Document

Exhibit 99.1

FOR IMMEDIATE RELEASE

Stoneridge Reports Fourth Quarter and Full-Year 2022 Results

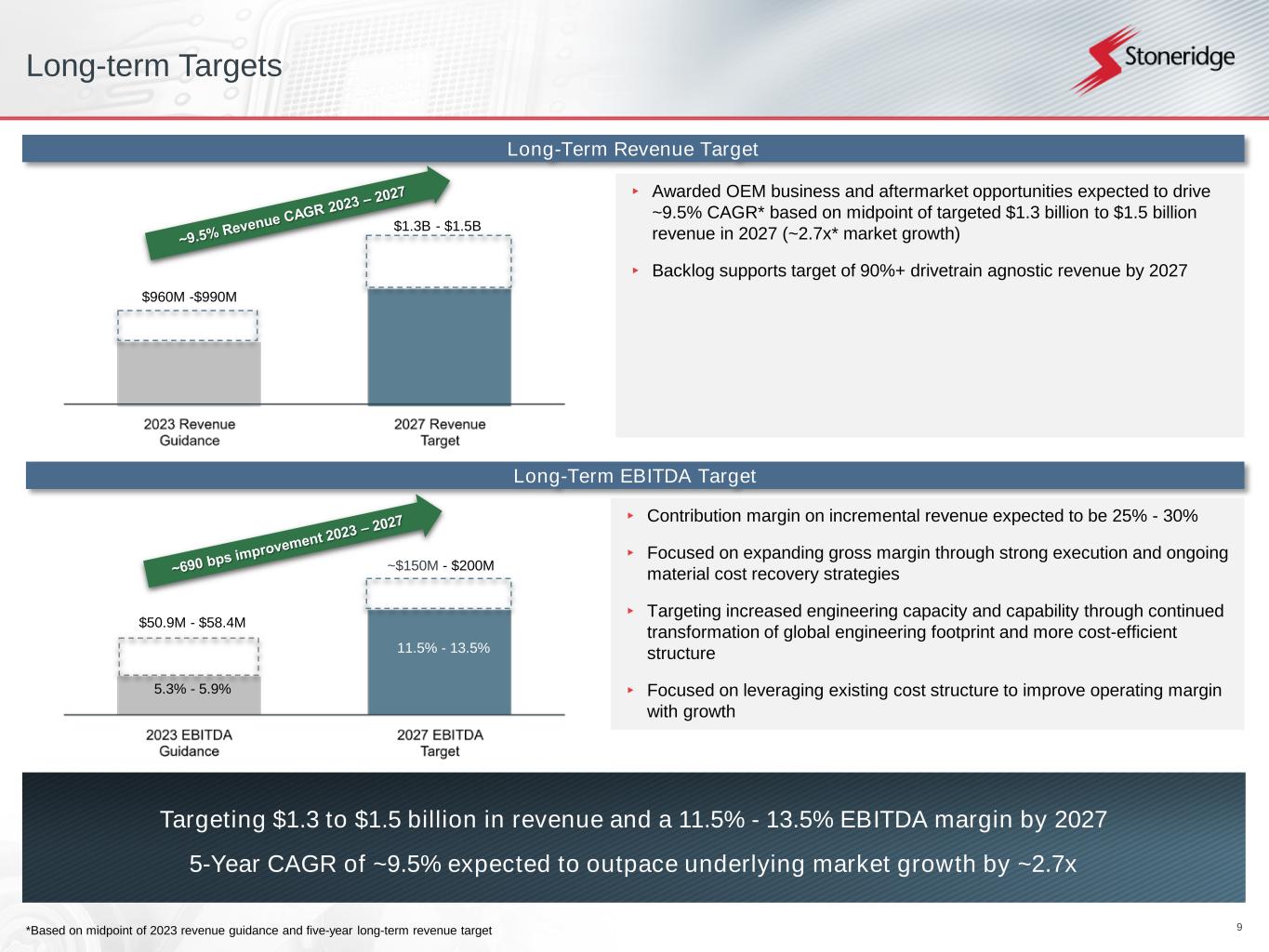

ESTABLISHES 2023 MIDPOINT REVENUE GUIDANCE OF $975 MILLION (15.9% GROWTH VS. 2022) AND MIDPOINT EBITDA MARGIN EXPANSION OF 210 BASIS POINTS OVER 2022

ESTABLISHES 2027 REVENUE TARGET OF $1.3 - $1.5 BILLION

AND EBITDA MARGIN TARGET OF 11.5% - 13.5%

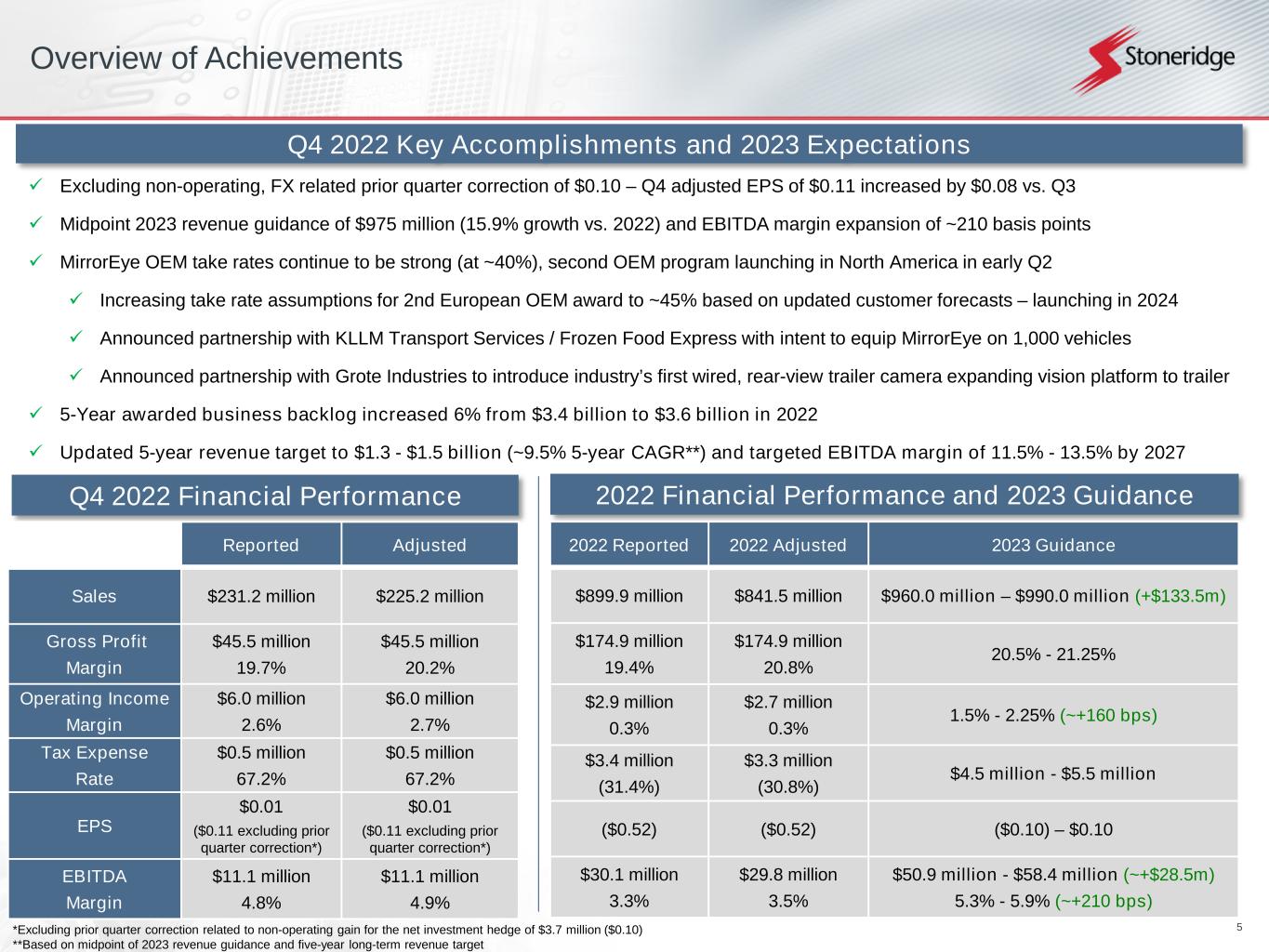

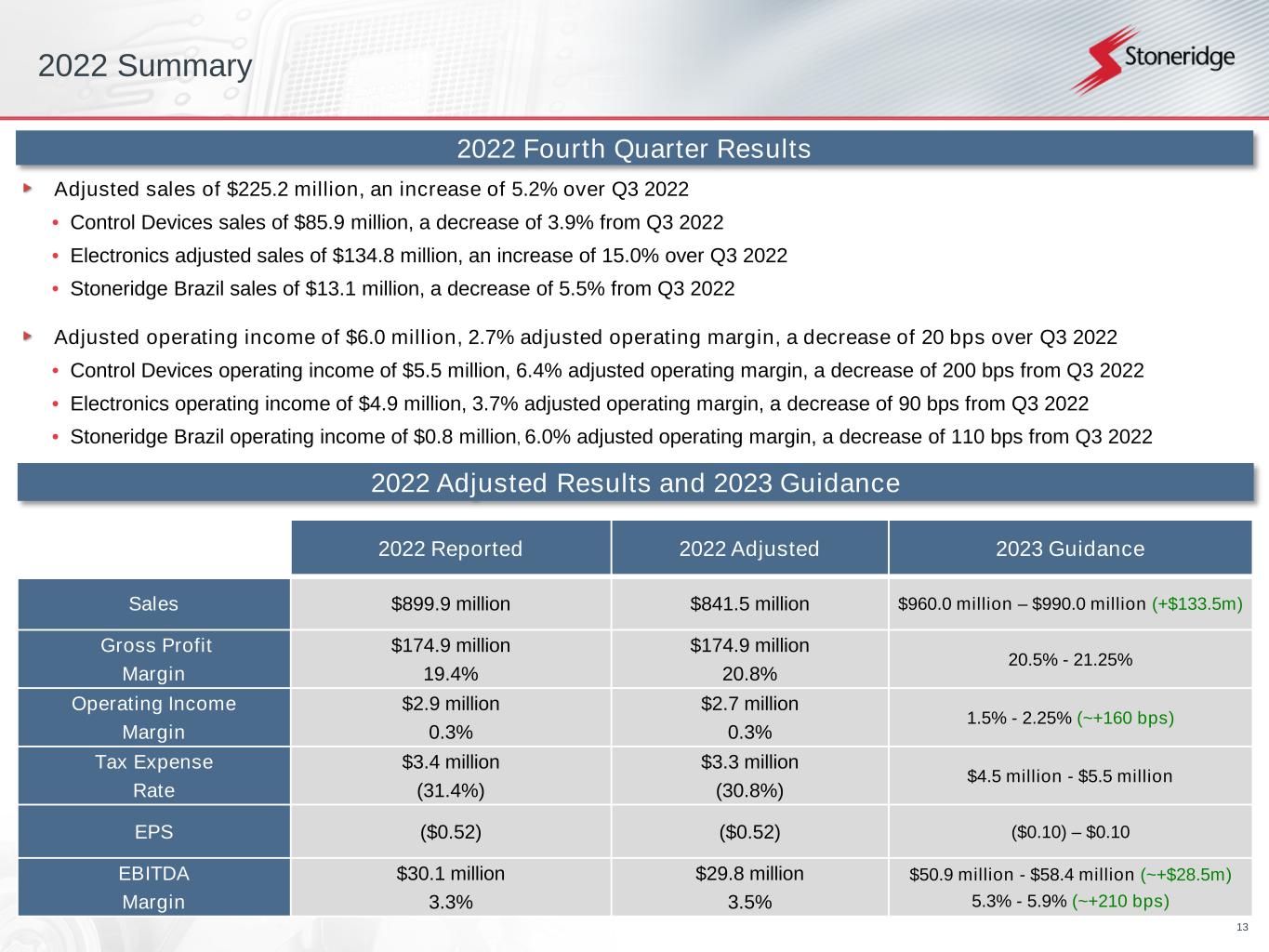

2022 Fourth Quarter Results

•Sales of $231.2 million

•Adjusted sales of $225.2 million (5.2% growth over Q3 2022)

•Gross profit of $45.5 million (19.7% of sales, 20.2% of adjusted sales)

•Operating income of $6.0 million (2.6% of sales, 2.7% of adjusted sales)

•EBITDA of $11.1 million (4.9% of adjusted sales)

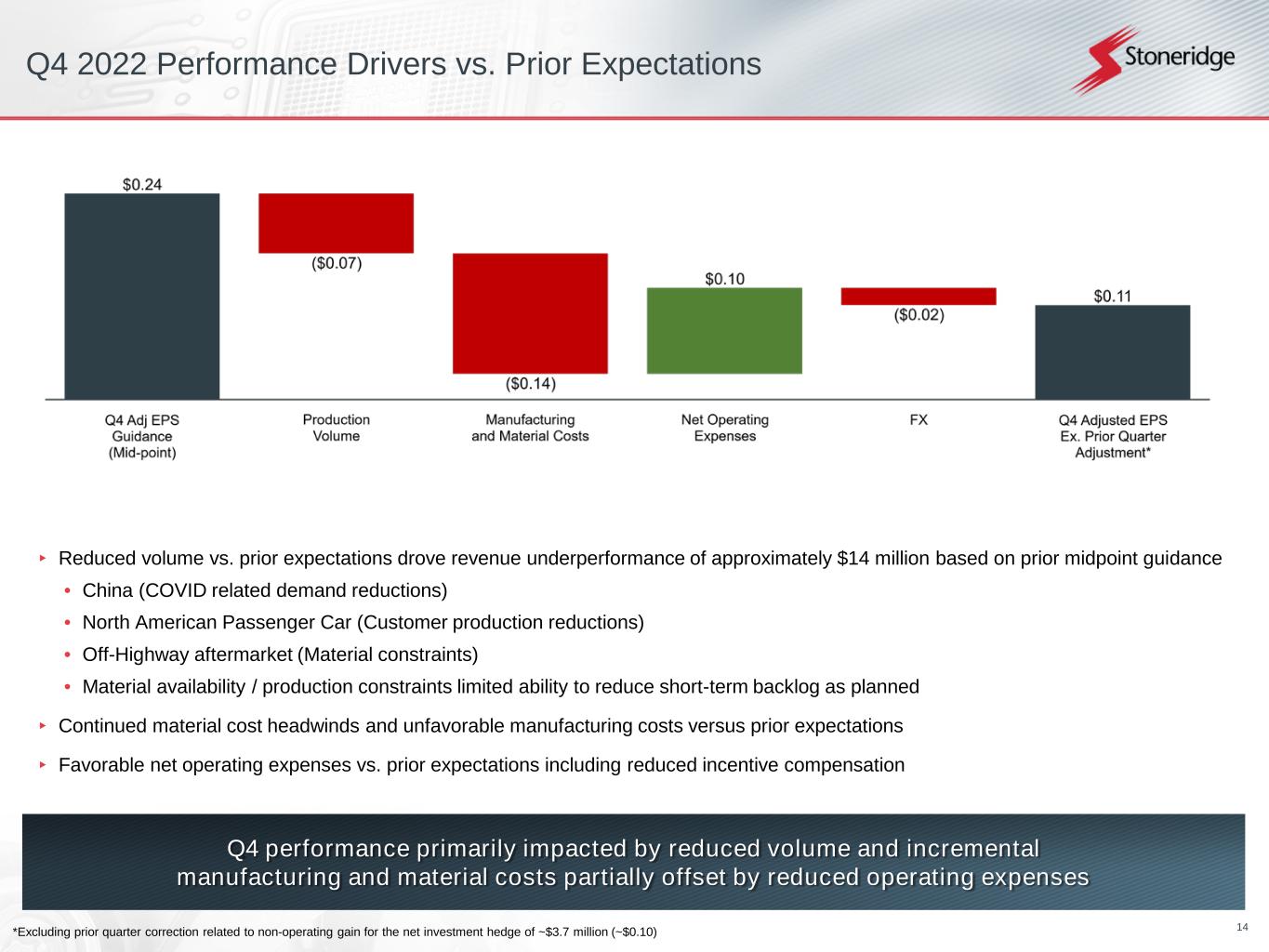

•Earnings per diluted share (“EPS”) of $0.01

◦Results include $3.7 million ($0.10 EPS) non-operating income correction related to prior quarter

◦EPS of $0.11 excluding non-operating prior quarter correction

2023 Guidance

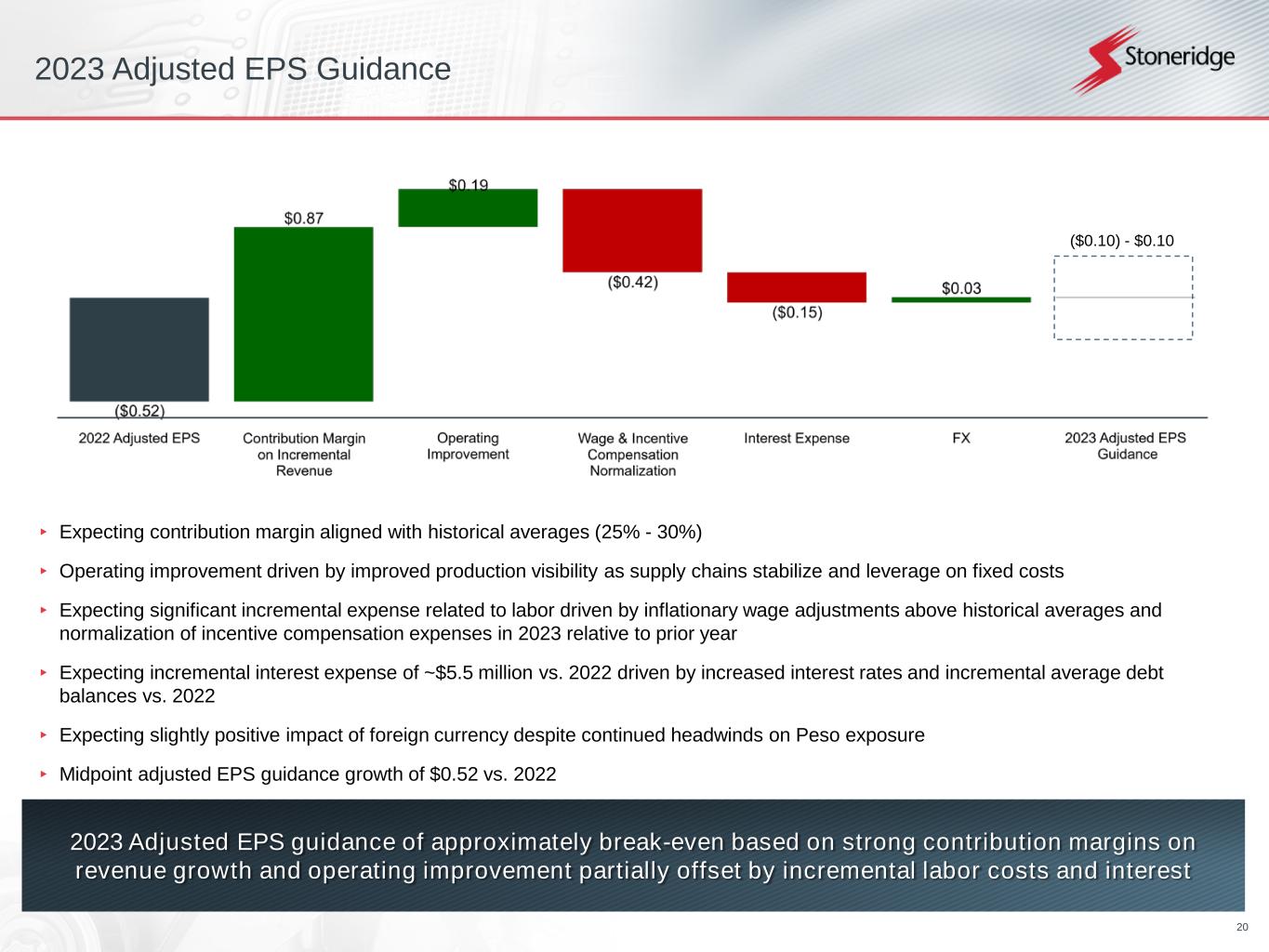

•Adjusted EPS of $(0.10) - $0.10 (break-even midpoint)

•Adjusted sales of $960.0 - $990.0 million

•Adjusted gross margin of 20.5% - 21.25%

•Adjusted operating margin of 1.5% - 2.25%

•Adjusted EBITDA margin of 5.3% - 5.9% ($50.9 - $58.4 million)

•Tax expense of $4.5 to $5.5 million

2027 Targets

•Sales target of $1.3 - $1.5 billion

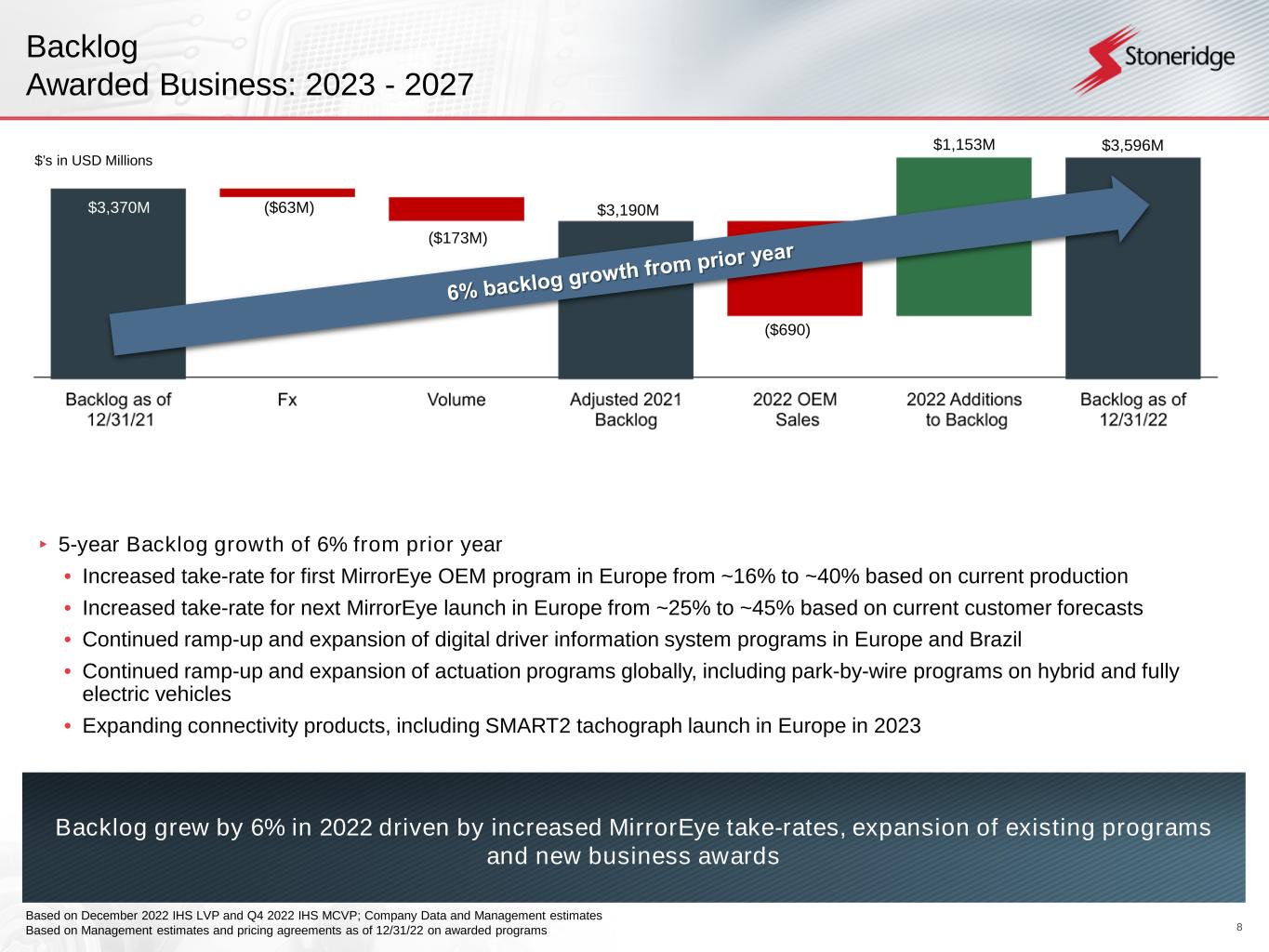

◦Backlog growth of 6% year-over-year from $3.4 billion to $3.6 billion

•EBITDA margin target of 11.5% - 13.5% ($175.0 million at the midpoint of targets)

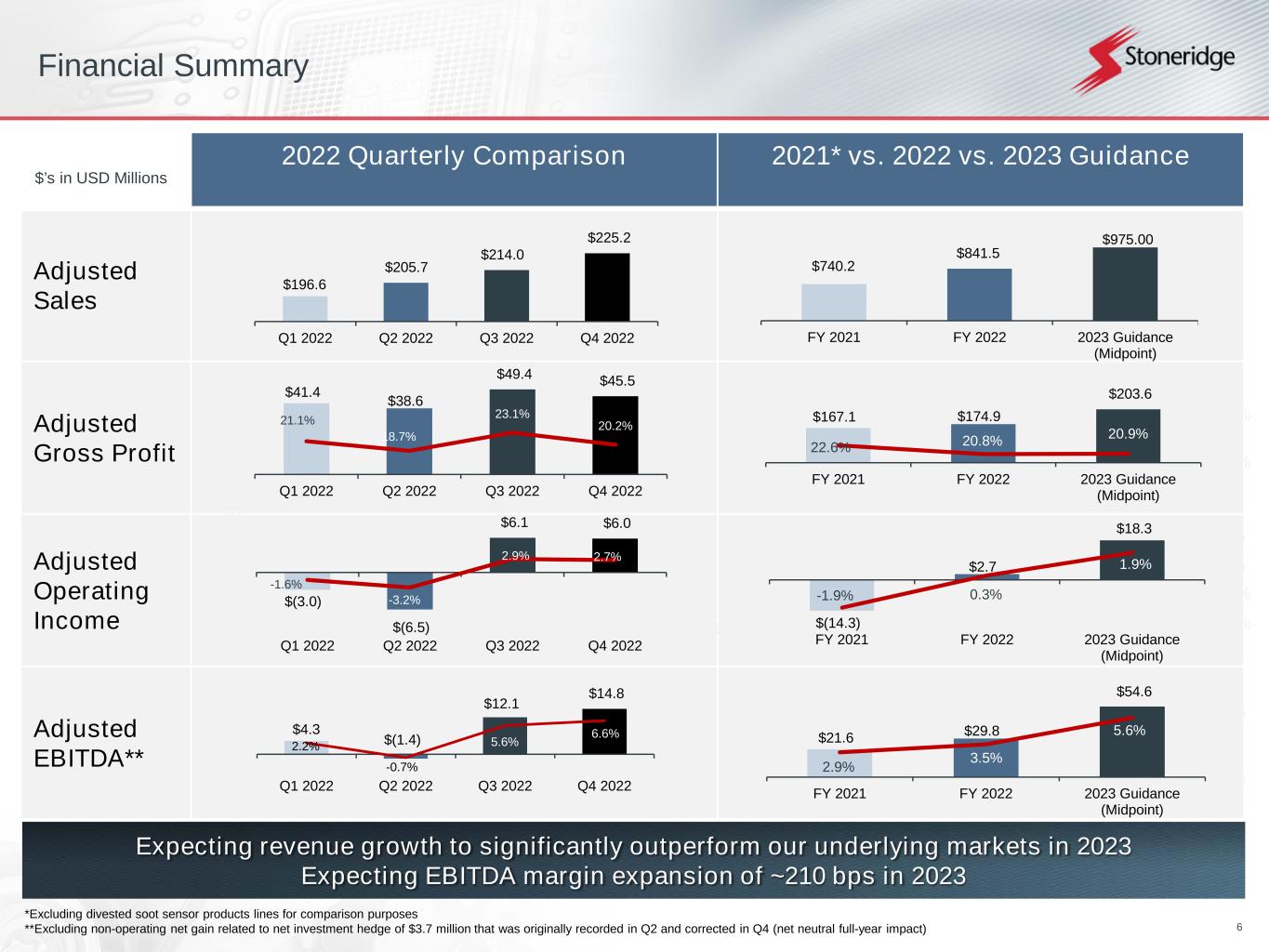

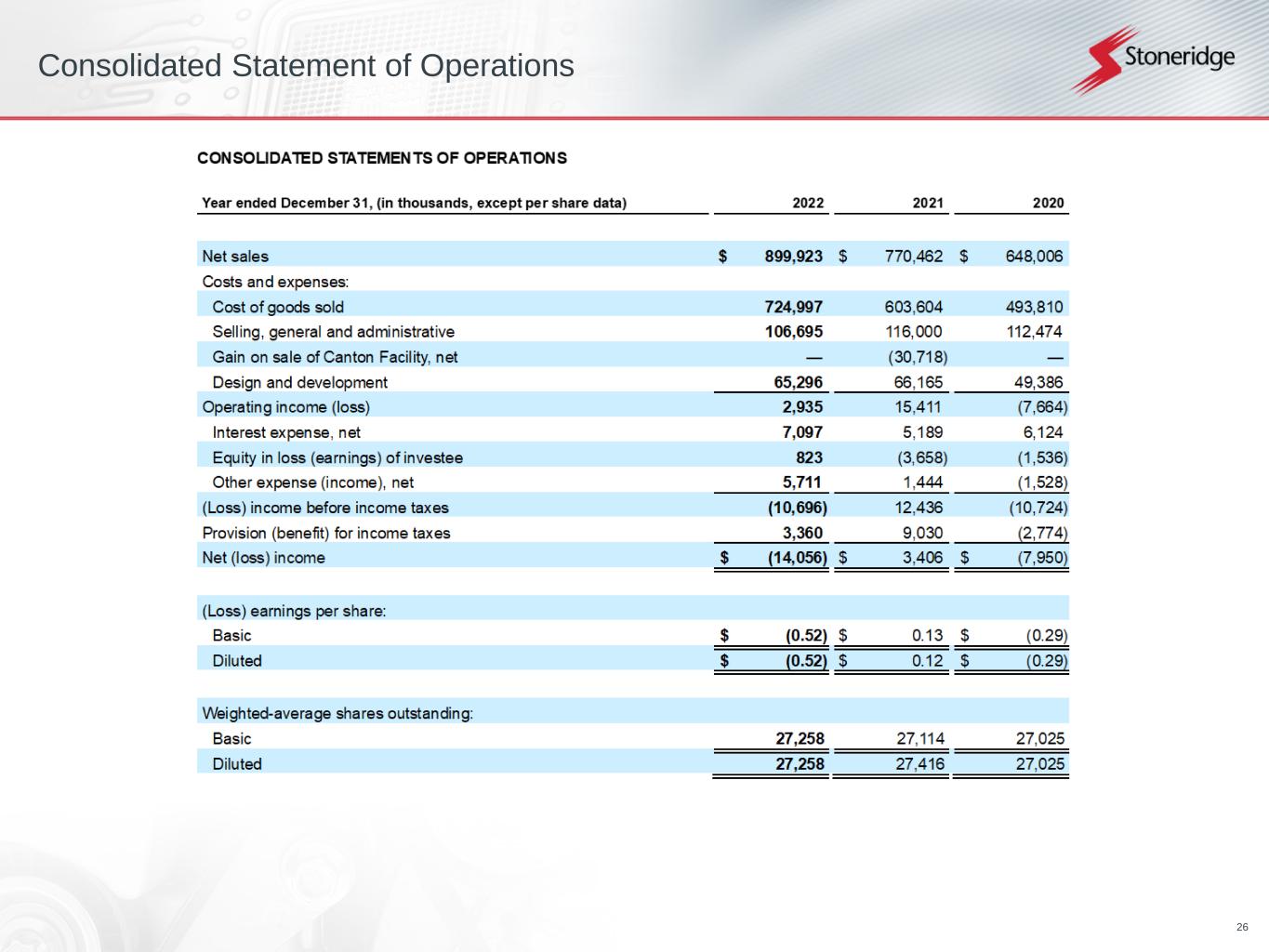

NOVI, Mich. – March 1, 2023 – Stoneridge, Inc. (NYSE: SRI) today announced financial results for the fourth quarter and full-year ended December 31, 2022, with fourth quarter sales of $231.2 million and earnings per share of $0.01 and full-year sales of $899.9 million with loss per share of $(0.52). Adjusted sales for the fourth quarter and full-year were $225.2 million and $841.5 million, respectively.

Fourth quarter results included a $3.7 million, or ($0.10) earnings per share, adjustment to non-operating income related to a prior quarter correction. As reported in the second quarter of 2022, the Company unwound two net investment hedges driven by favorable foreign currency movements and recognized a net gain to other non-operating income of approximately $3.7 million, or earnings per share of $0.10. In the fourth quarter, the Company determined the gain had been incorrectly recognized as other non-operating income and reclassified the gain to other comprehensive loss.

The Company received $3.8 million in cash in the second-quarter as part of the settlement, which was properly accounted for on the balance sheet and statement of cash flows.

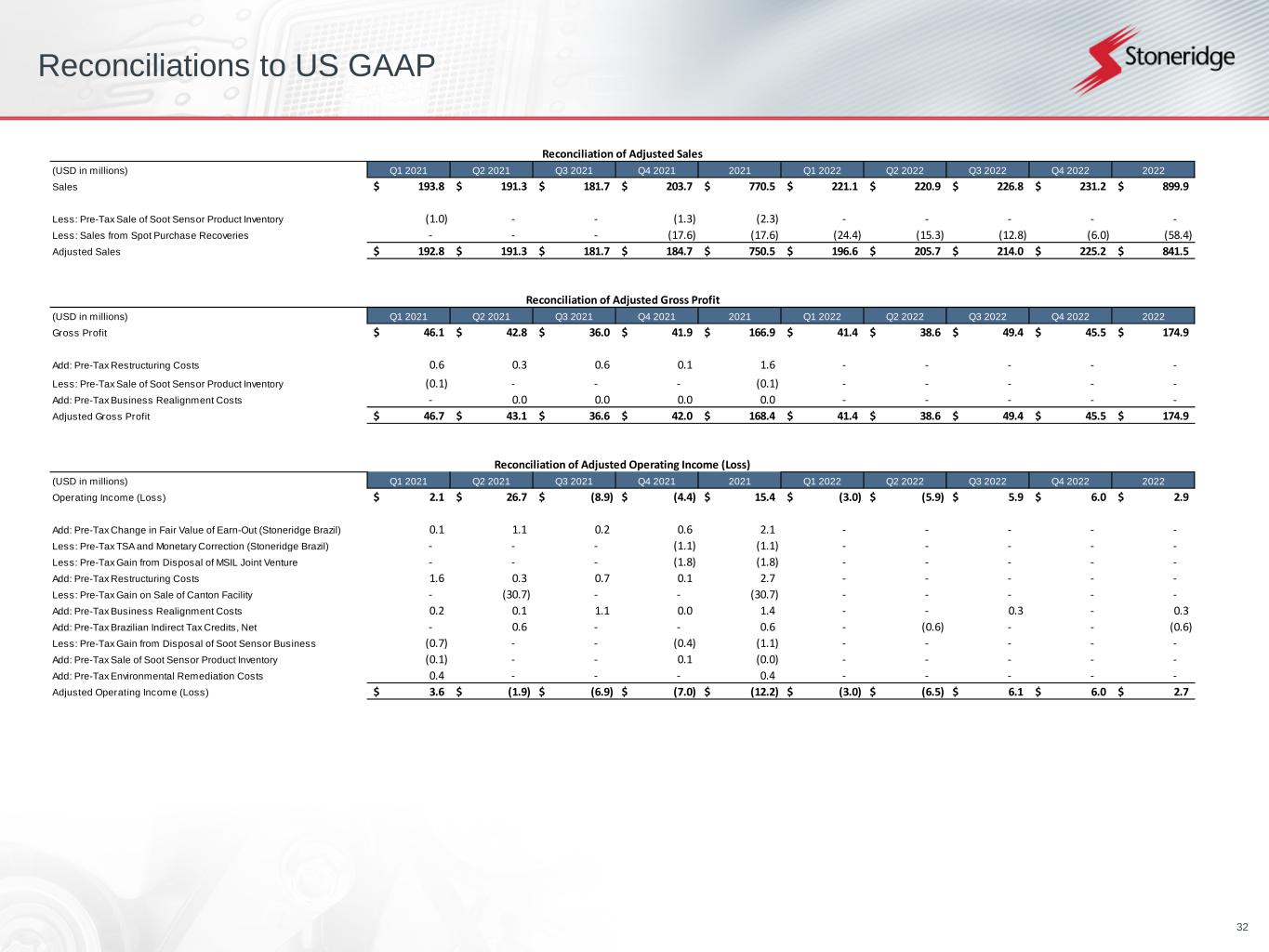

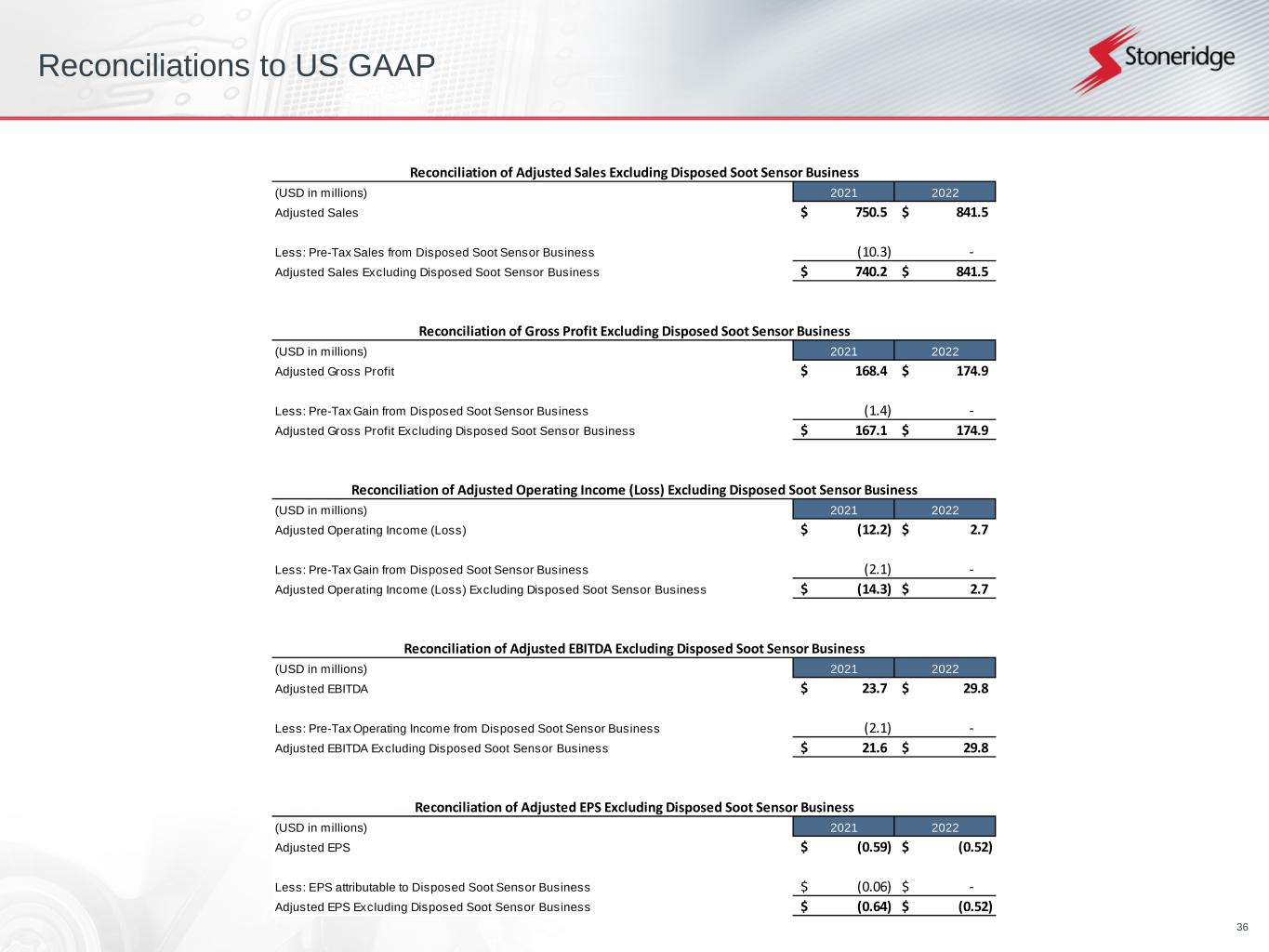

Sales were adjusted to normalize the impact of electronic component spot buys recovered from customers of $6.0 million for the fourth quarter of 2022 and $58.4 million for the full-year 2022. The exhibits attached hereto provide reconciliation detail on this and all other normalizing adjustments of Non-GAAP financial measures used in this press release.

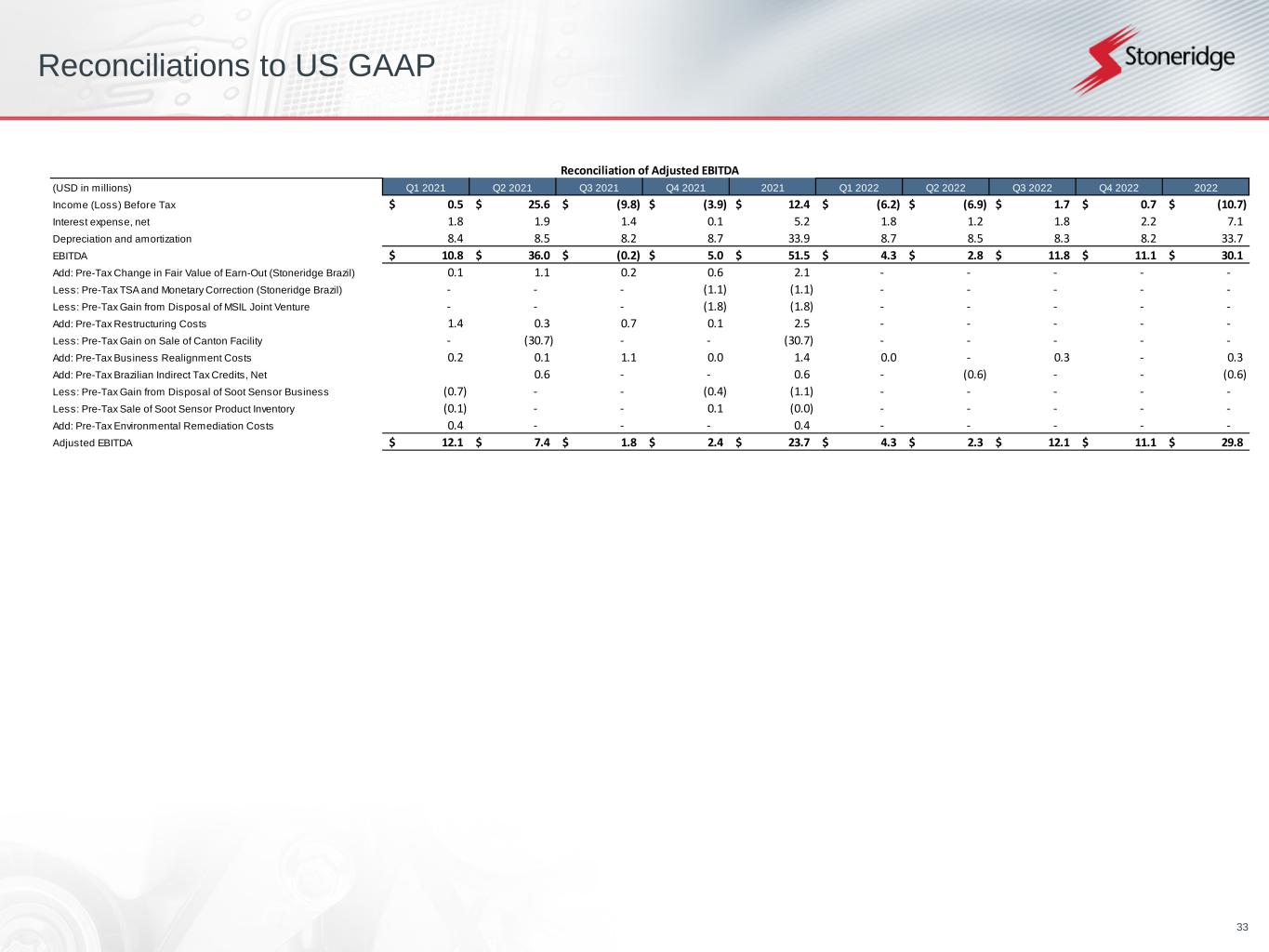

For the fourth quarter of 2022, Stoneridge reported gross profit of $45.5 million (19.7% of sales, 20.2% of adjusted sales). Operating income was $6.0 million (2.6% of sales and 2.7% of adjusted sales). EBITDA was $11.1 million (4.9% of adjusted sales). Excluding the impact of the prior quarter correction, EBITDA was $14.8 million (6.6% of adjusted sales), a $3.7 million and 100 basis point improvement over the third quarter.

For the full year of 2022, Stoneridge reported gross profit of $174.9 million (19.4% of sales, 20.8% of adjusted sales). Operating income was $2.9 million (0.3% of sales) and adjusted operating income was $2.7 million (0.3% of adjusted sales), a 190 basis point improvement over 2021. Adjusted EBITDA was $29.8 million (3.5% of adjusted sales), a 30 basis point improvement over 2021.

Jim Zizelman, president and chief executive officer, commented, “During the fourth quarter we continued to experience volatility in several of our primary end-markets. Rising COVID-19 infections in China and continued production volatility with our North American passenger car customers led to reduced fourth quarter production. We also had material constraints that reduced sales in our off-highway business that limited our ability to meet our expectations for reducing short-term backlog as quickly as we had previously expected. That said, these issues appear to be easing as we move into 2023, and we are beginning to recoup some of the production losses we saw in the fourth quarter.”

Zizelman continued, “Despite continued macroeconomic challenges in 2022, we believe we successfully managed the volatility and set ourselves up for stronger performance in 2023. We negotiated significant price increases with our customers to offset material and labor cost headwinds we continued our focus on cost management and operational efficiencies that will contribute to improved operating performance in 2023.”

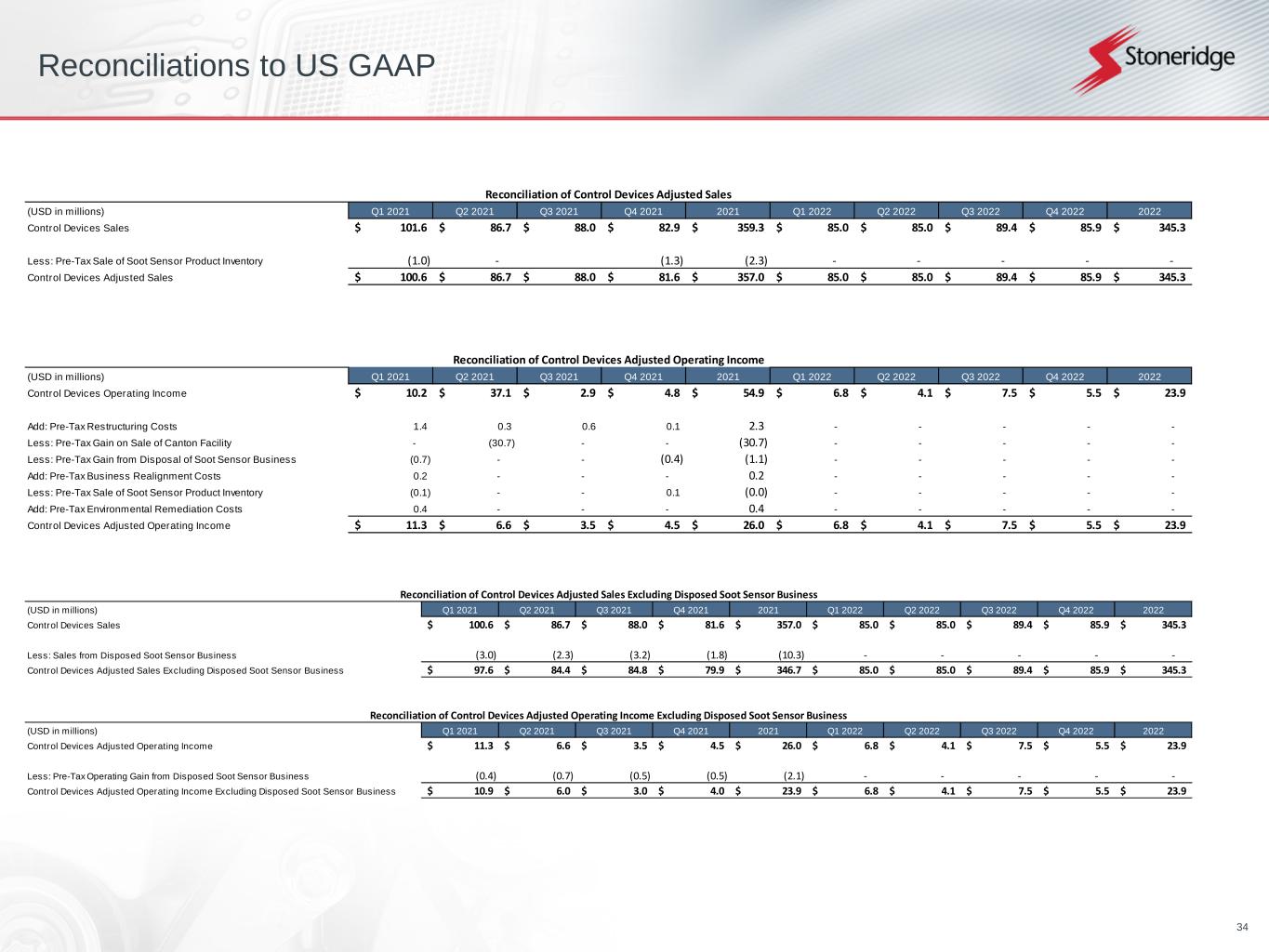

Fourth Quarter in Review

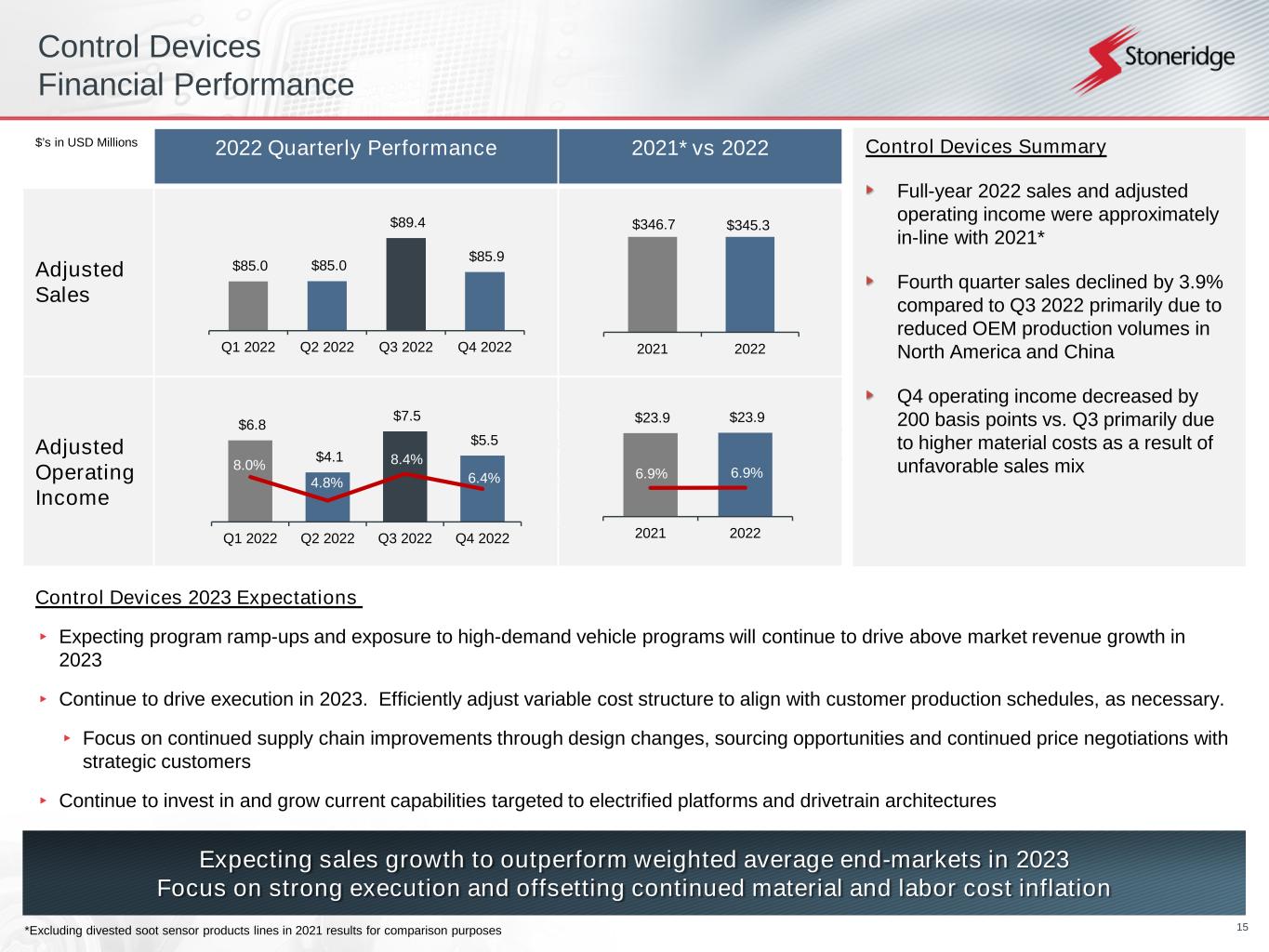

Control Devices sales totaled $85.9 million, an increase of 7.6% relative to adjusted sales excluding the impact of the divested business in the fourth quarter of 2021. This was primarily due to customer price increases and incremental revenue from new programs, as well as higher sales volumes in the North America commercial vehicle end-market. This growth was partially offset by reductions in customer production volumes in the North America passenger vehicle end-market and demand reductions resulting from COVID-19 related shutdowns in China impacting the fourth quarter of 2022. Fourth quarter operating margin was 6.4%, a 140 basis point improvement relative to adjusted operating margin, excluding the divested soot sensor business, in the fourth quarter of 2021, primarily due to lower SG&A costs.

Control Devices sales decreased by 3.9% compared to the third quarter of 2022, primarily due to lower sales in the North America passenger vehicle end-market and China passenger vehicle end-market. This decline was partially offset by incremental revenue from actuation programs and incremental pricing. Fourth quarter operating margin decreased by 200 basis points relative to the third quarter of 2022, primarily due to higher material costs driven by an unfavorable sales mix.

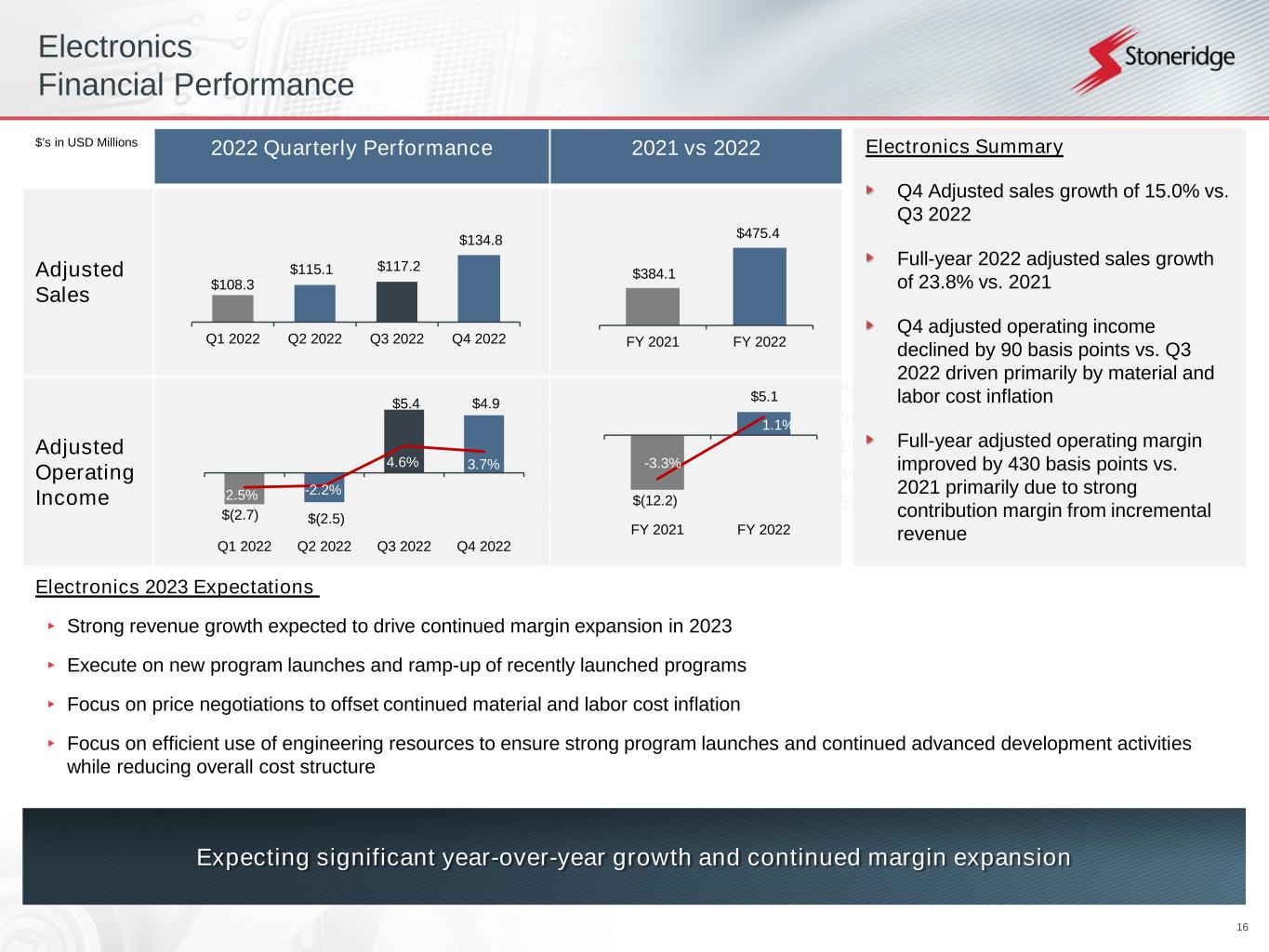

Electronics adjusted sales totaled $134.8 million, an increase of 39.7% relative to sales in the fourth quarter of 2021. This was driven by higher sales volumes in the European and North American commercial vehicle and off-highway end-markets, customer price increases and the ramp-up of new program launches. This growth was partially offset by an unfavorable foreign currency translation impact of $7.9 million. Fourth quarter operating margin was 3.7%, an improvement of 860 basis points relative to the fourth quarter of 2021 primarily due increased contribution margin from higher sales and incremental pricing as well as lower SG&A and D&D spend, offset by an increase in material costs due to supply chain constraints.

Relative to the third quarter of 2022, Electronics adjusted sales increased 15.0%, primarily due to higher sales volumes in the European commercial vehicle and off-highway end-markets, expansion of recently launched programs and pricing actions. This growth was partially offset by an unfavorable foreign currency impact of $1.5 million. Fourth quarter operating margin decreased 90 basis points relative to the third quarter of 2022, primarily due to higher material and labor costs partially offset by the favorable foreign currency impact of approximately $1.2 million, reduced SG&A spend and fixed cost leverage on incremental sales.

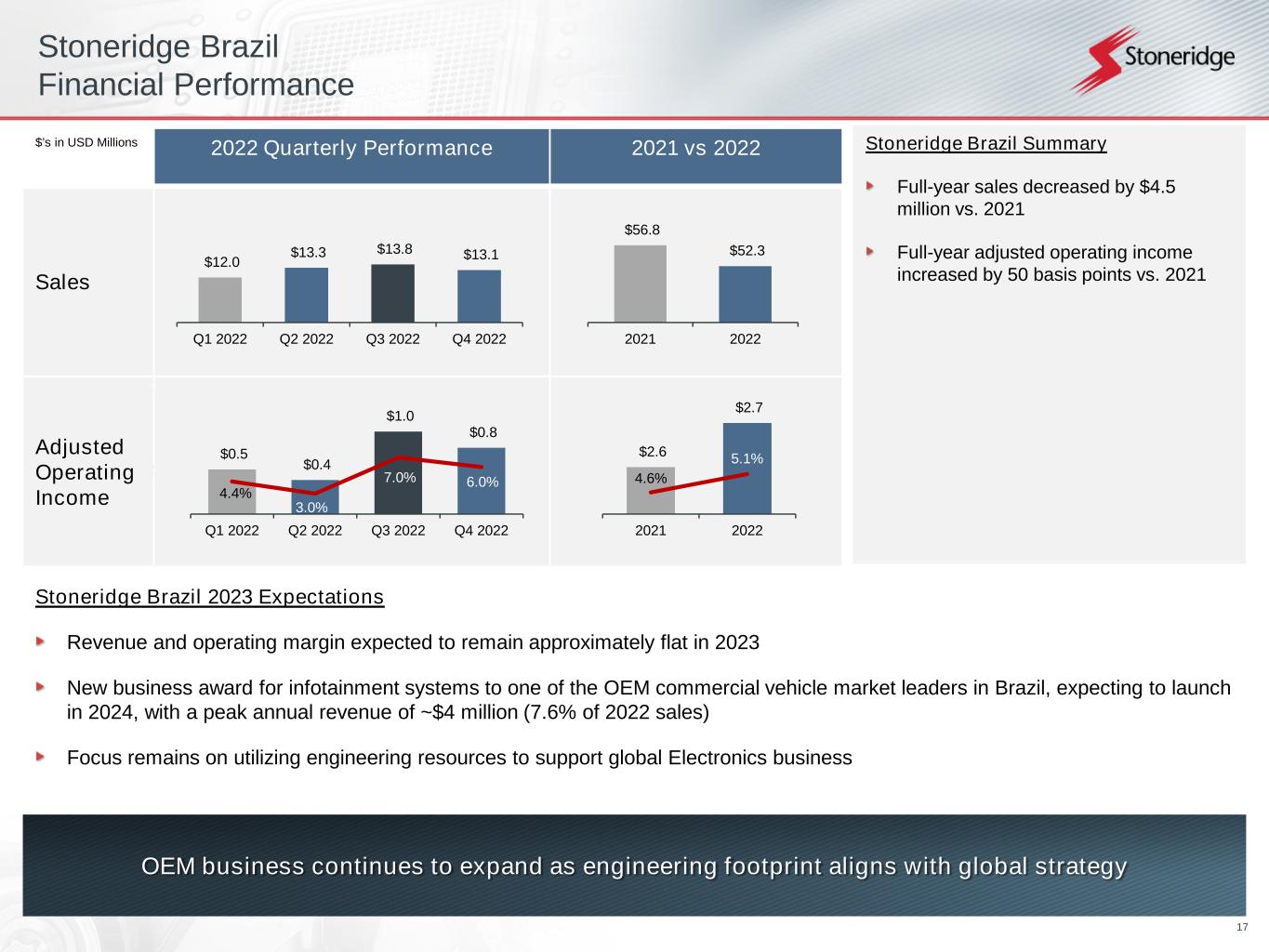

Stoneridge Brazil sales were $13.1 million, a decrease of 6.7% relative to sales in the fourth quarter of 2021, primarily due to lower sales in most product lines offset by favorable foreign currency translation of $0.9 million. Fourth quarter adjusted operating margin was 6.0%, an improvement of 350 basis points, primarily due to favorable product mix.

Relative to the third quarter of 2022, Stoneridge Brazil sales decreased by $0.8 million. Stoneridge Brazil adjusted operating margin decreased by 100 basis points relative to the third quarter of 2022 primarily due to recognizing indirect tax credits in the third quarter.

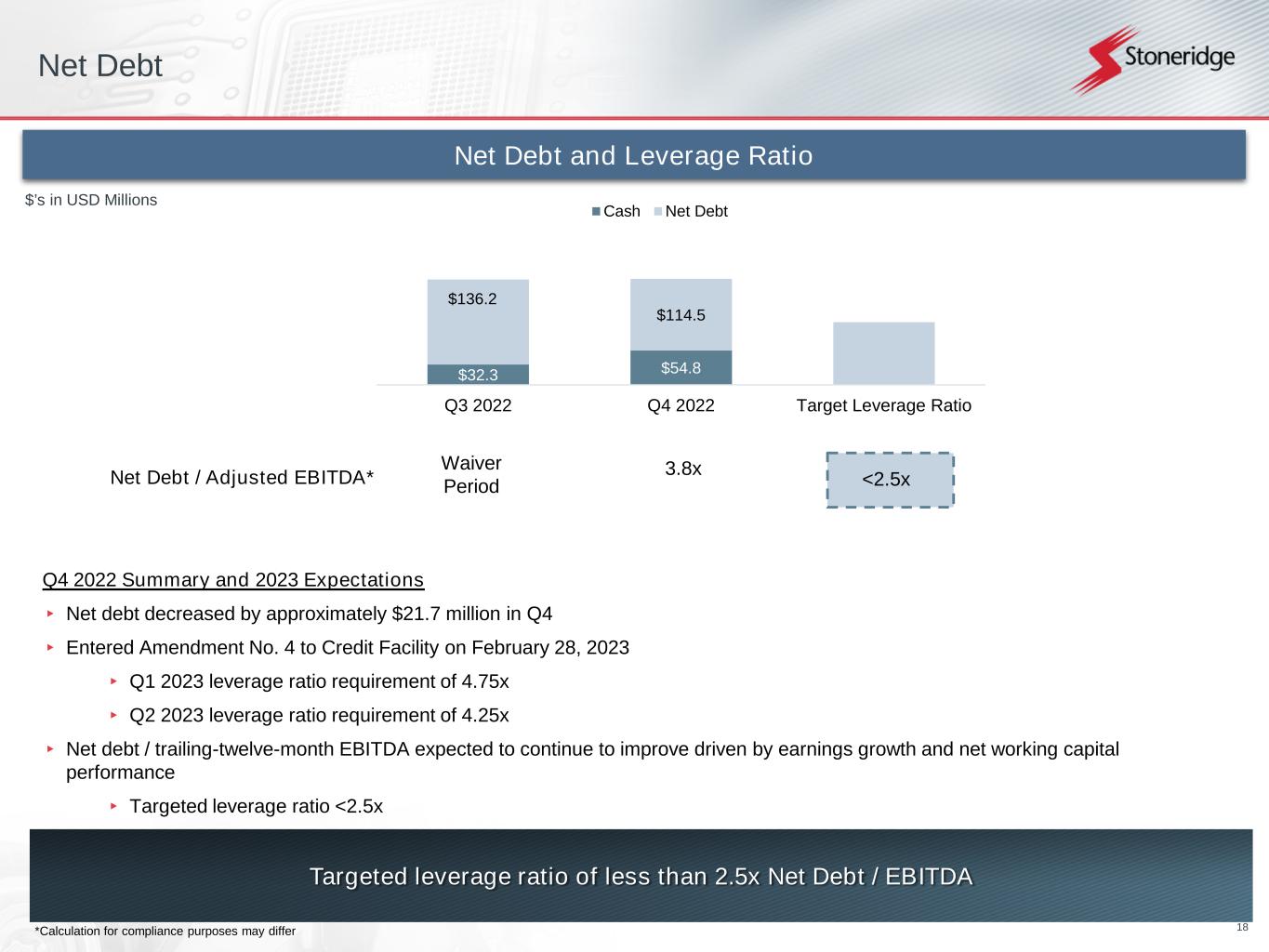

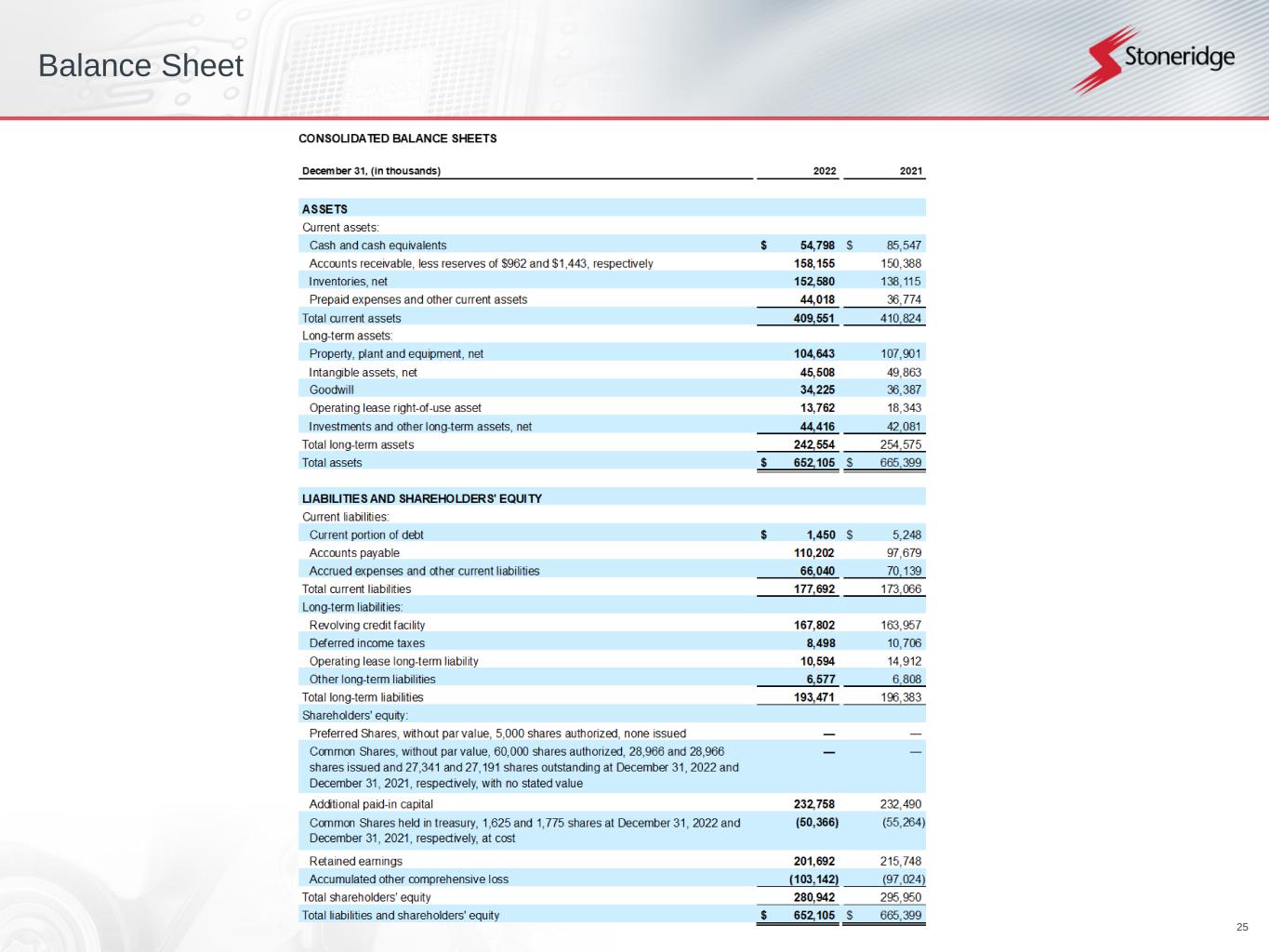

Cash and Debt Balances

As of December 31, 2022, Stoneridge had cash and cash equivalents balances totaling $54.8 million. Total debt as of December 31, 2022 was $169.3 million. Net debt was reduced by $21.7 million in the fourth quarter to $114.5 million as of December 31, 2022.

On March 1, 2023, the Company entered into Amendment No. 4 to our credit facility that provides for certain financial covenant relief for the first and second quarters of 2023. This amendment to the credit facility modified the covenant ratios for the first and second quarter of 2023 to include a maximum 4.75x and 4.25x leverage ratio respectively. This amendment also modified the minimum interest coverage covenant for the first two quarters of 2023 to 3.0x.

The Company continues to focus on operating performance and working capital improvement to drive cash performance. As a result, the Company expects that the net debt to EBITDA ratio will return to a more normalized level by the end of 2023 and is targeting a long-term net debt to EBITDA leverage ratio under 2.5x.

2023 and Future Outlook

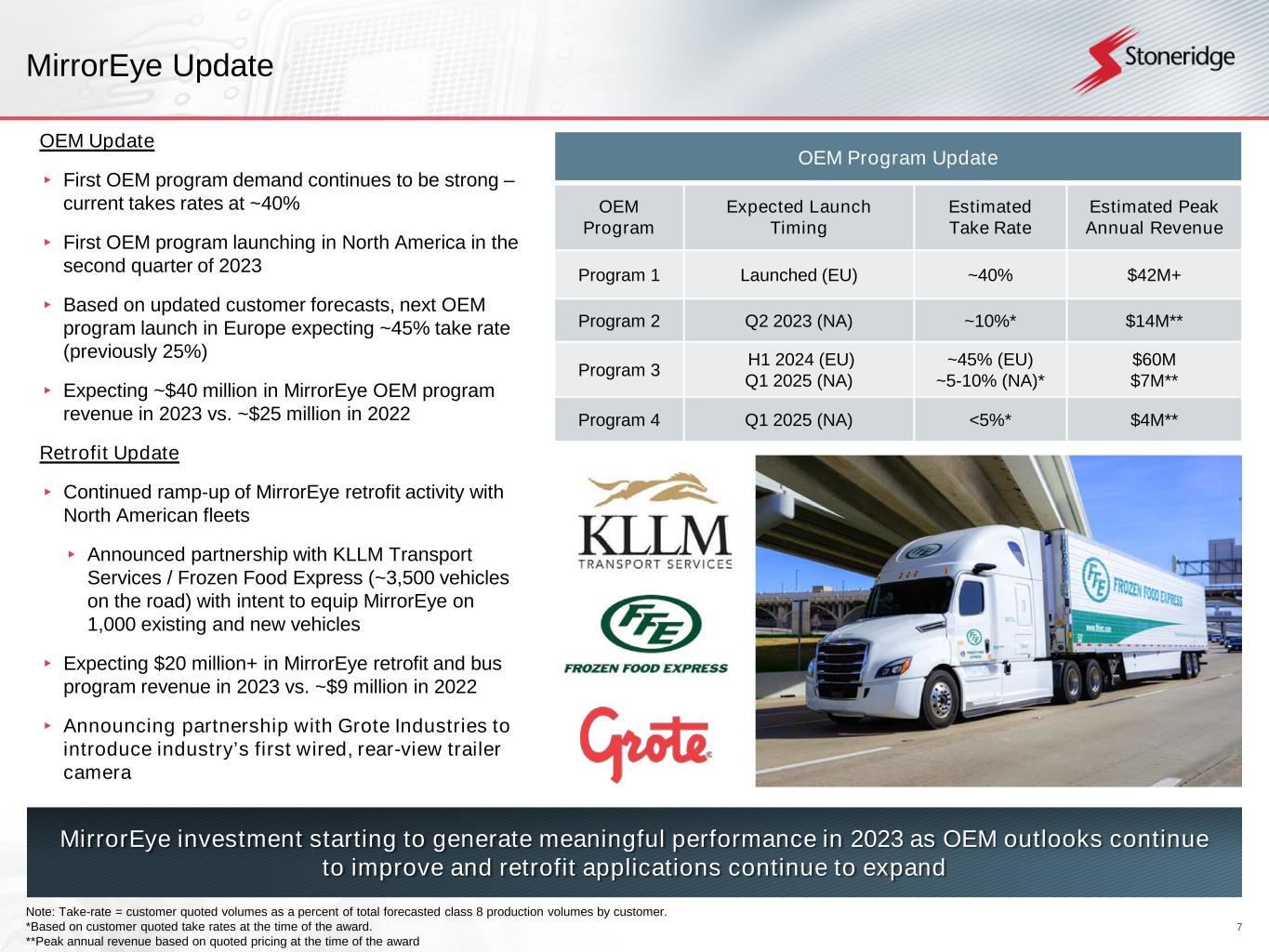

Zizelman commented, “MirrorEye has continued to accelerate and will start to deliver significant results for the Company during 2023. Despite a continued challenging macroeconomic environment, over the past several years we invested tens of millions of dollars to develop MirrorEye, a truly industry-changing technology. Our first OEM MirrorEye program continues to outperform original expectations with a take-rate of approximately 40% compared to the original customer communicated take-rate of 16%. Our next MirrorEye program launches in North America in the second quarter of this year and based on the momentum we are seeing for the first OEM program, we believe there is upside to the take-rate assumption in 2023. Our second European OEM partner, with a program launching in 2024, recently increased their forecasted take-rate from 25% to approximately 45% based on expected market demand. We are also seeing continued growth in our retrofit market for MirrorEye in North America. As an example, earlier this week, we announced a partnership with KLLM Transport and Frozen Food Express, outlining their intent to include MirrorEye on 1,000 of their new and existing vehicles. This is just one example of the many fleets Stoneridge continues to work with to expand MirrorEye in North America. We have a number of reasons why we believe that our MirrorEye technology will expand much further in the industry. For instance, we also just announced a partnership with Grote Industries to bring our innovative camera technology to the commercial vehicle trailer market.

This expansion not only builds on our existing MirrorEye platform, but also drives our overall cabin digitization strategy.”

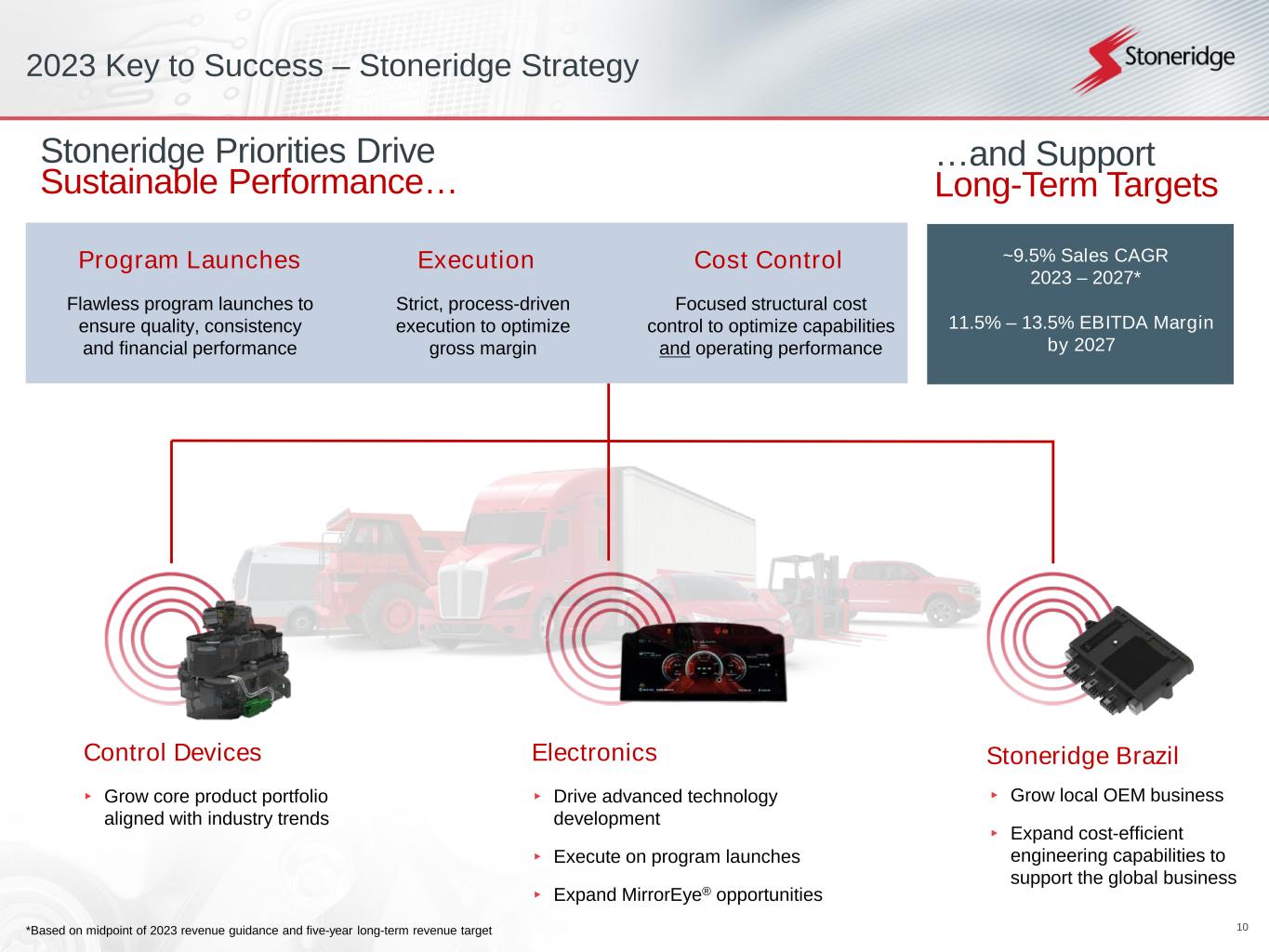

Zizelman added, “In Control Devices we continue to focus on growing our core product portfolio, particularly in our global actuation business, to align with industry megatrends supporting our target of being 90%+ drivetrain agnostic in the next five years over our entire product portfolio.”

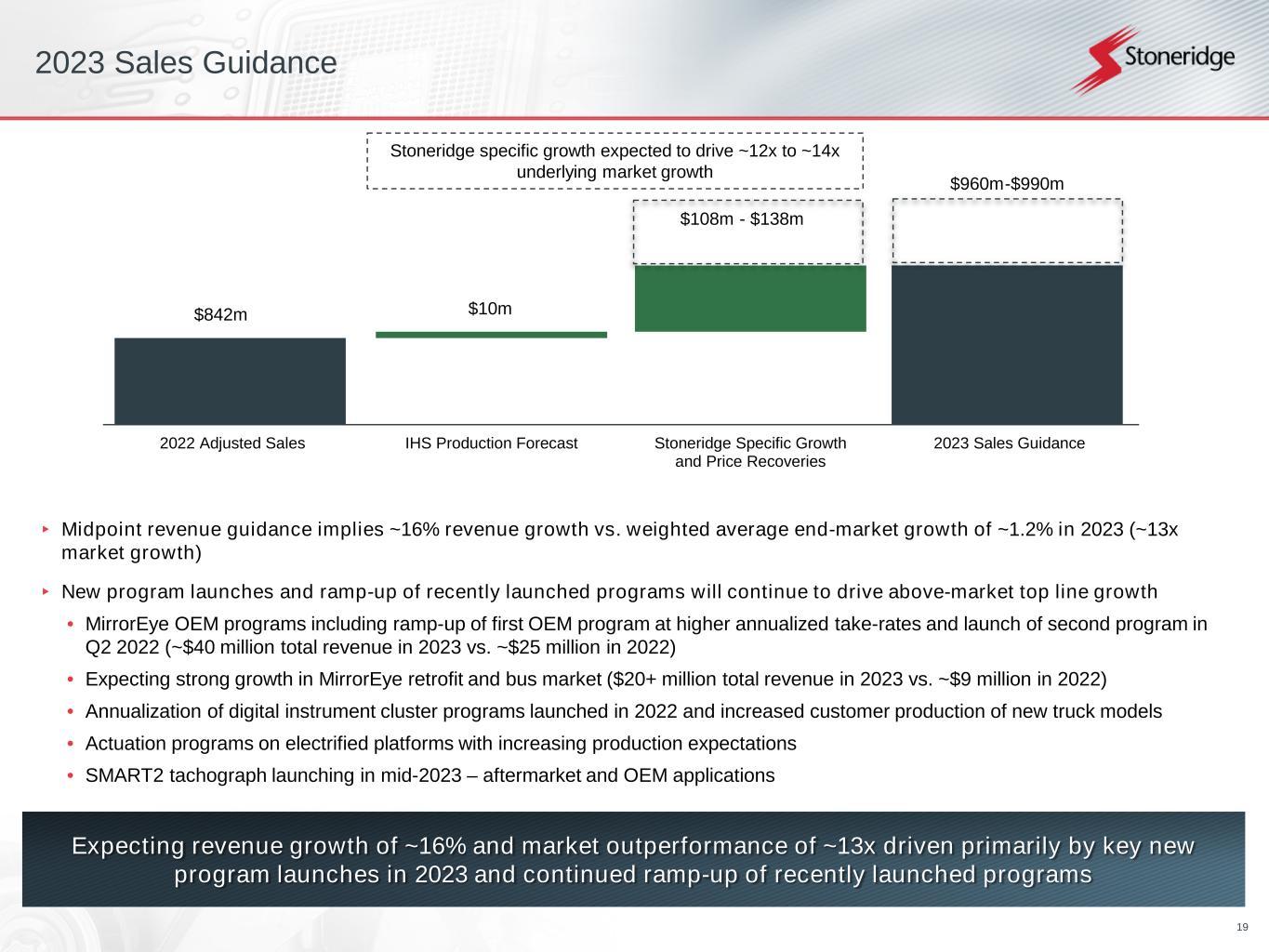

The Company announced 2023 adjusted sales guidance of $960.0 million to $990.0 million. Further, the Company announced 2023 adjusted gross margin guidance of 20.5% to 21.25%, adjusted operating margin guidance of 1.5% to 2.25% and adjusted EBITDA of $50.9 million to $58.4 million or 5.3% - 5.9% of adjusted sales.

Matt Horvath, chief financial officer, commented, “Our midpoint revenue guidance of $975.0 million resulting in approximately 16% growth relative to 2022 or approximately 13x the weighted average growth of our end-markets. We expect a gross margin of between 20.5% and 21.25%. As is typical, we expect our gross margin profile to continue to improve as newly launched programs mature. Driven primarily by our significant expected revenue growth and continued focus on cost control, we expect EBITDA margin expansion of 180 to 240 basis points relative to 2022.”

The Company also announced adjusted earnings per share guidance of $(0.10) to $0.10 and an expected tax expense of $4.5 million - $5.5 million.

Horvath continued, “With respect to adjusted earnings per share, we are expecting incremental contribution on revenue growth inline with our historical average of 25% - 30%. Partially offsetting the benefit of the Company’s growth in 2023 is meaningfully higher labor costs. We are expecting annual inflationary labor adjustment above historical levels creating a significant headwind to expected earnings performance this year. Finally, we expect incremental interest expense of approximately $5.5 million, or approximately ($0.15) of adjusted EPS, due to higher interest rates and somewhat higher average debt outstanding as compared to 2022. This results in adjusted EPS guidance of $(0.10) to $0.10 for 2023.”

Horvath concluded, “Moving forward, we expect the impact of new program launches and expansion of existing programs to drive significant growth. We have updated our long-term revenue target to $1.3 billion to $1.5 billion by 2027 which reflects a midpoint compound annual growth rate of approximately 9.5%. This is supported by a $3.6 billion backlog which grew 6% relative to 2021. Driven by incremental contribution margins, continued margin recovery actions, favorable mix related to our aftermarket products and continued leverage on our existing cost structure, we are targeting an EBITDA margin of 11.5% to 13.5% by 2027. Stoneridge remains well positioned to significantly outperform our underlying markets and drive significant margin expansion resulting in long-term shareholder value creation.”

Conference Call on the Web

A live Internet broadcast of Stoneridge’s conference call regarding 2022 fourth quarter and full-year results can be accessed at 9:00 a.m. Eastern Time on Thursday, March 2, 2023, at www.stoneridge.com, which will also offer a webcast replay.

About Stoneridge, Inc.

Stoneridge, Inc., headquartered in Novi, Michigan, is a global designer and manufacturer of highly engineered electrical and electronic systems, components and modules for the automotive, commercial, off-highway and agricultural vehicle markets. Additional information about Stoneridge can be found at www.stoneridge.com.

Forward-Looking Statements

Statements in this press release contain “forward-looking statements” under the Private Securities Litigation Reform Act of 1995.

These statements appear in a number of places in this report and may include statements regarding the intent, belief or current expectations of the Company, with respect to, among other things, our (i) future product and facility expansion, (ii) acquisition strategy, (iii) investments and new product development, (iv) growth opportunities related to awarded business, and (v) operational expectations. Forward-looking statements may be identified by the words “will,” “may,” “should,” “designed to,” “believes,” “plans,” “projects,” “intends,” “expects,” “estimates,” “anticipates,” “continue,” and similar words and expressions. The forward-looking statements are subject to risks and uncertainties that could cause actual events or results to differ materially from those expressed in or implied by the statements. Important factors that could cause actual results to differ materially from those in the forward-looking statements include, among other factors:

•the ability of our suppliers to supply us with parts and components at competitive prices on a timely basis, including the impact of potential tariffs and trade considerations on their operations and output;

•fluctuations in the cost and availability of key materials (including semiconductors, printed circuit boards, resin, aluminum, steel and copper) and components and our ability to offset cost increases through negotiated price increases with our customers or other cost reduction actions, as necessary;

•global economic trends, competition and geopolitical risks, including impacts from the ongoing conflict between Russia and Ukraine and the related sanctions and other measures, or an escalation of sanctions, tariffs or other trade tensions between the U.S. and China or other countries;

•our ability to achieve cost reductions that offset or exceed customer-mandated selling price reductions;

•the impact of COVID-19, or other future pandemics, on the global economy, and on our customers, suppliers, employees, business and cash flows;

•the reduced purchases, loss or bankruptcy of a major customer or supplier;

•the costs and timing of business realignment, facility closures or similar actions;

•a significant change in automotive, commercial, off-highway or agricultural vehicle production;

•competitive market conditions and resulting effects on sales and pricing;

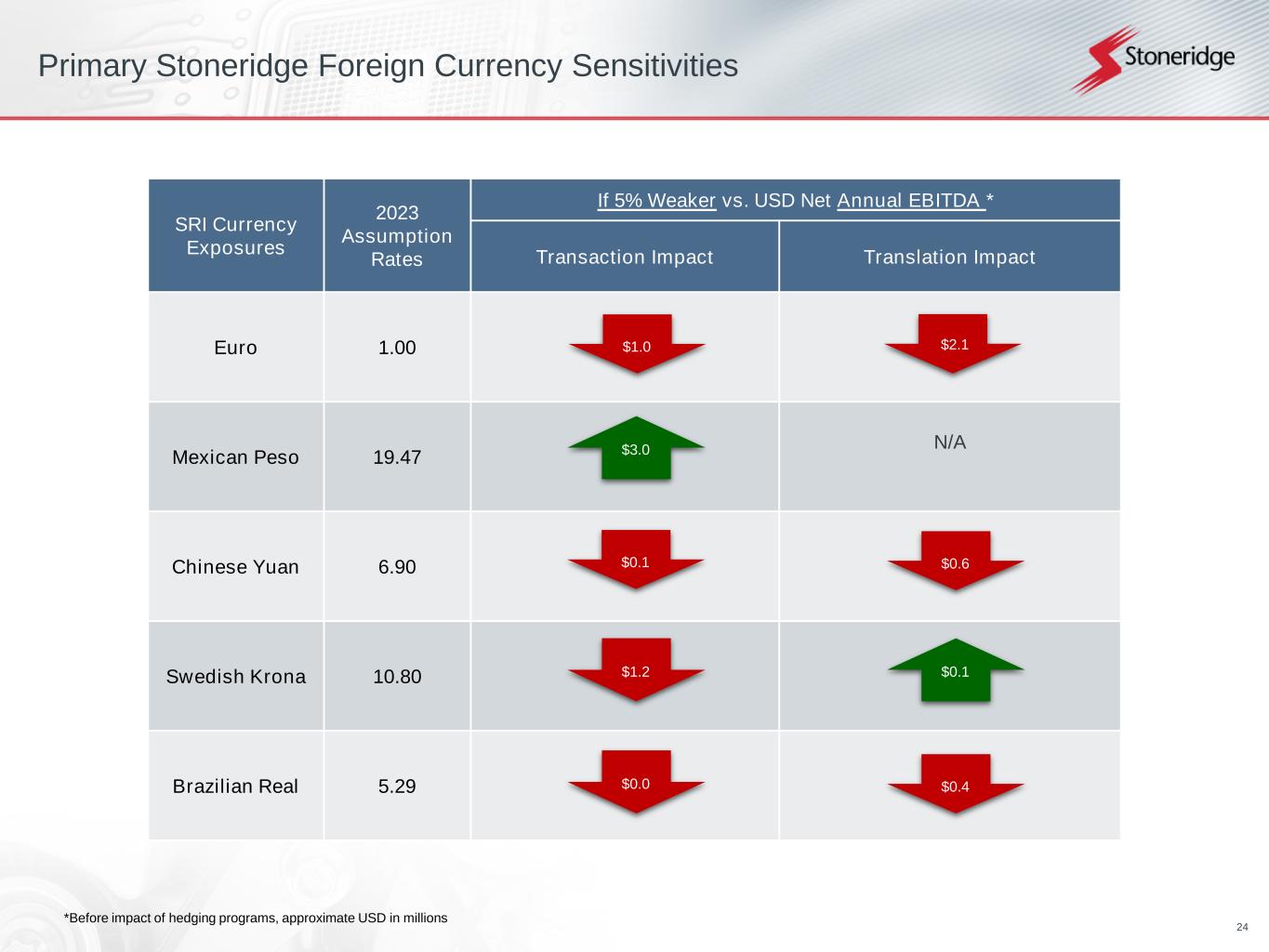

•foreign currency fluctuations and our ability to manage those impacts;

•customer acceptance of new products;

•our ability to successfully launch/produce products for awarded business;

•adverse changes in laws, government regulations or market conditions, including tariffs, affecting our products or our customers’ products;

•our ability to protect our intellectual property and successfully defend against assertions made against us;

•liabilities arising from warranty claims, product recall or field actions, product liability and legal proceedings to which we are or may become a party, or the impact of product recall or field actions on our customers;

•labor disruptions at our facilities or at any of our significant customers or suppliers;

•business disruptions due to natural disasters or other disasters outside of our control;

•the amount of our indebtedness and the restrictive covenants contained in the agreements governing our indebtedness, including our revolving Credit Facility;

•capital availability or costs, including changes in interest rates or market perceptions;

•the failure to achieve the successful integration of any acquired company or business;

•risks related to a failure of our information technology systems and networks, and risks associated with current and emerging technology threats and damage from computer viruses, unauthorized access, cyber-attack and other similar disruptions; and

•the items described in Part I, Item IA (“Risk Factors”) of our 10-K filed with the SEC.

The forward-looking statements contained herein represent our estimates only as of the date of this release and should not be relied upon as representing our estimates as of any subsequent date. While we may elect to update these forward-looking statements at some point in the future, we specifically disclaim any obligation to do so, whether to reflect actual results, changes in assumptions, changes in other factors affecting such forward-looking statements or otherwise.

Use of Non-GAAP Financial Information

This press release contains information about the Company’s financial results that is not presented in accordance with accounting principles generally accepted in the United States (“GAAP”). Such non-GAAP financial measures are reconciled to their closest GAAP financial measures at the end of this press release. The provision of these non-GAAP financial measures for 2022 and 2021 is not intended to indicate that Stoneridge is explicitly or implicitly providing projections on those non-GAAP financial measures, and actual results for such measures are likely to vary from those presented. The reconciliations include all information reasonably available to the Company at the date of this press release and the adjustments that management can reasonably predict.

Management believes the non-GAAP financial measures used in this press release are useful to both management and investors in their analysis of the Company’s financial position and results of operations. In particular, management believes that adjusted sales, adjusted gross income and margin, adjusted operating income (loss) and margin, adjusted net income (loss), adjusted earnings (loss) per share, adjusted EBITDA, adjusted EBITDA margin, adjusted income before tax, adjusted income tax expense and adjusted tax rate are useful measures in assessing the Company’s financial performance by excluding certain items that are not indicative of the Company’s core operating performance or that may obscure trends useful in evaluating the Company’s continuing operating activities. Management also believes that these measures are useful to both management and investors in their analysis of the Company’s results of operations and provide improved comparability between fiscal periods.

Adjusted sales, adjusted gross income and margin, adjusted operating income (loss) and margin, adjusted net income (loss), adjusted earnings (loss) per share, adjusted EBITDA, adjusted EBITDA margin, adjusted income before tax and adjusted tax rate should not be considered in isolation or as a substitute for sales, gross profit, operating income (loss), net income (loss), earnings per share, income before tax, income tax expense, tax rate, cash provided by operating activities or other income statement or cash flow statement data prepared in accordance with GAAP.

For more information, contact Kelly K. Harvey, Director Investor Relations (Kelly.Harvey@Stoneridge.com).

CONDENSED CONSOLIDATED BALANCE SHEETS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| December 31, (in thousands) |

|

2022 |

|

2021 |

| ASSETS |

|

|

|

|

| Current assets: |

|

|

|

|

| Cash and cash equivalents |

|

$ |

54,798 |

|

|

$ |

85,547 |

|

| Accounts receivable, less reserves of $962 and $1,443, respectively |

|

158,155 |

|

|

150,388 |

|

| Inventories, net |

|

152,580 |

|

|

138,115 |

|

| Prepaid expenses and other current assets |

|

44,018 |

|

|

36,774 |

|

| Total current assets |

|

409,551 |

|

|

410,824 |

|

| Long-term assets: |

|

|

|

|

| Property, plant and equipment, net |

|

104,643 |

|

|

107,901 |

|

| Intangible assets, net |

|

45,508 |

|

|

49,863 |

|

| Goodwill |

|

34,225 |

|

|

36,387 |

|

| Operating lease right-of-use asset |

|

13,762 |

|

|

18,343 |

|

| Investments and other long-term assets, net |

|

44,416 |

|

|

42,081 |

|

| Total long-term assets |

|

242,554 |

|

|

254,575 |

|

| Total assets |

|

$ |

652,105 |

|

|

$ |

665,399 |

|

|

|

|

|

|

| LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

| Current liabilities: |

|

|

|

|

| Current portion of debt |

|

$ |

1,450 |

|

|

$ |

5,248 |

|

| Accounts payable |

|

110,202 |

|

|

97,679 |

|

| Accrued expenses and other current liabilities |

|

66,040 |

|

|

70,139 |

|

| Total current liabilities |

|

177,692 |

|

|

173,066 |

|

| Long-term liabilities: |

|

|

|

|

| Revolving credit facility |

|

167,802 |

|

|

163,957 |

|

| Deferred income taxes |

|

8,498 |

|

|

10,706 |

|

| Operating lease long-term liability |

|

10,594 |

|

|

14,912 |

|

| Other long-term liabilities |

|

6,577 |

|

|

6,808 |

|

| Total long-term liabilities |

|

193,471 |

|

|

196,383 |

|

| Shareholders' equity: |

|

|

|

|

| Preferred Shares, without par value, 5,000 shares authorized, none issued |

|

- |

|

|

- |

|

| Common Shares, without par value, 60,000 shares authorized, 28,966 and 28,966 shares issued and 27,341 and 27,191 shares outstanding at December 31, 2022 and December 31, 2021, respectively, with no stated value |

|

- |

|

|

- |

|

| Additional paid-in capital |

|

232,758 |

|

|

232,490 |

|

| Common Shares held in treasury, 1,625 and 1,775 shares at December 31, 2022 and December 31, 2021, respectively, at cost |

|

(50,366) |

|

|

(55,264) |

|

| Retained earnings |

|

201,692 |

|

|

215,748 |

|

| Accumulated other comprehensive loss |

|

(103,142) |

|

|

(97,024) |

|

| Total shareholders' equity |

|

280,942 |

|

|

295,950 |

|

| Total liabilities and shareholders' equity |

|

$ |

652,105 |

|

|

$ |

665,399 |

|

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Year ended December 31, (in thousands, except per share data) |

|

2022 |

|

2021 |

|

2020 |

|

|

|

|

|

|

|

| Net sales |

|

$ |

899,923 |

|

|

$ |

770,462 |

|

|

$ |

648,006 |

|

| Costs and expenses: |

|

|

|

|

|

|

| Cost of goods sold |

|

724,997 |

|

|

603,604 |

|

|

493,810 |

|

| Selling, general and administrative |

|

106,695 |

|

|

116,000 |

|

|

112,474 |

|

| Gain on sale of Canton Facility, net |

|

— |

|

|

(30,718) |

|

|

— |

|

| Design and development |

|

65,296 |

|

|

66,165 |

|

|

49,386 |

|

| Operating income (loss) |

|

2,935 |

|

|

15,411 |

|

|

(7,664) |

|

| Interest expense, net |

|

7,097 |

|

|

5,189 |

|

|

6,124 |

|

| Equity in loss (earnings) of investee |

|

823 |

|

|

(3,658) |

|

|

(1,536) |

|

| Other expense (income), net |

|

5,711 |

|

|

1,444 |

|

|

(1,528) |

|

| (Loss) income before income taxes |

|

(10,696) |

|

|

12,436 |

|

|

(10,724) |

|

| Provision (benefit) for income taxes |

|

3,360 |

|

|

9,030 |

|

|

(2,774) |

|

| Net (loss) income |

|

$ |

(14,056) |

|

|

$ |

3,406 |

|

|

$ |

(7,950) |

|

|

|

|

|

|

|

|

| (Loss) earnings per share: |

|

|

|

|

|

|

| Basic |

|

$ |

(0.52) |

|

|

$ |

0.13 |

|

|

$ |

(0.29) |

|

| Diluted |

|

$ |

(0.52) |

|

|

$ |

0.12 |

|

|

$ |

(0.29) |

|

|

|

|

|

|

|

|

| Weighted-average shares outstanding: |

|

|

|

|

|

|

| Basic |

|

27,258 |

|

|

27,114 |

|

|

27,025 |

|

| Diluted |

|

27,258 |

|

|

27,416 |

|

|

27,025 |

|

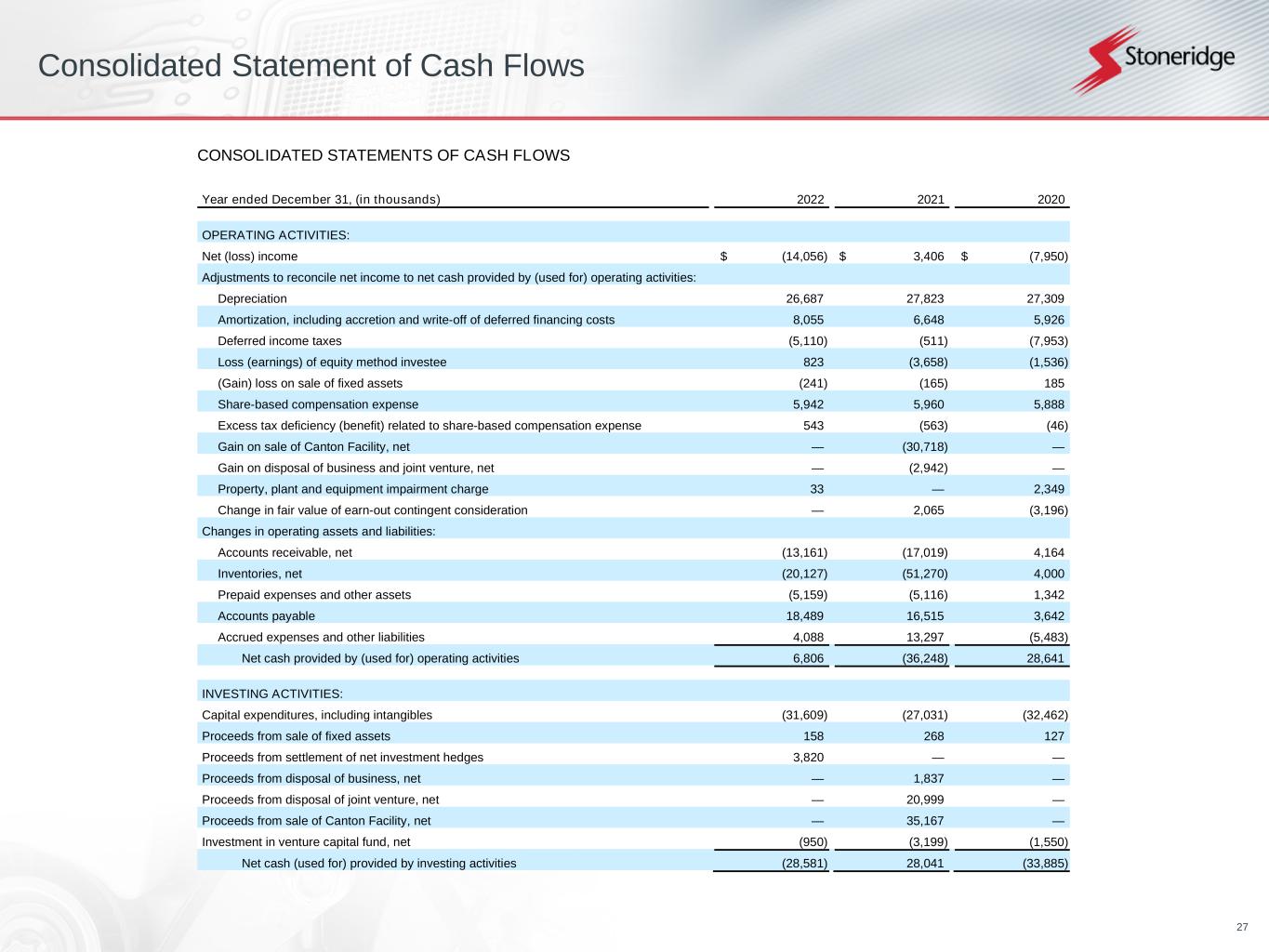

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Year ended December 31, (in thousands) |

|

2022 |

|

2021 |

|

2020 |

| OPERATING ACTIVITIES: |

|

|

|

|

|

|

| Net (loss) income |

|

$ |

(14,056) |

|

|

$ |

3,406 |

|

|

$ |

(7,950) |

|

| Adjustments to reconcile net income to net cash provided by (used for) operating activities: |

|

|

|

|

|

|

| Depreciation |

|

26,687 |

|

|

27,823 |

|

|

27,309 |

|

| Amortization, including accretion and write-off of deferred financing costs |

|

8,055 |

|

|

6,648 |

|

|

5,926 |

|

| Deferred income taxes |

|

(5,110) |

|

|

(511) |

|

|

(7,953) |

|

| Loss (earnings) of equity method investee |

|

823 |

|

|

(3,658) |

|

|

(1,536) |

|

| (Gain) loss on sale of fixed assets |

|

(241) |

|

|

(165) |

|

|

185 |

|

| Share-based compensation expense |

|

5,942 |

|

|

5,960 |

|

|

5,888 |

|

| Excess tax deficiency (benefit) related to share-based compensation expense |

|

543 |

|

|

(563) |

|

|

(46) |

|

| Gain on sale of Canton Facility, net |

|

— |

|

|

(30,718) |

|

|

— |

|

| Gain on disposal of business and joint venture, net |

|

— |

|

|

(2,942) |

|

|

— |

|

| Property, plant and equipment impairment charge |

|

33 |

|

|

— |

|

|

2,349 |

|

| Change in fair value of earn-out contingent consideration |

|

— |

|

|

2,065 |

|

|

(3,196) |

|

| Changes in operating assets and liabilities: |

|

|

|

|

|

|

| Accounts receivable, net |

|

(13,161) |

|

|

(17,019) |

|

|

4,164 |

|

| Inventories, net |

|

(20,127) |

|

|

(51,270) |

|

|

4,000 |

|

| Prepaid expenses and other assets |

|

(5,159) |

|

|

(5,116) |

|

|

1,342 |

|

| Accounts payable |

|

18,489 |

|

|

16,515 |

|

|

3,642 |

|

| Accrued expenses and other liabilities |

|

4,088 |

|

|

13,297 |

|

|

(5,483) |

|

| Net cash provided by (used for) operating activities |

|

6,806 |

|

|

(36,248) |

|

|

28,641 |

|

|

|

|

|

|

|

|

| INVESTING ACTIVITIES: |

|

|

|

|

|

|

| Capital expenditures, including intangibles |

|

(31,609) |

|

|

(27,031) |

|

|

(32,462) |

|

| Proceeds from sale of fixed assets |

|

158 |

|

|

268 |

|

|

127 |

|

| Proceeds from settlement of net investment hedges |

|

3,820 |

|

|

- |

|

|

— |

|

| Proceeds from disposal of business, net |

|

— |

|

|

1,837 |

|

|

— |

|

| Proceeds from disposal of joint venture, net |

|

— |

|

|

20,999 |

|

|

— |

|

| Proceeds from sale of Canton Facility, net |

|

— |

|

|

35,167 |

|

|

— |

|

| Investment in venture capital fund, net |

|

(950) |

|

|

(3,199) |

|

|

(1,550) |

|

| Net cash (used for) provided by investing activities |

|

(28,581) |

|

|

28,041 |

|

|

(33,885) |

|

|

|

|

|

|

|

|

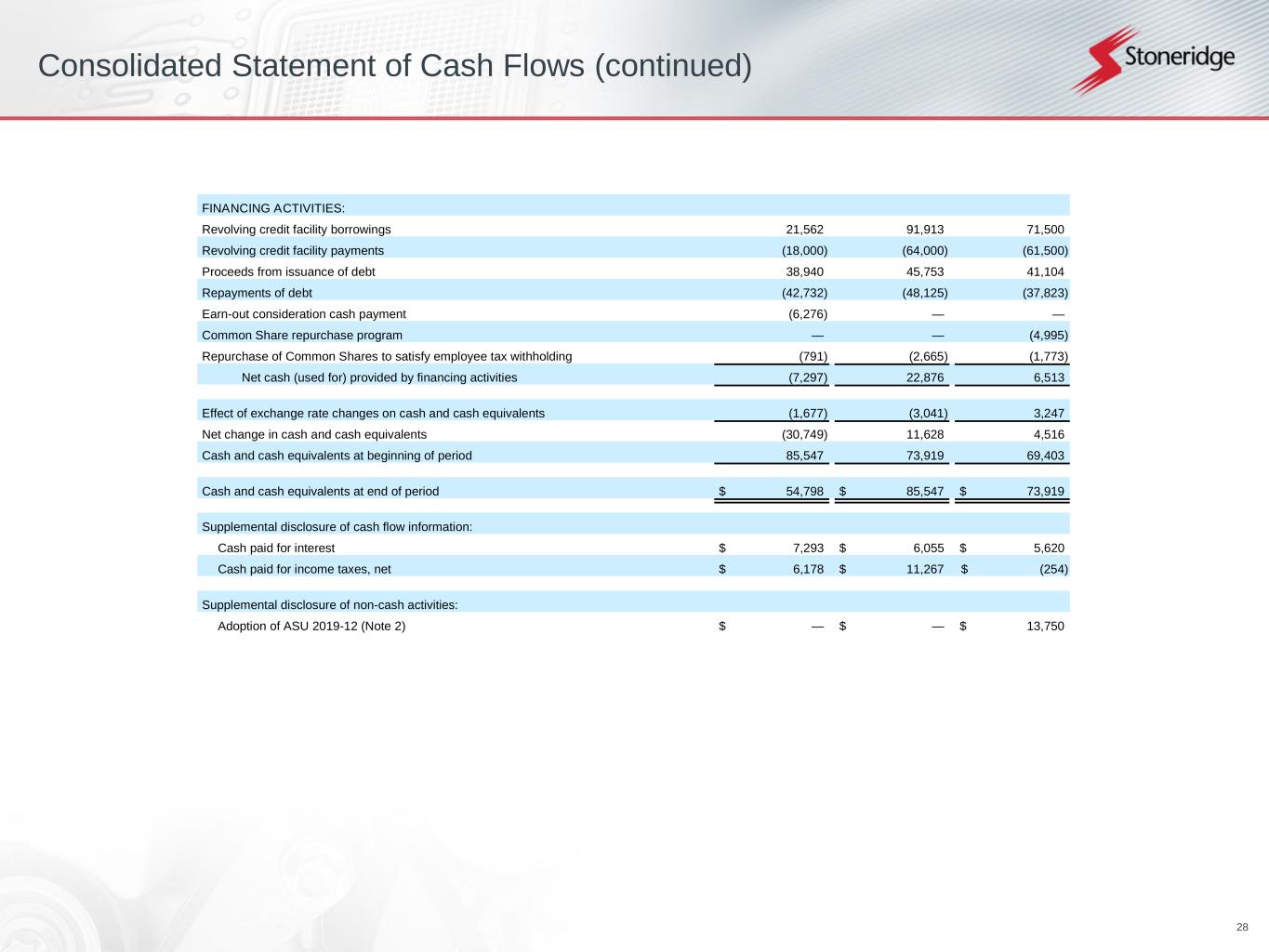

| FINANCING ACTIVITIES: |

|

|

|

|

|

|

| Revolving credit facility borrowings |

|

21,562 |

|

|

91,913 |

|

|

71,500 |

|

| Revolving credit facility payments |

|

(18,000) |

|

|

(64,000) |

|

|

(61,500) |

|

| Proceeds from issuance of debt |

|

38,940 |

|

|

45,753 |

|

|

41,104 |

|

| Repayments of debt |

|

(42,732) |

|

|

(48,125) |

|

|

(37,823) |

|

| Earn-out consideration cash payment |

|

(6,276) |

|

|

— |

|

|

— |

|

| Common Share repurchase program |

|

— |

|

|

— |

|

|

(4,995) |

|

| Repurchase of Common Shares to satisfy employee tax withholding |

|

(791) |

|

|

(2,665) |

|

|

(1,773) |

|

| Net cash (used for) provided by financing activities |

|

(7,297) |

|

|

22,876 |

|

|

6,513 |

|

|

|

|

|

|

|

|

| Effect of exchange rate changes on cash and cash equivalents |

|

(1,677) |

|

|

(3,041) |

|

|

3,247 |

|

| Net change in cash and cash equivalents |

|

(30,749) |

|

|

11,628 |

|

|

4,516 |

|

| Cash and cash equivalents at beginning of period |

|

85,547 |

|

|

73,919 |

|

|

69,403 |

|

|

|

|

|

|

|

|

| Cash and cash equivalents at end of period |

|

$ |

54,798 |

|

|

$ |

85,547 |

|

|

$ |

73,919 |

|

|

|

|

|

|

|

|

| Supplemental disclosure of cash flow information: |

|

|

|

|

|

|

| Cash paid for interest |

|

$ |

7,293 |

|

|

$ |

6,055 |

|

|

$ |

5,620 |

|

| Cash paid for income taxes, net |

|

$ |

6,178 |

|

|

$ |

11,267 |

|

|

$ |

(254) |

|

|

|

|

|

|

|

|

| Supplemental disclosure of non-cash activities: |

|

|

|

|

|

|

| Adoption of ASU 2019-12 (Note 2) |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

13,750 |

|

Regulation G Non-GAAP Financial Measure Reconciliations

Reconciliation to US GAAP

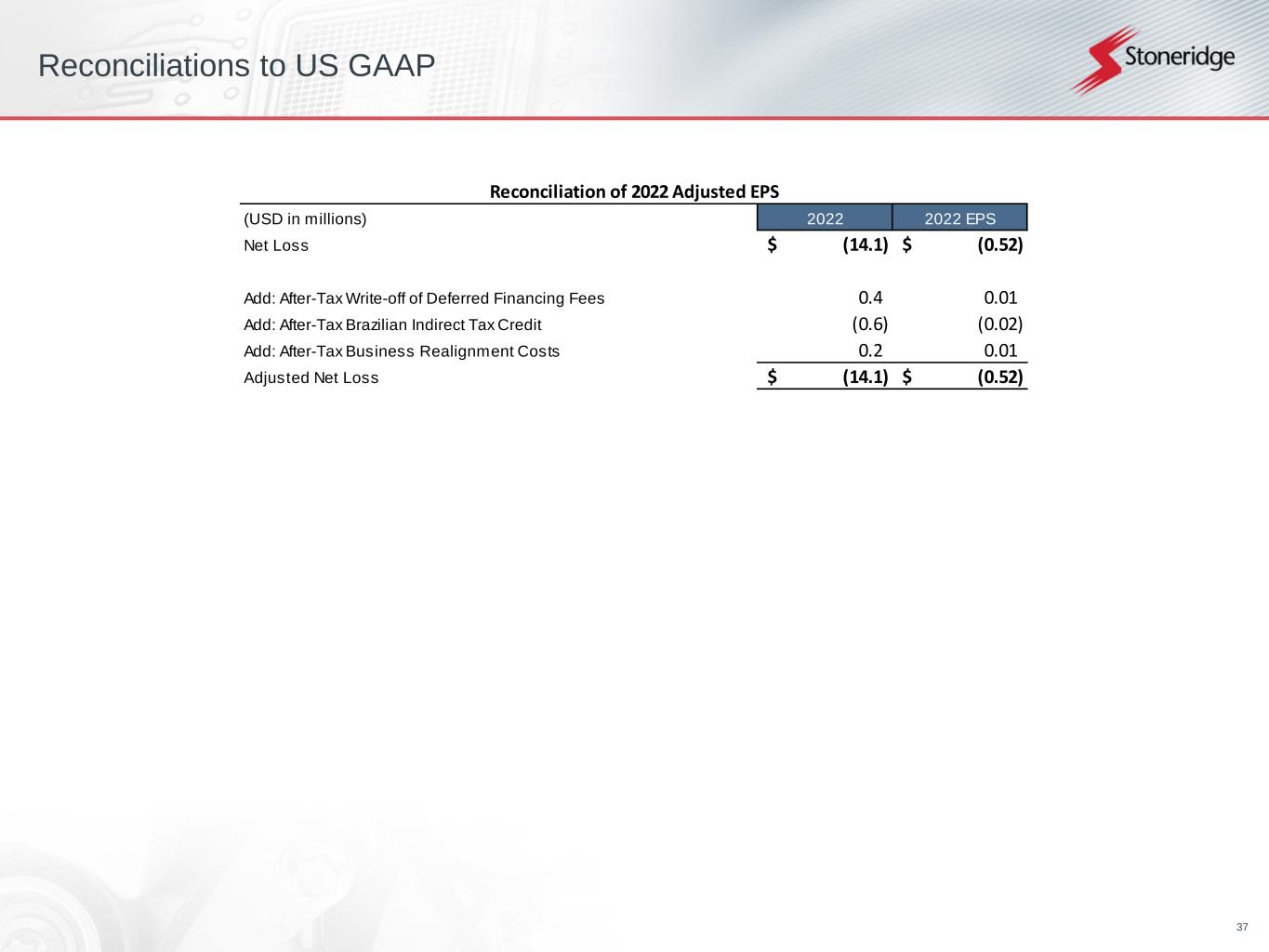

Exhibit 1 - Adjusted EPS

Reconciliation of 2022 Adjusted EPS

|

|

|

|

|

|

|

|

|

|

|

|

| (USD in millions) |

2022 |

|

2022 EPS |

| Net Loss |

$ |

(14.1) |

|

|

$ |

(0.52) |

|

|

|

|

|

| Add: After-Tax Write-off of Deferred Financing Fees |

0.4 |

|

|

0.01 |

|

| Add: After-Tax Brazilian Indirect Tax Credits, net |

(0.6) |

|

|

(0.02) |

|

| Add: After-Tax Business Realignment Costs |

0.2 |

|

|

0.01 |

|

| Adjusted Net Loss |

$ |

(14.1) |

|

|

$ |

(0.52) |

|

Exhibit 2 – Reconciliation of Adjusted EBITDA

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (USD in millions) |

Q4 2021 |

|

2021 |

|

Q1 2022 |

|

Q2 2022 |

|

Q3 2022 |

|

Q4 2022 |

|

2022 |

| Income (Loss) Before Tax |

$ |

(3.9) |

|

|

$ |

12.4 |

|

|

$ |

(6.2) |

|

|

$ |

(6.9) |

|

|

$ |

1.7 |

|

|

$ |

0.7 |

|

|

$ |

(10.7) |

|

| Interest expense, net |

0.1 |

|

|

5.2 |

|

|

1.8 |

|

|

1.2 |

|

|

1.8 |

|

|

2.2 |

|

|

7.1 |

|

| Depreciation and amortization |

8.7 |

|

|

33.9 |

|

|

8.7 |

|

|

8.5 |

|

|

8.3 |

|

|

8.2 |

|

|

33.7 |

|

| EBITDA |

$ |

5.0 |

|

|

$ |

51.5 |

|

|

$ |

4.3 |

|

|

$ |

2.8 |

|

|

$ |

11.8 |

|

|

$ |

11.1 |

|

|

$ |

30.1 |

|

| Add: Pre-Tax Change in Fair Value of Earn-Out (Stoneridge Brazil) |

0.6 |

|

|

2.1 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

| Less: Pre-Tax TSA and Monetary Correction (Stoneridge Brazil) |

(1.1) |

|

|

(1.1) |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

| Less: Pre-Tax Gain from Disposal of MSIL Joint Venture |

(1.8) |

|

|

(1.8) |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

| Add: Pre-Tax Restructuring Costs |

0.1 |

|

|

2.5 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

| Less: Pre-Tax Gain on Sale of Canton Facility |

— |

|

|

(30.7) |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

| Add: Pre-Tax Business Realignment Costs |

0.0 |

|

|

1.4 |

|

|

0.0 |

|

|

— |

|

|

0.3 |

|

|

— |

|

|

0.3 |

|

| Add: Pre-Tax Brazilian Indirect Tax Credits, Net |

— |

|

|

0.6 |

|

|

— |

|

|

(0.6) |

|

|

— |

|

|

— |

|

|

(0.6) |

|

| Less: Pre-Tax Gain from Disposal of Soot Sensor Business |

(0.4) |

|

|

(1.1) |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

| Less: Pre-Tax Sale of Soot Sensor Product Inventory |

0.1 |

|

|

0.0 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

| Add: Pre-Tax Environmental Remediation Costs |

— |

|

|

0.4 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

| Adjusted EBITDA |

$ |

2.4 |

|

|

$ |

23.7 |

|

|

$ |

4.3 |

|

|

$ |

2.3 |

|

|

$ |

12.1 |

|

|

$ |

11.1 |

|

|

$ |

29.8 |

|

Exhibit 3 – Adjusted Gross Profit

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (USD in millions) |

Q4 2021 |

|

2021 |

|

Q3 2022 |

|

Q4 2022 |

|

2022 |

| Gross Profit |

$ |

41.9 |

|

|

$ |

166.9 |

|

|

$ |

49.4 |

|

|

$ |

45.5 |

|

|

$ |

174.9 |

|

|

|

|

|

|

|

|

|

|

|

| Add: Pre-Tax Restructuring Costs |

0.1 |

|

|

1.6 |

|

|

— |

|

|

— |

|

|

— |

|

| Less: Pre-Tax Sale of Soot Sensor Product Inventory |

— |

|

|

(0.1) |

|

|

— |

|

|

— |

|

|

— |

|

| Adjusted Gross Profit |

$ |

42.0 |

|

|

$ |

168.4 |

|

|

$ |

49.4 |

|

|

$ |

45.5 |

|

|

$ |

174.9 |

|

Exhibit 4 - Adjusted Operating Income

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (USD in millions) |

Q4 2021 |

|

2021 |

|

Q3 2022 |

|

Q4 2022 |

|

2022 |

| Operating Income (Loss) |

$ |

(4.4) |

|

|

$ |

15.4 |

|

|

$ |

5.9 |

|

|

$ |

6.0 |

|

|

$ |

2.9 |

|

|

|

|

|

|

|

|

|

|

|

| Add: Pre-Tax Change in Fair Value of Earn-Out (Stoneridge Brazil) |

0.6 |

|

|

2.1 |

|

|

— |

|

|

— |

|

|

— |

|

| Less: Pre-Tax TSA and Monetary Correction (Stoneridge Brazil) |

(1.1) |

|

|

(1.1) |

|

|

— |

|

|

— |

|

|

— |

|

| Less: Pre-Tax Gain from Disposal of MSIL Joint Venture |

(1.8) |

|

|

(1.8) |

|

|

— |

|

|

— |

|

|

— |

|

| Add: Pre-Tax Restructuring Costs |

0.1 |

|

|

2.7 |

|

|

— |

|

|

— |

|

|

— |

|

| Less: Pre-Tax Gain on Sale of Canton Facility |

— |

|

|

(30.7) |

|

|

— |

|

|

— |

|

|

— |

|

| Add: Pre-Tax Business Realignment Costs |

0.0 |

|

|

1.4 |

|

|

0.3 |

|

|

— |

|

|

0.3 |

|

| Add: Pre-Tax Brazilian Indirect Tax Credits, Net |

— |

|

|

0.6 |

|

|

— |

|

|

— |

|

|

(0.6) |

|

| Less: Pre-Tax Gain from Disposal of Soot Sensor Business |

(0.4) |

|

|

(1.1) |

|

|

— |

|

|

— |

|

|

— |

|

| Add: Pre-Tax Sale of Soot Sensor Product Inventory |

0.1 |

|

|

0.0 |

|

|

— |

|

|

— |

|

|

— |

|

| Add: Pre-Tax Environmental Remediation Costs |

— |

|

|

0.4 |

|

|

— |

|

|

— |

|

|

— |

|

| Adjusted Operating Income (Loss) |

$ |

(7.0) |

|

|

$ |

(12.2) |

|

|

$ |

6.1 |

|

|

$ |

6.0 |

|

|

$ |

2.7 |

|

Exhibit 5 – Segment Adjusted Operating Income

Reconciliation of Control Devices Adjusted Operating Income

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (USD in millions) |

Q4 2021 |

|

2021 |

|

Q3 2022 |

|

Q4 2022 |

|

2022 |

| Control Devices Operating Income |

$ |

4.8 |

|

|

$ |

54.9 |

|

|

$ |

7.5 |

|

|

$ |

5.5 |

|

|

$ |

23.9 |

|

|

|

|

|

|

|

|

|

|

|

| Add: Pre-Tax Restructuring Costs |

0.1 |

|

|

2.3 |

|

|

— |

|

|

— |

|

|

— |

|

| Less: Pre-Tax Gain on Sale of Canton Facility |

— |

|

|

(30.7) |

|

|

— |

|

|

— |

|

|

— |

|

| Less: Pre-Tax Gain from Disposal of Soot Sensor Business |

(0.4) |

|

|

(1.1) |

|

|

— |

|

|

— |

|

|

— |

|

| Add: Pre-Tax Business Realignment Costs |

— |

|

|

0.2 |

|

|

— |

|

|

— |

|

|

— |

|

| Less: Pre-Tax Sale of Soot Sensor Product Inventory |

0.1 |

|

|

0.0 |

|

|

— |

|

|

— |

|

|

— |

|

| Add: Pre-Tax Environmental Remediation Costs |

— |

|

|

0.4 |

|

|

— |

|

|

— |

|

|

— |

|

| Control Devices Adjusted Operating Income |

$ |

4.5 |

|

|

$ |

26.0 |

|

|

$ |

7.5 |

|

|

$ |

5.5 |

|

|

$ |

23.9 |

|

Reconciliation of Electronics Adjusted Operating Income (Loss)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (USD in millions) |

Q4 2021 |

|

2021 |

|

Q3 2022 |

|

Q4 2022 |

|

2022 |

| Electronics Operating Income (Loss) |

$ |

(4.7) |

|

|

$ |

(12.5) |

|

|

$ |

5.4 |

|

|

$ |

4.9 |

|

|

$ |

5.1 |

|

|

|

|

|

|

|

|

|

|

|

| Add: Pre-Tax Restructuring Costs |

— |

|

|

0.3 |

|

|

— |

|

|

— |

|

|

— |

|

| Add: Pre-Tax Business Realignment Costs |

— |

|

|

0.0 |

|

|

— |

|

|

— |

|

|

— |

|

| Electronics Adjusted Operating Income (Loss) |

$ |

(4.7) |

|

|

$ |

(12.2) |

|

|

$ |

5.4 |

|

|

$ |

4.9 |

|

|

$ |

5.1 |

|

Reconciliation of Stoneridge Brazil Adjusted Operating Income

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (USD in millions) |

Q4 2021 |

|

2021 |

|

Q3 2022 |

|

Q4 2022 |

|

2022 |

| Stoneridge Brazil Operating Income (Loss) |

$ |

0.9 |

|

|

$ |

1.0 |

|

|

$ |

0.9 |

|

|

$ |

0.8 |

|

|

$ |

3.1 |

|

|

|

|

|

|

|

|

|

|

|

| Add: Pre-Tax Change in Fair Value of Earn-Out (Stoneridge Brazil) |

0.6 |

|

|

2.1 |

|

|

— |

|

|

— |

|

|

— |

|

| Less: Pre-Tax TSA and Monetary Correction (Stoneridge Brazil) |

(1.1) |

|

|

(1.1) |

|

|

— |

|

|

— |

|

|

— |

|

| Add: Pre-Tax Business Realignment Costs |

— |

|

|

0.1 |

|

|

0.1 |

|

|

— |

|

|

0.1 |

|

| Add: Pre-Tax Brazilian Indirect Tax Credits, Net |

— |

|

|

0.6 |

|

|

— |

|

|

— |

|

|

(0.6) |

|

| Stoneridge Brazil Adjusted Operating Income |

$ |

0.3 |

|

|

$ |

2.6 |

|

|

$ |

1.0 |

|

|

$ |

0.8 |

|

|

$ |

2.7 |

|

Exhibit 6 – Reconciliation of Adjusted Sales

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (USD in millions) |

Q4 2021 |

|

2021 |

|

Q3 2022 |

|

Q4 2022 |

|

2022 |

| Sales |

$ |

203.7 |

|

|

$ |

770.5 |

|

|

$ |

226.8 |

|

|

$ |

231.2 |

|

|

$ |

899.9 |

|

|

|

|

|

|

|

|

|

|

|

| Less: Pre-Tax Sale of Soot Sensor Product Inventory |

(1.3) |

|

|

(2.3) |

|

|

— |

|

|

— |

|

|

— |

|

| Less: Sales from Spot Purchase Recoveries |

$ |

(17.6) |

|

|

$ |

(17.6) |

|

|

$ |

(12.8) |

|

|

$ |

(6.0) |

|

|

$ |

(58.4) |

|

| Adjusted Sales |

$ |

184.7 |

|

|

$ |

750.5 |

|

|

$ |

214.0 |

|

|

$ |

225.2 |

|

|

$ |

841.5 |

|

Exhibit 7 – Reconciliation of Control Devices Adjusted Sales Excluding Disposed Soot Sensor Business

Reconciliation of Control Devices Adjusted Sales

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (USD in millions) |

Q4 2021 |

|

2021 |

|

Q3 2022 |

|

Q4 2022 |

|

2022 |

| Control Devices Sales |

$ |

82.9 |

|

|

$ |

359.3 |

|

|

$ |

89.4 |

|

|

$ |

85.9 |

|

|

$ |

345.3 |

|

|

|

|

|

|

|

|

|

|

|

| Less: Pre-Tax Sale of Soot Sensor Product Inventory |

(1.3) |

|

|

(2.3) |

|

|

— |

|

|

— |

|

|

— |

|

| Control Devices Adjusted Sales |

$ |

81.6 |

|

|

$ |

357.0 |

|

|

$ |

89.4 |

|

|

$ |

85.9 |

|

|

$ |

345.3 |

|

Reconciliation of Control Devices Adjusted Sales Excluding Disposed Soot Sensor Business

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (USD in millions) |

Q4 2021 |

|

2021 |

|

Q3 2022 |

|

Q4 2022 |

|

2022 |

| Control Devices Sales |

$ |

81.6 |

|

|

$ |

357.0 |

|

|

$ |

89.4 |

|

|

$ |

85.9 |

|

|

$ |

345.3 |

|

|

|

|

|

|

|

|

|

|

|

| Less: Sales from Disposed Soot Sensor Business |

(1.8) |

|

|

(10.3) |

|

|

— |

|

|

— |

|

|

— |

|

| Control Devices Adjusted Sales Excluding Disposed Soot Sensor Business |

$ |

79.9 |

|

|

$ |

346.7 |

|

|

$ |

89.4 |

|

|

$ |

85.9 |

|

|

$ |

345.3 |

|

Exhibit 8 – Control Devices Adjusted Operating Income Excluding Disposed Soot Sensor Business

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (USD in millions) |

Q4 2021 |

|

2021 |

|

Q3 2022 |

|

Q4 2022 |

|

2022 |

| Control Devices Adjusted Operating Income |

$ |

4.5 |

|

|

$ |

26.0 |

|

|

$ |

7.5 |

|

|

$ |

5.5 |

|

|

$ |

23.9 |

|

|

|

|

|

|

|

|

|

|

|

| Less: Pre-Tax Operating Gain from Disposed Soot Sensor Business |

(0.5) |

|

|

(2.1) |

|

|

— |

|

|

— |

|

|

— |

|

| Control Devices Adjusted Operating Income Excluding Disposed Soot Sensor Business |

$ |

4.0 |

|

|

$ |

23.9 |

|

|

$ |

7.5 |

|

|

$ |

5.5 |

|

|

$ |

23.9 |

|

Exhibit 9 – Reconciliation of Electronics Adjusted Sales

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (USD in millions) |

Q4 2021 |

|

2021 |

|

Q3 2022 |

|

Q4 2022 |

|

2022 |

| Electronics Sales |

$ |

114.1 |

|

|

$ |

384.1 |

|

|

$ |

130.0 |

|

|

$ |

140.7 |

|

|

$ |

533.8 |

|

|

|

|

|

|

|

|

|

|

|

| Less: Sales from Spot Purchase Recoveries |

(17.6) |

|

|

(17.6) |

|

|

(12.8) |

|

|

(6.0) |

|

|

(58.4) |

|

| Electronics Adjusted Sales |

$ |

96.5 |

|

|

$ |

366.5 |

|

|

$ |

117.2 |

|

|

$ |

134.8 |

|

|

$ |

475.4 |

|

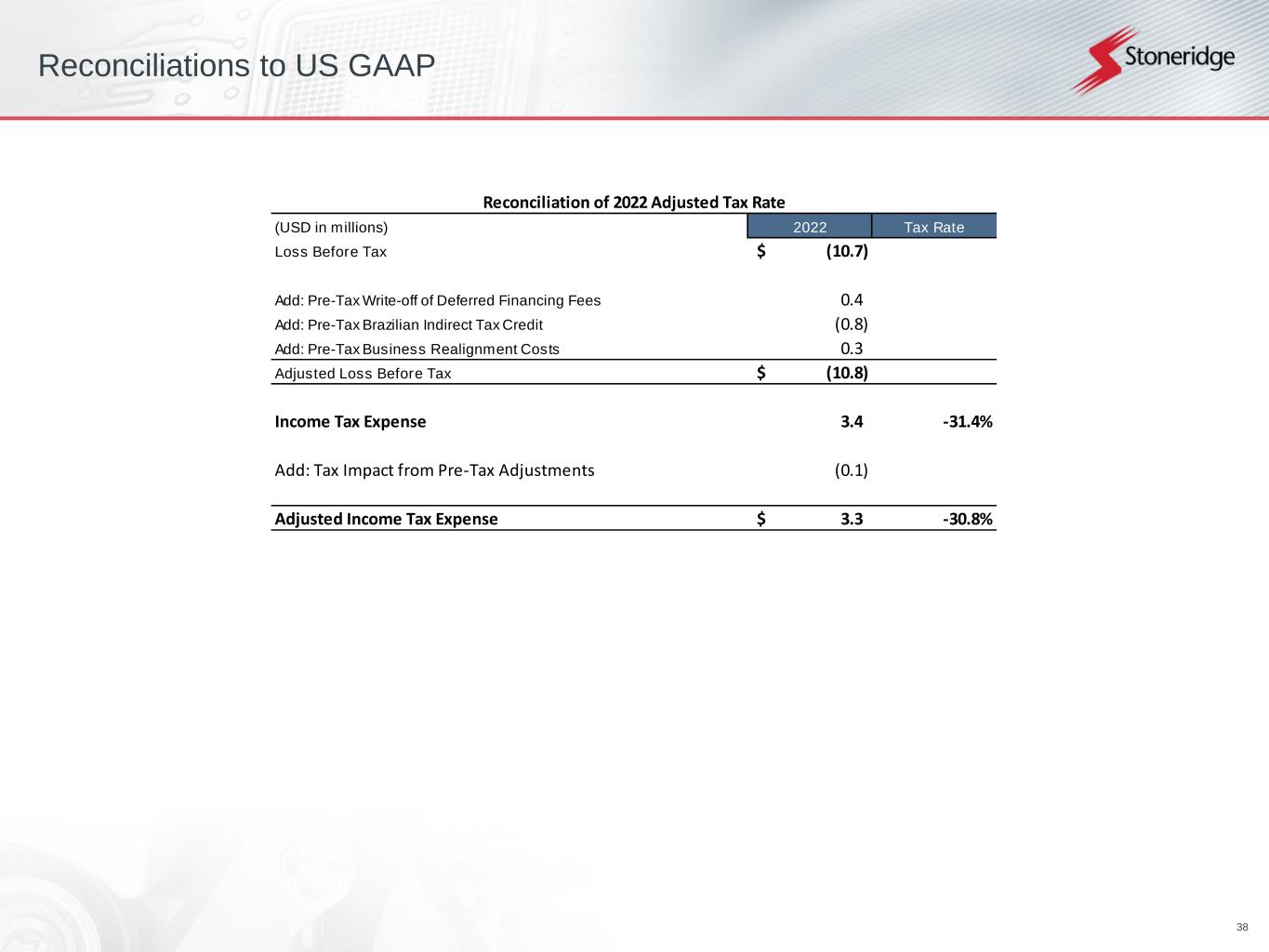

Exhibit 10 – Adjusted Tax Rate

Reconciliation of 2022 Adjusted Tax Rate

|

|

|

|

|

|

|

|

|

|

|

|

| (USD in millions) |

2022 |

|

Tax Rate |

| Loss Before Tax |

$ |

(10.7) |

|

|

|

|

|

|

|

| Add: Pre-Tax Write-off of Deferred Financing Fees |

0.4 |

|

|

|

| Add: Pre-Tax Brazilian Indirect Tax Credits, net |

(0.8) |

|

|

|

| Add: Pre-Tax Business Realignment Costs |

0.3 |

|

|

|

| Adjusted Loss Before Tax |

$ |

(10.8) |

|

|

|

|

|

|

|

| Income Tax Expense |

3.4 |

|

|

(31.4) |

% |

|

|

|

|

| Add: Tax Impact from Pre-Tax Adjustments |

(0.1) |

|

|

|

|

|

|

|

| Adjusted Income Tax Expense |

$ |

3.3 |

|

|

(30.8) |

% |

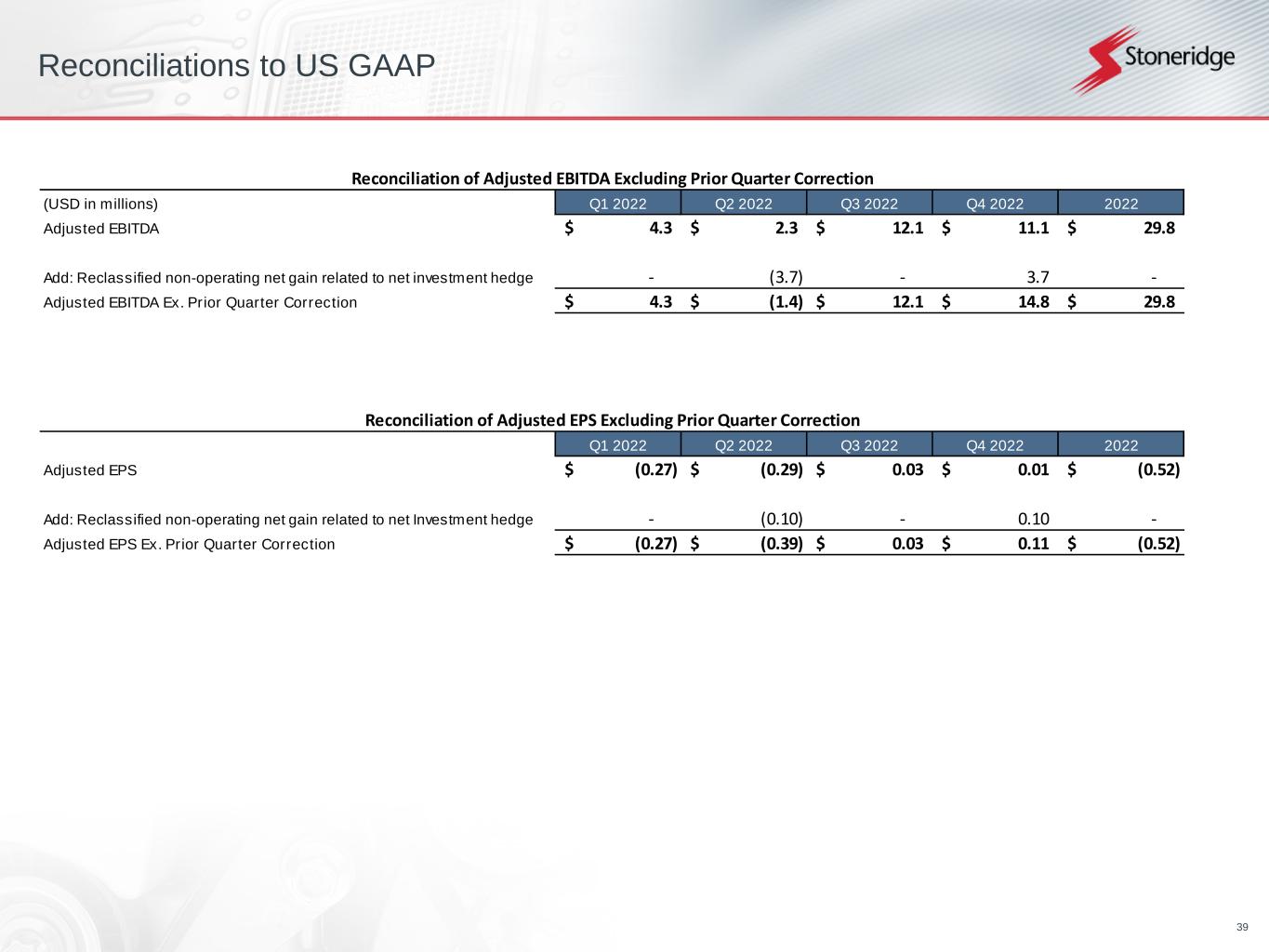

Exhibit 11 – Adjusted Results Excluding Prior Quarter Correction

Reconciliation of Adjusted EPS Excluding Prior Quarter Correction

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q1 2022 |

|

Q2 2022 |

|

Q3 2022 |

|

Q4 2022 |

|

2022 |

| Adjusted EPS |

$ |

(0.27) |

|

|

$ |

(0.29) |

|

|

$ |

0.03 |

|

|

$ |

0.01 |

|

|

$ |

(0.52) |

|

|

|

|

|

|

|

|

|

|

|

| Add: Reclassified non-operating net gain related to net investment hedge |

— |

|

|

(0.10) |

|

|

— |

|

|

0.10 |

|

|

— |

|

| Adjusted EPS Ex. Prior Quarter Correction |

$ |

(0.27) |

|

|

$ |

(0.39) |

|

|

$ |

0.03 |

|

|

$ |

0.11 |

|

|

$ |

(0.52) |

|

Reconciliation of Adjusted EBITDA Excluding Prior Quarter Correction

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q1 2022 |

|

Q2 2022 |

|

Q3 2022 |

|

Q4 2022 |

|

2022 |

| Adjusted EBITDA |

$ |

4.3 |

|

|

$ |

2.3 |

|

|

$ |

12.1 |

|

|

$ |

11.1 |

|

|

$ |

29.8 |

|

|

|

|

|

|

|

|

|

|

|

| Add: Reclassified non-operating net gain related to net investment hedge |

— |

|

|

(3.7) |

|

|

— |

|

|

3.7 |

|

|

— |

|

| Adjusted EBITDA Ex. Prior Quarter Correction |

$ |

4.3 |

|

|

$ |

(1.4) |

|

|

$ |

12.1 |

|

|

$ |

14.8 |

|

|

$ |

29.8 |

|