0001037976December 312025Q1FALSEFALSEFALSE34303/21/2025xbrli:sharesiso4217:USDiso4217:USDxbrli:sharesjll:acquisitionjll:investmentxbrli:pureiso4217:EUR00010379762025-01-012025-03-3100010379762025-05-020001037976jll:AndyPoppinkMember2025-01-012025-03-3100010379762025-03-3100010379762024-12-310001037976us-gaap:CommercialPaperMember2025-03-310001037976us-gaap:CommercialPaperMember2024-12-310001037976us-gaap:LineOfCreditMember2025-03-310001037976us-gaap:LineOfCreditMember2024-12-310001037976us-gaap:SeniorNotesMember2025-03-310001037976us-gaap:SeniorNotesMember2024-12-3100010379762024-01-012024-03-310001037976jll:SharesOutstandingSoEQTDMember2024-12-310001037976us-gaap:CommonStockMember2024-12-310001037976us-gaap:AdditionalPaidInCapitalMember2024-12-310001037976us-gaap:RetainedEarningsMember2024-12-310001037976jll:SharesHeldInTrustMember2024-12-310001037976us-gaap:TreasuryStockCommonMember2024-12-310001037976us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-12-310001037976us-gaap:NoncontrollingInterestMember2024-12-310001037976us-gaap:RetainedEarningsMember2025-01-012025-03-310001037976us-gaap:NoncontrollingInterestMember2025-01-012025-03-310001037976jll:SharesOutstandingSoEQTDMember2025-01-012025-03-310001037976us-gaap:AdditionalPaidInCapitalMember2025-01-012025-03-310001037976us-gaap:TreasuryStockCommonMember2025-01-012025-03-310001037976jll:SharesHeldInTrustMember2025-01-012025-03-310001037976us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-01-012025-03-310001037976jll:SharesOutstandingSoEQTDMember2025-03-310001037976us-gaap:CommonStockMember2025-03-310001037976us-gaap:AdditionalPaidInCapitalMember2025-03-310001037976us-gaap:RetainedEarningsMember2025-03-310001037976jll:SharesHeldInTrustMember2025-03-310001037976us-gaap:TreasuryStockCommonMember2025-03-310001037976us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-03-310001037976us-gaap:NoncontrollingInterestMember2025-03-310001037976jll:SharesOutstandingSoEQTDMember2023-12-310001037976us-gaap:CommonStockMember2023-12-310001037976us-gaap:AdditionalPaidInCapitalMember2023-12-310001037976us-gaap:RetainedEarningsMember2023-12-310001037976jll:SharesHeldInTrustMember2023-12-310001037976us-gaap:TreasuryStockCommonMember2023-12-310001037976us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001037976us-gaap:NoncontrollingInterestMember2023-12-3100010379762023-12-310001037976us-gaap:RetainedEarningsMember2024-01-012024-03-310001037976us-gaap:NoncontrollingInterestMember2024-01-012024-03-310001037976jll:SharesOutstandingSoEQTDMember2024-01-012024-03-310001037976us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310001037976us-gaap:TreasuryStockCommonMember2024-01-012024-03-310001037976jll:SharesHeldInTrustMember2024-01-012024-03-310001037976us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310001037976jll:SharesOutstandingSoEQTDMember2024-03-310001037976us-gaap:CommonStockMember2024-03-310001037976us-gaap:AdditionalPaidInCapitalMember2024-03-310001037976us-gaap:RetainedEarningsMember2024-03-310001037976jll:SharesHeldInTrustMember2024-03-310001037976us-gaap:TreasuryStockCommonMember2024-03-310001037976us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310001037976us-gaap:NoncontrollingInterestMember2024-03-3100010379762024-03-310001037976jll:OutofScopeofTopic606RevenueMember2025-01-012025-03-310001037976jll:OutofScopeofTopic606RevenueMember2024-01-012024-03-310001037976jll:WorkplaceManagementMemberjll:RealEstateManagementServicesMember2025-01-012025-03-310001037976jll:WorkplaceManagementMemberjll:RealEstateManagementServicesMember2024-01-012024-03-310001037976jll:ProjectManagementMemberjll:RealEstateManagementServicesMember2025-01-012025-03-310001037976jll:ProjectManagementMemberjll:RealEstateManagementServicesMember2024-01-012024-03-310001037976jll:PropertyManagementMemberjll:RealEstateManagementServicesMember2025-01-012025-03-310001037976jll:PropertyManagementMemberjll:RealEstateManagementServicesMember2024-01-012024-03-310001037976jll:PortfolioServicesAndOtherMemberjll:RealEstateManagementServicesMember2025-01-012025-03-310001037976jll:PortfolioServicesAndOtherMemberjll:RealEstateManagementServicesMember2024-01-012024-03-310001037976jll:RealEstateManagementServicesMember2025-01-012025-03-310001037976jll:RealEstateManagementServicesMember2024-01-012024-03-310001037976jll:LeasingMemberjll:LeasingAdvisoryMember2025-01-012025-03-310001037976jll:LeasingMemberjll:LeasingAdvisoryMember2024-01-012024-03-310001037976jll:AdvisoryAndConsultingMemberjll:LeasingAdvisoryMember2025-01-012025-03-310001037976jll:AdvisoryAndConsultingMemberjll:LeasingAdvisoryMember2024-01-012024-03-310001037976jll:LeasingAdvisoryMember2025-01-012025-03-310001037976jll:LeasingAdvisoryMember2024-01-012024-03-310001037976jll:InvestmentSalesDebtEquityAdvisoryAndOtherMemberjll:CapitalMarketsServicesMember2025-01-012025-03-310001037976jll:InvestmentSalesDebtEquityAdvisoryAndOtherMemberjll:CapitalMarketsServicesMember2024-01-012024-03-310001037976jll:ValuationAdvisoryMemberjll:CapitalMarketsServicesMember2025-01-012025-03-310001037976jll:ValuationAdvisoryMemberjll:CapitalMarketsServicesMember2024-01-012024-03-310001037976jll:LoanServicingMemberjll:CapitalMarketsServicesMember2025-01-012025-03-310001037976jll:LoanServicingMemberjll:CapitalMarketsServicesMember2024-01-012024-03-310001037976jll:CapitalMarketsServicesMember2025-01-012025-03-310001037976jll:CapitalMarketsServicesMember2024-01-012024-03-310001037976jll:AdvisoryFeesMemberjll:InvestmentManagementMember2025-01-012025-03-310001037976jll:AdvisoryFeesMemberjll:InvestmentManagementMember2024-01-012024-03-310001037976jll:TransactionFeesOtherMemberjll:InvestmentManagementMember2025-01-012025-03-310001037976jll:TransactionFeesOtherMemberjll:InvestmentManagementMember2024-01-012024-03-310001037976jll:IncentiveFeesMemberjll:InvestmentManagementMember2025-01-012025-03-310001037976jll:IncentiveFeesMemberjll:InvestmentManagementMember2024-01-012024-03-310001037976jll:InvestmentManagementMember2025-01-012025-03-310001037976jll:InvestmentManagementMember2024-01-012024-03-310001037976jll:SoftwareAndTechnologySolutionsMember2025-01-012025-03-310001037976jll:SoftwareAndTechnologySolutionsMember2024-01-012024-03-310001037976us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2025-03-310001037976us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001037976jll:RealEstateManagementServicesMember2024-12-310001037976jll:LeasingAdvisoryMember2024-12-310001037976jll:CapitalMarketsServicesMember2024-12-310001037976jll:InvestmentManagementMember2024-12-310001037976jll:SoftwareAndTechnologySolutionsMember2024-12-310001037976jll:RealEstateManagementServicesMember2025-03-310001037976jll:LeasingAdvisoryMember2025-03-310001037976jll:CapitalMarketsServicesMember2025-03-310001037976jll:InvestmentManagementMember2025-03-310001037976jll:SoftwareAndTechnologySolutionsMember2025-03-310001037976jll:MortgageservicingrightsMember2024-12-310001037976us-gaap:OtherIntangibleAssetsMember2024-12-310001037976jll:MortgageservicingrightsMember2025-01-012025-03-310001037976us-gaap:OtherIntangibleAssetsMember2025-01-012025-03-310001037976jll:MortgageservicingrightsMember2025-03-310001037976us-gaap:OtherIntangibleAssetsMember2025-03-310001037976jll:MortgageservicingrightsMember2023-12-310001037976us-gaap:OtherIntangibleAssetsMember2023-12-310001037976jll:MortgageservicingrightsMember2024-01-012024-03-310001037976us-gaap:OtherIntangibleAssetsMember2024-01-012024-03-310001037976jll:MortgageservicingrightsMember2024-03-310001037976us-gaap:OtherIntangibleAssetsMember2024-03-310001037976jll:InvestmentManagementMember2025-03-310001037976jll:InvestmentManagementMember2024-12-310001037976jll:SoftwareAndTechnologySolutionsMember2025-03-310001037976jll:SoftwareAndTechnologySolutionsMember2024-12-310001037976jll:OtherInvestmentsAndAdvanceToAffiliatesSubsidiariesAssociatesAndJointVenturesMember2025-03-310001037976jll:OtherInvestmentsAndAdvanceToAffiliatesSubsidiariesAssociatesAndJointVenturesMember2024-12-310001037976us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:InvestmentsMember2024-01-012024-03-310001037976us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:FairValueMeasurementsRecurringMember2025-03-310001037976us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001037976us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2025-03-310001037976us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2025-03-310001037976us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001037976us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001037976us-gaap:ForeignExchangeContractMember2025-03-310001037976us-gaap:ForeignExchangeContractMember2024-12-310001037976us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:InvestmentsMember2025-01-012025-03-310001037976us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:DerivativeMember2025-01-012025-03-310001037976us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberjll:EarnoutLiabilitiesMember2025-01-012025-03-310001037976us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001037976us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001037976us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:DerivativeMember2024-01-012024-03-310001037976us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberjll:EarnoutLiabilitiesMember2024-01-012024-03-310001037976jll:LongtermseniornotesEuronotes1.96dueJune2027Member2025-03-310001037976jll:LongtermseniornotesEuronotes1.96dueJune2027Member2024-12-310001037976jll:LongTermSeniorNotes6.875DueDecember2028Member2025-03-310001037976jll:LongTermSeniorNotes6.875DueDecember2028Member2024-12-310001037976jll:LongtermseniornotesEuronotes2.21dueJune2029Member2025-03-310001037976jll:LongtermseniornotesEuronotes2.21dueJune2029Member2024-12-310001037976us-gaap:CommercialPaperMember2025-03-310001037976us-gaap:LineOfCreditMember2025-01-012025-03-310001037976us-gaap:LineOfCreditMember2024-01-012024-03-310001037976jll:AgreementExpiresSeptember152025ExtensionMember2025-01-012025-03-310001037976jll:AgreementExpiresSeptember152025ExtensionMember2025-03-310001037976jll:AgreementExpiresSeptember152025ExtensionMember2024-12-310001037976jll:AgreementExpiresSeptember132025ExtensionMember2025-01-012025-03-310001037976jll:AgreementExpiresSeptember132025ExtensionMember2025-03-310001037976jll:AgreementExpiresSeptember132025ExtensionMember2024-12-310001037976jll:AgreementExpiresOctober242024ExtensionMember2025-01-012025-03-310001037976jll:AgreementExpiresOctober242024ExtensionMember2025-03-310001037976jll:AgreementExpiresOctober242024ExtensionMember2024-12-310001037976jll:FannieMaeASAPprogramMember2025-03-310001037976jll:FannieMaeASAPprogramMember2024-12-310001037976jll:LineofCreditGrossMember2025-03-310001037976jll:LineofCreditGrossMember2024-12-310001037976us-gaap:WarehouseAgreementBorrowingsMember2025-03-310001037976us-gaap:WarehouseAgreementBorrowingsMember2024-12-310001037976us-gaap:InsuranceClaimsMember2024-12-310001037976us-gaap:InsuranceClaimsMember2025-01-012025-03-310001037976us-gaap:InsuranceClaimsMember2025-03-310001037976us-gaap:InsuranceClaimsMember2023-12-310001037976us-gaap:InsuranceClaimsMember2024-01-012024-03-310001037976us-gaap:InsuranceClaimsMember2024-03-310001037976us-gaap:EmployeeSeveranceMember2025-01-012025-03-310001037976us-gaap:EmployeeSeveranceMember2024-01-012024-03-310001037976jll:ContractTerminationAndOtherChargesMember2025-01-012025-03-310001037976jll:ContractTerminationAndOtherChargesMember2024-01-012024-03-310001037976us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-12-310001037976us-gaap:AccumulatedTranslationAdjustmentMember2024-12-310001037976us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2025-01-012025-03-310001037976us-gaap:AccumulatedTranslationAdjustmentMember2025-01-012025-03-310001037976us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2025-03-310001037976us-gaap:AccumulatedTranslationAdjustmentMember2025-03-310001037976us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-12-310001037976us-gaap:AccumulatedTranslationAdjustmentMember2023-12-310001037976us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-01-012024-03-310001037976us-gaap:AccumulatedTranslationAdjustmentMember2024-01-012024-03-310001037976us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-03-310001037976us-gaap:AccumulatedTranslationAdjustmentMember2024-03-310001037976jll:AndyPoppinkTradingArrangementCommonStockMemberjll:AndyPoppinkMember2025-03-31

United States

Securities and Exchange Commission

Washington, D.C. 20549

Form 10-Q

☑ Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the quarterly period ended March 31, 2025

Or

☐ Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period from _____ to _____

Commission File Number 1-13145

Jones Lang LaSalle Incorporated

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Maryland |

36-4150422 |

|

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

|

200 East Randolph Drive |

Chicago, |

IL |

|

|

60601 |

|

|

(Address of principal executive offices) |

|

(Zip Code) |

|

|

Registrant's telephone number, including area code: |

(312) |

782-5800 |

|

|

|

|

|

Former name, former address and former fiscal year, if changed since last report: Not Applicable |

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Title of each class |

|

Trading Symbol |

|

Name of each exchange on which registered |

| Common Stock, par value $0.01 |

|

JLL |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Large accelerated filer |

x |

Accelerated filer |

☐ |

Non-accelerated filer |

☐ |

Smaller reporting company |

☐ |

Emerging growth company |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

The number of shares outstanding of the registrant's common stock (par value $0.01) as of the close of business on May 2, 2025 was 47,473,979.

|

|

|

|

|

|

|

|

|

| Table of Contents |

|

|

|

|

| Part I |

|

|

|

|

|

| Item 1. |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| Item 2. |

|

|

|

|

|

| Item 3. |

|

|

|

|

|

| Item 4. |

|

|

|

|

|

| Part II |

|

|

|

|

|

| Item 1. |

|

|

|

|

|

| Item 1A. |

|

|

|

|

|

| Item 2. |

|

|

|

|

|

| Item 5. |

|

|

|

|

|

| Item 6. |

|

|

|

|

|

|

|

Part I. Financial Information

Item 1. Financial Statements

JONES LANG LASALLE INCORPORATED

CONSOLIDATED BALANCE SHEETS

|

|

|

|

|

|

|

|

|

| (in millions, except share and per share data) |

March 31, 2025 |

December 31, 2024 |

| Assets |

(unaudited) |

|

| Current assets: |

|

|

| Cash and cash equivalents |

$ |

432.4 |

|

416.3 |

|

Trade receivables, net of allowance of $67.4 and $60.8 |

2,013.3 |

|

2,153.5 |

|

| Notes and other receivables |

457.4 |

|

456.9 |

|

| Reimbursable receivables |

2,833.9 |

|

2,695.0 |

|

| Warehouse receivables |

601.6 |

|

770.7 |

|

Short-term contract assets, net of allowance of $1.6 and $1.6 |

314.8 |

|

334.8 |

|

| Restricted cash, prepaid and other |

580.3 |

|

651.3 |

|

| Total current assets |

7,233.7 |

|

7,478.5 |

|

Property and equipment, net of accumulated depreciation of $1,220.3 and $1,161.6 |

585.9 |

|

598.1 |

|

| Operating lease right-of-use assets |

737.6 |

|

743.1 |

|

| Goodwill |

4,642.5 |

|

4,611.3 |

|

Identified intangibles, net of accumulated amortization of $704.3 and $670.8 |

701.8 |

|

724.1 |

|

Investments, including $856.0 and $742.0 at fair value |

902.4 |

|

812.7 |

|

| Long-term receivables |

387.6 |

|

394.7 |

|

| Deferred tax assets, net |

539.5 |

|

518.2 |

|

| Deferred compensation plan |

673.4 |

|

664.0 |

|

| Other |

226.7 |

|

219.1 |

|

| Total assets |

$ |

16,631.1 |

|

16,763.8 |

|

| Liabilities and Equity |

|

|

| Current liabilities: |

|

|

| Accounts payable and accrued liabilities |

$ |

1,201.4 |

|

1,322.7 |

|

| Reimbursable payables |

2,038.0 |

|

2,176.3 |

|

| Accrued compensation and benefits |

1,162.8 |

|

1,768.5 |

|

| Short-term borrowings |

88.3 |

|

153.8 |

|

|

|

|

Commercial paper, net of debt issuance costs of $1.7 and $0.7 |

898.3 |

|

199.3 |

|

| Short-term contract liabilities and deferred income |

187.7 |

|

203.8 |

|

| Warehouse facilities |

600.7 |

|

841.0 |

|

| Short-term operating lease liabilities |

155.5 |

|

157.2 |

|

| Other |

294.0 |

|

321.9 |

|

| Total current liabilities |

6,626.7 |

|

7,144.5 |

|

Credit facility, net of debt issuance costs of $10.7 and $11.4 |

409.3 |

|

88.6 |

|

Long-term debt, net of debt issuance costs of $6.0 and $6.4 |

772.1 |

|

756.7 |

|

| Deferred tax liabilities, net |

45.5 |

|

45.6 |

|

| Deferred compensation |

649.1 |

|

665.4 |

|

| Long-term operating lease liabilities |

754.2 |

|

748.8 |

|

| Other |

412.1 |

|

419.1 |

|

| Total liabilities |

9,669.0 |

|

9,868.7 |

|

|

|

|

|

|

|

| Company shareholders' equity: |

|

|

Common stock, $0.01 par value per share, 100,000,000 shares authorized; 52,120,548 and 52,120,548 shares issued; 47,513,451 and 47,415,584 outstanding |

0.5 |

|

0.5 |

|

| Additional paid-in capital |

2,001.9 |

|

2,032.7 |

|

| Retained earnings |

6,383.0 |

|

6,334.9 |

|

Treasury stock, at cost, 4,607,097 and 4,704,964 shares |

(923.5) |

|

(937.9) |

|

| Shares held in trust |

(12.1) |

|

(11.8) |

|

| Accumulated other comprehensive loss |

(610.6) |

|

(646.9) |

|

| Total Company shareholders’ equity |

6,839.2 |

|

6,771.5 |

|

| Noncontrolling interest |

122.9 |

|

123.6 |

|

| Total equity |

6,962.1 |

|

6,895.1 |

|

| Total liabilities and equity |

$ |

16,631.1 |

|

16,763.8 |

|

See accompanying notes to Consolidated Financial Statements.

JONES LANG LASALLE INCORPORATED

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

|

|

|

|

|

|

|

|

|

|

|

|

| (in millions, except share and per share data) (unaudited) |

|

|

Three Months Ended March 31, |

|

|

|

2025 |

2024 |

| Revenue |

|

|

|

$ |

5,746.4 |

|

5,124.5 |

|

| Operating expenses: |

|

|

|

|

|

| Compensation and benefits |

|

|

|

$ |

2,674.6 |

|

2,415.6 |

|

| Operating, administrative and other |

|

|

|

2,860.5 |

|

2,532.0 |

|

| Depreciation and amortization |

|

|

|

71.6 |

|

61.0 |

|

| Restructuring and acquisition charges |

|

|

|

19.7 |

|

1.7 |

|

| Total operating expenses |

|

|

|

$ |

5,626.4 |

|

5,010.3 |

|

| Operating income |

|

|

|

$ |

120.0 |

|

114.2 |

|

| Interest expense, net of interest income |

|

|

|

24.6 |

|

30.5 |

|

| Equity losses |

|

|

|

(25.6) |

|

(3.7) |

|

| Other income |

|

|

|

1.7 |

|

1.5 |

|

| Income before income taxes and noncontrolling interest |

|

|

|

71.5 |

|

81.5 |

|

| Income tax provision |

|

|

|

14.0 |

|

15.9 |

|

| Net income |

|

|

|

57.5 |

|

65.6 |

|

| Net income (loss) attributable to noncontrolling interest |

|

|

|

2.2 |

|

(0.5) |

|

| Net income attributable to common shareholders |

|

|

|

$ |

55.3 |

|

66.1 |

|

| Basic earnings per common share |

|

|

|

$ |

1.17 |

|

1.39 |

|

| Basic weighted average shares outstanding (in 000's) |

|

|

|

47,466 |

|

47,485 |

|

| Diluted earnings per common share |

|

|

|

$ |

1.14 |

|

1.37 |

|

| Diluted weighted average shares outstanding (in 000's) |

|

|

|

48,376 |

|

48,280 |

|

| Net income attributable to common shareholders |

|

|

|

$ |

55.3 |

|

66.1 |

|

| Change in pension liabilities, net of tax |

|

|

|

(0.5) |

|

0.3 |

|

| Foreign currency translation adjustments |

|

|

|

36.8 |

|

(37.7) |

|

| Comprehensive income attributable to common shareholders |

|

|

|

$ |

91.6 |

|

28.7 |

|

See accompanying notes to Consolidated Financial Statements.

JONES LANG LASALLE INCORPORATED

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

FOR THE THREE MONTHS ENDED MARCH 31, 2025 AND 2024

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Company Shareholders' Equity |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Common Stock |

Additional |

|

Shares |

|

|

|

|

|

(in millions, except share and

per share data) (unaudited) |

Shares Outstanding |

Amount |

Paid-In |

Retained |

Held in |

Treasury |

|

|

|

Total |

| Capital |

Earnings |

Trust |

Stock |

AOCI(1) |

NCI(2) |

|

Equity |

| December 31, 2024 |

47,415,584 |

|

$ |

0.5 |

|

2,032.7 |

|

6,334.9 |

|

(11.8) |

|

(937.9) |

|

(646.9) |

|

123.6 |

|

|

$ |

6,895.1 |

|

| Net income |

— |

|

— |

|

— |

|

55.3 |

|

— |

|

— |

|

— |

|

2.2 |

|

|

57.5 |

|

| Vesting of shares related to equity compensation plans, net of amounts withheld for payment of taxes |

171,231 |

|

— |

|

(52.8) |

|

(7.2) |

|

— |

|

34.1 |

|

— |

|

— |

|

|

(25.9) |

|

| Stock-based compensation |

— |

|

— |

|

22.0 |

|

— |

|

— |

|

— |

|

— |

|

— |

|

|

22.0 |

|

| Shares held in trust |

— |

|

— |

|

— |

|

— |

|

(0.3) |

|

— |

|

— |

|

— |

|

|

(0.3) |

|

| Repurchase of common stock |

(73,364) |

|

— |

|

— |

|

— |

|

— |

|

(19.7) |

|

— |

|

— |

|

|

(19.7) |

|

| Change in pension liabilities, net of tax |

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

(0.5) |

|

— |

|

|

(0.5) |

|

| Foreign currency translation adjustments |

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

36.8 |

|

— |

|

|

36.8 |

|

| Decrease in amounts due to noncontrolling interest |

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

(2.9) |

|

|

(2.9) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| March 31, 2025 |

47,513,451 |

|

$ |

0.5 |

|

2,001.9 |

|

6,383.0 |

|

(12.1) |

|

(923.5) |

|

(610.6) |

|

122.9 |

|

|

$ |

6,962.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Company Shareholders' Equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock |

Additional |

|

Shares |

|

|

|

|

|

(in millions, except share and

per share data) (unaudited) |

Shares Outstanding |

Amount |

Paid-In |

Retained |

Held in |

Treasury |

|

|

|

Total |

| Capital |

Earnings |

Trust |

Stock |

AOCI(1) |

NCI(2) |

|

Equity |

| December 31, 2023 |

47,509,750 |

|

$ |

0.5 |

|

2,019.7 |

|

5,795.6 |

|

(10.4) |

|

(920.1) |

|

(591.5) |

|

116.1 |

|

|

$ |

6,409.9 |

|

| Net income (loss) |

— |

|

— |

|

— |

|

66.1 |

|

— |

|

— |

|

— |

|

(0.5) |

|

|

65.6 |

|

| Vesting of shares related to equity compensation plans, net of amounts withheld for payment of taxes |

132,118 |

|

— |

|

(55.1) |

|

(4.1) |

|

— |

|

38.9 |

|

— |

|

— |

|

|

(20.3) |

|

| Stock-based compensation |

— |

|

— |

|

11.2 |

|

— |

|

— |

|

— |

|

— |

|

— |

|

|

11.2 |

|

| Shares held in trust |

— |

|

— |

|

— |

|

— |

|

0.1 |

|

— |

|

— |

|

— |

|

|

0.1 |

|

| Repurchase of common stock |

(144,523) |

|

— |

|

— |

|

— |

|

— |

|

(20.0) |

|

— |

|

— |

|

|

(20.0) |

|

| Change in pension liabilities, net of tax |

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

0.3 |

|

— |

|

|

0.3 |

|

| Foreign currency translation adjustments |

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

(37.7) |

|

— |

|

|

(37.7) |

|

| Decrease in amounts due to noncontrolling interest |

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

(1.5) |

|

|

(1.5) |

|

| March 31, 2024 |

47,497,345 |

|

$ |

0.5 |

|

1,975.8 |

|

5,857.6 |

|

(10.3) |

|

(901.2) |

|

(628.9) |

|

114.1 |

|

|

$ |

6,407.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) AOCI: Accumulated other comprehensive income (loss)

(2) NCI: Noncontrolling interest

See accompanying notes to Consolidated Financial Statements.

JONES LANG LASALLE INCORPORATED

CONSOLIDATED STATEMENTS OF CASH FLOWS

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

| (in millions) (unaudited) |

2025 |

2024 |

| Cash flows from operating activities: |

|

|

| Net income |

$ |

57.5 |

|

65.6 |

|

| Reconciliation of net income to net cash used in operating activities: |

|

|

| Depreciation and amortization |

71.6 |

|

61.0 |

|

| Equity losses |

25.6 |

|

3.7 |

|

|

|

|

| Distributions of earnings from investments |

1.6 |

|

3.2 |

|

| Provision for loss on receivables and other assets |

9.4 |

|

9.9 |

|

| Amortization of stock-based compensation |

22.0 |

|

11.2 |

|

| Net non-cash mortgage servicing rights and mortgage banking derivative activity |

12.9 |

|

9.0 |

|

| Accretion of interest and amortization of debt issuance costs |

1.7 |

|

1.4 |

|

| Other, net |

6.9 |

|

(8.6) |

|

| Change in: |

|

|

| Receivables |

163.5 |

|

156.2 |

|

| Reimbursable receivables and reimbursable payables |

(271.8) |

|

(193.4) |

|

| Prepaid expenses and other assets |

(24.0) |

|

(18.7) |

|

| Income taxes receivable, payable and deferred |

(22.7) |

|

(24.4) |

|

| Accounts payable, accrued liabilities and other liabilities |

(171.3) |

|

(154.5) |

|

| Accrued compensation (including net deferred compensation) |

(650.5) |

|

(599.1) |

|

| Net cash used in operating activities |

(767.6) |

|

(677.5) |

|

| Cash flows from investing activities: |

|

|

| Net capital additions – property and equipment |

(44.5) |

|

(43.2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Capital contributions to investments |

(112.9) |

|

(17.4) |

|

| Distributions of capital from investments |

4.9 |

|

5.7 |

|

|

|

|

| Other, net |

(0.3) |

|

0.6 |

|

| Net cash used in investing activities |

(152.8) |

|

(54.3) |

|

| Cash flows from financing activities: |

|

|

|

|

|

| Proceeds from borrowings under credit facility |

2,232.0 |

|

2,760.0 |

|

| Repayments of borrowings under credit facility |

(1,912.0) |

|

(1,990.0) |

|

| Proceeds from issuance of commercial paper |

1,000.0 |

|

— |

|

| Repayments of commercial paper |

(300.0) |

|

— |

|

| Net repayments of short-term borrowings |

(67.2) |

|

(18.7) |

|

| Payments of deferred business acquisition obligations and earn-outs |

(0.6) |

|

(3.1) |

|

|

|

|

|

|

|

|

|

|

| Repurchase of common stock |

(19.7) |

|

(20.0) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Noncontrolling interest distributions, net |

(2.9) |

|

(1.5) |

|

| Other, net |

(28.9) |

|

(23.3) |

|

| Net cash provided by financing activities |

900.7 |

|

703.4 |

|

| Effect of currency exchange rate changes on cash, cash equivalents and restricted cash |

11.7 |

|

(9.7) |

|

| Net change in cash, cash equivalents and restricted cash |

(8.0) |

|

(38.1) |

|

| Cash, cash equivalents and restricted cash, beginning of the period |

652.7 |

|

663.4 |

|

| Cash, cash equivalents and restricted cash, end of the period |

$ |

644.7 |

|

625.3 |

|

| Supplemental disclosure of cash flow information: |

|

|

| Restricted cash, beginning of period |

$ |

236.5 |

|

253.4 |

|

| Restricted cash, end of period |

212.3 |

|

228.6 |

|

| Cash paid during the period for: |

|

|

| Interest |

$ |

19.3 |

|

22.9 |

|

| Income taxes, net of refunds |

31.0 |

|

41.3 |

|

| Operating leases |

48.7 |

|

48.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See accompanying notes to Consolidated Financial Statements.

JONES LANG LASALLE INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

1.INTERIM INFORMATION

Readers of this quarterly report should refer to the audited financial statements of Jones Lang LaSalle Incorporated ("JLL," which may also be referred to as "the Company," "we," "us" or "our") for the year ended December 31, 2024, which are included in our 2024 Annual Report on Form 10-K, filed with the United States Securities and Exchange Commission ("SEC") and also available on our website (www.jll.com), since we have omitted from this quarterly report certain footnote disclosures which would substantially duplicate those contained in such audited financial statements. You should also refer to the "Summary of Critical Accounting Policies and Estimates" section within Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations and to Note 2, Summary of Significant Accounting Policies, in the Notes to Consolidated Financial Statements in our 2024 Annual Report on Form 10-K for further discussion of our significant accounting policies and estimates.

Our Consolidated Financial Statements as of March 31, 2025, and for the periods ended March 31, 2025 and 2024, are unaudited. In the opinion of management, we have included all adjustments (consisting solely of normal recurring adjustments) necessary for a fair presentation of the Consolidated Financial Statements for these interim periods.

Historically, our quarterly revenue and profits have tended to increase from quarter to quarter as the year progresses. This is the result of a general focus in the real estate industry on completing transactions by calendar year end, while certain expenses are recognized evenly throughout the year. Growth in our Workplace Management and Property Management businesses as well as other annuity-based services has, to an extent, lessened the seasonality in our revenue and profits during the past several years. Within our Leasing Advisory and Capital Markets Services segments, revenue from transaction-based activities is driven by the size and timing of our clients' transactions and can fluctuate significantly from period to period. Our Investment Management segment generally earns investment-generated performance fees on clients' real estate investment returns when assets are sold, the timing of which is geared toward the benefit of our clients, as well as co-investment equity gains and losses, primarily dependent on underlying valuations.

A significant portion of our compensation and benefits expense is from incentive compensation plans, which we generally accrue throughout the year based on progress toward annual performance targets. This process can result in significant fluctuations in quarterly compensation and benefits expense from period to period. Non-variable operating expenses, which we recognize when incurred during the year, are relatively constant on a quarterly basis.

We provide for the effects of income taxes on interim financial statements based on our estimate of the effective tax rate for the full year, which we base on forecasted income by country and expected enacted tax rates. As required, we adjust for the impact of discrete items in the quarters in which they occur. Changes in the geographic mix of income can impact our estimated effective tax rate.

As a result of the items mentioned above, the results for the periods ended March 31 are not fully indicative of what our results will be for the full fiscal year.

2.NEW ACCOUNTING STANDARDS

Recently issued accounting guidance

In December 2023, the FASB issued ASU 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures, which enhances the income tax disclosures to provide information to better assess how an entity’s operations and related tax risks and tax planning and operational opportunities affect its tax rate and prospects for future cash flows. This ASU is effective for annual periods beginning after December 15, 2024, with early adoption permitted. We are evaluating the effect this guidance will have on our tax disclosures.

In November 2024, the FASB issued ASU 2024-03, Income Statement—Reporting Comprehensive Income—Expense Disaggregation Disclosures (Subtopic 220-40), which requires disaggregated disclosure of income statement expenses for public entities. The ASU does not change the expense captions an entity presents on the face of the income statement; rather, it requires disaggregation of certain expense captions into specified categories in disclosures within the footnotes to the financial statements. This ASU is effective for annual periods beginning after December 15, 2026, and for interim periods beginning after December 15, 2027, with early adoption permitted. We are evaluating the effect this guidance will have on our disclosures.

3.REVENUE RECOGNITION

Capital Markets Services revenue excluded from the scope of Accounting Standards Codification Topic 606, Revenue from Contracts with Customers ("ASC Topic 606")

Our mortgage banking and servicing operations, comprised of (i) all Loan Servicing revenue and (ii) activities related to mortgage servicing rights ("MSR" or "MSRs") and loan origination fees (included in Investment Sales, Debt/Equity Advisory and Other), are not considered revenue from contracts with customers, and accordingly are excluded from the scope of ASC Topic 606. Such out-of-scope revenue is presented below.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

| (in millions) |

|

|

|

2025 |

2024 |

| Revenue excluded from scope of ASC Topic 606 |

|

|

|

$ |

70.4 |

|

67.2 |

|

Contract assets and liabilities

Our contract assets, net of allowance, are included in Short-term contract assets and Other assets and our contract liabilities are included in Short-term contract liabilities and deferred income on our Consolidated Balance Sheets. The majority of contract liabilities are recognized as revenue within 90 days. Such contract assets and liabilities are presented below.

|

|

|

|

|

|

|

|

|

| (in millions) |

March 31, 2025 |

December 31, 2024 |

| Contract assets, gross |

$ |

372.5 |

|

388.3 |

|

| Contract asset allowance |

(3.9) |

|

(3.9) |

|

| Contract assets, net |

$ |

368.6 |

|

384.4 |

|

|

|

|

| Contract liabilities |

$ |

140.9 |

|

154.7 |

|

Remaining performance obligations

Remaining performance obligations represent the aggregate transaction price for contracts where our performance obligations have not yet been satisfied. As of March 31, 2025, the aggregate amount of transaction price allocated to remaining performance obligations represented an insignificant amount of our total revenue. In accordance with ASC Topic 606, excluded from the aforementioned remaining performance obligations are (i) amounts attributable to contracts expected to be completed within 12 months and (ii) variable consideration for services performed as a series of daily performance obligations, such as facilities management, property management and Investment Management contracts. A significant portion of our customer contracts, which are not expected to be fulfilled within 12 months, are represented by the contracts within these businesses.

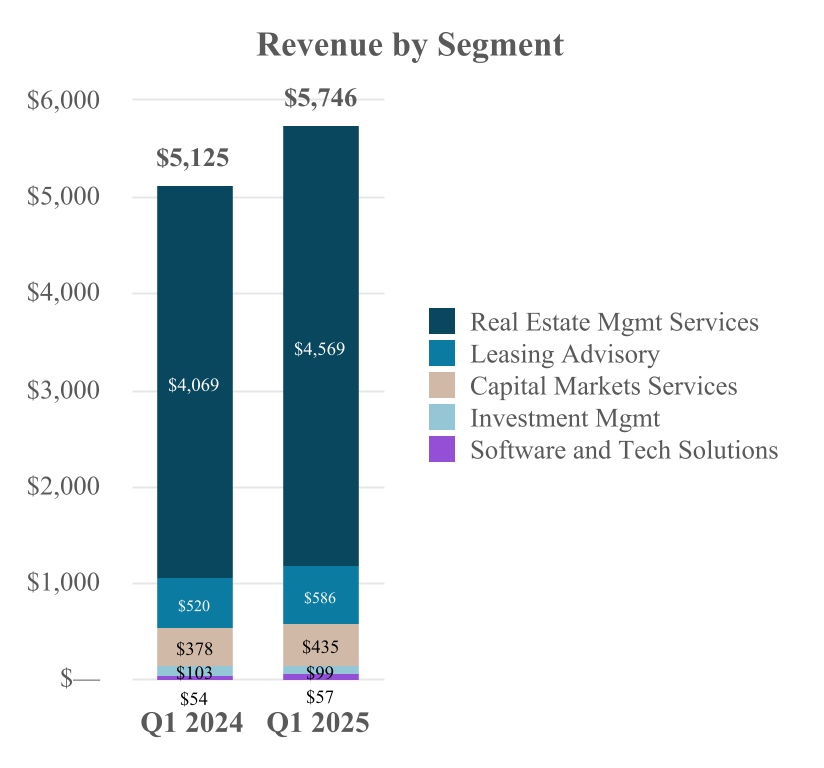

4.BUSINESS SEGMENTS

Effective January 1, 2025, we report Property Management (historically included in Markets Advisory, which was renamed Leasing Advisory) within Real Estate Management Services (formerly referred to as Work Dynamics). Prior period financial information was recast to conform with this presentation. Additionally, Capital Markets, LaSalle and JLL Technologies were renamed to Capital Markets Services, Investment Management and Software and Technology Solutions, respectively.

We manage and report our operations as five global business segments:

(1) Real Estate Management Services,

(2) Leasing Advisory,

(3) Capital Markets Services,

(4) Investment Management and

(5) Software and Technology Solutions.

Real Estate Management Services business provides a broad suite of integrated services to occupiers of real estate, including facility and property management, project management, and portfolio and other services. Leasing Advisory offers agency leasing and tenant representation, as well as advisory and consulting services. Capital Markets Services offerings include investment sales, debt and equity advisory, value and risk advisory, and loan servicing. Investment Management provides services on a global basis to institutional investors and high-net-worth individuals, while our Software and Technology Solutions segment offers various software products and services to our clients.

We allocate all indirect expenses to our segments, other than interest and income taxes, as nearly all expenses incurred benefit one or more of the segments. Allocated expenses primarily consist of corporate functional costs across the globe, which we allocate to the business segments using an expense-specific driver-based methodology.

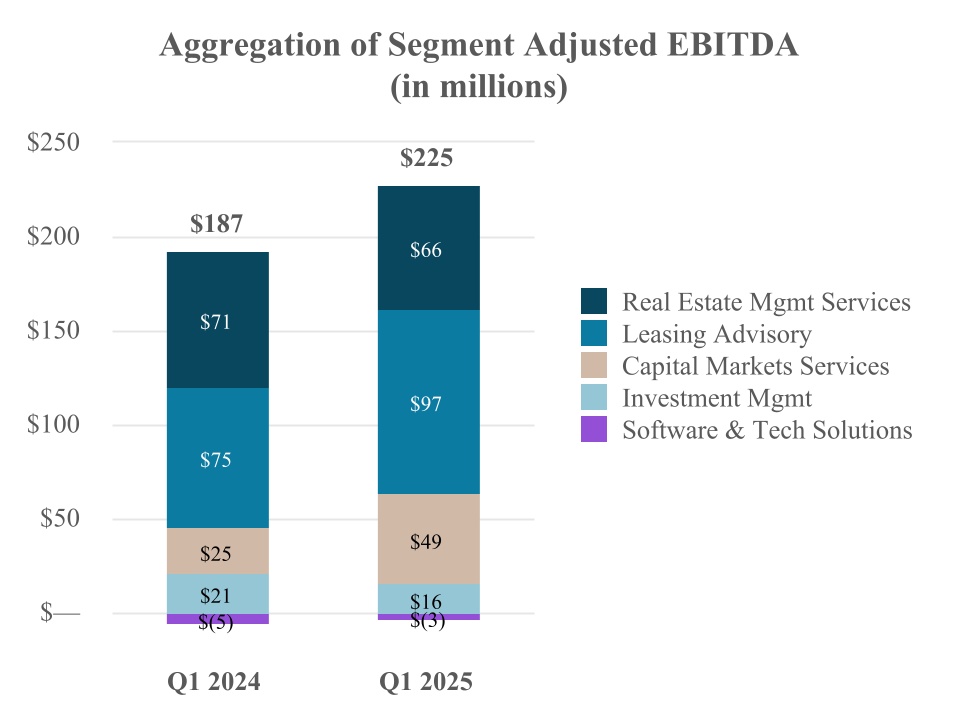

Adjusted EBITDA does not include (i) Restructuring and acquisition charges, (ii) gain/loss on disposal, (iii) interest on employee loans, net of forgiveness, (iv) Equity earnings/losses for Investment Management and Software and Technology Solutions, (v) credit losses on convertible note investments, (vi) net non-cash MSR and mortgage banking derivative activity, (vii) Interest expense, net of interest income, (viii) Income tax provision and (ix) Depreciation and amortization, which are otherwise included in Net income on the Consolidated Statements of Comprehensive Income.

The Other segment items caption includes (i) other income/loss, (ii) gain/loss on disposal, (iii) interest on employee loans, net of forgiveness, (iv) credit losses on convertible note investments, (v) net non-cash MSR and mortgage banking derivative activity, (vi) net income/loss attributable to noncontrolling interest, (vii) the noncontrolling interest portion of amortization of acquisition-related intangibles which is not attributable to common shareholders and (viii) the noncontrolling interest portion of Equity earnings/losses which are not attributable to common shareholders.

The Chief Operating Decision Maker ("CODM") of JLL measures and evaluates the segment results based on Adjusted EBITDA for purposes of making decisions about allocating resources and assessing performance. Our CODM is not provided with total asset information by segment and accordingly does not measure or allocate resources based on total assets information. Therefore, we have not disclosed asset information by segment. As of March 31, 2025, we define our Global Executive Board, collectively, as our CODM.

Summarized financial information by business segment is as follows.

|

|

|

|

|

|

|

|

|

|

|

| Real Estate Management Services |

|

Three Months Ended March 31, |

| (in millions) |

|

|

2025 |

2024 |

| Workplace Management |

|

|

$ |

3,263.6 |

|

2,871.7 |

|

| Project Management |

|

|

747.5 |

|

656.4 |

|

| Property Management |

|

|

445.6 |

|

429.7 |

|

| Portfolio Services and Other |

|

|

112.7 |

|

111.4 |

|

| Revenue |

|

|

$ |

4,569.4 |

|

4,069.2 |

|

| Less: |

|

|

|

|

| Platform compensation and benefits |

|

|

$ |

431.6 |

|

400.5 |

|

| Platform operating, administrative and other |

|

|

139.2 |

|

128.6 |

|

| Gross contract costs |

|

|

3,930.3 |

|

3,469.1 |

|

| Add: |

|

|

|

|

| Equity earnings |

|

|

0.4 |

|

1.1 |

|

| Other segment items |

|

|

(2.4) |

|

(0.7) |

|

| Adjusted EBITDA |

|

|

$ |

66.3 |

|

71.4 |

|

Depreciation and amortization(1) |

|

|

$ |

30.6 |

|

28.0 |

|

(1) Excludes the noncontrolling interest portion of amortization of acquisition-related intangibles which is not attributable to common shareholders.

|

|

|

|

|

|

|

|

|

|

|

| Leasing Advisory |

|

Three Months Ended March 31, |

| (in millions) |

|

|

2025 |

2024 |

| Leasing |

|

|

$ |

566.1 |

|

497.3 |

|

| Advisory, Consulting and Other |

|

|

20.0 |

|

23.1 |

|

| Revenue |

|

|

$ |

586.1 |

|

520.4 |

|

| Less: |

|

|

|

|

| Platform compensation and benefits |

|

|

$ |

426.8 |

|

381.8 |

|

| Platform operating, administrative and other |

|

|

60.4 |

|

57.6 |

|

| Gross contract costs |

|

|

2.0 |

|

6.4 |

|

| Add: |

|

|

|

|

| Equity losses |

|

|

— |

|

— |

|

| Other segment items |

|

|

0.1 |

|

0.2 |

|

| Adjusted EBITDA |

|

|

$ |

97.0 |

|

74.8 |

|

| Depreciation and amortization |

|

|

$ |

12.0 |

|

9.1 |

|

|

|

|

|

|

|

|

|

|

|

|

| Capital Markets Services |

|

Three Months Ended March 31, |

| (in millions) |

|

|

2025 |

2024 |

| Investment Sales, Debt/Equity Advisory and Other |

|

|

$ |

312.6 |

|

258.7 |

|

| Value and Risk Advisory |

|

|

81.6 |

|

80.2 |

|

| Loan Servicing |

|

|

41.1 |

|

38.7 |

|

| Revenue |

|

|

$ |

435.3 |

|

377.6 |

|

| Less: |

|

|

|

|

| Platform compensation and benefits |

|

|

$ |

329.5 |

|

287.6 |

|

| Platform operating, administrative and other |

|

|

70.7 |

|

60.8 |

|

| Gross contract costs |

|

|

1.1 |

|

13.6 |

|

| Add: |

|

|

|

|

| Equity earnings |

|

|

1.6 |

|

0.1 |

|

| Other segment items |

|

|

13.0 |

|

9.3 |

|

| Adjusted EBITDA |

|

|

$ |

48.6 |

|

25.0 |

|

| Depreciation and amortization |

|

|

$ |

18.9 |

|

16.4 |

|

|

|

|

|

|

|

|

|

|

|

|

| Investment Management |

|

Three Months Ended March 31, |

| (in millions) |

|

|

2025 |

2024 |

| Advisory fees |

|

|

$ |

89.3 |

|

92.3 |

|

| Transaction fees and other |

|

|

8.5 |

|

8.9 |

|

| Incentive fees |

|

|

0.7 |

|

2.2 |

|

| Revenue |

|

|

$ |

98.5 |

|

103.4 |

|

| Less: |

|

|

|

|

| Platform compensation and benefits |

|

|

$ |

58.3 |

|

61.3 |

|

| Platform operating, administrative and other |

|

|

16.3 |

|

12.9 |

|

| Gross contract costs |

|

|

8.2 |

|

8.4 |

|

| Add: |

|

|

|

|

| Other segment items |

|

|

0.1 |

|

0.2 |

|

| Adjusted EBITDA |

|

|

$ |

15.8 |

|

21.0 |

|

| Depreciation and amortization |

|

|

$ |

2.9 |

|

2.0 |

|

| Equity losses |

|

|

$ |

(6.1) |

|

(3.9) |

|

|

|

|

|

|

|

|

|

|

|

|

| Software and Technology Solutions |

|

Three Months Ended March 31, |

| (in millions) |

|

|

2025 |

2024 |

| Revenue |

|

|

$ |

57.1 |

|

53.9 |

|

| Less: |

|

|

|

|

| Platform compensation and benefits |

|

|

$ |

45.5 |

|

47.3 |

| Platform operating, administrative and other |

|

|

14.5 |

|

10.5 |

| Gross contract costs |

|

|

0.7 |

|

1.2 |

|

| Add: |

|

|

|

|

| Other segment items |

|

|

0.7 |

|

— |

|

| Adjusted EBITDA |

|

|

$ |

(2.9) |

|

(5.1) |

|

| Depreciation and amortization |

|

|

$ |

6.3 |

|

4.5 |

|

| Equity losses |

|

|

$ |

(21.5) |

|

(1.0) |

|

The following table is a reconciliation of Adjusted EBITDA to Net income attributable to common shareholders.

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

| (in millions) |

|

|

2025 |

2024 |

| Adjusted EBITDA - Real Estate Management Services |

|

|

$ |

66.3 |

|

71.4 |

|

| Adjusted EBITDA - Leasing Advisory |

|

|

97.0 |

|

74.8 |

|

| Adjusted EBITDA - Capital Markets Services |

|

|

48.6 |

|

25.0 |

|

| Adjusted EBITDA - Investment Management |

|

|

15.8 |

|

21.0 |

|

| Adjusted EBITDA - Software and Technology Solutions |

|

|

(2.9) |

|

(5.1) |

|

| Adjusted EBITDA - Consolidated |

|

|

$ |

224.8 |

|

187.1 |

|

| Adjustments: |

|

|

|

|

| Restructuring and acquisition charges |

|

|

$ |

(19.7) |

|

(1.7) |

|

|

|

|

|

|

| Interest on employee loans, net of forgiveness |

|

|

1.6 |

|

1.0 |

|

Equity losses - Investment Management and Software and Technology Solutions(1) |

|

|

(28.7) |

|

(4.9) |

|

| Credit losses on convertible note investments |

|

|

(0.5) |

|

— |

|

| Net non-cash MSR and mortgage banking derivative activity |

|

|

(12.9) |

|

(9.0) |

|

| Interest expense, net of interest income |

|

|

(24.6) |

|

(30.5) |

|

| Income tax provision |

|

|

(14.0) |

|

(15.9) |

|

Depreciation and amortization(1) |

|

|

(70.7) |

|

(60.0) |

|

| Net income attributable to common shareholders |

|

|

$ |

55.3 |

|

66.1 |

|

(1) This adjustment excludes the noncontrolling interest portion which is not attributable to common shareholders.

5.BUSINESS COMBINATIONS, GOODWILL AND OTHER INTANGIBLE ASSETS

2025 Business Combinations Activity

During the three months ended March 31, 2025 and 2024, we paid $0.6 million and $3.1 million, respectively, for deferred business acquisition and earn-out obligations for acquisitions completed in prior years. We completed no strategic acquisitions in either period.

Earn-Out Payments

|

|

|

|

|

|

|

|

|

|

|

|

| ($ in millions) |

March 31, 2025 |

|

December 31, 2024 |

| Number of acquisitions with earn-out payments subject to the achievement of certain performance criteria |

12 |

|

|

13 |

|

| Maximum earn-out payments (undiscounted) |

$ |

84.5 |

|

|

108.0 |

|

Short-term earn-out liabilities (fair value)(1) |

16.2 |

|

|

12.0 |

|

Long-term earn-out liabilities (fair value)(1) |

21.3 |

|

|

23.8 |

|

(1) Included in Other current and Other long-term liabilities on the Consolidated Balance Sheets.

Assuming the achievement of the applicable performance criteria, we anticipate making these earn-out payments over the next five years. Refer to Note 7, Fair Value Measurements, and Note 10, Restructuring and Acquisition Charges, for additional discussion of our earn-out liabilities.

Goodwill and Other Intangible Assets

Goodwill and unamortized intangibles as of March 31, 2025 consisted of: (i) goodwill of $4,642.5 million, (ii) identifiable intangibles of $653.2 million amortized over their remaining finite useful lives and (iii) $48.6 million of identifiable intangibles with indefinite useful lives that are not amortized. Notable portions of our goodwill and unamortized intangibles are denominated in currencies other than the U.S. dollar, which means a portion of the movements in the reported book value of these balances is attributable to movements in foreign currency exchange rates.

In conjunction with our new organizational structure described more fully in Note 4, Business Segments, we reassessed our reporting units as of January 1, 2025. As a result of the changes in Real Estate Management Services and Leasing Advisory, we reassigned goodwill to these reporting units using a relative fair value approach. Under this methodology, the fair value of each impacted reporting unit was determined using a combination of the income approach and the market approach, and this resulting relative fair value was used to reassign the balance of goodwill.

We considered the change to Real Estate Management Services and Leasing Advisory reporting units a triggering event requiring the testing of our goodwill for impairment as of January 1, 2025. We performed a quantitative test relying on the discounted cash flow ("DCF") method, an income approach, and a market approach in determining the estimated fair value of these reporting units. Our analysis relied on significant judgments and assumptions in determining the inputs, specifically, forecasted revenue growth, forecasted profitability margin and the discount rate used to present value the estimated future cash flows. Our analysis indicated that no impairment existed as the estimated fair value of both Real Estate Management Services and Leasing Advisory reporting units exceeded their respective carrying value.

The following table details, by reporting segment, movements in goodwill.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (in millions) |

Real Estate Management Services |

Leasing Advisory |

Capital Markets Services |

Investment Management |

Software and Technology Solutions |

|

Consolidated |

| Balance as of January 1, 2025 |

$ |

961.2 |

|

1,372.6 |

|

1,971.5 |

|

55.9 |

|

250.1 |

|

|

$ |

4,611.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Impact of exchange rate movements |

4.0 |

|

12.8 |

|

14.2 |

|

0.5 |

|

(0.3) |

|

|

31.2 |

|

| Balance as of March 31, 2025 |

$ |

965.2 |

|

1,385.4 |

|

1,985.7 |

|

56.4 |

|

249.8 |

|

|

$ |

4,642.5 |

|

The following tables detail, by intangible type, movements in the gross carrying amount and accumulated amortization of our identifiable intangibles.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (in millions) |

MSRs |

Other Intangibles |

|

Consolidated |

| Gross Carrying Amount |

|

|

|

|

| Balance as of December 31, 2024 |

$ |

851.1 |

|

543.8 |

|

|

$ |

1,394.9 |

|

| Additions, net of adjustments |

20.2 |

|

— |

|

|

20.2 |

|

| Adjustment for fully amortized intangibles |

(11.7) |

|

— |

|

|

(11.7) |

|

| Impact of exchange rate movements |

— |

|

2.7 |

|

|

2.7 |

|

| Balance as of March 31, 2025 |

$ |

859.6 |

|

546.5 |

|

|

$ |

1,406.1 |

|

|

|

|

|

|

| Accumulated Amortization |

|

|

|

|

| Balance as of December 31, 2024 |

$ |

(380.0) |

|

(290.8) |

|

|

$ |

(670.8) |

|

Amortization expense, net(1) |

(27.2) |

|

(17.0) |

|

|

(44.2) |

|

| Adjustment for fully amortized intangibles |

11.7 |

|

— |

|

|

11.7 |

|

| Impact of exchange rate movements |

— |

|

(1.0) |

|

|

(1.0) |

|

| Balance as of March 31, 2025 |

$ |

(395.5) |

|

(308.8) |

|

|

$ |

(704.3) |

|

|

|

|

|

|

| Net book value as of March 31, 2025 |

$ |

464.1 |

|

237.7 |

|

|

$ |

701.8 |

|

(1) Included in this amount for MSRs was $0.8 million relating to write-offs due to prepayments of sold warehouse receivables for which we retained the servicing rights. Amortization of MSRs is included in Revenue within the Consolidated Statements of Comprehensive Income.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (in millions) |

MSRs |

Other Intangibles |

|

Consolidated |

| Gross Carrying Amount |

|

|

|

|

| Balance as of December 31, 2023 |

$ |

801.8 |

|

546.2 |

|

|

$ |

1,348.0 |

|

| Additions, net of adjustments |

21.9 |

|

— |

|

|

21.9 |

|

| Adjustment for fully amortized intangibles |

(5.3) |

|

(9.2) |

|

|

(14.5) |

|

| Impact of exchange rate movements |

— |

|

(2.2) |

|

|

(2.2) |

|

| Balance as of March 31, 2024 |

$ |

818.4 |

|

534.8 |

|

|

$ |

1,353.2 |

|

|

|

|

|

|

| Accumulated Amortization |

|

|

|

|

| Balance as of December 31, 2023 |

$ |

(309.8) |

|

(253.2) |

|

|

$ |

(563.0) |

|

Amortization expense, net(1) |

(26.5) |

|

(16.2) |

|

|

(42.7) |

|

| Adjustment for fully amortized intangibles |

5.3 |

|

9.2 |

|

|

14.5 |

|

| Impact of exchange rate movements |

— |

|

0.6 |

|

|

0.6 |

|

| Balance as of March 31, 2024 |

$ |

(331.0) |

|

(259.6) |

|

|

$ |

(590.6) |

|

|

|

|

|

|

| Net book value as of March 31, 2024 |

$ |

487.4 |

|

275.2 |

|

|

$ |

762.6 |

|

(1) Included in this amount for MSRs was $1.6 million relating to write-offs due to prepayments of sold warehouse receivables for which we retained the servicing rights. Amortization of MSRs is included in Revenue within the Consolidated Statements of Comprehensive Income.

6.INVESTMENTS

Summarized investment balances as of March 31, 2025 and December 31, 2024 are presented in the following table.

|

|

|

|

|

|

|

|

|

|

|

|

| (in millions) |

March 31, 2025 |

|

December 31, 2024 |

| Investment Management co-investments |

$ |

514.5 |

|

|

406.1 |

|

| Software and Technology Solutions investments |

352.9 |

|

|

372.8 |

|

| Other investments |

35.0 |

|

|

33.8 |

|

| Total |

$ |

902.4 |

|

|

812.7 |

|

Our Investment Management co-investments are primarily direct investments in 50 separate property or commingled funds, where we co-invest alongside our clients and for which we also have an advisory agreement, while our Software and Technology Solutions investments are generally investments in early to mid-stage proptech companies as well as proptech funds.

We have maximum potential unfunded commitments to direct investments or investment vehicles of $192.2 million and $8.8 million as of March 31, 2025 for our Investment Management and Software and Technology Solutions businesses, respectively.

Impairment

There were no significant other-than-temporary impairment charges on investments for the three months ended March 31, 2025 and 2024.

Fair Value

We report a majority of our investments at fair value. For such investments, we increase or decrease our investment each reporting period by the change in the fair value and we report these fair value adjustments in our Consolidated Statements of Comprehensive Income within Equity earnings/losses. The table below shows the movement in our investments reported at fair value.

The table below does not include our $9.9 million investment in certain mid-stage non-public companies as they are non-marketable equity investments accounted for under the measurement alternative, defined as cost minus impairment.

|

|

|

|

|

|

|

|

|

| (in millions) |

2025 |

2024 |

| Fair value investments as of January 1, |

$ |

742.0 |

|

740.8 |

|

| Investments |

115.7 |

|

15.6 |

|

| Distributions |

(6.0) |

|

(6.4) |

|

| Change in fair value, net |

(27.7) |

|

(3.1) |

|

| Foreign currency translation adjustments, net |

7.4 |

|

(6.3) |

|

| Transfers in |

24.6 |

|

3.2 |

|

| Fair value investments as of March 31, |

$ |

856.0 |

|

743.8 |

|

See Note 7, Fair Value Measurements, for additional discussion of our investments reported at fair value.

7.FAIR VALUE MEASUREMENTS

We measure certain assets and liabilities in accordance with ASC Topic 820, Fair Value Measurements and Disclosures, which defines fair value as the price that would be received for an asset, or paid to transfer a liability, in an orderly transaction between market participants on the measurement date. In addition, it establishes a framework for measuring fair value according to the following three-tier fair value hierarchy:

•Level 1 - Quoted prices for identical assets or liabilities in active markets accessible as of the measurement date;

•Level 2 - Inputs, other than quoted prices in active markets, that are observable either directly or indirectly; and

•Level 3 - Unobservable inputs in which there is little or no market data, which require the reporting entity to develop its own assumptions.

Financial Instruments

Our financial instruments include Cash and cash equivalents, Trade receivables, Notes and other receivables, Reimbursable receivables, Warehouse receivables, restricted cash, contract assets, Accounts payable, Reimbursable payables, Commercial paper, Short-term borrowings, contract liabilities, Warehouse facilities, Credit facility, Long-term debt and foreign currency forward contracts. The carrying amounts of Cash and cash equivalents, Trade receivables, Notes and other receivables, Reimbursable receivables, restricted cash, contract assets, Accounts payable, Reimbursable payables, contract liabilities and the Warehouse facilities approximate their estimated fair values due to the short-term nature of these instruments. The carrying values of our Credit facility, Commercial paper and Short-term borrowings approximate their estimated fair values given the variable interest rate terms and market spreads.

We estimated the fair value of our Long-term debt using dealer quotes that are Level 2 inputs in the fair value hierarchy. The fair value and carrying value of our debt are presented in the following table.

|

|

|

|

|

|

|

|

|

|

|

|

| (in millions) |

March 31, 2025 |

|

December 31, 2024 |

| Long-term debt, fair value |

$ |

797.5 |

|

|

785.2 |

|

| Long-term debt, carrying value, net of debt issuance costs |

772.1 |

|

|

756.7 |

|

Investments at Fair Value - Net Asset Value ("NAV")

We report a significant portion of our investments at fair value. For such investments, we increase or decrease our investment each reporting period by the change in the fair value, and we report these fair value adjustments in our Consolidated Statements of Comprehensive Income within Equity earnings/losses.

For a subset of our investments reported at fair value, we estimate the fair value using the NAV per share (or its equivalent) our investees provide. Critical inputs to NAV estimates included valuations of the underlying real estate assets and borrowings, which incorporate investment-specific assumptions such as discount rates, capitalization rates, rental and expense growth rates, and asset-specific market borrowing rates. We did not consider any adjustments to NAV estimates provided by investees, including adjustments for any restrictions to the transferability of ownership interests embedded within investment agreements to which we are a party, to be necessary based upon (i) our understanding of the methodology utilized and inputs incorporated to estimate NAV at the investee level, (ii) consideration of market demand for the specific types of real estate assets held by each venture and (iii) contemplation of real estate and capital markets conditions in the localities in which these ventures operate. As of March 31, 2025 and December 31, 2024, investments at fair value using NAV were $502.4 million and $367.9 million, respectively. As these investments are not required to be classified in the fair value hierarchy, they have been excluded from the following table.

Recurring Fair Value Measurements

The following table categorizes by level in the fair value hierarchy the estimated fair value of our assets and liabilities measured at fair value on a recurring basis.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31, 2025 |

|

December 31, 2024 |