1ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 INVESTOR DAY 2025 Alexandria’s Reset and Path Forward ALEXANDRIA REAL ESTATE EQUITIES, INC. DECEMBER 3, 2025 | ALEXANDRIA CENTER® for LIFE SCIENCE – NYC

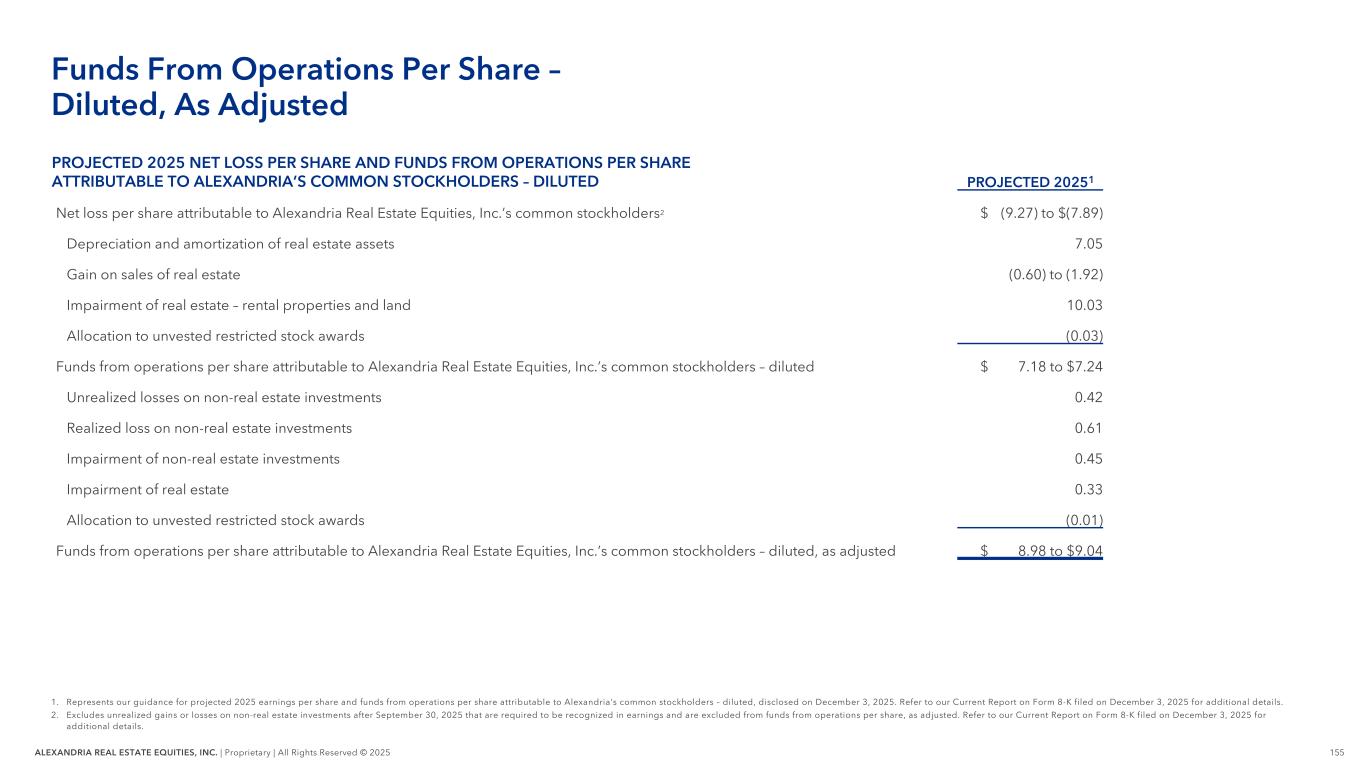

2ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 Safe Harbor Alexandria®, Lighthouse Design® logo, Building the Future of Life-Changing Innovation®, Megacampus™, Alexandria Center®, Alexandria Technology Center®, Alexandria Technology Square®, and The Miracle Mile of Medicine™ are copyrights and trademarks of Alexandria Real Estate Equities, Inc. All other company names, trademarks, and logos referenced herein are the property of their respective owners. This presentation contains forward-looking non-GAAP financial measures, including funds from operations, per share – diluted, as adjusted. We do not provide guidance for the most comparable GAAP financial measure or a reconciliation of the forward-looking non-GAAP financial measure of funds from operations, as adjusted, because we are unable to reasonably predict, without unreasonable effort, certain items that would be contained in the comparable GAAP measure, including items that are not indicative of our ongoing operations, such as, without limitation, unrealized gains or losses on non-real estate investments, potential impairments of real estate assets, and gains or losses on sales of real estate. These items are uncertain, depend on various factors, and could have a material impact on our GAAP results for the guidance periods. This presentation includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements include, without limitation, statements regarding our projected earnings per share attributable to Alexandria’s common stockholders – diluted, funds from operations per share attributable to Alexandria’s common stockholders – diluted, net operating income, sources and uses of capital, and targets and timing for rental revenues and development and value-creation projects, expenses, capital plan strategy, risk management strategy and related actions, and environmental, social, and governance goals. You can identify the forward-looking statements by their use of forward-looking words, such as “forecast,” “guidance,” “goals,” “projects,” “estimates,” “anticipates,” “believes,” “expects,” “intends,” “may,” “plans,” “seeks,” “should,” “targets,” or “will,” or the negative of those words or similar words. These forward-looking statements are based on our current expectations, beliefs, projections, future plans and strategies, anticipated events or trends, and similar expressions concerning matters that are not historical facts, as well as a number of assumptions concerning future events. There can be no assurance that actual results will not be materially higher or lower than these expectations. These statements are subject to risks, uncertainties, assumptions, and other important factors that could cause actual results to differ materially from the results discussed in the forward-looking statements. Factors that might cause such a difference include, without limitation, our failure to obtain capital (debt, construction financing, and/or equity) or refinance debt maturities, lower than expected yields, increased interest rates and construction and operating costs, adverse economic or real estate developments in our markets, greater than expected losses on disposition of properties, our failure to successfully place into service and lease any properties undergoing development or redevelopment and our existing space held for future development or redevelopment (including new properties acquired for that purpose), our failure to successfully operate or lease acquired or existing properties, decreased rental rates, increased vacancy rates or failure to renew or replace expiring leases, defaults on or non-renewal of leases by tenants, adverse general and local economic conditions, an unfavorable capital market environment, volatile, unfavorable, or uncertain social and political conditions (including the effects of new laws, regulations, and policies), decreased leasing activity or lease renewals, failure to obtain LEED and other healthy building certifications and efficiencies, and other risks and uncertainties detailed in our filings with the Securities and Exchange Commission (“SEC”). Accordingly, you are cautioned not to place undue reliance on such forward-looking statements. Other than as may be required by law, we assume no obligation to update this information and expressly disclaim any obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. For more discussion relating to risks and uncertainties that could cause actual results to differ materially from those anticipated in our forward-looking statements, and risks to our business in general, please refer to our SEC filings, including our most recent annual report on Form 10-K and any subsequent quarterly reports on Form 10-Q.

3ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 Alexandria’s Reset and Path Forward 4 The Future Prospects of the Life Science Industry 29 Alexandria’s Megacampus™ Business Model 55 2025 Guidance Update; 2026 Guidance and Balance Sheet 102 Appendix 149 TABLE OF CONTENTS 1 3 4 2 5

4ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 ALEXANDRIA: AT THE VANGUARD AND HEART OF THE LIFE SCIENCE INDUSTRY Refer to "Megacampus" in the appendix. WHAT DRIVES YOUR ECONOMIC ENGINE? WHAT ARE YOU DEEPLY PASSIONATE ABOUT? WHAT CAN YOU BE BEST IN THE WORLD AT? Enabling the most innovative scientific and technological minds to cure disease Delivering our differentiated Megacampus™ platform clustered in the key centers of life science innovation Developed in Jim Collins’ book Good to Great, the Hedgehog Concept is a strategic framework that crystallizes why we exist, what sets us apart, and what drives our lasting endurance. ALEXANDRIA’S RESILIENT AND PERSEVERANT HEDGEHOG Leveraging our strong brand trust, long-term tenant relationships, and Megacampus™ platform to increase occupancy and cash flows

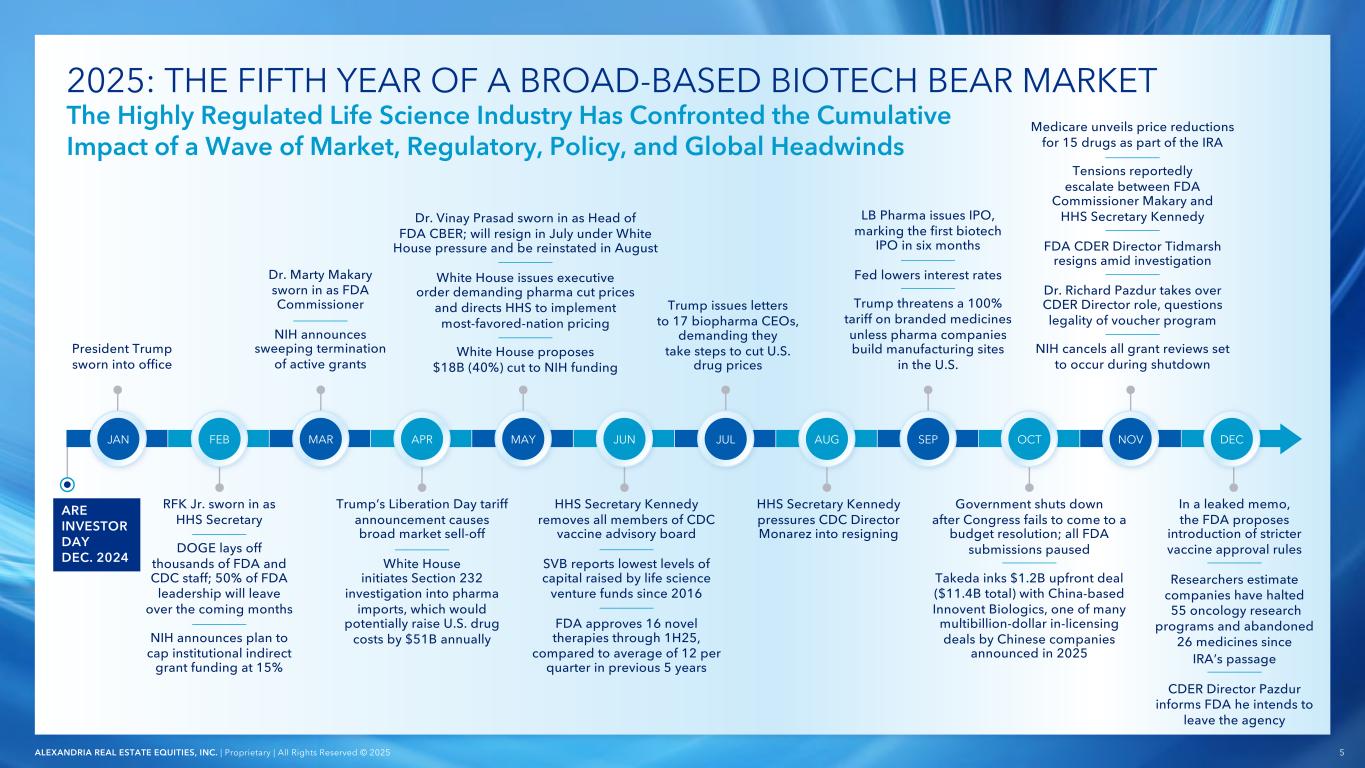

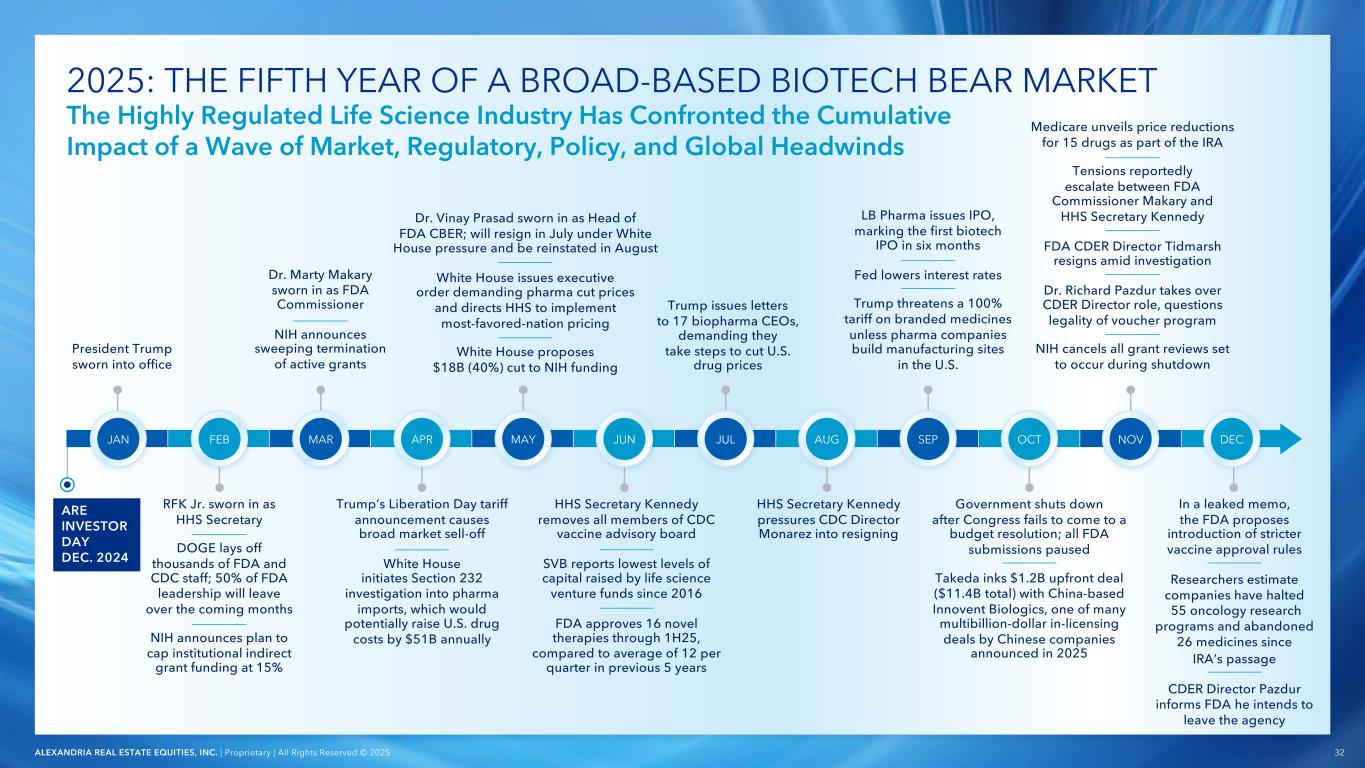

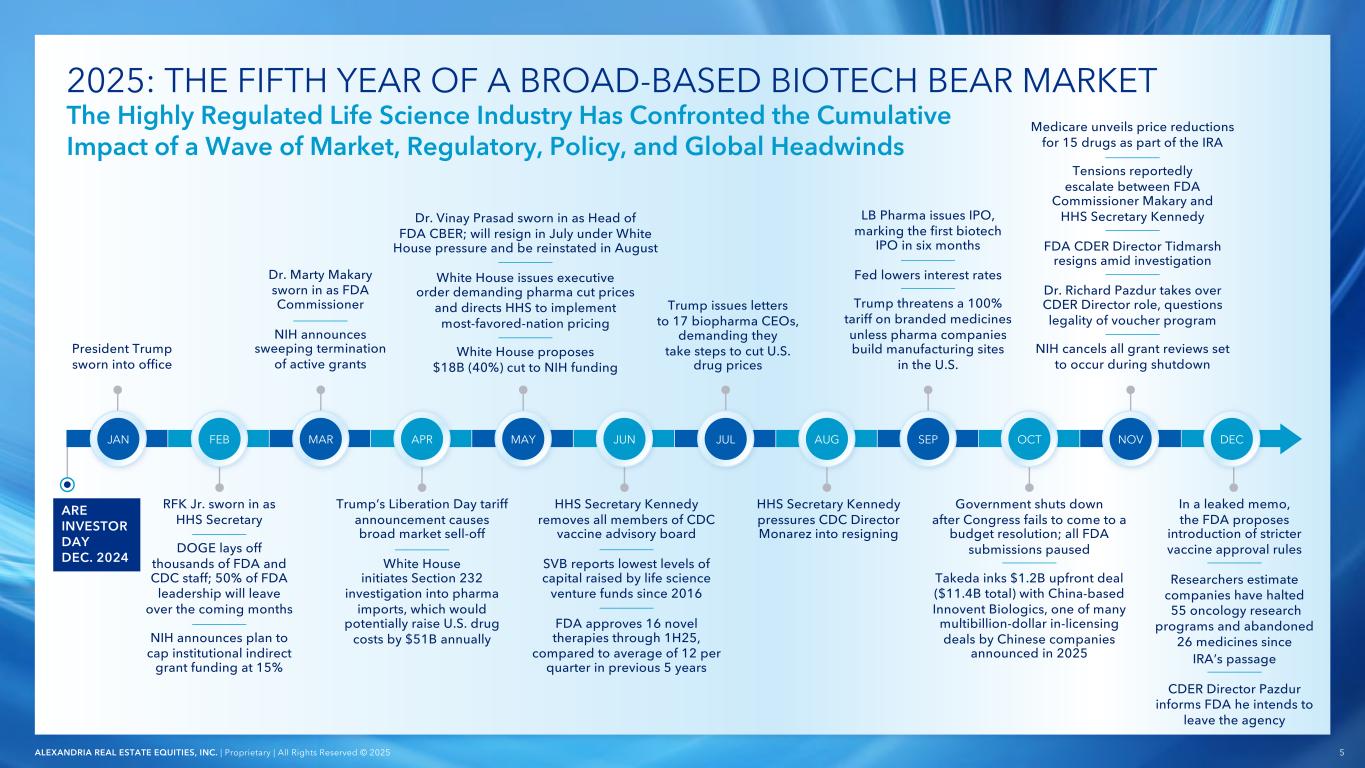

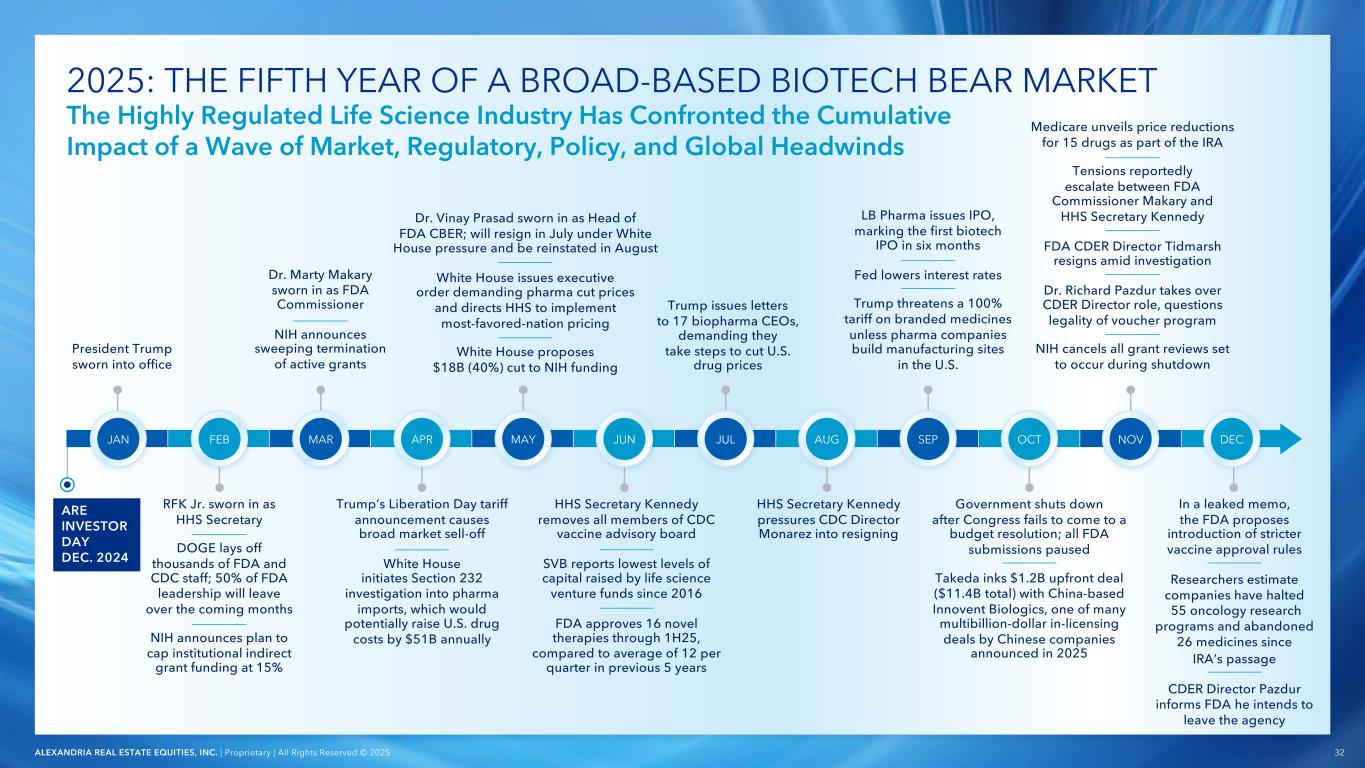

5ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 2025: THE FIFTH YEAR OF A BROAD-BASED BIOTECH BEAR MARKET President Trump sworn into office RFK Jr. sworn in as HHS Secretary DOGE lays off thousands of FDA and CDC staff; 50% of FDA leadership will leave over the coming months NIH announces plan to cap institutional indirect grant funding at 15% Trump’s Liberation Day tariff announcement causes broad market sell-off White House initiates Section 232 investigation into pharma imports, which would potentially raise U.S. drug costs by $51B annually LB Pharma issues IPO, marking the first biotech IPO in six months Fed lowers interest rates Trump threatens a 100% tariff on branded medicines unless pharma companies build manufacturing sites in the U.S. Dr. Vinay Prasad sworn in as Head of FDA CBER; will resign in July under White House pressure and be reinstated in August White House issues executive order demanding pharma cut prices and directs HHS to implement most-favored-nation pricing White House proposes $18B (40%) cut to NIH funding Dr. Marty Makary sworn in as FDA Commissioner NIH announces sweeping termination of active grants Trump issues letters to 17 biopharma CEOs, demanding they take steps to cut U.S. drug prices HHS Secretary Kennedy removes all members of CDC vaccine advisory board SVB reports lowest levels of capital raised by life science venture funds since 2016 FDA approves 16 novel therapies through 1H25, compared to average of 12 per quarter in previous 5 years HHS Secretary Kennedy pressures CDC Director Monarez into resigning Government shuts down after Congress fails to come to a budget resolution; all FDA submissions paused Takeda inks $1.2B upfront deal ($11.4B total) with China-based Innovent Biologics, one of many multibillion-dollar in-licensing deals by Chinese companies announced in 2025 JAN FEB MAR MAY JUN JUL SEP OCTAUG NOVAPR The Highly Regulated Life Science Industry Has Confronted the Cumulative Impact of a Wave of Market, Regulatory, Policy, and Global Headwinds Medicare unveils price reductions for 15 drugs as part of the IRA Tensions reportedly escalate between FDA Commissioner Makary and HHS Secretary Kennedy FDA CDER Director Tidmarsh resigns amid investigation Dr. Richard Pazdur takes over CDER Director role, questions legality of voucher program NIH cancels all grant reviews set to occur during shutdown In a leaked memo, the FDA proposes introduction of stricter vaccine approval rules Researchers estimate companies have halted 55 oncology research programs and abandoned 26 medicines since IRA’s passage CDER Director Pazdur informs FDA he intends to leave the agency DEC ARE INVESTOR DAY DEC. 2024

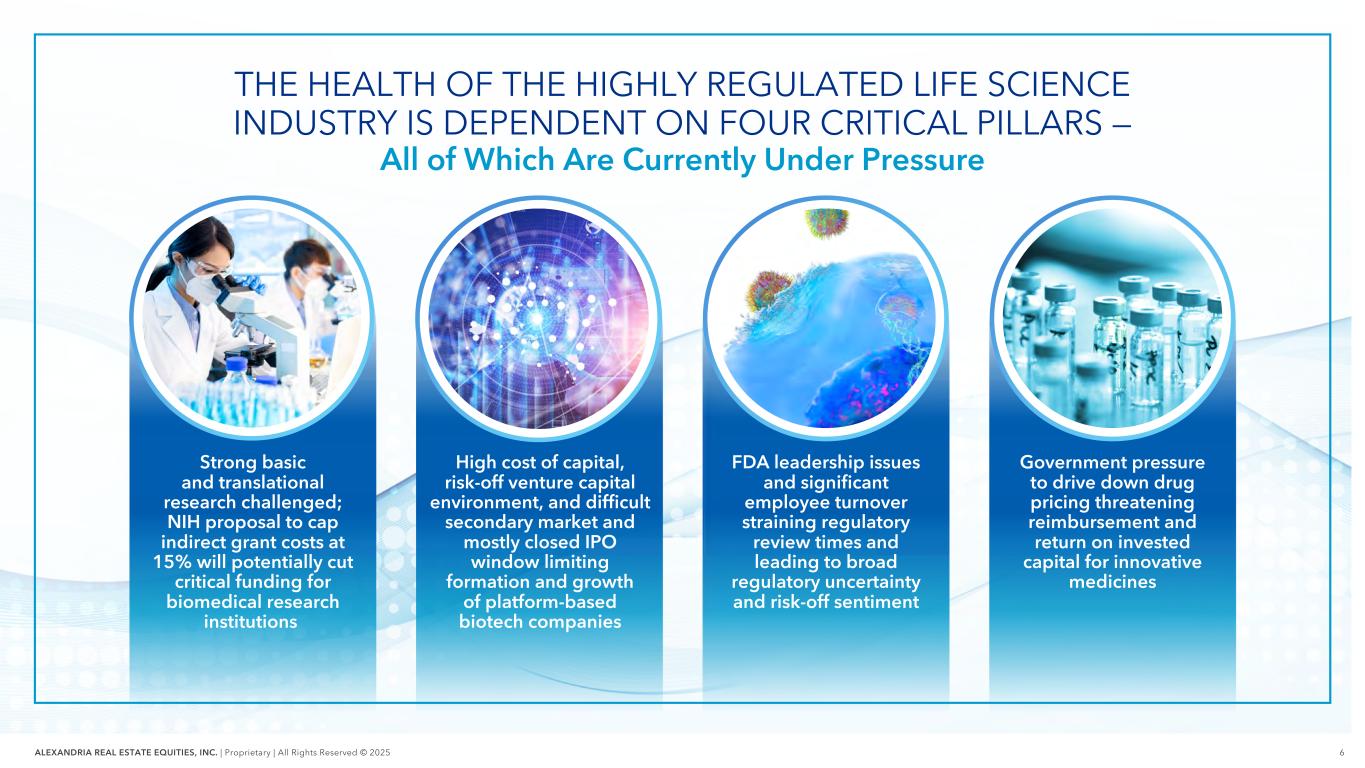

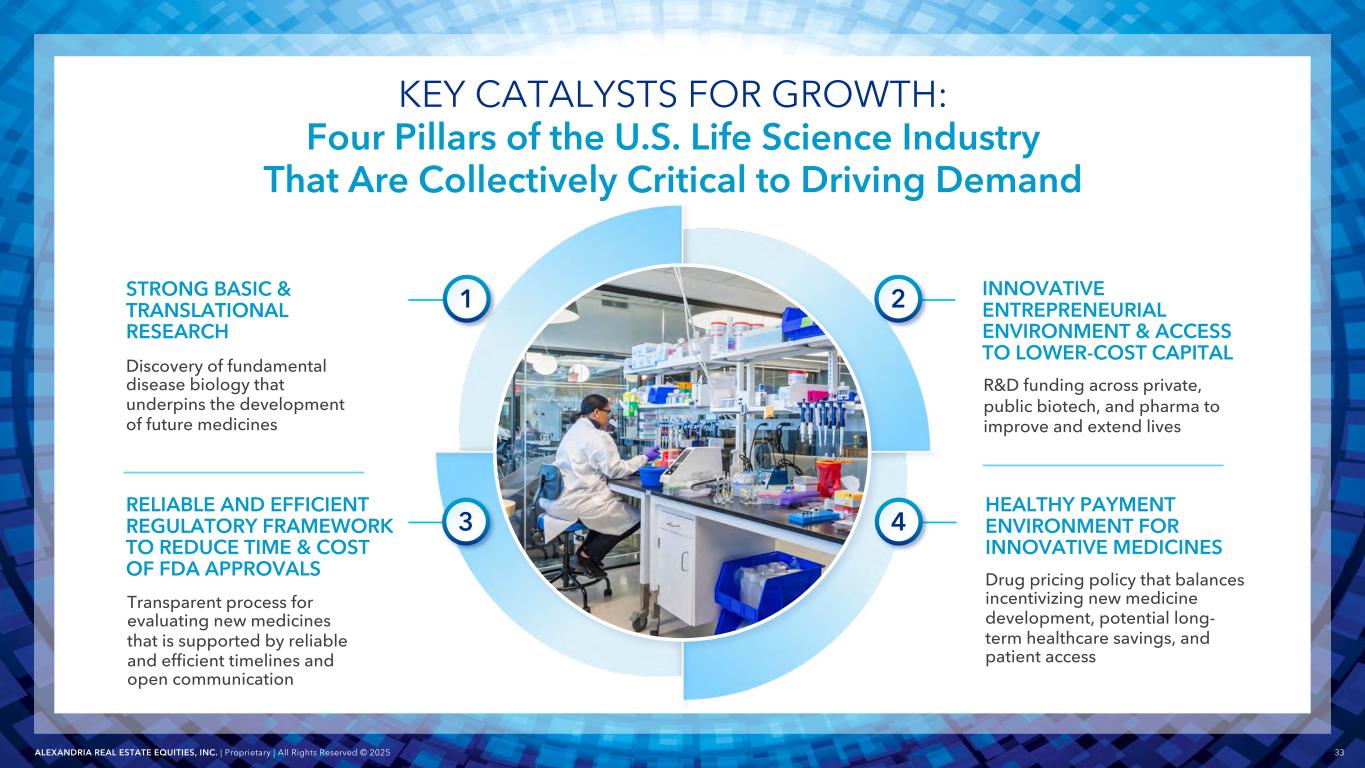

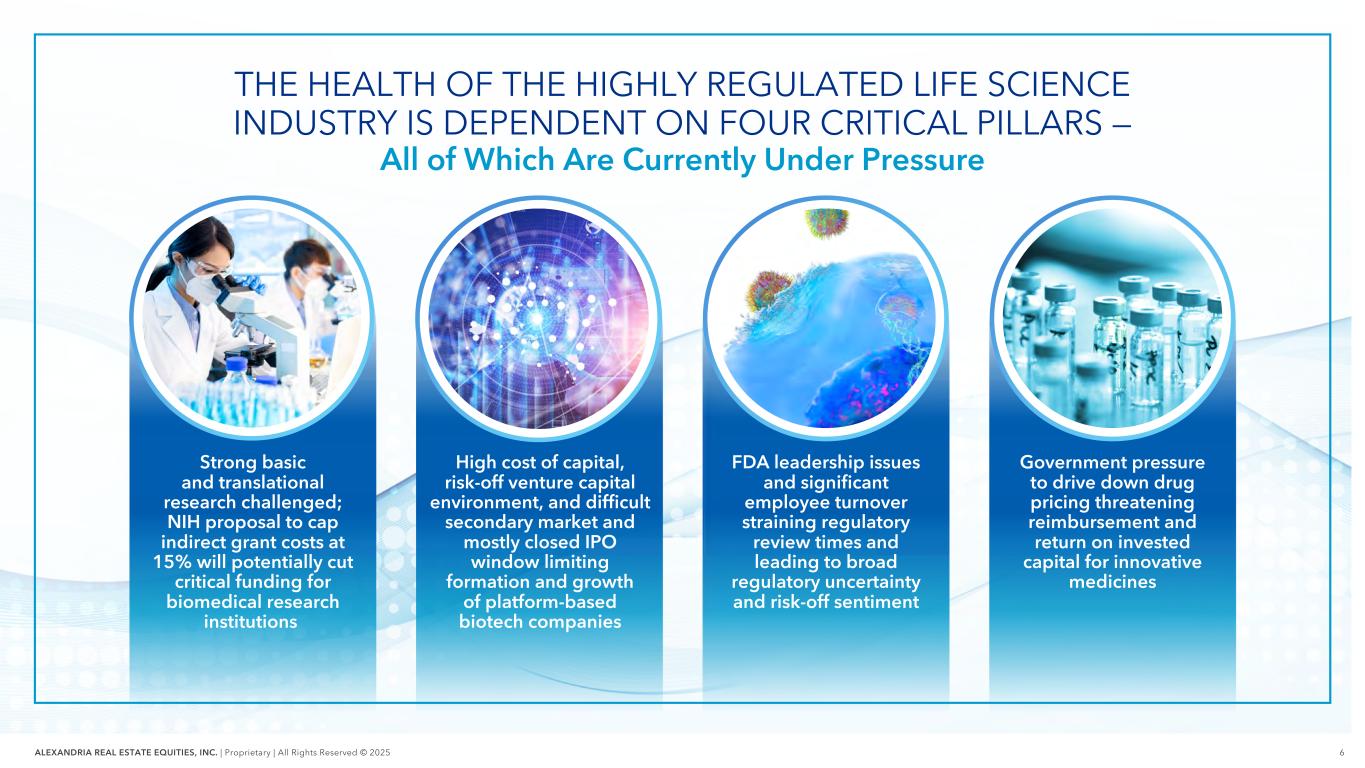

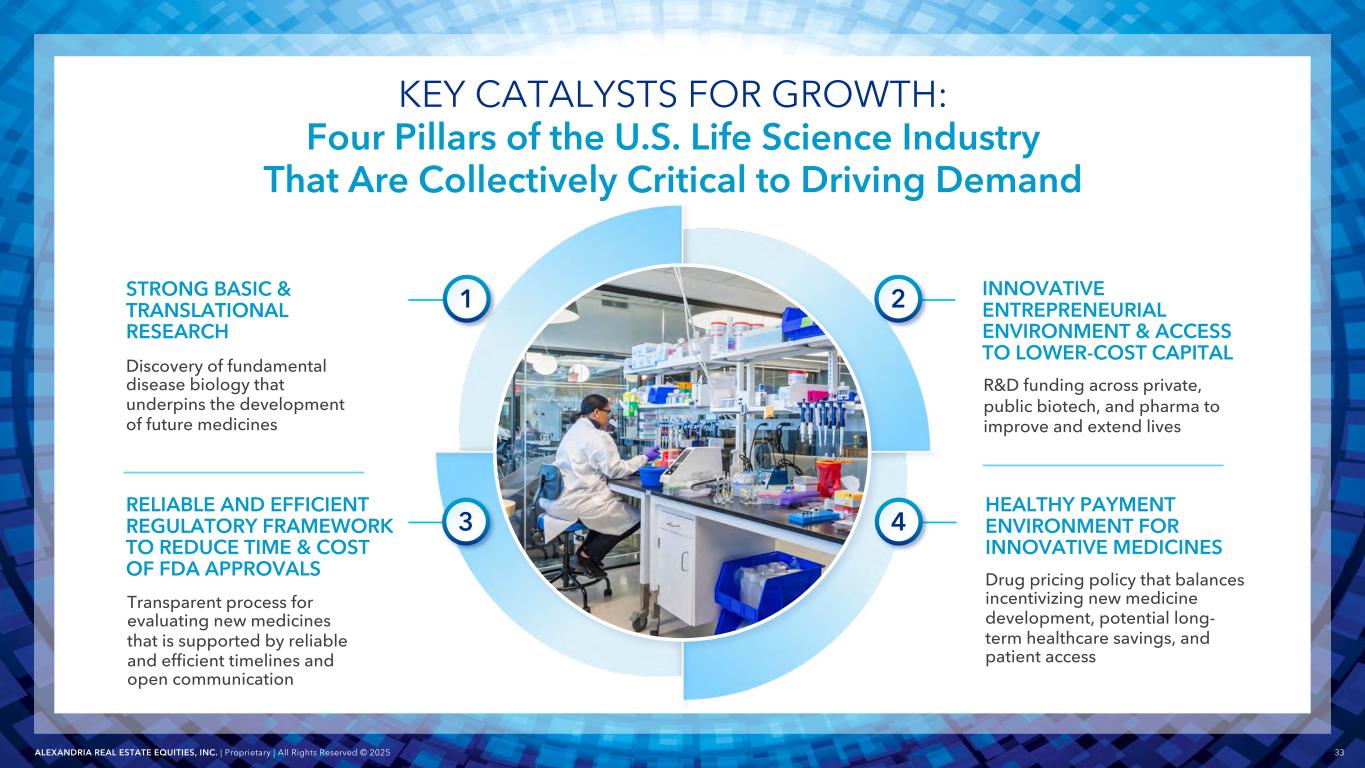

6ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 THE HEALTH OF THE HIGHLY REGULATED LIFE SCIENCE INDUSTRY IS DEPENDENT ON FOUR CRITICAL PILLARS — All of Which Are Currently Under Pressure Strong basic and translational research challenged; NIH proposal to cap indirect grant costs at 15% will potentially cut critical funding for biomedical research institutions High cost of capital, risk-off venture capital environment, and difficult secondary market and mostly closed IPO window limiting formation and growth of platform-based biotech companies FDA leadership issues and significant employee turnover straining regulatory review times and leading to broad regulatory uncertainty and risk-off sentiment Government pressure to drive down drug pricing threatening reimbursement and return on invested capital for innovative medicines

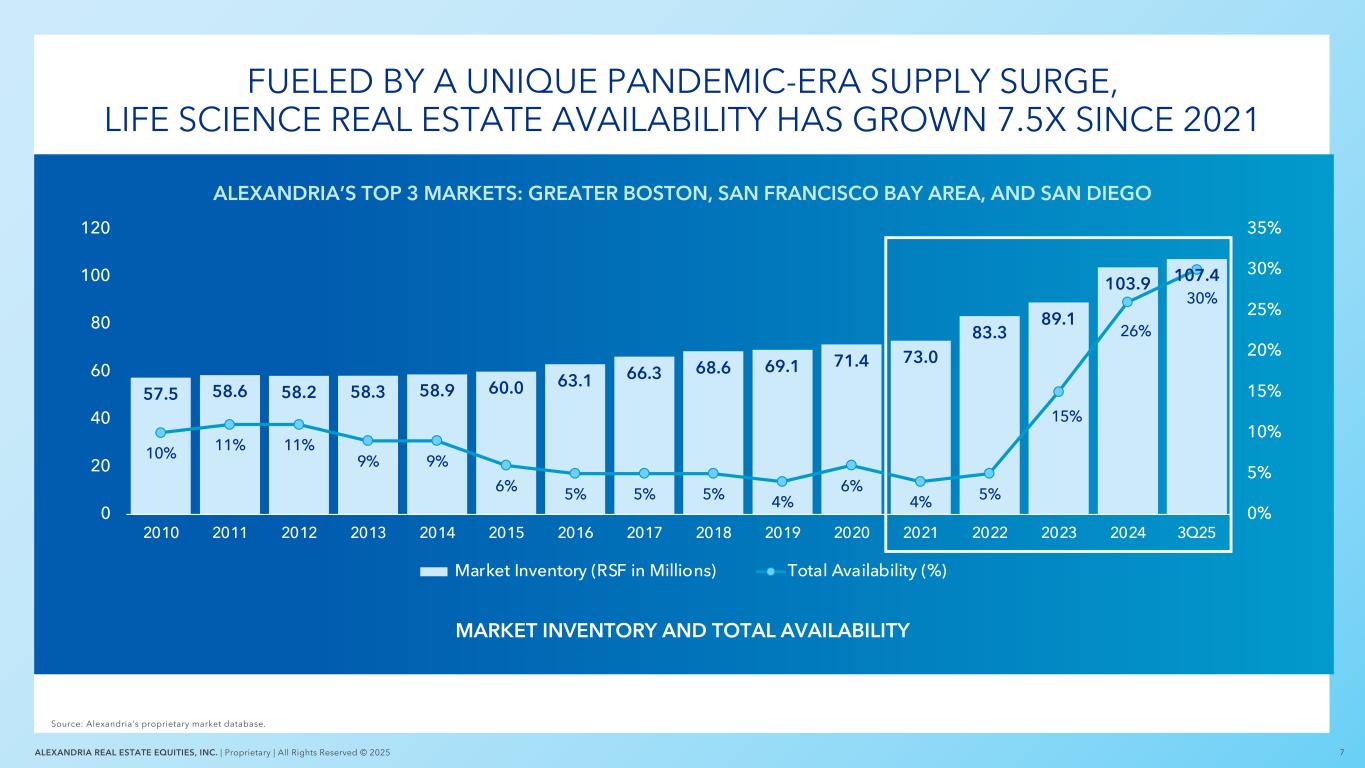

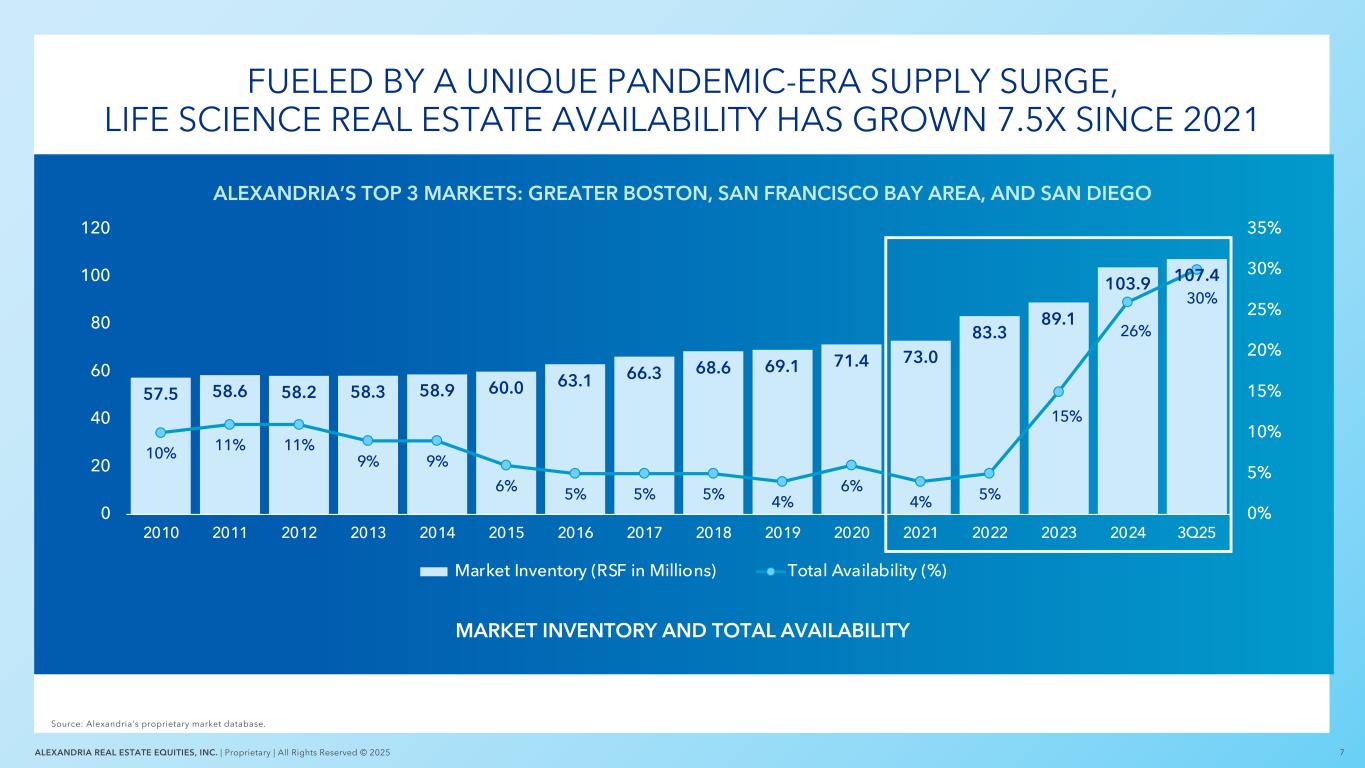

7ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 FUELED BY A UNIQUE PANDEMIC-ERA SUPPLY SURGE, LIFE SCIENCE REAL ESTATE AVAILABILITY HAS GROWN 7.5X SINCE 2021 Source: Alexandria’s proprietary market database. 57.5 58.6 58.2 58.3 58.9 60.0 63.1 66.3 68.6 69.1 71.4 73.0 83.3 89.1 103.9 107.4 10% 11% 11% 9% 9% 6% 5% 5% 5% 4% 6% 4% 5% 15% 26% 30% 0 20 40 60 80 100 120 0% 5% 10% 15% 20% 25% 30% 35% 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 3Q25 Market Inventory (RSF in Millions) Total Availability (%) MARKET INVENTORY AND TOTAL AVAILABILITY ALEXANDRIA’S TOP 3 MARKETS: GREATER BOSTON, SAN FRANCISCO BAY AREA, AND SAN DIEGO

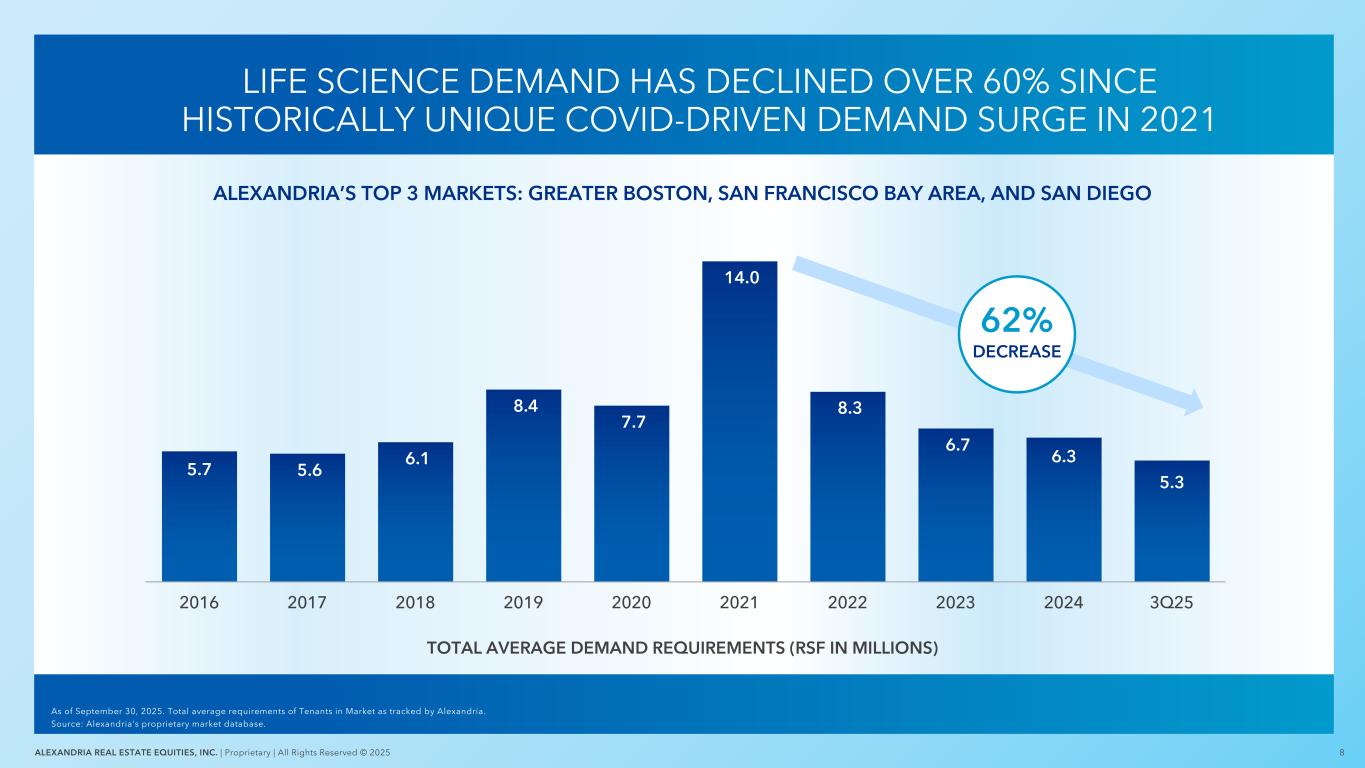

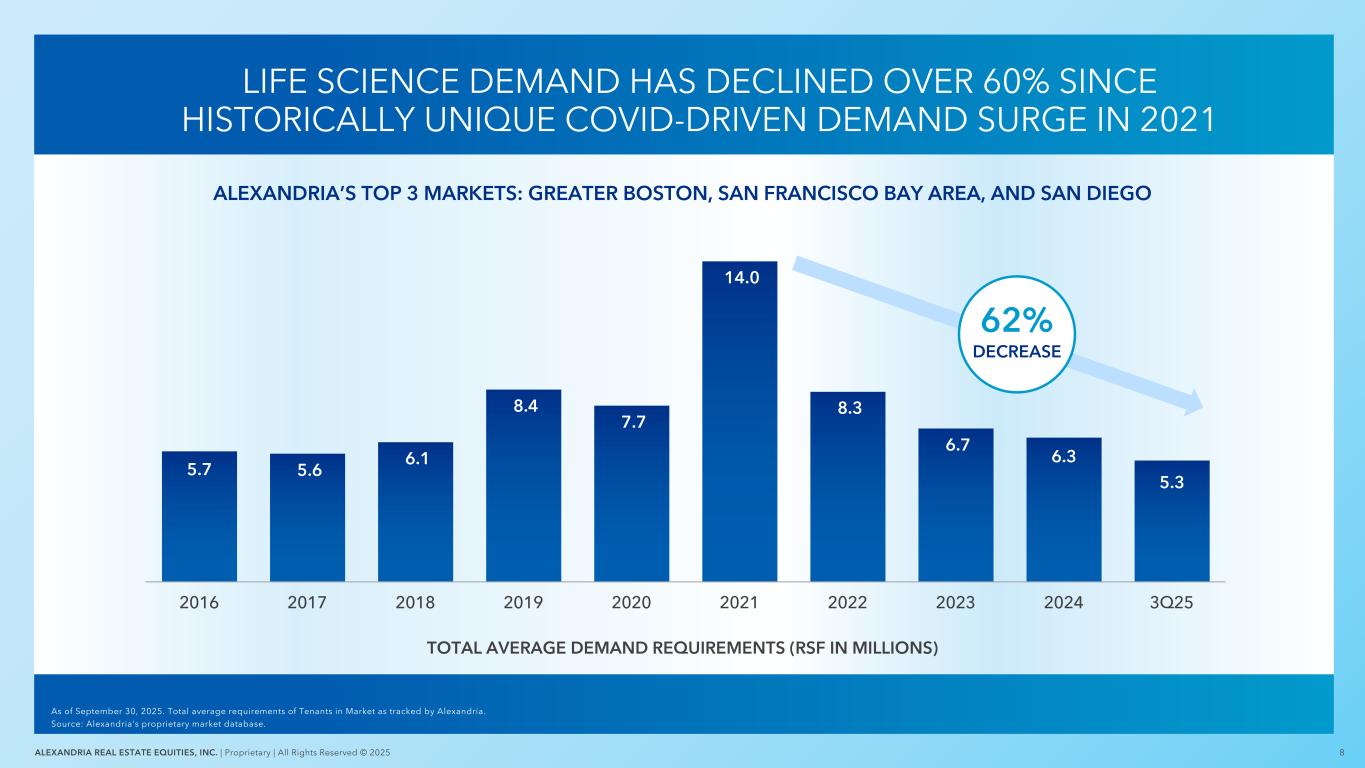

8ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 5.7 5.6 6.1 8.4 7.7 14.0 8.3 6.7 6.3 5.3 2016 2017 2018 2019 2020 2021 2022 2023 2024 3Q25 TOTAL AVERAGE DEMAND REQUIREMENTS (RSF IN MILLIONS) As of September 30, 2025. Total average requirements of Tenants in Market as tracked by Alexandria. Source: Alexandria’s proprietary market database. LIFE SCIENCE DEMAND HAS DECLINED OVER 60% SINCE HISTORICALLY UNIQUE COVID-DRIVEN DEMAND SURGE IN 2021 62% DECREASE ALEXANDRIA’S TOP 3 MARKETS: GREATER BOSTON, SAN FRANCISCO BAY AREA, AND SAN DIEGO

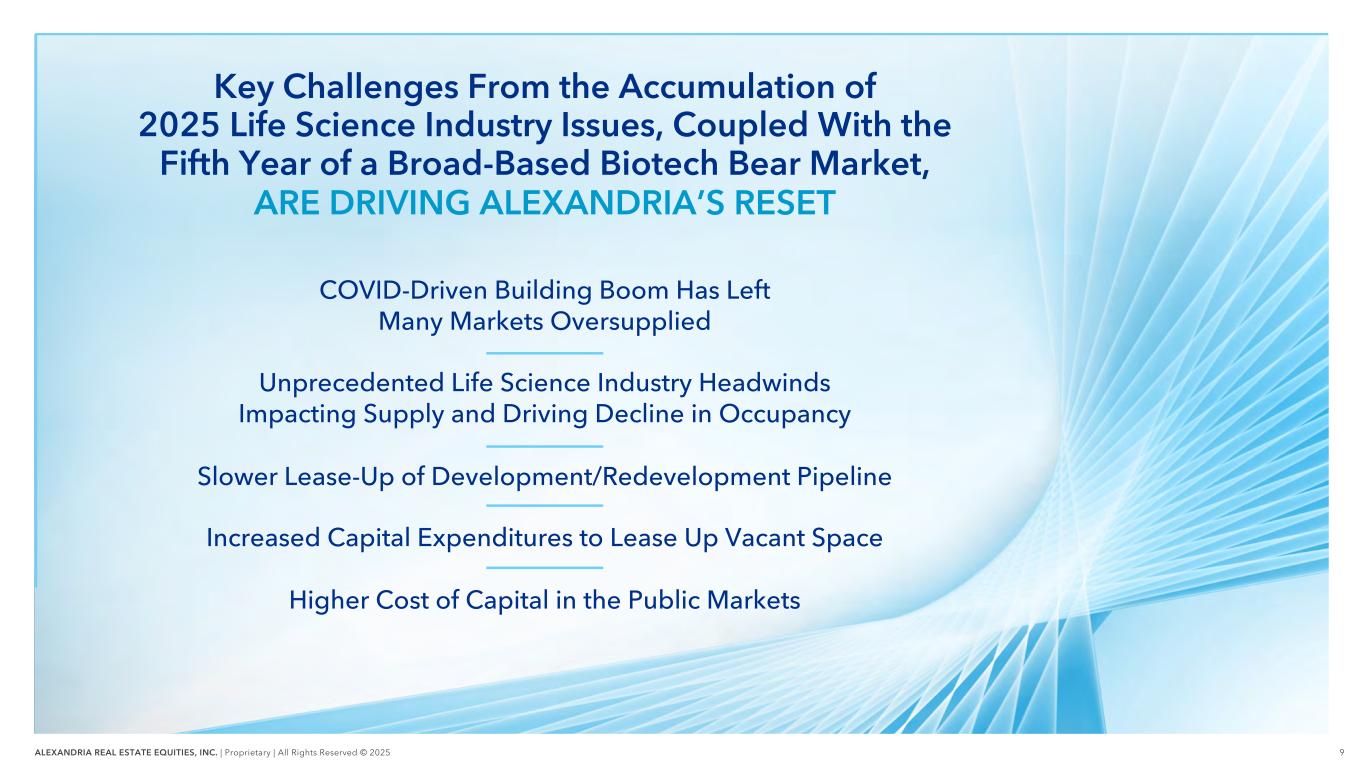

9ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 Key Challenges From the Accumulation of 2025 Life Science Industry Issues, Coupled With the Fifth Year of a Broad-Based Biotech Bear Market, ARE DRIVING ALEXANDRIA’S RESET COVID-Driven Building Boom Has Left Many Markets Oversupplied Unprecedented Life Science Industry Headwinds Impacting Supply and Driving Decline in Occupancy Slower Lease-Up of Development/Redevelopment Pipeline Increased Capital Expenditures to Lease Up Vacant Space Higher Cost of Capital in the Public Markets

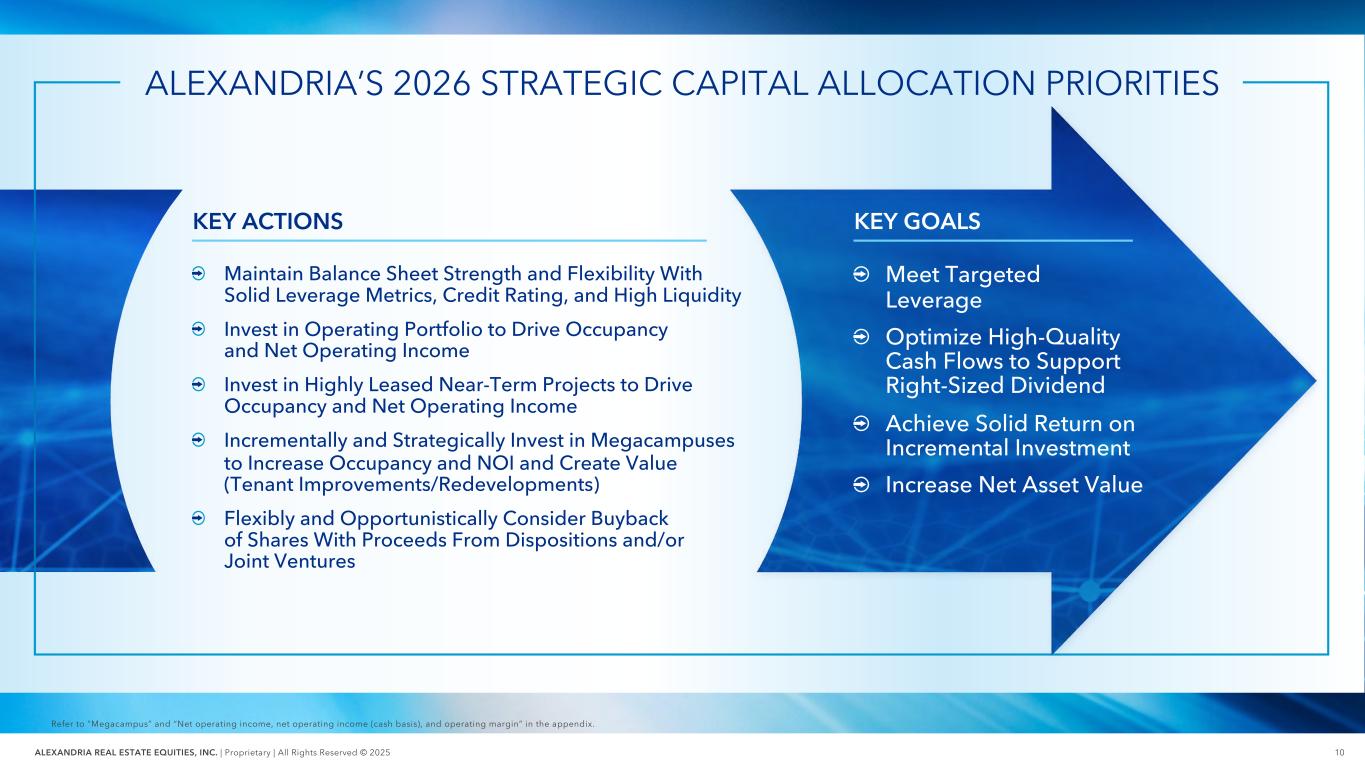

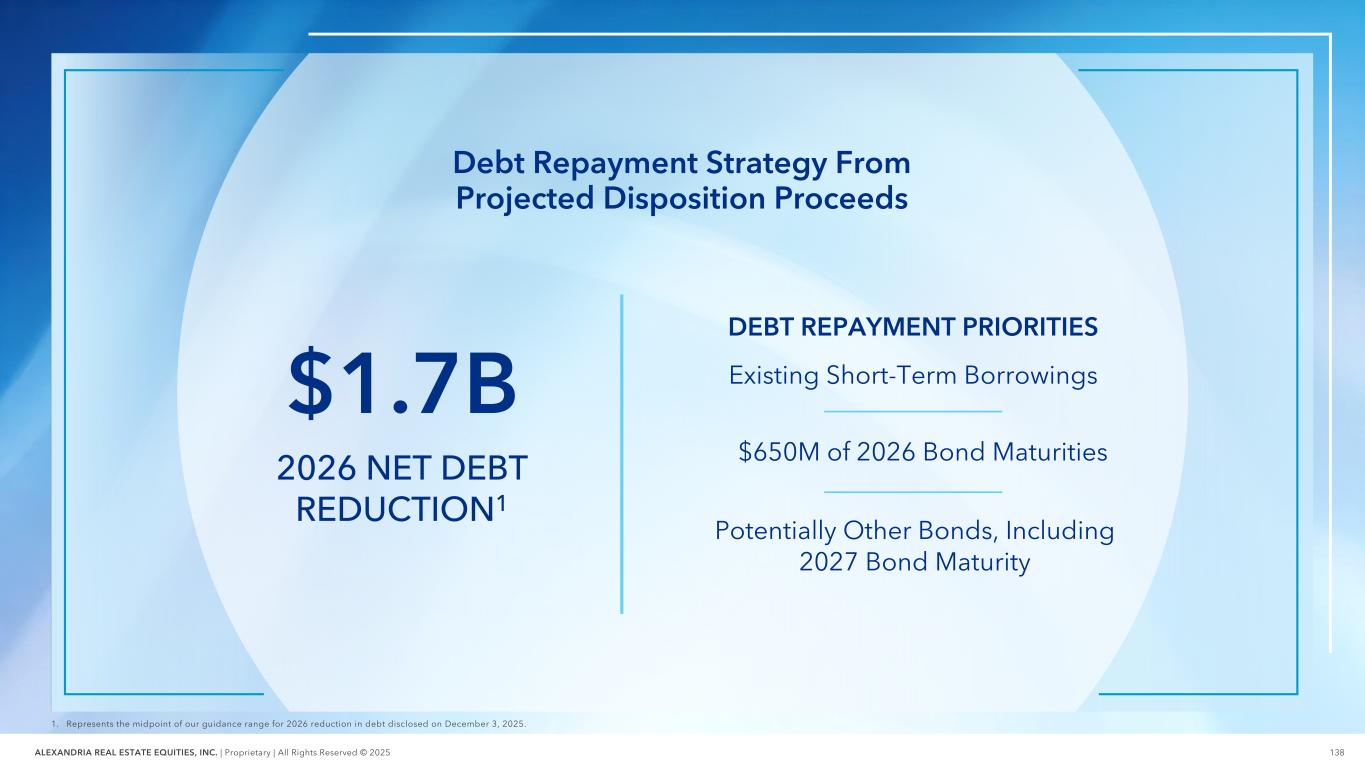

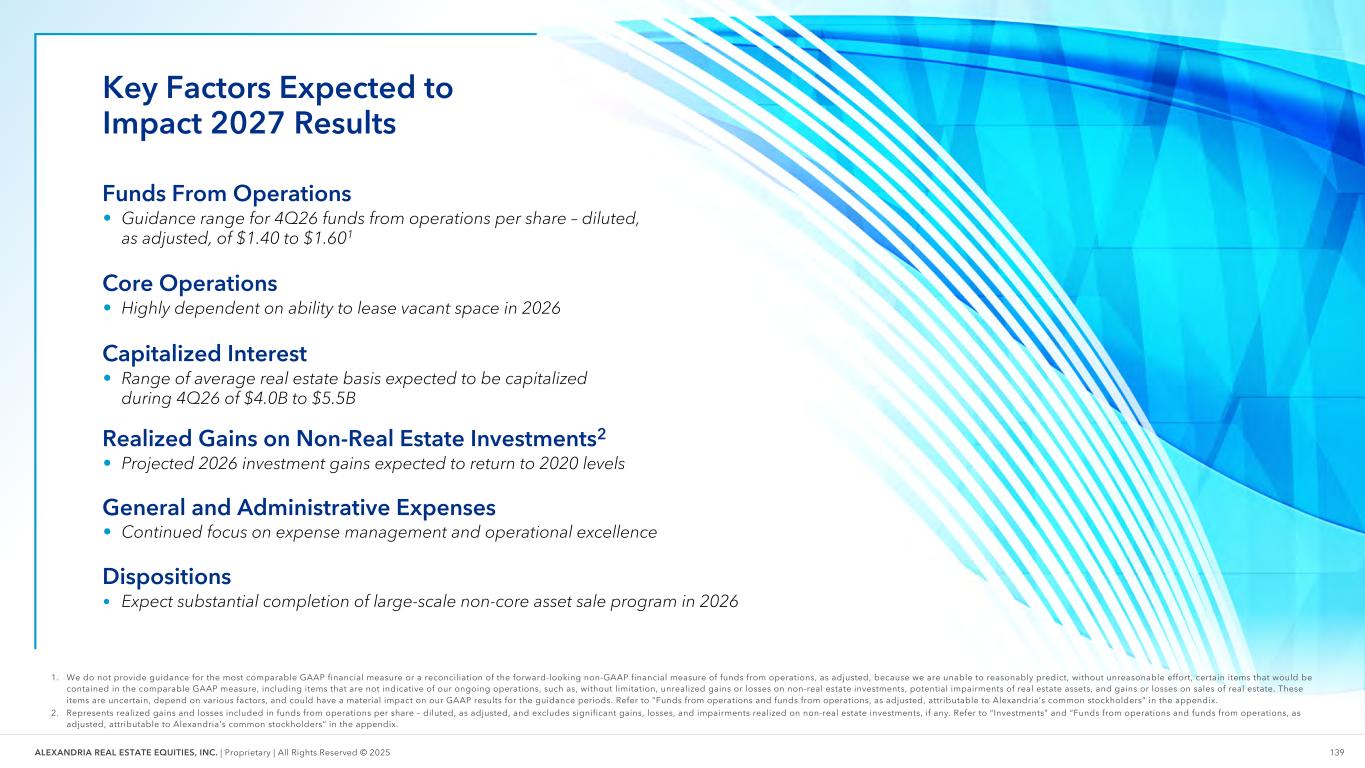

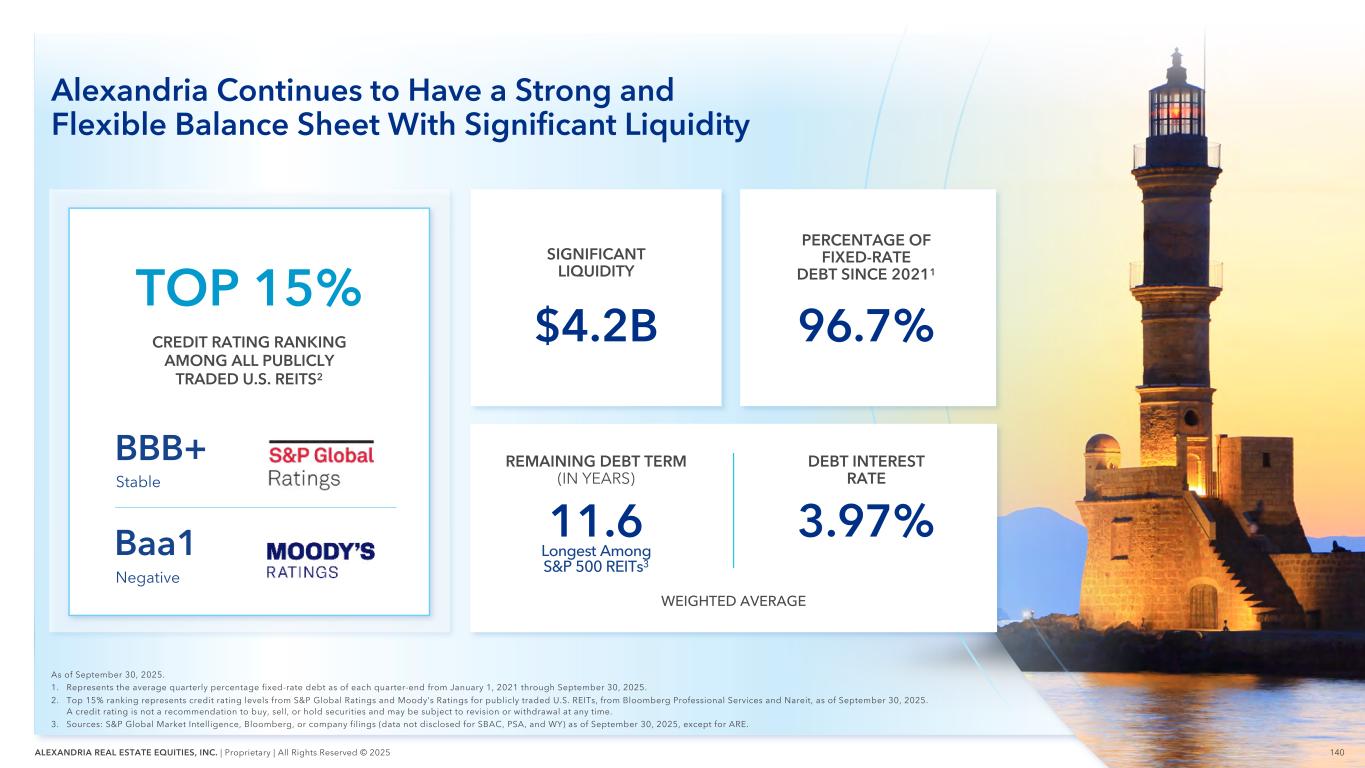

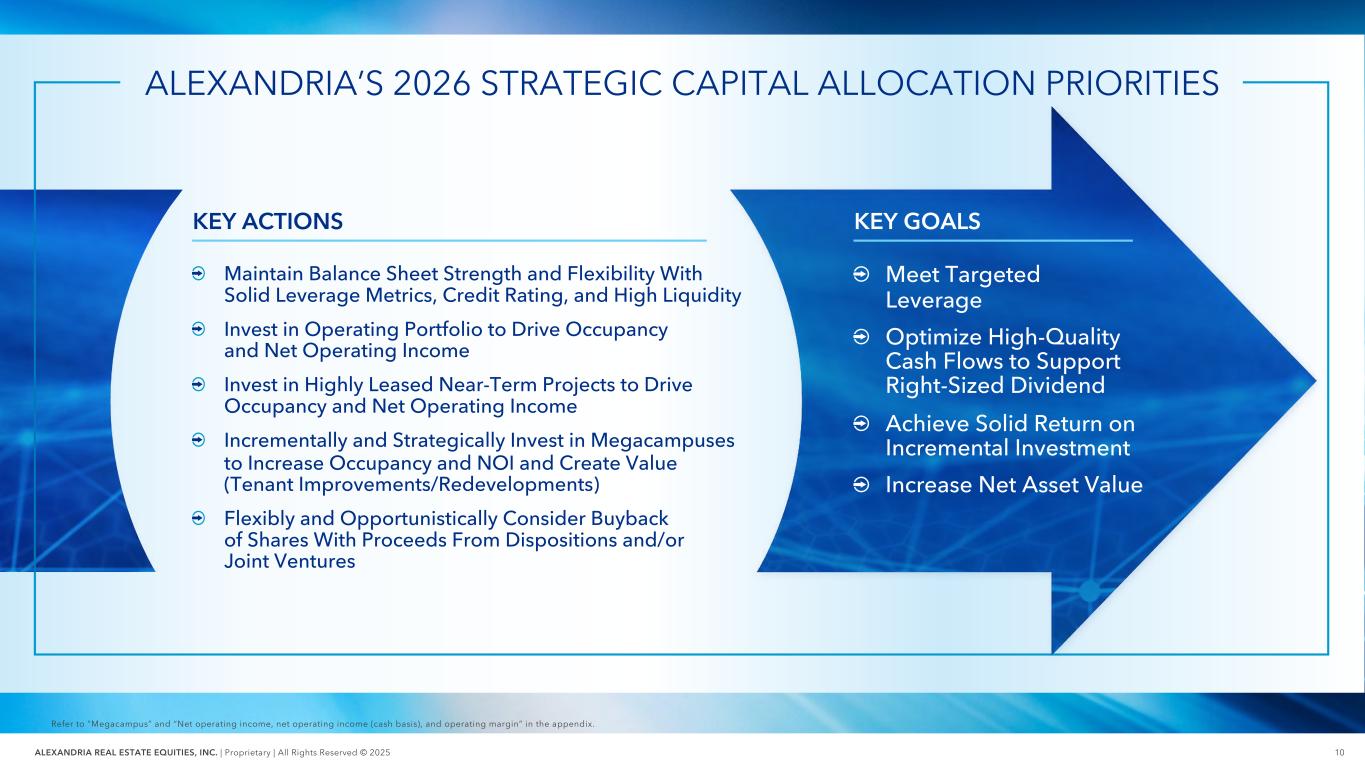

10ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 Refer to “Megacampus” and “Net operating income, net operating income (cash basis), and operating margin” in the appendix. Maintain Balance Sheet Strength and Flexibility With Solid Leverage Metrics, Credit Rating, and High Liquidity Invest in Operating Portfolio to Drive Occupancy and Net Operating Income Invest in Highly Leased Near-Term Projects to Drive Occupancy and Net Operating Income Incrementally and Strategically Invest in Megacampuses to Increase Occupancy and NOI and Create Value (Tenant Improvements/Redevelopments) Flexibly and Opportunistically Consider Buyback of Shares With Proceeds From Dispositions and/or Joint Ventures KEY ACTIONS ALEXANDRIA’S 2026 STRATEGIC CAPITAL ALLOCATION PRIORITIES Meet Targeted Leverage Optimize High-Quality Cash Flows to Support Right-Sized Dividend Achieve Solid Return on Incremental Investment Increase Net Asset Value KEY GOALS

11ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 PATH FORWARD Refer to “Megacampus” and “Net operating income, net operating income (cash basis), and operating margin” in the appendix. 1 2 5 Continue to Successfully Manage G&A Maintain a Strong and Flexible Balance Sheet, Significant Liquidity, and Targeted Leverage 6 Maintain Optionality for Future Growth Focused on Megacampus™ InvestmentReduce Capital Spend and Funding Needs Substantially Complete Large-Scale Non-Core Disposition Plan 3 7 Consider Flexible and Opportunistic Share Buyback Plan 4 Steadily Improve Occupancy and Increase NOI, Focusing on Leasing to All Sectors of Our Tenant Base, Including the Most Innovative Entities in a Rapidly Changing Environment Reduce Size of Our Asset Base and SUBSTANTIALLY FOCUS ON GROWTH OF MEGACAMPUSES

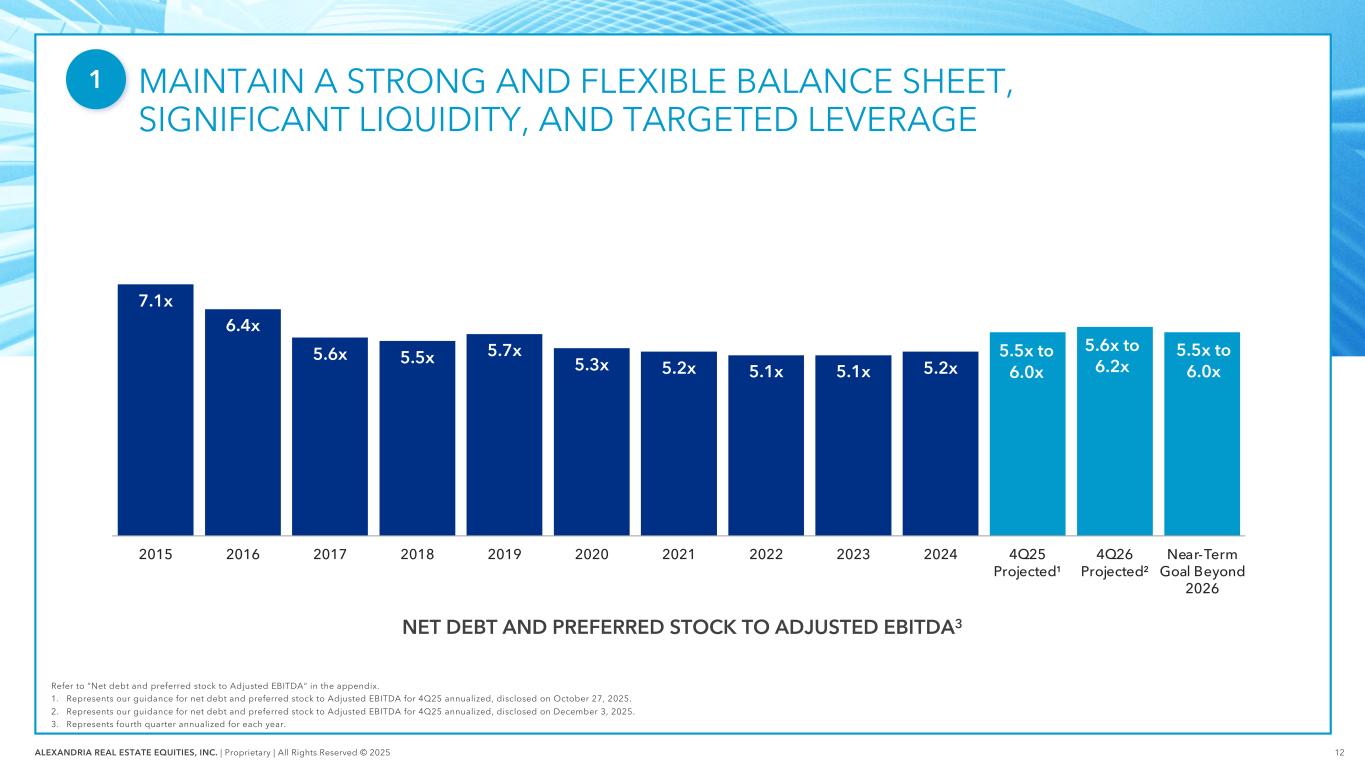

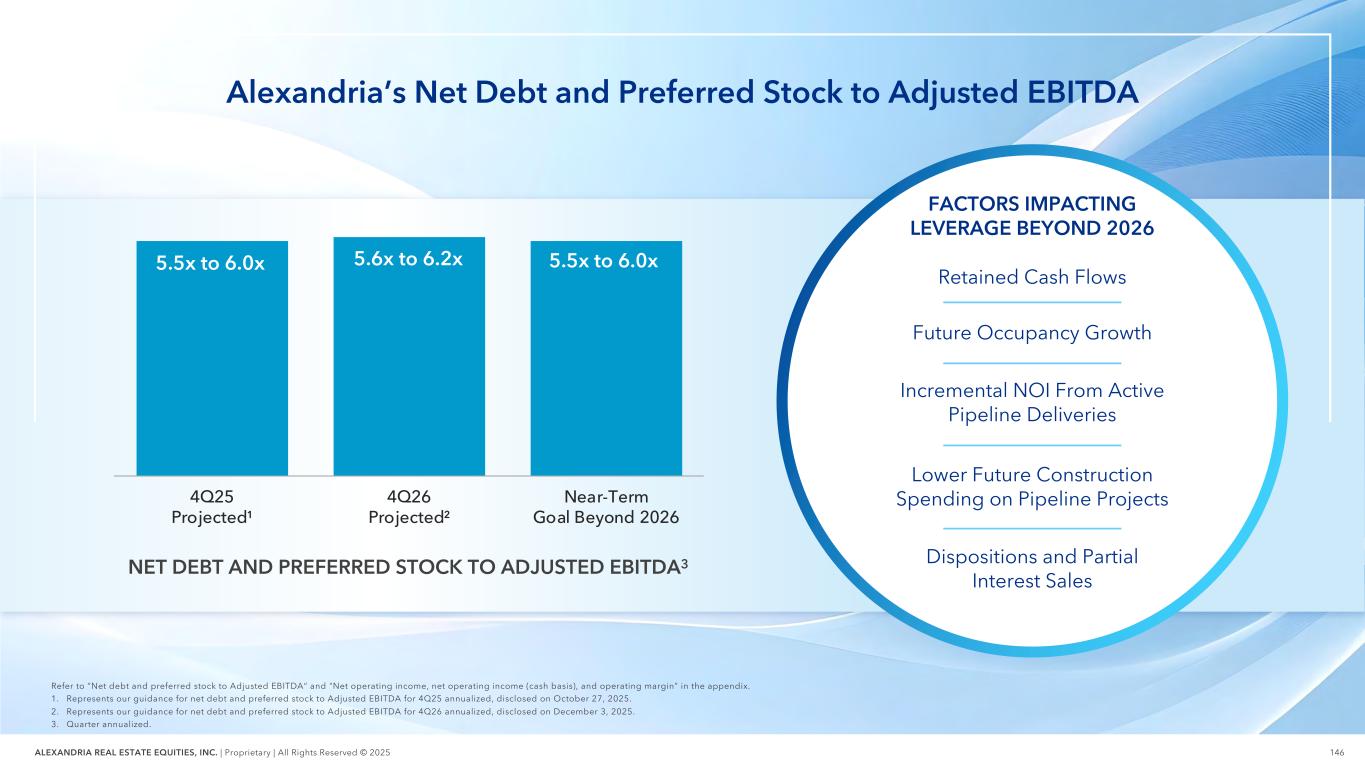

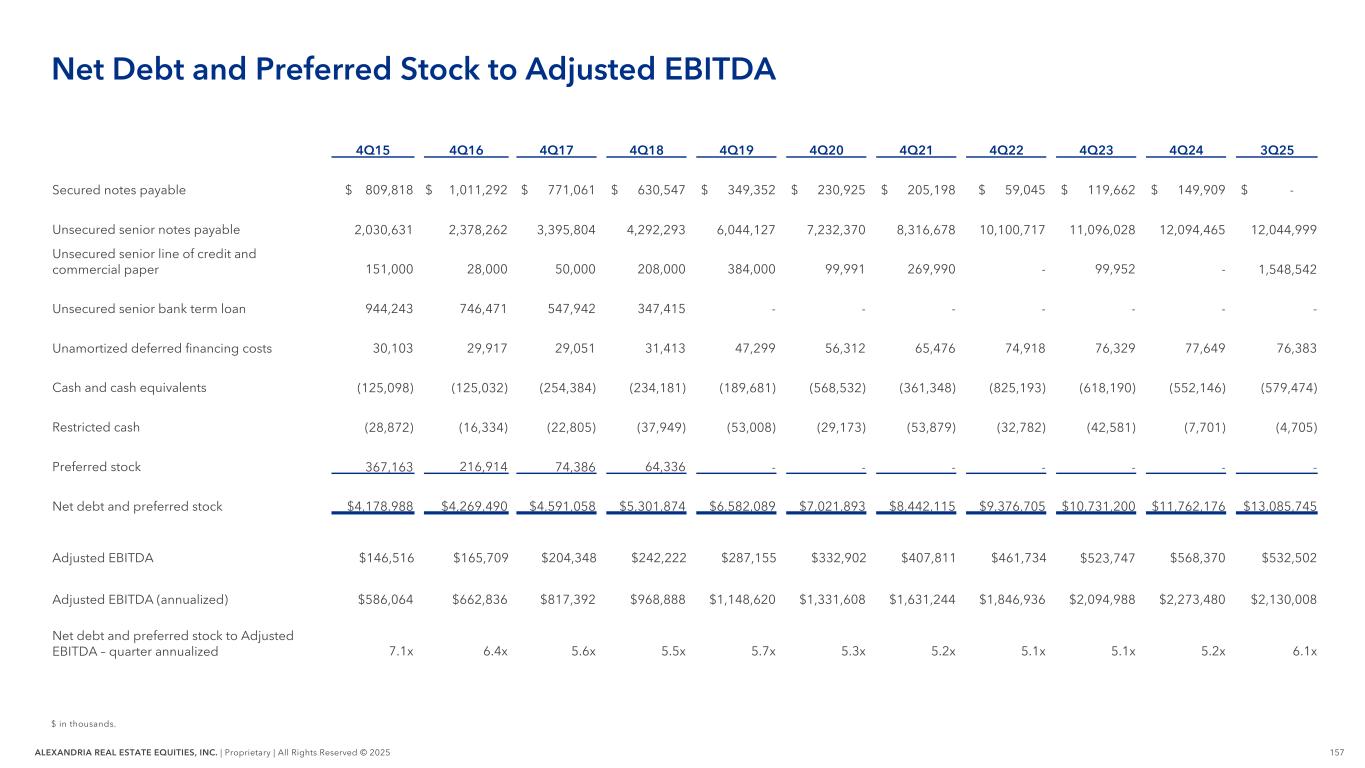

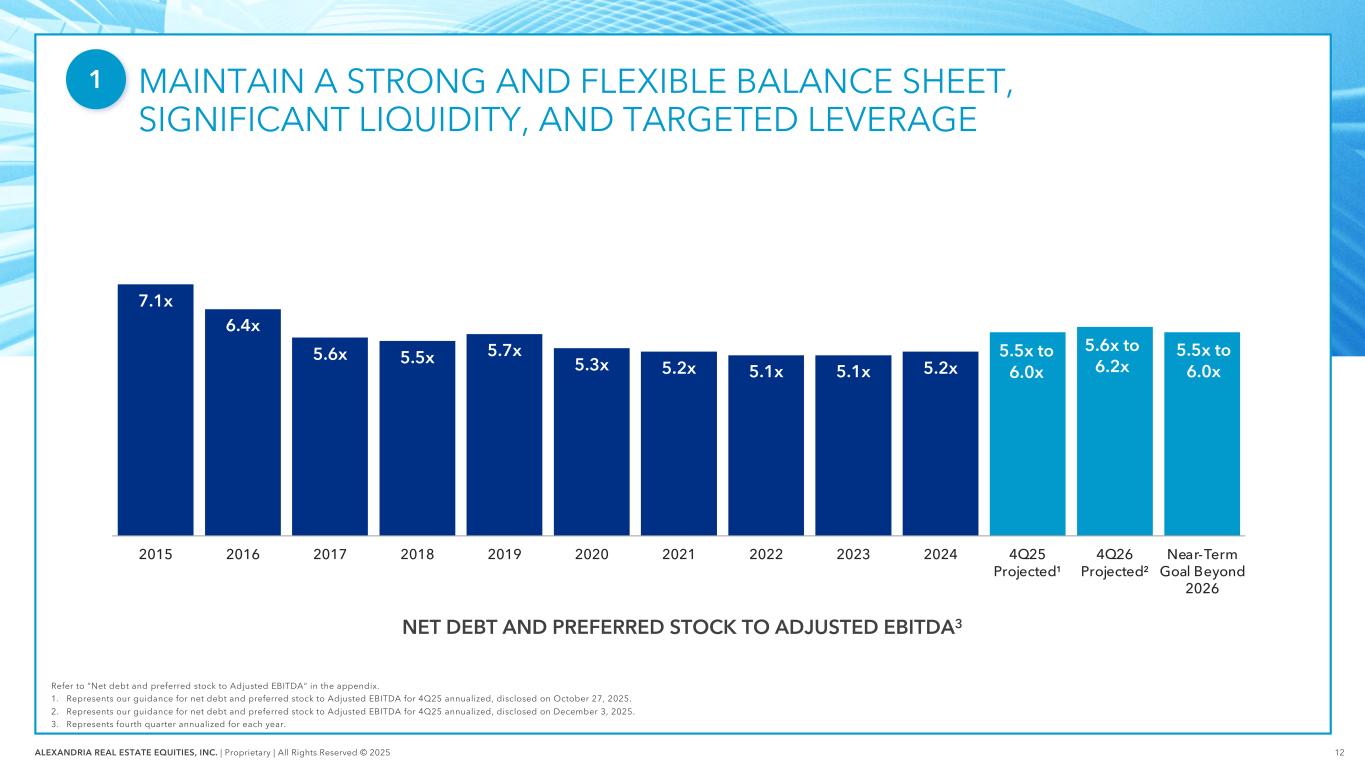

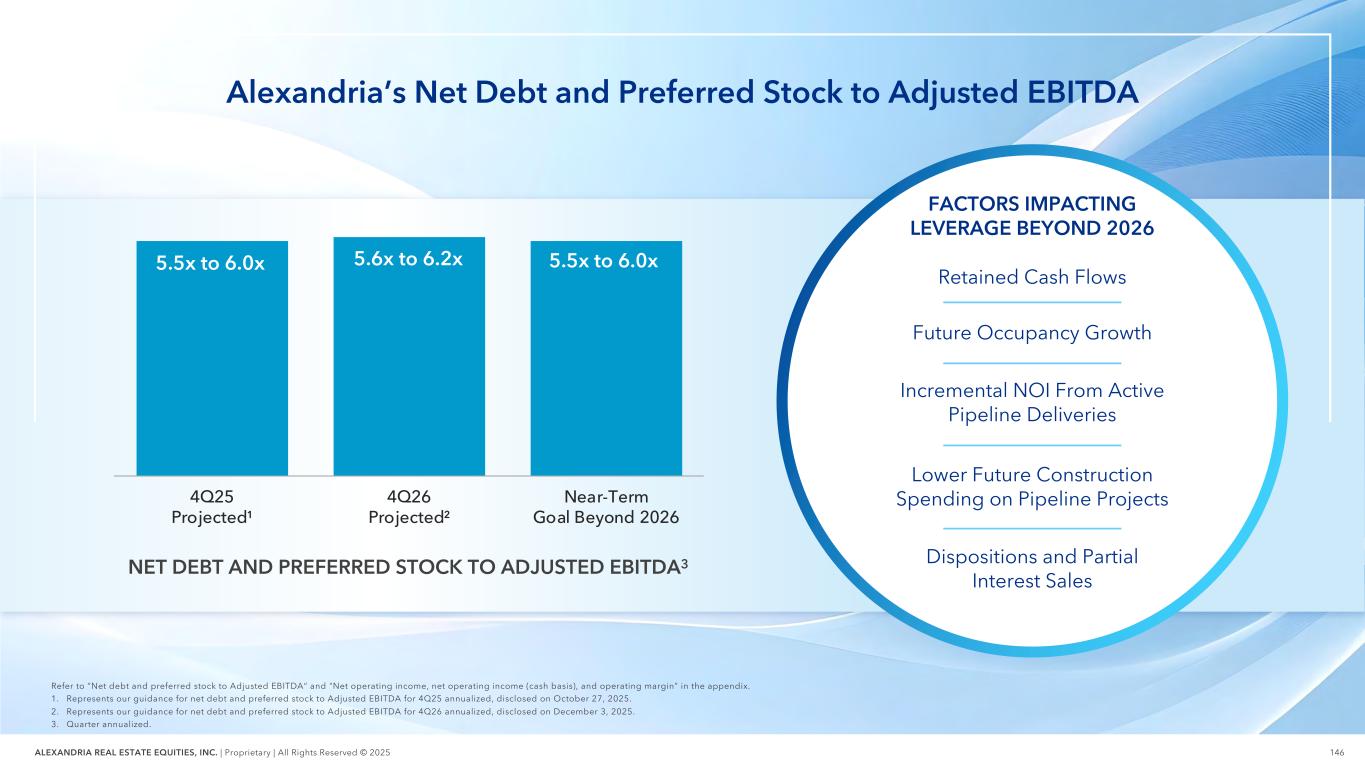

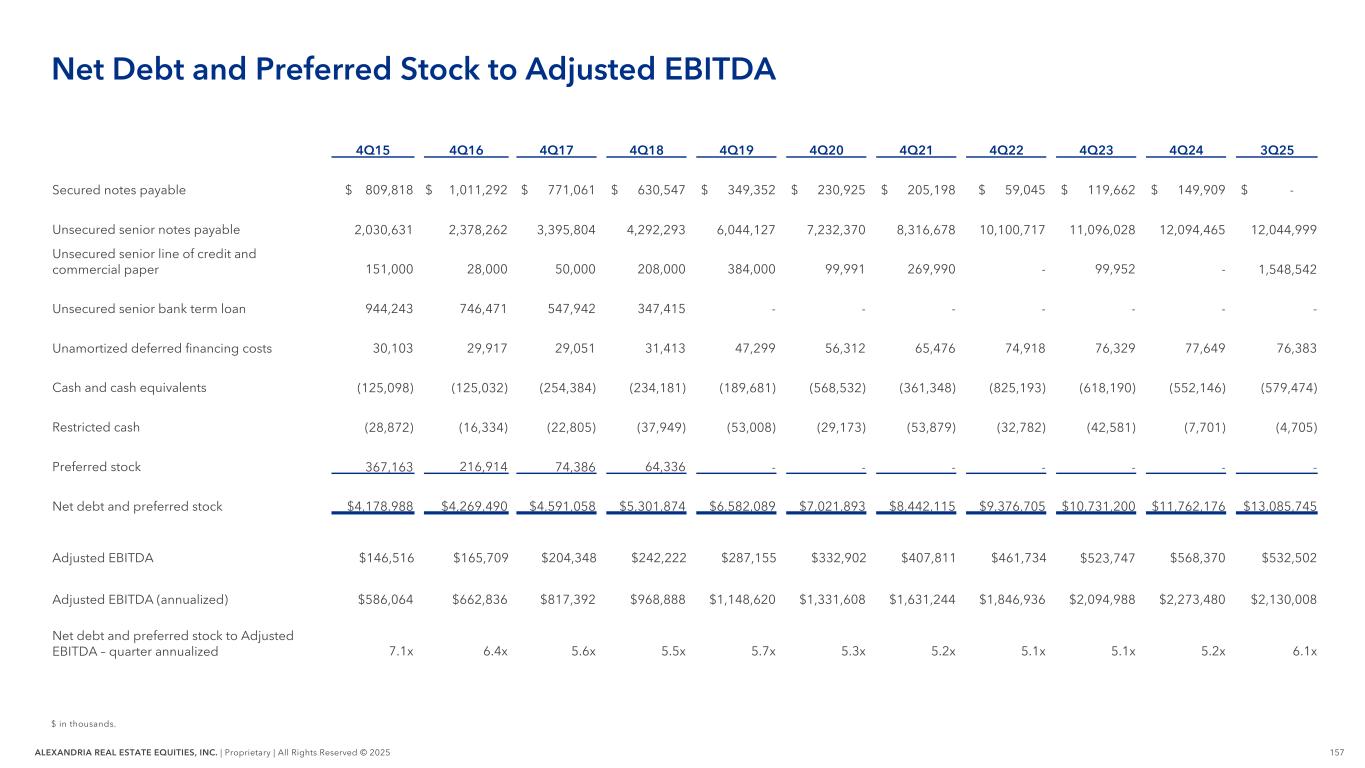

12ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 MAINTAIN A STRONG AND FLEXIBLE BALANCE SHEET, SIGNIFICANT LIQUIDITY, AND TARGETED LEVERAGE Refer to “Net debt and preferred stock to Adjusted EBITDA“ in the appendix. 1. Represents our guidance for net debt and preferred stock to Adjusted EBITDA for 4Q25 annualized, disclosed on October 27, 2025. 2. Represents our guidance for net debt and preferred stock to Adjusted EBITDA for 4Q25 annualized, disclosed on December 3, 2025. 3. Represents fourth quarter annualized for each year. NET DEBT AND PREFERRED STOCK TO ADJUSTED EBITDA3 7.1x 6.4x 5.6x 5.5x 5.7x 5.3x 5.2x 5.1x 5.1x 5.2x 5.5x to 6.0x 5.6x to 6.2x 5.5x to 6.0x 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 4Q25 Projected¹ 4Q26 Projected² Near-Term Goal Beyond 2026 1

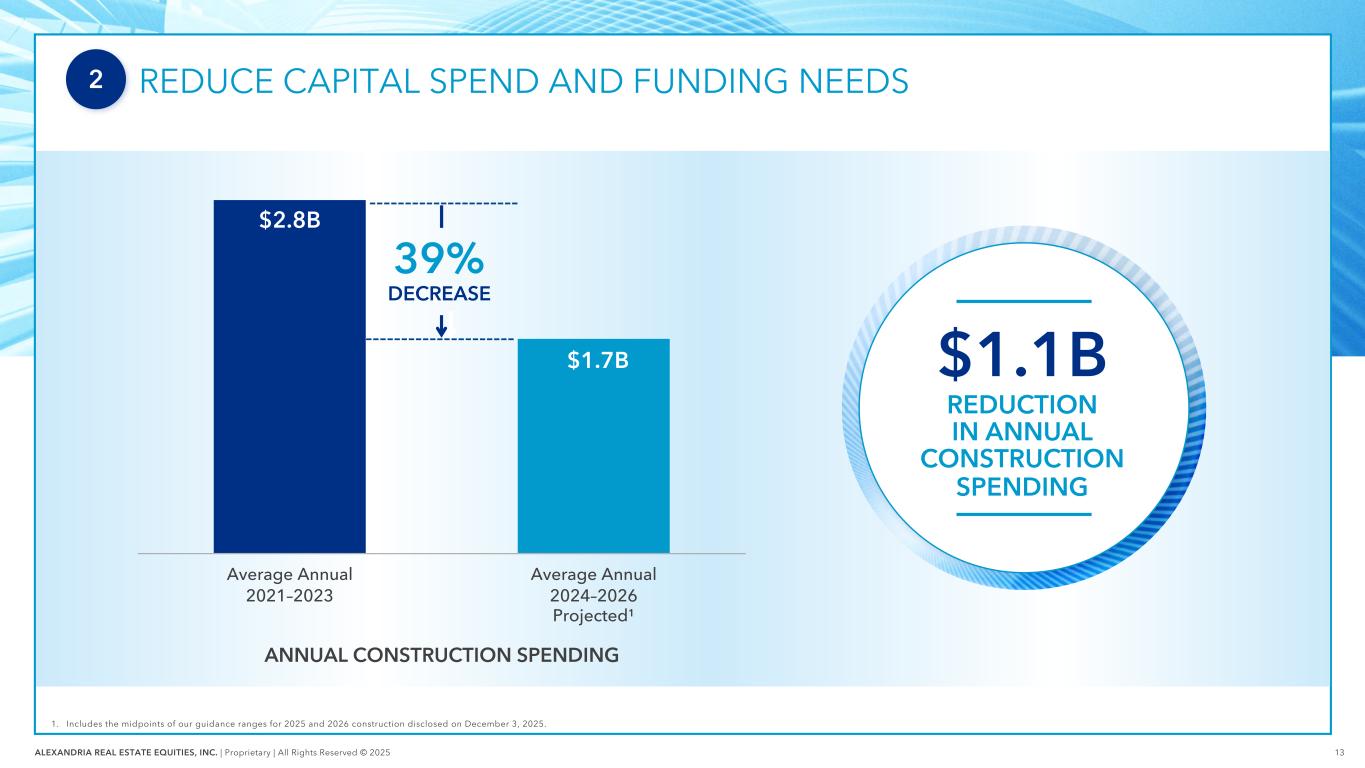

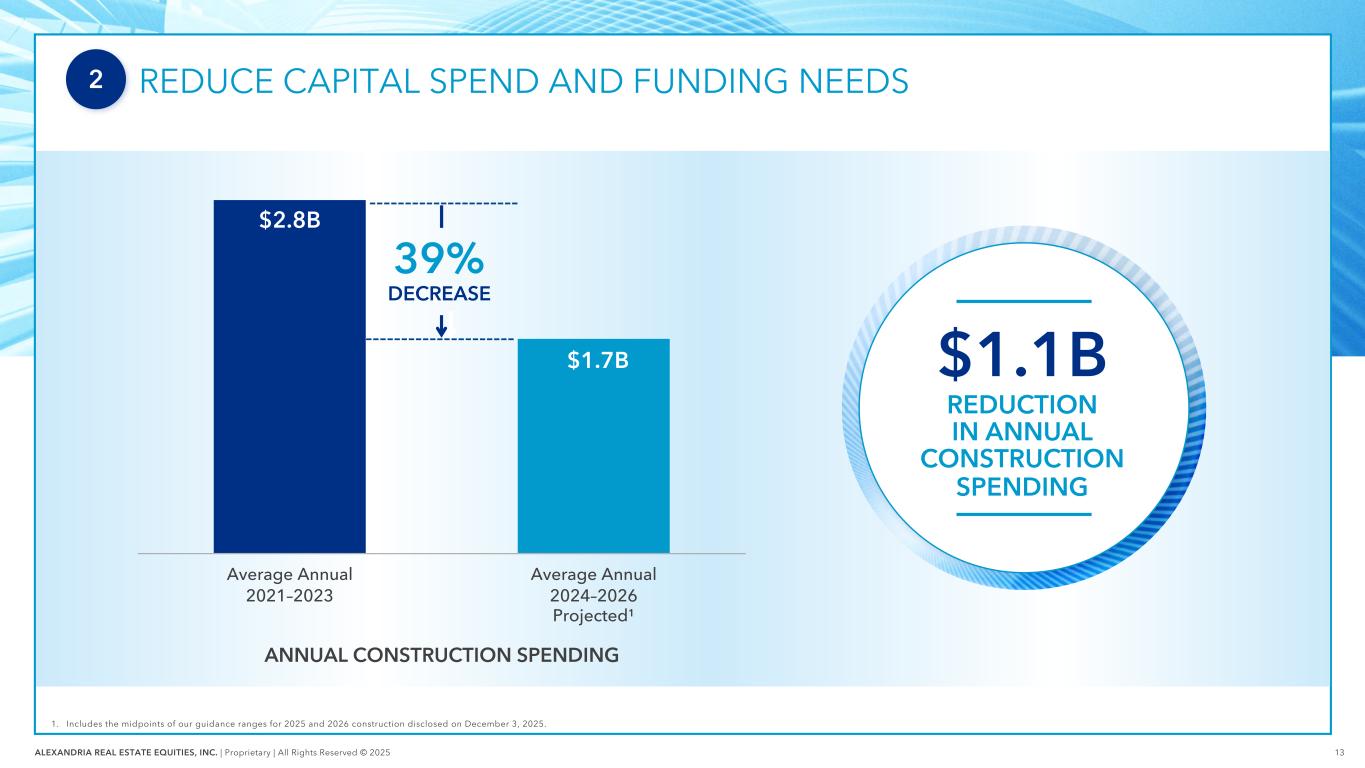

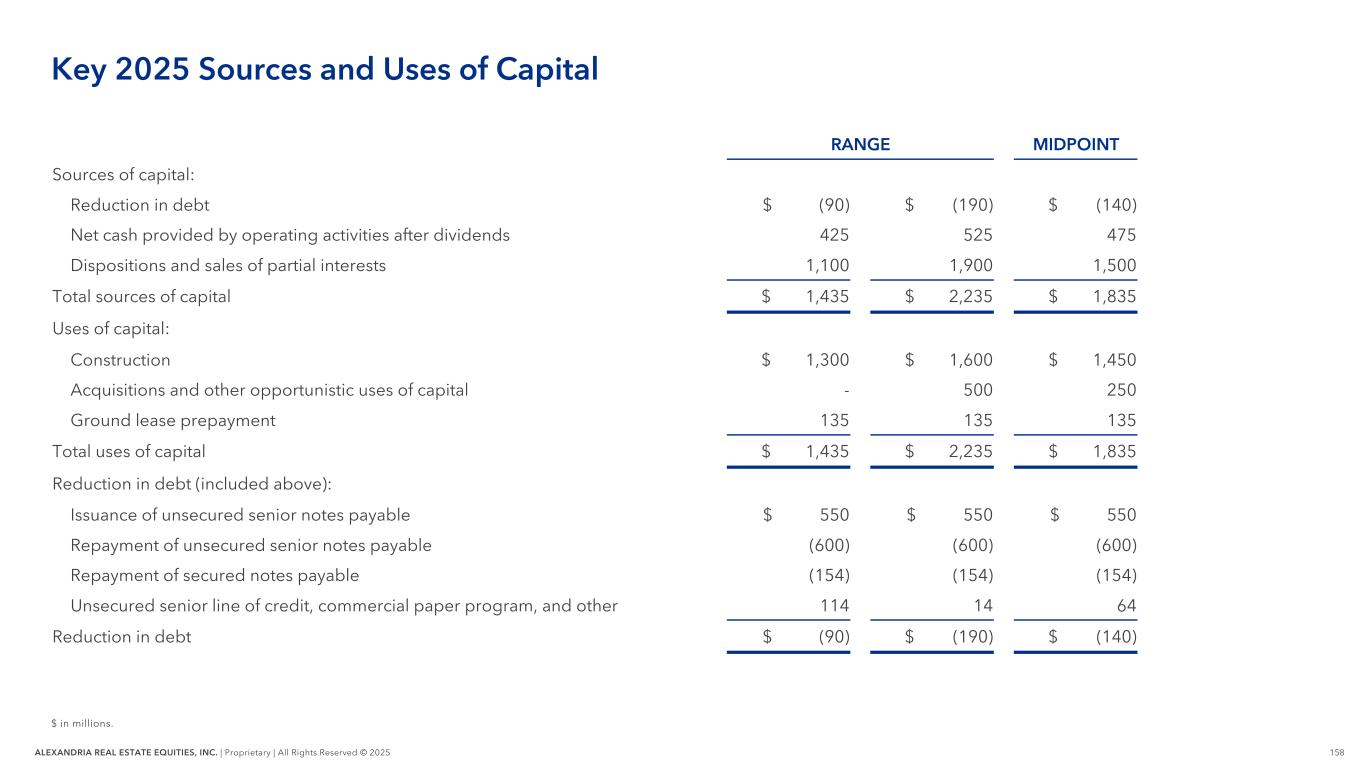

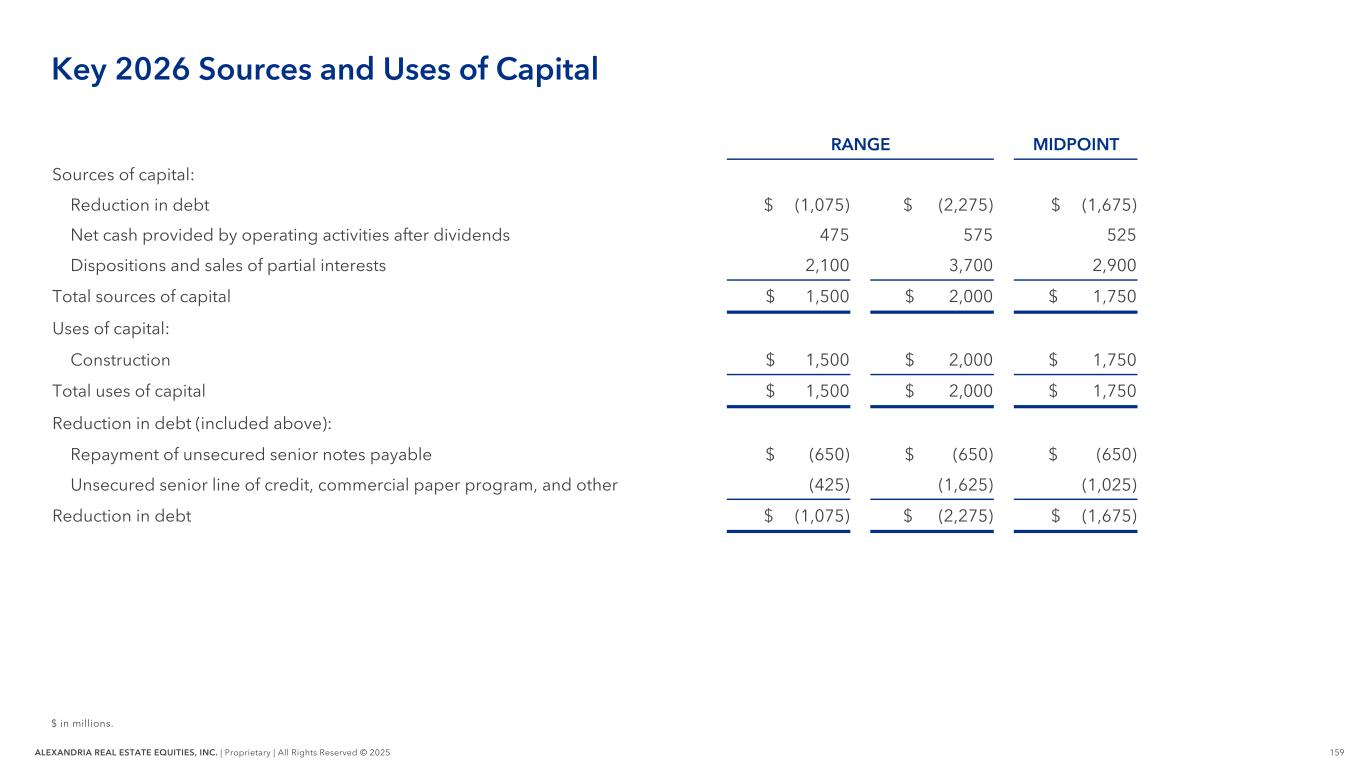

13ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 $2.8B $1.7B Average Annual 2021–2023 Average Annual 2024–2026 Projected¹ ANNUAL CONSTRUCTION SPENDING REDUCE CAPITAL SPEND AND FUNDING NEEDS 1. Includes the midpoints of our guidance ranges for 2025 and 2026 construction disclosed on December 3, 2025. 2 $1.1B REDUCTION IN ANNUAL CONSTRUCTION SPENDING 39% DECREASE

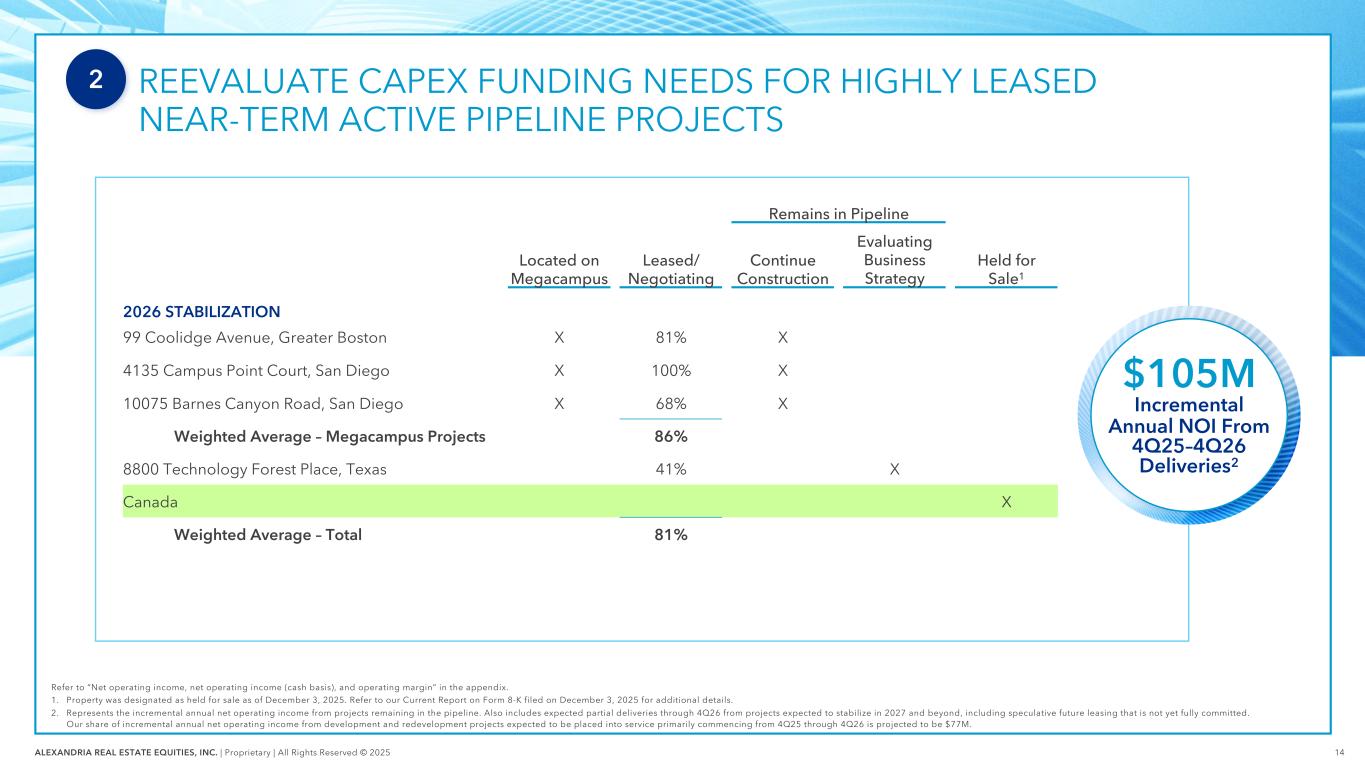

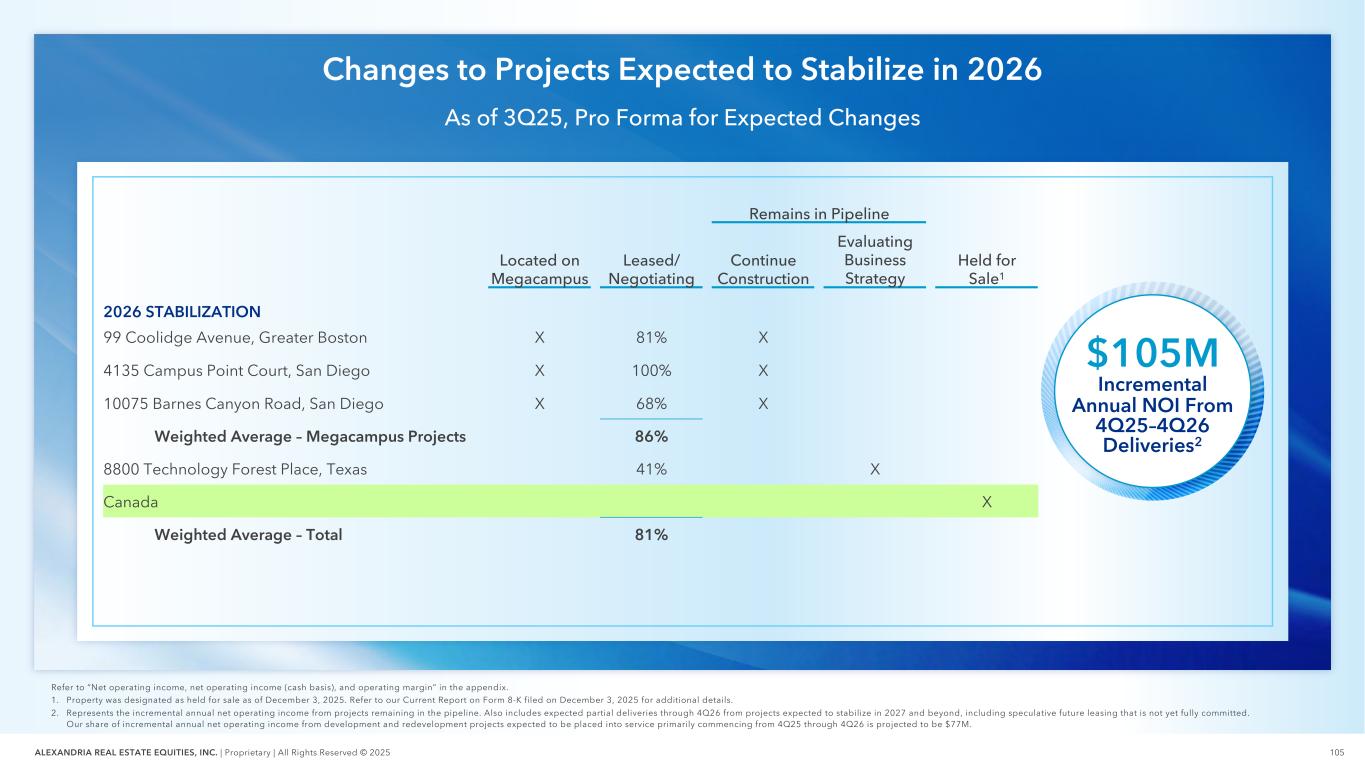

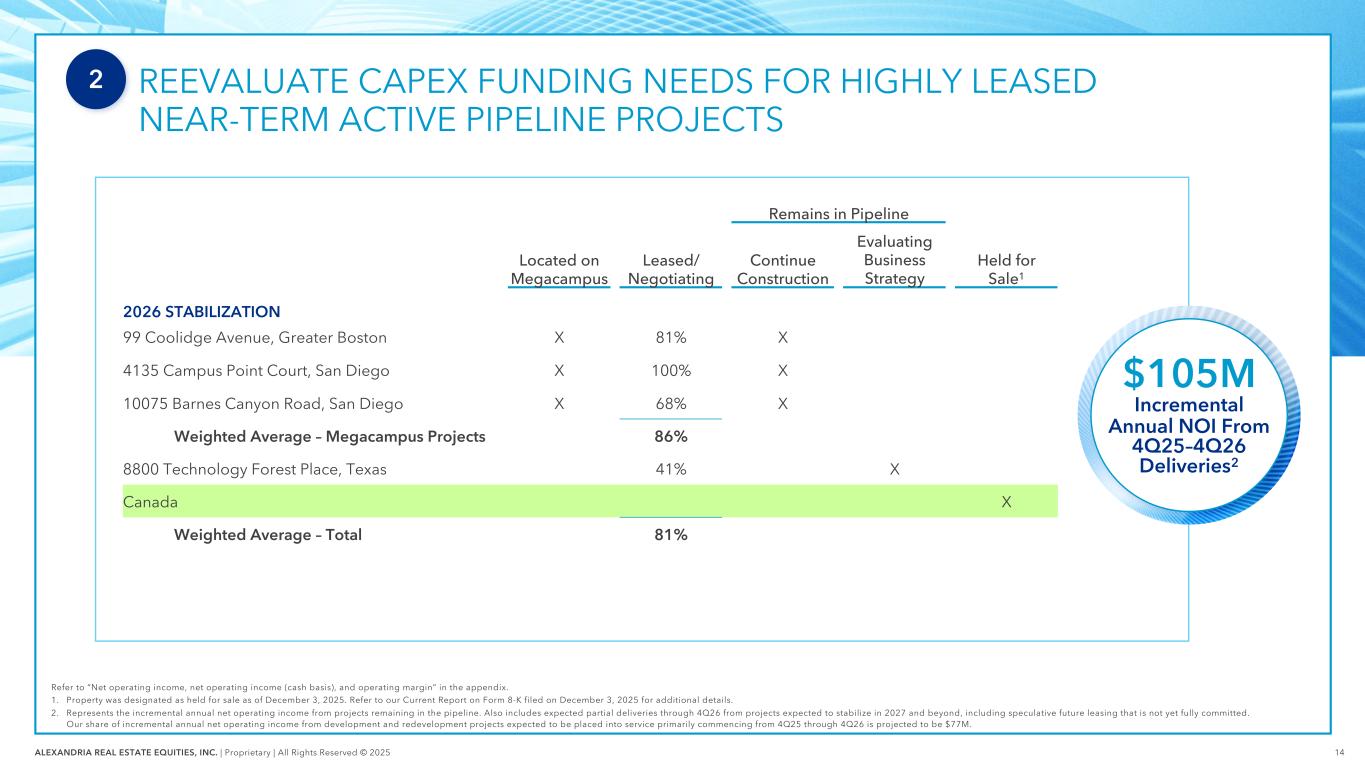

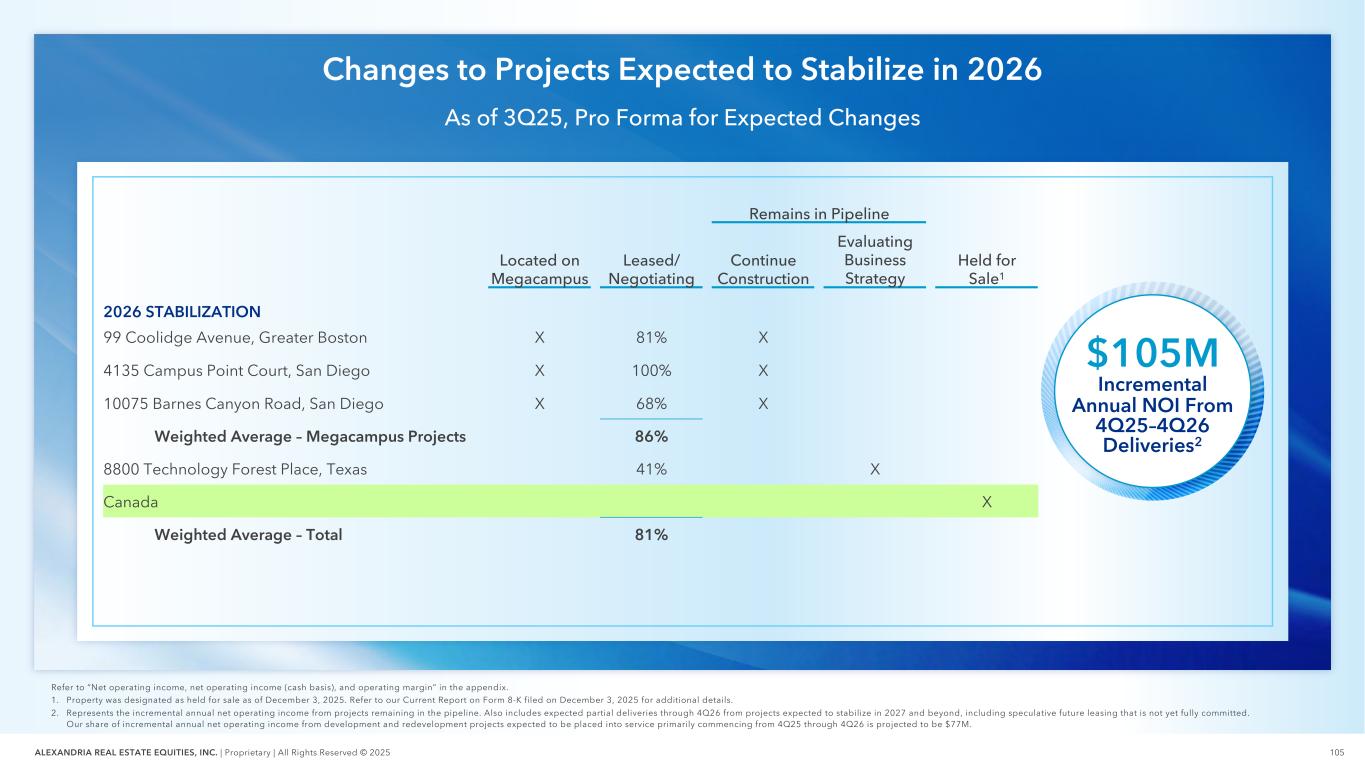

14ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 REEVALUATE CAPEX FUNDING NEEDS FOR HIGHLY LEASED NEAR-TERM ACTIVE PIPELINE PROJECTS 2 Refer to “Net operating income, net operating income (cash basis), and operating margin” in the appendix. 1. Property was designated as held for sale as of December 3, 2025. Refer to our Current Report on Form 8-K filed on December 3, 2025 for additional details. 2. Represents the incremental annual net operating income from projects remaining in the pipeline. Also includes expected partial deliveries through 4Q26 from projects expected to stabilize in 2027 and beyond, including speculative future leasing that is not yet fully committed. Our share of incremental annual net operating income from development and redevelopment projects expected to be placed into service primarily commencing from 4Q25 through 4Q26 is projected to be $77M. Located on Megacampus Leased/ Negotiating Remains in Pipeline Held for Sale1 Continue Construction Evaluating Business Strategy 2026 STABILIZATION 99 Coolidge Avenue, Greater Boston X 81% X 4135 Campus Point Court, San Diego X 100% X 10075 Barnes Canyon Road, San Diego X 68% X Weighted Average – Megacampus Projects 86% 8800 Technology Forest Place, Texas 41% X Canada X Weighted Average – Total 81% $105M Incremental Annual NOI From 4Q25–4Q26 Deliveries2

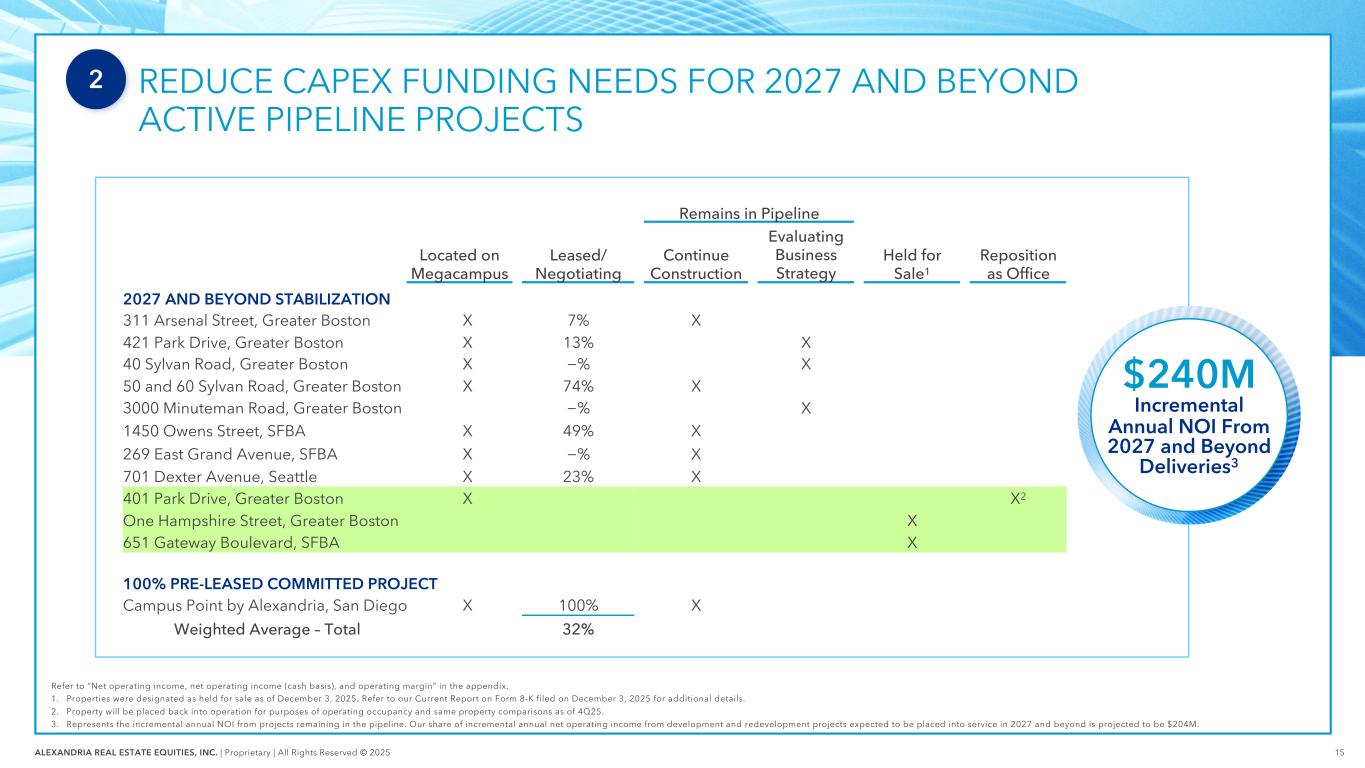

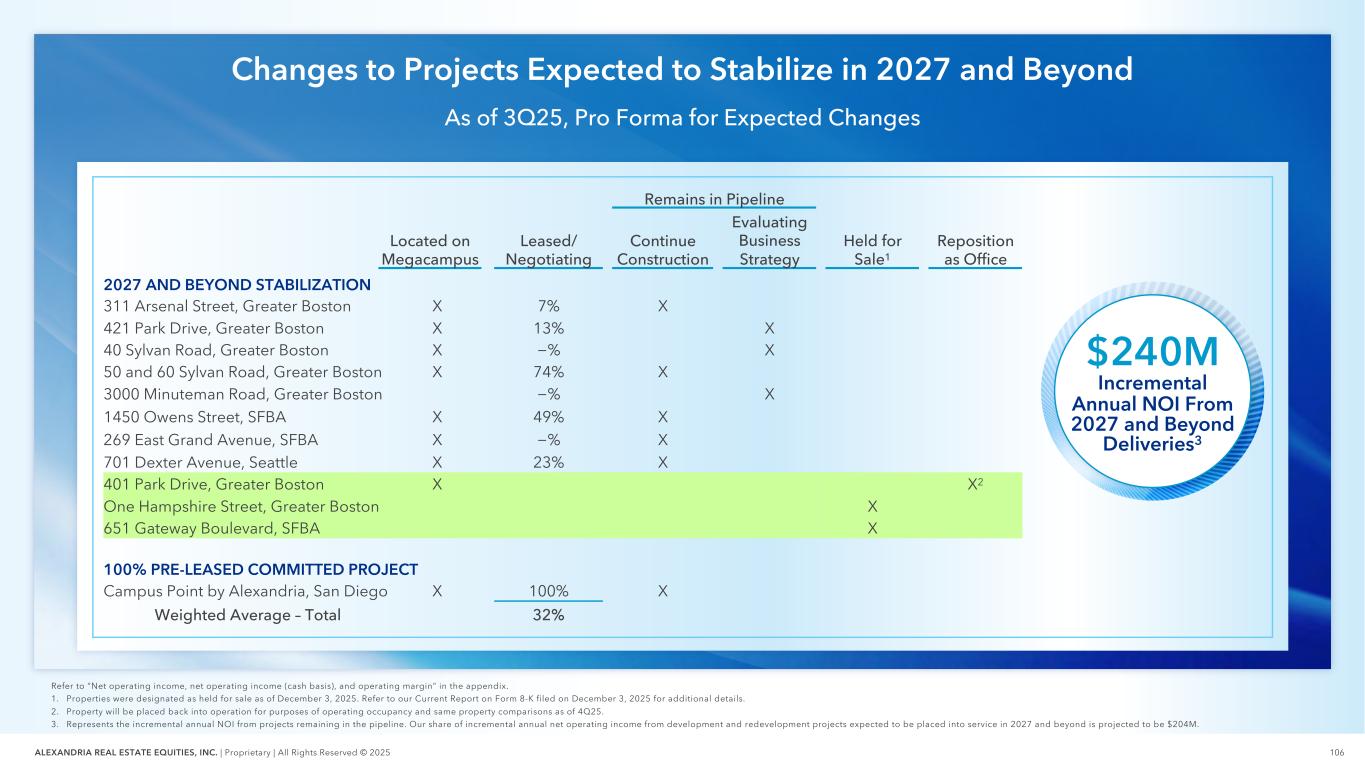

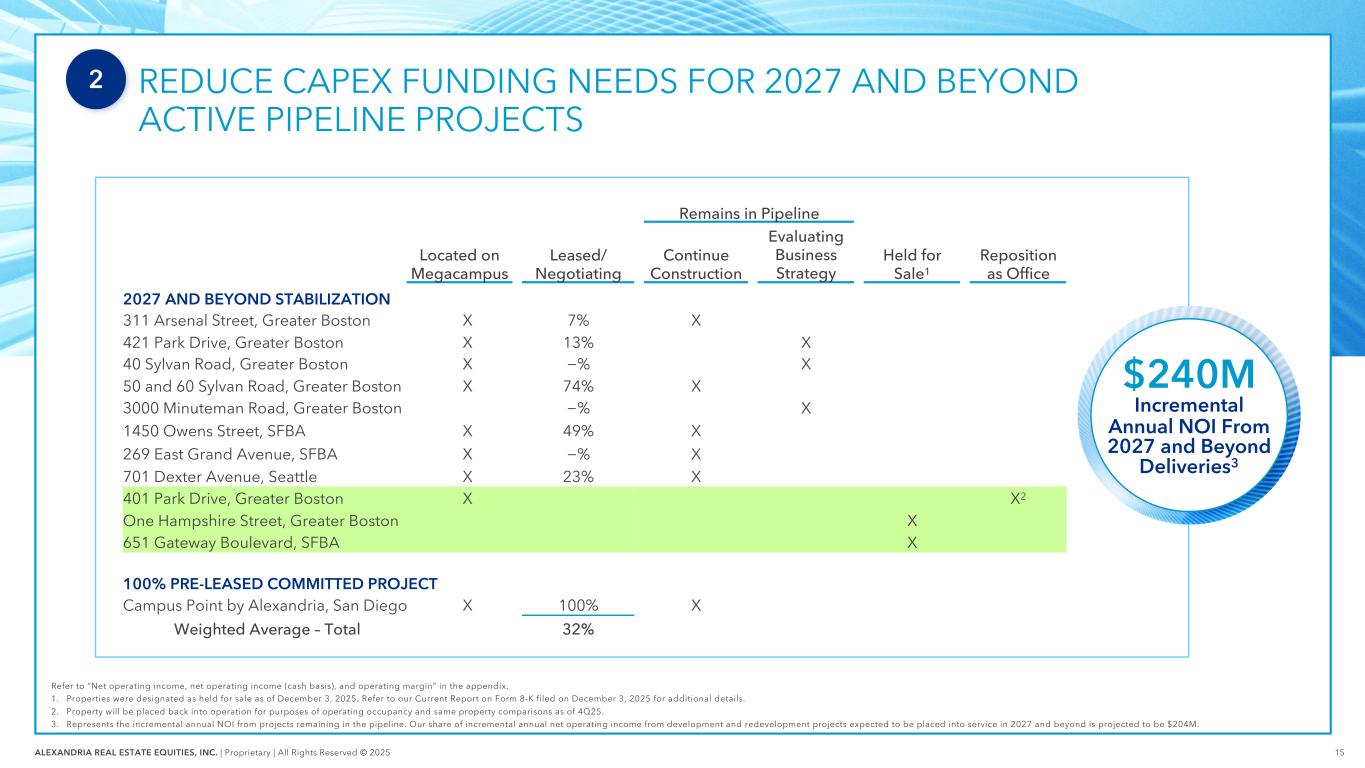

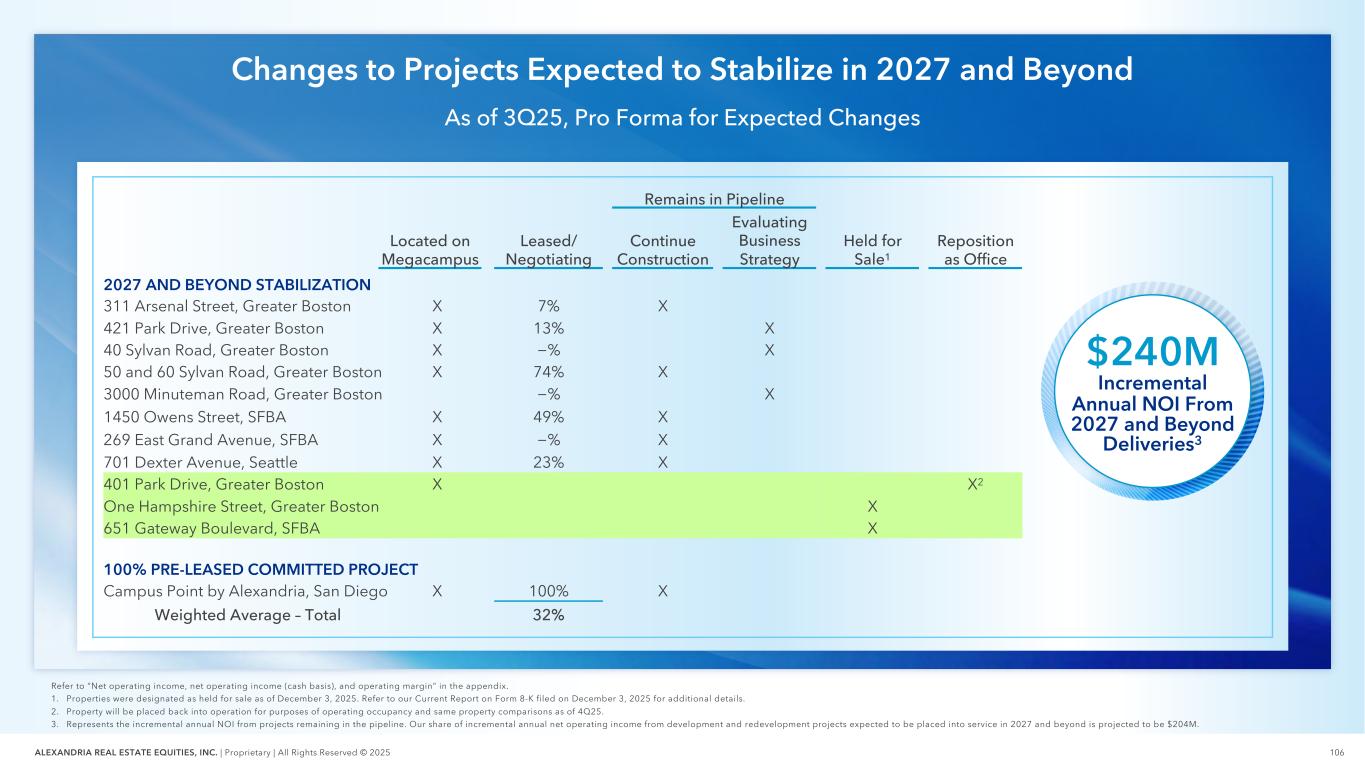

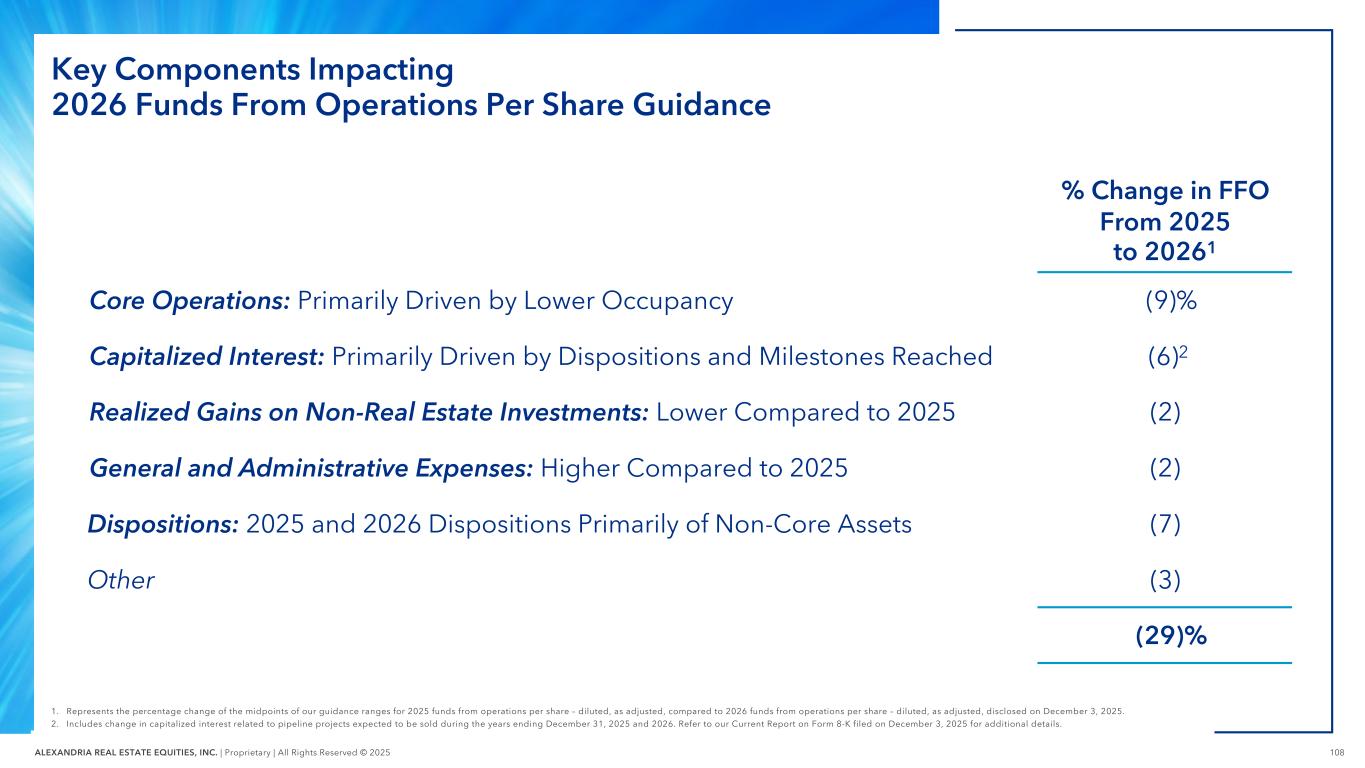

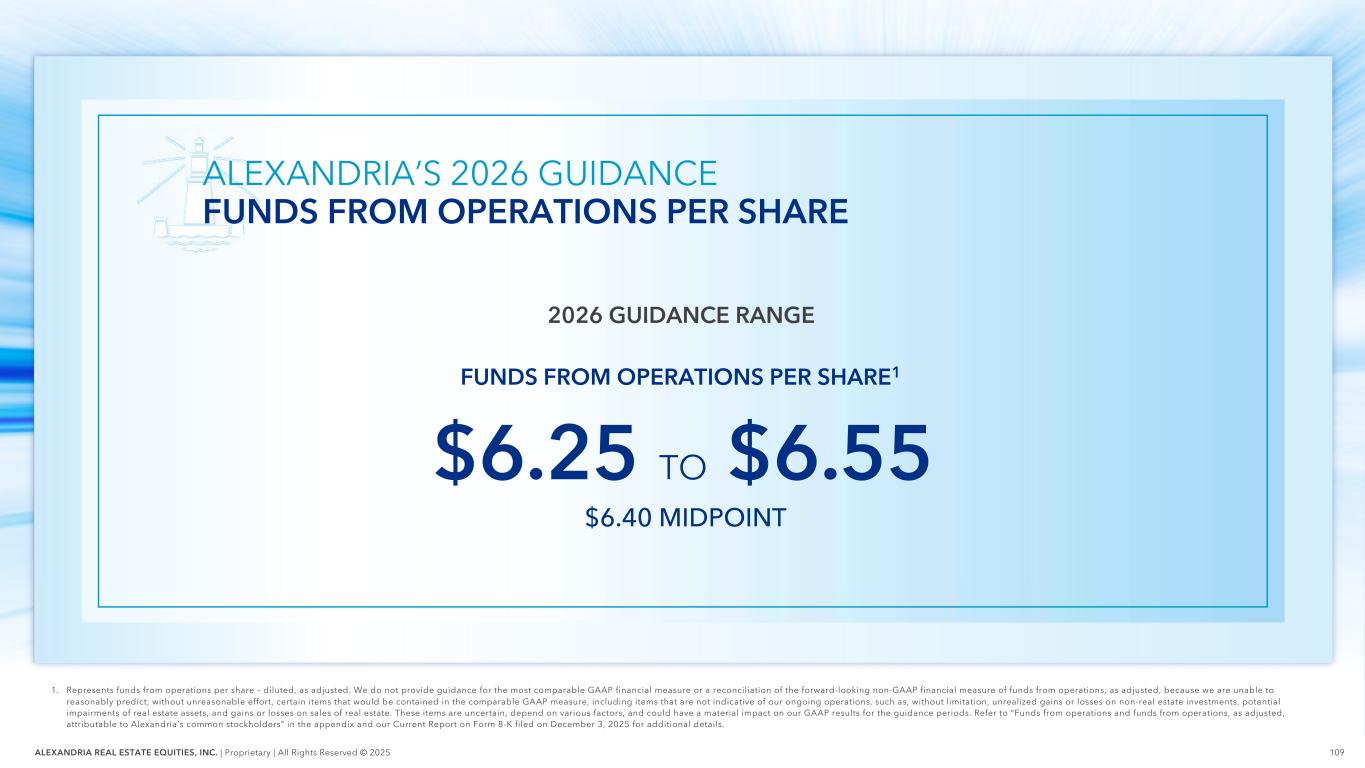

15ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 REDUCE CAPEX FUNDING NEEDS FOR 2027 AND BEYOND ACTIVE PIPELINE PROJECTS 2 Refer to “Net operating income, net operating income (cash basis), and operating margin” in the appendix. 1. Properties were designated as held for sale as of December 3, 2025. Refer to our Current Report on Form 8-K filed on December 3, 2025 for additional details. 2. Property will be placed back into operation for purposes of operating occupancy and same property comparisons as of 4Q25. 3. Represents the incremental annual NOI from projects remaining in the pipeline. Our share of incremental annual net operating income from development and redevelopment projects expected to be placed into service in 2027 and beyond is projected to be $204M. Located on Megacampus Leased/ Negotiating Remains in Pipeline Held for Sale1 Reposition as Office Continue Construction Evaluating Business Strategy 2027 AND BEYOND STABILIZATION 311 Arsenal Street, Greater Boston X 7% X 421 Park Drive, Greater Boston X 13% X 40 Sylvan Road, Greater Boston X −% X 50 and 60 Sylvan Road, Greater Boston X 74% X 3000 Minuteman Road, Greater Boston −% X 1450 Owens Street, SFBA X 49% X 269 East Grand Avenue, SFBA X −% X 701 Dexter Avenue, Seattle X 23% X 401 Park Drive, Greater Boston X X2 One Hampshire Street, Greater Boston X 651 Gateway Boulevard, SFBA X 100% PRE-LEASED COMMITTED PROJECT Campus Point by Alexandria, San Diego X 100% X Weighted Average – Total 32% $240M Incremental Annual NOI From 2027 and Beyond Deliveries3

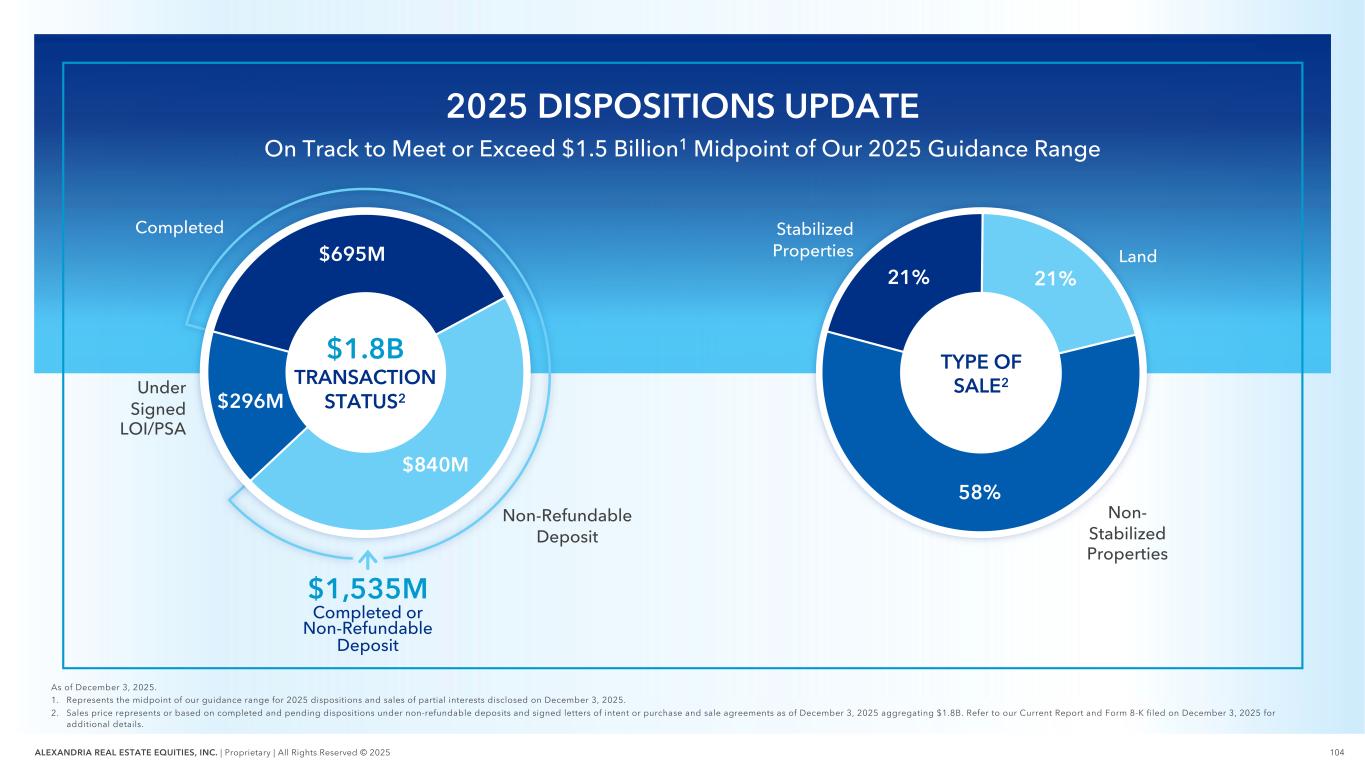

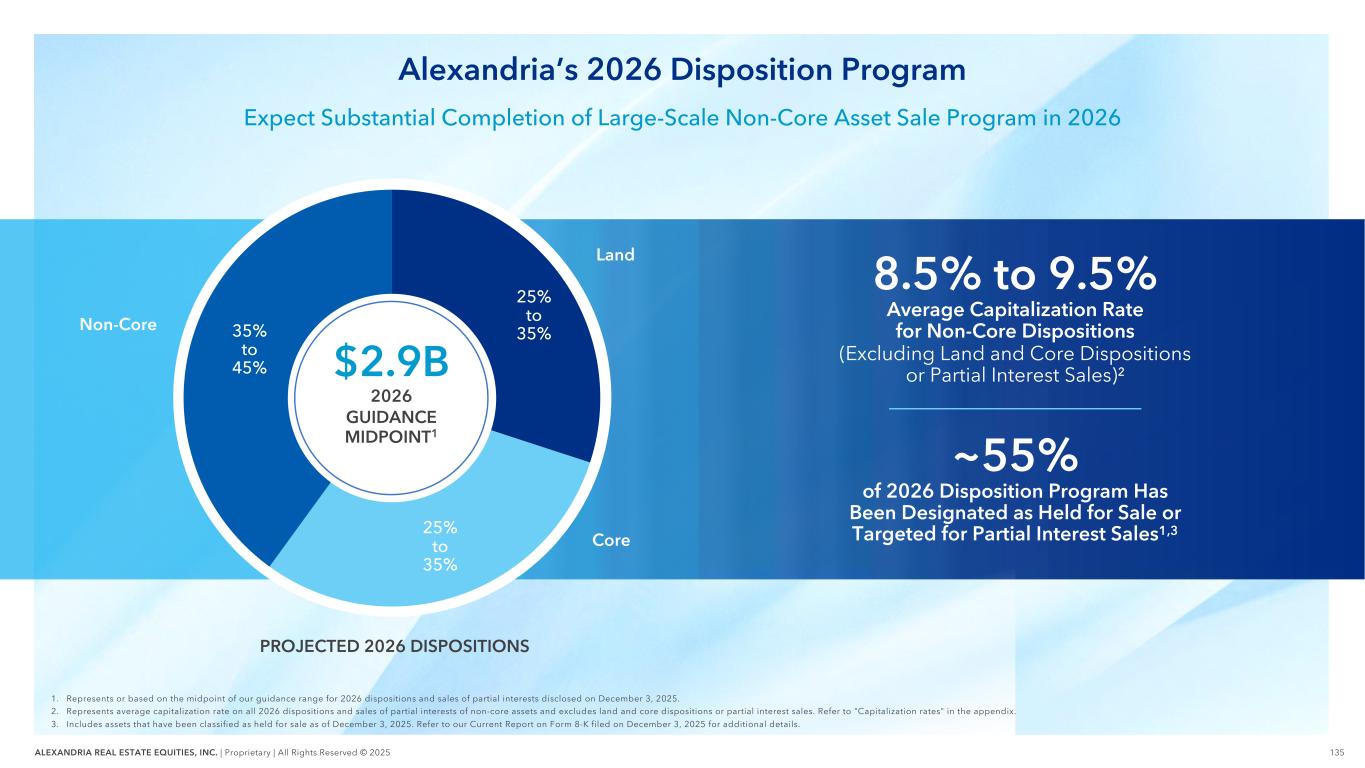

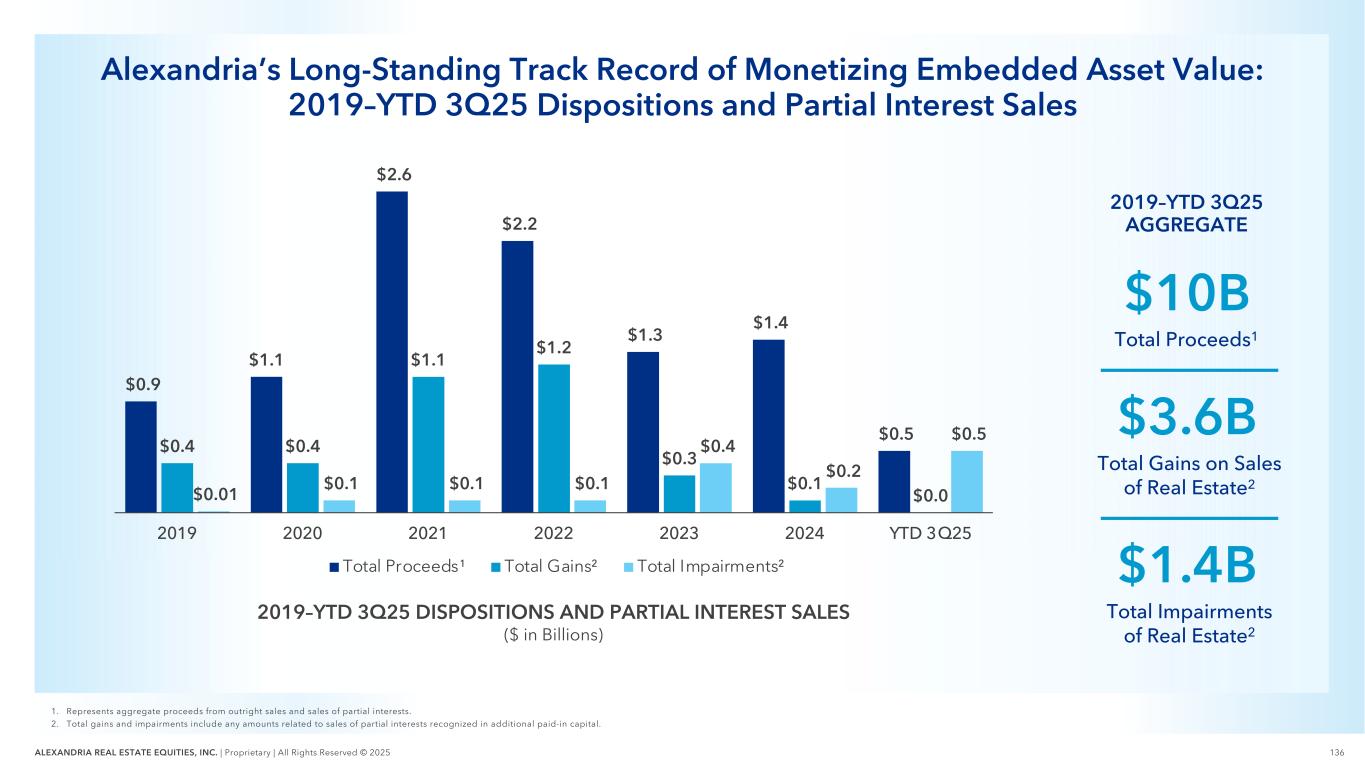

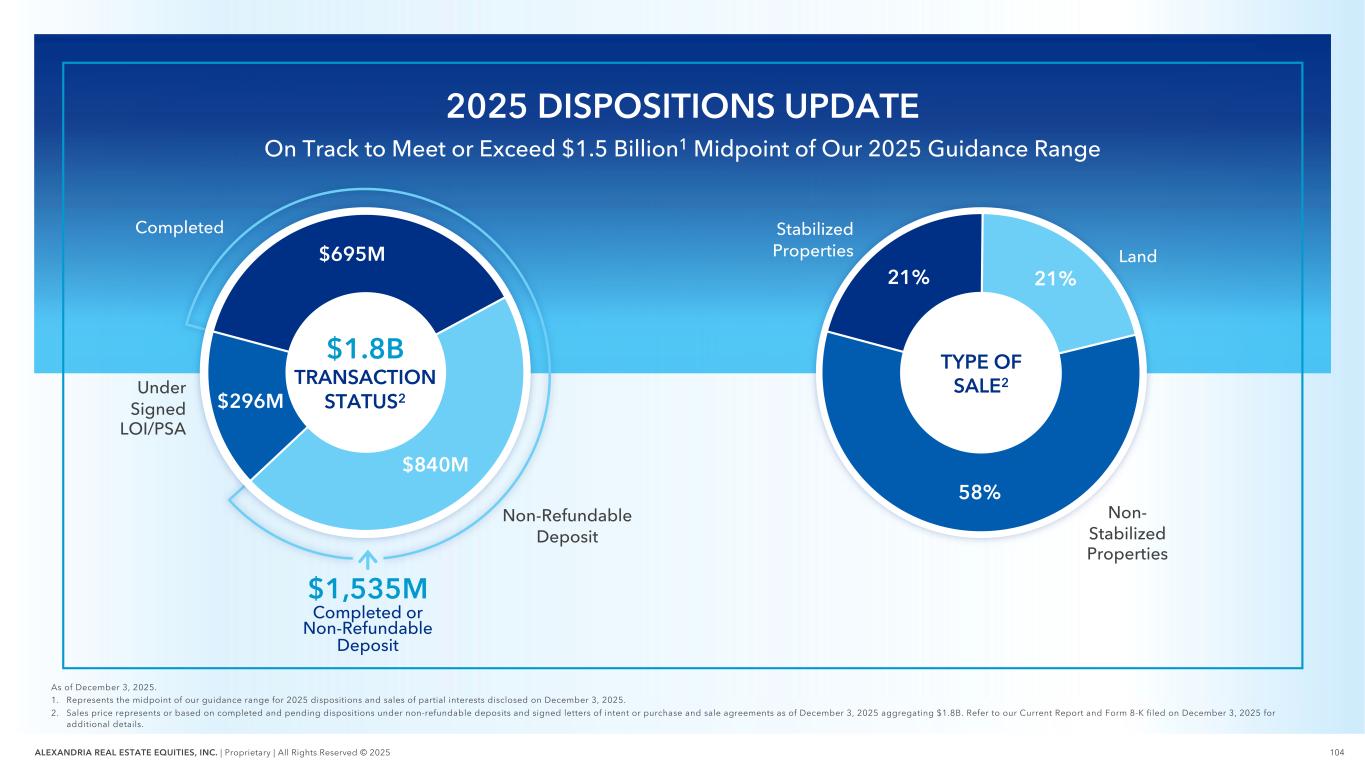

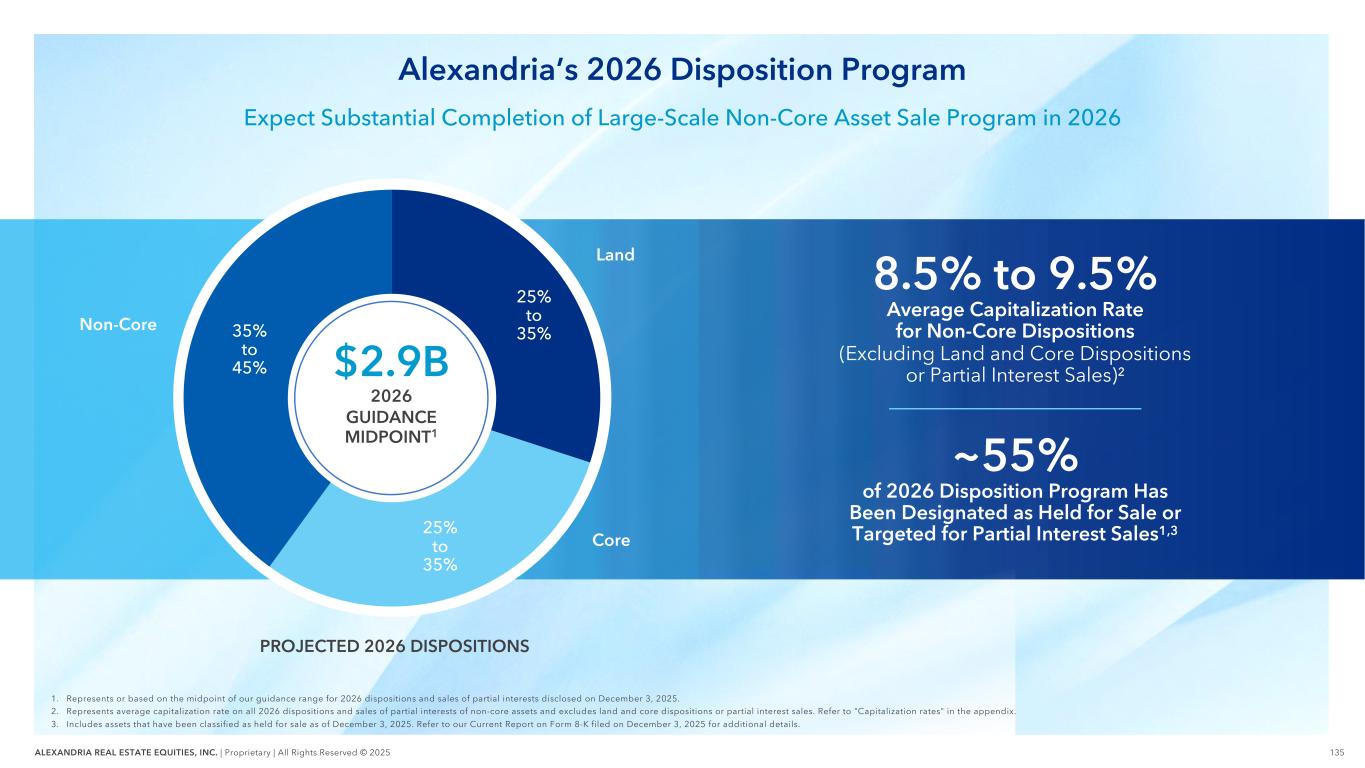

16ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 SUBSTANTIALLY COMPLETE LARGE-SCALE NON-CORE DISPOSITION PLAN 1. Represents completed and pending dispositions under non-refundable deposits and signed letters of intent or purchase and sale agreements as of December 3, 2025. 2. Represents the midpoint of our guidance range for 2026 dispositions and sales of partial interests disclosed on December 3, 2025. 3 DISPOSITIONS AND SALES OF PARTIAL INTERESTS $2.6B $2.2B $1.3B $1.4B $1.8B $2.9B 2021 2022 2023 2024 2025 Completed & Pending¹ 2026 Guidance Midpoint² Reduce Asset Base Size to Position the Company for Growth on Megacampuses

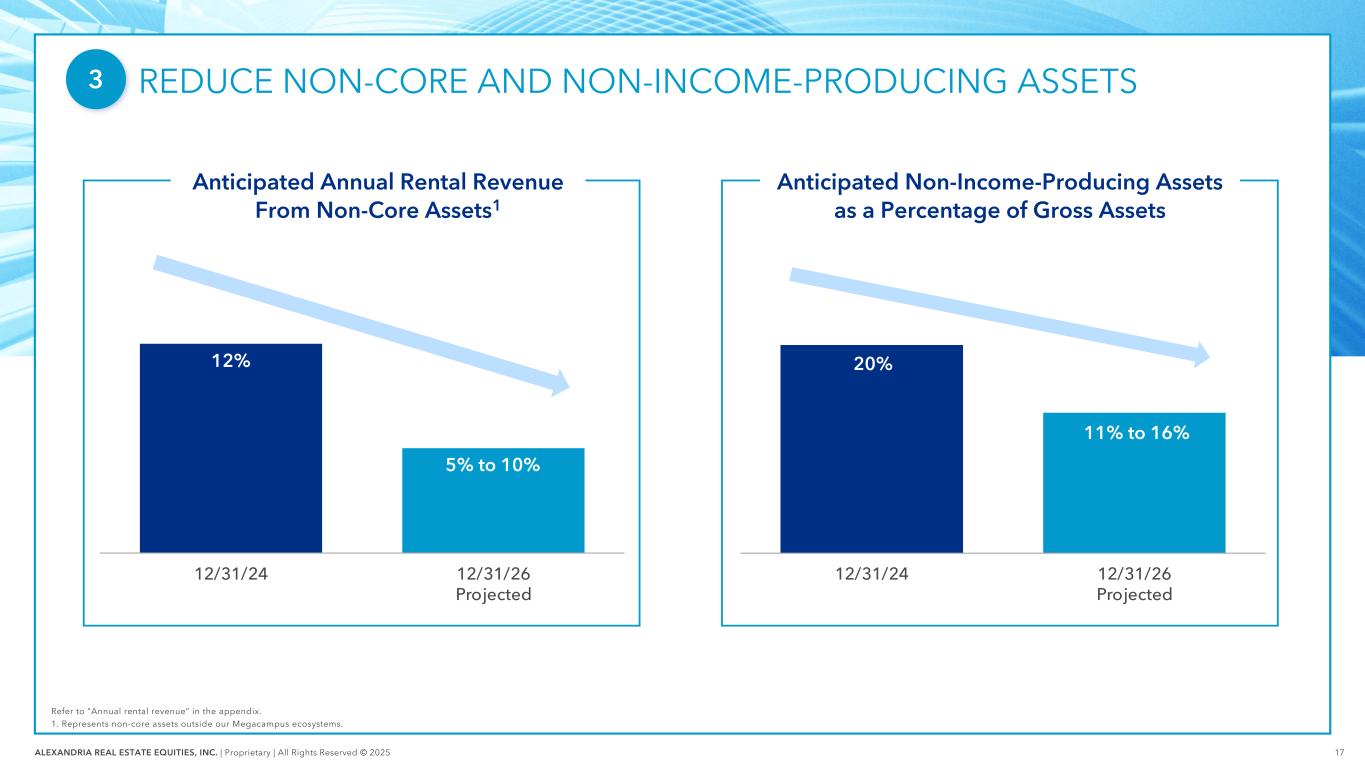

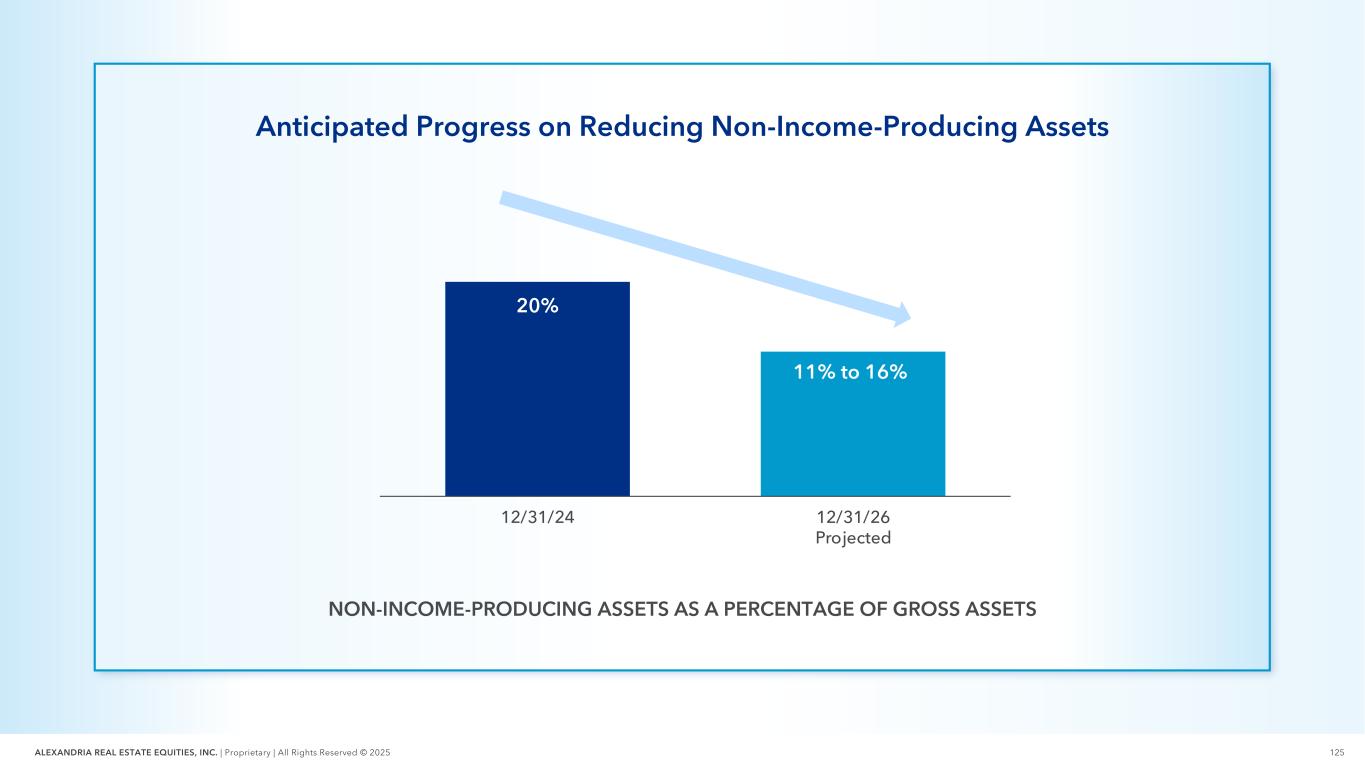

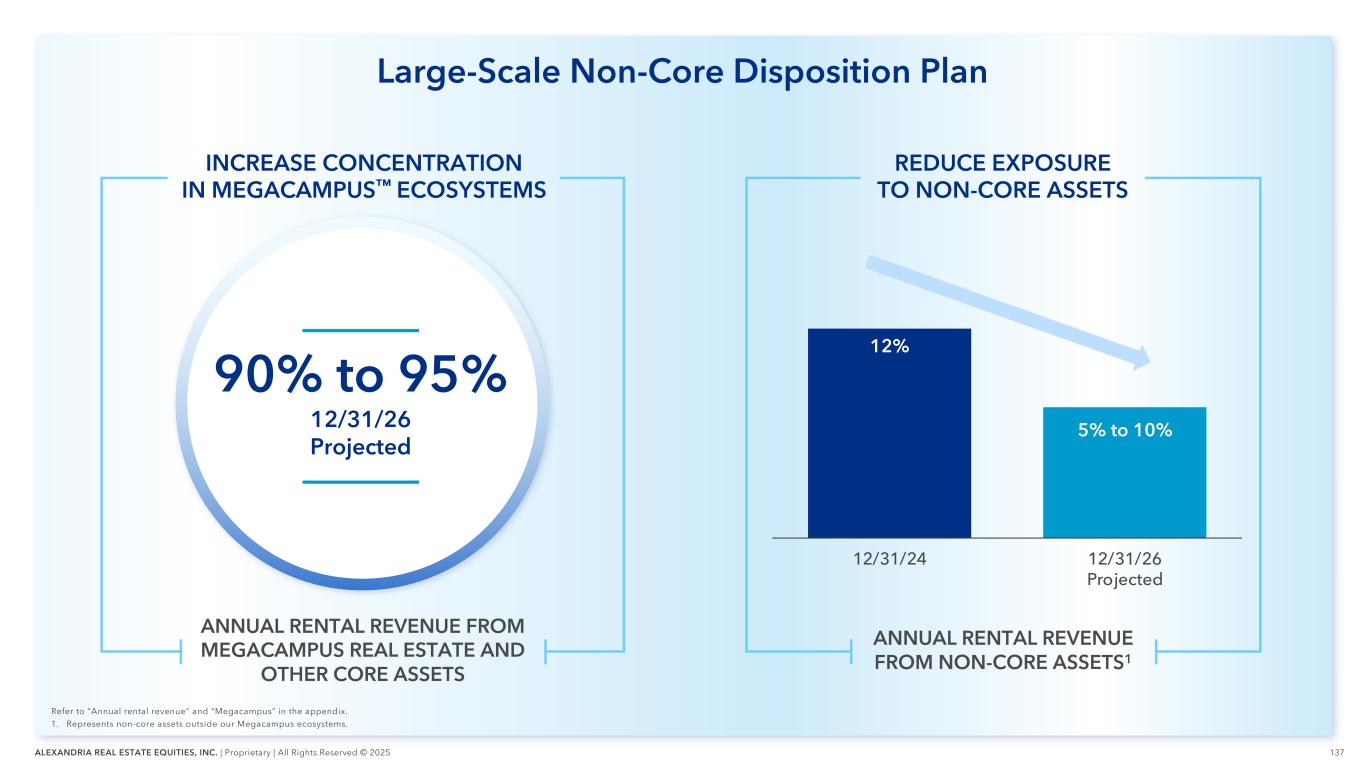

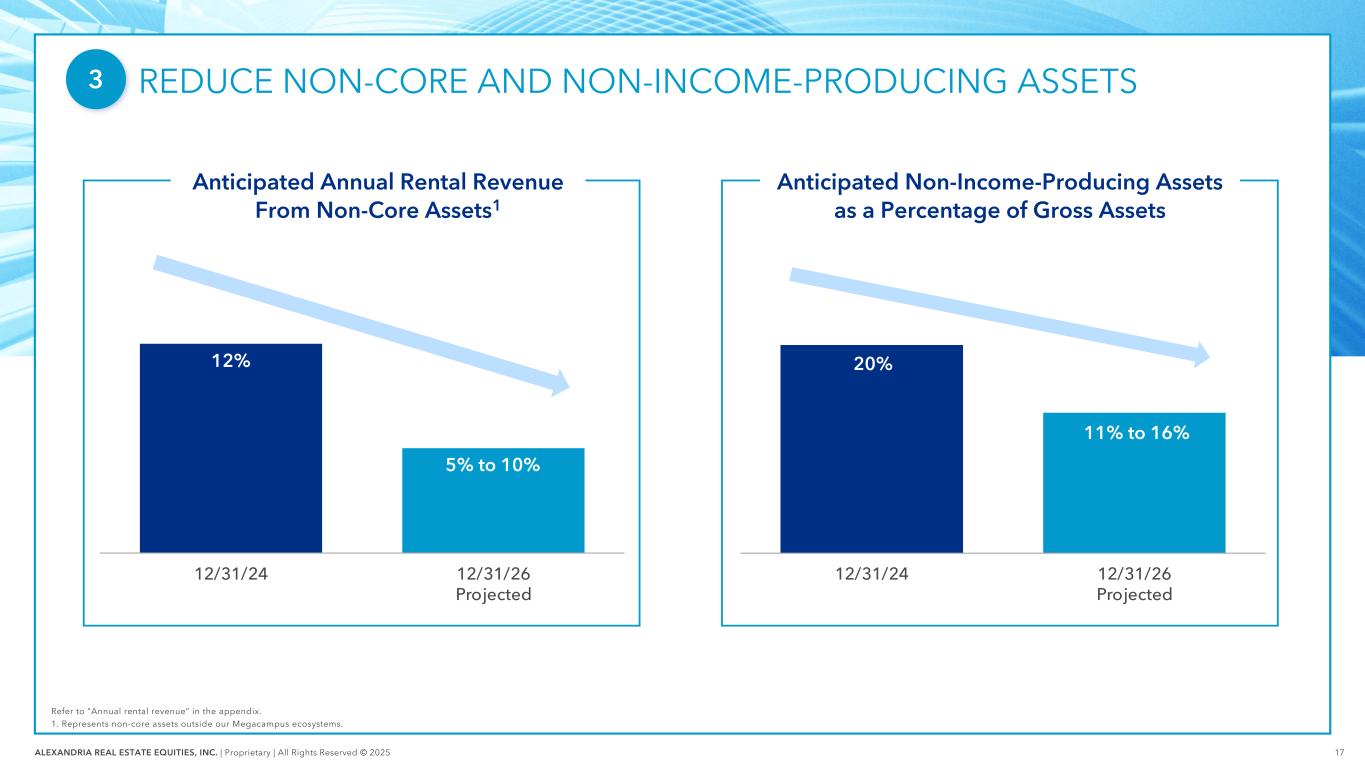

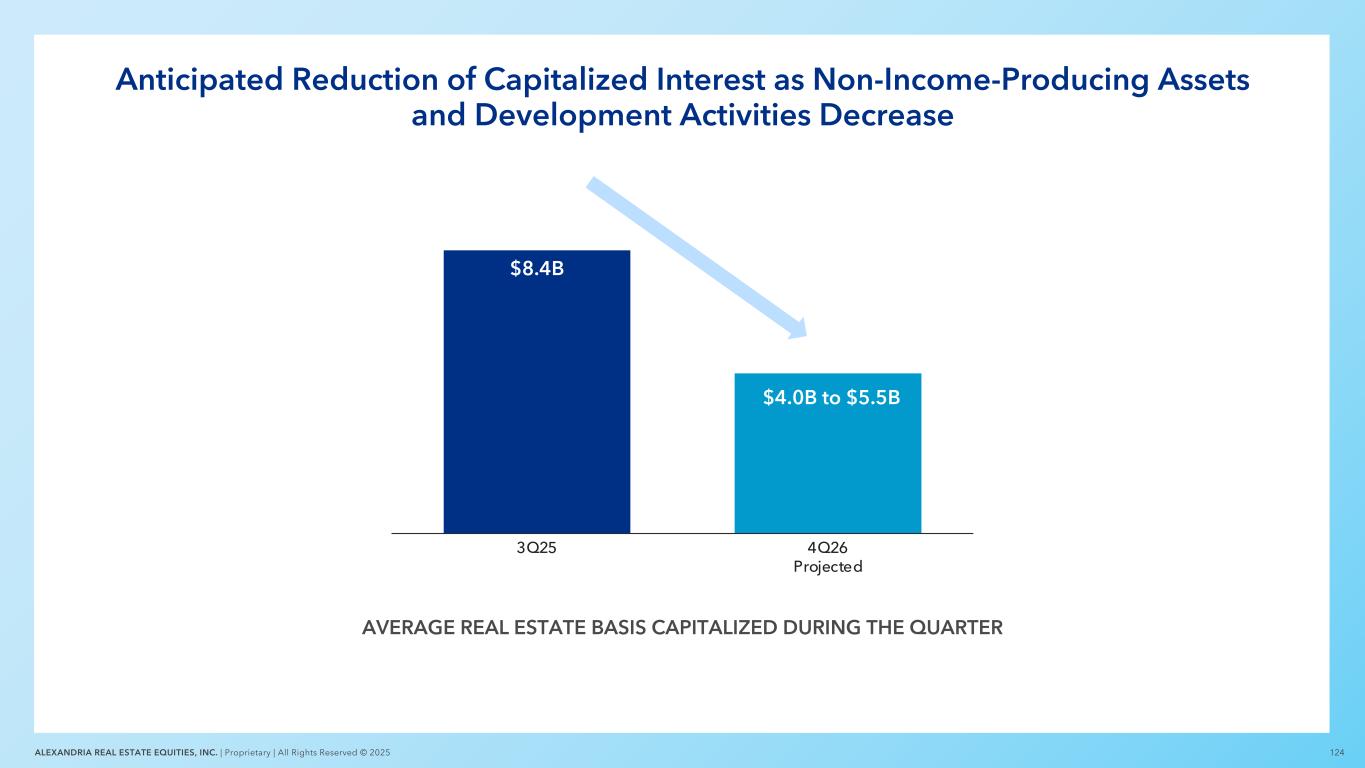

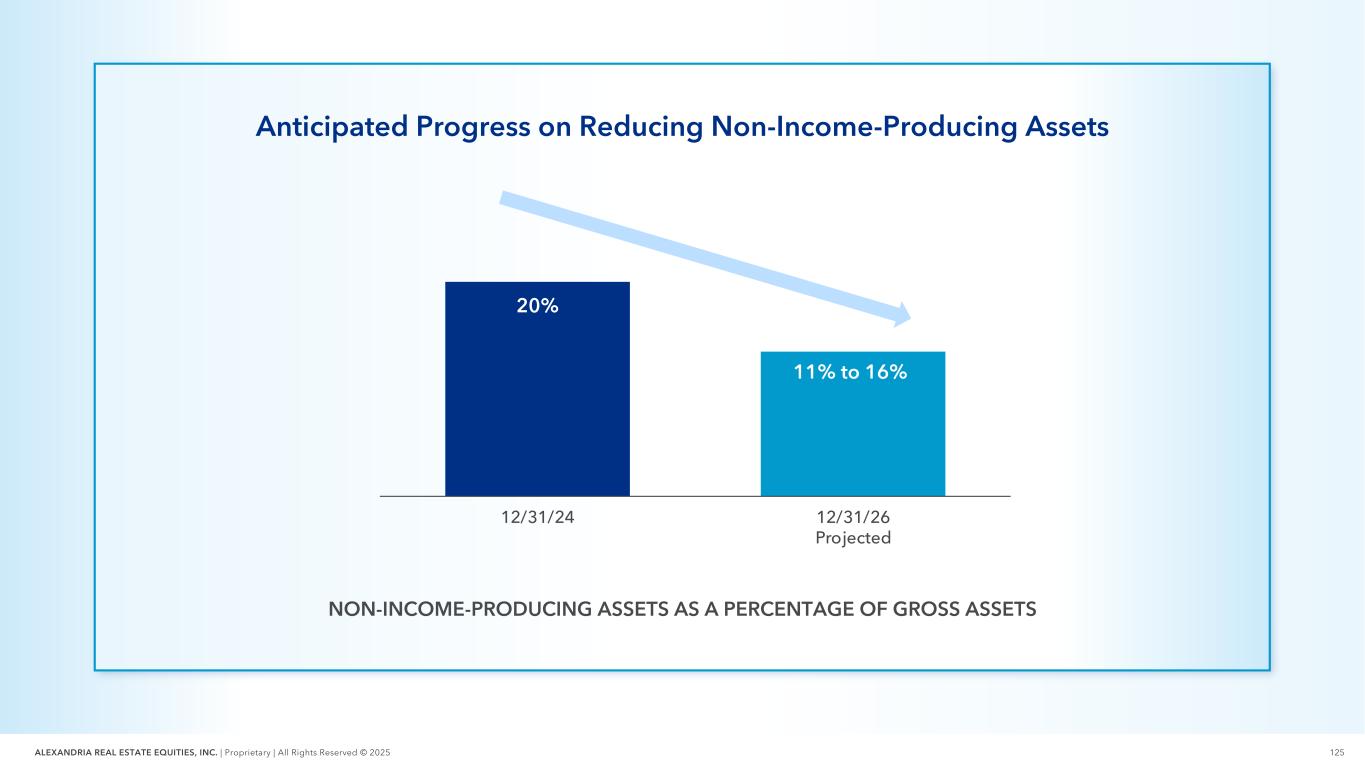

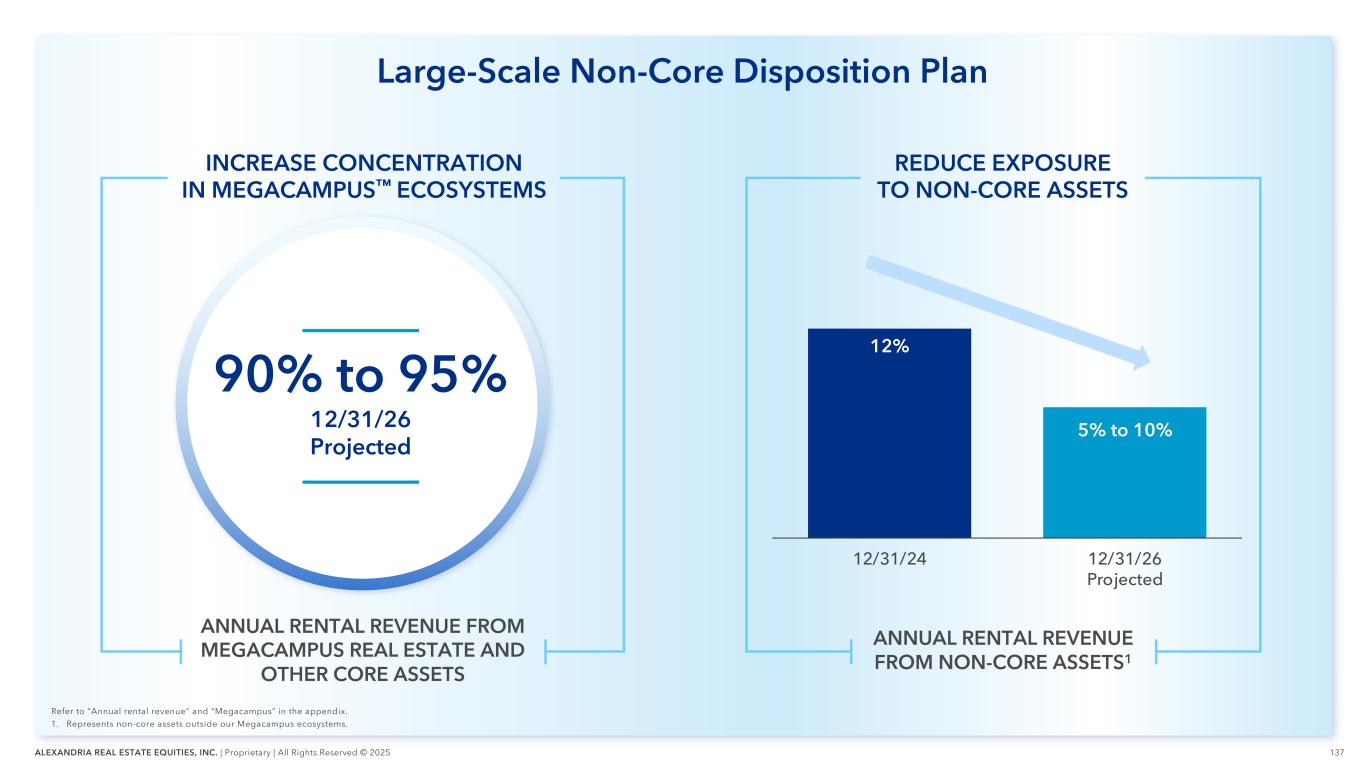

17ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 12% 5% to 10% 12/31/24 12/31/26 Projected REDUCE NON-CORE AND NON-INCOME-PRODUCING ASSETS Refer to “Annual rental revenue” in the appendix. 1. Represents non-core assets outside our Megacampus ecosystems. 3 20% 11% to 16% 12/31/24 12/31/26 Projected Anticipated Non-Income-Producing Assets as a Percentage of Gross Assets Anticipated Annual Rental Revenue From Non-Core Assets1

18ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 INCREASE CONCENTRATION IN MEGACAMPUS™ REAL ESTATE AND CORE ASSETS Refer to “Annual rental revenue” and “Megacampus” in the appendix. ANNUAL RENTAL REVENUE FROM MEGACAMPUS REAL ESTATE AND OTHER CORE ASSETS 3 90% to 95% 12/31/26 Projected CAMPUS POINT BY ALEXANDRIA MEGACAMPUS SAN DIEGO

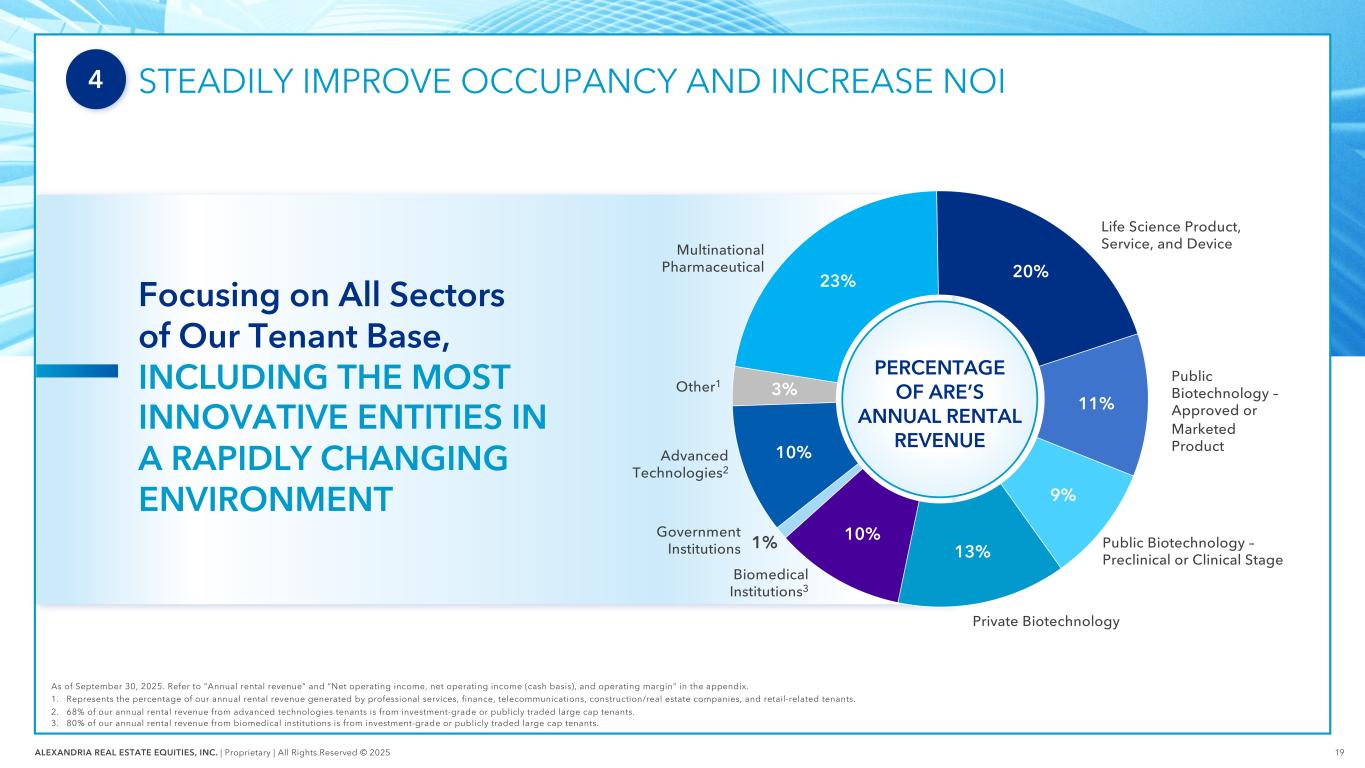

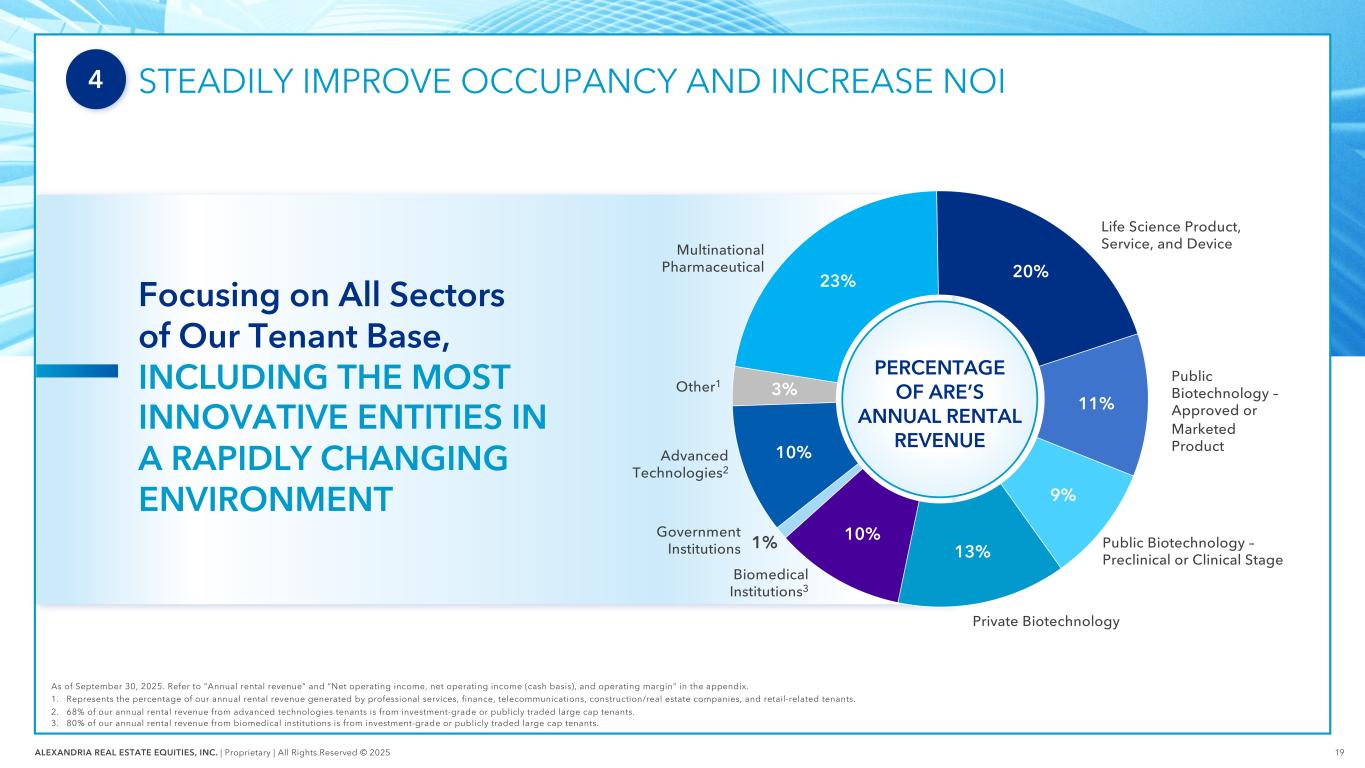

19ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 As of September 30, 2025. Refer to “Annual rental revenue” and “Net operating income, net operating income (cash basis), and operating margin” in the appendix. 1. Represents the percentage of our annual rental revenue generated by professional services, finance, telecommunications, construction/real estate companies, and retail-related tenants. 2. 68% of our annual rental revenue from advanced technologies tenants is from investment-grade or publicly traded large cap tenants. 3. 80% of our annual rental revenue from biomedical institutions is from investment-grade or publicly traded large cap tenants. STEADILY IMPROVE OCCUPANCY AND INCREASE NOI4 Public Biotechnology – Approved or Marketed Product 20% 11% 9% 13% 10%1% 10% 3% 23% Biomedical Institutions3 Life Science Product, Service, and Device Public Biotechnology – Preclinical or Clinical Stage Private Biotechnology Other1 Government Institutions Advanced Technologies2 PERCENTAGE OF ARE’S ANNUAL RENTAL REVENUE Focusing on All Sectors of Our Tenant Base, INCLUDING THE MOST INNOVATIVE ENTITIES IN A RAPIDLY CHANGING ENVIRONMENT Multinational Pharmaceutical

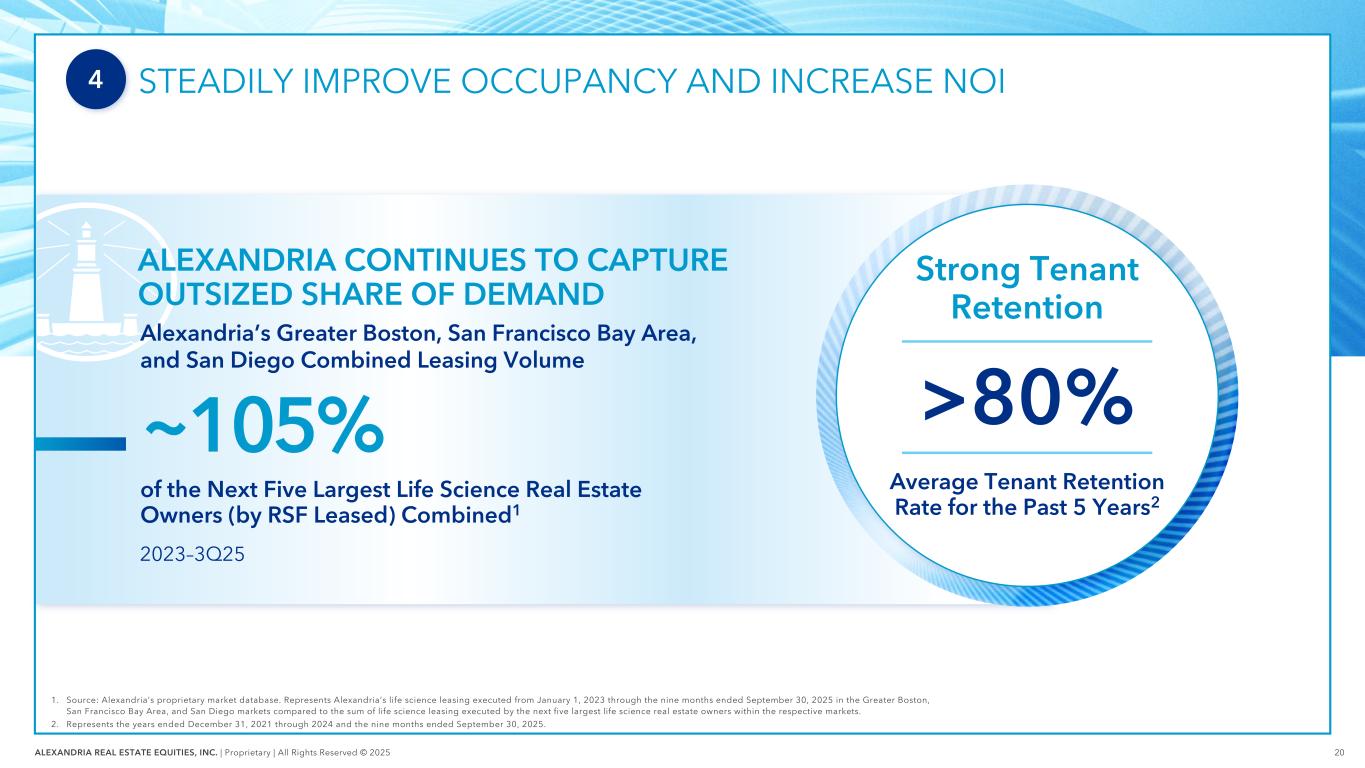

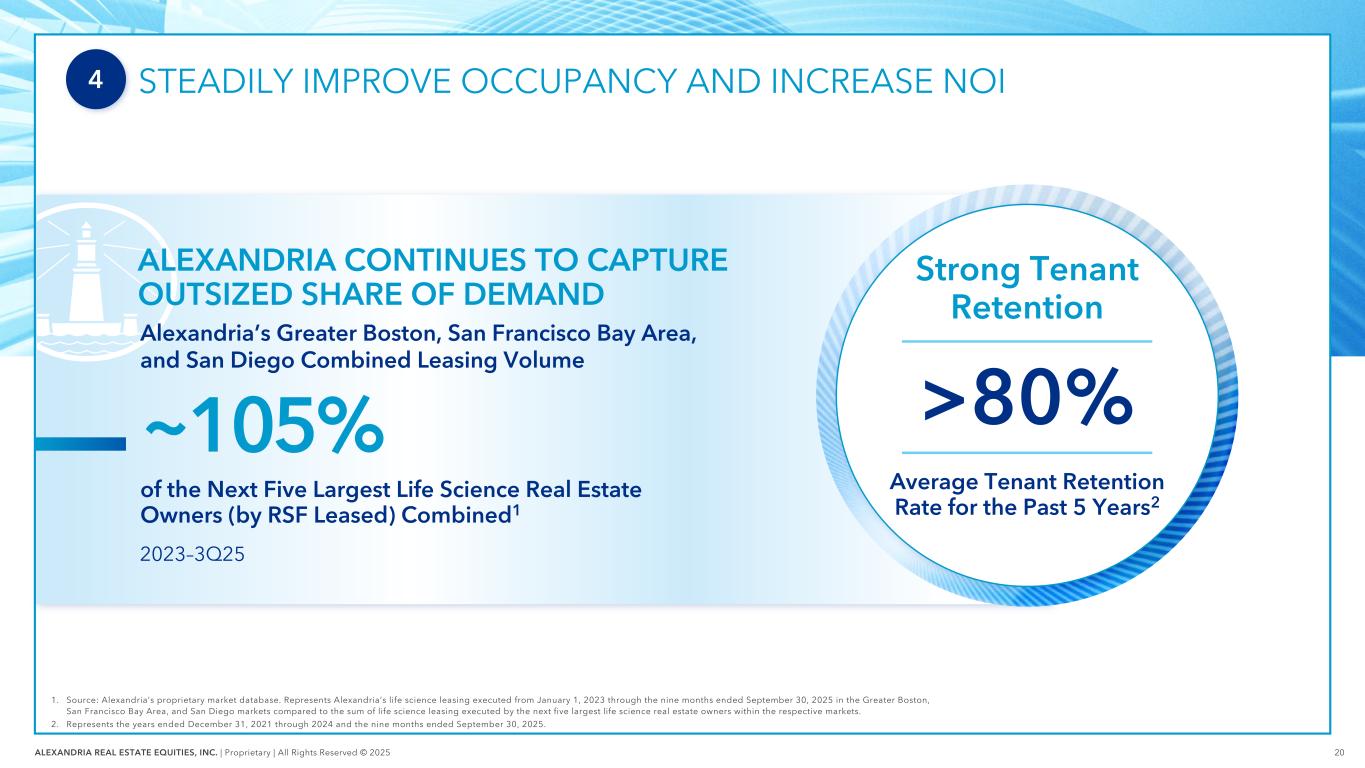

20ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 STEADILY IMPROVE OCCUPANCY AND INCREASE NOI4 2023–3Q25 1. Source: Alexandria’s proprietary market database. Represents Alexandria’s life science leasing executed from January 1, 2023 through the nine months ended September 30, 2025 in the Greater Boston, San Francisco Bay Area, and San Diego markets compared to the sum of life science leasing executed by the next five largest life science real estate owners within the respective markets. 2. Represents the years ended December 31, 2021 through 2024 and the nine months ended September 30, 2025. >80% Average Tenant Retention Rate for the Past 5 Years2 Strong Tenant Retention Alexandria’s Greater Boston, San Francisco Bay Area, and San Diego Combined Leasing Volume ~105% of the Next Five Largest Life Science Real Estate Owners (by RSF Leased) Combined1 ALEXANDRIA CONTINUES TO CAPTURE OUTSIZED SHARE OF DEMAND

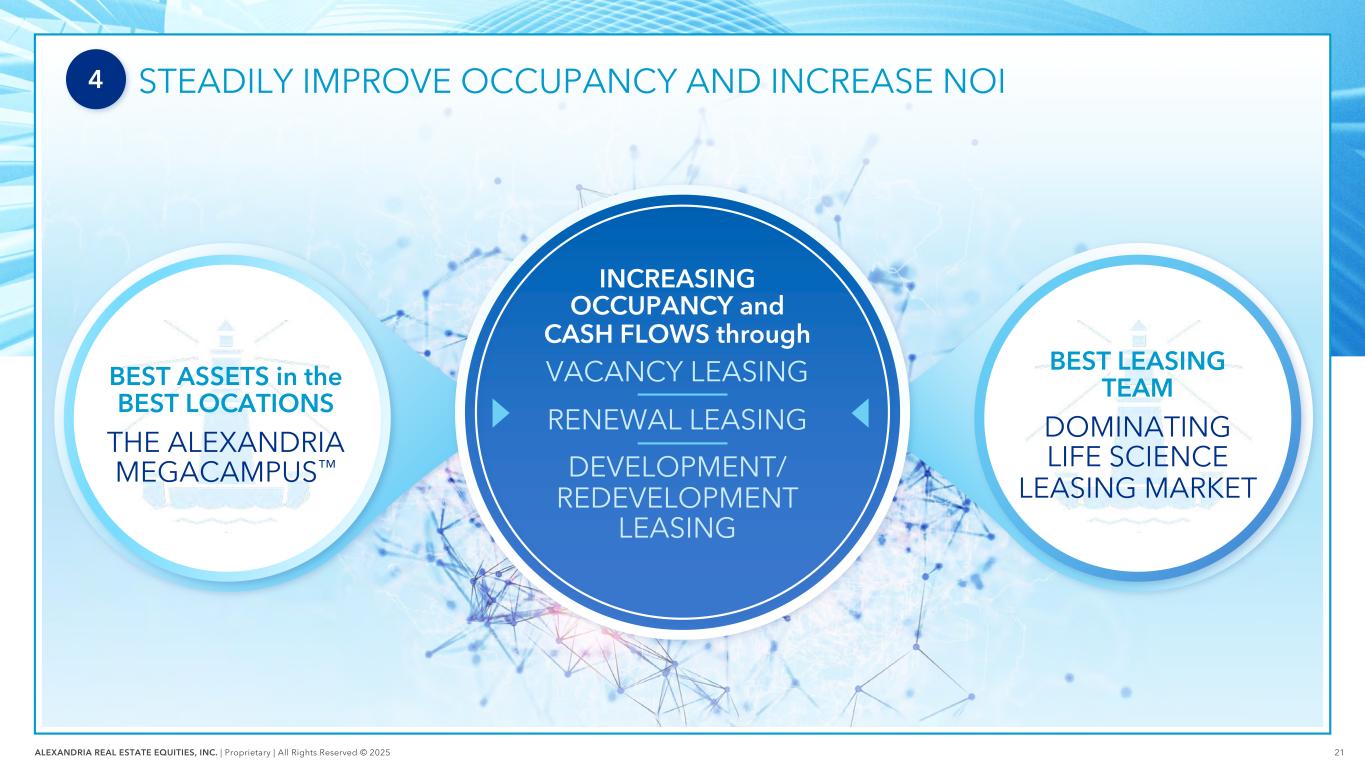

21ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 STEADILY IMPROVE OCCUPANCY AND INCREASE NOI4 BEST ASSETS in the BEST LOCATIONS THE ALEXANDRIA MEGACAMPUS™ BEST LEASING TEAM DOMINATING LIFE SCIENCE LEASING MARKET INCREASING OCCUPANCY and CASH FLOWS through VACANCY LEASING RENEWAL LEASING DEVELOPMENT/ REDEVELOPMENT LEASING

22ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 STEADILY IMPROVE OCCUPANCY AND INCREASE NOI 1. Refer to our Current Report on Form 8-K filed on December 3, 2025 for additional details. 2. Assumes static leasing volume for each year based on our leasing volume for the nine months ended September 30, 2025 annualized. 3. Assumes a base leasing volume in 2026 based on our leasing volume for the nine months ended September 30, 2025 annualized plus an additional 250K RSF of annual leasing volume each year thereafter. 4. Assumes a base leasing volume in 2026 based on our leasing volume for the nine months ended September 30, 2025 annualized plus an additional 400K RSF of annual leasing volume each year thereafter. 2026 2027 2028 2029 Total Lease Expirations as of 3Q25, Excluding Assets Held for Sale as of 12/3/251 2,867K 2,952K 3,817K 1,897K 4 RSF Illustrative Occupancy Crosswalk Through 2029 Annualized 3Q25 YTD Leasing + 400K RSF Annually Illustrative Leasing Volume4 (Excluding Development/Redevelopment) 3,031K 3,431K 3,831K 4,231K Implied Net Cumulative Occupancy Change 164K 643K 657K 2,990K 9.1% Implied Cumulative Occupancy Impact Annualized 3Q25 YTD Leasing Illustrative Leasing Volume2 (Excluding Development/Redevelopment) 3,031K 3,031K 3,031K 3,031K Implied Net Cumulative Occupancy Change 164K 243K (543K) 590K 1.8% Implied Cumulative Occupancy Impact 6.4% Implied Cumulative Occupancy Impact Annualized 3Q25 YTD Leasing + 250K RSF Annually Illustrative Leasing Volume3 (Excluding Development/Redevelopment) 3,031K 3,281K 3,531K 3,781K Implied Net Cumulative Occupancy Change 164K 493K 207K 2,090K

23ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 Average Annual Contractual Rent Escalations2 FAVORABLE LEASE STRUCTURE PROVIDES ANNUAL CONTRACTUAL CASH RENTAL REVENUE GROWTH 1. Percentage calculated based on our annual rental revenue in effect as of September 30, 2025. Refer to “Annual rental revenue” in the appendix. 2. Annual contractual escalations of approximately 3% are based on weighted-average annual rental revenues in effect as of September 30, 2025. 4 Percentage of Leases Containing Annual Rent Escalations1 97% ~3% Average Annual Contractual Rent Escalations2 ~$50M–$60M Average Annual Cash Rent Increases From Contractual Rent Escalations2

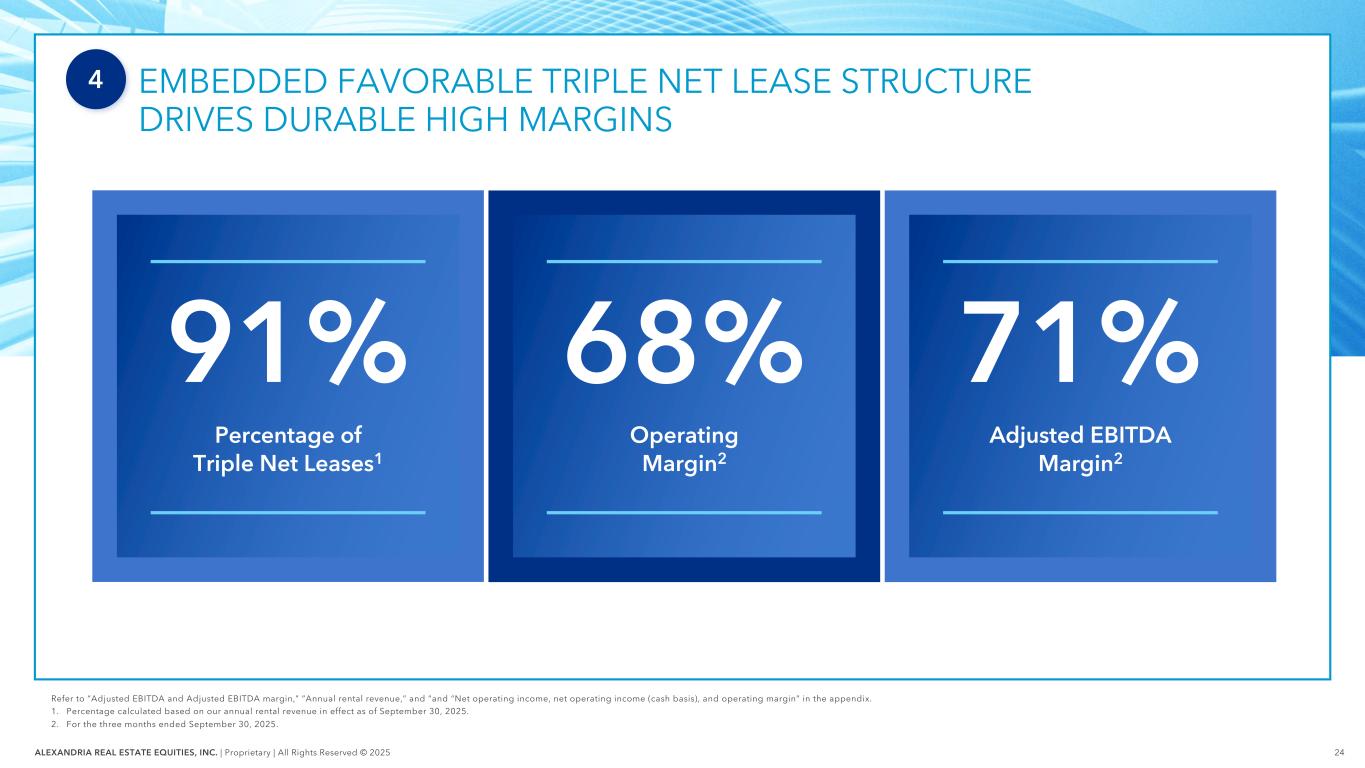

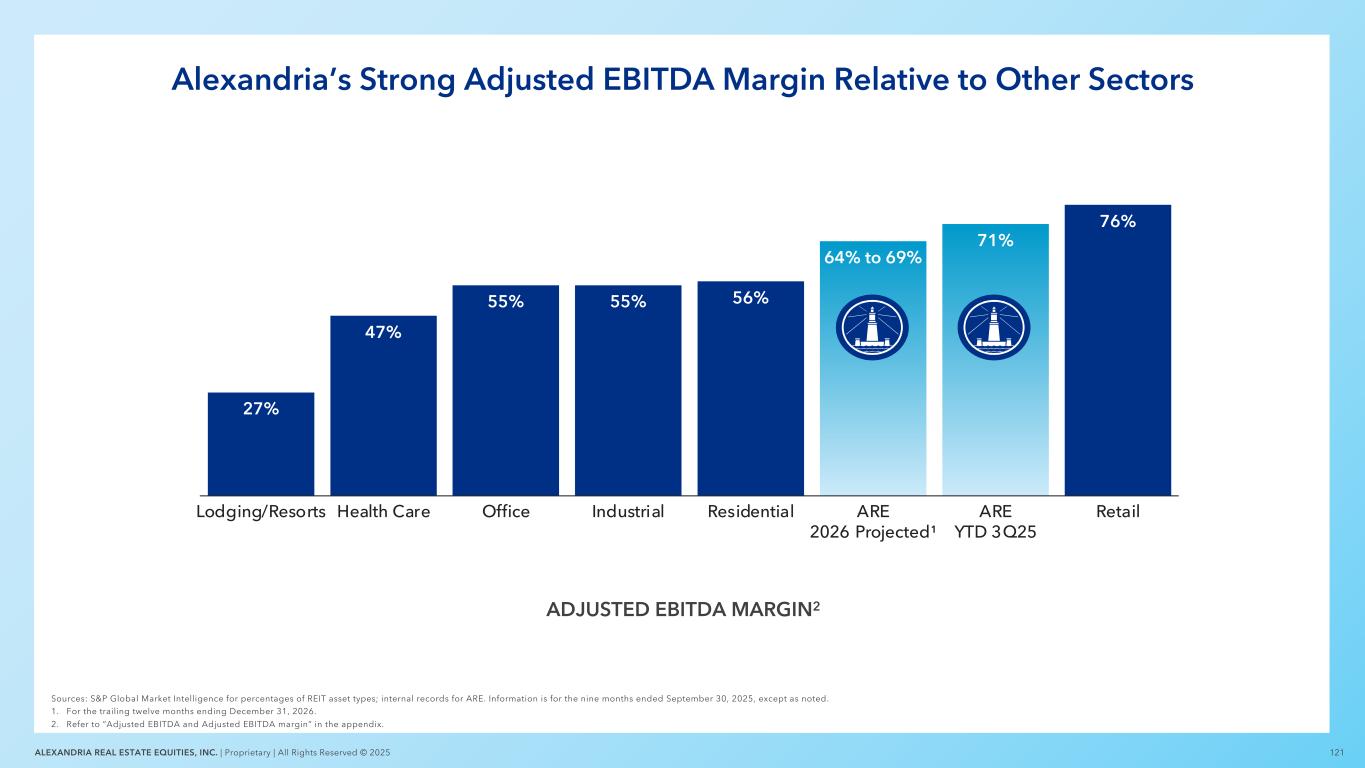

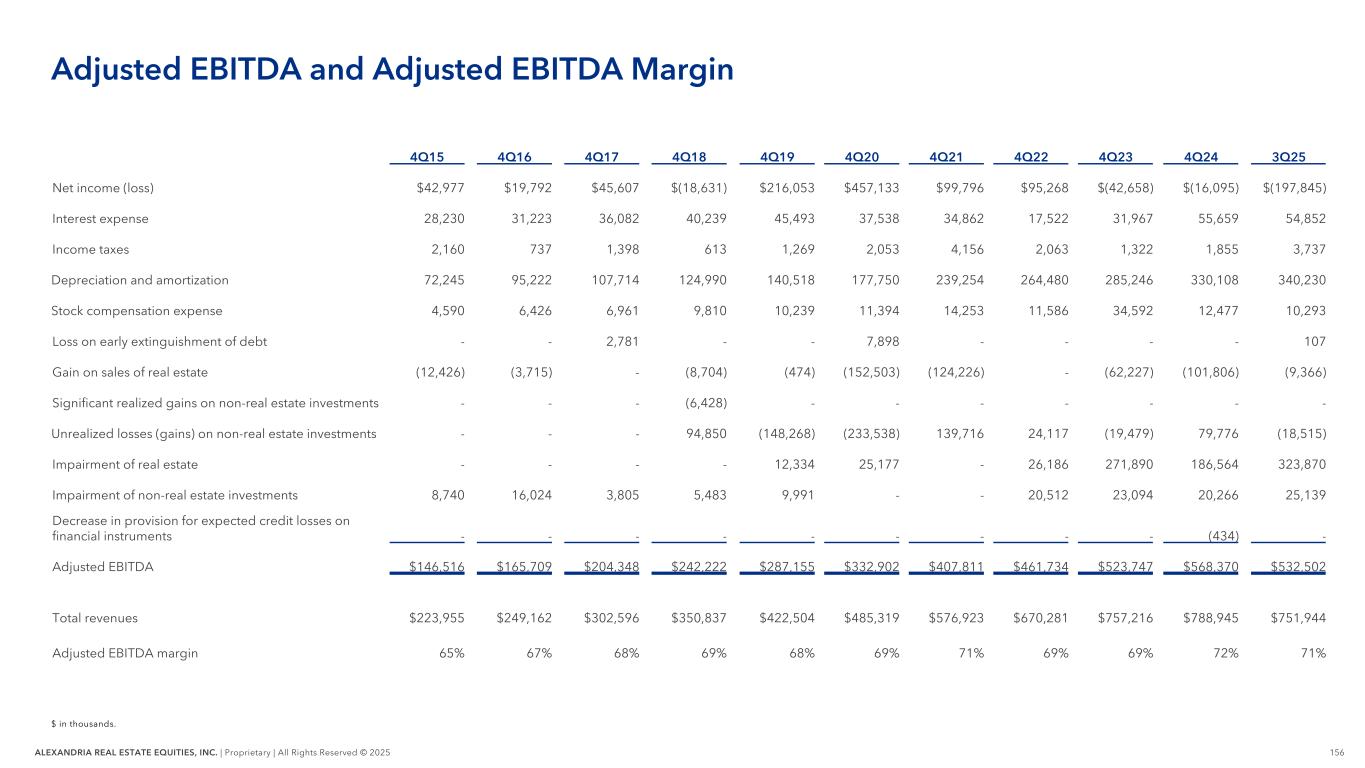

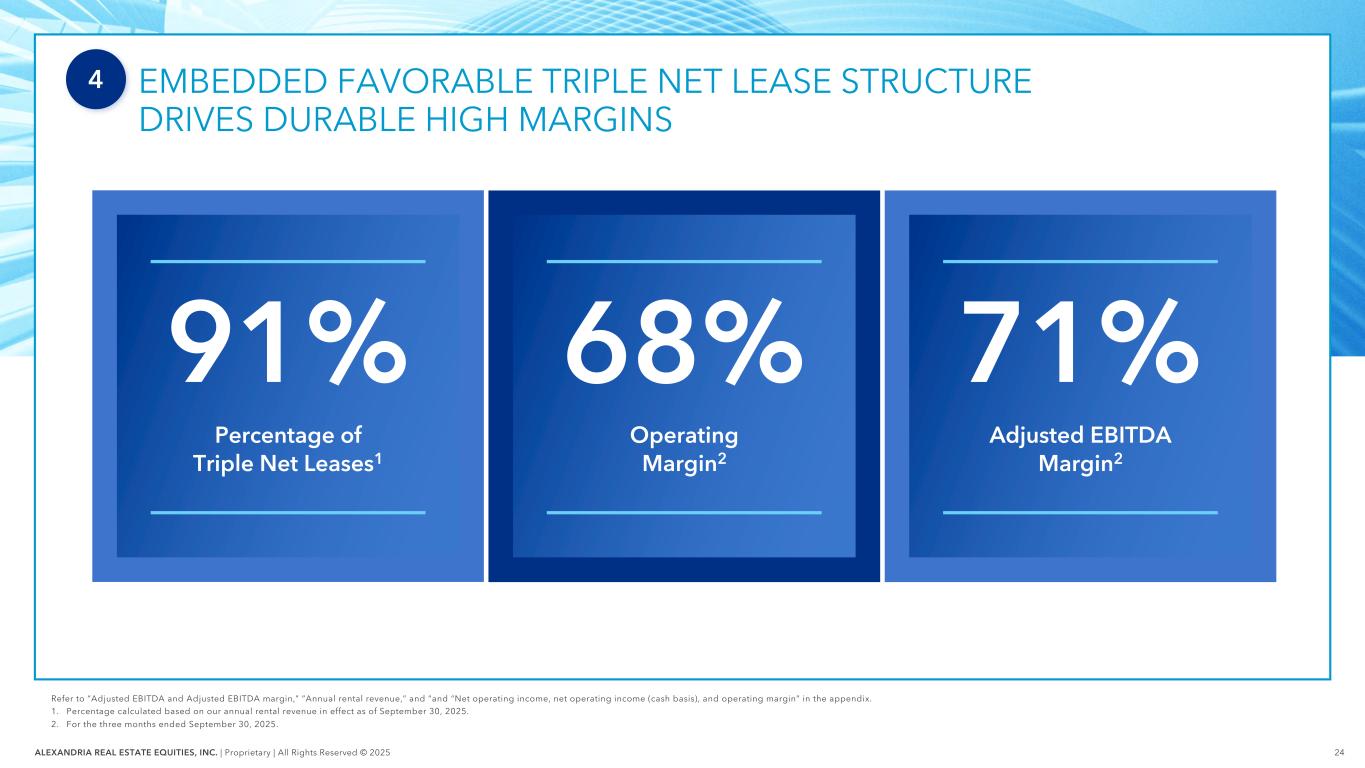

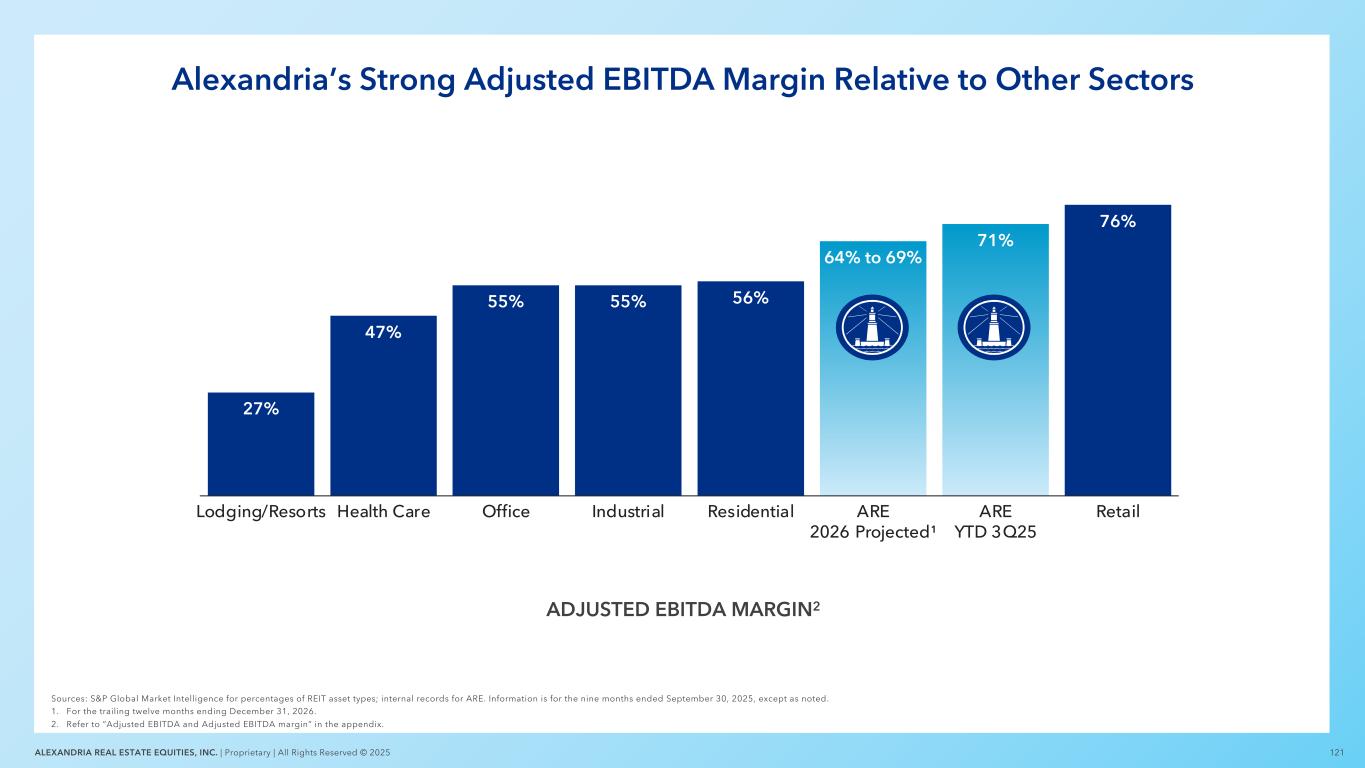

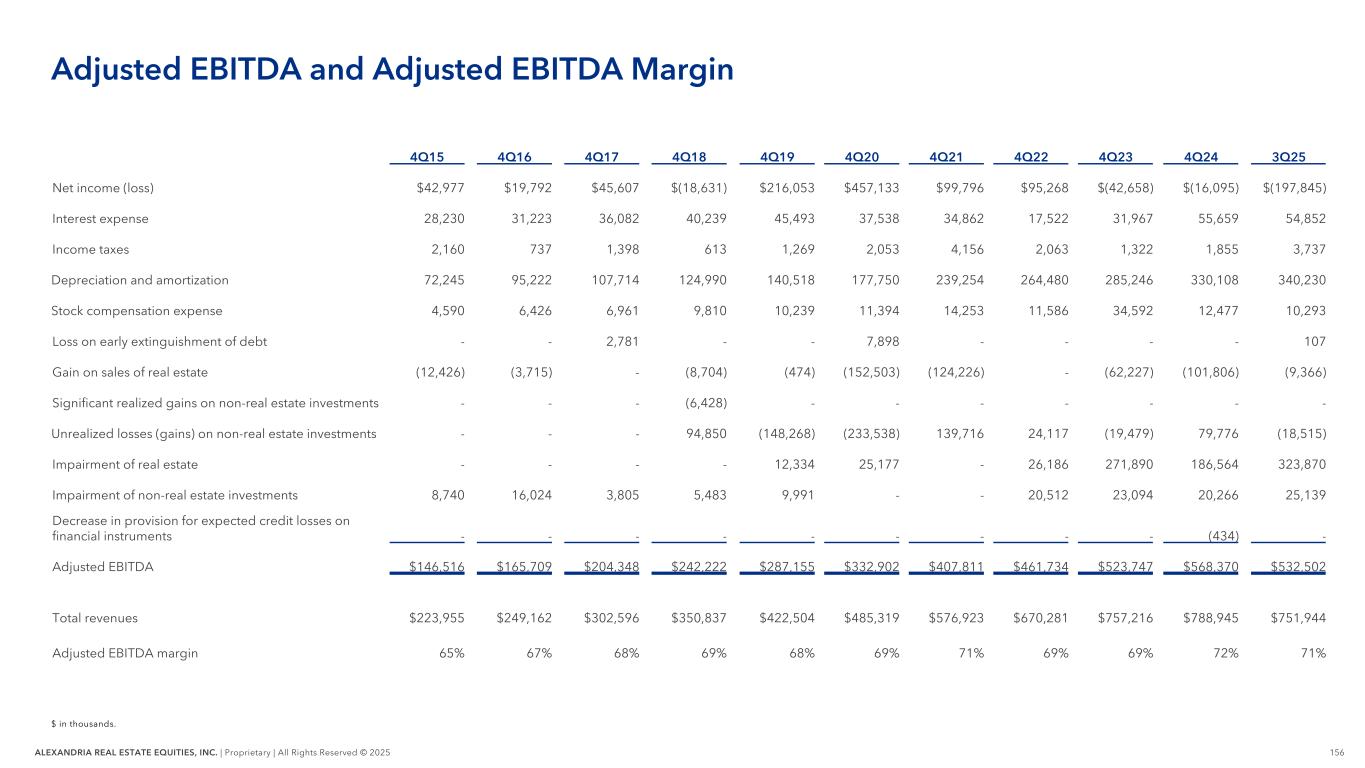

24ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 Average Annual Contractual Rent Escalations2 EMBEDDED FAVORABLE TRIPLE NET LEASE STRUCTURE DRIVES DURABLE HIGH MARGINS Refer to “Adjusted EBITDA and Adjusted EBITDA margin,” “Annual rental revenue,” and “and “Net operating income, net operating income (cash basis), and operating margin” in the appendix. 1. Percentage calculated based on our annual rental revenue in effect as of September 30, 2025. 2. For the three months ended September 30, 2025. 4 91% Percentage of Triple Net Leases1 68% Operating Margin2 71% Adjusted EBITDA Margin2

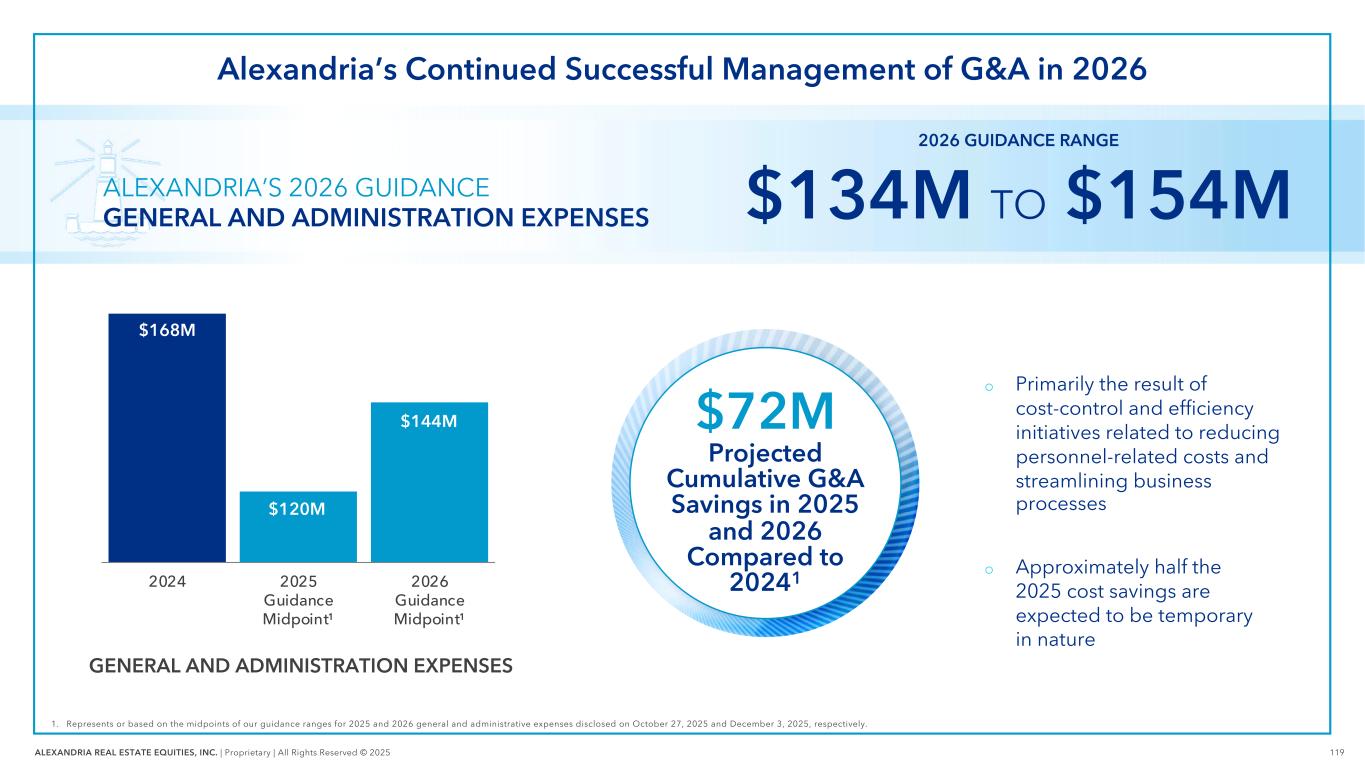

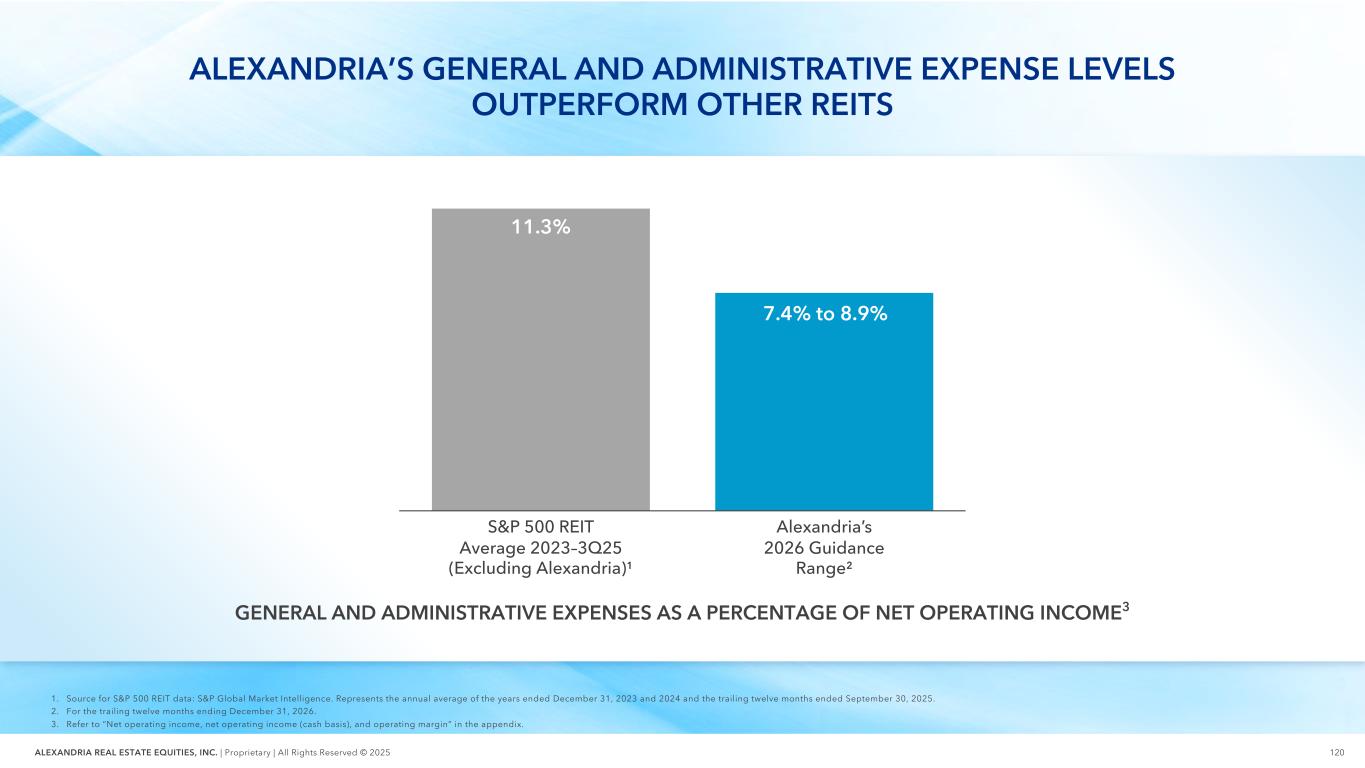

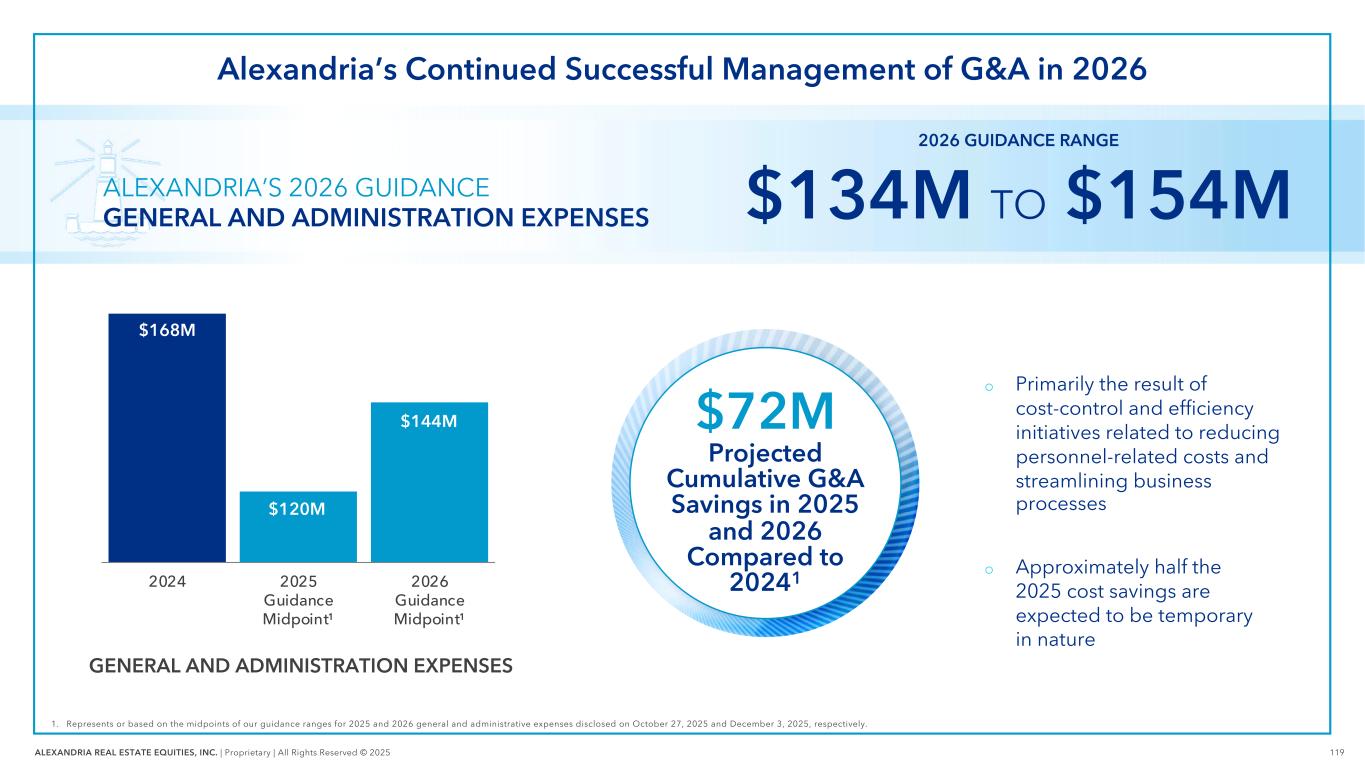

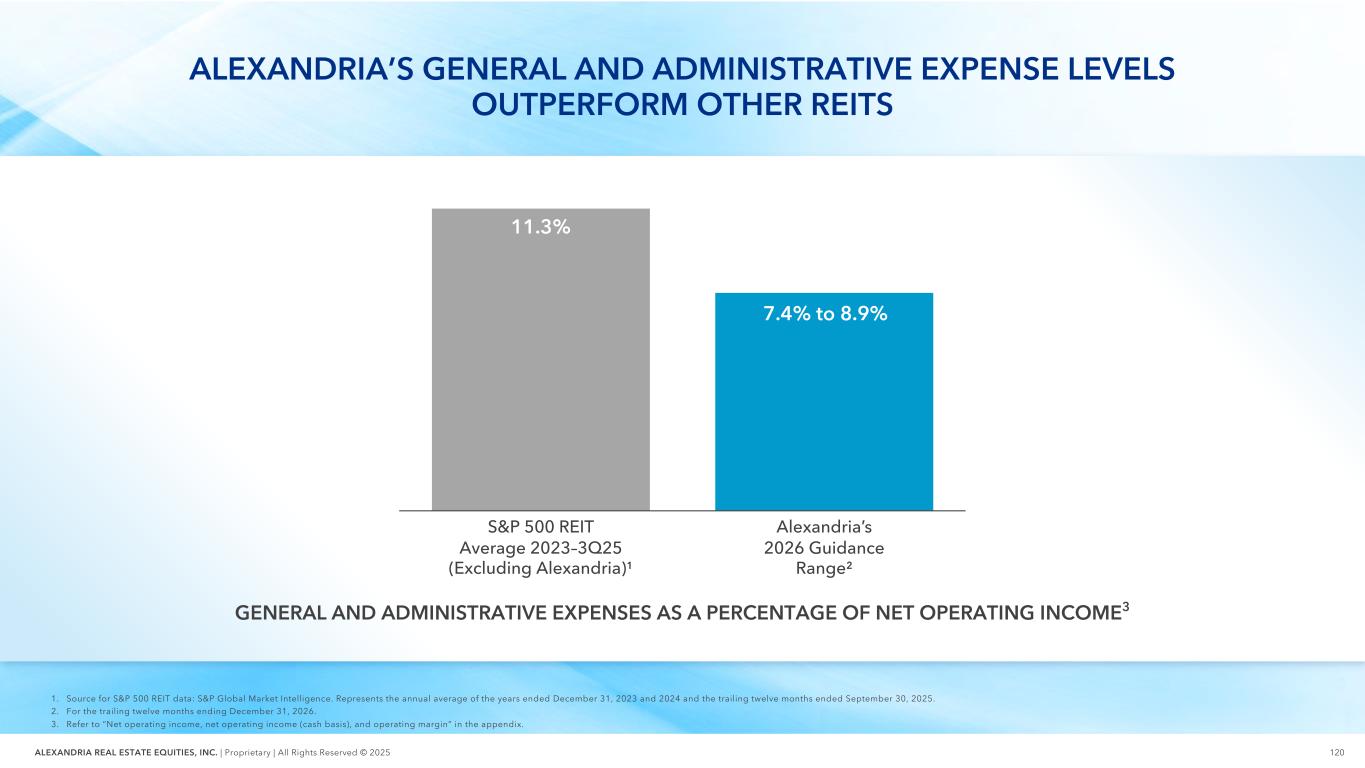

25ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 Alexandria’s General and Administrative Expense Levels Outperform Other REITs GENERAL AND ADMINISTRATIVE EXPENSES AS A PERCENTAGE OF NET OPERATING INCOME4 CONTINUE TO SUCCESSFULLY MANAGE G&A 1. Based on the midpoints of our guidance ranges for 2025 and 2026 general and administrative expenses disclosed on October 27, 2025 and December 3, 2025, respectively. 2. Trailing twelve months ended September 30, 2025. 3. Source for S&P 500 REIT data: S&P Global Market Intelligence. Represents the annual average of the years ended December 31, 2023 and 2024 and the trailing twelve months ended September 30, 2025. 4. Refer to “Net operating income, net operating income (cash basis), and operating margin” in the appendix. 5 11.3% S&P 500 REIT Average 2023–3Q25 (Excluding Alexandria)3 5.7% Alexandria 3Q252 $72M Projected Cumulative G&A Savings in 2025 and 2026 Compared to 20241

26ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 Refer to “Megacampus” in the appendix. MAINTAIN OPTIONALITY FOR FUTURE GROWTH FOCUSED ON MEGACAMPUS™ INVESTMENT 6 ALEXANDRIA CENTER® FOR LIFE SCIENCE – SAN CARLOS MEGACAMPUS SAN FRANCISCO BAY AREA

27ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 7 CONSIDER FLEXIBLE AND OPPORTUNISTIC SHARE BUYBACK PLAN 1. Alexandria’s closing share price on November 25, 2025. 2. Based on the average of net asset values provided by sell-side analysts with Alexandria coverage as of November 25, 2025. ALEXANDRIA SHARE PRICE1 $52.65 PER SHARE $94 AVERAGE SELL-SIDE NET ASSET VALUE2 Buyback Opportunity Represents Significant Discount to Net Asset Value

28ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 PRESERVE THE CORE AND STIMULATE PROGRESS Enduring great organizations exhibit a dynamic duality. On the one hand, they have a set of timeless core values and purpose that remain constant over time. On the other hand, they have a relentless drive for progress — change, improvement, innovation, and renewal.” JIM COLLINS Renowned Author & Business Strategist

29ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 INVESTOR DAY 2025 Alexandria’s Reset and Path Forward

30ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 KEY DISEASE AREAS OF SIGNIFICANT UNMET NEED IN THE UNITED STATES Adults Suffering From One or More Chronic Diseases2 CHRONIC DISEASE 129M Deaths Due to Heart Disease, the Leading Cause of Death3 HEART DISEASE 1 in 5 of Individuals Will Be Diagnosed With Cancer During Their Lifetime4 CANCER 40% Adults Over 65 Living With Alzheimer’s Disease5 ALZHEIMER’S DISEASE 7.2M IMMENSE OPPORTUNITY: 10,000 DISEASES 90% HAVE NO TREATMENTS1 1. Source: U.S. House Committee on Energy and Commerce, “The 21st Century Cures Discussion Document White Paper,” January 27, 2015. 2. Source: PhRMA, “Medicines in Development for Chronic Diseases: 2024 Report.” 3. Source: Centers for Disease Control and Prevention, “Heart Disease Facts,” October 24, 2024. Represents the latest published data, which reflects the U.S. estimate for 2022. 4. Source: National Cancer Institute, “Cancer Statistics,” updated May 7, 2025. Represents the latest published data, which reflects 2018–2021 data, not including 2020 due to lack of collection during COVID. 5. Source: Alzheimer’s Association, “2025 Alzheimer’s Disease Facts and Figures.” Represents the latest published data, which reflects the U.S. estimate for 2025. After transforming rare diseases and beginning to bend the mortality curve on cancer, the same tools, technologies, and molecular approaches — RNA interference, gene editing, and precision molecular engineering — are now turned toward the most prevalent and costly conditions ELI CASDIN Casdin Capital

31ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 CRITICAL PRIORITY FOR NATIONAL HEALTH, SECURITY, AND LEADERSHIP RELENTLESS INNOVATION SOLUTIONS TO ADDRESS MASSIVE UNMET MEDICAL NEED The life science industry is critical for maintaining a strong, safe, and healthy country and ensuring future economic growth The U.S. has the best substrate in the world to continue to drive the research, development, and commercialization of new medicines well into the future There are currently more than 10,000 diseases, over 90% of which still have NO approved treatments¹ THE LIFE SCIENCE INDUSTRY: A CORNERSTONE OF U.S. HEALTH, SECURITY, AND LEADERSHIP 1. Source: U.S. House Committee on Energy and Commerce, “The 21st Century Cures Discussion Document White Paper,” January 27, 2015.

32ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 2025: THE FIFTH YEAR OF A BROAD-BASED BIOTECH BEAR MARKET President Trump sworn into office RFK Jr. sworn in as HHS Secretary DOGE lays off thousands of FDA and CDC staff; 50% of FDA leadership will leave over the coming months NIH announces plan to cap institutional indirect grant funding at 15% Trump’s Liberation Day tariff announcement causes broad market sell-off White House initiates Section 232 investigation into pharma imports, which would potentially raise U.S. drug costs by $51B annually LB Pharma issues IPO, marking the first biotech IPO in six months Fed lowers interest rates Trump threatens a 100% tariff on branded medicines unless pharma companies build manufacturing sites in the U.S. Dr. Vinay Prasad sworn in as Head of FDA CBER; will resign in July under White House pressure and be reinstated in August White House issues executive order demanding pharma cut prices and directs HHS to implement most-favored-nation pricing White House proposes $18B (40%) cut to NIH funding Dr. Marty Makary sworn in as FDA Commissioner NIH announces sweeping termination of active grants Trump issues letters to 17 biopharma CEOs, demanding they take steps to cut U.S. drug prices HHS Secretary Kennedy removes all members of CDC vaccine advisory board SVB reports lowest levels of capital raised by life science venture funds since 2016 FDA approves 16 novel therapies through 1H25, compared to average of 12 per quarter in previous 5 years HHS Secretary Kennedy pressures CDC Director Monarez into resigning Government shuts down after Congress fails to come to a budget resolution; all FDA submissions paused Takeda inks $1.2B upfront deal ($11.4B total) with China-based Innovent Biologics, one of many multibillion-dollar in-licensing deals by Chinese companies announced in 2025 JAN FEB MAR MAY JUN JUL SEP OCTAUG NOVAPR The Highly Regulated Life Science Industry Has Confronted the Cumulative Impact of a Wave of Market, Regulatory, Policy, and Global Headwinds Medicare unveils price reductions for 15 drugs as part of the IRA Tensions reportedly escalate between FDA Commissioner Makary and HHS Secretary Kennedy FDA CDER Director Tidmarsh resigns amid investigation Dr. Richard Pazdur takes over CDER Director role, questions legality of voucher program NIH cancels all grant reviews set to occur during shutdown In a leaked memo, the FDA proposes introduction of stricter vaccine approval rules Researchers estimate companies have halted 55 oncology research programs and abandoned 26 medicines since IRA’s passage CDER Director Pazdur informs FDA he intends to leave the agency DEC ARE INVESTOR DAY DEC. 2024

33ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 KEY CATALYSTS FOR GROWTH: Four Pillars of the U.S. Life Science Industry That Are Collectively Critical to Driving Demand STRONG BASIC & TRANSLATIONAL RESEARCH INNOVATIVE ENTREPRENEURIAL ENVIRONMENT & ACCESS TO LOWER-COST CAPITAL 1 43 2 Discovery of fundamental disease biology that underpins the development of future medicines R&D funding across private, public biotech, and pharma to improve and extend lives RELIABLE AND EFFICIENT REGULATORY FRAMEWORK TO REDUCE TIME & COST OF FDA APPROVALS Transparent process for evaluating new medicines that is supported by reliable and efficient timelines and open communication HEALTHY PAYMENT ENVIRONMENT FOR INNOVATIVE MEDICINES Drug pricing policy that balances incentivizing new medicine development, potential long- term healthcare savings, and patient access

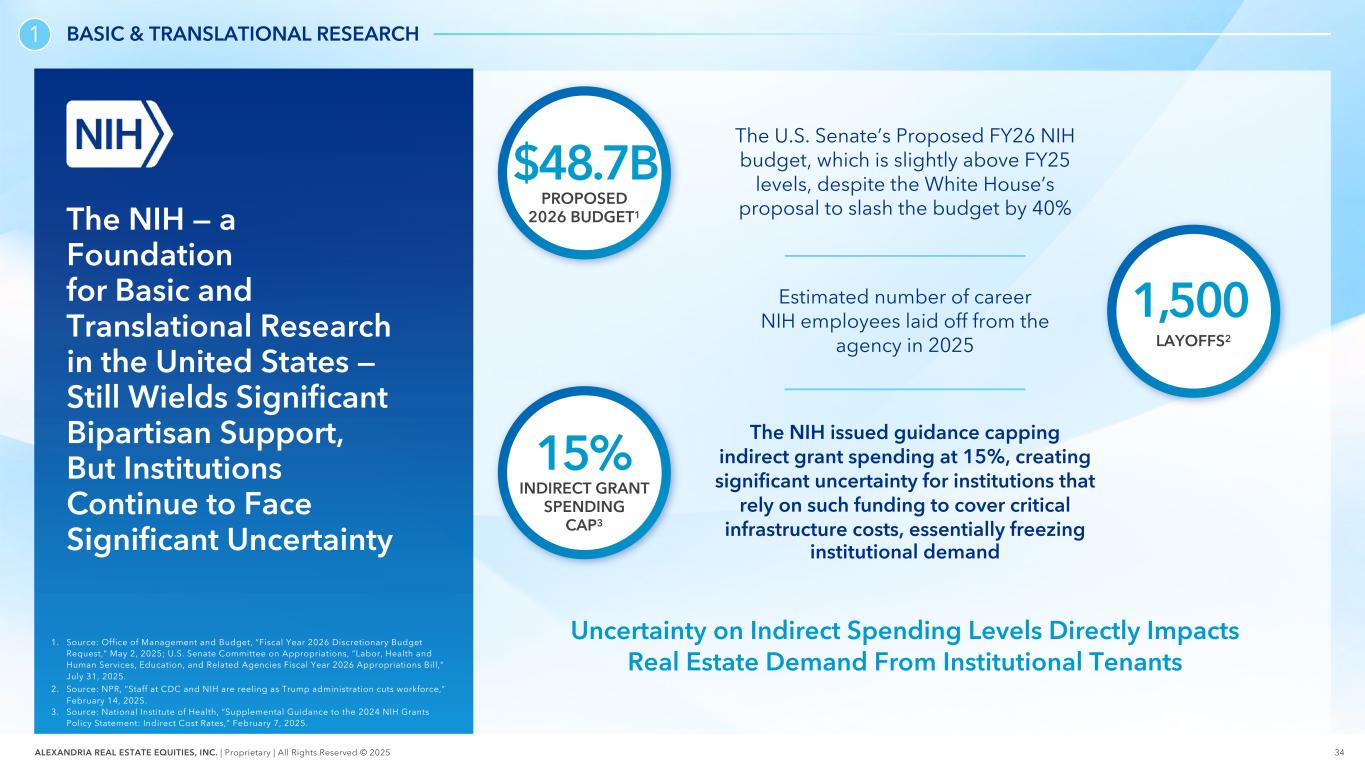

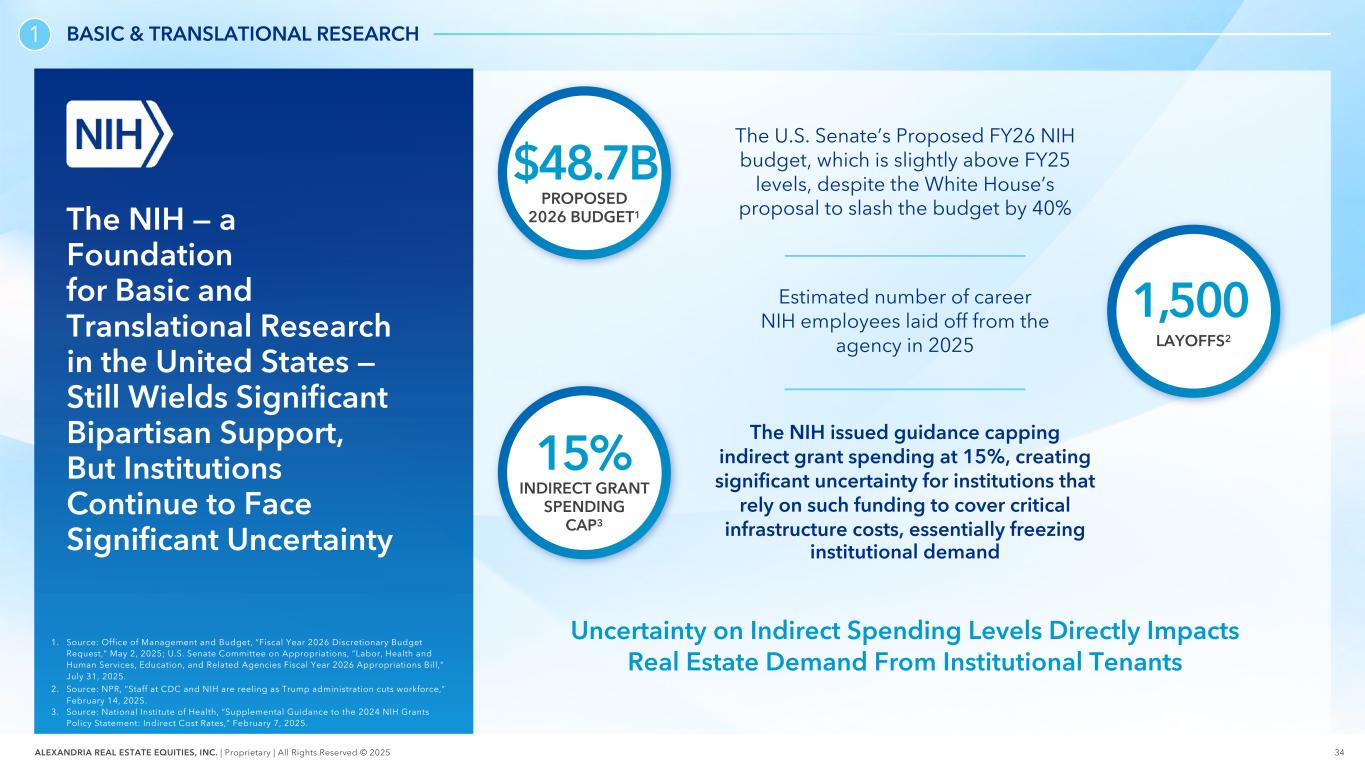

34ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 BASIC & TRANSLATIONAL RESEARCH1 The U.S. Senate’s Proposed FY26 NIH budget, which is slightly above FY25 levels, despite the White House’s proposal to slash the budget by 40% The NIH issued guidance capping indirect grant spending at 15%, creating significant uncertainty for institutions that rely on such funding to cover critical infrastructure costs, essentially freezing institutional demand $48.7B PROPOSED 2026 BUDGET1 15% INDIRECT GRANT SPENDING CAP3 The NIH — a Foundation for Basic and Translational Research in the United States — Still Wields Significant Bipartisan Support, But Institutions Continue to Face Significant Uncertainty Uncertainty on Indirect Spending Levels Directly Impacts Real Estate Demand From Institutional Tenants Estimated number of career NIH employees laid off from the agency in 2025 1,500 LAYOFFS2 1. Source: Office of Management and Budget, “Fiscal Year 2026 Discretionary Budget Request,“ May 2, 2025; U.S. Senate Committee on Appropriations, “Labor, Health and Human Services, Education, and Related Agencies Fiscal Year 2026 Appropriations Bill,“ July 31, 2025. 2. Source: NPR, “Staff at CDC and NIH are reeling as Trump administration cuts workforce,” February 14, 2025. 3. Source: National Institute of Health, “Supplemental Guidance to the 2024 NIH Grants Policy Statement: Indirect Cost Rates,” February 7, 2025.

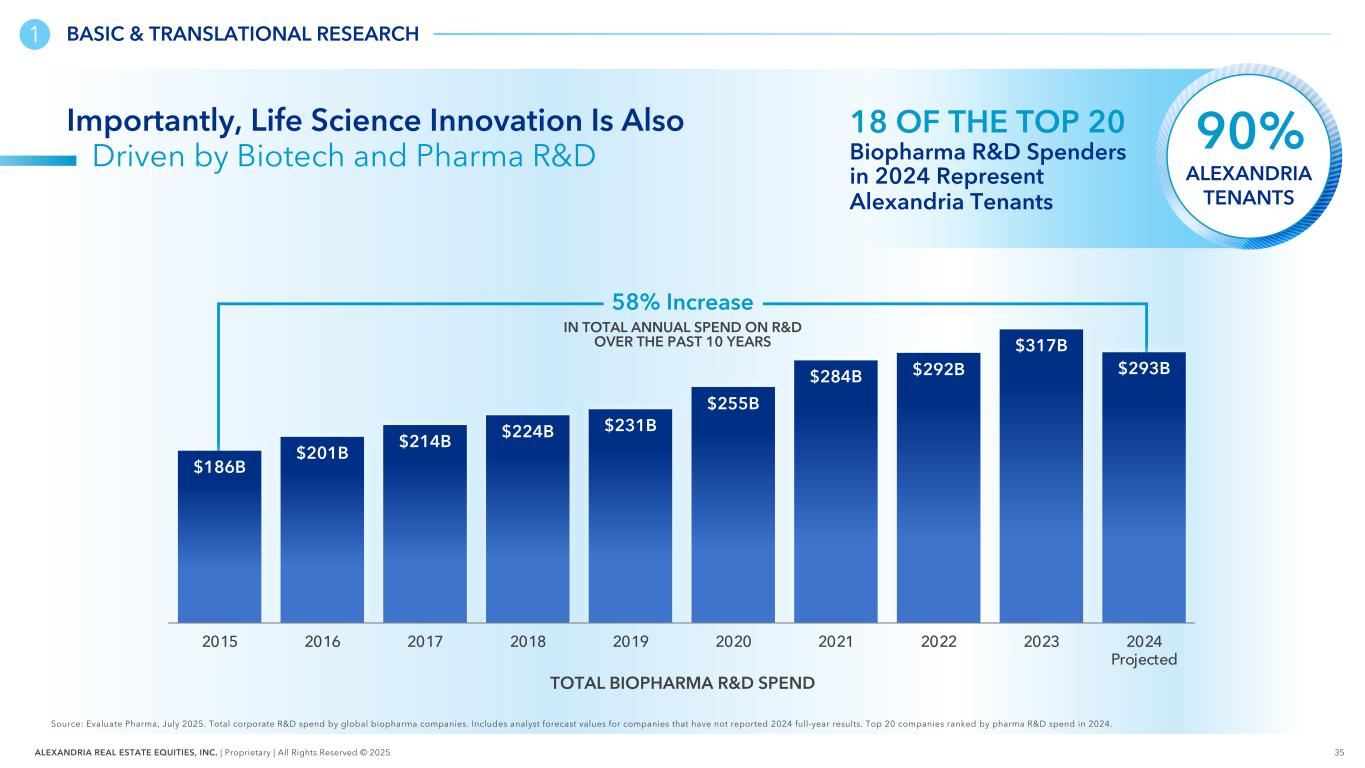

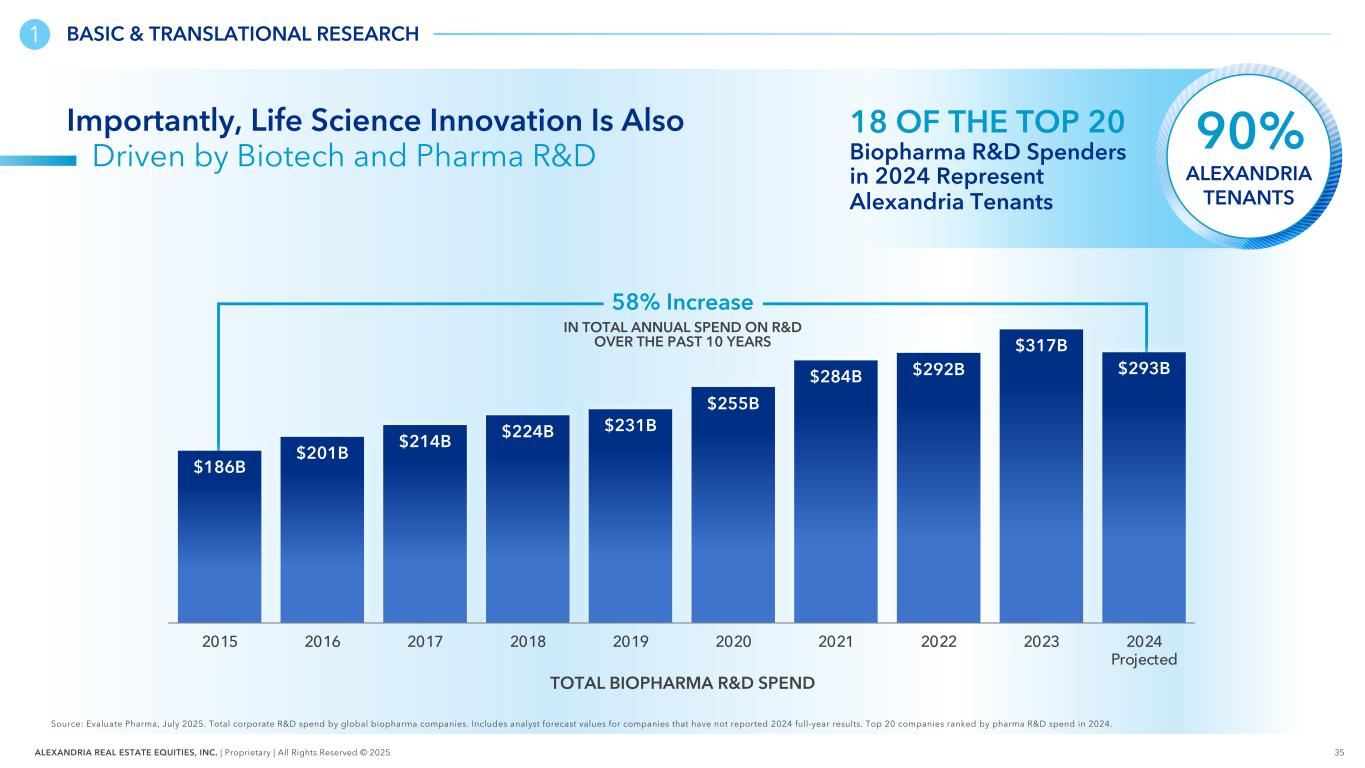

35ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 $186B $201B $214B $224B $231B $255B $284B $292B $317B $293B 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 Projected TOTAL BIOPHARMA R&D SPEND 58% Increase IN TOTAL ANNUAL SPEND ON R&D OVER THE PAST 10 YEARS 18 OF THE TOP 20 Biopharma R&D Spenders in 2024 Represent Alexandria Tenants 90% ALEXANDRIA TENANTS Importantly, Life Science Innovation Is Also Driven by Biotech and Pharma R&D Source: Evaluate Pharma, July 2025. Total corporate R&D spend by global biopharma companies. Includes analyst forecast values for companies that have not reported 2024 full-year results. Top 20 companies ranked by pharma R&D spend in 2024. BASIC & TRANSLATIONAL RESEARCH1

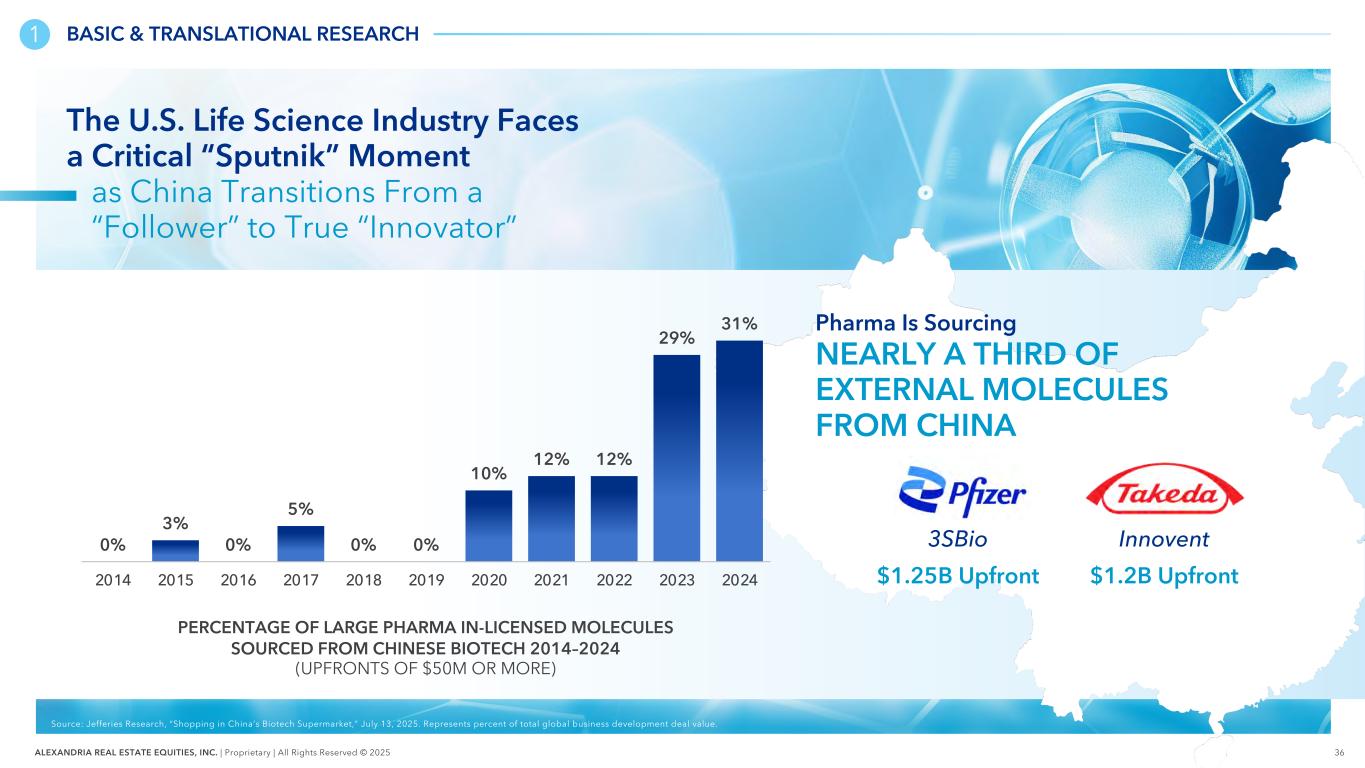

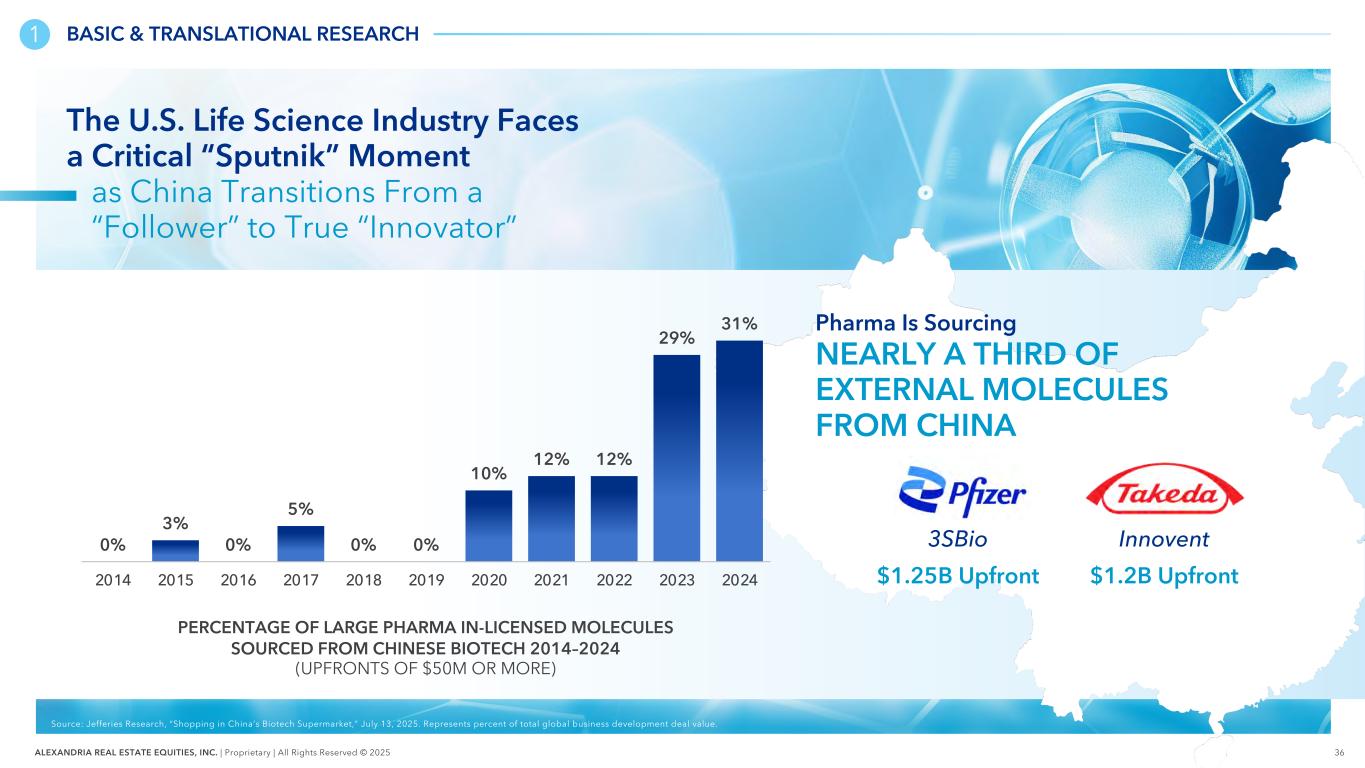

36ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 The U.S. Life Science Industry Faces a Critical “Sputnik” Moment as China Transitions From a “Follower” to True “Innovator” Source: Jefferies Research, “Shopping in China’s Biotech Supermarket,” July 13, 2025. Represents percent of total global business development deal value. BASIC & TRANSLATIONAL RESEARCH1 0% 3% 0% 5% 0% 0% 10% 12% 12% 29% 31% 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 PERCENTAGE OF LARGE PHARMA IN-LICENSED MOLECULES SOURCED FROM CHINESE BIOTECH 2014–2024 (UPFRONTS OF $50M OR MORE) Pharma Is Sourcing NEARLY A THIRD OF EXTERNAL MOLECULES FROM CHINA 3SBio $1.25B Upfront Innovent $1.2B Upfront

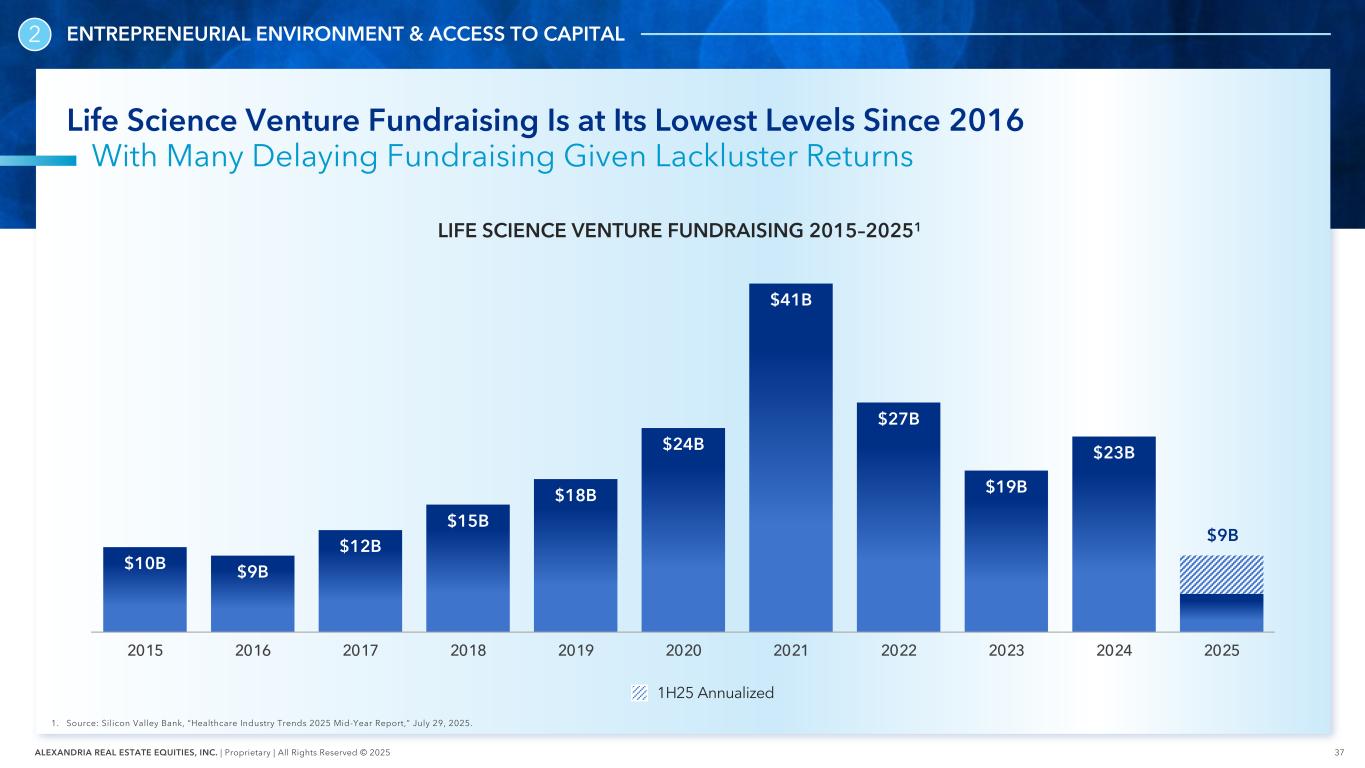

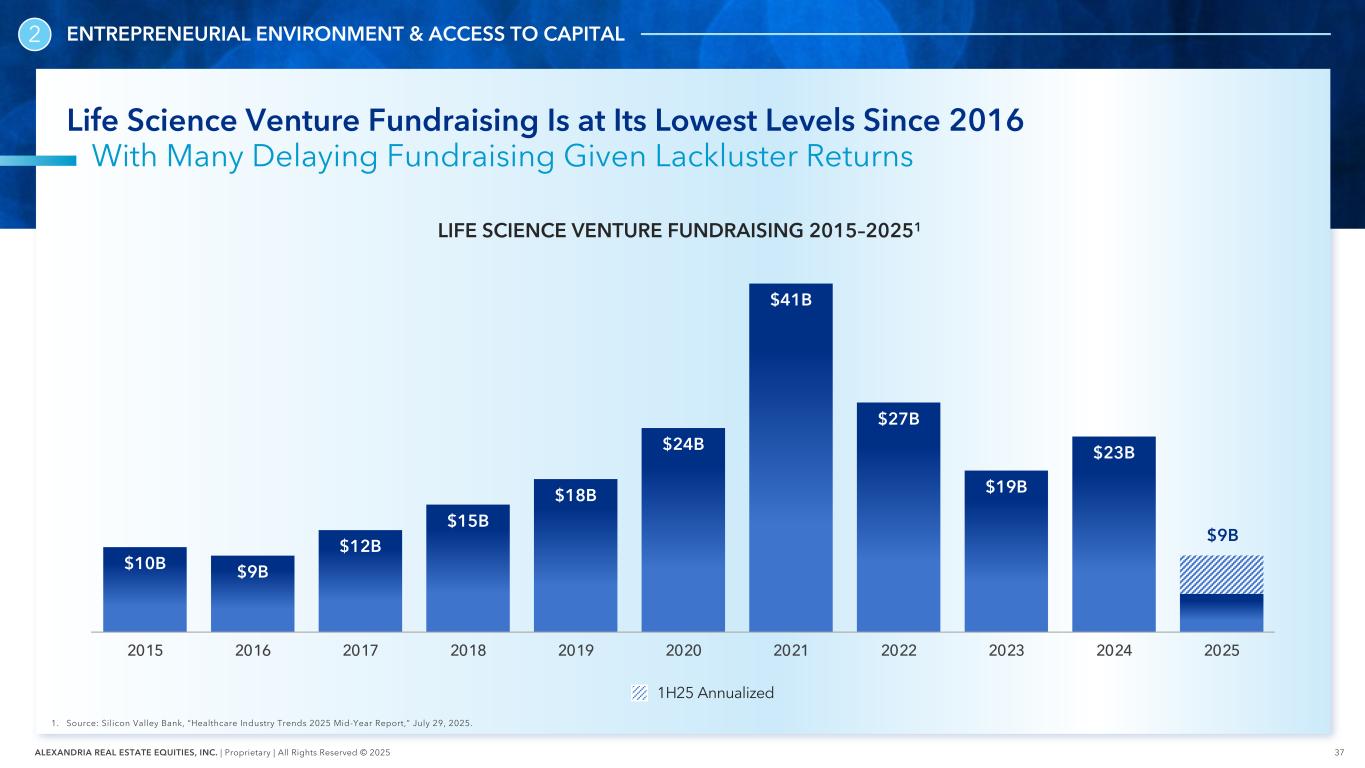

37ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 Life Science Venture Fundraising Is at Its Lowest Levels Since 2016 With Many Delaying Fundraising Given Lackluster Returns 1. Source: Silicon Valley Bank, “Healthcare Industry Trends 2025 Mid-Year Report,” July 29, 2025. $10B $9B $12B $15B $18B $24B $41B $27B $19B $23B 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 LIFE SCIENCE VENTURE FUNDRAISING 2015–20251 $9B 1H25 Annualized 2 ENTREPRENEURIAL ENVIRONMENT & ACCESS TO CAPITAL

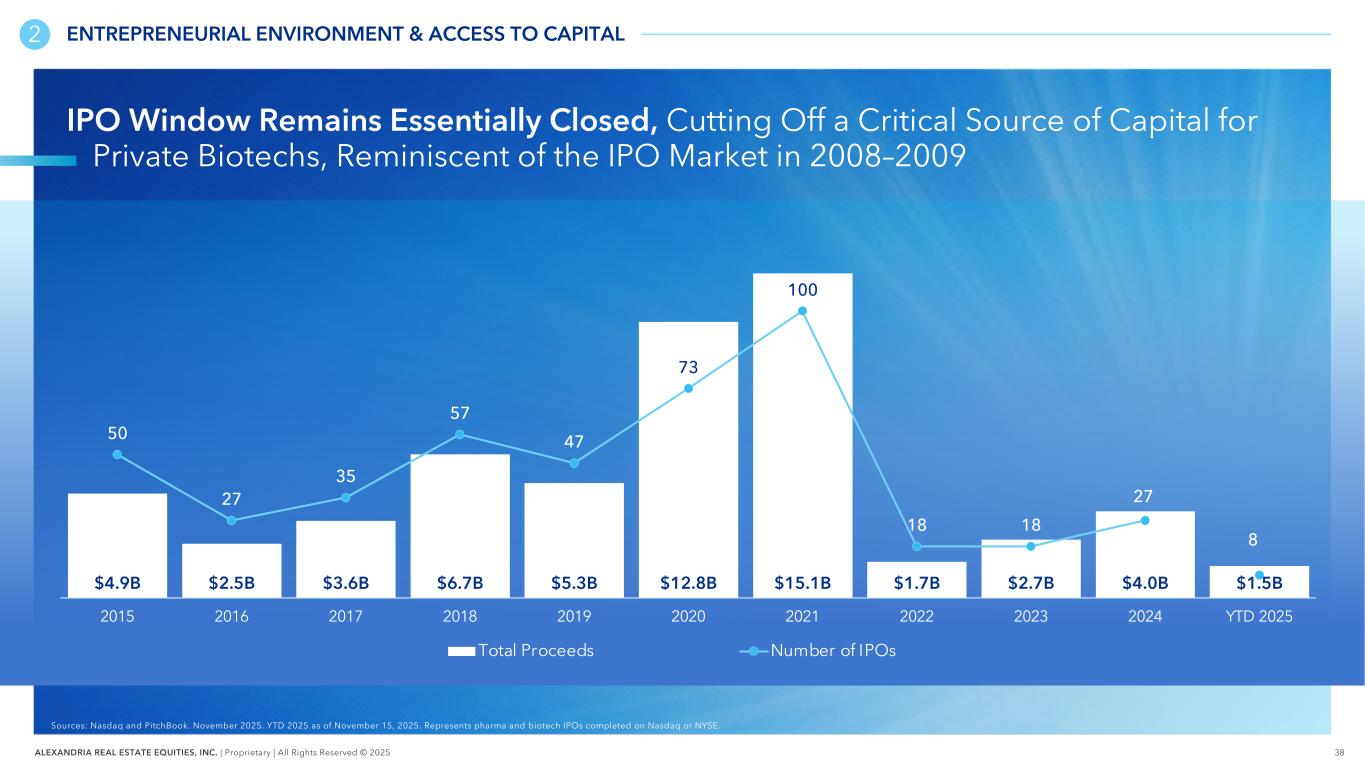

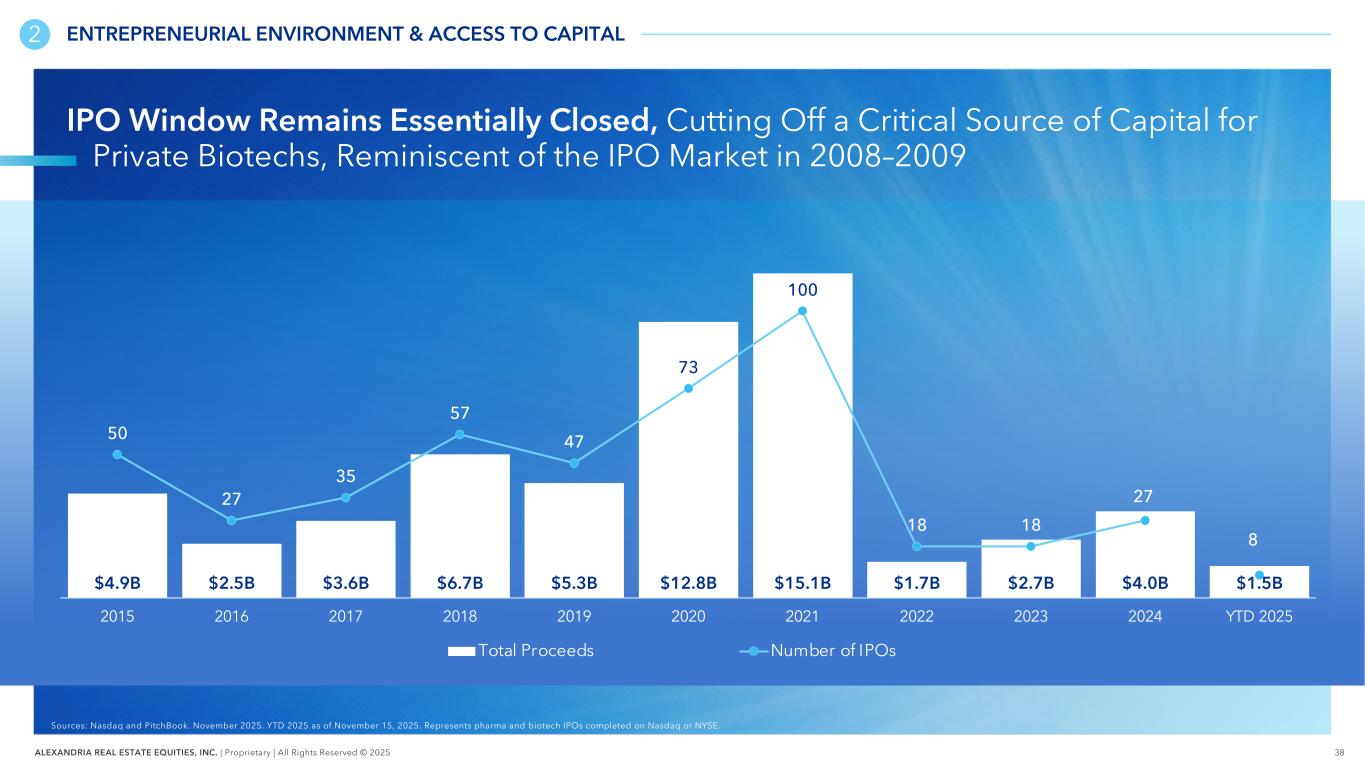

38ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 $4.9B $2.5B $3.6B $6.7B $5.3B $12.8B $15.1B $1.7B $2.7B $4.0B $1.5B 50 27 35 57 47 73 100 18 18 27 8 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 YTD 2025 Total Proceeds Number of IPOs IPO Window Remains Essentially Closed, Cutting Off a Critical Source of Capital for Private Biotechs, Reminiscent of the IPO Market in 2008–2009 Sources: Nasdaq and PitchBook. November 2025. YTD 2025 as of November 15, 2025. Represents pharma and biotech IPOs completed on Nasdaq or NYSE. 2 ENTREPRENEURIAL ENVIRONMENT & ACCESS TO CAPITAL

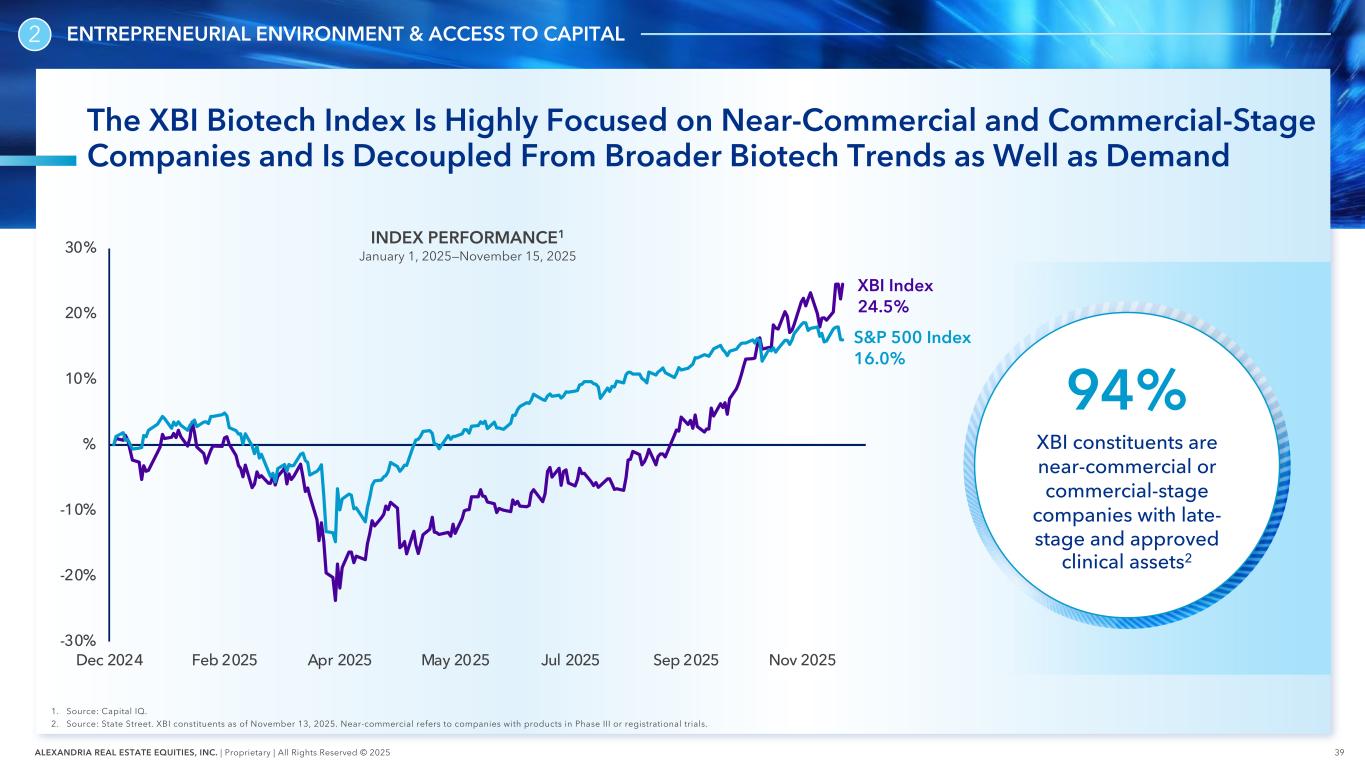

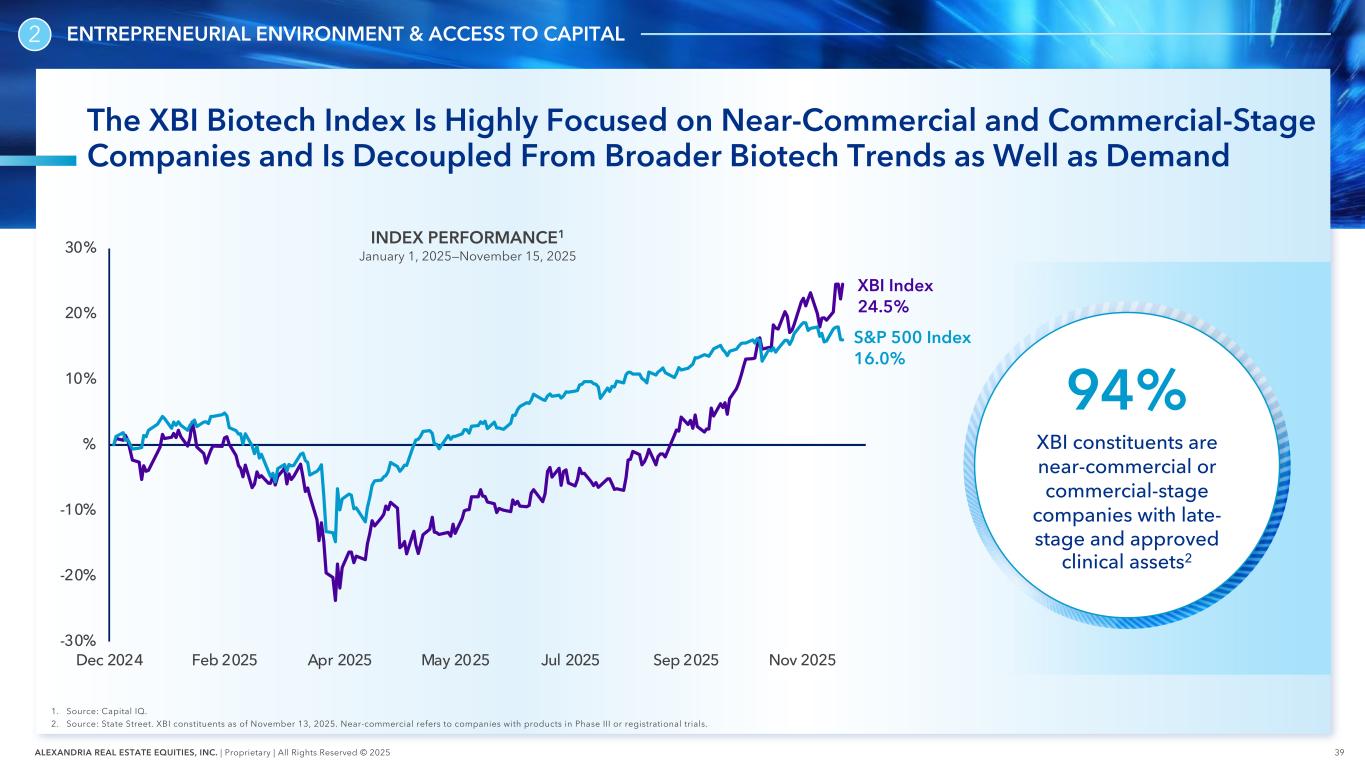

39ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 INDEX PERFORMANCE1 January 1, 2025—November 15, 2025 The XBI Biotech Index Is Highly Focused on Near-Commercial and Commercial-Stage Companies and Is Decoupled From Broader Biotech Trends as Well as Demand 1. Source: Capital IQ. 2. Source: State Street. XBI constituents as of November 13, 2025. Near-commercial refers to companies with products in Phase III or registrational trials. -30% -20% -10% % 10% 20% 30% Dec 2024 Feb 2025 Apr 2025 May 2025 Jul 2025 Sep 2025 Oct 2025 S&P 500 Index 16.0% XBI Index 24.5% 2 ENTREPRENEURIAL ENVIRONMENT & ACCESS TO CAPITAL XBI constituents are near-commercial or commercial-stage companies with late- stage and approved clinical assets2 94% Nov 0

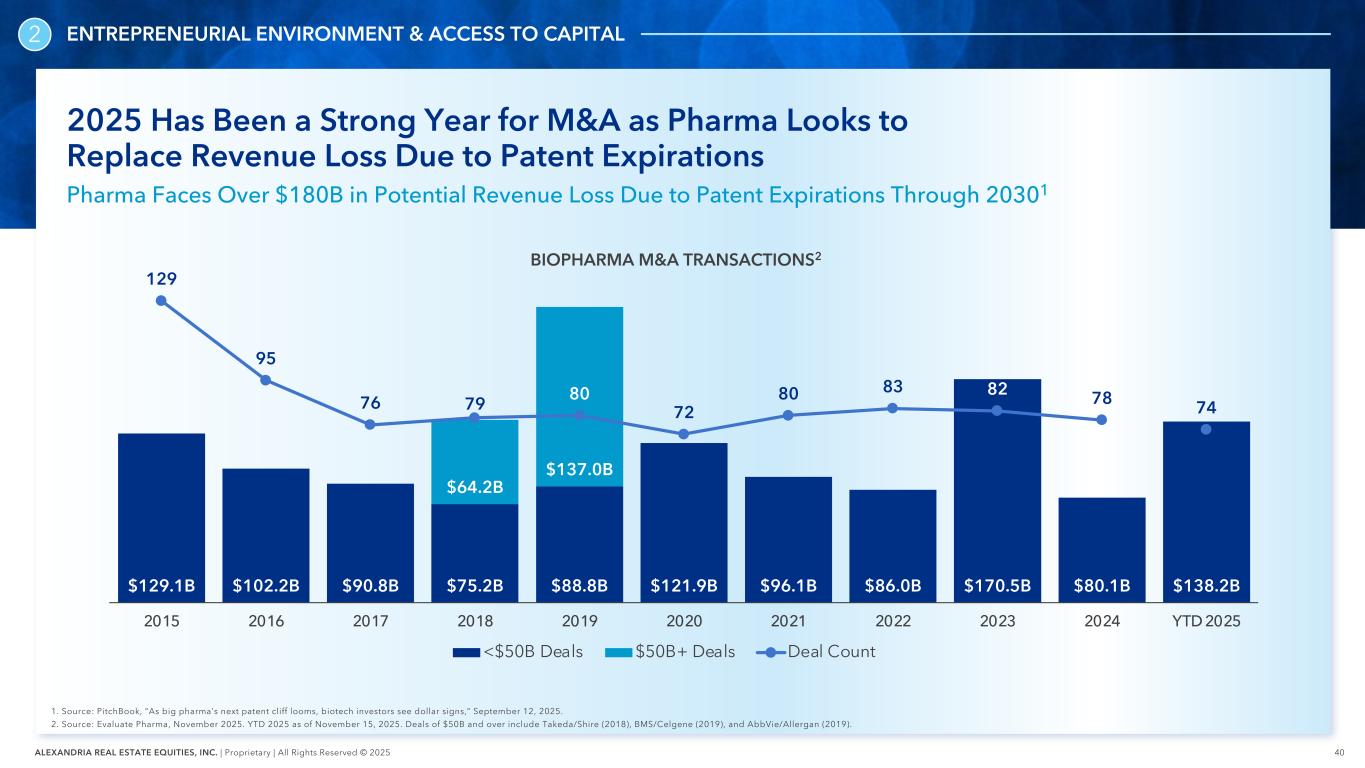

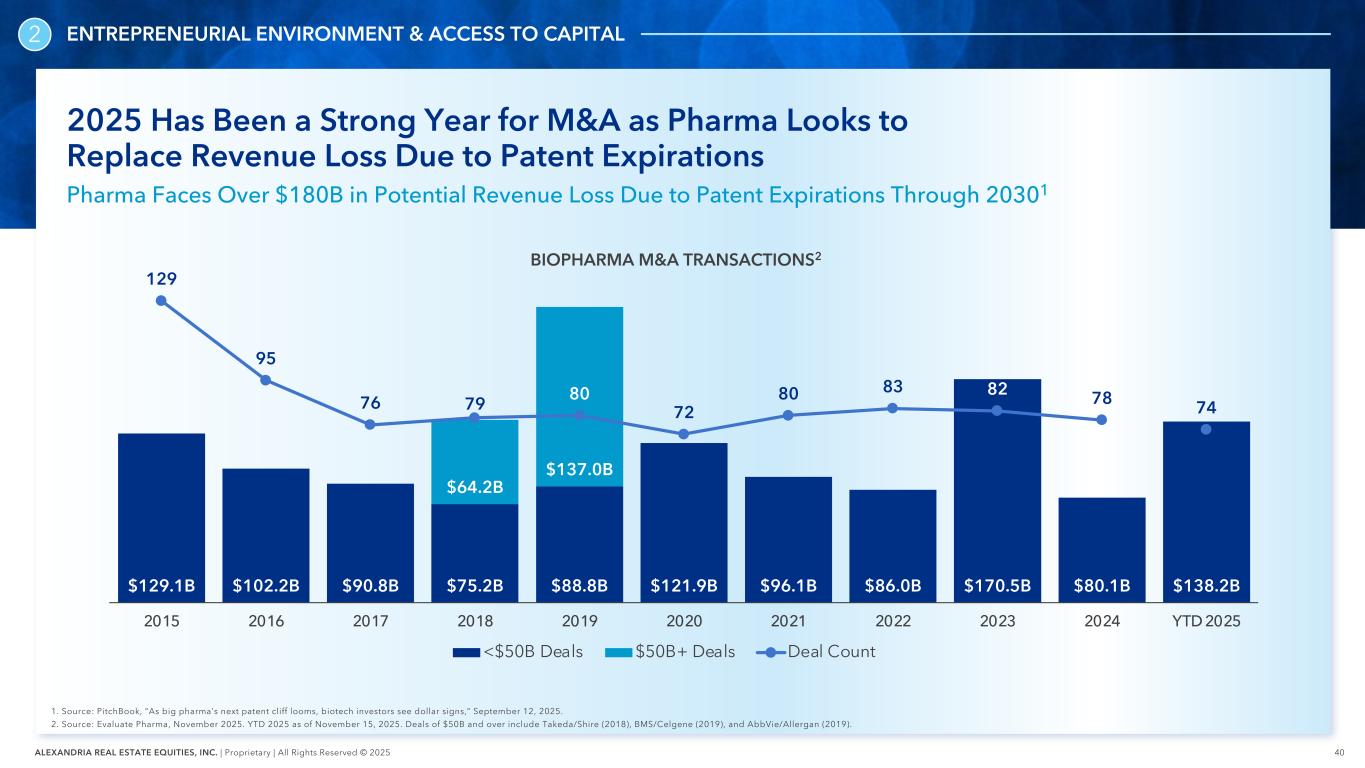

40ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 2 2025 Has Been a Strong Year for M&A as Pharma Looks to Replace Revenue Loss Due to Patent Expirations 1. Source: PitchBook, “As big pharma’s next patent cliff looms, biotech investors see dollar signs,” September 12, 2025. 2. Source: Evaluate Pharma, November 2025. YTD 2025 as of November 15, 2025. Deals of $50B and over include Takeda/Shire (2018), BMS/Celgene (2019), and AbbVie/Allergan (2019). $129.1B $102.2B $90.8B $75.2B $88.8B $121.9B $96.1B $86.0B $170.5B $80.1B $138.2B $64.2B $137.0B 129 95 76 79 80 72 80 83 82 78 74 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 YTD 2025 BIOPHARMA M&A TRANSACTIONS2 <$50B Deals $50B+ Deals Deal Count Pharma Faces Over $180B in Potential Revenue Loss Due to Patent Expirations Through 20301 ENTREPRENEURIAL ENVIRONMENT & ACCESS TO CAPITAL

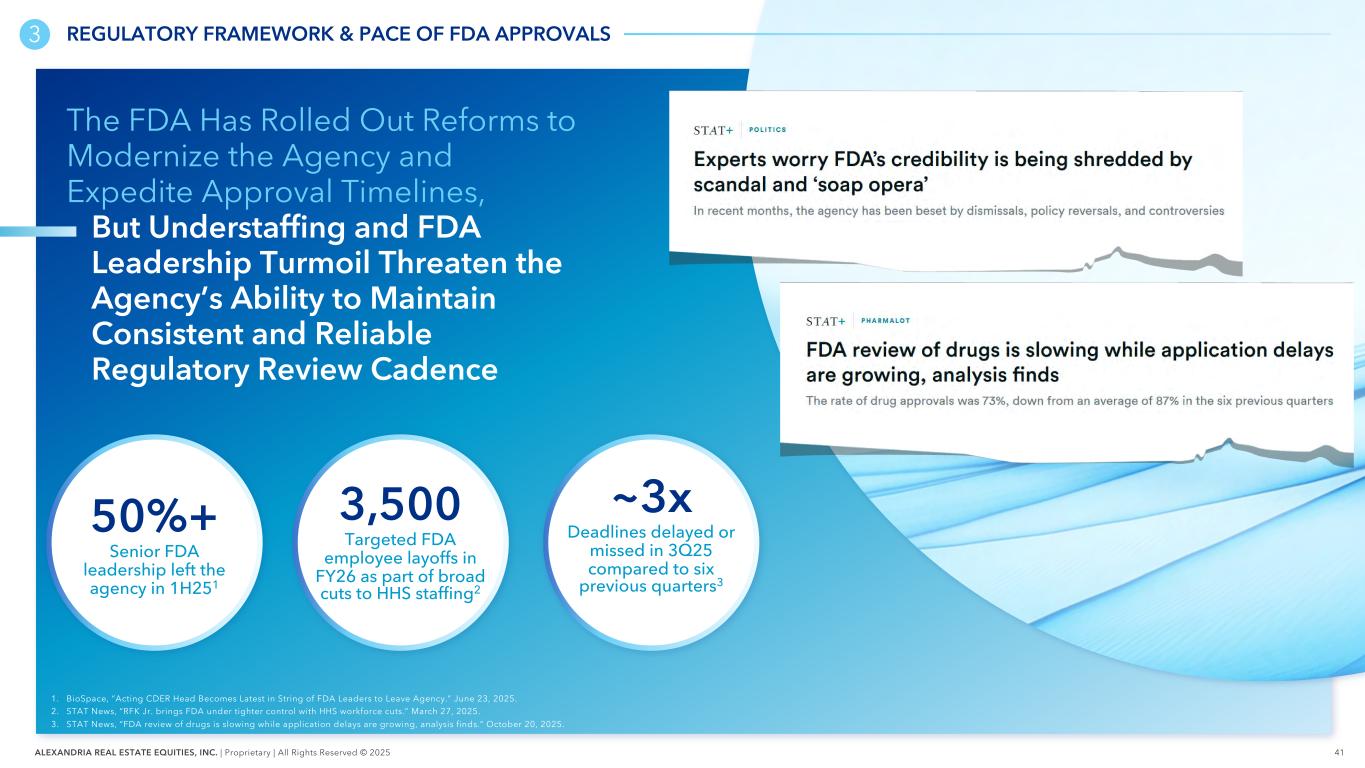

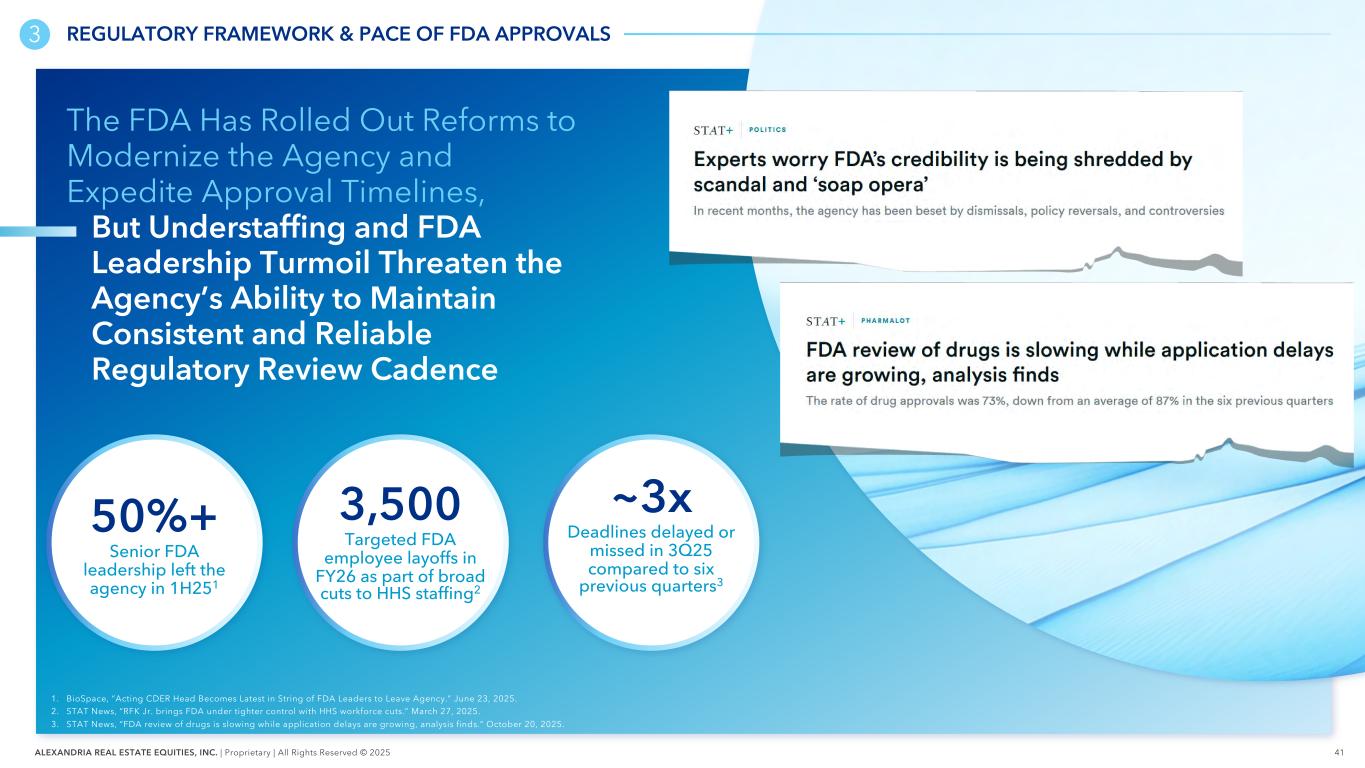

41ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 1. BioSpace, “Acting CDER Head Becomes Latest in String of FDA Leaders to Leave Agency.” June 23, 2025. 2. STAT News, “RFK Jr. brings FDA under tighter control with HHS workforce cuts.” March 27, 2025. 3. STAT News, “FDA review of drugs is slowing while application delays are growing, analysis finds.” October 20, 2025. 1 The FDA Has Rolled Out Reforms to Modernize the Agency and Expedite Approval Timelines, But Understaffing and FDA Leadership Turmoil Threaten the Agency’s Ability to Maintain Consistent and Reliable Regulatory Review Cadence 3 REGULATORY FRAMEWORK & PACE OF FDA APPROVALS 3,500 Targeted FDA employee layoffs in FY26 as part of broad cuts to HHS staffing2 ~3x Deadlines delayed or missed in 3Q25 compared to six previous quarters3 50%+ Senior FDA leadership left the agency in 1H251

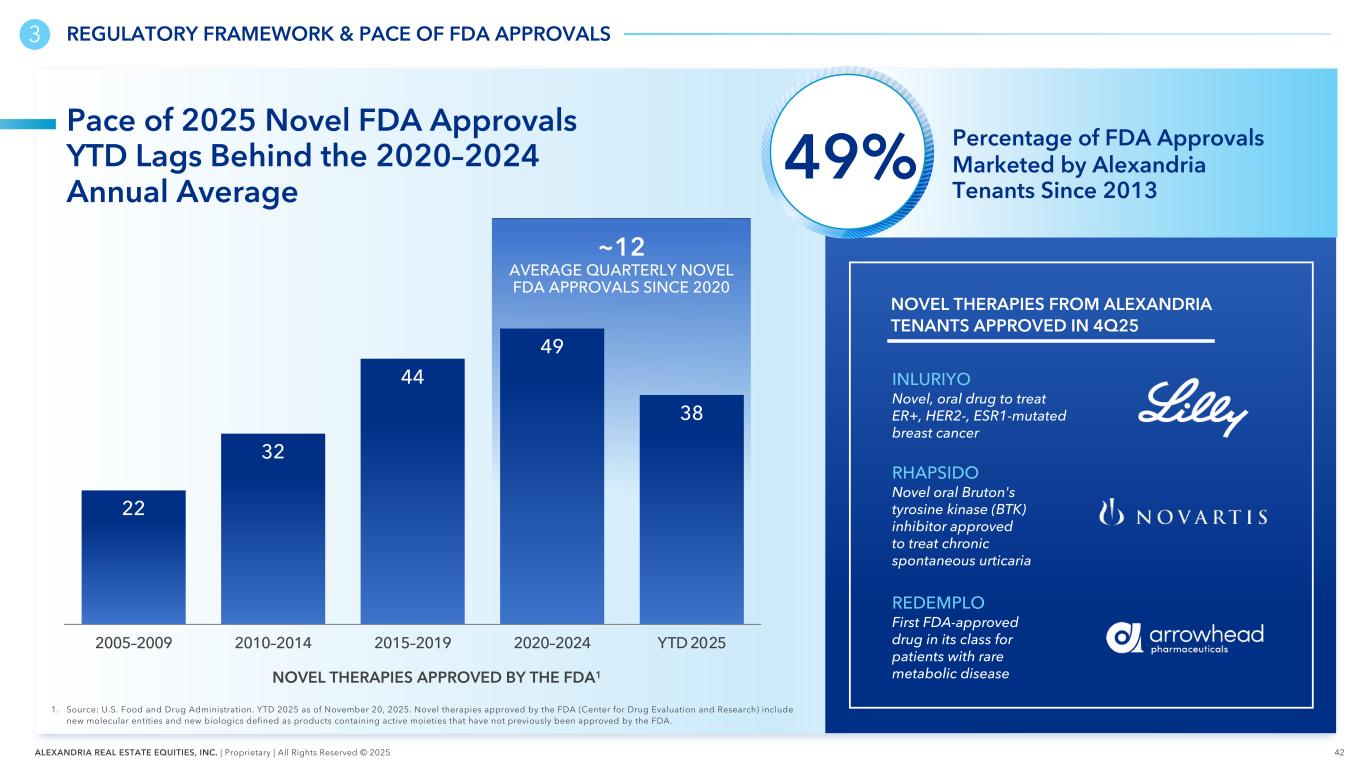

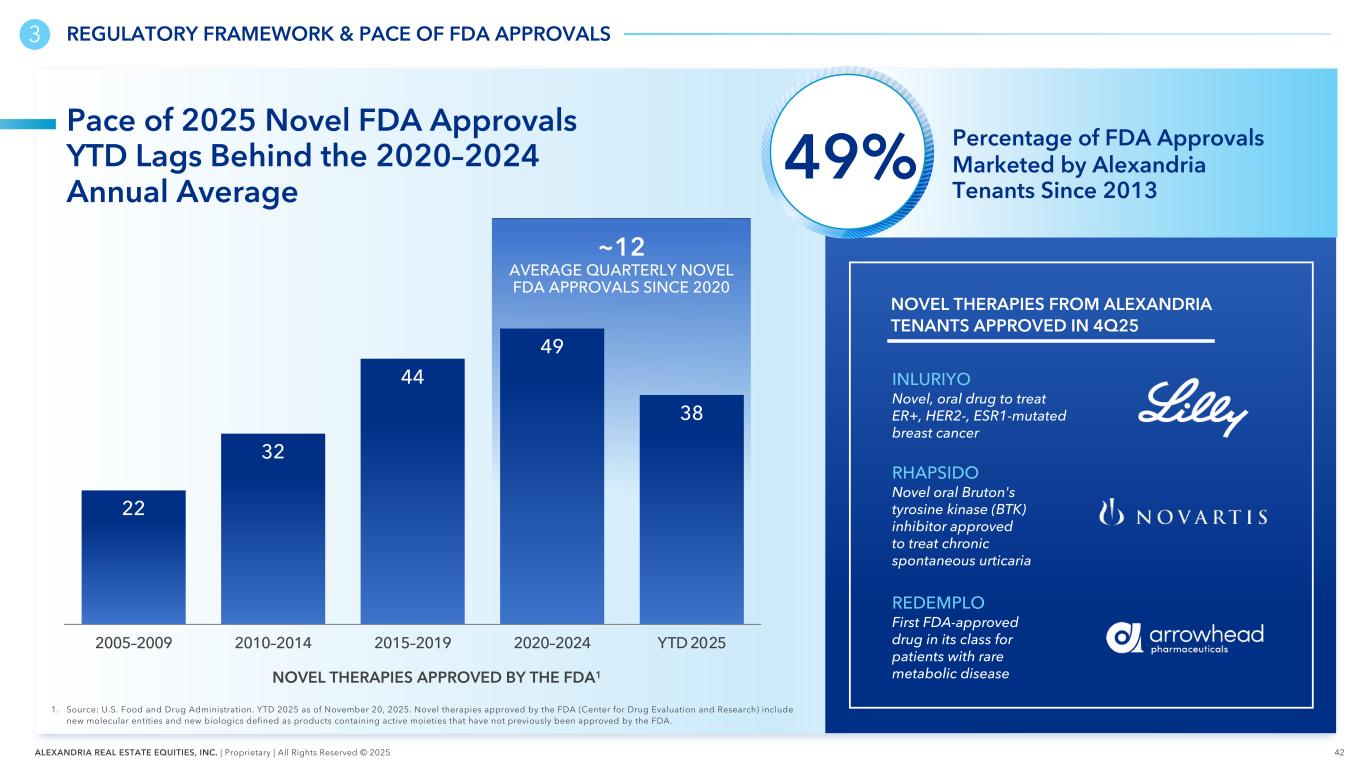

42ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 Pace of 2025 Novel FDA Approvals YTD Lags Behind the 2020–2024 Annual Average 1. Source: U.S. Food and Drug Administration. YTD 2025 as of November 20, 2025. Novel therapies approved by the FDA (Center for Drug Evaluation and Research) include new molecular entities and new biologics defined as products containing active moieties that have not previously been approved by the FDA. 3 REGULATORY FRAMEWORK & PACE OF FDA APPROVALS 22 32 44 49 38 2005–2009 2010–2014 2015–2019 2020–2024 YTD 2025 ~12 AVERAGE QUARTERLY NOVEL FDA APPROVALS SINCE 2020 NOVEL THERAPIES APPROVED BY THE FDA1 NOVEL THERAPIES FROM ALEXANDRIA TENANTS APPROVED IN 4Q25 RHAPSIDO Novel oral Bruton's tyrosine kinase (BTK) inhibitor approved to treat chronic spontaneous urticaria REDEMPLO First FDA-approved drug in its class for patients with rare metabolic disease INLURIYO Novel, oral drug to treat ER+, HER2-, ESR1-mutated breast cancer Percentage of FDA Approvals Marketed by Alexandria Tenants Since 2013 49%

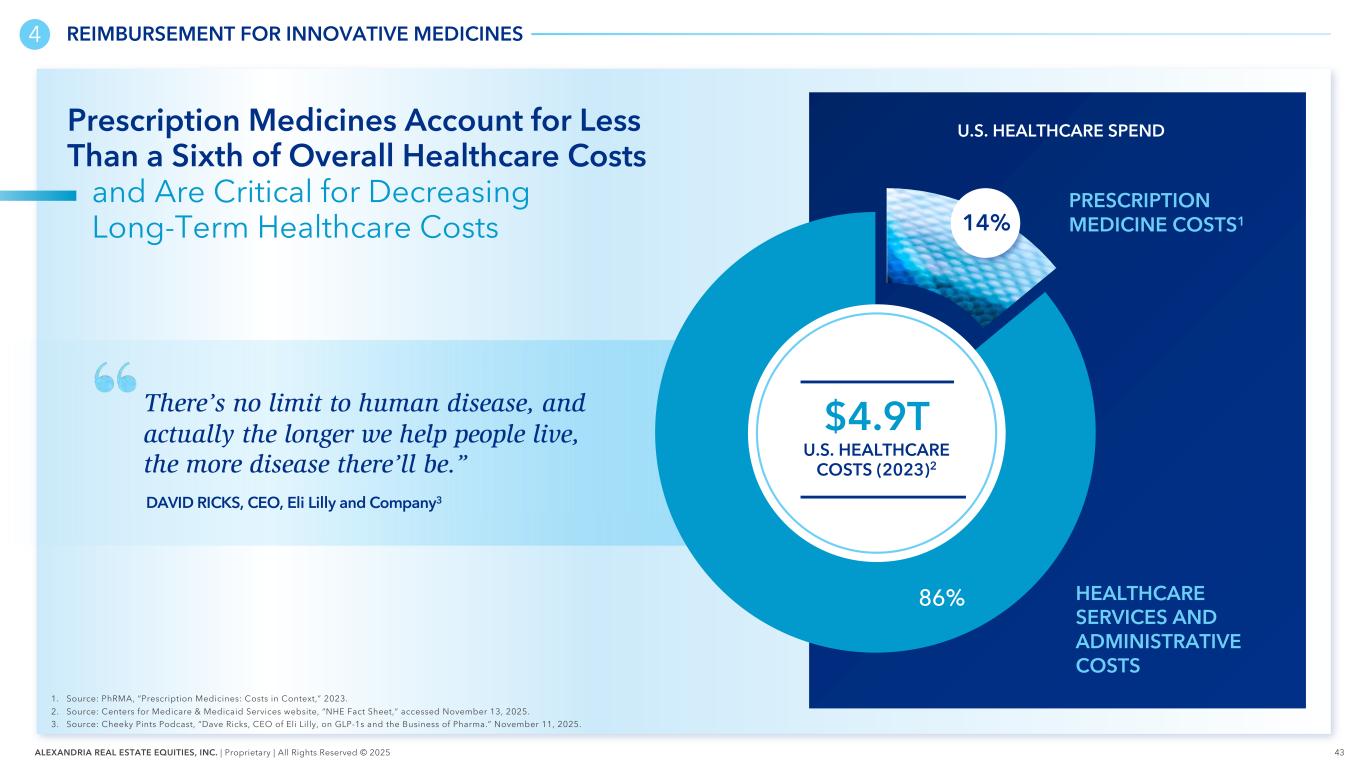

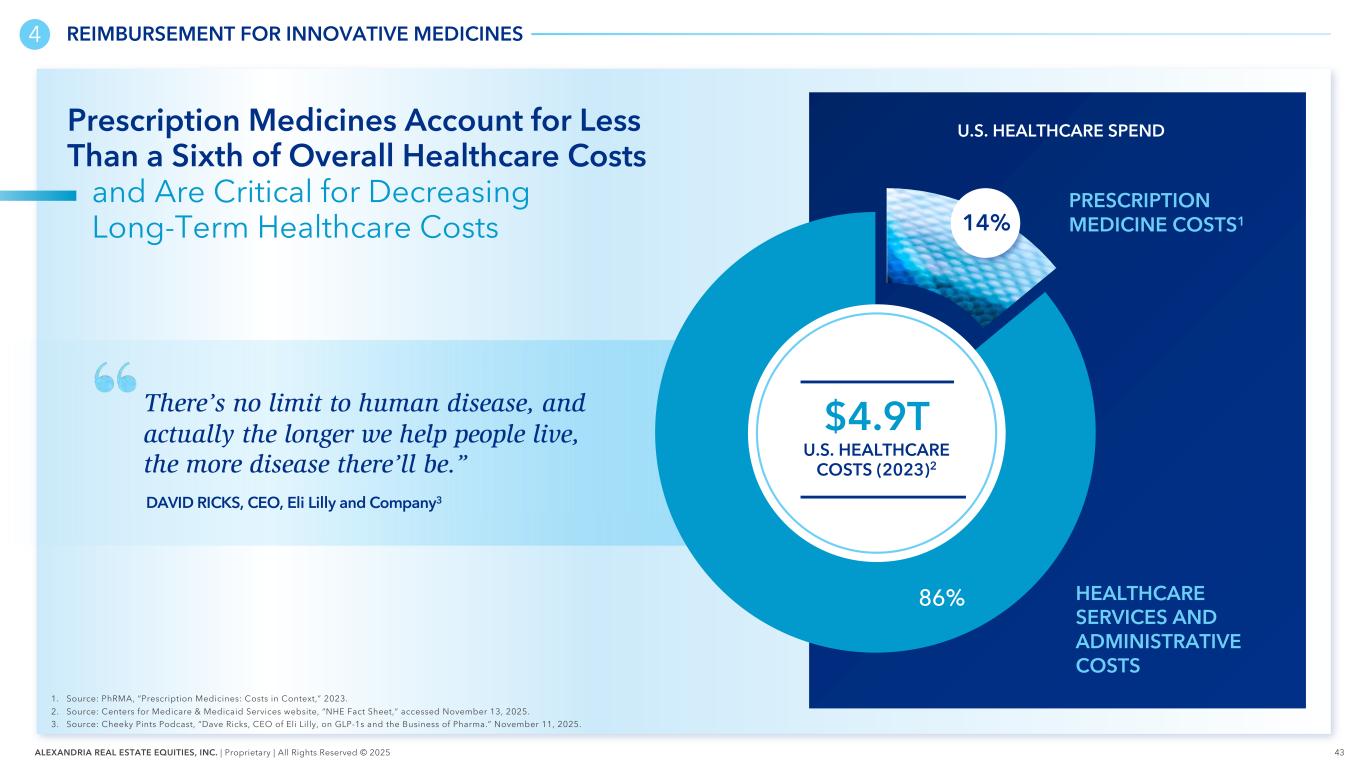

43ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 Prescription Medicines Account for Less Than a Sixth of Overall Healthcare Costs and Are Critical for Decreasing Long-Term Healthcare Costs 4 REIMBURSEMENT FOR INNOVATIVE MEDICINES 86% U.S. HEALTHCARE SPEND PRESCRIPTION MEDICINE COSTS1 HEALTHCARE SERVICES AND ADMINISTRATIVE COSTS $4.9T U.S. HEALTHCARE COSTS (2023)2 1. Source: PhRMA, “Prescription Medicines: Costs in Context,” 2023. 2. Source: Centers for Medicare & Medicaid Services website, “NHE Fact Sheet,“ accessed November 13, 2025. 3. Source: Cheeky Pints Podcast, “Dave Ricks, CEO of Eli Lilly, on GLP-1s and the Business of Pharma.” November 11, 2025. 14% There’s no limit to human disease, and actually the longer we help people live, the more disease there’ll be.” DAVID RICKS, CEO, Eli Lilly and Company3

44ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 Pharmacy Benefit Managers (PBMs) and Hospitals Significantly Drive Up the Cost of Medicines for Patients Source: PhRMA, “10 Things You Should Know About Medicine Spending and Costs.” March 10, 2022. >50% of Prescription Medicine Spend Goes to Middlemen, Including PBMs, Hospitals, and Insurers 4 REIMBURSEMENT FOR INNOVATIVE MEDICINES 9 out of 10 Medicines Dispensed in the U.S. Are Generics 500% Average Hospital Markup on Prescription Medicines

45ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 4 REIMBURSEMENT FOR INNOVATIVE MEDICINES 1. Source: KFF, “Health Insurance Coverage of the Total Population,” 2023. Number of individuals with both Medicare and Medicaid coverage categorized under Medicaid. Announced agreements between the White House and select pharma were received well by industry analysts, who projected minimal impact to the companies’ bottom lines. The White House and Select Pharma Have Struck One-Off Deals Aimed at Reducing U.S. Drug Prices to Those of Other Developed Countries INFLATION REDUCTION ACT To date, CMS has announced 25 medicines subject to price negotiation, most of which have been viewed as rational price targets based on net prices. MOST FAVORED NATIONS Deals primarily focused on Medicaid drug pricing, as well as avenues for direct-to-consumer purchase of select medicines Employer & Private 55% Medicaid 21% Medicare 15% Military 1% Uninsured 8% U.S. HEALTH INSURANCE COVERAGE1

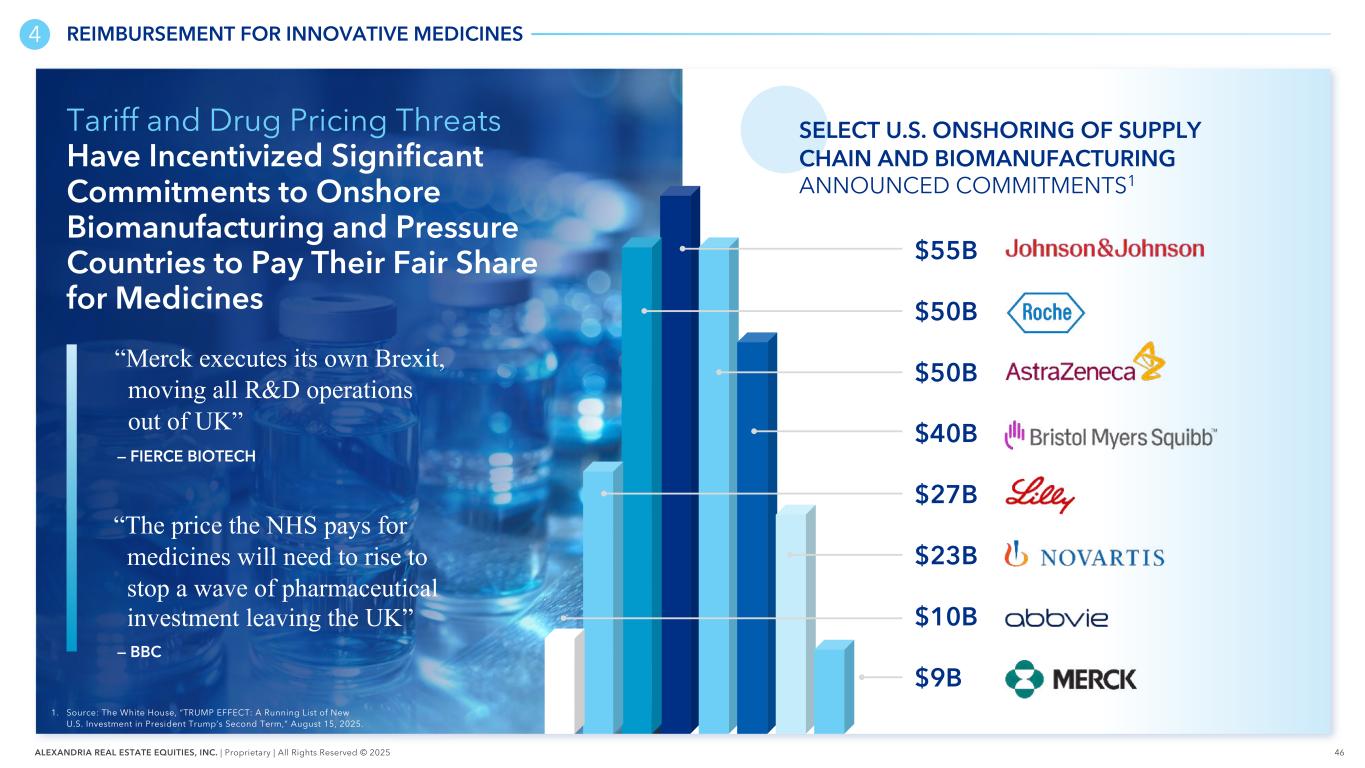

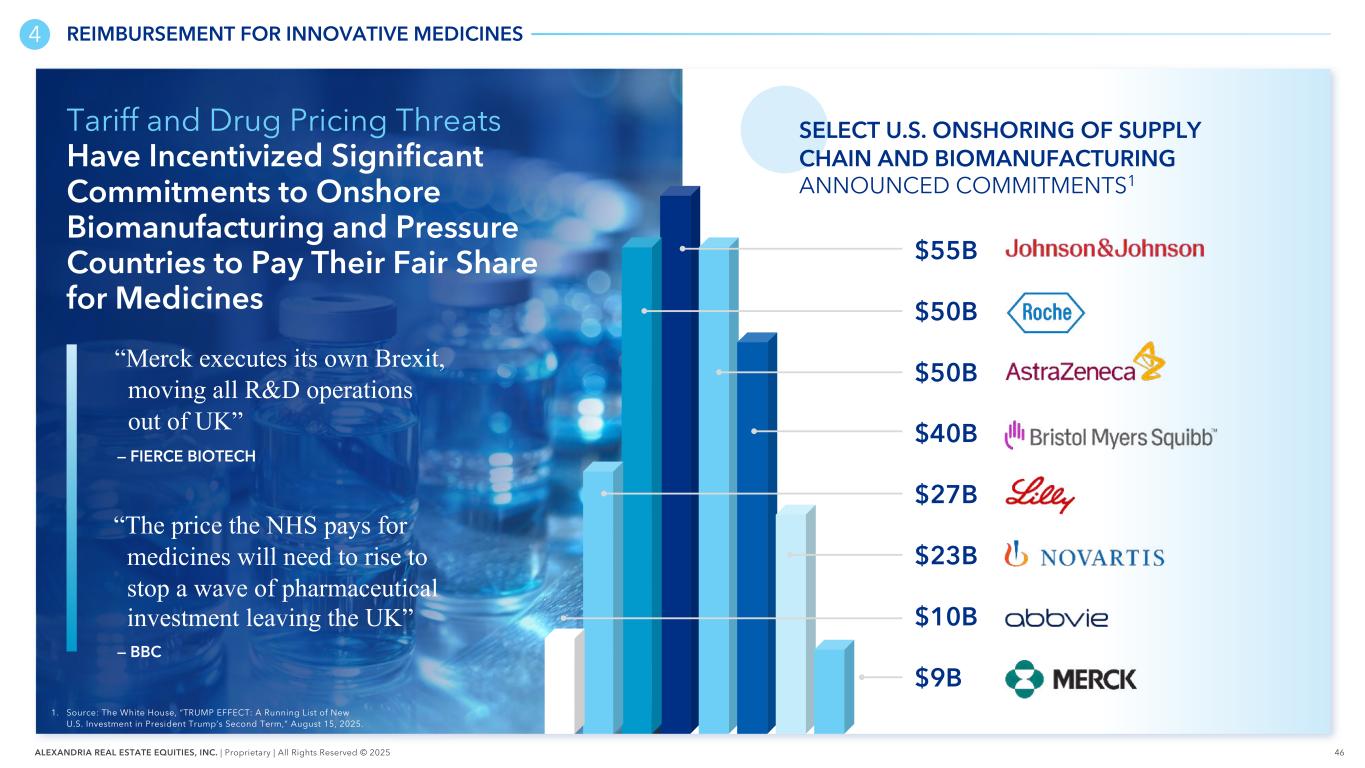

46ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 4 REIMBURSEMENT FOR INNOVATIVE MEDICINES Tariff and Drug Pricing Threats Have Incentivized Significant Commitments to Onshore Biomanufacturing and Pressure Countries to Pay Their Fair Share for Medicines “Merck executes its own Brexit, moving all R&D operations out of UK” — FIERCE BIOTECH “The price the NHS pays for medicines will need to rise to stop a wave of pharmaceutical investment leaving the UK” 1. Source: The White House, “TRUMP EFFECT: A Running List of New U.S. Investment in President Trump’s Second Term,” August 15, 2025. $55B $50B $40B $27B $23B $10B $9B $50B SELECT U.S. ONSHORING OF SUPPLY CHAIN AND BIOMANUFACTURING ANNOUNCED COMMITMENTS1 — BBC

47ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 THE CASE FOR OPTIMISM REDUCTION IN DRUG DEVELOPMENT COST AND TIMELINE M A SSIVE OPPORTU N ITY GOLDEN AGE OF BIOLOGICAL DISCOVERIES

48ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 MASSIVE OPPORTUNITY 1. Source: BCIQ as of November 18, 2025. Includes pharma, biotech, and medical device and diagnostic public companies with >$5M market cap listed on NASDAQ or NYSE. 2. Source: U.S. House Committee on Energy and Commerce, “The 21st Century Cures Discussion Document White Paper,” January 27, 2015. Thousands of Diseases Don’t Have Approved Medicines THOSE THAT DO ARE FAR FROM SOLVED Total Market Capitalization of the Biotech and Pharma Industry110% of Diseases With Approved Treatments2

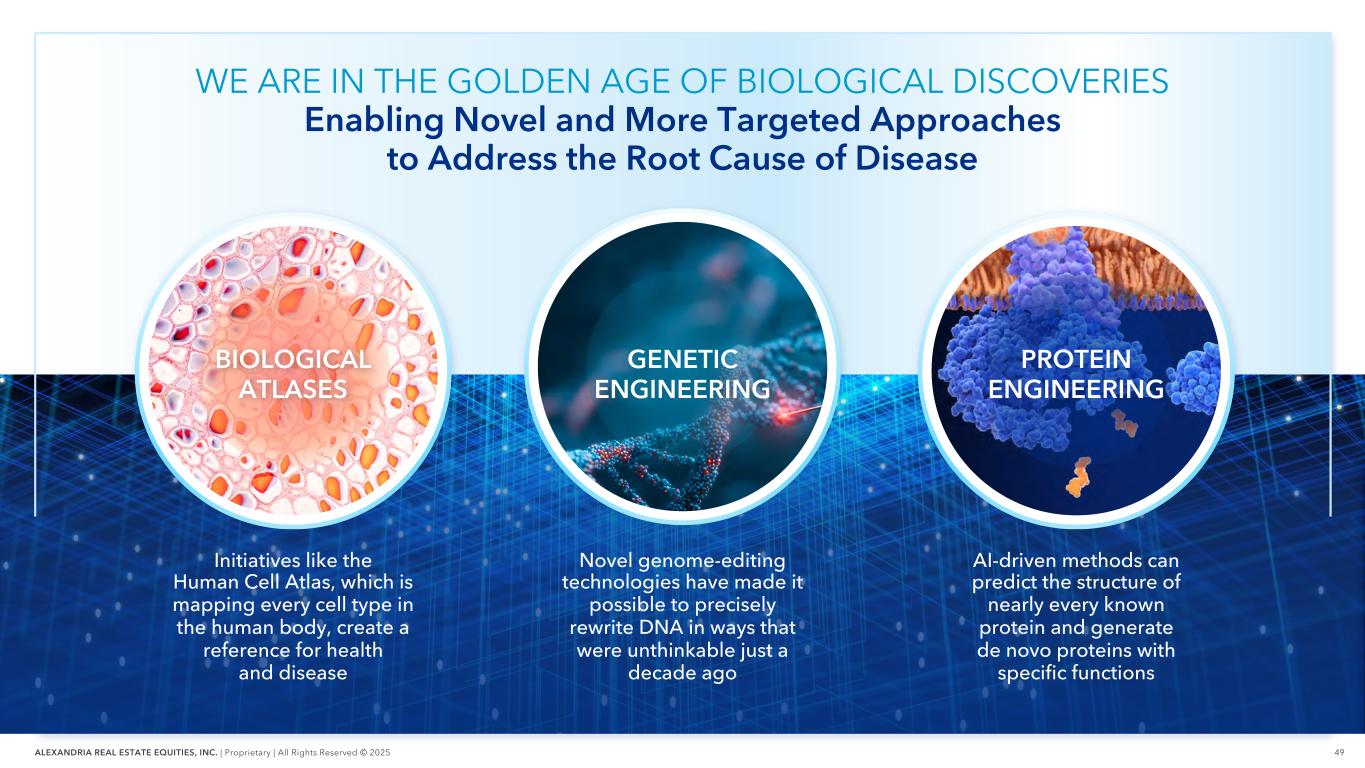

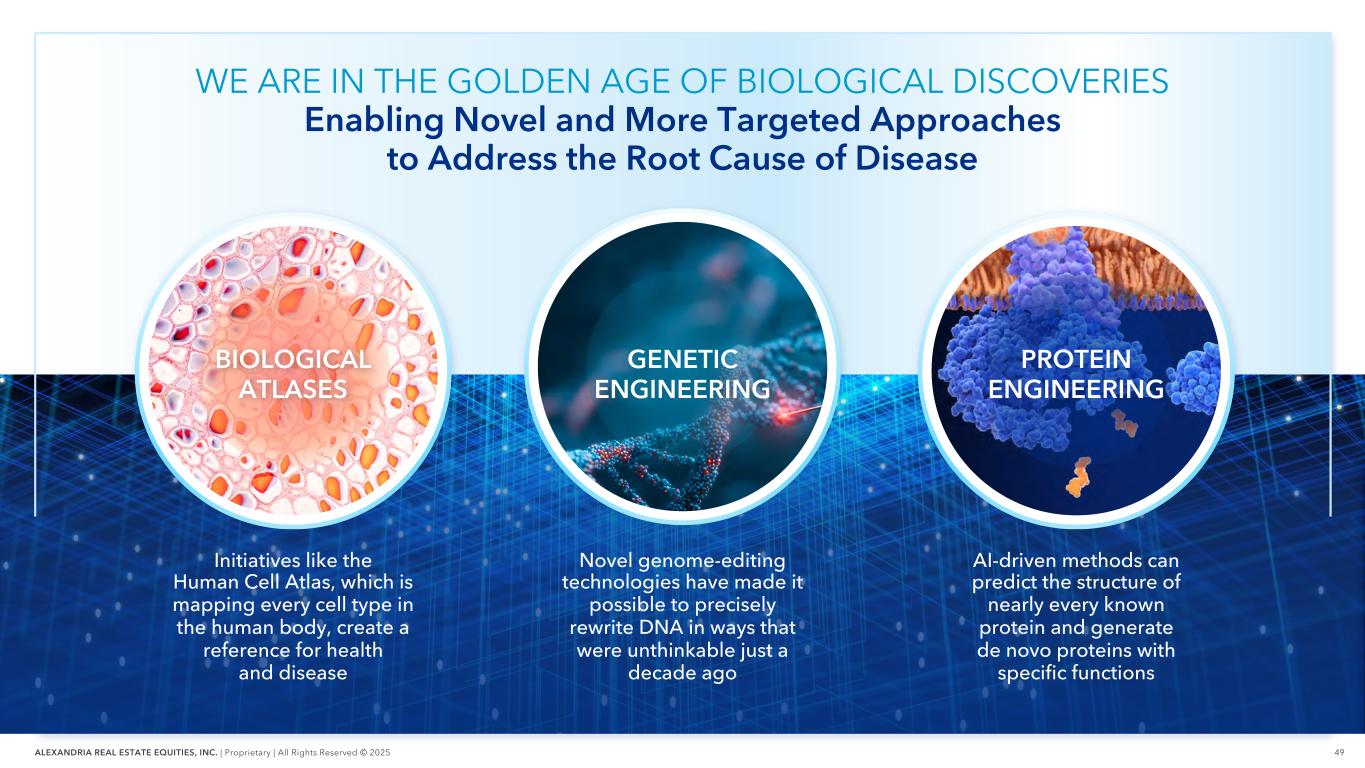

49ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 WE ARE IN THE GOLDEN AGE OF BIOLOGICAL DISCOVERIES Enabling Novel and More Targeted Approaches to Address the Root Cause of Disease Novel genome-editing technologies have made it possible to precisely rewrite DNA in ways that were unthinkable just a decade ago AI-driven methods can predict the structure of nearly every known protein and generate de novo proteins with specific functions Initiatives like the Human Cell Atlas, which is mapping every cell type in the human body, create a reference for health and disease BIOLOGICAL ATLASES PROTEIN ENGINEERING GENETIC ENGINEERING

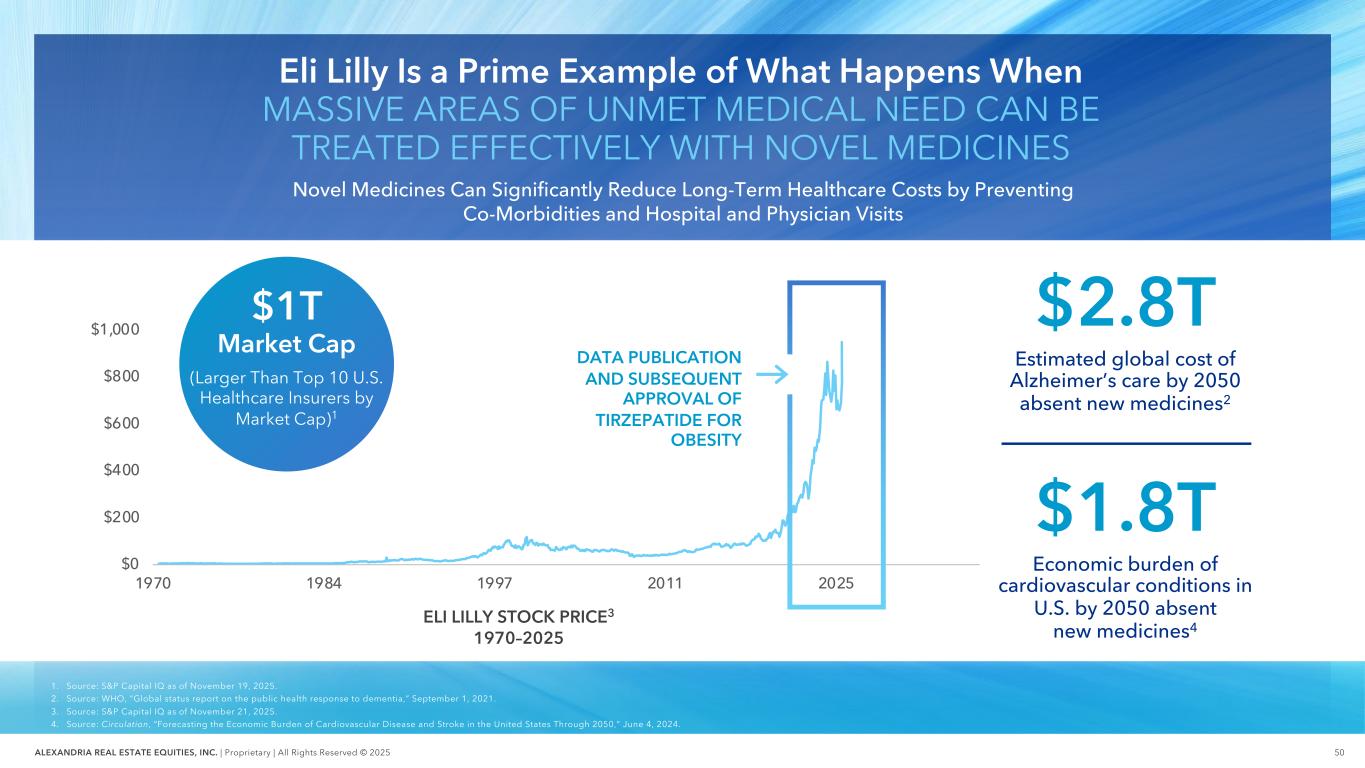

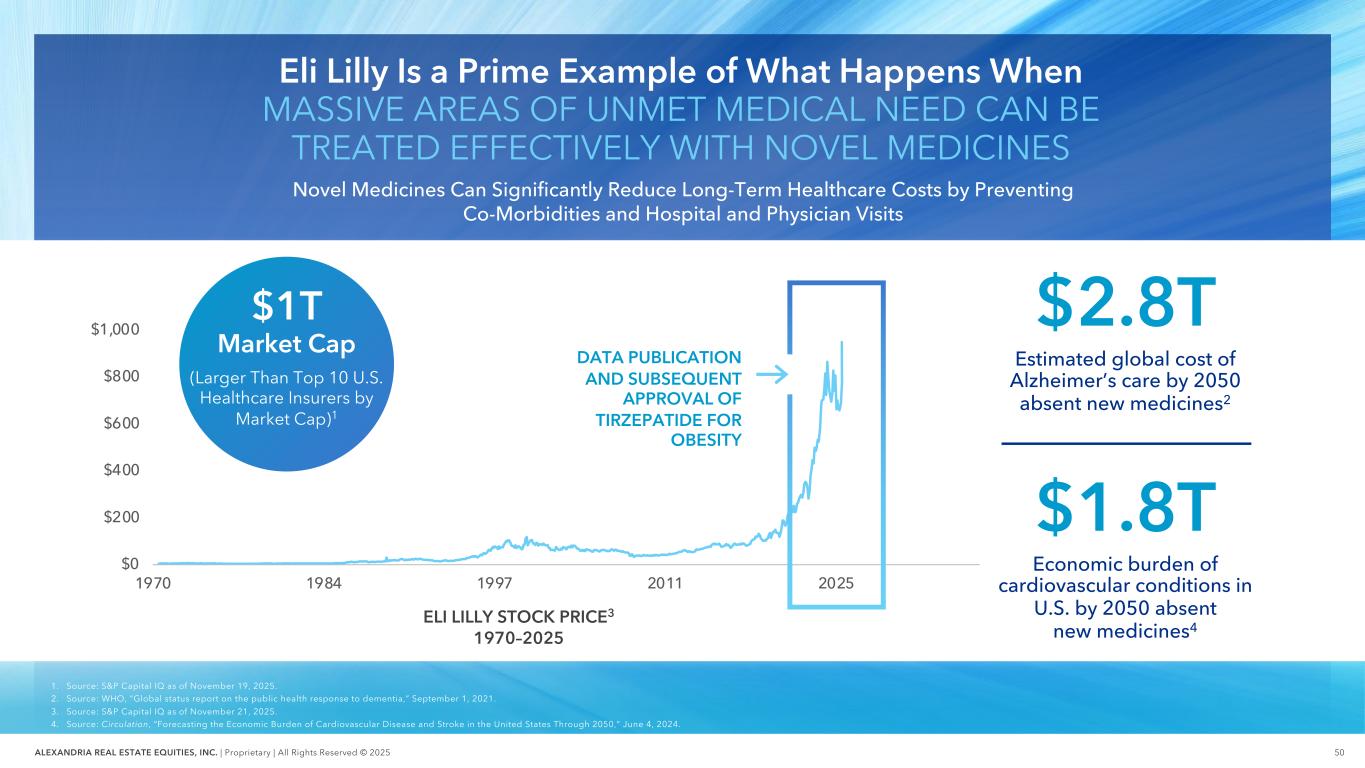

50ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 $0 $200 $400 $600 $800 $1,000 1970 1984 1997 2011 2025 ELI LILLY STOCK PRICE3 1970–2025 Eli Lilly Is a Prime Example of What Happens When MASSIVE AREAS OF UNMET MEDICAL NEED CAN BE TREATED EFFECTIVELY WITH NOVEL MEDICINES 1. Source: S&P Capital IQ as of November 19, 2025. 2. Source: WHO, “Global status report on the public health response to dementia,” September 1, 2021. 3. Source: S&P Capital IQ as of November 21, 2025. 4. Source: Circulation, “Forecasting the Economic Burden of Cardiovascular Disease and Stroke in the United States Through 2050,” June 4, 2024. DATA PUBLICATION AND SUBSEQUENT APPROVAL OF TIRZEPATIDE FOR OBESITY Estimated global cost of Alzheimer’s care by 2050 absent new medicines2 $2.8T Economic burden of cardiovascular conditions in U.S. by 2050 absent new medicines4 $1.8T $1T Market Cap (Larger Than Top 10 U.S. Healthcare Insurers by Market Cap)1 Novel Medicines Can Significantly Reduce Long-Term Healthcare Costs by Preventing Co-Morbidities and Hospital and Physician Visits

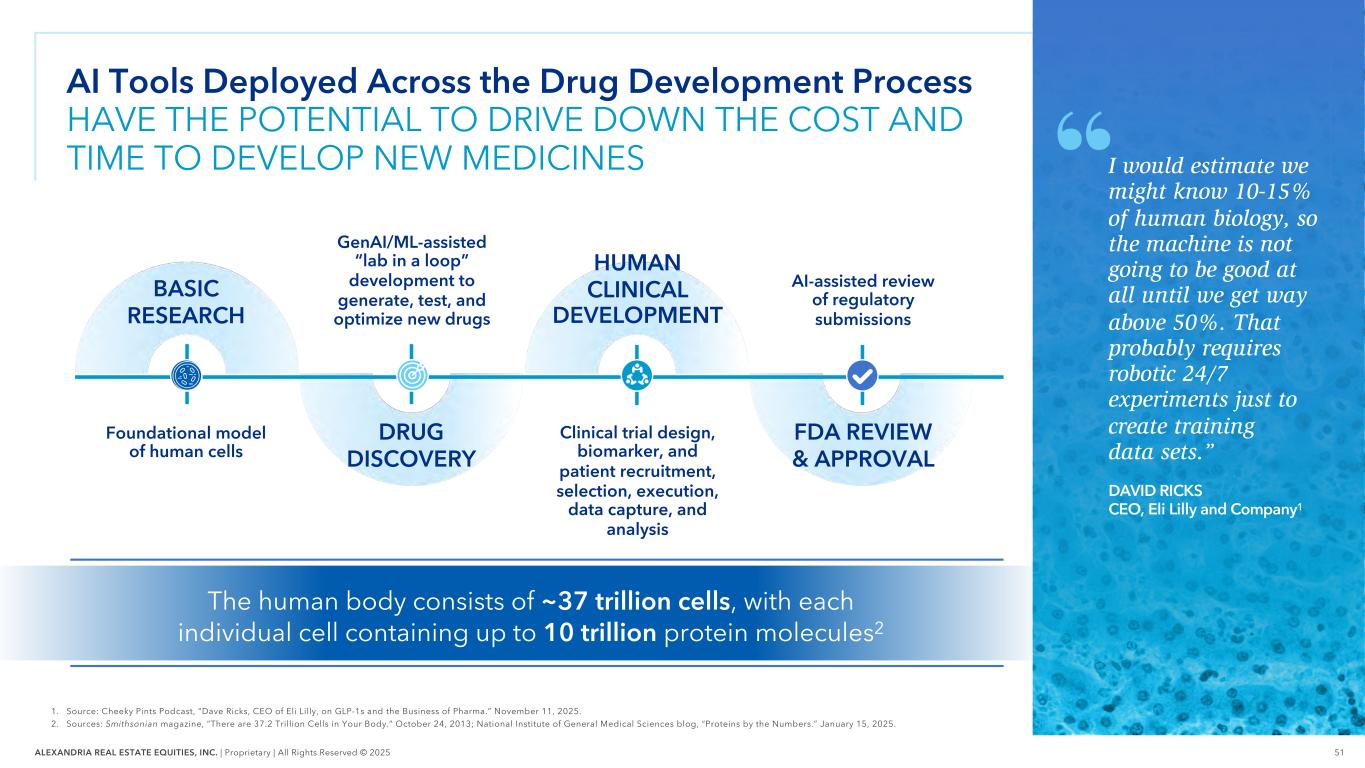

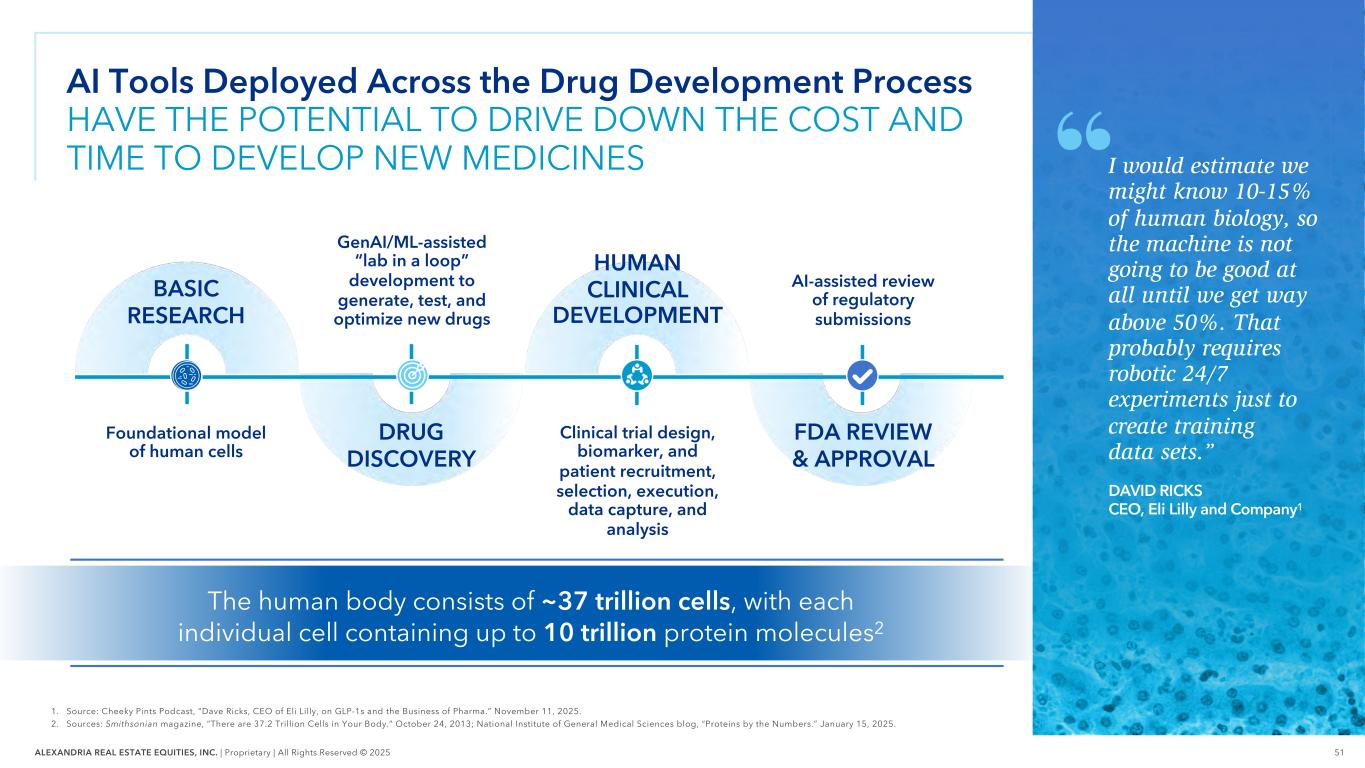

51ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 AI Tools Deployed Across the Drug Development Process HAVE THE POTENTIAL TO DRIVE DOWN THE COST AND TIME TO DEVELOP NEW MEDICINES 1. Source: Cheeky Pints Podcast, “Dave Ricks, CEO of Eli Lilly, on GLP-1s and the Business of Pharma.” November 11, 2025. 2. Sources: Smithsonian magazine, “There are 37.2 Trillion Cells in Your Body.” October 24, 2013; National Institute of General Medical Sciences blog, “Proteins by the Numbers.” January 15, 2025. BASIC RESEARCH HUMAN CLINICAL DEVELOPMENT FDA REVIEW & APPROVAL DRUG DISCOVERY Foundational model of human cells GenAI/ML-assisted “lab in a loop” development to generate, test, and optimize new drugs Clinical trial design, biomarker, and patient recruitment, selection, execution, data capture, and analysis AI-assisted review of regulatory submissions I would estimate we might know 10-15% of human biology, so the machine is not going to be good at all until we get way above 50%. That probably requires robotic 24/7 experiments just to create training data sets.” DAVID RICKS CEO, Eli Lilly and Company1 The human body consists of ~37 trillion cells, with each individual cell containing up to 10 trillion protein molecules2

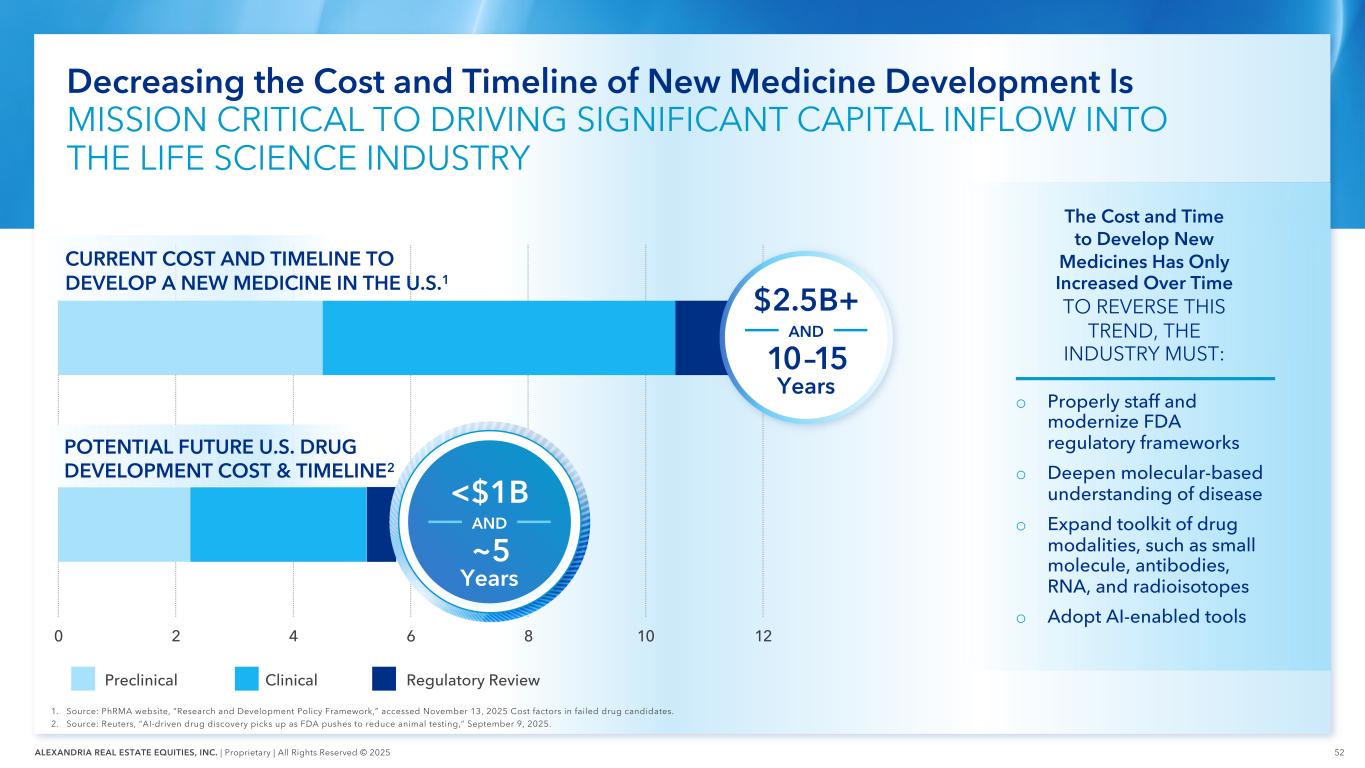

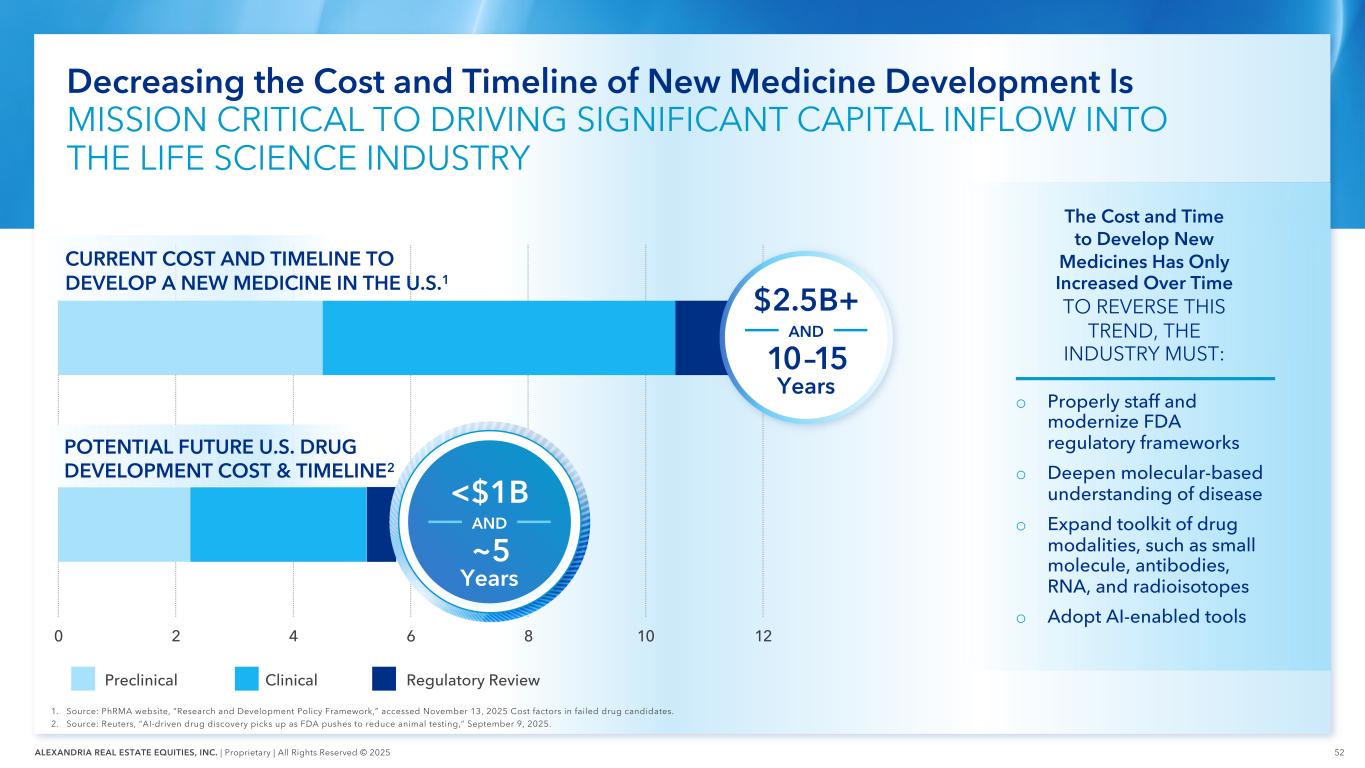

52ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 Decreasing the Cost and Timeline of New Medicine Development Is MISSION CRITICAL TO DRIVING SIGNIFICANT CAPITAL INFLOW INTO THE LIFE SCIENCE INDUSTRY 0 2 4 6 8 10 12 The Cost and Time to Develop New Medicines Has Only Increased Over Time TO REVERSE THIS TREND, THE INDUSTRY MUST: o Properly staff and modernize FDA regulatory frameworks o Deepen molecular-based understanding of disease o Expand toolkit of drug modalities, such as small molecule, antibodies, RNA, and radioisotopes o Adopt AI-enabled tools Preclinical Clinical Regulatory Review $2.5B+ 10 –15 Years AND CURRENT COST AND TIMELINE TO DEVELOP A NEW MEDICINE IN THE U.S.1 POTENTIAL FUTURE U.S. DRUG DEVELOPMENT COST & TIMELINE2 <$1B ~5 Years AND 1. Source: PhRMA website, ”Research and Development Policy Framework,” accessed November 13, 2025 Cost factors in failed drug candidates. 2. Source: Reuters, “AI-driven drug discovery picks up as FDA pushes to reduce animal testing,” September 9, 2025.

53ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 THE LIFE SCIENCE INDUSTRY HAS IMMENSE POTENTIAL TO GROW BIOTECH TIMELINE TODAY FUTURE BIRTH OF BIOTECH 1976 ONLY 10% DISEASES SOLVED¹ $6T TOTAL MARKET CAPITALIZATION² COTTAGE INDUSTRY DOMINATED BY SPECIALISTS 90% DISEASES SOLVED $20T+ TOTAL MARKET CAPITALIZATION (Equivalent to Today’s MAG7) MAINSTREAM ASSET CLASS 1. Source: U.S. House Committee on Energy and Commerce, “The 21st Century Cures Discussion Document White Paper,” January 27, 2015. 2. Source: BCIQ as of November 18, 2025. Includes pharma, biotech, and medical device and diagnostic public companies with >$5M market cap listed on NASDAQ or NYSE. 2026 (50 Years From When First Biotech, Genentech, Was Founded)

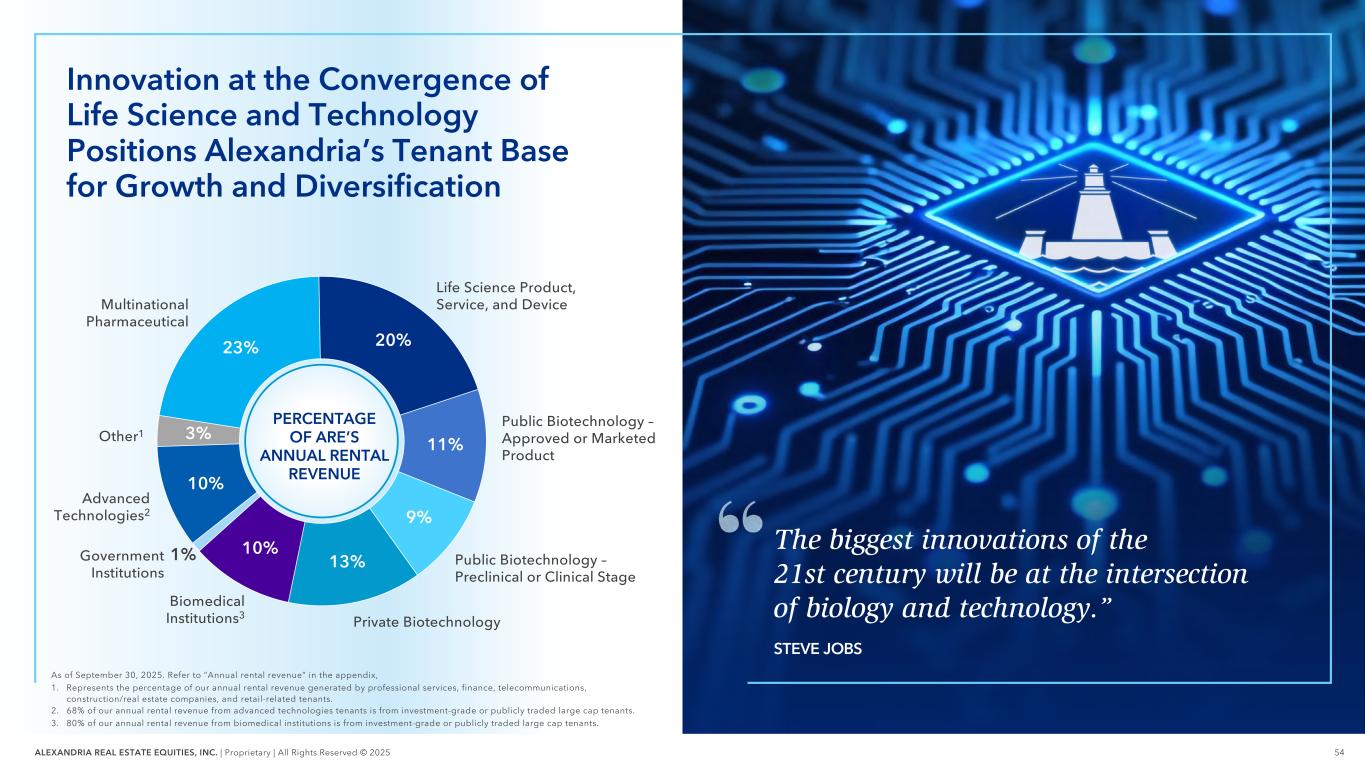

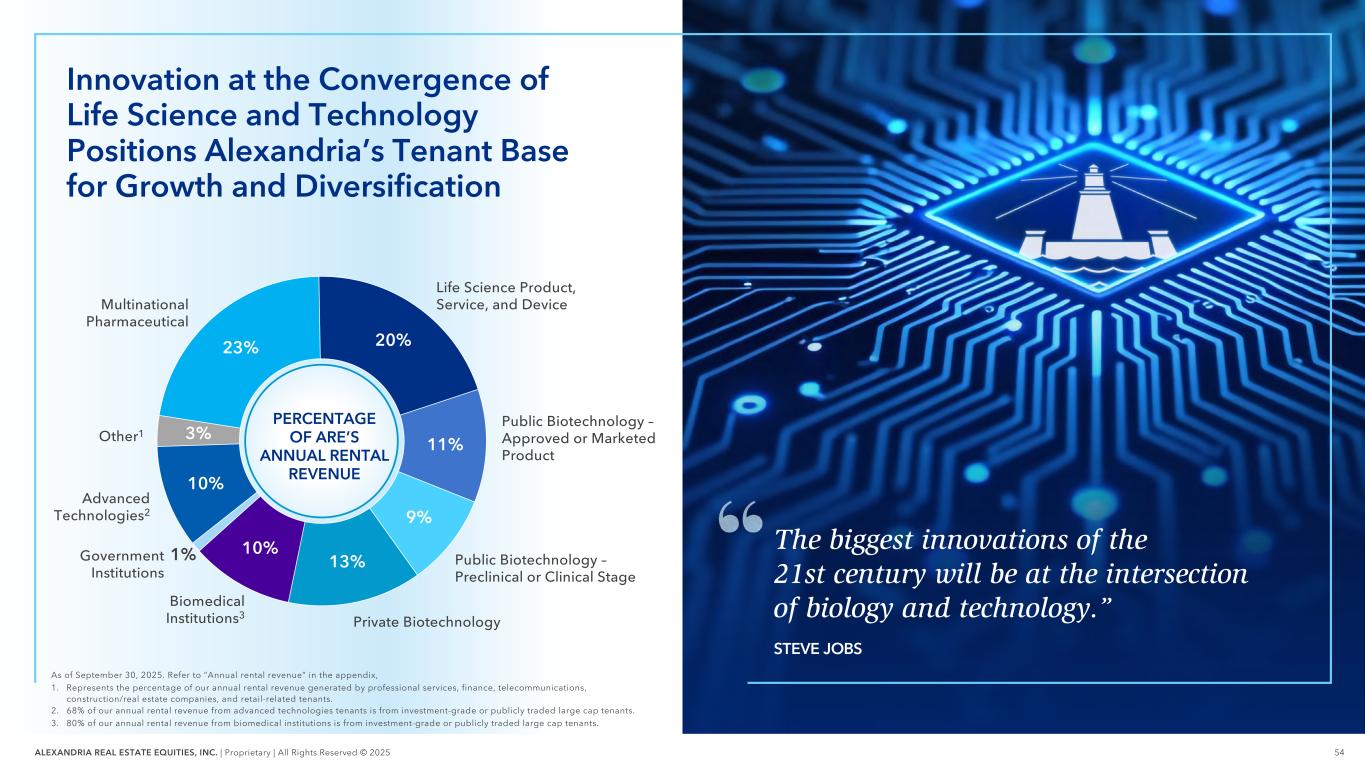

54ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 Public Biotechnology – Approved or Marketed Product 20% 11% 9% 13% 10%1% 10% 3% 23% Biomedical Institutions3 Life Science Product, Service, and Device Public Biotechnology – Preclinical or Clinical Stage Private Biotechnology Other1 Government Institutions Advanced Technologies2 As of September 30, 2025. Refer to “Annual rental revenue” in the appendix, 1. Represents the percentage of our annual rental revenue generated by professional services, finance, telecommunications, construction/real estate companies, and retail-related tenants. 2. 68% of our annual rental revenue from advanced technologies tenants is from investment-grade or publicly traded large cap tenants. 3. 80% of our annual rental revenue from biomedical institutions is from investment-grade or publicly traded large cap tenants. The biggest innovations of the 21st century will be at the intersection of biology and technology.” STEVE JOBS PERCENTAGE OF ARE’S ANNUAL RENTAL REVENUE Innovation at the Convergence of Life Science and Technology Positions Alexandria’s Tenant Base for Growth and Diversification Multinational Pharmaceutical

55ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 INVESTOR DAY 2025 Alexandria’s Reset and Path Forward

56ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 STATE OF THE MARKET Greater Boston & San Diego

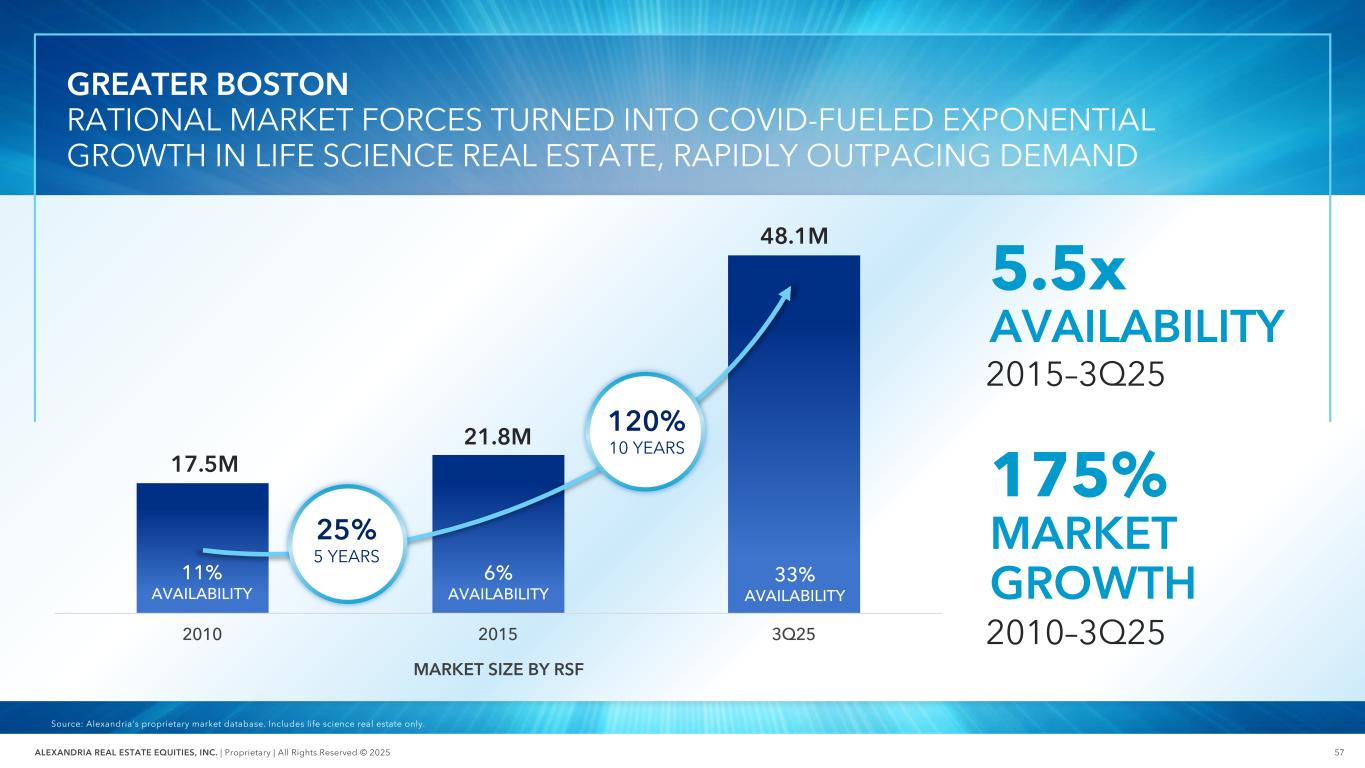

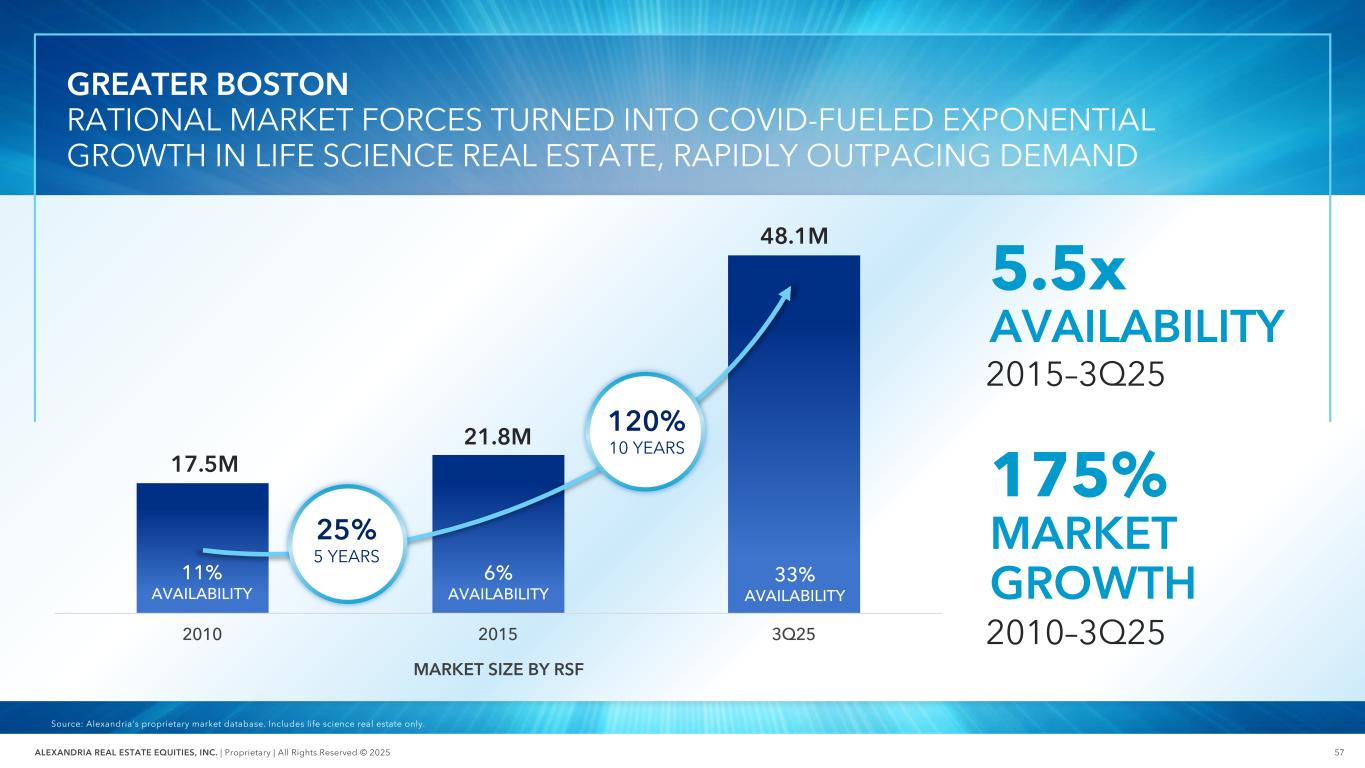

57ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 2010 2015 3Q25 Source: Alexandria’s proprietary market database. Includes life science real estate only. GREATER BOSTON RATIONAL MARKET FORCES TURNED INTO COVID-FUELED EXPONENTIAL GROWTH IN LIFE SCIENCE REAL ESTATE, RAPIDLY OUTPACING DEMAND 17.5M 21.8M 48.1M 175% MARKET GROWTH 2010–3Q25 25% 5 YEARS 120% 10 YEARS 6% AVAILABILITY 33% AVAILABILITY 5.5x AVAILABILITY 2015–3Q25 MARKET SIZE BY RSF 11% AVAILABILITY

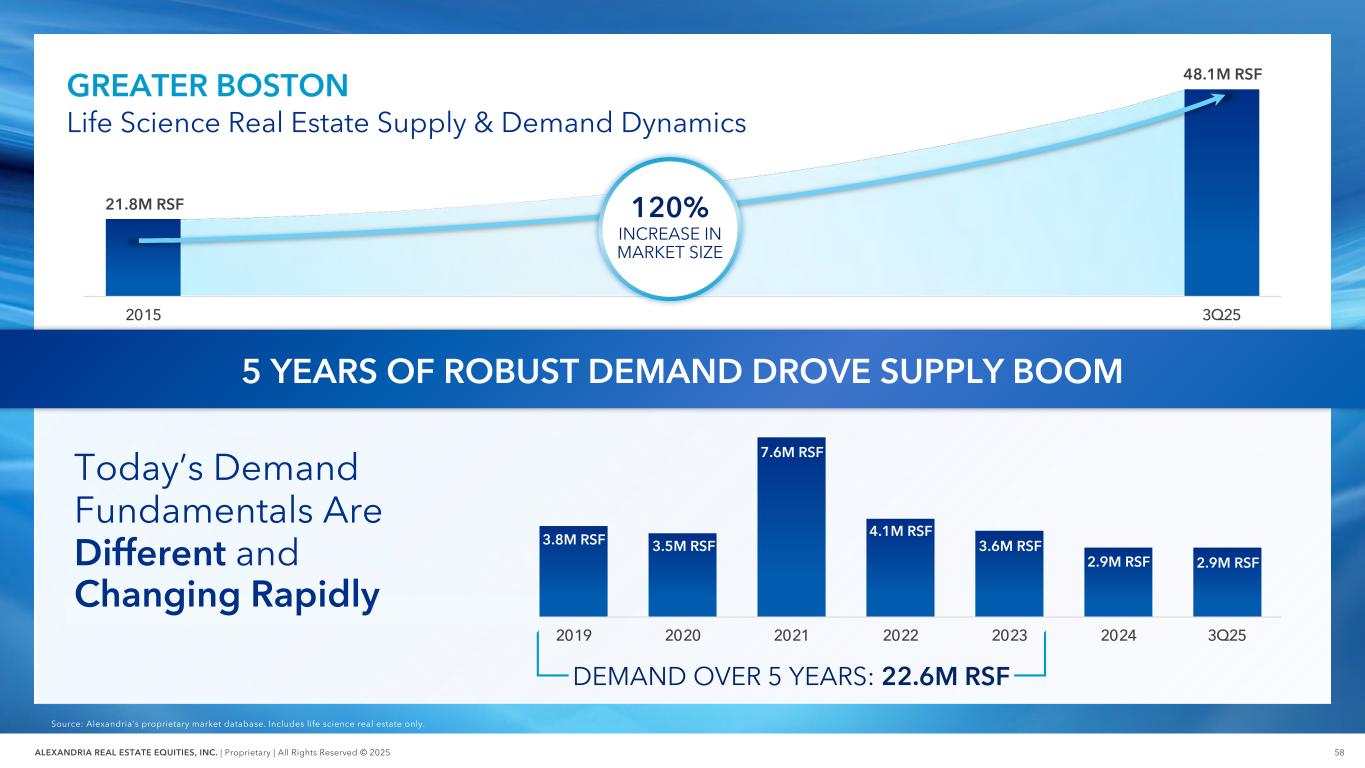

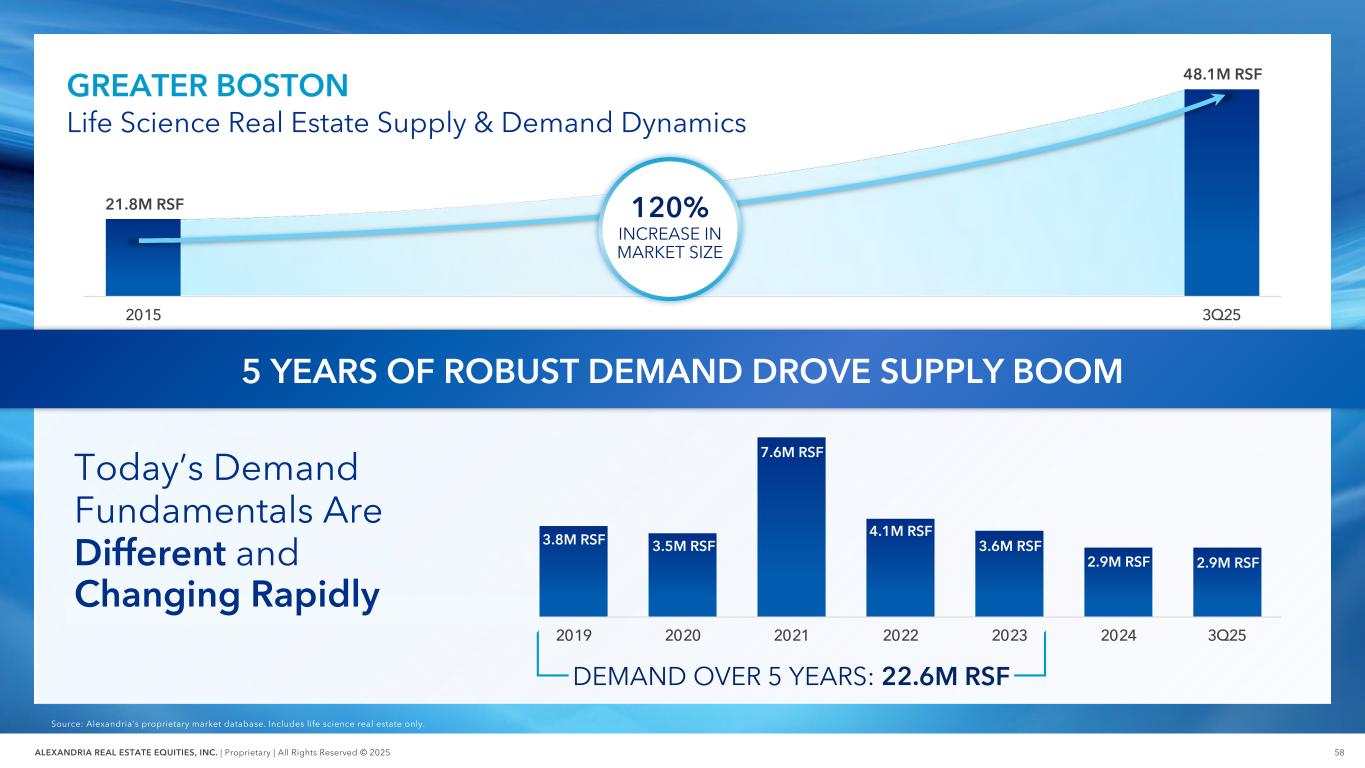

58ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 2019 2020 2021 2022 2023 2024 3Q25 2015 3Q25 Source: Alexandria’s proprietary market database. Includes life science real estate only. 21.8M RSF 48.1M RSF 7.6M RSF 3.6M RSF 4.1M RSF 2.9M RSF 120% INCREASE IN MARKET SIZE DEMAND OVER 5 YEARS: 22.6M RSF 2.9M RSF 5 YEARS OF ROBUST DEMAND DROVE SUPPLY BOOM GREATER BOSTON Life Science Real Estate Supply & Demand Dynamics Today’s Demand Fundamentals Are Different and Changing Rapidly 3.5M RSF3.8M RSF

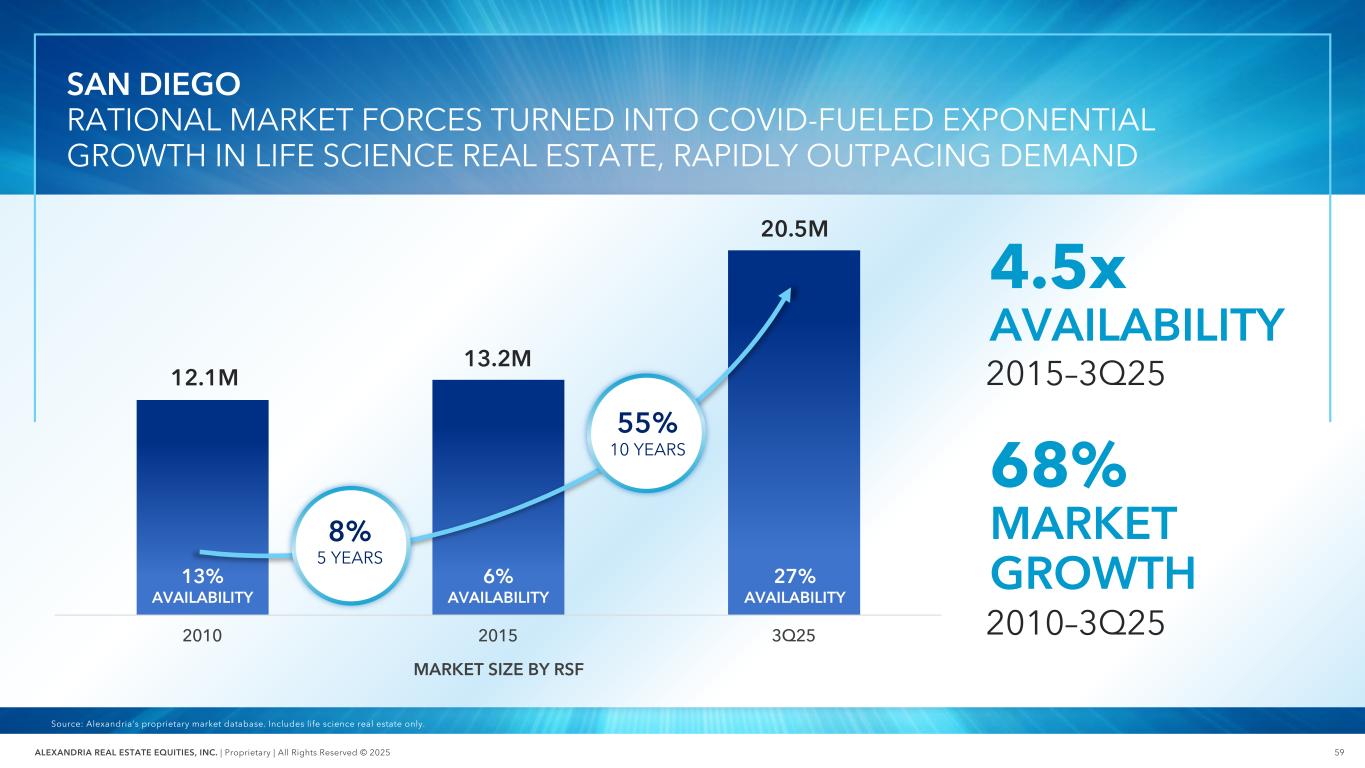

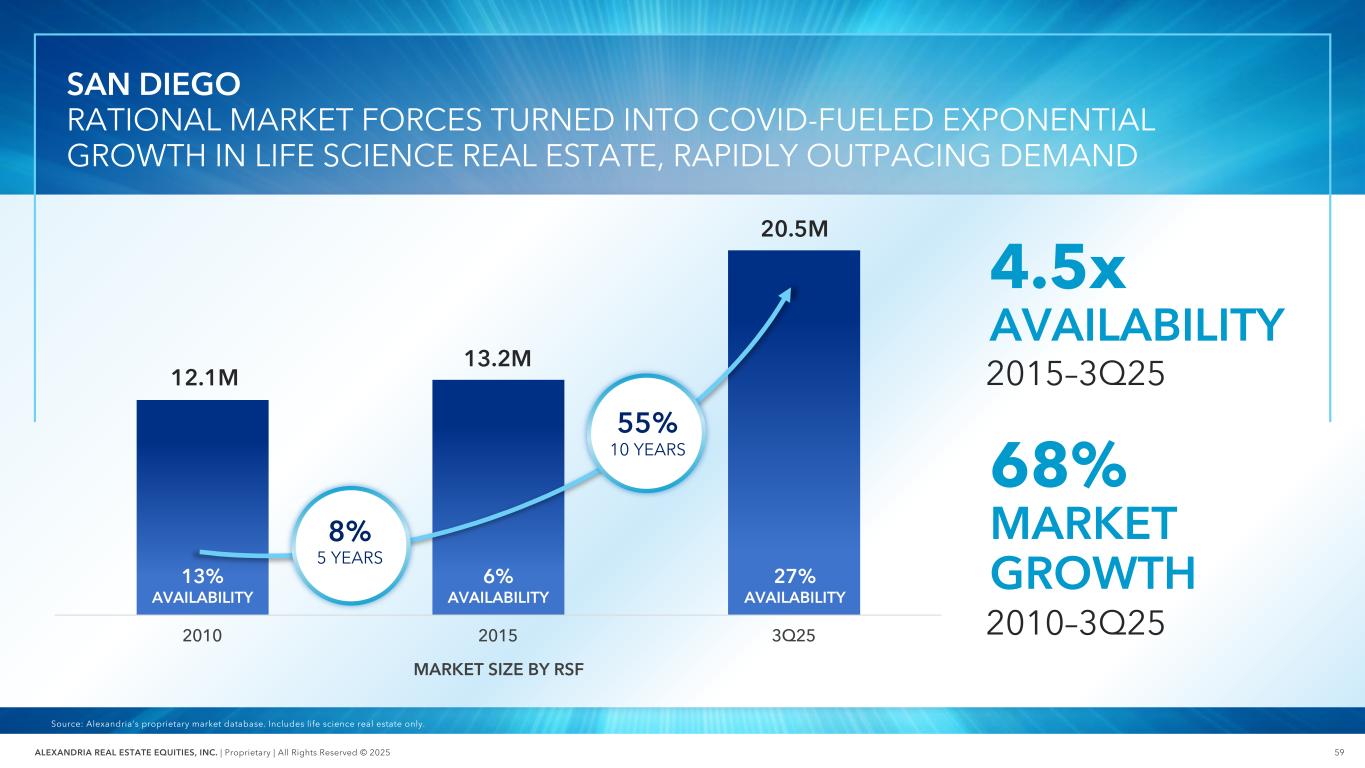

59ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 2010 2015 3Q25 Source: Alexandria’s proprietary market database. Includes life science real estate only. SAN DIEGO RATIONAL MARKET FORCES TURNED INTO COVID-FUELED EXPONENTIAL GROWTH IN LIFE SCIENCE REAL ESTATE, RAPIDLY OUTPACING DEMAND 12.1M 13.2M 20.5M 68% MARKET GROWTH 2010–3Q25 8% 5 YEARS 55% 10 YEARS 6% AVAILABILITY 27% AVAILABILITY 4.5x AVAILABILITY 2015–3Q25 MARKET SIZE BY RSF 13% AVAILABILITY

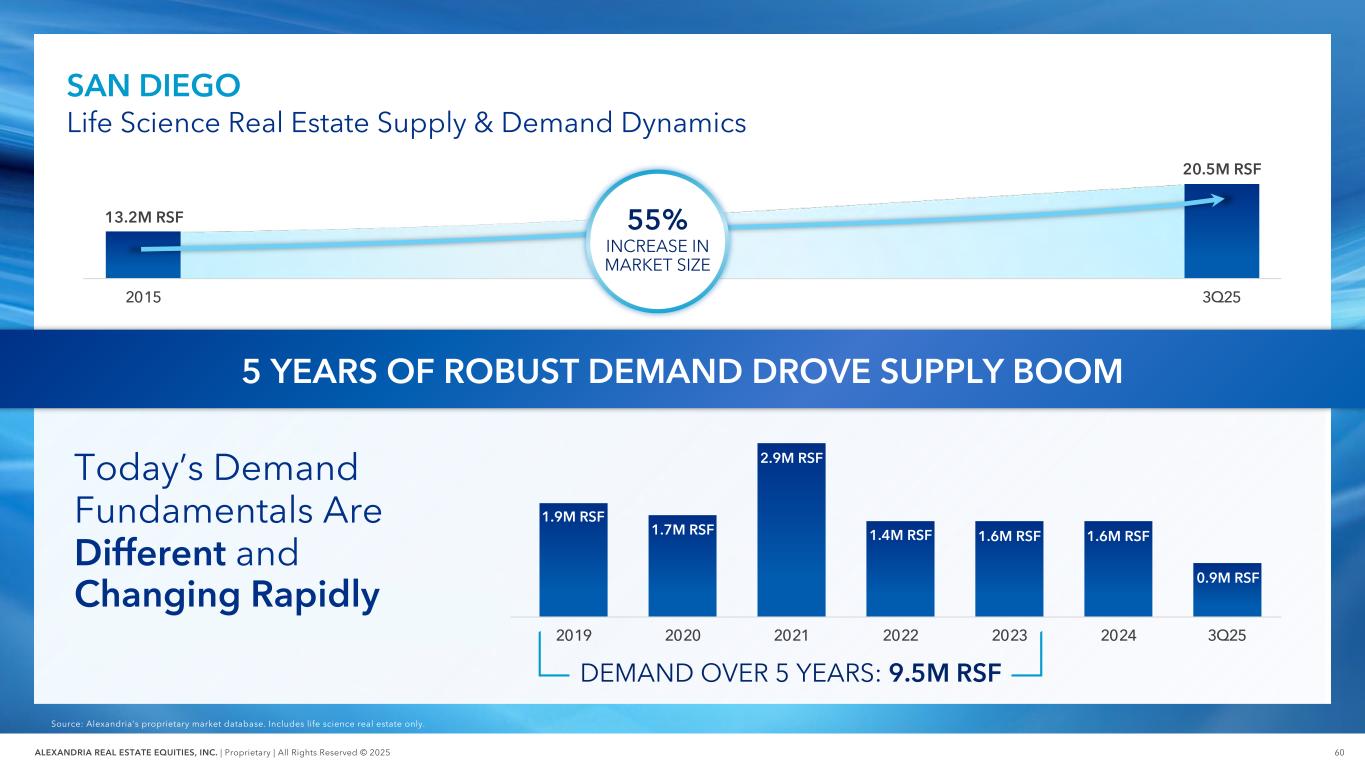

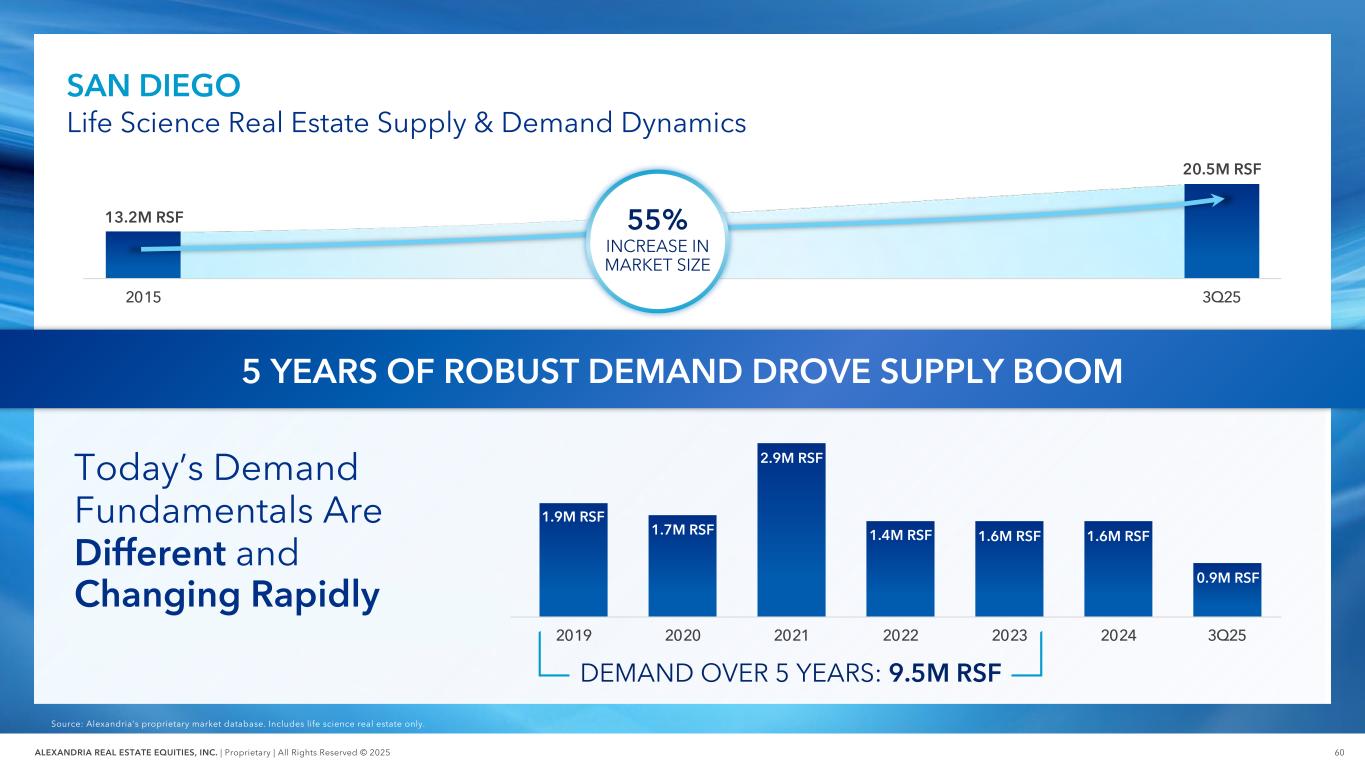

60ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 Source: Alexandria’s proprietary market database. Includes life science real estate only. 2019 2020 2021 2022 2023 2024 3Q25 1.9M RSF 1.7M RSF 2.9M RSF 1.4M RSF 1.6M RSF1.6M RSF 0.9M RSF 2015 3Q25 13.2M RSF 20.5M RSF 55% INCREASE IN MARKET SIZE DEMAND OVER 5 YEARS: 9.5M RSF SAN DIEGO Life Science Real Estate Supply & Demand Dynamics 5 YEARS OF ROBUST DEMAND DROVE SUPPLY BOOM Today’s Demand Fundamentals Are Different and Changing Rapidly

61ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 Refer to "Megacampus” in the appendix. CLUSTERING is MISSION CRITICAL for FUELING LIFE SCIENCE INNOVATION Alexandria Conceived Our Megacampus™ Platform to Meet the Needs of the Collaborative and Cooperative Life Science Industry Our Megacampus ecosystems are strategically located in key innovation clusters to enable us to capture outsized share of demand ONE ALEXANDRIA SQUARE MEGACAMPUS | SAN DIEGO

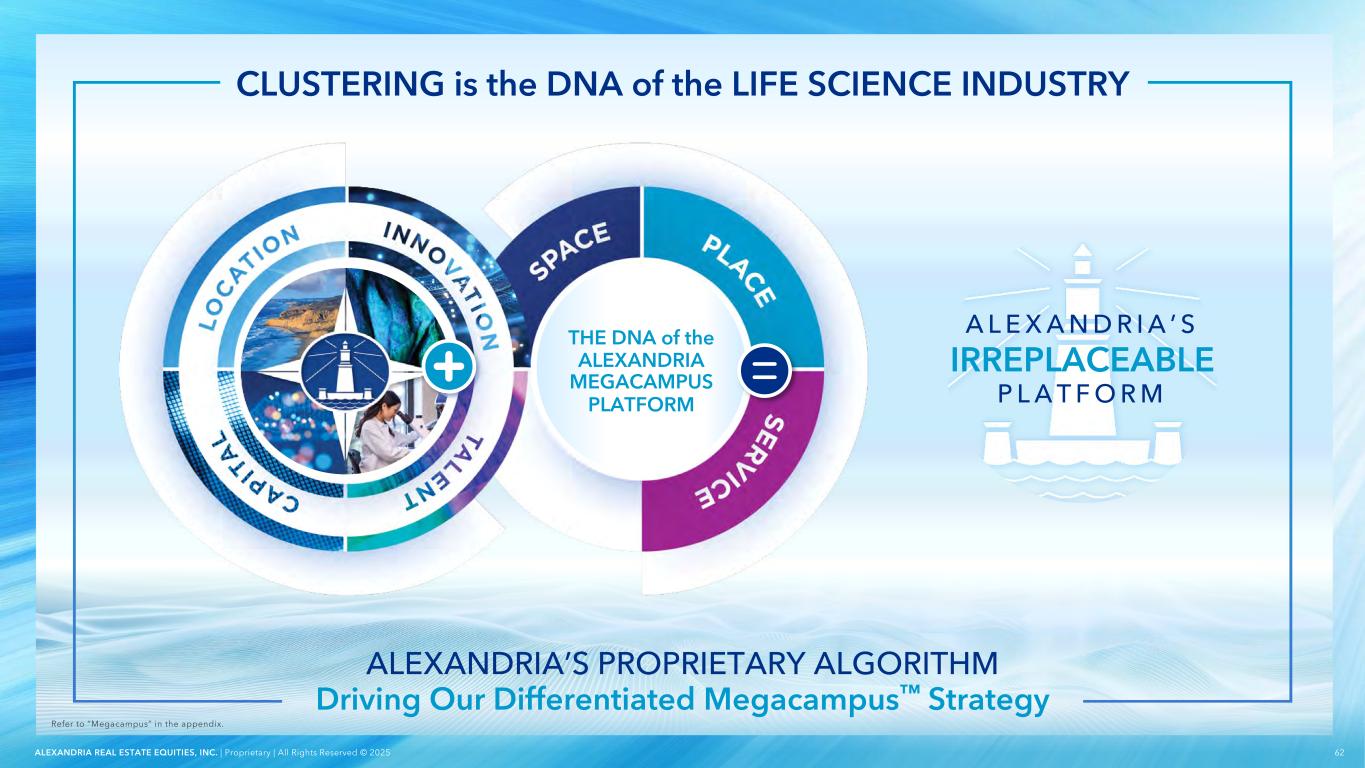

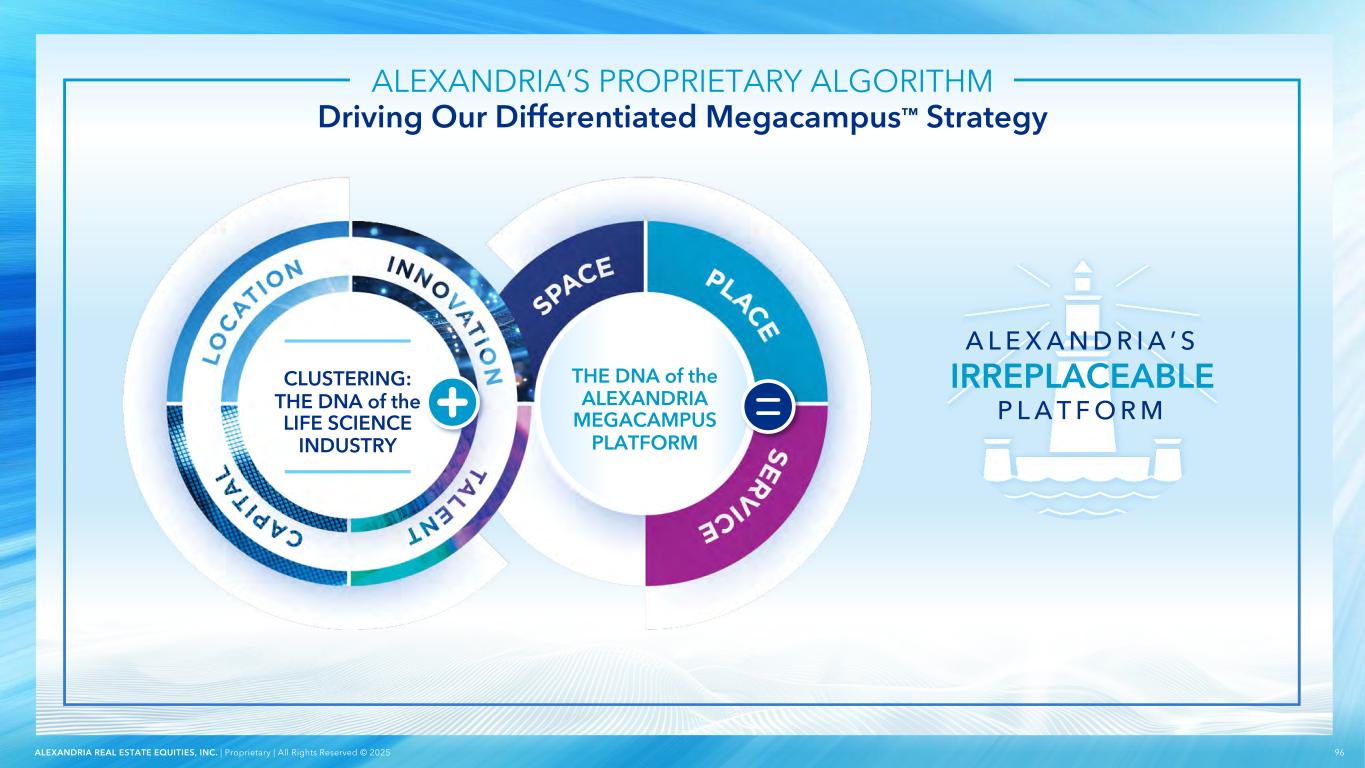

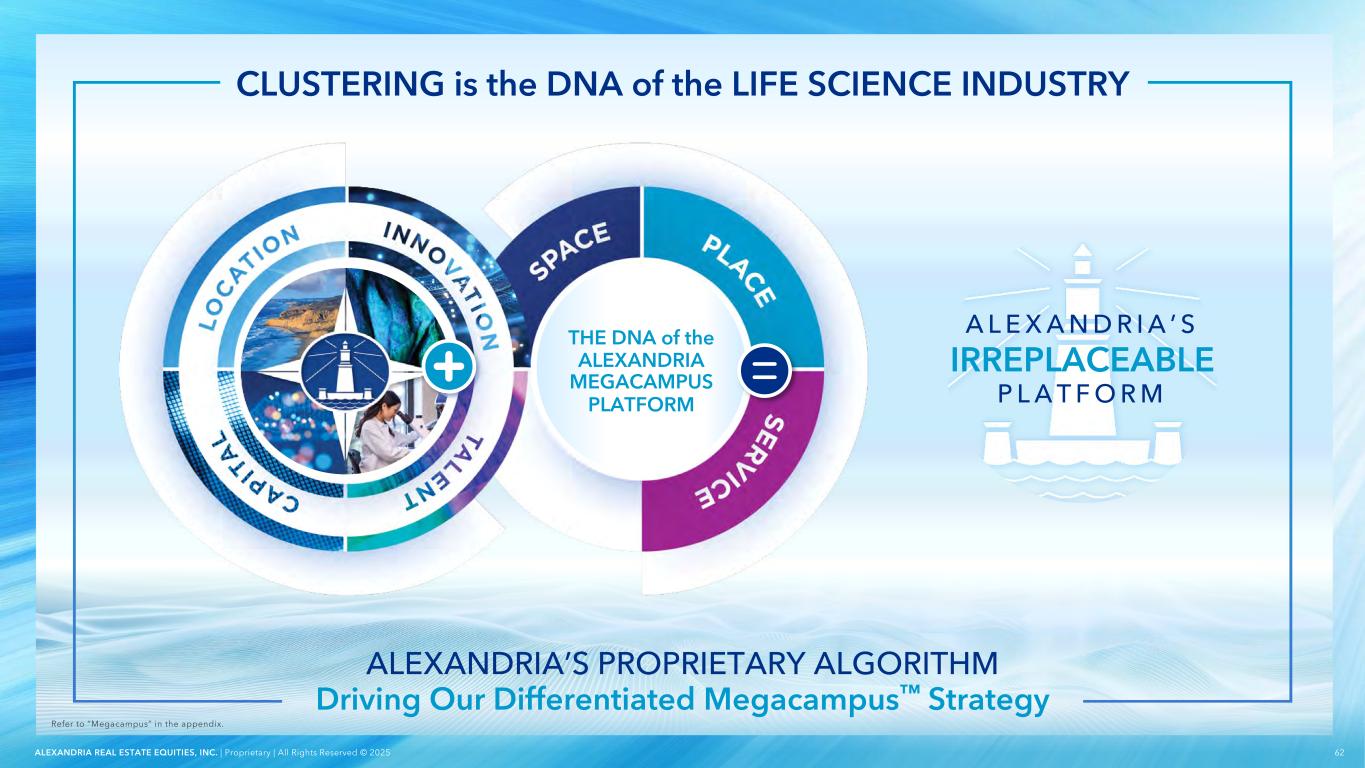

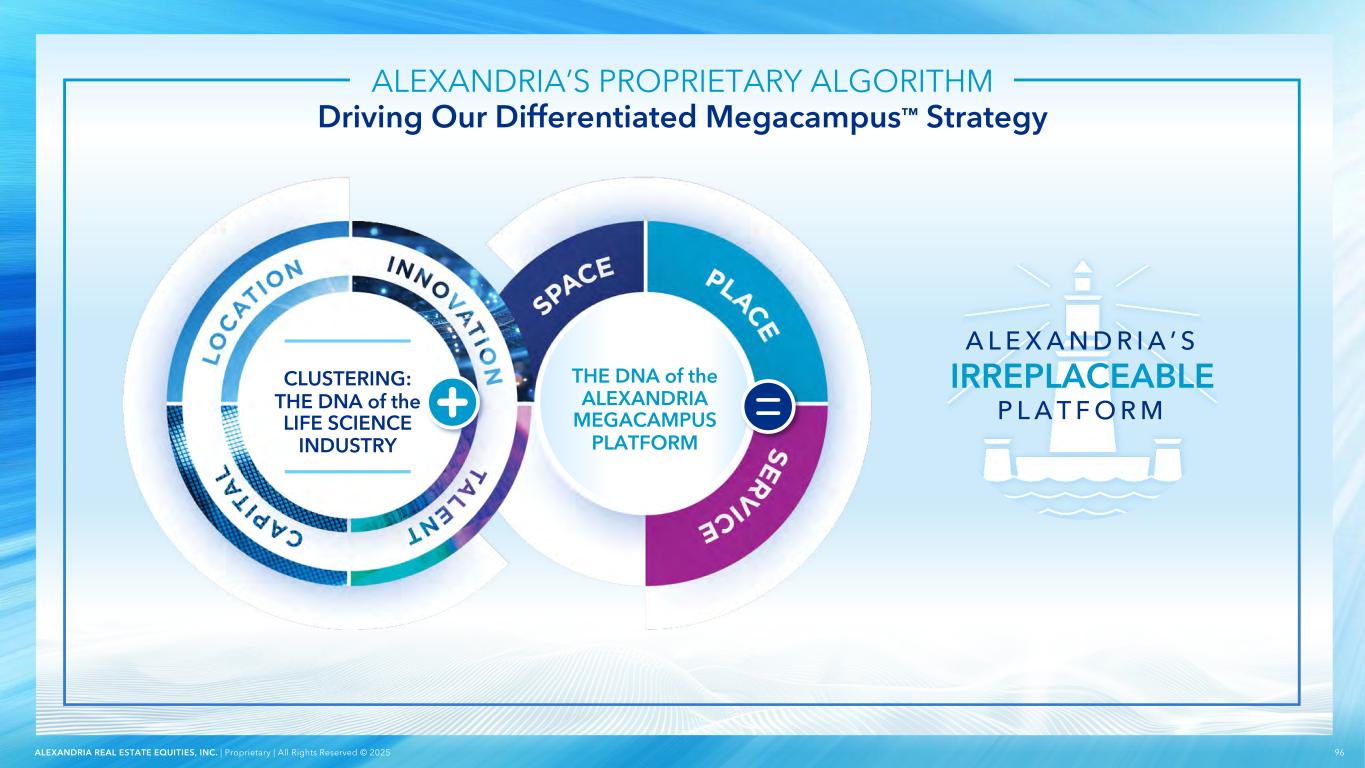

62ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 Refer to “Megacampus” in the appendix. CLUSTERING is the DNA of the LIFE SCIENCE INDUSTRY A L E X A N D R I A ’ S IRREPLACEABLE P L A T F O R M THE DNA of the ALEXANDRIA MEGACAMPUS PLATFORM ALEXANDRIA’S PROPRIETARY ALGORITHM Driving Our Differentiated Megacampus™ Strategy

63ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 Alexandria’s First-Mover Advantage Has Enabled Us to Secure Irreplaceable Real Estate in the Top Centers of Innovation Refer to "Megacampus” in the appendix. THE PIONEER OF LIFE SCIENCE REAL ESTATE 30+ YEARS Owning, Operating, and Developing Life Science Real Estate Infrastructure UNMATCHED EXPERIENCE 30+ YEARS Experience in Life Science Building Operations and Asset Management DOMINANT MARKET PRESENCE 27+ YEARS Average Tenure in Our Core Life Science Innovation Clusters 2004 | Pioneered our cluster campus strategy in Mission Bay, establishing the foundation for our Megacampus™ platform ALEXANDRIA CENTER® FOR SCIENCE AND TECHNOLOGY – MISSION BAY MEGACAMPUS | SAN FRANCISCO BAY AREA

64ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 ALEXANDRIA GREATER BOSTON: LIFE SCIENCE LEASING OUTPERFORMANCE 1. Source: Alexandria’s proprietary market database. Represents Alexandria’s life science leasing executed from January 1, 2023 through the nine months ended September 30, 2025 in the Greater Boston market compared to the sum of life science leasing executed by the next five largest life science real estate owners within that market. Alexandria’s Leading Real Estate Platform Continues to Capture Outsized Share of Demand ALEXANDRIA’S GREATER BOSTON LEASING VOLUME ~110% OF THE NEXT FIVE LARGEST LIFE SCIENCE REAL ESTATE OWNERS (BY RSF LEASED) COMBINED1 2023–3Q25 — SPONSORSHIP MATTERS — THE ARSENAL ON THE CHARLES MEGACAMPUS | WATERTOWN

65ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 1. Source: Alexandria’s proprietary market database. Represents Alexandria’s life science leasing executed from January 1, 2023 through the nine months ended September 30, 2025 in the San Diego market compared to the sum of life science leasing executed by the next five largest life science real estate owners within that market. ALEXANDRIA SAN DIEGO: LIFE SCIENCE LEASING OUTPERFORMANCE Alexandria’s Leading Real Estate Platform Continues to Capture Outsized Share of Demand — SPONSORSHIP MATTERS — ALEXANDRIA’S SAN DIEGO LEASING VOLUME ~150% OF THE NEXT FIVE LARGEST LIFE SCIENCE REAL ESTATE OWNERS (BY RSF LEASED) COMBINED1 2023–3Q25 CAMPUS POINT BY ALEXANDRIA MEGACAMPUS | UNIVERSITY TOWN CENTER

66ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 MEGACAMPUS™ CASE STUDIES A L E X A N D R I A ’ S IRREPLACEABLE P L A T F O R M ALEXANDRIA TECHNOLOGY SQUARE® CAMBRIDGE Established 2006 CAMPUS POINT BY ALEXANDRIA SAN DIEGO Established 2010 Refer to "Megacampus” in the appendix.

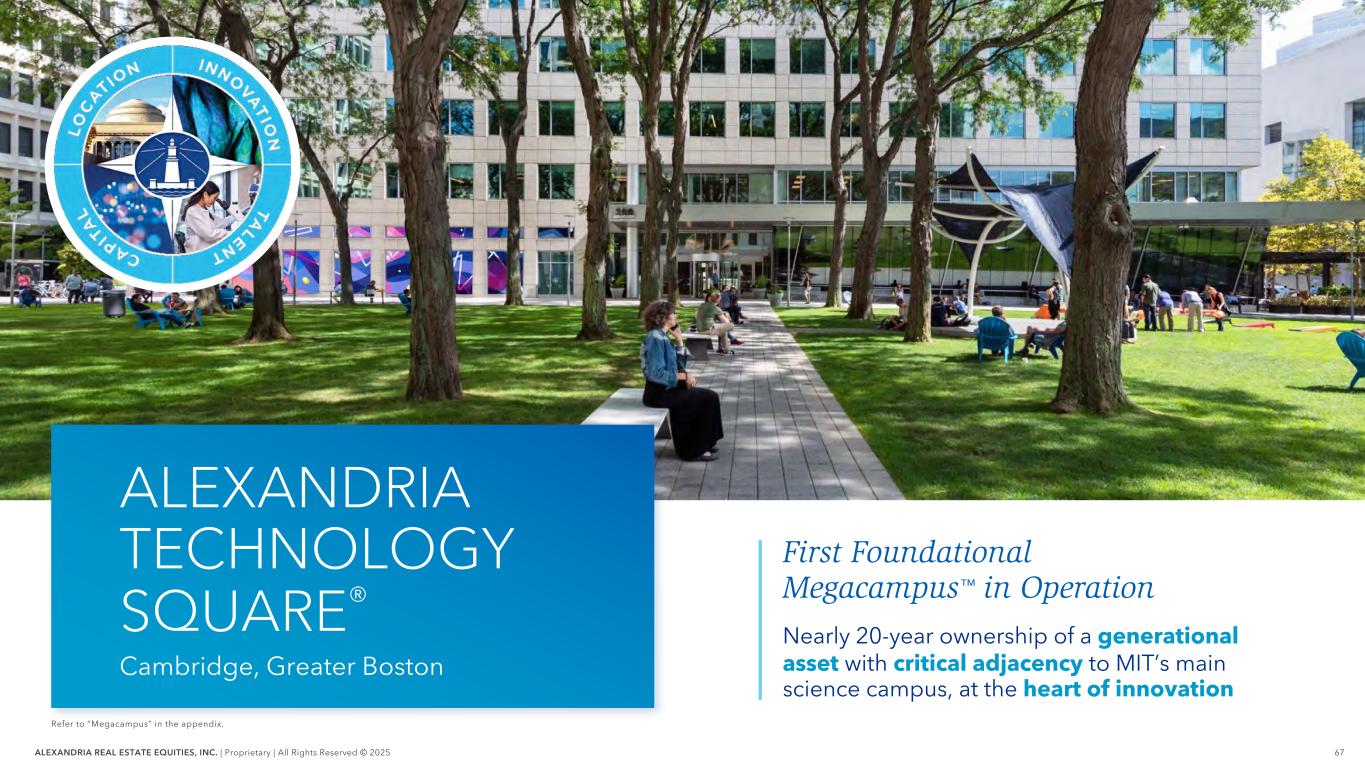

67ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 Refer to “Megacampus” in the appendix. First Foundational Megacampus™ in Operation Nearly 20-year ownership of a generational asset with critical adjacency to MIT’s main science campus, at the heart of innovation ALEXANDRIA TECHNOLOGY SQUARE® Cambridge, Greater Boston

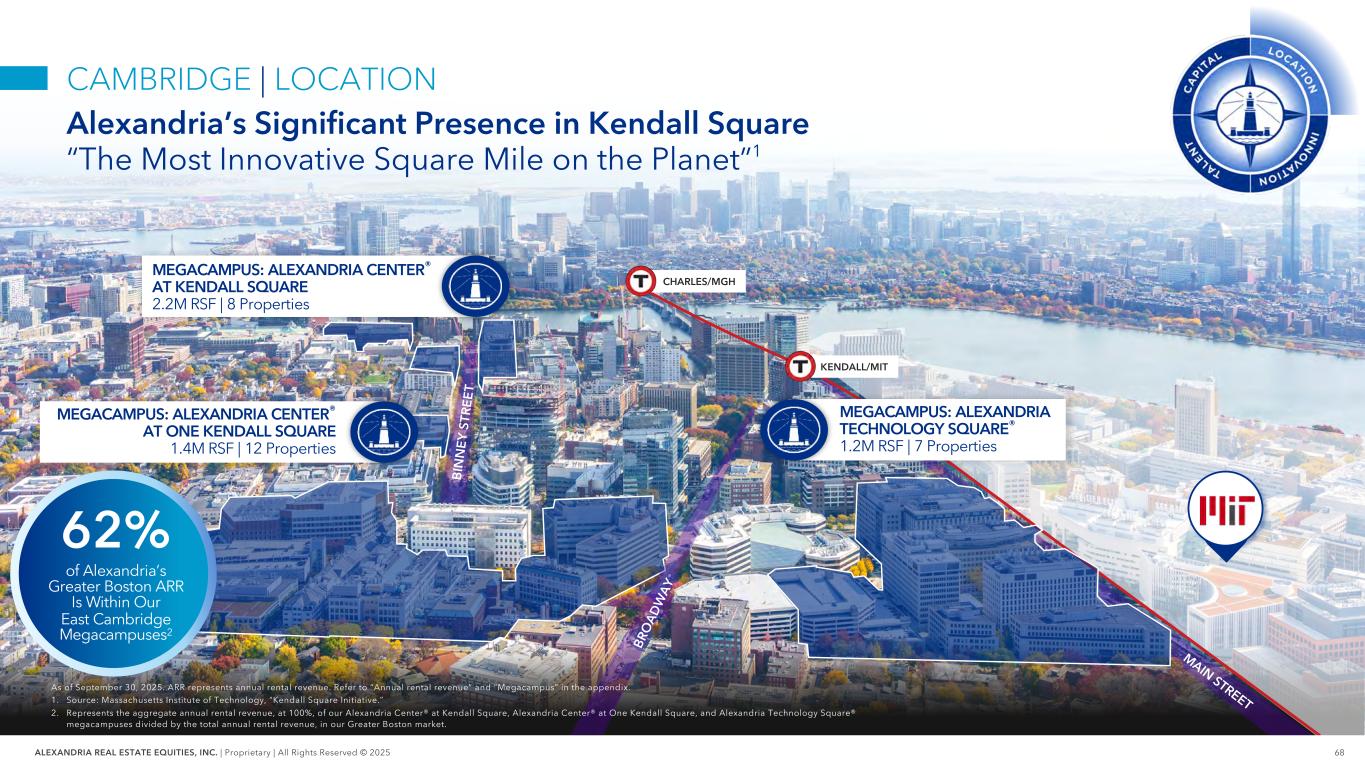

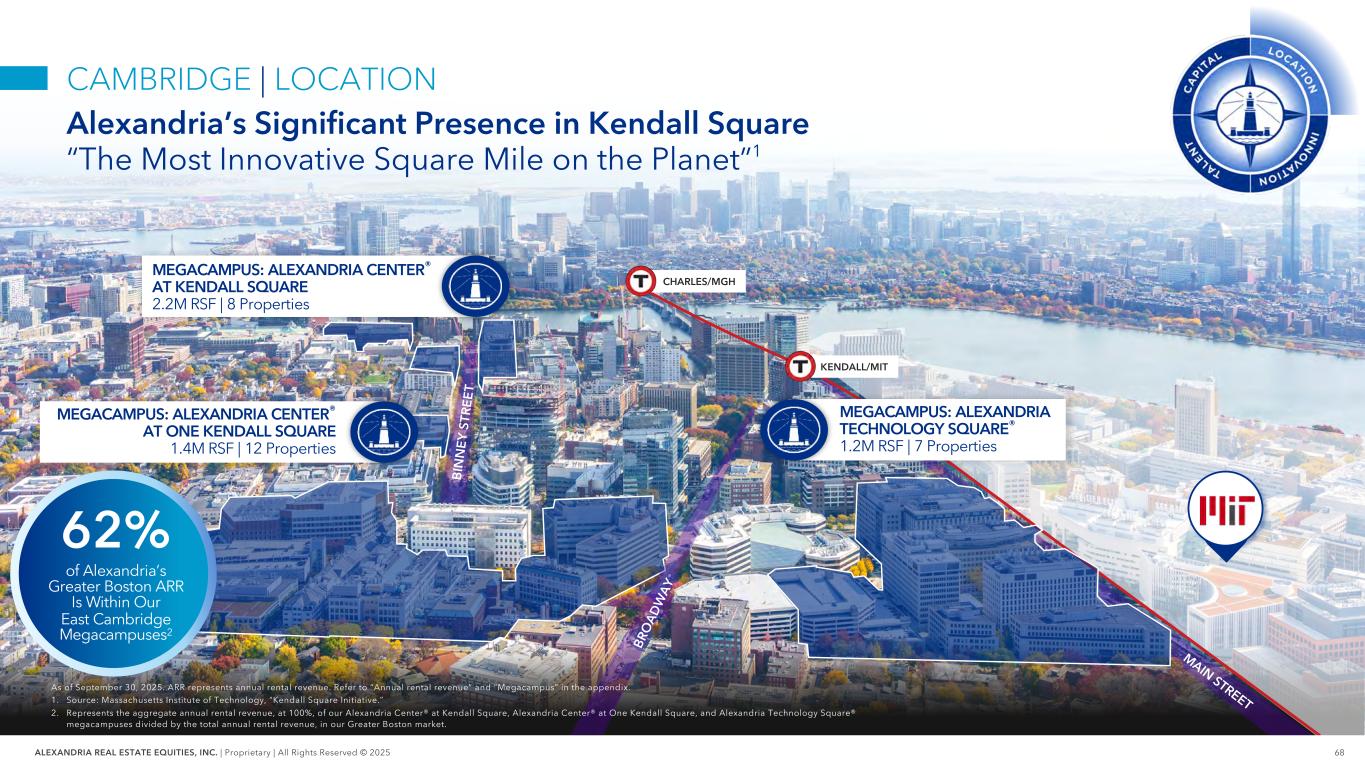

68ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 MAIN STREET MEGACAMPUS: ALEXANDRIA TECHNOLOGY SQUARE® 1.2M RSF | 7 Properties MEGACAMPUS: ALEXANDRIA CENTER® AT ONE KENDALL SQUARE 1.4M RSF | 12 Properties MEGACAMPUS: ALEXANDRIA CENTER® AT KENDALL SQUARE 2.2M RSF | 8 Properties B IN N E Y S TR E E T KENDALL/MIT BR O A D W A Y CHARLES/MGH CAMBRIDGE | LOCATION Alexandria’s Significant Presence in Kendall Square “The Most Innovative Square Mile on the Planet”1 of Alexandria’s Greater Boston ARR Is Within Our East Cambridge Megacampuses2 62% As of September 30, 2025. ARR represents annual rental revenue. Refer to “Annual rental revenue” and “Megacampus” in the appendix. 1. Source: Massachusetts Institute of Technology, “Kendall Square Initiative.” 2. Represents the aggregate annual rental revenue, at 100%, of our Alexandria Center® at Kendall Square, Alexandria Center® at One Kendall Square, and Alexandria Technology Square® megacampuses divided by the total annual rental revenue, in our Greater Boston market.

69ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 Electronic Research Center 1964-1970 Cambridge Scientific Center 1964-1992 Artificial Intelligence Laboratory 1963-2004 World Wide Web Consortium 1994-2004 Worldwide Drug Discovery Center 2002–Present CAMBRIDGE | INNOVATION Kendall Square Has Been the Home of Technology and Biotechnology Innovation for Over 60 Years

70ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 Refer to “Megacampus” in the appendix. 1. Source: Massachusetts Technology Collaborative website, “Why Massachusetts,” accessed November 10, 2025. 2. Source: The Innovation Institute at the MassTech Collaborative, “Annual Index of the Massachusetts Innovation Economy,” 2023 Edition. MEGACAMPUS: ALEXANDRIA TECHNOLOGY SQUARE® #1 STEM graduates per capita and percentage of adults with bachelor’s degree or higher1 #1 High-tech job concentration1 1.4M+ Workers in the innovation economy or 39% of Massachusetts workforce1,2 CAMBRIDGE | TALENT Greater Boston’s Attractive STEM Talent Base at the Intersection of Science and Technology The Ray and Maria Stata Center

71ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 Source: PitchBook, November 2025. $14B+ LIFE SCIENCE VENTURE CAPITAL RAISED SINCE 2023 However, in the Current Environment, Many Venture Investors Have Been Highly Focused on De-Risked and Later-Stage Assets 30%+ Proportion of U.S. Biotech Capital Deployed to Greater Boston Over the Past Decade CAMBRIDGE | CAPITAL Sophisticated Life Science Investors Continue to Focus on Core Markets Like Greater Boston

72ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 Refer to "Megacampus" in the appendix. Alexandria Technology Square® ALEXANDRIA’S UNIQUE MEGACAMPUS™ STRATEGY DELIVERS DIFFERENTIATED ECOSYSTEMS SPACE | PLACE | SERVICE

73ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 400 TECHNOLOGY SQUARE 200 TECHNOLOGY SQUARE 2006 YEAR ACQUIRED 7 PROPERTIES 1.2M RSF OPERATING ~100K SF FUTURE DEVELOPMENT ALEXANDRIA TECHNOLOGY SQUARE® Offers Scale and Flexibility That Delivers Tenants Strategic Optionality As of September 30, 2025. Refer to “Megacampus” in the appendix. SPACE PLACE SERVICEALEXANDRIA’S UNIQUE MEGACAMPUS™ STRATEGY 100 TECHNOLOGY SQUARE 700 TECHNOLOGY SQUARE 600 TECHNOLOGY SQUARE FUTURE DEVELOPMENT 500 TECHNOLOGY SQUARE 300 TECHNOLOGY SQUARE

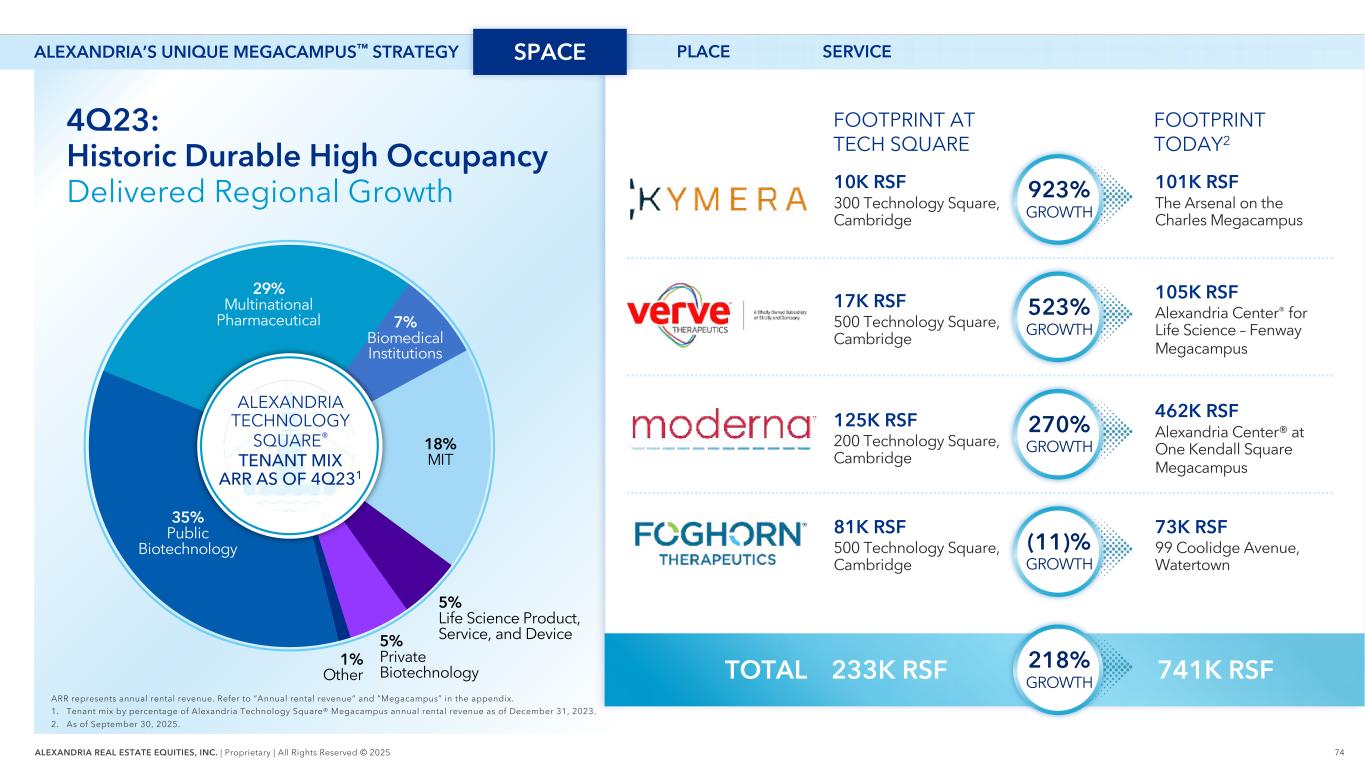

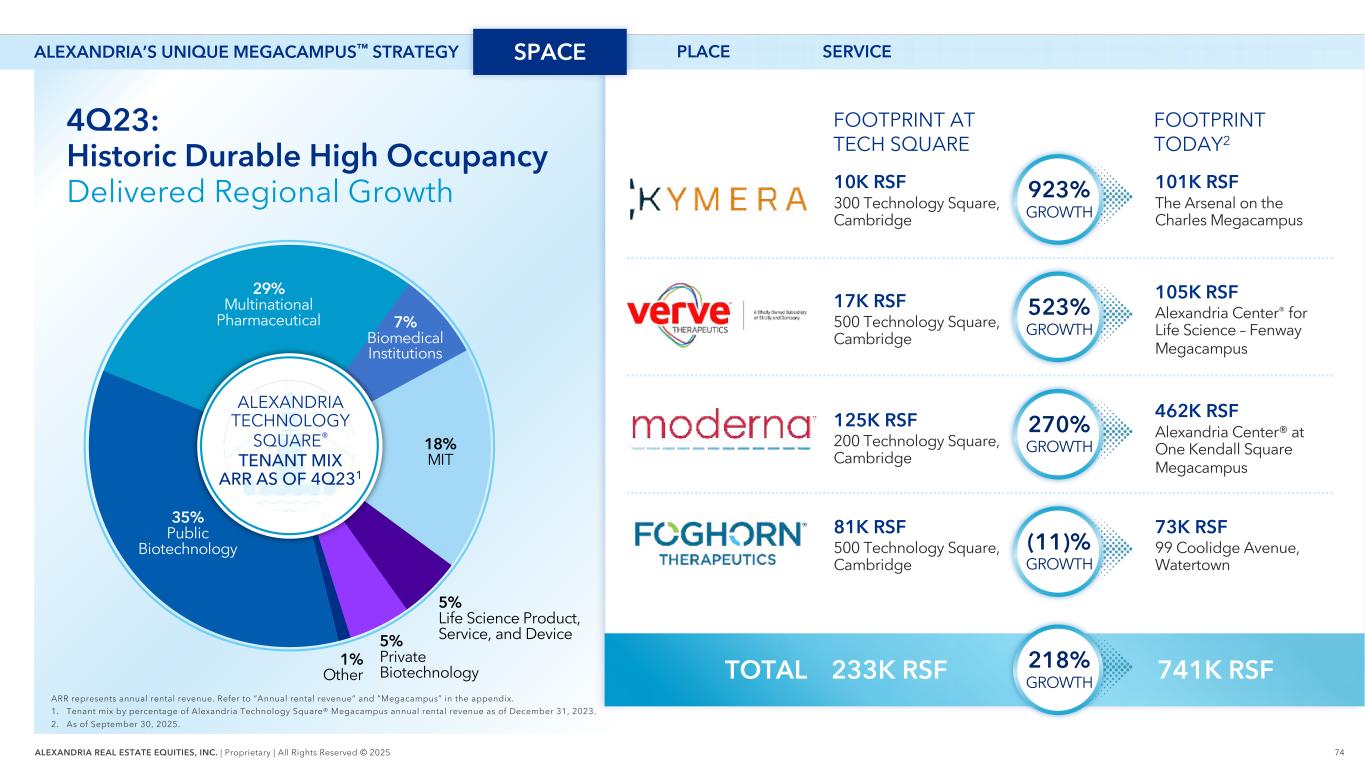

74ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 4Q23: Historic Durable High Occupancy Delivered Regional Growth ARR represents annual rental revenue. Refer to “Annual rental revenue” and “Megacampus” in the appendix. 1. Tenant mix by percentage of Alexandria Technology Square® Megacampus annual rental revenue as of December 31, 2023. 2. As of September 30, 2025. 35% Public Biotechnology 29% Multinational Pharmaceutical 18% MIT 5% Life Science Product, Service, and Device5% Private Biotechnology 1% Other FOOTPRINT AT TECH SQUARE FOOTPRINT TODAY2 7% Biomedical Institutions SPACE PLACE SERVICEALEXANDRIA’S UNIQUE MEGACAMPUS™ STRATEGY 10K RSF 300 Technology Square, Cambridge 17K RSF 500 Technology Square, Cambridge 125K RSF 200 Technology Square, Cambridge 81K RSF 500 Technology Square, Cambridge 101K RSF The Arsenal on the Charles Megacampus 105K RSF Alexandria Center® for Life Science – Fenway Megacampus 462K RSF Alexandria Center® at One Kendall Square Megacampus 73K RSF 99 Coolidge Avenue, Watertown 923% GROWTH 270% GROWTH (11)% GROWTH 523% GROWTH 741K RSF218% GROWTHTOTAL 233K RSF ALEXANDRIA TECHNOLOGY SQUARE® TENANT MIX ARR AS OF 4Q231

75ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 Alexandria’s Curated Technology Square Ecosystem Designed to Recruit & Retain Top Talent, Ignite Collaboration, and Catalyze Innovation We’re not here just to gain new knowledge; we’re here to transfer that new knowledge into useful things. It’s what made Kendall Square Kendall Square.” PHILLIP SHARP Nobel Laureate and Co-Founder of Biogen ALEXANDRIA’S UNIQUE MEGACAMPUS™ STRATEGY SPACE PLACE SERVICE Refer to “Megacampus” in the appendix.

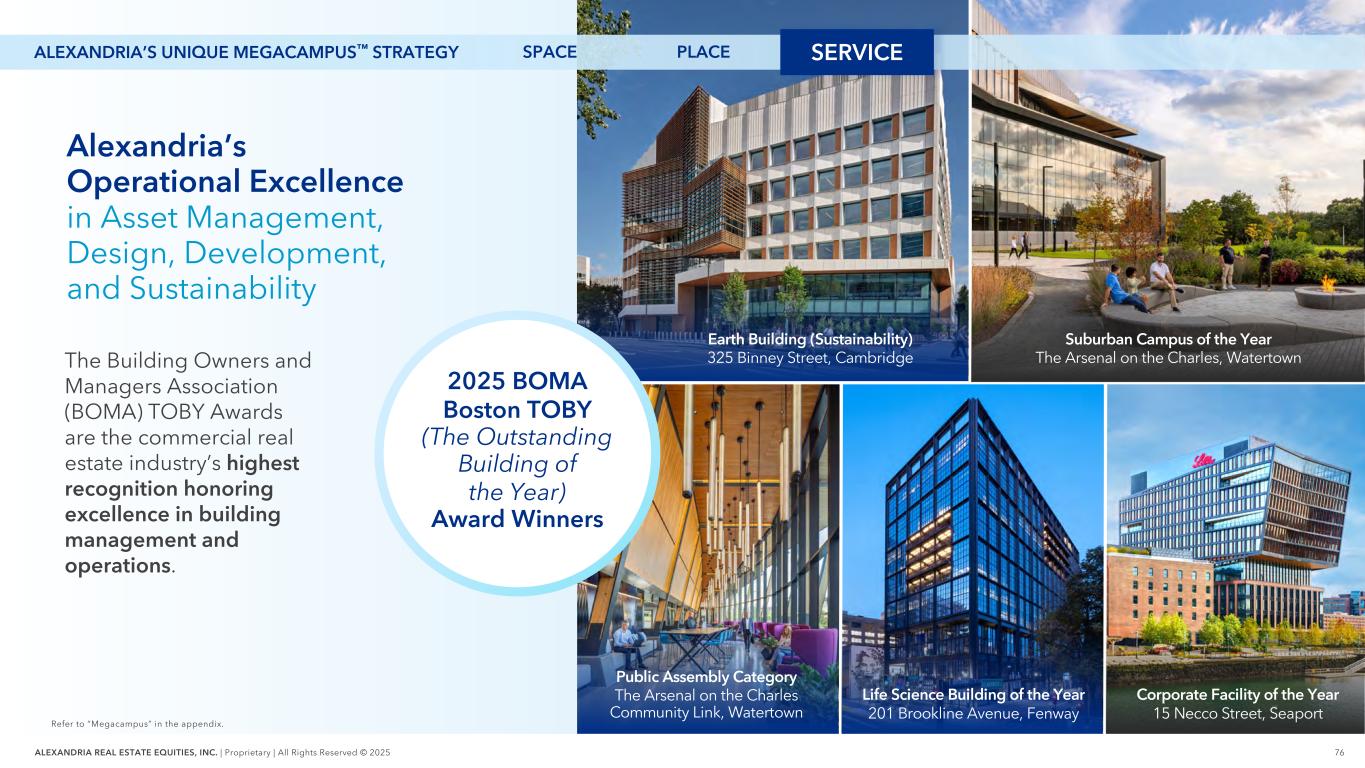

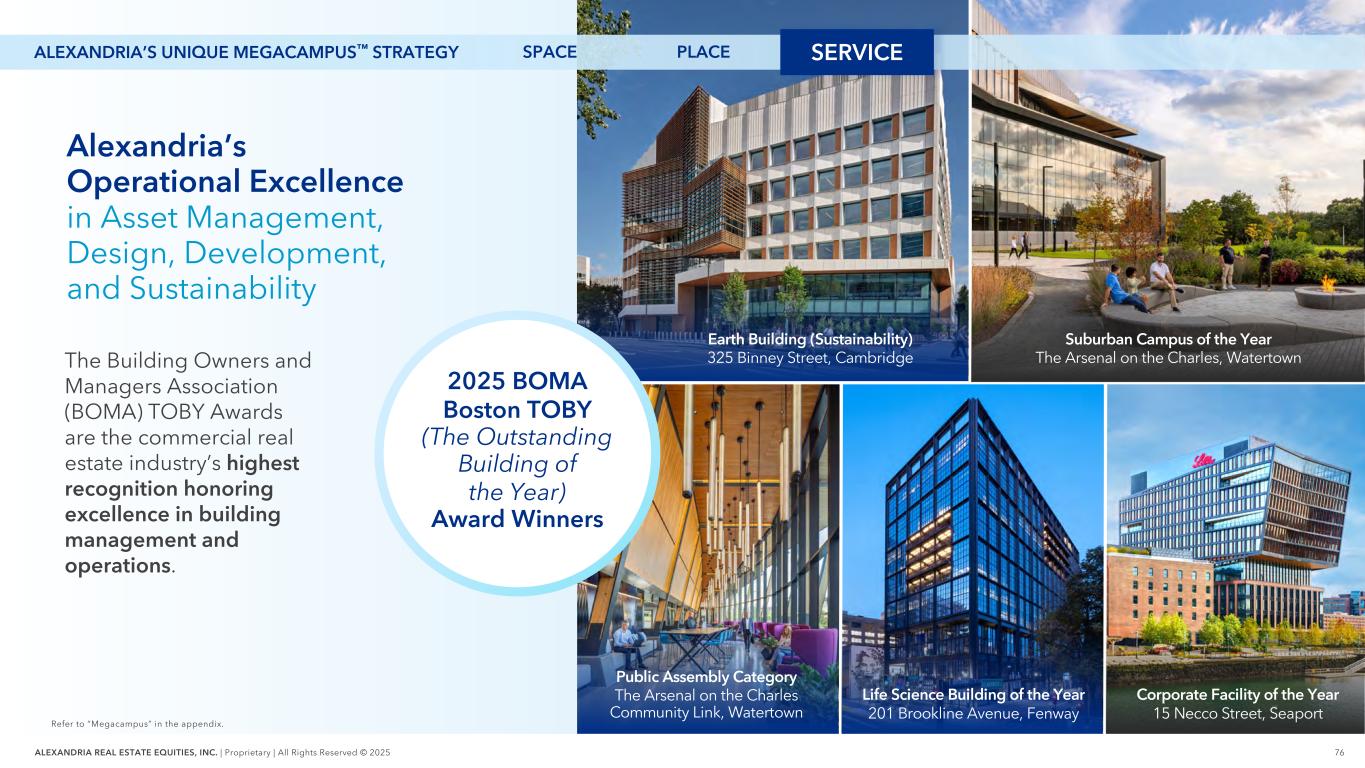

76ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 Refer to “Megacampus” in the appendix. SPACE PLACE SERVICEALEXANDRIA’S UNIQUE MEGACAMPUS™ STRATEGY Earth Building (Sustainability) 325 Binney Street, Cambridge Public Assembly Category The Arsenal on the Charles Community Link, Watertown 2025 BOMA Boston TOBY (The Outstanding Building of the Year) Award Winners Alexandria’s Operational Excellence in Asset Management, Design, Development, and Sustainability The Building Owners and Managers Association (BOMA) TOBY Awards are the commercial real estate industry’s highest recognition honoring excellence in building management and operations. Suburban Campus of the Year The Arsenal on the Charles, Watertown Life Science Building of the Year 201 Brookline Avenue, Fenway Corporate Facility of the Year 15 Necco Street, Seaport

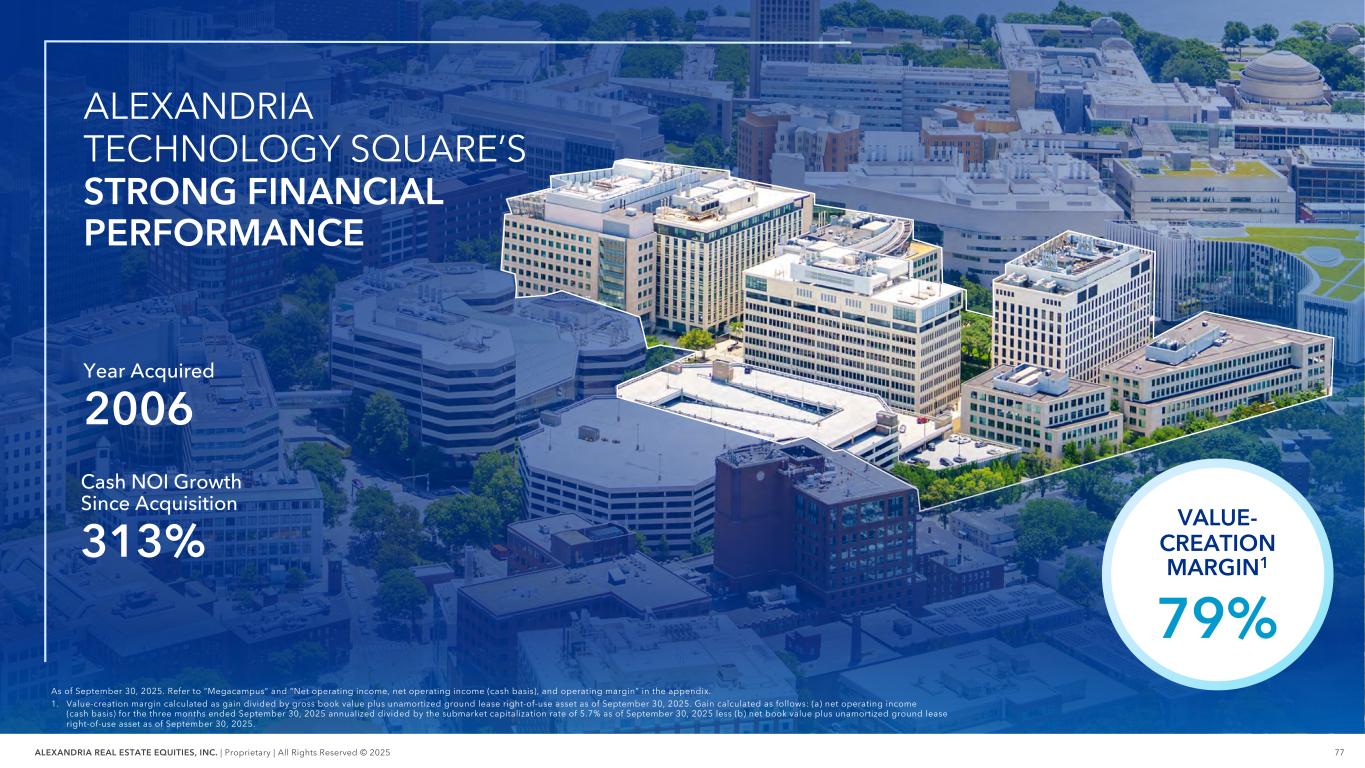

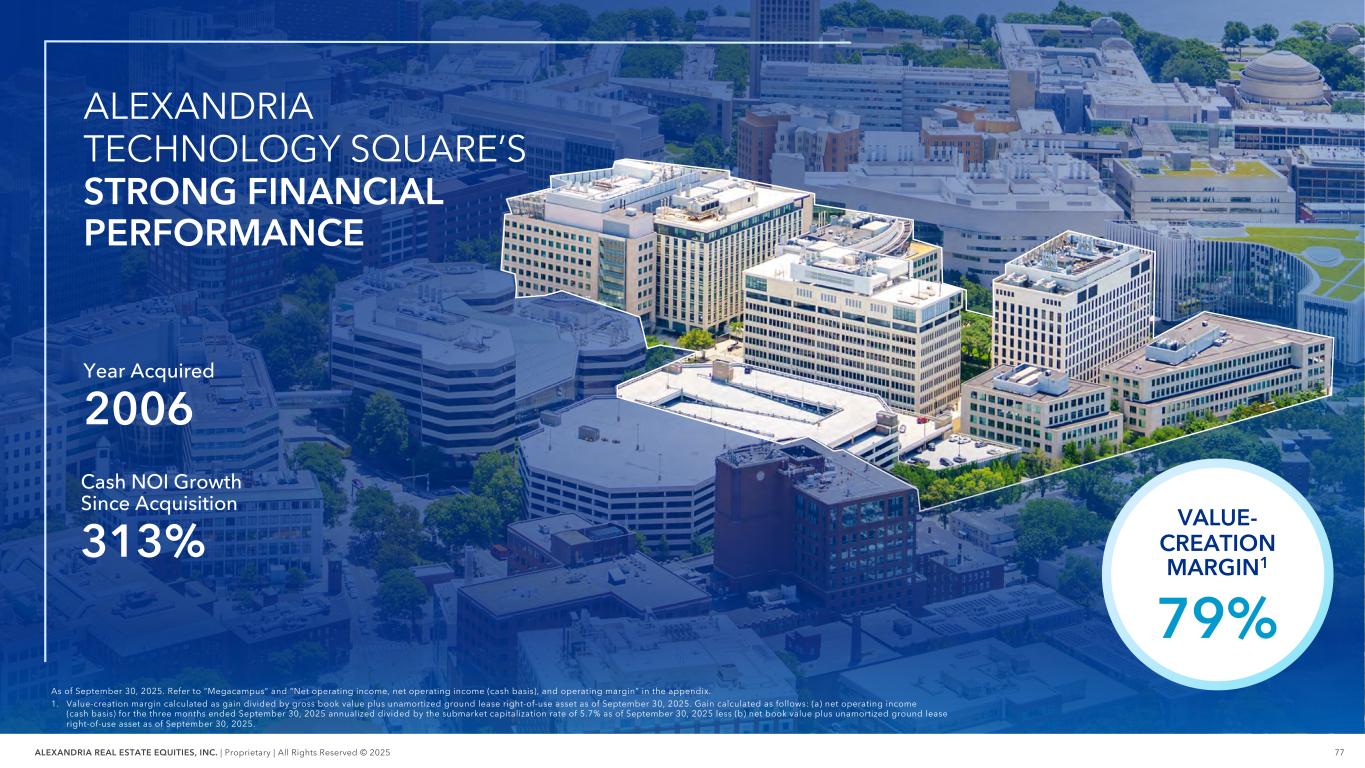

77ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 As of September 30, 2025. Refer to “Megacampus” and “Net operating income, net operating income (cash basis), and operating margin” in the appendix. 1. Value-creation margin calculated as gain divided by gross book value plus unamortized ground lease right-of-use asset as of September 30, 2025. Gain calculated as follows: (a) net operating income (cash basis) for the three months ended September 30, 2025 annualized divided by the submarket capitalization rate of 5.7% as of September 30, 2025 less (b) net book value plus unamortized ground lease right-of-use asset as of September 30, 2025. ALEXANDRIA TECHNOLOGY SQUARE’S STRONG FINANCIAL PERFORMANCE VALUE- CREATION MARGIN1 79% Year Acquired 2006 Cash NOI Growth Since Acquisition 313%

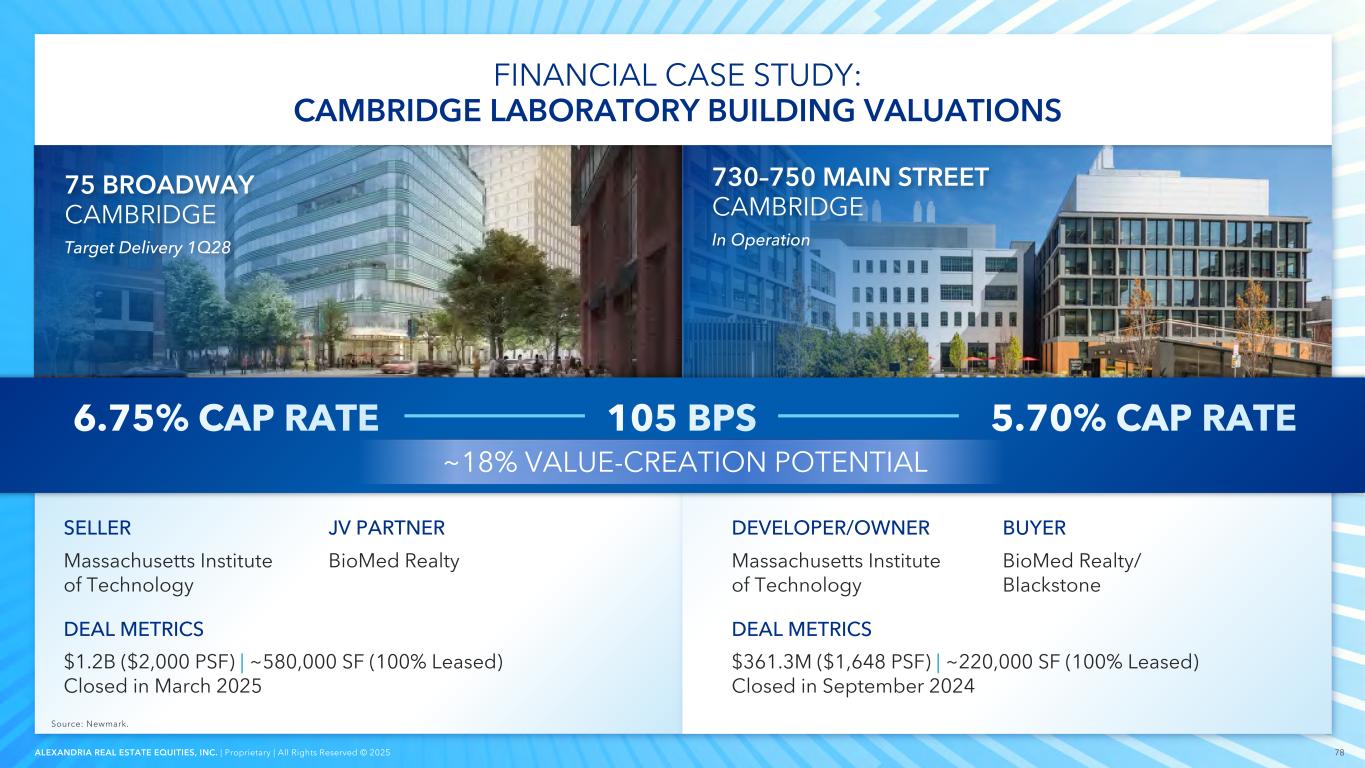

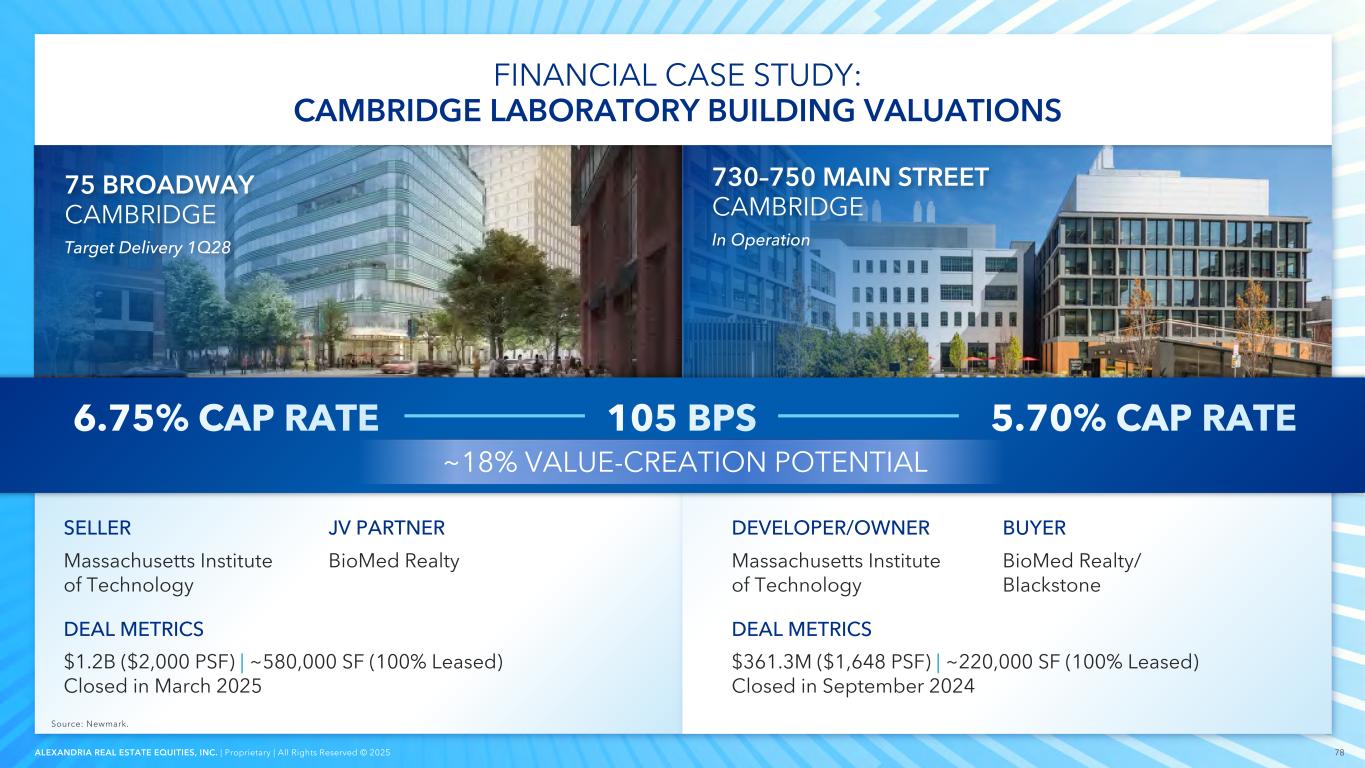

78ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 FINANCIAL CASE STUDY: CAMBRIDGE LABORATORY BUILDING VALUATIONS Source: Newmark. 75 BROADWAY CAMBRIDGE Target Delivery 1Q28 730–750 MAIN STREET CAMBRIDGE In Operation JV PARTNER BioMed Realty DEAL METRICS $1.2B ($2,000 PSF) | ~580,000 SF (100% Leased) Closed in March 2025 SELLER Massachusetts Institute of Technology DEAL METRICS $361.3M ($1,648 PSF) | ~220,000 SF (100% Leased) Closed in September 2024 BUYER BioMed Realty/ Blackstone DEVELOPER/OWNER Massachusetts Institute of Technology ~18% VALUE-CREATION POTENTIAL

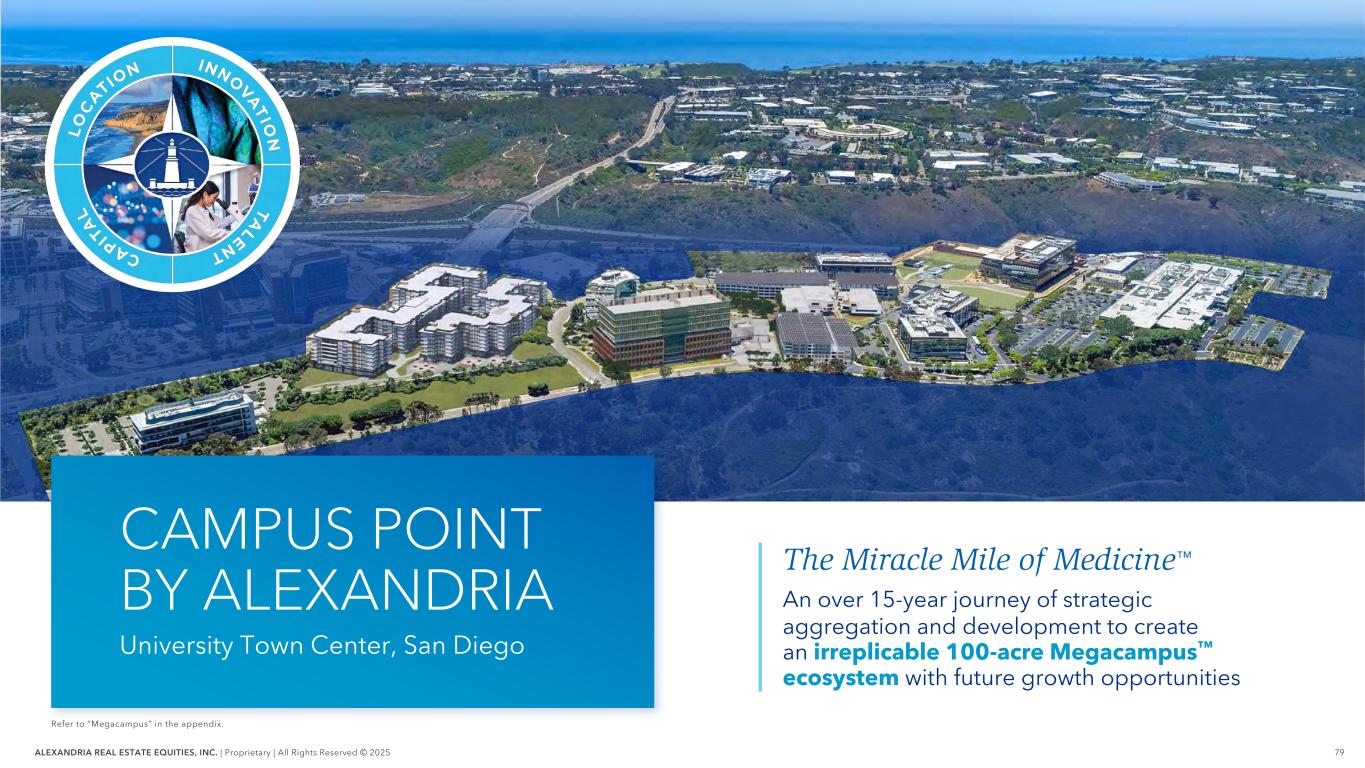

79ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 Refer to “Megacampus” in the appendix. The Miracle Mile of Medicine™ An over 15-year journey of strategic aggregation and development to create an irreplicable 100-acre Megacampus™ ecosystem with future growth opportunities CAMPUS POINT BY ALEXANDRIA University Town Center, San Diego

80ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 MEGACAMPUS: ONE ALEXANDRIA SQUARE 1.1M RSF | 10 Properties MEGACAMPUS: CAMPUS POINT BY ALEXANDRIA 1.7M RSF | 8 Properties MEGACAMPUS: SD TECH BY ALEXANDRIA 1.1M RSF | 11 Properties MEGACAMPUS: 5200 ILLUMINA WAY 793K RSF | 6 Properties SAN DIEGO | LOCATION Alexandria’s Premier Megacampus™ Ecosystems Within the San Diego Science Sector As of September 30, 2025. Refer to “Megacampus” in the appendix.

81ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 SAN DIEGO | INNOVATION & TALENT Deep and Diverse Innovation Ecosystem 1. Based on geographic proximity of life science assets owned by Alexandria. 2. Source: LinkedIn, ”Tech talent is surging in these 15 cities,” June 8, 2022. Reflects percentage growth from 2019 to 2022. 3. Source: San Diego Regional Economic Development Corporation website, “About the Region: Defense,” ”About the Region: Tech,” and ”About the Region: Life Sciences,” accessed November 13, 2025. HOSPITAL SYSTEMS RESEARCH INSTITUTIONS LIFE SCIENCE ADVANCED TECHNOLOGIES DEFENSE TECHNOLOGY & MILITARY #1 Densest Alexandria Life Science Cluster1 #1 Fastest-Growing U.S. Metro in Tech Talent2 #1 Largest Concentration of U.S. Military Assets3

82ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 1. Source: Evaluate Pharma. Includes biopharma M&A during 2024–2025 YTD; 2025 YTD as of November 15, 2025. San Diego’s Life Science M&A Activity Ranks #1 in Total Deal Value Since 2024, Exceeding Greater Boston and the San Francisco Bay Area1 $37B SAN DIEGO $32B GREATER BOSTON $19B SAN FRANCISCO BAY AREA SAN DIEGO | CAPITAL Significant M&A Has Driven the Growth of the San Diego Science Sector

83ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 Campus Point by Alexandria ALEXANDRIA’S UNIQUE MEGACAMPUS™ STRATEGY DELIVERS DIFFERENTIATED ECOSYSTEMS SPACE | PLACE | SERVICE Refer to "Megacampus" in the appendix.

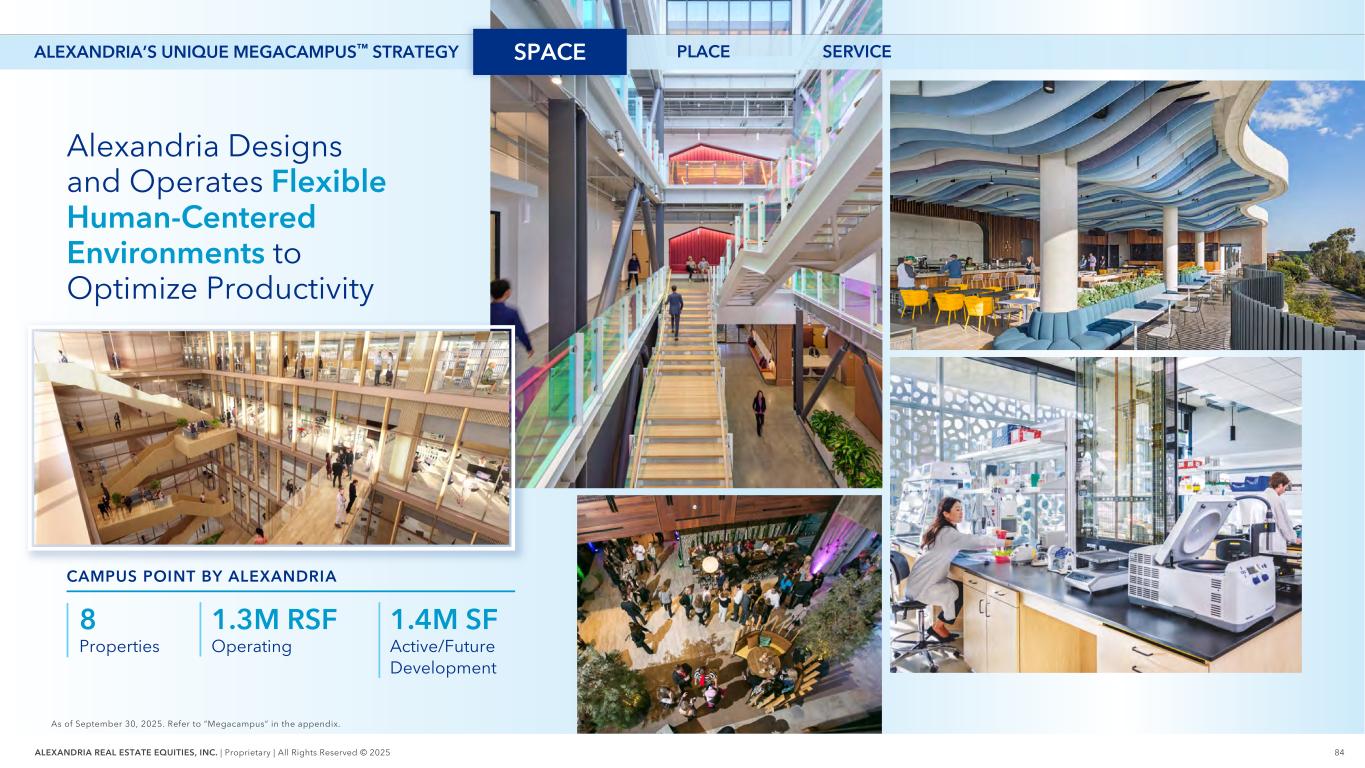

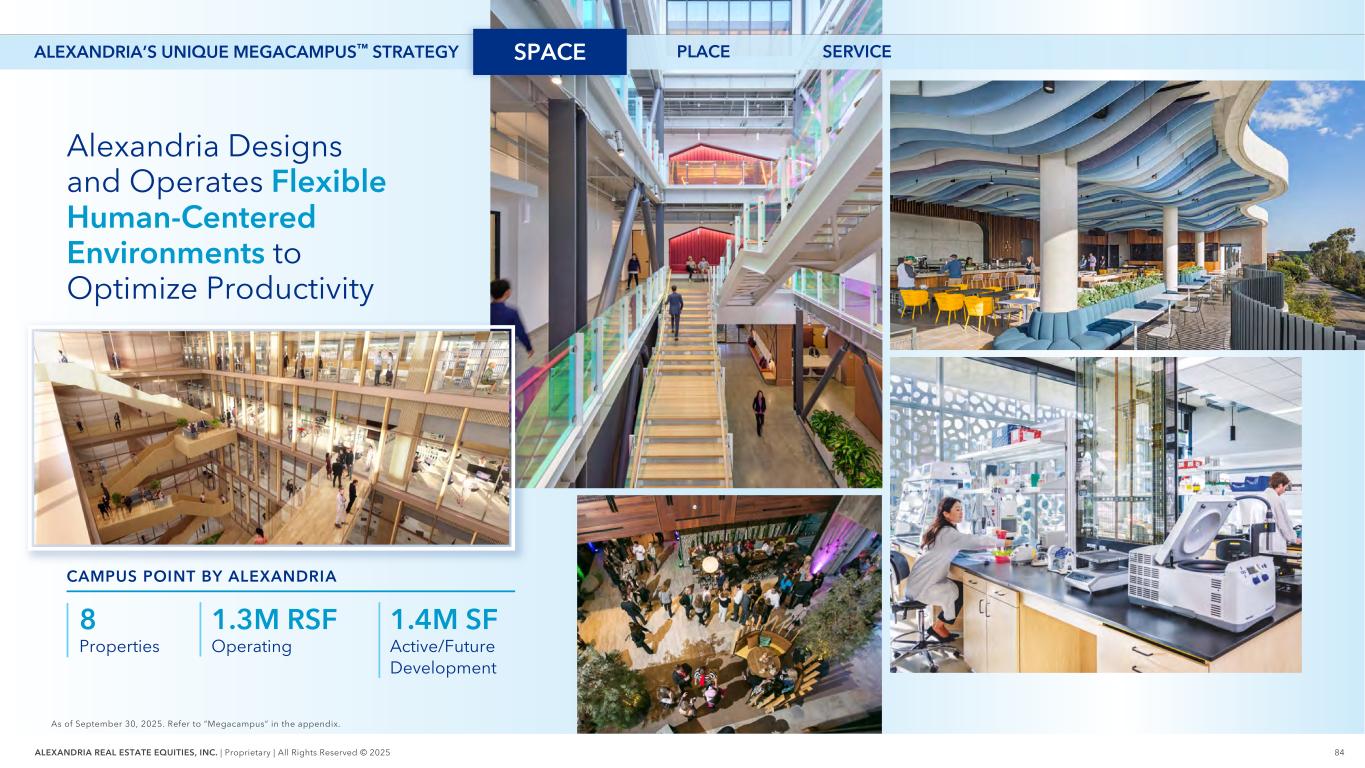

84ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 As of September 30, 2025. Refer to “Megacampus” in the appendix. Alexandria Designs and Operates Flexible Human-Centered Environments to Optimize Productivity 8 Properties SPACE PLACE SERVICEALEXANDRIA’S UNIQUE MEGACAMPUS™ STRATEGY CAMPUS POINT BY ALEXANDRIA 1.3M RSF Operating 1.4M SF Active/Future Development

85ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 Refer to "Megacampus" in the appendix. Campus Point Provides an Unmatched Campus Experience That Enables Tenants to Recruit and Retain Top Talent There is no way anyone would ever go back to any other real estate group after having access to all these amenities with ARE.” LARGE PHARMACEUTICAL TENANT ALEXANDRIA’S UNIQUE MEGACAMPUS™ STRATEGY SPACE PLACE SERVICE

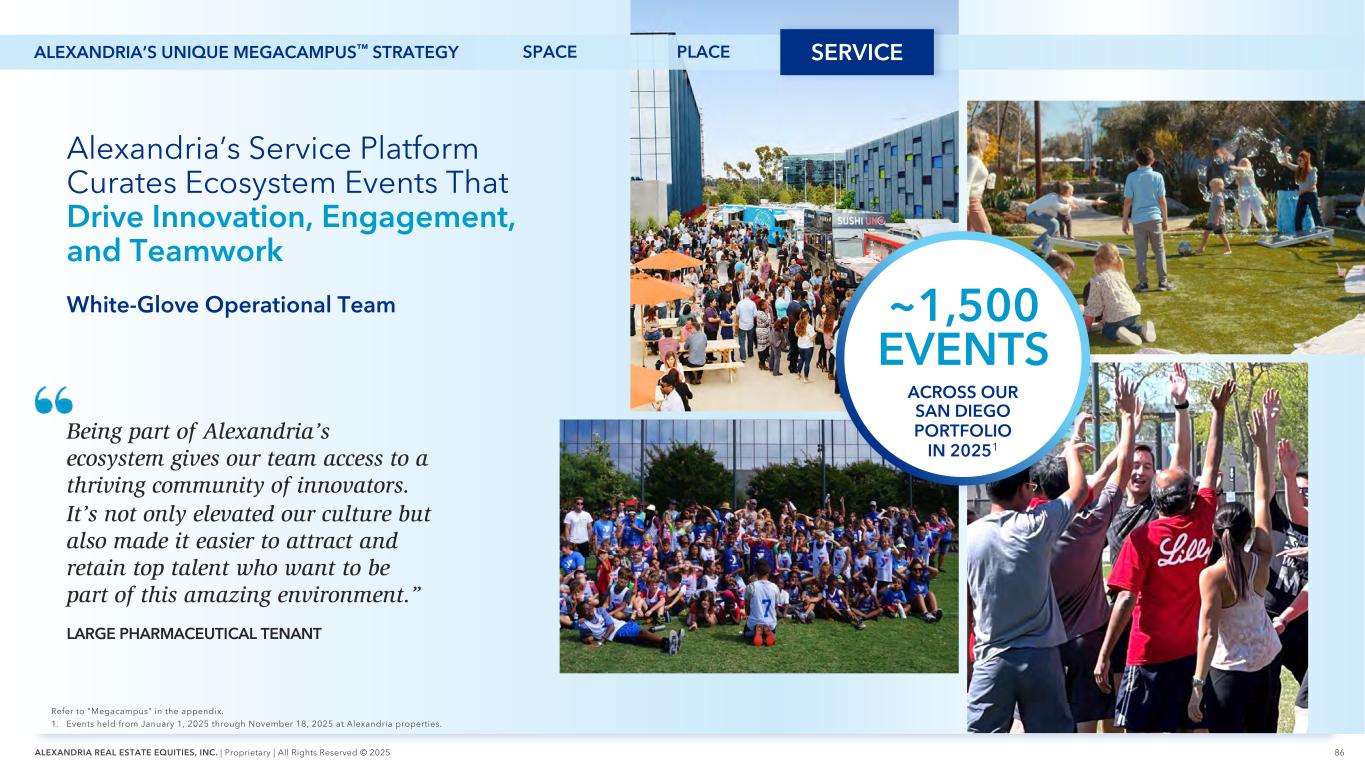

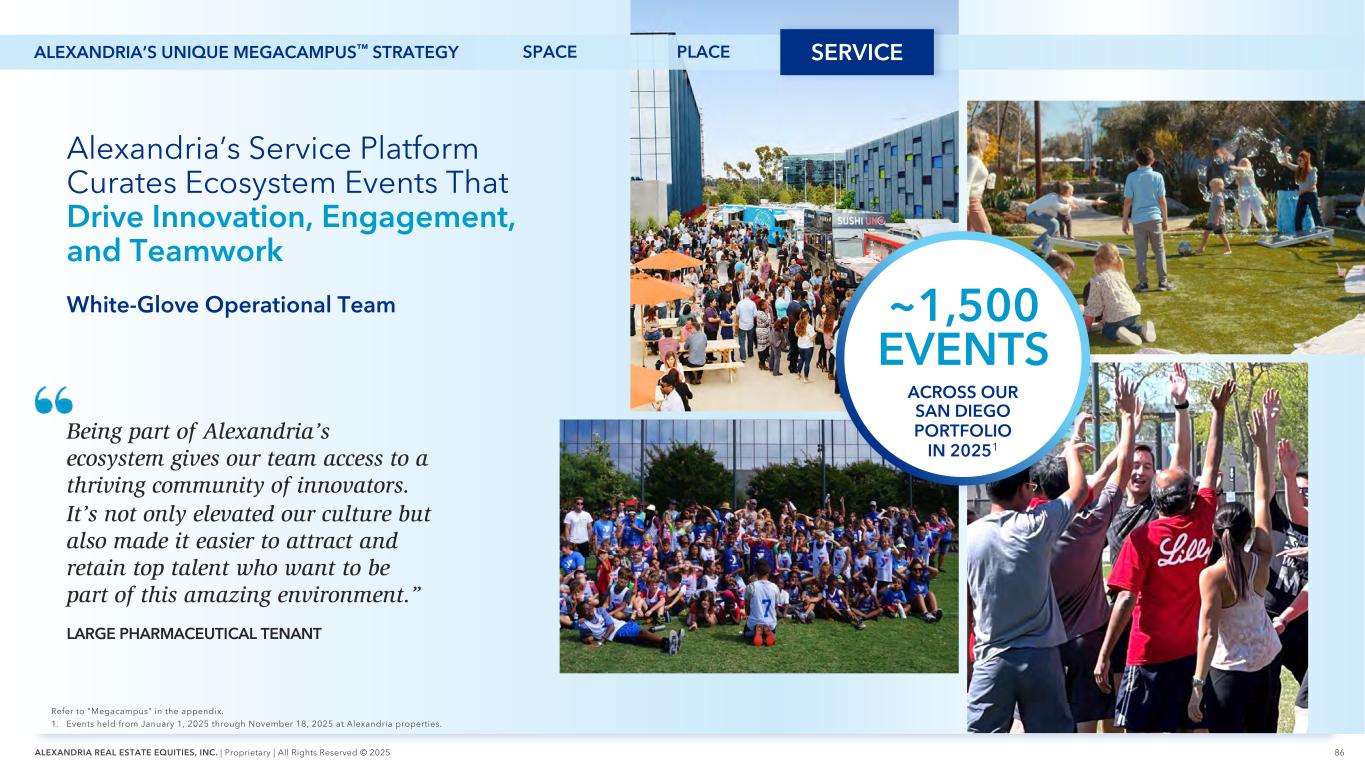

86ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 Alexandria’s Service Platform Curates Ecosystem Events That Drive Innovation, Engagement, and Teamwork White-Glove Operational Team Refer to "Megacampus" in the appendix. 1. Events held from January 1, 2025 through November 18, 2025 at Alexandria properties. Being part of Alexandria’s ecosystem gives our team access to a thriving community of innovators. It’s not only elevated our culture but also made it easier to attract and retain top talent who want to be part of this amazing environment.” LARGE PHARMACEUTICAL TENANT SPACE PLACE SERVICEALEXANDRIA’S UNIQUE MEGACAMPUS™ STRATEGY ACROSS OUR SAN DIEGO PORTFOLIO IN 20251 ~1,500 EVENTS

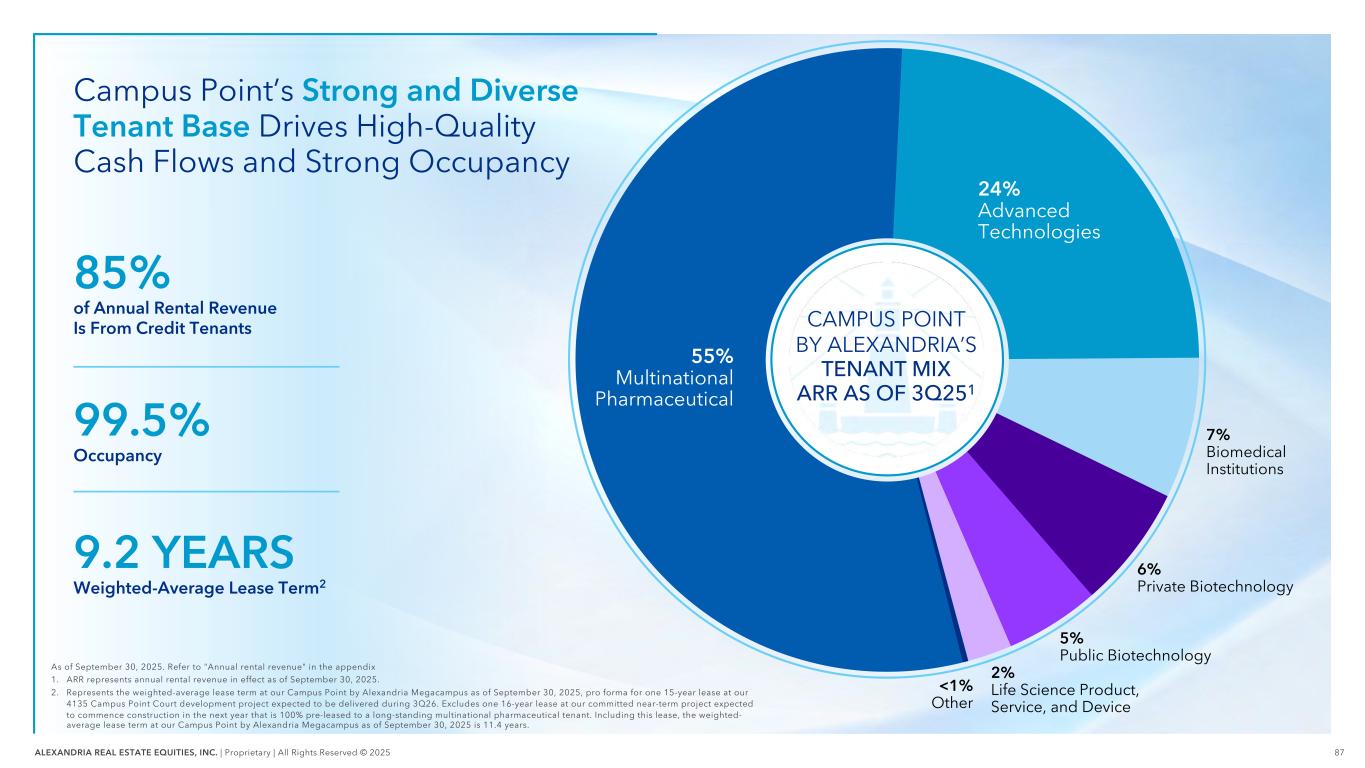

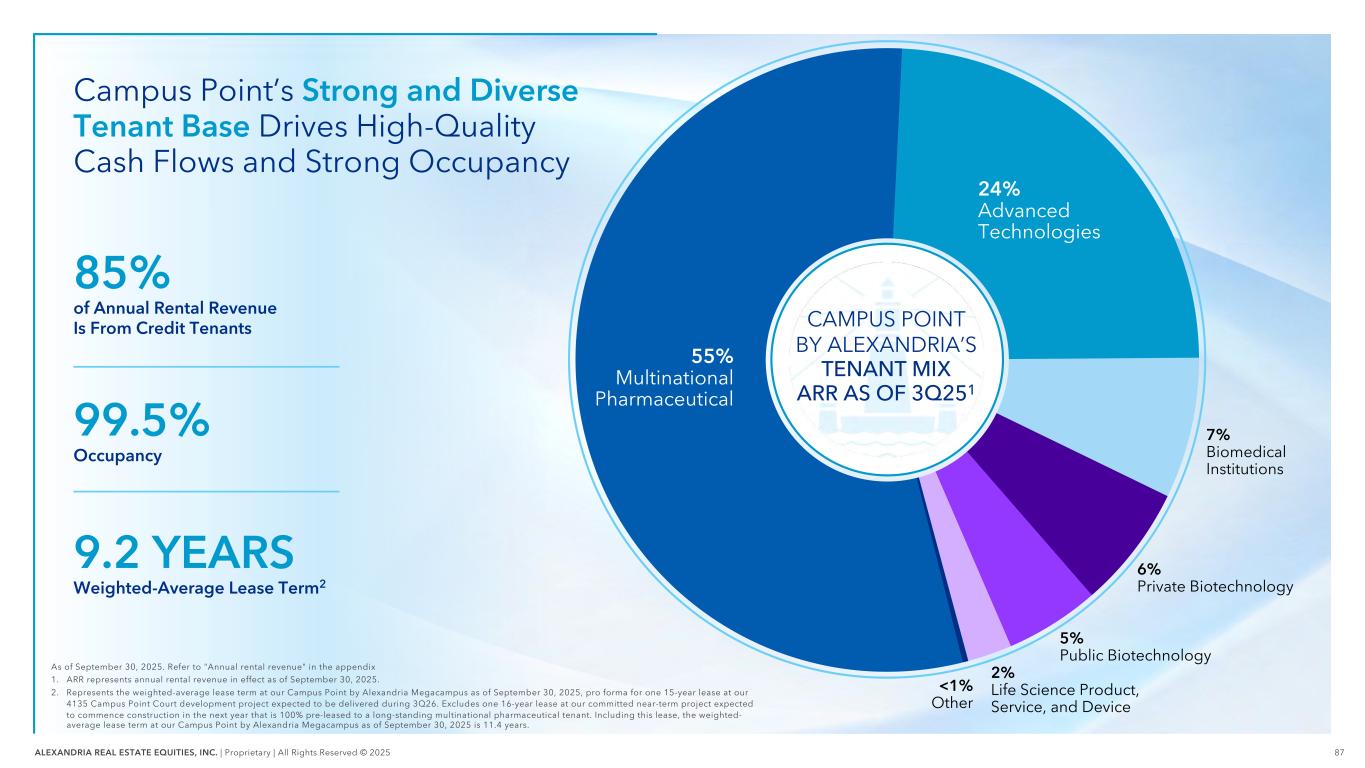

87ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 As of September 30, 2025. Refer to "Annual rental revenue" in the appendix 1. ARR represents annual rental revenue in effect as of September 30, 2025. 2. Represents the weighted-average lease term at our Campus Point by Alexandria Megacampus as of September 30, 2025, pro forma for one 15-year lease at our 4135 Campus Point Court development project expected to be delivered during 3Q26. Excludes one 16-year lease at our committed near-term project expected to commence construction in the next year that is 100% pre-leased to a long-standing multinational pharmaceutical tenant. Including this lease, the weighted- average lease term at our Campus Point by Alexandria Megacampus as of September 30, 2025 is 11.4 years. Campus Point’s Strong and Diverse Tenant Base Drives High-Quality Cash Flows and Strong Occupancy 24% Advanced Technologies 99.5% Occupancy 9.2 YEARS Weighted-Average Lease Term2 85% of Annual Rental Revenue Is From Credit Tenants 55% Multinational Pharmaceutical CAMPUS POINT BY ALEXANDRIA’S TENANT MIX ARR AS OF 3Q251 7% Biomedical Institutions 6% Private Biotechnology 5% Public Biotechnology 2% Life Science Product, Service, and Device <1% Other

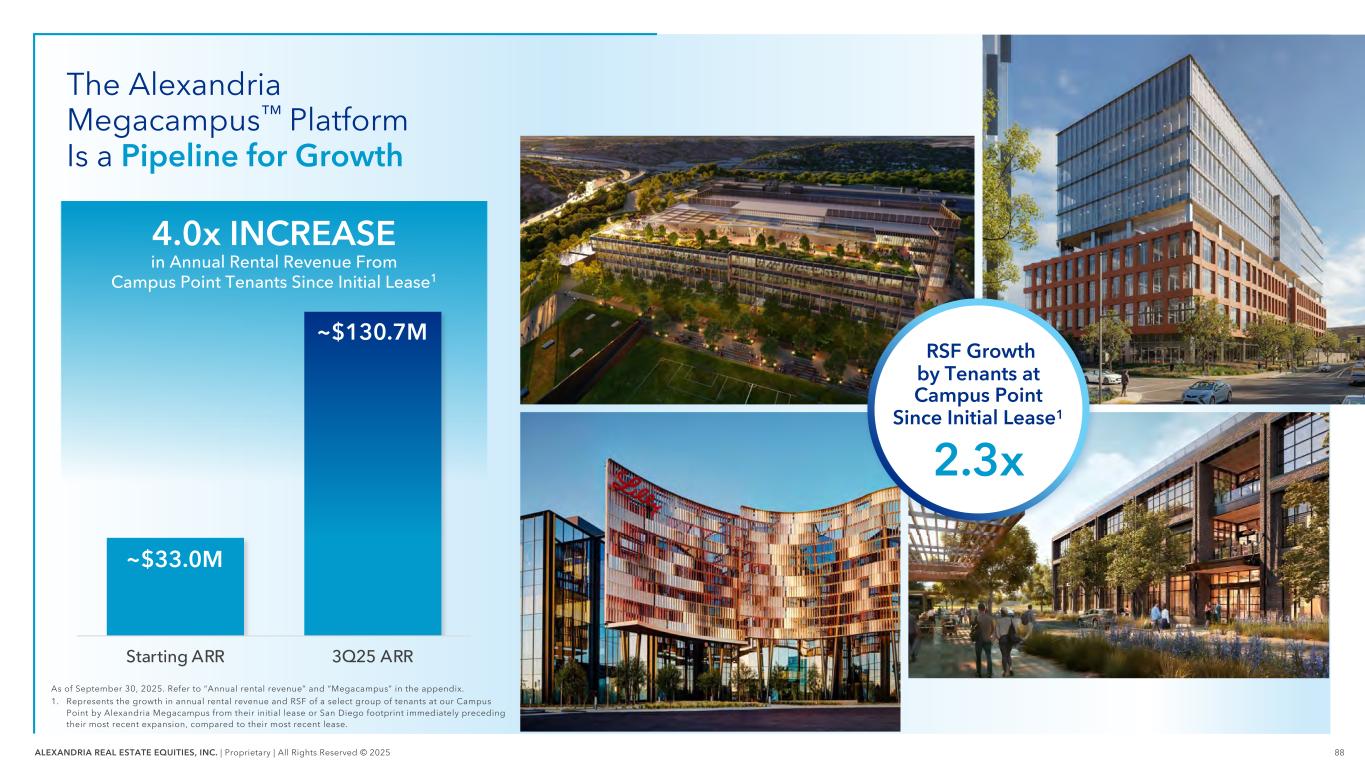

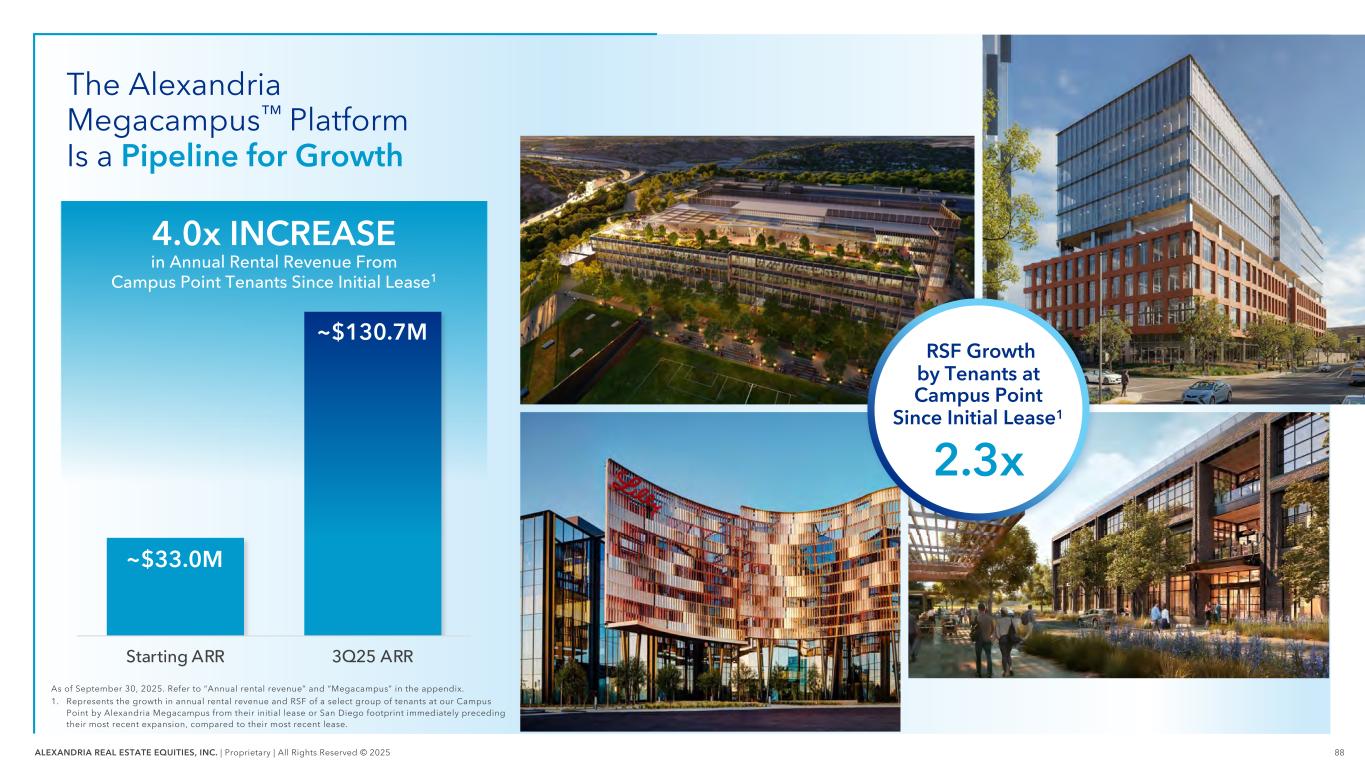

88ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 As of September 30, 2025. Refer to “Annual rental revenue” and “Megacampus” in the appendix. 1. Represents the growth in annual rental revenue and RSF of a select group of tenants at our Campus Point by Alexandria Megacampus from their initial lease or San Diego footprint immediately preceding their most recent expansion, compared to their most recent lease. The Alexandria Megacampus™ Platform Is a Pipeline for Growth Starting ARR 3Q25 ARR ~$33.0M ~$130.7M 4.0x INCREASE in Annual Rental Revenue From Campus Point Tenants Since Initial Lease1 RSF Growth by Tenants at Campus Point Since Initial Lease1 2.3x

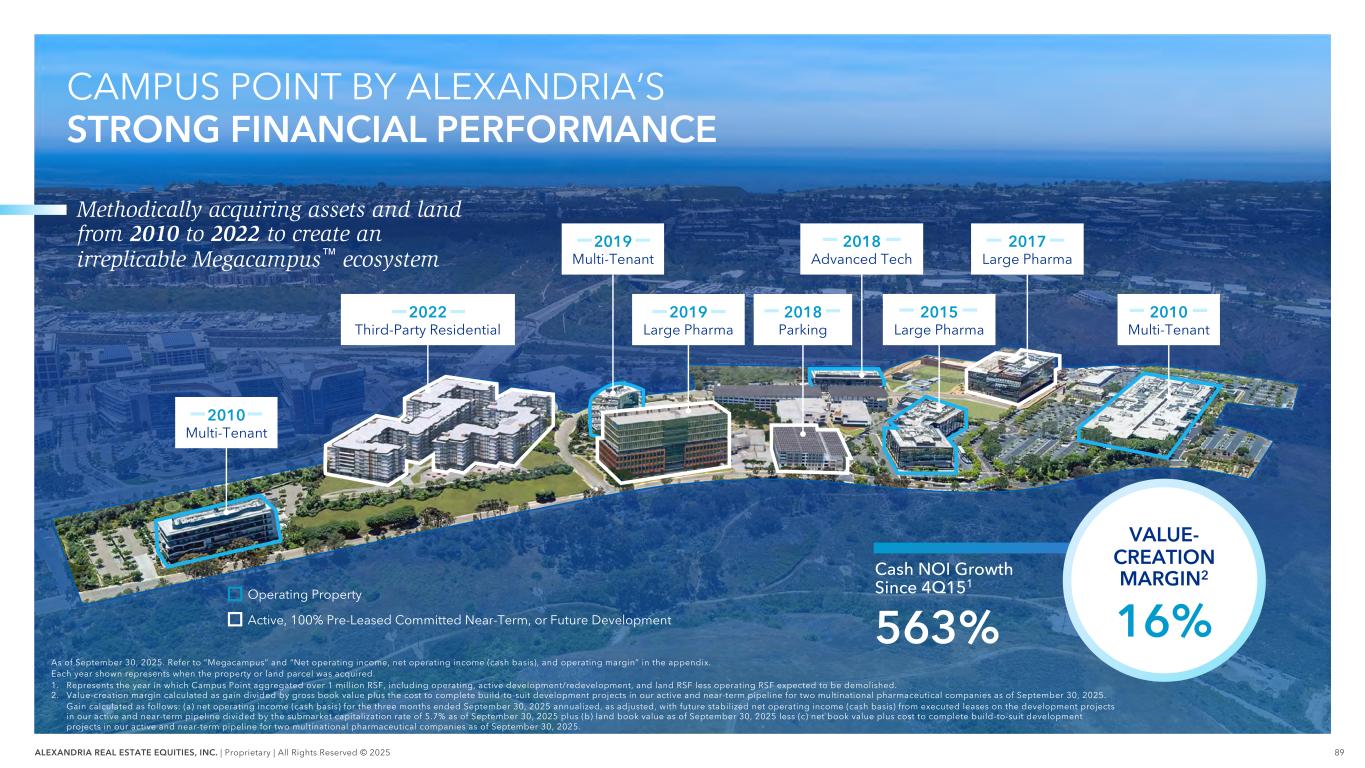

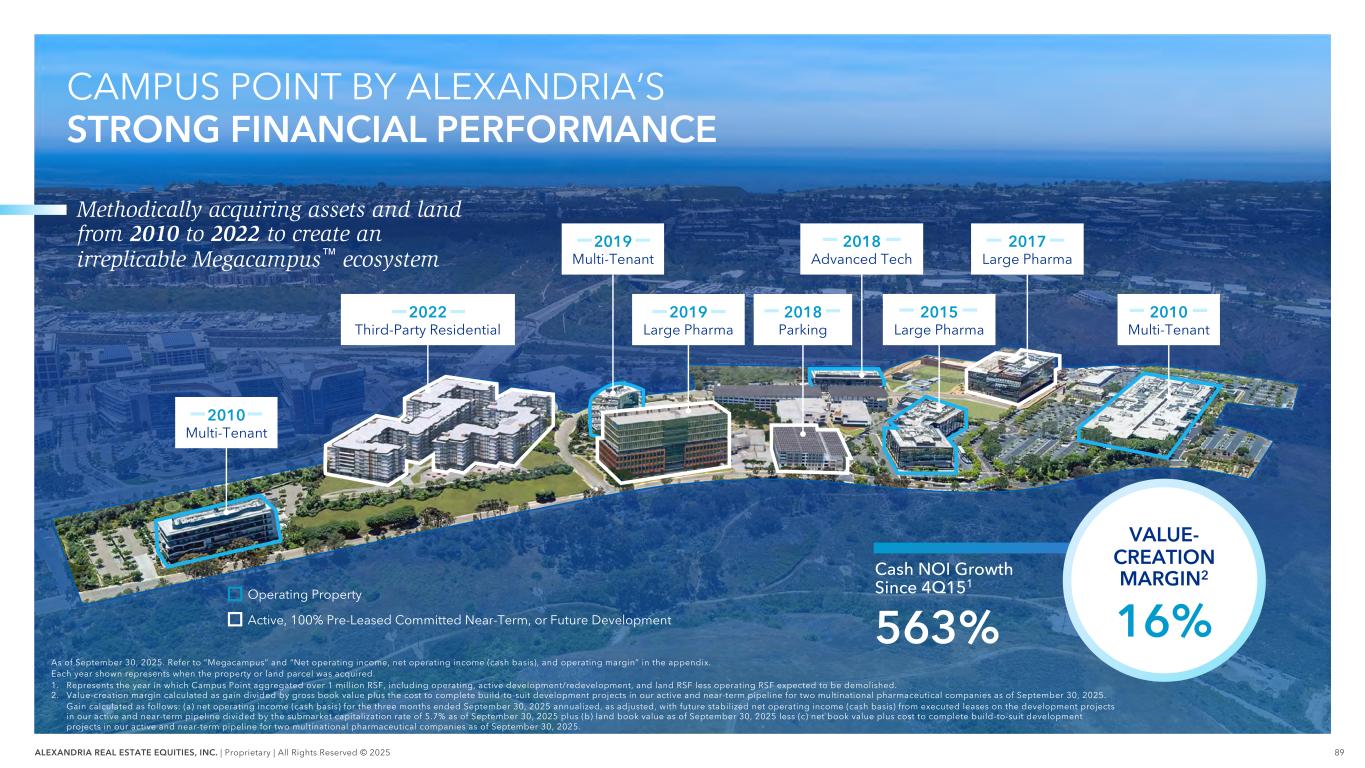

89ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 CAMPUS POINT BY ALEXANDRIA’S STRONG FINANCIAL PERFORMANCE As of September 30, 2025. Refer to “Megacampus” and “Net operating income, net operating income (cash basis), and operating margin” in the appendix. Each year shown represents when the property or land parcel was acquired. 1. Represents the year in which Campus Point aggregated over 1 million RSF, including operating, active development/redevelopment, and land RSF less operating RSF expected to be demolished. 2. Value-creation margin calculated as gain divided by gross book value plus the cost to complete build-to-suit development projects in our active and near-term pipeline for two multinational pharmaceutical companies as of September 30, 2025. Gain calculated as follows: (a) net operating income (cash basis) for the three months ended September 30, 2025 annualized, as adjusted, with future stabilized net operating income (cash basis) from executed leases on the development projects in our active and near-term pipeline divided by the submarket capitalization rate of 5.7% as of September 30, 2025 plus (b) land book value as of September 30, 2025 less (c) net book value plus cost to complete build-to-suit development projects in our active and near-term pipeline for two multinational pharmaceutical companies as of September 30, 2025. Active, 100% Pre-Leased Committed Near-Term, or Future Development Operating Property Cash NOI Growth Since 4Q151 563% 2010 Multi-Tenant 2019 Large Pharma 2018 Parking 2018 Advanced Tech 2017 Large Pharma 2010 Multi-Tenant 2015 Large Pharma 2019 Multi-Tenant VALUE- CREATION MARGIN2 16% 2022 Third-Party Residential Methodically acquiring assets and land from 2010 to 2022 to create an irreplicable Megacampus™ ecosystem

90ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 THE ALEXANDRIA BRAND MEANS TRUST Enduring, Long-Standing Strategic Relationships in the Life Science Community — 1996 —— 1996 — — 2009 —— 2009 —— 2007 — — 2008 — — 2010 — — 2011 — — 2013 — — 2015 —— 2010 — — 2006 —— 2004 — — 2005 — — 2005 — — 1998 — — 2000 — — 2002 — An Unmatched Client Base of ~700 Tenants1 Each year represents the start of Alexandria’s relationship with each tenant either through (i) an executed lease agreement with the tenant, (ii) Alexandria’s acquisition of property where the tenant was located, (iii) the tenant’s acquisition of an existing Alexandria tenant, or (iv) the sale-leaseback of the tenant’s property. 1. Represents the years ended December 31, 2021 through 2024 and the nine months ended September 30, 2025. >80% Average Tenant Retention Rate for the Past 5 Years1

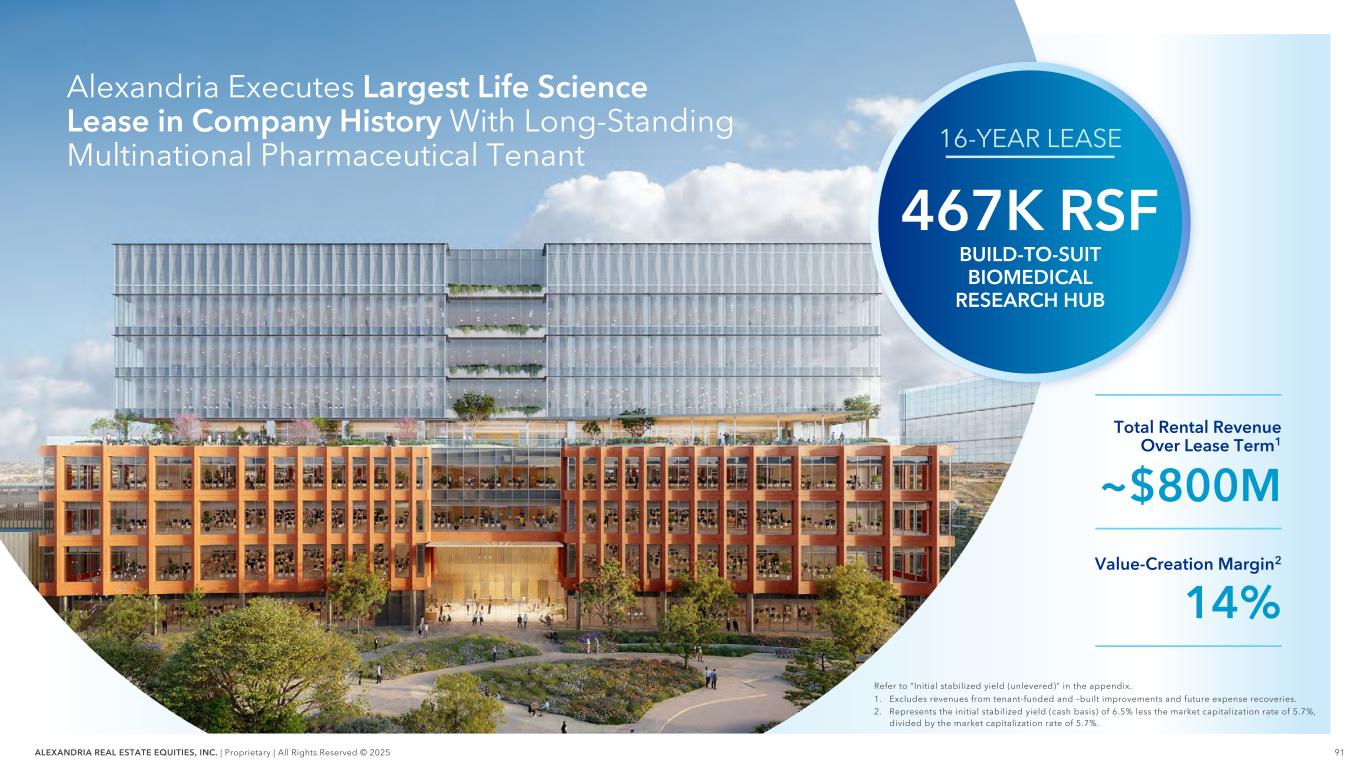

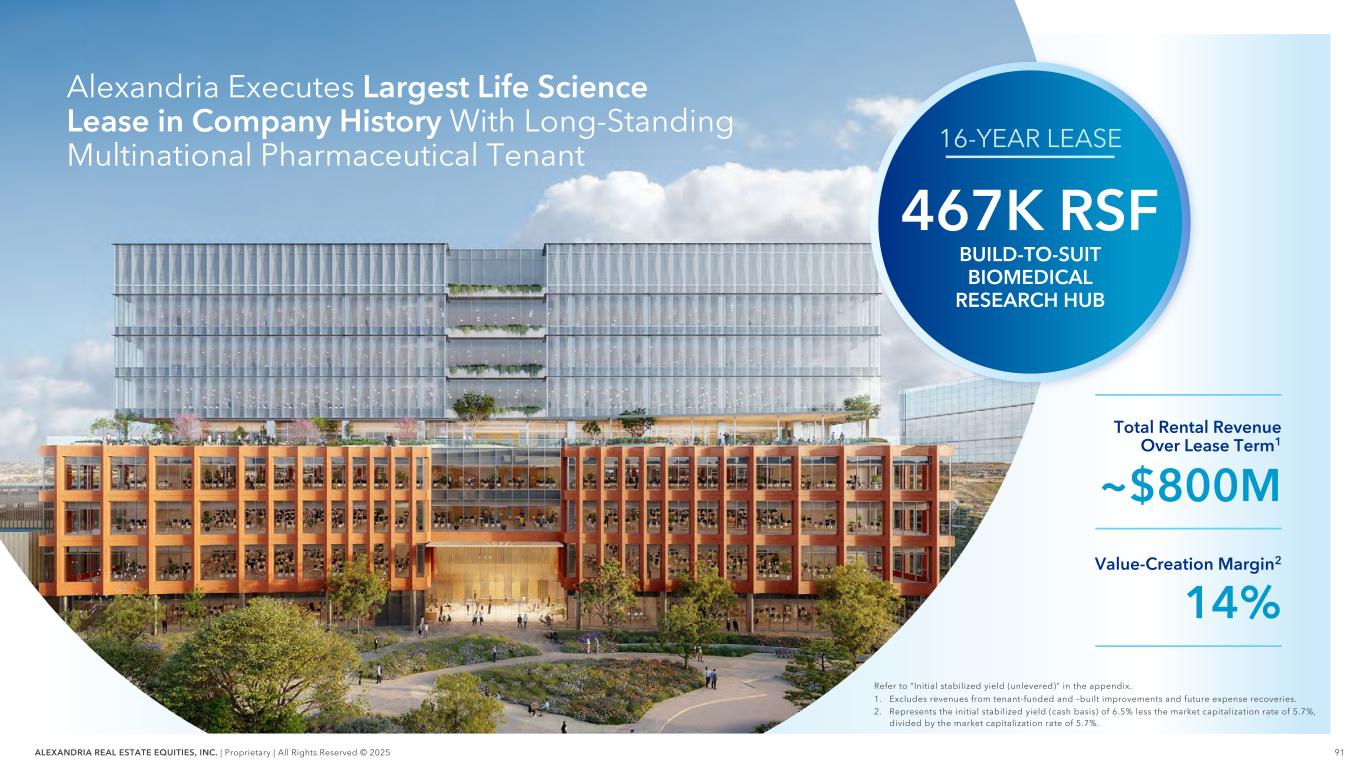

91ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 Refer to “Initial stabilized yield (unlevered)” in the appendix. 1. Excludes revenues from tenant-funded and –built improvements and future expense recoveries. 2. Represents the initial stabilized yield (cash basis) of 6.5% less the market capitalization rate of 5.7%, divided by the market capitalization rate of 5.7%. Total Rental Revenue Over Lease Term1 ~$800M Alexandria Executes Largest Life Science Lease in Company History With Long-Standing Multinational Pharmaceutical Tenant 16-YEAR LEASE 467K RSF BUILD-TO-SUIT BIOMEDICAL RESEARCH HUB Value-Creation Margin2 14%

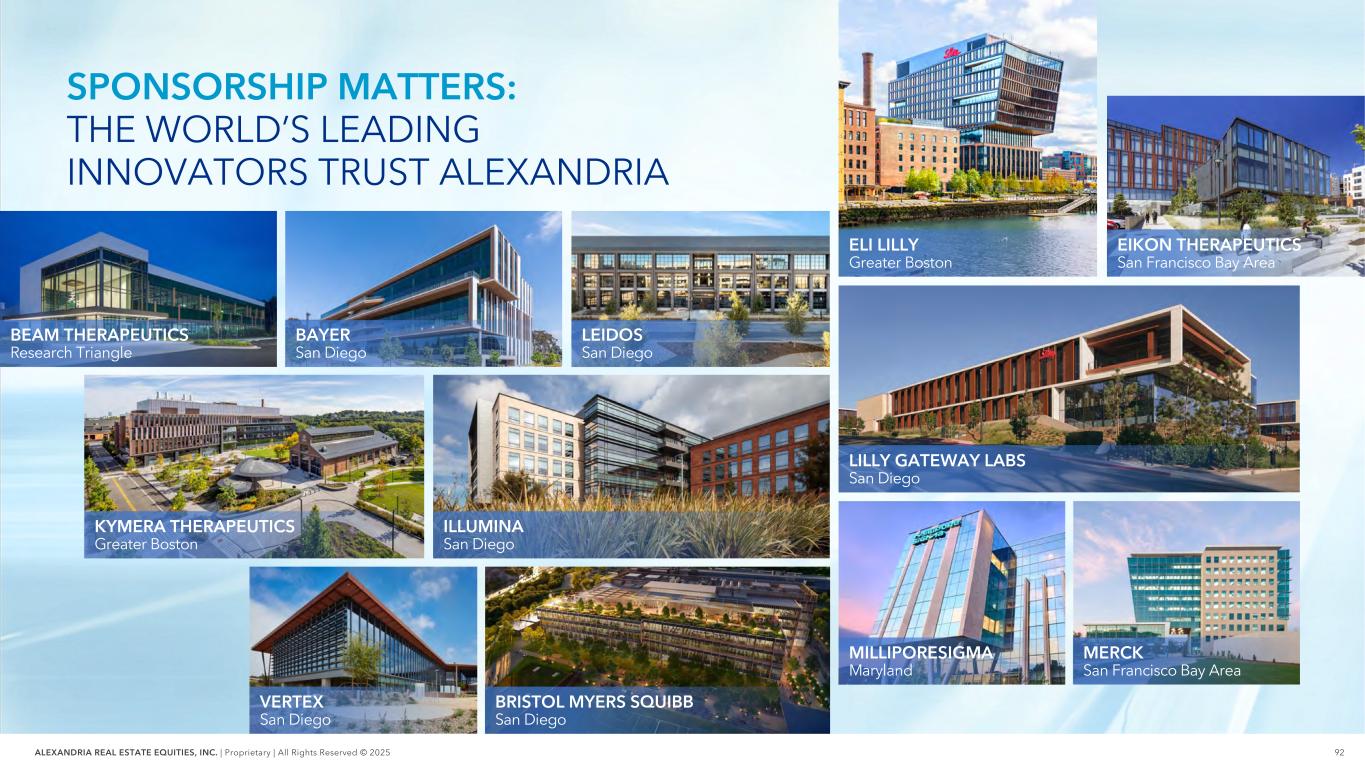

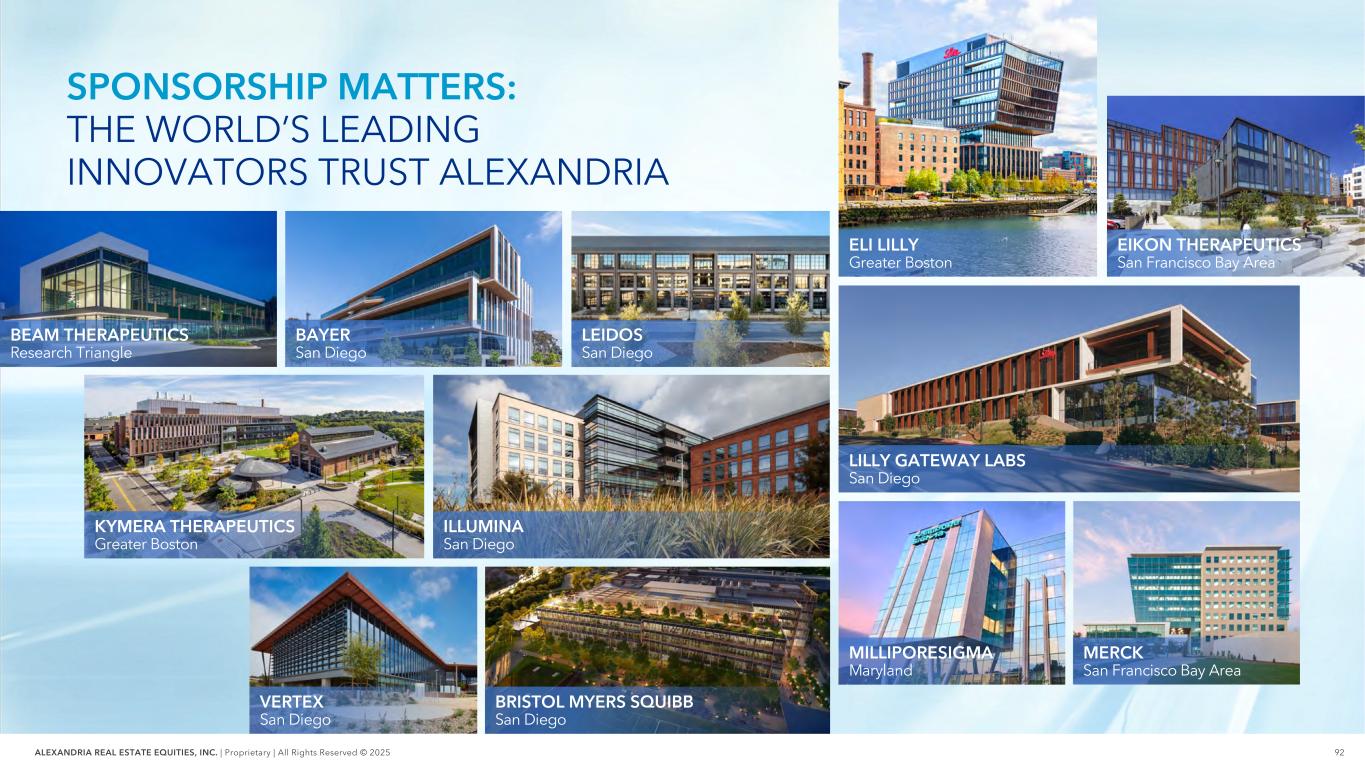

92ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 ELI LILLY Greater Boston SPONSORSHIP MATTERS: THE WORLD’S LEADING INNOVATORS TRUST ALEXANDRIA BAYER San Diego BRISTOL MYERS SQUIBB San Diego KYMERA THERAPEUTICS Greater Boston EIKON THERAPEUTICS San Francisco Bay Area LILLY GATEWAY LABS San Diego LEIDOS San Diego VERTEX San Diego BEAM THERAPEUTICS Research Triangle ILLUMINA San Diego MERCK San Francisco Bay Area MILLIPORESIGMA Maryland

93ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 ALEXANDRIA’S IRREPLACEABLE MEGACAMPUS™ PLATFORM DRIVES SUPERIOR OPERATING RESULTS 26 MEGACAMPUS ECOSYSTEMS As of September 30, 2025. Refer to “Megacampus” in the appendix. 27.1M RSF in Operation

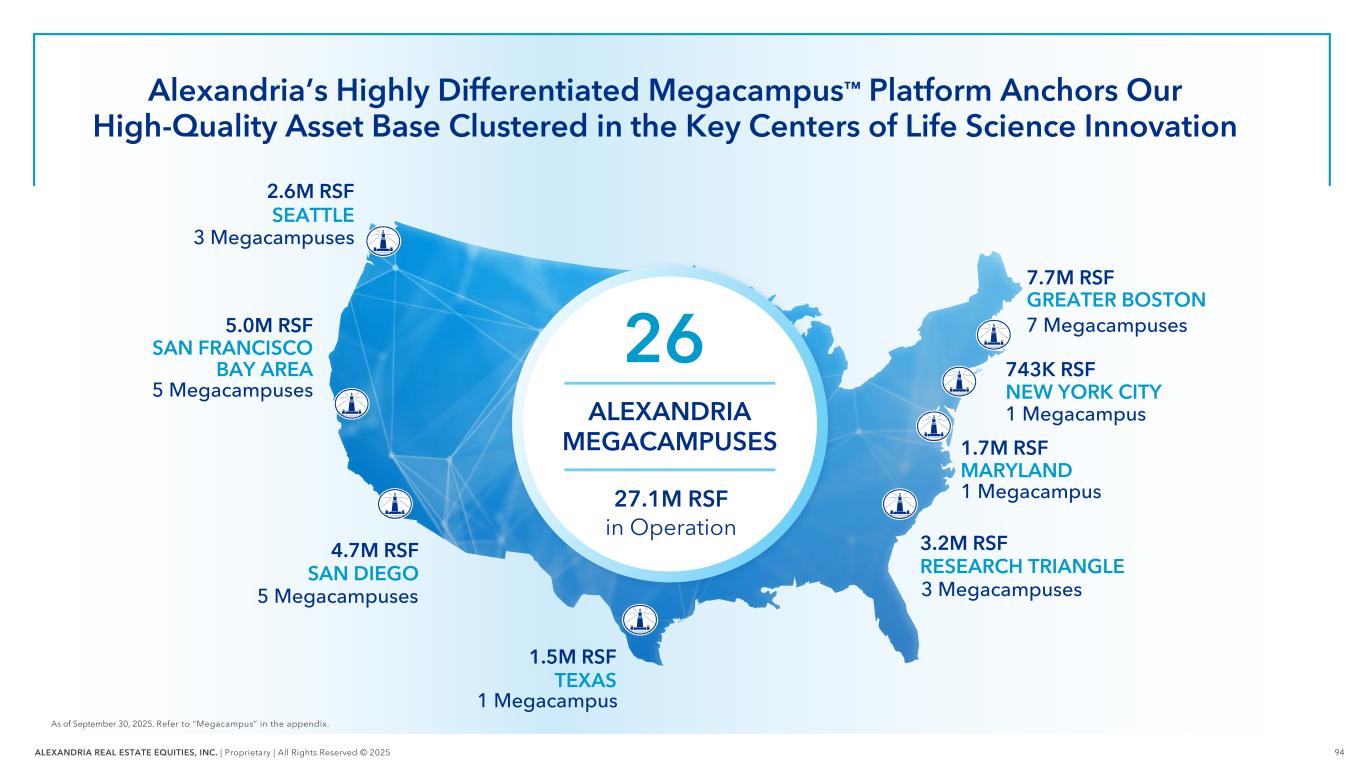

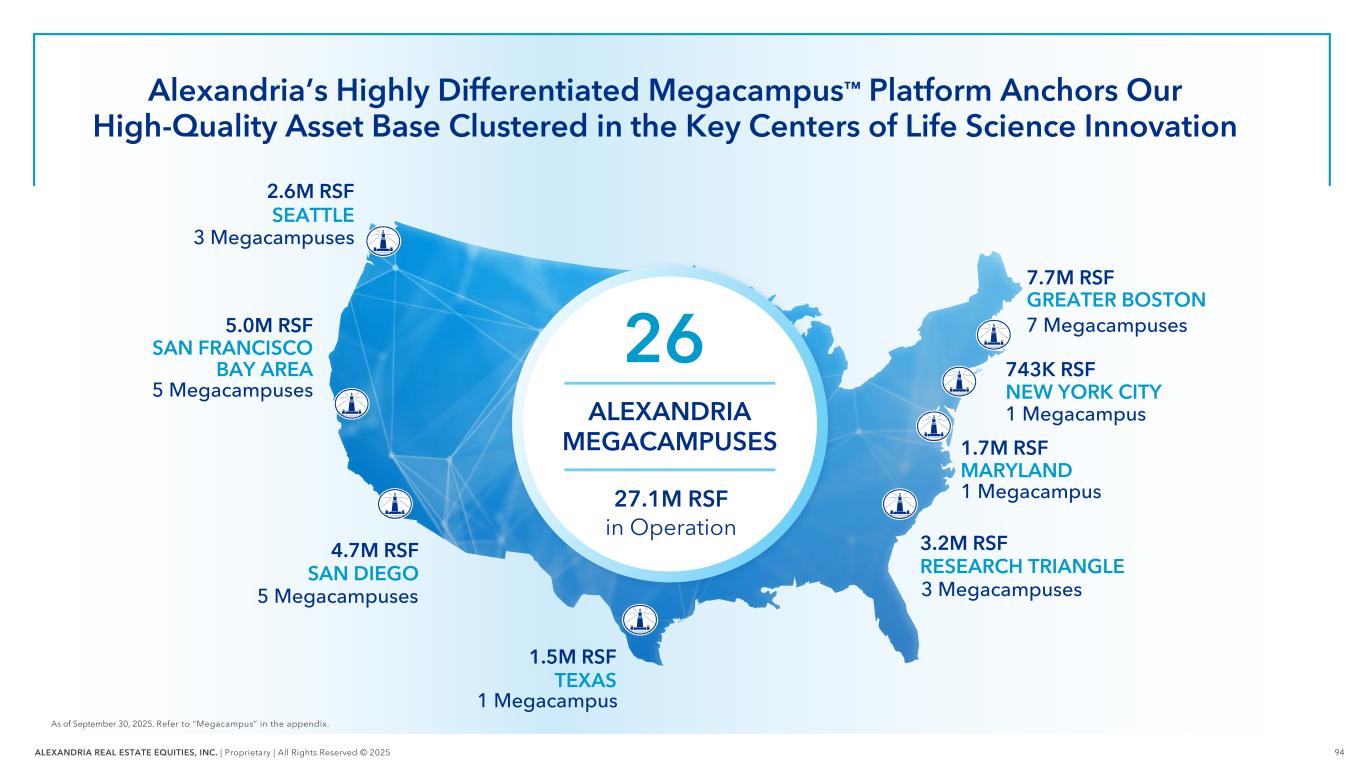

94ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 Alexandria’s Highly Differentiated Megacampus™ Platform Anchors Our High-Quality Asset Base Clustered in the Key Centers of Life Science Innovation As of September 30, 2025. Refer to “Megacampus” in the appendix. SEATTLE GREATER BOSTON SAN FRANCISCO BAY AREA RESEARCH TRIANGLE MARYLAND SAN DIEGO 4.7M RSF 7.7M RSF 5.0M RSF 2.6M RSF 3.2M RSF 1.7M RSF TEXAS 1.5M RSF 26 ALEXANDRIA MEGACAMPUSES 27.1M RSF in Operation 3 Megacampuses 5 Megacampuses 5 Megacampuses 7 Megacampuses 1 Megacampus 3 Megacampuses NEW YORK CITY 743K RSF 1 Megacampus 1 Megacampus

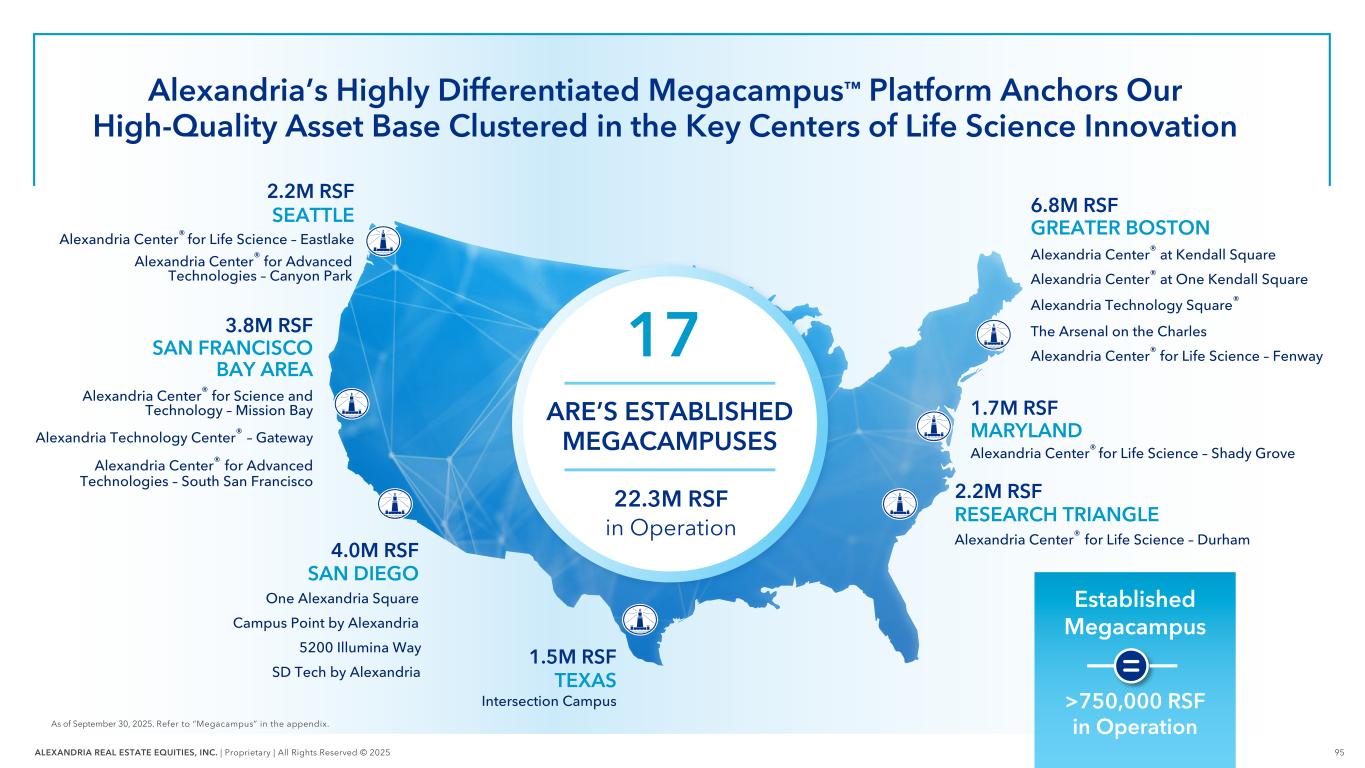

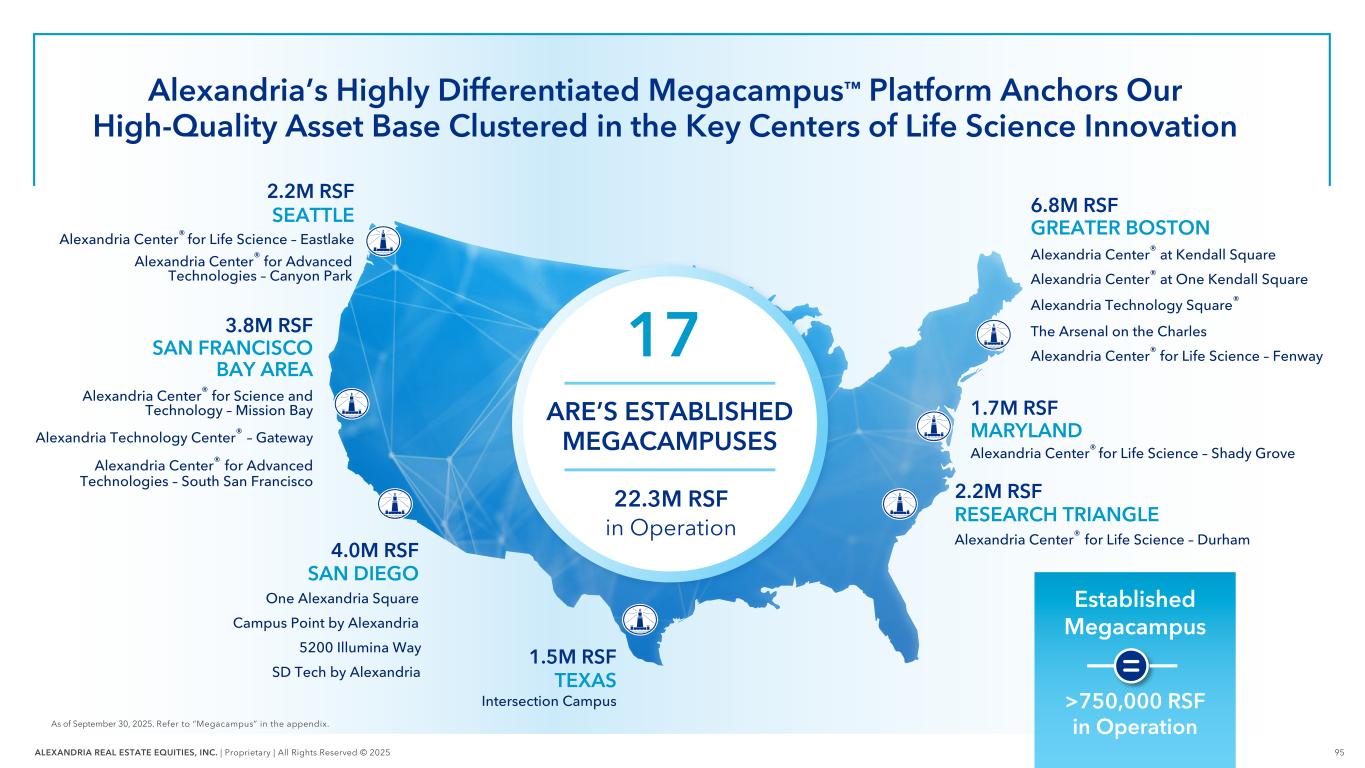

95ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 Alexandria’s Highly Differentiated Megacampus™ Platform Anchors Our High-Quality Asset Base Clustered in the Key Centers of Life Science Innovation As of September 30, 2025. Refer to “Megacampus” in the appendix. SEATTLE GREATER BOSTON SAN FRANCISCO BAY AREA RESEARCH TRIANGLE MARYLAND SAN DIEGO Alexandria Technology Square® Alexandria Center® for Science and Technology – Mission Bay Campus Point by Alexandria 4.0M RSF Alexandria Center® at Kendall Square 6.8M RSF Alexandria Center® at One Kendall Square One Alexandria Square 3.8M RSF Alexandria Center® for Life Science – Eastlake 2.2M RSF The Arsenal on the Charles Alexandria Technology Center® – Gateway Alexandria Center® for Life Science – Durham 2.2M RSF Alexandria Center® for Life Science – Fenway Alexandria Center® for Life Science – Shady Grove 1.7M RSF Alexandria Center® for Advanced Technologies – South San Francisco SD Tech by Alexandria 5200 Illumina Way TEXAS 1.5M RSF Intersection Campus Alexandria Center® for Advanced Technologies – Canyon Park 17 ARE’S ESTABLISHED MEGACAMPUSES 22.3M RSF in Operation Established Megacampus >750,000 RSF in Operation

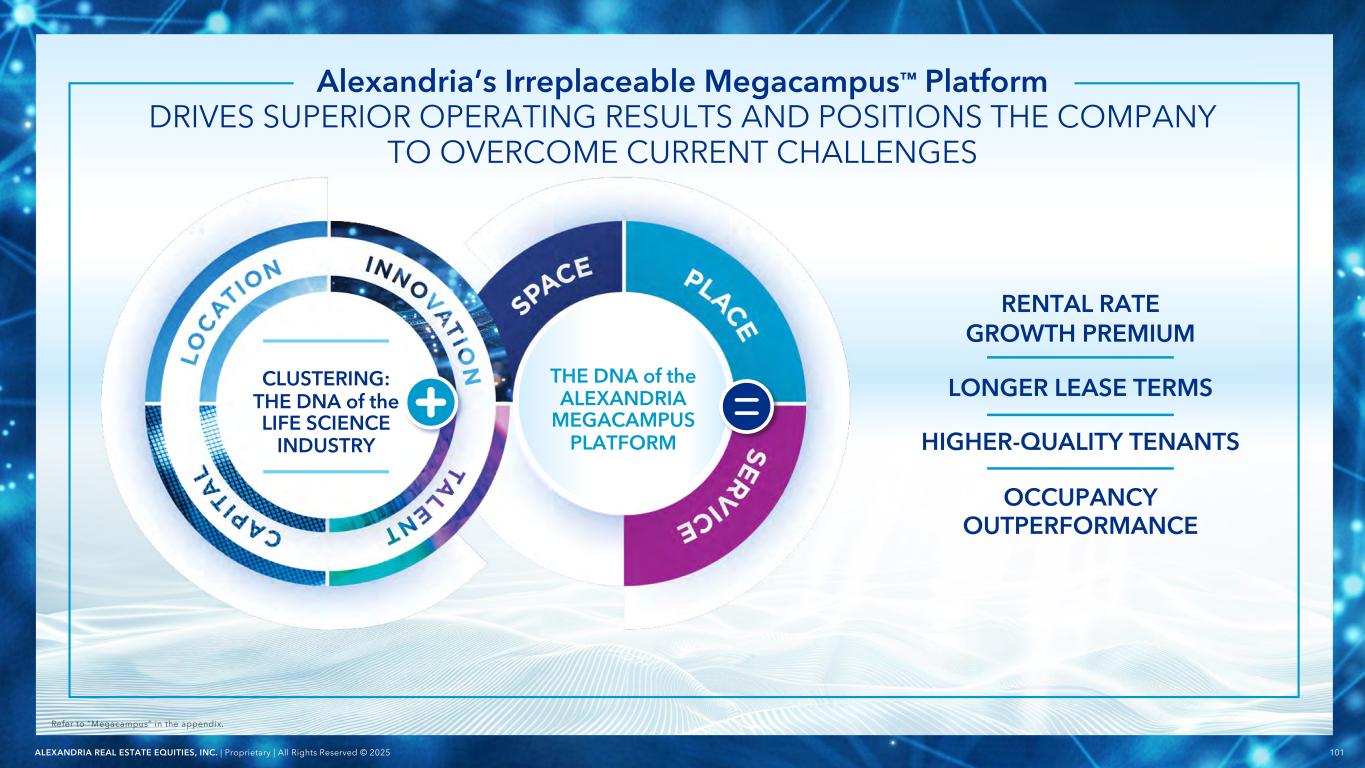

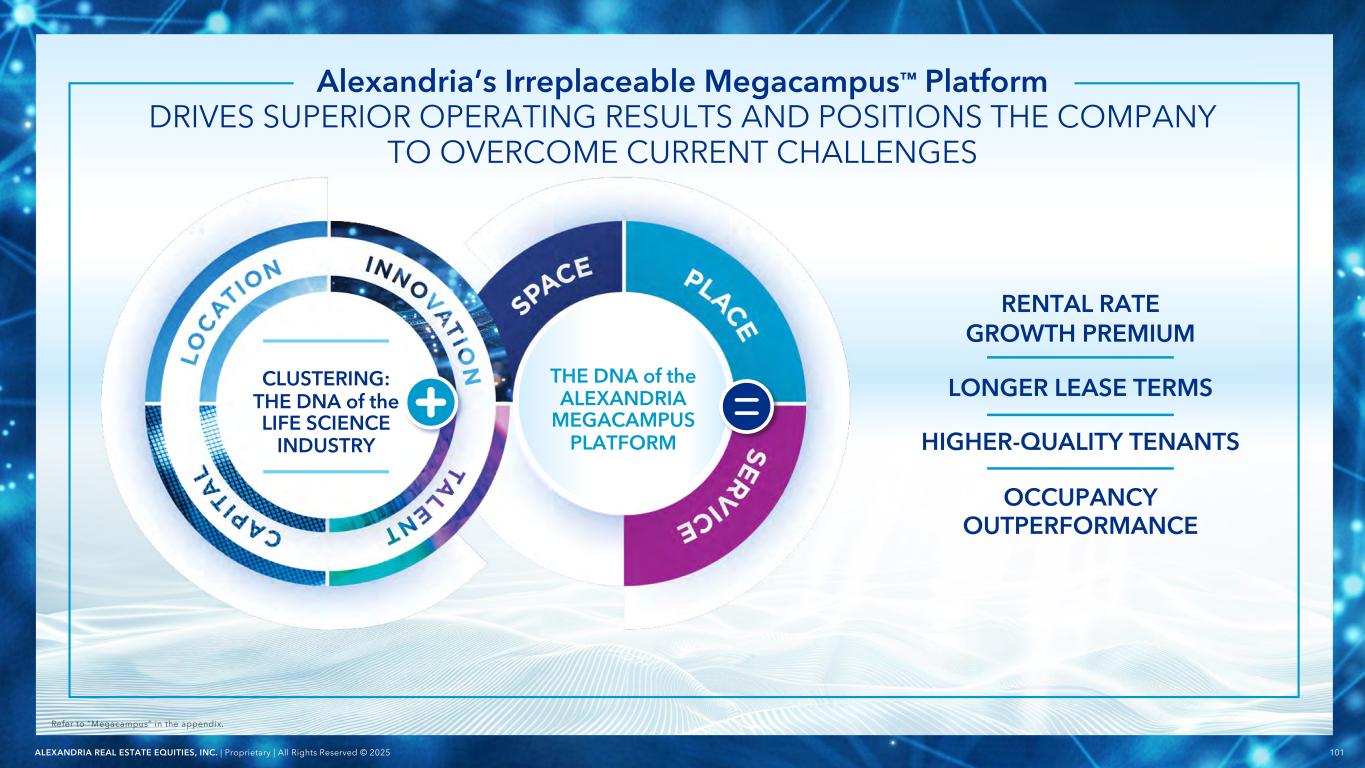

96ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 ALEXANDRIA’S PROPRIETARY ALGORITHM Driving Our Differentiated Megacampus™ Strategy CLUSTERING: THE DNA of the LIFE SCIENCE INDUSTRY THE DNA of the ALEXANDRIA MEGACAMPUS PLATFORM A L E X A N D R I A ’ S IRREPLACEABLE P L A T F O R M

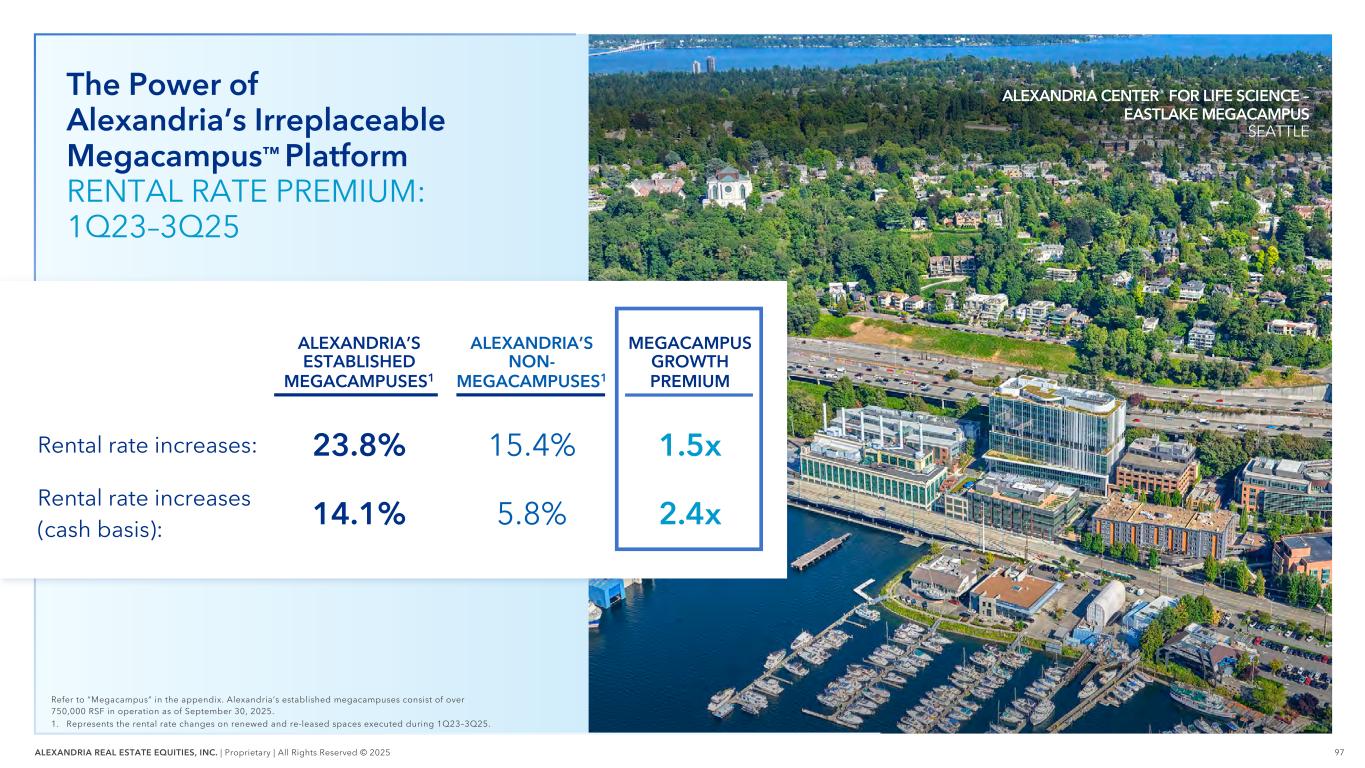

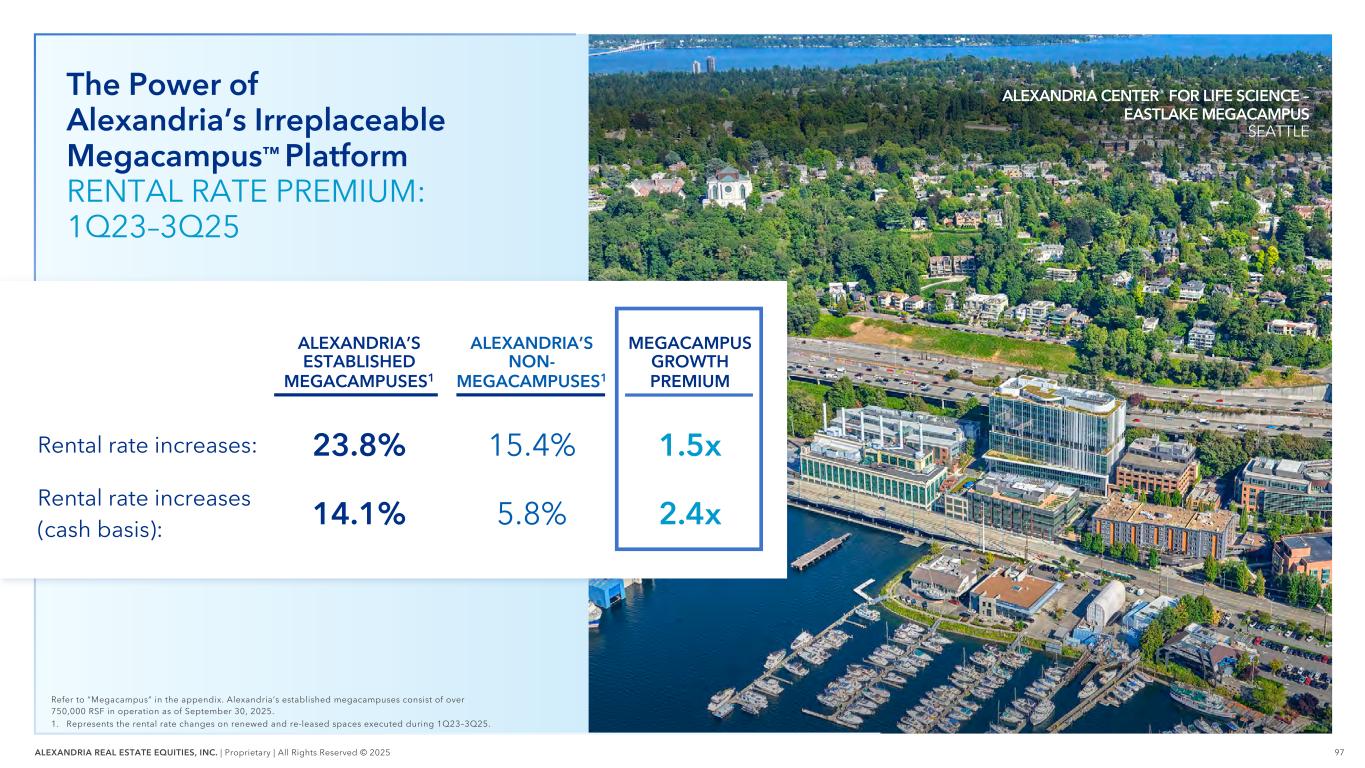

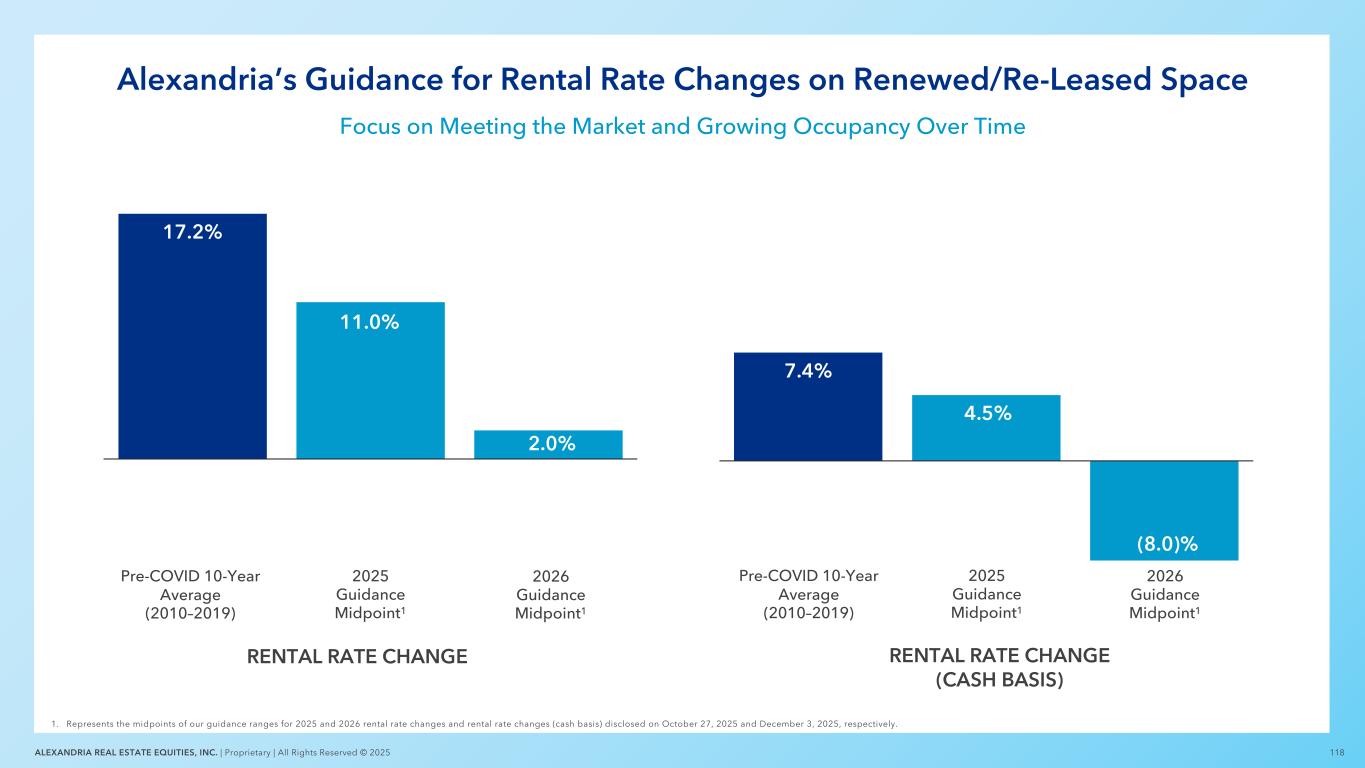

97ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 Refer to “Megacampus” in the appendix. Alexandria’s established megacampuses consist of over 750,000 RSF in operation as of September 30, 2025. 1. Represents the rental rate changes on renewed and re-leased spaces executed during 1Q23–3Q25. ALEXANDRIA’S ESTABLISHED MEGACAMPUSES1 ALEXANDRIA’S NON- MEGACAMPUSES1 MEGACAMPUS GROWTH PREMIUM Rental rate increases: 23.8% 15.4% 1.5x Rental rate increases (cash basis): 14.1% 5.8% 2.4x ALEXANDRIA CENTER® FOR LIFE SCIENCE – EASTLAKE MEGACAMPUS SEATTLE The Power of Alexandria’s Irreplaceable Megacampus™ Platform RENTAL RATE PREMIUM: 1Q23–3Q25

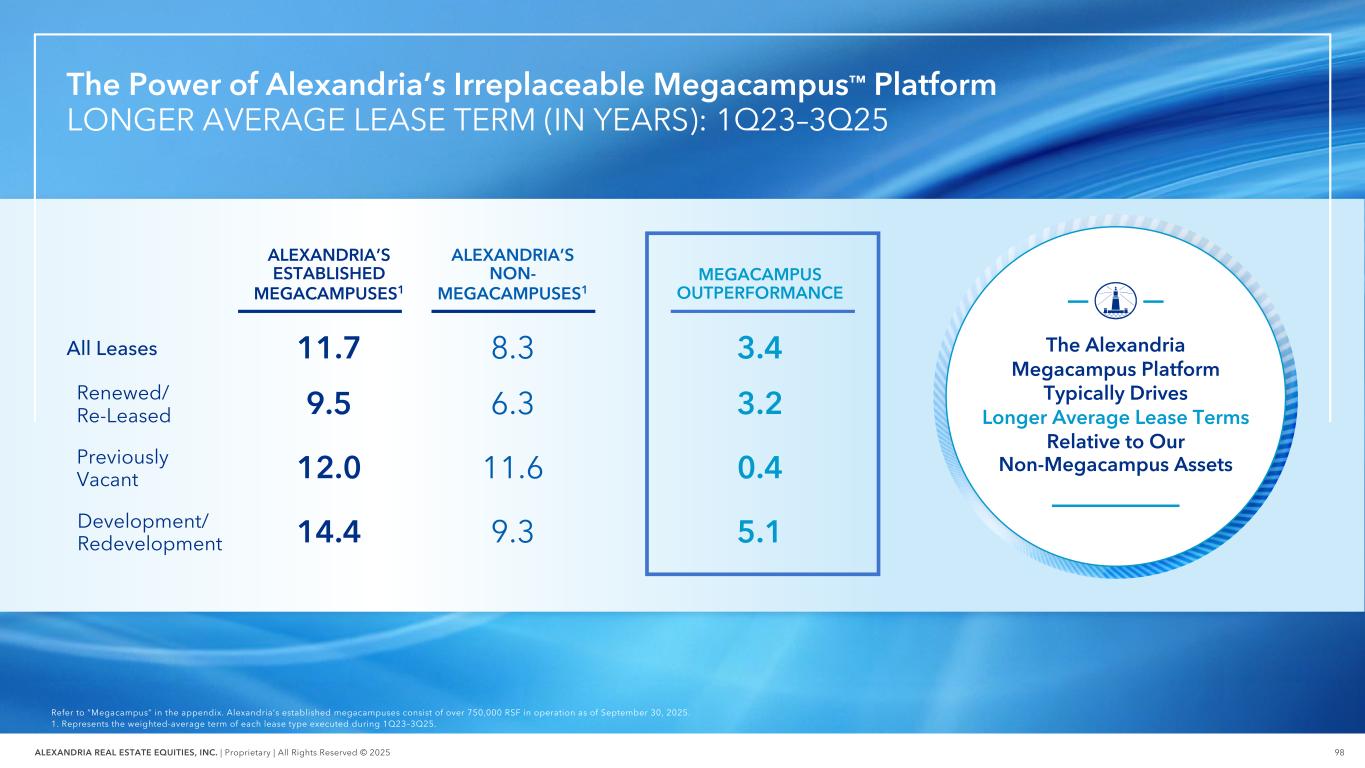

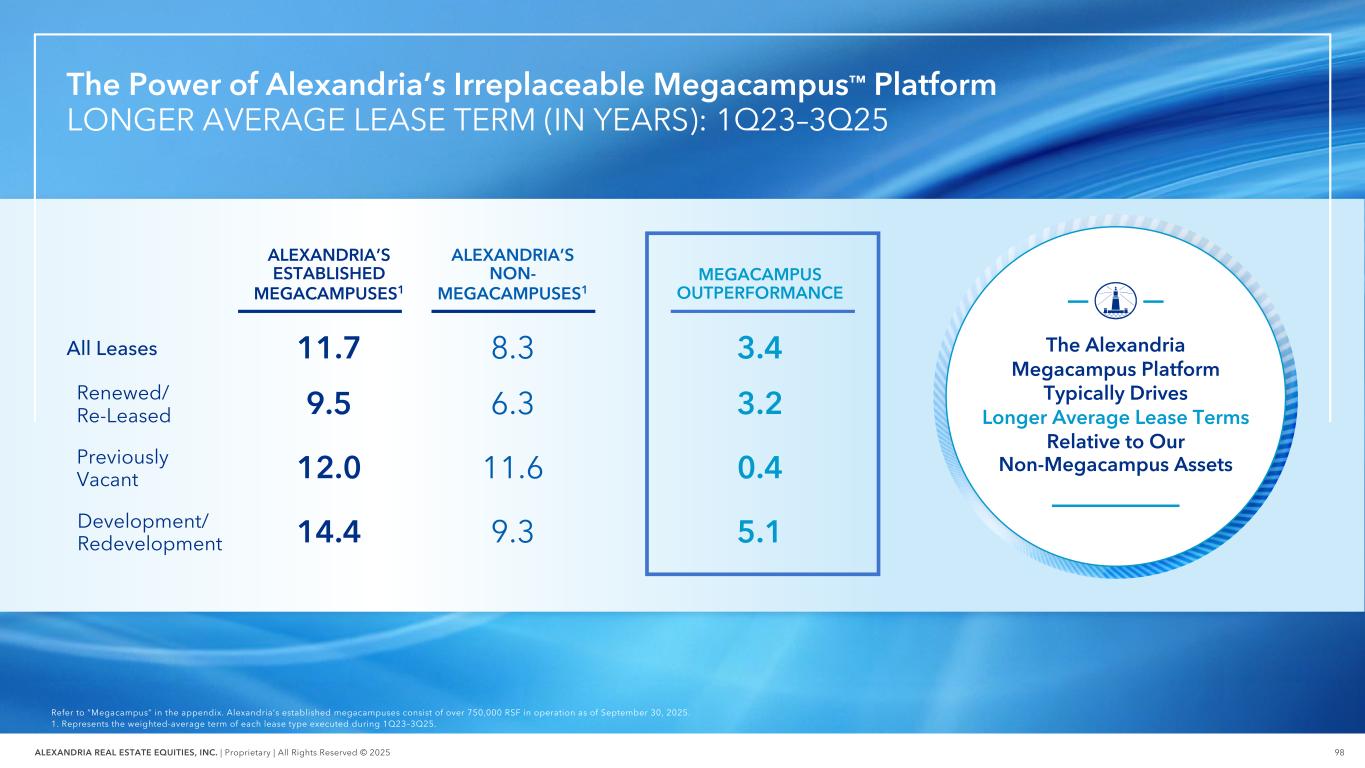

98ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 Refer to “Megacampus” in the appendix. Alexandria’s established megacampuses consist of over 750,000 RSF in operation as of September 30, 2025. 1. Represents the weighted-average term of each lease type executed during 1Q23–3Q25. ALEXANDRIA’S ESTABLISHED MEGACAMPUSES1 ALEXANDRIA’S NON- MEGACAMPUSES1 MEGACAMPUS OUTPERFORMANCE All Leases 11.7 8.3 3.4 Renewed/ Re-Leased 9.5 6.3 3.2 Previously Vacant 12.0 11.6 0.4 Development/ Redevelopment 14.4 9.3 5.1 The Alexandria Megacampus Platform Typically Drives Longer Average Lease Terms Relative to Our Non-Megacampus Assets The Power of Alexandria’s Irreplaceable Megacampus™ Platform LONGER AVERAGE LEASE TERM (IN YEARS): 1Q23–3Q25

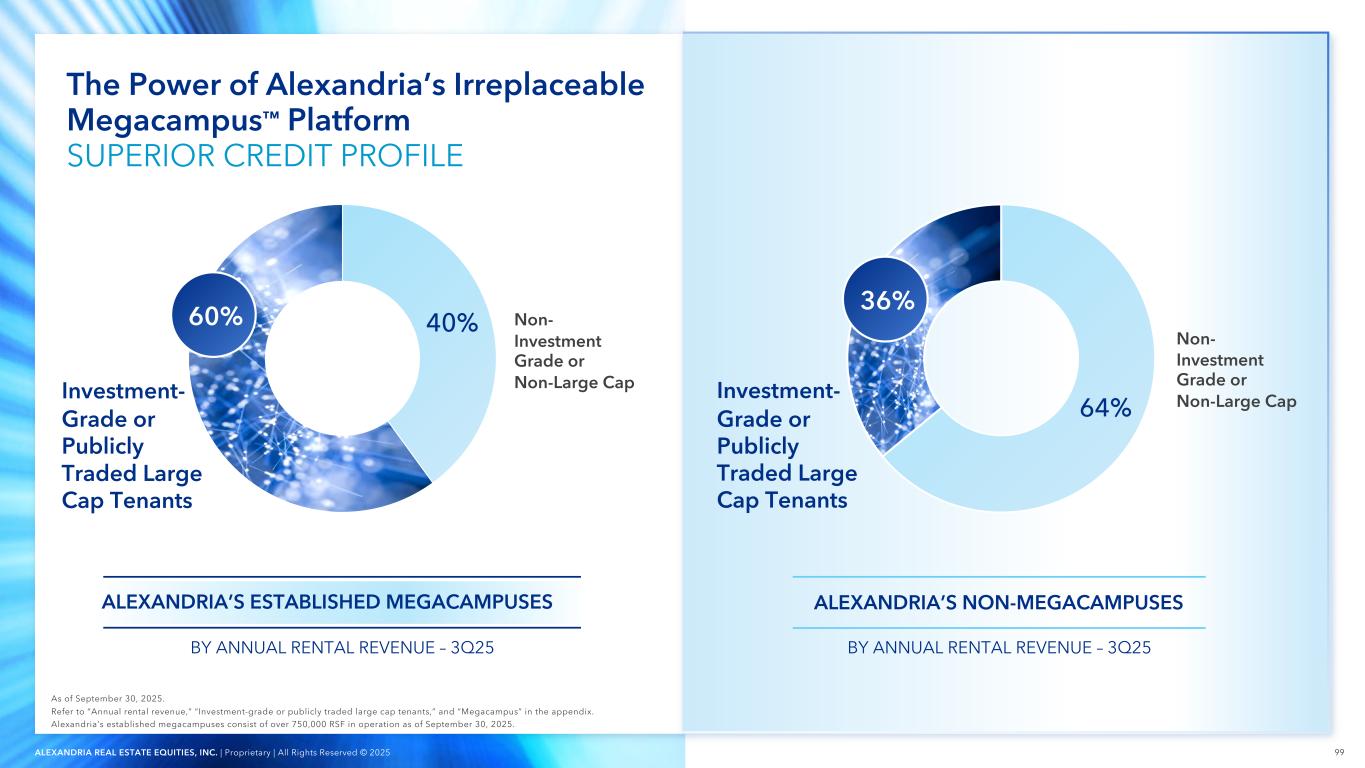

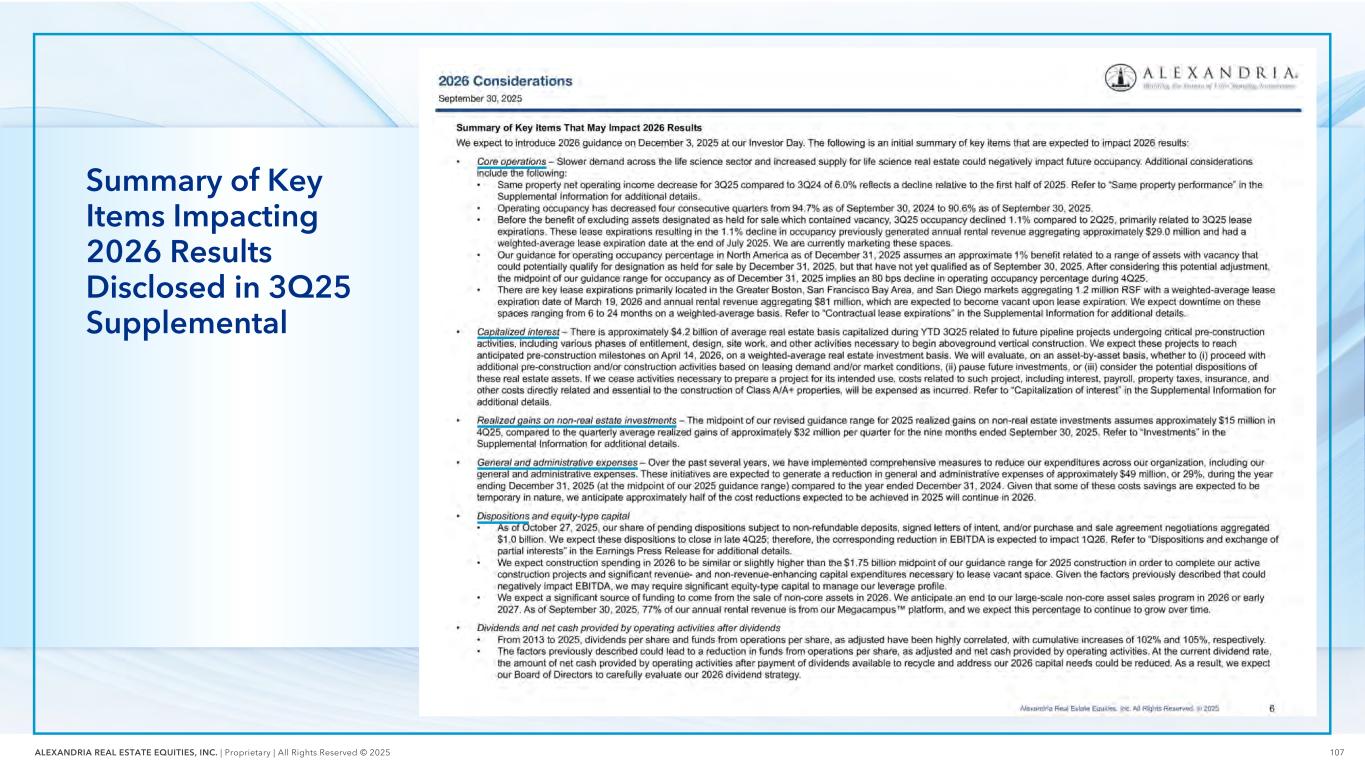

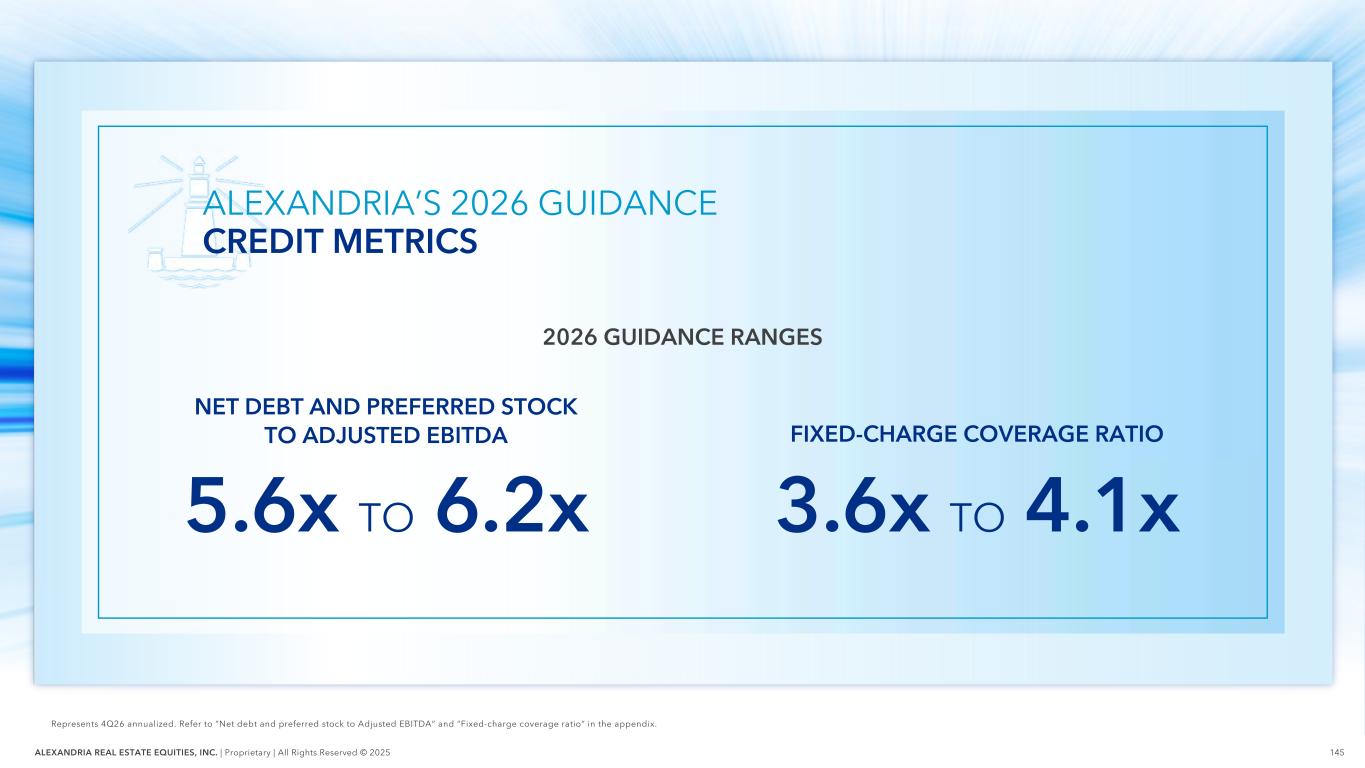

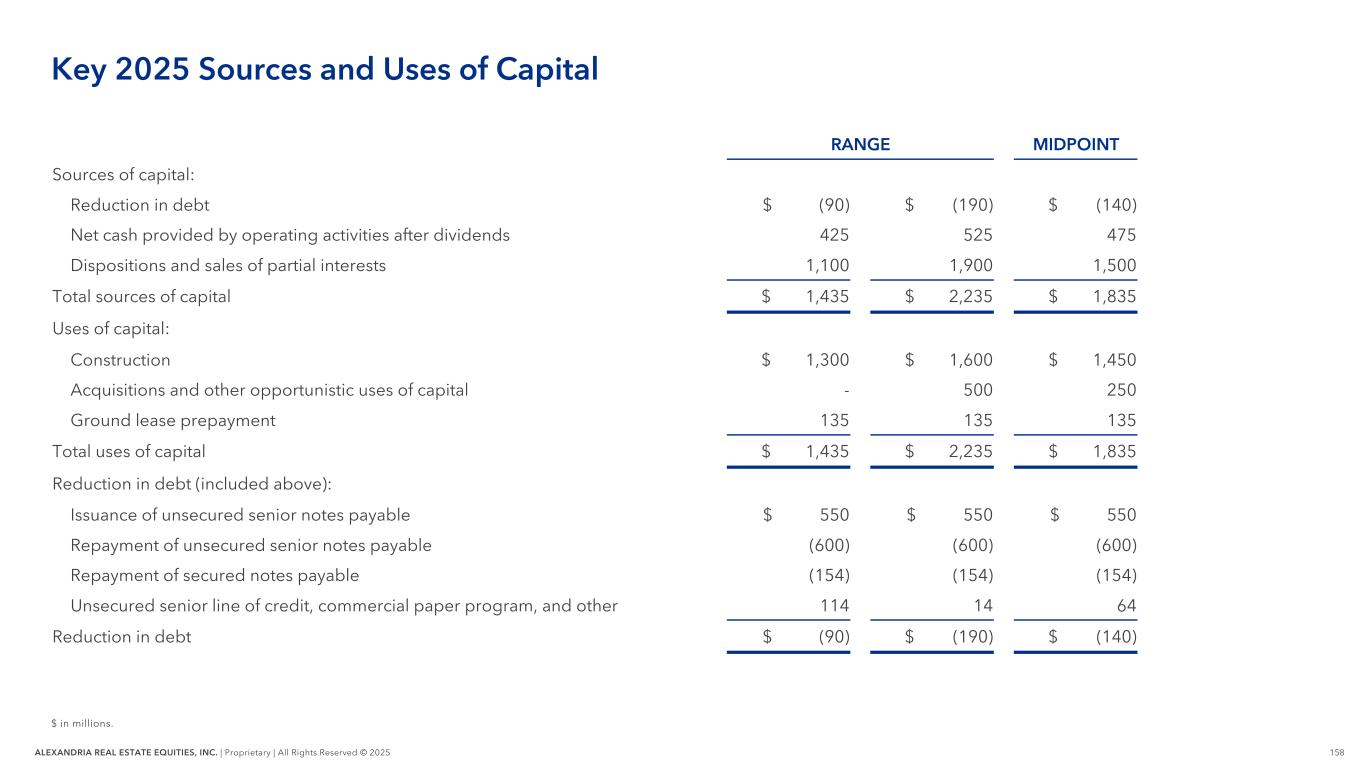

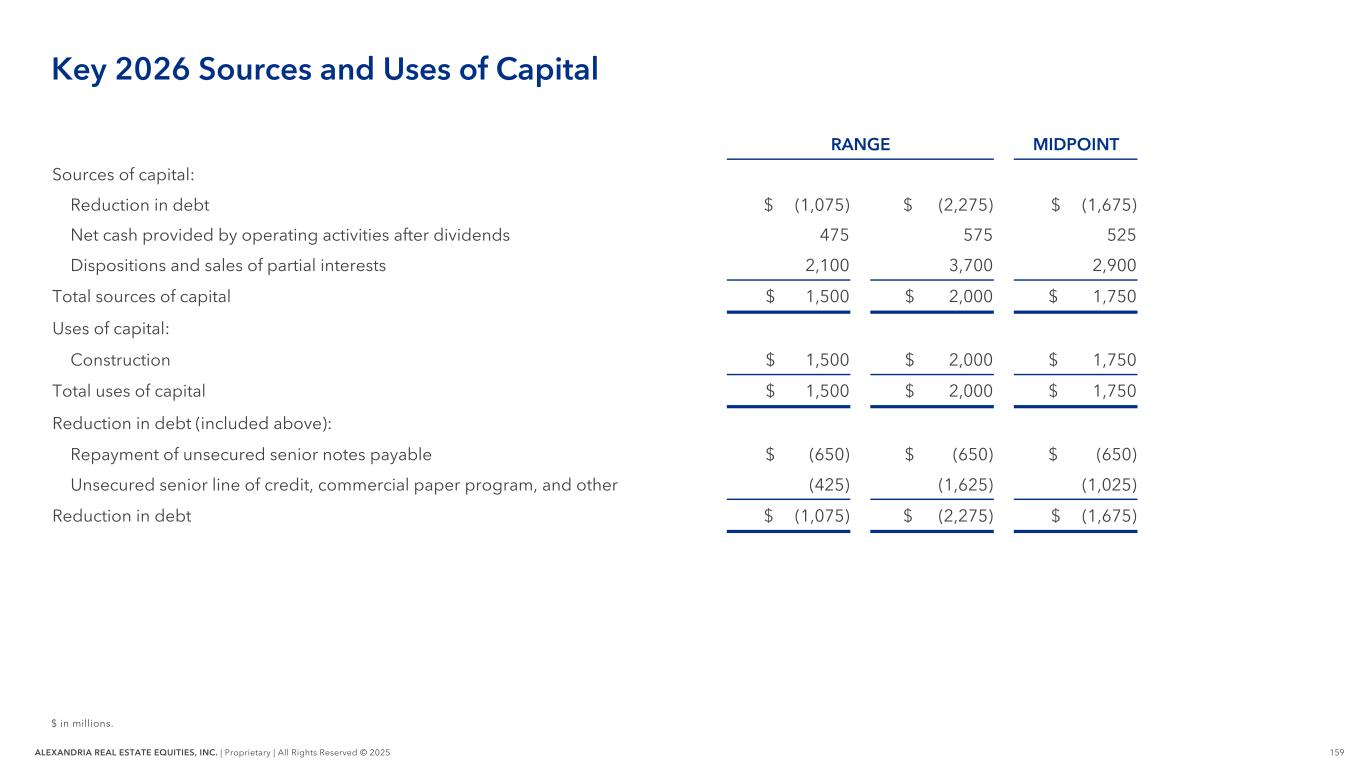

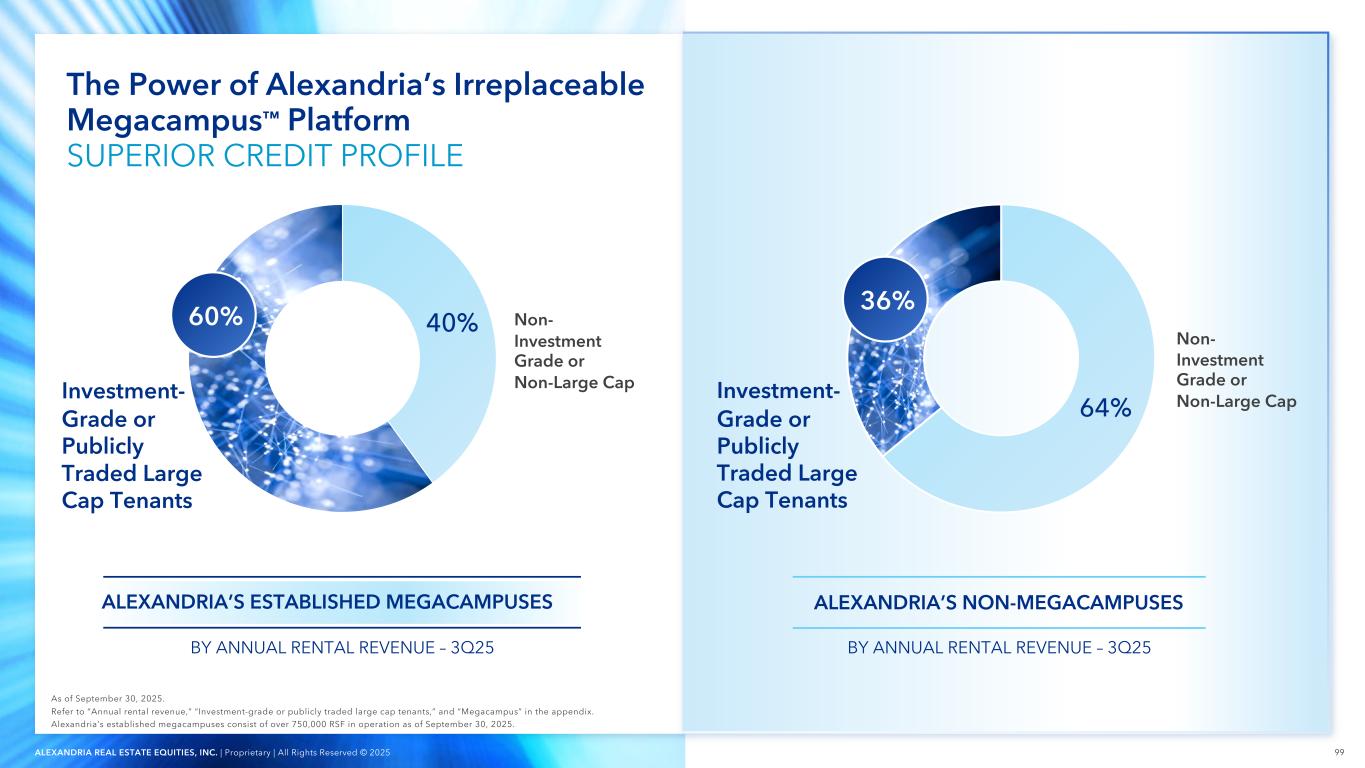

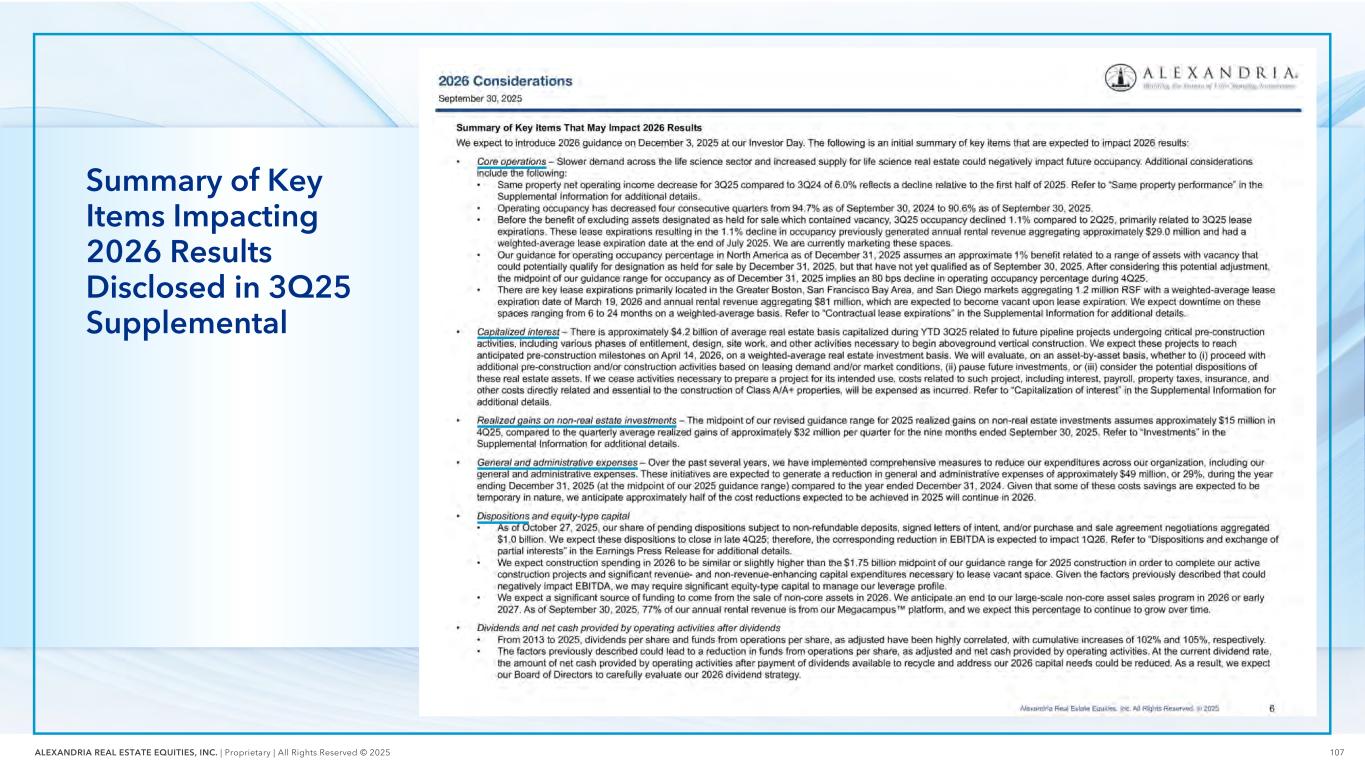

99ALEXANDRIA REAL ESTATE EQUITIES, INC. | Proprietary | All Rights Reserved © 2025 As of September 30, 2025. Refer to “Annual rental revenue,” “Investment-grade or publicly traded large cap tenants,” and “Megacampus” in the appendix. Alexandria’s established megacampuses consist of over 750,000 RSF in operation as of September 30, 2025. The Power of Alexandria’s Irreplaceable Megacampus™ Platform SUPERIOR CREDIT PROFILE ALEXANDRIA’S ESTABLISHED MEGACAMPUSES 40%60% Investment- Grade or Publicly Traded Large Cap Tenants Non- Investment Grade or Non-Large Cap 60% BY ANNUAL RENTAL REVENUE – 3Q25 ALEXANDRIA’S NON-MEGACAMPUSES 64% 36% Non- Investment Grade or Non-Large CapInvestment- Grade or Publicly Traded Large Cap Tenants 36% BY ANNUAL RENTAL REVENUE – 3Q25