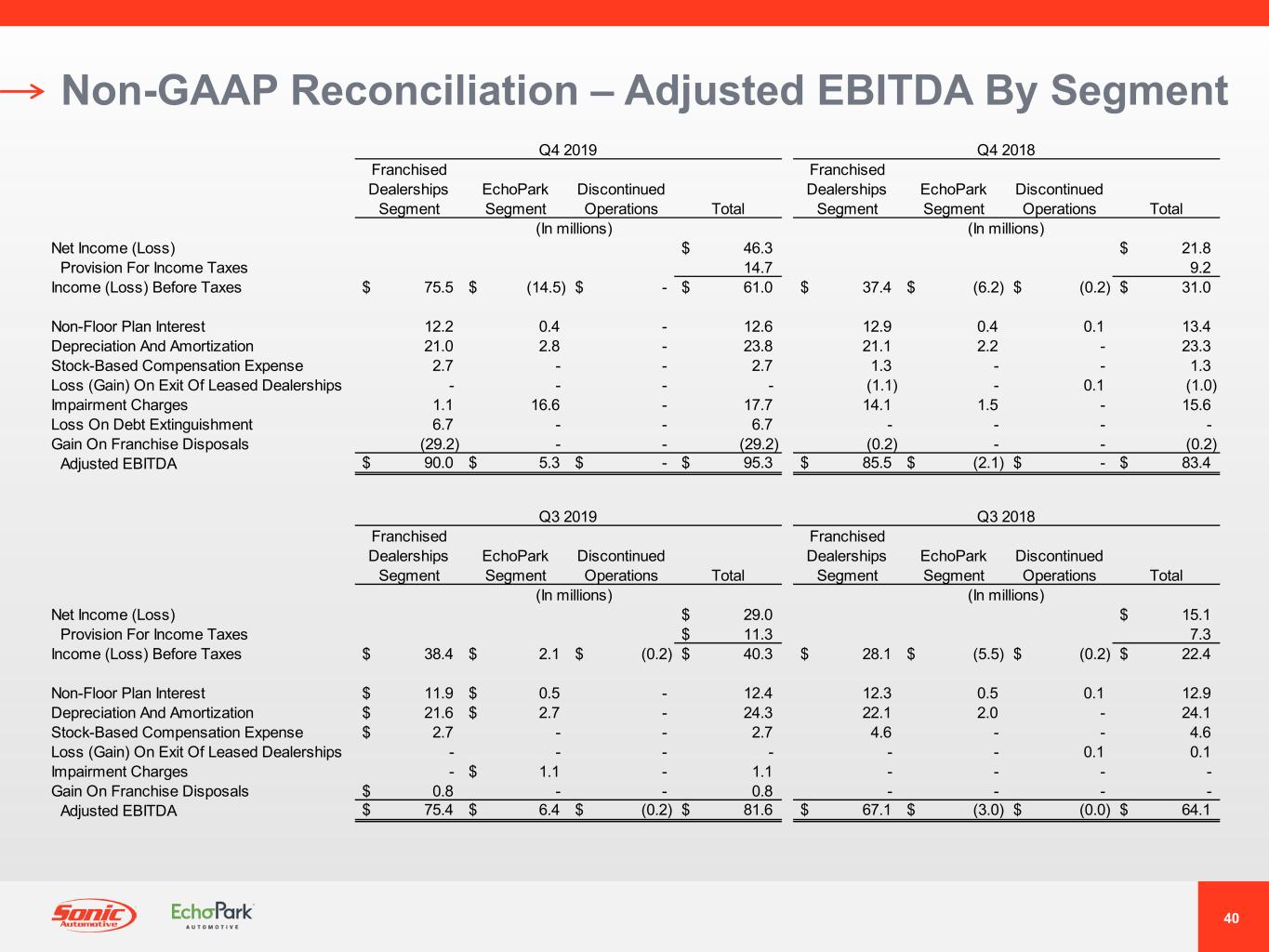

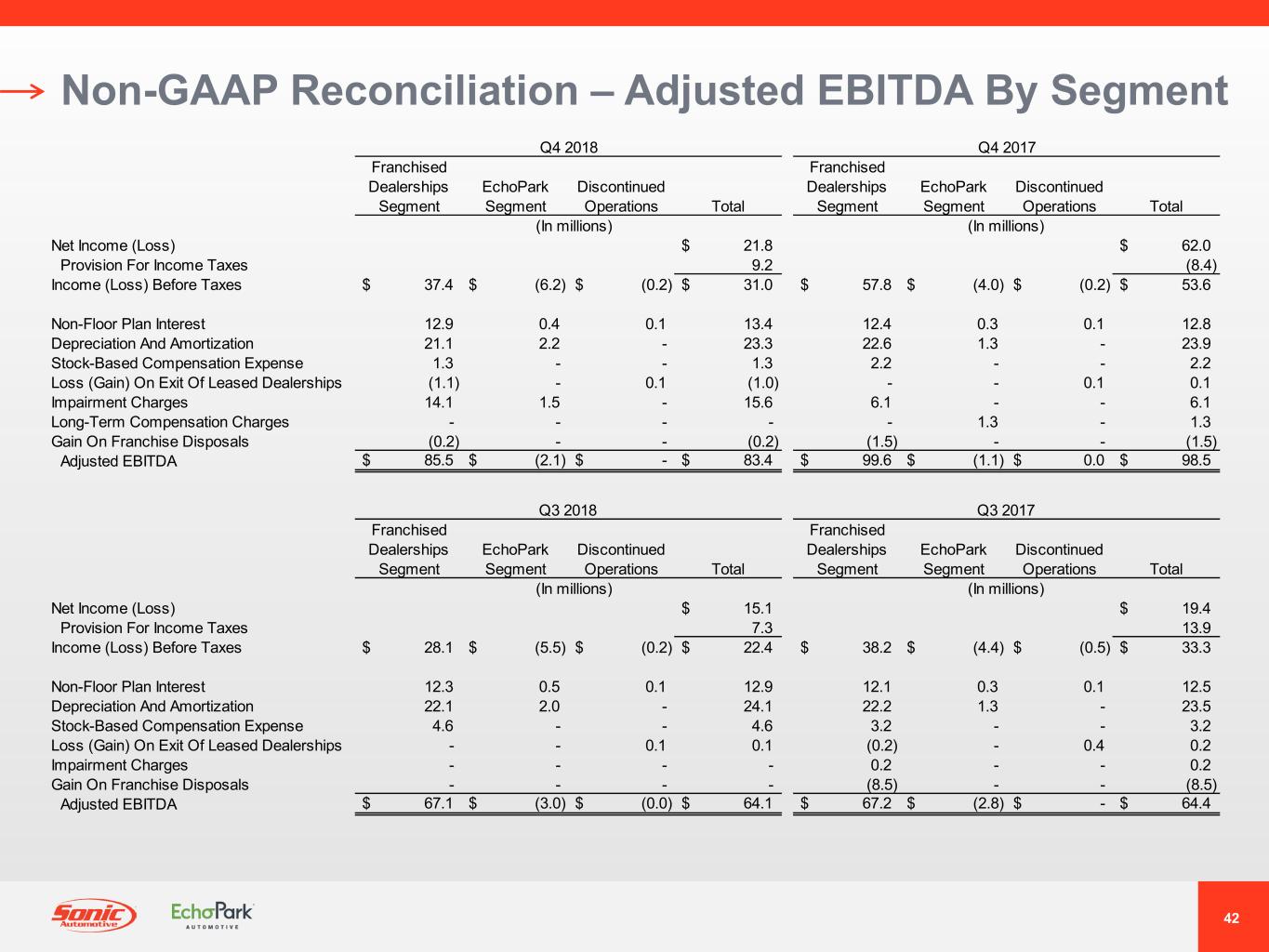

| Three Months Ended September 30, 2022 | Three Months Ended September 30, 2021 | ||||||||||||||||||||||||||||||||||||||||||||||

| Franchised Dealerships Segment | EchoPark Segment | Discontinued Operations | Total | Franchised Dealerships Segment | EchoPark Segment | Discontinued Operations | Total | ||||||||||||||||||||||||||||||||||||||||

| (In millions) | |||||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) | $ | 87.3 | $ | 84.5 | |||||||||||||||||||||||||||||||||||||||||||

| Provision for income taxes | 29.1 | 27.5 | |||||||||||||||||||||||||||||||||||||||||||||

| Income (loss) before taxes | $ | 146.3 | $ | (29.9) | $ | — | $ | 116.4 | $ | 145.1 | $ | (32.9) | $ | (0.2) | $ | 112.0 | |||||||||||||||||||||||||||||||

| Non-floor plan interest | 19.9 | 1.5 | — | 21.4 | 8.8 | 0.3 | — | 9.1 | |||||||||||||||||||||||||||||||||||||||

| Depreciation and amortization | 27.3 | 7.0 | — | 34.3 | 21.9 | 4.0 | — | 25.9 | |||||||||||||||||||||||||||||||||||||||

| Stock-based compensation expense | 3.8 | — | — | 3.8 | 3.7 | — | — | 3.7 | |||||||||||||||||||||||||||||||||||||||

| Long-term compensation charges | — | — | — | — | — | 0.5 | — | 0.5 | |||||||||||||||||||||||||||||||||||||||

| Loss (gain) on franchise and real estate disposals | 0.5 | — | — | 0.5 | (0.1) | (0.4) | — | (0.5) | |||||||||||||||||||||||||||||||||||||||

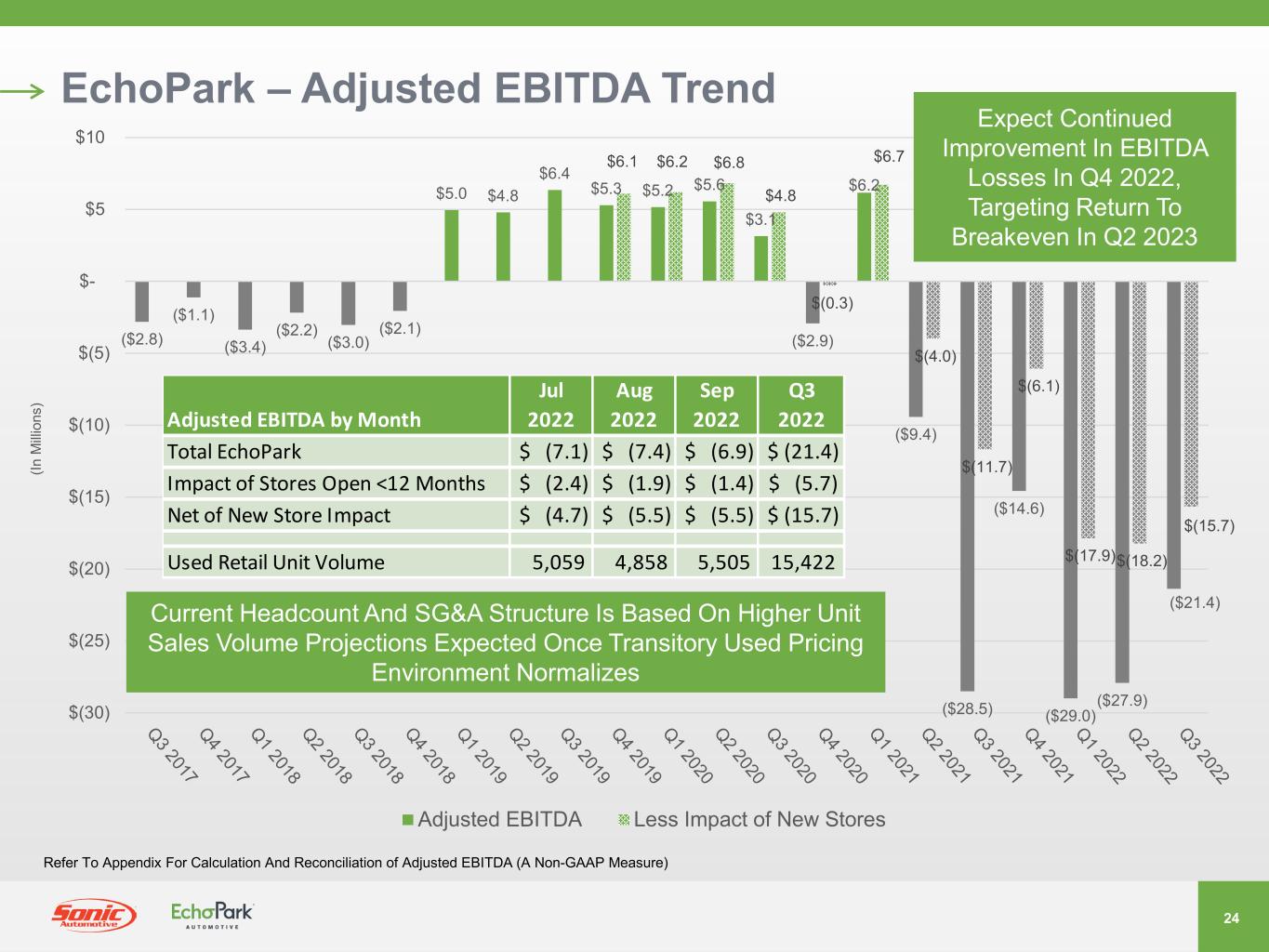

| Adjusted EBITDA | $ | 197.8 | $ | (21.4) | $ | — | $ | 176.4 | $ | 179.4 | $ | (28.5) | $ | (0.2) | $ | 150.7 | |||||||||||||||||||||||||||||||

| Nine Months Ended September 30, 2022 | Nine Months Ended September 30, 2021 | ||||||||||||||||||||||||||||||||||||||||||||||

| Franchised Dealerships Segment | EchoPark Segment | Discontinued Operations | Total | Franchised Dealerships Segment | EchoPark Segment | Discontinued Operations | Total | ||||||||||||||||||||||||||||||||||||||||

| (In millions) | |||||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) | $ | 279.4 | $ | 252.6 | |||||||||||||||||||||||||||||||||||||||||||

| Provision for income taxes | 93.1 | 83.4 | |||||||||||||||||||||||||||||||||||||||||||||

| Income (loss) before taxes | $ | 472.2 | $ | (99.7) | $ | — | $ | 372.5 | $ | 381.1 | $ | (45.3) | $ | 0.2 | $ | 336.0 | |||||||||||||||||||||||||||||||

| Non-floor plan interest | 58.0 | 3.2 | — | 61.2 | 26.8 | 1.0 | — | 27.8 | |||||||||||||||||||||||||||||||||||||||

| Depreciation & amortization | 79.6 | 18.1 | — | 97.7 | 64.6 | 11.4 | — | 76.0 | |||||||||||||||||||||||||||||||||||||||

| Stock-based compensation expense | 12.4 | — | — | 12.4 | 11.2 | — | — | 11.2 | |||||||||||||||||||||||||||||||||||||||

| Long-term compensation charges | 4.4 | — | — | 4.4 | — | 1.5 | — | 1.5 | |||||||||||||||||||||||||||||||||||||||

| Loss (gain) on franchise and real estate disposals | (0.5) | — | — | (0.5) | (0.4) | (0.4) | — | (0.8) | |||||||||||||||||||||||||||||||||||||||

| Adjusted EBITDA | $ | 626.1 | $ | (78.4) | $ | — | $ | 547.7 | $ | 483.3 | $ | (31.8) | $ | 0.2 | $ | 451.7 | |||||||||||||||||||||||||||||||