Document

Exhibit 99.1

FOR IMMEDIATE RELEASE

Stoneridge Reports Second Quarter 2025 Results

MirrorEye® Sets Another Quarterly Sales Record

Announces Largest Business Award in Company History for Global MirrorEye Program

Announces Largest OEM Business Award in Stoneridge Brazil History

Announces Review of Strategic Alternatives for Control Devices Business

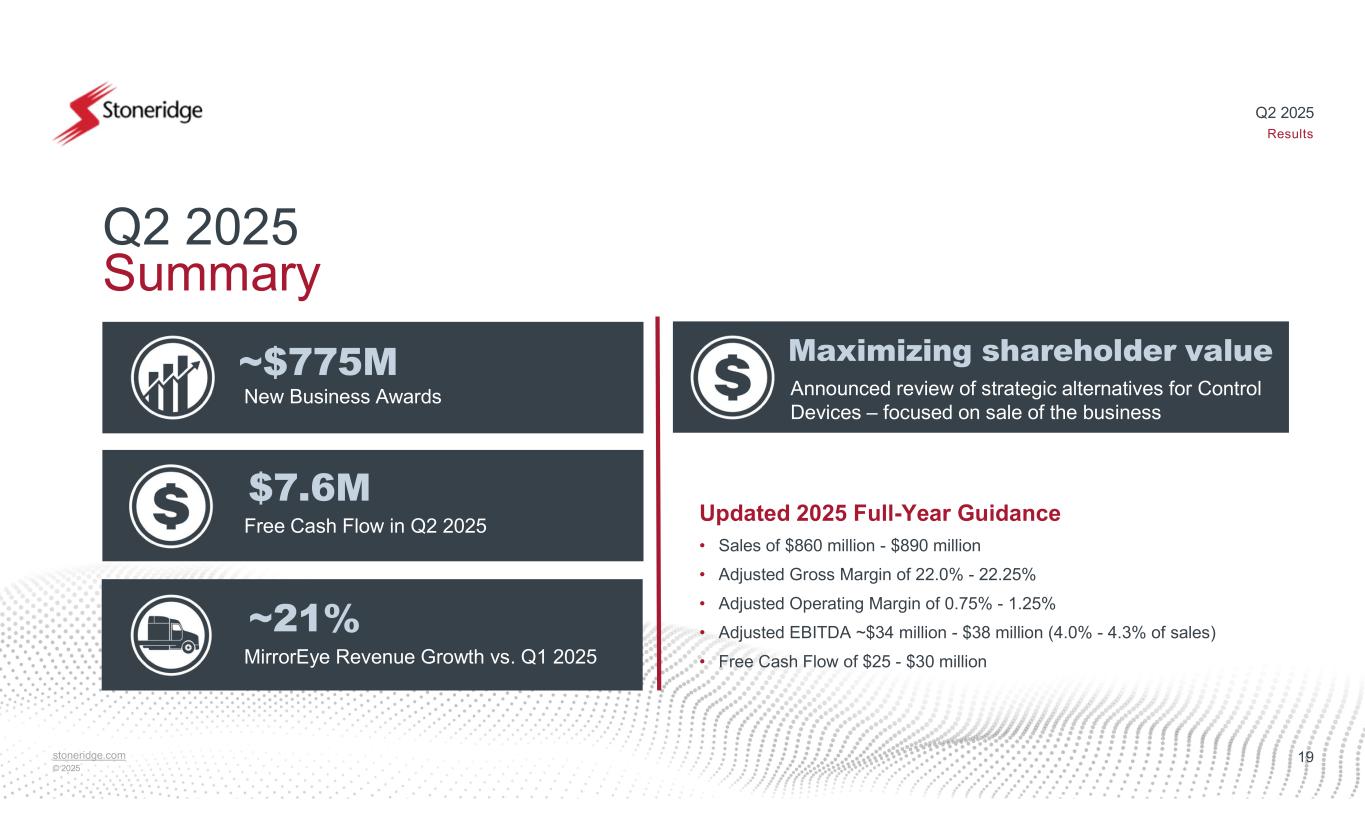

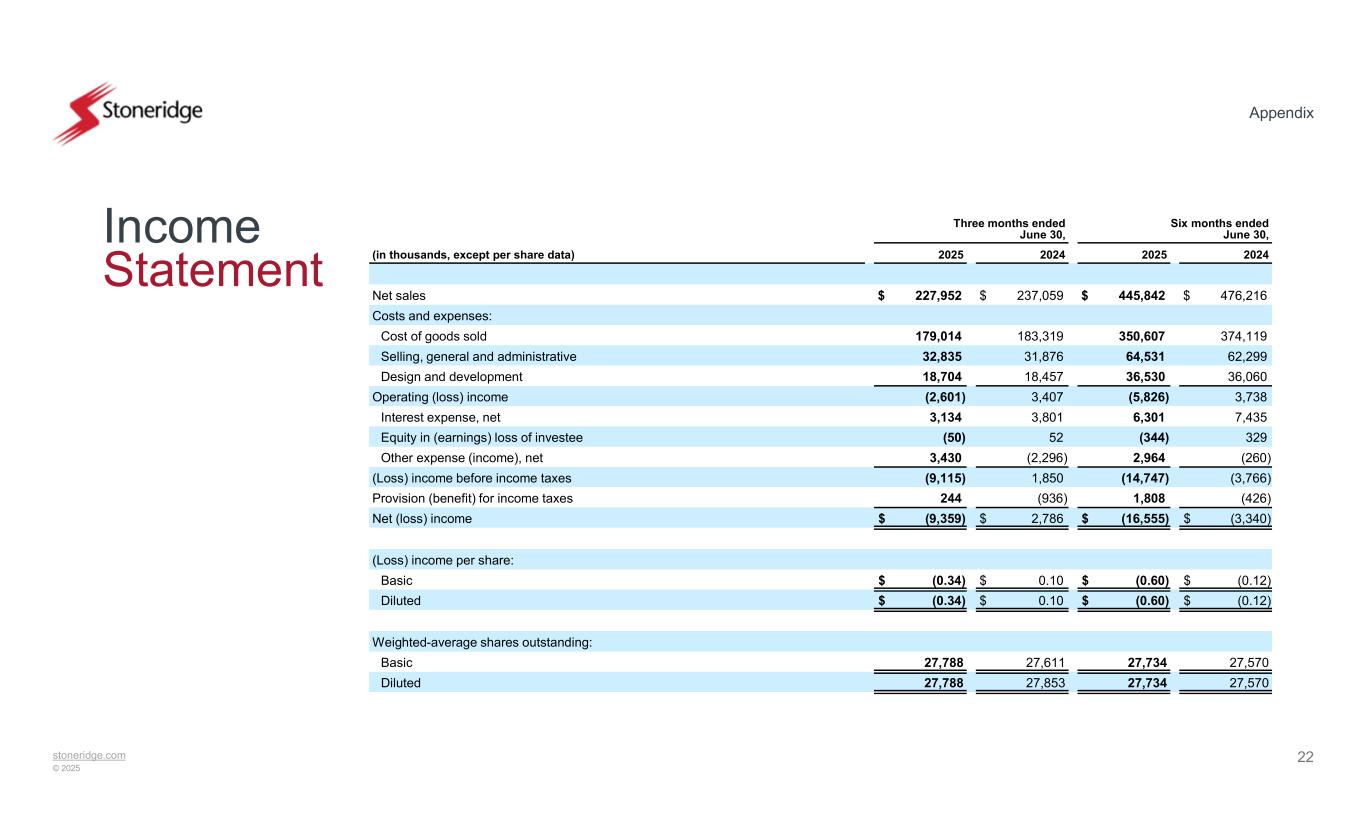

2025 Second Quarter Results

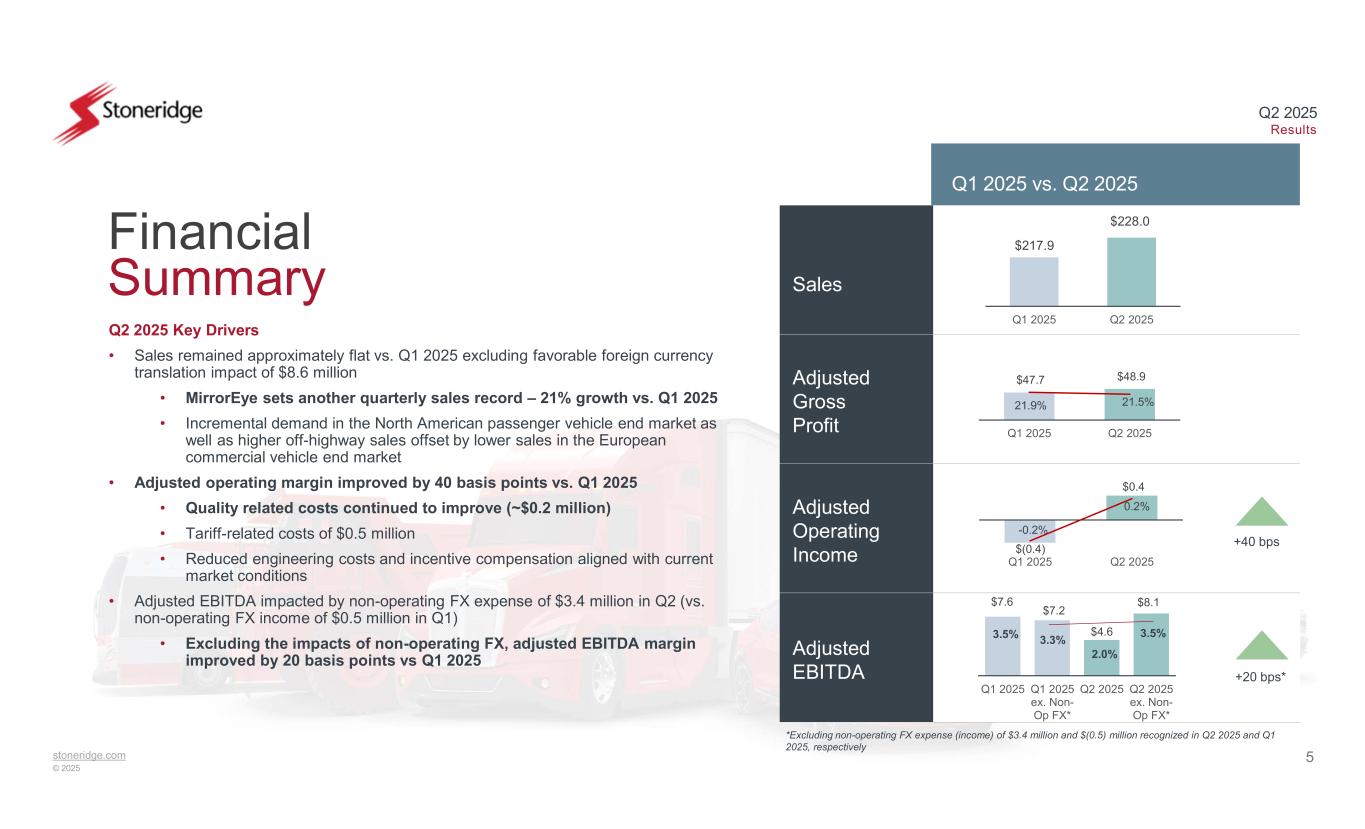

•Sales of $228.0 million

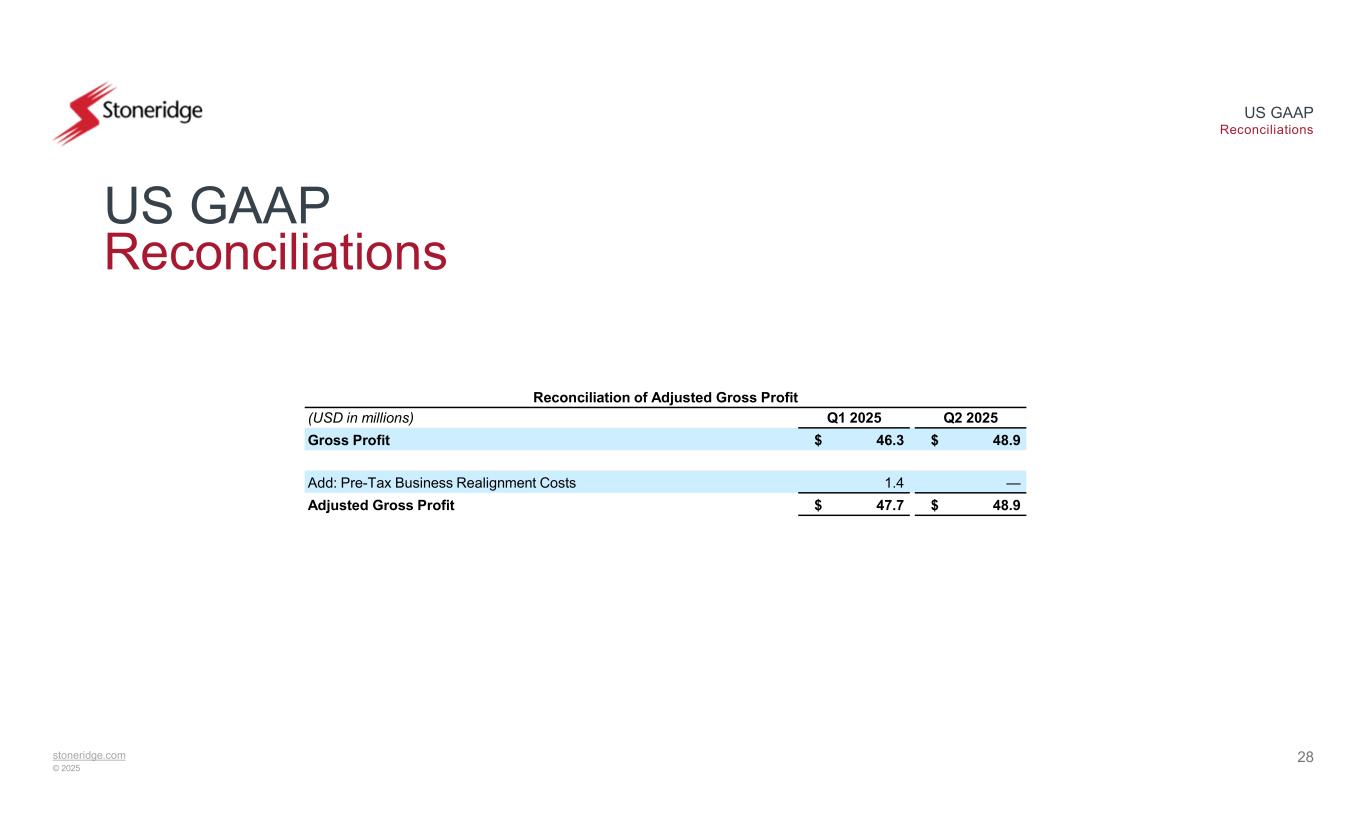

•Gross profit of $48.9 million (21.5% of sales)

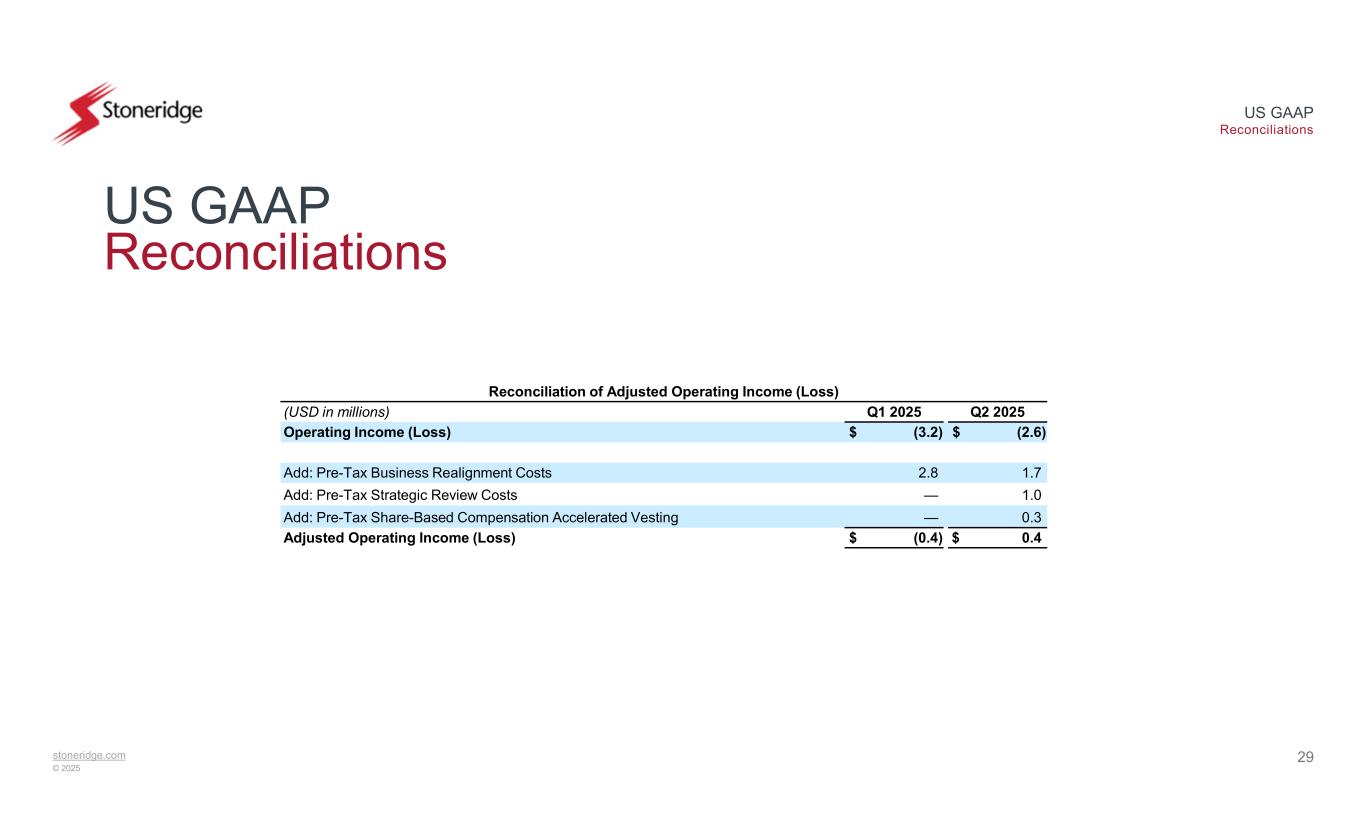

•Operating loss of $(2.6) million ((1.1)% of sales)

•Adjusted operating income of $0.4 million (0.2% of sales)

•Net loss of $(9.4) million ((4.1)% of sales)

•Adjusted net loss of $(7.0) million ((3.1)% of sales)

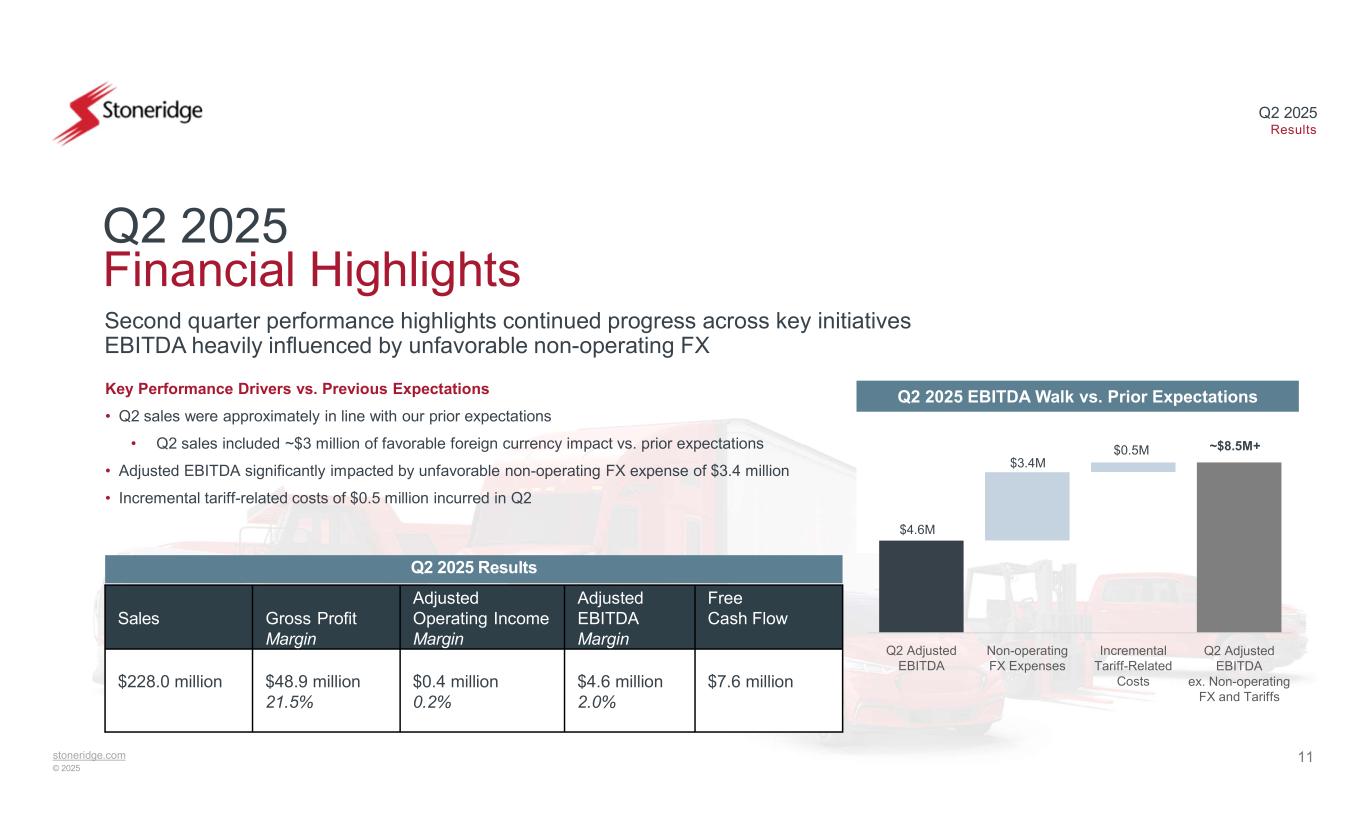

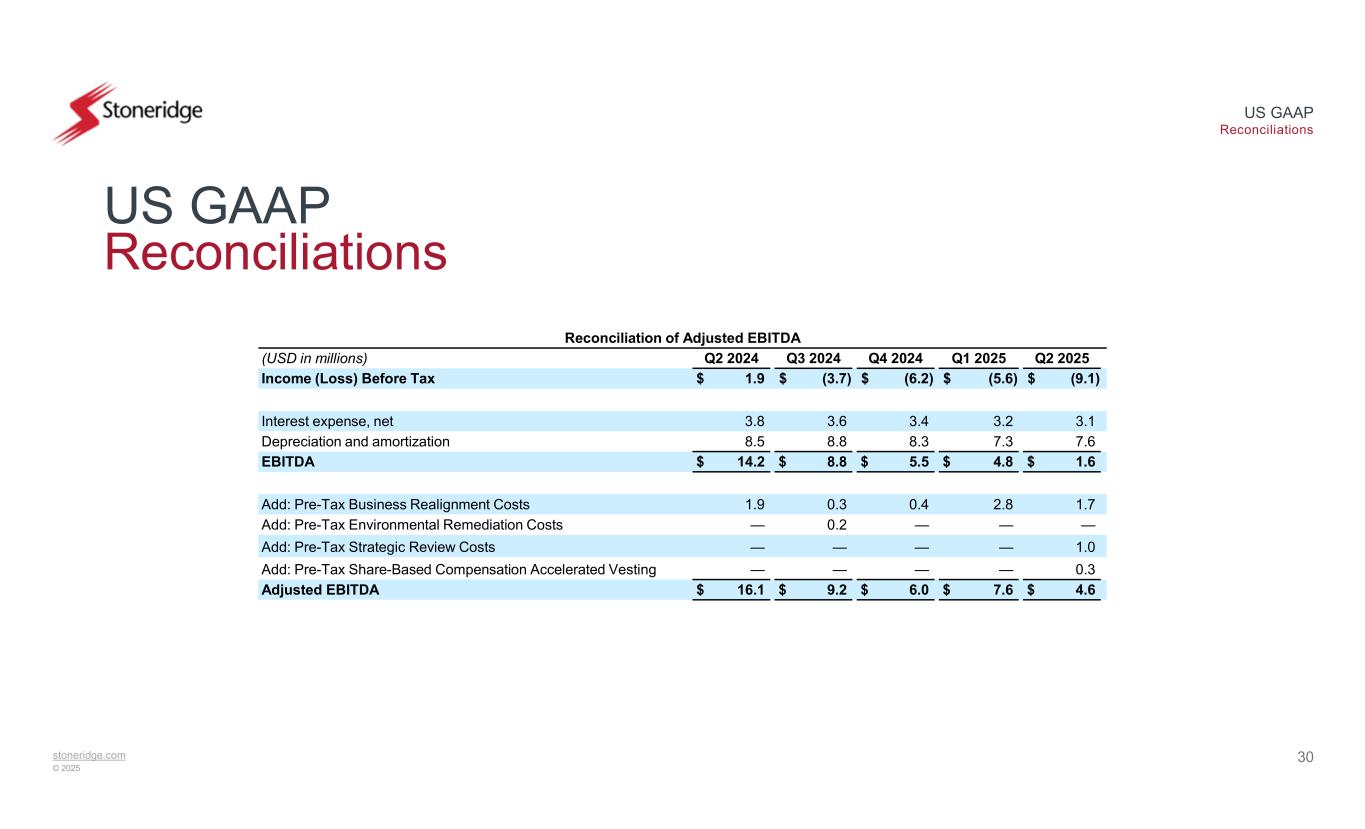

•Adjusted EBITDA of $4.6 million (2.0% of sales), including $3.4 million of non-operating FX expense

◦Excluding non-operating foreign currency expenses, adjusted EBITDA of $8.1 million (3.5% of sales)

•Total debt reduction of $38.8 million relative to the first quarter driven by a $43.8 million global cash repatriation program and an inventory reduction of $7.3 million

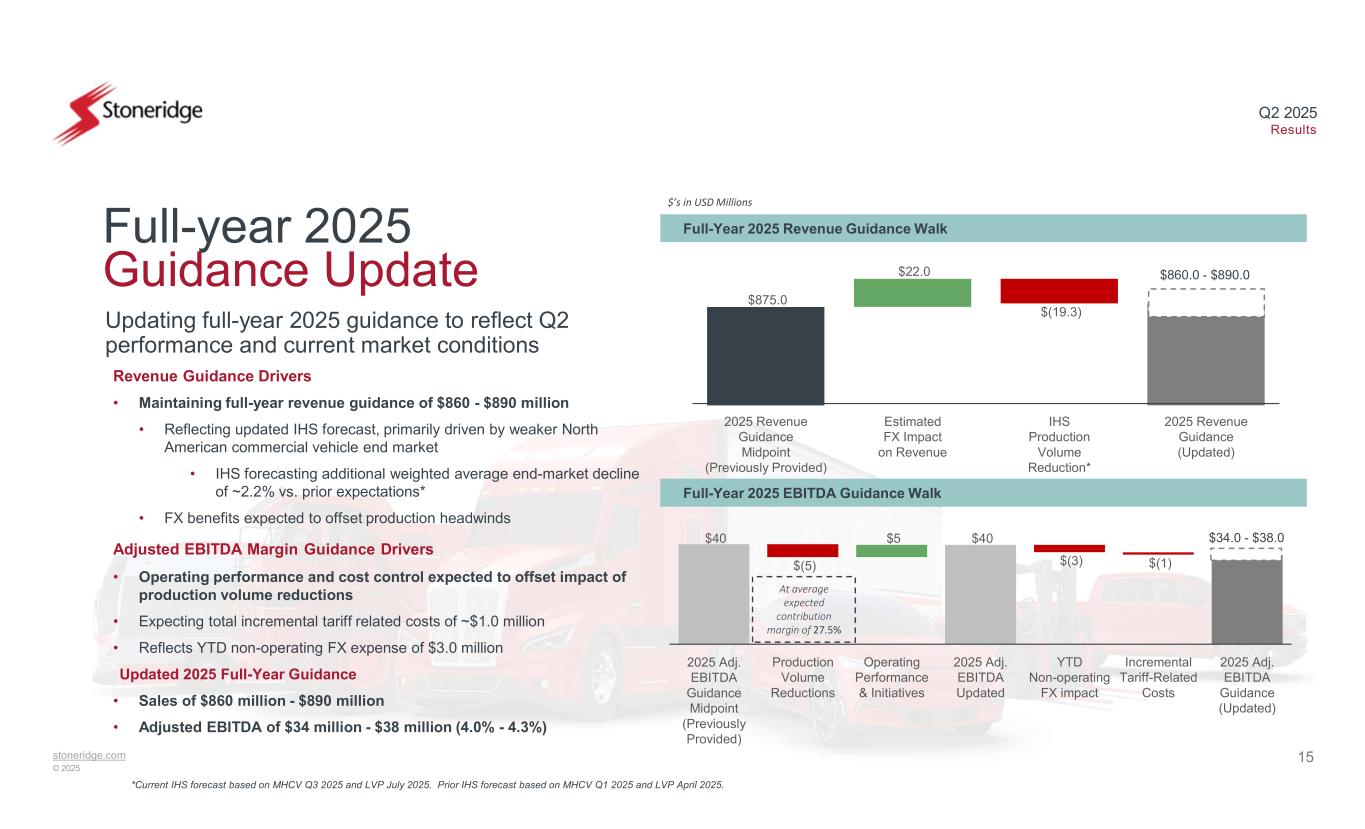

2025 Full-Year Guidance Update

•Maintaining revenue guidance of $860 million - $890 million (midpoint of $875 million)

◦Production volume reductions, particularly in the North American commercial vehicle end market, expected to be offset by foreign currency benefits

•Updating adjusted EBITDA to $34 million to $38 million (adjusted EBITDA margin of 4.0% to 4.3%)

◦Updating to reflect year-to-date non-operating net foreign currency expenses of $3.0 million and approximately $1.0 million in estimated tariff-related expenses for the full-year

◦Expecting operating performance improvements, including reduced operating expenses, to offset customer production volume headwinds

NOVI, Mich. – August 6, 2025– Stoneridge, Inc. (NYSE: SRI) today announced financial results for the second quarter ended June 30, 2025, including second quarter sales of $228.0 million and gross profit of $48.9 million (21.5% of sales). Operating loss was $(2.6) million ((1.1)% of sales) while adjusted operating income was $0.4 million (0.2% of sales). Net loss was $(9.4) million and adjusted net loss was $(7.0) million. Loss per share (EPS) was $(0.34) and adjusted EPS was $(0.25). Adjusted EBITDA was $4.6 million (2.0% of sales), including $3.4 million of non-operating foreign currency expense.

Excluding unfavorable non-operating foreign currency expense of $3.4 million, adjusted EBITDA was $8.1 million (3.5% of sales).

The exhibits attached hereto provide reconciliation details on normalizing adjustments of non-GAAP financial measures used in this press release.

Jim Zizelman, president and chief executive officer, commented, “Our second quarter performance highlights the steady momentum we’ve built across our strategic priorities. While market conditions remain challenging and volatile, we remain focused on managing the factors within our control. Our industry-changing camera monitor system, MirrorEye, set yet another quarterly sales record with an impressive 21% growth relative to the first quarter of this year. This was driven by the continued ramp-up of our OEM programs including two additional North American programs that launched in the first half of this year. MirrorEye clearly continues to gain momentum throughout our end markets including our OEM, aftermarket and bus applications.”

Today, the Company also announced several significant new program awards, in both the Electronics and Stoneridge Brazil segments, totaling approximately $775 million in lifetime revenue. Among these awards is the largest in Stoneridge history for a global MirrorEye program extension with estimated lifetime revenue of approximately $535 million and peak annual revenue of approximately $140 million. Also awarded this quarter is a new OEM program for the Smart 2 next generation tachograph and several programs for secondary displays and electronic control units, which in total, are expected to contribute an additional $155 million of estimated lifetime revenue. Finally, Stoneridge Brazil was awarded the largest OEM program in the segment’s history for an electronic control unit for a customer’s infotainment program. This new business is estimated to generate approximately $85 million of lifetime revenue, with approximately $20 million of peak annual revenue.

Zizelman continued, “As demonstrated by the significant new business awards announced this quarter, we remain committed to our long-term strategy aligned with industry megatrends and advanced technologies. We continue to lead the market in vision systems as a trusted and dependable partner, earning a global MirrorEye program extension with our next-generation system which exemplifies the value of our technology not only to our customers, but also to end-users. As the largest single program award in the Company’s history, this MirrorEye program will contribute to our substantial growth for many years to come. Additionally, we continue to shift our portfolio in Brazil to align with our global growth initiatives as demonstrated by the largest OEM program award in Stoneridge Brazil’s history. We believe this award will create additional opportunities in the OEM space in Brazil, both with this customer as well as others, as we become a trusted, reliable supplier in this region as well.”

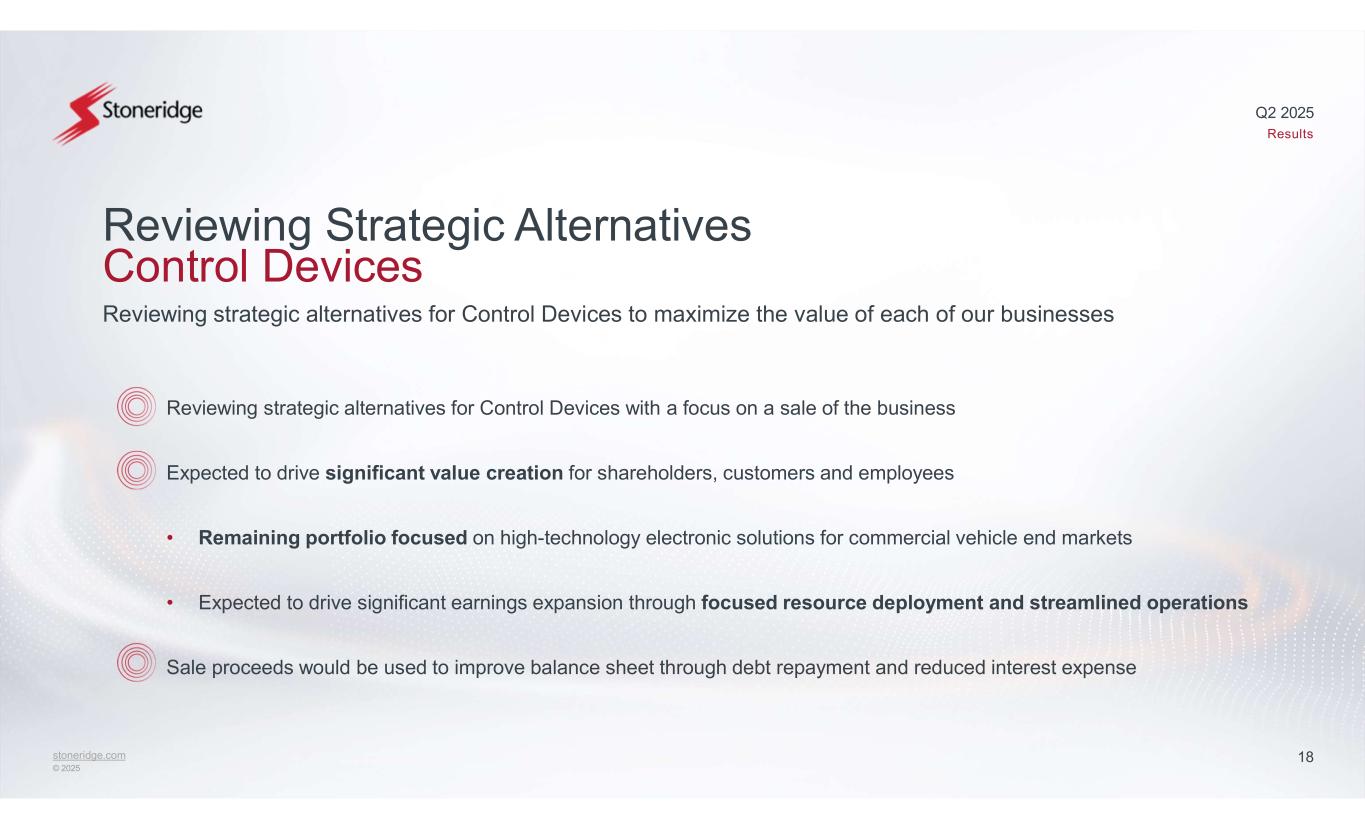

Review of Strategic Alternatives for the Control Devices Business

Stoneridge today also announced a review of strategic alternatives for its Control Devices business.

Zizelman continued, “As I have discussed consistently throughout my tenure as the CEO of Stoneridge, our management team and Board of Directors remain focused on creating value for our shareholders, employees, and customers. As our business continues to evolve and grow, we need to ensure each part of our business has both the resources and focus needed to reach its full potential. That said, we are seeing record-breaking business wins in several of our core growth platforms, in both Electronics and Stoneridge Brazil and to support and accelerate these growth platforms, we must dedicate our capital, engineering resources, and leadership focus accordingly. As a result, the next step in our long-term strategy is a review of strategic alternatives related to our Control Devices segment with the primary focus being a potential sale of the segment to maximize value for our shareholders.”

Zizelman concluded, “We are excited about the next stage of our long-term strategy. We believe this will maximize shareholder value, both immediately and longer term, and position us for sustainable success. We believe this process will also result in Control Devices being able to take advantage of the technology platforms that we have built and invest in the appropriate resources to accelerate growth and earnings potential for the business.”

The Company has engaged external advisors to assist in this process but has not set a definitive timetable for the completion of the process and does not intend to comment further unless or until the Board has approved a specific course of action.

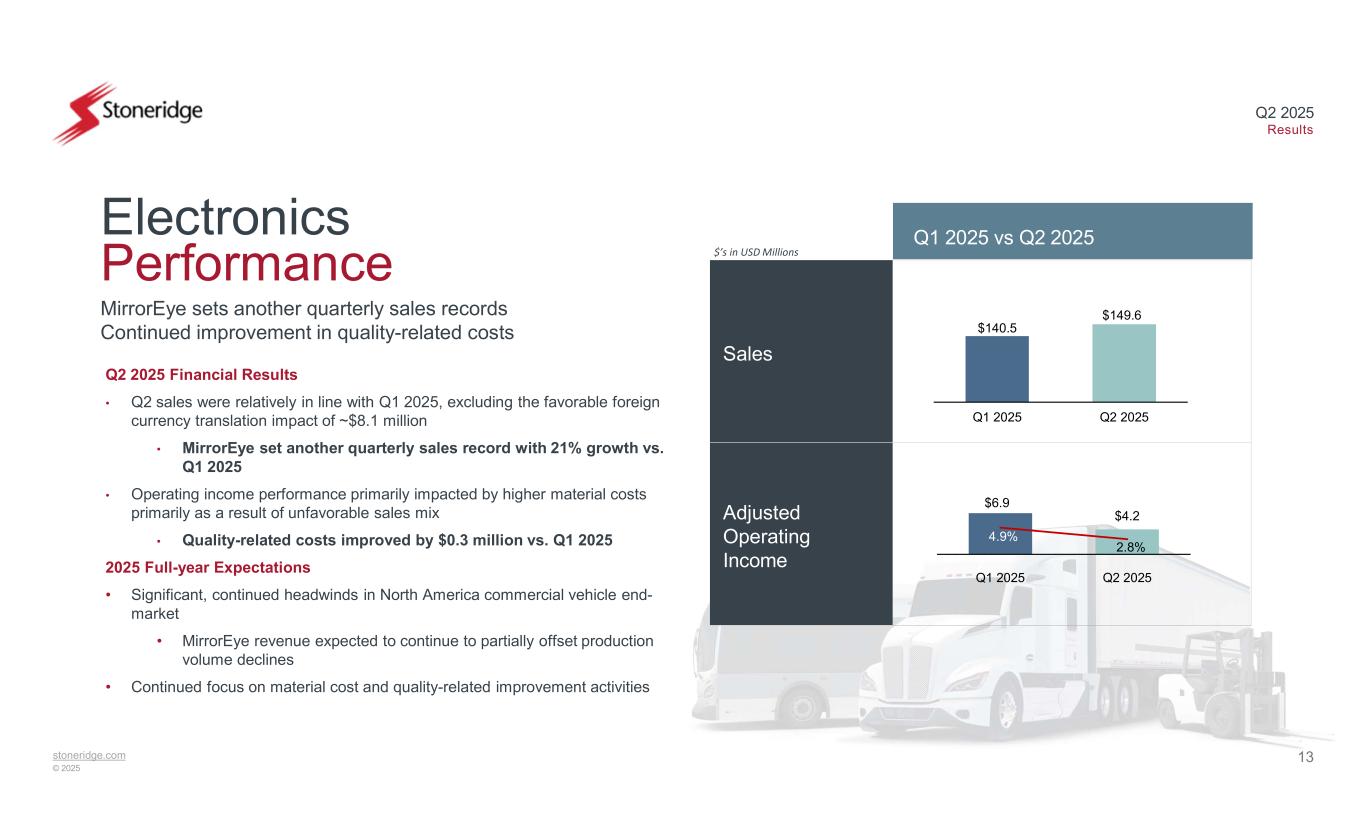

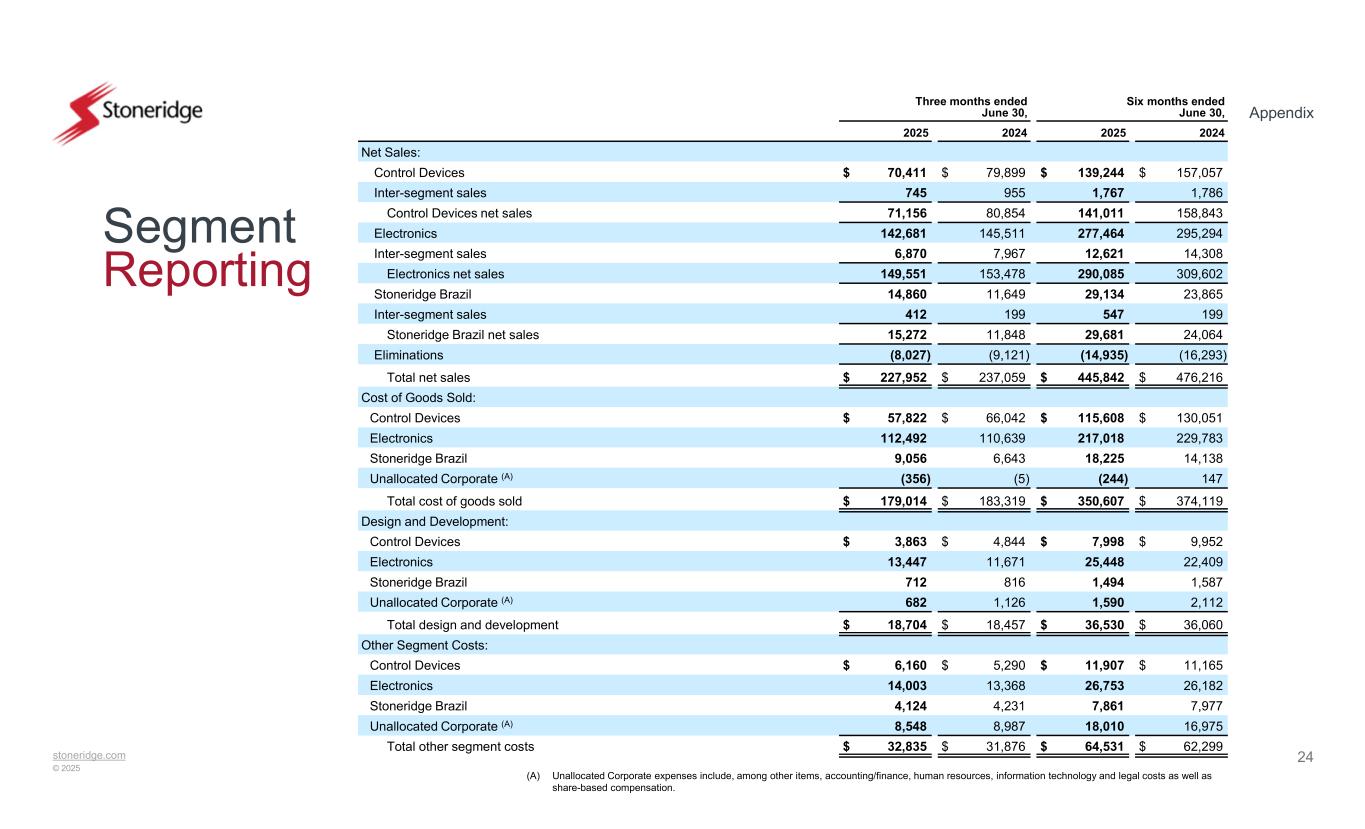

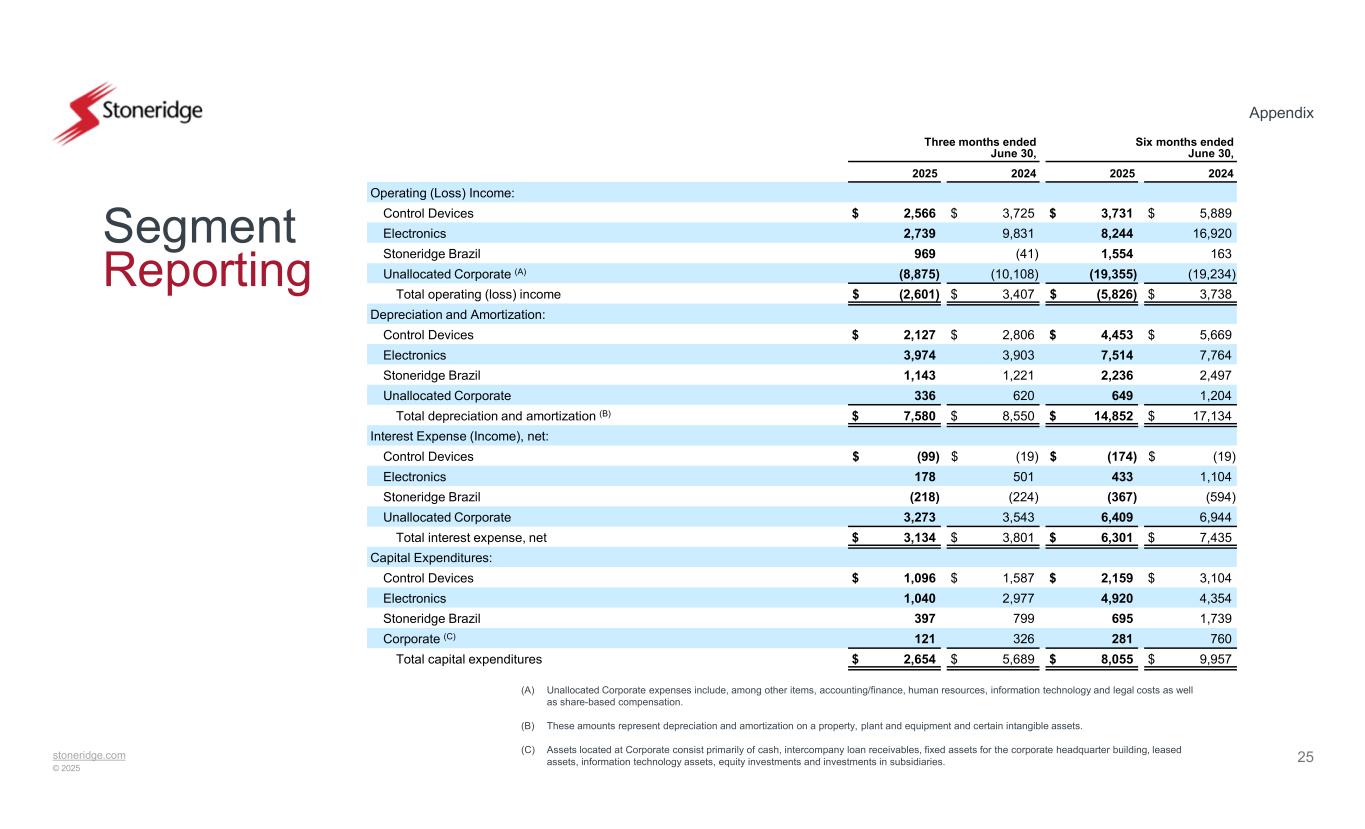

Second Quarter in Review

Electronics second quarter sales of $149.6 million increased by 6.4% relative to the first quarter of 2025. This was primarily driven by favorable foreign currency translation of $8.1 million and higher MirrorEye sales including the ramp-up of recently launched OEM programs, offset by lower sales in the European commercial vehicle end market. Second quarter adjusted operating margin of 2.8% declined by 210 basis points relative to the first quarter of 2025, primarily due to higher material costs, primarily driven by unfavorable sales mix, and higher SG&A, partially offset by lower quality-related costs.

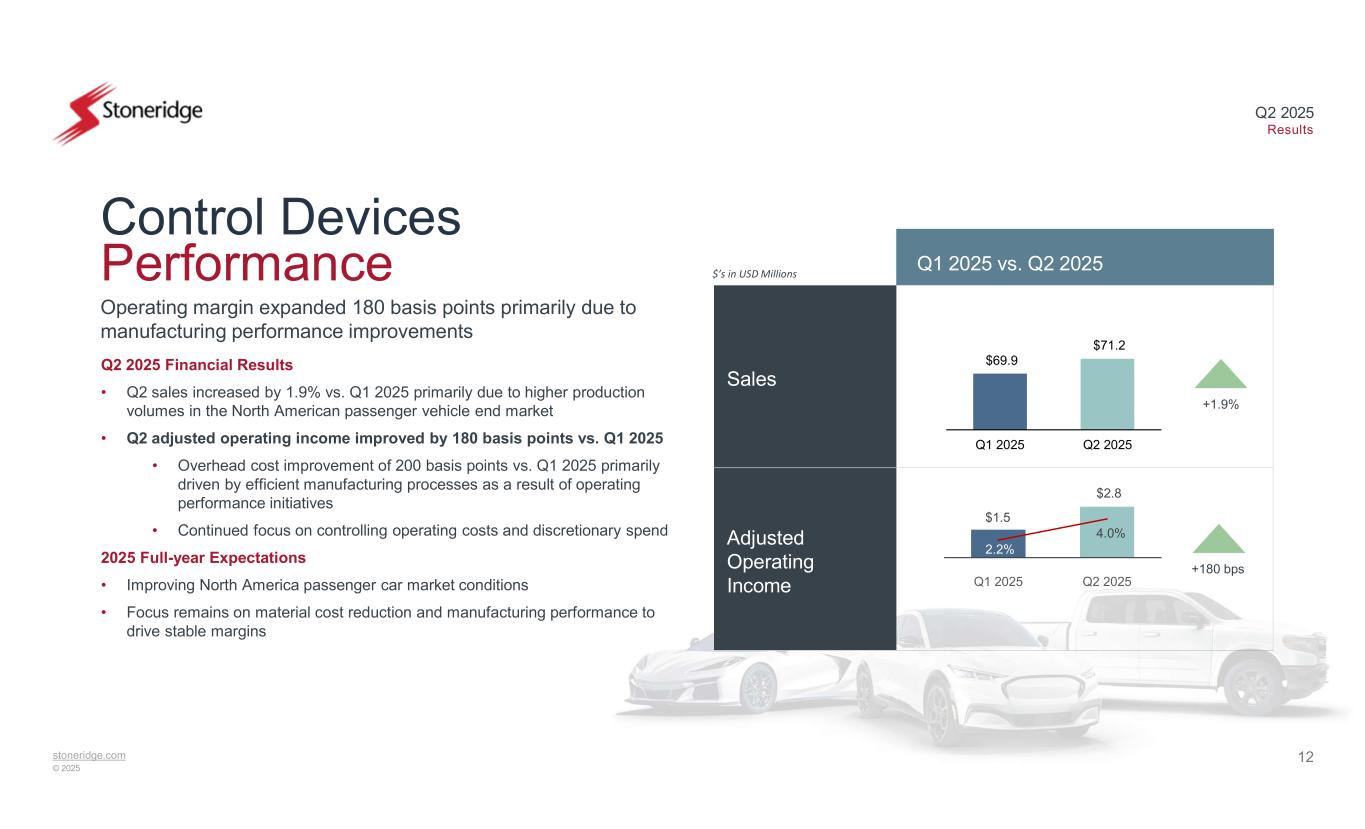

Control Devices second quarter sales of $71.2 million increased by 1.9% relative to the first quarter of 2025 driven by higher production volumes in the North American passenger vehicle end market. Second quarter adjusted operating margin of 4.0% increased by 180 basis points relative to the first quarter of 2025, primarily due to the contribution from higher sales and improved overhead costs as well as lower D&D costs.

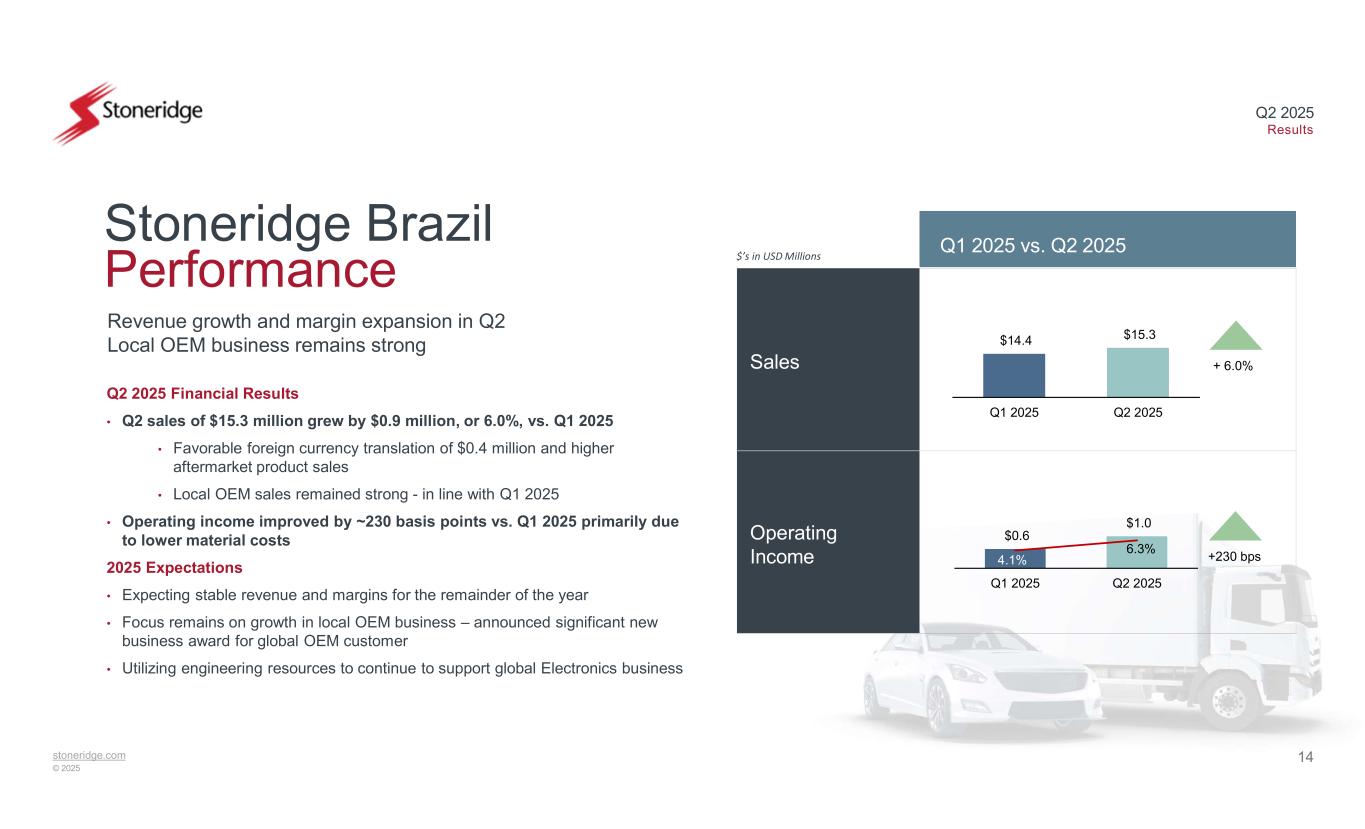

Stoneridge Brazil second quarter sales of $15.3 million increased by $0.9 million, or 6.0%, relative to the first quarter of 2025, driven by favorable foreign currency translation of $0.4 million and higher aftermarket product sales. Second quarter operating income of $1.0 million increased by approximately $0.4 million relative to the first quarter of 2025, primarily due to higher contribution from higher sales and lower material costs.

Relative to the second quarter of 2024, Electronics second quarter sales decreased by 2.6%. This decrease was primarily driven by lower production volumes in the North American commercial vehicle end market, partially offset by higher MirrorEye sales, including the ramp-up of recently launched OEM programs, and favorable foreign currency translation of $7.0 million. Second quarter adjusted operating margin of 2.8% decreased by 490 basis points relative to the second quarter of 2024, primarily driven by lower contribution from lower production volumes as well as higher material cost due to unfavorable sales mix and higher D&D expense due to lower customer reimbursements. This was partially offset by lower quality-related costs relative to the second quarter of 2024.

Relative to the second quarter of 2024, Control Devices second quarter sales decreased by 12.0%. This decrease was primarily due to lower customer production volumes in the North American passenger vehicle end market, as well as the expected wind-down of an end-of-life program. Second quarter adjusted operating margin of 4.0% decreased by 60 basis points relative to the second quarter of 2024, primarily due to lower contribution from lower sales offset by lower quality-related costs and D&D costs.

Relative to the second quarter of 2024, Stoneridge Brazil second quarter sales increased by $3.4 million, or 28.9%. This increase was primarily driven by higher OEM product sales, partially offset by unfavorable foreign currency translation of $0.9 million. Second quarter operating income of $1.0 million increased by approximately $1.0 million relative to the second quarter of 2024 due to higher contribution from higher sales.

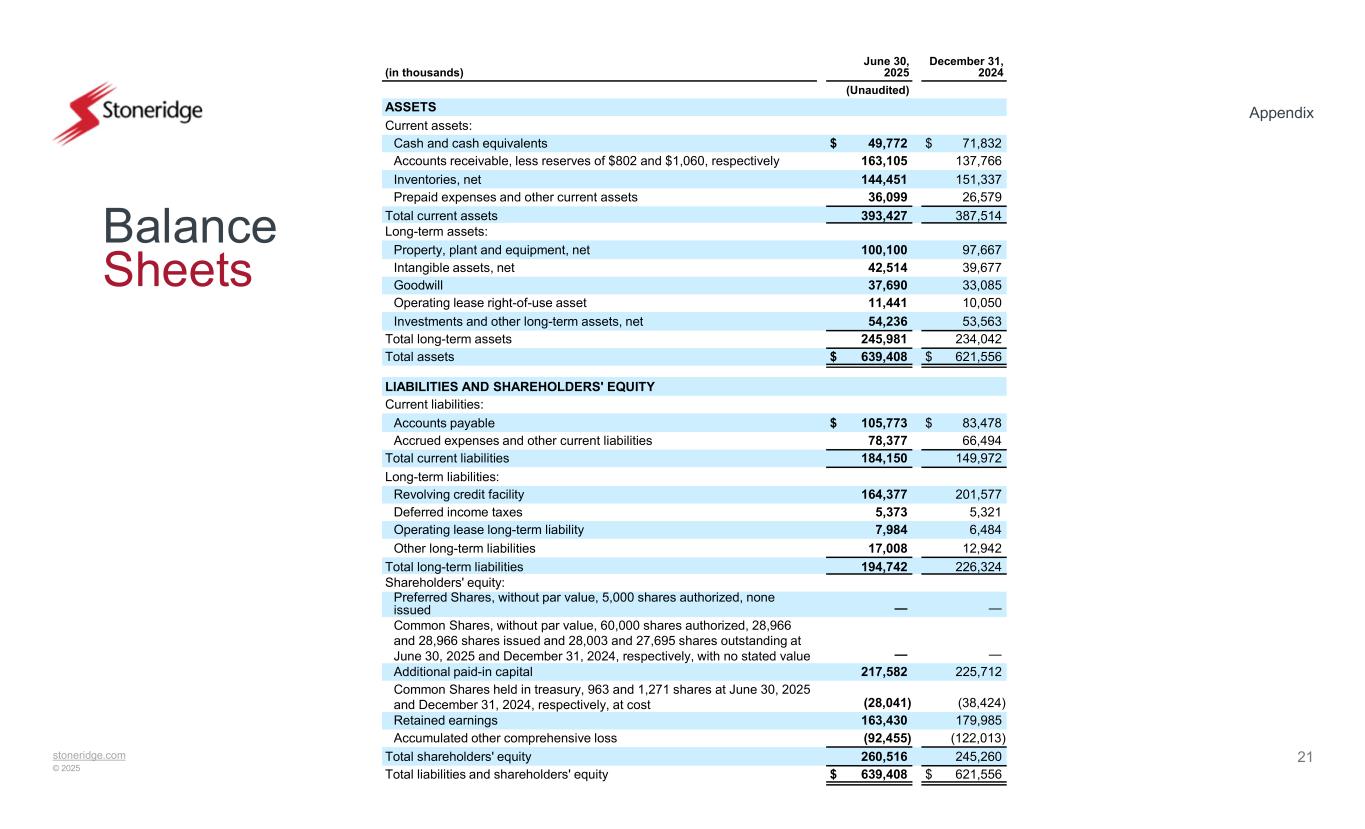

Cash and Debt Balances

As of June 30, 2025, Stoneridge had cash and cash equivalents totaling $49.8 million and total debt of $164.4 million. During the second quarter of 2025, the Company generated $10.7 million in net cash provided by operating activities and $7.6 million in free cash flow, an increase of $2.0 million and $5.9 million, respectively, relative to the second quarter of 2024. In addition, the Company reduced its total debt and net debt by $38.8 million and $9.5 million, respectively, relative to the first quarter, driven primarily by a $43.8 million global cash repatriation program and an inventory reduction of $7.3 million.

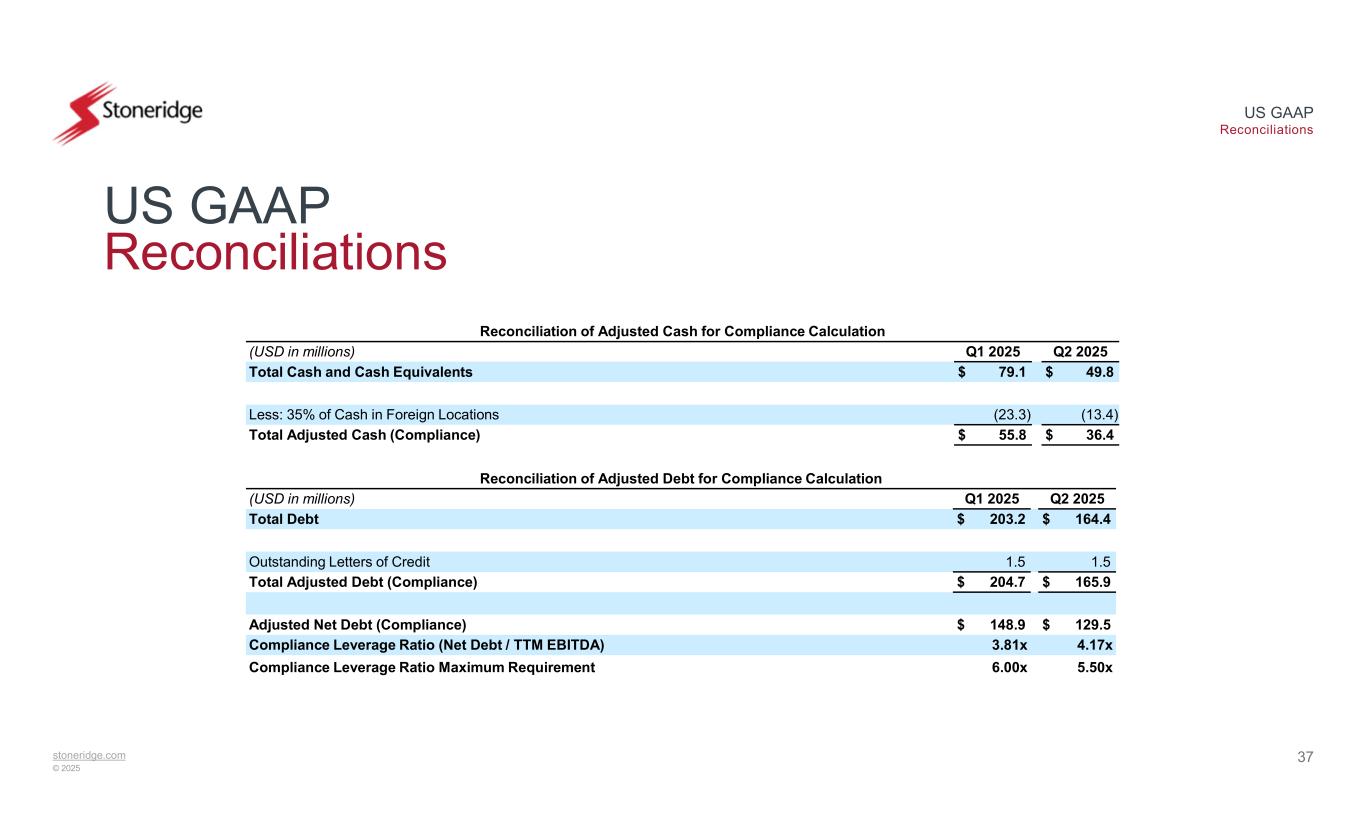

For Credit Facility compliance purposes, adjusted net debt was $129.5 million while adjusted EBITDA for the trailing twelve months was $31.1 million, resulting in an adjusted net debt to trailing twelve-month EBITDA compliance leverage ratio of 4.17x relative to a required leverage ratio of not greater than 5.50x as per the amended Credit Facility agreement.

Matt Horvath, chief financial officer, commented, “During the quarter, we continued to improve our cash performance driving working capital reductions through continued management of our inventory. Additionally, we executed on a global cash repatriation program that resulted in the tax-efficient repatriation of $43.8 million. We utilized this cash to pay down debt in North America resulting in a net debt reduction of $19.4 million in the quarter for compliance calculation purposes. We remain confident the Company has sufficient liquidity and flexibility to operate in the current macroeconomic environment.”

The Company continues to expect to remain compliant with all amended compliance ratios and is targeting a compliance net debt to EBITDA leverage ratio of approximately 2.5x by the end of the year, relative to a 3.5x leverage ratio requirement by the end of the year.

2025 Outlook

The Company is maintaining its previously provided full-year 2025 sales guidance range of $860 million to $890 million. The Company is narrowing its adjusted gross margin guidance to 22.0% to 22.25%, maintaining its adjusted operating margin guidance of 0.75% to 1.25%, and updating its adjusted EBITDA guidance to $34 million to $38 million, or approximately 4.0% to 4.3% of sales. The Company is also maintaining its full-year 2025 guidance range for free cash flow of $25 million to $30 million.

Horvath commented, “We are maintaining our full-year 2025 sales guidance as production volume headwinds, primarily in the North American commercial vehicle end market, are expected to be offset by favorable foreign currency benefits. We expect strong operating performance and reduced operating expenses to approximately offset the expected production headwinds. We are updating our adjusted EBITDA guidance to $34 million to $38 million, or a midpoint reduction of $4.0 million, to reflect the $3.0 million non-operating foreign currency headwind recognized in the first half of the year and approximately $1.0 million of tariff-related expenses based on current tariff policies, neither of which were assumed in our initial guidance. Finally, we remain committed to strong cash performance through continued inventory reductions and careful management of our capital expenditures and as such are maintaining our full-year free cash flow guidance to $25 million to $30 million.”

Horvath concluded, “We remain focused on building a strong foundation for continued earnings expansion as we capitalize on our impressive portfolio of advanced technologies. We will continue to monitor shifts in macroeconomic policies, including tariffs, and the impacts on our business to ensure that we respond quickly to offset any incremental costs, just as we have done historically. As demonstrated by our new business award announcements this quarter, Stoneridge remains well positioned to outperform our underlying markets and drive margin expansion resulting in long-term shareholder value creation.”

Conference Call on the Web

A live Internet broadcast of Stoneridge’s conference call regarding 2025 second quarter results can be accessed at 9:00 a.m. Eastern Time on Thursday, August 7, 2025, at www.stoneridge.com, which will also offer a webcast replay.

About Stoneridge, Inc.

Stoneridge, Inc., headquartered in Novi, Michigan, is a global supplier of safe and efficient electronic systems and technologies. Our systems and products power vehicle intelligence, while enabling safety and security for on- and off-highway transportation sectors around the world.

Additional information about Stoneridge can be found at www.stoneridge.com.

Forward-Looking Statements

Statements in this press release contain “forward-looking statements” under the Private Securities Litigation Reform Act of 1995. These statements appear in a number of places in this report and may include statements regarding the intent, belief or current expectations of the Company, with respect to, among other things, our (i) future product and facility expansion, (ii) acquisition strategy, (iii) investments and new product development, (iv) growth opportunities related to awarded business, and (v) operational expectations. Forward-looking statements may be identified by the words “will,” “may,” “should,” “designed to,” “believes,” “plans,” “projects,” “intends,” “expects,” “estimates,” “anticipates,” “continue,” and similar words and expressions. The forward-looking statements are subject to risks and uncertainties that could cause actual events or results to differ materially from those expressed in or implied by these statements. Important factors that could cause actual results to differ materially from those in the forward-looking statements include, among other factors:

•the ability of our suppliers to supply us with parts and components at competitive prices on a timely basis, including the impact of potential tariffs and trade considerations on their operations and output;

•fluctuations in the cost and availability of key materials and components (including semiconductors, printed circuit boards, resin, aluminum, steel and copper) and our ability to offset cost increases through negotiated price increases with our customers or other cost reduction actions, as necessary;

•global economic trends, competition and geopolitical risks, including impacts from ongoing or potential global conflicts and any related sanctions and other measures, or an escalation of sanctions, tariffs or other trade tensions between the U.S. and other countries;

•tariffs specifically in countries where we have significant direct or indirect manufacturing or supply chain exposure and our ability to either mitigate the impact of tariffs or pass any incremental costs to our customers;

•our ability to achieve cost reductions that offset or exceed customer-mandated selling price reductions;

•the reduced purchases, loss, financial distress or bankruptcy of a major customer or supplier;

•the costs and timing of business realignment, facility closures or similar actions;

•a significant change in commercial, automotive, off-highway or agricultural vehicle production;

•competitive market conditions and resulting effects on sales and pricing;

•foreign currency fluctuations and our ability to manage those impacts;

•customer acceptance of new products;

•our ability to successfully launch/produce products for awarded business;

•adverse changes in laws, government regulations or market conditions affecting our products, our suppliers, or our customers’ products;

•our ability to protect our intellectual property and successfully defend against assertions made against us;

•liabilities arising from warranty claims, product recall or field actions, product liability and legal proceedings to which we are or may become a party, or the impact of product recall or field actions on our customers;

•labor disruptions at our facilities, or at any of our significant customers or suppliers;

•business disruptions due to natural disasters or other disasters outside of our control;

•the amount of our indebtedness and the restrictive covenants contained in the agreements governing our indebtedness, including our revolving Credit Facility;

•capital availability or costs, including changes in interest rates;

•the failure to achieve the successful integration of any acquired company or business;

•risks related to a failure of our information technology systems and networks, and risks associated with current and emerging technology threats and damage from computer viruses, unauthorized access, cyber-attack and other similar disruptions; and

•the items described in Part I, Item IA (“Risk Factors”) in the Company’s 2024 Form 10-K.

The forward-looking statements contained herein represent our estimates only as of the date of this release and should not be relied upon as representing our estimates as of any subsequent date. While we may elect to update these forward-looking statements at some point in the future, we specifically disclaim any obligation to do so, whether to reflect actual results, changes in assumptions, changes in other factors affecting such forward-looking statements or otherwise.

There can be no assurance that the strategic review of the Control Devices business will result in a transaction. The Company does not intend to comment further regarding this matter unless and until further disclosure is determined to be appropriate.

Use of Non-GAAP Financial Information

This press release contains information about the Company’s financial results that is not presented in accordance with accounting principles generally accepted in the United States (“GAAP”). Such non-GAAP financial measures are reconciled to their closest GAAP financial measures at the end of this press release. The provision of these non-GAAP financial measures for 2025 and 2024 is not intended to indicate that Stoneridge is explicitly or implicitly providing projections on those non-GAAP financial measures, and actual results for such measures are likely to vary from those presented. The reconciliations include all information reasonably available to the Company at the date of this press release and the adjustments that management can reasonably estimate.

In evaluating its business, the Company considers and uses free cash flow and net debt as supplemental measures of its liquidity and the other non-GAAP financial measures as supplemental measures of its operating performance. Management believes the non-GAAP financial measures used in this press release are useful to both management and investors in their analysis of the Company’s financial position and results of operations. In particular, management believes that adjusted gross profit and margin, adjusted operating income (loss) and margin, adjusted income (loss) before tax, adjusted income tax expense (benefit), adjusted net income (loss), adjusted EPS, EBITDA, adjusted EBITDA, adjusted debt, adjusted net debt, adjusted cash and free cash flow are useful measures in assessing the Company’s financial performance by excluding certain items that are not indicative of the Company’s core operating performance or that may obscure trends useful in evaluating the Company’s continuing operating activities. Management also believes that these measures are useful to both management and investors in their analysis of the Company’s results of operations and provide improved comparability between fiscal periods.

Adjusted gross profit and margin, adjusted operating income (loss) and margin, adjusted income (loss) before tax, adjusted income tax expense (benefit), adjusted net income (loss), adjusted EPS, EBITDA, adjusted EBITDA, adjusted debt, adjusted net debt, adjusted cash and free cash flow should not be considered in isolation or as a substitute for gross profit, operating income (loss), income (loss) before tax, income tax expense (benefit), net income (loss), EPS, debt, cash and cash equivalents, cash provided by operating activities or other income statement or cash flow statement data prepared in accordance with GAAP.

For more information, contact Kelly K. Harvey, Director Investor Relations (Kelly.Harvey@Stoneridge.com).

CONDENSED CONSOLIDATED BALANCE SHEETS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (in thousands) |

|

June 30,

2025 |

|

December 31,

2024 |

|

|

(Unaudited) |

|

|

| ASSETS |

|

|

|

|

| Current assets: |

|

|

|

|

| Cash and cash equivalents |

|

$ |

49,772 |

|

|

$ |

71,832 |

|

Accounts receivable, less reserves of $802 and $1,060, respectively |

|

163,105 |

|

|

137,766 |

|

| Inventories, net |

|

144,451 |

|

|

151,337 |

|

| Prepaid expenses and other current assets |

|

36,099 |

|

|

26,579 |

|

| Total current assets |

|

393,427 |

|

|

387,514 |

|

| Long-term assets: |

|

|

|

|

| Property, plant and equipment, net |

|

100,100 |

|

|

97,667 |

|

| Intangible assets, net |

|

42,514 |

|

|

39,677 |

|

| Goodwill |

|

37,690 |

|

|

33,085 |

|

| Operating lease right-of-use asset |

|

11,441 |

|

|

10,050 |

|

| Investments and other long-term assets, net |

|

54,236 |

|

|

53,563 |

|

| Total long-term assets |

|

245,981 |

|

|

234,042 |

|

| Total assets |

|

$ |

639,408 |

|

|

$ |

621,556 |

|

|

|

|

|

|

| LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

105,773 |

|

|

$ |

83,478 |

|

| Accrued expenses and other current liabilities |

|

78,377 |

|

|

66,494 |

|

| Total current liabilities |

|

184,150 |

|

|

149,972 |

|

| Long-term liabilities: |

|

|

|

|

| Revolving credit facility |

|

164,377 |

|

|

201,577 |

|

| Deferred income taxes |

|

5,373 |

|

|

5,321 |

|

| Operating lease long-term liability |

|

7,984 |

|

|

6,484 |

|

| Other long-term liabilities |

|

17,008 |

|

|

12,942 |

|

| Total long-term liabilities |

|

194,742 |

|

|

226,324 |

|

| Shareholders' equity: |

|

|

|

|

Preferred Shares, without par value, 5,000 shares authorized, none issued |

|

— |

|

|

— |

|

Common Shares, without par value, 60,000 shares authorized, 28,966 and 28,966 shares issued and 28,003 and 27,695 shares outstanding at June 30, 2025 and December 31, 2024, respectively, with no stated value |

|

— |

|

|

— |

|

| Additional paid-in capital |

|

217,582 |

|

|

225,712 |

|

Common Shares held in treasury, 963 and 1,271 shares at June 30, 2025 and December 31, 2024, respectively, at cost |

|

(28,041) |

|

|

(38,424) |

|

| Retained earnings |

|

163,430 |

|

|

179,985 |

|

| Accumulated other comprehensive loss |

|

(92,455) |

|

|

(122,013) |

|

| Total shareholders' equity |

|

260,516 |

|

|

245,260 |

|

| Total liabilities and shareholders' equity |

|

$ |

639,408 |

|

|

$ |

621,556 |

|

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended

June 30, |

|

Six months ended

June 30, |

| (in thousands, except per share data) |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

|

|

|

|

|

|

|

|

|

| Net sales |

|

$ |

227,952 |

|

|

$ |

237,059 |

|

|

$ |

445,842 |

|

|

$ |

476,216 |

|

| Costs and expenses: |

|

|

|

|

|

|

|

|

| Cost of goods sold |

|

179,014 |

|

|

183,319 |

|

|

350,607 |

|

|

374,119 |

|

| Selling, general and administrative |

|

32,835 |

|

|

31,876 |

|

|

64,531 |

|

|

62,299 |

|

| Design and development |

|

18,704 |

|

|

18,457 |

|

|

36,530 |

|

|

36,060 |

|

| Operating (loss) income |

|

(2,601) |

|

|

3,407 |

|

|

(5,826) |

|

|

3,738 |

|

| Interest expense, net |

|

3,134 |

|

|

3,801 |

|

|

6,301 |

|

|

7,435 |

|

| Equity in (earnings) loss of investee |

|

(50) |

|

|

52 |

|

|

(344) |

|

|

329 |

|

| Other expense (income), net |

|

3,430 |

|

|

(2,296) |

|

|

2,964 |

|

|

(260) |

|

| (Loss) income before income taxes |

|

(9,115) |

|

|

1,850 |

|

|

(14,747) |

|

|

(3,766) |

|

| Provision (benefit) for income taxes |

|

244 |

|

|

(936) |

|

|

1,808 |

|

|

(426) |

|

| Net (loss) income |

|

$ |

(9,359) |

|

|

$ |

2,786 |

|

|

$ |

(16,555) |

|

|

$ |

(3,340) |

|

|

|

|

|

|

|

|

|

|

| (Loss) income per share: |

|

|

|

|

|

|

|

|

| Basic |

|

$ |

(0.34) |

|

|

$ |

0.10 |

|

|

$ |

(0.60) |

|

|

$ |

(0.12) |

|

| Diluted |

|

$ |

(0.34) |

|

|

$ |

0.10 |

|

|

$ |

(0.60) |

|

|

$ |

(0.12) |

|

|

|

|

|

|

|

|

|

|

| Weighted-average shares outstanding: |

|

|

|

|

|

|

|

|

| Basic |

|

27,788 |

|

27,611 |

|

27,734 |

|

27,570 |

| Diluted |

|

27,788 |

|

27,853 |

|

27,734 |

|

27,570 |

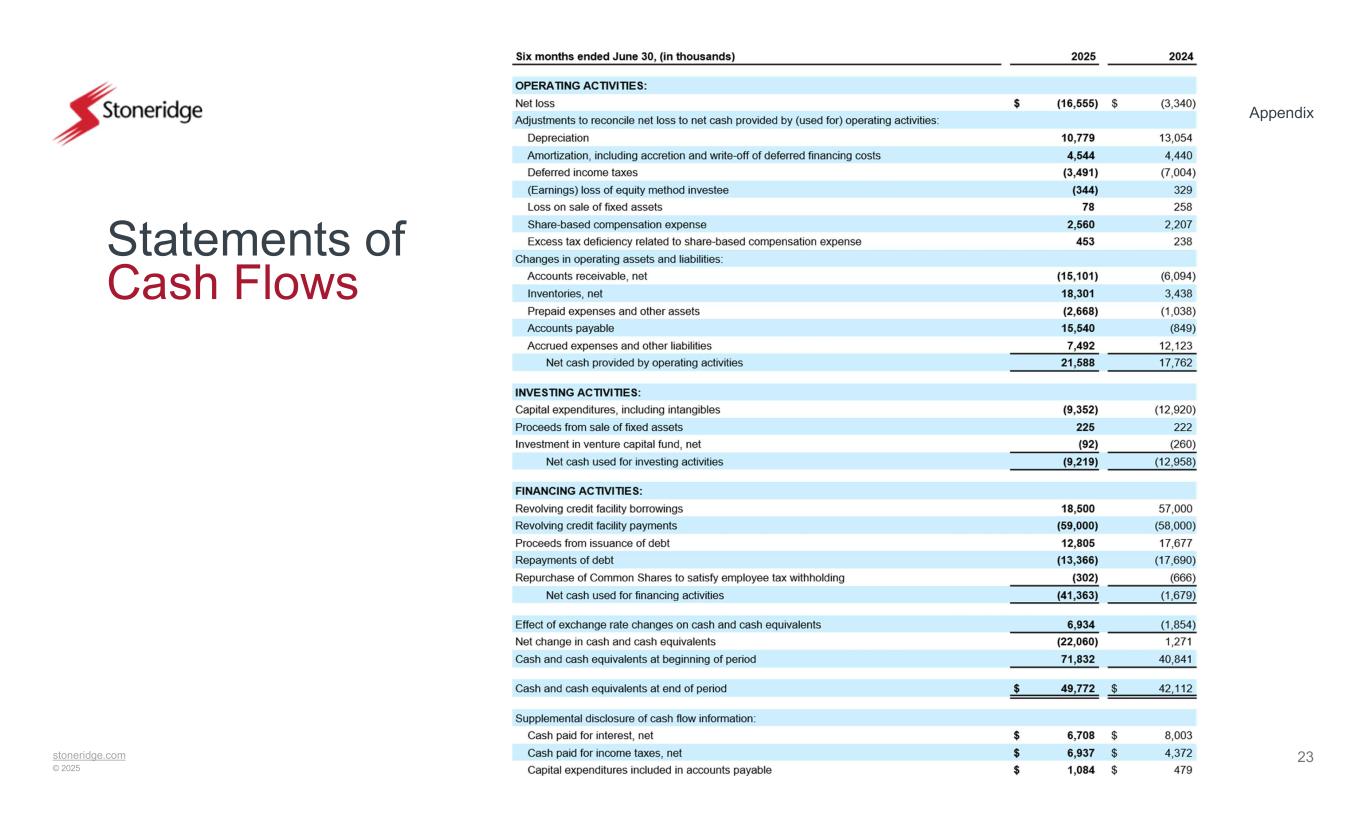

CONSOLIDATED STATEMENTS OF CASH FLOWS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Six months ended June 30, (in thousands) |

|

2025 |

|

2024 |

|

|

|

|

|

| OPERATING ACTIVITIES: |

|

|

|

|

| Net loss |

|

$ |

(16,555) |

|

|

$ |

(3,340) |

|

| Adjustments to reconcile net loss to net cash provided by (used for) operating activities: |

|

|

|

|

| Depreciation |

|

10,779 |

|

|

13,054 |

|

| Amortization, including accretion and write-off of deferred financing costs |

|

4,544 |

|

|

4,440 |

|

| Deferred income taxes |

|

(3,491) |

|

|

(7,004) |

|

| (Earnings) loss of equity method investee |

|

(344) |

|

|

329 |

|

| Loss on sale of fixed assets |

|

78 |

|

|

258 |

|

| Share-based compensation expense |

|

2,560 |

|

|

2,207 |

|

| Excess tax deficiency related to share-based compensation expense |

|

453 |

|

|

238 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Changes in operating assets and liabilities: |

|

|

|

|

| Accounts receivable, net |

|

(15,101) |

|

|

(6,094) |

|

| Inventories, net |

|

18,301 |

|

|

3,438 |

|

| Prepaid expenses and other assets |

|

(2,668) |

|

|

(1,038) |

|

| Accounts payable |

|

15,540 |

|

|

(849) |

|

| Accrued expenses and other liabilities |

|

7,492 |

|

|

12,123 |

|

| Net cash provided by operating activities |

|

21,588 |

|

|

17,762 |

|

|

|

|

|

|

| INVESTING ACTIVITIES: |

|

|

|

|

| Capital expenditures, including intangibles |

|

(9,352) |

|

|

(12,920) |

|

| Proceeds from sale of fixed assets |

|

225 |

|

|

222 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Investment in venture capital fund, net |

|

(92) |

|

|

(260) |

|

| Net cash used for investing activities |

|

(9,219) |

|

|

(12,958) |

|

|

|

|

|

|

| FINANCING ACTIVITIES: |

|

|

|

|

| Revolving credit facility borrowings |

|

18,500 |

|

|

57,000 |

|

| Revolving credit facility payments |

|

(59,000) |

|

|

(58,000) |

|

| Proceeds from issuance of debt |

|

12,805 |

|

|

17,677 |

|

| Repayments of debt |

|

(13,366) |

|

|

(17,690) |

|

|

|

|

|

|

| Repurchase of Common Shares to satisfy employee tax withholding |

|

(302) |

|

|

(666) |

|

| Net cash used for financing activities |

|

(41,363) |

|

|

(1,679) |

|

|

|

|

|

|

| Effect of exchange rate changes on cash and cash equivalents |

|

6,934 |

|

|

(1,854) |

|

| Net change in cash and cash equivalents |

|

(22,060) |

|

|

1,271 |

|

| Cash and cash equivalents at beginning of period |

|

71,832 |

|

|

40,841 |

|

|

|

|

|

|

| Cash and cash equivalents at end of period |

|

$ |

49,772 |

|

|

$ |

42,112 |

|

|

|

|

|

|

| Supplemental disclosure of cash flow information: |

|

|

|

|

| Cash paid for interest, net |

|

$ |

6,708 |

|

|

$ |

8,003 |

|

| Cash paid for income taxes, net |

|

$ |

6,937 |

|

|

$ |

4,372 |

|

| Capital expenditures included in accounts payable |

|

$ |

1,084 |

|

|

$ |

479 |

|

Regulation G Non-GAAP Financial Measure Reconciliations

Exhibit 1 - Reconciliation of Adjusted Operating Income (Loss)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation of Adjusted Operating Income (Loss) |

|

|

| (USD in millions) |

Q2 2024 |

|

|

|

|

|

|

|

|

|

Q2 2025 |

|

|

| Operating Income (Loss) |

$ |

3.4 |

|

|

|

|

|

|

|

|

|

|

$ |

(2.6) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Add: Pre-Tax Business Realignment Costs |

1.9 |

|

|

|

|

|

|

|

|

|

|

1.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Add: Pre-Tax Strategic Review Costs |

— |

|

|

|

|

|

|

|

|

|

|

1.0 |

|

|

|

| Add: Pre-Tax Share-Based Compensation Accelerated Vesting |

— |

|

|

|

|

|

|

|

|

|

|

0.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted Operating Income (Loss) |

$ |

5.4 |

|

|

|

|

|

|

|

|

|

|

$ |

0.4 |

|

|

|

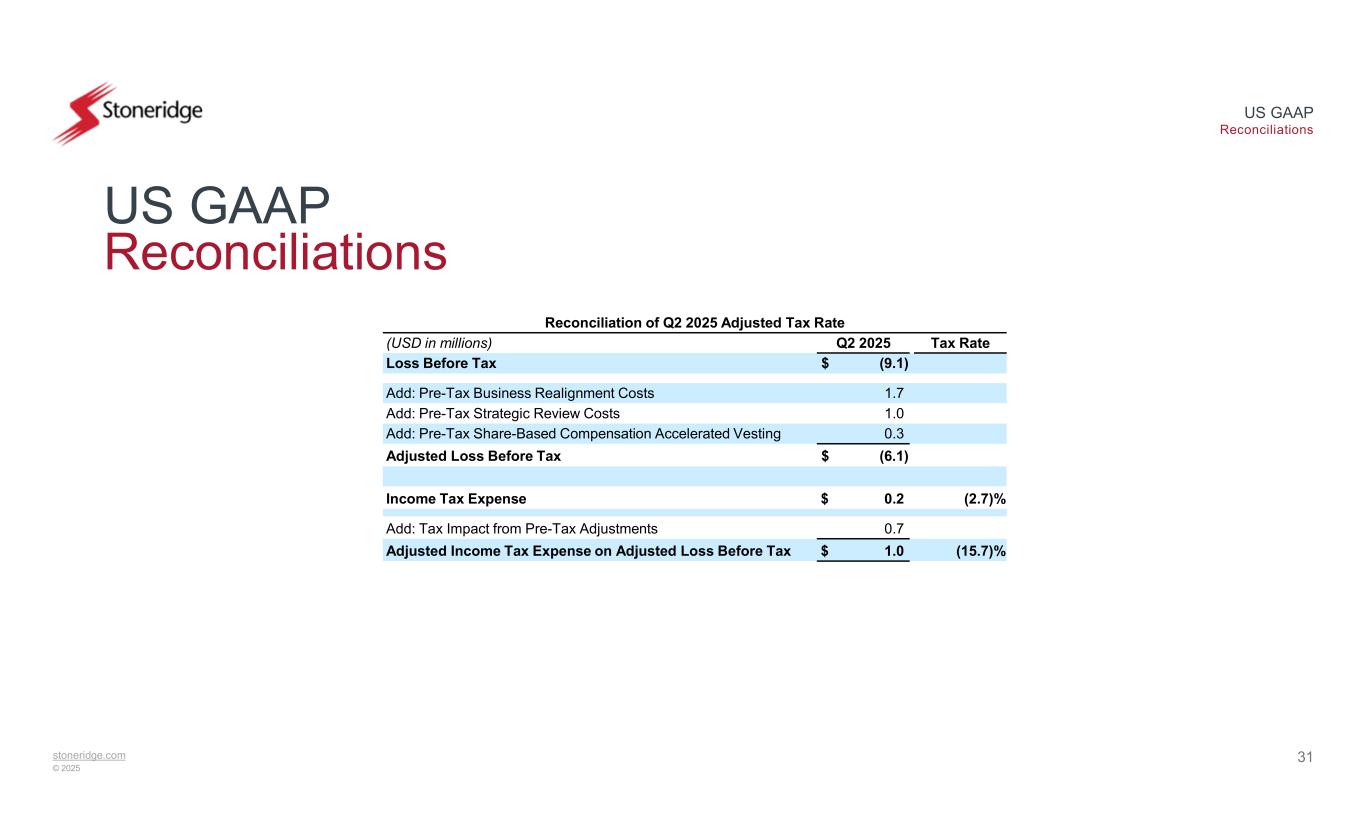

Exhibit 2 – Reconciliation of Adjusted Tax Rate

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Q2 2025 Adjusted Tax Rate |

|

| (USD in millions) |

Q2 2025 |

|

Tax Rate |

|

| Loss Before Tax |

$ |

(9.1) |

|

|

|

|

|

|

|

|

|

| Add: Pre-Tax Business Realignment Costs |

1.7 |

|

|

|

|

| Add: Pre-Tax Strategic Review Costs |

1.0 |

|

|

|

|

| Add: Pre-Tax Share-Based Compensation Accelerated Vesting |

0.3 |

|

|

|

|

|

|

|

|

|

| Adjusted Loss Before Tax |

$ |

(6.1) |

|

|

|

|

|

|

|

|

|

| Income Tax Expense |

$ |

0.2 |

|

|

(2.7) |

% |

|

|

|

|

|

|

| Add: Tax Impact from Pre-Tax Adjustments |

0.7 |

|

|

|

|

|

|

|

|

|

| Adjusted Income Tax Expense on Adjusted Loss Before Tax |

$ |

1.0 |

|

|

(15.7) |

% |

|

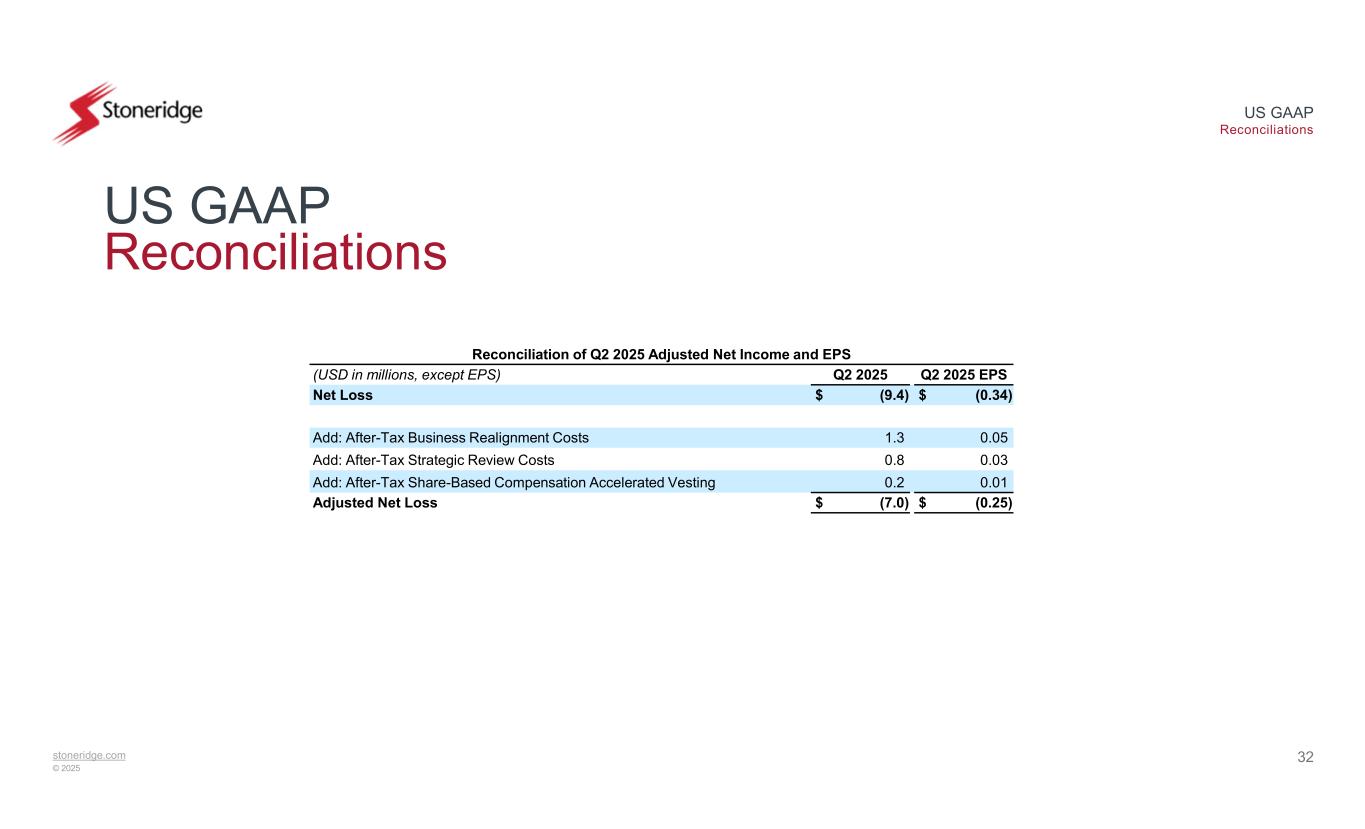

Exhibit 3 - Reconciliation of Adjusted Net Loss and EPS

|

|

|

|

|

|

|

|

|

|

|

|

|

| (USD in millions, except EPS) |

Q2 2025 |

|

Q2 2025 EPS |

| Net Loss |

$ |

(9.4) |

|

|

$ |

(0.34) |

|

|

|

|

|

| Add: After-Tax Business Realignment Costs |

1.3 |

|

|

0.05 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Add: After-Tax Strategic Review Costs |

0.8 |

|

|

0.03 |

|

| Add: After-Tax Share-Based Compensation Accelerated Vesting |

0.2 |

|

|

0.01 |

|

|

|

|

|

|

|

|

|

| Adjusted Net Loss |

$ |

(7.0) |

|

|

$ |

(0.25) |

|

Exhibit 4 – Reconciliation of Adjusted EBITDA

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation of Adjusted EBITDA |

|

|

| (USD in millions) |

|

|

Q2 2024 |

|

|

|

Q3 2024 |

|

Q4 2024 |

|

Q1 2025 |

|

Q2 2025 |

|

|

| Income (Loss) Before Tax |

|

|

$ |

1.9 |

|

|

|

|

$ |

(3.7) |

|

|

$ |

(6.2) |

|

|

$ |

(5.6) |

|

|

$ |

(9.1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense, net |

|

|

3.8 |

|

|

|

|

3.6 |

|

|

3.4 |

|

|

3.2 |

|

|

3.1 |

|

|

|

| Depreciation and amortization |

|

|

8.5 |

|

|

|

|

8.8 |

|

|

8.3 |

|

|

7.3 |

|

|

7.6 |

|

|

|

| EBITDA |

|

|

$ |

14.2 |

|

|

|

|

$ |

8.8 |

|

|

$ |

5.5 |

|

|

$ |

4.8 |

|

|

$ |

1.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Add: Pre-Tax Business Realignment Costs |

|

|

1.9 |

|

|

|

|

0.3 |

|

|

0.4 |

|

|

2.8 |

|

|

1.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Add: Pre-Tax Environmental Remediation Costs |

|

|

— |

|

|

|

|

0.2 |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Add: Pre-Tax Strategic Review Costs |

|

|

— |

|

|

|

|

— |

|

|

— |

|

|

— |

|

|

1.0 |

|

|

|

| Add: Pre-Tax Share-Based Compensation Accelerated Vesting |

|

|

— |

|

|

|

|

— |

|

|

— |

|

|

— |

|

|

0.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

|

$ |

16.1 |

|

|

|

|

$ |

9.2 |

|

|

$ |

6.0 |

|

|

$ |

7.6 |

|

|

$ |

4.6 |

|

|

|

Exhibit 5 – Segment Adjusted Operating Income (Loss)

Reconciliation of Control Devices Adjusted Operating Income

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (USD in millions) |

Q2 2024 |

|

|

|

|

|

|

|

Q1 2025 |

|

Q2 2025 |

|

|

| Control Devices Operating Income |

$ |

3.7 |

|

|

|

|

|

|

|

|

$ |

1.2 |

|

|

$ |

2.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Add: Pre-Tax Business Realignment Costs |

— |

|

|

|

|

|

|

|

|

0.4 |

|

|

0.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Control Devices Adjusted Operating Income |

$ |

3.7 |

|

|

|

|

|

|

|

|

$ |

1.5 |

|

|

$ |

2.8 |

|

|

|

Reconciliation of Electronics Adjusted Operating Income

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (USD in millions) |

Q2 2024 |

|

|

|

|

|

|

|

Q1 2025 |

|

Q2 2025 |

|

|

| Electronics Operating Income |

$ |

9.8 |

|

|

|

|

|

|

|

|

$ |

5.5 |

|

|

$ |

2.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Add: Pre-Tax Business Realignment Costs |

1.9 |

|

|

|

|

|

|

|

|

1.4 |

|

|

1.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Electronics Adjusted Operating Income |

$ |

11.7 |

|

|

|

|

|

|

|

|

$ |

6.9 |

|

|

$ |

4.2 |

|

|

|

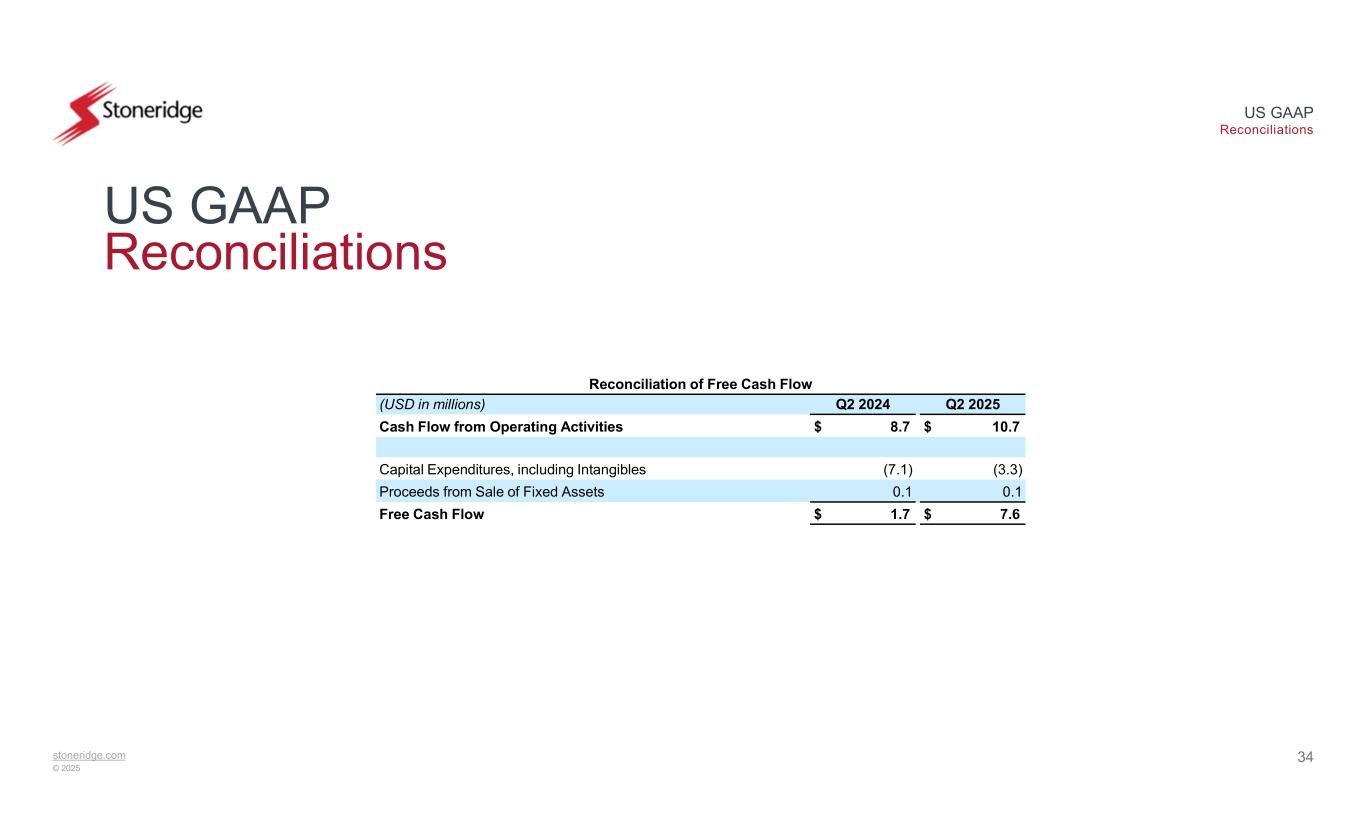

Exhibit 6 – Reconciliation of Free Cash Flow

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (USD in millions) |

Q2 2024 |

|

|

|

Q2 2025 |

|

|

| Cash Flow from Operating Activities |

$ |

8.7 |

|

|

|

|

$ |

10.7 |

|

|

|

|

|

|

|

|

|

|

|

| Capital Expenditures, including Intangibles |

(7.1) |

|

|

|

(3.3) |

|

|

| Proceeds from Sale of Fixed Assets |

0.1 |

|

|

|

0.1 |

|

|

|

|

|

|

|

|

|

|

| Free Cash Flow |

$ |

1.7 |

|

|

|

|

$ |

7.6 |

|

|

|

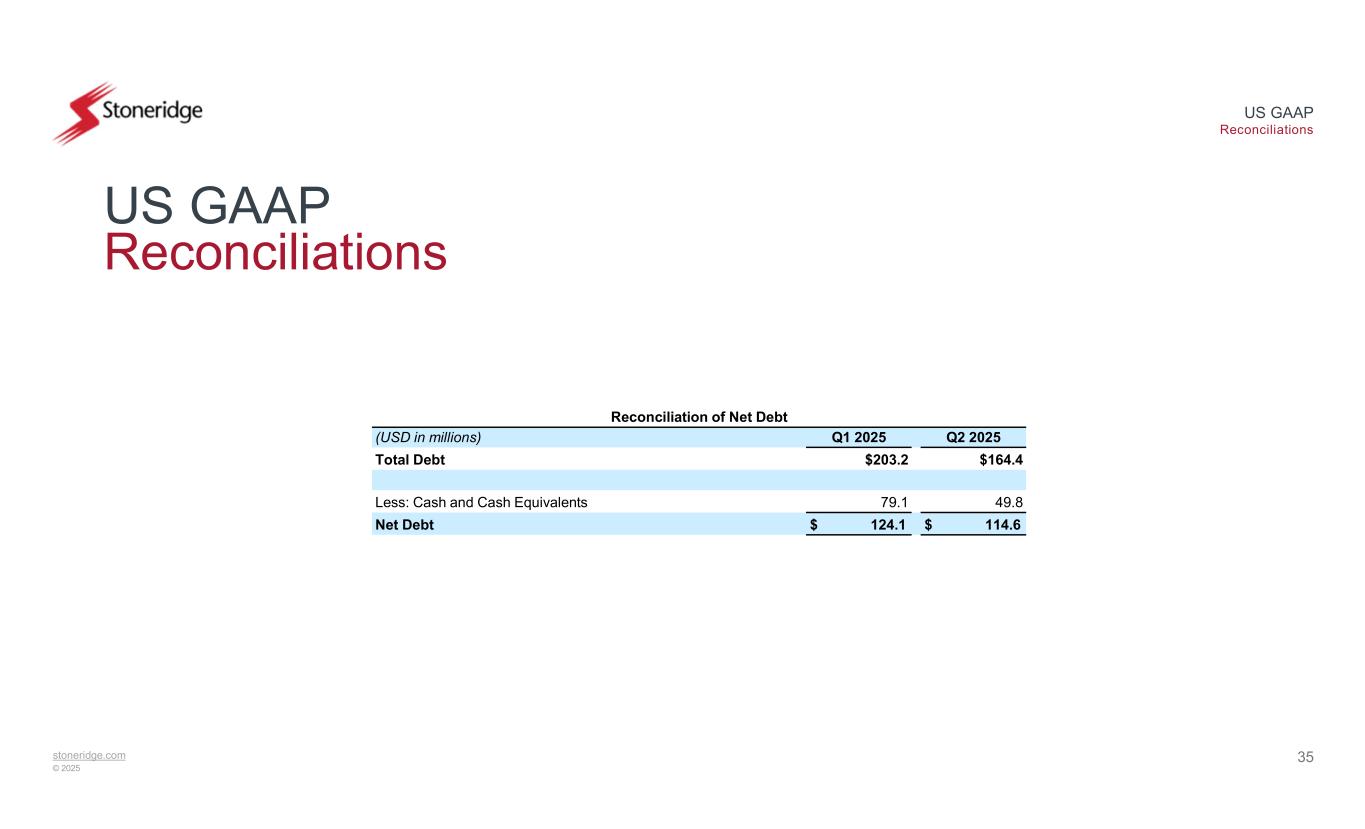

Exhibit 7 – Reconciliation of Net Debt

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (USD in millions) |

Q1 2025 |

|

|

|

Q2 2025 |

|

|

| Total Debt |

$203.2 |

|

|

|

$164.4 |

|

|

|

|

|

|

|

|

|

|

| Less: Cash and Cash Equivalents |

79.1 |

|

|

|

49.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Debt |

$ |

124.1 |

|

|

|

|

$ |

114.6 |

|

|

|

Exhibit 8 – Reconciliation of Compliance Leverage Ratio

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation of Adjusted EBITDA for Compliance Calculation |

| (USD in millions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q2 2024 |

|

Q3 2024 |

|

Q4 2024 |

|

Q1 2025 |

|

Q2 2025 |

| Income (Loss) Before Tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

1.9 |

|

|

$ |

(3.7) |

|

|

$ |

(6.2) |

|

|

$ |

(5.6) |

|

|

$ |

(9.1) |

|

| Interest Expense, net |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3.8 |

|

|

3.6 |

|

|

3.4 |

|

|

3.2 |

|

|

3.1 |

|

| Depreciation and Amortization |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8.5 |

|

|

8.8 |

|

|

8.3 |

|

|

7.3 |

|

|

7.6 |

|

| EBITDA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

14.2 |

|

|

$ |

8.8 |

|

|

$ |

5.5 |

|

|

$ |

4.8 |

|

|

$ |

1.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Compliance adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Add: Non-Cash Impairment Charges and Write-offs or Write Downs |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

— |

|

|

0.4 |

|

|

— |

|

|

0.1 |

|

| Add: Adjustments from Foreign Currency Impact |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(2.4) |

|

|

(0.3) |

|

|

(1.8) |

|

|

(0.4) |

|

|

3.4 |

|

| Add: Extraordinary, Non-recurring or Unusual Items |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

| Add: Cash Restructuring Charges |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0.5 |

|

|

0.7 |

|

|

0.3 |

|

|

1.6 |

|

|

0.5 |

|

| Add: Charges for Transactions, Amendments, and Refinances |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

— |

|

|

— |

|

|

0.3 |

|

|

1.0 |

|

| Add: Adjustment to Autotech Fund II Investment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0.1 |

|

|

0.8 |

|

|

0.2 |

|

|

(0.3) |

|

|

(0.1) |

|

| Add: Accrual-based Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7.1 |

|

|

1.3 |

|

|

6.4 |

|

|

7.3 |

|

|

5.6 |

|

| Less: Cash Payments for Accrual-based Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(3.7) |

|

|

(3.3) |

|

|

(2.8) |

|

|

(6.1) |

|

|

(4.3) |

|

| Adjusted EBITDA (Compliance) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

15.8 |

|

|

$ |

7.9 |

|

|

$ |

8.2 |

|

|

$ |

7.3 |

|

|

$ |

7.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted TTM EBITDA (Compliance) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

39.1 |

|

|

$ |

31.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation of Adjusted Cash for Compliance Calculation |

| (USD in millions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q1 2025 |

|

Q2 2025 |

| Total Cash and Cash Equivalents |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

79.1 |

|

|

$ |

49.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Less: 35% of Cash in Foreign Locations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(23.3) |

|

|

(13.4) |

|

| Total Adjusted Cash (Compliance) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

55.8 |

|

|

$ |

36.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation of Adjusted Debt for Compliance Calculation |

| (USD in millions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q1 2025 |

|

Q2 2025 |

| Total Debt |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

203.2 |

|

|

$ |

164.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Outstanding Letters of Credit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1.5 |

|

|

1.5 |

|

| Total Adjusted Debt (Compliance) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

204.7 |

|

|

$ |

165.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted Net Debt (Compliance) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

148.9 |

|

|

$ |

129.5 |

|

| Compliance Leverage Ratio (Net Debt / TTM EBITDA) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3.81x |

|

4.17x |

| Compliance Leverage Ratio Maximum Requirement |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6.00x |

|

5.50x |