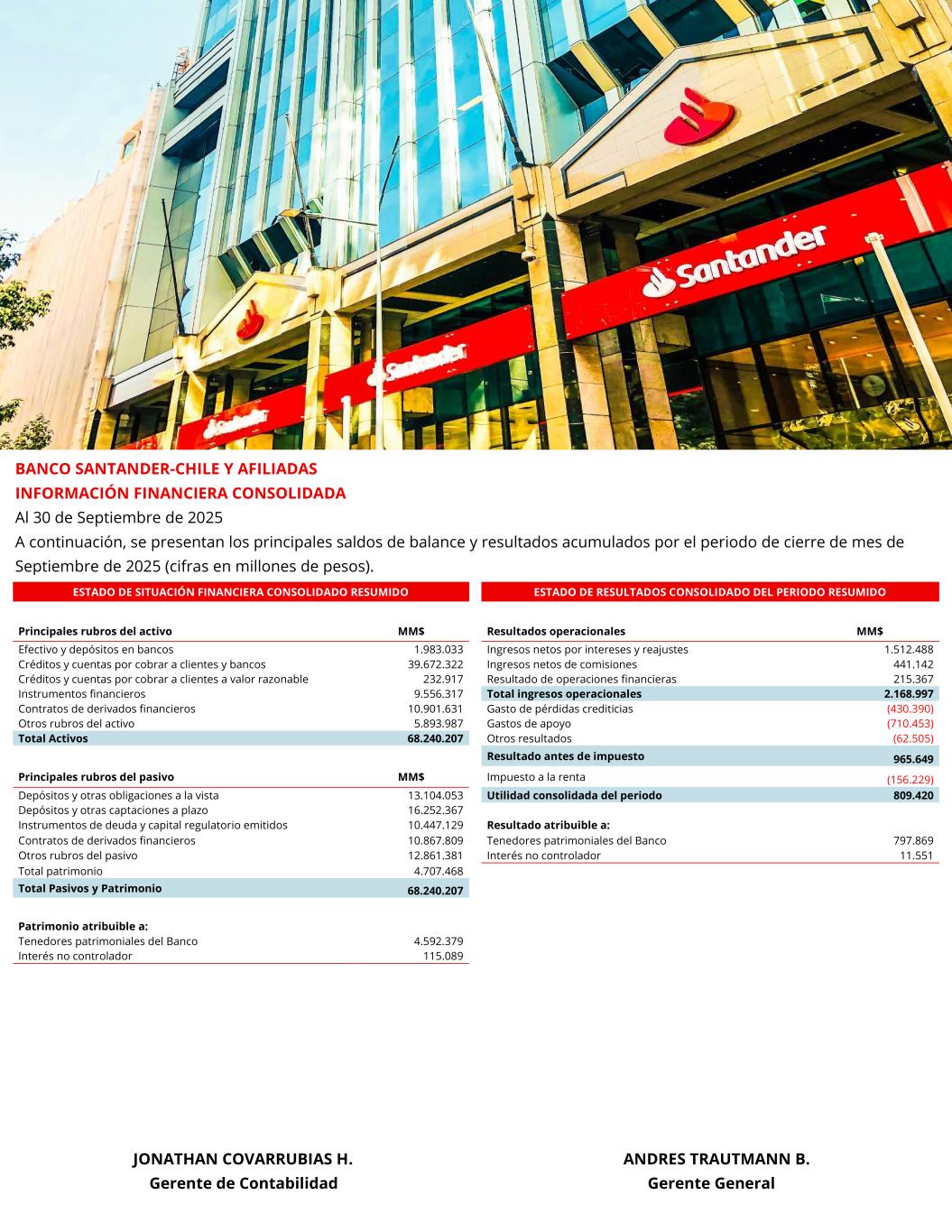

SUMMARIZED CONSOLIDATED STATEMENTS OF FINANCIAL POSITION SUMMARIZED CONSOLIDATED STATEMENTS OF INCOME FOR THE PERIOD Principal assets MCh$ Operational results MCh$ Cash and deposits in banks 1,983,033 Net interest income 1.512.488 Loans and accounts receivables from customers and banks, net 39,672,322 Net fee and commission income 441.142 Loans and accounts receivables from customers at fair value, net 232,917 Result from financial operations 215.367 Financial instruments 9,556,317 Total operating income 2.168.997 Financial derivative contracts 10,901,631 Provision for loan losses (430.390) Other asset ítems 5,893,987 Support expenses (710.453) Total assets 68,240,207 Other results (62.505) Income before tax 965.649 Principal liabilities MCh$ Income tax expense (156.229) Deposits and other demand liabilities 13,104,053 Net income for the period 809.420 Time deposits and other time liabilities 16,252,367 Issued debt and regulatory capital instruments 10,447,129 Attributable to: Financial derivative contracts 10,867,809 Equity holders of the Bank 797.869 Other liabilities ítems 12,861,381 Non-controlling interest 11.551 Total equity 4,707,468 Total liabilities and Equity 68,240,207 Equity attributable to: Equity holders of the Bank 4,592,379 Non-controlling interest 115,089 BANCO SANTANDER-CHILE AND SUBSIDIARIES CONSOLIDATED FINANCIAL INFORMATION As of September 30, 2025 The principal balances and results accumulated for the period ending September 2025 (amounts in millions of Chilean pesos). JONATHAN COVARRUBIAS H. ANDRES TRAUTMANN B. Chief Accounting Officer Chief Executive Officer

B ESTADO DE SITUACIÓN FINANCIERA CONSOLIDADO RESUMIDO ESTADO DE RESULTADOS CONSOLIDADO DEL PERIODO RESUMIDO Principales rubros del activo MM$ Resultados operacionales MM$ Efectivo y depósitos en bancos 1.983.033 Ingresos netos por intereses y reajustes 1.512.488 Créditos y cuentas por cobrar a clientes y bancos 39.672.322 Ingresos netos de comisiones 441.142 Créditos y cuentas por cobrar a clientes a valor razonable 232.917 Resultado de operaciones financieras 215.367 Instrumentos financieros 9.556.317 Total ingresos operacionales 2.168.997 Contratos de derivados financieros 10.901.631 Gasto de pérdidas crediticias (430.390) Otros rubros del activo 5.893.987 Gastos de apoyo (710.453) Total Activos 68.240.207 Otros resultados (62.505) Resultado antes de impuesto 965.649 Principales rubros del pasivo MM$ Impuesto a la renta (156.229) Depósitos y otras obligaciones a la vista 13.104.053 Utilidad consolidada del periodo 809.420 Depósitos y otras captaciones a plazo 16.252.367 Instrumentos de deuda y capital regulatorio emitidos 10.447.129 Resultado atribuible a: Contratos de derivados financieros 10.867.809 Tenedores patrimoniales del Banco 797.869 Otros rubros del pasivo 12.861.381 Interés no controlador 11.551 Total patrimonio 4.707.468 Total Pasivos y Patrimonio 68.240.207 Patrimonio atribuible a: Tenedores patrimoniales del Banco 4.592.379 Interés no controlador 115.089 BANCO SANTANDER-CHILE Y AFILIADAS INFORMACIÓN FINANCIERA CONSOLIDADA Al 30 de Septiembre de 2025 A continuación, se presentan los principales saldos de balance y resultados acumulados por el periodo de cierre de mes de Septiembre de 2025 (cifras en millones de pesos). JONATHAN COVARRUBIAS H. ANDRES TRAUTMANN B. Gerente de Contabilidad Gerente General

IMPORTANT NOTICE The unaudited financial information has been prepared in accordance with the Compendium of Accounting Standards for Banks effective from January 1, 2022 issued by the Financial Market Commission (FMC), The accounting principles issued by the FMC are substantially similar to IFRS but there are some exceptions, The FMC is the banking industry regulator according to article 2 of the General Banking Law, which by General Regulation establishes the accounting principles to be used by the banking industry, For those principles not covered by the Compendium of Accounting Standards for Banks, banks can use generally accepted accounting principles issued by the Chilean Accountant’s Association AG which coincide with International Financial Reporting Standards (IFRS) issued by the International Accounting Standards Board (IASB), If discrepancies exist between the accounting principles issued by the FMC (Compendium of Accounting Standards for Banks) and IFRS the Compendium of Accounting Standards for Banks will take precedence, ¿Qué podemos hacer por ti hoy?