| Maryland | 1-12993 | 95-4502084 | ||||||||||||

| (State or other jurisdiction of incorporation) |

(Commission File Number) | (I.R.S. Employer Identification No.) | ||||||||||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

| Common Stock, $0.01 par value per share | ARE |

New York Stock Exchange | ||||||

| ALEXANDRIA REAL ESTATE EQUITIES, INC. | ||||||||||||||

| April 28, 2025 | By: | /s/ Joel S. Marcus | ||||||||||||

| Joel S. Marcus | ||||||||||||||

| Executive Chairman | ||||||||||||||

| By: | /s/ Peter M. Moglia | |||||||||||||

| Peter M. Moglia | ||||||||||||||

| Chief Executive Officer and Chief Investment Officer |

||||||||||||||

| By: | /s/ Marc E. Binda | |||||||||||||

| Marc E. Binda | ||||||||||||||

| Chief Financial Officer and Treasurer | ||||||||||||||

|

|

Table of Contents | |

March 31, 2025 | |

COMPANY HIGHLIGHTS |

Page |

||||

Mission and Cluster Model ..................................................................... |

|||||

EARNINGS PRESS RELEASE |

Page |

Page |

|||

First Quarter Ended March 31, 2025 Financial and Operating

Results ...................................................................................................

|

Consolidated Statements of Operations .......................................... |

||||

Guidance ................................................................................................... |

Consolidated Balance Sheets ............................................................ |

||||

Dispositions and Sales of Partial Interests .......................................... |

|||||

Earnings Call Information and About the Company ........................... |

|||||

SUPPLEMENTAL INFORMATION |

Page |

Page |

|||

Company Profile ....................................................................................... |

External Growth / Investments in Real Estate |

||||

Investor Information ................................................................................. |

Investments in Real Estate ................................................................ |

||||

Financial and Asset Base Highlights ..................................................... |

New Class A/A+ Development and Redevelopment Properties: |

||||

High-Quality and Diverse Client Base ................................................. |

Recent deliveries ............................................................................ |

||||

Internal Growth |

Current Projects .............................................................................. |

||||

Key Operating Metrics ............................................................................. |

Summary of Pipeline ...................................................................... |

||||

Same Property Performance .................................................................. |

Construction Spending and Capitalization of Interest .................... |

||||

Leasing Activity ......................................................................................... |

Joint Venture Financial Information ................................................... |

||||

Contractual Lease Expirations ............................................................... |

Balance Sheet Management |

||||

Top 20 Tenants ......................................................................................... |

Investments .......................................................................................... |

||||

Summary of Properties and Occupancy .............................................. |

Key Credit Metrics ............................................................................... |

||||

Property Listing ........................................................................................ |

Summary of Debt ................................................................................. |

||||

Definitions and Reconciliations |

|||||

Definitions and Reconciliations .......................................................... |

|||||

CONFERENCE CALL

INFORMATION:

|

||

Tuesday, April 29, 2025

3:00 p.m. Eastern Time

|

||

12:00 p.m. Pacific Time |

||

(833) 366-1125 or

(412) 902-6738

|

||

Ask to join the conference call for

Alexandria Real Estate Equities, Inc.

|

||

CONTACT INFORMATION: |

||

Alexandria Real Estate Equities, Inc.

corporateinformation@are.com

|

||

JOEL S. MARCUS

Executive Chairman &

Founder

|

||

PETER M. MOGLIA

Chief Executive Officer &

Chief Investment Officer

|

||

MARC E. BINDA

Chief Financial Officer &

Treasurer

|

||

PAULA SCHWARTZ

Managing Director,

Rx Communications Group

(917) 633-7790

|

||

LARGEST, HIGHEST-QUALITY

ASSET BASE CLUSTERED IN

THE BEST LOCATIONS

|

SECTOR-LEADING CLIENT

BASE OF ~750 TENANTS

|

HIGH-QUALITY CASH FLOWS |

PROVEN UNDERWRITING |

FORTRESS BALANCE SHEET |

LONG-TENURED, HIGHLY

EXPERIENCED MANAGEMENT TEAM

|

ALEXANDRIA’S

MEGACAMPUS™

PLATFORM

|

75% |

OF OUR ANNUAL RENTAL REVENUE |

71% |

OF OUR OPERATING RSF |

ALEXANDRIA’S

MEGACAMPUS PLATFORM

| ||

75% |

||

of Annual Rental Revenue |

||

71% |

||

of Operating RSF |

||

71% |

||

of Total Development and

Redevelopment Pipeline RSF

|

||

ALEXANDRIA’S MEGACAMPUS

OCCUPANCY OUTPERFORMANCE

|

||||

Average Occupancy(1) Since 2021 |

||||

95% |

91% |

|||

Megacampus

Properties

|

Non-Megacampus

Properties

|

|||

4%

Occupancy Outperformance

|

||||

LONG-DURATION

LEASE TERMS

| |||

REMAINING

LEASE TERM

(in years)(2)

|

|||

Multinational

Pharmaceutical

|

7.3 |

||

Life Science Product,

Service, and Device

|

6.6 |

||

Government Institutions |

5.3 |

||

Biomedical Institutions |

7.7 |

||

Private Biotechnology |

7.3 |

||

Public Biotechnology |

7.5 |

||

FTSE NAREIT EQUITY

HEALTH CARE INDEX

|

|

S&P 500 |

|

FTSE ALL

EQUITY REITS

|

|

MSCI US

REIT INDEX

|

|

RUSSELL 2000 |

|

HIGH-QUALITY CASH FLOWS |

||||

STRONG MARGINS(1) |

||||

70% |

71% |

|||

Operating |

Adjusted EBITDA |

|||

LONG-DURATION LEASE TERMS |

||||

Top 20 Tenants |

All Tenants |

|||

9.6 |

7.6 |

|||

Weighted-Average Remaining Term (in Years)(2) |

||||

FAVORABLE LEASE STRUCTURE(3) | ||||

HIGH-CREDIT TENANT BASE | ||||

INVESTMENT-GRADE OR

PUBLICLY TRADED LARGE CAP TENANTS

| ||||

87% |

51% |

|||

of ARE’s Top 20 Tenant

Annual Rental Revenue(3)

|

of ARE’s

Annual Rental Revenue(3)

|

|||

SIGNIFICANT

LIQUIDITY(1)

|

4Q25 TARGET NET DEBT

AND PREFERRED STOCK

TO ADJUSTED EBITDA(2)

|

PERCENTAGE OF

FIXED-RATE DEBT

SINCE 2021(3)

|

||

$5.3B |

≤5.2x |

97.9% |

||

PERCENTAGE OF

DEBT MATURING

IN NEXT 3 YEARS

|

REMAINING

DEBT TERM

(IN YEARS)

|

DEBT

INTEREST

RATE

|

||

13% |

12.2 |

3.95% |

||

One of the Lowest Debt Maturities

for 2025–2027

among S&P 500 REITs(5)

|

5.7% |

Dividend

Yield

|

|

4.5% |

Average Annual

Dividend Per-Share

Growth

|

|

57% |

1Q25 Payout

Ratio

|

|

$2.3B |

Net Cash Provided by

Operating Activities

After Dividends

|

|

Key highlights |

||||

Operating results |

1Q25 |

1Q24 |

||

Total revenues: |

||||

In millions |

$758.2 |

$769.1 |

||

Net (loss) income attributable to Alexandria’s common stockholders – diluted: | ||||

In millions |

$(11.6) |

$166.9 |

||

Per share |

$(0.07) |

$0.97 |

||

Funds from operations attributable to Alexandria’s common stockholders – diluted, as adjusted: |

||||

In millions |

$392.0 |

$403.9 |

||

Per share |

$2.30 |

$2.35 |

||

(As of March 31, 2025, unless stated otherwise) |

|||

Occupancy of operating properties in North America |

91.7% |

(1) |

|

Percentage of annual rental revenue in effect from Megacampus™ platform |

75% |

||

Percentage of annual rental revenue in effect from investment-grade or publicly

traded large cap tenants

|

51% |

||

Operating margin |

70% |

||

Adjusted EBITDA margin |

71% |

||

Percentage of leases containing annual rent escalations |

98% |

||

Weighted-average remaining lease term: |

|||

Top 20 tenants |

9.6 |

years |

|

All tenants |

7.6 |

years |

|

Sustained strength in tenant collections: |

|||

April 2025 tenant rents and receivables collected as of April 28, 2025 |

99.8% |

||

1Q25 tenant rents and receivables collected as of April 28, 2025 |

99.9% |

1Q25 |

|||

Total leasing activity – RSF |

1,030,553 |

||

Lease renewals and re-leasing of space: |

|||

RSF (included in total leasing activity above) |

884,408 |

||

Rental rate increase |

18.5% |

||

Rental rate increase (cash basis) |

7.5% |

||

Leasing of development and redevelopment space – RSF |

6,430 |

(1) |

(in millions) |

||||

Completed dispositions |

$176 |

|||

Our share of pending transactions subject to non-refundable deposits,

signed letters of intent, and/or purchase and sale agreement

negotiations

|

433 |

|||

Our share of completed and pending 2025 dispositions |

609 |

31% |

||

Additional targeted dispositions |

1,341 |

69 |

||

2025 guidance midpoint for dispositions and sales of partial interests |

$1,950 |

100% |

||

|

|

First Quarter Ended March 31, 2025 Financial and Operating Results (continued) | |

March 31, 2025 | |

Development and Redevelopment Projects |

Incremental

Annual Net

Operating Income

|

RSF |

Leased/

Negotiating

Percentage

|

|||||

(dollars in millions) |

||||||||

Placed into service in 1Q25 |

$37 |

309,494 |

100% |

|||||

Expected to be placed into service: |

||||||||

2Q25 through 4Q26 |

$171 |

(1) |

1,597,920 |

(2) |

75% |

(3) |

||

2027 through 2Q28 |

$179 |

2,449,862 |

16% |

|||||

Occupancy as of December 31, 2024 |

94.6% |

||||

Lease expirations which became vacant as of March 31, 2025: |

|||||

Re-leased with future delivery or subject to ongoing negotiations |

(1.3) |

(1) |

|||

Marketing |

(1.6) |

(2.9) |

(2) |

||

Occupancy as of March 31, 2025 |

91.7% |

1Q25 |

Target |

|||||||

Quarter |

Trailing |

4Q25 |

||||||

Annualized |

12 Months |

Annualized |

||||||

Net debt and preferred stock to

Adjusted EBITDA

|

5.9x |

5.7x |

Less than or equal to 5.2x |

|||||

Fixed-charge coverage ratio |

4.3x |

4.4x |

4.0x to 4.5x |

|||||

|

|

First Quarter Ended March 31, 2025 Financial and Operating Results (continued) | |

March 31, 2025 | |

Key items included in net income attributable to Alexandria’s common stockholders: | |||||||

1Q25 |

1Q24 |

1Q25 |

1Q24 |

||||

(in millions, except per share amounts) |

Amount |

Per Share – Diluted |

|||||

Unrealized (losses) gains on non-real estate

investments

|

$(68.1) |

$29.2 |

$(0.40) |

$0.17 |

|||

Gain on sales of real estate |

13.2 |

0.4 |

0.08 |

— |

|||

Impairment of non-real estate investments |

(11.2) |

(14.7) |

(0.07) |

(0.09) |

|||

Impairment of real estate(1) |

(32.2) |

— |

(0.19) |

— |

|||

Increase in provision for expected credit losses on

financial instruments(1)

|

(0.3) |

— |

— |

— |

|||

Total |

$(98.6) |

$14.9 |

$(0.58) |

$0.08 |

|||

Guidance |

|

March 31, 2025 | |

(Dollars in millions, except per share amounts) | |

Projected 2025 Earnings per Share and Funds From Operations per Share Attributable to Alexandria’s Common Stockholders – Diluted | ||||||||||

As of 4/28/25 |

As of 1/27/25 |

Key Changes to Midpoint |

||||||||

Earnings per share(1) |

$1.36 to $1.56 |

$2.57 to $2.77 |

||||||||

Depreciation and amortization of real estate assets |

7.05 |

6.70 |

||||||||

Gain on sales of real estate |

(0.08) |

— |

(2) |

|||||||

Impairment of real estate – rental properties |

0.21 |

— |

(3) |

|||||||

Allocation to unvested restricted stock awards |

(0.03) |

(0.04) |

||||||||

Funds from operations per share(4) |

$8.51 to $8.71 |

$9.23 to $9.43 |

||||||||

Unrealized losses on non-real estate investments |

0.40 |

— |

||||||||

Impairment of non-real estate investments |

0.07 |

— |

(4) |

|||||||

Impairment of real estate |

0.19 |

— |

||||||||

Allocation to unvested restricted stock awards |

(0.01) |

— |

||||||||

Funds from operations per share, as adjusted(5) |

$9.16 to $9.36 |

$9.23 to $9.43 |

||||||||

Midpoint |

$9.26 |

$9.33 |

Reduction of 7-cents, or 75 bps |

|||||||

Guidance (continued) |

|

March 31, 2025 | |

(Dollars in millions) | |

As of 4/28/25 |

As of 1/27/25 |

Key Changes

to Midpoint

|

|||||||||

Key Assumptions |

Low |

High |

Low |

High |

|||||||

Occupancy percentage in North America as of December 31, 2025 |

90.9% |

92.5% |

91.6% |

93.2% |

70 bps reduction |

||||||

Lease renewals and re-leasing of space: |

|||||||||||

Rental rate changes |

9.0% |

17.0% |

9.0% |

17.0% |

No change |

||||||

Rental rate changes (cash basis) |

0.5% |

8.5% |

0.5% |

8.5% |

|||||||

Same property performance: |

|||||||||||

Net operating income |

(3.7)% |

(1.7)% |

(3.0)% |

(1.0)% |

70 bps reduction |

||||||

Net operating income (cash basis) |

(1.2)% |

0.8% |

(1.0)% |

1.0% |

20 bps reduction |

||||||

Straight-line rent revenue |

$96 |

$116 |

$111 |

$131 |

$15 million reduction |

||||||

General and administrative expenses |

$112 |

$127 |

$129 |

$144 |

$17 million reduction |

||||||

Capitalization of interest |

$320 |

$350 |

$340 |

$370 |

$20 million reduction |

||||||

Interest expense |

$185 |

$215 |

$165 |

$195 |

$20 million increase |

||||||

Realized gains on non-real estate investments(1) |

$100 |

$130 |

$100 |

$130 |

No change |

||||||

Key Credit Metrics Targets |

As of 4/28/25 |

As of 1/27/25 |

Key Changes |

|||

Net debt and preferred stock to Adjusted EBITDA – 4Q25 annualized |

Less than or equal to 5.2x |

Less than or equal to 5.2x |

No change |

|||

Fixed-charge coverage ratio – 4Q25 annualized |

4.0x to 4.5x |

4.0x to 4.5x |

As of 4/28/25 |

As of 1/27/25

Midpoint

|

Key Changes

to Midpoint

|

||||||||||||

Key Sources and Uses of Capital |

Range |

Midpoint |

Certain Completed Items |

|||||||||||

Sources of capital: |

||||||||||||||

Net reduction in debt |

$(290) |

$(290) |

$(290) |

See below |

$(190) |

See below |

||||||||

Net cash provided by operating activities after dividends(2) |

425 |

525 |

475 |

475 |

||||||||||

Dispositions and sales of partial interests (refer to page 6) |

1,450 |

2,450 |

1,950 |

(3) |

1,700 |

$250 million increase(4) |

||||||||

Total sources of capital |

$1,585 |

$2,685 |

$2,135 |

$1,985 |

||||||||||

Uses of capital: |

||||||||||||||

Construction |

$1,450 |

$2,050 |

$1,750 |

$1,750 |

||||||||||

Acquisitions and other opportunistic uses of capital |

— |

500 |

250 |

$208 |

(5) |

100 |

$150 million increase(4) |

|||||||

Ground lease prepayment |

135 |

135 |

135 |

$135 |

135 |

|||||||||

Total uses of capital |

$1,585 |

$2,685 |

$2,135 |

$1,985 |

||||||||||

Net reduction in debt (included above): |

||||||||||||||

Issuance of unsecured senior notes payable |

$550 |

$550 |

$550 |

$550 |

$600 |

|||||||||

Repayment of unsecured notes payable(6) |

(600) |

(600) |

(600) |

(600) |

||||||||||

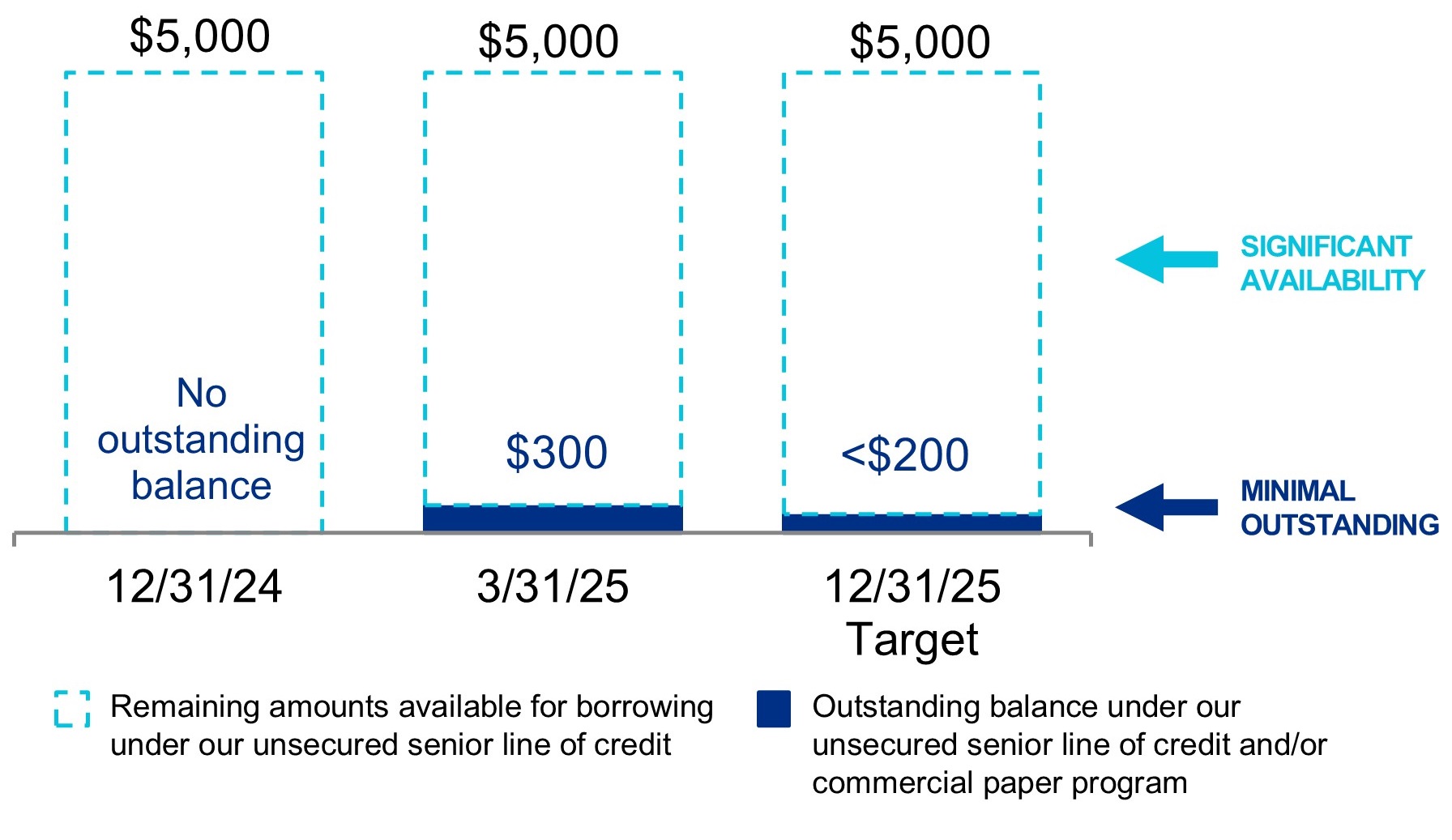

Unsecured senior line of credit, commercial paper, and other |

(240) |

(240) |

(240) |

(190) |

||||||||||

Net reduction in debt |

$(290) |

$(290) |

$(290) |

$(190) |

$100 million reduction |

|||||||||

Dispositions and Sales of Partial Interests |

|

March 31, 2025 | |

(Dollars in thousands) | |

Property |

Submarket/Market |

Date of

Sale

|

Interest

Sold

|

Future

Development

RSF

|

Sales Price |

Gain on

Sales of

Real Estate

|

|||||||

Completed in 1Q25: |

|||||||||||||

Land and other |

|||||||||||||

Costa Verde by Alexandria |

University Town Center/San Diego |

1/31/25 |

100% |

537,000 |

$124,000 |

(1) |

$— |

||||||

Other |

52,352 |

13,165 |

|||||||||||

176,352 |

$13,165 |

||||||||||||

Our share of pending 2025 dispositions and sales of partial interests expected to close

subsequent to April 28, 2025:

|

|||||||||||||

Subject to non-refundable deposits: |

|||||||||||||

Pending |

San Diego |

2H25 |

100% |

70,000 |

|||||||||

Pending |

Texas |

2Q25 |

100% |

73,287 |

|||||||||

Other |

63,000 |

||||||||||||

206,287 |

|||||||||||||

Subject to executed letters of intent and/or purchase and sale agreement negotiations |

226,250 |

||||||||||||

Our share of completed and pending 2025 dispositions and sales of partial interests |

$608,889 |

||||||||||||

2025 guidance range for dispositions and sales of partial interests |

$1,450,000 – $2,450,000 |

||||||||||||

|

|

Earnings Call Information and About the Company | |

March 31, 2025 | |

Consolidated Statements of Operations |

|

March 31, 2025 | |

(Dollars in thousands, except per share amounts) | |

Three Months Ended |

||||||||||

3/31/25 |

12/31/24 |

9/30/24 |

6/30/24 |

3/31/24 |

||||||

Revenues: |

||||||||||

Income from rentals |

$743,175 |

(1) |

$763,249 |

$775,744 |

$755,162 |

$755,551 |

||||

Other income |

14,983 |

25,696 |

15,863 |

11,572 |

13,557 |

|||||

Total revenues |

758,158 |

788,945 |

791,607 |

766,734 |

769,108 |

|||||

Expenses: |

||||||||||

Rental operations |

226,395 |

240,432 |

233,265 |

217,254 |

218,314 |

|||||

General and administrative |

30,675 |

32,730 |

43,945 |

44,629 |

47,055 |

|||||

Interest |

50,876 |

55,659 |

43,550 |

45,789 |

40,840 |

|||||

Depreciation and amortization |

342,062 |

330,108 |

293,998 |

290,720 |

287,554 |

|||||

Impairment of real estate |

32,154 |

186,564 |

5,741 |

30,763 |

— |

|||||

Total expenses |

682,162 |

845,493 |

620,499 |

629,155 |

593,763 |

|||||

Equity in (losses) earnings of unconsolidated real estate joint ventures |

(507) |

6,635 |

139 |

130 |

155 |

|||||

Investment (loss) income |

(49,992) |

(67,988) |

15,242 |

(43,660) |

43,284 |

|||||

Gain on sales of real estate |

13,165 |

101,806 |

27,114 |

— |

392 |

|||||

Net income (loss) |

38,662 |

(16,095) |

213,603 |

94,049 |

219,176 |

|||||

Net income attributable to noncontrolling interests |

(47,601) |

(46,150) |

(45,656) |

(47,347) |

(48,631) |

|||||

Net (loss) income attributable to Alexandria Real Estate Equities, Inc.’s stockholders |

(8,939) |

(62,245) |

167,947 |

46,702 |

170,545 |

|||||

Net income attributable to unvested restricted stock awards |

(2,660) |

(2,677) |

(3,273) |

(3,785) |

(3,659) |

|||||

Net (loss) income attributable to Alexandria Real Estate Equities, Inc.’s common stockholders |

$(11,599) |

$(64,922) |

$164,674 |

$42,917 |

$166,886 |

|||||

Net (loss) income per share attributable to Alexandria Real Estate Equities, Inc.’s common stockholders: |

||||||||||

Basic |

$(0.07) |

$(0.38) |

$0.96 |

$0.25 |

$0.97 |

|||||

Diluted |

$(0.07) |

$(0.38) |

$0.96 |

$0.25 |

$0.97 |

|||||

Weighted-average shares of common stock outstanding: |

||||||||||

Basic |

170,522 |

172,262 |

172,058 |

172,013 |

171,949 |

|||||

Diluted |

170,522 |

172,262 |

172,058 |

172,013 |

171,949 |

|||||

Dividends declared per share of common stock |

$1.32 |

$1.32 |

$1.30 |

$1.30 |

$1.27 |

|||||

Consolidated Balance Sheets |

|

March 31, 2025 | |

(In thousands) | |

3/31/25 |

12/31/24 |

9/30/24 |

6/30/24 |

3/31/24 |

||||||

Assets |

||||||||||

Investments in real estate |

$32,121,712 |

$32,110,039 |

$32,951,777 |

$32,673,839 |

$32,323,138 |

|||||

Investments in unconsolidated real estate joint ventures |

50,086 |

39,873 |

40,170 |

40,535 |

40,636 |

|||||

Cash and cash equivalents |

476,430 |

552,146 |

562,606 |

561,021 |

722,176 |

|||||

Restricted cash |

7,324 |

7,701 |

17,031 |

4,832 |

9,519 |

|||||

Tenant receivables |

6,875 |

6,409 |

6,980 |

6,822 |

7,469 |

|||||

Deferred rent |

1,210,584 |

1,187,031 |

1,216,176 |

1,190,336 |

1,138,936 |

|||||

Deferred leasing costs |

489,287 |

485,959 |

516,872 |

519,629 |

520,616 |

|||||

Investments |

1,479,688 |

1,476,985 |

1,519,327 |

1,494,348 |

1,511,588 |

|||||

Other assets |

1,758,442 |

1,661,306 |

1,657,189 |

1,356,503 |

1,424,968 |

|||||

Total assets |

$37,600,428 |

$37,527,449 |

$38,488,128 |

$37,847,865 |

$37,699,046 |

|||||

Liabilities, Noncontrolling Interests, and Equity |

||||||||||

Secured notes payable |

$150,807 |

$149,909 |

$145,000 |

$134,942 |

$130,050 |

|||||

Unsecured senior notes payable |

12,640,144 |

12,094,465 |

12,092,012 |

12,089,561 |

12,087,113 |

|||||

Unsecured senior line of credit and commercial paper |

299,883 |

— |

454,589 |

199,552 |

— |

|||||

Accounts payable, accrued expenses, and other liabilities |

2,281,414 |

2,654,351 |

2,865,886 |

2,529,535 |

2,503,831 |

|||||

Dividends payable |

228,622 |

230,263 |

227,191 |

227,408 |

222,134 |

|||||

Total liabilities |

15,600,870 |

15,128,988 |

15,784,678 |

15,180,998 |

14,943,128 |

|||||

Commitments and contingencies |

||||||||||

Redeemable noncontrolling interests |

9,612 |

19,972 |

16,510 |

16,440 |

16,620 |

|||||

Alexandria Real Estate Equities, Inc.’s stockholders’ equity: |

||||||||||

Common stock |

1,701 |

1,722 |

1,722 |

1,720 |

1,720 |

|||||

Additional paid-in capital |

17,509,148 |

17,933,572 |

18,238,438 |

18,284,611 |

18,434,690 |

|||||

Accumulated other comprehensive loss |

(46,202) |

(46,252) |

(22,529) |

(27,710) |

(23,815) |

|||||

Alexandria Real Estate Equities, Inc.’s stockholders’ equity |

17,464,647 |

17,889,042 |

18,217,631 |

18,258,621 |

18,412,595 |

|||||

Noncontrolling interests |

4,525,299 |

4,489,447 |

4,469,309 |

4,391,806 |

4,326,703 |

|||||

Total equity |

21,989,946 |

22,378,489 |

22,686,940 |

22,650,427 |

22,739,298 |

|||||

Total liabilities, noncontrolling interests, and equity |

$37,600,428 |

$37,527,449 |

$38,488,128 |

$37,847,865 |

$37,699,046 |

Funds From Operations and Funds From Operations per Share |

|

March 31, 2025 | |

(In thousands) | |

Three Months Ended |

||||||||||

3/31/25 |

12/31/24 |

9/30/24 |

6/30/24 |

3/31/24 |

||||||

Net (loss) income attributable to Alexandria’s common stockholders – basic and diluted |

$(11,599) |

$(64,922) |

$164,674 |

$42,917 |

$166,886 |

|||||

Depreciation and amortization of real estate assets |

339,381 |

327,198 |

291,258 |

288,118 |

284,950 |

|||||

Noncontrolling share of depreciation and amortization from consolidated real estate JVs |

(33,411) |

(34,986) |

(32,457) |

(31,364) |

(30,904) |

|||||

Our share of depreciation and amortization from unconsolidated real estate JVs |

1,054 |

1,061 |

1,075 |

1,068 |

1,034 |

|||||

Gain on sales of real estate |

(13,165) |

(100,109) |

(27,114) |

— |

(392) |

|||||

Impairment of real estate – rental properties and land |

— |

184,532 |

5,741 |

2,182 |

— |

|||||

Allocation to unvested restricted stock awards |

(686) |

(1,182) |

(2,908) |

(1,305) |

(3,469) |

|||||

Funds from operations attributable to Alexandria’s common stockholders – diluted(1) |

281,574 |

311,592 |

400,269 |

301,616 |

418,105 |

|||||

Unrealized losses (gains) on non-real estate investments |

68,145 |

79,776 |

(2,610) |

64,238 |

(29,158) |

|||||

Impairment of non-real estate investments |

11,180 |

(2) |

20,266 |

10,338 |

12,788 |

14,698 |

||||

Impairment of real estate |

32,154 |

(3) |

2,032 |

— |

28,581 |

— |

||||

Increase (decrease) in provision for expected credit losses on financial instruments |

285 |

(434) |

— |

— |

— |

|||||

Allocation to unvested restricted stock awards |

(1,329) |

(1,407) |

(125) |

(1,738) |

247 |

|||||

Funds from operations attributable to Alexandria’s common stockholders – diluted, as adjusted |

$392,009 |

$411,825 |

$407,872 |

$405,485 |

$403,892 |

|||||

Funds From Operations and Funds From Operations per Share (continued) |

|

March 31, 2025 | |

(In thousands, except per share amounts) | |

Three Months Ended |

||||||||||

3/31/25 |

12/31/24 |

9/30/24 |

6/30/24 |

3/31/24 |

||||||

Net (loss) income per share attributable to Alexandria’s common stockholders – diluted |

$(0.07) |

$(0.38) |

$0.96 |

$0.25 |

$0.97 |

|||||

Depreciation and amortization of real estate assets |

1.80 |

1.70 |

1.51 |

1.50 |

1.48 |

|||||

Gain on sales of real estate |

(0.08) |

(0.58) |

(0.16) |

— |

— |

|||||

Impairment of real estate – rental properties and land |

— |

1.07 |

0.03 |

0.01 |

— |

|||||

Allocation to unvested restricted stock awards |

— |

— |

(0.01) |

(0.01) |

(0.02) |

|||||

Funds from operations per share attributable to Alexandria’s common stockholders – diluted |

1.65 |

1.81 |

2.33 |

1.75 |

2.43 |

|||||

Unrealized losses (gains) on non-real estate investments |

0.40 |

0.46 |

(0.02) |

0.37 |

(0.17) |

|||||

Impairment of non-real estate investments |

0.07 |

0.12 |

0.06 |

0.08 |

0.09 |

|||||

Impairment of real estate |

0.19 |

0.01 |

— |

0.17 |

— |

|||||

Allocation to unvested restricted stock awards |

(0.01) |

(0.01) |

— |

(0.01) |

— |

|||||

Funds from operations per share attributable to Alexandria’s common stockholders – diluted, as

adjusted

|

$2.30 |

$2.39 |

$2.37 |

$2.36 |

$2.35 |

|||||

Weighted-average shares of common stock outstanding – diluted |

||||||||||

Earnings per share – diluted |

170,522 |

172,262 |

172,058 |

172,013 |

171,949 |

|||||

Funds from operations – diluted, per share |

170,599 |

172,262 |

172,058 |

172,013 |

171,949 |

|||||

Funds from operations – diluted, as adjusted, per share |

170,599 |

172,262 |

172,058 |

172,013 |

171,949 |

|||||

|

|

Company Profile | |

March 31, 2025 | |

EXECUTIVE MANAGEMENT TEAM | ||

Joel S. Marcus |

Peter M. Moglia |

|

Executive Chairman &

Founder

|

Chief Executive Officer &

Chief Investment Officer

|

|

Daniel J. Ryan |

Hunter L. Kass |

|

Co-President & Regional Market

Director – San Diego

|

Co-President & Regional Market

Director – Greater Boston

|

|

Marc E. Binda |

Lawrence J. Diamond |

|

Chief Financial Officer &

Treasurer

|

Co-Chief Operating Officer & Regional

Market Director – Maryland

|

|

Joseph Hakman |

Hart Cole |

|

Co-Chief Operating Officer &

Chief Strategic Transactions Officer

|

Executive Vice President – Capital

Markets/Strategic Operations &

Co-Regional Market Director – Seattle

|

|

Jackie B. Clem |

Gary D. Dean |

|

General Counsel & Secretary |

Executive Vice President –

Real Estate Legal Affairs

|

|

Andres R. Gavinet |

Onn C. Lee |

|

Chief Accounting Officer |

Executive Vice President –

Accounting

|

|

Kristina A. Fukuzaki-Carlson |

Madeleine T. Alsbrook |

|

Executive Vice President –

Business Operations

|

Executive Vice President –

Talent Management

|

|

|

|

Investor Information | |

March 31, 2025 | |

Corporate Headquarters |

New York Stock Exchange Trading Symbol |

Information Requests |

|||

26 North Euclid Avenue |

Common stock: ARE |

Phone: |

(626) 578-0777 |

||

Pasadena, California 91101 |

Email: |

corporateinformation@are.com |

|||

www.are.com |

Website: |

investor.are.com |

|||

Equity Research Coverage |

Alexandria is currently covered by the following research analysts. This list may be incomplete and is subject to change as firms initiate or discontinue coverage of our company.

Please note that any opinions, estimates, or forecasts regarding our historical or predicted performance made by these analysts are theirs alone and do not represent opinions, estimates, or

forecasts of Alexandria or our management. Alexandria does not by our reference or distribution of the information below imply our endorsement of or concurrence with any opinions,

estimates, or forecasts of these analysts. Interested persons may obtain copies of analysts’ reports on their own as we do not distribute these reports. Several of these firms may, from time to

time, own our stock and/or hold other long or short positions in our stock and may provide compensated services to us.

|

BNP Paribas Exane |

Citigroup Global Markets Inc. |

Green Street |

RBC Capital Markets |

|||

Nate Crossett / Monir Koummal |

Nicholas Joseph / Seth Bergey |

Dylan Burzinski |

Michael Carroll / Justin Haasbeek |

|||

(646) 342-1588 / (646) 342-1554 |

(212) 816-1909 / (212) 816-2066 |

(949) 640-8780 |

(440) 715-2649 / (440) 715-2651 |

|||

BofA Securities |

Citizens JMP Securities, LLC |

J.P. Morgan Securities LLC |

Robert W. Baird & Co. Incorporated |

|||

Jeff Spector / Farrell Granath |

Aaron Hecht / Linda Fu |

Anthony Paolone / Ray Zhong |

Wesley Golladay / Nicholas Thillman |

|||

(646) 855-1363 / (646) 855-1351 |

(415) 835-3963 / (415) 869-4411 |

(212) 622-6682 / (212) 622-5411 |

(216) 737-7510 / (414) 298-5053 |

|||

BTIG, LLC |

Deutsche Bank AG |

Jefferies |

Wedbush Securities |

|||

Tom Catherwood / Michael Tompkins |

Tayo Okusanya / Samuel Ohiomah |

Peter Abramowitz / Katie Elders |

Richard Anderson / Jay Kornreich |

|||

(212) 738-6140 / (212) 527-3566 |

(212) 250-9284 / (212) 250-0057 |

(212) 336-7241 / (917) 421-1968 |

(212) 931-7001 / (212) 938-9942 |

|||

CFRA |

Evercore ISI |

Mizuho Securities USA LLC |

||||

Nathan Schmidt |

Steve Sakwa / James Kammert |

Vikram Malhotra / Georgi Dinkov |

||||

(646) 517-1144 |

(212) 446-9462 / (312) 705-4233 |

(212) 282-3827 / (617) 352-1721 |

||||

Fixed Income Research Coverage |

Rating Agencies |

|||||

Barclays Capital Inc. |

J.P. Morgan Securities LLC |

Moody’s Ratings |

S&P Global Ratings |

|||

Srinjoy Banerjee / Japheth Otieno |

Mark Streeter |

(212) 553-0376 |

Alan Zigman |

|||

(212) 526-3521 / (212) 526-6961 |

(212) 834-5086 |

(416) 507-2556 |

||||

Mizuho Securities USA LLC |

||||||

Thierry Perrein |

||||||

(212) 205-7665 |

||||||

Financial and Asset Base Highlights |

|

March 31, 2025 | |

(Dollars in thousands, except per share amounts) | |

Three Months Ended (unless stated otherwise) |

||||||||||

3/31/25 |

12/31/24 |

9/30/24 |

6/30/24 |

3/31/24 |

||||||

Selected financial data from consolidated financial statements and related information |

||||||||||

Rental revenues |

$552,112 |

(1) |

$566,535 |

$579,569 |

$576,835 |

$581,400 |

||||

Tenant recoveries |

$191,063 |

$196,714 |

$196,175 |

$178,327 |

$174,151 |

|||||

General and administrative expenses |

$30,675 |

$32,730 |

$43,945 |

$44,629 |

$47,055 |

|||||

General and administrative expenses as a percentage of net operating income –

trailing 12 months

|

6.9% |

7.6% |

8.9% |

9.2% |

9.5% |

|||||

Operating margin |

70% |

70% |

71% |

72% |

72% |

|||||

Adjusted EBITDA margin |

71% |

72% |

70% |

72% |

72% |

|||||

Adjusted EBITDA – quarter annualized |

$2,165,632 |

$2,273,480 |

$2,219,632 |

$2,216,144 |

$2,206,428 |

|||||

Adjusted EBITDA – trailing 12 months |

$2,218,722 |

$2,228,921 |

$2,184,298 |

$2,122,250 |

$2,064,904 |

|||||

Net debt at end of period |

$12,687,856 |

$11,762,176 |

$12,191,574 |

$11,940,144 |

$11,569,666 |

|||||

Net debt and preferred stock to Adjusted EBITDA – quarter annualized |

5.9x |

5.2x |

5.5x |

5.4x |

5.2x |

|||||

Net debt and preferred stock to Adjusted EBITDA – trailing 12 months |

5.7x |

5.3x |

5.6x |

5.6x |

5.6x |

|||||

Total debt and preferred stock at end of period |

$13,090,834 |

$12,244,374 |

$12,691,601 |

$12,424,055 |

$12,217,163 |

|||||

Gross assets at end of period |

$43,486,989 |

$43,152,628 |

$44,112,770 |

$43,305,279 |

$42,915,903 |

|||||

Total debt and preferred stock to gross assets at end of period |

30% |

28% |

29% |

29% |

28% |

|||||

Fixed-charge coverage ratio – quarter annualized |

4.3x |

4.3x |

4.4x |

4.5x |

4.7x |

|||||

Fixed-charge coverage ratio – trailing 12 months |

4.4x |

4.5x |

4.5x |

4.6x |

4.7x |

|||||

Unencumbered net operating income as a percentage of total net operating income |

99.8% |

99.9% |

99.1% |

99.1% |

99.3% |

|||||

Closing stock price at end of period |

$92.51 |

$97.55 |

$118.75 |

$116.97 |

$128.91 |

|||||

Common shares outstanding (in thousands) at end of period |

170,130 |

172,203 |

172,244 |

172,018 |

172,008 |

|||||

Total equity capitalization at end of period |

$15,738,715 |

$16,798,446 |

$20,454,023 |

$20,120,907 |

$22,173,547 |

|||||

Total market capitalization at end of period |

$28,829,549 |

$29,042,820 |

$33,145,624 |

$32,544,962 |

$34,390,710 |

|||||

Dividend per share – quarter/annualized |

$1.32/$5.28 |

$1.32/$5.28 |

$1.30/$5.20 |

$1.30/$5.20 |

$1.27/$5.08 |

|||||

Dividend payout ratio for the quarter |

57% |

55% |

55% |

55% |

54% |

|||||

Dividend yield – annualized |

5.7% |

5.4% |

4.4% |

4.4% |

3.9% |

|||||

Amounts related to operating leases: |

||||||||||

Operating lease liabilities at end of period |

$371,412 |

$507,127 |

$648,338 |

$379,223 |

$381,578 |

|||||

Rent expense |

$11,666 |

$10,685 |

$10,180 |

$9,412 |

$8,683 |

|||||

Capitalized interest |

$80,065 |

$81,586 |

$86,496 |

$81,039 |

$81,840 |

|||||

Average real estate basis capitalized during the period |

$8,026,566 |

$8,118,010 |

$8,281,318 |

$7,936,612 |

$8,163,289 |

|||||

Weighted-average interest rate for capitalization of interest during the period |

3.99% |

4.02% |

3.98% |

3.96% |

3.92% |

|||||

Refer to “Definitions and reconciliations” in the Supplemental Information for additional details.

(1) Refer to “Consolidated statements of operations” in the Earnings Press Release for additional details.

| ||||||||||

Financial and Asset Base Highlights (continued) |

|

March 31, 2025 | |

(Dollars in thousands, except annual rental revenue per occupied RSF amounts) | |

Three Months Ended (unless stated otherwise) |

||||||||||

3/31/25 |

12/31/24 |

9/30/24 |

6/30/24 |

3/31/24 |

||||||

Amounts included in funds from operations and non-revenue-enhancing capital expenditures |

||||||||||

Straight-line rent revenue |

$22,023 |

$17,653 |

$29,087 |

$48,338 |

$48,251 |

|||||

Amortization of acquired below-market leases |

$15,222 |

$15,512 |

$17,312 |

$22,515 |

$30,340 |

|||||

Amortization of deferred revenue related to tenant-funded and -built landlord improvements |

$1,651 |

$1,214 |

$329 |

$— |

$— |

|||||

Straight-line rent expense on ground leases |

$149 |

$1,021 |

$789 |

$341 |

$358 |

|||||

Cash payment for ground lease extension(1) |

$(135,000) |

$(135,000) |

$— |

$— |

$— |

|||||

Stock compensation expense |

$10,064 |

$12,477 |

$15,525 |

$14,507 |

$17,125 |

|||||

Amortization of loan fees |

$4,691 |

$4,620 |

$4,222 |

$4,146 |

$4,142 |

|||||

Amortization of debt discounts |

$349 |

$333 |

$330 |

$328 |

$318 |

|||||

Non-revenue-enhancing capital expenditures: |

||||||||||

Building improvements |

$3,789 |

$4,313 |

$4,270 |

$4,210 |

$4,293 |

|||||

Tenant improvements and leasing commissions |

$73,483 |

(2) |

$81,918 |

$55,920 |

$15,724 |

$21,144 |

||||

Funds from operations attributable to noncontrolling interests |

$81,012 |

$76,111 |

$78,113 |

$78,711 |

$79,535 |

|||||

Operating statistics and related information (at end of period) |

||||||||||

Number of properties – North America |

386 |

391 |

406 |

408 |

410 |

|||||

RSF – North America (including development and redevelopment projects under construction) |

43,687,343 |

44,124,001 |

46,748,734 |

47,085,993 |

47,206,639 |

|||||

Total square footage – North America |

68,518,184 |

69,289,411 |

73,611,815 |

74,103,404 |

74,069,321 |

|||||

Annual rental revenue per occupied RSF – North America |

$58.38 |

$56.98 |

$57.09 |

$56.87 |

$56.86 |

|||||

Occupancy of operating properties – North America |

91.7% |

(3) |

94.6% |

94.7% |

94.6% |

94.6% |

||||

Occupancy of operating and redevelopment properties – North America |

86.9% |

89.7% |

89.7% |

89.9% |

90.2% |

|||||

Weighted-average remaining lease term (in years) |

7.6 |

7.5 |

7.5 |

7.4 |

7.5 |

|||||

Total leasing activity – RSF |

1,030,553 |

1,310,999 |

1,486,097 |

1,114,001 |

1,142,857 |

|||||

Lease renewals and re-leasing of space – change in average new rental rates over expiring rates: |

||||||||||

Rental rate changes |

18.5% |

18.1% |

5.1% |

7.4% |

33.0% |

|||||

Rental rate changes (cash basis) |

7.5% |

3.3% |

1.5% |

3.7% |

19.0% |

|||||

RSF (included in total leasing activity above) |

884,408 |

1,024,862 |

1,278,857 |

589,650 |

994,770 |

|||||

Top 20 tenants: |

||||||||||

Annual rental revenue |

$754,354 |

$741,965 |

$796,898 |

$805,751 |

$802,605 |

|||||

Annual rental revenue from investment-grade or publicly traded large cap tenants |

87% |

92% |

92% |

92% |

92% |

|||||

Weighted-average remaining lease term (in years) |

9.6 |

9.3 |

9.5 |

9.4 |

9.7 |

|||||

Same property – percentage change over comparable quarter from prior year: |

||||||||||

Net operating income changes |

(3.1)% |

(3) |

0.6% |

1.5% |

1.5% |

1.0% |

||||

Net operating income changes (cash basis) |

5.1% |

6.3% |

6.5% |

3.9% |

4.2% |

|||||

|

|

High-Quality and Diverse Client Base | |

March 31, 2025 | |

Stable Cash Flows From Our High-Quality and Diverse Mix of Approximately 750 Tenants | ||||

Investment-Grade or Publicly Traded

Large Cap Tenants

|

||||

87% |

||||

of ARE’s Top 20 Tenant

Annual Rental Revenue

|

||||

51% |

||||

Percentage of ARE’s Annual Rental Revenue |

of ARE’s

Annual Rental Revenue

|

|||

|

|

High-Quality and Diverse Client Base (continued) | |

March 31, 2025 | |

Sustained Strength in Tenant Collections(1) | ||||

99.9% |

99.8% |

|||

1Q25 |

April 2025 |

|||

Long-Duration Lease Terms | ||||

9.6 Years |

7.6 Years |

|||

Top 20 Tenants |

All Tenants |

|||

Weighted-Average Remaining Term(2) | ||||

|

|

Key Operating Metrics | |

March 31, 2025 | |

Same Property

Net Operating Income Performance

|

Rental Rate Growth:

Renewed/Re-Leased Space

|

||||||||||

Margins(2) |

Favorable Lease Structure(3) |

||||||||||

Operating |

Adjusted EBITDA |

Strategic Lease Structure by Owner and

Operator of Collaborative Megacampus Ecosystems

|

|||||||||

70% |

71% |

Increasing cash flows |

|||||||||

Percentage of leases containing

annual rent escalations

|

98% |

||||||||||

Stable cash flows |

|||||||||||

Historical Weighted-Average

Lease Term of Executed Leases(4)

|

Percentage of triple

net leases

|

91% |

|||||||||

8.9 Years |

Lower capex burden |

||||||||||

Percentage of leases providing for the

recapture of capital expenditures

|

93% |

||||||||||

2024 |

3/31/25 |

|

Same Property Performance |

|

March 31, 2025 | |

(Dollars in thousands) | |

Same Property Financial Data |

Three Months Ended

March 31, 2025

|

Same Property Statistical Data |

Three Months Ended

March 31, 2025

|

|||

Percentage change over comparable period from prior year: |

Number of same properties |

333 |

||||

Net operating income changes |

(3.1)% |

(1) |

Rentable square feet |

34,099,158 |

||

Net operating income changes (cash basis) |

5.1% |

(1)(2) |

Occupancy – current-period average |

93.3% |

||

Operating margin |

68% |

Occupancy – same-period prior-year average |

94.3% |

Three Months Ended March 31, |

|||||||||

2025 |

2024 |

$ Change |

% Change |

||||||

Income from rentals: |

|||||||||

Same properties |

$469,387 |

$476,074 |

$(6,687) |

(1.4)% |

|||||

Non-same properties |

82,725 |

105,326 |

(22,601) |

(21.5) |

|||||

Rental revenues |

552,112 |

581,400 |

(29,288) |

(5.0) |

|||||

Same properties |

170,823 |

155,405 |

15,418 |

9.9 |

|||||

Non-same properties |

20,240 |

18,746 |

1,494 |

8.0 |

|||||

Tenant recoveries |

191,063 |

174,151 |

16,912 |

9.7 |

|||||

Income from rentals |

743,175 |

755,551 |

(12,376) |

(1.6) |

|||||

Same properties |

346 |

340 |

6 |

1.8 |

|||||

Non-same properties |

14,637 |

13,217 |

1,420 |

10.7 |

|||||

Other income |

14,983 |

13,557 |

1,426 |

10.5 |

|||||

Same properties |

640,556 |

631,819 |

8,737 |

1.4 |

|||||

Non-same properties |

117,602 |

137,289 |

(19,687) |

(14.3) |

|||||

Total revenues |

758,158 |

769,108 |

(10,950) |

(1.4) |

|||||

Same properties |

203,497 |

180,739 |

22,758 |

12.6 |

|||||

Non-same properties |

22,898 |

37,575 |

(14,677) |

(39.1) |

|||||

Rental operations |

226,395 |

218,314 |

8,081 |

3.7 |

|||||

Same properties |

437,059 |

451,080 |

(14,021) |

(3.1) |

|||||

Non-same properties |

94,704 |

99,714 |

(5,010) |

(5.0) |

|||||

Net operating income |

$531,763 |

$550,794 |

$(19,031) |

(3.5)% |

(3) |

||||

Net operating income – same properties |

$437,059 |

$451,080 |

$(14,021) |

(3.1)% |

|||||

Straight-line rent revenue |

(6,396) |

(39,287) |

32,891 |

(83.7) |

|||||

Amortization of acquired below-market leases |

(10,002) |

(11,525) |

1,523 |

(13.2) |

|||||

Net operating income – same properties (cash basis) |

$420,661 |

$400,268 |

$20,393 |

5.1% |

|||||

Leasing Activity |

|

March 31, 2025 | |

(Dollars per RSF) | |

Three Months Ended |

Year Ended |

||||||||||||||

March 31, 2025 |

December 31, 2024 |

||||||||||||||

Including

Straight-Line Rent

|

Cash Basis |

Including

Straight-Line Rent

|

Cash Basis |

||||||||||||

Leasing activity: |

|||||||||||||||

Renewed/re-leased space(1) |

|||||||||||||||

Rental rate changes |

18.5% |

7.5% |

16.9% |

7.2% |

|||||||||||

New rates |

$57.56 |

$55.04 |

$65.48 |

$64.18 |

|||||||||||

Expiring rates |

$48.57 |

$51.18 |

$56.01 |

$59.85 |

|||||||||||

RSF |

884,408 |

3,888,139 |

|||||||||||||

Tenant improvements/leasing commissions |

$83.09 |

(2) |

$46.89 |

||||||||||||

Weighted-average lease term |

10.1 years |

8.5 years |

|||||||||||||

Developed/redeveloped/previously vacant space leased(3) |

|||||||||||||||

New rates |

$49.80 |

$49.51 |

$59.44 |

$57.34 |

|||||||||||

RSF |

146,145 |

1,165,815 |

|||||||||||||

Weighted-average lease term |

8.8 years |

10.0 years |

|||||||||||||

Leasing activity summary (totals): |

|||||||||||||||

New rates |

$56.46 |

$54.26 |

$64.16 |

$62.68 |

|||||||||||

RSF |

1,030,553 |

5,053,954 |

|||||||||||||

Weighted-average lease term |

10.0 years |

8.9 years |

|||||||||||||

Lease expirations(1) |

|||||||||||||||

Expiring rates |

$49.93 |

$51.55 |

$53.82 |

$57.24 |

|||||||||||

RSF |

1,923,048 |

5,005,638 |

|||||||||||||

|

|

Contractual Lease Expirations | |

March 31, 2025 | |

Year |

RSF |

Percentage of

Occupied RSF

|

Annual Rental Revenue

(per RSF)(1)

|

Percentage of

Annual Rental Revenue

|

|||||||||||||||

2025 |

(2) |

2,005,741 |

5.6% |

$46.91 |

4.6% |

||||||||||||||

2026 |

3,043,760 |

8.5% |

$56.08 |

8.3% |

|||||||||||||||

2027 |

3,130,452 |

8.7% |

$51.23 |

7.8% |

|||||||||||||||

2028 |

4,060,412 |

11.3% |

$52.17 |

10.3% |

|||||||||||||||

2029 |

2,429,749 |

6.8% |

$50.67 |

6.0% |

|||||||||||||||

2030 |

3,064,307 |

8.6% |

$43.86 |

6.5% |

|||||||||||||||

2031 |

3,579,117 |

10.0% |

$54.84 |

9.5% |

|||||||||||||||

2032 |

1,023,407 |

2.9% |

$58.33 |

2.9% |

|||||||||||||||

2033 |

2,539,851 |

7.1% |

$48.14 |

5.9% |

|||||||||||||||

2034 |

3,280,121 |

9.2% |

$67.72 |

10.7% |

|||||||||||||||

Thereafter |

7,673,811 |

21.3% |

$74.48 |

27.5% |

|||||||||||||||

Market |

2025 Contractual Lease Expirations (in RSF) |

Annual

Rental

Revenue

(per RSF)(1)

|

2026 Contractual Lease Expirations (in RSF) |

Annual

Rental

Revenue

(per RSF)(1)

|

||||||||||||||||||||||||

Leased |

Negotiating/

Anticipating

|

Targeted for

Future

Development/

Redevelopment(3)

|

Remaining

Expiring

Leases(4)

|

Total(2) |

Leased |

Negotiating/

Anticipating

|

Targeted for

Future

Development/

Redevelopment

|

Remaining

Expiring

Leases(4)

|

Total |

|||||||||||||||||||

Greater Boston |

136,506 |

5,597 |

25,312 |

261,540 |

428,955 |

$45.19 |

47,439 |

11,565 |

— |

399,436 |

458,440 |

$94.58 |

||||||||||||||||

San Francisco Bay Area |

293,051 |

110,549 |

— |

346,927 |

750,527 |

71.21 |

25,511 |

— |

— |

623,634 |

649,145 |

76.43 |

||||||||||||||||

San Diego |

28,760 |

— |

— |

85,189 |

113,949 |

34.37 |

— |

28,827 |

— |

873,855 |

902,682 |

47.04 |

||||||||||||||||

Seattle |

— |

— |

— |

67,114 |

67,114 |

31.33 |

26,266 |

— |

— |

166,491 |

192,757 |

31.57 |

||||||||||||||||

Maryland |

35,055 |

6,228 |

— |

31,683 |

72,966 |

22.19 |

— |

15,489 |

— |

276,969 |

292,458 |

20.20 |

||||||||||||||||

Research Triangle |

173,888 |

— |

— |

78,625 |

252,513 |

27.98 |

19,753 |

— |

— |

167,805 |

187,558 |

38.98 |

||||||||||||||||

New York City |

— |

— |

— |

42,002 |

42,002 |

99.58 |

— |

— |

— |

72,052 |

72,052 |

104.17 |

||||||||||||||||

Texas |

— |

— |

198,972 |

(5) |

— |

198,972 |

N/A |

— |

— |

— |

— |

— |

— |

|||||||||||||||

Canada |

22,991 |

— |

— |

54,752 |

77,743 |

18.35 |

— |

247,743 |

— |

— |

247,743 |

21.23 |

||||||||||||||||

Non-cluster/other markets |

— |

— |

— |

1,000 |

1,000 |

49.20 |

— |

— |

— |

40,925 |

40,925 |

75.98 |

||||||||||||||||

Total |

690,251 |

122,374 |

224,284 |

968,832 |

2,005,741 |

$46.91 |

118,969 |

303,624 |

— |

2,621,167 |

3,043,760 |

$56.08 |

||||||||||||||||

Percentage of expiring leases |

34% |

6% |

11% |

49% |

100% |

4% |

10% |

0% |

86% |

100% |

||||||||||||||||||

Top 20 Tenants |

|

March 31, 2025 | |

(Dollars in thousands, except average market cap amounts) | |

Tenant |

Remaining Lease

Term(1) (in years)

|

Aggregate

RSF

|

Annual Rental

Revenue(1)

|

Percentage of

Annual Rental

Revenue(1)

|

Investment-Grade

Credit Ratings

|

Average

Market Cap

(in billions)

|

|||||||||||||||||

Moody’s |

S&P |

||||||||||||||||||||||

1 |

Eli Lilly and Company |

9.7 |

1,070,953 |

$89,599 |

4.3% |

Aa3 |

A+ |

$797.9 |

|||||||||||||||

2 |

Moderna, Inc. |

11.1 |

496,814 |

89,347 |

4.3 |

— |

— |

$29.1 |

|||||||||||||||

3 |

Bristol-Myers Squibb Company |

5.2 |

999,379 |

77,188 |

3.7 |

A2 |

A |

$104.1 |

|||||||||||||||

4 |

Takeda Pharmaceutical Company Limited |

10.2 |

549,759 |

47,899 |

2.3 |

Baa1 |

BBB+ |

$43.8 |

|||||||||||||||

5 |

Eikon Therapeutics, Inc.(2) |

13.7 |

311,806 |

36,783 |

1.8 |

— |

— |

$— |

|||||||||||||||

6 |

Roche |

8.0 |

647,069 |

36,189 |

1.7 |

Aa2 |

AA |

$242.8 |

|||||||||||||||

7 |

Illumina, Inc. |

5.6 |

857,967 |

35,924 |

1.7 |

Baa3 |

BBB |

$19.5 |

|||||||||||||||

8 |

Alphabet Inc. |

2.6 |

625,015 |

34,899 |

1.7 |

Aa2 |

AA+ |

$2,143.6 |

|||||||||||||||

9 |

2seventy bio, Inc.(3) |

8.4 |

312,805 |

33,543 |

1.6 |

— |

— |

$0.2 |

|||||||||||||||

10 |

United States Government |

5.3 |

429,359 |

29,097 |

(4) |

1.4 |

Aaa |

AA+ |

$— |

||||||||||||||

11 |

Uber Technologies, Inc. |

57.5 |

(5) |

1,009,188 |

27,799 |

1.3 |

Baa2 |

BBB |

$148.3 |

||||||||||||||

12 |

Novartis AG |

3.3 |

387,563 |

27,709 |

1.3 |

Aa3 |

AA- |

$234.5 |

|||||||||||||||

13 |

AstraZeneca PLC |

4.6 |

450,848 |

27,226 |

1.3 |

A1 |

A+ |

$231.1 |

|||||||||||||||

14 |

Cloud Software Group, Inc. |

1.2 |

(6) |

292,013 |

26,446 |

1.3 |

— |

— |

$— |

||||||||||||||

15 |

Boston Children’s Hospital |

12.0 |

309,231 |

26,212 |

1.3 |

Aa2 |

AA |

$— |

|||||||||||||||

16 |

The Regents of the University of California |

6.2 |

369,753 |

23,330 |

1.1 |

Aa2 |

AA |

$— |

|||||||||||||||

17 |

Sanofi |

5.8 |

267,278 |

21,851 |

1.1 |

A1 |

AA |

$130.9 |

|||||||||||||||

18 |

Charles River Laboratories, Inc. |

10.1 |

256,066 |

21,202 |

1.0 |

— |

— |

$10.2 |

|||||||||||||||

19 |

New York University |

7.3 |

218,983 |

21,110 |

1.0 |

Aa2 |

AA- |

$— |

|||||||||||||||

20 |

Merck & Co., Inc. |

8.4 |

333,124 |

21,001 |

1.0 |

Aa3 |

A+ |

$281.3 |

|||||||||||||||

Total/weighted-average |

9.6 |

(5) |

10,194,973 |

$754,354 |

36.2% |

||||||||||||||||||

Summary of Properties and Occupancy |

|

March 31, 2025 | |

(Dollars in thousands, except per RSF amounts) | |

Market |

RSF |

Number of

Properties

|

Annual Rental Revenue |

||||||||||||||||

Operating |

Development |

Redevelopment |

Total |

% of Total |

Total |

% of Total |

Per RSF |

||||||||||||

Greater Boston |

9,304,074 |

632,850 |

1,601,010 |

11,537,934 |

26% |

65 |

$754,342 |

36% |

$88.20 |

||||||||||

San Francisco Bay Area |

7,971,965 |

109,435 |

366,939 |

8,448,339 |

19 |

65 |

455,516 |

22 |

68.28 |

||||||||||

San Diego |

7,140,194 |

903,792 |

— |

8,043,986 |

18 |

77 |

323,222 |

16 |

47.98 |

||||||||||

Seattle |

3,179,033 |

227,577 |

— |

3,406,610 |

9 |

45 |

137,539 |

6 |

47.27 |

||||||||||

Maryland |

3,848,870 |

— |

— |

3,848,870 |

9 |

50 |

141,895 |

7 |

39.70 |

||||||||||

Research Triangle |

3,801,564 |

— |

— |

3,801,564 |

9 |

38 |

109,002 |

5 |

30.71 |

||||||||||

New York City |

921,894 |

— |

— |

921,894 |

2 |

4 |

74,571 |

4 |

92.34 |

||||||||||

Texas |

1,845,159 |

— |

73,298 |

1,918,457 |

4 |

15 |

37,754 |

2 |

24.93 |

||||||||||

Canada |

895,182 |

— |

132,881 |

1,028,063 |

2 |

11 |

18,525 |

1 |

21.86 |

||||||||||

Non-cluster/other markets |

349,099 |

— |

— |

349,099 |

1 |

10 |

15,413 |

1 |

60.52 |

||||||||||

Properties held for sale |

382,527 |

— |

— |

382,527 |

1 |

6 |

9,031 |

— |

49.82 |

||||||||||

North America |

39,639,561 |

1,873,654 |

2,174,128 |

43,687,343 |

100% |

386 |

$2,076,810 |

100% |

$58.38 |

||||||||||

4,047,782 |

|||||||||||||||||||

Operating Properties |

Operating and Redevelopment Properties |

|||||||||||

Market |

3/31/25 |

12/31/24 |

3/31/24 |

3/31/25 |

12/31/24 |

3/31/24 |

||||||

Greater Boston |

91.8% |

(1) |

94.8% |

94.5% |

78.4% |

80.8% |

83.3% |

|||||

San Francisco Bay Area |

90.3 |

(1) |

93.3 |

94.4 |

86.3 |

89.1 |

91.2 |

|||||

San Diego |

94.3 |

96.3 |

95.2 |

94.3 |

96.3 |

95.2 |

||||||

Seattle |

91.5 |

92.4 |

94.9 |

91.5 |

92.4 |

93.9 |

||||||

Maryland |

94.1 |

95.7 |

95.4 |

94.1 |

95.7 |

95.4 |

||||||

Research Triangle |

93.4 |

(1) |

97.4 |

97.8 |

93.4 |

97.4 |

97.8 |

|||||

New York City |

87.6 |

(2) |

88.4 |

84.4 |

87.6 |

88.4 |

84.4 |

|||||

Texas |

82.1 |

(1) |

95.5 |

95.1 |

78.9 |

91.8 |

91.5 |

|||||

Subtotal |

91.8 |

94.8 |

94.9 |

87.1 |

90.0 |

90.6 |

||||||

Canada |

94.6 |

95.9 |

91.8 |

82.4 |

82.9 |

77.8 |

||||||

Non-cluster/other markets |

73.0 |

72.5 |

75.4 |

73.0 |

72.5 |

75.4 |

||||||

North America |

91.7% |

(1)(3) |

94.6% |

94.6% |

86.9% |

89.7% |

90.2% |

|||||

Property Listing |

|

March 31, 2025 | |

(Dollars in thousands) | |

Market / Submarket / Address |

RSF |

Number of

Properties

|

Annual

Rental

Revenue

|

Occupancy Percentage |

|||||||||||||||||

Operating |

Operating and

Redevelopment

|

||||||||||||||||||||

Operating |

Development |

Redevelopment |

Total |

||||||||||||||||||

Greater Boston |

|||||||||||||||||||||

Cambridge/Inner Suburbs |

|||||||||||||||||||||

Megacampus: Alexandria Center® at Kendall Square |

2,213,867 |

— |

— |

2,213,867 |

8 |

$223,621 |

97.4% |

97.4% |

|||||||||||||

50(1), 60(1), 75/125(1), 90, 100(1), and 225(1) Binney Street, 140 First Street, and

300 Third Street(1)

|

|||||||||||||||||||||

Megacampus: Alexandria Center® at One Kendall Square |

1,281,580 |

— |

104,956 |

1,386,536 |

12 |

148,198 |

93.7 |

86.6 |

|||||||||||||

One Kendall Square (Buildings 100, 200, 300, 400, 500, 600/700, 1400, 1800,

and 2000), 325 and 399 Binney Street, and One Hampshire Street

|

|||||||||||||||||||||

Megacampus: Alexandria Technology Square® |

1,193,634 |

— |

— |

1,193,634 |

7 |

106,901 |

83.9 |

83.9 |

|||||||||||||

100, 200, 300, 400, 500, 600, and 700 Technology Square |

|||||||||||||||||||||

Megacampus: The Arsenal on the Charles |

776,628 |

36,444 |

308,446 |

1,121,518 |

13 |

47,214 |

94.9 |

67.9 |

|||||||||||||

311, 321, and 343 Arsenal Street, 300, 400, and 500 North Beacon Street,

1, 2, 3, and 4 Kingsbury Avenue, and 100, 200, and 400 Talcott Avenue

|

|||||||||||||||||||||

Megacampus: 480 Arsenal Way, 446, 458, 500, and 550 Arsenal Street, and

99 Coolidge Avenue(1)

|

633,056 |

204,395 |

— |

837,451 |

6 |

27,340 |

98.4 |

98.4 |

|||||||||||||

Cambridge/Inner Suburbs |

6,098,765 |

240,839 |

413,402 |

6,753,006 |

46 |

553,274 |

93.7 |

87.8 |

|||||||||||||

Fenway |

|||||||||||||||||||||

Megacampus: Alexandria Center® for Life Science – Fenway |

1,293,731 |

392,011 |

137,675 |

1,823,417 |

3 |

96,917 |

87.2 |

78.9 |

|||||||||||||

401 and 421 Park Drive and 201 Brookline Avenue |

|||||||||||||||||||||

Seaport Innovation District |

|||||||||||||||||||||

5 and 15(1) Necco Street |

459,395 |

— |

— |

459,395 |

2 |

46,743 |

92.7 |

92.7 |

|||||||||||||

Seaport Innovation District |

459,395 |

— |

— |

459,395 |

2 |

46,743 |

92.7 |

92.7 |

|||||||||||||

Route 128 |

|||||||||||||||||||||

Megacampus: Alexandria Center® for Life Science – Waltham |

466,094 |

— |

596,064 |

1,062,158 |

5 |

38,471 |

100.0 |

43.9 |

|||||||||||||

40, 50, and 60 Sylvan Road, 35 Gatehouse Drive, and 840 Winter Street |

|||||||||||||||||||||

19, 225, and 235 Presidential Way |

585,226 |

— |

— |

585,226 |

3 |

14,171 |

97.1 |

97.1 |

|||||||||||||

Route 128 |

1,051,320 |

— |

596,064 |

1,647,384 |

8 |

52,642 |

98.4 |

62.8 |

|||||||||||||

Other |

400,863 |

— |

453,869 |

854,732 |

6 |

4,766 |

59.7 |

28.0 |

|||||||||||||

Greater Boston |

9,304,074 |

632,850 |

1,601,010 |

11,537,934 |

65 |

$754,342 |

91.8% |

78.4% |

|||||||||||||

Refer to “New Class A/A+ development and redevelopment properties: summary of pipeline” and “Definitions and reconciliations” in the Supplemental Information for additional details.

(1)We own a partial interest in this property through a real estate joint venture. Refer to “Joint venture financial information” in the Supplemental Information for additional details.

|

|||||||||||||||||||||

Property Listing (continued) |

|

March 31, 2025 | |

(Dollars in thousands) | |

Market / Submarket / Address |

RSF |

Number of

Properties

|

Annual

Rental

Revenue

|

Occupancy Percentage |

|||||||||||||||||

Operating |

Operating and

Redevelopment

|

||||||||||||||||||||

Operating |

Development |

Redevelopment |

Total |

||||||||||||||||||

San Francisco Bay Area |

|||||||||||||||||||||

Mission Bay |

|||||||||||||||||||||

Megacampus: Alexandria Center® for Science and Technology –

Mission Bay(1)

|

2,010,469 |

109,435 |

— |

2,119,904 |

10 |

$76,151 |

83.4% |

83.4% |

|||||||||||||

1455(2), 1515(2), 1655, and 1725 Third Street, 409 and 499 Illinois Street,

1450(3), 1500, and 1700 Owens Street, and 455 Mission Bay Boulevard

South

|

|||||||||||||||||||||

Mission Bay |

2,010,469 |

109,435 |

— |

2,119,904 |

10 |

76,151 |

83.4 |

83.4 |

|||||||||||||

South San Francisco |

|||||||||||||||||||||

Megacampus: Alexandria Technology Center® – Gateway(1) |

1,409,365 |

— |

259,689 |

1,669,054 |

12 |

75,819 |

82.3 |

69.5 |

|||||||||||||

600(2), 601, 611, 630(2), 650(2), 651, 681, 685, 701, 751, 901(2), and 951(2)

Gateway Boulevard

|

|||||||||||||||||||||

Megacampus: Alexandria Center® for Advanced Technologies – South San

Francisco

|

812,453 |

— |

107,250 |

919,703 |

5 |

52,990 |

100.0 |

88.3 |

|||||||||||||

213(1), 249, 259, 269, and 279 East Grand Avenue |

|||||||||||||||||||||

Alexandria Center® for Life Science – South San Francisco |

504,235 |

— |

— |

504,235 |

3 |

32,780 |

88.0 |

88.0 |

|||||||||||||

201 Haskins Way and 400 and 450 East Jamie Court |

|||||||||||||||||||||

Megacampus: Alexandria Center® for Advanced Technologies – Tanforan |

445,232 |

— |

— |

445,232 |

2 |

2,559 |

100.0 |

100.0 |

|||||||||||||

1122 and 1150 El Camino Real |

|||||||||||||||||||||

Alexandria Center® for Life Science – Millbrae(1) |

285,346 |

— |

— |

285,346 |

1 |

33,697 |

100.0 |

100.0 |

|||||||||||||

230 Harriet Tubman Way |

|||||||||||||||||||||

500 Forbes Boulevard(1) |

155,685 |

— |

— |

155,685 |

1 |

10,680 |

100.0 |

100.0 |

|||||||||||||

South San Francisco |

3,612,316 |

— |

366,939 |

3,979,255 |

24 |

208,525 |

91.4 |

83.0 |

|||||||||||||

Greater Stanford |

|||||||||||||||||||||

Megacampus: Alexandria Center® for Life Science – San Carlos |

738,038 |

— |

— |

738,038 |

9 |

41,601 |

94.5 |

94.5 |

|||||||||||||

825, 835, 960, and 1501-1599 Industrial Road |

|||||||||||||||||||||

Alexandria Stanford Life Science District |

704,559 |

— |

— |

704,559 |

9 |

73,213 |

98.5 |

98.5 |

|||||||||||||

3160, 3165, 3170, and 3181 Porter Drive and 3301, 3303, 3305, 3307, and

3330 Hillview Avenue

|

|||||||||||||||||||||

3412, 3420, 3440, 3450, and 3460 Hillview Avenue |

340,103 |

— |

— |

340,103 |

5 |

23,601 |

82.9 |

82.9 |

|||||||||||||

3875 Fabian Way |

228,000 |

— |

— |

228,000 |

1 |

9,402 |

100.0 |

100.0 |

|||||||||||||

2475 and 2625/2627/2631 Hanover Street and 1450 Page Mill Road |

198,548 |

— |

— |

198,548 |

3 |

13,450 |

89.4 |

89.4 |

|||||||||||||

2100, 2200, and 2400 Geng Road |

78,501 |

— |

— |

78,501 |

3 |

4,803 |

100.0 |

100.0 |

|||||||||||||

3350 West Bayshore Road |

61,431 |

— |

— |

61,431 |

1 |

4,770 |

100.0 |

100.0 |

|||||||||||||

Greater Stanford |

2,349,180 |

— |

— |

2,349,180 |

31 |

170,840 |

94.5 |

94.5 |

|||||||||||||

San Francisco Bay Area |

7,971,965 |

109,435 |

366,939 |

8,448,339 |

65 |

$455,516 |

90.3% |

86.3% |

|||||||||||||

Refer to “New Class A/A+ development and redevelopment properties: summary of pipeline” and “Definitions and reconciliations” in the Supplemental Information for additional details.

(1)We own a partial interest in this property through a real estate joint venture. Refer to “Joint venture financial information” in the Supplemental Information for additional details.

(2)We own 100% of this property.

(3)Includes 109,435 RSF at our 1450 Owens Street development project, where we have a 25% interest. In 4Q24, we executed a letter of intent with a biomedical institution for the sale of a condominium interest aggregating 103,361 RSF,