Document

|

|

|

|

|

|

|

C.H. Robinson

14701 Charlson Rd.

Eden Prairie, MN 55347

www.chrobinson.com

|

| FOR IMMEDIATE RELEASE |

FOR INQUIRIES, CONTACT:

Chuck Ives, Director of Investor Relations

Email: chuck.ives@chrobinson.com

|

C.H. Robinson Reports 2024 First Quarter Results

Eden Prairie, MN, May 1, 2024 - C.H. Robinson Worldwide, Inc. (“C.H. Robinson”) (Nasdaq: CHRW) today reported financial results for the quarter ended March 31, 2024.

First Quarter Key Metrics:

•Gross profits decreased 4.5% year-over-year to $647.5 million, but increased 6.3% sequentially

•Income from operations decreased 21.1% year-over-year to $127.1 million, but increased 18.3% sequentially

•Adjusted operating margin(1) decreased 420 basis points to 19.3%

•Diluted earnings per share (EPS) decreased 18.8% to $0.78

•Adjusted EPS(1) decreased 14.0% year-over-year to $0.86, but increased 72% sequentially

•Cash from operations decreased by $287.9 million to $33.3 million used by operations

(1) Adjusted operating margin and adjusted EPS are non-GAAP financial measures. The same factors described in this release that impacted these non-GAAP measures also impacted the comparable GAAP measures. Refer to pages 10 through 12 for further discussion and GAAP to Non-GAAP Reconciliations.

"Our first quarter results and adjusted earnings per share of $0.86 reflects a change in our execution and discipline, as we began implementing a new Lean-based operating model. And although we continue to battle through an elongated freight recession with an oversupply of capacity, I’m optimistic about our ability to continue improving our execution regardless of the market environment," said C.H. Robinson's President and Chief Executive Officer, Dave Bozeman. "Our new operating model is being deployed at the enterprise, divisional and shared service levels and is evolving our execution and accountability by bringing more structure to our continuous improvement cadence and culture. This new way of operating is starting to enable greater discipline, transparency, urgency and consistency in our decision making, based on data and input metrics that can reliably lead to better outputs. It's also setting the tone of how we operate and hold ourselves accountable, helping us make systemic improvements, build operational muscle and drive value at speed.

We began to see the benefits of our new operating model in our first quarter execution."

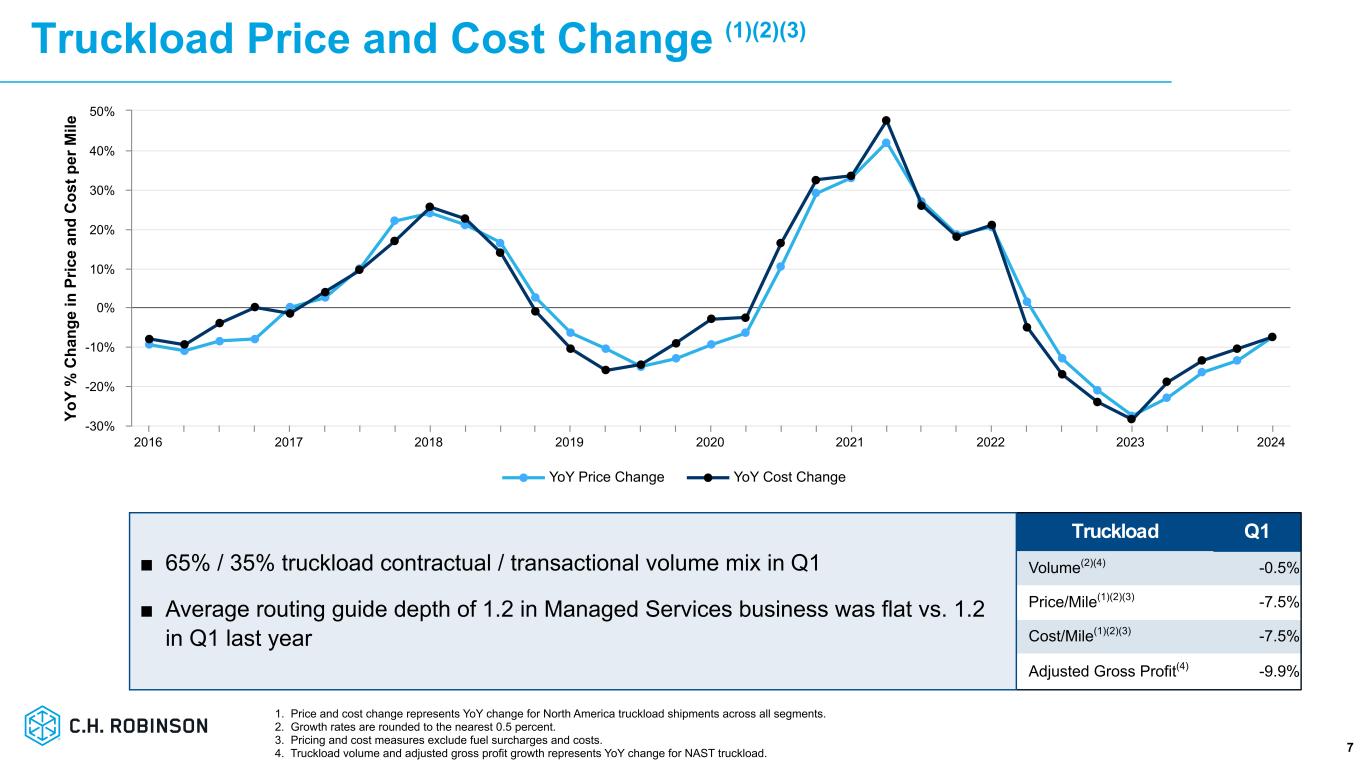

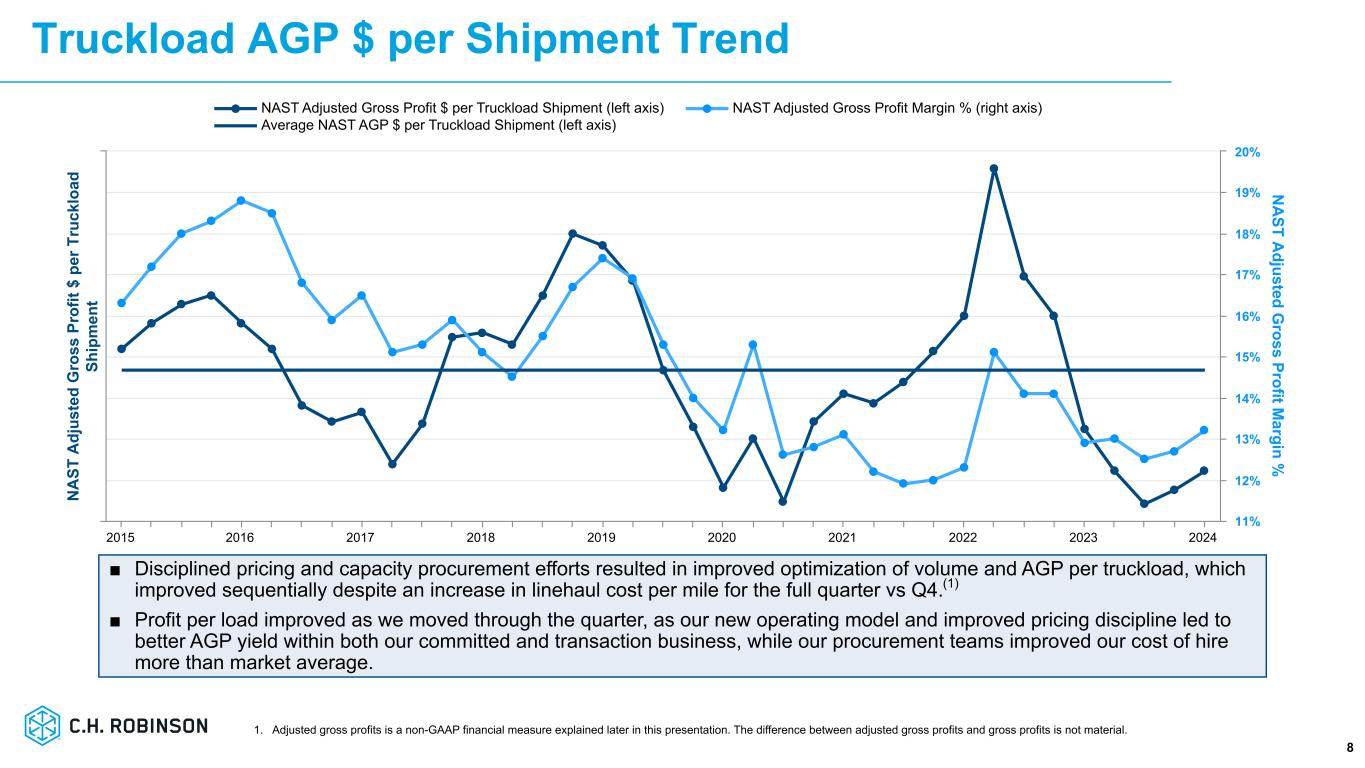

"As a result of disciplined pricing and capacity procurement efforts, we executed better across our contractual and transactional portfolios in our NAST business, and in particular, in our truckload business in the first quarter. This resulted in improved optimization of volume and adjusted gross profit per truckload, which improved sequentially despite an increase in our linehaul cost per mile for the full quarter versus the fourth quarter of 2023. Additionally, our first quarter truckload volume reflects growing market share, and we outpaced the market indices for the third quarter in a row," added Bozeman.

"In what continues to be a difficult environment, our resilient team of freight experts is responding to the challenge and embracing the new operating model and the innovative tools that we continue to arm them with. Our people have a powerful desire to win, and I thank them for their tireless efforts. They continue to be a differentiator for us and for our customers and carriers, and I’m confident in the team's willingness and ability to drive a higher level of discipline in our operational execution. We’re moving in the right direction, and at the same time, everyone understands that we have more work to do," Bozeman concluded.

Summary of First Quarter of 2024 Results Compared to the First Quarter of 2023

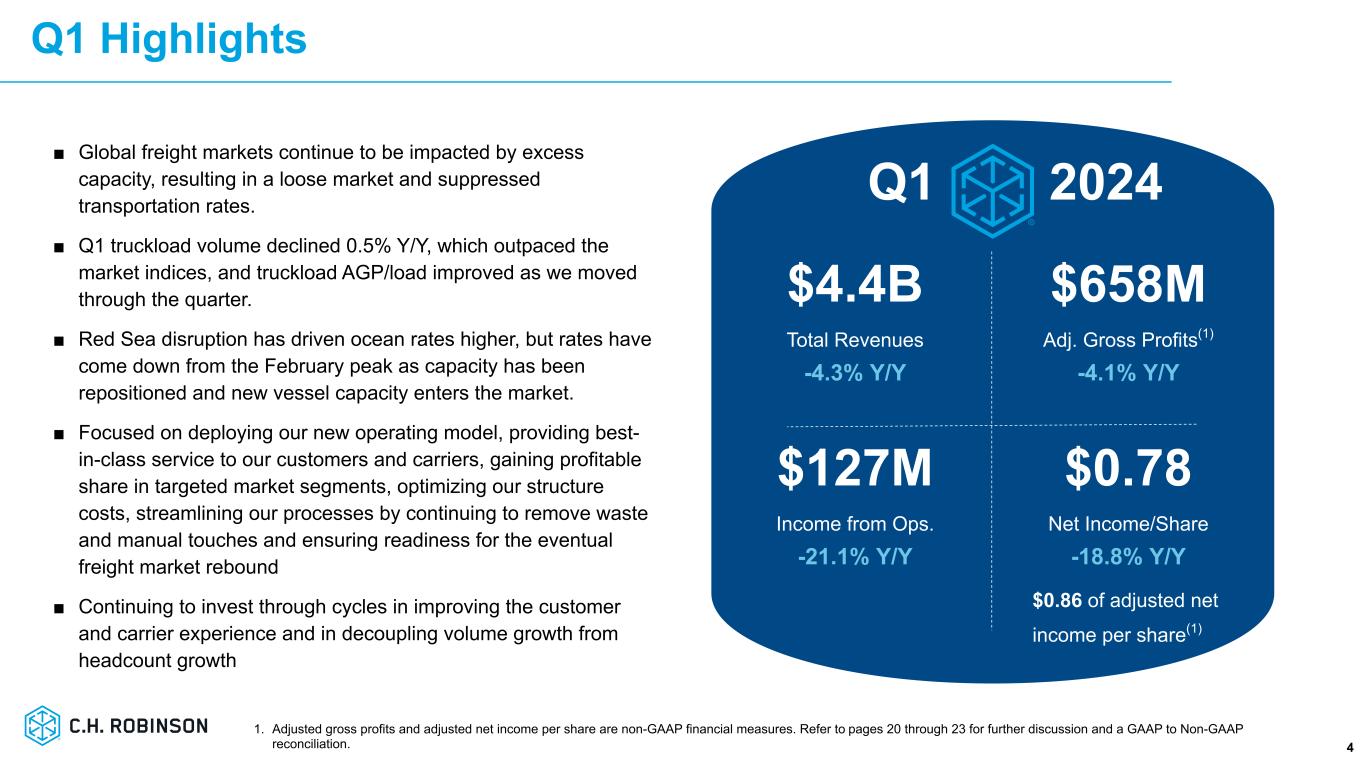

•Total revenues decreased 4.3% to $4.4 billion, primarily driven by lower pricing in our truckload services, partially offset by higher pricing and increased volume in our ocean services.

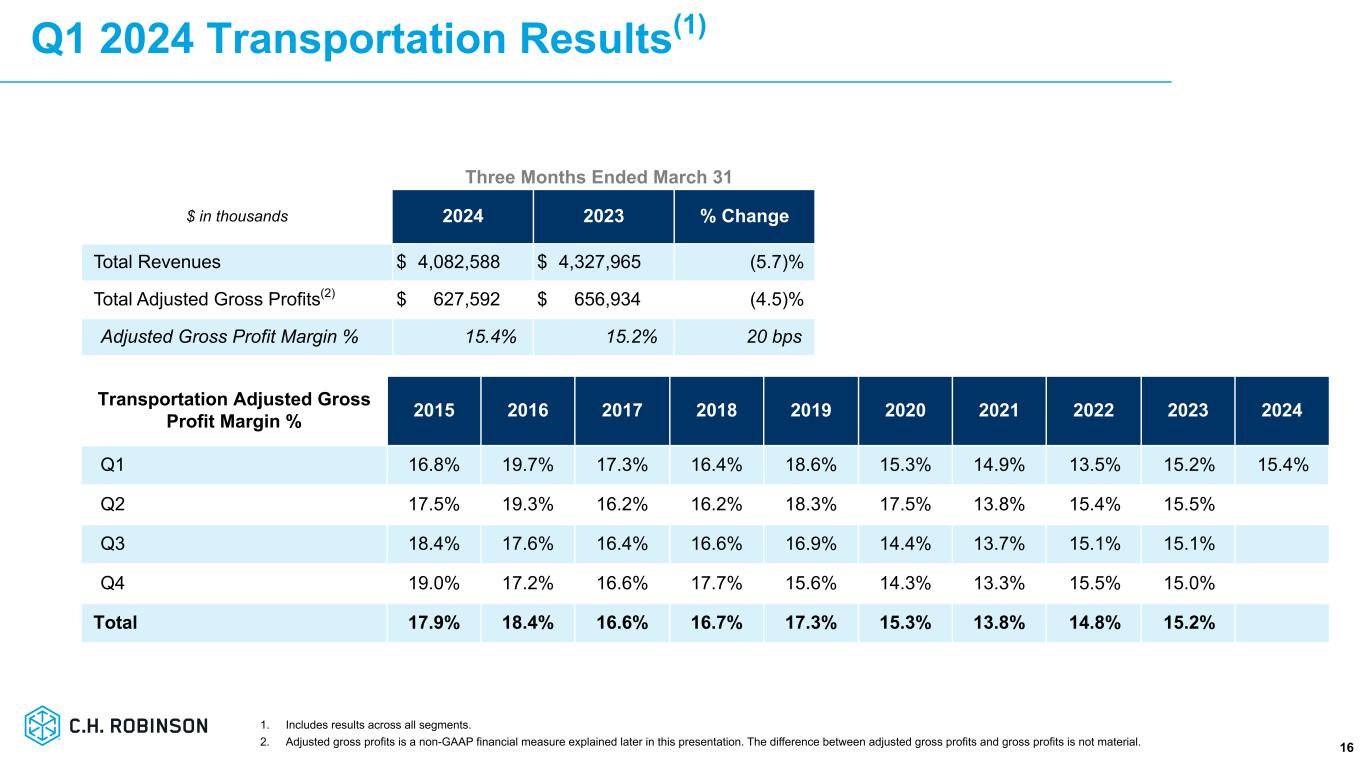

•Gross profits decreased 4.5% to $647.5 million. Adjusted gross profits decreased 4.1% to $657.7 million, primarily driven by lower adjusted gross profit per transaction in truckload.

•Operating expenses increased 1.1% to $530.6 million. Personnel expenses decreased 1.0% to $379.1 million, primarily due to cost optimization efforts and partially offset by higher restructuring charges related to workforce reductions. Average headcount declined 11.3%. Other selling, general and administrative (“SG&A”) expenses increased 7.1% to $151.5 million, primarily due to favorable credit losses in the prior year and restructuring charges in the current year related to the impairment of internally developed software.

•Income from operations totaled $127.1 million, down 21.1% due to the decrease in adjusted gross profits. Adjusted operating margin(1) of 19.3% declined 420 basis points.

•Interest and other income/expense, net totaled $16.8 million of expense, consisting primarily of $22.1 million of interest expense, which decreased $1.5 million versus last year, due to a lower average debt balance, and a $3.9 million net gain from foreign currency revaluation and realized foreign currency gains and losses.

•The effective tax rate in the quarter was 15.8%, compared to 13.5% in the first quarter last year. The higher rate in the first quarter of this year was driven by lower tax benefits related to stock-based compensation deliveries and higher foreign taxes, partially offset by higher U.S. tax credits and the impact of lower pretax income.

•Net income totaled $92.9 million, down 19.1% from a year ago. Diluted EPS of $0.78 decreased 18.8%. Adjusted EPS(1) of $0.86 decreased 14.0%.

(1) Adjusted operating margin and adjusted EPS are non-GAAP financial measures. The same factors described in this release that impacted these non-GAAP measures also impacted the comparable GAAP measures. Refer to pages 10 through 12 for further discussion and GAAP to Non-GAAP Reconciliations.

North American Surface Transportation (“NAST”) Results

Summarized financial results of our NAST segment are as follows (dollars in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

2024 |

|

2023 |

|

% change |

|

|

|

|

|

|

| Total revenues |

$ |

3,000,313 |

|

|

$ |

3,304,187 |

|

|

(9.2) |

% |

|

|

|

|

|

|

Adjusted gross profits(1) |

397,110 |

|

|

426,655 |

|

|

(6.9) |

% |

|

|

|

|

|

|

| Income from operations |

108,895 |

|

|

134,022 |

|

|

(18.7) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

____________________________________________

(1) Adjusted gross profits is a non-GAAP financial measure explained later in this release. The difference between adjusted gross profits and gross profits is not material.

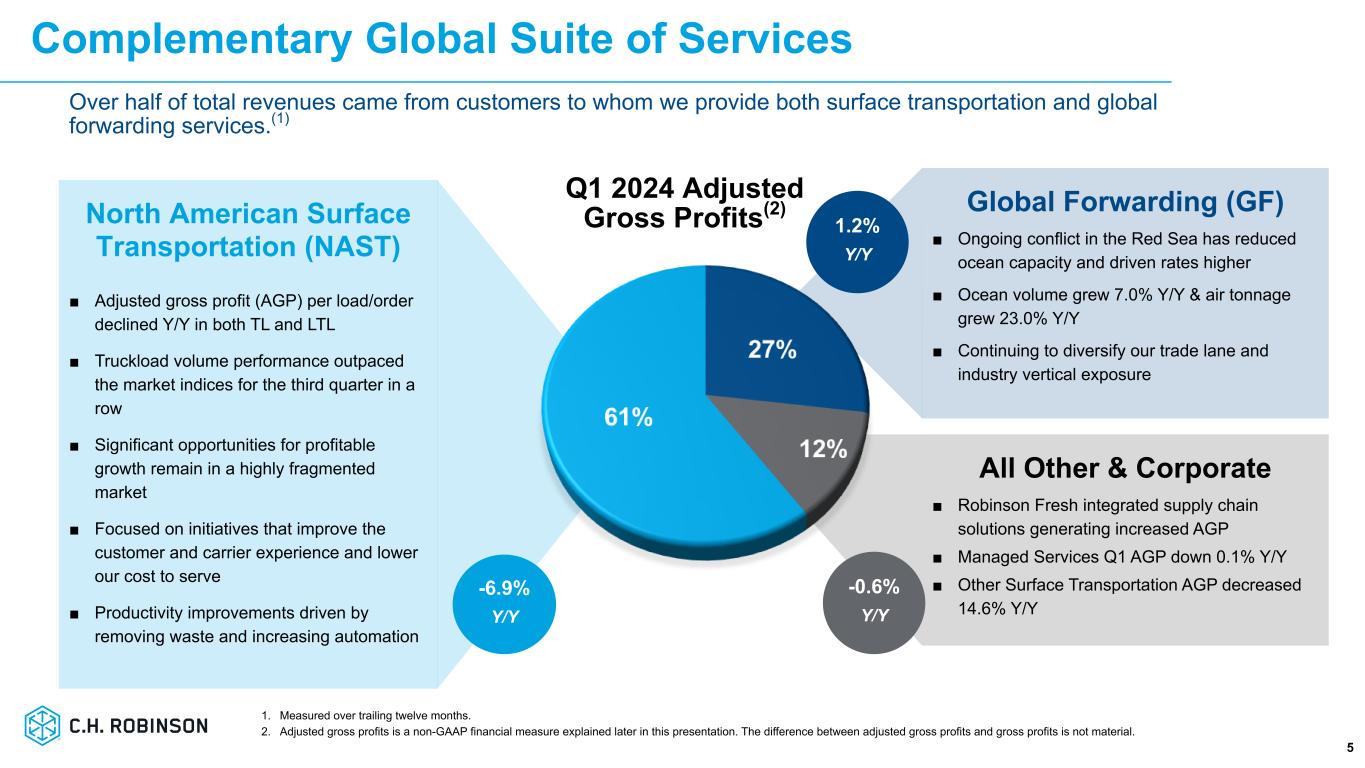

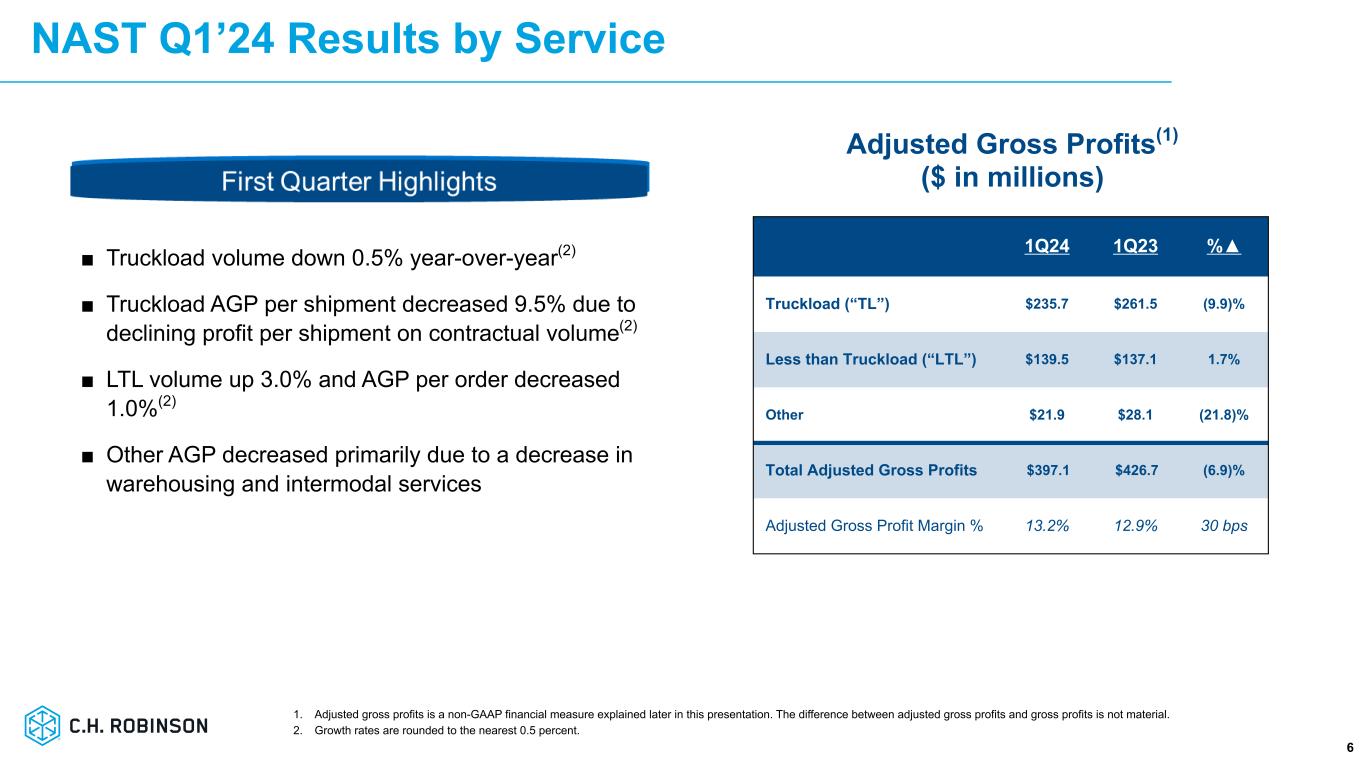

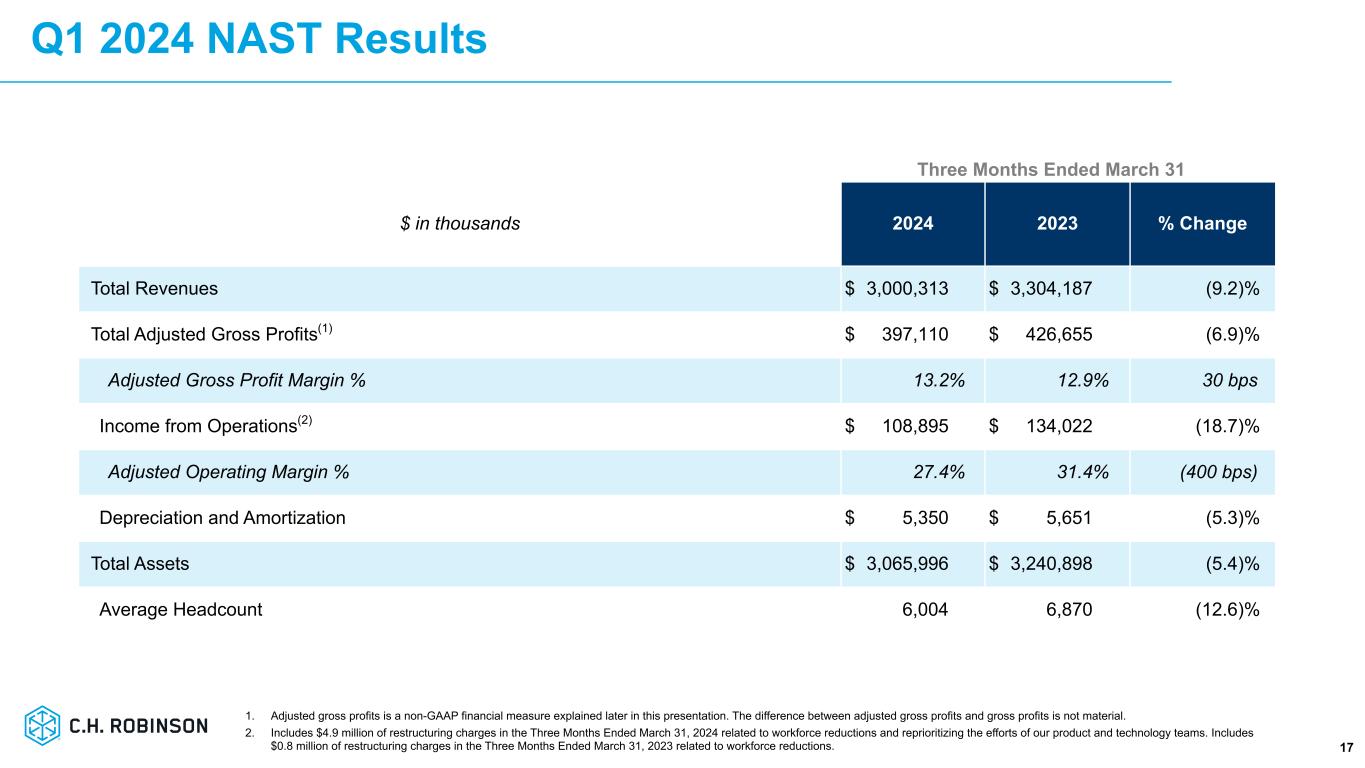

First quarter total revenues for the NAST segment totaled $3.0 billion, a decrease of 9.2% over the prior year, primarily driven by lower truckload pricing, reflecting an oversupply of truckload capacity compared to freight demand. NAST adjusted gross profits decreased 6.9% in the quarter to $397.1 million. Adjusted gross profits in truckload decreased 9.9% due to a 9.5% decrease in adjusted gross profit per shipment and a 0.5% decline in truckload shipments. Our average truckload linehaul rate per mile charged to our customers, which excludes fuel surcharges, decreased approximately 7.5% in the quarter compared to the prior year, while truckload linehaul cost per mile, excluding fuel surcharges, also decreased approximately 7.5%, resulting in an 8.5% decrease in truckload adjusted gross profit per mile. LTL adjusted gross profits increased 1.7% versus the year-ago period, driven by a 3.0% increase in LTL volume, partially offset by a 1.0% decrease in adjusted gross profit per order. NAST overall volume growth increased 1.5% for the quarter. Operating expenses decreased 1.5%, primarily due to lower technology expenses which were partially offset by a benefit in the prior year from lower credit losses. NAST average employee headcount was down 12.6% in the quarter. Income from operations decreased 18.7% to $108.9 million, and adjusted operating margin declined 400 basis points to 27.4%.

Global Forwarding Results

Summarized financial results of our Global Forwarding segment are as follows (dollars in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

2024 |

|

2023 |

|

% change |

|

|

|

|

|

|

| Total revenues |

$ |

858,637 |

|

|

$ |

789,978 |

|

|

8.7 |

% |

|

|

|

|

|

|

Adjusted gross profits(1) |

180,045 |

|

|

177,919 |

|

|

1.2 |

% |

|

|

|

|

|

|

| Income from operations |

31,552 |

|

|

30,116 |

|

|

4.8 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

____________________________________________

(1) Adjusted gross profits is a non-GAAP financial measure explained later in this release. The difference between adjusted gross profits and gross profits is not material.

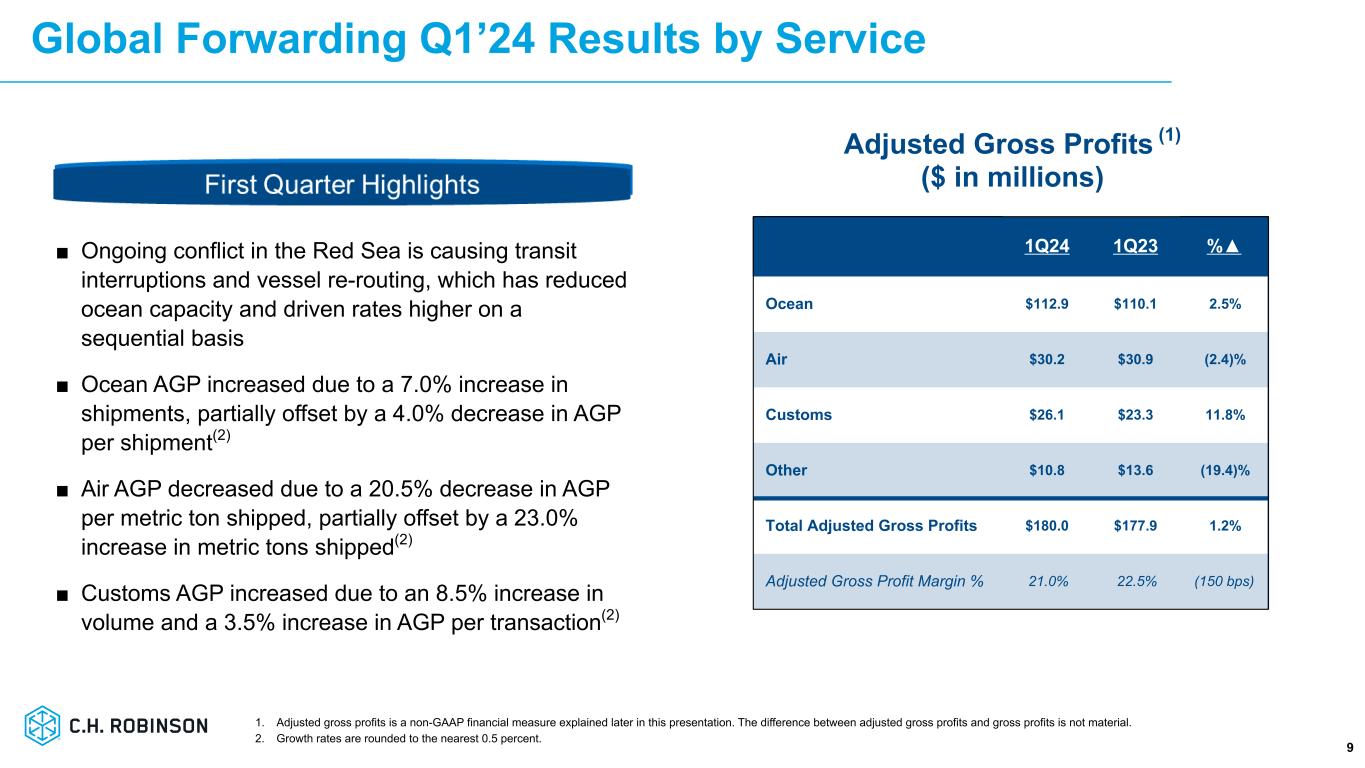

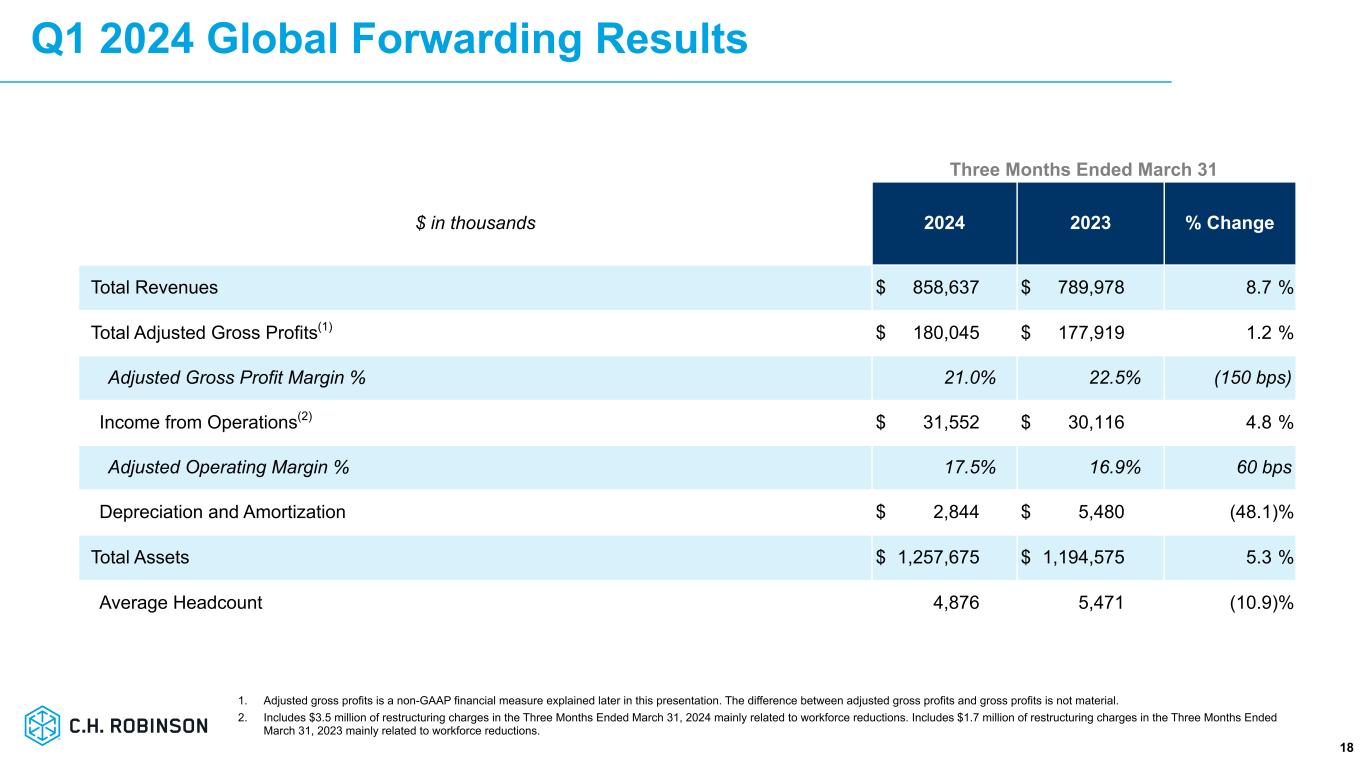

First quarter total revenues for the Global Forwarding segment increased 8.7% to $858.6 million, primarily driven by higher pricing and increased volume in our ocean services. Adjusted gross profits increased 1.2% in the quarter to $180.0 million. Ocean adjusted gross profits increased 2.5%, driven by a 7.0% increase in shipments, partially offset by a 4.0% decrease in adjusted gross profit per shipment. Air adjusted gross profits decreased 2.4%, driven by a 20.5% decrease in adjusted gross profit per metric ton shipped, partially offset by a 23.0% increase in metric tons shipped. Customs adjusted gross profits increased 11.8%, driven by an 8.5% increase in transaction volume and a 3.5% increase in adjusted gross profit per transaction. Operating expenses increased 0.5%, primarily due to higher variable compensation. First quarter average employee headcount decreased 10.9%. Income from operations increased 4.8% to $31.6 million, and adjusted operating margin expanded 60 basis points to 17.5% in the quarter.

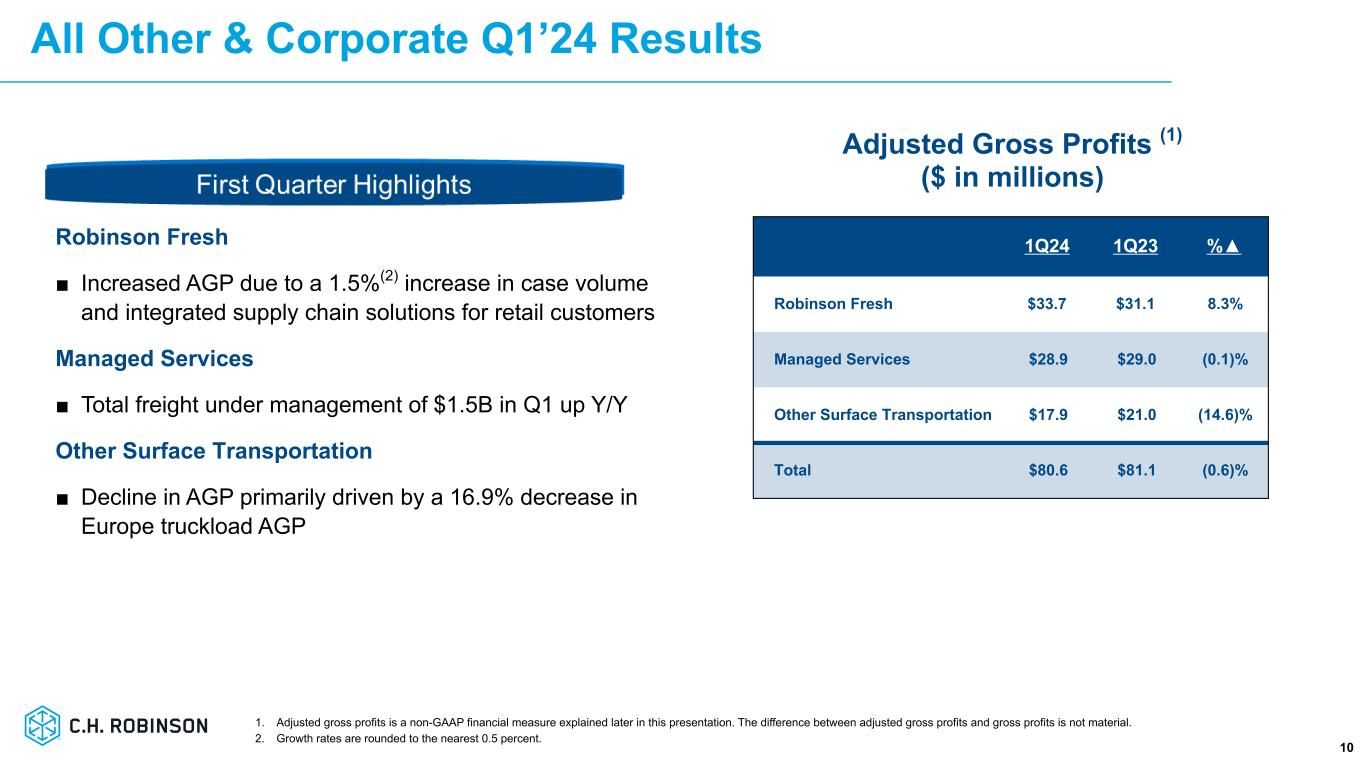

All Other and Corporate Results

Total revenues and adjusted gross profits for Robinson Fresh, Managed Services and Other Surface Transportation are summarized as follows (dollars in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

2024 |

|

2023 |

|

% change |

|

|

|

|

|

|

| Total revenues |

$ |

553,361 |

|

|

$ |

517,505 |

|

|

6.9 |

% |

|

|

|

|

|

|

Adjusted gross profits(1): |

|

|

|

|

|

|

|

|

|

|

|

| Robinson Fresh |

$ |

33,736 |

|

|

$ |

31,145 |

|

|

8.3 |

% |

|

|

|

|

|

|

| Managed Services |

28,936 |

|

|

28,970 |

|

|

(0.1) |

% |

|

|

|

|

|

|

| Other Surface Transportation |

17,902 |

|

|

20,951 |

|

|

(14.6) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

____________________________________________

(1) Adjusted gross profits is a non-GAAP financial measure explained later in this release. The difference between adjusted gross profits and gross profits is not material.

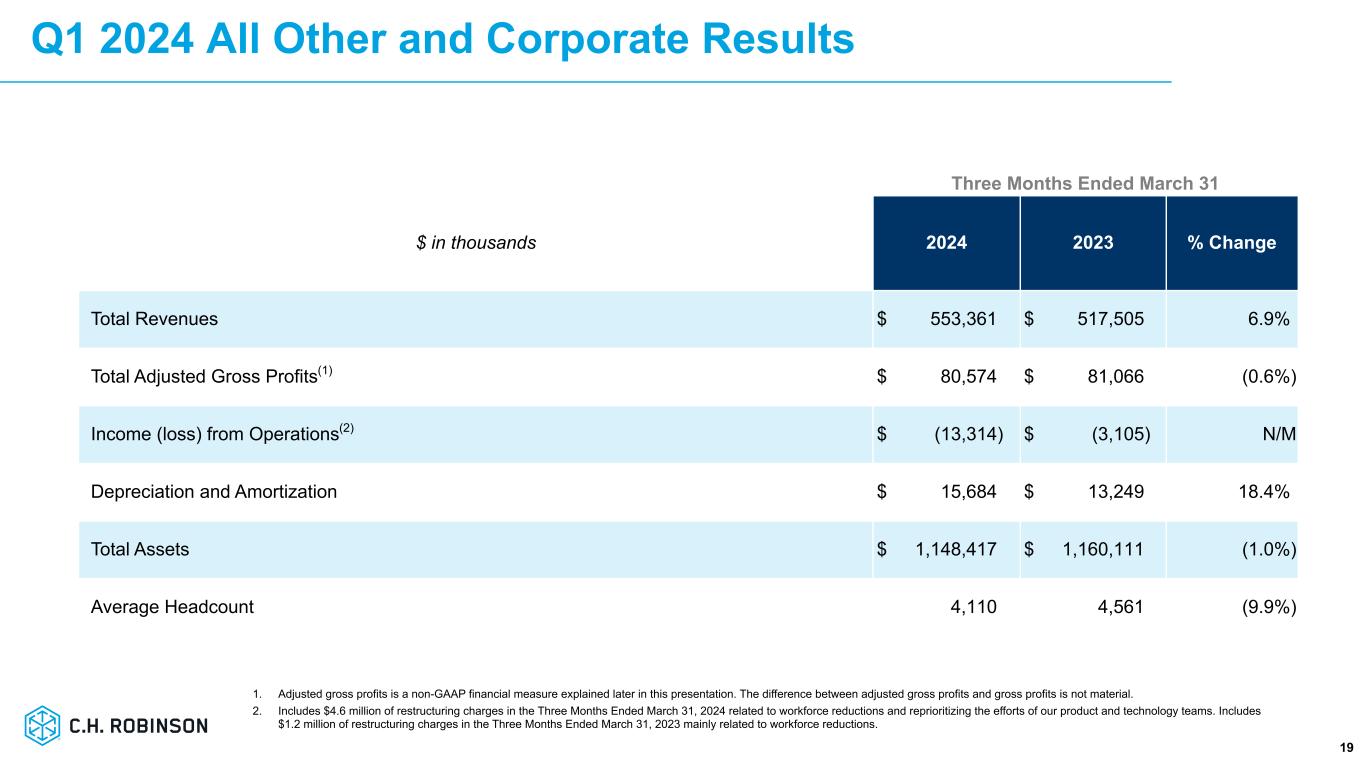

First quarter Robinson Fresh adjusted gross profits increased 8.3% to $33.7 million due to a 1.5% increase in case volume and integrated supply chain solutions for retail customers. Managed Services adjusted gross profits decreased 0.1%. Other Surface Transportation adjusted gross profits decreased 14.6% to $17.9 million, primarily due to a 16.9% decrease in Europe truckload adjusted gross profits.

Other Income Statement Items

The first quarter effective tax rate was 15.8%, up from 13.5% last year. The higher rate in the first quarter of this year was driven by lower tax benefits related to stock-based compensation deliveries and higher foreign taxes, partially offset by higher U.S. tax credits and the impact of lower pretax income. For 2024, we expect our full-year effective tax rate to be 17% to 19%.

Interest and other income/expense, net totaled $16.8 million of expense, consisting primarily of $22.1 million of interest expense, which decreased $1.5 million versus the first quarter of 2023 due to a lower average debt balance, and a $3.9 million net gain from foreign currency revaluation and realized foreign currency gains and losses.

Diluted weighted average shares outstanding in the quarter were down 0.3% due to lower dilutive impact of equity awards.

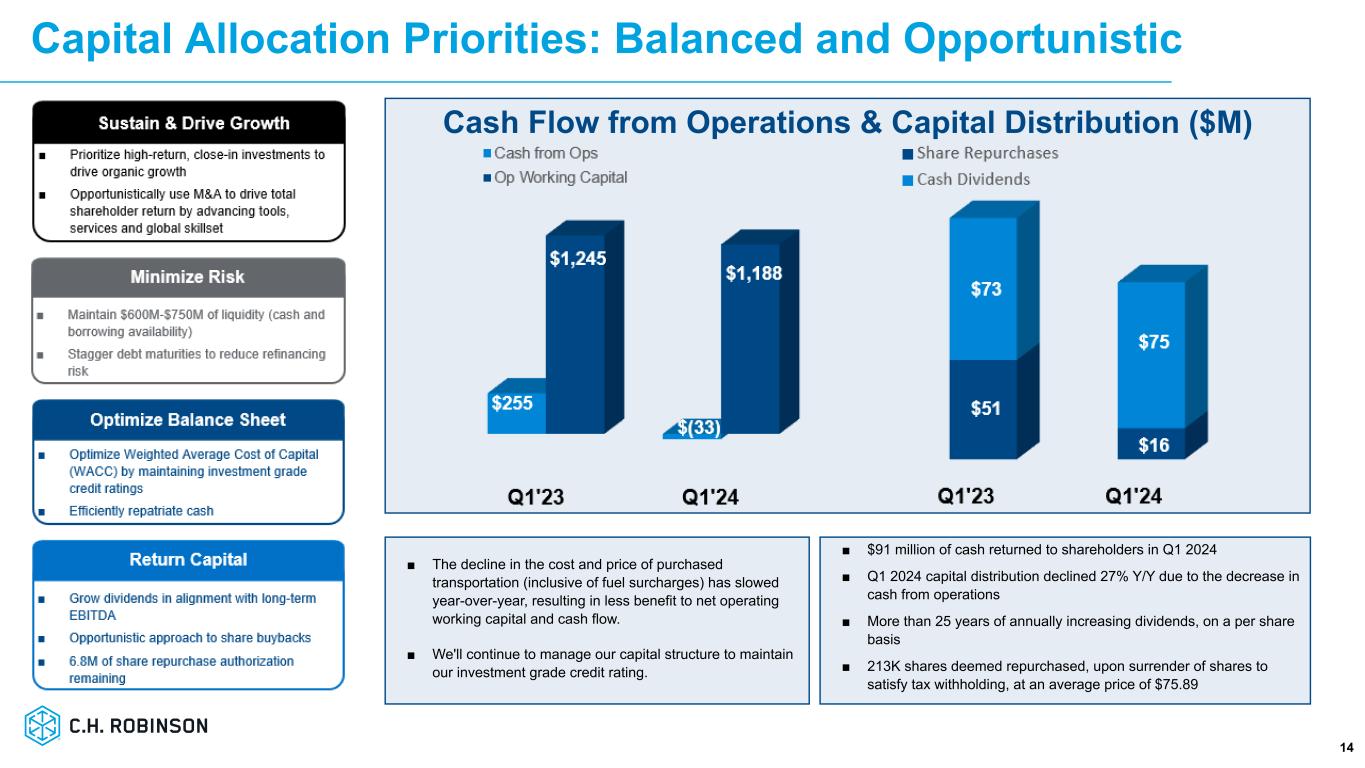

Cash Flow Generation and Capital Distribution

Cash used by operations totaled $33.3 million in the first quarter, compared to $254.5 million of cash generated from operations in the first quarter of 2023. The $287.9 million decrease in cash flow from operations was primarily related to a $369.5 million decline in cash provided by changes in net operating working capital, due to a $134.6 million sequential increase in net operating working capital in the first quarter of 2024 compared to a $234.9 million sequential decrease in the first quarter of 2023.

In the first quarter of 2024, cash returned to shareholders totaled $90.7 million, with $74.6 million in cash dividends and $16.1 million in repurchases of common stock.

Capital expenditures totaled $22.5 million in the quarter. Capital expenditures for 2024 are expected to be $85 million to $95 million.

About C.H. Robinson

C.H. Robinson solves logistics problems for companies across the globe and across industries, from the simple to the most complex. With $22 billion in freight under management and 19 million shipments annually, we are one of the world’s largest logistics platforms. Our global suite of services accelerates trade to seamlessly deliver the products and goods that drive the world’s economy. With the combination of our multimodal transportation management system and expertise, we use our information advantage to deliver smarter solutions for our more than 90,000 customers and the more than 450,000 contract carriers on our platform. Our technology is built by and for supply chain experts to bring faster, more meaningful improvements to our customers’ businesses. As a responsible global citizen, we are also proud to contribute millions of dollars to support causes that matter to our company, our Foundation and our employees. For more information, visit us at www.chrobinson.com (Nasdaq: CHRW).

Except for the historical information contained herein, the matters set forth in this release are forward-looking statements that represent our expectations, beliefs, intentions or strategies concerning future events. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from our historical experience or our present expectations, including, but not limited to, factors such as changes in economic conditions, including uncertain consumer demand; changes in market demand and pressures on the pricing for our services; fuel price increases or decreases, or fuel shortages; competition and growth rates within the global logistics industry that could adversely impact our profitability; freight levels and increasing costs and availability of truck capacity or alternative means of transporting freight; risks associated with seasonal changes or significant disruptions in the transportation industry; risks associated with identifying and completing suitable acquisitions; our dependence on and changes in relationships with existing contracted truck, rail, ocean, and air carriers; risks associated with the loss of significant customers; risks associated with reliance on technology to operate our business; cyber-security related risks; our ability to staff and retain employees; risks associated with operations outside of the U.S.; our ability to successfully integrate the operations of acquired companies with our historic operations; climate change related risks; risks associated with our indebtedness; risks associated with interest rates; risks associated with litigation, including contingent auto liability and insurance coverage; risks associated with the potential impact of changes in government regulations including environmental-related regulations; risks associated with the changes to income tax regulations; risks associated with the produce industry, including food safety and contamination issues; the impact of changes in political and governmental conditions; changes to our capital structure; changes due to catastrophic events; risks associated with the usage of artificial intelligence technologies; and other risks and uncertainties detailed in our Annual and Quarterly Reports.

Any forward-looking statement speaks only as of the date on which such statement is made, and we undertake no obligation to update such statement to reflect events or circumstances arising after such date. All remarks made during our financial results conference call will be current at the time of the call, and we undertake no obligation to update the replay.

Conference Call Information:

C.H. Robinson Worldwide First Quarter 2024 Earnings Conference Call

Wednesday, May 1, 2024; 5:00 p.m. Eastern Time

Presentation slides and a simultaneous live audio webcast of the conference call may be accessed through the Investor Relations link on C.H. Robinson’s website at www.chrobinson.com.

To participate in the conference call by telephone, please call ten minutes early by dialing: 877-269-7756

International callers dial +1-201-689-7817

Adjusted Gross Profit by Service Line

(in thousands)

This table of summary results presents our service line adjusted gross profits on an enterprise basis. The service line adjusted gross profits in the table differ from the service line adjusted gross profits discussed within the segments as our segments may have revenues from multiple service lines.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

2024 |

|

2023 |

|

% change |

|

|

|

|

|

|

Adjusted gross profits(1): |

|

|

|

|

|

|

|

|

|

|

|

| Transportation |

|

|

|

|

|

|

|

|

|

|

|

| Truckload |

$ |

257,413 |

|

|

$ |

288,654 |

|

|

(10.8) |

% |

|

|

|

|

|

|

| LTL |

141,136 |

|

|

138,637 |

|

|

1.8 |

% |

|

|

|

|

|

|

| Ocean |

112,858 |

|

|

110,079 |

|

|

2.5 |

% |

|

|

|

|

|

|

| Air |

30,532 |

|

|

31,317 |

|

|

(2.5) |

% |

|

|

|

|

|

|

| Customs |

26,095 |

|

|

23,334 |

|

|

11.8 |

% |

|

|

|

|

|

|

| Other logistics services |

59,558 |

|

|

64,913 |

|

|

(8.2) |

% |

|

|

|

|

|

|

| Total transportation |

627,592 |

|

|

656,934 |

|

|

(4.5) |

% |

|

|

|

|

|

|

| Sourcing |

30,137 |

|

|

28,706 |

|

|

5.0 |

% |

|

|

|

|

|

|

| Total adjusted gross profits |

$ |

657,729 |

|

|

$ |

685,640 |

|

|

(4.1) |

% |

|

|

|

|

|

|

____________________________________________

(1) Adjusted gross profits is a non-GAAP financial measure explained later in this release. The difference between adjusted gross profits and gross profits is not material.

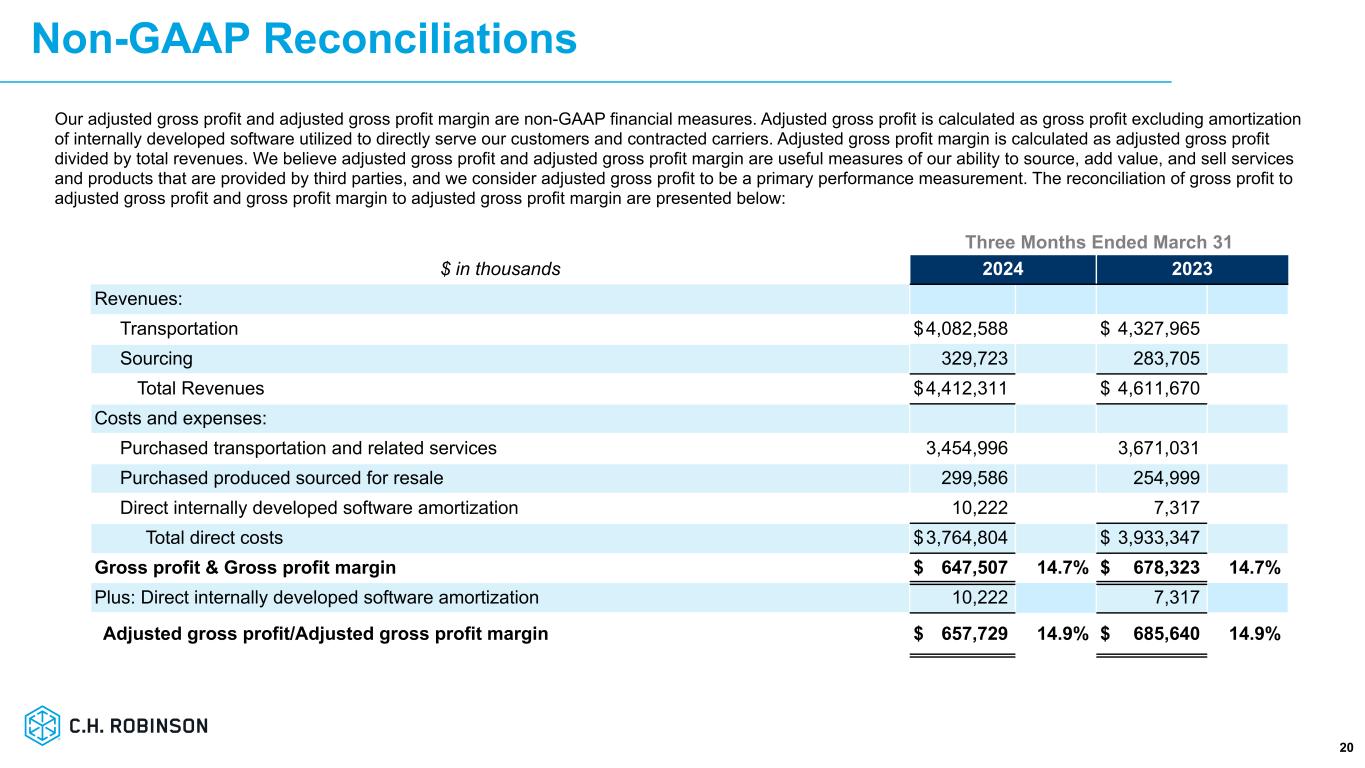

GAAP to Non-GAAP Reconciliation

(unaudited, in thousands)

Our adjusted gross profit is a non-GAAP financial measure. Adjusted gross profit is calculated as gross profit excluding amortization of internally developed software utilized to directly serve our customers and contracted carriers. We believe adjusted gross profit is a useful measure of our ability to source, add value, and sell services and products that are provided by third parties, and we consider adjusted gross profit to be a primary performance measurement. Accordingly, the discussion of our results of operations often focuses on the changes in our adjusted gross profit. The reconciliation of gross profit to adjusted gross profit is presented below (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended March 31, |

|

|

|

2024 |

|

2023 |

|

% change |

|

|

|

|

|

|

| Revenues: |

|

|

|

|

|

|

|

|

|

|

|

| Transportation |

$ |

4,082,588 |

|

|

$ |

4,327,965 |

|

|

(5.7) |

% |

|

|

|

|

|

|

| Sourcing |

329,723 |

|

|

283,705 |

|

|

16.2 |

% |

|

|

|

|

|

|

| Total revenues |

4,412,311 |

|

|

4,611,670 |

|

|

(4.3) |

% |

|

|

|

|

|

|

| Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

| Purchased transportation and related services |

3,454,996 |

|

|

3,671,031 |

|

|

(5.9) |

% |

|

|

|

|

|

|

| Purchased products sourced for resale |

299,586 |

|

|

254,999 |

|

|

17.5 |

% |

|

|

|

|

|

|

| Direct internally developed software amortization |

10,222 |

|

|

7,317 |

|

|

39.7 |

% |

|

|

|

|

|

|

| Total direct expenses |

3,764,804 |

|

|

3,933,347 |

|

|

(4.3) |

% |

|

|

|

|

|

|

| Gross profit |

$ |

647,507 |

|

|

$ |

678,323 |

|

|

(4.5) |

% |

|

|

|

|

|

|

| Plus: Direct internally developed software amortization |

10,222 |

|

|

7,317 |

|

|

39.7 |

% |

|

|

|

|

|

|

| Adjusted gross profit |

$ |

657,729 |

|

|

$ |

685,640 |

|

|

(4.1) |

% |

|

|

|

|

|

|

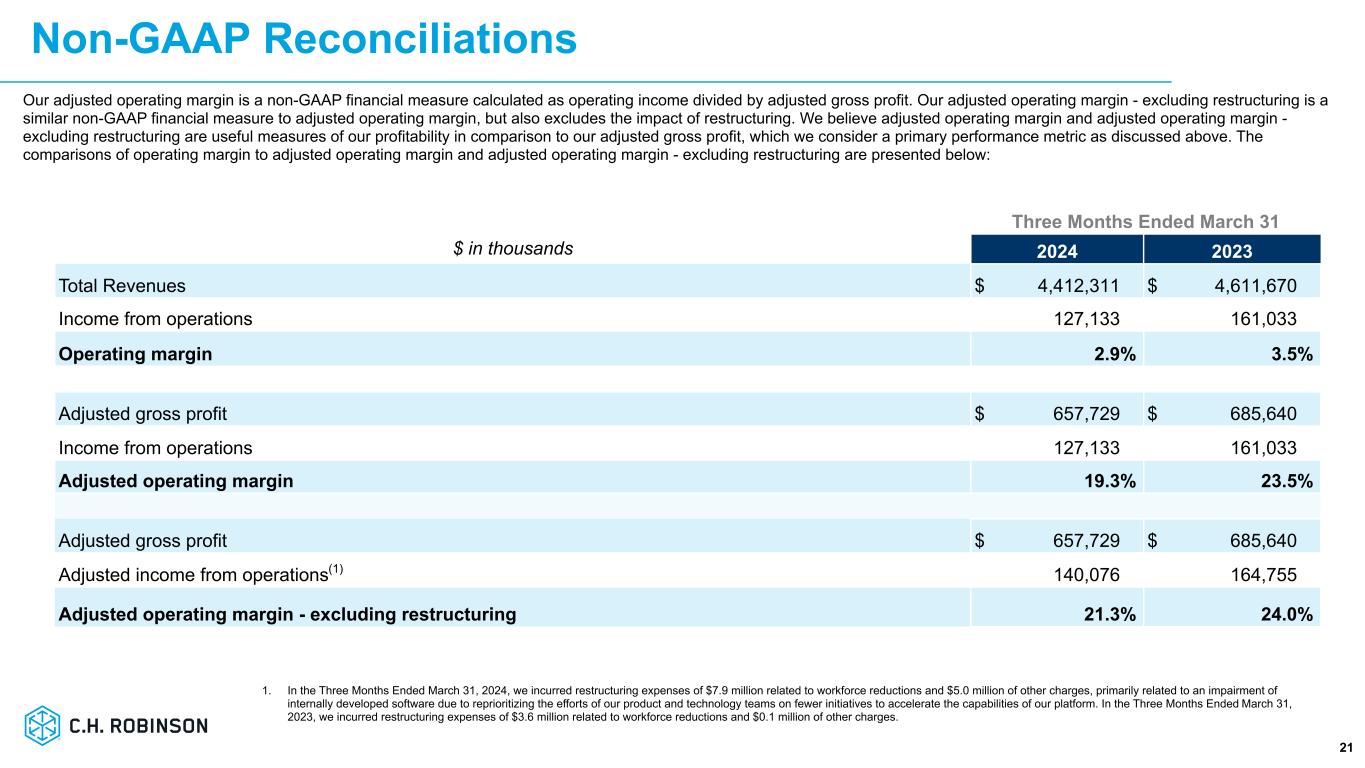

Our adjusted operating margin is a non-GAAP financial measure calculated as operating income divided by adjusted gross profit. Our adjusted operating margin - excluding restructuring is a similar non-GAAP financial measure as adjusted operating margin, but also excludes the impact of restructuring. We believe adjusted operating margin and adjusted operating margin - excluding restructuring are useful measures of our profitability in comparison to our adjusted gross profit, which we consider a primary performance metric as discussed above. The comparisons of operating margin to adjusted operating margin and adjusted operating margin - excluding restructuring are presented below:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

2024 |

|

2023 |

|

% change |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total revenues |

$ |

4,412,311 |

|

|

$ |

4,611,670 |

|

|

(4.3 |

%) |

|

|

|

|

|

|

| Income from operations |

127,133 |

|

|

161,033 |

|

|

(21.1 |

%) |

|

|

|

|

|

|

| Operating margin |

2.9 |

% |

|

3.5 |

% |

|

(60) bps |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted gross profit |

$ |

657,729 |

|

|

$ |

685,640 |

|

|

(4.1 |

%) |

|

|

|

|

|

|

| Income from operations |

127,133 |

|

|

161,033 |

|

|

(21.1 |

%) |

|

|

|

|

|

|

| Adjusted operating margin |

19.3 |

% |

|

23.5 |

% |

|

(420) |

bps |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted gross profit |

$ |

657,729 |

|

|

$ |

685,640 |

|

|

(4.1 |

%) |

|

|

|

|

|

|

| Adjusted income from operations |

140,076 |

|

|

164,755 |

|

|

(15.0 |

%) |

|

|

|

|

|

|

| Adjusted operating margin - excluding restructuring |

21.3 |

% |

|

24.0 |

% |

|

(270) |

bps |

|

|

|

|

|

|

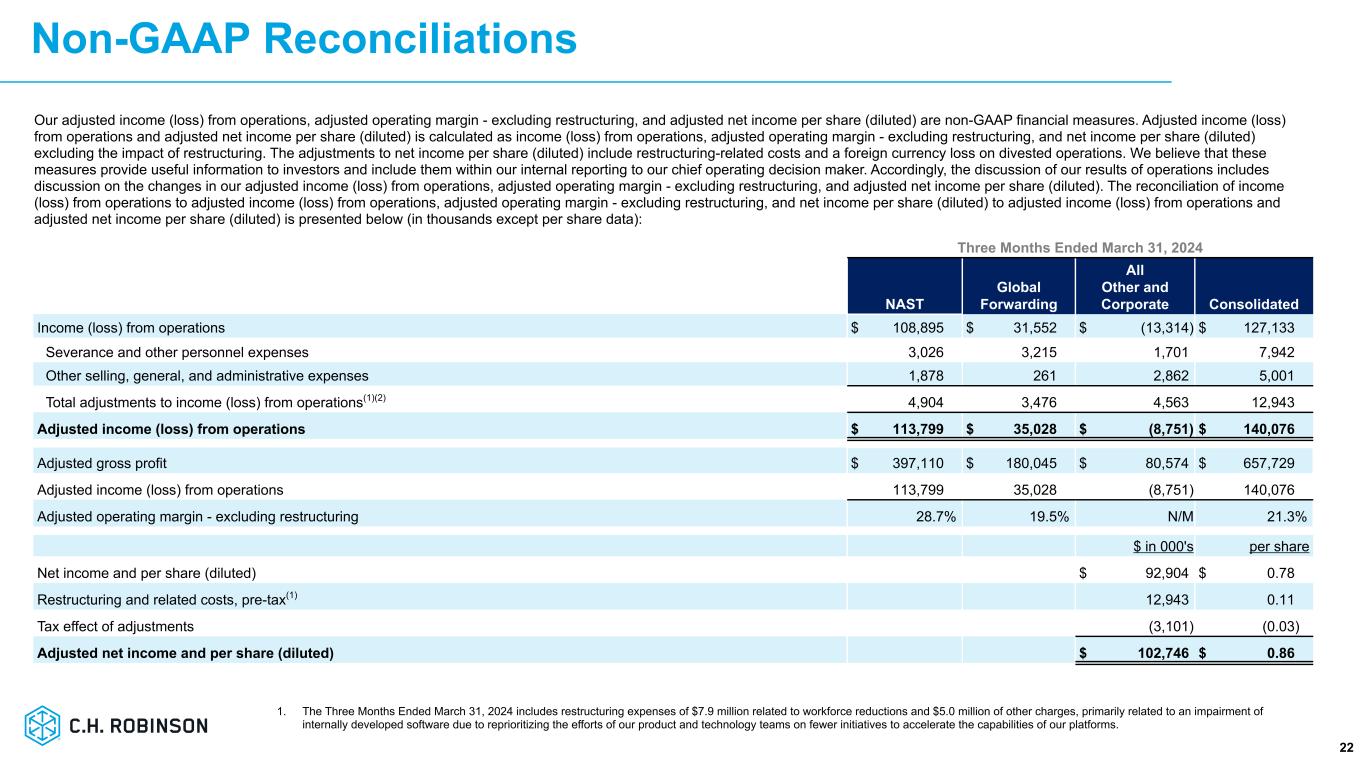

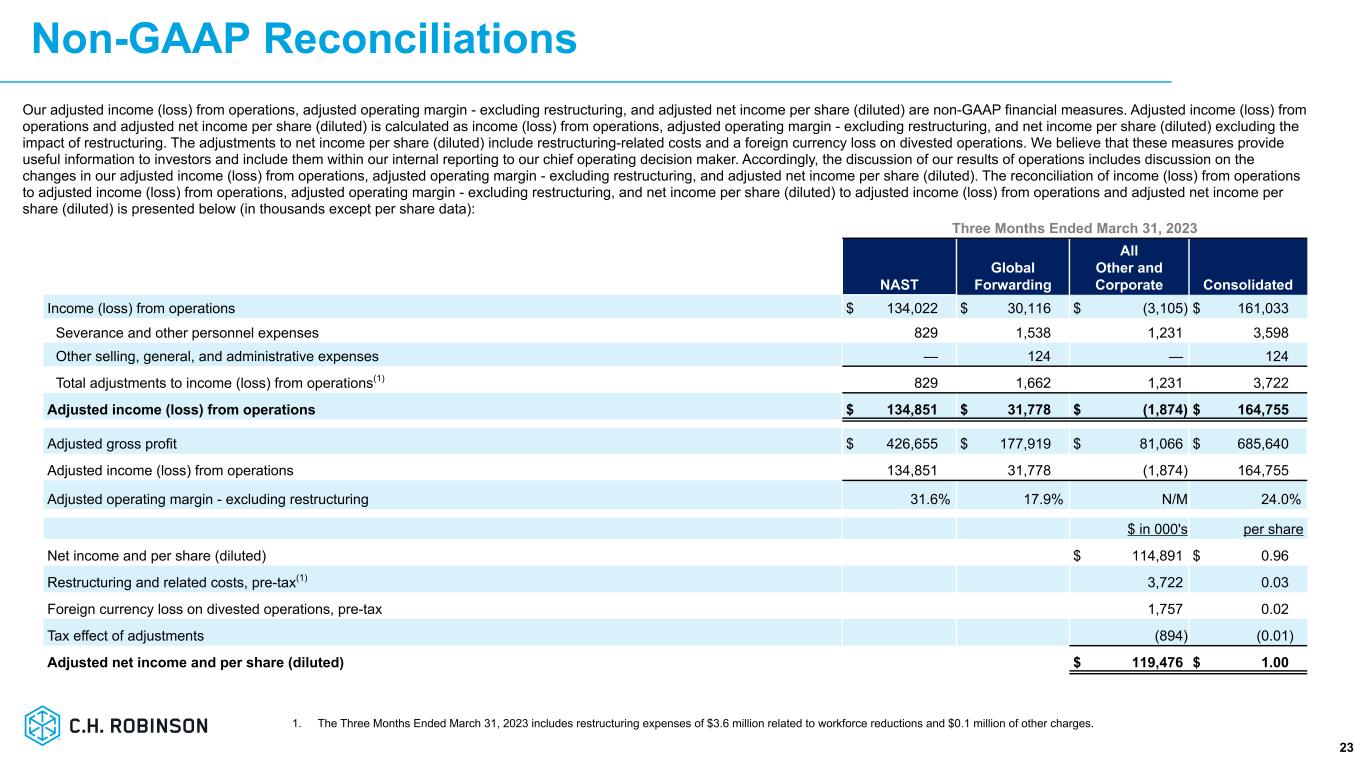

GAAP to Non-GAAP Reconciliation

(unaudited, in thousands)

Our adjusted income (loss) from operations, adjusted operating margin - excluding restructuring, and adjusted net income per share (diluted) are non-GAAP financial measures. Adjusted income (loss) from operations and adjusted net income per share (diluted) is calculated as income (loss) from operations, adjusted operating margin - excluding restructuring, and net income per share (diluted) excluding the impact of restructuring. The adjustments to net income per share (diluted) include restructuring-related costs and a foreign currency loss on divested operations. We believe that these measures provide useful information to investors and include them within our internal reporting to our chief operating decision maker. Accordingly, the discussion of our results of operations includes discussion on the changes in our adjusted income (loss) from operations, adjusted operating margin - excluding restructuring, and adjusted net income per share (diluted). The reconciliation of income (loss) from operations to adjusted income (loss) from operations, adjusted operating margin - excluding restructuring, and net income per share (diluted) to adjusted income (loss) from operations and adjusted net income per share (diluted) is presented below (in thousands except per share data):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAST |

|

Global Forwarding |

|

All

Other and Corporate |

|

Consolidated |

| Three Months Ended March 31, 2024 |

|

|

|

|

|

|

|

| Non-GAAP Reconciliation: |

|

|

|

|

|

|

|

| Income (loss) from operations |

$ |

108,895 |

|

|

$ |

31,552 |

|

|

$ |

(13,314) |

|

|

$ |

127,133 |

|

| Severance and other personnel expenses |

3,026 |

|

|

3,215 |

|

|

1,701 |

|

|

7,942 |

|

| Other selling, general, and administrative expenses |

1,878 |

|

|

261 |

|

|

2,862 |

|

|

5,001 |

|

Total adjustments to income (loss) from operations(1) |

4,904 |

|

|

3,476 |

|

|

4,563 |

|

|

12,943 |

|

| Adjusted income (loss) from operations |

$ |

113,799 |

|

|

$ |

35,028 |

|

|

$ |

(8,751) |

|

|

$ |

140,076 |

|

|

|

|

|

|

|

|

|

| Adjusted gross profit |

$ |

397,110 |

|

|

$ |

180,045 |

|

|

$ |

80,574 |

|

|

$ |

657,729 |

|

| Adjusted income (loss) from operations |

113,799 |

|

|

35,028 |

|

|

(8,751) |

|

|

140,076 |

|

| Adjusted operating margin - excluding restructuring |

28.7 |

% |

|

19.5 |

% |

|

N/M |

|

21.3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, 2024 |

|

|

|

$ in 000's |

|

per share |

|

|

|

|

| Net income and per share (diluted) |

$ |

92,904 |

|

|

$ |

0.78 |

|

|

|

|

|

Restructuring and related costs, pre-tax(1) |

12,943 |

|

|

0.11 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Tax effect of adjustments |

(3,101) |

|

|

(0.03) |

|

|

|

|

|

| Adjusted net income and per share (diluted) |

$ |

102,746 |

|

|

$ |

0.86 |

|

|

|

|

|

____________________________________________

(1) The three months ended March 31, 2024 include restructuring expenses of $7.9 million related to workforce reductions and $5.0 million of other charges, primarily related to an impairment of internally developed software due to reprioritizing the efforts of our product and technology teams on fewer initiatives to accelerate the capabilities of our platform.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAST |

|

Global Forwarding |

|

All

Other and Corporate |

|

Consolidated |

| Three Months Ended March 31, 2023 |

|

|

|

|

|

|

|

| Non-GAAP Reconciliation: |

|

|

|

|

|

|

|

| Income (loss) from operations |

$ |

134,022 |

|

|

$ |

30,116 |

|

|

$ |

(3,105) |

|

|

$ |

161,033 |

|

| Severance and other personnel expenses |

829 |

|

|

1,538 |

|

|

1,231 |

|

|

3,598 |

|

| Other selling, general, and administrative expenses |

— |

|

|

124 |

|

|

— |

|

|

124 |

|

Total adjustments to income (loss) from operations(1) |

829 |

|

|

1,662 |

|

|

1,231 |

|

|

3,722 |

|

| Adjusted income (loss) from operations |

$ |

134,851 |

|

|

$ |

31,778 |

|

|

$ |

(1,874) |

|

|

$ |

164,755 |

|

|

|

|

|

|

|

|

|

| Adjusted gross profit |

$ |

426,655 |

|

|

$ |

177,919 |

|

|

$ |

81,066 |

|

|

$ |

685,640 |

|

| Adjusted income (loss) from operations |

134,851 |

|

|

31,778 |

|

|

(1,874) |

|

|

164,755 |

|

| Adjusted operating margin - excluding restructuring |

31.6 |

% |

|

17.9 |

% |

|

N/M |

|

24.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, 2023 |

|

|

|

$ in 000's |

|

per share |

|

|

|

|

| Net income and per share (diluted) |

$ |

114,891 |

|

|

$ |

0.96 |

|

|

|

|

|

Restructuring and related costs, pre-tax(1) |

3,722 |

|

|

0.03 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Foreign currency loss on divested operations, pre-tax |

1,757 |

|

|

0.02 |

|

|

|

|

|

| Tax effect of adjustments |

(894) |

|

|

(0.01) |

|

|

|

|

|

| Adjusted net income and per share (diluted) |

$ |

119,476 |

|

|

$ |

1.00 |

|

|

|

|

|

____________________________________________

(1) The three months ended March 31, 2023 includes restructuring expenses of $3.6 million related to workforce reductions and $0.1 million of other charges.

Condensed Consolidated Statements of Income

(unaudited, in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

|

|

2024 |

|

2023 |

|

% change |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues: |

|

|

|

|

|

|

|

|

|

|

|

| Transportation |

$ |

4,082,588 |

|

|

$ |

4,327,965 |

|

|

(5.7) |

% |

|

|

|

|

|

|

| Sourcing |

329,723 |

|

|

283,705 |

|

|

16.2 |

% |

|

|

|

|

|

|

| Total revenues |

4,412,311 |

|

|

4,611,670 |

|

|

(4.3) |

% |

|

|

|

|

|

|

| Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

| Purchased transportation and related services |

3,454,996 |

|

|

3,671,031 |

|

|

(5.9) |

% |

|

|

|

|

|

|

| Purchased products sourced for resale |

299,586 |

|

|

254,999 |

|

|

17.5 |

% |

|

|

|

|

|

|

| Personnel expenses |

379,087 |

|

|

383,106 |

|

|

(1.0) |

% |

|

|

|

|

|

|

| Other selling, general, and administrative expenses |

151,509 |

|

|

141,501 |

|

|

7.1 |

% |

|

|

|

|

|

|

| Total costs and expenses |

4,285,178 |

|

|

4,450,637 |

|

|

(3.7) |

% |

|

|

|

|

|

|

| Income from operations |

127,133 |

|

|

161,033 |

|

|

(21.1) |

% |

|

|

|

|

|

|

| Interest and other income/expense, net |

(16,780) |

|

|

(28,265) |

|

|

(40.6) |

% |

|

|

|

|

|

|

| Income before provision for income taxes |

110,353 |

|

|

132,768 |

|

|

(16.9) |

% |

|

|

|

|

|

|

| Provision for income taxes |

17,449 |

|

|

17,877 |

|

|

(2.4) |

% |

|

|

|

|

|

|

| Net income |

$ |

92,904 |

|

|

$ |

114,891 |

|

|

(19.1) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income per share (basic) |

$ |

0.78 |

|

|

$ |

0.97 |

|

|

(19.6) |

% |

|

|

|

|

|

|

| Net income per share (diluted) |

$ |

0.78 |

|

|

$ |

0.96 |

|

|

(18.8) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average shares outstanding (basic) |

119,344 |

|

|

118,636 |

|

|

0.6 |

% |

|

|

|

|

|

|

| Weighted average shares outstanding (diluted) |

119,604 |

|

|

119,909 |

|

|

(0.3) |

% |

|

|

|

|

|

|

Business Segment Information

(unaudited, in thousands, except average employee headcount)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAST |

|

Global Forwarding |

|

|

All

Other and Corporate

|

|

|

|

Consolidated |

| Three Months Ended March 31, 2024 |

|

|

|

|

|

|

|

|

|

|

|

| Total revenues |

|

$ |

3,000,313 |

|

|

$ |

858,637 |

|

|

|

$ |

553,361 |

|

|

|

|

$ |

4,412,311 |

|

Adjusted gross profits(1) |

|

397,110 |

|

|

180,045 |

|

|

|

80,574 |

|

|

|

|

657,729 |

|

| Income (loss) from operations |

|

108,895 |

|

|

31,552 |

|

|

|

(13,314) |

|

|

|

|

127,133 |

|

| Depreciation and amortization |

|

5,350 |

|

|

2,844 |

|

|

|

15,684 |

|

|

|

|

23,878 |

|

Total assets(2) |

|

3,065,996 |

|

|

1,257,675 |

|

|

|

1,148,417 |

|

|

|

|

5,472,088 |

|

| Average employee headcount |

|

6,004 |

|

|

4,876 |

|

|

|

4,110 |

|

|

|

|

14,990 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAST |

|

Global Forwarding |

|

|

All

Other and Corporate

|

|

|

|

Consolidated |

| Three Months Ended March 31, 2023 |

|

|

|

|

|

|

|

|

|

|

|

| Total revenues |

|

$ |

3,304,187 |

|

|

$ |

789,978 |

|

|

|

$ |

517,505 |

|

|

|

|

$ |

4,611,670 |

|

Adjusted gross profits(1) |

|

426,655 |

|

|

177,919 |

|

|

|

81,066 |

|

|

|

|

685,640 |

|

| Income (loss) from operations |

|

134,022 |

|

|

30,116 |

|

|

|

(3,105) |

|

|

|

|

161,033 |

|

| Depreciation and amortization |

|

5,651 |

|

|

5,480 |

|

|

|

13,249 |

|

|

|

|

24,380 |

|

Total assets(2) |

|

3,240,898 |

|

|

1,194,575 |

|

|

|

1,160,111 |

|

|

|

|

5,595,584 |

|

| Average employee headcount |

|

6,870 |

|

|

5,471 |

|

|

|

4,561 |

|

|

|

|

16,902 |

|

____________________________________________

(1) Adjusted gross profits is a non-GAAP financial measure explained above. The difference between adjusted gross profits and gross profits is not material.

(2) All cash and cash equivalents are included in All Other and Corporate.

Condensed Consolidated Balance Sheets

(unaudited, in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31, 2024 |

|

December 31, 2023 |

| Assets |

|

|

|

| Current assets: |

|

|

|

| Cash and cash equivalents |

$ |

121,838 |

|

|

$ |

145,524 |

|

| Receivables, net of allowance for credit loss |

2,592,576 |

|

|

2,381,963 |

|

| Contract assets, net of allowance for credit loss |

235,326 |

|

|

189,900 |

|

| Prepaid expenses and other |

174,441 |

|

|

163,307 |

|

| Total current assets |

3,124,181 |

|

|

2,880,694 |

|

| |

|

|

|

| Property and equipment, net of accumulated depreciation and amortization |

143,497 |

|

|

144,718 |

|

| Right-of-use lease assets |

366,604 |

|

|

353,890 |

|

| Intangible and other assets, net of accumulated amortization |

1,837,806 |

|

|

1,845,978 |

|

| Total assets |

$ |

5,472,088 |

|

|

$ |

5,225,280 |

|

|

|

|

|

| Liabilities and stockholders’ investment |

|

|

|

| Current liabilities: |

|

|

|

| Accounts payable and outstanding checks |

$ |

1,453,669 |

|

|

$ |

1,370,334 |

|

| Accrued expenses: |

|

|

|

| Compensation |

110,899 |

|

|

135,104 |

|

| Transportation expense |

186,027 |

|

|

147,921 |

|

| Income taxes |

6,246 |

|

|

4,748 |

|

| Other accrued liabilities |

162,627 |

|

|

159,435 |

|

| Current lease liabilities |

74,818 |

|

|

74,451 |

|

| Current portion of debt |

280,000 |

|

|

160,000 |

|

| Total current liabilities |

2,274,286 |

|

|

2,051,993 |

|

|

|

|

|

| Long-term debt |

1,420,776 |

|

|

1,420,487 |

|

| Noncurrent lease liabilities |

310,285 |

|

|

297,563 |

|

| Noncurrent income taxes payable |

21,798 |

|

|

21,289 |

|

| Deferred tax liabilities |

12,090 |

|

|

13,177 |

|

| Other long-term liabilities |

2,859 |

|

|

2,074 |

|

| Total liabilities |

4,042,094 |

|

|

3,806,583 |

|

|

|

|

|

| Total stockholders’ investment |

1,429,994 |

|

|

1,418,697 |

|

| Total liabilities and stockholders’ investment |

$ |

5,472,088 |

|

|

$ |

5,225,280 |

|

Condensed Consolidated Statements of Cash Flow

(unaudited, in thousands, except operational data)

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

| Operating activities: |

2024 |

|

2023(1) |

|

|

|

|

| Net income |

$ |

92,904 |

|

|

$ |

114,891 |

|

| Adjustments to reconcile net income to net cash (used for) provided by operating activities: |

|

|

|

| Depreciation and amortization |

23,878 |

|

|

24,380 |

|

| Provision for credit losses |

2,813 |

|

|

(6,637) |

|

| Stock-based compensation |

22,673 |

|

|

15,607 |

|

| Deferred income taxes |

(6,805) |

|

|

(10,272) |

|

| Excess tax benefit on stock-based compensation |

(1,570) |

|

|

(7,011) |

|

|

|

|

|

| Other operating activities |

5,596 |

|

|

942 |

|

| Changes in operating elements: |

|

|

|

| Receivables |

(225,402) |

|

|

326,244 |

|

| Contract assets |

(45,574) |

|

|

66,124 |

|

| Prepaid expenses and other |

(11,409) |

|

|

433 |

|

| Right of use asset |

(13,933) |

|

|

13,841 |

|

| Accounts payable and outstanding checks |

84,966 |

|

|

(90,724) |

|

| Accrued compensation |

(23,407) |

|

|

(134,795) |

|

| Accrued transportation expenses |

38,106 |

|

|

(53,882) |

|

| Accrued income taxes |

3,619 |

|

|

(40) |

|

| Other accrued liabilities |

5,446 |

|

|

8,169 |

|

| Lease liability |

14,347 |

|

|

(14,003) |

|

| Other assets and liabilities |

429 |

|

|

1,277 |

|

| Net cash (used for) provided by operating activities |

(33,323) |

|

|

254,544 |

|

|

|

|

|

| Investing activities: |

|

|

|

| Purchases of property and equipment |

(8,620) |

|

|

(11,371) |

|

| Purchases and development of software |

(13,854) |

|

|

(15,579) |

|

|

|

|

|

|

|

|

|

| Net cash used for investing activities |

(22,474) |

|

|

(26,950) |

|

|

|

|

|

| Financing activities: |

|

|

|

| Proceeds from stock issued for employee benefit plans |

5,405 |

|

|

19,673 |

|

| Stock tendered for payment of withholding taxes |

(16,130) |

|

|

(20,048) |

|

| Repurchase of common stock |

— |

|

|

(31,182) |

|

| Cash dividends |

(74,580) |

|

|

(73,435) |

|

|

|

|

|

|

|

|

|

| Proceeds from short-term borrowings |

912,000 |

|

|

739,000 |

|

| Payments on short-term borrowings |

(792,000) |

|

|

(840,000) |

|

| Net cash provided by (used for) financing activities |

34,695 |

|

|

(205,992) |

|

| Effect of exchange rates on cash and cash equivalents |

(2,584) |

|

|

76 |

|

|

|

|

|

| Net change in cash and cash equivalents |

(23,686) |

|

|

21,678 |

|

| Cash and cash equivalents, beginning of period |

145,524 |

|

|

217,482 |

|

| Cash and cash equivalents, end of period |

$ |

121,838 |

|

|

$ |

239,160 |

|

|

|

|

|

|

As of March 31, |

| Operational Data: |

2024 |

|

2023 |

| Employees |

14,734 |

|

|

16,406 |

|

____________________________________________

(1) The three months ended March 31, 2023 has been adjusted to conform to current year presentation.

Source: C.H. Robinson

CHRW-IR