BANCO SANTANDER CHILE INTERIM CONSOLIDATED FINANCIAL STATEMENTS For the periods ending on September 30, 2025, and 2024 and December 31, 2024

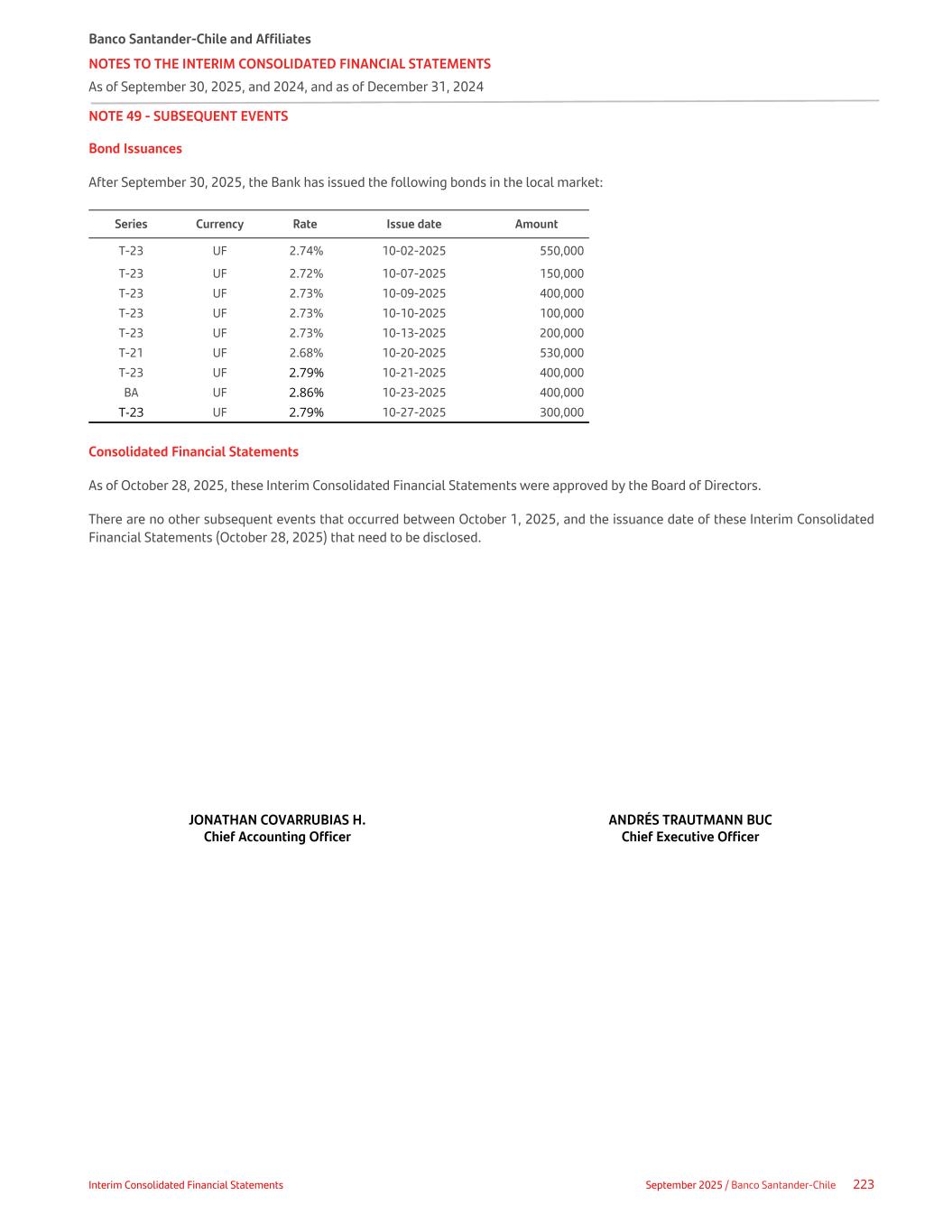

INTERIM CONSOLIDATED FINANCIAL STATEMENTS INTERIM CONSOLIDATED STATEMENTS OF FINANCIAL POSITION 3 INTERIM CONSOLIDATED STATEMENTS OF INCOME 5 INTERIM CONSOLIDATED STATEMENTS OF OTHER COMPREHENSIVE INCOME 7 INTERIM CONSOLIDATED STATEMENTS OF CASH FLOWS 8 INTERIM CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY 11 NOTES TO THE INTERIM CONSOLIDATED FINANCIAL STATEMENTS NOTE 01 - CORPORATE INFORMATION 12 NOTE 02 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES 12 NOTE 03 - NEW ACCOUNTING PRONOUNCEMENTS ISSUED AND ADOPTED OR ISSUED AND NOT YET ADOPTED 44 NOTE 04 - ACCOUNTING CHANGES 47 NOTE 05 - SIGNIFICANT EVENTS 48 NOTE 06 - REPORTING SEGMENTS 50 NOTE 07 - CASH AND CASH EQUIVALENTS 54 NOTE 08 - FINANCIAL ASSETS HELD FOR TRADING AT FAIR VALUE THROUGH PROFIT OR LOSS 55 NOTE 09 - FINANCIAL ASSETS NOT FOR TRADING MANDATORILY AT FAIR VALUE THROUGH PROFIT OR LOSS 57 NOTE 10 - FINANCIAL ASSETS AND LIABILITIES DESIGNATED AT FAIR VALUE THROUGH PROFIT OR LOSS 58 NOTE 11 - FINANCIAL ASSETS AT FAIR VALUE THROUGH OTHER COMPREHENSIVE INCOME 59 NOTE 12 - FINANCIAL DERIVATIVE CONTRACTS FOR HEDGE ACCOUNTING PURPOSES 64 NOTE 13 - FINANCIAL ASSETS AT AMORTISED COST 75 NOTE 14 - INVESTMENTS IN ASSOCIATES AND OTHER COMPANIES 100 NOTE 15 - INTANGIBLE ASSETS 102 NOTE 16 - FIXED ASSETS 104 NOTE 17 - RIGHT OF USE ASSETS AND LEASE CONTRACTS OBLIGATIONS 106 NOTE 18 - CURRENT AND DEFERRED TAXES 109 NOTE 19 - OTHER ASSETS 114 NOTE 20 - NON-CURRENT ASSETS AND DISPOSAL GROUPS HELD FOR SALE AND LIABILITIES INCLUDED IN DISPOSAL GROUPS HELD FOR SALE 115 NOTE 21 - FINANCIAL LIABILITIES HELD FOR TRADING AT FAIR VALUE THROUGH PROFIT OR LOSS 116 NOTE 22 - FINANCIAL LIABILITIES AT AMORTISED COST 118 NOTE 23 - REGULATORY CAPITAL FINANCIAL INSTRUMENTS 128 NOTE 24 - PROVISIONS FOR CONTINGENCIES 130 NOTE 25 - PROVISIONS FOR DIVIDENDS, INTEREST PAYMENTS AND REVALUATION OF REGULATORY CAPITAL FINANCIAL INSTRUMENTS ISSUED 131 NOTE 26 - SPECIAL PROVISIONS FOR CREDIT RISK 132 NOTE 27 - OTHER LIABILITIES 134 NOTE 28 - EQUITY 135 NOTE 29 - CONTINGENCIES AND COMMITMENTS 140 NOTE 30 - INTEREST INCOME AND EXPENSES 143 NOTE 31 - READJUSTMENT INCOME AND EXPENSE 145 NOTE 32 - COMMISSION INCOME AND EXPENSES 146 NOTE 33 - NET FINANCIAL INCOME 151 NOTE 34 - INCOME FROM INVESTMENTS IN COMPANIES 153 NOTE 35 - NON-CURRENT ASSETS AND DISPOSAL GROUPS NOT QUALIFYING AS DISCONTINUED OPERATIONS 154 NOTE 36 - OTHER OPERATING INCOME AND EXPENSES 155 NOTE 37 - EXPENSES FROM OBLIGATIONS TO EMPLOYEES 156 NOTE 38 - ADMINISTRATIVE EXPENSE 159 NOTE 39 - DEPRECIATION AND AMORTIZATION 160 NOTE 40 - IMPAIRMENT OF NON-FINANCIAL ASSETS 161 NOTE 41 - CREDIT LOSS EXPENSES 162 NOTE 42 - RESULTS FROM DISCONTINUED OPERATIONS 167 NOTE 43 - TRANSACTION WITH RELATED PARTIES 168 NOTE 44 - FAIR VALUE OF FINANCIAL ASSETS AND FINANCIAL LIABILITIES 175 NOTE 45 - MATURITY OF FINANCIAL ASSETS AND LIABILITIES ACCORDING TO REMAINING MATURITIES 183 NOTE 46 - FINANCIAL AND NON-FINANCIAL ASSETS AND LIABILITIES BY CURRENCY 185 NOTE 47 - RISK MANAGEMENT AND REPORTING 186 NOTE 48 - INFORMATION ON REGULATORY CAPITAL AND CAPITAL ADEQUACY INDICATORS 215 NOTE 49 - SUBSEQUENT EVENTS 223

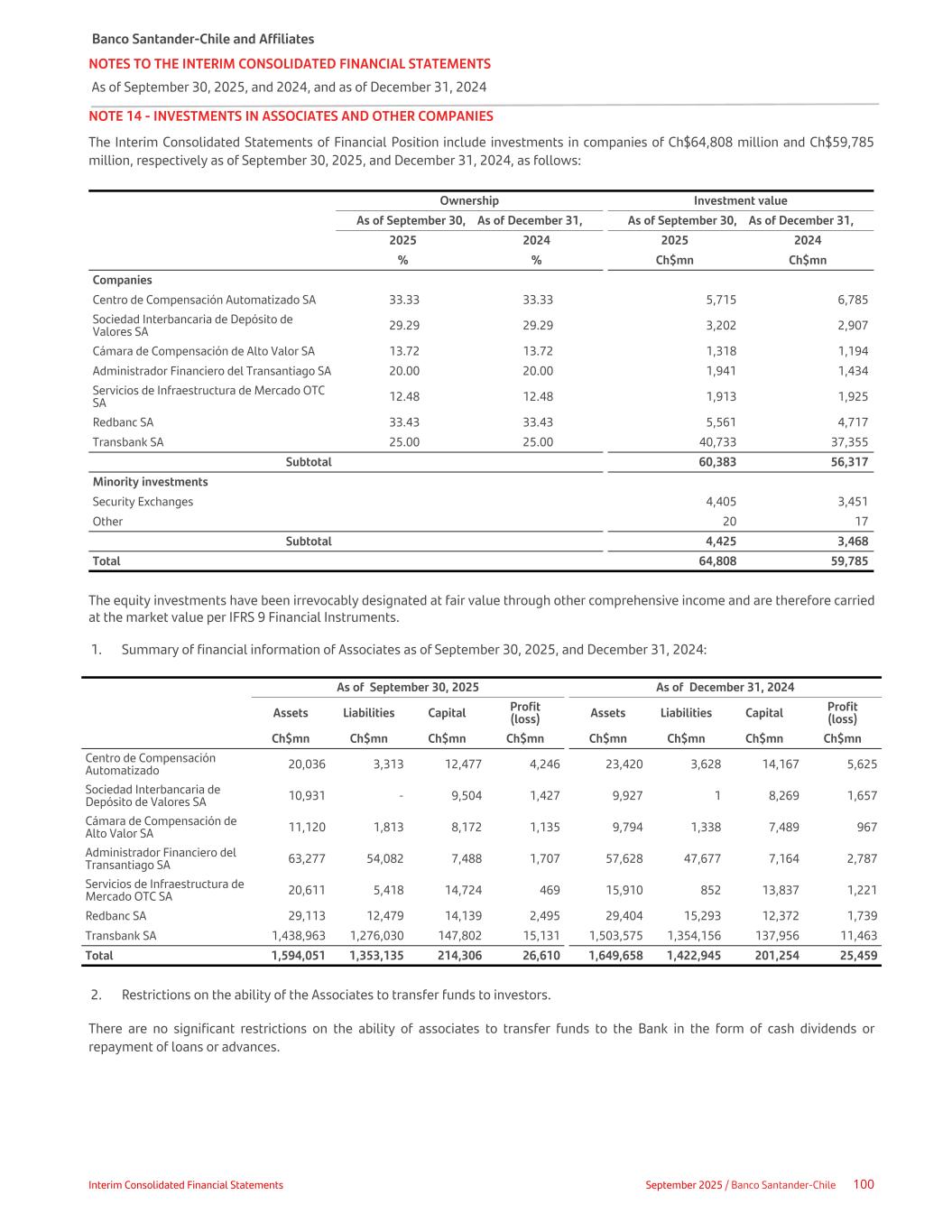

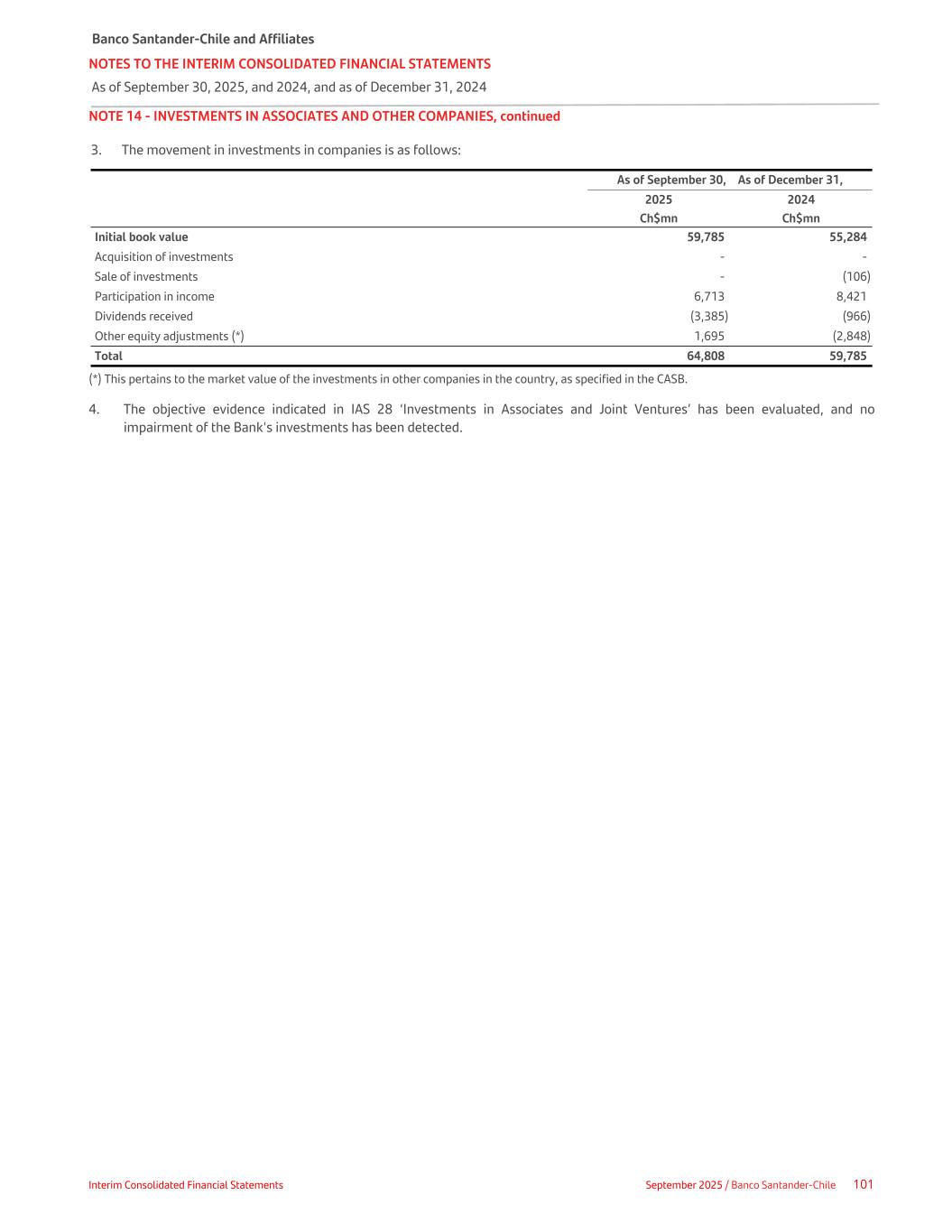

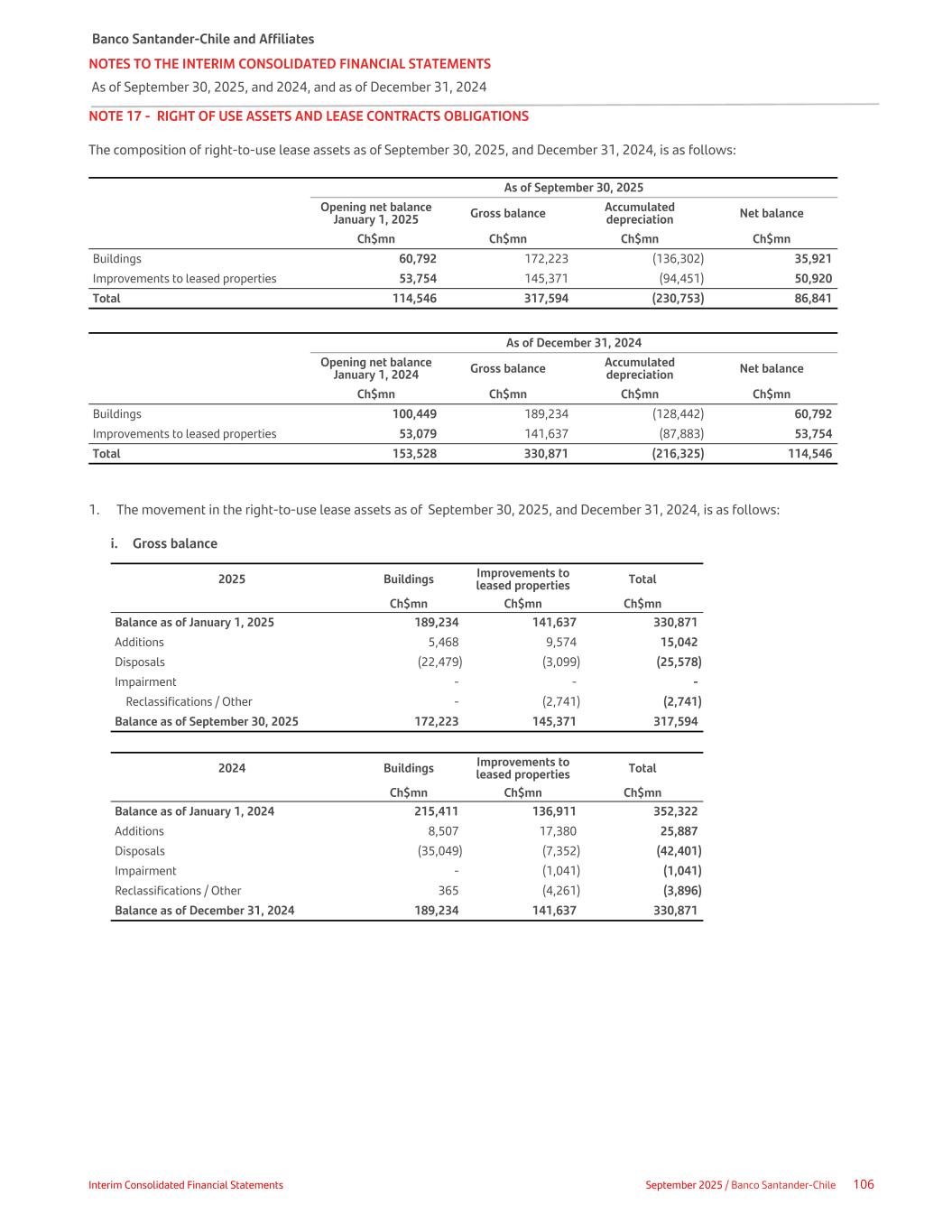

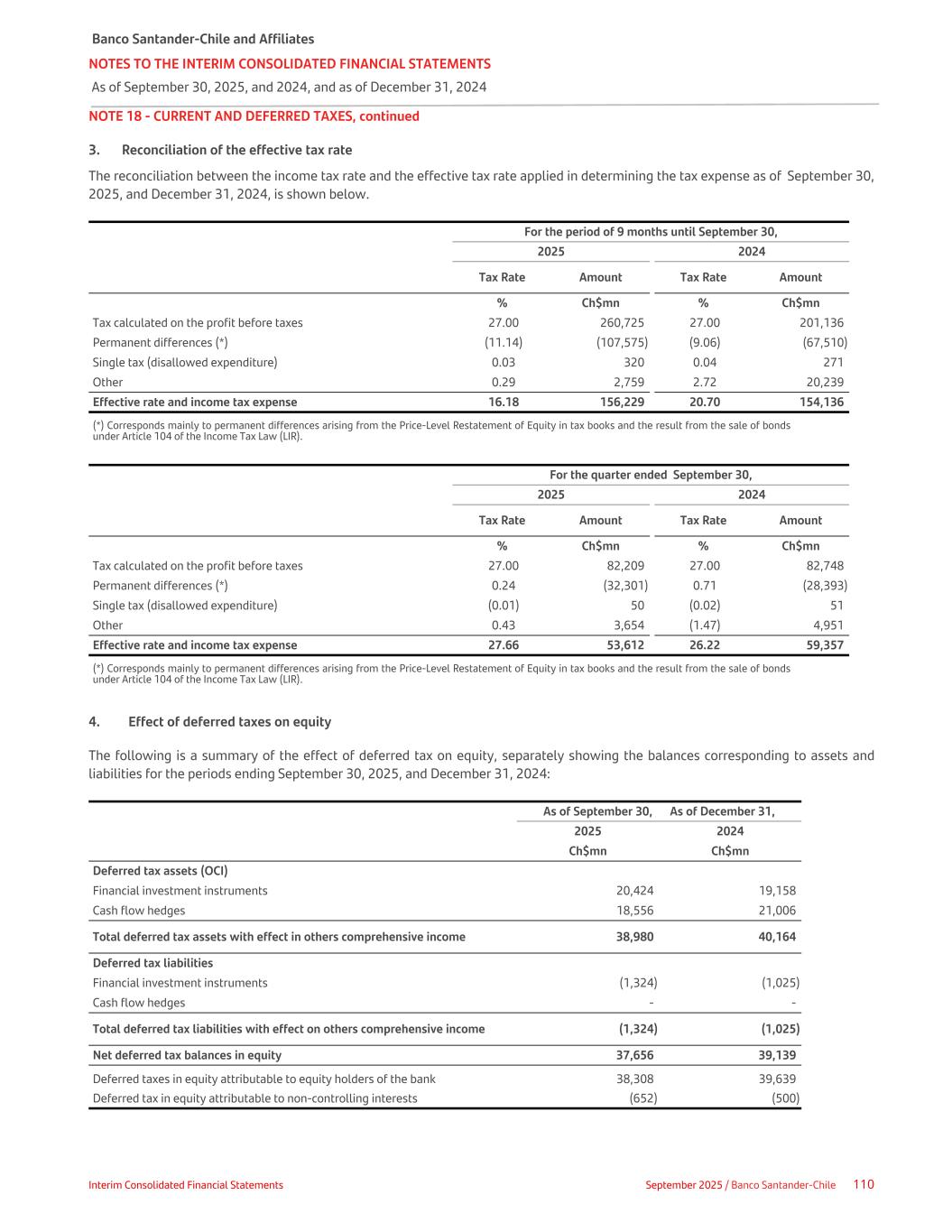

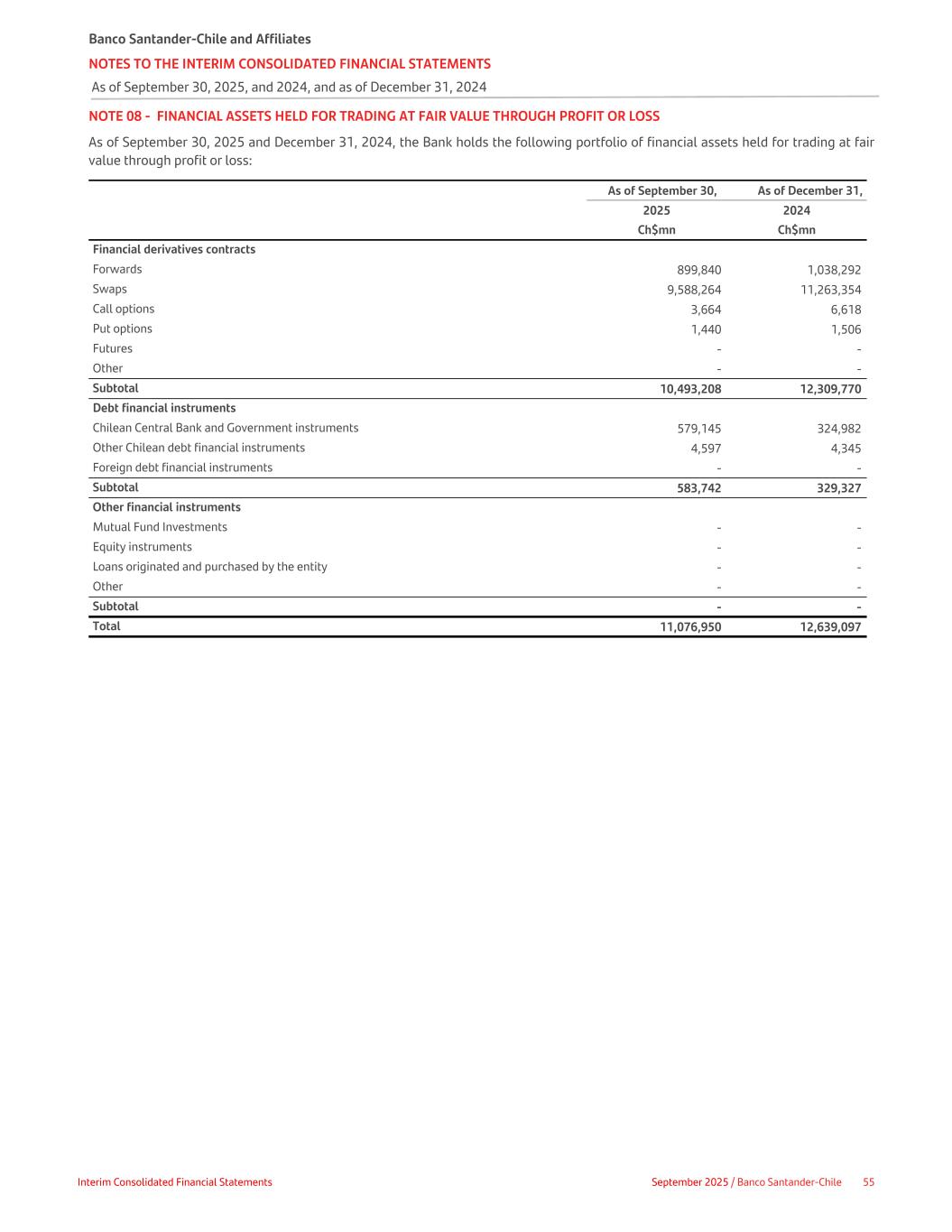

As of September 30, As of December 31, 2025 2024 ASSETS Note Ch$mn Ch$mn Cash and deposits in banks 7 1,983,033 2,695,560 Cash in collection process 7 1,973,045 572,552 Financial assets held for trading at fair value through profit or loss 8 11,076,950 12,639,097 Financial derivatives contracts 8 10,493,208 12,309,770 Debt financial instruments 8 583,742 329,327 Other 8 - - Non-trading financial assets mandatory measured at fair value 9 - - Financial assets designated at fair value through profit or loss 10 - - Financial assets at fair value through other comprehensive income 11 3,711,132 2,762,388 Debt financial instruments 11 3,478,215 2,687,485 Other 11 232,917 74,903 Financial derivative contracts for hedge accounting 12 408,424 843,628 Financial assets at amortized cost 13 45,601,016 45,438,590 Rights under repurchase and securities lending agreements 13 434,334 153,087 Debt financial instruments 13 5,494,359 5,176,005 Interbank loans 13 32,186 31,258 Loans and receivables from clients - Commercial 13 16,902,294 17,115,723 Loans and receivables from clients - Mortgage 13 17,269,116 17,398,598 Loans and receivables from clients - Consumer 13 5,468,727 5,563,919 Investment in companies 14 64,808 59,785 Intangible assets 15 77,491 88,669 Fixed assets 16 201,929 198,092 Assets with leasing rights 17 86,841 114,546 Current taxes 18 91 60 Deferred taxes 18 461,673 459,977 Other assets 19 2,538,382 2,535,775 Non-current assets and disposal groups for sale 20 55,392 50,214 TOTAL ASSETS 68,240,207 68,458,933 The accompanying notes form an integral part of the Interim Consolidated Financial Statements. Banco Santander-Chile and Affiliates INTERIM CONSOLIDATED STATEMENTS OF FINANCIAL POSITION As of September 30, 2025 and December 31, 2024 Interim Consolidated Financial Statements September 2025 / Banco Santander-Chile 3

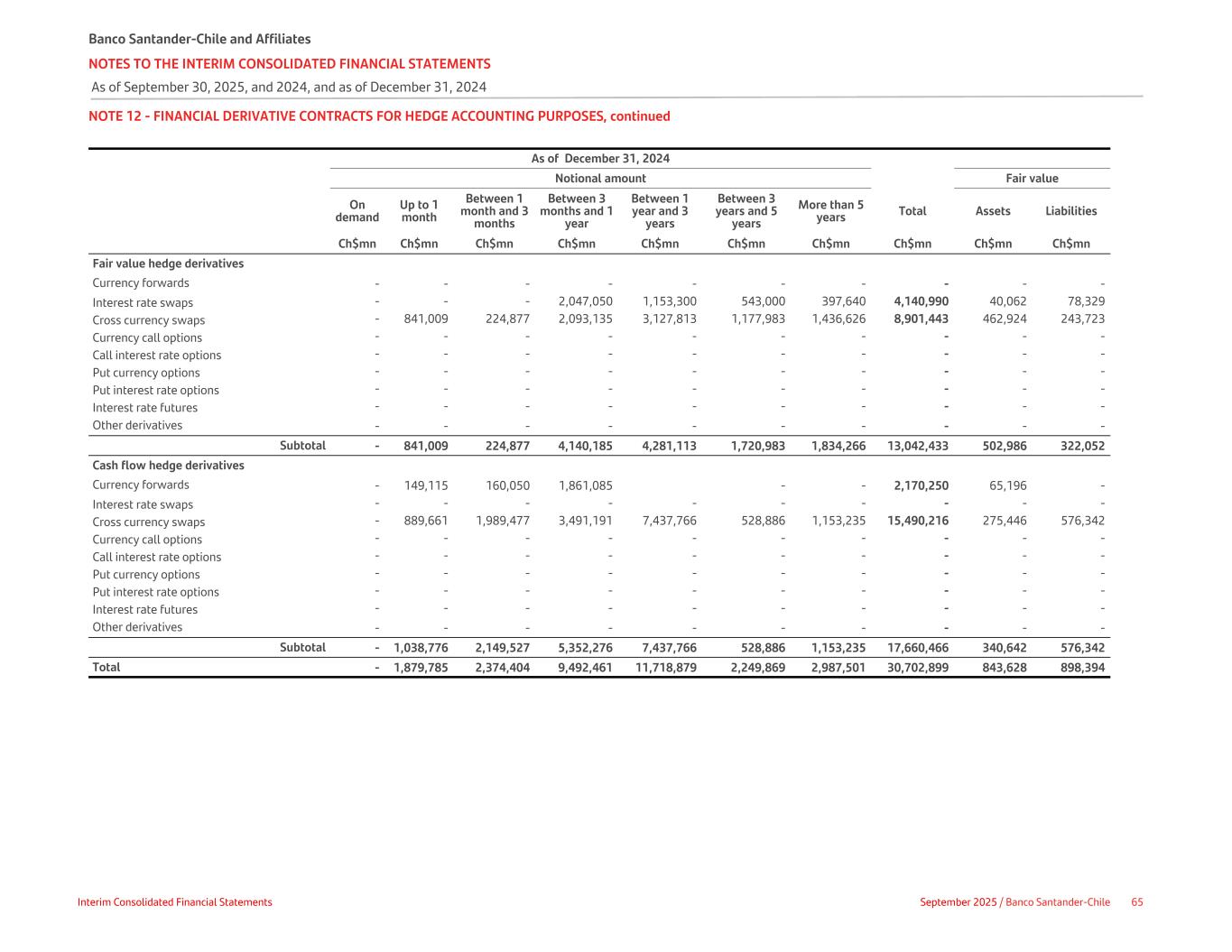

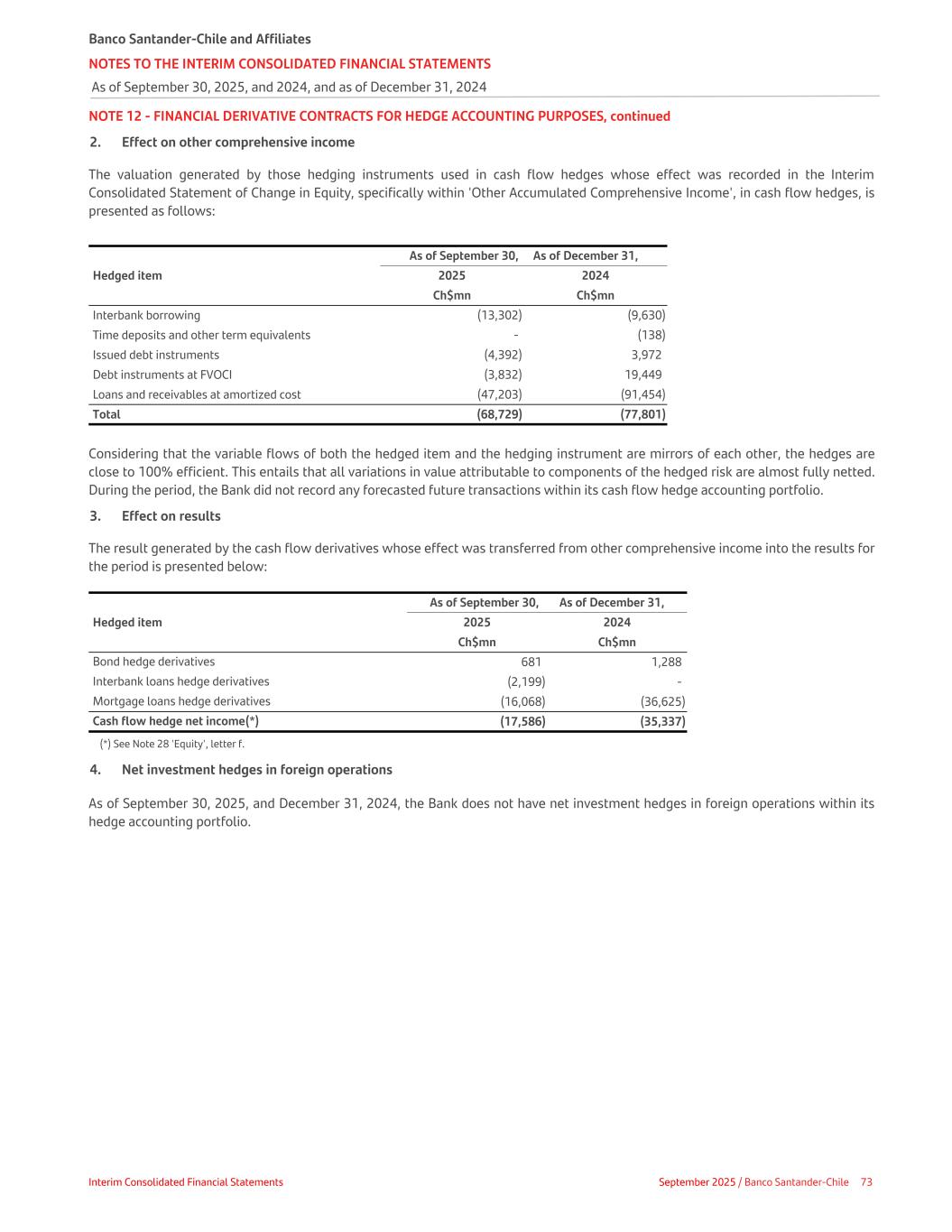

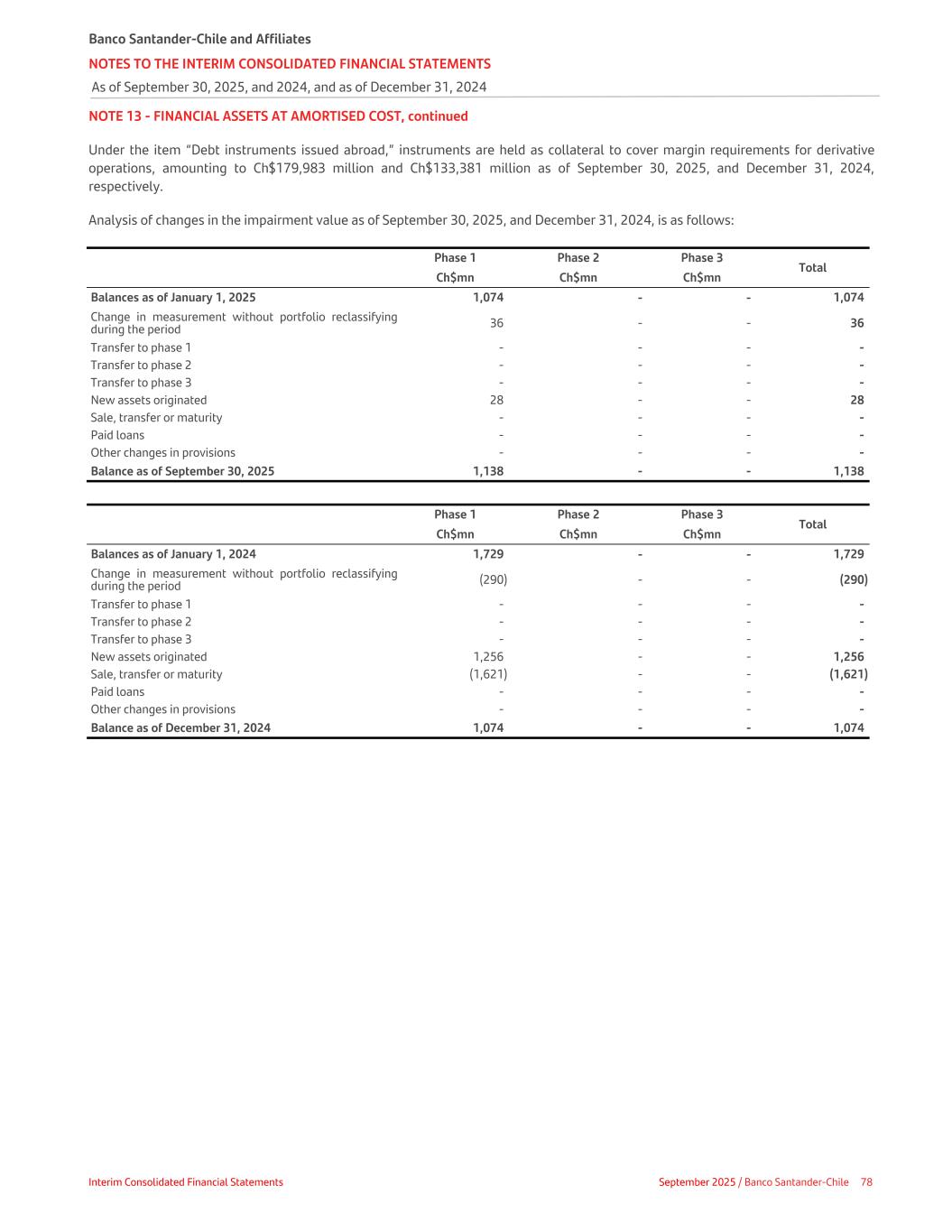

As of September 30, As of December 31, 2025 2024 LIABILITIES Note Ch$mn Ch$mn Cash in collection process 7 1,887,590 497,110 Financial liabilities held for trading at fair value through profit or loss 21 9,977,817 12,155,024 Financial derivatives contracts 21 9,977,817 12,155,024 Other 21 - - Financial liabilities designated at fair value through profit or loss 10 - - Financial derivative contracts for hedge accounting 12 889,991 898,394 Financial liabilities at amortized cost 22 44,700,351 44,307,585 Deposits and other demand liabilities 22 13,104,053 14,260,609 Time deposits and other term equivalents 22 16,252,367 17,098,625 Obligations under repurchase and securities lending agreements 22 3,331,393 276,588 Interbank borrowing 22 3,991,709 4,337,947 Debt financial instruments issued 22 7,832,365 8,133,275 Other financial liabilities 22 188,464 200,541 Obligations under leasing contracts 17 45,056 66,882 Financial instruments of regulatory capital issued 23 2,614,764 2,604,079 Provisions for contingencies 24 136,549 121,638 Provisions for dividends, payments of interest and reappreciation of financial instruments of issued regulatory capital 25 492,040 606,141 Special provisions for credit risk 26 247,013 343,788 Current taxes 18 37,554 48,548 Deferred taxes 18 3,611 - Other liabilities 27 2,500,403 2,412,910 Liabilities included in disposal groups for sale 20 - - TOTAL LIABILITIES 63,532,739 64,062,099 EQUITY Capital 28 891,303 891,303 Reserves 28 3,459,800 3,232,505 Other accrued comprehensive income 28 (103,575) (107,174) Items that will not be reclassified to profit or loss 1,747 1,393 Items that may be reclassified to profit or loss (105,322) (108,567) Retained earnings (expense) from prior years 39,022 24,324 Profit for the period 28 797,869 857,623 Minus: provisions for dividends, interest payments and reappreciation of issued financial instruments of regulatory capital 28 (492,040) (606,141) Equity holders of the Bank 4,592,379 4,292,440 Non-controlling interest 115,089 104,394 TOTAL EQUITY 4,707,468 4,396,834 TOTAL LIABILITIES AND EQUITY 68,240,207 68,458,933 The accompanying notes form an integral part of the Interim Consolidated Financial Statements. Banco Santander-Chile and Affiliates INTERIM CONSOLIDATED STATEMENTS OF FINANCIAL POSITION As of September 30, 2025 and December 31, 2024 Interim Consolidated Financial Statements September 2025 / Banco Santander-Chile 4

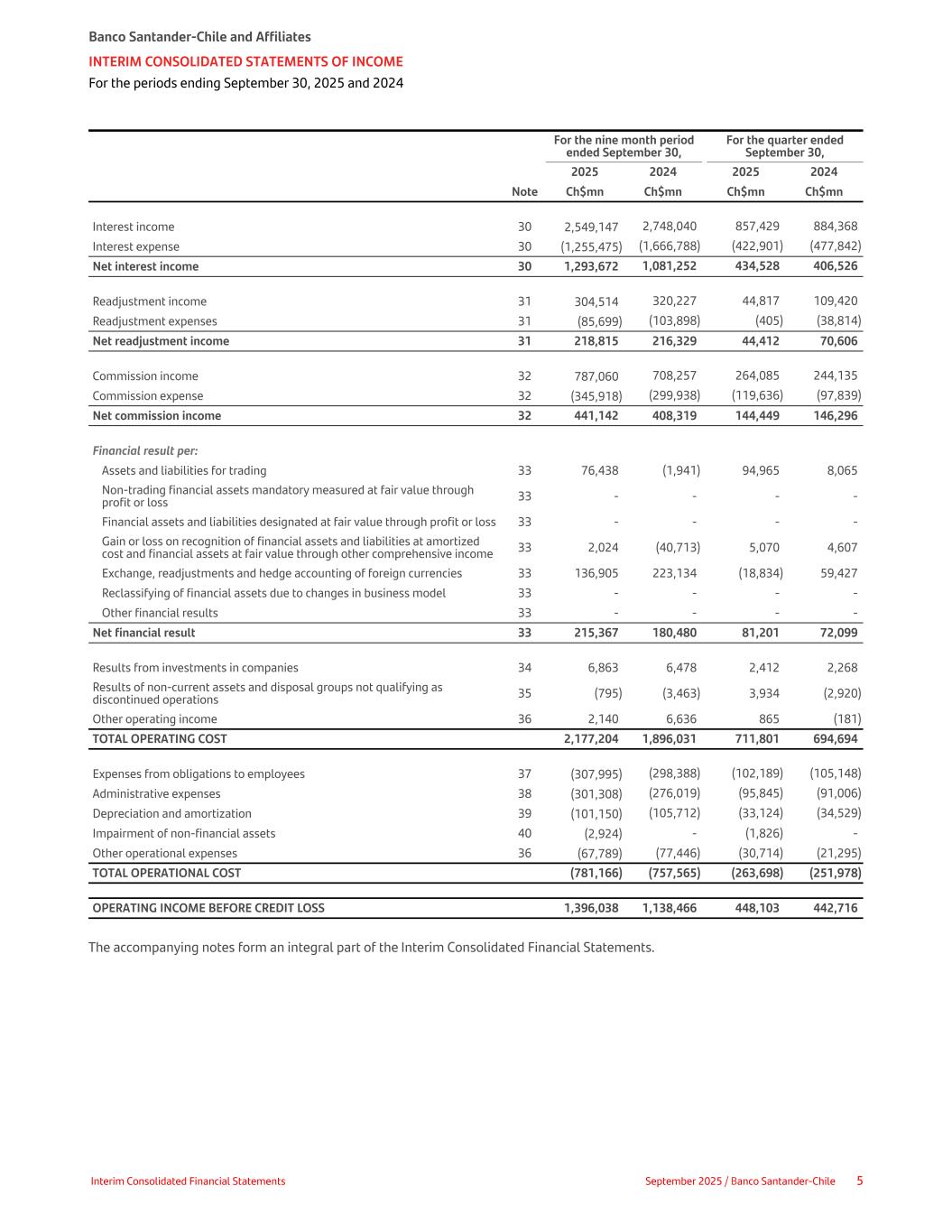

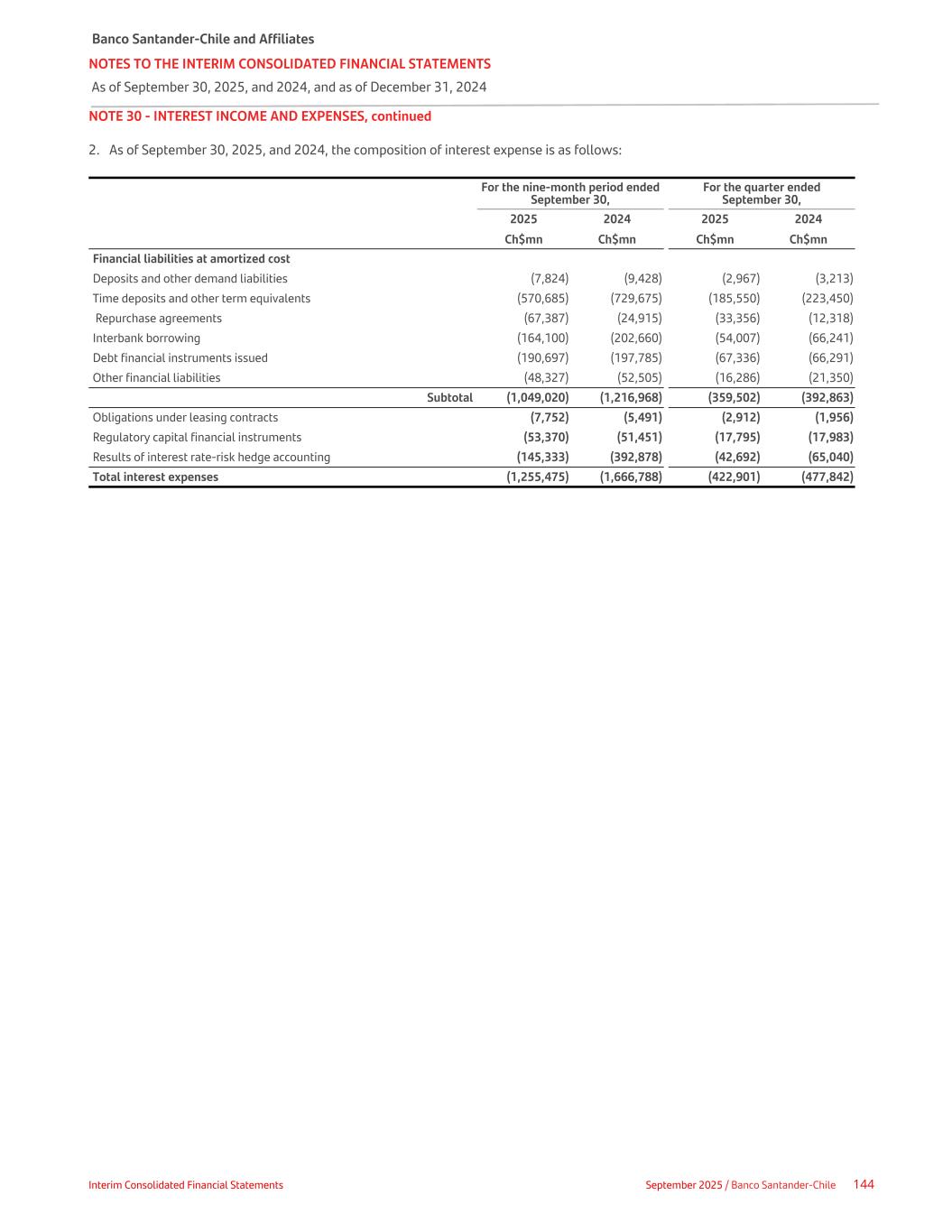

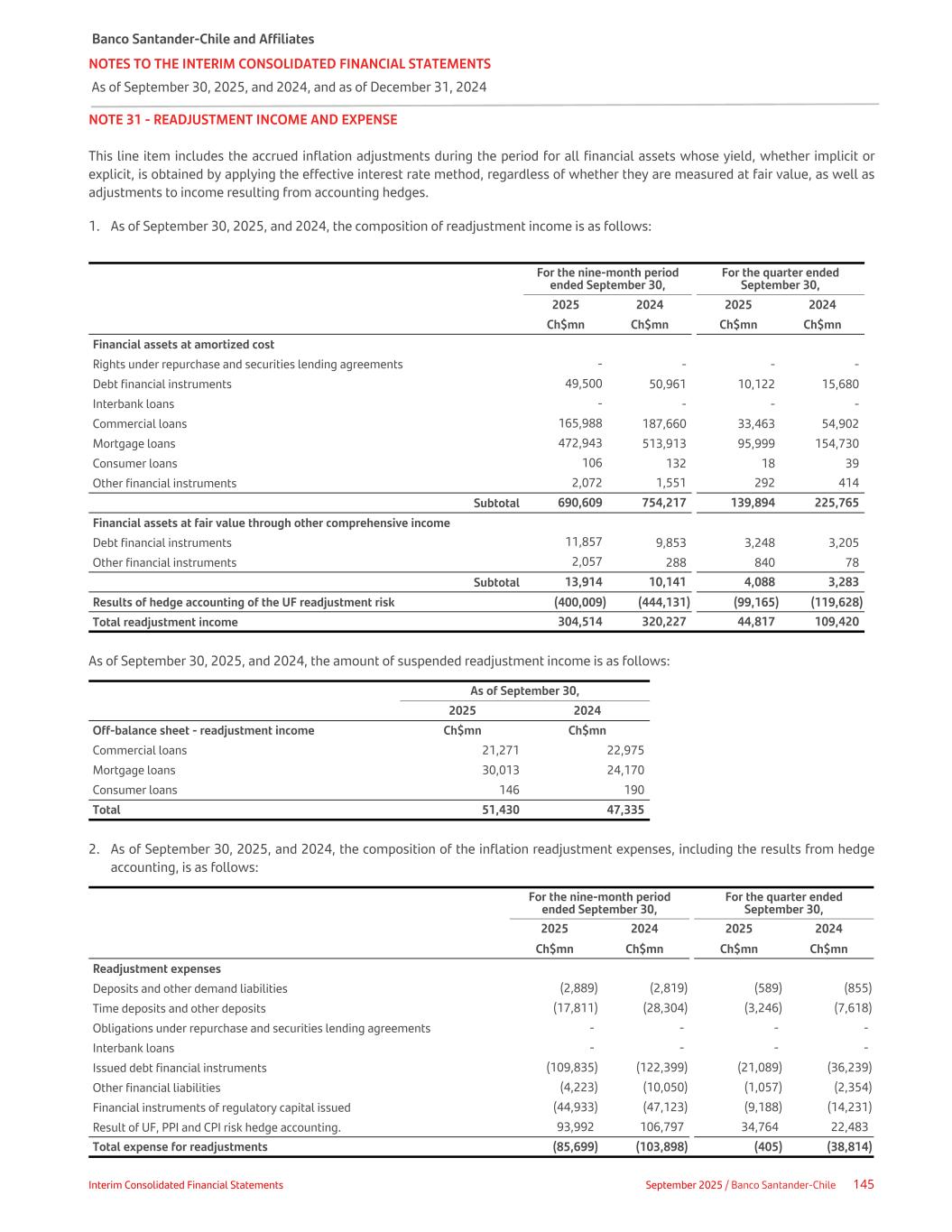

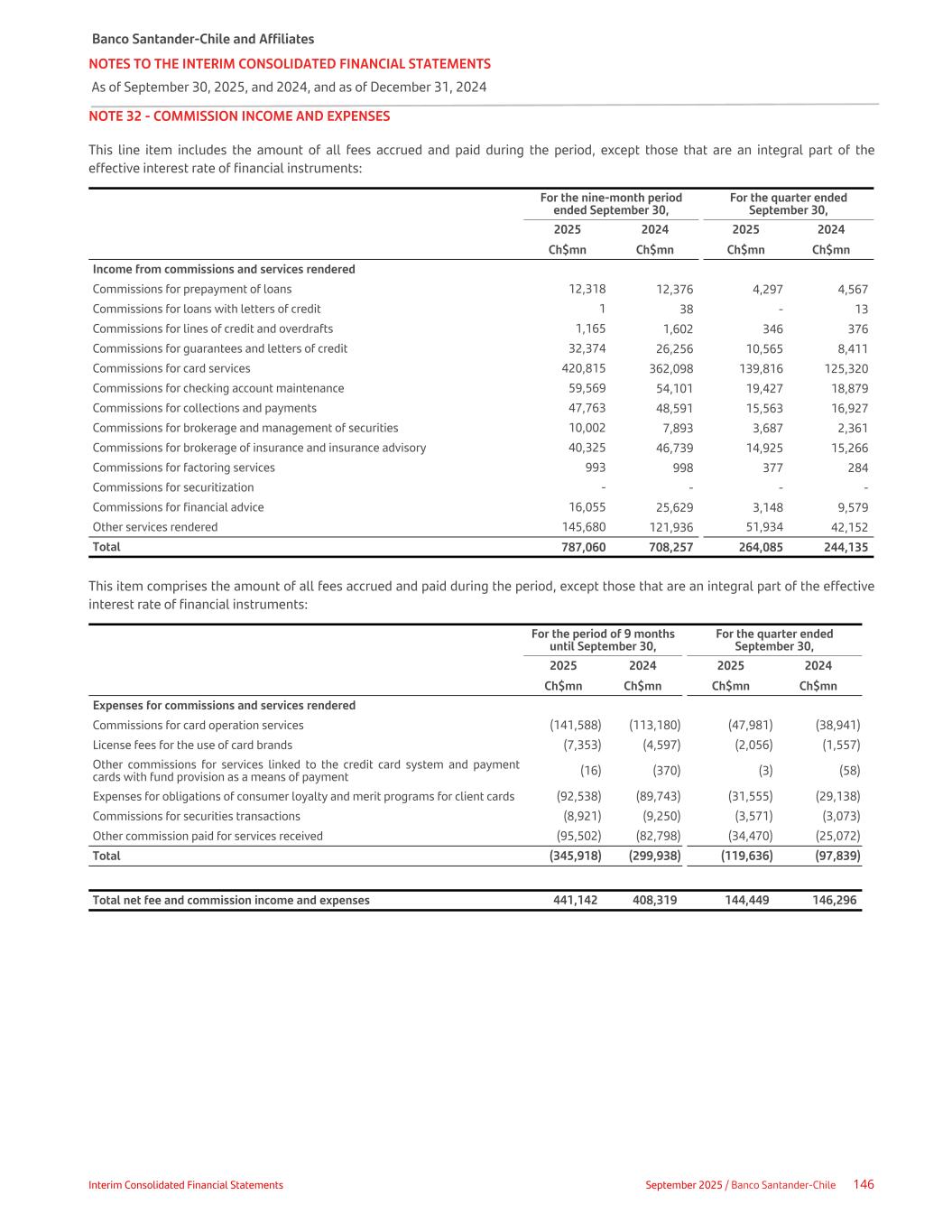

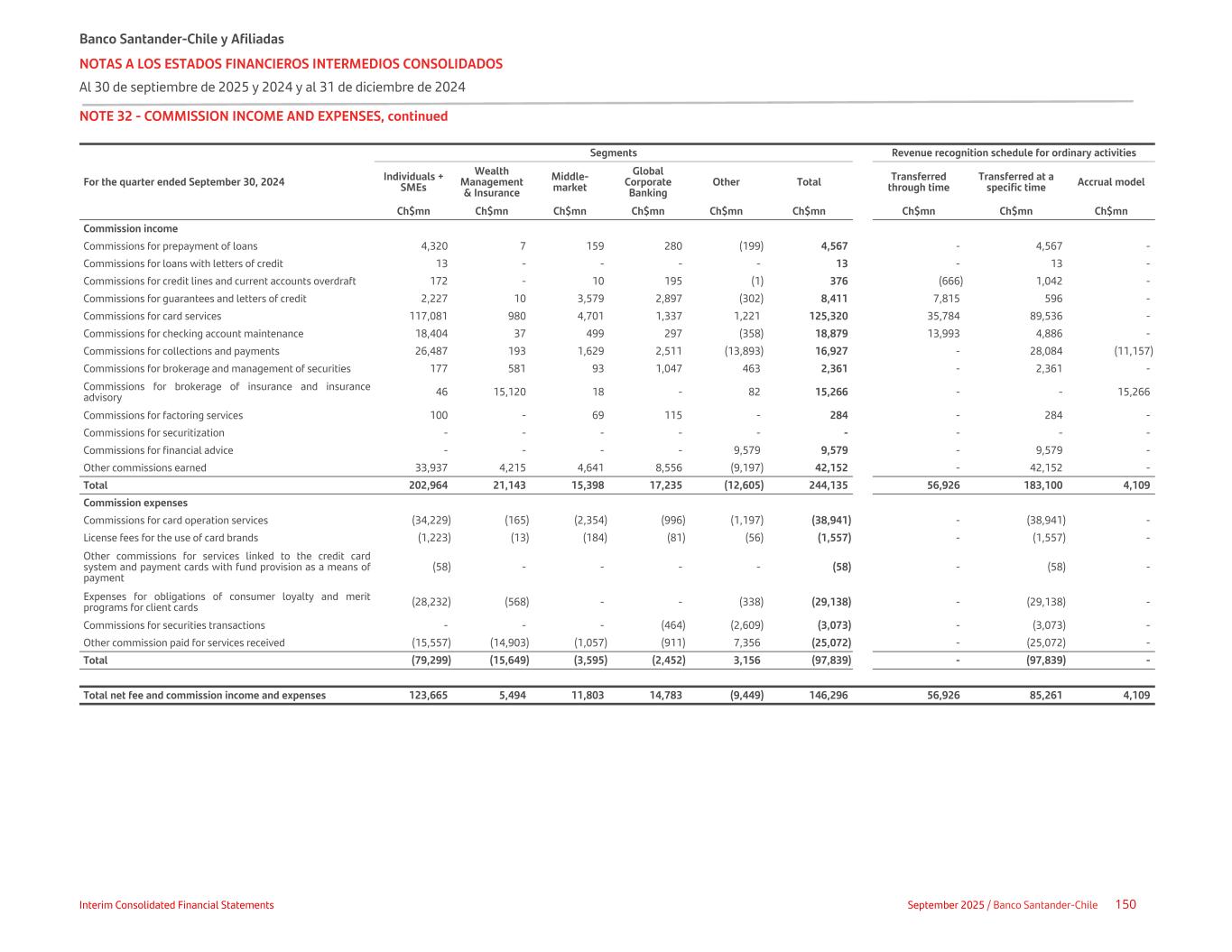

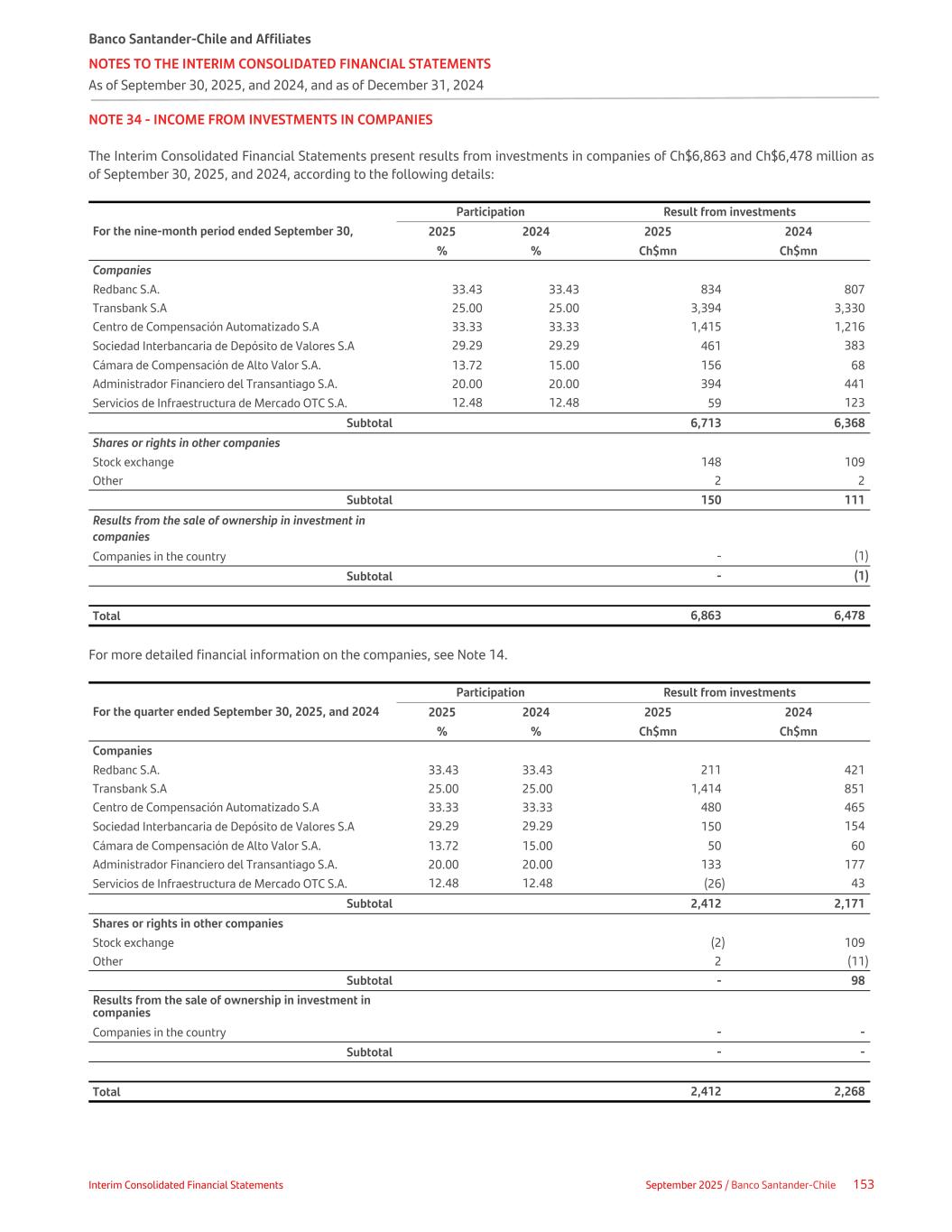

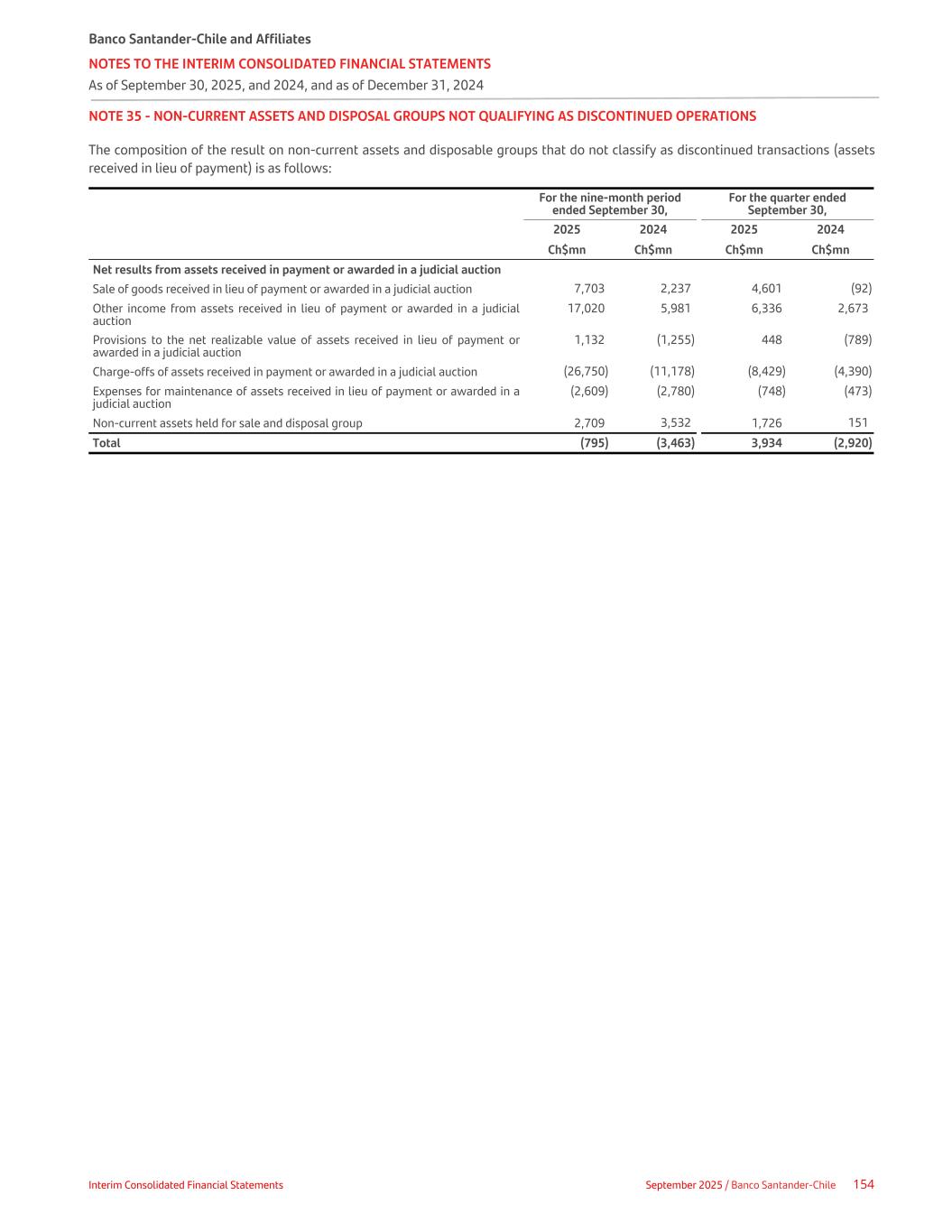

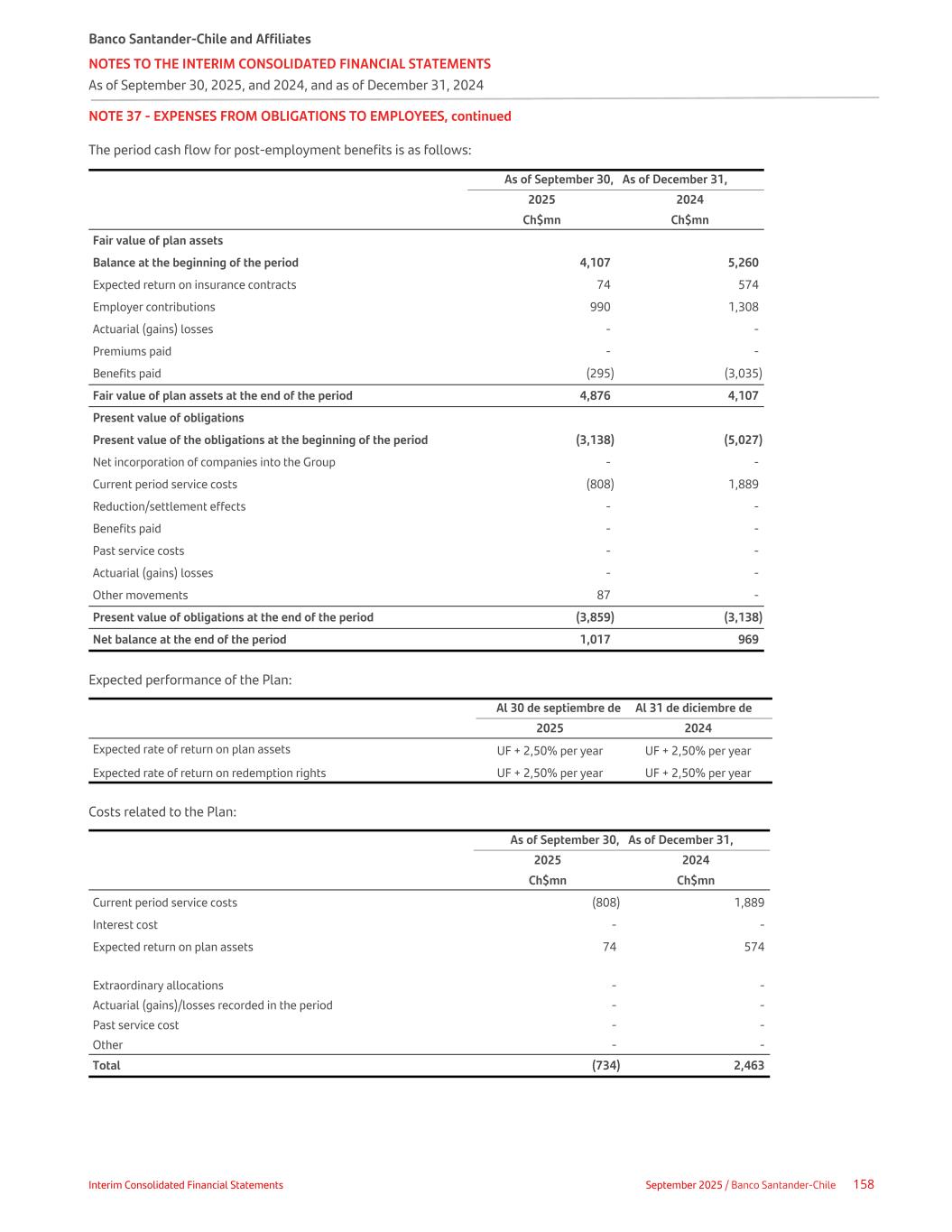

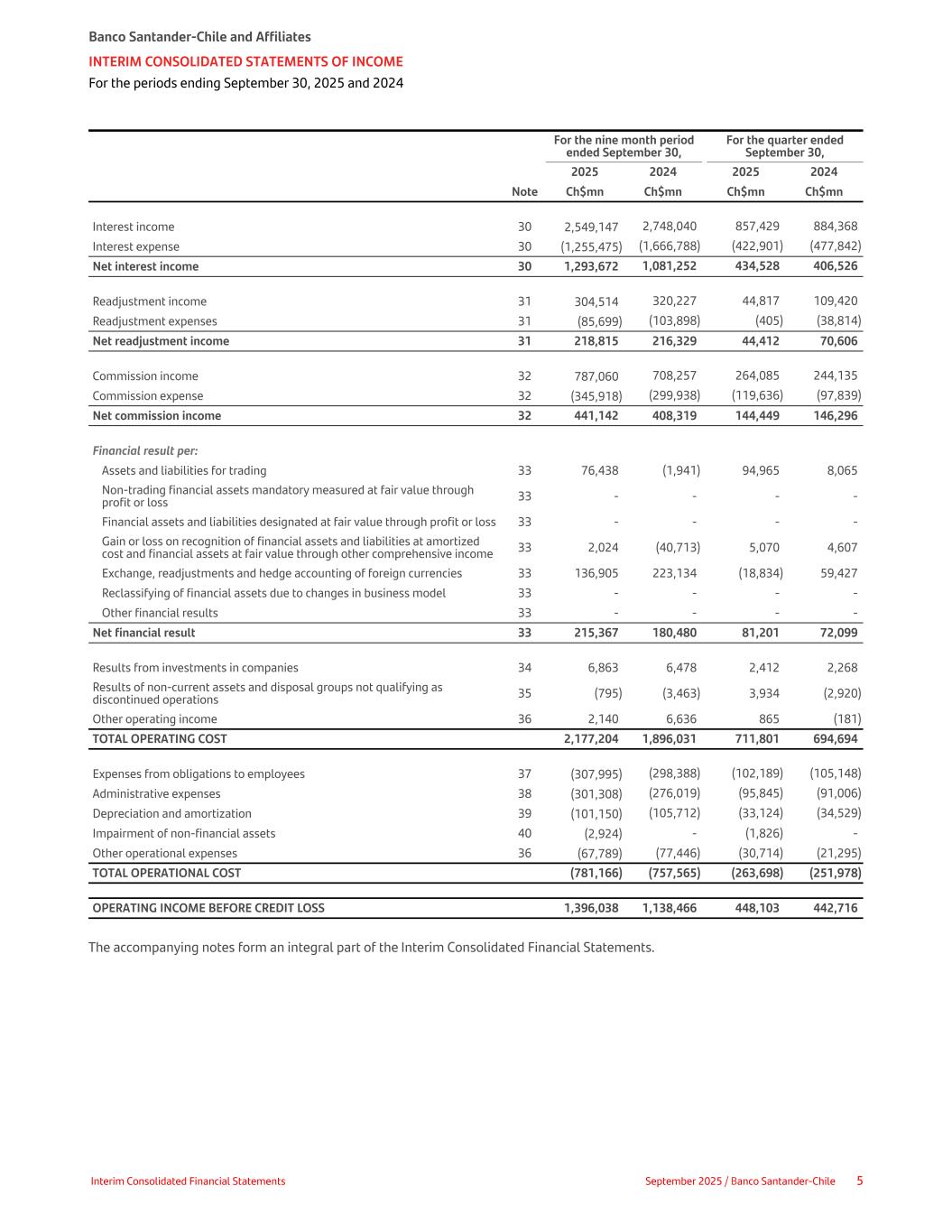

For the nine month period ended September 30, For the quarter ended September 30, 2025 2024 2025 2024 Note Ch$mn Ch$mn Ch$mn Ch$mn Interest income 30 2,549,147 2,748,040 857,429 884,368 Interest expense 30 (1,255,475) (1,666,788) (422,901) (477,842) Net interest income 30 1,293,672 1,081,252 434,528 406,526 Readjustment income 31 304,514 320,227 44,817 109,420 Readjustment expenses 31 (85,699) (103,898) (405) (38,814) Net readjustment income 31 218,815 216,329 44,412 70,606 Commission income 32 787,060 708,257 264,085 244,135 Commission expense 32 (345,918) (299,938) (119,636) (97,839) Net commission income 32 441,142 408,319 144,449 146,296 Financial result per: Assets and liabilities for trading 33 76,438 (1,941) 94,965 8,065 Non-trading financial assets mandatory measured at fair value through profit or loss 33 - - - - Financial assets and liabilities designated at fair value through profit or loss 33 - - - - Gain or loss on recognition of financial assets and liabilities at amortized cost and financial assets at fair value through other comprehensive income 33 2,024 (40,713) 5,070 4,607 Exchange, readjustments and hedge accounting of foreign currencies 33 136,905 223,134 (18,834) 59,427 Reclassifying of financial assets due to changes in business model 33 - - - - Other financial results 33 - - - - Net financial result 33 215,367 180,480 81,201 72,099 Results from investments in companies 34 6,863 6,478 2,412 2,268 Results of non-current assets and disposal groups not qualifying as discontinued operations 35 (795) (3,463) 3,934 (2,920) Other operating income 36 2,140 6,636 865 (181) TOTAL OPERATING COST 2,177,204 1,896,031 711,801 694,694 Expenses from obligations to employees 37 (307,995) (298,388) (102,189) (105,148) Administrative expenses 38 (301,308) (276,019) (95,845) (91,006) Depreciation and amortization 39 (101,150) (105,712) (33,124) (34,529) Impairment of non-financial assets 40 (2,924) - (1,826) - Other operational expenses 36 (67,789) (77,446) (30,714) (21,295) TOTAL OPERATIONAL COST (781,166) (757,565) (263,698) (251,978) OPERATING INCOME BEFORE CREDIT LOSS 1,396,038 1,138,466 448,103 442,716 The accompanying notes form an integral part of the Interim Consolidated Financial Statements. Banco Santander-Chile and Affiliates INTERIM CONSOLIDATED STATEMENTS OF INCOME For the periods ending September 30, 2025 and 2024 Interim Consolidated Financial Statements September 2025 / Banco Santander-Chile 5

For the nine month period ended September 30, For the quarter ended September 30, 2025 2024 2025 2024 Note Ch$mn Ch$mn Ch$mn Ch$mn Credit loss expenses due to: Provisions for credit risk due from banks and loans and receivables from clients 41 (663,240) (498,508) (186,349) (170,893) Special provisions for credit risk 41 96,222 (400) (1,466) (68) Recovery of impaired loans 41 136,721 104,933 43,446 34,027 Impairment of the credit risk of other financial assets at amortized cost and financial assets at fair value in other comprehensive income 41 (92) 455 744 690 Credit loss expenses 41 (430,389) (393,520) (143,625) (136,244) OPERATIONAL RESULT 965,649 744,946 304,478 306,472 Results from continuing operations before taxes 965,649 744,946 304,478 306,472 Income tax 18 (156,229) (154,136) (53,612) (59,357) Results from continuing operations after taxes 809,420 590,810 250,866 247,115 Results from discontinued operations before taxes 18 - - - - Discontinued operations tax - - - - Results from discontinued operations after taxes - - - - CONSOLIDATED PROFIT FOR THE PERIOD 28 809,420 590,810 250,866 247,115 Attributable to: Equity holders of the Bank 28 797,869 581,109 247,514 243,133 Non-controlling interest 28 11,551 9,701 3,352 3,982 Earnings per share attributable to equity holders of the Bank: Basic earnings 28 4.23 3.08 1.31 1.29 Diluted earnings 28 4.23 3.08 1.31 1.29 The accompanying notes form an integral part of the Interim Consolidated Financial Statements. Banco Santander-Chile and Affiliates INTERIM CONSOLIDATED STATEMENTS OF INCOME For the periods ending September 30, 2025 and 2024 Interim Consolidated Financial Statements September 2025 / Banco Santander-Chile 6

For the period of 9 months until September 30, For the quarter ended September 30, 31-12-2021 2025 2024 2025 2024 Note Ch$mn Ch$mn Ch$mn Ch$mn CONSOLIDATED PROFIT FOR THE PERIOD 809,420 590,810 250,866 247,115 Other comprehensive results for the period: ITEMS THAT WILL NOT BE RECLASSIFIED TO PROFIT OR LOSS New measurements of the net benefit liability (asset) and actuarial results for other employee benefit plans - - - - Changes in the fair value of equity instruments designated at fair value through other comprehensive income 958 (266) 105 (222) Changes in the fair value of financial liabilities designated at fair value through profit or loss attributable to changes in the credit risk of the financial liability - - - - OTHER COMPREHENSIVE INCOME THAT WILL NOT BE RECLASSIFIED TO PROFIT OR LOSS BEFORE TAXES 28 958 (266) 105 (222) Income tax on other comprehensive results that will not be reclassified to profit or loss 18 (259) 72 (29) 60 TOTAL OTHER COMPREHENSIVE INCOME THAT WILL NOT BE RECLASSIFIED TO PROFIT OR LOSS AFTER TAXES 28 699 (194) 76 (162) ITEMS THAT CAN BE RECLASSIFIED TO PROFIT OR LOSS 28 Changes in the fair value of financial assets at fair value through other comprehensive income 28 (5,738) 18,347 3,203 29,406 Translation differences by foreign entities 28 - - - - Hedge accounting of net investments in foreign entities 28 - - - - Cash flow hedge accounting 28 9,072 (155,896) (21,057) (39,778) Undesignated elements of hedge accounting instruments 28 - - - - Other 28 1,200 (1,053) (2) (8) OTHER COMPREHENSIVE INCOME THAT MAY BE RECLASSIFIED TO PROFIT OR LOSS BEFORE TAXES 28 4,534 (138,602) (17,856) (10,380) Income taxes on other comprehensive income that may be reclassified to profit or loss 18 (1,224) 37,423 4,821 2,808 TOTAL OTHER COMPREHENSIVE INCOME THAT MAY BE RECLASSIFIED TO PROFIT OR LOSS AFTER TAXES 28 3,310 (101,179) (13,035) (7,572) TOTAL OTHER COMPREHENSIVE INCOME FOR THE PERIOD 28 4,009 (101,373) (12,959) (7,734) CONSOLIDATED COMPREHENSIVE INCOME FOR THE PERIOD 28 813,429 489,437 237,907 239,381 Attributable to: Equity holders of the Bank 801,468 479,843 234,523 235,485 Non-controlling interest 11,961 9,594 3,384 3,896 The accompanying notes form an integral part of the Interim Consolidated Financial Statements. Banco Santander-Chile and Affiliates INTERIM CONSOLIDATED STATEMENTS OF OTHER COMPREHENSIVE INCOME For the periods ending September 30, 2025 and 2024 Interim Consolidated Financial Statements September 2025 / Banco Santander-Chile 7

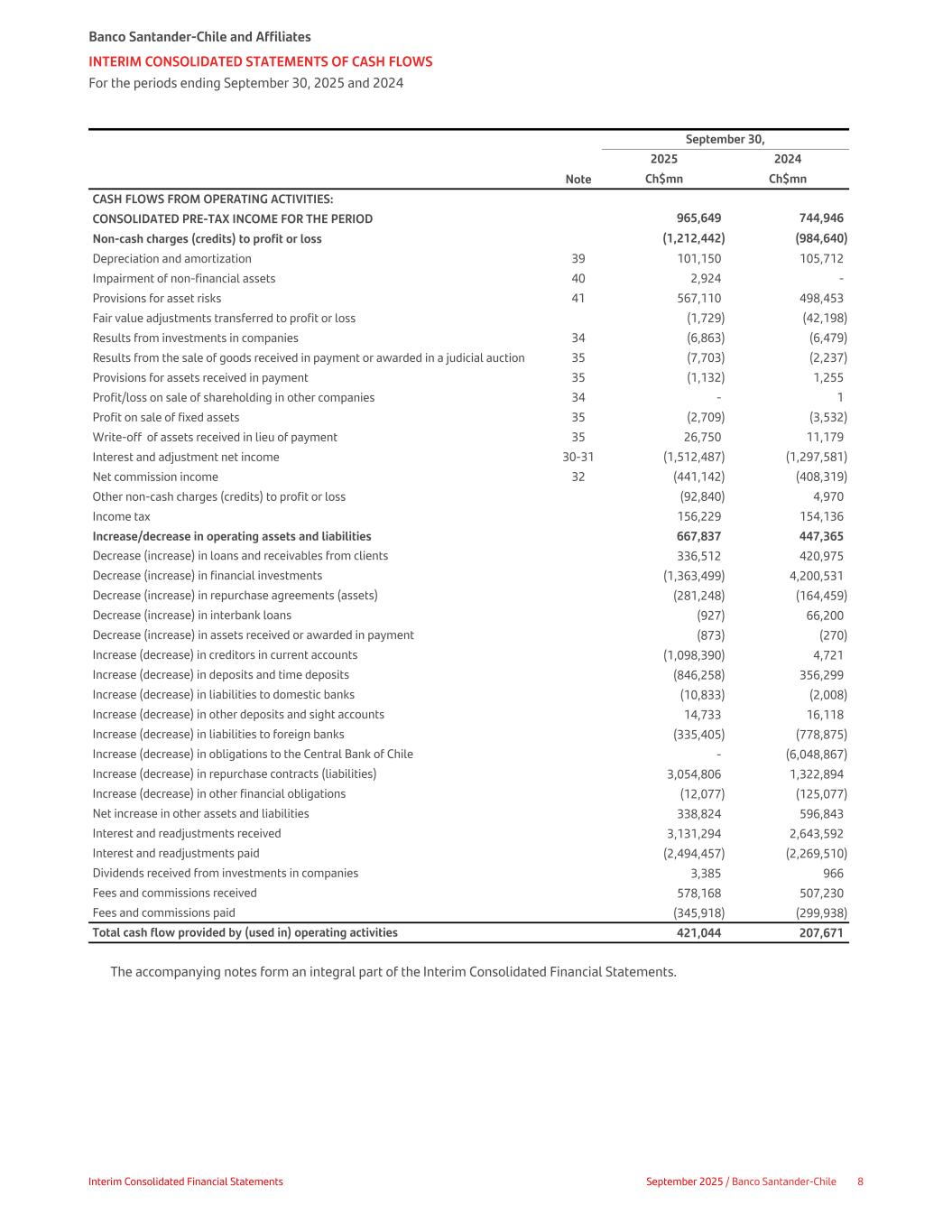

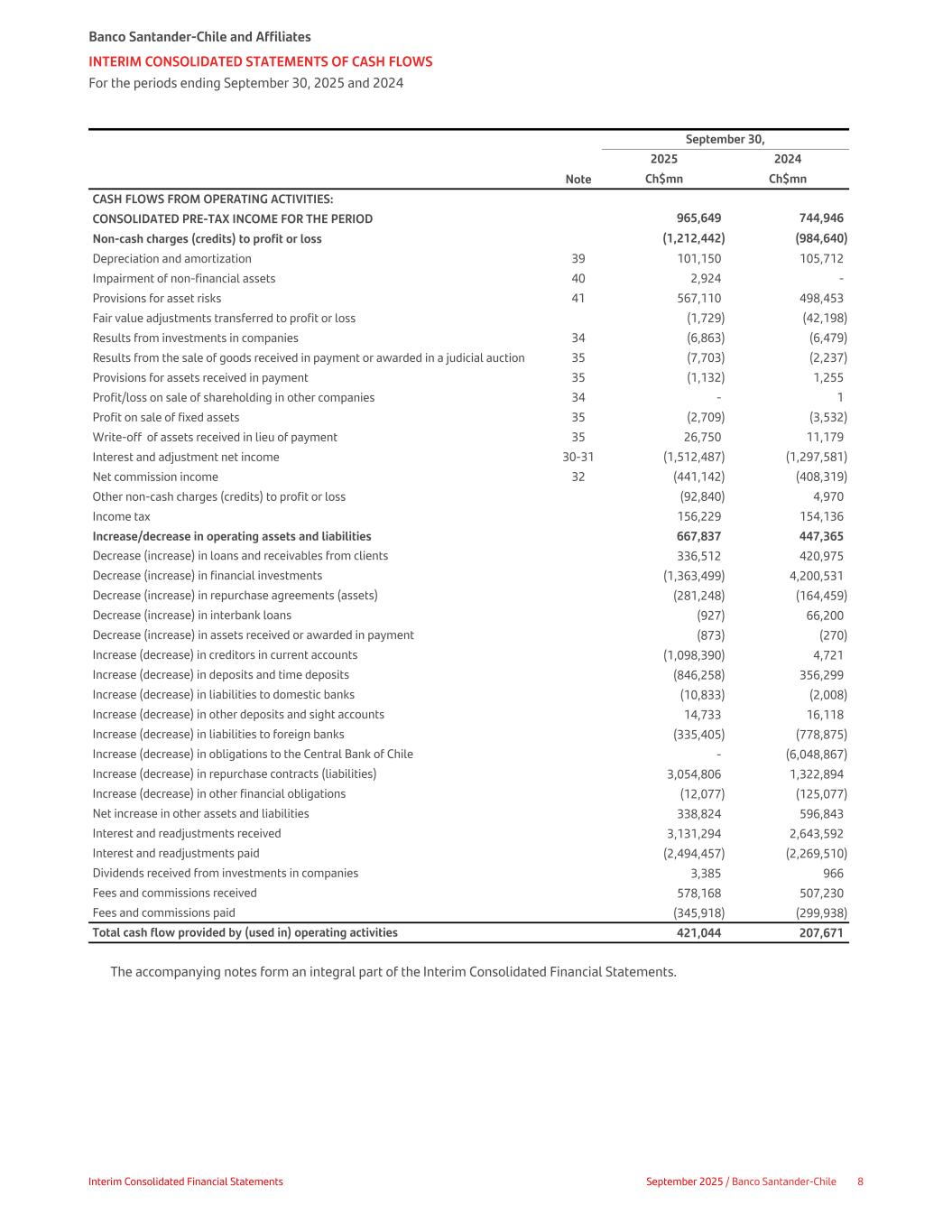

September 30, 2025 2024 Note Ch$mn Ch$mn CASH FLOWS FROM OPERATING ACTIVITIES: CONSOLIDATED PRE-TAX INCOME FOR THE PERIOD 965,649 744,946 Non-cash charges (credits) to profit or loss (1,212,442) (984,640) Depreciation and amortization 39 101,150 105,712 Impairment of non-financial assets 40 2,924 - Provisions for asset risks 41 567,110 498,453 Fair value adjustments transferred to profit or loss (1,729) (42,198) Results from investments in companies 34 (6,863) (6,479) Results from the sale of goods received in payment or awarded in a judicial auction 35 (7,703) (2,237) Provisions for assets received in payment 35 (1,132) 1,255 Profit/loss on sale of shareholding in other companies 34 - 1 Profit on sale of fixed assets 35 (2,709) (3,532) Write-off of assets received in lieu of payment 35 26,750 11,179 Interest and adjustment net income 30-31 (1,512,487) (1,297,581) Net commission income 32 (441,142) (408,319) Other non-cash charges (credits) to profit or loss (92,840) 4,970 Income tax 156,229 154,136 Increase/decrease in operating assets and liabilities 667,837 447,365 Decrease (increase) in loans and receivables from clients 336,512 420,975 Decrease (increase) in financial investments (1,363,499) 4,200,531 Decrease (increase) in repurchase agreements (assets) (281,248) (164,459) Decrease (increase) in interbank loans (927) 66,200 Decrease (increase) in assets received or awarded in payment (873) (270) Increase (decrease) in creditors in current accounts (1,098,390) 4,721 Increase (decrease) in deposits and time deposits (846,258) 356,299 Increase (decrease) in liabilities to domestic banks (10,833) (2,008) Increase (decrease) in other deposits and sight accounts 14,733 16,118 Increase (decrease) in liabilities to foreign banks (335,405) (778,875) Increase (decrease) in obligations to the Central Bank of Chile - (6,048,867) Increase (decrease) in repurchase contracts (liabilities) 3,054,806 1,322,894 Increase (decrease) in other financial obligations (12,077) (125,077) Net increase in other assets and liabilities 338,824 596,843 Interest and readjustments received 3,131,294 2,643,592 Interest and readjustments paid (2,494,457) (2,269,510) Dividends received from investments in companies 3,385 966 Fees and commissions received 578,168 507,230 Fees and commissions paid (345,918) (299,938) Total cash flow provided by (used in) operating activities 421,044 207,671 The accompanying notes form an integral part of the Interim Consolidated Financial Statements. Banco Santander-Chile and Affiliates INTERIM CONSOLIDATED STATEMENTS OF CASH FLOWS For the periods ending September 30, 2025 and 2024 Interim Consolidated Financial Statements September 2025 / Banco Santander-Chile 8

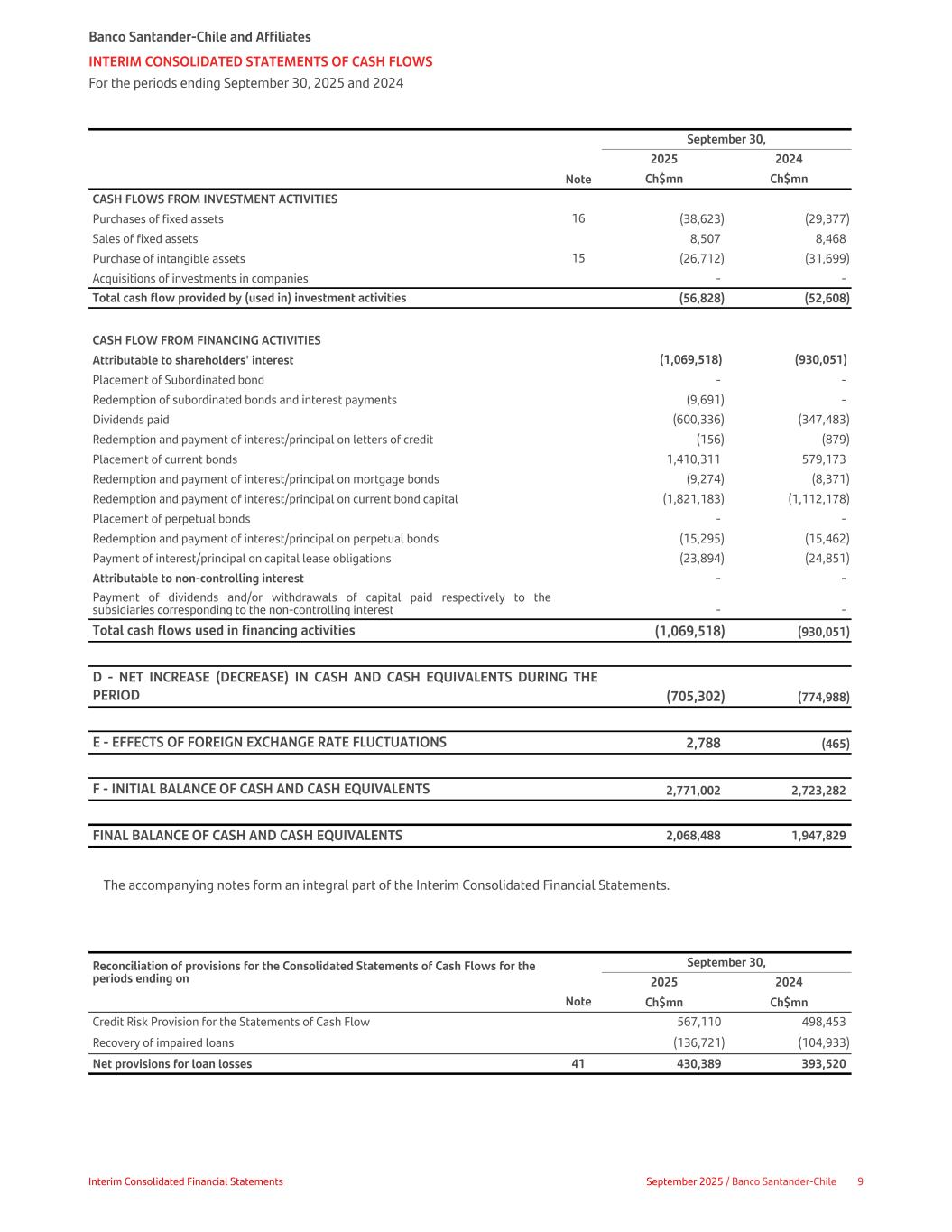

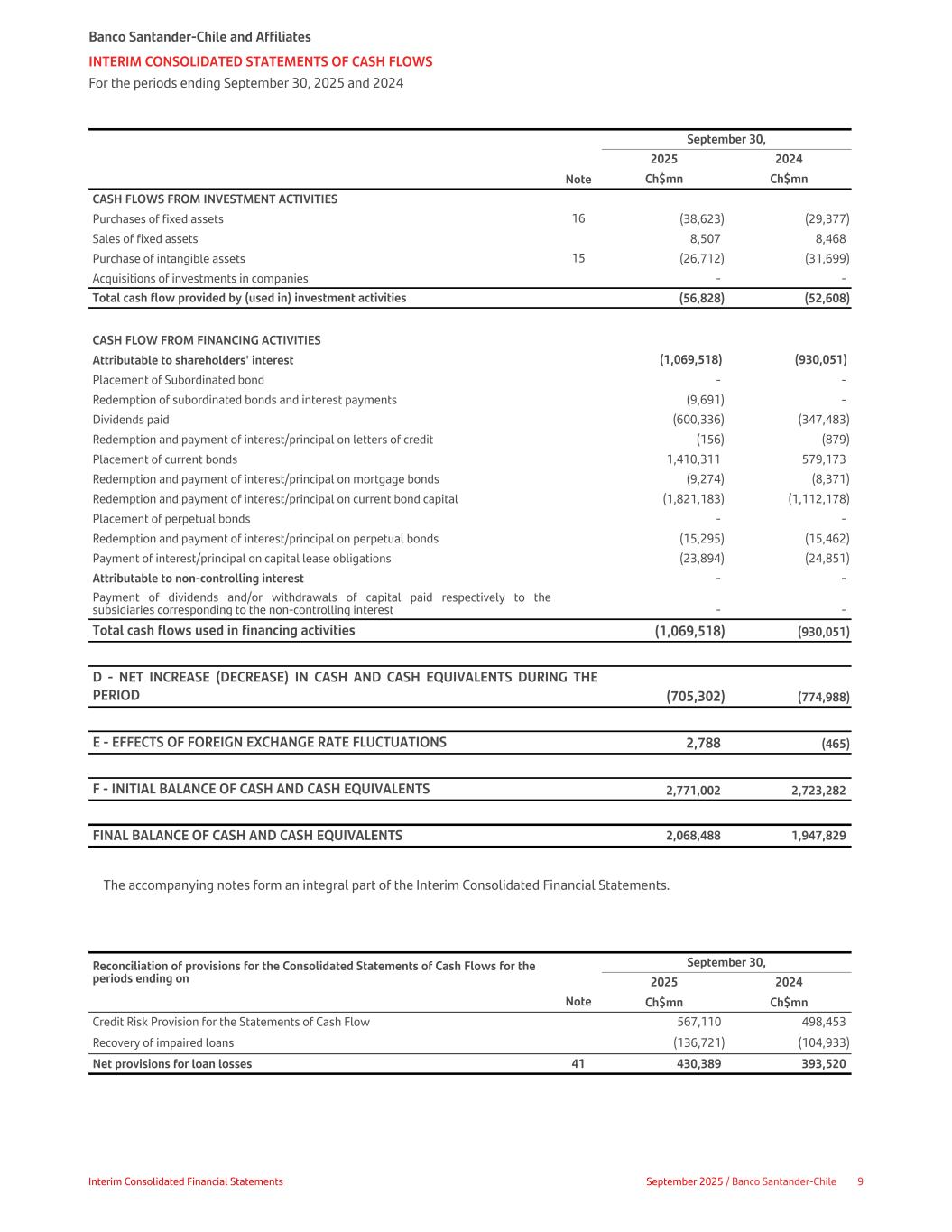

September 30, 2025 2024 Note Ch$mn Ch$mn CASH FLOWS FROM INVESTMENT ACTIVITIES Purchases of fixed assets 16 (38,623) (29,377) Sales of fixed assets 8,507 8,468 Purchase of intangible assets 15 (26,712) (31,699) Acquisitions of investments in companies - - Total cash flow provided by (used in) investment activities (56,828) (52,608) CASH FLOW FROM FINANCING ACTIVITIES Attributable to shareholders' interest (1,069,518) (930,051) Placement of Subordinated bond - - Redemption of subordinated bonds and interest payments (9,691) - Dividends paid (600,336) (347,483) Redemption and payment of interest/principal on letters of credit (156) (879) Placement of current bonds 1,410,311 579,173 Redemption and payment of interest/principal on mortgage bonds (9,274) (8,371) Redemption and payment of interest/principal on current bond capital (1,821,183) (1,112,178) Placement of perpetual bonds - - Redemption and payment of interest/principal on perpetual bonds (15,295) (15,462) Payment of interest/principal on capital lease obligations (23,894) (24,851) Attributable to non-controlling interest - - Payment of dividends and/or withdrawals of capital paid respectively to the subsidiaries corresponding to the non-controlling interest - - Total cash flows used in financing activities (1,069,518) (930,051) D - NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS DURING THE PERIOD (705,302) (774,988) E - EFFECTS OF FOREIGN EXCHANGE RATE FLUCTUATIONS 2,788 (465) F - INITIAL BALANCE OF CASH AND CASH EQUIVALENTS 2,771,002 2,723,282 FINAL BALANCE OF CASH AND CASH EQUIVALENTS 2,068,488 1,947,829 The accompanying notes form an integral part of the Interim Consolidated Financial Statements. Reconciliation of provisions for the Consolidated Statements of Cash Flows for the periods ending on September 30, 2025 2024 Note Ch$mn Ch$mn Credit Risk Provision for the Statements of Cash Flow 567,110 498,453 Recovery of impaired loans (136,721) (104,933) Net provisions for loan losses 41 430,389 393,520 Banco Santander-Chile and Affiliates INTERIM CONSOLIDATED STATEMENTS OF CASH FLOWS For the periods ending September 30, 2025 and 2024 Interim Consolidated Financial Statements September 2025 / Banco Santander-Chile 9

Changes other than cash Reconciliation of liabilities arising from financing activities 31.12.2024 Cash Flow Acquisition Foreign Currency Movement UF Movement Fair Value Changes 09.30.2025 Ch$mn Ch$mn Ch$mn Ch$mn Ch$mn Ch$mn Ch$mn Subordinated Bonds 1,910,697 (9,691) - - 42,020 - 1,943,026 Senior bonds 8,067,274 (410,872) - - 119,158 - 7,775,560 Mortgage bonds 65,781 (9,274) - - 234 - 56,741 Bonds without fixed maturity 693,382 (15,295) - (6,349) - - 671,738 Letters of credit 220 (156) - - - - 64 Dividends paid - (600,336) - - - - (600,336) Obligations under leasing contracts 66,882 (23,894) - - 2,068 - 45,056 Total liabilities from financing activities 10,804,236 (1,069,518) - (6,349) 163,480 - 9,891,849 Banco Santander-Chile and Affiliates INTERIM CONSOLIDATED STATEMENTS OF CASH FLOWS For the periods ending September 30, 2025 and 2024 Interim Consolidated Financial Statements September 2025 / Banco Santander-Chile 10

Equity attributable to shareholders Non- controlling interest (*) Total Equity Capital Reserves Other accrued comprehensive income Accrued profits and profits corresponding to the period TOTALReserves and other retained earnings Merger of companies under common control Changes in fair value of financial assets at fair value through OCI Cash flow hedge Income tax Retained profits from previous periods Annual Profits (**) Ch$mn Ch$mn Ch$mn Ch$mn Ch$mn Ch$mn Ch$mn Ch$mn Ch$mn Ch$mn Ch$mn Opening balances as of January 1, 2024 891,303 3,117,463 (2,224) (91,596) 84,416 1,938 519,891 (154,033) 4,367,158 124,735 4,491,893 Payment of common stock dividends - - - - - - (347,483) - (347,483) - (347,483) Income reserves from the previous period - 117,266 - - - - (117,266) - - - Provision for payment of common stock dividends - - - - - - - (451,409) (451,409) - (451,409) Provision and interest payments on bonds with no fixed term to maturity - - - - - - (30,818) (699) (31,517) - (31,517) Other movements - - - - - - - - - (27,229) (27,229) Subtotal: Transactions with shareholders during the period - 117,266 - - - - (495,567) (452,108) (830,409) (27,229) (857,638) Profit for the year (period) - - - - - - - 857,623 857,623 6,886 864,509 Other comprehensive income for the year - - - 22,584 (162,217) 37,701 - - (101,932) 2 (101,930) Subtotal: Comprehensive income for the year - - - 22,584 (162,217) 37,701 - 857,623 755,691 6,888 762,579 Closing balance on December 31, 2024 891,303 3,234,729 (2,224) (69,012) (77,801) 39,639 24,324 251,482 4,292,440 104,394 4,396,834 Distribution of results from previous year 857,623 (857,623) Opening balances as of January 1, 2025 891,303 3,234,729 (2,224) (69,012) (77,801) 39,639 881,947 (606,141) 4,292,440 104,394 4,396,834 Payment of common stock dividends - - - - - - (600,336) - (600,336) - (600,336) Reserves of income from the previous period - 227,295 - - - - (227,295) - - - - Provision for payment of common stock dividends - - - - - - - 121,608 121,608 - 121,608 Provision and interest payments on bonds with no fixed term to maturity - - - - - - (15,294) (7,507) (22,801) - (22,801) Other movements - - - - - - - - - (1,266) (1,266) Subtotal: Transactions with shareholders during the period - 227,295 - - - - (842,925) 114,101 (501,529) (1,266) (502,795) Profit for the year (period) - - - - - - - 797,869 797,869 11,551 809,420 Other comprehensive results for the period - - - (4,142) 9,072 (1,331) - - 3,599 410 4,009 Subtotal: Comprehensive income for the period - - - (4,142) 9,072 (1,331) - 797,869 801,468 11,961 813,429 Closing balance as of September 30, 2025 891,303 3,462,024 (2,224) (73,154) (68,729) 38,308 39,022 305,829 4,592,379 115,089 4,707,468 (*) See Note 02 letter c for non-controlling interest, (**) Contains profit for the period and provisions for dividends, interest payments and re-appreciation of issued financial instruments of regulatory capital. Period Profit attributable to equity holders Allocated to reserves Allocated to dividends Percentage distribution Number of shares Dividend per share (In Ch$) Ch$mn Ch$mn Ch$mn % Year 2024 (Shareholders Meeting April 2025) 857,623 227,295 600,336 70% 188,446,126,794 3.186 Year 2023 (Shareholders Meeting April 2024) 496,404 117,266 347,483 70% 188,446,126,794 1.844 The accompanying notes form an integral part of these Interim Consolidated Financial Statements. Banco Santander-Chile and Affiliates INTERIM CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY For the periods ending on September 30, 2025 and December 31, 2024 Interim Consolidated Financial Statements September 2025 / Banco Santander-Chile 11

NOTE 01 - CORPORATE INFORMATION Banco Santander-Chile is a banking corporation organized under the laws of the Republic of Chile, supervised by the Financial Market Commission (FMC). It is also subject to the regulations of the Securities and Exchange Commission of the United States of America (SEC), considering the Bank is listed on the New York Stock Exchange (NYSE) through an American Depositary Receipt (ADR) program. Banco Santander Spain controls Banco Santander Chile through its shareholdings in Teatinos Siglo XXI Inversiones S.A. and Santander Chile Holding S.A., both subsidiaries controlled by Banco Santander Spain. As of September 30, 2025, Banco Santander Spain directly or indirectly owns 99.8% of Santander Chile Holding S.A. and 100% of Teatinos Siglo XXI Inversiones S.A., which allows Banco Santander Spain control over 67.18% of the Bank's shares. The Bank provides its clients with a wide range of general banking services, from individuals to large corporations. In addition, Banco Santander-Chile and its affiliates (collectively referred to as 'Bank' or 'Santander-Chile' hereafter) offer consumer and commercial banking services, as well as other services, including factoring, collections, leasing, securities and insurance brokerage, brokerage of mutual and investment fund and investment banking. The Bank's legal address is Calle Bandera No 140 Santiago de Chile, and its website is www.santander.cl. NOTE 02 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES 1. Preparation basis These Interim Consolidated Financial Statements have been prepared following the Compendium of Accounting Standards for Banks (CASB), in its version applicable as of January 2022, as well as the instructions issued by the FMC. The FMC, under Law No 21,000, provides in numeral 6 of article 5 that the Financial Market Commission may set the rules for the preparation and presentation of the annual reports, balance sheets, statements of financial position and other financial statements of the supervised entities and determines the principles according to which companies must keep their accounts. Regarding all matters that are not covered by this regulation, if they do not conflict with its instructions, then they must adhere to generally accepted accounting criteria corresponding to the technical standards issued by the Chilean Association of Accountants AG, which coincide with the International Financial Reporting Standards (IFRS) agreed by the International Accounting Standards Board (IASB). In case of discrepancies between the accounting principles and the accounting criteria issued by the FMC in its Compendium of Accounting Standards for Banks and instructions, the latter shall prevail. The Bank uses certain currency terms and conventions for these Interim Consolidated Financial Statements. Thus, 'USD' stands for 'US dollar', 'EUR' stands for 'euro', 'CNY' stands for 'Chinese yuan', 'JPY' stands for 'Japanese yen', 'CHF' stands for 'Swiss franc', 'AUD' stands for 'Australian dollar' and 'UF' stands for 'Unidad de Fomento de Chile'. The notes in the Interim Consolidated Financial Statements contain information in addition to that presented in the Interim Consolidated Statements of Financial Position, Interim Consolidated Statements of Income, Interim Consolidated Statements of Other Comprehensive Income,Interim Consolidated Statement of Change in Equity and Interim Consolidated Statement of Cash Flows. They provide narrative descriptions or disaggregation of such states in a clear, relevant, reliable and comparable manner. 2. Preparation of the Interim Consolidated Financial Statements The Interim Consolidated Financial Statements as of September 30, 2025, and December 31, 2024 incorporate the individual financial statements of the Bank and its controlled entities (affiliates) and include the adjustments, reclassifying and eliminations necessary to comply with the accounting and measurement criteria established by IFRS 10 'Consolidated Financial Statements'. Control is achieved when the Bank: i. Has power over the investee (that is, it has rights that grant it the present capacity to manage the relevant activities of the investee); ii. Has exposure or rights to variable returns from its involvement with the investee; and iii. Has the ability to use its power over the investee to influence the amount of the investor's returns. Banco Santander-Chile and Affiliates NOTES TO THE INTERIM CONSOLIDATED FINANCIAL STATEMENTS As of September 30, 2025, and 2024, and as of December 31, 2024 Interim Consolidated Financial Statements September 2025 / Banco Santander-Chile 12

NOTE 02 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES, continued The Bank reassesses whether it controls an investee if facts and circumstances indicate that there are changes to one or more of the three elements of control listed above. For example, when the Bank has less than most of the voting rights in an investee, but those voting rights are sufficient to have the ability to direct the relevant activities, then it is concluded that the Bank has control. The Bank considers all relevant facts and circumstances in assessing whether the Bank's voting rights in an investee are sufficient to give it power. These include: • The size of the Bank's holding of voting rights relative to the size and dispersion of holdings of the other vote holders. • The potential voting rights held by the Bank, other vote holders or other parties. • The rights arising from other contractual agreements. • Any additional facts and circumstances that indicate that the Bank has or does not have the current ability to direct the relevant activities when decisions need to be made, including voting patterns at previous shareholders' meetings. Consolidation of a subsidiary begins when the Bank obtains control of the subsidiary and ceases when the Bank cedes control. Specifically, the income and expenses of a subsidiary acquired or disposed of during the period are included in the Interim Consolidated Statements of Income and Interim Consolidated Statements of Other Comprehensive Income from the date the Bank gains control until the date the Bank ceases to control the subsidiary. Profit or loss alongside each component of the Interim Consolidated Statements of Other Comprehensive Income is attributed to the Bank's holders and non-controlling interest. The total comprehensive income of subsidiaries is attributed to the owners of the Bank and the non-controlling interests, even if this results in the non-controlling interests having a deficit in certain circumstances. When necessary, adjustments are made to the financial statements of the subsidiaries to ensure their accounting standards are consistent with the Bank's accounting standards. All balances and transactions between consolidated entities are eliminated. Changes in the consolidated entities' participation that do not result in the loss of control are accounted for as equity transactions. Accordingly, the book value of the Bank’s equity holders and the non-controlling interests are adjusted to reflect the changes in participation over subsidiaries. Any difference between the amount by which the non-controlling interests are adjusted and the fair value of the consideration being paid or received is recognized directly in equity and attributed to the equity owners of the Bank. The non-controlling interest represents the participation of third parties in the Bank's consolidated equity, which is presented in the Interim Consolidated Statement of Change in Equity. Their share of the result for the year is shown as 'Profit attributable to non- controlling interest' in the Interim Consolidated Statements of Income. The following table shows the composition of the entities over which the Bank can exercise control and, therefore, form part of the consolidation perimeter: i. Entities controlled by the Bank through participation in equity Place of % of ownership Main Activity Incorporation As of September 30, 2025 As of December 31, 2024 As of September 30, 2024 and operation Direct Indirect Total Direct Indirect Total Direct Indirect Total Santander Corredora de Seguros Limitada Insurance brokerage Santiago, Chile 99.75 0.01 99.76 99.75 0.01 99.76 99.75 0.01 99.76 Santander Corredores de Bolsa Limitada Brokerage of financial instruments Santiago, Chile 50.59 0.41 51.00 50.59 0.41 51.00 50.59 0.41 51.00 Santander Asesorias Financieras Limitada Securities brokerage Santiago, Chile 99.03 - 99.03 99.03 - 99.03 99.03 - 99.03 Santander S.A. Sociedad Securitizadora Acquisition of loans and issuance of debt securities Santiago, Chile 99.64 - 99.64 99.64 - 99.64 99.64 - 99.64 Klare Corredora de Seguros S.A. Insurance brokerage Santiago, Chile - - - - - - 50.10 - 50.10 Santander Consumer Finance Limitada Automotive financing Santiago, Chile 51.00 - 51.00 51.00 - 51.00 51.00 - 51.00 Sociedad operadora de Tarjetas de Pago Santander Getnet Chile S.A. Administration of the infrastructure for the financial market of derivative instruments Santiago, Chile 99.99 0.01 100.00 99.99 0.01 100.00 99.99 0.01 100.00 Details of non-controlling interests are shown in Note 28 Equity letter g) non-controlling interest (minority interests). Banco Santander-Chile and Affiliates NOTES TO THE INTERIM CONSOLIDATED FINANCIAL STATEMENTS As of September 30, 2025, and 2024, and as of December 31, 2024 Interim Consolidated Financial Statements September 2025 / Banco Santander-Chile 13

NOTE 02 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES, continued The Bank was authorized by the FMC to carry out the sale of its stake in the subsidiary Klare Corredora de Seguros S.A., which was finalized at the close of fiscal year 2024, and therefore is no longer part of the Bank’s consolidation perimeter. ii. Entities controlled by the Bank through other considerations and Associates The following companies have been consolidated based on the fact that the Bank determines their relevant activities (these are companies complementary to the banking sector) and, therefore, over which the Bank exercises control: • Santander Gestión de Recaudación y Cobranza Limitada: its exclusive activity is administering and collecting loans. • Multiplica SpA: its primary purpose is the development of incentive programs that encourage the use of payment cards. The company Bansa Santander S.A. was included in the consolidation perimeter until May 2024. The company Pagonxt Payments Chile SpA was included in the consolidation perimeter until December 2024. See Note 05 – Significant Events. An associate is an entity over which the Bank can exercise significant influence but not control or joint control. This capacity is usually manifested in a 20% or more interest in the entity's voting rights and is accounted for using the equity method in accordance with IAS 28 ‘Investments in Associates and Joint Ventures’. The following entities in which the Bank has an interest and are recognized using the equity method are considered 'associates': Place of % of ownership Incorporation As of September 30, As of December 31, As of September 30, Name of associated entity Main Activity and operation 2025 2024 2024 Redbanc S.A. ATM service Santiago, Chile 33.43 33.43 33.43 Transbank S.A. Debit and credit card service Santiago, Chile 25.00 25.00 25.00 Centro de Compensación Automatizado S.A. Electronic funds transfer and compensation services Santiago, Chile 33.33 33.33 33.33 Sociedad Interbancaria de Depósito de Valores S.A. Repository of publicly offered securities Santiago, Chile 29.29 29.29 29.29 Cámara Compensación de Alto Valor S.A. Payment clearing Santiago, Chile 13.72 13.72 15.00 Administrador Financiero del Transantiago S.A. Administration of smart cards for public transportation Santiago, Chile 20.00 20.00 20.00 Servicios de Infraestructura de Mercado OTC S.A. Administration of the infrastructure for the financial market of derivative instruments Santiago, Chile 12.48 12.48 12.48 In the case of Cámara Compensación de Alto Valor S.A. and Servicios de Infraestructura de Mercado OTC S.A., Banco Santander-Chile has a representative on the Board of Directors, which is why the Administration has concluded that it exercises significant influence. iii. Share or rights in other companies Entities over which the Bank has no control or significant influence are presented in this category. These equity instruments must be measured at fair value in compliance with IFRS 9 ‘Financial Instruments’. Nevertheless, the Bank may consider the cost an appropriate fair value estimate in concrete circumstances. This may be the case if the most recently available information is insufficient to measure the fair value or if a wide range of possible fair value measurements and the cost involved represents the best estimate of fair value within that range. In another regard, the Bank may make an irrevocable decision to present subsequent changes to the fair value in other comprehensive income during its initial recognition. Subsequent changes in this valuation shall be recognized in 'Accumulated other comprehensive income - Items that will not be reclassified to profit or loss'. Dividends received from these investments are recorded in the Interim Consolidated Statements of Income under 'Result from investments in companies'. These instruments are not subject to the IFRS 9 ‘Financial Instruments’ impairment model. Banco Santander-Chile and Affiliates NOTES TO THE INTERIM CONSOLIDATED FINANCIAL STATEMENTS As of September 30, 2025, and 2024, and as of December 31, 2024 Interim Consolidated Financial Statements September 2025 / Banco Santander-Chile 14

NOTE 02 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES, continued 3. Non-controlling interest Non-controlling interest represents the portion of net income and net assets the Bank does not own, either directly or indirectly. It is presented separately in the Interim Consolidated Statements of Income and separately from the equity in the Interim Consolidated Statements of Financial Position . In the case of entities controlled by the Bank through other considerations, profit and equity are presented fully as a non-controlling interest. This is because the Bank controls them, but has no ownership expressed as a percentage. 4. Reporting segments The Bank's operating segments are those units whose operating results are reviewed regularly by the highest level of management regarding decision-making. Accordingly, two or more operating segments can be added into one only when the aggregation is consistent with the basic principle under the IFRS 8 'Operating Segments' and if the segments have similar economic characteristics and are alike in each one of the following aspects: i. The nature of the products and services. ii. The nature of production processes. iii. The type of customer category for which its products and services are intended. iv. The methods used to distribute their products or provide services. v. If applicable, the nature of the regulatory framework, e.g., banking, insurance, utilities. The Bank reports separately for each operating segment that meets any of the following quantitative thresholds: i. Its reported revenues from ordinary activities, including both sales to external clients and inter-segment sales or transactions, equal or exceed 10% of the combined revenues from all operating segments' ordinary internal and external activities. ii. The amount of its reported results is, in absolute terms, equal to or greater than 10% of the greater of (i) the combined profit reported by all operating segments that have not reported a loss; and (ii) the combined loss reported by all operating segments that have reported a loss. iii. Its assets equal or exceed 10% of the combined assets of all operating segments. Operating segments that do not meet any of the quantitative thresholds may be considered reportable segments. The information must be disclosed separately if management believes it would be helpful to Interim Consolidated Financial Statements users. Information regarding other business activities that do not correspond to reportable segments is combined and disclosed within the Corporate Activities category 'other'. Concerning the above, the Bank's segments were obtained under the consideration that an operating segment is a component of an entity that: i. Engages in business activities from which it may earn revenues and incur expenses (including revenues and expenses from transactions with other elements of the same entity). ii. Whose operating results are regularly reviewed by the entity's chief executive officer, who makes decisions about resources allocated to the segment and assesses its performance. iii. For which discrete financial information is available. 5. Functional and presentation currency The Bank, in according to IAS 21 'The Effects of Changes in Foreign Exchange Rates', has defined the Chilean Peso as its functional and presentation currency, as this is the currency of the primary economic environment in which the Bank operates, as well as the currency that influences the cost and revenue structure. Therefore, all balances and transactions denominated in currencies other than the Chilean Peso are considered 'foreign currency'. Banco Santander-Chile and Affiliates NOTES TO THE INTERIM CONSOLIDATED FINANCIAL STATEMENTS As of September 30, 2025, and 2024, and as of December 31, 2024 Interim Consolidated Financial Statements September 2025 / Banco Santander-Chile 15

NOTE 02 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES, continued 6. Transaction in foreign currencies The Bank conducts transactions in amounts denominated in foreign currencies, mainly US dollars. The assets and liabilities denominated in foreign currencies held by the Bank and its affiliates are translated into Chilean Pesos at the market exchange rate corresponding to the end of the reported month (spot rate), which amounts to $961.65 per US$ for September 2025 and $912.36 for September 2024 ($994.10 per US$1 for December 2024). For all other currencies, an external pricing provider is used. The net foreign exchange gain and loss includes recognizing the effects of exchange rate changes on assets and liabilities denominated in foreign currencies and the profit and loss on foreign exchange spot and forward transactions undertaken by the Bank. 7. Cash and cash equivalents The indirect method is used to prepare the Interim Consolidated Statement of Cash Flows, starting with the Bank's consolidated pre- tax income, and then incorporating non-cash transactions, cash-flow-related income, and expense of activities classified as investments or financing. The following items are taken into consideration in the preparation of the Interim Consolidated Statement of Cash Flows: i. Cash flows: inflows and outflows of cash and cash equivalents, defined as balances in items such as deposits with the Central Bank of Chile, deposits in domestic banks and deposits abroad. ii. Operating activities: these are the normal activities carried out by banks alongside other activities that cannot be classified as investments or financing. iii. Investing activities: these correspond to the acquisition, sale or disposal by other means of long-term assets and other investments not included in cash and cash equivalents. iv. Financing activities: those that result in changes to the size and composition of equity and liabilities that are not part of operating or investing activities. 8. Definitions, classification and measurement of financial assets/liabilities i. Definitions A 'financial instrument' is any contract that gives rise to a financial asset in an entity and a financial liability or equity instrument in another entity. A 'financial asset' is any asset that is: (a) cash; (b) an equity instrument of another entity; (c) a contractual right to receive cash or another financial asset from another entity or to exchange financial assets or financial liabilities with another entity under conditions that are potentially favorable to the entity; or (d) a contract that will or may be settled using the entity's own equity instruments. A 'financial liability' is any liability that is: (a) a contractual obligation to deliver cash or another financial asset to another entity or to exchange financial assets or financial liabilities with another entity under conditions that are potentially unfavorable to the entity; or (b) a contract that will or may be settled using the entity's equity instruments. An 'equity instrument' is any contract that evidences a residual interest in the assets of the issuing entity after deducting all of its liabilities. A 'financial derivative' is a financial instrument whose value fluctuates in response to changes concerning an observed market variable (such as an interest rate, a foreign exchange rate, a financial instrument's price, or a market index, including credit ratings), whose initial investment is minimal compared with other financial instruments with a similar response to changes in market factors, and which is generally settled at a future date. 'Fair value' is the price that would be received to sell an asset or paid to transfer a liability in a transaction between market participants at the measurement date. Banco Santander-Chile and Affiliates NOTES TO THE INTERIM CONSOLIDATED FINANCIAL STATEMENTS As of September 30, 2025, and 2024, and as of December 31, 2024 Interim Consolidated Financial Statements September 2025 / Banco Santander-Chile 16

NOTE 02 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES, continued ii. Initial recognition The Bank shall recognize a financial asset or financial liability only when it becomes part of the contractual terms of the instrument (rights and obligations). A conventional purchase or sale of financial assets shall be recognized using the accounting contract date or settlement date. iii. Classification of financial assets/liabilities Classification of financial assets Financial assets shall be classified into measurement categories based on the entity's business models for managing the financial assets and the contractual cash flow characteristics of said assets. The business model refers to how the Bank manages its financial assets to generate cash flows. In other words, the entity's business model determines whether the cash flows will come by obtaining contractual cash flows, selling financial assets, or both. Assessing the contractual flow characteristics (SPPI test) requires determining whether the asset's contractual flows are solely payments of principal on specified dates and interest on the principal outstanding amounts in the currency in which the financial asset is denominated. The principal is the fair value of the financial asset at initial recognition. Nevertheless, the principal amount may change over the life of the financial asset (if there are principal repayments). Interest is the compensation received for the time value of money and the credit risk related to the principal amount owed over a specified period, alongside other risks and administrative costs, and a profit margin. For the assessment, the Bank conducts a Test evaluating whether the contractual flows meet the criteria for a core lending arrangement. The Bank uses its professional assessment and considers relevant factors such as currency, interest rate (fixed or variable) and the period it sets. The assessment of business models is not an instrument-by-instrument ranking approach but at a higher level of aggregation and considers all relevant evidence: model performance, risks affecting performance, and how managers are rewarded, among others. According to the above, the objectives of the business models are: • To hold assets to collect cash flows – through management that produces cash flows by collecting contractual payments throughout the instrument's life. Models with this goal allow for sales if they are infrequent (even if significant in value) or insignificant in value both individually and in aggregate (even if frequent), and even more so if they result from a substantial increment in risk or the risk management of credit concentration. • To maintain financial assets for collection and sale. Per this objective, the entity's key management personnel have decided that the supply of contractual cash flows and the sale of financial assets are essential to achieve the business model's goal. Therefore, there is a higher frequency and value of sales for this purpose. • Other models - financial assets are measured at fair value through profit or loss if they are not held within a business model whose objective is to hold the assets to collect contractual cash flows or if their objective is achieved by obtaining contractual cash flows and selling financial assets. Assets are managed on a sales basis, and decisions are made on a fair value basis. In accordance with the above, the Bank will classify its financial assets based on whether they are subsequently measured at amortized cost, at fair value through other comprehensive income, or at fair value through profit or loss. Additionally, an irrevocable election may be made at the time of initial recognition of investments in equity instruments to present subsequent changes in fair value in other comprehensive income. Banco Santander-Chile and Affiliates NOTES TO THE INTERIM CONSOLIDATED FINANCIAL STATEMENTS As of September 30, 2025, and 2024, and as of December 31, 2024 Interim Consolidated Financial Statements September 2025 / Banco Santander-Chile 17

NOTE 02 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES, continued Classification of financial liabilities An entity shall classify all financial liabilities as subsequently measured at amortized cost, except for derivative liabilities measured at fair value through profit or loss. Reclassifications Reclassifying financial assets only occurs only when the business model for managing financial assets has changed. These changes are determined by top management due to external or internal changes. Financial liabilities are not reclassified. iv. Measurement of financial assets/liabilities Initial measurement Financial assets and liabilities are initially measured at fair value (transaction price), plus or minus transaction costs in the case of a financial asset or financial liability that is not carried at fair value through profit or loss. Subsequent measurement of financial assets A financial asset shall subsequently be measured according to the following: (i) Amortized cost A financial asset is measured at amortized cost if the financial asset is held within a business model whose objective is to hold financial assets to earn cash flows, and the contractual terms of the financial asset give rise, at specified dates, to cash flows that are solely payments of principal and interest on the outstanding principal amount. Interest income shall be calculated using the effective interest method. This method applies to financial assets and liabilities measured at amortized cost (interest income and interest expense). The effective interest rate is the rate that exactly discounts estimated future cash payments or receipts through the expected life of the financial asset or financial liability to the gross carrying amount of the financial asset or the amortized cost of a financial liability. (ii) Fair value through other comprehensive income A financial asset is measured at fair value through other comprehensive income if the financial asset is held within a business model in which the objective are to obtain the contractual cash flows, to sell financial assets, and if the contractual terms of the financial asset give rise, at specified dates, to receive cash flows that are solely payments of principal and interest on the outstanding principal amount. 1. Fair value through profit or loss A financial asset is measured at fair value through profit or loss unless measured at amortized cost or fair value through other comprehensive income. 2. Irrevocable election to measure at fair value with changes in other comprehensive income. Upon the initial recognition of Investments in equity instruments, a determination may be held to present subsequent changes in fair value in other comprehensive income that would otherwise be measured at fair value through profit or loss when not held for trading, except for dividend income, which is recognized in profit or loss for the period. Gains or losses arising from the de-recognition of these equity instruments are not transferred to profit or loss. Subsequent measurement of financial liabilities Financial liabilities are subsequently measured at amortized cost, except for derivatives measured at fair value through profit or loss. Banco Santander-Chile and Affiliates NOTES TO THE INTERIM CONSOLIDATED FINANCIAL STATEMENTS As of September 30, 2025, and 2024, and as of December 31, 2024 Interim Consolidated Financial Statements September 2025 / Banco Santander-Chile 18

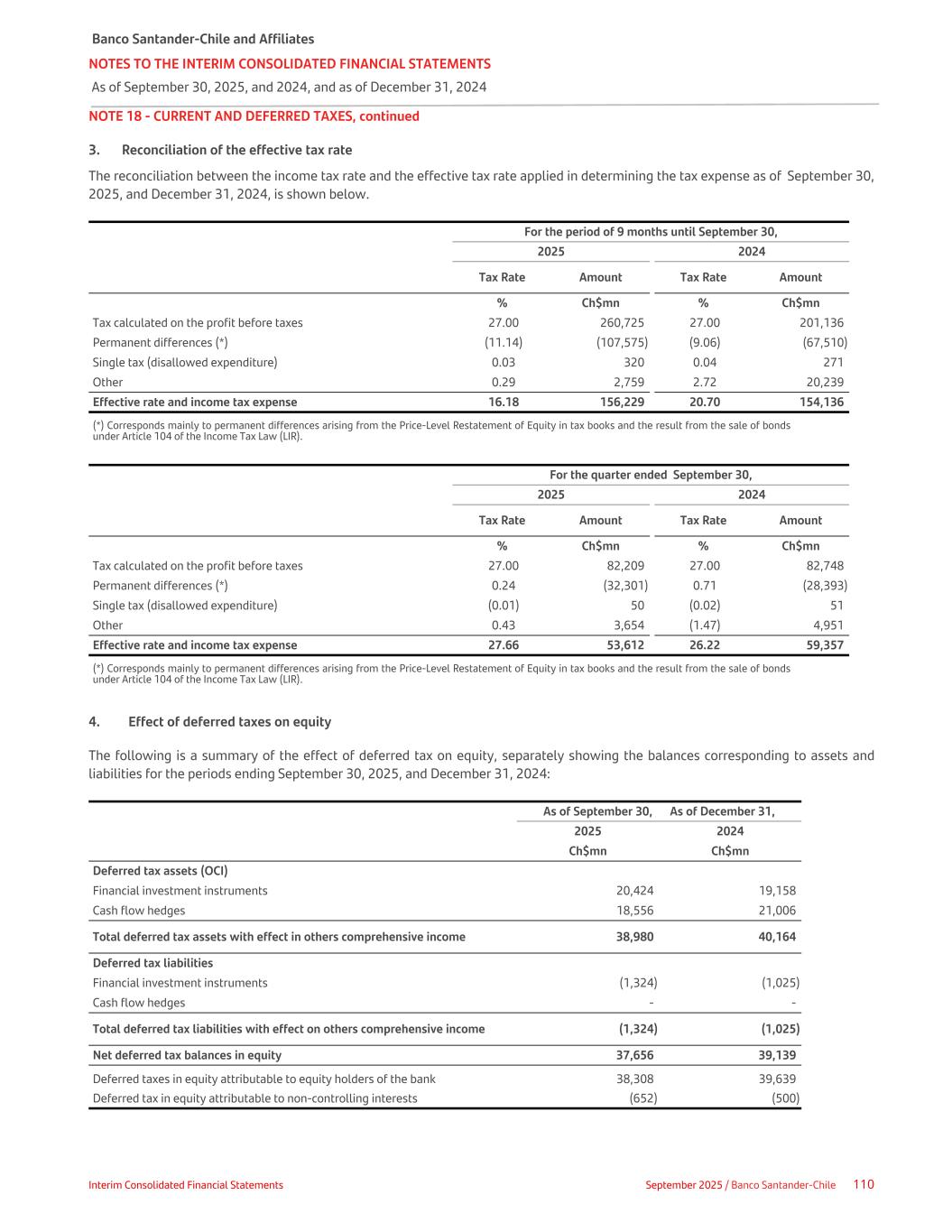

NOTE 02 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES, continued v. De- recognition of financial assets/liabilities A financial asset shall be derecognized when and only when: (i) The contractual rights to the cash flow from the financial asset expire, or (ii) The contractual rights to receive the cash flows of a financial asset are transferred, or it retains the contractual rights to receive the cash flows of a financial asset but assumes a contractual obligation to pay them to one or more recipients. In this sense, if the risks and rewards of ownership of the financial asset are substantially transferred, the financial asset is derecognized. In the case of unconditional sales, sales under repurchase agreements at fair value at the date of repurchase, sales of financial assets with a purchased call option or a written put option that is deeply out of the money, uses of assets where the transferor does not retain subordinated financing nor grants any credit enhancement to the new owners, and other similar cases, the transferred financial asset is recognized from the Interim Consolidated Statements of Financial Position with simultaneous recognition of any rights or obligations retained or created as a result of the transfer. In the case of sales of financial assets: (i) under fixed-price repurchase agreements or using the sale price plus interest, (ii) of securities lending agreements in which the borrower must return the same or (iii) similar assets and in other akin cases, the transferred financial asset is not recognized from the Interim Consolidated Statements of Financial Position and continues to be measured using the same criteria as before the transfer. A financial liability is recognized when and only when it is extinguished – that is, when the obligation specified in the contract is paid for, cancelled or expired. In the case of loans, the FMC requirements for recognition apply. See letter o), VIII. vi. Offsetting a financial asset with a financial liability A financial asset and a financial liability shall be offset and presented by their net amount in the Interim Consolidated Statements of Financial Position when, and only when, there is now a legally enforceable right to set off the recognized amounts and an intention to settle the net amount or to realize the asset and settle the liability, simultaneously. As of September 30, 2025, and 2024, and December 31, 2024, the Bank has no financial asset/liability that offset. 9. Financial derivatives and hedge accounting Derivatives are classified as either trading instruments or hedging instruments. The Bank uses financial derivatives for the following purposes: i. To provide such instruments to customers who request them to manage their market and credit risks. ii. To use them for the risk management of the proprietary position of the Bank's entities and their assets and liabilities ('hedging derivatives'). iii. To benefit from changes in the value of these derivatives (trading derivatives). Trading derivatives are measured at fair value through profit or loss and are presented as assets/liabilities according to their positive or negative fair value. Derivatives that do not qualify as hedging instruments are accounted for as trading instruments. The Bank has elected to continue to use the IAS 39 guidelines for hedge accounting. For a financial derivative to be considered a hedging derivative, all the following conditions must be met: 1. To cover one of the following three types of risk: a. Changes in the value of assets and liabilities due to fluctuations in, among other things, inflation (UF), interest rates and/or exchange rates to which the position or balance to be hedged is subject ('fair value hedging'). b. Changes in estimated cash flows originating from financial assets and liabilities, highly probable commitments and transactions that are expected to be carried out ("cash flow hedge"). c. The net investment in a foreign operation ('hedge of a net investment in a foreign operation'). Banco Santander-Chile and Affiliates NOTES TO THE INTERIM CONSOLIDATED FINANCIAL STATEMENTS As of September 30, 2025, and 2024, and as of December 31, 2024 Interim Consolidated Financial Statements September 2025 / Banco Santander-Chile 19

NOTE 02 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES, continued 2. To effectively eliminate some risk inherent in the hedged item or position for the entire expected term of the hedge, which entails that: a. At the date of arrangement, the hedge is expected, under normal conditions, to be highly effective ('prospective effectiveness'). b. There is sufficient evidence that the hedge was effective during the life of the hedged item or position ('retrospective effectiveness'). 3. There must be adequate documentation evidencing the specific designation of the financial derivative to hedge certain balances or transactions and how this effective hedge was expected to be achieved and measured, provided that this is consistent with the Bank's management of its risks. The changes in the value of financial instruments qualifying for hedge accounting are recorded as follows: a. For fair value hedges, the gains or losses arising on both hedging instruments and the hedged items (attributable to the type of risk being hedged) are included as 'Net income (expense) from financial operations' in the Interim Consolidated Statements of Income. b. For fair value hedges of the interest rate risk of a portfolio of financial instruments ('macro-hedges'), gains or losses arising on measurement of the hedging instruments are recognized directly in the Interim Consolidated Statements of Income under 'Interest and adjustment income'. c. For cash flow hedges, the efficient portion of the change in the value of the hedging instrument is recorded in the Interim Consolidated Statements of Other Comprehensive Income in 'Valuation accounts - cash flow hedges' within equity. d. Differences in the valuation of the hedging instrument corresponding to the inefficient portion of cash flow hedging transactions are recognized directly in the Interim Consolidated Statements of Income in 'Net income from financial operations'. If a derivative designated as a hedge, whether due to termination, ineffectiveness, or any other cause, does not meet the above requirements, hedge accounting is discontinued. When 'fair value hedging' is discontinued, the fair value adjustments to the carrying amount of the hedged item arising from the hedged risk are amortized to gain or loss from that date, when applicable. When cash flow hedges are discontinued, the cumulative gain or loss on the hedging instrument recognized in the Interim Consolidated Statements of Other Comprehensive Income in equity 'Valuation Accounts' (while the hedge was efficient) continues to be recognized in equity until the hedged transaction occurs. At that time, it is recognized in the Interim Consolidated Statements of Income unless the transaction is not expected to occur, in which case it is recognized immediately in the Interim Consolidated Statements of Income. Banco Santander Chile has initiated a transition plan to adopt hedge accounting in accordance with the guidelines of IFRS 9 for the year 2025. Embedded derivatives in hybrid financial instruments 'Embedded derivatives' is a hybrid contract component that simultaneously includes a host contract that is not a derivative and a financial derivative that is not individually transferable. It has the effect that some of the cash flows of the hybrid contract vary in the same way as the embedded derivative would on a stand-alone basis. As of September 30, 2025, and 2024, and December 31, 2024, Banco Santander-Chile holds embedded derivatives in dual currency contracts in its portfolio. 10. Fair value of financial assets and liabilities No transaction costs are deducted when financial assets and liabilities are measured at fair value. Assets and liabilities subsequently measured at amortized cost are not required to be measured at fair value. Banco Santander-Chile and Affiliates NOTES TO THE INTERIM CONSOLIDATED FINANCIAL STATEMENTS As of September 30, 2025, and 2024, and as of December 31, 2024 Interim Consolidated Financial Statements September 2025 / Banco Santander-Chile 20

NOTE 02 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES, continued 'Fair value' is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction in the principal market at the measurement date under current market conditions (i.e., an exit price) regardless of whether that price is directly observable or estimated using another valuation technique. Fair value measurement is for a specific asset or liability. Therefore, in measuring fair value, the Bank considers the characteristics of the asset or liability in the same way that market participants would consider in pricing the asset or liability at the measurement date. In addition, the fair value measurement assumes that the transaction of selling the asset or transferring the liability takes place either: (a) in the principal market for the asset or liability or (b) in the absence of a principal market, the most advantageous market for the asset or liability. When there is no market price for a given financial instrument, its fair value is estimated based on the price established in recent transactions involving similar instruments or, in the absence thereof, based on valuation models sufficiently contrasted by the international financial community, considering the specific peculiarities of the instrument to be valued and especially, the different types of risk related to the instrument. When valuation techniques are used, they maximize the use of the relevant observable input data and minimize that of unobservable input data. For example, when an asset or a liability measured at fair value has a bid price and an asking price, the price within the bid-ask spread that is most representative of fair value in the circumstances shall be used to measure fair value regardless of where the input is categorized within the fair value hierarchy. Although average prices are allowed as a practical resource to determine the fair value of an asset or a liability, the Bank makes an adjustment (FVA or fair value adjustment) when there is a gap between the purchase and sale price (close-out cost). All derivatives are recorded in the Interim Consolidated Statements of Financial Position at fair value from the trade date. If their fair value is positive, they shall be recorded as an asset; if their fair value is negative, they shall be recorded as a liability. In the absence of evidence to the contrary, the trade date's fair value is deemed the transaction price. Changes in the fair value of derivatives from the trade date are recognized with a balancing entry in the Interim Consolidated Statements of Income under "Profit/(loss) on financial assets/liabilities held for trading at fair value through profit or loss". Specifically, the fair value of financial derivatives included in the trading books is deemed similar to their daily quoted price. If, for exceptional reasons, the quoted price cannot be determined on a given date, the fair value is calculated using similar methods to those used for over-the-counter (OTC) derivatives. The fair value of OTC derivatives is the sum of the future cash flows stemming from the instrument that have been discounted to the present value at the appraisal date ('present value' or 'theoretical closure') using valuation techniques commonly used by the financial markets: 'net present value' (NPV) and option pricing models, among other methods. Also, within the fair value of derivatives are included the credit risk of the derivative, be it the Bank’s own credit risk (Debt Valuation Adjustment or “DVA”) or the counterparty’s credit risk (Credit Valuation Adjustment or “CVA”). The Counterparty Credit Risk (CVA) is a valuation adjustment to derivatives contracted in non-organized markets because of the exposure to counterparty credit risk. The CVA is calculated considering the potential exposure to each counterparty in future periods. The Debit Valuation Adjustment (DVA) is a valuation adjustment similar to CVA, but generated by the Bank's credit risk assumed by our counterparties. In the case of derivative instruments contracted with Central Clearing Houses, where the variation margin is contractually defined as a firm and irrevocable payment, this payment is considered part of the derivative's fair value. For loans and advances covered by fair value hedging transactions, changes in their fair value related to the risk or risks covered in these hedging transactions are recorded. Equity instruments and contracts related to these instruments must be measured at fair value. Nevertheless, in certain circumstances, the Bank may use cost as an appropriate fair value estimate. This may be necessary, for example, if the recently available information is insufficient to measure the fair value or if a wide range of possible fair value measures exists, and the cost represents the best fair value estimate within that range. Furthermore, the Bank may irrevocably elect to present subsequent changes in the instrument's fair value in other comprehensive income. As of September 30, 2025, and 2024, and December 31, 2024, no significant investments in listed financial instruments had ceased to be recorded at their quoted market value due to their market being unable to be considered active. Banco Santander-Chile and Affiliates NOTES TO THE INTERIM CONSOLIDATED FINANCIAL STATEMENTS As of September 30, 2025, and 2024, and as of December 31, 2024 Interim Consolidated Financial Statements September 2025 / Banco Santander-Chile 21

NOTE 02 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES, continued The amounts at which financial assets/liabilities are recorded represent, in all material respects, the Bank's maximum exposure to credit risk at each reporting date. The Bank also has collateral and other credit enhancements to mitigate its exposure to credit risk, consisting mainly of mortgages, cash, equity and personal guarantees, leased and rented assets, assets purchased under repurchase agreements, securities lending and credit derivatives. Valuation techniques According to IFRS 13 'Fair Value Measurement', a fair value hierarchy is established based on three levels: Level 1, Level 2 and Level 3, in which the highest priority is given to quoted prices (unadjusted) in active markets for identical assets and liabilities and the lowest priority to unobservable inputs. Financial instruments at fair value and determined by published prices in active markets (Level 1) comprise government bonds, corporate bonds, exchange-traded derivatives, securitized assets, equities, short positions and issued bonds. In cases where quotations cannot be observed, management best estimates what the market would price using its own internal models. In most cases, these internal models use data based on observable market parameters as significant inputs (level 2) and sometimes use significant unobservable inputs in market data (level 3). Various techniques are used to estimate it, including extrapolating observable market data. The most reliable evidence of the fair value of a financial instrument on initial recognition is the transaction price unless the value of that instrument can be derived from other market transactions by the same or a similar instrument or valued using a valuation technique in which the inputs used include only observable market data, mainly interest rates. The main techniques used as of September 30, 2025, and 2024, and December 31, 2024 by the Bank's internal models to determine the fair value of financial instruments are described below: i. The present value method is used to value financial instruments that allow static hedging (mainly forwards and swaps). Expected future cash flows are discounted using the interest rate curves of the corresponding currencies. As a rule, interest rate curves are data that can be observed on the markets. ii. In the valuation of financial instruments that require dynamic hedging (mainly structured options and other structured instruments), the “Black-Scholes” model is normally used. Where appropriate, observable market inputs are used to obtain factors such as the diluted bid-offer, exchange rates, volatility, correlation between indices and market liquidity. iii. In the valuation of certain financial instruments subject to interest rate risk, such as interest rate futures, caps and floors, the present value method (futures) and the “Black-Scholes” model (“plain vanilla” options) are used. The main inputs used in these models are mainly observable market data, including the corresponding interest rate curves, volatilities, correlations and exchange rates. The fair value of the financial instruments calculated by the aforementioned internal models considers contractual terms and observable market data, including interest rates, credit risk, exchange rates, the quoted market price of shares and market rates of raw materials, volatility, prepayments and liquidity. The Bank's management verifies that the valuation models do not incorporate significant subjectivity. Therefore, if necessary, these methodologies can be adjusted and calibrated through internal calculations of fair value and subsequent comparison with the corresponding actively traded prices. The Bank has developed a formal process for the systematic valuation and management of financial instruments, implemented in all units included in the scope of consolidation. The governance structure of this process distributes responsibilities between two separate divisions: Treasury (responsible for the development, marketing and daily management of financial products and market data) and Market Risks (responsible for the periodic validation of valuation models and market data, the process of calculating risk metrics, standards for approving new transactions, market risk management and the implementation of valuation adjustment standards). Approving a new product involves several steps (application, development, validation, integration into corporate systems and quality review) before production. This process ensures the rating systems are properly reviewed and stable before use. Details of the most significant derivative products and families, together with their respective valuation techniques and inputs, by type of asset, are set out in Note 44 'Fair value of financial assets and liabilities' in these Interim Consolidated Financial Statements. Banco Santander-Chile and Affiliates NOTES TO THE INTERIM CONSOLIDATED FINANCIAL STATEMENTS As of September 30, 2025, and 2024, and as of December 31, 2024 Interim Consolidated Financial Statements September 2025 / Banco Santander-Chile 22

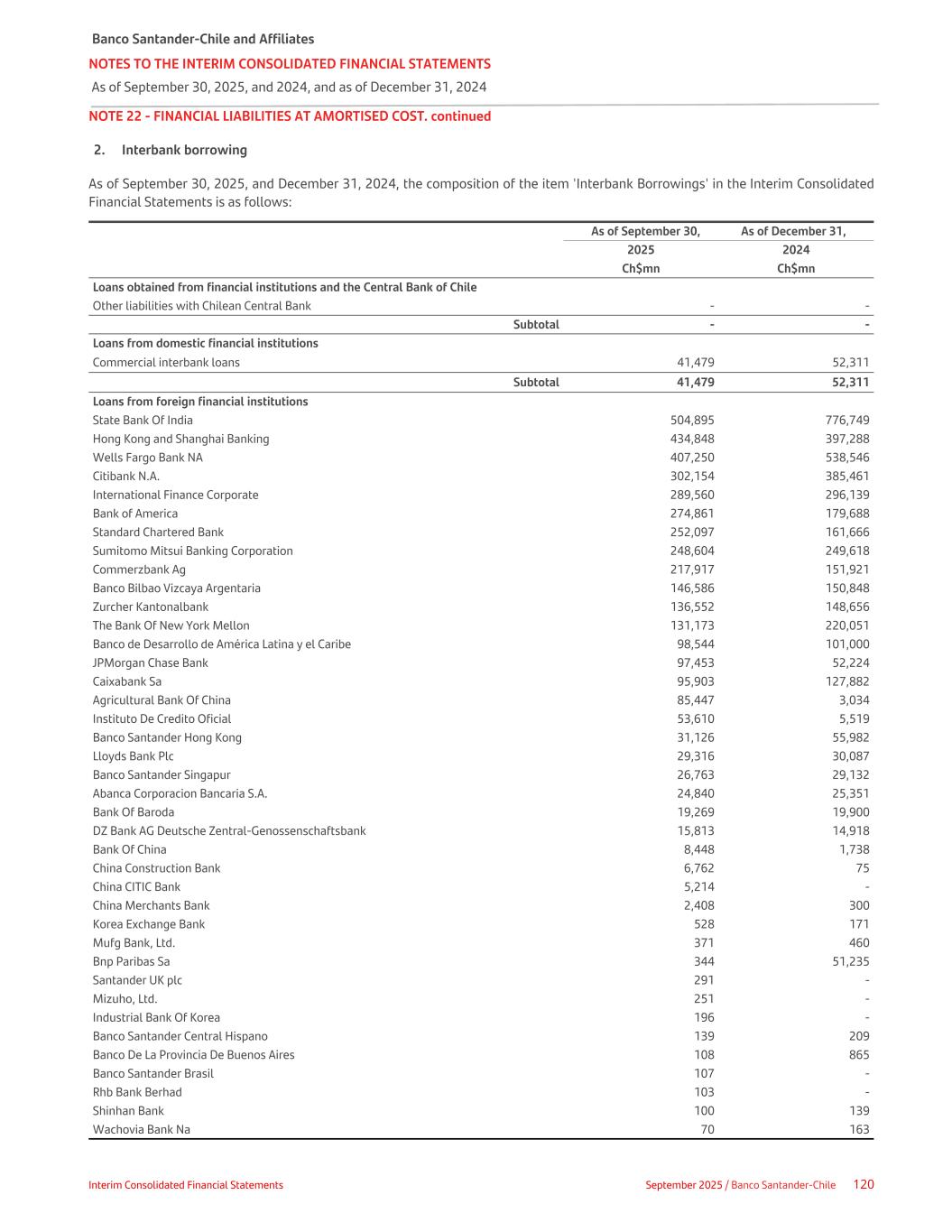

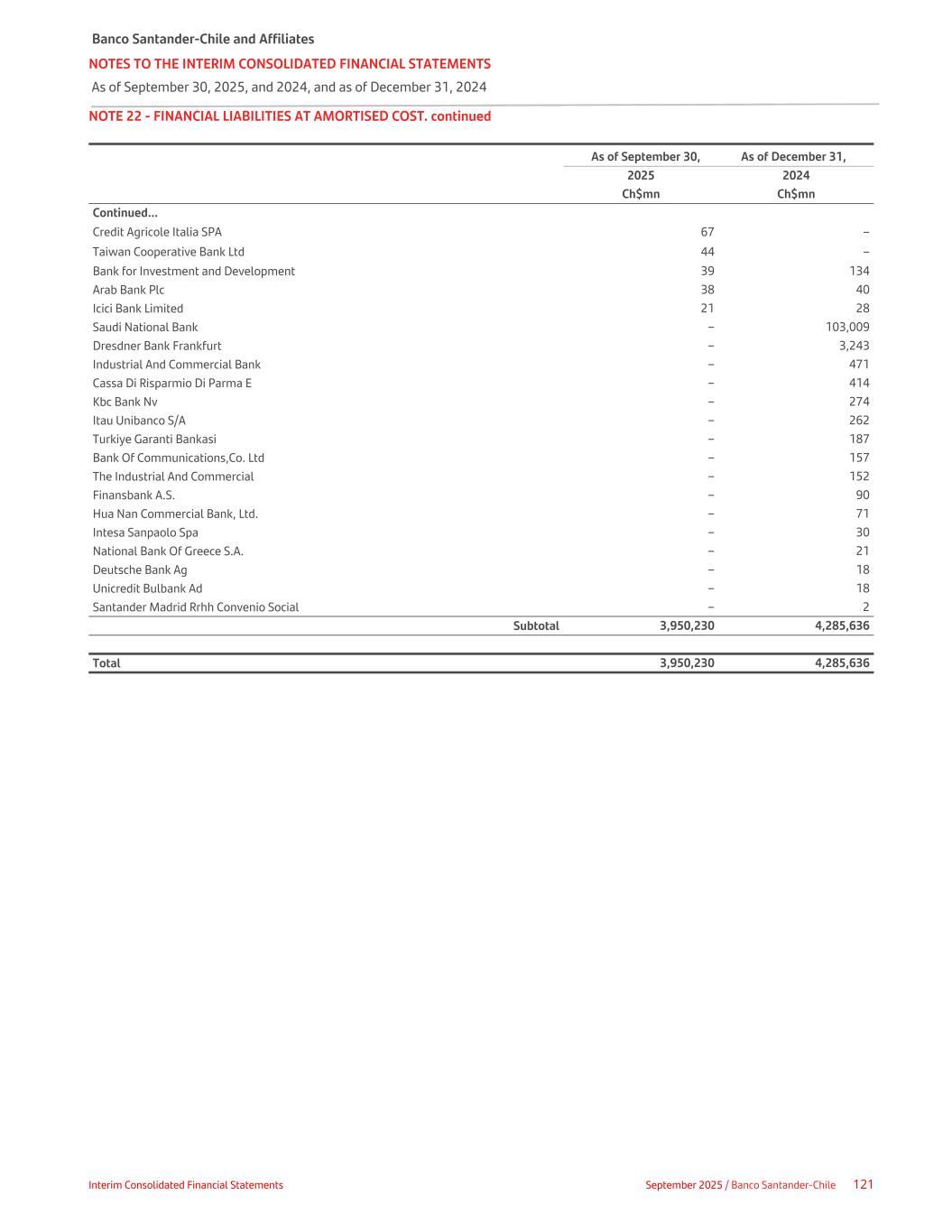

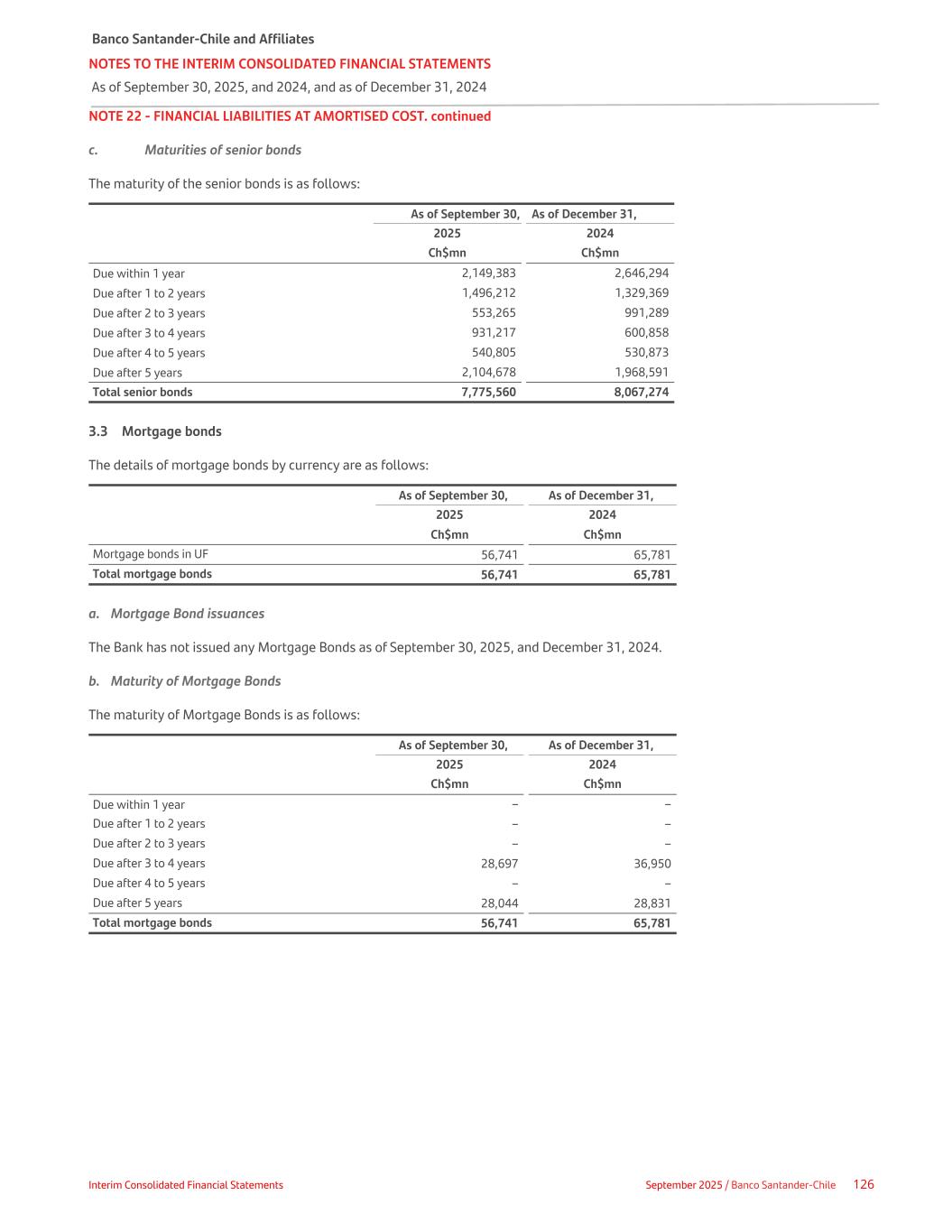

NOTE 02 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES, continued 11. Fixed assets This category includes the buildings, land, furniture, vehicles, computer hardware and other fixed assets owned by the consolidated entities. Assets are classified according to their use as follows: a. Fixed assets for own use Fixed assets for own use are presented at their acquisition cost, less its corresponding accumulated depreciation and, if applicable, the impairment losses that result from comparing the net value of each item with its corresponding recoverable amount. This includes, among others, the material assets received by the consolidated entities for the liquidation, in whole or in part, of financial assets that represent collection rights against third parties, and which are expected to be continuously used and owned. Depreciation is calculated using the straight-line method over the acquisition cost of assets minus their residual value, assuming that the land on which buildings and other structures stand has an indefinite life and is not subject to depreciation. The Bank applies the following useful lives for the tangible assets that comprise its assets: ITEM Useful Life (Months) Land - Paintings and works of art - Carpets and curtains 36 Computers and Hardware 36 Vehicles 36 Machines and general equipment 60 Office furniture 60 Telephone and communication systems 60 Security systems 60 Rights over telephone lines 64 Air conditioning systems 84 ATMs and teleconsultations 120 Other installations 120 Buildings 1,200 At each reporting period, the consolidated entities assess whether there is any indicator that the carrying amount of any tangible asset exceeds its recoverable amount. If this is the case, the asset's carrying amount is reduced to its recoverable amount. Future depreciation charges are adjusted under the revised carrying amount and to the new remaining useful life, if an adjustment of the latter is necessary. Likewise, the estimated useful lives of the items of property, plant and equipment held for own use are reviewed at the end of each reporting period to detect significant changes. If changes are detected, the useful lives of the assets are adjusted by correcting the depreciation charge to be recorded in the Interim Consolidated Statements of Income in future years based on the new useful lives. Maintenance expenses relating to tangible assets held for own use are recorded as an expense in the period in which they are incurred. b. Assets leased out under operating leases The criteria used to record the acquisition cost of assets leased out under operating leases, calculate their depreciation and their respective estimated useful lives, and record their impairment loss are the same criteria as those for fixed assets held for own use. Banco Santander-Chile and Affiliates NOTES TO THE INTERIM CONSOLIDATED FINANCIAL STATEMENTS As of September 30, 2025, and 2024, and as of December 31, 2024 Interim Consolidated Financial Statements September 2025 / Banco Santander-Chile 23

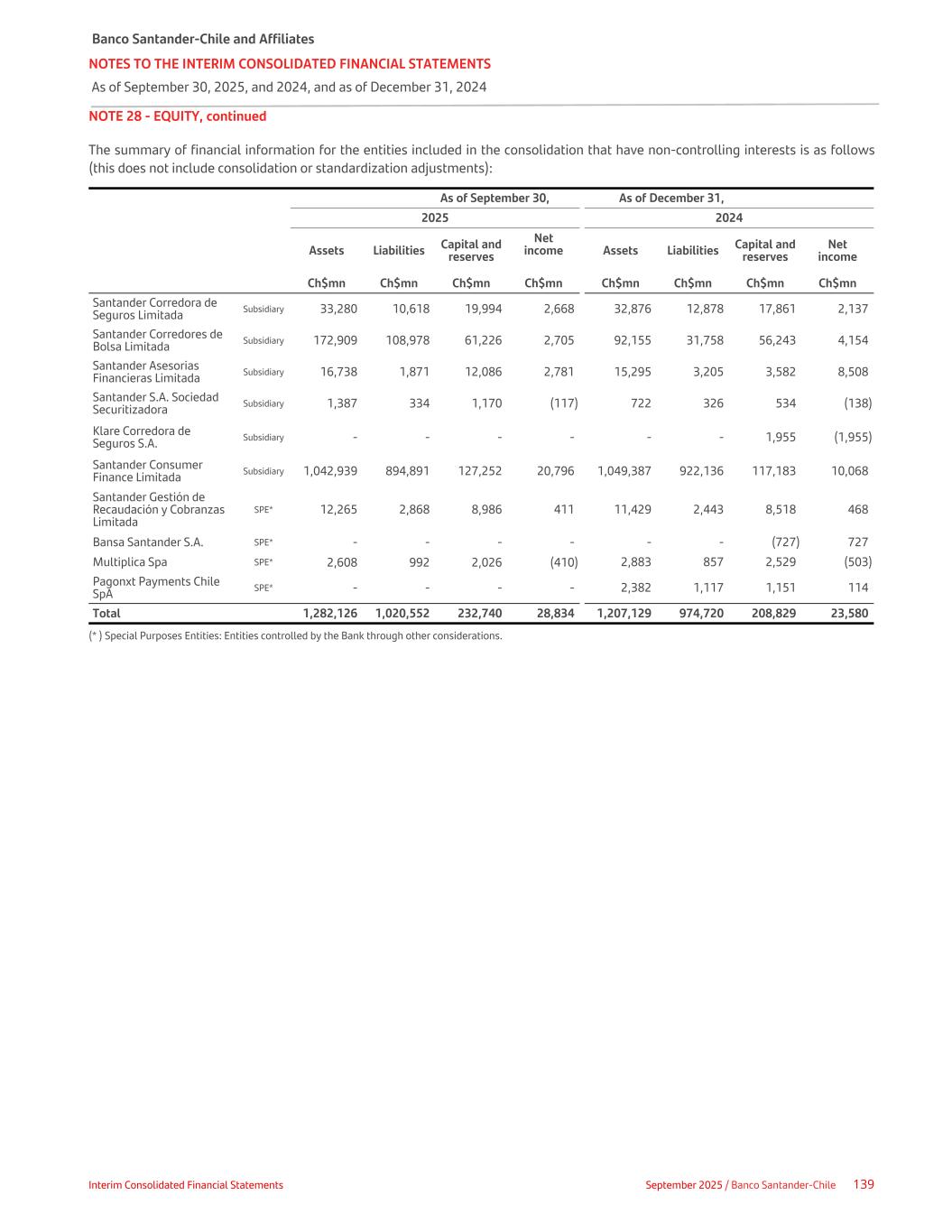

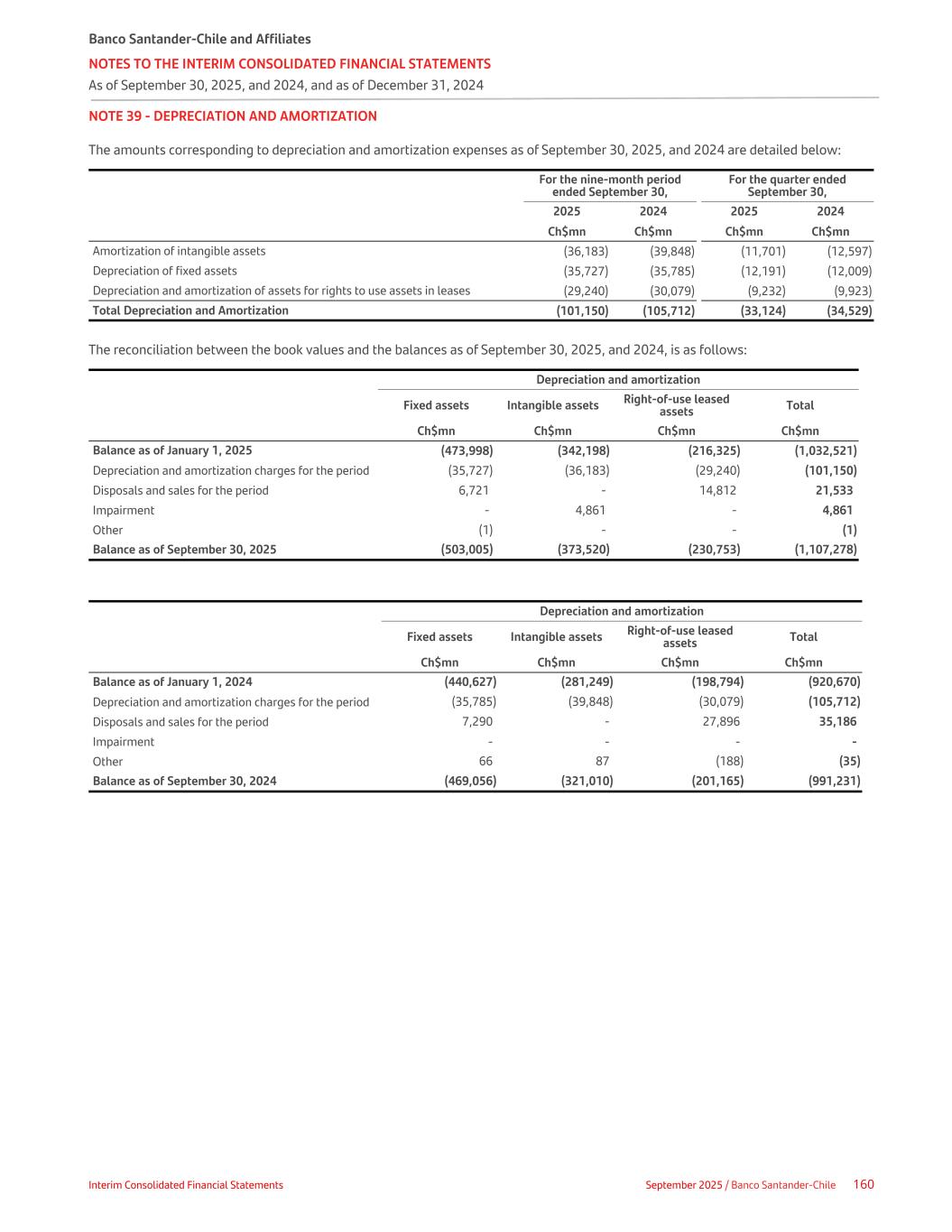

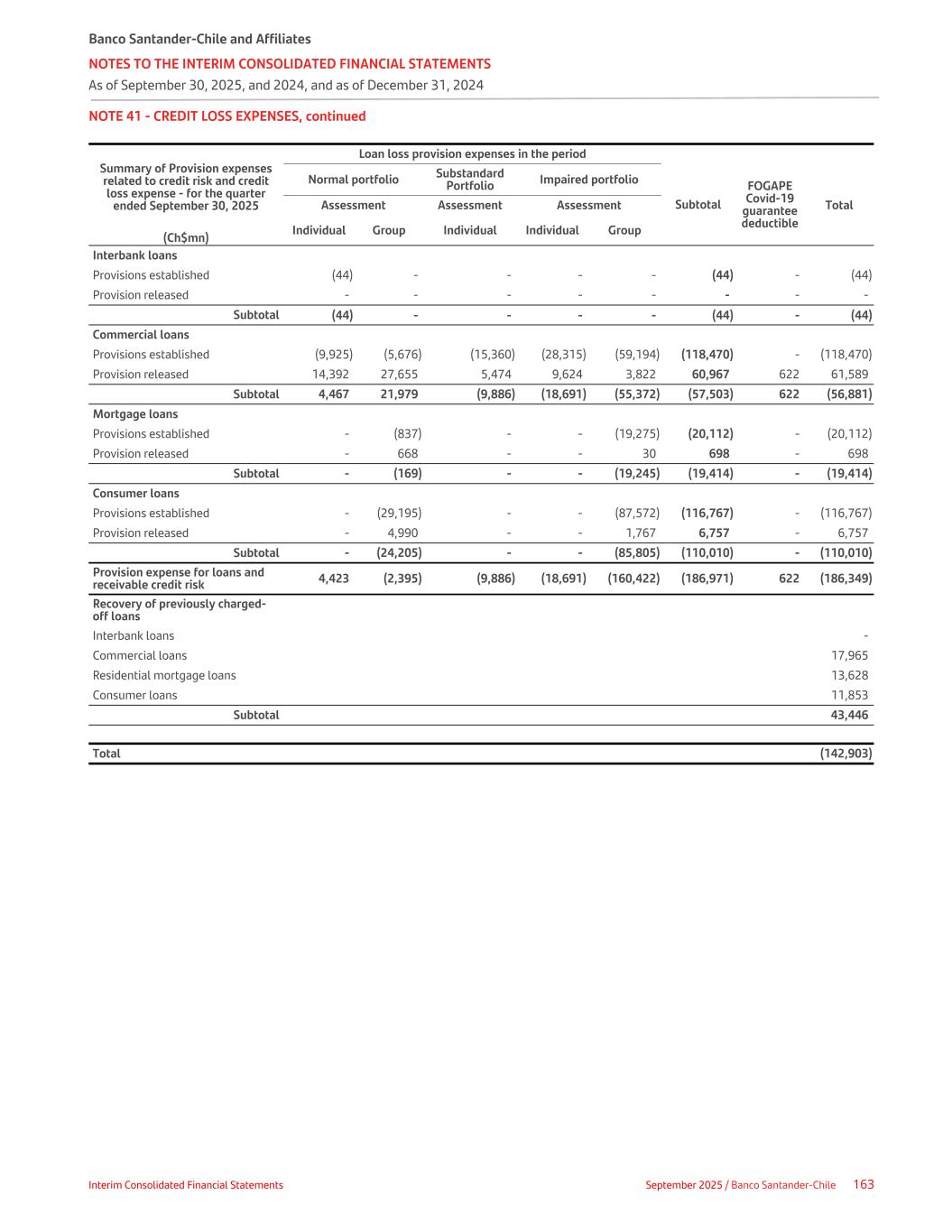

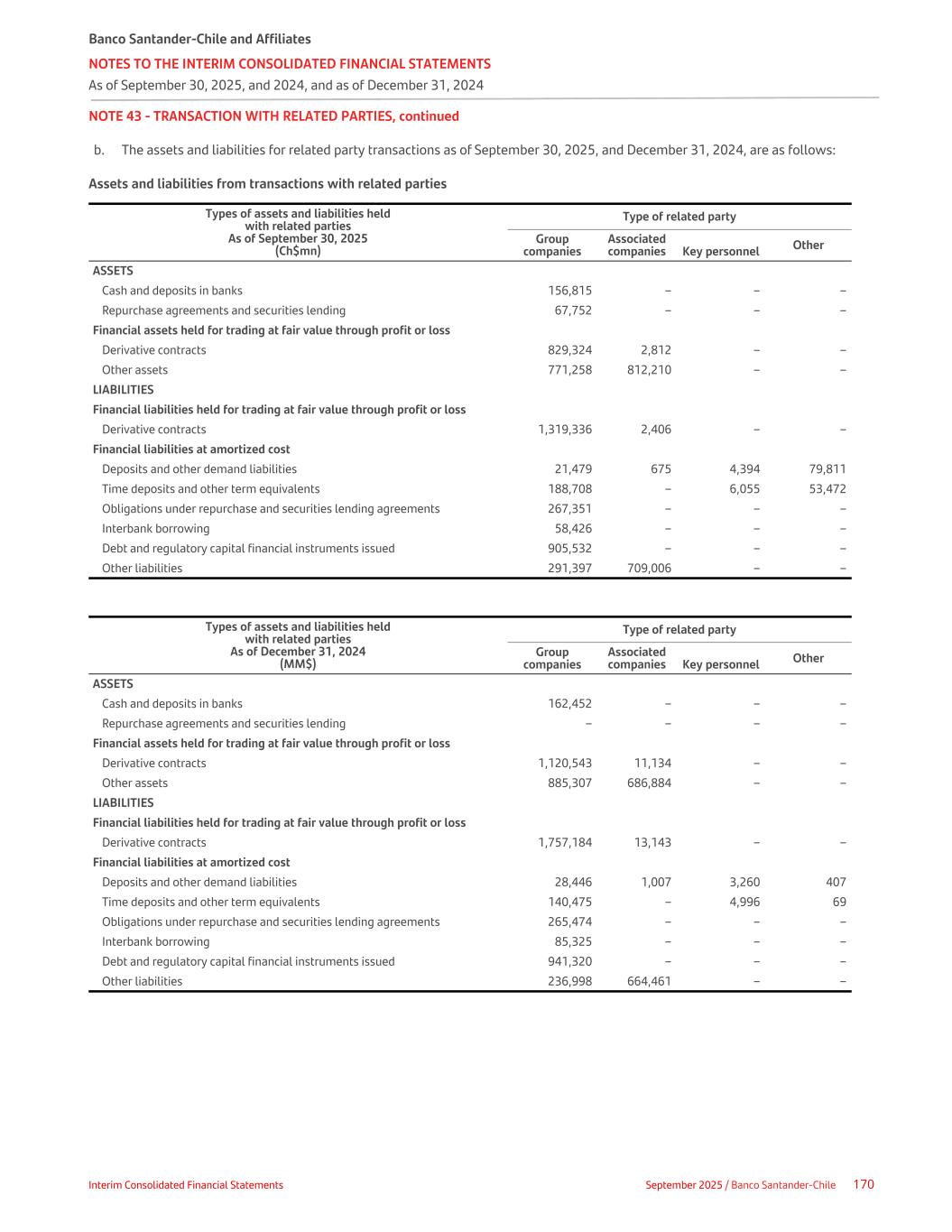

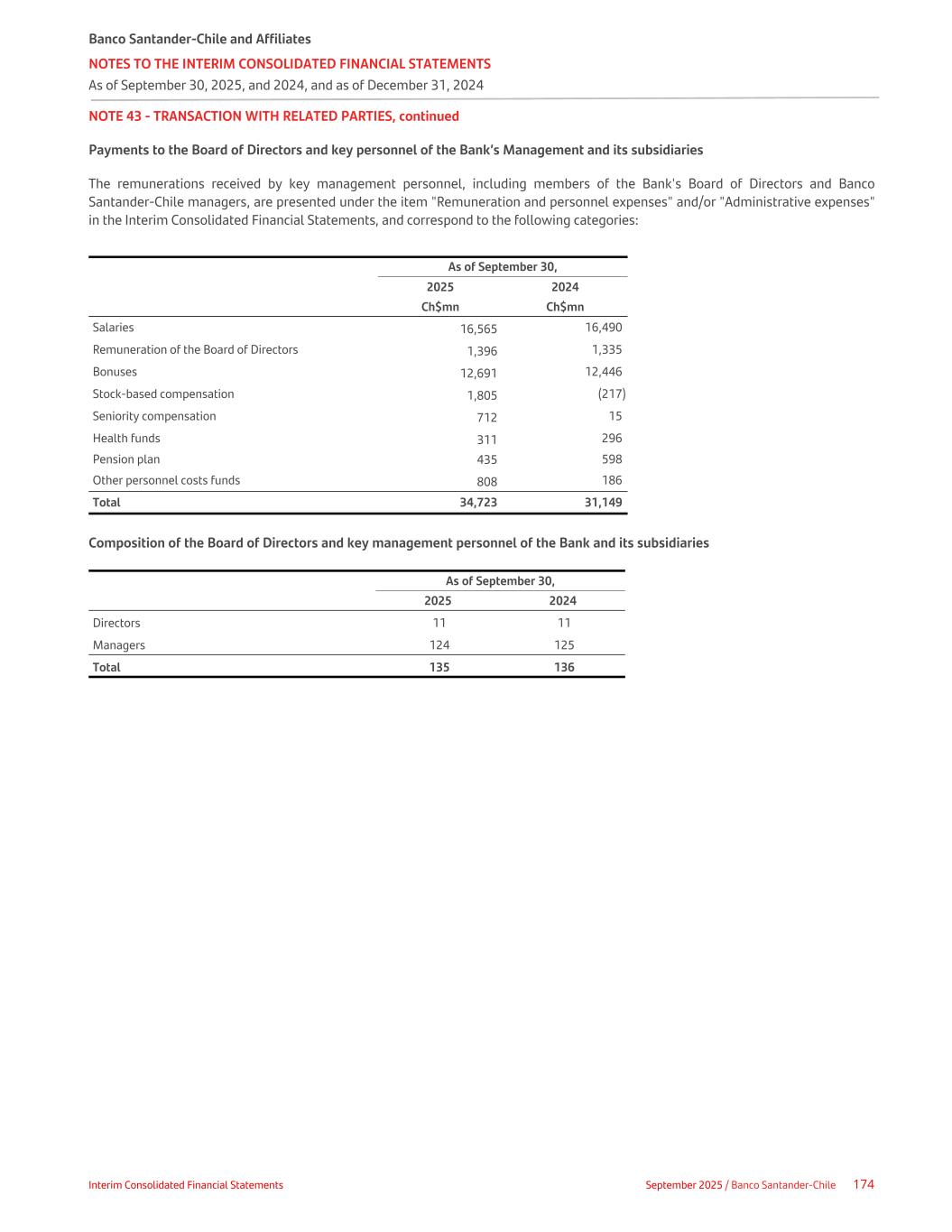

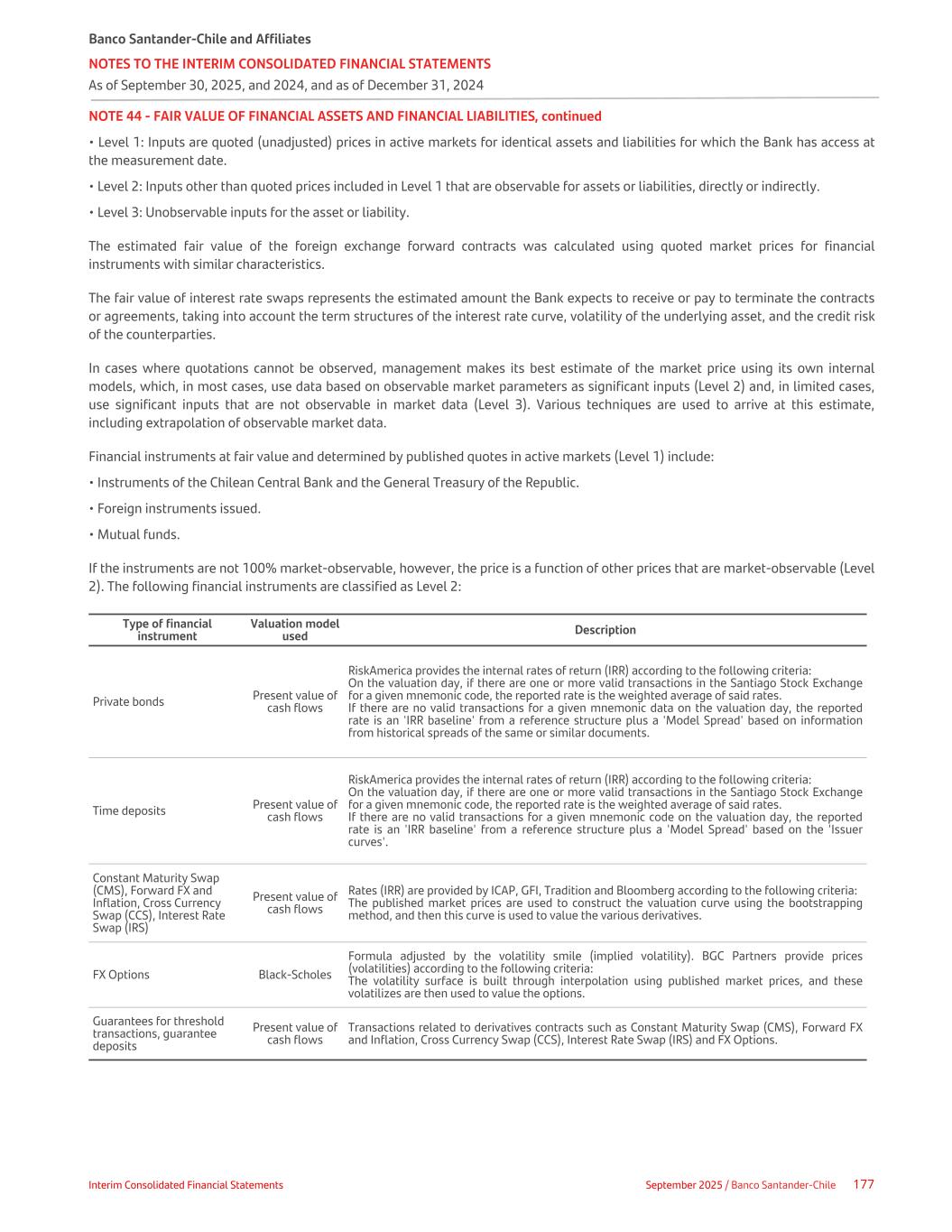

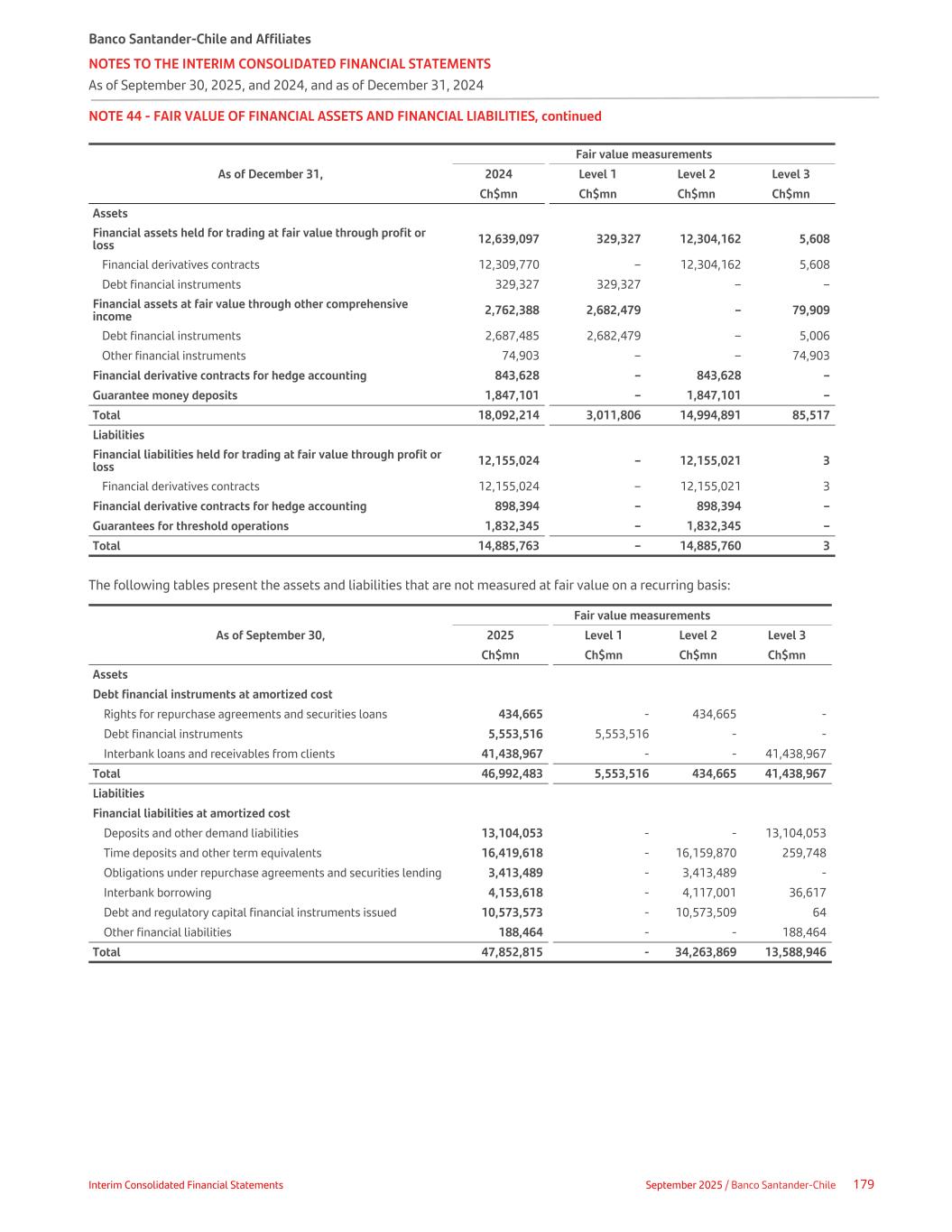

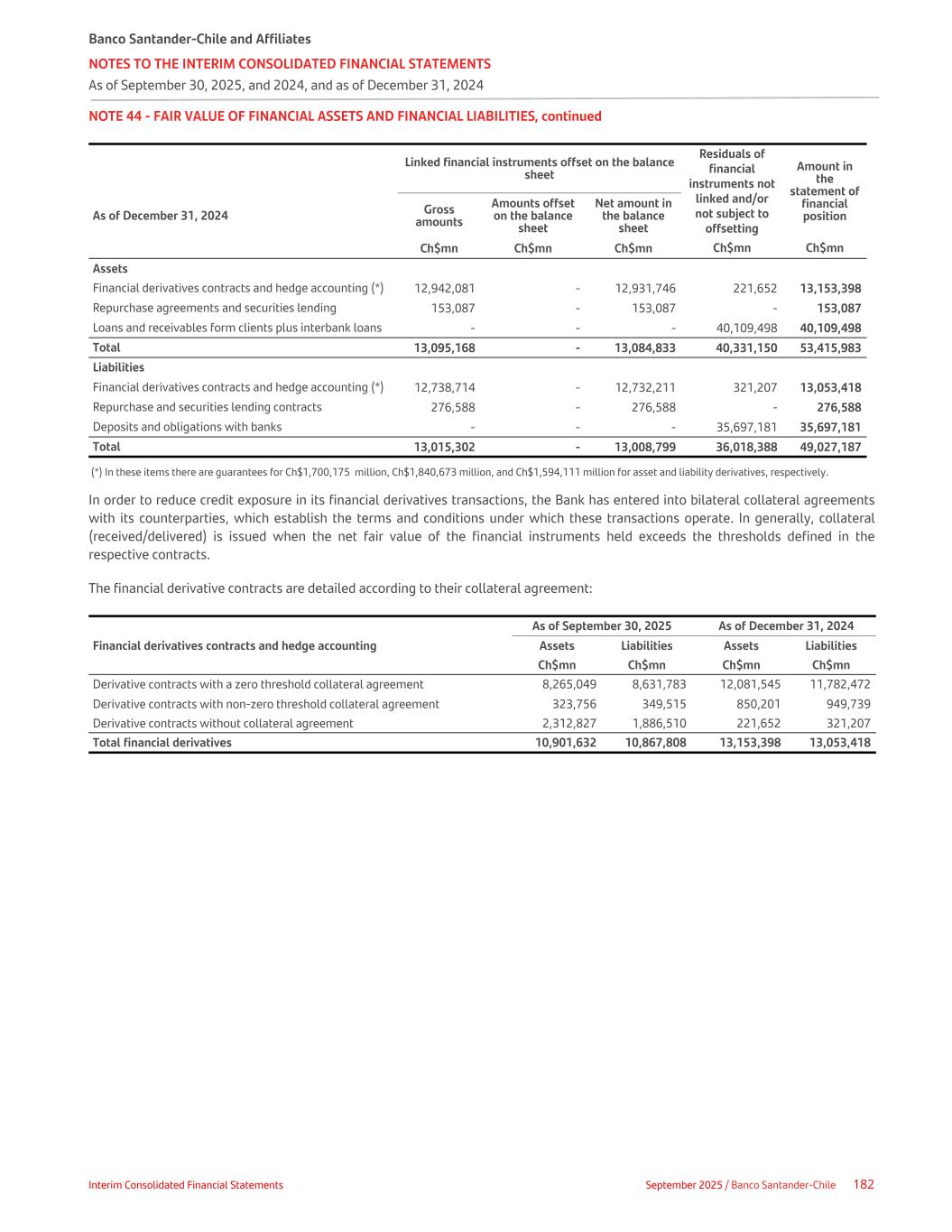

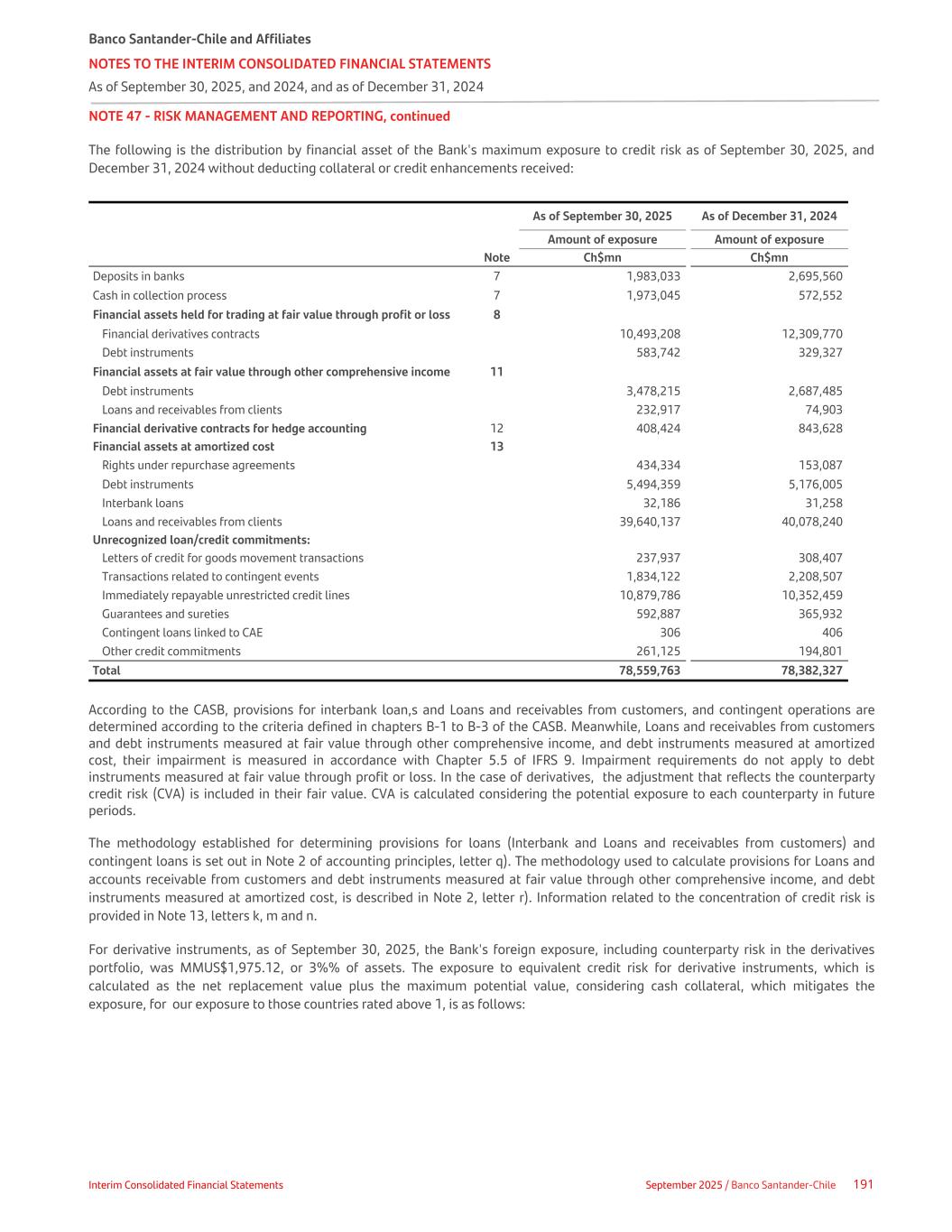

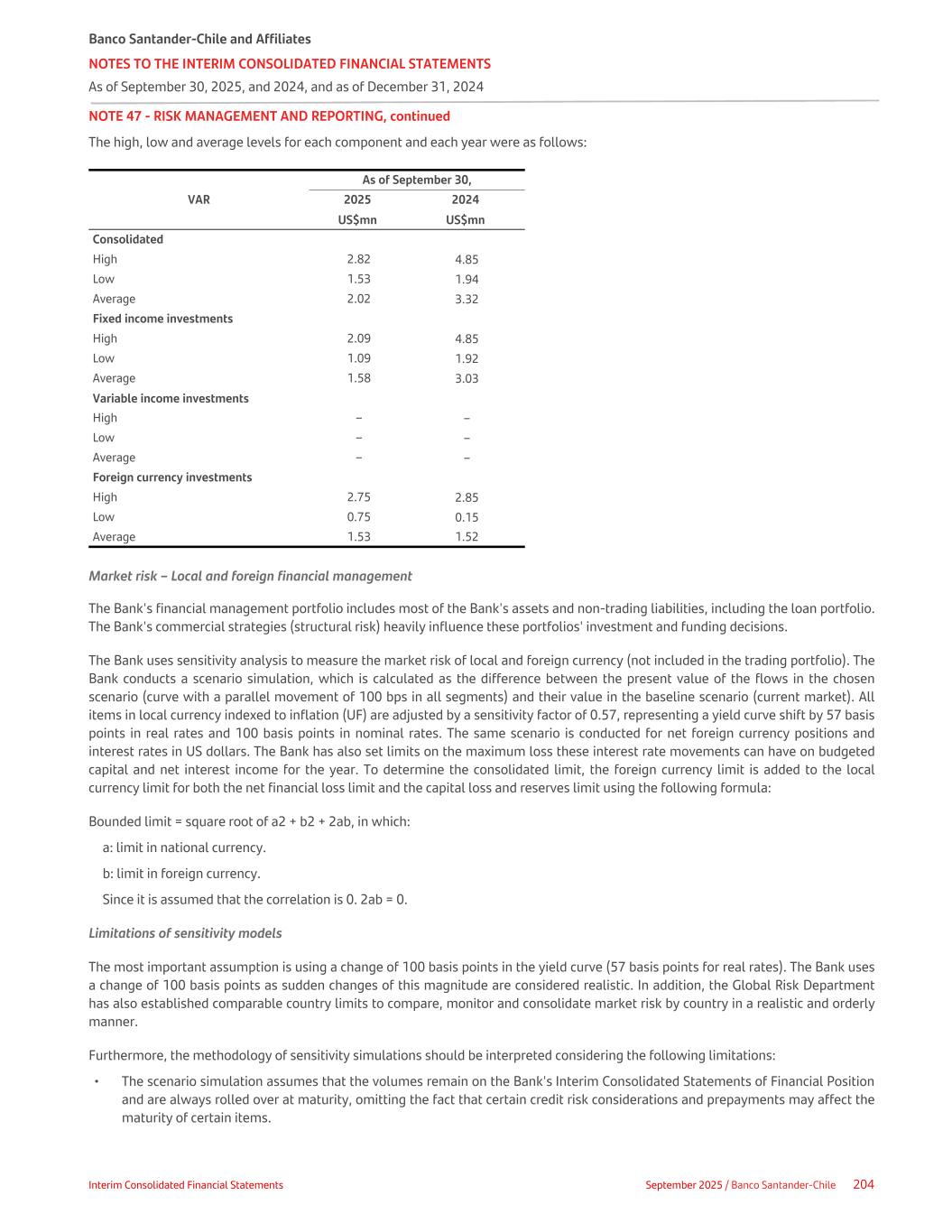

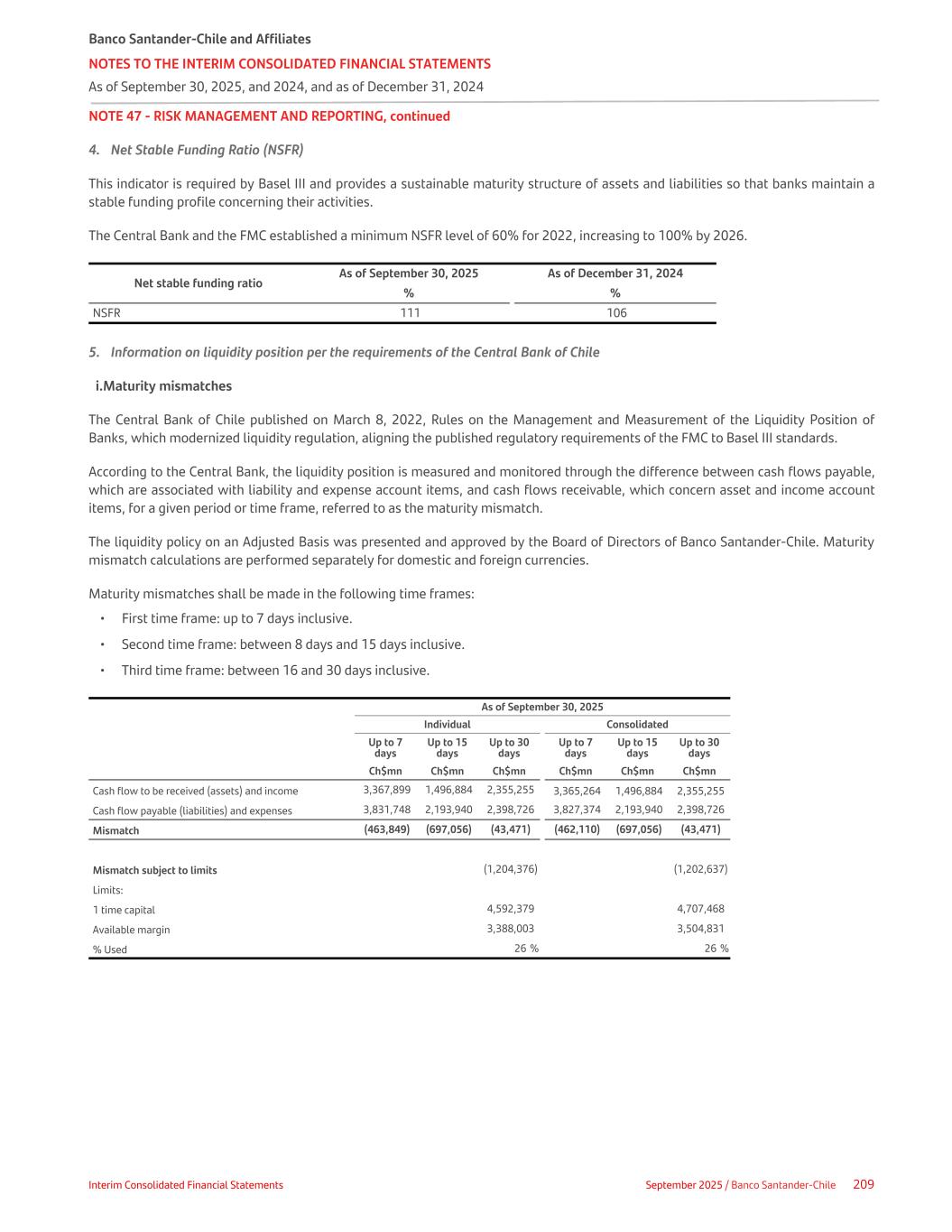

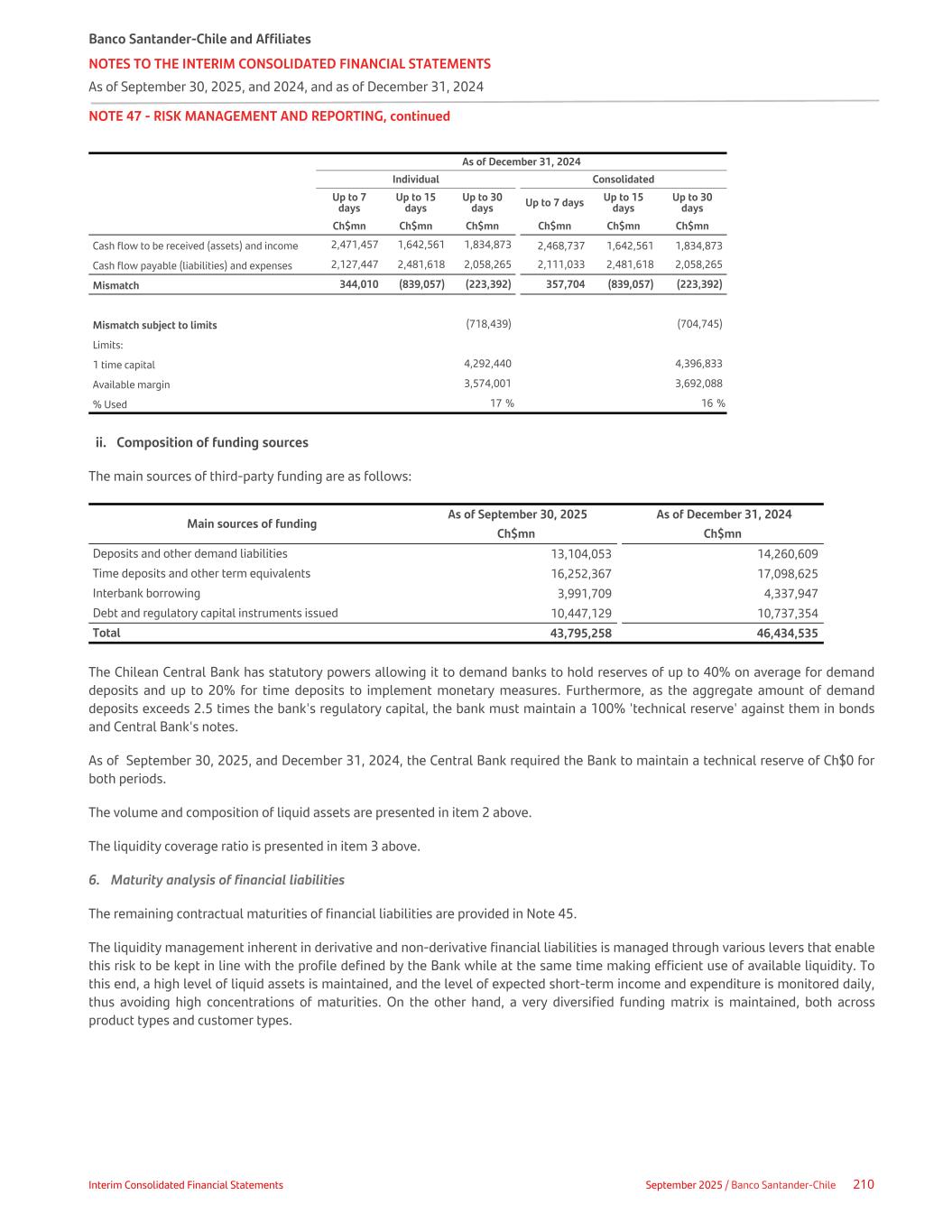

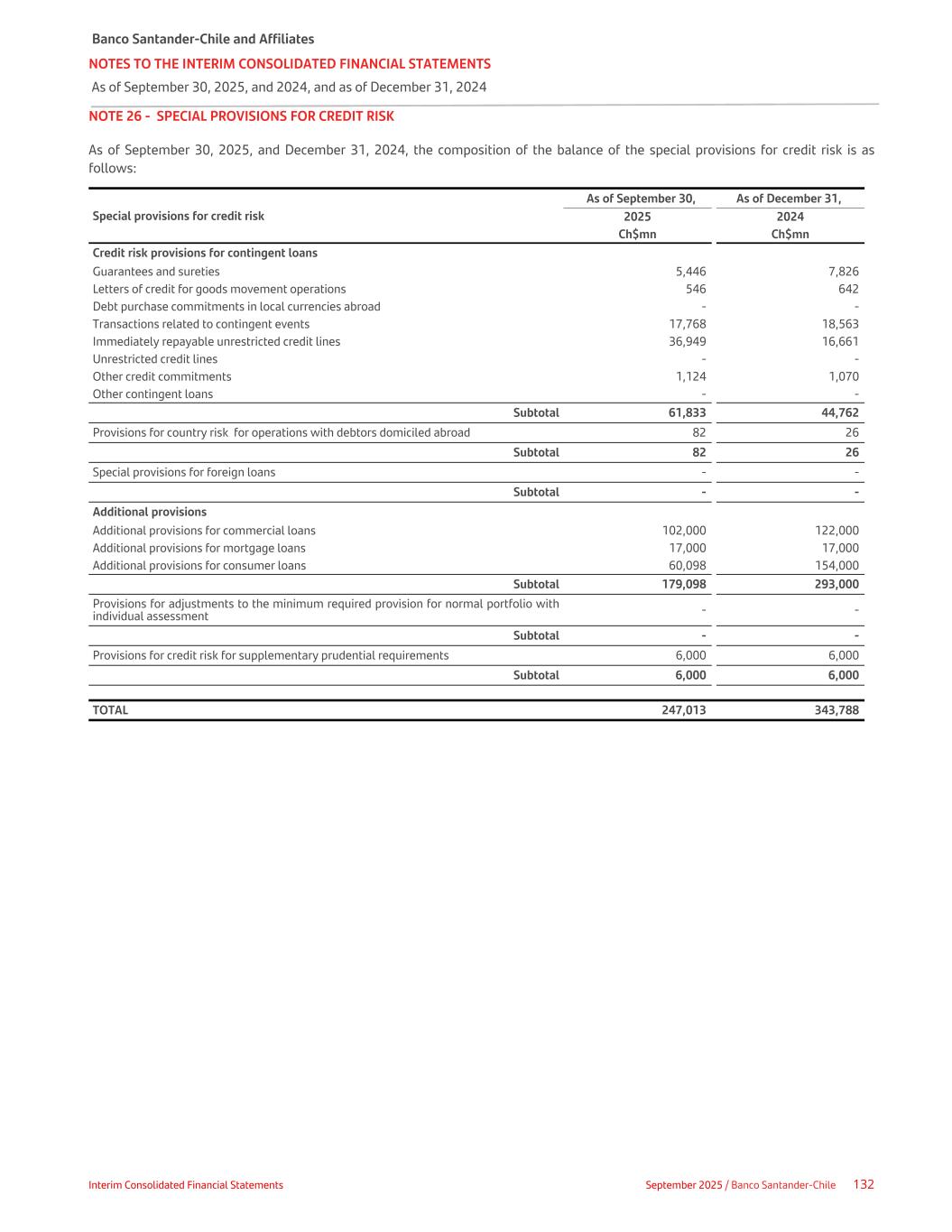

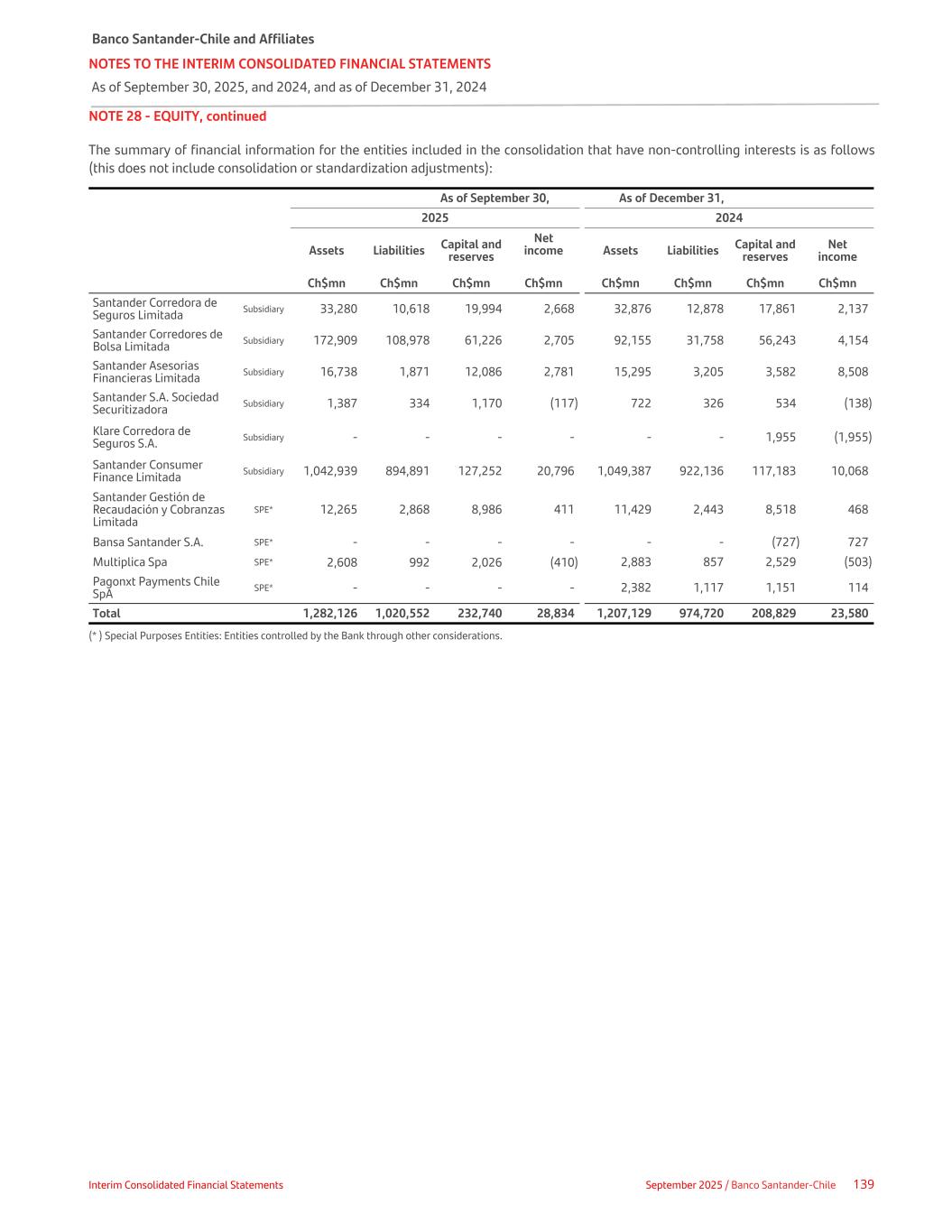

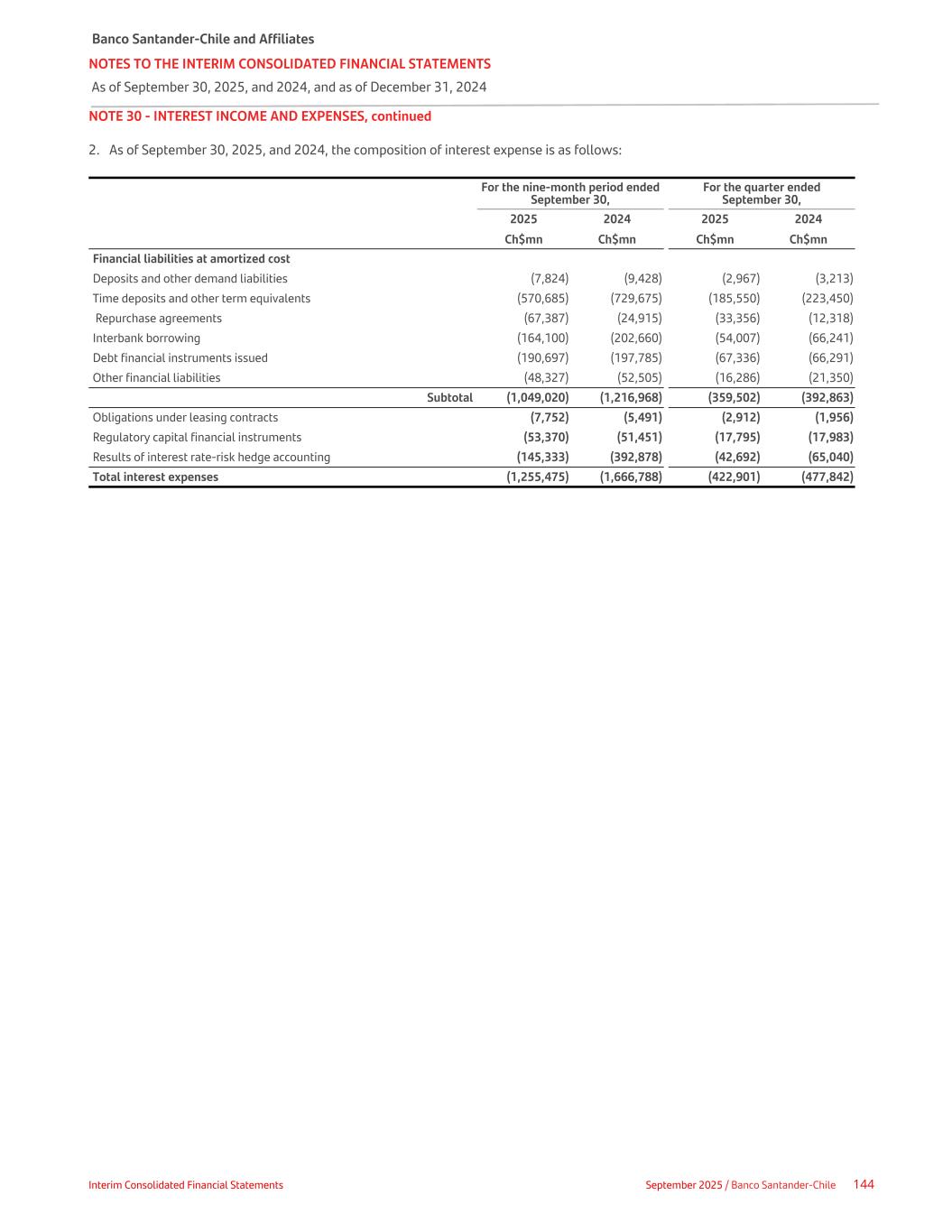

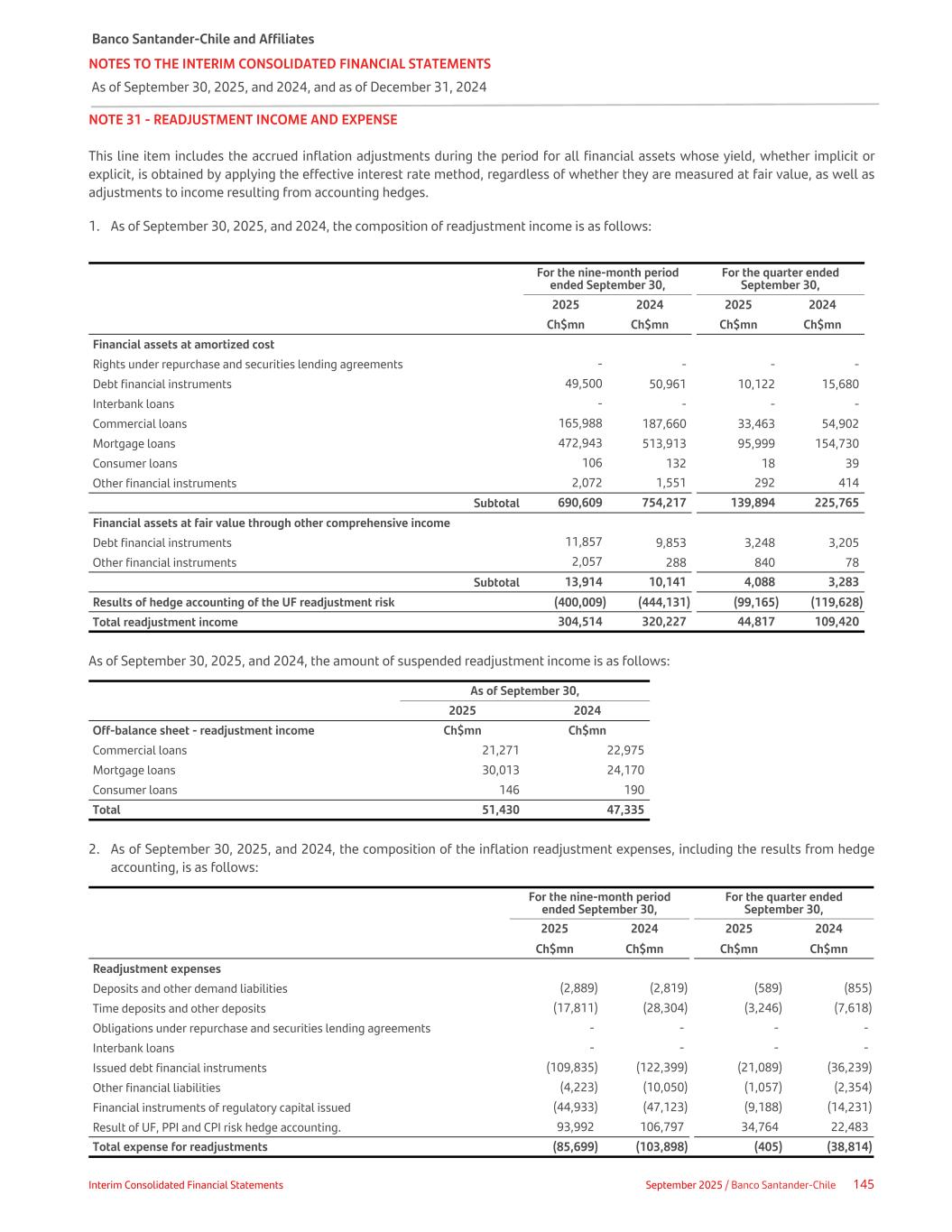

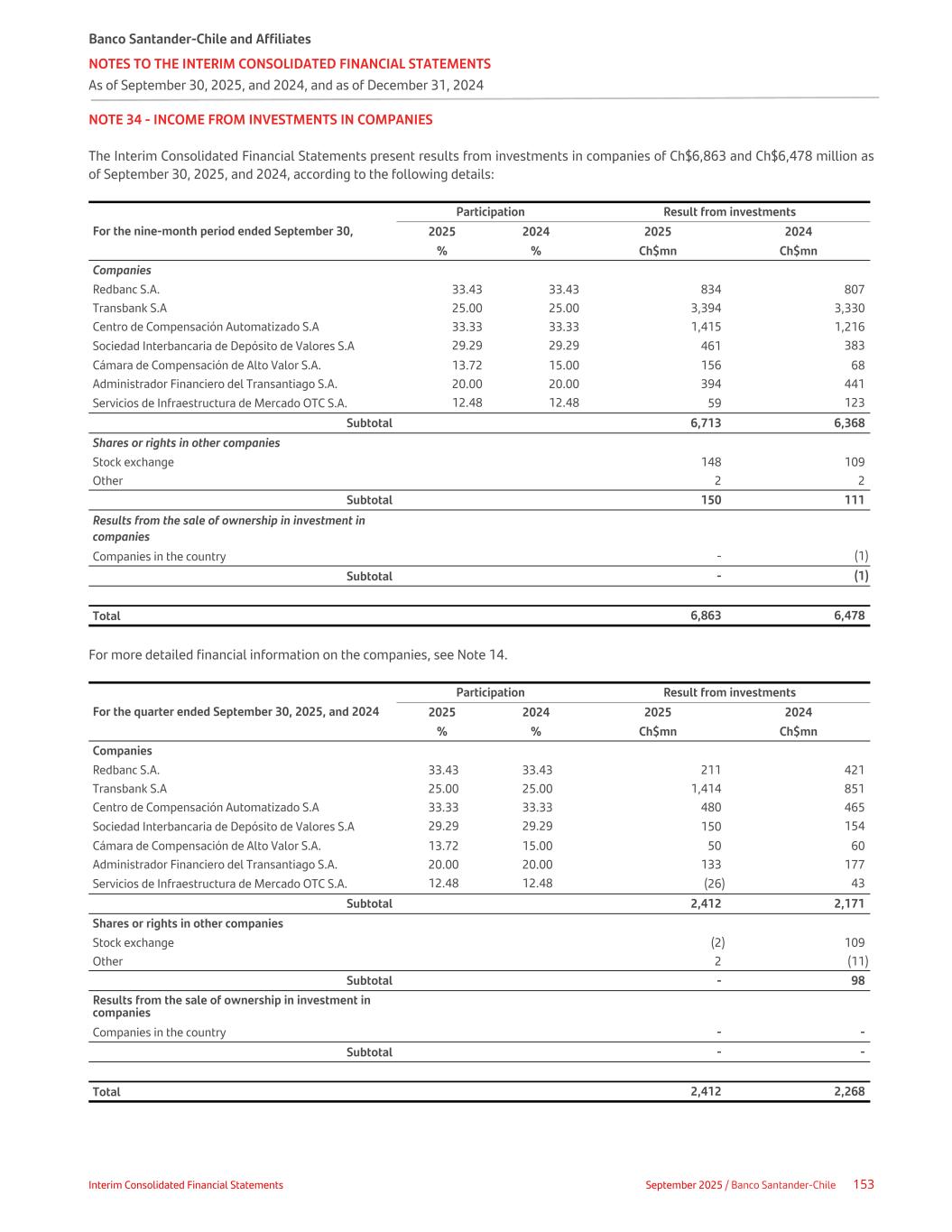

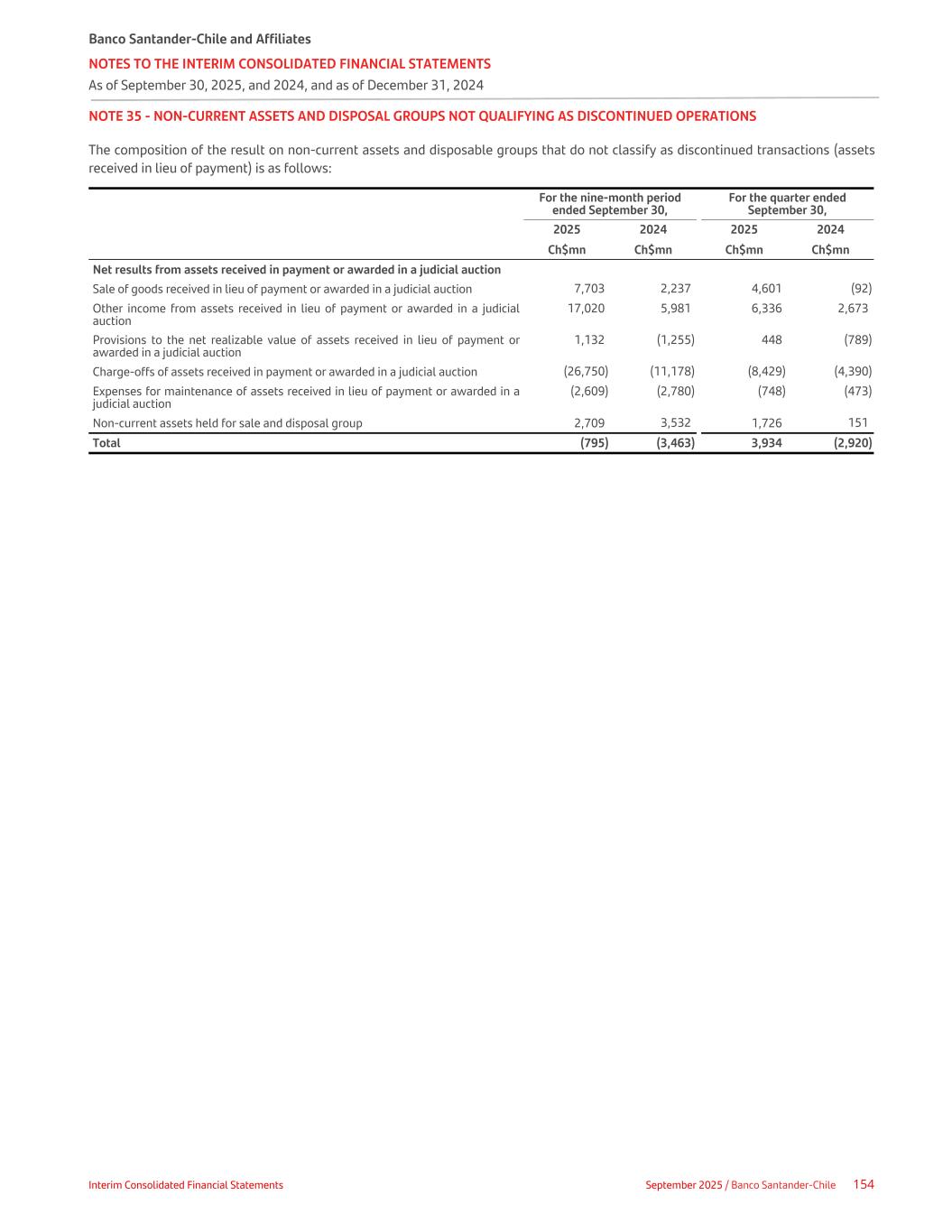

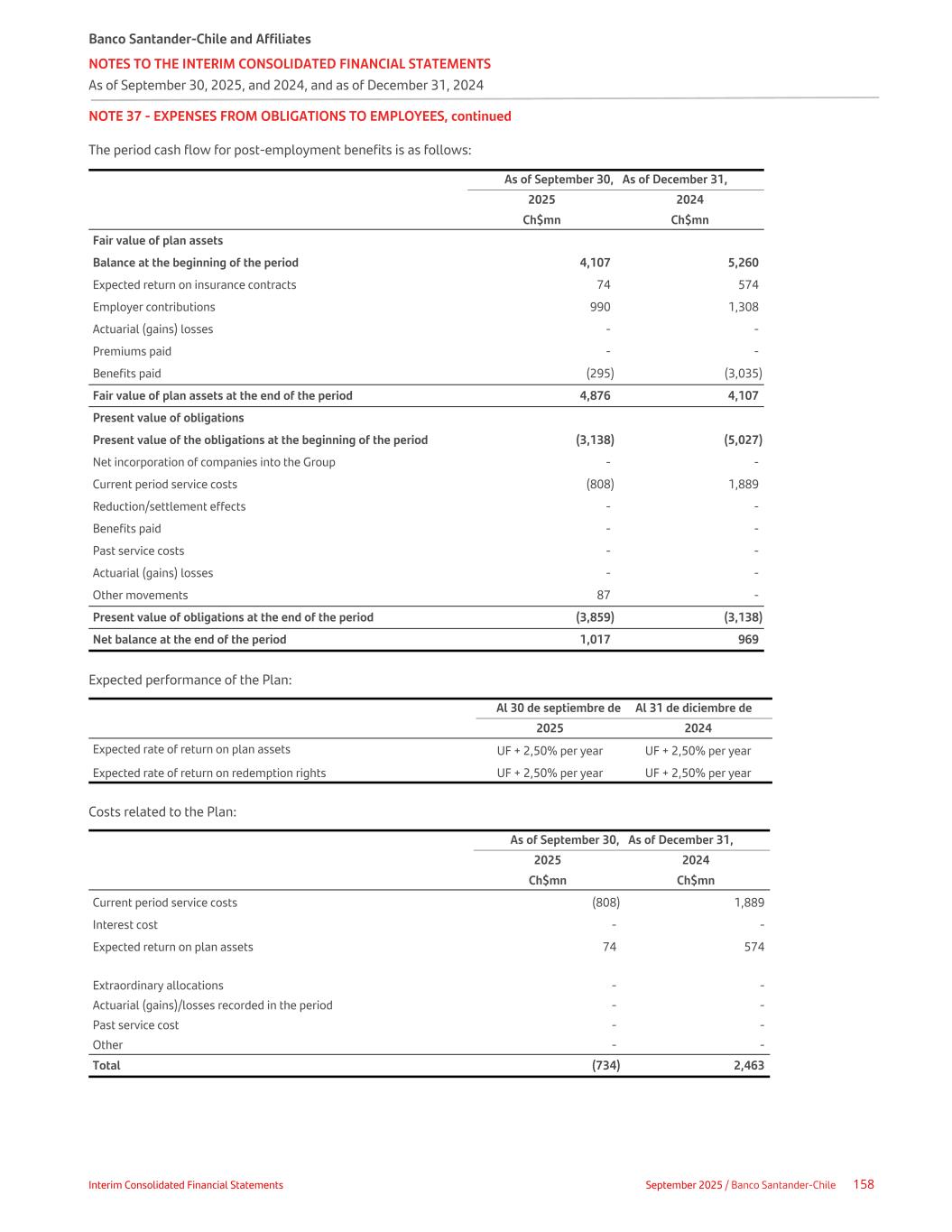

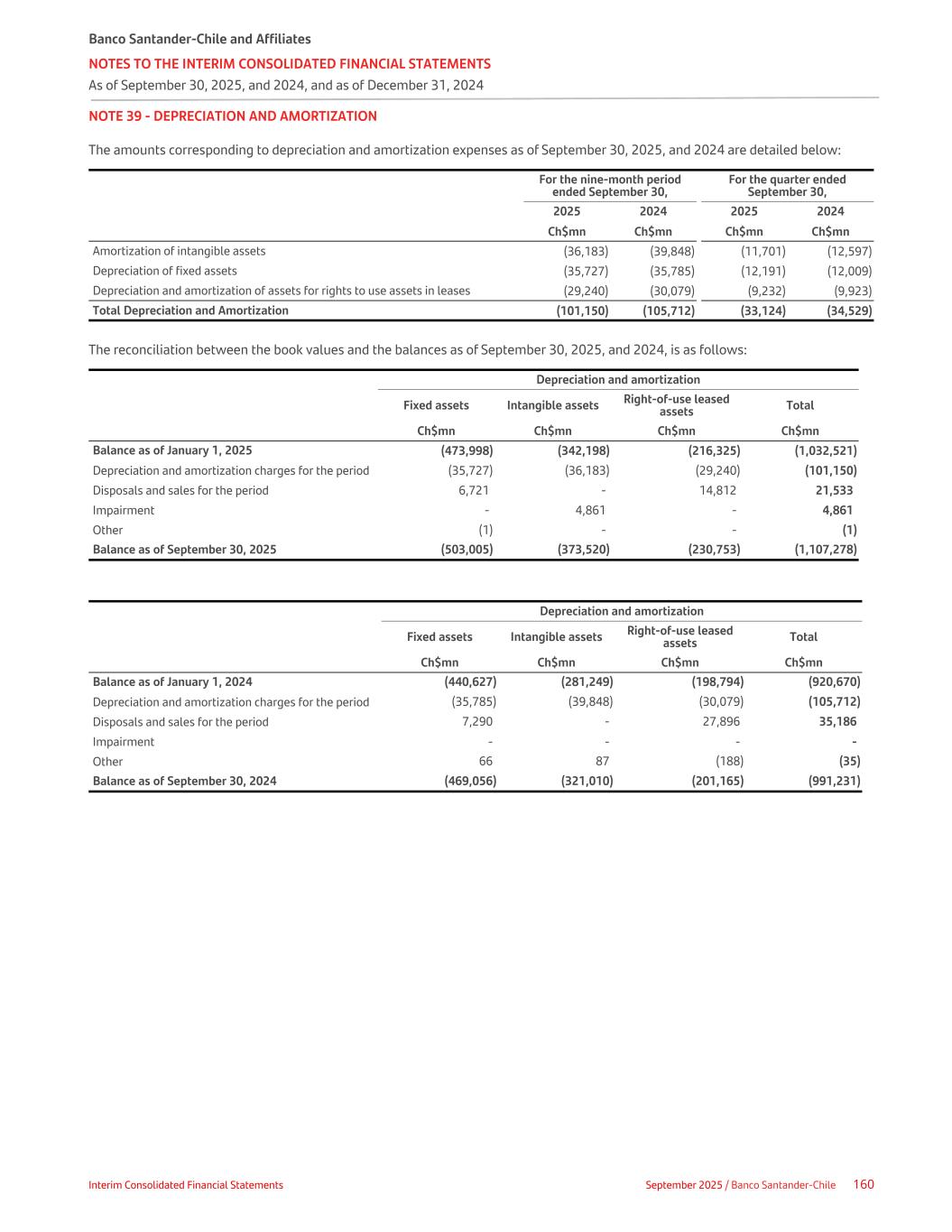

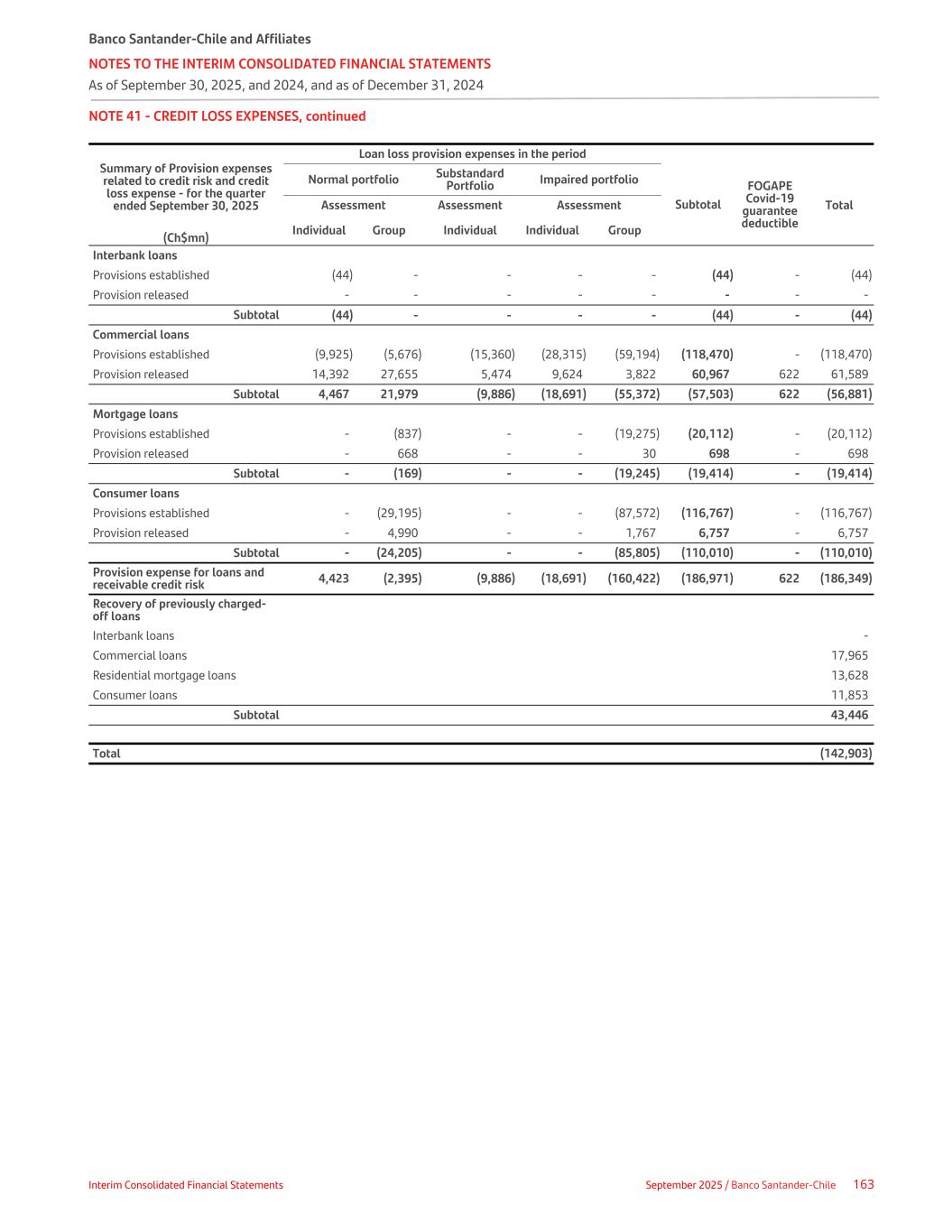

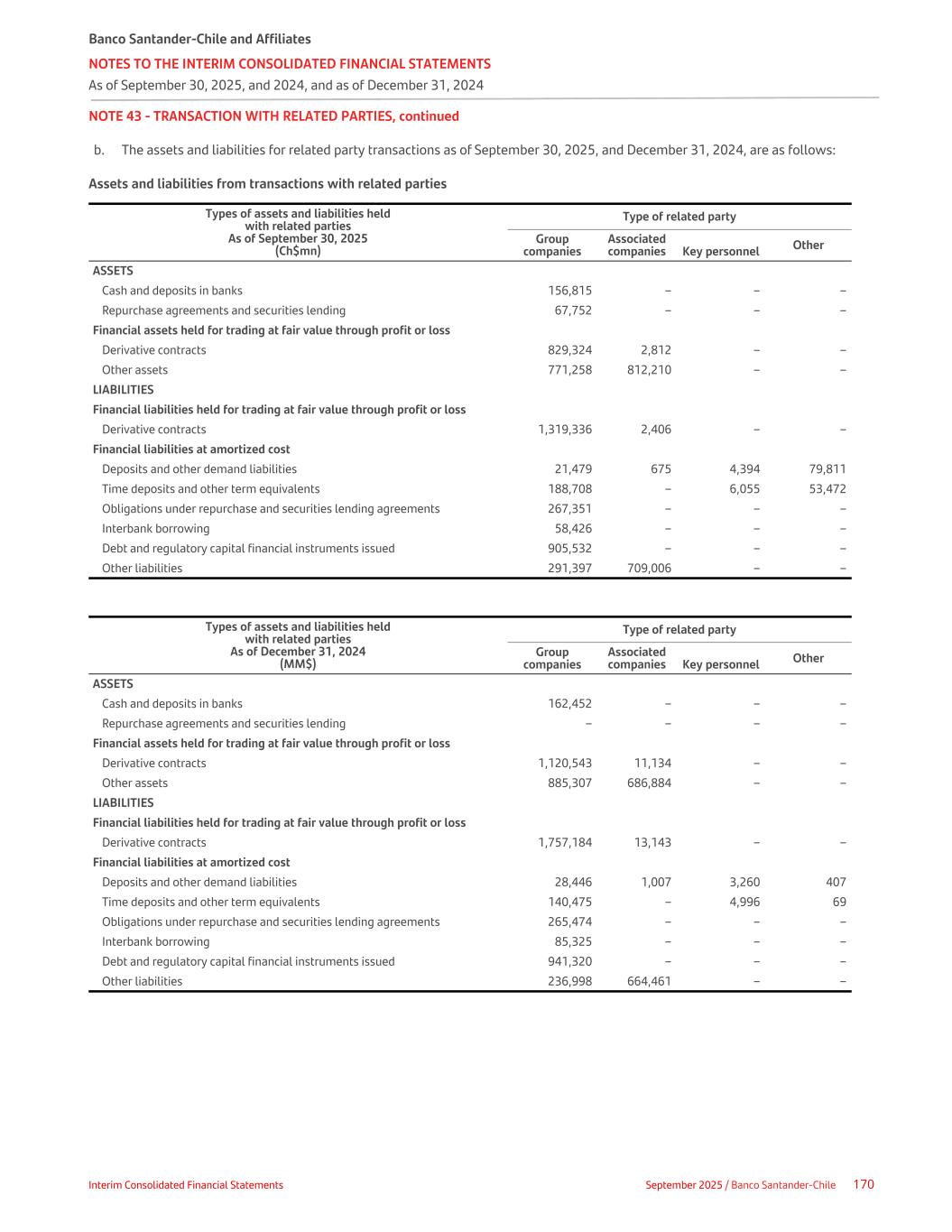

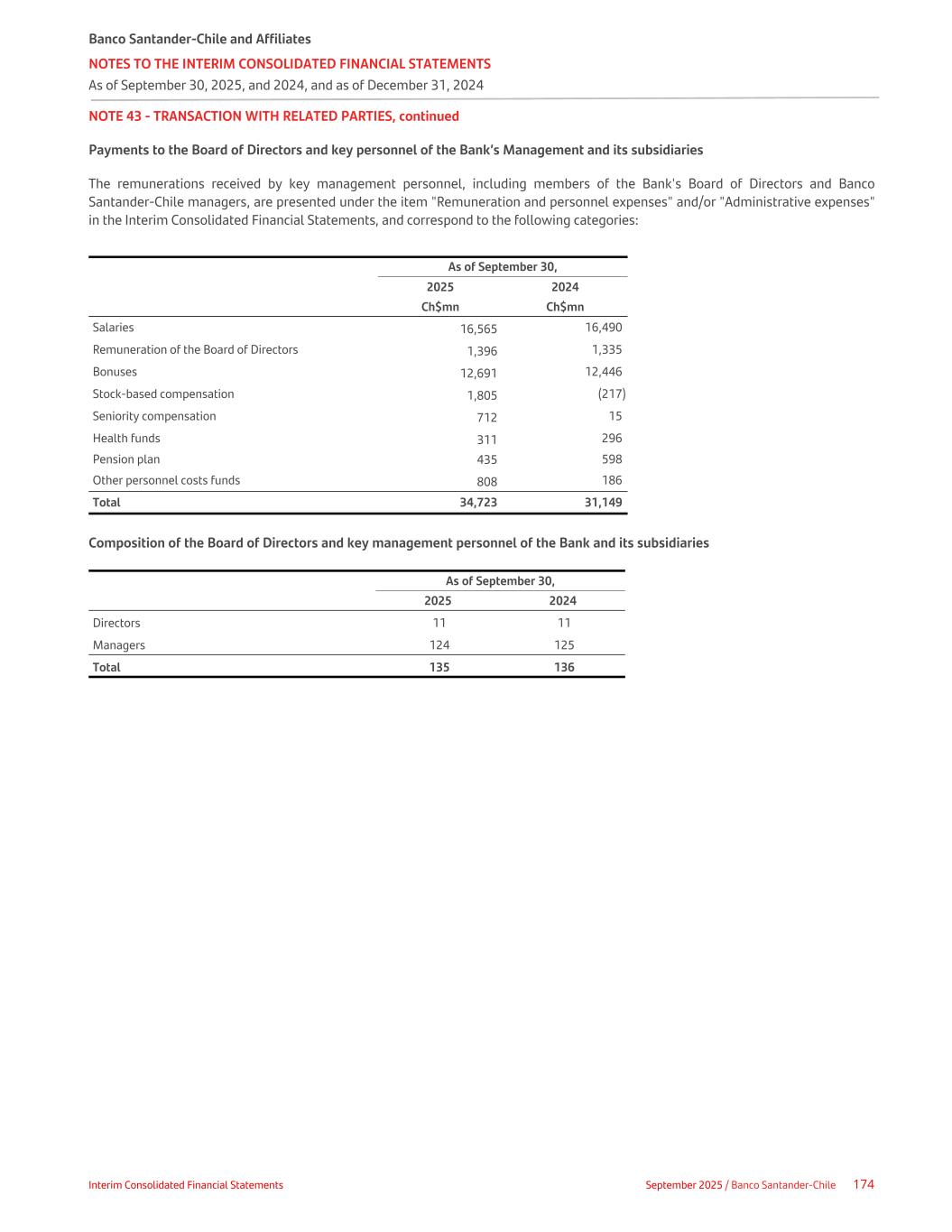

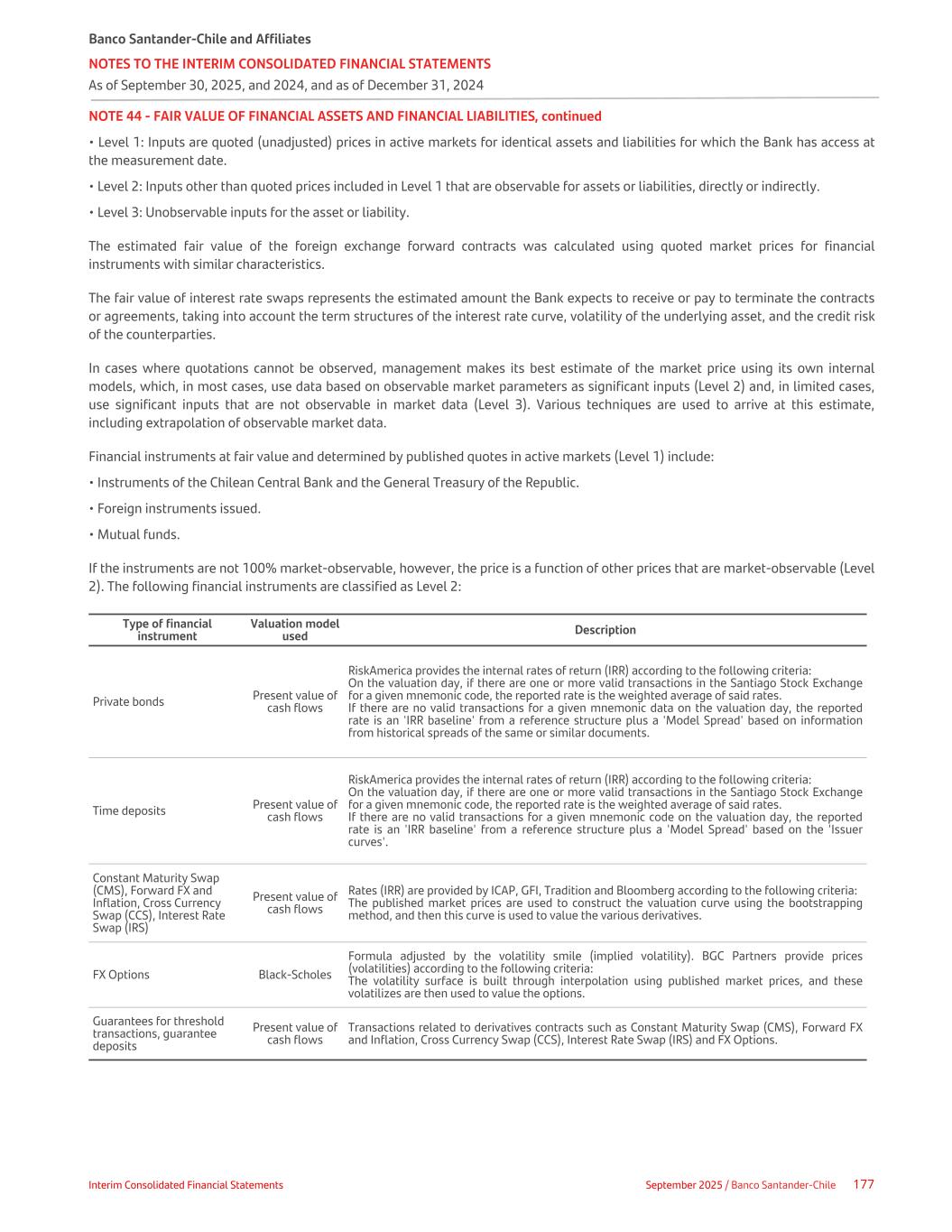

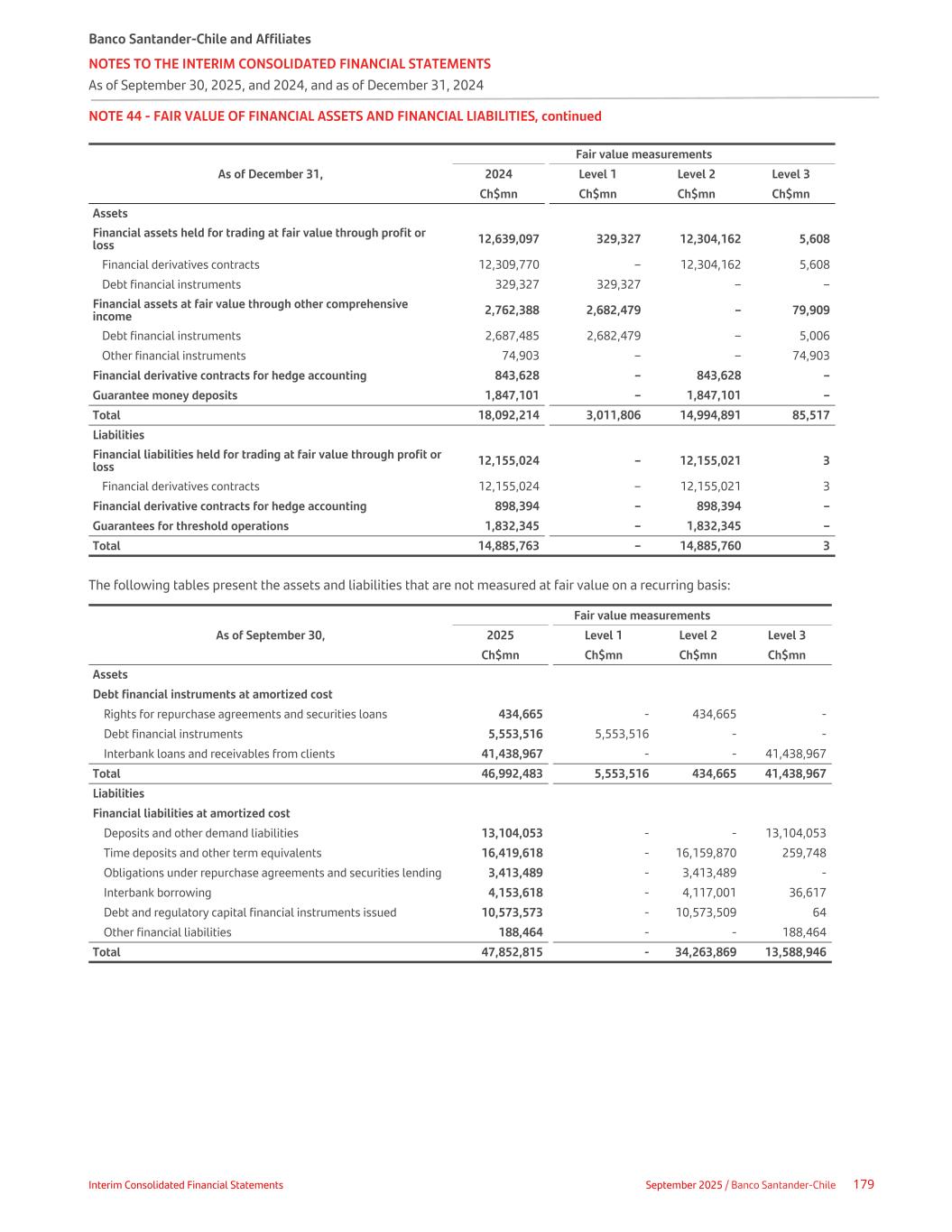

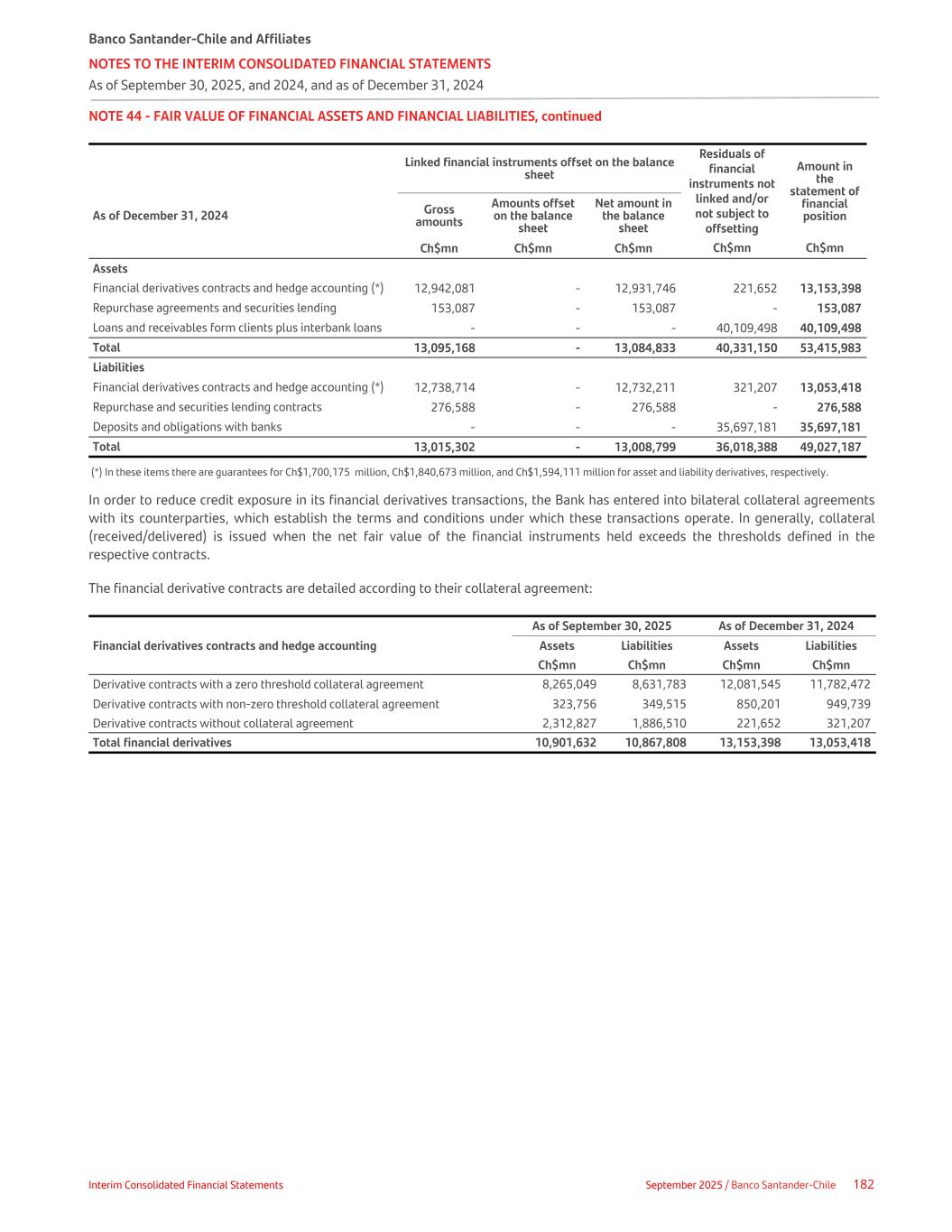

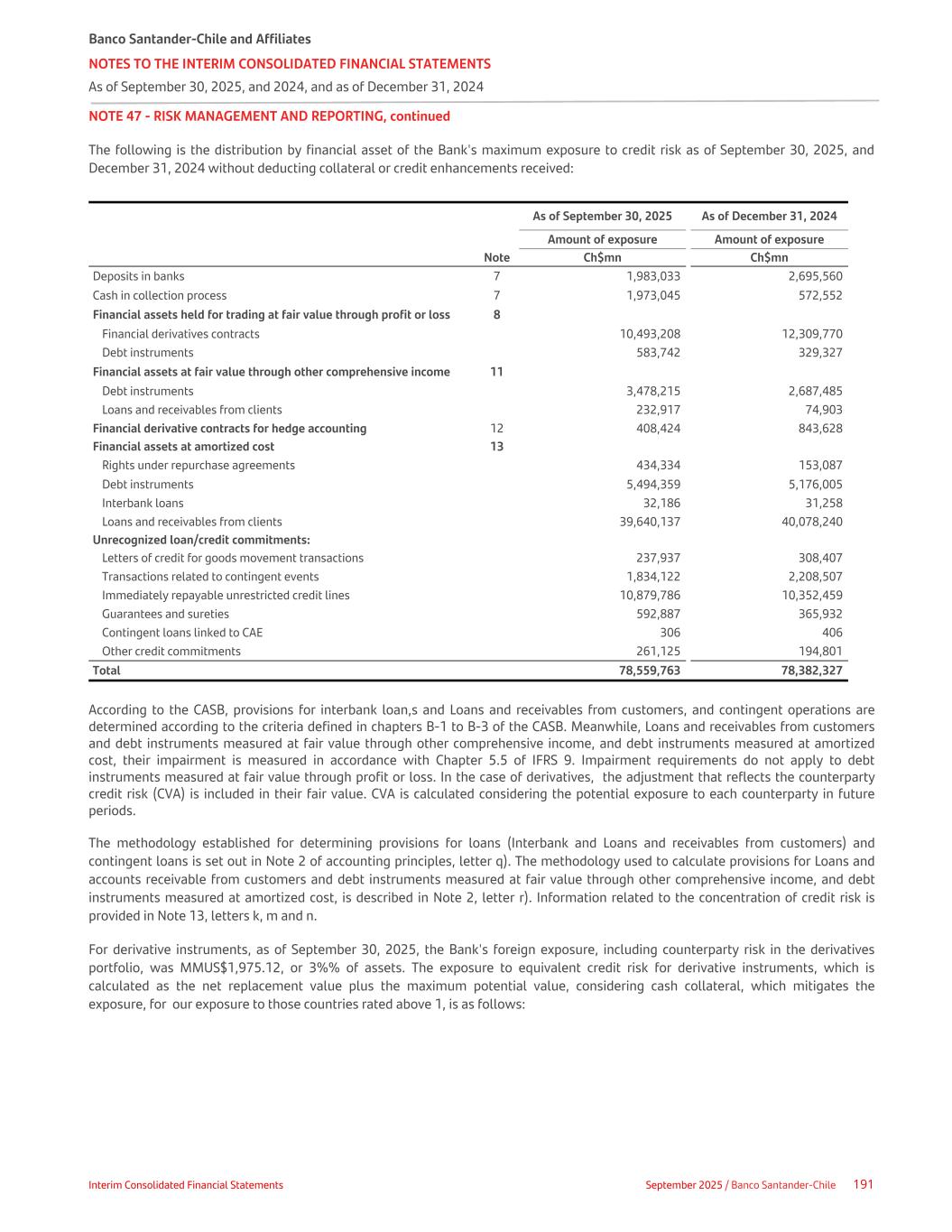

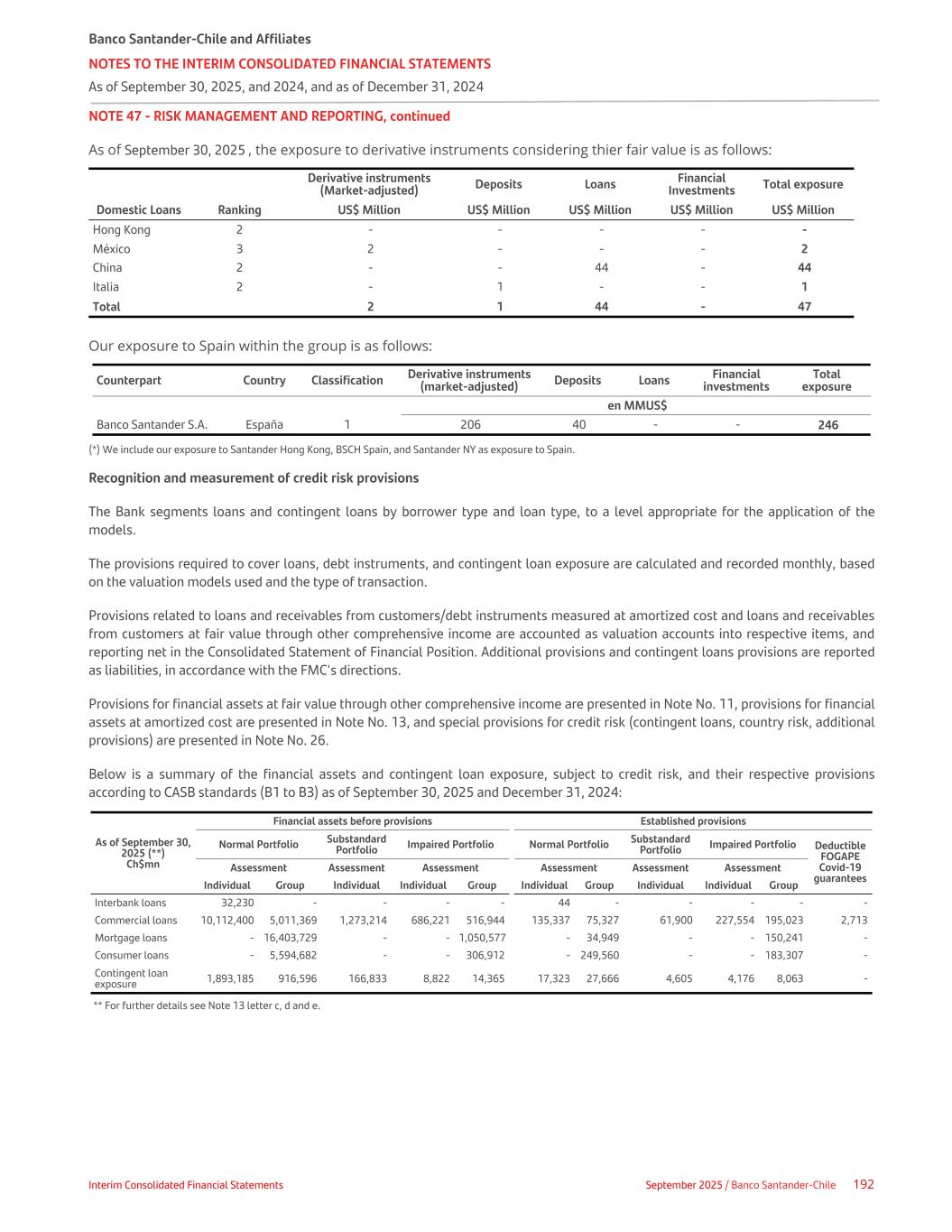

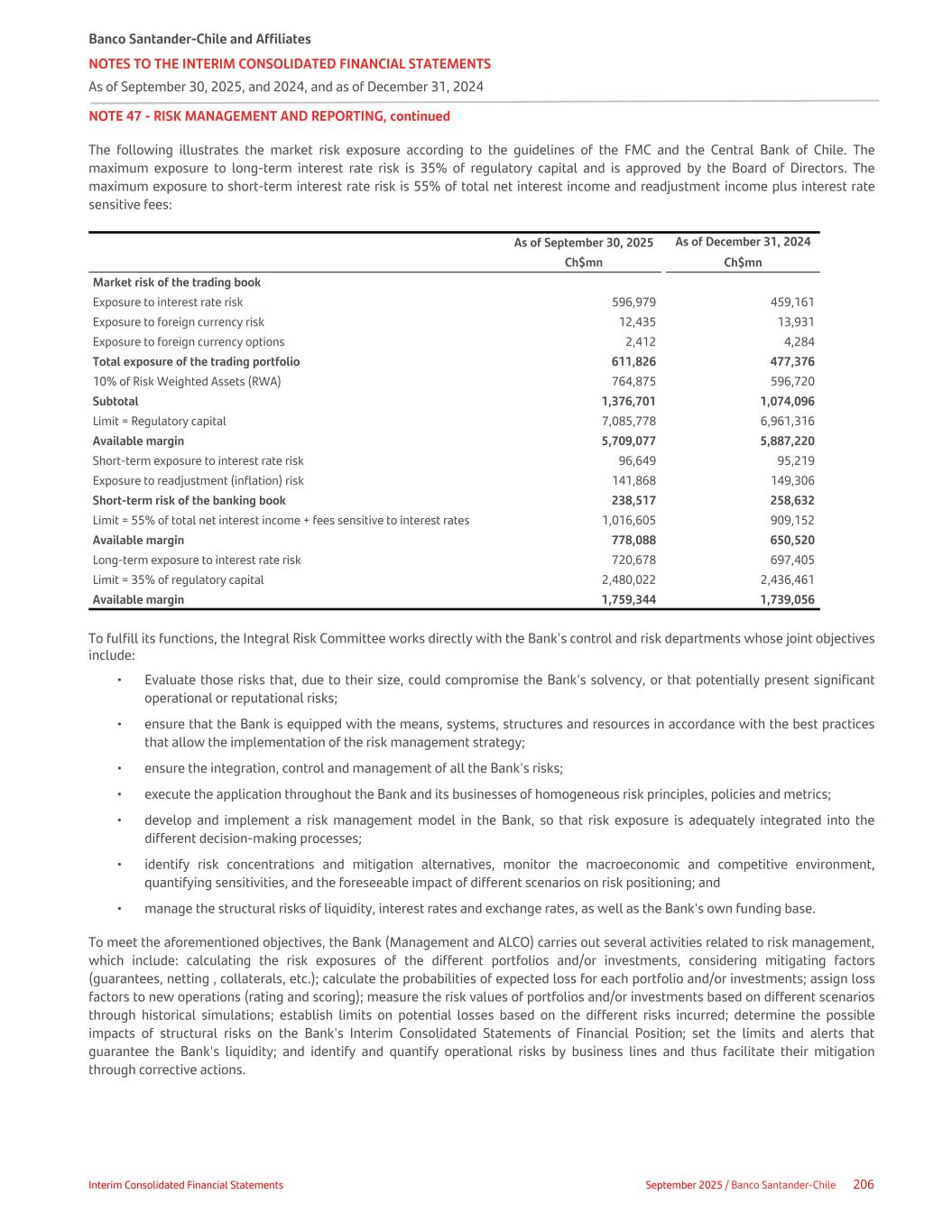

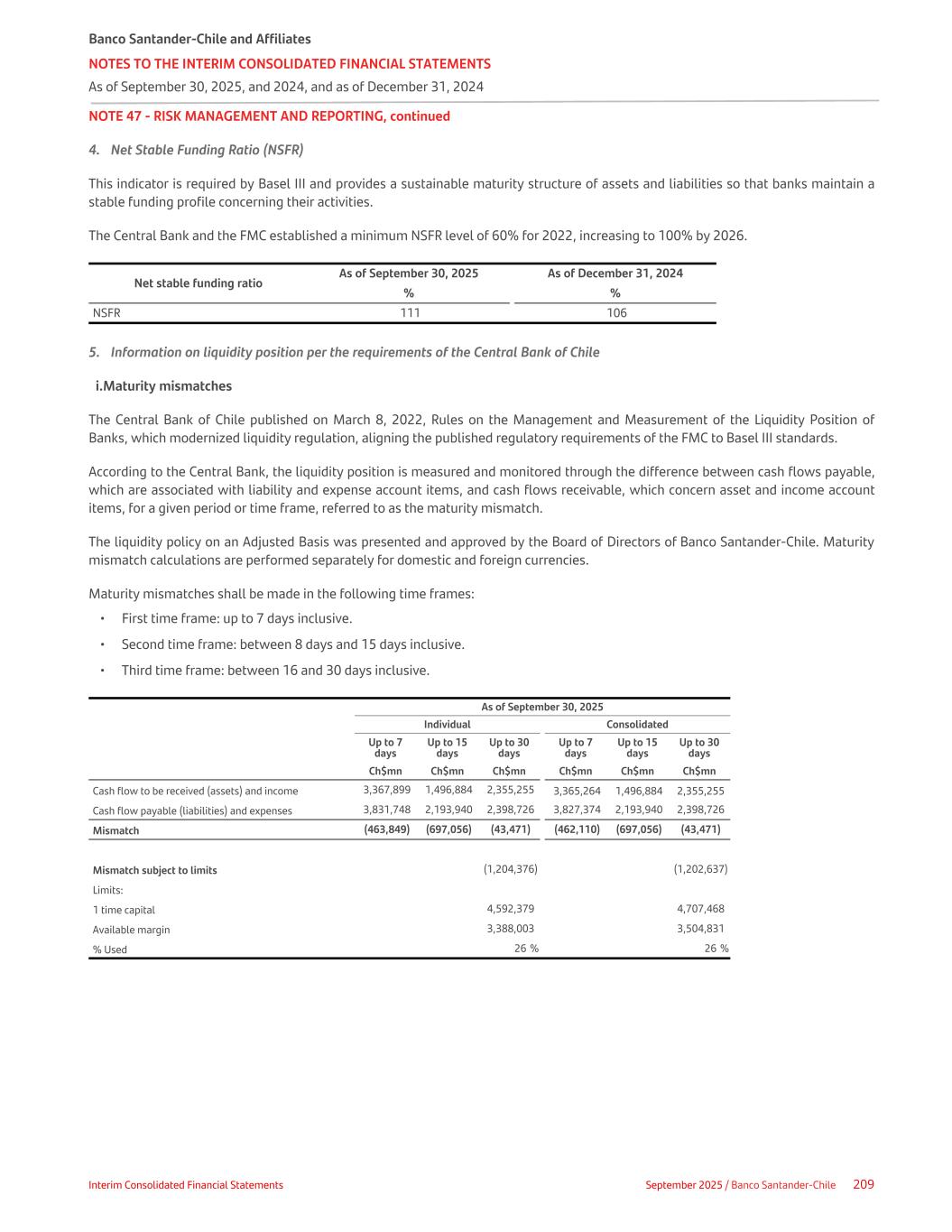

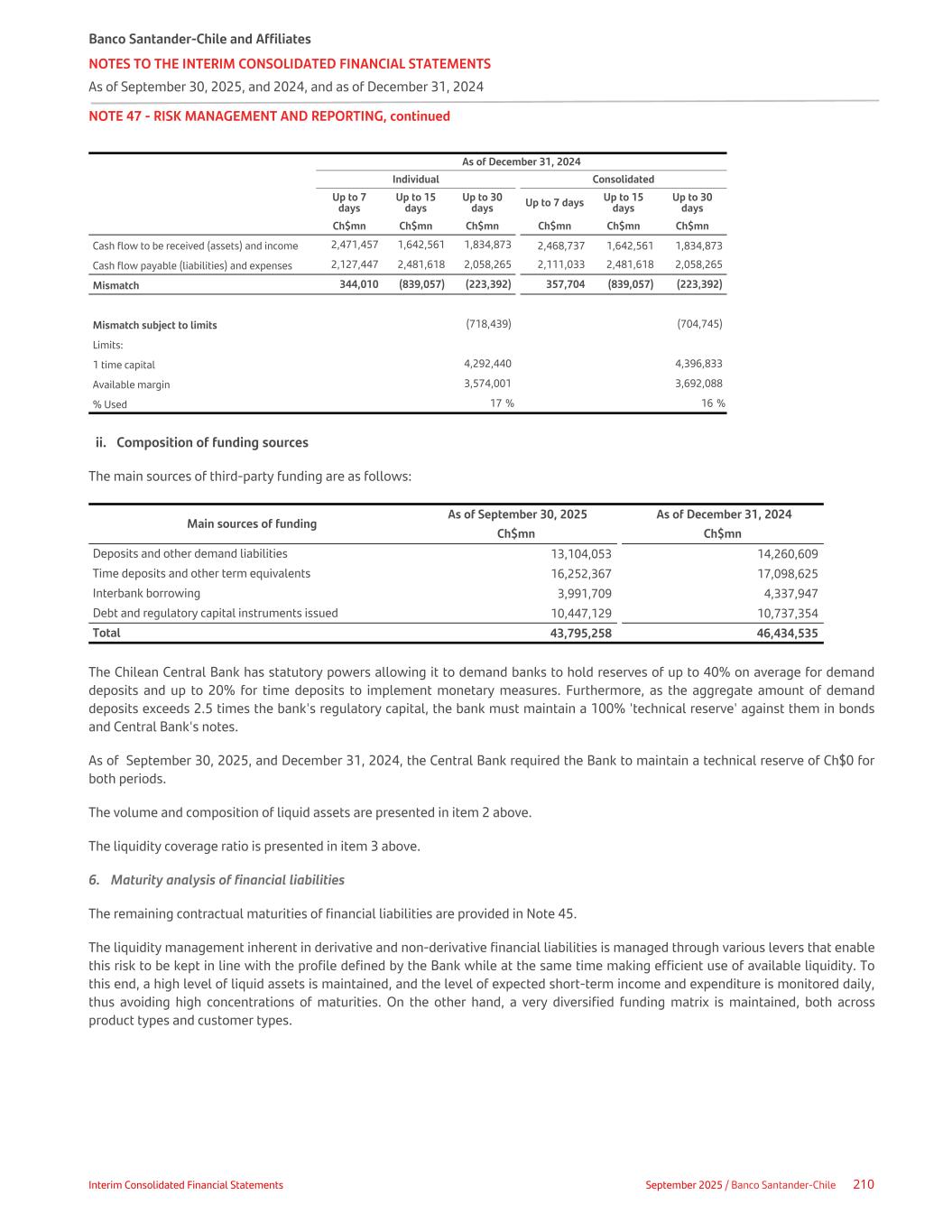

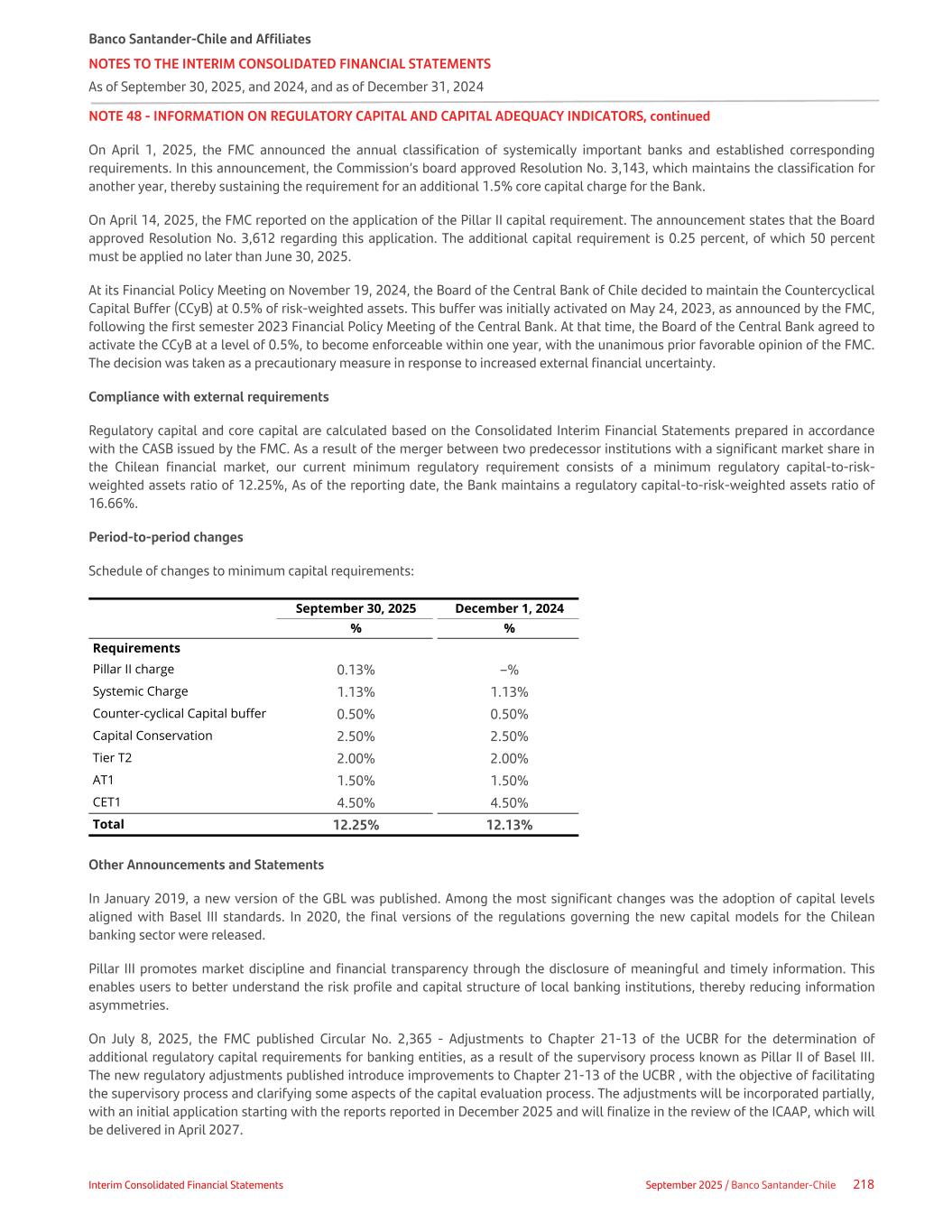

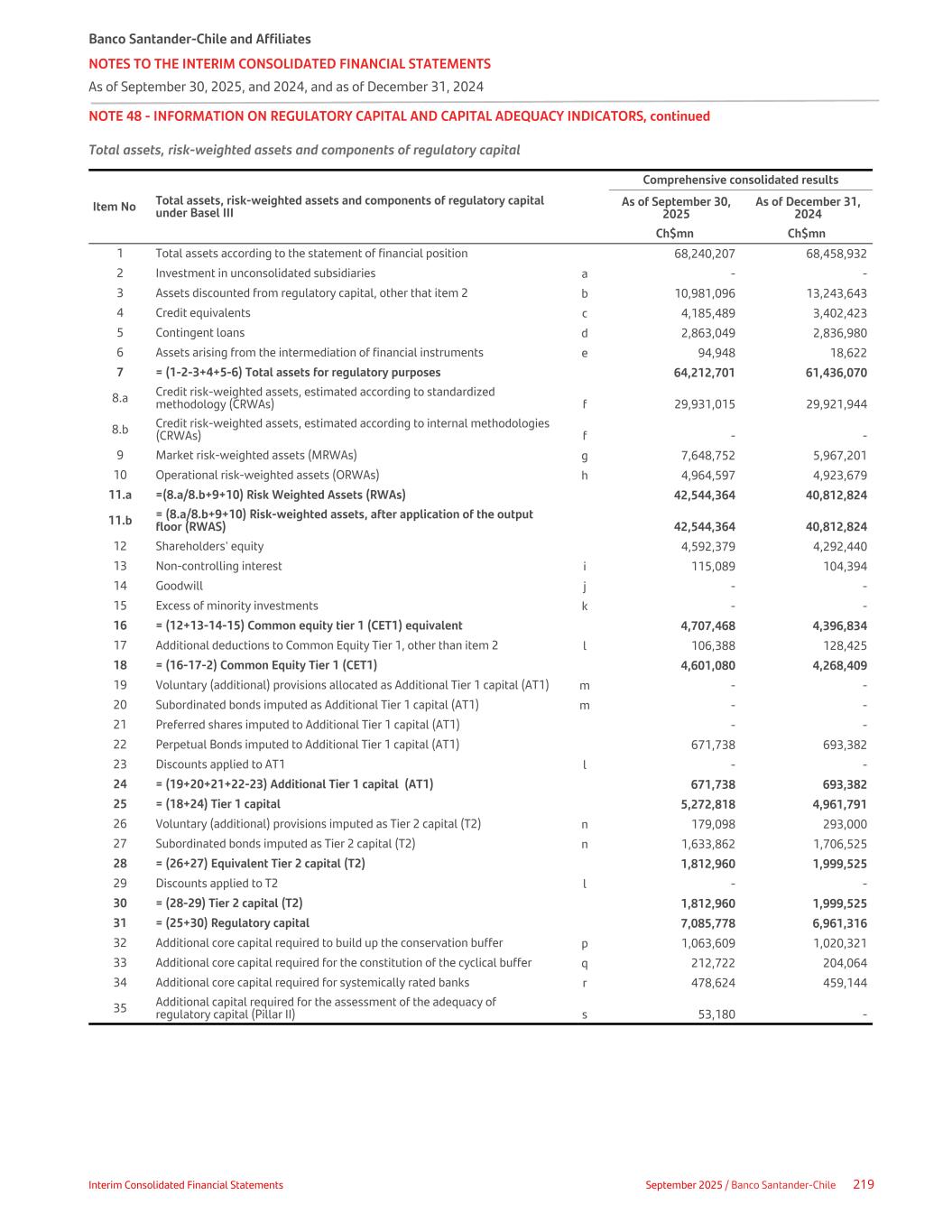

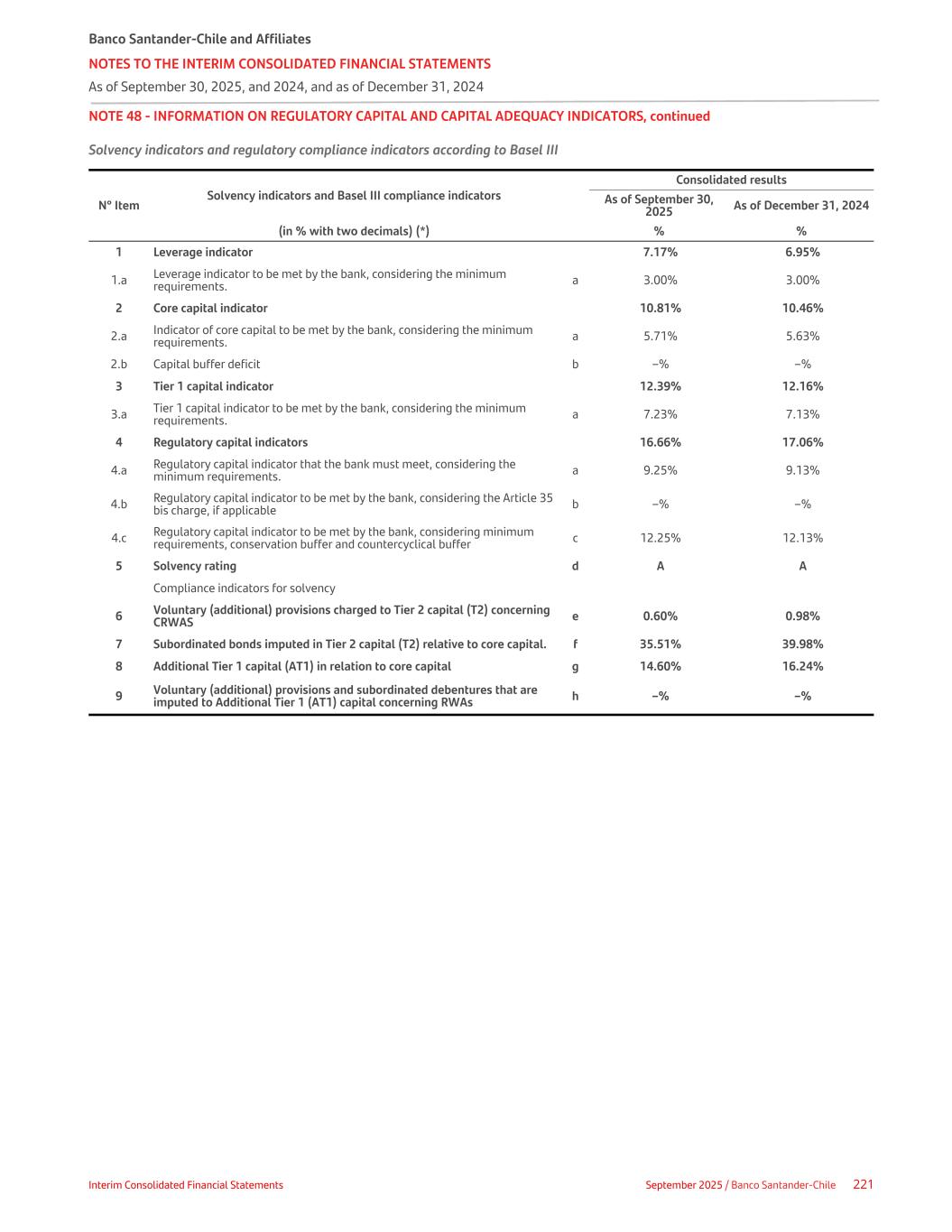

NOTE 02 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES, continued 12. Leases At the contract's creation, the Bank assesses whether it contains a lease or not. A contract contains a lease if the contract conveys the right to control the use of an identified asset for a period of time in exchange for compensation. To assess whether a contract conveys the right to control the use of an identified asset, the Bank assesses whether: • The contract involves using an identified asset. This may be specified explicitly or implicitly and should be physically identified. The asset is not identified if the supplier has a significant substitution right. • The Bank has the right to obtain all the economic benefits from using the asset throughout the contract's duration. • The Bank has the right to direct the use of the asset – this is the decision-making purpose for which the asset is used. i. As a lessee The Bank recognizes a right-of-use asset and a lease liability at the starting date of the lease according to the IFRS 16 'Leases'. The Bank's main contracts are for offices and branches which are necessary to undertake its activities. In the beginning, the right-of-use asset is equal to the lease liability. It is calculated as the present value of the lease payments, which are discounted using the Bank's incremental interest rate at the starting date and considering each contract's duration. The average incremental interest rate is 1.69%. Subsequently, the asset is straight-line depreciated according to the contract's duration, and the financial liability is amortized in terms of the monthly payments. The financial interest is charged to net interest income, and the depreciation is charged to the depreciation expense of each financial year. The lease's term encompasses non-cancellable periods stipulated within each contract. In the case of a lease contract with indefinite duration, the Bank has determined to assign a span equal to the longest of the non-cancellable period of its lease contracts. Contracts with a non-cancellable period of 12 months or less are treated as short-term leases. Therefore, the related payments are recorded as a straight-line expense. Any change in the lease term or rent is treated as a new measurement of the lease. In the initial measurement, the Bank measures the right-of-use of the asset at cost. The rent of the lease contracts is agreed in UF and payable in Chilean pesos. According to Circular No 3,649 of the FMC, the monthly UF variation that affects all contracts established in such monetary units should be treated as a new measurement. Therefore, readjustments should be recognized as an amendment to the obligation, and in parallel, the amount of the related asset should be adjusted. The Bank has not entered into lease agreements with guarantee clauses for residual value or variable lease payments. ii. As a lessor When the Bank acts as a lessor, it first determines if it corresponds to a financial or operating lease. To do this, the Bank evaluates whether it has substantially transferred all the risks and benefits of the asset. If so, this corresponds to a financial lease. Otherwise, it is an operating lease. The Bank recognizes lease rentals received on a straight-line income basis over the lease term. iii. Third-party financing The sum of present values of the lease payments receivable from the lessee is recognized in the line item: 'Loans and receivables from customers' in the Interim Consolidated Statements of Financial Position. This includes the price of the lessee's right-to-call option at the end of the lease term when there is reasonably certain that the lessee will exercise said right. The financial income and expense derived from these contracts are recorded in the Interim Consolidated Statements of Income under 'Interest income' and 'Interest expense', respectively, to achieve a constant return rate over the lease term. Banco Santander-Chile and Affiliates NOTES TO THE INTERIM CONSOLIDATED FINANCIAL STATEMENTS As of September 30, 2025, and 2024, and as of December 31, 2024 Interim Consolidated Financial Statements September 2025 / Banco Santander-Chile 24