Document

Exhibit 99.1

|

|

|

|

| News Release |

| For Immediate Release |

Sallie Mae Reports Fourth Quarter and Full-Year 2025 Financial Results

Board of Directors Approves New $500 Million Share Repurchase Program

NEWARK, Del., Jan. 22, 2026 — Sallie Mae (Nasdaq: SLM), formally SLM Corporation, today released fourth quarter and full-year 2025 financial results. Complete financial results and related materials are available at www.SallieMae.com/investors. The materials will also be available on the Securities and Exchange Commission’s website at www.sec.gov.

Sallie Mae will host an earnings conference call today, Jan. 22, 2026, at 5:30 p.m. ET. Executives will be on hand to discuss various highlights of the quarter and year and to answer questions related to Sallie Mae’s performance. A live audio webcast of the conference call and presentation slides may be accessed at www.SallieMae.com/investors and the hosting website.

A replay of the webcast will be available via the company’s investor website approximately two hours after the call’s conclusion.

Sallie Mae announced today that its Board of Directors authorized a new stock repurchase program of up to $500 million of the Company’s outstanding common stock, par value $0.20 per share, to begin on Jan. 22, 2026 (the “2026 Share Repurchase Program”). The 2026 Share Repurchase Program is expected to be completed over the next approximately 24 months ending Feb. 4, 2028. The Company’s “2024 Share Repurchase Program,” authorized on Jan. 23, 2024, with a repurchase capacity of $650 million, remains open. Repurchases may be made under the 2024 Share Repurchase Program until it expires on Feb. 6, 2026, or is expended (whichever comes first).

Under the announced program, Sallie Mae may repurchase shares of common stock from time to time in various transaction formats including, but not limited to, tender offers, open market purchases, accelerated share repurchases, negotiated or block purchases, and/ or pursuant to trading plans in accordance with Rules 10b5-1 and 10b-18 of the Exchange Act. The actual timing, number, and value of shares repurchased under the program will be determined by management at its discretion and are dependent on a number of factors. Sallie Mae reserves the right to suspend or discontinue share repurchases at any time and for any reason.

###

Sallie Mae (Nasdaq: SLM) believes education and life-long learning, in all forms, help people achieve great things. As the leader in private student lending, we provide financing and know-how to support access to college and offer products and resources to help customers make new goals and experiences, beyond college, happen. Learn more at SallieMae.com. Commonly known as Sallie Mae, SLM Corporation and its subsidiaries are not sponsored by or agencies of the United States of America.

Contacts:

Media

Rick Castellano, 302-451-2541, rick.castellano@SallieMae.com

Investors

Kate deLacy, 571-438-9574, kate.delacy@salliemae.com

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NEWARK, Del., Jan. 22, 2026 — Sallie Mae (Nasdaq:SLM), formally SLM Corporation, today released its fourth quarter and full-year 2025 financial results. |

| Full-Year 2025 Financial Results |

|

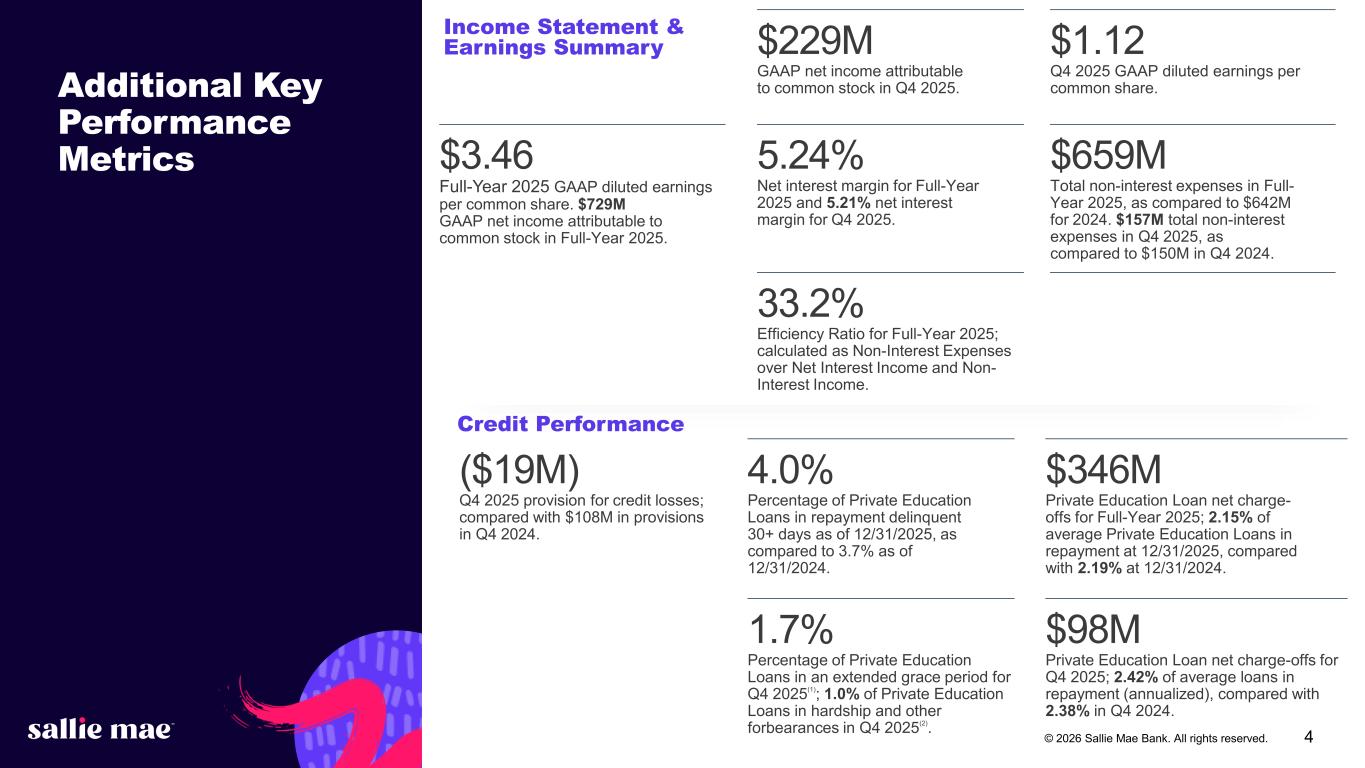

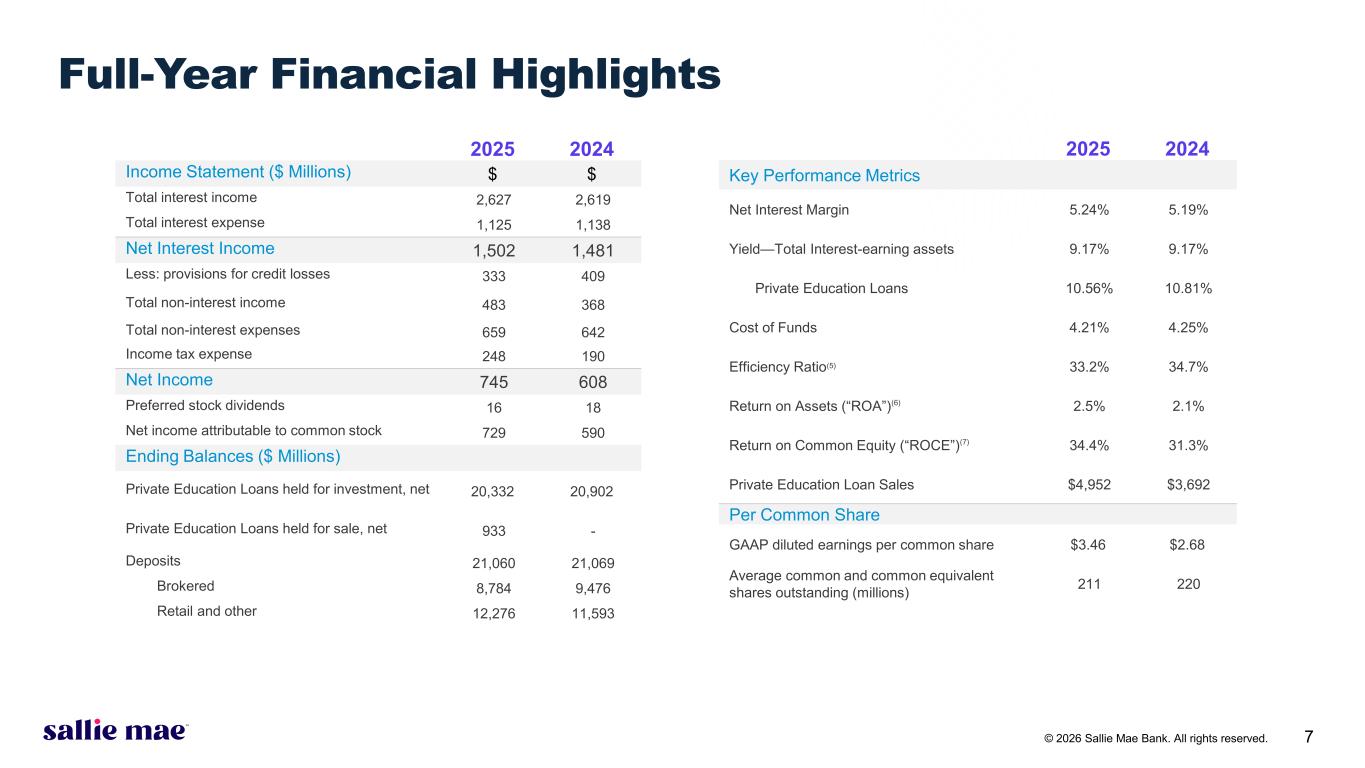

$3.46

GAAP Diluted Earnings Per Common Share in 2025

|

|

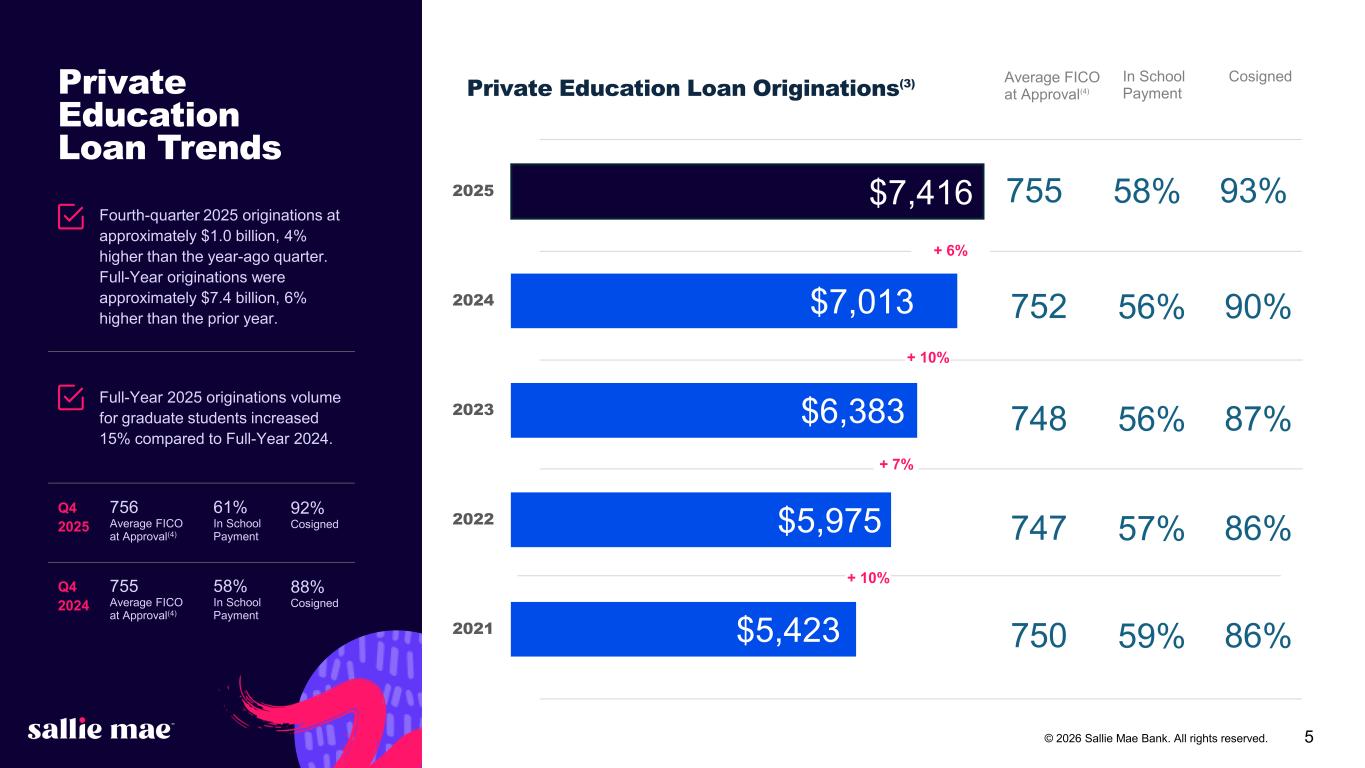

6%

Private Education Loan Originations Growth from 2024

|

|

12.8M

Shares repurchased in 2025 for $373M(1)

|

|

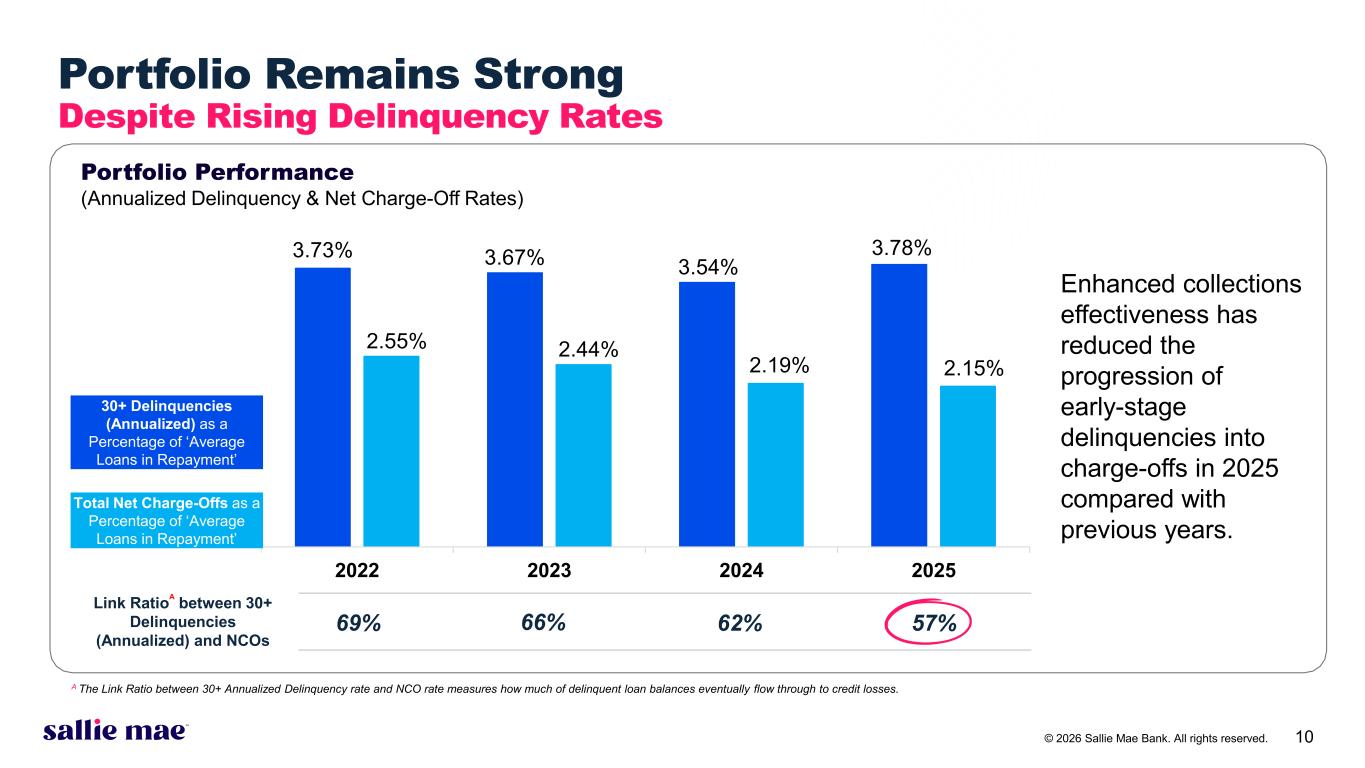

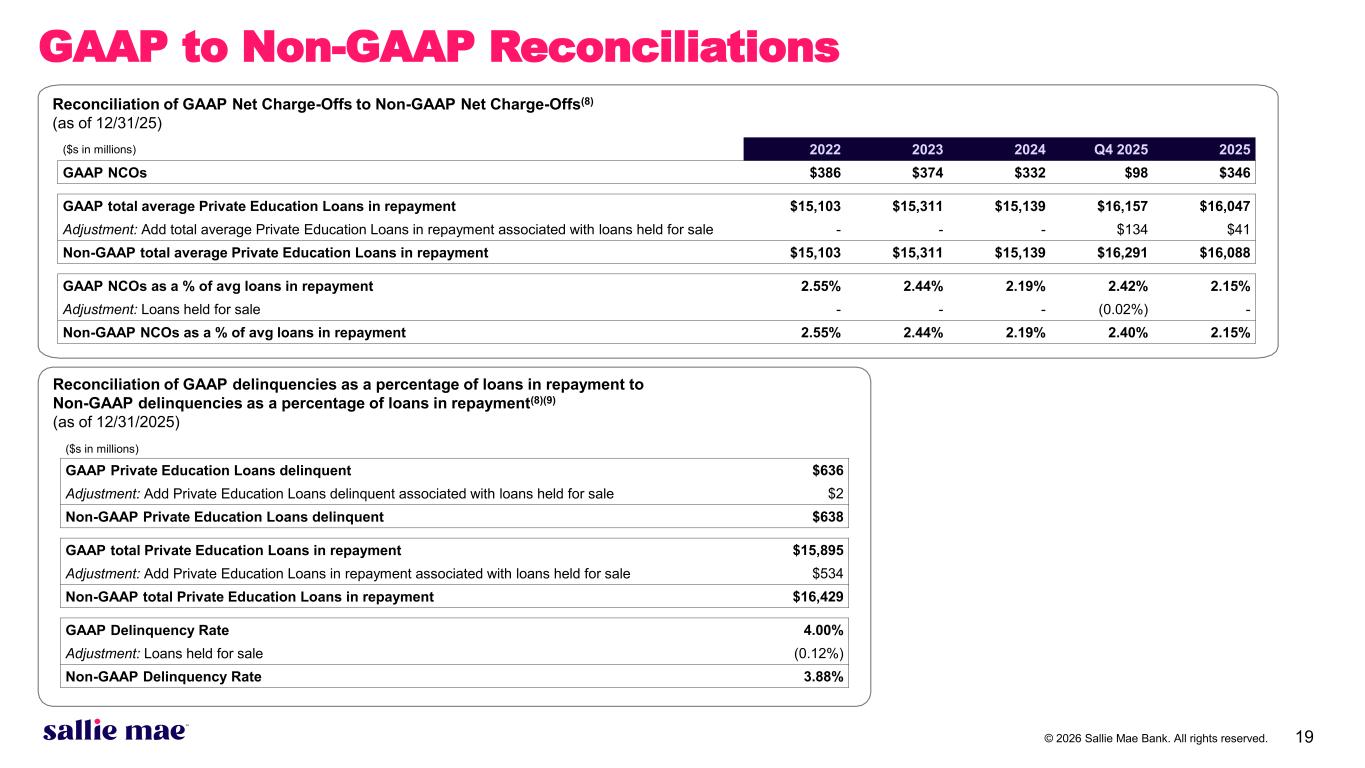

2.15%

Total Net Charge-Offs as a Percentage of Average Loans in Repayment

|

|

$659M

Non-Interest Expenses in 2025

|

| Fourth Quarter 2025 Financial Results |

|

$1.12

GAAP Diluted Earnings Per Common Share in Q4 2025

|

|

4%

Private Education Loan Originations Growth compared to Q4 2024

|

|

3.8M

Shares repurchased in Q4 2025 for $106M(1)

|

|

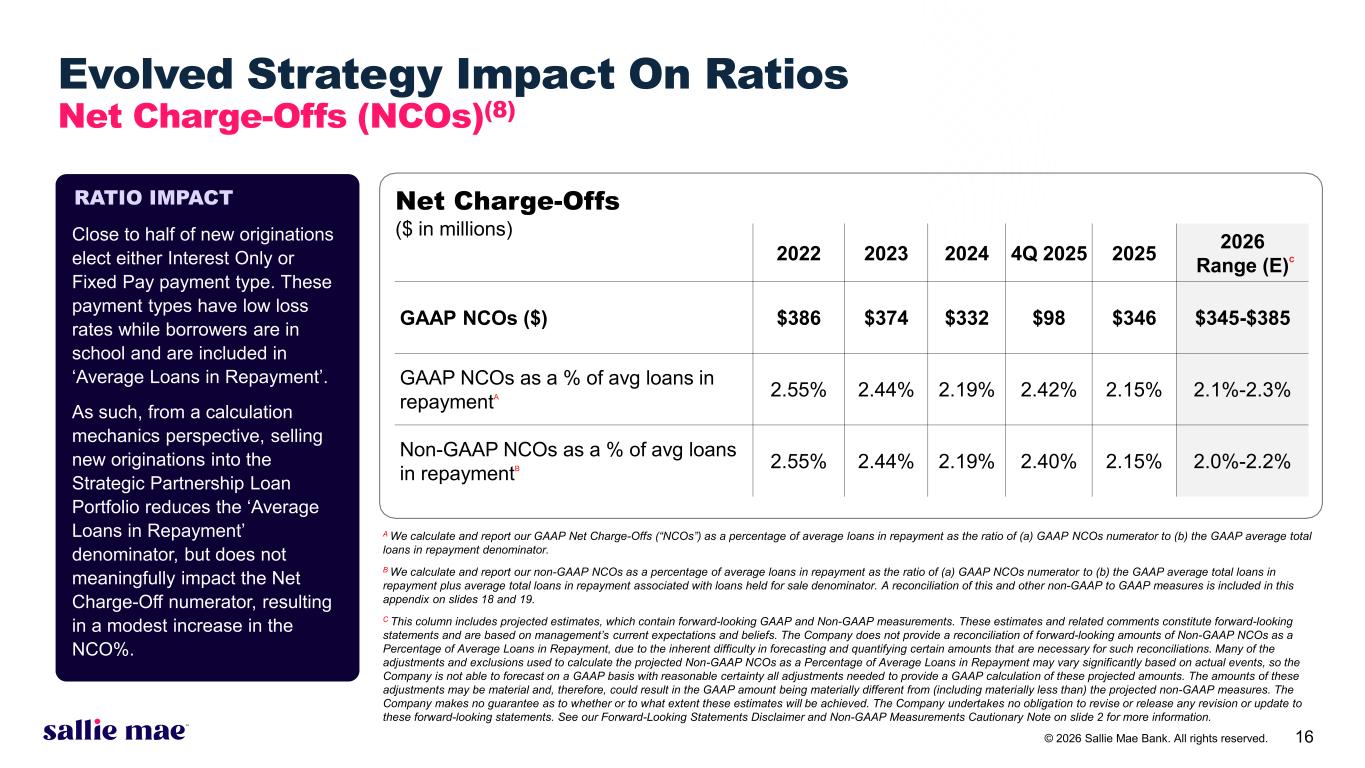

2.42%

Total Net Charge-Offs as a Percentage of Average Loans in Repayment (annualized)

|

|

$157M

Non-Interest Expenses in Q4 2025

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

“We delivered solid results for 2025, expanding originations, improving our net charge-off rate, returning capital to shareholders, and building further capabilities to serve more students and families through our new private credit strategic partnership. This momentum, coupled with recent reforms to the federal student loan program, should set us up for an exciting 2026 and beyond as families continue to value and invest in higher education.”

Jonathan Witter, CEO, Sallie Mae

|

|

Quarterly Private Education Loan Portfolio Trends

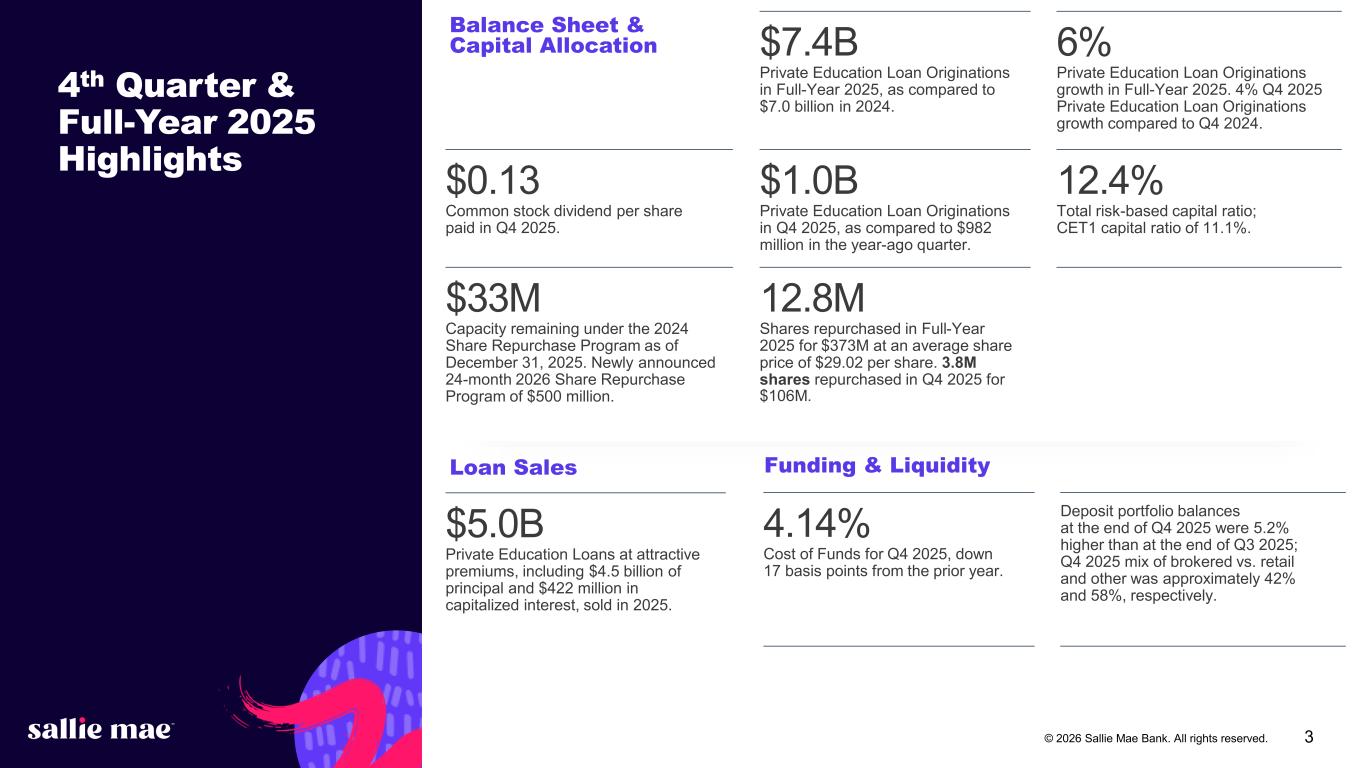

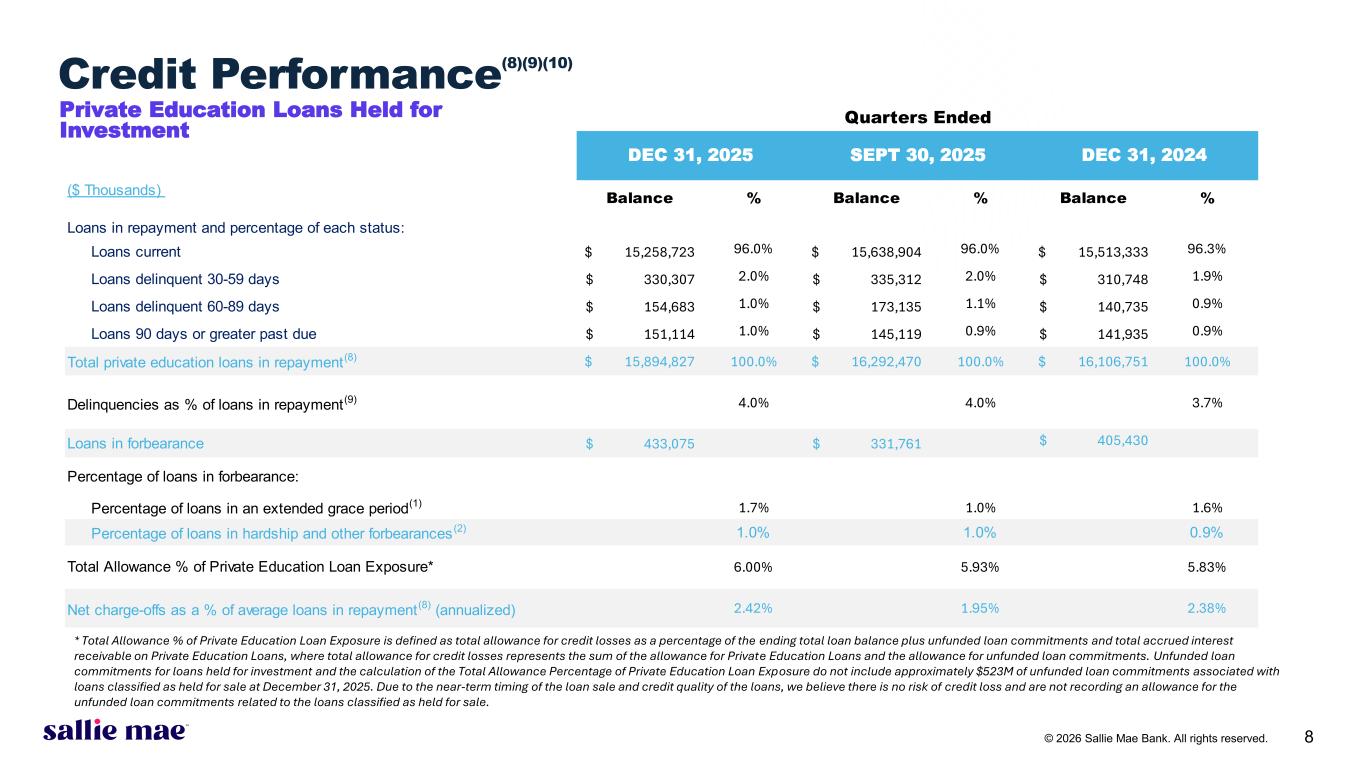

▪$22.9B of average loans outstanding, net, an increase of 4% compared to Q4 2024

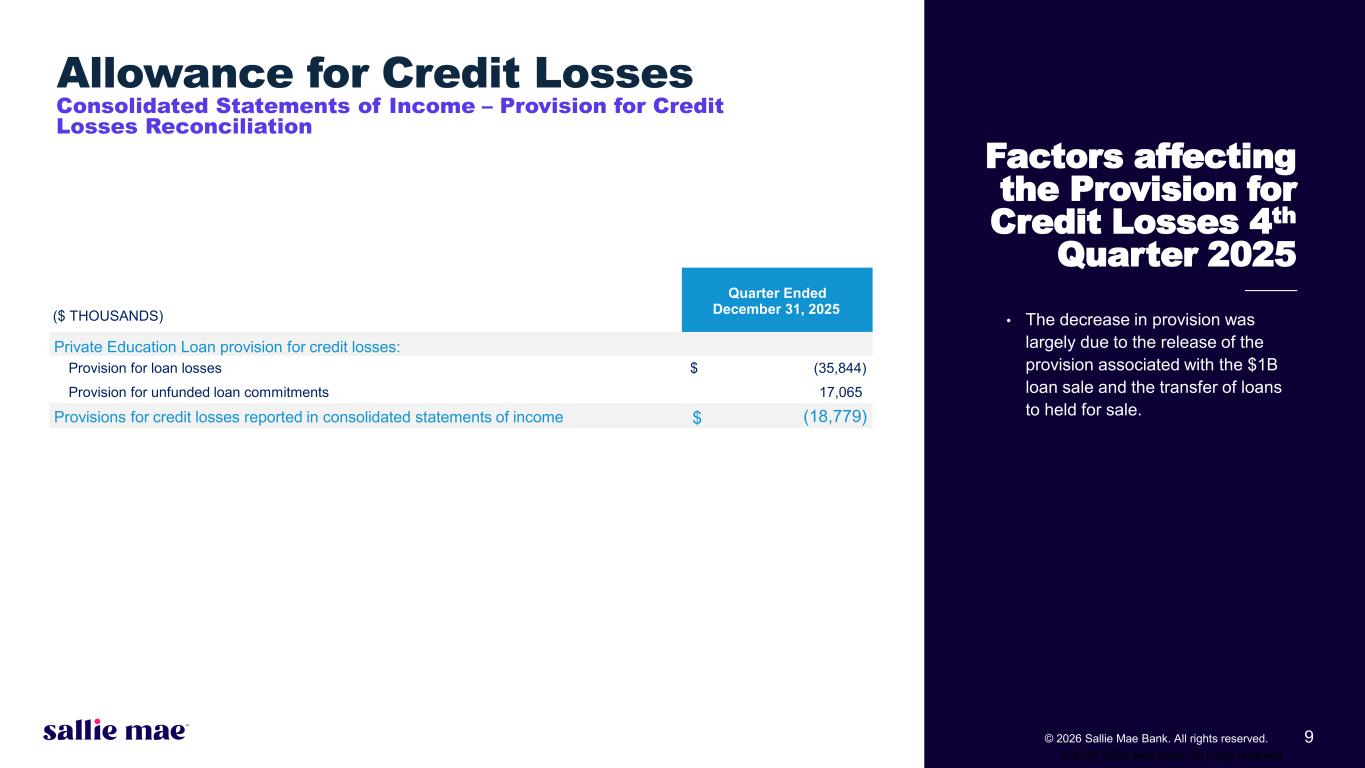

▪$19M in negative provisions for credit losses in Q4 2025, compared with $108M in provisions in Q4 2024

▪0.99% loans in a hardship forbearance, an increase from 0.92% in Q4 2024(2)

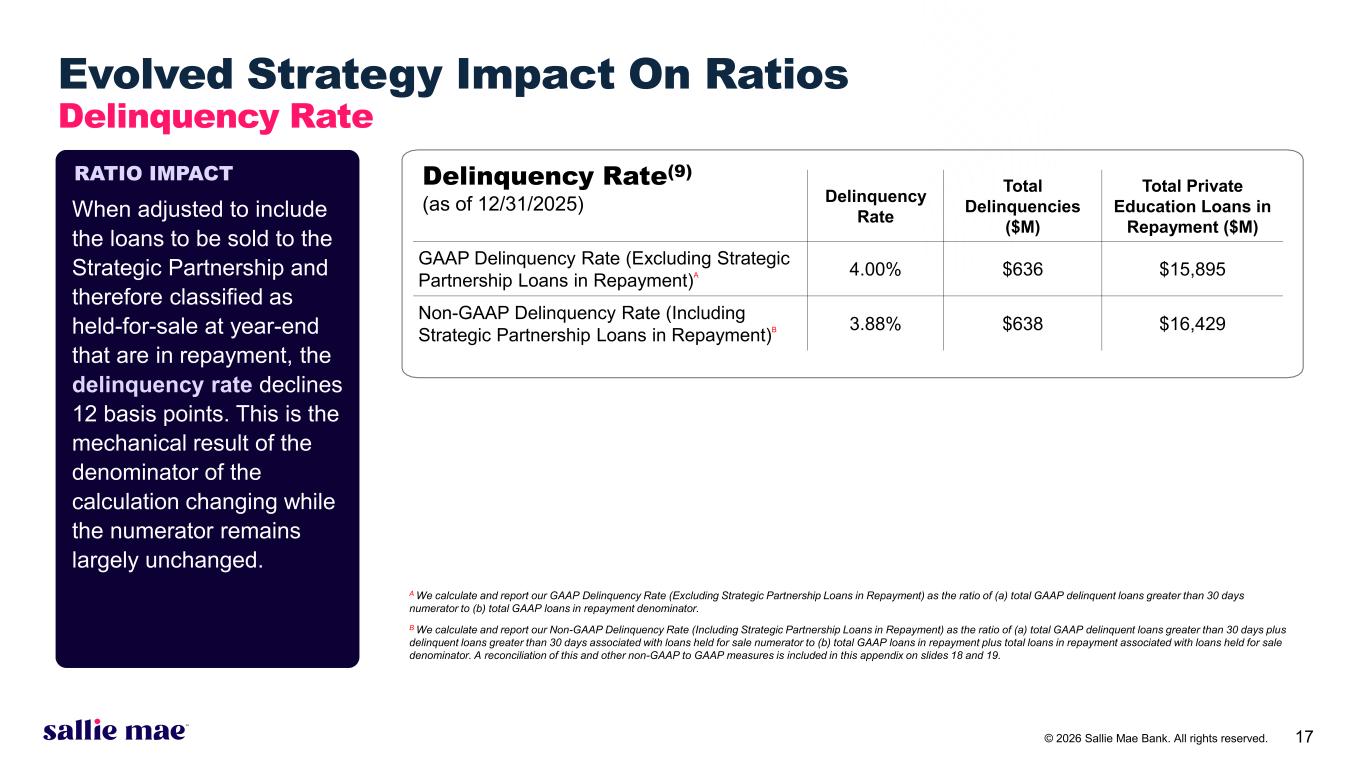

▪4.00% delinquencies as a percentage of loans in repayment, compared with 3.68% in Q4 2024

▪2.42% net charge-offs as a percentage of average loans in repayment (annualized), compared with 2.38% in Q4 2024

|

|

| Balance Sheet & Capital Allocation |

|

|

$0.13

Common stock dividend per share paid in Q4 2025

|

|

12.4%

Total risk-based capital ratio and CET1 capital ratio of 11.1%

|

|

|

$33M

Capacity remaining under the 2024 Share Repurchase Program as of December 31, 2025

|

|

| Income Statement & Earnings Summary |

|

2026 Guidance*

For the full year 2026, the Company expects:

|

|

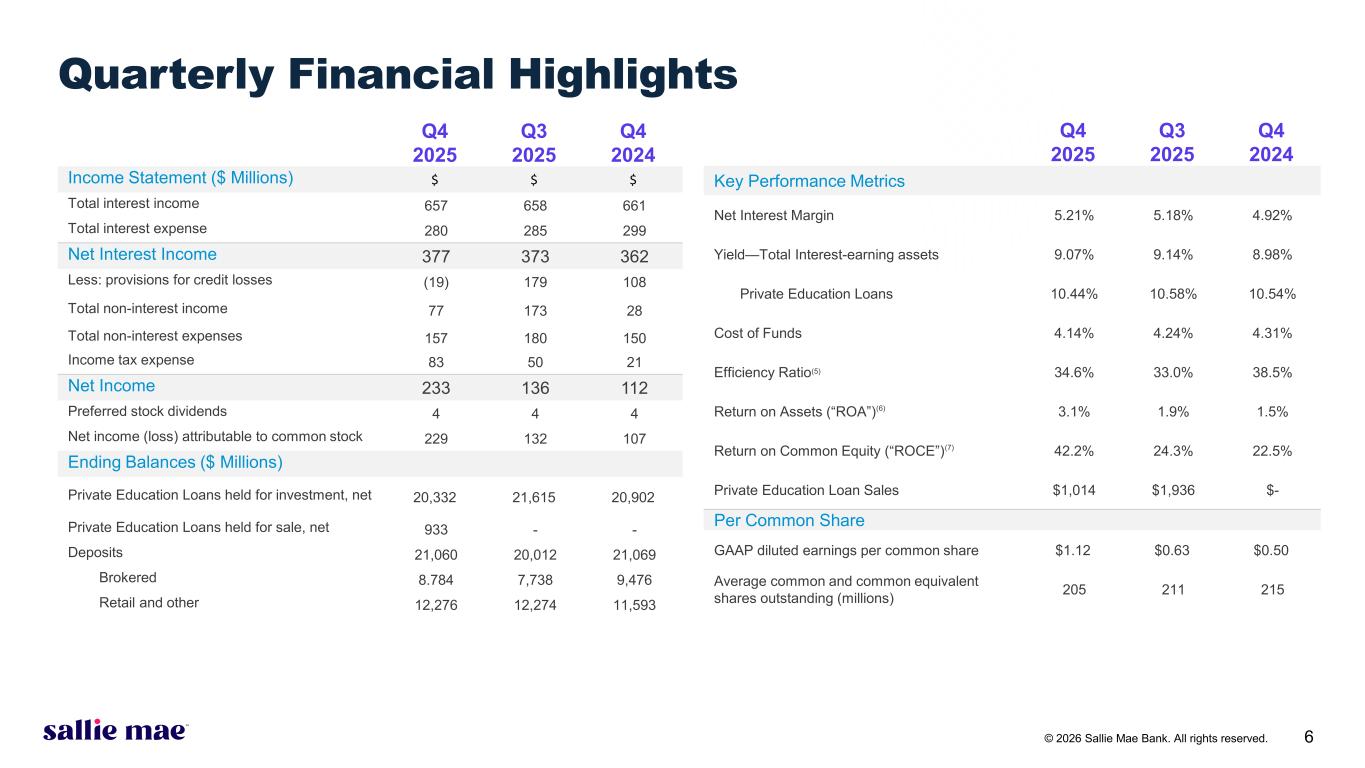

5.21%

Net interest margin for Q4 2025, an increase of 29 basis points from Q4 2024

|

|

34.6%

Efficiency Ratio for Q4 2025, a decrease from 38.5% for Q4 2024(3)

|

|

$2.70 - $2.80

GAAP Diluted Earnings Per Common Share

|

|

12% - 14% Private Education Loan Originations Year-over-Year Growth |

|

$45M

Gain on sale of loans in Q4 2025

|

|

$19M

Negative provision for credit losses in Q4 2025, a decrease from Q4 2024 provision largely due to a combined $106M release of provision from loan sale and loans transferred to held for sale, offset by an increase in loan commitments, net of expired commitments.

|

|

$345 million - $385 million

Net Charge-Offs

|

|

$750 million - $780 million

Non-Interest Expenses

|

Investor Contact: Kate deLacy, 571-438-9574 Media Contact: Rick Castellano, 302-451-2541

* The 2026 Guidance and related comments constitute forward-looking statements and are based on management’s current expectations and beliefs. There can be no guarantee as to whether and to what extent this guidance will be achieved. The Company undertakes no obligation to revise or release any revision or update to these forward-looking statements. See our Forward-Looking Statements disclosures on pg. 4 for more information.

|

|

|

| Quarterly and Full-Year Financial Highlights |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q4 2025 |

Q3 2025 |

Q4 2024 |

2025 |

2024 |

| Income Statement ($ millions) |

|

|

|

|

|

| Total interest income |

$657 |

$658 |

$661 |

$2,627 |

$2,619 |

| Total interest expense |

280 |

285 |

299 |

1,125 |

1,138 |

| Net interest income |

377 |

373 |

362 |

1,502 |

1,481 |

| Less: provisions for credit losses |

(19) |

179 |

108 |

333 |

409 |

| Total non-interest income |

77 |

173 |

28 |

483 |

368 |

| Total non-interest expenses |

157 |

180 |

150 |

659 |

642 |

| Income tax expense |

83 |

50 |

21 |

248 |

190 |

| Net income |

233 |

136 |

112 |

745 |

608 |

| Preferred stock dividends |

4 |

4 |

4 |

16 |

18 |

| Net income attributable to common stock |

$229 |

$132 |

$107 |

$729 |

$590 |

|

|

|

|

|

|

| Ending Balances ($ millions) |

|

|

|

|

|

| Private Education Loans held for investment, net |

$20,332 |

$21,615 |

$20,902 |

$20,332 |

$20,902 |

|

|

|

|

|

|

| Private Education Loans held for sale, net |

933 |

— |

— |

933 |

— |

| Deposits |

21,060 |

20,012 |

21,069 |

21,060 |

21,069 |

| -Brokered |

8,784 |

7,738 |

9,476 |

8,784 |

9,476 |

| -Retail and other |

12,276 |

12,274 |

11,593 |

12,276 |

11,593 |

|

|

|

|

|

|

| Key Performance Metrics ($ in millions) |

|

|

|

|

|

| Net interest margin |

5.21% |

5.18% |

4.92% |

5.24% |

5.19% |

| Yield - Total interest-earning assets |

9.07% |

9.14% |

8.98% |

9.17% |

9.17% |

| Private Education Loans |

10.44% |

10.58% |

10.54% |

10.56% |

10.81% |

| Cost of Funds |

4.14% |

4.24% |

4.31% |

4.21% |

4.25% |

Efficiency Ratio(3) |

34.6% |

33.0% |

38.5% |

33.2% |

34.7% |

Return on Assets (“ROA”)(4) |

3.1% |

1.9% |

1.5% |

2.5% |

2.1% |

Return on Common Equity (“ROCE”)(5) |

42.2% |

24.3% |

22.5% |

34.4% |

31.3% |

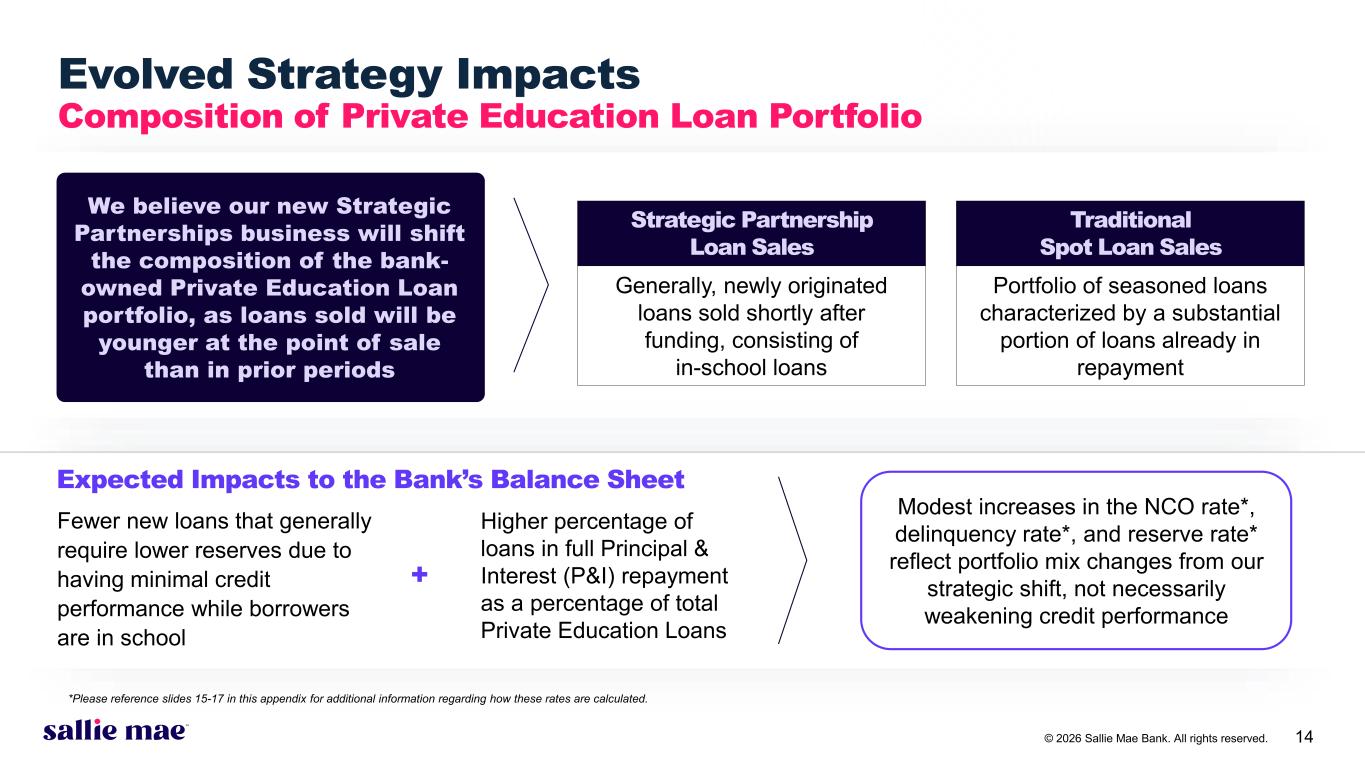

| Private Education Loan sales |

$1,014 |

$1,936 |

$— |

$4,952 |

$3,692 |

|

|

|

|

|

|

| Per Common Share |

|

|

|

|

|

| GAAP diluted earnings per common share |

$1.12 |

$0.63 |

$0.50 |

$3.46 |

$2.68 |

| Average common and common equivalent shares outstanding (millions) |

205 |

211 |

215 |

211 |

220 |

Footnotes:

(1) Shares of common stock were repurchased under Rule 10b5-1 trading plans authorized under the Company’s 2024 Share Repurchase Program. As of December 31, 2025, we had $33 million of capacity remaining under the 2024 Share Repurchase Program.

(2) We calculate the percentage of loans in hardship and other forbearances as the ratio of (a) Private Education Loans in hardship and other forbearances (excluding loans in an extended grace period and delinquent loans in disaster forbearance) numerator to (b) Private Education Loans in repayment and forbearance denominator. If the customer is in financial hardship, we work with the customer and/or cosigner and identify any available alternative arrangements designed to reduce monthly payment obligations, which may include a short-term hardship forbearance. Loans in hardship and other forbearances (excluding loans in an extended grace period and delinquent loans in disaster forbearance) were approximately $161 million and $152 million at December 31, 2025 and 2024, respectively.

(3) We calculate and report our Efficiency Ratio as the ratio of (a) total non-interest expenses numerator to (b) the net denominator, which consists of net interest income plus total non-interest income.

(4) We calculate and report our Return on Assets (“ROA”) as the ratio of (a) GAAP net income (loss) numerator (annualized) to (b) the GAAP total average assets denominator.

(5) We calculate and report our Return on Common Equity (“ROCE”) as the ratio of (a) GAAP net income (loss) attributable to common stock numerator (annualized) to (b) the net denominator, which consists of GAAP total average equity less total average preferred stock.

***

CAUTIONARY NOTE AND DISCLAIMER REGARDING FORWARD LOOKING STATEMENTS

This press release contains “forward-looking statements” and information based on management’s current expectations as of the date of this press release. Statements that are not historical facts, including statements about the Company’s beliefs, opinions, or expectations and statements that assume or are dependent upon future events, are forward-looking statements. These include, but are not limited to: strategies; goals and assumptions of SLM Corporation and its subsidiaries, collectively or individually as the context requires (the “Company”): the Company’s expectation and ability to execute loan sales and share repurchases; the Company’s expectation and ability to pay a quarterly cash dividend on our common stock in the future, subject to the approval of our Board of Directors; the Company’s 2026 guidance; the Company’s three-year horizon outlook; the Company’s credit outlook; the impact of acquisitions the Company has made or may make in the future; the Company’s projections regarding originations, net charge-offs, non-interest expenses, earnings, balance sheet position, and other metrics; any estimates related to accounting standard changes; and any estimates related to the impact of credit administration practices changes, including the results of simulations or other behavioral observations.

Forward-looking statements are subject to risks, uncertainties, assumptions, and other factors, many of which are difficult to predict and generally beyond the control of the Company, which may cause actual results to be materially different from those reflected in such forward-looking statements. There can be no assurance that future developments affecting the Company will be the same as those anticipated by management. The Company cautions readers that a number of important factors could cause actual results to differ materially from those expressed in, or implied or projected by, such forward-looking statements. These factors include, among others, the risks and uncertainties set forth in Item 1A. “Risk Factors” and elsewhere in the Company’s most recently filed Annual Report on Form 10-K and subsequent filings with the Securities and Exchange Commission; increases in financing costs; limits on liquidity; increases in costs associated with compliance with laws and regulations; failure to comply with consumer protection, banking, and other laws or regulations; changes in laws, regulations, and supervisory expectations, especially in light of the goals of the Trump administration; our ability to timely develop new products and services and the acceptance of those products and services by potential and existing customers; changes in accounting standards and the impact of related changes in significant accounting estimates, including any regarding the measurement of our allowance for credit losses and the related provision expense; any adverse outcomes in any significant litigation to which the Company is a party; credit risk associated with the Company’s exposure to third parties, including counterparties to the Company’s derivative transactions; the effectiveness of our risk management framework and quantitative models; changes in the terms of education loans and the educational credit marketplace (including changes resulting from new laws and the implementation of existing laws); and changes in the demand for our deposit products, including changes caused by new or emerging market entrants or technologies. We could also be affected by, among other things: changes in our funding costs and availability; reductions to our credit ratings; cybersecurity incidents, cyberattacks, risks related to artificial intelligence (AI), and other failures or breaches of our operating systems or infrastructure, including those of third-party vendors; the societal, demographic, business, and legislative/regulatory impact of pandemics, other public health crises, severe weather events, and/or natural disasters; damage to our reputation; risks associated with restructuring initiatives, including failures to successfully implement cost-cutting programs and the adverse effects of such initiatives on our business; changes in the demand for higher education, educational financing, or in financing preferences of lenders, educational institutions, students, and their families, including changes to the amount or availability of funding that educational institutions, students, or their families receive from government sources; changes in laws and regulations with respect to the student lending business and financial institutions generally; changes in banking rules and regulations, including increased capital requirements; increased competition from banks and other consumer lenders; the creditworthiness of our customers, or any change related thereto; changes in the general interest rate environment, including the rate relationships among relevant money-market instruments and those of our earning assets versus our funding arrangements; rates of prepayments on the loans owned by us; changes in general economic or macroeconomic conditions, including changes due to inflation, stagflation, recession, shifts in the labor market, changes to government policies or initiatives, such as tariffs, trade wars, wars, immigration, and student visa policies, which could negatively impact consumer or business sentiment, demand for higher education, demand for student loans, our financial and business results and/or modeling, and our ability to successfully effectuate any acquisitions, strategic partnerships, or initiatives. The preparation of our consolidated financial statements also requires management to make certain estimates and assumptions, including estimates and assumptions about future events. These estimates or assumptions may prove to be incorrect.

All oral and written forward-looking statements attributed to the Company are expressly qualified in their entirety by the factors, risks, and uncertainties set forth in the foregoing cautionary statements, and are made only as of the date of this press release or, where the statement is oral, as of the date stated. We do not undertake any obligation to update or revise any forward-looking statements to conform to actual results or changes in our expectations, nor to reflect events or circumstances that occur after the date on which such statements were made. In light of these risks, uncertainties, and assumptions, you should not put undue reliance on any forward-looking statements discussed hereto.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| SLM CORPORATION |

|

|

|

|

| CONSOLIDATED BALANCE SHEETS (Unaudited) |

|

|

|

|

|

As of December 31,

(dollars in thousands, except share and per share amounts)

|

|

2025 |

|

2024 |

| Assets |

|

|

|

|

| Cash and cash equivalents |

|

$ |

4,241,265 |

|

|

$ |

4,700,366 |

|

| Investments: |

|

|

|

|

Trading investments at fair value (cost of $37,606 and $41,715, respectively) |

|

49,250 |

|

|

53,262 |

|

Available-for-sale investments at fair value (cost of $1,812,408 and $2,042,473, respectively) |

|

1,758,070 |

|

|

1,933,226 |

|

| Other investments |

|

115,394 |

|

|

112,377 |

|

| Total investments |

|

1,922,714 |

|

|

2,098,865 |

|

Loans held for investment (net of allowance for losses of $1,430,318 and $1,435,920, respectively) |

|

20,332,124 |

|

|

20,902,158 |

|

| Loans held for sale |

|

933,256 |

|

|

— |

|

| Restricted cash |

|

177,263 |

|

|

173,894 |

|

| Other interest-earning assets |

|

120 |

|

|

4,880 |

|

| Accrued interest receivable |

|

1,562,811 |

|

|

1,546,590 |

|

| Premises and equipment, net |

|

122,193 |

|

|

119,354 |

|

| Goodwill and acquired intangible assets, net |

|

59,974 |

|

|

63,532 |

|

| Income taxes receivable, net |

|

347,260 |

|

|

425,625 |

|

|

|

|

|

|

| Other assets |

|

47,315 |

|

|

36,846 |

|

| Total assets |

|

$ |

29,746,295 |

|

|

$ |

30,072,110 |

|

|

|

|

|

|

| Liabilities |

|

|

|

|

| Deposits |

|

$ |

21,060,151 |

|

|

$ |

21,068,568 |

|

| Short-term borrowings |

|

498,415 |

|

|

— |

|

| Long-term borrowings |

|

5,362,494 |

|

|

6,440,345 |

|

|

|

|

|

|

|

|

|

|

|

| Other liabilities |

|

373,877 |

|

|

403,277 |

|

| Total liabilities |

|

27,294,937 |

|

|

27,912,190 |

|

| Commitments and contingencies |

|

|

|

|

| Equity |

|

|

|

|

Preferred stock, par value $0.20 per share, 20 million shares authorized: |

|

|

|

|

Series B: 2.5 million and 2.5 million shares issued, respectively, at stated value of $100 per share |

|

251,070 |

|

|

251,070 |

|

Common stock, par value $0.20 per share, 1.125 billion shares authorized: 443.2 million and 440.6 million shares issued, respectively |

|

88,650 |

|

|

88,121 |

|

| Additional paid-in capital |

|

1,240,250 |

|

|

1,193,753 |

|

Accumulated other comprehensive loss (net of tax benefit of $(13,446) and $(21,209), respectively) |

|

(40,128) |

|

|

(65,861) |

|

| Retained earnings |

|

4,734,313 |

|

|

4,114,446 |

|

| Total SLM Corporation stockholders’ equity before treasury stock |

|

6,274,155 |

|

|

5,581,529 |

|

Less: Common stock held in treasury at cost: 244.0 million and 230.2 million shares, respectively |

|

(3,822,797) |

|

|

(3,421,609) |

|

| Total equity |

|

2,451,358 |

|

|

2,159,920 |

|

| Total liabilities and equity |

|

$ |

29,746,295 |

|

|

$ |

30,072,110 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| SLM CORPORATION |

|

|

|

|

|

|

|

|

| CONSOLIDATED STATEMENTS OF INCOME (Unaudited) |

|

|

|

|

|

|

|

|

|

|

Quarters Ended |

|

Years Ended |

| |

|

December 31, |

|

December 31, |

| (Dollars in thousands, except per share amounts) |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| Interest income: |

|

|

|

|

|

|

|

|

| Loans |

|

$ |

602,307 |

|

|

$ |

587,426 |

|

|

$ |

2,392,417 |

|

|

$ |

2,314,417 |

|

| Investments |

|

15,404 |

|

|

15,467 |

|

|

58,815 |

|

|

61,412 |

|

| Cash and cash equivalents |

|

39,108 |

|

|

58,480 |

|

|

176,023 |

|

|

243,217 |

|

| Total interest income |

|

656,819 |

|

|

661,373 |

|

|

2,627,255 |

|

|

2,619,046 |

|

| Interest expense: |

|

|

|

|

|

|

|

|

| Deposits |

|

199,604 |

|

|

223,976 |

|

|

808,798 |

|

|

881,456 |

|

| Interest expense on short-term borrowings |

|

3,687 |

|

|

3,476 |

|

|

11,418 |

|

|

13,815 |

|

| Interest expense on long-term borrowings |

|

76,471 |

|

|

71,730 |

|

|

305,215 |

|

|

242,993 |

|

|

|

|

|

|

|

|

|

|

| Total interest expense |

|

279,762 |

|

|

299,182 |

|

|

1,125,431 |

|

|

1,138,264 |

|

| Net interest income |

|

377,057 |

|

|

362,191 |

|

|

1,501,824 |

|

|

1,480,782 |

|

| Less: provisions for credit losses |

|

(18,779) |

|

|

108,179 |

|

|

332,687 |

|

|

408,515 |

|

| Net interest income after provisions for credit losses |

|

395,836 |

|

|

254,012 |

|

|

1,169,137 |

|

|

1,072,267 |

|

| Non-interest income: |

|

|

|

|

|

|

|

|

| Gains (losses) on sales of loans, net |

|

45,200 |

|

|

(9) |

|

|

368,880 |

|

|

254,928 |

|

| Gains (losses) on securities, net |

|

(1,652) |

|

|

82 |

|

|

(9,795) |

|

|

467 |

|

|

|

|

|

|

|

|

|

|

| Other income |

|

33,499 |

|

|

27,709 |

|

|

123,484 |

|

|

112,873 |

|

| Total non-interest income |

|

77,047 |

|

|

27,782 |

|

|

482,569 |

|

|

368,268 |

|

| Non-interest expenses: |

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

| Compensation and benefits |

|

86,417 |

|

|

80,084 |

|

|

345,814 |

|

|

349,387 |

|

| FDIC assessment fees |

|

5,595 |

|

|

13,594 |

|

|

34,291 |

|

|

51,606 |

|

| Other operating expenses |

|

64,081 |

|

|

54,455 |

|

|

275,480 |

|

|

235,577 |

|

| Total operating expenses |

|

156,093 |

|

|

148,133 |

|

|

655,585 |

|

|

636,570 |

|

| Acquired intangible assets impairment and amortization expense |

|

793 |

|

|

1,495 |

|

|

3,558 |

|

|

5,329 |

|

|

|

|

|

|

|

|

|

|

| Total non-interest expenses |

|

156,886 |

|

|

149,628 |

|

|

659,143 |

|

|

641,899 |

|

| Income before income tax expense |

|

315,997 |

|

|

132,166 |

|

|

992,563 |

|

|

798,636 |

|

| Income tax expense |

|

82,812 |

|

|

20,613 |

|

|

247,716 |

|

|

190,311 |

|

| Net income |

|

233,185 |

|

|

111,553 |

|

|

744,847 |

|

|

608,325 |

|

| Preferred stock dividends |

|

3,803 |

|

|

4,367 |

|

|

15,725 |

|

|

18,296 |

|

| Net income attributable to SLM Corporation common stock |

|

$ |

229,382 |

|

|

$ |

107,186 |

|

|

$ |

729,122 |

|

|

$ |

590,029 |

|

| Basic earnings per common share |

|

$ |

1.14 |

|

|

$ |

0.51 |

|

|

$ |

3.52 |

|

|

$ |

2.73 |

|

| Average common shares outstanding |

|

201,612 |

|

|

210,741 |

|

|

207,155 |

|

|

216,220 |

|

| Diluted earnings per common share |

|

$ |

1.12 |

|

|

$ |

0.50 |

|

|

$ |

3.46 |

|

|

$ |

2.68 |

|

| Average common and common equivalent shares outstanding |

|

204,957 |

|

|

215,113 |

|

|

210,914 |

|

|

219,934 |

|

| Declared dividends per common share |

|

$ |

0.13 |

|

|

$ |

0.13 |

|

|

$ |

0.52 |

|

|

$ |

0.46 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| SLM CORPORATION |

|

|

|

|

|

|

|

|

CONSOLIDATED STATEMENTS OF COMPREHENSIVE

INCOME (Unaudited) |

|

|

|

|

|

|

|

|

|

|

Quarters Ended |

|

Years Ended |

|

|

December 31, |

|

December 31, |

| (Dollars in thousands) |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| Net income |

|

$ |

233,185 |

|

|

$ |

111,553 |

|

|

$ |

744,847 |

|

|

$ |

608,325 |

|

| Other comprehensive income (loss): |

|

|

|

|

|

|

|

|

| Unrealized gains (losses) on investments |

|

11,860 |

|

|

(18,546) |

|

|

54,935 |

|

|

42,604 |

|

| Unrealized gains (losses) on cash flow hedges |

|

(5,143) |

|

|

(1,975) |

|

|

(21,439) |

|

|

(30,394) |

|

| Total unrealized gains (losses) |

|

6,717 |

|

|

(20,521) |

|

|

33,496 |

|

|

12,210 |

|

| Income tax (expense) benefit |

|

(1,678) |

|

|

4,999 |

|

|

(7,763) |

|

|

(2,967) |

|

| Other comprehensive income (loss), net of tax (expense) benefit |

|

5,039 |

|

|

(15,522) |

|

|

25,733 |

|

|

9,243 |

|

| Total comprehensive income |

|

$ |

238,224 |

|

|

$ |

96,031 |

|

|

$ |

770,580 |

|

|

$ |

617,568 |

|

Average Balance Sheets

The following table reflects the rates earned on interest-earning assets and paid on interest-bearing liabilities and reflects our net interest margin on a consolidated basis.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Quarters Ended December 31, |

|

Years Ended December 31, |

| |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| (Dollars in thousands) |

|

Balance |

|

Rate |

|

Balance |

|

Rate |

|

Balance |

|

Rate |

|

Balance |

|

Rate |

| Average Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Private Education Loans |

|

$ |

22,882,452 |

|

|

10.44 |

% |

|

$ |

22,061,986 |

|

|

10.54 |

% |

|

$ |

22,654,942 |

|

|

10.56 |

% |

|

$ |

21,121,545 |

|

|

10.81 |

% |

| FFELP Loans |

|

— |

|

|

— |

|

|

149,225 |

|

|

7.16 |

|

|

— |

|

|

— |

|

|

413,338 |

|

|

7.45 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Taxable securities |

|

1,828,595 |

|

|

3.34 |

|

|

2,064,637 |

|

|

2.98 |

|

|

1,836,407 |

|

|

3.20 |

|

|

2,316,848 |

|

|

2.65 |

|

| Cash and other short-term investments |

|

4,025,614 |

|

|

3.88 |

|

|

5,028,902 |

|

|

4.65 |

|

|

4,164,094 |

|

|

4.25 |

|

|

4,700,066 |

|

|

5.19 |

|

| Total interest-earning assets |

|

28,736,661 |

|

|

9.07 |

% |

|

29,304,750 |

|

|

8.98 |

% |

|

28,655,443 |

|

|

9.17 |

% |

|

28,551,797 |

|

|

9.17 |

% |

| Non-interest-earning assets |

|

756,611 |

|

|

|

|

632,835 |

|

|

|

|

596,535 |

|

|

|

|

505,245 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

29,493,272 |

|

|

|

|

$ |

29,937,585 |

|

|

|

|

$ |

29,251,978 |

|

|

|

|

$ |

29,057,042 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average Liabilities and Equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Brokered deposits |

|

$ |

8,278,192 |

|

|

3.93 |

% |

|

$ |

9,628,044 |

|

|

4.10 |

% |

|

$ |

8,546,629 |

|

|

4.01 |

% |

|

$ |

10,009,221 |

|

|

3.89 |

% |

| Retail and other deposits |

|

12,182,687 |

|

|

4.00 |

|

|

11,627,142 |

|

|

4.48 |

|

|

11,830,694 |

|

|

4.13 |

|

|

11,142,798 |

|

|

4.65 |

|

Other interest-bearing liabilities(1) |

|

6,319,320 |

|

|

4.71 |

|

|

6,331,195 |

|

|

4.34 |

|

|

6,362,734 |

|

|

4.63 |

|

|

5,616,445 |

|

|

4.09 |

|

| Total interest-bearing liabilities |

|

26,780,199 |

|

|

4.14 |

% |

|

27,586,381 |

|

|

4.31 |

% |

|

26,740,057 |

|

|

4.21 |

% |

|

26,768,464 |

|

|

4.25 |

% |

| Non-interest-bearing liabilities |

|

306,427 |

|

|

|

|

206,242 |

|

|

|

|

141,396 |

|

|

|

|

149,594 |

|

|

|

| Equity |

|

2,406,646 |

|

|

|

|

2,144,962 |

|

|

|

|

2,370,525 |

|

|

|

|

2,138,984 |

|

|

|

| Total liabilities and equity |

|

$ |

29,493,272 |

|

|

|

|

$ |

29,937,585 |

|

|

|

|

$ |

29,251,978 |

|

|

|

|

$ |

29,057,042 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest margin |

|

|

|

5.21 |

% |

|

|

|

4.92 |

% |

|

|

|

5.24 |

% |

|

|

|

5.19 |

% |

(1) Includes the average balance of our unsecured borrowings, as well as secured borrowings and amortization expense of transaction costs related to our term asset-backed securitizations and our Secured Borrowing Facility.

Earnings per Common Share

Basic earnings per common share (“EPS”) are calculated using the weighted average number of shares of common stock outstanding during each period. A reconciliation of the numerators and denominators of the basic and diluted EPS calculations follows.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarters Ended |

|

Years Ended |

| |

|

December 31, |

|

December 31, |

| (In thousands, except per share data) |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| Numerator: |

|

|

|

|

|

|

|

|

| Net income |

|

$ |

233,185 |

|

|

$ |

111,553 |

|

|

$ |

744,847 |

|

|

$ |

608,325 |

|

| Preferred stock dividends |

|

3,803 |

|

|

4,367 |

|

|

15,725 |

|

|

18,296 |

|

| Net income attributable to SLM Corporation common stock |

|

$ |

229,382 |

|

|

$ |

107,186 |

|

|

$ |

729,122 |

|

|

$ |

590,029 |

|

| Denominator: |

|

|

|

|

|

|

|

|

| Weighted average shares used to compute basic EPS |

|

201,612 |

|

|

210,741 |

|

|

207,155 |

|

|

216,220 |

|

| Effect of dilutive securities: |

|

|

|

|

|

|

|

|

Dilutive effect of stock options, restricted stock, restricted stock units, performance stock units and Employee Stock Purchase Plan (“ESPP”) (1)(2) |

|

3,345 |

|

|

4,372 |

|

|

3,759 |

|

|

3,714 |

|

|

|

|

|

|

|

|

|

|

| Weighted average shares used to compute diluted EPS |

|

204,957 |

|

|

215,113 |

|

|

210,914 |

|

|

219,934 |

|

|

|

|

|

|

|

|

|

|

| Basic earnings per common share |

|

$ |

1.14 |

|

|

$ |

0.51 |

|

|

$ |

3.52 |

|

|

$ |

2.73 |

|

|

|

|

|

|

|

|

|

|

| Diluted earnings per common share |

|

$ |

1.12 |

|

|

$ |

0.50 |

|

|

$ |

3.46 |

|

|

$ |

2.68 |

|

(1) Includes the potential dilutive effect of additional common shares that are issuable upon exercise of outstanding stock options, restricted stock, restricted stock units, performance stock units and the outstanding commitment to issue shares under the ESPP, determined by the treasury stock method.

(2) For both the quarter and year ended December 31, 2025, securities covering less than 1 million shares were outstanding but not included in the computation of diluted earnings per share because they were anti-dilutive. For the quarter and year ended December 31, 2024, securities covering no shares and less than 1 million shares, respectively, were outstanding but not included in the computation of diluted earnings per share because they were anti-dilutive.

2026 Share Repurchase Program

The Company has been authorized to repurchase up to $500 million in common stock under a new share repurchase program (the “2026 Share Repurchase Program”), which became effective on January 22, 2026 and is expected to be completed over the next approximately 24 months ending February 4, 2028. The Company’s “2024 Share Repurchase Program,” authorized on January 23, 2024, with a repurchase capacity of $650 million, remains open. Repurchases may be made under the 2024 Share Repurchase Program until it expires on February 6, 2026, or is expended (whichever comes first). Under the 2026 Share Repurchase Program, the Company may repurchase shares of common stock from time to time in various transaction formats including, but not limited to, tender offers, open market purchases, accelerated share repurchases, negotiated or block purchases, and/ or pursuant to trading plans in accordance with Rules 10b5-1 and 10b-18 of the Exchange Act. The actual timing, number, and value of shares repurchased under the program will be determined by management at its discretion and are dependent on a number of factors. The Company reserves the right to suspend or discontinue share repurchases at any time and for any reason.

Allowance for Credit Losses Metrics

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended December 31, 2025

(dollars in thousands) |

|

|

|

Private Education

Loans |

| Allowance for loan losses, beginning balance |

|

|

|

$ |

1,526,104 |

|

| Transfer from allowance for unfunded loan commitments |

|

|

|

37,810 |

|

| Provisions: |

|

|

|

|

| Provision for current period |

|

|

|

69,701 |

|

| Loan sale reduction to provision |

|

|

|

(61,271) |

|

| Loans transferred to held-for-sale |

|

|

|

(44,274) |

|

Total provisions(1) |

|

|

|

(35,844) |

|

| Net charge-offs: |

|

|

|

|

| Charge-offs |

|

|

|

(114,795) |

|

| Recoveries |

|

|

|

17,043 |

|

| Net charge-offs |

|

|

|

(97,752) |

|

|

|

|

|

|

| Allowance for loan losses, ending balance |

|

|

|

1,430,318 |

|

Allowance for unfunded loan commitments, beginning balance(2) |

|

|

|

97,877 |

|

Provision(1)(3) |

|

|

|

17,065 |

|

| Transfer to allowance for loan losses |

|

|

|

(37,810) |

|

Allowance for unfunded loan commitments, ending balance(2) |

|

|

|

77,132 |

|

| Total allowance for credit losses, ending balance |

|

|

|

$ |

1,507,450 |

|

|

|

|

|

|

Net charge-offs as a percentage of average loans in repayment (annualized)(4) |

|

|

|

2.42 |

% |

| Allowance for loan losses coverage of net charge-offs (annualized) |

|

|

|

3.66 |

|

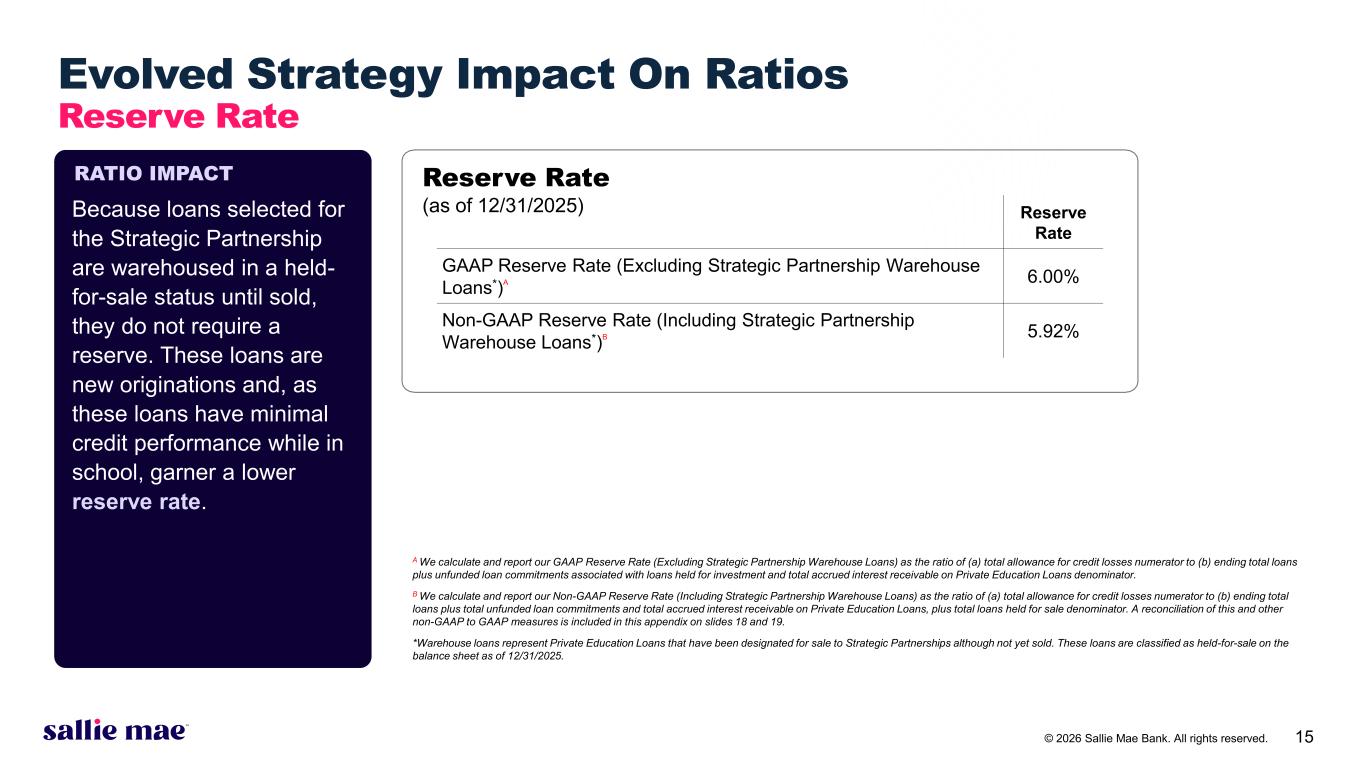

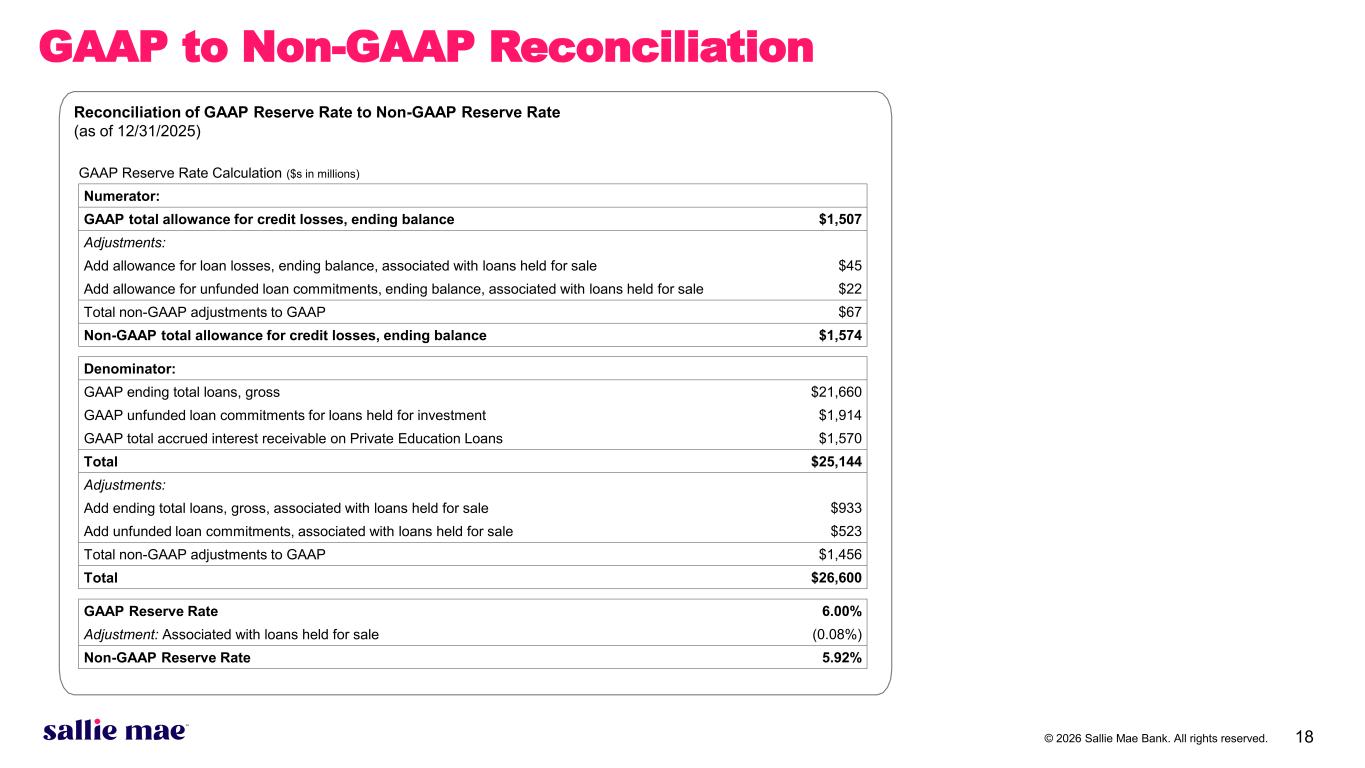

Total Allowance Percentage of Private Education Loan Exposure(5) (6) |

|

|

|

6.00 |

% |

|

|

|

|

|

| Ending total loans, gross |

|

|

|

$ |

21,660,434 |

|

Average loans in repayment(4) |

|

|

|

$ |

16,157,225 |

|

Ending loans in repayment(4) |

|

|

|

$ |

15,894,827 |

|

Unfunded loan commitments for loans held for investment(6) |

|

|

|

$ |

1,913,753 |

|

| Total accrued interest receivable |

|

|

|

$ |

1,570,069 |

|

|

|

|

|

|

|

|

|

|

|

(1) See “Provisions for Credit Loan Losses” on page 14 for a reconciliation of the provisions for credit losses reported in the consolidated statements of income.

(2) When a new loan commitment is made, we record an allowance to cover lifetime expected credit losses on the unfunded commitments, which is recorded in “Other Liabilities” on the consolidated balance sheet. See “Unfunded Loan Commitments” on page 14 for further discussion.

(3) Includes incremental provision for new commitments and changes to provision for existing commitments.

(4) Loans in repayment include loans on which borrowers are making interest only or fixed payments, as well as loans that have entered full principal and interest repayment status after any applicable grace period (but, for purposes of the table, do not include loans in the “loans in forbearance” metric).

(5) The Total Allowance Percentage of Private Education Loan Exposure is the total allowance for credit losses as a percentage of ending total loans plus unfunded loan commitments and total accrued interest receivable on Private Education Loans.

(6) Unfunded loan commitments for loans held for investment and the calculation of the Total Allowance Percentage of Private Education Loan Exposure do not include approximately $523 million of unfunded loan commitments associated with loans classified as held for sale at December 31, 2025. Due to the near-term timing of the loan sale and credit quality of the loans, we believe there is no risk of credit loss and are not recording an allowance for the unfunded loan commitments related to the loans classified as held for sale.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended December 31, 2024

(dollars in thousands) |

|

|

|

Private Education

Loans |

|

|

|

|

| Allowance for loan losses, beginning balance |

|

|

|

$ |

1,413,621 |

|

|

|

|

|

| Transfer from allowance for unfunded loan commitments |

|

|

|

35,037 |

|

|

|

|

|

| Provisions: |

|

|

|

|

|

|

|

|

| Provision for current period |

|

|

|

80,533 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total provisions(1) |

|

|

|

80,533 |

|

|

|

|

|

| Net charge-offs: |

|

|

|

|

|

|

|

|

| Charge-offs |

|

|

|

(104,187) |

|

|

|

|

|

| Recoveries |

|

|

|

10,916 |

|

|

|

|

|

| Net charge-offs |

|

|

|

(93,271) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Allowance for loan losses, ending balance |

|

|

|

1,435,920 |

|

|

|

|

|

Allowance for unfunded loan commitments, beginning balance(2) |

|

|

|

91,959 |

|

|

|

|

|

Provision(1)(3) |

|

|

|

27,646 |

|

|

|

|

|

| Transfer to allowance for loan losses |

|

|

|

(35,037) |

|

|

|

|

|

Allowance for unfunded loan commitments, ending balance(2) |

|

|

|

84,568 |

|

|

|

|

|

| Total allowance for credit losses, ending balance |

|

|

|

$ |

1,520,488 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net charge-offs as a percentage of average loans in repayment (annualized)(4) |

|

|

|

2.38 |

% |

|

|

|

|

| Allowance for loan losses coverage of net charge-offs (annualized) |

|

|

|

3.85 |

|

|

|

|

|

Total Allowance Percentage of Private Education Loan Exposure(5) |

|

|

|

5.83 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ending total loans, gross |

|

|

|

$ |

22,235,008 |

|

|

|

|

|

Average loans in repayment(4) |

|

|

|

$ |

15,681,361 |

|

|

|

|

|

Ending loans in repayment(4) |

|

|

|

$ |

16,106,751 |

|

|

|

|

|

| Unfunded loan commitments for loans held for investment |

|

|

|

$ |

2,311,660 |

|

|

|

|

|

| Total accrued interest receivable |

|

|

|

$ |

1,549,415 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) See “Provisions for Credit Loan Losses” on page 14 for a reconciliation of the provisions for credit losses reported in the consolidated statements of income.

(2) When a new loan commitment is made, we record an allowance to cover lifetime expected credit losses on the unfunded commitments, which is recorded in “Other Liabilities” on the consolidated balance sheet. See “Unfunded Loan Commitments” on page 14 for further discussion.

(3) Includes incremental provision for new commitments and changes to provision for existing commitments.

(4) Loans in repayment include loans on which borrowers are making interest only or fixed payments, as well as loans that have entered full principal and interest repayment status after any applicable grace period (but, for purposes of the table, do not include loans in the “loans in forbearance” metric).

(5) The Total Allowance Percentage of Private Education Loan Exposure is the total allowance for credit losses as a percentage of ending total loans plus unfunded loan commitments and total accrued interest receivable on Private Education Loans.

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31, 2025

(dollars in thousands) |

|

Private Education

Loans |

|

|

|

|

| Allowance for loan losses, beginning balance |

|

$ |

1,435,920 |

|

|

|

|

|

| Transfer from allowance for unfunded loan commitments |

|

280,244 |

|

|

|

|

|

| Provisions: |

|

|

|

|

|

|

| Provision for current period |

|

400,677 |

|

|

|

|

|

| Loan sale reduction to provision |

|

(296,524) |

|

|

|

|

|

| Loans transferred to held-for-sale |

|

(44,274) |

|

|

|

|

|

Total provisions(1) |

|

59,879 |

|

|

|

|

|

| Net charge-offs: |

|

|

|

|

|

|

| Charge-offs |

|

(399,636) |

|

|

|

|

|

| Recoveries |

|

53,911 |

|

|

|

|

|

| Net charge-offs |

|

(345,725) |

|

|

|

|

|

|

|

|

|

|

|

|

| Allowance for loan losses, ending balance |

|

1,430,318 |

|

|

|

|

|

Allowance for unfunded loan commitments, beginning balance(2) |

|

84,568 |

|

|

|

|

|

Provision(1)(3) |

|

272,808 |

|

|

|

|

|

| Transfer to allowance for loan losses |

|

(280,244) |

|

|

|

|

|

Allowance for unfunded loan commitments, ending balance(2) |

|

77,132 |

|

|

|

|

|

| Total allowance for credit losses, ending balance |

|

$ |

1,507,450 |

|

|

|

|

|

|

|

|

|

|

|

|

Net charge-offs as a percentage of average loans in repayment(4) |

|

2.15 |

% |

|

|

|

|

| Allowance for loan losses coverage of net charge-offs |

|

4.14 |

|

|

|

|

|

Total Allowance Percentage of Private Education Loan Exposure(5)(6) |

|

6.00 |

% |

|

|

|

|

|

|

|

|

|

|

|

| Ending total loans, gross |

|

$ |

21,660,434 |

|

|

|

|

|

Average loans in repayment(4) |

|

$ |

16,047,085 |

|

|

|

|

|

Ending loans in repayment(4) |

|

$ |

15,894,827 |

|

|

|

|

|

Unfunded loan commitments for loans held for investment(6) |

|

$ |

1,913,753 |

|

|

|

|

|

| Total accrued interest receivable |

|

$ |

1,570,069 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) See “Provisions for Credit Loan Losses” on page 14 for a reconciliation of the provisions for credit losses reported in the consolidated statements of income.

(2) When a new loan commitment is made, we record an allowance to cover lifetime expected credit losses on the unfunded commitments, which is recorded in “Other Liabilities” on the consolidated balance sheet. See “Unfunded Loan Commitments” on page 14 for further discussion.

(3) Includes incremental provision for new commitments and changes to provision for existing commitments.

(4) Loans in repayment include loans on which borrowers are making interest only or fixed payments, as well as loans that have entered full principal and interest repayment status after any applicable grace period (but, for purposes of the table, do not include loans in the “loans in forbearance” metric).

(5) The Total Allowance Percentage of Private Education Loan Exposure is the total allowance for credit losses as a percentage of ending total loans plus unfunded loan commitments and total accrued interest receivable on Private Education Loans.

(6) Unfunded loan commitments for loans held for investment and the calculation of the Total Allowance Percentage of Private Education Loan Exposure do not include approximately $523 million of unfunded loan commitments associated with loans classified as held for sale at December 31, 2025. Due to the near-term timing of the loan sale and credit quality of the loans, we believe there is no risk of credit loss and are not recording an allowance for the unfunded loan commitments related to the loans classified as held for sale.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31, 2024

(dollars in thousands) |

|

FFELP

Loans |

|

Private Education

Loans |

|

|

|

Total |

| Allowance for loan losses, beginning balance |

|

$ |

4,667 |

|

|

$ |

1,335,105 |

|

|

|

|

$ |

1,339,772 |

|

| Transfer from allowance for unfunded loan commitments |

|

— |

|

|

311,787 |

|

|

|

|

311,787 |

|

| Provisions: |

|

|

|

|

|

|

|

|

| Provision for current period |

|

4,010 |

|

|

357,067 |

|

|

|

|

361,077 |

|

| Loan sale reduction to provision |

|

— |

|

|

(235,955) |

|

|

|

|

(235,955) |

|

|

|

|

|

|

|

|

|

|

Total provisions(1) |

|

4,010 |

|

|

121,112 |

|

|

|

|

125,122 |

|

| Net charge-offs: |

|

|

|

|

|

|

|

|

| Charge-offs |

|

(380) |

|

|

(376,840) |

|

|

|

|

(377,220) |

|

| Recoveries |

|

— |

|

|

44,756 |

|

|

|

|

44,756 |

|

| Net charge-offs |

|

(380) |

|

|

(332,084) |

|

|

|

|

(332,464) |

|

Write-downs arising from transfer of loans to held for sale(2) |

|

(8,297) |

|

|

— |

|

|

|

|

(8,297) |

|

| Allowance for loan losses, ending balance |

|

— |

|

|

1,435,920 |

|

|

|

|

1,435,920 |

|

Allowance for unfunded loan commitments, beginning balance(3) |

|

— |

|

|

112,962 |

|

|

|

|

112,962 |

|

Provision(1)(4) |

|

— |

|

|

283,393 |

|

|

|

|

283,393 |

|

| Transfer to allowance for loan losses |

|

— |

|

|

(311,787) |

|

|

|

|

(311,787) |

|

Allowance for unfunded loan commitments, ending balance(3) |

|

— |

|

|

84,568 |

|

|

|

|

84,568 |

|

| Total allowance for credit losses, ending balance |

|

$ |

— |

|

|

$ |

1,520,488 |

|

|

|

|

$ |

1,520,488 |

|

|

|

|

|

|

|

|

|

|

Net charge-offs as a percentage of average loans in repayment(5) |

|

— |

% |

|

2.19 |

% |

|

|

|

|

| Allowance for loan losses coverage of net charge-offs |

|

— |

|

|

4.32 |

|

|

|

|

|

Total Allowance Percentage of Private Education Loan Exposure(6) |

|

— |

% |

|

5.83 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ending total loans, gross |

|

$ |

— |

|

|

$ |

22,235,008 |

|

|

|

|

|

Average loans in repayment(5) |

|

$ |

— |

|

|

$ |

15,139,184 |

|

|

|

|

|

Ending loans in repayment(5) |

|

$ |

— |

|

|

$ |

16,106,751 |

|

|

|

|

|

| Unfunded loan commitments for loans held for investment |

|

$ |

— |

|

|

$ |

2,311,660 |

|

|

|

|

|

| Total accrued interest receivable |

|

$ |

— |

|

|

$ |

1,549,415 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) See “Provisions for Credit Loan Losses” on page 14 for a reconciliation of the provisions for credit losses reported in the consolidated statements of income.

(2) Represents fair value adjustments on loans transferred to held for sale.

(3) When a new loan commitment is made, we record an allowance to cover lifetime expected credit losses on the unfunded commitments, which is recorded in “Other Liabilities” on the consolidated balance sheet. See “Unfunded Loan Commitments” on page 14 for further discussion.

(4) Includes incremental provision for new commitments and changes to provision for existing commitments.

(5) Loans in repayment include loans on which borrowers are making interest only or fixed payments, as well as loans that have entered full principal and interest repayment status after any applicable grace period (but, for purposes of the table, do not include loans in the “loans in forbearance” metric).

(6) The Total Allowance Percentage of Private Education Loan Exposure is the total allowance for credit losses as a percentage of ending total loans plus unfunded loan commitments and total accrued interest receivable on Private Education Loans.

Provisions for Credit Losses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated Statements of Income

Provisions for Credit Losses Reconciliation |

|

|

|

|

|

|

Quarters Ended

December 31, |

|

Years Ended

December 31, |

| (Dollars in thousands) |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| Private Education Loan provisions for credit losses: |

|

|

|

|

|

|

|

|

| Provisions for loan losses |

|

$ |

(35,844) |

|

|

$ |

80,533 |

|

|

$ |

59,879 |

|

|

$ |

121,112 |

|

| Provisions for unfunded loan commitments |

|

17,065 |

|

|

27,646 |

|

|

272,808 |

|

|

283,393 |

|

| Total Private Education Loan provisions for credit losses |

|

(18,779) |

|

|

108,179 |

|

|

332,687 |

|

|

404,505 |

|

|

|

|

|

|

|

|

|

|

| Total FFELP Loans provisions for credit losses |

|

— |

|

|

— |

|

|

— |

|

|

4,010 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Provisions for credit losses reported in consolidated statements of income |

|

$ |

(18,779) |

|

|

$ |

108,179 |

|

|

$ |

332,687 |

|

|

$ |

408,515 |

|

Unfunded Loan Commitments

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Quarters Ended December 31, (dollars in thousands) |

2025 |

|

2024 |

| Allowance |

|

Unfunded Commitments |

|

Allowance |

|

Unfunded Commitments |

|

|

|

|

|

|

|

|

| Beginning Balance |

$ |

97,877 |

|

|

$ |

2,673,369 |

|

|

$ |

91,959 |

|

|

$ |

2,476,785 |

|

Provision/New commitments - net(1) |

17,065 |

|

|

786,516 |

|

|

27,646 |

|

|

816,683 |

|

Transfer - funded loans(2) |

(37,810) |

|

|

(1,022,850) |

|

|

(35,037) |

|

|

(981,808) |

|

Ending Balance(3) |

$ |

77,132 |

|

|

$ |

2,437,035 |

|

|

$ |

84,568 |

|

|

$ |

2,311,660 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Years Ended December 31, (dollars in thousands) |

2025 |

|

2024 |

| Allowance |

|

Unfunded Commitments |

|

Allowance |

|

Unfunded Commitments |

|

|

|

|

|

|

|

|

| Beginning Balance |

$ |

84,568 |

|

|

$ |

2,311,660 |

|

|

$ |

112,962 |

|

|

$ |

2,221,077 |

|

Provision/New commitments - net(1) |

272,808 |

|

|

7,541,698 |

|

|

283,393 |

|

|

7,103,832 |

|

Transfer - funded loans(2) |

(280,244) |

|

|

(7,416,323) |

|

|

(311,787) |

|

|

(7,013,249) |

|

Ending Balance(3) |

$ |

77,132 |

|

|

$ |

2,437,035 |

|

|

$ |

84,568 |

|

|

$ |

2,311,660 |

|

(1) Net of expirations of commitments unused. Also includes incremental provision for new commitments and changes to provision for existing commitments.

(2) When a loan commitment is funded, its related liability for credit losses (which originally was recorded as a provision for unfunded commitments) is transferred to the allowance for credit losses.

(3) The ending balance of unfunded loan commitments includes approximately $523 million of unfunded loan commitments associated with the loans classified as held for sale at December 31, 2025. Due to the near-term timing of the loan sale and credit quality of the loans, we believe there is no risk of credit loss and are not recording an allowance for the unfunded loan commitments related to the loans classified as held for sale.

Private Education Loans Held for Investment - Key Credit Quality Indicators

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Private Education Loans Held for Investment

As of December 31,

(dollars in thousands) |

|

Credit Quality Indicators |

|

2025 |

|

2024 |

|

Balance(1) |

|

% of Balance |

|

Balance(1) |

|

% of Balance |

|

|

|

|

|

|

|

|

|

| Cosigners: |

|

|

|

|

|

|

|

|

| With cosigner |

|

$ |

19,215,391 |

|

|

89 |

% |

|

$ |

19,522,539 |

|

|

88 |

% |

| Without cosigner |

|

2,445,043 |

|

|

11 |

|

|

2,712,469 |

|

|

12 |

|

| Total |

|

$ |

21,660,434 |

|

|

100 |

% |

|

$ |

22,235,008 |

|

|

100 |

% |

|

|

|

|

|

|

|

|

|

FICO at Original Approval(2): |

|

|

|

|

|

|

|

|

| Less than 670 |

|

$ |

1,589,780 |

|

|

7 |

% |

|

$ |

1,674,778 |

|

|

8 |

% |

| 670-699 |

|

3,007,221 |

|

|

14 |

|

|

3,199,300 |

|

|

14 |

|

| 700-749 |

|

6,762,880 |

|

|

31 |

|

|

7,060,211 |

|

|

32 |

|

| Greater than or equal to 750 |

|

10,300,553 |

|

|

48 |

|

|

10,300,719 |

|

|

46 |

|

| Total |

|

$ |

21,660,434 |

|

|

100 |

% |

|

$ |

22,235,008 |

|

|

100 |

% |

|

|

|

|

|

|

|

|

|

FICO-Refreshed(2)(3): |

|

|

|

|

|

|

|

|

| Less than 670 |

|

$ |

3,127,160 |

|

|

14 |

% |

|

$ |

2,913,860 |

|

|

13 |

% |

| 670-699 |

|

2,580,061 |

|

|

12 |

|

|

2,719,797 |

|

|

12 |

|

| 700-749 |

|

5,750,872 |

|

|

27 |

|

|

6,203,257 |

|

|

28 |

|

| Greater than or equal to 750 |

|

10,202,341 |

|

|

47 |

|

|

10,398,094 |

|

|

47 |

|

| Total |

|

$ |

21,660,434 |

|

|

100 |

% |

|

$ |

22,235,008 |

|

|

100 |

% |

|

|

|

|

|

|

|

|

|

Seasoning(4): |

|

|

|

|

|

|

|

|

| 1-12 payments |

|

$ |

4,573,677 |

|

|

21 |

% |

|

$ |

4,898,818 |

|

|

22 |

% |

| 13-24 payments |

|

3,816,855 |

|

|

18 |

|

|

3,757,313 |

|

|

17 |

|

| 25-36 payments |

|

2,067,158 |

|

|

10 |

|

|

2,358,304 |

|

|

11 |

|

| 37-48 payments |

|

1,692,504 |

|

|

8 |

|

|

1,609,522 |

|

|

7 |

|

| More than 48 payments |

|

4,177,708 |

|

|

19 |

|

|

3,888,224 |

|

|

17 |

|

| Not yet in repayment |

|

5,332,532 |

|

|

24 |

|

|

5,722,827 |

|

|

26 |

|

| Total |

|

$ |

21,660,434 |

|

|

100 |

% |

|

$ |

22,235,008 |

|

|

100 |

% |

(1)Balance represents gross Private Education Loans held for investment.

(2)Represents the higher credit score of the cosigner or the borrower.

(3)Represents the FICO score updated as of the respective fourth-quarter.

(4)Number of months in active repayment (whether interest only payment, fixed payment, or full principal and interest payment status) for which a scheduled payment was due.

Delinquencies - Private Education Loans Held for Investment

The following table provides information regarding the loan status of our Private Education Loans held for investment. Loans in repayment include loans making interest only or fixed payments, as well as loans that have entered full principal and interest repayment status after any applicable grace period (but for purposes of the following table, do not include loans in the “loans in forbearance” metric).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Private Education Loans Held for Investment

As of December 31,

(dollars in thousands) |

|

2025 |

|

2024 |

|

|

Balance |

|

% |

|

Balance |

|

% |

|

Loans in-school/grace/deferment(1) |

|

$ |

5,332,532 |

|

|

|

|

$ |

5,722,827 |

|

|

|

|

Loans in forbearance(2) |

|

433,075 |

|

|

|

|

405,430 |

|

|

|

|

| Loans in repayment and percentage of each status: |

|

|

|

|

|

|

|

|

|

Loans current |

|

15,258,723 |

|

|

96.0 |

% |

|

15,513,333 |

|

|

96.3 |

% |

|

Loans delinquent 30-59 days(3) |

|

330,307 |

|

|

2.0 |

|

|

310,748 |

|

|

1.9 |

|

|

Loans delinquent 60-89 days(3) |

|

154,683 |

|

|

1.0 |

|

|

140,735 |

|

|

0.9 |

|

|

Loans 90 days or greater past due(3) |

|

151,114 |

|

|

1.0 |

|

|

141,935 |

|

|

0.9 |

|

|

| Total Private Education Loans in repayment |

|

15,894,827 |

|

|

100.0 |

% |

|

16,106,751 |

|

|

100.0 |

% |

|

| Total Private Education Loans, gross |

|

21,660,434 |

|

|

|

|

22,235,008 |

|

|

|

|

| Private Education Loans deferred origination costs and unamortized premium/(discount) |

|

102,008 |

|

|

|

|

103,070 |

|

|

|

|

| Total Private Education Loans |

|

21,762,442 |

|

|

|

|

22,338,078 |

|

|

|

|