| Date of Report (Date of earliest event reported) | April 24, 2024 | |||||||||||||

| PACIFIC PREMIER BANCORP, INC. | ||||||||||||||

| (Exact name of registrant as specified in its charter) | ||||||||||||||

| Delaware | 0-22193 | 33-0743196 | ||||||||||||

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(I.R.S. Employer

Identification No.)

|

||||||||||||

| Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered | ||||||||||||

| Common Stock, par value $0.01 per share | PPBI | NASDAQ Global Select Market | ||||||||||||

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | ||||

PACIFIC PREMIER BANCORP, INC. |

|||||||||||

| Dated: | April 24, 2024 | By: | /s/ STEVEN R. GARDNER |

||||||||

| Steven R. Gardner | |||||||||||

| Chairman, Chief Executive Officer, and President | |||||||||||

| Three Months Ended | ||||||||||||||||||||

| March 31, | December 31, | March 31, | ||||||||||||||||||

| (Dollars in thousands, except per share data) | 2024 | 2023 | 2023 | |||||||||||||||||

| Financial highlights (unaudited) | ||||||||||||||||||||

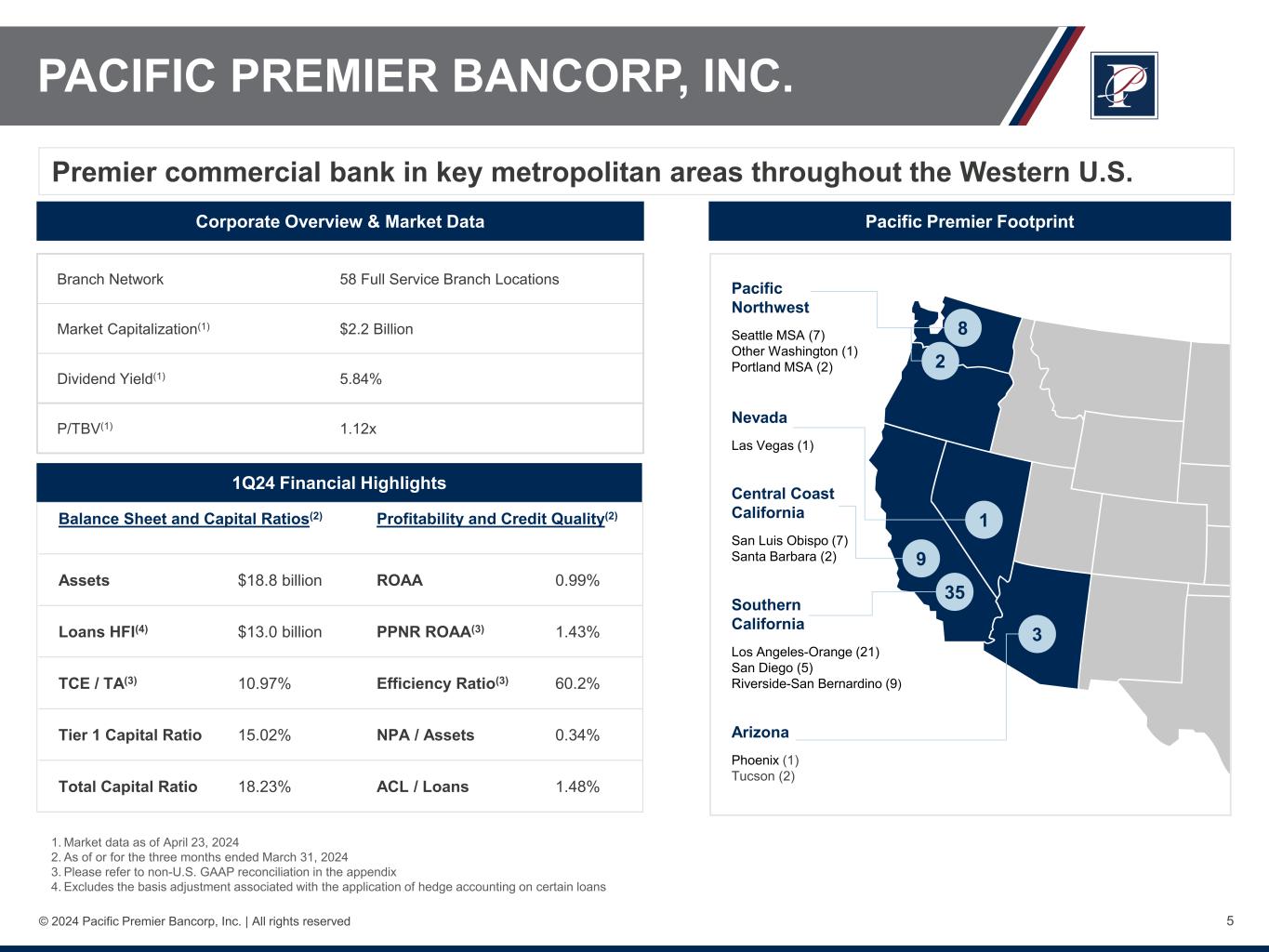

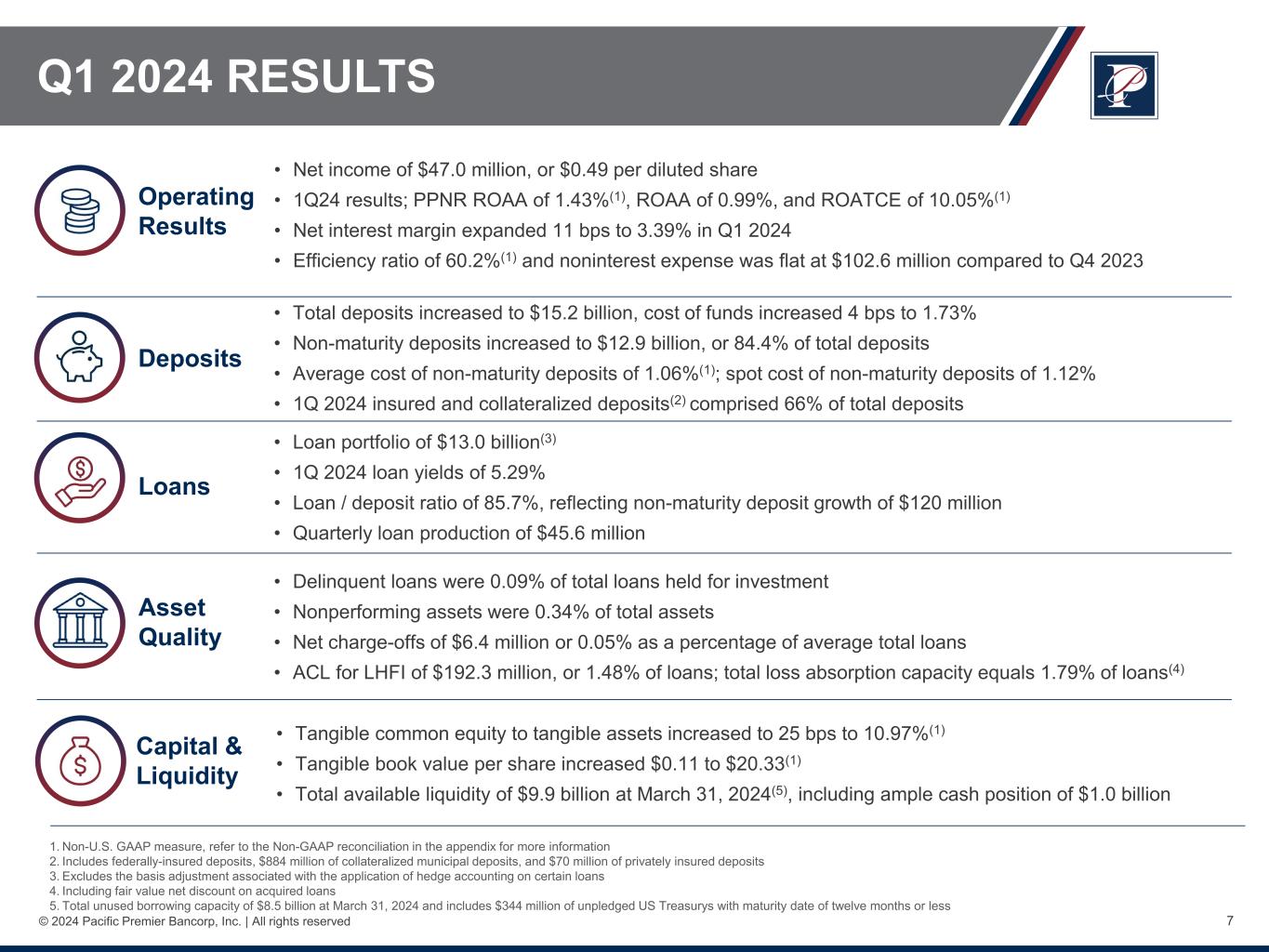

| Net income (loss) | $ | 47,025 | $ | (135,376) | $ | 62,562 | ||||||||||||||

| Net interest income | 145,127 | 146,789 | 168,610 | |||||||||||||||||

| Diluted earnings (loss) per share | 0.49 | (1.44) | 0.66 | |||||||||||||||||

| Common equity dividend per share paid | 0.33 | 0.33 | 0.33 | |||||||||||||||||

ROAA |

0.99 | % | (2.76) | % | 1.15 | % | ||||||||||||||

ROAE |

6.50 | (19.01) | 8.87 | |||||||||||||||||

ROATCE (1) |

10.05 | (28.01) | 13.89 | |||||||||||||||||

Pre-provision net revenue (loss) to average assets (1) |

1.43 | (3.88) | 1.63 | |||||||||||||||||

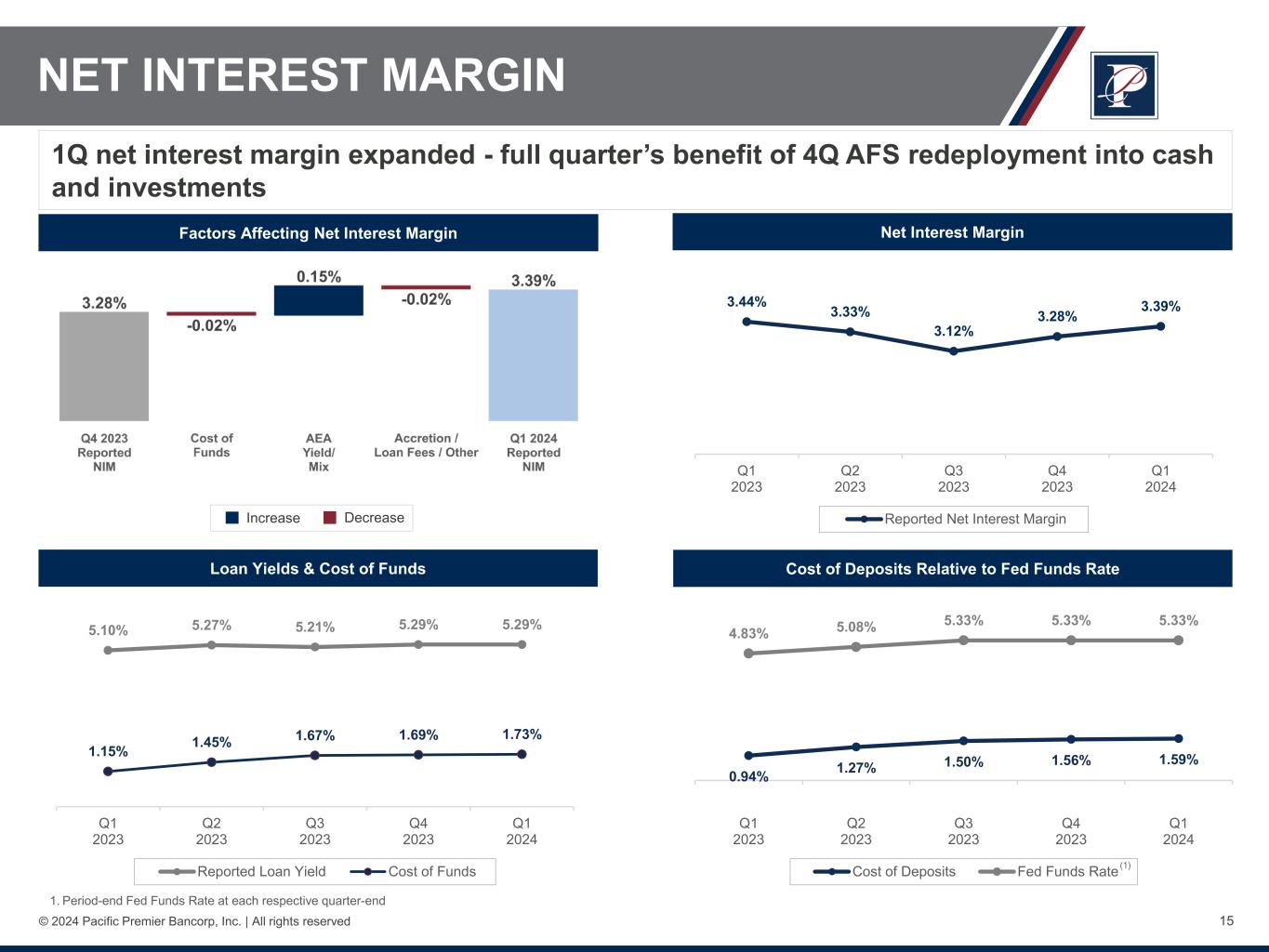

| Net interest margin | 3.39 | 3.28 | 3.44 | |||||||||||||||||

| Cost of deposits | 1.59 | 1.56 | 0.94 | |||||||||||||||||

Cost of non-maturity deposits (1) |

1.06 | 1.02 | 0.54 | |||||||||||||||||

Efficiency ratio (1) |

60.2 | 60.1 | 51.7 | |||||||||||||||||

| Noninterest expense as a percent of average assets | 2.16 | 2.09 | 1.87 | |||||||||||||||||

| Total assets | $ | 18,813,181 | $ | 19,026,645 | $ | 21,361,564 | ||||||||||||||

| Total deposits | 15,187,828 | 14,995,626 | 17,207,810 | |||||||||||||||||

Non-maturity deposits (1) as a percent of total deposits |

84.4 | % | 84.7 | % | 82.6 | % | ||||||||||||||

| Noninterest-bearing deposits as a percent of total deposits | 32.9 | 32.9 | 36.1 | |||||||||||||||||

| Loan-to-deposit ratio | 85.7 | 88.6 | 82.4 | |||||||||||||||||

| Nonperforming assets as a percent of total assets | 0.34 | 0.13 | 0.14 | |||||||||||||||||

| Delinquency as a percentage of loans held for investment | 0.09 | 0.08 | 0.15 | |||||||||||||||||

Allowance for credit losses to loans held for investment (2) |

1.48 | 1.45 | 1.38 | |||||||||||||||||

| Book value per share | $ | 30.09 | $ | 30.07 | $ | 29.58 | ||||||||||||||

Tangible book value per share (1) |

20.33 | 20.22 | 19.61 | |||||||||||||||||

Tangible common equity ratio (1) |

10.97 | % | 10.72 | % | 9.20 | % | ||||||||||||||

| Common equity tier 1 capital ratio | 15.02 | 14.32 | 13.54 | |||||||||||||||||

| Total capital ratio | 18.23 | 17.29 | 16.33 | |||||||||||||||||

| PACIFIC PREMIER BANCORP, INC. AND SUBSIDIARIES | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CONSOLIDATED AVERAGE BALANCES AND YIELD DATA | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Three Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| March 31, 2024 | December 31, 2023 | March 31, 2023 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | Average Balance | Interest Income/Expense | Average Yield/ Cost |

Average Balance | Interest Income/Expense | Average Yield/ Cost |

Average Balance | Interest Income/Expense | Average Yield/ Cost | |||||||||||||||||||||||||||||||||||||||||||||||

| Assets | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cash and cash equivalents | $ | 1,140,909 | $ | 13,638 | 4.81 | % | $ | 1,281,793 | $ | 15,744 | 4.87 | % | $ | 1,335,611 | $ | 13,594 | 4.13 | % | ||||||||||||||||||||||||||||||||||||||

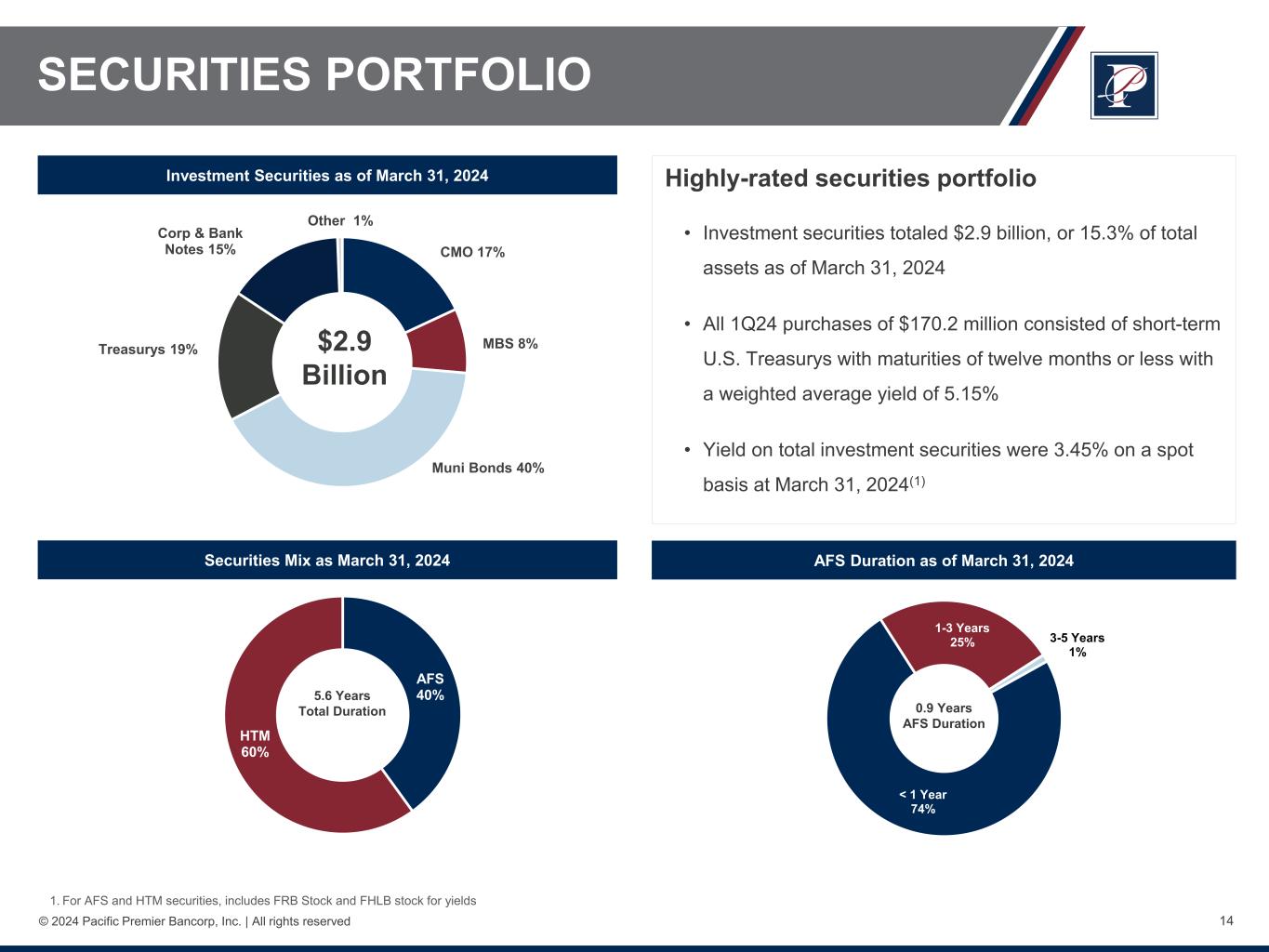

| Investment securities | 2,948,170 | 26,818 | 3.64 | 3,203,608 | 24,675 | 3.08 | 4,165,681 | 26,791 | 2.57 | |||||||||||||||||||||||||||||||||||||||||||||||

Loans receivable, net (1) (2) |

13,149,038 | 172,975 | 5.29 | 13,257,767 | 176,773 | 5.29 | 14,394,775 | 180,958 | 5.10 | |||||||||||||||||||||||||||||||||||||||||||||||

| Total interest-earning assets | $ | 17,238,117 | $ | 213,431 | 4.98 | $ | 17,743,168 | $ | 217,192 | 4.86 | $ | 19,896,067 | $ | 221,343 | 4.51 | |||||||||||||||||||||||||||||||||||||||||

| Liabilities | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing deposits | $ | 10,058,808 | $ | 59,506 | 2.38 | % | $ | 10,395,116 | $ | 60,915 | 2.32 | % | $ | 11,104,624 | $ | 40,234 | 1.47 | % | ||||||||||||||||||||||||||||||||||||||

| Borrowings | 850,811 | 8,798 | 4.15 | 942,689 | 9,488 | 4.01 | 1,319,114 | 12,499 | 3.83 | |||||||||||||||||||||||||||||||||||||||||||||||

| Total interest-bearing liabilities | $ | 10,909,619 | $ | 68,304 | 2.52 | $ | 11,337,805 | $ | 70,403 | 2.46 | $ | 12,423,738 | $ | 52,733 | 1.72 | |||||||||||||||||||||||||||||||||||||||||

| Noninterest-bearing deposits | $ | 4,996,939 | $ | 5,141,585 | $ | 6,219,818 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income | $ | 145,127 | $ | 146,789 | $ | 168,610 | ||||||||||||||||||||||||||||||||||||||||||||||||||

Net interest margin (3) |

3.39 | % | 3.28 | % | 3.44 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

Cost of deposits (4) |

1.59 | 1.56 | 0.94 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Cost of funds (5) |

1.73 | 1.69 | 1.15 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Cost of non-maturity deposits (6) |

1.06 | 1.02 | 0.54 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ratio of interest-earning assets to interest-bearing liabilities | 158.01 | 156.50 | 160.15 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Three Months Ended | ||||||||||||||||||||

| March 31, | December 31, | March 31, | ||||||||||||||||||

| (Dollars in thousands) | 2024 | 2023 | 2023 | |||||||||||||||||

| Provision for credit losses | ||||||||||||||||||||

| Provision for loan losses | $ | 6,288 | $ | 8,275 | $ | 3,021 | ||||||||||||||

| Provision for unfunded commitments | (2,425) | (6,577) | (189) | |||||||||||||||||

| Provision for held-to-maturity securities | (11) | (2) | 184 | |||||||||||||||||

| Total provision for credit losses | $ | 3,852 | $ | 1,696 | $ | 3,016 | ||||||||||||||

| Three Months Ended | ||||||||||||||||||||

| March 31, | December 31, | March 31, | ||||||||||||||||||

| (Dollars in thousands) | 2024 | 2023 | 2023 | |||||||||||||||||

| Noninterest income | ||||||||||||||||||||

| Loan servicing income | $ | 529 | $ | 359 | $ | 573 | ||||||||||||||

| Service charges on deposit accounts | 2,688 | 2,648 | 2,629 | |||||||||||||||||

| Other service fee income | 336 | 322 | 296 | |||||||||||||||||

| Debit card interchange fee income | 765 | 844 | 803 | |||||||||||||||||

| Earnings on bank owned life insurance | 4,159 | 3,678 | 3,374 | |||||||||||||||||

Net (loss) gain from sales of loans |

— | (4) | 29 | |||||||||||||||||

| Net (loss) gain from sales of investment securities | — | (254,065) | 138 | |||||||||||||||||

Trust custodial account fees |

10,642 | 9,388 | 11,025 | |||||||||||||||||

| Escrow and exchange fees | 696 | 1,074 | 1,058 | |||||||||||||||||

| Other income | 5,959 | 1,562 | 1,261 | |||||||||||||||||

| Total noninterest income (loss) | $ | 25,774 | $ | (234,194) | $ | 21,186 | ||||||||||||||

| Three Months Ended | ||||||||||||||||||||

| March 31, | December 31, | March 31, | ||||||||||||||||||

| (Dollars in thousands) | 2024 | 2023 | 2023 | |||||||||||||||||

| Noninterest expense | ||||||||||||||||||||

| Compensation and benefits | $ | 54,130 | $ | 51,907 | $ | 54,293 | ||||||||||||||

| Premises and occupancy | 10,807 | 11,183 | 11,742 | |||||||||||||||||

| Data processing | 7,511 | 7,409 | 7,265 | |||||||||||||||||

| Other real estate owned operations, net | 46 | 103 | 108 | |||||||||||||||||

| FDIC insurance premiums | 2,629 | 4,267 | 2,425 | |||||||||||||||||

| Legal and professional services | 4,143 | 4,663 | 5,501 | |||||||||||||||||

| Marketing expense | 1,558 | 1,728 | 1,838 | |||||||||||||||||

| Office expense | 1,093 | 1,367 | 1,232 | |||||||||||||||||

| Loan expense | 770 | 437 | 646 | |||||||||||||||||

| Deposit expense | 12,665 | 11,152 | 8,436 | |||||||||||||||||

| Amortization of intangible assets | 2,836 | 3,022 | 3,171 | |||||||||||||||||

| Other expense | 4,445 | 5,532 | 4,695 | |||||||||||||||||

| Total noninterest expense | $ | 102,633 | $ | 102,770 | $ | 101,352 | ||||||||||||||

| Three Months Ended | |||||||||||||||||

| March 31, | December 31, | March 31, | |||||||||||||||

| (Dollars in thousands) | 2024 | 2023 | 2023 | ||||||||||||||

| Beginning gross loan balance before basis adjustment | $ | 13,318,571 | $ | 13,319,591 | $ | 14,740,867 | |||||||||||

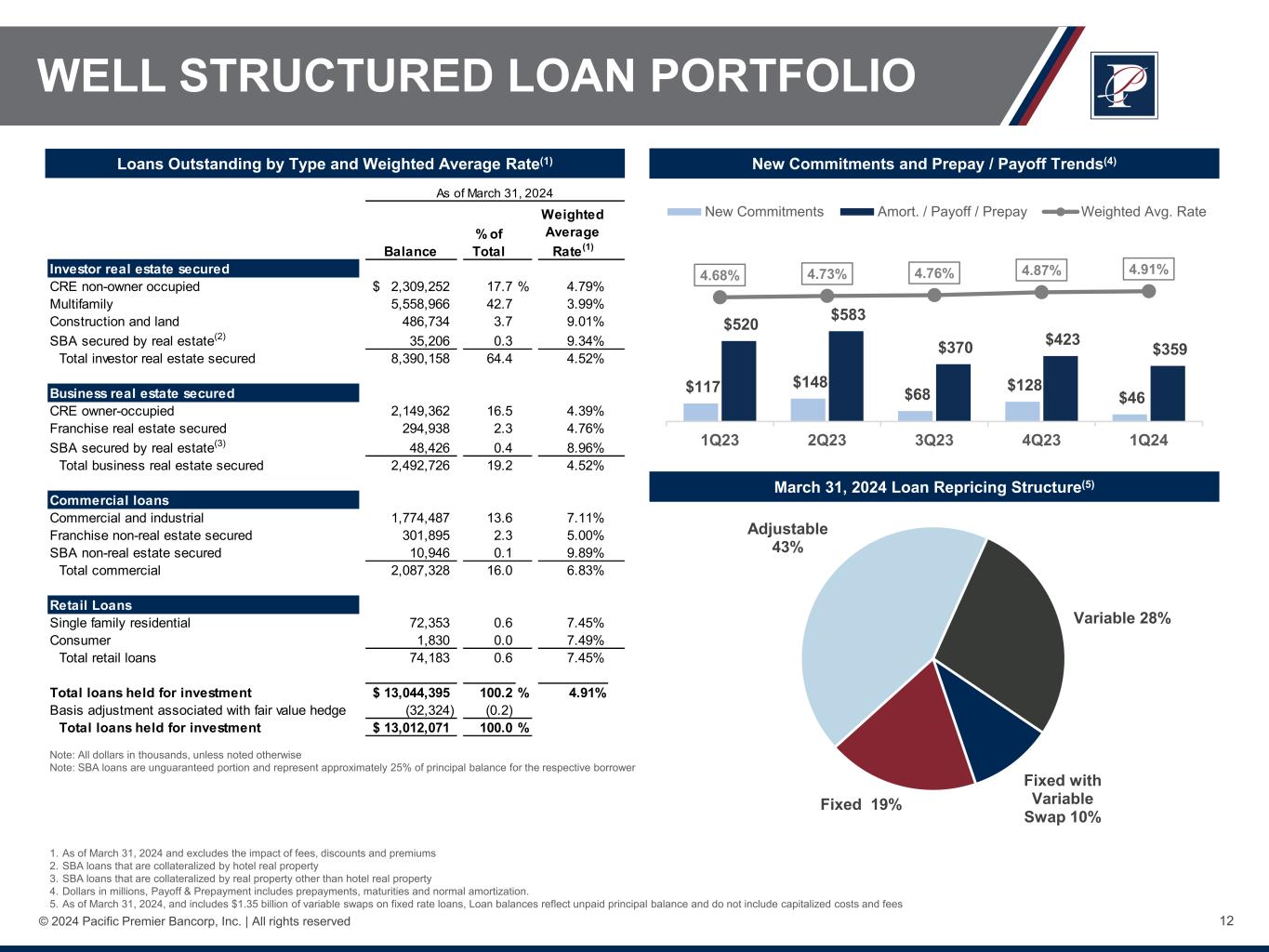

| New commitments | 45,563 | 128,102 | 116,835 | ||||||||||||||

| Unfunded new commitments | (31,531) | (24,429) | (49,891) | ||||||||||||||

| Net new fundings | 14,032 | 103,673 | 66,944 | ||||||||||||||

| Amortization/maturities/payoffs | (358,863) | (422,607) | (519,986) | ||||||||||||||

| Net draws on existing lines of credit | 109,860 | 354,711 | (53,436) | ||||||||||||||

| Loan sales | (32,676) | (32,464) | (803) | ||||||||||||||

| Charge-offs | (6,529) | (4,138) | (3,664) | ||||||||||||||

| Transferred to other real estate owned | — | (195) | (6,886) | ||||||||||||||

Net decrease |

(274,176) | (1,020) | (517,831) | ||||||||||||||

| Ending gross loan balance before basis adjustment | $ | 13,044,395 | $ | 13,318,571 | $ | 14,223,036 | |||||||||||

Basis adjustment associated with fair value hedge (1) |

(32,324) | (29,551) | (50,005) | ||||||||||||||

| Ending gross loan balance | $ | 13,012,071 | $ | 13,289,020 | $ | 14,173,031 | |||||||||||

| March 31, | December 31, | March 31, | ||||||||||||||||||

| (Dollars in thousands) | 2024 | 2023 | 2023 | |||||||||||||||||

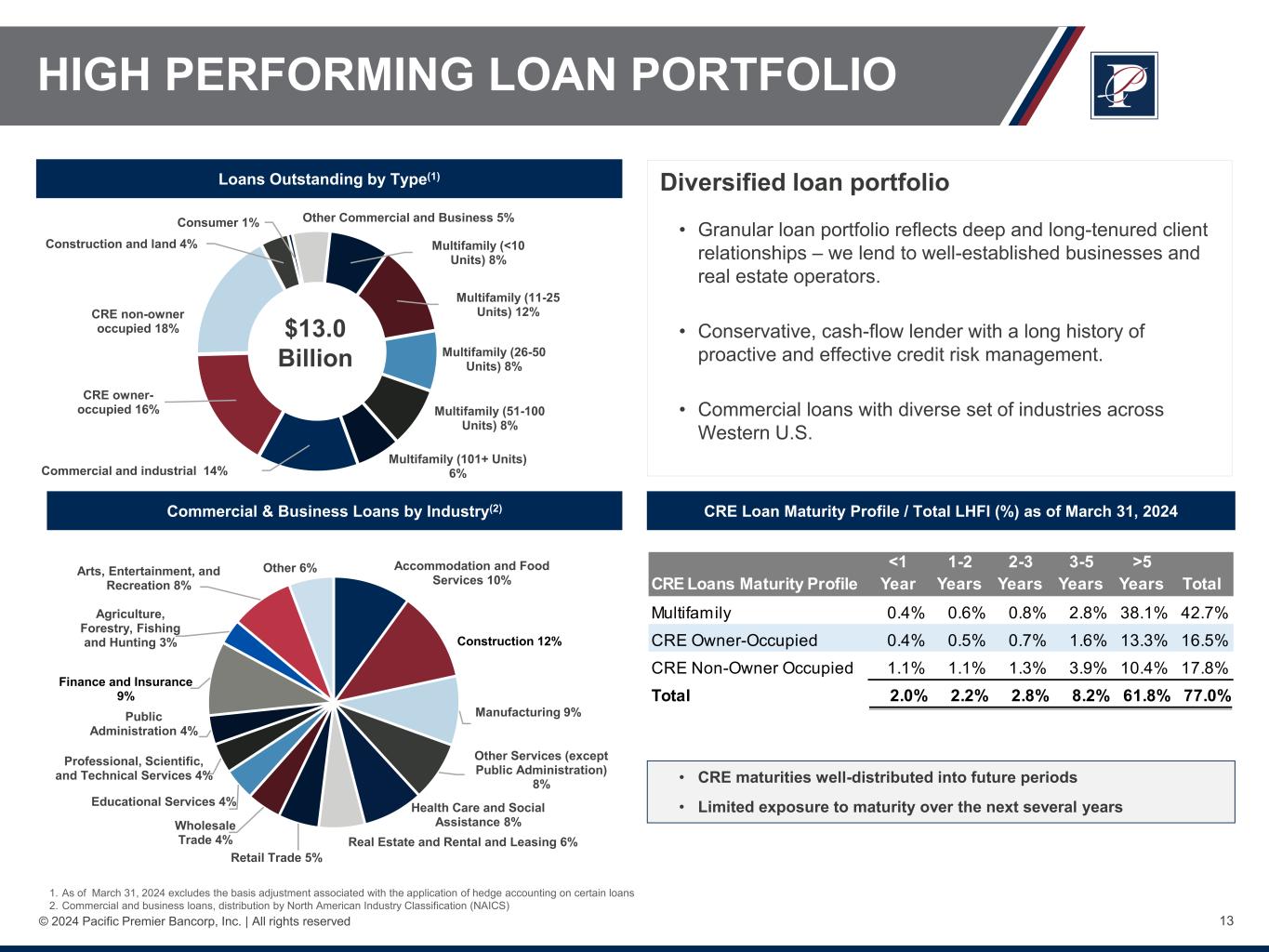

| Investor loans secured by real estate | ||||||||||||||||||||

| Commercial real estate (“CRE”) non-owner-occupied | $ | 2,309,252 | $ | 2,421,772 | $ | 2,590,824 | ||||||||||||||

| Multifamily | 5,558,966 | 5,645,310 | 5,955,239 | |||||||||||||||||

| Construction and land | 486,734 | 472,544 | 420,079 | |||||||||||||||||

SBA secured by real estate (1) |

35,206 | 36,400 | 40,669 | |||||||||||||||||

| Total investor loans secured by real estate | 8,390,158 | 8,576,026 | 9,006,811 | |||||||||||||||||

Business loans secured by real estate (2) |

||||||||||||||||||||

| CRE owner-occupied | 2,149,362 | 2,191,334 | 2,342,175 | |||||||||||||||||

| Franchise real estate secured | 294,938 | 304,514 | 371,902 | |||||||||||||||||

SBA secured by real estate (3) |

48,426 | 50,741 | 60,527 | |||||||||||||||||

| Total business loans secured by real estate | 2,492,726 | 2,546,589 | 2,774,604 | |||||||||||||||||

Commercial loans (4) |

||||||||||||||||||||

Commercial and industrial (“C&I”) |

1,774,487 | 1,790,608 | 1,967,128 | |||||||||||||||||

| Franchise non-real estate secured | 301,895 | 319,721 | 388,722 | |||||||||||||||||

| SBA non-real estate secured | 10,946 | 10,926 | 10,437 | |||||||||||||||||

| Total commercial loans | 2,087,328 | 2,121,255 | 2,366,287 | |||||||||||||||||

| Retail loans | ||||||||||||||||||||

Single family residential (5) |

72,353 | 72,752 | 70,913 | |||||||||||||||||

| Consumer | 1,830 | 1,949 | 3,174 | |||||||||||||||||

| Total retail loans | 74,183 | 74,701 | 74,087 | |||||||||||||||||

Loans held for investment before basis adjustment (6) |

13,044,395 | 13,318,571 | 14,221,789 | |||||||||||||||||

Basis adjustment associated with fair value hedge (7) |

(32,324) | (29,551) | (50,005) | |||||||||||||||||

| Loans held for investment | 13,012,071 | 13,289,020 | 14,171,784 | |||||||||||||||||

| Allowance for credit losses for loans held for investment | (192,340) | (192,471) | (195,388) | |||||||||||||||||

| Loans held for investment, net | $ | 12,819,731 | $ | 13,096,549 | $ | 13,976,396 | ||||||||||||||

| Total unfunded loan commitments | $ | 1,459,515 | $ | 1,703,470 | $ | 2,413,169 | ||||||||||||||

| Loans held for sale, at lower of cost or fair value | $ | — | $ | — | $ | 1,247 | ||||||||||||||

| Three Months Ended | ||||||||||||||||||||

| March 31, | December 31, | March 31, | ||||||||||||||||||

| (Dollars in thousands) | 2024 | 2023 | 2023 | |||||||||||||||||

| Investor loans secured by real estate | ||||||||||||||||||||

| CRE non-owner-occupied | $ | 850 | $ | 1,450 | $ | 1,200 | ||||||||||||||

| Multifamily | 480 | 94,462 | 4,464 | |||||||||||||||||

| Total investor loans secured by real estate | 1,330 | 95,912 | 5,664 | |||||||||||||||||

Business loans secured by real estate (1) |

||||||||||||||||||||

| CRE owner-occupied | 6,745 | 3,870 | 6,562 | |||||||||||||||||

| Franchise real estate secured | — | — | 3,217 | |||||||||||||||||

SBA secured by real estate (2) |

— | — | 497 | |||||||||||||||||

| Total business loans secured by real estate | 6,745 | 3,870 | 10,276 | |||||||||||||||||

Commercial loans (3) |

||||||||||||||||||||

| Commercial and industrial | 32,477 | 24,766 | 93,150 | |||||||||||||||||

| Franchise non-real estate secured | — | — | 1,666 | |||||||||||||||||

| SBA non-real estate secured | — | — | 720 | |||||||||||||||||

| Total commercial loans | 32,477 | 24,766 | 95,536 | |||||||||||||||||

| Retail loans | ||||||||||||||||||||

Single family residential (4) |

4,936 | 3,554 | 5,359 | |||||||||||||||||

| Consumer | 75 | — | — | |||||||||||||||||

| Total retail loans | 5,011 | 3,554 | 5,359 | |||||||||||||||||

| Total loan commitments | $ | 45,563 | $ | 128,102 | $ | 116,835 | ||||||||||||||

| Three Months Ended March 31, 2024 | |||||||||||||||||||||||||||||

| (Dollars in thousands) | Beginning ACL Balance | Charge-offs | Recoveries | Provision for Credit Losses | Ending ACL Balance |

||||||||||||||||||||||||

| Investor loans secured by real estate | |||||||||||||||||||||||||||||

| CRE non-owner-occupied | $ | 31,030 | $ | (927) | $ | — | $ | 678 | $ | 30,781 | |||||||||||||||||||

| Multifamily | 56,312 | — | 5 | 2,094 | 58,411 | ||||||||||||||||||||||||

| Construction and land | 9,314 | — | — | (1,143) | 8,171 | ||||||||||||||||||||||||

SBA secured by real estate (1) |

2,182 | (253) | — | 255 | 2,184 | ||||||||||||||||||||||||

Business loans secured by real estate (2) |

|||||||||||||||||||||||||||||

| CRE owner-occupied | 28,787 | (4,452) | 63 | 4,362 | 28,760 | ||||||||||||||||||||||||

| Franchise real estate secured | 7,499 | (212) | — | (29) | 7,258 | ||||||||||||||||||||||||

SBA secured by real estate (3) |

4,427 | — | 1 | (140) | 4,288 | ||||||||||||||||||||||||

Commercial loans (4) |

|||||||||||||||||||||||||||||

| Commercial and industrial | 36,692 | (585) | 39 | 961 | 37,107 | ||||||||||||||||||||||||

| Franchise non-real estate secured | 15,131 | (100) | — | (711) | 14,320 | ||||||||||||||||||||||||

| SBA non-real estate secured | 458 | — | 2 | 35 | 495 | ||||||||||||||||||||||||

| Retail loans | |||||||||||||||||||||||||||||

Single family residential (5) |

505 | — | — | (63) | 442 | ||||||||||||||||||||||||

| Consumer loans | 134 | — | — | (11) | 123 | ||||||||||||||||||||||||

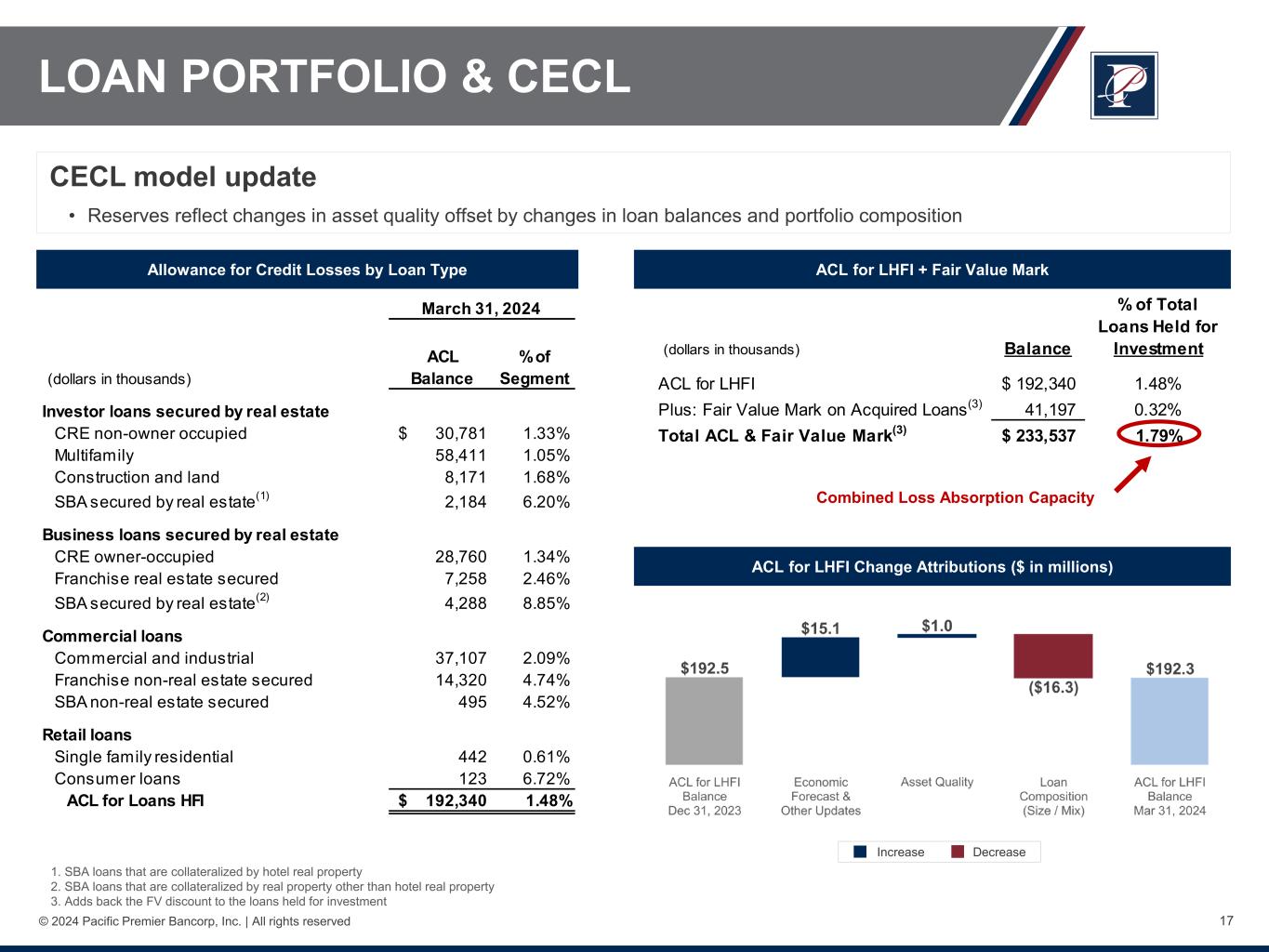

| Totals | $ | 192,471 | $ | (6,529) | $ | 110 | $ | 6,288 | $ | 192,340 | |||||||||||||||||||

| March 31, | December 31, | March 31, | ||||||||||||||||||

| (Dollars in thousands) | 2024 | 2023 | 2023 | |||||||||||||||||

| Asset quality | ||||||||||||||||||||

| Nonperforming loans | $ | 63,806 | $ | 24,817 | $ | 24,872 | ||||||||||||||

| Other real estate owned | 248 | 248 | 5,499 | |||||||||||||||||

| Nonperforming assets | $ | 64,054 | $ | 25,065 | $ | 30,371 | ||||||||||||||

Total classified assets (1) |

$ | 204,937 | $ | 142,210 | $ | 166,576 | ||||||||||||||

| Allowance for credit losses | 192,340 | 192,471 | 195,388 | |||||||||||||||||

| Allowance for credit losses as a percent of total nonperforming loans | 301 | % | 776 | % | 786 | % | ||||||||||||||

| Nonperforming loans as a percent of loans held for investment | 0.49 | 0.19 | 0.18 | |||||||||||||||||

| Nonperforming assets as a percent of total assets | 0.34 | 0.13 | 0.14 | |||||||||||||||||

| Classified loans to total loans held for investment | 1.57 | 1.07 | 1.14 | |||||||||||||||||

| Classified assets to total assets | 1.09 | 0.75 | 0.78 | |||||||||||||||||

| Net loan charge-offs for the quarter ended | $ | 6,419 | $ | 3,902 | $ | 3,284 | ||||||||||||||

| Net loan charge-offs for the quarter to average total loans | 0.05 | % | 0.03 | % | 0.02 | % | ||||||||||||||

Allowance for credit losses to loans held for investment (2) |

1.48 | 1.45 | 1.38 | |||||||||||||||||

Delinquent loans (3) |

||||||||||||||||||||

| 30 - 59 days | $ | 1,983 | $ | 2,484 | $ | 761 | ||||||||||||||

| 60 - 89 days | 974 | 1,294 | 1,198 | |||||||||||||||||

| 90+ days | 9,221 | 6,276 | 18,884 | |||||||||||||||||

| Total delinquency | $ | 12,178 | $ | 10,054 | $ | 20,843 | ||||||||||||||

| Delinquency as a percentage of loans held for investment | 0.09 | % | 0.08 | % | 0.15 | % | ||||||||||||||

| March 31, | December 31, | March 31, | ||||||||||||||||||

| (Dollars in thousands) | 2024 | 2023 | 2023 | |||||||||||||||||

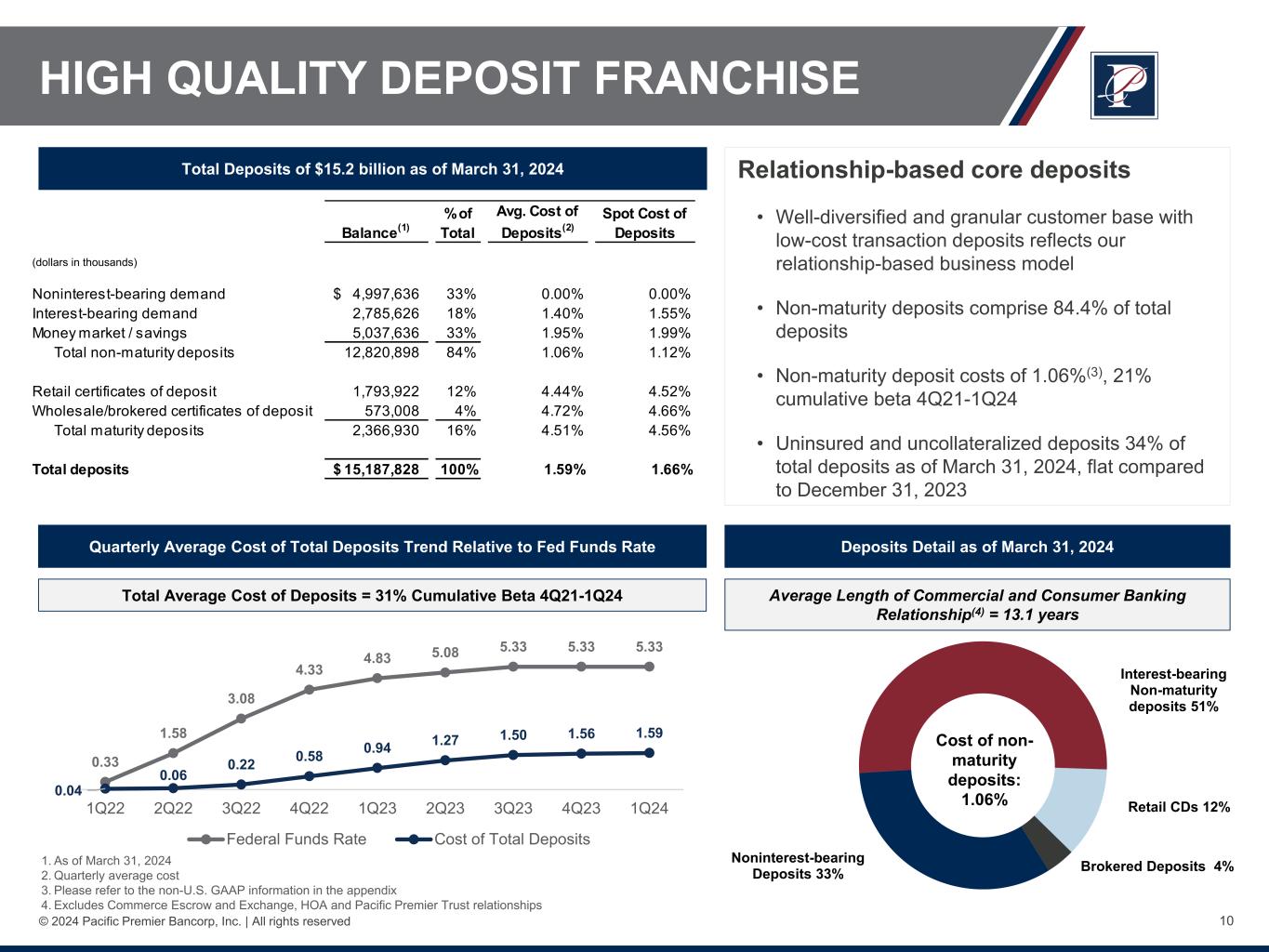

| Deposit accounts | ||||||||||||||||||||

| Noninterest-bearing checking | $ | 4,997,636 | $ | 4,932,817 | $ | 6,209,104 | ||||||||||||||

| Interest-bearing: | ||||||||||||||||||||

| Checking | 2,785,626 | 2,899,621 | 2,871,812 | |||||||||||||||||

| Money market/savings | 5,037,636 | 4,868,442 | 5,128,857 | |||||||||||||||||

Total non-maturity deposits (1) |

12,820,898 | 12,700,880 | 14,209,773 | |||||||||||||||||

| Retail certificates of deposit | 1,794,813 | 1,684,560 | 1,257,146 | |||||||||||||||||

| Wholesale/brokered certificates of deposit | 572,117 | 610,186 | 1,740,891 | |||||||||||||||||

| Total maturity deposits | 2,366,930 | 2,294,746 | 2,998,037 | |||||||||||||||||

| Total deposits | $ | 15,187,828 | $ | 14,995,626 | $ | 17,207,810 | ||||||||||||||

| Cost of deposits | 1.59 | % | 1.56 | % | 0.94 | % | ||||||||||||||

Cost of non-maturity deposits (1) |

1.06 | 1.02 | 0.54 | |||||||||||||||||

| Noninterest-bearing deposits as a percent of total deposits | 32.9 | 32.9 | 36.1 | |||||||||||||||||

Non-maturity deposits (1) as a percent of total deposits |

84.4 | 84.7 | 82.6 | |||||||||||||||||

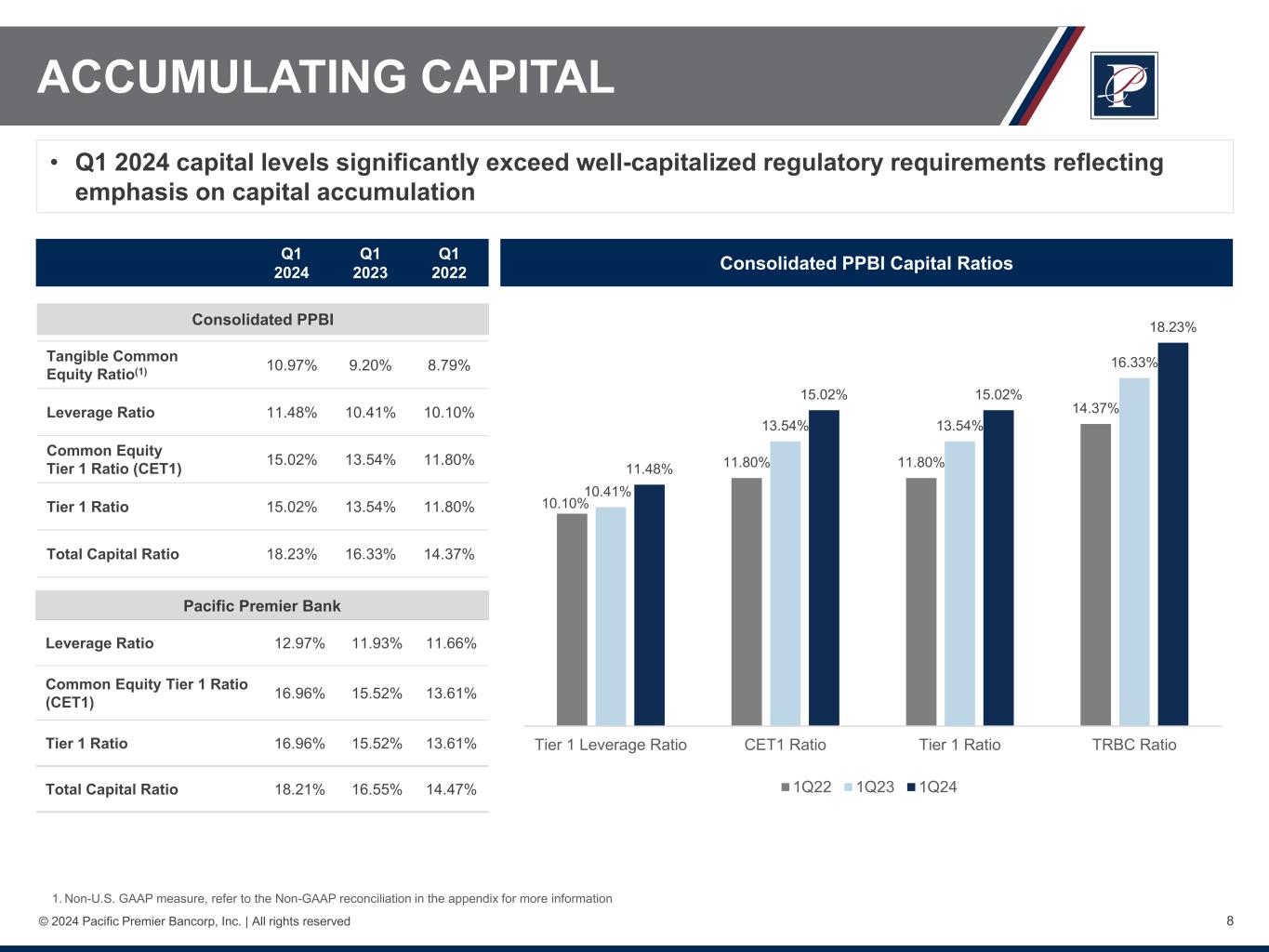

| March 31, | December 31, | March 31, | ||||||||||||||||||

| Capital ratios | 2024 | 2023 | 2023 | |||||||||||||||||

| Pacific Premier Bancorp, Inc. Consolidated | ||||||||||||||||||||

| Tier 1 leverage ratio | 11.48 | % | 11.03 | % | 10.41 | % | ||||||||||||||

| Common equity tier 1 capital ratio | 15.02 | 14.32 | 13.54 | |||||||||||||||||

| Tier 1 capital ratio | 15.02 | 14.32 | 13.54 | |||||||||||||||||

| Total capital ratio | 18.23 | 17.29 | 16.33 | |||||||||||||||||

Tangible common equity ratio (1) |

10.97 | 10.72 | 9.20 | |||||||||||||||||

| Pacific Premier Bank | ||||||||||||||||||||

| Tier 1 leverage ratio | 12.97 | % | 12.43 | % | 11.93 | % | ||||||||||||||

| Common equity tier 1 capital ratio | 16.96 | 16.13 | 15.52 | |||||||||||||||||

| Tier 1 capital ratio | 16.96 | 16.13 | 15.52 | |||||||||||||||||

| Total capital ratio | 18.21 | 17.23 | 16.55 | |||||||||||||||||

| Share data | ||||||||||||||||||||

| Book value per share | $ | 30.09 | $ | 30.07 | $ | 29.58 | ||||||||||||||

Tangible book value per share (1) |

20.33 | 20.22 | 19.61 | |||||||||||||||||

| Common equity dividends declared per share | 0.33 | 0.33 | 0.33 | |||||||||||||||||

Closing stock price (2) |

24.00 | 29.11 | 24.02 | |||||||||||||||||

| Shares issued and outstanding | 96,459,966 | 95,860,092 | 95,714,777 | |||||||||||||||||

Market capitalization (2)(3) |

$ | 2,315,039 | $ | 2,790,487 | $ | 2,299,069 | ||||||||||||||

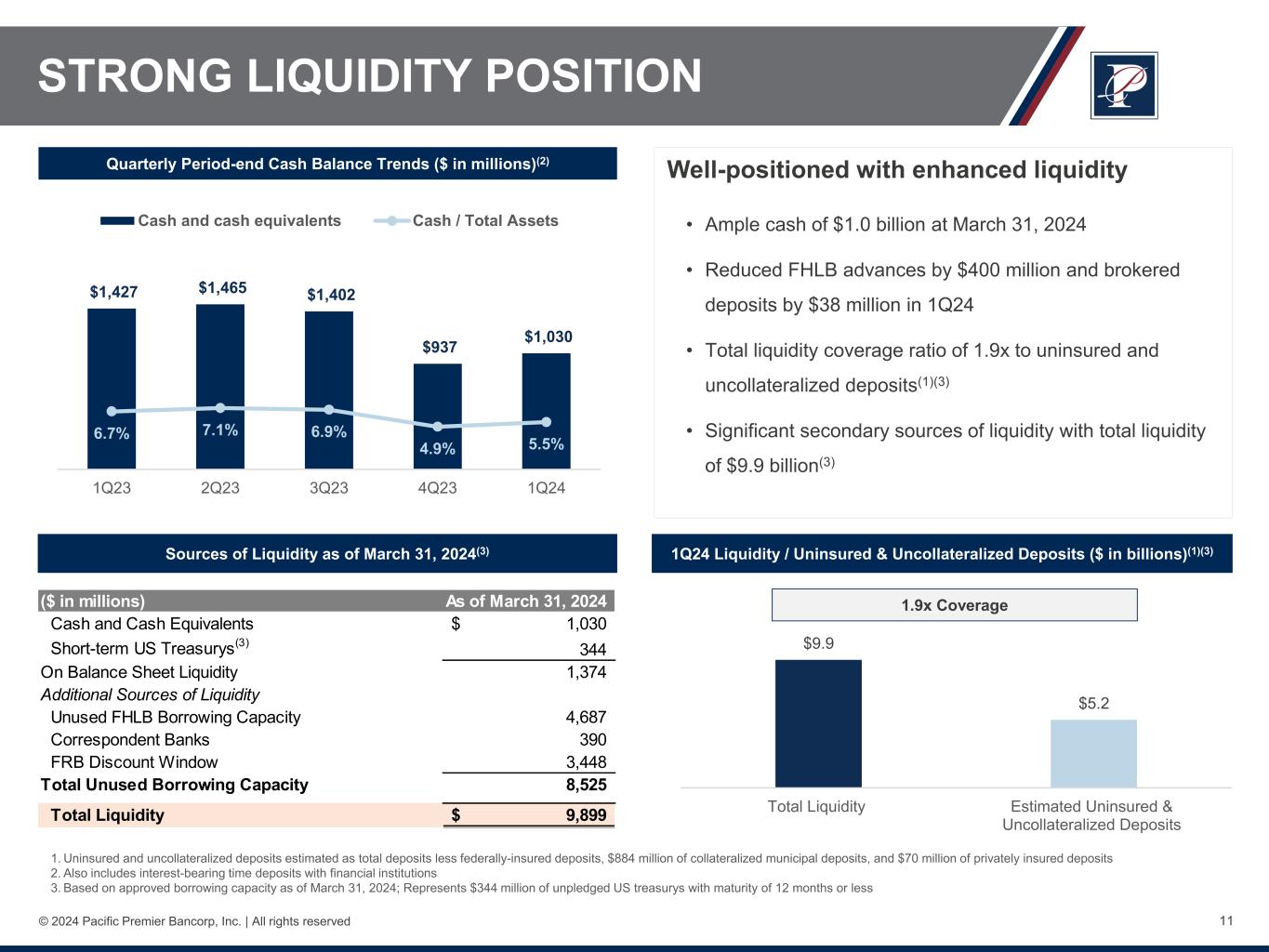

| PACIFIC PREMIER BANCORP, INC. AND SUBSIDIARIES | ||||||||||||||||||||||||||||||||

| CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION | ||||||||||||||||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||||||||||||||

| March 31, | December 31, | September 30, | June 30, | March 31, | ||||||||||||||||||||||||||||

| (Dollars in thousands) | 2024 | 2023 | 2023 | 2023 | 2023 | |||||||||||||||||||||||||||

| ASSETS | ||||||||||||||||||||||||||||||||

| Cash and cash equivalents | $ | 1,028,818 | $ | 936,473 | $ | 1,400,276 | $ | 1,463,677 | $ | 1,424,896 | ||||||||||||||||||||||

| Interest-bearing time deposits with financial institutions | 995 | 995 | 1,242 | 1,487 | 1,734 | |||||||||||||||||||||||||||

| Investment securities held-to-maturity, at amortized cost, net of allowance for credit losses | 1,720,481 | 1,729,541 | 1,737,866 | 1,737,604 | 1,749,030 | |||||||||||||||||||||||||||

| Investment securities available-for-sale, at fair value | 1,154,021 | 1,140,071 | 1,914,599 | 2,011,791 | 2,112,852 | |||||||||||||||||||||||||||

| FHLB, FRB, and other stock | 97,063 | 99,225 | 105,505 | 105,369 | 105,479 | |||||||||||||||||||||||||||

| Loans held for sale, at lower of amortized cost or fair value | — | — | 641 | 2,184 | 1,247 | |||||||||||||||||||||||||||

| Loans held for investment | 13,012,071 | 13,289,020 | 13,270,120 | 13,610,282 | 14,171,784 | |||||||||||||||||||||||||||

| Allowance for credit losses | (192,340) | (192,471) | (188,098) | (192,333) | (195,388) | |||||||||||||||||||||||||||

| Loans held for investment, net | 12,819,731 | 13,096,549 | 13,082,022 | 13,417,949 | 13,976,396 | |||||||||||||||||||||||||||

| Accrued interest receivable | 67,642 | 68,516 | 68,131 | 70,093 | 69,660 | |||||||||||||||||||||||||||

| Other real estate owned | 248 | 248 | 450 | 270 | 5,499 | |||||||||||||||||||||||||||

| Premises and equipment, net | 54,789 | 56,676 | 59,396 | 61,527 | 63,450 | |||||||||||||||||||||||||||

| Deferred income taxes, net | 111,390 | 113,580 | 192,208 | 184,857 | 177,778 | |||||||||||||||||||||||||||

| Bank owned life insurance | 474,404 | 471,178 | 468,191 | 465,288 | 462,732 | |||||||||||||||||||||||||||

| Intangible assets | 40,449 | 43,285 | 46,307 | 49,362 | 52,417 | |||||||||||||||||||||||||||

| Goodwill | 901,312 | 901,312 | 901,312 | 901,312 | 901,312 | |||||||||||||||||||||||||||

| Other assets | 341,838 | 368,996 | 297,574 | 275,113 | 257,082 | |||||||||||||||||||||||||||

| Total assets | $ | 18,813,181 | $ | 19,026,645 | $ | 20,275,720 | $ | 20,747,883 | $ | 21,361,564 | ||||||||||||||||||||||

| LIABILITIES | ||||||||||||||||||||||||||||||||

| Deposit accounts: | ||||||||||||||||||||||||||||||||

| Noninterest-bearing checking | $ | 4,997,636 | $ | 4,932,817 | $ | 5,782,305 | $ | 5,895,975 | $ | 6,209,104 | ||||||||||||||||||||||

| Interest-bearing: | ||||||||||||||||||||||||||||||||

| Checking | 2,785,626 | 2,899,621 | 2,598,449 | 2,759,855 | 2,871,812 | |||||||||||||||||||||||||||

| Money market/savings | 5,037,636 | 4,868,442 | 4,873,582 | 4,801,288 | 5,128,857 | |||||||||||||||||||||||||||

| Retail certificates of deposit | 1,794,813 | 1,684,560 | 1,525,919 | 1,366,071 | 1,257,146 | |||||||||||||||||||||||||||

| Wholesale/brokered certificates of deposit | 572,117 | 610,186 | 1,227,192 | 1,716,686 | 1,740,891 | |||||||||||||||||||||||||||

| Total interest-bearing | 10,190,192 | 10,062,809 | 10,225,142 | 10,643,900 | 10,998,706 | |||||||||||||||||||||||||||

| Total deposits | 15,187,828 | 14,995,626 | 16,007,447 | 16,539,875 | 17,207,810 | |||||||||||||||||||||||||||

| FHLB advances and other borrowings | 200,000 | 600,000 | 800,000 | 800,000 | 800,000 | |||||||||||||||||||||||||||

| Subordinated debentures | 332,001 | 331,842 | 331,682 | 331,523 | 331,364 | |||||||||||||||||||||||||||

| Accrued expenses and other liabilities | 190,551 | 216,596 | 281,057 | 227,351 | 191,229 | |||||||||||||||||||||||||||

| Total liabilities | 15,910,380 | 16,144,064 | 17,420,186 | 17,898,749 | 18,530,403 | |||||||||||||||||||||||||||

| STOCKHOLDERS’ EQUITY | ||||||||||||||||||||||||||||||||

| Common stock | 941 | 938 | 937 | 937 | 937 | |||||||||||||||||||||||||||

| Additional paid-in capital | 2,378,171 | 2,377,131 | 2,371,941 | 2,366,639 | 2,361,830 | |||||||||||||||||||||||||||

| Retained earnings | 619,405 | 604,137 | 771,285 | 757,025 | 731,123 | |||||||||||||||||||||||||||

| Accumulated other comprehensive loss | (95,716) | (99,625) | (288,629) | (275,467) | (262,729) | |||||||||||||||||||||||||||

| Total stockholders' equity | 2,902,801 | 2,882,581 | 2,855,534 | 2,849,134 | 2,831,161 | |||||||||||||||||||||||||||

| Total liabilities and stockholders' equity | $ | 18,813,181 | $ | 19,026,645 | $ | 20,275,720 | $ | 20,747,883 | $ | 21,361,564 | ||||||||||||||||||||||

| PACIFIC PREMIER BANCORP, INC. AND SUBSIDIARIES | ||||||||||||||||||||

| CONSOLIDATED STATEMENTS OF OPERATIONS | ||||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||

| Three Months Ended | ||||||||||||||||||||

| March 31, | December 31, | March 31, | ||||||||||||||||||

| (Dollars in thousands, except per share data) | 2024 | 2023 | 2023 | |||||||||||||||||

| INTEREST INCOME | ||||||||||||||||||||

| Loans | $ | 172,975 | $ | 176,773 | $ | 180,958 | ||||||||||||||

| Investment securities and other interest-earning assets | 40,456 | 40,419 | 40,385 | |||||||||||||||||

| Total interest income | 213,431 | 217,192 | 221,343 | |||||||||||||||||

| INTEREST EXPENSE | ||||||||||||||||||||

| Deposits | 59,506 | 60,915 | 40,234 | |||||||||||||||||

| FHLB advances and other borrowings | 4,237 | 4,927 | 7,938 | |||||||||||||||||

| Subordinated debentures | 4,561 | 4,561 | 4,561 | |||||||||||||||||

| Total interest expense | 68,304 | 70,403 | 52,733 | |||||||||||||||||

| Net interest income before provision for credit losses | 145,127 | 146,789 | 168,610 | |||||||||||||||||

| Provision for credit losses | 3,852 | 1,696 | 3,016 | |||||||||||||||||

| Net interest income after provision for credit losses | 141,275 | 145,093 | 165,594 | |||||||||||||||||

| NONINTEREST INCOME | ||||||||||||||||||||

| Loan servicing income | 529 | 359 | 573 | |||||||||||||||||

| Service charges on deposit accounts | 2,688 | 2,648 | 2,629 | |||||||||||||||||

| Other service fee income | 336 | 322 | 296 | |||||||||||||||||

| Debit card interchange fee income | 765 | 844 | 803 | |||||||||||||||||

| Earnings on bank owned life insurance | 4,159 | 3,678 | 3,374 | |||||||||||||||||

Net (loss) gain from sales of loans |

— | (4) | 29 | |||||||||||||||||

| Net (loss) gain from sales of investment securities | — | (254,065) | 138 | |||||||||||||||||

Trust custodial account fees |

10,642 | 9,388 | 11,025 | |||||||||||||||||

| Escrow and exchange fees | 696 | 1,074 | 1,058 | |||||||||||||||||

| Other income | 5,959 | 1,562 | 1,261 | |||||||||||||||||

| Total noninterest income (loss) | 25,774 | (234,194) | 21,186 | |||||||||||||||||

| NONINTEREST EXPENSE | ||||||||||||||||||||

| Compensation and benefits | 54,130 | 51,907 | 54,293 | |||||||||||||||||

| Premises and occupancy | 10,807 | 11,183 | 11,742 | |||||||||||||||||

| Data processing | 7,511 | 7,409 | 7,265 | |||||||||||||||||

| Other real estate owned operations, net | 46 | 103 | 108 | |||||||||||||||||

| FDIC insurance premiums | 2,629 | 4,267 | 2,425 | |||||||||||||||||

| Legal and professional services | 4,143 | 4,663 | 5,501 | |||||||||||||||||

| Marketing expense | 1,558 | 1,728 | 1,838 | |||||||||||||||||

| Office expense | 1,093 | 1,367 | 1,232 | |||||||||||||||||

| Loan expense | 770 | 437 | 646 | |||||||||||||||||

| Deposit expense | 12,665 | 11,152 | 8,436 | |||||||||||||||||

| Amortization of intangible assets | 2,836 | 3,022 | 3,171 | |||||||||||||||||

| Other expense | 4,445 | 5,532 | 4,695 | |||||||||||||||||

| Total noninterest expense | 102,633 | 102,770 | 101,352 | |||||||||||||||||

| Net income (loss) before income taxes | 64,416 | (191,871) | 85,428 | |||||||||||||||||

| Income tax expense (benefit) | 17,391 | (56,495) | 22,866 | |||||||||||||||||

| Net income (loss) | $ | 47,025 | $ | (135,376) | $ | 62,562 | ||||||||||||||

| EARNINGS (LOSS) PER SHARE | ||||||||||||||||||||

| Basic | $ | 0.49 | $ | (1.44) | $ | 0.66 | ||||||||||||||

| Diluted | $ | 0.49 | $ | (1.44) | $ | 0.66 | ||||||||||||||

| WEIGHTED AVERAGE SHARES OUTSTANDING | ||||||||||||||||||||

| Basic | 94,350,259 | 94,233,813 | 93,857,812 | |||||||||||||||||

| Diluted | 94,477,355 | 94,334,878 | 94,182,522 | |||||||||||||||||

| PACIFIC PREMIER BANCORP, INC. AND SUBSIDIARIES | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CONSOLIDATED AVERAGE BALANCES AND YIELD DATA | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Three Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| March 31, 2024 | December 31, 2023 | March 31, 2023 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | Average Balance | Interest Income/Expense | Average Yield/Cost | Average Balance | Interest Income/Expense | Average Yield/Cost | Average Balance | Interest Income/Expense | Average Yield/Cost | |||||||||||||||||||||||||||||||||||||||||||||||

| Assets | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-earning assets: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cash and cash equivalents | $ | 1,140,909 | $ | 13,638 | 4.81 | % | $ | 1,281,793 | $ | 15,744 | 4.87 | % | $ | 1,335,611 | $ | 13,594 | 4.13 | % | ||||||||||||||||||||||||||||||||||||||

| Investment securities | 2,948,170 | 26,818 | 3.64 | 3,203,608 | 24,675 | 3.08 | 4,165,681 | 26,791 | 2.57 | |||||||||||||||||||||||||||||||||||||||||||||||

Loans receivable, net (1)(2) |

13,149,038 | 172,975 | 5.29 | 13,257,767 | 176,773 | 5.29 | 14,394,775 | 180,958 | 5.10 | |||||||||||||||||||||||||||||||||||||||||||||||

| Total interest-earning assets | 17,238,117 | 213,431 | 4.98 | 17,743,168 | 217,192 | 4.86 | 19,896,067 | 221,343 | 4.51 | |||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest-earning assets | 1,796,279 | 1,881,777 | 1,788,806 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total assets | $ | 19,034,396 | $ | 19,624,945 | $ | 21,684,873 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Liabilities and equity | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing deposits: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest checking | $ | 2,838,332 | $ | 9,903 | 1.40 | % | $ | 3,037,642 | $ | 11,170 | 1.46 | % | $ | 3,008,712 | $ | 5,842 | 0.79 | % | ||||||||||||||||||||||||||||||||||||||

| Money market | 4,636,141 | 23,632 | 2.05 | 4,525,403 | 22,038 | 1.93 | 4,992,084 | 13,053 | 1.06 | |||||||||||||||||||||||||||||||||||||||||||||||

| Savings | 287,735 | 227 | 0.32 | 308,968 | 190 | 0.24 | 453,079 | 508 | 0.45 | |||||||||||||||||||||||||||||||||||||||||||||||

| Retail certificates of deposit | 1,727,728 | 19,075 | 4.44 | 1,604,507 | 16,758 | 4.14 | 1,206,966 | 7,775 | 2.61 | |||||||||||||||||||||||||||||||||||||||||||||||

| Wholesale/brokered certificates of deposit | 568,872 | 6,669 | 4.72 | 918,596 | 10,759 | 4.65 | 1,443,783 | 13,056 | 3.67 | |||||||||||||||||||||||||||||||||||||||||||||||

| Total interest-bearing deposits | 10,058,808 | 59,506 | 2.38 | 10,395,116 | 60,915 | 2.32 | 11,104,624 | 40,234 | 1.47 | |||||||||||||||||||||||||||||||||||||||||||||||

| FHLB advances and other borrowings | 518,879 | 4,237 | 3.28 | 610,913 | 4,927 | 3.20 | 987,817 | 7,938 | 3.26 | |||||||||||||||||||||||||||||||||||||||||||||||

| Subordinated debentures | 331,932 | 4,561 | 5.50 | 331,776 | 4,561 | 5.50 | 331,297 | 4,561 | 5.51 | |||||||||||||||||||||||||||||||||||||||||||||||

| Total borrowings | 850,811 | 8,798 | 4.15 | 942,689 | 9,488 | 4.01 | 1,319,114 | 12,499 | 3.83 | |||||||||||||||||||||||||||||||||||||||||||||||

| Total interest-bearing liabilities | 10,909,619 | 68,304 | 2.52 | 11,337,805 | 70,403 | 2.46 | 12,423,738 | 52,733 | 1.72 | |||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest-bearing deposits | 4,996,939 | 5,141,585 | 6,219,818 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other liabilities | 231,889 | 296,604 | 218,925 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities | 16,138,447 | 16,775,994 | 18,862,481 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stockholders' equity | 2,895,949 | 2,848,951 | 2,822,392 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities and equity | $ | 19,034,396 | $ | 19,624,945 | $ | 21,684,873 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income | $ | 145,127 | $ | 146,789 | $ | 168,610 | ||||||||||||||||||||||||||||||||||||||||||||||||||

Net interest margin (3) |

3.39 | % | 3.28 | % | 3.44 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

Cost of deposits (4) |

1.59 | 1.56 | 0.94 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Cost of funds (5) |

1.73 | 1.69 | 1.15 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Cost of non-maturity deposits (6) |

1.06 | 1.02 | 0.54 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ratio of interest-earning assets to interest-bearing liabilities | 158.01 | 156.50 | 160.15 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| PACIFIC PREMIER BANCORP, INC. AND SUBSIDIARIES | ||||||||||||||||||||||||||||||||

| LOAN PORTFOLIO COMPOSITION | ||||||||||||||||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||||||||||||||

| March 31, | December 31, | September 30, | June 30, | March 31, | ||||||||||||||||||||||||||||

| (Dollars in thousands) | 2024 | 2023 | 2023 | 2023 | 2023 | |||||||||||||||||||||||||||

| Investor loans secured by real estate | ||||||||||||||||||||||||||||||||

| CRE non-owner-occupied | $ | 2,309,252 | $ | 2,421,772 | $ | 2,514,056 | $ | 2,571,246 | $ | 2,590,824 | ||||||||||||||||||||||

| Multifamily | 5,558,966 | 5,645,310 | 5,719,210 | 5,788,030 | 5,955,239 | |||||||||||||||||||||||||||

| Construction and land | 486,734 | 472,544 | 444,576 | 428,287 | 420,079 | |||||||||||||||||||||||||||

SBA secured by real estate (1) |

35,206 | 36,400 | 37,754 | 38,876 | 40,669 | |||||||||||||||||||||||||||

| Total investor loans secured by real estate | 8,390,158 | 8,576,026 | 8,715,596 | 8,826,439 | 9,006,811 | |||||||||||||||||||||||||||

Business loans secured by real estate (2) |

||||||||||||||||||||||||||||||||

| CRE owner-occupied | 2,149,362 | 2,191,334 | 2,228,802 | 2,281,721 | 2,342,175 | |||||||||||||||||||||||||||

| Franchise real estate secured | 294,938 | 304,514 | 313,451 | 318,539 | 371,902 | |||||||||||||||||||||||||||

SBA secured by real estate (3) |

48,426 | 50,741 | 53,668 | 57,084 | 60,527 | |||||||||||||||||||||||||||

| Total business loans secured by real estate | 2,492,726 | 2,546,589 | 2,595,921 | 2,657,344 | 2,774,604 | |||||||||||||||||||||||||||

Commercial loans (4) |

||||||||||||||||||||||||||||||||

| Commercial and industrial | 1,774,487 | 1,790,608 | 1,588,771 | 1,744,763 | 1,967,128 | |||||||||||||||||||||||||||

| Franchise non-real estate secured | 301,895 | 319,721 | 335,053 | 351,944 | 388,722 | |||||||||||||||||||||||||||

| SBA non-real estate secured | 10,946 | 10,926 | 10,667 | 9,688 | 10,437 | |||||||||||||||||||||||||||

| Total commercial loans | 2,087,328 | 2,121,255 | 1,934,491 | 2,106,395 | 2,366,287 | |||||||||||||||||||||||||||

| Retail loans | ||||||||||||||||||||||||||||||||

Single family residential (5) |

72,353 | 72,752 | 70,984 | 70,993 | 70,913 | |||||||||||||||||||||||||||

| Consumer | 1,830 | 1,949 | 1,958 | 2,241 | 3,174 | |||||||||||||||||||||||||||

| Total retail loans | 74,183 | 74,701 | 72,942 | 73,234 | 74,087 | |||||||||||||||||||||||||||

Loans held for investment before basis adjustment (6) |

13,044,395 | 13,318,571 | 13,318,950 | 13,663,412 | 14,221,789 | |||||||||||||||||||||||||||

Basis adjustment associated with fair value hedge (7) |

(32,324) | (29,551) | (48,830) | (53,130) | (50,005) | |||||||||||||||||||||||||||

| Loans held for investment | 13,012,071 | 13,289,020 | 13,270,120 | 13,610,282 | 14,171,784 | |||||||||||||||||||||||||||

| Allowance for credit losses for loans held for investment | (192,340) | (192,471) | (188,098) | (192,333) | (195,388) | |||||||||||||||||||||||||||

| Loans held for investment, net | $ | 12,819,731 | $ | 13,096,549 | $ | 13,082,022 | $ | 13,417,949 | $ | 13,976,396 | ||||||||||||||||||||||

| Loans held for sale, at lower of cost or fair value | $ | — | $ | — | $ | 641 | $ | 2,184 | $ | 1,247 | ||||||||||||||||||||||

| PACIFIC PREMIER BANCORP, INC. AND SUBSIDIARIES | ||||||||||||||||||||||||||||||||

| ASSET QUALITY INFORMATION | ||||||||||||||||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||||||||||||||

| March 31, | December 31, | September 30, | June 30, | March 31, | ||||||||||||||||||||||||||||

| (Dollars in thousands) | 2024 | 2023 | 2023 | 2023 | 2023 | |||||||||||||||||||||||||||

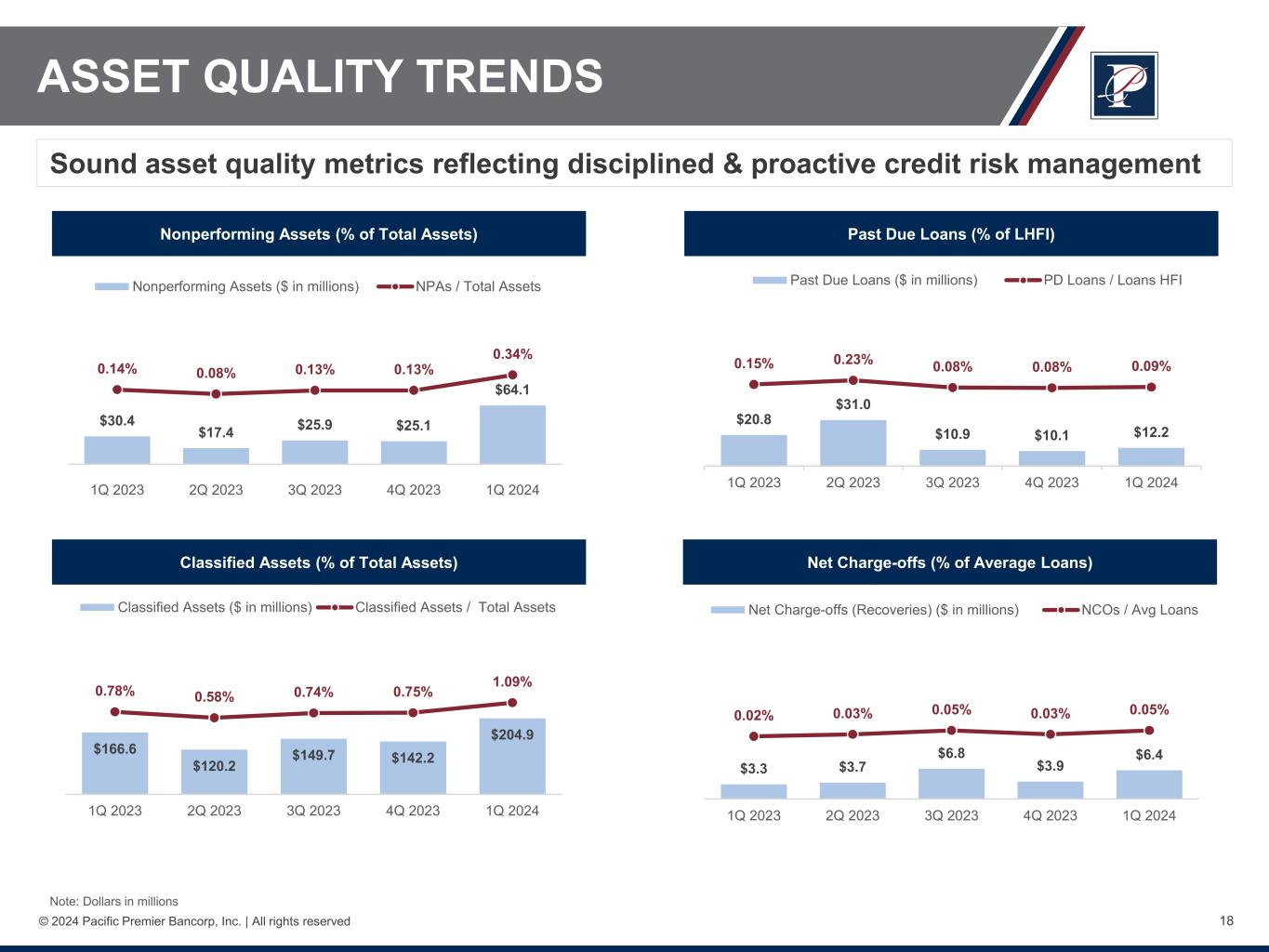

| Asset quality | ||||||||||||||||||||||||||||||||

| Nonperforming loans | $ | 63,806 | $ | 24,817 | $ | 25,458 | $ | 17,151 | $ | 24,872 | ||||||||||||||||||||||

| Other real estate owned | 248 | 248 | 450 | 270 | 5,499 | |||||||||||||||||||||||||||

| Nonperforming assets | $ | 64,054 | $ | 25,065 | $ | 25,908 | $ | 17,421 | $ | 30,371 | ||||||||||||||||||||||

Total classified assets (1) |

$ | 204,937 | $ | 142,210 | $ | 149,708 | $ | 120,216 | $ | 166,576 | ||||||||||||||||||||||

| Allowance for credit losses | 192,340 | 192,471 | 188,098 | 192,333 | 195,388 | |||||||||||||||||||||||||||

| Allowance for credit losses as a percent of total nonperforming loans | 301 | % | 776 | % | 739 | % | 1,121 | % | 786 | % | ||||||||||||||||||||||

| Nonperforming loans as a percent of loans held for investment | 0.49 | 0.19 | 0.19 | 0.13 | 0.18 | |||||||||||||||||||||||||||

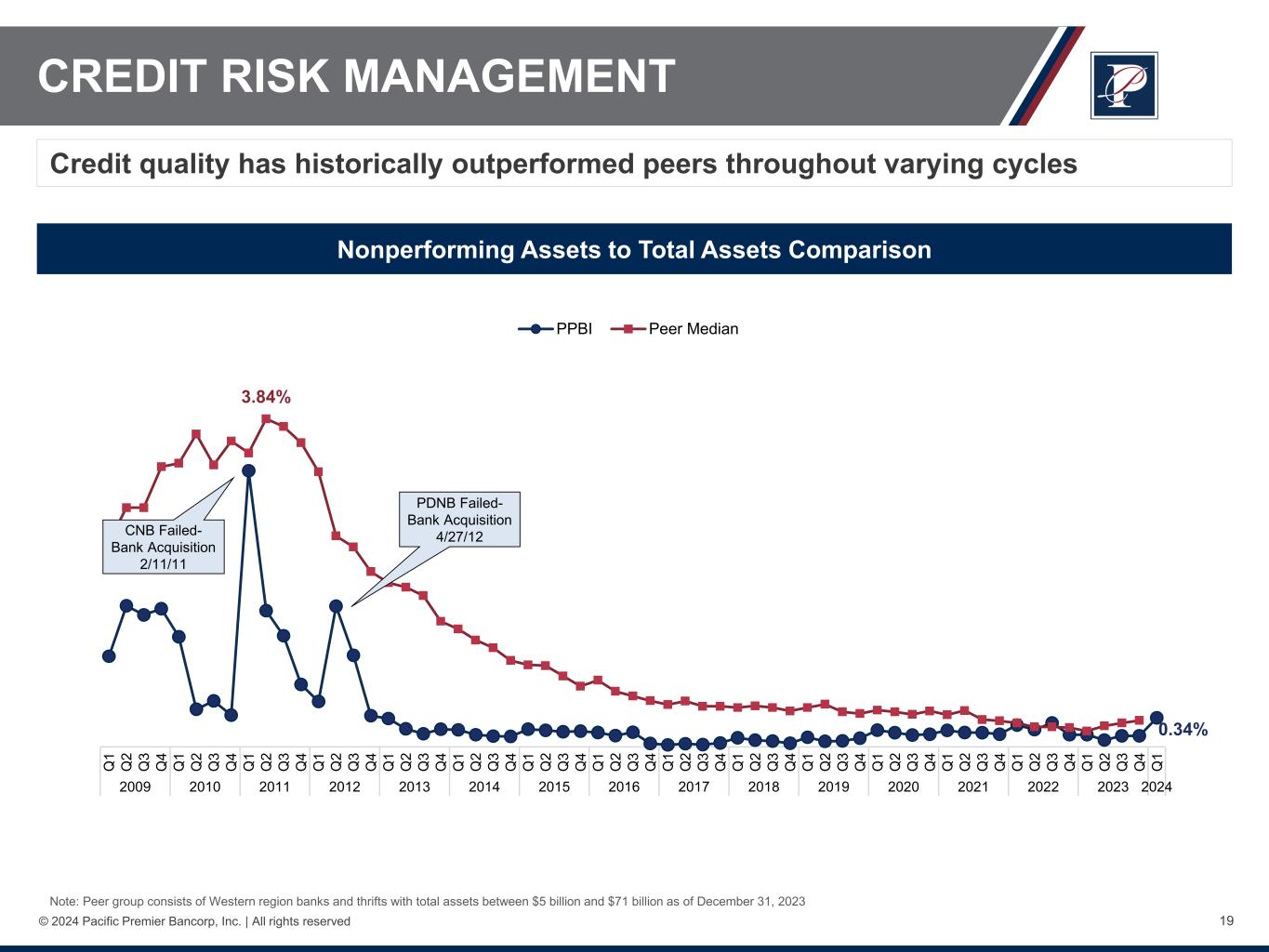

| Nonperforming assets as a percent of total assets | 0.34 | 0.13 | 0.13 | 0.08 | 0.14 | |||||||||||||||||||||||||||

| Classified loans to total loans held for investment | 1.57 | 1.07 | 1.12 | 0.88 | 1.14 | |||||||||||||||||||||||||||

| Classified assets to total assets | 1.09 | 0.75 | 0.74 | 0.58 | 0.78 | |||||||||||||||||||||||||||

| Net loan charge-offs for the quarter ended | $ | 6,419 | $ | 3,902 | $ | 6,752 | $ | 3,665 | $ | 3,284 | ||||||||||||||||||||||

| Net loan charge-offs for the quarter to average total loans | 0.05 | % | 0.03 | % | 0.05 | % | 0.03 | % | 0.02 | % | ||||||||||||||||||||||

Allowance for credit losses to loans held for investment (2) |

1.48 | 1.45 | 1.42 | 1.41 | 1.38 | |||||||||||||||||||||||||||

Delinquent loans (3) |

||||||||||||||||||||||||||||||||

| 30 - 59 days | $ | 1,983 | $ | 2,484 | $ | 2,967 | $ | 649 | $ | 761 | ||||||||||||||||||||||

| 60 - 89 days | 974 | 1,294 | 475 | 31 | 1,198 | |||||||||||||||||||||||||||

| 90+ days | 9,221 | 6,276 | 7,484 | 30,271 | 18,884 | |||||||||||||||||||||||||||

| Total delinquency | $ | 12,178 | $ | 10,054 | $ | 10,926 | $ | 30,951 | $ | 20,843 | ||||||||||||||||||||||

| Delinquency as a percent of loans held for investment | 0.09 | % | 0.08 | % | 0.08 | % | 0.23 | % | 0.15 | % | ||||||||||||||||||||||

| PACIFIC PREMIER BANCORP, INC. AND SUBSIDIARIES | ||||||||||||||||||||||||||||||||||||||

NONACCRUAL LOANS (1) | ||||||||||||||||||||||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | Collateral Dependent Loans | ACL | Non-Collateral Dependent Loans | ACL | Total Nonaccrual Loans | Nonaccrual Loans With No ACL | ||||||||||||||||||||||||||||||||

| March 31, 2024 | ||||||||||||||||||||||||||||||||||||||

| Investor loans secured by real estate | ||||||||||||||||||||||||||||||||||||||

| CRE non-owner-occupied | $ | 24,008 | $ | 2,657 | $ | — | $ | — | $ | 24,008 | $ | 17,499 | ||||||||||||||||||||||||||

SBA secured by real estate (2) |

1,258 | — | — | — | 1,258 | 1,258 | ||||||||||||||||||||||||||||||||

| Total investor loans secured by real estate | 25,266 | 2,657 | — | — | 25,266 | 18,757 | ||||||||||||||||||||||||||||||||

Business loans secured by real estate (3) |

||||||||||||||||||||||||||||||||||||||

| CRE owner-occupied | 12,602 | — | — | — | 12,602 | 12,602 | ||||||||||||||||||||||||||||||||

| Franchise real estate secured | — | — | 292 | 43 | 292 | — | ||||||||||||||||||||||||||||||||

| Total business loans secured by real estate | 12,602 | — | 292 | 43 | 12,894 | 12,602 | ||||||||||||||||||||||||||||||||

Commercial loans (4) |

||||||||||||||||||||||||||||||||||||||

| Commercial and industrial | 1,380 | — | 22,161 | 1,521 | 23,541 | 13,541 | ||||||||||||||||||||||||||||||||

| Franchise non-real estate secured | — | — | 1,559 | 231 | 1,559 | — | ||||||||||||||||||||||||||||||||

| SBA not secured by real estate | 546 | — | — | — | 546 | 546 | ||||||||||||||||||||||||||||||||

| Total commercial loans | 1,926 | — | 23,720 | 1,752 | 25,646 | 14,087 | ||||||||||||||||||||||||||||||||

| Totals nonaccrual loans | $ | 39,794 | $ | 2,657 | $ | 24,012 | $ | 1,795 | $ | 63,806 | $ | 45,446 | ||||||||||||||||||||||||||

| PACIFIC PREMIER BANCORP, INC. AND SUBSIDIARIES | ||||||||||||||||||||||||||||||||

| PAST DUE STATUS | ||||||||||||||||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||||||||||||||

Days Past Due (7) |

||||||||||||||||||||||||||||||||

| (Dollars in thousands) | Current | 30-59 | 60-89 | 90+ | Total | |||||||||||||||||||||||||||

| March 31, 2024 | ||||||||||||||||||||||||||||||||

| Investor loans secured by real estate | ||||||||||||||||||||||||||||||||

| CRE non-owner-occupied | $ | 2,308,852 | $ | — | $ | — | $ | 400 | $ | 2,309,252 | ||||||||||||||||||||||

| Multifamily | 5,558,966 | — | — | — | 5,558,966 | |||||||||||||||||||||||||||

| Construction and land | 486,734 | — | — | — | 486,734 | |||||||||||||||||||||||||||

SBA secured by real estate (1) |

34,409 | — | 381 | 416 | 35,206 | |||||||||||||||||||||||||||

| Total investor loans secured by real estate | 8,388,961 | — | 381 | 816 | 8,390,158 | |||||||||||||||||||||||||||

Business loans secured by real estate (2) |

||||||||||||||||||||||||||||||||

| CRE owner-occupied | 2,144,734 | — | — | 4,628 | 2,149,362 | |||||||||||||||||||||||||||

| Franchise real estate secured | 294,646 | — | — | 292 | 294,938 | |||||||||||||||||||||||||||

SBA secured by real estate (3) |

48,426 | — | — | — | 48,426 | |||||||||||||||||||||||||||

| Total business loans secured by real estate | 2,487,806 | — | — | 4,920 | 2,492,726 | |||||||||||||||||||||||||||

Commercial loans (4) |

||||||||||||||||||||||||||||||||

| Commercial and industrial | 1,770,803 | 1,729 | 575 | 1,380 | 1,774,487 | |||||||||||||||||||||||||||

| Franchise non-real estate secured | 300,336 | — | — | 1,559 | 301,895 | |||||||||||||||||||||||||||

| SBA not secured by real estate | 10,146 | 254 | — | 546 | 10,946 | |||||||||||||||||||||||||||

| Total commercial loans | 2,081,285 | 1,983 | 575 | 3,485 | 2,087,328 | |||||||||||||||||||||||||||

| Retail loans | ||||||||||||||||||||||||||||||||

Single family residential (5) |

72,335 | — | 18 | — | 72,353 | |||||||||||||||||||||||||||

| Consumer loans | 1,830 | — | — | — | 1,830 | |||||||||||||||||||||||||||

| Total retail loans | 74,165 | — | 18 | — | 74,183 | |||||||||||||||||||||||||||

Loans held for investment before basis adjustment (6) |

$ | 13,032,217 | $ | 1,983 | $ | 974 | $ | 9,221 | $ | 13,044,395 | ||||||||||||||||||||||

| PACIFIC PREMIER BANCORP, INC. AND SUBSIDIARIES | ||||||||||||||||||||||||||||||||

| CREDIT RISK GRADES | ||||||||||||||||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||||||||||||||

| (Dollars in thousands) | Pass | Special Mention |

Substandard | Doubtful |

Total Gross Loans |

|||||||||||||||||||||||||||

| March 31, 2024 | ||||||||||||||||||||||||||||||||

| Investor loans secured by real estate | ||||||||||||||||||||||||||||||||

| CRE non-owner-occupied | $ | 2,271,367 | $ | 6,699 | $ | 31,186 | $ | — | $ | 2,309,252 | ||||||||||||||||||||||

| Multifamily | 5,511,977 | 29,879 | 17,110 | — | 5,558,966 | |||||||||||||||||||||||||||

| Construction and land | 486,303 | 431 | — | — | 486,734 | |||||||||||||||||||||||||||

SBA secured by real estate (1) |

27,485 | — | 7,721 | — | 35,206 | |||||||||||||||||||||||||||

| Total investor loans secured by real estate | 8,297,132 | 37,009 | 56,017 | — | 8,390,158 | |||||||||||||||||||||||||||

Business loans secured by real estate (2) |

||||||||||||||||||||||||||||||||

| CRE owner-occupied | 2,056,124 | 49,227 | 44,011 | — | 2,149,362 | |||||||||||||||||||||||||||

| Franchise real estate secured | 287,593 | 1,597 | 5,748 | — | 294,938 | |||||||||||||||||||||||||||

SBA secured by real estate (3) |

43,907 | 82 | 4,437 | — | 48,426 | |||||||||||||||||||||||||||

| Total business loans secured by real estate | 2,387,624 | 50,906 | 54,196 | — | 2,492,726 | |||||||||||||||||||||||||||

Commercial loans (4) |

||||||||||||||||||||||||||||||||

| Commercial and industrial | 1,620,751 | 75,752 | 73,875 | 4,109 | 1,774,487 | |||||||||||||||||||||||||||

| Franchise non-real estate secured | 285,554 | 648 | 15,693 | — | 301,895 | |||||||||||||||||||||||||||

| SBA not secured by real estate | 10,147 | — | 799 | — | 10,946 | |||||||||||||||||||||||||||

| Total commercial loans | 1,916,452 | 76,400 | 90,367 | 4,109 | 2,087,328 | |||||||||||||||||||||||||||

| Retail loans | ||||||||||||||||||||||||||||||||

Single family residential (5) |

72,353 | — | — | — | 72,353 | |||||||||||||||||||||||||||

| Consumer loans | 1,830 | — | — | — | 1,830 | |||||||||||||||||||||||||||

| Total retail loans | 74,183 | — | — | — | 74,183 | |||||||||||||||||||||||||||

Loans held for investment before basis adjustment (6) |

$ | 12,675,391 | $ | 164,315 | $ | 200,580 | $ | 4,109 | $ | 13,044,395 | ||||||||||||||||||||||

| PACIFIC PREMIER BANCORP, INC. AND SUBSIDIARIES | ||||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||

| The Company uses certain non-GAAP financial measures to provide meaningful supplemental information regarding the Company’s operational performance and to enhance investors’ overall understanding of such financial performance. However, these non-GAAP financial measures are supplemental and are not a substitute for an analysis based on GAAP measures. As other companies may use different calculations for these adjusted measures, this presentation may not be comparable to other similarly titled adjusted measures reported by other companies. | ||||||||||||||||||||

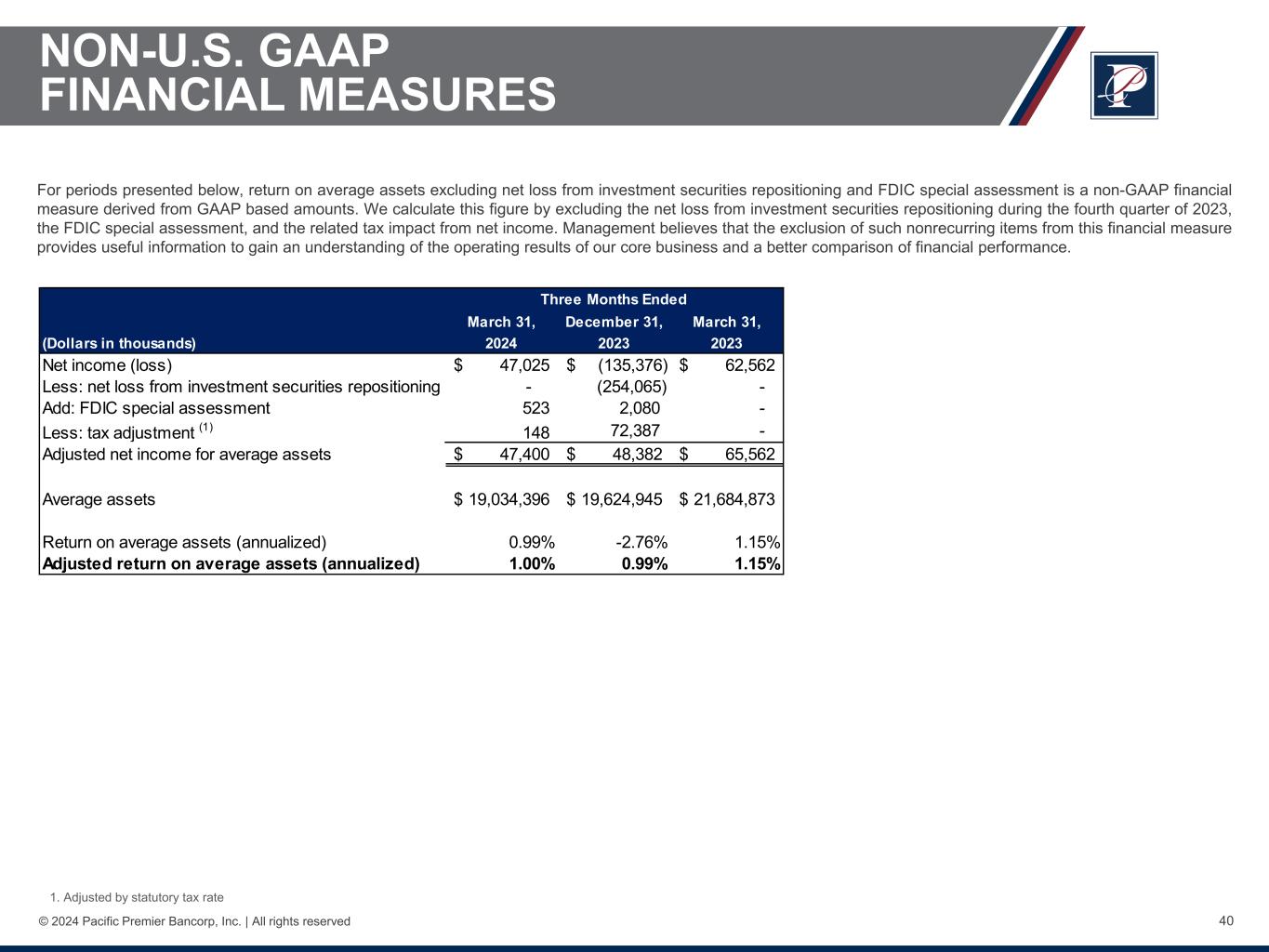

| For periods presented below, return on average assets excluding net loss from investment securities repositioning and FDIC special assessment is a non-GAAP financial measure derived from GAAP based amounts. We calculate this figure by excluding the net loss from investment securities repositioning during the fourth quarter of 2023, the FDIC special assessment, and the related tax impact from net income. Management believes that the exclusion of such nonrecurring items from this financial measure provides useful information to gain an understanding of the operating results of our core business and a better comparison of financial performance. | ||||||||||||||||||||

| Three Months Ended | ||||||||||||||||||||

| March 31, | December 31, | March 31, | ||||||||||||||||||

| (Dollars in thousands) | 2024 | 2023 | 2023 | |||||||||||||||||

| Net income (loss) | $ | 47,025 | $ | (135,376) | $ | 62,562 | ||||||||||||||

| Less: net loss from investment securities repositioning | — | (254,065) | — | |||||||||||||||||

| Add: FDIC special assessment | 523 | 2,080 | — | |||||||||||||||||

Less: tax adjustment (1) |

148 | 72,387 | — | |||||||||||||||||

| Adjusted net income for average assets | $ | 47,400 | $ | 48,382 | $ | 62,562 | ||||||||||||||

| Average assets | $ | 19,034,396 | $ | 19,624,945 | $ | 21,684,873 | ||||||||||||||

ROAA (annualized) |

0.99 | % | (2.76) | % | 1.15 | % | ||||||||||||||

Adjusted ROAA (annualized) |

1.00 | % | 0.99 | % | 1.15 | % | ||||||||||||||

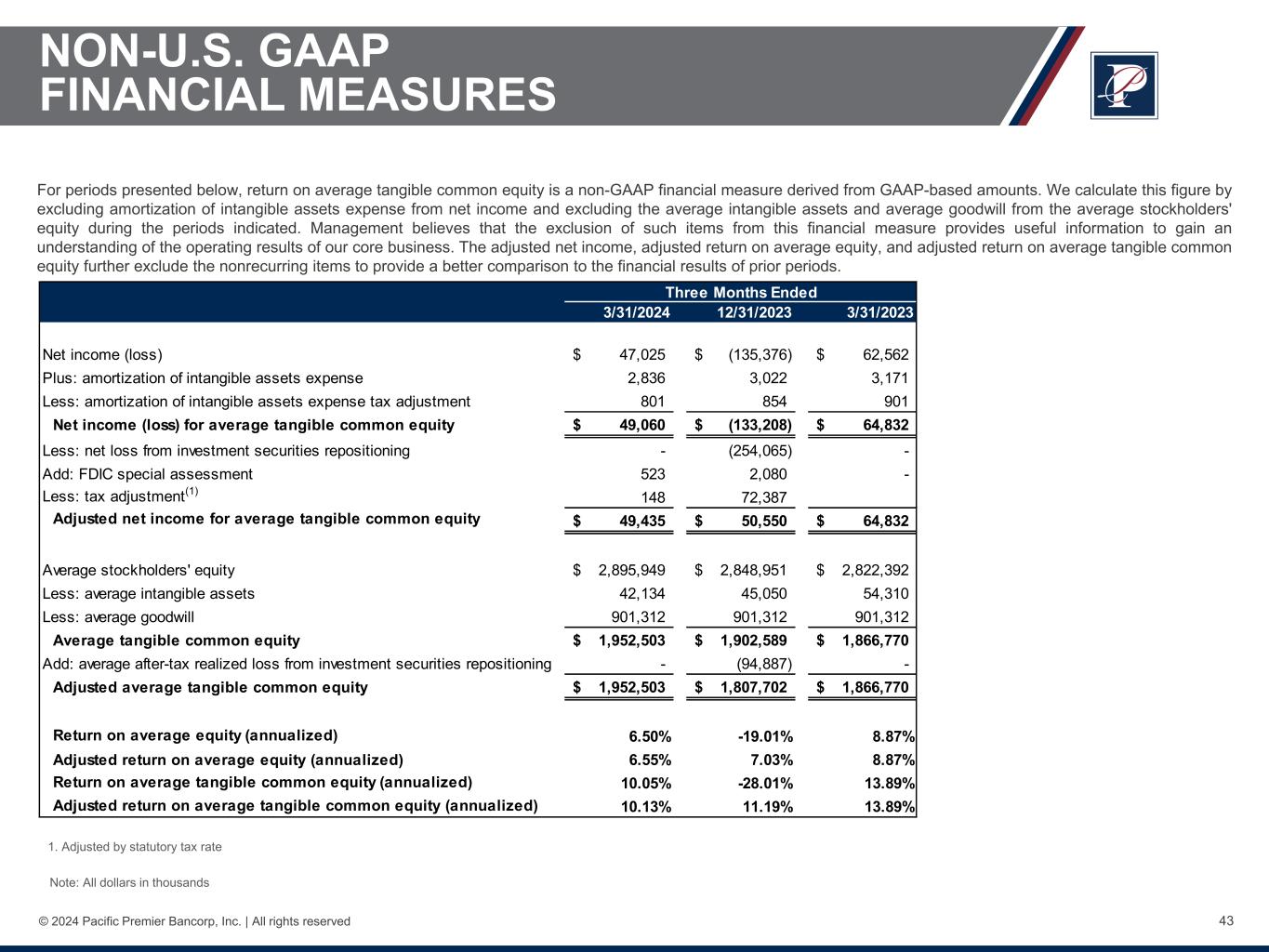

| For periods presented below, return on average tangible common equity is a non-GAAP financial measure derived from GAAP-based amounts. We calculate this figure by excluding amortization of intangible assets expense from net income and excluding the average intangible assets and average goodwill from the average stockholders' equity during the periods indicated. Management believes that the exclusion of such items from this financial measure provides useful information to gain an understanding of the operating results of our core business. The adjusted net income, adjusted return on average equity, and adjusted return on average tangible common equity further exclude the nonrecurring items to provide a better comparison to the financial results of prior periods. | ||||||||||||||||||||

| Three Months Ended | ||||||||||||||||||||

| March 31, | December 31, | March 31, | ||||||||||||||||||

| (Dollars in thousands) | 2024 | 2023 | 2023 | |||||||||||||||||

| Net income (loss) | $ | 47,025 | $ | (135,376) | $ | 62,562 | ||||||||||||||

| Plus: amortization of intangible assets expense | 2,836 | 3,022 | 3,171 | |||||||||||||||||

Less: tax adjustment (1) |

801 | 854 | 901 | |||||||||||||||||

| Net income (loss) for average tangible common equity | $ | 49,060 | $ | (133,208) | $ | 64,832 | ||||||||||||||

| Less: net loss from investment securities repositioning | — | (254,065) | — | |||||||||||||||||

| Add: FDIC special assessment | 523 | 2,080 | — | |||||||||||||||||

Less: tax adjustment (1) |

148 | 72,387 | — | |||||||||||||||||

| Adjusted net income for average tangible common equity | $ | 49,435 | $ | 50,550 | $ | 64,832 | ||||||||||||||

| Average stockholders' equity | $ | 2,895,949 | $ | 2,848,951 | $ | 2,822,392 | ||||||||||||||

| Less: average intangible assets | 42,134 | 45,050 | 54,310 | |||||||||||||||||

| Less: average goodwill | 901,312 | 901,312 | 901,312 | |||||||||||||||||

| Average tangible common equity | 1,952,503 | 1,902,589 | 1,866,770 | |||||||||||||||||

| Add: average after-tax realized loss from investment securities repositioning | — | (94,887) | — | |||||||||||||||||

| Adjusted average tangible common equity | $ | 1,952,503 | $ | 1,807,702 | $ | 1,866,770 | ||||||||||||||

| ROAE (annualized) | 6.50 | % | (19.01) | % | 8.87 | % | ||||||||||||||

| Adjusted ROAE (annualized) | 6.55 | % | 7.03 | % | 8.87 | % | ||||||||||||||

| ROATCE (annualized) | 10.05 | % | (28.01) | % | 13.89 | % | ||||||||||||||

| Adjusted ROATCE (annualized) | 10.13 | % | 11.19 | % | 13.89 | % | ||||||||||||||

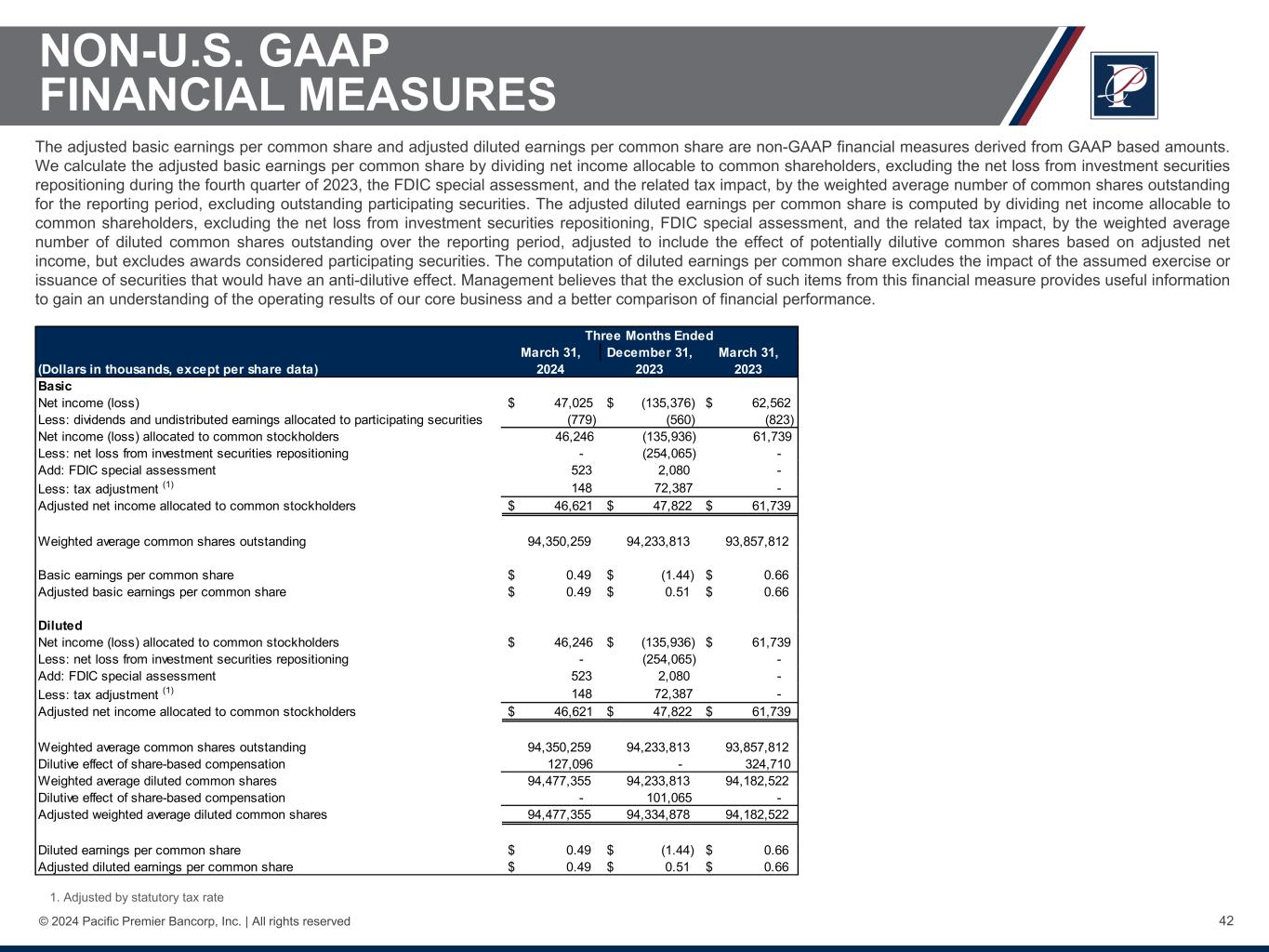

| The adjusted basic earnings per common share and adjusted diluted earnings per common share are non-GAAP financial measures derived from GAAP based amounts. We calculate the adjusted basic earnings per common share by dividing net income allocable to common shareholders, excluding the net loss from investment securities repositioning during the fourth quarter of 2023, the FDIC special assessment, and the related tax impact, by the weighted average number of common shares outstanding for the reporting period, excluding outstanding participating securities. The adjusted diluted earnings per common share is computed by dividing net income allocable to common shareholders, excluding the net loss from investment securities repositioning, FDIC special assessment, and the related tax impact, by the weighted average number of diluted common shares outstanding over the reporting period, adjusted to include the effect of potentially dilutive common shares based on adjusted net income, but excludes awards considered participating securities. The computation of diluted earnings per common share excludes the impact of the assumed exercise or issuance of securities that would have an anti-dilutive effect. Management believes that the exclusion of such items from this financial measure provides useful information to gain an understanding of the operating results of our core business and a better comparison of financial performance. | ||||||||||||||||||||

| Three Months Ended | ||||||||||||||||||||

| March 31, | December 31, | March 31, | ||||||||||||||||||

| (Dollars in thousands, except per share data) | 2024 | 2023 | 2023 | |||||||||||||||||

| Basic | ||||||||||||||||||||

| Net income (loss) | $ | 47,025 | $ | (135,376) | $ | 62,562 | ||||||||||||||

| Less: dividends and undistributed earnings allocated to participating securities | (779) | (560) | (823) | |||||||||||||||||

| Net income (loss) allocated to common stockholders | 46,246 | (135,936) | 61,739 | |||||||||||||||||

| Less: net loss from investment securities repositioning | — | (254,065) | — | |||||||||||||||||

| Add: FDIC special assessment | 523 | 2,080 | — | |||||||||||||||||

Less: tax adjustment (1) |

148 | 72,387 | — | |||||||||||||||||

| Adjusted net income allocated to common stockholders | $ | 46,621 | $ | 47,822 | $ | 61,739 | ||||||||||||||

| Weighted average common shares outstanding | 94,350,259 | 94,233,813 | 93,857,812 | |||||||||||||||||

| Basic earnings (loss) per common share | $ | 0.49 | $ | (1.44) | $ | 0.66 | ||||||||||||||

| Adjusted basic earnings per common share | $ | 0.49 | $ | 0.51 | $ | 0.66 | ||||||||||||||

| Diluted | ||||||||||||||||||||

| Net income (loss) allocated to common stockholders | $ | 46,246 | $ | (135,936) | $ | 61,739 | ||||||||||||||

| Less: net loss from investment securities repositioning | — | (254,065) | — | |||||||||||||||||

| Add: FDIC special assessment | 523 | 2,080 | — | |||||||||||||||||

Less: tax adjustment (1) |

148 | 72,387 | — | |||||||||||||||||

| Adjusted net income allocated to common stockholders | $ | 46,621 | $ | 47,822 | $ | 61,739 | ||||||||||||||

| Weighted average common shares outstanding | 94,350,259 | 94,233,813 | 93,857,812 | |||||||||||||||||

| Dilutive effect of share-based compensation | 127,096 | — | 324,710 | |||||||||||||||||

| Weighted average diluted common shares | 94,477,355 | 94,233,813 | 94,182,522 | |||||||||||||||||

| Dilutive effect of share-based compensation | — | 101,065 | — | |||||||||||||||||

| Adjusted weighted average diluted common shares | 94,477,355 | 94,334,878 | 94,182,522 | |||||||||||||||||

| Diluted earnings (loss) per common share | $ | 0.49 | $ | (1.44) | $ | 0.66 | ||||||||||||||

| Adjusted diluted earnings per common share | $ | 0.49 | $ | 0.51 | $ | 0.66 | ||||||||||||||

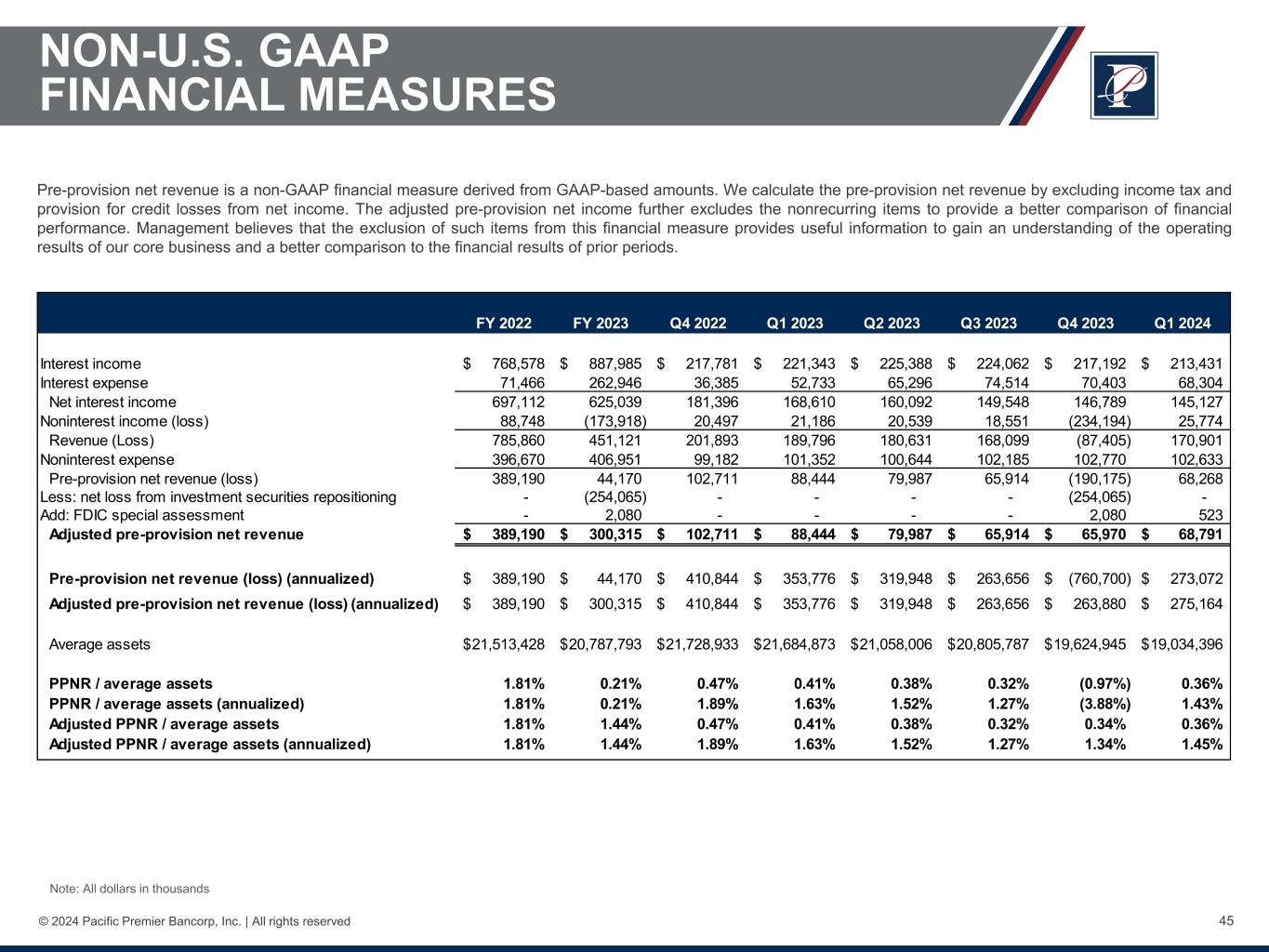

Pre-provision net revenue is a non-GAAP financial measure derived from GAAP-based amounts. We calculate the pre-provision net revenue by excluding income tax and provision for credit losses from net income. The adjusted pre-provision net income further excludes the net loss from investment securities repositioning during the fourth quarter of 2023 and the FDIC special assessment to provide a better comparison of financial performance. Management believes that the exclusion of such items from this financial measure provides useful information to gain an understanding of the operating results of our core business and a better comparison to the financial results of prior periods. | ||||||||||||||||||||

| Three Months Ended | ||||||||||||||||||||

| March 31, | December 31, | March 31, | ||||||||||||||||||

| (Dollars in thousands) | 2024 | 2023 | 2023 | |||||||||||||||||

| Interest income | $ | 213,431 | $ | 217,192 | $ | 221,343 | ||||||||||||||

| Interest expense | 68,304 | 70,403 | 52,733 | |||||||||||||||||

| Net interest income | 145,127 | 146,789 | 168,610 | |||||||||||||||||

| Noninterest income (loss) | 25,774 | (234,194) | 21,186 | |||||||||||||||||

| Revenue (loss) | 170,901 | (87,405) | 189,796 | |||||||||||||||||

| Noninterest expense | 102,633 | 102,770 | 101,352 | |||||||||||||||||

| Pre-provision net revenue (loss) | 68,268 | (190,175) | 88,444 | |||||||||||||||||

| Less: net loss from investment securities repositioning | — | (254,065) | — | |||||||||||||||||

| Add: FDIC special assessment | 523 | 2,080 | — | |||||||||||||||||

| Adjusted pre-provision net revenue | $ | 68,791 | $ | 65,970 | $ | 88,444 | ||||||||||||||

| Pre-provision net revenue (loss) (annualized) | $ | 273,072 | $ | (760,700) | $ | 353,776 | ||||||||||||||

| Adjusted pre-provision net revenue (annualized) | $ | 275,164 | $ | 263,880 | $ | 353,776 | ||||||||||||||

| Average assets | $ | 19,034,396 | $ | 19,624,945 | $ | 21,684,873 | ||||||||||||||

| Pre-provision net revenue (loss) to average assets | 0.36 | % | (0.97) | % | 0.41 | % | ||||||||||||||

| Pre-provision net revenue (loss) to average assets (annualized) | 1.43 | % | (3.88) | % | 1.63 | % | ||||||||||||||

| Adjusted pre-provision net revenue on average assets | 0.36 | % | 0.34 | % | 0.41 | % | ||||||||||||||

| Adjusted pre-provision net revenue on average assets (annualized) | 1.45 | % | 1.34 | % | 1.63 | % | ||||||||||||||

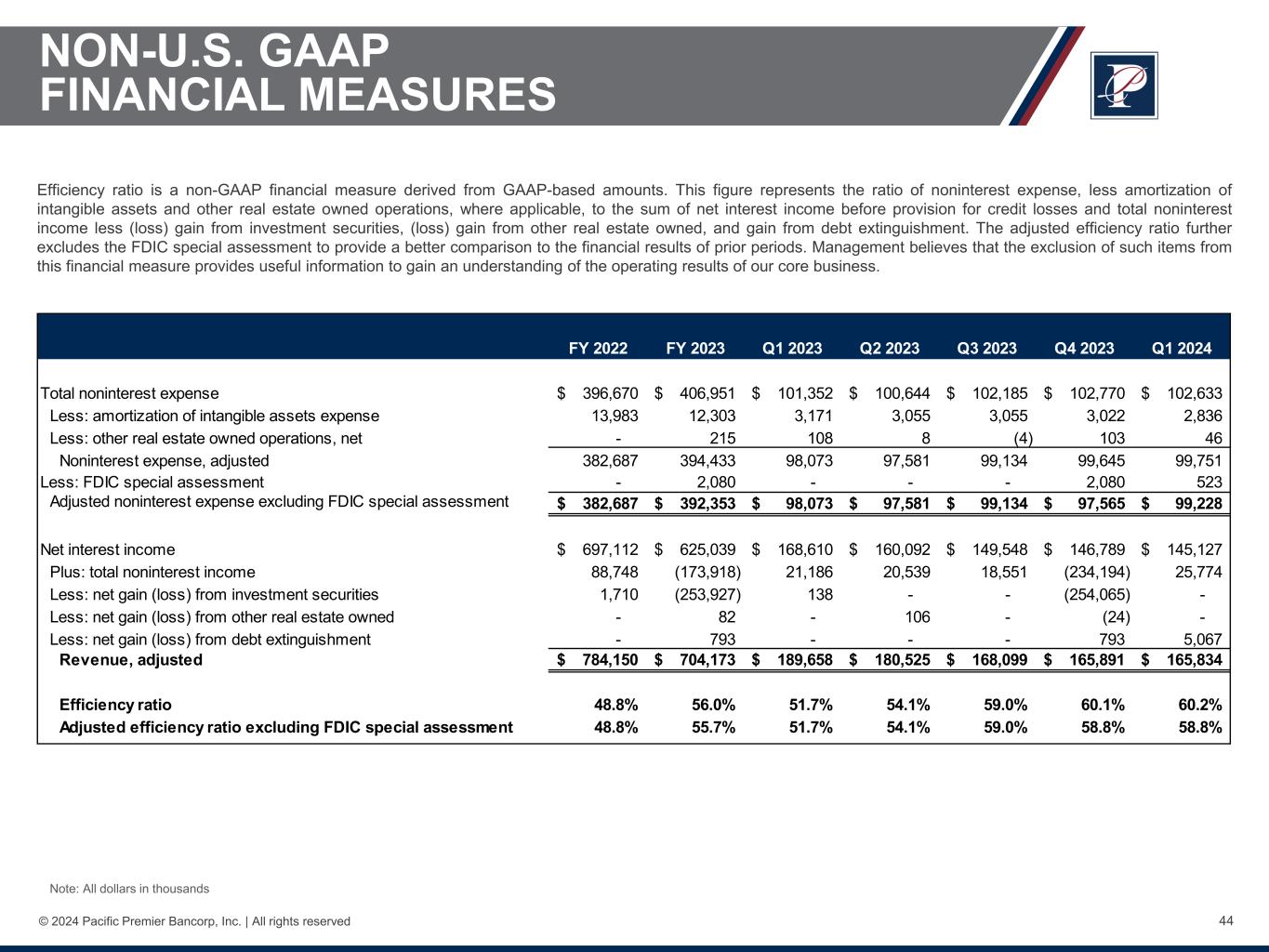

| Efficiency ratio is a non-GAAP financial measure derived from GAAP-based amounts. This figure represents the ratio of noninterest expense, less amortization of intangible assets and other real estate owned operations, where applicable, to the sum of net interest income before provision for credit losses and total noninterest income less (loss) gain from investment securities, (loss) gain from other real estate owned, and gain from debt extinguishment. The adjusted efficiency ratio further excludes the FDIC special assessment to provide a better comparison to the financial results of prior periods. Management believes that the exclusion of such items from this financial measure provides useful information to gain an understanding of the operating results of our core business. | ||||||||||||||||||||

| Three Months Ended | ||||||||||||||||||||

| March 31, | December 31, | March 31, | ||||||||||||||||||

| (Dollars in thousands) | 2024 | 2023 | 2023 | |||||||||||||||||

| Total noninterest expense | $ | 102,633 | $ | 102,770 | $ | 101,352 | ||||||||||||||

| Less: amortization of intangible assets | 2,836 | 3,022 | 3,171 | |||||||||||||||||

| Less: other real estate owned operations, net | 46 | 103 | 108 | |||||||||||||||||

| Adjusted noninterest expense | 99,751 | 99,645 | 98,073 | |||||||||||||||||

| Less: FDIC special assessment | 523 | 2,080 | — | |||||||||||||||||

| Adjusted noninterest expense excluding FDIC special assessment | $ | 99,228 | $ | 97,565 | $ | 98,073 | ||||||||||||||

| Net interest income before provision for credit losses | $ | 145,127 | $ | 146,789 | $ | 168,610 | ||||||||||||||

| Add: total noninterest income (loss) | 25,774 | (234,194) | 21,186 | |||||||||||||||||

| Less: net (loss) gain from sales of investment securities | — | (254,065) | 138 | |||||||||||||||||

Less: net loss from other real estate owned |

— | (24) | — | |||||||||||||||||

| Less: net gain from debt extinguishment | 5,067 | 793 | — | |||||||||||||||||

Adjusted revenue |

$ | 165,834 | $ | 165,891 | $ | 189,658 | ||||||||||||||

| Efficiency ratio | 60.2 | % | 60.1 | % | 51.7 | % | ||||||||||||||

| Adjusted efficiency ratio excluding FDIC special assessment | 59.8 | % | 58.8 | % | 51.7 | % | ||||||||||||||

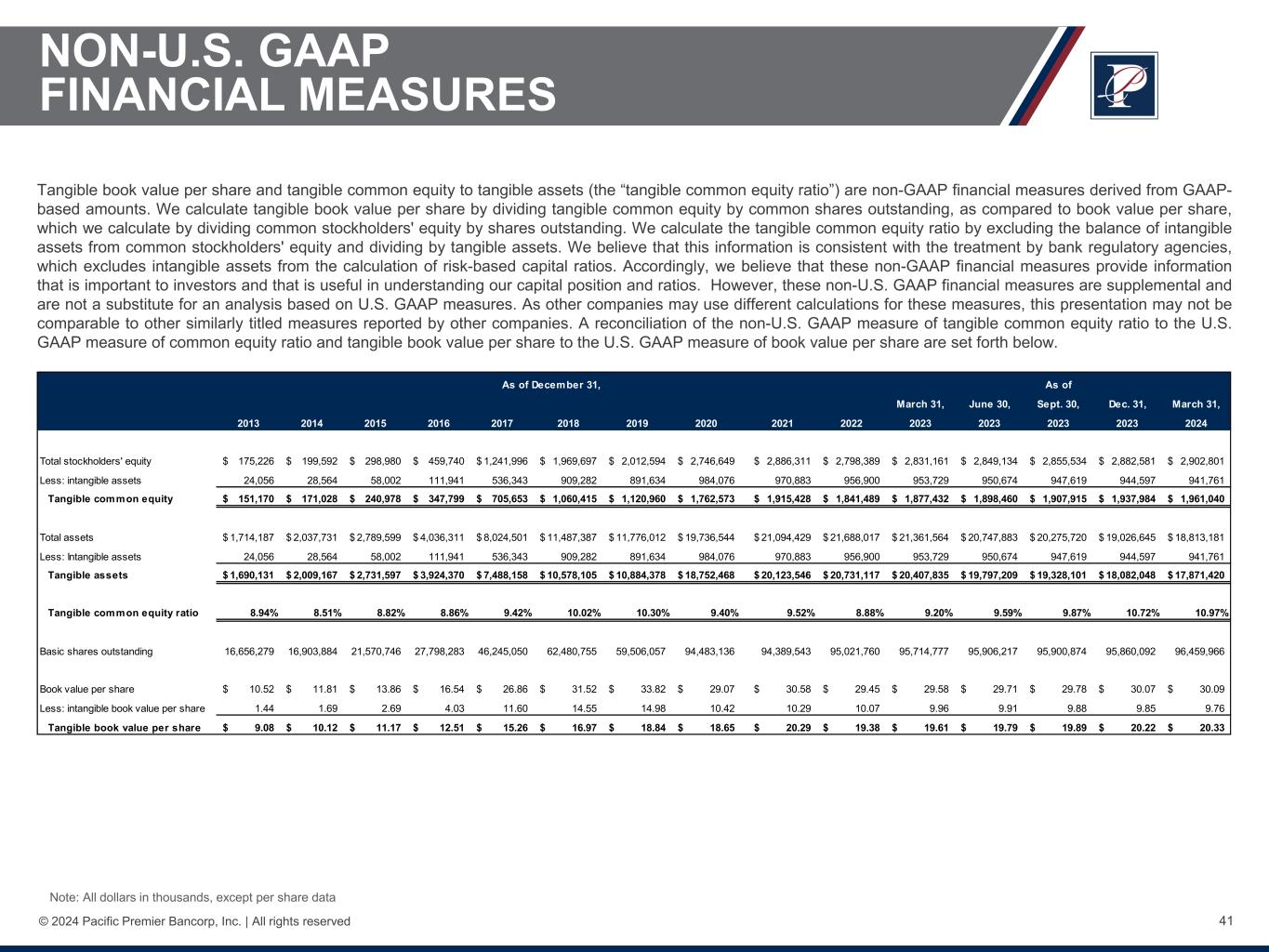

| Tangible book value per share and tangible common equity to tangible assets (the “tangible common equity ratio”) are non-GAAP financial measures derived from GAAP-based amounts. We calculate tangible book value per share by dividing tangible common equity by common shares outstanding, as compared to book value per share, which we calculate by dividing common stockholders' equity by shares outstanding. We calculate the tangible common equity ratio by excluding the balance of intangible assets from common stockholders' equity and dividing by tangible assets. We believe that this information is consistent with the treatment by bank regulatory agencies, which excludes intangible assets from the calculation of risk-based capital ratios. Accordingly, we believe that these non-GAAP financial measures provide information that is important to investors and that is useful in understanding our capital position and ratios. | ||||||||||||||||||||||||||||||||

| March 31, | December 31, | September 30, | June 30, | March 31, | ||||||||||||||||||||||||||||

| (Dollars in thousands, except per share data) | 2024 | 2023 | 2023 | 2023 | 2023 | |||||||||||||||||||||||||||

| Total stockholders' equity | $ | 2,902,801 | $ | 2,882,581 | $ | 2,855,534 | $ | 2,849,134 | $ | 2,831,161 | ||||||||||||||||||||||

| Less: intangible assets | 941,761 | 944,597 | 947,619 | 950,674 | 953,729 | |||||||||||||||||||||||||||

| Tangible common equity | $ | 1,961,040 | $ | 1,937,984 | $ | 1,907,915 | $ | 1,898,460 | $ | 1,877,432 | ||||||||||||||||||||||

| Total assets | $ | 18,813,181 | $ | 19,026,645 | $ | 20,275,720 | $ | 20,747,883 | $ | 21,361,564 | ||||||||||||||||||||||

| Less: intangible assets | 941,761 | 944,597 | 947,619 | 950,674 | 953,729 | |||||||||||||||||||||||||||

| Tangible assets | $ | 17,871,420 | $ | 18,082,048 | $ | 19,328,101 | $ | 19,797,209 | $ | 20,407,835 | ||||||||||||||||||||||

| Tangible common equity ratio | 10.97 | % | 10.72 | % | 9.87 | % | 9.59 | % | 9.20 | % | ||||||||||||||||||||||

| Common shares issued and outstanding | 96,459,966 | 95,860,092 | 95,900,847 | 95,906,217 | 95,714,777 | |||||||||||||||||||||||||||

| Book value per share | $ | 30.09 | $ | 30.07 | $ | 29.78 | $ | 29.71 | $ | 29.58 | ||||||||||||||||||||||

| Less: intangible book value per share | 9.76 | 9.85 | 9.88 | 9.91 | 9.96 | |||||||||||||||||||||||||||

| Tangible book value per share | $ | 20.33 | $ | 20.22 | $ | 19.89 | $ | 19.79 | $ | 19.61 | ||||||||||||||||||||||

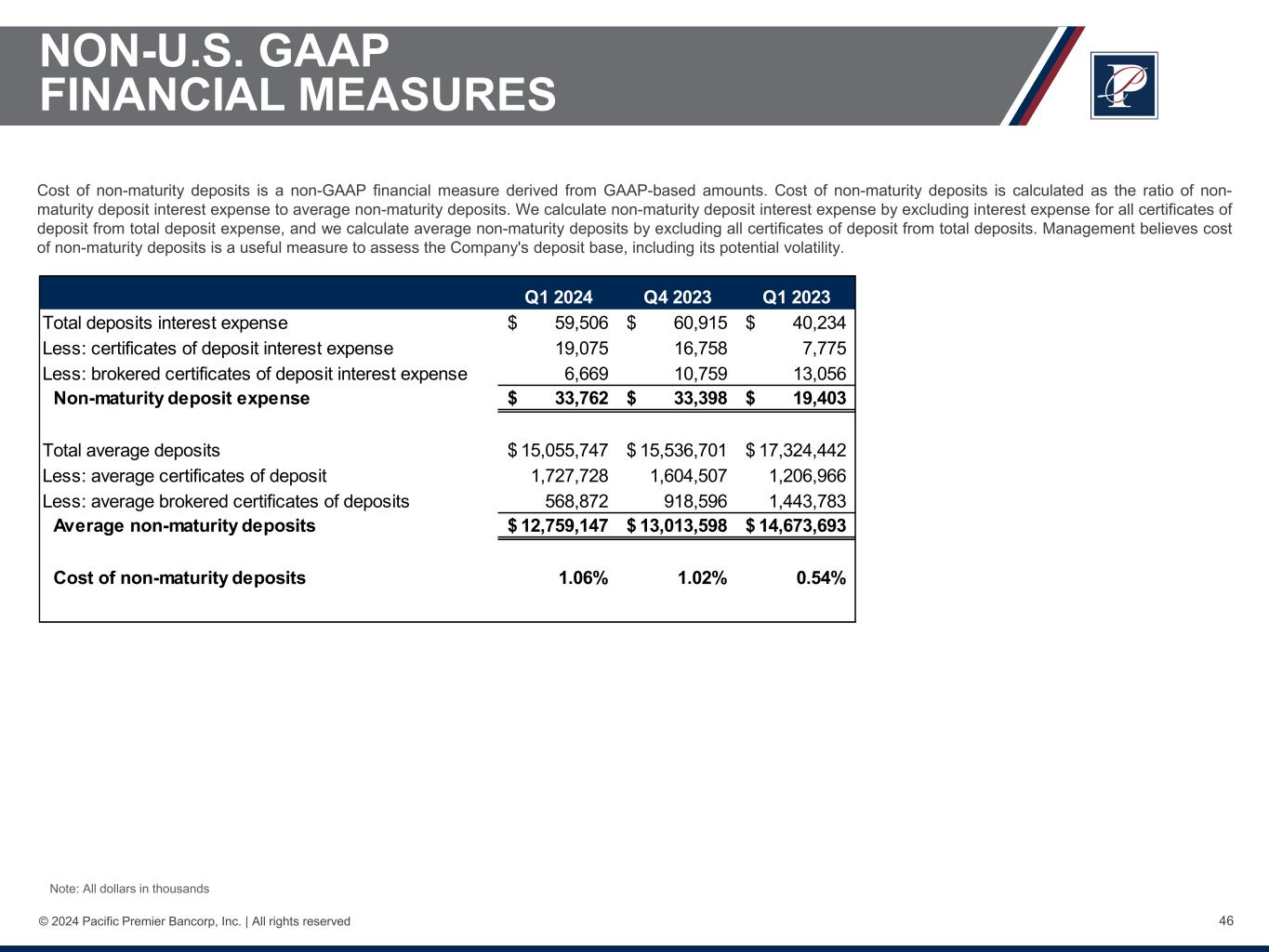

Cost of non-maturity deposits is a non-GAAP financial measure derived from GAAP-based amounts. Cost of non-maturity deposits is calculated as the ratio of non-maturity deposit interest expense to average non-maturity deposits. We calculate non-maturity deposit interest expense by excluding interest expense for all certificates of deposit from total deposit expense, and we calculate average non-maturity deposits by excluding all certificates of deposit from total deposits. Management believes cost of non-maturity deposits is a useful measure to assess the Company's deposit base, including its potential volatility. | ||||||||||||||||||||

| Three Months Ended | ||||||||||||||||||||

| March 31, | December 31, | March 31, | ||||||||||||||||||

| (Dollars in thousands) | 2024 | 2023 | 2023 | |||||||||||||||||

| Total deposits interest expense | $ | 59,506 | $ | 60,915 | $ | 40,234 | ||||||||||||||

| Less: certificates of deposit interest expense | 19,075 | 16,758 | 7,775 | |||||||||||||||||

| Less: brokered certificates of deposit interest expense | 6,669 | 10,759 | 13,056 | |||||||||||||||||

| Non-maturity deposit expense | $ | 33,762 | $ | 33,398 | $ | 19,403 | ||||||||||||||

| Total average deposits | $ | 15,055,747 | $ | 15,536,701 | $ | 17,324,442 | ||||||||||||||

| Less: average certificates of deposit | 1,727,728 | 1,604,507 | 1,206,966 | |||||||||||||||||

| Less: average brokered certificates of deposit | 568,872 | 918,596 | 1,443,783 | |||||||||||||||||

| Average non-maturity deposits | $ | 12,759,147 | $ | 13,013,598 | $ | 14,673,693 | ||||||||||||||

| Cost of non-maturity deposits | 1.06 | % | 1.02 | % | 0.54 | % | ||||||||||||||