| Maryland | 58-2328421 | |||||||

| (State or other jurisdiction of | (IRS Employer | |||||||

| incorporation) | Identification No.) | |||||||

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||||||||||||

| Common Stock, $0.01 par value | PDM | New York Stock Exchange | ||||||||||||

| Exhibit No. | Description | |||||||

| 99.1 | ||||||||

| 99.2 | ||||||||

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | |||||||

| Piedmont Office Realty Trust, Inc. | |||||||||||||||||

| (Registrant) | |||||||||||||||||

| Dated: | July 31, 2024 | By: | /s/ Robert E. Bowers | ||||||||||||||

| Robert E. Bowers | |||||||||||||||||

| Chief Financial Officer and Executive Vice President | |||||||||||||||||

| Three Months Ended | ||||||||

| (in 000s other than per share amounts ) | June 30, 2024 | June 30, 2023 | ||||||

| Net loss applicable to Piedmont | $(9,809) | $(1,988) | ||||||

| Net loss per share applicable to common stockholders - diluted | $(0.08) | $(0.02) | ||||||

| Interest expense, net of interest income | $29,381 | $21,858 | ||||||

| NAREIT and Core FFO applicable to common stock | $46,751 | $55,535 | ||||||

| NAREIT and Core FFO per diluted share | $0.37 | $0.45 | ||||||

| Adjusted FFO applicable to common stock | $27,758 | $44,444 | ||||||

| Same Store NOI - cash basis | 5.7 | % | ||||||

| Same Store NOI - accrual basis | 3.7 | % | ||||||

| Three Months Ended June 30, 2024 | |||||

| # of lease transactions | 65 | ||||

Total leasing sf (in 000s) |

1,038 | ||||

New tenant leasing sf (in 000s) |

404 | ||||

| Cash rent roll up | 15.2 | % | |||

| Accrual rent roll up | 23.0 | % | |||

| Leased Percentage as of period end | 87.3 | % | |||

| (in 000s except for ratios) | June 30, 2024 | December 31, 2023 | |||||||||

| Total Real Estate Assets | $3,468,030 | $3,512,527 | |||||||||

| Total Assets | $4,158,643 | $4,057,082 | |||||||||

| Total Debt | $2,221,738 | $2,054,596 | |||||||||

| Weighted Average Cost of Debt | 6.08 | % | 5.82 | % | |||||||

| Net Principal Amount of Debt/Total Gross Assets less Cash and Cash Equivalents | 39.1 | % | 38.2 | % | |||||||

| Average Net Debt-to-Core EBITDA (ttm*) | 6.6 x | 6.4 x | |||||||||

| Current | Previous | ||||||||||||||||||||||

| (in millions, except per share data) | Low | High | Low | High | |||||||||||||||||||

| Net loss | $ | (63) | $ | (60) | $ | (47) | $ | (41) | |||||||||||||||

| Add: | |||||||||||||||||||||||

| Depreciation | 147 | 149 | 148 | 151 | |||||||||||||||||||

| Amortization | 80 | 82 | 81 | 84 | |||||||||||||||||||

| Impairment Charges | 18 | 18 | — | — | |||||||||||||||||||

| Core FFO applicable to common stock | $ | 182 | $ | 189 | $ | 182 | $ | 194 | |||||||||||||||

| Core FFO applicable to common stock per diluted share | $1.46 | $1.52 | $1.46 | $1.56 | |||||||||||||||||||

| Piedmont Office Realty Trust, Inc. | ||||||||||||||

| Consolidated Balance Sheets (Unaudited) | ||||||||||||||

| (in thousands) | ||||||||||||||

| June 30, 2024 | December 31, 2023 | |||||||||||||

| Assets: | ||||||||||||||

Real estate assets, at cost: |

||||||||||||||

Land |

$ | 552,744 | $ | 559,384 | ||||||||||

Buildings and improvements |

3,791,196 | 3,788,249 | ||||||||||||

Buildings and improvements, accumulated depreciation |

(1,080,613) | (1,039,136) | ||||||||||||

Intangible lease assets |

151,015 | 170,654 | ||||||||||||

Intangible lease assets, accumulated amortization |

(80,251) | (88,066) | ||||||||||||

Construction in progress |

115,213 | 85,239 | ||||||||||||

| Real estate assets held for sale, gross | 26,547 | 43,579 | ||||||||||||

Real estate assets held for sale, accumulated depreciation and amortization |

(7,821) | (7,376) | ||||||||||||

Total real estate assets |

3,468,030 | 3,512,527 | ||||||||||||

Cash and cash equivalents |

138,454 | 825 | ||||||||||||

Tenant receivables |

7,619 | 7,915 | ||||||||||||

Straight line rent receivables |

186,913 | 182,856 | ||||||||||||

Restricted cash and escrows |

5,368 | 3,381 | ||||||||||||

Prepaid expenses and other assets |

25,224 | 27,559 | ||||||||||||

Goodwill |

53,491 | 53,491 | ||||||||||||

Interest rate swaps |

3,578 | 3,032 | ||||||||||||

Deferred lease costs |

467,710 | 485,531 | ||||||||||||

Deferred lease costs, accumulated depreciation |

(201,008) | (223,248) | ||||||||||||

Other assets held for sale, gross |

4,016 | 3,879 | ||||||||||||

Other assets held for sale, accumulated depreciation |

(752) | (666) | ||||||||||||

| Total assets | $ | 4,158,643 | $ | 4,057,082 | ||||||||||

| Liabilities: | ||||||||||||||

Unsecured debt, net of discount and unamortized debt issuance costs of $22,431 and $15,437, respectively |

$ | 2,027,569 | $ | 1,858,717 | ||||||||||

| Secured Debt | 194,169 | 195,879 | ||||||||||||

Accounts payable, accrued expenses, and accrued capital expenditures |

140,793 | 131,516 | ||||||||||||

Dividends payable |

— | 15,143 | ||||||||||||

Deferred income |

100,131 | 89,930 | ||||||||||||

Intangible lease liabilities, less accumulated amortization |

37,657 | 42,925 | ||||||||||||

| Total liabilities | 2,500,319 | 2,334,110 | ||||||||||||

| Stockholders' equity: | ||||||||||||||

Common stock (123,994,991 and 123,715,298 shares issued and outstanding as of June 30, 2024 and December 31, 2023, respectively) |

1,240 | 1,237 | ||||||||||||

Additional paid in capital |

3,719,419 | 3,716,742 | ||||||||||||

Cumulative distributions in excess of earnings |

(2,055,697) | (1,987,147) | ||||||||||||

Other comprehensive income |

(8,180) | (9,418) | ||||||||||||

| Piedmont stockholders' equity | 1,656,782 | 1,721,414 | ||||||||||||

Noncontrolling interest |

1,542 | 1,558 | ||||||||||||

| Total stockholders' equity | 1,658,324 | 1,722,972 | ||||||||||||

| Total liabilities and stockholders' equity | $ | 4,158,643 | $ | 4,057,082 | ||||||||||

| Net Principal Amount of Debt Outstanding (Unsecured and Secured Debt plus discounts and unamortized debt issuance costs less Cash and cash equivalents) | 2,105,715 | 2,069,208 | ||||||||||||

| Piedmont Office Realty Trust, Inc. | |||||||||||||||||||||||

| Consolidated Statements of Operations | |||||||||||||||||||||||

| Unaudited (in thousands, except for per share data) | |||||||||||||||||||||||

| Three Months Ended | Six Months Ended | ||||||||||||||||||||||

| 6/30/2024 | 6/30/2023 | 6/30/2024 | 6/30/2023 | ||||||||||||||||||||

| Revenues: | |||||||||||||||||||||||

| Rental and tenant reimbursement revenue | $ | 136,670 | $ | 137,503 | $ | 275,751 | $ | 274,332 | |||||||||||||||

| Property management fee revenue | 482 | 437 | 639 | 944 | |||||||||||||||||||

| Other property related income | 6,110 | 5,132 | 11,410 | 10,163 | |||||||||||||||||||

Total revenues |

143,262 | 143,072 | 287,800 | 285,439 | |||||||||||||||||||

| Expenses: | |||||||||||||||||||||||

| Property operating costs | 58,565 | 58,368 | 118,009 | 116,159 | |||||||||||||||||||

| Depreciation | 38,814 | 36,475 | 77,683 | 72,272 | |||||||||||||||||||

| Amortization | 18,097 | 21,333 | 36,217 | 43,364 | |||||||||||||||||||

| Impairment charges | — | — | 18,432 | — | |||||||||||||||||||

| General and administrative | 8,352 | 7,279 | 15,964 | 14,970 | |||||||||||||||||||

Total operating expenses |

123,828 | 123,455 | 266,305 | 246,765 | |||||||||||||||||||

| Other income (expense): | |||||||||||||||||||||||

| Interest expense | (29,569) | (23,389) | (59,283) | (45,466) | |||||||||||||||||||

Other income(1) |

328 | 1,787 | 606 | 3,443 | |||||||||||||||||||

| Loss on early extinguishment of debt | — | — | (386) | — | |||||||||||||||||||

Total other income (expense) |

(29,241) | (21,602) | (59,063) | (42,023) | |||||||||||||||||||

| Net loss | (9,807) | (1,985) | (37,568) | (3,349) | |||||||||||||||||||

| Net income applicable to noncontrolling interest | (2) | (3) | (4) | (6) | |||||||||||||||||||

| Net loss applicable to Piedmont | $ | (9,809) | $ | (1,988) | $ | (37,572) | $ | (3,355) | |||||||||||||||

| Weighted average common shares outstanding - basic and diluted | 123,953 | 123,671 | 123,877 | 123,611 | |||||||||||||||||||

| Net loss per share applicable to common stockholders - basic and diluted | $ | (0.08) | $ | (0.02) | $ | (0.30) | $ | (0.03) | |||||||||||||||

| Piedmont Office Realty Trust, Inc. | ||||||||||||||||||||||||||

| Funds from Operations ("FFO"), Core FFO and Adjusted FFO | ||||||||||||||||||||||||||

| Unaudited (in thousands, except for per share data) | ||||||||||||||||||||||||||

| Three Months Ended | Six Months Ended | |||||||||||||||||||||||||

| 6/30/2024 | 6/30/2023 | 6/30/2024 | 6/30/2023 | |||||||||||||||||||||||

| GAAP net loss applicable to common stock | $ | (9,809) | $ | (1,988) | $ | (37,572) | $ | (3,355) | ||||||||||||||||||

Depreciation of real estate assets(1) |

38,471 | 36,200 | 77,057 | 71,890 | ||||||||||||||||||||||

Amortization of lease-related costs |

18,089 | 21,323 | 36,201 | 43,344 | ||||||||||||||||||||||

Impairment charges |

— | — | 18,432 | — | ||||||||||||||||||||||

| NAREIT FFO applicable to common stock* | 46,751 | 55,535 | 94,118 | 111,879 | ||||||||||||||||||||||

Loss on early extinguishment of debt |

— | — | 386 | — | ||||||||||||||||||||||

| Core FFO applicable to common stock* | 46,751 | 55,535 | 94,504 | 111,879 | ||||||||||||||||||||||

Amortization of debt issuance costs and discounts on debt |

1,139 | 1,312 | 2,347 | 2,551 | ||||||||||||||||||||||

Depreciation of non real estate assets |

331 | 264 | 603 | 361 | ||||||||||||||||||||||

Straight-line effects of lease revenue |

(2,084) | (2,755) | (4,339) | (5,942) | ||||||||||||||||||||||

Stock-based compensation adjustments |

2,061 | 2,095 | 3,087 | 2,278 | ||||||||||||||||||||||

Amortization of lease-related intangibles |

(2,549) | (3,119) | (5,205) | (6,531) | ||||||||||||||||||||||

Non-incremental capital expenditures(2) |

(17,891) | (8,888) | (38,498) | (23,360) | ||||||||||||||||||||||

| Adjusted FFO applicable to common stock* | $ | 27,758 | $ | 44,444 | $ | 52,499 | $ | 81,236 | ||||||||||||||||||

Weighted average common shares outstanding - diluted(3) |

124,796 | 123,749 | 124,501 | 123,696 | ||||||||||||||||||||||

| NAREIT and Core FFO per share (diluted) | $ | 0.37 | $ | 0.45 | $ | 0.76 | $ | 0.90 | ||||||||||||||||||

| Piedmont Office Realty Trust, Inc. | |||||||||||||||||||||||

EBITDAre, Core EBITDA, Property Net Operating Income (Cash and Accrual), Same Store Net Operating Income (Cash and Accrual) |

|||||||||||||||||||||||

| Unaudited (in thousands) | |||||||||||||||||||||||

| Cash Basis | Accrual Basis | ||||||||||||||||||||||

| Three Months Ended | Three Months Ended | ||||||||||||||||||||||

| 6/30/2024 | 6/30/2023 | 6/30/2024 | 6/30/2023 | ||||||||||||||||||||

| Net loss applicable to Piedmont (GAAP) | $ | (9,809) | $ | (1,988) | $ | (9,809) | $ | (1,988) | |||||||||||||||

Net income applicable to noncontrolling interest |

2 | 3 | 2 | 3 | |||||||||||||||||||

Interest expense |

29,569 | 23,389 | 29,569 | 23,389 | |||||||||||||||||||

Depreciation |

38,802 | 36,464 | 38,802 | 36,464 | |||||||||||||||||||

Amortization |

18,089 | 21,323 | 18,089 | 21,323 | |||||||||||||||||||

| Depreciation and amortization attributable to noncontrolling interests | 20 | 21 | 20 | 21 | |||||||||||||||||||

EBITDAre* and Core EBITDA* |

76,673 | 79,212 | 76,673 | 79,212 | |||||||||||||||||||

General and administrative expenses |

8,352 | 7,279 | 8,352 | 7,279 | |||||||||||||||||||

Management fee revenue |

(256) | (254) | (256) | (254) | |||||||||||||||||||

Other income |

(220) | (1,571) | (220) | (1,571) | |||||||||||||||||||

Straight-line effects of lease revenue |

(2,084) | (2,755) | |||||||||||||||||||||

| Straight-line effects of lease revenue attributable to noncontrolling interests | — | (1) | |||||||||||||||||||||

Amortization of lease-related intangibles |

(2,549) | (3,119) | |||||||||||||||||||||

| Property NOI* | 79,916 | 78,791 | 84,549 | 84,666 | |||||||||||||||||||

| Net operating income from: | |||||||||||||||||||||||

Acquisitions |

— | — | — | — | |||||||||||||||||||

Dispositions |

(17) | (821) | (17) | (823) | |||||||||||||||||||

Other investments(1) |

(451) | (2,803) | (530) | (2,847) | |||||||||||||||||||

| Same Store NOI* | $ | 79,448 | $ | 75,167 | $ | 84,002 | $ | 80,996 | |||||||||||||||

| Change period over period in Same Store NOI | 5.7% | N/A | 3.7 | % | N/A | ||||||||||||||||||

| Piedmont Office Realty Trust, Inc. | |||||||||||||||||||||||

EBITDAre, Core EBITDA, Property Net Operating Income (Cash and Accrual), Same Store Net Operating Income (Cash and Accrual) |

|||||||||||||||||||||||

| Unaudited (in thousands) | |||||||||||||||||||||||

| Cash Basis | Accrual Basis | ||||||||||||||||||||||

| Six Months Ended | Six Months Ended | ||||||||||||||||||||||

| 6/30/2024 | 6/30/2023 | 6/30/2024 | 6/30/2023 | ||||||||||||||||||||

| Net loss applicable to Piedmont (GAAP) | $ | (37,572) | $ | (3,355) | $ | (37,572) | $ | (3,355) | |||||||||||||||

Net income applicable to noncontrolling interest |

4 | 6 | 4 | 6 | |||||||||||||||||||

Interest expense |

59,283 | 45,466 | 59,283 | 45,466 | |||||||||||||||||||

Depreciation |

77,660 | 72,251 | 77,660 | 72,251 | |||||||||||||||||||

Amortization |

36,201 | 43,344 | 36,201 | 43,344 | |||||||||||||||||||

| Depreciation and amortization attributable to noncontrolling interests | 40 | 41 | 40 | 41 | |||||||||||||||||||

Impairment charges |

18,432 | — | 18,432 | — | |||||||||||||||||||

EBITDAre* |

154,048 | 157,753 | 154,048 | 157,753 | |||||||||||||||||||

| Loss on early extinguishment of debt | 386 | — | 386 | — | |||||||||||||||||||

| Core EBITDA* | 154,434 | 157,753 | 154,434 | 157,753 | |||||||||||||||||||

General and administrative expenses |

15,964 | 14,970 | 15,964 | 14,970 | |||||||||||||||||||

Management fee revenue |

(252) | (546) | (252) | (546) | |||||||||||||||||||

Other income |

(391) | (3,012) | (391) | (3,012) | |||||||||||||||||||

| Reversal of non-cash general reserve for uncollectible accounts | — | (400) | |||||||||||||||||||||

Straight-line effects of lease revenue |

(4,339) | (5,942) | |||||||||||||||||||||

| Straight-line effects of lease revenue attributable to noncontrolling interests | — | (6) | |||||||||||||||||||||

Amortization of lease-related intangibles |

(5,205) | (6,531) | |||||||||||||||||||||

| Property NOI* | 160,211 | 156,286 | 169,755 | 169,165 | |||||||||||||||||||

| Net operating (income)/loss from: | |||||||||||||||||||||||

Acquisitions |

— | — | — | — | |||||||||||||||||||

Dispositions |

(1,157) | (1,383) | (1,481) | (1,737) | |||||||||||||||||||

Other investments(1) |

(1,653) | (5,615) | (1,817) | (5,609) | |||||||||||||||||||

| Same Store NOI* | $ | 157,401 | $ | 149,288 | $ | 166,457 | $ | 161,819 | |||||||||||||||

| Change period over period in Same Store NOI | 5.4 | % | N/A | 2.9 | % | N/A | |||||||||||||||||

| EXHIBIT 99.2 | |||||

| Page | Page | |||||||||||||

| Introduction | ||||||||||||||

| Corporate Data | ||||||||||||||

| Investor Information | Supporting Information | |||||||||||||

| Earnings Release | Definitions | |||||||||||||

| Key Performance Indicators | Research Coverage | |||||||||||||

| Financials | Non-GAAP Reconciliations | |||||||||||||

| Balance Sheets | In-Service Portfolio Detail | |||||||||||||

| Income Statements | Major Leases Not Yet Commenced and Major Abatements | |||||||||||||

| Funds From Operations / Adjusted Funds From Operations | Risks, Uncertainties and Limitations | |||||||||||||

| Same Store Analysis | ||||||||||||||

| Capitalization Analysis | ||||||||||||||

| Debt Summary | ||||||||||||||

| Debt Detail | ||||||||||||||

| Debt Covenant & Ratio Analysis | ||||||||||||||

| Operational & Portfolio Information - Office Property Investments | ||||||||||||||

| Tenant Diversification | ||||||||||||||

| Tenant Credit Rating & Lease Distribution Information | ||||||||||||||

| Leased Percentage Information | ||||||||||||||

| Rental Rate Roll Up / Roll Down Analysis | ||||||||||||||

| Lease Expiration Schedule | ||||||||||||||

| Quarterly Lease Expirations | ||||||||||||||

| Annual Lease Expirations | ||||||||||||||

| Contractual Tenant Improvements & Leasing Commissions | ||||||||||||||

| Geographic Diversification | ||||||||||||||

| Geographic Diversification by Location Type | ||||||||||||||

| Industry Diversification | ||||||||||||||

| Property Investment Activity | ||||||||||||||

| Notice to Readers: | ||

Please refer to page 39 for a discussion of important risks related to the business of Piedmont Office Realty Trust, Inc., as well as an investment in its securities, including risks that could cause actual results and events to differ materially from results and events referred to in the forward-looking information. Considering these risks, uncertainties, assumptions, and limitations, the forward-looking statements about leasing, financial operations, leasing prospects, acquisitions, dispositions, etc. contained in this quarterly supplemental information report may differ from actual results. | ||

| Certain prior period amounts have been reclassified to conform to the current period financial statement presentation. In addition, many of the schedules herein contain rounding to the nearest thousands or millions and, therefore, the schedules may not total due to this rounding convention. | ||

To supplement the presentation of the Company’s financial results prepared in accordance with U.S. generally accepted accounting principles (GAAP), this report contains certain financial measures that are not prepared in accordance with GAAP, including FFO, Core FFO, AFFO, Same Store NOI, Property NOI, EBITDAre and Core EBITDA. Definitions and reconciliations of these non-GAAP measures to their most comparable GAAP metrics are included beginning on page 32. Each of the non-GAAP measures included in this report has limitations as an analytical tool and should not be considered in isolation or as a substitute for an analysis of the Company’s results calculated in accordance with GAAP. In addition, because not all companies use identical calculations, the Company’s presentation of non-GAAP measures in this report may not be comparable to similarly titled measures disclosed by other companies, including other REITs. The Company may also change the calculation of any of the non-GAAP measures included in this report from time to time in light of its then existing operations. | ||

| As of | As of | |||||||

| June 30, 2024 | December 31, 2023 | |||||||

Number of in-service projects (1) |

31 | 34 | ||||||

Rentable square footage (in thousands) (1) |

15,658 | 16,563 | ||||||

Percent leased (2) |

87.3 | % | 87.1 | % | ||||

| Capitalization (in thousands): | ||||||||

| Total debt - GAAP (net of $143.8 million of cash and investments on hand at June 30, 2024) | $2,077,916 | $2,050,390 | ||||||

| Total principal amount of debt outstanding (net of $143.8 million of cash and investments on hand at June 30, 2024) (excludes premiums, discounts, and deferred financing costs) |

$2,100,347 | $2,065,827 | ||||||

Equity market capitalization (3) |

$898,964 | $879,616 | ||||||

Total market capitalization (3) |

$3,143,133 | $2,949,649 | ||||||

Average net principal amount of debt to Core EBITDA - quarterly (4) |

6.8 x | 6.5 x | ||||||

Average net principal amount of debt to Core EBITDA - trailing twelve months (5) |

6.6 x | 6.4 x | ||||||

Net principal amount of debt / Total gross assets less cash and cash equivalents (6) |

39.1 | % | 38.2 | % | ||||

| Common stock data: | ||||||||

| High closing price during quarter | $7.42 | $7.50 | ||||||

| Low closing price during quarter | $6.36 | $5.07 | ||||||

| Closing price of common stock at period end | $7.25 | $7.11 | ||||||

| Weighted average fully diluted shares outstanding during quarter (in thousands) | 124,796 | 123,846 | ||||||

| Shares of common stock issued and outstanding at period end (in thousands) | 123,995 | 123,715 | ||||||

Annualized current dividend per share (7) |

$0.50 | $0.50 | ||||||

| Ratings (Standard & Poor's / Moody's) | BBB- / Baa3 | BBB- / Baa3 | ||||||

| Employees | 151 | 150 | ||||||

| (1) | As of June 30, 2024, the Company's in-service office portfolio excluded three projects held out of service for redevelopment, totaling 783,000 square feet. Additional information on these projects can be found on page 31. |

||||

| (2) | Please refer to page 22 for additional analysis and definition regarding the Company's leased percentage. |

||||

| (3) | Reflects common stock closing price, shares outstanding and principal amount of debt outstanding as of the end of the reporting period. | ||||

| (4) | Calculated using the annualized Core EBITDA for the quarter and the average daily principal balance of debt outstanding during the quarter less the average balance of cash and escrow deposits and restricted cash during the quarter. | ||||

| (5) | Calculated using the sum of Core EBITDA for the trailing twelve month period and the average daily principal balance of debt outstanding for the trailing twelve months less the average balance of cash and escrow deposits and restricted cash during the trailing twelve month period. | ||||

| (6) | As of June 30, 2024, the Company held a large cash balance to be used for future debt retirement in early 2025; therefore, the metric shown is on a net debt basis to account for this cash balance. | ||||

| (7) | Annualized amount based on the regular dividends per share recorded for the most recent quarter. | ||||

| Corporate Office | |||||||||||

| 5565 Glenridge Connector, Suite 450 Atlanta, Georgia 30342 | |||||||||||

| 770.418.8800 | |||||||||||

| www.piedmontreit.com | |||||||||||

| Executive Management | |||||||||||

| C. Brent Smith | Robert E. Bowers | George Wells | Laura P. Moon | ||||||||

| Chief Executive Officer and President | Chief Financial and Administrative Officer | Chief Operating Officer | Chief Accounting Officer and Treasurer | ||||||||

| and Director | and Executive Vice President | and Executive Vice President | and Senior Vice President | ||||||||

| Kevin D. Fossum | Christopher A. Kollme | Thomas A. McKean | Damian J. Miller | ||||||||

| Executive Vice President, | Executive Vice President, | Senior Vice President, | Executive Vice President, | ||||||||

| Property Management | Investments | Associate General Counsel and | Dallas & Minneapolis | ||||||||

| Corporate Secretary | |||||||||||

| Lisa M. Tyler | Alex Valente | Robert K. Wiberg | |||||||||

| Senior Vice President, | Executive Vice President, | Executive Vice President, | |||||||||

| Human Resources | Southeast Region | Northeast Region and Head of Development | |||||||||

| Board of Directors | |||||||||||

| Kelly H. Barrett | Dale H. Taysom | Glenn G. Cohen | Venkatesh S. Durvasula | ||||||||

| Chair of the Board of Directors | Vice Chair of the Board of Directors | Director | Director | ||||||||

| Chair of the Audit Committee | Chair of the Capital Committee | Chair of the Compensation Committee | Member of the Capital Committee | ||||||||

| Member of the Governance Committee | Member of the Audit Committee | Member of the Audit Committee | Member of the Compensation Committee | ||||||||

| Member of the Capital Committee | |||||||||||

| Mary Hager | Barbara B. Lang | C. Brent Smith | |||||||||

| Director | Director | Director | |||||||||

| Member of the Capital Committee | Chair of the Governance Committee | Chief Executive Officer and President | |||||||||

| Member of the Governance Committee | Member of the Compensation Committee | ||||||||||

| Transfer Agent | Corporate Counsel | Institutional Analyst Contact | Investor Relations | ||||||||

| Computershare | King & Spalding | Phone: 770.418.8592 | Phone: 866.354.3485 | ||||||||

| P.O. Box 43006 | 1180 Peachtree Street, NE | research.analysts@piedmontreit.com | investor.services@piedmontreit.com | ||||||||

| Providence, RI 02940-3078 | Atlanta, GA 30309 | www.piedmontreit.com | |||||||||

| Phone: 866.354.3485 | Phone: 404.572.4600 | ||||||||||

| Three Months Ended | ||||||||

| (in 000s other than per share amounts) | June 30, 2024 | June 30, 2023 | ||||||

| Net loss applicable to Piedmont | $(9,809) | $(1,988) | ||||||

| Net loss per share applicable to common stockholders - diluted | $(0.08) | $(0.02) | ||||||

| Interest expense, net of interest income | $29,381 | $21,858 | ||||||

| NAREIT and Core FFO applicable to common stock | $46,751 | $55,535 | ||||||

| NAREIT and Core FFO per diluted share | $0.37 | $0.45 | ||||||

| Adjusted FFO applicable to common stock | $27,758 | $44,444 | ||||||

| Same Store NOI - cash basis | 5.7 | % | ||||||

| Same Store NOI - accrual basis | 3.7 | % | ||||||

| Three Months Ended June 30, 2024 | |||||

| # of lease transactions | 65 | ||||

Total leasing sf (in 000s) |

1,038 | ||||

New tenant leasing sf (in 000s) |

404 | ||||

| Cash rent roll up | 15.2% | ||||

| Accrual rent roll up | 23.0% | ||||

| Leased percentage as of period end | 87.3% | ||||

| (in 000s except for ratios) | June 30, 2024 | December 31, 2023 | |||||||||

| Total Real Estate Assets | $3,468,030 | $3,512,527 | |||||||||

| Total Assets | $4,158,643 | $4,057,082 | |||||||||

| Total Debt | $2,221,738 | $2,054,596 | |||||||||

| Weighted Average Cost of Debt | 6.08 | % | 5.82 | % | |||||||

| Net Principal Amount of Debt/Total Gross Assets less Cash and Cash Equivalents | 39.1 | % | 38.2 | % | |||||||

| Average Net Debt-to-Core EBITDA (ttm) | 6.6 x | 6.4 x | |||||||||

| Current | Previous | ||||||||||||||||||||||

| (in millions, except per share data) | Low | High | Low | High | |||||||||||||||||||

| Net loss | $ | (63) | $ | (60) | $ | (47) | $ | (41) | |||||||||||||||

| Add: | |||||||||||||||||||||||

| Depreciation | 147 | 149 | 148 | 151 | |||||||||||||||||||

| Amortization | 80 | 82 | 81 | 84 | |||||||||||||||||||

| Impairment charges | 18 | 18 | — | — | |||||||||||||||||||

| Core FFO applicable to common stock | $ | 182 | $ | 189 | $ | 182 | $ | 194 | |||||||||||||||

| Core FFO applicable to common stock per diluted share | $1.46 | $1.52 | $1.46 | $1.56 | |||||||||||||||||||

This section of our supplemental report includes non-GAAP financial measures, including, but not limited to, Earnings Before Interest, Taxes, Depreciation, and Amortization for real estate (EBITDAre), Core Earnings Before Interest, Taxes, Depreciation, and Amortization (Core EBITDA), Funds from Operations (FFO), Core Funds from Operations (Core FFO), Adjusted Funds from Operations (AFFO), and Same Store Net Operating Income (Same Store NOI). Definitions of these non-GAAP measures are provided on page 32 and reconciliations are provided beginning on page 34. | ||

| Three Months Ended | |||||||||||||||||||||||||||||

| Selected Operating Data | 6/30/2024 | 3/31/2024 | 12/31/2023 | 9/30/2023 | 6/30/2023 | ||||||||||||||||||||||||

Percent leased |

87.3 | % | 87.8 | % | 87.1 | % | 86.7 | % | 86.2 | % | |||||||||||||||||||

Percent leased - economic (1) |

78.8 | % | 81.2 | % | 81.5 | % | 80.8 | % | 80.0 | % | |||||||||||||||||||

| Total revenues | $143,262 | $144,538 | $145,331 | $146,986 | $143,072 | ||||||||||||||||||||||||

| Net income (loss) applicable to Piedmont | -$9,809 | -$27,763 | -$28,030 | -$17,002 | -$1,988 | ||||||||||||||||||||||||

| Net income (loss) per share applicable to common stockholders - diluted | -$0.08 | -$0.22 | -$0.23 | -$0.14 | -$0.02 | ||||||||||||||||||||||||

| Core EBITDA | $76,673 | $77,760 | $79,215 | $80,448 | $79,212 | ||||||||||||||||||||||||

| Core FFO applicable to common stock | $46,751 | $47,753 | $50,624 | $52,716 | $55,535 | ||||||||||||||||||||||||

| Core FFO per share - diluted | $0.37 | $0.39 | $0.41 | $0.43 | $0.45 | ||||||||||||||||||||||||

| AFFO applicable to common stock | $27,758 | $24,741 | $31,833 | $39,939 | $44,444 | ||||||||||||||||||||||||

Gross regular dividends (2) |

$15,499 | $15,479 | $15,464 | $15,462 | $25,975 | ||||||||||||||||||||||||

Regular dividends per share (2) |

$0.125 | $0.125 | $0.125 | $0.125 | $0.210 | ||||||||||||||||||||||||

Same store net operating income - accrual basis (3) |

3.7 | % | 2.1 | % | 1.1 | % | 1.7 | % | -3.7 | % | |||||||||||||||||||

Same store net operating income - cash basis (3) |

5.7 | % | 5.1 | % | 4.8 | % | 5.3 | % | 0.2 | % | |||||||||||||||||||

Rental rate roll up / roll down - accrual rents |

23.0 | % | 18.6 | % | 11.3 | % | 10.3 | % | 19.6 | % | |||||||||||||||||||

Rental rate roll up / roll down - cash rents |

15.2 | % | 8.0 | % | 0.0 | % | 11.7 | % | 14.3 | % | |||||||||||||||||||

| Selected Balance Sheet Data | |||||||||||||||||||||||||||||

| Total real estate assets, net | $3,468,030 | $3,452,475 | $3,512,527 | $3,502,576 | $3,512,128 | ||||||||||||||||||||||||

| Total assets | $4,158,643 | $3,993,996 | $4,057,082 | $4,073,778 | $4,094,349 | ||||||||||||||||||||||||

| Total liabilities | $2,500,319 | $2,312,084 | $2,334,110 | $2,306,713 | $2,297,015 | ||||||||||||||||||||||||

| Ratios & Information for Debt Holders | |||||||||||||||||||||||||||||

Core EBITDA to total revenues |

53.5 | % | 53.8 | % | 54.5 | % | 54.7 | % | 55.4 | % | |||||||||||||||||||

Fixed charge coverage ratio (4) |

2.3 x | 2.3 x | 2.5 x | 2.7 x | 3.2 x | ||||||||||||||||||||||||

Average net principal amount of debt to Core EBITDA - quarterly (5) |

6.8 x | 6.8 x | 6.5 x | 6.4 x | 6.4 x | ||||||||||||||||||||||||

| Total gross real estate assets | $4,636,715 | $4,596,744 | $4,647,105 | $4,601,792 | $4,576,943 | ||||||||||||||||||||||||

| Total debt - GAAP | $2,221,738 | $2,070,070 | $2,054,596 | $2,050,319 | $2,049,236 | ||||||||||||||||||||||||

Net principal amount of debt (6) |

$2,100,347 | $2,078,263 | $2,065,827 | $2,057,848 | $2,051,778 | ||||||||||||||||||||||||

| (1) | Economic leased percentage excludes the square footage associated with executed but not commenced leases for currently vacant spaces and the square footage associated with tenants receiving rental abatements. | ||||

| (2) | Dividends are reflected in the quarter in which the record date occurred. | ||||

| (3) | Please refer to the three pages starting with page 13 for reconciliations to net income and additional same store net operating income information. The statistic provided for each of the prior quarters is based on the same store property population applicable at the time that the metric was initially reported. |

||||

| (4) | Calculated as Core EBITDA divided by the sum of interest expense, principal amortization, capitalized interest and preferred dividends (none during periods presented). | ||||

| The Company had principal amortization of $0.9 million for the quarter ended June 30, 2024, $0.9 million for the quarter ended March 31, 2024, $0.8 million for the quarter ended December 31, 2023, $0.3 million for the quarter ended September 30, 2023, and no principal amortization for the quarter ended June 30, 2023. | |||||

| The Company had capitalized interest of $3.0 million for the quarter ended June 30, 2024, $2.8 million for the quarter ended March 31, 2024, $2.5 million for the quarter ended December 31, 2023, $1.9 million for the quarter ended September 30, 2023, and $1.4 million for the quarter ended June 30, 2023. | |||||

| (5) | Calculated using the annualized Core EBITDA for the quarter and the average daily principal balance of debt outstanding during the quarter less the average balance of cash and escrow deposits and restricted cash during the quarter. | ||||

| (6) | Defined as the total principal amount of debt outstanding, minus cash and escrow deposits and restricted cash, all as of the end of the period. | ||||

| 6/30/2024 | 3/31/2024 | 12/31/2023 | 9/30/2023 | 6/30/2023 | |||||||||||||||||||||||||

| Assets: | |||||||||||||||||||||||||||||

| Real estate assets, at cost: | |||||||||||||||||||||||||||||

| Land | $ | 552,744 | $ | 552,744 | $ | 559,384 | $ | 559,384 | $ | 559,384 | |||||||||||||||||||

| Buildings and improvements | 3,791,196 | 3,769,592 | 3,788,249 | 3,747,467 | 3,733,538 | ||||||||||||||||||||||||

| Buildings and improvements, accumulated depreciation | (1,080,613) | (1,056,469) | (1,039,136) | (1,005,991) | (974,372) | ||||||||||||||||||||||||

| Intangible lease assets | 151,015 | 156,804 | 170,654 | 177,584 | 182,127 | ||||||||||||||||||||||||

| Intangible lease assets, accumulated amortization | (80,251) | (80,070) | (88,066) | (86,197) | (83,763) | ||||||||||||||||||||||||

| Construction in progress | 115,213 | 91,112 | 85,239 | 74,200 | 58,847 | ||||||||||||||||||||||||

| Real estate assets held for sale, gross | 26,547 | 26,492 | 43,579 | 43,157 | 43,047 | ||||||||||||||||||||||||

| Real estate assets held for sale, accumulated depreciation & amortization | (7,821) | (7,730) | (7,376) | (7,028) | (6,680) | ||||||||||||||||||||||||

| Total real estate assets | 3,468,030 | 3,452,475 | 3,512,527 | 3,502,576 | 3,512,128 | ||||||||||||||||||||||||

| Cash and cash equivalents | 138,454 | 3,544 | 825 | 5,044 | 5,167 | ||||||||||||||||||||||||

| Tenant receivables, net of allowance for doubtful accounts | 7,619 | 10,338 | 7,915 | 8,806 | 5,387 | ||||||||||||||||||||||||

| Straight line rent receivable | 186,913 | 183,784 | 182,856 | 180,853 | 179,375 | ||||||||||||||||||||||||

| Escrow deposits and restricted cash | 5,368 | 4,221 | 3,381 | 5,983 | 5,055 | ||||||||||||||||||||||||

| Prepaid expenses and other assets | 25,224 | 22,908 | 27,559 | 25,974 | 23,453 | ||||||||||||||||||||||||

| Goodwill | 53,491 | 53,491 | 53,491 | 71,980 | 82,937 | ||||||||||||||||||||||||

| Interest rate swaps | 3,578 | 4,148 | 3,032 | 5,841 | 5,693 | ||||||||||||||||||||||||

| Deferred lease costs, gross | 467,710 | 472,757 | 485,531 | 481,365 | 480,161 | ||||||||||||||||||||||||

| Deferred lease costs, accumulated amortization | (201,008) | (216,835) | (223,248) | (217,069) | (207,406) | ||||||||||||||||||||||||

| Other assets held for sale, gross | 4,016 | 3,900 | 3,879 | 3,160 | 3,065 | ||||||||||||||||||||||||

| Other assets held for sale, accumulated amortization | (752) | (735) | (666) | (735) | (666) | ||||||||||||||||||||||||

| Total assets | $ | 4,158,643 | $ | 3,993,996 | $ | 4,057,082 | $ | 4,073,778 | $ | 4,094,349 | |||||||||||||||||||

| Liabilities: | |||||||||||||||||||||||||||||

| Unsecured debt, net of discount | $ | 2,027,569 | $ | 1,875,042 | $ | 1,858,717 | $ | 1,853,598 | $ | 1,852,236 | |||||||||||||||||||

| Secured debt | 194,169 | 195,028 | 195,879 | 196,721 | 197,000 | ||||||||||||||||||||||||

| Accounts payable, accrued expenses, and accrued capital expenditures | 140,793 | 106,638 | 146,659 | 120,579 | 107,629 | ||||||||||||||||||||||||

| Deferred income | 100,131 | 95,139 | 89,930 | 89,990 | 89,815 | ||||||||||||||||||||||||

| Intangible lease liabilities, less accumulated amortization | 37,657 | 40,237 | 42,925 | 45,825 | 50,335 | ||||||||||||||||||||||||

| Total liabilities | 2,500,319 | 2,312,084 | 2,334,110 | 2,306,713 | 2,297,015 | ||||||||||||||||||||||||

| Stockholders' equity: | |||||||||||||||||||||||||||||

| Common stock | 1,240 | 1,239 | 1,237 | 1,237 | 1,237 | ||||||||||||||||||||||||

| Additional paid in capital | 3,719,419 | 3,717,599 | 3,716,742 | 3,714,629 | 3,712,688 | ||||||||||||||||||||||||

| Cumulative distributions in excess of earnings | (2,055,697) | (2,030,389) | (1,987,147) | (1,943,652) | (1,911,188) | ||||||||||||||||||||||||

| Other comprehensive loss | (8,180) | (8,090) | (9,418) | (6,718) | (6,977) | ||||||||||||||||||||||||

| Piedmont stockholders' equity | 1,656,782 | 1,680,359 | 1,721,414 | 1,765,496 | 1,795,760 | ||||||||||||||||||||||||

| Non-controlling interest | 1,542 | 1,553 | 1,558 | 1,569 | 1,574 | ||||||||||||||||||||||||

| Total stockholders' equity | 1,658,324 | 1,681,912 | 1,722,972 | 1,767,065 | 1,797,334 | ||||||||||||||||||||||||

| Total liabilities, redeemable common stock and stockholders' equity | $ | 4,158,643 | $ | 3,993,996 | $ | 4,057,082 | $ | 4,073,778 | $ | 4,094,349 | |||||||||||||||||||

| Common stock outstanding at end of period | 123,995 | 123,888 | 123,715 | 123,696 | 123,692 | ||||||||||||||||||||||||

| Three Months Ended | ||||||||||||||||||||||||||||||||

| 6/30/2024 | 3/31/2024 | 12/31/2023 | 9/30/2023 | 6/30/2023 | ||||||||||||||||||||||||||||

| Revenues: | ||||||||||||||||||||||||||||||||

Rental income (1) |

$ | 111,581 | $ | 113,313 | $ | 114,357 | $ | 115,250 | $ | 112,238 | ||||||||||||||||||||||

Tenant reimbursements (1) |

25,089 | 25,768 | 25,090 | 26,284 | 25,265 | |||||||||||||||||||||||||||

| Property management fee revenue | 482 | 157 | 389 | 396 | 437 | |||||||||||||||||||||||||||

| Other property related income | 6,110 | 5,300 | 5,495 | 5,056 | 5,132 | |||||||||||||||||||||||||||

| 143,262 | 144,538 | 145,331 | 146,986 | 143,072 | ||||||||||||||||||||||||||||

| Expenses: | ||||||||||||||||||||||||||||||||

| Property operating costs | 58,565 | 59,444 | 59,085 | 59,847 | 58,368 | |||||||||||||||||||||||||||

| Depreciation | 38,814 | 38,869 | 38,036 | 38,150 | 36,475 | |||||||||||||||||||||||||||

| Amortization | 18,097 | 18,120 | 24,232 | 20,160 | 21,333 | |||||||||||||||||||||||||||

Impairment charges (2) |

— | 18,432 | 18,489 | 10,957 | — | |||||||||||||||||||||||||||

| General and administrative | 8,352 | 7,612 | 7,177 | 7,043 | 7,279 | |||||||||||||||||||||||||||

| 123,828 | 142,477 | 147,019 | 136,157 | 123,455 | ||||||||||||||||||||||||||||

| Other income (expense): | ||||||||||||||||||||||||||||||||

| Interest expense | (29,569) | (29,714) | (28,431) | (27,361) | (23,389) | |||||||||||||||||||||||||||

| Other income (expense) | 328 | 278 | 146 | 351 | 1,787 | |||||||||||||||||||||||||||

Loss on early extinguishment of debt (3) |

— | (386) | — | (820) | — | |||||||||||||||||||||||||||

Gain on sale of real estate |

— | — | 1,946 | — | — | |||||||||||||||||||||||||||

| Net income (loss) | (9,807) | (27,761) | (28,027) | (17,001) | (1,985) | |||||||||||||||||||||||||||

| Less: Net (income) loss applicable to noncontrolling interest | (2) | (2) | (3) | (1) | (3) | |||||||||||||||||||||||||||

| Net income (loss) applicable to Piedmont | $ | (9,809) | $ | (27,763) | $ | (28,030) | $ | (17,002) | $ | (1,988) | ||||||||||||||||||||||

| Weighted average common shares outstanding - diluted | 123,953 | 123,800 | 123,714 | 123,696 | 123,671 | |||||||||||||||||||||||||||

| Net income (loss) per share applicable to common stockholders - diluted | $ | (0.08) | $ | (0.22) | $ | (0.23) | $ | (0.14) | $ | (0.02) | ||||||||||||||||||||||

| Common stock outstanding at end of period | 123,995 | 123,888 | 123,715 | 123,696 | 123,692 | |||||||||||||||||||||||||||

| (1) | Not presented in conformance with GAAP. To be in conformance with the current GAAP standard, the Company would combine amounts presented on the rental income line with amounts presented on the tenant reimbursements line and present that aggregated figure on one line entitled "rental and tenant reimbursement revenue." | ||||

| (2) | Consists of the write down of the book value of two properties in the first quarter of 2024 due to changes in the estimated hold periods of the assets, the write down of the Company's goodwill balance allocated to its Boston and New York markets in the fourth quarter of 2023, and the write down of the Company's goodwill balance allocated to its Minneapolis market in the third quarter of 2023. | ||||

| (3) | Consists of the pro-rata write-off of unamortized debt issuance costs and discounts associated with the repayment of $100 million in unsecured term loan debt originally due at the end of 2024 but repaid in the first quarter of 2024. | ||||

| Three Months Ended | Six Months Ended | ||||||||||||||||||||||||||||||||||

| 6/30/2024 | 6/30/2023 | Change ($) | Change (%) | 6/30/2024 | 6/30/2023 | Change ($) | Change (%) | ||||||||||||||||||||||||||||

| Revenues: | |||||||||||||||||||||||||||||||||||

Rental income (1) |

$ | 111,581 | $ | 112,238 | $ | (657) | (0.6) | % | $ | 224,894 | $ | 224,798 | $ | 96 | — | % | |||||||||||||||||||

Tenant reimbursements (1) |

25,089 | 25,265 | (176) | (0.7) | % | 50,857 | 49,534 | 1,323 | 2.7 | % | |||||||||||||||||||||||||

| Property management fee revenue | 482 | 437 | 45 | 10.3 | % | 639 | 944 | (305) | (32.3) | % | |||||||||||||||||||||||||

| Other property related income | 6,110 | 5,132 | 978 | 19.1 | % | 11,410 | 10,163 | 1,247 | 12.3 | % | |||||||||||||||||||||||||

| 143,262 | 143,072 | 190 | 0.1 | % | 287,800 | 285,439 | 2,361 | 0.8 | % | ||||||||||||||||||||||||||

| Expenses: | |||||||||||||||||||||||||||||||||||

| Property operating costs | 58,565 | 58,368 | (197) | (0.3) | % | 118,009 | 116,159 | (1,850) | (1.6) | % | |||||||||||||||||||||||||

| Depreciation | 38,814 | 36,475 | (2,339) | (6.4) | % | 77,683 | 72,272 | (5,411) | (7.5) | % | |||||||||||||||||||||||||

| Amortization | 18,097 | 21,333 | 3,236 | 15.2 | % | 36,217 | 43,364 | 7,147 | 16.5 | % | |||||||||||||||||||||||||

Impairment charges (2) |

— | — | — | 18,432 | — | (18,432) | (100.0) | % | |||||||||||||||||||||||||||

| General and administrative | 8,352 | 7,279 | (1,073) | (14.7) | % | 15,964 | 14,970 | (994) | (6.6) | % | |||||||||||||||||||||||||

| 123,828 | 123,455 | (373) | (0.3) | % | 266,305 | 246,765 | (19,540) | (7.9) | % | ||||||||||||||||||||||||||

| Other income (expense): | |||||||||||||||||||||||||||||||||||

| Interest expense | (29,569) | (23,389) | (6,180) | (26.4) | % | (59,283) | (45,466) | (13,817) | (30.4) | % | |||||||||||||||||||||||||

| Other income (expense) | 328 | 1,787 | (1,459) | (81.6) | % | 606 | 3,443 | (2,837) | (82.4) | % | |||||||||||||||||||||||||

Loss on early extinguishment of debt (3) |

— | — | — | (386) | — | (386) | (100.0) | % | |||||||||||||||||||||||||||

| Net income (loss) | (9,807) | (1,985) | (7,822) | (394.1) | % | (37,568) | (3,349) | (34,219) | (1,021.8) | % | |||||||||||||||||||||||||

| Less: Net (income) loss applicable to noncontrolling interest | (2) | (3) | 1 | 33.3 | % | (4) | (6) | 2 | 33.3 | % | |||||||||||||||||||||||||

| Net income (loss) applicable to Piedmont | $ | (9,809) | $ | (1,988) | $ | (7,821) | (393.4) | % | $ | (37,572) | $ | (3,355) | $ | (34,217) | (1,019.9) | % | |||||||||||||||||||

| Weighted average common shares outstanding - diluted | 123,953 | 123,671 | 123,877 | 123,611 | |||||||||||||||||||||||||||||||

| Net income (loss) per share applicable to common stockholders - diluted | $ | (0.08) | $ | (0.02) | $ | (0.30) | $ | (0.03) | |||||||||||||||||||||||||||

| Common stock outstanding at end of period | 123,995 | 123,692 | 123,995 | 123,692 | |||||||||||||||||||||||||||||||

| (1) | Not presented in conformance with GAAP. To be in conformance with the current GAAP standard, the Company would combine amounts presented on the rental income line with amounts presented on the tenant reimbursements line and present that aggregated figure on one line entitled "rental and tenant reimbursement revenue." | ||||

| (2) | The six months ended June 30, 2024 consists of the write down of the book value of two properties due to changes in the estimated hold periods of the assets. | ||||

| (3) | The six months ended June 30, 2024 consists of the pro-rata write-off of unamortized debt issuance costs and discounts associated with the repayment of $100 million in unsecured term loan debt originally due at the end of 2024 but repaid in the first quarter of 2024. | ||||

| Three Months Ended | Six Months Ended | |||||||||||||||||||||||||

| 6/30/2024 | 6/30/2023 | 6/30/2024 | 6/30/2023 | |||||||||||||||||||||||

| GAAP net income (loss) applicable to common stock | $ | (9,809) | $ | (1,988) | $ | (37,572) | $ | (3,355) | ||||||||||||||||||

Depreciation of real estate assets (1) |

38,471 | 36,200 | 77,057 | 71,890 | ||||||||||||||||||||||

Amortization of lease-related costs (1) |

18,089 | 21,323 | 36,201 | 43,344 | ||||||||||||||||||||||

Impairment charges |

— | — | 18,432 | — | ||||||||||||||||||||||

| NAREIT Funds From Operations applicable to common stock | 46,751 | 55,535 | 94,118 | 111,879 | ||||||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||

| Loss on early extinguishment of debt | — | — | 386 | — | ||||||||||||||||||||||

| Core Funds From Operations applicable to common stock | 46,751 | 55,535 | 94,504 | 111,879 | ||||||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||

Amortization of debt issuance costs and discounts on debt |

1,139 | 1,312 | 2,347 | 2,551 | ||||||||||||||||||||||

| Depreciation of non real estate assets | 331 | 264 | 603 | 361 | ||||||||||||||||||||||

Straight-line effects of lease revenue (1) |

(2,084) | (2,755) | (4,339) | (5,942) | ||||||||||||||||||||||

| Stock-based compensation adjustments | 2,061 | 2,095 | 3,087 | 2,278 | ||||||||||||||||||||||

Amortization of lease-related intangibles (1) |

(2,549) | (3,119) | (5,205) | (6,531) | ||||||||||||||||||||||

Non-incremental capital expenditures (2) |

||||||||||||||||||||||||||

| Base Building Costs | (6,087) | (2,914) | (19,142) | (7,666) | ||||||||||||||||||||||

| Tenant Improvement Costs | (2,973) | (2,228) | (6,646) | (7,927) | ||||||||||||||||||||||

| Leasing Costs | (8,831) | (3,746) | (12,710) | (7,767) | ||||||||||||||||||||||

| Adjusted Funds From Operations applicable to common stock | $ | 27,758 | $ | 44,444 | $ | 52,499 | $ | 81,236 | ||||||||||||||||||

| Weighted average common shares outstanding - diluted | 124,796 | 123,749 | 124,501 | 123,696 | ||||||||||||||||||||||

| NAREIT Funds From Operations per share (diluted) | $ | 0.37 | $ | 0.45 | $ | 0.76 | $ | 0.90 | ||||||||||||||||||

| Core Funds From Operations per share (diluted) | $ | 0.37 | $ | 0.45 | $ | 0.76 | $ | 0.90 | ||||||||||||||||||

| Common stock outstanding at end of period | 123,995 | 123,692 | 123,995 | 123,692 | ||||||||||||||||||||||

| (1) | Includes our proportionate share of amounts attributable to consolidated properties. | ||||

| (2) | Non-incremental capital expenditures are defined on page 32. |

||||

| Three Months Ended | Six Months Ended | ||||||||||||||||||||||

| 6/30/2024 | 6/30/2023 | 6/30/2024 | 6/30/2023 | ||||||||||||||||||||

| Net income (loss) applicable to Piedmont | $ | (9,809) | $ | (1,988) | $ | (37,572) | $ | (3,355) | |||||||||||||||

| Net income (loss) applicable to noncontrolling interest | 2 | 3 | 4 | 6 | |||||||||||||||||||

Interest expense |

29,569 | 23,389 | 59,283 | 45,466 | |||||||||||||||||||

Depreciation (1) |

38,802 | 36,464 | 77,660 | 72,251 | |||||||||||||||||||

Amortization (1) |

18,089 | 21,323 | 36,201 | 43,344 | |||||||||||||||||||

| Depreciation and amortization attributable to noncontrolling interests | 20 | 21 | 40 | 41 | |||||||||||||||||||

Impairment charges |

— | — | 18,432 | — | |||||||||||||||||||

EBITDAre |

76,673 | 79,212 | 154,048 | 157,753 | |||||||||||||||||||

| Loss on early extinguishment of debt | — | — | 386 | — | |||||||||||||||||||

Core EBITDA (2) |

76,673 | 79,212 | 154,434 | 157,753 | |||||||||||||||||||

General and administrative expense |

8,352 | 7,279 | 15,964 | 14,970 | |||||||||||||||||||

| Non-cash general reserve for uncollectible accounts | — | — | — | (400) | |||||||||||||||||||

Management fee revenue (net) |

(256) | (254) | (252) | (546) | |||||||||||||||||||

Other (income) expense |

(220) | (1,571) | (391) | (3,012) | |||||||||||||||||||

Straight-line effects of lease revenue (1) |

(2,084) | (2,755) | (4,339) | (5,942) | |||||||||||||||||||

| Straight-line effects of lease revenue attributable to noncontrolling interests | — | (1) | — | (6) | |||||||||||||||||||

Amortization of lease-related intangibles (1) |

(2,549) | (3,119) | (5,205) | (6,531) | |||||||||||||||||||

| Property net operating income (cash basis) | 79,916 | 78,791 | 160,211 | 156,286 | |||||||||||||||||||

| Deduct net operating (income) loss from: | |||||||||||||||||||||||

Acquisitions |

— | — | — | — | |||||||||||||||||||

Dispositions (3) |

(17) | (821) | (1,157) | (1,383) | |||||||||||||||||||

Other investments (4) |

(451) | (2,803) | (1,653) | (5,615) | |||||||||||||||||||

| Same store net operating income (cash basis) | $ | 79,448 | $ | 75,167 | $ | 157,401 | $ | 149,288 | |||||||||||||||

| Change period over period | 5.7 | % | N/A | 5.4 | % | N/A | |||||||||||||||||

| (1) | Includes our proportionate share of amounts attributable to consolidated properties. | ||||

| (2) | The Company has historically recognized approximately $2 to $3 million of termination income on an annual basis. Given the size of its asset base and the number of tenants with which it conducts business, Piedmont considers termination income of that magnitude to be a normal part of its operations and a recurring part of its revenue stream; however, the recognition of termination income is typically variable between quarters and throughout any given year and is dependent upon when during the year the Company receives termination notices from tenants. During the three months ended June 30, 2024, Piedmont recognized $0.4 million of termination income, as compared with $0.2 million during the same period in 2023. During the six months ended June 30, 2024, Piedmont recognized $1.0 million of termination income, as compared with $0.4 million during the same period in 2023. | ||||

| (3) | Reflects the disposition of One Lincoln Park in Dallas, TX, sold in the first quarter of 2024. | ||||

| (4) | Reflects various land holdings and three out-of-service redevelopment projects. Additional information on these entities can be found on page 31. |

||||

| Three Months Ended | Six Months Ended | ||||||||||||||||||||||

| 6/30/2024 | 6/30/2023 | 6/30/2024 | 6/30/2023 | ||||||||||||||||||||

| Net income (loss) applicable to Piedmont | $ | (9,809) | $ | (1,988) | $ | (37,572) | $ | (3,355) | |||||||||||||||

| Net income (loss) applicable to noncontrolling interest | 2 | 3 | 4 | 6 | |||||||||||||||||||

Interest expense |

29,569 | 23,389 | 59,283 | 45,466 | |||||||||||||||||||

Depreciation (1) |

38,802 | 36,464 | 77,660 | 72,251 | |||||||||||||||||||

Amortization (1) |

18,089 | 21,323 | 36,201 | 43,344 | |||||||||||||||||||

| Depreciation and amortization attributable to noncontrolling interests | 20 | 21 | 40 | 41 | |||||||||||||||||||

Impairment charges |

— | — | 18,432 | — | |||||||||||||||||||

EBITDAre |

76,673 | 79,212 | 154,048 | 157,753 | |||||||||||||||||||

| Loss on early extinguishment of debt | — | — | 386 | — | |||||||||||||||||||

Core EBITDA (2) |

76,673 | 79,212 | 154,434 | 157,753 | |||||||||||||||||||

General and administrative expense |

8,352 | 7,279 | 15,964 | 14,970 | |||||||||||||||||||

Management fee revenue (net) |

(256) | (254) | (252) | (546) | |||||||||||||||||||

Other (income) expense |

(220) | (1,571) | (391) | (3,012) | |||||||||||||||||||

| Property net operating income (accrual basis) | 84,549 | 84,666 | 169,755 | 169,165 | |||||||||||||||||||

| Deduct net operating (income) loss from: | |||||||||||||||||||||||

Acquisitions |

— | — | — | — | |||||||||||||||||||

Dispositions (3) |

(17) | (823) | (1,481) | (1,737) | |||||||||||||||||||

Other investments (4) |

(530) | (2,847) | (1,817) | (5,609) | |||||||||||||||||||

| Same store net operating income (accrual basis) | $ | 84,002 | $ | 80,996 | $ | 166,457 | $ | 161,819 | |||||||||||||||

| Change period over period | 3.7 | % | N/A | 2.9 | % | N/A | |||||||||||||||||

| (1) | Includes our proportionate share of amounts attributable to consolidated properties. | ||||

| (2) | The Company has historically recognized approximately $2 to $3 million of termination income on an annual basis. Given the size of its asset base and the number of tenants with which it conducts business, Piedmont considers termination income of that magnitude to be a normal part of its operations and a recurring part of its revenue stream; however, the recognition of termination income is typically variable between quarters and throughout any given year and is dependent upon when during the year the Company receives termination notices from tenants. During the three months ended June 30, 2024, Piedmont recognized $0.4 million of termination income, as compared with $0.2 million during the same period in 2023. During the six months ended June 30, 2024, Piedmont recognized $1.0 million of termination income, as compared with $0.4 million during the same period in 2023. | ||||

| (3) | Reflects the disposition of One Lincoln Park in Dallas, TX, sold in the first quarter of 2024. | ||||

| (4) | Reflects various land holdings and three out-of-service redevelopment projects. Additional information on these entities can be found on page 31. |

||||

| Three Months Ended | Six Months Ended | |||||||||||||||||||||||||||||||

| 6/30/2024 | 6/30/2023 | Change ($) | Change (%) | 6/30/2024 | 6/30/2023 | Change ($) | Change (%) | |||||||||||||||||||||||||

| Revenue | ||||||||||||||||||||||||||||||||

| Cash rental income | $ | 105,809 | $ | 102,186 | $ | 3,623 | 3.5 | % | $ | 211,497 | $ | 204,098 | $ | 7,399 | 3.6 | % | ||||||||||||||||

| Tenant reimbursements | 24,456 | 23,311 | 1,145 | 4.9 | % | 48,761 | 46,075 | 2,686 | 5.8 | % | ||||||||||||||||||||||

| Straight line effects of lease revenue | 2,004 | 2,730 | (726) | (26.6) | % | 3,850 | 5,679 | (1,829) | (32.2) | % | ||||||||||||||||||||||

| Amortization of lease-related intangibles | 2,550 | 3,099 | (549) | (17.7) | % | 5,206 | 6,452 | (1,246) | (19.3) | % | ||||||||||||||||||||||

Total rents |

134,819 | 131,326 | 3,493 | 2.7 | % | 269,314 | 262,304 | 7,010 | 2.7 | % | ||||||||||||||||||||||

Other property related income |

6,320 | 5,255 | 1,065 | 20.3 | % | 11,724 | 10,439 | 1,285 | 12.3 | % | ||||||||||||||||||||||

| Total revenue | 141,139 | 136,581 | 4,558 | 3.3 | % | 281,038 | 272,743 | 8,295 | 3.0 | % | ||||||||||||||||||||||

| Property operating expense | 57,245 | 55,801 | (1,444) | (2.6) | % | 114,797 | 111,356 | (3,441) | (3.1) | % | ||||||||||||||||||||||

| Property other income (expense) | 108 | 216 | (108) | (50.0) | % | 216 | 432 | (216) | (50.0) | % | ||||||||||||||||||||||

| Same store net operating income (accrual) | $ | 84,002 | $ | 80,996 | $ | 3,006 | 3.7 | % | $ | 166,457 | $ | 161,819 | $ | 4,638 | 2.9 | % | ||||||||||||||||

| Less: | ||||||||||||||||||||||||||||||||

| Straight line effects of lease revenue | (2,004) | (2,730) | 726 | 26.6 | % | (3,850) | (5,679) | 1,829 | 32.2 | % | ||||||||||||||||||||||

| Amortization of lease-related intangibles | (2,550) | (3,099) | 549 | 17.7 | % | (5,206) | (6,452) | 1,246 | 19.3 | % | ||||||||||||||||||||||

| Non-cash general reserve for uncollectible accounts | — | (400) | 400 | 100.0 | % | |||||||||||||||||||||||||||

| Same store net operating income (cash) | $ | 79,448 | $ | 75,167 | $ | 4,281 | 5.7 | % | $ | 157,401 | $ | 149,288 | $ | 8,113 | 5.4 | % | ||||||||||||||||

| As of | As of | ||||||||||

| June 30, 2024 | December 31, 2023 | ||||||||||

| Market Capitalization | |||||||||||

| Common stock price | $7.25 | $7.11 | |||||||||

| Total shares outstanding | 123,995 | 123,715 | |||||||||

Equity market capitalization (1) |

$898,964 | $879,616 | |||||||||

| Total debt - GAAP (net of $143.8 million of cash and investments on hand at June 30, 2024) | $2,077,916 | $2,050,390 | |||||||||

| Total principal amount of debt outstanding (net of $143.8 million of cash and investments on hand at June 30, 2024) (excludes premiums, discounts, and deferred financing costs) |

$2,100,347 | $2,065,827 | |||||||||

Total market capitalization (1) |

$3,143,133 | $2,949,649 | |||||||||

| Ratios & Information for Debt Holders | |||||||||||

Total gross assets (2) |

$5,529,088 | $5,415,573 | |||||||||

Net principal amount of debt / Total gross assets less cash and cash equivalents (3) |

39.1 | % | 38.2 | % | |||||||

Average net principal amount of debt to Core EBITDA - quarterly (4) |

6.8 x | 6.5 x | |||||||||

Average net principal amount of debt to Core EBITDA - trailing twelve months (5) |

6.6 x | 6.4 x | |||||||||

| (1) | Reflects common stock closing price, shares outstanding, and principal amount of debt outstanding as of the end of the reporting period. | ||||

| (2) | Total gross assets is defined as total assets with the add-back of accumulated depreciation and accumulated amortization related to real estate assets and accumulated amortization related to deferred lease costs. | ||||

| (3) | As of June 30, 2024, the Company held a large cash balance to be used for future debt retirement in early 2025; therefore, the metric shown is on a net debt basis to account for this cash balance. | ||||

| (4) | Calculated using the annualized Core EBITDA for the quarter and the average daily principal balance of debt outstanding during the quarter less the average balance of cash and escrow deposits and restricted cash during the quarter. | ||||

| (5) | Calculated using the sum of Core EBITDA for the trailing twelve month period and the average daily principal balance of debt outstanding for the trailing twelve months less the average balance of cash and escrow deposits and restricted cash during the trailing twelve month period. | ||||

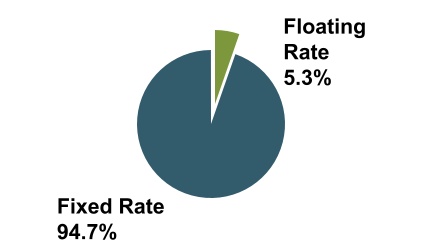

| Floating Rate & Fixed Rate Debt | |||||||||||

Debt |

Principal Amount

Outstanding (1)

|

Weighted Average

Interest Rate (2)

|

Weighted Average

Maturity

|

||||||||

Floating Rate (3) |

$120,000 | 6.71% | 31.0 months | ||||||||

| Fixed Rate | 2,124,169 | 6.04% | 55.6 months | ||||||||

| Total | $2,244,169 | 6.08% | 54.3 months | ||||||||

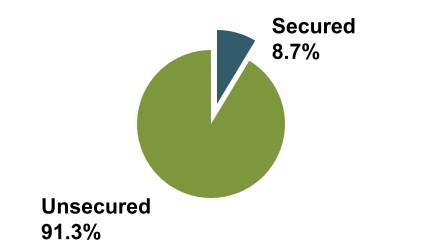

| Unsecured & Secured Debt | |||||||||||

Debt |

Principal Amount

Outstanding (1)

|

Weighted Average

Interest Rate (2)

|

Weighted Average

Maturity

|

||||||||

| Unsecured | $2,050,000 | 6.26% | 54.6 months | ||||||||

| Secured | 194,169 | 4.10% | 51.1 months | ||||||||

| Total | $2,244,169 | 6.08% | 54.3 months | ||||||||

Debt Maturities (4) |

||||||||||||||

|

Maturity

Year

|

Secured Principal Amount Outstanding (1) |

Unsecured Principal Amount Outstanding (1) |

Weighted Average

Interest Rate (2)

|

Percentage of

Total Debt

|

||||||||||

| 2024 | $— | $— | — | — | ||||||||||

| 2025 | — | 250,000 | 4.79% | 11.1% | ||||||||||

| 2026 | — | — | — | — | ||||||||||

| 2027 | — | 200,000 | 6.22% | 8.9% | ||||||||||

| 2028 | 194,169 | 600,000 | 7.99% | 35.4% | ||||||||||

| 2029 | — | 400,000 | 7.11% | 17.8% | ||||||||||

| 2030 | — | 300,000 | 3.90% | 13.4% | ||||||||||

| 2031 | — | — | — | — | ||||||||||

| 2032 | — | 300,000 | 2.78% | 13.4% | ||||||||||

| Total | $194,169 | $2,050,000 | 6.08% | 100.00% | ||||||||||

| (1) | All of Piedmont's outstanding debt as of June 30, 2024 was interest-only with the exception of the $197 million fixed-rate mortgage associated with 1180 Peachtree Street in Atlanta, GA. | ||||

| (2) | Calculated based upon the principal amounts outstanding and effective interest rates at June 30, 2024. | ||||

| (3) | Comprised of the $120 million variable-rate portion of the $200 million unsecured 2024 term loan. | ||||

| (4) | For loans that provide extension options that are conditional solely upon the Company providing proper notice to the loan's administrative agent and the payment of an extension fee, the final extended maturity date is reflected herein. | ||||

Facility |

Stated Rate (1) |

Effective Rate (2) |

Maturity Date | Principal Amount Outstanding as of June 30, 2024 | ||||||||||

| Secured Debt | ||||||||||||||

| $197 Million Fixed-Rate Mortgage (1180 Peachtree Street) | 4.10% | 4.10% | 10/1/2028 | 194,169 | ||||||||||

| Secured Subtotal / Weighted Average Interest Rate | 4.10% | $ | 194,169 | |||||||||||

| Unsecured Debt | ||||||||||||||

$250 Million Unsecured 2018 Term Loan (3) |

SOFR + 1.20% | 4.79% | 3/31/2025 | 250,000 | ||||||||||

$200 Million Unsecured 2024 Term Loan (4) |

SOFR + 1.30% | 6.22% | 1/29/2027 | 200,000 | ||||||||||

$600 Million Unsecured 2022 Line of Credit (5) |

SOFR + 1.04% | 6.45% | 6/30/2027 | — | ||||||||||

$600 Million Unsecured 2023 Senior Notes (6) |

9.25% | 9.25% | 7/20/2028 | 600,000 | ||||||||||

$400 Million Unsecured 2024 Senior Notes (7) |

6.88% | 7.11% | 7/15/2029 | 400,000 | ||||||||||

$300 Million Unsecured 2020 Senior Notes (8) |

3.15% | 3.90% | 8/15/2030 | 300,000 | ||||||||||

$300 Million Unsecured 2021 Senior Notes (9) |

2.75% | 2.78% | 4/1/2032 | 300,000 | ||||||||||

| Unsecured Subtotal / Weighted Average Interest Rate | 6.26% | $ | 2,050,000 | |||||||||||

Total Debt - Principal Amount Outstanding |

$ | 2,244,169 | ||||||||||||

GAAP Adjustments - Discounts and Unamortized Debt Issuance Costs |

$ | (22,431) | ||||||||||||

| Total Debt - GAAP Amount Outstanding / Weighted Average Interest Rate | 6.08% | $ | 2,221,738 | |||||||||||

| (1) | The all-in stated interest rates for the SOFR selections are comprised of the relevant adjusted SOFR rate (calculated as the base SOFR interest rate plus a fixed adjustment of 0.10%) and is a subject to an additional spread over the selected rate based on Piedmont's current credit rating. | ||||

| (2) | The effective rates reflect the consideration of settled or in-place interest rate swap agreements and issuance discounts. | ||||

| (3) | The $250 million unsecured term loan has a stated variable interest rate; however, Piedmont entered into multiple interest rate swap agreements which effectively fixes the interest rate on the entire facility through the loan's maturity date and can only change with a credit rating change for the Company. | ||||

| (4) | The $200 million unsecured term loan has a stated variable interest rate; however, Piedmont entered into two interest rate swap agreements which effectively fixes the interest rate on $80 million of the term loan to 5.50% through February 1, 2026 and can only change with a credit rating change for the Company. For the remaining $120 million variable portion of the loan, Piedmont may select from multiple interest rate options, including the prime rate and various length SOFR rates. | ||||

| (5) | There was no balance outstanding under the unsecured line of credit as of June 30, 2024. This revolving credit facility has an initial maturity date of June 30, 2026; however, there are two, six-month extension options available under the facility providing for a total extension of up to one year to June 30, 2027. Piedmont may select from multiple interest rate options with each draw under the facility, including the prime rate and various SOFR rates. | ||||

| (6) | The original $400 million unsecured senior notes were offered for sale at 99.000% of the principal amount; the resulting effective cost of the original $400 million financing is approximately 9.50% before the consideration of transaction costs. Piedmont offered an additional $200 million in unsecured senior notes for sale at 101.828% of the principal amount; the resulting effective cost of the $200 million additional financing is approximately 8.75%. | ||||

| (7) | The $400 million unsecured senior notes were offered for sale at 98.993% of the principal amount; the resulting effective cost of the financing is approximately 7.114% before the consideration of transaction costs. | ||||

| (8) | The $300 million unsecured senior notes were offered for sale at 99.236% of the principal amount; the resulting effective cost of the financing is approximately 3.24% before the consideration of transaction costs and the impact of interest rate hedges. After incorporating the results of the related interest rate hedging activity, the effective cost of the financing is approximately 3.90%. | ||||

| (9) | The $300 million unsecured senior notes were offered for sale at 99.510% of the principal amount; the resulting effective cost of the financing is approximately 2.80% before the consideration of transaction costs and the impact of interest rate hedges. After incorporating the results of the related interest rate hedging activity, the effective cost of the financing is approximately 2.78%. |

||||

| Three Months Ended | ||||||||||||||||||||

Bank Debt Covenant Compliance (1) |

Required | 6/30/2024 | 3/31/2024 | 12/31/2023 | 9/30/2023 | 6/30/2023 | ||||||||||||||

| Maximum leverage ratio | 0.60 | 0.41 | 0.41 | 0.37 | 0.36 | 0.37 | ||||||||||||||

Minimum fixed charge coverage ratio (2) |

1.50 | 2.49 | 2.67 | 2.91 | 3.16 | 3.52 | ||||||||||||||

| Maximum secured indebtedness ratio | 0.40 | 0.04 | 0.04 | 0.04 | 0.03 | 0.04 | ||||||||||||||

| Minimum unencumbered leverage ratio | 1.60 | 2.37 | 2.39 | 2.67 | 2.74 | 2.66 | ||||||||||||||

Minimum unencumbered interest coverage ratio (3) |

1.75 | 2.57 | 2.75 | 2.99 | 3.28 | 3.67 | ||||||||||||||

| Three Months Ended | ||||||||||||||||||||

Bond Covenant Compliance (4) |

Required | 6/30/2024 | 3/31/2024 | 12/31/2023 | 9/30/2023 | 6/30/2023 | ||||||||||||||

| Total debt to total assets | 60% or less | 46.8% | 45.2% | 44.4% | 44.7% | 44.8% | ||||||||||||||

| Secured debt to total assets | 40% or less | 4.1% | 4.2% | 4.2% | 4.3% | 4.3% | ||||||||||||||

| Ratio of consolidated EBITDA to interest expense | 1.50 or greater | 2.85 | 3.04 | 3.29 | 3.56 | 3.97 | ||||||||||||||

| Unencumbered assets to unsecured debt | 150% or greater | 212% | 220% | 225% | 223% | 223% | ||||||||||||||

| Three Months Ended | Six Months Ended | Twelve Months Ended | |||||||||

| Other Debt Coverage Ratios for Debt Holders | June 30, 2024 | June 30, 2024 | December 31, 2023 | ||||||||

Average net principal amount of debt to core EBITDA (5) |

6.8 x | 6.8 x | 6.4 x | ||||||||

Fixed charge coverage ratio (6) |

2.3 x | 2.3 x | 2.9 x | ||||||||

Interest coverage ratio (7) |

2.4 x | 2.4 x | 2.9 x | ||||||||

| (1) | Bank debt covenant compliance calculations relate to the most restrictive of the specific calculations detailed in the relevant credit agreements. Please refer to such agreements for relevant defined terms. | ||||

| (2) | Defined as EBITDA for the trailing four quarters (including the Company's share of EBITDA from unconsolidated interests), excluding one-time or non-recurring gains or losses, less a $0.15 per square foot capital reserve, and excluding the impact of straight line rent leveling adjustments and amortization of intangibles divided by the Company's share of fixed charges, as more particularly described in the credit agreements. This definition of fixed charge coverage ratio as prescribed by our credit agreements is different from the fixed charge coverage ratio definition employed elsewhere within this report. | ||||

| (3) | Defined as net operating income for the trailing four quarters for unencumbered assets (including the Company's share of net operating income from partially-owned entities and subsidiaries that are deemed to be unencumbered) less a $0.15 per square foot capital reserve divided by the Company's share of interest expense associated with unsecured financings only, as more particularly described in the credit agreements. | ||||

| (4) | Bond covenant compliance calculations relate to specific calculations prescribed in the relevant debt agreements. Please refer to the Indenture and the First Supplemental Indenture dated March 6, 2014, the Second Supplemental Indenture dated August 12, 2020, the Third Supplemental Indenture dated September 20, 2021, the Fourth Supplemental Indenture dated July 20, 2023, and the Fifth Supplemental Indenture dated June 25, 2024 for defined terms and detailed information about the calculations. | ||||

| (5) | Calculated using the average daily principal balance of debt outstanding during the identified period, less the average balance of cash and escrow deposits and restricted cash as of the end of each month during the relevant period. | ||||

| (6) | Calculated as Core EBITDA divided by the sum of interest expense, principal amortization, capitalized interest and preferred dividends (none during periods presented). The Company had principal amortization of $0.9 million for the three months ended June 30, 2024, $1.7 million for the six months ended June 30, 2024, and $1.1 million for the twelve months ended December 31, 2023. The Company had capitalized interest of $3.0 million for the three months ended June 30, 2024, $5.8 million for the six months ended June 30, 2024 and $7.0 million for the twelve months ended December 31, 2023. | ||||

| (7) | Calculated as Core EBITDA divided by the sum of interest expense and capitalized interest. The Company had capitalized interest of $3.0 million for the three months ended June 30, 2024, $5.8 million for the six months ended June 30, 2024, and $7.0 million for the twelve months ended December 31, 2023. | ||||

| Tenants Contributing 1% or More to Annualized Lease Revenue | |||||||||||||||||||||||

| Tenant | Credit Rating (1) |

Number of Properties |

Lease Term Remaining (2) |

Annualized Lease Revenue (in thousands) |

Percentage of Annualized Lease Revenue (%) |

Leased Square Footage (in thousands) |

Percentage of Leased Square Footage (%) |

||||||||||||||||

| State of New York | AA+ / Aa1 | 1 | 12.4 | $28,169 | 5.0 | 482 | 3.5 | ||||||||||||||||

| US Bancorp | A / A3 | 1 | 9.8 | 16,169 | 2.9 | 447 | 3.3 | ||||||||||||||||

| City of New York | AA / Aa2 | 1 | 1.9 | 15,941 | 2.8 | 313 | 2.3 | ||||||||||||||||

| Amazon | AA / A1 | 2 | 5.4 | 14,071 | 2.5 | 274 | 2.0 | ||||||||||||||||

| Microsoft | AAA / Aaa | 2 | 6.9 | 13,838 | 2.4 | 355 | 2.6 | ||||||||||||||||

| King & Spalding | No Rating Available | 1 | 6.8 | 13,214 | 2.3 | 268 | 2.0 | ||||||||||||||||

| Transocean | CCC+ / B3 | 1 | 11.8 | 11,569 | 2.0 | 301 | 2.2 | ||||||||||||||||

| Ryan | B+ / B2 | 1 | 2.3 | 9,628 | 1.7 | 178 | 1.3 | ||||||||||||||||

| VMware, Inc. | BBB / Baa3 | 1 | 3.1 | 9,097 | 1.6 | 215 | 1.6 | ||||||||||||||||

| Schlumberger Technology | A / A2 | 1 | 4.5 | 8,231 | 1.5 | 254 | 1.9 | ||||||||||||||||

| Gartner | BBB- / Baa3 | 2 | 10.0 | 7,875 | 1.4 | 207 | 1.5 | ||||||||||||||||

| Fiserv | BBB / Baa2 | 1 | 3.1 | 7,629 | 1.3 | 195 | 1.4 | ||||||||||||||||

| Salesforce.com | A+ / A1 | 1 | 5.1 | 7,586 | 1.3 | 182 | 1.3 | ||||||||||||||||

| Epsilon Data Management (subsidiary of Publicis) | BBB+ / Baa1 | 1 | 2.0 | 7,102 | 1.3 | 222 | 1.6 | ||||||||||||||||

| Eversheds Sutherland | No Rating Available | 1 | 1.8 | 7,076 | 1.3 | 180 | 1.3 | ||||||||||||||||

| MasterCard | A+ / Aa3 | 1 | 6.1 | 7,000 | 1.2 | 133 | 1.0 | ||||||||||||||||

| International Food Policy Research Institute | No Rating Available | 1 | 7.6 | 6,761 | 1.2 | 102 | 0.7 | ||||||||||||||||

| Travel + Leisure Co. | BB- / Ba3 | 1 | 16.3 | 5,702 | 1.0 | 182 | 1.3 | ||||||||||||||||

| Other | Various | 370,788 | 65.3 | 9,179 | 67.2 | ||||||||||||||||||

| Total | $567,446 | 100.0 | 13,669 | 100.0 | |||||||||||||||||||

| (1) | Credit rating may reflect the credit rating of the parent or a guarantor. When available, both the Standard & Poor's credit rating and the Moody's credit rating are provided. The absence of a credit rating for a tenant is not an indication of the creditworthiness of the tenant; in most cases, the lack of a credit rating reflects that the tenant has not sought such a rating. | ||||

| (2) | Reflects the weighted average lease terms remaining in years weighted by Annualized Lease Revenue. | ||||

Rating Level (1) |

Annualized Lease Revenue (in thousands) |

Percentage of Annualized Lease Revenue (%) |

||||||

| AAA / Aaa | $22,774 | 4.0 | ||||||

| AA / Aa | 72,736 | 12.8 | ||||||

| A / A | 57,800 | 10.2 | ||||||

| BBB / Baa | 67,524 | 11.9 | ||||||

| BB / Ba | 17,878 | 3.2 | ||||||

| B / B | 29,748 | 5.2 | ||||||

| Below | 1,837 | 0.3 | ||||||

Not rated (2) |

297,149 | 52.4 | ||||||

| Total | $567,446 | 100.0 | ||||||

| Lease Size | Number of Leases | Percentage of Leases (%) |

Annualized Lease Revenue (in thousands) |

Percentage of Annualized Lease Revenue (%) |

Leased Square Footage (in thousands) |

Percentage of Leased Square Footage (%) |

||||||||||||||

| 2,500 sf or Less | 340 | 35.4 | $25,307 | 4.5 | 234 | 1.7 | ||||||||||||||

| 2,501 - 10,000 sf | 351 | 36.6 | 71,137 | 12.5 | 1,792 | 13.1 | ||||||||||||||

| 10,001 - 20,000 sf | 104 | 10.8 | 56,194 | 9.9 | 1,413 | 10.3 | ||||||||||||||

| 20,001 - 40,000 sf | 94 | 9.8 | 99,641 | 17.6 | 2,532 | 18.5 | ||||||||||||||

| 40,001 - 100,000 sf | 45 | 4.7 | 113,135 | 19.9 | 2,799 | 20.5 | ||||||||||||||

| Greater than 100,000 sf | 26 | 2.7 | 202,032 | 35.6 | 4,899 | 35.9 | ||||||||||||||

| Total | 960 | 100.0 | $567,446 | 100.0 | 13,669 | 100.0 | ||||||||||||||

| (1) | Credit rating may reflect the credit rating of the parent or a guarantor. Where differences exist between the Standard & Poor's credit rating for a tenant and the Moody's credit rating for a tenant, the higher credit rating is selected for this analysis. | ||||

| (2) | The classification of a tenant as "not rated" is not an indication of the creditworthiness of the tenant; in most cases, the lack of a credit rating reflects that the tenant has not sought such a rating. Included in this category are such tenants as Piper Sandler, Ernst & Young, KPMG, BDO, and RaceTrac Petroleum. | ||||

| Three Months Ended | Three Months Ended | ||||||||||||||||||||||

| June 30, 2024 | June 30, 2023 | ||||||||||||||||||||||

|

Leased

Square Footage

|

Rentable

Square Footage

|

Percent

Leased (1)

|

Leased

Square Footage

|

Rentable

Square Footage

|

Percent

Leased (1)

|

||||||||||||||||||

| As of March 31, 20xx | 14,085 | 16,037 | 87.8 | % | 14,352 | 16,674 | 86.1 | % | |||||||||||||||

| Leases signed during period | 1,038 | 581 | |||||||||||||||||||||

Less: |

|||||||||||||||||||||||

| Lease renewals signed during period | (633) | (345) | |||||||||||||||||||||

| New leases signed during period for currently occupied space | (213) | (64) | |||||||||||||||||||||

| Leases expired during period and other | (578) | 18 | (159) | (2) | |||||||||||||||||||

| Subtotal | 13,699 | 16,055 | 85.3 | % | 14,365 | 16,672 | 86.2 | % | |||||||||||||||

Acquisitions and properties placed in service during period (2) |

— | — | — | — | |||||||||||||||||||

Dispositions and properties taken out of service during period (2) |

(30) | (397) | — | — | |||||||||||||||||||

| As of June 30, 20xx | 13,669 | 15,658 | 87.3 | % | 14,365 | 16,672 | 86.2 | % | |||||||||||||||

| Six Months Ended | Six Months Ended | ||||||||||||||||||||||

| June 30, 2024 | June 30, 2023 | ||||||||||||||||||||||

|

Leased

Square Footage

|

Rentable

Square Footage

|

Percent

Leased (1)

|

Leased

Square Footage

|

Rentable

Square Footage

|

Percent

Leased (1)

|

||||||||||||||||||

| As of December 31, 20xx | 14,426 | 16,563 | 87.1 | % | 14,440 | 16,658 | 86.7 | % | |||||||||||||||

| Leases signed during period | 1,538 | 1,125 | |||||||||||||||||||||

| Less: | |||||||||||||||||||||||